SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K for the year ended December 31, 2010, originally filed with the Securities and Exchange Commission (the “SEC”(this “Annual Report”) on March 31, 2011 and amended on June 8, 2011 (the “Original Form 10-K”), to make certain corrections as to: (i) the disclosure with respect to the default judgment of legal proceeding in Missouri at page 18 and F-35 in this Amendment and (ii) management’s evaluation on controls and procedures at page 33.

Although we believe that the expectations reflected in the forward looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Except as otherwise indicated by the context, references in this Annual Report to “we,” “us,” “our,” “Kandi,” or the “Company” are to the combined businesses of Kandi Technologies Group, Inc. and its subsidiaries.

Item 1. Business.

Introduction

Our Corporate Structure

In 2013, the Company experienced growth in both its traditional off-road vehicle business and in its electric vehicle business, but the growth in the electric vehicle business was particularly significant and we believe validates the Company's increased focus on that business in the past several years. We first produced an electric automobile, the “Coco” in August 2008. We took initial steps toward expanding that effort in early 2010, when, on January 4, 2010, we announced we had forged “The Alliance for Chinese Electric Vehicle Development and Commercialization” with major Chines energy, IT and battery companies to help launch a new electric vehicle era in China.

Based upon market factors as otherwise indicatedwe saw them, we expanded our operations in this market segment. The Company's shift in focus to the EV market has been the result of gradual and strategic efforts. We describe those factors below at “The Market For Electric Vehicles” and “Business Overview.” By mid-2012 we had begun programs for design, production and distribution of electric vehicles (which we sometimes refer to as “EVs” in this document). While we continue to actively engage in design, production and distribution of our traditional off-road vehicle products, we have greatly intensified our engagement in the EV market, principally in China. We believe our financial results in 2013 validate this expansion of our business strategy.

The Market for Electric Vehicles

Factors creating and driving the market

Research and Development of major EV technology projects in China began in 2001. Driven by two central government five-year plans for scientific and technological research as well as by the context, referencesOlympics, World Expo and the “1000 cars in 10 cities” demonstration platform, the Chinese electric automobile sector was officially born. And the pressure to enhance relevant technologies continues. While the program for developing technology has been established, however, the market for EVs has developed slowly for various reasons.

There is growing consumer demand for motor vehicles in China and in connection with that demand, many cities are experiencing severe problems of pollution and traffic congestion. The major cities such as Beijing and Shanghai are already introducing policies restricting the purchase of cars and placing limits on their use. We expect that more cities will adopt such policies. Urban resources are limited and without effective urban transportation plans, central cities will face exhaustion of space available for traffic and ever-worsening environmental contamination. As a result, there may literally be insufficient road space for automobiles. Meanwhile, urban parking, other road and vehicle resources are wasting because they are not being effectively utilized.

1

Issues confronting the market

We believe there are five major obstacles to extensive commercialization of EVs and the full development of the EV market: high cost, short driving range, long charging time, limited charging facilities, battery maintenance and pollution from non-recycling and improper disposition. We believe we have solutions and a strategy to address each of these issues.

Our Solutions and Growth Strategy

Given the economic and population growth in China, one solution to alleviate the increase in the number of resident-owned cars is to provide additional means of public transportation. Currently, subway, bus and taxi are the most common public transportation tools. The taxi is used by a small, subset of PRC residents. The subway and bus are used widely and are considered the main methods of mass public transportation. However, the cities lacks a form of capillary transportation that the residents need. Therefore, the Company provides a shared transportation platform for their convenience.

The best solution to slow an increase in the number of cars is to provide city public transportation. The taxi is relatively expensive compared to the mass transportation of subway or bus. However, these methods lack a form of specific transportation to meet residents' short-range transportation needs. A public EV sharing system, which we call “pure EV self-driving car rental sharing”, provides a shared transportation platform and commuting convenience to urban residents that is not afforded by or is complementary to that provided by mass transportation and is less expensive than taxis. Such a public EV leasing system, designed as a new business model for public transportation, maximizes the advantages of the EV and avoids its weakness compared to the traditional vehicles, will further stimulate the expansion of the EV market.

Kandi is the first in the market to have proposed the public pure electric vehicle sharing program (the “Car-Share” Project). Besides the zero-emission benefit, the Car-share Project combines city taxis, the resident cars, rental cars and traditional mass transportation advantages, along with vertical automatic charging/parking garage. It is a perfect transportation tool with all dynamics. This new business model for urban public transportation is designed to greatly improve the efficiency of urban car usage, ease traffic congestion, scarce parking resources, and the urban environment. Additionally, it will likely promote the global development of pure electric vehicles with significant impact.The project has already been launched in Hangzhou and, to date, it has been well received.

Individually driven pure EVs are utilized in the Car-Share Project. Its automated charging parking system is located at airports, train stations, hotels, business centers, selected residential areas and other places in the city that are the focus of commuter traffic. The network system provides EV rental service to individual drivers in and around the city. The network system also provides centralized management of EV maintenance, and battery charging to disperse self-service users. The EV rental station is the basic unit of the network system, providing a variety of services and transactions - - such as charging, maintenance, battery recycling and other services related to the rental of EVs. In addition, a tracking system allows the car-share project management to know at all times the precise location and the status of each vehicle.

2

This Car-share Project model has been implemented since the second half of 2013 in Hangzhou. It has received significant recognition from a large group of well-known national and international press, such as China Central Television (CCTV), Xinhua News Agency, Associated Press (AP), Agence France Presse (AFP), Bloomberg, Forbes, China Information Daily. Furthermore, representatives from China's new energy vehicle pilot cities have come to visit us in recent months to learn more about this Annual Reportproject and expressed their interest in partnering with us. Currently, we have been in discussion with Beijing, Shanghai, Chengdu, and Nantong City about expanding the Car-share.

The Joint Venture with Geely

As a part of our EV strategy, we concluded that we needed to “we,” “us,” “our,” “Kandi,” orhave additional resources to respond effectively and timely to market needs. In November 2012, we started negotiating a joint venture arrangement with Shanghai Maple Guorun Automobile Co., Ltd., a 99% owned subsidiary of Geely Automobile Holdings Ltd. (“Geely”) for the “Company”design, production and distribution of EVs. Geely is the one of the largest automobile manufacturers in China. After careful negotiation, the companies entered into a joint venture agreement in March 2013 and established Zhejiang Kandi Electric Vehicles Investment Co, Ltd. (the "JV Company") in April 2013. The JV Company's mission is to utilize the advanced technologies, modern operational model and management methods to invest, develop, produce and sell EVs to satisfy the consumers' needs, and to maximize the return on the investors.

The Operations of the JV

The business scope of JV is to develop, manufacture and sell EVs and to develop, purchase, manufacture and sell auto parts, and invest in other companies which engage in such businesses. Each party agreed to establish a new wholly owned subsidiary, and contributed its EVs assets and businesses to such subsidiary. After each party established such subsidiary, the JV entered into transfer agreements with the parties to acquire and become the 100% shareholder of these subsidiaries. The parties agreed that the JV can use certain of their trademarks, patents and technologies free of charge and have entered into trademark and patent license agreements with the JV. The board of the JV consists of four members and each party has the right to assign two members to the board. Mr. Li Shufu, the Chairman of Geely was appointed as the first Chairman of the JV and Mr. Hu Xiaoming, the Chairman and CEO of Kandi, was appointed as the first general manager and the legal representative of the JV. The term of the JV is twenty years from the date of issuance of its business license and the parties may discuss the extension of the term at least two years prior to expiration.

Understanding the Contribution of the JV to the Financial Results of the Company

The economic impact of the Company's participation in the JV is reflected in its 50% ownership of the JV through its subsidiary Kandi Vehicles.All of the Company's production and development efforts for the whole cars of EV is conducted through the JV Company, and revenue generated from the sale of electric vehicles is received by the JV Company and then distributed pursuant to the Joint Venture Agreement.

3

This means that the financial results of the JV are reflected as the results of an investment in the JV. Under existing accounting treatment for a joint venture position of 50% such as the Company's in the JV, it is difficult to discern in the Company's financial statements the effect of the financial results of the JV. These results are to some extent provided in Note 23 to the combined businessesaudited financial statements of Kandi Technologies, Corp. and its subsidiaries.

Pure Electric Vehicle Subsidies

The process of receiving government subsidies is as follows: manufacturers receive central government subsidies through application and sell the EVs to local dealers at a price reflecting the deduction of the central government subsidy from the normal sale price. Local dealers establish their retail price based upon their purchase price from the manufacturers, then deduct the local government subsidy from the retail price before selling the EVs to consumers. Through the above steps, consumers receive two subsidies – from the central and local governments when they purchase EVs.

Because the central and local government subsidy amounts and policies are open and disclosed to the public and all the subsidies are reviewed and verified by the respective governments, consumers know what subsidized prices they will receive and pay for EVs. Therefore, even though dealers can sell vehicles at prices established at their discretion, programs are designed to assure that consumers should receive the entire benefit from both subsidies.

Currently, there are two subsidies from central and local governments for the pure electric vehicles (the “Continental Shareholder”“EVs”). in China – one from each of the central and local governments. The ultimate beneficiary for these subsidies is the consumer and the actual prices that consumers pay reflect the deduction of both subsidies.

(a) The central government provides a subsidy to manufacturers paid in advance quarterly upon application and approval and settled annually. After selling product to dealers, manufacturers can submit subsidy payment applications with invoices and other supporting documents at the end of each quarter to the requisite central government agencies through their regional offices. After the review and approval by the agencies, the central government makes advance subsidy payments to the manufacturers. At the end of the year, the final subsidy amounts are verified, reconciled according to the number of vehicles actually sold to consumers and settled on an annual basis.

(b) Pursuant to the Exchange Agreement, Stone Mountain issued 12,000,000 sharesrequirement of its common stockthe central government, the local governments provide a subsidy to consumers who purchase EVs by a price reduction from the dealer. After the consumer purchases an EV at a reduced selling price from the dealer, the dealer submits a subsidy application to the Continental Shareholder, in exchangelocal government, including a consumer authorization letter for 100% ofsubsidy application, consumer personal I.D., EV Vehicle License, EV purchase invoice and other required documents and requests reimbursement (to the common stock of Continental. Afterdealer) for the closing of the Exchange Agreement, Stone Mountain had a total of 19,961,000 shares of common stock outstanding, with the Continental Shareholder owning 60.12% of the total issued and outstanding shares of Stone Mountain’s common stock, and the remaining shares outstanding were held by those who held shares of Stone Mountain’s common stock prior to the closing.

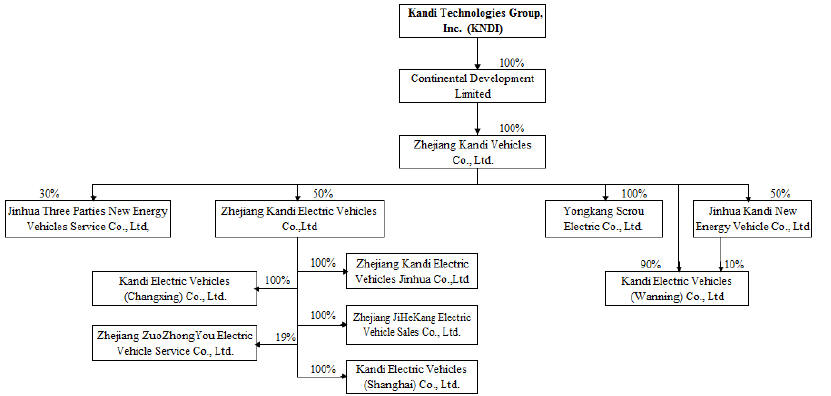

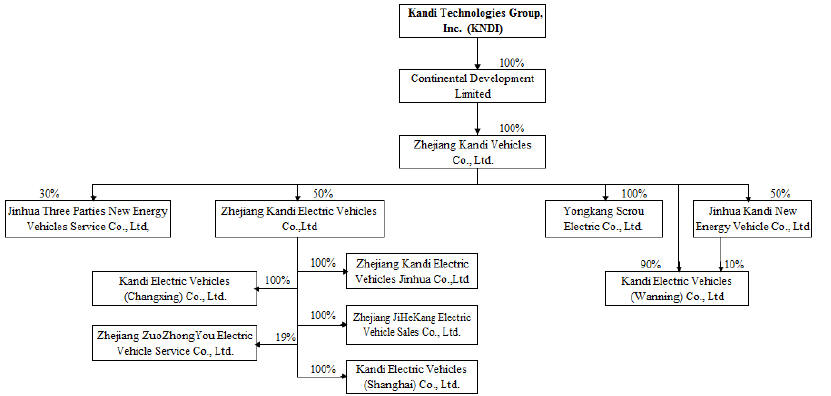

Our Organizational Structure

The Company was that of Continental’s wholly owned subsidiary, Zhejiang Kandi Vehicles Co., Ltd. On August 13, 2007, we changed our name from Stone Mountain Resources, Inc. to Kandi Technologies, Corp.

4

Headquartered in the “Company”).

The Company's organizational chart is as follows:

Operating Subsidiaries

In January 2011, pursuant to relevant agreements, Kandi Vehicles is entitled to 100% of the shareseconomic benefits, voting rights and residual interests (100% profits and loss absorption rate) of Kandi Special Vehicles Co., Ltd (“KSV”), after which KSV became a wholly-owned subsidiary of the Company. The acquisition was accounted for as a purchase in accordance with Statements of Financial Accounting Standards (“SFAS”) No. 141 “Business Combinations.” The consolidated statements of income include the results of operations of KSV at the date of acquisition. On March 10, 2009, KSV changed its name to Kandi New Energy Vehicles Co., Ltd, (“KNE”). On June 11, 2009, KNE changed its name back to KSV.

Jinhua Three Parties New Energy Vehicles Service Co., ltd. (“Jinhua Service”) was formed byas a joint venture, withby and among our wholly-owned subsidiary, Kandi Vehicles, the State Grid Power Corporation and Tianneng Power International, Inc.International. The Company, indirectly through Kandi Vehicles, has a 30% ownership interest in Jinhua Service.

In April 2012, pursuant to a share exchange agreement, the Company acquired 100% of Yongkang Scrou Electric Co. (“Yongkang Scrou”), a manufacturer of driving motor, air-conditioning and controllers for electric vehicles and auto generators.

In March 2013, pursuant to a joint venture agreement (the “JV Agreement”) entered into between Kandi Vehicles and Shanghai Maple Guorun Automobile Co., Ltd. (“Shanghai Maple”), a 99% owned subsidiary of Geely Automobile Holdings Ltd. (“Geely”), the parties established Zhejiang Kandi Electric Vehicles Co., Ltd. (the “JV Company”) in connection with developing, manufacturing and selling electrical vehicles (“EVs”) and related auto parts. Each of Kandi Vehicles and Shanghai Maple has a 50% ownership interest in the JV Company. The strategic purpose of the JV Company is to establishincrease the first Chinadevelopment and use of neighborhood electric super-mini automobiles battery replacement services.vehicles, which that parties believe address a growing and necessary market, particularly considering their relatively low price and the notorious street congestion and pollution of China's largest cities

5

In March 2013, Kandi Vehicles formed Kandi Electric Vehicles (Changxing) Co., Ltd. (“Kandi Changxing”) in the Changxing (National) Economic and Technological Development Zone. Kandi Changxing specializes in the production of EVs. In fourth quarter of 2013, Kandi Vehicle entered into an ownership transfer agreement with JV Company to transfer 100% ownership to Kandi Changxing to the JV Company. The Company, owns 30%indirectly, through its wholly-owned subsidiary, Kandi Vehicles, has a 50% ownership interest in Kandi Changxing.

In April 2013, Kandi Electric Vehicles (Wanning) Co., Ltd. (“Kandi Wanning”) was formed by Kandi Vehicles and Jinhua Kandi New Energy Vehicles Co., Ltd. (“Kandi New Energy”) in Wanning City of Jinhua Service.

In July 2013, Zhejiang ZuoZhongYou Electric Vehicle Service Co., Ltd. (the “Service Company”) was formed The JV Company arehas a 19% ownership interest in the design, development, manufacturing,Service Company. The Company, indirectly, through its wholly-owned subsidiary, Kandi Vehicles, has a 9.5% ownership interest in the Service Company.

In November 2013, Zhejiang Kandi Electric Vehicles Jinhua Co., Ltd. (“Kandi Jinhua”) was formed by the JV Company. The JV Company has 100% ownership interest in Kandi Jinhua, and commercializingthe Company, indirectly, through its wholly-owned subsidiary, Kandi Vehicles, has a 50% ownership interest in Kandi Jinhua.

In November 2013, Zhejiang JiHeKang Electric Vehicle Sales Co., Ltd. (“JiHeKang”) was formed by the JV Company. The JV Company has 100% ownership interest in JiHeKang, and the Company, indirectly, through its wholly-owned subsidiary, Kandi Vehicles, has a 50% ownership interest in JiHeKang.

In December 2013, the JV Company entered into an ownership transfer agreement with Shanghai Maple in connection with acquiring 100% ownership of all-terrain vehicles, go-karts,Kandi Electric Vehicles (Shanghai) Co., Ltd. (“Kandi Shanghai”). Kandi Shanghai is a wholly-owned subsidiary of the JV Company, and specialized automobile related products for the PRCCompany, indirectly, through its 50% ownership interest in the JV Company owns 50% of Kandi Shanghai.

Our Vehicles and global export markets. Sales are made to dealers in Asia, North America, Europe and Australia.

General

Kandi's products include EVs, off-road vehicles (which include ATVs, UTVs,utility vehicles (“UTVs”), and go-karts), motorcycles etc. According to our market research on consumer demand trends, the Company has adjusted its production line strategically and mini-cars.

| Fiscal Year Ended December 31 | ||||||||||||||||

| 2010 | 2009 | |||||||||||||||

| Unit | Revenue | Unit | Revenue | |||||||||||||

| All-terrain Vehicles (ATVs) | 5,868 | $ | 3,716,893 | 6,192 | $ | 3,020,271 | ||||||||||

| Super-mini car (EV) | 1,618 | 6,800,000 | 2,102 | 8,478,424 | ||||||||||||

| Go-Kart | 28,366 | 25,434,803 | 12,829 | 11,556,921 | ||||||||||||

| Mini Pick-up | - | - | 1 | 4,364 | ||||||||||||

| Utility vehicles (UTVs) | 2,270 | 4,839,256 | 3,508 | 8,477,828 | ||||||||||||

| Three-wheeled motorcycle (TT) | 917 | 2,089,348 | 1,313 | 2,289,954 | ||||||||||||

| Total | 39,039 | $ | 42,880,300 | 25,945 | $ | 33,827,762 | ||||||||||

6

| Year ended December 31 | |||||||||||

| 2013 | 2012 | ||||||||||

| Units | Revenue | Units | Revenue | ||||||||

All-terrain Vehicles (ATVs) | 18,295 | $ | 10,407,858 | 14,467 | $ | 6,402,753 | ||||||

Electric Vehicles (EVs) | 4,694 | 46,619,203 | 3,915 | 19,034,936 | ||||||||

Go-Kart | 36,499 | 33,187,877 | 34,517 | 30,794,415 | ||||||||

Utility vehicles (UTVs) | 440 | 1,155,221 | 93 | 319,014 | ||||||||

Three-wheeled motorcycles (TT) | 243 | 383,760 | 1,060 | 1,272,898 | ||||||||

Refitted car | 39 | 1,058,095 | 115 | 3,172,417 | ||||||||

Auto generator | 51,588 | 1,724,031 | 93,881 | 3,517,237 | ||||||||

Total | 111,798 | $ | 94,536,045 | 148,048 | $ | 64,513,670 | ||||||

Off-Road Vehicles

In 2003 Kandi began mass production of go-karts. The Company is now one of the leading manufacturers of go-karts in the People’s Republic of China (PRC). Kandi produces a wide range of go-karts, from the 90cc class to the 1,000cc class in cylinder displacement. Kandi also produces four-wheeled all-terrain vehicles (ATVs) and specialized utility vehicles (UTVs), which are ATVs special-fitted for agricultural and industrial use.

In 2010,2013, our Go-Kartsgo-karts experienced a significantan increase in revenue of $13.9 million$2,393,462, or 120% over7.8%, a 5.7% increase in unit sales, and a 1.9% increase in the average unit price compared to fiscal year 2009, which2012. The increase in revenue was mainly attributable to the relatively stable growth in go-karts sales. The Company manufactures both high-end, more expensive go-kart products and less expensive go-kart products to meet customers' various needs. The Company manufactures go-kart products at a 121%range of prices to meet the various needs and budgets of our diverse customer base.

In 2013, our utility vehicles (“UTVs”) experienced an increase in revenue of $836,207 or 262.1%, a 373.1% increase in unit sales, from 12,829 unitsand a 23.5% decrease in 2009the average unit price compared to 28,366 units in 2010. Infiscal year 2010, the improved market conditions, which benefited from the world economic recovery from the financial crisis, created a large2012. The increase in demand, especially demand for middlerevenue was mainly attributable to the increase of UTV orders. The decrease in the average unit price was due to the fact that cheaper model UTVs took a higher percentage of sales in year 2013.

EV Products

In 2013, our EV products experienced an increase in revenue of $27,584,267 or 144.9%, a 19.9% increase in unit sales, and small size products, which had been suppressed duringa 104.3% increase in the financial crisis.

7

Motorcycles

In 2013, our TT experienced a decrease in revenue of $889,138 or 69.9%, a 77.1% decrease in unit sales, of 30% from 1,313 unitsand a 31.5% increase in 2009 to 917 units in 2010. In year 2010, the Company modified the model 250MB2, and increased its performance. As a result, the Company increased its unit price in 2010. As the main product of our TT product line, the price increase of model 250MB2 caused the average unit price of TT productscompared to increase by 30.6% in year 2010. During fiscal year 2010, unit sales of 250MB2 remained stable; however, unit sales of other models decreased, which caused the total sales to dropped in general.

Refitted Car

In 2013, our refitted car experienced a decrease in revenue of $2,114,322, or 66.6%, a decrease of 66.1% in unit sales and a 1.7% decrease in the average unit price compared to fiscal year 2012. The decrease in revenue was mainly because the Company decided to discontinue this business during the third quarter of 2013 and focus its efforts on increasing its electric vehicles revenue in the Chinese market. “Refitted Car” is a term used by the Company to describe a line of business, where the Company modifies (refits) vehicles manufactured by unrelated, other companies to meet the special requirements of our customers. For example, the Company may make exterior changes, refit AMWS, or install nonstandard features, including, but not limited to, a rearview camera, TPMS, drive recorder, anti-theft device, reversing radar and DVD player.

Auto generator

In 2013, our auto generator experienced a decrease in revenue of $1,793,206 or 51.0%, a 45.0% decrease in unit sales of 23% from 2,102 unitsand a 10.8% decrease in 2009 to 1,618 units in 2010. In fiscal year 2010, the Company modified some models by equipping them with lithium batteries, and consequently increased their unit prices. Therefore, although the Company reduced the sale prices for some old models, the introduction of the vehicles equipped with lithium batteries increased the average unit price 4.2% from $4,034 in 2009compared to $4,203 in 2010.

The following table shows the breakdown of Kandi’sKandi's revenues from its customers by geographic markets based on the locationmarkets:

| Year Ended December 31 | ||||||||||||

| 2013 | 2012 | |||||||||||

| Sales Revenue | Percentage | Sales Revenue | Percentage | |||||||||

| North America | $ | 6,906,807 | 7% | $ | 7,243,257 | 11% | ||||||

| Europe and other regions | 2,394,948 | 3% | 1,639,990 | 3% | ||||||||

| China | 85,234,290 | 90% | 55,630,423 | 86% | ||||||||

| Total | 94,536,045 | 100% | 64,513,670 | 100% | ||||||||

The majority of the distributors during the fiscal years ended December 31, 2010 and 2009:

| The Years Ended of December 31 | ||||||||||||||||

| 2010 | 2009 | |||||||||||||||

| Sales Revenue | Percentage | Sales Revenue | Percentage | |||||||||||||

| North America | $ | 4,474,619 | 11 | % | $ | 4,058,400 | 12 | % | ||||||||

| Europe | 497,910 | 1 | % | 405,067 | 1 | % | ||||||||||

| China | 37,907,771 | 88 | % | 29,364,295 | 87 | % | ||||||||||

| Total | 42,880,300 | 100 | % | 33,827,762 | 100 | % | ||||||||||

As disclosed on a Form 8-K, filed January 16, 2014, the Company entered into warrant subscription agreements (the “Subscription Agreements”) with certain institutional investors (the “Investors”). Pursuant to the Subscription Agreements, the Company issued and sold to the Investors private placement warrants to purchase an increased focusaggregate of 1,429,393 shares of the Company hasCompany's common stock at an exercise price equal to $15.00 (the “Private Warrants”) for a total purchase price of approximately $14,294. Because this transaction was a private placement made in reliance upon exemptions from registration pursuant to Section 4(2) of the Securities Act, neither the Private Warrants nor the underlying shares of common stock issuable upon the exercise of the Private Warrants have been onregistered under the development of products for its domestic marketSecurities Act, and neither may be offered or sold in China, particularly battery powered all electric super-mini automobiles (EVs). In November, 2009,the United States absent registration or an applicable exemption from registration.

Immediately prior to entering into the Subscription Agreements, the Investors exercised then outstanding Series A Warrants and Series C Warrants (the “Registered Warrants”) that were issued to the Investors by the Company sold 30 specially designed low speed EVsin connection with a direct registered offering that, as reported on a Form 8-K, filed on June 26, 2013, were entered into on June 26, 2013 (the “Registered Offering”). As a result of such exercise, the Investors purchased an aggregate of: (i) 1,750,415 shares of our common stock at an exercise price of $7.24 per share (pursuant to the Postal Service in Jinhua,Series A Warrants) and in July, 2010,(ii) 291,574 shares of our common stock at an exercise price of $8.69 per share (pursuant to the Company announced that it received an order from the Postal Service in Hangzhou, Zhejiang Province, for 60 all electric vehicles.

During January to March of 2014, the construction of “battery farms” which will allocate power to a network of “express change” battery stations where batteries may be rented and exchanged utilizing Kandi technology. Central to the new business strategy, batteries will be made available on a rental basis separate from the sale of each vehicle. An initial goalPresident of the Alliance isCompany Mr. Hu Xiaoming accepted special interviews respectively from multiple news organizations such as China Central Televsion (CCTV), the establishmentXinhua News Agency, Agence France Press(AFP), Associated Press (AP) etc. to introduce them the business model- Mini-Public Transportation Pure EVs Program and the progress updates.

During January to March of a revolutionary comprehensive model EV city in Jinhua to be followed by other model cities in Zhejiang Province with the assistance and participation of the local and regional governments. The core members of the alliance with2014, the Company are China Potevio/CNOOC New Energy and Power Ltd. (a joint venture between China National Offshore Oil Corporation and China Potevio Co.) and Tianneng Power International, Ltd.

During Janurary to March of this large (6,505 square miles) and very prosperous (per capita GDP $10,972) city. The city has announced it intends to build four centralized battery charging stations, 38 changing stations, 145 distribution centers and 3,500 sets of charging poles to support both hybrid and pure EV sales. To better promote the sales of pure EVs in Hangzhou,2014, the Company also openedreceived a visiting delegation , consisting of local leaders from more than 20 new corporate office.

The Company sells its products through tento exporters (from China), to importers (including U.S. importers) and to distributors or dealers or our business partners (in China); the Company does not sell its products to retail (or end-user) customers. Independent third-party intermediaries distribute and resell our products on terms and conditions determined in their sole discretion. For example, the products exported to the U.S. market are sold to our U.S. importers. This model is used for all of our products, including the Semi Knocked Down (“SKD”) sets sold in our domestic market. SKD sets are complete sets of the main parts that can be assembled into whole vehicles. The SKD sets we sell are very close to the final whole vehicles, so we categorize them as vehicle products. The Company sells SKD sets to our regional partners (manufacturers or dealers), who then assemble, customize and resell the cars.

The terms of the products that we sell to our U.S. importers are similar to those for products that we export to other countries and regions where we sell to the independent distributorsintermediary companies. The re-sale terms of these products are determined by the intermediary companies and U.S. importers.

Customers

As of December 31, 2013, our major customers, in the aggregate, accounted for off-road vehicles.

The Company's major customers, each of Supply

| Sales | Accounts Receivable | ||||||||||

| Twelve | Twelve | ||||||||||

| Months | Months | ||||||||||

| Ended | Ended | ||||||||||

| December,31, | December,31, | December31, | December31, | |||||||||

Major Customers | 2013 | 2012 | 2013 | 2012 | ||||||||

Jinhua Baoxiang Import & Export Co., Ltd | 24% | 33% | 15% | 21% | ||||||||

Shanghai Huapu Auto Co., Ltd | 23% | - | 52% | - | ||||||||

Zhejiang Jin Li Ma Trading Co., Ltd. | 14% | 12% | 8% | 8% | ||||||||

Jinhua Chaoneng Auto Sales Co., Ltd. | 10% | 7% | 7% | 8% | ||||||||

During fiscal year ended December 31, 2010.2013, the Company sold products to Kandi USA Inc. carrying trade name of Eliteway Motorsports (“Eliteway”) amounting to $6,906,807 (2012:$5,297,548). At the fiscal year ended 2013, outstanding receivable due from Eliteway was $2,800,958 (2012: $2,678,349).

Mr. Hu Wangyuan was the sole shareholder and officer of Eliteway which served as a US importer of the Company's products. Mr. Hu Wangyuan is the adult son of the Company's chairman and Chief Executive Officer, Mr. Hu Xiaoming. As of and for the year ended December 31, 2013, Eliteway and Mr. Hu Wangyuan were financially independent from the Company. The transactions between the Company and Eliteway were carried at arm's-length without preferential terms comparing with other customers at the comparative order size or volume.

Sources of Supply

All the raw materials are purchased from the suppliers. The major parts of our products are mainly manufactured by Kandi. Other components and parts that are needed are purchased from third-party suppliers. Kandi does not have, and does not anticipate having, any difficulty in obtaining its required materials from suppliers and considers its suppliers. In reaching this determination, we considered our current contracts and our current business relationsrelationships with theour suppliers.

10

The Company's material suppliers, to be satisfactory.

| Purchases | Accounts Payable | ||||||||||

| Twelve | Twelve | ||||||||||

| Months | Months | ||||||||||

| Ended | Ended | ||||||||||

| December,31, | December,31, | December31, | December31, | |||||||||

Major Suppliers | 2013 | 2012 | 2013 | 2012 | ||||||||

Zhejiang New Energy Auto System Co., Ltd. | 33% | 26% | 12% | - | ||||||||

Zhejiang Mengdeli Electric Co., Ltd. | 32% | 32% | 13% | 4% | ||||||||

Competitors

Despite the fact that we have other competitors, some of whom are more diversifiedlarger and have greater financial and marketing resources than we do, we continue to believe that we are substantially greater than thoseone of Kandi.

Employees

As of December 31, 2010,2013, excluding the contractors and employees in the JV Company, Kandi had a total of 475 full time430 full-time employees. None of our employees are represented by any collective bargaining agreements.

Pure Electric Vehicles Subsidies

Currently, there are two subsidies from central and local governments for the pure electric vehicles (the “EVs”) in China – one from each of the central and local governments. The ultimate beneficiary for these subsidies is the consumer and the actual prices that consumers pay reflect the deduction of both subsidies.

a) The central government provides a subsidy to manufacturers paid in advance quarterly upon application and approval and settled annually. After selling product to dealers, manufacturers can submit subsidy payment applications with invoices and other supporting documents at the end of each quarter to the requisite central government agencies through their regional offices. After the review and approval by the agencies, the central government makes advance subsidy payments to the manufacturers. At the end of the year, the final subsidy amounts are verified, reconciled according to the number of vehicles actually sold to consumers and settled on an annual basis.

b) Pursuant to the requirement of the central government, the local governments provide a subsidy to consumers who purchase EVs by a price reduction from the dealer. After the consumer purchases an EV at a reduced selling price from the dealer, the dealer submits a subsidy application to the local government, including a consumer authorization letter for subsidy application, consumer personal I.D., EV Vehicle License, EV purchase invoice and other required documents and requests reimbursement (to the dealer) for the local government subsidy.

11

Environmental and Safety Regulation

Emissions

Our products are all subject to international laws and emissions related regulations, including regulations and related standards established by China Environmental Protection Agency, the United States Environmental Protection Agency (“EPA”) and, the California Air Resources Board (“CARB”) have adopted, Europe and Canada.

All Kandi's products comply with all applicable emissions regulations applicable to Kandi’s products. CARB has emissions regulations for ATVs and off-road vehicles which the Company already meets. In October 2002, the EPA established new corporate average emission standards effective for model years 2006 through 2012 for non-road recreational vehicles, including ATVs and off-road vehicles.

Use regulation

The sale and use of products must be subject to the "Traffic Law" and relevant laws & regulations in China. National, State, and federal laws and regulations have been promulgated, or are under consideration, relating tothat impact the use or manner of use of Kandi’sKandi's products. SomeCertain states and localitieslocal authorities have adopted, or are considering the adoption of, legislation and local ordinances which restrict the use of ATVs and off-road vehicles to specified hours and locations. The federal government also has restricted the use of ATVs and off-road vehicles in some national parks and federal lands. In several instances, thisthe restriction has been a complete ban on the recreational use of these vehicles. Kandi is unable to predict the outcome of such actions or the possible effect on its business. Kandi believes that its business would be no more adversely affected than those of its competitors by the adoption of any such pending laws or regulations.

Product Safety and Regulation

Safety Regulation

The U.S. federal government and individual states have promulgatedadopted, or are considering promulgatingthe adoption of, laws and regulations relating to the use and safety of Kandi’sKandi's products. The federal government is the primary regulator of product safety. The Consumer Product Safety Commission (“CPSC”) has federal oversight over product safety issues related to ATVs and off-road vehicles. The National Highway Transportation Safety Administration (“NHTSA”) has federal oversight over product safety issues related to on-road motorcycles.

In August 2008, the Consumer Product Safety Improvement Act (the “Act”) was passed. The Act includes a provision that requires all manufacturers and distributors who import into or distribute ATVs inwithin the United States to comply with the ANSI/SVIA safety standards, which were previously voluntary. The Act also requires the same manufacturers and distributors to have ATV action plans filed with the CPSC that are substantially similar to the voluntary action plans that were previously in effect. Kandi currently complies with the ANSI/SVIA standard.

12

Kandi's motorcycles are subject to federal vehicle safety standards administered by NHTSA. Kandi’sKandi's motorcycles are also subject to various state vehicle safety standards. Kandi believes that its motorcycles have always compliedcomply with safety standards relevantapplicable to motorcycles.

Kandi's products are also subject to international safety standards related to safety in places where it sells its products outside the United States. Kandi believes that its motorcycles and Super-mini cars have always compliedEVs comply with applicable safety standards in the United States and internationally.

Principal Executive Offices

Our principal executive office is located in the Jinhua City Industrial Zone in Jinhua, Zhejiang Province, PRC, 321016 and our telephone number (86-579)82239856.

13

Item 1A. Risk Factors.

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this annual report on Form 10-KAnnual Report that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occur,occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Overall Business Operations

We may not be able to comply with all applicable government regulations.

We are subject to extensive governmental regulation by the central, regional and local authorities in the PRC, where our business operations take place. We believe that we are currently in substantial compliance with all laws and governmental regulations and that we have all material permits and licenses required for our operations. Nevertheless, we cannot assure investors that we will continue to be in substantial compliance with current laws and regulations, or that we will be able to comply with any future laws and regulations. To the extent that new regulations are adopted, we willmay be required to conform our activities in order to comply with such regulations. Failure to comply with applicable laws and regulations could subject us to civil remedies, including fines, injunctions, recalls or seizures, as well as potential criminal sanctions, which could have a material adverse effect on itsour business, operations and finances.

Compliance with environmental regulations can be expensive, and noncompliance with these regulations may result in adverse publicity and potentially significant monetary damages and fines.

Our business operations generate noise, waste water, and gaseous byproduct and other industrial wastes.waste. We are required to comply with all national and local regulations regarding protection of the environment. We are in compliance with current environmental protection requirements and have all necessary environmental permits to conduct our business. However, if more stringent regulations are adopted in the future, the costs of compliance with these new regulations could be substantial. Additionally, if we fail to comply with present or future environmental regulations, we may be required to pay substantial fines, suspend production or cease operations. Any failure by us to control the use of, or to adequately restrict adequately the unauthorized discharge of, hazardous substances could subject us to potentially significant monetary damages and fines or suspensions into our business operations. Certain laws, ordinances and regulations could limit our ability to develop, use, or sell our products.

Our business depends substantially on the continuing efforts of our executive officers, and our business may be severely disrupted if we lose their services.

Our future success depends substantially on the continued services of our executive officers, especially our CEO and President,Chairman of the Board of Directors, Mr. Hu Xiaoming. We do not maintain key man life insurance on any of our executive officers. Although this possibility is low, ifIf any of our executive officers are unable or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. Therefore, our business may be severely disrupted, and we may incur additional expenses to recruit and retain new officers. In addition, if any of our executivesexecutive officers joins a competitor or forms a competing company, we may lose some of our customers.

14

We may be subject to product liability claims, recalls or warranty claims,recalls which could be expensive, damage our reputation and result in a diversion of management resources.

The Company may be subject to lawsuits resulting from injuries associated with the use of the vehicles that it sells. The Company may incur losses relating to these claims or the defense of these claims. There is a risk that claims or liabilities will exceed our insurance coverage. In addition, the Company may be unable to retain adequate liability insurance in the future.

The Company may also be required to participate in recalls involving our vehicles, if any prove to be defective, or we may voluntarily initiate a recall or make payments related to such claims as a result of various industry or business practices or the need to maintain good customer relationships. Such a recall would result in a diversion of resources. While we do maintain product liability insurance, we cannot assure you that it will be sufficient to cover all product liability claims, that such claims will not exceed our insurance coverage limits or that such insurance will continue to be available on commercially reasonable terms, if at all. Any product liability claim brought against us could have a material adverse effect on our results of operations.

In recent years, the economy of China has experienced unprecedented growth. This growth has slowed in the last year, and if the growth of the economy continues to slow or if the economy contracts, our financial condition may be materially and adversely affected.

The rapid growth of the PRC economy has historically resulted in widespread growth opportunities in industries across China. As a result of the global financial crisis and the inability of enterprises to gain comparable access to the same amounts of capital available in past years, there may be an adverse effect on the business climate and growth of private enterprise in the PRC. An economic slowdown could have an adverse effect on our sales and may increase our costs. Further, if economic growth slows, and if, in conjunction, inflation is allowed to proceed unchecked, our costs would likely increase, and there can be no assurance that we would be able to increase our prices to an extent that would offset the increase in our expenses.

In addition, a tightening of the labor markets in our geographic region may result in fewer qualified applicants for job openings in our facilities. Further, higher wages, related labor costs and other increasing cost trends may negatively impact our results.

Government policies may negatively affect our results.

Currently, the Company's EV products are mainly sold to in the Chinese domestic market, and the EV industry is supported by the Chinese central and local governments. Therefore, our EV products' performance is significantly affected by the policies adopted by governmental authorities in China. Any significant adverse changes in the Chinese government's supporting policies may negatively affect our results.

15

The audit report included in this Annual Report was prepared by auditors who are not inspected by the Public Company Accounting Oversight Board and, as a result, you are deprived of the benefits of such inspection

The independent registered public accounting firm that issues the audit reports included in our annual reports filed with the SEC, as auditors of companies that are traded publicly in the United States and a firm registered with the Public Company Accounting Oversight Board (United States), or the “PCAOB”, is required by the laws of the United States to undergo regular inspections by the PCAOB to assess its compliance with the laws of the United States and professional standards. Because our auditors are located in the PRC, a jurisdiction where the PCAOB is currently unable to conduct inspections without the approval of the PRC authorities, our auditors are not currently inspected by the PCAOB.

Inspections of other firms that the PCAOB has conducted outside China have identified deficiencies in those firms' audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. The inability of the PCAOB to conduct inspections in China prevents the PCAOB from regularly evaluating our auditor's statements, audits and quality control procedures. As a result, investors may be deprived of the benefits of PCAOB inspections.

The inability of the PCAOB to conduct inspections of auditors in China makes it more difficult to evaluate the effectiveness of our auditor's quality control and audit procedures as compared to auditors outside of China that are subject to PCAOB inspections. Investors may lose confidence in our reported financial information and procedures and the quality of our financial statements.

We face risks related to the ongoing SEC investigation

In November 2013, the SEC Denver office informed the Company that it was conducting an investigation of the Company and made a request for the production of documents and information. The Company is cooperating fully with the SEC in this matter. The Company is unable to predict what action, if any, might be taken in the future by the SEC as a result of the matters that are the subject of the investigation or what impact, if any, the cost of responding to the investigation might have on the Company's financial condition or results of operations. A protracted investigation could impose substantial costs and distractions, regardless of its outcome. There can be no assurance that any final resolution of this investigation will not have a material and adverse effect on the Company's financial condition and results of operations.

Risks Relating to Our Vehicle Machinery Production Operations

We may be subject to significant potential liabilities as a result of defects in production and product liability.

Through our machinery production operations, we may be subject to claims of product defects and/or product liability arising in the ordinary course of business. These claims are common to the machinery production industry and can be costly.

With respect to certain general liability exposures, including manufacturing defect and product liability, interpretation of underlying current and future trends, assessment of claims and the related liability and reserve estimation process is highly subjective due to the complex nature of these exposures, with each exposure exhibiting unique circumstances. Furthermore, once claims are asserted for constructionmanufacturing defects, it is difficult to determine the extent to which the assertion of these claims will expand geographically. We may not have sufficient funds available to cover any or all liability for damages, the cost of repairs, and/or the expense of litigation surrounding such claims, and future claims may arise out of events or circumstances not covered by insurance and not subject to effective indemnification agreements with our subcontractors.

16

The vehicle machinery industry is highly competitive, and we are subject to risks relating to competition that may adversely affect our performance.

The vehicle machinery industry is highly competitive, and our continued success depends upon our ability to compete effectively in markets that contain numerous competitors, some of which have significantly greater financial, marketing and other resources than we have. Competition may reduceaffect our pricing structures, potentially causing us to lower our prices, which may adversely impact our profits. New or existing competition that uses a business model that is different from our business model may put pressure on us to change our model so that we can remain competitive.

Our high concentration of sales to relatively few customers may result in significant uncollectible accounts receivable exposure, which may adversely impact our liquidity, business, results of operations and financial condition.

As of December 31, 2010,2013, our top five customers, in the first two customers aggressivelyaggregate, accounted for 81%78% and 81%91%, respectively, of our sales and accounts receivable. Due to the concentration of sales to relatively few customers, we face credit exposure from our customers and may experience uncollectible receivables fromloss of one or more of these customers should they face financial difficulties. If these customers fail to pay their accounts receivable, file for bankruptcy or significantly reduce their purchases of our programming, it wouldwill have an adverse effectrelatively high impact on our business, financial condition, results of operations, and liquidity.

| Sales | Accounts Receivable | |||||||||||||||

| Major Customers | Twelve Months Ended December, 31, 2010 | Twelve Months Ended December, 31, 2009 | December 31, 2010 | December 31, 2009 | ||||||||||||

| Company A | 46 | % | - | 61 | % | - | ||||||||||

| Company B | 35 | % | 56 | % | 20 | % | 92 | % | ||||||||

| Company C | 15 | % | 9 | % | 14 | % | 7 | % | ||||||||

| Company D | 1 | % | - | 4 | % | - | ||||||||||

Our business is subject to the risk of supplier concentrations.

We depend on a limited number of suppliers for the sourcing of major components and parts and principal raw materials. As ofFor the years ended December 31, 20102013 and 2009, one supplier2012, the top two suppliers accounted for 84%65% and 80%58% of our purchases, respectively. As a result of this concentration in our supply chain, our business and operations would be negatively affected if any of our key suppliers were to experience significant disruption affecting the price, quality, availability or timely delivery of their products. The partial or complete loss of these suppliers, or a significant adverse change in our relationship with any of these suppliers, could result in lost revenue, added costs and distribution delays that could harm our business and customer relationships. In addition, concentration in our supply chain can exacerbate our exposure to risks associated with the termination by key suppliers of our distribution agreements or any adverse change in the terms of such agreements, which could have a negative impact on our revenues and profitability.

| Purchases | Accounts Payable | |||||||||||||||

| Major Suppliers | Twelve Months Ended December, 31, 2010 | Twelve Months Ended December, 31, 2009 | December 31, 2010 | December 31, 2009 | ||||||||||||

| Company E | 84 | % | 80 | % | 26 | % | - | |||||||||

| Company F | 2 | % | 1 | % | 4 | % | 5 | % | ||||||||

| Company G | 1 | % | 1 | % | 3 | % | - | |||||||||

| Company H | 1 | % | 1 | % | 1 | % | 4 | % | ||||||||

| Company I | 1 | % | 1 | % | 4 | % | 3 | % | ||||||||

Risks Related to Doing Business in China

Changes in political and economic conditions may affect our business operations and profitability.

Since our business operations are primarily located in China, our business operations and financial position are subject, to a significant degree, to the economic, political and legal developments in China.

17

While the Chinese government has not halted its economic reform policy since 1978, any significant adverse changes in the social, political and economic conditions of China may fundamentally impact China’sChina's economic reform policies, and thus the Company’sCompany's operations and profits may be adversely affected.

Changes in tax laws and regulations in China may affect our business operations.

Various tax reform policies have been implemented in the PRC in recent years. However, there can be no assurance that the existing tax laws and regulations will not be revised or amended in the future.

Uncertainties with respect to the Chinese legal system could have a material adverse effect on us and may restrict the level of legal protections to foreign investors.

China's legal system is based on statutory law. Unlike the common law system, statutory law is based primarily on written statutes. Previous court decisions may be cited as persuasive authority but do not have a binding effect. Since 1979, the PRC government has been promulgating and amending the laws and regulations regarding economic matters, such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, since these laws and regulations are relatively new, and the PRC legal system continues to rapidly evolve, the interpretation of many laws, regulations and rules is not always uniform and enforcement of these laws, regulations and rules involves uncertainties, which may limit legal protections available to us.

In addition, any litigation in China may be protracted and may result in substantial costs and diversion of resources and managementmanagement's attention. The legal system in China cannot provide investors with the same level of protection as in the U.S. The Company is governed by the lawlaws and regulations generally applicable to local enterprises in China. Many of these laws and regulations were recently introduced and remain experimental in nature and subject to changes and refinements. Interpretation, implementation and enforcement of the existing laws and regulations can be uncertain and unpredictable and therefore may restrict the legal protections ofavailable to foreign investors.

Changes in Currency Conversion Policies in China may have a material adverse effect on us.

Renminbi (“RMB”) is still not a freely exchangeable currency. Since 1998, the State Administration of Foreign Exchange of China has promulgated a series of circulars and rules in order to enhance verification of foreign exchange payments under a Chinese entity’sentity's current account items, and has imposed strict requirements on borrowing and repayments of foreign exchange debts from and to foreign creditors under the capital account items and on the creation of foreign security in favor of foreign creditors.

This may complicate foreign exchange payments to foreign creditors under the current account items and thus willmay affect the ability to borrow under international commercial loans, the creation of foreign security, and the borrowing of RMB under guarantees in foreign currencies. Furthermore,Moreover, the value of RMB may become subject to supply and demand, which could be largely impacted by international economic and political environments. Any fluctuations in the exchange rate of RMB could have an adverse effect on the operational and financial condition of the Company and its subsidiaries in China.

18

You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions based on United States or other foreign laws against us, our management or the experts named in the prospectus.

We conduct substantially all of our operations in China and substantiallyalmost all of our assets are located in China. In addition, almost all of our senior executive officers reside in China. As a result, it may not be possible to effect service of process on our senior executive officers within the United States or elsewhere outside China, upon our senior executive officers, including with respect to matters arising under U.S. federal securities laws or applicable state securities laws. Moreover, our PRC counsel has advised us that the PRC does not have treaties with the United States or many other countries providing for the reciprocal recognition and enforcement of judgment of courts.

Risks Relating to Ownership of Our Securities

Our stock price may be volatile, which may result in losses to our shareholders.

The stock markets have experienced significant price and trading volume fluctuations, and the market prices and trading volumes of companies listed on the NASDAQ CapitalGlobal Market and the NASDAQ Global Select Market have been volatile in the past and have experienced sharp share price and trading volume changes.volatile. Although our stock iswas listed on the NASDAQ Global Market and upgraded to the NASDAQ Global Select Market on January 2, 2014, the trading price of our common stock is likely to be volatile and could fluctuate widelysignificantly in response to many factors, including the following, some of which are beyond our control:

variations in our operating results;

changes in expectations of our future financial performance, including financial estimates by securities analysts and investors;

changes in operating and stock price performance of other companies in our industry;

additions or departures of key personnel; and

future sales of our common stock.

Domestic and international stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic and political conditions unrelated to our performance, may adversely affect the price of our common stock.

Mr. Hu, our CEO, President and Chairman of our Board of Directors is the beneficial owner of a substantial portion of our outstanding common stock, which may enable this stockholderMr. Hu to exert significant influence many significanton corporate actions.

Excelvantage Group Limited controls approximately 43.8%32.4% of our outstanding shares of common stock as of December 31, 2010. As a result,2013. On March 29, 2010, Hu Xiaoming, the Company's Chief Executive Officer, President and Chairman of the Board of Directors, became the sole stockholder of Excelvantage Group Limited. Excelvantage Group Limited could havehas a substantial impact on matters requiring the vote of theour shareholders, including the election of our directors and most corporate actions. This control could delay, defer or prevent others from initiating a potential merger, takeover or other change in our control, even if these actions would benefit our other shareholders and the Company. This control could adversely affect the voting and other rights of our other shareholders and could depress the market price of our common stock.

We cannot predict the extent to which an active public market for trading our common stock will be sustained. Although our trading volume has increased gradually in recent years, our stock has historically been sporadic or “thinly-traded,” meaning that the number of persons interested in purchasing our common shares at any given time may be relatively small or non-existent.

This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the attention of such persons, those persons tend to be risk-averse and may be reluctant to follow, purchase, or recommend the purchase of shares of an unprovenunseasoned company such as ours until such time as we become more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The market price for our common stock is particularly volatile given our status as a relatively small company, which could lead to widesignificant fluctuations in our share price. You may be unable to sell your common stock, if at all, at or above your purchase price, if at all, which may result in substantial losses to you.

We do not anticipate paying any cash dividends to our common shareholders.

We presently do not anticipate that we will pay dividends on any of our common stock in the foreseeable future. If payment of dividends does occur at some point in the future, it would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any common stock dividends will be within the discretion of our Board of Directors. We presently intend to retain all earnings after paying the interest for the preferred stock, if any, to implement our business plan; accordingly, we do not anticipate the declaration of any dividends for common stock in the foreseeable future.

Fluctuation in the value of the RMB may have a material adverse effect on your investment.

The change in value of the RMB against the U.S. dollar, the Euro and other currencies is affected by changes in China’sChina's political and economic conditions, among other things. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the RMB to the U.S. dollar. Under the new policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in approximately 2.1% appreciation of RMB against the U.S. dollar. While the international reaction to the RMB revaluation has generally been positive, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the RMB against the U.S. dollar. As a portion of our costs and expenses is denominated in RMB, the revaluation in July 2005 and potential future revaluation has and could further increase our costs. In addition, any significant revaluation of the RMB may have a material adverse effect on our financial condition. For example, to the extent that we need to convert U.S. dollars we receive from financings into RMB for our operations, appreciation of the RMB against the U.S. dollar would have an adverse effect on the RMB amount we receive from the conversion. Conversely, if we decide to convert our RMB into U.S. dollars for the purpose of making payments for business purposes, appreciation of the U.S. dollar against the RMB would have a negative effect on the U.S. dollar amount available to us.

20

Volatility in our common stock could beshare price may subject us to “penny stock” rules which could negatively impact our liquidity and our shareholders’ ability to sell their shares.

The market for our common stock is characterized by significant price volatility as compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’smanagement's attention and resources.

The Eliminationlimitation of Monetary Liability Againstmonetary liability against our Directors, Officersdirectors, officers and Employeesemployees under Delaware law and the Existenceexistence of Indemnification Rightsstatutory indemnification rights of our Directors, Officersdirectors, officers and Employees May Resultemployees may result in Substantial Expendituressubstantial expenditures by our Company and may Discourage Lawsuits Againstdiscourage lawsuits against our Directors, Officersdirectors, officers and Employees.

Our articles of incorporation do not contain any specific provisions that eliminatelimit the liability of our directors for monetary damages to our companyCompany and shareholders; however, we are prepared to give such indemnification toindemnify our directors and officers to the extent provided for by Delaware law. We may also have include contractual indemnification obligations underin our employment agreements with our officers. The foregoing indemnification obligations could result in our companythe Company incurring substantial expenditures to cover the cost of settlement or damage awards against its directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our companyCompany from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit our companyCompany and shareholders.

We may need additional capital, and the sale of additional shares or other equity securities could result in additional dilution to our shareholders.

In the future, we may require additional cash resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If our resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity securities could result in dilution to our shareholders. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations. We cannot assure you that financing will be available, if at all, in amounts or on terms acceptable to us, if at all.

21

Our business is subject to changing regulations related to corporate governance and public disclosure that have increased both our costs and the risk of noncompliance.

Because our common stock is publicly traded, we are subject to certain rules and regulations of federal, state and financial market exchange entities charged with the protection of investors and the oversight of companies whose securities are publicly traded. These entities, including the Public Company Accounting Oversight Board, the SEC and NASDAQ, have issued requirements and regulations and continue to develop additional regulations and requirements in response to corporate scandals and laws enacted by Congress, most notably the Sarbanes-Oxley Act of 2002.Congress. Our efforts to comply with these regulations have resulted in, and are likely to continue resulting in, increased general and administrative expenses and diversion of management time and attention from revenue-generating activities to compliance activities. Because new and modified laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing revisions to our disclosure and governance practices.

Item 1B. Unresolved Staff Comments.

Not applicable.

22

Item 2. Properties.

All land in the PRC is owned by the government and cannot be sold to or ownedtransferred by or to any individual or private entity. Instead, the government grants or allocates landholders a “land use right.” There are four methods to acquire land use rights:

grant of the right to use land;

assignment of the right to use land;

lease of the right to use land; and

allocated land use rights.

In comparison with Western common law concepts, granted land use rights are similar to life estates and allocated land use rights are in some ways similar to leaseholds.

Granted land use rights are provided by the government in exchange for a grant fee and carry the rights to pledge, mortgage, lease, and transfer withinduring the term of the grant. Land is granted for a fixed term, -which is generally 70 years for residential use, 50 years for industrial use, and 40 years for commercial andor other use. The term is renewable in theory. Unlike the usual case in Western nations, grantedGranted land must be used for the specific purpose for which it was granted.

Allocated land use rights cannot be pledged, mortgaged, leased, or transferred. They are generally provided by the government for an indefinite period (usually to state-owned entities) and cannot be pledged, mortgaged, leased, or transferred by the user. Furthermore, allocated land can be reclaimed by the government at any time. Allocated land use rights may be converted into granted land use rights upon the payment of a grant fee to the government.

Kandi has the following granted land use rights:

| Area | ||||||

| Location | (square meters) | Term and Expiration | Certificate No. | |||

| Zhejiang Jinhua Industrial Park | 72900.90 | Nov 13, 2002 - Nov 13, 2052 | 10-15-0-203-1 | |||

| Zhejiang Jinhua Industrial Park | 39490.64 | Nov 13, 2002 - Nov 13, 2052 | 10-15-0-203-2 | |||

| Zhejiang Jinhua Industrial Park | 46650.70 | Dec 30, 2003 - Dec 30, 2053 | 10-15-0-16 | |||

| Zhejiang Jinhua Industrial Park | 37515.00 | Dec 30, 2003 - Dec 30, 2053 | 10-15-0-17 | |||

| Zhejiang Jinhua Industrial Park | 49162.00 | Dec 30, 2003 - Dec 30, 2053 | 10-15-0-18 | |||

| Zhejiang Jinhua Industrial Park | 19309.00 | Dec 07, 2009 - Dec 07, 2059 | 10-15-0-33 | |||

| Zhejiang Qiaoxia Industrial Park | 9405.00 | Apr 03, 2001 – Apr 03, 2051 | 574-26-36 |

Item 3. Legal Proceedings.

In July 2013, Judge Michael M. Pritchett of the Circuit Court of Ripley County of the State of Missouri against the Company(the “Court”) entered final orders and its subsidiary Zhejiang Kandi Vehicles Co., Ltd.(“Kandi Vehicles”), Kandi Investment Group, SunL and other parties, and they are related to two persons who died in an accident on March 3, 2006 while operating a go-cart allegedly manufactured by the Kandi Vehicles. Kandi Investment Group was a major shareholder of Kandi Vehicles but it transferred all its equity in Kandi Vehicles to Continental Development Limited in November 2006. Since then, Kandi Investment Group has been unrelated to the Company or its affiliates.

23

The Company has established by referencebeen furnishing documents to the VIN numberDenver Regional Office of the Securities and Exchange Commission in response to a document subpoena issued on November 21, 2013 regarding a matter known as In the vehicleMatter of Kandi Technologies Group, Inc. As indicated in the subpoena, the investigation is a fact-finding inquiry and does not mean that the manufacturer ofCompany or anyone has broken the vehicle waslaw. The Company has cooperated, and is cooperating fully, with the SEC in this matter and will continue to supply the SEC with whatever additional information and material that is requested. The Company does not Kandi Vehicles but a different manufacturer. Neither the Company norhave any of its subsidiaries actually has,information, at present, as to the bestduration or outcome of our knowledge, any involvement with respect to the subject vehicle.this investigation. The Company intends to propound discovery on the plaintiffs and will attempt to have the cases dismissed by summary judgment, if possible.

Item 4. Mine Safety Disclosures.

Not applicable.

24

Item 5.Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

On January 2, 2014, our common stock. Our common stock began trading on the NASDAQ Capital Market on March 18, 2008, and on January 10, 2011, our common stock began trading on NASDAQ Global Select Market. The following are the high and low bid prices for our common stock for each quarter from July 6, 2007January 1, 2012 to December 31, 2010.

| HIGH | LOW | |||||||

| FISCAL 2010 | ||||||||

| Fourth Quarter (through December 31, 2010) | $ | 7.25 | $ | 4.10 | ||||

| Third Quarter (through September 30, 2010) | $ | 4.45 | $ | 2.90 | ||||

| Second Quarter (through June 30, 2010) | $ | 5.19 | $ | 2.75 | ||||

| First Quarter (through March 31, 2010) | $ | 6.75 | $ | 3.24 | ||||

| FISCAL 2009 | ||||||||

| Fourth Quarter (through December 31, 2009) | $ | 6.20 | $ | 1.78 | ||||

| Third Quarter (through September 30, 2009) | $ | 2.47 | $ | 1.10 | ||||

| Second Quarter (through June 30, 2009) | $ | 1.74 | $ | 0.78 | ||||

| First Quarter (through March 31, 2009) | $ | 1.05 | $ | 0.46 | ||||

| FISCAL 2008 | ||||||||

| Fourth Quarter (through December 31, 2008) | $ | 2.40 | $ | 0.72 | ||||

| Third Quarter (through September 30, 2008) | $ | 4.30 | $ | 1.75 | ||||

| Second Quarter (through June 30, 2008) | $ | 7.25 | $ | 4.09 | ||||

| First Quarter (through March 31, 2008) | $ | 5.65 | $ | 4.28 | ||||

| FISCAL 2007 | ||||||||

| Fourth Quarter (through December 31, 2007) | $ | 5.30 | $ | 3.72 | ||||

| Third Quarter (through September 30, 2007) | $ | 4.25 | $ | 3.25 | ||||

| HIGH | LOW | |||||

| FISCAL 2013 | ||||||

| Fourth Quarter (through December 31, 2013) | $ | 12.79 | $ | 6.15 | ||

| Third Quarter (through September 30, 2013) | $ | 9.20 | $ | 4.12 | ||

| Second Quarter (through June 30, 2013) | $ | 8.50 | $ | 3.55 | ||

| First Quarter (through March 31, 2013) | $ | 4.19 | $ | 3.37 | ||

| FISCAL 2012 | ||||||

| Fourth Quarter (through December 31, 2012) | $ | 4.69 | $ | 3.52 | ||

| Third Quarter (through September 30, 2012) | $ | 5.13 | $ | 3.00 | ||

| Second Quarter (through June 30, 2012) | $ | 3.74 | $ | 2.33 | ||

| First Quarter (through March 31, 2012) | $ | 3.98 | $ | 2.95 |

Holders of Common Stock

As of March 25, 2011,11, 2014, there were 3,83719 shareholders of record holders of our common stock.

Dividends

We have never paid a dividend on our common stock. At present, we intend to retain any earnings for use in our business and do not anticipate paying cash dividends in the foreseeable future.

Item 6.Selected Financial Data.

Not applicable.

25

Item 7.Management's Discussion and Analysis |

Overview

Our core business is designing, developing, manufacturing and commercializing pure electric vehicles (“EVs”), all-terrain vehicles (“ATVs”), go-karts, three-wheeled motorcycles and other documents filed by the Company with the SEC.

During the year ended December 31, 2009, and no declines in net realizable value2013, we recognized total revenues of inventory$94,536,045, an increase of $30,022,375, or 46.5%, over total revenues for the year ended of December 31, 2010.

The vehicle manufacturing industry is highly competitive. Current and future factors impacting our industry include: (i) the exponential growth of electrical vehicle sales and dedicated platforms in the global market place, (ii) the consolidation of supply chains and costs of components, (iii) rapid technology developments (including 3D printing technology) and (iv) emerging strategic partnerships and joint ventures in the automotive industry generally.