•

•Pursuant to fundthe Tax Receivable Agreement, NuScale Corp will be required to pay to certain Legacy NuScale Equityholders 85% of certain tax benefits, if any, that it realizes (or in certain cases is deemed to realize) as a result of any increases in tax basis and related tax benefits resulting from any exchange of NuScale LLC Class B units for shares of Class A common stock or cash in the future, and those payments may be substantial; and

•We are a “controlled company” within the meaning of NYSE rules and, as a result, qualify for exemptions from certain corporate governance requirements, and our search forstockholders do not have the same protections afforded to stockholders of companies that are subject to such requirements.

Risks Related to NuScale’s Business and Industry

•We have not yet entered into a targetbinding contract with a customer to deliver NPMs, and there is no guarantee that we will be able to do so;

•Competitors in China and Russia currently operate commercial SMRs and may have advantages in marketing their SMRs to potential customers;

•Amounts we have agreed to pay to CFPP LLC under the Release Agreement are significant, and the loss of CFPP LLC as a customer may negatively affect perceptions of our business or businesses and our ability to completecommercialize our initialSMRs or our ability to raise capital for operations or development needs;

•Any delays in the development and manufacture of NPMs and related technology may adversely affect our business combination, and financial condition;

•We have incurred significant losses since inception, we will depend on loans from our sponsor, its affiliates or members of our management teamexpect to fund our search and to complete our initial business combination.

•The cost of electricity generated from nuclear sources or our legal rights.NPMs may not be cost competitive with other electricity generation sources in some markets, which could materially and adversely affect our business;

•

Our commercialization strategy relies on our relationship with Fluor and other strategic investors and partners, who may have interests that diverge from ours and who may not be easily replaced if their relationships terminate;

Our commercialization strategy relies on our relationship with Fluor and other strategic investors and partners, who may have interests that diverge from ours and who may not be easily replaced if their relationships terminate;

•We expect we will require additional future funding;

•If manufacturing and construction issues are not identified prior to design finalization, long-lead procurement, and/or module fabrication, then those issues will be realized during production, fabrication, or construction and may impact plant deployment cost and schedule;

•We and our customers operate in a politically sensitive environment, and the public perception of nuclear energy can affect our customers and us; and

•We are highly dependent on our senior management team and other highly skilled personnel, and if we are not successful in attracting or retaining highly qualified personnel, we may not be able to successfully implement our business strategy.

Regulatory Risk Factors

•Our SDA applications may not be approved, and any rework necessary to address NRC concerns could significantly delay the commercialization of our products;

•Our design is only approved in the United States and we must obtain approvals on a country- by-country basis before we can complete the sale of our products abroad, which approvals may be delayed or denied or which may require modification to our design;

•Our customers must obtain additional regulatory approvals before they construct power plants using our NPMs, and approvals may be denied or delayed;

•Our customers could incur substantial costs as a result of violations of, or liabilities under, environmental laws; and

•Our business is subject to a wide variety of extensive and evolving government laws and regulations. Changes in and/or failure to comply with such laws and regulations could have a material adverse effect on our business.

General Risk Factors

•We are subject to cybersecurity risk; and

•Changes in tax laws or regulations may increase tax uncertainty and adversely affect results of our operations and our effective tax rate.

Risks Related to Ownership of Our Shares of Class A common stock and Warrants

•The price of shares of Class A common stock and Warrants may be volatile;

•The resale of shares we have registered on a registration statement on Form S-3, which represent a majority of the shares that are or will be outstanding, could cause the market price of our stock to drop significantly.

•NuScale Warrants and Options will become exercisable for shares of Class A common stock, which, if exercised, would increase the number of shares eligible for future resale in the public market and result in dilution to our stockholders; and

•We have in the past and may in the future be subject to short selling strategies that could result in a reduction in the market price of our Class A common stock.

Part I

Item 1. Business

Unless the context otherwise requires, all references in this section to NuScale, the “Company,” “we,” “us” or “our” refer to the consolidated operations of NuScale Corp and NuScale LLC.

Overview

NuScale is redefining nuclear power through the development of proprietary and innovative SMR technology that will deliver safe, scalable, cost-effective and reliable carbon-free power. Our core technology, the NuScale Power Module™ (“NPM”), can generate 77 MWe and is premised on well-established nuclear technology principles, with a focus on the integration of components, simplification or elimination of systems and use of passive safety features. This results in a safe and highly reliable power plant suitable to be sited close to where electricity or process heat is needed. Our flagship VOYGRTM (“VOYGR”) power plant is a scalable plant design that can accommodate up to 12 NPMs, resulting in a total gross output of 924 MWe.

Since 2007, over $1.8 billion has been invested in the development of our technology and we have been issued 455 patents globally, with an additional 158 patent applications currently pending. In September 2020, our 12-module VOYGR-12 design (currently approved for 160 million watts of thermal power or 50 MWe per NPM) became the first and only SMR to receive an SDA from the NRC. The NRC’s final rulemaking approving NuScale’s design certification became effective in February 2023. The approval was a critical milestone that allows customers to move forward with plans to develop VOYGR power plants, knowing that safety aspects of the NuScale design are NRC-approved.

In January 2023, the Company submitted a second SDA Application and the associated licensing topical reports to the NRC for NuScale’s 6-module, 77 MWe NPM design. On July 31, 2023, the NRC formally announced that it accepted the Company’s SDA Application for formal review. Once approved, customers in the United States will be able to reference the certified design and SDA for expedited construction and operating licensing of NuScale’s SMR pursuant to 10 CFR Part 52. Based on the NRC’s published schedule for SDA Application review, we expect the NRC will complete its review and SDA approval to be received by July 31, 2025.

Our unique SMR has several key defining characteristics, including:

•Proven. Our NPM technology leverages existing light water nuclear reactor technology and fuel supply that have been operating globally for over 60 years.

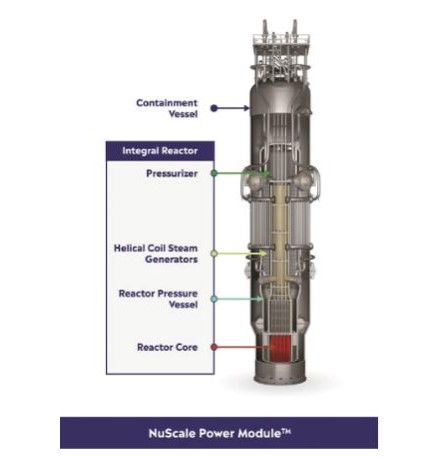

•Simple. NuScale’s simple NPM design, based on natural circulation, integrates the reactor core, steam generators and pressurizer in a single factory-built vessel and eliminates the need for reactor coolant circulating pumps, large bore piping and other components found in conventional large-scale nuclear reactors. This simplicity improves safety and reduces capital and operational costs.

•Scalable. In addition to our flagship 12-module (924 MWe) VOYGR-12TM power plant, we offer smaller power plant solutions including the six-module (462 MWe) VOYGR-6TM and the four-module (308 MWe) VOYGR-4TM. These VOYGR power plants can commence operation with one module and scale to house up to their approved capacity of twelve, six or four modules. This scalability will allow customers to right-size their up-front capital investment and economically increase installed capacity over time through the addition of NPMs.

•Safe. VOYGR power plants have been designed to be the safest nuclear plants in the world and have several industry-first advantages over conventional large-scale nuclear plants, including an unlimited “coping” period during which the NPMs can be shut down and kept in a safe condition without operator intervention, AC or DC power or any additional cooling water. As a result, we have numerous operational and commercial advantages including a safety case that supports a small, site-boundary emergency planning zone (“EPZ”) designation by the NRC, as well as various resiliency and reliability features including the ability to start and operate a plant without AC or DC power to provide first-responder power.

In addition to the sale of NPMs and our VOYGR power plant designs, we will offer a diversified suite of services throughout the development and operating life of the power plant. Our suite of services is planned to include licensing support, testing, training, fuel supply services and program management, among others. We anticipate that our services offerings will have high penetration rates across our customer base and will provide consistent, recurring revenues throughout the life of a VOYGR power plant. We expect service revenue to begin approximately eight years prior to a power plant’s commercial operation date and to extend throughout the life of the power plant.

1

Our potential customers are a mix of domestic and international governments, utilities, state-owned enterprises and industrial companies in need of carbon-free, reliable energy. In total, our sales pipeline currently includes over 100 active customer opportunities and several signed Memoranda of Understanding (“MOUs”) globally.

To date, the DOE has granted NuScale four separate cost-share awards totaling more than $578.3 million, including most recently, a cost-share award granted in 2020 in which the DOE obligated $262.7 million through the 2023 fiscal year. We also benefit from a global network of strategic investors and supply chain partners that we expect will play an integral role in bringing NuScale’s technology to market around the world. Fluor, a leading global engineering, procurement and construction (“EPC”) firm, is the majority stockholder in NuScale and collaborates with NuScale on plant standard design and the provision of EPC services to NuScale’s customers. Other strategic investors and supply chain partners include Doosan Enerbility Co., Ltd; Sargent & Lundy, LLC; Sarens Nuclear & Industrial Services, LLC; JGC Holdings Corporation; IHI Holdings Corporation; GS Energy Corporation; and Samsung C&T Corporation, among others.

As discussed in the section titled “Customers” below, the Company currently has only one “Class 1” customer:RoPower Nuclear S.A. (“RoPower”), which is a joint venture established by S.N. Nuclearelectrica S.A. (“Nuclearelectrica”) and Nova Power & Gas S.A. As noted below in the section titled, “Risks Related to NuScale’s Business and Industry”, in November 2023, we entered into the Release Agreement with CFPP LLC, the Company’s first customer, pursuant to which the Company agreed to terminate the DCRA, as amended, and our LLM Agreement. CFPP, LLC was receiving funding for about 79% of its qualified project costs, including the long-lead materials, under a cooperative agreement with the DOE. Under the Release Agreement, we agreed to repay CFPP LLC’s Net Development Costs. Once we reimburse these costs and terminate the LLM Agreement, we are entitled to the long-lead materials purchased under the LLM Agreement; however, because the Company is still in discussion with DOE regarding the means and timing for lifting a DOE lien on the long-lead materials (stemming from DOE’s funding under its cost share agreement with CFPP, LLC), the value of the long-lead materials may be significantly lower than reimbursement costs under the LLM Agreement. We may have to pay costs to DOE (in addition to the refund to CFPP LLC) to obtain the long-lead materials free of DOE liens in order to use the long-lead materials for a project at the CFPP site or for another customer. Until the Company formalizes an agreement with DOE and CFPP, LLC regarding disposition of the long-lead materials, there is no guarantee we will be able to use such materials in another project.

Merger Transaction

On December 13, 2021, Spring Valley, NuScale LLC and Merger Sub entered into the Merger Agreement. On May 2, 2022, pursuant to the Merger Agreement, Merger Sub merged into NuScale LLC (the “Merger”) with NuScale LLC surviving, Spring Valley was renamed NuScale Power Corporation, and NuScale LLC continued to be held as a wholly controlled subsidiary of NuScale Corp in an “Up-C” structure (collectively, the “Transaction”). As a result of the Transaction, NuScale Corp holds all of the NuScale LLC Class A units (which are the sole voting interests at the NuScale LLC level) and Legacy NuScale Equityholders hold NuScale LLC Class B units (which are non-voting) and shares of NuScale Corp Class B common stock (which entitle the Legacy NuScale Equityholder to vote at the NuScale Corp level but which carry no economic rights). At specified times, in NuScale Corp’s discretion, Legacy NuScale Equityholders may exchange NuScale LLC Class B units (together with cancellation of an equal number of shares of NuScale Corp Class B common stock) for NuScale Corp Class A common stock.

The Transaction was accounted for as a reverse recapitalization as provided under GAAP, with NuScale Corp treated as the acquired company and NuScale LLC treated as the acquirer. This determination reflects that Legacy NuScale Equityholders hold a majority of the voting power of NuScale Corp, that NuScale LLC’s pre-Merger operations constitute the majority post-merger operations of NuScale Corp, and that NuScale LLC’s management team retained similar roles at NuScale Corp.

Industry

According to BloombergNEF’s New Energy Outlook 2021 (“NEO 2021”), which includes SMR capacity as part of the pathway to global net-zero carbon emissions, global power consumption is expected to increase 191% between 2020 and 2040, requiring approximately 22,000 gigawatts (“GW”) of additional generating capacity. Today, the energy and power markets are undergoing dramatic changes as they shift from fossil fuels to carbon-free sources. A series of technological, economic, regulatory, social and investor pressures are leading the drive to decarbonize electricity and other sectors, such as transportation (electric vehicles) and buildings (electric heating). As such, the majority of required global capacity

2

additions, including the replacement of existing carbon-intensive power generation, is expected to come from carbon-free generation.

Technology Improvements. Technology advancements are expected to have a tremendous influence on world energy mix in the future. According to the NEO 2021, solar photovoltaic (“PV”) capacity has grown 37% annually since 2000 and now accounts for approximately 10% of global power generation capacity. We believe that technological improvements in SMRs and other carbon-free generation sources will catalyze similar adoption trends going forward.

Economic and Reliability Requirements. Utilities are looking to deploy carbon-free power generation technologies due to a variety of economic and reliability drivers. Renewables alone are not a practical solution for regional power grids and baseload generation is required to solve for factors such as intermittency, transmission constraints and land use limitations. In these cases, we believe that nuclear, and specifically SMRs, are the most viable carbon-free baseload power solution that can address the global need for carbon-free generation.

Regulatory Mandates and Government Funding. On December 8, 2021, President Biden signed an executive order mandating all electricity procured by the government be 100% carbon pollution-free by 2030, including at least 50% from around-the-clock dispatchable generation sources. The order also requires that federally owned buildings produce no net emissions by 2045 and that each federal agency achieve 100% zero-emission vehicle acquisitions by 2035. Additionally, on November 15, 2021, the U.S. Infrastructure Investment and Jobs Act was signed into law that includes $65 billion in funding for power and grid investments. This includes investments in grid reliability and resiliency as well as clean energy technologies such as carbon capture, hydrogen and advanced nuclear, including SMRs.

Internationally, more than 190 countries and the European Union have signed the Paris Agreement, which seeks to keep the rise in mean global temperature to below 2°C above pre-industrial levels. Currently, more than 130 countries, including China and the United States – the countries with the first and second largest CO2 emissions globally – have now set, or are considering setting, a target of reducing net emissions to zero by mid-century. Further, at the 2023 United Nations Climate Change Conference, more than 20 countries from four continents made a declaration to work together to advance a goal of tripling nuclear energy capacity globally by 2050.

Social and Environmental Preferences. The effects of climate change, including extreme weather events and rising temperature, and the resulting health and socio-economic stability of at-risk populations, have led to a societal focus on the environment. As a result, a global shift is occurring in societal preferences for a reduction in greenhouse gases and a move towards carbon-free power.

Investor Pressures. ESG investing has accelerated as institutional investors shift their portfolios away from carbon‐intensive assets. According to a 2023 study by the Global Sustainable Investment Alliance, approximately $30.3 trillion of global assets under management are “sustainable investments” that consider ESG factors. While there has been some retraction in companies trying to satisfy the needs of ESG-focused investing, shareholder advisory services, like Glass Lewis, adopted a policy for the 2023 proxy season to generally recommending voting against the governance committee chairs of Russell 1000 index companies that fail to provide explicit disclosures about the board’s role in overseeing environmental and social issues. This shift in investor sentiment has caused many large integrated energy companies, such as BP plc and Royal Dutch Shell plc, to set decarbonization strategies and to consider diversifying into different forms of carbon-free energy.

Our Market Opportunity

According to the NEO 2021, approximately 16,000 GW of carbon-free generation capacity additions are required globally through 2040 to meet domestic and international climate goals. These additions are a result of the growth in projected power use and the replacement of existing carbon-intensive generation, primarily from coal, oil and natural gas.

Although critical in helping meet climate goals, renewables, such as solar and wind, and hydroelectric are constrained due to intermittency, seasonality and issues associated with land use and grid interconnections. According to the U.S. Energy Information Administration, the average 2022 capacity factor (the ratio of actual power output over generation capacity) for solar, wind and hydro was 24.4%, 35.9%, and 36.3%, respectively, compared to 92.7% for nuclear. In most regions globally, flexible and dispatchable sources, such as long-duration storage, geothermal, gas, coal with carbon capture and nuclear, will be essential. Among these sources, SMRs represent an attractive option based on their near-term viability, competitive costs, carbon-free emissions and reliability.

3

Market Opportunity and the Role of SMRs

SMRs are small nuclear reactors designed with scalable technology using module factory fabrication that pursue economies of series production and short construction times. The four primary technologies currently being pursued in SMRs are water-cooled reactors, fast neutron reactors, high temperature gas reactors and molten salt reactors. Light water reactors, such as our assetsNPM, are considered by the World Nuclear Association to have the lowest technological risk and are the most developed from a commercial perspective benefiting from decades of proven technology.

SMRs have a number of inherent advantages over traditional large-scale nuclear and other carbon-free power generation, including:

•Simplicity of Design. Large scale nuclear plants, which typically generate 1 GW or more, are complex in terms of design and construction. SMRs are simpler to manufacture, construct, operate and maintain. SMRs are also designed to eliminate many of the nuclear components needed in large-scale plants which adds to their simplicity.

•Enhanced Safety Features. Although our NPM is the only SMR with an NRC-approved safety case, according to the DOE, “small modular reactors have the potential for enhanced safety and security compared to earlier designs.” The smaller reactor core and reduced potential for off-site release from SMRs means SMRs may be located closer to population centers and industrial facilities needing process heat. The robust design, small fuel inventory, and multiple barriers preventing fission product release contribute to a low probability and consequence of radionuclide release, even under extreme upset conditions, thus simplifying the emergency preparedness and response and providing a basis for reducing the EPZ. NuScale is the only company to obtain approval of its EPZ methodology from the NRC (or any other national government nuclear regulatory body) and NuScale is the only SMR developer to have an approved regulatory basis for obtaining a site boundary EPZ. In 2022, the NRC approved a new methodology for SMR emergency planning; however, no other SMR vendor has had its methodology approved following the new criteria.

•Economics versus Traditional Nuclear. Traditional large-scale nuclear facilities have high upfront capital costs due to the size of the power plants as well as long construction times. These plants require significant resource planning and utilities have hesitated to deploy the capital necessary to build large-scale nuclear plants because of these high costs. SMRs are simpler, smaller and the reactors are largely factory built, leading to shorter construction times and greater cost predictability.

•Modular and Scalable. SMRs can more easily match customer needs and avoid surplus capacity. Modularity results in splitting power plant development between the factory and the field, reducing the schedule risk that has impacted large reactor construction projects. The NuScale modular design has the benefit to customers of being right-sizable upon construction and scalable over time.

•Smaller Footprint. According to a 2021 report, the Office of Nuclear Energy noted a typical 1,000-megawatt nuclear facility in the United States needs little more than one square mile to operate, while wind farms require 360 times more land area to produce the same amount of electricity and solar photovoltaic plants require 75 times more space. Furthermore, SMRs can be sited closer to the end-user, significantly reducing the need for transmission infrastructure while also providing ancillary benefits such as process heat to end users.

Our Technology

Our NPM is the product of approximately 17 years of research and development by NuScale and key collaborators, including Oregon State University and the Idaho National Laboratory. Over $1.8 billion (including non-dilutive DOE grants) has been invested to date and the technology is protected by 613 issued and pending patents globally.

A NuScale power plant is composed of multiple NPMs. Each NPM is capable of producing 77 MWe. The NPM consists of an integral reactor composed of the reactor core, helical coil steam generators and pressurizer within the reactor pressure vessel, enclosed in a foreign countrysteel containment vessel. The reactor core consists of an array of fuel assemblies and substantiallycontrol rod clusters at standard enrichments. The helical coil steam generator consists of two independent sets of tube bundles with separate feedwater inlet and steam outlet lines. The integral reactor measures 65 feet tall and 9 feet in diameter. The containment vessel measures 76 feet tall and 15 feet in diameter and is much smaller and stronger than the concrete containment shells for large reactors. The NPM operates inside a stainless-steel lined water-filled pool located below ground level.

4

Our NPM technology leverages existing light water nuclear reactor technology and fuel that has been operating globally for over 60 years. The reactor operates using the principles of buoyancy-driven natural circulation; hence, no pumps are needed to circulate water through the reactor. Once the heated water reaches the top of the riser, it turns downward into an annulus where the hot water flows over the steam generator tubes. Water in the reactor system is kept separate from the water inside the steam generator to prevent contamination. As the hot water in the reactor system passes over the hundreds of tubes in the steam generator, heat is transferred through the tube walls and the water inside the tubes turns to superheated steam. This innovative design eliminates the need for reactor coolant pumps, large bore piping, complex safety systems and other components found in conventional large-scale nuclear reactors. The result is a simplified system that improves safety and reduces capital and operational costs.

Design Features and Innovations

Our NPM introduces a number of key design innovations that allows us to be the safest and most reliable provider of nuclear energy. Our design features include:

•Proven Technology. Our NPM design relies on well-established pressurized, light water reactor technology. As such, a VOYGR power plant can be licensed within the existing regulatory framework for light water reactors, drawing on a vast body of established research and development, proven codes and methods and existing regulatory standards. Because our technology was designed on the basis of this proven foundation, we believe NuScale has a significant advantage over other alternative and yet unproven nuclear technologies that may come to market, both with respect to obtaining regulatory approvals and attracting customer interest.

•Single, Integrated Unit. The NPM incorporates all of the components for steam generation and heat exchange into a single integrated unit. This design eliminates all large bore interconnection piping, which is historically a potential source of failure and cause of construction complexity for large-scale reactors.

•Compact Size. Each NPM, including the containment vessel, can be entirely fabricated in a factory and shipped by rail, truck, or barge to the power plant site for assembly and installation. Fabrication of the modules in a factory environment reduces fabrication cost, improves quality, reduces construction time and increases schedule predictability. This is a distinct benefit compared to traditional large-scale nuclear plants in which reactors are built on-site and only after their completion can the balance of the plant be constructed. We can fabricate our revenue mayNPMs in parallel with VOYGR power plant construction, saving time and reducing complexity, labor and construction costs.

•Natural Circulation. The reactor core of our NPM is cooled entirely by natural circulation of water. Natural circulation provides a significant advantage in that it reduces capital and operational costs by eliminating reactor coolant pumps, pipes and valves and the associated power, maintenance and potential failures of those components.

•Refueling and Maintenance Innovations. Each NPM can produce power continuously for approximately 20 months before refueling is required. Because of the multi-module design of VOYGR power plants, each NPM can be derivedrefueled in a staggered manner, reducing total plant output by only 77 MWe for approximately 10 days. This significantly reduces the cost of replacement power compared to large-scale nuclear plants (typically 1,000 MWe) that must shut

5

down their entire capacity for any outage. Whereas large-scale nuclear plants can require as many as 1,000 or more individuals for refueling and associated outage activities, a VOYGR power plant can undergo the same refueling and outage activities with a much smaller, permanent, in-house crew of as few as 50 individuals.

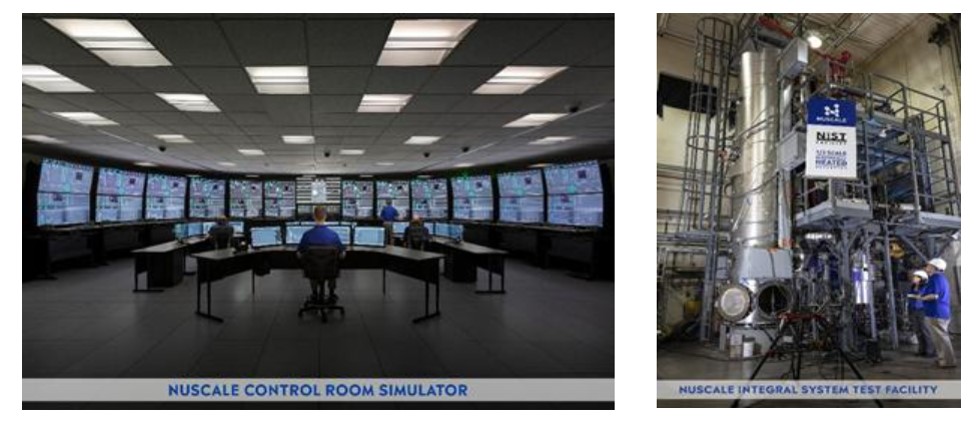

•Multi-Module Control Room. NuScale has designed, and received NRC approval for, an innovative control room that can control up to 12 NPMs with only three licensed operators. This compares with traditional large-scale nuclear plants that require a minimum six licensed operators for three reactors. This innovation is enabled by NuScale’s proprietary platform called the Highly Integrated Protection System (“HIPS”). The HIPS platform provides a robust safety platform to monitor NPMs and help protect VOYGR power plants from potential cybersecurity attacks.

Safety Case

NuScale’s design innovations have allowed for a number of industry-first and best-in-class safety attributes.

•Unlimited “coping period”. Our NPMs are designed with fully passive safety systems and are kept safe in a cooling condition for an unlimited time following any extreme event that renders a power plant without external power. During the span of such an event and for an unlimited time, the VOYGR power plant does not require any internal or external human or computer actions, AC or DC power or additional water to cool the reactors (referred to as NuScale’s Triple Crown For Nuclear Plant Safety). An unlimited coping period is unprecedented for commercial light water nuclear reactors. Historically, commercial light water nuclear reactors have maximum coping periods of 72 hours before operator action is required to keep the reactor safe.

•Support for Site Boundary EPZ. NuScale’s VOYGR power plants have been designed to allow an NRC-approved EPZ that does not extend beyond the power plant site boundary (the restricted area controlled by the plant owner). The NRC has approved NuScale’s methodology for calculating EPZ size. This methodology, approved solely for NuScale’s unique passively safe design, demonstrates that most NuScale plant sites in the U.S. can be approved with a 300-yard “site-boundary” EPZ. Currently operating commercial nuclear power plants in the U.S. are required to have a 10-mile radius EPZ from the reactor site and the population within the EPZ must be capable of evacuating within a specified time period. The smaller EPZ enables VOYGR power plants to be sited closer to end-users, which is of particular importance to process heat off-takers and to owners seeking to repower retiring coal-fired generation facilities.

•No Requirement for Backup Power. The NRC concluded that NuScale’s safety design eliminates the need for “Class 1E” power – i.e., safety-related, backup power. This means that VOYGR power plants do not need costly emergency diesel generators to ensure the safety of the reactors in the event of a power loss. Today, no operating nuclear plant in the United States can make this claim.

•Resilience to Man-made and Natural Events. The VOYGR reactor building is designed to withstand the impact from man-made and natural events, including floods, earthquakes (in excess of the Fukushima event), tornados and hurricanes in excess of 280 mph winds, and the impact of a large commercial airplane. The VOYGR power plant is also designed to safely shut down following an electromagnetic pulse or geomagnetic disturbance.

Technology-Enabled Operational Features

NuScale’s design innovations and best-in-class safety case create a number of technology-enabled operational features that no other carbon-free generation source can claim. These features address a host of critical industry needs with respect to grid resiliency and reliability and provide customers with related commercial benefits that other power generation solutions do not provide. Select features of NuScale’s VOYGR power plants include:

•No Requirement for connection to the grid. The VOYGR plant is the only commercial nuclear power plant approved by the NRC without requiring any connections to the transmission grid for safety. This allows off-grid operation such that NuScale plants can be sited in the proximity of industries needing electricity and process heat. It also enables a NuScale plant to replace a coal fired power station located at the end of a single transmission line.

•First Responder Power. When the transmission grid is lost, traditional large-scale nuclear power plants automatically and rapidly shutdown. Large-scale nuclear power plants are not capable of restarting, nor are they permitted to do so, until the transmission grid is restored because power from the grid (supplied by two off-site sources) is required to power the safety systems and operate the equipment necessary to start the power plant. The VOYGR power plant would remain at power, ready to immediately sell electricity to the grid when the grid is back online, making it a first responder to the restoration of the transmission grid.

•Black-Start Capability. A VOYGR power plant can start up from cold conditions without external grid connections. This NuScale design capability is a first-of-a-kind for the nuclear industry.

6

•Island Mode Power. A single NPM can supply all the “house load” electricity needs of the plant while also continuing to provide power to a local industrial customer or mission critical facility without external grid connection via a micro-grid connection.

•Highly Reliable Power. VOYGR-12 power plants will be able to provide 154 MWe of power to mission critical facilities with 99.95% availability over the 60-year life of the plant. In the event of a catastrophic loss of offsite grid and disruption of transportation infrastructure, a VOYGR-12 will be able to provide up to 120 MWe to a mission critical facility micro-grid for at least four years without refueling.

Design Validation and Testing

NuScale’s safety design has been validated through rigorous testing of critical components, such as fuel assemblies, control rod and control rod mechanisms and the integral helical coil steam generators. NuScale has constructed an electrically-heated, one-third scale, full-pressurized and temperature integral thermal-hydraulic test facility that demonstrates the operation of the entire nuclear steam supply system and safety systems.

In addition, we have proven the ability to safely operate 12 NPMs from a single control room by building and operating a full-scale simulated control room. Through comprehensive testing in this simulator, NuScale has shown that the demands on the reactor operators are significantly reduced compared with traditional large reactors, as a result of the simplicity of the design, advancements in digital controls, and the fact that NuScale’s design requires no operator-initiated safety functions for all design basis events. Through comprehensive analyses, demonstrations and audits, the NRC has approved NuScale’s conduct of operation such that three licensed operators can safely operate a VOYGR-12 plant without the need for a Shift Technical Advisor, a key safety-related role required by the NRC for all existing large-scale nuclear plants.

Products and Services

NuScale has determined that it currently operates in a single segment and will periodically reassess that determination as it nears commercialization and deployment of its NPMs.

NuScale VOYGR Power Plants

NuScale currently offers VOYGR power plant designs for three facility sizes that are scalable in that they are capable of housing from one to four, six or twelve NPMs, and can commence operation with as few as one module. For each of these plant configurations, the total facility gross electric output can be as much as 308 MWe, 462 MWe or 924 MWe, respectively, based on a capacity of each NPM of 77 MWe.This scalability allows customers to right-size their up-front capital investment and economically increase installed capacity over time through the addition of NPMs as needed.

A customer seeking to deploy a VOYGR power plant will be granted a license from NuScale to construct, operate, maintain and decommission the VOYGR plant. NuScale will also provide design and nuclear regulatory licensing basis

7

information necessary for the customer to obtain regulatory approval to construct and operate the power plant. In exchange for this license, the customer will pay an upfront technology licensing fee to NuScale.

Sale of Equipment including NuScale Power Modules. In addition to the customer paid technology license, NuScale also expects to sell to the customer major nuclear engineered equipment. For the VOYGR power plant, this will consist of the NPMs, the reactor building crane, nuclear fuel, module assembly and handling equipment and other equipment associated with the nuclear steam supply system and nuclear fuel handling and storage.NuScale expects to provide the manufacturing and delivery of modules to the customers’ VOYGR power plant site on a contracted basis. NuScale also expects to receive payment related to the fabrication of the NPMs coincident with the order of materials and commencement of manufacturing so that no working capital will be required from NuScale for work-in-progress or finished inventory.

Services

We will also offer customers a diversified suite of services throughout the life of the power plant, beginning approximately eight years prior to a plant’s commercial operation date. Pre- and post-operation date service offerings provide customers with critical services related to the licensing, design, development, construction, operation and maintenance of the VOYGR power plant. As a first mover and developer of the power plant’s nuclear technology, we believe we are well positioned to be a trusted service provider. As such, we anticipate our services will have high penetration rates and will provide consistent, recurring revenues that could become significant once a large number of VOYGR plants are in operation.

Our services include:

•regulatory licensing support, including in the United States preparation and prosecution support for the customer’s desired regulatory approval regimes under either 10 CFR, Part 50 or Part 52 pursuant to NRC regulations;

•start-up testing and commissioning support;

•accredited training programs to support initial and ongoing power plant operations;

•management of all aspects of the NRC required inspections, tests, analysis and acceptance criteria process;

•NPM mechanical handling;

•initial and ongoing fuel bundle loading and movement;

•design engineering management during commercial operation;

•operations and maintenance program management, including regulatory compliance reporting support;

•procurement and spare parts management;

•nuclear fuel management including reload analysis; and

•outage planning and execution support.

Competitive Strengths

Only Viable Carbon-free Baseload Power. Nuclear is the only viable carbon-free baseload power available to address the global need for carbon-free generation and to meet decarbonization targets year-round. SMRs such as NuScale’s VOYGR power plants provide highly reliable, cost-effective, carbon-free baseload power to electric grids – no other existing baseload technology can claim the same benefits on the scale needed to address the world’s growing needs.

Innovative Technology Platform and Intellectual Property Portfolio. We have 455 patents issued and an additional 158 patents pending. These 613 patents protect key aspects of our technology, and we continue to grow our intellectual property portfolio. In addition, we have a highly educated workforce of 398 employees, of whom 129 have master’s degrees in engineering and science and 20 have Ph.Ds. We believe our intellectual property rights, as well as our highly skilled personnel are important assets necessary to maintain our competitive advantage in the market and expand on our technology platform.

First to Receive an SDA from the NRC. Although China and Russia have currently operating SMRs, ours is the first and only SMR to receive a SDA from the NRC. This is an important regulatory milestone that provides customers with certainty – knowing that the NRC approves of the plant design – before committing significant capital to develop a nuclear facility. The SDA process took NuScale 41 months to complete – including preparation, application and receipt of approval. This was the fastest any nuclear reactor company has ever received approval from the NRC. To date, no SMR or advanced reactor company other than NuScale has even applied to the NRC for SMR design approval. We believe that this, and the fact that our design approval timeline was based on well-established light water nuclear technology, provides NuScale with a solid competitive advantage over other SMR competitors.

Unparalleled Safety Case. NuScale’s innovative, fully passive safety system design addresses the historical concerns of traditional large-scale nuclear power plants. In the event of a total loss of power to the facility, a VOYGR power plant does not require any operator or computer actions, grid connection or emergency backup power or additional water to cool the

8

reactors and can remain safe indefinitely. All large-scale nuclear reactors require one or all three of these within a period of days. The rigorously tested safety case results in an array of applications and commercial opportunities for NuScale that traditional nuclear power plants cannot support, and VOYGR power plants can be located closer to end-users and population centers.

Global Network of Strategic Investors and Supply Chain Partners with DOE Support. We have developed a global network of blue-chip supply chain partners, many of which are investors in NuScale. We believe these partners will play a critical role in the successful procurement and fabrication of components, manufacture of our NPMs and fuel supply. In addition, we have also received significant financial and regulatory support from the DOE since the inception of NuScale.

Cost-Competitive. NuScale’s technology is cost-competitive both in the United States and globally. Our technology’s reliability, resiliency and flexibility are key attributes customers and regulators value highly. We believe our competitive cost coupled with our differentiated capabilities gives us an advantage over other technologies.

Visionary Management Team. We have an experienced and passionate team of leaders and innovators who have developed the technology over the years and run the operations of the business today. Our management team has an average of over 8 years at NuScale (founded 17 years ago) and 30 years of commercial and energy industry experience. Our executives have extensive prior management experience in nuclear and engineering organizations, such as the NRC, United States Navy, DOE, General Electric Company, Exelon Corporation, Framatome, Babcock & Wilcox Company, LLC and others. Among key members of NuScale’s executive leadership team is Dr. José N. Reyes, Ph.D., co-founder and Chief Technology Officer of the Company. Dr. Reyes is co-designer of the NuScale SMR and is an internationally recognized expert on passive safety system design, testing and operations for nuclear power plants. Dr. Reyes has served as a technical expert at the International Atomic Energy Agency and as an engineer with the Reactor Safety Division of the NRC. He is Professor Emeritus in the School of Nuclear Science and Engineering at Oregon State University, was inducted into the National Academy of Engineering in 2018 and holds over 153 patents granted or pending in 21 countries.

Competition

Our competitors are other power generation technologies, including traditional baseload, renewables, long duration storage and other nuclear reactors, including SMRs. We believe our competitive strengths differentiate us from our competition globally, in part because NuScale’s SMR technology is currently the only NRC-approved SMR technology capable of meeting the growing demand for carbon-free baseload generation.

Traditional Baseload. According to BloombergNEF, approximately 62% of global generation capacity in 2020 was natural gas, coal, oil and large-scale nuclear. These technologies are highly reliable, cost-effective, dispatchable and land use efficient. However, with the exception of traditional large-scale nuclear, these resources are carbon-intensive and we expect them to largely be replaced with carbon-free generation over time.

Renewables. According to BloombergNEF, approximately 38% of global generation capacity in 2020 was wind, solar, hydroelectric and other renewable power generation sources. Although these sources generate carbon-free power, wind and solar are highly intermittent and non-dispatchable, and hydroelectric is seasonal and subject to curtailment. Additionally, since renewables are weather-dependent, they are too unreliable to support certain end-use cases, including mission-critical applications or industrial applications that require extensive on-site, always-available power. Due to their innovative design NuScale VOYGR plants can operate as baseload generation, load-follow renewables and/or support key industrial applications.

Other Advanced Nuclear Reactors. There are several reactor technologies that are in various stages of development, such as high temperature gas-cooled reactors, fast reactors, molten salt reactors, fusion technologies and others, and commercial SMRs are currently operating in China and Russia. These technologies, like ours, are designed to be clean, safe and highly reliable. However, these technologies have not received regulatory approval in the United States, and many of the technologies have not been demonstrated and do not have fuel supply infrastructure in place. Currently, we have the only SMR that has received an SDA from the NRC, and no other SMR company or customer has even applied for approval. Achieving SDA is a regulatory process that took us over $500 million to prepare and 41 months and over $200 million to complete.

9

Customers

NuScale has a strong pipeline of potential customers consisting of governments, political subdivisions, state-owned enterprises, investor-owned utilities and other technology and industrial companies, both in domestic and international markets, considering the deployment of an SMR power plant utilizing our technology. Our end-markets can be broken down into two general subsets: baseload generation and industrial applications. Baseload generation includes repurposing coal-fired facilities to nuclear or new clean baseload capacity. Many industrial customers require significant energy needs such as chemical plants, direct air capture facilities, hydrogen production facilities, oil refineries, metal smelters and water desalination plants. Our technology can provide the necessary reliable electricity and heat energy to these facilities in an environmentally efficient manner.

We estimate the market size for SMR technology will grow to over $100 billion by 2035. Today we have a pipeline of over 100 customer opportunities globally, which range from customer leads to one contracted customer. We currently have one contract in place with RoPower that has a stated commercial operation date in 2029-2030. We also currently have several MOUs in place with both utility and industrial customers across North America, Europe, the Middle East, Africa and Asia. MOUs are an important step toward advancing to a definitive contracted customer and we believe many of these MOUs will convert into signed contracts over time. In December 2022, we completed our Standard Plant Design (“SPD”), which provides potential customers with a generic VOYGR power plant design that will serve as a starting point for deploying site-specific designs, including supporting client licensing and deployment activities. Prospective customers in the United States are gaining an understanding of the potential benefits from the Inflation Reduction Act of 2022, which provides production tax credits for certain existing nuclear power plants but, more importantly, for certain new nuclear power plants and specifically for advanced reactors and small modular reactors. International customers seeking to decarbonize and meet climate change goals are increasingly looking at NuScale plants as their means to meet energy needs and carbon-reduction goals.

RoPower/SNN. On November 4, 2021, NuScale and Nuclearelectrica, a national energy company in Romania that produces electricity, heat and nuclear fuel, signed a teaming agreement to advance the delivery of NuScale’s SMR technology. NuScale and RoPower, owned in equal shares by Nuclearelectrica and Nova Power & Gas S.A., announced on January 4, 2023, that a contract for Front-End Engineering and Design (FEED) work was signed between parties on December 28, 2022, marking a significant step toward the near-term deployment of a NuScale VOYGR SMR power plant in Romania expected to occur by 2029-2030. FEED Phase 1 work has completed and RoPower is in negotiations with a Fluor subsidiary to perform FEED Phase 2 work. NuScale would work as a subcontractor to Fluor during RoPower FEED Phase 2. RoPower is in negotiation with NuScale for a technology license agreement in support of FEED Phase 2.

Other Potential Customers. We have signed non-binding MOUs with several potential customers around the world, including in North America, Europe, the Middle East, Africa and Asia. Potential customers with which we have publicly announced MOUs include CEZ Group, Prodigy Clean Energy Ltd., Energoatom, Kazakhstan Nuclear Power Plant and Kozloduy NPP – New Build Plc. In October 2023, Standard Power announced that it had selected NuScale technology to deploy at two sites. Standard Power has expressed an interest in deploying 12 NuScale units at each of these sites to power Standard Power’s data center operations.

Growth Strategy

We intend to grow our business by leveraging our competitive advantages in scalability, safety, reliability and cost. We have a number of avenues to achieve our growth objectives:

Traditional and New Applications. We believe the market for NuScale VOYGR power plants is wherever non-intermittent, reliable, carbon-free power is needed. Initially, we are focused on replacing carbon intensive coal-fired power plants and as an alternative to new-build gas-fired generation. Additionally, we are focused on marketing VOYGR power plants to industrial and micro-grid customers in sectors that include direct air capture, water desalinization, hydrogen production and mission critical facilities.

International Customer Development. We continue to develop our international customer base as we foresee a majority of our customer demand over the long-term to be outside of the United States. Our team puts significant effort into developing dialogue with foreign governments and corporations in order to educate and market our technology. The 2021 United Nations Climate Change Conference and other global climate events have generated significant inbound interest from potential global customers. We will continue to strengthen relations with these parties to accelerate sales globally.

10

Technology Advancements. Using our innovative technology platform and robust intellectual property portfolio, NuScale is well-positioned to continue making technology advancements over time. These improvements include increasing power output, simplifying operations, reducing construction time and reducing production cost. Just as we increased power to 77 MWe per module without increasing module size or construction costs, our R&D team is continuously researching and developing ways to improve our technology and meet our customers’ energy needs – creating top line growth opportunities and potential for increasing margins over time.

Development of New Products. We continue to explore the development of innovative new products based on our core NPM technology. For example, we are developing a micro-reactor for niche end-markets. Our micro-reactor design is a 0.01 MWe to 10 MWe module intended to supply power to remote, off-grid and small communities. Use applications could include mining, universities, space power, military installations and disaster relief. These micro-reactors are expected to be small, compact, highly reliable, fully automated and rapidly deployable.

Supply Chain

We have commenced NPM long lead material procurement, including forging manufacturing, for the first plant, enabling us to begin utilizing our extensive global supply chain ecosystem for all NPM components and for the construction of VOYGR power plants. We also have strategic and commercial partnerships in place globally that allow us to contract for the manufacturing of key NPM components.

We are working with suppliers, such as Doosan Enerbility Co., Ltd.; Precision Custom Components LLC; Sarens Nuclear & Industrial Services, LLC; Curtiss-Wright Corporation; and IHI Corporation, among others, who we expect to build components of NPMs to our specifications. Other key suppliers include Framatome, SA (fuel assemblies), Honeywell International Inc. (control systems), Paragon Energy Solutions (protection systems), Sensia LLC (sensors and instrumentation) and PaR Systems, Inc. (reactor building crane).

Partnerships

Fluor. Fluor, a leading global EPC firm, is the majority stockholder in NuScale and collaborates with NuScale on plant design and is a provider of engineering, project management, procurement and construction services. A number of the strategic investors including Fluor have business collaboration agreements with NuScale, under which the strategic investors have rights to perform engineering, procurement, construction and other specified services for NuScale.

DOE. The U.S. Department of Energy has granted NuScale four separate cost-share awards totaling more than $0.6 billion to develop, certify and commercialize our SMR technology. DOE-funded research in 2003 helped accelerate the development of NuScale’s SMR prior to forming NuScale in 2007. In addition, NuScale has ongoing collaborations with DOE labs, including the Idaho National Lab, Argonne National Lab, Oak Ridge National Lab and Pacific Northwest National Lab.

ENTRA1 Energy. NuScale has a strategic global commercialization partnership with ENTRA1 Energy focused on financing, distributing and deploying each NuScale NPM and power plant. ENTRA1 Energy leverages NuScale's certified SMR technology to energize a diverse portfolio of energy production plants, supporting energy consumers’ distinct needs through bespoke structuring, development and deployment. An independent energy development and production company, ENTRA1 Energy is focused on navigating the energy transition spectrum to help deliver reliable, carbon-free energy. Through ENTRA1 Energy, we expect to be able to provide customized plant development, financing, ownership and operating structures that promote de-risking of an energy project and support each energy consumer’s unique needs.

ENTRA1 Energy power plants with NuScale SMR-inside is a unique and exclusive model that allows us to provide a one-stop-shop energy solution to customers globally.

Strategic Investors. NuScale has a global network of strategic investors and supply chain partners that we expect to play an integral role in bringing our technology to market around the world. In addition to Fluor, existing strategic investors and supply chain partners include Doosan Enerbility Co., Ltd., Sargent & Lundy, LLC, Sarens Nuclear & Industrial Services, LLC, JGC Holdings Corporation, IHI Corporation, GS Energy Corporation and Samsung C&T Corporation.

Collaboration with Academic Institutions. NuScale has benefited from independent research, peer-reviewed studies and testing conducted by and with academic institutions, including Oregon State University, Boise State University, Colorado School of Mines, University of Houston, University of Idaho, University of Illinois Urbana-Champaign, Kansas State University, University of Maryland, College Park, Massachusetts Institute of Technology, University of Michigan, Missouri University of Science and Technology, Morgan State University, University of Nevada Las Vegas, North

11

Carolina State University , POLIMI (Italy), University of Sheffield (U.K.), University of Tennessee, Texas A&M, Utah State University, University of Utah, University of Wisconsin and University of Wyoming.

Other Collaboration. NuScale has been working with the International Atomic Energy Agency and regulators in Canada, Japan, Poland, Romania, the U.K. and Ukraine, and will be or are supporting our customers’ engagement with regulators in other international jurisdictions. We expect that our strategic relationships with governmental agencies will help facilitate the licensing our SMR in the United States and abroad, and that our relationships with experienced private companies, which have offices and projects in countries with potential NuScale customers, will allow us to reach customers globally.

Intellectual Property

As of December 31, 2023, NuScale had been issued 455 patents globally, and had 158 pending patents. These 613 issued or pending patents, filed across 21 jurisdictions including in the U.S., protect key aspects of our technology and demonstrate the continued growth of our intellectual property portfolio. We believe our intellectual property rights are important assets for our success and we aggressively protect these rights to maintain our competitive advantage in the market.

We own all necessary rights to the intellectual property associated with our technology to allow any capable manufacturer the ability to fabricate or build to print all components of the NPM. We also commissioned and own the rights to a NuScale standard plant design, giving customers significant cost savings in designing and engineering the balance of plant needed for electricity generation. Approximately one-third of our patent portfolio relates to our safety system, one-third relates to power production and the remaining third to other categories such country.as software and to the reactor module, operability, modularity and inspection. NuScale’s proprietary module protection system was developed in-house and has been approved by the NRC. We manage our patent portfolio to maximize the lifecycle of protecting our intellectual property, and various components and aspects of our system are protected by patents that will expire at staggered times.

Research & Development

The NuScale team has spent 17 years on R&D and testing and invested over $1.8 billion (including non-dilutive DOE grants) to date to develop its technology. Prior to forming our company in 2007, the DOE funded research from 2000 to 2003 to develop the fundamental concept for our SMR. Our current R&D efforts are centered on innovative plant operations and services, introducing new product innovations, improving plant quality and lowering the lifecycle cost of our NPMs and VOYGR plants. The R&D team is also involved in developing new innovative technologies that will represent future product offerings of NuScale, including steam compression and heating systems for industrial process heat, hydrogen production, storage and transport systems and advanced micro-reactor technologies.

Human Capital

As of December 31, 2023, approximately 27% of our full-time employees are women and 14% belong to historically underrepresented groups. We have one female executive and one executive belongs to a historically underrepresented group in the science and technology sectors. NuScale is a signatory to the International Energy Agency Clean Energy Ministerial’s “Equal by 30 Campaign”, a public commitment to increase the number of women in the clean energy sector by 2030.

On January 8, 2024, NuScale announced a plan (the “Plan”) to reduce the Company’s workforce by 154 full time employees, or 28%. These strategic actions aligned resources with core priorities, which include advancing revenue-generating projects, securing new orders and positioning NuScale towards technology commercialization and long-term success.

After the Plan was initiated, we had 398 full-time employees with an aggregate of 156 advanced degrees, including 129 master’s degrees in engineering and science and 20 Ph.Ds. Twelve percent of our engineers are veterans. Our workforce is concentrated in the Portland and Corvallis, Oregon areas, but we have employees working in 39 states and the District of Columbia. We have a seasoned leadership team with over 250 years of cumulative experience in the nuclear industry. Our management team places significant focus and attention on matters concerning our human capital assets, particularly our diversity, capability development and succession planning. Accordingly, we regularly review employee development and succession plans for each of our functions to identify and develop our pipeline of talent.

12

Information about our current Executive Officers and other Significant Employees

| Name | Age | Position | ||||||||||||

| John L. Hopkins | 70 | Chief Executive Officer, Director | ||||||||||||

| José N. Reyes | 68 | Chief Technical Officer | ||||||||||||

| Robert Ramsey Hamady | 49 | Chief Financial Officer | ||||||||||||

| Carl Fisher | 62 | Chief Operating Officer | ||||||||||||

| Clayton Scott | 62 | Chief Commercial Officer | ||||||||||||

| Robert Temple | 67 | General Counsel and Corporate Secretary | ||||||||||||

| Scott Bailey | 62 | Vice President, Supply Chain | ||||||||||||

| Carl Britsch | 60 | Vice President, Human Resources | ||||||||||||

| Robert Gamble | 61 | Vice President, Engineering | ||||||||||||

| Karin Feldman | 46 | Vice President, Program Management | ||||||||||||

| Carrie Fosaaen | 38 | Vice President, Regulatory Affairs | ||||||||||||

John L. Hopkins has served as NuScale’s chief executive officer and on its board of directors since December 2012, and he served as its executive chairman from December 2012 to December 2021. Before that, Mr. Hopkins was with Fluor Corporation, one of the world’s largest publicly traded engineering, procurement, fabrication, construction and maintenance companies. Mr. Hopkins started his career at Fluor Corporation in 1989, held numerous leadership positions in both global operations and business development, and served as a corporate officer from 1999 until 2012. Mr. Hopkins is active in a variety of professional and business organizations, and currently serves on the Executive Committee, Audit Committee and Compensation Committee of the United States Chamber of Commerce, Washington, D.C.; he was formerly the Chairman of the Board and Chairman of the Executive Committee. Mr. Hopkins served with the DOE’s Nuclear Energy Advisory Committee from 2019 to 2020, and is currently a member of the Nuclear Energy Institute Executive Committee and Energy Task Force Member, Atlantic Council and the Group of Vienna. He was a senior energy policy advisor of I Squared Capital, New York. He has also served as the senior executive member of both the Fluor Netherlands and Fluor United Kingdom board of directors; chairman of the board for Savannah River Nuclear Solutions, LLC; and as a director of the Business Council for International Understanding. Mr. Hopkins is qualified to serve as a director based on his knowledge of NuScale and its operations, his strategic relationships with NuScale partners, and his extensive experience in management and with the nuclear industry and with engineering and construction. Mr. Hopkins graduated with a B.B.A. from the University of Texas, Austin, and has completed several advanced management programs.

José N. Reyes, Ph.D., co-founded NuScale LLC and co-designed the NuScale passively-cooled small nuclear reactor. Dr. Reyes has served as our chief technology officer since 2007. Dr. Reyes is an internationally recognized expert on passive safety system design, testing and operations for nuclear power plants. He has served as a United Nations International Atomic Energy Agency technical expert on passive safety systems. He is a co-inventor on over 110 patents granted or pending in 20 countries. He has received several national awards including the 2013 Nuclear Energy Advocate Award, the 2014 American Nuclear Society Thermal Hydraulic Division Technical Achievement Award, the 2017 Nuclear Infrastructure Council Trailblazer Award, and the 2021 American Nuclear Society Walter H. Zinn Medal. He is a fellow of the American Nuclear Society and a member of the National Academy of Engineering. Dr. Reyes served as head of the Oregon State University (“OSU”) Department of Nuclear Engineering and Radiation Health Physics from 2006-2009. He directed the Advanced Thermal Hydraulic Research Laboratory and was the co-director of the Battelle Energy Alliance Academic Center of Excellence for Thermal Fluids and Reactor Safety in support of the Idaho National Laboratory mission from 1994-2009. Additionally, Dr. Reyes was the OSU principal investigator for the AP600 and AP1000 design certification test programs sponsored by the NRC, the DOE and Westinghouse from 1990-2005. He currently serves as a Professor Emeritus in the School of Nuclear Science and Engineering at OSU. He holds Ph.D. and Master of Science degrees in nuclear engineering from the University of Maryland, and a Bachelor of Science degree in nuclear engineering from the University of Florida. He is the author of numerous journal articles and technical reports, including a book chapter on SMRs for an American Society of Mechanical Engineering Boiler and Pressure Vessel Codes and Standards handbook. He has given lectures and keynote addresses to professional nuclear organizations in the United States, Europe and Asia.

Robert Ramsey Hamady has served as our chief financial officer since August 2023. Prior to coming to NuScale he served as chief financial officer at a U.S.-based finance firm, Equify Financial for July and August 2023, after spending time as chief financial officer at Western Magnesium Corporation from March 2022 to September 2022. Prior to this, Mr.

13

Hamady served from May 2016 to March 2022 as director of finance and investments at HG Global, a private asset management firm focused on investments in the energy, infrastructure and financial sectors. Mr. Hamady also founded an investment fund called Gulf Capital Credit Opportunities. Mr. Hamady began his career at Lehman Brothers before transitioning to J.P. Morgan. Mr. Hamady received his Bachelor of Science degree in Industrial Management from Carnegie Mellon University.

Carl Fisher joined NuScale in July 2023 as Chief Operating Officer.Mr. Fisher leads the operations, engineering, project management, quality assurance, information technology, and regulatory affairs functions.Mr. Fisher began his career in the nuclear field in the United States Naval Nuclear Propulsion Program, where he was involved in naval nuclear reactor operations and managed instrumentation and control startup, operations, maintenance, and commissioning activities. He continued his nuclear industry career with Framatome from April 2003 to June 2023 in various management roles in Instrumentation & Control (I&C), Electrical Systems, Hardware and Product Modernizations, Engineering, and Customer Accounts & Government Affairs over a 20-year period.Most recently, Mr. Fisher was Vice President of Instrumentation & Control in North America, where he was responsible for the execution and delivery of I&C products and services to North American nuclear customers. During this time, the I&C Business Unit experienced tremendous growth as a Tier 1 supplier of both Safety and Operational Instrumentation and Controls equipment and services to nuclear facilities in the United States, Canada, and Mexico.Prior to that, Fisher led various Framatome business lines, which included Plant Engineering, NSSS Engineering, Electrical Products, Mechanical Products, Commercial Grade Dedication, Qualification & Testing, Inventory Management, the Nuclear Parts Center, Strategic Alliance for FLEX Emergency Response (SAFER), and Cyber Security.Prior to joining Framatome, Mr. Fisher’s global experience began in January 1990 to December 2022 with Duke Energy International in Hong Kong, where he managed energy commercial development efforts in Australia, China, Indonesia, Malaysia, New Zealand, Thailand, and the Philippines.Mr. Fisher holds a Bachelor of Science degree in mechanical engineering from North Carolina State University and a master’s degree in business administration from Queens University. He is actively engaged at the industry level and currently a member of the Institute of Nuclear Power Operation’s Supplier Participant Advisory Committee, as well as a member of the Nuclear Energy Institute Digital I&C Working Group. Fisher is also a certified Project Management Professional and a licensed Professional Engineer in North Carolina and South Carolina.

Clayton Scott joined NuScale on January 10, 2022 as Executive Vice President, Business Development before being promoted to Chief Commercial Officer in August 2023. He is responsible for the global sales, marketing and communications for NuScale. Mr. Scott brings more than 40 years of diverse global experiences allowing him the ability to open markets and raise brand awareness, in addition to having closed over $2.5 billion in sales globally. Prior to NuScale, from February 2018 to December 2021, Mr. Scott was a Senior Vice President — Global Sales, Deputy Director Instrument & Control (“I&C”) Business Unit for Framatome, responsible for the global I&C sales and P&L within the group. He led a global staff of more than 2,000 and drove new business at the ministry levels in Russia, China, Uzbekistan, Egypt, Saudi Arabia, and others. Prior to Framatome, from January 2014 to February 2018 Mr. Scott served as the Chief Nuclear Officer for Schneider Electric, responsible for the company’s global nuclear organization, with offices and facilities in North America, Europe the Middle East and North Africa, and Asia. Before accepting this position with Schneider Electric, Mr. Scott served as the Chief Nuclear Officer of Invensys’s global nuclear business. He was appointed by the International Atomic Energy Agency (“IAEA”) to chair a taskforce on harmonizing digital licensing issues globally. He is a frequent lecturer on various topics within the energy sector. He is a member of the University of Tennessee Advisory Board. Mr. Scott was Chairman of Board for a newly created Framatome Company in South Korea. Mr. Scott carries dual citizenship in the United States and Canada. He has a Bachelor of Science degree in electrical engineering from the University of California, Irvine, Leading with Finance from the Harvard Business School online, and began his career as an instrumentation technologist for Ontario Hydro, where he was involved in commissioning and startup of four CANDU units at the Pickering Nuclear Power Station in Ontario, Canada.

Robert (Bob) Temple has served as general counsel and secretary of NuScale since 2016. Before NuScale, Mr. Temple served as general counsel and corporate secretary for Toshiba America Energy Systems Corporation (“TAES”) from 2015 to 2016, and as general counsel and corporate secretary for Toshiba America Nuclear Energy Corporation. Before joining TAES, Mr. Temple was assistant general counsel for The Babcock & Wilcox Company from 2010-2015, where he served as the chief legal advisor for Babcock & Wilcox Nuclear Energy, Inc. and Babcock & Wilcox mPower, Inc., as well as the general counsel and secretary for Generation mPower LLC. Mr. Temple joined Babcock & Wilcox in 2011 from the Washington, D.C. office of Haynes and Boone, LLP. During his career in private law practice, Mr. Temple worked as an associate, of counsel, or partner in the Chicago and Washington, D.C. offices of the law firms of Winston & Strawn, Hopkins & Sutter and McGuireWoods. Mr. Temple was Deputy General Counsel, vice president and secretary at CPS Energy from 2004 to 2009 and served as an in-house attorney with Commonwealth Edison (now Exelon) from 1995 to

14

1997. Before becoming an attorney, Mr. Temple was a licensed senior reactor operator at LaSalle County Station and served in the United States Navy aboard nuclear submarines. Mr. Temple received his J.D. from Illinois Institute of Technology’s Chicago-Kent College of Law (1995) and received his Bachelor of Science degree from Southern Illinois University (1988).

Scott Bailey has served as our vice president of Supply Chain since January 2011 and leads all aspects of NuScale’s supply chain function including internal procurement operations and supply chain development and manufacturing. Before joining NuScale, Mr. Bailey was the director of supply chain, nuclear generation, development and construction for the Tennessee Valley Authority (2009-2010). Mr. Bailey previously held senior supply chain management and consulting positions for NRG Energy (2007-2009), Sequoia Consulting Group (2004-2007), Pantellos (2001-2004) and Maine Yankee Atomic Power Company (1986-2001). Mr. Bailey holds a master’s degree in business from Husson University (1991) and a B.S. in marine engineering from Maine Maritime Academy (1983).

Carl Britsch has served as NuScale’s vice president of Human Resources since 2015. Before NuScale, Mr. Britsch worked in human resources for a wide variety of industries including automotive, logistics, oilfield services and energy. Early in his career, Mr. Britsch spent nearly 10 years with Ford Motor Company including roles in two Ford Assembly plants and a role in the United Kingdom. Mr. Britsch has led the human resources functions for Loomis Armored, a global cash logistics company and two Houston-based oilfield services companies. Mr. Britsch has a master’s degree in government administration from the University of Pennsylvania and a J.D. and undergraduate degree from Brigham Young University.

Robert Gamble, Ph.D., has served as NuScale’s vice president of Engineering since 2016, and is responsible for design of the NuScale Structures, Systems and Components, Nuclear Safety Analysis, Fuels, Testing and Code Development, and Engineering Support Programs. Dr. Gamble led major portions of the international technology program and NRC pre-application review for GE’s Economic Simplified BWR Gen 3 light water reactor. Subsequently, he led design finalization and the DCA to the NRC. Before that, he worked on design and licensing activities on the GE Advance BWR and Simplified BWR light water reactors. Prior to working on light-water reactors, Dr. Gamble worked on the development of the sodium cooled advanced liquid metal reactor and super power reactor innovative small module fast reactors as well as the Lithium cooled SP-100 space reactor, developing key aspects of the thermal hydraulic systems and technology development infrastructure. As vice president of Mechanical Design and Analysis Group, Dr. Gamble and his staff were responsible for the design and analysis of reactor pressure vessels, internals and piping, structural and vibrations analysis, seismic and dynamic analysis, fracture mechanics, and emergent outage work including diagnoses, evaluation, repair and replacement of all vessel hardware of the global operating fleet of GE BWRs. Before NuScale LLC, Dr. Gamble served as the vice president of Engineering and general manager for North American Operations for Areva Solar from 2012 to 2016. Dr. Gamble received his PhD, M.S. and B.S. in mechanical engineering from UC Berkeley and is a graduate of the Harvard Business School Executive Management Training Program.

Karin Feldman was recently named senior vice president, Program Management Office after serving as vice president, Program Management Office since January 2019. She is responsible for leading NuScale’s project and program management and establishing and maintaining project management, project controls, cost estimating, and risk management standards. Before assuming this role, Ms. Feldman served as NuScale’s director of planning and integration (2016-2018) and the program management office risk manager (2012-2016). Before joining NuScale, from 2008 to 2012 Ms. Feldman was the chief executive officer of Zero Point Frontiers Corp. a small business start-up that provided technical and programmatic support to United States government and commercial space programs. Ms. Feldman started her career at The Aerospace Corporation (2000-2008), a federally-funded research and development center, where provided risk planning and assessment support for United States Air Force and NASA programs. Ms. Feldman holds a B.S. in nuclear engineering and radiological sciences from the University of Michigan and a master’s degree in nuclear engineering from the Massachusetts Institute of Technology.

Carrie Fosaaen serves as our vice president of Regulatory Affairs, having assumed that role in June 2023, and is responsible for all licenses, certifications, relationships, and activities related to regulation of nuclear safety and security, environmental protection, and emergency management, both domestically and internationally. This includes domestic and international client licensing support and other industry activities that involve nuclear and other regulatory topics. Ms. Fosaaen joined NuScale as a Licensing Engineer. Ms. Fosaaen has more than 14 years of experience in the nuclear industry and is an expert in advanced reactor licensing and has led NuScale’s development of several major licensing applications. Prior to joining NuScale in 2015, Ms. Fosaaen worked in regulatory affairs for Xcel Energy, where she supported the organization through regulatory recovery, including successful resolution of 95001 and 95002 inspections. She also obtained her senior reactor operator certification at the Monticello Nuclear Generating Plant. Ms. Fosaaen is a 2023

15