Unless otherwise indicated, “Sanara MedTech,” “we,“Sanara,” the “Company,” “our,” “us,” “our,” and “the Company,or “we,” refer to Sanara MedTech Inc. and its consolidated subsidiaries.

| 2 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “aims,” “anticipates,” “believes,” “continue,“contemplates,” “contemplates,“continue,” “could,” “estimates,” “expects,” “forecast,” “guidance,” “intends,” “may,” “plans,” “possible,” “potential,” “predicts,” “preliminary,” “projects,” “seeks,” “should,” “target,” “will” or “would” or the negative of these words, variations of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Such forward-looking statements are subject to certain risks, uncertainties and assumptions relating to factors that could cause actual results to differ materially from those anticipated in such statements, including, without limitation, the following:

| ● | shortfalls in forecasted revenue growth; |

| ● | our ability to implement our comprehensive wound and skincare strategy through acquisitions and investments and our ability to realize the anticipated benefits of such acquisitions and investments; |

| ● | our ability to meet our future capital requirements; |

| ● | our ability to retain and recruit key personnel; |

| ● | the intense competition in the markets in which we operate and our ability to compete within our markets; |

| ● | the failure of our products to obtain market acceptance; |

| ● | the effect of security breaches and other disruptions; |

| ● | our ability to maintain effective internal controls over financial reporting; |

| ● | our ability to develop and commercialize new products and products under development, including the manufacturing, distribution, marketing and sale of such products; |

| ● | our ability to maintain and further grow clinical acceptance and adoption of our products; |

| ● | the impact of competitors inventing products that are superior to ours; |

| ● | disruptions of, or changes in, our distribution model, consumer base or the supply of our products; |

| ● | our ability to manage product inventory in an effective and efficient manner; |

| ● | the failure of third-party assessments to demonstrate desired outcomes in proposed endpoints; |

| ● | our ability to successfully expand into wound and skincare virtual consult and other services; |

| ● | our ability and the ability of our research and development partners to protect the proprietary rights to technologies used in certain of our products and the impact of any claim that we have infringed on intellectual property rights of others; |

| ● | our dependence on technologies and products that we license from third parties; |

| ● | the effects of current and future laws, rules, regulations and reimbursement policies relating to the labeling, marketing and sale of our products and our planned expansion into wound and skincare virtual consult and other services and our ability to comply with the various laws, rules and regulations applicable to our business; and |

| ● | the effect of defects, failures or quality issues associated with our products. |

All forward-looking statements speak only as of the date on which they are made. For a more detailed discussion of these and other factors that may affect our business, see the discussion in “Item 1A. Risk Factors” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this report. We caution that the foregoing list of factors is not exclusive, and new factors may emerge, or changes to the foregoing factors may occur, that could impact our business. We do not undertake any obligation to update any forward-looking statement, whether written or oral, relating to the matters discussed in this report, except to the extent required by applicable securities laws.

| 3 |

PART I

Overview

We are a medical technology company focused on developing and commercializing transformative technologies to improve clinical outcomes and reduce healthcare expenditures in the surgical, chronic and surgical wound and skin careskincare markets. Our portfolio of products and services will allow us to deliver comprehensive wound and skin care solutions for patients in all care settings, including acute (hospitals and long-term acute care hospitals (“LTACHs”)) and post-acute (wound care clinics, physician offices, skilled nursing facilities (“SNFs”), home health, hospice, and retail). Each of our products, services and technologies contributeare designed to achieve our overall goal of achievingproviding better clinical outcomes at a lower overall cost for patients regardless of where they receive care. We strive to be one of the most innovative and comprehensive providers of effective surgical, wound and skin care products and technologiesskincare solutions and are continually seeking to expand our offerings for patients requiring wound and skin care treatments across the entire continuum of care in the United States.

We currently market sevenseveral products across chronicsurgical and surgicalchronic wound care applications and have multiple products in our pipeline. We licenseOn August 1, 2023, we acquired, among other things, the underlying intellectual property of, as well as the rights to manufacture and sell, CellerateRX Surgical Activated Collagen (“CellerateRX Surgical”), our productsprimary product, and HYCOL Hydrolyzed Collagen (“HYCOL”) from research and development partners Applied Nutritionals, LLC (“AN”Applied”) (throughfor human wound care use (such transaction, the “Applied Asset Purchase”). Prior to such time, we had licensed the rights to these products through a sublicense agreement (the “Sublicense Agreement”) with CGI Cellerate RX, LLC (“CGI Cellerate RX”), an affiliate of The Catalyst Group, Inc. (“Catalyst”)) and, both of which are related parties. In connection with the asset purchase, Applied assigned its license agreement with CGI Cellerate RX to a wholly owned subsidiary of the Company. We also license certain products from Rochal Industries, LLC (“Rochal”) and have the right to exclusively distribute certain products under development by Cook Biotech Inc. (“Cook Biotech”).

In 2021,April 2022, we intendentered into a merger agreement through which Precision Healing Inc. (“Precision Healing”) became a wholly owned subsidiary of the Company. Precision Healing is developing a diagnostic imager and lateral flow assay (“LFA”) for assessing a patient’s wound and skin conditions. This comprehensive wound and skin assessment technology is designed to begin marketing three biologic productsquantify biochemical markers to determine the trajectory of a wound’s condition to enable better diagnosis and treatment protocol. In December 2023, we received 510(k) clearance from the U.S. Food and Drug Administration (“FDA”) for surgicalthe Precision Healing diagnostic imager. We are evaluating regulatory pathways for the Precision Healing LFA.

In July 2022, we entered into a membership interest purchase agreement with Scendia Biologics, LLC (“Scendia”) and Ryan Phillips (“Phillips”) pursuant to which we acquired 100% of the issued and outstanding membership interests in Scendia from Phillips. Since our acquisition of Scendia, we have been selling a full line of regenerative and orthobiologic technologies including (i) TEXAGEN Amniotic Membrane Allograft (“TEXAGEN”), (ii) BiFORM Bioactive Moldable Matrix (“BiFORM”), (iii) ACTIGEN Verified Inductive Bone Matrix (“ACTIGEN”) and (iv) ALLOCYTE Advanced Cellular Bone Matrix (“ALLOCYTE”).

In November 2022, we established a partnership with InfuSystem Holdings, Inc. (“InfuSystem”) focused on delivering a complete wound care applications pursuantsolution targeted at improving patient outcomes, lowering the cost of care, and increasing patient and provider satisfaction. The partnership enables InfuSystem to offer innovative products including negative pressure wound therapy (“NPWT”) devices and supplies and our marketingadvanced wound care product line and distribution agreement with Cook Biotech.

In November 2023, we launched BIASURGE Advanced Surgical Solution (“BIASURGE”). BIASURGE is a no-rinse, advanced surgical solution used for wound irrigation. It contains an antimicrobial preservative effective against a broad spectrum of pathogenic microorganisms. BIASURGE is indicated for use in the mechanical cleansing and removal of debris, including microorganisms, from surgical wounds.

Comprehensive Value-Based Care Strategy

In June 2020, we formed a subsidiary, United Wound and Skin Solutions, LLC (“UWSS”(formerly known as “WounDerm”), to hold certain investments and operations in wound and skin careskincare virtual consult services. In 2023, WounDerm was renamed and is now doing business as “Tissue Health Plus” (“THP”). THP is continuing its mission to simplify skin health, starting with wound care through a refined business plan. Through THP, we plan to offer a first of its kind value-based wound care program to payers and risk-bearing entities such as accountable care organizations and value-based care (“VBC”) primary care companies, with Medicare Advantage payers as the initial target segment for this program.

THP’s programs are expected to enable payers to divest wound care spend risk, reduce wound related hospitalizations and improve patient quality of life. THP plans to coordinate delivery of community and home-based wound care for its managed patients. Community based care spans a variety of settings including physician offices, skilled nursing homes, assisted living facilities and senior living facilities. THP programs are intended to integrate science and evidence-based medicine protocols to standardize wound prevention and treatment.

We anticipate that these various service offeringsTHP’s customer contracts will allow clinicians/physicians utilizinghave three-to-five-year terms. These contracts are expected to incorporate a mix of value-based pricing methodologies including episodic, “per member per month”, and “fee for value” pricing. We believe this approach is aligned with the financial goals of the payers and will help deliver outstanding clinical outcomes for the patients.

| 4 |

Our vision for our technologiescomprehensive approach consists of three key sets of planned capabilities:

| (a) | Care Hub – This virtual patient monitoring, care coordination and navigation center is expected to help doctors and nurses support their patients throughout their wound care journey, from prevention to treatment. We expect to have Care Hub staffed by wound care certified nurse practitioners (“NPs”) and registered nurses (“RNs”), incorporating care delivery best practices from partnerships with Direct Dermatology Inc. (“DirectDerm”) and certain physician-led multispecialty wound care groups. With NPs leading the care hub, RNs would assume the role of wound specialists, providing patients with expert review and support of the overarching plan of care on each patient’s journey through the process. In addition, care navigators are expected to serve as a primary point of contact for patients and their providers, coordinating care, managing appointments and ensuring seamless communication among all team members. |

| (b) | Managed Services Organization (“MSO”) Network – With respect to patient-side wound care, our plan is that THP’s programs would be performed by a network of third-party providers who will be contracted through managed services agreements. These providers would include podiatrists, wound care provider groups, primary care physicians, and home health agencies. The providers in the THP network are expected to leverage THP’s standard of care, patient education and tools to deliver optimal patient outcomes with high predictability and efficiency. |

| (c) | Technology Platform – THP’s technology platform will focus on scaling workflows of THP’s Care Hub and MSO Network through automation and integration. We expect the technology platform to enable enhanced patient empowerment and self-healthcare. We anticipate that our technology platform will leverage our technology investments and partnerships with Precision Healing, Pixalere Healthcare, Inc. (“Pixalere”) and others, by leveraging modern technology including artificial intelligence and machine learning. Our platform technology is expected to manage program economics, standards of care, patient monitoring, wound assessments, network performance monitoring, and revenue cycle management. We expect that each of these components will work in concert with each other, constantly improving economics and care delivery. |

We are seeking a partner to collectfacilitate commercialization of Tissue Health Plus and analyze large amounts of data on patient conditions and outcomes that will improve treatment protocols and ultimately lead to more evidence-based formulary to improve patient outcomes. We intend to launch our initial virtual consult service offerings in 2021. Through a combination of our UWSS services and our Sanara products, we believe we will be able to offer patient care solutions at every stepshare in the continuumcost of wound and skin care from diagnosis through healing.

Market Scale

A study by a physician at the Department of Surgery for the Indiana University Health Comprehensive Wound Center found that approximately 8.2 million patients suffer from surgical and chronic wounds each year in the United States. Furthermore, according to an article published by the American College of Surgeons and Surgical Infection Society,, in the United States, the annual treatment cost projections for all wounds is approximately $28 billion with the estimated annual cost of surgical site infections ranging from $3.5 billion to $10 billion. Looking at the target markets for our specific products, according to SmartTRAK Advanced Wound Care, the U.S. advanced dressings market is estimated to be $1.3 billion and the U.S. wound biologics market is estimated to be $2 billion. The U.S. teledermatology market alone is estimated to grow from $5 billion in 2019 to $45 billion by 2027 according to a research report by Fortune Business Insights. In addition to our surgical wound and chronic wound divisions, the Company is planning to launch virtual consult services through UWSS for both virtual wound and virtual skin (dermatology) consultations.

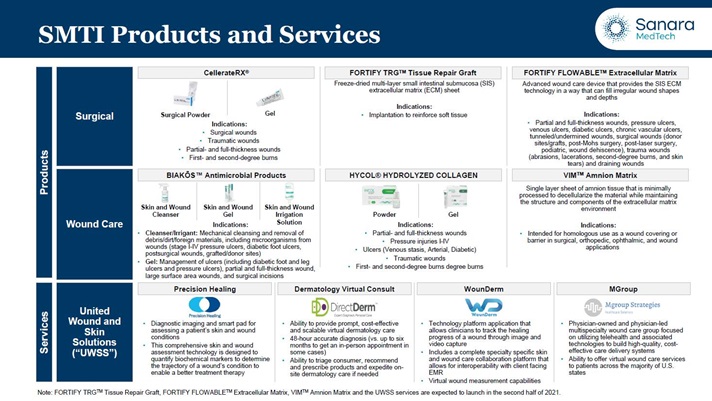

Summary of ourOur Product, & Service and Technology Offerings and Development Programs

We are committed to developing and commercializing innovative products that address the challenges physicians face in diagnosing and treating wound and skin careskincare ailments. The following table sets forth our product and service portfolio:

In 2021, we launched FORTIFY TRG and UWSS technology-based services will become meaningful drivers of revenueFORTIFY FLOWABLE, which we license from Cook Biotech. FORTIFY TRG and FORTIFY FLOWABLE, are currently 510(k) cleared for use in the future.surgical segment. We believe that both products are a complementary offering to CellerateRX Surgical and we are working to increase both the number of contract opportunities and facility approvals to drive further sales growth.

In July 2022, through the acquisition of Scendia, we expanded our surgical product offerings to include regenerative and orthobiologic technologies. We chose to focus our sales and marketing on four key products: TEXAGEN, BiFORM, ACTIGEN and ALLOCYTE. As part of the integration of Scendia into Sanara, we are continuing to work to add facility approvals for these products.

During the third quarter of 2022, we began to experience supply issues with the ALLOCYTE product line. From the fourth quarter of 2022 through September of 2023, we were unable to fill certain orders for this product, which negatively impacted our sales growth. The supply constraint was caused by significant supplier limits on qualifying eligible donor tissue and supplier necessity to subcontract all processing to secondary suppliers. We have since expanded the ALLOCYTE product line with the release of ALLOCYTE Plus, which is processed by an alternative supplier with in-house processing capabilities. Our first sales of ALLOCYTE Plus occurred in October 2023.

| 5 |

In November 2023, we launched BIASURGE. BIASURGE is a no-rinse, advanced surgical solution used for wound irrigation. It contains an antimicrobial preservative that is effective against a broad spectrum of pathogenic microorganisms. BIASURGE is indicated for use in mechanical cleansing and removal of debris, including microorganisms, from surgical wounds.

In December 2023, we entered into an exclusive license agreement with Tufts University (“Tufts”) to develop and commercialize certain new bioactive collagen peptide-based applications using patented technology licensed from Tufts. We believe the licensed technology, supported by the expertise of our research and development team, will help us expand our product offering of collagen products.

Our chronicpost-acute wound care products, HYCOL, Hydrolyzed Collagen (Powder and Gel) (collectively, “HYCOL”), BIAKŌS Antimicrobial Skin and Wound Cleanser (“BIAKŌBIAKŌS AWC”) and BIAKŌBIAKŌS Skin andAntimicrobial Wound Gel (“BIAKŌS AWG”), are usedtargeted for use across the post-acute continuum of care, including home health, hospice, physician offices, podiatrists, retail, SNFs,skilled nursing facilities (“SNFs”), and wound care centers.clinics. Our chronicpost-acute wound care products can be usedare indicated for use on stage I-IV pressure ulcers, diabetic foot ulcers (“DFUs”), venous stasis, arterial, post-surgical wounds, first- and second-degree burns and donor sites. BIAKŌBIAKŌS AWC is also available in an irrigation bottle (BIAKŌ(BIAKŌS Antimicrobial Skin and Wound Irrigation Solution) that can be used in conjunction with negative pressure wound therapy installationNPWT instillation and dwell (“NPWTi-d”) andas well as other wound irrigation needs.

Further, we have a robust pipeline of products under development for bothto further expand our position in the chronicsurgical and surgical wound care and virtual consult markets. We believe our pipeline effortsinitiatives will deepen our comprehensive portfolio of offerings as well asand allow us to address additional clinical applications. Wound care products in our pipeline include an over-the-counter handbuild product and skin cleanser, an antimicrobial skin protectant, a debrider product that leverages the body’s own enzymes and moisture, a newtechnology platforms related to hydrolyzed collagen, wound bed preparation, device for use with BIAKŌS AWC, next generation CellerateRX and HYCOL, a novel dressing that delivers oxygen to the wound bed, and a sterile BIAKŌS product for use in surgical settings. Additionally, Sanara expects to commercialize three products with Cook Biotech in the second half of 2021. The first two, FORTIFY TRG Tissue Repair Graft and FORTIFY FLOWABLE Extracellular Matrix, are currently 510(k) cleared for useantimicrobials in the surgical and wound care segment, and VIM Amnion Matrix is categorized by the U.S. Food and Drug Administration (“FDA”) as an HCT/P, subject to regulation under Section 361 of the Public Health Service Act (“PHSA”) (for which no premarket approval or clearance is required).

Strategy

●

●

●

● Seek and establish partnerships with Medicare Advantage, at-risk payors and other types of healthcare at-risk models. We believe we have assembled the products, services and technologies to offer a comprehensive strategy to help improve outcomes and lower wound care costs across the continuum of care. Looking ahead, we plan to leverage these capabilities to partner with value-based care models to aid in the treatment of their wound care patients who currently are a significant cost for the healthcare system and challenging population to heal.

● Capture patients throughout the entire continuum of care.

| 6 |

Competitive Strengths

●

●

● Wound care products for all care settings. Our wound care product portfolio allows clinicians to personalize solutions to meet the needs of individual wound care patients in all care settings including acute (hospitals and long-term acute care hospitals) and post-acute (wound care clinics, physician offices, SNFs, home health, hospice, podiatrists and retail).

● Innovative pipeline and proven clinical performance. We have a robust pipeline of surgical, wound and skincare products that we expect to market in the near term. We believe the efficacy of our offerings will be proven via statistically significant collected and analyzed clinical and health economic outcomes data, resulting in expanded adoption of our products at a lower overall cost to payors.

● Proven executive leadership team with a long-term track record of value creation.

Market Opportunities for ourOur Products, Services and Technology-Based Services

According to a study published by the Value in Health journal, roughly 15% of the Medicare beneficiary population has chronic nonhealing wounds. Chronic wounds do not advance through the phases of healing in a normal progression and do not show significant progress toward healing in 30 days. Factors contributing to the chronicity of the wound may include pressure / pressure/friction, trauma;trauma, insufficient blood flow and oxygenation in locations such as the lower extremities;extremities, increased bacterial load;load, excessive proteases;proteases, degraded growth factors;factors, matrix metalloproteinases, (“MMPs”); senescent / senescent/aberrant cells;cells or inappropriate treatment. Examples of chronic wounds include DFUs, venous leg ulcers (“VLUs”), arterial ulcers, pressure ulcers and hard-to-heal surgical/traumatic wounds. In each of the various wound types, the presence of biofilms is a frequent cause for chronificationchronicity of wounds and the removal of biofilms is a crucial step to commence healing. Biofilms need to be eradicated to prevent further deterioration of the wound that may result in additional negative patient outcomes. If not effectively treated, these wounds can lead to potentially severe complications, including further infection, osteomyelitis, fasciitis, amputation and increased mortality. Chronic wounds are primarily seen in the elderly population. For example, a 2019 study published in Advances in Wound Care reported that in the United States, 3% of the population over the age of 65 had open wounds. According to the same study, in 2020, the U.S. government estimated that the elderly population totaled 55 million people, suggesting that chronic wounds will continue to be an increasingly persistent problem in this population. Four common chronic and other hard-to-heal wounds are:

●

● Diabetic Foot Ulcers. Diabetes can lead to a reduction in blood flow, which can cause patients to lose sensation in their feet and may prevent them from noticing injuries, sometimes leading to the development of DFUs, which are open sores or ulcers on the feet that may take several weeks to heal, if ever. According to the 2020 National Diabetes Statistics Report by the Center for Disease Control and Prevention, in the United States alone, over 34 million people, or approximately 10% of the population, suffer from diabetes, a chronic, life-threatening disease.

● Venous Leg Ulcers. VLUs develop as a result of vascular insufficiency, or the inability for the vasculature of the leg to return blood back toward the heart properly and, according to a 2013 report published by the International Journal of Tissue Repair and Regeneration, VLUs affect approximately 600,000 people per year in the United States alone. These ulcers usually form on the sides of the lower leg, above the ankle and below the calf, and are slow to heal and often recur if preventative steps are not taken. The risk of VLUs can be increased as a result of a blood clot forming in the deep veins of the legs, obesity, smoking, lack of physical activity or work that requires many hours of standing.

● Pressure Injury/Ulcers. Pressure injury/ulcers are injuries to the skin and underlying tissue resulting from prolonged pressure, or pressure in combination with shear or friction. Constant pressure on an area of skin reduces blood supply to the area and over time can cause the skin to break down and form an open ulcer. These often occur in patients who are hospitalized or confined to a chair or bed and most often form on the skin over bony areas, where there is little cushion between the bone and the skin, such as heels, ankles, hips and the tailbone. Annually, 2.5 million pressure injury/ulcers are treated in the United States in acute care facilities alone, according to a 2006 study published in the Journal of the American Medical Association.

| 7 |

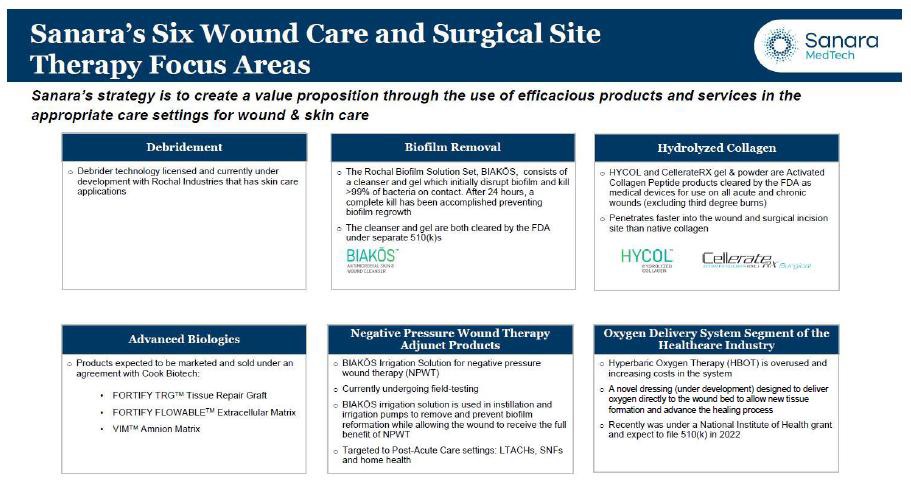

Sanara Products

We market and distribute surgical, wound and skin careskincare products and services to physicians, hospitals, clinics, and post-acute care settings. Our products are primarily sold in the U.S. surgical tissue repair and advanced wound care and surgical tissue repair markets. We are actively seekingbelieve we have the ability to expand withindrive our six focus areas of wound and skin care for the acute, post-acute, and surgical markets: (1) debridement, (2) biofilm removal, (3) hydrolyzed collagen, (4) advanced biologics, (5) negative pressure wound therapy adjunct products, and (6) the oxygen delivery system segment of the wound and skin care market. The table below summarizes how we believe our current products and product pipeline address our sixfrom concept to preclinical and clinical development while meeting quality and regulatory requirements. We are constantly seeking long-term strategic partnerships with a focus areas:

CellerateRX Surgical is a medical hydrolysate of Type I bovine collagen indicated for the management of surgical, traumatic, and partial- and full-thickness wounds as well as first- and second-degree burns. It is manufactured in what we believe to bewith a trade secret process and theproprietary process. CellerateRX Surgical powder is further processedsterilized, packaged and designed specifically for use in athe operating room or other sterile surgical environment. The gel is typically applied post-operatively. CellerateRX Surgical products are primarily purchased by hospitals and ambulatory surgical centers for use by surgeons on surgical wounds. The predominance of CellerateRX Surgical isproducts are used in foot and ankle, neuro/spinal, orthopedic/hip and knee replacement, orthofor a variety of surgical wounds, including those associated with orthopedic, spine, trauma and ortho oncology surgeries.oncologic procedures. Additional specialties benefitingsurgical wounds that may benefit from the use of CellerateRX Surgical include cardiothoracic, colorectal, general, general trauma,cardiovascular, gynecologic, oncology, hand, head and neck, Mohs, obstetrics and gynecology (including caesarean deliveries), plastic/reconstructive, urologic and vascular.

CellerateRX Surgical is used in operative cases where patients might have trouble healing normally due to underlying health complications. There is always a risk of complication with surgical incisions.wounds. This is especially true in patients with certain comorbidities, including obesity, diabetes and hypertension. These complications can include surgical sitewound infections, dehiscence (where an incision opens after primary closure) and necrosis. Surgeons use CellerateRX Surgical to complement the body’s normal healing process. By helpingsupporting the body to heal normally without complications, improved patient outcomes are achieved, thereby reducing downstream costs related to complications (such as re-operation, longer hospitalization, re-admittance, extended rehabilitative care and other additional treatments). Wound infectionsSurgical wound complications have become increasingly problematic due to the high rates of surgical patient comorbidities and the financial strain on insurance carrierspayors as well as hospitals who suffer exorbitant costs for readmission of these patients within 30 days of surgery.

HYCOL Hydrolyzed Collagen products are a medical hydrolysate of Type I bovine collagen intended for the management of full and partial thickness wounds including pressure ulcers, venous and arterial leg ulcers and DFUs. HYCOL is primarily used in or targeted to post-acute care settings such as home health, SNFs, wound care centersclinics and physician offices and is currently approvedeligible for reimbursement under Medicare Part B. HYCOL provides the benefit of hydrolyzed collagen fragments directly in the wound bed. Therefore, unlike with the body’s own native collagen or native collagen products, the body does not have to break HYCOL down before use, which is extremely beneficial when treating elderly and otherwise compromised patients with comorbidities such as diabetes and cardiovascularperipheral vascular disease.

BIAKŌS AWC is an FDAa 510(k) cleared, patented product that laboratory tests show effectively disrupts extracellular polymeric substancescontains synergistic ingredients that have been shown to eradicateimpact mature biofilm microbes. BIAKŌS AWC is indicated for the mechanical removal of debris, dirt, foreign materials, and microorganisms from wounds including stage I-IV pressure ulcers, DFUs, post-surgical wounds, firstfirst- and second-degree burns, as well as grafted and donor sites. BIAKŌS AWC is effective in killing free-floatingplanktonic microbes and immature and mature bacterial biofilms and fungal biofilms.biofilms within the wound. In addition, safety studies demonstrated that BIAKŌS AWC is biocompatible and supports the wound healing process. Initial sales of BIAKŌS AWC occurred in July 2019.

BIAKŌS Antimicrobial Wound GelAWG is an antimicrobial hydrogel wound dressing that can be used alone or in combination with BIAKŌS AWC. In February 2020, we received notification of FDAThe BIAKŌS AWG is also 510(k) clearance for BIAKŌS Antimicrobial Wound Gelcleared and launched the product launched in November 2020 to complement BIAKŌS AWC.

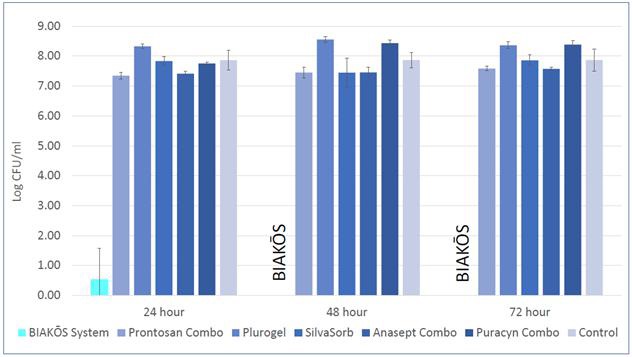

BIAKŌS AWC and BIAKŌS Antimicrobial Wound GelAWG are effective against planktonic microbes as well as immature and mature biofilms.biofilms within the wound. When used together, the cleanser can be used initially to clean a wound and disrupt biofilms (removing 99% in 10 minutes). The gel can then be applied and remains in the wound for up to 72 hours, helping to continue disrupting biofilm microbes. In a study conducted in 2020, BIAKŌS Antimicrobial Wound Gel,AWG, in combination with BIAKŌS AWC, was compared to a number of commercially available wound cleansers to treat chronic wounds such as pressure, diabetic and venous ulcersulcers. The BIAKŌS combination of cleansing and gel dressing demonstrated a reduction in the inflammatory phase of wound healing. The BIAKŌS system reduced the biofilm burdenmicrobes by 7.5 logs (>99.99% reduction) by the 24-hour time point and eradicated it by the 48-hour time point while the remaining commercial controls reduced the Methicillin-resistant Staphylococcus aureus (“MRSA”) biofilms by less than 1 log. Below.

BIASURGE is a graphic summarizingno-rinse advanced surgical solution used for wound irrigation. It contains an antimicrobial preservative effective against a broad spectrum of pathogenic microorganisms. BIASURGE is indicated for use in the efficacymechanical cleansing and removal of the usedebris, including microorganisms, from surgical wounds. First sales of BIAKŌS Antimicrobial Wound GelBIASURGE occurred in combination with BIAKŌS AWC when reducing the MRSA mature biofilm.

FORTIFY TRG Tissue Repair Graft;

| 8 |

FORTIFY FLOWABLE Extracellular Matrix is an advanced wound care device that presents the SIS ECMSmall Intestine Submucosa Extracellular Matrix technology in a way that can fill irregular wound shapes and depths. FORTIFY FLOWABLE Extracellular Matrix is indicated for the management of wounds including: partial and full-thickness wounds, pressure ulcers, venous leg ulcers, diabetic foot ulcers, chronic vascular ulcers, tunneled/undermined wounds, surgical wounds (donor sites/grafts, post-Mohs surgery, post-laser surgery, podiatric, wound dehiscence)dehiscence sites), traumatraumatic wounds (abrasions, lacerations, second-degree burns, and skin tears) and draining wounds. FORTIFY FLOWABLE Extracellular Matrix is provided sterile and is intended for one-time use. It is a 510(k) cleared product.

TEXAGEN is a single layer sheetmulti-layer amniotic membrane allograft used as an anatomical barrier with robust handling that can be sutured for securement if needed. BiFORM is an osteoconductive, bioactive, porous implant that allows for bony ingrowth across the graft site. It can be hydrated and used as a strip or molded into a putty to fill a bone defect. ACTIGEN is a verified inductive allograft putty with conformable handling properties. ALLOCYTE and ALLOCYTE Plus are human allograft cellular bone matrices containing bone-derived progenitor cells and conformable bone fibers. These viable cellular allografts are ready to use upon thawing and have fibrous handling properties.

Recent Published Studies on CellerateRX Surgical

CellerateRX Surgical is a medical hydrolysate of amnion tissueType I bovine collagen indicated for the management of surgical, traumatic, and partial- and full-thickness wounds as well as first- and second-degree burns. CellerateRX Surgical is sterilized, packaged and designed, specifically for use in the operating room (or sterile field), including additional sterility validation. It can be applied in the operating room to surgical wounds that is minimally processedmay result from a wide variety of surgical procedures to decellularizesupport the material while maintainingwound healing environment.

An animal study model by the structureIndiana University Center for Regenerative Medicine and componentsEngineering and the McGowan Institute for Regenerative Medicine was published in Advances in Wound Care in September of 2023. The study, titled “Hydrolyzed Collagen Powder Dressing Improves Wound Inflammation, Perfusion, and Breaking Strength of Repaired Tissue,” demonstrated the effects of CellerateRX Surgical powder on resolution of wound inflammation, perfusion, closure, and breaking strength of the extracellular matrix environment. All tissues are collected from consenting donors, testedrepaired skin. Moreover, the study provided translational research validating published clinical case series and further highlighting mechanistic effects of hydrolyzed collagen. Future empirical and clinical research revealing the unique support hydrolyzed collagen provides the wound environment is currently ongoing.

Several research findings involving CellerateRX Surgical powder have been noted in scientific literature. For example, in November 2021, Dr. William Hotchkiss published a retrospective study of 154 patients in JSM Neurosurgery and Spine, in which patients underwent spinal surgery and CellerateRX Surgical was utilized in the surgical wound. The study found a lower wound dehiscence rate in a high-risk patient population, when compared to previously published wound complication rates in the literature. Another retrospective case study regarding the use of CellerateRX Surgical was recently published by Dr. Alex Gitelman in November 2022. This study of 54 patients undergoing spinal surgery demonstrated no incidence of surgical wound complication.

In a retrospective study published in the Journal of Surgery in October 2023, the impact of CellerateRX Surgical collagen on surgical site infection rates in elective multispecialty surgical procedures was case matched 1:3 for infectious diseases,a total of 5,335 patients and determined eligible for transplantation by a licensed Medical Director. It is provided in multiple sizes and terminally sterilized. The VIM Amnion Matrix is intended for homologous use as a wound covering or barrierdemonstrated an overall reduction of 59% in surgical orthopedic, ophthalmic, and wound applications. It is air-dried for off-the-shelf room temperature storage with no product preparation. The graft is supplied sterile and is intended for one-time use in a single patient.

Intellectual Property

Since the acquisitions of Rochal and Precision Healing and the Applied Asset Purchase, our quality standards, we intend to relaunchresearch and development activities have included internally developing additional proprietary products, services and technologies for the product, which we expect to occur, if at all, in late 2021.

In July 2021, we expectacquired certain assets from Rochal, including intellectual property. With respect to report its operationsthe assets we acquired from Rochal and products developed following the Rochal acquisition, our patent portfolio includes, among others, eight issued U.S. patents, including U.S. Patent No. 8,829,053 entitled “Biocidal Compositions and Methods of Using the Same” (expiring December 7, 2031) relating to BIAKŌS AWC, BIAKŌS AWG and BIASURGE Surgical Wash, as a separate business divisionwell as over 100 issued patents in 2021. UWSS currently owns WounDermforeign jurisdictions. Following our acquisition by merger of Precision Healing in April 2022, described in further detail below, our patent portfolio now includes, among others, five pending U.S. patent applications as well as one pending international patent application. Following the Applied Asset Purchase in August 2023, described in further detail below, our portfolio also now includes, among others, nine additional U.S. patent applications, five trademarks, four 510(k) clearances and has investment interests in, or has exclusive affiliations with, three companies, which include DirectDerm, MGroup,various domain names.

In addition to the above patents, our pending patent applications and Precision Healing.new filings are representative of our ongoing efforts to broaden our portfolio as we continue developing new products for the surgical and chronic wound and skincare markets. We intend to begin launching UWSS’s service offerings in 2021.

| 9 |

Sales and Marketing

As of December 31, 2023, we employed 39 field sales managers (“RSMs”) and five wound care division RSMs.representatives covering 42 states. Our RSMsfield sales representatives are recruited based on their previous industry experience and professional performance and are required to have a minimum of three years of experience successfully selling into similar markets.performance. We constantly evaluate new markets and sales opportunities to add to our sales teams as warranted.

Field sales representatives are initially trained through an internal learning management system, SanaraU,“SanaraU”, which gives them further product and surgical specialty training including wound etiology, operating room etiquette and credentialing requirements. After completing their internal training, new hire RSMsfield sales representatives participate in field training with experienced RSM field trainers to get insights into best practice as well as real world training. The initial training period lasts approximately fiveeight weeks. RSMsField sales representatives are supported by regular updated training modules on product information and best practices.

A key component of our sales and marketing efforts involves working with physicians and clinicians to champion our products in their facilities. Our surgical division worksWe work closely with surgeons and health system stakeholders to demonstrate the efficacy and beneficial impact of our surgical products and successfully navigate the hospital value analysis committee (more commonly known as the “VAC”), approval process, allowing our products to be sold in those facilities. Similarly, our wound care division workswe work with clinicians to demonstrate the efficacy of our wound care products in their respective care settings. If our sales and marketing efforts are successful, the clinicians then advocate for the use of our products when medically necessary and push for their suppliers to carry our products.

Manufacturing, Supply and Production

We do not own or operate and do not intend to establish our own manufacturing facilities. We rely on, and plan to continue relying on contract manufacturing for our products. Our contract manufacturing strategy is intended to drive cost leverage andthrough scale and avoid the high capital outlays and fixed costs associated with constructing and operating manufacturing facilities. Our manufacturing partners have internal compliance processes to maintain the high quality and reliability of our products. They utilize annual internal audits, combined with external audits by regulatory agencies and commercial partners to monitor their quality control practices. We believe our contract manufacturers are well-positioned to support future expansion of our product sales. We do source some packaging and marketing materials separate from our licensing partners.

During the third quarter of 2022, we began to experience supply issues with the ALLOCYTE product line. The supply constraint was caused by significant supplier limits on qualifying eligible donor tissue and supplier necessity to subcontract all processing to secondary suppliers. From the fourth quarter of 2022 through September 2023, we were unable to fill certain orders for this product, which negatively impacted our sales. We have since expanded the ALLOCYTE product line with the release of ALLOCYTE Plus, which is processed by an alternative supplier with in-house processing capabilities. Our first sales of ALLOCYTE Plus occurred in October 2023. We have a sufficient supply of ALLOCYTE Plus to meet currently expected demand and believe we have measures in place to regularly stock the product in the future.

Reimbursement, Clinical Validation and Clinical Utility

We do not promote our products based on their reimbursement status, however, we are mindful of the benefits of a favorable reimbursement coverage status to increase patient access and support our research and development efforts to supply the highest efficacy solutions.

Three of our chronic wound care products (BIAKŌS Antimicrobial Skin and Wound Gel,AWG, HYCOL Hydrolyzed Collagen Powder and HYCOL Hydrolyzed Collagen Gel) have HCPCSHealthcare Common Procedure Coding System A codes and are eligible for reimbursement through Medicare Part B. There is currently no reimbursement for BIAKŌS AWC orand BIAKŌS Antimicrobial Skin and Wound Irrigation Solution. CellerateRX Surgical is currently captured as part of the cost of the surgical procedure.

We anticipate that our UWSS services,THP strategy, once launched, will provide a wealthsignificant amount of patient data to help us measure our products’ effectiveness on improving patient outcomes while simultaneously reducing healthcare costs. We believe our reimbursement strategy, including establishing the clinical validation, clinical utility and health economics of our products, will allow us to drive improved reimbursement coverage for our products and technologies.

Competition

The wound care market is served by a number ofseveral large, multi-product line companies as well as a number of small companies. Our products compete with primary dressings, advanced wound care products, collagen matrices and other biopharmaceutical products. Manufacturers and distributors of competitive products include Smith & Nephew plc, Medline Industries, Inc., ConvaTec Group plc, Mölnlycke Health Care AB, 3M Company, Integra LifeSciences Holdings Corporation (which acquired ACell Inc. on January 20, 2021) and numerous others. Many of our competitors are significantly larger than we are and have greater financial and personnel resources. We believe, however, that

With respect to our products outperform our competitors’ currently available equivalent products for the specific application in which they are intended by providing improved efficacy, better outcomes, and reduced cost of patient care.

| 10 |

Licensing Agreements

CellerateRX Surgical Activated Collagen

In August 27, 2018, we entered into an exclusive, world-wide sublicense agreementSublicense Agreement with CGI Cellerate RX to distribute CellerateRX Surgical and HYCOL products into the surgical and wound care and surgical markets. We payPursuant to the Sublicense Agreement, we paid royalties of 3-5% of annual collected net sales of CellerateRX Surgical and HYCOL. As amended,In August 2023, we acquired the termunderlying intellectual property of, as well as the sublicense extends through May 2050,rights to manufacture and sell, CellerateRX Surgical and HYCOL products from Applied. In connection with automatic year-to-year renewal terms thereafter so long as our Net Sales (as defined in the sublicense agreement) each year are equal to or in excess of $1,000,000. If our Net Sales fall below $1,000,000 for any year after the initial expiration date,this acquisition, Applied assigned its license agreement with CGI Cellerate RX will have the right to terminate the sublicense agreement upon written notice. Minimum royalties of $400,000 per year are payable for the first five yearsa wholly owned subsidiary of the sublicense agreement.

BIAKŌS Antimicrobial Wound Gel and BIAKŌS Antimicrobial Skin and Wound Cleanser

In July 7, 2019, we executed a license agreement with Rochal wherebypursuant to which we acquired an exclusive world-wide license to market, sell and further develop antimicrobial products for the prevention and treatment of microbes on the human body utilizing certain Rochal patents and pending patent applications (the “BIAKŌS License Agreement”). Currently, the products covered by the BIAKŌS License Agreement are BIAKŌS Antimicrobial Wound GelAWG and BIAKŌS Antimicrobial Skin and Wound Cleanser.AWC. Both products are 510(k) approved.cleared. Our Executive Chairman is a director of Rochal, and indirectly a significant shareholder of Rochal, and through the potential exercise of warrants, a majority shareholder of Rochal. Another one of our directors is also a director and significant shareholder of Rochal.

Future commitments under the terms of the BIAKŌS License Agreement include:

| ● | We pay Rochal a royalty of 2-4% of net sales. The minimum annual royalty due to Rochal was $130,000 in 2023 and will increase by $10,000 each subsequent calendar year up to a maximum amount of $150,000. |

| ● | We could pay an additional annual royalty based on specific net profit targets from sales of the licensed products, subject to a maximum of $1,000,000 during any calendar year. |

Unless previously terminated by the parties, the BIAKŌS License Agreement will expireexpires with the related patents in December 2031.

CuraShield Antimicrobial Barrier Film and No Sting Skin Protectant

In October 1, 2019, we executed a license agreement with Rochal wherebypursuant to which we acquired an exclusive world-wide license to market, sell and further develop certain antimicrobial barrier film and skin protectant products for use in the human health care market utilizing certain Rochal patents and pending patent applications (the “ABF License Agreement”). Currently, the products covered by the ABF License Agreement are CuraShield Antimicrobial Barrier Film and a no sting skin protectant product.

Future commitments under the terms of the ABF License Agreement include:

| ● | The Company will pay Rochal a royalty of 2-4% of net sales. The minimum annual royalty due to Rochal will be $50,000 beginning with the first full calendar year following the year in which first commercial sales of the products occur. The annual minimum royalty will increase by $5,000 each subsequent calendar year up to a maximum amount of $75,000. |

| ● | We could pay additional royalties annually based on specific net profit targets from sales of the licensed products, subject to a maximum of $500,000 during any calendar year. |

Unless previously terminated or extended by the parties, the ABF License Agreement will terminate upon expiration of the last U.S. patent in October 2033. No commercial sales or royalty payments hadroyalties have been maderecognized under ABF License Agreementthis agreement as of December 31, 2020.2023.

| 11 |

Debrider License Agreement

In May 4, 2020, we executed a product license agreement with Rochal, wherebypursuant to which we acquired an exclusive world-wide license to market, sell and further develop a debrider for human medical use to enhance skin condition or treat or relieve skin disorders, excluding uses primarily for beauty, cosmetic, or toiletry purposes (the “Debrider License Agreement”).

Future commitments under the terms of the Debrider License Agreement include:

| ● | Upon FDA clearance of the licensed products, we will pay Rochal $500,000 in cash and an additional $1,000,000, which, at our option, may be paid in any combination of cash and our common stock. |

| ● | We will pay Rochal a royalty of 2-4% of net sales. The minimum annual royalty due to Rochal will be $100,000 beginning with the first full calendar year following the year in which first commercial sales of the licensed products occur and increase by $10,000 each subsequent calendar year up to a maximum amount of $150,000. |

| ● | We could pay additional royalties annually based on specific net profit targets from sales of the licensed products, subject to a maximum of $1,000,000 during any calendar year. |

Unless previously terminated or extended by the parties, the Debrider License Agreement will expire in October 2034. No commercial sales or royalties hadhave been recognized under the Debrider License Agreementthis agreement as of December 31, 2020.

Cook Biotech Marketing and Distribution Agreement

In December 17, 2020, we entered into a marketing and distribution agreement with Cook Biotech whereby we were appointed as the exclusive distributor in the United States of threecertain Cook Biotech advanced biologic products. The first two products, FORTIFY TRG Tissue Repair Graft and FORTIFY FLOWABLE Extracellular Matrix, are for use in the surgical wound care segment, and VIM Amnion Matrix is for use in the chronic wound care and surgical wound care segments. We expect to commercialize these products in the second half of 2021.

Under the terms of the agreement, we will purchase the products from Cook Biotech at initial transfer prices stipulated in the agreement. Cook Biotech may update the transfer prices annually based on changes in the US Producer’s Price Index. Minimum annual order quantities will beare agreed upon by both parties after the firsteach year of the contract term. The agreement will terminate onWhile the third anniversaryterm of the date on whichagreement ends in June 2024, the first commercial sale to us from Cook Biotech is made, withagreement provides for automatic two-year renewal terms unlessif notice of non-renewalnonrenewal is not given by one party at least one year prior to the end of the initial term or renewal term that is then in effect.

Tufts University License Agreement

In December 2023, we signed an exclusive license agreement with Tufts to develop and delivery system for orthopedic bone void fillers. This patent is notcommercialize patented technology covering 18 unique collagen peptides. As part of our long-term strategic focus. We subsequentlythis agreement, we formed a new subsidiary, Sanara Collagen Peptides, LLC (“SCP”) and have issued 10% of SCP’s outstanding units to Tufts. SCP has exclusive rights to develop and commercialize new products based on the licensed patents and patents pending. SCP will pay royalties to Tufts based on net sales of licensed products and technologies. Pursuant to the patent toexclusive license agreement, royalties will be calculated at a third party to marketrate of 1.5% or 3%, depending on the type of product or technology developed. SCP will pay Tufts a bone void filler product for which we receiveminimum annual royalty of $50,000 on January 1 of the year following the first anniversary of the first commercial sale of the licensed products or technologies. SCP will pay Tufts a 3%$100,000 minimum annual royalty on product sales overJanuary 1 of each subsequent year during the life ofroyalty term specified in the patent, which expires in 2023, with annual minimum royalties of $201,000. We pay two unrelated third parties a combined royalty equal to eight percent (8%) of our net revenues and royalties generated from products that utilize the acquired patented bone hemostat and delivery system. To date, royalties received by us related to this licensing agreement have not exceeded the annual minimum of $201,000 ($50,250 per quarter). Therefore, our annual royalty obligation under the terms of theexclusive license agreement has been $16,080 ($4,020 per quarter).

Government Regulation

Our operations are subject to comprehensive federal, state and local laws and regulations in the jurisdictions in which we or our research and development partners or affiliates do business. The laws and regulations governing our business and interpretations of those laws and regulations and are subject to frequent change. Our ability to operate profitably will depend in part upon our ability, and that of our research and development partners and affiliates, to operate in compliance with applicable laws and regulations. The laws and regulations relating to medical products and healthcare services that apply to our business and that of our partners and affiliates continue to evolve, and we must, therefore, devote significant resources to monitoring developments in legislation, enforcement, and regulation in such areas. As the applicable laws and regulations change, we are likely to make conforming modifications in our business processes from time to time. We cannot provide assurance that a review of our business by courts or regulatory authorities will not result in determinations that could adversely affect our operations or that the regulatory environment will not change in a way that restricts our operations.

FDA Regulation

Our medical products and operations are regulated by the FDA and other federal and state agencies. TheMost of the products we currently market are regulated as medical devices in the United States under the Federal Food, Drug, and Cosmetic Act (“FDCA”), as implemented and enforced by the FDA. The FDA regulates the development, testing, manufacturing, labeling, packaging, storage, installation, servicing, advertising, promotion, marketing, distribution, import, export and market surveillance of our medical devices.

In addition, we have entered into an agreement to market and distribute VIM Amnion Matrixcertain products for use in the chronic wound care and surgical wound care segments. VIM Amnion Matrix is a tissue-based product regulated by the FDA under Section 361 of the PHSAPublic Health Service Act (“PHSA”) (42 U.S.C. § 264) and 21 C.F.R. Part 1271.

| 12 |

Device Premarket Regulatory Requirements

Before being introduced into the U.S. market, each medical device must obtain marketing clearance or approval from the FDA through the 510(k) premarket notification process, the de novo classification process (summarized below under De Novo Classification Process)below), or the premarket approval application (“PMA”) process, unless they are determined to be Class I devices or to otherwise qualify for an exemption from one of these available forms of premarket review and authorization by the FDA. Under the FDCA, medical devices are classified into one of three classes—Class I, Class II or Class III—depending on the degree of risk associated with each medical device and the extent of control needed to provide reasonable assurance of safety and effectiveness. Classification of a device is important because the class to which a device is assigned determines, among other things, the necessity and type of FDA review required prior to marketing the device. Class I devices are those for which reasonable assurance of safety and effectiveness can be assured by adherence to general controls that include compliance with the applicable portions of the FDA’s Quality System Regulation (“QSR”), as well as regulations requiring facility registration and product listing, reporting of adverse medical events, and appropriate, truthful and non-misleading labeling, advertising and promotional materials. The Class I designation also applies to devices for which there is insufficient information to determine that general controls are sufficient to provide reasonable assurance of the safety and effectiveness of the device or to establish special controls to provide such assurance, but that are not life-supporting or life-sustaining or for a use which is of substantial importance in preventing impairment of human health, and that do not present a potential unreasonable risk of illness ofor injury.

Class II devices are those for which general controls alone are insufficient to provide reasonable assurance of safety and effectiveness and there is sufficient information to establish “special controls.” These special controls can include performance standards, post-market surveillance requirements, patient registries and FDA guidance documents describing device-specific special controls. While most Class I devices are exempt from the 510(k) premarket notification requirement, most Class II devices require a 510(k) premarket notification prior to commercialization in the United States; however, the FDA has the authority to exempt Class II devices from the 510(k) premarket notification requirement under certain circumstances. As a result, manufacturers of most Class II devices must submit 510(k) premarket notifications to the FDA under Section 510(k) of the FDCA (21 U.S.C. § 360(k)) in order to obtain the necessary clearance to market or commercially distribute such devices. To obtain 510(k) clearance, manufacturers must submit to the FDA adequate information demonstrating that the proposed device is “substantially equivalent” to a predicate device already on the market. A predicate device is a legally marketed device that is not subject to PMA, meaning, (i) a device that was legally marketed prior to May 28, 1976 (“preamendments device”) and for which a PMA is not required, (ii) a device that has been reclassified from Class III to Class II or I, or (iii) a device that was found substantially equivalent through the 510(k) process. If the FDA agrees that the device is substantially equivalent to a predicate device currently on the market, it will grant 510(k) clearance to commercially market the device. If there is no adequate predicate to which the manufacturer can compare its proposed device, the proposed device is automatically classified as a Class III device. In such cases, the device manufacturer must then fulfill the more rigorous PMA requirements or can request a risk-based classification determination for the device in accordance with the de novo classification process.

The de novo classification process allows a manufacturer whose novel device is automatically classified into Class III to request down-classification of its device to Class I or Class II on the basis that the device presents low or moderate risk, rather than requiring the submission and approval of a PMA application.PMA. Under the Food and Drug Administration Safety and Innovation Act of 2012 (“FDASIA”), the FDA is required to classify a device within 120 days following receipt of the de novo classification request. If the manufacturer seeks reclassification into Class II, the classification request must include a draft proposal for special controls that are necessary to provide a reasonable assurance of the safety and effectiveness of the medical device. The FDA may reject the classification request if it identifies a legally marketed predicate device that would be appropriate for a 510(k) or determines that the device is not low to moderate risk or that general controls would be inadequate to control the risks and special controls cannot be developed.

Devices that are intended to be life sustaining or life supporting, devices that are implantable, devices that present a potential unreasonable risk of harm or are of substantial importance in preventing impairment of health and devices that are not substantially equivalent to a predicate device are placed in Class III and generally require FDA approval through the PMA process, unless the device is a preamendments device not yet subject to a regulation requiring premarket approval. The PMA process is more demanding than the 510(k) premarket notification process. For a PMA, the manufacturer must demonstrate through extensive data, including data from preclinical studies and clinical trials, that the device is safe and effective. The PMA must also contain a full description of the device and its components, a full description of the methods, facilities and controls used for manufacturing, and proposed labeling. Following receipt of a PMA, the FDA determines whether the application is sufficiently complete to permit a substantive review. If the FDA accepts the application for review, it has 180 days under the FDCA to complete its review of a PMA, although in practice, the FDA’s review often takes significantly longer, and can take up to several years. Before approving a PMA, the FDA generally also performs an on-site inspection of manufacturing facilities for the product to ensure compliance with the QSR.

Thus far, all of the medical devices that we currently market and distribute have been cleared through 510(k) premarket notifications filed by our third-party research and development partners, who are the manufacturers of such devices.notifications. We also are continuing to work through the development process for a number of products in our pipeline. We are currently working on final formulation and the development of a retail marketing strategy for an over-the-counter hand and skin cleanser. Our autolytic debrider product as well a novel dressing that delivers oxygen to the wound bed and a sterile BIAKŌSantimicrobial surgical wash product are currently under development at Rochal, and wedevelopment. We are in discussions concerning the best path for seeking clearance and approval for these products. In December 2023, we received 510(k) clearance from the FDA for the Precision Healing diagnostic imager. We are also exploring new indications of usecurrently evaluating commercial and improved formulasregulatory pathways for a next generation CellerateRX and a next generation HYCOL.the Precision Healing LFA.

| 13 |

Clinical trials are almost always required to support PMAs and are sometimes required to support 510(k) submissions. All clinical investigations of devices to determine safety and effectiveness must be conducted in accordance with the FDA’s investigational device exemption (“IDE”), regulations that govern investigational device labeling, prohibit promotion of the investigational device and specify recordkeeping, reporting and monitoring responsibilities of study sponsors and study investigators. If the device presents a “significant risk,” as defined by the FDA, the agency requires the device sponsor to submit an IDE application to the FDA, which must become effective prior to commencing human clinical trials. The IDE will automatically become effective 30 days after receipt by the FDA, unless the FDA denies the application or notifies the company that the investigation is on hold and may not begin until the sponsor provides supplemental information about the investigation that satisfies FDA’s concerns. If the FDA determines that there are deficiencies or other concerns with an IDE that require modification of the study, the FDA may permit a clinical trial to proceed under a conditional approval. In addition, the study must be approved by, and conducted under the oversight of, an institutional review board (“IRB”), for each clinical site. If the device presents a non-significant risk to the patient according to criteria established by the FDA as part of the IDE regulations, a sponsor may begin the clinical trial after obtaining approval for the trial by one or more IRBs without separate authorization from the FDA, but must still comply with abbreviated IDE requirements, such as monitoring the investigation, ensuring that the investigators obtain informed consent, and labeling and record-keeping requirements.

Device Post-marketPostmarket Regulatory Requirements

After a device is cleared or approved for commercialization, and prior to marketing, numerous regulatory requirements apply to the various entities responsible for preparing a device for distribution, including the manufacturer (including specification developer), contract manufacturers, relabelers/repackagers, sterilizers and initial importer, as applicable. These include:

| ● | establishment registration and device listing; |

| ● | development of a quality management system, including establishing and implementing procedures to design and manufacture devices in compliance with the QSR (unless a device category is exempt from this requirement by the FDA, such as in the case of many Class I devices); |

| ● | labeling regulations that prohibit the promotion of products for uncleared or unapproved uses (known as off-label uses), as well as requirements to provide accurate and non-misleading information and adequate information on both risks and benefits of the device; |

| ● | FDA’s unique device identification requirements that call for a unique device identifier on device labels, packages, and in some cases, on the device itself, and submission of data to the FDA’s Global Unique Device Identification Database; |

| ● | medical device reporting regulations that require manufacturers to report to the FDA if a device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if it were to recur; |

| ● | corrections and removal reporting regulations that require manufacturers report to the FDA field corrections and product recalls or removals if undertaken to reduce a risk to health posed by the device or to remedy a violation of the FDCA that may present a risk to health; and |

| ● | postmarket surveillance regulations, which apply to Class II or Class III devices if the FDA has issued a postmarket surveillance order and the failure of the device would be reasonably likely to have serious adverse health consequences, the device is expected to have significant use in the pediatric population, the device is intended to be implanted in the human body for more than one year, or the device is intended to be used to support or sustain life and to be used outside a user facility. |

Our research and development partners and their contract manufacturers may be subject to periodic scheduled or unscheduled inspections by the FDA. If we are required to register with the FDA, by becoming the manufacturer or specification developer of any medical device for instance, then we also may be subject to such inspections by the FDA. If the FDA believes we or any of our research and development partners or their contract manufacturers are not in compliance with the QSR, or other post-marketpostmarket requirements, it has broad authority to take significant enforcement actions to compel compliance. Specifically, if the FDA determines that we or our research and development partners or their contract manufacturers failed to comply with applicable regulatory requirements, the agency can take a variety of compliance or enforcement actions, which may result in any of the following sanctions:

| ● | untitled letters, warning letters, fines, injunctions, consent decrees and civil penalties; |

| ● | customer notifications or repair, replacement or refunds; |

| ● | mandatory recalls, withdrawals, or administrative detention or seizure of our products; |

| ● | operating restrictions or partial suspension or total shutdown of production; |

| ● | refusing or delaying requests for 510(k) marketing clearance or approval of premarket approval applications relating to new products or modified products; |

| ● | reclassifying a 510(k)-cleared device or withdrawing PMA approval; |

| ● | refusal to grant export approvals for our products; or |

| ● | pursuing criminal prosecution. |

Any such enforcement action by the FDA would have a material adverse effect on our business. In addition, these regulatory controls, as well as any changes in FDA policies, can affect the time and cost associated with the development, introduction, and continued availability of new products.

| 14 |

HCT/P Regulatory Requirements

Some of the products we currently market are regulated as biologics, more specifically as human cells, tissues, and cellular and tissue-based products (“HCT/Ps”). They include (i) TEXAGEN, (ii) BiFORM, (iii) ACTIGEN, (iv) ALLOCYTE and (v) ALLOCYTE Plus. HCT/Ps are regulated by the FDA’s Center for Biologics Evaluation and Research (“CBER”) or Center for Devices and Radiological Health (“CDRH”) depending on the type of product, how it is manufactured and its intended uses. HCT/Ps that meet all of the criteria described in 21 C.F.R. § 1271.10(a) are regulated by the CBER under Section 361 of the PHSA (42 U.S.C. § 264) and 21 C.F.R. Part 1271 only (“361 products”). Although 361 products do not require premarket review by the FDA prior to commercialization, manufacturers of 361 products must register with the FDA, submit a list of HCT/Ps manufactured, and comply with current good tissue practices (“cGTP”), among other things.

Federal Trade Commission Regulatory Oversight

Our advertising for our products and services is subject to federal truth-in-advertising laws enforced by the Federal Trade Commission or FTC,(the “FTC”), as well as comparable state consumer protection laws. Under the Federal Trade Commission Act (“FTC Act”), the FTC is empowered, among other things, to (a) prevent unfair methods of competition and unfair or deceptive acts or practices in or affecting commerce; (b) seek monetary redress and other relief for conduct injurious to consumers; and (c) gather and compile information and conduct investigations relating to the organization, business, practices, and management of entities engaged in commerce. The FTC has very broad enforcement authority, and failure to abide by the substantive requirements of the FTC Act and other consumer protection laws can result in administrative or judicial penalties, including civil penalties, injunctions affecting the manner in which we would be able to market services or products in the future, or criminal prosecution.

Fraud and Abuse and Transparency Laws and Regulations

Our business activities (and the business activities of our research and development partners and affiliates), including, but not limited to, research, sales, promotion, distribution and medical education, are subject to regulation by numerous federal and state regulatory and law enforcement authorities in the United States, including the Department of Justice, the Department of Health and Human Services and its various divisions, CMS, the Health Resources and Services Administration, the Department of Veterans Affairs, the Department of Defense, and state and local governments. Our business activities must comply with numerous healthcare laws, including, but not limited to, anti-kickback and false claims laws and regulations as well as data privacy and security laws and regulations, which are described below.

The federal Anti-Kickback Statute prohibits, among other things, any person or entity, from knowingly and willfully offering, paying, soliciting, or receiving any remuneration, directly or indirectly, overtly or covertly, in cash or in kind, to induce or in return for purchasing, leasing, ordering, or arranging for or recommending the purchase, lease, furnishing, or order of any item or service reimbursable under Medicare, Medicaid, or other federal healthcare programs, in whole or in part. The term “remuneration” has been interpreted broadly to include anything of value. The Anti-Kickback Statute has been interpreted to apply to arrangements between pharmaceutical manufacturers on one hand and prescribers, purchasers, formulary managers, and beneficiaries on the other. There are certain statutory exceptions and regulatory safe harbors protecting some common activities from prosecution. The exceptions and safe harbors are drawn narrowly, and practices that involve remuneration that may be alleged to be intended to induce prescribing, purchases, or recommendations may be subject to scrutiny if they do not qualify for an exception or safe harbor. Failure to meet all of the requirements of a particular applicable statutory exception or regulatory safe harbor does not make the conduct per se illegal under the Anti-Kickback Statute. Instead, the legality of the arrangement will be evaluated on a case-by-case basis based on a cumulative review of all of its facts and circumstances. Several courts have interpreted the statute’s intent requirement to mean that if any one purpose of an arrangement involving remuneration is to induce referrals of federal healthcare covered business, the statute has been violated. The Patient Protection and Affordable Care Act, of 2010, as amended (the “ACA”), modified the intent requirement under the Anti-Kickback Statute to a stricter standard, such that a person or entity no longer needs to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation. In addition, the ACA also provided that a violation of the federal Anti-Kickback Statute is grounds for the government or a whistleblower to assert that a claim for payment of items or services resulting from such violation constitutes a false or fraudulent claim for purposes of the federal civil False Claims Act (the “FCA”). The ACA further created new federal requirements for reporting, by applicable manufacturers of covered drugs, payments and other transfers of value to physicians and teaching hospitals, and ownership and investment interests held by physicians and other healthcare providers and their immediate family members.

| 15 |

The federal civil FCA, prohibits, among other things, any person or entity from knowingly presenting, or causing to be presented, a false or fraudulent claim for payment to, or approval by, the federal government, knowingly making, using, or causing to be made or used a false record or statement material to a false or fraudulent claim to the federal government, or avoiding, decreasing, or concealing an obligation to pay money to the federal government. A claim includes “any request or demand” for money or property presented to the U.S. government. The civil FCA has been used to assert liability on the basis of kickbacks and other improper referrals, improperly reported government pricing metrics such as Best Price or Average Manufacturer Price, or submission of inaccurate information required by government contracts, improper use of Medicare provider or supplier numbers when detailing a provider of services, improper promotion of off-label uses not expressly approved by the FDA in a drug’s label, and allegations as to misrepresentations with respect to the products supplied or services rendered. Several pharmaceutical and other healthcare companies have further been sued under these laws for allegedly providing free product to customers with the expectation that the customers would bill federal programs for the product. Intent to deceive is not required to establish liability under the civil FCA; however, a change in Department of Justice policy now prohibits enforcement actions for knowing violations of law based on non-compliancenoncompliance with agency subregulatory guidance. Civil FCA actions may be brought by the government or may be brought by private individuals on behalf of the government, called “qui tam” actions. If the government decides to intervene in a qui tam action and prevails in the lawsuit, the individual will share in the proceeds from any fines or settlement funds. If the government declines to intervene, the individual may pursue the case alone. Since 2004, these FCA lawsuits against pharmaceutical companies have increased significantly in volume and breadth, leading to several substantial civil and criminal settlements, as much as $3.0 billion, regarding certain sales practices and promoting off labeloff-label drug uses. Civil FCA liability may be imposed for Medicare or Medicaid overpayments, for example, overpayments caused by understated rebate amounts, that are not refunded within 60 days of discovering the overpayment, even if the overpayment was not caused by a false or fraudulent act.

The government may further prosecute conduct constituting a false claim under the criminal FCA. The criminal FCA prohibits the making or presenting of a claim to the government knowing such claim to be false, fictitious, or fraudulent and, unlike the civil FCA, requires proof of intent to submit a false claim. The civil monetary penalties statute is another potential statute under which drug and device companies may be subject to enforcement. Among other things, the civil monetary penalties statute imposes fines against any person who is determined to have presented, or caused to be presented, claims to a federal healthcare program that the person knows, or should know, is for an item or service that was not provided as claimed or is false or fraudulent.