Table of Contents

·

•intellectual property or litigation developments;·

•changes in our management team;·

•economic factors unrelated to our performance; and·

•our issuance of additional shares of stock or other securities. In addition, the securities markets have experienced significant price and trading volume fluctuations. These broad market fluctuations may adversely affect the trading price of our securities. In the past, following periods of volatility in the market price of a public company’scompany's securities, securities class action litigation has often been instituted against that company. Such litigation could result in substantial cost and a diversion of management’smanagement's attention and resources.

Our quarterly operating results are volatile and may adversely affect the market price of our securities.

Our future revenues and operating results are likely to vary significantly from quarter to quarter due to a number of factors, many of which are outside our control, and any of which could harm our business. As a result, we believe that quarterly comparisons of our operating results are not necessarily meaningful and that you should not rely on the results of one quarter as an indication of our future performance. In addition to the other risk factors described in this report, additional factors that have caused and/or could cause our quarterly operating results to fluctuate and in turn affect the market price of our securities include:

·

- •

- increases in the cost of advertising;

·

- •

- our inability to retain existing customers or encourage repeat purchases;

·

- •

- the extent to which our existing and future marketing agreements are successful;

·

- •

- price competition that results in lower profit margins or losses;

·

- •

- the amount and timing of operating costs and capital expenditures relating to the expansion of our business operations and infrastructure;

·

- •

- the amount and timing of our purchases of inventory;

·

- •

- our inability to manage distribution operations or provide adequate levels of customer service;

·

- •

- our ability to successfully integrate operations and technologies from acquisitions or other business combinations;

·

- •

entering intooffering new lines of products;·

- •

- our ability to attract users to our

new auctions, and car listing and real estate sites; and·

- •

- our inability to replace the loss of significant customers.

Our operating results may fluctuate depending on the season, and such fluctuations may affect the market price of our securities.

We have experienced and expect to continue to experience fluctuations in our operating results because of seasonal fluctuations in traditional retail patterns. Sales in the retail and wholesale industry tend to be significantly higher in the fourth calendar quarter of each year than in the preceding three quarters due primarily to increased shopping activity during the holiday season. However, there can be no assurance that our sales in the fourth quarter will exceed those of the preceding quarters or, if the fourth quarter sales do exceed those of the preceding quarters, that we will be able to manage the

Table of Contents

increased sales effectively. Further, we generally increase our inventories substantially in anticipation of holiday season shopping activity, which has a negative effect on our cash flow. Securities analysts and investors may inaccurately estimate the effects of seasonality on our results of operations in one or more future quarters and, consequently, our operating results may fall below expectations, causing the market price of our securities to decline.

We do not intend to pay dividends on our common stock and you may lose the entire amount of your investment in our common stock.

We have never declared or paid any cash dividends on our common stock and do not intend to pay dividends on our common stock for the foreseeable future. We intend to invest our future earnings, if any, to fund our growth. Therefore, you will not receive any funds without selling your shares. We cannot assure that you will receive a positive return on your investment when you sell your shares or that you will not lose the entire amount of your investment.

Our Amended and Restated Certificate of Incorporation, Amended and Restated Bylaws and the Delaware General Corporation Law contain anti-takeover provisions which could discourage or prevent a takeover, even if an acquisition would be beneficial to our stockholders.

Several provisions of our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws could discourage potential acquisition proposals and could delay or prevent a change in control of our company even if that change in control would be beneficial to our stockholders. For example, only one-third of our board of directors will be elected at each of our annual meetings of stockholders, which will make it more difficult for a potential acquirer to change the management of our company, even after acquiring a majority of the shares of our common stock. These provisions, which cannot be amended without the approval of two-thirds of our stockholders, could diminish the opportunities for a stockholder to participate in tender offers, including tender offers at a price above the then current market value of our common stock. In addition, our board of directors, without further stockholder approval, may issue preferred stock, with such terms as the board of directors may determine, that could have the effect of delaying or preventing a change in control of our company. The issuance of preferred stock could also adversely affect the voting powers of the holders of common stock, including the loss of voting control to others. We are also afforded the protections of Section 203 of the

21

Table of Contents

Delaware General Corporation Law, which could delay or prevent a change in control of our company or could impede a merger, consolidation, takeover or other business combination involving our company or discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of our company.

The price of our stock may be vulnerable to manipulation.

We have filed an unfair business practice lawsuit against, Gradient Analytics, Rocker Partners, L.P. and others, alleging that the defendants have conspired to denigrate Overstock’sOverstock's business for personal profit, as well as an amended complaint alleging additional causes of action and articulating in greater detail the allegations against the defendants. We have also filed an unfair business practice lawsuit against Morgan Stanley & Co. Incorporated, Goldman Sachs & Co., Bear Stearns Companies, Inc., Bank of America Securities LLC, Bank of New York, Citigroup Inc., Credit Suisse (USA) Inc., Deutsche Bank Securities, Inc., Merrill Lynch, Pierce, Fenner & Smith, Inc., and UBS Financial Services, Inc. In September 2007, we filed an amended complaint adding Lehman Brothers Holdings Inc. as an additional defendant and articulating in greater detail the allegations against the defendants. We believe that the defendants in both of these lawsuits have engaged in unlawful actions and have caused substantial harm to Overstock, and that certain of the defendants have made efforts to drive the market price of Overstock’sOverstock's common stock down. To the extent that the defendants or other persons engage in any such actions or take any other actions to interfere with or destroy or harm Overstock’s Overstock's

Table of Contents

existing and/or prospective business relationships with its suppliers, bankers, customers, lenders, investors, prospective investors or others, our business, prospects, financial condition and results of operation may suffer, and the price of our common stock may be more volatile than it might otherwise be and/or may trade at prices below those that might prevail in the absence of any such efforts.

Our stock has consistently been on the Regulation SHO threshold list.

Regulation SHO requires the stock exchanges to publish daily a list of companies whose stock has failures-to-deliver above a certain threshold. It also requires mandatory close-outs for open fail-to-deliver positions in threshold securities persisting for over 13 days, with the aim that no security would appear on the threshold for any extended period. Despite that aim, we have consistently appeared on the Regulation SHO threshold list and, while we do not currently appear on the Regulation SHO threshold list, we have been on the list for more trading days than any other company.

Any investment in our securities involves a high degree of risk. Investors should consider carefully the risks and uncertainties described above, and all other information in this Form 10-K/A and in any reports we file with the SEC after we file this Form 10-K/A, before deciding whether to purchase or hold our securities. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also become important factors that may harm our business. The occurrence of any of the risks described in this Form 10-K/A could harm our business. The trading price of our securities could decline due to any of these risks and uncertainties, and investors may lose part or all of their investment.

Available Information

Our Internet website address is http://www.overstock.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through our Internet website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Our Internet website and the information contained therein or connected thereto are not a part of or incorporated into this Annual Report on Form 10-K/A.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Corporate office space

ThroughIn July 2005, we leased 43,000 square feet of office space at Old Mill Corporate Center I for our principal executive offices under an operating lease which was originally scheduled to expire in January 2007. Beginning July 2005, this lease was terminated and replaced with a lease for approximately 154,000 rentable square feet in the Old Mill Corporate Center III in Salt Lake City, Utah for a term of ten years.

We entered into a Tenant Improvement Agreement (the “OMIII Agreement”) with Old Mill Corporate Center III, LLC (the “Lessor”) relating to the office building in February 2005. The OMIII Agreement sets forth the terms on which we paid the costs of certain improvements to the leased office space. The amount of the costs was approximately $2.0 million. The OMIII Agreement also required us to provide a letter of credit in the amount of $500,000 to the Lessor to provide funds for the removal of certain improvements upon the termination of the lease.

In 2006, we commenced implementation of a facilities consolidation and restructuring program. Under the program, we recorded $638,000 of accelerated depreciation of leasehold improvements related to our current office facilities that we are attempting to sublease, and $450,000 of costs incurred to return our office facilities to their original condition as required by the lease agreement.

During fiscal year 2007, we recorded an additional $6.2 million of restructuring costs related to our marketing for sub-lease office and data center space in our current corporate office facilities. We also recorded an additional $2.2 million of restructuring charges related to accelerated depreciation of leasehold improvements located in the abandoned office and co-location data center space and $200,000 of other miscellaneous restructuring charges (see Item 15 of Part IV, “Financial Statements (Restated)”—Note 4—“Restructuring Expense”).

Logistics and warehouse space

In July 2004, we entered into a logistics service agreement (the “Logistics Agreement”) wherein the handling, storage and distribution of some of our prepackaged products were performed by a third party. The Logistics Agreement and subsequent amendment set forth terms on which we paid various fixed fees based onWe currently lease 795,000 square feet of storage and various variable costs based on product handling costs for a term of five years.

In December 2005, we entered into a warehouse facilities lease agreement (the “License Agreement”) to license approximately 400,000 square feet of warehouse space in Indiana. The License Agreement was subsequently amended, reducing the amount of lease space to approximately 300,000 and extending the term to 2011.

In the first quarter of 2007, we terminated the Logistics Agreement and gave notice of intent to sublease the Indiana warehouse facilities under the License Agreement. During the second quarter of 2007, we reached an agreement to terminate the Indiana warehouse facilities lease effective August 15, 2007. As a result of the termination of the License agreement and warehouse lease, we incurred $3.7 million of related restructuring charges in 2007 (see Item 15 of Part IV, “Financial Statements (Restated)”—Note 4—“Restructuring Expense”).

We lease 561,000 square feet for our warehouse facilities in Utah under operating leases which expire in August 2012. We also temporarily2012 and August 2015.

On April, 8, 2008, we entered into a lease agreement with Natomas Meadows, LLC (the "Natomas Lease"). The Natomas Lease is for a 686,865 square foot warehouse facility in Salt Lake City, Utah (the "New Warehouse"). The Natomas Lease provides that we will lease the New Warehouse in stages: on October 15, 2008, we leased an additional 251,000the initial 232,900 square feet of warehouse space in Utah under operating leasesthe New Warehouse; on February 1, 2009, we leased a total of 435,400 square feet; and, on September 1, 2009, we will lease the remainder, for a total of 686,865 square feet. The Natomas Lease term is seven years, and specifies rent, exclusive of common area maintenance fees, at a variable rate over the course of the staged lease term, ranging from $0.3300 per square foot for the seasonal increasefirst stage, to $0.3950 per square foot for the last year of the Natomas Lease term. Including the space now leased in inventory during the fourth quarterNew Warehouse, we currently have warehouse operations in two facilities in Salt Lake City. The Natomas Lease anticipates that we may construct a corporate office facility within the New Warehouse. We constructed a 40,000 square foot customer service facility in the New Warehouse and commenced use of 2007.

22the facility on November 3, 2008.

Table of Contents

Co-location data center

In July 2005, we entered into a Co-location Center Agreement (the “Co-location Agreement”) to build out and lease 11,289 square feet of space at Old Mill Corporate Center II for an IT co-location data center. The Co-location Agreement set forth the terms on which the Lessor would incur the costs to build out the IT co-location data center and we would commence to lease the space upon its completion for a term of ten years. In November 2006 however, we made the determination to consolidate our facilities and to not occupy the IT co-location data center, and the Co-location Agreement was terminated effective December 29, 2006, for which we incurred a $4.6 million restructuring charge (see Item 15 of Part IV, “Financial Statements (Restated)”—Note 4—“Restructuring Expense”).

In December 2006, we entered into a Data Center Agreement (the “OM"OM I Agreement”Agreement") to lease 3,999 square feet of space at Old Mill Corporate Center I for an IT data center to allow us to consolidate other IT data center facilities at the Old Mill Corporate Center II and at our current corporate offices facilities.

We believe that theseall the above listed facilities will be sufficient for our needs for at least the next twelve months, subject to seasonal requirements for additional warehouse space during the fourth quarter. Also, we are still considering further consolidation of office space, possibly through a complete relocation of our corporate office facilities.

ITEM 3. LEGAL PROCEEDINGS

The information set forth under Item 15 of Part IV, “Financial Statements (Restated)”"Financial Statements"—Note 13—“14—"Commitments and Contingencies”,Contingencies," subheading “Legal Proceedings”,"Legal Proceedings," contained in the “Notes"Notes to Consolidated Financial Statements”Statements" of this Annual Report on Form 10-K/A is incorporated by reference in answer to this Item.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of security holders during the fourth quarter of 2007.2008.

EXECUTIVE OFFICERS OF THE REGISTRANT

The following persons were executive officers of Overstock.com as of March 1, 2008:

Executive Officers

|

| Age

|

| Position

|

Patrick M. Byrne

| | 45

| | Chairman, Chief Executive Officer

|

Stephen P. Tryon

| | 46

| | Senior Vice President, Logistics

|

Jonathan E. Johnson III

| | 42

| | Senior Vice President, Corporate Affairs and Legal

|

David K. Chidester

| | 36

| | Senior Vice President, Finance

|

Stormy Simon

| | 39

| | Senior Vice President, Customer Care, PR and Branding

|

Sam Peterson

| | 32

| | Senior Vice President, Technology

|

Jacob Hawkins

| | 32

| | Senior Vice President, Change Management

|

Dr. Patrick M. Byrne has served as our Chief Executive Officer (principal executive officer) and as a Director since October 1999, as Chairman of the Board from February 2001 through October 2005, and since July 2006. From September 1997 to May 1999, Dr. Byrne served as President and Chief Executive Officer of Fechheimer Brothers, Inc., a manufacturer and distributor of uniforms. From 1995 until its sale in September 1999, Dr. Byrne was Chairman, President and Chief Executive Officer of Centricut, LLC, a manufacturer and distributor of industrial torch parts. From 1994 to the present, Dr. Byrne has served as a Manager of the Haverford Group, an investment company and an affiliate of Overstock. Dr. Byrne has a Bachelor of Arts degree in Chinese studies from Dartmouth College, a Master’s degree from Cambridge University as a Marshall Scholar, and a Ph.D. in philosophy from Stanford University.

Mr. Stephen P. Tryon joined Overstock.com in August 2004, and serves as Senior Vice President, Logistics, with primary responsibility for logistics and supervision of the Company’s warehouse operations, and most recently, managing the Company’s human resources. Prior to joining Overstock.com, Mr. Tryon was the Legislative Assistant to the Chief of Staff of the United States Army. During his 21 years with the Army, his assignments included director of plans for the 10th Mountain Division, Congressional Fellow for United States Senator Max Cleland, Assistant Professor of Philosophy at the United States Military Academy, and commander of a company of paratroopers. Mr.Tryon received a B.S. in Applied Sciences from the U.S. Military Academy in 1983 and a M.A. in Philosophy from Stanford University in 1992.

Mr. Jonathan E. Johnson III joined Overstock.com in September 2002. He has served as our General Counsel and as our Vice President, Strategic Projects, and currently serves as our Senior Vice President, Corporate Affairs and Legal and as our Secretary. From May 1999 to September 2002, Mr. Johnson held various positions with TenFold Corporation, including positions as General Counsel, Executive Vice President and Chief Financial Officer. From October 1997 to April 1999, Mr. Johnson practiced law in the Los Angeles offices of Milbank, Tweed, Hadley & McCloy and from September 1994 to September 1997, he practiced law in the Los Angeles offices of Graham & James. From February 1994 to August 1994, Mr. Johnson served as a judicial clerk at the Utah Supreme Court for Justice Leonard H. Russon, and prior to that, from August 1993 to January 1994, Mr. Johnson served as a judicial clerk at the Utah Court of Appeals for Justice Russon. Mr. Johnson holds a Bachelor’s Degree in Japanese from Brigham Young University, studied for a year at Osaka University of Foreign Studies in Japan, and received his law degree from the J. Reuben Clark, Jr. Law School at Brigham Young University.

Mr. David K. Chidester currently serves as our Senior Vice President, Finance (our principal financial and accounting officer). Mr. Chidester served as our Controller from August 1999 to August 2003 and as our Acting Chief Financial Officer from August 2003 to January 2004. Prior to joining Overstock.com, Mr. Chidester was with PricewaterhouseCoopers LLP from December 1995 to August 1999. Mr. Chidester holds a Bachelor of Science Degree in Accounting and a Master’s Degree in Business Administration, both from the University of Utah.

Ms. Stormy Simon currently serves as our Senior Vice President, Customer Care and Strategic Marketing. Ms. Simon previously served as our Vice President, BMMG, Travel and Off-Line Advertising, Chief of Staff and as our Director of B2B. Prior to joining Overstock.com in 2001, Ms. Simon worked in the media and travel industries.

Mr. Sam Peterson currently serves as our Senior Vice President, Technology. Mr. Peterson previously served as the Vice President, Software Development from early 2005, and was appointed as Director, Network and Systems Engineering in 2003. Prior to joining Overstock in 1999, Mr. Peterson was involved in creating several start-up internet ventures, including Fitnesoft, Inc.

Mr. Jacob Hawkins currently serves as Senior Vice President, Change Management. Mr. Hawkins has performed various roles across the organization, including business development, marketing, merchandising, technology, and project management. Prior to joining Overstock.com, Mr. Hawkins worked for Professional Marketing International. Mr. Hawkins holds a Bachelor’s degree in Business Management from Brigham Young University and a Masters of Business Administration with an emphasis in information systems from the University of Utah.

There are no family relationships among any of the current officers and directors of the Company.

23

Table of Contents

PART II

ITEM 5. MARKET FOR THE REGISTRANT’SREGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is traded on the NASDAQ Global Market under the symbol “OSTK”."OSTK." Prior to May 30, 2002, there was no public market for our common stock. The following table sets forth, for the periods indicated, the high and low sales prices per share for our common stock as reported by NASDAQ.

| | | | | | | | |

| | Common

Stock Price | |

|---|

| | High | | Low | |

|---|

Year Ended December 31, 2007 | | | | | | | |

| | First Quarter | | | 19.72 | | | 14.05 | |

| | Second Quarter | | | 19.98 | | | 15.80 | |

| | Third Quarter | | | 28.99 | | | 17.22 | |

| | Fourth Quarter | | | 39.39 | | | 14.75 | |

Year Ended December 31, 2008 | | | | | | | |

| | First Quarter | | | 15.68 | | | 8.61 | |

| | Second Quarter | | | 28.50 | | | 11.50 | |

| | Third Quarter | | | 29.59 | | | 13.64 | |

| | Fourth Quarter | | | 20.13 | | | 6.34 | |

Table of Contents

STOCK PERFORMANCE GRAPH

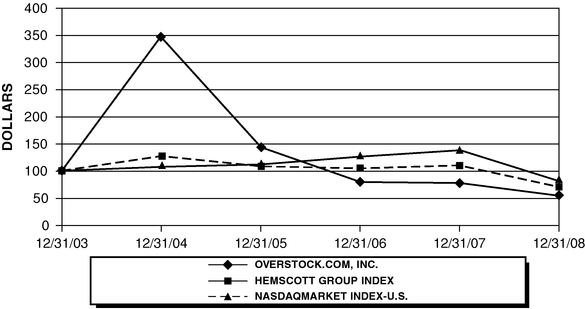

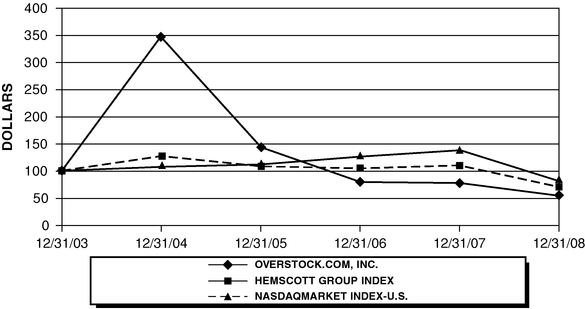

The following graph shows a comparison of cumulative total stockholder return, calculated on a dividend reinvested basis, from the market closing price on December 31, 2003 through December 31, 2008 for Overstock.com, Inc., Hemscott's (formerly Media General's) Nasdaq U.S. Index and Hemscott's Internet Software and Services Index. The graph assumes that $100 was invested in Overstock's common stock and the above indices at the closing prices on December 31. Historic stock price performance is not necessarily indicative of future stock price performance.

| | Common

Stock Price | |

| | High | | Low | |

Year Ended December 31, 2006 | | | | | |

First Quarter | | 35.02 | | 21.60 | |

Second Quarter | | 30.63 | | 19.00 | |

Third Quarter | | 22.93 | | 16.03 | |

Fourth Quarter | | 19.09 | | 13.40 | |

Year Ended December 31, 2007 | | | | | |

First Quarter | | 19.72 | | 14.05 | |

Second Quarter | | 15.80 | | 19.98 | |

Third Quarter | | 28.99 | | 17.22 | |

Fourth Quarter | | 39.39 | | 14.75 | |

COMPARISON OF CUMULATIVE TOTAL RETURN

AMONG OVERSTOCK.COM, INC.,

NASDAQ MARKET INDEX-U.S. AND HEMSCOTT GROUP INDEX

ASSUMES $100 INVESTED ON DEC. 31, 2003

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING DEC. 31, 2008

Holders

As of March 14, 2008,February 23, 2009, there were 194183 holders of record of our common stock. Because many of our shares of common stock are held by brokers and other institutions on behalf of shareholders, we are unable to estimate the total number of shareholders represented by these record holders.

Dividends

We have never declared or paid any cash dividends on our common stock. We currently intend to retain any earnings for future growth and do not anticipate paying any cash dividends in the foreseeable future. Any future determination to pay dividends will be at the discretion of our board of directors and will depend on our results of operations, financial conditions, contractual and legal restrictions and other factors the board deems relevant. Our Loan and Security Agreement with Wells Fargo Retail Finance, LLC dated December 12, 2005as amended and restated on January 6, 2009, prohibits us from paying dividends without the consent of the lender.

Table of Contents

Recent Sales of Unregistered Securities

During January 2005, the BoardNone.

Issuer Purchases of Directors authorized a stock repurchase program under which we were authorized to repurchase up to $50.0 million of our common stock through December 31, 2007. On April 26, 2005, the Board of Directors increased the amount of the share repurchase program to $100.0 million. Additionally, on June 14, 2005, the Board of Directors authorized an amendment of the stock repurchase program to include the repurchase of its Convertible Senior Notes.

During 2005, we entered into several purchased call options, pursuant to which we could have been required to purchase up to 1.3 million shares of our common stock at certain settlement dates during the quarter ended June 30, 2005. In connection with these repurchase transactions; we paid approximately $47.5 million, which was recorded in shareholders’ equity in the consolidated balance sheet.

At our option, the purchased call options were settled in cash or stock, based on the market price of our common stock on the date of the settlement. Upon settlement, we either had our capital investment returned with a premium or received shares of our common stock, depending, respectively, on whether the market price of our common stock was above or below a pre-determined price agreed in connection with each such transaction.

Under the share repurchase program, we repurchased approximately 665,000 shares of our common stock in open market transactions for $24.1 million during the year ended December 31, 2005. In addition, approximately 1.0 million shares of common stock were acquired as a result of the settlement of $41.1 million of structured stock repurchase transactions during the twelve months ended December 31, 2005. The purchased call options that did not settle in stock settled in cash totaling $7.9 million, which we received in July 2005.

Equity Securities

In January 2008, the Board of Directors an additionalapproved a repurchase program under which we arewere authorized to repurchase up to $20.0 million of our common stock and/or Convertible Senior Notes due 2011 through December 31, 2009. Under this repurchase program, we repurchased approximately 1.11.2 million shares of our common stock in open market transactions for $12.0$13.4 million through March 14, 2008. None of the purchases were made during the fourth quarteryear ended December 31, 2008. The Company had fully utilized the authorized this $20.0 million repurchase program as of 2007.

December 31, 2008.

We have a 401(k) defined contribution plan which permits participating employees to defer up to a maximum of 25% of their compensation, subject to limitations established by the Internal Revenue Code. Employees who have completed a half-year of service and are 21 years of age or older are qualified to participate in the plan. We match 50% of the first 6% of each participant’sparticipant's contributions to the plan. Participant contributions are immediately vested. Company contributions vest based on the participant’sparticipant's years of service at 20% per year over five years. Our matching contribution totaled $261,000, $389,000, $494,000 and $494,000$570,000 during 2005,the years ended December 31, 2006, 2007 and 2007,2008, respectively. Beginning in 2006 and through January of 2008, our matching contribution was paid using common stock issued from treasury. In addition, for the 2005, 2006 and 2007, years, the board of directors approved a discretionary contributioncontributions of 2% of salary to all employees eligible to participate in the plan totaling $342,000, $409,000 and $408,000, respectively. The contributions in 2006 and 2007 were settled with shares of our common stock in the following year. No discretionary contributions were approved or paid for 2008.

Stock based Compensation

Stock Options

Our board of directors adopted the Amended and Restated 1999 Stock Option Plan, the 2002 Stock Option Plan and the 2005 Equity Incentive Plan (collectively, the “Plans”"Plans"), in May 1999, April 2002 and April 2005, respectively. Under these Plans, the Board of Directors may issue incentive stock options to our employees and directors and non-qualified stock options to our consultants, as well as other types of awards under the 2005 Equity Incentive Plan. Options granted under these Plans generally expire at the end of either five or ten years and vest in accordance with a vesting schedule determined by our Board of Directors, usually over four years from the grant date. As of the initial public offering, the Amended and Restated 1999 Stock Option Plan was terminated. FutureSubsequent awards will be made under the 2005 Equity Incentive Plan. As of December 31, 2007, 608,0002008, 1.2 million shares of stock based awards were available for future grants under these Plans.

24

Table of Contents

the 2005 Equity Incentive Plan.

The following is a summary of stock option activity (amounts in thousands, except per share data):

| | | | | | | | | | | | | | | | | | | | |

| | 2006 | | 2007 | | 2008 | |

|---|

| | Shares | | Weighted

Average

Exercise

Price | | Shares | | Weighted

Average

Exercise

Price | | Shares | | Weighted

Average

Exercise

Price | |

|---|

Outstanding—beginning of year | | | 1,299 | | $ | 18.09 | | | 1,011 | | $ | 18.97 | | | 1,161 | | $ | 20.48 | |

| | Granted at fair value | | | 183 | | | 22.47 | | | 762 | | | 18.14 | | | 11 | | | 14.14 | |

| | Exercised | | | (276 | ) | | 9.19 | | | (354 | ) | | 8.81 | | | (112 | ) | | 12.96 | |

| | Canceled/forfeited | | | (195 | ) | | 30.17 | | | (258 | ) | | 23.65 | | | (86 | ) | | 20.45 | |

| | | | | | | | | | | | | | | | | |

Outstanding—end of year | | | 1,011 | | | 18.97 | | | 1,161 | | | 20.48 | | | 974 | | | 21.27 | |

| | | | | | | | | | | | | | | | | |

Options exercisable at year-end | | | 679 | | $ | 15.74 | | | 408 | | $ | 22.36 | | | 609 | | $ | 23.18 | |

Table of Contents

| | 2005 | | 2006 | | 2007 | |

| | Shares | | Weighted

Average

Exercise

Price | | Shares | | Weighted

Average

Exercise

Price | | Shares | | Weighted

Average

Exercise

Price | |

Outstanding—beginning of year | | 1,512 | | $ | 12.90 | | 1,299 | | $ | 18.09 | | 1,011 | | $ | 18.97 | |

Granted at fair value | | 220 | | 44.44 | | 183 | | 22.47 | | 762 | | 18.14 | |

Exercised | | (298 | ) | 8.56 | | (276 | ) | 9.19 | | (354 | ) | 8.81 | |

Canceled/forfeited | | (135 | ) | 24.08 | | (195 | ) | 30.17 | | (258 | ) | 23.65 | |

| | | | | | | | | | | | | |

Outstanding—end of year | | 1,299 | | 18.09 | | 1,011 | | 18.97 | | 1,161 | | 20.48 | |

| | | | | | | | | | | | | |

Options exercisable at year-end | | 739 | | $ | 11.33 | | 679 | | $ | 15.74 | | 408 | | $ | 22.36 | |

Restricted Stock Units Activity

InDuring the first quarter ofyear ended December 31, 2008, the Compensation Committee of the Board of Directors approved grants of approximately 460,000491,000 restricted stock units towere granted. The cost of restricted stock units is determined using the fair value of our officerscommon stock on the date of the grant and employees whichcompensation expense is recognized in accordance with the vesting schedule. The weighted average grant date fair value of restricted stock units granted during the year ended December 31, 2008 was $12.64.

The following is a summary of restricted stock unit activity (amounts in thousands, except per share data):

| | | | | | | | |

| | 2008 | |

|---|

| | Units | | Grant Date

Fair Value | |

|---|

Outstanding—beginning of year | | | — | | $ | — | |

| | Granted at fair value | | | 491 | | | 12.64 | |

| | Vested | | | — | | | — | |

| | Canceled/forfeited | | | (42 | ) | | 12.13 | |

| | | | | | | |

Outstanding—end of year | | | 449 | | | 12.69 | |

| | | | | | | |

Restricted stock units vested at year-end | | | — | | | — | |

Restricted stock units vest over three years at 25% at the end of the first year, an additional 25% at the end of the second year and 50% at the end of the third year. During 2007, except as previously reported in a Quarterly Report on Form 10-Q/A, or current Report on Form 8-K, we did not sell any equity securities that were not registered under the Securities Act.

STOCK PERFORMANCE GRAPH

The following graph shows a comparison of cumulative total stockholder return, calculated on a dividend reinvested basis, from the market closing price onyears ended December 31, 2002 through2006, 2007 and 2008, the Company recorded stock based compensation related to restricted stock units of $0, $0 and $896,000.

At December 31, 2007 for Overstock.com, Inc., Hemscott’s (formerly Media General’s) Nasdaq U.S. Index and Hemscott’s Internet Software and Services Index. The graph assumes that $100 was invested in Overstock’s common2008, 449,000 restricted stock and the above indices at the closing prices onunits were outstanding. No restricted stock units had been vested as of December 31, 2002. Historic2008. On January 13, 2009, 337,000 restricted stock price performance is not necessarily indicativeunits were granted.

Table of future stock price performance.Contents

COMPARISON OF CUMULATIVE TOTAL RETURN ITEM 6. SELECTED FINANCIAL DATA

AMONG OVERSTOCK.COM, INC.,

NASDAQ MARKET INDEX-U.S. AND HEMSCOTT GROUP INDEX

ASSUMES $100 INVESTED ON DEC. 31, 2002

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING DEC. 31, 2007

25

| | | | | | | | | | | | | | | | | | |

| | Year ended December 31, | |

|---|

| | 2004 | | 2005 | | 2006(1) | | 2007 | | 2008 | |

|---|

| | (in thousands, except per share data)

| |

|---|

Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | |

Revenue | | | | | | | | | | | | | | | | |

| | Direct revenue | | $ | 212,264 | | $ | 323,136 | | $ | 301,509 | | $ | 197,088 | | $ | 174,203 | |

| | Fulfillment partner revenue | | | 278,357 | | | 471,839 | | | 478,628 | | | 568,814 | | | 660,164 | |

| | | | | | | | | | | | |

| | | Total revenue | | | 490,621 | | | 794,975 | | | 780,137 | | | 765,902 | | | 834,367 | |

| | | | | | | | | | | | |

Cost of goods sold | | | | | | | | | | | | | | | | |

| | Direct | | | 183,653 | | | 280,647 | | | 284,774 | | | 168,008 | | | 154,501 | |

| | Fulfillment partner | | | 240,530 | | | 397,855 | | | 405,559 | | | 473,344 | | | 536,957 | |

| | | | | | | | | | | | |

| | | Total cost of goods sold | | | 424,183 | | | 678,502 | | | 690,333 | | | 641,352 | | | 691,458 | |

| | | | | | | | | | | | |

Gross profit | | | 66,438 | | | 116,473 | | | 89,804 | | | 124,550 | | | 142,909 | |

| | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | |

| | Sales and marketing | | | 40,559 | | | 77,155 | | | 70,897 | | | 55,458 | | | 57,634 | |

| | Technology | | | 8,509 | | | 27,901 | | | 65,158 | | | 59,453 | | | 57,815 | |

| | General and administrative | | | 22,024 | | | 33,043 | | | 46,837 | | | 41,976 | | | 38,373 | |

| | Restructuring(2) | | | — | | | — | | | 5,674 | | | 12,283 | | | — | |

| | | | | | | | | | | | |

| | | Total operating expenses | | | 71,092 | | | 138,099 | | | 188,566 | | | 169,170 | | | 153,822 | |

| | | | | | | | | | | | |

Operating loss | | | (4,654 | ) | | (21,626 | ) | | (98,762 | ) | | (44,620 | ) | | (10,913 | ) |

Interest income, net | | | 1,064 | | | (161 | ) | | 3,566 | | | 4,788 | | | 3,163 | |

Interest expense | | | (775 | ) | | (5,582 | ) | | (4,765 | ) | | (4,188 | ) | | (3,462 | ) |

Other income (expense), net | | | (49 | ) | | 4,728 | | | 81 | | | (92 | ) | | (1,446 | ) |

| | | | | | | | | | | | |

Loss from continuing operations | | | (4,414 | ) | | (22,641 | ) | | (99,880 | ) | | (44,112 | ) | | (12,658 | ) |

Loss from discontinued operations | | | — | | | (2,571 | ) | | (6,882 | ) | | (3,924 | ) | | — | |

| | | | | | | | | | | | |

Net loss | | | (4,414 | ) | | (25,212 | ) | | (106,762 | ) | | (48,036 | ) | | (12,658 | ) |

Deemed dividend related to redeemable common stock | | | (188 | ) | | (185 | ) | | (99 | ) | | — | | | — | |

| | | | | | | | | | | | |

Net loss attributable to common shares | | $ | (4,602 | ) | $ | (25,397 | ) | $ | (106,861 | ) | $ | (48,036 | ) | $ | (12,658 | ) |

| | | | | | | | | | | | |

Net loss per common share—basic and diluted | | | | | | | | | | | | | | | | |

| | Loss from continuing operations | | $ | (0.26 | ) | $ | (1.17 | ) | $ | (4.91 | ) | $ | (1.86 | ) | $ | (0.55 | ) |

| | Loss from discontinued operations | | $ | — | | $ | (0.13 | ) | $ | (0.34 | ) | $ | (0.17 | ) | $ | — | |

Net loss per common share—basic and diluted | | $ | (0.26 | ) | $ | (1.30 | ) | $ | (5.25 | ) | $ | (2.03 | ) | $ | (0.55 | ) |

Weighted average common shares outstanding—basic and diluted | | | 17,846 | | | 19,429 | | | 20,332 | | | 23,704 | | | 22,901 | |

Table of Contents

ITEM 6. SELECTED FINANCIAL DATA (RESTATED)

Restatement

As discussed in Item 15 of Part IV “Financial Statements (Restated)” – Note 3 – “Restatement of Financial Statements”, the Company is restating (1) its consolidated financial statements as of December 31, 2007 and 2006 and for the years ended December 31, 2007, 2006, 2005; (2) its selected financial data as of and for the years ended December 31, 2007, 2006, 2005, 2004 and 2003; and (3) its quarterly results of operations for all quarters in the years ended December 31, 2007 and 2006 in this Amendment to the Company’s Annual Report on Form 10-K for the year ended December 31, 2007 to correct errors related to the accounting for customer refunds and credits and the accounting for gift cards issued to customers. All amounts in Selected Financial Data (Restated) have been adjusted, as appropriate, for the effects of the restatement.

The following selected consolidated financial data as of December 31, 2006 and 2007 and for each of the three years in the period ended December 31, 2007, are derived from our audited consolidated financial statements included elsewhere in this Form 10-K/A. The consolidated financial data as of December 31, 2003, 2004 and 2005 and for the years ended December 31, 2003 and 2004 are derived from our restated unaudited consolidated financial statements not contained herein. The historical results do not necessarily indicate results expected for any future period. This information should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations (Restated)” and the Consolidated Financial Statements and the related notes thereto included elsewhere in this Form 10-K/A.

| | Year ended December 31, | |

| | 2003(4)

(Restated) | | 2004(4)

(Restated) | | 2005(4)

(Restated) | | 2006(1)(4)

(Restated) | | 2007(4)

(Restated) | |

| | (in thousands, except per share data) | |

| | | | | | | | | | | |

Consolidated Statement of Operations Data: | | | | | | | | | | | |

Revenue | | | | | | | | | | | |

Direct revenue | | $ | 136,317 | | $ | 212,264 | | $ | 323,136 | | $ | 301,509 | | $ | 197,088 | |

Fulfillment partner revenue | | 98,286 | | 278,357 | | 471,839 | | 478,628 | | 568,814 | |

| | | | | | | | | | | |

Total revenue | | 234,603 | | 490,621 | | 794,975 | | 780,137 | | 765,902 | |

| | | | | | | | | | | |

Cost of goods sold | | | | | | | | | | | |

Direct | | 122,418 | | 183,653 | | 280,647 | | 284,774 | | 168,008 | |

Fulfillment partner | | 86,902 | | 240,530 | | 397,855 | | 405,559 | | 473,344 | |

| | | | | | | | | | | |

Total cost of goods sold | | 209,320 | | 424,183 | | 678,502 | | 690,333 | | 641,352 | |

| | | | | | | | | | | |

Gross profit | | 25,283 | | 66,438 | | 116,473 | | 89,804 | | 124,550 | |

| | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | |

Sales and marketing | | 20,228 | | 40,559 | | 77,155 | | 70,897 | | 55,458 | |

Technology | | 2,549 | | 8,509 | | 27,901 | | 65,158 | | 59,453 | |

General and administrative | | 14,987 | | 22,024 | | 33,043 | | 46,837 | | 41,976 | |

Restructuring(2) | | — | | — | | — | | 5,674 | | 12,283 | |

| | | | | | | | | | | |

Total operating expenses | | 37,764 | | 71,092 | | 138,099 | | 188,566 | | 169,170 | |

| | | | | | | | | | | |

Operating loss | | (12,481 | ) | (4,654 | ) | (21,626 | ) | (98,762 | ) | (44,620 | ) |

Interest income, net | | 461 | | 1,064 | | (161 | ) | 3,566 | | 4,788 | |

Interest expense | | (76 | ) | (775 | ) | (5,582 | ) | (4,765 | ) | (4,188 | ) |

Other (expense) income, net | | 115 | | (49 | ) | 4,728 | | 81 | | (92 | ) |

| | | | | | | | | | | |

Loss from continuing operations | | (11,981 | ) | (4,414 | ) | (22,641 | ) | (99,880 | ) | (44,112 | ) |

Discontinued operations(3): | | — | | — | | — | | — | | — | |

Loss from discontinued operations | | — | | — | | (2,571 | ) | (6,882 | ) | (3,924 | ) |

| | | | | | | | | | | |

Net loss | | (11,981 | ) | (4,414 | ) | (25,212 | ) | (106,762 | ) | (48,036 | ) |

Deemed dividend related to redeemable common stock | | (262 | ) | (188 | ) | (185 | ) | (99 | ) | — | |

| | | | | | | | | | | |

Net loss attributable to common shares | | $ | (12,243 | ) | $ | (4,602 | ) | $ | (25,397 | ) | $ | (106,861 | ) | $ | (48,036 | ) |

| | | | | | | | | | | |

Net loss per common share—basic and diluted | | | | | | | | | | | |

Loss from continuing operations | | $ | (0.76 | ) | $ | (0.26 | ) | $ | (1.17 | ) | $ | (4.91 | ) | $ | (1.86 | ) |

Loss from discontinued operations | | $ | — | | $ | — | | $ | (0.13 | ) | $ | (0.34 | ) | $ | (0.17 | ) |

Net loss per common share—basic and diluted | | $ | (0.76 | ) | $ | (0.26 | ) | $ | (1.30 | ) | $ | (5.25 | ) | $ | (2.03 | ) |

Weighted average common shares outstanding—basic and diluted | | 16,198 | | 17,846 | | 19,429 | | 20,332 | | 23,704 | |

26

| | | | | | | | | | | | | | | | |

| | As of December 31, | |

|---|

| | 2004 | | 2005 | | 2006(3) | | 2007(3) | | 2008 | |

|---|

| | (in thousands)

| |

|---|

Balance Sheet Data: | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 198,678 | | $ | 55,875 | | $ | 126,965 | | $ | 101,394 | | $ | 100,577 | |

Marketable securities | | | 88,802 | | | 55,799 | | | — | | | 46,000 | | | 8,989 | |

Working capital | | | 267,640 | | | 79,561 | | | 59,475 | | | 62,621 | | | 39,679 | |

Total assets | | | 381,600 | | | 335,953 | | | 264,453 | | | 231,143 | | | 172,445 | |

Total indebtedness | | | 117,589 | | | 84,676 | | | 84,336 | | | 82,453 | | | 69,130 | |

Redeemable common stock | | | 3,166 | | | 3,205 | | | — | | | — | | | — | |

Stockholders' equity (deficit) | | | 169,504 | | | 89,148 | | | 56,367 | | | 18,212 | | | (2,985 | ) |

Table of Contents

| | As of December 31, | |

| | 2003 (4)

(Restated) | | 2004 (4)

(Restated) | | 2005 (4)

(Restated) | | 2006 (4)

(Restated) | | 2007 (4)

(Restated) | |

| | (in thousands) | |

| | | | | | | | | | | |

Balance Sheet Data: | | | | | | | | | | | |

Cash and cash equivalents | | $ | 28,846 | | $ | 198,678 | | $ | 55,875 | | $ | 126,965 | | $ | 101,394 | |

Marketable securities | | 11,500 | | 88,802 | | 55,799 | | — | | 46,000 | |

Working capital | | 45,668 | | 267,640 | | 79,561 | | 59,475 | | 62,621 | |

Total assets | | 100,170 | | 381,600 | | 335,953 | | 264,453 | | 231,143 | |

Total indebtedness | | 161 | | 117,589 | | 84,676 | | 84,336 | | 82,453 | |

Redeemable common stock | | 2,978 | | 3,166 | | 3,205 | | — | | — | |

Stockholders’ equity | | 55,298 | | 169,504 | | 89,148 | | 56,367 | | 18,212 | |

| | | | | | | | | | | | | | | | |

- (1)

Effective January 1, 2006, we adopted SFAS 123(R) and recognized stock-based compensation of $4.1 million, and $4.5 million, inand $3.3 million during the years ended December 31, 2006, 2007 and 2007,2008, respectively.

(2)During the fourth quarter of 2006, we commenced implementation of a facilities consolidation and restructuring program designed to reduce the overall expense structure in an effort to improve future operating performance (see Item 15 of Part IV, “Financial Statements (Restated)”"Financial Statements"—Note 4—“3—"Restructuring Expense”Expense").

(3)As part of the program to reduce our expense structure and sell non-core businesses, we decided during the fourth quarter of 2006 to sell our travel subsidiary (“OTravel”("OTravel"). As a result, OTravel’sOTravel's operations have been classified as a discontinued operation and therefore are not included in the results of continuing operations. The loss from discontinued operations for OTravel was $6.9 million for the year ended December 31, 2006 (including a goodwill impairment charge of $4.5 million) and $3.9 million for the year ended December 31, 2007 (including a goodwill impairment charge of $3.8 million—see Item 15 of Part IV, “Financial Statements (Restated)”"Financial Statements"—Note 5—“4—"Acquisition and Subsequent Discontinued Operations”Operations").

(4)As discussed in Item 15 of Part IV “Financial Statements (Restated)” — Note 3 — “Restatement of Financial Statements”, the Company is restating (1) its consolidated financial statements as of December 31, 2007 and 2006 and for the years ended December 31, 2007, 2006, 2005; (2) its selected financial data as of and for the years ended December 31, 2007, 2006, 2005, 2004 and 2003; and (3) its quarterly results of operations for all quarters in the years ended December 31, 2007 and 2006 in this Amendment No. 1 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2007 to correct errors related to the accounting for customer refunds and credits and the accounting for gift cards issued to customers. The effect of the error adjustments on the Consolidated Results of Operations for the years ended December 31, 2003, 2005, 2006 and 2007 is to increase net loss by $433,000, $294,000, $5.0 million and $3.0 million, respectively and decrease net loss for the year ended December 31, 2004 by $126,000. The effect of the error adjustments on loss per common share from continuing operations for the years ended December 31, 2003, 2005, 2006 and 2007 is to increase loss per common share from continuing operations by $0.03, $0.01, $0.24 and $0.13, respectively. The error adjustments did not have an effect on loss per common share from continuing operations for the year ended December 31, 2004. All amounts in Management’s Discussion and Analysis of Financial Condition and Results of Operations (Restated) have been adjusted, as appropriate, for the effects of the restatement.

The consolidated financial data as of December 31, 2003, 2004 and 2005 and for the years ended December 31, 2003 and 2004 have been restated as follows:

| | Year ended December 31, 2003 | |

| | As Reported | | Adjustments | | As Restated | |

| | (in thousands, except per share data) | |

| | | | | | | |

Consolidated Statement of Operations Data: | | | | | | | |

Revenue | | | | | | | |

Direct revenue | | $ | 138,134 | | (1,817 | ) | $ | 136,317 | |

Fulfillment partner revenue | | 100,811 | | (2,525 | ) | 98,286 | |

| | | | | | | |

Total revenue | | 238,945 | | (4,342 | ) | 234,603 | |

| | | | | | | |

Cost of goods sold | | | | | | | |

Direct | | 124,039 | | (1,621 | ) | 122,418 | |

Fulfillment partner | | 89,190 | | (2,288 | ) | 86,902 | |

| | | | | | | |

Total cost of goods sold | | 213,229 | | (3,909 | ) | 209,320 | |

| | | | | | | |

Gross profit | | 25,716 | | (433 | ) | 25,283 | |

| | | | | | | |

Operating expenses: | | | | | | | |

Sales and marketing | | 20,228 | | — | | 20,228 | |

Technology | | 2,549 | | — | | 2,549 | |

General and administrative | | 14,987 | | — | | 14,987 | |

Restructuring | | — | | — | | — | |

| | | | | | | |

Total operating expenses | | 37,764 | | — | | 37,764 | |

| | | | | | | |

Operating loss | | (12,048 | ) | (433 | ) | (12,481 | ) |

Interest income, net | | 461 | | — | | 491 | |

Interest expense | | (76 | ) | — | | (76 | ) |

Other (expense) income, net | | 115 | | — | | 115 | |

| | | | | | | |

Loss from continuing operations | | (11,548 | ) | (433 | ) | (11,981 | ) |

Discontinued operations: | | — | | — | | — | |

Loss from discontinued operations | | — | | — | | | |

| | | | | | | |

Net loss | | (11,548 | ) | (433 | ) | (11,981 | ) |

Deemed dividend related to redeemable common stock | | (262 | ) | — | | (262 | ) |

| | | | | | | |

Net loss attributable to common shares | | $ | (11,810 | ) | (433 | ) | $ | (12,243 | ) |

| | | | | | | |

Net loss per common share—basic and diluted | | | | | | | |

Loss from continuing operations | | $ | (0.73 | ) | (0.03 | ) | $ | (0.76 | ) |

Loss from discontinued operations | | $ | — | | — | | $ | — | |

Net loss per common share—basic and diluted | | $ | (0.73 | ) | (0.03 | ) | $ | (0.76 | ) |

| | | | | | | | | |

Weighted average common shares outstanding—basic and diluted | | 16,198 | | | | 16,198 | |

27

Table of Contents

| | Year ended December 31, 2004 | |

| | As Reported | | Adjustments | | As Restated | |

| | (in thousands, except per share data) | |

| | | | | | | |

Consolidated Statement of Operations Data: | | | | | | | |

Revenue | | | | | | | |

Direct revenue | | $ | 213,210 | | (946 | ) | $ | 212,264 | |

Fulfillment partner revenue | | 281,425 | | (3,068 | ) | 278,357 | |

| | | | | | | |

Total revenue | | 494,635 | | (4,014 | ) | 490,621 | |

| | | | | | | |

Cost of goods sold | | | | | | | |

Direct | | 184,964 | | (1,311 | ) | 183,653 | |

Fulfillment partner | | 243,468 | | (2,938 | ) | 240,530 | |

| | | | | | | |

Total cost of goods sold | | 428,432 | | (4,249 | ) | 424,183 | |

| | | | | | | |

Gross profit | | 66,203 | | 235 | | 66,438 | |

| | | | | | | |

Sales and marketing | | 40,559 | | — | | 40,559 | |

Technology | | 8,509 | | — | | 8,509 | |

General and administrative | | 22,024 | | — | | 22,024 | |

Restructuring | | — | | | | –– | |

| | | | | | | |

Total operating expenses | | 71,092 | | — | | 71,092 | |

| | | | | | | |

Operating loss | | (4,889 | ) | 235 | | (4,654 | ) |

Interest income, net | | 1,173 | | (109 | ) | 1,064 | |

Interest expense | | (775 | ) | — | | (775 | ) |

Other (expense) income, net | | (49 | ) | — | | (49 | ) |

| | | | | | | |

Loss from continuing operations | | (4,540 | ) | 126 | | (4,414 | ) |

Discontinued operations(3): | | — | | — | | — | |

Loss from discontinued operations | | — | | — | | — | |

| | | | | | | |

Net loss | | (4,540 | ) | 126 | | (4,414 | ) |

Deemed dividend related to redeemable common stock | | (188 | ) | — | | (188 | ) |

| | | | | | | |

Net loss attributable to common shares | | $ | (4,728 | ) | 126 | | $ | (4,602 | ) |

| | | | | | | |

Net loss per common share—basic and diluted | | | | | | | |

Loss from continuing operations | | $ | (0.26 | ) | — | | $ | (0.26 | ) |

Loss from discontinued operations | | $ | — | | — | | $ | — | |

Net loss per common share—basic and diluted | | $ | (0.26 | ) | — | | $ | (0.26 | ) |

| | | | | | | |

Weighted average common shares outstanding—basic and diluted | | 17,846 | | | | 17,846 | |

28

Table of Contents

| | As of December 31, 2003 | |

| | As Reported | | Adjustments | | As Restated | |

| | (in thousands) | |

| | | | | | | |

Balance Sheet Data: | | | | | | | |

Cash and cash equivalents | | $ | 28,846 | | — | | $ | 28,846 | |

Marketable securities | | 11,500 | | — | | 11,500 | |

Working capital | | 46,101 | | (433 | ) | 45,668 | |

Total assets | | 98,549 | | 1,621 | | 100,170 | |

Total indebtedness | | 161 | | — | | 161 | |

Redeemable common stock | | 2,978 | | — | | 2,978 | |

Stockholders’ equity | | 55,731 | | (433 | ) | 55,298 | |

| | | | | | | | | |

| | As of December 31, 2004 | |

| | As Reported | | Adjustments | | As Restated | |

| | (in thousands) | |

| | | | | | | |

Balance Sheet Data: | | | | | | | |

Cash and cash equivalents | | $ | 198,678 | | — | | $ | 198,678 | |

Marketable securities | | 88,802 | | — | | 88,802 | |

Working capital | | 267,947 | | (307 | ) | 267,640 | |

Total assets | | 377,543 | | 4,057 | | 381,600 | |

Total indebtedness | | 117,589 | | — | | 117,589 | |

Redeemable common stock | | 3,166 | | — | | 3,166 | |

Stockholders’ equity | | 169,811 | | (307 | ) | 169,504 | |

| | | | | | | | | |

| | As of December 31, 2005 | |

| | As Reported | | Adjustments | | As Restated | |

| | (in thousands) | |

| | | | | | | |

Balance Sheet Data: | | | | | | | |

Cash and cash equivalents | | $ | 55,875 | | — | | $ | 55,875 | |

Marketable securities | | 55,799 | | — | | 55,799 | |

Working capital | | 80,162 | | (601 | ) | 79,561 | |

Total assets | | 325,913 | | 10,040 | | 335,953 | |

Total indebtedness | | 84,676 | | — | | 84,676 | |

Redeemable common stock | | 3,205 | | — | | 3,205 | |

Stockholders’ equity | | 89,749 | | (601 | ) | 89,148 | |

| | | | | | | | | |

29

Table of Contents

ITEM 7. MANAGEMENT’SMANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION (RESTATED)OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operation should be read in conjunction with our Consolidated Financial Statements and the related Notes thereto. This discussion containsAnnual Report on Form 10-K/A includes forward-looking statements based uponwithin the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, including statements regarding guidance, industry prospects or future results of operations or financial position, made in this Annual Report on Form 10-K/A are forward-looking. We use words such as anticipates, believes, expects, future, intends, and similar expressions to identify forward-looking statements. Forward-looking statements reflect management's current expectations and are inherently uncertain. Actual results could differ materially for a variety of reasons, including, among others, changes in global economic conditions and consumer spending, world events, the rate of growth of the Internet and online commerce, the amount that involve risks and uncertainties, such as our plans, objectives, expectations and intentions, as set forth under “Special Note Regarding Forward-Looking Statements.” Our actual resultsOverstock.com invests in new business opportunities and the timing of eventsthose investments, the mix of products sold to customers, the mix of net sales derived from products as compared with services, the extent to which we owe income taxes, competition, management of growth, potential fluctuations in operating results, international growth and expansion, fluctuations in foreign exchange rates, the outcomes of legal proceedings and claims, fulfillment center optimization, risks of inventory management, seasonality, the degree to which the Company enters into, maintains, and develops commercial agreements, acquisitions, and strategic transactions, payments risks, and risks of fulfillment throughput and productivity. In addition, the current global economic climate amplifies many of these risks. These risks and uncertainties, as well as other risks and uncertainties that could cause our actual results to differ materiallysignificantly from those anticipatedmanagement's expectations, are described in these forward-looking statements as a resultgreater detail in Item 1A of several factors, including those set forth in the following discussion and under “Risk Factors” and elsewhere in this Form 10-K/A.Part I, "Risk Factors."

Restatement

The Company is restating (1) its consolidated financial statements as of December 31, 2007 and 2006 and for the years ended December 31, 2007, 2006, 2005; (2) its selected financial data as of and for the years ended December 31, 2007, 2006, 2005, 2004 and 2003; and (3) its quarterly results of operations for all quarters in the years ended December 31, 2007 and 2006 in this Amendment to the Company’s Annual Report on Form 10-K for the year ended December 31, 2007 to correct errors related to the accounting for customer refunds and credits and the accounting for gift cards issued to customers.

There was no effect of the of the error corrections prior to 2003. The effect of the error adjustments on the Consolidated Results of Operation for the years ended December 31, 2003, 2005, 2006 and 2007 is to increase net loss by $433,000, $294,000, $5.0 million and $3.0 million, respectively and decrease net loss for the year ended December 31, 2004 by $126,000. All amounts in Management’s Discussion and Analysis of Financial Condition and Results of Operations (Restated) have been adjusted, as appropriate, for the effects of the restatement.

A more complete discussion of the restatement can be found in “Selected Financial Data (Restated)” contained in Part I Item 6 and Note 3 to the consolidated financial statements contained in Part IV, Item 15 of this Amendment and Item 4.02(a) of the Company’s Current Report on Form 8-K filed with the Commission on October 24, 2008.

Overview

We are an online “closeout”"closeout" retailer offering discount brand name merchandise, including bed-and-bath goods, home décor, kitchenware, watches, jewelry, electronics and computers, sporting goods, apparel, and designer accessories, among other products. We also sell books, magazines, CDs, DVDs videocassettes and video games (“BMMG”("BMMG"). We also operate as part of our Website an online auctions business—a marketplace for the buying and selling of goods and services—as well as an online sitesites for listing cars and real estate for sale.

Our Company,We are based in Salt Lake City, Utah, wasand were founded in 1997, and we1997. We launched our first Website through which customers could purchase products in March 1999. Our Website offers our customers an opportunity to shop for bargains conveniently, while offering our suppliers an alternative inventory liquidation distribution channel. We continually add new, limited inventory products to our Website in order to create an atmosphere that encourages customers to visit frequently and purchase products before our inventory sells out. We offer approximately 63,000201,000 products under multiple departments under the shopping tab on our Website, and offer almost 724,000approximately 450,000 media products in the Books etc. department on our Website.

Closeout merchandise is typically available in inconsistent quantities and often is only available to consumers after it has been purchased and resold by disparate liquidation wholesalers. We believe that the traditional liquidation market is therefore characterized by fragmented supply and fragmented demand. We utilize the Internet to aggregate both supply and demand and create a more efficient market for liquidation merchandise. Our objective is to provide a one-stop destination for discount shopping for products and services sold through the Internet.

In the fourth quarter 2008, we faced unusual competition from brick and mortar retailers seeking to liquidate inventory directly. The macroeconomic slowdown and discounting by brick and mortar retailers have mixed effects on us. The effects include increased price competition and cautious consumers, but also include opportunities for us to acquire inventory at unusually low prices.

Table of Contents

Our Business

We utilizeuse the Internet to create a more efficient market for liquidation, closeout and other discount merchandise. We provide consumers and businesses with quick and convenient access to high-quality, brand-name merchandise at discount prices. Our shopping business (sales of product offered through the Shopping section of our Website) includes both a “direct”"direct" business and a “fulfillment partner” business. Some products"fulfillment partner" business (see Item 15 of Part IV, "Financial Statements"—Note 23—"Business Segments"). Products from our direct segment and fulfillment partner segments (including products from various industry verticals, such as florist supplies, restaurant supplies, and office supplies) are also available in bulk to both consumers and businesses through the Wholesale departmentproduct category on our Website. During the years ended December 31, 2005, 2006, 2007, and 2007,2008, no single customer accounted for more than 1% of our total revenue.

Direct business

Our direct business includes sales made to individual consumers and businesses, which are fulfilled from our warehouses in Salt Lake City, Utah.Utah (see Item 2 of Part I, "Properties"). During the years ended December 31, 20062007 and 2007,2008, we fulfilled approximately 39%25% and 25%21%, respectively, of all orders through our warehouses. Our warehouses generally ship between 5,000 and 8,000 orders per day and up to approximately 34,00032,000 orders per day during peak periods, using overlapping daily shifts.

Fulfillment partner business

For our fulfillment partner business, we sell merchandise of other retailers, cataloguers or manufacturers (“("fulfillment partners”partners") through our Website. We are considered to be the primary obligor for the majority of these sales transactions and we record revenue from the majority of these sales transactions on a gross basis. Our use of the term “partner”"partner" or “fulfillment partner”"fulfillment partner" does not mean that we have formed any legal partnerships with any of our fulfillment partners. We currently have fulfillment partner relationships with approximately 7301,200 third parties which post approximately 57,000196,000 non-BMMG products, as well as most of the BMMG products, on our Website.

Our revenue from sales on our shopping site from both the direct and fulfillment partner businesses is recorded net of returns, coupons and other discounts. During the third quarter of 2007, we updated our returns policy. For products other than computers, electronics and mattresses the returns policy provides for a full refund of the cost of the merchandise and all shipping charges if the item shipped is returned unopened within 30 days of delivery. If the item is returned after 30 days of delivery, opened or shows signs of wear, the transaction may only be subject to partial refund. For items shipped from our Computers and Electronics department, returns must be initiated within 20 days of the purchase date and must be received in the original condition within 30 days of purchase. Computer and Electronics items returned opened or received at our warehouse after 30 days may only qualify for up to a 70 percent refund. Damaged or defective mattresses qualify for a full refund only if the items are refused at the time of delivery.

Unless otherwise indicated or required by the context, the discussion herein of our financial statements, accounting policies and related matters, pertains to our shopping site and not necessarily to our auctions or cars tabs sites.

Both direct and fulfillment partner revenues are seasonal, with revenues historically being the highest in the fourth quarter, reflecting higher consumer holiday spending. We anticipate this will continue in the foreseeable future.

Unless otherwise indicated or required by the context, the discussion herein of our financial statements, accounting policies and related matters, pertains to the Shopping section of our Website and not necessarily to the Auctions, Cars, Real Estate or Community sections of our Website.

Auctions business

We operate an online auction service as part of our Website. Our auction tab allows sellers to list items for sale, buyers to bid on items of interest, and users to

30

Table of Contents

browse through listed items online. We record only our listing fees and commissions for items sold as revenue. From time to time, we also sell items returned from our shopping site on our auction site, and for these sales, we record the revenue on a gross basis. Revenue from our auction business is included in the fulfillment partner segment, as it is not significant enough to segregate as its own segment.

Car listing business

We operate an online site for listing cars for sale as a part of our Website. The car listing service allows sellers to list vehicles for sale and allows buyers to review vehicle descriptions, post offers to

Table of Contents

purchase, and provides the means for purchasers to contact sellers for further information and negotiations on the purchase of an advertised vehicle. Revenue from our car listing business is included in the fulfillment partner segment, as it is not significant enough to separate outsegregate as its own segment.

Cost of goods soldReal Estate listing business

Cost of goods sold consists of the cost of the product,We operate an online site for listing real estate for sale as well as inbound and outbound freight, warehousing and fulfillment costs (including payroll and related expenses and stock-based compensation), credit card fees and customer service costs.

Operating expenses

Sales and marketing expenses consist primarily of advertising, public relations and promotional expenditures, as well as payroll and related expenses, including stock-based compensation, for personnel engaged in marketing and selling activities.

Advertising expense is the largest componenta part of our salesWebsite. The real estate listing service allows customers to search active listings across the country. Listing categories include foreclosures, live and marketing expenseson-line auctions, for sale by owner listings, broker/agent listings and numerous aggregated classified ad listings. Advertising revenue from the real estate business is primarily attributableincluded in the fulfillment partner segment, as it is not significant enough to expenditures related to online marketing activities and offline national radio and television advertising. Our advertising expenses totaled approximately $75.3 million, $68.1 million and $51.0 million for the years ended December 31, 2005, 2006 and 2007, respectively, representing 98%, 96% and 92% of sales and marketing expenses for those respective periods.segregate as its own segment.

Technology expenses consist of wages and benefits, including stock-based compensation, for technology personnel, rent, utilities, connectivity charges, as well as support and maintenance and depreciation and amortization related to software and computer equipment.

General and administrative expenses consist of wages and benefits, including stock-based compensation, for executive, legal, accounting, merchandising and administrative personnel, rent and utilities, travel and entertainment, depreciation and amortization of intangible assets and other general corporate expenses.

International business

We have recorded no provision or benefit for federal and state income taxes as we have incurred net operating losses since inception. We have provided a full valuation allowance on the net deferred tax assets, consisting primarily of net operating loss carry-forwards, because of uncertainty regarding their realizability.

Executive Commentary

This executive commentary is intended to provide investors with a view of our businessbegan selling products through the eyes of our management. As an executive commentary, it necessarily focuses on selected aspects of our business. This executive commentary is intended as a supplement to, but not a substitute for, the more detailed discussion of our business included elsewhere herein. Investors are cautioned to read our entire “Management’s Discussion and Analysis of Financial Condition and Results of Operations (Restated)”, as well as our interim and audited financial statements, and the discussion of our business and risk factors and other information included elsewhere in this report. This executive commentary includes forward-looking statements, and investors are cautioned to read the “Special Note Regarding Forward-Looking Statements” included elsewhere in this report.

Commentary—Revenue. Total revenue decreased 2% for the fiscal year 2007 to $765.9 million and increased 4% for Q4 2007 to $294.5 million. The fulfillment partner business, which accounted for 74% of total revenue, during 2007 and 77% during Q4, grew 19% for the full year, and 21% in Q4 2007, an improvement from the -2% and 5% growth during the same periods in 2006, respectively. Our direct business, on the other hand, shrunk 35% for the year and 29% in Q4, compared to shrinking 7% and 24% during the same periods in 2006.

Total revenues decreased at the same rate we experienced in 2006;-2%. However, we did show progress toward returning to positive revenue growth throughout the year (Q1: -10%, Q2: -7%, Q3:1%, and Q4: 4%). This was driven primarily through our efforts to become more efficient in our marketing activities, and by nearly doubling our product selection through adding new fulfillment partners, as well as increasing the number of items offered by existing fulfillment partners. This initiative increased the number of products listed on our website to 63,000 non-BMMG products at December 31, 2007 compared to 36,000 atcustomers outside the end of 2006.

We also announced during the fourth quarter that we are planning to begin selling productsUnited States in international markets in 2008, first inlate August 2008. The initial launch included Canada and then potentially into other markets. Our initial approach will be to leverage existing partners in each country or region rather than opening our own distribution facilities33 European countries, including the U.K. and Germany. We do not have operations outside of the United States.

Commentary—Gross ProfitStates, and Gross Margin. Gross profit dollars increased 39%are utilizing a U.S. based third party to $124.6 million in 2007. Gross margin expanded to 16.3%provide logistics and fulfillment for all international orders. Revenue generated from 11.5%, a 480 basis point improvement, and a historical best for the company. Gross profit improved 95% in the fourth quarter, while total revenue increased by 4%. Gross margins for each of the quarters and fiscal years during 2006 and 2007 were:

Q1 2006

(Restated) | | Q2 2006

(Restated) | | Q3 2006

(Restated) | | Q4 2006

(Restated) | | FY 2006

(Restated) | | Q1 2007

(Restated) | | Q2 2007

(Restated) | | Q3 2007

(Restated) | | Q4 2007

(Restated) | | FY 2007

(Restated) | |

12.8 | % | 13.5 | % | 13.6 | % | 8.4 | % | 11.5 | % | 15.2 | % | 17.6 | % | 17.1 | % | 15.7 | % | 16.3 | % |

The improvement in gross margin is primarily due to significant expansion in our direct margins, which were up 920 basis points to 14.8% in fiscal 2007 from 5.6% in 2006. We significantly reduced our inventory in 2006, and in 2007, we maintained lower levels of inventory by refining the selection of products that we purchase directly to those that turn faster and have higher profitability. We believe that we can continue to do so, while filling in product selection using fulfillment partners, rather than acquiring the inventory directly. As a result of these efforts, we have seen a substantial improvement in direct and overall gross margin in 2007. With reduced inventory levels, we have also successfully reduced our warehouse space and the related costs, which we expect will assist in our efforts to further improve our direct gross margin.

While direct gross margin showed sequential improvement in the fourth quarter, overall gross margins decreased from Q3 2007 levels. This was primarily due to heavy shipping promotions and discounts offered during the holiday shopping season. In addition, demand for lower margin products like BMMG was up 200 basis points sequentially to 8.6% of gross sales and computers and consumer electronics (C&E) increased during the fourth quarter relative to other categories. Although C&E products typically have lower gross margin, we have aggressively expanded our product offering in this area throughout the year to better meet consumer demand.

Commentary—Marketing. While revenues declined by 2% this year, we were able to substantially reduce the dollars spent on marketing (down 22% to $55.5 million during fiscal 2007 from $70.9 million in 2006), and those dollars were spent more efficiently (7% of total revenue during fiscal 2007 versus 9% in 2006). However, with fewer dollars spent on advertising, the amount of traffic that came to our website was lower compared to 2006, and we believe our revenue growth was impacted throughout the year as a result. During the fourth quarter we decided to invest more heavily in television, radio and print advertising to both strengthen our

31

Table of Contents

brand and enhance revenue growth. Marketing expenses in the period were $27.4 million, or 9% of total revenue compared to $29.0 million, or 10% in Q4 2006.

Commentary—Contribution and Contribution Margin. Contribution (gross profit dollars less sales and marketing expense) increased 265%, from $18.9 million in 2006 to $69.1 million during fiscal 2007. For the three months ended December 31, 2007, contribution was $19.0 million, a $24.3 million improvement from $(5.3) million during Q4 2006. This was due to the improvements we made in gross margin combined with a slight reduction in total sales and marketing dollars spent. The following table represents our calculation of contribution (in thousands):

| | Three months ended

December 31, | | Twelve months ended

December 31, | |

| | 2006

(Restated) | | 2007

(Restated) | | 2006

(Restated) | | 2007

(Restated) | |

Total revenue | | $ | 282,407 | | $ | 294,516 | | $ | 780,137 | | $ | 765,902 | |

Cost of goods sold | | 258,636 | | 248,134 | | 690,333 | | 641,352 | |

| | | | | | | | | |

Gross profit | | 23,771 | | 46,382 | | 89,804 | | 124,550 | |

Less: Sales and marketing expense | | 29,045 | | 27,377 | | 70,897 | | 55,458 | |

| | | | | | | | | |

Contribution | | $ | (5,274 | ) | $ | 19,005 | | $ | 18,907 | | $ | 69,092 | |

| | | | | | | | | |

Contribution margin | | (1.9 | )% | 6.5 | % | 2.4 | % | 9.0 | % |

Commentary—Technology and G&A costs. We terminated a long-term computer co-location facility lease in December 2006 and we have reduced corporate headcount during 2007. We have also reduced facilities costs and other expenses by reducing corporate office space. As a result, our combined technology and G&A costs were down 9% for fiscal 2007 and down 23% for Q4 2007 versus 2006.

Overall, our operating expenses, including sales and marketing and restructuring were down 10% for fiscal 2007 and down 22% for Q4 2007 compared to the previous year.

Commentary—Operating loss. Our operating loss for fiscal 2007 was $44.6 million, down 55% from $98.8 million in 2006. For the three months ended December 31, 2007, our operating loss was $6.8 million, an 85% improvement from $44.5 million during the same period last year.

The 2007 operating loss includes $12.3 million of restructuring costs ($6.1 million in Q1 and $6.2 million in Q2). During 2006, we incurred restructuring costs of $5.7 million during the fourth quarter.