UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

AMENDMENT NO. 1

10-K

(Mark(Mark One) |

x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | |

o | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 20102013

Commission File No. 1-8726

RPC, INC.

Delaware (State of Incorporation) | 58-1550825 (I.R.S. Employer Identification No.) |

2801 BUFORD HIGHWAY NE, SUITE 520

ATLANTA, GEORGIA 30329

(404) 321-2140

Securities registered pursuant to Section 12(b) of the Act:

Title of each class COMMON STOCK, $0.10 PAR VALUE | Name of each exchange on which registered NEW YORK STOCK EXCHANGE |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

xYeso Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. oYes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes xNoo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website,website, if any, every Interactive Data Fileinteractive data file required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes xNoo No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filerox | Accelerated filerxo | Non-accelerated filero | Smaller reporting companyo |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes oNo x

The aggregate market value of RPC, Inc. Common Stock held by non-affiliates on June 30, 2010,2013, the last business day of the registrant’s most recently completed second fiscal quarter, was $384,671,517$852,785,460 based on the closing price on the New York Stock Exchange on June 30, 20102013 of $13.65$13.81 per share.

RPC, Inc. had 147,964,000219,289,400 shares of Common Stock outstanding as of February 18, 2011.14, 2014.

Documents Incorporated by Reference

Portions of the Proxy Statement for the 20112014 Annual Meeting of Stockholders of RPC, Inc. are incorporated by reference into Part III, Items 10 through 14 of this report.

EXPLANATORY NOTE

The sole purpose of this Amendment No. 1 to our Annual Report on Form 10-K for the year ended December 31, 2010 (“Form 10-K”), as filed with the Securities and Exchange Commission on March 4, 2011, is to amend Exhibits 31.1, 31.2 and 32.1 to correct certain typographical errors contained in those exhibits. In accordance with Compliance and Disclosure Interpretations of the staff of the Securities and Exchange Commission, the Form 10-K is set forth herein in its entirety; however, no other amendments or changes have been made to the Form 10-K. This Amendment No. 1 does not reflect subsequent events occurring after the original filing date of the Form 10-K or modify or update in any way disclosures made in the Form 10-K.

PART I

Throughout this report, we refer to RPC, Inc., together with its subsidiaries, as “we,” “us,” “RPC” or “the Company.”

Forward-Looking Statements

Certain statements made in this report that are not historical facts are “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may include, without limitation, statements that relate to our business strategy, plans and objectives, and our beliefs and expectations regarding future demand for our products and services and other events and conditions that may influence the oilfield services market and our performance in the future. Forward-looking statements made elsewhere in this report include without limitation statements regarding our belief that the long-term prospects for our business are favorable due to growing demand for oilbeliefs regarding natural gas prices, production levels and natural gas; drilling activities; our belief that the long-term demand outlook for natural gas is still favorable; our belief that the lack of foreign competition with domestic natural gas production tends to keep prices high enough to ensure that domestic drilling and production will continue at certain minimum levels; our belief that gas-directedoil-directed drilling will continue to represent the majority of the total drilling rig count inunless the foreseeable future; sustained level of demand for natural gas increases tremendously; our expectation to continue to focus on the development of international business opportunities in current and other international markets; our ability to obtain other customers in the event of a loss of our largest customers; the adequacy of our insurance coverage; the impact of lawsuits, legal proceedings and claims on our business and financial condition; our expectation to continue to pay cash dividends to the common stockholders subject to the earnings and financial condition of the Company and other relevant factors; our belief that no catalysts exist which will change overall industry activity in the near term; our belief that the favorable long-term returns on our purchasesconsistently high price of revenue producing equipment will continue, thus justifyingoil over the fundingpast three years and during the beginning of these expenditures with debt; the first quarter of 2014 holds positive implications for RPC’s activity levels for 2014; our belief that continued increasesthe percentage of wells drilled for oil will remain high in 2014; our expectation not to enter into additional contractual arrangements with customers on terms similar to those having expired during 2012 and 2013; our belief that the high price of oil should continue to have a positive impact on our customers’ activity levels and our financial results; our belief that the overall rig count will not increase significantly during 2014 unless the price of natural gas observed during the beginning of the first quarter of 2014 is sustained during the year; our belief that the excess service capacity in the industry is still an issue in the U.S. domestic rig count during 2011 may be limited bymarket; our plans not to significantly increase the numbersize of rigs available to drill new wells; that the outlook for the U.S. domestic rig count is for it to remain stable or increase slightly during 2011 with the service-intensive natureour revenue-producing fleet of the activity being projected to continue to increase; our belief that an increase in the supply in oilfield equipment in our markets can cause a decrease in the price we receive for our services if commodity prices and drilling activity do not also increase; our expectations to take delivery of a large amount of revenue-producing equipment during the first and second quarters of 2011; our expectation that our consolidated revenues and financial performance will improve;2014; our ability to maintain sufficient liquidity and a conservative capital structure; our belief about the amount of the contribution to the defined benefit pension plan in 2011;2013; our ability to fund capital requirements in the future; the estimated amount of our capital expenditures and contractual obligations for future periods; estimates made with respect to our critical accounting policies; and the effect of new accounting standards.

The words “may,” “will,” “expect,” “believe,” “anticipate,” “project,” “estimate,” and similar expressions generally identify forward-looking statements. Such statements are based on certain assumptions and analyses made by our management in light of its experience and its perception of historical trends, current conditions, expected future developments and other factors it believes to be appropriate. We caution you that such statements are only predictions and not guarantees of future performance and that actual results, developments and business decisions may differ from those envisioned by the forward-looking statements. See “Risk Factors” contained in Item 1A. for a discussion of factors that may cause actual results to differ from our projections.

Item 1. Business

Organization and Overview

RPC is a Delaware corporation originally organized in 1984 as a holding company for several oilfield services companies and is headquartered in Atlanta, Georgia.

RPC provides a broad range of specialized oilfield services and equipment primarily to independent and major oil and gas companies engaged in the exploration, production and development of oil and gas properties throughout the United States, including the southwest, mid-continent, Gulf of Mexico, mid-continent, southwest, Rocky Mountain and northeastAppalachian regions, and in selected international markets. The services and equipment provided include, among others, (1) pressure pumping services, (2) downhole tool services, (3) coiled tubing services, (3)(4) snubbing services (also referred to as hydraulic workover services), (4)(5) nitrogen services, (5)(6) the rental of drill pipe and other specialized oilfield equipment, (6) downhole tool services and (7) well control. RPC acts as a holding company for its operating units, Cudd Energy Services, Patterson Rental and Fishing Tools, Bronco Oilfield Services, Thru Tubing Solutions, Well Control School, and others. As of December 31, 2010,2013, RPC had approximately 2,5003,900 employees.

Business Segments

RPC’s service lines have been aggregated into two reportable oil and gas services business segments, Technical Services and Support Services, because of the similarities between the financial performance and approach to managing the service lines within each of the segments, as well as the economic and business conditions impacting their business activity levels.

During 2010,2013, approximately three percent of RPC’s consolidated revenues were generated from offshore operations in the U.S. Gulf of Mexico. In addition, approximately one percent of RPC’s consolidated revenues were generated from offshore operationsMexico and in the offshore territoryGulf of other countries, principally in New Zealand.Alaska. We also estimate that 3364 percent of our 20102013 revenues were related to drilling and production activities for oil, and 6736 percent were related to drilling and production activities for natural gas.

Technical Services include RPC’s oil and gas service lines that utilize people and equipment to perform value-added completion, production and maintenance services directly to a customer’s well. The demand for these services is generally influenced by customers’ decisions to invest capital toward initiating production in a new oil or natural gas well, improving production flows in an existing formation, or to address well control issues. This business segment consists primarily of pressure pumping, downhole tools, coiled tubing, snubbing, nitrogen, well control, wireline and fishing. The principal markets for this business segment include the United States, including the southwest, mid-continent, Gulf of Mexico, mid-continent, southwest, Rocky Mountain and Appalachian regions, and contract or project work in selected international locations in the last three years including primarily Africa, Canada, China, Eastern Europe, Latin America, the Middle East and New Zealand.markets. Customers include major multi-national and independent oil and gas producers, and selected nationally owned oil companies.

Support Services include RPC’s oil and gas service lines that primarily provide equipment for customer use or services to assist customer operations. The equipment and services include drill pipe and related tools, pipe handling, pipe inspection and storage services, and oilfield training services. The demand for these services tends to be influenced primarily by customer drilling-related activity levels. The principal markets for this segment include the United States, including the Gulf of Mexico, mid-continent, Rocky Mountain and Appalachian regions and project work in selected international locations in the last three years including primarily Canada, Latin America and the Middle East. Customers primarily include domestic operations of major multi-national and independent oil and gas producers, and selected nationally owned oil companies.

Technical Services

The following is a description of the primary service lines conducted within the Technical Services business segment:

Pressure Pumping. Pressure pumping services, which accounted for approximately 4855 percent of 20102013 revenues, 3853 percent of 20092012 revenues and 4155 percent of 20082011 revenues are provided to customers throughout Texas, and the Gulf Coast,Appalachian, mid-continent and Rocky Mountain regions of the United States and are generally utilizedStates. We primarily provide these services to initiatecustomers in order to enhance the initial production of hydrocarbons in new or enhance production in existing customer wells.formations that have low permeability. Pressure pumping services involve using complex, truck or skid-mounted equipment designed and constructed for each specific pumping service offered. The mobility of this equipment permits pressure pumping services to be performed in varying geographic areas. Principal materials utilized in the pressure pumping business include fracturing proppants, acid and bulk chemical additives. Generally, these items are available from several suppliers, and the Company utilizes more than one supplier for each item. Pressure pumping services offered include:

Fracturing — Fracturing services are performed to stimulate production of oil and natural gas by increasing the permeability of a formation. Fracturing is particularly important in shale formations, which have low permeability, and unconventional completion, because the formation containing hydrocarbons is not concentrated in one area and requires multiple fracturing operations. The fracturing process consists of pumping nitrogen or a fluid gel and sometimes nitrogen into a cased well at sufficient pressure to fracture the formation at desired locations and depths. Sand, bauxite or synthetic proppant, which is often suspended in the gel, is pumped into the fracture. When the pressure is released at the surface, the fluid gel returns to the well surface, but the proppant remains in the fracture, thus keeping it open so that oil and natural gas can flow through the fracture into the well.production tubing and ultimately the well surface. In some cases, fracturing is performed in formations with a high amount of carbonate rock by an acid solution pumped under pressure without a proppant or with small amounts of proppant.

Acidizing — Acidizing services are also performed to stimulate production of oil and natural gas, but they are used in wells that have undergone formation damage due to the buildup of various materials that block the formation. Acidizing entails pumping large volumes of specially formulated acids into reservoirs to dissolve barriers and enlarge crevices in the formation, thereby eliminating obstacles to the flow of oil and natural gas. Acidizing services can also enhance production in limestone formations.

Downhole Tools. Thru Tubing Solutions (“TTS”) accounted for approximately 16 percent of 2013 revenues, 14 percent of 2012 revenues and 12 percent of 2010 revenues, 15 percent of 2009 revenues and nine percent of 20082011 revenues. TTS provides services and proprietary downhole motors, fishing tools and other specialized downhole tools and processes to operators and service companies in drilling and production operations, including casing perforation at the completion stage of an oil or gas well. The services that TTS provides are especially suited for unconventional drilling and completion activities. TTS’ experience providing reliable tool services allows it to work in a pressurized environment with virtually any coiled tubing unit or snubbing unit.

Coiled Tubing. Coiled tubing services, which accounted for approximately 10 percent of 2010 revenues and nine percent of 20092013 revenues and 200811 percent of 2012 and 2011 revenues, involve the injection of coiled tubing into wells to perform various applications and functions for use principally in well-servicing operations and more recently to facilitate completion of horizontal wells. Coiled tubing is a flexible steel pipe with a diameter of less than four inches manufactured in continuous lengths of thousands of feet and wound or coiled around a large reel. It can be inserted through existing production tubing and used to perform workovers without using a larger, more costly workover rig. Principal advantages of employing coiled tubing in a workover operation include: (i) not having to “shut-in” the well during such operations, (ii) the ability to reel continuous coiled tubing in and out of a well significantly faster than conventional pipe, (iii) the ability to direct fluids into a wellbore with more precision, and (iv) enhanced access to remote or offshore fields due to the smaller size and mobility of a coiled tubing unit compared to a workover rig. Increasingly, coiled tubing units are also used to support completion activities in directional and horizontal wells. Such completion activities usually require multiple entrances in a wellbore in order to complete multiple fractures in a pressure pumping operation. A coiled tubing unit can accomplish this type of operation because its flexibility allows it to be steered in a direction other than vertical, which is necessary in this type of wellbore. At the same time, the strength of the coiled tubing string allows various types of tools or motors to be conveyed into the well effectively. The uses for coiled tubing in directional and horizontal wells have been enhanced by improved fabrication techniques and higher-diameter coiled tubing which allows coiled tubing units to be used effectively over greater distances, thus allowing them to function in more of the completion activities currently taking place in the U.S. domestic market. There are several manufacturers of flexible steel pipe used in coiled tubing services, and the Company believes that its sources of supply are adequate.

Snubbing. Snubbing (also referred to as hydraulic workover services), which accounted for approximately fivefour percent of 2010 revenues eight percent of 2009 revenues,in 2013, 2012 and seven percent of 2008 revenues,2011, involves using a hydraulic workover rig that permits an operator to repair damaged casing, production tubing and downhole production equipment in a high-pressure environment. A snubbing unit makes it possible to remove and replace downhole equipment while maintaining pressure on the well. Customers benefit because these operations can be performed without removing the pressure from the well, which stops production and can damage the formation, and because a snubbing rig can perform many applications at a lower cost than other alternatives. Because this service involves a very hazardous process that entails high risk, the snubbing segment of the oil and gas services industry is limited to a relative few operators who have the experience and knowledge required to perform such services safely and efficiently. Increasingly, snubbing units are used for unconventional completions at the outer reaches of long wellbores which cannot be serviced by coiled tubing because coiled tubing has a more limited range than drill pipe conveyed by a snubbing unit.

Nitrogen. Nitrogen accounted for approximately fivefour percent of 2010 revenues seven percent of 2009 revenues,in 2013, 2012 and eight percent of 2008 revenues.2011. There are a number of uses for nitrogen, an inert, non-combustible element, in providing services to oilfield customers and industrial users outside of the oilfield. For our oilfield customers, nitrogen can be used to clean drilling and production pipe and displace fluids in various drilling applications. Increasingly, it is used as a displacement medium to increase production in older wells in which production has depleted. It also can be used to create a fire-retardant environment in hazardous blowout situations and as a fracturing medium for our fracturing service line. In addition, nitrogen can be complementary to our snubbing and coiled tubing service lines, because it is a non-corrosive medium and is frequently injected into a well using coiled tubing. Nitrogen is complementary to our pressure pumping service line as well, because foam-based nitrogen stimulation is appropriate in certain sensitive formations in which the fluids used in fracturing or acidizing would damage a customer’s well.

For non-oilfield industrial users, nitrogen can be used to purge pipelines and create a non-combustible environment. RPC stores and transports nitrogen and has a number of pumping unit configurations that inject nitrogen in its various applications. Some of these pumping units are set up for use on offshore platforms or inland waters. RPC purchases its nitrogen in liquid form from several suppliers and believes that these sources of supply are adequate.

Well Control. Cudd Energy Services specializes in responding to and controlling oil and gas well emergencies, including blowouts and well fires, domestically and internationally. In connection with these services, Cudd Energy Services, along with Patterson Services, has the capacity to supply the equipment, expertise and personnel necessary to restore affected oil and gas wells to production. TheDuring the past several years, the Company has responded to well control situations in several international locations including Algeria, Argentina, Australia, Bolivia, Canada, Colombia, Egypt, Hungary, India, Kuwait, Libya, Mexico, Peru, Qatar, Taiwan, Trinidad, Turkmenistan, Tanzania, Abu Dhabi and Venezuela.

The Company’s professional firefighting staff has many years of aggregate industry experience in responding to well fires and blowouts. This team of experts responds to well control situations where hydrocarbons are escaping from a well bore,wellbore, regardless of whether a fire has occurred. In the most critical situations, there are explosive fires, the destruction of drilling and production facilities, substantial environmental damage and the loss of hundreds of thousands of dollars per day in well operators’ production revenue. Since these events ordinarily arise from equipment failures or human error, it is impossible to predict accurately the timing or scope of this work. Additionally, less critical events frequently occur in connection with the drilling of new wells in high-pressure reservoirs. In these situations, the Company is called upon to supervise and assist in the well control effort so that drilling operations can resume as promptly as safety permits.

Wireline Services. Wireline is classified into two types of services: slick or braided line and electric line. In both, a spooled wire is unwound and lowered into a well, conveying various types of tools or equipment. Slick or braided line services use a non-conductive line primarily for jarring objects into or out of a well, as in fishing or plug-setting operations. Electric line services lower an electrical conductor line into a well allowing the use of electrically-operated tools such as perforators, bridge plugs and logging tools. Wireline services can be an integral part of the plug and abandonment process, near the end of the life cycle of a well.

Fishing. Fishing involves the use of specialized tools and procedures to retrieve lost equipment from a well drilling operation and producing wells. It is a service required by oil and gas operators who have lost equipment in a well. Oil and natural gas production from an affected well typically declines until the lost equipment can be retrieved. In some cases, the Company creates customized tools to perform a fishing operation. The customized tools are maintained by the Company after the particular fishing job for future use if a similar need arises.

Support Services

The following is a description of the primary service lines conducted within the Support Services business segment:

Rental Tools. Rental tools accounted for approximately eightfour percent of 2010 and 20092013 revenues, five percent of 2012 revenues and 11six percent of 20082011 revenues. The Company rents specialized equipment for use with onshore and offshore oil and gas well drilling, completion and workover activities. The drilling and subsequent operation of oil and gas wells generally require a variety of equipment. The equipment needed is in large part determined by the geological features of the production zone and the size of the well itself. As a result, operators and drilling contractors often find it more economical to supplement their tool and tubular inventories with rental items instead of owning a complete inventory. The Company’s facilities are strategically located to serve the major staging points for oil and gas activities in Texas, the Gulf of Mexico, mid-continent region, northeastAppalachian region and the Rocky Mountains.

Patterson Rental Tools offers a broad range of rental tools including:

| Blowout Preventors | Diverters |

| High Pressure Manifolds and Valves | Drill Pipe |

| Hevi-wate Drill Pipe | Drill Collars |

| Tubing | Handling Tools |

| Production Related Rental Tools | Coflexip® Hoses |

| Pumps | Wear KnotTM Drill Pipe |

Oilfield Pipe Inspection Services, Pipe Management and Pipe Storage. Storage. Pipe inspection services include Full Body Electromagnetic and Phased Array Ultrasonic inspection of pipe used in oil and gas wells. These services are provided at both the Company’s inspection facilities and at independent tubular mills in accordance with negotiated sales and/or service contracts. Our customers are major oil companies and steel mills, for which we provide in-house inspection services, inventory management and process control of tubing, casing and drill pipe. Our locations in Channelview, Texas and Morgan City, Louisiana are equipped with large capacity cranes, specially designed forklifts and a computerized inventory system to serve a variety of storage and handling services for both the oilfield and non-oilfield customers.

Well Control School. Well Control School provides industry and government accredited training for the oil and gas industry both in the United States and in limited international locations. Well Control School provides this training in various formats including conventional classroom training, interactive computer training including training delivered over the internet, and mobile simulator training.

Energy Personnel International. Energy Personnel International provides drilling and production engineers, well site supervisors, project management specialists, and workover and completion specialists on a consulting basis to the oil and gas industry to meet customers’ needs for staff engineering and well site management.

Refer to Note 12 in the Notes to the Consolidated Financial Statements for additional financial information on our business segments.

Industry

United States. RPC provides its services to its domestic customers through a network of facilities strategically located to serve oil and gas drilling and production activities of its customers in Texas, the Gulf of Mexico, the mid-continent, the southwest, the Rocky Mountains and the northeast production fields.Appalachian regions. Demand for RPC’s services in the U.S. tends to be extremely volatile and fluctuates with current and projected price levels of oil and natural gas and activity levels in the oil and gas industry. Customer activity levels are influenced by their decisions about capital investment toward the development and production of oil and gas reserves.

Due to aging oilfields and lower-cost sources of oil internationally, the drilling rig count in the U.S. has declined by approximately 6361 percent from its peak in 1981. DueHowever, due to recently enhanced technology, however, more wells are being drilled, and these wells are increasingly productive. For these reasons, the domestic production of oil and natural gas remains roughly equivalenthas risen to prior years. Record low drillingrecord levels, and we estimate that the domestic production of crude oil during 2013 was at its highest level since 1989. Oil and gas industry activity levels were experiencedhave historically been volatile, experiencing multiple cycles, including down cycle troughs in 1986, 1992, 1999 (with April 1999 recording the lowest U.S. drilling rig count in the industry’s history), 2002 and again in 2009.

The rig count during the peak of the most recent prior cycle peakedoccurred at the end of the third quarter of 2008, and began to decline sharply during the fourth quarter of 2008. U.S. domestic drilling activity declined by 57 percent from the third quarter of 2008 to the second quarter of 2009, which was the steepest annualized decline rate in the industry’s history. Between the second quarter of 2009 and the endfourth quarter of 2010,2011, U.S. domestic drilling activity increased by 93129 percent but is 17before declining gradually throughout the remainder of 2011 and 2012. At the end of 2013, the U.S. domestic rig count was approximately 100 percent lowerhigher than the prior cyclical peak intrough recorded during the thirdsecond quarter of 2008. As of a recent date2009.

The fluctuations in 2011, U.S. domestic drilling activity has increased by approximately two percent compared tosince 2008 are consistent with the fourth quarterchanges in the prices of 2010.

oil and natural gas, the overall economic recovery following the recession in 2008 and 2009, and the financial returns from drilling in unconventional shale plays during the past several years. During 20102013 the average price of natural gas increased by approximately 1236 percent and the price of benchmark natural gas liquids was unchanged compared to prior year. The average price of oil increased by approximately 17 percent.four percent during 2013 compared to 2012. The changecurrent sustained high price of oil has increased the attractiveness of drilling for oil in several unconventional basins in the U.S. domestic market. During 2013, oil-directed drilling activity increased slightly, offset by a decrease in natural gas-directed drilling during 2010the year. The price of natural gas liquids has become an increasingly important determinant of our customers’ activity levels, since it is produced in many of the shale resource plays which also produce oil, and production of various natural gas liquids has increased to a level comparable to that of natural gas. The price of benchmark natural gas liquids peaked during the third quarter of 2008, and declined by approximately 69 percent during the third and fourth quarters of 2008. Thereafter, the price of benchmark natural gas liquids climbed steadily until the third quarter of 2011, but declined by 45 percent by the end of 2012. The average price of benchmark natural gas liquids was consistent withunchanged in 2013 compared to 2012, but its price increased by approximately 46 percent between the recoverybeginning and the end of 2013, and early in the pricesfirst quarter of oil and natural gas, as well as2014 increased by approximately 43 percent compared to the improvementaverage price in the overall economy following the financial crisis and recession in 2008 and 2009. Although our business has repeatedly demonstrated that it is cyclical, we continue to believe that the long-term prospects for our business are favorable due to growing global demand for oil and natural gas. In addition, we believe in the long-term growth of our business due to increased need for RPC’s services demanded by current drilling and completion techniques.2013.

SinceFrom 2001 andto 2009, gas drilling rigs represented an increasing percentage of the total drilling rig count, and have represented over 7080 percent of the drilling rig count during these years.count. In 2010, the percentage of drilling rigs drilling for natural gas declined,began to decline, and represented 61by the end of 2013 had fallen to approximately 21 percent of total drilling activity. Although the demand trend for natural gas is continuing to rise,has remained stable, the price of natural gas has remained lowfallen in recent years due to increased domestic reserves and productivity of new wells. In contrast,The price of natural gas rose during 2013 and has risen again early in 2014 to levels not observed since the first quarter of 2010, and the amount of U.S. domestic natural gas in storage was approximately 27 percent below its five-year average. Although the current industry metrics regarding natural gas are favorable, we do not believe that they are sufficient to encourage renewed natural gas-directed drilling because of continued record natural gas production levels and the opinion among our customers that the high price of natural gas is due to unseasonably cold weather in the first quarter of 2014 and will not be sustainable in the near term. Although the price of oil has increased,did not increase significantly during 2013 or early in the first quarter of 2014, it remains high, and producers in the domestic market have started to exploit neware exploiting resource plays that are economical at current high oil prices Theprices. Although natural gas-directed drilling activity has declined to its lowest level in almost 19 years, the long-term demand outlook for natural gas is still favorable because, unlike oil, foreign imports of natural gas do not compete with domestic production to a meaningful degree. This lack of foreign competition tends to keep prices high enough to ensure that domestic drilling and production will continue at certain minimum levels. Based on current demand levels for natural gas as well as the high oil and gas well depletion rates experienced over the past several years, it is anticipatedWe anticipate that gas-directedoil-directed drilling will continue to represent the majority of the total drilling rig count unless the sustained level of demand for natural gas increases significantly due to U.S. exports of natural gas or changes in demand due to increased use of natural gas as a transportation fuel or for other purposes. We continue to believe in the foreseeable future.long-term growth opportunities for our business due to the continued high demand for hydrocarbons generally and the growing production of oil in the domestic U.S. market in particular. Furthermore, we note that the techniques used to extract oil and natural gas in the U.S. domestic market increasingly require the types of services that RPC provides to its customers, so the composition of the U.S. domestic drilling rig count is not as meaningful as the overall level of drilling activity.

In addition, thereThere are certain types of wells being drilled in the U.S. domestic market for which there is a higher demand for RPC’s services. Known as either directional or horizontal wells, these wells are more difficult and costly to complete. These wells are predominantly natural gas wells, although they areThey have become an increasingly being drilled for oil as well.large percentage of the U.S. domestic market, and since the third quarter of 2008, have consistently comprised the majority of U.S. domestic drilling. Because they are drilled through a typically narrow formation and the formation is typically a relatively impermeable formation such as shale, they require additional stimulation when they are completed. Also, many of these formations require high pumping rates of stimulation fluids under high pressures, which in turn means that there isrequires a great deal of pressure pumping horsepower required to complete the well. Furthermore, since they are not drilled in a straight vertical direction from the Earth’s surface, they require tools and drilling mechanisms that are flexible, rather than rigid, and can be steered once they are downhole. Specifically, these types of wells require RPC’s pressure pumping and coiled tubing services, as well as our downhole tools and services.

International.RPC has historically operated in several countries outside of the United States, although international revenues have never accounted for more than 10 percent of total revenues. Over the past several years, RPC has continued its focus on developing international opportunities, although ourRPC’s equipment investments over the last couple ofseveral years have emphasized domestic rather than international expansion.expansion because of higher expected financial returns. International revenues for 2010 increased2013 decreased compared to 2012 due to higherlower customer activity levels in Canada, Columbia,New Zealand and Qatar, among other countries, partially offset by decreases in Mexico, and in the eliminationaggregate accounted for approximately four percent of revenueconsolidated RPC revenues. International revenues in Egypt.2013 compared to 2012 increased in Equatorial Guinea, Gabon, Australia, Argentina and Bolivia. During 2010,2013, RPC provided snubbing, well control and oilfield training services in New Zealand, Qatar, Columbia,several countries including Gabon, Saudi Arabia,Australia and Mexico, among other countries.China. We also provided rental tools in Columbia and Argentina, and downhole motors and tools in Canada, Tunisia, Mexico, the CongoChina, Argentina, Tunisia and Oman. We continue to focus on the selectiveselected development of international opportunities in these and other markets, although we believe that it will continue to be less than 10 percent of total revenues.revenues in 2014.

RPC provides services to its international customers through branch locations or wholly owned foreign subsidiaries. The international market is prone to political uncertainties, including the risk of civil unrest and conflicts. However, due to the significant investment requirement and complexity of international projects, customers’ drilling decisions relating to such projects tend to be evaluated and monitored with a longer-term perspective with regard to oil and natural gas pricing, and therefore have the potential to be more stable than most U.S. domestic operations. Additionally, the international market is dominated by major oil companies and national oil companies which tend to have different objectives and more operating stability than the typical independent oil and gas producer in the U.S. Predicting the timing and duration of contract work is not possible. Pursuing selective international opportunities for revenue growth continues to be a strong emphasis for RPC. Refer to Note 12 in the Notes to Consolidated Financial Statements for further information on our international operations.

Growth Strategies

RPC’s primary objective is to generate excellent long-term returns on investment through the effective and conservative management of its invested capital thus yieldingto generate strong cash flow. This objective continues to be pursued through strategic investments and opportunities designed to enhance the long-term value of RPC while improving market share, product offerings and the profitability of existing businesses. Growth strategies are focused on selected customers and markets in which we believe there exist opportunities for higher growth, customer and market penetration, or enhanced returns achieved through consolidations or through providing proprietary value-added products and services. RPC intends to focus on specific market segments in which it believes that it has a competitive advantage and on potential large customers who have a long-term need for our services in markets in which we operate.

RPC seeks to expand its service capabilities through a combination of internal growth, acquisitions, joint ventures and strategic alliances. Because of the fragmented nature of the oil and gas services industry, RPC believes a number of attractive acquisition opportunities exist. However, currentthe favorable long-term outlook for our industry and the strong business conditions havehistorical profitability of many potential acquisitions has encouraged potential sellers of businesses to expect high pricesvaluations for their businesses. Due to these high valuations and the potential difficulty of integrating acquired businesses sointo our existing operations, we believe we generate better returns on investments growing organically in service lines and geographic locations in which we have experience and presence. We will continue to be selective in pursuing growth through acquisitions of existing businesses.

RPC has a revolving credit facility to fund the purchase of revenue-producing equipment and other working capital requirements. During the third quarter of 2010, we renewed ourIn January 2014, this facility to fund our ongoing capital needs.was extended for five years. We have pursued this capital source because of the high returns on investment that have been generated by many of our service lines during the previous several years, and because of the low cost and ready availability of debt capital. During 2009 we reduced capital expenditures due to the industry downturn2011 and the resulting lowerfirst two quarters of 2012, we purchased additional revenue-producing equipment to support high industry activity levels. Our scheduled purchases of equipment declined during the third and fourth quarters of 2012 and during 2013 as pricing for our services became increasingly competitive, and the anticipated near-term expectedfinancial returns on investment. However, we increased our purchasesof a larger fleet of revenue-producing equipment in 2010also declined. The outstanding balance on our credit facility at the end of 2013 was lower than at the end of the prior year due to support new and projected significant customer agreements. In spite of increaseda reduction in capital expenditures and working capital, requirements during 2010, at the end of the yearand our levelratio of debt wasto total capitalization continues to be conservative compared to a number of our peers. Furthermore, we believe that the favorable long-term returns on investment in our revenue-producing equipment justify financing their purchase using debt.

Customers

Demand for RPC’s services and products depends primarily upon the number of oil and natural gas wells being drilled, the depth and drilling conditions of such wells, the number of well completions and the level of production enhancement activity worldwide. RPC’s principal customers consist of major and independent oil and natural gas producing companies. During 2010,2013, RPC provided oilfield services to several hundred customers. Of these customers, only one, Chesapeake Energy Corporation at approximately 15 percentnone of revenues,which accounted for more than 10 percent of revenues. RPC believes that its relationship with this customer is good. Although the Company believes that we would be able to obtain other customers for our services in the event of the loss of this major customer, the loss of this customer could have a material adverse effect on Company revenues and operating results in the near term.

Sales are generated by RPC’s sales force and through referrals from existing customers. During 2010Over the past three years we have from time to time entered into several agreements, with terms beyond one year, to provide services to certain domestic customers. These agreements represent a growing percentage of our revenues, and weWe monitor closely the financial condition of these customers, their capital expenditure plans, and other indications of their drilling and completion activities. Due to the short lead time between ordering services or equipment and providing services or delivering equipment, there is no significant sales backlog in most of our service lines.

Competition

RPC operates in highly competitive areas of the oilfield services industry. RPC’sOur products and services are sold in highly competitive markets, and itsthe revenues and earnings generated are affected by changes in prices for our services, fluctuations in the level of customer activity in major markets, general economic conditions and governmental regulation. RPC competes with many large and small oilfield industry competitors, including the largest integrated oilfield services companies. Strong oilfield activity during the past several years and the availability of capital have encouraged several new, smaller companies to seek debt and equity capital and accelerate their growth rates. The presence of these new competitors has increased competitive pricing pressures as domestic oilfield activity moderated during the third and fourth quarters of 2011 and throughout 2012 and 2013. Although the growth in the overall domestic fleet of revenue-producing equipment has moderated, pricing for our services remains competitive. RPC believes that the principal competitive factors in the market areas that it serves are product availability and quality of our equipment and raw materials used to provide our services, service quality, and availability, reputation for safety and technical proficiency, and price.

The oil and gas services industry includes a small number of dominant global competitors including, among others, Halliburton Energy Services Group, a division of Halliburton Company, Baker Hughes and Schlumberger Ltd., and a significant number of locally oriented businesses.

Facilities/Equipment

RPC’s equipment consists primarily of oil and gas services equipment used either in servicing customer wells or provided on a rental basis for customer use. Substantially all of this equipment is Company owned. RPC purchases oilfield service equipment from a limited number of manufacturers. These manufacturers of our oilfield service equipment may not be able to meet our requests for timely delivery during periods of high demand which may result in delayed deliveries of equipment and higher prices for equipment.

RPC both owns and leases regional and district facilities from which its oilfield services are provided to land-based and offshore customers. RPC’s principal executive offices in Atlanta, Georgia are leased. The Company ownshas two primary administrative buildings, one it leases in Houston,The Woodlands, Texas that includes the Company’s operations, engineering, sales and marketing headquarters, and one it owns in Houma, Louisiana that includes certain administrative functions. RPC believes that its facilities are adequate for its current operations. For additional information with respect to RPC’s lease commitments, see Note 9 of the Notes to Consolidated Financial Statements.

Governmental Regulation

RPC’s business is affected by state, federal and foreign laws and other regulations relating to the oil and gas industry, as well as laws and regulations relating to worker safety and environmental protection. RPC cannot predict the level of enforcement of existing laws and regulations or how such laws and regulations may be interpreted by enforcement agencies or court rulings, whether additional laws and regulations will be adopted, or the effect such changes may have on it, its businesses or financial condition.

In addition, our customers are affected by laws and regulations relating to the exploration for and production of natural resources such as oil and natural gas. These regulations are subject to change, and new regulations may curtail or eliminate our customers’ activities in certain areas where we currently operate. We cannot determine the extent to which new legislation may impact our customers’ activity levels, and ultimately, the demand for our services.

Intellectual Property

RPC uses several patented items in its operations, which management believes are important but are not indispensable to RPC’s success. Although RPC anticipates seeking patent protection when possible, it relies to a greater extent on the technical expertise and know-how of its personnel to maintain its competitive position.

Availability of Filings

RPC makes available, free of charge, on its website, www.rpc.net, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports on the same day as they are filed with the Securities and Exchange Commission.

Item 1A. Risk Factors

Demand for our products and services is affected by the volatility of oil and natural gas prices.

Oil and natural gas prices affect demand throughout the oil and gas industry, including the demand for our products and services. Our business depends in large part on the conditions of the oil and gas industry, and specifically on the capital investments of our customers related to the exploration and production of oil and natural gas. When these capital investments decline, our customers’ demand for our services declines.

Although the production sector of the oil and gas industry is less immediately affected by changing prices, and, as a result, less volatile than the exploration sector, producers react to declining oil and gas prices by curtailing capital spending, which would adversely affect our business. A prolonged low level of customer activity in the oil and gas industry will adversely affect the demand for our products and services and our financial condition and results of operations.

The relationship between the prices of oil and natural gas and our customers’ drilling and production activities may not be highly correlated in the future.

Historically, fluctuations in the prices of oil and natural gas have led to corresponding changes in our customers’ drilling and production activities as measured by the domestic rig count. As drilling and production activities increase (or remain active) or decrease (or remain stagnant), our operating results are correspondingly favorably or adversely impacted. If this correlation weakens in the future, then it is possible that increases in the prices of oil and natural gas will not lead to corresponding increases in our customers’ activities, and our future operating results could be negatively impacted.

We may be unable to compete in the highly competitive oil and gas industry in the future.

We operate in highly competitive areas of the oilfield services industry. The products and services in our industry segments are sold in highly competitive markets, and our revenues and earnings have in the past been affected by changes in competitive prices, fluctuations in the level of activity in major markets and general economic conditions. We compete with the oil and gas industry’s many large and small industry competitors, including the largest integrated oilfield service providers. We believe that the principal competitive factors in the market areas that we serve are product and service quality and availability, reputation for safety, technical proficiency and price. Although we believe that our reputation for safety and quality service is good, we cannot assure you that we will be able to maintain our competitive position.

We may be unable to identify or complete acquisitions.

Acquisitions have been and may continue to be a key element of our business strategy. We cannot assure you that we will be able to identify and acquire acceptable acquisition candidates on terms favorable to us in the future. We may be required to incur substantial indebtedness to finance future acquisitions and also may issue equity securities in connection with such acquisitions. The issuance of additional equity securities could result in significant dilution to our stockholders. We cannot assure you that we will be able to integrate successfully the operations and assets of any acquired business with our own business. Any inability on our part to integrate and manage the growth from acquired businesses could have a material adverse effect on our results of operations and financial condition.

Our operations are affected by adverse weather conditions.

Our operations are directly affected by the weather conditions in several domestic regions, including the Gulf of Mexico, the Gulf Coast, the mid-continent, the Rocky Mountains and the Northeast.Appalachian region. Hurricanes and other storms prevalent in the Gulf of Mexico and along the Gulf Coast during certain times of the year may also affect our operations, and severe hurricanes may affect our customers’ activities for a period of several years. While the impact of these storms may increase the need for certain of our services over a longer period of time, such storms can also decrease our customers’ activities immediately after they occur. Such hurricanes may also affect the prices of oil and natural gas by disrupting supplies in the short term, which may increase demand for our services in geographic areas not damaged by the storms. Prolonged rain, snow or ice in many of our locations may temporarily prevent our crews and equipment from reaching customer work sites. Due to seasonal differences in weather patterns, our crews may operate more days in some periods than others. Accordingly, our operating results may vary from quarter to quarter, depending on the impact of these weather conditions.

Our ability to attract and retain skilled workers may impact growth potential and profitability.

Our ability to be productive and profitable will depend substantially on our ability to attract and retain skilled workers. Our ability to expand our operations is, in part, impacted by our ability to increase our labor force. A significant increase in the wages paid by competing employers could result in a reduction in our skilled labor force, increases in the wage rates paid by us, or both. If either of these events occurred, our capacity and profitability could be diminished, and our growth potential could be impaired.

Our concentration of customers in one industry may impact our overall exposure to credit risk.

Substantially all of our customers operate in the energy industry. This concentration of customers in one industry may impact our overall exposure to credit risk, either positively or negatively, in that customers may be similarly affected by changes in economic and industry conditions. We perform ongoing credit evaluations of our customers and do not generally require collateral in support of our trade receivables.

Reliance upon a large customer may adversely affect our revenues and operating results.

During 2010,At times our business has had a concentration of one or more major customers. In 2013 and 2012, none of our customers exceeded 10 percent of our total revenues, while in 2011, one of our largest customers accounted for approximately 1512 percent of our total revenues. This relianceIn addition, no customer accounted for more than ten percent of accounts receivable as of December 31, 2013 and 2012. Reliance on a large customer for a significant portion of our total revenues exposescould expose us to the risk that the loss or reduction in revenues from this customer, which could occur unexpectedly, could have a material and disproportionate adverse impact upon our revenues and operating results.

Our business has potential liability for litigation, personal injury and property damage claims assessments.

RPC’s subsidiaries have a number of agreements of various types in place with our customers. In general, these agreements indemnify RPC and its subsidiaries against damage or liabilities that arise from the actions of our employees or the operation of our equipment. The provisions in these agreements do not make a distinction among the types of services that RPC provides or the location of the work. These agreements also require that RPC maintain a certain level and type of insurance coverage against any claims that are determined to be our responsibility. RPC has insurance coverage in place with several well-capitalized insurance companies for accidental environmental claims.

Our operations involve the use of heavy equipment and exposure to inherent risks, including blowouts, explosions and fires. If any of these events were to occur, it could result in liability for personal injury and property damage, pollution or other environmental hazards or loss of production. Litigation may arise from a catastrophic occurrence at a location where our equipment and services are used. This litigation could result in large claims for damages. The frequency and severity of such incidents will affect our operating costs, insurability and relationships with customers, employees and regulators. These occurrences could have a material adverse effect on us. We maintain what we believe is prudent insurance protection. We cannot assure you that we will be able to maintain adequate insurance in the future at rates we consider reasonable or that our insurance coverage will be adequate to cover future claims and assessments that may arise.

Our operations may be adversely affected if we are unable to comply with regulatoryregulations and environmental laws.

Our business is significantly affected by stringent environmental laws and other regulations relating to the oil and gas industry and by changes in such laws and the level of enforcement of such laws. We are unable to predict the level of enforcement of existing laws and regulations, how such laws and regulations may be interpreted by enforcement agencies or court rulings, or whether additional laws and regulations will be adopted. The adoption of laws and regulations curtailing exploration and development of oil and gas fields in our areas of operations for economic, environmental or other policy reasons would adversely affect our operations by limiting demand for our services. We also have potential environmental liabilities with respect to our offshore and onshore operations, and could be liable for cleanup costs, or environmental and natural resource damage due to conduct that was lawful at the time it occurred, but is later ruled to be unlawful. We also may be subject to claims for personal injury and property damage due to the generation of hazardous substances in connection with our operations. We believe that our present operations substantially comply with applicable federal and state pollution control and environmental protection laws and regulations. We also believe that compliance with such laws has had no material adverse effect on our operations to date. However, such environmental laws are changed frequently. We are unable to predict whether environmental laws will, in the future, materially adversely affect our operations and financial condition. Penalties for noncompliance with these laws may include cancellation of permits, fines, and other corrective actions, which would negatively affect our future financial results.

Compliance with federal and state regulations relating to hydraulic fracturing and designation of economic development zones related to natural gas-directed drilling from shale formations could increase our operating costs, cause operational delays, and could reduce or eliminate the demand for our pressure pumping services.

RPC’s pressure pumping services are the subject of continuing federal, state and local regulatory oversight. This scrutiny is prompted in part by public concern regarding the potential impact on drinking and ground water and other environmental issues arising from the growing use of hydraulic fracturing. Among these regulatory entities is the White House Council on Environmental Quality, which is coordinating a review of hydraulic fracturing practices. In addition, a committee of the United States House of Representatives has investigated hydraulic fracturing practices and publicized information regarding the materials used in hydraulic fracturing. The U.S. Environmental Protection Agency has also undertaken a study of the environmental impact of hydraulic fracturing practices, and is expected to issue its findings in 2014. One of the results of this scrutiny has been to require disclosure of materials used in hydraulic fracturing on certain public lands. RPC participates in this disclosure process and has cooperated fully with all governmental requests for information regarding our operations. In addition, during the first quarter of 2014, the federal government proposed that specific geographic areas in which natural gas-directed drilling and production from shale formations be set aside as economic development zones. Such designations, if they arise in geographic areas in which RPC conducts its operations, may increase demand for our customers’ natural gas production, thus increasing demand for RPC’s services. Such designations may also increase our operating costs due to the cost of compliance with increased regulation as well as subsidies paid by firms engaged in natural gas-directed drilling to other industries which establish operations in these economic development zones. We are unable to predict whether the scrutiny of RPC’s pressure pumping business and any resulting regulatory change will impact our business through increased operational costs, operational delays, or a reduction in demand for hydraulic fracturing services. Also, we are unable to predict the magnitude and timing of the impact on our operations and operational costs, if any, of the creation of economic development zones in geographic areas in which natural gas-directed drilling and production from shale formations take place.

Our international operations could have a material adverse effect on our business.

Our operations in various countries including, but not limited to, Africa, Canada, China, Eastern Europe, Latin America, the Middle East and New Zealand are subject to risks. These risks include, but are not limited to, political changes, expropriation, currency restrictions and changes in currency exchange rates, taxes, boycotts and other civil disturbances. The occurrence of any one of these events could have a material adverse effect on our operations.

Our common stock price has been volatile.

Historically, the market price of common stock of companies engaged in the oil and gas services industry has been highly volatile. Likewise, the market price of our common stock has varied significantly in the past.

Our management has a substantial ownership interest, and public stockholders may have no effective voice in the management of the Company.

The Company has elected the “Controlled Corporation” exemption under RuleSection 303A of the New York Stock Exchange (“NYSE”) Listed Company Guide.Manual. The Company is a “Controlled Corporation” because a group that includes the Company’s Chairman of the Board, R. Randall Rollins and his brother, Gary W. Rollins, who is also a director of the Company, and certain companies under their control, controls in excess of fifty percent of the Company’s voting power. As a “Controlled Corporation,” the Company need not comply with certain NYSE rules including those requiring a majority of independent directors.

RPC’s executive officers, directors and their affiliates hold directly or through indirect beneficial ownership, in the aggregate, approximately 7172 percent of RPC’s outstanding shares of common stock. As a result, these stockholders effectively control the operations of RPC, including the election of directors and approval of significant corporate transactions such as acquisitions and other matters requiring stockholder approval. This concentration of ownership could also have the effect of delaying or preventing a third party from acquiring control over the Company at a premium.

Our management has a substantial ownership interest, and the availability of the Company’s common stock to the investing public may be limited.

The availability of RPC’s common stock to the investing public may be limited to those shares not held by the executive officers, directors and their affiliates, which could negatively impact RPC’s stock trading prices and affect the ability of minority stockholders to sell their shares. Future sales by executive officers, directors and their affiliates of all or a portion of their shares could also negatively affect the trading price of our common stock.

Provisions in RPC’s Certificatecertificate of Incorporationincorporation and Bylawsbylaws may inhibit a takeover of RPC.

RPC’s certificate of incorporation, bylaws and other documents contain provisions including advance notice requirements for stockholder proposals and staggered terms for the Board of Directors. These provisions may make a tender offer, change in control or takeover attempt that is opposed by RPC’s Board of Directors more difficult or expensive.

Some of our equipment and several types of materials used in providing our services are available from a limited number of suppliers.

We purchase equipment provided by a limited number of manufacturers who specialize in oilfield service equipment. During periods of high demand, these manufacturers may not be able to meet our requests for timely delivery, resulting in delayed deliveries of equipment and higher prices for equipment. There are a limited number of suppliers for certain materials used in pressure pumping services, our largest service line. While these materials are generally available, supply disruptions can occur due to factors beyond our control. Such disruptions, delayed deliveries, and higher prices can limit our ability to provide services, or increase the costs of providing services, thus reducing our revenues and profits.

We have used outside financing to accomplish our growth strategy, and outside financing may become unavailable or may be unfavorable to us.

Our business requires a great deal of capital in order to maintain our equipment and increase our fleet of equipment to expand our operations, and we have access to our $350 million credit facility to fund our necessary working capital and equipment requirements. Most of our existing credit facility bears interest at a floating rate, which exposes us to market risks as interest rates rise. If our existing capital resources become unavailable, inadequate or unfavorable for purposes of funding our capital requirements, we would need to raise additional funds through alternative debt or equity financings to maintain our equipment and continue our growth. Such additional financing sources may not be available when we need them, or may not be available on favorable terms. If we fund our growth through the issuance of public equity, the holdings of stockholders will be diluted. If capital generated either by cash provided by operating activities or outside financing is not available or sufficient for our needs, we may be unable to maintain our equipment, expand our fleet of equipment, or take advantage of other potentially profitable business opportunities, which could reduce our future revenues and profits.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

RPC owns or leases approximately 100120 offices and operating facilities. The Company leases approximately 17,25018,600 square feet of office space in Atlanta, Georgia that serves as its headquarters, a portion of which is allocated and charged to Marine Products Corporation. See “Related Party Transactions” contained in Item 7. The lease agreement on the headquarters is effective through October 2013.2020. RPC believes its current operating facilities are suitable and adequate to meet current and reasonably anticipated future needs. Descriptions of the major facilities used in our operations are as follows:

Owned Locations

Broussard, Louisiana — Operations, sales and equipment storage yards

Vilonia, Arkansas — Maintenance and rebuild facilities

Elk City, Oklahoma — Operations, sales and equipment storage yards

Houma, Louisiana — Administrative office

Houston, Texas — Pipe storage terminal and inspection sheds

Houston,Kilgore, Texas — Operations, sales and administrative officeequipment storage yards

Elk City, OklahomaOdessa, Texas — Operations, sales and equipment storage yards

Rock Springs, Wyoming — Operations, sales and equipment storage yards

Lafayette, LouisianaVernal, Utah — Operations, sales and equipment storage yards

Conway, ArkansasWilliston, North Dakota — Operations, sales and equipment storage yards

Kilgore, TexasLeased Locations

Canton, Pennsylvania — Pumping services facility

Leased Locations

Seminole, OklahomaHobbs, New Mexico — Pumping services facility

Odessa, Texas — Operations, sales and equipment storage yards

Oklahoma City, Oklahoma — Operations, sales and administrative office

Houston, Texas — Operations, sales and administrative office

Odessa,San Antonio, Texas — Operations, sales and equipment storage yards

Seminole, Oklahoma — Pumping services facility

The Woodlands, Texas — Operations, sales and administrative office

Washington, Pennsylvania — Operations, sales and equipment storage yards

Item 3. Legal Proceedings

RPC is a party to various routine legal proceedings primarily involving commercial claims, workers’ compensation claims and claims for personal injury. RPC insures against these risks to the extent deemed prudent by its management, but no assurance can be given that the nature and amount of such insurance will, in every case, fully indemnify RPC against liabilities arising out of pending and future legal proceedings related to its business activities. While the outcome of these lawsuits, legal proceedings and claims cannot be predicted with certainty, management believes that the outcome of all such proceedings, even if determined adversely, would not have a material adverse effect on RPC’s business or financial condition.

Item 4. Mine Safety Disclosures

The information required by Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 4. Reserved104 of Regulation S-K is included in Exhibit 95.1 to this Form 10-K.

Item 4A. Executive Officers of the Registrant

Each of the executive officers of RPC was elected by the Board of Directors to serve until the Board of Directors’ meeting immediately following the next annual meeting of stockholders or until his or her earlier removal by the Board of Directors or his or her resignation. The following table lists the executive officers of RPC and their ages, offices, and terms of office with RPC.

Name and Office with Registrant | Age | Date First Elected to Present Office |

| R. Randall Rollins (1) | 7982 | 1/24/84 |

| | | |

| Chairman of the Board | | |

| | |

| Richard A. Hubbell (2) | 6669 | 4/22/03 |

| | |

President and Chief Executive Officer | | |

| | |

| Linda H. Graham (3) | 7477 | 1/27/87 |

| | |

Vice President and Secretary | | |

| | |

| Ben M. Palmer (4) | 5053 | 7/8/96 |

| | |

Vice President, Chief Financial Officer and Treasurer | | |

| (1) | R. Randall Rollins began working for Rollins, Inc. (consumer services) in 1949. Mr. Rollins has served as Chairman of the Board of RPC since the spin-off of RPC from Rollins, Inc. in 1984. He has served as Chairman of the Board of Marine Products Corporation (boat manufacturing) since it was spun off from RPC in 2001 and Chairman of the Board of Rollins, Inc. since October 1991. He is also a director of Dover Downs Gaming and Entertainment, Inc. and Dover Motorsports, Inc. |

| (2) | Richard A. Hubbell has been the President of RPC since 1987 and Chief Executive Officer since 2003. He has also been the President and Chief Executive Officer of Marine Products Corporation since it was spun off from RPC in February 2001. Mr. Hubbell serves on the Board of Directors forof both of these companies. |

| (3) | Linda H. Graham has been the Vice President and Secretary of RPC since 1987. She has also been the Vice President and Secretary of Marine Products Corporation since it was spun off from RPC in 2001. Ms. Graham serves on the Board of Directors forof both of these companies. |

| (4) | Ben M. Palmer has been the Vice President, Chief Financial Officer and Treasurer of RPC since 1996. He has also been the Vice President, Chief Financial Officer and Treasurer of Marine Products Corporation since it was spun off from RPC in 2001. |

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

RPC’s common stock is listed for trading on the New York Stock Exchange under the symbol RES. On October 26, 2010 RPC’s BoardAs of Directors declared a three-for-two stock split of the Company’s common shares. The additional shares were distributed on December 10, 2010 to stockholders of record on November 10, 2010. All share, earnings per share, and dividends per share data presented throughout this document have been adjusted to reflect this stock split. At February 18, 201114, 2014 there were 147,964,000219,289,400 shares of common stock outstanding and approximately 7,80022,300 beneficial holders of our common stock. The following table sets forth the high and low prices of RPC’s common stock and dividends paid for each quarter in the years ended December 31, 20102013 and 2009:2012:

| | | 2010 | | | 2009 | | | 2013 | | | 2012 | |

| Quarter | | High | | | Low | | | Dividends | | | High | | | Low | | | Dividends | | | High | | | Low | | | Dividends | | | High | | | Low | | | Dividends | |

| First | | $ | 9.00 | | | $ | 7.07 | | | $ | 0.027 | | | $ | 7.63 | | | $ | 3.45 | | | $ | 0.047 | | | $ | 17.40 | | | $ | 12.46 | | | $ | 0.10 | | | $ | 14.03 | | | $ | 9.31 | | | $ | 0.08 | |

| Second | | | 10.00 | | | | 6.61 | | | | 0.027 | | | | 7.98 | | | | 4.29 | | | | 0.047 | | | | 15.55 | | | | 12.41 | | | | 0.10 | | | | 11.95 | | | | 8.75 | | | | 0.08 | |

| Third | | | 14.47 | | | | 8.69 | | | | 0.040 | | | | 7.29 | | | | 4.73 | | | | 0.027 | | | | 15.94 | | | | 13.48 | | | | 0.10 | | | | 14.64 | | | | 11.04 | | | | 0.08 | |

| Fourth | | | 22.53 | | | | 13.64 | | | | 0.047 | | | | 7.57 | | | | 6.10 | | | | 0.027 | | | | 18.88 | | | | 15.34 | | | | 0.10 | | | | 12.70 | | | | 10.45 | | | | 0.28 | |

On January 26, 2011, the28, 2014 RPC’s Board of Directors approved a $0.07$0.105 per share cash dividend, payable March 10, 20112014 to stockholders of record at the close of business on February 10, 2011.2014. The Company expects to continue to pay cash dividends to the common stockholders, subject to the earnings and financial condition of the Company and other relevant factors.

Issuer Purchases of Equity Securities

SharesThe Company has a stock buyback program initially adopted in 1993 that authorizes the repurchase of up to 26,578,125 shares. On June 5, 2013, the Board of Directors authorized an additional 5,000,000 shares for repurchase under this program. There were no shares repurchased inas part of this program during the fourth quarter of 20102013. As of December 31, 2013, there are outlined below.

| Period | | Total Number of Shares (or Units) Purchased | | | | | | Average Price Paid Per Share (or Unit) | | | Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs | | | Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs | |

| | | | | | | | | | | | | | | | |

| October 1, 2010 to October 31, 2010 | | | - | | | | | | $ | - | | | | - | | | | 4,210,898 | |

| | | | | | | | | | | | | | | | | | | | |

| November 1, 2010 to November 30, 2010 | | | - | | | | | | | - | | | | - | | | | 4,210,898 | |

| | | | | | | | | | | | | | | | | | | | |

| December 1, 2010 to December 31, 2010 | | | 2,700 | | | (1) | | | | 14.03 | | | | - | | | | 4,210,898 | |

| | | | | | | | | | | | | | | | | | | | | |

| Totals | | | 2,700 | | | | | | | $ | 14.03 | | | | - | | | | 4,210,898 | |

| (1) | Consists of shares repurchased by the Company in connection with option exercises. |

The Company’s Board of Directors announced a stock buyback program in March 1998 authorizing4,712,234 shares available to be repurchased under the repurchase of 17,718,750 shares in the open market.current authorization. Currently the program does not have a predetermined expiration date.

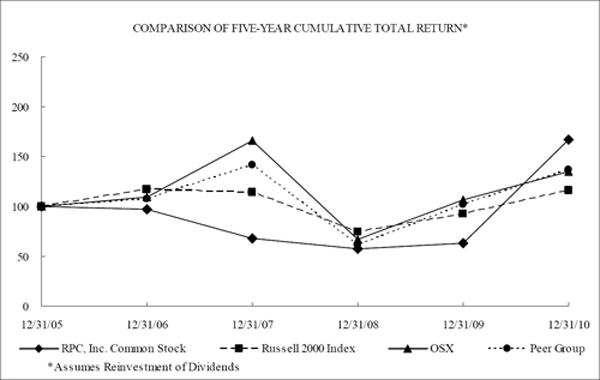

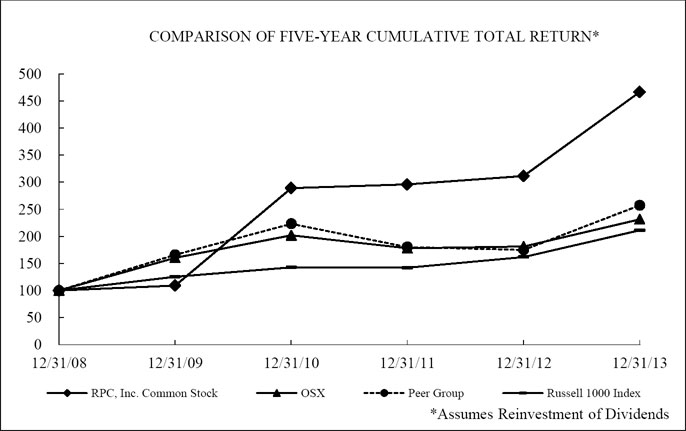

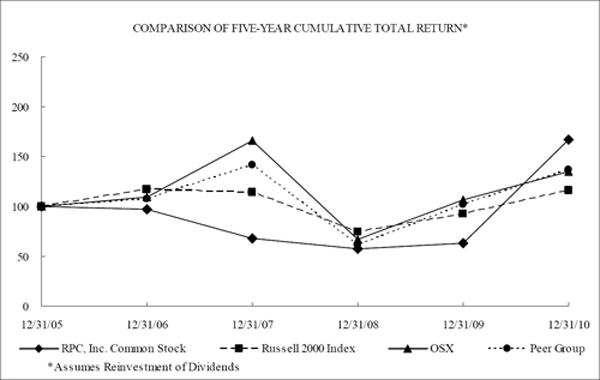

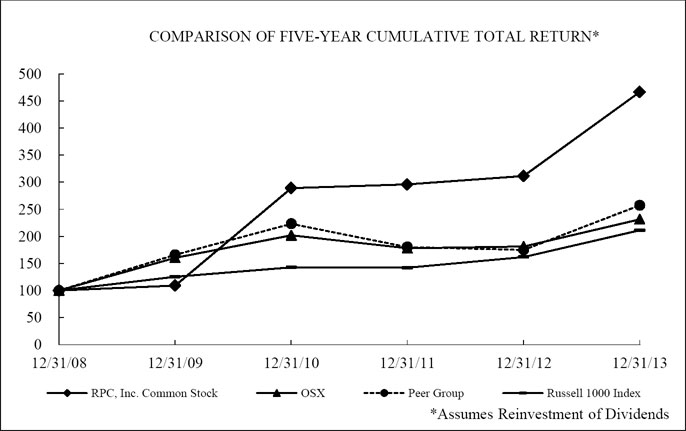

Performance Graph

The following graph shows a five yearfive-year comparison of the cumulative total stockholder return based on the performance of the stock of the Company, assuming dividend reinvestment, as compared with both a broad equity market index and an industry or peer group index. The indices included in the following graph are the Russell 20001000 Index (“Russell 2000”1000”), the Philadelphia Stock Exchange’s Oil Service Index (“OSX”), and a peer group which includes companies that are considered peers of the Company as discussed below (the “Peer Group”). The Company has voluntarily chosen to provide both an industry and a peer group index.