UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 1)10-K

|

| |

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20122015

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-1023

McGraw Hill Financial, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

| New York | | 13-1026995 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

| | |

1221 Avenue of the Americas,55 Water Street, New York, New York | | 1002010041 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 212-512-2000212-438-1000

|

| | |

| Title of each class | | Name of exchange on which registered |

| Common Stock — $1 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES þ¨ NO ¨þ

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

YES ¨ NO þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES þ NO ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

YES þ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

þ Large accelerated filer | | o Accelerated filer | | o Non-accelerated filer | | o Smaller reporting company |

| | (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES ¨ NO þ

The aggregate market value of voting stock held by non-affiliates of the Registrant as of the last business day of the second fiscal quarter ended June 30, 2012,2015, was $12.6$27.4 billion, based on the closing price of the common stock as reported on the New York Stock Exchange of $45.00$100.45 per common share. For purposes of this calculation, it is assumed that directors, executive officers and beneficial owners of more than 10% of the registrant outstanding stock are affiliates. The number of shares of common stock of the Registrant outstanding as of February 1, 2013January 22, 2016 was 280.8265.3 million shares.

Part III incorporates information by reference from the definitive proxy statement for the 20132016 annual meeting of shareholders.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (the "Amendment") amends the Form 10-K of The McGraw-Hill Companies, Inc. (the "Company") for the fiscal year ended December 31, 2012, as filed with the Securities and Exchange Commission on February 28, 2013 (the "Original Filing"). The Amendment is being filed for the purpose of correcting the following items:

| |

(i) | 2009 and 2008 revenue amounts, 2008 segment operating profit, 2009 and 2008 net income from continuing operations attributable to The McGraw-Hill Companies, Inc., 2009 and 2008 earnings per share from continuing operations and related operating statistics for 2009 and 2008 in “Item 6. Selected Financial Data” in the Original Filing on page 18 have been corrected. Revenue amounts were corrected as McGraw-Hill Education's gross profit was inadvertently subtracted from the Company's total revenue instead of subtracting McGraw-Hill Education's total revenue from the Company's total revenue. Additionally, segment operating profit, net income from continuing operations attributable to The McGraw-Hill Companies, Inc. and earnings per share from continuing operations were corrected as they were inadvertently impacted by discontinued operations adjustments that should not have affected those amounts. Therefore, "Item 6. Selected Financial Data" has been restated as follows: |

|

| | | | | | | | | | | | | |

| (in millions, except per share data) | 2009 | | 2008 |

| | Reported | Restated | | Reported | Restated |

| Revenue | $ | 4,132 |

| $ | 3,483 |

| | $ | 4,354 |

| $ | 3,609 |

|

| Segment operating profit | | | | $ | 1,118 |

| $ | 1,143 |

|

| Net income from continuing operations attributable to The McGraw-Hill Companies, Inc. | $ | 543 |

| $ | 546 |

| | $ | 582 |

| $ | 569 |

|

| Earnings per share attributable to the McGraw-Hill Companies, Inc. common shareholders: | | | | | |

| Basic | $ | 1.74 |

| $ | 1.75 |

| | $ | 1.85 |

| $ | 1.80 |

|

| Diluted | $ | 1.73 |

| $ | 1.74 |

| | $ | 1.83 |

| $ | 1.79 |

|

| Income from continuing operations before taxes on income as a percent of revenue from continuing operations | 21.2 | % | 25.1 | % | | 21.4 | % | 25.8 | % |

| Net income from continuing operations as a percent of revenue from continuing operations | 13.6 | % | 16.1 | % | | 13.4 | % | 16.2 | % |

| |

(ii) | The approximate number of record holders of our common stock as of February 1, 2013 disclosed in “Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” in the Original Filing on page 16 has been corrected as the Company inadvertently disclosed the number of shares of common stock outstanding as of February 1, 2013, which was 280.8 million. The correct number of record holders of our common stock as of February 1, 2013 was 3,885. |

| |

(iii) | A typographical error in “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations” in the Original Filing on page 27 has been corrected as the total intangible asset impairment charge and the impairment charge on certain prepublication and inventory assets for McGraw-Hill Education's School Education Group was inadvertently stated to be $497,000,000 million and $19,000,000 million, respectively. However, as dollar figures in Item 7 were presented in millions, this figure should have been stated as $497 million and $19 million, respectively. |

Except for these corrections, there have been no changes in any of the financial or other information contained in this Form 10-K/A. The Amendment does not reflect events occurring after the Original Filing, or modify or update the disclosures therein in any way other than as required to reflect the amendments set forth above.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report on Form 10-K/A to be signed on its behalf by the undersigned, thereunto duly authorized, on the 20th day of March 2013.

The McGraw-Hill Companies, Inc.

/s/ Kenneth M. Vittor

Kenneth M. Vittor

Executive Vice President and General Counsel

TABLE OF CONTENTS

| | | | PART I | | PART I | |

| Item | | Page | | Page |

| 1 | | | | |

| 1a. | | | | |

| 1b. | | | | |

| 2 | | | | |

| 3 | | | | |

| 4 | | | | |

| | | | | |

| | | |

| | PART II | | PART II | |

| | | |

| 5 | | | | |

| 6 | | | | |

| 7 | | | | |

| 7a. | | | | |

| 8. | | | | |

| 9. | | | | |

| 9a. | | | | |

| 9b. | | | | |

| | | |

| | PART III | | PART III | |

| | | |

| 10 | | | | |

| 11 | | | | |

| 12 | | | | |

| 13 | | | | |

| 14 | | | | |

| | | |

| | PART IV | | PART IV | |

| | | |

| 15 | | | | |

| | | | | |

| | | | | |

| | | | | |

FORWARD-LOOKING STATEMENTS

This reportAnnual Report on Form 10-K contains forward-looking“forward-looking statements, including without limitation statements relating to our businesses and our prospects, new products, sales, expenses, tax rates, cash flows, and operating and capital requirements that are made pursuant to the safe harbor provisions of” as defined in the Private Securities Litigation Reform Act of 1995. These statements, which express management’s current views concerning future events, trends, contingencies or results, appear at various places in this report and use words like “anticipate,” “assume,” “believe,” “continue,” “estimate,” “expect,” “forecast,” “future,” “intend,” “plan,” “potential,” “predict,” “project,” “strategy,” “target” and similar terms, and future or conditional tense verbs like “could,” “may,” “might,” “should,” “will” and “would.” For example, management may use forward-looking statements are intended to provide management’s current expectationswhen addressing topics such as: the outcome of contingencies; future actions by regulators; changes in the Company’s business strategies and methods of generating revenue; the development and performance of the Company’s services and products; the expected impact of acquisitions and dispositions; the Company’s effective tax rates; and the Company’s cost structure, dividend policy, cash flows or plans for our future operating and financial performance and are based on assumptions management believes are reasonable at the time they are made.

liquidity.

Forward-looking statements can be identified by the use of words such as “believe,” “expect,” “plan,” “estimate,” “project,” “target,” “anticipate,” “intend,” “may,” “will,” “continue”are subject to inherent risks and other words of similar meaning in connection with a discussion of future operating or financial performance. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptionsuncertainties. Factors that are difficultcould cause actual results to predict; therefore, actual outcomes and results could differ materially from what is expectedthose expressed or forecasted. These risks and uncertaintiesimplied in forward-looking statements include, among others:other things:

the Company’s ability to make acquisitions and dispositions and to integrate, and realize expected synergies, savings or benefits from the businesses it acquires, including the impact of the acquisition of SNL on the Company’s results of operations, any failure to successfully integrate SNL into the Company’s operations and generate anticipated synergies and other cost savings, any failure to attract and retain key employees to execute the combined company’s growth strategy, any failure to realize the intended tax benefits of the acquisition, and the risk of litigation, competitive responses, or unexpected costs, charges or expenses resulting from or relating to the SNL acquisition;

the rapidly evolving regulatory environment, in the United States, Europe and elsewhere, affecting Standard & Poor’s Ratings Services, Platts, S&P Dow Jones Indices, S&P Capital IQ and SNL and the Company’s other businesses, including new and amended regulations and the Company’s compliance therewith;

the outcome of litigation, government and regulatory proceedings, investigations and inquiries;

worldwide economic, financial, political and regulatory conditions;

currency and foreign exchange volatility;

the effect of competitive products and pricing;

the level of success of new product development and global expansion;

the level of future cash flows;

the levels of capital investments;

income tax rates;

restructuring charges;

the health of debt and equity markets, including credit quality and spreads, the level of liquidity and future debt issuances;

the level of interest rates and the strength of the domestic and global credit and capital markets in the U.S.United States and abroad;

the demand and market for debtcredit ratings including collateralized debt obligations, residentialin and commercial mortgageacross the sectors and asset-backed securities and related asset classes;geographies where the Company operates;

concerns in the marketplace affecting the Company’s credibility or otherwise affecting market perceptions of the integrity or utility of independent credit ratings;

the stateCompany’s ability to maintain adequate physical, technical and administrative safeguards to protect the security of the credit marketsconfidential information and their impact on Standard & Poor’s Ratingsdata, and the economypotential of a system or network disruption that results in general;regulatory penalties, remedial costs or improper disclosure of confidential information or data;

the regulatory environment affecting Standard & Poor’s Ratingseffect of competitive products and our other businesses;pricing;

consolidation in the Company’s end-customer markets;

the likely outcome and impact of litigationcost-cutting pressures across the financial services industry;

a decline in the demand for credit risk management tools by financial institutions;

the level of success of new product developments and investigations on our operations and financial condition;global expansion;

the level of merger and acquisition activity in the U.S.United States and abroad;

continued investment by

the construction, automotive, computervolatility of the energy marketplace;

the health of the commodities markets;

the impact of cost-cutting pressures and aviation industries;reduced trading in oil and other commodities markets;

the level of the Company’s future cash flows;

the level of the Company’s capital investments;

the level of restructuring charges the Company incurs;

the strength and performance of the domestic and international automotive markets;

the volatility of the energy marketplace;

and the contract value of public works, manufacturing and single-family unit construction.Company’s ability to successfully recover should it experience a disaster or other business continuity problem from a hurricane, flood, earthquake, terrorist attack, pandemic, security breach, cyber-attack, power loss, telecommunications failure or other natural or man-made event;

In addition, there are certain risks and uncertainties relating to our previously announced Growth and Value Plan which contemplates a separation of our education business, including, but not limited to, changes in applicable tax or accounting requirements;

the impact on the Company’s net income caused by fluctuations in foreign currency exchange rates; and

the Company’s exposure to potential criminal sanctions or civil penalties if it fails to comply with foreign and possible disruption to our operations,U.S. laws and regulations that are applicable in the timingdomestic and certainty of completinginternational jurisdictions in which it operates, including trade sanctions laws, anti-corruption laws such as the transaction, unanticipated developments that may delay or negatively impact the transaction,U.S. Foreign Corrupt Practices Act and the ability of eachU.K. Bribery Act 2010, anti-bribery laws, anti-money laundering laws, and other financial crimes laws.

The factors noted above are not exhaustive. The Company and its subsidiaries operate in a dynamic business to operate as an independent entity upon completion ofenvironment in which new risks emerge frequently. Accordingly, the transaction. We cautionCompany cautions readers not to place undue reliance on any forward-looking statements.

statements, which speak only as of the dates on which they are made. The Company undertakes no obligation to update or revise any forward-looking statement to reflect events or circumstances arising after the date on which it is made, except as required by applicable law. Further information about the Company’s businesses, including information about factors that could materially affect its results of operations and financial condition, is contained in the Company’s filings with the SEC, including Item 1a, Risk Factors, in this Annual Report on Form 10-K.

PART I

Item 1. Business

Overview

The McGraw-Hill Companies,McGraw Hill Financial, Inc. (together with its consolidated subsidiaries, the “Company,” the “Registrant,” “we,” “us” or “our”) is a leading contentbenchmarks and ratings, analytics, data and research provider serving the global capital, commodities and commercial markets. The capital markets include asset managers, investment banks, commercial banks, insurance companies, exchanges, issuers and financial advisors;issuers; the commodities markets include producers, traders and intermediaries within energy, metals, petrochemicals and agriculture; and the commercial markets include professionals and corporate executives within automotive, construction, aerospace and defense,financial services, insurance and marketing / research information services. We serve our global customers through a broad range of products and services available through both third-party and proprietary distribution channels. We were incorporated in December of 1925 under the laws of the state of New York.

In the fourth quarter of 2015, we began exploring strategic alternatives for J.D. Power, included in our Commodities & Commercial segment. We committed to and initiated an active program to sell J.D. Power in its current state that we believe is probable in the next year. As a result, we have classified the assets and liabilities of J.D. Power as held for sale in our consolidated balance sheet as of December 31, 2015. The anticipated disposal does not represent a strategic shift that will have a major effect on operations and financial results, therefore, it is not classified as a discontinued operation.

On September 12, 2011,November 3, 2014, we announced that our Boardcompleted the sale of Directors had unanimously approved a comprehensive Growth and Value Plan that includes separation into two companies: McGraw Hill Financial ("MHF"), focusedConstruction, which has historically been part of our Commodities & Commercial segment, to Symphony Technology Group for $320 million in cash. We recorded an after-tax gain on providing essential informationthe sale of $160 million, which is included in discontinued operations, net in the consolidated statement of income for the year ended December 31, 2014. We used the after-tax proceeds from the sale to make selective acquisitions, investments, share repurchases and for general corporate purposes.

On March 22, 2013, we completed the capital, commodities and commercial markets, andsale of McGraw-Hill Education ("MHE"), focused on education products and services and digital learning. The Growth and Value Plan has been focused on accelerating growth and increasing shareholder value through not only this separation, but also through substantial cost-cutting initiatives and increased share repurchases.

As we approach the completion of our Growth and Value Plan we have achieved our objectives under our Growth and Value Plan relating to the separation of MHE, cost reductions, increased shareholder return and investing / divesting in targeted assets that position us for long-term growth.

Separation of MHE

Our Board of Directors determined that the separation would provide benefits to the Company, including:

Strategic Focus. Allow each independent company to design and implement corporate strategies and policies based on the industries that they serve and each specific business' unique characteristics, including customers, sales cycles and product life cycles.

Management Focus. Allow management of both companies to design and implement plans and policies in line with the specific business characteristics and strategic objectives of the respective companies.

Management and Employee Incentives. Enable both companies to create incentives for its management and employees that are more closely tied to its business performance. Separate compensation arrangements more closely align the interests of each company's management and employees with the interests of its stockholders and increase their ability to attract and retain personnel.

Access to Capital. Remove the need for the businesses to compete internally for capital. Instead, both companies would have the ability to tailor their capital structures and financial policies to fit their individual business needs.

Flexibility for Acquisitions and Partnerships. Provide each independent company increased strategic flexibility to make acquisitions and form partnerships and alliances in its target markets, unencumbered by considerations of the potential impact on the businesses of the other company.

Investor Choice. Provide investors in each company with a more targeted investment opportunity with different investment and business characteristics, including different opportunities for growth, capital structure, business models and financial returns. This will allow investors to evaluate the separate and distinct merits, performance and future prospects of each company.

The timing of completing the separation has been dependent on many factors, including whether the separation occurs through a spin-off to our shareholders or a sale. After carefully considering all of the options for creating shareholder value, our Board of Directors concluded that a sale of MHE would generate the best value and certainty for our shareholders and most favorably position MHE for long-term success.

As such, on November 26, 2012, we entered into a definitive agreement to sell MHE to investment funds affiliated with Apollo Global Management, LLC for a purchase price of $2.5$2.4 billion subject to certain closing adjustments. As partin cash. We recorded an after-tax gain on the sale of this transaction, McGraw-Hill will receive $250$589 million, which is included in senior unsecured notes issued by the purchaser at an annual interest rate of 8.5%. We are currentlydiscontinued operations, net in the processconsolidated statement of determiningincome for the fair value of these notes. For all periods presentedyear ended December 31, 2013. We used the after-tax proceeds from the sale to pay down short-term debt for the special dividend paid in this Form 10-K,2012, to make selective acquisitions, investments, share repurchases and for general corporate purposes.

In 2015, we continued to focus on investments in targeted financial assets, divesting selected non-core assets, reducing our real estate portfolio and increasing shareholder return.

In 2016, pending shareholder approval, the results of operations of MHE have been reclassified to reflectCompany will be re-branded S&P Global. This name better leverages the businessCompany's rich heritage as a discontinued operationfinancial data and analytics brand while signaling that we have a strong global footprint and broad portfolio.

Investments in Targeted Financial Assets / Divest Selected Non-Core Assets

During 2015, we continued to create a portfolio focused on scalable, industry leading, interrelated businesses in the assetscapital and liabilitiescommodity markets.

S&P Capital IQ and SNL— we acquired SNL Financial LC ("SNL"), a leading provider of news, data, and analytics to five sectors in the business have been reclassified as held for saleglobal economy: financial institutions, real estate, energy, media & communications, and metals & mining;

Commodities & Commercial:

| |

| ◦ | we acquired the entire issued share capital of Petromedia Ltd and its operating subsidiaries, an independent provider of data, intelligence, news and tools to the global fuels market that offers a suite of products providing clients with actionable data and intelligence that enables informed decisions, minimizes risk and increases efficiency; |

| |

| ◦ | we acquired National Automobile Dealers Association's Used Car Guide, a leading provider of U.S. retail, trade-in and auction used-vehicle valuation products, services and information. |

In 2015, we further reduced our real estate footprint by completing the consolidation of our corporate headquarters with our operations in our consolidated balance sheets. The sale of MHE is subject to variousNew York City.

closing conditionsDuring 2014, we continued to execute our strategy of investing for growth in markets that have size and is anticipated to closescale while exiting non-core assets.

Commodities & Commercial— we acquired Eclipse Energy Group AS which complements our North American natural gas capabilities, which we obtained from our Bentek Energy LLC acquisition in 2011;

S&P Ratings— we acquired BRC Investor Services S.A., a Colombia-based ratings firm providing risk classifications of banks, financial services providers, insurance companies, corporate bonds and structured issues that will expand our presence in the first quarter of 2013. See Item 1a,Latin American credit markets. Risk Factors,

In 2014, in this Form 10-K for updates to certain risk factors relatedaddition to the sale.divestiture of McGraw Hill Construction discussed above, we streamlined our infrastructure by reducing our real estate footprint through selling our data facility, initiating the consolidation of our corporate headquarters with our operations in New York City, as well as disposing of our corporate aircraft.

During 2013, we acquired an incremental 11 million equity shares representing 15.07% of CRISIL's total outstanding equity shares for $214 million, concurrently increasing our ownership percentage in CRISIL to 67.84% from 52.77%.

We planIn 2013, we also completed certain dispositions of our non-core assets that allow us to use the proceeds ofapply greater focus on our high-growth, high-margin benchmark businesses.

Commodities & Commercial— we completed the sale of Aviation Week to pay off any short-term borrowing obligations, to make selective acquisitions that enhance our portfolioPenton, a privately held business information company;

S&P Capital IQ and SNL— we completed the sale of brands and to sustain our share repurchase program.

Cost Reductions

FromFinancial Communications as well as the announcementclosure of our Growth and Value Plan we have been committed to on-going cost savings by year-end of greater than $100 million. We have surpassed that goal by approaching $175 million in savings by the end of 2012 through a focused effort on our cost structure, including:several non-core businesses.

select headcount reductions of approximately 670 employees within MHF and 530 employees within MHE,

the migration of numerous accounting work-streams, human resource processes and selected information-technology support services to world-class partners that specialize in these operations, and

redesigning the employee benefit plans including a freeze of our U.S. employee retirement plan.

These cost goals were focused across the entire Company, including MHE. Approximately two-thirds of these cost reductions benefited MHE. Cost savings at MHF were partially offset by costs that were previously allocated to MHE, such as costs for centralized departments, that could not be classified as discontinued operations due to the nature of the expense. We will continue to look to extend outsourcing efforts to enhance cost synergies and realign administrative support for a leaner overall cost structure.

Increased Shareholder Return

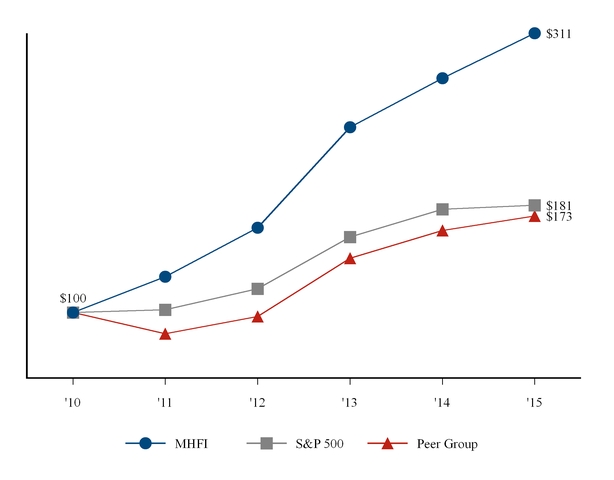

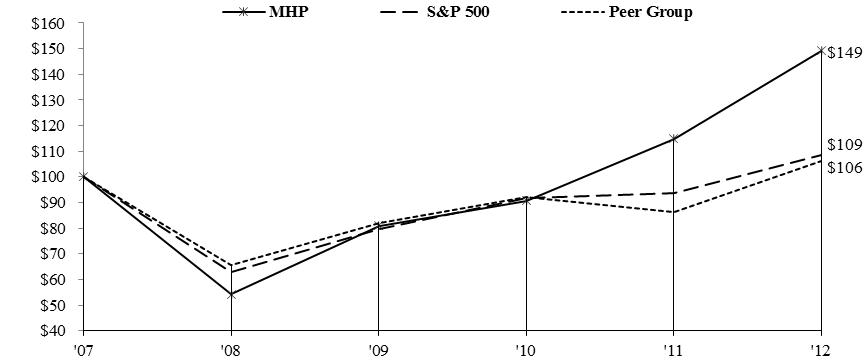

During the twothree years ended December 31, 2012,2015, we have returned $3.1$3.3 billion to our shareholders through a combination of share repurchases and our quarterly dividend and a special dividend.

Wedividends: we completed share repurchases of $1.8$2.3 billion and distributed regularlyregular quarterly dividends totaling approximately $600 million during the two years ended December 31, 2012. On December 6, 2012, our Board of Directors approved a special dividend in the amount of $2.50 per share on our common stock, payable on December 27, 2012 to shareholders on record on December 18, 2012. This returned an additional approximately $700 million to our shareholders.$997 million. Also, on January 30, 2013,27, 2016, the Board of Directors approved an increase in the quarterly common stock dividend from $0.255$0.33 per share to $0.28$0.36 per share.

Investing / Divesting Targeted Assets

During 2012, we completed several acquisitions that we believe will position us for long-term growth across all our segments.

S&P Dow Jones Indices - our transaction with CME Group, Inc. and CME Group Index Services LLC to form a new company, S&P Dow Jones Indices LLC;

S&P Capital IQ - Credit Market Analysis Limited, a provider of independent data concerning the over-the-counter markets; QuantHouse, an independent global provider of end-to-end systematic low-latency market data solutions; and R² Technologies, a provider of advanced risk and scenario-based analytics;

Commodities & Commercial - Kingsman SA, a privately-held, Switzerland-based provider of price information and analytics for the global sugar and biofuels markets;

Standard & Poor's Ratings - Coalition Development Ltd., a privately-held U.K. analytics company.

Refer to "Acquisitions and Partnerships" below for further discussion.

We completed the sale of our Broadcasting Group, previously included in our Commodities & Commercial segment, on December 30, 2011 and, accordingly, for the year ended December 31, 2011 and prior periods, the results of operations of the Broadcasting Group have been reclassified to reflect the business as a discontinued operation and assets and liabilities of the business have been removed from our consolidated balance sheet as of December 31, 2011.

The Growth and Value Plan has required us to incur non-recurring costs necessary to enable separation, reduce our cost structure, accelerate growth and increase shareholder value. The table below summarizes these costs including restructuring charges for the year ended December 31, 2012:

|

| | | | | | | |

| (in millions) | | | |

| | Continuing | | Discontinued |

| Professional fees | $ | 117 |

| | $ | 17 |

|

| Restructuring charges | 68 |

| | 39 |

|

| Transaction costs for our S&P Dow Jones Indices LLC joint venture | 15 |

| | — |

|

| Charges related to our lease commitments | 8 |

| | 3 |

|

| Miscellaneous charges | 18 |

| | 2 |

|

| | $ | 226 |

| | $ | 61 |

|

Total costs incurred since the Growth and Value Plan was announced in September of 2011 have been $297 million. These one-time expenses are largely professional fees, as we need the support of various consultants, business process and information technology firms, and financial advisors.

Our Businesses

As a result of our transaction with CME Group, Inc. and CME Group Index Services LLC to form a new company, S&P Dow Jones Indices LLC and how we are managing this company, combined with the formation of MHF, we have separated our previously reported S&P Capital IQ / S&P Indices segment into two separate reportable segments. Our operations now consist of four reportable segments: Standard & Poor’s Ratings Services (“S&P Ratings”), S&P Capital IQ and SNL, S&P Dow Jones Indices ("S&P DJ Indices") and Commodities & Commercial (“C&C”). Our previously reported MHE segment is reported asFor a discontinued operation as discussed previously underdiscussion on the heading, "competitive conditions in our businesses, see “MD&A – Segment Review” contained in Item 7, SeparationManagement’s Discussion and Analysis of MHEFinancial Condition and Results of Operations"., in this Annual Report on Form 10-K.

S&P Ratings

S&P Ratings is aan independent provider of credit ratings, offeringresearch and analytics to investors, issuers and market participants information and independent ratings benchmarks.participants. Credit ratings are one of several tools that investors can use when making decisions about purchasing bonds and other fixed income investments. They are opinions about credit risk and our ratings express our opinion about the ability and willingness of an issuer, such as a corporation or state or city government, to meet its financial obligations in full and on time. Our credit ratings can also speakrelate to the credit quality of an individual debt issue, such as a corporate or municipal bond, and the relative likelihood that the issueissuer may default.

As the capital markets continue to evolve, S&P Ratings is well-positioned to capitalize on opportunities driven by continuing regulatory changes through its global network, well-established position in corporate markets and strong investor reputation.

With offices in over 2325 countries around the world, S&P Ratings is an important part of the world's financial infrastructure and has played a leading role for over 150 years in providing investors with information and independent benchmarks for their investment and financial decisions as well as access to the capital markets. The key constituents S&P Ratings serves are investors; corporations; governments; municipalities;investors, corporations, governments, municipalities, commercial and investment banks;banks, insurance companies;companies, asset managers;managers, and other debt issuers.

As the capital markets continue to evolve, S&P Ratings is well-positioned to capitalize on opportunities, driven by continuing regulatory changes, through its global network, well-established position in corporate markets and strong investor reputation.

S&P Ratings differentiates its revenue between transaction and non-transaction. Transaction revenue primarily includes fees associated with:

ratings related to new issuance of corporate and government debt instruments, and structured finance debt instruments;

bank loan ratings; and

corporate credit estimates, which are intended, based on an abbreviated analysis, to provide an indication of our opinion regarding creditworthiness of a company which does not currently have an S&P Ratings credit rating.

Non-transaction revenue primarily includes fees for surveillance of a credit rating, annual fees for customer relationship-based pricing programs and fees for entity credit ratings.

S&P Capital IQ and SNL

S&P Capital IQ and SNL is a global provider of digital and traditional financial research and analytical tools for capital market participants. It deploys the latest technology-driven strategies to deliver to customers an integrated portfolio of cross-asset analytics, desktop services, and investment recommendationsinformation in the rapidly growing financial information, data and analytics market. The key

constituents S&P Capital IQ and SNL serves are asset managers; investment banks; investors; brokers; financial advisors; insurance companies; investment sponsors; and companies’ back-office functions, including compliance, operations, risk, clearance, and settlement.

S&P Capital IQ'sIQ and SNL's portfolio of products brings together integrated data sets, indices, research, and analytic insights in an integrated desktop solutioncapabilities are designed to serve multiple investor segments acrosshelp the financial community. In addition, the segment has products that integrate its content for delivery to the financial market via feeds, as well as through on-demandcommunity track performance, generate better investment returns (alpha), identify new trading and customizable delivery tools. Specific products include:investment ideas, perform risk analysis, and develop mitigation strategies.

S&P Capital IQ - and SNL includes the following business lines:

S&P Capital IQ Desktop & Enterprise Solutions — a product suite that provides data, analytics and third-party research for global finance professionals, which includes the S&P Capital IQ Desktop and integrated bulk data feeds that can be customized, which include QuantHouse, S&P Securities Evaluations, CUSIP and Compustat;

Global Risk Services — commercial arm that sells Standard & Poor's Ratings Services' credit ratings and related data, analytics and research, which includes subscription-based offerings, RatingsDirect® and RatingsXpress®;

S&P Capital IQ Markets Intelligence — a comprehensive source of market research for financial professionals;professionals, which includes Global Markets Intelligence, Leveraged Commentary & Data and Equity Research Services; and

Global Credit Portal -SNL — a web-based solutionproduct suite that includes standardized and as-reported financials, sector-specific templates, asset-level data, mapping and regulatory data accessible through SNL Unlimited that provides real-time credit research, market information and risk analytics, which includes RatingsDirect®;

Global Data Solutions - combines high-quality, multi-asset class andin-depth coverage of industry-specific financial market data to help professional investors, traders,from over 6,500 public companies and analysts meetover 50,000 private companies across the new analytical, risk management, regulatoryglobe, comprehensive market data on a variety of assets, and front-to-back office operation requirements, which includes RatingsXpress®;M&A and Capital Market activities.

investment research products.

S&P DJDow Jones Indices

S&P DJ Indices is a global index provider that maintains a wide variety of investable and benchmark indices to meet an array of investor needs. S&P DJ Indices’ mission is to provide transparent benchmarks to help with decision making, collaborate with the financial community to create innovative products and provide investors with tools to monitor world markets.

S&P DJ Indices generates subscription revenue but primarily derivesgenerates revenue from non-subscription products based on the S&P and Dow Jones Indices, specifically through fees on exchange traded funds, mutual funds and insurance assets. Additionally, fees are generated through both over-the-counter derivative issuances as well as exchange traded derivatives.

S&P DJ Indices includes our transaction with CME Group, Inc. and CME Group Index Services LLC to form a new company, S&P Dow Jones Indices LLC. The combination of these businesses created the world's largest provider of market indices.

also generates subscription revenue. Specifically, S&P DJ Indices generate revenue through investmentfrom the following sources:

Investment vehicles —such as:

as exchange traded funds (“ETFs”), which are based on the S&P and Dow Jones IndicesIndices' benchmarks and generate revenue through fees based on assets and underlying funds;

index-related licensing fees, which are generally either annual fees based on assets under management or flat fees for over-the-counterExchange traded derivatives and retail-structured products;

data subscriptions, which support index fund management, portfolio analytics and research; and

listed derivatives,— which generate royalties based on trading volumes of derivatives contracts.contracts listed on various exchanges;

Index-related licensing fees — which are either fixed or variable annual and per-issue fees for over-the-counter derivatives and retail-structured products; and

Data and customized index subscription fees — which support index fund management, portfolio analytics and research.

Commodities & Commercial

C&C consists of business-to-business companies specializing in the commodities and commercial markets that deliver their customers access to high-value information, data, analytic services and pricing benchmarks. C&C includes such brands as the following brands:

Platts — provides essential price data, analytics, and industry insight that enable commodities markets to perform with greater transparency and efficiency; and

J.D. Power — provides essential consumer intelligence to help businesses measure, understand, and Associates, McGraw-Hill Constructionimprove the key performance metrics that drive growth and profitability.Aviation Week.

In the fourth quarter of 2015, we began exploring strategic alternatives for J.D. Power, included in our C&C segment. We committed to and initiated an active program to sell J.D. Power in its current state that we believe is probable in the next year. As a result, we have classified the assets and liabilities of J.D. Power as held for sale in our consolidated balance sheet as of December 31, 2015. The anticipated disposal does not represent a strategic shift that will have a major effect on operations and financial results, therefore, it is not classified as a discontinued operation.

The C&C business is driven by the need for high-value information and transparency in a variety of industries. C&C seeks to deliver premier content that is deeply embedded in customer workflows and decision making processes. Our commodities business serves producers, traders, and intermediaries within energy, metals and agriculture markets. Our commercial business serves professionals and executives within automotive, construction, aerospace and defensefinancial services, insurance and marketing / research services markets. C&C delivers premier content that is deeply embedded in customer workflows and decision making processes.

CommoditiesC&C's revenue is generated primarily through the following sources:

Subscription revenue —subscriptions to itsour real-time news, market data and price information; end-of-dayassessments, along with other information products, primarily serving the energy and the automotive industry; and

Non-subscription revenue — primarily from licensing of our proprietary market data; newsletters and reports; and geospatialprice data and maps;

price assessments to commodity exchanges, syndicated and trading services related products.proprietary research studies, commercial-oriented data and analytics, conference sponsorship, consulting engagements and events.

Commercial revenue is generated primarily from digital and print subscriptions for a variety of products, proprietary research and consulting, ad claims and industry conferences.

Our Strategy

We striveOur vision is to be the foremostleading provider of essential information such astransparent and independent benchmarks intelligence and ratings, analytics, data and research in the global capital, commodities and commercialcorporate markets. We seek to leverage the strength of our globally recognized brandsOur mission is to promote sustainable growth in these markets by bringing transparencyproviding customers with essential intelligence and independent insightssuperior service. We seek to those markets. Our strategy seeks to understandaccomplish our mission and vision within the key trends affecting our businesses and address them through the achievementframework of our enterprise objectives.

Four key trends are increasing the need for contentcore values of fairness, integrity and analyticstransparency. We intend to deliver our products and services through customer-centric distribution channels that enable mission-critical decisions in the markets we serve:

The globalizationour core customer sets of the capital markets: the global demand for capitalinvestment management, investment banking, commercial banking, insurance, specialty financial institutions and commodities markets trading and liquidity is expanding rapidly in both developed and growth markets;

The need for data-driven decision making tools: developments in technology, communications and data processing have increased the demand for time-critical, multi-asset class data and solutions;

Systemic regulatory change: new global legislation (e.g. Dodd-Frank, U.S. Commodity Futures Trading Commission and Basel III) is creating new and complex operating and capital models for banks and market participants; and

Increased volatility and risk: amplified uncertainty and market volatility around short-term events are driving the need for new methodologies to measure risk, return and profitability.corporates.

We are focused on deliveringaligning our efforts against these enterprise objectives:

•Extend Market Leadership: extend our position as a global leader in our market segments

•Build Scalable Capabilities: further institutionalizetwo key capabilities such as technology and risk management

•Foster Talent: attract and retain top talent

Create Shareholder Value: deliver high top-line and bottom-linestrategic priorities: creating growth and positive returns to shareholdersdriving performance.

Our enterprise strategy, which will support the achievement of these core objectives, includes the following components:

Organic Growth: support a portfolio of leading market brands that delivers high top-line and bottom-line growth

Global Expansion: expand our global footprint to capture opportunities in both mature and growth markets

Acquisitions and Partnerships: supplement organic growth with acquisitions and partnerships

Scalable Capabilities: create and leverage efficiency and effectiveness through common platforms, processes and standards

Talent Retention and Acquisition: leverage our position as a market leader to become an employer of choice in our chosen markets and geographiesCreating Growth

Organic Growth

Our businesses share a set of competitive advantages, including leading global brands, scalable technology and multi-channel distribution capabilities. We will leverage these capabilities to extend and expand our product offerings across high-value segments of the information value chain, such as benchmarks, pricing and valuation, analytics and tools, research and desktop / enterprise solutions. Additionally, we will seek out cross-business growth initiatives and synergies, in areas such as adjacent asset classes and parts of the value-chain. This will result in the creation of innovative new solutions that help investors face the evolving challenges of today's volatile and changing market landscape.

Global Expansion

Global growth remains a high priority for our Company as we continue to expand our footprint to capture opportunities in mature and growth markets. Our scale and leadership position within our core markets will enable us to identify and capitalize on growth trends and further extend our position in fast-developing growth markets. We are committed to enhancing our local data capabilities in growth markets for both local and global distribution.

Acquisitions and Partnerships

We will continuestrive to drive acquisitionsglobal growth by focusing on executing our strategic initiatives, strengthening core capabilities and partnerships that supplement organic growth and strengthen our market position in our target asset classes, high-value segments of the information value chain, and high-priority geographic markets. Our acquisition and partnership activity in 2012 included the following transactionscollaborating across all our segments:

S&P DJ Indices

On June 29, 2012, we closed our transaction with CME Group, Inc. (“CME Group”) and CME Group Index Services LLC, a joint venture between CME Group and Dow Jones & Company, Inc., to form a new company, S&P Dow Jones Indices LLC.businesses.

S&P Capital IQ

On June 29, 2012, we acquired Credit Market Analysis Limited (“CMA”) from the CME Group. CMA provides independent data concerning the over-the-counter markets. CMA's data and technology will enhance our capability to provide pricing and related over-the-counter information.

On April 3, 2012, we completed the acquisition of QuantHouse, an independent global provider of end-to-end systematic low-latency market data solutions. The acquisition allows us to offer real-time monitors, derived data sets and analytics as well as the ability to package and resell this data as part of a core solution.

On February 8, 2012, we completed the acquisition of R² Technologies (“R²”). R² provides advanced risk and scenario-based analytics to traders, portfolio and risk managers for pricing, hedging and capital management across asset classes. Driving Performance

C&C

On November 1, 2012, we completed the acquisition of Kingsman SA (“Kingsman”), a privately-held, Switzerland-based provider of price information and analytics for the global sugar and biofuels markets. The acquisition of Kingsman will expand our presence in sugar and biofuels information markets and has the potential to provide growth in the global agricultural information markets.

S&P Ratings

On July 4, 2012, CRISIL, our majority owned Indian credit rating agency, completed the acquisition of Coalition Development Ltd. (“Coalition”), a privately-held U.K. analytics company, and its subsidiaries. Coalition provides high-end analytics to leading global investment banks and other financial services firms. Coalition will be integrated into CRISIL's Global Research & Analytics business.

Scalable Capabilities

We will maximize the capabilities of our entire portfolio of assets through an operating model that allows usstrive to leverage infrastructure,deliver operational excellence, manage and more quicklymitigate risk and effectively combine assets to create new solutions. We will further institutionalize enterprise-wide functions, including: technologyenhance leadership and data operations; marketing, branding and communications; and risk management and compliance. This will allow us to create high-value, differentiated solutions and serve as a platform for growth.accountability.

Talent Retention and Acquisition

Consistent with our position as one of the leading content and analytics providers, we have a professional workforce of analysts, researchers and technologists, including the world's largest credit analytics teams, with over 1,400 analysts at S&P Ratings. We will promote a culture that is results-oriented and serves customers in a responsible and innovative way. We strive to recruit and retain the top talent required to deliver on our vision to be a leading provider of benchmarks, intelligence and analytics in the global capital, commodities and commercial markets.

There can be no assurance that we will achieve success in implementing any one or more of these strategies as a variety of factors could unfavorably impact operating results, including prolonged difficulties in the global credit markets and a change in the regulatory environment affecting our businesses. See Item 1a, Risk Factors, in this Annual Report on Form 10-K.

Further projections and discussion on our 2016 outlook for our segments can be found within “Results“MD&A – Results of Operations”.

Segment and Geographic Data

The relative contribution of our operating segments to operating revenue, operating profit, long-lived assets and geographic area for the three years ended December 31, 2012 is2015 are included in Note 1211 – Segment and Geographic Information to the consolidated financial statements under Item 8, Consolidated Financial Statements and Supplementary Data, in this Form 10-K.

Our Personnel

As of December 31, 2012,2015, we have 21,687had approximately 20,400 employees located worldwide, of which 9,942approximately 5,700 were employed in the United States. Of these 21,687 employees, approximately 5,000 were MHE employees.U.S.

Available Information

The Company's investor kit includes the current Annual Report, Proxy Statement, Form 10-Qs,Reports on Form 10-K, andProxy Statements, Quarterly Reports on Form 10-Q, current reports on Form 8-K, the current earnings release.release and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. For online access to the Digital Investor Kit, go to www.mcgraw-hill.com/investor_relations.http://investor.mhfi.com. Requests for printed copies, free of charge, can be e-mailed to investor_relations@mcgraw-hill.cominvestor.relations@mhfi.com or mailed to Investor Relations, The McGraw-Hill Companies,McGraw Hill Financial, Inc., 1221 Avenue of the Americas,55 Water Street, New York, NY 10020-1095.10041-0001. Interested parties can also call Investor Relations toll-free at 866-436-8502 (domestic callers) or 212-512-2192212-438-2192 (international callers). The information on our website is not, and shall not be deemed to be part hereof or incorporated into this or any of our filings with the SEC.

Access to more than 10 years of the Company's filings made with the Securities and Exchange Commission is available through the Company's Investor Relations Web site. Go to www.mcgraw-hill.com/investor_relationshttp://investor.mhfi.com and click on the SEC Filings link. In addition, these filings are available to the public on the Commission's Web site through their EDGAR filing system at www.sec.gov. Interested parties may also read and copy materials that the Company has filed with the Securities and Exchange Commission (“SEC”) at the SEC's public reference room located at 450 Fifth100 F Street, N.W., Room 1024,NE, Washington, D.C. 20549.20549 on official business days between the hours of 10AM and 3PM. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room.

Item 1a. Risk Factors

We are providing the following cautionary statements which identify all known material risks, uncertainties and other factors that could cause our actual results to differ materially from historical and expected results.

We operate in the capital, commodities and commercial markets. The capital markets include asset managers, investment banks, commercial banks, insurance companies, exchanges, issuers and financial advisors;issuers; the commodities markets include producers, traders and intermediaries within energy, metals, petrochemicals and agriculture; and the commercial markets include professionals and corporate executives within automotive, construction, aerospace and defense,financial services, insurance and marketing / research information services. Certain risk factors are applicable to certain of our individual marketssegments while other risk factors are applicable company-wide.

Market Risks

Introduction of new products, services or technologies could impact our profitability

We operate in highly competitive markets that continue to change to adapt to customer needs. In order to maintain a competitive position, we must continue to invest in new offerings and new ways to deliver our products and services.

| |

◦ | These investments may not be profitable or may be less profitable than what we have experienced historically. |

We could experience threats to our existing businesses from the rise of new competitors due to the rapidly changing environment within which we operate.

We rely on our information technology environment and certain critical databases, systems and applications to support key product and service offerings. We believe we have appropriate policies, processes and internal controls to ensure the stability of our information technology, provide security from unauthorized access to our systems and maintain business continuity, but our business could be subject to significant disruption and our operating results may be adversely impacted by unanticipated system failures, data corruption or unauthorized access to our systems.

Exposure to litigation and government and regulatory proceedings, investigations and inquiries could have a material adverse effect on our business, financial position andcondition or results of operationsoperations.

WeIn the normal course of business, both in the United States and abroad, we and our subsidiaries are involveddefendants in numerous legal actionsproceedings and claims arising from our business practices,are often the subject of government and regulatory proceedings, investigations and inquiries, as discussed under Item 7, Management'sManagement’s Discussion and Analysis of Financial Condition and Results of Operations, in this Annual Report on Form 10-K and in Note 13 –12 - Commitments and Contingencies to the consolidated financial statements under Item 8, Consolidated Financial Statements and Supplementary Data, in this Annual Report on Form 10-K, and we face the risk that additional actionsproceedings, investigations and claimsinquiries will be filedarise in the future. Due

Many of these proceedings, investigations and inquiries relate to the inherent uncertaintyratings activity of the litigation process, the resolutionS&P Ratings brought by issuers and alleged purchasers of any actionsrated securities. In addition, various government and self-regulatory agencies frequently make inquiries and conduct investigations into our compliance with applicable laws and regulations, including those related to ratings activities and antitrust matters.

Any of these proceedings, investigations or claims that may be broughtinquiries could ultimately result in the future,adverse judgments, damages, fines, penalties or the change in applicable legal standardsactivity restrictions, which could have a material adverse effect on our business, financial position andcondition or results of operations.

In view of the uncertainty inherent in litigation and government and regulatory enforcement matters, we cannot predict the eventual outcome of the matters we are currently facing or the timing of their resolution, or in most cases reasonably estimate what the eventual judgments, damages, fines, penalties or impact of activity restrictions may be. As a result, we cannot provide assurance that the outcome of the matters we are currently facing or that we may face in the future will not have a material adverse effect on our business, financial condition or results of operations.

As litigation or the process to resolve pending matters progresses, as the case may be, we continuously review the latest information available and assess our ability to predict the outcome of such matters and the effects, if any, on our consolidated financial condition, cash flows, business and competitive position, which may require that we record liabilities in the consolidated financial statements in future periods.

Legal proceedings impose additional expenses on the Company and require the attention of senior management to an extent that may significantly reduce their ability to devote time addressing other business issues.

Risks relating to legal proceedings may be heightened in foreign jurisdictions that lack the legal protections or liability standards comparable to those that exist in the United States. In addition, new laws and regulations have been and may continue to be enacted that establish lower liability standards, shift the burden of proof or relax pleading requirements, thereby increasing the risk of successful litigations against the Company in the United States and in foreign jurisdictions. These litigation risks are often difficult to assess or quantify and could have a material adverse effect on our business, financial condition or results of operations.

We may not have adequate insurance or reserves to cover these risks, and the existence and magnitude of these risks often remains unknown for substantial periods of time and could have a material adverse effect on our business, financial condition or results of operations.

Our acquisitions and other strategic transactions may not produce anticipated results.

We have made and expect to continue to make acquisitions or enter into other strategic transactions to strengthen our business and grow our Company.

Such transactions, including our recent acquisition of SNL Financial LC, present significant challenges and risks.

The market for acquisition targets and other strategic transactions is highly competitive, especially in light of industry consolidation, which may affect our ability to complete such transactions.

If we are unsuccessful in completing such transactions or if such opportunities for expansion do not arise, our business, financial condition or results of operations could be materially adversely affected.

If such transactions are completed, the anticipated growth and other strategic objectives of such transactions may not be fully realized, and a variety of factors may adversely affect any anticipated benefits from such transactions. For instance, the process of integration may require more resources than anticipated, we may assume unintended liabilities, there may be unexpected regulatory and operating difficulties and expenditures, we may fail to retain key personnel of the acquired business and such transactions may divert management’s focus from other business operations.

The anticipated benefits from an acquisition or other strategic transaction may not be realized fully, or may take longer to realize than expected. For instance, although we have identified approximately $100 million in synergies expected to be realized by 2019 largely from operational efficiencies and our ability to accelerate SNL Financial’s international growth through its global footprint, there is no guarantee that we will be able to achieve any or all of these synergies. As a result, the failure of acquisitions and other strategic transactions to perform as expected could have a material adverse effect on our business, financial condition or results of operations.

Changes in the volume of securities issued and traded in domestic and/or global capital markets and changes in interest rates and volatility in the financial markets could have a material impactadverse effect on our business, financial condition or results of operationsoperations.

UnfavorableOur business is impacted by general economic conditions and volatility in the United States and world financial markets. Therefore, since a significant component of our credit-rating based revenue is transaction-based, and is essentially dependent on the number and dollar volume of debt securities issued in the capital markets, unfavorable financial or economic conditions that either reduce investor demand for debt securities or reduce issuers'issuers’ willingness or ability to issue such securities could reduce the number and dollar volume of debt issuanceissuances for which S&P Ratings provides credit ratings.

Unfavorable financial or economic conditions could also adversely impacts S&P DJ Indices, which receives a portion of its revenue from fees based on derivatives trading volumes and index-based ETF assets under management.

Increases in interest rates or credit spreads, volatility in financial markets or the interest rate environment, significant political or economic events, defaults of significant issuers and other market and economic factors may negatively impact the general level of debt issuance, the debt issuance plans of certain categories of borrowers, the level of derivatives trading and/or the types of credit-sensitive products being offered.offered, any of which could have a material adverse effect on our business, financial condition or results of operations.

Any weakness in the macroeconomic environment could constrain customer budgets across the markets we serve, potentially leading to a reduction in their employee headcount and a decrease in demand for our subscription-based

products.

Increased domesticIncreasing regulation of our S&P Ratings business in the United States, Europe and foreign regulation may adversely impactelsewhere can increase our businesses

Ourcosts of doing business and therefore could have a material adverse effect on our business, financial condition or results could be adversely affected because of public statements or actions by market participants, government officials and others who may be advocates of increased regulation or regulatory scrutiny.operations.

The financial services industry is highly regulated, rapidly evolving and subject to the potential for increasing regulation in the United States, Europe and abroad.elsewhere. The businesses conducted by S&P Ratings are in certain cases regulated under the U.S. Credit Rating Agency Reform Act of 2006 (the “Reform Act”), the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), the U.S. Securities Exchange Act of 1934 (the “Exchange Act”), and/or the laws of the states or other jurisdictions in which they conduct business.

| |

◦ | In the past several years, the U.S. Congress, the SEC and the European Commission, through regulators including the International Organization of Securities Commissions and the European Securities and Markets Authority, as well as regulators in other countries in which S&P Ratings operates have been reviewing the role of rating agencies and their processes and the need for greater oversight or regulations concerning the issuance of credit ratings or the activities of credit rating agencies. |

| |

▪ | We do not believe that the laws, regulations and rules that have been adopted as part of this process will have a material adverse effect on our financial condition or results of operations. |

| |

◦ | Other laws, regulations and rules relating to credit rating agencies are being considered by local, national, foreign and multinational bodies and are likely to continue to be considered in the future, including provisions seeking to reduce regulatory and investor reliance on credit ratings, rotation of credit rating agencies and liability standards applicable to credit rating agencies. The impact on us of the adoption of any such laws, regulations or rules remains uncertain, but could increase the costs and legal risks relating to S&P Rating's rating activities. |

| |

◦ | Additional information regarding rating agencies is provided under Item 7, Management'sIn the past several years, the U.S. Congress, the International Organization of Securities Commissions ("IOSCO"), the SEC and the European Commission, including through the European Securities Market Authority ("ESMA"), as well as regulators in other countries in which S&P Ratings operates, have been reviewing the role of rating agencies and their processes and the need for greater oversight or regulations concerning the issuance of credit ratings or the activities of credit rating agencies. Other laws, regulations and rules relating to credit rating agencies are being considered by local, national and multinational bodies and are likely to continue to be considered in the future, including provisions seeking to reduce regulatory and investor reliance on credit ratings, rotation of credit rating agencies and liability standards applicable to credit rating agencies. These laws and regulations, and any future rulemaking, could result in reduced demand for credit ratings and increased costs, which we may be unable to pass through to customers. In addition, there may be uncertainty over the scope, interpretation and administration of such laws and regulations. We may be required to incur significant expenses in order to comply with such laws and regulations and to mitigate the risk of fines, penalties or other sanctions. Legal proceedings could become increasingly lengthy and there may be uncertainty over and exposure to liability. It is difficult to accurately assess the future impact of legislative and regulatory requirements on our business and our customers’ businesses, and they may affect S&P Ratings’ communications with issuers as part of the rating assignment process, alter the manner in which S&P Ratings’ ratings are developed, affect the manner in which S&P Ratings or its customers or users of credit ratings operate, impact the demand for ratings and alter the economics of the credit ratings business. Each of these developments increase the costs and legal risk associated with the issuance of credit ratings and may have a material adverse effect on our operations, profitability and competitiveness, the demand for credit ratings and the manner in which such ratings are utilized. Additional information regarding rating agencies is provided under Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, in this Annual Report on Form 10-K. |

Our commodities business isS&P DJ Indices and C&C businesses are subject to the potential for increasing regulatory review in the United States, Europe and abroad.

| |

◦ | In the fall of 2011, the G20 Cannes Final Summit Declaration called upon the International Organization of Securities Commissions ("IOSCO"), International Energy Forum, International Energy Agency and the Organization of Petroleum Exporting Countries to prepare recommendations to improve the functioning and oversight of price reporting companies by mid-2012. |

| |

◦ | In a meeting with representatives of IOSCO in January 2012, principals at IOSCO advised Platts management that among the recommendations the regulatory group is considering is establishment of formal oversight of price reporting organizations and their processes, or a self-regulatory oversight regime. |

| |

◦ | In addition, new rules that are expected to be adopted by the U.S. Commodity Futures Trading Commission in 2013 affecting transactions in oil derivatives may hinder Platts in relation to its administration of the Platts electronic window (eWindow) as a means of determining price assessments in oil. Similar new rules and regulations in Europe are currently under consideration, albeit on a slower time frame. |

| |

◦ | On October 5, 2012, IOSCO issued its final report to the G-20, including Principles for Oil Price Reporting Agencies, which sets out principles IOSCO states are intended to enhance the reliability of oil price assessments that are referenced in derivative contracts subject to regulation by IOSCO members. On January 9, 2013, IOSCO held a meeting with the Price Reporting Organizations to discuss implementation of the Principles for Oil Price Reporting Agencies. At the meeting, Platts was able to obtain clarification from IOSCO on its expectations for voluntary implementation of the Principles by Platts and the other PROs and, with that clarification, Platts believes that the Principles will not have a significant negative impact on its ongoing business operations. |

| |

◦ | We do not believe that any new regulatory or self-regulatory oversight regime would have a material adverse effect on our financial condition or results of operations. |

Operating Risks

A significant increase in operating costsdoing business and expensestherefore could have a material adverse effect on our profitabilitybusiness, financial condition or results of operations.

Our major expenses include employee compensationIn addition to the extensive and capital investments.

| |

◦ | We offer competitive salary and benefit packages in order to attract and retain the quality employees required to grow and expand our businesses. Compensation costs are influenced by general economic factors, including those affecting the cost of health insurance and postretirement benefits, and any trends specific to the employee skill sets we require. |

| |

◦ | We make significant investments in information technology data centers and other technology initiatives. Although we believe we are prudent in our investment strategies and execution of our implementation plans, there is no assurance as to the ultimate recoverability of these investments. |

evolving U.S. laws and regulations, foreign jurisdictions, principally in Europe, have taken measures to increase regulation of the financial services and commodities industries.

Our abilityIn October of 2012, IOSCO issued its Principles for Oil Price Reporting Agencies ("PRA Principles"), which IOSCO states are intended to protect our intellectual property rightsenhance the reliability of oil price assessments that are referenced in derivative contracts subject to regulation by IOSCO members. Platts has taken steps to align its operations with the PRA Principles and, as recommended by IOSCO in its final report on the PRA Principles, has aligned to the PRA Principles for other commodities for which it publishes benchmarks.

In July of 2013, IOSCO issued its Principles for Financial Benchmarks ("Financial Benchmark Principles"), which are intended to promote the reliability of benchmark determinations, and address governance, benchmark quality and accountability mechanisms, including with regard to the indices published by S&P DJ Indices. S&P DJ Indices has taken steps to align its governance regime and operations with the Financial Benchmark Principles and engaged an independent auditor to perform a reasonable assurance review of such alignment.

The financial benchmarks industry is subject to the new pending benchmark regulation in the European Union (the “E.U. Benchmark Regulation”) as well as potential increased regulation in other jurisdictions. The proposed E.U. Benchmark Regulation has been released for final approval and is expected to be published later this year. The E.U. Benchmark

Regulation will likely require S&P DJ Indices and Platts in due course to obtain registration or authorization in connection with its benchmark activities in Europe. This legislation will likely cause additional operating obligations but they are not expected to be material at this time and until the regulation is finalized the exact impact is not certain.

The European Union has recently finalized a package of legislative measures known as MiFID II ("MiFID II"), which revise and update the existing E.U. Markets in Financial Instruments Directive framework. MiFID II will apply in full in all E.U. Member States from January 3, 2017. MiFID II includes provisions that, among other things: (i) impose new conditions and requirements on the licensing of benchmarks and provide for non-discriminatory access to exchanges and clearing houses; (ii) modify the categorization and treatment of certain classes of derivatives; (iii) expand the categories of trading venue that are subject to regulation; and (iv) provide for the mandatory trading of certain derivatives on exchanges (complementing the mandatory derivative clearing requirements in the E.U. Market Infrastructure Regulation of 2011). Although the MiFID II package is “framework” legislation (meaning that much of the detail of the rules will be set out in subordinate measures to be agreed upon in the period before 2017), it is possible that the introduction of these laws and rules could affect S&P DJ Indices’ and Platts’ abilities both to administer and license their indices and price assessments, respectively.

Changes to regulations in the United States, Europe and elsewhere may impact our competitive position

Our products contain intellectual property delivered through a variety of media, including printS&P Capital IQ and digital. Our ability to achieve anticipated results depends in part on our ability to defend our intellectual property against infringement. Our operating results may be adversely affectedSNL business by inadequate or changing legal and technological protections for intellectual property and proprietary rights in some jurisdictions and markets.

Riskincreasing the costs of doing business abroadglobally, which could have a material adverse effect on our business, financial condition or results of operations.

As we continueS&P Capital IQ and SNL operates regulated investment advisory businesses in the United States, the European Union and certain other countries. These and other S&P Capital IQ and SNL businesses may increasingly become subject to expand our operations overseas, we facenew or more stringent regulations that will increase the increased riskscost of doing business, abroad, including inflation, fluctuationwhich could have a material adverse effect on our business, financial condition or results of operations.

MiFID II and the Market Abuse Regulation (“MAR”) may impose additional regulatory burdens on S&P Capital IQ and SNL's activities in interest ratesthe European Union, although the exact severity and currency exchange rates, changescost are not yet known.

We may become subject to liability based on the use of our products by our clients.

Some of our products support the investment processes of our clients, which, in applicable laws and regulatory requirements, export and import restrictions, tariffs, nationalization, expropriation, limitsthe aggregate, manage trillions of dollars of assets. Use of our products as part of the investment process creates the risk that clients, or the parties whose assets are managed by our clients, may pursue claims against us for very significant dollar amounts, which could have a material adverse effect on repatriationour business, financial condition or results of funds, civil unrest, terrorism, unstable governments and legal systems,operations.

Any such claim, even if the outcome were to be ultimately favorable to us, would involve a significant commitment of our management, personnel, financial and other factors. Adverse developments in anyresources and could have a negative impact on our reputation. In addition, such claims and lawsuits could have a material adverse effect on our business, financial condition or results of these areas could cause actual results to differ materially from historical and/or expected operating results.

operations.

Increased competition could result in a loss of market share or revenuerevenue.