| (Mark One) | ||

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the fiscal year ended December 31, | ||

OR | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

Commission File No. 1-13906 | ||

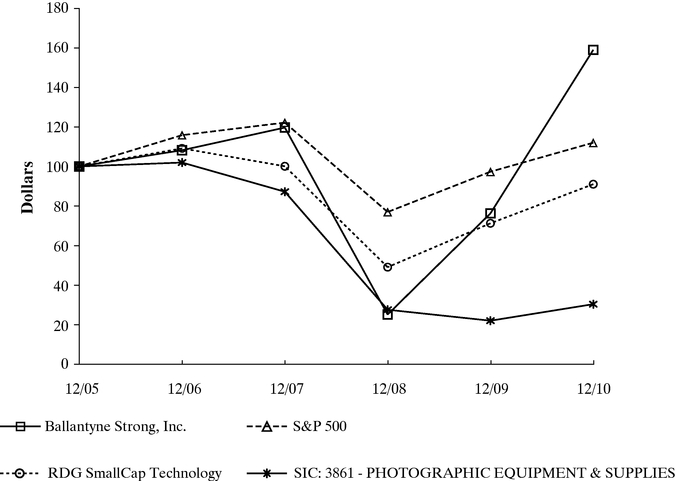

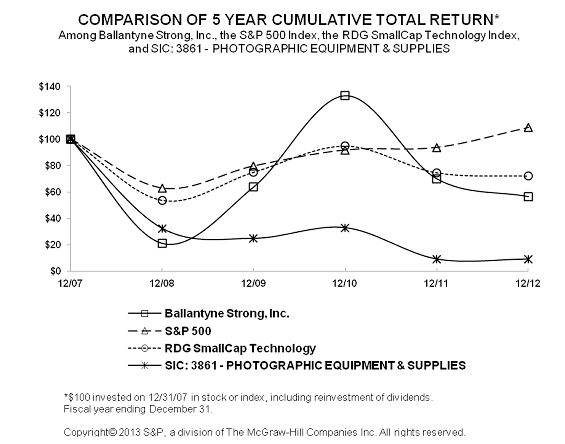

Item 1. Unresolved Staff Comments Item 2. Item 3. Legal Proceedings Item 4. PART II Item 5. Market for Item 6. Selected Financial Data Item 7. Item 7A. Quantitative and Qualitative Disclosures about Market Risk Item 8. Financial Statements and Supplementary Data Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Item 9A. Controls and Procedures Item 9B. Other Information PART III Item 10. Directors, Executive Officers and Corporate Governance Item 11. Executive Compensation Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Item 13. Certain Relationships and Related Transactions, and Director Independence Item 14. Principal Accounting Fees and Services PART IV Item 15. Exhibits, Financial Statement Schedules 2013. for digital menu boards and other digital signage on ad hoc, as-needed basis. We also offer long term contractual service packages for maintenance and repairs to a wide range of installed digital equipment for customers including equipment originally installed by our competitors. These long term service packages provide our Company with recurring revenue. Digital BARCO and can distribute NEC products in Hong Kong and certain other areas of Asia. We do not have any territorial restrictions for any of our other products and services. America. We also distribute their servers in certain other areas of the world under less formal arrangements. In addition, we distribute servers for other server manufacturers including those manufactured by Doremi. Digital servers and the related integrated media block are used by our customers for the storage and delivery of digital content. The significant accessories include, but are not limited to: 1) library management systems; 2) automation products; 3) pedestals; 4) 3D accessories; 5) lenses; and 6) lamps. We market and sell our products directly to end users Digital Equipment—The markets for our products in the theatre segment have been highly competitive during the analog-to-digital cinema conversion. The primary competitive factors are Under the trademark We sell our lighting products through a combination of a small direct sales force, dealer network and commissioned sales representatives to arenas, stadiums, theme parks, theatres, auditoriums, film and digital marketplace. a/k/a American West Beijing Trading Company, Ltd. is located in Beijing, China and is our sales and service We are one of the only screen manufacturers in the world with Silver Screen technologies capable of supporting RealD projections. We own or otherwise have rights to agreement. 2010. 2012. industry which result in continued exposure to Ballantyne. Company sells its products. December 31, 2012. We believe this facility is well maintained and adequate for future needs. The leases expire between August and December 2013. retaining occupancy of any leased facilities, either by renewing leases prior to expiration or replacing them with equivalent leased facilities. 4, 2013. Equity compensation plans approved by security holders Equity compensation plans not approved by security holders Total December 31, 2012. Ballantyne Strong, Inc. S&P 500 RDG SmallCap Technology SIC: 3861—PHOTOGRAPHIC EQUIPMENT & SUPPLIES Statement of operations data Net revenue Gross profit Net earnings (loss) Net earnings (loss) per share Basic Diluted Balance sheet data Working capital Total assets Total debt Stockholders' equity We are a manufacturer, distributor, integrator and service provider needs. Net revenue Cost of revenues Gross profit Selling and administrative expenses(1) Income (loss) from operations Net earnings (loss) 2010 Theatre Products Services Total theatre revenues Lighting Other Total net revenues 2010. being substantially completed. 2010 period. We sell screens for both digital cinema and film applications. In some instances, a screen can be used interchangeably with either a digital projector or a film projector. However, there are certain digital 3D applications such as the technology by RealD that require special projection equipment declined to $5.7 million from $10.9 million. 2010. historically carry strong margins. 2011. due to a favorable product mix. expense. dollar from year-to-year. income (losses)) was approximately 31.3% for 2011 and 31.9% certain Canadian tax credits. respectively. Borrowings available under the Credit Agreement were temporarily reduced to $19.6 million at December 31, 2012 due to outstanding standby letters of credit of $0.4 million. change is primarily due to a $13.7 million decrease in inventory and increases in customer deposits/deferred revenue and current income taxes payable partially offset by a $12.0 million increase in accounts, unbilled and notes receivables and increases in other current assets. Changes in receivables, inventory, unbilled revenue and customer deposits primarily resulted from the sale to a significant theatre customer recorded in the latter part of the third quarter of 2011. working capital used cash of Investing Activities our new corporate headquarters. share-based arrangements. share-based arrangements. 2010, respectively. 2012. Non-competition agreement Postretirement benefits Postretirement benefits Operating leases Operating leases Contractual cash obligations We have issued a July-08 November-08 November-08 January-09 April-09 September-09 October-09 March-10 March-10 March-10 March-10 seasonality. product returns. We currently have long-term notes receivables bearing interest rates of 15% which are recorded at fair value. A change in long-term interest rates for comparable types of instruments would have the effect of us recording changes in fair value through our statement of operations. Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets—December 31, Consolidated Statements of Operations—Years Ended December 31, Consolidated Statements of 30 Notes to Consolidated Financial Statements—Years Ended December 31, Financial Statement Schedule Supporting Consolidated Financial Statements Schedule II—Valuation and Qualifying Accounts Assets Current assets: Cash and cash equivalents Restricted cash Accounts receivable (less allowance for doubtful accounts of $306,133 in 2010 and $205,314 in 2009) Unbilled revenue Inventories, net Recoverable income taxes Deferred income taxes Consignment inventory Other current assets Total current assets Investment in joint venture Property, plant and equipment, net Intangible assets, net Other assets Deferred income taxes Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Other accrued expenses Customer deposits Income tax payable Total current liabilities Deferred income taxes Other accrued expenses, net of current portion Total liabilities Commitments and contingencies Stockholders' equity: Preferred stock, par value $.01 per share; Authorized 1,000,000 shares, none outstanding Common stock, par value $.01 per share; Authorized 25,000,000 shares; Additional paid-in capital Accumulated other comprehensive loss: Foreign currency translation Minimum pension liability Retained earnings Less 2,139,982 of common shares in treasury, at cost Total stockholders' equity Total liabilities and stockholders' equity Net revenues Cost of revenues Gross profit Selling and administrative expenses: Selling Administrative Goodwill impairment Total selling and administrative expenses Gain on transfer of assets Gain (loss) on sale or disposal of assets Income (loss) from operations Interest income Interest expense Equity in income (loss) of joint venture Other income (expense), net Earnings (loss) before income taxes Income tax benefit (expense) Net earnings (loss) Basic earnings (loss) per share Diluted earnings (loss) per share Weighted average shares outstanding: Basic Diluted Balance at December 31, 2007 Comprehensive Loss: Net loss Foreign currency translation Unrealized loss on investments in securities, net of tax Adjustment to minimum pension liability Comprehensive Loss Issuance of 123,625 shares of common stock upon exercise of stock options Issuance of 69,000 shares of common stock under the restricted stock plan Issuance of 19,642 shares of common stock under the employees stock purchase plan Stock Buyback Income tax benefit related to stock option plans Stock compensation expense Balance at December 31, 2008 Comprehensive Income: Net income Foreign currency translation Unrealized gain on investments in securities, net of tax Adjustment to minimum pension liability Comprehensive income Issuance of 99,615 shares of common stock under the restricted stock plans Issuance of 15,551 shares of common stock under the employees stock purchase plan Stock compensation expense Balance at December 31, 2009 Comprehensive Income: Net income Foreign currency translation Unrealized gain on investments in securities, net of tax Adjustment to minimum pension liability Comprehensive income Issuance of 105,875 shares of common stock upon exercise of stock options Issuance of 51,230 shares of common stock under the restricted stock plans Issuance of 12,359 shares of common stock under the employees stock purchase plan Income tax benefit related to stock option plans Stock compensation expense Balance at December 31, 2010 Cash flows from operating activities: Net earnings (loss) Adjustments to reconcile net earnings (loss) to net cash provided by operating activities: Provision for doubtful accounts Provision for obsolete inventory Provision for warranty Depreciation of other assets Depreciation of property, plant and equipment Amortization of intangibles Equity in (income) loss of joint venture Goodwill impairment Loss on forward contracts Loss (gain) on the sale of assets Loss (gain) on disposal of assets Deferred income taxes Share-based compensation expense Excess tax benefits from share-based arrangements Changes in assets and liabilities: Accounts receivable Unbilled revenue Inventories Consignment inventory Other current assets Accounts payable Other accrued expenses Customer deposits Current income taxes Other assets Net cash provided by operating activities Cash flows from investing activities: Acquisitions, net of cash acquired Investment in joint venture/return of investment Decrease in restricted investments Capital expenditures Proceeds from sale of assets Proceeds from sales of investments in securities Net cash provided by (used in) investing activities Cash flows from financing activities: Increase in checks outstanding in excess of bank balances Proceeds from employee stock purchase plan Payments under share repurchase program Proceeds from exercise of stock options Excess tax benefits from stock options exercised Net cash provided by financing activities Effect of exchange rate changes on cash and cash equivalents Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year per share amounts) Presentation product returns. The Company the notes receivables, based on ongoing monitoring of the counterparty’s financial position and results of operations. Digital and lighting equipment on consignment amounted to approximately $0.06 million and $0.5 million at December 31, 2012 and 2011, respectively. equipment over their fair value. Basic earnings (loss) per share: Earnings (loss) applicable to common stock Weighted average common shares outstanding Basic earnings (loss) per share Diluted earnings (loss) per share: Earnings (loss) applicable to common stock Weighted average common shares outstanding Assuming conversion of options and restricted stock awards outstanding Weighted average common shares outstanding, as adjusted Diluted earnings (loss) per share Warranty accrual at December 31, 2007 Charged to expense Amounts written off, net of recoveries Foreign currency translation adjustment Warranty accrual at December 31, 2008 Charged to expense Amounts written off, net of recoveries Foreign currency translation adjustment Warranty accrual at December 31, 2009 Charged to expense Amounts written off, net of recoveries Foreign currency translation adjustment Warranty accrual as of December 31, 2010 Comprehensive income (loss): Net income (loss) Other comprehensive income (loss): Unrealized gain (loss) on investment in securities Foreign currency translation adjustment Adjustment to minimum pension liability Total comprehensive income (loss) Current assets Non-current assets Current liabilities Non-current liabilities Equity Revenue Cost of sales Selling and administrative expenses Operating income (loss) Other expense Net income (loss) July-08 November-08 November-08 January-09 April-09 September-09 October-09 March-10 March-10 March-10 March-10 Raw materials and components Work in process Finished goods Land Buildings and improvements Machinery and equipment Office furniture and fixtures Total properties cost Less accumulated depreciation Net property, plant and equipment Intangible assets subject to amortization: Customer relationships Trademarks Non-competition agreement Total Intangible assets subject to amortization: Customer relationships Trademarks Non-competition agreement Intangible assets not subject to amortization: Trademark Total 2011 2012 2013 2014 2015 Employee related Interest and taxes Acquisition and related accruals Post-retirement benefit obligation Legal and professional fees Warranty obligation Other Total Acquisition and related accruals Post-retirement benefit obligation Other Total United States Foreign Current: Federal expense (benefit) State expense (benefit) Foreign expense Deferred: Federal expense (benefit) State expense (benefit) Foreign expense (benefit) Expected tax expense (benefit) State income taxes, net of federal effect Foreign tax rates varying from 34% Tax-exempt interest Non-deductible goodwill Other Deferred tax assets: Non-deductible accruals Inventory reserves Warranty reserves Net operating losses Uncollectible receivable reserves Accrued group health insurance claims AMT credit carry forward Stock compensation expense Depreciation and amortization Other Net deferred tax assets Deferred tax liability—equity in loss of joint venture Net deferred tax assets Cash paid during the year for: Interest Income taxes 2012. Options the options at the date of grant. The expected life of options is the average number of years the Company estimates that options will be outstanding. The Company considers groups of associates that have similar historical exercise behavior separately for valuation purposes. Outstanding at December 31, 2007 Granted Exercised Forfeited Outstanding at December 31, 2008 Granted Exercised Forfeited Outstanding at December 31, 2009 Granted Exercised Forfeited Outstanding at December 31, 2010 Exercisable at December 31, 2010 date indicated. $0.62 $4.25 $8.32 $0.62 to 8.32 2.8 years. 2.4 years. Nonvested at December 31, 2008 Granted Shares vested Shares forfeited Nonvested at December 31, 2009 Granted Shares vested Shares forfeited Nonvested at December 31, 2010 Risk-free interest rate Dividend yield Expected volatility Expected term (years) Estimated grant date fair value contracts to manage a portion of this risk. The Company has recorded expenses related to the Plan of approximately $0.6 million, The following table sets forth the Reconciliation of benefit obligation Benefit obligation at January 1 Interest cost Benefits paid, net of contributions Actuarial gain Benefit obligation at December 31 Fair value of plan assets at December 31 Funded status at end of year Amounts recognized in the balance sheet consist of: Noncurrent assets Current liabilities Noncurrent liabilities Accumulated other comprehensive income Net amount recognized Net actuarial gain Total accumulated other comprehensive income Interest cost Amortization of gain Net periodic benefit cost recognized was: Net actuarial gain (loss) Amortization of (gain) loss Total recognized in accumulated other comprehensive income Total recognized in net periodic benefit cost and accumulated other comprehensive income year is expected to be insignificant. Discount rate Rate of compensation increase Health care cost trend rate Discount rate Expected long-term rate of return on plan assets Rate of compensation increase Health care cost trend rate Effect on total service and interest cost components of periodic postretirement health care benefit cost Effect on the health care component of the accumulated postretirement benefit obligation For measurement purposes, a Benefit cost Employer contribution Plan participants' contributions Benefits paid The Company expects to contribute 2013. 2011 2012 2013 2014 2015 2016 - 2020 service, if any. Operating leases Net revenue Theatre Products Services Total theatre Lighting Other Total revenue Operating income (loss) Theatre Products Services Total theatre Lighting Other Total segment operating income Unallocated general and administrative expenses Gain on disposal or transfer of assets Interest, net Equity in loss of joint venture Other income (loss) Income (loss) before income taxes Expenditures on capital equipment Theatre Products Services Total theatre Lighting Total Depreciation, amortization and impairment Theatre Products Services Total theatre Lighting Total Gain (loss) on disposal of long-lived assets Theatre Products Services Total theatre Lighting Other Total Identifiable assets Theatre Products Services Total theatre Lighting Total Summary by Geographical Area Net revenue United States Canada China Asia (excluding China) Mexico South America Europe Other Total Identifiable assets United States China Asia (excluding China) Canada Total 2010: Net revenue Gross profit Net earnings Basic and diluted earnings per share: Basic(2) Diluted(2) Stock price: High Low 2009: Net revenue Gross profit Net earnings(1) Basic and diluted earnings per share: Basic(2) Diluted(2) Stock price: High Low Allowance for doubtful accounts and notes Year ended December 31, 2010— Allowance for doubtful accounts Year ended December 31, 2009— Allowance for doubtful accounts Year ended December 31, 2008— Allowance for doubtful accounts Inventory reserves Year ended December 31, 2010— Inventory reserves Year ended December 31, 2009— Inventory reserves Year ended December 31, 2008— Inventory reserves 2012. 2010. By: By: By: By: Assets Current assets: Cash and cash equivalents Accounts receivable Total current assets Digital equipment Total assets Liabilities and Members' Equity Current liabilities: Accounts payable Current portion of long-term debt Deferred revenue Accrued property taxes Due to related parties Other accrued expenses Total current liabilities Virtual print fees Customer deposits Deferred revenue, net of current portion Long-term debt, net of current portion Total liabilities Members' equity Total liabilities and members' equity Digital equipment revenues Installation revenues Total revenues Cost of revenues Gross profit (loss) Operating expenses Selling and marketing expenses Administrative expenses Income (loss) from operations Interest expense, net Income (loss) before income taxes Income tax expense Net income (loss) Cash flows from operating activities: Net income (loss) Adjustments to reconcile net income (loss) to net provided by operating activities: Depreciation of digital equipment Interest on long-term debt Non-cash effect of digital equipment sold Changes in assets and liabilities: Accounts receivable Accounts payable Accrued property tax Due to related parties Other accrued expenses Deferred revenue Customer deposits Virtual print fees Net cash provided by operating activities Cash flows from investing activities: Purchases of digital equipment Net cash used in investing activities Cash flows from financing activities: Payments on long-term debt Proceeds from the issuance of long-term debt Proceeds from member contributions Distribution to members Net cash provided by (used in) financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Trade accounts receivable Accounts receivable from Digital Link I, LLC Digital equipment Less accumulated depreciation Net digital equipment Members' equity at March 31, 2008 Capital contributions Net loss Members' equity at March 27, 2009 Net loss Members' equity at March 26, 2010 Capital Distributions (unaudited) Net income (unaudited) Members' equity at March 25, 2011 (Unaudited) Cash paid during the period for: Interest Taxes