SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

(

Amendment No. 2)

Mark One) | | | | | |

| ☒ | |

☒

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

| | | | | |

| For the fiscal year ended December 31, 2020

|

OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| FOR THE TRANSITION PERIOD FROM __________ TO ________

|

COMMISSION FILE NUMBER

For the transition period from _____ to _____

Commission file number 001-39248

The Oncology Institute, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | 84-3562323 |

Delaware

| | 84-3562323

|

(State or other jurisdiction of incorporation or organization) | |

(I.R.S. Employer Identification Number) No.) |

| incorporation or organization)

|

|

|

|

|

18000 Studebaker Rd,. |

|

Suite 800 |

Cerritos,, California |

| 90703 |

(Address of principal executive offices) |

| (Zip Code)

Principal Executive Offices) |

Registrant’s

(562) 735-3226

Registrant's telephone number, including area code: (213) 760-1328code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.0001 par value per share | | TOI | | The Nasdaq Stock Market LLC |

|

|

|

|

|

Redeemable warrants, each whole warrant exercisable for one share ofWarrants to purchase common stock each at an exercise price of $11.50 per share

| | TOIIW | | The Nasdaq Stock Market LLC |

Securities registered pursuant to

Sectionsection 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

☐No☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes

☐No☒

Indicate by check mark whether the

registrantregistrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports)

; and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

(1) has submitted electronically

and posted on its corporate web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to

filesubmit and post such

reports) and has been subject to such filing requirements for the past 90 days.files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer,

or a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated

filer,”filer” and “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

Large accelerated filer ☐ | ☐ | Accelerated filer ☐ | ☐ |

Non-accelerated filer ☒ | ☒ | Smaller reporting company☒ | ☒ |

| | Emerging growth company☒ | |

| | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b).☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☒☐ No ☐☒

The aggregate market value of

the commonvoting stock held by non-affiliates of the

registrant, computedRegistrant, based on the closing price of $0.55 per shares of the Registrant’s common stock as reported by the Nasdaq Capital Market as of June 30,

2020 (the last business day of the registrant’s most recently completed second fiscal quarter)2023, was approximately

$173,362,500.

As$41.6 million.

The registrant had outstanding 74,312,921 shares of common stock as of March

1, 2021, the Registrant had 23,000,000 shares of its Class A common stock, $0.0001 par value per share, and 5,750,000 shares of its Class B common stock, $0.0001 par value per share, outstanding.19, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

References throughout this Amendment No. 2 toForm 10-K incorporates by reference information from the Annual Report on Form 10-K/A to “we,” “us,” the “Company” or “our company” are to The Oncology Institute, Inc. (formerly, DFP Healthcare Acquisitions Corp.), unless the context otherwise indicates.

This Amendment No. 2 ("Amendment No. 2") to the Annual Report on Form 10-K/A amends Amendment No. 1 to the Annual Report on Form 10-K/A of the Company as of andregistrant’s proxy statement for the fiscal period ended December 31, 2020, asannual meeting of stockholders expected to be held on June 13, 2024, which will be filed with the Securities and Exchange Commission ("SEC") on May 24, 2021 (the "2020 Form 10/A No. 1"). The Company has re-evaluatedpursuant to Regulation 14A within 120 days after the Company’s application of ASC 480-10-S99-3A to its accounting classificationend of the redeemable Class A common stock, par value $0.0001 per share (the “Public Shares”), issued as partRegistrant’s fiscal year ended December 31, 2023.

Table of Contents

| | | | | |

| Page |

| 6 |

| 6 |

| 16 |

| 45 |

| 45 |

| 46 |

| 46 |

| 46 |

| 47 |

| 47 |

| 47 |

| 48 |

| 60 |

| 61 |

| 110 |

| 110 |

| 111 |

| 111 |

| 112 |

| 112 |

| 112 |

| 112 |

| 112 |

| 112 |

| 113 |

| 113 |

| 115 |

| 116 |

INTRODUCTORY NOTE

Unless the

units sold in the Company’s initial public offering (the “IPO”) on March 13, 2020. Historically, a portion of the Public Shares was classified as permanent equity to maintain stockholders’ equity greater than $5 million on the basis that the Company will not redeem its Public Shares in an amount that would cause its net tangible assets to be less than $5,000,001, as described in the Company’s amended and restated certificate of incorporation (the “Charter”). Pursuant to such re-evaluation, the Company revised its interpretation to include temporary equity in net tangible assets. In addition, in connection with the change in presentation for the Public Shares, the Company determined it should restate its earnings per share calculation to allocate income and losses shared pro rata between the two classes of shares. This presentation contemplates a Business Combination as the most likely outcome, in which case, both classes of shares share pro rata in the income and losses of the Company.Therefore, on December 8, 2021, the Company’s management and the audit committee of the Company’s board of directors (the “Audit Committee”) concluded that the Company’s previously issued (i) balance sheet as of March 13, 2020 (the "Post IPO Balance Sheet"), as previously restated in the 2020 Form 10-K/A No. 1, (ii) financial statements included in the 2020 Form 10-K/A No. 1, as previously restated in the 2020 Form 10-K/A No.1 as previously restated (iii) unaudited interim financial statements included in the Form 10-Q for the quarterly period ended March 31, 2020 as previously restated in the 2020 Form 10-K/A No. 1; (iv) unaudited interim financial statements included in the Form 10-Q for the quarterly period ended June 30, 2020 as previously restated in the 2020 Form 10-K/A No. 1; (v) unaudited interim financial statements included in the Form 10-Q for the quarterly period ended September 30, 2020 as previously restated in the 2020 Form 10-K/A No. 1 (vi) unaudited interim financial statements included in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2021, filed with the SEC on May 24, 2021; (vii) unaudited interim financial statements included in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2021, filed with the SEC on August 12, 2021; and (viii) footnote 2 to the unaudited interim financial statements and Item 4 of Part 1 included in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2021, filed with the SEC on November 8, 2021 (collectively, the “Affected Periods”) , should be restated to report all Public Shares as temporary equity and should no longer be relied upon. As such, the Company will restate its financial statements for the Affected Periods in this Form 10-K/A for the Post IPO Balance Sheet, the Company's financial statements included in the 2020 Form 10-K/A No. 1, and the unaudited interim financial statements for the quarterly periods ended March 31, 2020, June 30, 2020, and September 30, 2020. The unaudited interim financial statements for the periods ended March 31, 2021, and June 30, 2021 will be restated in an amendment to the Company’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2021, to be filed with the SEC (the “Q3 2021 Form 10-Q/A”).

The restatement does not have an impact on its cash position and the cash formerly held in the trust account established in connection with the IPO (the “Trust Account”).

The Company’s management has concluded that a material weakness remains in the Company’s internal control over financial reporting and that the Company’s disclosure controls and procedures were not effective. As a result of that reassessment, we determined that our disclosure controls and procedures for such periods were not effective with respect to the proper accounting and classification of complex financial instruments. For more information, see Item 9A includedcontext dictates otherwise, references in this Annual Report on Form 10-K/A.

10-K to the “Company,” “we,” “us,” “our,” and similar words are references to The Oncology Institute, Inc., a Delaware corporation (“TOI”), and its consolidated subsidiaries and affiliated entities, as appropriate, including its consolidated variable interest entities (“VIEs”).

Trade names and trademarks of TOI referred to herein, and their respective logos, are our property. This Annual Report on Form 10-K may contain additional trade names and/or trademarks of other companies, which are the property of their respective owners. We do not intend our use or display of other companies’ trade names and/or trademarks, if any, to imply an endorsement or sponsorship of us by such companies, or any relationship with any of these companies.

We are filingThe Centers for Medicare & Medicaid Services (“CMS”) have not reviewed any statements contained in this Amendment No. 2 to amendAnnual Report on Form 10-K.

FORWARD-LOOKING STATEMENTS

In this Annual Report on Form 10-K, including "Business” in Item 1, “Risk Factors” in Item 1A, and restate the 2020 Form 10-K/A No. 1 with modification as necessary to reflect the restatements. The following items have been amended to reflect the restatements:Part I, Item 1A. Risk Factors

Part II, Item 7.

"Management’s Discussion and Analysis of Financial Condition and Results of OperationsPart II,

" in Item 8. Financial Statements7, and Supplementary DataPart II, Item 9A. Controls and Procedures

In addition, the Company’s Chief Executive Officer and Chief Financial Officer have provided new certifications dateddocuments incorporated by reference herein, we make forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for our business. These statements may be preceded by, followed by or include the words "may," "might," "will," "will likely result," "should," "estimate," "plan," "project," "forecast," "intend," "expect," "anticipate," "believe," "seek," "continue," "target" or similar expressions. These forward-looking statements are based on information available to us as of the date of this filing in connection with this Form 10-K/A (Exhibits 31.1, 31.2, 32.1they were made, and 32.2).Except as described above, and including the closing of our Business Combination, no other information included in the 2020 Form 10-K/A No.1 is being amended or updated by this Amendment No. 2 and this Amendment No. 2 does not purport to reflect any information or events subsequent to the 2020 Form 10-K/A No.1. This Amendment No. 2 continues to describe the conditions as of the date of the 2020 Form 10-K/A No.1 and, except as expressly contained herein, we have not updated, modified or supplemented the disclosures contained in the 2020 Form 10-K/A No. 1 to give effect to any subsequent events, including the closing of the Company’s business combination. Accordingly, this Amendment No. 2 should be read in conjunction with the 2020 Form 10-K/A No.1 and with our filings with the SEC subsequent to the 2020 Form 10-K/A No. 1.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this report that are not purely historical are forward-looking statements. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward- looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this Annual Report on Form 10-K/A may include, for example, statements about:

| ● | our ability to select an appropriate target business or businesses; |

| ● | our ability to complete our initial business combination; |

| ● | our expectations around the performance of any prospective target business or businesses; |

| ● | our success in retaining or recruiting, or changes required in, our officers, key employees or directors following our initial business combination; |

| ● | our officers and directors allocating their time to other businesses and potentially having conflicts of interest with our business or in approving our initial business combination; |

| ● | our potential ability to obtain additional financing to complete our initial business combination; |

| ● | our pool of prospective target businesses; |

| ● | the ability of our officers and directors to generate a number of potential investment opportunities; |

| ● | our public securities’ potential liquidity and trading; |

| ● | the lack of a market for our securities; |

| ● | the use of proceeds not held in the Trust Account (as described herein) or available to us from interest income on the Trust Account balance; or |

| ● | the Trust Account not being subject to claims of third parties; or |

| ● | our financial performance. |

The forward-looking statements contained in this report are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks and uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performancethem to turn out to be materially different from those expressed or implied by thesewrong. Accordingly, forward-looking statements. These risksstatements should not be relied upon as representing our views as of any subsequent date, and uncertainties include, but arewe do not limited to, those factors described under the heading “Risk Factors” in this Annual Report. Should one or more of these risks or uncertainties materialize, or shouldundertake any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward- looking statements. Some factors that could cause actual results to differ include:

•

expectations and assumptions about growth rate and market opportunity of TOI;•our public securities’ potential liquidity and trading;

•our ability to raise financing in the future;

•our success in retaining or recruiting, or changes required in, our officers, key employees or directors;

•the impact of the regulatory environment and complexities with compliance related to such environment;

•the outcome of judicial and administrative proceedings to which TOI may become a party or investigations to which TOI may become subject that could interrupt or limit TOI’s operations, result in adverse judgments, settlements or fines and create negative publicity;

•failure to continue to meet, or to cure any deficiency with respect to, stock exchange listing standards;

•factors relating to the business, operations and financial performance of TOI, including:

◦the potential short and long-term impact of a re-emergence of COVID-19 variants or any other pandemic, epidemic or similar broad health-related outbreaks;

◦the ability of TOI to maintain an effective system of internal controls over financial reporting;

◦the ability of TOI to grow market share in its existing markets or any new markets it may enter;

◦the ability of TOI to respond to general economic conditions;

◦the ability of TOI to manage its growth effectively;

◦the ability of TOI to achieve and maintain profitability in the future;

◦the ability of TOI to attract new patients;

◦the ability to recognize and react to changes in TOI’s clients’ preferences, prospects and the competitive conditions prevailing in the healthcare sector;

◦continued reimbursement from third-party payors; and

◦other factors detailed under the section titled “Risk Factors” within this Annual Report on Form 10-K.

Item 1. Business

Overview

The Oncology Institute, Inc. ("TOI", the "Company", "we", or "our) is a leading value-based oncology company that manages community-based oncology practices which serve patients at 83 clinic locations across 15 markets and five states throughout the United States. Our community-based oncology practices are staffed with 130 oncologists and advanced practice providers. 69 of these clinics are staffed with 119 providers employed by our affiliated physician-owned professional corporations, referred to as the "TOI PCs", which provided care for more than 72,000 patients in 2023 and managed a population of approximately 1.8 million patients under value-based agreements as of December 31, 2023. We also provide management services to 14 clinic locations owned by independent oncology practices. Our mission is to heal and empower cancer patients through compassion, innovation, and state-of-the-art medical care.

Our managed clinics provide a range of medical oncology services, including physician services, in-house infusion and dispensary, radiation, innovative programs like outpatient blood product transfusions, along with 24/7 patient support. Through TOI Clinical Research, LLC ("TCR"), the clinical research arm of the TOI PCs, we also provide and manage clinical trial services and research for the benefit of cancer patients. Many of our services, such as managing clinical trials and palliative care programs, are traditionally accessed through academic and tertiary care settings, while the TOI PCs bring these services to patients in a community setting, by which we mean, providing care in our convenient clinic locations rather than academic or tertiary care settings. As scientific research progresses and more treatment options become available, cancer care is shifting from acute care episodes to chronic disease management. With this shift, it is increasingly important for high-quality, high-value cancer care to be available in a local community setting to all patients in need.

As a value-based oncology company, we seek to deliver better quality care while managing costs for patients and payors that we serve. We define value-based care as care that focuses on providing optimal health outcomes and healthcare

affordability and a value-based contract as any contract that removes the incentive to drive up cost of care or overutilization, while rewarding better clinical outcomes, cost and quality. We work to accomplish this goal by reducing wasteful, inefficient or futile care that drives up costs but does not improve outcomes. We believe payors and employers are aligned with the value-based model due to its enhanced access, improved outcomes, and lower costs. Patients under our affiliated providers’ care can benefit from evidence-based and personalized care plans, gain access to sub-specialized care in convenient community locations, and lower out-of-pocket costs. We believe our affiliated providers enjoy the stability and predictability of a large multi-state practice, are not incentivized or pressured to over-treat when it may be inconsistent with a patient’s goals of care and can focus on practicing outstanding evidence-based oncology care.

In contrast to value-based care, we believe much of traditional fee-for-service, or FFS, oncology care is plagued by misaligned incentives that drive up costs and often lower the quality of care. In FFS care, oncologists are reimbursed on a “cost-plus” basis for drugs which in turn are often responsible for the majority of a practice’s revenue. This "cost-plus" model may incentivize oncologists to prescribe the most expensive treatments even if lower cost alternatives that are still medically appropriate are available, as well as to continue to utilize chemotherapy in advanced cancer patients who may no longer benefit from such treatment. In these cases, patients and payors not only bear the burden of higher cost of care, but patients may also suffer negative health outcomes including higher rates of emergency room visits and hospitalizations for supportive care needs due to the side effects associated with chemotherapy.

In 2023, we generated more than 47% of our revenue from patients who are covered by value-based contracts. Historically, our value-based contracts have predominately taken the form of capitated contracts. Our capitated contracts remove incentives to drive up costs, and they also have incentives for meeting or exceeding certain quality metrics. In some capitated contracts we are penalized if we fail to meet certain quality metrics. In other capitated contracts, we receive bonuses/rewards if we meet or exceed certain quality metrics. Our value-based contracts could also take on other forms, such as sharing with payors in the cost savings generated for specific medical oncology costs (which we refer to as 'gain-sharing' contract), along with incentives to meet certain quality metrics. These contracts, despite their modifications on how reimbursement is structured, still meet the definition of value-based care. We and our affiliated providers have contractual relationships with payors serving a variety of patients, including Medicare Advantage ("MA"), Medicaid, and commercial patients. These payors include affiliates of Anthem, CareMore Health, Heritage Provider Network and Optum Care.

In 2023, we continued to evolve the way we structure our value-based arrangements, particularly in areas of the country where there are limits on medical group delegation, or an increased desire from groups to incentivize TOI for cost of care that extends beyond medical oncology and includes elements such as management of acute care utilization and/or management of non-employed oncologists. We believe that these new contracting methodologies are furthering our mission to provide access to world-class oncology care in an affordable manner to underserved populations.

We believe that our position in the market and focus on elevating the state of oncology care with a value-based care model positions our affiliated providers well for future growth. Our technology platform supports this growth and enables the TOI PCs to standardize and deliver consistent value-based care at scale. We believe that our model will support growth into new markets, allow us to continue service more patients across the United States.

Our website is www.theoncologyinstitute.com. The information contained on our website is not a part of this annual report.

Affiliated Physician Practices

Some states have laws that prohibit business entities with non-physician owners from practicing medicine, which are generally referred to as the corporate practice of medicine. States that have corporate practice of medicine laws require only physicians to practice medicine, exercise control over medical decisions or engage in certain arrangements with other physicians, such as fee-splitting. For example, under California's corporate practice of medicine doctrine, physicians and certain licensed professionals cannot be employed by non-professional corporations, except under limited exceptions which do not apply to us. Additionally, all clinical decisions and certain business or management decisions that result in control over a physician's practice of medicine must be made by a licensed physician and not by an unlicensed person or entity. California also prohibits professional fee-splitting arrangements, but management fees based on a percentage of gross revenue or similar arrangement that is commensurate with fair market value of services provided by the management company are generally permissible.

We have entered into a management services agreement with each of the TOI PCs, which are entirely physician owned. Under our management services agreements, we have agreed to serve, on an exclusive basis, as manager and administrator of each TOI PC’s non-medical functions and services related to healthcare services and items provided to patients by physicians and other licensed healthcare providers employed by or under contract with a TOI PC. The non-medical functions and services we provide under the management services agreements include practice management services and non-clinical operational assistance for all TOI PC clinic locations, assistance with provider and payor contract negotiations and administration, billing

and collection services, financial and accounting services, electronic medical records and practice management technology solutions, assistance in maintaining licensure, permits and other credentialing requirements for the TOI PCs, risk management services, non-clinical personnel services, provider recruitment services and other administrative services required for the day-to-day operations of the clinics and TOI PCs. Our management services agreements with the TOI PCs have 20-year terms, unless terminated upon mutual agreement of the parties or unilaterally by a party following a material breach or commencement of bankruptcy or liquidation events by the other party, or a governmental or judicial termination order against a party. Under the management services agreement, we receive a monthly management fee that is structured as direct reimbursement of all costs incurred plus a percentage of the TOI PC’s gross revenue, which is defined as the TOI PC’s total revenues payable for all healthcare services and items rendered by the TOI PC, adjusted for bad debt, discounts and payor contract adjustments. In accordance with relevant accounting guidance, each of the TOI PCs is determined to be a variable interest entity, or VIE, of the Company as the Company has the ability, through the management services agreement, to direct the activities (excluding clinical decisions) that most significantly affect the TOI PC’s economic performance.

Market Overview

Our business is focused on caring for adult and senior populations with medical oncology and related care needs, including members of MA plans run by private insurance companies on behalf of the Centers for Medicare and Medicaid Services, or CMS, as well as traditional FFS Medicare, Medicaid, other government healthcare programs and commercial insurance populations. One of our primary focuses is on value-based contracts in which we manage the medical oncology care for a population of patients for a pre-determined, population-based capitated payment. Many of the patients that we manage under value-based arrangements are referred to as “capitated” populations, however our affiliated providers also provide care to patients outside of these arrangements under traditional FFS arrangements as well as other types of value-based contract.

As of December 31, 2023, we were active in 15 markets in five states. Across these states, there were approximately 81 million commercial, Medicaid, and MA lives. This population provides us with a substantial opportunity to capture a portion of those lives in both our legacy, existing markets, as well as in our new expansion geographies.

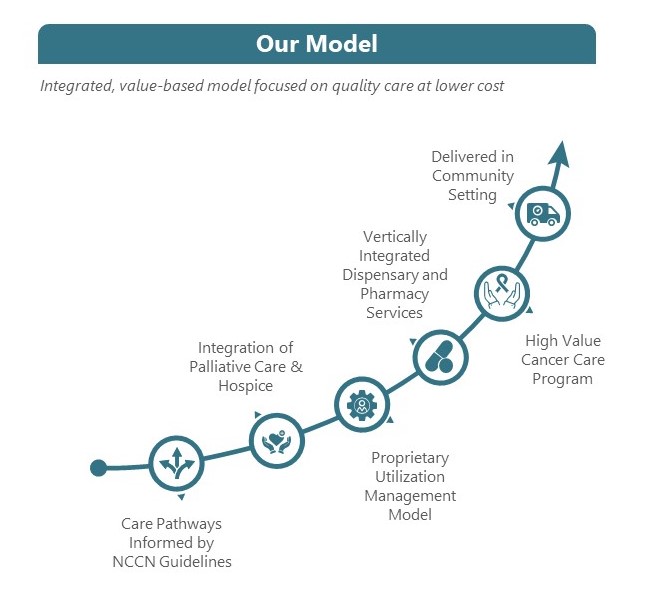

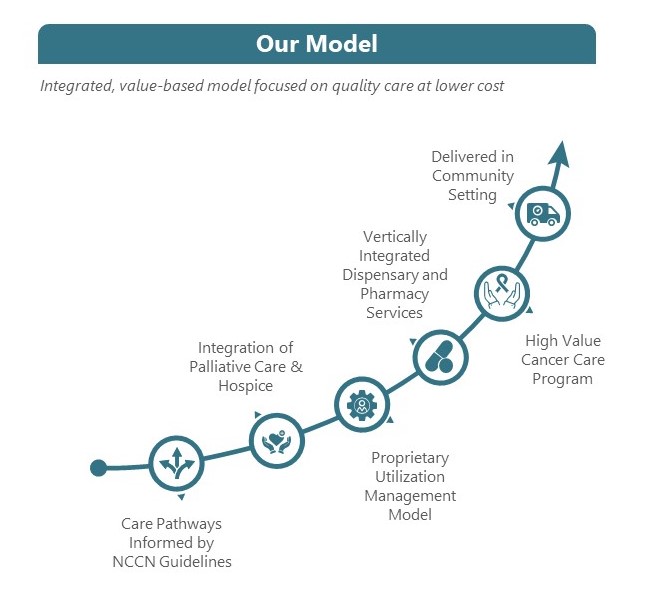

Our Care Model

Since our founding over 15 years ago, we have built a solid track record around our care model for value-based oncology care. Our care model is focused on delivering personalized, evidenced-based care, consistently, and at scale. We seek to deliver better patient outcomes for lower costs, and to care for more of our payors’ patient populations.

Our care model is designed to remove physicians’ incentives to over-prescribe or prescribe high-cost chemotherapy that is of limited clinical utility to patients, but rather focus on NCCN guideline adherence and, when possible, choose clinically equivalent but lower-cost therapeutics to benefit patients and our payor partners. We invest in nurse practitioners to help with advanced care planning and palliative care discussions with patients. We give patients the education and tools to make their own decisions about when the right time is to choose palliative care or hospice.

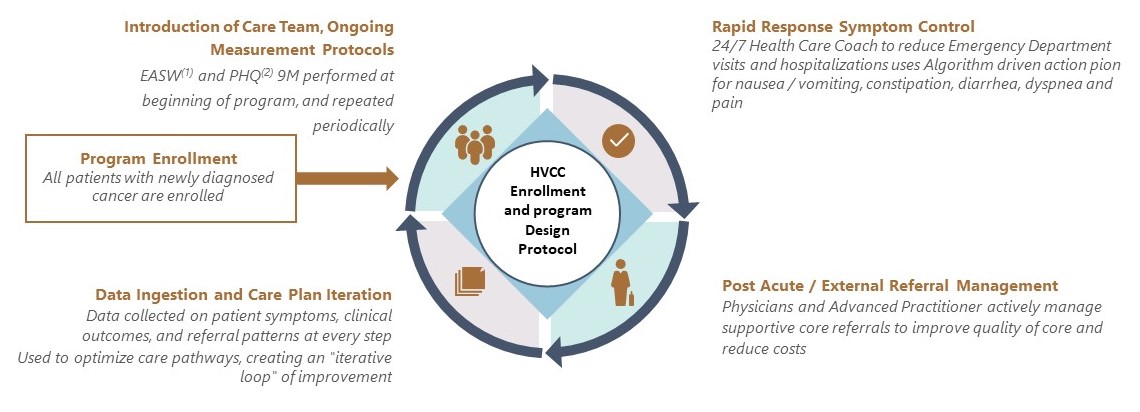

While the TOI PCs treat patients under both value-based and FFS contracts, our affiliated providers’ approach to care focuses on achieving the best outcomes at the lowest cost, regardless of the reimbursement methodology. We have developed a High Value Cancer Care, or HVCC, program, in which patients are able to access targeted care resources that augment and support their treatment. Our treatment regimens are based on algorithms established by the National Comprehensive Cancer Network (“NCCN”) and are evidence-based. NCCN is a not-for-profit alliance of 32 leading cancer centers devoted to patient care, research and education (not including TOI). NCCN focuses on improving cancer care through the input of clinical thought leaders at its member organizations. NCCN publishes guidelines developed from evidence- based medicine to ensure that all cancer patients receive preventative, diagnostic, treatment, and supportive services that are most likely to lead to optimal outcomes. The NCCN guidelines are widely recognized as the standard for clinical care in medical oncology, and the intent of the guidelines is to assist in clinical decision making. Our affiliated providers strive to ensure that clinical pathways in our electronic health records system, as well as recommendations on use of chemotherapy and supportive care medications are consistent with NCCN guidelines to ensure patients receive the best clinical care based on their individual disease and comorbidities. Moreover, the TOI PCs operate physician dispensaries that allow our affiliated providers to prescribe and dispense oral oncolytics and related medications to patients, alongside chemotherapy infusion and injections. This provides patients with holistic and convenient access to the most appropriate treatment pathways, all in a community setting. According to a study conducted by researchers at Stanford University on the TOI PCs’ patients in 2019 who were enrolled in our HVCC program, we saw improvements in several key metrics, including:

Overall, the study demonstrated greater than 25% lower median total healthcare costs from diagnosis to death. We are continuously improving and innovating our care model, using the clinical data from the HVCC program to develop evidence-based care and treatment protocols for all patients.

Our Value Proposition and Differentiated Care Model

Our managed clinics primarily serve adult and senior cancer patients in markets that have MA plans and primary care medical groups reimbursed on a capitated basis. Our affiliated providers provide these services primarily through employed providers who are responsible for patient care. We intend to leverage our long-established, strong relationships with payors to continue to build out our network and increase access to cancer patients in adjacent markets, while at the same time, decreasing oncology care costs for both patients and payors. Through the TOI PCs, we seek to provide high quality and lower cost care delivery through the following capabilities:

•recruiting process focused on selecting physicians that want to practice evidence-based medicine;

•technology-enabled care pathways ensuring adherence to evidence-based clinical protocols;

•strong clinical culture and physician oversight;

•care management to prevent unnecessary hospitalizations;

•care delivered in community clinics vs. hospital setting;

•clinically appropriate integration of palliative care and hospice aligned with patients’ goals of care;

•access to clinical trials providing cutting-edge treatment options at low or no cost to patients or payors; and

•appropriate provider training on clinical documentation to ensure proper risk adjustment and reimbursement for complex patients.

We strive to add value by consistently performing these activities effectively. The goal is a lower cost of care for the same or better clinical outcomes while providing a superior patient experience.

Patient Experience

We believe our patient-centric focus facilitates high levels of patient satisfaction and supports our care delivery model while strengthening payor relationships. We employ a continuous feedback mechanism to ensure superior patient experience and satisfaction among our affiliated physicians and advanced practice providers.

As of a recent patient survey in 2022, 88% of our oncologists and 90% of our locations were rated 4.0 or above as measured by our survey, which we distribute to patients via text or e-mail following their clinic visit.

Growth Strategy and Opportunities

To date, revenue has grown at a roughly 26% CAGR from 2016 to 2023, driven by robust growth in capitated lives under value-based contracts.

Our footprint as of December 31, 2023 spanned five states and is growing rapidly.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| California | | Arizona | | Nevada | | Florida | | Texas |

| Markets | 7 | | 1 | | 1 | | 5 | | 1 |

Managed and Affiliated Clinics(1) | 62 | | 4 | | 4 | | 11 | | 2 |

| Providers | 99 | | 5 | | 4 | | 21 | | 2 |

(1) 69 clinics operated under the TOI PCs, whereby we receive a percentage of revenues under our management services agreements, or MSAs and are consolidated; and 14 independent oncology practice locations that are under MSAs for limited management and administrative services but do not bear any direct operating costs.

We anticipate adding more TOI PC clinics and other managed practices in the future across our markets through acquisitions and through de novo clinic builds, and we are in constant discussion with payors and providers to enter new markets. We continually seek to evaluate our growth strategy and may continue to modify it in the future, and there can be no assurance that we will be able to successfully capitalize on growth strategies.

Our go-to-market strategy focuses on both payors and providers. This blend is important given the increasing penetration of non-traditional payors, such as Oscar and Bright HealthCare, and primary care risk models such as Agilon health and ChenMed LLC.

We believe that our existing payor relationships provide us leads on opportunities to enter new markets, and we often receive outreach from new management services organizations, health plans and risk bearing organizations. When evaluating a new market, we consider three primary factors:

1.the penetration and growth of Medicare Advantage and other value-based reimbursement models;

2.the presence of value-based primary care groups with whom we can partner to generate referrals and manage outcomes; and

3.how well oncology spend is currently managed in that market.

We believe that new markets we are focused on meet all of the above criteria and could provide us with significant opportunity to create value for patients, providers and payors.

We have multiple strategies we believe can achieve long term growth.

•Existing Market Contract Growth: Continue driving covered lives growth. Significant growth potential in existing markets can be achieved through expanding the scope of our services with existing partners and securing new contracts with new payors and independent practices. The addition of new de novo clinics and affiliated providers can drive additional growth. By continuing to build regional density in existing markets, we also have an opportunity to achieve efficiencies with increased scale.

•New Market Contract Growth: Our replicable operating model enables quick scaling in new markets. Oncology continues to be a key focus area for payors and providers, who are highly supportive of our entry into new markets. Our high priority markets have attractive market dynamics due to the high cost of oncology care in these geographies, the prevalence of risk-bearing organizations, and the presence of national payor partners with whom we collaborate in existing markets. Our initial approach to value-based contracting in new markets is likely to be in the form of gain share contracts These new contracts, which will enable us to work with payors and risk-taking providers as they continue their shift to value-based care, are likely to produce lower revenue and profitability in the initial period as compared to full capitation. Once payors and risk-bearing providers in these new markets become comfortable with our ability to generate savings and better outcomes, we believe these contracts are likely to shift to capitation.

•M&A Opportunities: Leveraging our existing pipeline and mergers and acquisition expertise can help us facilitate growth in both existing and new markets, allowing us to rapidly establish market presence. Once on-boarded, we can transition the affiliated practice to our value-based model, as well as expand and enhance the scope of services provided to patients by the affiliated practice, such as adding dispensary operations, managing clinical trials and access to our broad purchasing contracts. Independent oncologists continue to face multitude of challenges and our acquisition model offers a path for these oncologists to continue to practice in their community without the burdens of business building or administration, while at the same time working alongside a dynamic and growing organization at the forefront of value-based care. We look for acquisition targets where the practice is philosophically aligned with us in driving the shift to value-based care.

•Service Expansion: We can broaden scope and diversify service offerings, including ancillary and adjacent services focused on patient care and innovation and providing access to new oncology treatments being investigated in clinical trials that our affiliated practices manage. We have the potential to scale significantly faster with additional capital via

new oncologist on-boarding and training, further technology investments, investments in ancillaries, and strategic acquisitions. In Q4 2023, we opened our California-based pharmacy for specialty medication fills.

Contracting Overview

At a time when many FFS healthcare organizations have been struggling due to the decrease in service volumes, our value-based capitation payments have allowed us to maintain our level of member care and prioritize member safety by incentivizing the provision of care in the most appropriate setting.

We have focused our business on capitation arrangements and other types of value-based contracts, which we believe align provider incentives with both quality and efficiency of care. Under capitation arrangements, payors pay a fixed per member per month, or PMPM, amount for every plan member within a population assigned to us for oncology care.

Our affiliated providers are responsible for managing oncology care for this population based on a scope of medical services and drugs agreed upon by both parties. The PMPM rates for our capitation arrangements are determined based on our analysis of historical patient data and agreements with contractual partners. In new markets, this may require the TOI PCs to contract with both the health insurance company and their risk-bearing provider organization in order to service these members.

In addition to capitation-based arrangements, we continue to explore several other forms of value-based arrangements. Although many of these arrangements continue to be based on a FFS-based methodology, our affiliated providers are eligible to earn additional bonuses based on their ability to achieve oncology specific clinical and other quality of care based benchmarks. While these alternative value-based arrangements may not produce as much initial revenue on a PMPM basis as capitation, we believe this flexibility in contracting models will allow us to speed our expansion into new markets while preserving the value-based economics that are critical for our business’ growth and success.

Payor Relationships

Our ability to consistently attract patients across multiple geographic markets depends on our ability to contract with payors in each market. Depending on the market, payors can be delegated medical groups who are taking risk or insurance companies themselves. By opening clinics in locations where the TOI PCs currently manage the oncology care for a large number of insured Medicare, commercial and Medicaid members, we believe we are creating net benefits for payors, as our affiliated providers are able to reduce unnecessary costs and improve patient care and experience. This also allows us to benefit from the value-based offerings already established by payors in the market, therefore not requiring us to single-handedly drive patient growth. Some of the biggest and most respected names in healthcare contract with the TOI PCs to provide oncology care to their members, including Anthem, CareMore Health, Heritage Provider Network and Optum Care. More than half of our revenue in 2023 was generated from value-based contracts where payors have made our affiliated providers their preferred or exclusive oncology group.

While our relationships with payors are long-standing, we believe we have limited concentration risk as our largest customer by revenue in 2023 represented approximately 15% of our revenue.

Provider and Clinic Capacity Growth

Our primary driver for growth in provider and clinic capacity is to create network adequacy to service members from payors with whom we have capitated or other value-based arrangements. For each market we currently operate in or are considering entering, we do a detailed assessment of the existing market landscape and determine the optimal approach to create the capacity we need given our payor relationships and pipeline of contracts. We can achieve capacity growth through multiple avenues, including practice acquisitions and de novo clinics. Practice acquisitions offer an opportunity to gain scale and market presence rapidly, while de novo clinics allow us to build out our network in a highly capital efficient manner. We believe both approaches can work in tandem to achieve optimal scale, network presence and speed to market. In addition, we have an active recruitment pipeline for providers to join our network and help us both manage patient load and grow the patient base.

We believe we have built a robust and data-driven approach to acquisitions, with a dedicated team to identify, assess and integrate physician practices into our network, and a strong pipeline of targets in both existing and new markets. We have invested in resources to continually add to our pipeline.

Clinic Structure, Staffing and Network Design

We have a standard clinic design and approach to staffing that has been refined over many years. Managed clinics typically range from 2,000 to 3,000 square feet with 3-4 providers (physicians and advanced practice providers) per clinic. We have flexibility around clinic size to allow us to establish smaller clinics and part time staffing in areas where needed to ensure the

TOI PCs can meet network adequacy under existing payor contracts. We group our managed clinics in a similar geographic area into pods, with multiple pods in each market. We have operations teams managing our markets and pods allowing us to drive performance and scale efficiently.

Competition

The U.S. healthcare industry is generally highly competitive. We compete with large and medium-sized local and national providers of cancer care services, such as health system affiliated practices, for, among other things, contracts with payors, recruitment of physicians and other medical and non-medical personnel and patients. The closest competitors are traditional oncology physician practices, such as American Oncology Network, Inc., Florida Cancer Specialists & Research Institute, LLC, U.S. Oncology Network, Inc., and OneOncology, Inc. These organizations are predominantly reimbursed via FFS contracts, which we believe can often lead to over utilization of treatments that may be medically appropriate but often results in higher costs. Secondary competitors may include specialty benefit managers. These include companies such as AIM Specialty Health, eviCore Healthcare, Magellan Health, New Century Health, One Oncology, Thyme Care, and OncoHealth. These benefit managers seek to change provider behavior by reviewing and authorizing treatment requests. The benefit manager model can produce incremental improvement in utilization, but the benefit managers are often unable to achieve results comparable to managed healthcare practices like ours. Furthermore, the benefit manager model frequently results in an antagonistic relationship with physicians who are operating in a traditional FFS-based practice. We distinguish ourselves from other managed oncology practices and specialty benefit managers in our ability to align incentives across the care continuum, including physicians and payors in delivering high quality care at lower costs, and we believe there are currently no other value-based oncology management companies of meaningful scale in the U.S.

We believe the principal competitive factors for serving the healthcare market for Medicare beneficiaries include: patient experience, quality of care, health outcomes, total cost of care, brand identity and trust in that brand. We believe we compete favorably on all these factors.

Government Regulation

Regulatory Licensing, Accreditation and Certification

Many states, including California, require regulatory approval, including licensure, accreditation and certification before establishing certain types of clinics offering certain professional and ancillary services, including the services we offer. The operations of our managed clinics are subject to extensive federal, state and local regulation relating to, among other things, the adequacy of medical care, equipment, personnel, operating policies and procedures, dispensing of prescription drugs, fire prevention, rate-setting and compliance with building codes and environmental protection. Our ability to operate profitably will depend in part on the ability of our managed clinics and doctors to obtain and maintain all necessary licenses, accreditation and other approvals, and maintain updates to their enrollment in the Medicare and Medicaid programs, including the addition of new clinic locations, providers and other enrollment information. In addition, certain ancillary services such as the provision of diagnostic laboratory testing require additional state and federal licensure and regulatory oversight, including oversight by CMS, under Clinical Laboratory Improvement Amendments of 1988, which requires all clinical laboratories to meet certain quality assurance, quality control and personnel standards, and comparable state laboratory licensing authorities, including for example, the California Department of Public Health. Our dispensary operations must also comply with applicable laws. Sanctions for failure to comply with applicable state and federal licensing, accreditation, certification and other regulatory requirements include suspension, revocation or limitation of the applicable authorization, significant fines and penalties and/or an inability to receive reimbursement from government healthcare programs and other third-party payors.

State Corporate Practice of Medicine and Fee-Splitting Laws

Our arrangements with the TOI PCs are subject to various state laws, including California, commonly referred to as corporate practice of medicine and fee-splitting laws, which are intended to prevent unlicensed persons from interfering with or influencing the physician’s professional judgment, and prohibiting the sharing of professional service fees with non-professional or business interests. These laws vary from state to state and are subject to broad interpretation and enforcement by state regulators. A determination of non-compliance against us and/or the TOI PCs could lead to adverse judicial or administrative action, civil or criminal penalties, receipt of cease and desist orders from state regulators, loss of provider licenses, and/or restructuring of these arrangements.

Healthcare Fraud and Abuse Laws

We are subject to a number of federal and state healthcare regulatory laws that restrict certain business practices in the healthcare industry. These laws include, but are not limited to, federal and state anti- kickback, false claims, self-referral and other healthcare fraud and abuse laws.

The federal Anti-Kickback Statute, or AKS, prohibits, among other things, knowingly and willfully offering, paying, soliciting or receiving remuneration, directly or indirectly, in cash or kind, to induce or reward either the referral of an individual for, or the purchase, order or recommendation of, any good or service, for which payment may be made under federal and state healthcare programs such as Medicare and Medicaid. A person or entity does not need to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation. The AKS includes statutory exceptions and regulatory safe harbors that protect certain arrangements. The AKS safe harbors for value-based arrangements require, among other things, that the arrangement does not induce a person or entity to reduce or limit medically necessary items or services furnished to any patient. Failure to meet the requirements of the safe harbor, however, does not render an arrangement illegal. Rather, the government may evaluate such arrangements on a case-by-case basis, taking into account all facts and circumstances, including the parties’ intent and the arrangement’s potential for abuse, and may be subject to greater scrutiny by enforcement agencies.

The Stark Law prohibits a physician who has a financial relationship, or who has an immediate family member who has a financial relationship, with entities providing Designated Health Services, or DHS, from referring Medicare and Medicaid patients to such entities for the furnishing of DHS, unless an exception applies. The Stark Law also prohibits the entity from billing for any such prohibited referral. Unlike the AKS, the Stark Law is violated if the financial arrangement does not meet an applicable exception, regardless of any intent by the parties to induce or reward referrals or the reasons for the financial relationship and the referral.

The Federal False Claims Act, or FCA, prohibits a person from knowingly presenting, or caused to be presented, a false or fraudulent request for payment from the federal government, or from making a false statement or using a false record to have a claim approved. The FCA further provides that a lawsuit thereunder may be initiated in the name of the United States by an individual, a “whistleblower,” who is an original source of the allegations. Moreover, the government may assert that a claim including items and services resulting from a violation of the AKS or the Stark Law constitutes a false or fraudulent claim for purposes of the civil False Claims Act. Penalties for a violation of the FCA include fines for each false claim, plus up to three times the amount of damages caused by each false claim.

Further, the Civil Monetary Penalties Statute authorizes the imposition of civil monetary penalties, assessments and exclusion against an individual or entity based on a variety of prohibited conduct, including, but not limited to offering remuneration to a federal health care program beneficiary that the individual or entity knows or should know is likely to influence the beneficiary to order or receive health care items or services from a particular provider.

Health Insurance Portability and Accountability Act of 1996 ("HIPAA") also established federal criminal statutes that prohibit, among other things, knowingly and willfully executing, or attempting to execute, a scheme to defraud any healthcare benefit program, including private third-party payors, and knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services. Similar to the AKS, a person or entity does not need to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation.

Several states in which we operate have also adopted similar fraud and abuse laws as described above. The scope of these laws and the interpretations of them vary from state to state and are enforced by state courts and regulatory authorities, each with broad discretion. Some state fraud and abuse laws apply to items or services reimbursed by any payor, including patients and commercial insurers, not just those reimbursed by a federally funded healthcare program, including California's anti-kickback statutes and the Physician Ownership and Referral Act of 1993.

Violation of any of these laws or any other governmental regulations that apply may result in significant penalties, including, without limitation, administrative civil and criminal penalties, damages, disgorgement, fines, additional reporting requirements and compliance oversight obligations, contractual damages, the curtailment or restructuring of operations, exclusion from participation in governmental healthcare programs and/ or imprisonment.

Healthcare Reform

In the United States, there have been, and we expect there will continue to be, a number of legislative and regulatory changes to the healthcare system, many of which are intended to contain or reduce healthcare costs. By way of example, in the United States, the Affordable Care Act (“ACA”), substantially changed the way healthcare is financed by both governmental and private insurers. Since its enactment, there have been judicial, executive and Congressional challenges to certain aspects of the ACA. On June 17, 2021, the U.S. Supreme Court dismissed the most recent judicial challenge to the ACA without specifically ruling on the constitutionality of the ACA. Prior to the Supreme Court’s decision, President Biden issued an executive order initiating a special enrollment period from February 15, 2021 through August 15, 2021 for purposes of obtaining health insurance coverage through the ACA marketplace. The executive order also instructed certain governmental agencies to review and reconsider their existing policies and rules that limit access to healthcare. It is unclear how other

healthcare reform measures of the Biden administration or other efforts, if any, to challenge, repeal or replace the ACA will impact the ACA or our business.

In addition, other legislative changes have been proposed and adopted since the ACA was enacted. These changes included aggregate reductions to Medicare payments to providers of 2% per fiscal year, which went into effect on April 1, 2013 and, due to subsequent legislative amendments to the statute, will remain in effect through 2030, with the exception of a temporary suspension from May 1, 2020 through March 31, 2022 and a 1% payment reduction from April 1, 2022 to June 30, 2022, unless additional Congressional action is taken. In addition, on January 2, 2013, the American Taxpayer Relief Act of 2012 was signed into law, which, among other things, reduced Medicare payments to several providers, including hospitals, and increased the statute of limitations period for the government to recover overpayments to providers from three to five years.

CMS, through the Centers for Medicare and Medicaid Innovation, or CMMI, has implemented or has announced plans to implement numerous demonstration models designed to test value-based reimbursement models, some of which are specifically focused on oncology services. For example, in 2016, CMS initiated the Oncology Care Model demonstration, which continued throughout 2023, and provides participating physician practices, including the TOI PCs that participate in this reportprogram, with performance-based financial incentives that aim to “we,” “us”manage or reduce Medicare costs without negatively affecting the efficacy of care. In late 2019, CMS issued a request for information on the Oncology Care First model, a new voluntary model that, if implemented, would build on the Oncology Care Model. More recently, CMMI has announced plans to implement the Radiation Oncology Model, which would require radiotherapy providers in certain regions to participate in a prospective, episode-based payments model where payment is based on a patient’s diagnosis as opposed to the traditional volume-based FFS payment model. Although the Radiation Oncology Model was originally intended to begin on January 1, 2022, recent legislation delayed its implementation until July 1, 2023 and therefore, the impact of this new model has yet to determined. There likely will continue to be regulatory proposals directed at containing or lowering the cost of healthcare. The implementation of cost containment measures or other healthcare reforms may prevent us from being able to generate revenue or attain growth, any of which could have a material impact on our business.

Further, healthcare providers and industry participants are also subject to a growing number of requirements intended to promote the interoperability and exchange of patient health information. For example, on April 5, 2021, healthcare providers and certain other entities became subject to information blocking restrictions pursuant to the Cures Act that prohibit practices that are likely to interfere with the access, exchange or use of electronic health information ("EHI"), except as required by law or specified by HHS as a reasonable and necessary activity.

Violations may result in penalties or other disincentives. It is unclear at this time what the costs of compliance with the new rules will be, and what additional risks there may be to our business.

Federal and State Insurance and Managed Care Laws

Regulation of downstream risk-sharing arrangements, including, but not limited to, global risk and other value-based arrangements, varies significantly from state to state. Some states require downstream entities and Risk Bearing Organization ("RBOs") to obtain an insurance license, a certificate of authority, or an equivalent authorization, in order to participate in downstream risk-sharing arrangements with payors. In some states, statutes, regulations and/or formal guidance explicitly address whether and in what manner the state regulates the transfer of risk by a payor to a downstream entity. However, the majority of states do not explicitly address the issue, and in such states, regulators may nonetheless interpret statutes and regulations to regulate such activity. If downstream risk-sharing arrangements are not regulated directly in a particular state, the state regulatory agency may nonetheless require oversight by the licensed payor as the party to such a downstream risk-sharing arrangement. Such oversight is accomplished via contract and may include the imposition of reserve requirements, as well as reporting obligations. Further, state regulatory stances regarding downstream risk-sharing arrangements can change rapidly and codified provisions may not keep pace with evolving risk-sharing mechanisms and other new value-based reimbursement models. Certain of the states where we currently operate or may choose to operate in the future regulate the operations and financial condition of RBOs like us and our affiliated providers. These regulations can include capital requirements, licensing or certification, governance controls and other similar matters. While these regulations have not had a material impact on our business to date, as we continue to expand, these rules may require additional resources and capitalization and add complexity to our business.

Privacy and Security

Numerous state, federal and foreign laws, including consumer protection laws and regulations, govern the collection, dissemination, use, access to, confidentiality and security of personal information, including health-related information. In the United States, numerous federal and state laws and regulations, including data breach notification laws, health information privacy and security laws, including HIPAA, and federal and state consumer protection laws and regulations (e.g., Section 5 of

the Federal Trade Commission ["FTC"] Act), that govern the collection, use, disclosure, and protection of health-related and other personal information could apply to our operations or the “Company” referoperations of the TOI PCs.

In addition, certain state laws, such as the California Consumer Privacy Act, or the CCPA and the California Privacy Rights Act of 2020, or the CPRA, govern the privacy and security of personal information, including health-related information in certain circumstances, some of which are more stringent than HIPAA and many of which differ from each other in significant ways and may not have the same effect, thus complicating compliance efforts. Failure to comply with these laws, where applicable, can result in the imposition of significant civil and/or criminal penalties and private litigation. Privacy and security laws, regulations, and other obligations are constantly evolving, may conflict with each other to complicate compliance efforts, and can result in investigations, proceedings, or actions that lead to significant civil and/or criminal penalties and restrictions on data processing.

Intellectual Property

At present, we own no material intellectual property.

Insurance

We maintain insurance, excess coverage, or reinsurance for property and general liability, professional liability, directors’ and officers’ liability, workers’ compensation, cybersecurity and other coverage in amounts and on terms deemed adequate by management, based on our actual claims experience and expectations for future claims. Future claims could, however, exceed our applicable insurance coverage.

Employees and Human Capital Resources

As of December 31, 2023, we and TOI PCs collectively had approximately 800 employees, including approximately 119 oncologists and advanced practice providers. We consider our relationship with our employees to be good. None of our employees are represented by a labor union or party to a collective bargaining agreement.

Our goal is to provide top quality oncology care to our patients, and we view our human capital-related initiatives as essential to continuing to reach that goal. Such initiatives include: (i) implementing a robust talent acquisition approach, including through competitive pay and benefits, (ii) implementing programs to promote diversity and foster a sense of connection and community throughout our company, (iii) offering an array of opportunities for learning and development opportunities, and (iv) conducting annual employee engagement surveys and developing action plans based on the survey outcomes.

Availability of Information

We were originally incorporated in Delaware on November 19, 2019 as a special purpose acquisition company (f/k/a DFP Healthcare Acquisition Corp.). In November 2021, we consummated our business combination with TOI Parent, Inc. (the “Business Combination”). In connection with the closing of the Business Combination, TOI Parent, Inc. became our wholly owned subsidiary and we changed our name to The Oncology Institute, Inc. (formerly, DFP Healthcare Acquisitions Corp.) References to our “management”We file or our “management team” refer to our executive officersfurnish annual, quarterly and directors,current reports, proxy statements and references to the “Sponsor” refer to DFP Sponsor LLC, a Delaware limited liability company. References to our “initial stockholders” refer to the Sponsor and the Company’s executive officers and independent directors.

ITEM 1: BUSINESS.

Introduction

We are a blank check company incorporated on November 1, 2019 as a Delaware corporation formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. We have neither engaged in any operations nor generated any revenue to date. Based on our business activities, the Company is a “shell company” as defined under the Exchange Act of 1934 (the “Exchange Act”) because we have no operations and nominal assets consisting almost entirely of cash.

We were jointly founded by our management team and Deerfield Management Company, L.P. (“Deerfield Management”), a healthcare investment firm with over $10.5 billion in regulatory assets under management as of March 31, 2020. We believe that the experience of our management team and our relationship with Deerfield Management will allow us to source, identify and execute an attractive transaction for our stockholders.

On March 13, 2020, we consummated our initial public offering (the “initial public offering”) of 23,000,000 units, including the issuance of 3,000,000 units as a result of the underwriters’ exercise of their over-allotment option in full. Each unit consists of one share of Class A common stock and one-fourth of one warrant. Each whole warrant entitles the holder thereof to purchase one share of Class A common stock at a price of $11.50 per share. The units were sold at an offering price of $10.00 per unit, generating gross proceeds, before expenses, of $230,000,000.

Prior to the consummation of the initial public offering, on December 30, 2019, our sponsor, DFP Sponsor LLC (the “Sponsor”), received 4,312,500 shares of Class B common stock (the “founder shares”) in exchange for a capital contribution of $25,000, or $.006 per share. In January 2020, the Sponsor transferred 100,000 founder shares to each of Mr. Steven Hochberg, Mr. Christopher Wolfe, and Mr. Richard Barasch, our executive officers, and 30,000 founder shares to each of Dr. Jennifer Carter, Dr. Mohit Kaushal and Dr. Gregory Sorensen, our independent directors, for the same per-share price initially paid by our sponsor, resulting in our sponsor holding 3,922,500 founder shares. On February 19, 2020, we effected a 1:1 1/3 stock split of Class B common stock resulting in the Sponsor holding an aggregate of 5,360,000 founder shares, resulting in an increase in the total number of founder shares from 4,312,500 to 5,750,000. The number of founder shares outstanding was determined so that such founder shares would represent 20% of the outstanding shares after the initial public offering.

Simultaneouslyother documents with the consummation of the initial public offering, we consummated the private sale of an aggregate of 3,733,334 warrants, each exercisable to purchase one share of Class A common stock at $11.50 per share, to the Sponsor at the time of the initial public offering at a price of $1.50 per warrant, generating gross proceeds, before expenses, of approximately $5,600,000 (the “Private Placement”). The warrants sold in the Private Placement, or the private placement warrants, are identical to the warrants included in the units sold in the initial public offering, except that, so long as they are held by the Sponsor or its permitted transferees, (i) they will not be redeemable by the Company, (ii) they (including the shares of Class A common stock issuable upon exercise of these warrants) may not, subject to certain limited exceptions, be transferred, assigned or sold until 30 days after the Company completes its initial business combination; (iii) they may be exercised by the holders on a cashless basis and (iv) they will be entitled to registration rights.

Upon the closing of the initial public offering and the Private Placement, $230,000,000 was placed in a Trust account with Continental Stock Transfer & Trust Company acting as trustee (the “Trust Account”). Except with respect to interest earned on the funds held in the Trust Account that may be released to the Company to pay its taxes, the funds held

in Trust Account will not be released from the Trust Account until the earliest of (i) the completion of our initial business combination, the redemption of any shares of Class A common stock included in the units sold in the initial public offering (“public shares”) properly submitted in connection with a stockholder vote to approve an amendment to our second amended and restated certificate of incorporation to modify the substance or timing of the Company’s obligation to redeem 100% of the public shares if the Company does not complete its initial business combination by March 13, 2022 or with respect to any other material provisions relating to stockholders’ rights or pre-initial business combination activity and (ii) the redemption of the public shares if the Company is unable to complete an initial business combination by March 13, 2022, subject to applicable law. The proceeds held in the Trust Account may only be invested in United States “government securities” within the meaning of Section 2(a)(16) of the Investment Company Act of 1940, as amended (the “Investment Company Act”), having a maturity of 180 days or less or in money market funds meeting certain conditions under Rule 2a-7 promulgated under the Investment Company Act which invest only in direct U.S. government treasury obligations.

The net proceeds deposited into the Trust Account remain on deposit in the Trust Account earning interest. As of December 31, 2020, there was approximately $230.0 million remaining in the Trust Account and approximately $1.5 million of cash held outside the Trust Account available for working capital purposes. As of December 31, 2020, no funds had been withdrawn from the Trust Account to fund the Company’s working capital expenses. As of December 31, 2020, approximately $43,000 of interest income held within the Trust Account is available to pay for franchise and income taxes.

Effecting Our Initial Business Combination

General

We are not presently engaged in, and we will not engage in, any operations for an indefinite period of time. We intend to effectuate our initial business combination using cash from the proceeds of the initial public offering and the Private Placement, the proceeds of the sale of our shares in connection with our initial business combination (pursuant to forward purchase agreements or backstop agreements we may enter into following the consummation of the initial public offering or otherwise), shares issued to the owners of the targets, debt issued to bank or other lenders or the owners of the targets, or a combination of the foregoing. We may seek to complete our initial business combination with a company or business that may be financially unstable or in its early stages of development or growth, which would subject us to the numerous risks inherent in such companies and businesses.

If our initial business combination is paid for using equity or debt securities, or not all of the funds released from the Trust Account are used for payment of the consideration in connection with our initial business combination or used for redemptions of our Class A common stock, we may apply the balance of the cash released to us from the Trust Account for general corporate purposes, including for maintenance or expansion of operations of the post- transaction company, the payment of principal or interest due on indebtedness incurred in completing our initial business combination, to fund the purchase of other companies or for working capital.

Selection of Target Businesses

While we may pursue an initial business combination opportunity in any business, industry, sector or geographical location, we intend to focus on industries that complement our management team’s background, and to capitalize on the ability of our management team to identify and acquire a business, focusing on the healthcare or healthcare-related industries. Our strategy will be to identify, acquire and, after our initial business combination, build, a healthcare or healthcare-related business. We intend to focus our investment effort broadly across the entire healthcare industry, which encompasses services, therapeutics, devices, diagnostics and animal health. We have entered into an agreement with Deerfield Management pursuant to which we have agreed not to complete a business combination without their consent, which consent Deerfield Management has indicated it does not intend to provide if the proposed business combination is with a target that is not in the healthcare industry.

Our initial business combination must occur with one or more target businesses that together have an aggregate fair market value of at least 80% of the assets held in the Trust Account (excluding the deferred underwriting commissions and taxes payable on the interest earned on the trust account) at the time of our signing a definitive agreement in connection with our initial business combination. Our board of directors will make the determination as to the fair market value of our

initial business combination. If our board of directors is not able to independently determine the fair market value of our initial business combination, we will obtain an opinion from an independent investment banking firm which is a member of FINRA or a valuation or appraisal firm with respect to the satisfaction of such criteria. While we consider it unlikely that our board of directors will not be able to make an independent determination of the fair market value, If our board of directors is not able to independently determine the fair market value of our initial business combination, we will obtain an opinion from an independent investment banking firm which is a member of FINRA or a valuation or appraisal firm with respect to the satisfaction of such criteria. While we consider it unlikely that our board of directors will not be able to make an independent determination of the fair market value of our initial business combination, it may be unable to do so if it is less familiar or experienced with the business of a particular target or if there is a significant amount of uncertainty as to the value of the target’s assets or prospects.