UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No.110-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For fiscal year ended December 31, 20092012

or

Or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to_____________

Commission File Number: 000-52807

China Changjiang Mining and& New Energy Company,Co., Ltd.

(Exact name of registrant as specified in its charter)

Nevada | | 75-2571032 |

| (State or Other Jurisdiction of Incorporation or Organization) | 75-2571032

| (I.R.S. Employer Identification No.) |

| | | |

Seventeenth Floor, Xinhui Mansion, Gaoxin Road | +86(29) 8833-1685 |

Hi-Tech Zone, Xi’An P.R. China 71005 | | +86(29) 8833-1685 |

| (Address of Principal Executive Offices; Zip Code) | | (Registrant’s Telephone Number)Number, including area code) |

| |

Securities registered pursuant to Section 12(b) of the Act: |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

| None | |

| None | None |

Securities registered pursuant to Section 12(g) of the Act:

Title of each classCommon Stock, par value $0.001$0.01 per share (Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ]o No [üx]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ]o No [üx]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been bjectsubject to such filing requirements for the past 90 days. Yes [ ]o No [üx]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes [ ]o No [üx]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in artPart III of this Form 10-K or any amendment to this Form 10-K. [Yes üx] No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| (Check one): | | | |

Large accelerated filer [ ] | o | Accelerated filer [ ] | o |

Non-accelerated filer [ ] | o | Smaller reporting company | x |

| (Do not check if a smaller reporting company) | Smaller reporting company [ü] | |

1

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ]o No [üx]

The aggregate market value of the voting common stock held by non-affiliates of the issuer, based on the average bid and asked price of such stock, was $484,321 at December 31, 2009 and the number of shares of voting Series C Preferred Stock issued and outstanding was 500,000.2012.

At December 31, 2009,2012, the registrant had outstanding 24,216,05864,629,559 shares of common stock, $0.01 par value.

DOCUMENTS INCORPORATED BY REFERENCE

None.

2

CHINA CHANGJIANG MINING AND NEW ENERGY COMPANY LTD.

Amendment No. 1 to Annual Report on FORM 10-K/A

For the Fiscal Year Ended December 31, 2009

TABLE OF CONTENTS | |

| |

PART I | |

| |

Item 1. Business | 5 |

| |

Item 1A. Risk Factors | 9 |

| |

Item 1B. Unresolved Staff Comments | 16 |

| |

Item 2. Properties. | 16 |

| |

Item 3. Legal Proceedings | 18 |

| |

Item 4. (Removed and Reserved) | 18 |

| |

PART II | |

| |

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

| |

| |

Item 6. Selected Financial Data | 19 |

| |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 |

| |

Item 7A. Quantitative and Qualitative Disclosures About Market Risk | 28 |

| |

Item 8. Financial Statements and Supplementary Data | 29 |

| |

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 29 |

| |

Item 9A. Controls and Procedures | 30 |

| |

Item 9B. Other Information | 31 |

| |

PART III | |

| |

Item 10. Directors, Executive Officers and Corporate Governance | 31 |

| |

Item 11. Executive Compensation | 34 |

| |

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 35 |

| |

Item 13. Certain Relationships and Related Transactions, and Director Independence | 35 |

| |

Item 14. Principal Accounting Fees and Services | 37 |

| |

PART IV | |

| |

Item 15. Exhibits, Financial Statement Schedules | 38 |

3

Explanatory Note

The purpose of this Amendment No. 1 on Form 10-K/A is to amend and restate the Form 10-K of China Changjiang

Mining and New Energy Company, Ltd. (the “Company”) for the year ended December 31, 2009, filed with the

Securities and Exchange Commission (the “SEC”) on April 16, 2010, to respond to comments received by the

Company from the SEC.

Special Notes Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,”

“aim, “aim,” “will” or similar expressions, which are intended to identify forward-looking statements. Such statements

include, among others, those concerning market and industry segment growth and demand and acceptance of new

and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements

of the plans, strategies and objectives of management for future operations; any statements regarding future

economic conditions or performance; as well as all assumptions, expectations, predictions, intentions or beliefs

about future events. You are cautioned that any such forward-looking statements are not guarantees of future

performance and involve risks and uncertainties, including those identified in Item 1A “Risk Factors” included

herein, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of

the Company to differ materially from those expressed or implied by such forward-looking statements.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other

filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our

business, financial condition and results of operations and prospects. The forward-looking statements made in this

report speak only as of the date hereof and we disclaim any obligation to provide updates, revisions or amendments

to any forward-looking statements to reflect changes in our expectations or future events.

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

“we, “we,” “us,” “our,” or the “Company” are to CHINA CHANGJIANG MINING AND& NEW ENERGY

COMPANY, CO., LTD., and its consolidated subsidiaries;

“PRC” and “China” are to the People’s Republic of China;

| | “PRC” and “China” are to the People’s Republic of China; | |

“SEC” are to the Securities and Exchange Commission;

| | “SEC” are to the Securities and Exchange Commission; | |

“Securities Act” are to the Securities Act of 1933, as amended;

| | “Securities Act” are to the Securities Act of 1933, as amended; | |

“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

| | “Exchange Act” are to the Securities Exchange Act of 1934, as amended; | |

“Renminbi” and “RMB” are to the legal currency of China; and

| | “Renminbi” and “RMB” are to the legal currency of China; and | |

“U.S. dollars,” “dollars” and “$” are to the legal currency of the United States.

4 | | “U.S. dollars,” “dollars” and “$” are to the legal currency of the United States. | |

CHINA CHANGJIANG MINING AND NEW ENERGY COMPANY LTD.

For the Fiscal Year Ended December 31, 2012

TABLE OF CONTENTS

| PART I |

| | | | |

| Item 1. | Business | | | 4 | |

| Item 1A. | Risk Factors | | | 11 | |

| Item 1B. | Unresolved Staff Comments | | | 15 | |

| Item 2. | Properties | | | 15 | |

| Item 3. | Legal Proceedings | | | 16 | |

| Item 4. | Mine Safety Disclosures | | | 16 | |

| | | | | |

| PART II |

| | | | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | | 17 | |

| Item 6. | Selected Financial Data | | | 18 | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | 18 | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | | | 21 | |

| Item 8. | Financial Statements and Supplementary Data | | | 22 | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | | 22 | |

| Item 9A. | Controls and Procedures | | | 23 | |

| Item 9B. | Other Information | | | 23 | |

| | | | | |

| PART III |

| | | | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | | | 24 | |

| Item 11. | Executive Compensation | | | 26 | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | | 26 | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | | | 27 | |

| Item 14. | Principal Accounting Fees and Services | | | 29 | |

| | | | | |

| PART IV |

| | | | | |

| Item 15. | Exhibits, Financial Statement Schedules | | | 30 | |

PART I

ITEM 1. BUSINESS.

Overview

China Changjiang Mining & New Energy Co., Ltd. (the “Company”) is currently a turnkey developer and Engineering, Procurement and Construction (“EPC”) contractor of photovoltaic (“PV”) solar energy facilities (“SEF”).We design, engineer, construct, market and sell high-quality PV SEFs for commercial and utility applications to local markets..

On June 1, 2012, we entered into an agreement with Xunyang Yongjin Mining Co., Ltd to transfer our mining exploration rights for a cash payment of $2,380,612 (RMB15,000,000). Together with Mr. Zhang Hongjun, the Company established a subsidiary, named Shaanxi Weinan Changjiang Solar Photovoltaic Energy Applied Science and Technology Co., Ltd (“Changjiang PV”), to develop the new solar energy business in April 2012. Our subsidiary holds a 51% interest in Changjiang PV. We and Mr. Zhang Hongjun have invested new energy industry for several years. With close relations with government departments and extensive personal connections, we devoted our major efforts to the Solar photovoltaic downstream market after disposing our mining business in June 2012.

Our subsidiary, Changjiang PV, concentrates on the development and operation of EPC projects. Our first EPC project, the Weinan Hechuan 137KWp solar PV building applications has been completed and is expected to begin operating in the near future.

We also hold land use rights in a land parcel and we lease a portion of the land use rights on the 5.7 square kilometer parcel to Shaanxi Huanghe Bay Springs Lake Theme Park Ltd. (“Huanghe”), a company with a common control person. The term of the lease agreement is from January 1, 2011 to December 31, 2029 and the annual rent is approximately $1.2 million.

Subsequent Event

The Company has completed the transfer procedure for the mining exploration rights transfer transaction and the final payment was deposited in the escrow account at the end of the first quarter of 2013.

Our Corporate History and Background

China Changjiang Mining and New Energy Co., Ltd. (the “Company”) is an exploration-stage company engaged in

exploration in Shaanxi Province, China, for commercially recoverable metal-bearing mineral deposits. The

Company has not yet identified any proven or probable mineral reserves, and only limited exploration activity has so

far been undertaken, primarily by governmental bodies in Shaanxi Province. Provided the Company successfully

identifies commercializable mineral deposits, it intends to engage in mining, processing and distributing zinc, lead,

and gold.

The Company is the result of a 2008 share exchange transaction among: (i) North American Gaming and

Entertainment Corporation, a Delaware corporation (“North American”); (ii) Shaanxi Changjiang Petroleum &

Energy Development Stock Co., Ltd. (“CJP”), a limited liability company established and existing under the law of

People’s Republic of China; and (iii) the shareholders of CJP, among whom the predominant shareholder, holding

97.2% of CJP’s shares, was a Hong Kong company, Hong Kong Wah Bon Enterprise Limited (“Wah Bon”). After

completion of the share exchange transaction, the Company went public in the United States throughentered into a reverse

merger with North American.

At the time of the share exchange transaction, CJP owned 60%, and the Company continues to control, Shaanxi

Dongfang Mining Co., Ltd., (“Dongfang”East Mining”) which as discussed further under “Item 2. Properties,” holdsheld the Chinese

exploration license through which we pursuepursued our exploration activity.

The share exchange was completed on February 4, 2008, resulting in the shareholders of CJP controlling

approximately 96% of the equity ownership of North American At the time of the closing of the share exchange,

North American was a shell company domiciled in Delaware which filed reports under the Exchange Act and whose

shares traded in the U.S. over-the-counter market. Wah Bon caused its subsidiary, CJP, to pay $370,000 in cash,

and Wah Bon delivered shares constituting 97.2% of the outstanding equity of CJP, in exchange for 3,800,000

shares of North American common stock and 500,000 shares of Series C Preferred Stock of North American, which

originally were entitled to 1,218 votes per share. Two U.S. individuals, through their advisory company, Capital

Advisory Services, Inc., were paid in the aggregate 4,500,000 shares of North American. In June 2008, CJP

changed its name to “Shaanxi Changjiang Mining New&New Energy Co., Ltd.Ltd (“Shaanxi Changjiang”).”

Following the share exchange transaction, Wah Bon replaced North American’s Board of Directors.

China Changjiang Mining & New Energy Co., Ltd. was incorporated in the state of Nevada on September 19, 2008

for the purposes of re-domesticating the Company from Delaware to Nevada, adopting the Company’s current name,

and going public into serve as the United States by meanssurviving company of a reverse merger with North American.

Pursuant to Articles of Merger filed with the Secretary of the State of the State of Nevada on December 4, 2008 and

the Secretary of the State of the State of Delaware on April 2, 2009, North American was merged with and into the

Company, with the Company being the surviving entity.

After the close of the 2009 fiscal year, but prior to the filing of this Form 10-K/A, onOn February 9, 2010, we filed a

Certificate of Amendment to our Articles of Incorporation to effect a 1-for-10 reverse stock split of our common

stock, subject to FINRA approval. The 1-for-10 reverse split was approved by FINRA on July 30, 2010, effective

August 2, 2010.

On September 15, 2010, the Company filed with the Nevada Secretary of State a Certificate of Designation and a

Certificate of Conversion and Elimination of the Series C Convertible Preferred Stock, pursuant to which: (i) all

shares of our Series C Preferred Stock were converted into shares of common stock at a rate of 1,218 shares of

common stock for each outstanding share of Series C Preferred Stock; and (ii) we canceled and eliminated the Series

5

C Preferred Stock. In the aggregate, the outstanding shares of the Company’s Series C Preferred Stock were

converted into 609 million shares of common stock.

As a result of these transactions, we currently have 250,000,000 authorized shares of common stock, par value

$0.01 $0.01 per share, of which 37,716,58864,629,559 shares are issued and outstanding on the date of filing of this Form 10-K/A,

10-K, and 10,000,000 authorized shares of preferred stock, of which no shares are presently issued and outstanding. At the

time our share exchange transaction was completed, approximately 96% of the outstanding shares of North

American were owned by Wah Bon. See Item 12, “Security Ownership of Certain Beneficial Owners and

Management and Related Stockholder Matters.”

We established a subsidiary, named Shaanxi Weinan Changjiang solar photovoltaic energy applied science and technology Co., Ltd. (“Changjiang PV”), in April 2012 to develop the new solar energy business. Our subsidiary, Shaanxi Changjiang accounted for 51% shares of Changjiang PV, and Mr. Zhang Hongjun, the actual controller, accounted for the other 49% shares.

Industry overview

Solar photovoltaic energy is an emerging, clean energy industry with a growing market share. The global solar PV market has grown from 6.1Gigawatt (“GW”) in 2008 to an estimated 25GW in 2012 but with imbalanced development. Application of solar energy in developed countries such as Germany and Japan, are relatively comprehensive and mature. At the present corporate structure of ourtime, the Chinese subsidiariesPV downstream market is as depictedstill in the chart below:initial stages of development, though most of the PV modules are manufactured in China,

In the past year, China's solar PV module manufacturers were hit by the European Union and the United States anti-dumping sanctions. Businesses and governments are trying to find better alternative applications market to absorb the huge domestic surplus solar PV capacity. The untapped domestic PV downstream market is one of the best ways to absorb the surplus production capacity.

The Chinese government is encouraging the construction of a large PV base and the development of distributed photovoltaic. Currently, we mainly focus on the development of distributed photovoltaic power generation projects.

Since the first half of 2012, the supply and demand of silicon in the international market has undergone great changes, resulting in obvious decline in the cost of solar modules. With the declining cost of solar modules from RMB15 to RMB6 per watt, the cost of PV power generation was significantly reduced.

We believe the next few years will show protracted continued growth in the PV solar market. Government policies, in the form of both regulation and incentives, have accelerated the adoption of solar technologies by businesses and consumers and have provided opportunities for developers to construct PV systems as an alternative to more traditional forms of power generation.

Our Industry and Principal Market

Sales and Marketing

Although we are still in the exploration phase, weWe have established a sales and marketing department which is

focused on identifying and establishing relationships with companiesentities that are likely to have a need for our products.products and services.

We

Our products and services are seeking to explore further onlargely represented through our property for commercializable zinc, leadCompany’s sales force located in Xi’an City and gold deposits. Zinc and lead

can be freely sold and marketed throughout the PRC. China remains a net importer of these metals, and we believe a

customer base exists withinWeinan City, Shaanxi Province, China.

Current Business Operations

Our Businessa ) At the present time, we focus on serving the local distributed solar PV market,

According to the national policy and because of the favorable market conditions, Weinan City is to develop photovoltaic power generation demonstration area. Weinan city is a prosperous city, adjacent to the capital of Shaanxi province, Xian city. With rich solar radiation and developed business in the Northwest, Weinan city took advantage to accelerate the development of the distributed solar PV.

We established a subsidiary, named Shaanxi Weinan Changjiang solar photovoltaic energy applied science and technology Co., Ltd. (“Changjiang PV”), in April 2012 to develop the local distributed solar PV business..

The following chart showed our distributed solar PV business model.

Through

Our main EPC projects are as follows.

Huanghe Bay Project

In September 2012, Changjiang PV entered into an agreement with Shaanxi Changling Solar Energy & Electric Co., Ltd (“Changling”) to outsource the construction of a solar energy project located in Huanghe Bay Springs Lake Theme Park. The project, with a total contract amount of $310,548, was completed by the year end of 2012.

A series of licenses or permits must be obtained from the government organizations for power generation and distribution in PRC. Up to present, we have obtained following permits: a) The Heyang County Power Grid Access license; b) Application for the provincial solar photovoltaic building demonstration projects nominated by both the Housing and Urban-Rural Construction Bureau of Weinan City and Weinan Municipal Finance Bureau; and c) Filing in the Weinan City Municipal Development and Reform Commission.

The project was designed to generate electricity preferentially for Huanghe, and sell the surplus power to the grid company. We have received the subsidy funds of $159,096 (RMB1,000,000) from the local government for the project in December, 2012. As of May 2013, Huanghe Bay Project is ready to supply electricity to Huanghe.

Baisui Project

We are applying for the Building-integrated photovoltaic (BIPV) demonstration project of Weinan City for Baisui Project. Which is the way to obtain the subsidy funds. This EPC project, with a total investment amount of $1,166,615 (RMB7,341,740), commenced construction in March 2013 and is expected to be completed at the end of 2013.

We are responsible to install PV modules for all of the roofs of Weinan baisui dukang liquid factory, with a total power capacity of 649.2KW. A PV module is an assembly of PV cells that are electrically interconnected, laminated and framed in a durable and weatherproof package. The DC (direct current) power generated from the PV module is converted into AC (alternating current) power by the inverter to supply the electricity needs inside the building. The surplus electricity is fed to a power grid.

On May 3, 2012, The Department of Finance, Department of Science & Technology, and Development & Reform Commission of Shaanxi Province jointly promulgated a Notice to set the subsidy standard for distributed solar PV investment to be RMB 7 per watt.

Thes kinds of incentive policies have greatly promoted Baisui Project and our majority-controlled subsidiary, Dongfang,other EPC projects. We have compared the cost of the project before and after the subsidy as follows.

| Before subsidy | After the subsidy RMB 7 per watt |

| Installed capacity | 649.2KWp | 649.2KWp |

Investment cost per watt(including equipment & installment) | RMB 11.3 | RMB 4.3 |

| Total amount of investment | RMB 7,341,740 | RMB 2,792,000 |

| Annual generating capacity (25 years project working life) | 21,329,000 kilowatt-hour | 21,329,000 kilowatt-hour |

| Cost of power generation | RMB 0.34/kilowatt-hour | RMB 0.13/kilowatt-hour |

| Cost of power generation after the maintenance expense, salary and depreciation | RMB 0.51/kilowatt-hour | RMB 0.33/kilowatt-hour |

b) Our joint venture, Shaanxi Changjiang electricity & new energy Co., Ltd (“Changjiang Electricity”), is dedicated to the construction and operation of the biomass incineration power. Currently, we account for 20% shares of Changjiang Electricity, Mr. Zhang Hongjun and Shaanxi Changfa Industrial Co., LTD (“Changfa”) accounts for 52% and 28% respectively.

In order to further develop the clean energy projects, we are engagedentrusted full responsibility by Mr. Zhang Hongjun and Changfa to manage the following cooperation issues.

In October 2011, we entered into an agreement with Shaanxi Lanniao New Energy Development Co., Ltd (“Shaanxi Lanniao”) to jointly develop Changjiang Electricity. In the near future, according to the agreement, Shaanxi Lanniao will invest around $11,529,000 in projects construction and accounts for 68% shares of the explorationnew Changjiang Electricity. We will invest a portion of our land in Huanghe Bay into Changjiang Electricity. As a result, Mr. Zhang Hongjun, Changfa and we account for commercially32% shares of the new Changjiang Electricity.

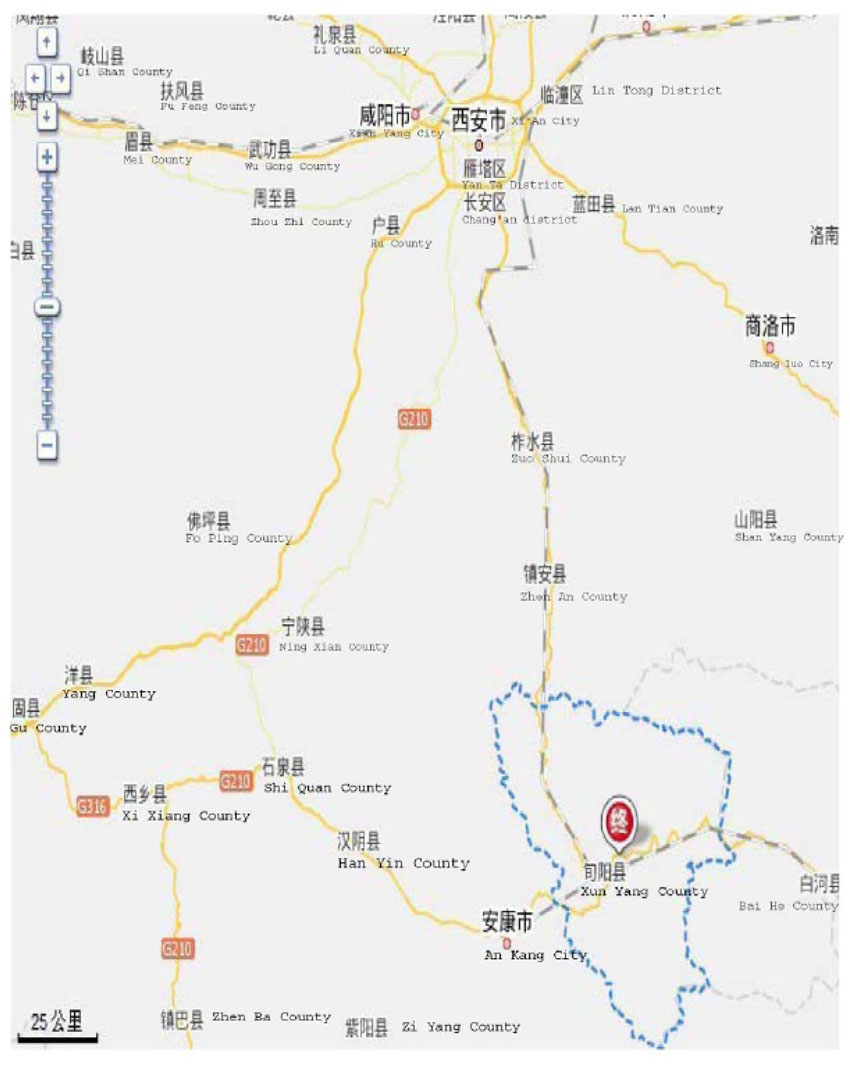

recoverable metal-bearing mineral deposits, such as zinc, lead and gold. Currently, our exploration activities are in a

61.27 square kilometer area in Jiao Shan Zhai, Guo Jia Ling, Xunyang County, in the Shaanxi Province of China. To

date, our activities have not resulted in the location of proven reserves.c ) We also hold land use rights in a 5.7 square

kilometer parcel located in Huanghe Nantan, Heyang County, in the Shaanxi Province of China. We lease a portion

6

of the land use rights on the 5.7 square kilometer parcel to Shaanxi Huanghe WetlandBay Springs Lake Theme Park Company Ltd.

(“Huanghe”) for the development and operation of a theme park. The term of the lease agreement is from January 1,

2009 2011 to December 31, 2029. The annual rent is approximately $1.1$1.2 million. In November 2010, the Company

received the first rent payment under the lease, in the amount of approximately US$601,504. For additional

information, see “Item 2. Properties.”Properties”.

The following table summarizes the business activities of the Company’s subsidiaries:

MiningSolar PV Industry

General

IfThough we successfully identify commercializable mineral deposits and obtainmay be a new participant in solar PV industry, we also realized that the required government license, our

primarylocal downstream market of solar PV industry was as new as we are. Experience in some developed countries has shown that there should be a business activity is anticipated to be mining, processing and distributing zinc, lead and gold, and other

mineral products. China is currently a net importer of nonferrous metals. There are governmental restrictions on

exploration and mining activityopportunity in China, discussed further below.

We believe that China will continue to industrialize and this will cause increased demand for industrial raw

materials such as non-ferrous metals. We expect prices of non-ferrous metals to increase in ChinaChina’s PV downstream market in the future,near future.

although prices may experience significant fluctuations.

Each of our EPC projects is a strategic long-term investment, with relatively low risk, a stable cash inflow can be generated and little ongoing maintenance costs would be incurrd once the project begins operations.

Competition

We anticipate that our competitors in the nonferrous metalssolar PV markets will be local and regional mining enterprises.

EPC contractors and developers. Other companies in China that mine zinc, lead and gold andengage in solar PV power generation that we consider to be likely competitors, include:

Dongschengmiao Mining Industry Xiaan Huanghe Photovoltaic Technology Co., Ltd., Wancheng Trading & Mining Col, Ltd., Xinjian Woquia Tianzhen

MiningLtd, Shaanxi Tuori New Energy Technology Limited, and Shaanxi Changling Electric Co., Ltd., and Wulatehouqi Qingshan Nonferrous Metal Development Co., Ltd. TheseLtd etc.These competitors have

more experience in the operation of mines and mining activitiessolar PV energy and have superior financial resources than we do.

In the past, China protected its domestic metallurgy industry with high tariffs, import quotas and restrictions on

foreign ownership. Due to China’s WTO membership, China has reduced and is expected to further reduce

protection for Chinese companies against foreign competitors. To maintain its WTO membership, China must

gradually reduce its tariffs, quotas and restrictions, and permit foreign enterprises the opportunity to sell and

distribute in China. Tariffs will eventually be eliminated altogether. This is expected to increase the effect of

foreign competition and the importation of foreign products into China. We are unable to predict the effect these

changes may have on our Company.

Business Strategies

Our business strategies and near-term plans are as follows:

7

The entire solar industry also faces competition from other power generation sources, both conventional sources as well as other emerging technologies. Solar power has certain advantages and disadvantages when compared to other power generating technologies. The advantages include the ability to deploy products in many sizes and configurations, provide reliable power for many applications, serve as both a power generator and the skin of a building and eliminate air, water and noise emissions.The disadvantages mainly came from the relatively high cost of power generation.

Further evaluate prospecting

The cost of electricity generated by PV products currently still exceeds the cost of electricity generated from conventional power such as coal and hydropower in Chinese markets. A significant reduction in the scope or discontinuation of government incentive programs,could cause demand for our products and our revenue to decline, and have a material adverse effect on our business, financial condition, results to date;of operations and prospects.

As an emerging industry, the rapid growth of the solar PV could reduce the intensity of competition from alternative products and services.

Perform a rough surveyIn the near term, mature government subsidy roadmaps from the government have led developers to be aggressive with their solar installations so that they can enjoy better economic returns. Cost reductions of zinc, leadsolar installations have proven to be viable and gold over a test area;have also led to aggressive solar installation. In the long run, we believe that solar energy continues to have significant future growth potential and

that demand for our products and services will continue to grow significantly for the following reasons:

| increasing demand for renewable energies, including solar energy, due to the finiteness of fossil fuels and concerns over nuclear power; |

Investigate other metallogenic areas, mainly through surface work, which may be combined with limited tunnel exploration and drilling. | increasing environmental awareness leading to regulations and taxes aimed at limiting emissions from fossil fuels; |

| continued adoption or maintenance of government incentives for solar energy at all level of Chinese government; |

| narrowing cost differentials between solar energy and conventional energy sources due to market-wide decreases in the average selling prices for PV products driven by lower raw materials costs and increased production efficiencies; and |

| continual improvements in the conversion efficiency of PV products leading to lower costs per watt of electricity generated, making solar energy more efficient and cost-effective. |

Government Regulation

UnderThis section sets forth a system established by China’s State Council, industrial activity is categorized as “permitted,” restricted,”summary of the most significant regulations or requirements that affect our business activities in China.

“prohibited.” Our proposed exploration and mining activities fall into the “restricted” category, which means that

we may engage in these activities only with prior governmental approvals, as described below.

Exploration and mining activities are regulated in the PRC. Regulations issued or implemented by the State

Council, the Ministry of LandChina’s National Development and Resources, Reform Commission (“NDRC”),and other relevant government authorities cover many aspects of

exploration and mining of natural resources, new energy industry, including, but not limited to entry into the mining industry,following principal regulations:

Renewable Energy Law

On December 26, 2009, China revised its Renewable Energy Law, which originally became effective on January 1, 2006. The revised Renewable Energy Law became effective on April 1, 2010 and has laid the scope

of permissible business activities, tariff policies and foreign investment.legal foundation for developing renewable energy in China.

The principal regulations governingRenewable Energy Law clearly stipulates the mining business infollowing principles for the PRC include:development of new energy.

China Mineral Resources Law, which requires a mining business to have exploration and mining licenses from provincial or local land and resources agencies.

| ● | encourage and support the use of solar and other renewable energy and the use of on-grid generation. | |

China Mine Safety Law, which requires a mining business to have a safe production license and provides for random safety inspections of mining facilities.

| ● | encourage the installation and use of solar energy water-heating systems, solar energy heating and cooling systems, solar PV systems and other solar energy utilization systems. |

China Environmental Law, which requires a mining project to obtain an environmental feasibility study of each project.

| ● | authorizes the relevant pricing authorities to set favorable prices for the purchase of electricity generated by solar and other renewable power generation systems. | |

Permits| ● | provides financial incentives, such as national funding, preferential loans and tax preferences for the development of renewable energy projects. | |

In China, companies that seek to engage in mining must obtain two separate licenses from the land resource division

of the provincial government. The first license must be obtained before an enterprise may commence mineral

exploration activities. We have obtained this license. The law also requires a second license, for extraction

activities, including the excavation and sale of extracted minerals. As of December 31, 2009, we had not yet

received a mining license. If we do not obtain a mining license, the value of our interest in the mining properties

would be seriously impaired, and would result in a significant loss of value to us.

Mineral exploration also requires approval from the Environmental Department of the provincial government, which

must first determine that the exploration project will not cause environmental harm. In addition, the Security

Department controls strictly the explosives which are needed for exploration. The sale of mineral products is

managed by a joint department including industrial, commercial, taxation, and local public finance authorities.

There are also detailed rules and regulations related to management of the processing and transportation of mineral

products and the approval certificates needed in connection therewith. As of the date of this report, we have

obtained all necessary approvals from the Environmental Department and the Security Department with regard to

our activities to date.

Environmental Impact

Environmental protection laws in China are established on a national basis by the State Environmental Protection

Administration. Provincial and local authorities may set local regulations which may be more restrictive than the

national standards. Environmental standards govern a variety of matters, including disposal of solid waste,

discharge of contaminated water and handling of gases and emissions. The local authorities generally monitor and

enforce the regulations, including the assessment and collection of fees and the imposition of fines and

administrative orders.

8

Because weGovernment Directives

In January 2006, the NDRC promulgated two implementation directives of the Renewable Energy Law. These directives set forth specific measures in setting prices for electricity generated by solar and other renewal power generation systems and in sharing additional expenses occurred. The directives further allocate the administrative and supervisory authorities among different government agencies at the national and provincial levels and stipulate responsibilities of electricity grid companies and power generation companies with respect to the implementation of the Renewable Energy Law.

China’s Ministry of Construction issued a directive in June of 2005, which seeks to expand the use of solar energy in residential and commercial buildings and encourages the increased application of solar energy in townships. In addition, China’s State Council promulgated a directive in June of 2005, which sets forth specific measures to conserve energy resources and encourage exploration, development and use of solar energy in China’s western areas, which are stillnot fully connected to electricity transmission grids, and other rural areas.

In July 2007, the PRC State Electricity Regulatory Commission issued the Supervision Regulations on the Purchase of All Renewable Energy by Power Grid Enterprises which became effective on September 1, 2007. To promote the use of renewable energy for power generation, the regulations require that electricity grid enterprises must in a timely manner set up connections between the grids and renewable power generation systems and purchase all the electricity generated by renewable power generation systems. The regulations also provide that power dispatch institutions shall give priority to renewable power generation companies in respect of power dispatch services provision.

On September 4, 2006, China’s Ministry of Finance and Ministry of Construction jointly promulgated the Interim Measures for Administration of Special Funds for Application of Renewable Energy in Building Construction, which provides that the Ministry of Finance will arrange special funds to support the application of renewable energy in building construction in order to enhance building energy efficiency, protect the ecological environment and reduce the consumption of fossil energy. These special funds provide significant support for the application of solar energy in hot water supply, refrigeration and heating, PV technology and lighting integrated into building construction materials.

On October 28, 2007, the Standing Committee of the National People’s Congress adopted amendments to the PRC Energy-saving Law, which sets forth policies to encourage the conservation of energy in manufacturing, civic buildings, transportation, government agents and utilities sectors. The amendments also seek to expand the use of the solar energy in construction areas.

In March 2009, China’s Ministry of Finance promulgated the Interim Measures for Administration of Government Subsidy Funds for Application of Solar Photovoltaic Technology in Building Construction, or the Interim Measures, to support the demonstration and the promotion of solar PV applications in China. Local governments are encouraged to issue and implement supporting policies for the development of solar PV technology. These Interim Measures set forth subsidy funds set at RMB20 per watt for 2009 to cover solar PV systems integrated into building construction that have a minimum capacity of 50 kilowatt peak.

In April 2009, the Ministry of Finance and the Ministry of Housing and Urban-Rural Development jointly issued the “Guidelines for Declaration of Demonstration Project of Solar Photovoltaic Building Applications.” These guidelines created a subsidy of up to RMB20 per watt for building integrated PV or BIPV projects using solar-integrated building materials and components and up to RMB15 per watt for BIPV projects using solar-integrated materials for rooftops or walls.

In July 2010, the Ministry of Housing and Urban-Rural Development issued the “City Illumination Administration Provisions” or the Illumination Provision. The Illumination Provisions encourage the installation and use of renewable energy system such as PV systems in the exploration stage, our environmental impact has been limited. If weprocess of construction and re-construction of city illumination projects.

On March 8, 2011, the Ministry of Finance and the Ministry of Housing and Urban-Rural Development jointly promulgated the Notice on Further Application of Renewable Energy in Building Construction, which aims to raise the percentage of renewable energy used in buildings.

On March 27, 2011, the NDRC promulgated the revised Guideline Catalogue for Industrial Restructuring which categorizes the solar power industry as an encouraged item.

On March 14, 2012, the Ministry of Finance, the NDRC and the National Energy Bureau jointly issued the interim measures for the management of additional subsidies for renewable-energy power prices, according to which relevant renewable-energy power generation enterprises are successfulentitled to apply for subsidies for their renewable power generation projects that satisfy relevant requirements set forth in the measures.

commencing our extraction operations, we expect to generate waste water, gases

On March 1, 2013, China’s State Council issued the “Twelfth Five Year Plan.” The plan supports the promotion and solid waste. We will therefore

be subject to all national and local regulations governing these activities, and will likely require licenses fordevelopment of renewable energy, including the

disposal solar energy. The plan also encourages the development of water and solid wastes.solar PV power stations in the areas with abundant solar power resource.

Summary of Exploration Activity

Geological SurveyRestrictions on Foreign Businesses and Investments

The regionprincipal regulation governing foreign ownership of photovoltaic businesses in which we have exploration rightsthe PRC is one in which miningthe Foreign Investment Industrial Guidance Catalogue, updated and effective as of January 30, 2012. Under this regulation, industrial activity has long been conducted,is categorized as “permitted,” “restricted,” or “prohibited.” and the solar photovoltaic business is listed as an industry of “permitted” where

there foreign investments are several operating mines for non-ferrous metals.encouraged.

We have not conducted geological exploration sufficient to form a conclusion

Enterprise Income Tax

On March 16, 2007, the National People’s Congress passed the new Enterprise Income Tax Law (“the new EIT Law”), which was effective as to whether there are provenof January 1, 2008.

The key changes for the new EIT Law are:

| a) | The new EIT Law imposes a single income tax rate of 25% for most domestic enterprises and foreign investment enterprises. |

| b) | The Companies established before March 16, 2007 continue to enjoy tax holiday treatment approved by local government for a grace period of either for the next 5 years or until the tax holiday term is completed, whichever is sooner. |

| c) | Entities that qualify as “High and New Technology Enterprises” are entitled to the preferential lower tax rate of 15%. |

| d) | The new EIT Law grants tax holiday to entities operating in certain beneficial industries, such as environmental protection, energy – saving, etc. Entities in beneficial industries enjoy a three-year tax exempt and a three-year period with 50% reduction in the income tax rates. |

The new EIT Law also provides that an enterprise established under the laws of foreign countries or

probable mineral reserves regions but whose “de facto management body” is located in the areaPRC be treated as a resident enterprise for PRC tax purpose and consequently be subject to the PRC income tax at the rate of 25% for its worldwide income. The Implementing Rules of the new EIT Law merely defines the location of the “de facto management body” as “the place where the exercising, in which we have exploration rights. The principal surveys conducted to date

substance, of the overall management and control of the production and business operation, personnel, accounting, properties, etc., of a non-PRC company is located.” On April 22, 2009, the PRC State Administration of Taxation further issued a notice entitled “Notice regarding Recognizing Offshore-Established Enterprises Controlled by PRC Shareholders as Resident Enterprises Based on Their place of Effective Management.” Under this land have been preliminary geological surveys conductednotice, a foreign company controlled by a unitPRC company or a group of PRC companies shall be deemed as a PRC resident enterprise, if (ⅰ)the senior management and the core management departments in charge of its daily operations mainly function in the PRC; (ⅱ) its financial decisions and human resource decisions are subject to decisions or approvals of persons or institutions in the PRC; (ⅲ) its major assets, accounting books, company sales, minutes and files of board meetings and shareholders’ meetings are located or kept in the PRC; and (ⅳ) more than half of the Shaanxi Provincial Government.

Itdirectors or senior management personnel with voting rights reside in the PRC. Based on a review of surrounding facts and circumstances, the Company does not believe that it is costlylikely that its operations outside of the PRC should be considered a resident enterprise for PRC tax purposes. However, due to conduct detailed mineralogy studies,limited guidance and we may not haveimplementation history of the resources to undertake them. If we fail

to identify proven or probable mineral resources,new EIT Law, should the value of our Company and our securitiesbe treated as a resident enterprise for PRC tax purposes, the Company will be materially andsubject to PRC tax on worldwide income at a uniform tax rate of 25% retroactive to September 19, 2008.

adversely affected.

The new EIT Law also imposes a withholding income tax of 10% on dividends distributed by a foreign invested enterprise to its immediate holding company outside of China, if such immediate holding company is considered as a non-resident enterprise without any establishment or place within China or if the received dividends have no connection with the establishment or place of such immediate holding company within China, unless such immediate holding company’s jurisdiction of incorporation has a tax treaty with China that provides for a different withholding arrangement. Such withholding income tax was exempted under the previous income tax regulations. The United States of America, where the Company is incorporated, has such tax treaty with China.

Our Employees

As of December 31, 2009,2012, we had an aggregate of 1921 employees, of whom 16 were full-time employees. This

includes two people in marketing, one in manufacturing, four in research and development and quality control, two

in financial and accounting, and seven in general management.

Available Information

We currently do not maintain a web site; however, our annual, periodic and current reports can be accessed on the

web site of the SEC at www.sec.gov and printed free of charge.

ITEM 1A. RISK FACTORS.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described

below, together with all of the other information included in this report, before making an investment decision. If

any of the following risks actually occurs, our business, financial condition and results of operations could suffer.

In that case, the trading price of our common stock could decline, and you may lose part or all of your investment.

You should read the section entitled “Special Notes Regarding Forward-Looking Statements” above for a

discussion of what types of statements are forward-looking statements, as well as the significance of such statements

in the context of this report.

RISKS RELATED TO OUR BUSINESS

WE ARE AN EARLY STAGE EXPLORATION COMPANY FACINGHAVE TRANSITIONED OUR BUSINESS FROM MINING TO NEW CLEAN ENERGY BUSINESS, WHICH INVOLVED SIGNIFICANT FINANCIALTRANSITION AND

OPERATING RISKS. INTEGRATION RISK

We have completed the procedures of disposing our mining business sector at the end of first quarter of 2013, and currently we are an exploration stagedeveloping our new clean energy solar business. This change involves significant transition and integration risks, both because we are required to end our participation in mining operations and wind down our existing relationships prior to our being able to participate in a new energy business and because we may incur costs and/or a loss of revenue (or a delay in anticipated increased revenue from the new business) in connection with these changes. The significant transition and integration risks include:

| an inability to transition our business to clean energy due to a lack of applicable approvals or difficulty in satisfying entrance requirements; |

| |

| significant revenue dilution as we terminate our participation in mining operations and/or insufficient, or delay in receipt of, revenue from our participation in current operations, including an inability to maintain our key customer and business relationships as we transition to new energy; and |

| |

| difficulties integrating our technology processes, and |

| |

| lack of experience in EPC project management. |

If any of these risks or costs materializes, they could have a material adverse effect on our business, results of operations and financial condition.

OUR LIMITED OPERATING HISTORY IN CLEAN NEW ENERGY INDUSTRY MAKE IT DIFFICULT TO EVALUATE OUR RESULTS OF OPERATIONS AND PROSPECTS.

We are a company engaged in the business of local clean solar energy development with land use rights to a 61.27 square kilometer tract of land in

Shaanxi Province, in Central China.two EPC projects under construction and several potential projects. We also hold land use rights in a 5.7 square kilometer parcel located in

Huanghe Nantan (Huanghe Bay), Heyang County, in the Shaanxi Province of China, which is not held for leasing purpose.

Though we commenced the purposebiomass incineration power business in 2009 by cooperation with our strategic partner, our business change in 2012 was our first time to enter the solar photovoltaic industry and determine the strategy of mining.mainly focusing on PV EPC developing in the future.

We seekexpected to determine if there are commercially adequate deposits of zinc, lead and gold within our properties. The

exploration and extraction of mineral deposits involve significant financial risks. The results of exploratory

investigations are not always reliable or accurate even if conductedgenerate revenue from PV business in strict compliance with professional guidelines.

Furthermore, exploration and extraction activities require substantial investment which must occur over a significant

period of time even though the quantity of minerals within any property is finite. Many properties are unable to

develop commercially viable mines even with positive exploration results. Successful extraction depends on very

9

expensive processes such as drilling, mine construction and establishment of processing facilities. Mines are also

hazardous and only a limited number of qualified, experienced miners exist. The Company must obtain additional

government approvals and must ramp up operations after obtaining permission to begin extraction. We are unable to

assure you that we will ultimately be successful in meeting these challenges or whether we will commence

commercial mining operations. Our failure to do so would have a substantial adverse effect in the value of our

company and our securities.

WE HAVE HAD A LIMITED OPERATING HISTORY AND A HISTORY OF FINANCIAL LOSSES.

We have no revenues from mining and do not anticipate generating mining revenues until exploitation has been

approved and undertaken, the mine infrastructure has been completed and the extraction of minerals has begun.

During the years ended December 31, 2009, 2008 and 2007, we had net losses of $ 921,675, $ 1,700,599, and

$ 568,756, respectively. During the years ended December 31, 2009, 2008 and 2007, we had comprehensive losses of

$ 911,535, $ 2,456,679, and $ 157,620, respectively.

These losses resulted from our exploration activities and corporate expenses, including the amortization of our land

use rights. We may never achieve profitable operations, and if we fail to do so, the value of our Company and our

securities will be substantially adversely affected.

WE HAVE NOT YET OBTAINED ALL OF THE LICENSES REQUIRED BY CHINESE LAW.

China employs a two-stage permitting process for permission to explore and to extract minerals. Although we

obtained the exploration license, as of December 31, 2009, we did not yet have the second required license needed

to permit the excavation and subsequent sale of extracted minerals. We cannot give assurance that we will obtain

this license. If we fail to do so, the value of our interests in the mining properties would be seriously impaired, and

would result in a material loss of value to us and our investors.

THERE IS NO ASSURANCE THAT OUR PROPERTY WILL CONTAIN SUFFICIENT QUANTITIES OF

COMMERCIALLY MARKETABLE MINERALS FOR US TO BECOME COMMERCIALLY VIABLE OR

THAT WE WILL BE ABLE TO ECONOMICALLY EXTRACT THE MINERALS.

We have engaged in limited investigation and geologic testing. There can be no assurance that our initial

exploratory efforts will prove satisfactory or correct, or that commercially mineable mineralization exists on our

property. It may not be economically feasible to profitably extract the minerals for many reasons, including some

reasons which are beyond our ability to control. We can offer no assurance that a profitable mining business will

result from our efforts.

WE HAVE NOT CONDUCTED GEOLOGICAL EXPLORATION SUFFICIENT TO FORM A CONCLUSION

THAT THERE ARE PROVEN OR PROBABLE MINERAL RESERVES ON OUR PROPERTY.

As of December 31, 2009, we had not yet conducted geological explorations sufficient to form a conclusion that

there are proven or probable mineral reserves in the area in which we have exploration rights. The only surveys

conducted on this land through the 2009 calendar year have been preliminary geological surveys conducted by a unit

of the Shaanxi Provincial Government. It is costly to conduct detailed mineralogy studies, and we may not have the

resources to undertake them. If we fail to identify commercially reasonable mineral resources, the value of our

Company and our securities will be materially and adversely affected.

DUE TO OUR LIMITED OPERATING HISTORY AND LIMITED EXPLORATION ACTIVITY, WE ARE

UNABLE TO FORECAST MINING REVENUES.

Due to2013. However, our limited operating history makes the prediction of future results of operations difficult, and limited exploration activity,in addition, we arecannot assure that the existing management model is suitable for the EPC project development.

We will devote more resources in our marketing promotion, and attempt to adapt our management to a more flexible operation environment as we have to deal with a variety of competitors due to the relatively lower entrance barrier for solar PV downstream industry.

WE DEPEND ON OUR SENIOR MANAGEMENT AND KEY EMPLOYEES, THE LOSS OF WHOM COULD ADVERSELY AFFECT OUR OPERATIONS.

Our success will depend to a large degree upon our ability to identify, hire, and retain personnel, particularly persons familiar with the marketing, manufacturing and administrative processes associated with the solar energy business. We depend on the skills of our management team and current key employees, such as Mr. Chen Wei Dong, our Chairman, President, and Chief Executive Officer. We may be unable to forecast future miningretain our existing key personnel or attract and retain additional key personnel.

revenues. We have not yet generated

The loss of any revenue from mining operations. Our current and future anticipated

expense levels are largely based onof our investment plans. Failure to generate revenues,key employees or the failure to attract, investment,

10

sufficient to support our planned expenditures, wouldand retain experienced or additional key employees could have a material adverse effect on our business prospects,and financial condition.

WE ACT AS THE GENERAL CONTRACTOR FOR OUR CUSTOMERS IN CONNECTION WITH THE INSTALLATIONS OF OUR SOLAR POWER SYSTEMS AND ARE SUBJECT TO RISKS ASSOCIATED WITH CONSTRUCTION, BONDING, COST OVERRUNS, DELAYS AND OTHER CONTINGENCIES, WHICH COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS AND RESULTS OF OPERATIONS.

We act as the general contractor for our customers in connection with the installation of our solar power systems. All essential costs are estimated at the time of entering into the sales contract for a particular project, and these are reflected in the overall price that we charge our customers for the project. These cost estimates are preliminary and may or may not be covered by contracts between us or the other project developers, subcontractors, suppliers and other parties to the project. In addition, we require qualified, licensed subcontractors to install most of our systems. Shortages of such skilled labor could significantly delay a project or otherwise increase our costs. Should miscalculations in planning a project or defective or late execution occur, we may not achieve our expected margins or cover our costs. Additionally, many systems customers require performance bonds issued by a bonding agency. Due to the general performance risk inherent in construction activities, it is sometimes difficult to secure suitable bonding agencies willing to provide performance bonding. In the event we are unable to obtain bonding, we will be unable to bid on, or enter into sales contracts requiring such bonding.

Delays in solar panel or other supply shipments, other construction delays, unexpected performance problems in electricity generation or other events could cause us to fail to meet these performance criteria, resulting in unanticipated and severe revenue and earnings losses and financial condition,penalties. Construction delays are often caused by inclement weather, failure to timely receive necessary approvals and permits, or delays in obtaining necessary solar panels, inverters or other materials. The occurrence of any of these events could have a material adverse effect on our business and results of operations.

WE WILL NEED ADDITIONAL CAPITALARE A PRIVATE COMPANY MAINLY OPERATING IN CHINA, WHICH MAY RESULT IN A MORE DIFFICULT BUSINESS ENVIRONMENT FOR US, COMPAIRED WITH THE STATE OWNED COMPANY IN PV INDUSTRY

We are a private company operating in China in PV industry, which may incur more cost in obtaining administrative permit, acquiring EPC project, etc, while many competitors are state-owned Companies and operate in a preferable business environment. The PV developer must apply for the PV demonstration project for financial subsidy. Usually the relevant government agencies give priority to the state-owned company under equal conditions.

RISKS RELATED TO PURSUE OUR PLANS,PV INDUSTRY

A SIGNIFICANT REDUCTION IN OUR DISCONTINUATION OF GOVERNMENT SUBSIDIES AND ECONOMIC INCENTIVES MAY HAVE A MATERIAL ADVERSE EFFECT ON OUR RESULTS OF OPERATIONS.

Demand for our products and services substantially depends on government incentives aimed to promote greater use of solar power. The PV application markets would not be commercially viable without government incentives. This is because the cost of generating electricity from solar power currently exceeds the cost of generating electricity from conventional or non-solar renewable energy sources.

The scope of the government incentives for solar power depends, to a large extent, on political and policy developments in China related to environmental, economic or other concerns, which could lead to a significant reduction in or a discontinuation of the support for renewable energy sources .

Any new government regulations or utility policies pertaining to our solar power products may result in significant additional expenses to us, our resellers, and our customers and as a result, could cause a significant reduction in demand for our solar power products.

BECAUSE THE MARKETS IN WHICH WE COMPETE ARE HIGHLY COMPETITIVE AND MANY OF OUR COMPETITORS HAVE GREATER RESOURCES THAN US, WE MAY NOT BE ABLE TO COMPETE SUCCESSFULLY AND WE MAY LOSE OR BE UNABLE TO GAIN MARKET SHARE.

OBTAIN SUFFICIENT CAPITAL AND MAY BE FORCED TO LIMIT THE SCOPE OF OUR OPERATIONS.

We mainly focus on the local solar PV downstream market. Our competitors include Xiaan Huanghe Photovoltaic Technology Co.,Ltd, Shaanxi Tuori New Energy Technology Limited, and Shaanxi Changling Electric Co.,Ltd etc. Most of them have a stronger market position than ours, more sophisticated technologies greater resources and better name recognition than we do.

The barriers to entry are relatively low in the PV consumer market. Financial strength and social relations resource were the key barriers to entry for the EPC project acquisition. Because of the government's continuous efforts to encourage the PV consumer market, more and more companies with strong financial support commenced their solar PV energy business. It is a challenge for us to establish our competitive market position in the industry. In order to acquire more market share, we must respond more quickly to changing customer demands or market conditions or to devote greater resources to the marketing promotion.

New competitors or alliances among existing competitors could emerge and rapidly acquire a significant market share, which would harm our business. If we fail to compete successfully, our business would suffer and we may lose or be unable to gain market share.

RISKS RELATED TO THE REAL ESTATE INDUSTRY

THE CHINESE GOVERNMENT OWNS ALL LAND IN CHINA, AND CHINA ISSUES LAND USE RIGHTS INSTEAD OF LEGAL TITLE TO THE PROPERTIES. THERE IS NO ASSURANCE THAT OUR RIGHTS TO THE PROPERTIES WILL NOT BE SUBJECT TO IMPAIRMENT OR LOSS.

In China, all property is owned by the central government. Unlike deeds or other evidence of December 31, 2009a fee simple ownership interest, land use rights are always subject to fixed periods and December 31, 2008, we had current assetspermitted land use, usually for long periods of $ 488,698time. These periods are frequently 50 years. Disputes over mining claims are common. A loss of our property rights would cause material damage to the Company and $ 850,627,the price of its securities and could result in the loss of the entire value of our Company.

respectively. The remainder

RISKS RELATED TO DOING BUSINESS IN THE PEOPLE'S REPUBLIC OF CHINA

WE ARE SUBJECT TO THE POLITICAL AND ECONOMIC POLICIES OF THE PEOPLE’S REPUBLIC OF CHINA, AND GOVERNMENT REGULATION COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR INTENDED BUSINESS.

All of our assets and operations are illiquid. Explorationin the PRC. As a result, our operating results and financial performance as well as the value of our securities could be affected by adverse changes in economic, political and social conditions in China.

The Chinese government adopted a policy to transition from a planned economy to a market driven economy in 1978. Since then, the economy of the PRC has undergone rapid modernization, although the Chinese government still exerts a dominant force in the nation's economy. This continues to include reservation to the state of land use rights, and includes controls on foreign exchange rates and restrictions or prohibitions on foreign ownership in various industries. All lands in China are state owned and only limited “land use rights” are conveyed to business enterprises or individuals.

All of our intended exploration and mining activities will likely generate cash flow deficitsrequire approvals from the local government authorities in China. Obtaining governmental approval is typically a lengthy and difficult process with no guaranty of success. Since the lands where our activities are located were acquired through the grant of a land use right, changes in government policy could adversely affect our business.

The Chinese government operates the economy in many industries through various five-year plans and increased capital needs that will exceed our available capital. In that event, we will need to obtain additional

funding.

We currentlyeven annual plans. A large degree of uncertainty is associated with potential changes in these plans. Since China’s economic reforms have no lines of credit or other arrangements for capital and cannot provide anyprecedent, there can be no assurance that wefuture changes will not create materially adverse conditions for our business.

be able to obtain funding in the future to meet our needs. Even if we locate available capital, it may be on

unfavorable terms. Any future capital investments could dilute or otherwise materially and adversely affect the

rights of our existing shareholders.

FLUCTUATION OF THE CHINESE CURRENCY COULD MATERIALLY AFFECT OUR FINANCIAL

CONDITION AND RESULTS OF OPERATIONS.

We have not yet commenced mining operations and do not have mining revenues. We expect that our future

revenues, if any, revenue and expenses will be generated in China, but our reporting currency is US dollars and reported

results will be affected by exchange rate fluctuations between the RMB and the US dollar. We cannot give any

assurance that the value of the RMB will continue to appreciate, or even remain stable against the US dollar or any

other foreign currency. Accordingly, we may experience economic losses and negative impacts, as reported in U.S.

Dollars, as a result of foreign exchange rate fluctuations.

The RMB is currently not a fully convertible currency. The Chinese government may restrict future access to

foreign currencies for current account transactions. This may make it difficult for us to transfer money from China to

other countries on an economically advantageous basis or even at all. It may also make it difficult for us to pay cash

returns on the investment of foreign capital.

WE MAY BE ADVERSELY AFFECTED BY ENVIRONMENTAL REGULATIONS.

We are subject to China’s national and local environmental protection regulations which currently impose fees for

the discharge of waste substances, require the payment of fines for pollution, and provide for the closure by the

Chinese government of any facility that fails to comply with orders requiring a company to cease or improve upon

certain activities causing environmental damage. Due to the nature of the mining business, future mining operations

could produce significant amounts of waste water, gas, and solid waste materials. Chinese national, provincial, or

local authorities may impose legal requirements which would require additional expenditures on environmental

matters or changes in our processes or systems, the cost of which may exceed our financial resources.

WE DEPEND ON OUR SENIOR MANAGEMENT AND KEY EMPLOYEES, THE LOSS OF WHOM COULD

ADVERSELY AFFECT OUR OPERATIONS.

Our success will depend to a large degree upon our ability to identify, hire, and retain personnel, particularly

experienced miners and persons familiar with the marketing, manufacturing and administrative processes associated

with mining. We depend on the skills of our management team and current key employees, such as Mr. Chen Wei

Dong, our Chairman, President, and Chief Executive Officer. We may be unable to retain our existing key personnel

or attract and retain additional key personnel.

The loss of any of our key employees or the failure to attract, and retain experienced miners or additional key

employees could have a material adverse effect on our business and financial condition.

RISKS RELATED TO OUR INDUSTRY

11

HAZARDS AND RISKS ASSOCIATED WITH MINING MAY CAUSE SUBSTANTIAL DELAYS OF

OPERATIONS AND REQUIRE SIGNIFICANT EXPENDITURES.

The Company's operations are subject to all of the hazards and risks normally incident to the exploration for and

development and production of minerals, any of which could result in damages for which the Company may be held

responsible. Many hazards are beyond our control, such as unusual or unexpected rock formations, bad weather, and

high water tables. We could also experience landslides, cave-ins, flooding or other unfavorable conditions. If we

experience losses from these or other risks, it may cause substantial delays and require significant additional

expenditures. These conditions would adversely affect the Company's business, financial condition and the value of

our securities.

China has experienced a number of serious incidents in its mining industry that resulted in loss of life and serious

personal injury. Some mines have collapsed or were otherwise forced to close due to unsafe conditions. We would

suffer material losses if any of these events were to occur, and they would have a material adverse effect on our

business and the value of our securities.

RISKS RELATED TO THE REAL ESTATE INDUSTRY

THE CHINESE GOVERNMENT OWNS ALL LAND IN CHINA, AND CHINA ISSUES LAND USE RIGHTS

INSTEAD OF LEGAL TITLE TO THE PROPERTIES. THERE IS NO ASSURANCE THAT OUR RIGHTS TO

THE PROPERTIES WILL NOT BE SUBJECT TO IMPAIRMENT OR LOSS.

In China, all property is owned by the central government. Unlike deeds or other evidence of a fee simple ownership

interest, land use rights are always subject to fixed periods and permitted land use, usually for long periods of time.

These periods are frequently 50 years. Disputes over mining claims are common. A loss of our property rights or

mining rights would cause material damage to the Company and the price of its securities and could result in the loss

of the entire value of our Company.

MARKET PRICES FOR NON-FERROUS METALS FLUCTUATE AND COULD ADVERSELY AFFECT THE

VALUE OF OUR COMPANY AND OUR SECURITIES.

Market prices for zinc, lead and gold, the metals for which we explore, experience significant fluctuations in price.

The profitability of any mining operations will be directly related to these market prices. The market prices of non-

ferrous metals are subject to factors beyond our control. These factors include, but are not limited to, changes in

legal and regulatory requirements, changes in the exchange rates of the RMB and other currencies, worldwide

economic conditions, political and economic factors and variations in production costs. A reduction in the price or

demand for lead, zinc or gold would adversely affect our Company and the value of our securities.

WE ARE EXPOSED TO BUSINESS CYCLE RISK .

Our business is located in China and will be conducted in China. We expect to sell any minerals we extract within

China. The need for these minerals throughout the world is affected by the demand for such minerals in China. We

are dependant on the continued economic growth in China to maintain demand for our mineral products. The recent

global recession has adversely affected the non-ferrous metals industry. Our business and results of operation may

be adversely affected if Chinese economic growth were to decline.

SHORTAGES OF CRITICAL PARTS, EQUIPMENT AND SKILLED LABOR MAY ADVERSELY AFFECT

OUR DEVELOPMENT PROJECTS.

The mining industry has been impacted by increased worldwide demand for resources such as input commodities,

drilling equipment, tires and skilled labor. These shortages have caused, and may continue to cause, unanticipated

cost increases and delays in delivery times, potentially impacting operating costs, capital expenditures and

production schedules.

12

RISKS RELATED TO DOING BUSINESS IN THE PEOPLE'S REPUBLIC OF CHINA

WE ARE SUBJECT TO THE POLITICAL AND ECONOMIC POLICIES OF THE PEOPLE’S REPUBLIC OF

CHINA, AND GOVERNMENT REGULATION COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR

INTENDED BUSINESS.

All of our assets and operations are in the PRC. As a result, our operating results and financial performance as well

as the value of our securities could be affected by adverse changes in economic, political and social conditions in

China.

The Chinese government adopted a policy to transition from a planned economy to a market driven economy in

1978. Since then, the economy of the PRC has undergone rapid modernization, although the Chinese government

still exerts a dominant force in the nation's economy. This continues to include reservation to the state of land use

rights or mining and exploration rights, and includes controls on foreign exchange rates and restrictions or

prohibitions on foreign ownership in various industries including mining. All lands in China are state owned and

only limited “land use rights” are conveyed to business enterprises or individuals.

All of our intended exploration and mining activities require approvals from the local government authorities in

China. Obtaining governmental approval is typically a lengthy and difficult process with no guaranty of success.

Since the lands where our exploration activities are located were acquired through the grant of a land use right,

changes in government policy could adversely affect our business.

The Chinese government operates the economy in many industries through various five-year plans and even annual

plans. A large degree of uncertainty is associated with potential changes in these plans. Since China’s economic

reforms have no precedent, there can be no assurance that future changes will not create materially adverse

conditions for our business.

THERE ARE RISKS INHERENT IN DOING BUSINESS IN CHINA OVER WHICH WE HAVE NO

CONTROL.

The political and economic systems of the PRC are very different from those of the United States and other western

countries. China remains volatile with respect to certain social, economic and political issues which could lead to

revocation or adjustment of reforms. There are also issues between China and the United States that could result in

disputes or instabilities. The role of China and its government remain in flux both domestically and internationally,

and could cause shocks or setbacks that may adversely affect our business.

THE CHINESE LEGAL SYSTEM DIFFERS FROM THAT OF THE UNITED STATES, PROVIDING LESS

PROTECTION FOR INVESTORS, AND IT MAY BE DIFFICULT FOR INVESTORS TO SEEK LEGAL

REDRESS AGAINST US OR OUR OFFICERS AND DIRECTORS, INCLUDING CLAIMS THAT ARE

BASED UPON U.S. SECURITIES LAWS.

All of our current operations are conducted in China. All of our current directors and officers are nationals or

residents of China. All of the assets of these persons are located in China. The PRC legal system is a civil law

system. Unlike the common law system, the civil law system is based on written statutes in which decided legal

cases have little value as precedents. Differences in interpretations and rulings can occur with limited opportunity

for redress or appeal.

It may not be possible to effect service of process within the U.S. or elsewhere outside China upon our officers and

directors. Even if service of process were successful, considerable uncertainty exists as to whether Chinese courts

would recognize and enforce U. S. laws or judgments obtained in the U.S. federal and state securities laws as the U.

S. laws confer substantial rights to investors and shareholders that have no equivalent in China. Therefore a claim

against us or our officers and/or directors or even a final judgment in the U. S. may not be recognized or enforced by

Chinese courts.

13

In 1979, the PRC began to reform its legal system and has enacted numerous laws regulating economic and business

development, including those related to foreign investment. Currently many of the approvals required for our

business may be obtained at local or provincial level. We believe that it is relatively easier and faster to obtain