Loan categories: The principal categories of our loans held for investment portfolio are discussed below: | | | | | | | Commercial and industrial loans. | We provide a mix of variable and fixed rate commercial and industrial loans. Our commercialCommercial and industrial loans are typically made to smallsmall- and medium-sized manufacturing, wholesale, retail and service businesses, and farmers for working capital and operating needs and business expansions, including the purchase of capital equipment and loans made to farmers relating to their operations.expansions. This category also includes loans secured by manufactured housing receivables.receivables made primarily to manufactured housing communities. Commercial and industrial loans generally include lines of credit and loans with maturities of five years or less. Commercial and industrial loans are generally made with operating cash flows as the primary source of repayment, but may also include collateralization by inventory, accounts receivable, equipment and personal guarantees. Growth in our commercial and industrial loans portfolio is expected to decrease as we position for potential economic headwinds in 2023 and beyond. | | | | | | | | | | | Construction loans. | Our constructionConstruction loans include commercial construction, land acquisition and land development loans and single-family interim construction loans to small- and medium-sized businesses and individuals. These loans are generally secured by the land or the real property being built and are made based on ourthe Company's assessment of the value of the property on an as-completed basis. These loans can carry riskbasis and repayment depends upon project completion and sale, refinancing, or operation of repayment when projects incur cost overruns, have an increase in the price of building materials, encounter zoning and environmental issues, or encounter other factors that may affect the completion of a project on time and on budget. Additionally, repayment risk may be negatively impacted when the market experiences a deterioration in the value of real estate. We expect to make construction loans at a more moderate pace compared to recent periods due to our current macroeconomic forecasts, the potential of a recession in near future, and the heightened inherent risk associated with these loans. | | | | | | | | | | | | 1-4 family mortgage loans. | Our residential real estate 1-4 family mortgage loans are primarily made with respect to and secured by single family homes, including manufactured homes with real estate, which are both owner-occupied and investor owned. Our future origination volume could be impacted by any deteriorationRepayment depends primarily upon the cash flow of housing values in our markets and increased unemployment or underemployment.the borrower as well as the value of the real estate collateral. | | | | | | | Residential line of credit loans. | Our residential line of credit loans are primarily revolving, open-end lines of credit secured by 1-4 family residential properties. We intend to continue to make residential lineRepayment depends primarily upon the cash flow of credit loans if housing values in our markets do not deteriorate from current prevailing levels and we are able to make such loans consistent with our current credit and underwriting standards. Residential linethe borrower as well as the value of credit loans may also be affected by unemployment or underemployment and deteriorating market values ofthe real estate.estate collateral. | | | | |

| | | | | | | Multi-family residential loans. | Our multi-family residential loans are primarily secured by multi-family properties, such as apartments and condominium buildings. TheRepayment depends primarily upon the cash flow of the borrower as well as the value of these loans and growth in this area of our portfolio may be affected by unemployment or underemployment and deteriorating market values ofthe real estate.estate collateral. | | | | | Commercial real estate owner-occupied loans. | Our commercial real estate owner-occupied loans include loans to finance commercial real estate owner occupied properties for various purposes including use as offices, warehouses, production facilities, health care facilities, retail centers, restaurants, churches and agricultural based facilities. Commercial real estate owner-occupied loans are typically repaid through the ongoing business operations of the borrower, and hence are dependent on the success of the underlying business for repayment and are more exposed to general economic conditions. Due to current market conditions and macroeconomic forecasts, we expect growth in commercial real estate owner-occupied loans to be moderated compared to historical growth.borrower. | | | | | | | | | Commercial real estate non-owner occupied loans. | Our commercial real estate non-owner occupied loans include loans to finance commercial real estate non-owner occupied investment properties for various purposes including use as offices, warehouses, health care facilities, hotels, mixed-use residential/commercial, manufactured housing communities, retail centers, multifamily properties, assisted living facilities and agricultural based facilities. Commercial real estate non-owner occupied loans are typically repaid with the funds received from the sale or refinancing of the completed property or rental proceedsincome from such property, and are therefore more sensitive to adverse conditions in the real estate market, which can also be affected by general economic conditions. We expect growth in commercial real estate non-owner occupied loans to be reduced in comparison to historical growth due to our current macroeconomic outlook.property. | | | | | | | | | | | Consumer and other loans. | Consumer and other loans include consumer loans made to individuals for personal, family and household purposes, including car, boat and other recreational vehicle loans, manufactured homes (without real estate) and other recreational vehicle loans and personal lines of credit. TheseConsumer loans are generally secured by vehicles manufactured homes, and other household goods. The collateral securing consumer loans may depreciate over time. We seek to minimize these risks through its underwriting standards.goods, with repayment depending primarily on the cash flow of the borrower. Other loans also include loans to states and political subdivisions in the U.S. These loansand are generally subject to the risk that the borrowing municipalityrepaid through tax revenues or political subdivision may lose a significant portion of its tax base or that the project for which the loan was made may produce inadequate revenue. None of these categories of loans represent a significant portion of our loan portfolio.refinancing.

| | | | | | | | |

As part of our lending policy and risk management activities, the Company tracks lending exposure of commercial and industrial and owner-occupied commercial real estate by industry classification (as defined by the North American Industry Classification System) and type to determine potential risks associated with industry concentrations, and if any risk issues could lead to additional credit loss exposure. The table below provides a summary of our commercial and industrial and owner-occupied commercial real estate portfolios by industry classification. | | | | | | | | | | | | | | | | | | | | | | | December 31, 2023 | | (dollars in thousands) | | Committed | | Amount Outstanding | | Nonperforming | | Commercial and industrial | | | | | | | | Real estate rental and leasing | | $ | 534,638 | | | $ | 335,619 | | | $ | 173 | | | Finance and insurance | | 493,237 | | | 327,194 | | | — | | | Construction | | 471,837 | | | 146,185 | | | 3,928 | | | Manufacturing | | 266,628 | | | 172,955 | | | 4,512 | | | Wholesale trade | | 161,955 | | | 93,842 | | | 189 | | | Retail trade | | 156,342 | | | 117,409 | | | 9,761 | | | Professional, scientific and technical services | | 136,748 | | | 70,453 | | | 2,393 | | | Information | | 114,889 | | | 54,547 | | | — | | | Transportation and warehousing | | 97,286 | | | 81,163 | | | 177 | | Administrative and support and waste management and

remediation services | | 95,441 | | | 60,759 | | | 130 | | | Other services (except public administration) | | 91,073 | | | 52,295 | | | — | | | Health care and social assistance | | 89,693 | | | 56,893 | | | 135 | | | Educational services | | 64,972 | | | 37,850 | | | — | | | Accommodation and food services | | 41,073 | | | 29,979 | | | — | | | Arts, entertainment and recreation | | 32,275 | | | 29,329 | | | — | | | Agriculture, forestry, fishing and hunting | | 28,485 | | | 20,524 | | | 315 | | | Other | | 106,395 | | | 33,737 | | | 17 | | | Total | | $ | 2,982,967 | | | $ | 1,720,733 | | | $ | 21,730 | | | | | | | | | | Commercial real estate owner-occupied | | | | | | | | Real estate rental and leasing | | $ | 254,514 | | | $ | 247,196 | | | $ | — | | | Other services (except public administration) | | 181,870 | | | 178,266 | | | 130 | | | Retail trade | | 156,501 | | | 150,745 | | | — | | | Health care and social assistance | | 127,194 | | | 125,933 | | | 243 | | | Accommodation and food services | | 103,404 | | | 103,246 | | | — | | | Manufacturing | | 89,691 | | | 85,485 | | | 82 | | | Wholesale trade | | 69,316 | | | 65,702 | | | — | | | Construction | | 67,069 | | | 61,119 | | | 5 | | | Transportation and warehousing | | 53,648 | | | 25,103 | | | — | | | Professional, scientific and technical services | | 41,586 | | | 40,221 | | | 199 | | | Arts, entertainment and recreation | | 34,944 | | | 33,419 | | | — | | | Agriculture, forestry, fishing and hunting | | 24,563 | | | 22,164 | | | 1,083 | | | Educational services | | 23,579 | | | 21,769 | | | — | | | Finance and insurance | | 17,921 | | | 17,619 | | | — | | | Information | | 16,126 | | | 14,250 | | | 871 | | | Management of companies and enterprises | | 16,057 | | | 14,187 | | | — | | | Other | | 27,520 | | | 25,647 | | | 575 | | | Total | | $ | 1,305,503 | | | $ | 1,232,071 | | | $ | 3,188 | |

Additionally, the Company tracks lending exposure of non-owner occupied commercial real estate and construction by collateral property type to determine potential risks associated with collateral types, and if any risk issues could lead to additional credit loss exposure. The following table provides a summary of our non-owner occupied commercial real estate and construction loan portfolios by collateral property type: | | | | | | | | | | | | | | | | | | | | | | | December 31, 2023 | | (dollars in thousands) | | Committed | | Amount Outstanding | | Nonperforming | | Commercial real estate non-owner occupied | | | | | | | | Retail | | $ | 492,336 | | | $ | 481,541 | | | $ | 381 | | | Office | | 374,213 | | | 348,205 | | | 35 | | | Warehouse/industrial | | 340,351 | | | 312,728 | | | — | | | Hotel | | 310,522 | | | 308,875 | | | 2,935 | | | Self-storage | | 114,178 | | | 109,112 | | | — | | | Land-mobile home park | | 113,528 | | | 107,633 | | | — | | | Assisted living and special care facilities | | 82,045 | | | 81,626 | | | — | | | Healthcare facility | | 76,899 | | | 76,481 | | | — | | | Restaurants, bars and event venues | | 30,833 | | | 28,944 | | | — | | | Recreation/sport/entertainment | | 29,973 | | | 29,973 | | | — | | | Other | | 61,613 | | | 58,407 | | | — | | | Total | | $ | 2,026,491 | | | $ | 1,943,525 | | | $ | 3,351 | | | | | | | | | | Construction | | | | | | | | Consumer: | | | | | | | | Construction | | $ | 211,443 | | | $ | 144,232 | | | $ | 695 | | | Land | | 38,325 | | | 37,274 | | | 75 | | | Commercial: | | | | | | | | Multi-family | | 407,800 | | | 167,385 | | | — | | | Land | | 274,187 | | | 243,270 | | | — | | | Retail | | 39,227 | | | 26,922 | | | — | | | Self Storage | | 34,830 | | | 23,474 | | | — | | | Hotel | | 23,668 | | | 18,804 | | | — | | | Recreation/sport/entertainment | | 18,952 | | | 1,901 | | | — | | | Convenience Store/Gas Station | | 16,654 | | | 11,579 | | | — | | | Office | | 15,355 | | | 12,334 | | | — | | | Car Washes | | 15,324 | | | 8,741 | | | — | | | Healthcare Facility | | 9,300 | | | 8,357 | | | — | | | Other | | 26,327 | | | 11,317 | | | 350 | | | Residential Development: | | | | | | | | Construction | | 788,010 | | | 532,732 | | | 1,917 | | | Land | | 151,833 | | | 109,353 | | | — | | | Lots | | 51,942 | | | 39,638 | | | — | | | Total | | $ | 2,123,177 | | | $ | 1,397,313 | | | $ | 3,037 | |

Loan maturity and sensitivities The following table presents the contractual maturities of our loan portfolio as of December 31, 2022.2023. Loans with scheduled maturities are reported in the maturity category in which the payment is due. Demand loans with no stated maturity and overdrafts are reported in the “due in 1 year or less” category. Loans that have adjustable rates are shown as amortizing to final maturity rather than when the interest rates are next subject to change. The tables do not include prepayment assumptions or scheduled repayments. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Loan type (dollars in thousands) | | Maturing in one

year or less | | Maturing in one

to five years | | Maturing in

five to fifteen years | | Maturing after

fifteen years | | Total | | As of December 31, 2022 | | | | | | | | | | | | Commercial and industrial | | $ | 608,008 | | | $ | 843,288 | | | $ | 193,492 | | | $ | 995 | | | $ | 1,645,783 | | | Commercial real estate: | | | | | | | | | | | | Owner-occupied | | 124,064 | | | 537,673 | | | 423,648 | | | 29,195 | | | 1,114,580 | | | Non-owner occupied | | 193,062 | | | 823,537 | | | 919,179 | | | 28,232 | | | 1,964,010 | | | Residential real estate: | | | | | | | | | | | | 1-to-4 family mortgage | | 87,480 | | | 419,183 | | | 297,574 | | | 768,884 | | | 1,573,121 | | | Residential line of credit | | 35,554 | | | 97,101 | | | 363,489 | | | 516 | | | 496,660 | | | Multi-family mortgage | | 41,787 | | | 270,171 | | | 133,831 | | | 33,783 | | | 479,572 | | | Construction | | 917,133 | | | 557,487 | | | 176,765 | | | 6,103 | | | 1,657,488 | | | Consumer and other | | 34,779 | | | 67,274 | | | 67,730 | | | 197,215 | | | 366,998 | | | Total ($) | | $ | 2,041,867 | | | $ | 3,615,714 | | | $ | 2,575,708 | | | $ | 1,064,923 | | | $ | 9,298,212 | | | Total (%) | | 22.0 | % | | 38.9 | % | | 27.7 | % | | 11.4 | % | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | December 31, 2023 | | Loan type (dollars in thousands) | | Maturing in one

year or less | | Maturing in one

to five years | | Maturing in

five to fifteen years | | Maturing after

fifteen years | | Total | | Commercial and industrial | | $ | 757,697 | | | $ | 825,135 | | | $ | 136,928 | | | $ | 973 | | | $ | 1,720,733 | | | Construction | | 877,916 | | | 440,735 | | | 71,418 | | | 7,244 | | | 1,397,313 | | | Residential real estate: | | | | | | | | | | | | 1-to-4 family mortgage | | 69,867 | | | 429,307 | | | 248,361 | | | 821,017 | | | 1,568,552 | | | Residential line of credit | | 42,881 | | | 97,115 | | | 390,621 | | | 295 | | | 530,912 | | | Multi-family mortgage | | 89,138 | | | 362,551 | | | 136,891 | | | 15,224 | | | 603,804 | | | Commercial real estate: | | | | | | | | | | | | Owner-occupied | | 122,077 | | | 638,791 | | | 446,580 | | | 24,623 | | | 1,232,071 | | | Non-owner occupied | | 162,595 | | | 978,007 | | | 785,530 | | | 17,393 | | | 1,943,525 | | | Consumer and other | | 20,457 | | | 68,902 | | | 68,249 | | | 254,265 | | | 411,873 | | | Total ($) | | $ | 2,142,628 | | | $ | 3,840,543 | | | $ | 2,284,578 | | | $ | 1,141,034 | | | $ | 9,408,783 | | | Total (%) | | 22.8 | % | | 40.8 | % | | 24.3 | % | | 12.1 | % | | 100.0 | % |

For loans due after one year or more, the following table presents the interest rate composition for loans outstanding as of December 31, 2022.2023. | | | December 31, 2023 | | | | December 31, 2023 | | Loan type (dollars in thousands) | Loan type (dollars in thousands) | | Fixed

interest rate | | Floating

interest rate | | Total | Loan type (dollars in thousands) | | Fixed

interest rate | | Floating

interest rate | | Total | | As of December 31, 2022 | | | | | | | | Commercial and industrial | Commercial and industrial | | $ | 517,618 | | | $ | 520,157 | | | $ | 1,037,775 | | | Commercial real estate: | | | Owner-occupied | | 767,304 | | | 223,212 | | | 990,516 | | | Non-owner occupied | | 951,952 | | | 818,996 | | | 1,770,948 | | | Construction | | | Residential real estate: | Residential real estate: | | | 1-to-4 family mortgage | | | 1-to-4 family mortgage | | | 1-to-4 family mortgage | 1-to-4 family mortgage | | 1,175,605 | | | 310,036 | | | 1,485,641 | | | Residential line of credit | Residential line of credit | | 4,680 | | | 456,426 | | | 461,106 | | | Multi-family mortgage | Multi-family mortgage | | 307,597 | | | 130,188 | | | 437,785 | | | Construction | | 276,492 | | | 463,863 | | | 740,355 | | | Commercial real estate: | | | Owner-occupied | | | Owner-occupied | | | Owner-occupied | | | Non-owner occupied | | | Consumer and other | Consumer and other | | 318,354 | | | 13,865 | | | 332,219 | | | Total ($) | Total ($) | | $ | 4,319,602 | | | $ | 2,936,743 | | | $ | 7,256,345 | | | Total (%) | Total (%) | | 59.5 | % | | 40.5 | % | | 100.0 | % | Total (%) | | 58.7 | % | | 41.3 | % | | 100.0 | % |

The following table presents the contractual maturities of our loan portfolio segregated into fixed and floating interest rate loans as of December 31, 2022.2023. As of December 31, 2022, and 2021, we had $17.4 million and $21.5 million, respectively, in fixed-rate loans in which we have entered into variable rate swap contracts. There were no such loans outstanding as of December 31, 2023. | | | | | | | | | | | | | | | | | | | | | | (dollars in thousands) | | Fixed

interest rate | | Floating

interest rate | | Total | | As of December 31, 2022 | | | | | | | | One year or less | | $ | 637,515 | | $ | 1,404,352 | | $ | 2,041,867 | | One to five years | | 2,252,295 | | 1,363,419 | | 3,615,714 | | Five to fifteen years | | 1,303,577 | | 1,272,131 | | 2,575,708 | | Over fifteen years | | 763,730 | | 301,193 | | 1,064,923 | | Total ($) | | $ | 4,957,117 | | $ | 4,341,095 | | $ | 9,298,212 | | Total (%) | | 53.3 | % | | 46.7 | % | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | December 31, 2023 | | (dollars in thousands) | | Fixed

interest rate | | Floating

interest rate | | Total | | As of December 31, 2023 | | | | | | | | One year or less | | $ | 584,894 | | $ | 1,557,734 | | $ | 2,142,628 | | One to five years | | 2,299,058 | | 1,541,485 | | 3,840,543 | | Five to fifteen years | | 1,161,075 | | 1,123,503 | | 2,284,578 | | Over fifteen years | | 804,743 | | 336,291 | | 1,141,034 | | Total ($) | | $ | 4,849,770 | | $ | 4,559,013 | | $ | 9,408,783 | | Total (%) | | 51.5 | % | | 48.5 | % | | 100.0 | % |

Of the loans shown above with floating interest rates as of December 31, 2022,2023, many have interest rate floors as follows: | | Loans with interest rate floors (dollars in thousands) | Loans with interest rate floors (dollars in thousands) | | Maturing in one year or less | Weighted average level of support (bps) | Maturing in one to five years | Weighted average level of support (bps) | Maturing in five years to fifteen years | Weighted average level of support (bps) | Maturing after

fifteen years | Weighted average level of support (bps) | Total | Weighted average level of support (bps) | Loans with interest rate floors (dollars in thousands) | | Maturing in one year or less | Weighted average level of support (bps) | Maturing in one to five years | Weighted average level of support (bps) | Maturing in five years to fifteen years | Weighted average level of support (bps) | Maturing after

fifteen years | Weighted average level of support (bps) | Total | Weighted average level of support (bps) | Loans with

current rates

above floors: | Loans with

current rates

above floors: | | | | 1-25 bps | 1-25 bps | | $ | 12 | | 5.00 | | $ | 2,344 | | 17.12 | | $ | 20 | | 25.00 | | $ | — | | — | | $ | 2,376 | | 17.12 | | | | 1-25 bps | | | | 1-25 bps | | | 26-50 bps | 26-50 bps | | 1,034 | | 50.00 | | — | | — | | 1,509 | | 39.36 | | — | | — | | 2,543 | | 43.68 | | | 51-75 bps | 51-75 bps | | — | | — | | 9,609 | | 71.52 | | 399 | | 55.56 | | 2,155 | | 53.90 | | 12,163 | | 67.87 | | | 76-100 bps | 76-100 bps | | 859 | | 100.00 | | 6,836 | | 99.91 | | 17,390 | | 85.20 | | 4,669 | | 88.07 | | 29,754 | | 89.46 | | | 101-125 bps | | 8,530 | | 125.00 | | 16,239 | | 120.38 | | 23,127 | | 114.75 | | 3,495 | | 106.10 | | 51,391 | | 117.64 | | | 126-150 bps | | 8,227 | | 136.22 | | 14,080 | | 148.29 | | 13,181 | | 134.18 | | 2,538 | | 128.78 | | 38,026 | | 139.49 | | | 151-200 bps | | 20,079 | | 199.46 | | 35,936 | | 180.08 | | 70,463 | | 171.75 | | 3,722 | | 198.71 | | 130,200 | | 179.10 | | | 201-250 bps | | 33,686 | | 236.20 | | 74,115 | | 228.80 | | 38,595 | | 224.62 | | 14,820 | | 223.23 | | 161,216 | | 228.83 | | | 251-300 bps | | 74,535 | | 287.75 | | 91,652 | | 277.09 | | 135,221 | | 274.21 | | 20,685 | | 276.14 | | 322,093 | | 278.28 | | | 301-350 bps | | 224,859 | | 343.14 | | 170,872 | | 341.62 | | 153,009 | | 331.98 | | 30,868 | | 334.72 | | 579,608 | | 339.30 | | 351 bps and

above | | 661,055 | | 413.24 | | 559,681 | | 412.15 | | 471,609 | | 411.76 | | 172,978 | | 430.73 | | 1,865,323 | | 414.16 | | | 101-200 bps | | | 201-300 bps | | | 301-400 bps | | | 401-500 bps | | | 501-600 bps | | 601 bps and

above | | Total loans with

current rates

above floors | Total loans with

current rates

above floors | | $ | 1,032,876 | | 373.78 | | $ | 981,364 | | 349.84 | | $ | 924,523 | | 334.04 | | $ | 255,930 | | 374.41 | | $ | 3,194,693 | | 354.97 | | Loans at interest

rate floors

providing

support: | Loans at interest

rate floors

providing

support: | | | | | | | | | | | | | 1-25 bps | 1-25 bps | | $ | — | | — | | $ | — | | — | | $ | 434 | | 22.00 | | $ | 139 | | 22.00 | | $ | 573 | | 22.00 | | | 1-25 bps | | | 1-25 bps | | | | 51-75 bps | | | 51-75 bps | | | 51-75 bps | | | | 101-200 bps | | | 101-200 bps | | | 101-200 bps | | | | 101-125 bps | | — | | — | | — | | — | | 287 | | 122.00 | | — | | — | | 287 | | 122.00 | | | 126-150 bps | | — | | — | | 41 | | 137.00 | | — | | — | | — | | — | | 41 | | 137.00 | | | Total loans at

interest rate

floors

providing

support | Total loans at

interest rate

floors

providing

support | | $ | — | | — | | $ | 41 | | 137.00 | | $ | 721 | | 61.81 | | $ | 139 | | 22.00 | | $ | 901 | | 59.04 | | | Total loans at

interest rate

floors

providing

support | | | Total loans at

interest rate

floors

providing

support | |

Asset quality In order to operate with a sound risk profile, we focus on originating loans that we believe to be of high quality. We have established loan approval policies and procedures to assist us in maintaining the overall quality of our loan portfolio. When delinquencies in our loans exist, we rigorously monitor the levels of such delinquencies for any negative or adverse trends. From time to time, we may modify loans to extend the term or make other concessions, including extensions or interest rate modifications, to help a borrower with a deteriorating financial condition stay current on their loan and to avoid foreclosure. Furthermore, we are committed to collecting on all of our loans, which can result in us carrying higher nonperforming assets. We believe thisloans. This practice leads to higher recoveries in the long-term. Nonperforming assets Our nonperforming assets consist of nonperforming loans, other real estate owned and other repossessed non-earning assets. As of December 31, 20222023 and 2021,2022, we had $87.5$86.5 million and $63.0$87.5 million, respectively, in nonperforming assets. Nonperforming loans are those on which the accrual of interest has stopped, as well as loans that are contractually 90 days past due on which interest continues to accrue. Generally, the accrual of interest is discontinued when the full collection of principal or interest is in doubt or when the payment of principal or interest has been contractually 90 days past due, unless the obligation is both well secured and in the process of collection. In our loan review process, we seek to identify and proactively address nonperforming loans. Accrued interest receivable written off as an adjustment to interest income amounted to $1.1 million and $0.8 million for both the years ended December 31, 20222023 and 2021, respectively.2022. Additionally, we had net interest recoveries on nonperforming assets previously charged off of $2.7$1.4 million and $2.3$2.7 million for the years ended December 31, 20222023 and 2021,2022, respectively.

Nonperforming loans HFI increased $15.1 million to $60.9 million as of December 31, 2023 compared to $45.8 million as of December 31, 2022. The increase is primarily attributable to three commercial and industrial relationships moving to nonaccrual status. In addition to loans HFI, we also includeincluded loans HFS that have stopped accruing interest or become 90 days or more past due. As such, ourOur nonperforming commercial loans HFS representrepresented a pool of previously acquired shared national credits and institutional healthcarecommercial loans. These loans that amounted to $9.3 million and $5.2 million as of December 31, 2022 and 2021, respectively. During the year ended2022. There were no such loans outstanding as of December 31, 2022, we identified a more-than-trivial benefit associated with serviced GNMA loans previously sold that are contractually delinquent greater than 90 days and recorded this right to repurchase option on the balance sheet. See Note 1, "Basis of presentation" within this Report for additional information. 2023.

As of December 31, 2023 and 2022, we had $21.2 million and $26.2 million, respectively, of these delinquent GNMA optional repurchase loans previously sold included on our consolidated balance sheets in loans held for sale. These are considered nonperforming assets as we do not earn any interest on the unexercised option to repurchase these loans. Rebooked GNMA optional repurchase loans do not meet the requirements under FASB ASC Topic 825 to be accounted for under the fair value option. As of December 31, 2021, there was $91.9 million of delinquent GNMA loans previously sold that we did not record on our consolidated balance sheets as we determined there not to be a more-than-trivial benefit based on an analysis of interest rates2023 and an assessment of potential reputational risk associated with these loans. These rebooked GNMA optional repurchase loans negatively impacted our NPA ratio by 20 bps as of December 31, 2022. As of December 31, 2022, and 2021, other real estate owned included $2.1$0.1 million and $3.3$2.1 million, respectively, of excess land and facilities held for sale resulting from branch consolidations from our prior acquisitions. Other nonperformingrepossessed assets also included other repossessed non-real estate amounting to $0.4$1.1 million and $0.7$0.4 million as of December 31, 20222023 and 2021,2022, respectively.

The following table provides details of our nonperforming assets, the ratio of such loans and other nonperforming assets to total assets, and certain other related information as of the dates presented: | | | | | | | | | | | | | | | | | | | | | | December 31, | | | | | | | | | | (dollars in thousands) | | 2022 | | 2021 | | | | | | | | | | Loan Type | | | | | | | | | | | | | Commercial and industrial | | $ | 1,443 | | $ | 1,583 | | | | | | | | | | | Construction | | 389 | | 4,340 | | | | | | | | | | | Residential real estate: | | | | | | | | | | | | | 1-to-4 family mortgage | | 23,115 | | 13,956 | | | | | | | | | | | Residential line of credit | | 1,531 | | 1,736 | | | | | | | | | | | Multi-family mortgage | | 42 | | 49 | | | | | | | | | | | Commercial real estate: | | | | | | | | | | | | | Owner-occupied | | 5,410 | | 6,710 | | | | | | | | | | | Non-owner occupied | | 5,956 | | 14,084 | | | | | | | | | | | Consumer and other | | 7,960 | | 4,845 | | | | | | | | | | | Total nonperforming loans held for investment | | $ | 45,846 | | $ | 47,303 | | | | | | | | | | | Commercial loans held for sale | | 9,289 | | 5,217 | | | | | | | | | | Mortgage loans held for sale(1) | | 26,211 | | — | | | | | | | | | | | Other real estate owned | | 5,794 | | 9,777 | | | | | | | | | | | Other | | 351 | | 686 | | | | | | | | | | | Total nonperforming assets | | $ | 87,491 | | $ | 62,983 | | | | | | | | | | | Nonperforming loans held for investment as a percentage of total loans HFI | | 0.49 | % | 0.62 | % | | | | | | | | | | Nonperforming assets as a percentage of total assets | | 0.68 | % | 0.50 | % | | | | | | | | | | Nonaccrual loans HFI as a percentage of loans HFI | | 0.30 | % | 0.47 | % | | | | | | | | | | Loans restructured as troubled debt restructurings | | $ | 13,854 | | $ | 32,435 | | | | | | | | | | | Troubled debt restructurings as a percentage of total loans held for investment | | 0.15 | % | 0.43 | % | | | | | | | | | (1) Represents optional right to repurchase government guaranteed GNMA mortgage loans previously sold that have become past due greater than 90 days as of December 31, 2022. | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | December 31, | | | | | | | | | | (dollars in thousands) | | 2023 | | 2022 | | | | | | | | | | Loan Type: | | | | | | | | | | | | | Commercial and industrial | | $ | 21,730 | | $ | 1,443 | | | | | | | | | | | Construction | | 3,037 | | 389 | | | | | | | | | | | Residential real estate: | | | | | | | | | | | | | 1-to-4 family mortgage | | 16,073 | | 23,115 | | | | | | | | | | | Residential line of credit | | 2,473 | | 1,531 | | | | | | | | | | | Multi-family mortgage | | 32 | | 42 | | | | | | | | | | | Commercial real estate: | | | | | | | | | | | | | Owner-occupied | | 3,188 | | 5,410 | | | | | | | | | | | Non-owner occupied | | 3,351 | | 5,956 | | | | | | | | | | | Consumer and other | | 11,039 | | 7,960 | | | | | | | | | | | Total nonperforming loans HFI | | $ | 60,923 | | $ | 45,846 | | | | | | | | | | | Commercial loans held for sale | | — | | 9,289 | | | | | | | | | | Mortgage loans held for sale(1) | | 21,229 | | 26,211 | | | | | | | | | | | Other real estate owned | | 3,192 | | 5,794 | | | | | | | | | | | Other repossessed assets | | 1,139 | | 351 | | | | | | | | | | | Total nonperforming assets | | $ | 86,483 | | $ | 87,491 | | | | | | | | | | | Nonperforming loans held for investment as a percentage of total loans HFI | | 0.65 | % | 0.49 | % | | | | | | | | | | Nonperforming assets as a percentage of total assets | | 0.69 | % | 0.68 | % | | | | | | | | | | Nonaccrual loans HFI as a percentage of loans HFI | | 0.51 | % | 0.30 | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (1) Represents optional right to repurchase government guaranteed GNMA mortgage loans previously sold that have become past due greater than 90 days. | | | | | | |

We have evaluated our nonperforming loans held for investmentHFI classified as nonperforming and believe all nonperforming loans have been adequately reserved for in the allowance for credit losses on loans HFI as of December 31, 20222023 and 2021.2022. Management also continually monitors past due loans for potential credit quality deterioration. Loans not considered nonperforming include loans 30-89 days past due that continue to accrue interest amounting to $47.0 million at December 31, 2023 as compared to $31.3 million at December 31, 2022 as compared to $26.5 million at2022. The increase from December 31, 2021.2022 to December 31, 2023 was primarily noted in our 1-to-4 family mortgage and our construction portfolios.

Allowance for credit losses We calculate our expected credit loss using a lifetime loss rate methodology. We utilize probability-weighted forecasts, which consider multiple macroeconomic variables from a third-party vendor that are applicable to the type of loan. Each of our loss rate models incorporate forward-looking macroeconomic projections throughout the reasonable and supportable forecast period and the subsequent historical reversion at the macroeconomic variable input level. In order to estimate the life of a loan, the contractual term of the loan is adjusted for estimated prepayments based on market information and our prepayment history.

The allowance for credit losses represents the portion of the loan's amortized cost basis that we do not expect to collect due to credit losses over the loan's life, considering past events, current conditions, and reasonable and supportable forecasts of future economic conditions considering macroeconomic forecasts.conditions. Loan losses are charged against the allowance when we believe the uncollectibility of a loan balance is confirmed. Subsequent recoveries, if any, are credited to the allowance. The allowance for credit losses is based on the loan's amortized cost basis, excluding accrued interest receivable, as we promptly charge off uncollectible accrued interest receivable determinedreceivable. We calculate our expected credit loss using a lifetime loss rate methodology. We utilize probability-weighted forecasts, which consider multiple macroeconomic variables from Moody's that are applicable to be uncollectible. We determine the appropriatenesseach type of the allowance through periodic evaluation of the loan portfolio, lending-related commitments and other relevant factors, including macroeconomic forecasts and historical loss rates. In future quarters, we may update information and forecasts that may cause significant changes in the estimate in those future quarters.loan. See "Critical“Critical Accounting Estimates - Allowance for credit losses"losses” and Note 53 “Loans and allowance for credit losses“losses” in the notes to the consolidated financial statements for additional information regarding our methodology. The following table presents the allocation of the allowance for credit losses on loans HFI by loan category as well as the ratio of loans by loan category compared to the total loan portfolio as of the dates indicated: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | December 31, | | | 2022 | | 2021 | | (dollars in thousands) | | Amount | | % of

Loans | | ACL

as a % of loans HFI category | | Amount | | % of

Loans | | ACL

as a % of loans HFI category | | | | | | | | | | | | | | | Loan Type: | | | | | | | | | | | | | | Commercial and industrial | | $ | 11,106 | | | 18 | % | | 0.67 | % | | $ | 15,751 | | | 17 | % | | 1.22 | % | | Construction | | 39,808 | | | 18 | % | | 2.40 | % | | 28,576 | | | 17 | % | | 2.15 | % | | Residential real estate: | | | | | | | | | | | | | | 1-to-4 family mortgage | | 26,141 | | | 17 | % | | 1.66 | % | | 19,104 | | | 17 | % | | 1.50 | % | | Residential line of credit | | 7,494 | | | 5 | % | | 1.51 | % | | 5,903 | | | 5 | % | | 1.54 | % | | Multi-family mortgage | | 6,490 | | | 5 | % | | 1.35 | % | | 6,976 | | | 4 | % | | 2.14 | % | | Commercial real estate: | | | | | | | | | | | | | | Owner occupied | | 7,783 | | | 12 | % | | 0.70 | % | | 12,593 | | | 13 | % | | 1.32 | % | | Non-owner occupied | | 21,916 | | | 21 | % | | 1.12 | % | | 25,768 | | | 23 | % | | 1.49 | % | | Consumer and other | | 13,454 | | | 4 | % | | 3.67 | % | | 10,888 | | | 4 | % | | 3.35 | % | | Total allowance | | $ | 134,192 | | | 100 | % | | 1.44 | % | | $ | 125,559 | | | 100 | % | | 1.65 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | December 31, | | | 2023 | | 2022 | | (dollars in thousands) | | Amount | | | | ACL

as a % of loans HFI category | | Amount | | | | ACL

as a % of loans HFI category | | | | | | | | | | | | | | | Loan Type: | | | | | | | | | | | | | | Commercial and industrial | | $ | 19,599 | | | | | 1.14 | % | | $ | 11,106 | | | | | 0.67 | % | | Construction | | 35,372 | | | | | 2.53 | % | | 39,808 | | | | | 2.40 | % | | Residential real estate: | | | | | | | | | | | | | | 1-to-4 family mortgage | | 26,505 | | | | | 1.69 | % | | 26,141 | | | | | 1.66 | % | | Residential line of credit | | 9,468 | | | | | 1.78 | % | | 7,494 | | | | | 1.51 | % | | Multi-family mortgage | | 8,842 | | | | | 1.46 | % | | 6,490 | | | | | 1.35 | % | | Commercial real estate: | | | | | | | | | | | | | | Owner-occupied | | 10,653 | | | | | 0.86 | % | | 7,783 | | | | | 0.70 | % | | Non-owner occupied | | 22,965 | | | | | 1.18 | % | | 21,916 | | | | | 1.12 | % | | Consumer and other | | 16,922 | | | | | 4.11 | % | | 13,454 | | | | | 3.67 | % | | Total allowance for credit losses on loans HFI | | $ | 150,326 | | | | | 1.60 | % | | $ | 134,192 | | | | | 1.44 | % |

The following table summarizes activity in our allowance for credit losses on loans HFI during the periods indicated: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Years Ended December 31, | | | | | | | | | | | | | | (dollars in thousands) | | | | | | 2022 | | | 2021 | | | | | 2020 | | | | | | | | | | | | | | Allowance for credit losses at beginning of period | | | | | | $ | 125,559 | | | $ | 170,389 | | | | | $ | 31,139 | | | | | | | | | | | | | | | Impact of adopting ASC 326 on non-purchased credit deteriorated loans | | | | | | — | | | — | | | | | 30,888 | | | | | | | | | | | | | | | Impact of adopting ASC 326 on purchased credit deteriorated loans | | | | | | — | | | — | | | | | 558 | | | | | | | | | | | | | | | Charge-offs: | | | | | | | | | | | | | | | | | | | | | | | | | | Commercial and industrial | | | | | | (2,087) | | | (4,036) | | | | | (11,735) | | | | | | | | | | | | | | | Construction | | | | | | — | | | (30) | | | | | (18) | | | | | | | | | | | | | | | Residential real estate: | | | | | | | | | | | | | | | | | | | | | | | | | | 1-to-4 family mortgage | | | | | | (77) | | | (154) | | | | | (403) | | | | | | | | | | | | | | | Residential line of credit | | | | | | — | | | (18) | | | | | (22) | | | | | | | | | | | | | | | Multi-family mortgage | | | | | | — | | | (1) | | | | | — | | | | | | | | | | | | | | | Commercial real estate: | | | | | | | | | | | | | | | | | | | | | | | | | | Owner occupied | | | | | | (15) | | | — | | | | | (304) | | | | | | | | | | | | | | | Non-owner occupied | | | | | | (268) | | | (1,566) | | | | | (711) | | | | | | | | | | | | | | | Consumer and other | | | | | | (2,254) | | | (2,063) | | | | | (2,112) | | | | | | | | | | | | | | | Total charge-offs | | | | | | $ | (4,701) | | | $ | (7,868) | | | | | $ | (15,305) | | | | | | | | | | | | | | | Recoveries: | | | | | | | | | | | | | | | | | | | | | | | | | | Commercial and industrial | | | | | | $ | 2,005 | | | $ | 861 | | | | | $ | 1,712 | | | | | | | | | | | | | | | Construction | | | | | | 11 | | | 3 | | | | | 205 | | | | | | | | | | | | | | | Residential real estate: | | | | | | | | | | | | | | | | | | | | | | | | | | 1-to-4 family mortgage | | | | | | 54 | | | 125 | | | | | 122 | | | | | | | | | | | | | | | Residential line of credit | | | | | | 17 | | | 115 | | | | | 125 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Commercial real estate: | | | | | | | | | | | | | | | | | | | | | | | | | | Owner-occupied | | | | | | 88 | | | 156 | | | | | 83 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Consumer and other | | | | | | 766 | | | 773 | | | | | 756 | | | | | | | | | | | | | | | Total recoveries | | | | | | $ | 2,941 | | | $ | 2,033 | | | | | $ | 3,003 | | | | | | | | | | | | | | | Net charge-offs | | | | | | (1,760) | | | (5,835) | | | | | (12,302) | | | | | | | | | | | | | | | Provision for credit losses | | | | | | 10,393 | | | (38,995) | | | | | 94,606 | | | | | | | | | | | | | | | Initial allowance for credit losses on loans purchased with credit deterioration | | | | | | — | | | — | | | | | 25,500 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Allowance for credit losses at the end of period(1) | | | | | | $ | 134,192 | | | $ | 125,559 | | | | | $ | 170,389 | | | | | | | | | | | | | | | Ratio of net charge-offs during the period to average loans outstanding during the period | | | | | | (0.02) | % | | (0.08) | % | | | | (0.22) | % | | | | | | | | | | | | | Allowance for credit losses as a percentage of loans at end of period(1) | | | | | | 1.44 | % | | 1.65 | % | | | | 2.41 | % | | | | | | | | | | | | | Allowance for credit losses as a percentage of nonaccrual loans HFI(1) | | | | | | 489.2 | % | | 353.0 | % | | | | 335.7 | % | | | | | | | | | | | | | Allowance for credit losses as a percentage of nonperforming loans at end of period(1) | | | | | | 292.7 | % | | 265.4 | % | | | | 264.3 | % | | | | | | | | | | | | | (1) Excludes reserve for credit losses on unfunded commitments of $23.0 million, $14.4 million, and $16.4 million recorded in accrued expenses and other liabilities on our consolidated balance sheets as of December 31, 2022, 2021, and 2020 respectively. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Years Ended December 31, | | | | | | | | | | | | | | (dollars in thousands) | | | | | | 2023 | | | 2022 | | | | | 2021 | | | | | | | | | | | | | | Allowance for credit losses on loans HFI at beginning of period | | | | | | $ | 134,192 | | | $ | 125,559 | | | | | $ | 170,389 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Charge-offs: | | | | | | | | | | | | | | | | | | | | | | | | | | Commercial and industrial | | | | | | (462) | | | (2,087) | | | | | (4,036) | | | | | | | | | | | | | | | Construction | | | | | | — | | | — | | | | | (30) | | | | | | | | | | | | | | | Residential real estate: | | | | | | | | | | | | | | | | | | | | | | | | | | 1-to-4 family mortgage | | | | | | (46) | | | (77) | | | | | (154) | | | | | | | | | | | | | | | Residential line of credit | | | | | | — | | | — | | | | | (18) | | | | | | | | | | | | | | | Multi-family mortgage | | | | | | — | | | — | | | | | (1) | | | | | | | | | | | | | | | Commercial real estate: | | | | | | | | | | | | | | | | | | | | | | | | | | Owner-occupied | | | | | | (144) | | | (15) | | | | | — | | | | | | | | | | | | | | | Non-owner occupied | | | | | | — | | | (268) | | | | | (1,566) | | | | | | | | | | | | | | | Consumer and other | | | | | | (2,851) | | | (2,254) | | | | | (2,063) | | | | | | | | | | | | | | | Total charge-offs | | | | | | $ | (3,503) | | | $ | (4,701) | | | | | $ | (7,868) | | | | | | | | | | | | | | | Recoveries: | | | | | | | | | | | | | | | | | | | | | | | | | | Commercial and industrial | | | | | | $ | 273 | | | $ | 2,005 | | | | | $ | 861 | | | | | | | | | | | | | | | Construction | | | | | | 10 | | | 11 | | | | | 3 | | | | | | | | | | | | | | | Residential real estate: | | | | | | | | | | | | | | | | | | | | | | | | | | 1-to-4 family mortgage | | | | | | 100 | | | 54 | | | | | 125 | | | | | | | | | | | | | | | Residential line of credit | | | | | | 1 | | | 17 | | | | | 115 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Commercial real estate: | | | | | | | | | | | | | | | | | | | | | | | | | | Owner-occupied | | | | | | 109 | | | 88 | | | | | 156 | | | | | | | | | | | | | | | Non-owner occupied | | | | | | 1,833 | | | — | | | | | — | | | | | | | | | | | | | | | Consumer and other | | | | | | 573 | | | 766 | | | | | 773 | | | | | | | | | | | | | | | Total recoveries | | | | | | $ | 2,899 | | | $ | 2,941 | | | | | $ | 2,033 | | | | | | | | | | | | | | | Net charge-offs | | | | | | (604) | | | (1,760) | | | | | (5,835) | | | | | | | | | | | | | | | Provision for (reversal of) credit losses on loans HFI | | | | | | 16,738 | | | 10,393 | | | | | (38,995) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Allowance for credit losses on loans HFI at the end of period | | | | | | $ | 150,326 | | | $ | 134,192 | | | | | $ | 125,559 | | | | | | | | | | | | | | | Ratio of net charge-offs during the period to average loans outstanding during the period | | | | | | (0.01) | % | | (0.02) | % | | | | (0.08) | % | | | | | | | | | | | | | | Allowance for credit losses on loans HFI as a percentage of loans at end of period | | | | | | 1.60 | % | | 1.44 | % | | | | 1.65 | % | | | | | | | | | | | | | | Allowance for credit losses on loans HFI as a percentage of nonaccrual loans HFI | | | | | | 311.7 | % | | 489.2 | % | | | | 353.0 | % | | | | | | | | | | | | | Allowance for credit losses on loans HFI as a percentage of nonperforming loans at end of

period | | | | | | 246.7 | % | | 292.7 | % | | | | 265.4 | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The following tables details our provision for credit losses on loans HFI and net charge-offs(charge-offs) recoveries to average loans HFI outstanding by loan category during the periods indicated: | | Provision for credit losses(1) | | Net (charge-offs) recoveries | | Average loans HFI | | Ratio of annualized net (charge-offs) recoveries to average loans HFI | | | Provision for (reversal of) credit losses on loans HFI | | | | Provision for (reversal of) credit losses on loans HFI | | Net (charge-offs) recoveries | | Average loans HFI | | Ratio of annualized net (charge-offs) recoveries to average loans HFI | | (dollars in thousands) | (dollars in thousands) | | Provision for credit losses(1) | | Net (charge-offs) recoveries | | Average loans HFI | | Ratio of annualized net (charge-offs) recoveries to average loans HFI | | | | Year ended December 31, 2022 | | | Year Ended December 31, 2023 | | | | Year Ended December 31, 2023 | | | | Year Ended December 31, 2023 | | | Commercial and industrial | | | Commercial and industrial | | | Commercial and industrial | Commercial and industrial | | $ | (4,563) | | | $ | (82) | | | $ | 1,466,685 | | | (0.01) | % | | $ | 8,682 | | | $ | | $ | (189) | | | $ | | $ | 1,678,832 | | | (0.01) | | (0.01) | % | | Construction | Construction | | 11,221 | | | 11 | | | 1,549,622 | | | — | % | Construction | | (4,446) | | | 10 | | 10 | | | 1,594,317 | | 1,594,317 | | | — | | — | % | | Residential real estate: | Residential real estate: | | | 1-to-4 family mortgage | | | 1-to-4 family mortgage | | | 1-to-4 family mortgage | 1-to-4 family mortgage | | 7,060 | | | (23) | | | 1,438,801 | | | — | % | | 310 | | | 54 | | 54 | | | 1,558,477 | | 1,558,477 | | | — | | — | % | | Residential line of credit | Residential line of credit | | 1,574 | | | 17 | | | 431,826 | | | — | % | Residential line of credit | | 1,973 | | | 1 | | 1 | | | 507,884 | | 507,884 | | | — | | — | % | | Multi-family mortgage | Multi-family mortgage | | (486) | | | — | | | 411,509 | | | — | % | Multi-family mortgage | | 2,352 | | | — | | — | | | 519,554 | | 519,554 | | | — | | — | % | | Commercial real estate: | Commercial real estate: | | | Owner-occupied | Owner-occupied | | (4,883) | | | 73 | | | 1,060,523 | | | 0.01 | % | | Owner-occupied | | | Owner-occupied | | | 2,905 | | | (35) | | | 1,169,680 | | | — | % | | Non-owner occupied | Non-owner occupied | | (3,584) | | | (268) | | | 1,839,577 | | | (0.01) | % | Non-owner occupied | | (784) | | | 1,833 | | 1,833 | | | 1,925,759 | | 1,925,759 | | | 0.10 | | 0.10 | % | | Consumer and other | Consumer and other | | 4,054 | | | (1,488) | | | 343,107 | | | (0.43) | % | Consumer and other | | 5,746 | | | (2,278) | | (2,278) | | | 381,474 | | 381,474 | | | (0.60) | | (0.60) | % | | Total | Total | | $ | 10,393 | | | $ | (1,760) | | | $ | 8,541,650 | | | (0.02) | % | Total | | $ | 16,738 | | | $ | | $ | (604) | | | $ | | $ | 9,335,977 | | | (0.01) | | (0.01) | % | | Year ended December 31, 2021 | | | | | Year ended December 31, 2022 | | | Commercial and industrial | | | Commercial and industrial | | | Commercial and industrial | Commercial and industrial | | $ | 4,178 | | | $ | (3,175) | | | $ | 1,271,476 | | | (0.25) | % | | $ | (4,563) | | | $ | | $ | (82) | | | $ | | $ | 1,466,685 | | | (0.01) | | (0.01) | % | | Construction | Construction | | (29,874) | | | (27) | | | 1,138,769 | | | — | % | Construction | | 11,221 | | | 11 | | 11 | | | 1,549,622 | | 1,549,622 | | | — | | — | % | | Residential real estate: | Residential real estate: | | | 1-to-4 family mortgage | | | 1-to-4 family mortgage | | | 1-to-4 family mortgage | | | 7,060 | | | (23) | | | 1,438,801 | | | — | % | | Residential line of credit | | Residential line of credit | | 1,574 | | | 17 | | | 431,826 | | | — | % | | Multi-family mortgage | | Multi-family mortgage | | (486) | | | — | | | 411,509 | | | — | % | | Commercial real estate: | | | Owner-occupied | | | Owner-occupied | | | Owner-occupied | | | (4,883) | | | 73 | | | 1,060,523 | | | 0.01 | % | | Non-owner occupied | | Non-owner occupied | | (3,584) | | | (268) | | | 1,839,577 | | | (0.01) | % | | Consumer and other | | Consumer and other | | 4,054 | | | (1,488) | | | 343,107 | | | (0.43) | % | | Total | | Total | | $ | 10,393 | | | $ | (1,760) | | | $ | 8,541,650 | | | (0.02) | % | | Year Ended December 31, 2021 | | | Commercial and industrial | | | Commercial and industrial | | | Commercial and industrial | | | $ | 4,178 | | | $ | (3,175) | | | $ | 1,271,476 | | | (0.25) | % | | Construction | | Construction | | (29,874) | | | (27) | | | 1,138,769 | | | — | % | | Residential real estate: | | | 1-to-4 family mortgage | | | 1-to-4 family mortgage | | | 1-to-4 family mortgage | 1-to-4 family mortgage | | (87) | | | (29) | | | 1,130,019 | | | — | % | | (87) | | | (29) | | (29) | | | 1,130,019 | | 1,130,019 | | | — | | — | % | | Residential line of credit | Residential line of credit | | (4,728) | | | 97 | | | 392,907 | | | 0.02 | % | Residential line of credit | | (4,728) | | | 97 | | 97 | | | 392,907 | | 392,907 | | | 0.02 | | 0.02 | % | | Multi-family mortgage | Multi-family mortgage | | (197) | | | (1) | | | 310,874 | | | — | % | Multi-family mortgage | | (197) | | | (1) | | (1) | | | 310,874 | | 310,874 | | | — | | — | % | | Commercial real estate: | Commercial real estate: | | | Owner occupied | Owner occupied | | 7,588 | | | 156 | | | 917,334 | | | 0.02 | % | | Non-owner occupied | | (16,813) | | | (1,566) | | | 1,683,413 | | | (0.09) | % | | Consumer and other | | 938 | | | (1,290) | | | 352,421 | | | (0.37) | % | | Total | | $ | (38,995) | | | $ | (5,835) | | | $ | 7,197,213 | | | (0.08) | % | | Year ended December 31, 2020 | | | | | Commercial and industrial | | $ | 13,830 | | | $ | (10,023) | | | $ | 1,278,794 | | | (0.78) | % | | Construction | | 40,807 | | | 187 | | | 787,881 | | | 0.02 | % | | Residential real estate: | | | 1-to-4 family mortgage | | 6,408 | | | (281) | | | 874,270 | | | (0.03) | % | | Residential line of credit | | 5,649 | | | 103 | | | 301,449 | | | 0.03 | % | | Multi-family mortgage | | 5,506 | | | — | | | 127,257 | | | — | % | | Commercial real estate: | | | Owner occupied | | | Owner occupied | Owner occupied | | (1,739) | | | (221) | | | 708,874 | | | (0.03) | % | | 7,588 | | | 156 | | 156 | | | 917,334 | | 917,334 | | | 0.02 | | 0.02 | % | | Non-owner occupied | Non-owner occupied | | 17,789 | | | (711) | | | 1,239,644 | | | (0.06) | % | Non-owner occupied | | (16,813) | | | (1,566) | | (1,566) | | | 1,683,413 | | 1,683,413 | | | (0.09) | | (0.09) | % | | Consumer and other | Consumer and other | | 6,356 | | | (1,356) | | | 303,663 | | | (0.45) | % | Consumer and other | | 938 | | | (1,290) | | (1,290) | | | 352,421 | | 352,421 | | | (0.37) | | (0.37) | % | | Total | Total | | $ | 94,606 | | | $ | (12,302) | | | $ | 5,621,832 | | | (0.22) | % | Total | | $ | (38,995) | | | $ | | $ | (5,835) | | | $ | | $ | 7,197,213 | | | (0.08) | | (0.08) | % |

1) Excludes provision (reversalThe ACL on loans HFI was $150.3 million and $134.2 million and represented 1.60% and 1.44% of provision)loans HFI as of December 31, 2023 and 2022, respectively. For further information related to the change in the ACL refer to “Provision for credit losses” section herein and Note 3, “Loans and allowance for credit losses on unfunded commitments of $8.6 million, $(2.0) million, and $13.4 million recorded forloans HFI” in the years ended December 31, 2022, 2021, and 2020. respectively.The allowance for credit losses was $134.2 million and $125.6 million and represented 1.44% and 1.65% of loans held for investment as of December 31, 2022 and 2021, respectively.notes to our consolidated financial statements. For the year ended December 31, 2022,2023, we experienced improvednet charge-offs of $0.6 million, or 0.01% of average loans HFI, compared to net charge-offs of $1.8 million, or 0.02% of average loans HFI, compared to $5.8 million, or 0.08% for the year ended December 31, 2021.2022. Our ratio of total nonperforming loans HFI as a percentage of total loans HFI decreasedincreased by 16 basis points to 0.49% at0.65% as of December 31, 2023 compared to December 31, 2022 compared to 0.62% at December 31, 2021.

The primary reason for the increase in the allowance for credit losses isprimarily due to loan growththree commercial and a tightening monetary policy environment during the year ended December 31, 2022. Specifically, we performed qualitative evaluations within our established qualitative framework, weighting the impact uncertainty dueindustrial relationships moving to inflation, negative economic forecasts, predicted Federal Reserve rate increases, status of federal government stimulus programs, supply chain disruptions for our customers and other considerations. Further, the increase in estimated required reserve was attributable to forecasted deterioration in asset quality projected over life of the loan portfolio. nonaccrual status.

As a ratio of ACL to loans HFI by loan type, our

construction, commercial and industrial, HELOC and consumer and other and residential 1-4 family mortgage portfolios incurred the largest increases year-over-year due to weighted projections that the economy may be nearing a recession.period-over-period. These portfolios are heavily reliant on the strength of the economy; and therefore, they are adversely affected by inflation supply chain disruptions, and unemployment.high interest rates.

We also maintain an allowance for credit losses on unfunded commitments, which increaseddecreased to $8.8 million as of December 31, 2023 from $23.0 million as of December 31, 2022 from $14.4 million as of December 31, 2021 due to ana 18.5% or $657.2 million decrease in unfunded loan commitments during the period. Notably, there was a $913.2 million decrease in unfunded loan commitments in our construction loan category pipeline which resulted in a $14.2 million decrease in required ACL related to unfunded commitments. Our unfunded commitments in our construction loan category decreased as a result of management's concentrated effort over the last year to reduce commitments in specific categories judged to be inherently higher risk considering the current and projected economic conditions. Partially offsetting the decrease in unfunded loan commitments in our construction portfolio was a $236.2 million increase in unfunded loan commitments particularly in ourfor commercial and construction unfunded pipelines, and change in macroeconomic forecasts as discussed above.industrial loans compared to December 31, 2022. Loans held for sale Commercial loans held for sale OurHistorically, our loans held for sale includesincluded a previously acquired portfolio of commercial loans, including shared national credits and institutional healthcare loans that are accounted for as held for sale. Theseloans. During the year ended December 31, 2023, we exited the final relationship. As of December 31, 2022, the loans had a fair value of $30.5 million as of December 31, 2022 compared to $79.3 million as of December 31, 2021. The change is primarily attributable to loans within the portfolio being paid off through external refinancing and pay-downs, net of loan fundings on pre-existing loan commitments.million.

This decrease for the year ended December 31, 2022 also includes a loss recognized on theThe change in fair value of the portfolio of $5.1 millionwhich is included in 'other'Other noninterest income' on the consolidated statementsstatement of income representingamounted to a decreaseloss of $10.0$2.1 million from the gain recorded in the previous year of $4.9 million recognized on the change in fair value of the portfolio. In addition to the change in fair value for the year ended December 31, 2021, we also recognized2023 compared to a loss of $5.1 million for the year ended December 31, 2022. The portfolio experienced a net gain of $6.3$7.2 million related toover the pay-off of a loan that had been partially charged off prior to acquisitionlife of the portfolio, resulting in a total gain of $11.2 million during the period included in 'other noninterest income'. As of December 31, 2022, there were three relationships remaining within this portfolio.

Subsequent to December 31, 2022, one of the remaining relationships in the commercial loans held for sale portfolio of $20.6 million was paid-off.

Mortgage loans held for sale Mortgage loans held for sale consisted of $46.6 million of residential real estate mortgage loans in the process of being sold to third-party private investors or government sponsored agencies and $21.2 million of GNMA optional repurchase loans. This compares to $82.8 million of residential real estate mortgage loans in the process of being sold to third partiesthird-party private investors or government sponsored agencies and $26.2 million of GNMA optional repurchase loans. This compares to $672.9 million of residential mortgage loans in the process of being sold as of December 31, 2021. There were no GNMA optional repurchase loans recorded on our consolidated balance sheet as of December 31, 2021. For additional information regarding GNMA optional repurchase loans, please refer to the nonperforming assets table and discussion included under the section captioned 'Asset Quality' within this MD&A.2022. Generally, mortgage volume decreases in rising interest rate environments and slower housing markets and increases in lower interest rate environments and robust housing markets. Interest rate lock volume for the years ended December 31, 2023 and 2022 and 2021 totaled $2.70$1.40 billion and $7.16$2.70 billion, respectively. The decrease in interest rate lock volume during the year ended December 31, 20222023 reflects the slow down experienced across the industry compared with the year ended December 31, 2021, which benefited from historically lowdue primarily to higher interest rates pre-empted by the COVID-19 Pandemic.rates. The decrease also reflects the exit from our direct-to-consumer internet delivery channel completed during 2022. Interest rate lock volume within our direct-to-consumer internet delivery channel for the yearsyear ended December 31, 2022 and 2021 totaled $0.66 billion and $3.75 billion, respectively. Additional details related to the Mortgage restructuring are included under the subheadings 'Noninterest income' and 'Noninterest expense', respectively, included within this management's discussion and analysis and at Note 20, "Segment reporting" in the notes to the consolidated financial statements.$663.8 million. Interest rate lock commitments in the pipeline were $69.2 million as of December 31, 2023 compared with $118.3 million as of December 31, 2022 compared with $487.4 million as of December 31, 2021. The decrease in our pipeline year-over-year was partially due to our exit from our direct-to-consumer channel, which was completed during the third quarter of 2022. Looking ahead to 2023, we expect our interest rate lock commitment volume in the remaining retail channel to be similar to what was experienced in the retail channel for the year ended December 31, 2022. Mortgage loans to be sold are sold either on a “best efforts” basis or under a mandatory delivery sales agreement. Under a “best efforts” sales agreement, residential real estate originations are locked in at a contractual rate with third party private investors or directly with government sponsored agencies, and we are obligated to sell the mortgages to such investors only if the mortgages are closed and funded. The risk we assume is conditioned upon loan underwriting and market conditions in the national mortgage market. Under a mandatory delivery sales agreement, we commit to deliver a

certain principal amount of mortgage loans to an investor at a specified price and delivery date. Penalties are paid to the investor if we fail to satisfy the contract. Gains and losses are realized at the time consideration is received and all other criteria for sales treatment have been met. These loans are typically sold within fifteen to twenty-five days after the loan is funded, depending on the economic environment and competition in the market. Although loan fees and some interest income are derived from mortgage loans held for sale, the main source of income is gains from the sale of these loans in the secondary market.

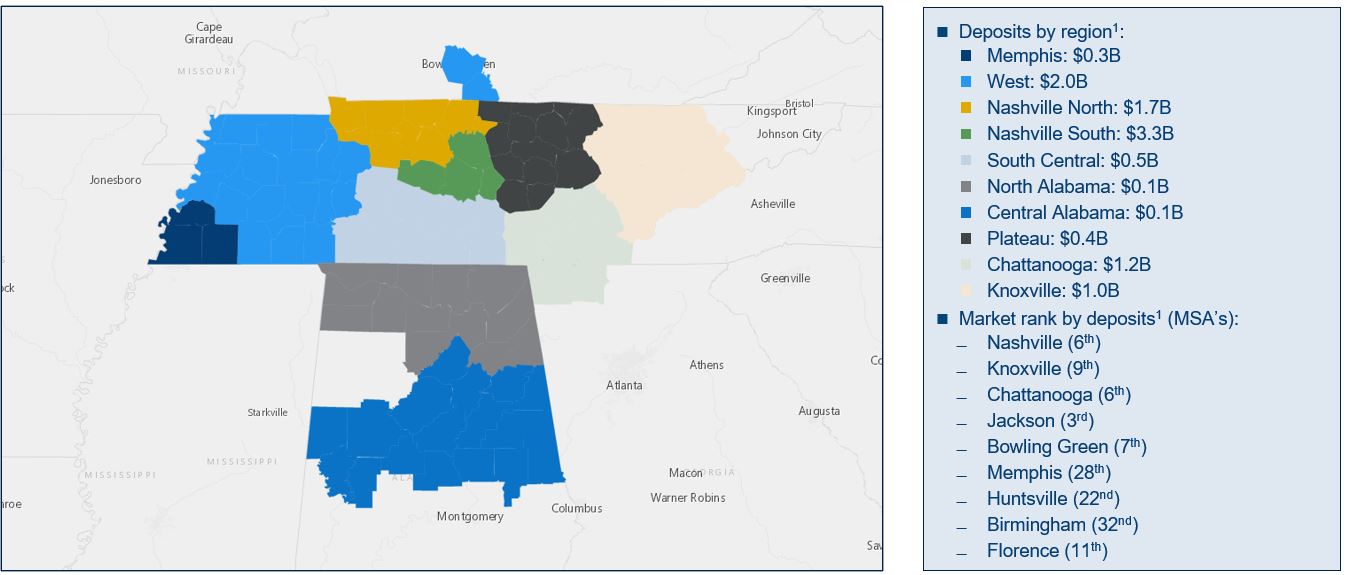

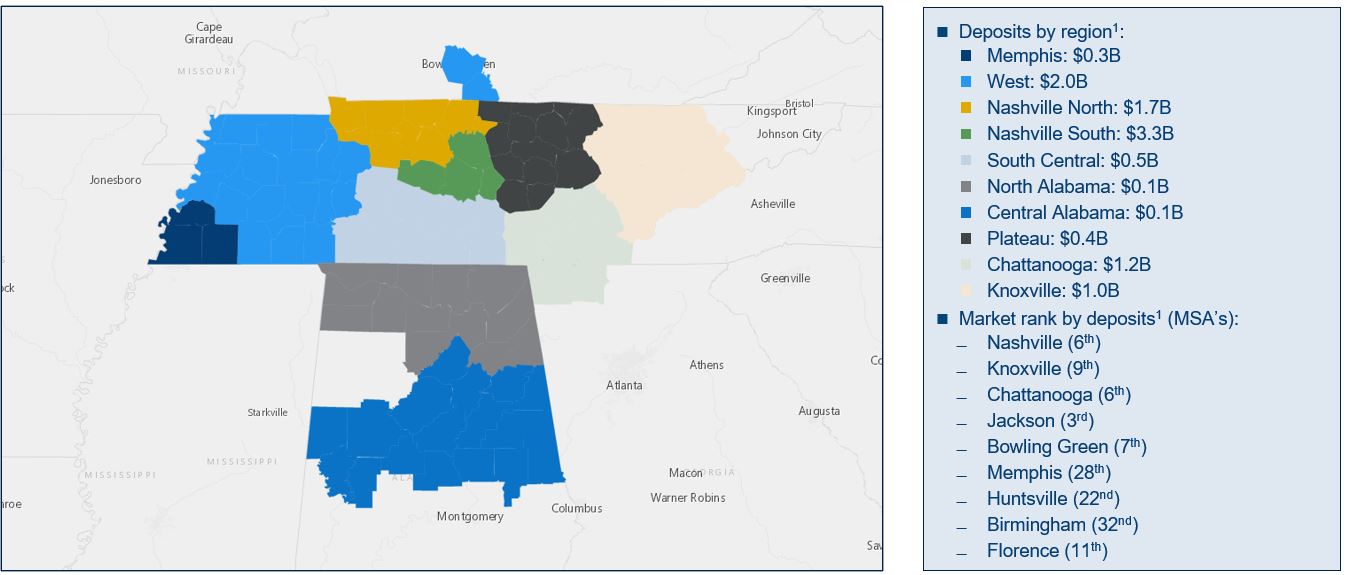

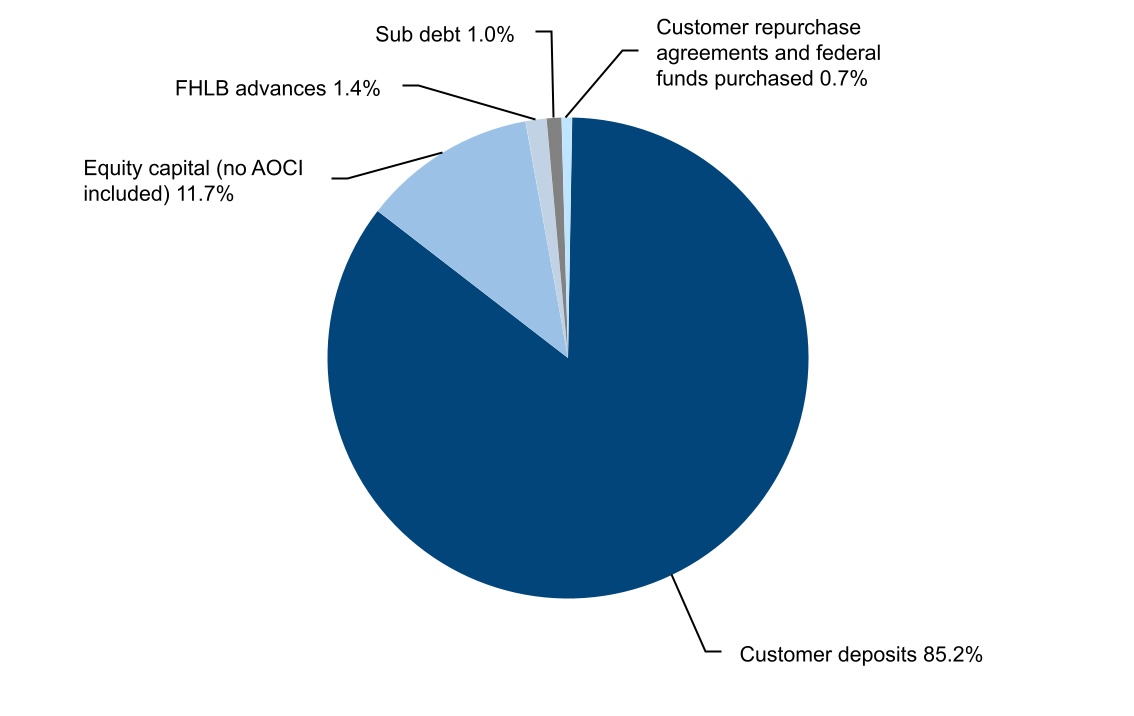

Deposits Deposits represent the Bank’s primary source of funds.funding. We continue to focus on growing core customer deposits through our relationship driven banking philosophy, community-focused marketing programs and initiatives such as the development of our treasury management services. Total deposits were $10.86$10.55 billion and $10.84$10.86 billion as of December 31, 20222023 and 2021,2022, respectively. Noninterest-bearing deposits at December 31, 2023 and December 31, 2022 and 2021 were $2.68$2.22 billion and $2.74$2.68 billion, respectively, while interest-bearing deposits were $8.18$8.33 billion and $8.10$8.18 billion at December 31, 2023 and 2022, respectively. The decrease in noninterest-bearing deposits of $458.2 million from December 31, 2022 to December 31, 2023 is attributable to migration to interest-yielding products such as money market and 2021, respectively. Includedsavings deposits, which increased by $507.6 million from December 31, 2022. Also included in noninterest-bearing deposits are certain mortgage escrow deposits from our third-party mortgage servicing provider, amountingwhich amounted to $63.6 million and $75.6 million as of December 31, 2023 and $127.62022, respectively. Interest-bearing checking deposits decreased by $555.6 million atfrom December 31, 2022 and 2021, respectively. Money market and customer time deposits increased by $159.8 million and $316.5 million during the year ended December 31, 2022, respectively. These increases weredue largely offset byto decreases in non-interest bearing deposits and interest-bearing checking deposits of $63.6 million and $358.7 million during the same period. The shift in deposit composition mix impacted the banking industry as banks were competing for customers who were searching for higher yields. Further, during the year ended December 31, 2022, we exited certain high-costour deposits from municipal and governmental entities, (i.e. "public deposits"). As such, ouralso known as public funds, which decreased by $475.9 million during the period. The decrease in public funds was due to management's decision to not renew certain maturing public deposits decreased from $2.29 billion atdue to rising costs of these deposits.

Additionally, brokered and internet time deposits increased by $149.0 million to $150.8 million as of December 31, 20212023 compared to $2.08 billion at December 31, 2022.2022, which was a result of our balance sheet and liquidity management strategy, which included issuing brokered time deposits in order to increase the liquidity of our balance sheet. As a result of the rising interest rate environment our total cost of deposits increased during the year ended December 31, 2022 from the year ended December 31, 2021 by 24 basis points to 0.54%, and the shift in our deposit composition, we have experienced an increase in our cost of interest-bearing deposits increased to 0.74% from 0.40%and total deposits. Average deposit balances by type, together with the average rates per period are reflected in the same period foraverage balance sheet amounts, interest paid, and rate analysis tables included in this management's discussion and analysis under the prior year.subheading “Results of operations” discussion. During the year ended December 31, 2022, we entered into twoWe utilize designated fair value hedges to mitigate interest rate exposure associated with certain fixed-rate money market deposits. The aggregate fair value of these hedges included in the carrying amount of total money market deposits as of December 31, 2023 and 2022 was $4.5 million and $9.8 million.million, respectively.

Our deposit base also includes certain commercial and high net worth individuals that periodically place deposits with the Bank for short periods of time and can cause fluctuations from period to period in the overall level of customer deposits outstanding. These fluctuations may include certain deposits from related parties as disclosed within Note 24, "Related22, “Related party transactions"transactions” in the notes to our consolidated financial statements included in this Report. Average deposit balances by type, together with the average rates per period are reflected in the average balance sheet amounts, interest paid and rate analysis tables included in this management's discussion and analysis under the subheading "Results of operations" discussion.

The following table sets forth the distribution by type of our deposit accounts as of the dates indicated: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | As of December 31, | | | 2022 | | | 2021 | | | 2020 | | | (dollars in thousands) | | Amount | | % of total deposits | | Average rate | | Amount | | % of total deposits | | Average rate | | Amount | | % of total

deposits | | Average rate | | | | | | | | | | | | | | | | | | | | | Deposit Type | | | | | | | | | | | | | | | | | | | Noninterest-bearing

demand | | $ | 2,676,631 | | | 25 | % | | — | % | | $ | 2,740,214 | | | 26 | % | | — | % | | $ | 2,274,103 | | | 24 | % | | — | % | | Interest-bearing demand | | 3,059,984 | | | 28 | % | | 0.70 | % | | 3,418,666 | | | 32 | % | | 0.35 | % | | 2,491,765 | | | 26 | % | | 0.61 | % | | Money market | | 3,226,102 | | | 30 | % | | 0.80 | % | | 3,066,347 | | | 28 | % | | 0.36 | % | | 2,902,230 | | | 30 | % | | 0.76 | % | | Savings deposits | | 471,143 | | | 4 | % | | 0.05 | % | | 480,589 | | | 4 | % | | 0.06 | % | | 352,685 | | | 4 | % | | 0.08 | % | | Customer time deposits | | 1,420,131 | | | 13 | % | | 0.99 | % | | 1,103,594 | | | 10 | % | | 0.67 | % | | 1,375,695 | | | 15 | % | | 1.52 | % | Brokered and internet time

deposits | | 1,843 | | | — | % | | 1.36 | % | | 27,487 | | | — | % | | 1.69 | % | | 61,559 | | | 1 | % | | 0.90 | % | | Total deposits | | $ | 10,855,834 | | | 100 | % | | 0.54 | % | | $ | 10,836,897 | | | 100 | % | | 0.30 | % | | $ | 9,458,037 | | | 100 | % | | 0.62 | % | | | | | | | | | | | | | | | | | | | | | Total Uninsured Deposits | | $ | 5,661,186 | | | 52 | % | | | | $ | 4,877,819 | | | 45 | % | | | | $ | 4,957,766 | | | 52 | % | | | | | | | | | | | | | | | | | | | | | | | Customer Time Deposits | | | | | | | | | | | | | | | | | | | | 0.00-0.50% | | $ | 296,143 | | | 21 | % | | | | $ | 792,020 | | | 72 | % | | | | $ | 454,429 | | | 34 | % | | | | 0.51-1.00% | | 91,596 | | | 6 | % | | | | 97,644 | | | 9 | % | | | | 253,883 | | | 18 | % | | | | 1.01-1.50% | | 79,924 | | | 6 | % | | | | 78,539 | | | 7 | % | | | | 155,755 | | | 11 | % | | | | 1.51-2.00% | | 261,797 | | | 18 | % | | | | 36,090 | | | 3 | % | | | | 169,414 | | | 12 | % | | | | 2.01-2.50% | | 44,901 | | | 3 | % | | | | 44,653 | | | 4 | % | | | | 159,699 | | | 12 | % | | | | Above 2.50% | | 645,770 | | | 46 | % | | | | 54,648 | | | 5 | % | | | | 182,515 | | | 13 | % | | | Total customer time

deposits | | $ | 1,420,131 | | | 100 | % | | | | $ | 1,103,594 | | | 100 | % | | | | $ | 1,375,695 | | | 100 | % | | | Brokered and Internet

Time Deposits | | | | | | | | | | | | | | | | | | | | 0.00-0.50% | | $ | 99 | | | 5 | % | | | | $ | 99 | | | — | % | | | | $ | — | | | — | % | | | | 0.51-1.00% | | — | | | — | % | | | | — | | | — | % | | | | — | | | — | % | | | | 1.01-1.50% | | 247 | | | 14 | % | | | | 595 | | | 2 | % | | | | 5,660 | | | 9 | % | | | | 1.51-2.00% | | 500 | | | 27 | % | | | | 16,358 | | | 60 | % | | | | 42,311 | | | 69 | % | | | | 2.01-2.50% | | 498 | | | 27 | % | | | | 4,464 | | | 16 | % | | | | 5,312 | | | 9 | % | | | | Above 2.50% | | 499 | | | 27 | % | | | | 5,971 | | | 22 | % | | | | 8,276 | | | 13 | % | | | | Total brokered and internet time deposits | | $ | 1,843 | | | 100 | % | | | | $ | 27,487 | | | 100 | % | | | | $ | 61,559 | | | 100 | % | | | | Total time deposits | | $ | 1,421,974 | | | | | | | $ | 1,131,081 | | | | | | | $ | 1,437,254 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | December 31, | | | 2023 | | | 2022 | | | 2021 | | | (dollars in thousands) | | Amount | | % of total deposits | | Average rate(1) | | Amount | | % of total deposits | | Average rate(1) | | Amount | | % of total

deposits | | Average rate(1) | | Deposit Type | | | | | | | | | | | | | | | | | | | Noninterest-bearing

demand | | $ | 2,218,382 | | | 21 | % | | — | % | | $ | 2,676,631 | | | 25 | % | | — | % | | $ | 2,740,214 | | | 26 | % | | — | % | | Interest-bearing demand | | 2,504,421 | | | 24 | % | | 2.86 | % | | 3,059,984 | | | 28 | % | | 0.70 | % | | 3,418,666 | | | 32 | % | | 0.35 | % | | Money market | | 3,819,814 | | | 36 | % | | 3.53 | % | | 3,226,102 | | | 30 | % | | 0.80 | % | | 3,066,347 | | | 28 | % | | 0.36 | % | | Savings deposits | | 385,037 | | | 4 | % | | 0.06 | % | | 471,143 | | | 4 | % | | 0.05 | % | | 480,589 | | | 4 | % | | 0.06 | % | | Customer time deposits | | 1,469,811 | | | 14 | % | | 3.15 | % | | 1,420,131 | | | 13 | % | | 0.99 | % | | 1,103,594 | | | 10 | % | | 0.67 | % | Brokered and internet time

deposits | | 150,822 | | | 1 | % | | 5.27 | % | | 1,843 | | | — | % | | 1.36 | % | | 27,487 | | | — | % | | 1.69 | % | | Total deposits | | $ | 10,548,287 | | | 100 | % | | 2.39 | % | | $ | 10,855,834 | | | 100 | % | | 0.54 | % | | $ | 10,836,897 | | | 100 | % | | 0.30 | % | | | | | | | | | | | | | | | | | | | | | Total Uninsured Deposits | | $ | 4,899,349 | | | 46 | % | | | | $ | 5,644,534 | | | 52 | % | | | | $ | 4,877,819 | | | 45 | % | | | | | | | | | | | | | | | | | | | | | | Customer Time Deposits(2) | | | | | | | | | | | | | | | | | | | | 0.00-1.00% | | $ | 62,464 | | | 4 | % | | | | $ | 387,739 | | | 27 | % | | | | $ | 889,664 | | | 81 | % | | | | 1.01-2.00% | | 114,521 | | | 8 | % | | | | 341,721 | | | 24 | % | | | | 114,629 | | | 10 | % | | | | 2.01-3.00% | | 51,346 | | | 4 | % | | | | 89,916 | | | 6 | % | | | | 91,007 | | | 8 | % | | | | 3.01-4.00% | | 268,550 | | | 18 | % | | | | 342,576 | | | 24 | % | | | | 8,288 | | | 1 | % | | | | 4.01-5.00% | | 812,781 | | | 55 | % | | | | 224,308 | | | 16 | % | | | | 6 | | | — | % | | | | Above 5.00% | | 160,149 | | | 11 | % | | | | 33,871 | | | 3 | % | | | | — | | | — | % | | | Total customer time

deposits | | $ | 1,469,811 | | | 100 | % | | | | $ | 1,420,131 | | | 100 | % | | | | $ | 1,103,594 | | | 100 | % | | | Brokered and Internet Time Deposits(2) | | | | | | | | | | | | | | | | | | | | 0.00-1.00% | | $ | 99 | | | — | % | | | | $ | 99 | | | 5 | % | | | | $ | 99 | | | — | % | | | | 1.01-2.00% | | — | | | — | % | | | | 747 | | | 41 | % | | | | 16,953 | | | 62 | % | | | | 2.01-3.00% | | 248 | | | — | % | | | | 747 | | | 41 | % | | | | 6,201 | | | 23 | % | | | | 3.01-4.00% | | — | | | — | % | | | | 250 | | | 13 | % | | | | 4,234 | | | 15 | % | | | | 4.01-5.00% | | — | | | — | % | | | | — | | | — | % | | | | — | | | — | % | | | | Above 5.00% | | 150,475 | | | 100 | % | | | | — | | | — | % | | | | — | | | — | % | | | | Total brokered and internet time deposits | | $ | 150,822 | | | 100 | % | | | | $ | 1,843 | | | 100 | % | | | | $ | 27,487 | | | 100 | % | | | | Total time deposits | | $ | 1,620,633 | | | | | | | $ | 1,421,974 | | | | | | | $ | 1,131,081 | | | | | |

At(1) Average rates are presented for the years ended December 31, 2023, 2022, we held an estimated $5.66 billion in uninsured deposits. Asand 2021, respectively.

(2) Rates are presented as of December 31, 2022,period-end. Further details related to our deposit customer base is presented below as of the dates indicated: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | December 31, | | | 2023 | | | 2022 | | | (dollars in thousands) | | Amount | | % of total deposits | | Amount | | % of total deposits | Deposits by customer segment(1) | | | | | | | | | | Consumer | | $ | 4,880,890 | | | 46 | % | | $ | 4,985,544 | | | 46 | % | | Commercial | | 4,069,724 | | | 39 | % | | 3,796,698 | | | 35 | % | | Public | | 1,597,673 | | | 15 | % | | 2,073,592 | | | 19 | % | | Total deposits | | $ | 10,548,287 | | | 100 | % | | $ | 10,855,834 | | | 100 | % |

(1) Segments are determined based on the customer account level.

The tables below set forth maturity information on time deposits and amounts in excess of the FDIC insurance limit as of December 31, 2023: | | | | | | | | | | | | | | | | | December 31, 2023 | | (dollars in thousands) | | Amount | | Weighted average interest rate at period end | | Time deposits of $250 and less | | | | | | Months to maturity: | | | | | | Three or less | | $ | 142,229 | | | 3.15 | % | | Over Three to Six | | 258,108 | | | 3.84 | % | | Over Six to Twelve | | 318,942 | | | 3.86 | % | | Over Twelve | | 256,766 | | | 3.53 | % | | Total | | $ | 976,045 | | | 3.66 | % | | | | | | | Time deposits of greater than $250 | | | | | | Months to maturity: | | | | | | Three or less | | $ | 84,439 | | | 4.16 | % | | Over Three to Six | | 249,085 | | | 4.73 | % | | Over Six to Twelve | | 226,453 | | | 4.55 | % | | Over Twelve | | 84,611 | | | 3.92 | % | | Total | | $ | 644,588 | | | 4.49 | % |

Uninsured deposits are defined as the portion of deposit accounts in U.S. offices that exceed the FDIC insurance limit and amounts in any other uninsured investment or deposit account that are classified as deposits and are not subject to any federal or state deposit insurance regimes. Collateralized deposits are included within our total uninsured deposits. As of December 31, 2023, the estimated portion of time deposits outstanding that are otherwise uninsured by maturity were as follows: | | | | | | | | | | | | | | | | (dollars in thousands) | | Individual

Instruments in

Denominations that

Meet or Exceed the

FDIC Insurance

Limit | | Estimated Aggregate

Time Deposits that Exceed the

FDIC Insurance

Limit and Otherwise

Uninsured Time

Deposits | | Months to maturity: | | | | | | Three or less | | $ | 49,851 | | | $ | 51,068 | | | Over Three to Six | | 217,258 | | | 218,724 | | | Over Six to Twelve | | 128,030 | | | 114,471 | | | Over Twelve | | 161,398 | | | 144,624 | | | Total | | $ | 556,537 | | | $ | 528,887 | |

| | | | | | | | | | | | | December 31, 2023 | | (dollars in thousands) | | | | Amount | | Months to maturity: | | | | | | Three or less | | | | $ | 57,368 | | | Over Three to Six | | | | 147,821 | | | Over Six to Twelve | | | | 148,948 | | | Over Twelve | | | | 83,473 | | | Total | | | | $ | 437,610 | |

Further details related to our estimated insured or collateralized deposits and uninsured and uncollateralized deposits is presented below as of the dates indicated: | | | | | | | | | | | | | | | | | | | | | | December 31, | | | 2023 | | | 2022 | | Estimated insured or collateralized deposits(1) | | $ | 7,414,224 | | | $ | 7,288,641 | | Estimated uninsured deposits(2) | | $ | 4,899,349 | | | $ | 5,644,534 | | Estimated uninsured and uncollateralized deposits(1) | | $ | 3,134,063 | | | $ | 3,567,193 | | Estimated uninsured and uncollateralized deposits as a % of total deposits(1) | | 29.7 | % | | 32.9 | % |

(1) Amounts are shown on a fully consolidated basis and exclude deposits of affiliates that are eliminated in consolidation. (2) Amounts are shown on an unconsolidated basis consistent with regulatory reporting requirements.

Other earning assets Securities purchased under agreements to resell ("(“reverse repurchase agreements"agreements”) We enter into agreements with certain customers to purchase investment securities under agreements to resell at specific dates in the future. This investment deploys some of our liquidity position into an instrument that improves the return on those funds in low interest rate environments. Additionally, we believe it positions us more favorably for a rising interest rate environment.funds. Securities purchased under agreements to resell totaled $75.4$47.8 million and $74.2$75.4 million at December 31, 20222023 and 2021,2022, respectively. InvestmentFederal Funds Sold