UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20042006

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-30975

TRANSGENOMIC, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 91-1789357 | |

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification Number) |

12325 Emmet Street Omaha, NE 68164 | 68164 | ||

| (Address of Principal Executive Offices) | (Zip Code) | ||

(402) 452-5400

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange On Which Registered | |

None | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.01 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes No X

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x X No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form10-K x X

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer (as definedor a non-accelerate filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Act). YesExchange Act.

Large Accelerated Filer ¨ NoAccelerated Filer ¨ Non-Accelerated Filer x

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2).

Yes No X

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant based on the last reported closing price per share of Common Stock as reported on The Nasdaq NationalGlobal Market on the last business day of the registrant’s most recently completed second fiscal quarter was approximately $38.4$22.63 million.

As of April 14, 2005,At March 30, 2007, the registrant had 34,238,97049,189,672 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant Proxy Statement relating to its 2007 Annual Meeting of Stockholders (the “Proxy Statement”) have been incorporated into Part III of this Report on Form 10-K.

Explanatory NoteTRANSGENOMIC, INC.

Transgenomic, Inc (the “Company”) is amending its annual report onIndex to Form 10-K for the year endedFiscal Year Ended December 31, 2004 (“Form 10-K”) to include the information required by Part III of the Form 10-K. The Company filed its Form 10-K on April 15, 2005, which indicated that it would incorporate many sections of Part III by reference to the Company’s definitive proxy statement. At this time, the Company no longer expects to be able to file its definitive proxy statement within the applicable time frame required for incorporating by reference information into the Company’s Form 10-K. Therefore, the Company is filing this amended Form 10-K/A to include such information and to remove references to the proxy statement. Except as indicated, the Company has made no other changes to its annual report on Form 10-K for the year ended December 31, 2004.

Part III2006

Item 10. Directors and Executive Officers of the Registrant.

Directors

The following table sets forth information about our directors, including the nominees who are to be voted on at our annual meeting. There are no arrangements or understandings pursuant to which either nominee was selected. The Board of Directors has determined that Messrs. Saxena, Sloma, Sklar and Santoni are independent directors of the Company under the listing standards adopted by the Nasdaq Stock Market. All directors have held the positions with the companies (or their predecessors) set forth under “Principal Occupation” for at least five years, unless otherwise indicated.

Name | Age | Principal Occupation | Director Since | Term To Expire | ||||

| NOMINEES | ||||||||

| Gregory T. Sloma | 53 | Executive Vice President and Chief Financial Officer of SpeedNet Services, Inc.(1) | 2004 | 2005 | ||||

| Jeffrey L. Sklar, M.D., Ph.D. | 57 | Professor of Pathology, Yale University School of Medicine(2) | 1997 | 2005 | ||||

| DIRECTORS CONTINUING IN OFFICE | ||||||||

| Gregory J. Duman | 49 | President of Prism Technologies LLC(3) | 2000 | 2006 | ||||

| Roland J. Santoni | 63 | Vice President of West Development, Inc.(4) | 2000 | 2006 | ||||

| Collin J. D’Silva | 48 | President and Chief Executive Officer of the Company(5) | 1997 | 2007 | ||||

| Parag Saxena | 49 | Chief Executive Officer of INVESCO Private Capital, Inc. | 1999 | 2007 | ||||

The Board of Directors has established and assigned certain responsibilities to an Audit Committee and a Compensation Committee. We do not have a standing nominating committee. The Board determined that due to the relatively small size of the Board, and due to the policy on director nominations, which is described below, it was not necessary to form a separate committee to evaluate director nominations. Under the director nomination policy, director candidates are identified primarily through suggestions made by directors, management and stockholders of the Company. We have implemented no material changes to the procedures by which shareholders may recommend nominees for the Board of Directors. The Board of Directors will consider director nominees

recommended by stockholders that are submitted in writing to the Secretary of the Company in a timely manner and which provide necessary biographical and business experience information regarding the nominee. All candidates for director will be evaluated based on their independence, character, judgment, diversity of experience, financial or business acumen, ability to represent and act on behalf of all shareholders, and the needs of the Board. In general, the Board expects to nominate incumbent directors who express an interest in continuing to serve on the Board. The independent directors of the Company review and consider all candidates to serve as a director of the Company who are properly suggested by directors, management and stockholders of the Company, and that the Board of Directors will select its nominees to serve as a director of the Company from among those candidates who are recommended to the Board of Directors by a majority of the independent directors of the Company.

Audit Committee. The Audit Committee’s primary duties and responsibilities include monitoring the integrity of our financial statements, monitoring the independence and performance of our external auditors, and monitoring our compliance with applicable legal and regulatory requirements. The functions of the Audit Committee also include reviewing periodically with independent auditors the performance of the services for which they are engaged, including reviewing the scope of the annual audit and its results, reviewing with management and the auditors the adequacy of our internal accounting controls, reviewing with management and the auditors the financial results prior to the filing of quarterly and annual reports, and reviewing fees charged by our independent auditors. Our independent auditors report directly and are accountable solely to the Audit Committee. The Audit Committee has the sole authority to hire and fire the independent auditors and is responsible for the oversight of the performance of their duties, including ensuring the independence of the independent auditors. The Audit Committee also approves in advance the retention of, and all fees to be paid to, the independent auditors. The rendering of any auditing services and all non-auditing services by the independent auditors is subject to the approval in advance of the Audit Committee. The Audit Committee operates under a written charter which is available on our website at www.transgenomic.com. The Audit Committee is required to be composed of directors who are independent of the Company under the rules of the Securities and Exchange Commission and under the listing standards of the Nasdaq Stock Market. The current members of the Audit Committee are directors Santoni, Saxena and Sloma. The Board of Directors has determined that Mr. Sloma qualifies as an “audit committee financial expert” under the rules of the Securities and Exchange Commission.

Compensation Committee.The Compensation Committee reviews and approves our compensation policy, changes in salary levels and bonus payments to our executive officers and other management and determines the timing and terms of awards made pursuant to our stock option plan. The Compensation Committee currently consists of directors Sklar, Santoni and Saxena, each of whom has been determined by the Board of Directors to be independent under the listing standards of the Nasdaq Stock Market.

Executive Officers.

Our executive officers are appointed annually by the Board of Directors at the first meeting following the annual stockholder’s meeting. Other officers are appointed by the Board of Directors from time to time. Each officer holds office until a successor has been duly appointed and qualified or until the death, resignation or removal of such officer.

Our officers and their ages as of December 31, 2004 are listed below followed by a brief biography.

This Annual Report on Form 10-K references the following registered trademarks which are the property of Transgenomic: DNASEP® Columns, WAVE® System, WAVEMAKER® Software, TRANSFORMING THE WORLD® for Laboratory Equipment, TRANSGENOMIC® and the Globe Logo®; MutationDiscovery.com® Website, OLIGOSEP® for Systems and Reagents, OPTIMASE® Polymerase, RNASEP® Columns, SURVEYOR® WAVE OPTIMIZED® reagents, and WAVE® MD Systems. Additionally, this Annual Report on Form 10-K references the following trademarks which are the property of Transgenomic: MitoScreen™ Kits, ProtocolWriter™ Software, Navigator™ Software, THE POWER OF DISCOVERY™ for Lab Reagents and Educational Programs, and Surveyor™ Nuclease. All other trademarks or trade names referred to in this Annual Report on Form 10-K are the property of their respective owners.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains or incorporates by reference certain forward-looking statements. Many of these forward-looking statements refer to our plans, objectives, expectations and intentions, as well as our future financial results and are subject to risk and uncertainty. You can identify these forward-looking statements by words such as “expects,” “anticipates,” “intends,” “plans,” “may,” “will,” “believes,” “seeks,” “estimates” and similar expressions. Because these forward-looking statements involve risks and uncertainties, there are many factors that could cause our actual results to differ materially from those expressed or implied by these forward-looking statements, including those discussed under “Risks Related to Our Business” and other factors identified by cautionary language used elsewhere in the Annual Report on Form 10-K.

Business |

Transgenomic, Inc. (the “Company”) provides innovative products for the synthesis, purification and analysis of nucleic acids used in the life sciences industry for research focused on molecular genetics and diagnostics. We also provide genetic variation analytical services to the medical research, clinical and pharmaceutical markets. Net sales are categorized as bioinstruments, bioconsumables and discovery services.

· | Bioinstruments. Our flagship product is the WAVE System which has broad applicability to genetic variation detection in both molecular genetic research and molecular diagnostics. There is a world-wide installed base of over 1,350 WAVE Systems as of December 31, 2006. We also distribute bioinstruments produced by other manufacturers through our sales and distribution network. Service contracts to maintain installed systems are sold and supported by technical support personnel. |

· | Bioconsumables. The installed WAVE base and some third-party installed platforms generate a demand for consumables that are required for the system’s continued operation. We develop, manufacture and sell these products. In addition, we manufacture and sell consumable products that can be used on multiple, independent platforms. These products include SURVEYOR Nuclease and a range of HPLC separation columns. |

· | Discovery Services. We provide various genetic laboratory services through a contract research lab in Gaithersburg, Maryland and a second laboratory in Omaha, Nebraska that operates in a Good Laboratory Practices (“GLP”) compliant environment and is certified under the Clinical Laboratory Improvement Amendment. The services provided primarily include (1) genomic biomarker analysis services to pharmaceutical and biopharmaceutical companies to support preclinical and clinical development of targeted therapeutics; and (2) molecular-based testing for hematology, oncology and certain inherited diseases for physicians and third-party laboratories. |

Historically, we operated a segment (the “Nucleic Acids operating segment”) that developed, manufactured and marketed chemical building blocks for nucleic acid synthesis. In the fourth quarter of 2005, we implemented a plan to exit the Nucleic Acids operating segment and have recently completed the sale of the remaining assets associated with this segment. Accordingly, the assets and results of the Nucleic Acids operating segment are reflected as discontinued operations for all periods presented in this filing.

Business Strategy

Since inception, our business strategy has been to provide products and services to biomedical researchers, medical institutions, diagnostic and pharmaceutical companies that are tied to advancements in the field of genomics. Advances in genomics have fueled efforts to understand individual differences in disease susceptibility, disease progression, and response to therapy. Accordingly, a principal component of our strategy has been to establish our WAVE System as an industry standard in the biomedical research market and to develop additional markets for the WAVE System such as clinical research and diagnostics. Through an expanding base of installed systems, we expect to increase the sales of consumable products used with the WAVE System and create opportunities to market additional products to this customer base.

In addition, through our Discovery Services offerings, we have gained exposure to the translational and clinical research markets, laying the foundation for increasing our participation in the full value chain associated with activities ranging from basic biomedical research to development of diagnostic and therapeutic products. During the fourth quarter of 2005, our laboratory in Omaha, Nebraska was certified under the Clinical Laboratory Improvement Amendments and we received our first patient samples for molecular-based testing for hematology, oncology and certain inherited diseases for physicians and third-party laboratories. We believe there is a significant opportunity for us to capitalize on the increasing demand for molecular-based personalized medicine by leveraging on our technologies and experience gained from the genomic biomarker analysis that our Discovery Services Group has and will continue to provide to pharmaceutical and biopharmaceutical companies.

Significant Recent Events

There have been key changes to our senior management.

On April 3, 2006, Collin J. D’Silva.D’Silva resigned as our President and Chief Executive Officer. Mr. D’Silva has served as our Chairman until January 19, 2007, when he also resigned from our Board of Directors and as our Chairman. The Board of Directors appointed Gregory Sloma, a current independent director, to serve as the interim Chairman of the BoardBoard.

Craig J. Tuttle joined the Company as the President and Chief Executive Officer since 1997on July 12, 2006, Mr. Tuttle, age 54, has over 25 years of general management, sales and is alsomarketing, and research and development experience in medical diagnostic and biotechnology companies. During 2004 and 2005, Mr. Tuttle was the President and Chief Operating Officer of Duke Scientific, a Director. Mr. D’Silva, a co-founderNorthern California specialty chemistry manufacturer, and led the sale of Transgenomic, has worked forDuke Scientific to Fisher Healthcare in 2005.

On September 20, 2006, Michael A. Summers, resigned as our Chief Financial Officer in order to pursue another professional opportunity. On December 4, 2006, Debra A. Schneider, age 48, joined the Company and its predecessors since 1988. Mr. D’Silva was employed by AT&T from 1980 to 1988. At AT&T, he held various positions in engineering, materials management, sales support and business development. His last position at AT&T was Business Unit Manager and Engineering Manager for a network distribution products division. Mr. D’Silva holds a B.S. degree and a M.Eng. degree in industrial engineering from Iowa State University and an M.B.A. from Creighton University.

Michael A. Summers.Mr. Summers joined Transgenomic, Inc. in August 2004 and currently serves as Chief Financial Officer. Mr. Summers was employed with C&A Industries, Inc. from 2003 to 2004 where as General Manager he was responsible for the operations of various divisions that provided human capital management and consulting services. From 2001 to 2003, he was Executive Vice President and Chief Financial Officer. Ms. Schneider also serves as the Secretary and Treasurer of the Company. Ms. Schneider was most recently employed by First Data Corporation, a provider of processing and related services to institutions issuing credit and debit cards. Ms Schneider’s tenure at First Data Corporation covered seventeen years during which she served in a number of roles including finance planning, accounting and Chief Financial Officer for Nexterna, Inc.,various business units. Most recently she served as Senior Vice President of Finance.

The Company has been engaged in a wholly-owned technology subsidiaryprocess of exploring strategic alternatives, which it recently terminated.

The Company’s Board of Directors hired an independent financial advisor to assist the Board in its evaluation of potential strategic alternatives available to the Company that included but were not

limited to (i) the sale of all or a portion of the Union Pacific Corporation. From 2000 to 2001, he wascontinuing business or related assets; (ii) the Chief Accounting Officer for Able Telcom Holding Corp.,acquisition of complementary businesses or assets; (iii) a publicly-owned projectmerger; and (iv) other complementary business partnerships and collaborations. Although the financial advisor contacted a substantial number of companies, both in and outside of the genomics industry, regarding a potential strategic transaction, and management and construction company. Mr. Summers graduated from Creighton University in 1987entered into negotiations with a B.S. degree in business administrationnumber of these companies, no agreements were reached with an accounting major. He isany company with respect to such a Certified Public Accountant.

Keith A. Johnson.Mr. Johnson joined us in 2002 as Vice President, General Counsel. Mr. Johnson has a B.A. in Biochemistry from Kalamazoo College, an M.B.A. in International Business and Marketing from Michigan State, and a law degree from the University of San Diego. Before joining Transgenomic Mr. Johnson was Director of Intellectual Property, Technology Development and Licensing at Integra LifeSciences in Plainsboro, NJ, from 1999 to 2001. Mr. Johnson’s previous experience also includes Senior Licensing Manager, Rutgers University, from 1998 to 1999 and Technology Licensing Officer, Washington State University, from 1995 to 1998. Mr. Johnson is a member of the state bars of California, Washington, New Jersey and Nebraska and is admitted to practice before the United States Patent and Trade Office.

Mitchell L. Murphy.Mr. Murphy joined us in 1992. His current duties include the overall corporate administration and shareholder relations. Prior to joining Transgenomic, he held accounting and financial management positions for 15 years with companies involved in manufacturing, steel distribution and rebar fabrication. He spent over two years as an auditor for the Omaha, Nebraska office of Deloitte, Haskins & Sells (now Deloitte & Touche LLP) working in a broad range of industries. Mr. Murphy graduated with honors from Creighton University in 1978 with a B.S. degree in business administration with an accounting major.

Section16(a) Beneficial Ownership Reporting Compliance. Item 405 of Regulation S-K requires disclosure of any known late filing or failure by an insider to file a report required by Section 16 of the Securities Exchange Act of 1934. We believe all Section 16 reports were filed in a timely manner during 2004.

Code of Ethics.transaction. The Board of Directors has adoptedelected to terminate its contract with the independent financial advisor effective April 25, 2007.

We exited our former Nucleic Acids operating segment.

On December 22, 2005, the Company’s Directors voted to either sell or close and liquidate the Nucleic Acids operating segment, which consisted primarily of a codemanufacturing facility in Glasgow, Scotland. This decision was made after an evaluation of, ethical conduct that appliesamong other things, short and long-term sales projections for products sold by this operating segment, including estimates of 2006 sales to our principal executive officersthe operating segment’s largest customer. While opportunities to sell this operating segment as a going concern were evaluated, we did not receive any offers to purchase the Nucleic Acids operating segment. Accordingly, we closed the Glasgow facility and senior financial officers as required by Section 406began the liquidation of the Sarbanes Oxley Act of 2002. This code of ethical conduct is embodied within our Business Ethics Policy, which applies to all personsassets associated with the Company,Nucleic Acids operating segment. All employees of this operating segment were either dismissed or redeployed to our Bioinstruments operating segment. The Glasgow facility was sold on February 28, 2007 for approximately $2.7 million after associated selling costs. Proceeds will be used in the normal operations of the Company.

We have continued to work to reduce operating costs

On February 20, 2007, we announced a cost reduction plan designed to align our cost structure with anticipated revenues. The plan is expected to yield annualized savings of approximately $1.5 million once all components of the plan are fully implemented. The closing of the Company’s Cramlington, England production facility is the principal component of this plan. We expect to incur aggregate charges estimated at $1.2 to $1.4 million during the first and second quarters of 2007, relating primarily to severance, benefits and facility closure costs.

Our stock has been delisted from the Nasdaq Capital Market and is now trading on the OTC Bulletin Board (OTCBB)

On February 1, 2007, we received a staff determination letter from Nasdaq’s Listing Qualifications Department indicating that we no longer met the minimum bid price requirement for continued listing on the Nasdaq Capital Market. As a result, the listing of our common stock on the Nasdaq Capital Market was ended on February 22, 2007. Trading information about our common stock became available on the OTC Bulletin Board beginning on February 26, 2007.

Sales and Marketing

We have sold our products to customers in over 50 countries. We use a direct sales and support staff for sales in the U.S., U.K. and most countries in Western Europe. For the rest of the world, we sell our products through dealers and distributors located in those local markets. We have over 35 dealers and distributors. We also maintain regionally-based technical support staffs and applications scientists to support our sales and marketing activities throughout the U.S. and Europe. The nature of our instruments and bioconsumables business does not generally lend itself to tracking and reporting sales backlog.

Customers

Customers include numerous leading academic and medical institutions in the U.S. and abroad. In addition, our customers also include a number of large, established U.S. and foreign pharmaceutical, biotech and commercial companies. No customer accounts for more than 10% of consolidated net sales.

Research and Development

We maintain an active program of research and development primarily directed toward the improvement of the DNA separation media used in our WAVE System, the refinement of the hardware and software components of the WAVE System, the creation of unique enzymes and WAVE-Optimized enzymes, and the development of assays on the WAVE System. We have also focused on further refinements and process manufacturing improvements for our Surveyor DNA mismatch cutting enzyme. Most importantly, we completed a large cancer mutation scanning study where we employed our SURVEYOR and WAVE System technology to discover a significant number of cancer linked mutations which we believe may have commercial value in the future. We plan to prepare patent submissions on discovered mutations for up to 40 key cancer regulating and signaling genes.

For the years ended December 31, 2006, 2005 and 2004, our research and development expenses were $2.36 million, $2.20 million and $4.50 million, respectively. We will need to continue to invest in research and development activities in order to remain competitive and to take advantage of new business opportunities as they arise. During 2007, we expect research and development expense to be approximately equal to the 2006 levels.

In addition to the amounts reflected above, our discontinued operations incurred no research and development expenses during the years ended December 31, 2006 and 2005 and $2.18 million during the year ended December 31, 2004.

Manufacturing

We manufacture bioconsumable products including our directors, officers,separation columns, liquid reagents, and enzymes. The major components of our WAVE Systems are manufactured for us by a third party. We integrate our own hardware and software with these third party manufactured components. Our manufacturing facilities for our WAVE Systems and bioconsumables are located in Omaha, Nebraska, San Jose, California, and Cramlington, England (through December 31, 2006). As noted earlier, we plan to close the Cramlington, England facility in 2007.

Intellectual Property

To establish and protect our proprietary technologies and products, we rely on a combination of patent, copyright, trademark and trade-secret laws, as well as confidentiality provisions in our contracts. We presently own rights to more than 70 issued patents and 13 pending applications in both the U.S. and abroad. Our WAVE System and related consumables are protected by patents and in-licensed technologies that expire in various periods beginning in 2013 through 2022. We will continue to file patent applications and seek new licenses as warranted to protect and develop new technologies of interest to our customer base in the coming years.

Competition

The markets in which we operate are highly competitive and characterized by rapidly changing technological advances. A number of our competitors possess substantial resources and are able to develop and offer a much greater breadth of products and/or services, coupled with significant marketing and distribution capabilities. We compete principally on the basis of uniquely enabling technical advantages in specific but significant market segments.

Competition for our WAVE Systems arises primarily from DNA sequencing and genotyping technologies. Competitors in these areas include Applied Biosystems, Beckman Coulter, Amersham (now part of GE Healthcare), Affymetrix, Agilent Technologies, Nanogen, Illumina, Sequenom, Pyrosequencing (now part of Biotage AB), Varian, and others. Competition for some of our non-WAVE consumable products comes from numerous well-diversified life sciences reagents providers, including, among others, Invitrogen, Qiagen, Roche, Stratagene, and Promega. Our discovery services face competition from a number of companies offering contract DNA sequencing and other genomic analysis services, including Genaissance Pharmaceuticals, GeneLogic, Agencourt, SeqWright, Gentris, and Perlagen. In addition, several clinical diagnostics service providers, such as Labcorp, Quest, and Specialty Laboratories, also offer related laboratory services in support of clinical trials. Finally, additional competition arises from academic core laboratory facilities.

Employees

As of December 31, 2006, 2005 and 2004, we had employees focused in the following areas of our operation:

| December 31, | ||||||

| 2006 | 2005 | 2004 | ||||

Manufacturing | 47 | 56 | 52 | |||

Sales, Marketing and Administration | 65 | 73 | 75 | |||

Research and Development | 16 | 10 | 19 | |||

| 128 | 139 | 146 | ||||

Personnel associated with discontinued operations | — | 17 | 32 | |||

| 128 | 156 | 178 | ||||

Our employees were employed in the following geographical locations:

| December 31, | ||||||

| 2006 | 2005 | 2004 | ||||

United States | 84 | 94 | 106 | |||

Europe (other than the United Kingdom) | 23 | 23 | 22 | |||

United Kingdom | 21 | 39 | 50 | |||

| 128 | 156 | 178 | ||||

We supplement our workforce through the use of independent contractors and compliesconsultants. At December 31, 2006, 2005 and 2004, we have engaged independent contractors or consultants who provide services to us approximately equivalent to one, one and five full-time employees, respectively.

General Information

We were incorporated in Delaware on March 6, 1997. Our principal office is located at 12325 Emmet Street, Omaha, Nebraska 68164 (telephone: 402-452-5400). We maintain manufacturing facilities in Omaha, Nebraska, San Jose, California, and Cramlington, England. We maintain research and development offices in Gaithersburg, Maryland and Omaha, Nebraska. As noted earlier, we plan to close the Cramlington, England facility in 2007.

We make reports filed by us with the listing standards adoptedSEC available free of charge on our website as soon as reasonably practicable after these reports are filed. The address of our website iswww.transgenomic.com. Information on our website, including any SEC report, is not part of this Annual Report on Form 10-K.

Risk Factors |

We may not have adequate financial resources to execute our business plan.

We have historically operated at a loss and have not generated sufficient cash from operating activities to cover our operating and other cash expenses. While we have been able to historically finance our operating losses through borrowings or from the issuance of additional equity, we currently have no plans to borrow additional funds or to issue additional equity securities for this purpose. At March 30, 2007 and December 31, 2006, we had cash and cash equivalents of$7.91 million and $5.87 million, respectively. While we believe that existing sources of liquidity are sufficient to meet expected cash needs through 2007, we will need to increase our revenues or further reduce our operating expenses in order to be assured of meeting our liquidity needs on a long-term basis. However, we cannot assure you that we will be able to increase our revenues or further reduce our expenses and, accordingly, we may not have sufficient sources of liquidity to continue the operations of the Company indefinitely.

We have a history of operating losses and may incur losses in the future.

We have experienced annual losses from continuing operations since inception of our operations. Our losses from continuing operations for the years ended December 31, 2006, 2005 and 2004 were $2.96 million, $4.98 million, and $13.75 million, respectively. These losses have been due principally to the high levels of research and development expenses and sales and marketing expenses that we have incurred in order to develop and market our products, the fixed nature of our manufacturing costs, restructuring charges and impairment charges. In addition, markets for our products and services have developed more slowly than expected in many cases and may continue to do so. As a result, we may incur operating losses in the future.

Markets for our products and services may continue to develop slowly.

There are many factors that affect the market demand for our products and services that we cannot control. Demand for our WAVE System is affected by the Nasdaq Stock Market.needs and budgetary resources of research institutions, universities, hospitals and others who use the WAVE System for genetic-variation research. The Business Ethics PolicyWAVE System represents a significant expenditure by these types of customers and often requires a long sales cycle. If revenues from the sales of our products and services continue at current levels, we may need to take steps to further reduce operating expenses or raise additional working capital. We cannot assure you that sales will increase or that we will be able to reduce operating expenses or raise additional working capital. Similarly, the sales cycle for the OEM products that we sell can also be a long sales cycle.

Sales of our Discovery Services have been variable.

Sales of discovery services have varied significantly due in large part to the fact that approximately 82% and 90% of discovery services sales in 2004 and 2005, respectively, were realized from orders from a single large pharmaceutical company. Sales to this customer were governed by a non-binding master services agreement dated August 22, 2002. Accordingly, the amount of sales to this customer is subject to change. In 2006, we did not sell any discovery services to this customer.

The sale of our products and business operations in international markets subjects us to additional risks.

During the past several years, international sales have represented more than half of our total net sales. As a result, a major portion of our revenues and expenses are subject to risks associated with international sales and operations. These risks include:

Ÿ | payment cycles in foreign markets are typically longer than in the U.S., and capital spending budgets for research agencies can vary over time with foreign governments; |

Ÿ | changes in foreign currency exchange rates can make our products more costly and operating expenses higher in local currencies since our foreign sales and operating expenses are typically paid for in U.S. Dollars, British Pounds or the Euro; and |

Ÿ | the potential for changes in U.S. and foreign laws or regulations that result in additional import or export restrictions, higher tariffs or other taxes, more burdensome licensing requirements or similar impediments to our ability to sell products and services profitably in these markets. |

Our WAVE System includes hardware components and instrumentation manufactured by a single supplier and if we are no longer able to obtain these components and instrumentation our ability to manufacture our products could be impaired.

We rely on a single supplier, Hitachi High Technologies America, to provide the basic instrument used in our WAVE Systems. While other suppliers of instrumentation and computer hardware are available, we believe that our arrangement with Hitachi offers strategic advantages. Hitachi is replacing its current instrument line with a new instrument line. While we presently plan to convert our technology and applications to this new instrument line, such conversion may not be successful and, therefore, we may incur additional costs for the custom manufacturing of the current instrument line. If we were required to seek alternative sources of supply, it could be time consuming or expensive or require significant and costly modification of our WAVE System. Also, if we were unable to obtain instruments from Hitachi in sufficient quantities or in a timely manner, our ability to manufacture our products could be impaired, which could limit our future revenues.

We may not have adequate personnel to execute our business plan.

In order to reduce our operating costs, we have reduced the number of employees in all area of the business. In addition, we may lose other key management, scientific, technical, sales and manufacturing personnel from time to time. It may be very difficult to replace personnel if they are needed in the future, and the loss of key personnel could harm our business and operating results. We cannot assure you that our employee reductions will not impair our ability to continue to develop new products and refine existing products in order to remain competitive. In addition, these reductions could prevent us from successfully marketing our products and developing our customer base.

Our markets are very competitive.

Many of our competitors have greater resources than we do and/or may enjoy other competitive advantages. This may allow them to more effectively market their products to our customers or potential customers, to develop products that make our products obsolete or to produce and sell products less expensively than us. As a result of these competitive factors, demand for and pricing of our products and services could be negatively affected.

Our patents may not protect us from others using our technology that could harm our business and competitive position.

Patent law relating to the scope of claims in the technology fields in which we operate is still evolving. The degree of future protection for our proprietary rights is uncertain. Furthermore, we cannot be certain that others will not independently develop similar or alternative products or technology, duplicate any of our products, or, if patents are issued to us, design around the patented products developed by us. Our patents or licenses could be challenged by litigation and, if the outcome of such litigation were adverse to us, our competitors could be free to use our technology. We may not be able to obtain additional patents for our technology, or if we are able to do so, patents may not provide us with substantial protection or be commercially beneficial. In addition, we could incur substantial costs in litigation if we are required to defend ourselves in patent suits brought by third parties or if we initiate such suits.

We cannot be certain that other measures taken to protect our intellectual property will be effective.

We rely upon trade secret protection, copyright and trademark laws, non-disclosure agreements and other contractual provisions for some of our confidential and proprietary information that is not subject matter for which patent protection is being sought. Such measures, however, may not provide adequate protection for our trade secrets or other proprietary information. If such measures do not protect our rights, third parties could use our technology and our ability to compete in the market would be reduced.

We are dependent upon our licensed technologies and may need to obtain additional licenses in the future to offer our products and remain competitive.

We have licensed key components of our technologies from third parties. If these agreements were to terminate prematurely due to our breach of the terms of these licenses or we otherwise fail to maintain our rights to such technology, we may lose the right to manufacture or sell a substantial portion of our products. In addition, we may need to obtain licenses to additional technologies in the future in order to keep our products competitive. If we fail to license or otherwise acquire necessary technologies, we may not be able to develop new products that we need to remain competitive.

The protection of intellectual property in foreign countries is uncertain.

A significant percentage of our sales are to customers located outside the U.S. The patent and other intellectual property laws of some foreign countries may not protect our intellectual property rights to the same extent as U.S. laws. We may need to bring proceedings to defend our patent rights or to determine the validity of our competitors’ foreign patents. These proceedings could result in substantial cost and diversion of our efforts. Finally, some of our patent protection in the U.S. is not available to us in foreign countries due to the laws of those countries.

Our products could infringe on the intellectual property rights of others.

There are a significant number of U.S. and foreign patents and patent applications submitted for technologies in, or related to, our area of business. As a result, any application or exploitation of our technology could infringe patents or proprietary rights of others and any licenses that we might need as a result of such infringement might not be available to us on commercially reasonable terms, if at all. This may lead others to assert patent infringement or other intellectual property claims against us.

Our failure to comply with any applicable government regulations or otherwise respond to claims relating to improper handling, storage or disposal of hazardous chemicals that we use may adversely affect our results of operations.

Our research and development and manufacturing activities involve the controlled use of hazardous materials and chemicals. We are subject to federal, state, local and international laws and regulations governing the use, storage, handling and disposal of hazardous materials and waste products. If we fail to comply with applicable laws or regulations, we could be required to pay penalties or be held liable for any damages that result and this liability could exceed our financial resources. We cannot assure you that accidental contamination or injury will not occur. Any such accident could damage our research and manufacturing facilities and operations, resulting in delays and increased costs.

The price for our common stock is volatile and may drop.

The trading price for our common stock has fluctuated significantly over recent years. The volatility in the price of our stock is attributable to a number of factors, not all of which relate to our operating results and financial position. The delisting of our stock from the NASDAQ may negatively affect the volume of shares traded and the price for our stock. Continued volatility in the market price for our stock should be expected and we cannot assure you that the price of our stock will not decrease in the future. Fluctuations or further declines in the price of our stock may affect our ability to sell shares of our stock and to raise capital through future equity financing.

Our common stock is deemed to be “penny stock”, which may make it more difficult for investors to sell their shares due to suitability requirements.

Our common stock is classified as a “penny stock” under the rules of the SEC. The Securities and Exchange Commission has adopted Rule 3a51-1 which establishes the definition of a “penny stock”, for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, Rule 15g-9 requires:

· | that a broker or dealer approve a person's account for transactions in penny stocks; and |

· | that the broker or dealer receives from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

· | obtain financial information and investment experience objectives of the person; and |

· | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form:

· | sets forth the basis on which the broker or dealer made the suitability determination; and |

· | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

We may issue a substantial amount of our common stock to holders of options and warrants and this could reduce the market price for our stock.

At December 31, 2006, we had obligations to issue 13,530,241 shares of common stock including outstanding stock options representing 5,467,664 shares and warrants representing 8,062,577 shares. The issuance of these additional shares of common stock may be dilutive to our current shareholders and could negatively impact the market price of our common stock.

Our common stock is thinly traded and a large percentage of our shares are held by a small group of unrelated, institutional owners.

At March 30, 2007, we had 49,189,672 shares of common stock outstanding. Fewer than ten unrelated, institutional holders own more than 50% of these shares The sale of significant shares into the public market has potential to cause significant downward pressure on the price of our common stock. This is particularly the case if the shares being placed into the market exceed the market’s ability to absorb the stock. Such an event could place further downward pressure on the price of our common stock. This presents an opportunity for short sellers to contribute to the further decline of our stock price. If there are significant short sales of our stock, the price decline that would result from this activity will cause the share price to decline more so, which, in turn, may cause long holders of the stock to sell their shares thereby contributing to sales of stock in the market.

Unresolved Staff Comments |

None.

Properties |

We currently lease and occupy a total of seven facilities throughout the world under non-cancelable leases with various terms. The following table summarizes certain information regarding the leased facilities. Annual rent amounts presented in the table are reflected in thousands.

Location | Function | Square Footage | 2007 Scheduled Rent | Lease Term | ||||

Omaha, Nebraska | WAVE and Consumable Manufacturing | 25,000 | $130 | June 2009 | ||||

San Jose, California | Consumable Manufacturing | 14,360 | $158 | October 2010 | ||||

Cramlington, England | Consumable Manufacturing(2) | 8,500 | $73 | March 2008 | ||||

Glasgow, Scotland | Multi Functional(1) | 5,059 | $31 | March 2012 | ||||

Omaha, Nebraska | Multi Functional(1) | 18,265 | $201 | July 2012 | ||||

Paris, France | Multi Functional(1) | 4,753 | $962 | January 2014 | ||||

Gaithersburg, Maryland | Multi Functional(1) | 6,560 | $46 | May 2007 |

(1) | Multi Functional facilities include functions related to manufacturing, services, sales and marketing, research and development and/or administration. |

(2) | As noted earlier, we plan to close this facility in 2007. Notice has been given to landlord, we will exit facility in March 2008. |

The Company no longer occupies its former facilities in San Diego, California and Cambridge, Massachusetts and leases on these facilities expired in January 2007. The Company expects to be able to renew leases that expire in 2007 on terms substantially similar to the existing lease terms.

Legal Proceedings |

The Company is not a party to any pending legal proceedings which, if decided adversely to the Company, will have a material adverse effect on our financial position, results of operations or cash flows.

Submission of Matters to a Vote of Security Holders. |

We did not submit any matters to our stockholders for a vote or other approval during the fourth quarter of the fiscal year covered by this report.

Market for Registrant’s Common Stock, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market Information. Share price information for our common stock is available on the OTC Bulletin Board under the symbol TBIO.OB. Prior to February 22, 2007, our website at www.transgenomic.com.

Item 11. Executive Compensation.

common stock was listed for trading on the Nasdaq Capital Market under the symbol TBIO. The following table sets forth the high and low closing prices for our common stock during each of the quarters of 2005 and 2006.

| High | Low | |||||

Year Ended December 31, 2005 | ||||||

First Quarter | $ | 1.11 | $ | 0.53 | ||

Second Quarter | $ | 0.90 | $ | 0.45 | ||

Third Quarter | $ | 1.24 | $ | 0.70 | ||

Fourth Quarter | $ | 1.11 | $ | 0.80 | ||

Year Ended December 31, 2006 | ||||||

First Quarter | $ | 1.03 | $ | 0.62 | ||

Second Quarter | $ | 0.84 | $ | 0.39 | ||

Third Quarter | $ | 0.77 | $ | 0.31 | ||

Fourth Quarter | $ | 0.89 | $ | 0.40 | ||

Holders. At March 30, 2007, there are 49,189,672 shares of our common stock outstanding and approximately 3,310 holders of record.

Dividends. We have never declared or paid any cash dividends on our common stock and we do not anticipate paying any cash dividends on our common stock in the foreseeable future. We expect to retain all earnings, if any, for investment in our business. Dividends on our common stock will be paid only if and when declared by our Board of Directors. The Board’s ability to declare a dividend is subject to limits imposed by Delaware corporate law. In determining whether to declare dividends, the Board may consider our financial condition, results of operations, working capital requirements, future prospects and other relevant factors.

Securities authorized for issuance under equity compensation plans.

The following equity compensation plan information summarizes plans and securities approved and not approved by security holders as of December 31, 2006.

| (a) | (b) | (c) | ||||

PLAN CATEGORY | Number of | Weighted-average option, warrants | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a) | |||

Equity compensation plans approved by security holders(1) | 5,467,664 | $4.08 | 3,778,567 | |||

Equity compensation plans not approved by security holders | — | — | — | |||

Total | 5,467,664 | $4.08 | 3,778,567 | |||

(1) | Consists of our 2006 Equity Compensation Plan |

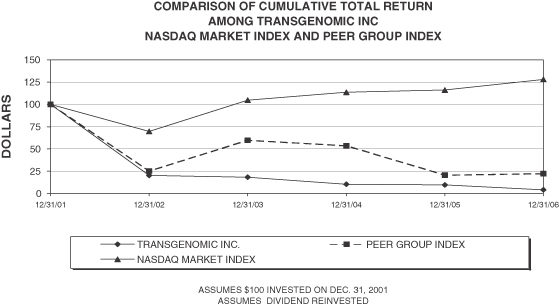

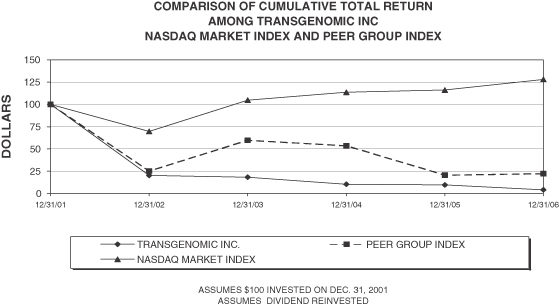

Five Year Performance Comparison: The following graph provides an indicator of cumulative total shareholder returns for the Company as compared to a peer group index comprised of Argonaut Technologies, Caliper Life Sciences, Cepheid, Cipergen Biosystems, Inc,Harvard Bioscience IC, Illumina, Inc., Luminex Corporation, Nuvelo, Inc., Orchid Biosciences, Inc. and Sequenom, Inc and to the Nasdaq Market Index. The graph assumes that the value of the investment in the Company’s common stock, the Nasdaq Market Index and the Peer Group Index, was $100 on December 31, 2001, and that all dividends were reinvested.

Sale of Unregistered Securities. The Company made no sales of its common stock during the years ended December 31, 2006 and 2004 that were not registered under the Securities Act of 1933 (the “Securities Act”). Information regarding sales of equity securities by the annualCompany during the years ended December 31, 2005 that were not registered under the Securities Act of 1933 have been previously reported by the Company on Form 8-Ks filed on March 18, 2005, March 30, 2005 and October 31, 2005.

Issuer Purchase of Equity Securities. The Company made no purchases of its common stock during the quarter ended December 31, 2006. Therefore, tabular disclosure is not presented.

Selected Consolidated Financial Data |

The selected consolidated balance sheet data as of December 31, 2006 and 2005 and the selected consolidated statements of operations data for each year ended December 31, 2006, 2005 and 2004 have been derived from our audited consolidated financial statements that are included elsewhere in this Annual Report on Form 10-K. The selected consolidated balance sheet data as of December 31, 2004, 2003 and 2002 and the selected consolidated statements of operations data for each year ended December 31, 2003 and 2002 have been derived from our audited consolidated financial statements that are not included in this Annual Report on Form 10-K. Dollar amounts, except per share data, are presented in thousands.

| Year Ended December 31, | ||||||||||||||||||||

| 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||

Net sales | $ | 23,415 | $ | 25,828 | $ | 25,243 | $ | 26,044 | $ | 24,235 | ||||||||||

Cost of good sold | 12,046 | 13,497 | 11,997 | 11,374 | 9,935 | |||||||||||||||

Gross profit | 11,369 | 12,331 | 13,246 | 14,670 | 14,300 | |||||||||||||||

Selling, general and administrative | 12,138 | 12,218 | 15,961 | 16,586 | 20,539 | |||||||||||||||

Research and development | 2,362 | 2,199 | 4,501 | 6,834 | 11,173 | |||||||||||||||

Restructuring charges(1) | — | — | 1,267 | 516 | 3,282 | |||||||||||||||

Impairment charges(2) | — | 425 | — | — | — | |||||||||||||||

Operating expenses | 14,500 | 14,842 | 21,729 | 23,936 | 34,994 | |||||||||||||||

Other income (expense)(3) | 198 | (2,447 | ) | (5,263 | ) | (181 | ) | 512 | ||||||||||||

Loss before income taxes | (2,933 | ) | (4,958 | ) | (13,746 | ) | (9,447 | ) | (20,182 | ) | ||||||||||

Income tax expense | 30 | 26 | 4 | 65 | 105 | |||||||||||||||

Loss from continuing operations | (2,963 | ) | (4,984 | ) | (13,750 | ) | (9,512 | ) | (20,287 | ) | ||||||||||

(Loss) income from discontinued operations, net of tax(4) | (468 | ) | (10,009 | ) | (20,622 | ) | (13,446 | ) | (1,078 | ) | ||||||||||

Net loss | $ | (3,431 | ) | $ | (14,993 | ) | $ | (34,372 | ) | $ | (22,958 | ) | $ | (21,365 | ) | |||||

Basic and diluted (loss) income per share:(4) | ||||||||||||||||||||

From continuing operations | $ | (0.06 | ) | $ | (0.14 | ) | $ | (0.47 | ) | $ | (0.39 | ) | $ | (0.86 | ) | |||||

From discontinued operations(4) | (0.01 | ) | (0.28 | ) | (0.72 | ) | (0.55 | ) | (0.05 | ) | ||||||||||

| $ | (0.07 | ) | $ | (0.42 | ) | $ | (1.19 | ) | $ | (0.94 | ) | $ | (0.91 | ) | ||||||

Basic and diluted weighted average shares outstanding | 49,188 | 35,688 | 29,006 | 24,484 | 23,583 | |||||||||||||||

| As of December 31, | ||||||||||||||||||||

| 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||

Total assets | $ | 21,367 | $ | 25,340 | $ | 37,458 | $ | 57,306 | $ | 74,035 | ||||||||||

Borrowings under credit line | — | — | 6,514 | 2,142 | — | |||||||||||||||

Current portion of long-term debt | — | — | 825 | 1,693 | 63 | |||||||||||||||

Long-term debt, less current portion | — | — | 2,199 | — | 1,499 | |||||||||||||||

Total stockholders’ equity | 16,038 | 17,906 | 16,535 | 45,058 | 61,515 | |||||||||||||||

(1) | Restructuring plans were implemented in 2002 and 2004 to reduce and align our expenses with current business prospects. The plans included employee terminations, office closures, termination of collaborations and write-offs of abandoned intellectual property. As a result, restructuring charges were recorded and are included in operating expenses. Refer to Note M to the accompanying consolidated financial statements. |

(2) | Impairment charges in 2005 relate to the impairment of patent pursuits and write-down of inventory to net realizable value. Refer to Notes to the accompanying consolidated financial statements. |

(3) | Other income (expense) for all years presented primarily includes interest expense and interest income, loss on debt extinguishment of $0.5 million in 2005 related to the repayment of long-term debt and $2.9 million resulting from certain modifications to long-term borrowing agreements that were treated as extinguishments for financial reporting purposes. Refer to Note F to the accompanying consolidated financial statements. |

(4) | During 2005, we decided to exit our Nucleic Acids operating segment and, as a result, we recorded impairment and exit charges of $8.8 million consisting of valuation adjustments to reflect the carrying value of related net assets at estimated fair market value. We now reflect the results of this business as discontinued operations for all periods presented. Refer to Note C to the accompanying consolidated financial statements. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

The following discussion should be read in conjunction with the Consolidated Financial Statements and applicable Notes to Consolidated Financial Statements and other information in this report, including Risk Factors set forth in Item 1A and Critical Accounting Policies at the end of this Item 7.

The Company’s continuing operations consist of the manufacture and sale of its WAVE System and related consumable products and discovery services which make use of the Company’s WAVE System to perform genomic research on a contract basis and disease testing services. These functions are categorized as one reportable operating segment. Although revenue is analyzed by type, the Company’s net financial results are analyzed as a single segment due to the integrated nature of the products and services that we sell. The Consolidated Financial Statements also reflect the assets and results of our former Nucleic Acids operating segment, which are shown as discontinued operations in all periods as a result of the implementation of a plan to exit this operating segment in the fourth quarter of 2005.

Executive Summary

2006 Results

Sales of bioinstruments and associated consumables continued to decline in 2006, due to a number of factors including competition from sequencing and other evolving technologies. Sales from our discovery services group during the year were down substantially from 2005 as we completed a significant engagement for a large pharmaceutical company and were not able to replace these sales in 2006. Although we have taken significant steps to reduce our operating expenses in response to declining revenues, we continued to operate at a loss and to generate a negative cash flow during the year. However, our loss and use of cash were reduced significantly over each of the last three years.

We continue to work to respond to changes in the overall business climate for our products and our liquidity position. On December 22, 2005, we decided to sell or close and liquidate the Nucleic Acids operating segment, which consisted primarily of a manufacturing facility in Glasgow, Scotland. This decision was made after an evaluation of, among other things, short and long-term compensation paidsales projections for products sold by this operating segment, including estimates of 2006 sales to the operating segment’s largest customer. While opportunities to sell the operating segment as a going concern were evaluated, we ultimately ended up closing the facility and terminating or redeploying all of the employees of this business segment. In February of 2007, we completed the sale of the facility in Glasgow, Scotland. We now reflect the results of this operating segment as discontinued operations for all periods presented.

As a result of the actions undertaken since the fourth quarter of 2004, including the reclassification of the Nucleic Acids operating segment as a discontinued operation, our losses from

continuing operations have gone from $13.75 million and $4.98 million in 2004 and 2005, respectively, to $2.96 million in 2006. Net cash flows used by operating activities have gone from $12.75 million and $3.63 million in 2004 and 2005, respectively to $1.21 million in 2006.

2007 Outlook

Timing of the demand for our products, particularly our flagship WAVE Systems, has been difficult to predict due largely to ongoing changes in the marketplace and the funding arrangements of our customers. Because our net sales are largely dependent upon sales of a limited number of products, including WAVE Systems and OEM Instruments, and our cost structure is largely fixed, historical results have been somewhat sporadic. For these reasons, it is not our practice to provide prospective financial guidance related specifically to revenues, costs, net income (loss) or cash flows. However, our financial objectives are to generate income from continuing operations and positive cash flows from continuing operations. To accomplish these goals we must generate sequential growth in net sales, leverage manufacturing expenses and continue to better control operating expenses. We will continue to look for opportunities, through consolidation or otherwise, to reduce our operating expenses related to our core business.

Develop sequential growth in net sales.

We will work to continue to leverage on and strengthen our core instrument business. Challenges exist for WAVE System and consumable growth in traditional markets. We believe emerging markets and novel applications will provide for opportunities for our WAVE System. We intend to continue to diversify into new markets, including the personalized medicine market (particularly in oncology), where the sensitivities of our technologies are essential. In the short-term, we believe that the introduction of the newest generation of our flagship product, the WAVE System 4500 will provide upgrade opportunities to our current installed base. In addition, we are also selling refurbished WAVESystems in order to allow an opportunity for customers that may not be able to afford the cost of a new system. In the intermediate to longer-term, we believe that newly developed “targeted” consumable products will increase usability of our installed base and enhance net sales of consumables. Additionally, we have developed credibility and momentum with third-party platforms that will allow us to leverage on our Chief Executive Officer,direct sales force and distribution network.

On the discovery services front, we will seek to leverage past successes with pharmaceutical customers to diversify our customer base. While we have performed discovery services for a number of large pharmaceutical customers, these engagements do not materialize at a constant rate and the lead time to develop major contracts is often lengthy. To mitigate this risk, we believe there is a significant opportunity for us to capitalize on the increasing demand for molecular-based personalized medicine by leveraging our technologies and experience gained from the genomic biomarker analysis that discovery services provides to pharmaceutical and biopharmaceutical companies. During the fourth quarter of 2005, our laboratory in Omaha, Nebraska was certified under the Clinical Laboratory Improvement Amendments, and we received our first patient samples from physicians and third-party laboratories for molecular-based testing for hematology, oncology and certain inherited diseases. This capability also allows us to offer a vertically-integrated suite of services that can support activities ranging from discovery research to clinical trials to diagnostic testing. As the need for drug/diagnostic combination products increases, we believe this suite of service offerings will prove attractive to various customers. We have recently added some new customers in this area of the business.

Continue to control operating expenses.

Operating expenses include selling, general and administrative expenses and research and development expenses. We will need to continue to invest in research and development activities in order to remain competitive and to take advantage of new business opportunities as they arise. During 2007, we expect operating expenses, including research and development expense, to be approximately equal to 2006 levels.

Results of Continuing Operations

Years Ended December 31, 2006 and 2005

Net Sales. Net sales for the years ended December 31, 2006 and 2005 consisted of the following (dollars in thousands):

| Change | ||||||||||||

| 2006 | 2005 | $ | % | |||||||||

Bioinstruments | $ | 13,604 | $ | 14,427 | $ | (823) | (6) | % | ||||

Bioconsumables | 8,719 | 8,981 | (262) | (3) | % | |||||||

Discovery Services | 1,092 | 2,420 | (1,328) | (55) | % | |||||||

Net sales | $ | 23,415 | $ | 25,828 | $ | (2,413) | (9) | % | ||||

Bioinstrument sales consist of sales of our WAVE System and associated equipment that we manufacture or assemble, revenues from service contracts that we enter into with purchasers of our instruments, as well as sales of instruments we distribute for other manufacturers (“OEM equipment”). We also sell refurbished WAVE Systems in order to access customers that may not be able to afford new systems. We sold 68 WAVE Systems during the year ended December 31, 2006 compared to 97 systems during the same period of 2005. This decrease resulted from lower demand in all major geographic markets and among both research and diagnostic users particularly in our largest markets throughout Western Europe. Demand for the WAVE has been affected by significant competitive challenges from traditional (i.e. sequencing) and evolving technologies. The decrease in WAVE System sales was largely offset by OEM instrument sales, increased net sales from product upgrades and service contracts.

Bioconsumable net sales decreased during year ended December 31, 2006 compared to 2005. Despite the increase in installed base of WAVE instruments from 1,290 units at December 31, 2005 to 1,358 units at December 31, 2006, we do not believe that all of these instruments are being fully utilized. In addition, consumable products are available from other manufacturers which can be used in place of many of our consumable products. Some of these competitive products sell at prices below the prices we charge for our products, which have caused us to have some price compression, principally in Europe.

The decrease in discovery services net sales was primarily attributable to the expiration of certain research contracts with a large pharmaceutical company in 2005, of $2,188 that was partially offset by increased net sales from research projects from other pharmaceutical companies and services provided by our CLIA lab, of $384.

Costs of Goods Sold Costs of goods sold include material costs for the products that we sell and substantially all other costs associated with our manufacturing facilities (primarily personnel costs, rent and depreciation) as well as the wholesale price we pay manufacturers of OEM equipment that we distribute. It also includes direct costs (primarily personnel costs, rent, supplies and depreciation) associated with our discovery services operations. Cost of goods sold for the years ended December 31, 2006 and 2005 consisted of the following (dollars in thousands):

| Change | ||||||||||||

| 2006 | 2005 | $ | % | |||||||||

Bioinstruments | $ | 5,745 | $ | 6,442 | $ | (697) | (11) | % | ||||

Bioconsumables | 4,530 | 4,762 | (232) | (5) | % | |||||||

Discovery Services | 1,771 | 2,293 | (522) | (23) | % | |||||||

Cost of goods sold | $ | 12,046 | $ | 13,497 | $ | (1,451) | (11) | % | ||||

Gross profit equaled $11.37 million or 49% of total net sales during the year ended December 31, 2006 compared to $12.33 million and 48% during the same period of 2005. The increase in gross profit as a percent of revenue is largely attributable to changes in the composition of products sold. Sales of our OEM instruments (third party platforms) provided for higher gross profit in 2006, while gross profit on WAVE sales is down, due to the lower number of instruments sold and the fixed base of costs associated with this area. Sales of specialty consumables (SURVEYOR Nuclease, HPLC separation columns, etc.) were up slightly in 2006 and these products generate higher gross profits than base buffers and enzymes. Gross profit from discovery services is significantly less in 2006 due to the decrease in net sales to a large pharmaceutical customer which produced net sales of $2,188 in 2005 and $8 in 2006, coupled with a much smaller decrease in the cost of goods sold due to the fixed base of cost associated with the discovery services group.

Selling, General and Administrative Expenses. Selling, general and administrative expenses primarily include personnel costs, marketing, travel and entertainment costs, professional fees, and facility costs. These costs remained essentially flat in 2006 compared to 2005, but increased as a percentage of net sales from 47% to 52% as a result of reduced sales. Foreign currency transaction adjustments increased operating expenses by approximately $.08 million compared to the year ended December 31, 2005

Research and Development Expenses. Research and development expenses primarily include personnel costs, supplies, and facility costs. These costs totaled $2.36 million during the year ended December 31, 2006 compared to $2.20 million during the same period of 2005, an increase of $0.16 million or 7%. As a percentage of net sales, research and development expenses totaled 10% and 9% of net sales during the year ended December 31, 2006 and 2005 respectively. We expect to continue to invest up to 10% of our net sales in research and development activities. Research and development costs are expensed in the year in which they are incurred.

Impairment Charges. We did not incur any impairment charges during 2006, but incurred $0.43 million of impairment charges during 2005 consisting of a $0.25 million charge associated with certain international patent pursuits that were no longer consistent with our strategic plan and a charge of $0.18 million related to inventory associated with certain OEM instruments.

Other Income (Expense). Other income during the year ended December 31, 2006 of $0.20 million consisted of interest income of $0.22 million which was partially offset by interest expense of

$0.01 million, and other expense of $0.01 million. Other expense during the year ended December 31, 2005 consisted of interest expense of $1.98 million and a loss on debt extinguishment of $0.54 million which was partially offset by interest income of $0.03 and other income of $0.04 million. Interest expense consisted of the following for the years ended December 31, 2006 and 2005 (dollars in thousands):

| 2006 | 2005 | ||||||

Interest paid or accrued on outstanding debt | $ | — | $ | 553 | |||

Amortization of debt premiums | — | (857 | ) | ||||

Amortization of debt discounts – warrants | — | 28 | |||||

Amortization of debt discount – beneficial conversion feature | — | 725 | |||||

Fair value of incremental shares received by Laurus | — | 1,365 | |||||

Other | 11 | 164 | |||||

| $ | 11 | $ | 1,978 | ||||

We had previously entered into a $7,500,000 line of credit (the “Credit Line”) and a $2,750,000 convertible note (the “Term Note,” and collectively with the Credit Line the “Laurus Loans”) from Laurus Master Fund, Ltd. (“Laurus”). On March 18, 2005, Laurus converted $1.87 million of the outstanding principal balance under the Credit Line into 3,600,000 shares of our common stock at $0.52 per share. In addition, on March 24, 2005, Laurus converted $0.65 million of the outstanding principal balance of the Term Note into 1,250,000 shares of our common stock at $0.52 per share. In conjunction with these conversions, we accelerated amortization of $0.41 million of related debt premiums and discounts and recorded a charge to interest expense of $1.37 million related to the fair value of incremental shares received by Laurus. Contemporaneously with the closing of a private offering of common stock in November 2005 (the “2005 Private Placement”), we repaid all outstanding principal and accrued interest on the Laurus Loans. In conjunction with this prepayment, we recorded a loss on debt extinguishment of $0.54 million. This loss consisted of prepayment penalties and fees paid to Laurus to facilitate the 2005 Private Placement of $0.84 million offset by the elimination of associated net debt premiums of $0.30 million.

Income Tax Expense. Income tax expense recorded during the years ended December 31, 2006 and 2005 related to income taxes in states, foreign countries and other local jurisdictions. Due to the our cumulative losses, expected losses in future years and inability to utilize any additional losses as carrybacks, we did not provide for an income tax benefit during the years ended December 31, 2006 or 2005 based on our determination that it was more likely than not that such benefits would not be realized. We will continue to assess the recoverability of deferred tax assets and the related valuation allowance. To the extent we begin to generate taxable income in future periods and determine that such valuation allowance is no longer required, the tax benefit of the remaining deferred tax assets will be recognized at such time. While the Company has significant net operating loss carryforwards, it is likely that Section 382 (Limitation on Net Operating Loss Carryforwards and Certain Built-In Losses following Ownership Change) of the Internal Revenue Code, and the regulations promulgated thereunder, will significantly limit the amount of net operating loss carryforward that the Company could utilize in any tax year. Our federal net operating loss carryforwards from continuing and discontinued operations of $106.23 million will expire at various dates from 2008 through 2026, if not utilized. We also had state income tax loss carryforwards from continuing and discontinued operations of $43.84 million at December 31, 2006. These carryforwards will also expire at various dates beginning in 2007 if not utilized.

Years Ended December 31, 2005 and 2004

Net Sales. Net sales for the years ended December 31, 2005 and 2004 consisted of the following (dollars in thousands):

| Change | ||||||||||||

| 2005 | 2004 | $ | % | |||||||||

Bioinstruments | $ | 14,427 | $ | 14,385 | $ | 42 | 1 | % | ||||

Bioconsumables | 8,981 | 8,838 | 143 | 2 | % | |||||||

Discovery Services | 2,420 | 2,020 | 400 | 20 | % | |||||||

Net sales | $ | 25,828 | $ | 25,243 | $ | 585 | 2 | % | ||||

WAVE Systems sold totaled 97 during the year ended December 31, 2005 compared to 107 during the same period of 2004. We had an installed base of 1,290 units at December 31, 2005 compared to 1,193 units at December 31, 2004. The increase in the installed base of instruments continues to drive increases in sales of bioconsumables used with these instruments. The increase in Discovery Services revenue during 2004 was primarily attributable to the discovery services agreements that we entered into with pharmaceutical companies to support their clinical development of oncology therapeutics.

Costs of Goods Sold. Cost of goods sold for the years ended December 31, 2005 and 2004 consisted of the following (dollars in thousands):

| Change | ||||||||||||

| 2005 | 2004 | $ | % | |||||||||

Bioinstruments | $ | 6,442 | $ | 6,382 | $ | 60 | 1 | % | ||||

Bioconsumables | 4,762 | 4,012 | 750 | 19 | % | |||||||

Discovery Services | 2,293 | 1,603 | 690 | 43 | % | |||||||

Cost of goods sold | $ | 13,497 | $ | 11,997 | $ | 1,500 | 13 | % | ||||

Overall, our cost of goods sold increased despite an overall decline in net sales due to the fixed-cost burden associated with our manufacturing facilities.

Gross profit equaled $12.33 million or 48% of total net sales during the year ended December 31, 2005 compared to $13.25 million and 52% during the same period of 2004. The decrease in gross profit as a percent of revenue is largely attributable to changes in the composition of products sold. Generally, sales of WAVE Systems and ancillary instrumentation generate higher gross profits than sales of third party platforms. Sales of specialty consumables (SURVEYOR Nuclease, HPLC separation columns, etc.) generate higher gross profits than base buffers and enzymes. Gross profits from discovery services have been less than expected due to the continuing build out of capacity and expansion of product offerings.