Due to the types of contracts we enter into and the markets in which we operate, the cumulative loss of several major contracts, customers, or alliances may have an adverse effect on our results of operations.

We often enter into large, long-term contracts that, collectively, represent a significant portion of our revenue. These agreements, if terminated or breached, may have a larger impact on our operating results or our financial condition than shorter-term contracts due to the value at risk. Moreover, the global market for the production, transportation, and transformation of hydrocarbons and by-products, as well as the other industrial markets in which we operate, is dominated by a small number of companies. As a result, our business relies on a limited number of customers. If we were to lose several key contracts, customers, or alliances over a relatively short period of time, we could experience a significant adverse impact on our financial condition, results of operations, or cash flows.

Disruptions in the political, regulatory, economic, and social conditions of the countries in which we conduct business could adversely affect our business or results of operations.

We operate in various countries across the world. Instability and unforeseen changes in any of the markets in which we conduct business, including economically and politically volatile areas could have an adverse effect on the demand for our services and products, our financial condition, or our results of operations. These factors include, but are not limited to, the following:

•nationalization and expropriation;

•potentially burdensome taxation;

•inflationary and recessionary markets, including capital and equity markets;

•civil unrest, labor issues, political instability, disease outbreaks, terrorist attacks, cyber-terrorism,cyber terrorism, military activity, and wars;

•supply disruptions in key oil producing countries;

•the ability of OPECOPEC+ to set and maintain production levels and pricing;

•trade restrictions, trade protection measures, price controls, or trade disputes;

•sanctions, such as prohibitions or restrictions by the United States against countries that are the targets of economic sanctions, or are designated as state sponsors of terrorism;

•foreign ownership restrictions;

•import or export licensing requirements;

•restrictions on operations, trade practices, trade partners, and investment decisions resulting from domestic and foreign laws, and regulations;

•regime changes;

•changes in, and the administration of, treaties, laws, and regulations;regulations including in response to public health issues;

•inability to repatriate income or capital;

•reductions in the availability of qualified personnel;

•foreign currency fluctuations or currency restrictions; and

•fluctuations in the interest rate component of forward foreign currency rates.

DTC and Euroclear Paris may cease to act as depository and clearing agencies for our shares.

34

Our shares were issued into the facilities of The Depository Trust Company (“DTC”) with respect to shares listed on the NYSE and Euroclear with respect to shares listed on Euronext Paris (DTC and Euroclear being referred to as the “Clearance Services”). The Clearance Services are widely used mechanisms that allow for rapid electronic transfers of securities between the participants in their respective systems, which include many large banks and brokerage firms. The Clearance Services have general discretion to cease to act as a depository and clearing agencies for our shares. If either of the Clearance Services determine at any time that our shares are not eligible for continued deposit and clearance within its facilities, then we believe that our shares would not be eligible for continued listing on the NYSE or Euronext Paris, as applicable, and trading in our shares would be disrupted. Any such disruption could have a material adverse effect on the trading price of our shares.

The United Kingdom’s proposed withdrawal from the European Union may have a negative effect on global economic conditions, financial markets, and our business.

We are based in the United Kingdom and have operational headquarters in Paris, France; Houston, Texas, United States; and in London, United Kingdom, with worldwide operations, including material business operations in Europe. In June 2016, a majority of voters in theThe United Kingdom elected to withdrawwithdrew from the European Union in a national referendumon January 31, 2020 (“Brexit”). The referendum was advisory, andIn connection with Brexit, the United Kingdom government served notice under Article 50 of the Treaty of the European Union in March 2017 to formally initiate a withdrawal process. The United Kingdom and the European Union have had a two-year period under Article 50 to negotiateagreed on the terms forTrade and Cooperation Agreement (“TCA”) that governs the United Kingdom’s withdrawal from the European Union. The withdrawal agreement and political declaration that were endorsed at a special meeting of the European Council on November 25, 2018 did not receive the approval of the United Kingdom Parliament in January 2019. Further discussions are ongoing, although the European Commission has stated that the European Union will not reopen the withdrawal agreement. Any extension of the negotiation period for withdrawal will require the consent of the remaining 27 member states of the European Union. Brexit has created significant uncertainty about the future trading relationship between the United Kingdom and the European Union and has given rise to calls for certain regions within thein specified areas. The TCA took effect on January 1, 2021. The United Kingdom to preserve their placeis no longer in the European Union by separatingcustoms union and is outside of the European Union single market. The TCA addresses trade, economic arrangements, law enforcement, judicial cooperation and a governance framework including procedures for dispute resolution, among other things.Because the agreement merely sets forth a framework in many respects and will require complex additional bilateral negotiations between the United Kingdom and the European Union as both parties continue to work on the rules for implementation, significant political and economic uncertainty remains about whether the terms of the relationship will differ materially from the United Kingdom.terms before withdrawal.

These developments or the perception that any of them could occur, could have a material adverse effect on global economic conditions and the stability of the global financial markets and could significantly reduce global market liquidity and restrict the ability of key market participants to operate in certain financial markets. Asset valuations, currency exchange rates, and credit ratings may be especially subject to increased market volatility. LackIn addition, there is a lack of clarity about applicablethe future United Kingdom laws and regulations or treaties as the United Kingdom negotiates the terms of a withdrawal, as well as the operation of any such rules pursuantdetermines which European Union laws to any withdrawal terms,replicate or replace, including financial laws and regulations, tax and free trade agreements, intellectual property rights, supply chain logistics, environmental, health and safety laws and regulations, immigration laws, employment laws, and other rules that would apply to us and our subsidiaries, could increase our costs, restrict our access to capital within the United Kingdom and the European Union, depress economic activity, and further decrease foreign direct investment in the United Kingdom. For

example, withdrawalany divergence in the United Kingdom from the European Union law could depending on the negotiated terms of such withdrawal, eliminate the benefit of certain tax-related E.U.European Union directives currently applicable to U.K.United Kingdom companies such as us, including the Parent-Subsidiary Directive and the Interest and Royalties Directive, which could, subject to any relief under an available tax treaty, raise our tax costs.cost.

Any of these factors could have a material adverse effect on our business, financial condition, andor results of operations.

Our existing and future debt may limit cash flow available to invest in the ongoing needs of our business and could prevent us from fulfilling our obligations under our outstanding debt.

We have substantial existing debt. As of December 31, 2018, after giving effect to the Merger,2020, our total debt is $4.2was $4.0 billion. In addition, in connection with Spin-off, we obtained commitments from a syndicate of financial institutions for a senior secured revolving credit facility of up to $1.0 billion. We will also have the capacity under our $2.5 billion credit facility, in addition to our bilateral facilitiesdebt agreements to incur substantial additional debt.

Our level of debt could have important consequences. For example, it could:

•make it more difficult for us to make payments on our debt;

•require us to dedicate a substantial portion of our cash flow from operations to the payment of debt service, reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions, distributions, and other general partnership purposes;

35

•increase our vulnerability to adverse economic or industry conditions;

•limit our ability to obtain additional financing to enable us to react to changes in our business; or

•place us at a competitive disadvantage compared to businesses in our industry that have less debt.

Additionally, any failure to meet required payments on our debt or to comply with any covenants in the instruments governing our debt, could result in an event of default under the terms of those instruments. In the event of such default, the holders of such debt could elect to declare all the amounts outstanding under such instruments to be due and payable. Such default could also trigger a cross default or our other debt.

The London Inter-bankInterbank Offered Rate (“LIBOR”), the Euro Interbank Offered Rate and certain other interest “benchmarks” may be subject to further regulatory guidance and/or reform that could cause interest rates under our current or future debt agreements to perform differently than in the past or cause other unanticipated consequences. The United Kingdom’s Financial Conduct Authority, which regulates LIBOR, has announced that it intends to stop encouraging or requiring banks to submitthe continuation of LIBOR rateson the current basis cannot and will not be guaranteed after 2021 and it is unclear if LIBOR will cease to exist or if new methods of calculating LIBOR will evolve. If LIBOR ceases to exist or if the methods of calculating LIBOR change from their current form, interest rates on our current or future debt obligations may be adversely affected.

The terms of the agreements governing our existing indebtedness restrict our current and future operations, particularly our ability to respond to changes or to take certain actions.

The terms of the agreements governing our indebtedness contain a number of restrictive covenants that limit our flexibility in conducting our debt rating couldbusiness and restrict our ability to access the capital markets.

A breach of the covenants or refinancerestrictions under our existing indebtedness could result in an event of default under the applicable indebtedness. Such default may allow the creditors to accelerate the related debt or cause us to refinance or issue debt with less favorable terms and conditions. Moreover, our revolving credit agreement includes an increase in interest rates if the ratings for our debt are downgraded, which could have an adverse effect on our results of operations. An increasemay result in the levelacceleration of any other debt to which a cross-acceleration or cross-default provision applies. An event of default under our Revolving Credit Facility would also permit the lenders to terminate all commitments to extend further credit under that facility. Furthermore, if we were unable to repay the amounts due and payable under our Revolving Credit Facility, lenders thereunder could proceed against the collateral granted to them to secure that indebtedness. In the event our lenders or noteholders accelerate the repayment of our indebtednessborrowings, we and related interest costsour subsidiaries may increase our vulnerabilitynot have sufficient assets to adverse general economic and industry conditions andrepay that indebtedness.

These restrictions may affect our ability to obtain additional financing, as well as have a material adverse effect ongrow in accordance with our business, financial condition, and results of operations.

Our acquisition and divestiture activities involve substantial risks.

We have made and expect to continue to pursue acquisitions, dispositions, or other investments that may strategically fit our business and/or growth objectives. We cannot provide assurances that we will be able to locate suitable acquisitions, dispositions, or investments, or that we will be able to consummate any such transactions on terms and conditions acceptable to us. Even if we do successfully execute such transactions, they may not result in anticipated benefits, which could have a material adverse effect on our financial results. If we are unable to successfully integrate and develop acquired businesses, we could fail to achieve anticipated synergies and cost savings, including any expected increases in revenues and operating results. We may not be able to successfully cause a buyer of a divested business to assume the liabilities of that business or, even if such liabilities are assumed, we may have difficulties enforcing our rights, contractual or otherwise, against the buyer. We may invest in companies or businesses that fail, causing a loss of all or part of our investment. In addition, if we determine that an other-than-temporary decline in the fair value exists for a company in which we have invested, we may have to write down that investment to its fair value and recognize the related write-down as an investment loss.

36

In connection with the Spin-off, we agreed to indemnify Technip Energies for certain liabilities and Technip Energies agreed to indemnify us for certain liabilities. If we are required to act on these indemnities to Technip Energies, our financial results could be negatively impacted. Additionally, any indemnity from Technip Energies may not be sufficient to insure us against the full amount of liabilities for which we are responsible and Technip Energies may not be able to satisfy its indemnification obligations in the future.

Risks Related to Our Operations

We may lose money on fixed-price contracts.

As customary for some of our projects, we often agree to provide products and services under fixed-price contracts. We are subject to material risks in connection with such fixed-price contracts. It is not possible to estimate with complete certainty the final cost or margin of a project at the time of bidding or during the early phases of its execution. Actual expenses incurred in executing these fixed-price contracts can vary substantially from those originally anticipated for several reasons including, but not limited to, the following:

•unforeseen additional costs related to the purchase of substantial equipment necessary for contract fulfillment or labor shortages in the markets where the contracts are performed;

•mechanical failure of our production equipment and machinery;

•delays caused by local weather conditions and/or natural disasters (including earthquakes, floods and public health crises such as the COVID-19 pandemic); and

•a failure of suppliers, subcontractors, or joint venture partners to perform their contractual obligations.

The realization of any material risks and unforeseen circumstances could also lead to delays in the execution schedule of a project. We may be held liable to a customer should we fail to meet project milestones or deadlines or to comply with other contractual provisions. Additionally, delays in certain projects could lead to delays in subsequent projects that were scheduled to use equipment and machinery still being utilized on a delayed project.

Pursuant to the terms of fixed-price contracts, we are not always able to increase the price of the contract to reflect factors that were unforeseen at the time our bid was submitted, and this risk may be heightened for projects with longer terms. Depending on the size of a project, variations from estimated contract performance, or variations in multiple contracts, could have a significant impact on our financial condition, results of operations or cash flows.

New capital asset construction projects for vessels and manufacturing facilities are subject to risks, including delays and cost overruns, which could have a material adverse effect on our financial condition, or results of operations.

From time to time, we carry out capital asset construction projects to maintain, upgrade, and develop our asset base, and such projects are subject to risks of delay and cost overruns that are inherent in any large construction project, resulting from numerous factors including, but not limited to, the following:

•shortages of key equipment, materials or skilled labor;

•delays in the delivery of ordered materials and equipment;

•design and engineering issues; and

•shipyard delays and performance issues.

Failure to complete construction in time, or the inability to complete construction in accordance with design specifications, may result in the loss of revenue. Additionally, capital expenditures for construction projects could materially exceed the initially planned investments, or there could be delays in putting such assets into operation.

Our failure to timely deliver our backlog could affect future sales, profitability, and relationships with our customers.

37

Many of the contracts we enter into with our customers require long manufacturing lead times due to complex technical and logistical requirements. These contracts may contain clauses related to liquidated damages or financial incentives regarding on-time delivery, and a failure by us to deliver in accordance with customer expectations could subject us to liquidated damages or loss of financial incentives, reduce our margins on these contracts, or result in damage to existing customer relationships. The ability to meet customer delivery schedules for this backlog is dependent upon a number of factors, including, but not limited to, access to the raw materials required for production, an adequately trained and capable workforce, subcontractor performance, project engineering expertise and execution, sufficient manufacturing plant capacity, and appropriate planning and scheduling of manufacturing resources. Failure to deliver backlog in accordance with expectations could negatively impact our financial performance.

We face risks relating to our reliance on subcontractors, suppliers, and our joint venture partners.

We generally rely on subcontractors, suppliers, and our joint venture partners for the performance of our contracts. Although we are not dependent upon any single supplier, certain geographic areas of our business or a project or group of projects may depend heavily on certain suppliers for raw materials or semi-finished goods.

Any difficulty in engaging suitable subcontractors or acquiring equipment and materials could compromise our ability to generate a significant margin on a project or to complete such project within the allocated time frame. If subcontractors, suppliers or joint venture partners refuse to adhere to their contractual obligations with us or are unable to do so due to a deterioration of their financial condition, we may be unable to find a suitable replacement at a comparable price, or at all. Moreover, the failure of one of our joint venture partners to perform their obligations in a timely and satisfactory manner could lead to additional obligations and costs being imposed on us as we may be obligated to assume our defaulting partner’s obligations or compensate our customers.

Any delay, failure to meet contractual obligations, or other event beyond our control or not foreseeable by us, that is attributable to a subcontractor, supplier or joint venture partner, could lead to delays in the overall progress of the project and/or generate significant extra costs. Even if we are entitled to make a claim for these extra costs against the defaulting supplier, subcontractor or joint venture partner, we may be unable to recover the entirety of these costs and this could materially adversely affect our business, financial condition or results of operations.

A failure of our IT infrastructure, including as a result of cyber attacks,cyber-attacks, could adversely impact our business and results of operations.

The efficient operation of our business is dependent on our IT systems. Accordingly, we rely upon the capacity, reliability, and security of our IT hardware and software infrastructure and our ability to expand and update this infrastructure in response to changing needs. We have been subject to cyber attackscyber-attacks in the past, including phishing, malware, and ransomware, and although noransomware. No such attack has had a material adverse effect on our business, however this may not be the case with future attacks. Our systems may be vulnerable to damages from such attacks, as well as from natural disasters, failures in hardware or software, power fluctuations, unauthorized access to data and systems, loss or destruction of data (including confidential customer information), human error, and other similar disruptions, and we cannot give assurance that any security measures we have implemented or may in the future implement will be sufficient to identify and prevent or mitigate such disruptions. In response to the COVID-19 pandemic, we have transitioned many of our employees to remote working arrangements which presents increased cybersecurity risks. If a cyber-attack, power outage, connectivity issue, or other event occurred that impacted our employees’ ability to work remotely, it may be difficult or, in certain cases, impossible, for us to continue our business for a substantial period of time.

We rely on third parties to support the operation of our IT hardware, software infrastructure, and cloud services, and in certain instances, utilize web-based and software-as-a-service applications. The security and privacy measures implemented by such third parties, as well as the measures implemented by any entities we acquire or with whom we do business, may not be sufficient to identify or prevent cyber attacks,cyber-attacks, and any such attacks may have a material adverse effect on our business. While our IT vendor agreements typically contain provisions that seek to eliminate or limit our exposure to liability for damages from a cyber-attack,cyber attack, we cannot ensure such provisions will withstand legal challenges or cover all or any such damages.

Threats to our IT systems arise from numerous sources, not all of which are within our control, including fraud or malice on the part of third parties, accidental technological failure, electrical or telecommunication outages, failures of computer servers or other damage to our property or assets, outbreaks of hostilities, or terrorist acts. The failure

38

of our IT systems or those of our vendors to perform as anticipated for any reason or any significant breach of security could disrupt our business and result in numerous adverse consequences, including reduced effectiveness and efficiency of operations, inappropriate disclosure of confidential and proprietary information, including personal data, regulatory action and fines included for a breach of data protection laws, reputational harm, regulatory fines or investigations, increased overhead costs, and loss of important information, which could have a material adverse effect on our business and results of operations. In addition, we may be required to incur significant costs to protect against or to mitigate damage caused by these disruptions or security breaches in the future. Our insurance coverage may not cover all of the costs and liabilities we incur as the result of any disruptions or security breaches, and if our business continuity and/or disaster recovery plans do not effectively and timely resolve issues resulting from a cyber-attack, we may suffer material adverse effects on our business.

Pirates endanger our maritime employees and assets.

We face material piracy risks in the Gulf of Guinea, the Somali Basin, and the Gulf of Aden, and, to a lesser extent, in Southeast Asia, Malacca, and the Singapore Straits. Piracy represents a risk for both our projects and our vessels, which operate and transport through sensitive maritime areas. Such risks have the potential to significantly harm our crews and to negatively impact the execution schedule for our projects. If our maritime employees or assets are endangered, additional time may be required to find an alternative solution, which may delay project realization and negatively impact our business, financial condition, or results of operations.

Risks Related to Legal Proceedings, Tax, and Regulatory Matters

The industries in which we operate or have operated expose us to potential liabilities, including the installation or use of our products, which may not be covered by insurance or may be in excess of policy limits, or for which expected recoveries may not be realized.

We are subject to potential liabilities arising from, among other possibilities, equipment malfunctions, equipment misuse, personal injuries, and natural disasters, any of which may result in hazardous situations, including uncontrollable flows of gas or well fluids, fires, and explosions. Our insurance against these risks may not be adequate to cover our liabilities. Further, the insurance may not generally be available in the future or, if available, premiums may not be commercially justifiable. If we incur substantial liability and the damages are not covered by insurance or are in excess of policy limits, or if we were to incur liability at a time when we were not able to obtain liability insurance, such potential liabilities could have a material adverse effect on our business, results of operations, financial condition or cash flows.

Our operations require us to comply with numerous regulations, violations of which could have a material adverse effect on our financial condition, results of operations, or cash flows.

Our operations and manufacturing activities are governed by international, regional, transnational, and national laws and regulations in every place where we operate relating to matters such as environmental protection, health and safety, labor and employment, import/export controls, currency exchange, bribery and corruption, and taxation. These laws and regulations are complex, frequently change, and have tended to become more stringent over time. In the event the scope of these laws and regulations expand in the future, the incremental cost of compliance could adversely impact our financial condition, results of operations, or cash flows.

Our international operations are subject to anti-corruption laws and regulations, such as the U.S. Foreign Corrupt Practices Act (“FCPA”), the U.K. Bribery Act of 2010 (the “Bribery Act”), the anti-corruption provisions of French law n° 2016-1691 dated December 9, 2016 relating to Transparency, Anti-corruption and Modernization of the Business Practice (“Sapin II Law”), the Brazilian law nº 12,846/13, or the Brazilian Anti-Bribery Act (also known as the Brazilian Clean Company Act), and economic and trade sanctions, including those administered by the United Nations, the European Union, the Office of Foreign Assets Control of the U.S. Department of the Treasury (“U.S. Treasury”), and the U.S. Department of State. The FCPA prohibits corruptly providing anything of value to foreign officials for the purposes of obtaining or retaining business or securing any improper business advantage. We may deal with both governments and state-owned business enterprises, the employees of which are considered foreign officials for purposes of the FCPA. The provisions of the Bribery Act extend beyond bribery of foreign public officials and are more onerous than the FCPA in a number of other respects, including jurisdiction, non-exemption of facilitation payments, and penalties. Economic and trade sanctions restrict our transactions or dealings with certain sanctioned countries, territories, and designated persons.

39

As a result of doing business in countries throughout the world, including through partners and agents, we are exposed to a risk of violating anti-corruption laws and sanctions regulations. Some of the international locations in which we currently operate or may, in the future, operate, have developing legal systems and may have higher levels of corruption than more developed nations. Our continued expansion and worldwide operations, including in developing countries, our development of joint venture relationships worldwide, and the employment of local agents in the countries in which we operate increases the risk of violations of anti-corruption laws and economic and trade sanctions. Violations of anti-corruption laws and economic and trade sanctions are punishable by civil penalties, including fines, denial of export privileges, injunctions, asset seizures, debarment from government contracts (and termination of existing contracts), and revocations or restrictions of licenses, as well as criminal fines and imprisonment. In addition, any major violations could have a significant impact on our reputation and consequently on our ability to win future business.

We have implemented internal controls designed to minimize and detect potential violations of laws and regulations in a timely manner but we can provide no assurance that such policies and procedures will be followed at all times or will effectively detect and prevent violations of the applicable laws by one or more of our employees, consultants, agents, or partners. The occurrence of any such violation could subject us to penalties and material adverse consequences on our business, financial condition, results of operations, or cash flows.

Compliance with environmental and climate change-related laws and regulations may adversely affect our business and results of operations.

Environmental laws and regulations in various countries affect the equipment, systems, and services we design, market, and sell, as well as the facilities where we manufacture our equipment and systems, and any other operations we undertake. We are required to invest financial and managerial resources to comply with environmental laws and regulations, and believe that we will continue to be required to do so in the future. Failure to comply with these laws and regulations may result in the assessment of administrative, civil, and criminal penalties, the imposition of remedial obligations, the issuance of orders enjoining our operations, or other claims and complaints. Additionally, our insurance and compliance costs may increase as a result of changes in environmental laws and regulations or changes in enforcement. These laws and regulations, as well as any new laws and regulations affecting exploration and development of drilling for crude oil and natural gas, are becoming increasingly strict and could adversely affect our business and operating results by increasing our costs, limiting the demand for our products and services, or restricting our operations.

Regulatory requirements related to Environmental, Social and Governance (ESG) (including sustainability) matters have been, and are being, implemented in the European Union in particular in relation to financial market participants. Such regulatory requirements are being implemented on a phased basis. We expect regulatory requirements related to, and investor focus on, ESG (including sustainability) matters to continue to expand in the EU, the United States, and more globally. We establish ESG objectives that align with our foundational beliefs and corporate strategy with an aim toward reducing our carbon footprint, raising awareness and making advancements in inclusion and diversity. If, in relation to ESG (including sustainability) matters, we are not able to meet current and future regulatory requirements, the reporting requirements of regulators, or the current and future expectations of investors, customers or other stakeholders, our business and ability to raise capital may be adversely affected.

Existing or future laws and regulations relating to greenhouse gas emissions and climate change may adversely affect our business.

Climate change continues to attract considerable public and scientific attention. As a result, numerous laws, regulations, and proposals have been made and are likely to continue to be made at the international, national, regional, and state levels of government to monitor and limit emissions of carbon dioxide, methane, and other “greenhouse gases” (“GHGs”). These efforts have included cap-and-trade programs, carbon taxes, GHG reporting and tracking programs and regulations that directly limit GHG emissions from certain sources. Such existing or future laws, regulations, and proposals concerning the release of GHGs or that concern climate change (including laws, regulations, and proposals that seek to mitigate the effects of climate change) may adversely impact demand for the equipment, systems and services we design, market and sell. For example, oil and natural gas exploration and production may decline as a result of such laws, regulations, and proposals, and as a consequence, demand for our equipment, systems and services may also decline. In addition, such laws, regulations, and proposals may also result in more onerous obligations with respect to our operations, including the facilities where we manufacture our equipment and systems. Such decline in demand for our equipment, systems and services and such onerous

40

obligations in respect of our operations may adversely affect our financial condition, results of operations, or cash flows.

As an English public limited company, we must meet certain additional financial requirements before we may declare dividends or repurchase shares and certain capital structure decisions may require stockholder approval which may limit our flexibility to manage our capital structure. We may not be able to pay dividends or repurchase shares of our ordinary shares in accordance with our announced intent, or at all.

Under English law, we will only be able to declare dividends, make distributions, or repurchase shares (other than out of the proceeds of a new issuance of shares for that purpose) out of “distributable profits.” Distributable profits are a company’s accumulated, realized profits, to the extent that they have not been previously utilized by distribution or capitalization, less its accumulated, realized losses, to the extent that they have not been previously written off in a reduction or reorganization of capital duly made. In addition, as a public limited company incorporated in England and Wales, we may only make a distribution if the amount of our net assets is not less than the aggregate of our called-up share capital and non-distributable reserves and to the extent that the distribution does not reduce the amount of those assets to less than that aggregate.

Our articles of association permit us by ordinary resolution of the stockholders to declare dividends, provided that the directors have made a recommendation as to its amount. The dividend shall not exceed the amount recommended by the Board of Directors. The directors may also decide to pay interim dividends if it appears to them that the profits available for distribution justify the payment. When recommending or declaring payment of a dividend, the directors are required under English law to comply with their duties, including considering our future financial requirements.

In addition, the Board of Directors’ determinations regarding dividends and share repurchases will depend on a variety of other factors, including our net income, cash flow generated from operations or other sources, liquidity position, and potential alternative uses of cash, such as acquisitions, as well as economic conditions and expected future financial results. Our ability to declare and pay future dividends and make future share repurchases will depend on our future financial performance, which in turn depends on the successful implementation of our strategy and on financial, competitive, regulatory, technical, general economic conditions, demand and selling prices for our products and services, and other factors specific to our industry or specific projects, many of which are beyond our control. Therefore, our ability to generate cash depends on the performance of our operations and could be limited by decreases in our profitability or increases in costs, regulatory changes, capital expenditures, or debt servicing requirements.

Any failure to pay dividends or repurchase shares of our ordinary shares could negatively impact our reputation, harm investor confidence in us, and cause the market price of our ordinary shares to decline.

Uninsured claims and litigation against us, including intellectual property litigation, could adversely impact our financial condition, results of operations, or cash flows.

We could be impacted by the outcome of pending litigation, as well as unexpected litigation or proceedings. We have insurance coverage against operating hazards, including product liability claims and personal injury claims related to our products or operating environments in which our employees operate, to the extent deemed prudent by our management and to the extent insurance is available. However, our insurance policies are subject to exclusions, limitations, and other conditions and may not apply in all cases, for example where willful wrongdoing on our part is alleged. Additionally, the nature and amount of that insurance may not be sufficient to fully indemnify us against liabilities arising out of pending and future claims and litigation. Additionally, in individual circumstances, certain proceedings or cases may also lead to our formal or informal exclusion from tenders or the revocation or loss of business licenses or permits. Our financial condition, results of operations, or cash flows could be adversely affected by unexpected claims not covered by insurance.

In addition, the tools, techniques, methodologies, programs, and components we use to provide our services may infringe upon the intellectual property rights of others. Infringement claims generally result in significant legal and other costs. The resolution of these claims could require us to pay damages, enter into license agreements or develop alternative technologies. The development of these technologies or the payment of royalties under licenses from third parties, if available, would increase our costs. If a license were not available, or we are not able to

41

develop alternative technologies, we might not be able to continue providing a particular service or product, which could adversely affect our financial condition, results of operations, or cash flows.

We are subject to governmental regulation and other legal obligations related to privacy, data protection, and data security. Our actual or perceived failure to comply with such obligations could harm our business.

We are subject to international data protection laws, such as the General Data Protection Regulation, or GDPR, in the European Economic Area.Area, or EEA, and the United Kingdom (“UK”) GDPR and Data Protection Act 2018 in the UK. The GDPR imposesand implementing legislation in the EEA and UK impose several stringent requirements for controllers and processors of personal data which have increased our obligations, including, for example, by requiring more robust disclosures to individuals, notifications, in some cases, of data breaches to regulators and data subjects, and a record of processing and other policies and procedures to be maintained to adhere to the accountability principle. In addition, we are subject to the GDPR’s rules on transferring personal data outside of the EEA and UK (including to the United States), and somerecent legal developments in Europe have created complexity and uncertainty regarding such transfers. In addition, the UK’s withdrawal from the European Union may mean that in future we are required to find alternative solutions for the compliant transfer of these rules are currently being challenged inpersonal data into the courts. UK.

Failure to comply with the requirements of GDPR and the local laws implementing or supplementing the GDPR could result in fines of up to €20,000,000 or up to 4% of the total worldwide annual turnover of the preceding financial year, whichever is higher, as well as other administrative penalties. The UK GDPR mirrors the fines under the GDPR. In addition, a breach of the GDPR or UK GDPR could result in regulatory investigations and enforcement action, reputational damage, and civil claims including representative actions and other class action type litigation.

We are likely to be required to expend significant capital and other resources to ensure ongoing compliance with the GDPR and UK GDPR and other applicable data protection legislation, and we may be required to put in place additional control mechanisms which could be onerous and adversely affect our business, financial condition, results of operations, and prospects.or cash flows.

The IRS may not agree that we should be treated as a foreign corporation for U.S. federal tax purposes and may seek to impose an excise tax on gains recognized by certain individuals.

Although we are incorporated in the United Kingdom, the U.S. Internal Revenue Service (the “IRS”) may assert that we should be treated as a U.S. “domestic” corporation (and, therefore, a U.S. tax resident) for U.S. federal income tax purposes pursuant to Section 7874 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”). For U.S. federal income tax purposes, a corporation (i) is generally considered a “domestic” corporation (or U.S. tax resident) if it is organized in the United States or of any state or political subdivision therein, and (ii) is generally considered a “foreign” corporation (or non-U.S. tax resident) if it is not considered a domestic corporation. Because we are a U.K. incorporated entity, we would be considered a foreign corporation (and, therefore, a non-U.S. tax resident) under these rules. Section 7874 of the Code (“Section 7874”) provides an exception under which a foreign incorporated entity may, in certain circumstances, be treated as a domestic corporation for U.S. federal income tax purposes.

We do not believe this exception applies. However, the Section 7874 rules are complex and subject to detailed regulations, the application of which is uncertain in various respects. It is possible that the IRS will not agree with our position. Should the IRS successfully challenge our position, it is also possible that an excise tax under Section 4985 of the Code (the “Section 4985 Excise Tax”) may be assessed against certain “disqualified individuals” (including former officers and directors of FMC Technologies, Inc.) on certain stock-based compensation held thereby. We may, if we determine that it is appropriate, provide disqualified individuals with a payment with respect to the Section 4985 Excise Tax, so that, on a net after-tax basis, they would be in the same position as if no such Section 4985 Excise Tax had been applied.

In addition, there can be no assurance that there will not be a change in law or interpretation, including with retroactive effect, that might cause us to be treated as a domestic corporation for U.S. federal income tax purposes.

U.S. tax laws and/or guidance could affect our ability to engage in certain acquisition strategies and certain internal restructurings.

Even if we are treated as a foreign corporation for U.S. federal income tax purposes, Section 7874, U.S. Treasury regulations, and other guidance promulgated thereunder may adversely affect our ability to engage in certain future

42

acquisitions of U.S. businesses or to restructure the non-U.S. members of our group. These limitations, if applicable, may affect the tax efficiencies that otherwise might be achieved in such potential future transactions or restructurings.

In addition, the IRS and the U.S. Treasury have issued final and temporary regulations providing that, even if we are treated as a foreign corporation for U.S. federal income tax purposes, certain intercompany debt instruments issued on or after April 4, 2016 will be treated as equity for U.S. federal income tax purposes, therefore limiting U.S. tax benefits and resulting in possible U.S. withholding taxes. Although recent guidance from the U.S. Treasury proposes deferringremoves certain documentation requirements that would otherwise be imposed with respect to covered debt instruments, announces an intention to further modify and possibly withdraw certain classification rules relating to covered debt instruments, and further indicates that these rules generally are the subject of continuing study and may be further materially modified, the current regulations may adversely affect our future effective tax rate and could also

impact our ability to engage in future restructurings if such transactions cause an existing intercompany debt instrument to be treated as reissued for U.S. federal income tax purposes.

We are subject to the tax laws of numerous jurisdictions; challenges to the interpretation of, or future changes to, such laws could adversely affect us.

We and our subsidiaries are subject to tax laws and regulations in the United Kingdom, the United States, France, and numerous other jurisdictions in which we and our subsidiaries operate. These laws and regulations are inherently complex, and we are, and will continue to be, obligated to make judgments and interpretations about the application of these laws and regulations to our operations and businesses. The interpretation and application of these laws and regulations could be challenged by the relevant governmental authorities, which could result in administrative or judicial procedures, actions, or sanctions, which could be material.

On December 22, 2017, the Tax Cuts and Jobs Act was signed into law in the United States, which made extensive changes to the U.S. taxation of multinational companies, and is subject to continuing regulatory and possible legislative changes, especially given the new Administration and Congress in the United States. In addition, the U.S. Congress, the U.K. Government, the European Union, the Organization for Economic Co-operation and Development (the “OECD”), and other government agencies in jurisdictions where we and our affiliates do business have had an extended focus on issues related to the taxation of multinational corporations. New tax initiatives, directives, and rules, such as the U.S. Tax Cuts and Jobs Act, the OECD’s Base Erosion and Profit Shifting initiative, and the European Union’s Anti-Tax Avoidance Directives, may increase our tax burden and require additional compliance-related expenditures. As a result, our financial condition, results of operations, or cash flows may be adversely affected. Further changes, including with retroactive effect, in the tax laws of the United States, the United Kingdom, the European Union, or other countries in which we and our affiliates do business could also adversely affect us.

We may not qualify for benefits under tax treaties entered into between the United Kingdom and other countries.

We operate in a manner such that we believe we are eligible for benefits under tax treaties between the United Kingdom and other countries. However, our ability to qualify for such benefits will depend on whether we are treated as a U.K. tax resident, the requirements contained in each treaty and applicable domestic laws, on the facts and circumstances surrounding our operations and management, and on the relevant interpretation of the tax authorities and courts. For example, because of the anticipated withdrawal of the United Kingdom from the European Union (“Brexit”),Brexit, we may lose some or all of the benefits of tax treaties between the United States and the remaining members of the European Union, and face higher tax liabilities, which may be significant. Another example is the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (the “MLI”), which entered into force for participating jurisdictions on July 1, 2018. The MLI recommends that countries adopt a “limitation-on-benefit” (“LOB”) rule and/or a “principle purposes“principal purpose test” (“PPT”) rule with regards to their tax treaties. The scope and interpretation of these rules as adopted pursuant to the MLI are presently under development, but the application of eitherthe LOB rule mightor the PPT rule could deny us tax treaty benefits (such as a reduced rate of withholding tax) that were previously available and as such there remains uncertainty as to whether and, if so, to what extent such treaty benefits will continue to be available. The position is likely to remain uncertain for a number of years.

The failure by us or our subsidiaries to qualify for benefits under tax treaties entered into between the United Kingdom and other countries could result in adverse tax consequences to us (including an increased tax burden and increased filing obligations) and could result in certain tax consequences of owning and disposing of our shares.

43

We intend to be treated exclusively as a resident of the United Kingdom for tax purposes, but French or other tax authorities may seek to treat us as a tax resident of another jurisdiction.

We are incorporated in the United Kingdom. English law currently provides that we will be regarded as a U.K. resident for tax purposes from incorporation and shall remain so unless (i) we are concurrently a resident in another jurisdiction (applying the tax residence rules of that jurisdiction) that has a double tax treaty with the United Kingdom and (ii) there is a tiebreaker provision in that tax treaty which allocates exclusive residence to that other jurisdiction.

In this regard, we have a permanent establishment in France to satisfy certain French tax requirements imposed by the French Tax Code with respect to the Merger. Although it is intended that we will be treated as having our exclusive place of tax residence in the United Kingdom, the French tax authorities may claim that we are a tax resident of France if we were to fail to maintain our “place of effective management” in the United Kingdom. Any such claim would be settled between the French and U.K. tax authorities pursuant to the mutual assistance procedure provided for by the tax treaty concluded between France and the United Kingdom. There is no assurance that these authorities would reach an agreement that we will remain exclusively a U.K. tax resident; aan adverse determination which could materially and adversely affect our business, financial condition, results of operations, and future prospects.or cash flows. A failure to maintain exclusive tax residency in the United Kingdom could result in adverse tax

consequences to us and our subsidiaries and could result in certain adverse changes in the tax consequences of owning and disposing of our shares.

Risks Related to the Spin-off and the Other Transactions

The Company has identified material weaknesses relatingSpin-off may subject us to internalfuture liabilities.

On February 16, 2021, we completed the Spin-off, resulting in Technip Energies, which holds our former Technip Energies business segment, becoming a stand-alone publicly traded corporation. Pursuant to agreements we entered into with Technip Energies in connection with the Spin-off, we and Technip Energies are each generally responsible for the obligations and liabilities related to our respective businesses. Pursuant to those agreements, we and Technip Energies each agreed to cross-indemnities principally designed to allocate financial responsibility for the obligations and liabilities of our business to us and those of Technip Energies’ business to it. However, third parties, including governmental agencies, could seek to hold us responsible for obligations and liabilities that Technip Energies agreed to retain or assume, and there can be no assurance that the indemnification from Technip Energies will be sufficient to protect us against the full amount of such obligations and liabilities, or that Technip Energies will be able to fully satisfy its indemnification obligations. Additionally, if a court were to determine that the Spin-off or related transactions were consummated with the actual intent to hinder, delay or defraud current or future creditors or resulted in Technip Energies receiving less than reasonably equivalent value when it was insolvent, or that it was rendered insolvent, inadequately capitalized or unable to pay its debts as they become due, then it is possible that the court could disregard the allocation of obligations and liabilities agreed to between us and Technip Energies, impose substantial obligations and liabilities on us and void some or all of the transactions related to the Spin-off. Any of the foregoing could adversely affect our results of operations and financial position.

The Spin-off may not achieve some or all of the anticipated benefits.

We may not realize some or all of the anticipated strategic, financial, operational or other benefits from the Spin-off. As independent publicly-traded companies, we and Technip Energies are smaller, less diversified companies with a narrower business focus, and may be more vulnerable to changing market conditions, which could materially adversely affect our and its results of operations, cash flows and financial position.

In addition, other events outside of our control, including, but not limited to, political climate, the severity and duration of the pandemic, and regulatory or legislative changes, could also adversely affect our ability to realize the anticipated benefits from the Spin-off. Any such difficulties could have an adverse effect on our business, financial condition, or results of operations, and cause the combined market value of us and Technip Energies after the Spin-off to fall short of the market value of our shares prior to the Spin-off.

We are a significant shareholder of Technip Energies and the value of our investment in Technip Energies may fluctuate substantially.

44

Following completion of the Spin-off, we own approximately 49.9% of the outstanding shares of common stock of Technip Energies. The value of our investment in Technip Energies may be adversely affected by negative changes in its results of operations, cash flows and financial position, which may occur as a result of the many risks attendant with operating in the onshore/offshore industry, including the effect of laws and regulations on the operation of Technip Energies’ business and the development of its assets, increased competition, loss of contract commitments, delays in the timing of or the failure to complete projects, lack of access to capital and operating risks and hazards. The value of our investment in Technip Energies may fluctuate substantially and may result in a significant impact to our results of operations.

We intend to significantly reduce our shareholding in Technip Energies over financial reporting. If our remedial measures are insufficientthe 18 months following the Spin-off, including in connection with the sale of Technip Energies shares to addressBPI (as defined herein) pursuant to the material weaknesses,Investment (as defined herein). However, we can offer no guarantee that we will be able to complete such disposition or, if onecompleted, the extent to which we will reduce our shareholding or more additional material weaknesses or significant deficienciesthe value that we will realize in connection with such disposition. The occurrence of any of these and other risks faced by Technip Energies could adversely affect the value of our internal control over financial reporting are discovered or occurinvestment in the future, our consolidated financial statementsTechnip Energies.

We may contain material misstatements and we could be required to further restate our financial results,refund the Purchase Price under the Share Purchase Agreement to BPI in the event that certain conditions thereunder are not met.

In connection with the Spin-off, we entered into the Share Purchase Agreement with BPI, pursuant to which BPI agreed to purchase from us for $200.0 million, subject to a purchase price adjustment as described below (the “Purchase Price”), a number of Technip Energies shares (the “Purchased Shares”) determined based upon a thirty day volume-weighted average price of Technip Energies’ shares, less a six percent discount (the “Investment”). Pursuant to the Share Purchase Agreement, BPI paid us the Purchase Price on February 25, 2021, however (i) if the number of Purchased Shares due from us to BPI is less than 11.82% of the number of Technip Energies shares outstanding immediately following completion of the Spin-off, then BPI may, upon written notice to us, terminate the Share Purchase Agreement and we will be required to refund the Purchase Price to BPI or (ii) if the number of Purchased Shares due from us to BPI exceeds 17.25% of the number of Technip Energies shares outstanding immediately following completion of the Spin-off (the “Cap”), then we will transfer to BPI an aggregate number of Technip Energies shares equal to the Cap and will pay to BPI, as a reduction of the Purchase Price, an amount equal to (x) the difference between the number of Technip Energies shares that we would have delivered to BPI but for the Cap and the number of Technip Energies shares that we actually delivered to BPI, multiplied by (y) the applicable price per Technip Energy share. Any such refund or reduction of the Purchase Price could have a material adverse effect on our financial condition resultsor cash flows.

General Risk Factors

Our businesses are dependent on the continuing services of our key managers and employees.

We depend on key personnel. The loss of any key personnel could adversely impact our business if we are unable to implement key strategies or transactions in their absence. The loss of qualified employees or failure to retain and motivate additional highly-skilled employees required for the operation and expansion of our business could hinder our ability to successfully conduct research activities and develop marketable products and services.

Seasonal and weather conditions could adversely affect demand for our services and operations.

Our business may be materially affected by variation from normal weather patterns, such as cooler or warmer summers and winters. Adverse weather conditions, such as hurricanes in the Gulf of Mexico or extreme winter conditions in Canada, Russia, and the North Sea, may interrupt or curtail our operations, or our customers’ operations, cause supply disruptions or loss of productivity, and may result in a loss of revenue or damage to our equipment and facilities, which may or may not be insured. Increasing concentrations of greenhouse gases in the Earth’s atmosphere may produce climate changes that increase variation from normal weather patterns, such as increased frequency and severity of storms, floods, droughts, and other climatic events, which could further impact our operations. Significant physical effects of climate change could also have a direct effect on our operations and cash flows.

45

Currency exchange rate fluctuations could be required to restate our financial results, which could have a material adverse effect onadversely affect our financial condition, results of operations, or cash flows.

We conduct operations around the world in many different currencies. Because a significant portion of our revenue is denominated in currencies other than our reporting currency, the U.S. dollar, changes in exchange rates will produce fluctuations in our revenue, costs, and cash flows, restrictearnings, and may also affect the book value of our abilityassets and liabilities and related equity. We hedge transaction impacts on margins and earnings where a transaction is not in the functional currency of the business unit, but we do not hedge translation impacts on earnings. Our efforts to accessminimize our currency exposure through such hedging transactions may not be successful depending on market and business conditions. Moreover, certain currencies in which we conduct operations, specifically currencies in countries such as Angola and Nigeria, do not actively trade in the capitalglobal foreign exchange markets require significant resources to correct the weaknesses or deficiencies,and may subject us to fines, penaltiesincreased foreign currency exposures. As a result, fluctuations in foreign currency exchange rates may adversely affect our financial condition, results of operations, or judgments, harmcash flows.

We are exposed to risks in connection with our reputationdefined benefit pension plan commitments.

We have funded and unfunded defined benefit pension plans, which provide defined benefits based on years of service and salary. We are required to recognize the funded status of defined benefit post-retirement plans as an asset or otherwise cause a decline in investor confidence andliability in the consolidated balance sheet and recognize changes in that funded status in comprehensive income in the year in which the changes occur. Further, we are required to measure each plan’s assets and its obligations that determine its funded status as of the date of the consolidated balance sheet. Each

defined benefit pension plan’s assets are invested in different asset classes and their value may fluctuate in accordance with market priceconditions. Any deterioration in the value of the defined benefit pension plan assets could therefore increase our stock.

In addition, applicable law and/or implement required new or improved controls, or any difficulties we encounter in their implementation, could result in additional significant deficiencies or material weaknesses, causethe terms of the relevant defined benefit pension plan may require us to failmake cash contributions or provide financial support upon the occurrence of certain events. We cannot predict whether, or to meetwhat extent, changing market or economic conditions, regulatory changes or other factors will further increase our periodic reporting obligationspension expense or result in material misstatements infunding obligations. For further information regarding our financial statements. Any such failure could also adversely affect the results of periodic management evaluations and annual auditor attestation reports regarding the effectiveness of our internal control over financial reporting required under Section 404 of the U.S. Sarbanes-Oxley Act of 2002 and the rules promulgated under Section 404. The existence of a material weakness could result in errors in our financial statements that could result in a restatement of financial statements, cause us to fail to meet our reporting obligations and cause investors to lose confidence in our reported financial information, leading to, among other things, a decline in our stock price.pension liabilities, see Note 22 for further information.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

46

ITEM 2. PROPERTIES

Our corporate headquarters is in London, England. We also maintain corporate offices in Houston, Texas and Paris, France, where significant worldwide global support activity occurs. In addition, we own or lease numerous properties throughout the world.

We believe our properties and facilities are suitable for their present and intended purposes and are operating at a level consistent with the requirements of the industry in which we operate. We also believe that our leases are at competitive or market rates and do not anticipate any difficulty in leasing suitable additional space upon expiration of our current lease terms.

The following table shows our principal properties by reporting segment atas of December 31, 2018:

2020:

| Location | Segment | |||||||

| Africa | ||||||||

| Dande, Angola | Subsea | |||||||

| Hassi-Messaoud, Algeria | Surface | |||||||

| Lagos, Nigeria | Subsea | |||||||

| Lobito, Angola | Subsea | |||||||

| Luanda, Angola | Subsea | |||||||

| Malabo, Equatorial | Subsea | |||||||

| Port Harcourt, Nigeria | Subsea | |||||||

| Takoradi, Ghana | Subsea | |||||||

| Asia | ||||||||

| Chennai, India | Technip Energies | |||||||

| Dahej, India | Technip Energies | |||||||

| Hyderabad, India | Surface | |||||||

| Jakarta, Indonesia | Surface | |||||||

| Johor, Malaysia | Subsea | |||||||

| Kuala Lumpur, Malaysia | Subsea, | |||||||

| New Delhi, India | ||||||||

| Noida, India | Subsea, | |||||||

| Nusajaya, Malaysia | Subsea, Surface | |||||||

| Singapore | Subsea, Surface | |||||||

| Australia | ||||||||

| Henderson, Australia | Subsea | |||||||

| Perth, Australia | Subsea, | |||||||

| Europe | ||||||||

| Aberdeen, United Kingdom | Subsea, Surface | |||||||

| Aktau, Kazakhstan | ||||||||

| Arnhem, The Netherlands | Surface | |||||||

| Atyrau, Kazakhstan | Surface | |||||||

| Barcelona, Spain | ||||||||

| Bergen, Norway | Subsea | |||||||

| Compiegne, France | ||||||||

| Courbevoie (Paris - La Défense), France | Subsea, | |||||||

| Dunfermline, United Kingdom | Subsea, Surface | |||||||

| Surface | ||||||||

| Evanton, United Kingdom | Subsea | |||||||

| Horten, Norway | Subsea | |||||||

| Kongsberg, Norway | Subsea, Surface | |||||||

| Krakow, Poland | Subsea | |||||||

| La Garenne-Colombes, France | Technip Energies | |||||||

| Le Trait, France | Subsea, Surface | |||||||

| Lisbon, Portugal | Subsea | |||||||

47

| London, United Kingdom | Subsea, | |||||||

| Lyon, France | Technip Energies | |||||||

| Lysaker, Norway | Subsea, Technip Energies | |||||||

| Moscow, Russia | Subsea, Surface, Technip Energies | |||||||

| Newcastle, United Kingdom | ||||||||

| Subsea | ||||||||

| Orkanger, Norway | Subsea | |||||||

| Rome, Italy | ||||||||

| Sens, France | Surface, Technip Energies | |||||||

| St. Petersburg, Russia | Technip Energies | |||||||

| Stavanger, Norway | Subsea, Surface | |||||||

| Veenord, Netherlands | Surface | |||||||

| Zoetermeer, Netherlands | ||||||||

| Middle East | ||||||||

| Abu Dhabi, United Arab Emirates | ||||||||

| Al-Khobar, Saudi Arabia | Technip Energies | |||||||

| Dammam, Saudi Arabia | Surface | |||||||

| Doha, Qatar | Technip Energies | |||||||

| North America | ||||||||

| Brighton (Colorado), United States | Surface | |||||||

| Calgary (Alberta), Canada | ||||||||

| Surface | ||||||||

| Davis (California), United States | Subsea | |||||||

| Erie (Pennsylvania), United States | Surface | |||||||

| Houston (Texas), United States | Subsea, | |||||||

| Odessa (Texas), United States | Surface | |||||||

| Oklahoma City (Oklahoma), United States | Surface | |||||||

| San Antonio (Texas), United States | Surface | |||||||

| Surface | ||||||||

| St. John’s (Newfoundland), Canada | Subsea | |||||||

| Stephenville (Texas), United States | Surface | |||||||

| Theodore (Alabama), United States | Subsea | |||||||

| South America | ||||||||

| Bogota, Colombia | ||||||||

| Macaé, Brazil | Subsea | |||||||

| Neuquén, Argentina | Surface | |||||||

| Rio de Janeiro, Brazil | Subsea, Surface | |||||||

| São João da Barra, Brazil | Subsea | |||||||

| Surface | ||||||||

48

The following table shows marine vessels in which we held an interest or operated as of December 31, 2018:2020:

| Vessel Name | Vessel Type | Special Equipment | ||||||||||||

| Deep Blue | PLSV | Reeled pipelay/flexible pipelay/umbilical systems | ||||||||||||

| Deep Energy | PLSV | Reeled pipelay/flexible pipelay/umbilical systems | ||||||||||||

| Apache II | PLSV | Reeled pipelay/umbilical systems | ||||||||||||

Global 1200(a) | PLSV/HCV | Conventional pipelay/Heavy handling operations | ||||||||||||

| Deep Orient | HCV | Construction/installation systems | ||||||||||||

North Sea Atlantic | HCV | Construction/installation systems | ||||||||||||

Skandi Africa | HCV | Construction/installation systems | ||||||||||||

| Deep Arctic | DSV/HCV | Diver support systems | ||||||||||||

| Deep | DSV/HCV | Diver support systems | ||||||||||||

| Deep Explorer | DSV/HCV | Diver support systems | ||||||||||||

| Skandi Vitória | PLSV | Flexible pipelay/umbilical systems | ||||||||||||

| Skandi Niterói | PLSV | Flexible pipelay/umbilical systems | ||||||||||||

| Coral do Atlantico | PLSV | Flexible pipelay/umbilical systems | ||||||||||||

| PLSV | Flexible pipelay/umbilical systems | |||||||||||||

| Skandi Açu | PLSV | Flexible pipelay/umbilical systems | ||||||||||||

| Skandi Búzios | PLSV | Flexible pipelay/umbilical systems | ||||||||||||

Skandi Olinda | PLSV | Flexible pipelay/umbilical systems | ||||||||||||

| Skandi Recife | PLSV | Flexible pipelay/umbilical systems | ||||||||||||

(a) At December 31, 2020, this vessel is held for sale.

(b) Vessels under long term charter.

PLSV: Pipelay Support Vessel

HCV: Heavy Duty Construction Vessel

DSV: Diving Support Vessel

49

PART II

ITEM 3. LEGAL PROCEEDINGS5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

For information about dividends, see Note 17 “Stockholders’ Equity” to the Consolidated Financial Statements in Item 8.

As of February 25, 2021, according to data provided by our transfer agent, there were 101 shareholders of record. However, many of our shareholders hold their shares in "street name" by a nominee of Depository Trust Company, which is a single shareholder class action filedof record. We estimate that there were approximately 20,500 shareholders whose shares were held in “street name” by banks, brokers, or other financial institutions at February 25, 2021.

We had no unregistered sales of equity securities during the year ended December 31, 2020.

Issuer Purchases of Equity Securities

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares That May Yet Be Purchased Under the Plans or Programs (a) | |||||||||||||||||||

| October 1, 2020 – October 31, 2020 | — | $ | — | — | 14,286,427 | ||||||||||||||||||

| November 1, 2020 – November 30, 2020 | — | $ | — | — | 14,286,427 | ||||||||||||||||||

| December 1, 2020 – December 31, 2020 | — | $ | — | — | 14,286,427 | ||||||||||||||||||

| Total | — | — | 14,286,427 | ||||||||||||||||||||

(a)In December 2018, our Board of Directors authorized an extension of our share repurchase program for $300 million for the purchase of ordinary shares. As of December 31, 2020, $207.8 million remained authorized under the share repurchase program.

50

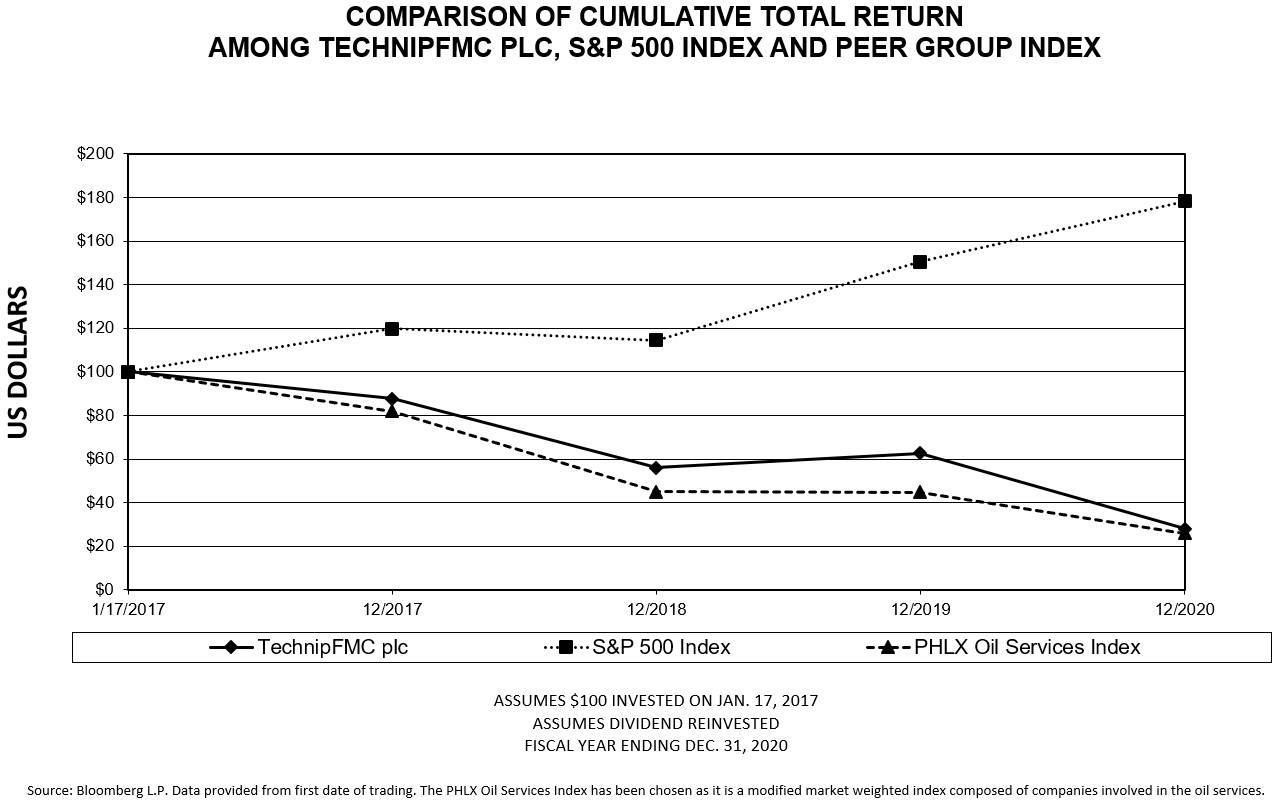

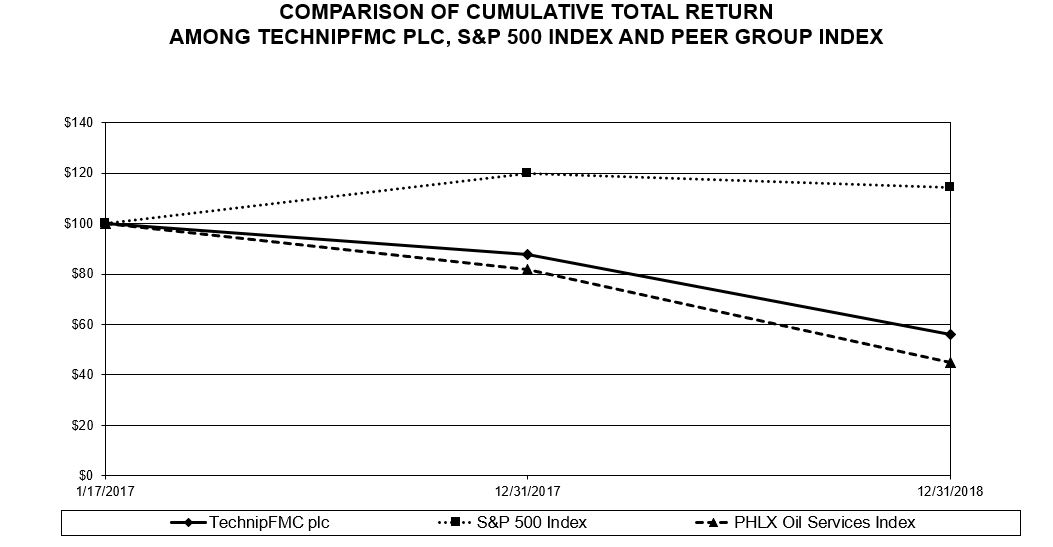

Performance Graph

The graph below compares the cumulative total shareholder return on our ordinary shares for the period from January 17, 2017 to December 31, 2020 with the Standard & Poor’s 500 Index (“S&P 500 Index”) and PHLX Oil Services Index. The comparison assumes $100 was invested, including reinvestment of dividends, if any, in our ordinary shares on January 17, 2017 and amended in January 2018 and captioned Prause v. TechnipFMC, et al., No. 4:17-cv-02368 (S.D. Texas) is pendingboth of the indexes on the same date. The results shown in the U.S. District Court for the Southern Districtgraph below are not necessarily indicative of Texas against the Company and certain current and former officers and employees of the Company. The suit alleged violations of the federal securities laws in connection with the Company's restatement of our first quarter 2017 financial results and a material weakness in our internal control over financial reporting announced on July 24, 2017. On January 18, 2019, the District Court dismissed claims under Section 10(b) and 20(a) of the Securities Exchange Act of 1934, as amended, and Section 15 of the Securities Act of 1933, as amended (“Securities Act”). A remaining claim for alleged violation of Section 11 of the Securities Act in connection with the reporting of certain financial results in the Company’s Form S-4 Registration Statement filed in 2016 is pending and seeks unspecified damages. The Company is vigorously contesting the litigation and cannot predict its duration or outcome.future performance.

| December 31 | |||||||||||||||||||||||

| 2017 | 2018 | 2019 | 2020 | ||||||||||||||||||||

| TechnipFMC plc | $ | 87.76 | $ | 55.89 | $ | 62.63 | $ | 28.03 | |||||||||||||||

| S&P 500 Index | 119.82 | 114.56 | 150.62 | 178.32 | |||||||||||||||||||

| PHLX Oil Services Index | 82.00 | 44.93 | 44.68 | 25.88 | |||||||||||||||||||

51

ITEM 4. MINE SAFETY DISCLOSURES6. SELECTED FINANCIAL DATA

| Year Ended December 31, | |||||||||||||||||||||||||||||||||||

| (In millions, except per share data) | 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||||||||||

| Statement of income data | |||||||||||||||||||||||||||||||||||

| Total revenue | $ | 13,050.6 | $ | 13,409.1 | $ | 12,552.9 | $ | 15,056.9 | $ | 9,199.6 | |||||||||||||||||||||||||

| Total costs and expenses | $ | 15,936.2 | $ | 14,935.8 | $ | 13,470.5 | $ | 14,091.7 | $ | 8,743.6 | |||||||||||||||||||||||||

| Net income (loss) | $ | (3,237.9) | $ | (2,412.1) | $ | (1,910.8) | $ | 134.2 | $ | 371.1 | |||||||||||||||||||||||||

| Net income (loss) attributable to TechnipFMC plc | $ | (3,287.6) | $ | (2,415.2) | $ | (1,921.6) | $ | 113.3 | $ | 393.3 | |||||||||||||||||||||||||

| Earnings (loss) per share from continuing operations attributable to TechnipFMC plc | |||||||||||||||||||||||||||||||||||

| Basic earnings (loss) per share | $ | (7.33) | $ | (5.39) | $ | (4.20) | $ | 0.24 | $ | 3.29 | |||||||||||||||||||||||||

| Diluted earnings (loss) per share | $ | (7.33) | $ | (5.39) | $ | (4.20) | $ | 0.24 | $ | 3.16 | |||||||||||||||||||||||||

| As of December 31, | |||||||||||||||||||||||||||||

| (In millions) | 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||||

| Balance sheet data | |||||||||||||||||||||||||||||

| Total assets | $ | 19,692.6 | $ | 23,518.8 | $ | 24,784.5 | $ | 28,263.7 | $ | 18,679.3 | |||||||||||||||||||

| Long-term debt, less current portion | $ | 3,317.7 | $ | 3,980.0 | $ | 4,124.3 | $ | 3,777.9 | $ | 1,869.3 | |||||||||||||||||||

| Total TechnipFMC plc stockholders’ equity | $ | 4,154.2 | $ | 7,659.3 | $ | 10,357.6 | $ | 13,345.9 | $ | 5,013.8 | |||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||||||||||||||

| (In millions) | 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||||||||||||||

| Other financial information | ||||||||||||||||||||||||||||||||

| Capital expenditures | $ | 291.8 | $ | 454.4 | $ | 368.1 | $ | 255.7 | $ | 312.9 | ||||||||||||||||||||||

| Cash flows provided (required) by operating activities | $ | 656.9 | $ | 848.5 | $ | (185.4) | $ | 210.7 | $ | 493.8 | ||||||||||||||||||||||

| Net cash | $ | 853.9 | $ | 714.8 | $ | 1,348.3 | $ | 2,882.4 | $ | 3,716.4 | ||||||||||||||||||||||

| Order backlog | $ | 21,388.2 | $ | 24,251.1 | $ | 14,560.0 | $ | 12,982.8 | $ | 15,002.0 | ||||||||||||||||||||||

The results of our operations for the “FTI” symbol. Prioryear ended December 31, 2020 include goodwill and long-lived asset impairment charges of $3,083.4 million and $204.0 million, respectively. The results of our operations for the year ended December 31, 2019 include goodwill and long-lived asset impairment charges of $1,988.7 million and $495.4 million, respectively. The results of our operations for the year ended December 31, 2018 include goodwill and vessels impairment charges of $1,383.0 million and $372.9 million, respectively, and a legal provision of $280.0 million. See Notes 19 and 20 to our consolidated financial statements for further details.

The results of our operations for the year ended December 31, 2017 consist of the combined results of operations of Technip and FMC Technologies. Due to the Merger, FMC Technologies common stockTechnologies’ results of operations have been included in our financial statements for periods subsequent to the consummation of the Merger on January 16, 2017 and as a result, data presented for the year December 31, 2017 is not comparable to actual results presented in prior periods. Technip was quotedthe accounting acquirer, therefore results for the years ended December 31, 2016 represent Technip only.

Net cash consists of cash and cash equivalents less short-term debt, long-term debt and the current portion of long-term debt. Net cash is a non-GAAP measure that management uses to evaluate our capital structure and financial leverage. See “Liquidity and Capital Resources” in Part II, Item 7 of this Annual Report on Form 10-K for additional discussion and reconciliations of net cash.

Order backlog is calculated as the estimated sales value of unfilled, confirmed customer orders at the reporting date.

52

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

EXECUTIVE OVERVIEW