UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A(Amendment No. 1)10-K

(Mark One)

[X]☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedJanuary 31, 20142016

[ ]

☐ TRANSITION REPORT UNDERPURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________to______________

Commission file number000-50071

LIBERTY STAR URANIUM & METALS CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 90-0175540 | |

| (State or other jurisdiction of | (IRS Employer | |

| incorporation or organization) | Identification No.) | |

5610 EE. Sutler Lane, Tucson, Arizona 85712

(Address of principal executive offices)

520.731.8786

(Registrant’s telephone number, including area code)

Not Applicable(Former name, former address and former fiscal year, if changed since last report)

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of each class | Name of each exchange on which registered | |

| N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.00001

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

Act. Yes [ ]☐ No [X]☒

2

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. [ ]Note: Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X]☒ No [ ]☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X]☒ No [ ]☐

Indicate by check mark if there is disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained in herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitiondefinitions of “large accelerated filer”,filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | |||

| Smaller reporting company | ☒ | ||

| (Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ]☐ No [X]☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked pricesprice of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Note: If a determination $1,996,418 as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this form.

823,918,971 shares of Common Stock @ $0.0186(1)= $15,324,891

(1)Adjusted for retroactive effect of 1 for 4 reverse stock split on September 1, 2009. Closing price on July 31, 2013 was $0.0186.2015.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

866,445,497date: 1,632,552,893 shares of Common Stock issued and outstanding as of May 14, 2014.17, 2016.

DOCUMENTS INCORPORATED BY REFERENCE

Not applicable.

EXPLANATORY NOTENone.

The Company is filing this Amendment No. 1 to its Form 10-K in its entirety to include additional detail regarding our mineral claims under Part I, Item 2. Properties, including claim descriptions, location, maps, exploration plans, sampling procedures, and clarification regarding the preparation of Canadian NI 43-101 reports.

3

TABLE OF CONTENTS

4

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors", that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

All dollar amounts refer to U.S. dollars unless otherwise indicated. Our consolidated financial statements are stated in United States Dollars (US$) and arewere prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The following discussion should be read in conjunction with our consolidated financial statements and the related notes that appear elsewhere in this annual report.report on Form 10-K.

5

As used in this annual report on Form 10-K, the terms "we", "us", the “Company” and "Liberty Star" mean Liberty Star Uranium & Metals Corp. and our subsidiarysubsidiaries, Big Chunk Corp., unless otherwise indicated. All dollar amounts refer to U.S. dollars and Hay Mountain Super Project, LLC, unless otherwise indicated.

Business development

Liberty Star Uranium & Metals Corp. (the “Company”, “we” or “Liberty Star”) was formerly Liberty Star Gold Corp. and formerly Titanium Intelligence, Inc. (“Titanium”). Titanium was incorporated on August 20, 2001 under the laws of the State of Nevada. On February 5, 2004, we commenced operations in the acquisition and exploration of mineral properties business. Big Chunk Corp. (“Big Chunk”) is, our wholly owned subsidiary, and was incorporated on December 14, 2003 in the State of Alaska. Big Chunk is engaged in the acquisition and exploration of mineral properties business in the State of Alaska. Redwall Drilling Inc. (“Redwall”) was our wholly owned subsidiary and was incorporated on August 31, 2007 in the State of Arizona. Redwall performed drilling services on our mineral properties. Redwall ceased drilling activities in July 2008 and was dissolved on March 30, 2010. In April 2007, we changed our name to Liberty Star Uranium & Metals Corp. to reflectHay Mountain Super Project LLC (“HMSP”), our current general explorationwholly owned subsidiary, serves as the primary holding company for base and precious metals.development of the potential ore bodies encompassed in the Hay Mountain area of interest in Arizona. We are considered to be anin the exploration stage company, as wephase of operations and have not generated any revenues from operations.

Our current business

We are an exploration stage company engaged in the acquisition and exploration of mineral properties in the States of Arizona and Alaska. Claims in the State of Alaska are held in the name of our wholly-owned subsidiary, Big Chunk Corp.Chunk. Claims in the State of Arizona are held in the name of Liberty Star. We use the term “Super Project” to indicate a project in which numerous mineral targets have been identified, any one or more of which could potentially contain commercially viable quantities of minerals. Our significant projects are described below.

North Pipes Super Project (“North Pipes” and “NPSP”):Located The NPSP is located in Northern Arizona on the Arizona Strip, weStrip. We plan to ascertain whether the NPSP claims possess commercially viable deposits of uranium and associated co-product metals. We have not identified any ore reserves to date.

Big Chunk Super Project: The Big Chunk Super Project (“Big Chunk”):Locatedis located in the Iliamna region of Southwestern Alaska, weAlaska. We plan to ascertain whether the Big Chunk Super Project claims possess commercially viable deposits of copper, gold, molybdenum, silver, palladium rhenium and zinc. We have not identified any ore reserves to date.

Tombstone Super Project (“Tombstone”)(formerly (formerly referred to as Tombstone Porphyry Precious Metals Project): Tombstone is located in Cochise County, Arizona and the Super Project covers the Tombstone caldera and its environs. Within the Tombstone Calderacaldera is the Hay Mountain target where we are concentrating our work at this time. We plan to ascertain whether the Tombstone, Hay Mountain claims possess commercially viable deposits of copper, molybdenum, gold, silver, lead, zinc, manganese and other metals including Rare Earth Elements (REE’s). We have not identified any ore reserves to date.

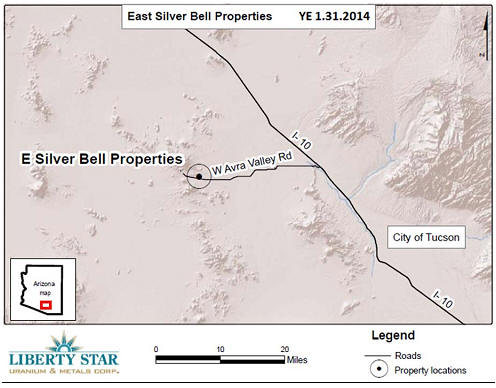

East Silver Bell Porphyry Copper Project (“East Silver Bell”):Located East Silver Bell is located northwest of Tucson, Arizona, weArizona. We plan to ascertain whether the East Silver Bell claims possess commercially viable deposits of copper. We have not identified any ore reserves to date.

Title to mineral claims involves certain inherent risks due to difficulties ofin determining the validity of certain claims, as well as potential for problems arising from the frequently ambiguous conveyancing history characteristic of many mineral properties. We have investigated title to all the Company’s mineral properties and, to the best of its knowledge, title to all properties are in good standing.

6

The mineral resource business generally consists of three stages: exploration, development and production. Mineral resource companies that are in the exploration stage have not yet found mineral resources in commercially exploitable quantities, and are engaged in exploring land in an effort to discover them. Mineral resource companies that have located a mineral resource in commercially exploitable quantities and are preparing to extract that resource are in the development stage, while those engaged in the extraction of a known mineral resource are in the production stage. We are in the exploration stage – as we have not found any mineral resources in commercially exploitable quantities.

There is no assurance that a commercially viable mineral deposit exists on any of our properties, and further exploration is required before we can evaluate whether any exist and, if so, whether it would be economically feasible to develop or exploit those resources. Even if we complete our current exploration program and we are successful in identifying a mineral deposit, we would be required to spend substantial funds on further drilling and engineering studies before we could know whether that mineral deposit will constitute an ore reserve (an ore reserve is a commercially viable mineral deposit).deposit, known as an “ore reserve.”

To date, we have not generated any revenues and we remain in the exploration stage.revenues. Our ability to pursue our business plan and generate revenues is subject to our ability to obtain additional financing, and we cannot give any assurance that we will be able to do so.

| 1 |

Competition

We are a mineral resource exploration stage company engaged in the business of mineral exploration. We compete with other mineral resource exploration stage companies for financing from a limited number of investors that are prepared to make investments in mineral resource exploration stage companies. The presence of competing mineral resource exploration stage companies may impact our ability to raise additional capital in order to fund our property acquisitions and exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors.

We also compete for mineral properties of merit with other exploration stage companies. Competition could reduce the availability of properties of merit or increase the cost of acquiring additional mineral properties.

Many of the resource exploration stage companies with whom we compete may have greater financial and technical resources than we do. Accordingly, these competitors may be able to spend greater amounts on acquisitions of properties of merit and on exploration of their properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of resource properties. This competition could result in our competitors having resource properties of greater quality and interest to prospective investors who may finance additional exploration and to senior exploration stage companies that may purchase resource properties or enter into joint venture agreements with junior exploration stage companies. This competition could adversely impact our ability to finance property acquisitions and further exploration.

Compliance with Government Regulation

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the States of Arizona and Alaska.

We are required to perform annual assessment work in order to maintain the Big Chunk Alaska State mining claims. If annual assessment work is not performed, we must pay the assessment amount in cash in order to maintain the claims. Completion of annual assessment work in the amount of $400 per 1/4 section (160 acre) claim or $100 per 1/16 section (40 acre) claim extends the claims for a one year period. Assessment work performed in excess of the required amount may be carried forward for up to 4 years to reduce future obligations for assessment work. We estimate thatSince we have in excess of the required annual assessments to maintainamount remaining from work performed within the claimsfour year period, assessment work was not required, but was and will be approximately $19,200.carried forward up to 4 years.

The annual state rentals for the Big Chunk Alaska State mining claims vary from $70 to $280$680 per mineral claim and escalate with the age of the mining claim. The rental period begins at noon September 1stthrough the following September 1stand annual rental payments are due on November 30thof each year. Annual rent is due in full within 45 days of staking a new claim and covers the period from staking until the next September 1st. The rentals of $30,640$6,120 to extend the Big Chunk claims through September 1, 20142015 were paid in November 2013.2014. The estimated state rentals due for the Big Chunk claims were not paid for 2016, but we may remedy that up to November 2016 by November 30, 2014 for the period from September 1, 2014 through September 1, 2015 are $30,640.paying rentals due. Alaska State production royalty is three percent of net income. State law prescribes that after a 3.5 -year exemption from state taxes, a metal mine is liable for a 15% state licensing tax on net income from the mine.

7

Our North Pipes claims are Federalfederal lode mining claims located on U.S. Federal Landsfederal lands and administered by the Department of Interior, Bureau of Land Management.Management (the “BLM”). The Bureau of Land Management (“BLM”)BLM has prepared an environmental impact statement (“EIS”) addressing potential for contamination of significant amounts of uranium leaking into the Colorado River. The EIS indicated the danger of such contamination insignificant. Regardless, the United States Secretary of the Interior, Kenneth Salazar, through executive order, has withdrawn Federalfederal lands from locatable mineral exploration and mining North of the Grand Canyon along the Utah border in Arizona, the so-called “Arizona Strip”. Nearly 1 million acres of land managed by the BLM and the Forest Service were segregated in July 2009 by the Secretary of Interior. The executive order has resulted in the withdrawal of an area of the Arizona Strip from mining in particular, and the moratorium now is instated for the next 20 years. However, the moratorium permits existing claims and mines to continue as before, including our North Pipes lode mining claims.

We are required to pay annual rentals to maintain our North Pipes Federalfederal lode mining claims in good standing. The rental period begins at 12:01 PM on September 1stthrough the following September 1stat 12:00 PM, and rental payments are due by the first day of the rental period starting at 12:01 PM. The annual rental is $140$155 per claim. Additional fees of $45$57 per claim are due in the first year of filing a Federalfederal lode mining claim along with the first year’s rent. The rentals of $54,600$1,705 for the period from September 1, 20132015 to September 1, 20142016 have been paid. The annual rentals due by September 1, 20142016 of $54,600$1,705 are required to maintain the North Pipes claims for the period from September 1, 20142016 through September 1, 2015.2017. There is no requirement for annual assessment or exploration work on the Federalfederal lode mining claims, this having been supplanted by the rental fee. There are no royalties associated with the Federalfederal lode mining claims.

| 2 |

We are required to pay annual rentals for our Federalfederal lode mining claims for our East Silver Bell project in the State of Arizona. The rental period begins at noon on September 1stthrough the following September 1st, and rental payments are due by the first day of the rental period. The annual rental is $140$155 per claim. The rentalsrental fees of $3,640$4,030 for the period from September 1, 20132015 to September 1, 20142016 have been paid. The annual rentals due by September 1, 20142016 of $3,640$4,030 are required to maintain the East Silver Bell claims are for the period from September 1, 20142016 through September 1, 2015.2017. There is no requirement for annual assessment or exploration work on the Federalfederal lode mining claims, this having been supplanted by the rental fee. There are no royalties associated with the Federalfederal lode mining claims.

We are required to pay annual rentals for our Federalfederal lode mining claims for our Tombstone project in the State of Arizona. The rental period begins at noon on September 1stthrough the following September 1st, and rental payments are due by the first day of the rental period. The annual rental is $140$155 per claim. Additional fees of $45$57 per claim are due in the first year of filing a Federalfederal lode mining claim along with the first year’s rent. The rentals and initial filingrental fees of $14,725 for the period from September 1, 20132015 to September 1, 20142016 have been paid. The annual rentals due by September 1, 20142016 of $ $13,860$14,725 are required to maintain the Tombstone claims for the period from September 1, 20142016 through September 1, 2015.2017. There is no requirement for annual assessment or exploration work on the Federalfederal lode mining claims, this having been supplanted by the rental fee. There are no royalties associated with the Federalfederal lode mining claims. Beginning September 1, 2011 at 12:01 PM, Liberty Star started, and subsequently completed, staking 9 Federalfederal lode mining claims along the east edge of old patented mining claims in the main producing part of the old Tombstone mining area. These new claims are adjacent to the south end of the Walnut Creek TS claim block and are also named the TS claims. These claims occupy fractional land areas open to location by federal lode claimmining claims.

8

We are required to pay annual rentals for our Arizona State Land Department (“ASLD”) Mineral Exploration Permits (“AZ MEP”) at our Tombstone Hay Mountain Project in the State of Arizona. A mineral exploration permit is permission from ASLD to prospect and explore for minerals on State Trust land. Exploration is any activity conducted for the purpose of determining the existence of a valuable mineral deposit, such as: geologic mapping, drilling, geochemical sampling, and geophysical surveys. Prior to exploration, the Plan of Operations must be approved by ASLD. The permitting process for an exploration permit takes a minimum of sixty (60)60 days. If the application is approved, the initial rent is $2 per acre. If renewed, no additional rents are due for the second year. Rents are set at $1 per acre for years 3 thru 5. Work expenditure requirements are: $10 per acre for years 1-2; and $20 per acre for years 3-5. Removal of any minerals or materials from State Trust land without the appropriate lease or permit is prohibited. The permit is valid for one year from the due date of the rental and bond. If renewal requirements are met, the permit can be renewed annually for up to five years. If discovery of a valuable mineral deposit is made, the permiteepermittee must apply for a mineral lease before actual mining activities can begin. A mineral lease permits the mining of minerals discovered under the exploration permit. The approval process takes a minimum of six (6) months. The mineral lease is issued for a term of twenty (20)20 years. Leases may be renewed for an additional term. Both rents and royalties are determined by appraisal. Royalties may be based on: 1) a fixed rate subject to annual adjustment; or 2) a sliding-scale rate which is linked to a commodity index price and the operation's break-even price. There is a statutory minimum royalty rate of 2% of gross value. These AZ MEPs require a reclamation bond of $3,000 which we currently hold. The first year’s rental has been paid for these MEPs and the escalating rental is due on the anniversary of the MEP each year. After the end of the 4th year, the MEPs must transition to a State Mineral Lease upon satisfaction of the State Mineral Inspector that economic indications of a minable deposit exist. After commencement of mining, the State of Arizona shall be paid a minimal net smelter return after taking into consideration any extenuating mining challenges royalty but not less than a 2% gross royalty. The rental period begins on September 30ththrough the following September 29thand rental payments are due by the first day of the rental period. We hold AZ MEP permits for 7,5151,886.88 acres at our Tombstone project. We paid initial rental fees from the date of application through September 29, 2012 of $8,254. Required minimum work expenditures for the period ended September 29, 2014 are$157,578.2016 are $37,737. The annual rentals and renewal fees due by September 30, 20142016 to maintain the AZ MEP permits are $7,515.$3,886.88.

With respect to the foregoing properties, additional approvals and authorizations may be required from other government agencies, depending upon the nature and scope of the proposed exploration program. The amount of these costs is not known at this time as we do not know the size, quality of any resource or reserve at this time, and it is extremely difficult to assess the impact of any capital expenditures on earnings or our competitive position.

Personnel

Currently we employ one full time geologist who is also our CEO, CFO, President and Chairman of the Board, James A. Briscoe. We also employ one full time executive, one full time executive assistant/accountant,VP for management of finance and accounting, one as-needed PhD consulting geologist specializing in GIS computer mapping and database creation, one full time geo-tech, who is also our manager of field operations, and one investor relations representative, andrepresentative.and one CPA on an as needed basis. We hire consultants for investor relations, exploration, derivative accounting, and administrative functions also on an as needed basis.

Item

Not Required.

Investing in our common stock involves a high degree of risk. You should not invest in our stock unless you are able to bear the complete loss of your investment. You should carefully consider the risks described below, as well as other information provided to you in this prospectus, including information in the section of this annual report on Form 10-K entitled “Forward-Looking Statements” before making an investment decision. The risks and uncertainties described below are not the only ones facing our company. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial may also impair our business operations. If any of the following risks actually occur, our business, financial condition or results of operations could be materially adversely affected, the value of our common stock could decline, and you may lose all or part of your investment.

| 3 |

Risks Related to Our Company and Our Business

Because of the speculative nature of the exploration of natural resource properties, there is substantial risk that this business will fail.

There is no assurance that any of the claims we explore or acquire will contain commercially exploitable reserves of minerals. Exploration for natural resources is a speculative venture involving substantial risk. Hazards such as unusual or unexpected geological formations and other conditions often result in unsuccessful exploration efforts. We may also become subject to significant liability for pollution or hazards, which we cannot insure or which we may elect not to insure. There is substantial risk that our business will fail.

If we cannot compete successfully for financing and for qualified managerial and technical employees, our exploration program may suffer.

Our competition in the mining industry includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may be unable to acquire additional financing on terms we consider acceptable because investors may choose to invest in our competitors instead of investing in us. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. Our success will be largely dependent on our ability to hire and retain highly qualified personnel. These individuals are in high demand and we may not be able to attract the personnel we need. We may not be able to afford the high salaries and fees demanded by qualified personnel, or may lose such employees after they are hired. If we are unable to successfully compete for financing or for qualified employees, our exploration program may be slowed down or suspended.

Exploration and exploitation activities are subject to comprehensive regulation which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on our company.

Exploration and exploitation activities are subject to federal, state, and local laws, regulations and policies, including laws regulating the removal of natural resources from the ground and the discharge of materials into the environment. Exploration and exploitation activities are also subject to federal, state, and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment.

Various permits from government bodies are required for drilling operations to be conducted; no assurance can be given that such permits will be received. Environmental and other legal standards imposed by federal, state, or local authorities may be changed and any such changes may prevent us from conducting planned activities or increase our costs of doing so, which would have material adverse effects on our business. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may not be able to or elect not to insure against due to prohibitive premium costs and other reasons. Any laws, regulations or policies of any government body or regulatory agency may be changed, applied or interpreted in a manner which will alter and negatively affect our ability to carry on our business.

There are no known reserves of minerals on our mineral claims and we cannot guarantee that we will find any commercial quantities of minerals.

We have not found any mineral reserves on our claims and there can be no assurance that any of our mineral claims contain commercial quantities of any minerals. Even if we identify commercial quantities of minerals in any of our claims, there can be no assurance that we will be able to exploit the reserves or, if we are able to exploit them, that we will do so on a profitable basis.

Because the probability of an individual prospect ever having reserves is extremely remote, any funds spent on exploration will probably be lost.

The probability of an individual prospect ever having reserves is extremely remote. In all probability our properties do not contain any reserves. As such, any funds spent on exploration will probably be lost which would most likely result in a loss of your investment.

We have a limited operating history and as a result there is no assurance we can operate on a profitable basis.

We have a limited operating history and must be considered in the exploration stage. Our operations will be subject to all the risks inherent in the establishment of an exploration stage enterprise and the uncertainties arising from the absence of a significant operating history. Potential investors should be aware of the difficulties normally encountered by mineral exploration companies and the high rate of failure of such enterprises, especially those with a limited operating history. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations of rock or land and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration or cease operations. The acquisition of additional claims will be dependent upon us possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations. No assurance can be given that we will ever operate on a profitable basis.

| 4 |

If we do not obtain additional financing, our business will fail and our investors could lose their investment.

We had cash and cash equivalents in the amount of $536 and negative working capital of $943,763 as of January 31, 2016. We currently do not generate revenues from our operations. Our business plan calls for substantial investment and cost in connection with the acquisition and exploration of our mineral properties currently under lease and option. Any direct acquisition of any of the claims under lease or option is subject to our ability to obtain the financing necessary for us to fund and carry out exploration programs on the subject properties. The requirements are substantial. There is no assurance that we will be able to maintain operations at a level sufficient for an investor to obtain a return on their investment in our common stock. Further, we may continue to be unprofitable. Obtaining additional financing would be subject to a number of factors, including market prices for minerals, investor acceptance of our properties, contractual restrictions on our ability to enter into further financing arrangements, and investor sentiment. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us and our business could fail.

Because there is no assurance that we will generate revenues, we face a high risk of business failure.

We have not earned any revenues and have never been profitable. We do not have an interest in any revenue generating properties. We were incorporated in 2001 and took over our current business in 2004. To date, we have been involved primarily in organizational and exploration activities. We will incur substantial operating and exploration expenditures without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We have limited operating history upon which an evaluation of our future success or failure can be made. We recognize that if we are unable to generate significant revenues from our activities, we will not be able to earn profits or continue operations. Based upon current plans, we also expect to incur significant operating losses in the future. We cannot guarantee that we will be successful in raising capital to fund these operating losses or generate revenues in the future. We can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail and our investors could lose their investment.

Our independent registered public accounting firm’s report states that there is a substantial doubt about our ability to continue as a going concern.

Our independent registered public accounting firm, MaloneBailey, LLP, stated in its audit report attached to our audited financial statements for the fiscal year ended January 31, 2016 that since we have suffered recurring losses from operations, requires additional funds for further exploratory activity prior to attaining a revenue generating status, and we may not find sufficient ore reserves to be commercially mined, there is a substantial doubt about our ability to continue as a going concern.

The existence of our mining claims depends on our ability to fund exploratory activity or to pay fees.

Our mining claims, which are the central part of our business, require that we either pay fees, or incur certain minimum development costs annually, or the claims will be forfeited. Due to our current financial situation we may not be able to meet these obligations and we could therefore lose our claims. This would impair our ability to raise capital and would negatively impact the value of our company.

Risks Related to Our Common Stock

Because we will likely issue additional shares of our common stock, investment in our company could be subject to substantial dilution.

Investors’ interests in our company will be diluted and investors may suffer dilution in their net book value per share when we issue additional shares. We are authorized to issue 6,250,000,000 shares of common stock, $0.00001 par value per share. As of May 3, 2016, there were 1,632,552,893 shares of our common stock issued and outstanding. We anticipate that all or at least some of our future funding, if any, will be in the form of equity financing from the sale of our common stock. If we do sell more common stock, investors’ investment in our company will likely be diluted. Dilution is the difference between what you pay for your stock and the net tangible book value per share immediately after the additional shares are sold by us. If dilution occurs, any investment in our company’s common stock could seriously decline in value.

The sale of our stock under the convertible notes and the common share purchase warrants could encourage short sales by third parties, which could contribute to the future decline of our stock price.

In many circumstances, the provision of financing based on the distribution of equity for companies that are traded on the OTC Pink market tier has the potential to cause a significant downward pressure on the price of common stock. This is especially the case if the shares being placed into the market exceed the market’s ability to take up the increased stock or if we have not performed in such a manner to show that the equity funds raised will be used to grow our business. Such an event could place further downward pressure on the price of our common stock. Regardless of our activities, the opportunity exists for short sellers and others to contribute to the future decline of our stock price. If there are significant short sales of our common stock, the price decline that would result from this activity will cause the share price to decline more, which may cause other stockholders of the stock to sell their shares, thereby contributing to sales of common stock in the market. If there are many more shares of our common stock on the market for sale than the market will absorb, the price of our common shares will likely decline.

| 5 |

Trading in our common stock on the OTC Pink market tier is limited and sporadic making it difficult for our stockholders to sell their shares or liquidate their investments.

Our common stock is currently quoted for public trading on the OTC Pink market tier. The trading price of our common stock has been subject to wide fluctuations. Trading prices of our common stock may fluctuate in response to a number of factors, many of which will be beyond our control. The stock market has generally experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of companies with no current business operation. There can be no assurance that trading prices and price earnings ratios previously experienced by our common stock will be matched or maintained. These broad market and industry factors may adversely affect the market price of our common stock, regardless of our operating performance. In the past, following periods of volatility in the market price of a company’s securities, securities class-action litigation has often been instituted. Such litigation, if instituted, could result in substantial costs for us and a diversion of management’s attention and resources.

Our bylaws contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our bylaws contain provisions with respect to the indemnification of our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by them, including an amount paid to settle an action or satisfy a judgment in a civil, criminal or administrative action or proceeding to which they are made parties by reason of their being or having been our directors or officers.

Our bylaws do not contain anti-takeover provisions which could result in a change of our management and directors if there is a take-over of our company.

We do not currently have a shareholder rights plan or any anti-takeover provisions in our bylaws. Without any anti-takeover provisions, there is no deterrent for a take-over of our company, which may result in a change in our management and directors. This could result in a disruption to the activities of our company, which could have a material adverse effect on our operations.

We do not intend to pay dividends on any investment in the shares of stock of our company and any gain on an investment in our company will need to come through an increase in our stock’s price, which may never happen.

We have never paid any cash dividends and currently do not intend to pay any dividends for the foreseeable future. To the extent that we require additional funding currently not provided for in our financing plan, our funding sources may prohibit the payment of a dividend. Because we do not intend to declare dividends, any gain on an investment in our company will need to come through an increase in the stock’s price. This may never happen and investors may lose all of their investment in our company.

Because our securities are subject to penny stock rules, you may have difficulty reselling your shares.

Our shares as penny stocks, are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which imposes additional sales practice requirements on broker/dealers who sell our company’s securities including the delivery of a standardized disclosure document; disclosure and confirmation of quotation prices; disclosure of compensation the broker/dealer receives; and, furnishing monthly account statements. These rules apply to companies whose shares are not traded on a national stock exchange, trade at less than $5.00 per share, or who do not meet certain other financial requirements specified by the Securities and Exchange Commission (the “SEC”). These rules require brokers who sell “penny stocks” to persons other than established customers and “accredited investors” to complete certain documentation, make suitability inquiries of investors, and provide investors with certain information concerning the risks of trading in such penny stocks. These rules may discourage or restrict the ability of brokers to sell our shares of common stock and may affect the secondary market for our shares of common stock. These rules could also hamper our ability to raise funds in the primary market for our shares of common stock.

FINRA sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common shares, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

| 6 |

Tangiers Investment Group, LLC will pay less than the then-prevailing market price for our common stock.

Our common stock to be issued to Tangiers Investment Group, LLC (“Tangiers”) pursuant to the investment agreement dated June 20, 2015 will be purchased at the 80% of the lowest day of the daily volume weighed average price of our common stock during the five consecutive trading days immediately prior to the receipt by Tangiers of the put notice;provided, however, an additional 5% will be added to the discount of each put if (i) we are not DWAC eligible and (ii) an additional 5% will be added to the discount of each put if we are under DTC “chill” status on the applicable date of the put notice. Tangiers has a financial incentive to sell our common stock immediately upon receiving the shares to realize the profit equal to the difference between the discounted price and the market price. If Tangiers sells the shares, the price of our common stock could decrease. If our stock price decreases, Tangiers may have a further incentive to sell the shares of our common stock that it holds. These sales may have a further impact on our stock price.

Your ownership interest may be diluted and the value of our common stock may decline by exercising the put right pursuant to the investment agreement with Tangiers.

Pursuant to the investment agreement with Tangiers, when we deem it necessary, we may raise capital through the private sale of our common stock to Tangiers at a discounted price. Because the put price is lower than the prevailing market price of our common stock, to the extent that the put right is exercised, your ownership interest may be diluted.

We may not have access to the full amount available under the investment agreement with Tangiers.

Our ability to draw down funds and sell shares under the investment agreement with Tangiers requires that the registration statement declared effective on March 15, 2016 continues to be effective. The registration statement registers the resale of 350,000,000 shares issuable under the investment agreement with Tangiers Investment Group, LLC, and our ability to sell any remaining shares issuable under the investment with Tangiers Investment Group, LLC is subject to our ability to prepare and file one or more additional registration statements registering the resale of these shares. These registration statements may be subject to review and comment by the staff of the SEC, and will require the consent of our independent registered public accounting firm. Therefore, the timing of effectiveness of these registration statements cannot be assured. The effectiveness of these registration statements is a condition precedent to our ability to sell all of the shares of our common stock to Tangiers Investment Group, LLC under the investment agreement. Even if we are successful in causing one or more registration statements registering the resale of some or all of the shares issuable under the investment agreement with Tangiers Investment Group, LLC to be declared effective by the SEC in a timely manner, we may not be able to sell the shares unless certain other conditions are met. For example, we might have to increase the number of our authorized shares in order to issue the shares to Tangiers Investment Group, LLC. Increasing the number of our authorized shares will require board and stockholder approval. Accordingly, because our ability to draw down any amounts under the investment agreement with Tangiers Investment Group, LLC is subject to a number of conditions, there is no guarantee that we will be able to draw down future amounts of the $8,000,000 under the investment agreement with Tangiers Investment Group, LLC.

Certain restrictions on the extent of puts and the delivery of advance notices may have little, if any, effect on the adverse impact of our issuance of shares in connection with the investment agreement with Tangiers, and as such, Tangiers may sell a large number of shares, resulting in substantial dilution to the value of shares held by existing stockholders.

Tangiers has agreed, subject to certain exceptions listed in the investment agreement with Tangiers, to refrain from holding an amount of shares which would result in Tangiers or its affiliates owning more than 4.99% of the then-outstanding shares of our common stock at any one time. These restrictions, however, do not prevent Tangiers from selling shares of our common stock received in connection with a put, and then receiving additional shares of our common stock in connection with a subsequent put. In this way, Tangiers could sell more than 4.99% of the outstanding common stock in a relatively short time frame while never holding more than 4.99% at one time.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not Applicable.applicable to smaller reporting companies.

Our offices

We rent the premises for our principal office located at 5610 EE. Sutler Lane, Tucson, Arizona 85712. We rent this office space which is located in the home of our Chief GeologistCEO, CFO and CEOPresident for $522 per month plus a pro rata share of taxes and maintenance. Our employees work either from our principal office or from offices maintained in their homes.

9

We believe that our existing office facilities are adequate for our needs. Should we require additional space at that time, or prior thereto,in the future, we believe that such space can be secured on commercially reasonable terms.

| 7 |

Our warehouse

On June 1,

In 2011 we rented a warehouse located at Building No. 1, 7900 South Kolb Road, Tucson, Arizona 85706. We rent this warehouse space for $3,645$3,673 per month. The lease is in effect until May 31, 2014 with an option to extend for two additional years.currently on a month-to-month basis. In addition to using the warehouse for standard purposes, such as storage of our exploration equipment, supplies and samples, the warehouse space also includes office facilities for the use of field geologists and geotechs.facilities.

Our mineral claims

All of the Company’s claims for mineral properties are in good standing as of January 31, 2014.2016.

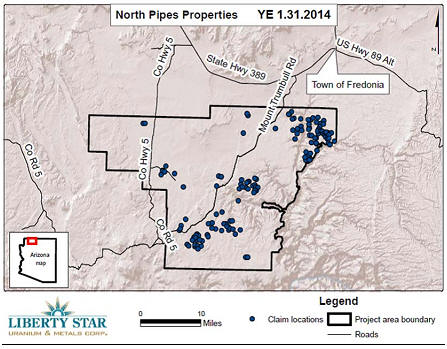

North Pipes Super Project (“North Pipes” and “NPSP”):Pipes:

We hold a 100% interest in 37611 (unpatented) Federalfederal lode mining claims strategically placed on the Arizona Strip. The 37611 unpatented Federalfederal lode mining claims with an area of 7,761227.7 acres include breccia pipe targets (“Pipes”). Breccia pipes are cylindrical formations in the earth’s crust sometimes identified by a surface depression, or surface bump or no visible surface expression at all, and contain a high concentration of fragmented rock “breccia” sometimes cemented by uranium and other minerals. We plan to ascertain whether our North Pipes claims possess commercially viable deposits of uranium. Due to the moratorium of location of lode mining claims on the Arizona Strip and the low price of U3O8 we have no current exploration plans and will not until the uranium price increases and the moratorium expires in about 15 years. We intend to hold a strategic position until such time that it is economically feasible to mount a new drilling program. We want to take advantage of more than a million dollars of exploration data which was acquired by Liberty Star when uranium prices were higher and before the moratorium was instituted.

North Pipes is located on the Arizona Strip, which is located approximately 10 miles south of the town of Fredonia, AZ. Access is by Hwy 389 and various dirt roads, some of which are maintained and some that are very primitive. 4WD vehicles are necessary for the primitive dirt roads. Some of the claims cannot be driven to and require hiking to their location or under an approved plan of operation it is possible to create an access road.

| North Pipes-AZ | ||||||

| Total:11 | ||||||

Our NPSP claims are undeveloped. There are neither open-pit nor underground mines, nor is there any mining plant or equipment located on the properties. There is no power supply to the properties. We have not found any mineral resources on any of our claims. The Arizona Strip was an active exploration district in the 1970’s and 1980’s with multiple producing uranium mines. No evidence of actual development work has been found on any of our properties and no significant exploration activities have been performed on our NPSP claims since 2008 due to many factors including the lowered uranium prices and the moratorium on locating claims. Below is a summary of prior exploration activities performed on our NPSP claims:

| 8 |

Geophysics:We have completed PEM (Pulse Electro-magnetic) geophysical surveys on some of our NPSP claims. Two types of PEM surveys were conducted in 2007: (i) Downhole PEM and (ii) In-Loop PEM. We have also used CSAMT and NSAMT (Controlled and Natural Source Audio-range Magneto Tellurics), run on the ground and executed by Zonge Engineering of Tucson AZ. A survey was also completed on an approximately six square mile area by VTEM helicopter borne electromagnetic survey along right angle crossing grid lines spaced 100 meters apart, which was performed by Geotech of Aurora, Ontario, Canada. Significant anomalies resulted from this survey. Preliminary drilling on one of Liberty Star’s anomalies intersected strong breccia, alteration and pyrite mineralization. The holes did not penetrate down to the elevation where uranium mineralization would be expected, but are targets for future work. As of this date we have not developed any uranium resources on the Arizona Strip.

Stereoscopic geologic color air photo interpretation (photo-geology):Stereoscopic geologic interpretation of 1:24,000 (1 inch = 2,000 feet) high resolution color air photographs were contracted for and completed by Dr. Karen WeinrichWenrich and Edward Ulmer, a Registered Professional Geologist. Dr. WeinrichWenrich worked on the Arizona Strip uranium bearing breccia pipes almost exclusively during her twenty three year tenure with the United States Geological Survey from which she is now retired. During this period of study she authored many professional papers on breccia pipes of the Grant Canyon area, and is considered a foremost expert on them. Mr. Ulmer worked on the Arizona Strip in the mid to late 1970s working on both imagery interpretation and surface geology.

Geologic field mapping on the surface:Geological field mapping was conducted in the fall of 2005 through 2007 by our staff geologists as well as contracted geologists. Approximately 180 of the breccia pipe target areas have been mapped in detail 1:5,000 (1 inch = 417 feet). Several detailed measured stratigraphic sections have also been completed.

10

Geochemical sampling:A comprehensive soil geochemical survey was completed in 2007. We have collected approximately 14,000 soil samples over all identifiable breccia pipes, both those with known ore and those that are yet to be proven by drilling. A strict chain of custody procedures were followed and quality assurance/quality control (QA/QC) samples were inserted regularly into the sample stream. The samples were assayed for 63 elements. Assay analyses were conducted by a Certified Assay Lab, Acme Analytical Laboratories of Vancouver, British Columbia, Canada. We believe that these samples allow us to identify potential uranium bearing breccia pipes versus barren or non-uranium bearing breccia pipes.

Drilling:In 2007 a drilling program was undertaken using both rotary drilling and core drilling. Rotary drilling was contracted by Boart Longyear. Diamond core drilling was completed by Redwall Drilling Inc., a former wholly owned subsidiary of Liberty Star. A total of 22 holes were drilled for a total of 16,226 feet of drilling. Important intersections of rock generally associated with producing breccia pipes were made. We did not intersect any ore mineralization during the drilling program.

Total costs including claim staking (initially in 2005), claim maintenance (see PART I ITEM1. Business. “Compliance with Government Regulation” in each Form 10K for the years ended January 31, 2006 through January 31, 2014) and a drilling program (exploratory) in calendar years 2007 and 2008, are $5,220,794.

Beginning in 2006, Certified Professional Geologist DrDr. Karen Wenrich and a dozen other well regarded geoscientists engaged in an exploratory program centering on the region’s breccia pipes. By the time Dr. Wenrich came to work on the North Pipes project, she had 27 years with the USGS working on breccia pipe research and was a member of a Nobel Peace Prize winning team of UN atomic science specialists. The Liberty Star team worked with high resolution color aerial photographs and other reconnaissance covering approximately 2,000 square miles to format geological maps of the terrain. In addition to geology, geophysics gamma ray spectroscopy, approximately 14,000 soil samples were collected and analyzed by a certified lab for 63 elements. These were located precisely as they were collected using GPS. The results were compiled and plotted using GIS software, and various contouring and interpretation techniques. Expenses included food and lodging and a daily commute of approximately 100 miles. Road conditions were extreme and resulted in vehicle expenses of approximately $2.00 per mile. Various contractors were used in claim staking, and other contract work in sample collection. Helicopters and light planes were used for various transportation tasks. Home office support also involved permanent and contract support.

Exploratory drilling includes costs of travel, food and lodging, payments on the drill rig, drill bits, fuel, drilling permits, and maintenance costs of the drill rig and of support vehicles. Also included are the costs of reclamation bonds and reclamation costs of lands disturbed by drilling, as well as the costs of conducting archaeological surveys to identify prehistoric remains of human habitation or human activity.

Currently there are no planned costs for the North Pipes Super Project unless commodity prices, specifically for uranium, increase sufficiently to make exploration financially tenable. The Moratorium on acquiring any additional land has also negatively affected the current investment climate for such work. However we have a letter agreement with Mr. Andrew Mueller to option our existing claims North Pipes claims to him for mining using his vertical bore technology. He believes this will make the Pipes exploitable.

| 9 |

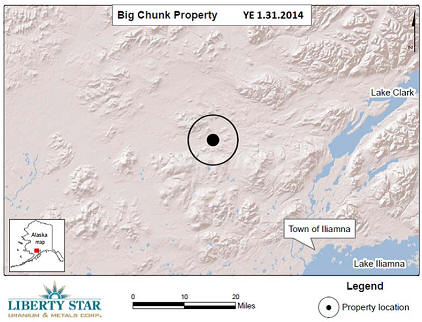

Big Chunk Super Project (“Big Chunk”) – Location, claims, geology and technical studies:

We hold

We’ve held and may retain a 100% interest in 549 State mining claims in the Iliamna region of Southwestern Alaska with an area of 7,6801,440 acres, located on the north side of the Cook Inlet, approximately 265 miles southwest of the city of Anchorage, Alaska. We plan to ascertain whether the Big Chunk claims possess commercially viable deposits of copper, gold, molybdenum, silver, palladium, rhenium and zinc. Due to decisions made by the EPA regarding the nearby Pebble Deposit we have no immediate exploration plans, however, we intend to hold our land position until such a time we determine it is clear that exploration is economically viable again.

| Big Chunk-AK Claims | ||||

| BC 817 | BC 1114 | |||

| BC 818 | BC 1115 | |||

| BC 841 | ||||

| BC | ||||

| BC | ||||

| BC | ||||

| BC | ||||

| 1113 | ||||

Our Big Chunk claims are undeveloped. Big Chunk is in the Iliamna region of Southwestern Alaska, located on the north side of the Cook Inlet, approximately 265 miles southwest of the city of Anchorage Alaska. The claims are located in a remote area of Southwestern Alaska near Lake Iliamna, Alaska’s largest lake. The claims are immediately adjacent and contiguous to the Pebble mine property and about 3 miles north east from the Pebble Porphyry copper, gold, molybdenum, silver, palladium, rhenium and zinc mineral deposit which is reportedly one of the largest of its type in the world. Two or more Air Taxi services connect to the village of Iliamna roughly 240 miles distant from Anchorage. At Iliamna, approximately 27 miles southeast of Big Chunk, there is a major regional airport, Fixed Base Operator (FBO), fuel, bush planes and, periodically, helicopters for rent with pilot. Air is the only practical way to the property either by float plane, ski plane in the winter, or helicopter. Ground travel is unsafe and impractical in the summer due to the dense population of black bears, grizzly bears, bogs and small lakes. Winter access by snow machine could be possible, although difficult.

| 10 |

In 2011, the Company engaged the international firm of SRK Consulting, Engineering and Scientist of Tucson (“SRK”) through its Tucson, Arizona office to prepare a Technical Report in the same format of the internationally accepted Canadian National Instrument NI 43-101. Because the Company’s stock does not trade on any Canadian stock exchanges, this Technical Report was not submitted to SEDAR, the electronic system for the official filing of documents by public companies and investment funds across Canada. In their report which encompasses some 194 pages of technical data, they compared the Northern Dynasty NI 43-101 geologic and drill data, published on the Northern Dynasty web site in its entirety, to results of Liberty Star’s technical work on the Big Chunk ground. They concluded amongst other things: (1) Twenty seven scout diamond drill holes drilled by Liberty Star in 2004 – 2005 intersected the same rock types as were intersected in the exploration drilling on the Pebble deposit (2) All drill holes, which were spaced over some 500 square miles, intersected the outer shell or propylitic halo of multiple porphyry copper systems, which is the model co-developed by our director, Dr. John Guilbert; and (3) Copper and molybdenum sulfides along with low grade gold were intersected in two drill holes in the White Sox target area. “This mineralization and associated alteration may indicate a porphyry Cu-Mo system” (SRK Big Chunk Technical Report- page 109, 11.2 Results of Drilling, available onDrilling). After publication of the Liberty Star Web Site.report in August of 2012 during a review of core logs it was discovered that diamond core hole 1003 showed characteristic copper and molybdenum chalcopyrite and molybdenite, as well as lead, zinc and silver. The hole was stopped prematurely in increasing values of these metals at a depth of 206.4 meters. The area of the Big Chunk Claims is largely covered by glacial debris, soil, and tundra. There are no open-pit or underground mines, nor is there any mining plant or equipment located on the properties. There is no power supply to the properties. There is no road access to the properties, but such public road access is planned for the Pebble mine, and as currently planned, that road will cross the Company’s land, and be accessible for the Company’s use. Extensive geotechnical data on the Big Chunk claims has been acquired between startup of 2004 and the current time. Extensive geophysical data has been acquired by the Company of several types, which includes the following:

(1) an extensive air borneairborne magnetic survey flown by McPhar Geosurveys Ltd., Newmarket, Ontario Canada over 18,243 line kilometers covering 3,646 square kilometers using: (a) a draped survey with a mean elevation of the instrument above the terrain of 200 meters (600 feet) feet; (b) a line spacing of 250 meters (800 feet); (c) and a sample interval of 8 meters (26.4 feet). State of the art magnetometer, GPS, radar altimeter, and computer recording of data were used and in our opinion no other survey of this quality and precision is available in the area.

11

(2) one hundred twenty seven127 linear miles of Induced Polarization (IP) was run by Zonge Engineering of Tucson AZ. Of necessity lines were brushed of all trees and undergrowth and all access was by helicopter, however, the lines themselves were done on the ground by foot. All data was recorded on appropriate computers, downloaded each evening and sent to the Zonge Office in Tucson and to our consulting geophysicist Mr. Jan Klein in Vancouver, BC, Canada. Mr. Klein supervised all IP and other geophysical surveys over the Pebble for Cominco who sold the Pebble Project to Northern Dynasty. Thus, we believe Mr. Klein has had more experience in the geophysics of the area, which includes over 2,000 square miles, than any other geophysicist. The results were interpreted and sent back to the Alaska headquarters every night.

(3) Liberty Star contracted with Geotech Limited of London, Ontario, Canada to run their ZTEM Electro Magnetic (EM) airborne survey equipment over the Big Chunk project. This thoroughly tested system can look down 2,000 meters (6,000 feet) in to the crust of the earth and detect sulfide mineralization associated with porphyry copper-gold systems, as well as other geologic features. This survey was completed in August 2009. The survey covered 315.2 sqsq. kilometers (121.7 sqsq. miles) and consisted of north-south lines spaced 250 meters apart on our Big Chunk Super Project mineral claims. In May 2010, Liberty Star received feedback from Geotech Ltd. that its interpretation showed at least 4 to 7 signatures that are consistent with porphyry copper responses. The 2D computer model shows typical low responsive areas, which could correspond to an ore mineral core zones with a surrounding responsive cylinders representing a pyrite halos typical of Porphyry copper systems. For control, Geotech flew a survey the day after completing the Big Chunk survey, over the Pebble mineral deposit. The anomalies on Big Chunk show strong similarities to the Pebble.

During the field seasons of 2004 and 2005 Liberty collected approximately eleven thousand11,000 geochemical samples. The sampling program was designed by both consulting geochemist, Shea Clark Smith, of MEG Laboratories in the Reno area of Nevada, and Liberty Chief Geologist, James A. Briscoe. The sampling program was based on many years of geochemical studies and sampling throughout the world by Mr. Smith and his Master’s Degree thesis on sampling tundra plants and detecting metals in their woody stems reflecting metals at depth. Further, Mr. Smith and Mr. Briscoe used this technique to locate buried porphyry copper deposits in the Silver Bell district (see discussion of the East Silver Bell Project in this report) near Tucson, Arizona in 1996 -1998. The methodology was conceived, discovered and proven in a well-known porphyry district south of Tucson, Arizona between the periodperiods 1950 to 1955. At Big Chunk the samples collected included: (1) stream sediment; (2) stream water; (3) pond and small-lake water; (4) soil samples; and (5) vegetation sampling new growth of woody plants. These samples were analyzed by Acme Labs, a Certified Assayer in Canada for 64 elements for each sample. For the eleven thousand samples, this resulted in approximately seven hundred thousand separate analyses including blanks, repeat and control samples part of the QA/QC (Quality Assurance Quality Control) procedures. Because of the overload worldwide in all assay labs at the time, turnaround time for the assays was up to three or more months. After receipt of the samples, they were processed using computer techniques and the results analyzed and interpreted. Known indicator elements, including porphyry copper-gold mineral center elements, formed typical porphyry copper center anomaly zones. Additionally, samples taken by Liberty Star over the Pebble deposit, with the permission of Northern Dynasty, indicated that mineral body to be detectable by these methods. The geochemical methodology was used by the US Geological Survey, under contract for the Pebble partnership over the Pebble mineral zone, and data was published in 2010. It was again shown to be effective in indicating the Pebble deposit mineralization at depth. The anomalies generated by both deep looking ZTEM and geochemistry by Liberty Star have been tested by published results from drilling in the Pebble mineral body. The same types of targets in the Liberty Star Big Chunk have yet to be tested by drilling.drilling in a significant way.

We are unaware of any previous claim ownership anywhere on our Big Chunk claims in Alaska. No historical drilling resulting in mineral resources or reserves appears in the published literature concerning the property. Minor exploration was conducted by Teck Cominco Alaska, and Anaconda Mining Inc. The United States Geological Survey does not do exploration but they had done minor geological mapping in the north part of the Big Chunk caldera, along with widely spaced aeromag surveys in the same area. We are not aware of any prior exploration that was conducted on our Big Chunk claims in Alaska prior to January 10, 2004, when our aerial magnetic survey began.

We have not defined mineral resources on any of our claims at Big Chunk.

| 11 |

Letter Agreement and Secured Convertible Note with Northern Dynasty Minerals Ltd. With Respect to Big Chunk

12

On July 15, 2010, we issued a secured convertible promissory note (the “2010 Convertible Note”) to Northern Dynasty Minerals Ltd (“Northern Dynasty”). The original advanced amount is $4,000,000 and bears interest at a rate of 10% per annum compounded monthly (the “Loan”). On August 17, 2010, we transferred 95 of our Alaska State mineral claims from the Big Chunk Super Project to Northern Dynasty for consideration of $1,000,000 of the original advanced amount under the Convertible Note, leaving $3,000,000 of the Loan amount outstanding. No interest accrued on the $1,000,000 of the original advanced amount. Effective September 1, 2011, the agreement with Northern Dynasty was amended to increase the 2010 Convertible Note by $561,816 to reimburse Northern Dynasty for assessment work, rental fees, cash in lieu of assessment work and filing fees on the mineral claims that was paid in fiscal 2011 and fiscal 2012 because we could not come to an agreement on an earn-in option and joint venture agreement with Northern Dynasty. On February 29, 2012, with effect from November 30, 2011, we executed an additional convertible promissory note (the “2011 Convertible Note” and together with the 2010 Convertible Note, the “Convertible Notes”) in the amount of $168,358 in reimbursement to Northern Dynasty of assessment work, rental fees and filing fees on our mineral claims.

As part of the transactions noted above, we entered into a letter agreement with Northern Dynasty whereby, subject to negotiating and signing a definitive earn-in option and joint venture agreement, Northern Dynasty could earn a 60% interest in our Big Chunk and Bonanza Hills projects in Alaska (the “Joint Venture Claims”) by spending $10,000,000 on those properties over six years. The outstanding loan amounts from Northern Dynasty could be applied as part of Northern Dynasty’s earn-in requirements. Northern Dynasty’s minimum annual expenditures under the earn-in would be the minimum level necessary to keep the Joint Venture Claims in good standing. Northern Dynasty could elect to abandon the earn-in at any time on 30 days’ notice, so long as sufficient annual labor was performed, or a cash payment in lieu of labor was made, in order to fulfill the annual labor requirements for the Joint Venture Claims for a minimum of 12 months after termination of the earn-in.

On November 13,14, 2012, we signed a loan settlement agreement with Northern Dynasty which would have discharged the $3,730,174 principal balance and $972,617$1,592,769 of accrued interest for the 2010 Convertible Note and would have terminated Northern Dynasty’s earn-in rights. In exchange for the settlement, we initiated the transfer of 199 Alaska mining claims to Northern Dynasty’s subsidiary, U5 Resources. The transaction was not closed at that time, pending resolution to a lien placed byHowever, MBGS, LLC..LLC filed liens against the claims before the transfer could be completed. In March 2014 Liberty Star and Big Chunk entered into a settlement agreement with MBGS, LLC, following a resolution conference conducted in Anchorage, Alaska whereby all claims involving Northern Dynasty’s 199Dynasty claims recorded by MBGS, LLC were released. The company has nowAs a result of the settlement agreement with MBGS, LLC, the Company completed its loan settlement agreement with Northern Dynasty and discharged the principal balance and accrued interest for the 2010 Convertible Note and terminated Northern Dynasty’s earn-in-rights are terminated.earn-in-rights. A gain of $5,322,943 for the settlement of the Northern Dynasty debt and accrued interest was recorded in other income in April 2014.

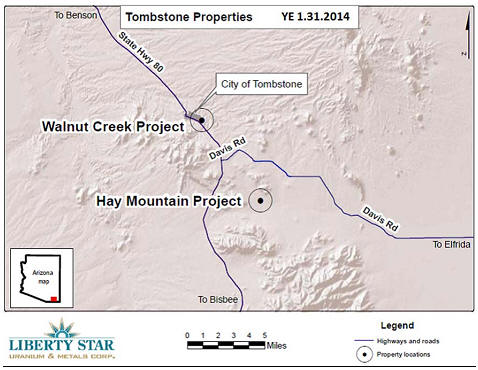

Tombstone Super Project (“Tombstone”):Tombstone:

Our CEO, andCFO, President, Chief Geologist and Chairman of the Board, James A. Briscoe, has long experience in the Tombstone district, southeast Arizona, where he first worked in 1972. In the mid-1980s, he concluded that much earlier regional geologic work had reached erroneous conclusions and that Tombstone was a large and ancient (72 million years before the present – or Laramide in age) volcanic structure – a caldera. He brought this to the attention of the US Geological Survey caldera experts, who after study concluded that Briscoe was correct. Subsequently, more than seventeen calderas of various ages have been identified in Arizona by the US Geological survey, the Arizona Geological Survey and others. Such calderas of Laramide age are all associated with porphyry alteration and copper and associated mineralization; many of these have become very large copper mines. Studies by Mr. Briscoe over the years, and more recently using advanced technology, have indicated that alteration associated mineralization at Tombstone is much more extensive than originally thought. This alteration lies largely under cover and is indicated by geochemistry, geophysics and projection of known geology into covered areas.

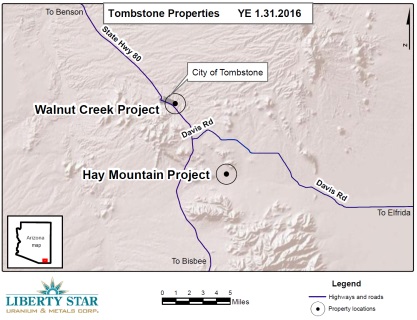

We hold 9995 unpatented standard Federalfederal lode mining claims with an area of 1878.681,798.68 acres located due east and southeast of the town of Tombstone, Arizona. The Walnut Creek Project is located immediately east of the town of Tombstone. The Hay Mountain Project is located 6.5 miles southeast of Tombstone; access is by Hwy 89 and Davis Rd. We also hold Arizona State Mineral Exploration Permits (MEPs) covering (7,515(1,886.88 acres) or 11.743 square miles in the same area. We also hold an option to explore 3329 unpatented standard Federalfederal lode mining claims located in the same region. We also hold an option to explore 33 unpatented standard Federal lode mining claims (684(604 acres out of the total 1878.681,798.68 acres) located in the same region. On April 29, 2008 Liberty Star announced that it had leased, with an option to purchase, three properties from JABA US Inc. in Arizona and Nevada, USA. Liberty Star President James A. Briscoe controls JABA US INC and Dr. J. M. Guilbert, Director of the Company, holds a small stock position as well. The properties in Arizona are part of the Tombstone and the 26 claims East Silver Bell projects. The option covering the property in Nevada was sold in October, 2008 to NPX Metals. Proceeds from that sale were loaned immediately back to Liberty Star by Mr. Briscoe. For the remaining claims, according to the option agreement, Liberty Star could earn up to 100% interest by keeping up annual assessment work and spending $175,000 in exploration expenditures on the properties between April 2008 and January 1, 2011. This provision payment of assessment and related expenses has been met and option agreement has been maintained over the Tombstone and East Silver Bell Claims.

| LIBERTY STAR | ||

| TOMBSTONE-AZ | JABA Optioned Claims | |

| Federal Unpatented Claims | ||

| Claim Names | ||

| HM 87-143 | TS | |

| TS 168-176 | TS 163- 167 | |

| Claim Acreage | ||

| 57 HM Claims- 1095.18 acres | 29 TS Claims- | |

| 9 TS Claims- 99.5 acres | ||

| State Exploration Permits | ||

| 12 |

At Hay Mountain, (HM), weplanwe plan to ascertain whether the HM lodeminingHay Mountain lode mining claims and AZ MEPs possess commercially viable deposits of copper, gold, molybdenum,,silver, zinc, rare earth metals and other valuable metals. We have a phased exploration plan that involves diamond core drilling of multiple holes over targets determined by analysis of geochemical sampling and ZTEM electromagnetic and magnetic survey. Initial phase 1 drilling is planned to take approximatelyone year.Shouldapproximately one year. Should results indicate the viability of the project, additional phased work, both exploration and development, is planned over the course of seven total years to define the nature and size of an ore body(s) and move toward mining. Any exploration plans are dependent on acquiring suitable funding. No part of the phased program is currently funded.

13

The Tombstone claims are undeveloped. However significant amounts of aeromagnetic surveys, IP (Induced Polarization Surveys), geologic mapping by the USGS and others, and geochemical surveys including soil, rock and vegetation sampling have been conducted at various times by various parties, over the last 60 years. When compiled and analyzed these various data suggest a compelling series of anomalies that are typical of buried, dirt and rock covered porphyry copper system(s). Below is a summary of prior exploration activities performed on our Tombstone claims: