| | | | | | | | |

| Item No. | | Page No. |

| | |

| | |

| | 1 |

| | 17 |

| | 18 |

Item 21C. | | 1826 |

| | |

| | 18 |

| | 18 |

| | |

| | |

| | 19 |

| | 20 |

| | 20 |

| | 25 |

| | 25 |

| | 25 |

| | 25 |

| | 26 |

| | |

| | |

| | |

| | 27 |

| | 27 |

| | 27 |

| | 27 |

| | 27 |

| | |

| | |

| | 28 |

| Item 16. | | |

| | |

| | 29 |

2-

FORWARD LOOKING STATEMENTS

Cautionary Information about Forward-Looking Statements

This Annual Report on Form 10-K

("Form 10-K" or this "Report") contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended (the "Securities Act") and Section 21E of the Securities Exchange Act of

1934. The1934, as amended (the "Exchange Act"), including statements

regarding urban-gro, Inc. contained in this Reportrelated to: future events; challenges we may face; growth strategy; expansion and future operations; the ability to recognize backlog as revenue; financial position; estimated or projected revenues, losses, costs, gross profit, earnings or other financial items; business strategy, prospects, plans and objectives of management; anticipated or pending investigations, legal claims, proceedings or litigation that

may involve or affect us; implementation of ESG initiatives; industry-specific trends, events or regulations and the impact of those trends, events and regulations on us or our financial performance; and updates to regulations and the impact of those regulations on us. All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements are

often, but not

historical in nature, particularly those that utilize terminologyalways, identified by the use of words such as

“may,” “will,” “should,” “likely,” “expects,” “anticipates,” “estimates,” “believes”"seek," "anticipate," "plan," "continue," "estimate," "expect," "may," "will," "project," "predict," "potential," "target," "intend," "could," "might," "should," "believe" and variations of such words or

“plans,”their negative and similar expressions. Forward-looking statements should not be read as a guarantee of future performance or

comparable terminology,results and may not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are

forward-looking statements based on

current expectationsmanagement’s belief, based on currently available information, as to the outcome and

assumptions, and entail various risks and uncertainties that could cause actual results to differ materially from those expressed in such forward-looking statements.timing of future events

Important factors known to us that could cause such material differences are identified in this

Report. We undertakeReport, including the factors described in Part I, Item 1A, "Risk Factors," and other cautionary statements described in this Report on Form 10-K. These factors are not necessarily all of the important factors that could cause actual results or events to differ materially from those expressed in the forward-looking statements. Other unknown or unpredictable factors could also cause actual results or events to differ materially from those expressed in the forward-looking statements. urban-gro, Inc. is under no obligation to correct or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any future disclosures we make on related subjects in future reports to the

SEC.Securities and Exchange Commission ("SEC").

PART I

ItemITEM 1.

Business.History

We wereBUSINESS

Background

urban-gro, Inc. (together with its wholly owned subsidiaries, collectively "urban-gro," "we," "us," or "the Company") was originally formed on March 20, 2014, as a Colorado limited liability company.

InOn March

10, 2017, we converted to a

Colorado corporation and

issued 193.3936722exchanged shares of our

Common Stockcommon stock for every

Member Interestmember's interest issued and outstanding on the date of conversion.

In August 2016, when still On October 29, 2020, we reincorporated as a Delaware corporation. On December 31, 2020, we effected a 1-for-6 reverse stock split with respect to our common stock. All information in this Report gives effect to this reverse stock split, including restating prior period reported amounts. On February 12, 2021, we completed an LLC, we undertook a private offeringuplisting to the Nasdaq Capital Market ("Nasdaq") under the ticker symbol "UGRO".

Overview

urban-gro is an integrated professional services and construction design-build firm. Our business focuses primarily on providing fee-based knowledge-based services as well as the value-added reselling of equipment. We derive income from our ability to generate revenue from our clients through the billing of our member interests wherein we received subscriptions of $575,107employees’ time spent on client projects. We offer value-added architectural, engineering, systems procurement and integration, and construction design-build solutions to customers operating in the formcontrolled environment agriculture ("CEA") and industrial and other commercial ("Commercial") sectors. Our evolution, both organically and through the acquisition of 6,392 member interestsengineering, architecture, and construction management firms has enabled us to successfully diversify into the commercial sectors of the clients we serve, as well as the capabilities we offer, which we believe has helped insulate our business from any one sector. Even with this successful diversification, our main focus and value-add has always been and remains in providing solutions to our CEA clients, where we have experience and expertise in designing, engineering, building, and integrating complex environmental equipment systems into indoor CEA cultivation and retail facilities, and then providing ongoing maintenance, training, and support services to those same facilities.

We aim to work with our clients from inception of their project in a way that provides value throughout the life of their facility. Clients, regardless of sector they are in, engage us to deliver their vision because of our experience and expertise, and because our integrated, design-build solutions offer a value-add approach to design, engineering, procurement, construction-management, construction, and equipment integration, providing a single point of accountability across all aspects of a project.

For our CEA clients in particular, we create high-performance indoor cultivation facilities to grow specialty crops, including cannabis as well as produce such as leafy greens, vegetables, herbs and berries. We also provide design-build solutions for our CEA clients' retail facilities. We help our clients achieve operational efficiency and economic advantages through a full spectrum of professional services and programs focused on facility optimization and environmental health which establish facilities that allow clients to manage, operate and perform at the highest level throughout their entire cultivation lifecycle once they are up and running. For these CEA clients, our team provides services to meet the most stringent regulatory environments, whether they are energy efficiency goals, Good Agricultural and Collection Practices ("GACP"), or Good Manufacturing Practice ("GMP") and/or European Medicine Agency EU GMP ("EU/GMP") certification.

While we have successfully diversified our target markets across several commercial sectors, the majority of our clients are commercial CEA cultivators. We believe a key differentiation point that clients value is the depth of our employees’ and Company’s experience. As of December 31, 2023, we employed 130 full time employees, approximately two-thirds of which are considered experts in their areas of focus. Our team includes Designers (Architects, Interior Designers, Cultivation Space Planners), Engineers (Mechanical, Electrical, Plumbing, Controls, and Fire Protection), Construction Managers (Project Managers and Supervisors), and horticulturists. As a company, we have worked on over 1000 CEA projects, and believe that the experience of our team and Company provides clients with the confidence that will proactively keep them from making common costly mistakes during the design and build process that would impact operational stages. Our expertise translates into clients saving time, money, and resources through expertise that they can leverage without having to add headcount to their own operations. We provide this experience in addition to offering a platform of the highest quality equipment systems that can be integrated holistically into our clients’ facilities.

Since January 1, 2023, we have announced the following contracts:

•September 26, 2023 - Awarded contract for more than $11.0 million of design-build services with an existing client in the Hospitality & Recreation sector to be recognized over the next six quarters. While this contract has been started as of December 31, 2023, the Company now expects that the contract will take two quarters longer than expected to complete, therefore extending into 2025.

•October 2, 2023 - Secured contracts of nearly $8.0 million across four clients in the CEA sector to be recognized over the next four quarters. While the largest of these contracts, valued at approximately $7 million dollars, did start in the first quarter of 2024, the Company now it will be completed by the first quarter of 2025, one additional quarter more than had been forecast. The Company expects that the other three (3) accredited investors (approximately $90 per member interest,contracts will be completed in the previously announced timeframe.

•October 4, 2023 - Signed multiple contracts valued at more than $4.5 million to be recognized over the next two quarters. The Company expects that these contracts will be completed in the previously announced timeframe.

•November 30, 2023 - Awarded $9.6 million industrial design-build contract with an existing CPG client to be recognized over the next three quarters. While this contract did not start as anticipated in the fourth quarter of 2023, the value was increased to $11 million dollars with the addition of supplying mechanical equipment systems to the scope, it did kick off in the first quarter of 2024. The Company now expects that the contract will take one additional quarter over the previously announced timeframe to be completed.

•January 2, 2024 - Secures design-build contract valued at approximately $20.0 million of design-build services with an existing vertically integrated United States based multi-state cannabis cultivation and retail dispensary operator to be recognized over the next six quarters. This contract was not started as of December 31, 2023, but kicked off in the first quarter of 2024, and the Company still expects that the contract will be completed in the previously announced timeframe.

Our Solutions

Since commencing business in March 2014, we have expanded our ongoing operations across North America and Europe while diversifying our services offerings organically and through acquisitions into full design-build solutions by adding design, engineering, construction, and construction-management services, introducing new equipment solutions, products and services, and successfully diversifying into several additional commercial sectors beyond cannabis-focused CEA, including produce-focused CEA; or approximately $0.46 per sharevertical farming, healthcare, industrial, commercial packaged goods ("CPG"), and retail. We are a trusted partner and adviser to our clients and provide value to our clients regardless of the sector in which they sit or solution for which they are utilizing us.

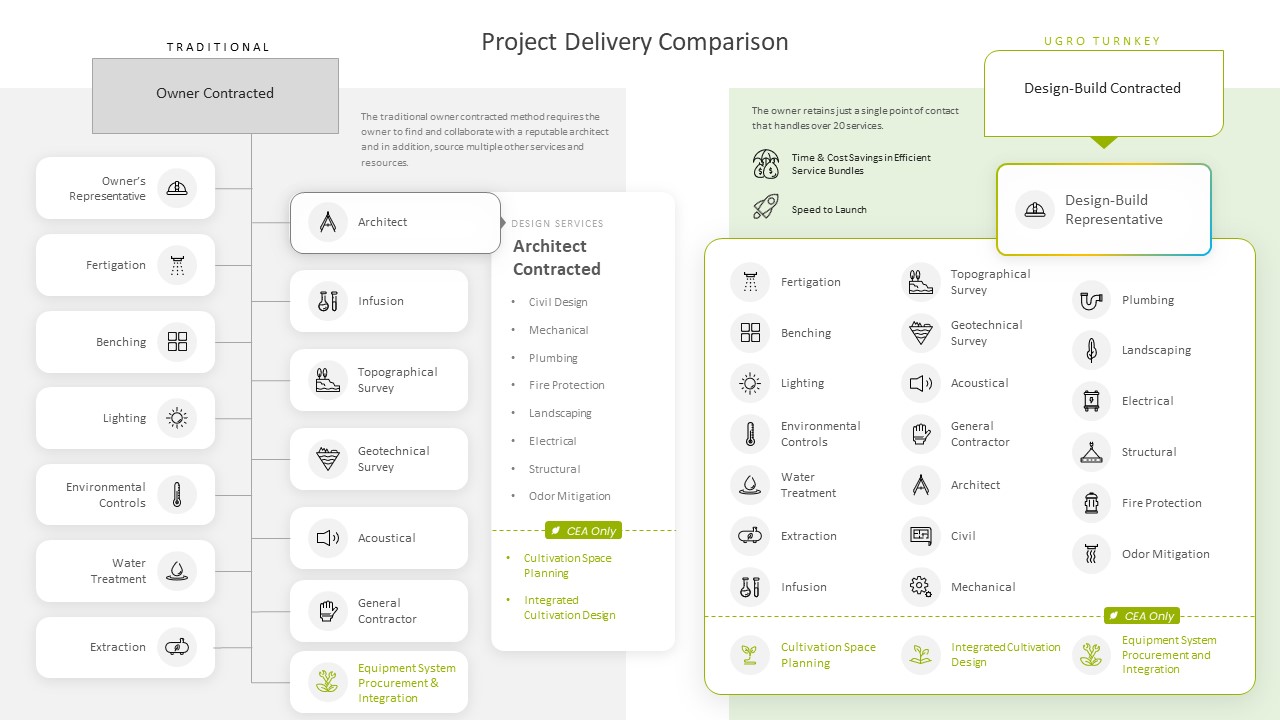

As is detailed in the Project Delivery Comparison chart below, in the CEA sector, the advantages of the urban-gro design-build model vs the traditional owner-contracted model are clear. There is a single responsible party for our clients' needs from conception through operational start. This results in greater efficiencies throughout the design-build process and a faster speed to launch. Additionally, our experience and expertise within our sectors help to prevent costly mistakes for our clients.

Outlined below is an example of a complete end-to-end design-build project that demonstrates how we provide value to our clients over time.

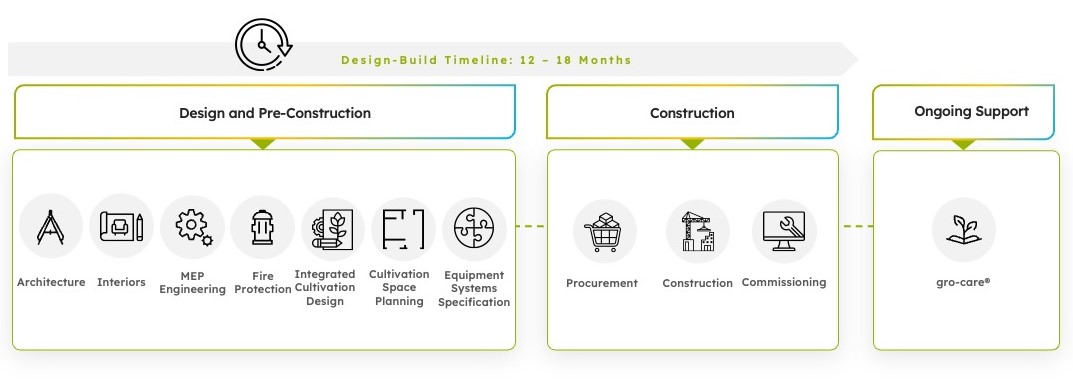

Our design-build solution, when focused on indoor CEA, offers an integrated suite of in-house services and equipment systems that generally fall within the following categories:

•Service Solutions:

•Architectural Design, Engineering, and Construction Services – A comprehensive collection of services including:

i.Pre-Construction Services

ii.Cultivation Space Programming ("CSP")

iii.Architectural Design and Interior Design

iv.Engineering

v.Integrated Cultivation Design ("ICD")

vi.Owner's Representative Services / Construction Management ("CM")

vii.General Contracting ("GC")

•Additional Service Offerings including:

i.Facility and Equipment Commissioning Services

ii.gro-care® Crop and Asset Protection Services including Training Services, Equipment Maintenance Services, Asset Protection Program, and an Interactive Online Operating Support System ("OSS") for gro-care® and client document delivery and project management

iii.Property Condition Assessment ("PCA")

•Integrated Equipment Systems Solutions:

•Design, Source, and Integration of Complex Environmental Equipment Systems including Heating, Ventilation, and Air Conditioning ("HVAC") solutions, Environmental Controls, Fertigation, and Irrigation Distribution

•Value-Added Reselling ("VAR") of Cultivation Equipment Systems

•Strategic Vendor Relationships with Premier Manufacturers

Service Solutions

Architectural Design, Engineering, and Construction Services

We generate revenue by providing our clients with design-build service offerings that include architectural, interior, and engineering design, construction and construction management, as well as services for the operational stages of the facility. Our in-house architectural, interior design, engineering, construction and cultivation design services integrate design with pre-construction services and thereby reduce project schedule and capital investments.

Pre-Construction Services include providing a forecast summary of what it will take to get a high-performance facility built, giving initial indication and detailed analysis of budget, timeline/schedule, and potential large decision impacts including value analysis and value engineering options. The integration of Pre-Construction Services can expedite project completion, lower initial project costs, and help reduce costly change orders.

CSP is an early-stage engagement with stakeholders that provides an optimized basis of design including the interaction of people, plants, and processes. The output of CSP provides an optimized analysis of spatial needs based uponon stipulated criteria and can accelerate construction and regulatory approval paths, save stakeholders money and time, and enable a process-driven decision-making approach.

Architectural Design is the conversion rateimplementation of 193.3936722 shares per member interest issued when we converteda defined process from development of vision to built environment. Architecture includes the integration and coordination of all project required disciplines such as civil, landscape, structural, mechanical, plumbing and electrical engineering, fire protection, security, interior design, and other specialty disciplines. Our services are built around an integrated design process focused on the collaborative development of client-driven solutions. Specific to the CEA industry, our team’s understanding of the relationship between people, plants, and process helps clients maximize profits and efficiencies while minimizing capital investments, and operational and maintenance costs.

Interior Design involves branding and development of the interior aesthetic vision. Our collaborative and integrated approach from our award-winning team begins with inspiration boards focused on understanding the client’s aesthetic desires. Interior design is holistic and thereby includes all aspects of the building interiors from full branding to the selection and design of all finishes and interior systems. Common discussions beyond aesthetics include the cost, durability, and maintainability of systems presented.

Mechanical, Electrical, and Plumbing ("MEP") engineering design focuses on the entire building, not just the cultivation space, which in turn eliminates the "gap" between cultivation systems and the building systems. We provide engineered construction contract documents for mechanical, HVAC, plumbing and electrical systems required for the building permits necessary to obtain a Certificate of Occupancy. Our team evaluates client capabilities, needs, desires, and budget in development of recommended systems through a client-focused collaborative process culminating in the delivery of high-performance and low-maintenance systems.

ICD creates cultivation space-focused design layouts that integrate climate control, fertigation, benching, air flow, and lighting. Our ICD team’s deep understanding of cultivation systems provides the foundation for ensuring optimal space utilization as they utilize an integrated and collaborative design process focused on understanding, vetting, and implementing the client’s vision. Products utilized in the ICD’s basis-of-design ensures the integration of high-quality systems and product performance. These detailed ICD plans are taken through the construction document stage and are leveraged by our clients to efficiently solicit contractor bids.

Construction and Construction Management provides all the additional necessary parts to deliver our clients' projects, from the initial estimate and bid process, to subcontractor selection, and management of all construction details. Our skilled project managers, specialized within our clients' sectors, maintain knowledgeable open lines of communication with both clients, onsite superintendents, and internal and external construction partners to manage expectations, costs and schedules.

Our Additional Service Offerings

Our Facility and Equipment Commissioning Services provide a cultivation-level view of the complex system made up by each piece of equipment and ensures systems are running properly. Many of the current service options available to CEA cultivation clients are isolated to vendors providing post-sale service for a single piece of equipment. Our team confirms contractors and specialty trades are installing systems to the design intent allowing for rapid installation, continuous process improvement, and increased revenue for our clients.

gro-care® is a highly differentiated service offering that provides a combination of CEA cultivation facility commissioning and an asset protection program through training, equipment maintenance, on-demand support, standard operating procedures ("SOP"), and a client-specific OSS that acts as an online hub for clients’ ongoing services. Combined, this solution focuses on the troubleshooting, tuning, and support of a myriad of cultivation systems and equipment while further providing guidance for client interactions with tradespeople working on HVAC, electrical, and plumbing in the facility on an ongoing basis.

Our PCA offering provides value to all clients regardless of sector, but also adds unique value for our clients in the CEA sector. PCA includes researching historical records of the building as related to code issues, field documentation of existing conditions, a report of findings with materials systems categorized by condition, and a capital expenditure report for correction of any deficiencies. For our clients in the CEA sector, our PCA offering provides analysis of components specifically within CEA facilities, both with an eye towards critical cultivation and manufacturing systems as well as helping clients understand a facility's ability to meet any state regulations that may have evolved such as adherence to standards such as Current Good Manufacturing Practices ("cGMP"), EU-GMP, and/or World Health Organization guidelines on GACP. PCA provides necessary data for clients to understand options for optimizing operational performance, understanding deficiencies, and property preparing for necessary capital expenditures.

Integrated Equipment Solutions

While our engineers play an integral part in the design of most of the complex equipment systems that are then integrated into a corporation in 2017). These funds were used to (i) add two systems designers to expand our Cultivation Technologies team to support market demand; (ii) expand our operationsCEA facility, we also provide consultative reselling of more common solutions that we integrate into the expandingoverall design. For CEA, the environmental goal is to maintain a stable and consistent vapor pressure deficit ("VPD") according to the client’s priorities through environmental control of relative humidity and temperature during all stages of growth. There are four main variables in CEA that affect plant growth (and can impact VPD): (i) water and nutrients; (ii) environmental control; (iii) CO2; and (iv) lighting. The complex equipment systems that we design and procure for our clients play an important role in helping control and maintain the cultivation facility's environment for plants.

Design, Source, and Integration of Complex Environmental Equipment Systems

Complex Environment Systems for CEA include environmental controls, fertigation marketplaceand irrigation distribution, a complete line of water treatment and wastewater reclamation systems, and HVAC equipment systems.

As related to systems and equipment, the most significant and influential variable within a CEA facility is the ability to control and maintain the cultivation environment. This is accomplished through the integration of mechanical systems (HVAC), lighting, air movement systems, irrigation systems, and environmental controls. Maintaining a consistent desired temperature and humidity level within the cultivation spaces ensures less stress on plants. urban-gro designs these systems to fit within our clients'

budgets and provides our clients' facilities a more stable environment to maximize plant health and yields, minimize crop loss, minimize utility costs, save on capital equipment, and maximize sustainability.

Value-Added Reselling of Cultivation Equipment Systems

We act as States approving legalized cannabis increased, (iii) hire a mechanical engineer to begin vetting opportunities to add IP and technologyan experienced vendor providing VAR to our future business offering, (iv) hiredclients when selling vetted best-in-class commercial horticulture lighting solutions, rolling and automated container benching systems, specialty fans, fertigation/irrigation systems, environmental control systems, and microbial mitigation and odor reduction systems. The acquired knowledge of how each of these systems work in combination with and in tangent to the overall ecosystem is a strategic financial consultantsignificant benefit that our engineers and product experts offer to aidour clients. Not only are many competing products reviewed in compilingeach category with the intention of vetting the best solution, but we also continually search out and review competing technologies to ensure that only the best-in-class equipment systems are integrated into our projects. As such, we believe it will be imperative to maintain and to continue to develop close relationships with both existing and new leading technology and manufacturing providers.

Today, we typically do not sell any cultivation equipment systems individually as a

business forecast model;,one-time sale. The majority of equipment sales are sold as part of a larger all-encompassing project solution that spans over a 12 to 24 month period and

(v) fund working capital to support brand building marketing initiatives focused on trade show participationincludes design, engineering, and

an Increased on-hand inventory position.In May 2017, we commenced a private offering of our Common Stock wherein we received subscriptions of $2,546,000 from the sale of 2,546,000 shares, at $1 per share,both custom complex and more standard equipment systems.

Strategic Vendor Relationships with Premier Manufacturers

We work closely with leading technology and manufacturing providers to

76 investors, including 58 “accredited” investors, as that term is defined underdeliver an integrated solution designed to achieve the

Securities Act of 1933, as amended. These funds were used to repay debt, expansionstated objectives of our

existing business operations, new investment opportunitiesclients. We pride ourselves as being equipment agnostic – meaning we do not have allegiances to any single manufacturer – we offer the solution that will best meet the design and

working capital.Thereafter, on May 15, 2018, we filed a registration statement on Form S-1 with the US Securities and Exchange Commission (“SEC”) wherein we registered 4,157,936 sharesbudget constraints of our Common Stock withclients and design, engineer, and integrate whatever equipment fits the SEC. Our registration statement became effectiveclient's needs.

Revenues and Gross Profit Margins

As our business has evolved and diversified into design-build offerings, our margin profiles have changed. Professional service revenues for engineering design services contracts can be hundreds of thousands of dollars, depending on

August 8, 2018. As partthe spectrum of

this process we also filed a registration statement on Form 8-A, causing our Common Stock to be registered underservices desired by the

Securities Exchange Actclient and the size of

1934, as amended.In June 2018, we formed urban-gro Canada Technologies, Inc. as a wholly owned Canadian subsidiary company which we intend to utilize for all of our Canadian sales operationsthe facility. Construction design-build contracts can run in the future.

Our Company website iswww.urban-gro.com, which contain a descriptiontens of our Companymillions of dollars depending on the overall size of the facility. Equipment revenues for customized equipment systems can be millions of dollars, depending on the size of the cultivation facilities, the complexity and products, but such websitestypes of systems purchased by the client, and the information containednumber of systems purchased by the client. Sales of other products are typically of a recurring nature each month to a client and can be in the tens of thousands of dollars.

Targeted gross profit margins for each of the Company’s revenue categories are as follows:

•Professional services - greater than forty percent;

•Construction design-build services - greater than six percent;

•Customized equipment systems - greater than ten percent; and

•Other products revenues - greater than fifteen percent.

Gross profit margins are highly dependent on the complexity and size of the project.

Our Clients

We primarily market and sell our

websites are not part of this Report.solutions to clients in the CEA and Commercial sectors. In

addition, we also maintain branded technology product website under www.soleiltech.ag.Business Overview

We are an end-to-end agricultural solutions firm focused onthe CEA sector, our clients include operators and facilitators in both the cannabis and traditional agriculture produce growers. We provide design, engineering,markets in the United States, Canada, and technology implementationEurope. In the Commercial sector, we work with leading food and beverage consumer packaged goods companies in high-performance commercial cannabis cultivation facilities. Integration of systems through comprehensive design ensures a cohesive approach to cultivation that is both economical and regulatory compliant. We market our products and services throughout the United States, and Canada. During 2018clients in healthcare, higher education, and hospitality.

Environment, Social, and Governance

At urban-gro, we also made preliminary effortsrecognize the critical role that sustainable and responsible business practices play in shaping a resilient and prosperous future. In 2023, we partnered with an ESG service provider to proactively embark on projectsour corporate ESG journey. While we are not formally aligning with a specific framework, we are using the World Economic Forum (WEF)’s Stakeholder Capitalism Metrics as a guide for our reporting. The WEF has created a framework of ESG metrics and disclosures based on what it refers to as

the four pillars: Planet, People, Prosperity, and Governance. Currently in

other countriesthe final stages of development, our inaugural ESG report will be published on our website and will serve as

well, including Mexico, Jamaicaa reflection of our commitment to transparency and

Colombia.Revenuethe integration of ESG principles into our core business strategies.

urban-gro’s ESG initiative is generatedled by 1) workinga Board of Directors subcommittee which was formed in recognition of the increasing importance of sustainable and ethical business practices and responsible governance in the modern business landscape. In partnership with ownersthe broader Board of Directors, the ESG committee aims to:

•Strengthen the alignment of our corporate values

•Align stakeholder expectations

•Manage risk

•Ensure compliance

•Support investor relations

•Enhance the brand

•Boost innovation and efficiency

•Boost employee engagement

•Create long-term value

•Adapt to changing markets and trends

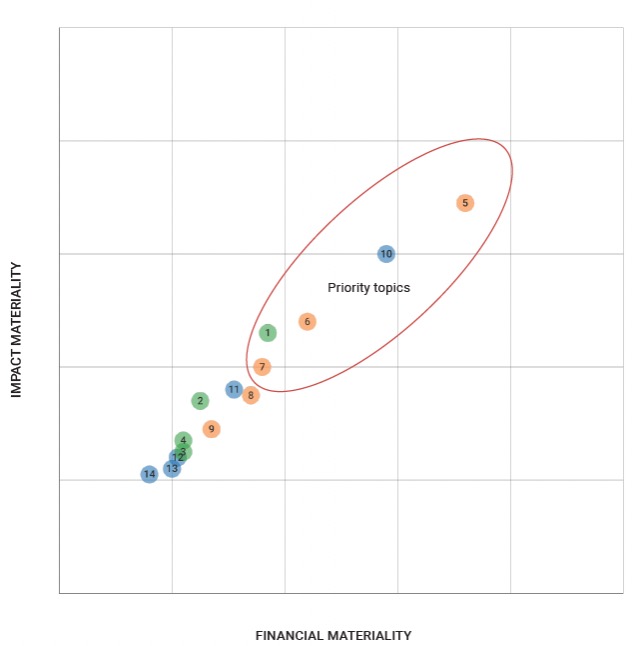

To better understand the topics most material to our business and actively engage stakeholders, urban-gro conducted a double materiality assessment to gain ‘inside-out’ and ‘outside-in’ perspectives. We engaged 29 internal and external stakeholders with a web-based materiality survey to gather quantitative and qualitative insights on impacts, risks, and opportunities. Analysis of this data identified 14 sustainability areas that present material impacts and opportunities for our organization. Of those 14, we prioritized the top five to inform our decision-making and reporting goals for the upcoming year. The top five topics are listed below:

•Data and Cybersecurity

•Business Ethics

•Diversity, Inclusion, and Equal Opportunity

•Energy Management

•Recruitment, Development, and Retention

Environment

Focus on environmental material matters, stakeholders emphasized energy and water management alongside clean technology to foster sustainable, efficient, and regulatory compliance in our operational practices. Climate adaptation and transition risk management were classified as essential in the Materiality Assessment in navigating the shift toward a low-carbon economy. As a professional services design-build firm focused on Controlled Environment Agriculture (CEA), our approach to sustainable facility design and engineer automatedconstruction has a direct impact on environmental well-being. We aim to be a part of the solution to the climate challenge by aligning with CEA industry best practices around water conservation and reuse, reduction of the carbon footprint associated with production and distribution, and increasing the efficiency of harvests. Our team has worked on over 1,000 CEA projects around the

world and combined with our team’s experience with Leadership in Energy and Environmental Design (LEED) and (EU)GMP facility certification, we are successfully reducing waste, water consumption, and carbon consumption across multiple market sectors. As technological advancement continues, we intend to work with our partners to incorporate more earth-friendly practices and solutions in CEA and other commercial sectors. Such concepts include, but are not limited to, active energy management, HVAC efficiency, and innovations in lighting.

By helping to reduce our clients’ footprints, we recognize the importance of measuring and reducing our own carbon footprint as well. While we have not formally begun measuring and reporting on our greenhouse gas (GHG) emissions due to our small size and the early nature of our operations, as we grow and add resources—or if the results of future stakeholder Materiality Assessments emphasize a growing interest in this metric—we will further investigate regular GHG emissions monitoring and reporting.

Social

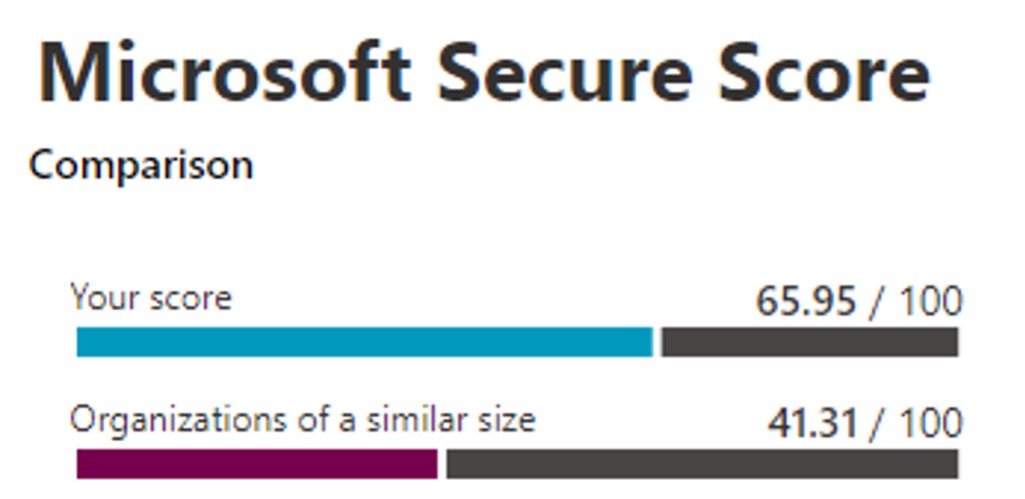

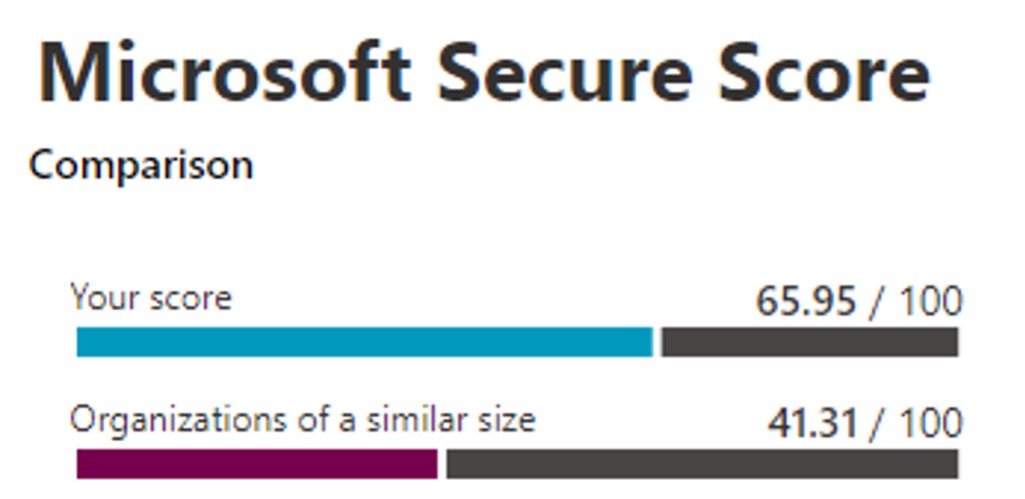

Data and cybersecurity topped the social material matters, with the criticality of safeguarding data integrity, privacy, and resilience against cyberattacks essential to maintaining stakeholder trust, regulatory compliance, and business continuity. We understand the material effects that cybersecurity has on our business operations and have various measures in place to monitor and safeguard our information technology systems. These tactics include ongoing employee training, maintenance of backup and protective systems, for large commercial facilities, and 2) delivering recurring consumable product salesuse of modern endpoint detection and response tools. We operate in a fully cloud-based environment to enhance scalability, flexibility and resilience against damage, disruption, and unauthorized access. In 2023, we documented over 100 hours of company-wide training. Documented policies and requirements cover topics like data security, email, hardware and software compliance, network security, password policy, patch policy, purchasing policy, and technology integration. Soleil® Technologiesdisposal. A combination of these and other efforts like third-party supported internal and external pen testing, real-time backups, and full adoption of the NIST Cyber Security Framework 2.0 have resulted in a nearly 25-point advantage in urban-gro’s Microsoft Secure Score relative to other similar-sized businesses.

Promoting diversity and employee well-being is likewise crucial to building trust, fostering innovation and resilience, and driving long-term organizational success. In the Materiality Assessment, stakeholders noted how promoting diversity in the workforce enhances morale, productivity, and social cohesion within communities. By fostering an inclusive workplace culture, urban-gro not only meets societal expectations but also contributes to economic equity and social progress. In the spirit of this commitment, the Company introduced a ‘floating holiday’ in 2024 that allows each employee flexibility and choice when it comes to observing holidays. The ‘floating holiday’ aims to empower each of our proprietary IoT platform providing senseteam members to celebrate meaningful moments in a way that aligns with their values and control capabilities, allowingbeliefs. We are also proud supporters of several charities and associations including Teens for Food Justice, an organization that is catalyzing a youth-led movement to end food insecurity through high-capacity, school-based hydroponic farming. Our company and/or employees are also members of industry associations and trade groups like American Hort, Association for Vertical Farming, the operatorAmerican Society of Heating, Refrigeration, and Air-Conditioning (ASHRAE), the Georgia City-County Management Association (GCCMA), the Georgia Chapter of APPA (GAPPA), the Global Cannabis Network Collective (GCNC), the National Cannabis Industry Association (NCIA), and the National Cannabis Roundtable (NCR). At urban-gro, we understand that the workplace reflects the world around us, and we want to remotely monitorensure that everyone feels valued and respected.

Governance

From a governance perspective, prioritizing ethics, resilient business models, and effective governance was highlighted by stakeholders in the

crop, ensuring real-time protectionMateriality Assessment to bring integrity, adaptability, and sustained performance amidst evolving market landscapes. Stakeholders recognized how adherence to high ethical standards fosters transparency, accountability, and investor confidence. urban-gro takes a multi-pronged approach to guide a successful governance program and ensure that our stakeholders’ best interests are acted upon. This starts with our strong and diverse Board of

investments.Directors comprised of leaders from a variety of fields and backgrounds. The Board Diversity matrix is published annually on our website ir.urban-gro.com and within our proxy materials. Currently, we utilize four Board committees:

•The Audit Committee: Focuses on internal controls, risk management, and multi-discipline oversight enabled by its charter and structure.

•The Compensation Committee: Focuses on compensation principles, policies, and practices for all employees.

•The Nominating and Corporate Governance Committee: Oversees the Company’s corporate governance practices and procedures and recruits, nominates, and makes recommendations to retain Board members.

•The Environmental, Social, Governance Committee: Oversees the Company’s approach to ESG practices and procedures.

In addition to charters for the committees listed above, we have a Code of Business Ethics and Conduct along with documented policies related to Anti-Corruption/Code of Business Ethics, Whistleblower Policy and Hotline, Enterprise Risk Management, Independent Pay Consultant, and Insider Trading. By upholding governance excellence, we aim to mitigate risks and contribute to the stability and integrity of our business environment.

Costs and Effects of Compliance with Environmental Laws

Our current servicesbusiness operations are not subject to any material environmental laws, rules or regulations that would have an adverse material effect on our business operations or financial condition or result in a material compliance cost.

Growth Strategy

Our employees and

products include: | · | Full design, engineering, sales, and start-up commissioning of integrated cultivation systems that includes: |

| o | Environmental controls, fertigation and irrigation distribution; |

| o | Commercial grade light systems, includinglight-emitting diode (LED) and high-pressure sodium (HPS);

|

| o | Complete line of water treatment and reclamation systems;

|

| o | Rolling and automated bench systems;

|

| · | Integrated pest management plan design and product solutions; and |

| · | Soleil 360, an agriculture technology platform |

Since inception,the application of their acquired knowledge are our most valuable assets as an organization. Our growth strategy involves leveraging this considerable strength as a basis for growth across three pillars of focus and exploration. These three pillars allow us to continue to provide value to our current and future clients:

•Leverage our sector diversification and in-house capability offerings

•Focus on design-build solution

•Expand our regional client base

Leverage our Sector Diversification and In-House Capability Offerings

Our vision is to be a leading provider for purpose-built turnkey indoor CEA facilities. To that end, we have

serviced over 500 clients and

have designed and assisted in build out of over 75 facilities owned by some of the largest multi-state cannabis focused operating companies in both the United States and Canada. While no assurances can be provided, we forecast over a thousand customers will be purchasing our cultivation products bi-monthly by 2020, provided that additional countries and states in the US continue to adopt legislation approving the useseek to diversify our service capabilities to provide value to our clients through acting as a single point of medical or recreational marijuana.According to Viridian Capital Advisors, an estimated $13.8 billion was raised by cannabis companiesresponsibility in

2018. A significant portion of this capital is expected to be used for facility buildouts. New Cannabis Ventures reported that as of April 2018 there were over 7,000 cultivation licenses issued in the US. This number is rapidly increasing as more states enter the legal cannabis industry.our turnkey design-build, approach. While

no assurances can be provided, we

believe this gives us a large and growing market.To date, our revenues have been derived from sales to the cannabis industry. On average, our revenues have grown by 70% per year since 2015. During 2018 we provided services to over 1.2 million square feet of canopy to the cannabis industry.

Our primary business purpose is to engage directly with large scale indoor and greenhouse commercial cultivators growing high-value crops and design and engineer state of the art facilities and systems that focus on maximizing plants yields and lowering overall operational costs. We have and will continue to workexpand our services organically, we began this journey through the acquisition of engineering, architecture, and construction management firms over the last 18-month period. This in-house service capability diversification also brought with it a diversified client base that included clients from sectors outside of CEA. We expect to continue to compete successfully in all of these sectors as we believe it helps us attract the best talent, weather the downturns of any one sector, and continue to find growth and future returns for our shareholders.

We believe that acting as a single point of responsibility as a provider of turnkey design-build solutions, especially one with the depth and breadth of experience within all sectors that we've served, we can get our clients to market more quickly and more efficiently than others.

We intend to continue to leverage all our service capabilities within our design-build delivery model, across sectors, to grow operationsthe services and production facilitiesvalue we are providing to pursue strategiesour clients. As an example, some clients may currently only be engaged with us for architectural design - we plan to leverage our in-house model and take advantage of every opportunity to cross sell our other services such as engineering; or construction management or general contracting, to provide services, products,further value to our clients and other potential revenue-producing opportunitiesgrow our revenues and margin dollars.

Focus on Design-Build Solution

As written previously, through both organic and inorganic means, we have diversified our in-house service capabilities so that we are able to provide full turnkey design-build solutions to our clients. These design-build projects allow us to engage with a client at the conception of a project and act as a single point of responsibility to provide value throughout and beyond the project lifecycle. These design-build projects are also much larger from a revenue and project complexity perspective - instead of working on 100s of projects, our goal will be to grow through working on a smaller number of projects of a much larger size, allowing us to capture greater revenue and more margin dollars and overall, provide greater value to our clients. We expect these larger projects will also provide us with the foresight to more accurately forecast our future quarterly business performance.

Expand our Regional Client Base

While continuing to focus on building out our solution set and expanding our client base in all sectors, and more specifically establishing our end-to-end solution as the industry standard for CEA indoor cultivation in the

high value crop arenas. We engage directly with the ownership groups and growers at these facilities and strategically work with them to provide value-added services and industry best products that assist them in lowering production costs and increasing crop yields. We believe our customers work with us becauseU.S. market, we

save them time, money, and resources.In 2018, we accomplished several objectives, including the hiring and placement of our executive leadership team. We consider this a major milestone. To help us efficiently and effectively accomplish our growth objectives, management believes that hiring qualified, experienced persons and placing them into executive management is critical. During 2018 we hired George R. Pullar, our CFO; Larry Dodson, our CTO; Dan Droller, our EVP of Corporate and Business Development; and, Jonathan Nassar, our EVP of Sales. With this team in place, we believe we have the leadership necessary to help usalso plan to continue to expand our business. See “Part III, Item 10, Directors, Executive Officers and Corporate Governance”: included in our Proxy Statement, which has been incorporated herein as if set forth.

As discussed below we also increased our ownership in key technology companies. We believe that the additional investment into EDYZA (additional 5% ownership) and Total Grow Holdings (additional 10% ownership in 2018 and an additional 15% in 2019) will allow our technology team to continually integrate and solidify the Soleil Sense & Control platform to further gain meaningful and valuable insight from the mined data available in a closed-loop platform.

In 2018, we surpassed the 50-employee mark, and consequently, decided to seek out additional office space. The Company opened a satellite office in the downtown WeWork The Lab facility. This centrally located office allows us access to the larger technology and engineering talents pools located in the Denver metro area and the Denver Tech Center. Our technology team and design teams are now located in this facility. See “Item 2, Properties” below.

Current Business

Our intent is to continue to capture market share as the cannabis industry continues to develop and mature, and to leverage that experience and our technology development to penetrate the faster growing segments of the broader horticultural and agricultural industries.In the cannabis industry we engage directly with ownership groups and growers operating large indoor and outdoor greenhouse cultivation facilities and strategically work with them to provide value-added services and industry best products that assist them in lowering production costs and increasing crop yields.

We define our relationships with our customers through two areas comprised of design & integration services and agricultural technology:

We offer the following Design & Integration Services:

| · | Systems Design, Engineering & Integration |

| · | Start-up Commissioning and Post-Commissioning Services |

| · | Remote Monitoring and Support |

| · | Integrated Pest Management |

We also offer the following agricultural technology hardware and software solutions:

| · | Wired and wireless communications equipment that is used for the customer on-premise network, connecting our Sensing and Control systems |

| · | Cloud-based secure data services and back-end management and administration system |

| · | Customer graphical user interface (GUI) |

As a part of our design and integration services and ag-tech offerings, we offer the following cultivation systems and crop management products:

| · | Climate Control, Fertigation & Irrigation Distribution |

| · | Freshwater, Wastewater & Condensate Treatment Systems |

| · | LED , HPS, and CMH Light Planning and CAD Design |

| · | Rolltop and Automated Benches |

| · | Odor Mitigation & Air Sanitizing |

| · | Pesticides & Bio-controls |

| · | Fans & Industrial Spray Applicators |

| · | Fertilizer & Plant Nutrition Products |

Business Growth and Diversification

We are focused on driving shareholdersecuring and providing value by continually developingto clients in the technology platformCEA sector, and continue to develop and iterate on our marketing and outreach plans as the sector comes online slowly. We have thus far signed several engagements with CEA clients in multiple countries and look to continue our growth through this geographic expansion.

Our Competition

We believe that our experience and expertise combined with our complex end-to-end design-build solutions places us as a growing leader in the indoor-CEA sector. Within that CEA sector, we do face competition from companies that offer some, but not all, portions of an all-encompassing design-build facility solution. We compete for projects with other smaller and mid-sized companies that focus solely on architectural and interior design, engineering, construction, or product sales. For services, we see these competitors as offering similar specific area solutions, though not integrated nor as in depth on fertigation design. For product sales, we currently view our competition to be focused on predominantly commodity "off-the-shelf" items like lighting and other cultivation staple products, both pre-startup and post-startup. This competition comes from traditional wholesale horticulture dealers, online retailers, and some manufacturers who sell direct.

Greenhouse manufacturers and European systems integrators may increasingly seek to offer comprehensive product and service solutions to compete with our integrated solution, but they are primarily focused on the greenhouse industry, and not on indoor-CEA facilities. European systems integrators in particular are experienced and have a strong operating history in traditional horticulture and provide specialized, intensive, and large-scale solutions that revolve around greenhouse projects. Instead of competing with these integrators, we find ourselves working with them and combining synergies to work on projects together.

For our clients from non-CEA sectors such as Industrial, Food and Beverage CPG, Healthcare, Education, and Civic, we believe we face more competition from those who offer some, but not all, portions of a design-build facility solution but also those who employ the design-build methodology. We believe we compete successfully here because while the overall design-build projects come at higher revenues and margin dollars, the projects from non-CEA on which we typically engage are of a size that we addedbelieve is smaller than our design-build competitors are set up to take on. In addition, the majority of our non-CEA client base is developed from long-term relationships that provide our Company with a strategic advantage.

Regulation

As it relates to our business

plan in 2017 and focusing on bringing more intellectual property (“IP”) in-house. We are focused on integrating technologies including high density wireless sensors, machine learning, and artificial intelligence into our product offerings. We intend to diversify our sector sales strategy by targeting traditional horticulture operators with our service and systems to companies involved in growing herbs, microgreens, leafy greens and lettuce, strawberries, and vine crops including tomatoes, cucumbers, chilies and peppers. The technologies we have developed, deployed, and in continuous innovation are described below as Soleil® 360, Soleil® Sense and Soleil® Control, within the section on Product Branding and Strategy.Focusing on global agriculture and all high value crops, this technology is expected to allow us to offer our customers drastically better efficiencies while decreasing costs of production and increasing yields. There are no assurances this benefit will accrue.

Industry Partnerships

As a systems integrator we believe it is imperative for us to maintain close relationships with leading technology partners, and as such, we have attempted to integrate ourselvesconducted in the horticulture and agriculture industry, having formed strategic partnerships with a number of industry-leading solution providers like Edyza, Fluence Lighting, Priva, Argus, Total Grow Control, Netafim and Biobest Group NV. A brief description of these companies is as follows:

Edyza - Based in Irvine CA, Edyza is an advanced technology development company focusing on high-density IoT (Internet of Things), wireless networking and Cloud-based computing. Development includes proprietary designs of sensor nodes hardware and firmware, architecting wireless networks, and optimal use of network equipment such as Edge-servers, Gateways, wireless Hubs. Primary goals are to provide for high volume data acquisition and data visualizations, and software algorithm solutions.

Fluence Lighting -Fluence Bioengineering LED-based lighting systems are designed to provide high levels of photosynthetically active radiation (PAR) ideal for commercial cultivation and research applications from microgreens to cannabis. From sole-source indoor grow lighting to supplemental greenhouse lighting, Fluence custom tailors the light spectrum and form-factors to optimize plant growth and increase yields while consuming less energy and reducing operating costs versus legacy technologies. All of the LED-based grow lights are built in Austin, Texas. All grow lights are ETL listed and come with a 3-year or optional 5-year warranty.

Priva -Based in Ontario Canada, Priva provides building automation technology for the optimization of environmental conditions and process management for horticulture. Priva offers the best solutions for multiple indoor growing facilities from vertical farms to grow containers, warehouses to rooftop greenhouses. Priva’s solutions address water (hydroponics), climate & cultivation, and labor & management. Priva is a horticulture industry leader with more than 50 years of experience in horticulture developing algorithms for plant-based control strategies. These strategies create the best indoor growing solution when combined with Priva hardware and software modules.

Argus – Argus Controls, a division of Conviron, provides automated control systems for the horticulture and aquaculture industries. Argus systems provide three essential functions: 1) Fully integrated equipment control; 2) Advanced monitoring and alarms, and 3) Comprehensive data acquisition and management information. Argus capabilities include facilities automation and specialty monitoring and control applications to support the needs of cultivators. With over 30 years of leadership and innovation in control technology, Argus systems are used in horticulture and biotechnology research facilities, universities, aquaculture and aquaponics, and many other custom control applications at sites throughout the world.

Total Grow Control – Total Grow Control (TGC) provides advanced control systems for large scale indoor facilities. TGC provides cultivators with a control system that manages watering & nutrient delivery, lighting and environmental control. With internet-based monitoring, cultivators have access to up-to-the-minute operational performance as well as complete control via mobile devices.

Netafim - Netafim is recognized as the world leader in drip irrigation systems and agricultural projects. Since 1965, Israel based Netafim has been a pioneer in drippers, dripper lines, sprinklers and micro-emitters. Netafim also manufactures and distributes crop management technologies including monitoring and control systems, dosing systems, and crop management software.

Biobest Group NV –This company specializes in pollination and biological control. In 1987, Biobest was the first company to put bumblebees on the market. With thirty years of expertise, Biobest continues to deliver high quality products at all times by maintaining quality at every level: in the factory and during the transport in order to guarantee an optimal result in the crop. Biobest strongly focuses on research and development, providing tailored advice for crops worldwide.

Product Branding and Strategy; Soleil® 360 Ag-Tech Platform, Soleil® Sense and Soleil® Control Technologies

Soleil® 360 Ag-Tech Platform

Soleil Technologies is one of our divisions. The Soleil’s technology platform comprises a Cloud-based services back-end management and administration system, and an intuitive customer graphical user interface (GUI). It is built with the capability to handle over 22 billion records per annum, and several thousands of subscription-paying customers.

Soleil sensors are connected to the Soleil 360 Platform employing a robust, high performance, proprietary, tree-mesh wireless network topology. The user interface is designed for intuitive ease-of-use navigation of the customer’s systems, and as a universal user interface that will integrate all typically disparate systems within the grow environment.

The Soleil 360 business model is a subscription-based, high-value data services product. Hardware and network services remain the property of the company, and subscription fees provide for data hosting, data analysis, reporting and visualizations. The subscription sales contracts will increase adoption in the industry due to lower capital costs for acceptance and implementation by customers.

Standard and customized data visualizations are provided and available, and types and details are dependent on the subscribed level of service. Standard reporting consists of graphs and charts, and custom visualizations also include Augmented Reality and Mixed Reality data representations.

Soleil® Sense

The Soleil 360 technology platform utilizes Soleil Sensors to acquire data within the grow environment. Sensed data is transmitted over the wireless network and to Soleil 360 Cloud services. Data undergoes processing for reporting analysis and data visualizations important to the grower for actions and corrections to the grow environment equilibrium and balance. The current Soleil sensor product family includes sensing for temperature, humidity, carbon dioxide, organic compounds, barometric pressure, soil moisture, conductance (nutrients), and grow light output intensity. The combination of sensing with the environmental factors that are measured, are essential components to achieve the careful balance of a grow environment.

The platform leverages sensor data and machine-based learning in order to reduce operating costs and increase yields. Scalable to thousands of ultra-high-efficiency sensors, growers are able to access real-time, actionable data from anywhere in the world and use that insight to optimize growing conditions or address potential issues before they affect the crop.

Target applications goals of Soleil technologies are as complete solutions utilized by customers for increased operational efficiency, efficient use of hardware and network systems, reduced waste, all leading to improvements in profitability.

As water resources become scarce and transportation, energy, and labor costs rise,legalized cannabis-focused CEA (Controlled Environment Agriculture, the production of cannabis, vegetables, and flowers indoors) is quickly gaining popularity across the globe. The ability to precisely control environmental and plant conditions in a regulated, indoor environment helps optimize crop yield and quality. With just a few clicks, growers are able to assess temperature, moisture content, nutrient content, and pH—among other factors—in order to maintain ideal growing conditions. While existing substrate (soil) sensing technology is very costly to implement and is subject to scalability, wire, efficiency, and reliability constraints, the demand for real-time data is on the rise.

In addition to environmental and soil sensing, the same platform is being leveraged to economically monitor mission critical mechanical systems using vibration, energy consumption, and temperature. The sensors will alert cultivators to potential equipment failures like broken fans, clogged emitters, or inefficient HVAC systems.

Soleil® Control –Focus on Vertical Integration

As the cannabis industry consolidates and larger players enter, we believe that the ability to manage operations on a massive scale is a key differentiator that allows cultivators to drive higher yields at lower costs. Since our inception, our management has designed and engineered a multitude of projects that seek to leverage scale that also require complex and sophisticated climate and fertigation controls. Based on these insights and experiences we recognized that the current technology available in the agricultural space is not sufficient, scalable or flexible to meet the growing and complex demands of cultivators seeking to maximize yields in cannabis and modern horticulture and agriculture. In that light, we sought out new and highly sophisticated tools that brought together the latest in a broad spectrum of controls technologies.

In February 2018, we acquired a 5% interest in Total Grow Holdings, LLC ("TGH"), for $125,000. TGH was borne out of the highly complex petrochemical industry. This agreement also provides us with the right to purchase an additional5% on a fully diluted basis at the same valuation on or before August 31, 2018. We also have the right to name one of the three Board members to the company. The TGH technology and the management team experiences bring us the ability to meet our increasingly complex needs of supplying product and services to the larger sized cannabis grow operations that are being developed as the cannabis industry matures. TGH markets their products under the brand name Total Grow Control.

In the second quarter of 2018 we launched a co-branded product called Soleil® Control powered by Total Grow Control (TGC). The Soleil® Control platform combines climate, environmental and lighting controls.

In the second quarter of 2018 we also partnered with TGH to develop and launch a line of fertigation products in the form a Batch Fertigation System and an Inline Fertigation System. We believe these two systems position us to meet the needs of cultivators seeking to maintain strict nutrient recipe mixes in smaller controlled environment (Batch) and for those seeking to scale a fertigation system for more expansive cultivations (Inline.)

Soleil® Lighting Product Line

Over the course of the last several years as the cannabis market matured and grew more competitive, we witnessed downward pressure on the pricing and margins of grow light systems. In response to this evolution of the industry our lighting team sought a middle-market alternative to the high-end systems previously marketed. In 2016, we began manufacturing our own fixtures under the Soleil® brand. First to market was our 315W Ceramic Metal Halide system for vegetative growth stage. The following year, Soleil® introduced a 1000W Double-Ended High-Pressure Sodium (HPS) grow light system for the flower growth stage. This fixture features wireless control capability, dimming options, two reflector options (wide and narrow) to accommodate desired light distribution, and various hanging methods (greenhouse bracket, chain, unistrut bracket, custom brackets). Testing by a third-party lab has verified that the Soleil® HPS fixture delivers comparable intensity and light distribution relative to the most superior fixtures on the market. All Soleil® fixtures are ETL listed and assembled either at our facility in Colorado or at our partner’s facility in Asia.

While the prevalence of LED lighting is growing in the horticulture market, traditional HID Lighting still maintains the majority of the market share. Industry indicators suggest that trend will continue as LED systems are tested in facilities and the price of technology decreases to achieve a reasonable ROI.

Opti-Dura® Cultivation Product & Equipment Offering

Since commencement of adult-use legalization in 2014, the price of legal, commercially produced cannabis has dropped from highs of $5,000 per lb., to below $1,000 per lb. in some mature state markets. We expect this trend to continue as additional states adopt legal cannabis. We believe this is a positive develop as it drives out the black and grey markets.

With lower product prices there is increased interest in reducing cultivation costs through procurement of new products and equipment. We have created a high-quality, value-driven “house brand” of cultivation products and equipment. Our sourcing of cultivation products and equipment has been researched and developed by cultivators – those who know first-hand the quality and specifications desired by cultivators.

Our OPTI-DURA product line includes:

| · | OPTI-DURA Large-Scale Pesticide Applicators - Many cannabis cultivators have grown from small operations over the years. As they have grown, they have kept application processes that are out-of-date and inefficient for larger-scale operations. Our OPTI-DURA commercial pesticide applicators are made in America and built by farmers. They are a must-have for commercial cannabis facilities utilizing high pressures and special spray nozzles that help get under the leaves where pests like to hide. We are an exclusive distributor of the heaviest duty sprayers on the market. |

| · | OPTI-DURA Nutrients and Fertilizers – Currently in development, OPTI-DURA nutrients and fertilizers are expected to significantly reduce the price of these key components to cultivation. The nutrient and fertilizer lines will enable cultivators to “dial in” the needs of specific strains for high quality, consistent cannabis. |

SALES STRATEGY

“The urban-gro® Systems Integration Solution”

Our sales team is comprised of one Executive Vice President, five Regional Sales Directors, two Sales Associates, and one contract Sales Management Company. These “relationship ambassadors” are located across the U.S. and their sole responsibility is to find, build, and support customer relationships. The internal sales management team is compensated with a base salary and are additionally leveraged on a commission structure tied to quarterly revenues and gross profits.

When the technical sell window opens on a specific opportunity, we provide the appropriate technical expert whom is able to quickly and effectively explain a proposed solution to resolve customer’s specific challenges. While we only sell solutions, we believe the true value is in the expertise behind the product. Services like full fertigation and irrigation distribution design in CAD, light plan layout design, air flow design, air sanitizing and odor mitigation design, bench layout design, and complete system commissioning are all services that our customers pay us for.

We believe this technical sales process requires true segment, expertise, which we also believe has not been readily available to cannabis companies.As a systems integrator we employ a team of segment-specific educated and technical experts with deep experience in each of the five solution segments, including:

| · | Environmental Sense and Control |

| · | Fertigation and Irrigation Distribution Design and Engineering, |

| · | Integrated Pest Management (IPM) |

Our team includes highly talented and educated individuals including individuals with a Master’s degree in Business Administration, Plant Science, Horticulture, Biology, and post-secondary degrees in Environmental Science, Horticulture, Agricultural Engineering, and Electrical/Mechanical/Controls.We rely on these technical experts in their areas of expertise to find and vet the best-in-class solutions, and then educate and inform our customers on best solution use and techniques.

In addition to leads generated from the execution of our marketing strategy, for additional new business opportunities, we focus on referrals generated from our relationships with industry partners, and from contract referral agents. By offering a referral program to consultants whose primary business model is to help their clients set up cultivation facilities from the design stage through cultivation, we ensure access to a strong network of commercial cultivators.

MARKETING STRATEGY

urban-gro Brand Strategy:For the Life of the Grow

Our existing customer base consists of large-scale commercial cannabis cultivators located throughout the United States, Canada, and around the world. We provide customers with services and solutions throughout the life of their grow — from system design and engineering, through compliance and competitiveness—our team of scientists and experts understand the regulations challenges, and opportunities unique to cultivators. The following outlines the various stages of cultivation operation and defines the ways in which we serve the needs of cultivators and their stakeholders.

Early-Stage Engagement/ Planning & Building Consensus

| · | Cultivation Systems Expertise | Early-stage engagement with stakeholders builds consensus -- saving stakeholders money and time through smart, informed decision making. |

| · | Systems & Space Programming | Early-stage engagement with stakeholders builds consensus -- saving stakeholders money and time through smart, informed decisions. |

| · | Specification & Design | Guaranteed Design Professionally designed layouts for irrigation, climate control, benches, fans, and lighting ensure optimal space utilization and product performance. |

| · | Actionable Data | Soleil® Sense and Control Technology’s high-density wireless network provides real-time data-driven monitoring for a complete picture of a cultivation. |

| · | Durable Products | Fertigation systems, rolling bench systems, HAF / VAF fans and commercial sprayers are effective and efficient. |

Today’s cultivation systemsfor each region are extremely complex. Our team of project managers and engineers support the installation process by coordinating with a client’s engineers and stakeholders to avoid project bottlenecks and support construction trades. Our commissioning team ensure that the equipment is installed according to the design and operatesdetailed as committed.

In addition, our team of IPM technologists and pest control advisors understand the complex cannabis cultivation laws around the country and assists our clients in maintaining their grow in compliance with the evolving legislation.

Through our IPM (integrated pest management) subscription service, we work with cultivators to provide cutting-edge pesticide and biocontrol regimens that adhere to a client’s regulatory environment. Our procurement team leverages our national buying power to ensure the best product value. These are consumables that commercial cultivators purchase on a regular basis. They include pesticides, nutrients and fertilizers and are paid for prior to ship or on terms for existing customers. Net 30-day terms are offered to existing customers and lines are increased according to account history.

Our Soleil® climate sensors and environmental controls offer real-time data to make informed decisions to optimize crop environments, preventing crop loss through actionable alerts and programmed responses to conditions.

We generate our profits based on the value we provide for design, engineering, and systems expertise. We begin projects by using a proprietary project estimation tool that inputs multiple variables about the size and complexity of a potential new facility or a retrofitted facility. The output of the tool estimates the dollar amount of design and engineering time, systems, materials, project management, and miscellaneous costs necessary to provide a system that meets the needs of the customer. Once the project estimate is determined, a design fee and project deposit are determined. The design fee is a function of the complexity of the controls system, the number of irrigation zones, types of nutrients used, and the number of individual plants that require individual irrigation. The project deposit is between 10% and 15% of total project cost and varies based complexity and type of systems.

When the customer approves the estimate and pays the respective fee and deposit, our designers and engineers begin configuring and customizing the system. When a final design is approved by the customer, we then determine a final cost for time and materials and provides a final quote to meet all specifications. We then collect an order deposit to begin the procurement process. Within two weeks of system readiness, we collect a final deposit from the customer. We then ship the final system to our customer. Once the system is installed by the customer’s chosen mechanical, electrical and plumbing contractors we dispatch an engineering team to commission the system.

To date, the cost to our customers for our systems have ranged between $75,000 and $2,500,000, depending upon depending on the size of cultivation, the complexity of systems, types, and the number of systems utilized from our product portfolio. We do not provide financing.

Subsequent Event

Effective March 7, 2019, we acquired 100% of the stock of Impact Engineering, Inc., a provider of mechanical and electrical engineering services. Since 2009, Impact has operated in the cannabis industry under the dba “Grow2Guys”. We issued an aggregate of 500,000 shares of our Common Stock in exchange for all of the issued and outstanding stock of Impact Engineering (hereinafter referred to as “Impact” or “Grow2Guys”).

We believe this acquisition will allow us to consolidate our internal fertigation design team with the Mechanical, Electrical, and Plumbing design team of Impact. The consolidation of this group allows us the opportunity to continue to deliver integrated designs for all of the key systems in a large, commercial grow. With the ability to have Professionally Engineered (PE) stamping to all of our designs, this solution will also bring considerable cost reduction opportunities to our customers.

Grow2Guys has provided full-service mechanical, electrical, and plumbing (MEP) engineering services for commercial owners since 1982. Its services include:

| · | HVAC engineering and design; |

| · | plumbing engineering and design; |

| · | electrical engineering and design; and |

| · | documentation for the building permits necessary to obtain Certificate of Occupancy. |

Impact has provided design and engineering services for over 300 cannabis related facilities across North America, including cultivation and extraction facilities, dispensaries, and MIP kitchens. The firm’s customer base includes U.S. and Canadian single facility owners and multi-state operators with cultivation facilities ranging from 5,000 square feet to over 200,000 square feet. With this industry-specific experience, Impact has developed significant expertise in cannabis facility design and engineering, which we believe compliments our current operations. Impact is licensed to provide professional engineering services and stamp drawings in 47 states.

During each of its past two fiscal years Impact generated revenues in excess of $700,000, with 5 figure net profits in each year. Management expects that this accretive acquisition will have an immediate positive impact on our revenues and favorably impact our goal of attaining profitability in the near future.

As a result of the acquisition, Impact is now a wholly-owned subsidiary of our Company, allowing us to engage with cultivators earlier in the design process. While no assurances can be provided, we believe that this avenue for early engagement will support our continued growth in the cannabis sector, providing facility design, products, solutions, and agricultural technology. Through the acquisition of Impact we expect to expand our cultivation system design operations which, together with our full-service MEP engineering services, should allow us to effectively engage customers much earlier during the building design stage. Our firms’ combined experience allows us to now offer the market a united team highly experienced in the end-to-end design and delivery of optimized cultivation systems.

Management believes the acquisition of Impact will improve our ability to better serve our current and future customer base by expanding on the fully integrated products and services that we currently offer. While we have acquired Impact for coordinated building and cultivations systems design, we intend to continue to expand our current relationships, as well as to develop new relationships with regional MEP engineering firms in other regions throughout North America.

With the addition of the Impact team our number of employees expands with the addition of five full-time employees, including 37-year mechanical engineering veteran and founder of Impact, Brian Zimmerman, who is a licensed professional engineer (PE). Other added positions include a project manager and three mechanical designers. As part of the terms of the acquisition we entered into an employment agreement with Mr. Zimmerman, who shall remain as the President of Impact. Impact will operate at our downtown Denver offices located at WeWork, The Lab, 4th floor, Room 4A, 2420 17th St., Denver, CO 80202.

Growth by Acquisitions

As discussed above, our management is always aware of other related companies and how they may positively impact our business. We have already consummated two acquisitions and intend to continue to engage in what we believe to be synergistic acquisitions or joint ventures with unrelated companies that we believe will enhance our business plan. Ultimately, our intent is to become a national or internationally branded cultivation company. One of the principal reasons why we have elected to become a reporting, trading company is to allow us to utilize our securities as compensation for these potential acquisitions. There are no assurances we will become a reporting, trading company or if we are so successful, that we will be able to consummate additional acquisitions using our securities as consideration, or at all.

There are numerous things that will need to occur in order to allow us to implement this aspect of our business plan and there are no assurances that any of these developments will occur, or if they do occur, that we will be successful in fully implementing our plan. Among other things, the most important developments that need to occur include the legalization and commercialization of marijuana in the United States Until this occurs, we will be unable to fully integrate all aspects of the marijuana industry under our corporate umbrella.