0001803498bcred:RevolverMemberClearview Buyer,0001803498Kwol Acquisition, Inc., Revolver2023-12-310001803498Progress Residential PM Holdings, LLC, Delayed Draw Term Loan 12022-12-310001803498bcred:CommonClassDMember2023-04-300001803498Phoenix Newco, Inc. 2us-gaap-supplement:InvestmentUnaffiliatedIssuerMember2022-12-310001803498bcred:RevolverMemberCumming Group, Inc. 2us-gaap-supplement:InvestmentUnaffiliatedIssuerMember2021-12-310001803498bcred:A20211BSLJuniorSecuredDeferrableFloatingRateMemberus-gaap:SecuredDebtMember2022-12-310001803498Loar Acquisition 13, LLC - Common Unitsbcred:BCREDEmeraldJVLPMember2022-12-311 Emerald JV LP2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20222023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 814-01358

Blackstone Private Credit Fund

(Exact name of Registrant as specified in its Charter)

_______________________________________________________________________ | | | | | | | | |

| Delaware | | 84-7071531 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

345 Park Avenue, 31st Floor New York, New York | | 10154 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 503-2100

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading

| | Name of each exchange

|

| None | | None | | None |

Securities registered pursuant to Section 12(g) of the Act:

Class I Common shares of beneficial interest, par value $0.01

Class S Common shares of beneficial interest, par value $0.01

Class D Common shares of beneficial interest, par value $0.01

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act: | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of December 31, 2022, there wasThere is currently no established public market for the Registrant’s common sharesRegistrant's Common Shares of beneficial interest, $0.01 par value per share (“Common Shares”).

The number of shares of the Registrant’s Common Shares $0.01 par value per share, outstanding as of March 13, 202311, 2024 was 607,214,020, 291,608,554,787,273,337, 395,772,185, and 50,503,70216,356,017 of Class I, Class S and Class D common shares,Common Shares, respectively. Common Shares outstanding exclude March 1, 20232024, subscriptions since the issuance price is not yet finalized at the date of this filing.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements that involve substantial risks and uncertainties. Such statements involve known and unknown risks, uncertainties and other factors and undue reliance should not be placed thereon. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about Blackstone Private Credit Fund (together, with its consolidated subsidiaries, the “Company,” “we,” “us,” or “our”), our current and prospective portfolio investments, our industry, our beliefs and opinions, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including without limitation:

•our future operating results;

•our business prospects and the prospects of the companies in which we may invest;

•the impact of the investments that we expect to make;

•our ability to raise sufficient capital and repurchase shares to execute our investment strategy;

•general economic, logistical and political trends and other external factors, including inflation and recent supply chain disruptions and labor market disruptions;their impacts on our portfolio companies and on the industries in which we invest;

•the ability of our portfolio companies to achieve their objectives;

•our current and expected financing arrangements and investments;

•changes in the general interest rate environment;

•the adequacy of our cash resources, financing sources and working capital;

•the timing and amount of cash flows, distributions and dividends, if any, from our portfolio companies;

•our contractual arrangements and relationships with third parties;

•actual and potential conflicts of interest with Blackstone Credit BDC Advisors LLC (the “Adviser”) or any of its affiliates;

•the elevating levels of inflation, and its impact on our portfolio companies and on the industries in which we invest;

•the dependence of our future success on the general economy and its effect on the industries in which we may invest;

•our use of financial leverage, including the use of borrowed money to finance a portion of our investments and the effect of the COVID-19 pandemic on the availability of equity and debt capital on favorable terms or at all;

•our business prospects and the prospects of our portfolio companies, including our and their ability to effectively respond to challenges posed by the novel coronavirus (“COVID-19”);macroeconomic effects from adverse public health developments;

•the ability of the Adviser to source suitable investments for us and to monitor and administer our investments;

•the impact of future acquisitions and divestitures;

•the ability of the Adviser or its affiliates to attract and retain highly talented professionals;

•general price and volume fluctuations in the stock market;

•our ability to maintain our qualification as a regulated investment company and as a business development company (“BDC”);

•the impact on our business of U.S. and international financial reform legislation, rules and regulations;

•the effect of changes to tax legislation and our tax position; and

•the tax status of the enterprises in which we may invest.

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. In light of these and other uncertainties, the inclusion of any projection or forward-looking statement in this report should not be regarded as a representation by us that our plans and objectives will be achieved. These risks and uncertainties include those described or identified in the section entitled “Item 1A. Risk Factors” and elsewhere in this report. These forward-looking statements apply only as of the date of this report. Moreover, we assume no duty and do not undertake to update the forward-looking statements, except as required by applicable law. You are advised to consult any additional disclosures that we make directly to you or through reports that we have filed or in the future file with the Securities and Exchange Commission (“SEC”) including annual reports on Form 10-K, registration statements on Form N-2, quarterly reports on Form 10-Q and current reports on Form 8-K. This annual report on Form 10-K contains statistics and other data that have been obtained from or compiled from information made available by third-party service providers. We have not independently verified such statistics or data.

Because we are an investment company, the forward-looking statements and projections contained in this report are excluded from the safe harbor protection provided by Section 21E of the U.S. Securities Exchange Act of 1934, Act, as amended (the “1934Exchange Act”).

Risk Factor Summary

The following is only a summary of the principal risks that may materially adversely affect our business, financial condition, results of operations and cash flows. The following should be read in conjunction with the more complete discussion of the risk factors we face, which are set forth in the section entitled “Item 1A. Risk Factors” in this report.

Risks Related to Our Business and Structure

•We are a relatively new companyPrice declines in the medium and have limited operating history andlarge-sized U.S. corporate debt market may adversely affect the fair value of our portfolio.

•Our ability to achieve our investment objectives depends on the ability of the Adviser to manage and support our investment process largely through relationships with private equity sponsors, investment banks and commercial banks.

•Our Board of Trustees (“Board”) may in certain circumstances change our operating policies and strategies or amend our Fifth Amended and Restated Declaration of Trust (the “Declaration of Trust”) without prior notice or shareholder approval, the effects of which may be adverse to our results of operations and financial condition.

•Price declines in the medium- and large-sized U.S. corporate debt market may adversely affect the fair value of our portfolio.

•We may face increasing competition for investment opportunities, have difficulty sourcing investment opportunities and experience fluctuations in our quarterly results.

•As required by the Investment Company Act of 1940, Act (as defined below)as amended (the “1940Act”), a significant portion of our investment portfolio is and will be recorded at fair value as determined in good faith by our Board and, as a result, there is and will be uncertainty as to the value of our portfolio investments.

•There is a risk that investors in our shares may not receive distributions or that our distributions may decrease over time.

•Extensive regulationChanges in laws or regulations governing our operations and the possibility of increased regulatory focus on areas related to our businesses affects our activities, creates the potential for significant liabilities and penalties, may make it more difficult for us to deploy capital in certain jurisdictions or sell assets to certain buyers, andbusiness could result in additional burdens on our business.

•Changes in laws or regulations governing our operations may adversely affect our business, and the impact of financial reform legislation on us is uncertain.

•Although we have implemented a share repurchase program, we have discretion to repurchase shares at a disadvantageous time to our shareholders or not repurchase such shares, and our Board has the ability to amend or suspend any share repurchase program.

•Efforts to comply with regulations applicable to a public reporting company will involve significant expenditures, and non-compliance with such regulations may adversely affect us.

•General economic conditions, including those in Europe, could adversely affect the performance of our investments and operations.operations, including recessionary fears, geopolitical events and inflation.

•We and our portfolio companies and service providers may be subject to cybersecurity risks and our business could be adversely affected by changes to data protection laws and regulations.

Risks Related to Our Investments

•We generally will not control our portfolio companies and our investments in prospective portfolio companies may be risky.

•Economic recessions or downturns could impair our portfolio companies and adversely affect our operating results.

•Our portfolio companies may be highly leveraged, incur debt that ranks equally with, or senior to, our investments in such companies and breach covenants or default on such debt.

•We are exposed to risks associated with changes in interest rates.

•Second priority liens on collateral securing debt investments that we make to our portfolio companies may be subject to control by senior creditors with first priority liens.

•Economic recessions or downturns could impair our portfolio companies and adversely affect our operating results.

•Our portfolio may be concentrated in a limited number of industries, which may subject us to specific risks.

Risks Related to the Adviser and Its Affiliates; Conflicts of InterestAffiliates

•The Adviser and its affiliates, including our officers and some of our Board,trustees, face conflicts of interest caused by compensation arrangements with us and our affiliates, which could result in actions that are not in the best interests of our shareholders.

•We may be obligated to pay the Adviser incentive compensation even if we incur a net loss due to a decline in the value of our portfolio and the compensation paid to the Adviser is determined without independent assessment.

•The Adviser relies on key personnel, the loss of any of whom could impair its ability to successfully manage us.

Risks Related to Business Development Companies

•The requirement that we invest a sufficient portion of our assets in assets of the type listed in Section 55(a) of the 1940 Act (“Qualifying Assets”) could preclude us from investing in accordance with our current business strategy; conversely, the failure to invest a sufficient portion of our assets in Qualifying Assets could result in our failure to maintain our status as a BDC.

•Regulations governing our operation as a BDC and a regulated investment company (“RIC”) will affect our ability to raise, and the way in which we raise, additional capital or borrow for investment purposes.

Risks Related to Debt Financing

•We borrow money, which magnifies the potential for loss on amounts invested in us and may increase the risk of investing in us.

•Provisions in a credit facility may limit our investment discretion and we may default under our credit facilities.

•We are subject to risks associated with the unsecured notes and debt securitizations that we have issued and our credit facilities.

Federal Income Tax Risks

•We will be subject to corporate-level income tax if we are unable to qualify as amaintain RIC tax treatment under Subchapter M of the Internal Revenue Code of 1986, as amended (together with the rules and regulations promulgated thereunder, the “Code”) or to satisfy RIC distribution requirements.

•Our portfolio investments may present special tax issues.

•Legislative or regulatory tax changes could adversely affect investors.

Risks Related to an Investment in the Common Shares

•The value of your investment in us may be reduced in the event our assets under-perform.

•An investment in our shares involves a high degree of risk, our NAV may fluctuate significantly, and our shares will have limited liquidity.

•Shareholders may experience dilution.

Website Disclosure

We use our website (www.bcred.com) as a channel of distribution of company information. The information we post through this channel may be deemed material. Accordingly, investors should monitor this channel, in addition to following our press releases, SEC filings and webcasts. The contents of our website are not, however, a part of this report.

PART I

Item 1. Business.

Our Company

Blackstone Private Credit Fund (together with its consolidated subsidiaries, “BCRED” or the “Company”, “we”, “us,” or “our”), is a Delaware statutory trust formed on February 11, 2020, and structured as an externally managed, non-diversified, closed-end management investment company. The Company has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (together with the rules and regulations promulgated thereunder, the “1940 Act”). In addition, the Company has elected to be treated for U.S. federal income tax purposes, and intends to qualify annually, as a regulated investment company ((a “RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (together with the rules and regulations promulgated thereunder, the “Code”).

We are externally managed by Blackstone Credit BDC Advisors LLC (the “Adviser”), an affiliate of Blackstone Alternative Credit Advisors LP (the “Administrator” and, collectively with its affiliates in the credit-focusedcredit, asset based finance and insurance asset management business unit of Blackstone Inc. (“Blackstone”), “Blackstone Credit & Insurance,” which, for the avoidance of doubt, excludes Harvest Fund Advisors LLC (or “Harvest”) and Blackstone Insurance Solutions (“BIS”BXCI”). The Administrator provides certain administrative and other services necessary for the Company to operate pursuant to an administration agreement (the “Administration Agreement”). References herein to information about Blackstone Credit is part of the credit-focused platform of Blackstone and is the primary part of its "Credit & Insurance" reporting segment.

The Company was formedInsurance from December 31, 2023 or prior refers solely to invest primarily in originated loans and other securities, including broadly syndicated loans, of U.S. private companies. Our investment objectives are to generate current income and, to a lesser extent, long-term capital appreciation. We will seek to meet our investment objectives by:

•utilizing the experience and expertise of the management team of the Adviser alongand Blackstone Alternative Credit Advisors LP, collectively with the broader resources oftheir credit-focused affiliates within Blackstone Credit and Blackstone, in sourcing, evaluating and structuring transactions, subject to Blackstone’s policies and procedures regarding the management of conflicts of interest;& Insurance.

•employing a defensive investment approach focused on long-term credit performance and principal protection, generally investing in loans with asset coverage ratios and interest coverage ratios that the Adviser believes provide substantial credit protection, and also seeking favorable financial protections, including, where the Adviser believes necessary, one or more financial maintenance covenants;

•focusing on loans and securities of U.S. private companies, and to a lesser extent European and other non-U.S. companies. In many market environments, we believe such a focus offers an opportunity for superior risk-adjusted returns;

•maintaining rigorous portfolio monitoring in an attempt to anticipate and pre-empt negative credit events within our portfolio; and

•utilizing the power and scale of Blackstone and Blackstone Credit platform to offer operational expertise to portfolio companies through the Blackstone Credit Advantage program.

Our investment strategy is expected to capitalize on Blackstone Credit’s scale and reputation in the market as an attractive financing partner to acquire our target investments at attractive pricing. We also expect to benefit from Blackstone’s reputation and ability to transact in scale with speed and certainty, and its long-standing and extensive relationships with private equity firms that require financing for their transactions.

Under normal circumstances, the Company will invest at least 80% of its total assets (net assets plus borrowings for investment purposes) in private credit investments (loans, bonds and other credit instruments that are issued in private offerings or issued by private companies). Once the Company has invested a substantial amount of proceeds from its offering, under normal circumstances the Company expects that the majority of its portfolio will be in privately originated and privately negotiated investments, predominantly direct lending to U.S. private companies through (i) first lien senior secured and unitranche loans (including first-out/last-out loans) (generally with total investment sizes less than $300 million, which criteria may change from time to time) and (ii) second lien, unsecured, subordinated or mezzanine loans and structured credit (generally with total investment sizes less than $100 million, which criteria may change from time to time), as well as broadly syndicated loans (for which the Company may serve as an anchor investor), club deals (generally investments made by a small group of investment firms) and other debt and equity securities (the investments described in this sentence, collectively, “Private Credit”). In limited instances we may retain the “last out” portion of a first-lien loan. In such cases, the “first out” portion of the first lien loan would receive priority with respect to payment over our “last out” position. In exchange for the higher risk of loss associated with such “last out” portion, we would earn a higher rate of interest than the “first out” position. To a lesser extent, the Company will also invest in publicly traded securities of large corporate issuers (“Opportunistic Credit”). The Company

expects that the Opportunistic Credit investments will generally be liquid, and may be used for the purposes of maintaining liquidity for the Company’s share repurchase program and cash management, while also presenting an opportunity for attractive investment returns.

Most of our investments will be in U.S. private companies, but (subject to compliance with BDCs’ requirement to invest at least 70% of its assets in U.S. private companies), we also expect to invest to some extent in European and other non-U.S. companies, but we do not expect to invest in emerging markets. We may invest in companies of any size or capitalization. Subject to the limitations of the 1940 Act, we may invest in loans or other securities, the proceeds of which may refinance or otherwise repay debt or securities of companies whose debt is owned by other Blackstone Credit & Insurance funds. From time to time, we mayWe generally will co-invest with other Blackstone Credit & Insurance funds.

As a BDC, at least 70% of our assets must be the type of “qualifying” assets listed in Section 55(a) of the 1940 Act, as described herein, which are generally privately-offered securities issued by U.S. private or thinly-traded companies. We may also invest up to 30% of our portfolio opportunistically in “non-qualifying” portfolio investments, such as investments in non-U.S. companies.

The loans in which we invest will generally pay floating interest rates based on a variable base rate. The senior secured loans, unitranche loans and senior secured bonds in which we will invest generally have stated terms of five to eight years, and the mezzanine, unsecured or subordinated debt investments that we may make will generally have stated terms of up to ten years, but the expected average life of such securities is generally between three and five years. However, there is no limit on the maturity or duration of any security we may hold in our portfolio. Loans and securities purchased in the secondary market will generally have shorter remaining terms to maturity than newly issued investments. We expect most of our debt investments will be unrated. Our debt investments may also be rated by a nationally recognized statistical rating organization, and, in such case, generally will carry a rating below investment grade (rated lower than “Baa3” by Moody’s Investors Service, Inc. or lower than “BBB-” by Standard & Poor’s Ratings Services). We expect that our unrated debt investments will generally have credit quality consistent with below investment grade securities. In addition, we may invest in collateralized loan obligations (“CLOs”) and will generally have the right to receive payments only from the CLOs, and will generally not have direct rights against the underlying borrowers or entities that sponsored the CLOs.

We may, but are not required to, enter into interest rate, foreign exchange or other derivative agreements to hedge interest rate, currency, credit or other risks, but we do not generally intend to enter into any such derivative agreements for speculative purposes. Any derivative agreements entered into for speculative purposes are not expected to be material to the Company’s business or results of operations. These hedging activities, which will be in compliance with applicable legal and regulatory requirements, may include the use of futures, options and forward contracts. We will bear the costs incurred in connection with entering into, administering and settling any such derivative contracts. There can be no assurance any hedging strategy we employ will be successful.

To seek to enhance our returns, we use and continue to expect to use leverage as market conditions permit and at the discretion of the Adviser, but in no event will leverage employed exceed the limitations set forth in the 1940 Act; which currently allows us to borrow up to a 2:1 debt to equity ratio. We use and continue to expect to use leverage in the form of borrowings, including loans from certain financial institutions and may also issue debt securities. We may also use leverage in the form of the issuance of preferred shares, but do not currently intend to do so.shares. In determining whether to borrow money, we will analyze the maturity, covenant package and rate structure of the proposed borrowings as well as the risks of such borrowings compared to our investment outlook. Any such leverage, if incurred, would be expected to increase the total capital available for investment by the Company.

We are currently offering on a continuous basis up to $36.5 billion of Common Shares pursuant to an offering registered with the Securities and Exchange Commission (“SEC”). The Company expects to offer to sell any combination of three classes of Common Shares, Class I shares, Class S shares, and Class D shares, with a dollar value up to the maximum offering amount. The share classes have different ongoing shareholder servicing and/or distribution fees. The per share purchase price for Common Shares in the primary offering was $25.00 per share. Thereafter, the purchase price per share for each class of Common Shares will equal the net asset value (“NAV”) per share, as of the effective date of the monthly share purchase date. Blackstone Securities Partners L.P. (the “Intermediary Manager”) will use its best efforts to sell shares, but is not obligated to purchase or sell any specific amount of shares in the offering.

Our Investment Adviser

Our investment activities are managed by our Adviser, a subsidiary of Blackstone Alternative Credit Advisors LP, the primary investment manager for Blackstone Credit.LP. The principal executive offices of our Adviser are located at 345 Park Avenue, 31st Floor New York, NY, 10154. Our Adviser is responsible for originating prospective investments, conducting research and due diligence investigations on potential investments, analyzing investment opportunities, negotiating and structuring our investments and monitoring our investments and portfolio companies on an ongoing basis.

In conducting our investment activities, we believe that we benefit from the significant scale and resources of Blackstone Credit & Insurance, including our Adviser and its affiliates, subject to the policies and procedures of Blackstone regarding the management of conflicts of interest. In order to source transactions, the Adviser utilizes its significant access to transaction flow, along with its trading platform. The Adviser seeks to generate investment opportunities through direct origination channels as well as through syndicate and club deals (i.e., where a limited number of investors participate in a loan transaction).deals. With respect to Blackstone Credit’sCredit & Insurance’s origination channel, the global presence of Blackstone Credit & Insurance generates access to a substantial amount of directly originated transactions with what we believe to be attractive investment characteristics. With respect to syndicate and club deals (i.e., where a limited number of investors participate in a loan transaction), Blackstone Credit & Insurance has built a network of relationships with commercial and investment banks, finance companies and other investment funds as a result of the long track record of its investment professionals in the leveraged finance marketplace. Blackstone Credit & Insurance also has a significant trading platform, which, we believe, allows us access to the secondary market for investment opportunities. Blackstone Credit & Insurance employs a rigorous investment process and defensive investment approach to evaluate all potential opportunities with a focus on long-term credit performance and principal protection. The investment professionals employed by Blackstone Credit & Insurance have spent their careers developing the resources necessary to invest in private companies. Before undertaking an investment, the Adviser’s transaction team conducts a thorough and rigorous due diligence review of the opportunity to ensure the portfolio company fits our investment strategy.

Our Adviser’s investment committee (the “Investment Committee”) is responsible for reviewing and approving our investment opportunities. The Adviser’s Investment Committee review process is consensus-driven, multi-step and iterative, and occurs in parallel with the diligence and structuring of investments. Others who participate in the Investment Committee process include the team responsible for conducting due diligence, others on the investing team and other senior members of Blackstone and Blackstone Credit. There are no representatives from other business groups of Blackstone involved in the Adviser’s Investment Committee process.Credit & Insurance.

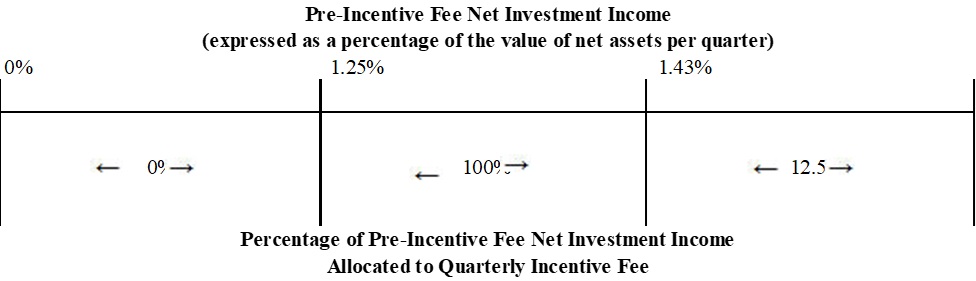

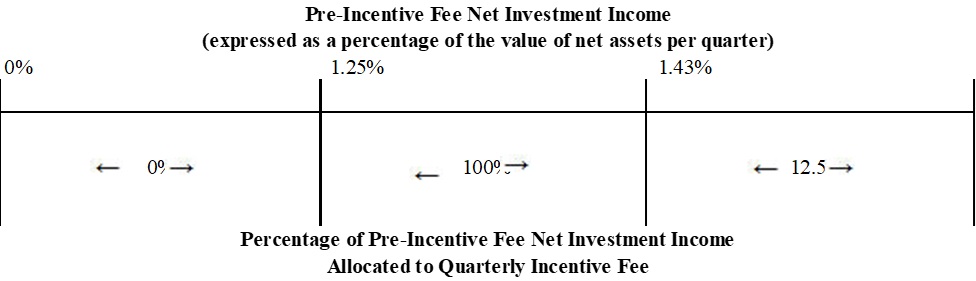

We have agreed to pay our Adviser a management fee payable monthly and settled and paid quarterly in arrears at an annual rate of 1.25% of the value of the Company’s net assets as of the beginning of the first calendar day of the applicable month. We also pay the Adviser an income based incentive fee and a capital gains based incentive fee. See “—“Investment Advisory Agreement”Agreement” for more information.

The members of the senior management and Investment Team of the Adviser serve or may serve as officers, directors or principals of entities that operate in the same or a related line of business as we do, or of investment funds managed by the same personnel. As a result, the Adviser, its officers and employees and certain of its affiliates will have conflicts of interest in allocating their time between us and other activities in which they are or may become involved, including the management of its affiliated equipment funds. See “—Allocation of Investment Opportunities and Potential Conflicts of Interests” and “Item 1A. Risk Factors—Risks Related to the Adviser and Its Affiliates”.Affiliates and –Allocation of Investment Opportunities and Potential Conflicts of Interests” for more information.

Our Administrator

Blackstone Alternative Credit Advisors LP, a Delaware limited partnership, serves as our Administrator. The principal executive offices of our Administrator are located at 345 Park Avenue, New York, New York 10154. We reimburse the Administrator for ourits costs, expenses and allocable portion of compensation, overhead (including rent, office equipment and utilities) and other expenses in connection with administrative services performed for us. See “—“Administration AgreementAgreement””. for more information.

Blackstone Credit & Insurance

Blackstone Credit & Insurance is part of the credit-focused platformcredit, asset based finance and insurance asset management business unit of Blackstone, which is the largest alternative asset manager in the world with leading investment businesses across asset classes. Blackstone’s platform provides significant competitive advantages including scale, expertise across industries and capital structures, and deep relationships with companies and financial sponsors.

Blackstone’s four business segments are real estate, private equity, credit and insurance, and hedge fund solutions. Through its different investment businesses, as of December 31, 2022,2023, Blackstone had total assets under management (“AUM”) of approximately $975 billion.more than $1 trillion. As of December 31, 2022,2023, Blackstone Credit’sCredit & Insurance’s asset management operation had aggregate assets under managementAUM of approximately $246$318.9 billion across multiple strategies withinprivate corporate credit, liquid corporate credit, and infrastructure and asset based credit. Blackstone Credit & Insurance’s total AUM includes AUM of a platform managed by Harvest Fund Advisors LLC (“Harvest”), which primarily invests in publicly traded energy infrastructure, renewables and master limited partnerships holding midstream energy assets in North America. Effective the leveraged finance marketplace, including loans, high yield bonds, distressed and mezzanine debt and private equity, including hedge funds, and approximately $280 billion withsecond quarter of 2024, Harvest will be included in Blackstone Alternative Asset Management, which will be renamed Blackstone Multi-Asset Investing effective the inclusionfirst quarter of Harvest and BIS. 2024.

Blackstone Credit & Insurance, through its affiliates, employed 518626 people headquartered in New York withand in offices in London, Dublin, Houston, Baltimore, San Francisco, Chicago, Miami, Toronto, Frankfurt, Madrid, Milan, Paris, Sydney, Hong Kong, Tokyo and Singaporeglobally as of January 1, 2023.2024. Blackstone Credit’s 138-person private creditCredit & Insurance’s 360-person investment team (excluding Dwight Scott, Global Head of Blackstone Credit) is supported by a 56-personalso includes an 84-person Chief Investment Office team, which consists of individuals focused on Investment Process, Portfolio Management,Underwriting & Execution, Capital Formation, Asset Allocation, Structuring, Asset Management, Capital

Formation, Insurance Portfolios,Portfolio Insights, and Data Sciences.Portfolio Analytics. Blackstone Credit’sCredit & Insurance’s Senior Managing Directors have on average 24 years of industry experience. Since inception, Blackstone Credit has originated over $149 billion in private credit transactions and during 2022, Blackstone Credit originated over $34 billion in private credit transactions. Blackstone Credit believes that the depth and breadth of its team provides it with a significant competitive advantage in sourcing product on a global basis, structuring transactions and actively managing investments in the portfolio.

Market Opportunity

We believe that there are and will continue to be significant investment opportunities in the targeted asset classes discussed below.

Attractive Opportunities in Floating Rate, Senior Secured Loans

We believe that opportunities in senior secured loans are significant because of the strong defensive characteristics of this asset class. While there is inherent risk in investing in any securities, senior secured debt is on the top of the capital structure and thus has priority in payment among an issuer’s security holders (i.e., senior secured debt holders are due to receive payment before junior creditors and equity holders). Further, these investments are secured by the issuer’s assets, which may be collateralized in the event of a default, if necessary. Senior secured debt often has restrictive covenants for the purpose of additional principal protection and ensuring repayment before junior creditors (i.e., most types of unsecured bondholders, and other security holders) and preserving collateral to protect against credit deterioration. The senior secured loans we invest in will generally pay floating interest rates based on a variable base rate, such as the Secured Overnight Financing Rate (“SOFR”). We expect that our loans will generally pay floating interest rates and are likely to benefit from the current higher rate environment. With base rates (3 month SOFR) at approximately 5.33% as of December 29, 2023, we believe the market provides an attractive opportunity to generate strong all-in yields and risk-adjusted returns for investors.

Opportunity in U.S. Private Companies

In addition to investing in senior secured loans generally, we believe that the market for lending to private companies, which includes middle market private companies within the United States is underserved and presents a compelling investment opportunity. We believe that the following characteristics support our belief:

Secular Tailwinds in the Private Market, Including Private Credit. One of the important drivers of growth in the strategy is the increasing secular tailwinds in the private markets (i.e., social or economic trends positively impacting private markets), including growing demand for private credit, which has created attractive opportunities for private capital providers like Blackstone Credit. As of December 31, 2022, privateCredit & Insurance. Private equity funds with strategies focused on leveraged buyouts in North America had approximately $579.1 billion$1.5 trillion of “dry powder” (i.e., uncalled capital commitments) (as of December 31, 2023, as published by Preqin as of March 11, 2024), which should similarly drive demand for private capital providers like Blackstone Credit.1Credit & Insurance. This shift is partially due to traditional banks continuing to face regulatory limitations and retreating from the space, creating additional opportunities for private credit to take advantage of. Further, financial sponsors and companies are becoming increasingly interested in working directly with private lenders as they are seeing the tremendous benefits versus accessing the public credit markets. The Company believes some of these benefits include faster execution and greater certainty, ability to partner with sophisticated lenders, a more efficient process, and in some instances fewer regulatory requirements. As a result, Blackstone Credit & Insurance benefits from increasing flow of larger scale deals that have become increasingly available to the direct lending universe over traditional banks and other financing institutions.

Attractive Market Segment. We believe that the underserved nature of such a large segment of the market can at times create a significant opportunity for investment. In many environments, we believe that private companies are more likely to offer attractive economics in terms of transaction pricing, up-front and ongoing fees, prepayment penalties and security features in the form of stricter covenants and quality collateral than loans to public companies.

Limited Investment Competition. Despite the size of the market, we believe that regulatory changes and other factors have diminished the role of traditional financial institutions and certain other capital providers in providing financing to companies. As tracked by Leverage Commentary & Data (LCD), private credit markets financed 274177 leveraged buyouts (“LBO”) (83%(86% of total LBOs in 2022)2023) compared to the publicly syndicated markets, which financed only 56 (17%28 (14% of total LBOs in 2022)2023). In addition, due to bank consolidation, the number of banks has also rapidly declined during the past several decades, furthering the lack of supply in financing to private companies. As of July 2020, there were approximately 4,375 banks in the U.S., which was only one-third of the number of banks in 1984, according to Federal Reserve Economic Data.

We also believe that lending and originating new loans to private companies generally requires a greater dedication of the lender’s time and resources compared to lending to public companies, due in part to the size of each investment and the often fragmented nature of information available from these companies. Further, we believe that many investment firms lack

1 Source: Preqin, December 2022. Represents dry powder (i.e., uncalled capital commitments) for private equity buyouts in North America.

the breadth and scale necessary to identify investment opportunities, particularly in regardregards to directly originated investments in private companies, and thus attractive investment opportunities are often overlooked.

Growing Opportunities in Europe. We believe the market for European direct lending provides attractive opportunities. In recent years, we have continued to see a growing number of corporate carve-outs and divestitures driven by pressure on European public companies from activists, streamlining of operations, and sustained pressure from European competition authorities. This creates a source of deal flow that we believe Blackstone Credit & Insurance is uniquely placed to execute. We further believe that the strong fundraising environment globally for private equity over the past few years will also continue to drive deal flow for European originated transactions. We anticipate that many of our opportunities to provide originated loans or other financing will be in connection with leveraged buy-outs by private equity firms. Globally, private equity dry powder (uncalled capital commitments) currently stands at over $900 billion2nearly $2.7 trillion (as of December 31, 2023, as published by Preqin as of March 11, 2024), which means that these private equity firms have a large amount of capital available to conduct transactions, which we believe will create debt financing opportunities for us. Although we believe the alternative credit market in Europe is still somewhat less developed compared to its U.S. counterpart, acceptance of private capital in Europe has grown substantially in recent years. Across the U.S. and Europe, we believe Blackstone Credit & Insurance has the ability to take advantage of a dislocation in capital markets as a result of volatility by providing financing solutions, including anchoring loan syndications, originating loans where traditional banks are unwilling or unable to do so, or buying investments in the secondary market, all of which we may be able to do on more attractive terms in times of market disruption than would otherwise be available. This deployment of capital through a market dislocation strategy remains firmly within Blackstone Credit’sCredit & Insurance’s investment philosophy—focusing on performing companies where Blackstone Credit & Insurance has enhanced access and a due diligence advantage.

Blackstone Credit & Insurance Strengths

Blackstone Credit & Insurance is one of the largest private credit investment platforms globally and a key player in the direct lending space. Blackstone Credit & Insurance has experience scaling funds across its platform that invest throughoutin all parts of the capital structure. Blackstone Credit strives to focus& Insurance focuses on transactions where it can differentiate itself from other providers of capital, targeting largerlarge transactions and those where Blackstone Credit & Insurance can bring its expertise and experience in negotiating and structuring. We believe that Blackstone Credit & Insurance has the scale and platform to effectively manage a U.S.North American private credit investment strategy, offering investors the following potential strengths:

Ability to Provide Scale, Differentiated Capital Solutions. We believe that the breadth and scale of Blackstone Credit’s approximately $246Credit & Insurance’s platform, with $318.9 billion platform,AUM as of December 31, 2022,2023, and affiliation with Blackstone areprovide a distinct strengths whenadvantage in sourcing and deploying capital toward proprietary investment opportunities including those that are large and providecomplex. Blackstone Credit with a differentiated capability to invest in large, complex opportunities. Blackstone Credit& Insurance is invested in over 3,1004,500 corporate issuers across its portfolios globally and has focused primarily on theoffers its clients and borrowers a comprehensive solution across corporate and asset-based, as well as investment grade and non-investment grade corporate credit market since its inception in 2005.credit.31 Blackstone Credit & Insurance expects that in the current environment, in whichwhere committed capital from banks remains scarce, that the ability to provide flexible, well-structured capital commitments in appropriate sizes will enable Blackstone Credit & Insurance to command more favorable terms for its investments. Blackstone Credit & Insurance seeks to generate investment opportunities through its direct origination channels and through syndicate and club deals (generally, investments made by a small group of investment firms). With respect to Blackstone Credit’sCredit & Insurance’s origination channel, we seek to leverage the global presence of Blackstone Credit & Insurance to generate access to a substantial amount of directly originated transactions with attractive investment characteristics. We believe that the broad network of Blackstone Credit & Insurance provides a significant pipeline of investment opportunities for us. With respect to syndicate and club deals, Blackstone Credit & Insurance has built a network of relationships with commercial and investment banks, finance companies and other investment funds as a result of the long track record of its investment professionals in the leveraged finance marketplace.funds. Blackstone Credit & Insurance also has a significant trading platform, which, we believe, allows us access to the secondary market for investment opportunities.

Established Origination Platform with Strong Credit Expertise. AsThe global presence of December 31, 2022, Blackstone Credit through& Insurance generates access to a substantial amount of directly originated transactions with what Blackstone Credit & Insurance believes to be attractive investment characteristics. Over the last several years, Blackstone Credit & Insurance has expanded its affiliates, employed 518 people headquartered in New York,origination and sponsor coverage footprint with regional offices in London, Dublin, Houston, Baltimore, San Francisco, Chicago, Miami, Toronto, Frankfurt, Madrid, Milan, Paris, Sydney, Hong Kong, Tokyo and Singapore as of January 1, 2023. Blackstone Credit’s 138-person private credit investment team (excluding Dwight Scott, Global Head of Blackstone Credit) is supported by a 56-person Chief Investment Office team, which consists of individuals focusedselect markets. We anticipate capitalizing on Investment Process, Portfolio Management, Asset Management, Capital Formation, Insurance Portfolios, and Data Sciences. Blackstone Credit’s Senior Managing Directors have on average 24 years of industry experience. Since inception, Blackstone

2 Source: Preqin, December 2022. Represents dry powder (i.e., uncalled capital commitments) for private equity buyouts globally.

3 As of December 31, 2022. Reflects unique corporate issuers across funds and accounts managed by Liquid Credit Strategies and Private Credit Strategies.

Credit has originated over $149 billion in private credit transactions and during 2022, Blackstone Credit originated over $34 billion in private credit transactions.& Insurance’s global footprint and broad and diverse origination platform to provide, primarily, senior secured financings.4

We believe that Blackstone Credit’sCredit & Insurance’s strong reputation and longstanding relationships with corporate boards, management teams, leveraged buyout sponsors, financial advisors, and intermediaries position Blackstone Credit & Insurance as a partner and counterparty of choice and provides us with attractive sourcing capabilities. In Blackstone Credit’sCredit & Insurance’s experience, these relationships help drive substantial proprietary deal flow and insight into investment opportunities. With Blackstone's scale and experienced platform, and the Company’s high-quality portfolio and floating-rate focus, we think BCRED is enviably well-positioned to help investors adapt to today’s challenging inflationary and interest-rate environment.

Blackstone Credit & Insurance believes that having one team responsible for alternatives private origination allows us to leverage the strengths and experiences of investment professionals to deliver the leading financing solutions to our companies. The team has operated through multiple industry cycles, with deep credit expertise, providing them valuable experience and a long-term view of the market. The team is also focused on making investments in what are characterized as “good neighborhoods”,neighborhoods,” which are industries experiencing favorable tailwinds, such as life sciences, software & technology, and renewable energy.professional services. In addition, the team is able to leverage the expertise of other parts of Blackstone’s business that specialize in these fields.

Additionally, over the last several years, Blackstone Credit & Insurance has also expanded its U.S.North American origination and sponsor coverage footprint withby opening regional offices opened in select markets. Blackstone Credit & Insurance has investment professionals across the U.S.North America, Europe, Asia and EuropeAustralia, and has developed a reputation for being a valued partner with the ability to provide speed, creativity, and assurance of transaction execution. We believe that establishing this regionalBlackstone Credit & Insurance’s global presence in the U.S. may help usBlackstone Credit & Insurance to more effectively source investment opportunities from private equity buyout sponsors as well as directiondirectly from companies, while potentially strengthening the Blackstone Credit brand.companies.

1 As of December 31, 2023. Reflects unique corporate issuers across funds and accounts managed by Liquid Credit Strategies, Private Credit Strategies, Infrastructure & Asset Based Credit excluding FX derivatives and LP interests.

Value-Added Capital Provider and Partner Leveraging the Blackstone Credit Advantage& Insurance Value Creation Program. Blackstone Credit & Insurance has established a reputation for providing creative, value-added solutions to address a company’s financing requirements and believeswe believe our ability to solve a need for a company can lead to attractive investment opportunities. In addition, Blackstone Credit & Insurance has access to the significant resources of the Blackstone platform, including the Blackstone AdvantageCredit & Insurance Value Creation Program (“Blackstone Advantage”), which refers to the active management of the Blackstone portfolio company network, including cross-selling efforts across all of Blackstone, and aims to ensure practice sharing, operational, and commercial synergies among portfolio companies, effective deployment of Blackstone resources, and communication of the program with businesses and partners, and the Blackstone Credit Advantage Program (“Blackstone Credit Advantage”Value Creation Program”), which is a global platform that provides accessintends to a range of cost saving, revenue generating and best practice sharing opportunities. Specifically,help Blackstone Credit Advantage provides& Insurance investments create meaningful value by leveraging the scale, network, and expertise within the Blackstone platform. Specifically, the Value Creation Program focuses on three areas of improvement (i) partnershipreducing costs by leveraging the scale and best practicespurchasing power of Blackstone through our Group Purchasing Organization, preferred partnerships, and the Blackstone Sourcing Center, (ii) identifying cross-sell opportunities across Blackstone’s portfolio for potential introductions to other Blackstone portfolio companies, by offering invaluablewhich includes a network of over 350 Blackstone portfolio companies as of December 31, 2023 and (iii) providing valuable access to industry and functionfunctional experts both within the Blackstone organization (including the Blackstone Portfolio Operations team)team which consists of over 100 internal resources as of December 31, 2023) who are focused on areas such as cybersecurity, ESG, data science, healthcare, human resources, information technology, among others, and the network among portfolio companies; (ii) cross selling opportunities across Blackstone and Blackstone Credit portfolio companies; (iii) industry knowledge via leadership summits and roundtables; and (iv) quarterly reports sharing meaningful insights from CEOs on business and economic trends. Finally, one ofcompanies. Through the most important benefits of the program is Blackstone’s GPO,Value Creation Program, which is a collective purchasing platform that leverages the scale and buying power of the $5.9 billion of estimated total spending of Blackstone’sBCRED portfolio companies with strategic partners and vendors measured over the past 10+ years.can fully access, Blackstone and Blackstone Credit portfolio companies havehas generated significant cost savings through their use of the GPO, up to 40%, often from existing suppliers, on maintenance, repair, operations, back office, information technology, hardware, software, telecommunications, business insurance and human resources, among others. The benefits of working with Blackstone’s GPO can include improved pricing and terms, differentiated service, and ongoing service that drops straight to the bottom line. As of December 31, 2022, Blackstone Advantage has grownmeaningful revenue by over $500 million for Blackstone portfolio companies through cross-sell introductions across Blackstone and created over $3.5 billion of implied enterprise value across Blackstone Credit Advantage has reduced annual costs by $249 million. The dedicated Blackstone Credit operational program provides support to portfolio companies and has created approximately $3 billion& Insurance.5 in value. Blackstone Advantage has 112 internal Blackstone resources available to our portfolio companies as of December 31, 2022.2

Flexible Investment Approach. Blackstone Credit & Insurance believes that the ability to invest opportunistically throughout a capital structure is a meaningful strength when sourcing transactions and enables the Company to seek investments that provide the best risk/return proposition in any given transaction. Blackstone Credit’sCredit & Insurance’s creativity and flexibility with regard to deal-structuring distinguishes it from other financing sources, including traditional mezzanine providers, whose investment mandates are typically more restrictive. Over time, Blackstone Credit & Insurance has demonstrated the ability to negotiate more favorable terms for

4 As of December 31, 2022. Includes invested and committed capital for privately originated and anchor investments across private credit strategies and vehicles since 2005, including Direct Lending, Sustainable Resources, Mezzanine, and Opportunistic. Excludes liquid credit strategy investments.

5 Value creation represents $249 million of total annual savings as of December 31, 2022, representing estimated savings utilizing the Blackstone Credit Advantage program at the time cost is benchmarked with portfolio companies. Savings improved portfolio company EBITDA and created value assuming a 12x average EBITDA multiple.

its investments by providing creative structures that add value for an issuer. Blackstone Credit & Insurance will continue to seek to use this flexible investment approach to focus on principal preservation, while generating attractive returns throughout different economic and market cycles.

Long-Term Investment Horizon. Our long-term investment horizon gives us great flexibility, which we believe allows us to maximize returns on our investments. Unlike most private equity and venture capital funds, as well as many private debt funds, we will not be required to return capital to our shareholders once we exit a portfolio investment. We believe that freedom from such capital return requirements, which allows us to invest using a long-term focus, provides us with an attractive opportunity to increase total returns on invested capital.

Disciplined Investment Process and Income-Oriented Investment Philosophy. Blackstone Credit & Insurance employs a rigorous investment process and defensive investment approach to evaluate all potential opportunities with a focus on long-term credit performance and principal protection. We believe Blackstone Credit & Insurance has generated attractive risk-adjusted returns in its investing activities throughout many economic and credit cycles by (i) maintaining its investment discipline; (ii) performing intensive credit work; (iii) carefully structuring transactions; and (iv) actively managing its portfolios. Blackstone Credit’sCredit & Insurance’s investment approach involves a multi-stage selection process for each investment opportunity, as well as ongoing monitoring of each investment made, with particular emphasis on early detection of deteriorating credit conditions at portfolio companies, which would result in adverse portfolio developments. This strategy is designed to maximize current income and minimize the risk of capital loss while maintaining the potential for long-term capital appreciation. Additionally, Blackstone Credit’sCredit & Insurance’s senior investment professionals have dedicated their careers to the leveraged finance and private equity sectors, and we believe that their experience in due diligence, credit analysis and ongoing management of investments is invaluable to the success of the North America direct lending investment strategy. Blackstone Credit & Insurance generally targets businesses with leading market share positions, sustainable barriers to entry, high free cash flow generation, strong asset values, liquidity to withstand market cycles, favorable underlying industry trends, strong internal controls and high-quality management teams.

2 Amounts presented are since inception of the Value Creation Program in 2016, and data presented is based on internal Blackstone data recorded and not from financial statements of portfolio companies. Represents (a) identified total cost reduction at the time cost is benchmarked with portfolio companies, multiplied by (b) enterprise value multiple at the time of Blackstone Credit & Insurance’s initial investment. The number is presented for illustrative purposes and does not reflect actual realized proceeds to Blackstone Credit & Insurance or to the equity sponsor or the company, and there can be no assurance that realized proceeds received by Blackstone or any investor in a Blackstone fund, including us, will be increased as a result.

Strong Investment Track Record. Blackstone Credit’sCredit & Insurance’s track record in private debt lending and investing in below investment grade credit dates back to the inception of Blackstone Credit.Credit & Insurance. Since 2005 through December 31, 2022,2023, Blackstone Credit & Insurance has investedprovided approximately $149$164 billion in capital in privately-originated transactions63. Specifically within the North America Direct Lending Strategy, Blackstone Credit has invested approximately $85 billion7& Insurance believes that the depth and breadth of its team provides it with a competitive advantage in privately originated or privately negotiated first l

6 Includes investedsourcing product on a global basis, structuring transactions and committed capital for privately originated and anchoractively managing investments across private credit strategies and vehicles since 2005, including Direct Lending, Sustainable Resources, Mezzanine, and Opportunistic. Excludes liquid credit strategy investments.

7 Represents U.S. and Canada first lien and unitranche debt (which may be secured by the applicable borrower’s assets and/or equity) transactions in companies that were originated or anchored by certain Blackstone Credit managed, advised or sub-advised funds, Blackstone Credit managed mezzanine funds and Blackstone Credit advised business development companies (such advised business development companies, the “BDCs”), as well as certain other Blackstone Credit managed funds and accounts) and, with respect to certain transactions, investments allocated to affiliates of Blackstone Credit, which may be sold to Blackstone Credit managed funds or accounts in the future, since 2006 (the “North America Direct Lending Track Record”). With respect to certain transactions, the North America Direct Lending Track Record includes free equity and/or warrants that accompanied the debt financings, as well as any loans or securities into which the applicable first lien and unitranche debt may have been restructured subsequent to Blackstone Credit’s initial investment. The North America Direct Lending Track Record excludes (i) broadly syndicated, mezzanine, second lien and equity (other than the aforementioned free equity and/or warrants or securities issued upon restructuring) transactions, among others and (ii) transactions where Blackstone Credit’s invested capital (net of transactions fees) was under $25 million.

ien and unitranche transactions. Corresponding to this North America Direct Lending track record, Blackstone Credit has an annualized loss rate of 0.14%.8portfolio.

Efficient Cost Structure. We believe that we have an efficient cost structure, as compared to other non-traded BDCs, with low management fees, expenses, and financing costs. We believe our operating efficiency and senior investment strategy enable us to generate greater risk-adjusted investment returns for our investors relative to other non-traded BDCs.

Scale. Scale allows for more resources to source, diligence and monitor investments, and enables us to move up market where there is often less competition.

The Board of Trustees

Overall responsibility for the Company’s oversight rests with the Board. We have entered into the Investment Advisory Agreement with the Adviser, pursuant to which the Adviser will manage the Company on a day-to-day basis. The Board is responsible for overseeing the Adviser and other service providers in our operations in accordance with the provisions of the 1940 Act, the Company’s bylaws and applicable provisions of state and other laws. The Adviser will keep the Board well informed as to the Adviser’s activities on our behalf and our investment operations and provide the Board information with additional information as the Board may, from time to time, request. The Board is currently composed of seven members, five of whom are Trustees who are not “interested persons” of the Company or the Adviser as defined in the 1940 Act.

Investment Strategy

The Company was formed to invest primarily in originated loans and other securities, including broadly syndicated loans, of U.S. private companies. Our investment objectives are to generate current income and, to a lesser extent, long-term capital appreciation. We will seek to meet our investment objectives by:

•utilizing the experience and expertise of the management team of the Adviser, along with the broader resources of Blackstone Credit & Insurance and Blackstone, in sourcing, evaluating and structuring transactions, subject to Blackstone’s policies and procedures regarding the management of conflicts of interest;

•employing a defensive investment approach focused on long-term credit performance and principal protection, generally investing in loans with asset coverage ratios and interest coverage ratios that the Adviser believes provide substantial credit protection, and also seeking favorable financial protections, including, where the Adviser believes necessary, one or more financial maintenance and incurrence covenants (i.e., covenants that are tested when affirmative action is taken, such as the incurrence of additional debt and/or making dividend payments);

•focusing on loans and securities of U.S. private companies, and to a lesser extent European and other non-U.S. companies. In many market environments, we believe such a focus offers an opportunity for superior risk-adjusted returns;

•maintaining rigorous portfolio monitoring in an attempt to anticipate and pre-empt negative credit events within our portfolio; and

•utilizing the power and scale of Blackstone and Blackstone Credit & Insurance platform to offer operational expertise to portfolio companies through the Blackstone Credit & Insurance Value Creation program (as defined below).

Our investment strategy is expected to capitalize on Blackstone Credit & Insurance’s scale and reputation in the market as an attractive financing partner to acquire our target investments at attractive pricing. We also expect to benefit from Blackstone’s reputation and ability to transact in scale with speed and certainty, and its long-standing and extensive relationships with private equity firms that require financing for their transactions.

3 Includes invested and committed capital for privately originated and anchor investments across private credit strategies and vehicles since 2005, including Direct Lending, Sustainable Resources, Mezzanine, and Opportunistic. Excludes liquid credit strategy investments.

Investment Selection

When identifying prospective investment opportunities, the Adviser currently intends to rely on fundamental credit analysis in order to minimize the loss of the Company’s capital. The Adviser expects to invest in companies generally possessing the following attributes, which it believes will help achieve our investment objectives:

Leading, Defensible Market Positions. The Adviser intends to invest in companies that it believes have developed strong positions within their respective markets and exhibit the potential to maintain sufficient cash flows and profitability to service their obligations in a range of economic environments. The Adviser will seek companies that it believes possess advantages in scale, scope, customer loyalty, product pricing, or product quality versus their competitors, thereby minimizing business risk and protecting profitability.

Proven Management Teams. The Adviser focuses on investments in which the target company has an experienced and high-quality management team with an established track record of success. The Adviser typically requires companies to have in place proper incentives to align management’s goals with the Company’s goals.

Private Equity Sponsorship. Often the Adviser seeks to participate in transactions sponsored by what it believes to be high-quality private equity firms. The Adviser believes that a private equity sponsor’s willingness to invest significant sums of equity capital into a company is an implicit endorsement of the quality of the investment. Further, private equity sponsors of companies with significant investments at risk generally have the ability and a strong incentive to contribute additional capital in difficult economic times should operational issues arise, which could provide additional protections for our investments.

8 Represents Blackstone Credit North America Direct Lending platform’s annualized net losses for substantially realized (in the manager’s discretion) defaulted investments from 2006 to December 31, 2022, across the platform. An investment is deemed defaulted if 1. a payment was missed, 2. bankruptcy was declared, 3. there was a restructuring, or 4. it was realized with a total multiple on invested capital less than 1.0x. Net losses include all profits and losses associated with the defaulted investment, including interest payments received. Net losses are represented in the year the defaulted investment is substantially realized and excludes all losses associated with unrealized investments. The annualized net loss rate is the Net losses divided by the average annual remaining invested capital within the platform. The realized loss rate includes investments for periods prior to December 31, 2017, in BDCs that were sub-advised by Blackstone Credit on a non-discretionary basis until April 9, 2018. Investments sourced by Blackstone Credit for these BDCs did, in certain cases, experience defaults and losses after Blackstone Credit was no longer sub-adviser and such defaults and losses are not included in the rates provided. Previously, Blackstone Credit North America Direct Lending platform’s methodology for calculating the platform’s average annual loss rate was based on net loss of principal resulting only from payment defaults in the year of default, but excluding interest payments. Past performance is not necessarily indicative of future results, and there can be no assurance that Blackstone Credit will achieve comparable results or that any entity or account managed or advised by Blackstone Credit will be able to implement its investment strategy or achieve its investment objectives.

Diversification.Broad Exposure. The Adviser seeks to invest broadly among companiesindustries and industries,issuers, thereby potentially reducing the risk of a downturn in any one company or industry having a disproportionate impact on the value of the Company’s portfolio.

Viable Exit Strategy. In addition to payments of principal and interest, we expect the primary methods for the strategy to realize returns on our investments include refinancings, sales of portfolio companies, and in some cases initial public offerings and secondary offerings. While many debt instruments in which we will invest have stated maturities of five to eight years, we expect the majority to be redeemed or sold prior to maturity. These instruments often have call protection that requires an issuer to pay a premium if it redeems in the early years of an investment. The Investment Team regularly reviews investments and related market conditions in order to determine if an opportunity exists to realize returns on a particular investment. We believe the ability to utilize the entire resources of Blackstone Credit & Insurance, including the public market traders and research analysts, allows the Adviser to gain access to current market information where the opportunity may exist to sell positions into the market at attractive prices.

Investment Process Overview

Our investment activities are managed by our Adviser. The Adviser is responsible for originating prospective investments, conducting research and due diligence investigations on potential investments, analyzing investment opportunities, negotiating and structuring our investments and monitoring our investments and portfolio companies on an ongoing basis.

The investment professionals employed by Blackstone Credit & Insurance have spent their careers developing the resources necessary to invest in private companies. Our transaction process is highlighted below.

Sourcing and Origination

In orderThe private credit investment team, comprised of 97 dedicated investment professionals as of January 1, 2024, is responsible for establishing regular dialogue with, and coverage of, the financial advisory, corporate issuer, financial sponsor, legal and restructuring communities. The team also has regular contact with Wall Street firms, business brokers, industry executives and others who help identify direct origination investment opportunities. Blackstone Credit & Insurance seeks to source transactions, the Adviser utilizesbe a value-added partner to its significant accesscounterparties in connection with their capital needs, and believes that these relationships have driven, and will continue to transactiondrive, substantial proprietary deal flow along with its trading platform. The Adviser seeksand insight into investment opportunities.

BCRED will seek to generate investment opportunities primarily through direct origination channels, and also through syndicate and club deals. With respect to Blackstone Credit’s origination channel, thechannels. The global presence of Blackstone Credit & Insurance generates access to a substantial amount of directly originated transactions with what we believeit believes to be attractive investment characteristics. Blackstone Credit & Insurance’s team covers over 200 sponsors with a primary focus on what it believes are the largest, highest quality, and most-well capitalized sponsors, leading to substantial repeat counterparties and making Blackstone Credit & Insurance a partner of choice to these sponsors. In addition to the depth and breadth of Blackstone Credit & Insurance’s relationships, sponsor and advisor partners also seek to transact with Blackstone Credit & Insurance due to its value-add through the Value Creation Program by not only helping companies with operational support, but also enhancing revenue generation and cost savings opportunities for Blackstone Credit & Insurance’s portfolio companies, all of which further contribute to its origination efforts. With respect to syndicate and club deals, Blackstone Credit & Insurance has built a network of relationships with commercial and investment banks, finance companies and other investment funds as a result of the long track record of its investment professionals in the leveraged finance marketplace. Blackstone Credit & Insurance also has a $109 billion Liquid Credit platform, which, we believe, allows us access to the secondary market for investment opportunities. Blackstone Credit & Insurance is invested in over 4,500 issuers across its $318.9 billion platform which we believe offers us deep insight across all sectors and industries in our market.

Blackstone Credit & Insurance aims to leverage the broader Blackstone network to generate additional deal flow. Blackstone’s Private Equity platform has been built over the past 35 years and invests globally across industries in both established and growth-oriented structures. Blackstone’s Real Estate group is among the largest owners of commercial real estate in the world. Blackstone’s General Partnership Stakes group, seeks to serve as a strategic partner to talented managers at all stages of their life cycles and help them build enduring franchises. Through such other business units of Blackstone, Blackstone Credit & Insurance aims to increase its connectivity and deepen sponsor relationships.

We believe that Blackstone Credit’s BlackstoneCredit&Insurance’sstrong reputationandlongstandingrelationshipswithitsbroadnetworkwillhelpdrivesubstantialproprietarydealflow andprovideasignificantpipelineofinvestmentopportunitiesforus.

Evaluation and longstanding relationshipsDue Diligence

The hallmark of Blackstone Credit & Insurance’s approach to investing will continue to be defined by a rigorous due diligence process focused on downside protection and capital preservation. This process includes a thorough business review of the industry, competitive landscape, products, customers, returns on capital, strength of management team and consultation with outside advisors and industry experts, and benefits from Blackstone’s global platform, offering broad access and insight. When a new investment opportunity is sourced, the Blackstone Credit & Insurance team spends time with management, analyzing the company’s assets and its broad network will help drive substantial proprietary dealfinancial position. This initial assessment is then followed by extensive credit analysis, including asset valuation work; financial modeling and scenario analysis; cash flow and provideliquidity analyses; and legal, tax and accounting review. Blackstone Credit & Insurance’s diligence process will also include a significant pipelinedetailed review of investment opportunities for us.

Evaluationkey qualitative factors, including the strength of management, quality / strategic value of the company’s assets, and potential operational risks. Further detail on this process is outlined below.