UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20202023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission File Number 012-34567001-39614

TARSUS PHARMACEUTICALS, INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 81-4717861 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification Number) |

| | | | | | | | |

| 15440 Laguna Canyon Road, Suite 160 | | |

| Irvine, California | | 92618 |

| (Address of principal executive offices) | | (Zip Code) |

(949) 409-9820418-1801

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | TARS | The Nasdaq Global Market LLC (Nasdaq Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by an of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price of the registrant’s common stock as reported by the Nasdaq Global Select Market on October 16, 2020,June 30, 2023, was approximately $312$460.0 million. The registrant has elected to use October 16, 2020 as the calculation date, which was the initial trading date of the registrant’s common stock on the Nasdaq Global Select Market, because on June 30, 2020 (the last business day of the registrant’s second fiscal quarter), the registrant was a privately-held company. Shares of common stock held by each executive officer, director, and holder of 5%10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 19, 2021,February 21, 2024, the number of outstanding shares of the registrant’s common stock, par value $0.0001 per share, was 20,503,096.34,218,886.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the information called for by Part III of this Annual Report on Form 10-K is hereby incorporated by reference to portions of the registrant’s definitive proxy statement for its 20212024 annual meeting of stockholders, which will be filed with the Securities and Exchange Commission not later than 120 days after the registrant’s fiscal year ended December 31, 2020.2023.

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements”forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended ("Exchange Act"). All statements other than statements of historical facts contained in this Annual Report on Form 10-K, including statements regarding our future results of operations and financial position, business strategy, product candidates, planned preclinical studies and clinical trials, results of clinical trials, research and development costs, regulatory approvals, timing and likelihood of success, as well as plans and objectives of management for future operations, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that are in some cases beyond our control and may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that may cause actual results to differ from expected results include, among others:

•our ability to successfully commercialize XDEMVY®, formerly known as TP-03, for the treatment of Demodex blepharitis;

•the prevalence of Demodex blepharitis and the size of the market opportunity for XDEMVY;

•our plans relating to commercializing XDEMVY and our product candidates, if approved, including commercialization timelines and sales strategy;

•any statements regarding our ability to achieve distribution and patient access for our products including XDEMVY and timing and breadth of payer coverage; our expectations of the potential market size, pricing, gross-to-net yields, eye care provider and patient acceptance of our product and product candidates, opportunity and patient populations for our product and product candidates, including XDEMVY;

•the rate and degree of market acceptance and clinical utility of XDEMVY and our product candidates;

•the likelihood of our clinical trials demonstrating safety and efficacy of our product candidates, and other positive results;

•the timing and progress of our current clinical trials and timing of initiation of our future clinical trials, and the reporting of data from our current and future trials;

•the timing or likelihood of regulatory filings and approval for our product candidates and our ability to meet existing or future regulatory standards or comply with post-approval requirements;

•our plans relating to the clinical development of our current and future product candidates, including the size, number and disease areas to be evaluated;

•the prevalenceimpact of Demodex blepharitishealth epidemics on our business and the size of the market opportunity for our product candidates;

•the rate and degree of market acceptance and clinical utility of our product candidates;

•our plans relating to commercializing our product candidates, if approved, including sales strategy;operations;

•the impact of COVID-19unfavorable global and geopolitical economic conditions on our business and operations;

•the success of competing therapies that are or may become available;

•our estimates of the number of patients in the United States ("U.S.") or globally, as applicable, who suffer from Demodex blepharitis, Meibomian Gland Disease ("MGD"), rosacea, Lyme disease and malaria and the number of patients that will enroll in our clinical trials;

•the beneficial characteristics, safety, efficacy, therapeutic effects and potential advantages of our product candidates;

•the timing or likelihood of regulatory filings and approval for our product candidates;

•our ability to obtain and maintain regulatory approval of our product candidates and our product candidates to meet existing or future regulatory standards;

•our plans relating to the further development and manufacturing of our product and product candidates, including additional indications for which we may pursue;

•our ability to identify additional products, product candidates or technologies with significant commercial potential that are consistent with our commercial objectives;

•the expected potential benefits of strategic collaborations with third parties (including, for example, the receipt of payments, achievement and timing of milestones under license agreements, and the ability of our third party collaborators to commercialize our product candidates in the territories under license) and our ability to attract collaborators with development, regulatory and commercialization expertise;

•existing regulations and regulatory developments in the United StatesU.S. and other jurisdictions;

•our plans and ability to obtain, maintain, and/or protect intellectual property rights, including extensions of existing patent terms where available;

•our continued reliance on third parties to conduct additional clinical trials of our product candidates, and for the manufacture of our product candidates for preclinical studies and clinical trials;

•the need to hire additional personnel, in particular sales personnel and our ability to attract and retain such personnel;

•the accuracy of our estimates regarding expenses, future revenue, capital requirements and needs for additional financing;

•our financial performance;

•the sufficiency of our existing capital resources to fund our future operating expenses and capital expenditure requirements;

•our competitive position;

•our expectations regarding the period during which we will qualify as an emerging growth company under the JOBS Act; and

•our anticipated use of our existing resources and the proceeds from our Initial Public Offering.

We have based these forward-looking statements largely on our current expectations and projections about our business, the industry in which we operate and financial trends that we believe may affect our business, financial condition, results of operations and growth prospects, and these forward-looking statements are not guarantees of future performance or development. These forward-looking statements speak only as of the date of this Annual Report on Form 10-K and are subject to a number of risks, uncertainties and assumptions, including those described in the section titled “Risk Factors” and elsewhere in this Annual Report on Form 10-K. BecauseMoreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements are inherently subject towe may make. In light of these risks, uncertainties and uncertainties, some of which cannot be predicted or quantified, you should not rely on theseassumptions, the forward-looking statements as predictions of future events. The events and circumstances reflecteddiscussed in our forward-looking statementsthis report may not be achieved or occur and actual results could differ materially and adversely from those projectedanticipated or implied in the forward-looking statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements after the date of this Annual Report on Form 10-K, whether as a result of any new information, future events or otherwise.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, advancements, discoveries, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update

In addition,publicly any forward-looking statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as offor any reason after the date of this Annual Report on Form 10-K,report to conform these statements to actual results or to changes in our expectations.

You should read this report and whilethe documents that we believe such information forms a reasonable basis for such statements, such informationreference in this report and have filed with the SEC as exhibits to this report with the understanding that our actual future results, levels of activity, performance and events and circumstances may be limited or incomplete, and our statements should not be read to indicate thatmaterially different from what we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon these statements.

Unless the context otherwise requires, all references in this Annual Report on Form 10-K to the “Company”, “we,” “us,” “our,” “Tarsus”“Tarsus,” and “Tarsus Pharmaceuticals” refer to Tarsus Pharmaceuticals, Inc. We primarily conduct our business activities as Tarsus Pharmaceuticals.

***

Tarsus Pharmaceuticals, Tarsus, and Tarsus Pharmaceuticals, Inc., our logo, XDEMVY, and other registered or common law trade names, trademarks or service marketsmarks of Tarsus appearing in this report are the property of the Company. This report contains additional trade names, trademarks and service marks of other companies that are the property of their respective owners. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies. Solely for convenience, our trade names, trademarks and service marks referred to in this report appear without the ®, ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trade names, trademarks and service marks.

SUMMARY OF RISKS ASSOCIATED WITH OUR BUSINESS

We face risks and uncertainties associated with our business, many of which are beyond our control. Some of the more significant risks associated with our business include the following:

•We are a late clinical-stagecommercial-stage biopharmaceutical company with a limited operating history.history and a single product approved for commercial sale. We have incurred significant losses and negative cash flows from operations since our inception and anticipate that we will continue to incur significant expenses and losses for the foreseeable future.

•Due to the recently initiated commercialization of XDEMVY and our continued development of our pipeline of product candidates through clinical trials and other indications, our capital requirements are difficult to predict and may change. We may need to obtain substantial additional funding to complete the developmentachieve our goals and any commercialization of our product candidates, if approved. If we are unablea failure to raiseobtain this necessary capital when needed we would be forcedon acceptable terms, or at all, could force us to delay, reduce or eliminate our product development programs, commercialization efforts or other operations.

•We are heavily dependent on the successsuccessful commercialization of XDEMVY and the development, regulatory approval, and commercialization of our leadcurrent and future product candidate, TP-03 for the treatment of Demodex blepharitis.

•The COVID-19 pandemic, which began in late 2019 and has spread worldwide, may continue to affect our ability to initiate and complete preclinical studies and clinical trials, disrupt regulatory activities, disrupt our manufacturing and supply chain or have other adverse effects on our business and operations.

•Even if TP-03 or any other product candidate that we develop receives marketing approval, weWe may not be successful in educating eye care physicianproviders ("ECPs"), and the market about the need for treatments specifically for Demodex blepharitis and or other diseases or conditions targeted by XDEMVY or our product candidates, and TP-03candidates. XDEMVY or other product candidates that we may develop may fail to achieve market acceptance by ECPs, other healthcare providers and patients, or adequate formulary coverage, pricing or reimbursement by third-party payorspayers and others in the medical community, and the market opportunity for these products may be smaller than we estimate.

•The development XDEMVY and commercialization of our products, including our leadany product candidate, TP-03candidates for the potential treatment of Demodex blepharitis and Meibomian Gland Disease ("MGD"), TP-04 for the potential treatment of rosacea and TP-05 for potential Lyme prophylaxis and community malaria reduction, is dependent on intellectual propertywhich we license from Elanco Tiergesundheit AG ("Elanco"). If we breach our agreements with Elancoobtain marketing approval may become subject to unfavorable pricing regulations, third-party coverage or the agreements are terminated, we could lose license rights that are important to our business. Furthermore, some of our revenue is dependent on receipt of payments and achievement and timing of milestones under the terms of our out-license agreement with LianBio Ophthalmology Limited ("LianBio"), granting exclusive commercial rights of TP-03 for the treatment of Demodex blepharitis and MGD within the People's Republic of China, Macau, Hong Kong, and Taiwan (the "Territory"). Adverse effects on our business could occur if LianBio is not able to make payments, achieve milestones, and/reimbursement practices or successfully commercialize TP-03 in the Territory.

•We will need to develop and expand our company and we may encounter difficulties in managing our growth,healthcare reform initiatives, which could disruptharm our operations.

•The sizes of the market opportunity for our product candidates, particularlyXDEMVY for the treatment of Demodex blepharitis and TP-03 for the treatment of Demodex blepharitis and MGD, as well as our other product or product candidates, have not been established with precision and may be smaller than we estimate, possibly materially. If our estimates of the sizes overestimate these markets, our sales growth may be adversely affected. We may also not be able to grow the markets for our product candidates as intended or at all.

•The development and commercialization of our products, including XDEMVY, for the treatment of Demodex blepharitis, TP-03 for the potential treatment of MGD, TP-04 for the potential treatment of rosacea and TP-05 for potential Lyme disease prophylaxis and community malaria reduction, is dependent on intellectual property we license from Elanco Tiergesundheit AG ("Elanco").

•We expect to expand our development, regulatory and operational capabilities, and, as a result, we may encounter difficulties in managing our growth, which could disrupt our operations.

•We contract with third parties for the commercial manufacture of XDEMVY and for the manufacture of our product candidates for preclinical studies, clinical trials and for eventual commercialization. This reliance on third parties increases the risk that we will not have sufficient quantities of XDEMVY or our product candidates or compounds or that such supply will not be available to us at an acceptable cost, which could delay, prevent or impair our commercialization or development efforts.

•Clinical drug development involvesis a lengthy, expensive and expensiverisky process with uncertain timelines and uncertain outcomes, and results of earlier studies and trials may not be predictive of future results.

•Any termination or suspension of, or delays in the commencement or completion of, our planned clinical trials could result in increased costs to us, delay or limit our ability to generate revenue and adversely affect our commercial prospects.

•We rely on third parties to conduct our clinical trials and perform some of our research and preclinical studies.

•If we are unable to obtain and maintain sufficient intellectual property protection for XDEMVY or our product candidates, or if the scope of the intellectual property protection is not sufficiently broad, our competitors could develop and

commercialize products similar or identical to ours, and our ability to successfully commercialize our products may be adversely affected.

•Patent terms may be inadequate to protect our competitive position on our product candidates and preclinical programs for an adequate amount of time.

•The concentration of our stock ownership will likely limit your ability to influence corporate matters, including the ability to influence the outcome of director elections and other matters requiring stockholder approval.

PART I

Item 1. Business

Overview

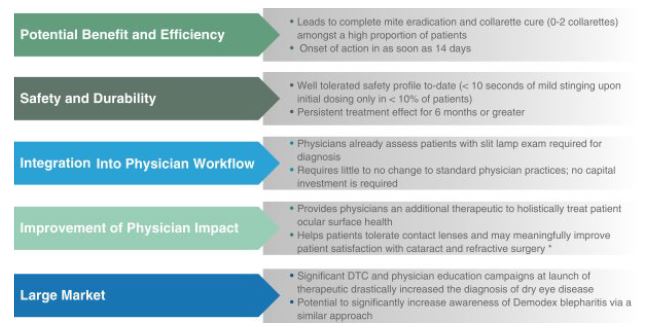

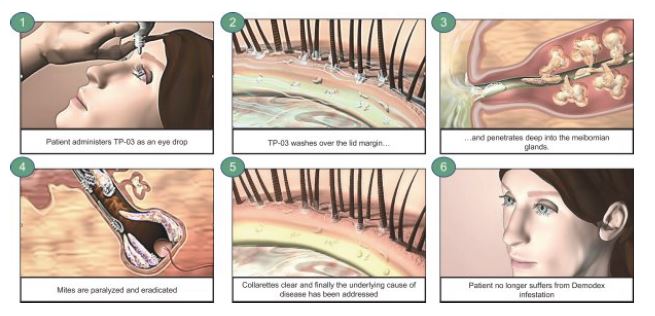

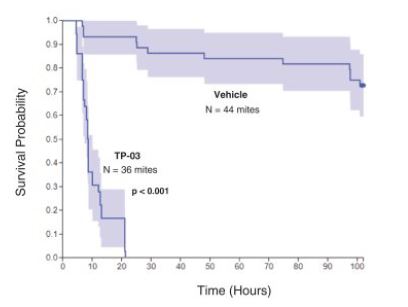

We are a late clinical-stagecommercial-stage biopharmaceutical company focused on the development and commercialization of therapeutic candidates to address large market opportunities, initially in ophthalmic conditions, where there are limited treatment alternatives.therapeutics, starting with eye care. Our lead commercial product, candidate,XDEMVY (lotilaner ophthalmic solution) 0.25%, formerly known as TP-03, is a novel therapeutic in Phase 2b/3 that is being developedwas approved by the U.S. Food and Drug Administration ("FDA") on July 24, 2023 for the treatment of Demodexblepharitis, caused by the infestation of Demodex mites, which is referred to as Demodex blepharitis. Blepharitis (“Blephar” is a reference toan eyelid and “itis” is a reference to inflammation) is a conditionmargin disease characterized by inflammation, of the eyelid margin, redness and ocular irritation, including a specific type of eyelash dandruff called collarettes in Demodex blepharitis. The healthy interaction of the eyelid and the surface of the eyeball is crucial to ocular health. Poorly controlled and progressive blepharitis can lead to worsening of corneal damage over time and, in extreme cases, blindness.

According to published studies, thereirritation. There are an estimated 2025 million patientspeople in the United StatesU.S. who suffer from blepharitis, with approximately 45% or nine million of cases caused by Demodex infestation. Further, blepharitis. XDEMVY is the possible number of Demodex blepharitis cases may be as high as approximately 25 million, based on our internal research indicating approximately 58% of patients presenting to eye care clinics have collarettesfirst and a published study estimating that at least 45 million people annually visit an eye care clinic.

We believe that TP-03 has the potential to be the firstonly FDA-approved therapeutic for the treatment of Demodex blepharitis and becomewe believe it is the definitive standard of care.

XDEMVY targets and eradicates the root cause of Demodex blepharitis – Demodex mite infestation. The active pharmaceutical ingredient ("API") of TP-03,XDEMVY, lotilaner, is designed to paralyzeparalyzes and eradicateeradicates mites and other parasites through the inhibition of parasite-specific gamma-aminobutyric acid-gated chloride ("GABA-Cl") channels.

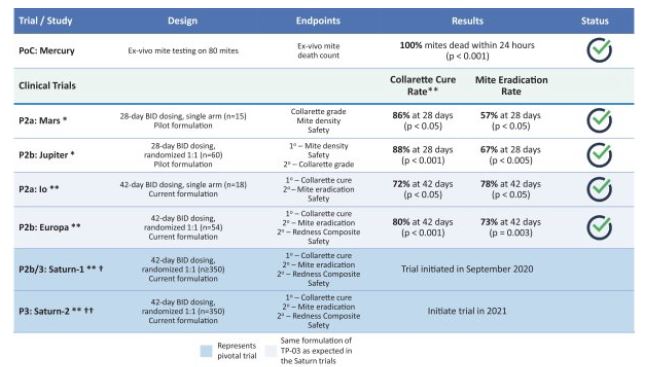

To date, we have completed seven clinical trials that include a Phase 3 trial (the "Saturn-2 trial"), a Phase 2b/3 trial (the "Saturn-1 trial"), four Phase 2 trials, and a Phase 1 trial (the "Hyperion trial") for TP-03XDEMVY in Demodex blepharitis, all of which met their primary, secondary and/or certain exploratory endpoints, as applicable, and during which TP-03 was well tolerated. Our Phase 2b/3 trial, Saturn-1, commenced in September 2020. We expect to begin our Phase 3 trial, Saturn-2, in the second quarter of 2021, both with primary and secondary endpoints consistent with those of our Europa and Io Phase 2 trials. If successful, we expect the Saturn-1 and Saturn-2 trials to support our submission of a new drug application ("NDA") with the United States Food and Drug Administration ("FDA")drug well tolerated throughout each trial. We have also completed, and/or have ongoing clinical trials for TP-03 for the potential treatment of Demodex blepharitis.

In December 2020 we had a Type C meeting with the FDA for TP-03. This meeting confirmed our planned NDA pathway with respect to the data and information required in our forthcoming NDA filing. Furthermore, we intend to pursue marketing authorizations in jurisdictions outside the United States, including Europe and Japan.

On March 26, 2021, we executed an out-license agreement with LianBio Ophthalmology Limited ("LianBio"), granting exclusive commercial rights of TP-03MGD, TP-04 for the potential treatment of Demodex blepharitisrosacea, and MGD within the People’s Republic of China, Macau, Hong Kong,TP-05 for potential Lyme disease prophylaxis and Taiwan (the "Territory"). We are contractually entitled to receive (i) an aggregate $25 million by June 30, 2021, (ii) regulatory and sales milestone receipts totaling $75 million and $100 million, respectively, (iii) tiered royalties in the low double-digits on the net sales of TP-03 within the Territory, and (iv) a minority interest in LianBio that vests upon the achievement of certain clinical and regulatory milestones.

We intend to further advance our pipeline with the lotilaner API to address several diseases across therapeutic categories in human medicine, including eye care, dermatology, and other diseases. Theseinfectious disease prevention. We are investigating the development of our product candidates to address targeted diseases with high unmet medical needneeds, which currently include TP-03 for the potential treatment of MGD, TP-04, a novel gel formulation of lotilaner for the potential treatment of rosacea, and TP-05, a novel investigative oral formulation of lotilaner, for potential Lyme disease prophylaxis and malaria.community malaria reduction.

TP-03 for the Potential Treatment of Meibomian Gland Disease (MGD)

TP-04 for the Potential Treatment of Rosacea

We are exploring the therapeutic potential of TP-04 as a novel topical gel formulation for the treatment of rosacea, a chronic skin disease characterized by facial redness, inflammatory lesions, burning and stinging, which can flare up in response to certain triggers such as sun exposure or emotional stress. There may be several factors that contribute to the cause of rosacea, including genetics, environmental factors, an overactive immune system, and Demodex mites. According to the U.S. National Rosacea Society, approximately 16 million people in the U.S. are affected by rosacea and rosacea prevalence can represent up to 5% of the global population.

inflammatory lesions and Investigator's Global Assessment (IGA) score (change in baseline and success rate) compared to vehicle at Week 12. We plan to discuss and determine the potential regulatory path with the FDA.

TP-05 for the Potential Prevention of Lyme Disease

Lyme disease can potentially cause severe, often debilitating symptoms with permanent and irreversible damage. The disease can result in inflammation, nerve, joint and muscle pain or swelling, numbness, shortness of breath and, in severe cases, neurological complications such as facial palsy, vision issues and meningitis, including severe headaches and neck stiffness. Lyme disease can often go undetected and untreated because the ticks are not always noticed before they transmit the disease. People who are in high-risk areas and/or spend extended amounts of time outdoors in wooded, grassy areas are at higher risk of contracting the infection. Data from the Centers for Disease Control and Prevention ("CDC") show that the risk of Lyme disease is spreading to new geographic areas, resulting in a significant need for prophylactic solutions.

Currently, there are no FDA-approved pharmacological prophylactic options for Lyme disease. We believe TP-05 is currently the only non-vaccine, drug-based, preventive therapeutic in clinical development that targets the ticks, and potentially prevents Lyme disease transmission. It is designed to rapidly provide systemic blood levels of lotilaner, a well-characterized anti-parasitic agent that paralyzes and kills infected ticks attached to the human body through selective targeting of parasite-specific GABA-CI channels, before they can transmit the Borrelia burgdorferi infection that causes Lyme disease.

In December 2022, we announced positive topline results from the completed Phase 1 Callisto trial (the "Callisto trial") and enrollment of the first patient in the Phase 2a clinical trial (the "Carpo trial"). The Carpo trial is designed to evaluate TP-05, a novel investigative oral, non-vaccine prophylactic for the potential prevention of Lyme disease in humans. The Carpo trial is a randomized, double-blind, placebo-controlled trial that evaluated the efficacy of TP-05 in killing lab grown, non-disease carrying ticks after they have attached to the skin of healthy volunteers, as well as confirm the safety, tolerability, and blood concentration of TP-05. Sterile, non-pathogenic nymphal ticks were placed on the skin of healthy human volunteers at two separate instances (one day prior to dosing and 30 days after dosing). Tick mortality was evaluated within 24 hours of attachment after each placement. In most cases, ticks must be attached for 36-48 hours or more before Lyme disease can be transmitted, so killing ticks within 24 hours of attachment can greatly increase the probability of disease prevention.

On February 22, 2024, we announced positive topline results from the Carpo trial which demonstrated a statistically significant benefit in killing ticks compared to (p < 0.0001). Specifically, after the Day 1 tick challenge, mean tick mortality was 97.0% (± 1.4 standard error, SE) and 92.0% (± 6.3 SE) for the high and low doses of TP-05, respectively, compared to only 5.0% (± 2.5 SE) for placebo. Similarly, at the 30-day challenge, mean tick mortality at 24 hours after placement was 89.0% (± 11.1 SE) and 91.0% (± 6.1 SE) for the high and low doses of TP-05, respectively, compared to only 9.0% (± 8.0 SE) for placebo (p<0.001). No statistically significant differences in tick mortality were observed between the two TP-05 treatment arms, and TP-05 was generally well tolerated. We plan to discuss and determine the potential regulatory path with the FDA.

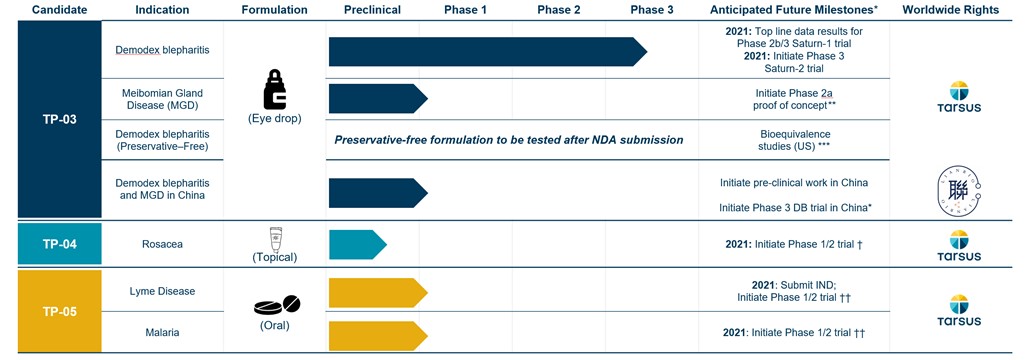

The following pipeline chart presents our wholly-ownedwholly owned product candidates and clinical development status:

Figure 1: Pipeline Chart

| | | | | | | | |

| WW | | | | | Worldwide |

*EU | | Anticipated milestones are subject to the impact of the ongoing COVID-19 pandemic on our business and those of our partners.European Union |

**OUS | | Outside the U.S. |

Our Strategy

Our goal is to transform the treatment of Demodex blepharitis with XDEMVY, the first ever FDA-approved pharmaceutical therapeutic for the treatment of Demodex blepharitis, and to develop our pipeline of innovative therapies that target certain parasite-mediated diseases with large market opportunities. We intend to achieve these goals by pursuing the following key strategic objectives:

| | | | | | | | | | | |

| • | | Continue to obtain payer coverage and grow sales of XDEMVY for the treatment of Demodex blepharitis. We intendlaunched XDEMVY for the treatment of Demodex blepharitis in August 2023 after receiving FDA approval in July 2023. |

| | | | | | | | | | | |

| • | | Continue to rely on preclinical studieseducate eye care providers ("ECPs"). Active disease education is continuing to drive awareness and clinical safety assessmentsencourage ECPs to proactively diagnose Demodex blepharitis through a standard eye examination. |

| | | | | | | | | | | |

| • | | Expand the eye care applications of TP-03 for other indications, including MGD. Similar to blepharitis, MGD may also be caused by Demodex infestation, and we are exploring TP-03 in this indication. In December 2023, we announced positive topline results from the Demodex blepharitis program. We have not conductedErsa Phase 2a clinical trial and do not intendplan to conduct any preclinical studiesdiscuss and determine the regulatory path with the FDA. |

| | | | | | | | | | | |

| • | | Continue to advance and expand our pipeline, bringing novel products utilizing lotilaner to unmet needs across human medicine, including MGD, rosacea and Lyme disease prophylaxis. The mechanism of lotilaner coupled with our insights into disease where it can demonstrate clinical benefit, provides an opportunity to expand into new indications for treatment or prevention. In December 2023, we announced positive topline results from the Ersa trial, designed to evaluate TP-03 for the treatment of MGDMGD. TP-03 demonstrated statistically significant and clinically meaningful improvements compared to baseline in order to advance to Phase 2a. |

*** | We intend to leverage all preclinical, Phase 2two objective measures of the disease – the presence and Phase 3 dataquality of liquid secretion as measured by the Meibomian Gland Secretion Score ("MGSS") and the number of glands secreting normal (clear) liquid and was well tolerated. In February 2024, we announced positive topline results from the TP-03 Demodex blepharitis program. We intendGalatea and Carpo trials and plan to conduct discuss and determine the potential regulatory paths with the FDA.

|

| | | | | | | | | | | |

| • | | in vitroEvaluate and selectively enter collaborations to maximize the potential of our pipeline and the scope of our eye care product offerings. or in vivo bioequivalence studiesApart from the development and license agreement (the "China Out-License") with our preservative-free formulation to compare it to the current preserved formulationLianBio Ophthalmology Limited ("LianBio") of TP-03 in for the treatment of Demodex blepharitis after NDA submission and file a supplement.MGD within the China Territory, as described below within

|

† | We intend License Agreements: LianBio Agreement, we have retained our rights globally to leverage systemic preclinical data fromall of our TP-03 program and augment with additional dermal preclinical studies to select formulation in order to advance to Phase 1/2, which we intend to conduct outside the United States. We may need to address this approach with the FDA if we were to conduct a clinical trial in the United States. We have not conducted any preclinical studies in rosacea with TP-04 to date. |

†† | In relation to Lyme disease and malaria, we intend to leverage oral systemic preclinical data from our TP-03 program as well as third-party oral systemic preclinical studies for Lyme disease or community malaria reduction, respectively (and will not conduct our own preclinical studies for Lyme disease and malaria). The formulations used in preclinical studies use the common approach of a gavage that is scaled as appropriateindications for use in animals. However, human administration, while continuinghumans, including for XDEMVY for the treatment of Demodex blepharitis, TP-03 for the potential treatment of MGD, TP-04 for the potential treatment of rosacea and TP-05 for potential Lyme disease prophylaxis and community malaria reduction. Given the potential to be oral, will take the form of a tablet or capsule. In relation to lyme, we had a successful pre-IND meeting with the FDA in February 2021 and gained agreement on our proposed Phase1 study design. We plan to file an IND in the US in the second quarter of 2021 and, subject to FDA approval of the IND, we intend to initiate our Phase 1 trials to evaluate safety and pharmacokinetics of TP-05 from single ascending dose (SAD) and multiple ascending dose (MAD) studies in normal healthy volunteers. In relation to malaria,treat patients worldwide we may conduct our Phase 1/2 trial outside the United States.opportunistically enter into additional strategic collaborations around certain product candidates, disease and/or geographic regions. |

In August 2023 we launched XDEMVY in the U.S. with a specialty sales force, social and digital media, and ECP education campaigns and targeted prescribing ophthalmologists and optometrists. In our work with key opinion leaders and various associations to increase Demodex blepharitis awareness and education, we have highlighted prevalence, impact, and simplicity of diagnosis of Demodex blepharitis. Our goal is to continue to educate ECPs about the prevalence of Demodex blepharitis, simplicity and efficient diagnosis, and the positive profile of our product. In addition to educating ECPs, we believe that patient awareness and identification is important and plan to continue to increase awareness through education and marketing efforts directed toward patients with Demodex blepharitis.

Consistent with our goal to educate ECPs, we established a field medical team that is actively communicating with ECPs across the country. We also launched a physician-facing disease education campaign geared at increased disease awareness and encouraging ECPs to more proactively diagnose Demodex blepharitis by incorporating eyelid screening as part of their routine exams.

Blepharitis: Market Overview

Blepharitis is a common, chronic ophthalmic conditionlid margin disease characterized by inflammation of the eyelid margin, redness and ocular irritation. It is also a progressive disease that often manifests with more severe symptoms if left untreated, such as blurring of vision, missing eyelashes, corneal damage and potentially, in extreme cases, blindness. According to published studies, an estimated 20 million patients suffer fromDemodex blepharitis in the United States, and there is growing recognition within the ophthalmic community about Demodex mitesmay affect as an underlying cause of blepharitis. Demodex mites are the most common ectoparasite found on humans. Demodex mites potentially cause approximately 45%, or approximately nine million, of blepharitis cases in the United States and we believe that the number of Demodex blepharitis patients in the United States may bemany as high as approximately 25 million Americans based on our internal researchan extrapolation from the Titan study indicating approximately 58% of patients presenting to U.S. eye care clinics have collarettes, and a published study estimatingpathognomonic sign of Demodex infestation, and that at least 45 million people annually visit an eye care clinic. In addition, there is growing awareness among ECPs of the pathognomonic sign of Demodex infestation called collarettes or cylindrical dandruff; which is a specific type of debris found at the base of the eyelashes, known as collarettes, or cylindrical dandruff, which are highly correlated with Demodex infestation.eyelashes. Collarettes are composed of partially digested epithelial cells, mite waste products and eggs among other things and can be easily diagnosed by ECPs withas part of a standard eye examination. The prevalence of Demodex blepharitis increases progressively with aging, which is theone main risk factor for the condition.disease, though other frequently presenting patients can also suffer from dry eye, contact lens intolerance, and cataracts. These aging patients commonly present to the offices of ECPs for other ophthalmic conditionsdiseases besides blepharitis, such as cataract surgery evaluation and contact lens discomfort. Accordingly, we believe that there is significant opportunity to increase the diagnosis rate of Demodex blepharitis through ECP and patient education that encourages examination of the conditiondisease in standard practice.

Despite the high prevalence of patients with Demodex blepharitis and growing awareness of the condition amongstdisease among ECPs, there arewere no FDA-approved therapeutics for the treatment of blepharitis, or for let alone Demodex blepharitis. blepharitis, until XDEMVY was approved in July 2023. Although we believe blepharitis and Demodex blepharitis are significantly underdiagnosed conditions,under-diagnosed diseases with limited treatment alternatives, there are already an estimated 2.1approximately 1.5 million annual Demodexblepharitis

diagnoses in the United States withU.S. based on findings from the Titan study and data that show blepharitis classified per the International Classification of Diseases, Tenth Revision, Clinical Modification ("ICD-10-CM"). Demodex blepharitis is

currently treated with a variety of over the counter remedies such as tea tree oil, lid wipes and artificial tears, as well as off-label prescription products, which often show sub-optimal efficacy, are poorly tolerated and lead to significant irritation and dissatisfaction for patients, and do not eradicate the Demodex mites.

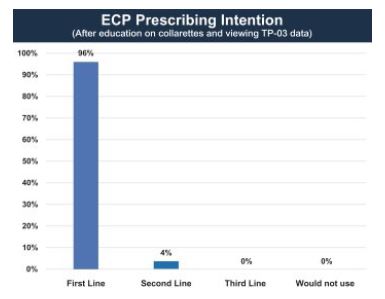

We have conducted epidemiology and market research on the prevalence of blepharitis and potential adoption of TP-03.XDEMVY. Our research indicates approximately 58% of patients presenting to ECP offices have collarettes and, based on the Gao (2005),study, all patients with collarettes were also found to have Demodex. This further validates the accessible opportunity to increase diagnosis rates among patients.Demodex mites. In addition, our market research suggests the potential for a high level of adoption of TP-03, if approved.XDEMVY. In our surveys completed during 2023, we interviewed 50approximately 250 ECPs, 96%over 90% of whom indicated they would prescribe TP-03an FDA approved prescription therapy as a first-line treatment for Demodex blepharitis after exposure to the TP-03 target product profile. See the section titled “Market Opportunity in Blepharitis—Our Market Research Studies and Surveys” for more information regarding our surveys. Further, patients continue to have underlying risk of Demodex infestation, so there could be a recurrence based on the presence of Demodex mites in the skin even after eradication of Demodex mites from the eyelid. Our Phase 2 data from the Mars and Jupiter clinical trials followed patients to one year after treatment and showed meaningful recurrence of Demodex blepharitis within six to nine months, which increased considerably one year after treatment. We believe this data suggests TP-03, if approved, may be used on a chronic, intermittent basis in Demodex blepharitis.

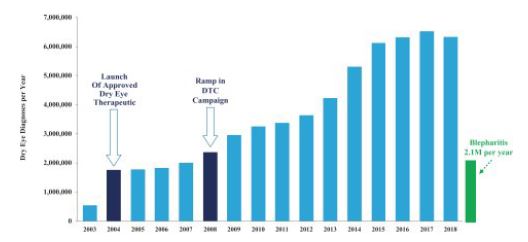

We believe the blepharitis market has the potential to be analogous to other ophthalmic markets that grew significantly once there was a product to address the large, latent demand for an effective therapy, such as dry eye. For example, another ocular surface disease, dry eye, had no approved therapeutic for the condition until 2003. With the approval of a therapeutic to treat dry eye in 2003 and concurrent ECP and patient education, the diagnosis rate increased by approximately 12 times, growing from 500,000 annual diagnoses in 2003 to over six million annual diagnoses in 2015. Annual diagnoses rates have been maintained at similar levels since 2015. Blepharitis already has 2.1 million diagnoses per year with blepharitis classified per the ICD-10-CM, despite no approved therapies to help with market awareness, but we believe there is potential for significant market expansion. The markets may be analogous because both Demodex blepharitis and dry eye are diseases that affect the front of the eye, are treated by ECPs, can cause an inflamed ocular surface or eyelids and have similar patient demographics. The potential market for Demodex blepharitis, however, may not be analogous to the market for dry eye due to differences in symptoms, regulatory approval and market dynamics and certain other factors. See “Risk Factors – Risk Related to Development and Commercialization of Our Product Candidates—The market for blepharitis and Demodex blepharitis may be not be similar to the market for dry eye.” for additional information and risks related to the comparison of the Demodex blepharitis market to that of dry eye.

We believe there is a significant opportunity to increase the diagnosis rate of Demodex blepharitis and build a significant new market with the approval ofXDEMVY, a safe and effective therapeutic alternativetherapy that addresses the underlying root cause of the condition.disease.

Our Approach: TP-03

We are developing TP-03, formulated infestation, as an eye drop, which we believe, if approved, has the potential to become the standard of care for Demodex blepharitis. TP-03 isthere could be a novel therapeuticrecurrence or reinfestation based on the drug, lotilaner, which is designed to paralyze and eradicatepresence of Demodex mites and other parasites throughin the inhibitionfacial pores even after eradication of parasite-specific GABA-Cl channels.

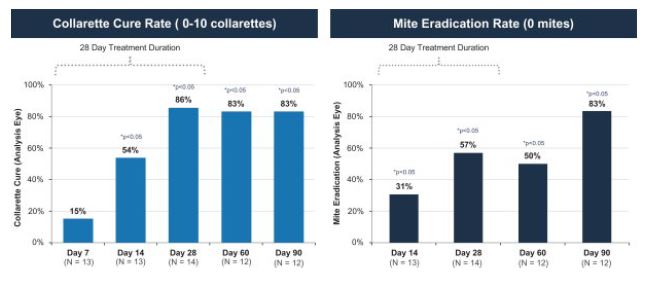

We have completed four Phase 2 clinical trials to date, along with one additional ex vivoDemodex study. Key efficacy endpoints for our Mars and Jupiter clinical trials included collarette grade and mite density and key efficacy endpoints for our Io and Europa clinical trials included collarette cure rate based on collarette grade, which we refer to herein as collarette cure rate, and mite eradication rate. TP-03 met its primary, secondary and/or exploratory endpoints, as applicable, in such trials, and showed statistically significant cure and eradication rates in our two most recent trials, Io and Europa. TP-03 was generally well tolerated throughout these trials. The Phase 2a Mars trial was a smaller single arm trial evaluating the safety and efficacy of TP-03 with a 28-day twice per day, or BID, dosing regimen, with exploratory endpoints including collarette grade and mite density. We utilized the datamites from the exploratory endpoints to determine collarette cure rate, defined as 10 or fewereyelid, that may potentially necessitate retreatment. The Saturn-2 trial enrolled 412 adults having, among other things, more than ten collarettes per lid and mite eradication rate, defined as zero mites per lash. Both collarette cure and mite eradication rates were assessed at 28 days, which were 86% and 57%, respectively.

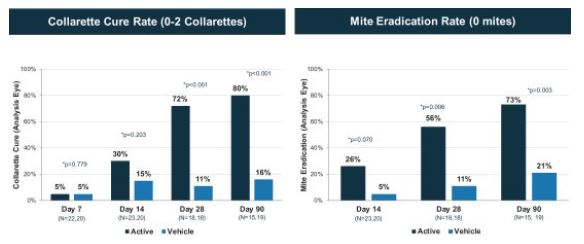

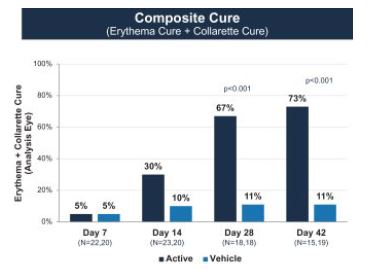

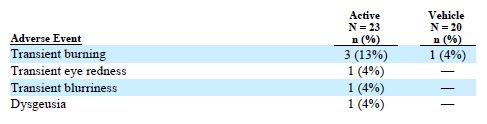

The Phase 2b Jupiter trial was a larger randomized, controlled double-blind trial with mite density and collarette grade asleast mild lid erythema. All pre-specified primary and secondary endpoints respectively. Similarlywere met, XDEMVY was well tolerated, and improvement in lids (reduction of collarettes to the Marsno more than 2 collarettes per upper lid) was demonstrated in 55% of patients treated with XDEMVY. The Saturn-1 trial we utilized the collarette grade and mite density data to determine collarette cure and mite eradication rates, which were both defined consistently with those used in the Mars trial. The efficacy observed in the Jupiter trial appeared consistent with the Mars trial, with a collarette cure rate of 88%, and mite eradication rate of 66%, which were statistically significant compared to the vehicle control. We subsequently conducted the Io Phase 2a and Europa Phase 2b trials to evaluate the safety and efficacy of TP-03 formulation for the treatment of Demodex blepharitis. The design of the Io trial took into account feedback from the FDA, and accordingly we defined collarette cure rate as aenrolled 421 adult patients having more stringent standard of two or fewerthan ten collarettes on the eyelid, with a treatment duration of 42 days.

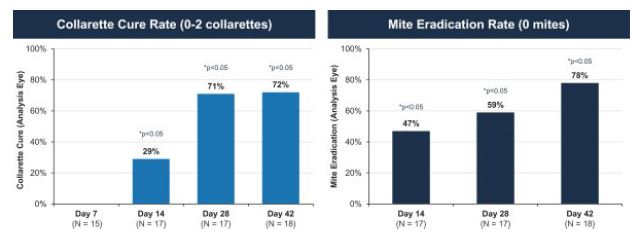

In the Io trial, we utilized for the first time in clinical trials the formulation of TP-03 that is expected to support our NDA submission for Demodex blepharitis. The change in formulation consisted of replacing LAK with sorbate as the preservative as well as adding a chelating agent. The key differences between the Ioupper lid and Europa trials, were that Io was a smaller single-arm trial, while Europa was a slightly larger randomized vehicle-controlled trial. The endpoints achieved in Io and Europa were consistent across both trials, with a collarette cure rate of 72% and 80%, respectively, and a mite eradication rate of 78% and 73%, respectively. The achievement of primary, secondary and/or exploratory endpoints, as applicable, in such trials, and safety results across our comprehensive Phase 2 program provided us with the basis to design and initiate our pivotal Phase 2b/3 and Phase 3 clinical trials for TP-03 for the treatment of Demodex blepharitis.

We plan to evaluate TP-03 in two pivotal registration trials, referred to as Saturn-1 and Saturn-2. Saturn-1 is a Phase 2b/3, randomized, controlled, double-blind trial to evaluate the safety and efficacy of TP-03 that is expected to enroll at least 350 Demodex blepharitis patients in multiple centers in the United States. Saturn-1 commenced in September 2020 and top-line data is expected in 2021, subject to the impactmild erythema of the ongoing COVID-19 pandemic. Saturn-2, our confirmatory Phase 3 randomized, controlled, double-blindupper eyelid margin. The Saturn-1 trial has a highly comparable designresults showed the pre-specified primary and secondary endpoints were met, and improvement in lids (reduction of collarettes to that of Saturn-1 and is also expected to enroll approximately 350 Demodex blepharitis patients. Enrollment of Saturn-2 is expected to begin in 2021, subject to the impact of the ongoing COVID-19 pandemic.

In connection with our IND application, we have received a “no-objection” letter from the FDA regarding the trial design for Saturn-1. The trial design for Saturn-2 is highly comparable to that of Saturn-1 and we expect to update the IND protocol prior to commencing Saturn-2. We expect these trials to support the potential submission of an NDA for TP-03 for the treatment of Demodex blepharitis. In December 2020 we had a Type C meeting with the FDA; this meeting confirmed our planned NDA pathway with respect to the data and information required in our forthcoming NDA filing.

We also intend to explore the therapeutic potential of TP-03 for a second ophthalmic condition, MGD, commonly characterized in part by a widespread clogging of the meibomian glands that can result in tear film deficiency, and is one of the leading causes of dry eye disease. There are no FDA-approved therapeutics for MGD. In the United States, MGD prevalence has been found to be approximately two-thirds of the estimated 34 million dry eye patient population. One species of Demodex mite, Demodex brevis, is known to infest the meibomian gland, and clinical signs of MGD have been shown to be correlated with infestation of Demodex brevis. While dry eye is a multi-factorial disease, TP-03 is designed to relieve some of the key elements of MGD by virtue of causing the death of the Demodex brevis mites.

Our Approach: TP-04 and TP-05

We are also developing additional clinical-stage product candidates with lotilaner. These include TP-04 for the potential treatment of rosacea as well as TP-05 for potential Lyme prophylaxis and community malaria reduction.

Rosacea is a chronic skin disease characterized by facial redness, inflammatory lesions, burning and stinging, which can flare up in response to certain triggers such as sun exposure or emotional stress. According to the U.S. National Rosacea Society, approximately 16 million people in the United States are affected by rosacea and a study estimates rosacea prevalence can represent up to 5.4% of the global population. We intend to develop TP-04 as a topical formulation, and we plan to initiate a Phase 1/2 trial of TP-04 outside the United States, for the treatment of rosacea in 2021. We initiated preclinical studies to select Phase 1/2 formulation for TP-04.

Lyme disease is the most common vector-borne disease in the United States, caused by infection of Borrelia bacteria following bite by a tick vector. Estimates of annual cases of Lyme disease in the United States range from approximately 300,000 to 400,000. Malaria is one of the world’s highest unmet public health needs, with approximately 228 million cases and more than 400,000 deaths caused2 collarettes per upper lid) was demonstrated in 44% of patients treated with XDEMVY by malaria worldwide. We are developing TP-05 as an oral formulation that is designed as a prophylactic drug against Lyme disease to eradicate the tick before it can transmit the Borrelia bacteria. Further, we believe TP-05 also has the potential to significantly reduce malaria transmission through reducing the lifespan of mosquitos that transmit malaria. This may in turn provide herd protection against the spread of malaria. TP-05 is not intended to treat the disease, but to limit its transmission. We have obtained FDA feedback in a pre-IND meeting and plan to submit an IND and initiate a Phase 1/2 trial of TP-05 for Lyme disease in 2021. For malaria, we may conduct the Phase 1/2 trial outside of the United States.

Our Strategy

Our goal is to transform the treatment of Demodex blepharitis with a first ever FDA approved pharmaceutical therapeutic, and to develop our pipeline of innovative therapies that target certain parasite-mediated diseases with large market opportunities. We intend to achieve these goals by pursuing the following key strategic objectives:

| | | | | | | | | | | |

| • | | Advance TP-03 through clinical development and eventual approval for the treatment of Demodex blepharitis. We have observed in multiple Phase 2 trials across 147 patients that TP-03 results in the achievement of clinical endpoints, which are generally the same clinical endpoints that will be utilized in our pivotal Phase 2b/3 and Phase 3 trials. We have commenced our first pivotal trial, Saturn-1, a Phase 2b/3 trial, in September 2020, and we expect top-line data in 2021, subject to the impact of the ongoing COVID-19 pandemic. Enrollment of our second pivotal trial, Saturn-2, which will be a Phase 3 trial, is expected to begin in 2021, subject to the impact of the ongoing COVID-19 pandemic.

|

| | | | | | | | | | | |

| • | | Educate ECPs and establish our own specialty sales organization to commercialize TP-03 in the United States. If approved by the FDA for Demodex blepharitis, we intend to commercialize TP-03 by developing our own sales organization targeting a subset of the approximately 25,000 prescribing ECPs in the United States. Throughout our commercialization efforts, we intend to educate ECPs on Demodex blepharitis and how to diagnose it with a standard eye examination.

|

| | | | | | | | | | | |

| • | | Expand the label of TP-03 for other indications, including MGD. Like blepharitis, MGD may also be caused by Demodex infestation, and we intend to explore the clinical potential for TP-03 in the indication.

|

| | | | | | | | | | | |

| • | | Develop our pipeline, bringing novel products utilizing lotilaner to unmet needs across human medicine, including rosacea, Lyme disease and malaria. We plan to expand our pipeline of novel, differentiated product candidates that target parasites to treat or prevent important diseases. The mechanism of lotilaner coupled with our insights into disease where it can demonstrate clinical benefit, provides an opportunity to expand into new indications for treatment or prevention. By utilizing new formulations of lotilaner, we intend to develop a topical formulation designed to treat rosacea, and oral formulations for the prophylaxis of Lyme and community malaria reduction. We intend to expand into Phase 1/2 clinical trials for these indications in 2021.

|

| | | | | | | | | | | |

| • | | Evaluate and selectively enter into strategic collaborations to maximize the potential of our pipeline and the scope of our eye care product offerings. Other than the recent out-license to LianBio of TP-03 for the treatment of Demodex blepharitis and MGD within the Territory as noted above, we have retained our rights globally to all of our indications for use in humans, including our lead product candidate, TP-03, for the potential treatment of Demodex blepharitis and MGD, TP-04 for the potential treatment of rosacea and TP-05 for potential prophylaxis of Lyme and community malaria reduction. We are dependent on licenses from Elanco for the development and commercialization of these products. Given the potential to treat patients worldwide we may opportunistically enter into strategic collaborations around certain product candidates, disease or geographic regions.

|

Blepharitis Overview

Blepharitis

Ocular surface disease represents a broad category of disease that affects at least 35 million people in the United States. The ocular surface comprises the cornea, conjunctiva, eyelids and lacrimal glands and as such any diseases in these structures can be classified as ocular surface disease. Common ocular surface diseases include dry eye disease, ocular allergy, blepharitis and MGD. Almost all of the ocular surface diseases are associated with eye redness and ocular surface inflammation and in some cases conjunctival and/or lid edema. Patients often present with multiple ocular surface diseases and the symptoms have significant overlap, leading to frequent misdiagnosis of the various conditions.

Blepharitis is a common, chronic ophthalmic conditionlid margin disease, which may lead to or exacerbate ocular surface disease. Blepharitis is characterized by inflammation of the eyelid margin, redness and ocular irritation, and is primarily diagnosed and treated by ECPs, including ophthalmologists and optometrists. Based on published studies, an estimated 20 million patients suffer from blepharitis in the United States. Typical signs and symptoms of blepharitis include debris on the eyelashes, redness of the eye and eyelid, missing or misdirected eyelashes, blurring of vision, irritation, lid itchiness and ocular discomfort. It isBlepharitis can be challenging to manage, recurs frequently, and its progression can lead to scarring of the eyelid, loss of proper eyelid and tear-film function, eyelid and lash abnormalities, inflammation of the conjunctiva and surrounding skin, suboptimal surgical outcomes, corneal damage, and potentially in extreme cases, blindness. Further, approximately 67% of cataract patients have Demodex infestation, which can increase the risk for both infection after cataract and refractive surgery. Therefore, treating Demodex blepharitis may improve patient satisfaction with cataract and refractive surgery. Additionally, the primary reason people stop wearing contact lenses is discomfort and blepharitis has been shown to cause contact lens intolerance. Therefore, treating Demodex blepharitis may reduce contact lens intolerance. We believe these benefits may lead to better vision and an improved quality of life for patients.

Multiple factors can cause blepharitis, including infestation by Demodex mites, bacterial infection, clogging of the meibomian glands and seborrheic dermatitis.

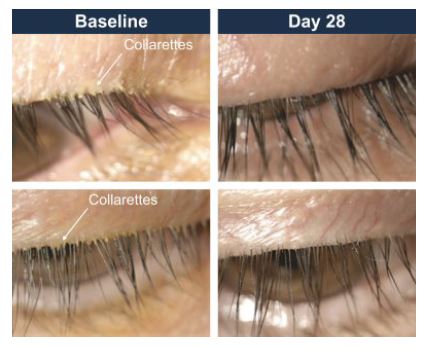

The following image showsimages illustrate representative eyelids with blepharitis:Demodex blepharitis demonstrating the characteristic sign of collarettes:

Figure 2: Eyelids With Demodex Blepharitis

Demodex Blepharitis

Demodex infestation is a major cause of blepharitis, implicated in approximately 45% of blepharitis cases, or approximately nine million patients. Weand we estimate that the number of Demodex blepharitis patients in the United StatesU.S. may be as high as approximately 25 million. Although we believe blepharitis and Demodex blepharitis are significantly under-diagnosed diseases, with limited treatment options, there are already an estimated 1.5 million annual Demodex blepharitis diagnoses in the U.S. based on our internal research indicating approximately 58% of patients presenting to eye care clinics have collarettesthe Titan study and a published study estimating that at least 45 million people annually visit an eye care clinic. Thesecoding for blepharitis cases are referred to classified per the ICD-10-CM. Demodex blepharitis. Demodex mites are the most common ectoparasite found on humans and are more likely to cause infestation and disease with aging. Demodex blepharitis typically presents bilaterally in patients with the condition.disease. There are two species of Demodex, folliculorum and brevis, that live on the skin of the face and eyelids. Demodex folliculorum, which is commonly found in the follicle, is the more common sub-species of mite that causes Demodex blepharitis.

The key clinicalpathognomonic sign of Demodex blepharitis is a specific type of eyelid debris known as the collarette, which is also sometimes referred to as cylindrical dandruff, sleeves, or waxy scurf. Collarettes are composed of partially digested epithelial cells, mite waste products and eggs among other things and can be easily diagnosed by ECPs with a standard eye examination known as the slit lamp examination. Other bothersome signs and symptoms of Demodex blepharitis that can lead to further disease progression include missing or misdirected eyelashes, crusting, redness of the lid margin, inflammation of the lid margin, inflammation of the conjunctiva and/or inflammation of the cornea, also known as blepharoconjunctivitis and blepharokeratitis. Demodex blepharitis is a progressive disease that often manifests with more severe signs and symptoms if left untreated, such as blurring of vision, missing eyelashes, corneal damage and potentially, in extreme cases, blindness. Furthermore, Demodex blepharitis can negatively impact quality of lifedaily activities and create an emotional burden for individuals with the condition.

disease. According to studies we have conducted, approximately 56% of cataract patients have

The following figures demonstrateillustrate how Demodex folliculorum mites enter and reside in the eyelash follicles:

Figure 3: Demodex folliculorum Mites Entering and Residing in Eyelash Follicles

Demodex infestation can lead to Demodex blepharitis in three main ways:

| | | | | | | | |

| 1) | Mechanical: Overcrowded mites scrape the epithelial cell lining of the eyelash follicles with their claws and lay eggs, causing follicular distention, misdirected lashes, eyelash loss and irritation. Dead mites and collarettes also obstruct the hair follicle opening, leading to inflammation. |

| | | | | | | | |

| 2) | Chemical: Mites excrete digestive enzymes as they feed and exude digestive waste when they die, resulting in inflammation, redness, irritation and epithelial hyperplasia. |

| | | | | | | | |

| 3) | Bacterial: Bacteria living on the mite surface or in its gut may cause inflammation of the surrounding ocular tissues. |

As mites scratch and feed on the skin, the partially digested epithelial cells, keratin, mite waste and eggs combine to form collarettes. These collarettes are typically found at the base of the lash but can migrate away as the hair shaft grows.

The following figure showsillustrates collarettes at the base of an eye lash:eyelash:

Figure 4: Collarettes Are the Pathognomonic Sign of Demodex Blepharitis

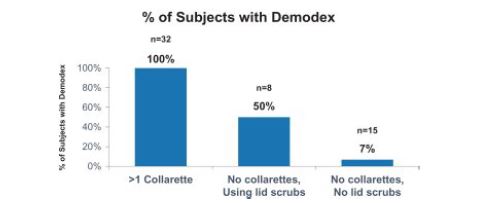

AThe Gao study conducted by Gao et al. (Gao et al. (2005): High Prevalence of Demodex in Eyelashes with Cylindrical Dandruff. Invst Ophth and Vis Sci, September 2005, Vol. 46, No. 3089-3094.) confirmed the pathognomonic relationship of the collarette to Demodex infestation. The study included 55 patients seen at the Ocular Surface Center in Miami, Florida to determine the prevalence of Demodex in eyelashes with collarettes. All patients underwent a routine, complete eye examination and external photography. Patients were divided into three main groups: those with collarettes; those without collarettes and those who had been using daily lid scrubs for a full year; and as well as those without collarettes who were not performing theusing daily lid scrubs. As illustratedOf the thirty-two patients in the figure below,study, 100% (n=32) of patients with at least one collarette had Demodex present. Those patients without collarettes were divided into two groups; patients who were using lid scrubs for a full year and those who were not. Only 7% (n=15) of patients without collarettes and who were not performing the daily lid scrubs had Demodex, while 50% (n=8) of those subjects without collarettes, but who were using daily lid scrubs with shampoo for a full year, had Demodex infestation, implying that hygiene alone did not eradicate the mites. All 55 patients were seen at one location and may not be representative of the United StatesU.S. population. However, subsequent studies including the two TP-03 pivotal Saturn studies that had >800 patients, consistently demonstrated a correlation between the presence of collarettes and Demodex mites.

The following figure shows that 100% of patients with at least one collarette had Demodex infestation:

Figure 5: 100% of Patients With at Least One Collarette Had Demodex Infestation

Demodex blepharitis can be easily diagnosed by ECPs with the standard eye examination, thea slit lamp examination, by confirming the presence of collarettes. The slit lamp examination is routinely performed by ECPs as part of standard practice during a customary eye examination, so diagnosing Demodex blepharitis via presence of collarettes would not involve any additional equipment, training or workflow alterations on the part of the ECP.

Treatment Options Before Approval of XDEMVY and Their Limitations

Market Opportunity in Blepharitis

According to published studies, there are an estimated 20 million patients inOther than the United States who suffer from blepharitis, with approximately 45%, or approximately nine million,use of cases caused by Demodex infestation. Further, we estimate thatXDEMVY, the number of Demodex blepharitis cases in the United States may be as high as approximately 25 million based on our internal research indicating approximately 58% of patients presenting to eye care clinics have collarettes and a published study estimating that at least 45 million people annually visit an eye care clinic. Despite the high prevalence of patients with Demodex blepharitis and growing awareness of the condition amongst ECPs, there are nofirst ever FDA-approved therapeuticspharmaceutical therapy for the treatment of Demodex blepharitis, or for Demodex blepharitis. Although we believe blepharitis and Demodex blepharitis are significantly underdiagnosed conditions, with limited treatment alternatives, there are already an estimated 2.1 million annual blepharitis diagnoses in the United States with blepharitis classified per the ICD-10-CM.

Our Market Research Studies and Surveys

Our market research studies include an ECP survey of 50 ECPs, or the ECP Survey, that we commissioned and which was conducted in 2019 and 2020 tohas been generally determine market awareness and current management of Demodex blepharitis and introduce a hypothetical TP-03 product profile. Twenty ECPs were interviewed in 2019 and 30 ECPs were interviewed in 2020. ECPs were chosen based on a random sample of ophthalmologists and optometrists nationwide that had sufficient exposure to blepharitis patients to provide a representative sample of ECPs who see and manage blepharitis patients, and would potentially be in a position to prescribe TP-03 if it were approved and available. The ECP Survey generally asked ECPs questions regarding their patient base and also introduced the TP-03 product profile to them. The ECP Survey showed that 44% of all diagnosed patients were over the age of 65, and 57% of diagnosed patients were female. Distribution of diagnoses across race and income metrics was approximately proportional to that of the United States population, implying little correlation of the condition with socioeconomic status. The ECP Survey also showed that in April through May of 2020, the number of blepharitis patients in the eye care clinic, which represented 60% of the total patients, was approaching the level of dry eye patients, which represented approximately 65% of the total patients. We believe this demonstrates that the market size for blepharitis may be similar to the market size of dry eye and that both are common in the eye care clinics, which informs us on the potential to increase diagnoses through ECP education. As the population of the United States continues to age, we believe this disease will become more prevalent. While we believe the ECP survey provides insight to the potential market size of Demodex patients, since it was a random sampling of ECPs nationwide that had sufficient exposure to blepharitis patients, the sample size of ECPs and corresponding potential patient population was relatively small and the number of blepharitis patients may not be comparable to the number of dry eye patients. The patients may have had overlapping diagnoses but the ECP Survey did not measure any such potential overlap.

The following figures show that according to the ECP Survey, the number of blepharitis diagnoses approached the number of dry eye diagnoses. This trend is also supported by independent epidemiology studies:

Figures 6 and 7: Blepharitis Diagnoses Approaching Number of Dry Eye Diagnoses

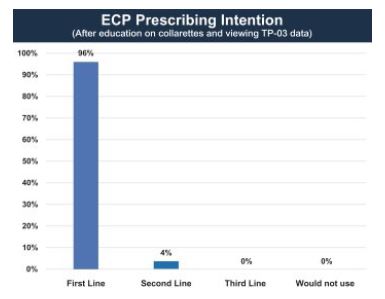

Additionally, the ECP Survey obtained feedback on a hypothetical TP-03 product profile, based on the Mars and Jupiter clinical trial data. In the ECP Survey, a total of 25 ophthalmologists and 25 optometrists were educated on the pathognomonic relationship of collarettes to Demodex blepharitis and exposed to the Mars and Jupiter clinical trial data. After exposure, ECPs were asked their intent to prescribe TP-03 if it were available for their patients presenting with Demodex blepharitis as indicated by collarettes. In these studies, 48 of 50 (96%) ECPs indicated that they would prescribe TP-03 as first-line treatment, and 2 of 50 (4%) indicated that they would prescribe it as second-line treatment. No ECPs indicated that they would prescribe TP-03 as third line or not prescribe TP-03.

The following figure shows that 96% of the surveyed ECPs indicated they would prescribe TP-03 as a first-line treatment:

Figure 8: 96% of Surveyed ECPs Indicated Prescribing Intention TP-03 as First-Line Treatment

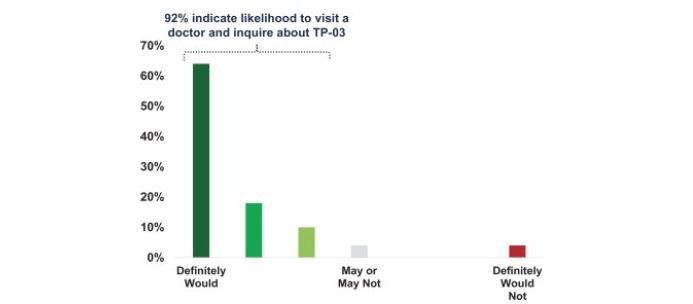

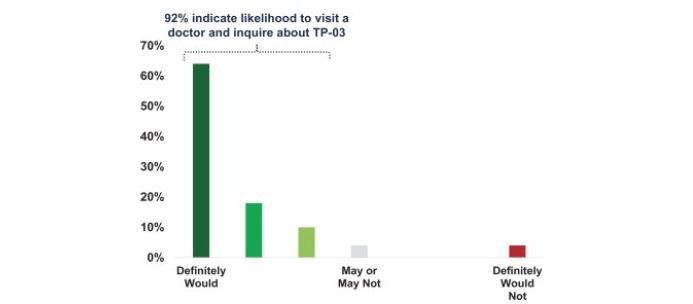

We also sponsored a separate market research survey of 50 patients with blepharitis symptoms, where the presence of “eye crust” on eye lashes was noted as a primary symptom. These patients were randomly selected nationwide and not chosen in connection with the identity of his or her ECP. The individuals with blepharitis symptoms were educated on collarettes and that Demodex mites cause collarettes, and provided with a description of a hypothetical product with the target profile of TP-03, which can potentially eradicate Demodex mites in the eyelid and eliminate collarettes in a majority of patients. After considering the target product profile, the individuals with blepharitis symptoms were asked how likely they were to visit a doctor and ask about whether a product such as TP-03 would be right for them (on a scale of 1-7). Forty-six of 50 (92%) of the individuals with blepharitis symptoms indicated a likelihood to visit a doctor and ask about a product with a target profile of TP-03, and 32 of 50 (64%) indicated a response of “definitely would.” Two of 50 (4%) of the individuals with blepharitis symptoms indicated that they “may or may not,” and two of 50 (4%) of the individuals with blepharitis symptoms indicated that they “definitely would not.”

The following figure shows the results of this survey:

Figure 9: 92% of Individuals with Blepharitis Symptoms Indicated Likelihood To Inquire About a TP-03-Type Product

We believe that blepharitis is underdiagnosed due to the lack of an approved treatment and associated patient and physician education, and the lack of awareness of the role of Demodex mites in the disease process. The ECP Survey showed that only 10-15% of ECPs were aware that collarettes are highly correlated with Demodex infestation. Despite the current lack of awareness by ECPs, we believe that the ocular surface disease marketplace is highly responsive to education of both the ECP and the patient. For example, as a result of ECP and patient education, the dry eye market grew significantly once there was a product to address the large, latent demand for an effective therapy. Dry eye had no approved therapeutic until 2003. Once a therapeutic was approved, the diagnosis rate increased by approximately 12 times, growing from 500,000 annual diagnoses in 2003 to over six million annual diagnoses by 2015. Annual diagnoses rates have been maintained at similar levels since 2015. We believe the Demodex blepharitis and dry eye markets may be analogous because both Demodex blepharitis and dry eye are diseases that affect the front of the eye, are treated by ECPs, can cause an inflamed ocular surface or eyelids and have similar patient demographics. The potential market for Demodex blepharitis, however, may not be analogous to the market for dry eye

due to differences in symptoms, regulatory approval and market dynamics and other factors. See “Risk Factors—Risk Related to Development and Commercialization of Our Product Candidates—The market for blepharitis and Demodex blepharitis may be not be similar to the market for dry eye” for additional information and risks related to the comparison of the Demodex blepharitis market to that of dry eye.

The following figure shows the annual diagnoses of dry eye disease prior to and after and the launch of an approved therapy for dry eye, with the 2.1 million diagnoses for blepharitis in 2019 shown on the plot for reference:

Figure 10: Dry Eye Diagnoses Per Year

Demodex mites have been implicated in approximately 45% of all blepharitis cases in a meta-analysis of 11 studies consisting of an aggregate of 4,741 patients with blepharitis. The incidence of Demodex blepharitis increases progressively with aging, which is the main risk factor for the condition, with the majority of people over the age of 60 having been shown to have the disease.

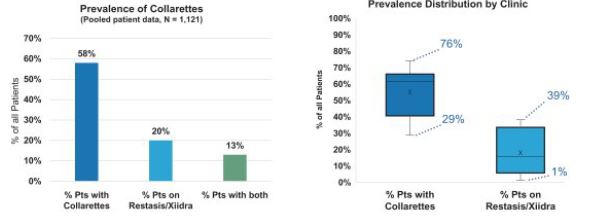

Our market research studies also included an epidemiological evaluation we conducted of 1,121 consecutive patients in eight ophthalmology and optometry practices conducted in 2020 (the "Patient Epidemiology Survey"), which showed that 58% of all patients entering the practices had collarettes and all patients entering practices with collarettes were also found to have Demodex blepharitis. By comparison, 20% of those same 1,121 patients were currently on a prescription therapeutic for dry eye disease (Restasis or Xiidra). Additionally, 13% of the 1,121 patients presented with collarettes and were also on a prescription therapeutic for dry eye at the same time. The clinics in the Patient Epidemiology Survey were geographically diverse and represented both high and low dry eye prescription rates. Each practice was required to enroll between 100 and 180 consecutive patients. The clinic with the lowest prevalence demonstrated 29% of consecutive patients had collarettes, and the clinic with the highest prevalence demonstrated 76% of consecutive patients had collarettes.

The following figure shows the prevalence of collarettes and prevalence distribution by clinic, from the Patient Epidemiology Survey:

Figures 11 and 12: Prevalence of Collarettes

We believe the data has demonstrated that there is a significant population for blepharitis, and for Demodex blepharitis more specifically, since the number of patients with collarettes exceeded by almost three times the number of patients on a prescription therapeutic for dry eye disease. While there is overlap between the number of patients with collarettes and the number of patients with dry eye and the number of patients with dry eye is most likely higher than the number of patients currently on a prescription for dry eye, and we believe the data shows a potential significant population for Demodex blepharitis. We also believe the data illustrates a significant opportunity to increase the diagnosis rate of Demodex blepharitis by educating ECPs on the high correlation of the presence of collarette to Demodex blepharitis in order for ECPs to incorporate the examination of the condition into standard practice.

Over the past several years, an increasing number of clinical studies on Demodex have been published in the context of ocular surface disease, with more than half of these studies published in the last four years. We believe this shows an increased understanding of the importance of Demodex in the scientific ophthalmic community and represents an important step in educating ECPs about Demodex blepharitis.

Current Treatment Options and Their Limitations