UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

| ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For fiscal year ended: December 31 2017, 2023

OR

| TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission file number: _______________________001-12555

| Protagenic Therapeutics, Inc. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 06-1390025 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

| 149 Fifth Avenue | ||

| New York, New York | 10010 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:(212)994-8200

Securities registered under Section 12(b) of the Exchange Act:

| Title of each class | Name of exchange on which registered | |

| Common Stock Purchase Warrant, PTIXW | Nasdaq Capital Market |

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0.0001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes [ ] ☐ No [X] ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] ☒ No [ ]☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).Yes ☒ No ☐

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated file, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | Accelerated filer | |

| Non-accelerated filer | Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]☐

Indicate by check mark whether the registrant has filed a report and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. Yes [ ]☐ No [X]☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2017,2023, based on a closing price as reported on the OTCQBNasdaq Capital Market of $2.00$2.03 was approximately $15,230,814.$8,791,847.

As of March 30, 2018,29, 2024, there were 10,261,419 shares of the registrant'sregistrant’s common stock, par value $0.0001, issued and outstanding, and 872,766 shares of the registrant’s Series B Preferred Stock, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.None.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (Amendment No. 1) is being filed to amend our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (Original Filing), filed with the U.S. Securities and Exchange Commission on April 2, 2018 (Original Filing Date). The sole purpose of this Amendment No. 1 is to insert the dates and electronic signatures on the Signature page (page 72) and in the Certifications (Exhibit 31.2 and 32.1).

Except as described above, no material changes have been made to the Original Filing and this Amendment No. 1 does not modify, amend or update in any way any of the financial or other information contained in the Original Filing.

PROTAGENIC THERAPEUTICS, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 20172023

TABLE OF CONTENTS

| 2 |

EXPLANATORY NOTE

Protagenic Therapeutics, Inc. (the “Company”) is filing this Amendment No. 1 (this “Amendment”) to its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the Securities and Exchange Commission (the “SEC”) on April 1, 2023 (the “Original Filing”) to correct an inadvertent error in the Original Filing. Exhibit 32.1 (Certification Pursuant To 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes Oxley Act of 2002) was inadvertently omitted from the filed version of the Original Filing. The Company is filing this Amendment solely for the purpose of including Exhibit 32.1.

No attempt has been made in this Amendment to otherwise modify or update the other disclosures presented in the Original Filing. This Amendment does not reflect events occurring after the Original Filing (i.e., those events occurring after April 1, 2024) or modify or update those disclosures that may be affected by subsequent events. Such subsequent matters are addressed in subsequent reports filed with the SEC. Accordingly, this Amendment should be read in conjunction with the Original Filing and the Company’s other filings with the SEC.

| 3 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report on Form 10-K contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “can,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “seek,” “estimate,” “continue,” “plan,” “point to,” “project,” “predict,” “could,” “intend,” “target,” “potential” and other similar words and expressions of the future. The matters discussed in these forward-looking statements are subject to risks, uncertainties and other factors that could cause our actual results to differ materially from those projected, anticipated or implied in the forward-looking statements. As a result, you should not place undue reliance on any forward-looking statements. The most significant of these risks, uncertainties and other factors are described in “Item 1A — Risk Factors” of this Annual Report on Form 10-K. Except to the limited extent required by applicable law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Risk Factors Summary

Below is a summary of material factors that make an investment in our securities speculative or risky. Importantly, this summary does not address all of the risks and uncertainties that we face. Additional discussion of the risks and uncertainties summarized in this risk factor summary, as well as other risks and uncertainties that we face, can be found under “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K. The below summary is qualified in its entirety by that more complete discussion of such risks and uncertainties. You should consider carefully the risks and uncertainties described under “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K as part of your evaluation of the risks associated with an investment in our securities.

Risks Related to Our Financial Condition and Capital Requirements

| ● | The Company’s financial statements have been prepared on a going concern basis, and do not include adjustments that might be necessary if the Company is unable to continue as a going concern. | |

| ● | If we continue to incur operating losses and fail to obtain the capital necessary to fund our operations, we will be unable to advance our development programs, complete our clinical trials, or bring products to market, or may be forced to reduce or cease operations entirely. In addition, any capital obtained by us may be obtained on terms that are unfavorable to us, our investors, or both. | |

| ● | Unstable market and economic conditions may have serious adverse consequences on our ability to raise funds, which may cause us to cease or delay our operations. |

Risks Related to Clinical Development and Regulatory Approval

| ● | Our results to date provide no basis for predicting whether any of our product candidates will be safe or effective, or receive regulatory approval. | |

| ● | We may not be able to initiate and complete preclinical studies and clinical trials for our product candidates which could adversely affect our business. | |

| ● | If we experience delays or difficulties in the enrollment of subjects to our clinical trials, our receipt of necessary regulatory approvals could be delayed or prevented, which could materially affect our financial condition. | |

| ● | If the market opportunities for our current and potential future drug candidates are smaller than we believe they are, our ability to generate product revenues will be adversely affected and our business may suffer. |

| 4 |

Risks Related to Our Reliance on Third Parties

| ● | We have no experience in sales, marketing and distribution and may have to enter into agreements with third parties to perform these functions, which could prevent us from successfully commercializing our product candidates. | |

| ● | Data provided by collaborators and other parties upon which we rely have not been independently verified and could turn out to be inaccurate, misleading, or incomplete. | |

| ● | We rely on third parties to conduct our non-clinical studies and our clinical trials. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may be unable to obtain regulatory approval for or commercialize our current product candidates or any future products, on a timely basis or at all, and our financial condition will be adversely affected. |

Risks Related to Commercialization of Our Product Candidates

| ● | We have no experience as a company in commercializing any product. If we fail to obtain commercial expertise, upon product approval by regulatory agencies, our product launch and revenues could be delayed. | |

| ● | We may not be able to gain market acceptance of our product candidates, which would prevent us from becoming profitable. | |

| ● | We may not be able to manufacture our product candidates in clinical or commercial quantities, which would prevent us from commercializing our product candidates. | |

| ● | Disputes under key agreements or conflicts of interest with our scientific advisors or clinical investigators could delay or prevent development or commercialization of our product candidates. |

Risks Related to Our Intellectual Property

| ● | We may not be able to maintain our exclusive worldwide license to use and develop PT00114 which could materially affect our business plan. |

Risks Related to Our Business Operations and Industry

| ● | If we are not able to retain our current senior management team and our scientific advisors or continue to attract and retain qualified scientific, technical and business personnel, our business will suffer. | |

| ● | We may encounter difficulties in managing our growth, which could adversely affect our operations. | |

| ● | Healthcare reform measures could adversely affect our business. | |

| ● | Our business and operations are vulnerable to computer system failures, cyber-attacks or deficiencies in our cyber-security, which could increase our expenses, divert the attention of our management and key personnel away from our business operations and adversely affect our results of operations. | |

| ● | Failure to comply with health and data protection laws and regulations could lead to government enforcement actions (which could include civil or criminal penalties), private litigation or adverse publicity and could negatively affect our operating results and business. | |

| ● | If we, our CROs or our IT vendors experience security or data privacy breaches or other unauthorized or improper access to, use of, or destruction of personal data, we may face costs, significant liabilities, harm to our brand and business disruption. | |

| ● | If we do not comply with laws regulating the protection of the environment and health and human safety, our business could be adversely affected. |

| 5 |

Risks Associated to our Common Stock

| ● | If we fail to comply with the continued minimum closing bid requirements of Nasdaq or other requirements for continued listing, including stockholder equity requirements, our common stock may be delisted and the price of our common stock and our ability to access the capital markets could be negatively impacted. | |

| ● | Our common stock is a “Penny Stock” subject to specific rules governing its sale to investors that could impact its liquidity. | |

| ● | The market price of our common stock may be volatile, which could lead to losses by investors and costly securities litigation. | |

| ● | If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or detect fraud. Consequently, investors could lose confidence in our financial reporting and this may decrease the trading price of our stock. | |

| ● | Investors may experience dilution of their ownership interests because of the future issuance of additional shares of our common stock. | |

| ● | Our common stock is controlled by insiders. | |

| ● | We do not intend to pay dividends for the foreseeable future and may never pay dividends. | |

| ● | Our certificate of incorporation allows for our board to create new series of preferred stock without further approval by our stockholders, which could adversely affect the rights of the holders of our common stock. |

PART I

OverviewItem 1. Business.

Overview

Protagenic Therapeutic, Inc. (together with its subsidiary, “Protagenic,” the “Company,” “we,” “our” or “us”) isare a Delaware corporationbiopharmaceutical company specializing in the discovery and development of therapeutics to treat central nervous system (CNS)stress-related neuropsychiatric and mood disorders. Our missionproprietary, patent-protected, first-in-class lead compound, PT00114, is a synthetic form of Teneurin Carboxy-terminal Associated Peptide (“TCAP”), an endogenous brain signaling peptide that can dampen overactive stress responses. Our preclinical models have demonstrated efficacy of PT00114 in animal models of depression, anxiety, substance abuse & addiction, and PTSD.

PT00114 leverages a completely novel mechanism of action. Protagenic owns exclusive, worldwide rights to provide safePT00114 through its license agreement with the University of Toronto and effective treatments for mood,has an exclusive right to license additional intellectual property generated by Dr. David Lovejoy’s lab at University of Toronto. Additionally, the company is engaged in the research & development of follow-on compounds in the TCAP family. Extensive publications in peer-reviewed scientific journals underline the central role stress plays in the onset and proliferation of neuropsychiatric disorders like depression, anxiety, depressionsubstance abuse & addiction, and neurodegenerative disorders by using novel peptide-base, brain active therapeutics. Our strategy isPTSD. The mechanism of action of TCAP suggests that it counterbalances stress overdrive at the cellular level within the brain’s stress response cascade. TCAP works to develop, testalleviate the harmful behavioral, biochemical, and obtain regulatory approval for various applicationsphysiological effects of these disorders, while simultaneously restoring brain active therapeutics.

Our current business model is designed aroundhealth. This mechanism has been corroborated in preclinical animal models of the further development of these applications, and to obtain thepsychiatric disorders listed above. We completed our preclinical experiments required regulatory approvals to allow for the commercialization of our neuropeptide-based applications and products (see “Governmental Regulation” below). If approval is obtained, we expect to begin a clinical trial in the first half of 2023. We commenced our sales effortsfirst human trial, seeking to prove the safety and anticipate generating revenue through both licensing and direct salesefficacy of our products.PT00114, on September 26, 2023. We believeannounced that the trial has passed its safety milestone, relating to the complete enrollment of the first cohort of patients in the single-dose portion of the Phase I trial, on February 13, 2024. We currently anticipate that we can establish and subsequently strengthen our market positionwill be able to announce the complete results of the single-dose portion of the Phase I trial in the following ways: (i) working to obtain FDA approvalsecond quarter of current and future neuropeptide applications; (ii) investigating foreign markets for the use of our current and future products; (iii) securing relationships with strong partners in our field; (iv) entering into license agreements, strategic partnerships and joint ventures for our various applications; and, (v) continuing our current research into improving our processes, reducing costs and developing new and innovative applications.2024.

We intend to advance our lead drug candidate, PT00114 through Investigational New Drug (IND)-enabling studies, and enter PT00114 into clinical proof-of-concept studies in Treatment-Resistant Depression (TRD) and/or Post-Traumatic Stress Disorder (PTSD) (anticipated clinical start: 2017-2018).

Corporate History

We are currently a Delaware corporation with one subsidiary named Protagenic Therapeutics Canada (2006) Inc., a corporation formed in 2006 under the laws of the Province of Ontario, Canada.

We were previously known as Atrinsic, Inc., a company that was once a reporting company under the Securities Act, but that, in 2012 and 2013, reorganized under Chapter 11 of the United States Bankruptcy Code and emerged from bankruptcy. On February 12, 2016, we acquired Protagenic Therapeutics, Inc. through a reverse merger (see “Corporate History – The Reverse Business Combination (Merger) Transaction”). On June 17, 2016, Protagenic Therapeutics, Inc. (the then wholly-owned subsidiary of Atrinsic, Inc.) was merged with and into Atrinsic, Inc. Atrinsic, Inc. was the surviving corporation in this merger and changed its name from Atrinsic, Inc. to Protagenic Therapeutics, Inc. (see “Corporate History – The Subsidiary Merger”).

The Reverse Business Combination (Merger) Transaction

On February 12, 2016, which we refer to as the Merger Closing Date, we (as Atrinsic, Inc.), Protagenic Therapeutics, Inc. and Protagenic Acquisition Corp., Atrinsic, Inc.’s wholly-owned subsidiary, entered into a merger agreement and completed the merger contemplated by the merger agreement. Pursuant to the merger agreement, on the Merger Closing Date, Protagenic Acquisition Corp. merged with and into Protagenic Therapeutics, Inc., with Protagenic Therapeutics, Inc. remaining as the surviving entity and wholly-owned subsidiary of Atrinsic, Inc. (the “Merger”)

Simultaneously with the Merger, on the Merger Closing Date all of the issued and outstanding shares of Protagenic common stock converted, on a 1-for-1 basis into shares of the Company’s Series B Preferred Stock, par value $0.000001 per share (“Series B Preferred Stock”) (assuming no exercise of dissenters’ rights by any Protagenic stockholder). Also on the Merger Closing Date, all of the issued and outstanding options to purchase shares of Protagenic common stock, and all of the issued and outstanding warrants to purchase shares of Protagenic common stock, converted, on a 1-for-1 basis, into options (the “New Options”) and new warrants (the “New Warrants”) respectively, to purchase shares of our Series B Preferred Stock. The New Options will be administered under Protagenic’s 2006 Employee, Director and Consultant Stock Plan (the “2006 Plan”), which the Company assumed and adopted on the Merger Closing Date in connection with the Merger.

On the Closing Date, (i) the former Protagenic common stock was exchanged for the right to receive 6,612,838 shares of Series B Preferred Stock; (ii) New Options to purchase 1,807,744 shares of Series B Preferred Stock granted under the 2006 Plan, having an average exercise price of approximately $0.87 per share, were issued to optionees pursuant to the assumption of the 2006 Plan; (iii) the holders of options to purchase the common stock of Atrinsic before the Merger (“Predecessor”) were issued options (“Predecessor Options”) to purchase 17,784 shares of Series B Preferred Stock at $1.25 per share; (iv) New Warrants to purchase 3,403,367 shares of Series B Preferred Stock at an average exercise price of approximately $1.05 per share were issued to holders of Protagenic warrants; and (v) 2,775,000 shares of Series B Preferred Stock were issued to investors at a purchase price of $1.25 per share in the Private Offering, as defined below. In addition, warrants (“Predecessor Warrants”) to purchase 295,945 shares of Series B Preferred Stock at $1.25 per share were issued to Strategic Bio Partners, LLC, the designee (the “Designee”) of the holders of Predecessor’s debt, in consideration of the cancellation of debt of $665,000 in principal and $35,000 in interest, and Placement Agent Warrants, as such term is defined below, to purchase 127,346 shares of Series B Preferred Stock were issued to the Placement Agent of the Private Offering. The common stockholders of Predecessor before the Merger retained 25,867 shares of our common stock, par value $0.000001 per share. In addition, upon the effectiveness of the Merger, the holders of the Predecessor’s Series A Preferred Stock exchanged all of the issued and outstanding Series A Preferred Stock for an aggregate of 297,468 shares of Series B Preferred Stock. These shares were issued to the Designee.

The Merger was treated as a recapitalization of Protagenic for financial accounting purposes and the historical financial statements of Protagenic Therapeutics, Inc. are our financial statements as a result of the Merger. The parties to the merger agreement have agreed to take all actions necessary to ensure the Merger is treated as a “plan of reorganization” under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”).

2016 Private Placement

Concurrently with the closing of the Merger, we conducted the first closing of an offering (the “Private Offering”) of our Series B Preferred Stock. At the first closing, we sold 2,775,000 shares of Series B Preferred Stock at a purchase price of $1.25 per share, for which we received total gross consideration of $3,468,750. Of this amount, $350,000 consisted of conversion of outstanding stockholder debt held by Garo H. Armen, our chairman and a member of our board of directors (“Board”), and $150,000 of legal expenses incurred by Strategic Bio Partners LLC, stockholders of the Predecessor, in conjunction with and as allowed by the merger agreement. On March 2, 2016, we completed the second closing of the Private Offering, at which we issued an additional 913,200 shares of Series B Preferred Stock to accredited investors, for total gross proceeds of $1,141,500. On April 15, 2016, we completed the final closing of the Private Offering, at which we issued an additional 420,260 shares of Series B Preferred Stock to accredited investors, for total gross proceeds of $525,325.

| 6 |

As Protagenic transitions into a clinical-stage company, we aim to complete certain key strategic and tactical milestones over the coming two years;

| ● | Rapidly advance our lead product candidate, PT00114, through clinical trials in treatment resistant depression, substance use disorder, generalized anxiety disorder, and/or post-traumatic stress disorder | |

| ● | Develop additional product candidates from the TCAP family to build out a broad pipeline of assets with differentiated features using our unique expertise with this mechanism | |

| ● | Explore efficacy in additional stress-related neuropsychiatric and mood disorders beyond initially targeted indications | |

| ● | Facilitate long-term growth by building a nimble R&D, operational, clinical and commercial team | |

| ● | Proactively assess strategic partnership opportunities including in important international markets |

Continue with our strategy of strengthening our IP position in this important novel field of neuropsychiatry

IND Submission

We paid Katalyst Securities LLC,currently anticipate re-submitting an investigational new drug (IND) application in advance of initiating the Phase IIa portion of our placement agent (the “Placement Agent”) and its selected dealers for the Private Offering a commission of 10%present clinical study, to ascertain whether this portion of the funds raisedstudy may be conducted in the Private Offering from investors introducedUnited States. The Phase I/IIa study, to evaluate the safety, tolerability, and early activity of PT100114 (TCAP) in healthy volunteers and patients with psychiatric illnesses, commenced in the third quarter of 2023. The IND enabling studies, including the preclinical efficacy data generated, as well as the GLP toxicology study, and a summary of the Phase I clinical trial plan, were among the components of this regulatory submission.

Clinical Development

The clinical development program will be led by Dr. Maurizio Fava, MD, PhD, a world-leader in psychiatric disorders, the Psychiatrist-in-Chief of the Massachusetts General Hospital and Slater Family Professor of Psychiatry at Harvard Medical School. Dr. Fava was co-principal investigator of STAR*D, the largest research study ever conducted in depression, has coauthored more than 800 medical journal publications, and is one of the top enrolling psychiatry clinicians in the US. Protagenic’s Phase I/II clinical study was designed by Dr. Fava, who will be the trial’s principal investigator.

We will launch our clinical program with a basket trial designed first to evaluate the safety of TCAP in a small cohort of healthy volunteers, immediately followed by the Placement Agentevaluation of safety, pharmacological and its selected dealers. In addition,clinical activity in cohorts of patients with stress-related neuropsychiatric disorders including, but not limited to depression, addiction, anxiety, and Post-Traumatic Stress Disorder (PTSD). We will be using this study for both safety and preliminary efficacy to prioritize indications for later phase development that would ultimately support a New Drug Application (NDA) and registration. The four indications were chosen for multiple reasons, including the Placement Agent received $15,000 to reimburse it for its expensesmechanism of TCAP in the private Offering,reducing biological stress signals, preclinical evidence of efficacy in animal models of these disorders and the placement Agent and its selected dealers were issued warrants (the “Placement Agent Warrants”) to purchase a number of shares of Series B Preferred Stock equal to 10% of the shares of Series B Preferred Stock sold to investors in the Private Offering who were introduced by the Placement Agent and its selected dealers. The Placement Agent Warrants, which contain a “cashless exercise” provision, are exercisable for a period of five years from the initial closing of the Private Offering at a price of $1.25 per share.

Pursuant to a registration statement declared effective by the SEC on February 8, 2017, we registered the shares of common stock underlying the Series B Preferred Stock and the Placement Agent Warrants issued in the 2016 Private Placement for public resale by the selling stockholders named therein and their assigns. The Company was not required to update and maintain the effectiveness of this registration statement after February 8, 2018.

Debt Exchange

Simultaneous with the Merger and the Private Offering, holders of $665,000 of Atrinsic’s debt accompanied with $35,000 in accrued interest exchanged such debt for five-year warrants of Predecessor (the “Predecessor Warrants”) to purchase 295,945 shares of Series B Preferred Stock at $1.25 per share.

Split-Off Agreements

At the closing of the Merger we had a 51% interest in MomSpot LLC, and the remaining 49% was held by B.E. Global LLC. Barry Eisenberg is the sole owner of B.E. Global LLC and is the Chief Executive Officer of MomSpot LLC. Immediately after the closing of the Merger, we split off our 51% membership interests in MomSpot LLC. The split-off was accomplished through the transfer of all of our membership interests of MomSpot LLC to B.E. Global LLC.

Immediately after the closing of the Merger, we split off all of our equity interest in 29 wholly-owned subsidiaries. The split-off was accomplished through the sale of all equity interestshigh unmet need in these wholly-owned subsidiariespatient populations, which creates significant market opportunity. We believe the basket trial structure offers the most efficient use of capital in early-stage development and will give us insights into which indication we should focus on in advanced clinical trials. Healthy volunteers will be the first cohort and subsequent parallel cohorts will include patients with:

| ● | Major Depressive Disorder (MDD) who have suboptimal response to or poorly tolerated two prior SSRIs / SNRIs | |

| ● | Generalized Anxiety Disorder (GAD) who have suboptimal response to or poorly tolerated two prior SSRIs /SNRIs | |

| ● | Opioid Use Disorder (OUD) who are on treatment with Suboxone and have suboptimal response | |

| ● | Post-Traumatic Stress Disorder (PTSD) who have suboptimal response to or intolerance of sertraline and paroxetine |

The trial will use a classic sequential dose escalation design using cohort replication with initial doses estimated from non-clinical data. The study will assess dose ranging through standard and small cohorts with a rules-based approach for dose, safety, efficacy, and biomarkers. Trial participants will have a maximal 28-day exposure. As this will be the first in human study of TCAP, safety and adverse events will be the primary endpoint. Key secondary endpoints were chosen to Quintel Holdings, Inc.ascertain efficacy in individual conditions and compare drug impact across disparate diseases. All disease cohorts will be measured for Strengths and Difficulties Questionnaire (SDQ), which is a validated broad self-rated outcome measure that has outperformed the clinician-rated Montgomery–Åsberg Depression Rating Scale (MADRS) scale in previous trials. Patients will also be assessed for stress biomarkers via pre- and post-treatment systemic cortisol levels and skin conductance. Each disease cohort (anxiety, depression, PTSD and addiction) will also have disease specific assessments.

Reverse Stock Split

Our stockholders voted at a special meeting held on June 17, 2016 in favor of, and we effectuated, a 1-for-15,463.7183 reverse stock split of our common stock, or the Reverse Split. As a result of the Reverse Split, 400,000,000 shares of common stock were split into 25,867 shares of common stock. Additionally, as a result of the Reverse Split and in accordance with our certificate of designations for our Series B Preferred Stock, our Series B Preferred Stock immediately and automatically converted into our common stock on a 1-for-1 basis other than any Series B Preferred Stock (i) to the extent (but only to the extent) a Series B Preferred Stock holder would beneficially own greater than 9.99% of our common stock (the “Springing Blocker”) and (ii) such holder has notified the Company in writing that it wants the Springing Blocker to apply to such holder. On July 27, 2016, 10,146,000 of the Company’s 11,018,766 outstanding shares of Series B Preferred Stock were eligible to immediately convert into 10,146,000 shares of the Company’s common stock with 872,766 shares of Series B Preferred Stock remaining as a result of one holder exercising the Springing Blocker. As of December 31, 2017, 10,146,000 shares of the Series B Preferred Stock were converted into 10,146,000 shares of common stock on the records of the Company. As of December 31, 2017 872,766 shares of Series B Preferred Stock remained outstanding.

Any Series B Preferred Stock not converted as a result of this provision would automatically convert into common stock as soon as such conversion would not violate the Springing Blocker. Our Series B Preferred Stock will cease to be designated as a separate series of our preferred stock when all of such shares have converted into shares of our common stock.

| 7 |

Furthermore, although patient populations and their responses to CNS agents can be highly variable in clinical studies, we attempt to mitigate this by stratifying the initial series of cohorts to select for and control for corticosterone levels to enable the broadest window of effect detection. Preclinical studies of TCAP demonstrate that its beneficial actions are most easily observed in stressed animals, which show elevations of plasma corticosterone levels at baseline before TCAP treatment. Anxious or depressed patients have elevated corticosterone levels, providing an opportunity to identify patients more likely to benefit pharmacologically and potentially clinically. This also provides a useful translational bridge between preclinical behavioral models and human clinical studies and enables flexibility in evaluating routes of administration.

Market for Stress-Related Neuropsychiatric Disorders: Depression, Addiction, Anxiety, and PTSD

Humans living in our modern world, in both developed and developing nations, are being exposed to a multitude of life stressors that are progressively taking a toll on our mental health. The Subsidiary Merger

On June 17, 2016, we merged our wholly-owned subsidiary, Protagenic Therapeutics, Inc.recent COVID-19 has exacerbated both near-term and long-term global impacts of stress-induced disorders on modern society. Stress-related mental, mood and behavioral disorders include, but are not limited to: treatment resistant depression (TRD), withwhich is a subgroup of major depressive disorder (MDD); addiction or substance use disorder (SUD); and intoanxiety, including generalized anxiety disorder (GAD) and post-traumatic stress disorder (PTSD). These disorders are a leading cause of disability worldwide and also a major contributor to suicide. Yet, a majority of these patients are inadequately served by current therapeutic options, which can have limited efficacy, significant side effects and high treatment burden. We believe these stress-related disorders are suitable indications for the Company and we changed our name from Atrinsic, Inc. to Protagenic Therapeutics, Inc. We are the parent companyuse of Protagenic Therapeutics Canada (2006), Inc.,neuropeptide-based drug candidates.

Major depressive disorder (MDD) is highly prevalent and disabling. The lifetime prevalence is approximately 12% with a corporation incorporated in the Provincepast year prevalence of Ontario.

Mood and Anxiety Disorders

An estimated 340 million people worldwide and 40-60 million people7.8% of adults in the United States alonein 2019, translating to over 19 million adults each year. The World Health Organization estimates 264 million people globally suffer from mental disorders including Major Depressive Disorder, or MDD, including TRD, PTSD, Bipolar Disorderdepression, which ranks depression as one of the highest causes of disability and various Anxiety Disorders. The global sales of anxiolytic and antidepressant drugsmortality in the U.S. were estimated to be $69 billion in 2013 and are projected to grow to nearly $77.1 billion by 2018. Yet, up to one-half of mood disorder patients are unresponsive to current treatments. Efficacy of therapy is challenged by non-compliance during the weeks to months required to achieve therapeutic benefit in combination with daily dosing requirements. Major targets in this space include TRD and PTSD, both indications which are highly resistant to available therapies.

Approximately 37% of those suffering from a MDD that do not respond to the current antidepressant medications constitute a separate group of people suffering from TRD. Despite a large patient population and current treatments that leave much room for improvement, the developmental pipelines are sparse and few novel candidates are in development. The serendipitous discoveries of current drug classes, and lack of efficacy have led to shrinkage or extinction of many pharma or small biotech neuroscience research programs. It is in this TRD market that we intend to focus our PT00114 development efforts.

TRD is the type of MDD that does not respond to standard courses of antidepressant medication.world. Stress plays a significant role in this illness thatand affects as many as half of people diagnosed with depression. MDD is characterized by multiple symptoms, potentially including depressed mood, loss of interest or pleasure, change in appetite or weight, sleep disturbance, fatigue or loss of energy, neurocognitive dysfunction, psychomotor agitation or retardation, feelings of worthlessness or excessive guilt, and suicidal ideation and behavior. MDD is highly treatment resistant, with 45-50% of patients who receive initial treatment for MDD not achieving long term remission, generally referred to as Treatment Resistant Depression (TRD). Patients suffering with TRD are at greater risk of hospitalization for their psychiatric illness and are more likely to abuse drugs and alcohol. These patients have a lower long-term quality of life and are at increased risk of attempting suicide. MDD is also highly recurrent and the estimated rate of recurrence over two years is over 40%, which rises to 75% after two episodes within five years.

Treatment guidelines recommend the combination of pharmacotherapy plus psychotherapy, but pharmacotherapy alone and psychotherapy alone are frequently used. For initial pharmacotherapy with antidepressants, selective serotonin reuptake inhibitors (SSRIs) are recommended. However, several classes of antidepressants are available, including serotonin-norepinephrine reuptake inhibitors (SNRIs), atypical antidepressants, and serotonin modulators, with efficacy generally comparable across and within classes. Drug choice is based on multiple factors, including side effect profile, comorbid illnesses, concurrent medications, patient preference, and cost. Physicians typically cycle through multiple generics if the initial response is suboptimal or patients experience AEs. Efficacy of therapy is challenged by non-compliance during the weeks to months required to achieve therapeutic benefit in combination with daily dosing requirements. However, SSRIs can produce significant quality of life side effects that interfere with medication adherence, including sexual dysfunction, gastrointestinal nausea and diarrhea, insomnia and weight gain. As a last resort, this disease is currently managed by invasive treatment, primarily electroconvulsive therapy (ECT). However, the ECT treatment’s side effects and high cost prevent millionswidespread adoption. Several drugs that have launched in recent years validate the market for branded agents in this field, in spite of people from taking advantage of it.their marginal improvements in safety or efficacy.

According to an article titled “Global prevalence of anxiety disorders: a systemic review and meta-regression,” written by AJ Baxter et al., (published inPsychological Medicine in 2013), PTSD affects an estimated 7.7 million adults (3.5%) in the US, with a disproportionately high prevalence in war veterans. Therapeutic approaches include cognitive therapy in combination with antidepressants, such as selective serotonin reuptake inhibitors (SSRIs). In addition to the vulnerabilities noted above for antidepressant-related treatments, PTSD patients often present with co-morbidities such as addictions or dependencies, which make therapeutic case management difficult.

Protagenic Research

PT00114 is the first known example of a new class of brain-targeted therapies based on a newly-described and highly conserved family of neuropeptides that regulate stress-induced mood and addictive behaviors. PT00114 is believed to act via a novel mechanism of action and is therefore expected to provide an extremely attractive therapeutic and commercial profile, especially for those patients who are not fully responsive to or compliant with current interventions. Based on preclinical data, we believe that PT00114 is well differentiated from other drug candidates on the basis of having: Dual activity on stress- and addiction-related pathways (as present in TRD and PTSD); Blood-brain barrier permeability; Rapid onset of action and long duration of therapeutic effects; Restoration of normalcy in stress, anxiety and addiction disorders; No adverse effects with little to no accumulation; Good safety and tolerability profiles; Convenient dosing route and schedule; High potency/low dose; and, Ease of chemical synthesis.

We believe that optimal cellular energy metabolism is fundamental to the biology of the brain, and clinical manifestation of aberrant energy metabolism often manifests in debilitating neurological disorders. PT00114’s ability in preclinical models to enhance glucose mobilization and utilization in the brain, maintain energy homeostasis, inhibit stress-related pathways and protect cells from oxidative damage suggests potential therapeutic benefits in a range of indications involving both acute and chronic neurological injury. Potential applications include traumatic brain injury, stroke recovery, and neurodegenerative diseases such as Alzheimer’s disease, Parkinson’s disease and ALS, among others.

| 8 |

Technology

PT00114Generalized anxiety disorder (GAD) is one of the most common mental disorders in both community and clinical settings. In the United States, the estimated lifetime prevalence of GAD is 5.7%, corresponding to 18 million and 9 million individuals, respectively. GAD is characterized by excessive and persistent worrying that causes significant distress or impairment on most days and is hard to control. Other symptoms can include apprehensiveness, irritability, increased fatigue and muscular tension. GAD is also associated with increased rates of substance abuse, posttraumatic stress disorder, and obsessive-compulsive disorder. GAD is a syntheticpotentially chronic illness, with symptom severity fluctuating over time. A 12-year study of treated patients showed approximately 60% of patients had symptoms resolve, but around one-half of those subsequently relapsed.

Pharmacotherapy for GAD is primarily selective-serotonin reuptake inhibitors (SSRIs) and serotonin-norepinephrine reuptake inhibitors (SNRIs), which are mildly efficacious. Clinical trials for different SSRIs and SNRIs have shown approximately the same effectiveness, with response rates of approximately 60- 70% for the drug and 40% for placebo. However, SSRIs can produce significant quality of life side effects that interfere with medication adherence, including sexual dysfunction, gastrointestinal nausea and diarrhea, insomnia and weight gain. Thus, choice of agent is often dependent on the patient’s side effect profile for individual drugs. Benzodiazepines are efficacious and can reduce emotional and somatic symptoms within hours. However, concerns about dependence risk has contributed to a decline in their use. Buspirone has similar efficacy to benzodiazepines without the risk of dependence but has a time to onset of approximately four weeks. As the majority of these agents are now available as generics, the worldwide market for GAD therapies was expected to reach $1.8 billion in 2023 and with an anticipated forecasted value of $4.3 billion by 2033 (https://www.futuremarketinsights.com/reports/generalized-anxiety-disorder-treatment-market).

Post-traumatic stress disorder (PTSD) is one of the most common psychiatric disorders, with an estimated past-year and lifetime prevalence of 4.7% and 6.1%, translating to 11.5M adults in the US each year. PTSD develops in some patients following exposure to a traumatic event involving actual or threatened injury to themselves or others, such as war, natural disasters, rape or assault. Symptoms can be severe, chronic and disabling, which can include intrusive thoughts, nightmares and flashbacks of past traumatic events, avoidance of reminders of trauma, hypervigilance, and sleep disturbance, all of which lead to significant occupational and social impairment. Currently, PTSD is treated with psychotherapy and/or pharmacotherapy, with psychotherapy as the recommended primary intervention. Logistics and cost often limit access to psychotherapy, which results in many patients needing to rely on pharmacotherapy. Guidelines for pharmacotherapy recommend first-line treatment with sertraline and paroxetine, selective serotonin reuptake inhibitors (SSRI) antidepressants, as these are the only approved medications for PTSD. However, these only treat one aspect of symptomology and efficacy is limited, with fewer than 30% of patients experiencing remission. The side effect profile of these agents results in significant rates of discontinuation, particularly the severe effects such as suicidality and sexual dysfunction. Serotonin-norepinephrine reuptake inhibitors (SNRI) and second-generation antipsychotics are used off-label in some patients, but efficacy is sporadic, and side-effects can make these undesirable therapeutic options. As all of these options are currently generic, branded commercial sales for PTSD is almost non-existent. Given the size of the potential addressable population and limited therapeutic options available, a therapy with a superior therapeutic index could achieve significant market penetration and sales.

Substance use disorders (SUDs) are highly prevalent. According to the 2020 National Survey on Drug Use and Health (NSDUH), 40.3 million Americans, aged 12 or older, had a substance use disorder (SUD) in the past year. The majority of SUDs involve alcohol use disorder (14 million), followed by illicit drug use disorder (8 million). Illicit drug use and nonmedical use of medications alone or in combination with alcohol are associated with a substantial proportion of emergency department visits in the United States. Pharmacologic options to treat SUDs typically have limited efficacy, high treatment burden, with suboptimal side-effect profiles, ultimately leading to limited uptake and high remaining unmet medical need. 40- 60% of patients who receive SUD care experience chronic or relapsing disease course.

The incidence of opioid use disorder (OUD) and overdose deaths have reached epidemic proportions. Opioid use disorder is typically a chronic, relapsing illness, associated with significantly increased rates of morbidity and mortality. Opioid use disorder can be related to misuse of pharmaceutical opioids, heroin, or other opioids such as fentanyl and its analogues. In 2021, 3.3% of those 12 or older in the US were estimated to have used heroin at some point in their lives, translating 9.2 million people (https://www.samhsa.gov/data/sites/default/files/reports/rpt39443/2021NSDUHFFRRev010323.pdf)., Worldwide, an estimated 60 million people engaged in non-medical opioid use in 2021 (https://www.unodc.org/res/WDR-2023/WDR23_Exsum_fin_DP.pdf, https://www.unodc.org/res/wdr2022/MS/WDR22_Booklet_3.pdf ). Correspondingly, overdose deaths involving opioids in the US increased from an estimated 70,029 in 2020 to 80,816 in 2021, representing a 15% increase.

| 9 |

Unmet needs are particularly high in OUD. First-line treatment for most patients is medication-assisted treatment, consisting of pharmacotherapy with an opioid agonist or antagonist in combination with psychotherapy. Pharmacotherapy can include an opioid agonist (methadone or buprenorphine) and/or an opioid antagonist (e.g. naltrexone). Guidelines for mild opioid use disorder suggest first-line treatment with long-acting injectable naltrexone (e.g. Vivitrol) administered monthly. Guidelines for moderate to severe opioid use disorder suggest initial use of buprenorphine (e.g. Suboxone) due to the higher risk of lethal overdose with methadone. Treatment can allow patients to return to a productive lifestyle but has low success rates and can be extremely burdensome. These therapies require patients remain on maintenance treatment with an opioid agonist for many years as they are physically dependent upon the medications. A minority may be tapered off after a few years, with the taper itself taking several months to years.

The worldwide market for OUD therapies was valued at $3.5 billion in 2023 (https://www.thebusinessresearchcompany.com/report/opioid-use-disorder-oud-global-market-report#:~:text=It%20is%20distributed%20by%20hospital,and%20stores%2C%20and%20online%20pharmacies.&text=The%20opioid%20use%20disorder%20(OUD)%20market%20size%20has%20grown%20rapidly,(CAGR)%20of%2011.3%25. ) and projected to reach $8.4 billion by 2033 (https://www.futuremarketinsights.com/reports/opioid-use-disorder-treatment-market ).

The treatment burden and side effect profile of these therapies is substantial. Buprenorphine is classified as a schedule III controlled substance in the United States, with use limited to certified and specially trained physicians. Side effects include sedation, headache, nausea, constipation, insomnia, and sweating. Death is possible if buprenorphine is taken in combination with other substances, especially benzodiazepines and alcohol. Methadone is highly regulated in the United States, where it is classified as a schedule II drug. Only licensed opioid treatment programs or inpatient hospital units are permitted to dispense. Typical side effects of methadone include constipation, drowsiness, sweating, peripheral edema, reduced libido, and erectile dysfunction, with some patients experiencing severe adverse effects including cardiac arrhythmias, hyperalgesia, and overdose.

Alcohol use disorder (AUD) is extraordinarily prevalent. Approximately 30% of adults in the United States use alcohol in an unhealthy manner and may need some form of intervention. The 2019 United States National Survey on Drug Use and Health estimated that of Americans over the natural peptide sequence TCAP-1.age of 12 in the past 30 days, 24% reported binge drinking (five or more drinks on one occasion) and 6% reported heavy drinking (five or more drinks on each of five or more days). The National Institute on Alcohol Abuse and Alcoholism (NIAAA) reports 28% of US adults exceed thresholds for risky use alcohol consumption, with 19% exceeding the daily limit and 9% exceeding both the daily and weekly limits. Rates of diagnosable AUD by DSM-5 criteria from the third National Epidemiologic Survey on Alcohol and Related Conditions showed that 29% had met criteria for an alcohol use disorder in their lifetime and 14% met criteria for a current alcohol use disorder. Worldwide, the World Health Organization estimates that 5% of adults (>283 million people) had alcohol use disorder within the prior 12 months.

AUD is responsible for significant mortality and morbidity. Excessive alcohol consumption is the third leading preventable cause of death in the United States directly causing approximately 85,000 deaths per year, roughly 10% of deaths among working age adults. Nearly 5% of all deaths worldwide (approximately three million each year) have been attributed to alcohol use with 5% of those specifically due to AUD. The economic cost of excessive alcohol use in the United States is estimated to be $249 billion in 20101 by the CDC. Therapeutic unmet needs are significant for AUD and the condition is frequently untreated. Psychosocial interventions can be effective for treatment but up to 70% of individuals return to heavy drinking. For patients who met DSM-IV criteria for alcohol abuse, 46% were in remission, 24% continued to meet abuse criteria, and 30% met criteria for alcohol dependence in the future. For patients who met DSM-IV criteria for alcohol dependence, 39% were in remission, 15% met criteria for abuse only, and 46% continued to meet dependence criteria.

1As of March 2023, these are the most recent data released by the CDC.

| 10 |

TCAP-1

Several medications can be used to treat AUD, which can lead to reduced heavy drinking and increased days of abstinence. For most patients treated with moderate to severe alcohol use disorder, guidelines recommend first-line treatment with naltrexone (e.g. Vivitrol), an opioid antagonist. Vivitrol is an extended-release injectable naltrexone that allows for once monthly dosing that was approved in 2006. Vivitrol is priced at $~1,738/month (https://www.drugs.com/price-guide/vivitrol ) and 2023 worldwide sales have grown to $400.4 million (https://investor.alkermes.com/news-releases/news-release-details/alkermes-plc-reports-financial-results-fourth-quarter-and-year-3). The manufacturer projects Vivitrol sales will increase to $410 – 430 million in 2024 (https://investor.alkermes.com/news-releases/news-release-details/alkermes-plc-reports-financial-results-fourth-quarter-and-year-3), with patent expiry in 2029 (https://www.fdanews.com/articles/192221-alkermes-grants-amneal-generic-rights-for-vivitrol). Acamprosate (e.g. Campral) is recommended for those in whom naltrexone is contraindicated, such as those taking opioids or with acute hepatitis. Campral (Acamprosate) was approved by the FDA in 2004 and reached peak worldwide sales of $87M in 2008. Acamprosate is currently only available as generic in the US, but is still sold as branded Campral ex-US. Given the overall prevalence of AUD, these relatively low sales numbers indicate the vast majority of patients with AUD are not treated with pharmacotherapy.

Teneurin Carboxy-terminal Associated Peptide (TCAP) as a Therapy

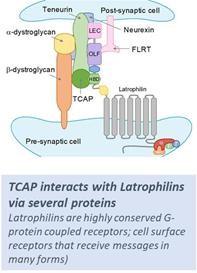

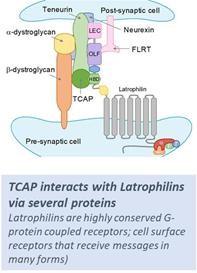

Our approach to treating stress-related neuropsychiatric and mood disorders is based on research into brain mechanisms conducted over the last 15 years in the laboratory of the company’s scientific founder, Dr. David Lovejoy, from the University of Toronto. TCAP was discovered in a genome-wide search for proteins related to corticotropin releasing factor (CRF), a keyan endogenous brain peptide known to be the central mechanism coupling external stress to psychological, behavioral, and endocrine responses. Dr. Lovejoy and his colleagues discovered and characterized Teneurin Carboxy-terminal Associated Peptide (TCAP); their further work revealed that TCAP is of ancient evolutionary origin and plays a central role in maintaining healthy brain structure and function in the face of the negative effects of stress. Although four TCAP peptides were discovered, only TCAP-1 is expressed independent of a larger Teneurin protein and is the primary focus of our development (PT00114).

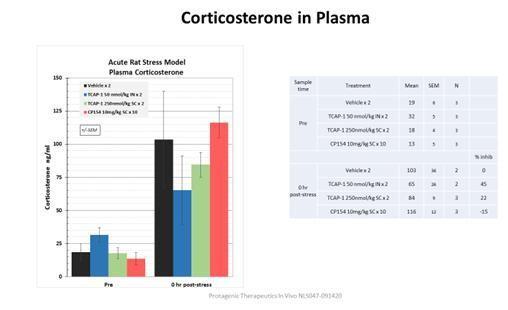

TCAP reverses the impact of stress on the Hypothalamic-Pituitary-Adrenal (HPA) axis, the endocrine and behavioral control system which connects environmental stress to behavioral responses via brain levels of Corticotropin Releasing Factor (CRF) and blood levels of the stress hormone cortisol. Stress elevates CRF, which in stress response. While TCAP-1turn elevates cortisol levels. Studies have demonstrated that TCAP counteracts stress, it does so bythe effects of either endogenous or pharmacologically-administered CRF via a non-CRF receptor pathway and unlike direct CRF antagonists it does not exhibitin the brain, that is believed to be evolved over millions of years as a homeostasis-related pathway. There has been strong interest in the pharmaceutical industry for decades to develop drug candidates that block the negative effects of CRF by attempting to directly antagonize the CRF receptor, however clinical results to date with prior CRF receptor antagonists have been disappointing. Because TCAP counteracts the action of CRF by activating separate receptors instead of directly blocking CRF receptors, we believe it is a superior approach to alleviating stress-related neuropsychiatric disorders; TCAP-1 acts by binding to Latrophilin-1 and Latrophilin-3, G-protein-coupled receptors (GPCRs) expressed on nerve cells in animal models studiedthe extended amygdala, the region of the brain involved in memory, emotion, and fear. TCAP acts through these receptors to date.block the effects of CRF and potentially other stress mediators such as Arginine-Vasopressin (AVP). Due to differences in the mechanism of action, TCAP is expected to be efficacious in clinical settings in which earlier studies with CRF receptor antagonists were not. We believe this novel mechanism of action can provide an attractive therapeutic profile for patients who are not fully responsive to currently available therapies.

| 11 |

PT00114 inhibits

|  |

Two key effects of TCAP may contribute to its pharmacological activity in reversing or preventing stress-induced behavioral distortions. In settings of stress and stress (CRF)-induced actionsdepression, the activity of specific neural circuits can be diminished compared to the levels of activity observed in clinically-relevant gold-standard animal models of anxiety, depression and addiction at concentrations several magnitudes below current front-line therapeutics. These beneficial effects are maintained for as long as three weeks after treatment. PT00114 promotes neuronal process development, spine density, axon fasciculation and branching in neurons.

PT00114healthy brain tissue. After administration, TCAP crosses the blood brain barrier and concentrates in regions of the brain associated with the regulation of mood disorders. Preliminary toxicity assessment (non-GLP) indicates no clear or significant adverseAdministered TCAP can lead to increases in activity in some of the neuronal circuitry implicated in depression, demonstrated by increases in the utilization of glucose, a surrogate for cell activity. The fact that the pharmacological effects although further toxicity testingof TCAP persist after the drug has been cleared aligns with findings that TCAP applied to neurons in culture stabilizes dendritic spines, structures that sprout from the surface of neurons and can form synapses with other neurons to create functional circuitry. Stress and the associated rise in CRF have been reported to cause loss of synapses in animal models. The fact that the pharmacological actions of TCAP persist for weeks are consistent with its producing lasting changes in neuronal function by changing patterns of gene expression and thus creating relatively stable changes in neuronal function. In a number of these models, a single subcutaneous dose of TCAP will prevent the behavioral consequences of stress encountered three weeks later. This is required.especially notable since the administered dose of TCAP is eliminated from the plasma within hours of administration.

PT00114Our lead compound is highly soluble and shows excellent stabilitya 41-residue peptide synthetic TCAP-1, which we have designated PT00114. In addition, we have a portfolio of earlier stage neuropeptides targeting the TCAP pathway that are in several storage conditions.preclinical evaluation. The initial dosage form is intended as a subcutaneous injection but is also amenable to other routes of administration.administration including sublingually or intra-nasally. This affords a range of target product profiles and opportunities for lifecycle management.

Business plan / Proposed next steps

The Company’s business plan calls for the following processes during 2018 and 2019:

Preclinical Efficacy Data

Historically, muchWhile many of the preclinical efficacy data regarding specific therapeutic benefitsinitial studies of PT00114TCAP had been generated in the lab of our Chief Technology Officer, Dr. David Lovejoy, atwe have designed several preclinical studies over the Universitylast four years to validate the safety and efficacy of Toronto. The Company recognizes that to fully validate its business proposal, and persuade potential corporate partners of target-disease efficacy, additional preclinical efficacy data from unaffiliated research organizations would be valuable. Hence, the Company has engaged twoPT00114, for which we hired multiple independent contract research organizations (CROs) to conduct these studies. In preclinical testsrodent models, administration of PT00114 results in reproducible, dose-dependent reversal of a range of stress-induced behavioral distortions, including depression, stress-exacerbated anxiety, excessive startle, drug seeking, and opioid withdrawal. Stress-induced anxiety was measured by an elevated plus maze, an open field with stressed animals, and acoustic startle in CRF-treated animals. Depression was measured by tail suspension and forced swim. Stress-induced changes in tube-restrained rodents were used as a well-validated model for anxiety and depression, as well as alleviationsub-acute stress. Notably, PT00114 was found to be pharmacologically active in stressed rodents but relatively inactive in non-stressed rodents.

In studies conducted with Charles River Laboratories in Kuopio, Finland, PT00114 showed beneficial effects in Chronic Social Defeat, a murine model of drug addictive behavior.

Process Development and Manufacturing

stress-induced behavioral dysfunction that has features of depression. In parallelthis model, male mice are placed in cages along with older, dominant male mice. This results in progressively more “resigned” behaviors in the Company’s external CRO research studies,mice experiencing this domineering exposure. This results in a series of behaviors in the Company is pursuing good manufacturing practices (cGMP) synthesis of PT00114. The Company obtained enough TCAP in July 2017 to supply its Phase I human clinical trials anticipated to begin in 2019. The Company intends to secure at least two supplier relationships for sourcing synthesized human PT00114.

Preclinical Safety & Toxicology

A key partcowed mice, termed Chronic Social Defeat. PT00114 reverses many of the Company’s preclinical studies for IND readiness iscomponent behaviors typically measured in this model, suggesting that it reverses the toxicology testingnegative effects of PT00114 in two animal species. Because these toxicology tests will be carried out with a drug concentration that is a multiple of the intended concentrationstress in the eventual marketable drug, the Company plans to commence its safety and toxicology testing only after receiving a confirmatory positive result from the latest external CRO efficacy tests. This means toxicology testing could begin as soon as the third quarter of 2018.“defeated” animals.

Pursue Strategic Partnership

The Company believes it would be to its advantage to secure a collaboration with a pharma/biopharma company with a presence in neurological and psychiatric diseases and/or addiction. Therefore, it plans to use the preclinical efficacy data generated during 2017 and the first quarter 2018 as a point of instigation with potential pharma/biopharma corporate partners.

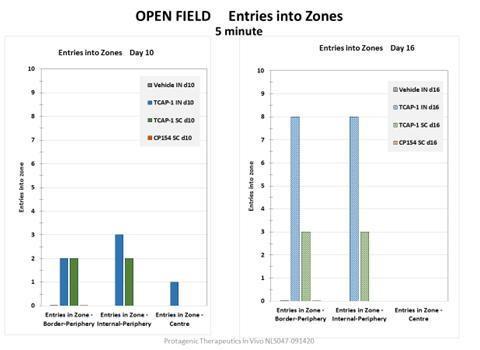

CompilePT00114 demonstrated efficacy in a variable chronic stress model that has features of anxiety and File INDPTSD. In an open field assessment, mice or rats are stressed by being placed in a tube for several hours, then placed in an open box where their movement is observed for 20 minutes. Control animals exhibit stress response behavior by not moving around much and staying near the edges of the box. Animal receiving PT00114 at the end of the stress condition moved around the open field. Animals receiving multiple administrations of a control small molecule CRH antagonist did not venture into the open field, indicating they were stressed. These results are also reflected in blood cortisol levels, where control mice had increased cortisol levels, which were reduced by treatment with PT00114, but not by the small molecule CRF antagonist.

| 13 |

Stress plays a central role in a broad range of addictions, including alcohol and opioids. The most important corporate goal for whichability of PT00114 to blunt excessive stress may be able to provide non-dependence forming treatment of addictions. A series of studies conducted at Porsolt Laboratories in Lavel France support the Company is deployingpotential utility of PT00114 as a treatment to help people defeat opioid addiction. In rats addicted to opioids, administering CRF models environmental stress, causing them to frantically seek opioids. PT00114 reduces the working capital it raisedopioid seeking behavior in 2016 is the compilationresponse to CRF administration. Further studies conducted by Porsolt following EMEA guidelines demonstrated that on its own, PT00114 was not addictive and submission of an investigational new drug (IND) applicationrats did not develop dependence to the FDA.peptide after chronic administration.

PT00114 has also demonstrated pre-clinical efficacy in a murine model of opioid withdrawal called the Saleens test. In this test, mice are addicted to opioids and the animals are then administered the opioid antagonist naloxone, which immediately blocks opioid action and triggers profound stress and opioid withdrawal. This manifests as a behavioral stress response with the mice jumping up to six inches into the air over 70 times in a 20-minute observation period. Administering PT00114 at three different time points within the experiment – before the naloxone-driven withdrawal, before the period of opioid addiction, or up to three weeks before the induced withdrawal – results in a reproducible, dose-dependent restoration to non-stressed behavior and reduced jumping. Significantly, this is not accompanied by any evidence of sedation or reduced activity. This effect appears independent of the opioid used as PT00114 ameliorates this withdrawal-triggered jumping stress behavior in mice experiencing withdrawal from both fentanyl and morphine.

Preclinical Safety and Toxicology

Preclinical safety data for PT00114 demonstrates a robust profile in both rats and non-human primates. As the mechanism is unique and TCAP is a prerequisitepart of healthy brain signaling, we believe PT00114 will have a differentiated side effect profile relative to begin Phase I human testingexisting antidepressant and antipsychotic agents. A key aspect of the TCAP mechanism is that it does not completely block the perception of and responses to stress; it rather protects against stress overload. Some perception of environmental stress and a proportionate response to that stress is adaptive behavior and it is not desirable to completely block stress responses. Unlike benzodiazepines that can cause sedation and are prone to dependence, TCAP prevents the maladaptive response to environmental stress without sedation and without developing dependence.

We have completed non-GLP Dose-Range-Finding (DRF) toxicology studies of PT00114 administered subcutaneously daily for any indication.five days in rats and non-human primates. The preclinical efficacy datadoses tested were substantially above the anticipated clinical doses and were well tolerated and safe, with no dose-limiting toxicities observed at doses at least 50-fold higher than anticipated clinical exposures. No major changes in hematology or clinical chemistries were seen, including prolactin levels or testosterone levels, changes in which may impact libido. Distinct from SSRI’s, there was no impact on ambulation, sedation or weight gain. Importantly, further studies conducted following EMEA guidelines, demonstrated that on its own PT00114 was not addictive and rats did not develop dependence to the peptide after chronic administration. The in life 28-day GLP toxicology testing in both the rats and non-human primate have been completed. There have been no changes in clinical chemistries or pathology that would prompt a stop in the program and the therapeutic margin if large. The final audited reports are currently being generatedcompiled.

Process Development and Manufacturing

We currently do not own any manufacturing facilities and rely on 3rd party contract manufacturers for synthesis of PT00114. We have sufficient PT00114 synthesized under current Good Manufacturing Practices (“cGMP”) conditions to complete GLP toxicology studies and Phase 1 human clinical trials. This material is currently undergoing requisite stability and accelerated stability testing. PT00114 is highly soluble and has shown excellent preliminary stability in several storage conditions, with the material being stable for at two external CROs, as well as the toxicology test results that the Company plans to obtain, and a specific plan and protocol for a Phase I trial,least 12 months.

The initial dosage form developed will be among the componentsa subcutaneous injection. Because PT00114 is also amenable to other routes of this key regulatory submission anticipatedadministration including sublingually or intra-nasally, we will be doing preliminary process work to develop these formulations, and anticipate using one of these dosage forms in early 2019.later stage clinical studies.

| 14 |

Initiate Phase I Clinical Studies

One the Company’s IND application has been filed, the next major milestone is anticipated to be an approval by the Company’s FDA review team that the Phase I trial protocol proposed in the IND application is acceptable to begin. The Company believes that this may be achieved in the second half of 2019.

Technology License Agreement

On July 31, 2005, the Company had entered into a Technology License Agreement (“License Agreement”) with the University of Toronto (the “University” or “UT”) pursuant to which the University agreed to license to the Company patent rights and other intellectual property, among other things (the “Technologies”). The Technology License Agreement was amended on February 18, 2015 and currently does not provide for an2015. Unless earlier terminated, the term of this License Agreement shall terminate on the expiration date.or invalidity of the last issued Patent in the License Agreement

Pursuant to the License Agreement and its amendment, the Company obtained an exclusive worldwide license to make, have made, use, sell and import products based upon the Technologies, or to sublicense the Technologies in accordance with the terms of the License Agreement and amendment. In consideration, the Company agreed to pay to the University a royalty payment of 2.5% of net sales of any product based on the Technologies. If the Company elects to sublicense any rights under the License Agreement and amendment, the Company agrees to pay to the University 10% of any up-front sub-license fees for any sub-licenses that occurred on or after September 9, 2006, and, on behalf of the sub-licensee, 2.5% of net sales by the sub-licensee of all products based on the Technologies. The Company had no sales revenue for the year ended December 31, 20172023 and therefore was not subject to paying any royalties.

In the event the Company fails to provide the University with semi-annual reports on the progress or fails to continue to make reasonable commercial efforts towards obtaining regulatory approval for products based on the Technologies, the University may convert our exclusive license into a non-exclusive arrangement. Interest on any amounts owed under the License Agreement and amendment will be at 3% per annum. All intellectual property rights resulting from the Technologies or improvements thereon will remain the property of the other inventors and/or Dr. David Lovejoy (“The Professor”) at the University, and/or the University, as the case may be. The Company has agreed to pay all out-of- pocketout-of-pocket filing, prosecution and maintenance expenses in connection with any patents relating to the Technologies. In the case of infringement upon any patents relating to the Technologies, the Company may elect, at its own expense, to bring a cause of action asserting such infringement. In such a case, after deducting any legal expenses the Company may incur, any settlement proceeds will be subject to the 2.5% royalty payment owed to the University under the License Agreement and amendment.

The patent applications were made in the name of the ProfessorDr. Lovejoy and other inventors, but the Company’s exclusive, worldwide rights to such patent applications are included in the License Agreement and its amendment with the University. The Company maintains exclusive licensing agreements and it currently controls the six intellectual patent properties.

Sales and Marketing

We currently have no sales, marketing or distribution capabilities. In order to commercially market PT00114 and any product candidates we develop in the future, we would either need to develop an internal sales team and marketing department or collaborate with third parties who have sales and marketing capabilities. As we commenced clinical trials in the third quarter of 2023, we expect to seek a Market Access expert or consultancy to better understand clinician and payor dynamics in the therapeutic areas we are focused on, so that, as we begin later stage studies, we are working on a deeper commercial assessment in parallel. We have done some high-level benchmarking of pricing based on the current landscape of approved and available therapies for psychiatric disorders we are targeting, both in the generics and on-patent realms.

ManufacturingCompetition

We currently do not own any manufacturing facilities, nor have we entered into any agreements with contract manufacturer for the production of PT00114. Currently we synthesize all the PT00114 we use in our development activities.

Competition

The pharmaceutical and biotechnology industries are highly competitive and characterized by rapidly evolving technology and intense research and development efforts. We expect to compete with companies, including major international pharmaceutical companies and other institutions that have substantially greater financial, research and development, marketing and sales capabilities and have substantially greater experience in undertaking preclinical and clinical testing of products, obtaining regulatory approvals and marketing and selling biopharmaceutical products. We will face competition based on, among other things, product efficacy and safety, the timing and scope of regulatory approvals, product ease of use and price.

Major depressive disorder patients that do not respond to the current antidepressant medications constitute a separate group of TRD. Despite a large patient population and current treatments that leave much room for improvement, the developmental pipelines are sparse and few novel candidates are in development. The serendipitous discoveries of current drug classes, side effects and lack of efficacy have led to shrinkage or extinction of many pharma or small biotech neuroscience research programs. According to a May 10, 2016 Zion Research report, the current global depression drug market was valued at approximately $14.5 billion in 2014, and is expected to generate $16.8 billion by the end of 2020. The pharmaceutical addiction market is very large but has not yet been quantified because no successful drug has been launched to treat victims. We intend to launch PT00114 into either the TRD, anti-anxiety, or pharmaceutical addiction markets.

| 15 |

Set forth below is a discussion of competitive factors for each of the current drug classes commercially available for TRD, and the competitive advantages that we believe PT00114 may offer. The basis for our beliefs regarding the competitive advantages that PT00114 may offer over its competitors is our own pre-clinical animal studies. We acknowledge that these beliefs and conclusions about competitive advantages must be regarded as theoretical until such time as we have human clinical data that supports and re-affirms the results seen in the pre-clinical animal studies.

Opioid receptor modulators