The registrant had 9,907,548,9541,147,698,199 shares of common stock outstanding as of October 11, 2017.December 31, 2020.

As used herein, the term “we,” “us,” “our,” and the “Company” refers to Kallo, Inc. a Nevada corporation.

FORWARD-LOOKING STATEMENTS

THIS FORM 10-K CONTAINS "FORWARD-LOOKING STATEMENTS". FORWARD-LOOKING STATEMENTS ARE STATEMENTS CONCERNING ESTIMATES, PLANS, OBJECTIVES, GOALS, STRATEGIES, EXPECTATIONS, INTENTIONS, PROJECTIONS, DEVELOPMENTS, FUTURE EVENTS, PERFORMANCE OR PRODUCTS, UNDERLYING (EXPRESSED OR IMPLIED) ASUMPTIONS AND OTHER STATEMENTS THAT ARE OTHER THAN HISTORICAL FACTS. IN SOME CASES FORWARD-LOOKING STATEMENTS CAN BE IDENTIFIED BY THE USE OF FORWARD-LOOKING WORDS SUCH AS “ESTIMATED,” "BELIEVES," "EXPECTS," "MAY," "WILL," "SHOULD," OR "ANTICIPATES," OR THE NEGATIVE OF THESE WORDS OR OTHER VARIATIONS OF THESE WORDS OR COMPARABLE WORDS, OR BY DISCUSSIONS OF PLANS OR STRATEGY THAT INVOLVE RISKS AND UNCERTAINTIES. MANAGEMENT WISHES TO CAUTION THE READER THAT THESE FORWARD-LOOKING STATEMENTS, INCLUDING, BUT NOT LIMITED TO, STATEMENTS REGARDING THE COMPANY AND ITS PLANS OR INTENTIONS, ESTIMATES, GOALS, COMPETITIVE TRENDS AND OTHER MATTERS THAT ARE NOT HISTORICAL FACTS ARE ONLY PREDICTIONS. NO ASSURANCES CAN BE GIVEN THAT SUCH PREDICTIONS WILL PROVE CORRECT OR THAT THE ANTICIPATED FUTURE RESULTS WILL BE ACHIEVED. ACTUAL EVENTS OR RESULTS MAY DIFFER MATERIALLY EITHER BECAUSE ONE OR MORE PREDICTIONS PROVE TO BE ERRONEOUS OR AS A RESULT OF OTHER RISKS FACING THE COMPANY. FORWARD-LOOKING STATEMENTS SHOULD BE READ IN LIGHT OF THE CAUTIONARY STATEMENTS AND IMPORTANT FACTORS DESCRIBED IN THIS FORM 10-K, INCLUDING, BUT NOT LIMITED TO "THE FACTORS THAT MAY AFFECT FUTURE RESULTS" SHOWN AS ITEM 1A AND IN MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. THE RISKS INCLUDE, BUT ARE NOT LIMITED TO, THE RISKS ASSOCIATED WITH AN EARLY-STAGE COMPANY HAS LIMITED ASSETS AND OPERATIONS, THE COMPARATIVELY LIMITED FINANCIAL RESOURCES OF THE COMPANY, THE COMPANY IS INSOLVENT AND ITS TOTAL LIABILITIES EXCEED ITS TOTAL ASSETS, THE INTENSE COMPETITION THE COMPANY FACES FROM OTHER ESTABLISHED COMPETITORS, AND THE LEGAL UNCERTAINTIES THAT DIRECTLY AND INDIRECTLY IMPACT DEVELOPMENT-STAGE COMPANIES. ANY ONE OR MORE OF THESE OR OTHER RISKS COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THE FUTURE RESULTS INDICATED, EXPRESSED, OR IMPLIED IN SUCH FORWARD-LOOKING STATEMENTS. WE UNDERTAKE NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENT TO REFLECT EVENTS, CIRCUMSTANCES, OR NEW INFORMATION AFTER THE DATE OF THIS FORM 10-K OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED OR OTHER SUBSEQUENT EVENTS.

We were incorporated in the state of Nevada on December 12, 2006 as Printing Components Inc. and then changed our name to Diamond Technologies Inc. and then to our current name of Kallo Inc. On December 11, 2009, we merged with Kallo Technologies Inc. (formerly known as Rophe Medical Technologies Inc.), an Ontario corporation and its shareholders (collectively "Rophe"“Rophe”) wherein we acquired all of the issued and outstanding shares of common stock of Rophe in exchange for 3,000,000 common shares and $1,200,000.

Upon acquiring Rophe, the focus of our business was to develop medical information technology software. It has since expanded to the delivery and support of an end to endend-to-end healthcare solution for developing countries and rural communities with the focus on improving all aspects of health care delivery.

Business Overview

We are a small company with limited financial resources and we offer what we believe may be an end-to-end health care solution that is called the Kallo Integrated Delivery System (KIDS) and. Our KIDS product currently consists of the following 3three (3) components:

| 1. | Care Platforms |

| a. | These include the care facility platforms – MobileCareTM and RuralCareTM described in more detail in the MD&A section, Dialysis care and brick and mortar hospitals as well as the emergency medical services care both land and air transportation. |

| 2. | Digital Technology |

| a. | This component of the business includes the Electronic Medical Records (EMR), Picture Archiving and Communication System (PACS), eLearning system, eGovernance solutions as well as our Tele-health solution that supports the Global and Regional response centers for real time support of medical emergencies. |

| 3. | Education & Training |

| a. | This component includes the education and training for all aspects of healthcare management – clinical including clinical informatics, engineering including bio-medical, information and communications technology and health administration. |

Each of these components are currently included in the full KIDS solution but can also be used as individual components to enhance an existing health care infrastructure.

Our Copyrighted Technologies:

While we believe that our technologies are protected under Canadian and International copyrights and are authored by John Cecil and owned by Kallo Inc.John Cecil., we have not obtained any evaluation of the extent of our copyright or other intellectual property right claims by any independent third party and we have no present plans to obtain any such evaluation. And in that context, we believe that Kallo Inc. has ownershipthe rights ofto the products referred in this section, of which items B, C, and D (listed below) are under development and we anticipate that they will likely require further development work. There can be no assurance that we will not later discover that the extent of our copyright claims are limited and/or that we may be subject to claims of infringement asserted by other persons.

-1-

| A. | M.C. Telehealth – Mobile Clinic Telehealth System – Developed and launched in November 2011. |

| B. | EMR Integration Engine – Electronic Medical Record Integration Engine - Under development. |

| C. | C&ID-IMS – Communicable and Infectious Disease Information Management System - Under Development |

| D. | CCG Technology – Clinical-Care Globalization technology – Under Development |

The following is a summary of the information:

| Number | Date of Filing | Place of Filing | Duration | |||||||||

| 1072203 | November 3, 2009 | Canada | Life of the Author, the remainder of the calendar year in which the author dies, and a period of 50 years following the end of that calendar year | |||||||||

| 1072204 | November 3, 2009 | Canada | Life of the Author, the remainder of the calendar year in which the author dies, and a period of 50 years following the end of that calendar year | |||||||||

| 1072205 | November 3, 2009 | Canada | Life of the Author, the remainder of the calendar year in which the author dies, and a period of 50 years following the end of that calendar year | |||||||||

| 1072543 | November 17, 2009 | Canada | Life of the Author, the remainder of the calendar year in which the author dies, and a period of 50 years following the end of that calendar year | |||||||||

Our Products in Development

Our product portfolio includes three earlier stage products listed below, all of which highlight the broad applicability of our proprietary technologies to a diverse range ofwhat we believe may offer us potential future products. Weproduct opportunities if market conditions allow and in that event we plan to evaluate partnership opportunities for further development and commercialization of these products.

| 1. | The company has |

| 2. | C&ID-IMS is an Internet-based solution for monitoring and managing Communicable and Infectious Disease information. Our target markets are Health Organizations and Ministries of Health, hospitals and Center for Disease Control (CDC) & the World Health Organization (WHO) members around the globe. While we believe that our technologies are protected under Canadian and International copyrights and are authored by and owned by John Cecil, we have not obtained any third-party independent evaluation of the extent of our copyright or other intellectual property right claims by any independent third-party and we have no present plans to obtain any such evaluation. And in that context, we believe that Kallo Inc. has the rights to the products referred in this section, of which items B, C, and D (listed below) are under development and we anticipate that they will likely require further development work. There can be no assurance that we will not later discover that the extent of our copyright claims are limited and/or that we may be subject to claims of infringement asserted by other persons. |

-2-

| 3. | CCG is our clinical-care globalization technology. |

| 4. | MC-Telehealth (Mobile Clinic with Telehealth system) is our planned mobile clinic long distance or Telehealth technology. |

| 5. | KIDS (Kallo Integrated Delivery System), a Technology & process framework defines and describes the component parts of the various products and services |

| 6. | KIDS (Kallo Integrated Delivery System) Global Tele-Health Ecosystems. The Tele-health Program encompasses the broad variety of Technologies and administrative processes needed to deliver virtual medical care, health promotion/prevention and other patient education to KIDS patients. Overall, we have conducted only a limited amount of internal evaluation of our technology and our planned business operations. That is, we have not engaged or secured any independent third-party evaluation of our technology, our copyright claims, and our planned business operations and even our business model. In that respect there is a clear risk that we may later discover that our limited internal management assessments are materially inaccurate and in one or more respects we have made inaccurate assumptions regarding the willingness of the marketplace to adopt, accept or utilize all of our technology and/or the business model that we have adopted. We may also discover that our copyright claims are invalid and conflict with superior claims asserted by other persons with the result we are exposed to conflicting claims with resulting liability thereby. To the extent that our assumptions and/or our business model is materially inaccurate or fails to address the needs of the healthcare marketplace, we will likely incur significant and protracted financial losses thereby. |

-3-

Target Market

Based on our current internal management assessments undertaken without the benefit of any independent third-party review or evaluation, we believe that our primary target market for the Kallo Integrated Delivery System is global with the current focus(KIDS) may be one or more selected markets in certain developing countries where health care services are limited. Welimited and where we may be able to enter into what we hope may be commercially feasible contractual arrangements without undue and unacceptable risks and challenges. To that end and in anticipation that we may be successful in these efforts, we have established several sales and marketing partnership agreements under "Business Associate"“Business Associate” section either representing Kallo independently or as an organization. WeWhile we are currently in various stages of our sales cycle with more than 10 countries.

Additionally, with the components of our KIDS solution, we are targeting markets where, if our financial resources and market conditions allow, we can providebelieve we may be able to offer complimentary services to existing health care infrastructures. These markets currently include the following:

| · | Communicable & Infectious disease Information Management System – supporting World Health Organization (WHO) and Center for Disease Control (CDC); $200B market |

| · | Electronic Medical Records integration engine for Health Information Access Layer – focused on clinics, hospitals, IDC & IHC; $100B market |

| · | Clinical Care Globalization – focused on medical tourism; $40B market |

| · | Mobile Medical Clinics – focused on disaster recovery management and rural community health services for wide range of services, HIV monitoring, chemotherapy, acute care, dialysis, etc; $30B market However, we are acutely aware that market conditions are ever-changing and we can not assure you that we can undertake these efforts, or if we do, that we can do so without incurring significant and protracted losses and negative cash flow. |

Intellectual Property and Research and Development

If market conditions and our financial resources allow, we anticipate that we likely will continue our efforts in research and development through collaborations with medical faculties in Canada and the United States on an ongoing basis where our company stands to benefit from the technology ownership of the treatment or diagnostic systems developed for commercial use.

Since 2016, we decreased our expenses relating to research and development but plan towe anticipate that we will, if market conditions and our financial resources allow, continue our research and development work on the Mobile Clinic and Telehealth system, which we believeanticipate will may1 be in demand in the future.

Competition

We are a small company with limited financial resources. We compete with many larger, well-established entities in various sectors; mobile clinic and temporary medical facility manufacturers, health care equipment resellers, EMR developers, health care education providers, EMS contracted services, etc. Our competitors tend to be focused on a component of our health care solution, but do have established histories in their particular area of expertise affording them a resource advantage. We are effectively in the start-up phase of operations and as a result, we have little or no impact upon our competition. Our differentiating factor however isWe believe that, if market conditions and our financial resources allow, we may be able to offer a fully integrated solution. In the opportunities that we have been engaged in, we have not encountered a competitor that offers the full end to end solution that we are proposing to our customers.

-4-

Management’s View of the Market Trend

The Intelligence Unit of The Economist published a report in 2017 recognizing that access to healthcare is a key topic of debate worldwide and that countries are facing a range of healthcare challenges.

In 2016, they developed the Global Access to Healthcare Index to measure how healthcare systems across 60 countries are working to address their most pressing healthcare needs.

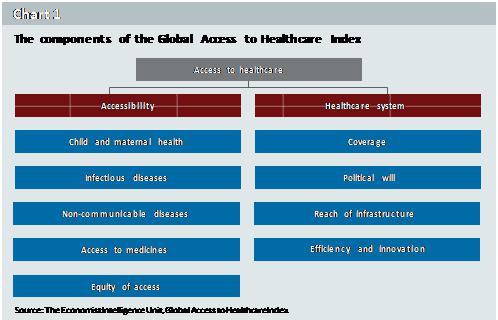

As shown in Chart 1 below, the index is based on a set of accessibility and healthcare-system measures. The accessibility domain measures access to specific kinds of care and the healthcare systems domain measures access to effective and relevant healthcare services such as policy, institutions, and infrastructure.

One of the primary findings of this report is that much more needs to be done to develop and extend coverage, the geographical reach of infrastructure, equity of access, and efficiency to improve the sustainability of health systems.

Specifically, the key findings of the report are as follows:

| 1. | Political will and a social compact are prerequisites for both access and sustainable health systems. |

| 2. | Public investment underpins good access and demonstrates the commitment of governments to ensuring the health of their populations. |

| 3. | Universal coverage does not mean universal access, but extending universal health coverage (UHC) can be a crucial part of improving access. |

| 4. | Access to data is fundamental. |

| 5. | A well-trained and integrated workforce is the backbone of a sustainable healthcare system. |

| 6. | Good primary care is a vital building block for good access. |

-5-

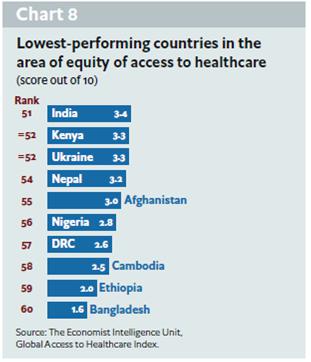

As might be expected, the index reveals that wedeveloped countries are well positioned to assistperforming much better in all areas compared with developing countries. For example, Chart 8 below identifies the lowest performing countries in the global focusarea of equity of access to healthcare.

The report also recognizes that many developing countries have shown significant improvements in their efforts to meet the UN’s Millennium Development Goals (MDGs), and the countries that have signed up to the Sustainable Development Goals (SDGs) have agreed to aim for a 40% reduction in premature deaths by 2030. As part of the SDGs, countries have pledged to reduce child and maternal deaths and mortality from tuberculosis, HIV and malaria by two-thirds, and deaths from non-communicable diseases (NCDs) and other causes by one-third. Yet it is increasingly clear that insufficient investment in healthcare, particularly in the developing world, has led to disparities in health outcomes globally.

Over the last couple of decades there have been growing multilateral efforts to encourage countries to increase the amount of money they spend on improving health care delivery through our solution platforms. Global spendinghealthcare. The WHO has recommended that countries spend a minimum of 5% of GDP on health care in 2013 totaled $7.2 trillion or 10.6%order to be taken seriously on provision of global gross domestic product. Health spending is expectedaccess. Meanwhile, in the Abuja Declaration of 2001 the heads of state of African Union countries pledged to rise an averageset a target of 5.2%allocating at least 15% of their budgets to improving healthcare. Over a year in 2014 – 2018decade later, however, many of them were still making insufficient progress.

The extensive work that Kallo has done over the past 10 years studying the health challenges faced by many African countries has led to $9.3 trillion. A numberthe design of our comprehensive healthcare delivery solution which addresses all of the driving factorskey findings of this report.

-6-

With regards to the importance of political will, Kallo’s approach of working closely with the government, providing a national healthcare system tailored to the specific needs of the increase, emerging market expansion, infrastructure improvementscountry and treatmentKallo’s commitment to providing ongoing support helps to engender the political will that developing countries need to achieve success.

With regards to the importance of public investment in healthcare, Kallo is helping to address this need by providing innovative financing options which allow developing countries to make the needed healthcare investments without creating undue negative economic impact.

With regards to the issue of universal health coverage, the report states that there is an important distinction to be made between the ability to access healthcare services and its successful delivery to a wide population. Further, the report states that a right to healthcare may be guaranteed in law, but not actually available in reality, especially in remote and underdeveloped regions. Kallo’s KIDS solution specifically recognizes the importance of extending universal health coverage through the innovative use of a variety of care platforms that can reach the unreached while using technology advances, fall into our portfolioto ensure that the access to healthcare services is available to all the citizens of productsa country.

With regards to access to data, the KIDS solution includes state-of-the-art integrated electronic medical records and services. Other factors includehospital information systems to gather and process the health needsdata that is critical to allowing governance structures to effectively oversee the entire healthcare system.

With regards to the importance of an aginga well-trained and growing populationintegrated workforce, Kallo has recognized the importance of providing education and training to local healthcare practitioners by establishing Kallo University which collaborates with teaching institutions and hospitals in Canada to provide a wide range of these services.

With regards to the importance of good primary care, the KIDS solution specifically focuses on providing primary care through all of its care platforms as well as providing specialized care as required.

Through all of Kallo’s extensive study of the rising prevalencehealthcare challenges of chronic diseases. The most rapid growth is expected to be indeveloping countries and as confirmed by the Middle East and Africa due, in part, to population growth and efforts to expand access to care. All figures quoted from "World Industry Outlook: Healthcare and Pharmaceuticals, Thekey findings of this Economist Intelligence Unit May 2104".

Government Regulation and Compliance

The healthcare regulations and standards vary widely in the geographic areas that we are focused in, with the primary concerns around patient health, safety, and privacy. With rapid advances in clinical and technology changes, the increased scrutiny by governments, the media and consumers has created continual monitoring and increased regulation on drug and patient safety specifically.

Within the global market that we serve, North America has some of the most stringent regulations and standards for medical technology and pharmaceutical approvals. As such, we have partnered with a number of major biomedical devices/equipment suppliers to ensure the highest standards of equipment. WeIf we are successful, we intend to utilize only the highest standards of product regardless of the market that we are serving.

Employees

As of October 9, 2017,January 14, 2021, we have four full time employees.

-7-

Warranties

We do not provide warranties in connection with our products or services. Our third party products are supplied with the manufacturer'smanufacturer’s warranty and we offer additional coverage with a service agreement.

Insurance

We currently do not have insurance but, do intendif our financial resources allow, we plan to insure the businessobtain general liability and other insurance as soon as fiscally possible.

Executive Offices

Our administrative office is located at 225255 Duncan MillsMill Road, Suite 504, Toronto, Ontario, Canada, M3B 3H9, our telephone number is (416) 246-9997. Our registered agent for services of process is the Corporation Trust Company of Nevada, located at 6100 Neil Road, Suite 500, Reno, Nevada 89511. Our fiscal year end is December 31st.

Our Common Stock is subject to a number of substantial risks, including those described below. No attempt has been made to rank these risks in the order of their likelihood or potential harm. In addition to those general risks enumerated elsewhere in the document, any purchaser of the Company’s common stock should also consider the following risk factors:

Risks Related to the Ownership of the Company’s Stock

1. No Revenues from Operations & Continuing Losses; Risk of Loss & Insolvency. During the past two fiscal years we have not generated and revenues and there can be no assurances that we will be successful in generating revenues in the future. In that respect we face all of the risks inherent in an early-stage business. We have incurred losses and there can be no assurance that we will ever achieve profitability and positive cash flow. While we believe that our business strategies are sound, there can be no assurance that our business will generate profits and positive cash flow or if we generate profits and positive cash flow, that it can be sustained. Investors should be aware that they may lose all or substantially all of their investment. We are also insolvent since our Total Liabilities exceed our Total Assets.

2. Limited Corporate Officers & Employees. We have only three corporate officers, one of which is part-time and an aggregate of four employees, including our three officers.

3. Auditor's Opinion: Going Concern & Insolvency. Our independent auditors have expressed substantial doubt about the Company's ability to continue as a smaller reportinggoing concern since: (a) our Total Current Liabilities exceed our Total Current Assets; (b) our Total Liabilities exceed our Total Assets; and (c) we are an early-stage company and there exists only a limited history of operations. Since our Total Liabilities exceed our Total Assets, we are insolvent and anyone who acquires our Common Stock should be prepared to lose their entire investment.

-8-

4. Limited Financial Resources; Need for Additional Financing. Our financial resources are minimal and we are insolvent. We need to obtain additional financing from the sale of our Common Stock, Debt, or some combination thereof in order to undertake further business plans. Our ability to operate as defineda going concern is contingent upon our receipt of additional financing through private placements or by loans. We anticipate that we will require significant additional funds in the future if we are successful in marketing our products and services. There can be no assurance that if additional funds are required they will be available, or, if available, that they can be obtained on terms satisfactory to our Board of Directors. In the event the Company elects to issue stock to raise additional capital, any rights or privileges attached to such stock may either (i) dilute the percentage of ownership of the already issued common shares or (ii) dilute the value of such shares; or (iii) both. No rights or privileges have been assigned to the stock and any such rights and privileges will be at the total discretion of the Board of Directors of the Company. There can be no guarantee that we will be able to obtain additional financing, or if we are successful, that we will be able to do so on terms that are reasonable in light of current market conditions. Further, we have not received any commitment from any person to provide any additional financing and we cannot assure that any such commitment is forthcoming.

5. Limited and Sporadic Trading Market for Common Stock. Our Common Stock trades on the OTC Market on a limited and sporadic basis and there can be no assurance that a liquid trading market for our Common Stock will develop and, if it does develop, that it can be sustained.

6. Lack of Revenues and Development Stage Company. We face all of the risks inherent in a new business. There is no information at this time upon which to base an assumption that our plans will either materialize or prove successful. Our present business plans and strategies have been developed by our corporate officers and they have been evaluated by any independent third party. plans have not been determined. There can be no assurance that any of our business plans and strategies will generate sales revenues that will result in any profits or positive cash flow. Investors should be aware that they may lose all or substantially all of their investment.

7. Lack of Dividends & No Likelihood of Dividends. We have not paid dividends and do not contemplate paying dividends in the foreseeable future.

8. Competition. We are an insignificant participant among firms which offer health care products and services. There are many well-established health care product and service companies which have significantly greater financial and managerial resources, technical expertise and experience than the Company. In view of our limited financial and managerial resources, we will likely be at a significant competitive disadvantage vis-a-vis our competitors.

9. No Ability to Control. Any person who acquires our Common Stock will have no real ability to influence or control the Company or otherwise have any ability to elect any person to our Board of Directors. Our officers, directors, and certain other persons currently control the Company and there is no likelihood that any person who acquires our Common Stock will have any real ability to influence or control the Company in any meaningful way.

10. Negative Equity. Our Total Liabilities exceed our Total Assets. As a result, we are insolvent and we cannot assure you that we will be able to become solvent at any time in the future.

11. Possible Rule 144 Stock Sales. Many of our shares of our outstanding Common Stock are "restricted securities" and may be sold only in compliance with Rule 144 adopted under the Securities Act of 1933, as amended or other applicable exemptions from registration. Any person who acquires our common stock in any private placement should carefully review Rule 144 since any potential public resale may be limited and current broker-dealer and clearing firm requirements may make any re-sale of our common stock difficult at best.

12. Absence of Underwriter Commitment. Based on our current plans, we anticipate that we will likely need to raise significant additional capital to meet our current and anticipated financial needs, we have not received any commitment from any registered broker-dealer or underwriter to assist us in raising needed capital. As a result, we face a clear risk that we will not have sufficient cash resources to meet our current financial obligations and otherwise implement our business plans. In that event, we may not be able to implement our plans and we will not be able to achieve profitability and positive cash flow or, if we do, that we can sustain either or both of them for any period of time.

-9-

13. Risks of Low-Priced Stocks. Currently, our common stock is not trading in any market and there is no certain prospect that the Company’s common stock will regain any trading in any organized market. In the past, the Company’s common stock had only limited and sporadic trading in the so-called "pink sheets," and before that, on the "Electronic Bulletin Board." As a result and due to the absence of a market, a shareholder may find it more difficult to dispose of, or to obtain accurate quotations as to the price of, the Company's securities. In the absence of a security being quoted on NASDAQ, or the Company having $2,000,000 in net tangible assets, trading in the Common Stock is covered by Rule 12b-23a51-1 promulgated under the Securities Exchange Act of 1934 for non-NASDAQ and non-exchange listed securities. Under such rule, broker/dealers who recommend such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or an annual income exceeding $200,000 or $300,000 jointly with their spouse) must make a special written suitability determination for the purchaser and receive the purchaser's written agreement to a transaction prior to sale.

In general, securities are also exempt from this rule if the market price is at least $5.00 per share, or for warrants, if the warrants have an exercise price of at least $5.00 per share. The Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure related to the market for penny stocks and for trades in any stock defined as a penny stock. The Commission has recently adopted regulations under such Act which define a penny stock to be any NASDAQ or non-NASDAQ equity security that has a market price or exercise price of less than $5.00 per share and allow for the enforcement against violators of the Exchange Actproposed rules.

In addition, unless exempt, the rules require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule prepared by the Commission explaining important concepts involving the penny stock market, the nature of such market, terms used in such market, the broker/dealer's duties to the customer, a toll-free telephone number for inquiries about the broker/dealer's disciplinary history, and the customer's rights and remedies in case of fraud or abuse in the sale.

Disclosure also must be made about commissions payable to both the broker/dealer and the registered representative, current quotations for the securities, and if the broker/dealer is the sole market-maker, the broker/dealer must disclose this fact and its control over the market.

Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. While many NASDAQ stocks are covered by the proposed definition of penny stock, transactions in NASDAQ stock are exempt from all but the sole market-maker provision for (i) issuers who have $2,000,000 in tangible assets ($5,000,000 if the issuer has not been in continuous operation for three years), (ii) transactions in which the customer is an institutional accredited investor and (iii) transactions that are not requiredrecommended by the broker/dealer. In addition, transactions in a NASDAQ security directly with the NASDAQ market-maker for such securities, are subject only to provide the information under this item.sole market-maker disclosure, and the disclosure with regard to commissions to be paid to the broker/dealer and the registered representatives.

Finally, all NASDAQ securities are exempt if NASDAQ raised its requirements for continued listing so that any issuer with less than $2,000,000 in net tangible assets or stockholder's equity would be subject to delisting. These criteria are more stringent than the proposed increased in NASDAQ's maintenance requirements.

Our securities are subject to the above rules on penny stocks and the market liquidity for our securities could be severely affected by limiting the ability of broker/dealers to sell our securities.

-10-

None.

The executive offices of Kallo Inc. are located at 225255 Duncan MillsMill Road, Suite 504, Toronto, Ontario, Canada, M3B 3H9, our telephone number is (416) 246-9997.

| ITEM 3. | LEGAL PROCEEDINGS. |

On April 21, 2017, an ex-employee of Kallo obtained a judgement ordering Kallo to pay Canadian $ 135,959 for unpaid wages and expenses relating to services performed in 2016. The full amount has been accrued for in the financial statements of Kallo.

On October 24, 2016, a consultant obtained a judgement ordering Kallo to pay Canadian $25,000$34,924 for unpaid fees. The full amount has been accrued for in the financial statements of Kallo.

On October 6, 2017, Thornley Fallis Communications Inc. ("Thornley") commenced a third party claim against Kallo concerning monies that Kallo allegedly owed to Thornley for redesign of a website and public relation services. Thornley is seeking damages in the amount of Canadian $169,345 plus interest on the amounts outstanding and indemnification of the costs of the action. An amount of Canadian $134,960 has been accrued for in the financial statements of Kallo.

While we believe that we may be successful in resolving these claims, we cannot assure that the outcome will not have a material adverse effect upon us.

| ITEM 4. | MINE SAFETY DISCLOSURES. |

None.

-11-

| ITEM 5. | MARKET FOR OUR COMMON STOCK, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our shares are traded on OTC Markets under the symbol "KALO"“KALO”. A summary of trading by quarter for 20162019 and 20152018 is as follows:

| Fiscal Year – 2016 | High Bid | Low Bid | |

| Fourth Quarter 10-1-16 to 12-31-16 | $0.0002 | $0.00005 | |

| Third Quarter 7-1-16 to 9-30-16 | $0.0001 | $0.0001 | |

| Second Quarter 4-1-16 to 6-30-16 | $0.0001 | $0.0001 | |

| First Quarter 1-1-16 to 3-31-16 | $0.0002 | $0.00001 | |

| Fiscal Year – 2015 | High Bid | Low Bid | |

| Fourth Quarter 10-1-15 to 12-31-15 | $0.0011 | $0.0001 | |

| Third Quarter 7-1-15 to 9-30-15 | $0.035 | $0.0008 | |

| Second Quarter 4-1-15 to 6-30-15 | $0.15 | $0.265 | |

| First Quarter 1-1-15 to 3-31-15 | $0.11 | $0.0462 | |

Fiscal Year 2019 | High Bid | Low Bid | ||||||

| Fourth Quarter 10-1-19 to 12-31-19 | $ | 0.0400 | $ | 0.0013 | ||||

| Third Quarter 7-1-19 to 9-30-19 | $ | 0.0360 | $ | 0.0128 | ||||

| Second Quarter 4-1-19 to 6-30-19 | $ | 0.0237 | $ | 0.0125 | ||||

| First Quarter 1-1-19 to 3-31-19 | $ | 0.0400 | $ | 0.0140 | ||||

Fiscal Year 2018 | High Bid | Low Bid | ||||||

| Fourth Quarter 10-1-18 to 12-31-18 | $ | 0.0600 | $ | 0.0150 | ||||

| Third Quarter 7-1-18 to 9-30-18 | $ | 0.0420 | $ | 0.0113 | ||||

| Second Quarter 4-1-18 to 6-30-18 | $ | 0.0600 | $ | 0.0101 | ||||

| First Quarter 1-1-18 to 3-31-18 | $ | 0.0825 | $ | 0.0080 | ||||

Dividends

We have not declared any cash dividends, nor do we intend to declare cash dividends at this point. We are not subject to any legal restrictions respecting the payment of cash dividends, except that they may not be paid to render us insolvent.insolvent and any payment of any dividends is subject to the limitations of the Nevada General Corporation Law. Dividend policy will be based on our cash resources and needs and it is anticipated that allany cash that may be available cash will likely be needed for our operations and to pay our creditors in the foreseeable future.

A stock dividend was declared on February 11, 2008, wherein two additional common shares were issued for each one common share issued and outstanding as at February 25, 2008. We have not declared any other dividends.

Section 15(g) of the Securities Exchange Act of 1934

Our company'scompany’s shares are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser'spurchaser’s written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as "bid"“bid” and "offer"“offer” quotes, a dealers "spread"“spread” and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the FINRA'sFINRA’s toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

-12-

Securities authorized for issuance under equity compensation plans

We currently have two equity compensation plans: the 2012 Non-Qualified Incentive Stock Option Plan and the 2011 Non-Qualified Incentive Stock Option Plan.

The 2012 Non-Qualified Incentive Stock Option Plan provides for the issuance of shares of our Common Stock for services rendered to us. The board of directors is vested with the power to determine the terms and conditions of the options. The Plan includes 50,000,000 shares of common stock.

The 2011 Non-Qualified Incentive Stock Option Plan provides for the issuance of shares of our Common Stock for services rendered to us. The board of directors is vested with the power to determine the terms and conditions of the shares. The Plan included 10,000,000 shares of common stock. On September 7, 2012, 7,233,334 shares have been issued under this 2011 Non-Qualified Stock Option Plan; and, 2,766,666 shares of common stock remain available under this plan.

| Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities in column (a)) (c) |

Equity compensation plans approved by security holders | None | None | None |

Equity compensation plans not approved by securities holders | 0 | $0.0 | 52,766,666 |

| Total | 0 | $0.0 | 52,766,666 |

| Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities in column (a)) | ||||||||||

| Plan category | (a) | (b) | (c) | |||||||||

| Equity compensation plans | ||||||||||||

| approved by security holders | None | None | None | |||||||||

| Equity compensation plans | ||||||||||||

| not approved by securities holders | 0 | $ | 0.0 | 52,766,666 | ||||||||

| Total | 0 | $ | 0.0 | 52,766,666 | ||||||||

| ITEM 6. | SELECTED FINANCIAL DATA. |

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

| ITEM 7. |

Our management believes that, if market conditions and our financial resources allow, we may be well-positioned to assist in the global focus on improving health care delivery through our solution platforms. Global spending on health care in 2013 totaled $7.2 trillion or 10.6% of the report includesglobal gross domestic product. Health spending is expected to increase an average of 5.2% a year in 2014 – 2018 to $9.3 trillion. A number of forward-looking statementsthese factors drive the increase that includes emerging market expansion, infrastructure improvements and treatment and technology advances. Overall, we believe that if these market trends and our financial resources allow, may offer us opportunities to provide our products and services. Our assessments and our plans are based solely upon the determinations made by our internal management without the benefit of any independent third party review or evaluation. In that respect there is a clear risk that our plans do not accurately reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You shoulddo not place undue certainty on these forward-looking statements, which apply only as of the date of this report. These forward-looking statements are subject to certainaccurately incorporate market trends, inherent risks and uncertaintiesother known and unknown factors that could cause actual results to differresult in protracted and significant losses and further negative cash flow with the result that our financial condition could materially from historical results or our predictions. All funds are reflected in United States dollars unless otherwise indicated.deteriorate with resulting destruction of each stockholder’s investment.

-13-

There is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have generated no revenues from our operations during the last eightnine years. We have been able to remain in business as a result of investments, in debt or equity securities, by our officers and directors and by other unrelated parties. We expect to incur operating losses in the foreseeable future and our ability to continue as a going concern is dependent upon our ability to raise additional money through investments by others and achieve profitable operations. There is no assurance that we will be able to raise additional money or that additional money or that additional financing will be available to us on satisfactory terms or that we will be able to achieve profitable operations. The consolidated statements were prepared under the assumption that the Companywe will continue as a going concern, however, there can be no assurance that such financial support shall be ongoing or available on terms or conditions acceptable to the Company. This raises substantial doubt about the Company'sour ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

For the last sixnine fiscal years, starting January 2010, our management and board of directors have raised funds through a personal and professional network of investors. This has enabled product and business development, continued operations, and generation of customer interest. In order to continue operations, management has contemplated several options to raise capital and sustain operations in the next 12 months. These options include, but are not limited to, debt and equity offers to existing shareholders, debt and equity offers to independent investment professionals and through various other financing alternatives. Management's opinion isWe currently believe that the combination of the three options along with the forecasted closing ofif we can secure sufficient additional capital on reasonable terms and on a timely basis and if we are successful in securing at least one project that likely will enable continuedus to continue operations for the next 12 months. There iscan be no assuranceguarantee that we will receive sufficient additional moneycapital on a timely basis in sufficient amounts and on reasonable terms that will allow is to continue to remain in business. Currently we have not received any commitment from these options and our existing shareholders are under no legal dutyany third party to provide the additional capital that we believe we will require to sustain our company as a corporate entity or otherwise allow us with additional financing nor haveto meet our shareholders committed to provide us with additional financing.

On April 8, 2017, the Company entered into an agreement with FE Pharmacy Inc. whereby in consideration for the issuance of 475,000,000 post reverse stock splitshares of our common stock, of Kallo, FE Pharmacy Inc. assumed and will assume and pay all of the Company'sCompany’s outstanding indebtedness as at April 7, 2017. Management believes that with this agreement in place, it can concentrate on bringing the potential projects as detailed below to fruition

In 2017 the signingGovernment of a US$200,000,925 (Two Hundred million nine hundred and twenty-five US dollars) Supply ContractGhana initiated several discussions with us, to revisit how the Ministry of Defense – Military Hospital requirements, the Ministry of Health healthcare infrastructure requirements and Public Hygienethe Ministry of Education Teaching Hospital infrastructure requirements can be met using the Kallo Integrated Delivery Model. The success of these discussions confirmed Ghana’s continued belief in the Kallo Integrated Delivery System, as the best solution for the nation’s healthcare infrastructure development, which is very encouraging for our continued business in Ghana.

On June 20, 2017, our branch office was legally registered in Ghana. A valid tax identification number was issued and this number is to be used by us in all of our anticipated business that we hope to conduct within Ghana. We have incorporated four SPVs (Special Purpose Vehicles / Companies) to oversee the various projects we seek to undertake in Ghana. The SPVs are all incorporated under the laws of Ghana as private companies. Based on our internal management assessments conducted without the benefit of any independent third-party review or evaluation, we believe that our business plans involving Ghana are sound and may offer us significant business opportunities. However, we cannot assure you that we will be able to obtain sufficient financing on reasonable terms and on a timely basis that will allow us to pursue these opportunities.

-14-

We have entered into four major concession agreements with four key governmental institutions in Ghana. We have also through our SPVs has entered into the following concession arrangements for the construction and operation of various hospital facilities in Ghana:

| Project Description | Kallo SPV | ||||

| 1 | Tamale Military Hospital project | K-TMH Ghana Limited | |||

| 2 | Cape Coast Teaching Hospital project | K-UCC Cape Coast Limited | |||

| 3 | Sunyani Teaching Hospital project | K-UENR Sunyani Limited | |||

| 4 | Ho Teaching Hospital project | K-UHAS Ho Limited | |||

These agreements are effective upon execution and the concession period will start from the date on which appropriate financial commitments are received and all conditions precedent are satisfied or waived. The financing has not closed yet and there is no guarantee that financial close will be achieved.

The Global need for standardized healthcare service delivery to all geographies and to all people is the fundamental business driver for the innovation of the Kallo Integrated Delivery System – “KIDS”.

This unique and comprehensive concept was developed based on first hand discovery and a detailed study of ground realities and causal analysis over 15 years. The business issues in the current healthcare systems are addressed by intricate orchestration of technologies both proprietary and off the shelf to create a standardized healthcare delivery model across the continuum of care.

A strategic market approach was defined for customers to take a well-informed decision and to work with Kallo on a national strategy for healthcare infrastructure and a standardized healthcare services delivery model across the country. This led to the development of a structured business development process and management for business success.

After many years of hard work in developing countries we now see a dynamic shift in the thought process within the developing countries to consider innovative solutions leveraging technology for strengthening and advancing their healthcare infrastructure and services delivery for all citizens alike.

On June 26, 2020, the Cabinet Secretary of the Department of Health and the Cabinet Secretary of the National Treasury and Planning of the Republic Of Guinea. of Kenya entered into a Project Contract with Kallo Inc. and a Loan Contract with Techno-Investment Module Ltd., now with its registered office in Spain for implementing Kallo Integrated Delivery Systems (KIDS) in the Republic of Kenya to strengthen their National Healthcare Infrastructure and build a robust, sustainable healthcare ecosystem.

On April 14, 2015,November 10, 2020, the Minister of Health and Public Hygiene,the Minister of Finance of the Kingdom of Eswatini entered into a Project Contract with Kallo Inc. and a Loan Contract with Techno-Investment Module Ltd., now with its registered office in a letter confirmedSpain for implementing Kallo Integrated Delivery Systems (KIDS) in the selectionRepublic of Kallo Inc., as supplier pursuantKenya to the MobilCareTM Supply Contract, to designstrengthen their National Healthcare Infrastructure and build specialized hospitalsa robust, sustainable healthcare ecosystem.

On November 30, 2020, the Minister of Health and the Minister of Finance of the Federal Democratic Republic of Ethiopia entered into a Project Contract with Kallo Inc. and a Loan Contract with Techno-Investment Module Ltd., now with its registered office in Spain for implementing Kallo Integrated Delivery Systems (KIDS) in the regionsRepublic of Conakry, Kindia, Labe, KankanKenya to strengthen their National Healthcare Infrastructure and Nzerekore, and asked Kallo to mobilize its technical teams for site visits to engagebuild a robust, sustainable healthcare ecosystem. Included in preliminary studies for the constructioncontract is Medical Tourism project with a Medical Center of these hospitals. No equipment has been sold under the terms of this supply contract, nor is there any assurance any equipment will be sold thereunder.Excellence.

-15-

On December 10, 2020, the Supply Contract, Kallo will implement an integrated healthcare delivery solution forMinister of Health and the Minister of Finance of the Republic of Guinea. The componentsMozambique entered into a Project Contract (Phase-1) with Kallo Inc. and a Loan Contract (Phase-1) with Techno-Investment Module Ltd., now with its registered office in Spain for implementing Kallo Integrated Delivery Systems (KIDS) in the Republic of the solution include, MobileCare, RuralCare, Hospital Information Systems, Telehealth Systems, Pharmacy Information, disaster management, airKenya to strengthen their National Healthcare Infrastructure and surface patient transportation systems and clinical training.

Plan of Operation

The following plan of operation contains forward-looking statements, which involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth elsewhere in this document. Because of the speculative nature of our operations and the nature of the African countries we are attempting to do business with, there is no assurance that any of the planned operations will occur.

To the extent that we are financially able and if market conditions are favorable, we plan to continue to develop components of Kallo Integrated Delivery System:

Kallo Integrated Delivery System (KIDS)

MobileCareTM– a mobile trailer that opens into a state of the art clinical setup in a vehicle equipped with the latest technology in healthcare. More than just a facility, MobileCareTM can instantly connect the onboard physician with specialists for on-demand consultation via satellite through its Telehealth system. This is truly a holistic approach to delivering healthcare to the remotely located. For many rural communities, the nearest hospital, doctor or nurse may be hundreds of kilometers away. In many cases, this gap can be bridged using Telehealth technology that allows patients, nurses and doctors to talk as if they were in the same room.

RuralCareTM – prefabricated modular healthcare units focused in rural areas where no roads infrastructure is available. They are equipped to provide primary healthcare including X-Ray, ultrasound, surgery, pharmacy and lab services. Ranging from 1,200 to 3,800 square feet, these clinics can be up and running in disaster zones or rural areas in as little as one week. Similar to the MobileCareTM product, RuralCareTM also utilizes satellite communications to access the Telehealth system.

Our overall healthcare mission is to "reach the unreached". TheBased on our own internal assessments conducted by our officers and without the benefit of any independent third party evaluation, we believe that may be able to offer end-to-end solution includesthat may include the following:

Global response center

– located in the Kallo headquarters in Canada, this is the escalation point for the coordination of delivery of Telehealth and eHealth support. It consists of both the Clinical Command Center and the Administrative CommandRegional response centers, Clinical and Administrative Command centers

– located in the urban area hospitals and connected with satellite communications, these centers coordinate all aspects of the healthcare delivery solution with the Mobile clinics and Rural clinics including clinical services, Telehealth services, pharmacy and medical consumable coordination as well as escalations to the Global responseKallo University

– provides education, training and development of local resources for all aspects of the healthcare delivery which includes clinical, engineering andEmergency Medical Services

– provides ground and air ambulance vehicles for emergency patient-16-

Based solely on our internal management assessments conducted without the benefit of any independent third-party review or evaluation, we believe that our end-to-end delivery solution is equipped with necessary medical equipment as per regional healthcare requirements. We also install our copyrighted software and third partythird-party software as required along with a 5five (5) year support agreement renewable after the 5five (5) year initial term that includes the medical equipment, software licenses,

Business Overview

The Global need for standardized healthcare service delivery to all geographies and to all people is the fundamental business driver for the innovation of the Kallo Integrated Delivery System – “KIDS”.

This unique and comprehensive concept was developed based on first hand discovery and a detailed study of ground realities and causal analysis over 15 years. The business issues in the current healthcare systems are addressed by intricate orchestration of technologies both proprietary and off the shelf to create a standardized healthcare delivery model across the continuum of care.

A strategic market approach was defined for customers to take a well-informed decision and to work with Kallo on a national strategy for healthcare infrastructure and a standardized healthcare services delivery model across the country. This led to the development of a structured business development process and management for business success.

The business development model, unique to KIDS, included in-country stakeholder workshops and white-board sessions on the KIDS concept and it’s application in their context of healthcare infrastructure and healthcare services delivery model.

Kallo instituted the concept of conducting detailed Clinical, Engineering and Technology studies led by Kallo to establish detailed requirements for preparation of a customized proposal for the country and a phased roll out plan.

In addition, Kallo has addressed the major issue of financing such large initiatives in under developed countries by developing a network of financial institutions and Banks across the globe focused on humanitarian and healthcare projects.

Go-to-Market Strategy

Our Sales Go-To-Market Strategy is segmented based on the varying needs of our customers in the following three categories:

| 1. | Full solution with Kallo Integrated Delivery System (KIDS) – typically longer sales cycle and includes the end to end solution of Mobile Clinics, Rural Poly Clinics, Global and Regional response centers, Clinical and Administrative command centers, telehealth support, Kallo University training, pharmacy and medical consumable support and Emergency services with ground and air ambulance vehicles. This solution is focused on the end-to-end healthcare needs of developing countries. |

| 2. | Medical Tourism |

| 3. | COVID-19 Rapid Response Program |

-17-

Kallo’s Value Proposition

| · | Laying the foundational elements in building the primary care infrastructure for an entire country |

| · | Providing Technologies for current and future adoption of advancements in clinical services such as Telemedicine, remote maintenance and management etc. |

| · | Creating operational policies and procedures to set higher standards of care |

| · | Provide Education and training to build resource capacity within the country |

| · | KIDS provide a modular and flexible Point-of-Care facility to enable healthcare services from cities to the most rural areas in a given country and helps overcome inequalities in healthcare services across all geographies. |

Kallo’s Key Market Differentiators

Kallo differentiates itself in our market segment by offering the most comprehensive and holistic healthcare deliver solution

available to meet the needs of developing countries and countries with rural and remote populations. Kallo has invested considerable time and energy studying and understanding the healthcare needs of our target market.Unequivocal Differentiators

| 1. | Care platforms (Point-of-care facilities - Mobile Clinics, Rural clinics & Modular Hospitals) manufactured to North American and internationally accepted standards |

| 2. | Programs, facilities and services set-up to proactively detect and treat infectious diseases |

| 3. | On-going Tele-health service support, leveraging both local and international expertise |

| 4. | On-going education, training, & certification programs offered through Kallo University |

| 5. | On-going service & maintenance programs for all facilities and equipment |

| 6. | Leverages local skillsets and creates employment opportunities |

Competitive Landscape

Healthcare landscape is the most complex industry at large. It has developed in each area of its function in an isolated fashion and hence today we have disparate functions, technologies and infrastructure. Globally healthcare industry leaders are working hard to bring a synchronized approach in patient encounter, diagnosis and treatment including preventive care. Kallo has leaped into the future with the KIDS concept and have successfully brought together technologies including global telemedicine, infrastructure and functional expertise leading the industry and have created the Kallo business ecosystem.

Kallo Integrated Delivery System (KIDS) – typically longer sales cyclehas been the key to our success in the under-developed, countries and includeswill take a lead into developing and developed countries with the end to end solutionflexibility of Mobile Clinics, Rural Poly Clinics, Global and Regional response centers, Clinical and Administrative command centers, telehealth support, Kallo University training, pharmacy and medical consumable support and Emergency services with ground and air ambulance vehicles. This solution is focused on the end to end healthcare needs of developing countries.

Need for additional capital

We have incurred significant and protracted operating losses since inception and has an accumulated deficit and a working capital deficit at December 31, 2019. We expect to incur additional losses as it executes its go to market strategy. This raises substantial doubt about the Company’s ability to continue as a going concern.

-18-

We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a business enterprise, including limited capital resources and possible cost overruns due to price increases in services and products.

To become profitable and competitive, we anticipate that we will have to sell our products and services.

There is no guaranty that we will obtain sufficient additional financing on acceptablea timely basis and on reasonable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop, or expand our operations. EquityAny equity financing couldwill likely result in additionalimmediate and substantial dilution toof existing shareholders.

Results of operations

December 31, 20162019 compared to December 31, 2015

Revenues

We did not generate any revenues during the year ended December 31, 20162019 or 2015. We2018. However, we are pursuing numerous saleswhat we hope may be suitable business opportunities that, based on our own internal management assessments conducted without the benefit of any independent third-party review or evaluation, may offer us commercially feasible and appropriate opportunities.

Expenses

During the year ended December 31, 20162019 we incurred total expenses of $2,999,110,$2,355,889, including $1,928,905$1,974,082 in salaries and compensation, $31,533 in depreciation, $96,661$39,647 in professional fees, $25,553$51,908 in selling and marketing, $323,944$111,292 in interest and financing costs, $147,970$160,062 in foreign exchange loss in change in fair value on derivative liabilities, $104,018 in fixed asset impairment and $371,318$18,898 as other expenses, net of $30,792 foreign exchange gain.general and administrative expenses. Our professional fees consist of legal, consulting, accounting and auditing fees.

During the year ended December 31, 20152018 we incurred total expenses of $8,964,960.

The decreaseincrease in our expenses for the year ended December 31, 20162019 was primarily due to a decreasean increase in salaries and compensation of $2,875,926,$1,303,898 as a result of non-cash stock-based compensation of $1,574,480 in 2019 compared to $270,516 in 2018 issued to management and employees. There is also a decrease in professional fees of $1,387,248, a decrease$45,651 as the Company was catching up on all its previously late filings in interest2018 and financing costs of $624,663, a decrease in other expenses of $621,911, a decrease in selling and marketing expenses of $204,612$68,821. There is a foreign exchange loss of $160,062 in 2019 compared to a foreign exchange gain of $258,866 in 2018 as a result of the appreciation of the Canadian dollar versus the US dollar. The Company is operating with a minimal number of full-time employees and a decrease in the impairment charge of $251,490. The decreases are due to significant curtailing of operations mid-year because theoffice space until it can secure new contracts that the Company was anticipating did not materialize and Kallo had to significantly reduce its operations.

Net Loss

During the year ended December 31, 20162019 we incurred a net loss of $2,999,110$2,355,889 compared to a net loss of $8,964,960$763,631 in 2015.2018. The main reason for the increase in the loss is the increase in salaries and compensation and negative movement in exchange rate as discussed above. In that respect, we can not assure you that we will be successful in reducing our losses at any time in the future and we may face significant and protracted financial losses and we cannot guarantee that we will achieve any of our business goals.

-19-

Liquidity and capital resources

As at December 31, 2016,2019, we had no current assets, of $57,011, current liabilities of $4,151,405$6,823,659 and a working capital deficiency of $4,094,394.$6,823,659. As of December 31, 2016, our total2019, we had no assets were $57,011 in prepaid expenses and our total liabilities were $4,151,405$6,823,659 comprised of $2,731,879$3,860,499 in accounts payable and accrued liabilities, loans payable of $16,215, derivative liabilities of $270,581, deferred lease inducement of $1,260,$66,521, convertible loans payable of $806,673, bank overdraft$1,172,349 and liability for issuable shares of $211 and convertible promissory notes of $324,586.

Cash used in operating activities amounted to $328,848$27,362 during fiscal 2016,2019, primarily and as a result of the net loss adjusted for non-cash items and various changes in operating assets and liabilities.

Cash provided by financing activities during the year amounted to $323,878 and represented mainly$27,362 from proceeds from convertibleshort term loans payable.

As of December 31, 2019, our Total Liabilities exceeded our Total Assets and we were insolvent. In that respect we face all the risks and uncertainties that could easily result in stockholders losing all or substantially all of their investment. Our common stock and our preferred stock are securities that should only be acquired by persons who can accept the HIGH RISK of such an investment.

Summary of critical accounting policies

Basis of Presentation

The accompanying consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles ("GAAP"(“GAAP”) and in accordance with the instructions to Form 10-K related to smaller reporting companies as promulgated by the Securities and Exchange Commission.

Stock-Based Compensation

The Company accounts for share-based compensation in accordance with ASC 718, Stock Compensation. Under the provisions of ASC 718, share-based compensation cost is measured at the grant date, based on the calculated fair value of the award, and is recognized as an expense for services rendered and over the employee'semployee’s requisite service period (generally the vesting period of the equity grant).

Stock Issued in Exchange for Services

The valuation of the Company'sCompany’s common stock issued to non-employees in exchange for services is valued at an estimated fair market value as determined by Management of the Company based upon trading prices of the Company'sCompany’s common stock on the dates of the stock transactions. The corresponding expense of the services rendered is recognized over the contractor'scontractor’s requisite service period (generally the vesting period of the equity grant).

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK. |

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

-20-

| PAGE | |

| 2018 | |

-21-

To the StockholdersShareholders and Board of

Kallo Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Kallo Inc. and its subsidiary (collectively, the "Company"“Company”) as of December 31, 20162019 and 20152018, and the related consolidated statements of operations, changes in stockholders'stockholders’ deficiency, and cash flows for the years then ended. These consolidated financial statements areended, and the responsibility ofrelated notes (collectively referred to as the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

Going Concern Matter

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, the Company has suffered recurring losses since inceptionfrom operations and had an accumulated deficit andhas a workingnet capital deficit at December 31, 2016 whichdeficiency that raises substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 1. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ |

We have served as the Company's auditor since 2020. Lakewood, Colorado | |

-22-

KALLO INC.

As at December 31, 20162019 and 2015

(Amounts expressed in US dollars)

| 2016 | 2015 | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | - | $ | 4,998 | ||||

| Prepaid expenses | 57,011 | 132,259 | ||||||

| Total Current Assets | 57,011 | 137,257 | ||||||

| Deposit – long term | - | 20,627 | ||||||

| Equipment, net | - | 135,551 | ||||||

| TOTAL ASSETS | $ | 57,011 | $ | 293,435 | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIENCY | ||||||||

| Current Liabilities: | ||||||||

| Bank overdraft | $ | 211 | $ | - | ||||

| Accounts payable and accrued liabilities | 2,731,879 | 1,204,942 | ||||||

| Derivative liabilities | 270,581 | 210,834 | ||||||

| Convertible promissory notes, net of discount of $8,872 and $69,568 respectively | 324,586 | 204,826 | ||||||

| Convertible loans payable – third parties | 191,510 | 105,395 | ||||||

| Short term loans payable | 16,215 | 15,730 | ||||||

| Convertible loans payable – related parties | 615,163 | 272,712 | ||||||

| Deferred lease inducement | 1,260 | 15,380 | ||||||

| Total Current Liabilities | 4,151,405 | 2,029,819 | ||||||

| Convertible promissory notes, net of discount of $Nil and $59,939 respectively | - | 24,551 | ||||||

| TOTAL LIABILITIES | 4,151,405 | 2,054,370 | ||||||

| Commitments and Contingencies | ||||||||

| Stockholders' Deficiency: | ||||||||

Preferred stock, $0.00001 par value, 100,000,000 shares authorized, 95,000,000 Series A preferred shares issued and outstanding | 950 | 950 | ||||||

Common stock, $0.00001 par value, 15,000,000,000 shares authorized, 8,098,742,772 and 5,648,390,746 shares issued and outstanding respectively. | 80,988 | 56,485 | ||||||

| Additional paid-in capital | 30,965,822 | 30,324,674 | ||||||

| Accumulated deficit | (35,142,154 | ) | (32,143,044 | ) | ||||

| Total Stockholders' Deficiency | (4,094,394 | ) | (1,760,935 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIENCY | $ | 57,011 | $ | 293,435 | ||||

| ASSETS | 2019 | 2018 | ||||||

| Current Assets: | ||||||||

| Total Current Assets | $ | — | $ | — | ||||

| TOTAL ASSETS | $ | — | $ | — | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIENCY | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable and accrued liabilities | $ | 3,860,499 | $ | 3,307,421 | ||||

| Convertible loans payable – third parties | 265,217 | 240,369 | ||||||

| Short term loans payable | 66,521 | 38,355 | ||||||

| Convertible loans payable – related parties | 907,132 | 820,688 | ||||||

| Liability for issuable shares | 1,724,290 | 149,240 | ||||||

| Total Current Liabilities | 6,823,659 | 4,556,073 | ||||||

| TOTAL LIABILITIES | 6,823,659 | 4,556,073 | ||||||

| Commitments and Contingencies | ||||||||

| Stockholders’ Deficiency: | ||||||||

| Preferred stock, $0.00001 par value, 100,000,000 shares authorized, 95,000,000 Series A preferred shares issued and outstanding | 950 | 950 | ||||||

| Common stock, $0.00001 par value, 1,150,000,000 shares authorized, 1,147,698,199 and 1,147,698,199 shares issued and outstanding respectively | 11,478 | 11,478 | ||||||

| Additional paid-in capital | 41,920,116 | 41,920,116 | ||||||

| Assignment of liabilities | (3,462,554 | ) | (3,550,857 | ) | ||||

| Accumulated deficit | (45,293,649 | ) | (42,937,760 | ) | ||||

| Total Stockholders’ Deficiency | (6,823,659 | ) | (4,556,073 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIENCY | $ | — | $ | — | ||||

The accompanying notes are an integral part of these consolidated financial statements

-23-

KALLO INC.

(Amounts expressed in US dollars)

For the Year Ended December 31, 2016 | For the Year Ended December 31, 2015 | |||||||

| Operating Expenses | ||||||||

| General and administration | 2,396,884 | 7,434,862 | ||||||

| Selling and marketing | 25,553 | 230,165 | ||||||

| Impairment of assets | 104,018 | 355,508 | ||||||

| Depreciation | 31,533 | 76,457 | ||||||

| Operating loss | (2,557,988 | ) | (8,096,992 | ) | ||||

| Interest and financing costs | (323,944 | ) | (948,607 | ) | ||||

| Change in fair value of derivative liabilities | (147,970 | ) | 97,890 | |||||

| Foreign exchange gain | 30,792 | 66,093 | ||||||

Loss on extinguishment of convertible promissory note and short term loan payable | - | (83,344 | ) | |||||

| Net loss | $ | (2,999,110 | ) | $ | (8,964,960 | ) | ||

| Net loss per share - Basic and diluted | $ | (0.00 | ) | $ | (0.01 | ) | ||

| Weighted average number of shares outstanding - Basic and diluted | 7,366,923,856 | 966,447,335 | ||||||

| For the Year Ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| Operating Expenses | ||||||||

| General and administration | $ | 2,032,627 | $ | 790,477 | ||||

| Selling and marketing | 51,908 | 120,729 | ||||||

| Operating loss | (2,084,535 | ) | (911,206 | ) | ||||

| Interest and financing costs | (111,292 | ) | (111,291 | ) | ||||

| Foreign exchange gain (loss) | (160,062 | ) | 258,866 | |||||

| Net loss | $ | (2,355,889 | ) | $ | (763,631 | ) | ||

| Net loss per share - Basic and diluted | $ | (0.00 | ) | $ | (0.00 | ) | ||

| Weighted average number of shares outstanding - Basic and diluted | 1,147,698,199 | 1,136,329,577 | ||||||

The accompanying notes are an integral part of these consolidated financial statements

-24-

Consolidated Statements of Changes in Stockholders'Stockholders’ Deficiency

(Amounts expressed in US dollars)

Preferred Stock $.00001 par value | Common Stock $.00001 par value | Additional Paid-In | Deficit Accumulated During the Development | Total Stockholders' | ||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Stage | Equity (Deficit) | ||||||||||||||||||||||

| Balance December 31, 2014 | 95,000,000 | $ | 950 | 382,156,160 | $ | 3,822 | $ | 22,297,758 | $ | (23,178,084 | ) | $ | (875,554 | ) | ||||||||||||||

| Issuance of common shares – Kodiak put | - | - | 6,250,000 | 63 | 172,120 | - | 172,183 | |||||||||||||||||||||