| | | | | | | | |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| | |

| FORM 10-K | |

(Mark one)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20202023

ORor

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d)15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-39452

| | | | | | | | |

| | |

| INHIBRX, INC. |

|

| (Exact name of registrant as specified in its charter) |

| | |

| Delaware | | 82-4257312 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number)No.) |

| | |

| 11025 N. Torrey Pines Road, Suite 200 | | |

| La Jolla, California | | 92037 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

| (858) 795-4220 | |

| (Registrant’s telephone number, including area code) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Securities registered pursuant to Section 12(b) of the Act |

| | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 | | INBX | | The Nasdaq Global Market |

| | | | | | |

| Securities registered pursuant to Section 12(g) of the Act |

| | | None | | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐☒ No ☒☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant:registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports);, and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large Accelerated Filer | ☐☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒☐ | | Smaller reporting company | ☒ |

| | | Emerging growth company | ☒☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B)13(a) of the SecuritiesExchange Act. ☒☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐☒ No ☒☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 31, 2020,June 30, 2023, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $261.4$892.9 million, based on the closing price of the registrant’s common stock on the Nasdaq Global Market of $17.49$25.96 per share. The registrant has elected to use August 31, 2020 as the calculation date, as on June 30, 2020 (the last business day of the registrant’s most recently completed second fiscal quarter) the registrant was a privately-held concern.

As of February 28, 2021,21, 2024, the registrant had 37,747,66447,392,447 shares of common stock outstanding.

Documents Incorporated By Reference

The following documents (or parts thereof) are incorporated by reference into the following parts of this Form 10-K: Certain information required in Part III of this Annual Report on Form 10-K is incorporated from the Registrant’s Proxy Statement for the 2021 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission.None.

INHIBRX, INC.

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 20202023

| | | | | | | | |

| TABLE OF CONTENTS | |

| | PAGEPage |

| |

| |

| | |

| | |

| Item 1B. | Unresolved Staff Comments | |

| Item 1C. | | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or this Annual Report of Inhibrx, Inc., or Inhibrx, or the Company (also referred to as “we,” “us,” and “our”) contains forward-looking statements that involve risks and uncertainties. Except as otherwise indicated by the context, references in this Annual Report to “we,” “us” and “our” are to the consolidated business of the Company. All statements other than statements of historical facts contained in this Annual Report are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “possible,” “potential,” “predict,” “project,” “design,” “seek,” “should,” “target,” “will,” “would,”“would” or the negative of these words or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

•our ability to complete the Merger (as defined below) and related spin-out transaction (as described below);

•the initiation, timing, progress and results of our research and development programs as well as our preclinical studies and clinical trials;

•our ability to advance therapeutic candidates into, and successfully complete, clinical trials;

•our interpretation of initial, interim or preliminary data from our clinical trials, including interpretations regarding disease control and disease response;

•the timing or likelihood of regulatory filings and approvals;

•the commercialization of our therapeutic candidates, if approved;

•the pricing, coverage and reimbursement of our therapeutic candidates, if approved;

•our ability to utilize our technology platform to generate and advance additional therapeutic candidates;

•the implementation of our business model and strategic plans for our business and therapeutic candidates;

•our ability to successfully manufacture our therapeutic candidates for clinical trials and commercial use, if approved;

•our ability to contract with third-party suppliers and manufacturers and their ability to perform adequately;

•the scope of protection we are able to establish and maintain for intellectual property rights covering our therapeutic candidates;

•our ability to enter into strategic partnerships and the potential benefits of such partnerships;

•our estimates regarding expenses, capital requirements and needs for additional financing;

•our ability to raise funds needed to satisfy our capital requirements, which may depend on financial, performance;

•our expectations regarding the impact of the COVID-19 pandemic on our business;economic and market conditions and other factors, over which we may have no or limited control;

•our and our third party partnersthird-party partners’ and service providers’ ability to continue operations and advance our therapeutic candidates through clinical trials, andas well as the ability of our third party manufacturers to provide the required raw materials, antibodies and other biologics for our preclinical research and clinical trials, in light of the COVID-19 pandemic and the recent political developments in Hong Kong;current market conditions or any pandemics, regional conflicts, sanctions, labor conditions, geopolitical events, natural disasters or extreme weather events;

•our ability to retain the continued service of our key professionals and to identify, hire and retain additional qualified professionals; and

•developments relating to our competitors and our industry.

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the section titled “Risk Factors” elsewhere in this Annual Report. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Annual Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant

information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report to conform these statements to new information, actual results or to changes in our expectations, except as required by law.

You should read this Annual Report and the documents that we file with the Securities and Exchange Commission, or the SEC, with the understanding that our actual future results, levels of activity, performance, and events and circumstances may be materially different from what we expect.

This annual reportAnnual Report includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this annual reportAnnual Report appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks and tradenames.

Part I.

Item 1. Business.

Overview

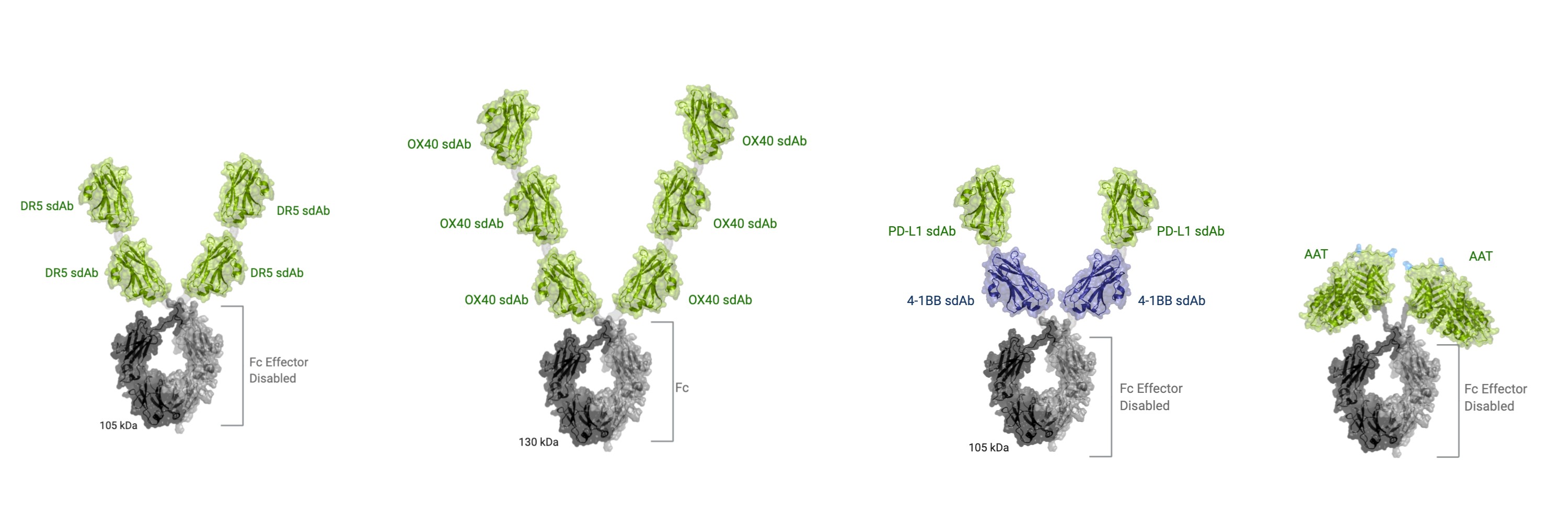

We are a clinical-stage biotechnologybiopharmaceutical company with a pipeline of novel biologic therapeutic candidates, developed using our proprietary modular protein engineering expertiseplatforms. We leverage our innovative protein engineering technologies and proprietary single domain antibody, or sdAb, platform. Our sdAb platform allows usdeep understanding of target biology to pursuecreate therapeutic candidates with attributes and mechanisms superior to current approaches and applicable to a range of challenging, validated targets with clinical promise, but where other antibodyhigh potential.

Recent Developments

Sale of INBRX-101 to Sanofi

In January 2024, we announced that we entered into a definitive agreement, or the Merger Agreement, with Aventis Inc., or Aventis, a wholly owned indirect subsidiary of Sanofi, whereby Sanofi will indirectly acquire, through Aventis, all the assets and biologic based approaches have failed. Highly modular, our sdAbs can be combined with precise valencies and multiple specificities, creating therapeutic candidates designedliabilities primarily related to be capable of enhanced cell signaling, conditional activationINBRX-101, or combined synergistic functions.

Wethe Merger, an optimized, recombinant alpha-1 antitrypsin, or AAT, augmentation therapy currently have four programs in ongoing clinical trials, with the most advanced expected to initiate a registration-enablingregistrational trial in mid-2021. Three of these programs are for the treatment of various cancers, and one for the treatment of Alpha-1 Antitrypsin Deficiency,patients with alpha-1 antitrypsin deficiency, or AATD. Our most advanced therapeutic candidate, INBRX-109, is a tetravalent death receptor 5, or DR5, agonist currently being evaluated in patients diagnosed with difficult-to-treat cancers, such as chondrosarcoma, synovial sarcoma, mesothelioma and pancreatic adenocarcinoma. We plan to submit an amended Investigational New Drug Application, or IND,Immediately prior to the U.S. Foodclosing of the Merger, all assets and Drug Administration,liabilities not primarily related to INBRX-101 will be spun out into a new publicly traded company, Inhibrx Biosciences, Inc., or New Inhibrx.

Under the FDA, for INBRX-109 during March 2021. We expect to initiateterms of the definitive agreements, Aventis will acquire all of our outstanding shares through a registration-enabling trial evaluating INBRX-109 in patients diagnosed with conventional chondrosarcoma around mid-2021. INBRX-106 is a hexavalent OX40 agonist, currently being investigated as a single agentmerger, and in combinationturn, each of our shareholders will receive: (i) $30.00 per share in cash, (ii) one contingent value right per share, representing the right to receive a contingent payment of $5.00 in cash upon the achievement of a regulatory milestone and (iii) one SEC-registered, publicly listed, share of New Inhibrx for every four shares of Inhibrx common stock held. In addition, in connection with Keytruda,the transaction, Aventis will (1) assume and retire our outstanding third-party debt with Oxford Finance, LLC, or Oxford, (2) cause New Inhibrx to be funded with $200 million in patients with locally advanced or metastatic solid tumors. Both INBRX-109cash, and INBRX-106 programs are designed(3) retain an equity interest in New Inhibrx of approximately 8%. Subject to achieve target agonism through precise controlthe satisfaction of therapeutic valency. INBRX‑105 is a conditional 4-1BB agonist,customary closing conditions, including the receipt of regulatory approvals, we currently being investigated in patients with locally advanced or metastatic solid tumors, as a single agent and initiating in combination with Keytrudaexpect the transaction to close during the second quarter of 2021. 2024.

Discontinuation of INBRX-105

We have decided to terminate our INBRX-105 program, a tetravalent programmed death-ligand 1, or PD-L1, targeted 4-1BB agonist. During the length of our Phase 1/2 trial, we dosed approximately 150 patients. We initially observed single agent complete and partial responses in non-small cell lung cancer, or NSCLC, and head and neck squamous cell carcinoma, or HNSCC. We also observed partial responses with INBRX-105 in combination with Keytruda® (pembrolizumab). However, after evaluation of the totality of the data from the expansion cohorts, the initial signal was not sufficiently validated to support the continuation of this program. We are in the process of winding down the clinical trial and expect it to be complete within the first half of 2024. Consequently and in conjunction with this decision, Elpiscience Biopharmaceuticals, Inc, or Elpiscience, terminated its rights to commercialize INBRX-105 in greater China.

Current Clinical Pipeline

Our fourth program, current clinical pipeline includes therapeutic candidates in the following categories:

•INBRX-101, is an optimized, recombinant alpha 1which seeks to maintain the natural function of Alpha-1 antitrypsin, or AAT, augmentation therapyin a recombinant format, optimized for AATD. We anticipate additional data releases from all fourless frequent dosing and greater potential therapeutic activity as compared to plasma-derived AAT, or pdAAT; and

•INBRX-109 and INBRX-106, both of which utilize our clinical programsmultivalent formats where the precise valency can be optimized in 2021.

Our Pipeline

We have developed a diverse pipeline of therapeutic candidates that are specifically designedtarget-centric way to leveragemediate what we believe to be the power of our core sdAb platform and protein engineering expertise, as shown below:

| | | | | | | | | | | | | | | | | | | | |

|

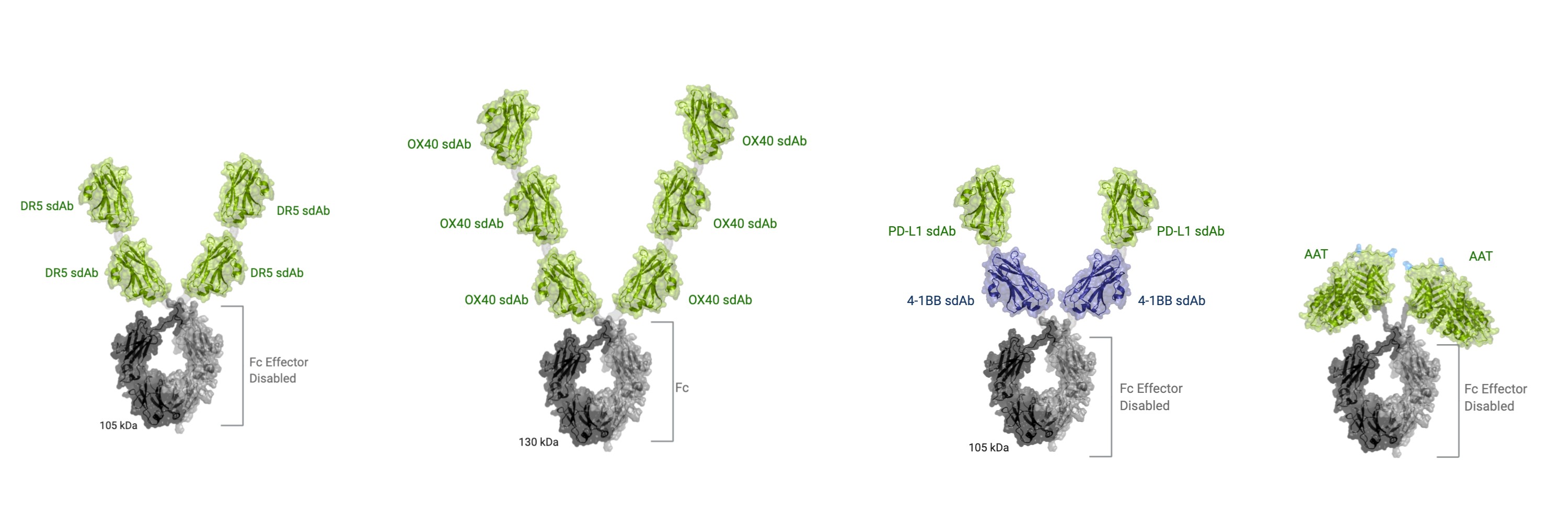

INBRX-109most appropriate agonist function. | | INBRX-106 | | INBRX-105 | | INBRX-101 |

Tetravalent DR5 agonist | | Hexavalent OX40 agonist | | PD-L1x4-1BB tetravalent conditional agonist | | AAT-Fc fusion protein |

| | | | | | | | | | | | | | | | |

| | | | | | |

| INBRX-101 | | INBRX-109 | | INBRX-106 | | |

AAT-Fc fusion

protein | | Tetravalent DR5

agonist | | Hexavalent OX40

agonist | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Program | Therapeutic Area | Target(s)/Format | STAGE OF DEVELOPMENT | Anticipated Next Milestones |

| Preclinical | Phase 1 | Phase 2 | Phase 3 |

| INBRX-101* | Orphan/Respiratory | Neutrophil Elastase Inhibitor

AAT-Fusion Protein | |

| | | |

|

| INBRX-109** | Oncology | DR5

Tetravalent Agonist | | • Initiation of Trials-

◦Registration-enabling Phase 2 trial in conventional chondrosarcoma –Mid-2021^

◦Ewing combination cohort – Mid-2021

• Initial Data-

◦Mesothelioma and pancreatic adenocarcinoma chemotherapy combination cohorts – Q4 2021

◦Synovial sarcoma cohort (single agent) – 2H 2021

◦Ewing combination cohort –1H 2022

|

| |

|

| INBRX-106*** | Oncology | OX40

Hexavalent Agonist | | • Initial Data-

◦ Escalation with Keytruda – Q3 2021

◦ Expansion with Keytruda cohorts – Mid-2022

|

| | | | | |

|

| INBRX-105** | Oncology | PD-L1 x 4-1BB

Tetravalent Conditional Agonist | • Initial Data-

◦ Escalation with Keytruda cohorts – Q4 2021

◦ Expansion with Keytruda cohorts – Q3 2022

|

| |

|

| INBRX-101*** | Orphan/Respiratory | Neutrophil Elastase

AAT-Fusion Protein | • Initial multiple ascending dose data – Q4 2021 |

| |

|

__________________

* Subject to potential acquisition by Aventis as described above.

** Third party partnership with Chinese biotechnology company, Transcenta Holding, Ltd. (formerly Hangzhou Just Biotherapeutics Co., Ltd.), or Transcenta, currently in place for development and commercialization in China, Hong Kong, Macau and/or Taiwan.

*** Third party partnership with Chinese biotechnology company, Elpiscience Biopharmaceuticals, Inc., or Elpiscience, currently in place for development and commercialization in China, Hong Kong, Macau and/or Taiwan.

*** Commercialization and development rights outside of the United States and Canada, subject to an option agreement with Chiesi Farmaceutici S.p.A., or Chiesi.

^ The FDA granted fast track designation to INBRX-109 for the treatment of patients with unresectable or metastatic conventional chondrosarcoma in January 2021. Advancing INBRX-109 into registration-enabling randomized Phase 2 trials is contingent upon the FDA’s approval of the Company’s IND amendment, which is planned to be submitted in March 2021.

INBRX-109

INBRX-109 is a precisely engineered tetravalent sdAb-based therapeutic candidate that agonizes DR5 to induce tumor selective programmed cell death. The IND for INBRX-109 became effective in August 2018, and we initiated a three-part, Phase 1 clinical trial in the United States in November 2018. Part 1, the traditional single agent 3+3 dose escalation portion of this trial, was completed in August 2019, with enrollment of 20 patients. INBRX-109 was well-tolerated, with no significant toxicities observed at doses up to and including the maximum administered dose of 30 mg/kg. No maximum tolerated dose, or MTD, was reached.

In September 2019, we commenced Part 2 of this trial with single agent dose expansion cohorts, enrollment of which is still ongoing. During the fourth quarter of 2020, we initiated Part 3, chemotherapy combination cohorts, in malignant pleural mesothelioma and pancreatic adenocarcinoma. Initial data from the combination dose escalation cohorts are expected in the fourth quarter of 2021. As of February 2, 2021, we have enrolled over 104 patients in Part 1 and in the following cancer type specific cohorts: colorectal, gastric and pancreatic adenocarcinomas, malignant pleural mesothelioma, chondrosarcoma and synovial sarcoma.

In January 2021, the FDA granted fast track designation to INBRX-109 for the treatment of patients with unresectable or metastatic conventional chondrosarcoma, which is a serious, life-threatening medical condition with no currently approved effective systemic therapy options. We plan to initiate a registration-enabling Phase 2 trial with progression free survival as the primary endpoint in mid-2021.

We plan to investigate the therapeutic utility of INBRX-109 through a broad clinical development plan across difficult-to-treat cancers. Future clinical development of INBRX-109 may include combinations with additional chemotherapies and potentially synergistic agents in multiple solid tumors and hematologic malignancies. We are currently conducting preclinical studies with INBRX-109 and various rational combination agents, including targeted therapeutics and apoptotic pathway modulators, aimed at guiding our future clinical plans.

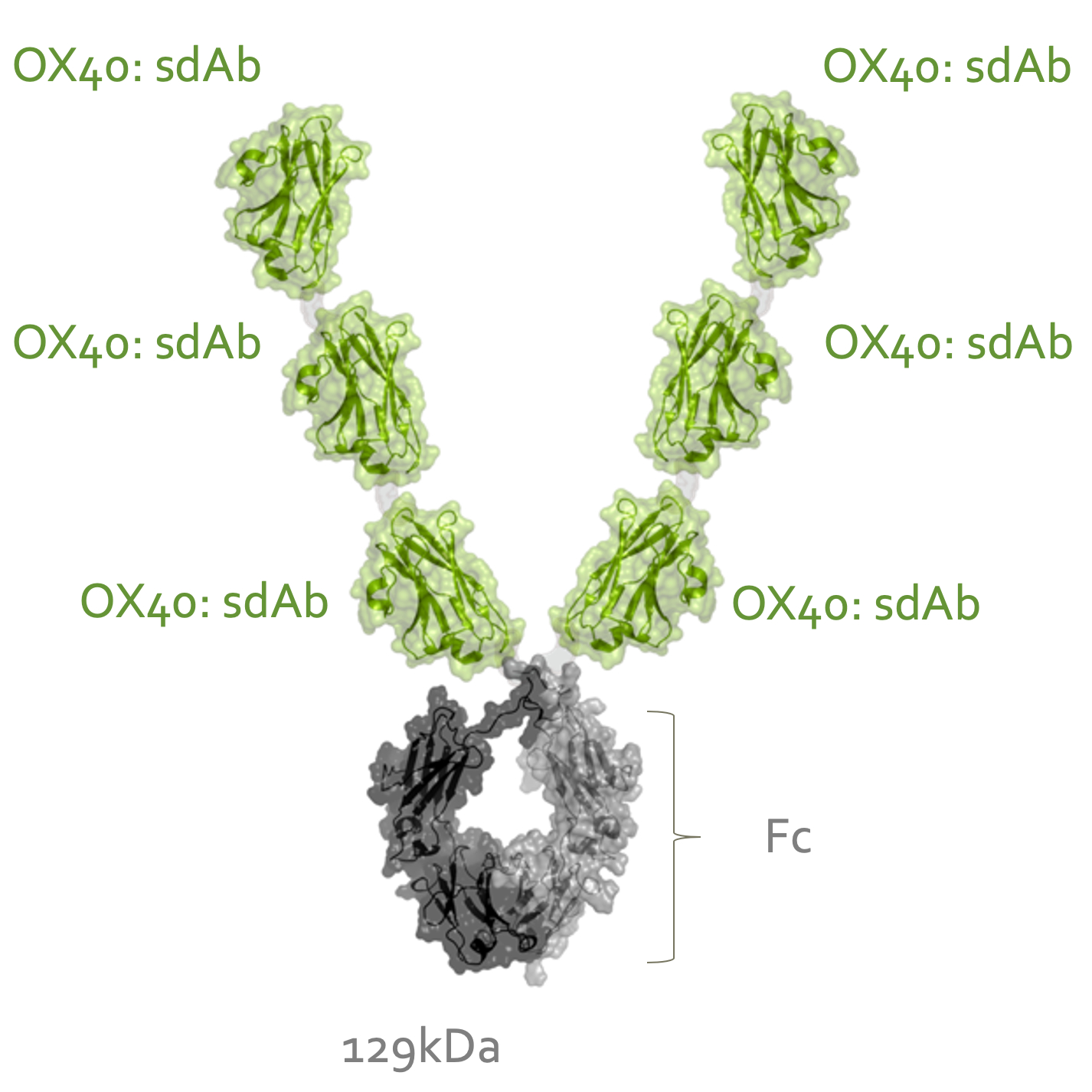

INBRX-106

INBRX-106 is a precisely engineered hexavalent sdAb-based therapeutic candidate targeting OX40 that has the potential to treat numerous cancer indications, both as a single agent and in combination. OX40, also known as TNFRSF4, is a member of the tumor necrosis factor receptor superfamily, or TNFRSF, and is predominately expressed on activated T-cells. Signaling through OX40 provides co-stimulation that promotes T-cell expansion, enhanced effector function and memory cell formation, and prevents activation induced cell death. Based on the capacity for OX40 signaling to enhance anti-tumor immunity in preclinical studies, there have been many efforts to therapeutically exploit this pathway for cancer immunotherapy.

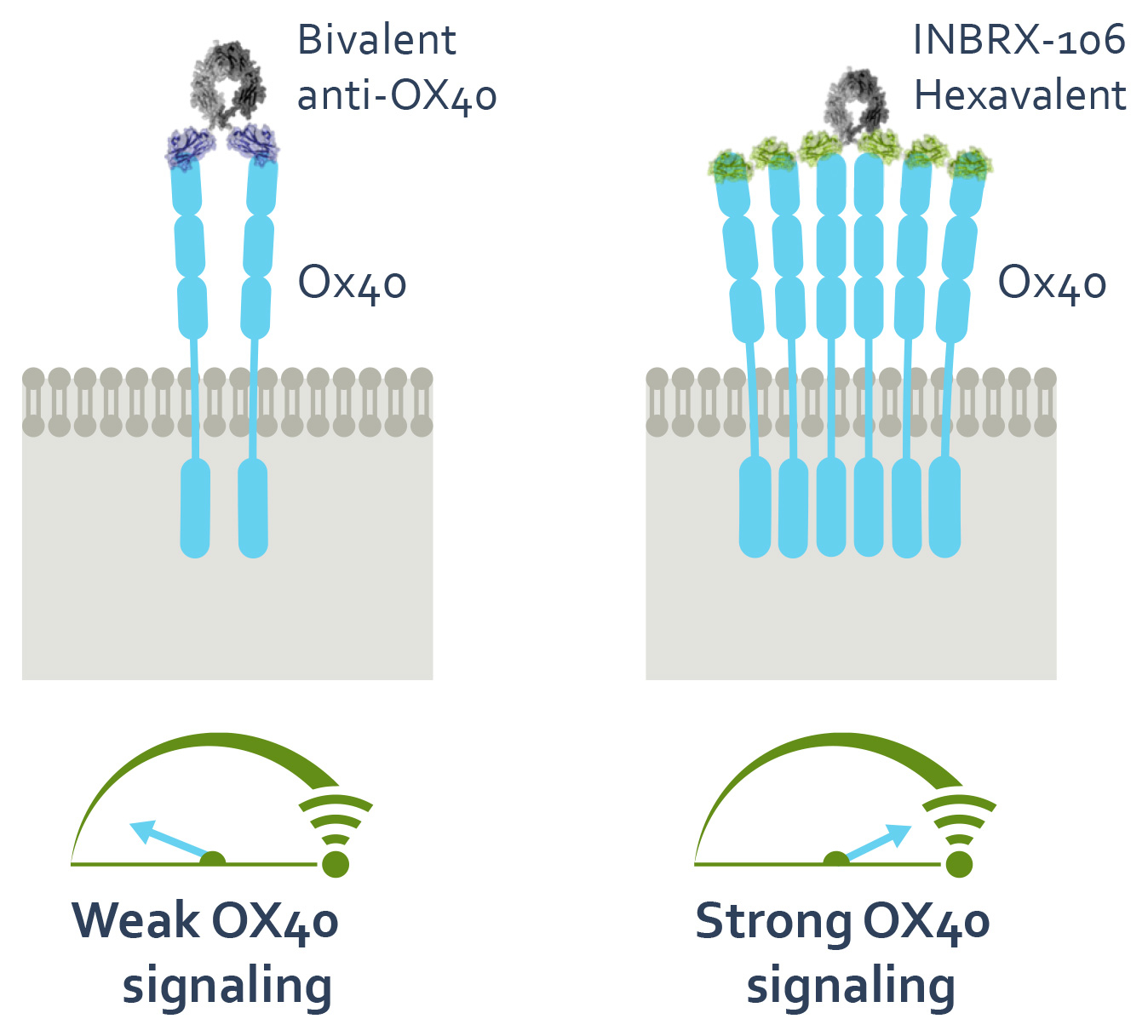

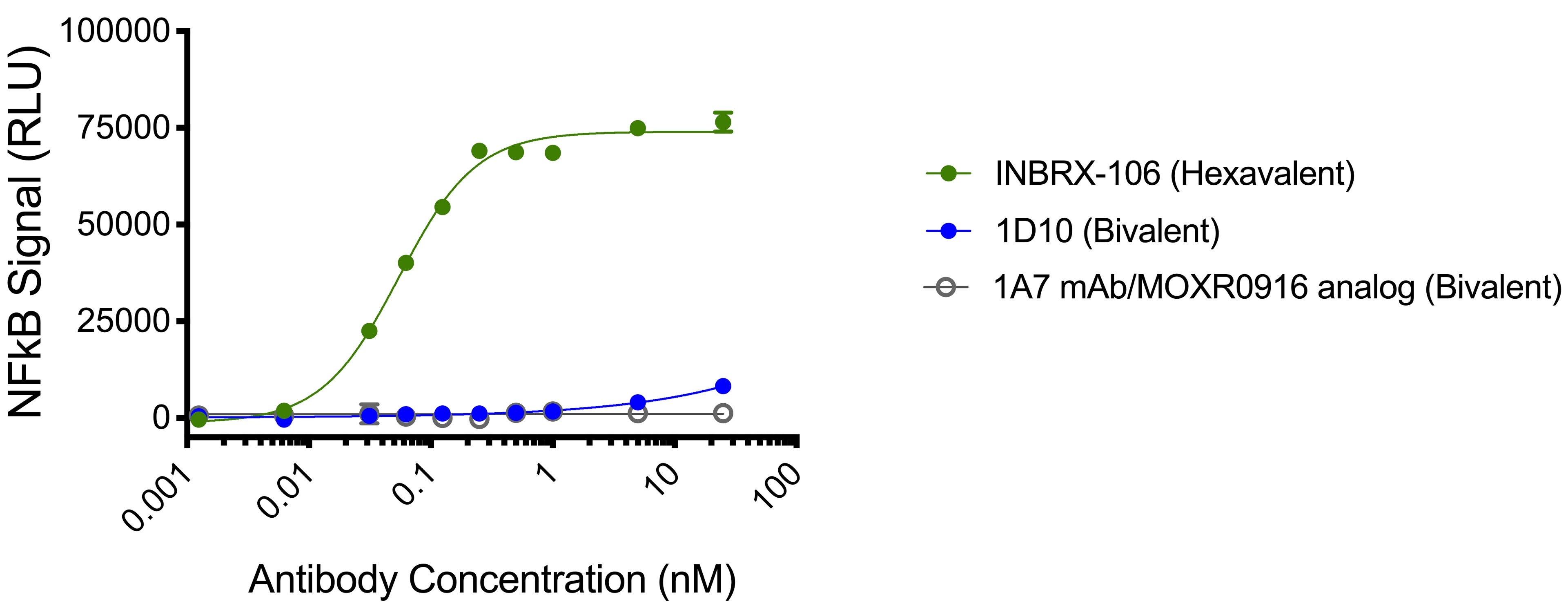

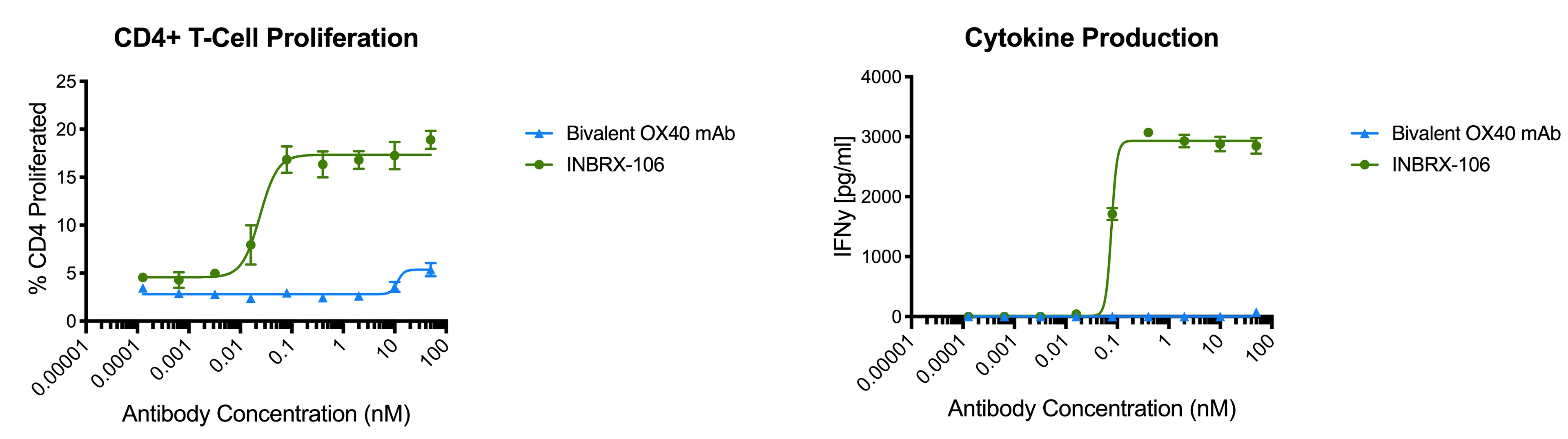

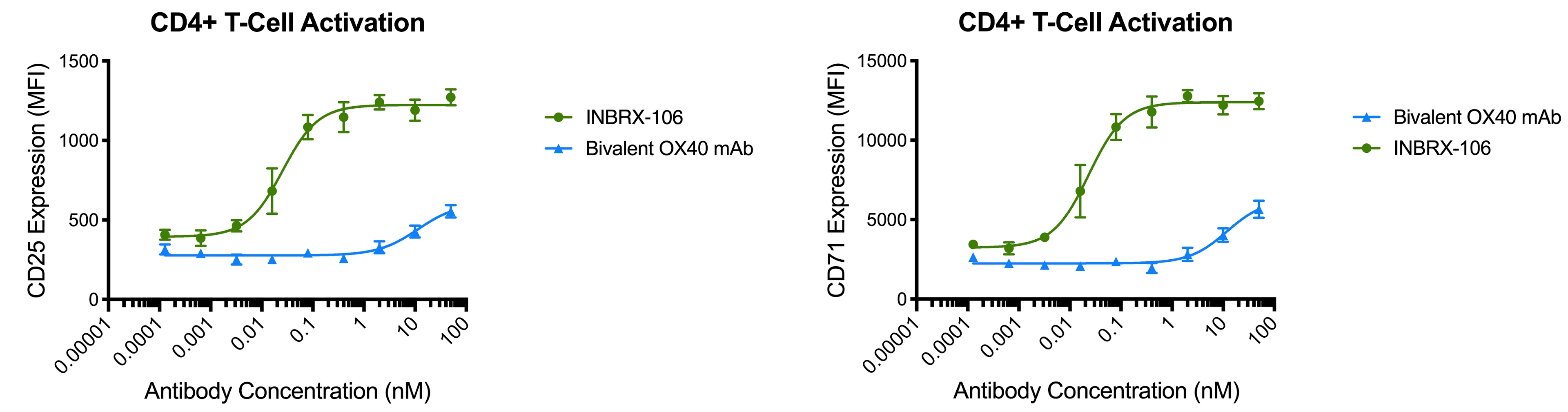

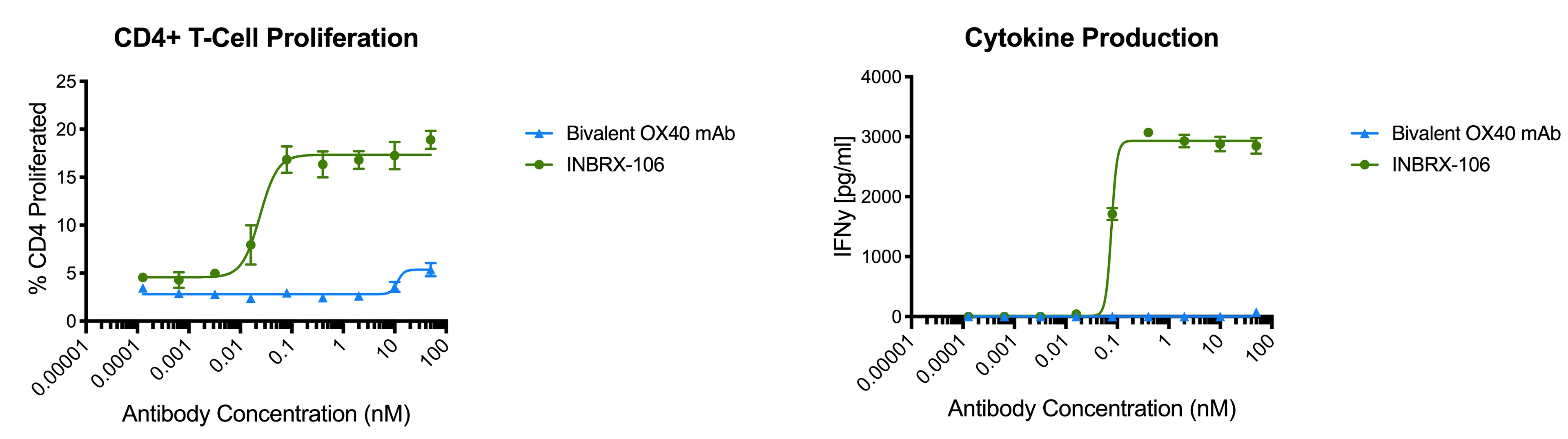

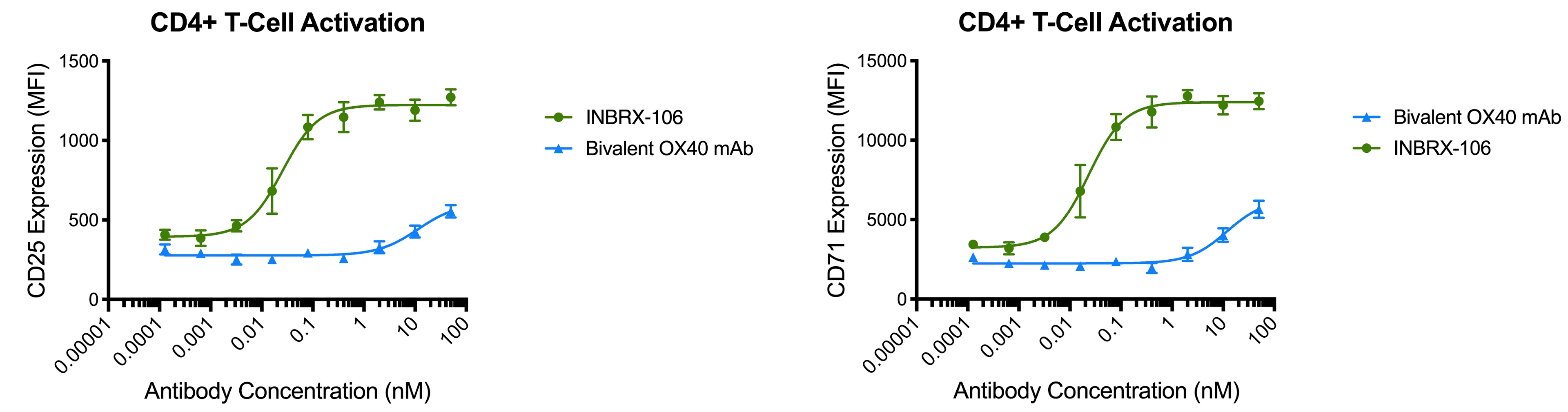

To date, OX40 agonism has mainly been clinically explored with bivalent antibodies. We believe the lack of success with many of these prior attempts resulted from insufficient valency to achieve receptor clustering. We believe INBRX-106, a hexavalent therapeutic candidate with the ability to bind six OX40 molecules per molecule of drug, has the potential to achieve improved receptor clustering and downstream signaling. In preclinical studies, we have observed that INBRX-106 mediated T-cell co-stimulation and also reduced the suppressive activity of regulatory T-cells, with superior activity to bivalent comparators.

The IND for INBRX-106 became effective in June 2019, and we initiated a four-part Phase 1 clinical trial in the United States in December 2019. Part 1 of this trial, single agent dose escalation, was completed in January 2021 with enrollment of 20 patients. INBRX-106 was well-tolerated, without reaching an MTD up to the maximum administered dose of 3 mg/kg.

Part 2 of this trial, single-agent dose expansion, and Part 3 of this trial, dose escalation in combination with Keytruda, were both initiated in February 2021. Initial data from the combination dose escalation cohort of this trial is expected to be announced during the third quarter of 2021. We expect to initiate Part 4 of this trial, the combination expansion cohorts, upon the completion of Part 3 of this trial and to announce initial data from those combination expansion cohorts during the middle of 2022.

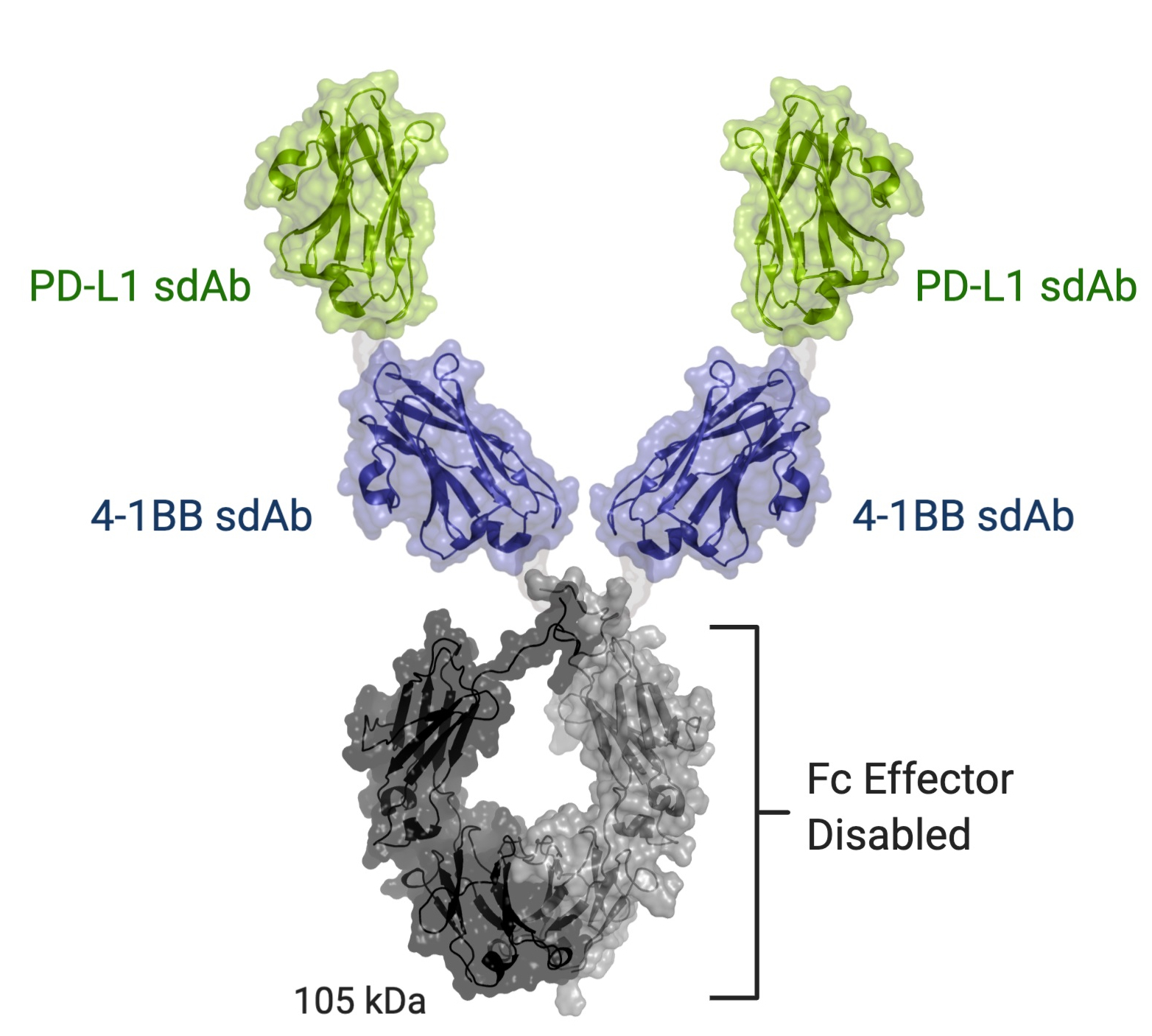

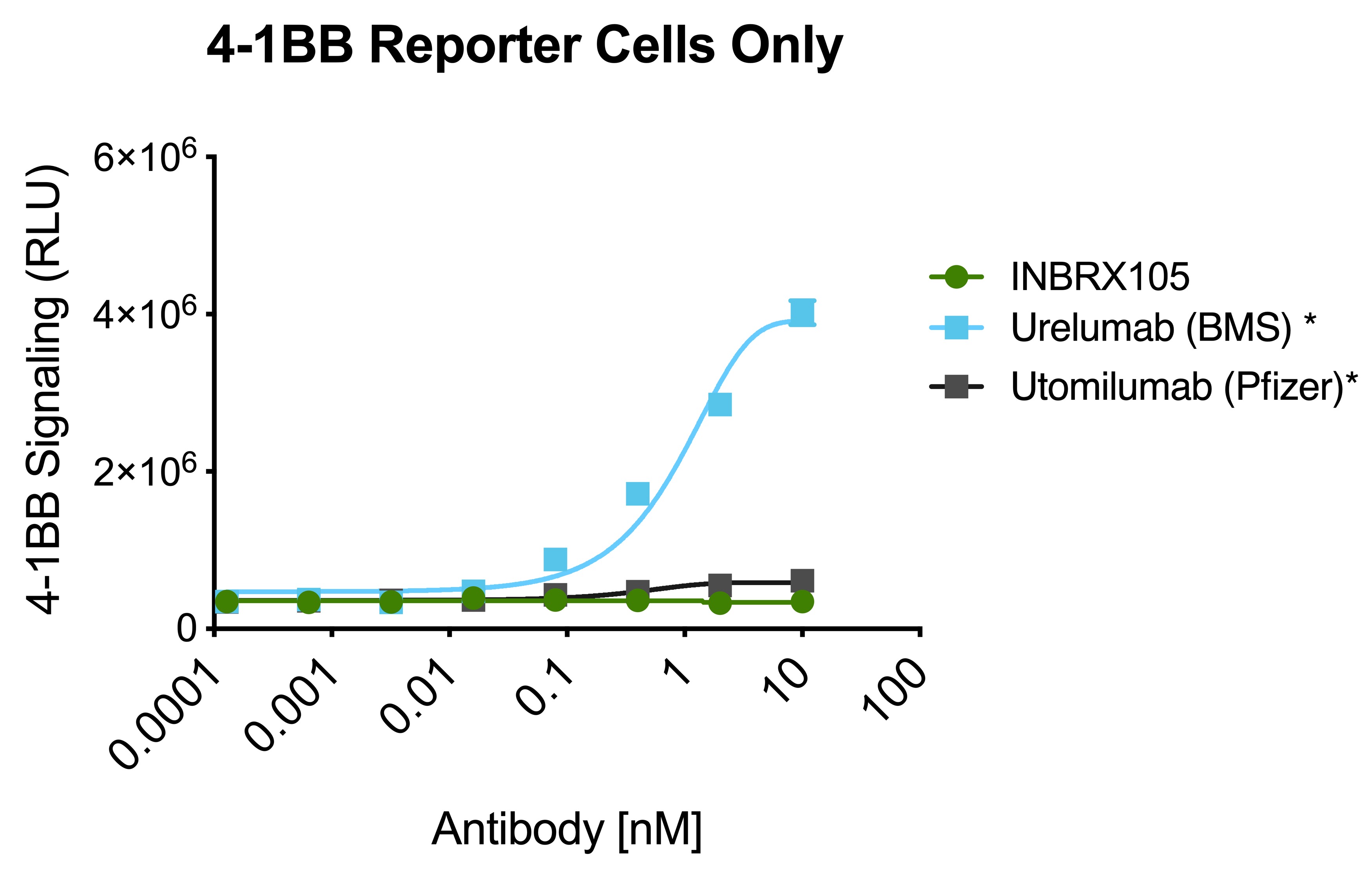

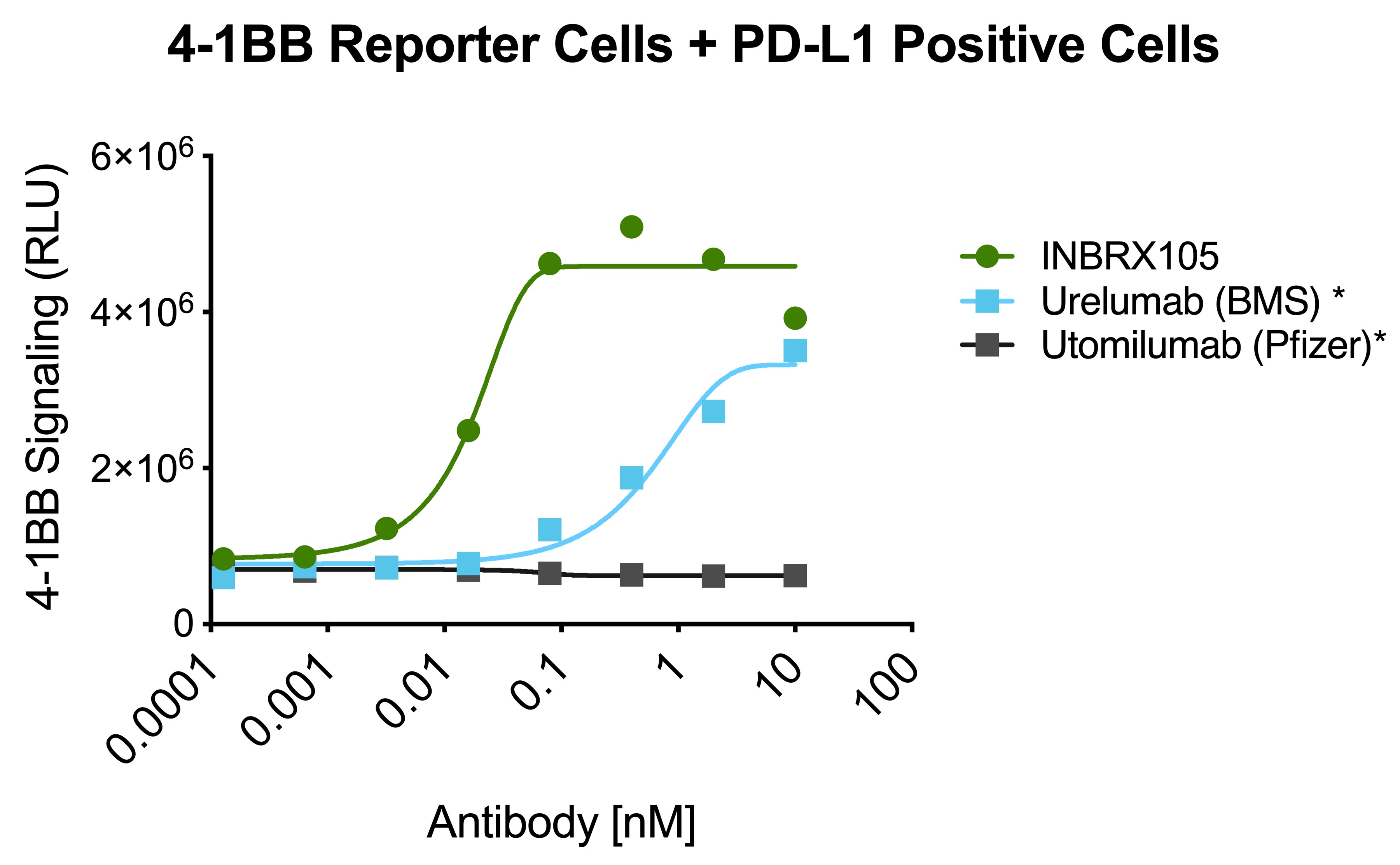

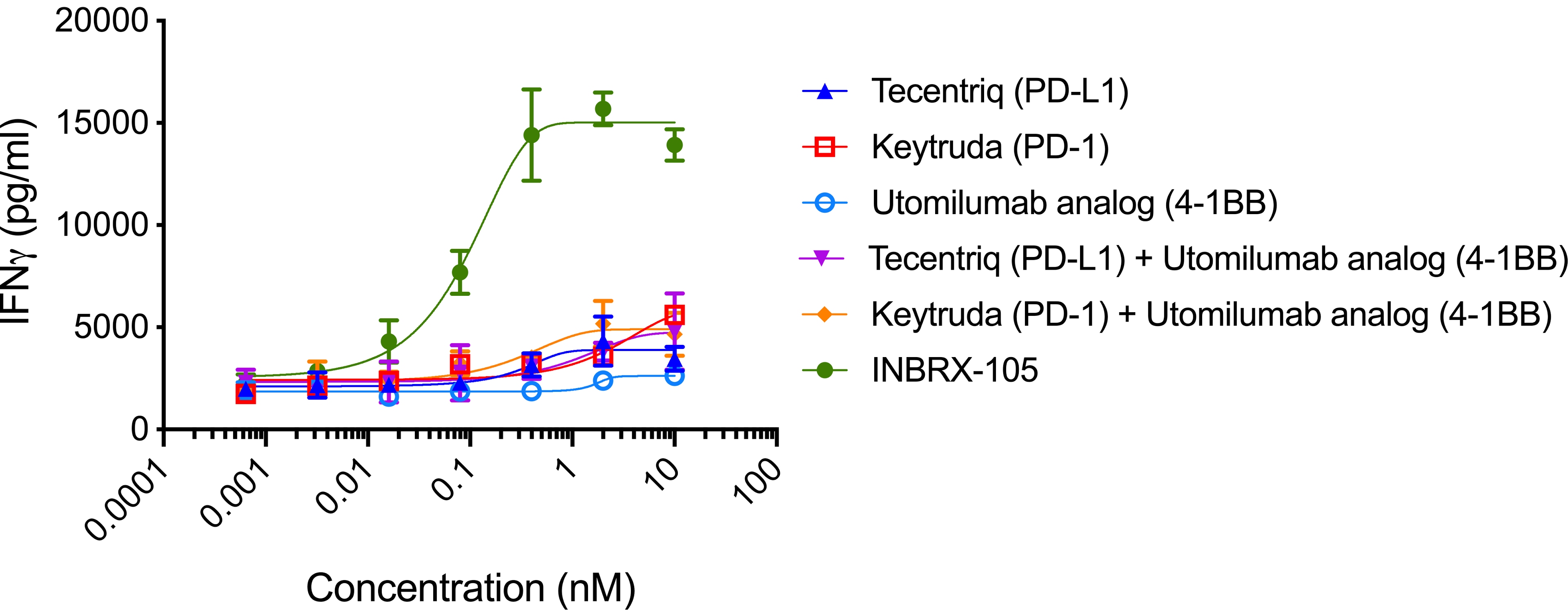

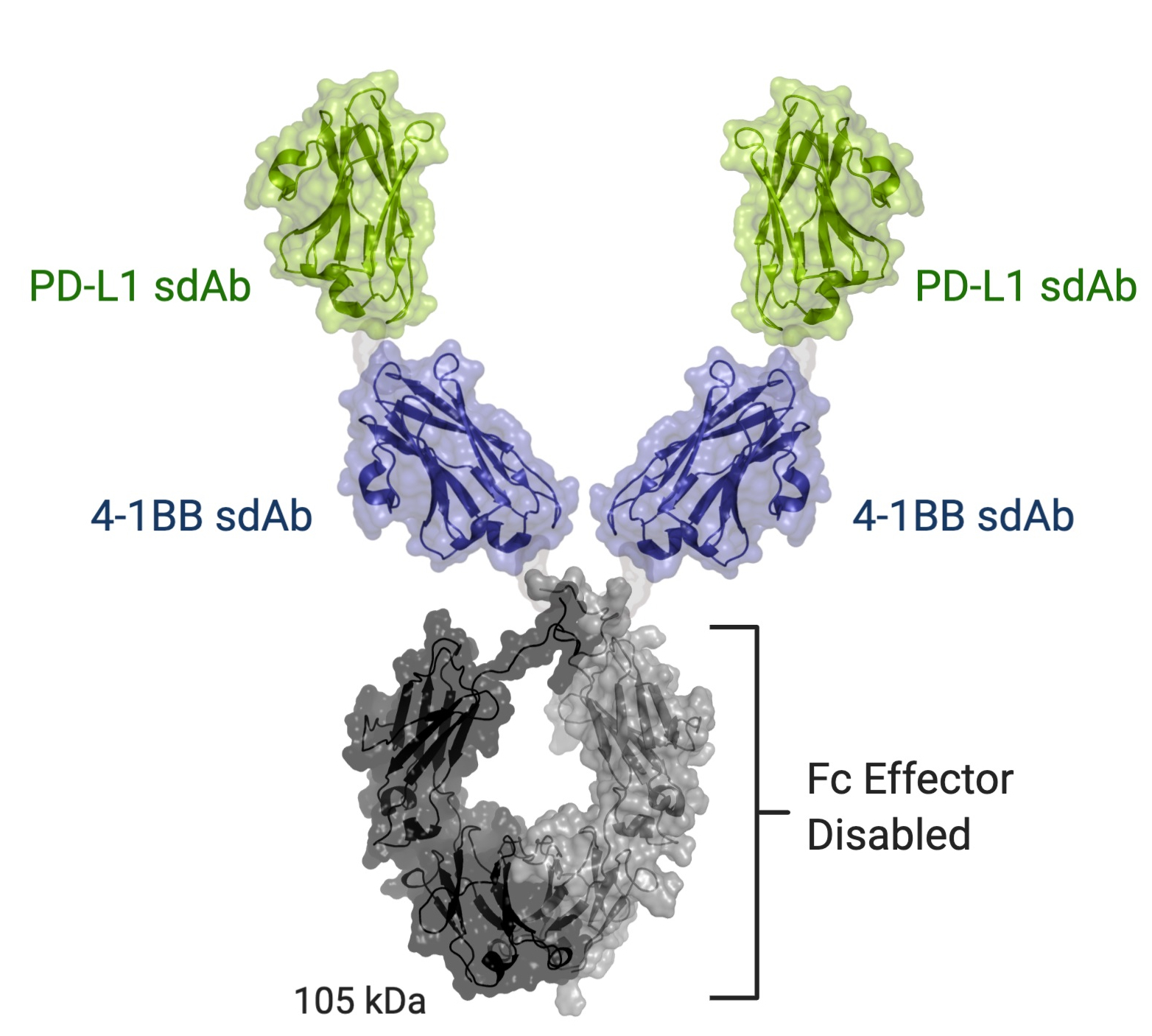

INBRX-105

INBRX-105 is a precisely engineered multi-specific sdAb-based therapeutic candidate that is designed to agonize 4-1BB selectively in the presence of PD-L1, which is typically found in the tumor microenvironment and associated lymphoid tissues. We believe that the unique format of INBRX-105, comprised of two PD-L1 targeting domains, each arranged adjacent to a 4-1BB targeting domain, will result in a selective PD-L1 targeted 4-1BB agonist. Based on the enrichment of PD-L1 expression in the tumor microenvironment, we believe INBRX-105 has the potential to selectively activate 4-1BB + T-cells in the tumor microenvironment, thus potentially overcoming the toxicity issues that have limited the success of prior 4-1BB agonists. PD-L1 is a validated biomarker for tumors with the potential for anti-tumor immune activation and thus we believe represents an ideal anchor antigen to drive 4-1BB agonism.

We initiated a four-part Phase 1 clinical trial in February 2019. Part 1, single-agent dose escalation, was completed with enrollment of 32 patients. Part 2, single-agent expansion, was initiated during the first quarter of 2021 and we expect to initiate Part 3 of this trial, escalation in combination with Keytruda, during the second quarter of 2021. We expect to announce initial data from Part 3 of this trial during the fourth quarter of 2021 and Part 4 of this trial, Keytruda combination expansion cohorts, during the third quarter of 2022.

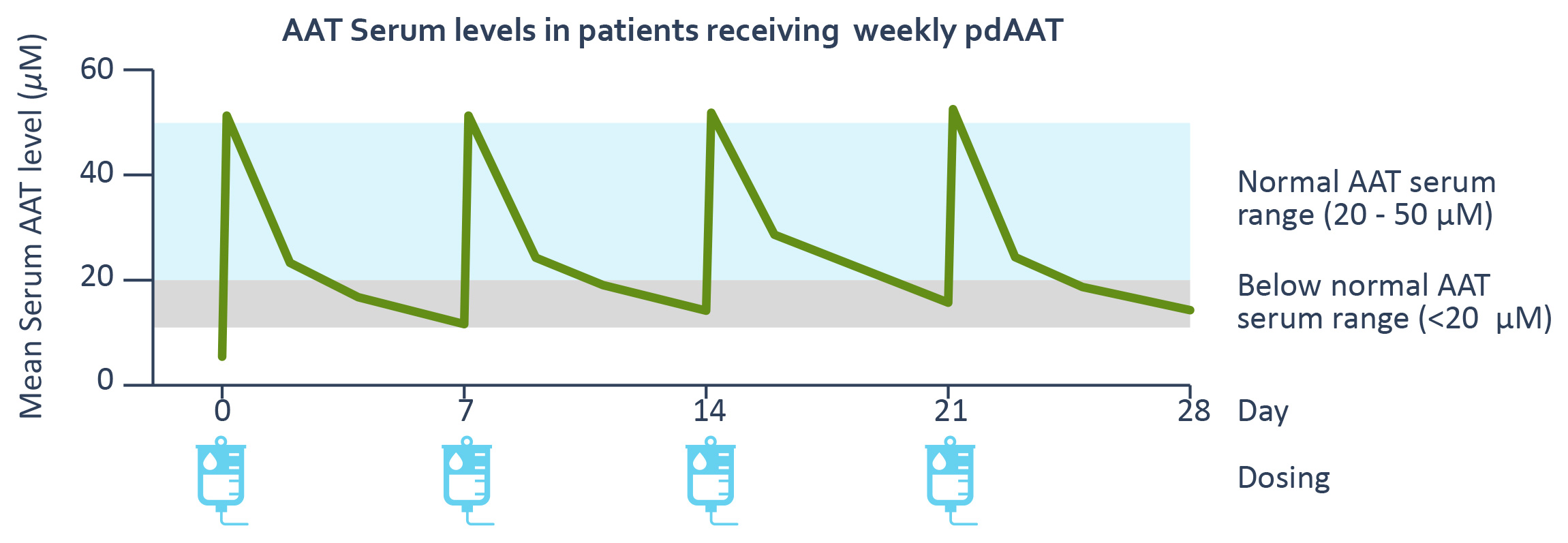

INBRX-101

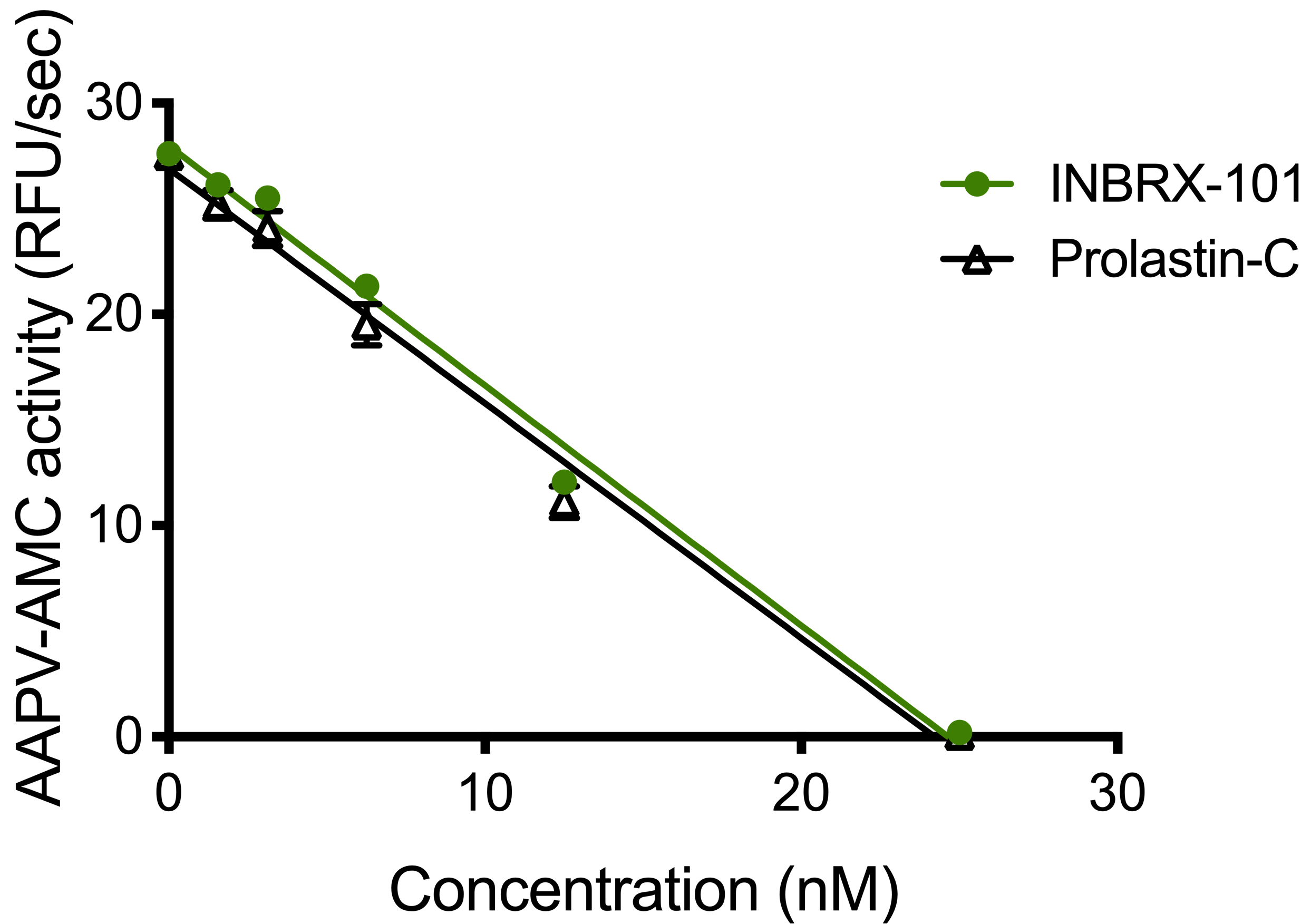

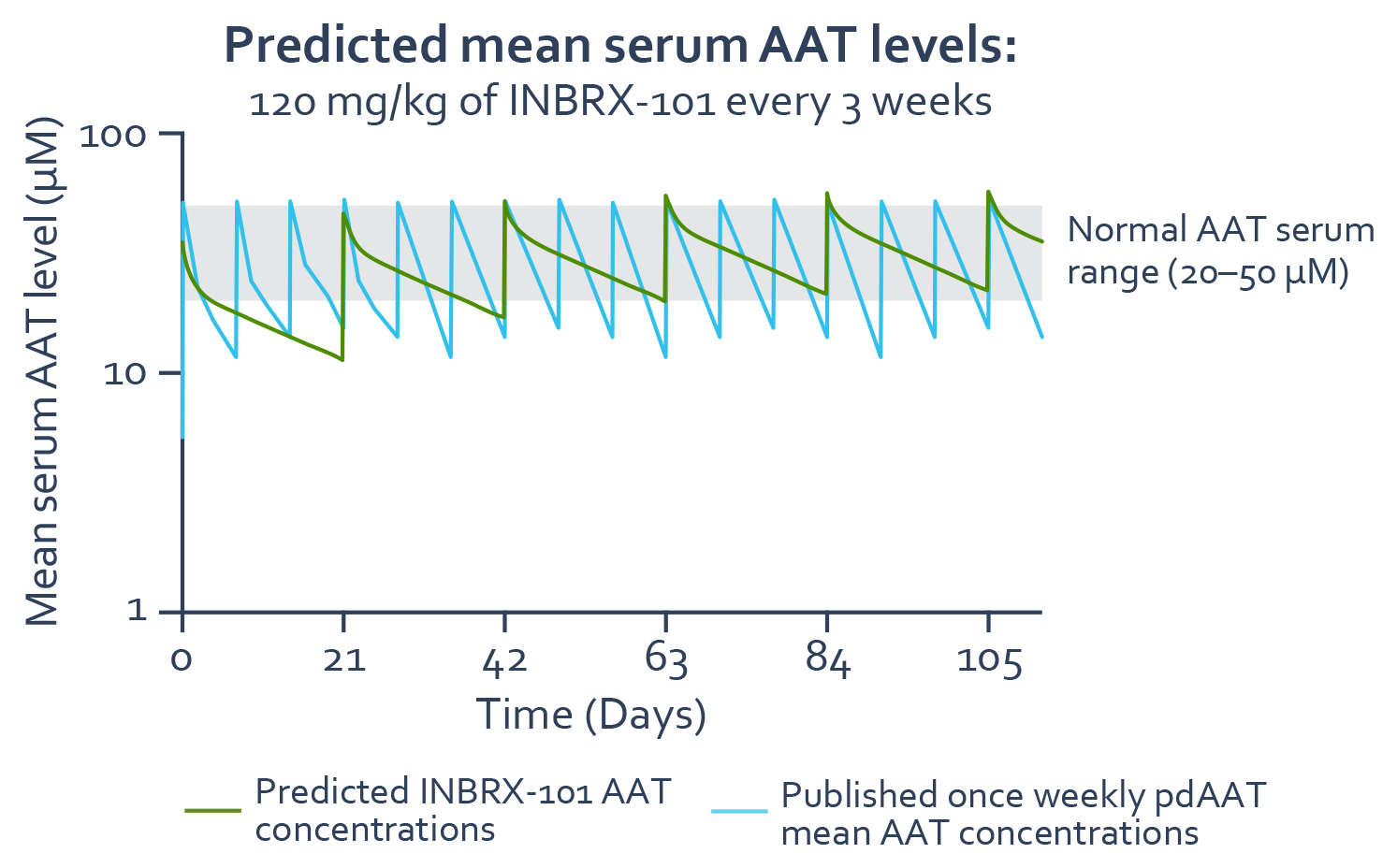

INBRX-101 is a precisely engineered recombinant human AAT-Fc fusion protein therapeutic candidate, in development for the treatment of AATD. The current standard of care for patients with AATD has been unchanged for decades and relies on weekly infusions of plasma derived AAT, or pdAAT, therapeutics. In spite of the frequent dosing, this therapy is incapable of maintaining serum AAT levels in the normal range for individuals affected by the disease.

Combining proprietary protein engineering with robust process development in INBRX-101, we are seeking to overcome the previous challenge in this field of maintaining the function of recombinant AAT, while manufacturing at commercial scale. We believe INBRX-101 has the potential to be dosed every three weeks, while maintaining patients in the normal range of AAT exposure. This would be a significant improvement for patients, currently receiving weekly infusions and sub-optimal augmentation.

The IND for INBRX-101 became effective in November 2018, and we initiated a Phase 1 dose escalation clinical trial in July 2019. As a result of the COVID-19 pandemic, we temporarily suspended enrollment for this trial but resumed recruitment during the fourth quarter of 2020. This temporary suspension was not a result of an observation of adverse events and was solely related to circumstances relating to the COVID-19 pandemic. Assuming enrollment continues as we currently anticipate, we expect to complete the multi-dose cohorts during the fourth quarter of 2021.

In May 2019, we entered into an option agreement, as amended in August 2019, or the Chiesi Option Agreement, with Chiesi, pursuant to which we granted Chiesi an exclusive option to obtain an exclusive license to develop and commercialize INBRX-101 outside of the United States and Canada following completion of the Phase 1 trial.

Our Leadership Team

We have assembled a team with deep scientific, manufacturing, and clinical experience in discovering and developing protein therapeutics.therapeutics, as well as an accomplished commercial team with the expertise to successfully bring our therapeutic candidates, if approved, to market. Our in-house capabilities span the disciplines of discovery, protein engineering, cell biology, translational research, chemistry, manufacturing and controls, or CMC, clinical development, and clinical development.commercialization. Members of our team bring experience from multiple organizations including Genentech, Inc., Gilead Sciences, Inc., Merck & Co., Novartis AG, Pfizer Inc., and Novartis AG.Roche. Our board of directors is comprised of individuals with proven business and scientific accomplishments and significant operating knowledge of our company.

Our Strategy

Our mission is to discover and develop effective biologic treatments for people with life-threatening conditions and to evolve Inhibrx into a commercial-stage biotechnologybiopharmaceutical company with a differentiated and sustainable product portfolio by focusing on the following:

Rapidly advance and optimize the clinical development of our lead programs.

We are focused on rapidly advancingEach of our four therapeutic candidates, each withclinical programs has key clinical data readoutsor milestone events expected in 2021 and 2022. To augment our U.S.-centric clinical strategy for our oncology therapeutic candidates,2024/2025. Since entering the clinic, we have formed collaborations in China designed to provide access to patient populations for clinical trials not readily available in the United States, including treatment-naïve patients,made great strides and to facilitate rapid patient enrollment with the goal of generating more robust early clinical data. We believe this harmonized clinical strategy may allow us to accelerate our development timelines. In addition, for each of our therapeutic candidates, should single agent efficacy be demonstrated, we plan to maximizehave the potential benefit to patients by broadly exploring combinationsreach the marketplace as soon as 2026 with standard of care agents and other rational combination agents.our first commercial therapeutic.

Apply our sdAb platform and other protein technologiesengineering platforms to create differentiated, next-generation therapeutics in focused disease areas with particular emphasis on oncology.

We have developed an sdAb platform and other protein technologies that we believe can be applied to meet the specific challenges of complex target biology. Our current pipeline is focused on oncology and orphan diseases. We plancontinue to focus our internal clinical development where we believe we can create effective and flexible solutions to address the challenges of both validated and novel targets and generate differentiated therapeutics that can be advancedin areas with a high unmet medical need. Our modular protein engineering platforms enable us to efficiently through clinical development.identify optional therapeutic formats customized to the target biology.

Maintain our culture of innovation, execution and efficiency.

Over the last 11 years weWe have successfully built an innovative culture that encourages scientific risk-taking within the bounds of our data-driven philosophy. This enables our research and development team to discover numerous promising preclinical candidates cost effectively, from which we select what we believe are highly differentiated programs for clinical development.

Maximize the potential of our therapeutic pipeline by retaining rights as well as selectively entering into additional strategic partnerships depending on the therapeutic candidate, indication and geography.pipeline.

We have a disciplined strategy to maximize the potential of our therapeutic pipeline by retaining developmentin order to bring the greatest value to our shareholders and commercialization rightsthe most significant impact to those therapeutic candidates, indicationspatients. We are continuously looking to streamline operations to increase efficiency and geographies thatto ensure maximum value is achieved with the capital we believeraise. Additionally, such as with Sanofi, we can develop and eventually commercialize successfully and efficiently on our own if they are approved, while also seeking towill enter into additional strategic partnerships and transactions in instances where we believe partnering will accelerate our development timelines and/or maximize the worldwide commercial potential of any approved therapeutic candidates. Forcandidate.

Our Pipeline

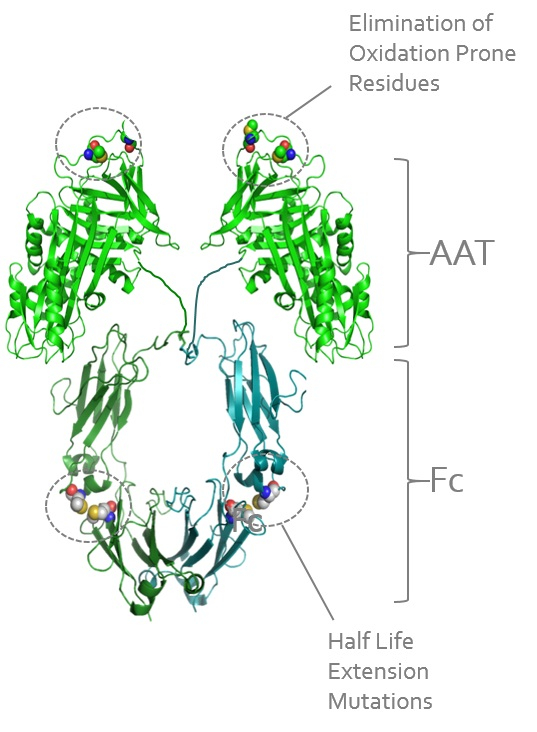

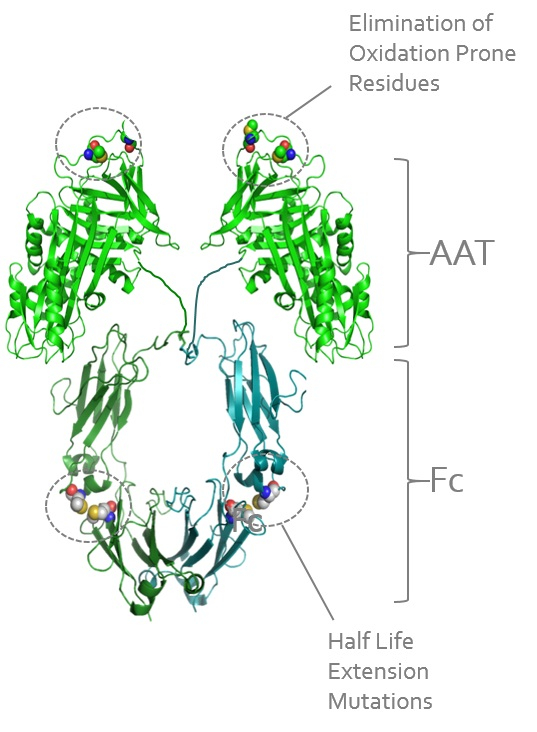

INBRX-101

INBRX-101 is a precisely engineered recombinant human AAT-Fc fusion protein therapeutic candidate that we are developing for the treatment of patients with AATD. We believe INBRX-101 for AATD has the potential to be dosed monthly, while maintaining patients in the normal range of AAT exposure, which would be a significant improvement for patients currently receiving weekly plasma-derived AAT infusions that do not maintain normal AAT exposure. Through our proprietary engineering capabilities, we were able to overcome the challenges of producing AAT recombinantly and manufacturing at commercial scale. Additionally, we believe there is an opportunity for INBRX-101 to be used as a treatment for Acute graft-versus-host disease. It has the potential for a more sustainable dosing schedule and could provide a superior safety benefit over existing approved therapies coupled with greater efficacy.

In January 2024, we announced that we entered into a definitive agreement with Aventis, a wholly owned indirect subsidiary of Sanofi, whereby Sanofi will, indirectly through Aventis, acquire the INBRX-101 program. Subject to the satisfaction of customary closing conditions, including the receipt of regulatory approvals, we expect the transaction to close during the second quarter of 2024.

Overview of AATD

AATD is an inherited disease that causes an increased risk of developing pulmonary disease defined by progressive loss of lung tissue and function and is associated with decreased life expectancy. The pulmonary manifestations of AATD include the entire spectrum of emphysema and disorders associated with chronic obstructive pulmonary disease. Patients with AATD harbor mutations in the AAT-encoding gene Serpin family A member 1, which causes AAT protein misfolding, loss of activity, and retention in the liver. AAT is a protease inhibitor that primarily targets human neutrophil elastase, or NE, an enzyme that is released by white blood cells in response to infections and has the capacity to degrade normal tissues, especially in the lung, if not tightly controlled by AAT.

Unmet Medical Need

This disease affects roughly 100,000 people in the United States, with a similar number of patients in Europe. Since AATD must be diagnosed using laboratory testing and cannot be diagnosed by symptoms or by a medical examination alone, it is believed that many individuals with AATD are likely undiagnosed or misdiagnosed. In April 2017, the United States Food and Drug Administration, or FDA, allowed for the marketing of direct-to-consumer tests that provide genetic risk information for certain conditions, including AATD. We believe such tests will lead to earlier diagnosis and an increase in the number of patients identified with AATD.

We performed a study where functional AAT levels were measured in plasma samples from 65 normal MM genotype individuals. Consistent with other published data, this analysis revealed the 5th and 95th percentiles of functional AAT levels in the normal MM genotype individuals were 21 and 54 µM, respectively, with a median of 36 µM.

Functional AAT levels in 65 healthy volunteers and 30 Phase 1 AAT study participants at baseline prior to dosing of INBRX-101

–Box plots show the minimum, lower quartile, median, upper quartile and maximum.

–The shaded region represents the 5th-95th percentiles of the normal range of functional AAT in healthy MM genotype adults.

–AAT variant determination was conducted by the Mayo Clinic Laboratories using an LC-MS/MS method (A1ALC).

–The Ph 1 baseline data represents the functional AAT levels measured in patients at the beginning of the study prior to dosing of INBRX-101.

example, we have granted Chiesi an exclusive optionThe approved standard of care for AATD has been augmentation therapy using pdAAT and has not been substantially improved since 1987. Plasma-derived treatments are highly dependent on human donor blood supply, which is costly and can be limited. Due to obtain an exclusive licensethe short half-life of pdAAT therapeutics, patients require weekly infusions to developachieve and commercialize INBRX-101 outsidemaintain serum concentration above the protective threshold, presumed to be 11 µM. Even with frequent treatments, the AAT serum concentration following plasma-derived treatment remains considerably below the normal range of 21 to 54 µM as seen in the United States and Canada following completionadaptation graph below that depicts the pharmacokinetic profile of the Phase 1 trial. In addition, wepdAAT based on published data. There is clinical evidence suggesting that maintenance of higher AAT serum trough levels may better protect against lung function decline.

Additionally, there are currently party to license agreements for the development and, if approved, commercialization of INBRX-105, INBRX-106 and INBRX-109 solely in China, Hong Kong, Macau and Taiwan. We otherwise possess the worldwide rights to these candidates. Where appropriate, we plan to seek to enter into additional strategic partnershipsother significant barriers with the goalcurrent standard of maximizing the potentialcare for patients with AATD, including under-diagnosis, high cost of our therapeutic pipeline.

Selectively enter into additional strategic partnerships to maximize the potential of our protein engineering technologies in non-core areas or indications ancillary to oncology.

We believe that the broad potential of our protein engineering technologies, coupled with our strong intellectual property portfolio, can lead to the generation of multiple additional novel product candidates addressing a wide range of therapeutic areas. For example, we licensed our sdAb technologies for specific binders to bluebird bio, Inc., or bluebird, for use in cell therapy. Moreover, we have several preclinical programs focused on non-oncology indications that we are actively seeking to license. Where appropriate, we plan to continue to seek to opportunistically enter into additional strategic partnerships in areas that are considered non-core or indications ancillary to oncology to maximize the potential of our technology platform.

Our Approach

With the goal of addressing unmet medical needs, we leverage our deep understanding of target biology and innovative protein engineering technologies to create therapeutic candidates with attributes and mechanisms of action that are superior to current approaches and applicable to a range of challenging, validated targets withchronic augmentation therapy, high potential.

Our proprietary sdAb platform allows us to address complex target biology where other biologic approaches have failed or are sub-optimal. Our precision engineering enables the generation of therapeutic candidates with defined valencies and specificities, which we believe can result in optimal mechanisms of action. Initially, we have focused on applying these technologies to targets with clinically validated mechanistic rationales but where prior approaches have lacked sufficient therapeutic activity or safety.

Our clinical pipeline is enabled by our protein and process engineering capabilities, and includes therapeutic candidates in the following categories:

•INBRX-109 and INBRX-106 utilize our multivalent formats, for which the precise valency was optimized in a target-centric way to mediate what we believe to be the most appropriate agonist function;

•INBRX-105’s mechanism of action is enabled by a multi-specific format that we believe enables PD-L1 targeted 4-1BB agonism; and

•INBRX-101 seeks to maintain the natural function of AAT in a recombinant format, optimized for less frequent dosing and greater potential therapeutic activity as compared to pdAAT.

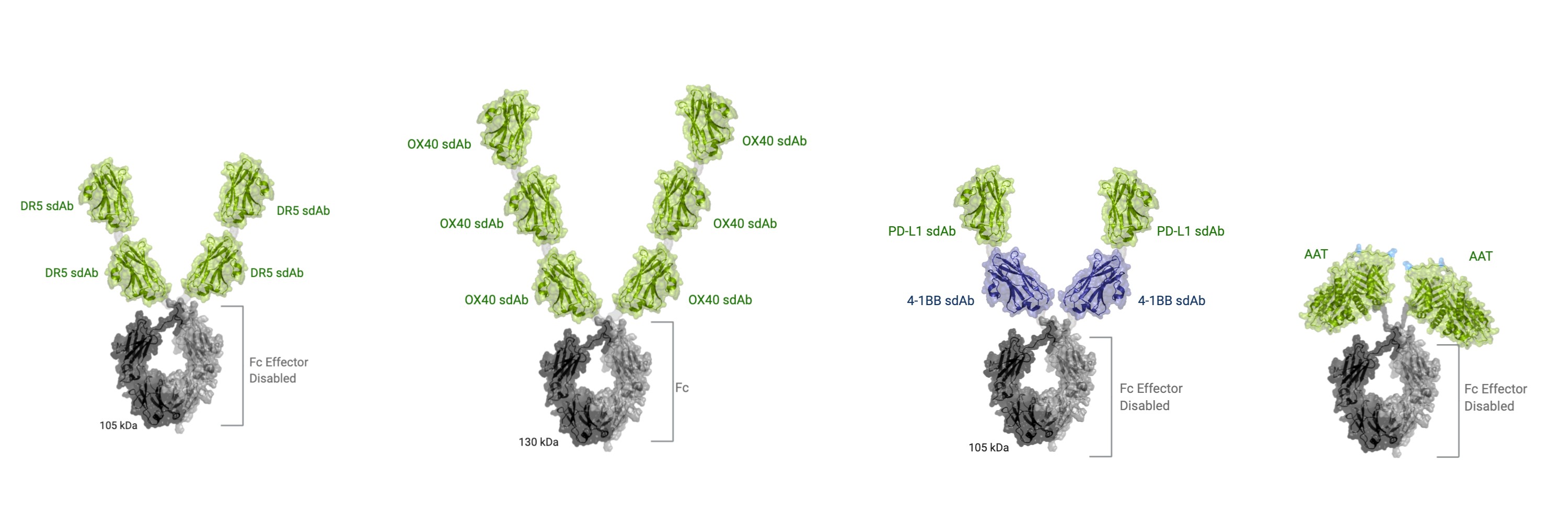

Conventional Antibodies and Their Limitations

Antibodies are multifunctional, Y-shaped proteins, made up of a pair of interacting heavy and light chains to form a symmetric, dimeric molecule with 4 total protein chains. Each arm of the antibody contains an antigen binding region (also referred to as the variable fragment, or Fv), which consists of both a heavy and light variable domain, or VH and VL, respectively, held together through interaction of constant domains. The Fc portion of the heavy-chain constant domain extends the half-life of the antibody in circulation and has the potential to modulate the function of immune cells through interaction with various Fc receptors found on the surface of cells of the immune system.

We believe that antibody Fv domains are not optimal building blocks for multispecific and multivalent therapeuticspatient burden due to frequent infusions, and the extensive protein engineering required to ensure the correct pairinginherent risks of the appropriate VH and VL domains to construct functional Fvs.

One common approach used to achieve correct pairing is the production of single chain variable fragments, or scFvs, which are generated by combining the VH and VL domain antigen binding domains using a flexible linker. Despite the addition of this linker, VH or VL sequences within an scFv have the propensity to errantly pairreceiving human blood products with a neighboring scFv, and can lead to disruption of proper Fv formation or aggregation. This issue canplasma collection practices that may not be exacerbated insustainable.

constructsOur Solution - INBRX-101

INBRX-101 is a recombinant AAT protein that contain multiple scFvs, with each entity requiring significant up-front optimization. These formatting challenges may restrict broad applicabilityis comprised of this technology.

To address these limitations, we have developed our sdAb platform to enable the streamlined production of protein formats with multiple antigen specificities. sdAbs are conceptually similartwo human AAT molecules covalently linked to the VH domainFc region of human immunoglobulin G4. AAT has proven difficult to develop recombinantly, often displaying loss of activity and experiencing accelerated degradation. Fusion of AAT to the Fc region allows for production using a conventionalstandard antibody but do not contain nor require a paired VL domain, as shownexpression system, which, when combined with our proprietary AAT-function preserving purification process, generates substantial and scalable yields of active recombinant AAT protein.

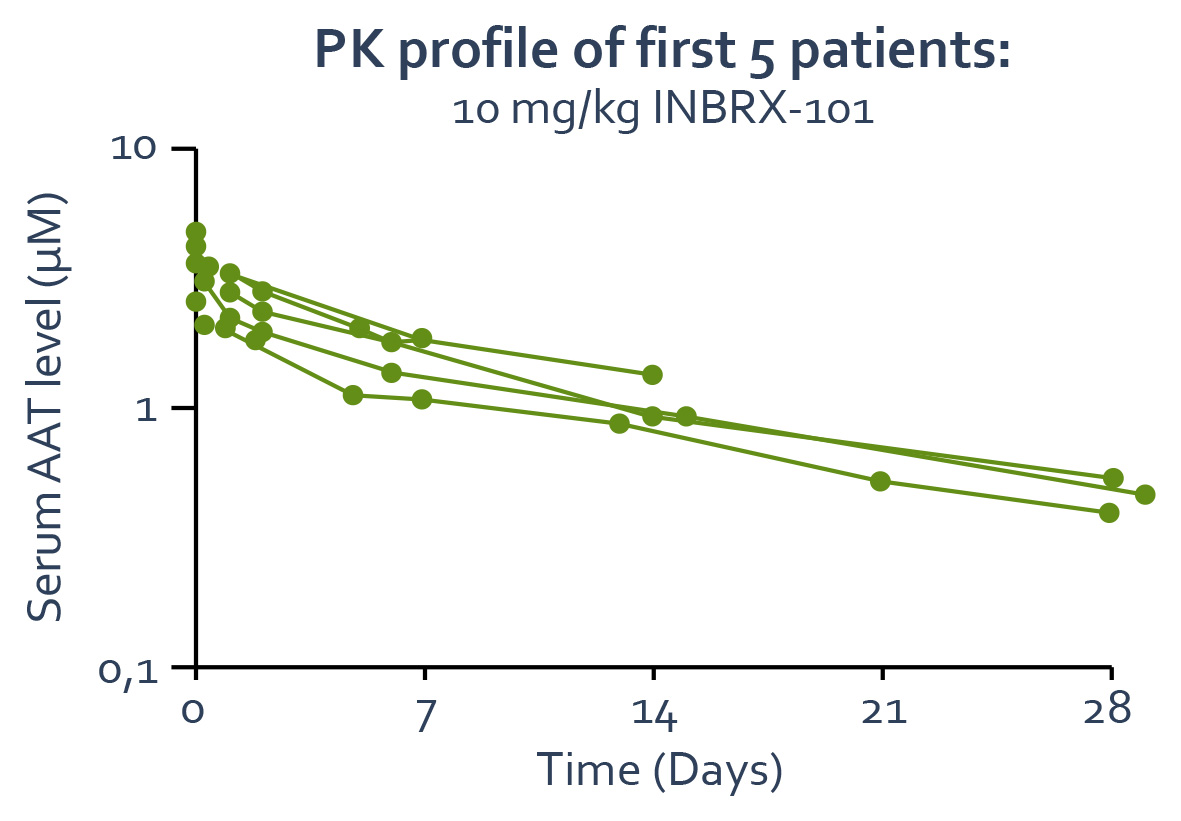

Clinical Data

In July 2019, we initiated an open-label, dose escalating Phase 1 trial which was conducted in approximately 10 clinical sites in the image below. DenotedUnited States, the United Kingdom and New Zealand and enrolled a total of 31 patients. The trial was designed as heavy-chain only antibodies, sdAbs are half the molecular weightsingle ascending dose, or SAD, administrations of an ScFv, but maintain specific target bindingINBRX-101, with an affinity range that is comparabledoses of 10 mg/kg, 40 mg/kg, 80 mg/kg or 120 mg/kg, followed by multiple ascending dose, or MAD, administrations of INBRX-101, with doses of 40 mg/kg, 80 mg/kg or 120 mg/kg. These doses were administered every three weeks intravenously to those achieved by conventional antibodies. sdAbs are derived from heavy-chain only antibodies that are naturally produced by animals in the camelid family, which includes camels, alpacas and llamas. Unlike the antibody systems of other mammals, a subsetpatients diagnosed with AATD who were either treatment naïve or previously treated with pdAAT therapeutics. The primary objective of the camelid antibody repertoire is composedtrial was safety and tolerability. Secondary objectives included AAT serum exposure, immunogenicity, as measured by frequency of heavy-chain onlyanti-drug antibodies, that can be miniaturized into sdAbs. Modularand NE activity. In addition, we measured pharmacokinetic and pharmacodynamic biomarkers in nature, they can be linked tobronchoalveolar lavage fluid, or BALF, for those patients who received MAD administrations of INBRX-101 at doses of 80 mg/kg or 120 mg/kg.

In March 2022, the FDA granted orphan drug designation for INBRX-101 for the treatment of AATD.

In May 2022, we announced topline results from the Phase 1 trial. Data from this Phase 1 trial included patients with AATD with the ZZ genotype, SZ genotype, and the MZ genotype of the SERPINA1 gene. There were no drug-related severe or serious adverse events, or AEs. Drug-related AEs were predominantly mild with a constant domain to capture half-life extendingfew moderate events, and immune cell modulating function. We believe that the small sizeall were transient and reversible. No signs of sdAbs, along with their stable nature and simple structure, make them ideal building blocks to construct novel biologics with multiple specificities and functions.

Comparison of Conventional Antibody and Single Domain Antibody Structure

Overview of Our sdAb Platform Technology

sdAbs provide a small, simple, modular target binding domain that can be combined in a variety of ways to meet the unique needs of each biological target. We have deep domain expertise surrounding discovery, humanization and optimization of sdAbs and their incorporation into unique configurations enabling the generation of therapeutic candidates with favorable drug-like properties and differentiated mechanisms of action. We have created various multivalent and multispecific therapeutic formats that are each designed to achieve unique functions specifically tailored to the requirements of a given biological target, including the ability to:

•effectively cluster receptors with precisely defined valency;

•simultaneously engage multiple antigens or epitopes;

•combine synergistic functions in a single molecule; and

•restrict therapeutic activity to specific micro environments in the body.neutralizing anti-drug antibodies were seen. Dose-related

Whileincreases in maximal and total INBRX-101 exposure occurred across the benefits of sdAb proteins are well documented, the presence of pre-existing anti-drug antibodies in human serum may limit the broad use of these agents as therapeutics. We have developed a series of patented modifications to our humanized sdAb scaffold that are designed to eliminate recognition by these pre-existing anti-drug antibodies, without compromising affinity, specificity or stabilityentirety of the sdAb. We believe this improvement, combined with our extensive knowledgesingle and multiple ascending dose ranges.

The topline data from the multiple ascending dose cohorts of INBRX-101 at 40, 80 and 120 mg/kg IV every three weeks showed the expected accumulation of functional AAT levels. Based on and assuming the accuracy of the structural nuancesPK modeling, accumulation is expected to continue following subsequent doses and to reach a steady state after a total of sdAbs, will enableapproximately five to six consecutive doses, administered every three weeks.

Functional AAT levels over time in AATD patients administered

40, 80 or 120 mg/kg INBRX-101 every three weeks

–Arrows indicate INBRX-101 IV dosing.

–The shaded region represents the streamlined developmentnormal range of therapeutic candidates with favorable biophysical properties,functional AAT in healthy adults.

–Functional AAT samples were not collected immediately following the second dose (Day 21).

–Results shown are from preliminary, unaudited data. Data shown from the 120 mg/kg multiple dose cohort are from the first four evaluable patients; the full dataset is still being collected and analyzed and will greatly extend the utility and applicability of our sdAb platform. Through our experience, we have found that our sdAb-based therapeutic candidates can be readily manufacturedpresented at high yields with established processes used to produce therapeutic proteins.

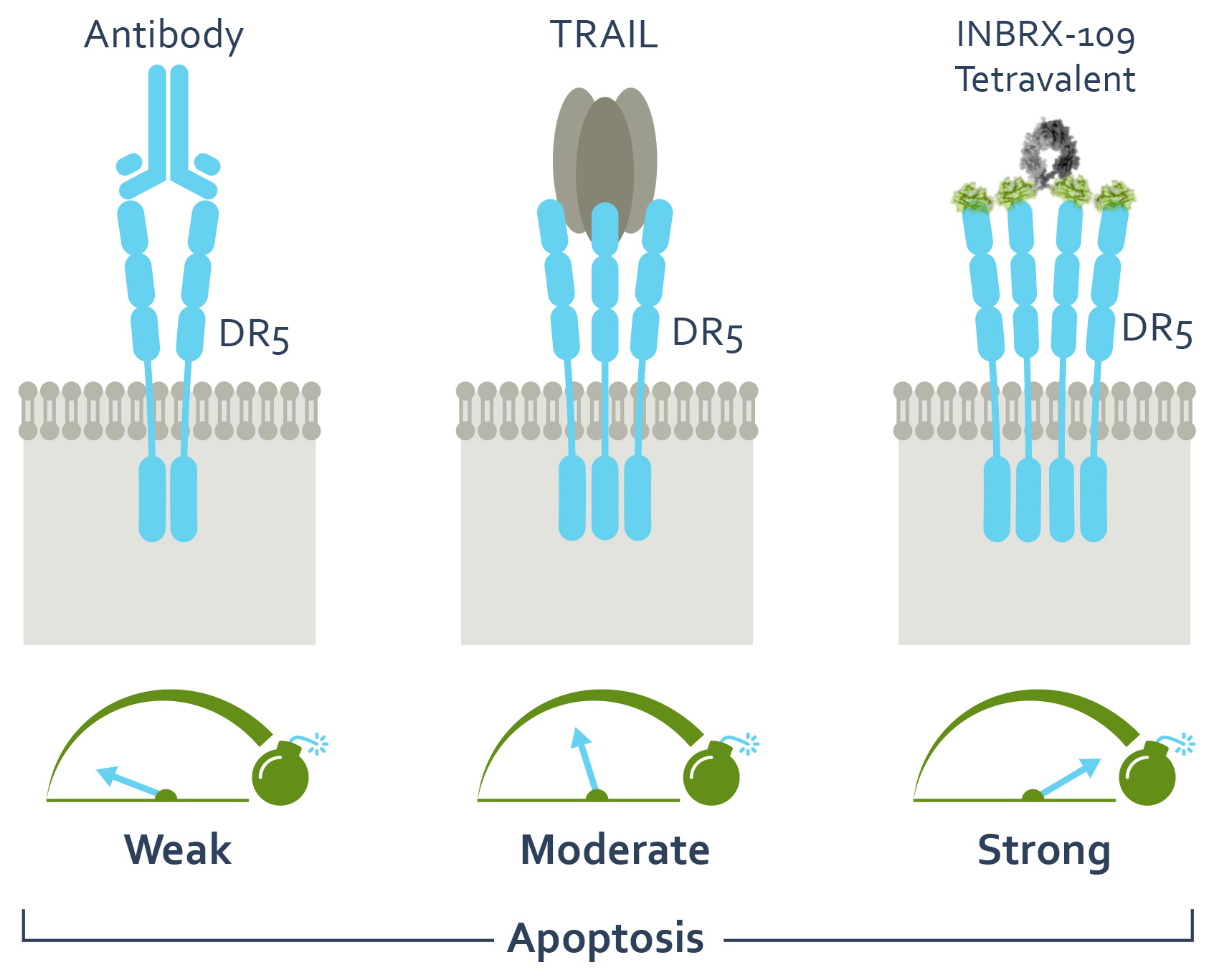

Overview of Our Multivalent Agonists

Cell surface receptors often require clustering to induce activation and effect downstream signaling. Receptors that require clustering are inherently difficult targets for conventional bivalent therapeutic antibodies, which are limited to interaction with no more than two receptors per molecule. In preclinical studies, we and third parties have observed that increased valency enhances receptor clustering and achieves the desired agonism of specific targets. Our sdAb platform enables us to build therapeutic candidates with a defined number of binding domains, customized to the valency requirements of a given target. We believe this precise protein engineering will increase the potential to achieve optimal clinical benefit by appropriately engaging these clustering-dependent receptors. Using our sdAb platform, we have developed higher order, multivalent antibodies that target TNFRSF agonists, as described below, that contain four (tetravalent) or six (hexavalent) antigen binding domains. Our multivalent therapeutic candidates are generally smaller than conventional antibodies and other multivalent formats that utilize fusions of natural ligands or immunoglobulin M-based, or IgM-based, constant regions, which we believe may confer advantages in the clinic.later date.

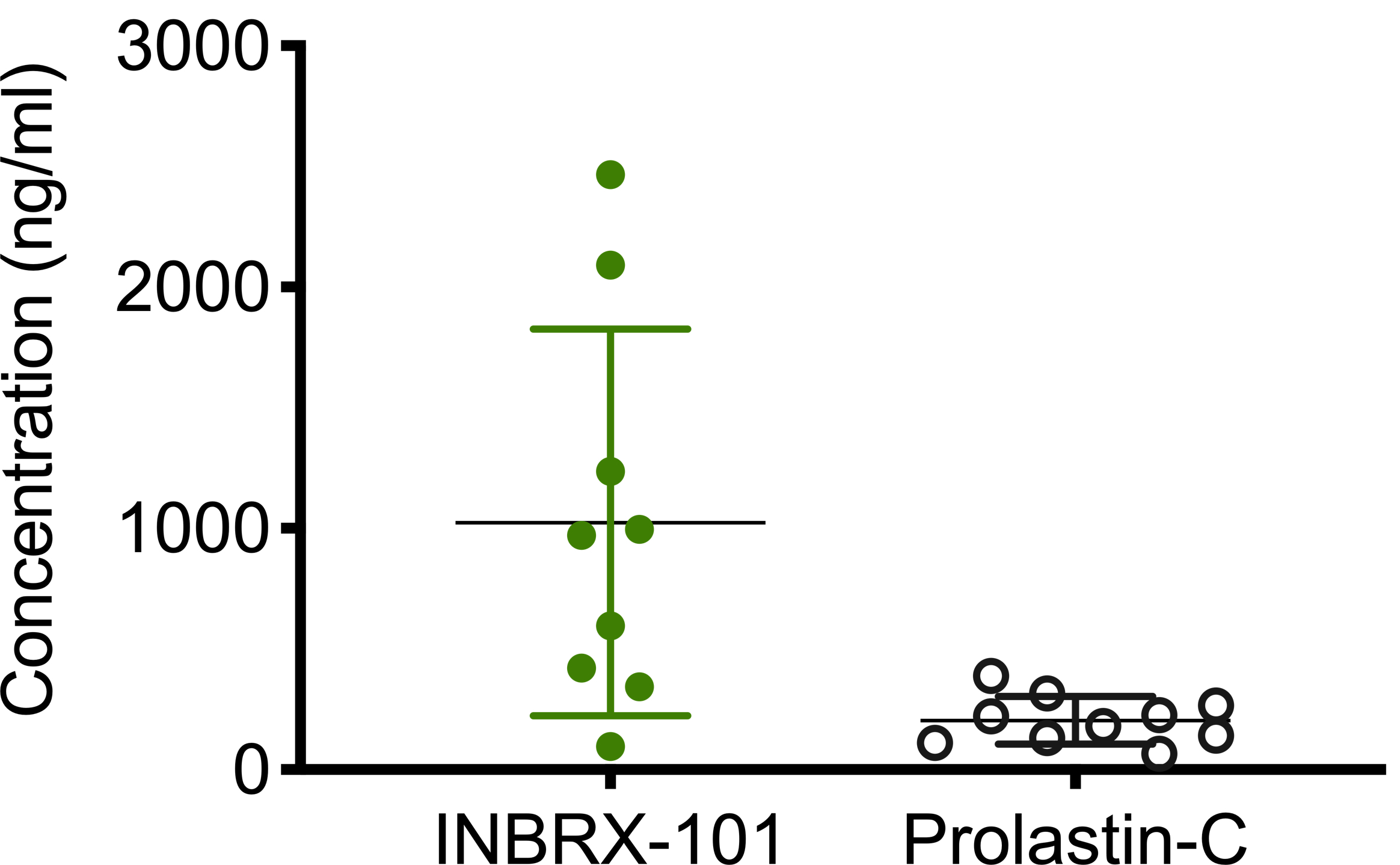

The current standard of care, plasma-derived AAT, dosed once weekly at 60 mg/kg, achieves an average concentration, or Cavg, of functional AAT of 17.8 µM over the weekly dosing interval as calculated from steady-state area under the curve, or AUC. INBRX-101 achieved a mean Cavg of functional AAT of 40.4 µM over the 21-day dosing interval following the third 80 mg/kg dose.

In October 2022, we reported BALF data where we observed the post-dose presence of INBRX-101 in every patient and in all three lobes of the lung collected from each of these patients. This data showed emerging evidence of a dose dependent increase of INBRX-101 lung exposure. These BALF samples were from eleven AATD patients in the 80mg/kg and 120mg/kg multiple ascending dose cohorts of the Phase 1 trial and were analyzed using a proprietary and validated mass spectrometry assay developed by Inhibrx to detect INBRX-101 specifically.

In April 2023, we initiated ElevAATe, a registration-enabling trial for INBRX-101 for the treatment of patients with emphysema due to AATD. The primary endpoint of the trial is the mean change in the average functional AAT, or fAAT, concentration as measured by anti-neutrophil elastase capacity from baseline to average serum trough fAAT concentration at steady state (Ctrough,ss). The initial read-out from the ElevAATe trial is expected to occur in mid-2025.

INBRX-109

INBRX-109 is a precisely engineered tetravalent sdAb-based therapeutic candidate targeting DR5.death-receptor 5, or DR5, a TNFRSF member, also known as tumor necrosis factor-related apoptosis-inducing ligand, or TRAIL, receptor 2. DR5 activation induces cancer-specific programmed cell death. The valency of INBRX-109 was selected to maximize the therapeutic index. In patients treated with INBRX-109 to date in our Phase 1 clinical trial, we have observed signs of single agent activity in serious,

life-threatening medical conditions that havewith limited treatment options. We observed signs of activity with INBRX-109 in combination with standard chemotherapies, the trial of which is still ongoing. In particular, there are no FDA-approved systemic therapiesJune 2021, based on the initial Phase 1 data results observed, we initiated a registration- enabling Phase 2 trial for the treatment of unresectable or metastatic conventional chondrosarcoma. In addition toData from the developmentregistration-enabling trial in unresectable or metastatic conventional chondrosarcoma is expected during the first half of INBRX-109 as a single agent, we have initiated cohorts with INBRX-109 in combination with chemotherapies in two solid tumor indications. We continue to conduct preclinical studies with INBRX-109 in combination with various rational combination agents, including targeted therapeutics and apoptotic pathway modulators, aimed at guiding these future clinical plans.2025.

Background on DR5

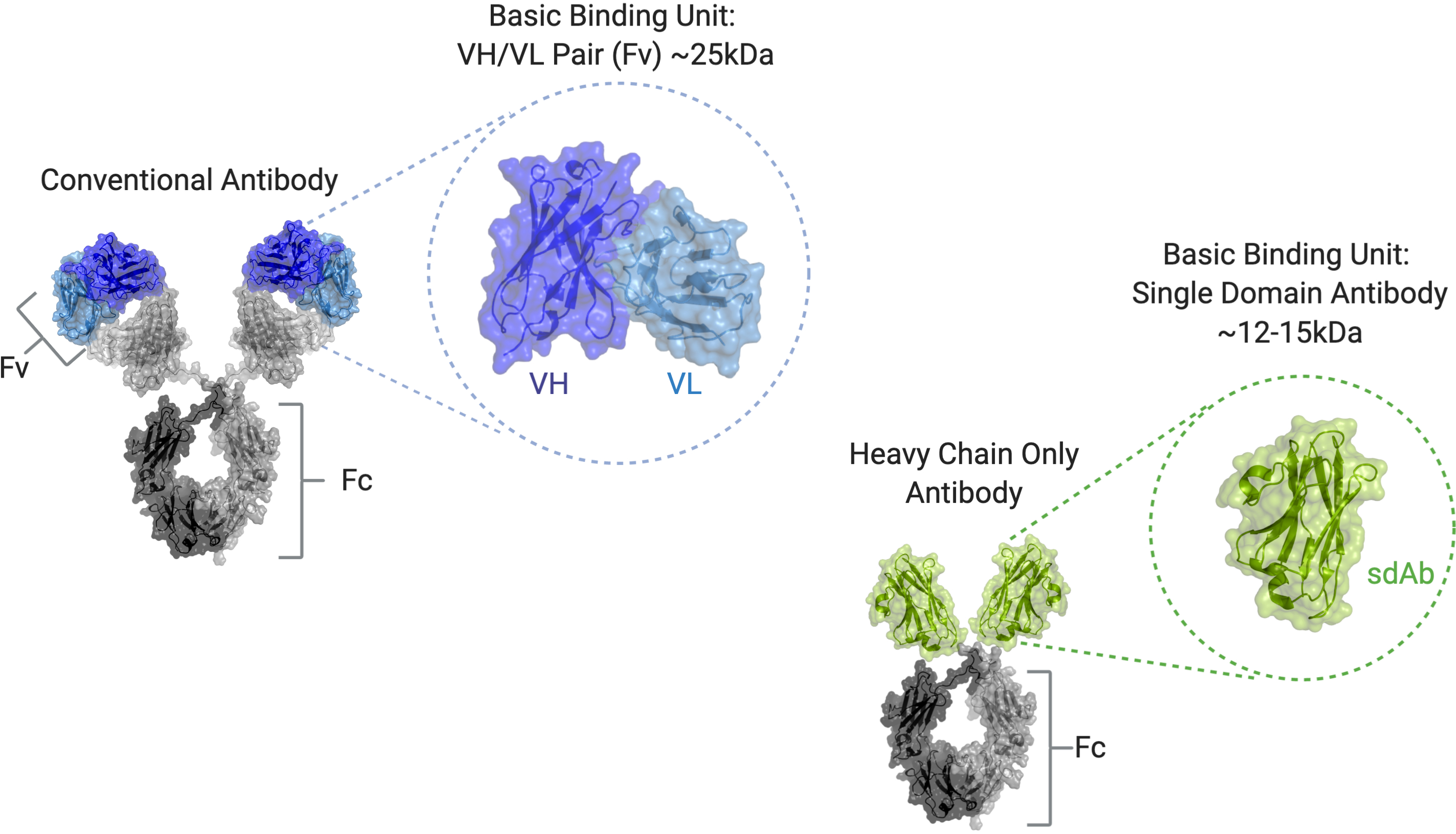

Apoptosis is a critical process for maintaining healthy tissue homeostasis, but this process is frequently altered in cancer patients leading to the accumulation of malignant cells. Apoptotic signaling pathways are tightly regulated by the balance of pro- and anti-apoptotic factors, and their therapeutic modulation has the potential to be exploited for the treatment of cancer. Targeting the anti-apoptotic proteins has been a clinically successful strategy. For example, Venetoclax, an inhibitor of B-cell lymphoma 2, or Bcl-2, was approved by the FDA for the treatment of chronic lymphocytic leukemia in 2016.

Alternatively, we believe therapeutically targeting pro-apoptotic proteins such as DR5 a TNFRSF member, also known as tumor necrosis factor-related apoptosis-inducing ligand, or TRAIL, receptor 2, is a promising oncology treatment strategy. DR5 signaling is induced by clustering of multiple receptors, which initiates an apoptotic signaling pathway resulting in cell death. The strength of apoptotic signaling is proportional to the degree of DR5 clustering. Importantly, although DR5 is expressed throughout the body, cancer cells have been shown to be more sensitive to DR5 signaling compared to healthy cells of normal tissues.

The promise of inducing cancer-specific cell death has led to extensive efforts by pharmaceutical and biotechnology companies to therapeutically exploit the DR5 pathway for the treatment of cancer. These initial efforts centered around developing recombinant versions of the DR5 ligand, TRAIL, and agonistic bivalent DR5 antibodies. Despite demonstrated clinical safety as single agents and in combination with chemotherapies, these first generation DR5

agonists failed to meet clinical efficacy endpoints. We believe these failures were caused by insufficient clustering of DR5, which is necessary for activation of this pathway.

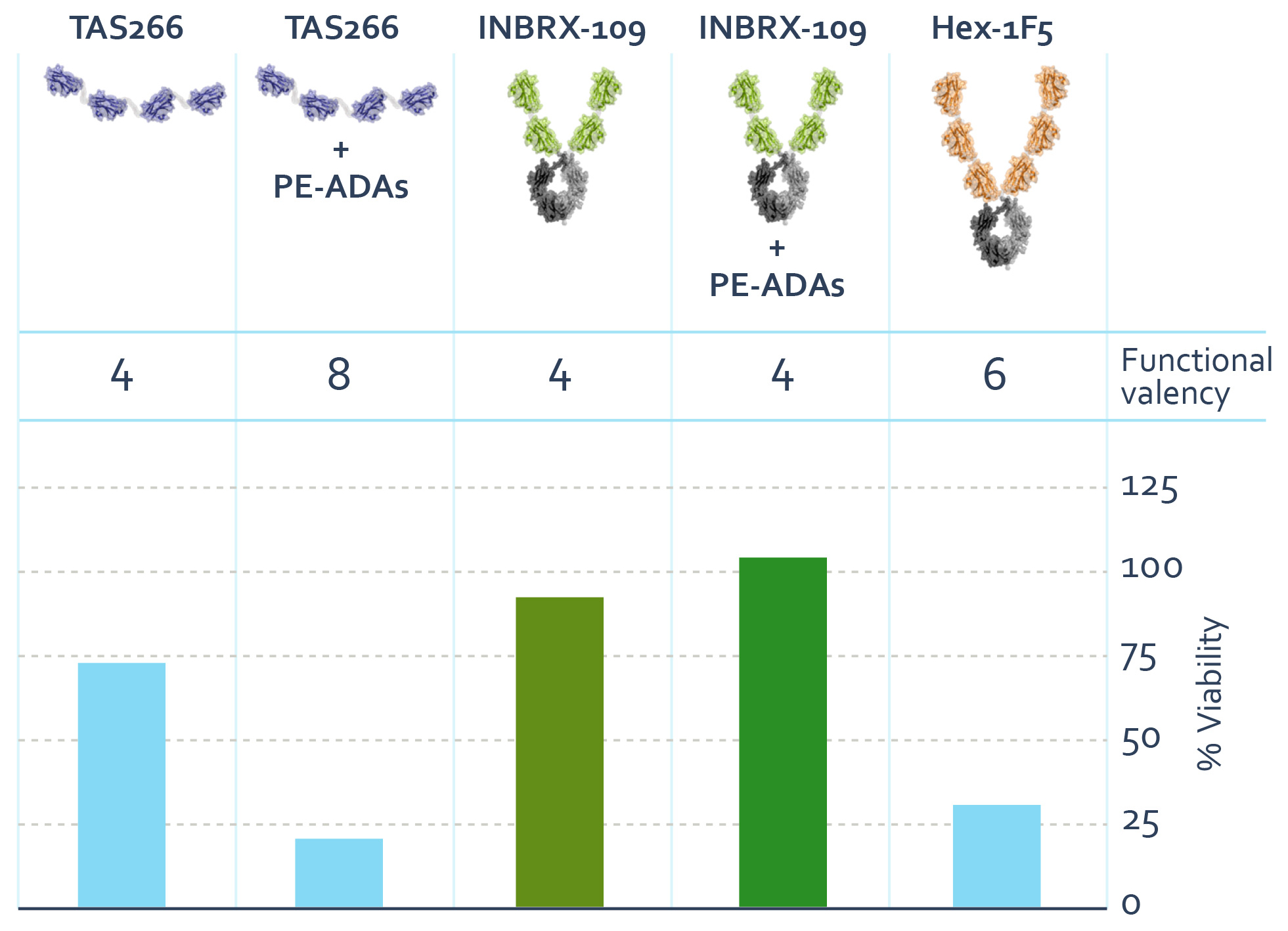

The prospect of improved efficacy through enhanced DR5 clustering led to the development by a third party of TAS266, a tetravalent DR5 agonist comprised of four DR5 binding sdAbs. This therapeutic candidate showed significantly more potency as compared to the previous generations of DR5 agonists. TAS266 was evaluated preclinicallyUnmet Medical Need

We are currently investigating INBRX-109 in over 600 human cancer cell lineschondrosarcoma, Ewing sarcoma and demonstrated the greatest activity for mesothelioma, gastric cancer, colorectal cancer, pancreatic cancer and non-small cell lung cancer. Despite these preclinical data, an initial clinical trial indicated that TAS266 caused dose-limiting liver toxicity, or hepatotoxicity. Subsequent analysis suggested pre-existing anti-sdAb antibodies, or PE-ADAs, to TAS266 led to the hyper-clustering of TAS266, adversely increasing the effective valencycertain other solid tumor types. These are some of the drug candidatemost aggressive diseases, some of which are also orphan oncology indications that have shown signs of activity in preclinical studies. These indications and causing apoptosismany of liver cells. These findings highlight the importance of tightly controlling valency when developingthese cancer subtypes do not respond well to currently approved therapies and represent a drug candidate against this high potential oncology target.significant unmet need.

Our Solution - INBRX-109

INBRX-109 is a tetravalent agonist of DR5 that we designed with our proprietary single domain antibody, or sdAb, platform to drive cancer-selective programmed cell death and to maximize potency while minimizing on-target liver toxicity arising from hepatocyte apoptosis. We believe INBRX-109 has the potential to overcome the limitations of previous DR5 agonists. As shown in the diagram below, INBRX-109 is comprised of four DR5 targeted sdAbs fused to an Fc region that has been modified to prevent Fc receptor interactions. In preclinical studies, we have observed that INBRX-109 has the ability to potently agonize DR5 through efficient receptor clustering, causing cancer cell death. Based upon the observation that TAS266 induced hepatotoxicity in a Phase 1 clinical trial,experience with earlier generation DR5 agonists, hepatocytes appear to be a non-cancerous cell type particularly sensitive to DR5 agonism. We have engineered INBRX-109 with our proprietary sdAb modifications to reduce recognition by pre-existing anti-drug antibodies in humans, which can lessen the potential for hyper-clustering.hyper-clustering and thereby reduce potential hepatotoxicity.

Primary objectives of the Phase 1 trial are safety, tolerability, and determination of the maximum tolerated dose, or MTD, and recommended Phase 2 dose. Secondary objectives are serum exposure and immunogenicity, as measured by frequency of anti-drug antibodies. Exploratory objectives include clinical anti-tumor efficacy, based on response rate, duration of response, disease control rate, progression-free survival and overall survival, as well as evaluation of potential predictive diagnostic and pharmacodynamic biomarkers.

INBRX-109: Tetravalent DR5 Agonistic Antibody

Clinical Data

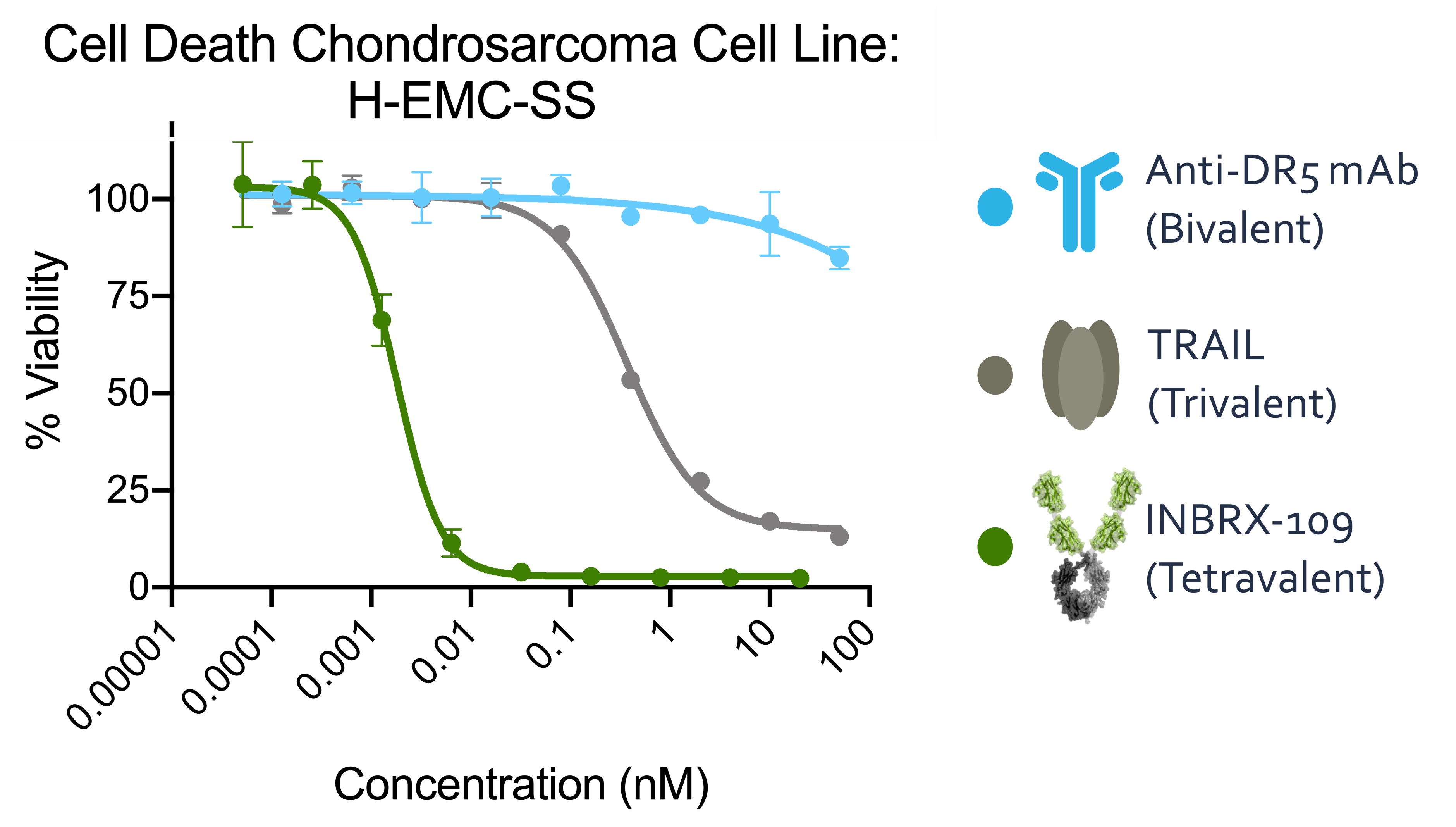

We measuredinitiated a Phase 1 clinical trial in the ability of INBRX-109 to kill cancer cells at various antibody concentrations, and compared INBRX-109 to other DR5 binding test articles including a bivalent DR5 antibody and a trivalent TRAIL protein. The figure below shows the viabilityUnited States in November 2018. This Phase 1 clinical trial is designed as an open-label, three-part trial in patients with locally advanced or metastatic solid tumors.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Phase 1 INBRX-109 Trial Design and Status | |

| First in human Phase 1 trial started November 2018 | |

| Part 1: Single-Agent Dose Escalation |

⇨

| Part 2: Single-Agent Dose Expansion |

⇨

| Part 3: Dose Expansion with Chemotherapy | |

| Completed | Completed | Ongoing | |

| Dose Range: 0.3 to 30 mg/kg

N= 20

Result: Maximum tolerated dose not reached | N=20 | Colorectal adenocarcinoma | N=10 | Mesothelioma with carboplatin or cisplatin | |

| |

| N=10 | Gastric adenocarcinoma | N=10 | Mesothelioma with carboplatin and pemetrexed or cisplatin and pemetrexed | |

| |

| N=20 | Malignant pleural mesothelioma | |

| N=20 | Pancreatic adenocarcinoma 2L with fluorouracil and irinotecan (mFOLFIRI) | |

| N=20 | Chondrosarcoma | |

| |

| N=10 | Synovial sarcoma | N=20 | Colorectal adenocarcinoma with FOLFIRI | |

| |

| N=12 | IDH1/2-mutant conventional chondrosarcoma | N=20-50 | Ewing sarcoma 2-4L with irinotecan and temozolomide | |

| |

| N=12 | Nonconventional chondrosarcoma | N=20 | SDH-def solid tumors or GIST with temozolomide | |

| |

| N=12 | Solid tumors, BMI>30 | | | |

| | | |

| | | | | | | | |

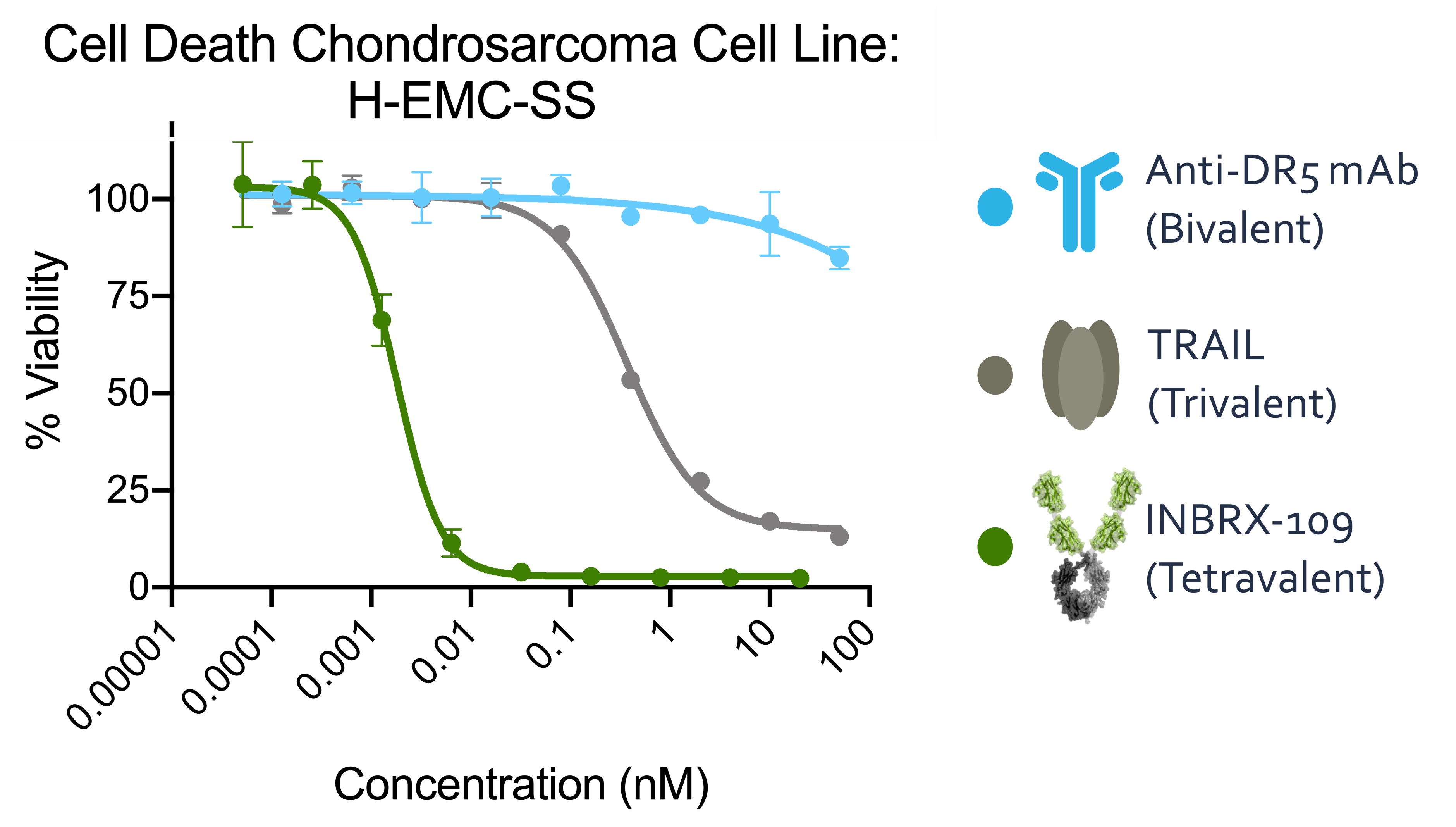

Part 1

Part 1 of the human chondrosarcoma cell line, H-EMC-SS, ontrial utilized a traditional 3+3 dose escalation design escalating INBRX-109 as a single agent from 0.3 mg/kg to 30 mg/kg. Twenty patients were enrolled in this portion of the vertical Y-axis, and

a range of test article concentration on the horizontal X-axistrial, which was completed in nanomolar, or nM, units. This assay was used to measure whether these test articles kill cancer cells by reducing the viability from approximately 100% down toward 0%, and also to measure the minimal concentration of test article needed to kill these cancer cells. We observed that only test articles that bound three or more DR5 molecules killed this cancer cell line, while the bivalent conventional antibody did not have any effect. Additionally, we found that the tetravalent DR5 agonist, INBRX‑109, killed H-EMC-SS cells at concentrations over 100 times lower than trivalent TRAIL. Our preclinical data and early clinical data indicate INBRX‑109 may be substantially more potent than recombinant TRAIL or conventional DR5 antibodies previously studied in clinical trials.

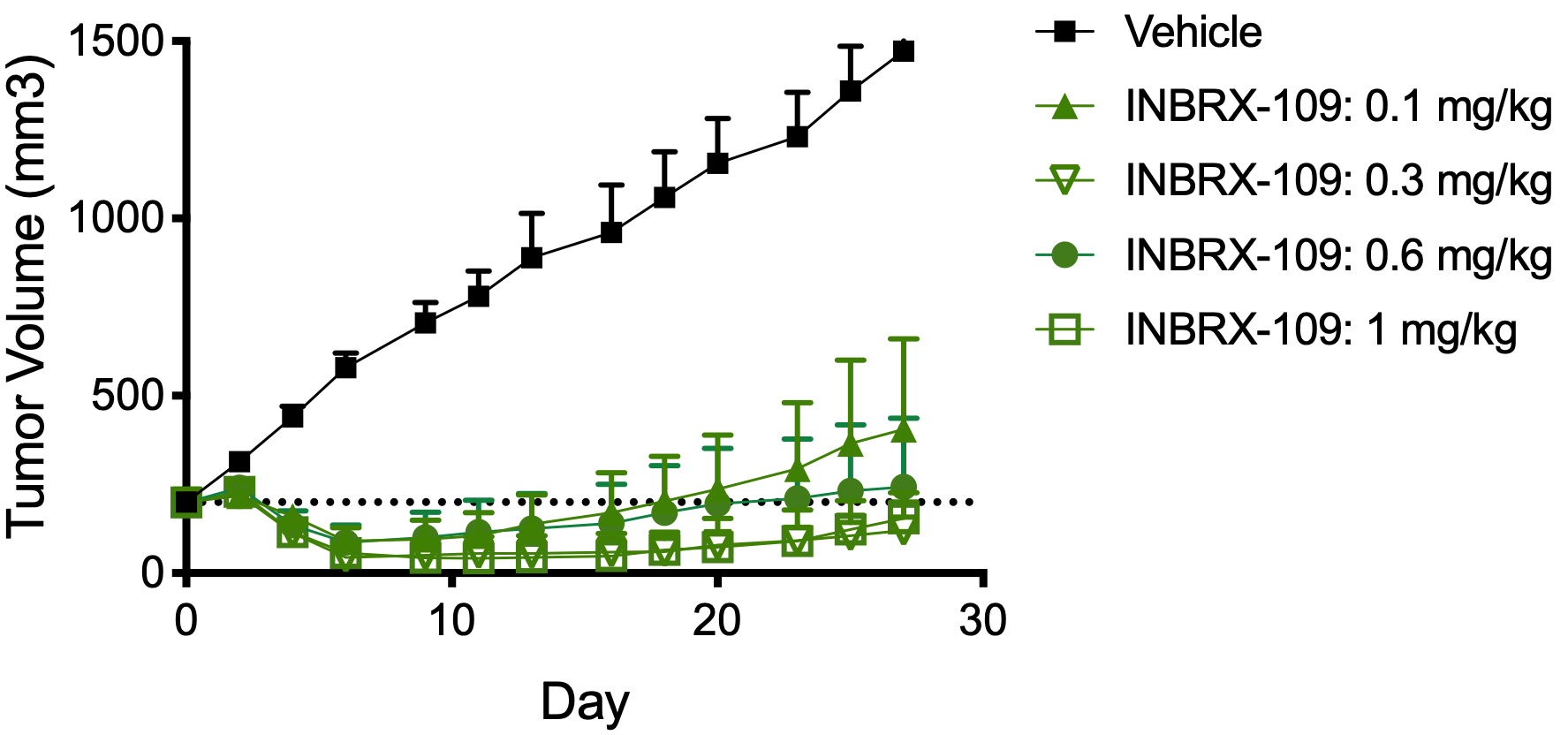

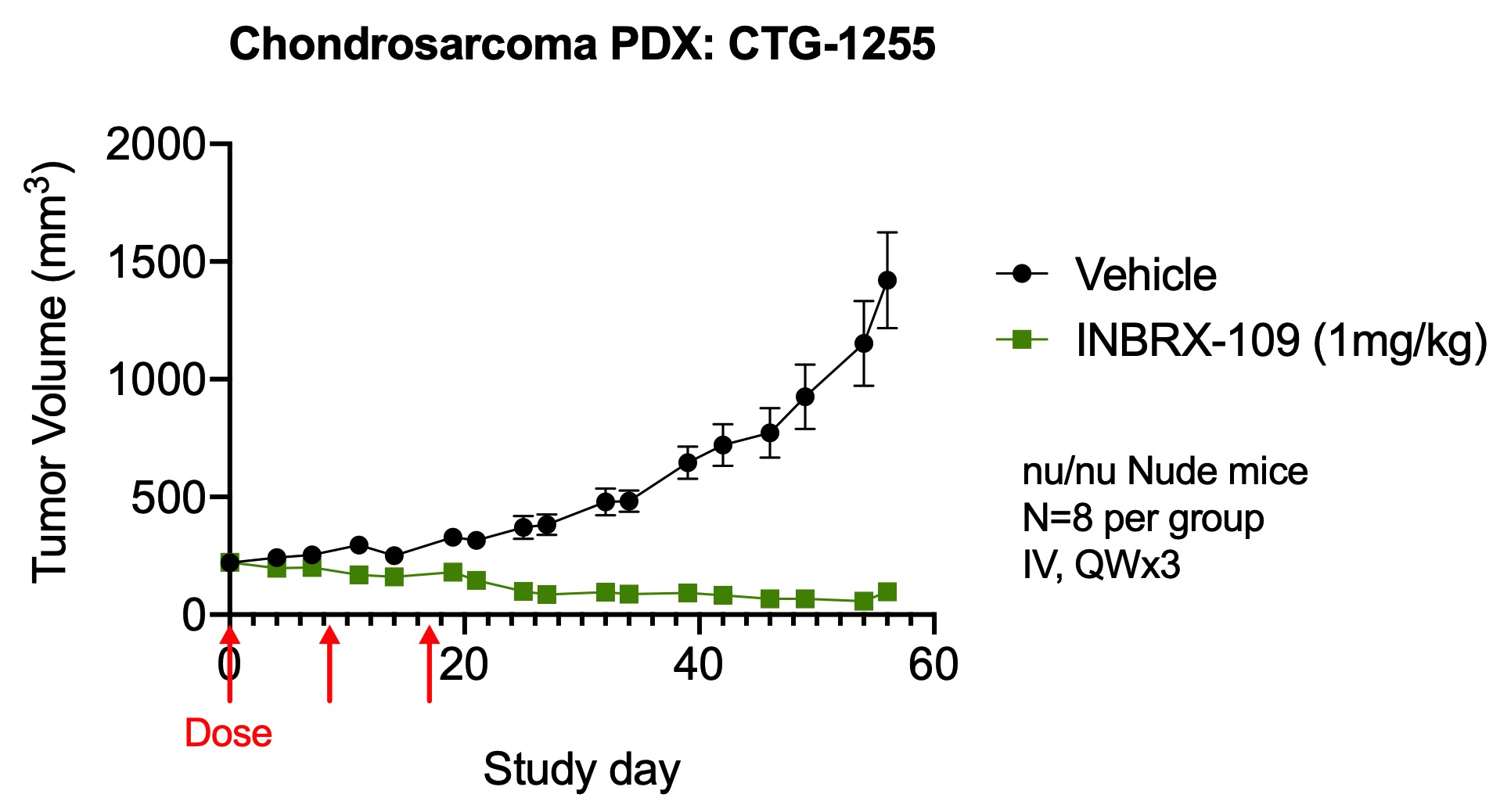

Impact of Valency on DR5 Induced Tumor Cell Death

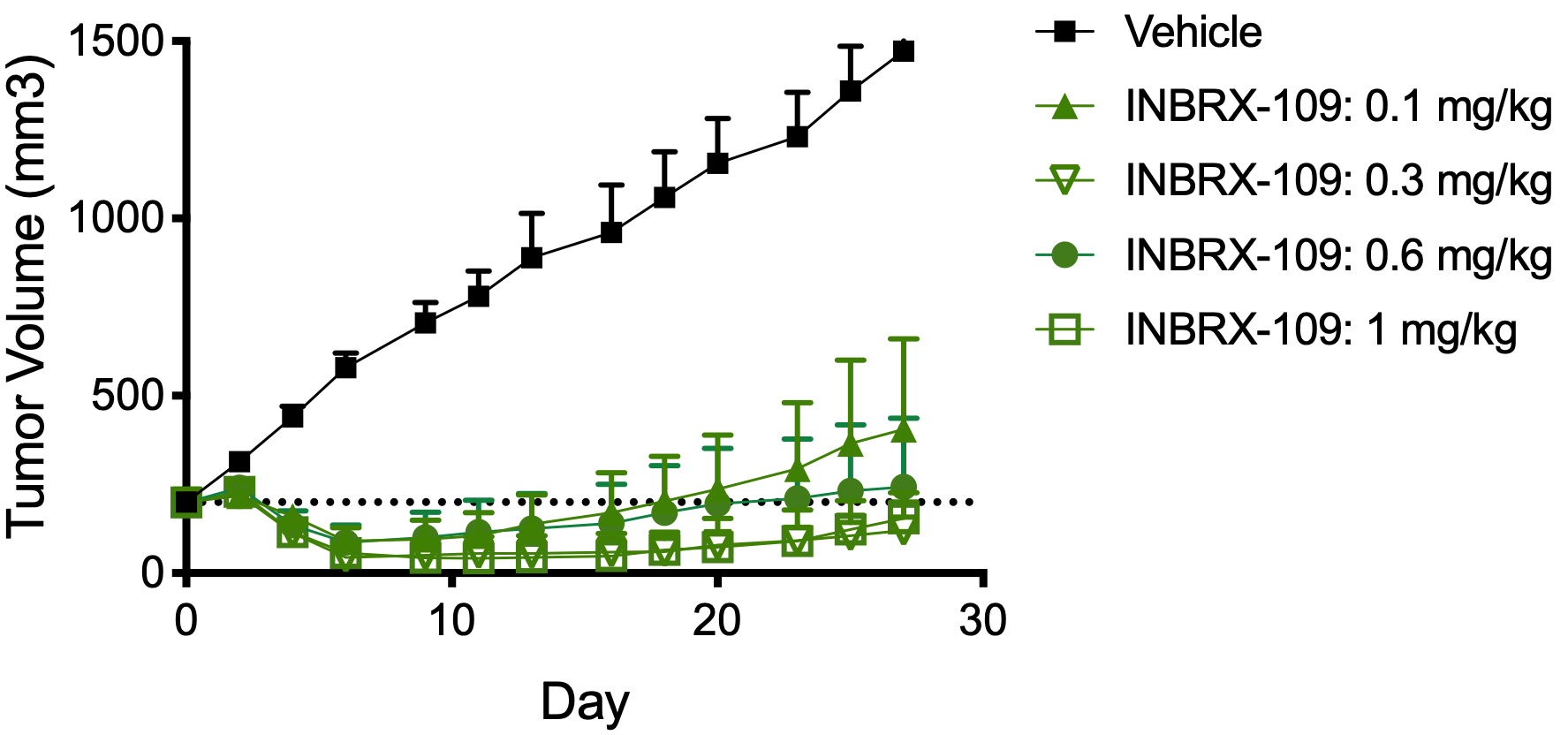

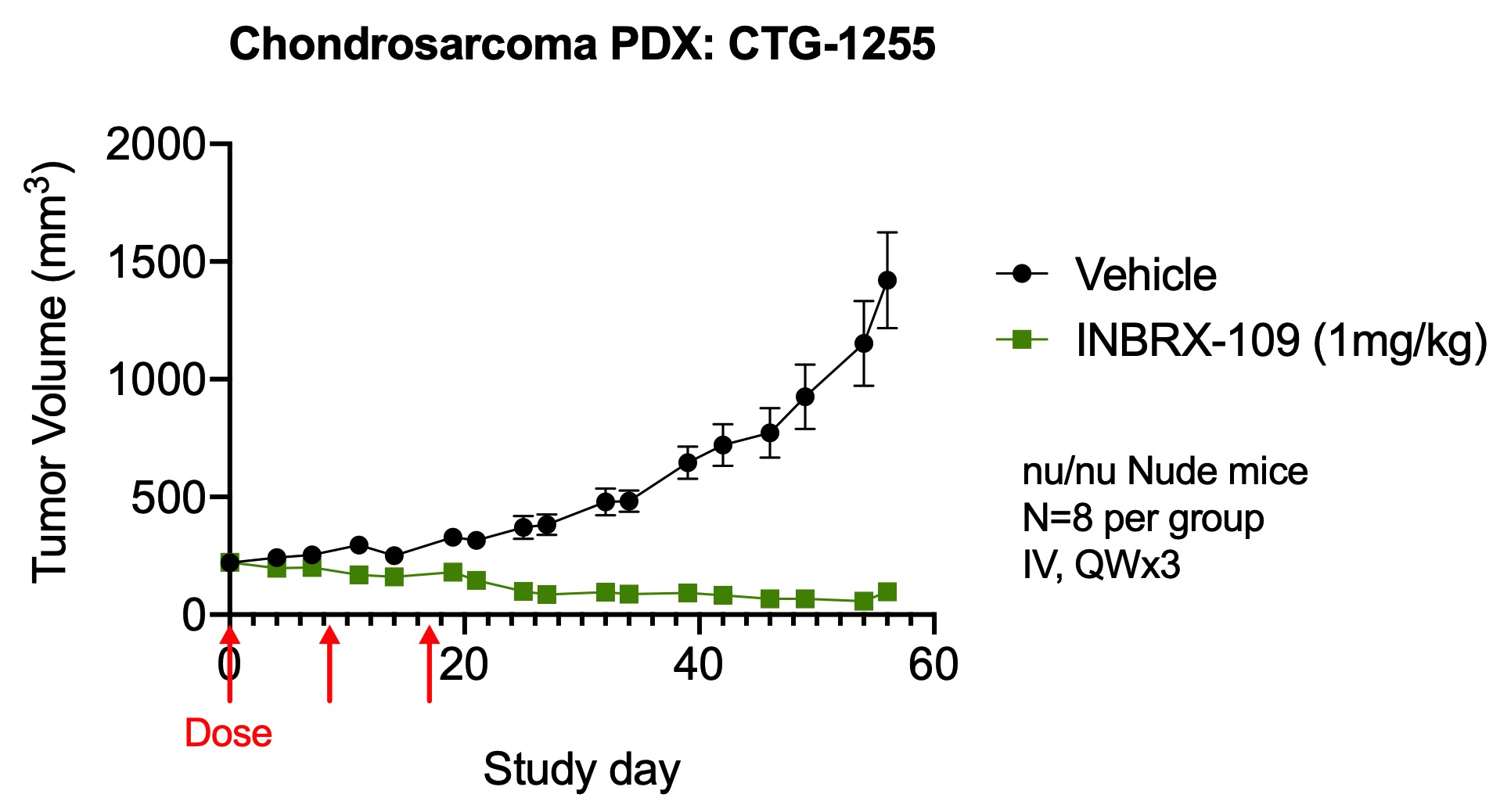

The anti-tumor activity of INBRX-109 was further assessed in multiple in vivo xenograft models using primary patient-derived, or PDX, tumors or cancer cell lines. In these models, immunodeficient mice were engrafted with either human primary tumor cells or the tumor cell lines. For example, mice bearing tumors of Colo-205 were treated with different doses of INBRX-109 when their tumors reached an average size of about 300 mm3. As shown in the image below, we observed that tumor volume was reduced in mice treated with a single dose of INBRX-109 as low as 0.1mg/kg, administered intravenously, as compared to vehicle-treated mice. Additionally, mice bearing tumors of chondrosarcoma PDX were treated intravenously with 1 mg/kg of INBRX-109 when their tumors reached an average size of about 220 mm3. As shown in the second image below, webe well-tolerated without significant toxicities observed that tumor volume was reduced in mice treated with three doses of INBRX-109.

Colo-205 Dose Response

The observed clinical hepatotoxicity of hyper-clustered TAS266 highlights the importance of valency toward the therapeutic index of DR5 agonism. We developed an in vitro human hepatocyte assay, that enables us to compare constructs of different valencies and the impact of PE-ADA recognition on hepatocyte viability. Shown below as percentage viability, in this assay, a hexavalent construct, Hex-1F5, composed of six DR5 binding domains, was found to mediate significant hepatocyte death. Additionally, an analog of TAS266 caused the death of human hepatocytes in the presence of pooled immunoglobulins known to contain PE‑ADAs, that recognize single domain antibodies, while meaningful hepatocyte death with INBRX-109 was not observed. We believe that the hepatocyte death mediated by TAS266 observed in this assay was due to hyper-clustering of TAS266 by the PE-ADAs and resulted in an increase in the functional valency. Furthermore, the finding of hepatocyte cell death with the hexavalent DR5 agonist represents a collapsing of the therapeutic index as compared to a tetravalent agonist. We

believe our assay provides meaningful evidence of an upper bound of the optimal valency and that a tetravalent agonist with reduced recognition by PE-ADAs is the preferred therapeutic strategy for exploiting the DR5 pathway.

Human Hepatocyte Toxicity Assay

Additionally, we observed that INBRX-109 did not induce toxicities in cynomolgus monkeys after up to five weekly INBRX-109 administrations ofat doses up to and including the maximum administered dose of 30 mg/kg. No MTD was reached.

Part 2

In September 2019, we commenced single agent dose expansion cohorts, Part 2 is now complete and enrolled 116 patients in single agent dose cohorts in the following tumor types: colorectal and gastric adenocarcinomas, malignant pleural mesothelioma, chondrosarcoma, synovial sarcoma, and solid tumors with BMI>30.

Part 3

In February 2021, we initiated chemotherapy combination cohorts in Part 3 of this trial and will enroll up to 100 mg/kg.

Unmet Medical Need

patients. We are currently investigating INBRX-109 in chondrosarcoma, synovialEwing sarcoma, malignant pleural mesothelioma,colorectal cancer cohorts, and gastricSDH-deficient solid tumors, or GIST.

Initial Results from Phase 1 INBRX-109 Ewing

We announced preliminary efficacy and pancreatic adenocarcinomas. These are somesafety data from the Phase 1 trial of INBRX-109 in combination with Irinotecan, or IRI, and Temozolomide, or TMZ, for the treatment of advanced or metastatic, unresectable Ewing sarcoma. Among the 13 patients evaluable as of the most aggressive diseases, certaindata cut of which are also orphan oncology indications, that showed signsSeptember 8, 2023, the observed disease control rate was 76.9%, or 10 out of activity13 patients as measured by RECISTv1.1, with seven patients achieving partial responses (53.8%) and three patients achieving stable disease (23.1%). Overall, INBRX-109 in preclinical studies. These indications and manycombination with IRI/TMZ was well- tolerated from a safety perspective. We have expanded recruitment of this cohort as a result of these cancer subtypes do not respond well to currently approved immunotherapies and represent a significant unmet need.preliminary findings.

Initial Results from Phase 1 INBRX-109 Chondrosarcoma

Chondrosarcoma is a rare malignant bone tumor composed of cartilage matrix-producing cells. It is reported to be the second most common primary bone sarcoma with an incidence of 1 in 200,000 per year globally. The incidence in the United States is reported to be about 1,400 cases per year. There is currently no approved systemic treatment for patients with unresectable or metastatic disease. The placebo arm of a placebo-controlled trial, which tested the hedgehog pathway inhibitor IPI-926 in this indication had a progression free survival of approximately three months. In this trial, IPI-926 did not result in any partial responses and only a small subset of patients had minor reductions in their tumor size.

Malignant Pleural Mesothelioma

Mesothelioma is a malignant tumor most often caused by inhaled asbestos fibers which accumulate in the lining of the lungs, abdomen or heart. The epithelioid subtype is the most common histology of malignant pleural mesothelioma, reportedly comprising about 70% of all cases. It is estimated that as many as 43,000 people worldwide die from mesothelioma each year. There are currently limited approved therapeutic treatments. The placebo arm of a recent large double-blind, placebo-controlled trial testing tremelimumab, an anti-CTLA-4 antibody

(DETERMINE trial), in malignant pleural or peritoneal mesothelioma with second and third-line patients had a progression free survival rate of 2.7 months and an overall survival rate of 7.3 months. In this trial, tremelimumab did not significantly prolong progression free survival or overall survival compared with placebo in patients with previously treated malignant mesothelioma.

Synovial Sarcoma

Synovial sarcoma is a cancer that can arise from different types of soft tissue, such as muscle or ligaments. It is often found in the arm, leg, or foot and near joints such as the wrist or ankle. It can also form in soft tissues in the lung or abdomen. It is estimated that one to three people per 1,000,000 people are diagnosed with synovial sarcoma each year. Current therapeutic treatments available for unresectable or metastatic synovial sarcoma are doxorubicin or ifosfamide. Pazopanib and trabectedin have also shown activity.

Pancreatic Adenocarcinoma

Pancreatic cancer is a malignant tumor that originates in the pancreas and quickly metastasizes. The most common type of pancreatic cancer, comprising over 90% of all cases, begins in the cells that line the ducts that carry digestive enzymes out of the pancreas, or pancreatic adenocarcinoma. It is estimated that pancreatic cancer accounts for about 3% of all cancers in the U.S. and about 7% of all cancer deaths. Unresectable or metastatic pancreatic adenocarcinoma is often treated with fluorouracil, or 5FU, irinotecan and oxaliplatin, or gemcitabine and albumin-bound paclitaxel chemotherapies, with generally short-lived benefit.

Gastric Adenocarcinoma

Gastric cancer is the second most common cancer worldwide. Greater than 50% of patients present with unresectable locally advanced or metastatic gastric adenocarcinoma. Standard protocols include fluorouracil or capecitabine and oxaliplatin with or without nivolumab, fluorouracil or capecitabine and cisplatin, or other combinations containing irinotecan, paclitaxel, carboplatin, docetaxel, and trastuzumab for HER2 positive gastric adenocarcinoma.

Clinical Data

The IND for INBRX-109 became effective in August 2018, and we initiated a Phase 1 clinical trial in the United States in November 2018. This Phase 1 clinical trial is designed as an open-label, three-part trial in patients with locally advanced or metastatic solid tumors.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | Phase 1 INBRX-109 Trial Design and Status | | |

| | First in human Phase 1 trial started November 2018 | | |

| | Part 1:

Dose Escalation |

⇨

⇨ | Part 2:

Dose Expansion Cohorts |

⇨

⇨ | Part 3:

Combination Studies | | |

| | Completed August 2019 | Ongoing | Initiated | | |

| | Dose Range:

0.3 to 30 mg/kg

N= 20

Result:

Maximum tolerated

dose not reached

| N=32

N=10

N=20

N=20

N=10 | Chondrosarcoma

Synovial sarcoma

Malignant pleural mesothelioma

Colorectal adenocarcinoma

Gastric adenocarcinoma | N=20

N=20

| Pancreatic adenocarcinoma 2nd line with FOLFIRI

Mesothelioma with Cisplatin/Carboplatin

or

Cisplatin/Carboplatin & Pemetrexed | | |

| | | | | | | | | | |

Part 1

Part 1 of the trial utilized a traditional 3+3 dose escalation design escalating INBRX-109 as a single agent from 0.3 mg/kg to 30 mg/kg. Twenty patients were enrolled in this portion of the trial, which was completed in August 2019. INBRX-109 was observed to be well-tolerated without significant toxicities observed at doses up to and including the maximum administered dose of 30 mg/kg. No MTD was reached.

Part 2

In September 2019, we commenced Part 2 of this trial with single agent dose expansion cohorts, enrollment of which is still ongoing. As of February 2, 2021, we have enrolled over 104 patients in single agent dose cohorts in the following tumor types: colorectal and gastric adenocarcinomas, malignant pleural mesothelioma, chondrosarcoma and synovial sarcoma. We expect to announce initial data from the synovial sarcoma cohort during the second half of 2021.

Part 3

During the fourth quarter of 2020, we initiated chemotherapy combination cohorts in malignant pleural mesothelioma and pancreatic adenocarcinoma. We expect to announce initial data from these combination cohorts during the fourth quarter of 2021.

Primary objectives of the Phase 1 trial are safety, tolerability, and determination of the MTD and recommended Phase 2 dose. Secondary objectives are serum exposure and immunogenicity, as measured by frequency of anti-drug antibodies. Exploratory objectives include clinical anti-tumor efficacy, based on response rate, duration of response, disease control rate, progression-free survival and overall survival, as well as evaluation of potential predictive diagnostic and pharmacodynamic biomarkers.

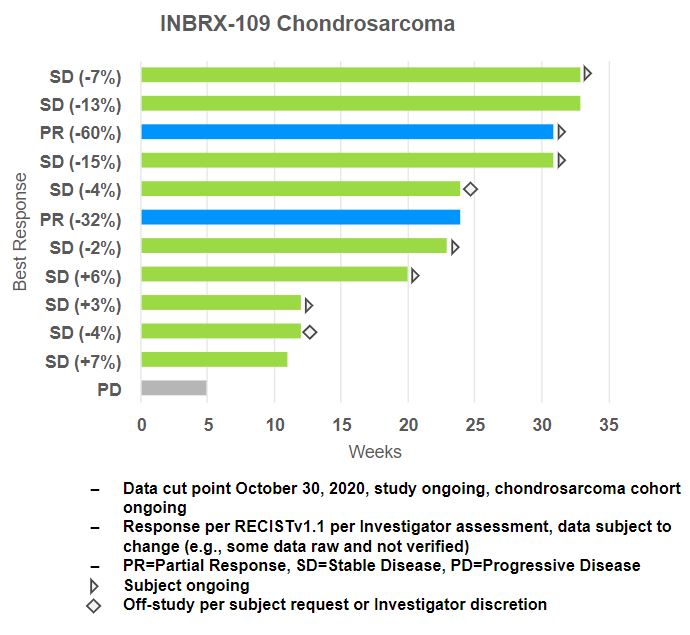

INBRX-109 Chondrosarcoma

Based on initial data from the chondrosarcoma cohort of our Phase 1 trial, stable disease or partial responses were observed in 9 out of 12 patients with chondrosarcoma, with six of these patients still on treatment as of October 30, 2020. Per investigator requests, an additional 10 patient enrollment slots were added to the chondrosarcoma cohort of the ongoing trial, which were filled as of January 2021. We plan to provide a more mature data set from the chondrosarcoma cohort during the second half of 2021, which will include data on conventional and non-conventional chondrosarcoma patients.

The CT tumor imaging scan of a chondrosarcoma patient below shows a target lesion, at baseline and at tumor assessment after eight cycles of INBRX-109. This patient achieved a best response of partial response with 60% shrinkage in the target lesions per RECIST (version 1.1).

In January 2021, the FDA granted fast trackFast Track designation to INBRX-109 for the treatment of patients with unresectable or metastatic conventional chondrosarcoma. We plan to submit an IND amendmentIn November 2021, the FDA granted orphan drug designation for INBRX-109 duringfor the first quartertreatment of 2021. We plan to initiateconventional chondrosarcoma. In August 2022, the EMA granted orphan drug designation for INBRX-109 for the treatment of conventional chondrosarcoma.

In November 2022, we announced efficacy and safety data from the ongoing Phase 1 INBRX-109 expansion cohorts for the treatment of chondrosarcoma. Among the 33 patients evaluable as of November 8, 2022, the observed disease control rate was 87.9%, or 29 out of 33 patients as measured by RECISTv1.1, with two patients achieving partial responses (6.1%) and 27 patients achieving stable disease (81.8%). Disease control was observed in patients with and without IDH1/IDH2 mutations. Of those achieving stable disease, 55.6% had decreases from baseline in tumor size. Clinical benefit was durable, 14 of 33 patients (42.4%) who achieved disease control had a clinical benefit lasting greater than 6 months, and the longest duration of stable disease observed was 20 months. At that time, the median progression-free survival, or PFS, was 7.6 months, and five patients remained on study.

Treatment-related AE, were reported in less than 5% of the patients with the most common being increased alanine aminotransferase, or ALT, increased aspartate aminotransferase, or AST, and increased blood bilirubin and fatigue. There were no grade 4 or 5 events reported among patients with treatment-related AEs.

Phase 2 INBRX-109 Chondrosarcoma

In June 2021, we initiated a registration-enabling Phase 2 trial in this patient population, which will enroll approximately 200 patients in total at 50 different sites worldwide, with progression free survival, or mPFS, as the endpoint, in mid-2021.primary endpoint.

Primary objectives of the ongoing Phase 2 trial are to evaluate the efficacy of INBRX-109 as measured by mPFS, assessed by central real-time independent radiology review. Secondary objectives are to evaluate the overall survival, mPFS by investigator assessment, quality of life, objective response rate, duration of response, disease control rate, safety and tolerability, pharmacokinetics and anti-drug antibodies to INBRX-109.

In early 2023, the Phase 2 trial was placed on partial clinical hold by the FDA, and we paused patient enrollment in the trial, following the occurrence of a grade 5 hepatotoxicity event and pre-defined stopping rules built into the protocol. The additional insight gained on patients at risk of significant hepatotoxicity led us to believe that elderly patients with fatty liver disease are the at-risk population. We implemented the Hepatic Steatosis Index, or HSI, into the protocol and excluded elderly patients with an HSI score of 36 or higher, which has helped to address the patients at risk of significant hepatotoxicity. The FDA lifted the hold in April 2023 after we amended the trial protocol. We expect to announce data from this trial during the first half of 2025.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | Planned Phase 2 Trial Design | | |

| | Randomized, Blinded, Placebo-controlled, Phase 2 Study of INBRX-109 in Conventional Chondrosarcoma, Grades 2 and 3, Unresectable or Metastatic Conventional Chondrosarcoma | | |

| | Randomization 2:1

Key eligibility criteria: • Conventional chondrosarcoma • Grade 2 and 3 • Unresectable or metastatic

Stratification by histologic grade and line of therapytherapy. Grade and IDH1/2 mutation status | | | | ⇨

⇨Until progressive disease (PD) or toxicity with cross-over

Including interim futility analysis

• Primary Endpoint: progression free survival (PFS)

• Secondary Endpoints: overall survival, (OS),quality of life, overall response rate, (ORR)/duration of response, (DOR), disease control rate, (DCR), quality of life (QoL)safety, etc. | | |

| ⇨ | INBRX-109 N= 134

3 mg/kg every three weeks

(Ongoing) | ⇨ | | INBRX-109

(2) | |

| | | < | | |

| ⇨ | Placebo N= 67 (allows for crossover)

3 mg/kg every three weeks

(Ongoing) | ⇨ | | Placebo

(1) | |

| | | | | |

| | | | | | | | |

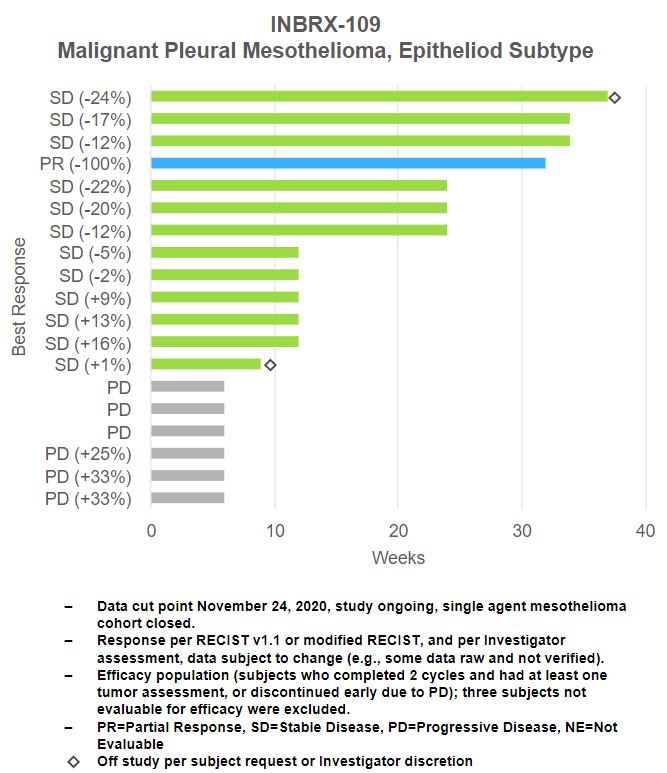

MesotheliomaINBRX-106

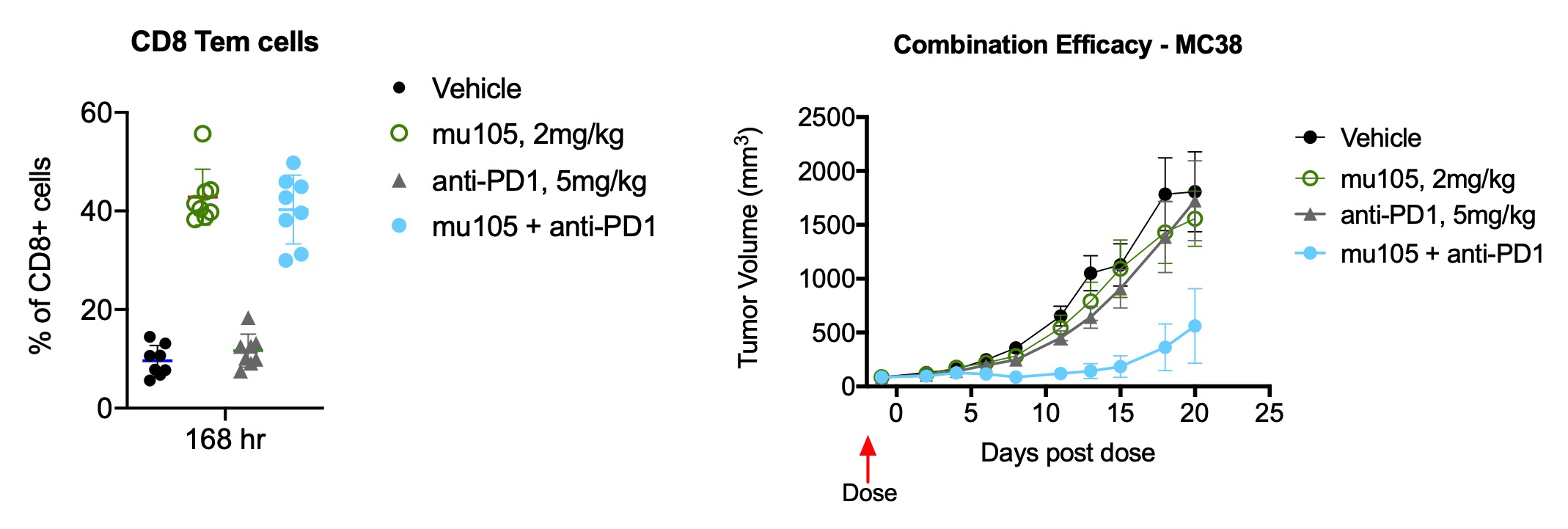

In initial data fromINBRX-106 is a hexavalent OX40 agonist, currently being investigated as a single agent and in combination with Keytruda, a PD-1 blocking checkpoint inhibitor, in patients with locally advanced or metastatic solid tumors. We continue to enroll and/or have active patients in Part 2, of this trial, we have observed signs of single agent activity in malignant pleural mesothelioma, epithelioid subtype. As of November 24, 2020, time on treatment with INBRX-109 was equal to or greater than 24 weeks in seven of the 19 patients evaluable for response (~37%).

Phase 1 Safety Data

As of February 2, 2021,dose expansion, and based on preliminary Phase 1 data, INBRX-109 has been generally well tolerated in the majority of patients. The chart below is based on 92 patients with available adverse event data and details the adverse events, or AEs, related to INBRX-109 per Investigator assessments. There has been a low incidence of Grade 1, 2, and 3 AEs. Few serious adverse events, or SAEs (including one Grade 5 liver failure and death), and one dose-limiting toxicity, or DLT, were observed.