| Location | Functional Use | Owned/Leased | |

| U.S. Properties: | |||

| Ontario, California | Distribution/Manufacturing | Leased | |

| Booneville, Mississippi | Distribution/Manufacturing | Owned/Leased | |

| Ogdensburg, New York | Distribution/Manufacturing | Owned/Leased | |

| Sidney, New York | Distribution/Manufacturing | Owned | |

| Alexandria, Pennsylvania | Distribution/Manufacturing | Owned | |

East Texas, Pennsylvania(1) | Distribution/Manufacturing/Office | Owned | |

| Pleasant Prairie, Wisconsin | Distribution/Manufacturing | Leased | |

| Non-U.S. Properties: | |||

| Sydney, Australia | Distribution/Manufacturing | Owned | |

| Bauru, Brazil | Distribution/Manufacturing/Office | Owned | |

| Brampton, Canada | Distribution/Manufacturing/Office | Leased | |

| Missisauga, Canada | Distribution/Manufacturing/Office | Leased | |

| Tabor, Czech Republic | Manufacturing | Owned | |

| Halesowen, England | Distribution | Owned | |

| Lillyhall, England | Manufacturing | Leased | |

| Tornaco, Italy | Distribution | Leased | |

| Lerma, Mexico | Manufacturing/Office | Owned | |

| Born, Netherlands | Distribution | Leased | |

| Wellington, New Zealand | Distribution/Office | Owned | |

| Arcos de Valdevez, Portugal | Manufacturing | Owned | |

| (1) | Scheduled to be closed during the second quarter of 2013. Manufacturing and distribution activities will be substantially relocated to Sidney, New York. |

We believe that the properties are suitable to the respective businesses and have production capacities adequate to meet the needs of our businesses.

ITEM 3.LEGAL PROCEEDINGS

In January of 2013, Tilibra filed a protest disputing the tax assessment at the first administrative level of appeal within the FRD. We believe that we have meritorious defenses and intend to vigorously contest this matter, however, there can be no assurances that we will ultimately prevail. We are in the early stages of the process to challenge the FRD's tax assessment, and the ultimate outcome will not be determined until the Brazilian tax appeal process is complete, which is expected to take many years. In addition, Tilibra's 2008-2012 tax years remain open and subject to audit, and there can be no assurances that we will not receive additional tax assessments regarding the goodwill deducted for the Tilibra acquisition for one or more of those years, which could increase the Company's exposure to a total of approximately $44.5 million (based on current exchange rates), including interest

16

and penalties which have accumulated to date. If the FRD's initial position is ultimately sustained, the amount assessed would adversely affect our reported cash flow in the year of settlement.

Because there is no settled legal precedent on which to base a definitive opinion as to whether we will ultimately prevail, the Company considers the outcome of this dispute to be uncertain. Since it is not more likely than not that we will prevail, in the fourth quarter of 2012, we recorded a reserve in the amount of $44.5 million in consideration of this matter. In addition, the Company will continue to accrue interest related to this matter until such time as the outcome is known or until evidence is presented that we are more likely than not to prevail.

For further information see Note 3, Acquisitions, to the consolidated financial statements contained in Item 8 of this report.

There are various other claims, lawsuits and pending actions against us incidental to our operations. It is the opinion of management that the ultimate resolution of these matters will not have a material adverse effect on our consolidated financial position, results of interest and concern to ACCO Brands.operations or cash flows. However, we can make no assurances that we will ultimately be successful in our defense of any of these matters.

ITEM 4.MINE SAFETY DISCLOSURES

Not applicable.

17

PART II

Our common stock is traded on the New York Stock Exchange (“NYSE”) under the symbol “ACCO.” The following table sets forth, for the periods indicated, the high and low sales prices for our common stock as reported on the NYSE for 2011 and 2012:

| High | Low | ||||||

| 2011 | |||||||

| First Quarter | $ | 9.66 | $ | 7.77 | |||

| Second Quarter | $ | 10.39 | $ | 6.91 | |||

| Third Quarter | $ | 8.89 | $ | 4.62 | |||

| Fourth Quarter | $ | 10.20 | $ | 4.33 | |||

| 2012 | |||||||

| First Quarter | $ | 13.25 | $ | 9.24 | |||

| Second Quarter | $ | 13.30 | $ | 8.50 | |||

| Third Quarter | $ | 10.94 | $ | 6.01 | |||

| Fourth Quarter | $ | 7.95 | $ | 5.80 | |||

As of February 1, 2013, we had approximately 18,263 registered holders of our common stock.

Dividend Policy

We have not paid any dividends on our common stock since becoming a public company. We intend to retain any future earnings to reduce our indebtedness and fund the development and growth of our business. Currently our debt agreements restrict our ability to make dividend payments and we do not anticipate paying any cash dividends in the foreseeable future. Any determination as to the declaration of dividends is at our Board of Directors’ sole discretion based on factors it deems relevant.

18

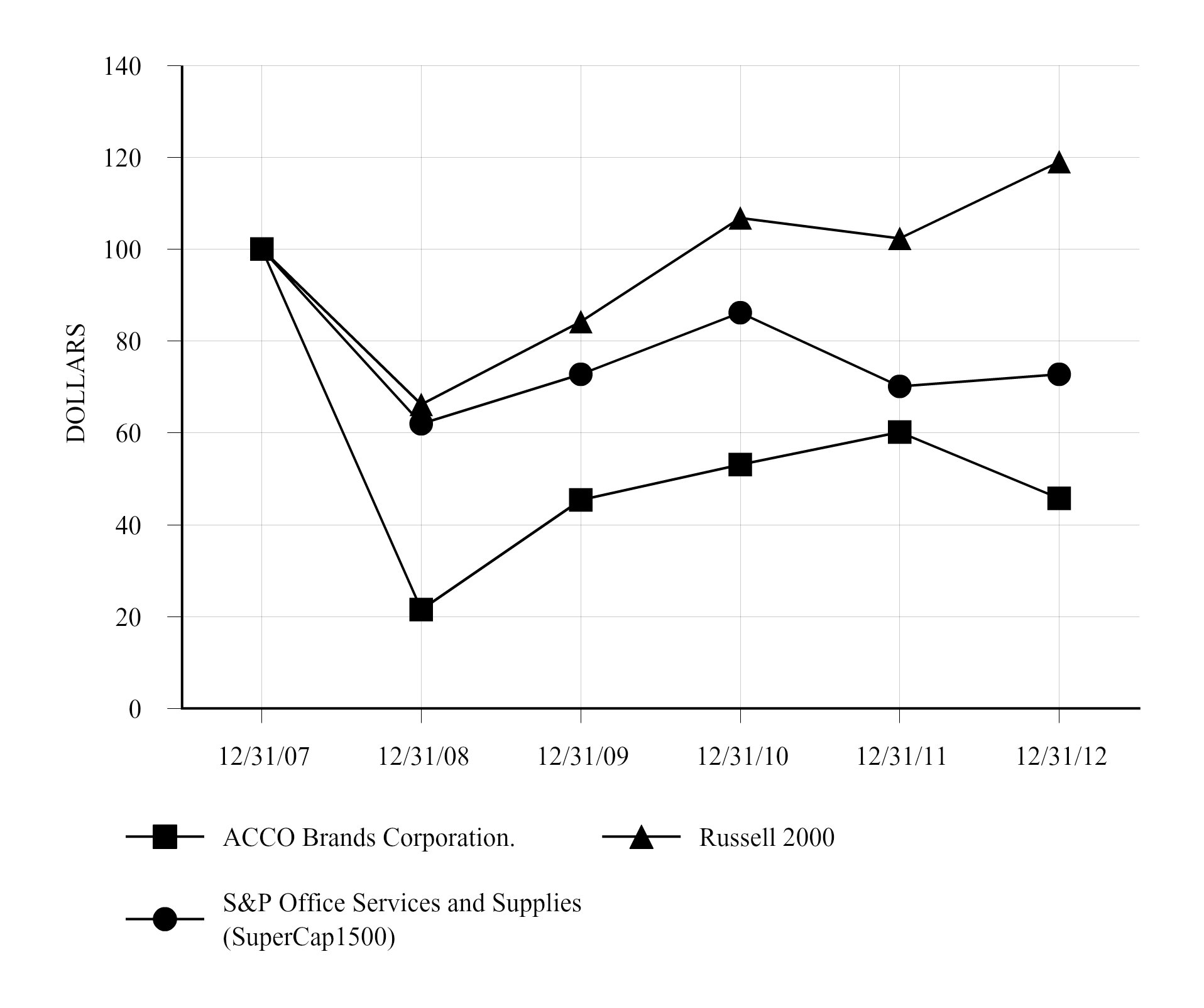

STOCK PERFORMANCE GRAPH

The following graph compares the cumulative total stockholder return on our common stock to that of the S&P Office Services and Supplies (SuperCap1500) Index and the Russell 2000 Index assuming an investment of $100 in each from December 31, 2007 through December 31, 2012.

| Cumulative Total Return | |||||||||||||||||||||||

| 12/31/07 | 12/31/08 | 12/31/09 | 12/31/10 | 12/31/11 | 12/31/12 | ||||||||||||||||||

| ACCO Brands Corporation. | $ | 100.00 | $ | 21.51 | $ | 45.39 | $ | 53.12 | $ | 60.16 | $ | 45.76 | |||||||||||

| Russell 2000 | 100.00 | 66.21 | 84.20 | 106.82 | 102.36 | 119.09 | |||||||||||||||||

S&P Office Services and Supplies (SuperCap1500) | 100.00 | 61.97 | 72.79 | 86.16 | 70.12 | 72.79 | |||||||||||||||||

19

ITEM 6.SELECTED FINANCIAL DATA

SELECTED HISTORICAL FINANCIAL DATA

The following table sets forth our selected consolidated financial data. The selected consolidated financial data as of and for the five fiscal years ended December 31, 2012 are derived from our consolidated financial statements. The data should be read in conjunction with the consolidated financial statements and related notes included elsewhere in this annual report.

| Year Ended December 31, | |||||||||||||||||||

2012(1) | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

| (in millions of dollars, except per share data) | |||||||||||||||||||

| Income Statement Data: | |||||||||||||||||||

| Net sales | $ | 1,758.5 | $ | 1,318.4 | $ | 1,284.6 | $ | 1,233.3 | $ | 1,539.2 | |||||||||

Operating income (loss)(2) | 139.3 | 115.2 | 109.7 | 75.4 | (199.9 | ) | |||||||||||||

| Interest expense, net | 89.3 | 77.2 | 78.3 | 67.0 | 63.7 | ||||||||||||||

Other expense (income), net(2) | 61.3 | 3.6 | 1.2 | 5.4 | (17.8 | ) | |||||||||||||

Income (loss) from continuing operations(3) | 117.0 | 18.6 | 7.8 | (118.6 | ) | (255.1 | ) | ||||||||||||

| Per common share: | |||||||||||||||||||

Income (loss) from continuing operations(3) | |||||||||||||||||||

| Basic | $ | 1.24 | $ | 0.34 | $ | 0.14 | $ | (2.18 | ) | $ | (4.71 | ) | |||||||

| Diluted | $ | 1.22 | $ | 0.32 | $ | 0.14 | $ | (2.18 | ) | $ | (4.71 | ) | |||||||

| Balance Sheet Data (at year end): | |||||||||||||||||||

| Total assets | $ | 2,507.7 | $ | 1,116.7 | $ | 1,149.6 | $ | 1,106.8 | $ | 1,282.2 | |||||||||

| External debt | 1,072.1 | 669.0 | 727.6 | 725.8 | 708.7 | ||||||||||||||

| Total stockholders’ equity (deficit) | 639.2 | (61.9 | ) | (79.8 | ) | (117.2 | ) | (3.4 | ) | ||||||||||

| Other Data: | |||||||||||||||||||

| Cash (used) provided by operating activities | $ | (7.5 | ) | $ | 61.8 | $ | 54.9 | $ | 71.5 | $ | 37.2 | ||||||||

| Cash (used) provided by investing activities | (423.2 | ) | 40.0 | (14.9 | ) | (3.9 | ) | (18.7 | ) | ||||||||||

| Cash provided (used) by financing activities | 360.1 | (63.1 | ) | (0.1 | ) | (44.5 | ) | (37.7 | ) | ||||||||||

| (1) | On May 1, 2012, the Company completed the Merger of the Mead C&OP with a wholly-owned subsidiary of the Company. Accordingly, the results of Mead C&OP are included in the Company's consolidated financial statements from the date of the Merger. For further information on the Merger, see Note 3, Acquisitions, to the consolidated financial statements, contained in Item 8 of this report. |

| (2) | Income (loss) from continuing operations in the years 2009 and 2008 was impacted by non-cash goodwill and asset impairment charges of $1.7 million and $263.8 million, respectively. |

Income (loss) from continuing operations in the year 2012 was impacted by $61.4 million in charges related to the refinancing completed in 2012 and recorded within Other expense (income), net. For further information on our refinancing, see Note 4, Long-term Debt and Short-term Borrowings, to the consolidated financial statements, contained in Item 8 of this report. The year 2008 was impacted by a $19.0 million gain due to early extinguishment of debt relating to the purchase of $49.6 million of our debt.

| (3) | Income (loss) from continuing operations for the years 2012, 2011, 2010, 2009 and 2008 was impacted by restructuring charges (income) of $24.3 million, $(0.7) million, $(0.5) million, $17.4 million and $28.8 million, respectively. |

Income (loss) from continuing operations for the years 2009 and 2008 was impacted by certain other charges that have been recorded within cost of products sold, and advertising, selling, general and administrative expenses. These charges are incremental to the cost of our underlying restructuring actions and do not qualify as restructuring. These charges include redundant warehousing or storage costs during the transition to new distribution centers, equipment and other asset move costs, ongoing facility overhead and maintenance costs after exit, gains on the sale of exited facilities, certain costs associated with our debt refinancing and employee retention incentives. Within cost of products sold on the Consolidated Statements of Operations for the years ended December 31, 2009 and 2008, these charges totaled $3.4

20

million and $7.5 million, respectively. Within advertising, selling, general and administrative expenses on the Consolidated Statements of Operations for the years ended December 31, 2009, and 2008, these charges totaled $1.2 million and $3.1 million, respectively. Included within the 2008 result, is a charge for $4.2 million related to the exit of the Company’s former CEO, a $3.5 million gain on the sale of a manufacturing facility and net gains of $2.4 million on the sale of three additional properties. We did not incur these other charges in 2012, 2011 and 2010.

During 2009, we recorded a non-cash charge of $108.1 million to establish a valuation allowance against our U.S. deferred taxes. Following the Merger in the second quarter of 2012, we released into income $126.1 million of the valuation allowance that had been previously recorded against the U.S. deferred income tax assets. For a further discussion of the valuation allowance, see Note 11, Income Taxes, to the consolidated financial statements, contained in Item 8 of this report.

21

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

INTRODUCTION

ACCO Brands is one of the world's largest suppliers of branded school and office products (excluding furniture, computers, printers and bulk paper). We sell our products through many channels that include the office products resale industry as well as through mass retail distribution and e-tailers. We design, develop, manufacture and market a wide variety of traditional and computer-related office products, school supplies and paper-based time management products. Through a focus on research, marketing and innovation, we seek to develop new products that meet the needs of our consumers and commercial end-users, and support our brands. We compete through a balance of innovation, a low-cost operating model and an efficient supply chain. We sell our products primarily to markets located in the United States, Northern Europe, Canada, Brazil, Australia and Mexico.

Our office, school and calendar product lines use name brands such as AT-A-GLANCE®, Day-Timer®, Five Star®, GBC®, Hilroy®, Marbig, Mead®, NOBO, Quartet®, Rexel, Swingline®, Tilibra®, Wilson Jones® and many others. Our products and brands are not confined to one channel or product category and are designed based on end-user preference. We currently manufacture approximately half of our products, and specify and source approximately the other half of our products, mainly from Asia.

The majority of our office products, such as stapling, binding and laminating equipment and related consumable supplies, shredders and whiteboards, are used by businesses. Most of these business end-users purchase their products from our customers, which include commercial contract stationers, retail superstores, mass merchandisers, wholesalers, resellers, mail order and internet catalogs, club stores and dealers. We also supply some of our products directly to large commercial and industrial end-users. Historically, we have targeted the premium end of the product categories in which we compete. However, we also supply private label products for our customers and provide business machine maintenance and certain repair services.

Our school products include notebooks, folders, decorative calendars, and stationery products. We distribute our school products primarily through traditional and online retail mass market, grocery, drug and office superstore channels. We also supply private label products within the school products sector. Our calendar products are sold throughout all channels where we sell office or school products, and we also sell direct to consumers.

Our Computer Products Group designs, distributes, markets and sells accessories for laptop and desktop computers, tablets and smartphones. These accessories primarily include security products, iPad® covers and keypads, smartphone accessories, power adapters, input devices such as mice, laptop computer carrying cases, hubs, docking stations and ergonomic devices. We sell these products mostly under the Kensington®, Microsaver® and ClickSafe® brand names. All of our computer products are manufactured by third-party suppliers, principally in Asia, and are stored in and distributed from our regional facilities. These computer products are sold primarily to consumer electronics online retailers, information technology value-added resellers, original equipment manufacturers and office products retailers.

We believe our leading product positions provide the above-named officersscale to enable us to invest in product innovation and drive growth across our product categories. In addition, the expertise we use to satisfy the exacting technical specifications of our more demanding commercial customers is in many instances the basis for expanding our products and innovations to consumer products. We plan to grow via a strategy of organic growth supplemented by acquisitions that can leverage our existing business.

Mead C&OP Merger and Debt Refinancing

On November 17, 2011, we announced the signing of a definitive agreement to acquire the Mead Consumer and Office Products Business (“Mead C&OP”). On May 1, 2012, we completed the merger ("Merger") of Mead C&OP with a wholly-owned subsidiary of the Company. Mead C&OP is a leading manufacturer and marketer of school supplies, office products, and planning and organizing tools - including the Mead®, Five Star®, Trapper Keeper®, AT-A-GLANCE®, Cambridge®, Day Runner®, Hilroy, Tilibra and Grafons brands in the U.S., Canada and Brazil.

In the Merger, MeadWestvaco Corporation (“MWV”) shareholders received 57.1 million shares of the Company's common stock, or 50.5% of the combined company, valued at $602.3 million on the date of the Merger. After the transaction was completed we had 113.1 million common shares outstanding.

Under the terms of the Merger agreement, MWV established a new subsidiary (“Monaco SpinCo Inc.”) to which it conveyed Mead C&OP in return for a $460.0 million payment. The shares of Monaco SpinCo Inc. were then distributed to MWV's shareholders

22

as a dividend. Immediately after the spin-off and distribution, a newly formed subsidiary of the Company merged with and into Monaco SpinCo Inc. and MWV shareholders effectively received in the stock dividend and subsequent conversion approximately one share of ACCO Brands common stock for every three shares of MWV they held. Fractional shares were paid in cash. The subsidiary company subsequently merged with Mead Products LLC (“Mead Products”), the surviving corporate entity, which is a wholly-owned subsidiary of ACCO Brands Corporation.

As of December 31, 2012, $30.5 million has been received back from MWV through working capital adjustments to the purchase price.

For accounting purposes, the Company was the acquiring enterprise. The Merger was accounted for as a purchase business combination. Accordingly, the results of Mead C&OP are included in the Company's consolidated financial statements from the date of the Merger. In connection with this transaction, in the years ended December 31, 2012 and 2011, we incurred expenses of $22.9 million and $5.6 million, respectively, related to the transaction, including integration costs.

On May 1, 2012, we entered into a refinancing in conjunction with the Merger. The refinancing transactions reduced our effective interest rate while increasing our borrowing capacity and extending the maturities of our credit facilities.

The new credit facilities and notes are as follows:

$250 million of U.S. Dollar Senior Secured Revolving Credit Facilities due May 2017

$285 million of U.S. Dollar Senior Secured Term Loan A due May 2017

C$34.5 million of Canadian Dollar Senior Secured Term Loan A due May 2017

$450 million of U.S. Dollar Senior Secured Term Loan B due May 2019

$500 million of U.S. Dollar Senior Unsecured Notes due May 2020

Interest rates under the senior secured term loans are based on the London Interbank Offered Rate (LIBOR). The range of borrowing costs under the pricing grid is LIBOR plus 3.00% for the Term A loans and LIBOR plus 3.25% with a LIBOR rate floor of 1.00% for the Term B loans. The senior secured credit facilities had a weighted average interest rate of 3.89% as of December 31, 2012 and the senior unsecured notes have an interest rate of 6.75%.

In addition, on May 1, 2012, we repurchased or discharged all of our outstanding senior secured notes of $425.1 million, due March 2015, for $464.7 million including a premium and related fees of $39.6 million. On May 4, 2012, we redeemed all of our outstanding senior subordinated notes of $246.3 million, due August 2015, for $252.6 million including a premium of $6.3 million. We also terminated our senior secured asset-based revolving credit facility of $175.0 million, which was undrawn as of May 1, 2012. Associated with these transactions were $15.5 million in write-offs for original issue discount and debt origination costs.

In conjunction with our refinancing, we paid $38.5 million in additional bank, legal and advisory fees associated with our new credit facilities. These fees were capitalized and will be amortized over the life of the credit facilities and senior unsecured notes.

During 2012, we voluntarily repaid $200.3 million of our debt comprising $64.2 million of our U.S. Dollar Senior Secured Term Loan A, $12.9 million of our Canadian Dollar Senior Secured Term Loan A and $123.2 million of our U.S. Dollar Senior Secured Term Loan B.

As part of the inclusion of Mead C&OP 's financial results with those of the Company, certain information technology costs associated with the manufacturing and distribution operations have been actively engagedreclassified from advertising, selling, general and administrative expenses (SG&A) to cost of products sold. This reclassification was done to enable the financial results of the two businesses to be consistent and to better reflect those costs associated with the cost of products sold. All prior periods have been reclassified to make the results comparable. For the years ended December 31, 2011 and 2010 reclassified costs totaled $15.5 million and $14.6 million, respectively. These historical reclassifications have had no effect on net income.

Discontinued Operations

As of May 31, 2011, we disposed of the GBC Fordigraph Pty Ltd (“GBC Fordigraph”) business. The Australia-based business was formerly part of the ACCO Brands International segment and the results of operations are included in the financial statements as a discontinued operation for all periods presented. GBC Fordigraph represented $45.9 million in annual net sales for the year ended December 31, 2010. In 2011, we received net proceeds of $52.9 million and recorded a gain on the sale of $41.9 million ($36.8 million after-tax).

23

For further information on the Company’s discontinued operations see Note 19, Discontinued Operations, to the consolidated financial statements contained in Item 8 of this report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with the consolidated financial statements of ACCO Brands Corporation and the accompanying notes contained therein. Unless otherwise noted, the following discussion pertains only to our continuing operations.

Adjustments Subsequent to the Earnings Release Filed on Form 8-K on February 13, 2013

On February 21, 2013, in connection with completing our 2012 audited financial statements for filing in this report, we determined that the Company should record a reserve in the amount of $44.5 million in consideration of a contingent liability related to a tax assessment issued in December 2012 by the Federal Revenue Department of the Ministry of Finance of Brazil against the Company's newly acquired indirect subsidiary, Tilibra Produtos de Papelaria Ltda. ("Tilibra"). Of the total reserve recorded, $43.3 million was an adjustment to the allocation of the purchase price for the fair value of non-current liabilities assumed as of the acquisition date and was recorded as an increase to goodwill and the remaining $1.2 million was charged to current income tax expense and represents additional interest that has accumulated since the date of the acquisition. One additional revision resulted in a reduction of both deferred tax liabilities and goodwill of $9.9 million. These adjustments were recorded as the Company continues its process of finalizing the purchase price allocation for the Merger. For further information see Note 3, Acquisitions, to the consolidated financial statements contained in Item 8 of this report.

The Company also recorded an additional tax expense of $2.9 million reflecting an adjustment to the deferred tax expense to reflect a change in certain tax rates for which deferred taxes have previously been provided in other comprehensive income (loss).

The net effect of these changes was to reduce the Company's previously reported net income for the twelve months ended December 31, 2012 as included on the Form 8-K filed on February 13, 2013 by $4.1 million to $115.4 million, reduce earnings per diluted share by $0.04 to $1.20 per diluted share and increase our previously reported net loss for the three months ended December 31, 2012 by $4.1 million to $16.6 million or by $0.04 per diluted share to $0.15 loss per diluted share. There was no change to the amount of pretax income previously reported.

Overview of Company Performance

ACCO Brands’ results are dependent upon a number of factors affecting sales, including pricing and competition. Historically, key drivers of demand in the office and school products industries have included trends in white collar employment levels, enrollment levels in education, gross domestic product (GDP) and growth in the number of small businesses and home offices together with usage of personal computers. Pricing and demand levels for office products have also reflected a substantial consolidation within the global resellers of office products. This consolidation has led to multiple years of industry pricing pressure and a more efficient level of asset utilization by customers, resulting in lower sales pricing and volume for suppliers of office products. In February 2013, two of our largest customers, Office Depot and Office Max, announced that they have entered into a merger agreement. While management currently expects that the effects on our business of the proposed merger, if consummated, would be realized primarily in our retail channel, which only represents approximately one-third of our business with these customers, there can be no assurance that the combination of these two large customers will not adversely affect our business and results of operations. See “Risk Factors - Our customers may further consolidate, which could adversely impact our margins and sales."

With 45% of revenues for the year ended December 31, 2012 arising from foreign operations, exchange rate fluctuations can play a major role in our reported results. Foreign currency fluctuations impact the business in two ways: 1) the translation of our foreign operations results into U.S. dollars: a weak U.S. dollar benefits us and a strong U.S. dollar reduces the dollar-denominated contribution from foreign operations; and 2) the impact of foreign currency fluctuations on cost of goods sold. Approximately half of the products we sell worldwide are sourced from Asia, and are paid for in U.S. dollars. However, our international operations sell in their local currency and are exposed to their domestic currency movements against the U.S. dollar. A strong U.S. dollar, therefore, increases our cost of goods sold and a weak U.S. dollar decreases our cost of goods sold for our international operations.

We respond to these market changes by adjusting selling prices, but this response can be difficult during periods of rapid fluctuation. A significant portion of our foreign-currency cost of goods purchases is hedged with forward foreign currency contracts, which delays the economic effect of a fluctuating U.S. dollar helping us align our market pricing. The financial impact on our business from foreign exchange movements for our cost of goods is also further delayed until the inventory is sold. Foreign exchange exposures impact the business at different times: the translation of results is impacted immediately when the exchange

24

rates move, whereas the impact on cost of goods is typically delayed due to a combination of currency hedging strategies and our inventory cycle.

The cost of certain commodities used to make products increased significantly, during 2011, negatively impacting cost of goods, mainly for products sold in the second half of the year. We implemented price increases in the first and third quarters of 2011 to offset these cost increases. As commodity costs continued to rise, in the first quarter of 2012, we implemented price increases in a limited number of markets in an effort to further offset increases in commodity costs. We continue to monitor commodity costs and work with suppliers and customers to negotiate balanced and fair pricing that best reflects the current economic environment.

During the first quarter of 2012, we committed to new cost savings plans intended to improve the efficiency and effectiveness of our businesses. The cost savings activities are principally in the U.S. and the U.K. We believe these actions will benefit our efforts to improve profitability and enhance shareholder value. These actions are expected to result in approximately $8 million in annualized cost savings when fully realized. In connection with these actions, we incurred pretax charges, principally employee termination and severance costs, of approximately $7 million in 2012, substantially all of which were recorded in the six months ending June 30, 2012. Cash costs related to these charges, net of asset sale proceeds, are expected to be approximately $5 million, which we substantially recovered in savings in the second half of 2012. During the year ended December 31, 2012, we received proceeds of $2.7 million related to the sale of a facility in the U.K.

The actions described in the preceding paragraph were independent of and not a part of any plan of integration related to our acquisition of Mead C&OP.

In the second quarter of 2012, we committed to cost savings plans largely related to the consolidation and integration of Mead C&OP. The largest plan, which is expected to result in employee severance charges of approximately $11 million, is related to our dated goods business and involves closing a facility in East Texas, Pennsylvania during March 2013 and relocating its activities. We expect to realize cash savings equal to the cash cost by the end of 2014. The East Texas facility is owned by us and will be marketed for sale. However, current real estate market conditions make a future sale date uncertain and therefore the foregoing estimates do not reflect potential cash sale proceeds from the sale of the facility. The remaining plans are primarily related to eliminating duplication in the management advertising, selling, general and administrative structures in the U.S. and Canada. Between now and the fourth quarter of 2013, we anticipate additional restructuring charges of approximately $25 million, of which approximately $4 million are non-cash charges. These charges relate to cost-reduction initiatives in the company's European and North American operations and are associated with the completion of the Mead integration and productivity initiatives. The cash component of the charge will approximate $15 million in 2013 and $6 million in 2014.

In the first quarter of 2011, we initiated plans to rationalize our European operations. The associated costs primarily related to employee terminations, which were accounted for as regular business expenses in selling, general and administrative expenses and were primarily incurred in the first half of 2011. These were largely offset by associated savings realized in the second half of 2011. These costs totaled $4.5 million during the year ended December 31, 2011.

We fund our liquidity needs for capital investment, working capital and other financial commitments through cash flow from continuing operations and our $250.0 million senior secured revolving credit facility. Based on our borrowing base, as of December 31, 2012, $238.5 million remained available for borrowing under this facility.

During 2009, we determined that it was no longer more likely than not that our U.S. deferred tax assets would be realized, and as a result, we recorded a non-cash charge of $108.1 million to establish a valuation allowance against our U.S. deferred tax assets. Due to the acquisition of Mead C&OP in the second quarter of 2012, we analyzed our need for maintaining valuation reserves against the expected U.S. future tax benefits. Based on our analysis we determined that there existed sufficient evidence in the form of future taxable income from the combined operations to release $126.1 million of the valuation allowance that had been previously recorded against the U.S. deferred income tax assets. The resulting deferred tax assets are comprised principally of net operating loss carry-forwards, that are expected to be fully realized within the expiration period and other temporary differences.

25

Fiscal 2012 versus Fiscal 2011

The following table presents the Company’s results for the years ended December 31, 2012 and 2011.

| Year Ended December 31, | Amount of Change | ||||||||||||||

| (in millions of dollars) | 2012 | 2011 | $ | % | |||||||||||

| Net sales | $ | 1,758.5 | $ | 1,318.4 | $ | 440.1 | 33 | % | |||||||

| Cost of products sold | 1,225.1 | 919.2 | 305.9 | 33 | % | ||||||||||

| Gross profit | 533.4 | 399.2 | 134.2 | 34 | % | ||||||||||

| Gross profit margin | 30.3 | % | 30.3 | % | 0.0 | pts | |||||||||

| Advertising, selling, general and administrative expenses | 349.9 | 278.4 | 71.5 | 26 | % | ||||||||||

| Amortization of intangibles | 19.9 | 6.3 | 13.6 | NM | |||||||||||

| Restructuring charges (income) | 24.3 | (0.7 | ) | 25.0 | NM | ||||||||||

| Operating income | 139.3 | 115.2 | 24.1 | 21 | % | ||||||||||

| Operating income margin | 7.9 | % | 8.7 | % | (0.8) | pts | |||||||||

| Interest expense, net | 89.3 | 77.2 | 12.1 | 16 | % | ||||||||||

| Equity in earnings of joint ventures | (6.9 | ) | (8.5 | ) | (1.6 | ) | (19 | )% | |||||||

| Other expense, net | 61.3 | 3.6 | 57.7 | NM | |||||||||||

| Income tax (benefit) expense | (121.4 | ) | 24.3 | (145.7 | ) | NM | |||||||||

| Effective tax rate | NM | 56.6 | % | NM | |||||||||||

| Income from continuing operations | 117.0 | 18.6 | 98.4 | NM | |||||||||||

| Income (loss) from discontinued operations, net of income taxes | (1.6 | ) | 38.1 | (39.7 | ) | (104 | )% | ||||||||

| Net income | 115.4 | 56.7 | 58.7 | NM | |||||||||||

Net Sales

Net sales increased$440.1 million, or 33%, to $1.76 billion compared to $1.32 billion in the prior-year period. The acquisition of Mead C&OP contributed sales of $551.5 million. The underlying decline of $111.4 million includes an unfavorable currency translation of $17.1 million, or 1%. The remaining decline of $94.3 million, or 7%, occurred primarily in the International and North America business segments.

International segment sales declined $61 million (excluding the effect of Mead C&OP and currency translation) of which the decline in the European business accounted for $56 million. Approximately $32 million of the European decline was due to the Company's decision to re-focus on more profitable business; the remainder of the European decline was due to the weak economic environment. Australia also experienced weak consumer demand and lower price points.

North American segment sales declined $27 million (excluding the effect of Mead C&OP and currency translation). Approximately half of the sales decline was in the direct channel, which services large U.S. print finishing customers, with the remainder mainly from lower Canadian sales and declines in the calendar business.

Cost of Products Sold

Cost of products sold includes all manufacturing, product sourcing and distribution costs, including depreciation related to assets used in the manufacturing, procurement and distribution process, allocation of certain information technology costs supporting those processes, inbound and outbound freight, shipping and handling costs, purchasing costs associated with materials and packaging used in the production processes. Cost of products sold increased $305.9 million, or 33%, to $1.23 billion. The acquisition of Mead C&OP contributed $355.8 million, which includes $13.3 million in amortization of the acquisition step-up in inventory value. Excluding the impact of Mead C&OP acquisition, the principal drivers of the underlying decline of $49.9 million were lower sales volumes and a $12.1 million impact of favorable currency translation.

As part of the inclusion of Mead C&OP's financial results with those of the Company, certain information technology costs associated with the manufacturing and distribution operations have been reclassified from advertising, selling, general and administrative expenses to cost of products sold. This reclassification was done to enable the financial results of the two businesses to be consistent and to better reflect those costs associated with the cost of products sold. All prior periods have been reclassified

26

to make the results comparable. For the year ended December 31, 2011, reclassified costs totaled $15.5 million. These historical reclassifications were not material and had no effect on net income.

Gross Profit

Management believes that gross profit and gross profit margin provide enhanced shareholder understanding of underlying profit drivers. Gross profit increased $134.2 million, or 34%, to $533.4 million. The acquisition of Mead C&OP contributed $195.7 million, which includes a $13.3 million charge for the acquisition step-up in inventory value. The principal drivers of the underlying decline of $61.5 million were lower sales volumes and a $5.0 million impact of unfavorable currency translation. Gross profit margin was unchanged at 30.3%. The inclusion of Mead C&OP, which has a mix of relatively higher margin products, was offset by an adverse sales mix in the legacy ACCO Brands businesses and the charge for the acquisition step-up in inventory value.

SG&A (Advertising, selling, general and administrative expenses)

Advertising, selling, general and administrative expenses (SG&A) include advertising, marketing, selling (including commissions), research and development, customer service, depreciation related to assets outside the manufacturing and distribution processes and all other general and administrative expenses outside the manufacturing and distribution functions (e.g., finance, human resources, etc.). SG&A increased $71.5 million, or 26%, to $349.9 million, and as a percentage of sales, SG&A decreased to 19.9% from 21.1% in the prior-year period. The acquisition of Mead C&OP contributed $77.9 million of the increase. The underlying decrease of $6.4 million was driven by savings in the North America and International business segments and the absence of $4.5 million of business rationalization charges within our European operations incurred during 2011 as well as favorable currency translation of $2.6 million, partially offset by $22.9 million in transaction and integration costs associated with the acquisition of Mead C&OP.

Restructuring Charges

Employee termination and severance charges included in restructuring charges primarily relate to our plans for integration with Mead C&OP that were initiated in the second quarter of 2012. These charges were $24.3 million in the current year period compared to income of $0.7 million in the prior-year period due to the release of reserves related to prior projects no longer required. The current year period charges primarily relate to consolidation and integration of the recently acquired Mead C&OP business, but also include certain cost savings plans that are expected to improve the efficiency and effectiveness of our U.S. and European businesses.

Operating Income

Operating income increased$24.1 million, or 21%, to $139.3 million and as a percentage of sales operating income declined to 7.9% from 8.7%. The acquisition of Mead C&OP increased operating income by $101.2 million. The underlying decline of $77.1 million was driven by $24.3 million in restructuring costs, $22.9 million in transaction and integration costs associated with the acquisition of Mead C&OP, a $13.3 million charge for the acquisition step-up in inventory value, lower sales volume in the legacy ACCO Brands businesses and unfavorable currency translation of $2.2 million. Savings in the North America and International business segments and the absence of $4.5 million of business rationalization charges within our European operations incurred during 2011 partially offset the underlying decline.

Interest Expense, Net, Equity in Earnings of Joint Ventures and Other Expense, Net

Interest expense was $89.3 million compared to $77.2 million in the prior-year period. The increase was due to merger-related expenses for the committed financing required for the Merger of $16.4 million and accelerated amortization of debt origination costs of $3.6 million. The underlying decrease was due to our refinancing completed in May 2012 which substantially lowered our effective interest rate. Also, 2011 includes $1.2 million of accelerated amortization of debt origination costs resulting from debt repayments in the third quarter of 2011.

Equity in earnings of joint ventures was income of $6.9 million compared to $8.5 million in the prior-year period. During the fourth quarter of 2012 we took an impairment charge of $1.9 million related our Neschen GBC Graphics Films, LLC ("Neschen")joint venture. The Company has committed at the end of 2012 to pursue an exit strategy with regards to Neschen, due to significant excess capacity and other opportunities to reduce our costs of products sourced from Neschen.

Other expense, net, was $61.3 million compared to expense of $3.6 million in the prior year period. The significant increase was due to the refinancing of our debt in May 2012. The Company repurchased or discharged all of its outstanding Senior Secured Notes of $425.1 million, due March 2015, for $464.7 million including a premium and related fees of $39.6 million, and redeemed

27

all of its outstanding Senior Subordinated Notes of $246.3 million, due August 2015, for $252.6 million including a premium of $6.3 million. The increase was also due to the write-off of debt origination costs of $15.5 million related to the refinanced debt. In the prior year we paid $3.0 million in premiums on the repurchase of $34.9 million of our Senior Secured Notes.

Income Taxes

Income tax benefit from continuing operations was $121.4 million on a loss before taxes of $4.4 million compared to an income tax expense from continuing operations of $24.3 million on income before taxes of $42.9 million in the prior-year period. The tax benefit for 2012 is primarily due to the release of certain valuation allowances for the U.S. of $126.1 million and certain foreign jurisdictions in the amount of $19.0 million. The high effective tax rate for 2011 of 56.6% is due to no tax benefit being provided on losses incurred in the U.S. and certain foreign jurisdictions where valuation reserves are recorded against future tax benefits. For a further discussion of income taxes and the release of the valuation allowances see Note 11 Income Taxes, to the consolidated financial statements contained in Item 8 of this report.

Income from Continuing Operations

Income from continuing operations was $117.0 million, or $1.22 per diluted share, compared to income of $18.6 million, or $0.32 per diluted share in the prior-year.

Income (loss) from Discontinued Operations

Loss from discontinued operations was $1.6 million, or $0.02 per diluted share, compared to income of $38.1 million, or $0.66 per diluted share in the prior-year.

Discontinued operations include the results of GBC Fordigraph, which was sold during the second quarter of 2011, and the commercial print finishing business, which was sold during 2009. For a further discussion of discontinued operations see Note 19, Discontinued Operations, to the consolidated financial statements contained in Item 8 of this report.

The components of discontinued operations for the years ended December 31, 2012 and 2011 are as follows:

| (in millions of dollars) | 2012 | 2011 | |||||

| Income from operations before income taxes | $ | — | $ | 2.5 | |||

| Gain (loss) on sale before income taxes | (2.1 | ) | 41.5 | ||||

| Provision (benefit) for income taxes | (0.5 | ) | 5.9 | ||||

| Income (loss) from discontinued operations | $ | (1.6 | ) | $ | 38.1 | ||

Net Income

Net income was $115.4 million, or $1.20 per diluted share, compared to net income of $56.7 million, or $0.98 per diluted share, in the prior year.

28

Segment Discussion

| Year Ended December 31, 2012 | Amount of Change | |||||||||||||||||||||||||||||

| Net Sales | Segment Operating Income (A) | Operating Income Margin | Adjusted Charges (B) | Net Sales | Net Sales | Segment Operating Income | Segment Operating Income | Margin Points | ||||||||||||||||||||||

| (in millions of dollars) | $ | % | $ | % | ||||||||||||||||||||||||||

| ACCO Brands North America | $ | 1,028.2 | $ | 86.2 | 8.4 | % | $ | 37.2 | $ | 405.1 | 65% | $ | 48.8 | 130 | % | 240 | ||||||||||||||

| ACCO Brands International | 551.2 | 62.0 | 11.2 | % | 5.2 | 46.2 | 9% | 3.1 | 5 | % | (50 | ) | ||||||||||||||||||

| Computer Products Group | 179.1 | 35.9 | 20.0 | % | 0.3 | (11.2 | ) | (6)% | (11.2 | ) | (24 | )% | (480 | ) | ||||||||||||||||

| Total segment sales | $ | 1,758.5 | $ | 184.1 | $ | 440.1 | $ | 40.7 | ||||||||||||||||||||||

| Year Ended December 31, 2011 | ||||||||||||||||||||||||||||||

| Net Sales | Segment Operating Income (A) | Operating Income Margin | Adjusted Charges (B) | |||||||||||||||||||||||||||

| (in millions of dollars) | ||||||||||||||||||||||||||||||

| ACCO Brands North America | $ | 623.1 | $ | 37.4 | 6.0 | % | $ | — | ||||||||||||||||||||||

| ACCO Brands International | 505.0 | 58.9 | 11.7 | % | — | |||||||||||||||||||||||||

| Computer Products Group | 190.3 | 47.1 | 24.8 | % | — | |||||||||||||||||||||||||

| Total segment operating income | $ | 1,318.4 | $ | 143.4 | ||||||||||||||||||||||||||

(A) Segment operating income excludes corporate costs; Interest expense, net; Equity in earnings of joint ventures and Other expense, net. See Note 16, Information on Business Segments, to the consolidated financial statements contained in Item 8 of this report for a reconciliation of total segment operating income to income from continuing operations before income taxes.

(B) Adjusted charges include restructuring charges for 2012 and non-recurring charges related to the Merger.

ACCO Brands North America

ACCO Brands North America net sales increased $405.1 million, or 65%, to $1.03 billion, compared to $623.1 million in the prior-year period. The acquisition of Mead C&OP contributed sales of $432.6 million. The remaining decline of $27.5 million includes an unfavorable currency translation of $0.9 million. The comparable decline (exclusive of currency translation) of $26.6 million, or 4%, occurred in the legacy ACCO Brands U.S. and Canadian businesses due to lower demand from large print finishing customers, weak demand including lower customer inventories and declines in the calendar business.

ACCO Brands North Americas operating income increased $48.8 million, or 130%, to $86.2 million, and operating income margin increased to 8.4% from 6.0% in the prior-year period. The acquisition of Mead C&OP contributed $81.4 million, net of other charges consisting of $11.5 millionin amortization of the acquisition step-up in inventory value and $2.2 million of restructuring charges. The underlying decrease of $32.6 million was driven by $23.5 million of other charges, consisting of $18.4 million of restructuring charges, $5.1 million of integration charges, as well as, lower sales and unfavorable product mix (higher sales of low-margin products). This was partially offset by savings within SG&A.

ACCO Brands International

ACCO Brands International net sales increased $46.2 million, or 9%, to $551.2 million compared to $505.0 million in the prior-year period. The acquisition of Mead C&OP contributed sales of $118.9 million. The remaining decline of $72.7 million includes an unfavorable currency translation of $11.9 million, or 2%. The comparable decline (exclusive of currency translation) was $60.8 million, or 12%. Of this decline, Europe accounted for $56 million - of which approximately $32 million was anticipated from our previously announced plans to restructure the business and focus on more profitable products, channels and/or geographic markets. The remaining $24 million in European sales decline together with an $11 million decline in our Australian sales was due to weak consumer demand, lower pricing, customer focus on lower-price-point items and share loss to our customers' directly sourced opening price point items. We achieved some modest growth in the legacy Latin American business that partially offset the declines noted above.

ACCO Brands International operating income increased $3.1 million, or 5%, to $62.0 million, and operating income margin decreased to 11.2% from 11.7% in the prior-year period. The acquisition of Mead C&OP contributed $19.8 million, net of other

29

charges consisting of $1.8 million in amortization of the acquisition step-up in inventory value. Europe also incurred $3.4 million in restructuring charges, primarily during the first quarter of 2012. The remaining decrease of $13.3 million in operating income was primarily driven by lower sales volume and pricing in Australia. The European business largely offset its substantial top-line decline through cost reductions.

Computer Products Group

Computer Products net sales decreased $11.2 million, or 6%, to $179.1 million compared to $190.3 million in the prior-year period. Unfavorable foreign currency translation decreased sales by $4.3 million, or 2%. The remaining decrease primarily reflects lower net pricing due to promotions and the loss of $3.2 million in royalty income. Volume increased slightly as sales of new products for smartphones and tablets offset lower sales of PC accessories, including high-margin PC security products.

Operating income decreased $11.2 million, or 24%, to $35.9 million, and operating margin decreased to 20.0% from 24.8%. The decrease was primarily due to lower pricing, loss of royalty income and unfavorable product mix, impacted by the lower security product volume as noted above.

Fiscal 2011 versus Fiscal 2010

The following table presents the Company’s results for the years ended December 31, 2011, and 2010.

| Year Ended December 31, | Amount of Change | ||||||||||||||

| (in millions of dollars) | 2011 | 2010 | $ | % | |||||||||||

| Net sales | $ | 1,318.4 | $ | 1,284.6 | $ | 33.8 | 3 | % | |||||||

| Cost of products sold | 919.2 | 902.0 | 17.2 | 2 | % | ||||||||||

| Gross profit | 399.2 | 382.6 | 16.6 | 4 | % | ||||||||||

| Gross profit margin | 30.3 | % | 29.8 | % | 0.5 | pts | |||||||||

| Advertising, selling, general and administrative expenses | 278.4 | 266.7 | 11.7 | 4 | % | ||||||||||

| Amortization of intangibles | 6.3 | 6.7 | (0.4 | ) | (6 | )% | |||||||||

| Restructuring income | (0.7 | ) | (0.5 | ) | (0.2 | ) | (40 | )% | |||||||

| Operating income | 115.2 | 109.7 | 5.5 | 5 | % | ||||||||||

| Operating income margin | 8.7 | % | 8.5 | % | 0.2 | pts | |||||||||

| Interest expense, net | 77.2 | 78.3 | (1.1 | ) | (1 | )% | |||||||||

| Equity in earnings of joint ventures | (8.5 | ) | (8.3 | ) | 0.2 | 2 | % | ||||||||

| Other expense, net | 3.6 | 1.2 | 2.4 | 200 | % | ||||||||||

| Income tax expense | 24.3 | 30.7 | (6.4 | ) | (21 | )% | |||||||||

| Effective tax rate | 56.6 | % | 79.7 | % | NM | ||||||||||

| Income from continuing operations | 18.6 | 7.8 | 10.8 | NM | |||||||||||

| Income from discontinued operations, net of income taxes | 38.1 | 4.6 | 33.5 | 728 | % | ||||||||||

| Net income | 56.7 | 12.4 | 44.3 | NM | |||||||||||

Net Sales

Net sales increased $33.8 million, or 3%, to $1.32 billion, primarily due to translation gains from the U.S. dollar weakening relative to the prior-year period, which favorably impacted sales by $39.8 million, or 3%. Underlying sales declined modestly as lower volume in the International and Americas segments were partially offset by higher pricing and volumes gains in the Computer Products segment.

Cost of Products Sold

Cost of products sold includes all manufacturing, product sourcing and distribution costs, including depreciation related to assets used in the manufacturing, procurement and distribution process, allocation of certain information technology costs supporting those processes, inbound and outbound freight, shipping and handling costs, purchasing costs associated with materials and packaging used in the production processes. Cost of products sold increased $17.2 million, or 2% to $919.2 million. The

30

increase reflects the impact of unfavorable currency translation of $25.8 million as well as higher commodity and fuel costs, which were partially offset by lower sales volume and improved manufacturing, freight and distribution efficiencies.

As part of the inclusion of Mead C&OP's financial results with those of the Company, certain information technology costs associated with the manufacturing and distribution operations have been reclassified from advertising, selling, general and administrative expenses to cost of products sold. This reclassification was done to enable the financial results of the two businesses to be consistent and to better reflect those costs associated with the cost of products sold. All prior periods have been reclassified to make the results comparable. For the years ended December 31, 2011 and 2010, reclassified costs totaled $15.5 million and $14.6 million, respectively. These historical reclassifications were not material and had no effect on net income.

Gross Profit

Management believes that gross profit and gross profit margin provide enhanced shareholder appreciation of underlying profit drivers. Gross profit increased $16.6 million, or 4%, to $399.2 million. The increase in gross profit was primarily due to the benefit from favorable currency translation of $14.0 million. Gross profit margin increased to 30.3% from 29.8%, primarily due to improved freight and distribution efficiencies, particularly in Europe.

SG&A (Advertising, selling, general and administrative expenses)

SG&A expenses include advertising, marketing, selling (including commissions), research and development, customer service, depreciation related to assets outside the manufacturing and distribution processes and all other general and administrative expenses outside the manufacturing and distribution functions (e.g., finance, human resources, etc.). SG&A increased $11.7 million, or 4%, to $278.4 million, of which currency translation contributed $6.8 million of the increase. SG&A as a percentage of sales increased to 21.1% from 20.8% . This increase was due to $5.6 million in costs associated with the pending acquisition of Mead C&OP. Business rationalization charges of $4.5 million, primarily incurred in the first quarter of 2011, were offset by savings during the rest of the 2011.

Operating Income

Operating income increased $5.5 million, or 5%, to $115.2 million, and as a percentage of sales, operating income increased modestly to 8.7% from 8.5%. The increase in operating income was driven by $7.0 million of favorable currency translation and improved gross margins, partially offset by the SG&A cost increases described above.

Interest Expense, Net and Other Expense, Net

Interest expense was $77.2 million compared to $78.3 million in the prior-year. The decrease in interest was due to repurchases of our Senior Secured Notes and Senior Subordinated Notes totaling $34.9 million and $25.0 million, respectively, as well as lower borrowings under our revolving credit facility during the year. This reduction was partially offset by the acceleration of debt origination amortization costs resulting from bond repurchases of $1.2 million.

Other expense was $3.6 million compared to $1.2 million in the prior-year period. The increase was due to $3.0 million of premium paid on the repurchase of $34.9 million of the Senior Secured Notes, partially offset by lower foreign exchange losses in the current year.

Income Taxes

Income tax expense from continuing operations was $24.3 million on income before taxes of $42.9 million compared to an income tax expense from continuing operations of $30.7 million on income before taxes of $38.5 million in the prior year. The high effective tax rates for 2011 and 2010 are due to no tax benefit being provided on losses incurred in the U.S. and certain foreign jurisdictions where valuation reserves are recorded against future tax benefits. Included in the 2011 amount is a $2.8 million benefit from the reversal of a valuation reserve in the U.K. Included in the 2010 amount is an $8.6 million expense recorded to reflect the tax impact of foreign currency fluctuations on an intercompany debt obligation, partially offset by the benefit of a $2.8 million out-of-period adjustment to increase deferred tax assets of a non-U.S. subsidiary.

Income from Continuing Operations

Income from continuing operations was $18.6 million, or $0.32 per diluted share, compared to income of $7.8 million, or $0.14 per diluted share in the prior-year period.

31

Income from Discontinued Operations

Income from discontinued operations was $38.1 million, or $0.66 per diluted share, compared to income of $4.6 million, or $0.08 per diluted share in the prior-year period.

Discontinued operations include the results of GBC Fordigraph, which was sold during the second quarter of 2011, and the commercial print finishing business, which was sold during 2009. For a further discussion of discontinued operations see Note 19, Discontinued Operations, to the consolidated financial statements contained in Item 8 of this report.

The components of discontinued operations for the years ended December 31, 2011 and 2010 are as follows:

| (in millions of dollars) | 2011 | 2010 | |||||

| Income from operations before income tax | $ | 2.5 | $ | 6.6 | |||

| Gain (loss) on sale before income tax | 41.5 | (0.1 | ) | ||||

| Income tax expense | 5.9 | 1.9 | |||||

| Income from discontinued operations | $ | 38.1 | $ | 4.6 | |||

Net Income

Net income was $56.7 million, or $0.98 per diluted share, compared to net income of $12.4 million, or $0.22 per diluted share, in the prior-year period.

Segment Discussion

| Year Ended December 31, 2011 | Amount of Change | |||||||||||||||||||||||||

| Net Sales | Segment Operating Income (A) | Operating Income Margin | Net Sales | Net Sales | Segment Operating Income | Segment Operating Income | Margin Points | |||||||||||||||||||

| (in millions of dollars) | $ | % | $ | % | ||||||||||||||||||||||

| ACCO Brands North America | $ | 623.1 | $ | 37.4 | 6.0 | % | $ | (8.5 | ) | (1)% | $ | (6.8 | ) | (15 | )% | (100 | ) | |||||||||

| ACCO Brands International | 505.0 | 58.9 | 11.7 | % | 29.0 | 6% | 15.3 | 35 | % | 250 | ||||||||||||||||

| Computer Products Group | 190.3 | 47.1 | 24.8 | % | 13.3 | 8% | 4.1 | 10 | % | 50 | ||||||||||||||||

| Total segment sales | $ | 1,318.4 | $ | 143.4 | $ | 33.8 | $ | 12.6 | ||||||||||||||||||

| Year Ended December 31, 2010 | ||||||||||||||||||||||||||

| Net Sales | Segment Operating Income (A) | Operating Income Margin | ||||||||||||||||||||||||

| (in millions of dollars) | ||||||||||||||||||||||||||

| ACCO Brands North America | $ | 631.6 | $ | 44.2 | 7.0 | % | ||||||||||||||||||||

| ACCO Brands International | 476.0 | 43.6 | 9.2 | % | ||||||||||||||||||||||

| Computer Products Group | 177.0 | 43.0 | 24.3 | % | ||||||||||||||||||||||

| Total segment operating income | $ | 1,284.6 | $ | 130.8 | ||||||||||||||||||||||

(A) Segment operating income excludes corporate costs; Interest expense, net; Equity in earnings of joint ventures and Other expense, net. See Note 16, Information on Business Segments, to the consolidated financial statements contained in Item 8 of this report for a reconciliation of total segment operating income to income from continuing operations before income taxes.

ACCO Brands North America

ACCO Brands North America net sales decreased $8.5 million, or 1% to $623.1 million, compared to $631.6 million in the prior-year period. Foreign currency translation favorably impacted sales by $3.9 million. Sales volume declined 4%, primarily in the U.S. due to inventory management initiatives by certain customers. The decline was partially offset by higher pricing and increased volumes in Canada.

32

Operating income decreased $6.8 million, or 15%, to $37.4 million and included favorable foreign currency translation of $0.6 million. Operating income margin decreased to 6.0% from 7.0% in the prior-year period primarily due to the deleveraging of fixed costs due to lower sales volume.

ACCO Brands International

ACCO Brands International net sales increased $29.0 million, or 6%, to $505.0 million, compared to $476.0 million in the prior-year period. The increase was driven by foreign currency translation, which increased sales by $31.4 million, or 7%. Sales volume declined 3% due to weak European market demand, partially offset by European price increases and small volume gains in the Latin America and Asia-Pacific regions.

Operating income increased $15.3 million, or 35%, to $58.9 million, including a $4.9 million benefit from foreign currency translation. Operating income margin increased to 11.7% from 9.2%, mainly due to the substantial improvements in European operations, resulting from higher pricing, improved freight and distribution efficiencies, as well as SG&A savings. Included in the net SG&A savings were $4.5 million of business rationalization charges within Europe.

Computer Products Group

Computer Products net sales increased $13.3 million, or 8%, to $190.3 million. The favorable impact from foreign currency translation increased sales by $4.5 million, or 3%. The remainder of the increase primarily reflects volume gains from sales of new accessory products for smartphones and tablets.

Operating income increased $4.1 million, or 10%, to $47.1 million, resulting from a $1.5 million benefit from foreign currency translation, higher volume and lower SG&A expenses, partially offset by lower security product sales, which adversely impacted both margin and royalty income. Operating income margins increased to 24.8% from 24.3% primarily due to the favorable benefit from increased sales, partially offset by the adverse sales mix.

Liquidity and Capital Resources

Our primary liquidity needs are to service indebtedness, reduce our borrowing, fund capital expenditures and support working capital requirements. Our principal sources of liquidity are cash flows from operating activities, cash and cash equivalents held and seasonal borrowings under our senior secured revolving credit facility. We maintain adequate financing arrangements at market rates. Because of the seasonality of our business we typically carry greater cash balances in the first, second and third quarters of our fiscal year. Lower cash balances are typically carried during the fourth quarter due to the absorption of our Brazilian cash into working capital. Our Brazilian business is highly seasonal due to the combined impact of the back-to-school season coinciding with the calendar year-end in the fourth quarter. Due to various tax laws, it is costly to transfer short-term working capital in and out of Brazil. Our normal practice is therefore to hold seasonal cash requirements within Brazil, invested in Brazilian government securities. Our priority for all other cash flow use over the near term, after funding internal growth, is debt reduction, and investment in new products through both organic development and acquisitions.

Any available overseas cash, other than that held for working capital requirements in Brazil, is repatriated on a continuous basis. Undistributed earnings of foreign subsidiaries that are expected to be permanently reinvested and thus not available for repatriation, aggregate approximately $586 million and $517 million as of December 31, 2012 and 2011, respectively. If these amounts were distributed to the U.S., in the form of a dividend or otherwise, we would be subject to additional U.S. income taxes. Determination of the amount of unrecognized deferred income tax liabilities on these earnings is not practicable.

Refinancing Transactions

On May 1, 2012 we entered into a refinancing in conjunction with the Merger.

For further information on our refinancing see Introduction - Mead C&OP Merger and Debt Refinancing contained elsewhere in Item 7 of this report and Note 4, Long-term Debt and Short-term Borrowings, to the consolidated financial statements contained in Item 8 of this report.

Loan Covenants

We must meet certain restrictive financial covenants as defined under the senior secured credit facilities. The covenants become more restrictive over time and require us to maintain certain ratios related to consolidated leverage and consolidated interest coverage. We are also subject to certain customary restrictive covenants under the senior unsecured notes.

33

The table below sets forth the financial covenant ratio levels under the senior secured credit facilities:

Maximum Consolidated Leverage Ratio(1) | Minimum - Interest Coverage Ratio(2) | |||

| May 1, 2012 to December 31, 2012 | 4.50:1.00 | 3.00:1.00 | ||

| January 1, 2013 to December 31, 2013 | 4.25:1.00 | 3.00:1.00 | ||

| January 1, 2014 to December 31, 2014 | 4.00:1.00 | 3.25:1.00 | ||

| January 1, 2015 to December 31, 2015 | 3.75:1.00 | 3.25:1.00 | ||

| January 1, 2016 and thereafter | 3.50:1.00 | 3.50:1.00 | ||

| (1) | The leverage ratio is computed by dividing our net funded indebtedness by the cumulative four-quarter-trailing EBITDA, which excludes restructuring, transaction costs, integration and other charges up to certain limits as well as other adjustments defined under the senior secured credit facilities. |

| (2) | The interest coverage ratio for any period is the cumulative four-quarter-trailing EBITDA, for the Company, for such period, adjusted as provided in (1), divided by cash interest expense for the Company for such period and other adjustments, all as defined under the senior secured credit facilities. |

The senior secured credit facilities contain customary events of default, including payment defaults, breach of representations and warranties, covenant defaults, cross-defaults and cross-accelerations, certain bankruptcy or insolvency events, certain ERISA-related events, changes in control or ownership, and invalidity of any loan document.

The indenture governing the senior unsecured notes does not contain financial performance covenants. However, that indenture does contain covenants that limit, among other things, our ability and the ability of our restricted subsidiaries to:

incur additional indebtedness;

pay dividends on our capital stock or repurchase our capital stock;

enter into or permit to exist contractual limits on the ability of our subsidiaries to pay dividends to the Company;

enter into certain transactions with affiliates;

make investments;

create liens; and

sell certain assets or merge with or into other companies.

Certain of these covenants will be subject to suspension when and if the notes are rated at least “BBB–” by Standard & Poor’s or at least “Baa3” by Moody’s. Each of the covenants is subject to a number of important exceptions and qualifications.

See also Note 4, Long-term Debt and Short-term Borrowings, to the consolidated financial statements contained in Item 8 of this report.

Compliance with Loan Covenants

As of December 31, 2012 our Leverage Ratio was approximately 3.7 to 1 and the Interest Coverage was approximately 4.5 to 1. The amount available for borrowings under our revolving credit facilities was $238.5 million (allowing for $11.5 million of letters of credit outstanding on that date).

As of and for the period ended December 31, 2012, we were in compliance with all applicable loan covenants.

Guarantees and Security

Obligations under the senior secured credit facilities are guaranteed by certain of our existing and future domestic subsidiaries. In the case of the obligations of ACCO Brands Canada its Senior Secured Term Loan A is guaranteed by its future subsidiaries and by our other existing and future Canadian subsidiaries.

The senior unsecured notes are fully and unconditionally guaranteed, jointly and severally, on a senior unsecured basis by each of our existing and future domestic subsidiaries other than certain excluded subsidiaries. The senior unsecured notes and the related guarantees will rank equally in right of payment with all of the existing and future senior debt of the Company, Mead Products and the guarantors, senior in right of payment to all of the existing and future subordinated debt of the Company, Mead Products and the guarantors, and effectively subordinated to all of the existing and future secured indebtedness of the Company,

34

Mead Products and the guarantors to the extent of the value of the assets securing such indebtedness. The senior unsecured notes and the guarantees will be structurally subordinated to all existing and future liabilities, including trade payables, of each of the Company's and Mead Products’ subsidiaries that do not guarantee the notes.

Cash Flow

Fiscal 2012 versus Fiscal 2011

Cash Flow from Operating Activities

For the year ended December 31, 2012, cash used by operating activities was $7.5 million, compared to the cash provided in the prior-year period of $61.8 million. Net income for 2012 was $115.4 million, compared to $56.7 million in 2011. Non-cash and non-operating adjustments to net income on a pre-tax basis in 2012 totaled $106.6 million, compared to $10.0 million in 2011. The 2012 net adjustments were substantially higher than 2011, largely due to the inclusion of Mead C&OP in 2012 and the sale of GBC Fordigraph in 2011 which resulted in a pre-tax net gain of $41.9 million.

The operating cash outflow in 2012 of $7.5 million for the year ended December 31, 2012 was driven by the May 1, 2012 timing of the Merger with Mead C&OP, and only includes the cash flow from Mead C&OP since that date. The outflow includes cash payments of $16.1 million related to the transaction and $61.6 million related to the associated debt extinguishment and refinancing. This was largely offset by cash generated from operating profits. The use of cash for net working capital was $117.0 million in 2012, and reflects a large seasonal investment in working capital for the Mead C&OP business. The Mead business has a very seasonal cash flow pattern whereby strong sales during the fourth quarter result in substantial accounts receivable at the end of the year and strong cash collections during the early part of the following year. As a result, nearly all of the Mead annual net cash generation occurs during the first quarter. The use of cash for accounts payable reflects lower inventory purchases, primarily for Mead C&OP, due to the seasonally lower sales volume anticipated during the first quarter. Other significant cash payments in 2012 included interest payments of $79.3 million (excluding financing-related payments), income tax payments of $28.8 million and contributions to the Company's pension and defined benefit plans of $19.2 million.

The table below shows our cash flow from accounts receivable, inventories and accounts payable for the years ended December 31, 2012 and 2011, respectively:

| 2012 | 2011 | |||||||

| Accounts receivable | $ | (153.8 | ) | $ | 0.6 | |||

| Inventories | 61.8 | 5.4 | ||||||

| Accounts payable | (25.0 | ) | 16.8 | |||||

| Cash flow (used by)/provided by net working capital | $ | (117.0 | ) | $ | 22.8 | |||

Cash Flow from Investing Activities

Cash used by investing activities was $423.2 million for the year ended December 31, 2012 and reflects $397.5 million of net cash paid for Mead C&OP. For additional information, see Note 3, Acquisitions, to the consolidated financial statements contained in Item 8 of this report. Cash provided by investing activities in 2011 was $40.0 million and included proceeds from the sale of GBC Fordigraph of $53.6 million. Capital expenditures were $30.3 million and $13.5 million for the years ended December 31, 2012 and 2011, respectively. The increase in capital expenditures reflects the acquisition of Mead C&OP, as well as additional investments in information technology systems, including the cost of replacing the IT infrastructure previously supplied by Mead C&OP's former parent company. During 2012, the Company also received net proceeds of $3.1 million from the sale of assets, which included a manufacturing facility located in the United Kingdom. In addition, $1.5 million of net proceeds associated with the 2009 sale of the Company’s former commercial print finishing business were collected in 2012, while additional cash expenditures associated with the sale and exit of the business of approximately $2.4 million are anticipated during the Company2013 year.

Cash Flow from Financing Activities

Cash provided by financing activities for the year ended December 31, 2012 was $360.1 million, and its predecessor as employees (orincludes proceeds from new debt facilities of $1.27 billion, offset by repayments of the Company's extinguished and new debt facilities of $872.0 million and debt issuance payments of $38.5 million. Cash used by financing activities in 2011 was $63.1 million, primarily representing repayments of long-term debt.

35

Fiscal 2011 versus Fiscal 2010

Cash Flow from Operating Activities

For the year ended December 31, 2011, cash provided by operating activities was $61.8 million, compared to $54.9 million in the caseprior year. Net income for 2011 was $56.7 million, compared to $12.4 million in 2010. Non-cash and non-operating adjustments to net income on a pre-tax basis in 2011 totaled $10.0 million, compared to $46.2 million in 2010. The 2011 net adjustments were substantially lower than 2010, largely due to the sale of Mr. Rubin, as an employeeGBC Fordigraph which resulted in a pre-tax net gain of General Binding Corporation (“GBC”)$41.9 million.

The table below shows our cash flow from accounts receivable, inventories and accounts payable for the years ended December 31, 2011 and 2010, respectively:

| 2011 | 2010 | |||||||

| Accounts receivable | $ | 0.6 | $ | (18.5 | ) | |||

| Inventories | 5.4 | (9.8 | ) | |||||

| Accounts payable | 16.8 | 14.8 | ||||||

| Cash flow from net working capital | $ | 22.8 | $ | (13.5 | ) | |||

Operating cash flow in 2011 of $61.8 million was the result of the realization of income from operations and net working capital, partially offset by the use of cash to fund income tax and interest payments and contributions to our pension plans. Compared to the prior year, accounts receivable levels reflect improved customer collections and increased sales in the early part of the fourth quarter, which allowed us to its mergercollect more of our receivables before the end of the quarter. Inventory levels demonstrate improved supply chain management. Payments associated with the predecessor2010 annual incentive plan of approximately $9 million were made during the first quarter of 2011, compared to approximately $1 million in the prior year. Income tax payments were $27.7 million in 2011, compared to only $13.9 million in the 2010 period when we benefited from substantial refunds related to prior years and had lower operating profit. Interest payments of $71.9 million were slightly higher than the prior year, while contributions to our pension plans of $13.5 million were slightly less than payments made during the prior year. Payments associated with our wind-down of restructuring activities were $3.4 million, while European business rationalization activity resulted in payments of $4.2 million during 2011. In addition, the second half of 2011 included payments in pursuit of the CompanyMead C&OP acquisition of $4.8 million.

During the 2010 year, a recurring pattern of strong sales during the final month of each quarter lead to high quarter-end accounts receivable balances. In addition, inventory levels increased due to higher commodity costs and in August 2005)support of the sales growth anticipated during the first quarter of 2011.

Cash Flow from Investing Activities

Cash provided by investing activities was $40.0 million for the past fiveyear ended December 31, 2011 and cash used was $14.9 million for the year ended December 31, 2010. The sale of GBC Fordigraph during the second quarter of 2011 generated net proceeds of $52.9 million, and approximately $5.4 million of taxes associated with the sale were paid in 2012. We also received $0.6 million of net proceeds associated with the 2009 sale of our former commercial print finishing business. Capital expenditures were $13.5 million and $12.6 million for the periods ended December 31, 2011 and 2010, respectively. Additional cash payments of $1.4 million associated with the purchase of two minor product line acquisitions were also recognized during the first half of 2011.

Cash Flow from Financing Activities

Cash used by financing activities was $63.1 million and $0.1 million for the years ended December 31, 2011 and 2010, respectively. During 2011, principally during the third quarter, we repurchased $59.9 million of our Senior Subordinated Notes and Senior Secured Notes debt.

Capitalization

We had approximately 113.1 million common shares outstanding as of December 31, 2012.

36

Adequacy of Liquidity Sources

We are subject to credit risk relative to the ability of counterparties to meet their contractual payment obligations or the potential non-performance of counterparties to deliver contracted commodities or services at the contracted price. The impact of any global economic downturn and the ability of our suppliers and customers to access credit markets is also unpredictable, outside of our control and may create additional risks for us, both directly and indirectly. The inability of suppliers to access financing or the insolvency of one or more of our suppliers could lead to disruptions in our supply chain, which could adversely impact our sales and/or increase our costs. Our suppliers may require us to pay cash in advance or obtain letters of credit for their benefit as a condition to selling us their products and services. If one or more of our principal customers were to file for bankruptcy, our sales could be adversely impacted and our ability to collect outstanding accounts receivable from any such customer could be limited. Any of these risks and uncertainties could have a material adverse effect on our business, financial condition, results of operations or cash flows.