We file or furnish annual, quarterly and current reports, proxy statements and other documents with the SEC under the Exchange Act. The SEC also maintains an internet website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers, including us, that file electronically with the SEC.

We also make available free of charge through our website, www.libertyfrac.com, electronic copies of certain documents that we file with the SEC, including our Annual Reportsannual reports on Form 10-K, Quarterly Reportsquarterly reports on Form 10-Q, Current Reportscurrent reports on

Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Item 1A. Risk Factors

Described below are certain risks that we believe apply to our business and the industry in which we operate. You should carefully consider each of the following risk factorsrisks described below in conjunction with other information including the financial statements and related notes provided in this Annual Report on Form 10-K and in our other public disclosures. The risks described below highlight potential events, trends or other circumstances that could adversely affect our business, financial condition, results of operations, cash flows, liquidity or access to sources of financing, and consequently, the market value of our Class A Common Stock. These risks could cause our future results to differ materially from historical results and from guidance we may provide regarding our expectations of future financial performance. The risks described below are those that we have identified as material and is not an exhaustive list of all the risks we face. There may be other risks that we haveand uncertainties not identifiedcurrently known to us or that we have deemedcurrently deem to be immaterial.immaterial which may also materially and adversely affect our business operations in the future. Please refer to the explanation of the qualifications and limitation on forward-looking statements set forth on page ii hereof.

Risks Related to Our Businessthe COVID-19 Pandemic

The COVID-19 pandemic significantly reduced demand for our services, and had, and may in the future have, a material adverse effect on our operations, business and financial results.

We face risks related to public health crises, including the ongoing COVID-19 pandemic. Many of the COVID-19 precautions taken by governments and businesses, including travel bans, prohibitions on group events and gatherings, shutdowns of certain businesses, curfews and shelter-in-place orders that were enacted in 2020 have been lifted or reduced. However, during 2020 these actions resulted in a significant and swift reduction in international and U.S. economic activity. The collapse in the demand for oil during 2020 caused by this unprecedented global health and economic crisis, coupled with an oil oversupply, had a material adverse impact on the demand for our services and on our financial condition, results of operations and cash flows. Additionally, the COVID-19 pandemic could worsen despite the increased availability of vaccines in certain jurisdictions, including as a result of the emergence of more infectious strains of the virus, vaccine hesitancy or increased business and social activities, which may cause governmental authorities to reconsider restrictions on business and social activities.

We are closely monitoring the continuing effects of the pandemic on our customers, operations, and employees. During 2021, oil demand and the demand for our services recovered from the lows experienced during the onset of the pandemic. The extent to which our operating and financial results will be affected by COVID-19 in the future will depend on various factors and consequences, such as the ultimate duration and scope of the pandemic, any additional actions by businesses and governments in response to the pandemic, and the speed and effectiveness of responses to combat the virus. COVID-19, and the volatile regional and global economic conditions stemming from the pandemic, could also aggravate the other risk factors that we identify herein. COVID-19 may also materially adversely affect our operating and financial results in a manner that is not currently known to us or that we do not currently consider presenting significant risks to us.

We cannot predict the ultimate duration or scope of the COVID-19 pandemic. Accordingly, if the pandemic worsens or if actions taken by governments and businesses in response to the pandemic in 2020 are re-enacted, the demand for our services may fall again, which would have a material adverse impact on our financial condition, results of operations and cash flows.

Potential future vaccine mandates for employers could have a material adverse impact on our business and results of operations.

On September 9, 2021, President Biden announced plans for the federal Occupational Safety and Health Administration (“OSHA”) to issue an Emergency Temporary Standard (“ETS”) mandating that all employers with more than 100 employees ensure their workers are either fully vaccinated against COVID-19 or produce, on a weekly basis, a negative COVID-19 test (the “Vaccine Mandate”). OSHA issued the ETS on November 4, 2021, requiring covered employers to comply with the Vaccine Mandate beginning with January 4, 2022 or face substantial penalties for non-compliance. The U.S. Supreme Court issued a stay on the Vaccine Mandate on January 13, 2022, and OSHA thereafter withdrew the ETS. It is possible that future vaccine mandates may be announced by the federal, state or local jurisdictions in which we operate. Although it is not possible to predict with certainty the impact of these measures on our business and workforce, these requirements may result in attrition, including attrition of skilled labor, and difficulty securing future labor needs, which could have a material adverse effect on our business, financial condition and results of operations.

Risks Related to the OneStim Acquisition

The Company's results may suffer if it does not effectively manage its expanded operations following the OneStim Acquisition.

Since the OneStim Acquisition, the size of the Company’s business has increased significantly. In addition, we now own and operate two sand mines. While we have retained qualified personnel to operate the mines, we have not undertaken mining operations in the past. The Company’s future success will depend, in part, on the Company’s ability to manage this expanded business, which poses numerous risks and uncertainties.

The Schlumberger Parties have significant influence over us.

As of February 18, 2022, Schlumberger owned approximately 30.5% of the outstanding shares of Common Stock. As long as Schlumberger owns or controls a significant percentage of the Company’s outstanding voting power, they will have the ability to significantly influence corporate actions requiring stockholder approval, including the election and removal of directors, any amendment to the Company’s certificate of incorporation or bylaws, or the approval of any merger or other significant corporate transaction, including a sale of substantially all of the Company’s assets. Schlumberger’s influence over our management could have the effect of delaying or preventing a change in control or otherwise discouraging a potential acquirer from attempting to obtain control of us, which could cause the market price of the shares of Class A Common Stock to decline or prevent stockholders from realizing a premium over the market price for the shares of Class A Common Stock.

Pursuant to the Amended and Restated Stockholders Agreement, dated as of December 13, 2020, Schlumberger has designated two directors to the Company’s board of directors. Schlumberger’s right to designate directors to our Board is subject to the Schlumberger’s ownership percentage of the total outstanding shares of Common Stock. If Schlumberger and its affiliates collectively beneficially own: (a) 20% or greater of the outstanding shares of Common Stock, they will have the right to appoint two directors or (b) at least 10% but less than 20% of the outstanding shares of Common Stock, they will have the right to appoint one director.

Schlumberger’s interests may not align with the Company’s interests or the interests of the Company’s other stockholders.

Following the OneStim Acquisition, we expanded our operations to Canada and may be subject to increased business and economic risks.

The Company has historically owned and operated its assets exclusively within the United States. In connection with the OneStim Acquisition, we acquired certain Canadian assets and liabilities, which marked our entry into a new geographical territory where we had limited experience in owning and operating assets and providing our services. As a result, we are subject to a variety of risks inherent in doing business internationally, including: risks related to the legal and regulatory environment in foreign jurisdictions; fluctuations in currency exchange rates; complying with multiple tax jurisdictions; difficulties in staffing and managing international operations and the increased travel, infrastructure and compliance costs associated with international locations and employees; regulations that might add difficulties in repatriating cash earned outside the United States and otherwise preventing us from freely moving cash; complying with statutory equity requirements; and complying with the U.S. Foreign Corrupt Practices Act and the Corruption of Foreign Public Officials Act (Canada) and other similar laws in Canada. If we fail to manage our operations in Canada successfully, our business may suffer.

Risks Related to the Oil and Natural Gas Industry

Federal, state, local and other applicable legislative and regulatory initiatives relating to hydraulic fracturing may serve to limit future oil and natural gas E&P activities and could have a material adverse effect on our results of operations and business.

Various federal, state, local and other applicable legislative and regulatory initiatives have been, or could be undertaken which could result in additional requirements or restrictions being imposed on hydraulic fracturing operations. Currently, hydraulic fracturing is generally exempt from federal regulation under the Safe Drinking Water Act Underground Injection Control (the “SDWA UIC”) program and is typically regulated by state oil and gas commissions or similar agencies but increased scrutiny and regulation, by federal agencies does occur. For example, in late 2016, the EPA released a final report on the potential impacts of hydraulic fracturing on drinking water resources, concluding that “water cycle” activities associated with hydraulic fracturing may impact drinking water resources. Additionally, the EPA has asserted regulatory authority pursuant to the SDWA UIC program over hydraulic fracturing activities involving the use of diesel fuel in the fracturing fluid and issued guidance regarding the permitting of such activities. Furthermore, the U.S. Bureau of Land Management has previously published rules that established stringent standards relating to hydraulic fracturing on federal and Native American lands. Similarly, the EPA has adopted rules on the capture of methane and other emissions released during hydraulic fracturing. These rules have been the subject of ongoing legal challenges. In January 2021, President Biden issued an executive order that called for issuance of proposed rules by no later than September 2021 that would restore rules for methane standards applicable to new, modified, and reconstructed sources and establish new methane and volatile organic compound standards applicable to existing oil and gas operations, including the production, transmission, processing and storage segments. On November 2021, the EPA proposed such a rule. Such a rule could make it significantly more difficult and/or costly to drill and operate oil and gas wells. As a result, such rule, if adopted, could result in a decline in the completion of new oil and gas wells or the recompletion of existing wells, which could negatively impact the drilling programs of our customers and, consequently, delay, limit or reduce the demand for our services. In addition to federal regulatory actions, legislation has been introduced, but not enacted, in Congress to provide for further federal regulation of hydraulic fracturing and to require disclosure of the chemicals used in the hydraulic fracturing process.

Moreover, many states and local governments have adopted regulations that impose more stringent permitting, disclosure, disposal and well-construction requirements on hydraulic fracturing operations, including states where we or our customers operate, such as Texas, Colorado and North Dakota. States could also elect to place prohibitions on hydraulic fracturing, as several states have already done. In addition, some states have adopted broader sets of requirements related to oil and gas development more generally that could impact hydraulic fracturing activities. For example, in 2019 the Colorado legislature adopted SB 19-181, which gave greater regulatory authority to local jurisdictions and reoriented the mandate of the Colorado Oil and Gas Conservation Commission to place more emphasis on the protection of human health and the environment. In response, a reconstituted Colorado Oil and Gas Conservation Commission modified its rules to address the requirements of the legislation, adopting increased setback requirements, provisions for assessing alternative sites for well pads to minimize environmental impacts, and consideration to cumulative impacts, among other provisions. Environmental groups, local citizens groups and others continue to seek to use a variety of means to force action on additional restrictions on hydraulic fracturing and oil and gas development generally.

Additionally, in July 2021, a non-governmental organization issued a report that raised concerns that chemicals used in hydraulic fracturing could be within the class of chemicals known as per- and polyfluoroalkylated substances (“PFAS”) or precursors to such substances. PFAS is the subject of intense federal and state regulatory scrutiny. Should PFAS be in hydraulic fracturing chemicals, this could open up a new front for the regulation of hydraulic fracturing.

Some states in which we operate require the disclosure of some or all of the chemicals used in our hydraulic fracturing operations. Certain aspects of one or more of these chemicals may be considered proprietary by us or our chemical suppliers. Disclosure of our proprietary chemical information to third parties or to the public, even if inadvertent, could diminish the value of our trade secrets or those of the chemicals suppliers and could result in competitive harm to us, which could have an adverse impact on our business, financial condition, prospects and results of operations.

In recent years, there have been allegations that hydraulic fracturing may result in seismic activities. Although the extent of any correlation between hydraulic fracturing and seismic activity has been and remains the subject of studies and debate, some parties believe that there is a causal relationship. As a result, federal and state legislatures and agencies may seek to further regulate, restrict or prohibit hydraulic fracturing. Such actions could result in a decline in the completion of new oil and gas wells, which could negatively impact the drilling programs of our customers and, consequently, delay, limit or reduce the demand for our services.

Increased regulation and attention given to the hydraulic fracturing process could lead to greater opposition to, and litigation concerning, oil and natural gas production activities using hydraulic fracturing techniques. Additional legislation or regulation could also lead to operational delays for our customers or increased operating costs in the production of oil and natural gas, including from the developing shale plays, or could make it more difficult for (or could result in a prohibition for) us and our customers to perform hydraulic fracturing. The adoption of any additional laws or regulations regarding hydraulic fracturing or limitation in hydraulic fracturing could potentially cause a decrease in the completion of new oil and natural gas wells and an associated decrease in demand for our services and increased compliance costs and time. Such events could have a material adverse effect on our liquidity, consolidated results of operations, and consolidated financial condition.

Additionally, in January 2021, the U.S. Department of the Interior issued an order that effectively suspends new oil and gas leases and drilling permits on non-Indian federal lands and waters for a period of 60 days, but the suspension does not limit existing operations under valid leases. President Biden followed with an executive order that ordered the Secretary of the Interior to pause the issuance of new oil and gas leases on federal public lands and offshore waters pending completion of a comprehensive review of federal oil and gas permitting and leasing practices that take into consideration potential climate and other impacts associated with oil and gas activities. This order further directs agencies to identify fossil fuel subsidies provided by such agencies and take measures to ensure that federal funding is not directly subsidizing fossil fuels, with an objective of eliminating fossil fuel subsidies from federal budget requests beginning in 2022. This order is currently being challenged in court by industry groups.

Additional legislation, executive actions, regulations or other regulatory initiatives to limit, delay or prohibit hydraulic fracturing or other aspects of oil and gas development may be pursued. In the event that these or other new federal restrictions, delays or prohibitions relating to the hydraulic fracturing process are adopted in areas where we or our customers conduct business, we or our customers may incur additional costs or permitting requirements to comply with such federal requirements that may be significant and, in the case of our customers, also could result in added restrictions or delays in the pursuit of exploration, development, or production activities, which would in turn reduce the demand for our services and have a material adverse effect on our results of operations.

Our business depends on domestic capital spending by the oil and natural gas industry, and reductions in capital spending could have a material adverse effect on our liquidity, results of operations and financial condition.

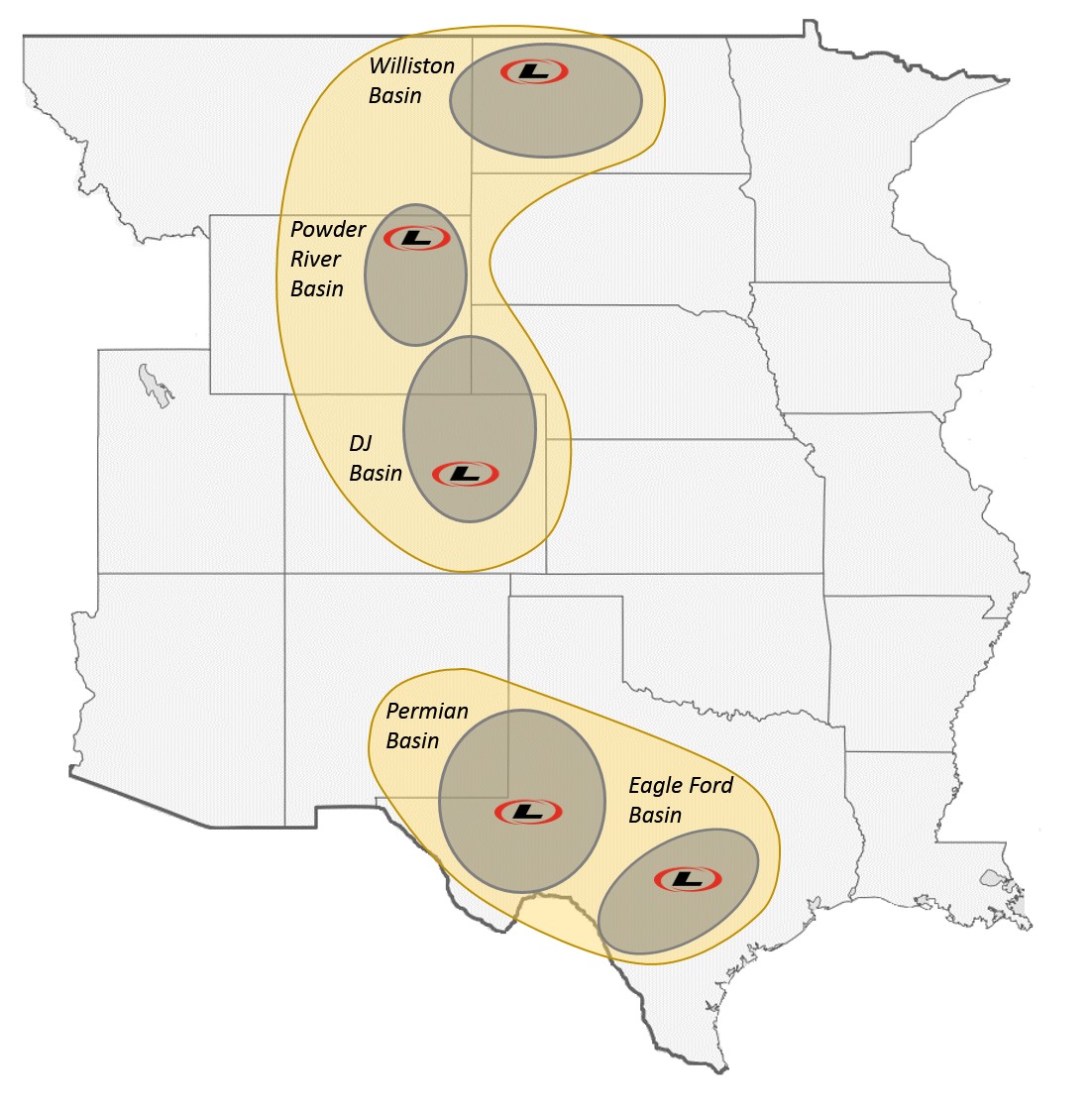

Our business is directly affected by our customers’ capital spending to explore for, develop and produce oil and natural gas in the United States. The significant decline in oilStates and natural gas prices that began in late 2014 caused a reduction in the exploration, development and production activities of most of our customers and their spending on our services. These cuts in spending curtailed drilling programs, which resulted in a reduction in the demand for our services, as well as the prices we can charge. These reductions negatively affected our revenue per average active fleet in 2015 and 2016. While industry conditions improved and activity levels increased during 2017 and part of 2018, there can be no assurance that these increased levels will be sustained.Canada. In addition, certain of our customers could become unable to pay their vendors and service providers, including us, as a result of a decline in commodity prices. Reduced discovery rates of new oil and natural gas reserves in our areas of operation as a result of decreased capital spending may also have a negative long-term impact on our business, even in an environment of stronger oil and natural gas prices. Any of these conditions or events could adversely affect our operating results. If the recent recovery and increasedcurrent activity levels do not continuedecrease or our customers fail to further increasereduce their capital spending, it could have a material adverse effect on our liquidity, results of operations and financial condition.

Industry conditions are influenced by numerous factors over which we have no control, including:

•expected economic returns to E&P companies of new well completions;

•domestic and foreign economic conditions and supply of and demand for oil and natural gas;

•the level of prices, and expectations about future prices, of oil and natural gas;

•the level of global oil and natural gas exploration and production;

•the level of domestic and global oil and natural gas inventories;

•the supply of and demand for hydraulic fracturing services and equipment in the United States;States and Canada;

•federal, tribal, state and local laws, regulations and taxes, including the policies of governments regarding hydraulic fracturing, and oil and natural gas exploration, development and production activities and the transportation of oil and gas by pipeline, as well as non-U.S. governmental regulations and taxes;

•governmental regulations, including the policies of governments regarding the exploration for and production and development of their oil and natural gas reserves;

•political and economic conditions in oil and natural gas producing countries;

•actions by the members of the Organization of Petroleum Exporting Countries and other oil exporting nations with respect to oil production levels and potential changes in such levels, including the failure of such countries to comply with production cuts announced in December 2018, to take effect at the beginning of 2019 and to last for six months;levels;

•global weather conditions and natural disasters;

•worldwide political, military and economic conditions;

•the cost of producing and delivering oil and natural gas;

•lead times associated with acquiring equipment and products and availability of qualified personnel;

•the discovery rates of new oil and natural gas reserves;

•the production decline rate of existing oil and gas wells;

•stockholder activism or activities by non-governmental organizations to limit certain sources of funding for the energy sector or to restrict the exploration, development, production and productiontransportation of oil and natural gas;

•the availability of water resources, suitable proppant and chemical additives in sufficient quantities for use in hydraulic fracturing fluids;

•advances in exploration, development and production technologies or in technologies affecting energy consumption;

•the potential accelerationavailability, proximity and capacity of developmentoil and natural gas pipelines and other transportation facilities;

•merger and divestiture activity among oil and natural gas producers;

•the price and availability of alternative fuels;fuels and energy sources; and

•uncertainty in capital and commodities markets and the ability of oil and natural gas companies to raise equity capital and debt financing.

The volatility of oil and natural gas prices may adversely affect the demand for our hydraulic fracturing services and negatively impact our results of operations.

The demand for our hydraulic fracturing services is primarily determined by current and anticipated oil and natural gas prices and the related levels of capital spending and drilling activity in the areas in which we have operations. Volatility or weakness in oil prices or natural gas prices (or the perception that oil prices or natural gas prices will decrease) affects the spending patterns of our customers and may result in the drilling of fewer new wells. This, in turn, could lead to lower demand for our services and may cause lower utilization of our assets. We have experienced, and may in the future experience significant fluctuations in operating results as a result of the reactions of our customers to changes in oil and natural gas prices. For example, prolonged low commodity prices experienced by the oil and natural gas industry beginning in late 2014 and uncertainty about future prices even when prices increased, combined with adverse changes in the capital and credit markets, caused many E&P companies to significantly reduce their capital budgets and drilling activity. This resulted in a significant decline in demand for oilfield services and adversely impacted the prices oilfield services companies could charge for their services.

Prices for oil and natural gas historically have been extremely volatile and are expected to continue to be volatile. During the past four years,year 2021, the posted West Texas Intermediate (“WTI”)WTI price for oil has ranged from a lowtraded at an average of $26.19$68.13 per barrel (“Bbl”) in February 2016, as compared to a highthe 2020 average of $77.41$39.16 per Bbl in June 2018. During 2018, WTI prices ranged from $44.48 to $77.41and the 2019 average of $56.99 per Bbl. The combined impact of the COVID-19 pandemic and the breakdown of OPEC+ production cut negotiations in Spring 2020 caused oil prices to drop to historical lows in April 2020. During the fourth quarter of 2021, WTI oil prices averaged $77.33 compared to $70.58 in the third quarter of 2021 and $42.52 in the fourth quarter of 2020. If the prices of oil and natural gas continue to beremain or become more volatile, our operations, financial condition, cash flows and level of expenditures may be materially and adversely affected.

We may be adversely affected by uncertainty in the global financial markets and the deterioration of the financial condition of our customers.

Our future results may be impacted by the uncertainty caused by an economic downturn, volatility or deterioration in the debt and equity capital markets, inflation, deflation or other adverse economic conditions that may negatively affect us or parties with whom we do business resulting in a reduction in our customers’ spending and their non-payment or inability to perform obligations owed to us, such as the failure of customers to honor their commitments or the failure of major suppliers to complete orders. Additionally, during times when the crude oil or natural gas markets weaken, our customers are more likely to experience financial difficulties, including being unable to access debt or equity financing, which could result in a reduction in our customers’ spending for our services. In addition, in the course of our business we hold accounts receivable from our customers. In the event of the financial distress or bankruptcy of a customer, we could lose all or a portion of such outstanding accounts receivable associated with that customer. Further, if a customer was to enter into bankruptcy, it could also result in the cancellation of all or a portion of our service contracts with such customer at significant expense or loss of expected revenues to us.

Our operations are subject to significant risks, some of which are beyond our control. These risks may be self-insured, or may not be fully covered under our insurance policies.

Our operations are subject to significant hazards often found in the oil and natural gas industry, such as, but not limited to, accidents, blowouts, explosions, craterings, fires, natural gas leaks, oil and produced water spills and releases of hydraulic fracturing fluids or other well fluids into the environment. These conditions can cause:

disruption in operations;

substantial repair or remediation costs;

personal injury or loss of human life;

significant damage to or destruction of property, and equipment;

environmental pollution, including groundwater contamination;

unusual or unexpected geological formations or pressures and industrial accidents;

impairment or suspension of operations; and

substantial revenue loss.

In addition, our operations are subject to, and exposed to, employee/employer liabilities and risks such as wrongful termination, discrimination, labor organizing, retaliation claims and general human resource related matters.

The occurrence of a significant event or adverse claim in excess of the insurance coverage that we maintain or that is not covered by insurance could have a material adverse effect on our liquidity, combined results of operations and combined financial condition. Claims for loss of oil and natural gas production and damage to formations can occur in the well services industry. Litigation arising from a catastrophic occurrence at a location where our equipment and services are being used may result in our being named as a defendant in lawsuits asserting large claims.

We do not have insurance against all foreseeable risks, either because insurance is not available or because of the high premium costs. The occurrence of an event not fully insured against or the failure of an insurer to meet its insurance obligations could result in substantial losses. In addition, we may not be able to maintain adequate insurance in the future at rates we consider reasonable. Insurance may not be available to cover any or all of the risks to which we are subject, or, even if available, it may be inadequate, or insurance premiums or other costs could rise significantly in the future so as to make such insurance prohibitively expensive.

Reliance upon a few large customers may adversely affect our revenue and operating results.

Our top five customers represented approximately 42%, 53%, and 59% of our consolidated and combined revenue for the years ended December 31, 2018, 2017 and 2016, respectively. It is likely that we will continue to derive a significant portion of our revenue from a relatively small number of customers in the future. If a major customer fails to pay us, revenue would be impacted and our operating results and financial condition could be materially harmed. Additionally, if we were to lose any material customer, we may not be able to redeploy our equipment at similar utilization or pricing levels or within a short period of time and such loss could have a material adverse effect on our business until the equipment is redeployed at similar utilization or pricing levels.

We are exposed to the credit risk of our customers, and any material nonpayment or nonperformance by our customers could adversely affect our financial results.

We are subject to the risk of loss resulting from nonpayment or nonperformance by our customers, many of whose operations are concentrated solely in the domestic E&P industry which, as described above, is subject to volatility and, therefore, credit risk. Our credit procedures and policies may not be adequate to fully reduce customer credit risk. If we are unable to adequately assess the creditworthiness of existing or future customers or unanticipated deterioration in their creditworthiness, any resulting increase in nonpayment or nonperformance by them and our inability to re-market or otherwise use our equipment could have a material adverse effect on our business, financial condition, prospects or results of operations.

We face intense competition that may cause us to lose market share and could negatively affect our ability to market our services and expand our operations.

The oilfield services business is highly competitive. Some of our competitors have a broader geographic scope, greater financial and other resources, or other cost efficiencies. Additionally, there may be new companies that enter our business, or re-enter our business with significantly reduced indebtedness following emergence from bankruptcy, or our existing and potential customers may develop their own hydraulic fracturing business, or direct source proppant, negatively affecting our revenue and potentially resulting in shortfall obligations under some of our supply agreements. Our ability to maintain current revenue and cash flows, and our ability to market our services and expand our operations, could be adversely affected by the activities of our competitors and our customers. If our competitors substantially increase the resources they devote to the development and marketing of competitive services or substantially decrease the prices at which they offer their services, we may be unable to effectively compete. All of these competitive pressures could have a material adverse effect on our business, results of operations and financial condition. Some of our larger competitors provide a broader range of services on a regional, national or worldwide basis. These companies may have a greater ability to continue oilfield service activities during periods of low commodity prices and to absorb the burden of present and future federal, tribal, state, local and other laws and regulations.

Any inability to compete effectively with larger companies could have a material adverse impact on our financial condition and results of operations.

Our assets require significant amounts of capital for maintenance, upgrades and refurbishment and may require significant capital expenditures for new equipment.

Our hydraulic fracturing fleets and other completion service-related equipment require significant capital investment in maintenance, upgrades and refurbishment to maintain their competitiveness. For example, since January 1, 2011, we have deployed 22 hydraulic fracturing fleets to service customers at a total cost to deploy of approximately $838.1 million. The costs of components and labor have increased in the past and may increase in the future with increases in demand, which will require us to incur additional costs to upgrade any fleets we may acquire in the future. Our fleets and other equipment typically do not generate revenue while they are undergoing maintenance, upgrades or refurbishment. Any maintenance, upgrade or refurbishment project for our assets could increase our indebtedness or reduce cash available for other opportunities. Furthermore, such projects may require proportionally greater capital investments as a percentage of total asset value, which may make such projects difficult to finance on acceptable terms. To the extent we are unable to fund such projects, we may have less equipment available for service or our equipment may not be attractive to potential or current customers. Additionally, competition or advances in technology within our industry may require us to update or replace existing fleets or build or acquire new fleets. Such demands on our capital or reductions in demand for our hydraulic fracturing fleets and the increase in cost of labor necessary for such maintenance and improvement, in each case, could have a material adverse effect on our business, liquidity position, financial condition, prospects and results of operations and may increase our costs.

We rely on a limited number of third parties for proppant and chemical additives, and delays in deliveries of such materials, increases in the cost of such materials or our contractual obligations to pay for materials that we ultimately do not require could harm our business, results of operations and financial condition.

We have established relationships with a limited number of suppliers of our raw materials (such as proppant and chemical additives). Should any of our current suppliers be unable to provide the necessary materials or otherwise fail to deliver the materials in a timely manner and in the quantities required, any resulting delays in the provision of services could have a material adverse effect on our business, results of operations and financial condition. Additionally, increasing costs of such materials may negatively impact demand for our services or the profitability of our business operations. In the past, our industry faced sporadic proppant shortages associated with hydraulic fracturing operations requiring work stoppages, which are believed to have adversely impacted the operating results of several competitors. We may not be able to mitigate any future shortages of materials, including proppant. Furthermore, to the extent our contracts require us to purchase more materials, including proppant, than we ultimately require, we may be forced to pay for the excess amount under “take or pay” contract provisions.

We currently rely on one assembler and a limited number of suppliers for major equipment to both build new fleets and upgrade any fleets we acquire to our custom design, and our reliance on these vendors exposes us to risks including price and timing of delivery.

We currently rely on one assembler and a limited number of suppliers for major equipment to both build our new fleets and upgrade any fleets we may acquire to our custom design. If demand for hydraulic fracturing fleets or the components necessary to build such fleets increases or these vendors face financial distress or bankruptcy, these vendors may not be able to provide the new or upgraded fleets on schedule or at the current price. If this were to occur, we could be required to seek another assembler or other suppliers for major equipment to build or upgrade our fleets, which may adversely affect our revenues or increase our costs.

Interruptions of service on the rail lines by which we receive proppant could adversely affect our results of operations.

We receive a significant portion of the proppant used in our hydraulic fracturing services by rail. Rail operations are subject to various risks that may result in a delay or lack of service, including lack of available capacity, mechanical problems, extreme weather conditions, work stoppages, labor strikes, terrorist attacks and operating hazards. Additionally, if we increase the amount of proppant we require for delivery of our services, we may face difficulty in securing rail transportation for such additional amount of proppant. Any delay or failure in the rail services on which we rely could have a material adverse effect on our financial condition and results of operations.

Delays or restrictions in obtaining permits by us for our operations or by our customers for their operations could impair our business.

In most states, our operations and the operations of our oil and natural gas producing customers require permits from one or more governmental agencies in order to perform drilling and completion activities, secure water rights, or other regulated activities. Such permits are typically issued by state agencies, but federal and local governmental permits may also be required.

The requirements for such permits vary depending on the location where such regulated activities will be conducted. As with all governmental permitting processes, there is a degree of uncertainty as to whether a permit will be granted, the time it will take for a permit to be issued, and the conditions that may be imposed in connection with the granting of the permit. In addition, some of our customers’ drilling and completion activities may take place on federal land or Native American lands, requiring leases and other approvals from the federal government or Native American tribes to conduct such drilling and completion activities or other regulated activities. Under certain circumstances, federal agencies may cancel proposed leases for federal lands and refuse to grant or delay required approvals. Therefore, our customers’ operations in certain areas of the United States may be interrupted or suspended for varying lengths of time, causing a loss of revenue to us and adversely affecting our results of operations in support of those customers.

Federal or state legislative In January 2021, the U.S. Department of the Interior issued an order that effectively suspends new oil and regulatory initiatives relatedgas leases and drilling permits on non-Indian federal lands and waters for a period of 60 days, but the suspension does not limit existing operations under valid leases. President Biden followed with an executive order that ordered the Secretary of the Interior to induced seismicity could result in operating restrictions or delays inpause the drillingissuance of new oil and gas leases on federal public lands and offshore waters pending completion of a comprehensive review of federal oil and gas permitting and leasing practices that take into consideration potential climate and other impacts associated with oil and gas activities. This order further directs agencies to identify fossil fuel subsidies provided by such agencies and take measures to ensure that federal funding is not directly subsidizing fossil fuels, with an objective of eliminating fossil fuel subsidies from federal budget requests beginning in 2022. This order is currently being challenged by industry groups.

Oil and natural gas companies’ operations using hydraulic fracturing are substantially dependent on the availability of water. Restrictions on the ability to obtain water for E&P activities and the disposal of flowback and produced water may impact their operations and have a corresponding adverse effect on our business, results of operations and financial condition.

Water is an essential component of shale oil and natural gas wells that may reduce demand for our servicesproduction during both the drilling and could have a material adverse effect on our liquidity, combined results of operations and combined financial condition.

hydraulic fracturing processes. Our oil and natural gas producing customers disposecustomers’ access to water to be used in these processes may be adversely affected due to reasons such as periods of flowback and producedextended drought, privatization, third party competition for water in localized areas or certain other oilfield fluids gathered from oil and natural gas producing operations in accordance with permits issued by government authorities overseeing such disposal activities. While these permits are issued pursuantthe implementation of local or state governmental programs to existing laws and regulations, these legal requirements aremonitor or restrict the beneficial use of water subject to change based on concerns of the public or governmental authorities regarding such disposal activities. One such concern relatestheir jurisdiction for hydraulic fracturing to seismic events near underground disposal wells used for the disposal by injection of flowback and producedassure adequate local water or certain other oilfield fluids resulting from oil and natural gas activities. In 2016, the United States Geological Survey identified six states with the most significant hazards from seismicity events suspected of having been induced by injection of oilfield fluids into underground disposal wells, including Oklahoma, Kansas, Texas, Colorado, New Mexico, and Arkansas. In response to concerns regarding the use of underground disposal wells and thesupplies. The occurrence of seismic events, regulators in some states have imposed,these or are considering imposing, additional requirements in the permitting of produced water disposal wells or otherwise to assess any relationship between seismicity and the use of such wells. For example, Oklahoma has issued rules for produced water disposal wells that imposed certain permitting and operating restrictions and reporting requirements on disposal wells in proximity to faults and also, from time to time, has developed and implemented plans directing certain wells where seismic incidents have occurred to restrict or suspend disposal well operations. The Texas Railroad Commission has adopted similar rules. In late 2016, the Oil and Gas Conservation Division of the OCC and the Oklahoma Geological Survey released well completion seismicity guidance, which requires operators to take certain prescriptive actions, including an operator’s planned mitigation practices, following certain unusual seismic activity within 1.25 miles of hydraulic fracturing operations. In recent years, including during 2018, the OCC’s Oil and Gas Conservation Division issued orders limiting future increases in the volume of oil and natural gas produced water injected belowground into the Arbuckle formation in an effort to reduce the number of earthquakes in the state. Another consequence of seismic eventsdevelopments may be lawsuits alleging that disposal well operations have caused damage to neighboring properties or otherwise violated state and federal rules regulating waste disposal. These developments could result in additional regulationlimitations being placed on allocations of water due to needs by third party businesses with more senior contractual or permitting rights to the water. Our customers’ inability to locate or contractually acquire and sustain the receipt of sufficient amounts of water could adversely impact their E&P operations and have a corresponding adverse effect on our business, results of operations and financial condition.

Moreover, the imposition of new environmental regulations and other regulatory initiatives could include increased restrictions on the use of injection wells by our customersproducing customers’ ability to dispose of flowback and produced water and certain other oilfield fluids. Increased regulation and attention given to seismicity events suspected of having been induced by injection of oilfield fluids into underground disposal wells also could lead to greater opposition to, and litigation concerning, oil and natural gas activities utilizing injection wells for waste disposal. Any of these developments may resultgenerated in our customers having to limit disposal well volumes, disposal rates or locations, or require our customers or third party disposal well operators that are used to dispose of customers’ produced water to shut down disposal wells, which developments could adversely affect our customers’ business and result in a corresponding decrease in the need for our services, which could have a material adverse effect on our business, financial condition, and results of operations.

Federal, state and local legislative and regulatory initiatives relating to hydraulic fracturing as well as governmental reviews of such activities may serve to limit future oilor other fluids resulting from E&P activities. Applicable laws impose restrictions and natural gas exploration and production activities and could have a material adverse effect on our results of operations and business.

Currently, hydraulic fracturing is generally exempt from regulation under the SDWA UIC program and is typically regulated by state oil and gas commissions or similar agencies. However, federal agencies have conducted investigations or asserted regulatory authority over certain aspects of the process. For example, in late 2016, the EPA released its final report on the potential impacts of hydraulic fracturing on drinking water resources, concluding that “water cycle” activities associated with hydraulic fracturing may impact drinking water resources under certain circumstances. Additionally, the EPA has asserted regulatory authority pursuant to the SDWA’s UIC program over hydraulic fracturing activities involving the use of diesel and issued guidance covering such activities, as well as published an Advance Notice of Proposed Rulemakingstrict controls regarding Toxic Substances Control Act reporting of the chemical substances and mixtures used in hydraulic fracturing. The EPA also published final CAA regulations in 2012 and 2016 governing performance standards, including standards for the capture of emissions released during oil and natural gas hydraulic fracturing. Moreover, in 2016, the EPA published an effluent limit guideline final

rule prohibiting the discharge of produced waterpollutants into waters of the United States and require that permits or other approvals be obtained to discharge pollutants to such waters. Additionally, in 2016 EPA engaged a pretreatment standard that prohibits the discharge of wastewater pollutants from onshore unconventional oil and natural gas extraction facilities to publicly owned wastewater treatment plants. The BLM publishedworks. Further, regulations implemented under both federal and state laws prohibit the discharge of produced water and sand, drilling fluids, drill cuttings and certain other substances related to the natural gas and oil industry into coastal waters. These laws provide for civil, criminal and administrative penalties for any unauthorized discharges of pollutants and unauthorized discharges of reportable quantities of oil and hazardous substances. Compliance with current and future environmental regulations and permit requirements governing the withdrawal, storage and use of surface water or groundwater necessary for hydraulic fracturing of wells and any inability to secure transportation and access to disposal wells with sufficient capacity to accept all of our flowback and produced water on economic terms may increase our customers’ operating costs and could result in restrictions, delays, or cancellations of our customers’ operations, the extent of which cannot be predicted.

Our operations are subject to risks associated with climate change and potential regulatory programs meant to address climate change; these programs may impact or limit our business plans, result in significant expenditures or reduce demand for our services and reduce our revenues.

Climate change continues to be the focus of political and societal attention. Numerous proposals have been made and are likely to be forthcoming on the international, national, regional, state and local levels to reduce GHG emissions. These efforts have included or may include cap-and-trade programs, carbon taxes, GHG reporting obligations and other regulatory programs that limit or require control of GHG’s from certain sources. Upon taking office, President Biden issued several Executive Orders relating climate change, envisioning a final rule“government-wide approach” to climate policy. At the 26th Conference of the Parties of the United Nations Framework Convention on Climate Change held in 2015October and November 2021, President Biden announced a commitment to significantly reduce GHG’s and transition the U.S. economy to net-zero carbon by 2050. Programs addressing climate change may limit the ability to produce crude oil and natural gas, require stricter limits on the release of methane or other GHGs, increase reporting and/or other compliance obligations associated with GHG emissions, limit the ability to explore in new areas, limit the construction of pipelines and related equipment or may make it more expensive to produce, any of which may decrease the demand for our services and our revenues. Related, President Biden has called on OPEC+ to produce more oil, which if heeded could result in lower oil and gas prices and lower domestic production. As of February 2, 2022, OPEC+ authorized a 400,000-barrel-per-day increase for March 2022.

Incentives to conserve energy or use alternative energy sources, which can be part of climate change programs, may increase the competitiveness of alternative energy sources (such as wind, solar, geothermal, tidal and biofuels) or increase the focus on reducing the use of combustion engines in transportation (such as governmental mandates that establishedban the sale of new gasoline-powered automobiles). These actions could, in turn, reduce demand for hydrocarbons and therefore for our services, which would lead to a reduction in our revenues.

An increased societal and governmental focus on ESG and climate change issues may adversely impact our business, impact our access to investors and financing, and decrease demand for our services.

An increased expectation that companies address environmental (including climate change), social and governance (“ESG”) matters may have a myriad of impacts on our business. Some investors and lenders are factoring these issues into investment and financing decisions. They may rely upon companies that assign ratings to a company’s ESG performance. Unfavorable ESG ratings, as well as recent activism around fossil fuels, may dissuade investors or more stringent standards relatinglenders from us and toward other industries, which could negatively impact our stock price or our access to capital. Additionally, some potential sources of investment or financing have announced an intention to avoid or limit investment in companies that engage in hydraulic fracturing. For example, in 2020, Deutsche Bank announced that it would no longer finance oil and gas projects that use hydraulic fracturing in countries with scarce water supplies, and BlackRock affirmed its commitment to divest from investments in fossil fuels due to concerns over climate change. In 2021, BlackRock announced a continuing commitment to the goal of net zero GHG emissions by 2050 or sooner, and noted that key actions for 2021 included asking companies to disclose a business plan aligned with the goal of achieving net zero global GHG emissions by 2050 and using “investment stewardship” to ensure companies its clients invest in are mitigating climate risk and considering opportunities presented by the net zero transition. While a substantial number of major banks and financing sources remain active in investments related to hydraulic fracturing, on federalit is possible that the investment avoidance or limitation theme could expand in the future and Native American lands, but the BLM rescinded the 2015 rule in late 2017; however, litigation challenging the BLM’s decisionrestrict access to rescind the 2015 rule is pending in federal district court. Fromcapital for companies like us.

Moreover, while we have and may continue to create and publish voluntary disclosures regarding ESG matters from time to time, legislation has been introduced, but not enacted, in Congress to provide for federal regulation of hydraulic fracturing and to require disclosuremany of the chemicals usedstatements in the hydraulic fracturing process. In the event that new federal restrictions relating to the hydraulic fracturing processthose voluntary disclosures are adopted in areas where we or our customers conduct business, we or our customers may incur additional costs or permitting requirements to comply with such federal requirementsbased on hypothetical expectations and assumptions that may or may not be significantrepresentative of current or actual risks or events or forecasts of expected risks or events, including the costs associated therewith. Such expectations and inassumptions are necessarily uncertain and may be prone to error or subject to

misinterpretation given the caselong timelines involved and the lack of an established single approach to identifying, measuring and reporting on many ESG matters.

In addition, ESG and climate change issues may cause consumer preference to shift toward other alternative sources of energy, lowering demand for oil and natural gas and consequently lowering demand for our customers, also could result in added restrictions, delaysservices. In some areas these concerns have caused governments to adopt or curtailments inconsider adopting regulations to transition to a lower-carbon economy. These measures may include adoption of cap-and-trade programs, carbon taxes, increased efficiency standards, prohibitions on the pursuitmanufacture of exploration, development,certain types of equipment (such as new automobiles with internal combustion engines), and requirements for the use of alternate energy sources such as wind or production activities, which would in turnsolar. These types of programs may reduce the demand for oil and natural gas and consequently the demand for our services.

Moreover,

Approaches to climate change and a transition to a lower-carbon economy, including government regulation, company policies, and consumer behavior, are continuously evolving. At this time, we cannot predict how such approaches may develop or otherwise reasonably or reliably estimate their impact on our financial condition, results of operations and ability to compete. However, any long-term material adverse effect on the oil and gas industry may adversely affect our financial condition, results of operations and cash flows.

Our operations are subject to significant risks, some states and local governments have adopted, and other governmental entitiesof which are considering adopting, regulations that could impose more stringent permitting, disclosure and well-construction requirements on hydraulic fracturingbeyond our control. These risks may be self-insured, or may not be fully covered under our insurance policies.

Our operations including states where we or our customers operate. For example, Texas, Colorado and North Dakota among others have adopted regulations that impose new or more stringent permitting, disclosure, disposal, and well construction requirements on hydraulic fracturing operations. States could also electare subject to prohibit high volume hydraulic fracturing altogether, followingsignificant hazards often found in the approach taken by the State of New York. Local land use restrictions, such as city ordinances, may also restrict drilling in general and/or hydraulic fracturing in particular.

Additionally, certain interest groups in Colorado opposed to oil and natural gas development generally,industry, such as, but not limited to, accidents, including accidents related to trucking operations provided in connection with our services, blowouts, explosions, craterings, fires, natural gas leaks, oil and produced water spills and releases of hydraulic fracturing fluids or other well fluids into the environment. These conditions can cause:

•disruption in particular, have from timeoperations;

•substantial repair or remediation costs;

•personal injury or loss of human life;

•significant damage to time advanced various options for ballot initiatives that, if approved, would revise either statutory law or the state constitutiondestruction of property, and equipment;

•environmental pollution, including groundwater contamination;

•unusual or unexpected geological formations or pressures and industrial accidents;

•impairment or suspension of operations; and

•substantial revenue loss.

In addition, our operations are subject to, and exposed to, employee/employer liabilities and risks such as wrongful termination, discrimination, labor organizing, retaliation claims and general human resource related matters.

The occurrence of a significant event or adverse claim in a manner that would effectively prohibit or make such exploration and production activities in the state more difficult or expensive in the future. For example, in eachexcess of the November 2014, 2016 and 2018 general election cycles, ballot initiatives have been pursued, with the 2018 initiative making the November 2018 ballot, seeking to increase setback distances between new oil and natural gas development and specific occupied structures and/insurance coverage that we maintain or certain environmentally sensitive or recreational areas that if adopted, may have had significant adverse impacts on new oil and natural gas developments in the state. However, in each election cycle, the ballot initiative either didis not secure a place on the general ballot or, as was the case in November 2018, was defeated. In the event that ballot initiatives or other regulatory programs arising out of protests or oppositioncovered by non-governmental organizations are adopted and result in more stringent limitations on the production and development of oil and natural gas in areas where we or our customers conduct operations, whether in Colorado or in another state, we may incur significant costs to comply with such requirements or our customers may experience restrictions, delays or curtailments in the permitting or pursuit of exploration, development, or production activities, which could reduce demand for our services. Such compliance costs or reduced demand for our services could have a material adverse effect on our business, prospects, results of operations, financial conditions, and liquidity.

Increased regulation and attention given to the hydraulic fracturing process could lead to greater opposition to, and litigation concerning, oil and natural gas production activities using hydraulic fracturing techniques. Additional legislation or regulation could also lead to operational delays for our customers or increased operating costs in the production of oil and natural gas, including from the developing shale plays, or could make it more difficult for us and our customers to perform hydraulic fracturing. The adoption of any federal, state or local laws or the implementation of regulations regarding hydraulic fracturing could potentially cause a decrease in the completion of new oil and natural gas wells and an associated decrease in demand for our services and increased compliance costs and time, whichinsurance could have a material adverse effect on our liquidity, consolidated results of operations and consolidated financial condition. Claims for loss of oil and natural gas production and damage to formations can occur in the well services industry. Litigation arising from a catastrophic occurrence at a location where our equipment and services are being used or trucking services provided in connection therewith may result in our being named as a defendant in lawsuits asserting large claims.

Changes

We do not have insurance against all foreseeable risks, either because insurance is not available or because of the high premium costs. The occurrence of an event not fully insured against or the failure of an insurer to meet its insurance obligations could result in transportation regulationssubstantial losses. In addition, we may increase ournot be able to maintain adequate insurance in the future at rates we consider reasonable. Insurance may not be available to cover any or all of the risks to which we are subject, or, even if available, it may be inadequate, or insurance premiums or other costs and negatively impactcould rise significantly in the future so as to make such insurance prohibitively expensive.

We could experience continued or increased severity of trucking related issues or trucking accidents, which could materially affect our results of operations.

Trucking services can be adversely impacted by traffic congestion, shortage of drivers and weather delays which could hinder our service levels. During 2021 and into 2022 there has been a shortage of available trucking services in the United States due to the industry not having enough qualified drivers, which has impacted our field operations at times. In addition, our field employees are generally required to have a commercial driver’s license (“CDL”) so they can drive trucks and move our frac pumps and other equipment from location to location. Obtaining employees with CDLs can be challenging during times when the trucking industry has driver shortages, as competition for qualified employees is often more intense. If we are unable to obtain trucking services on a timely basis or the services of a sufficient number of field employees with CDLs, it could have a material adverse impact on our financial condition, results of operations and cash flows.

In addition, potential liability and unfavorable publicity associated with accidents in the trucking industry can be severe and occurrences are unpredictable. The number and severity of litigation claims may be worsened by distracted driving by both

truck drivers and other motorists. Our transportation operations often involve traveling on unpaved roads located in rural areas, increasing the risk of accidents. If we are involved in an accident involving hazardous substances, if there are releases of hazardous substances we transport, if soil or groundwater contamination is found at our facilities or results from our operations, or if we are found to be in violation of applicable environmental laws or regulations, we could owe cleanup costs and incur related liabilities, including substantial fines or penalties or civil and criminal liability. A material increase in the frequency or severity of accidents or workers’ compensation claims or the unfavorable development of existing claims could materially adversely affect our results of operations. In the event that accidents occur, we may be unable to obtain desired contractual indemnities, and our insurance may be inadequate in certain cases which could result in substantial losses. Any such lawsuits in the future may result in the payment of substantial settlements or damages and increases to our insurance costs.

We may be subject to claims for personal injury and property damage, which could materially adversely affect our financial condition, prospects and results of operations.

Our services are subject to various transportation regulations includinginherent risks that can cause personal injury or loss of life, damage to or destruction of property, equipment or the environment or the suspension of our operations. Litigation arising from operations where our services are provided, may cause us to be named as a motor carrierdefendant in lawsuits asserting potentially large claims including claims for exemplary damages. We maintain what we believe is customary and reasonable insurance to protect our business against these potential losses, but such insurance may not be adequate to cover our liabilities, and we are not fully insured against all risks.

In addition, our customers usually assume responsibility for, including control and removal of, all other pollution or contamination which may occur during operations, including that which may result from seepage or any other uncontrolled flow of drilling and completion fluids. We may have liability in such cases if we are grossly negligent or commit willful acts. Our customers generally agree to indemnify us against claims arising from their employees’ personal injury or death to the extent that, in the case of our hydraulic fracturing operations, their employees are injured by such operations, unless resulting from our gross negligence or willful misconduct. Our customers also generally agree to indemnify us for loss or destruction of customer-owned property or equipment. In turn, we agree to indemnify our customers for loss or destruction of property or equipment we own and for liabilities arising from personal injury to or death of any of our employees, unless resulting from gross negligence or willful misconduct of the DOT and by various federal, state and tribal agencies, whose regulations include certain permit requirementscustomer. However, we might not succeed in enforcing such contractual liability allocation or might incur an unforeseen liability falling outside the scope of highway and safety authorities. These regulatory authorities exercise broad powers over our trucking operations, generally governing such matters as the authorization to engage in motor carrier operations, safety, equipment testing, driver requirements and specifications and insurance requirements. The trucking industry is subject to possible regulatory and legislative changes that may impact our operations, such as changes in fuel emissions limits, hours of service regulations that govern the amount of timeallocation. As a driver may drive or work in any specific period and requiring onboard electronic logging devices or limits on vehicle weight and size. As the federal government continues to develop and propose regulations relating to fuel quality, engine efficiency and GHG emissions,result, we may experience an increase in costs related to truck purchasesincur substantial losses which could materially and maintenance, impairment of equipment productivity, a decrease in the residual value of vehicles, unpredictable fluctuations in fuel prices and an increase in operating expenses. Increased truck traffic may contribute to deteriorating road conditions in some areas where our operations are performed. Our operations, including routing and weight restrictions, could be affected by road construction, road repairs, detours and state and local regulations and ordinances restricting access to certain roads. Proposals to increase federal, state or local taxes, including taxes on motor fuels, are also made from time to time, and any such increase would increase our operating costs. Also, state and local regulation of permitted routes and times on specific roadways could adversely affect our operations. We cannot predict whether, or in whatfinancial condition and results of operation.

form, any legislative or regulatory changes or municipal ordinances applicable to our logistics operations will be enacted and to what extent any such legislation or regulations could increase our costs or otherwise adversely affect our business or operations.

We are subject to environmental and occupational health and safety laws and regulations that may expose us to significant costs and liabilities.

Our operations and the operations of our customers are subject to numerous federal, tribal, regional, state and local laws and regulations relating to protection of the environment including natural resources, health and safety aspects of our operations and waste management, including the transportation and disposal of waste and other materials. These laws and regulations may impose numerous obligations on our operations and the operations of our customers, including the acquisition of permits or other approvals to conduct regulated activities, the imposition of restrictions on the types, quantities and concentrations of various substances that may be released into the environment or injected in non-productive formations below ground in connection with oil and natural gas drilling and production activities, the incurrence of capital expenditures to mitigate or prevent releases of materials from our equipment, facilities or from customer locations where we are providing services, the imposition of substantial liabilities for pollution resulting from our operations, and the application of specific health and safety criteria addressing worker protection. Any failure on our part or the part of our customers to comply with these laws and regulations could result in assessment of sanctions including administrative, civil and criminal penalties; imposition of investigatory, remedial or corrective action obligations or the incurrence of capital expenditures; the occurrence of restrictions, delays or cancellations in the permitting, performance or development of projects or operations; and the issuance of orders enjoining performance of some or all of our operations in a particular area. In addition to civil and other penalties associated with enforcement activities regarding compliance with occupational health and safety laws, our operations may be subject to abatement obligations that could require significant modifications to existing operations to achieve compliance.

Our business activities present risks of incurring significant environmental costs and liabilities, including costs and liabilities resulting from our handling of oilfield and other wastes, because of air emissions and wastewater discharges related to our operations, and due to historical oilfield industry operations and waste disposal practices. Moreover, accidental releases or spills may occur in the course of our operations or at facilities where our wastes are taken for reclamation or disposal, and we cannot assure you that we will not incur significant costs and liabilities as a result of such releases or spills, including any third-party claims for injuries to persons or damages to properties or natural resources. Some environmental laws and regulations may impose strict liability, which means that in some situations we could be exposed to liability as a result of our conduct that was lawful at the time it occurred or the conduct of, or conditions caused by, prior operators or other third parties. Remedial and abatement costs and other damages arising as a result of environmental and occupational health and safety laws and costs associated with changes in environmentalthese laws and regulations could be significant and have a material adverse effect on our liquidity, combinedconsolidated results of operations and combined financial condition.

Laws and regulations protecting the environment generally have become more stringent in recent years and are expected to continue to do so, which could lead to material increases in costs for future environmental compliance and remediation. In particular, the ESA restricts activities that may result in a “take” of endangered or threatened species and provides for substantial penalties in cases where listed species are taken by being harmed. The dunes sagebrush lizard is one example of a species that, if listed as endangered or threatened under the ESA, could impact our operations and the operations of our customers. The dunes sagebrush lizard is found in the active and semi-stable shinnery oak dunes of southeastern New Mexico and adjacent portions of Texas, including areas where our customers operate and our frac sand facilities are located. The FWS is currently conducting a review to determine whether listing the dunes sagebrush lizard as endangered or threatened under the ESA is warranted. In July 2020, the FWS published a 90-day finding that a 2018 petition seeking that the dunes sagebrush lizard be listed as endangered or threatened presented substantial evidence indicating that listing may be warranted. In November 2021, an environmental group filed a notice of intent to sue the U.S. Department of the Interior and the FWS for unlawfully delaying protection of the dunes sagebrush lizard and five other species. According to the petition, if a determination is not made by January 2022, the environmental group will file suit to enforce the ESA. If the dunes sagebrush lizard is listed as an endangered or threatened species, our operations and the operations of our customers in any area that is designated as the dunes sagebrush lizard’s habitat may be limited, delayed or, in some circumstances, prohibited, and we and our customers could be required to comply with expensive mitigation measures intended to protect the dunes sagebrush lizard and its habitat. Furthermore, new laws and regulations, amendment of existing laws and regulations, reinterpretation of legal requirements or increased governmental enforcement with respect to environmental matters could restrict, delay or curtail exploratory or developmental drilling for oil and natural gas by our customers and could limit our well servicing opportunities. For example, in 2015 the EPA issued a final rule under the CAA, lowering the NAAQS for ground-level ozone from 75 parts per billion to 70 parts per billion under both the primary and secondary standards to provide requisite protection of public health and welfare, respectively. In 2017 and 2018, the EPA issued area designations with respect to ground-level ozone as either “attainment/unclassifiable,” “unclassifiable” or “nonattainment.” Additionally, in November 2018, the EPA issued final requirements that apply to state, local, and tribal air agencies for implementing the 2015 NAAQS for ground-level ozone. State implementation of the revised NAAQS could, among other things, require installation of new emission controls on some of our or our customer’s equipment, result in longer permitting timelines, and significantly increase our or our customers’ capital expenditures and operating costs. In another example, pursuant to a consent decree issued by the U.S. District Court for the District of Columbia in 2016, the EPA is required to propose no later than March 15, 2019, a rulemaking for revision of certain Subtitle D criteria regulations that could result in oil and natural gas exploration and production wastes being regulated as hazardous wastes, or sign a determination that revision of the regulations is necessary. If the EPA proposes a rulemaking for revised oil and natural gas wastes regulations, the consent decree requires that the EPA take final action following notice and comment rulemaking no later than July 15, 2021. We may not be able to recover some or any of our costs of compliance with these laws and regulations from insurance.

Silica-related legislation, health issues and litigation could have a material adverse effect on our business, reputation or results of operations.

We are subject to laws and regulations relating to human exposure to crystalline silica. For example, in 2016, OSHA published a final rule that established a more stringent permissible exposure limit for exposure to respirable crystalline silica and provided other provisions to protect employees, such as requirements for exposure assessments, methods for controlling exposure, respiratory protection, medical surveillance, hazard communication, and recording. Compliance with most aspects of the 2016 rule relating to hydraulic fracturing was required by June 2018, and the 2016 rule further requires compliance with

engineering control obligations to limit exposures to respirable crystalline silica in connection with hydraulic fracturing activities by June 2021. Historically, our environmental compliance costs with respect to existing crystalline silica requirements have not had a material adverse effect on our results of operations; however, federal regulatory authorities, including OSHA, and analogous state agencies may continue to propose changes in their regulations regarding workplace exposure to crystalline silica, such as permissible exposure limits and required controls and personal protective equipment. We may not be able to comply with any new laws and regulations that are adopted, and any new laws and regulations could have a material adverse effect on our operating results by requiring us to modify or cease our operations.