UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K/A

(Amendment No. 1)10-K

(Mark One)

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the year ended December 31, 20192020

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-36362

BioLife Solutions, Inc.

(Exact name of registrant as specified in its charter)

| 94-3076866 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

3303 MONTE VILLA PARKWAY, SUITEMonte Villa Parkway, Suite 310, BOTHELL, WASHINGTON,Bothell, Washington, 98021

(Address of registrant’sregistrant’s principal executive offices, Zip Code)

(425) 402-1400

(Telephone number, including area code)

Securities registered pursuant to Section12(b) of the Act:

Title of each class | Trading symbol ($) | Name of exchange on which registered |

Common | BLFS | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐☑ No ☑☐

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (S232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such said files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☑☐ Non-accelerated filer ☐☑ Smaller reporting company ☑ Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

As of the registrant’s most recently completed second fiscal quarter, the aggregate market value of common equity (based on closing price on June 28, 201930, 2020 of $16.95$16.35 per share) held by non-affiliates was approximately $230$263 million.

As of June 12, 2020, 25,963,241March 19, 2021, 33,401,359 shares of the registrant’s common stock were outstanding.

Explanatory NoteTable of Contents

Page No. | ||

ITEM 1. | 4 | |

ITEM 1A. | 11 | |

ITEM 1B. | 21 | |

| ITEM 2. | 22 | |

ITEM 3. | 22 | |

ITEM 4. | 22 | |

ITEM 5. | 22 | |

ITEM 6. | 22 | |

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 23 |

ITEM 7A. | 33 | |

ITEM 8. | 34 | |

34 | ||

35 | ||

ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 71 |

ITEM 9A. | 71 | |

ITEM 9B. | 72 | |

ITEM 10. | 73 | |

ITEM 11. | 77 | |

ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 83 |

ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | 85 |

ITEM 14. | 85 | |

ITEM 15. | 87 | |

ITEM 16. | 88 | |

89 | ||

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K (“Form 10-K” or “Annual Report”) contains forward-looking statements which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The forward-looking statements in this Form 10-K do not constitute guarantees of future performance and actual results could differ materially from those contained in the forward-looking statements. These statements are based on current expectations of future events. Such statements include, but are not limited to, statements about our products, including our newly acquired products, customers, regulatory approvals, the potential utility of and market for our products and services, our ability to implement our business strategy and anticipated business and operations, in particular following our 2019 and 2020 acquisitions, future financial and operational performance, our anticipated future growth strategy, including the closing of our merger with Global Cooling, Inc. and the acquisition of other synergistic cell and gene therapy manufacturing tools and services or technologies or other companies or technologies, capital requirements, intellectual property, suppliers, joint venture partners, future financial and operating results, the impact of the COVID-19 pandemic, plans, objectives, expectations and intentions, revenues, costs and expenses, interest rates, outcome of contingencies, business strategies, regulatory filings and requirements, the estimated potential size of markets, capital requirements, the terms of any capital financing agreements and other statements that are not historical facts. You can find many of these statements by looking for words like “believes,” “expects,” “anticipates,” “estimates,” “may,” “should,” “will,” “could,” “plan,” “intend,” or similar expressions in this Form 10-K. We intend that such forward-looking statements be subject to the safe harbors created thereby.

These forward-looking statements are based on the current beliefs and expectations of our management and are subject to significant risks and uncertainties. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results may differ materially from current expectations and projections. Factors that might cause such a difference include those discussed under “Risk Factors,” as well as those discussed elsewhere in the Form 10-K.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Form 10-K or, in the case of documents referred to or incorporated by reference, the date of those documents.

All subsequent written or oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this Form 10-K or to reflect the occurrence of unanticipated events, except as may be required under applicable U.S. securities law. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

References throughout this Amendment No. 1 to the Annual Report on Form 10-K to “BioLife“BioLife Solutions, Inc.”, “BioLife”“BioLife”, “we”“we”, “us”“us”, “our”“our”, or the “Company”“Company” refer to BioLife Solutions, Inc. and its subsidiaries, taken as a whole, unless the context otherwise indicates.

This Amendment No. 1 ("Amendment No. 1") to the Annual Report on Form 10-K/A amends the Annual Report on Form 10-K of BioLife Solutions, Inc. for the fiscal year ended December 31, 2019, as filed with the Securities and Exchange Commission ("SEC") on May 15, 2020 (the "Original Filing"). In the Original Filing, the Company, in consultation with its Audit Committee, concluded that its previously issued Consolidated Financial Statements for the periods beginning with the first quarter of 2018 through the third quarter of 2019 (collectively, the “Affected Periods”) should be restated because of a misapplication in the guidance around accounting for certain of our outstanding warrants to purchase common stock (the “Warrants”) and should no longer be relied upon (the Audit Committee concluded that it was not necessary to restate the financial statements for any period prior to January 1, 2018).

Historically, the Warrants were reflected as a component of equity as opposed to liabilities on the balance sheets and the statements of operations did not include the subsequent non-cash changes in estimated fair value of the Warrants in accordance with Accounting Standards Codification 480, “Distinguishing Liabilities from Equity” (“ASC 480”). The Warrants generally provide that, in the event of a fundamental transaction under rule 13(e)-3, the holder may receive cash value for the Warrants calculated using a Black Scholes model with a volatility rate equal to the greater of (i) the historical 100-day look-back period or (ii) 100% equity volatility. As a result, the Warrant cannot be classified within equity according to generally accepted accounting principles. Instead, the Warrants issued by the Company should be recorded as a liability at fair value at the date of grant, and marked to market at each reporting period. Changes in fair value are recorded in earnings.

We are filing this Amendment No. 1 to include the selected financial data described in Item 6. Selected Financial Data which such financial data give effect to the change in accounting for the Warrants as previously disclosed in the Original Filing.

The change in accounting for the Warrants did not have any impact on our liquidity, cash flows, revenues or costs of operating our business and the other non-cash adjustments to the Consolidated Financial Statements, in all of the Affected Periods or in any of the periods included in Item 6, Selected Financial Date in this filing. The change in accounting for the warrants does not impact the amounts previously reported for the Company’s cash and cash equivalents, operating expenses or total cash flows from operations for any of these periods.

While, as a smaller reporting company, we are not required to include Item 6. information, we have elected to do so to provide additional disclosure surrounding the Warrants. This Amendment No. 1 consists solely of the preceding cover page, this explanatory note, the information required by Item 6 of Form 10-K, a signature page and the certifications required to be filed as exhibits.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), Item 6, Selected Financial Data, of the Original Filing is hereby amended and restated in its entirety. This Amendment No. 1 should be read in conjunction with the Original Filing and with our filings with the SEC subsequent to the Original Filing.

This Amendment No. 1 does not reflect events occurring after the filing of the Original Filing, and, except as described above, does not modify or update any other disclosures in the Original Filing.

| ||

|

| |

|

| |

| ||

BUSINESS |

ITEM 6. SELECTED FINANCIAL DATA

The following discussion of our business contains forward-looking statements that involve risks and uncertainties (see the section entitled “Forward Looking Statements” herein). Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those factors set forth under “Risk Factors” and elsewhere in this Form 10-K.

Overview

We develop, manufacture, and market bioproduction tools and services to the cell and gene therapy (“CGT”) industry, which are designed to improve quality and de-risk biologic manufacturing and delivery. We also provide biological and pharmaceutical storage services to the CGT industry. Our products are used in basic and applied research, and commercial manufacturing of biologic-based therapies. Customers use our products to maintain the health and function of biologic material during sourcing, manufacturing, storage, and distribution of cells and tissues.

We currently operate as one bioproduction tools and services business with product lines that support several steps in the biologic material manufacturing and delivery process. We have a diversified portfolio of tools and services that focus on biopreservation, frozen storage, and thawing of biologic materials. We have in-house expertise in cryobiology and continue to capitalize on opportunities to maximize the value of our product platform for our extensive customer base through both organic growth innovations and acquisitions.

COVID-19 Considerations

In March 2020, the World Health Organization declared the COVID-19 outbreak to be a pandemic. During 2020, we believe our quarterly revenues were affected by COVID-19. During the first quarter, our biopreservation media product lines benefited due to what we believe was safety stock purchasing by our customers due to COVID-19. In the second and third quarters, we believe that revenues were negatively impacted by a reduction in clinical trial progression and temporary halts. We then noticed an increase of purchasing in biopreservation media in the fourth quarter as clinical trials and research lab activity resumed with reduced restrictions. Our biological and pharmaceutical services business that we acquired in the fourth quarter was in-line with expectations and we expect increased demand for biological material storage with the reduction of COVID-19 restrictions. Our 2020 revenue was negatively affected for our automated thawing devices, cloud connected “smart” shipping containers, and freezer and storage technology lines of business by the COVID-19 pandemic due to restrictions on in-person selling, customer budget cuts for capital equipment and lack of personnel at our customer sites to receive capital equipment. We have tried and, to date, have been successful in mitigating any supply chain problems. However, we cannot provide any assurance that a continued or prolonged global pandemic will not have a negative impact on our manufacturing and shipping processes or our product costs. The consolidated statementextent to which the COVID-19 pandemic affects our future financial results and operations will depend on future developments which are highly uncertain and cannot be predicted, including the recurrence, severity and/or duration of the ongoing pandemic, and current or future domestic and international actions to contain and treat COVID-19.

We are following public and private sector policies and initiatives to reduce the transmission of COVID-19, such as the imposition of travel restrictions and the promotion of social distancing and work-from-home arrangements. We are taking a variety of measures to ensure the availability and functioning of our critical infrastructure, to promote the safety and security of our employees and to support the communities in which we operate. These measures include increasing our raw materials, manufacturing safety stock inventory for our biopreservation media and expanding availability of our biological and pharmaceutical storage, requiring remote working arrangements for employees who are not integral to physically making and shipping our products or who do not need specialized equipment to perform their work, restricting on-site visits by non-employees and implementing social distancing protocols, and investing in personal protective equipment. Beginning April 2, 2020 face masks were required to be worn by all employees and contractors at all sites. Effective May 11, 2020, temperature screening was required upon entering our facilities where mandated by state law. Starting on May 11, 2020, our employees were required to complete daily COVID-19 exposure and symptom questionnaires where mandated, with the requirement rolling out companywide on October 13, 2020 for all locations.

For further discussion of the risks relating to COVID-19, see “Our financial condition and results of operations formay be adversely affected by the years ended December 31, 2019 and 2018 and the consolidated balance sheet data as of December 31, 2019 and 2018 presented below have been derived from our audited consolidated financial statements and footnotes includedCOVID-19 pandemic” in the Original Filing. The consolidated statement of operations for the years ended December 31, 2017, 2016 and 2015 and the consolidated balance sheet data as of December 31, 2017, 2016 and 2015 have been derived from previously filed consolidated financial statements which were not restated in connection with the reclassification of our Warrants (and, as described in the Original Filing, should not be relied upon) and are not included in our Original Filing. Historical results are not necessarily indicative of future results. The following data should be read in conjunction with Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated financial statements and related notes included elsewhere in our Original Filing.1A. “Risk Factors”, below.

Statement of Operations Data:Our Products

For the Years Ended December 31, | ||||||||||||||||||||

(In thousands, except per share and share data) | 2019(1)(2) | 2018(3) (Restated) | 2017(4) (Restated) (Unaudited) | 2016(4) (Restated) (Unaudited) | 2015(4) (Restated) (Unaudited) | |||||||||||||||

Total product and rental revenue | $ | 27,371 | $ | 19,742 | $ | 11,022 | $ | 8,227 | $ | 6,449 | ||||||||||

Operating costs and expenses: | ||||||||||||||||||||

Cost of product and rental revenue (exclusive of intangible assets amortization) | 8,760 | 6,217 | 4,276 | 3,448 | 2,635 | |||||||||||||||

Research and development | 3,168 | 1,298 | 1,193 | 2,028 | 1,379 | |||||||||||||||

Sales and marketing | 4,701 | 2,615 | 2,086 | 3,010 | 2,583 | |||||||||||||||

General and administrative | 8,893 | 5,950 | 4,523 | 4,592 | 4,869 | |||||||||||||||

Intangible assets amortization | 1,079 | — | — | — | — | |||||||||||||||

Acquisition costs | 940 | — | — | — | — | |||||||||||||||

Change in fair value of contingent consideration | 50 | — | — | — | — | |||||||||||||||

Total operating expenses | 27,591 | 16,080 | 12,078 | 13,078 | 11,466 | |||||||||||||||

Operating income (loss) | (220 | ) | 3,662 | (1,056 | ) | (4,851 | ) | (5,017 | ) | |||||||||||

Change in fair value of warrant liability | (12,835 | ) | (28,271 | ) | (18,456 | ) | 6,529 | (2,237 | ) | |||||||||||

Other income (expenses) | 9,857 | (396 | ) | (1,459 | ) | (3,190 | ) | 22 | ||||||||||||

Total other expenses | (2,978 | ) | (28,667 | ) | (19,915 | ) | 3,339 | (2,215 | ) | |||||||||||

Net income (loss) before provision for income taxes | (3,198 | ) | (25,005 | ) | (20,971 | ) | (1,512 | ) | (7,232 | ) | ||||||||||

Income tax (benefit) | (1,541 | ) | — | — | — | — | ||||||||||||||

Net loss | (1,657 | ) | (25,005 | ) | (20,971 | ) | (1,512 | ) | (7,232 | ) | ||||||||||

Net loss attributable to non-controlling interest | — | — | — | 1,166 | 781 | |||||||||||||||

Net loss attributable to BioLife Solutions, Inc. | (1,657 | ) | (25,005 | ) | (20,971 | ) | (346 | ) | (6,451 | ) | ||||||||||

Less: Preferred stock dividends | — | (339 | ) | (213 | ) | — | — | |||||||||||||

Net loss attributable to common stockholders | $ | (1,657 | ) | $ | (25,344 | ) | $ | (21,184 | ) | $ | (346 | ) | $ | (6,451 | ) | |||||

Earnings per share attributable to common stockholders: | ||||||||||||||||||||

Basic and diluted | $ | (0.09 | ) | $ | (1.56 | ) | $ | (1.60 | ) | $ | (0.03 | ) | $ | (0.53 | ) | |||||

Weighted average shares outstanding | ||||||||||||||||||||

Basic and diluted | 19,460,299 | 16,256,465 | 13,263,881 | 12,642,996 | 12,177,396 | |||||||||||||||

Our bioproduction tools and services are comprised of five main offerings

● | Biopreservation media | |

● | Automated thawing devices | |

● | Cloud connected “smart” shipping containers | |

● | Freezer and storage technology and related components | |

● | Biological and pharmaceutical material storage |

Biopreservation Media

Our proprietary biopreservation media products, HypoThermosol® FRS and CryoStor®, are formulated to mitigate preservation-induced, delayed-onset cell damage and death, which result when cells and tissues are subjected to reduced temperatures. Our technology can provide our CGT customers with significant shelf life extension of biologic source material and final cell products, and can also greatly improve post-preservation cell and tissue viability and function. Our biopreservation media is serum-free, protein-free, fully defined, and manufactured under current Good Manufacturing Practices (cGMP). We strive to source wherever possible, the highest available grade, multi-compendium raw materials. We estimate our media products have been incorporated in over 450 customer clinical applications, including numerous chimeric antigen receptor (CAR) T cell and other cell types.

Stability (i.e. shelf-life) and functional recovery are crucial aspects of academic research and clinical practice in the biopreservation of biologic-based source material, intermediate derivatives, and isolated/derived/expanded cellular products and therapies. Limited stability is especially critical in the CGT field, where harvested cells and tissues will lose viability over time, if not maintained appropriately at normothermic body temperature (37ºC) or stored in a hypothermic state in an effective preservation medium. Chilling (hypothermia) is used to reduce metabolism and delay degradation of harvested cells and tissues. However, subjecting biologic material to hypothermic environments induces damaging molecular stress and structural changes. Although cooling successfully reduces metabolism (i.e., lowers demand for energy), various levels of cellular damage and death occur when using suboptimal methods. Traditional biopreservation media range from simple “balanced salt” (electrolyte) formulations to complex mixtures of electrolytes, energy substrates such as sugars, osmotic buffering agents and antibiotics. The limited stability, which results from the use of these traditional biopreservation media formulations, is a significant shortcoming that our optimized proprietary products address with great success.

Our scientific research activities over the last 20+ years enabled a detailed understanding of the molecular basis for the hypothermic and cryogenic (low-temperature induced) damage/destruction of cells through apoptosis and necrosis. This research led directly to the development of our HypoThermosol® FRS and CryoStor® technologies. Our proprietary biopreservation media products are specifically formulated to:

● | Minimize cell and tissue swelling |

● | Reduce free radical levels upon formation |

● | Maintain appropriate low temperature ionic balances |

● | Provide regenerative, high energy substrates to stimulate recovery upon warming |

● | Avoid the creation of an acidic state (acidosis) |

● | Inhibit the onset of apoptosis and necrosis |

A key feature of our biopreservation media products is their “fully-defined” profile. All of our cGMP products are serum-free, protein-free and are formulated and filled using aseptic processing. We strive to use USP/Multicompendial grade or the highest quality available synthetic components. All of these features benefit prospective customers by facilitating the qualification process required to incorporate our products into their regulatory filings.

The results of independent testing demonstrate that our biopreservation media products significantly extend shelf-life and improve cell and tissue post-thaw viability and function. Our products have demonstrated improved biopreservation outcomes, including greatly extended shelf-life and post-thaw viability, across a broad array of cell and tissue types.

Competing biopreservation media products are often formulated with simple isotonic media cocktails, animal serum, potentially a single sugar or human protein. A key differentiator of our proprietary HypoThermosol FRS formulation is the engineered optimization of the key ionic component concentrations for low temperature environments, as opposed to normothermic body temperature around 37°C, as found in culture media or saline-based isotonic formulas. Competing cryopreservation freeze media is often comprised of a single permeating cryoprotectant such as dimethyl sulfoxide (“DMSO”). Our CryoStor formulations incorporate multiple permeating and non-permeating cryoprotectant agents which allow for multiple mechanisms of protection and reduces the dependence on a single cryoprotectant. We believe that our products offer significant advantages over in-house formulations, or commercial “generic” preservation media, including, time saving, improved quality of components, more rigorous quality control release testing, more cost effective and improved preservation efficacy.

We estimate that annual revenue from each customer commercial application in which our products are used could range from $500,000 to $2.0 million, if such application is approved and our customer commences large scale commercial manufacturing of the biologic based therapy.

Automated, Water-Free Thawing Products

In April 2019, we acquired Astero Bio Corporation (“Astero”), to expand our bioprocessing tools portfolio and diversify our revenue streams. The Astero ThawSTAR® line includes automated vial and cryobag thawing products that control the heat and timing of the thawing process of biologic material. Our customizable, automated, water-free thawing products uses algorithmic programmed, heating plates to consistently bring biologic material from a frozen state to a liquid state in a controlled and consistent manner. This helps reduce damage during the temperature transition. The ThawSTAR products can reduce risks of contamination versus using a traditional water bath.

evo® Cloud Connected Shipping Containers

In August 2019, we acquired the remaining shares of SAVSU Technologies, Inc. (“SAVSU”) we did not previously own. SAVSU is a leading developer and supplier of next generation cold chain management tools for cell and gene therapies. The evo.is cloud app allows biologic products to be traced and tracked in real time. Our evo platform consists of rentable cloud-connected shippers and include technologies that enable tracking software provides real-time information on geolocation, payload temperature, ambient temperature, tilt of shipper, humidity, altitude, and real-time alerts when a shipper has been opened. Our internally developed evo.is software allows customers to customize alert notifications both in data measurements and user requirements. The evo Dry Vapor Shipper (“DVS”) is specifically marketed to cell and gene therapies. The evo DVS has improved form factor and ergonomics over the traditional dewar, including extended thermal performance, reduced liquid nitrogen recharge time, improved payload extractors and ability to maintain temperature for longer periods on its side.

We utilize couriers who already have established logistic channels and distribution centers. Our strategy greatly reduces the cash need to build out specialized facilities around the world. Our partnerships with several white glove couriers allow us to scale our sales and marketing effort by utilizing their salesforce. Our courier partnerships market our evo platform to their existing cell and gene therapy customers as a cost effective and innovative solution. We also market directly to our existing and prospective customers who can utilize the evo platform through our courier partnerships.

Liquid Nitrogen Freezer and Storage Devices

In November 2019, we acquired Custom Biogenic Systems, Inc. (“CBS”) a global leader in the design and manufacture of state-of-the-art liquid nitrogen laboratory freezers, cryogenic equipment and accessories. The addition of CBS allows for product line growth, diversification of revenue and the potential for reduction of supply chain costs for our evo dry vapor shippers.

Included in CBS’s product line of liquid nitrogen freezers are the Isothermal LN2 freezers, constructed with a patented system which stores liquid nitrogen in a jacketed space in the walls of the freezer. This dry storage method eliminates liquid nitrogen contact with stored specimens, reduces the risk of cross-contamination and provides increased user safety in a laboratory setting. To accommodate customer requirements, we offer customizable features including wide bodied and extended height.

To accompany the offerings of cryogenic freezer equipment, we supply equipment for storing critically important biological materials. This storage equipment includes upright freezer racks, chest freezer racks, liquid nitrogen freezer racks, canisters/cassettes and frames as well as laboratory boxes and dividers. Due to our onsite design and manufacturing capability, racks and canisters can be customized to address customers’ varying requirements.

In order to provide customers with a proactive approach to safety and monitoring of equipment containing liquefied gas, CBS offers Versalert, a patented wireless remote asset monitoring system that can monitor and record temperatures. Versalert has an intelligent mesh network system that enables customers to view current equipment conditions and receive alarm notification on smartphones, tablets or personal computers and maintain permanent electronic records for regulatory compliance and legal verification.

Biological and Pharmaceutical Storage

In October 2020, we acquired SciSafe Holdings, Inc. (“SciSafe”), a premier provider of biological and pharmaceutical storage. In addition to providing storage services, SciSafe provides cold chain logistics that ensures materials are kept at target temperatures from the moment that the materials leave the customer’s premises to their ultimate return. State-of-the-art monitoring systems employed by SciSafe allow for customers to monitor the storage temperatures of their materials throughout the entire logistics chain.

We operate four storage facilities in the USA.

Our Market Opportunity

The CGT market has been rapidly expanding, treating diseases once thought incurable. According to the Alliance for Regenerative Medicine (“ARM”) there were over 1,100 ongoing clinical trials utilizing regenerative medicine at the end of 2020. ARM also states there were over $19.9 billion in total global financings in the regenerative market in 2020. The FDA predicts ten to twenty cell and gene therapies per year will be approved by 2025.

These technologies change the way physicians treat patients. The manufacturing, distribution and the delivery process is significantly different from many other types of medicines and therapies. We believe we are well positioned to address many of the manufacturing difficulties in the process of producing cell and gene therapies.

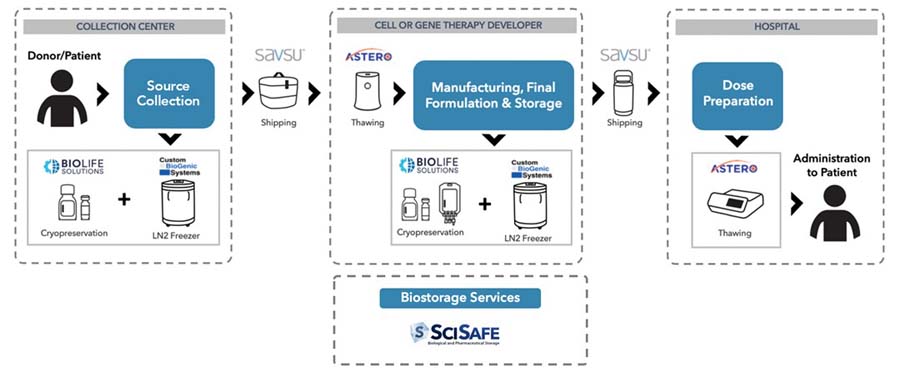

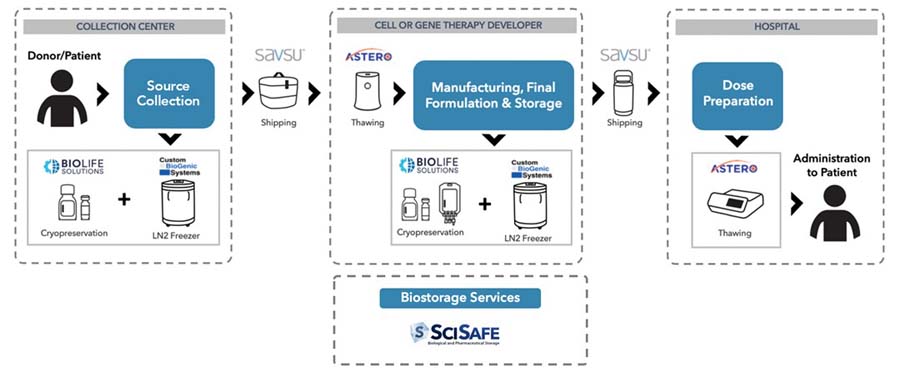

The Bioproduction Process

Our products currently fulfill several steps in the bioproduction process for cell and gene therapies. See the diagram below from an illustration of this process and our product roles. We now offer products that integrate into the critical steps of preservation, thawing, fixed storage, and transportable storage under controlled conditions.

Complementary Products Portfolio

Expanding Participation in Customers’ Workflow

Our Strategy

We aggressively leverage our numerous relationships with the leading cell and gene therapy companies that use our expanded product portfolio of bioproduction tools to cross-sell our portfolio of products and services. Over the last several years, we have built a strong reputation as a trusted supplier of critical tools used in cell and gene therapy manufacturing. We believe that our relationships and reputation could enable us to drive incremental revenue growth through the sale of additional products to a captive customer base. Our products are designed to increase our customers’ product yield and functionality, and we are committed to supporting our customers with strong customer service and our expertise associated with the clinical applications of our products.

Business Operations

Research and Development

Our research and development activity is focused on evaluating new potential disruptive technologies which may be applicable throughout the cell and gene therapy manufacturing workflow. We routinely assess and analyze the strengths and weaknesses of competitive products and are typically engaged in business development discussions on an ongoing basis. We strive to continue to introduce differentiated and high-quality products that address specific difficulties in the biologic storage preservation and thawing process.

Sales and Marketing

We market and sell our products through direct sales and third-party distribution.

We have experienced field-based sales employees who market our growing product portfolio on a direct basis. Over time, we anticipate expanding our sales team. Our technical applications engineers and customer care support teams have extensive experience in cell processing, biopreservation, freezing and thawing.

In the years ended December 31, 2020 and 2019, we derived approximately 13% of our revenue from one customer and approximately 15% of our revenue from one customer, respectively.

Our products are marketed and distributed by STEMCELL Technologies, MilliporeSigma, VWR, Thermo Fisher and several other regional distributors under non-exclusive agreements. In 2020, sales to third party distributors accounted for 45% of our revenue compared to 46% in 2019.

The following table represents the Company’s total revenue by geographic area (based on the location of the customer):

Year Ended December 31, | ||||||||

Revenue by customers’ geographic locations | 2020 | 2019 | ||||||

United States | 73 | % | 69 | % | ||||

Canada | 13 | % | 16 | % | ||||

Europe, Middle East, Africa (EMEA) | 12 | % | 14 | % | ||||

Other | 2 | % | 1 | % | ||||

Total revenue | 100 | % | 100 | % | ||||

Manufacturing

Biopreservation Media - We maintain and operate two independent cGMP clean room production suites for manufacturing sterile biopreservation media products in Bothell, Washington. Our quality management system (“QMS”) is certified to the ISO 13485:2016 standard. Our QMS is aligned with applicable sections of 21 CFR Part 820 - Quality System Regulation for Good Manufacturing Practice of medical devices, 21 CFR Parts 210 and 211 - cGMP for Finished Pharmaceuticals, FDA Guidance - Sterile Drug Products, Volume 4, EU Guidelines Annex 1 - Manufacture of Sterile Medicinal Products, ISO 13408 - Aseptic Processing of Healthcare Products, and ISO 14644 - Clean Rooms and Associated Controlled Environments. We seek to manage single-source supplier risk by regularly assessing the quality and capacity of our suppliers, implementing supply and quality agreements where appropriate and actively managing lead times and inventory levels of sourced components. Pursuant to our supply agreements, we are required to notify customers of any changes to our raw materials. For certain components in which we do not have a secondary supplier, we estimate that it would take up to six months to find and qualify a second source. Order quantities and lead times for externally sourced components are based on our forecasts, which are derived from historical demand and anticipated future demand. Lead times for components may vary depending on the size of the order, specific supplier requirements and current market demand for the materials and parts. Due to COVID-19, we have seen increased lead times for certain raw materials, particularly personal protective equipment used in our clean rooms and certain form factors of bottles and vials used in our finished products. To date, we have not experienced significant difficulties in obtaining raw materials for the manufacture of our biopreservation media products.

Automated Thawing –Our ThawSTAR automated, water-free thawing products are produced by a contract manufacturing organization (“CMO”) based in the United States. We believe this CMO has the skills, experience and capacity needed to meet our quality standards and demand expectations for the product line. Due to COVID-19, we have seen increased lead times from our CMO due to increased lead times from our CMO’s suppliers. We estimate that it would take up to six months to find and qualify an alternative CMO. To date, we have not experienced significant difficulties in obtaining our automated thaw products from our CMO.

evo Cold Chain Products –Production of our evo cold chain management hardware products is performed by external CMOs and by personnel in our Albuquerque, New Mexico facility. Our QMS is certified to the ISO 9001:2015 standard. Due to COVID-19, we have seen increased lead times for certain raw materials and components from our suppliers. To date, we have not experienced significant difficulties in obtaining raw materials for the manufacture of our evo cold chain products.

Freezer and Storage – The majority of our CBS freezers and related accessories are manufactured in our facility in Bruce Township, Michigan. We are reliant on certain critical suppliers for some components. Due to COVID-19, we have seen increased lead times for certain raw materials and components from our suppliers as well as increased costs on certain raw materials. To date, we have not experienced significant difficulties in obtaining raw materials for the manufacture of our freezer and storage products.

We practice continuous improvement based on routine internal audits as well as external feedback and audits performed by our partners and customers. In addition, we maintain a business continuity management system that focuses on key areas such as contingency planning, security stocks and off-site storage of raw materials and finished goods to ensure continuous supply of our products.

Biological storage

Biological and Pharmaceutical Storage –SciSafe operates three cGMP compliant storage facilities and two other state-of-the-art facilities in the United States. Two facilities are certified to the ISO 20387:2018 standard. We rely on outside suppliers for the build out of our cold-storage chambers and stand-alone freezers. Due to COVID-19, we have experienced increased lead times in acquiring stand-alone freezers, which we use to store customer’s biologic materials.

Product Regulatory Status

Our media, thawing, freezer, and evo products are not subject to any specific United States Food and Drug Administration (“FDA”) or other international marketing regulations for drugs, devices, or biologics. We are not required to sponsor formal prospective, controlled clinical trials in order to establish safety and efficacy. However, to support our current and prospective clinical customers, we manufacture and release our products in compliance with cGMP and other relevant quality standards.

To assist customers with their regulatory applications, we maintain Type II Master Files at the FDA for CryoStor, HypoThermosol FRS, BloodStor 27, and our Cell Thawing Media products, which provide the FDA with information regarding our manufacturing facility and process, our quality system, stability and safety, and any additional testing that has been performed. Customers engaged in clinical and commercial applications may notify the FDA of their intention to use our products in their product development and manufacturing process by requesting a cross-reference to our master files.

One freezer in our Customer Biogenic Systems product line is currently regulated as a Class 2 medical device in the EU.

Intellectual Property

The following table lists our granted and pending patents. We have also obtained certain trademarks and tradenames for our products to distinguish our genuine products from our competitors’ products and we maintain certain details about our processes, products, and strategies as trade secrets. While we believe that the protection of patents and trademarks is important to our business, we also rely on a combination of trade secrets, nondisclosure and confidentiality agreements, scientific expertise and continuing technological innovation to maintain our competitive position. Despite these precautions, it may be possible for unauthorized third parties to copy certain aspects of our products and/or to obtain and use information that we regard as proprietary (see “Item 1A. Risk Factors” of this Annual Report for additional details). The laws of some foreign countries in which we may sell our products do not protect our proprietary rights to the same extent as do the laws of the United States.

Issued Patents | Patents Applied For | Registered Trademarks | |

Media and thaw | 31 | 32 | 17 |

evo cold chain | 11 | 6 | 6 |

Freezers and accessories | 1 | 3 | 6 |

Storage services | - | - | 1 |

Total | 43 | 41 | 30 |

Competition

Our bioproduction products and services compete on the basis of value proposition, performance, quality, cost effectiveness, and application suitability with numerous established technologies. Additional products using new technologies that may be competitive with our products may also be introduced. Many of the companies selling or developing competitive products have greater financial and human resources, R&D, manufacturing and marketing experience than we do. They may undertake their own development of products that are substantially similar to or compete with our products and they may succeed in developing products that are more effective or less costly than any that we may develop. These competitors may also prove to be more successful in their production, marketing and commercialization activities. We cannot be certain that the research, development and commercialization efforts of our competitors will not render any of our existing or potential products obsolete.

Recent Developments

On March 19, 2021, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) by and between us, BLFS Merger Subsidiary, Inc., our wholly-owned subsidiary (“Merger Sub”), and Global Cooling, Inc. (“Global Cooling”) pursuant to which Merger Sub will merge with and into Global Cooling, with Global Cooling continuing as the surviving entity and a wholly-owned subsidiary of the Company (the “GCI Merger”). The total consideration to be paid by us to the stockholders of Global Cooling at the closing will be 6,646,870 shares of our common stock (representing 19.9% of the number of our shares of common stock issued and outstanding immediately prior to the date of the execution of the Merger Agreement), a portion of which will be held in two segregated escrow accounts to serve as the sole source of payment for post-closing indemnification claims. The Merger Agreement provides for mutual indemnification, subject, in certain instances, to a basket and cap. The closing of the GCI Merger is subject to various customary closing conditions, including the approval of Global Cooling’s stockholders, and may be terminated by mutual agreement, for the other party’s uncured material breach, or if there is a government order preventing the closing, among other reasons. There is no assurance that the GCI Merger will close or that, if the GCI Merger does close, it will be successful or that Global Cooling will be, or will remain, profitable. For more information regarding the GCI Merger, please see our Current Report on Form 8-K filed on March 25, 2021. For further discussion of the risks relating to the GCI Merger, see “Risks Related to our Acquisition Strategy” in Item 1A. “Risk Factors”, below.

Human Capital

We view our employees and our culture as key to our success. As of December 31, 2020, we had 193 full time employees and 6 part-time employees. Our employees are not covered by any collective bargaining agreement. We consider relations with our employees to be good.

Corporate History

We were incorporated in Delaware in 1987 under the name Trans Time Medical Products, Inc. In 2002, the Company, then known as Cryomedical Sciences, Inc. was engaged in manufacturing and marketing cryosurgical products. The entity was merged with our wholly-owned subsidiary, BioLife Solutions, Inc., which was engaged as a developer and marketer of biopreservation media products for cells and tissues. Following the merger, we changed our name to BioLife Solutions, Inc.

Principal Offices; Available Information

Our principal executive offices are located at 3303 Monte Villa Parkway, Suite 310, Bothell, Washington 98021 and the telephone number is (425) 402-1400. We maintain a website at www.biolifesolutions.com. The information contained on or accessible through our website is not part of this Annual Report on Form 10-K and is not incorporated in any manner into this Annual Report. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”), are available free of charge on our website as soon as reasonably practicable after we electronically file such reports with, or furnish those reports to, the Securities and Exchange Commission (the “SEC”). The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

RISK FACTORS |

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information contained in this Annual Report, before deciding to invest in our common stock. If any of the following risks materialize, our business, financial condition, results of operation and prospects will likely be materially and adversely affected. In that event, the market price of our common stock could decline and you could lose all or part of your investment.

Risks Related to our Financial Condition

The majority of our net product revenue come from a relatively small number of customers and products in a limited number of market sectors; if we lose any of these customers or if there are problems in those market sectors, particularly as a result of the COVID-19 pandemic, our net product revenue and operating results could decline significantly.

In the years ended December 31, 2020 and 2019, we derived approximately 13% and 15% of our revenue from one customer, respectively. No other customer accounted for more than 10% of revenue in the years ended December 31, 2020 or 2019. In the years ended December 31, 2020 and 2019, we derived approximately 60% and 74% of our revenue from CryoStor products, respectively. Due to our acquisitions in 2020 and 2019, and our expected merger with Global Cooling in 2021, we expect both our revenue concentration related to CryoStor, and our customer concentration to be reduced for the year ending December 31, 2021. Our principal customers may vary from period to period and such customers may not continue to purchase products from us at current levels or at all (particularly as a result of the COVID-19 pandemic). Further, the inability of some of our customers to consummate anticipated purchases of our products due to changes in end-user demand, and other unpredictable factors that may affect customer ordering patterns could lead to significant reductions in net product revenue which could harm our business. Because our revenue and operating results are difficult to predict (particularly as a result of the COVID-19 pandemic), we believe that period-to-period comparisons of our results of operations are not a good indicator of our future performance. Additionally, if revenue declines in a quarter, whether due to a delay in recognizing expected revenue, adverse economic conditions, the COVID-19 pandemic or otherwise, our results of operations will be harmed because many of our expenses are relatively fixed. In particular, a large portion of our manufacturing costs, our research and development, sales and marketing and general and administrative expenses are not significantly affected by variations in revenue. Further, our cost of product revenue is dependent on product mix. If our quarterly operating results fail to meet investor expectations, the price of our common stock may decline.

We expect our operating results to fluctuate significantly from period to period.

Following our acquisitions in 2020 and 2019, we have increased our fixed costs and now sell products having higher costs of product revenue than our biopreservation media products. We expect that the result of these acquisitions will make it more difficult to predict our revenue and operating results from period-to-period and that, as a result, comparisons of our results of operations are not currently and will not be for the foreseeable future a good indicator of our future performance. For example, if revenue declines in a quarter, whether due to a delay in recognizing expected revenue, adverse economic conditions, the COVID-19 pandemic or otherwise, our results of operations in such period will be harmed because many of our expenses are now relatively fixed. In particular, a large portion of our manufacturing costs, research and development expenses, sales and marketing expenses and general and administrative expenses are not significantly affected by variations in revenue. Further, a shift in product revenue concentration away from our CryoStor products and towards our new products with higher costs of product revenue will adversely affect our operating margin. If our quarterly operating results fail to meet investor expectations, the price of our common stock may decline.

Risks Related to our Acquisition Strategy and the GCI Merger

We may engage in future acquisitions or strategic transactions which may require us to seek additional financing or financial commitments, increase our expenses and/or present significant distractions to our management.

In fiscal 2020 and 2019, we acquired four companies and made investments in three other companies (including a follow-on investment in one company). Additionally, on March 19, 2021, we entered into an agreement and plan of merger with Global Cooling to acquire all of the shares of Global Cooling, which we expect to close, subject to receipt of approval from the stockholders of Global Cooling and certain regulatory approvals, on or prior to May 1, 2021. We are continuing to actively evaluate opportunities to grow our portfolio of cell and gene therapy tools. In the event we engage in an acquisition or strategic transaction, including by making an investment in another company, we may need to acquire additional financing. Obtaining financing through the issuance or sale of additional equity and/or debt securities, if possible, may not be at favorable terms and may result in additional dilution to our current stockholders. Additionally, any such transaction may require us to incur non-recurring or other charges, may increase our near and long-term expenditures and may pose significant integration challenges or disrupt our management or business, which could adversely affect our operations and financial results. For example, an acquisition or strategic transaction, including the merger with Global Cooling, may entail numerous operational and financial risks, including the risks outlined above and additionally:

● | exposure to unknown liabilities; |

● | disruption of our business and diversion of our management's time and attention in order to develop acquired products or technologies; |

● | higher than expected acquisition and integration costs; |

● | write-downs of assets or goodwill or impairment charges; |

● | increased amortization expenses; |

● | difficulty and cost in combining the operations and personnel of any acquired businesses with our operations and personnel; |

● | impairment of relationships with key suppliers or customers of any acquired businesses due to changes in management and ownership; and |

● | inability to retain key employees of any acquired businesses. |

Accordingly, although there can be no assurance that we will undertake or successfully complete any transactions of the nature described above, including the Global Cooling transaction, any transactions that we do complete could have a material adverse effect on our business, results of operations, financial condition and prospects.

If intangible assets and goodwill that we recorded in connection with our acquisitions become impaired, we may have to take significant charges against earnings.

In connection with the accounting for our completed acquisitions in 2020 and 2019, we recorded a significant amount of intangible assets, including developed technology and customer relationships relating to the acquired product lines, and goodwill. Under U.S. GAAP, we must assess, at least annually and potentially more frequently, whether the value of intangible assets and goodwill has been impaired. Intangible assets and goodwill will be assessed for impairment in the event of an impairment indicator. Any reduction or impairment of the value of intangible assets and goodwill will result in a charge against earnings, which could materially adversely affect our results of operations and shareholders’ equity in future periods.

Our acquisitions expose us to risks that could adversely affect our business, and we may not achieve the anticipated benefits of acquisitions of businesses or technologies.

As a part of our growth strategy, we have made and may continue to make selected acquisitions of complementary products and/or businesses, including the expected merger with Global Cooling. Any acquisition involves numerous risks and operational, financial, and managerial challenges, including the following, any of which could adversely affect our business, financial condition, or results of operations:

• | difficulties in integrating new operations, technologies, products, and personnel; |

• | problems maintaining uniform procedures, controls and policies with respect to our financial accounting systems; |

• | lack of synergies or the inability to realize expected synergies and cost-savings; |

• | difficulties in managing geographically dispersed operations, including risks associated with entering foreign markets in which we have no or limited prior experience; |

• | underperformance of any acquired technology, product, or business relative to our expectations and the price we paid; |

• | negative near-term impacts on financial results after an acquisition, including acquisition-related earnings charges; |

• | the potential loss of key employees, customers, and strategic partners of acquired companies; |

• | claims by terminated employees and shareholders of acquired companies or other third parties related to the transaction; |

• | the assumption or incurrence of additional debt obligations or expenses, or use of substantial portions of our cash; |

• | the issuance of equity securities to finance or as consideration for any acquisitions that dilute the ownership of our stockholders (which in the case of Global Cooling, is significant); |

• | the issuance of equity securities to finance or as consideration for any acquisitions may not be an option if the price of our common stock is low or volatile which could preclude us from completing any such acquisitions; |

• | diversion of management’s attention and company resources from existing operations of the business; |

• | inconsistencies in standards, controls, procedures, and policies; |

• | the impairment of intangible assets as a result of technological advancements, or worse-than-expected performance of acquired companies; |

• | assumption of, or exposure to, historical liabilities of the acquired business, including unknown contingent or similar liabilities that are difficult to identify or accurately quantify; and |

• | risks associated with acquiring intellectual property, including potential disputes regarding acquired companies’ intellectual property. |

In addition, the successful integration of acquired businesses requires significant efforts and expense across all operational areas, including sales and marketing, research and development, manufacturing, finance, legal, and information technologies. There can be no assurance that any of the acquisitions we may make will be successful or will be, or will remain, profitable. Our failure to successfully address the foregoing risks may prevent us from achieving the anticipated benefits from any acquisition in a reasonable time frame, or at all.

The closing of the GCI Merger is subject to various closing conditions, including the receipt of stockholder approval from the Global Cooling Stockholders, and if these conditions are not met or waived, we will not be able to close the GCI Merger which may adversely affect our business, financial results and stock price.

The Merger Agreement provides that various closing conditions must be met before the GCI Merger will close including, but not limited to, receipt of stockholder approval from the Global Cooling stockholders and receipt of certain regulatory approvals. If these closing conditions are not met or waived, if permissible, we will not be able to close the GCI Merger. If the GCI Merger is not completed, our ongoing business may be adversely affected and we could see an impact on our financial results and stock price.

The integration of Global Cooling after the GCI Merger may result in significant accounting charges that adversely affect the announced results of our company.

The financial results of our company may be adversely affected by cash expenses and non-cash accounting charges incurred in connection with the GCI Merger. In addition to the anticipated cash charges, costs associated with the amortization of intangible assets are expected. The parties are in the process of preparing pro forma financial statements that reflect the effects of the GCI Merger and, accordingly, the amount and timing of these possible charges are not yet known. The price of our common stock could decline to the extent our financial results are materially affected by the foregoing charges or if the foregoing charges are larger than anticipated.

The announcement and pendency of the GCI Merger could cause disruptions in the businesses of our company and Global Cooling which could have an adverse effect on our and their business and financial results both prior to and after the closing of the GCI Merger.

Each party has operated and, until the completion of the GCI Merger, will continue to operate independently. Uncertainty about the effect of the GCI Merger on employees, customers, distributors and suppliers may have an adverse effect on us and Global Cooling both prior to and following closing of the GCI Merger. These uncertainties may impair each parties’ ability to retain and motivate key personnel and could cause customers, distributors, suppliers and others with whom each company deals to seek to change existing business relationships which may materially and adversely affect their respective businesses. Due to the materiality standards agreed to by the parties in the Merger Agreement, each party may be obligated to consummate the GCI Merger in spite of the adverse effects resulting from the disruption of our and Global Cooling’s ongoing businesses. Furthermore, this disruption could adversely affect our ability to maintain relationships with our and their customers, distributors, suppliers and employees after the GCI Merger or to achieve the anticipated benefits of the GCI Merger. Moreover, integration efforts between the two companies will also divert management attention and resources. These integration matters could have an adverse effect on each party. Each of these events could adversely affect us, in the near term and, if the GCI Merger is completed, thereafter.

The regulatory approvals required to close the GCI Merger may not be obtained or may contain materially burdensome conditions.

Completion of the GCI Merger is conditioned upon the receipt of certain governmental approvals, including the expiration or termination of the applicable antitrust waiting periods, and any extension of the waiting periods. Although the parties have agreed in the Merger Agreement to use their best efforts to obtain the requisite governmental approvals, there can be no assurance that these approvals will be obtained. In addition, the governmental entities from which these approvals are required may impose conditions on the completion of the GCI Merger or require changes to the terms of the GCI Merger. While the parties do not currently expect that any such conditions or changes would be imposed, there can be no assurance that they will not be, and such conditions or changes could have the effect of jeopardizing or delaying completion of the GCI Merger or reducing the anticipated benefits of the GCI Merger. If either party agrees to any material conditions in order to obtain any approvals required to complete the GCI Merger, the business and results of operations of the combined company may be adversely affected.

The GCI Merger may result in unexpected consequences to our business and results of operations.

Although Global Cooling’s business will generally be subject to risks similar to those to which we are subject to in our existing operations, we may not have discovered all risks applicable to Global Cooling’s business during the due diligence process and such risks may not be discovered prior to closing. Some of these risks could produce unexpected and unwanted consequences for us. Undiscovered risks may result in us incurring financial liabilities, which could be material and have a negative impact on our business operations.

Failure to realize the benefits expected from the GCI Merger could adversely affect the value of our common stock.

The success of the GCI Merger will depend, in part, on our ability to:

● | capitalize on our cross-selling opportunities by leveraging our extensive relationships with cell and gene therapy companies to drive sales of Global Cooling’s freezers and leveraging Global Cooling’s relationships with its customers to offer them our full portfolio of bioproduction tools and services; |

● | realize the anticipated cost savings from vertical integration of our synergies including lower capital costs in deploying Global Cooling’s freezers in SciSafe global biorepositories, expanding manufacturing capacity for Global Cooling’s freezers at our CBS facilities and expanding the reach of the Global Cooling sales team and distributors to provide access to our entire portfolio of bioproduction tools and services offered to the cell and gene therapy and biopharma markets; and |

● | realize cost savings from reduced back-office and infrastructure expenses, elimination of duplicative company and management structure costs, and improved purchasing power through greater scale. |

However, to realize the anticipated benefits of the GCI Merger we must successfully integrate the business of Global Cooling in a manner that permits those benefits and cost savings to be realized. Although we expect significant benefits to result from the GCI Merger, there can be no assurance that we will be able to successfully realize these benefits. The challenges involved in this integration, which will be complex and time consuming. If we do not successfully manage these and related issues and challenges, we may not achieve the anticipated benefits of the GCI Merger and our revenue, expenses, operating results, financial condition and stock price could be materially adversely affected.

Risks Related to our Business and Operations

Healthcare reform measures could adversely affect our business.

The efforts of governmental and third-party payors to contain or reduce the costs of healthcare may adversely affect the business and financial condition of pharmaceutical and biotechnology companies, including ours. Specifically, in both the United States and some foreign jurisdictions, there have been a number of legislative and regulatory proposals to change the healthcare system in ways that could affect our ability to sell our products profitably. Efforts by governments and other third-party payors to contain or reduce the costs of healthcare through various means may limit our commercial opportunities and adversely affect our operating results and result in a decrease in the price of our common stock or limit our ability to raise capital.

If our products do not perform as expected or the reliability of the technology on which our products are based is questioned, we could experience lost revenue, delayed or reduced market acceptance of our products, increased costs and damage to our reputation.

Our success depends on the market’s confidence that we can provide reliable, high-quality products to our customers. We believe that customers in our target markets are likely to be particularly sensitive to product defects and errors. Our reputation and the public image of our products and technologies may be impaired if our products fail to perform as expected. Although our products are tested prior to shipment, defects or errors could nonetheless occur in our products. In the future, if our products experience, or are perceived to experience, a material defect or error, this could result in loss or delay of revenues, delayed market acceptance, damaged reputation, diversion of development resources, legal claims, increased insurance costs or increased service and warranty costs, any of which could harm our business. Such defects or errors could also narrow the scope of the use of our products, which could hinder our success in the market. Even after any underlying concerns or problems are resolved, any lingering concerns in our target market regarding our technology or any manufacturing defects or performance errors in our products could continue to result in lost revenue, delayed market acceptance, damaged reputation, increased service and warranty costs and claims against us.

We face significant competition.

The life sciences industry is highly competitive. We anticipate that we will continue to face increased competition as existing companies may choose to develop new or improved products and as new companies could enter the market with new technologies, any of which could compete with our product or even render our products obsolete. Many of our competitors are significantly larger than us and have greater financial, technical, research, marketing, sales, distribution and other resources than us. There can be no assurance that our competitors will not succeed in developing or marketing technologies and products that are more effective or commercially attractive than any that are being developed or marketed by us, or that such competitors will not succeed in obtaining regulatory approval, or introducing or commercializing any such products, prior to us. Such developments could have a material adverse effect on our business, financial condition and results of operations. Also, even if we can compete successfully, there can be no assurance that we can continue do so in a profitable manner.

We are dependent on outside suppliers for all our manufacturing supplies.

We rely on outside suppliers for all our manufacturing supplies, parts and components. Although we believe we could develop alternative sources of supply for most of these components within a reasonable period of time, there can be no assurance that, in the future, our current or alternative sources will be able to meet all our demands on a timely basis, particularly given the uncertainty surrounding the COVID-19 pandemic. Unavailability of necessary components could require us to re-engineer our products to accommodate available substitutions, which could increase costs to us and/or have a material adverse effect on manufacturing schedules, products performance and market acceptance. In addition, an uncorrected defect or supplier’s variation in a component or raw material, either unknown to us or incompatible with our manufacturing process, could harm our ability to manufacture products. We might not be able to find a sufficient alternative supplier in a reasonable amount of time, or on commercially reasonable terms, if at all. If we fail to obtain a supplier for the components of our products, our operations could be disrupted.

Our success will depend on our ability to attract and retain key personnel.

In order to execute our business plan, we must attract, retain and motivate highly qualified managerial, scientific, manufacturing, and sales personnel. If we fail to attract and retain skilled scientific and sales personnel, our sales efforts will be hindered. Our future success depends to a significant degree upon the continued services of key scientific and technical personnel. If we do not attract and retain qualified personnel, we will not be able to achieve our growth objectives.

Difficulties in manufacturing could have an adverse effect upon our expenses and our product revenues.

We currently manufacture all of our biopreservation media products, freezer products and related components. We currently outsource most of the manufacturing of our ThawSTAR and evo products. The manufacturing of our products is difficult and complex. To support our current and prospective clinical customers, we comply with and intend to continue to comply with cGMP in the manufacture of our products. Our ability to adequately manufacture and supply our products in a timely matter is dependent on the uninterrupted and efficient operation of our facilities and those of third-parties producing raw materials and supplies upon which we rely in our manufacturing. The manufacture of our products may be impacted by:

● | availability or contamination of raw materials and components used in the manufacturing process, particularly those for which we have no other source or supplier; |

● | the ongoing capacity of our facilities; |

● | our ability to comply with new regulatory requirements, including our ability to comply with cGMP; |

● | inclement weather and natural disasters; |

● | changes in forecasts of future demand for product components; |

● | potential facility contamination by microorganisms or viruses; |

● | updating of manufacturing specifications; |

● | product quality success rates and yields; and |

● | global viruses and pandemics, including the current COVID-19 pandemic. |

If efficient manufacture and supply of our products is interrupted, we may experience delayed shipments or supply constraints. If we are at any time unable to provide an uninterrupted supply of our products to customers, our customers may be unable to supply their end-products incorporating our products to their patients and other customers, which could materially and adversely affect our product revenue and results of operations.

While we are not currently subject to FDA or other regulatory approvals on our products, if we become subject to regulatory requirements, the manufacture and sale of our products may be delayed or prevented, or we may become subject to increased expenses.

None of our products are subject to FDA. In particular, we are not required to sponsor formal prospective, controlled clinical-trials to establish safety and efficacy. Additionally, we comply with cGMP requirements. This is done solely to support our current and prospective clinical customers. However, there can be no assurance that we will not be required to obtain approval from the FDA, or foreign regulatory authorities, as applicable, prior to marketing any of our products in the future. Any such requirements could delay or prevent the sale of our products or may subject us to additional expenses.

We are and may become the subject of various claims, litigation or investigations which could have a material adverse effect on our business, financial condition, results of operations or price of our common stock.

We are and may become subject to various claims (including “whistleblower” complaints), litigation or investigations, including commercial disputes and employee claims, and from time to time may be involved in governmental or regulatory investigations or similar matters. Any claims asserted against us or our management, regardless of merit or eventual outcome, could harm our reputation and have an adverse impact on our relationship with our clients, distribution partners and other third parties and could lead to additional related claims. Furthermore, there is no guarantee that we will be successful in defending ourselves in pending or future litigation or similar matters under various laws. Any judgments or settlements in any pending litigation or future claims, litigation or investigation could have a material adverse effect on our business, financial condition, results of operations and price of our common stock.

Risks Related to our Intellectual Property and Cyber Security

Expiration of our patents may subject us to increased competition and reduce our opportunity to generate product revenue.

The patents for our products have varying expiration dates and, when these patents expire, we may be subject to increased competition and we may not be able to recover our development costs. In some of the larger economic territories, such as the United States and Europe, patent term extension/restoration may be available. We cannot, however, be certain that an extension will be granted or, if granted, what the applicable time or the scope of patent protection afforded during any extended period will be. If we are unable to obtain patent term extension/restoration or some other exclusivity, we could be subject to increased competition and our opportunity to establish or maintain product revenue could be substantially reduced or eliminated. Furthermore, we may not have sufficient time to recover our development costs prior to the expiration of our U.S. and non-U.S. patents.

Our proprietary rights may not adequately protect our technologies and products.

Our commercial success will depend on our ability to obtain patents and/or regulatory exclusivity and maintain adequate protection for our technologies and products in the United States and other countries. We will be able to protect our proprietary rights from unauthorized use by third parties only to the extent that our proprietary technologies and products are covered by valid and enforceable patents or are effectively maintained as trade secrets.

We intend to apply for additional patents covering both our technologies and products, as we deem appropriate. We may, however, fail to apply for patents on important technologies or products in a timely fashion, if at all. Our existing patents and any future patents we obtain may not be sufficiently broad to prevent others from practicing our technologies or from developing competing products and technologies. In addition, the patent positions of life science industry companies are highly uncertain and involve complex legal and factual questions for which important legal principles remain unresolved. As a result, the validity and enforceability of our patents cannot be predicted with certainty. In addition, we cannot guarantee that:

● | we were the first to make the inventions covered by each of our issued patents and pending patent applications; |

● | we were the first to file patent applications for these inventions; |

● | others will not independently develop similar or alternative technologies or duplicate any of our technologies; |

● | any of our pending patent applications will result in issued patents; |

● | any of our patents will be valid or enforceable; |

● | any patents issued to us will provide us with any competitive advantages, or will not be challenged by third parties; and |

● | we will develop additional proprietary technologies that are patentable, or the patents of others will not have an adverse effect on our business. |