CANADIAN PACIFIC KANSAS CITY LIMITED FORM 10-K/A TABLE OF CONTENTS

PART III ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE Directors

Directors On April 14, 2023, Canadian Pacific Railway Limited (“CPRL” or “CP”) assumed control of Kansas City Southern (“KCS”) (through an indirect wholly-owned subsidiary), and filed articles of amendment to change CPRL’s name to Canadian Pacific Kansas City Limited (“CPKC” or “Company”). CPKC owns and operates the only freight railway spanning Canada, the United States (“U.S.”), and Mexico. CPKC provides rail and intermodal transportation services over a network of approximately 20,000 miles, serving principal business centres across Canada, the U.S., and Mexico. CPKC transports bulk commodities, merchandise freight, and intermodal traffic. All of the current directors were elected at the last annual and special meeting of shareholders on June 15, 2023. The directors are qualified and experienced, possessing a broad range of skills that facilitate strong oversight of CPKC’s management and strategy and have agreed to serve on our Board. Share Ownership All directors are CPKC shareholders and must meet our director share ownership requirements within five years of joining the Board. Share ownership listed here is as at March 12, 2024 and includes shares directors beneficially own or control, or hold directly or indirectly. Share ownership includes holdings under the Directors’ Deferred Share Unit (DDSU) plan. See page 51 for full details on share ownership by our directors. 1

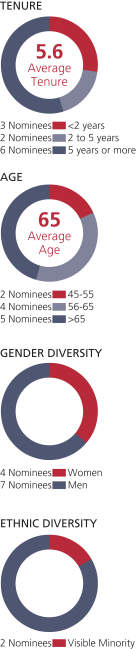

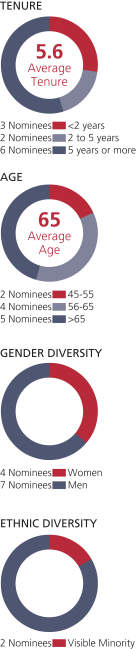

Director Profile Highlights

| | | | | | | | Director profilesIsabelle Courville

All nine nominated directors are qualified and experienced, and have agreed to serve on our Board.

All are CP shareholders and must meet our director share ownership requirements within five years of joining the Board.

Share ownership listed here is as at March 15, 2018 and includes shares directors beneficially own or control, or hold directly or indirectly. Share ownership includes holdings under the Directors’ Deferred Share Unit (DDSU) plan.

Directors are elected for a term of one year until the close of the next annual meeting of shareholders, unless a director resigns or is otherwise removed.Chair

| | |

| | | Andrew F. Reardon

Chairman of the Board

|   | | Independent Age:7261 Director since: May 1, 2013 Residence:MarcoMont-Tremblant, Québec, Canada Island, Florida, U.S.A.

20172023 voting results:

99.20%97.74%for

|

| 2017 attendance:DIRECTOR SKILLS AND QUALIFICATIONS

100%

Brings experience in the following areas: senior executive leadership, accounting & financial literacy, accounting & financial expertise, environment, health & safety, executive compensation/human resources, transportation industry knowledge, governance, government/regulatory affairs and legal, risk management, sales & marketing, climate expertise and strategic oversight. |

ChairmanCURRENT PUBLIC COMPANY BOARD EXPERIENCE

Veolia Environnement S.A. (2015 to present) | • | | Chair Research, Innovation and Sustainable Development Committee | |

| • | | Member of Nominations Committee, Purpose Committee and Presidents’ Committee | |

| | | | | | | | OVERALL 2023 ATTENDANCE(1) | | | | | 100% | | | | | | Meeting Attendance | | | | | | | | | | | Board | | 7 of 7 | | | 100% | | | Audit and Finance | | 6 of 6 | | | 100% | | | Governance | | 3 of 3 | | | 100% | | | Compensation | | 6 of 6 | | | 100% | | | Risk and Sustainability | | 3 of 3 | | | 100% | | | Integration | | 3 of 3 | | | 100% | |

BUSINESS EXPERIENCE President of the Board since July Hydro-Québec Distribution and Hydro-Québec TransÉnergie (2007 to 2013) 20 2015. Brings extensiveyears of experience in executive management, law, corporate governancethe Canadian telecommunications industry, including President of Bell Canada’s Enterprise Group (2003 to 2006) and the rail industry BUSINESS EXPERIENCE

Chairman and Chief Executive Officer (2001 to 2008), President and Chief Executive Officer from 2001of Bell Nordiq Group (2002 to 2008, and Vice-President, Law and Human Resources (1992 to 2000) of TTX Company, the leading railcar leasing company in North America

Previously Senior Vice-President, Law and Administration for Illinois Central Railroad2003)

PAST PUBLIC COMPANY BOARD EXPERIENCE | • | | SNC-Lavalin Group Inc. (2017 to 2023) |

Laurentian Bank of Canada (2007 to 2019) (Chair of the Board) Gecina S.A. (2016 to April 2017) TVA Group (2013 to 2016) OTHER EXPERIENCE Other Boards - Current | • | | Institute for Governance of Private and Public Organizations (IGOPP) (2016 to present) (member of Human Resources Committee) |

Other Boards - Past Appvion Inc. (2007Institute of Corporate Directors (ICD) (2013 to 2015) (member2017)

Quebec Institute of the Audit Committee, Compensation Committee and Chair of the Governance Committee)Corporate Directors (IAS) (2013-2022) OTHER EXPERIENCE

Other Boards

TTX Company (2001 to 2008)

Other rail industry boards: Terminal Railroad Association of St. Louis and Peoria and Pekin Union Railway

Presidential appointee to the Railroad Retirement Board (1990 to 1992)

Barriger Railroad Library (St. Louis) Board of Trustees (Board member (1998 to present), and President Emeritus (2009 to 2012)

Other experience

Officer, United States Navy (1967 to 1971)

EDUCATION Bachelor’s degree University of Notre Damein Engineering Physics, École Polytechnique de Montréal Juris Doctor degree, University of Cincinnati

Master’sBachelor’s degree in Taxation, WashingtonCivil Law, McGill University Law School

Doctorate Honoris Causa, Université de Montréal Fellow of the Institute of Corporate Directors SHARE OWNERSHIP Shares: 4,0314,500 DDSUs: 10,463 Options: 063,898

Meets share ownership requirements | (1) | Ms. Courville is an ex-officio member of all standing committees and may attend committee meetings at her discretion. |

2

| | | The Hon. John Baird, P.C.

|   | | Independent

Age:4854 Director since: May 14, 2015 Residence:Toronto, Ontario, Canada 20172023 voting results:

97.94%97.73%for

|

| 2017 attendance:DIRECTOR SKILLS AND QUALIFICATIONS

100%

Brings experience in the following areas: senior executive leadership, environment, health & safety, transportation industry knowledge, governance, government/regulatory affairs and legal, risk management, climate expertise, investment management and strategic oversight. |

Brings senior level executive experience in public policy and regulatory affairs, especially in transport, environment andCanada-U.S. relationsCURRENT PUBLIC COMPANY BOARD EXPERIENCE

Canfor/Canfor Pulp (CPPI) (2016 to present) | | | | | | | | OVERALL 2023 ATTENDANCE | | | | | 100% | | | | | | Meeting Attendance | | | | | | | | | | | Board | | 7 of 7 | | | 100% | | | Governance (Chair) | | 3 of 3 | | | 100% | | | Risk and Sustainability | | 3 of 3 | | | 100% | |

BUSINESS EXPERIENCE Senior Advisor at the law firm of Bennett Jones LLP , Hatch Ltd. (an engineering firm) and(2015 to present) Senior Advisor at Eurasia Group (a geopolitical risk consultancy) (2015 to present) Member of the International Advisory Board, Barrick Gold Corporation (2015 to present) President ofat Grantham Finchley Consulting Inc. (2015 to present) PAST PUBLIC COMPANY BOARD EXPERIENCE Canfor Corporation and Canfor Pulp Products Inc. (2016Osisko Gold Royalties Ltd. (2020 to present) (member of Environmental, Health and Safety Committee; Capital Expenditure Committee and Corporate Governance Committee)January 31, 2024)

OTHER EXPERIENCE Other Boards - Current FWD Group Ltd./FWD Ltd. (2015 to present) (member of AuditRisk Committee) / FWD Group Holdings Ltd. (2022 to present) (Chair of Compensation Committee, member of Nominating and Corporate Governance Committee and Risk Management and Actuarial Committee) PineBridge Investments (2015 to present) Friends of Israel Initiative (2015 to present) (member of the Board)Audit Committee)

Other experience Served as Canadian Foreign Minister, Minister of Transport and Infrastructure, Minister of the Environment, and President of the Treasury Board during his three terms as a Member of the Canadian Parliament (2006 to 2015) Appointed to the Privy Council in 2006 Former Minister of Community and Social Services and Minister of Energy in the Government of Ontario provincial legislature Senior Advisor to Community Living Ontario, an organization that supports individuals with developmental disabilities Advisory Board member toCouncil Member, Prince’s CharitiesTrust Canada, the charitable office of His Royal Highness The Prince of WalesMajesty King Charles III EDUCATION Honours Bachelor of Arts (Political Studies), Queen’s University SHARE OWNERSHIP Shares: 0 DDSUs: 3,23942,235 Options: 0

Has until May 2020 to meet theMeets share ownership requirements

1

| | | | | | | Isabelle CourvilleKeith E. Creel

|  |  | Not Independent Age: 55 Director since: May 14, 2015 Residence: Wellington,Florida, U.S.A. 2023 voting results: 99.91%for |

| DIRECTOR SKILLS AND QUALIFICATIONS President and Chief Executive Officer of the Company since January 31, 2017. Brings experience in the following areas: senior executive leadership, accounting & financial literacy, environment, health & safety, executive compensation/human resources, transportation industry knowledge, governance, government/regulatory affairs and legal, risk management, sales & marketing and strategic oversight. |

| | | | | | | | OVERALL 2023 ATTENDANCE | | | | | 100% | | | | | | Meeting Attendance | | | | | | | | | | | Board | | 7 of 7 | | | Independent

Age:55

Director since:

May 1, 2013

Residence:Rosemère, Québec, Canada

2017 voting results:

94.94%for

2017 attendance:100%

| |

Brings significant executive level management experience including financial and legal expertise

BUSINESS EXPERIENCE President ofHydro-Québec Distribution andHydro-Québec TransÉnergie (2007 to 2013)

20 years of experience inBecame the Canadian telecommunications industry, including President of Bell Canada’s Enterprise Group (2003 to 2006) andfirst President and Chief Executive Officer of Bell Nordiq Group (2002 to 2003)

PUBLIC COMPANY BOARD EXPERIENCE

SNC Lavalin (2017 to present) (memberCPKC on April 14, 2023 with the combination of GovernanceCanadian Pacific and Ethics Committee)Kansas City Southern

Laurentian Bank of Canada (2007 to present) (Chair of the Board and member of Human Resources and Corporate Governance Committee)

Veolia Environment (2015 to present) (member of Audit Committee and Research and Development Committee)

Gecina S.A. (2016 to April 2017) (member of Audit Committee)

TVA Group (2013 to 2016)

OTHER EXPERIENCE

Other Boards

Institute of Corporate Directors (ICD) (2013 to present)

Institute for Governance of Private and Public Organizations (IGOPP) (2016 to present)

EDUCATION

Bachelor’s degree in Engineering Physics, Ecole Polytechnique de Montréal

Bachelor’s degree in Civil Law, McGill University

Doctorate Honoris Causa, University of Montréal

SHARE OWNERSHIP

Shares: 900

DDSUs: 6,292

Options: 0

Meets share ownership requirements

| | | | | | Keith E. Creel

| |  | | | Not Independent

Age:49

Director since:

May 14, 2015

Residence:Wellington,

Florida, U.S.A.

2017 voting results:

99.61%for

2017 attendance:100%

|

President and Chief Executive Officer of CP since January 31, 2017. Brings extensive railroad operating experience and expertise in executive management and marketing and sales

BUSINESS EXPERIENCE

President and Chief Executive Officer of CP (2017 to present, April 14, 2023) President and Chief Operating Officer of CP (February 2013(2013 to January 2017) Named “Railroad Innovator” for 2014 by Progressive Railroading in recognition of his leadership at CP

Executive Vice-President and Chief Operating Officer of Canadian National Railway Company (CN) (2010 to 2013) Other positions at CN included Executive Vice- President,Vice-President, Operations, Senior Vice-President Eastern Region, Senior Vice-President Western Region, and Vice-President of CN’s Prairie division (2002 to 2010) Superintendent and general manager at Grand Trunk Western Railroad (1999 to 2002) Trainmaster and director of corridor operations at Illinois Central Railway prior to its merger with CN in 1999 Superintendent and general manager at Grand Trunk Western Railroad (1999 to 2002)

Began his railroad career in 1992 as an intermodal ramp manager at Burlington Northern Railway in Birmingham, Alabama INDUSTRY RECOGNITIONS Named “2021 CEO of the Year” and “2021 Strategist of the Year” by The Globe and Mail’s Report on Business Magazine Named “Railroader of the Year” for 2022 & 2021 by Railway Age magazine Named “Railroad Innovator” for 2014 by Progressive Railroading in recognition of his leadership at CP. OTHER EXPERIENCE Other Boards - Current Member of the Board of TTX Company (2014 to present)

Representative on American Association of American Railroads Other experience Commissioned officer in the U.S. Army and served in the Persian Gulf War in Saudi Arabia EDUCATION Bachelor of Science in Marketing, Jacksonville State University Advanced Management Program, Harvard Business School SHARE OWNERSHIP Shares: 2,411Shares(1): 96,723

DSUs*DSUs: 164,889

PSUs: 236,415 Options(2): 31,218 Options*: 579,5462,609,378

Meets executive share ownership requirements (see page 31)15) *(1) | | Mr. Creel received a special make-whole DSU grant when he was hiredReflects CPKC shares in 2013Employee Share Purchase Plan, 401(k) and a stand-alone stock option award as part of his executive compensation.personal accounts. |

| (2) | Reflects stock options outstanding as of Record Date. |

3

| | | | | | | Gillian (Jill) H. DenhamAmb. Antonio Garza (Ret.)(1)

| |  |  | | Independent Age:5764 Director since: September 6, 2016June 15, 2023

Residence:Toronto, Ontario, CanadaMexico City, Mexico (U.S. Citizen) 20172023 voting results:

99.30%99.90%for

|

| 2017 attendance:100%DIRECTOR SKILLS AND QUALIFICATIONS

Brings experience in the following areas: senior executive leadership, transportation industry knowledge, governance, government/regulatory affairs and legal, risk management and strategic oversight. |

Brings significant experience in finance, corporate governance, human resources and executive management

BUSINESS EXPERIENCE

Vice Chair Retail Markets for CIBC (2001 to 2005)

Previously held senior positions at Wood Gundy and CIBC, including: Managing Director Head of Commercial Banking andE-Commerce; President of Merchant Banking/Private Equity and Managing Director Head responsible for the bank’s European Operations

CURRENT PUBLIC COMPANY BOARD EXPERIENCE The Greenbriar Companies (2021 to present) | • | | Member of the Nominating and Corporate Governance Committee | |

| | | | | | | | OVERALL 2023 ATTENDANCE(2) | | | | | 100% | | | | | | Meeting Attendance | | | | | | | | | | | Board | | 5 of 5 | | | 100% | | | Governance | | 2 of 2 | | | 100% | | | Risk and Sustainability | | 2 of 2 | | | 100% | |

BUSINESS EXPERIENCE Morneau Shepell Inc. (2008Counsel to the law firm of White & Case LLP, Mexico City (2009 to present)

PAST PUBLIC COMPANY BOARD EXPERIENCE MoneyGram International (2012 to 2023) Americas Technology Acquisition Corp (2022) Kansas City Southern (2010 to April 13, 2023) Basic Energy Services (2010 to 2016) OTHER EXPERIENCE Other Boards - Current Grupo KUA, S.A. de C.V. (Independent Director) Southern Methodist University (Board Trustee member) Americas Council/Council of the Americas Society (Director) Texas Tribune (Director) American Chamber de Mexico (Honorary Director) George W. Bush Foundation (Director) Other Boards - Past Tricolor Holdings, LLC (2019 to 2023) Grupo ODH, Lux S.A.(2014 to 2023) BBVA Compass and the U.S Companies of BBVA (2009 to 2012) Saavi Energia de Mexico (2018 to 2020) Other Experience Chairman, Vianovo Ventures (2009 to present) United States Ambassador to Mexico (2002 to 2009) Chairman, Texas Railroad Commission (1998 to 2002) Vice Chairman, Interstate Oil and Gas Compact Commission (1998-2002) Partner, Bracewell Law Firm (2017) Secretary of State, State of Texas (1995 to 1997) Senior Policy Advisor, Governor of the State of Texas (1994 to 1997) Cameron County Judge (1988 to 1994) EDUCATION JD (Doctor of Jurisprudence), Southern Methodist University School of Law BBA Finance, University of Texas at Austin RECOGNITIONS Aguila Azteca/Aztec Eagle Distinguished Alumni at both the University of Texas at Austin and the Southern Methodist University, Dallas, TX SHARE OWNERSHIP Shares: 12,828 DDSUs: 2,589 Expected to meet share ownership requirements in 2028 | | | Hon. Edward R. Hamberger |  | | Independent Age: 73 Director since: July 15, 2019 Residence: Delray Beach, Florida, U.S.A. 2023 voting results: 99.90% for |

| DIRECTOR SKILLS AND QUALIFICATIONS Brings experience in the following areas: senior executive leadership, accounting & financial literacy, environment, health & safety, executive compensation/human resources, transportation industry knowledge, governance, government/regulatory affairs and legal, risk management and strategic oversight. |

| | | | | | | | OVERALL 2023 ATTENDANCE(3) | | | | | 100% | | | | | | Meeting Attendance | | | | | | | | | | | Board | | 7 of 7 | | | 100% | | | Audit and Finance | | 4 of 4 | | | 100% | | | Integration | | 3 of 3 | | | 100% | | | Risk and Sustainability | | 3 of 3 | | | 100% | |

BUSINESS EXPERIENCE President and Chief Executive Officer, Association of American Railroads (1998 to 2019) OTHER EXPERIENCE Other Boards - Current Transportation Institute, University of Denver (2002 to present) Other Boards - Past Business Advisory Committee, Kellogg School of Management, Northwestern University (2000 to 2019) TTCI (Chair of the Board and Chair of the Governance Committee)Board) (1998 to 2019) National Bank of Canada (2010Railinc Corporation (1998 to present) (member of Human Resources Committee)2019)

Kinaxis Inc. (2016Mineta Transportation Institute, San Jose State University (2005 to present) (member of Nominating and Governance2019)

Baker Donelson, Management Committee and Audit Committee)(1989 to 1998) Markit Ltd. (2014Asociación Mexicana de Ferrocarriles (2005 to 2016)2008)

Penn West Petroleum (2012 to 2016)

Calloway Real Estate Investment Trust (2011 to 2012)

OTHER EXPERIENCE

Other Boards Munich Reinsurance Company of Canada (Chair) (2012 to present)

Temple Insurance Company (Chair) (2012 to present)

Centre for Addiction and Mental Health (CAMH) (Board member and Chair of the Investment Committee)

EDUCATIONExperience

Honours Business Administration (HBA) degree, Ivey Business School, WesternServed as Assistant Secretary for governmental affairs at the U.S. Department of Transportation (1987 to 1989)

EDUCATION Juris Doctor, Georgetown University MBA, Harvard Business SchoolMaster of Science, Foreign Service, Georgetown University

Bachelor of Science, Foreign Service, Georgetown University SHARE OWNERSHIP Shares: 0 DDSUs: 1,50916,527 Options: 0

Has until September 2021Expected to meet share ownership requirements in 2024

| (1) | Identifies as a visible minority. |

| (2) | Mr. Garza was appointed to the Board of CPRC and appointed a member of the CPRC Corporate Governance, Nominating and Social Responsibility Committee and CPRC Risk and Sustainability Committee on April 14, 2023. Mr. Garza was subsequently elected to the Board of CPKC and appointed a member of the CPKC Corporate Governance, Nominating and Society Responsibility Committee and the CPKC Risk and Sustainability Committee on June 15, 2023. |

| (3) | The Hon. Ed Hamberger became Chair of the Integration Committee on January 31, 2023. The Hon. Ed Hamberger ceased to be a member of the Audit and Finance Committee on June 15, 2023. |

4

| | | Janet H. Kennedy |  | | Independent Age: 63 Director since: June 15, 2023 Residence: Naples, Florida, U.S.A. 2023 voting results: 99.93% for |

| DIRECTOR SKILLS AND QUALIFICATIONS Brings experience in the following areas: senior executive leadership, accounting & financial literacy, accounting & financial expertise, executive compensation/human resources, transportation industry knowledge, investment management, governance, risk management, sales & marketing, cybersecurity trainingand strategic oversight. |

CURRENT PUBLIC BOARD EXPERIENCE Duluth Holdings Inc. (2023 to present) | • | | Member of the Audit Committee | |

| | | | | | | | OVERALL 2023 ATTENDANCE(1) | | | | | 100% | | | | | | Meeting Attendance | | | | | | | | | | | Board | | 5 of 5 | | | 100% | | | Audit and Finance | | 3 of 3 | | | 100% | | | Risk and Sustainability | | 2 of 2 | | | 100% | |

BUSINESS EXPERIENCE Vice President, North America Regions of Google Cloud at Google (2019 to April, 2023) Partner/Principal, Americas Advisory Digital Transformation Leader of Ernst & Young (2018 to 2019) Vice President of US Digital Transformation for Microsoft Corp. (2018 to 2019) President of Microsoft Canada (2013 to 2017) Vice President, U.S. Enterprise of Microsoft Corp. (2009 to 2013) Vice President, Central Region EPG for Microsoft Corp. (2002 to 2013) Business Unit Executive for IBM (1990 to 2002) PAST PUBLIC COMPANY BOARD EXPERIENCE Kansas City Southern (2017 to 2018 and from 2019 to April 13, 2023) OTHER EXPERIENCE Other Boards - Past Information Technology Association of Canada (2013 to 2017) Business Council of Canada (2014 to 2017) EDUCATION BSIM, Industrial Mgmt/Industrial Engineering, Purdue University, Daniels School of Business MBA, Queens University of Charlotte Directors Consortium 2018, Stanford Graduate School of Business Executive Education Diligent Cyber Risk and Strategy Certification SHARE OWNERSHIP Shares: 7,944 DDSUs: 2,589 Expected to meet share ownership requirements in 2028 | | | Henry Maier |  | | Independent Age: 70 Director since: June 15, 2023 Residence: Gallatin, Tennessee, U.S.A. 2023 voting results: 93.82% for |

| DIRECTOR SKILLS AND QUALIFICATIONS Brings experience in the following areas: senior executive leadership, accounting & financial literacy, executive compensation/human resources, transportation industry knowledge, governance, risk management, sales & marketingand strategic oversight. |

CURRENT PUBLIC COMPANY BOARD EXPERIENCE CalAmp Corp. (2021 to present) | • | | Member of the Governance and Nominating Committee and the Human Capital Committee | |

CarParts.com (2021 to present) | • | | Member of the Nominating and Corporate Governance Committee | |

CH Robinson Worldwide Inc. (2022 to present) | • | | Member of the Governance Committee and the Capital Allocation and Planning Committee | |

| | | | | | | | OVERALL 2023 ATTENDANCE(2) | | | | | 100% | | | | | | Meeting Attendance | | | | | | | | | | | Board | | 5 of 5 | | | 100% | | | Compensation | | 4 of 4 | | | 100% | | | Integration | | 3 of 3 | | | 100% | |

BUSINESS EXPERIENCE President and Chief Executive Officer of FedEx Ground (2013 to 2021) Executive Vice President, Strategic Planning, Communications, and Contractor Relations for FedEx Corp. (2009 to 2013) PAST PUBLIC COMPANY BOARD EXPERIENCE Kansas City Southern (2017 to April 13, 2023) OTHER EXPERIENCE Other Boards - Past United Way of Southwestern Pennsylvania EDUCATION Bachelor of Arts in Economics, University of Michigan SHARE OWNERSHIP Shares: 26,206 DDSUs: 2,589 Meets share ownership requirements 2

| (1) | Ms. Kennedy was appointed to the Board of CPRC and appointed a member of the CPRC Audit and Finance Committee and CPRC Risk and Safety Committee on April 14, 2023. Ms. Kennedy was subsequently elected to the Board of CPKC and appointed a member of the CPKC Audit and Finance Committee and the CPKC Risk and Safety Committee on June 15, 2023. |

| (2) | Mr. Maier was appointed to the Board of CPRC and appointed a member of the CPRC Management Resources and Compensation Committee and the CPRC Integration Committee on April 14, 2023. Mr. Maier was subsequently elected to the Board of CPKC and appointed a member of the CPKC Management Resources and Compensation Committee and the CPKC Integration Committee on June 15, 2023. |

5

| | | | | | | Rebecca MacDonaldMatthew H. Paull(1)

| |  |  | | Independent Age:6472 Director since: May 17, 2012January 26, 2016

Residence:North York, Ontario, CanadaWilmette, Illinois, U.S.A. 20172023 voting results:

97.60%98.53%for

|

| 2017 attendance:100%DIRECTOR SKILLS AND QUALIFICATIONS

Brings experience in the following areas: senior executive leadership, accounting & financial literacy, accounting & financial expertise, executive compensation/human resources, investment management, governance, government/regulatory affairs and legal, risk management and strategic oversight. |

Brings extensive executive management, marketing, sales and corporate governance experience

BUSINESS EXPERIENCE

Founder and current Executive Chair of Just Energy Group Inc., a Toronto-based independent marketer of deregulated gas and electricity

President and Chief Executive Officer of Just Energy (2001 to 2007)

Founded Energy Savings Income Fund in 1997, another company which aggregated customers in the deregulation of the U.K. natural gas industry

Founded Energy Marketing Inc. in 1989

CURRENT PUBLIC COMPANY BOARD EXPERIENCE Air Products & Chemicals Corporation (2013 to Present) Just Energy Group Inc. (2001 to present) (Executive Chair since 2007)

OTHER EXPERIENCE

Other Boards

Horatio Alger Association in both Canada and the United States

Other experience

Founded the Rebecca MacDonald Centre for Arthritis and Autoimmune Disease at Mount Sinai Hospital in Toronto

Previously Vice-Chair of the Board of Directors of Mount Sinai Hospital

Previously a member of the Board of Governors of the Royal Ontario Museum

EDUCATION

Honorary LLD degree, University of Victoria

SHARE OWNERSHIP

Shares: 0

DDSUs: 9,187

Options: 0

Meets share ownership requirements

| | | | | | Matthew H. Paull

| | |  | | Chair of Audit and Finance Committee | |

| • | | Member of Corporate Governance and Nominating Committee and Executive Committee | |

| | | | | | | | OVERALL 2023 ATTENDANCE(2) | | | | | 90% | | | | | | Meeting Attendance | | | | | | | | | | | Board | | 6 of 7 | | | Independent

Age:66

Director since:

January 26, 2016

Residence:Willmette, Illinois, U.S.A.

2017 voting results:

98.96%for

2017 attendance:86%

| | | Compensation (Chair) | | 6 of 6 | | | 100% | | | Audit and Finance | | 5 of 6 | | | 83% | |

Brings significant expertise in financial markets, corporate finance, accounting and controls, and investor relations and extensive experience in international operations and marketing

BUSINESS EXPERIENCE Senior Executive Vice-President and Chief Financial Officer of McDonald’s Corporation (2001 until his retirement in 2008)

before joining McDonald’s in 1993, was a partner at Ernst & Young where he managed a variety of financial practices during his18-year career and consulted with many leading multinational corporations

| • | | Senior Executive Vice-President and Chief Financial Officer of McDonald’s Corporation (2001 until his retirement in 2008)(3) |

| • | | Before joining McDonald’s in 1993, was a partner at Ernst & Young where he managed a variety of financial practices during his 18-year career and consulted with many leading multinational corporations |

PAST PUBLIC COMPANY BOARD EXPERIENCE Chipotle Mexican Grill Inc. (2016 to present) Air Products & Chemicals Corporation (2013 to present) (Chair of Audit Committee and member of Corporate Governance and Nominating Committee and Executive Committee)

KapStone Paper and Packaging Corporation (2010 to present) (Chair of Audit Committee until 2018 and member2020) (member of Compensation Committee)

Best Buy Co. (2003 to 2013) (lead(Lead independent director and chair of Finance Committee) WMS Industries Inc. (2012 to 2013) KapStone Paper and Packaging Corporation (2010 to 2018) OTHER EXPERIENCE Other Boards - Past Pershing Square Capital Management, L.P. (2008 to 2023) (member of Advisory Board) EDUCATION Master’s degree in Accounting, University of Illinois Bachelor’s degree, University of Illinois SHARE OWNERSHIP Shares: 1,00018,690 DDSUs: 3,35045,791 Options: 0

Has until January 2021 to meet theMeets share ownership requirements

| | | | | | | Jane L. Peverett(1) | |  |  | | Independent Age:5965 Director since: December 13, 2016 Residence:WestVancouver, British Columbia, Canada 20172023 voting results:

99.31%98.93%for

|

| 2017 attendance:100%DIRECTOR SKILLS AND QUALIFICATIONS

Brings experience in the following areas: senior executive leadership, accounting & financial literacy, accounting & financial expertise, environment, health & safety, executive compensation/human resources, governance, government/regulatory affairs and legal, risk management and strategic oversight. |

Brings significant Board and senior management experience and extensive knowledge and training in finance, accounting and corporate governanceCURRENT PUBLIC COMPANY BOARD EXPERIENCE

Northwest Natural Gas Company (2007 to present) | • | | Chair of Audit Committee | |

| • | | Member of Governance Committee and Organization and Executive Compensation Committee | |

Capital Power Corporation (2019 to present) | • | | Member of People, Culture and Governance Committee and the Health, Safety and Environment Committee | |

Suncor Energy Inc. (2023 to present) | • | | Member of the Audit Committee and Governance Committee | |

| | | | | | | | OVERALL 2023 ATTENDANCE | | | | | 100% | | | | | | Meeting Attendance | | | | | | | | | | | Board | | 7 of 7 | | | 100% | | | Audit and Finance (Chair) | | 6 of 6 | | | 100% | | | Governance | | 3 of 3 | | | 100% | |

BUSINESS EXPERIENCE President & Chief Executive Officer of BC Transmission Corporation (electrical transmission) (2005 to 2009) Vice-President, Corporate Services and Chief Financial Officer of BC Transmission Corporation (2003 to 2005)

| • | | Vice-President, Corporate Services and Chief Financial Officer of BC Transmission Corporation (2003 to 2005)(3) |

President of Union Gas Limited (a natural gas storage, transmission and distribution company) (2002 to 2003) Other positions at Union Gas Limited: President & Chief Executive Officer (2001 to 2002); Senior Vice-President Sales & Marketing (2000 to 2001) and Chief Financial Officer (1999 to 2000)

| • | | Other positions at Union Gas Limited: President & Chief Executive Officer (2001 to 2002); Senior Vice-President Sales & Marketing (2000 to 2001) and Chief Financial Officer (1999 to 2000)(3) |

PAST PUBLIC COMPANY BOARD EXPERIENCE CIBC (2009 to present) (Chair of Audit Committee)

Hydro One Limited (2015 to present) (member of Human Resources Committee and Chair of Nominating, Corporate Governance, Public Policy & Regulatory Committee)

Northwest Natural Gas Company (2007 to present) (member of Organization and Executive Compensation Committee and Public Affairs and Environmental Policy Committee)

Encana Corp. (2003 to 2017) Postmedia Network Canada Corp. (2013 to 2016) | • | | HydroOne Limited (2015 to 2018) |

CIBC (2009 to April 2023) OTHER EXPERIENCE Other Boards - Current CSA Group (2019 to present) (Chair of the Board) British Columbia Institute of Corporate Directors Executive CommitteeAdvisory Board EDUCATION Bachelor of Commerce degree, McMaster University Master of Business Administration degree, Queen’s University Certified Management Accountant A Fellow of the Society of Management Accountants Holds the ICD.D designation from the Institute of Corporate Directors SHARE OWNERSHIP Shares: 0 DDSUs: 1,27530,406 Options: 0

Has until January 2021 to meet theMeets share ownership requirements

3

| (1) | Mr. Paull and Ms. Peverett meet the SEC definition of “Audit Committee Financial Expert”. |

| (2) | Mr. Paull missed a one hour board and audit committee meeting during July of 2023 due to a prescheduled ankle surgery. |

| (3) | Mr. Paull is an audit financial expert by virtue of, among other things, having been the CFO of a public company. Ms. Peverett is an audit financial expert by virtue of, among other things her past CFO experience and related background. |

6

| | | | | | | Gordon T. Trafton IIAndrea Robertson

| |  |  | | Independent Age:6460 Director since: January 1, 2017July 15, 2019

Residence:Naperville, Illinois, U.S.A.Calgary, Alberta, Canada 20172023 voting results:

99.16%99.22%for

2017 attendance:100%

|

| DIRECTOR SKILLS AND QUALIFICATIONS Brings experience in the following areas: senior executive leadership, accounting & financial literacy, environment, health & safety, executive compensation/human resources, transportation industry knowledge, governance, government/regulatory affairs and legal, risk management, and strategic oversight. |

| | | | | | | | OVERALL 2023 ATTENDANCE | | | | | 100% | | | | | | Meeting Attendance | | | | | | | | | | | Board | | 7 of 7 | | | 100% | | | Governance | | 3 of 3 | | | 100% | | | Compensation | | 6 of 6 | | | 100% | | | Integration | | 3 of 3 | | | 100% | |

BUSINESS EXPERIENCE Chair of the Board, Calgary Airport Authority (2023 to present) President & Chief Executive Officer, Shock Trauma Air Rescue Service (STARS) (2011 to 2023) President & Chief Operating Officer, STARS (2011 to 2012) Chief Nursing and Health Professions Officer, Alberta Health Services (2009 to 2011) Vice President, Foothills Medical Centre (2008 to 2009) Vice President, Alberta Children’s Hospital (2008 to 2009) Vice President, South Health Campus (2005 to 2007) Brings extensive experienceOTHER EXPERIENCE

Other Boards - Current The Calgary Airport Authority (2017 to present) Other Boards - Past Bow Valley College (2015 to 2018) United Way (2007 to 2013) University of Alberta, Faculty of Medicine & Dentistry (2021 to 2023) EDUCATION Executive Leadership, Harvard University ICD.D Rotman School of Business Masters in the rail industry including executive positionsHealth-Care Administration, Central Michigan University Baccalaureate of Nursing, University of Calgary Executive Fellowship, Wharton University SHARE OWNERSHIP Shares: 0 DDSUs: 16,141 Expected to meet share ownership requirements in rail operations, sales and marketing and risk management2024 | | | Gordon T. Trafton(1) |  | | Independent Age: 70 Director since: January 1, 2017 Residence: Naperville, Illinois, U.S.A. 2023 voting results: 99.28%for |

| DIRECTOR SKILLS AND QUALIFICATIONS Brings experience in the following areas: senior executive leadership, accounting & financial literacy, environment, health & safety, executive compensation/human resources, transportation industry knowledge, governance, government/regulatory affairs and legal, risk management, sales & marketing and strategic oversight. |

| | | | | | | | OVERALL 2023 ATTENDANCE(2) | | | | | 100% | | | | | | Meeting Attendance | | | | | | | | | | | Board | | 7 of 7 | | | 100% | | | Governance | | 2 of 2 | | | 100% | | | Risk and Sustainability (Chair) | | 3 of 3 | | | 100% | | | Integration | | 3 of 3 | | | 100% | |

BUSINESS EXPERIENCE Consultant, Brigadier Consulting (2014 to 2015) Consultant, CPKC (f/k/a Canadian Pacific Railway Limited) (2013) Special Advisor to the Canadian National Railway (CN) leadership team (2009 to his retirement in 2010) Senior Vice-President Strategic Acquisitions and Integration, Canadian National Railway (2003CN (2009 to 2009)2010) Senior Vice-President, Southern Region, Canadian National RailwayCN (2003 to 2009) heldVice-President, Operations Integration, CN (2001 to 2003)

Vice-President, Transportation and IT Services, Illinois Central Railroad (1999 to 2001) Held a number of leadership positions with Illinois Central Railroad and Burlington Northern Railroad OTHER EXPERIENCE Other Boards - Current Leeds School of Business Advisory Board, of Alumni and Friends, University of Colorado Boulder (Chair)(2012 to present) Sacred Cow Consulting, Inc., Advisory Board (2020 to present) Pacific National (2023 to present) EDUCATION Bachelor of Science, Transportation Management from the Leeds School of Business, University of Colorado Boulder SHARE OWNERSHIP Shares: 0 DDSUs: 1,45130,065 Options: 0

Has until January 2022 to meet theMeets share ownership requirements

Notes:

| (1) | Identifies as a visible minority. |

| (2) | Mr. Trafton ceased to be a member of the Corporate Governance, Nominating and Social Responsibility Committee on June 15, 2023. |

7

| Other than as disclosed below, none of the nominated directors is, or has been in the last 10 years: (a) | a director, chief executive officer or chief financial officer of a company that: |

was subject to a cease trade or similar order or an order that denied the issuer access to any exemptions under securities legislation for over 30 consecutive days, that was issued while the proposed director was acting in that capacity, or

was subject to a cease trade or similar order or an order that denied the issuer access to an exemption under securities legislation for over 30 consecutive days, that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in that capacity

• was subject to a cease trade or similar order or an order that denied the issuer access to any exemptions under securities legislation for over 30 consecutive days, that was issued while the proposed director was acting in that capacity, or • was subject to a cease trade or similar order or an order that denied the issuer access to an exemption under securities legislation for over 30 consecutive days, that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in that capacity (b) | a director or executive officer of a company that, while that proposed director was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets, or |

(c) | become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold their assets.assets, or(d) subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities commission. Ms. Peverett was a director of Postmedia Network Canada Corp. (Postmedia) from April 2013 to January 2016. On October 5, 2016, Postmedia completed a recapitalization transaction under a court-approved plan of arrangement under the CBCA. Approximately US$268.6 million of debt was exchanged for shares that represented approximately 98 percent of the outstanding shares of Postmedia at that time. Postmedia repaid, extended and amended the terms of its outstanding debt obligations. |

Ms. Denham served as a director of Penn West Petroleum from June 2012 to June 2016, which was subject to cease trade orders on its securities following the July 2014 announcement of the review of it accounting practices and restatement of its financial statements. Those cease trade orders ended on September 23, 2014.

Ms. Peverett was a director of Postmedia Network Canada Corp. (Postmedia) from April 2013 to January 2016. On October 5, 2016, Postmedia completed a recapitalization transaction under a court-approved plan of arrangement under the Canada Business Corporations Act. Approximately US$268.6 million of debt was exchanged for shares that represented approximately 98% of the outstanding shares at that time. Postmedia repaid, extended and amended the terms of its outstanding debt obligations.8

4

Executive Officers The information regarding executive officers is included in Part I1 of our 20172023 Form 10-K under Information about our Executive Officers, of the Registrant, following Item 4. Mine Safety Disclosures Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act required our directors and executive officers, and any certain persons owning more than 10% of our common shares, to file certain reports of ownership and changes in ownership with the SEC. As of June 30, 2017, Section 16(a) of the Exchange Act no longer applied to us because we qualified as a foreign private issuer under U.S. securities laws. Based solely on our review of the copies of Forms 3, 4 and 5 filed between January 1, 2017 and June 30, 2017, we believe that all reports required to be filed under Section 16(a) were made on a timely basis with respect to transactions that occurred during such period.Disclosures.

Code of Business Ethicsethics and business ethics reporting policy(1) Our updated code of business ethics (Code) for the combined CPKC, which now applies to employees of CPKC in Canada and the United States, sets out our expectations for conduct. It covers confidentiality, protecting our assets, avoiding conflicts of interest, fair dealing with third parties, compliance with applicable laws, environmental protection, rules and regulations, as well as reporting any illegal or unethical behaviour, among other things. The codeCode applies to everyone at CP and our subsidiaries: directors, officers, employees (unionized andnon-unionized) and contractors who do work for us. Directors, officers andnon-union employees must sign an acknowledgementacknowledge every year that they have read, understood and agree to comply with the code. Directors mustCode. We have also confirm annuallyintroduced a separate Code of Ethics for CPKC employees in Mexico (Mexico Code). The Mexico Code is largely identical to the Code, with key differences being that the Mexico Code is presented in Spanish and cross references policies for Mexico. We also have a Business ethics reporting policy (Business Ethics Policy) that outlines the processes the Company has established for our personnel and others to report concerns regarding conduct within the Company, including questionable management and/or corporate practices, the potential violation of any applicable law, or a potential violation of the Code. Our Business Ethics Policy now applies to employees in Canada and the United States. We have a separate but largely identical Business Ethics Reporting Policy for our Mexico based employees (Mexico Business Ethics Policy), with the key differences being reference to Mexico based policies and presentation in Spanish. Legacy CP All legacy Canadian Pacific non-unionized employees were required to complete online scenario based training to ensure that they have compliedunderstood the legacy CP Code of Business Ethics. For the 2022/2023 survey year, 100 percent of non-union employees completed this training. In addition, legacy CP unionized employees in the Teamsters Canada Rail Conference (Train and Engine) were also required to complete scenario based training and 100% of those employees completed the scenario based training. Legacy KCS and Legacy KCSM All legacy KCS and KCSM employees completed the legacy KCS and KCSM conflict of interest survey questionnaire. The survey was launched prior to integration with legacy CP and the code. The code is partprocess was completed shortly after the combination of the termsCPKC. 100 percent of legacy KCS and conditions of employment fornon-unionKCSM employees and contractors must agree to follow principles of standards of business conduct consistent with those set out in our code as part of the terms of engagement.management completed this survey. We also have a supplemental code of ethics for the CEO and other senior financial officers (the CFO(including the Executive Vice-President and Chief Financial Officer, the Vice-President Capital Markets, Senior Vice-President of Accounting, Planning and Procurement and the Assistant Vice-President and Controller) which sets out our longstandinglong-standing principles of conduct for these senior roles. A copyThe latest version of the code (and any amendments)Code and the business ethics reporting policy is posted on our website (www.cpr.ca)(investor.cpkcr.com/governance). Only the Board or Governance Committee (audit committee(Audit and Finance Committee in the case of the CEO and senior financial officers) can waive an aspect of the code.Code. Any waivers are posted on our website. NoneNo waivers were requested or granted in 2017.2023.

Monitoring compliance and updating the Code The Governance Committee is responsible for monitoring compliance with the Code, reviewing it periodically and recommending changes as appropriate, and promptly disclosing any aspects of the Code that have been waived. The Audit and Finance Committee ensures compliance with the Code. Corporate Governance CPKC has a strong governance culture and we have adopted many leading policies and practices. As a U.S. and Canadian listed company, our corporate governance practices comply with or exceed the requirements ofpractices outlined by the Canadian Securities Administrators (CSA) in National Policy58-201 Effective Corporate Governance Guidelines and the Toronto Stock Exchange (TSX), Item 407 of RegulationS-K ofTSX, the SEC and the NYSE. | (1) | Our Code of Business Ethics and the Code of Business Ethics for Mexico employees were updated in November, 2023. Our Business Ethics Reporting Policy and Business Ethics Reporting Policy for employees in Mexico were updated in February, 2024. |

9

We regularly review our policies and practices and make changes as appropriate, so we stay at the forefront of good governance as standards and guidelines continue to evolve in Canada and the United States. The Board and the Governance Committee are responsible for developing our approach to corporate governance. This includes annual reviews of the corporate governance principles and guidelines which were established by the Board, as well as the terms of reference for the Board and each of the New York StockBoard’s standing committees. CP’s corporate governance principles and guidelines are available on our website at investor.cpr.ca/governance. Audit and Finance Committee CP’s Audit and Finance Committee has been established in accordance with Section 3(a)(58)(A) of the Exchange (NYSE). Act and NYSE standards and CSA National Instrument 52-110-Audit Committees. The current members of the Audit and Finance Committee are Jane Peverett (Chair), Isabelle Courville, Jill Denham, David Garza-Santos, Janet Kennedy and Matthew Paull, all of whom are independent. All members of the Audit and Finance Committee are “financially literate” as required by the NYSE and applicable Canadian securities laws. Of the current Audit and Finance Committee members, Ms. Peverett, Ms. Kennedy, Ms. Courville and Mr. Paull have been determined to be “audit committee financial experts” as defined by the SEC. If significant corporate governance differences between CP’s corporate governance practices and Item 303A of the NYSE arise, they will be disclosed on our website at investor.cpr.ca/governance. CP’s audit committee has been established in accordance with Section 3(a)(58)(A) the Exchange Act and NYSE standards and CSA National Instrument52-110. The current members of the audit committee are Jane Peverett (chair), Jill Denham and Andrew Reardon, all of whom are independent. All members of the audit committee are “financially literate” as required by the NYSE and CSA. Ms. Peverett and Mr. Reardon have been determined to meet the audit committee financial expert criteria prescribed by the SEC.

10

ITEM 11. EXECUTIVE COMPENSATION As a foreign private issuer in the United States, we are deemed to comply with this Item if we provide information required by Items 6.B and 6.E.2 of Form20-F, with more detailed information provided if otherwise made publicly available or required to be disclosed in Canada. We have provided information required by Items 6.B and 6.E.2 of Form20-F in our management proxy circular related to the Meeting (the “proxy circular”) and have filed it through the Canadian System for Electronic Document Analysis and Retrieval (“SEDAR”), the Canadian equivalent of the SEC’s Next-Generation EDGAR system, at www.sedar.com. In addition, our proxy circular has been furnished to the SECthis Annual Report on Form8-K.10-K/A. As a foreign private issuer in the U.S., we are not required to disclose executive compensation according to the requirements of RegulationS-K that apply to U.S. domestic 5

issuers, and we are otherwise not required to adhere to the U.S. requirements relative to certain other proxy disclosures and requirements. Our executive compensation disclosure complies with Canadian requirements, which are, in most respects, substantially similar to the U.S. rules. We generally attempt to comply with the spirit of the U.S. proxy rules when possible and to the extent that they do not conflict, in whole or in part, with required Canadian corporate or securities requirements or disclosure. All dollar amounts included in this Item 11 are in Canadian dollars, unless otherwise expressly stated to be in U.S. dollars. EXECUTIVE COMPENSATIONCompensation Committee Interlocks and Insider Participation

Our executive compensation program is designed to pay for performance,There were no reportable interlocks or insider participation affecting the Company’s Management Resources and to align management’s interests with our business strategy andCompensation Committee during the interestsyear ended December 31, 2023. None of our shareholders.executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board or our Management Resources and Compensation Committee.

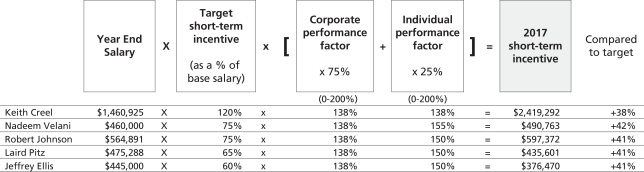

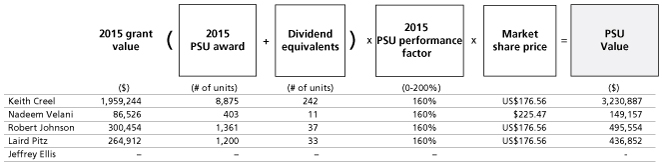

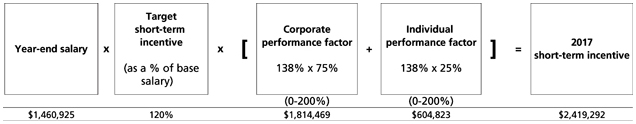

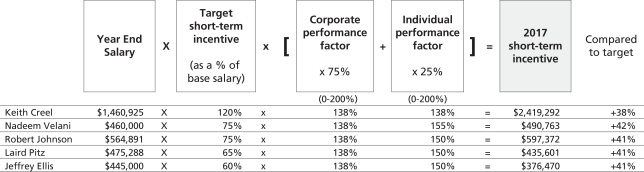

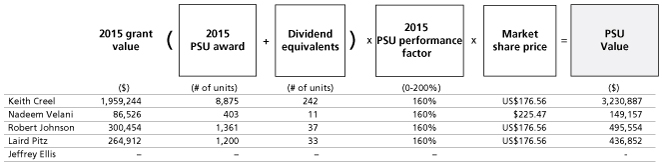

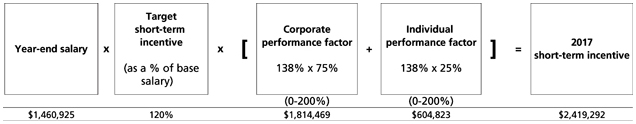

The next section describes our compensation program and explains the 2017 compensation decisions for our named executives:

Keith E. Creel, President and Chief Executive Officer

Nadeem S. Velani, Executive Vice-President and Chief Financial Officer

Robert A. Johnson, Executive Vice-President Operations

Laird J. Pitz, Senior Vice-President and Chief Risk Officer

Jeffrey J. Ellis, Chief Legal Officer and Corporate Secretary

E. Hunter Harrison, former Chief Executive Officer (resigned on January 31, 2017)

Compensation Committee Report The Management Resources and Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis contained in this Annual Report on Form 10-K/A with management resourcesof the Company and, compensation committeebased on such review and discussion, the Management Resources and Compensation Committee recommended to the Board that the information set forth under “Compensation Discussion and Analysis” below be included in this Annual Report on Form 10-K/A. Respectfully submitted, Management Resources and Compensation Committee Matthew Paull (Chair) Isabelle Courville Jill Denham Henry Maier Andrea Robertson 11

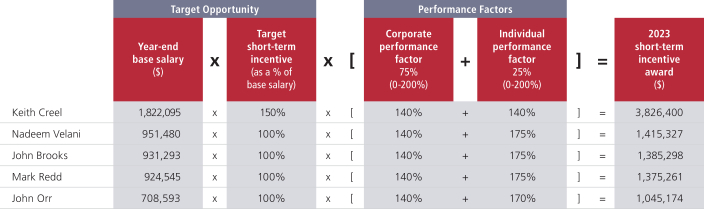

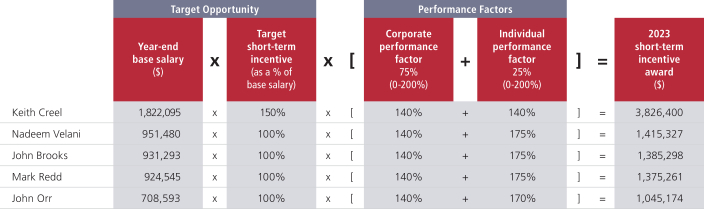

PART III – EXECUTIVE COMPENSATION COMPENSATION DISCUSSION AND ANALYSIS The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis with management. Based on its review, and on the discussion described above, on February 14, 2018, the Compensation Committee recommended to the full Board that the Compensation Discussion and Analysis be included in this 10-K/A. Our executive compensation program is designed to pay for performance, to align management interests with our business strategy and the Circularinterests of our shareholders, and this Annual Report on Form to engage and retain our executives. This section of our 10-K/A.A provides shareholders with descriptions of our compensation programs and 2023 compensation decisions for our Named Executive Officers (NEOs), listed below. Compensation Committee

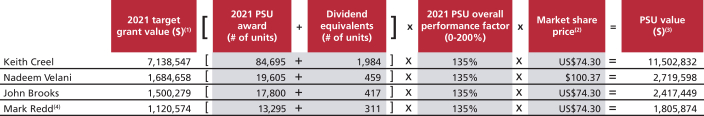

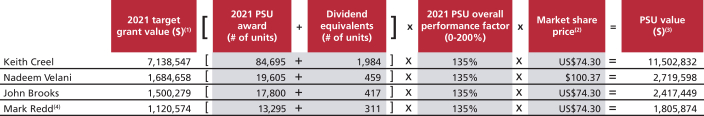

| 2023 NAMED EXECUTIVE OFFICERS | Keith E. Creel President and Chief Executive Officer | Nadeem S. Velani Executive Vice-President and Chief Financial Officer | John K. Brooks Executive Vice-President and Chief Marketing Officer | Mark A. Redd(1) Executive Vice-President and Chief Operating Officer | John F. Orr(2) Executive Vice-President and Chief Transformation Officer |

Isabelle Courville (Chair)

| (1) | Until April 13, 2023, Mr. Redd held the role of Executive Vice-President Operations at CP. He was appointed Executive Vice-President and Chief Operating Officer of CPKC effective April 14, 2023. |

| (2) | Until April 13, 2023, Mr. Orr held the role of Executive Vice-President Operations at KCS. He was appointed Executive Vice-President and Chief Transformation Officer of CPKC effective April 14, 2023. Mr. Orr’s employment with the company terminated on March 19, 2024. |

John Baird

Rebecca MacDonald

Matthew Paull

Andrew Reardon

Gordon Trafton

Where to find it 612

COMPENSATION DISCUSSION AND ANALYSIS

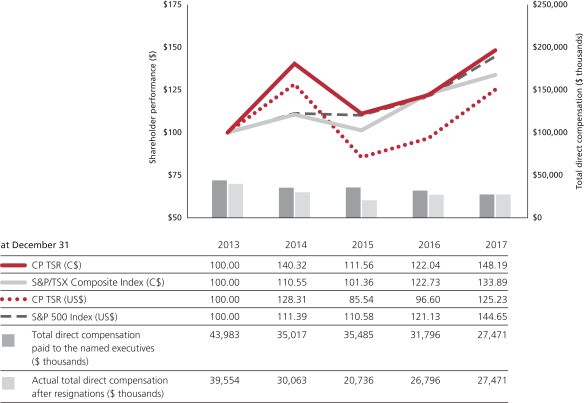

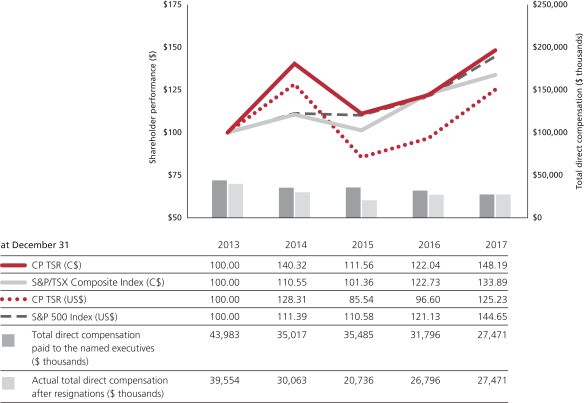

Our approach to executive compensation We believe in the importance of paying for performance and aligning management’s interests with those of our shareholders.

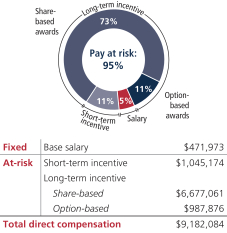

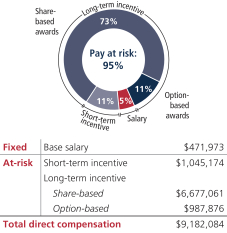

Our executive compensation program supports our railroad-focusedoperations-focused culture, is closely linked to the critical metrics that drive the achievement of our strategic plan without taking on undue risk, and is designed to create long-term sustainable value for our shareholders. The key elements of our approach to executive compensation include: | • | | competitive market pay practices to attract and retain talent |

| • | | a compensation mix that is incentive-driven with a large portion of total direct compensation that is variable or “at-risk” to support our pay for performance culture |

| • | | compensation components paying out over multiple performance periods to link to our short and long-term business strategy |

| • | | alignment management’s interests with those of our shareholders through equity-based compensation and share ownership requirements |

We have five key performance driversfoundations designed to focus us on our goal of being the best railroad company in North America: 1. | Provide customers with industry-leading rail service |

4. | Remain a leader in rail safety |

We implemented several changes to our compensation program in 2017, as disclosed in last year’s proxy circular. These changes were the result of an extensive shareholder engagement program and an extensive review of executive compensation by the Compensation Committee, the Board and our human resources group. You can read about the program changes starting on page 15, and in the letter of the Compensation Committee chair beginning on page 5 of the Circular.

We received a 71.11% votefor our 2017 advisory vote on executive compensation, compared to 49.9% in 2016. The Compensation Committee continues to focus on making sure our compensation program pays for performance, reflects sound principles, supports long-term sustainable value, is clear and transparent and aligns with shareholder interests.

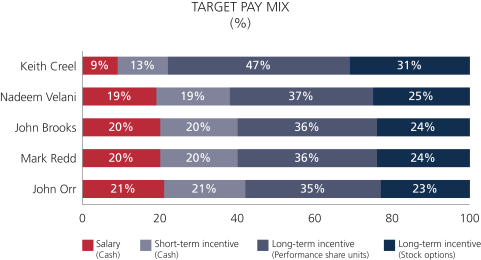

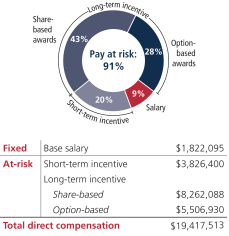

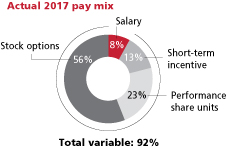

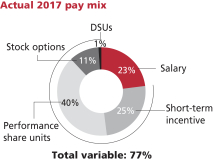

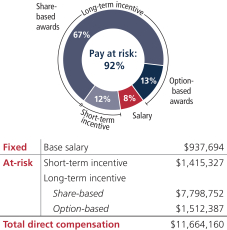

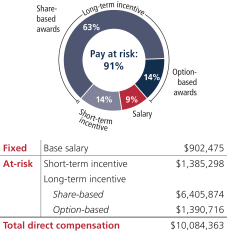

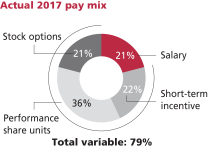

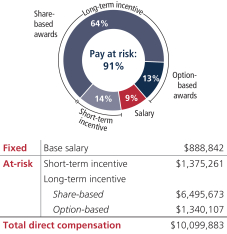

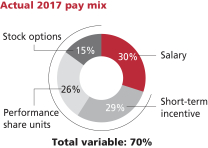

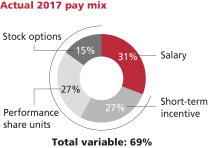

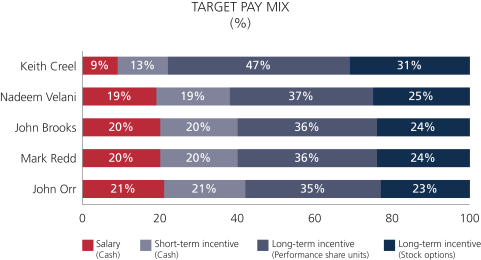

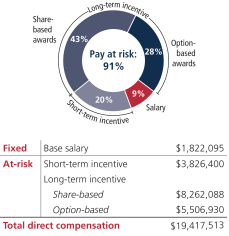

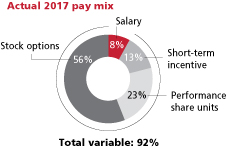

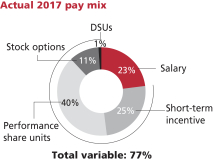

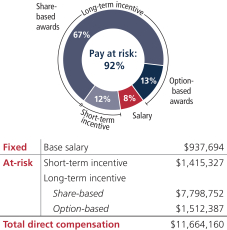

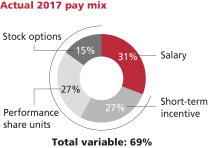

Compensation mix Attracting and retaining high calibreperforming executives is key to our long-term sustainable growth and success. We believe strong performance should yield Built into our compensation pay mix is a significant rewards. Our executive compensation includes fixed and variable(at-risk)emphasis on incentive-driven pay andwhere the proportion ofat-risk pay increases by level. Executives earn more if we perform well, and less when performance is not as strong. A significant portioncomponent of executive at-riskpay is tiedequity-based compensation, which links directly to the value of our shares, aligningensuring alignment with shareholder interests.the interest of our shareholders. We also require our executives to own CPCPKC equity and our share ownership guidelines increase by executive level (see page 10)15).

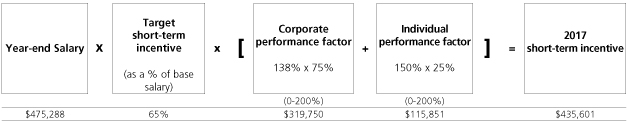

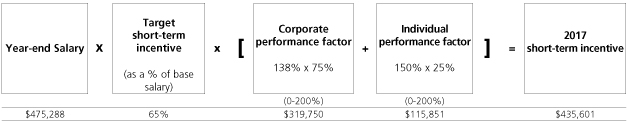

Variable cash compensation is more focused on corporate results for executives (75% of target) than for other employees (50% of target) who have more emphasis placed on individual

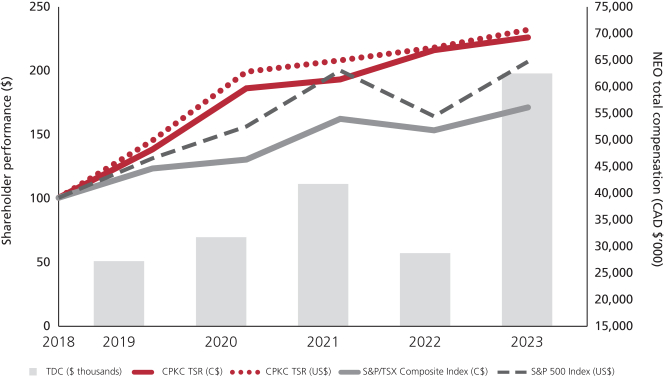

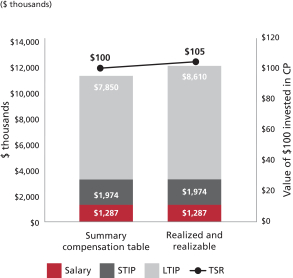

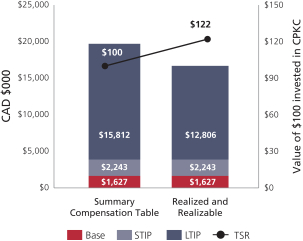

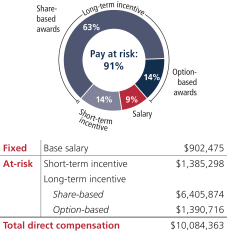

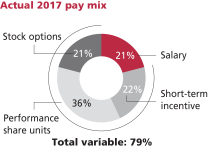

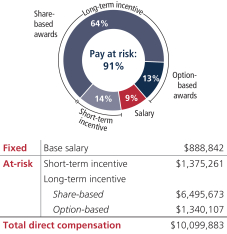

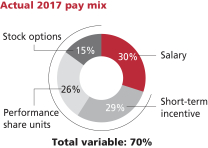

| | | | | | | | | Target total direct compensation mix for our NEOs is shown in the graph. 91 percent of our CEO’s and an average of 80 percent of our other NEOs’ target total direct compensation is at risk. | | | |  |

13

Benchmarking The peer group used in 2023 was unchanged from the prior year and departmental goals. This supports our view that the short-term incentive plan should be tied to overall corporate performance and the areasconsisted of our business that each employee influences directly.Class I peers plus 11 capital-intensive Canadian companies.

7

The table below showsAs a larger, more complex North American entity, the pay mix forCompensation Committee reviewed and approved updates to our current named executives based on their total target compensation.

Benchmarking

We benchmark the compensation for our named executives against a peer group of companies that consists of BNSF Railway, CN, CSX Corporation, Kansas City Southern Railroad, Norfolk Southern Corporation and Union Pacific Corporation.

These companies areto better reflect the Class 1 railroads, the North American railroad companies thatmarket we compete with for executive talent. Benchmarking against thisThe group continues to include our Class I railroad peers plus, effective for 2024, 14 capital-intensive North American companies. For certain positions within the organization, we apply a heavier weighting to Class I railroad peers.

Our revised compensation peer group ensuresis comprised of 11 Canadian companies and eight (8) U.S. companies that each component of our compensation program is competitiveare similar in geography, size, industry and in line with our strongest competitors, so we can attractbusiness complexity. Size criteria considers metrics such as EBITDA (Earnings Before Interest, Tax, Depreciation and retain experienced railroad executives with highly specialized skills. We reviewed the peer group in 2017 to make sure it is still a relevantAmortization), market capitalization, enterprise value and appropriate benchmark in the context of our growth strategy and operations and do not plan to make changes to the comparator group for 2018.total assets. | | | | | | | Class I Railroads | | North American Capital-Intensive Companies | | | | | BNSF Railway Company | | Air Canada | | Enbridge Inc. | | Suncor Energy Inc. | | | | | | Canadian National Railway Company | | Barrick Gold Corporation | | FedEx Corporation | | TC Energy Corporation | | | | | | CSX Corporation | | BCE Inc. | | Nutrien Ltd. | | TELUS Corporation | | | | | | Norfolk Southern Corporation | | Canadian Natural Resources Ltd. | | Old Dominion Freight Line Inc. | | United Parcel Services Inc. | | | | | | Union Pacific Corporation | | Cenovus Energy Inc. | | Republic Services Inc. | | |

8

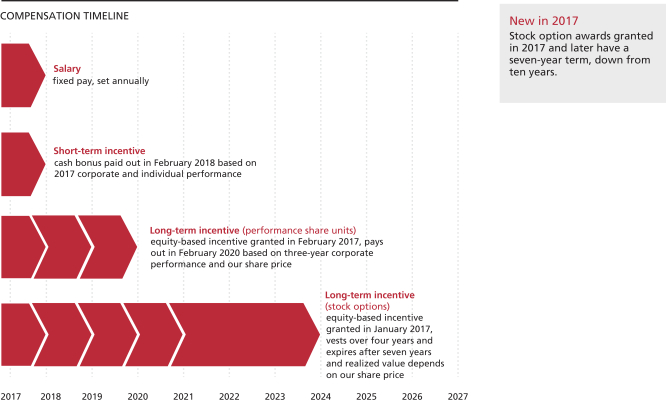

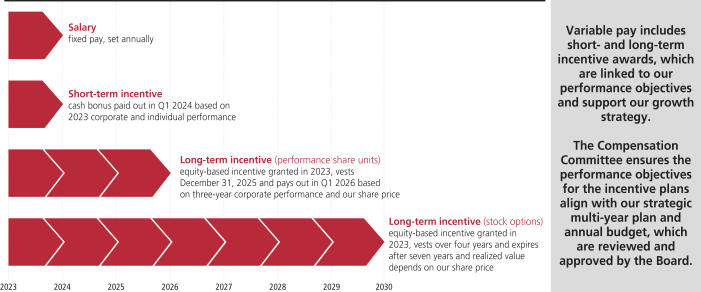

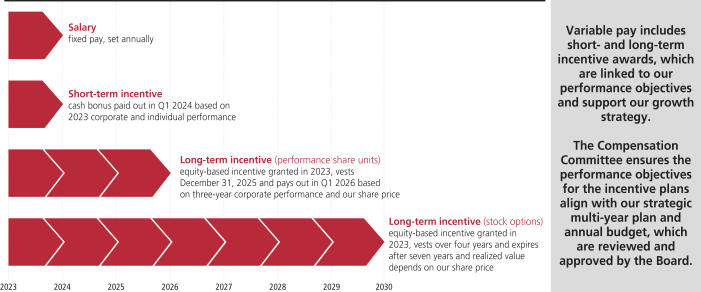

Compensation pays out over time Variable pay includes short and long-term incentive awards to drive annual and longer-term performance and align with shareholder interests.

Incentive awards are cash and equity-based. Equity-based awards vest at the end of three years for performance share units and over four years for stock options. Stock options expire at the end of seven years.

The Compensation Committee ensures the performance objectives for the incentive plans align directly with our strategic plan, which is reviewed and approved by the Board.

14

Executives are CPCPKC shareholders We require executives and senior management employees to own equity in the companyCompany so they have a stake in our future success. Share ownership requirements are set as a multiple of base salary and increase by level. ExecutivesThe ownership requirement must satisfy the requirementbe achieved within five years of the employee being appointed to their position and can meet the requirementsbe met by holding common shares or deferred share units (DSUs). TheNotional shares in the form of PSUs, restricted share units (RSUs), and stock options do not count towards ownership requirements. Once executives have met their initial shareholding requirements, they are required to maintain compliance, which is reported annually to the Compensation Committee. Starting in 2024, the CEO must maintain the ownership level of sixseven times his base salary for one year after he retires or leaves CP.the cessation of employment. Executives have the opportunity to participate in the Senior Executive’s DSU Plan (see page 44 for further plan details). DSUs are redeemedmust be held for cash no earlier thana minimum of six months after the executive retires or leaves the company or untilCompany. The units are redeemed for cash, with (i) Canadian-resident executives being entitled to elect a date of payment between the enddate that is six months following their departure from the Company and December 15th of the following calendar year, forin compliance with Canadian executives. Payment totax rules; and (ii) U.S. resident executives who participate inbeing paid six months after their departure from the DSU plan is made after thesix-month waiting period to beCompany, in compliance with U.S. tax regulations. 9

The table below shows the share ownership requirement by executive level, which appliedapplicable to approximately 77143 executives and senior management employees in 2017.2023. | | | | | | | Executive Level | | 2023 Ownership requirement requirement (as a multiple of base salary) | | CEO

| | | | 6x | Starting in 2024, the Board approved increased share ownership requirement for the CEO (7x), Executive Vice-President (5x) and Senior Vice-President (3x) levels, consistent with our commitment to align executive compensation with shareholder interests and market competitive practices. | Executive Vice-President

CEO | | | 3x | | Senior Vice-President

6x | | | 2x | | Executive Vice-President | | | 1.5 to 2x | | Senior management

4x | | | 1xSenior Vice-President | | 2x | | | Vice-President | | 1.5 to 2x | | | Senior management | | 1x | | |

We use the acquisition value or our closing share price on the last trading day of the year (whichever is higher) to value the holdings.Equity ownership (as at December 31, 2023)

Mr. Creel, Mr. Velani, Mr. Johnson, Mr. Pitz and Mr. Ellis are expected to meet their requirement within the five-year period following their appointment. We used our closing share price on December 29, 2017 to value their share ownership: $229.66 for the TSX or US$182.76 on the NYSE, depending on whether the executive is paid in Canadian or U.S. dollars. You can read about each executive’s share ownership in the profiles beginning on page 27.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Executive | |

| 2023

Requirement

(as a multiple of salary) |

| |

| Minimum

ownership

value ($)(1) |

| |

| Shares

($)(2) |

| |

| Deferred

share units ($)(2) |

| |

| Total

ownership value ($)(2) |

| |

| Total

ownership (as a multiple of salary) |

| | | | | | | | | Keith Creel | | | 6x | | | | 10,713,060 | | | | 10,075,117 | | | | 17,210,372 | | | | 27,285,489 | | | | 15.28x | | | | | | | | | | Nadeem Velani | | | 4x | | | | 3,805,920 | | | | 438,429 | | | | 7,805,207 | | | | 8,243,636 | | | | 8.66x | | | | | | | | | | John Brooks | | | 4x | | | | 3,650,376 | | | | 1,385,313 | | | | 1,775,437 | | | | 3,160,750 | | | | 3.46x | | | | | | | | | | Mark Redd(3) | | | 4x | | | | 3,623,924 | | | | 2,528,836 | | | | 2,278,986 | | | | 4,807,822 | | | | 5.31x | | | | | | | | | | John Orr | | | 4x | | | | 2,777,460 | | | | 3,435 | | | | 2,163,251 | | | | 2,166,686 | | | | 3.12x | |

| (1) | Minimum ownership values for Messrs. Creel, Brooks, Redd and Orr have been converted to Canadian dollars using a year-end exchange rate of $1.3226. |

| (2) | Values for Messrs. Creel, Brooks, Redd and Orr are based on US$79.06, the closing NYSE share price on December 29, 2023 (the last trading day of the year), converted to Canadian dollars using a year-end exchange rate of $1.3226. Values for Mr. Velani are based on $104.84, the closing TSX share price on December 29, 2023. |

15

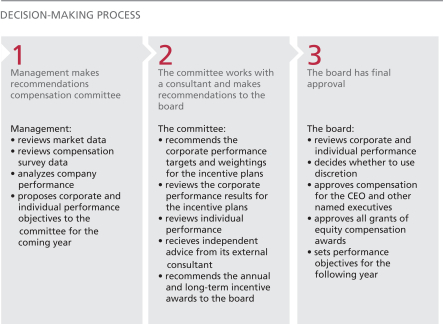

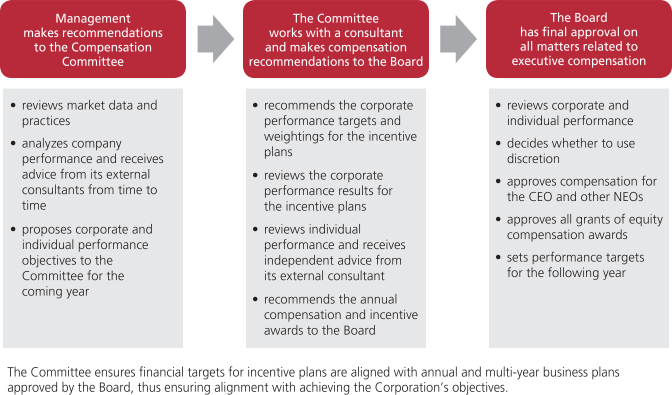

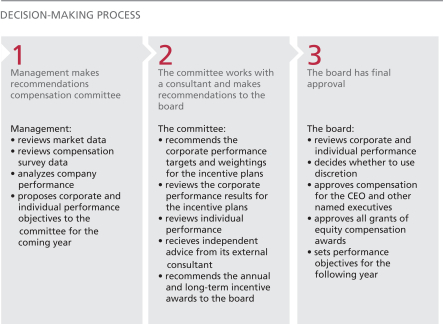

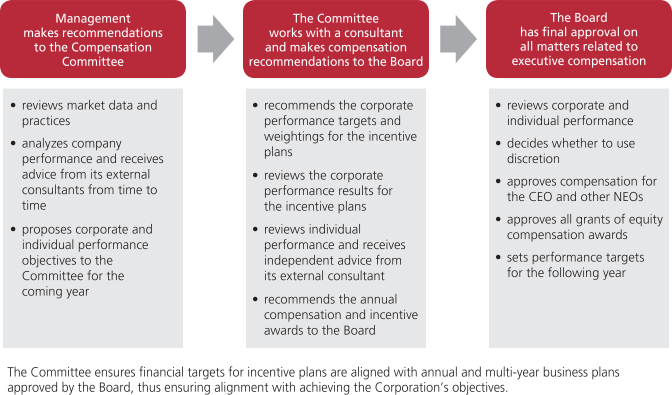

Compensation governance Disciplined decision-making process Executive compensation decisions involve management, the Compensation Committee and the Board. The Board has final approval for setting, amending and adopting any equity compensation plans or awards, subject to applicable shareholder approval requirements. The Compensation Committee also receives advice and support from an external consultantconsultants from time to time.time and since June 2020, has retained Frederic W. Cook & Co., Inc. (FW Cook) as an independent compensation consultant to provide objective analysis and assessment of the Company’s executive compensation program. In 2023, management received advice and support from Willis Towers Watson plc (WTW), and other external consultants to the Company, but not FW Cook.

The Board has final approval on all matters relating to executive compensation. It can also use its discretion to adjust pay decisions as appropriate.

10

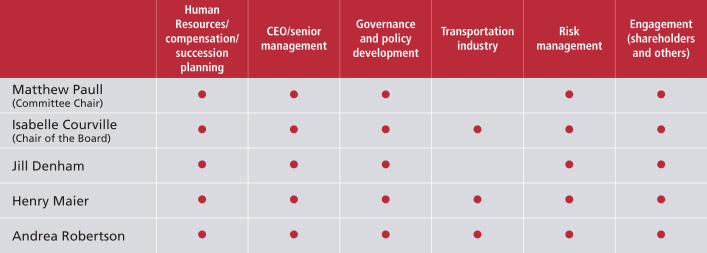

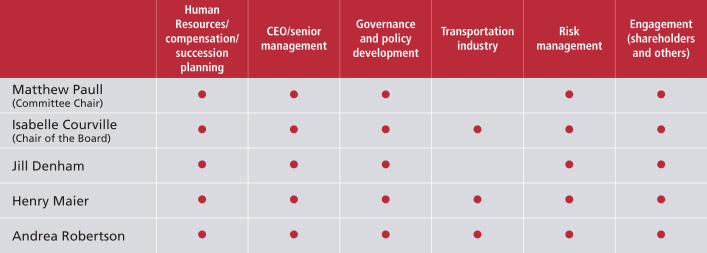

Qualified and experienced Compensation Committee Compensation Committee Interlocks and Insider Participation

The Compensation Committee is responsible for our compensation philosophy, and strategy and for program design. The Compensation Committee consists of sixfive independent directors. The Compensation Committee has the relevant skills, background and experience for carryingto carry out its duties. The table below shows the key skills and experience of each member: | | | | | | | | | | | | | | | | | | | | | | | | | | | Human resources/

compensation/

succession planning

| | | CEO/senior

management | | | Governance

and policy

development | | | Transportation

industry

| | | Risk

management | | | Engagement

(shareholders

and others) | | Isabelle Courville

(Committee Chair)

| | ✓ | | | | ✓ | | | | ✓ | | | | | | | | ✓ | | | | ✓ | | | John Baird

| | | | | | ✓ | | | | ✓ | | | | ✓ | | | | ✓ | | | | ✓ | | | Rebecca MacDonald

| | ✓ | | | | ✓ | | | | ✓ | | | | | | | | ✓ | | | | | | | Andrew Reardon

(Chairman of the Board)

| | ✓ | | | | ✓ | | | | ✓ | | | | ✓ | | | | ✓ | | | | ✓ | | | Matthew Paull

| | | | | | ✓ | | | | ✓ | | | | ✓ | | | | ✓ | | | | ✓ | | | Gordon Trafton

| | ✓ | | | | ✓ | | | | ✓ | | | | ✓ | | | | ✓ | | | | | | |

16

Compensation Committee members also have specific human resources and compensation-related experience, including: direct responsibility for executive compensation matters membership on other human resources committees compensation plan design, and administration, compensation decision-making, risk management and understanding the Board’s role in the oversight of these practices understanding the principles and practices related to leadership development, talent management, succession planning and employment contracts engagement with investors on compensation issues financial literacy, oversight of financial analysis related to compensation plan design and practices oversight of labour matters and a unionized workforce

pension benefit oversight, investment management recruitment of senior executives The Compensation Committee has no interlocks or insider participation. None of the members were employed by or had any relationship with CPCPKC during 20172023 requiring disclosure under Item 404 or Item 407(e)(4) of RegulationS-K of the Exchange Act. You can read about the background and experience of each member in the director profiles beginning on page 1.2. Our Compensation Committee members also serve on other standing committees. Mr. Paull and Ms. Denham are members of the Audit and Finance Committee, Mr. Maier is a member of the Integration Committee and Ms. Robertson is a member of the Governance Committee. Ms. Courville, in her capacity as Chair of the Board, is an ex-officio member of all standing committees and may attend committee meetings at her discretion. This cross-membership provides directors with a broader perspective of risk oversight and a deeper understanding of our enterprise risks, ultimately strengthening overall risk management. 11

Independent advice The Compensation Committee and management retain separate independent executive compensation advisors to provide advice on compensation-related matters and to avoid any conflicts of interest:interest. | | | | | | Compensation Committee advisor FW Cook | | Management Compensation advisor WTW | | | • The Compensation Committee retained Meridian Compensation Partners LLC (Meridian)retains FW Cook to act as itsan independent compensation consultant for early 2017advisor, attending committee meetings (unless otherwise requested by the Committee Chair) • In 2017 Meridian advised the Compensation Committee on various matters relating to executive compensation and assisted the Compensation Committee with the 2016 compensation risk review • The Compensation Committee has also engaged Kingsdale Advisors as a compensation consultant on an as needed basis

• The Compensation Committee chair approves all compensation-related fees and work performed by the external consultantFW Cook

| | • Management engages Willis Towers WatsonWTW to provide market survey data, analysis and advice relating to executivemanagement related to compensation matters |

The next table below shows the fees paid to MeridianFW Cook and Willis Towers WatsonWTW in 20162022 and 2017.2023 for compensation advisory services. | | | | | | | | | | | | | | | | | | | | | | | | 2023 | | | 2022 | | | | | | | | | | | Committee advisor | | | Management advisor | | | Committee advisor | | | Management advisor | | | | | | | | Fees | | FW Cook (1) | | | WTW | | | FW Cook (1) | | | WTW | | | | | | | | Executive compensation-related fees | | $ | 125,378 | | | $ | 74,667 | | | $ | 119,864 | | | $ | 57,808 | | | | | | | | Other fees(2) | | $ | 0 | | | $ | 947,315 | | | $ | 0 | | | $ | 1,161,580 | | | | | | | | Total fees | | $ | 125,378 | | | $ | 1,021,982 | | | $ | 119,864 | | | $ | 1,219,388 | |

| (1) | FW Cook fees have been converted to Canadian dollars using the average exchange rate for 2023 of $1.3497. |

| (2) | In addition to the amounts shown in the table, a one-time fee of $13,500 for Committee advice from an independent consultant was paid in 2022. No such fees were incurred in 2023. |

Fees paid In 2023, $74,667 was paid to WTW for compensation advisory services provided to management. Fees paid to Meridian in 2017 reflect work conducted early in the year, prior to ending the engagement. Any fees paid to Kingsdale for executive compensation services in 2017 were part of the overall retainer described on page 13 of the Circular. | | | | | | | | | | | | | | | | | | | | | | | | 2017 | | | | | | 2016 | | | | | Meridian | | | Willis Towers Watson | | | | | | Meridian | | | Willis Towers Watson | | Executive compensation-related fees | | $ | 50,751 | | | $ | 78,923 | | | | | | | $ | 170,267 | | | $ | 59,264 | | Other fees | | | - | | | $ | 1,975,629 | | | | | | | | - | | | $ | 2,215,142 | | Total fees | | $ | 50,751 | | | $ | 2,054,552 | | | | | | | $ | 170,267 | | | $ | 2,274,406 | |

Fees paid

In 2016, $170,267 was paid to Meridian for executive compensation advisory fees provided to the Compensation Committee. This is 100% of the total fees paid to Meridian in 2016. In 2017, $50,751 was paid to Meridian for executive compensation advisory fees. This is 100% of the total fees paid to Meridian in 2017.

In 2017, $78,923 was paid to Willis Towers Watson for executive compensation advisory fees provided to management. The total executive compensation fees represent 4% of the $2,054,552 paid in total to Willis Towers WatsonWTW for all services provided to management, including actuarial and pension and benefits consulting, corporate risk and insurance broking services.were $1,021,982. The total executive compensation fees represent 7.3 percent of the total fees in 2023.

17

Compensation risk Effective risk management is integral to achieving our business strategies and to our long-term success. The Board believes that our executive compensation program should not increase our risk profile. The Compensation Committee is responsible for overseeing compensation risk. It reviews the executive compensation program, incentive plan design and our policies and practices to make sureensure they encourage the right decisions and actions to reward performance and align management interests with shareholder interests. Incentive plan targets are linked to our corporate objectives and our corporate risk profile. The Compensation Committee believes that our approach to goal setting, establishing performance measures and targets and evaluating performance results helps mitigate risk-taking that could reward poor judgment by executives or have a negative effect on shareholder value. All of the Compensation Committee members other than Mr. Paull are also a member of the Governance Committee. Mr. Reardon and Mr. Paull are also members of the finance committee and Mr. Reardon is a member of the audit committee. This cross-membership strengthens risk oversight because it gives the directors a broader perspective of risk oversight and a deeper understanding of our enterprise risks.

12

Regular riskRisk review

The Compensation Committee conducts a comprehensive compensation risk review every two yearsperiodically to make sureensure that we have identified theany compensation risks and have appropriate measures in place to mitigate those risks. An independent consultant assists the Compensation Committee with the review, which includes looking at:oversight of: the targets for STIP and the short-term incentive and performance share unitPSU plan, anticipated payout levels and the risks associated with achieving targettargeted performance the design of the long-term incentive awards, which rewardsreward sustainable financial and operating performance the compensation program, policies and practices to ensure alignment with our enterprise risk management practices.practices The last review wasWTW completed attheir risk assessment in 2023 and concluded that there were no risks identified as arising from the end of 2016 in conjunction with all the changesCompany’s compensation programs that were being proposed to the 2017 compensation plans. Based on the findings of the review, the Compensation Committee concluded that our compensation program, policies and practices are not reasonably likely to have ana material adverse effect on our business or the company overall.Company.

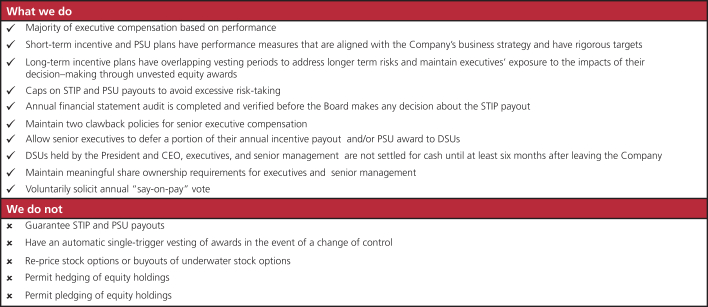

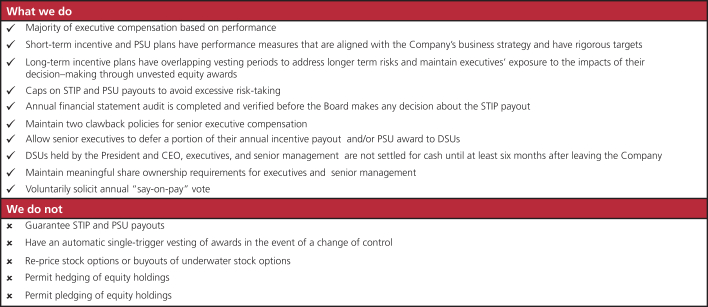

Managing compensation risk We mitigateOur commitment to risk mitigation of the Company’s executive compensation program is reflected in three ways:the following practices and policies:

| | | 1. Plan design | | • We use a mix of fixed and variable(at-risk) compensation and a significant proportion isat-risk pay

• Short and long-term incentive plans have specific performance measures that are closely aligned with the achievement of our business strategy and performance required to achieve results in accordance with guidance provided to the market

• The payout curve for the short-term incentive plan is designed asymmetrically to reflect the significant stretch in target performance

• The payout under the short-term incentive plan is capped and not guaranteed, and the Compensation Committee has discretion to reduce the awards

• The long-term incentive plan has overlapping vesting periods to address longer-term risks and maintain executives’ exposure to the risks of their decision-making through unvested share based awards

| 2. Policies | | • We promote an ethical culture and everyone is subject to a code of business ethics

• We have share ownership requirements for executives and senior management so they have a stake in our future success

• We have a disclosure and insider trading/reporting policy to protect our interests and ensure high business standards and appropriate conduct

• Our anti-hedging policy prohibits directors, officers and employees from hedging our shares and share-based awards

• Our anti-pledging policy prohibits directors and senior officers from holding our shares in a margin account or otherwise pledging them as security

• We also have a policy that prohibits employees from forward selling shares that may be delivered on the future exercise of stock options, or otherwise monetizing their option awards, other than through exercising the options and subsequently selling the shares through a public venue or the company’s cashless exercise option

• Our clawback policy allows us to recoup incentive pay from current and former senior executives as appropriate (see below)

• DSUs held by the CEO and executives are not settled for cash until six months after leaving the company

• Our whistleblower policy applies to all employees and prohibits retaliation against anyone who makes a complaint acting in good faith

| 3. Mitigation measures | | • More senior roles have a significant portion of their compensation deferred

• We must achieve a specific threshold of operating income, otherwise no short-term incentive awards are granted

• Financial performance is verified by our external auditor (completion of annual financial statement audit) before the Board makes any decisions about short-term incentive

• The Compensation Committee adopted principles for adjusting payout under the short-term incentive plan, and provides them to the Board as part of their review of the Compensation Committee’s recommendations and performance overall