| ||

|

| ||

| ||

| F-1 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

��

For the Fiscal Year Ended December 31, 20182019

OR

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

For the Transition Period From ____________ to ____________

Commission File Number:333-208293000-55753

CANBIOLA, INC.Can B̅ Corp.

(f/k/a Canbiola, Inc.)

(Exact name of registrant as specified in its charter)

| Florida | 20-3624118 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

960 South Broadway, Suite 120, Hicksville NY 11801,

(Address of principal executive offices)

516-595-9544

Registrant’s telephone number, including area code:

None

Securities Registered Pursuant to Section 12(b) of the Act:

| Tile of each class | Trading Symbol(s) | Name of each exchange onwhich registered | ||

| Common Stock | CANB | N/A |

Common Stock, par value $0.001 per share

Securities Registered Pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter time that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] (Do not check if a smaller reporting company) | Smaller reporting company | |

| Emerging Growth Company [X] | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of voting stock held by non-affiliates of the registrant on June 30, 2018, was $4,466,469, based on the last reported sale price of the registrant’s Common Stock on the OTC Markets on that date.

As of April 12, 2019,March 13, 2020, the registrant had outstanding 548,487,7142,861,740 shares of common stock, $0.00 par value per share.

EXPLANATORY NOTE

Canbiola, Inc. (the “Company”) inadvertently provided an incorrect contact phone number in its Annual Report on Form 10-K for the fiscal year ended December 31, 2018 (the “Original Filing”) and did not include interactive data (aka XBRL’s) for the Original Filing. This Amendment No. 1 on Form 10-K (“Amendment No. 1”) is being filed solely to include the Company’s interactive data and to amend the Company’s phone number.

CANBIOLA, INC.Can B̅ Corp.

20172019 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained or incorporated by reference in this Annual Report on Form 10-K are considered forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) concerning our business, results of operations, economic performance and/or financial condition, based on management’s current expectations, plans, estimates, assumptions and projections. Forward-looking statements are included, for example, in the discussions about:

| ● | strategy; | |

| ● | new product discovery and development; | |

| ● | current or pending clinical trials; | |

| ● | our products’ ability to demonstrate efficacy or an acceptable safety profile; | |

| ● | actions by regulatory authorities; | |

| ● | product manufacturing, including our arrangements with third-party suppliers; | |

| ● | product introduction and sales; | |

| ● | royalties and contract revenues; | |

| ● | expenses and net income; | |

| ● | credit and foreign exchange risk management; | |

| ● | liquidity; | |

| ● | asset and liability risk management; | |

| ● | the outcome of litigation and other proceedings; | |

| ● | intellectual property rights and protection; | |

| ● | economic factors; | |

| ● | competition; and | |

| ● | legal risks. |

Any statements contained in this report that are not statements of historical fact may be deemed forward-looking statements. Forward-looking statements generally are identified by the words “expects,” “anticipates,” “believes,” “intends,” “estimates,” “aims,” “plans,” “may,” “could,” “will,” “will continue,” “seeks,” “should,” “predict,” “potential,” “outlook,” “guidance,” “target,” “forecast,” “probable,” “possible” or the negative of such terms and similar expressions. Forward-looking statements are subject to change and may be affected by risks and uncertainties, most of which are difficult to predict and are generally beyond our control. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update any forward-looking statement in light of new information or future events, except as required by law, although we intend to continue to meet our ongoing disclosure obligations under the U.S. securities laws and other applicable laws.

We caution you that a number of important factors could cause actual results or outcomes to differ materially from those expressed in, or implied by, the forward-looking statements, and therefore you should not place too much reliance on them. These factors include, among others, those described herein, under “Risk Factors” and elsewhere in this Annual Report and in our other public reports filed with the Securities and Exchange Commission. It is not possible to predict or identify all such factors, and therefore the factors that are noted are not intended to be a complete discussion of all potential risks or uncertainties that may affect forward-looking statements. If these or other risks and uncertainties materialize, or if the assumptions underlying any of the forward-looking statements prove incorrect, our actual performance and future actions may be materially different from those expressed in, or implied by, such forward-looking statements. We can offer no assurance that our estimates or expectations will prove accurate or that we will be able to achieve our strategic and operational goals.

Forward-looking statements are based on information we have when those statements are made or management’s good faith belief as of that time with respect to future events, and are subject to significant risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements.

Moreover, new risks regularly emerge and it is not possible for our management to predict or articulate all risks we face, nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements. All forward-looking statements included in this prospectus are based on information available to us on the date of this Annual Report. Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above and throughout this Annual Report.

JUMPSTART OUR BUSINESS STARTUPS ACT

We qualify as an “emerging growth company” as defined in Section 101 of the Jumpstart our Business Startups Act (“JOBS Act”) as we do not have more than $1,000,000,000$1,700,000,000 in annual gross revenue and did not have such amount as of December 31, 2018,2019, the last day of our last fiscal year. We are electing to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act.

As an emerging growth company, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this annual report; | |

| ● | not being requested to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley Act”); | |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and | |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We will remain an emerging growth company until the earliest to occur of: (i) our reporting $1 billion or more in annual gross revenues; (ii) the end of fiscal year 2019; (iii) our issuance, in a three year period, of more than $1 billion in non-convertible debt; and (iv) the end of the fiscal year in which the market value of our common stock held by non-affiliates exceeded $700 million on the last business day of our second fiscal quarter.

| 3 |

| Item 1. | Business |

Company Overview

Canbiola, Inc.Can B̅ Corp. (the “Company,” “CAN B,” “CANB,” “we,” “us,” and “our”) was originally incorporated as WrapMail, Inc. (“WRAP”) in Florida on October 11, 2005 in order to tap into a largely un-serviced segment of the web-based advertising industry. Effective December 27, 2010, WRAP effected a 10 for 1 forward stock split of its common stock. Effective June 4, 2013, WRAP effected a 1 for 10 reverse stock split of its common stock. The accompanying consolidated financial statements retroactively reflect these stock splits. On March 6, 2020, Can B̅ effected a 1 for 300 reverse stock split of its common stock.

Effective January 5, 2015, WRAP acquired 100% ownership of Prosperity Systems, Inc. (“Prosperity”), a New York corporation incorporated on April 2, 2008, in order to acquire Prosperity’s office productivity software suite as a complement to WRAP’s existing intellectual property. After its acquisition, the Company transferred Prosperity’s operations to WRAP and is presently in the process of dissolving Prosperity.WRAP. For the periods presented, the assets, liabilities, revenues, and expenses are those of the Company. Prosperity had no activity for the periods presented.

Around the first quarter of 2017, the Company began to transition into the Hemp CBD industry and now primarily offersoperates four distinct health and beauty productswellness divisions, Pure Health Products (R&D and supplements containing CBD.manufacturing), Duramed (medical devices), Green Grow Farms, Inc. (cultivation and processing), and licensing under its new agreement with Lifeguard brand. On May 15, 2017, WRAP changed its name to Canbiola, Inc. (the “Company” or “CANB” or “Canbiola”) to reflect its transition. On March 6, 2020 CANB changed its name to “Can B̅ Corp.” in order to segregate its corporate identity from its lead products branded under the “Canbiola” brand.

Business Segments

The Company’s primaryCompany is in the business is theof promoting health and wellness through its development production and sale of products containing CBD (with no psychoactive THC) the production of hemp biomass, the licensing of durable medical devises and delivery devices containing CBD.the sale of non-CBD products such as sunscreen and lip balm.

| I- | Pure Health Products – R&D, Manufacturing and “CBD” Business |

The Company’s Research, Development, and core manufacturing arm also is a direct producer, seller and purveyor of products to private label products for multiple distributors of CBD products. The Company’s products contain CBD derived from Hemp and include products such as oils, creams, moisturizers, isolate, and gel caps. In addition to offering white labeled products, Canbiolathe Company has developed its own line of proprietary products, as well asproducts. The Company is always seeking synergistic value through acquisitions of products and brands in the Hemp industry. CanbiolaThe Company aims to be the premier provider of the highest quality natural Hemp CBD products on the market through sourcing the very best raw material and developing a variety of products we believe will improve people’s lives in a variety of areas.

“CBD” Business

Cannabidiol (“CBD”) is one of nearly 85 naturally occurring compounds (cannabinoids) found in industrial hemp (it is also contained in marijuana, but the Company’s products are derived only from hemp). CBD is non-psychoactive and is thought to have numerous uses, including, but not limited to, for pain, insomnia, epilepsy, anxiety, inflammation, and nausea. Unlike CBD derived from marijuana, CBD derived from the seeds and stalks of industrial hemp is generally considered “legal” in the U.S. so long as it contains less than 0.3% of “THC,” another, but psychoactive, cannabinoid found in cannabis. This purported “legal status” is because the 2018 Farm Bill removed hemp as a Schedule I drug under the Controlled Substances Act and hemp may now be grown as a commodity crop, with restrictions; however, the 2018 Farm Bill did not specifically legalize CBD. Until Congress promulgates rules and regulations relating to hemp derived CBD under the 2018 Farm Bill, the “legal” status of CBD from hemp, or the processes the Company may have to implement (and at what expense), are still unknowns. A similar paradigm exists under various state laws with which the Company will have to comply. In any case, CBD derived from marijuana, marijuana and other marijuana derivatives are federally illegal in the U.S. under the Controlled Substances Act, despite being medically or recreationally legal in numerous states, which is why the Company has established procedures to ensure that its CBD is derived from hemp in compliance with the Farm Bill.TheBill. The Company has all of its hemp based raw materials (isolate) tested by a 3tf3rd party independent laboratory and those results are posted on the Company web site.

| 4 |

In order to facilitate its operations, the Company has (and will) form or acquire a number of subsidiaries. Its goal is to eventually operate a vertically integrated hemp conglomerate that has operations spanning from seed to sale. Currently, the

The Company’s primary focus is the development, sale and manufacture of CBD products. The Company’smedical office products are marketed under the tradename “Canbiola.,“Canbiola,” and sold via its website and through doctors and other medical professionals with which the Company enters intounder distribution agreements. The Company also manufactures and/or sells separately branded CBD products through its subsidiaries and websites for “Pure Leaf Oil”, essentially its retail consumer brand and “Sevenis sold via the Company’s website as well as direct internet sales for retail use consumers. Additionally, the Pure Leaf Oil products are targeted to be featured in the Company’s new line of vending machines, currently in test markets such as medical facilities and retail centers., Nu Wellness its independent pharmacy brand and targets toward the over three-thousand independent retail drug stores nationally with its first product schedule for roll-out in the 1st quarter 2020. , The” Seven Chakras” brand.brand is targeted toward health clubs, spas, and beauty lines and is expecting a major launch in 2nd quarter 2020 to include a full line of related topical products both with and without CBD. The Severn Chakras has a customer base and following and compliments the Canbiola and Pure Leaf Oil brands with additional new products such as bath bombs, stress relief products, and lotions. Seven Chakras has its own internet website and continues in its direct marketing to its customer base.

In December, 2018, the Company acquired 100% of the membership interests in Pure Health Products, LLC, a New York limited liability company (“PHP” or “Pure Health Products”), with which it had had and has an exclusive production agreement, pursuant to an Acquisition Agreement (“PHP Acquisition Agreement”). PHP manufactures and packages the Company’s CBD infused products. PHP may also white label / rebrand or relabel the Company’s products pursuant to “white label agreements” entered into between the Company and/or PHP and third-party customers. Through PHP, the Company is able to control the manufacturing process of its products while reducing its production costs. In January, 2019, PHP acquired certain assets from Seven Chakras, LLC (“Seven Chakras”), a former competitor, which assets included the rights and title to (i) Seven Chakras’ proprietary formulas, methods, trade secrets, and know-how related to the production of Seven Chakras’ CBD products, (ii) Seven Chakras’ tradename, domain name, and social media sites, and (iii) other assets of Seven Chakras including but not limited to raw materials, equipment, packaging and labeling materials, mailing lists, and marketing materials.

The Company believes the acquisitionproducts are distributed through an array of Seven Chakra’s assets will bring accretive valuemethods including: 1- For Canbiola brand directly though doctors and expand the Company’s market base. The Severn Chakras has a customer following in the northwest and compliments the Canbiola andmedical offices, 2- For Pure Leaf Oil brands with additional new products such as bath bombs, stress relief products,direct to consumer via walk-in business, internet and lotions.other distributors, 3- for Seven Chakras hasvia direct sales and through internet sales. The Company’s newest brand Nu Wellness is distributed to independent pharmacies through distributor relationships. The White or Private Label business is sold direct to the companies for distribution through their own network of retailers.

| II- | Duramed Division- Durable Medical Equipment |

Through its own internet websitemedical device division, Duramed, Inc. and continuesDuramedNJ LLC, the Company serves the post-surgery medical patient arena aiming to reduce the reliance of opiates in its direct marketingfavor of a wearable ultrasound device to its customer base.aid in recovery and pain reduction.

In November 2018, the Company formed Duramed, Inc., a Nevada corporation (“Duramed”) to facilitate the manufacture and sale of durable medical equipment incorporating CBD. On January 14, 2019, Duramed entered into a Memorandum of Understanding (the “Sam MOU”) with Sam International (“Sam”) and ZetrOZ Systems LLC (“ZetrOZ” and, collectively with Sam, the “Manufacturers”). Pursuant to the Sam MOU, the Manufacturers granted Duramed the exclusive right to distribute sam® Pro 2.0 (SA271) and sam® Gel Coupling Patches (UB-14-72) within the United States for the Personal Injury Protection/No Fault Market during the term of the Sam MOU. Duramed has agreed to purchase monthly minimums from the Manufacturers at a price per Unit of $2,447. The exclusivity of the Distribution License granted to Duramed under the Sam MOU is dependent upon meeting the monthly minimum. In addition, Duramed was granted the right to distribute sam® Gel Capture Patches (UB-14-24). Duramed will get rebates of 2%-3% based on the volume of Products sold by it. The initial term of the Sam MOU expires December 31, 2019 (the “Initial Term”). The agreement contemplated by the Sam MOU will automatically renew for additional one-year terms at the end of each calendar year,providedthe monthly minimums have been met. The primary thrust of the Duramed Divisiondivision is to market to patients via doctors via a device rental program reimbursable by insurance carriers to help patient with pain reductions and faster healing.

| 5 |

On May 29, 2019, the Company created DuramedNJ LLC to execute the same business strategy into the no-fault insurance market in New Jersey that it had developed in New York. That company continues to develop opportunities into 2020.

| III- | Hemp Production, Aggregation, Processing, and Sale |

On July 11, 2019, Canbiola, Inc. (the “Company” or “CANB”) entered into a Joint Venture Agreement (the “JV Agreement”) with NY – SHI, LLC, a New York limited liability company (“NY – SHI”), EWSD I LLC dba SHI Farms, a Delaware limited liability company (“SHI Farms”), NY Hemp Depot LLC, a Nevada limited liability company and wholly-owned subsidiary of CANB (“CANB Sub”). Pursuant to the JV Agreement, NY – SHI and CANB Sub entered into a joint venture for the purpose of jointly implementing a business model referred to as the “Depot Model” (the “Joint Venture”) to aggregate and purchase fully-grown, harvested industrial hemp from third-party farmers (“Farmers”) in the State of New York. The Joint Venture may also sell feminized seeds, clones, and additional materials required to grow and cultivate industrial hemp to the Farmers and provide the Farmers with initial training reasonably required for them to be able to grow industrial hemp and maximize CBD potency.

Pursuant to the JV Agreement, NY – SHI agreed to provide (i) technical expertise regarding the growth and cultivation of industrial hemp, (ii) certain products that may include feminized hemp seeds and/or clone plants to sell to the Farmers, (iii) growing technology and expertise to grow, cultivate, and harvest industrial hemp, including the initial training of Farmers to grow industrial hemp and maximize CBD potency, (iv) use of its cultivating license, which shall be amended to add a New York hemp depot facility (the “NY Hemp Depot Facility”) once such facility is obtained by CANB Sub, and (v) services for the recruitment of Farmers to grow and cultivate industrial hemp for sale to the Joint Venture.

CANB Sub agreed to provide (i) a building for the operation of the NY Hemp Depot Facility, (ii) location services in connection with its securing the building for the NY Hemp Depot Facility, (iii) management and other services for the day-to-day operation of the Joint Venture, and (iv) services for the recruitment of Farmers to grow and cultivate industrial hemp for sale to the Joint Venture. CANB Sub shall have full and complete discretion to manage and control the business and affairs of the Joint Venture, to make all decisions affecting the business and affairs of the Joint Venture, and to take all such actions as it deems necessary or appropriate to accomplish the purposes of the Joint Venture. Notwithstanding the foregoing, unanimous consent between NY – SHI and CANB Sub is required for certain transactions, including but not limited to amending the JV Agreement, obligating the Joint Venture to pay an excess of $20,000 for any transaction or series of transactions, and terminating the Joint Venture.

As consideration for the foregoing, CANB Sub delivered to NY – SHI a cash payment of $500,000.00 upon execution of the JV Agreement. Additionally, per the terms of the JV Agreement, CANB issued $500,000.00 in value of its Common Stock to NY – SHI;provided, however, that the NY – SHI’s cultivating license shall have been amended to add the NY Hemp Depot Facility as a condition to such issuance. SHI Farms has also agreed to sell certain isolate to the Company or its designated affiliate at a discounted rate equal to the cost of processing the isolate from biomass and granted CANB Sub an interest in the 1.5% payments due to SHI Farms in connection with its separate agreements with Mile High Labs.

The “gross profits” from the Joint Venture, which are defined as gross revenues less certain direct operational costs, will be distributed quarterly in arrears with the first distribution scheduled to be made on March 31, 2020, of which 70% is to be distributed to CANB Sub and 30% is to be distributed to NY – SHI.

NY Hemp Depot production is coordinated via the new acquisition of Green Grow Farms, Inc.

On December 4, 2019, the Company entered into a Stock Purchase Agreement (the “GGFI Agreement” with Iconic Brands, Inc., a Nevada corporation (“ICNB”) and Green Grow Farms, Inc., a New York corporation (“GGFI” or “Green Grow” and, collectively with ICNB and the Company, the “Parties”). Pursuant to the terms of the GGFI Agreement, at closing, the Company received 51% equity interest in Green Grow (the “GG Shares”) in exchange for an aggregate of 37,500,000 pre-split shares of the Company’s common stock (the “Purchase Shares”). On June 30, 2020 (the “Valuation Date”), a valuation of the Purchase Shares shall be performed for the purpose of determining whether the Market Price Per Purchase Share (as defined in the GGFI Agreement) on the Valuation Date is less than $1,000,000. In the event that the aggregate Market Price Per Purchase Share on the Valuation Date is less than $1,000,000, the Company shall issue to the ICNB such a number of additional shares (“Additional Purchase Shares”) so that the aggregate value of aggregate shares issued to ICNB for the purchase of the GG Shares (taking into account the Purchase Shares and the Additional Purchase Shares) equals $1,000,000. For purposes of the valuation, Market Price Per Purchase Share shall be determined based upon the 10-day average VWAP for the 10-day period ending on June 30, 2020.

| 6 |

In the event that ICNB determines to make a distribution of the Purchase Shares to its shareholders, whether by way of dividend or otherwise, the Company agreed to cooperate in the filing of a registration statement (the “Registration Statement”) with the SEC covering the Purchase Shares, if requested by ICNB. ICNB shall be responsible for directly paying all expenses relating to such Registration Statement, including, but not limited to, filing fees, the Company’s counsel legal fees, blue sky filing fees and audit fees. Pursuant to the GGFI Agreement, the Company has agreed to indemnify and hold ICNB harmless from and against any and all liabilities, obligations or claims arising out of or resulting from Green Grow’s operation of its business or its assets after the closing of the GGFI Agreement and the Company’s breach of any covenants, warranties or agreements set forth therein, provided the amount of any indemnification shall not exceed an amount equal to the value of the GG Shares as of the closing. The GGFI Agreement otherwise contains customary representations and warranties, termination rights, and certain covenants of the Parties.

On January 27, 2020, the Company entered into an Amendment to Stock Purchase Agreement (the “Amendment”) with ICNB and Green Grow. The Amendment was to correct a scrivener’s error in the GGFI Agreement. The Amendment clarifies that Additional Purchase Shares will be issued to ICNB only if the Market Price Per Purchase Share on the Valuation Datemultiplied by the 37,500,000 pre-split Purchase Shares is less than $1,000,000.

On March 3, 2020, the Company entered into an Agreement (the “Modification Agreement”) with Green Grow, New York Farm Group, Inc., a New York corporation (“NYFG”), Steven Apolant, an individual, and Peter Scalise, an individual, relating to the GGFI Agreement, as amended. Following the closing of the GGFI Agreement, the Company discovered that certain assets of GGFI were valued at less than the amount GGFI had previously represented. In light of the foregoing, pursuant to the Modification Agreement, NYFG agreed to assign to CANB (i) all of the equity interests in GGFI held by NYFG and (ii) 1,000,000 shares of ICNB’s common stock. The ICNB shares are subject to a lock up leak out agreement with ICNB whereby the Company has agreed not to transfer the ICNB shares until July 1, 2020 and for the six (6) months thereafter not sell or transfer more than the greater of 3.5% of ICNB’s trading volume or $5,000. Pursuant to the Modification Agreement, CANB agreed to forgive a loan to Apolise LLC in the amount of $144,310 and to assume the lease liability for 1545 Ocean Ave., Suite 1, Bohemia, NY 11716. Each party to the Modification Agreement also agreed to release the other parties thereto from all claims relating to the GGFI Agreement and the transactions contemplated thereby. As a result of the transaction contemplated by the Modification Agreements, the Company now owns 100% of GGFI.

| IV- | Licensing |

On January 28, 2020, Canbiola, Inc. (the “Company” or “CANB”) entered into a License Agreement (the “Lifeguard Agreement”) with LIFEGUARD LICENSING CORP., a Delaware corporation (“Lifeguard”). Pursuant to the Lifeguard Agreement, Lifeguard granted the Company the right to use its “LIFEGUARDTM” trademark (the “Mark”) in connection with the Company’s manufacture, marketing, distribution, and sale of products (the “License”). In consideration for the License, the Company agreed to pay Lifeguard a royalty equal to six percent (6%) of net sales of its LIFEGUARD branded products on a quarterly basis. The Company further agreed that, regardless of the net sales generated, each royalty payment will be in an amount not less than $60,000, which minimum amount will increase annually following December 31, 2021. The Lifeguard Agreement will continue until December 31, 2025, unless earlier terminated by the parties, and may be renewed for additional five (5)-year terms if certain performance conditions are met.

Under the License, the Company has various performance and sales obligations including initial product introduction timing and Lifeguard has various oversight rights such as audit rights, quality control and inspection rights. Licensor has the right to terminate the License in the event of certain breaches by the Company, at which point, the Company will be required all licensed material; however it will be permitted to sell its existing inventory so long as termination is not due to quality issues. Lifeguard and the Company have agreed to indemnify each other, which indemnification obligations will survive the termination of the Agreement. The Company also agreed to procure and maintain certain insurance policies for the benefit of the Company and Lifeguard.

| 7 |

The Lifeguard Agreement otherwise contains terms, conditions, and representation common with this type of transaction.

Competitive Conditions

The CBD and cannabis markets are flooded with competition ranging from mom and pop operations to multi-million-dollar conglomerates, many with longer operating histories, more capital and/or more industry knowledge than the Company. The Company hopes to partner with or engage industry specialists to help set it apart from its numerous competitors. One of those points of differentiation is its 3rd party independent testing “Certificate of Analysis” conducted on all of the CBD isolate products it purchases and posting of those lab results on its website.

CBD biomass, that is farmers growing product, has created a glut on the US market with the supply chain breakdown being processing, extraction, and use of product. The Company believes there will be a leveling out of supply and demand but strongly believes that the companies with the greatest potential are those with a final consumer end-use for the product. One of the Company’s strengths is that it built a demand side consumer base prior to any vertical integration. Ergo, our GGFI Division will be growing under our own license in New York for our own manufacturing facility production, for our own customer demand.

The statements found herein have not been evaluated by the Food and Drug Administration (FDA) and the Company’s products are not intended to diagnose, treat, cure or prevent any disease or medical condition.

WRAPmail

The Company owns a patented technology that combines custom marketing content with organization e-mail to provide a next generation marketing platform for organizations and personal use. WRAPMail had provided software solutions for marketing and is no longer being sold or serviced.Intellectual Property

We are not aware of any competitors developing a similar solution to WRAPmail, possibly giving us first mover advantage. Nonetheless, we may face competition from stationary letterhead, bulk e-mail and similar product providers.

Currently the Company is not pursuing additional customers for WRAPmail but does continue to service current customers using the software.

Bullseye

The Bullseye Productivity Suite is a cloud-based system that consolidates all necessary office productivity tools into one online experience, accessible everywhere when you need it with full disaster recovery mechanisms built in. All functions and features are audited to help users with corporate governance and compliance issues.

The Company is not presently seeking additional customers for Bullseye but continues to service the existing customer base.

Intellectual Property

We ownwon the following patents for our WRAPmail technology: US patentPatent no. 8572275 issued on October 29, 2013. This patent expires in October 2033.2022. On July 20, 2015, WRAPmail filed for a new patent under the title:title Method, System and Software for Dynamically Extracting Content for Integrationintegration with Instant Messages, which application is still pending and not being actively pursued by the Company.

The above patents relate to the document management and email marketing divisions.divisions which are not presently being developed. Due to diminishing revenue from these divisions,this division, the Company’sCompany accountant determined to reduce the fair value of these patents to $0.

The Company employesemploys through its Pure Health Product LLC Division, two full time product researchers and developers and technology experts who, on a daily basis, set the quality standards and new product development status and time-line agendas under the direct supervision of the Company’s management team.

Employees

The Company currently has nineteen employees, 17 of which are full-time employees and 2 who are under service agreements.

The Company employs through its Pure Health Products LLC Division, two full time product researchers and CBD technology experts who, on a daily basis, set the quality standards and new product development status and time-line agendas under the direct supervision of the company’s management team. Additionally, there is a division president, three production personnel, and five sales/ marketing and fulfillment personnel.

EmployeesDuramed, the medical device company employees four people including the division president and 3 field operation personnel.

The Company currently hasremaining four full-time employeepeople are corporate staff and seven under services agreements.general sales and are directly employed by the Company.

| 8 |

Reports to Security Holders

Our common stock is registered under the Securities Exchange Act of 1934 and we are required to file current, quarterly and annual reports and other information with the SEC. You may read and copy any document that we file at the SEC’s public reference facilities at 100 F. Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-732-0330 for more information about its public reference facilities. Our SEC filings are available to you free of charge at the SEC’s web site at www.sec.gov. We are an electronic filer with the SEC and, as such, our information is available through the Internet site maintained by the SEC that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. This information may be found at www.sec.gov and posted on our website at www.canbiola.com.

Research and Development

In fiscal year 20172019 and 2018 we spent respectively $37,000$150,000 and $75,000, respectively, in research and development which was expensesexpensed as spent.

Government Regulation

The cultivation and sale of hemp and hemp products is federally regulated under the United States Farm Bill. The 2018 Farm Bill removed hemp as a Schedule 1 Substance under the Controlled Substances Act; however, rules and regulations relating to manufacture and sale of CBD products under the Farm Bill must still be promulgated and are expected to impact the Company’s operations. As the legal CBD industry and our product lines expand, it is uncertain what other statutory schemes and agencies will start to regulate our CBD products. The FDA currently still considers the addition of CBD to food products or supplements to be illegal and prohibits the advertisement of CBD products with health claims. The Company must also comply with each state’s laws relating to the sale of hemp basedhemp-based CBD products. These regulations may affect, among others, the way the Company manufactures and distributes its products, the way the Company is taxed, the way the Company banks, the location of the Company’s facilities, the content and testing of the Company’s products, and the quality of the Company’s services.

Through our document managementThe Company is presently growing and email marketing platforms, wecultivating in New York State under a State License provided by its GGFI Division. Once processing the biomass into isolate, it is shipped to the Company’s manufacturing facility in Lacey WA under the provisions of the Farm Bill of 2018.

We are also subject to general business regulations and laws as well as Federal and state regulations and laws specifically governing the Internet and e-commerce. Existing and future laws and regulations may impede the growth of the Internet, e-commerce or other online services, and increase the cost of providing online services. These regulations and laws may cover sweepstakes, taxation, tariffs, user privacy, data protection, pricing, content, copyrights, distribution, electronic contracts and other communications, consumer protection, broadband residential Internet access and the characteristics and quality of services. It is not clear how existing laws governing issues such as property ownership, sales, use and other taxes, libel and personal privacy apply to the Internet and e-commerce. Unfavorable resolution of these issues may harm our business and results of operations. CBD sales are additional state regulated for shipping and the Company maintains a current list.

Transfer Agent

We had engaged Island Stock Transfer, located at 15500 Roosevelt Blvd, Suite 301, Clearwater, FL 33760, as our stock transfer agent. Phone: 727.289.0010. Our former director, Carl Dilley, is a principal of Island Stock Transfer.

On April 1st, 2019 we changed Transfer Agents to Transhare Corporation located at 15500 Roosevelt Blvd,2849 Executive Drive, Suite 302,200, Clearwater, FL 33760.33762.

| Item1A. | Risk Factors |

We are a smaller reporting company and not required to provide the information in this Item.

| Item 1B. | Unresolved Staff Comments |

Not applicable.

| 9 |

| Item 2. | Properties |

The Company does not currently own any real property. We do however lease office space in Hicksville, New York, and Bohemia New York. The Company’s wholly-owned subsidiary, Pure Health Products, operates its manufacturing facility in the state of Washington.

The lease payments are: Pure Health Products in Lacey WA $2,300, Can B̅ Corp. home office in Hicksville NY $3,350, and Green Grow Farms, Inc. in Bohemia NY $1,575.

| Item 3. | Legal Proceedings |

We are not aware of any pending or threatened legal proceedings in which we are involved, except as disclosed herein. On or around May 11, 2018, the Company initiated arbitration proceedings against T8 Partners, Inc., a New York Corporation (“T8”), pursuant to the American Arbitration Association (“AAA”) rules, for breach of contract and return of 2.5M shares of the Company’s common stock for non-performance by T8 under a services contract. The case, Case No. 01-18-0001-8823, is being heard in AAA’s Los Angeles Regional Office.

| Item 4. | Mine Safety Disclosures |

Not applicable.

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market Information

Our common stock is not registered or traded on any national stock market or NASDAQ but is listed for quotation on OTCQB Market’sOTC market’s OTCQB® Venture Market under the symbol “CANB.” Our common stock began trading in April 2011. Trading in our common stock has historically lacked consistent volume, and the market price has been volatile.

The following table presents, for the periods indicated, the high and low bid prices of the Company’s common stock and is based upon information provided by OTC Market. These quotations below reflect inter-dealer prices, without retail mark-up, mark-down, or commission, and may not necessarily represent actual transactions.

| 2018 | ||||||||

| High | Low | |||||||

| First Quarter | $ | 0.05 | $ | 0.02 | ||||

| Second Quarter | $ | 0.03 | $ | 0.01 | ||||

| Third Quarter | $ | 0.10 | $ | 0.01 | ||||

| Fourth Quarter | $ | 0.10 | $ | 0.03 | ||||

| 2019 – Prior to 300:1 reverse stock split | ||||||||

| High | Low | |||||||

| First Quarter | $ | .10 | $ | .03 | ||||

| Second Quarter | $ | .06 | $ | .03 | ||||

| Third Quarter | $ | .04 | $ | .01 | ||||

| Fourth Quarter | $ | .02 | $ | .01 | ||||

| 2017 | ||||||||

| High | Low | |||||||

| First Quarter | $ | 0.09 | $ | 0.07 | ||||

| Second Quarter | $ | 0.04 | $ | 0.03 | ||||

| Third Quarter | $ | 0.03 | $ | 0.03 | ||||

| Fourth Quarter | $ | 0.04 | $ | 0.03 | ||||

| 2018 – Prior to 300:1 reverse stock split | ||||||||

| High | Low | |||||||

| First Quarter | $ | 0.05 | $ | 0.02 | ||||

| Second Quarter | $ | 0.03 | $ | 0.01 | ||||

| Third Quarter | $ | 0.10 | $ | 0.01 | ||||

| Fourth Quarter | $ | 0.10 | $ | 0.03 | ||||

The last reported sale price of the Company’s common stock as of April 12, 2019March 13, 2020 was $0.039$1.04 per share.

Record Holders

As April 12, 2019,of March 13, 2020, there were 548,487,7142,861,740 shares of common stock issued and outstanding to approximately 163197 shareholders of record.

| 10 |

Dividends

The Company paid $0 and $13,779 in in-kind dividends on its ClassSeries B Preferred Stock by the issuance of common stock to the ClassSeries B holders in 2019 and 2018, and $0 in 2017.respectively. Each share of Series B Preferred Stock has the first preference to dividends, distributions and payments upon liquidation, dissolution and winding-up of the Company, and is entitled to an accrued cumulative but not compounding dividend at the rate of 5% per annum whether or not declared. After six months of the issuance date, such share and any accrued but unpaid dividends can be converted into common stock at the conversion price which is the lower of (i) $0.0101; or (ii) the lower of the dollar volume weighted average price of CANB common stock on the trading day prior to the conversion day or the dollar volume weighted average price of CANB common stock on the conversion day. The Series B Preferred Stock have no voting rights. There are no currently outstanding shares of Series B Preferred Stock.

We do not anticipate paying any cash dividends in the foreseeable future. Except for its ClassSeries B Preferred Stock, the payment of dividends is within the discretion of our Board of Directors and will depend on our earnings, capital requirements, financial condition, and other relevant factors. There are no restrictions that currently limit our ability to pay dividends on our common stock other than those generally imposed by applicable state law.

Securities Authorized for Issuance under Equity Compensation Plans

We do not now have, or plan to have in the near future, an equity incentive plan.

Recent Sales of Unregistered Securities

Note- The share amounts referenced below do not reflect the 300:1 reverse split in March 2020.

The following is a summary of transactions since our previous disclosure on our Form 10-Q filed with the Securities and Exchange Commission on November 14, 201819, 2019 involving sales of our securities that were not registered under the Securities Act of 1933, as amended (the “Securities Act”). Each offer and sale were exempt from registration under either Section 4(a)(2) of the Securities Act or Rule 506(b) under Regulation D of the Securities Act.

From October 2, 2018 to November 7, 2018,On December 16, 2019, the Company issued aggregately 13,094,73310,700,000 shares of CANB common stock to RedDiamond in exchangeas agreed for the early retirement of 101,736 shares of CANB Series B Preferred Stock.

From November 5, 2018 to December 28, 2018, the Company issued aggregately 2,125,000 shares of CANB common stock to multiple consultants for services rendered. The $80,665 fair value of the 2,125,000 shares of CANB common stock was partially charged to consulting feesStock converted in the three months ended December 30, 2018.

From December 3, 2018 to December 28, 2018, the Company issued aggregately 1,500,000 shares of CANB common stock to three board members for services rendered. The $62,342 fair value of the 1,500,000 shares of CANB common stock was charged to director fees in the three months ended December 30, 2018.

From December 3, 2018 to December 28, 2018, the Company issued aggregately 22,413,794 shares of CANB common stock to multiple investors pursuant to relative Stock Purchase Agreements dated on various dates, in exchange for total proceeds of $650,000.

On December 11, 2018, the Company issued 891,089 shares of CANB common stock to RedDiamond in satisfaction of dividend payable of $9.000.

On December 19, 2018, the Company issued 891,089 shares of CANB common stock to Auctus, LLC pursuant to a cashless exercise of stock options.

On December 21, 2018, Company received a conversion notice from a lender. As a result, 9,372,100 shares of CANB common stock was issued to the lender in satisfaction of notes payable of $83,500 and accrued interest payable of $10,221.

On December 21, 2018, Company issued aggregately 4,370,629 shares of CANB common stock to four officers and key executives of the Company in satisfaction of accrued compensation of $192,300.

On December 28, 2018, the Company issued 3,096,827 shares of CANB common stock for the acquisition of Pure Health Products, LLC.

On December 28, 2018, the Company issued 245,789 shares of CANB common stock to a key executive of the Company pursuant to the Employment Agreement dated December 29, 2018 with Andrew Holtmeyer. The $14,207 fair value of the issuance was charged to stock-based compensation in the three months ended December 31, 2018.

On December 29, the Company issued 30,000,000 shares of CANB common stock to Marco Alfonsi in exchange for the return of 3 shares of CANB Series A Preferred Stock owned by Marco Alfonsi.

On January 28, 2019, the Company issued 10,000,000 shares of CANB common stock to a consultant of the Company in exchange for the return of 1 share of CANB Series A Preferred Stock.

From February 21, 2019 to March 12, 2019, the Company issued aggregately 20,221,436 shares of CANB common stock to RedDiamond in exchange for the retirement of 157,105 shares of CANB Series B Preferred Stock.

From January 4, 2019 to March 27, 2019, the Company issued aggregately 41,431,994 shares of CANB common stock to multiple investors pursuant to relative Stock Purchase Agreements dated on various dates, in exchange for total proceeds of $1,196,100.

On January 14, 2019, the Company issued 7,500,000 shares of CANB common stock the owner of Hudilab, Inc., pursuant to a License and Acquisition Agreement dated January 14,August 2019.

From January 18,October 1, 2019 to March 17,through December 31, 2019, the Companycompany issued aggregately 24,600,000an aggregate of 36,677,274 shares of CANB common stockCommon Stock to multiple consultants for services rendered.

From January 19,October 1, 2019 to March 27,through December 31, 2019, the Company issued aggregately 1,167,959an aggregate of 4,250,000 shares of CANB common stockCommon Stock to key employees and officersmembers of the Company pursuant to employee agreementAdvisory Board, Medical Advisory Board, and in satisfaction of accrued compensationSports Advisory Board for the quarter ended March 31, 2019.services rendered.

On February 5,From October 1, 2019 through December 31, 2019, the Company issued 2,000,000an aggregate of 1,500,000 shares toof Common Stock under the ownerterms of TZ Wholesale LLC, pursuant to a Memorandum of Understanding (the “MOU”) dated November 9, 2018.executive employment agreements.

On February 20,From October 1, 2019 through December 31, 2019, the Company issued 1,000,000an aggregate of 37,500,000 shares of CANB common stock to ownersCommon Stock under the terms of Seven Chakras pursuant to an Asset Purchase Agreement dated January 31, 2019.inventory purchase agreement for total inventory of $487,500.

On March 3, 2020, the Company issued an aggregate of 11,650,000 shares of CANB Common Stock to multiple consultants for services rendered.

On March 3, 2020, the Company issued an aggregate of 6,000,000 shares of CANB Common Stock to members of the Advisory Board, Medical Advisory Board, and Sports Advisory Board for services rendered.

| 11 |

| Item 6. | Selected Financial Data |

Not required for smaller reporting companies.

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation |

General

Canbiola, Inc.Can B̅ Corp. was originally formed as a Florida corporation on October 11, 2005, under the name of WrapMail, Inc. Effective January 5, 2015, we acquired 100% ownership of Prosperity Systems, Inc., which the Company is in the process of dissolving. Effective December 28, 2018, we acquired 100% ownership of Pure Health Products. In November 2018, we formed Duramed as a wholly-owned subsidiary. The Company is presently in the process of dissolving Prosperity.

We manufacture and sell products containing CBD. We also provide document, project, marketing and sales management systems to our residual business clients through our website and proprietary software, which divisions are being wound-down. The consolidated financial statements include the accounts of CANB and its wholly ownedwholly-owned subsidiary Pure Health Products from the date of its acquisition on December 28, 2018.

Results of Operations

Year Ended December 31, 20182019 compared with Year Ended December 31, 2017:2018:

Revenues increased $545,857$1,636,900 from $122,746 in 2017 to $668,603 in 2018.2018 to $2,305,503 in 2019. The increase was due to the growth of CBD product and durable equipment sales.

Cost of product sales increased $361,068$193,050 from $44,466$405,534 in 20172018 to $405,434$598,584 in 20182019 due to the growth of product sales and outreach into additional market segments such as wholesale and private label opportunities.

Officers and director’s compensation and payroll taxes increased $1,324,581$784,579 from to $154,406 in 2017 to $1,478,987 in 2018.2018 to $2,263,566 in 2019. The 20172019 expense amount ($154,406) consists of salaries accrued to our Chief Executive Officer ($84,000) and stock based2,263,566) includes additional stock-based compensation of ($63,902)1,210,915) pursuant to their respective employment agreements and related payroll taxes ($6,504)39,962). The 2018 expense amount ($1,478,987) includes additional stock-based compensation of ($1,255,193) pursuant to their respective employment agreements and related payroll taxes ($2,559).

Consulting fees increased $1,384,902$412,741 from $284,741 in 2017 to $1,669,443 in 2018.2018 to $2,082,184 in 2019. The 20172018 expense amount ($284,741)1,669,443) includes stock-based compensation of ($167,688)1,524,107), resulting from stock issued for the service of consultants. The 20182019 expense amount ($1,669,443)2,041,934) includes stock-based compensation of ($1,527,107)1,858,837), resulting from stock issued for the service of consultants.

Advertising expense increased $55,994$249,125 from $28,322 in 2017 to $84,316 in 2018.2018 to $333,441 in 2019.

Hosting expense decreased $7,266$1,663 from $21,963 in 2017 to $14,697 in 2018.2018 to $13,034 in 2019.

Rent expense increased $2,105$179,803 from $65,060 in 2017 to $67,165 in 2018.2018 to $246,968 in 2019.

Professional fees increased $22,172$169,723 from $95,546 in 2017 to $117,718 in 2018.2018 to $287,441 in 2019.

Depreciation of property and equipment increased $2,246$7,154 from $3,227 in 2017 to $5,473 in 2018.2018 to $12,627 in 2019.

Amortization of intangible assets decreased $3,972increased $142,093 from $3,972 in 2017 to $0 in 2018.2018 to $142,093 in 2019.

Reimbursed expenses increased $242,585 from $0 in 2018 to $242,585 in 2019.

| 12 |

Other operating expenses increased $107,215$426,053 from $133,829 in 2017 to $241,044 in 2018.2018 to $667,097 in 2019. The increase was due largely to higher commission fees, supplies expense and shipping expensesoffice expense in 20182019 compared to 2017.2018.

Net loss increased $1,972,558$480,193 from $2,139,719 in 2017 to $4,112,277 in 2018.2018 to $4,592,470 in 2019. The increase was due to the $2,877,777$2,612,193 increase in total operating expenses offset by the $730,430$690,234 decrease in other expense -– net, the $2,084 increase in provision for income taxes and by the $184,989$1,443,850 increase in gross profit.

Liquidity and Capital Resources

At December 31, 2018,2019, the Company had cash and cash equivalents of $807,747$46,540 and a working capital of $939,582.$2,881,147. Cash and cash equivalents increased $806,095decreased $761,207 from $1,652 at December 31, 2017 to $807,747 at December 31, 2018.2018 to $46,540 at December 31, 2019. For the year ended December 31, 2018, $1,605,6442019, $3,312,495 was provided by financing activities, $753,569$2,413,420 was used in operating activities, and $45,980$1,660,282 was used in investing activities.

The Company currently has no agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit or any other sources.

We currently have no commitments with any person for any capital expenditures.

We have no off-balance sheet arrangements.

| Item 7A. | Quantitative and Qualitative Disclosure About Market Risk |

Not applicable.

| Item 8. | Financial Statements and Supplementary Data |

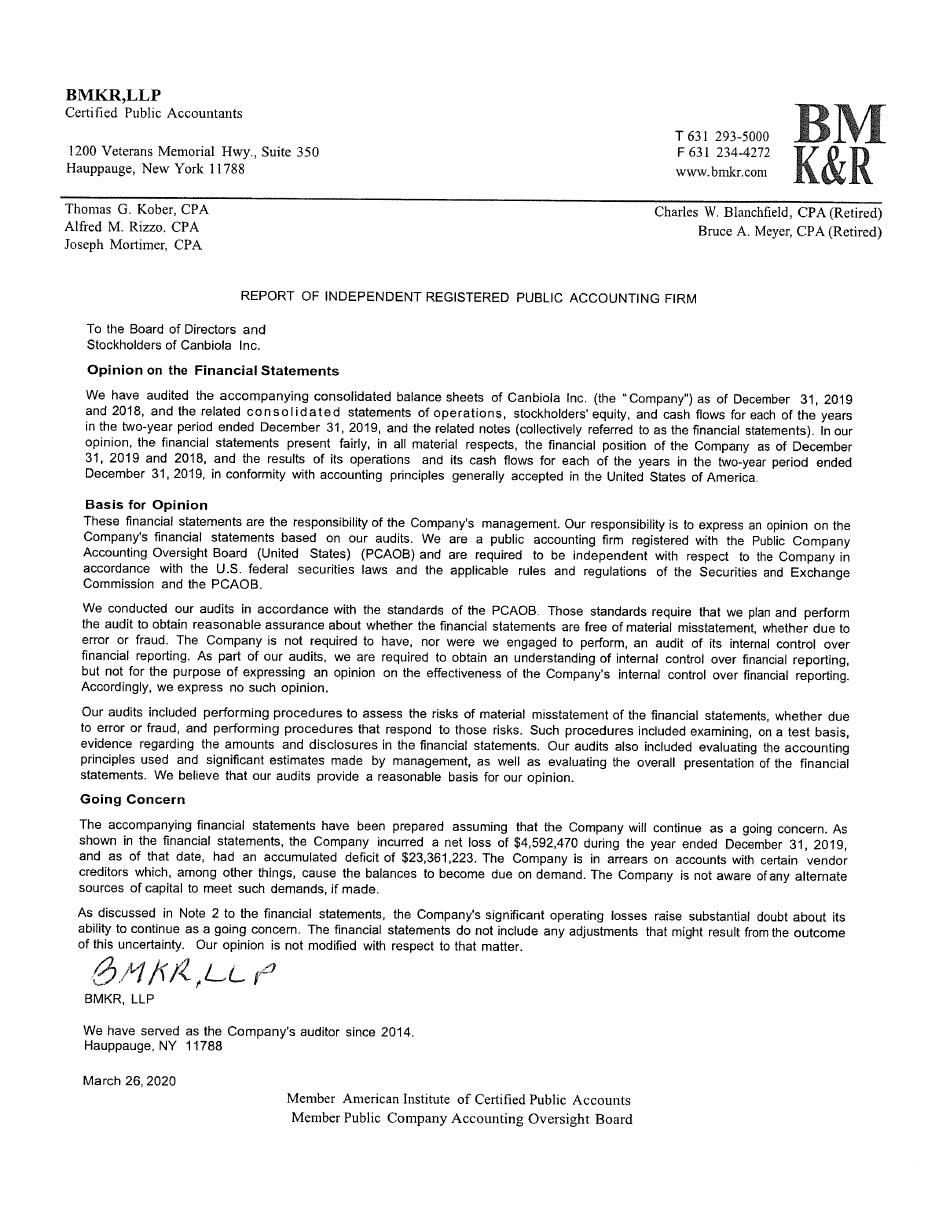

Our Consolidated Financial Statements and Notes thereto, for the fiscal years ended December 31, 20182019 and 20172018 and the report of BMKR, LLP, our independent registered public accounting firm, are set forth on pages F-1 through F-27F-30 of this Annual Report.

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

Not applicable.

| Item 9A. | Controls and Procedures |

Evaluation of Disclosure Controls and Procedures

Disclosure controls and procedures are designed to ensure that information required to be disclosed in the reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported, within the time period specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in the reports filed under the Exchange Act is accumulated and communicated to management, including the Chief Executive Officer (CEO), as appropriate, to allow timely decisions regarding required disclosure. Based on the evaluation, the CEO has concluded that our disclosure controls and procedures are ineffective to ensure that information disclosed by us in the reports we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission rules and forms. This determination was based on the small size of our accounting staff, the lack of segregation of duties and the lack of an audit committee.

To address the material weaknesses, we performed additional analysis and other post-closing procedures in an effort to ensure our financial statements included in this annual report have been prepared in accordance with generally accepted accounting principles. Accordingly, management believes that the financial statements included in this report fairly present in all material respects our financial condition, results of operations and cash flows for the periods presented.

| 13 |

Management Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Our internal control system was designed to provide reasonable assurance to our management and board of directors regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

Any internal control system, no matter how well designed, has inherent limitations and may not prevent or detect misstatements. Accordingly, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation.

Management, with the participation of our Chief Executive Officer, has evaluated the effectiveness of our internal control over financial reporting as of December 31, 20182019 based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, because of the Company’s limited resources and limited number of employees, and the absence of an audit committee, management concluded that, as of December 31, 2018,2019, our internal control over financial reporting is not effective in providing reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. generally accepted accounting principle, which creates a material weakness. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis. A material weakness means there is a risk that our financial reports or other filings may contain an error or inaccuracy or not submitted timely.

There was a material weakness in the Company’s internal control over financial reporting due to the fact that the Company did not have an adequate process established to ensure appropriate levels of review of accounting and financial reporting matters, which resulted in our closing process not identifying all required adjustments and disclosures in a timely fashion. We expect that the Company will need to hire accounting personnel with the requisite knowledge to improve the levels of review of accounting and financial reporting matters. The Company may experience delays in doing so and any such additional employees would require time and training to learn the Company’s business and operating processes and procedures. For the near-term future, until such personnel are in place, this will continue to constitute a material weakness in the Company’s internal control over financial reporting that could result in material misstatements in the Company’s financial statements not being prevented or detected.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal control over financial reporting (as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Securities and Exchange Act of 1934) during the year ended December 31, 20182019 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Other Information |

None.

| Item 10. | Directors, Executive Officers and Corporate Governance |

Our board of directors is elected annually by our shareholders. The board of directors elects our executive officers annually. Our directors and executive officers as of April __, 2019March 13, 2020 are as follows:

| Name | Age | Position | ||

| Marco Alfonsi | CEO, Director and Chairman since June 15, 2017 | |||

| Stanley L. Teeple | CFO, Secretary and Director since October 1, 2018 | |||

| Phil Scala | 68 | Interim COO since August 15, 2019 | ||

| Pasquale Ferro | 57 | President, Pure Health Products since December 31, 2018 | ||

| Andrew Holtmeyer | VP of Business Development since December 31, 2018 | |||

| David Posel | 41 | COO. Pure Health Products- since February 12, 2018 | ||

| Frederick Alger Boyer, Jr. | 50 | Independent Director appointed October 9, 2019 | ||

| Ronald A. Silver | 84 | Independent Director appointed October 9, 2019 | ||

| James F. Murphy | 72 | Independent Director appointed October 9, 2019 |

| 14 |

Marco Alfonsi, CEO and Chairman Director has been a financial service professional for the past 20 years. Mr. Alfonsi was appointed director and CEO of the Company in or around January 2015. Immediately prior to that, he spent eight years serving as the CEO of Prosperity Systems, Inc.

Throughout his career, Mr. Alfonsi was directly and indirectly involved in raising over $100 million dollars for small and medium sized business. Prior to his involvement in the financial services industry, Mr. Alfonsi has owned, operated, financed and sold several businesses. Mr. Alfonsi successfully started and managed two companies (ExecuteDirect.com, and Bakers Express of New York, Inc.), and held senior management positions with a number of financial institutions, including: Global American Investments, Clark Street Capital and Basic Investors.

Stanley L. Teeple –Mr. Teeple, CFO, Secretary, Director, was engaged from 2017-2018 with Solis Tek, Inc. (OTCQB:SLTK) a California based publicly traded corporation as Senior Vice President, Corporate Secretary , and Chief Compliance Officer. Solis Tek, Inc. a NV Corporation, is a developer of lighting and nutrient products, and most recently in cultivation and processing for the cannabis industry. Previously, from 2015-2016 Mr. Teeple was Chief Financial Officer and Secretary for Zonzia Media, Inc. (OTC:ZONX), a provider of streaming video and content to cable subscribers and hotel networks throughout the eastern US. From 2008 to 2014 Mr. Teeple was Chief Financial Officer and Secretary of Indigo-Energy, Inc. (OTC:IDGG) a publicly traded company in the oil and gas exploration business. Over the prior three plus decades Mr. Teeple through his turnaround consulting business, Stan Teeple, Inc., has held numerous senior management positions in several public and private companies across a broad spectrum of industries. Additionally, he has operated and worked for various court appointed trustees and principals as CEO, COO, and CFO in the entertainment, pharmaceuticals, food, travel, and tech industries. He operated his consulting business on a project-to-project basis and holds various other directorships. His businesses operational strengths include knowing how to manage and maximize the resources and preserve the integrity of a company from start-up through to maturity and corporate compliance in a regulatory environment.

Phil Scala, Interim Chief Operating Officer, 40 year career offers unique expertise in delivering the information needed to make informed decisions, whether in times of crisis or in the course of simply running our business; is highlighted by his 29 years of service with the FBI. Throughout his 29-year career with the FBI, he worked, supervised and lead investigations on nearly every type of federal crime, including securities fraud, white collar crime, money laundering, tax violations, narcotics, racketeering, homicide, violent crime, kidnappings, and public corruptions. Mr. Scala has been the recipient of numerous commendations and awards for outstanding service, notably the FBI Shield of Bravery, as a group commendation, as the SWAT team leader of the Al-Qaeda Bomb Factory Raid, on June 3, 1993.

Mr. Scala was assigned to the Criminal Division of the New York Office. He served in numerous assignments within the Organized crime branch and was sent to the Defense language Institute in Monterey, California to gain proficiency in the Italian/ Sicilian languages. From 2003-2008, Mr. Scala, developed and implemented the NY Office’s Leadership Development Program, which assisted relief supervisors develop excellence in leadership through mentoring, journalizing, “Best Practice” experiences, and accountability tools. The program was designed to be continuous, progressive, and measurable in assisting the FBI leaders maximize their leadership potential throughout their careers.

Mr. Scala received his Bachelor’s degree and Master of Business Administration in accounting from St. John’s University, he also earned a Master of Arts degree in Psychology from New York University.

| 15 |

Pasquale Ferro (“Pat” to his friends and co-workers), President of Pure health Products LLC, built Pure Health Products from the ground up inside a vacant warehouse including all mechanical, electrical, environmental, regulatory, and lab-quality specifications. Right out of school Pat began a career in real estate development both on the retail and commercial side of the business. Pat formed a company that would take new or distressed buildings (or anything in-between) and rehab and repair the facilities so they were commercially viable and move-in ready. During the course of this career Pat was often in charge of multiple work crews, union and non-union, for work in demolition, construction, plumbing, electrical, grounds crew and other professionally skilled tradesmen required to complete a building project.

Pat had his first foray into the manufacturing process in 2015 when he started Pure Health Products, LLC, which he developed into a regional research laboratory, new product development resource, and full-on production facility capable of producing capsules, tinctures, drops, salves, tablets and other products for the supplement and custom label community. Later in 2015, Pat connected with Marco Alfonsi, CEO of the Company, and became the production facility for all of the Company’s CBD based products. In late 2018, Pat sold Pure Health Products to the Company and became the President of that wholly-owned facility which he operates and manages today under a long term employment services agreement.

Andrew Holtmeyer –, Director of Business Development Mr. Holtmeyer started his business career in the financial services sector. During his 20 year career on wall street,Wall Street, Mr. Holtmeyer worked at and built several investment firms that employed hundreds of salesmen. During the last 5 years of his career, he concentrated mostly on investment banking. After leaving the financial sector, Mr. Holtmeyer started a highly successful consulting firm, which concentrated on raising capital for small to mid-sized companies that were both private and public. After selling his consulting business, Mr. Holtmeyer started a very successful real estatesestate business which is now run by his family.

Carl Dilley, 63, served on our BoardDavid Posel, COO of Directors until he resigned for personal reasons on February 21, 2019.

David Posel, 39,Pure Health Products, LLC, 40, served as the Company’s COO during 2018, when the Company’s operations were limited to its contractual arrangement with Pure Health Products. After acquiring PHP directly, Mr. Posel was transitioned to COO of PHP.

Frederick Alger Boyer, Jr. Independent Director, is President & CEO of Advance Care Medical, Inc. - Mr. Boyer has over 25 years of Wall Street experience having worked on both the investment side as well as the banking side of the business Most recently he served as Head of Equities for the New York based investment bank H.C. Wainwright & Co. where he had overseen efforts in capital markets, sales, and trading. Prior to that he worked and or supervised teams at Rodman & Renshaw, Oppenheimer, Piper Jaffray, and Credit Suisse in New York, San Francisco, and Minneapolis. In his various roles he has advised hundreds of companies in their financing efforts both publicly and privately. Mr. Boyer has numerous securities licenses and is a graduate of the University of California at Berkeley.

Ronald A. Silver, Independent Director, was first elected to the Florida House of Representatives In 1978 and continued his tenure in that body until 1992. While in the Florida House, Silver served in major positions including Majority Whip (1984-1986) and Majority Leader (1986-1988). He also chaired various committees including the Select Committee on Juvenile Justice, Criminal Justice, Ethics and Elections and the subcommittee of Appropriations on General Government. He was then elected to the Florida Senate in 1992 and subsequently re-elected, serving as the Majority (Democratic) leader for the 1994 session. During his last term in the Senate he was designated by both the House and Senate as the Dean of the Legislature recognizing his standing as the longest serving member. His career as a lawmaker has yielded a vast and extensive knowledge of public policy issues and the legislative process, allowing him to be an advocate and servant for his diverse community. Throughout his tenure in the House and Senate, Mr. Silver has been known to tackle tough issues, transcend partisanship and build strong coalitions and in addition served on the Judiciary committee, which heard all condominium issues. As Senator, he served on a variety of committees, and was chairman of both the Appropriations Subcommittee on Health and Human Services and Criminal Justice. His career in the Senate has earned praise from his colleagues, in both the legislature and other branches of government throughout the nation. In 1993 Mr. Silver was elected Chairman of the Southern Legislative Conference (17 Southern States) of the Council of State Governments. Most recently, a new prescription drug plan of Medicare-eligible senior citizens in the State of Florida has been named “Silver Saver” in his honor. Since his retirement from the Senate in 2002, Mr. Silver also functions as President of his own consulting firm (Ron Silver & Associates) and maintains his law practice in Miami Beach, Florida. Mr. Silver is married with two children and three grandchildren.

| 16 |

James F. Murphy, Independent Director, brings more than 40 years of investigative and consulting experience as the Founder and President of Sutton Associates. From 1980 to 1984, Mr. Murphy was an Assistant Special Agent in Charge with the Federal Bureau of Investigation, responsible for a territory encompassing more than seven million people. His investigative specialties included organized crime, white-collar crime, labor racketeering and political corruption. From 1976 to 1980, Mr. Murphy was assigned to the Office of Planning and Evaluation at FBI headquarters, Washington, D.C. In this capacity, he evaluated and recommended changes in the FBI’s administrative and investigative programs. Since entering the private sector in 1984, Mr. Murphy has advanced the industry by developing systematic and professional protocols for performing due diligence, as well as other investigative services.

Board Committees

We have not yet established an audit committee, compensation committee, or nominating committee. During 2018,2019, the functions ordinarily handled by these committees were handled by our entire Board.

Family Relationships

There are no familial relationships between any of our officers and directors.

Director or Officer Involvement in Certain Legal Proceedings

Our current directors and executive officers have not been involved in any legal proceedings as described in Item 401(f) of Regulation S-K in the past ten years.

Director Independence

The Company is not currently listed on any national securities exchange that has a requirement that the board of directors be independent. NoneHowever, in anticipation of a possible exchange up listing, and in an effort toward better Board oversight, the Company’s directors are independent.company has engaged three independent Directors making the independent outside Director a majority on the Board of Directors.

Code of Ethics

We have not adopted a Code of Ethics that applies to all of our employees and officers, and the members of our Board of Directors dueDirectors. This Code of Ethics is posted on the Company’s website and applies to the financial constraints of doing so.all executive officers including CEO, CFO and COO.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than 10% shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based on our review of the reports filed by Reporting Persons, we believe that, during the year ended December 31, 2018,2019, the following Reporting Persons did not meet all applicable Section 16(a) filing requirements: (i) Stanley Teeple, (ii) David Posel, and (iii) Carl Dilley.(iii Phil Scala. (iv.) Frederick Alger Boyer, (v.) Ronald Silver, (vi) James Murphy, (vi.) Pasquale Ferro, (vii.) Andrew Holtmeyer. Otherwise, we believe that the Reporting Persons met such filing requirements.

| 17 |

| Item 11. | Executive Compensation |

The table below summarizes all compensation awarded to, earned by, or paid to our executive officers and directors for all services rendered in all capacities to us during the previous two fiscal years, as of December 31, 2018.2019.

| Executive Summary Compensation Table | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Name and principal position | Year | Salary | Bonus | Stock awards | Option awards | Non-equity incentive plan compensation | Non-qualified deferred compensation earnings | All other compensation | Total | Year | Salary | Bonus | Stock awards | Option awards | Non-equity incentive plan comp. | Non-qualified deferred comp. earnings | All other comp. | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marco Alfonsi(1) | 2017 | $ | 84,000 | $ | 0 | $ | 63,902 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 147,902 | 2018 | $ | 104,500 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 104,500 | ||||||||||||||||||||||||||||||||||||

| CEO and Director | 2018 | $ | 104,500 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 104,500 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 | $ | 180,000 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 180,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stanley L. Teeple(2) | 2018 | $ | 45,000 | $ | 0 | $ | 144,500 | $ | 118,200 | $ | 0 | $ | 0 | $ | 0 | $ | 307,700 | 2018 | $ | 45,000 | $ | 0 | $ | 144,500 | $ | 118,200 | $ | 0 | $ | 0 | $ | 0 | $ | 307,700 | ||||||||||||||||||||||||||||||||||||

| 2019 | $ | 180,000 | $ | 0 | $ | 372,667 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 552,667 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Andrew Holtmeyer(3) | 2018 | $ | 118,400 | $ | 0 | $ | 1,169,658 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 1,288,058 | 2018 | $ | 118,400 | $ | 0 | $ | 1,169,658 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 1,288,058 | ||||||||||||||||||||||||||||||||||||

| 2019 | $ | 180,000 | $ | 0 | $ | 105,485 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 285,485 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| David Posel (4) | 2018 | $ | 60,000 | $ | 0 | $ | 58,720 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 118,720 | 2018 | $ | 60,000 | $ | 0 | $ | 58,720 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 118,720 | ||||||||||||||||||||||||||||||||||||

| 2019 | $ | 60,000 | $ | 0 | $ | 64,355 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 124,355 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pasquale Ferro (5) | 2019 | $ | 180,000 | $ | 0 | $ | 527,425 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 707,425 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Johnny Mack PhD (6) | 2019 | $ | 31,154 | $ | 0 | $ | 89,513 | $ | 192,000 | $ | 0 | $ | 0 | $ | 0 | $ | 312,667 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Phil Scala (7) | 2019 | $ | 7,500 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 7,500 | |||||||||||||||||||||||||||||||||||||||||||||||||||||