Form 10-K/A

(Amendment No. 1)

| |

| |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

| ||

| ||||

| Delaware | 2834 | 45-4440364 | ||

f(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) | ||

300 George Street, Suite 301

New Haven, CT 06511

(312) 767-0291

Title of Each Class | Name of Exchange on which Registered |

Common Stock, $0.001 Par Value | Nasdaq Global Market |

Large accelerated filer | ☐ | Accelerated filer | ☒ |

Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company |

☒ |

Emerging growth company | ☐ | ||

The aggregate market value of the voting stock held by non-affiliates of the registrant, as of June 30, 2017,2018, was approximately $241.5 $180.3million. Such aggregate market value was computed by reference to the closing price of the common stock as reported on the Nasdaq Global Market on June 30, 2017.2018. For purposes of making this calculation only, the registrant has defined affiliates as including only directors and executive officers and shareholders holding greater than 10% of the voting stock of the registrant as of June 30, 2017.

2018.

Tableoutstanding

| |||

| Item 1. | |||

| Item 1A. | |||

| Item 1B. | |||

| Item 2. | |||

| Item 3. | |||

| Item 4. | |||

| Item 5. | |||

| Item 6. | |||

| Item 7. | |||

| Item 7A. | |||

| Item 8. | |||

| Item 9. | |||

| Item 9A. | |||

| Item 9B. | |||

| |||

| |||

| |||

| |||

| |||

| |||

| |||

| |||

| |||

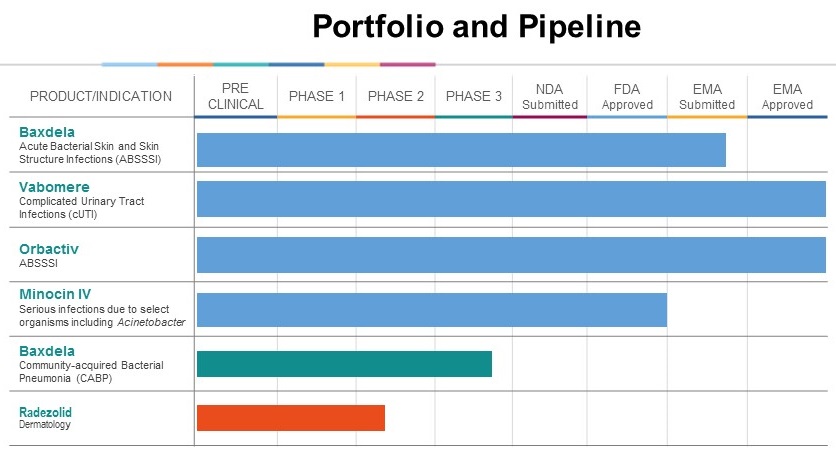

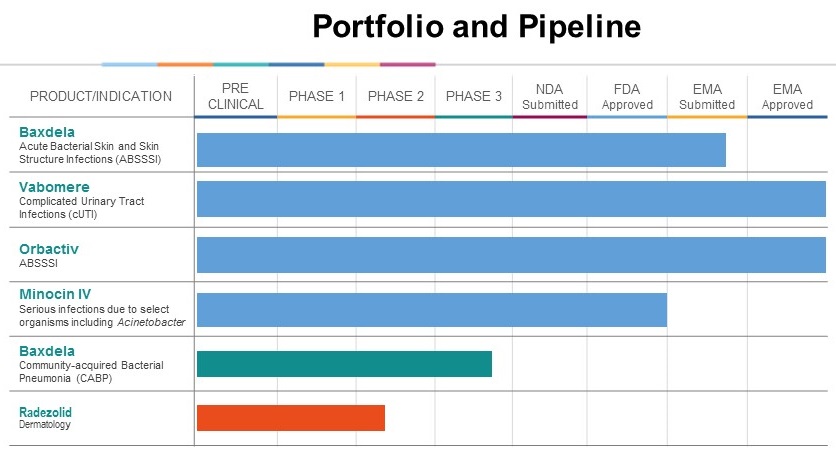

(delafloxacin), in June 2017. On March 16, 2018,November 3, 2017, we completed a reverse merger with Cempra, Inc., the result of which the registrant Cempra, Inc. was re-named Melinta Therapeutics, Inc. and we became a publicly-traded company. On January 5, 2018, we acquired the Infectious Disease Businesses (“IDB”) from The Medicines Company (“Medicines”), including the capital stock of certain subsidiaries of Medicines and certain assets related to its infectious disease business (the “Company”“IDB Transaction”), including the pharmaceutical products containing (i) meropenem and vaborbactam as the active pharmaceutical ingredient and distributed under the brand name Vabomere® (“Vabomere”), (ii) oritavancin as the active pharmaceutical ingredient and distributed under the brand name Orbactiv® (“Orbactiv”), and (iii) minocycline as the active pharmaceutical ingredient and distributed under the brand name Minocin® for injection and line extensions of such products (the “MDCO Products” and together with Baxdela, the "Products" or “Melinta”the “Product Portfolio”). See “Corporate History and information” below for further information.

| 1. | Commercial Product Sales Growth |

| a. | Commercialize Baxdela in the United States. We launched Baxdela oral and IV in the first quarter of 2018 for the treatment of ABSSSI and continue our commercialization of the product with an efficient, targeted sales force consisting of approximately 60 sales territories, prioritizing high-value retail and hospital accounts. In addition, sales representatives target other market channels, such as the emergency department and select community settings, in an attempt to realize the full market potential of Baxdela. We are also pursuing an additional indication, CABP, for which we expect to file an sNDA in the first half of 2019. |

| b. | Commercialize Vabomere for cUTI in the United States. We market Vabomere in the United States with our combined sales force consisting of approximately 70 sales representatives, prioritizing high-value hospital accounts, focusing on infectious disease and critical care physicians and pharmacists. |

| c. | Optimize commercialization of Orbactiv and Minocin for injection within the United States. Sales representatives target emergency department and community market channels to realize the full market potential of Orbactiv in the treatment of ABSSSI. In addition, we are leveraging our sales force presence within the hospital to appropriately position Minocin for injection for the treatment of serious infections due to Acinetobacter. |

| 2. | Stewardship of financial resources. We are focused on using the existing sources of cash for the Company, including cash on hand, revenue from product sales and licensing arrangements, and capital available under existing and permitted financing facilities, to achieve future profitability. In order to succeed with this strategy, we must successfully execute sales strategies and reduce operating spend from historical levels. We have an experienced management team and sales force to lead the Company's product sales effort. In addition, we have taken steps to reduce operating expenses, including (a) narrowing the scope of future research and development activities, which involved the natural reduction in costs for large clinical studies that are nearing completion and winding down our early-stage research programs, (b) rationalizing costs in the selling, general and administrative areas, many due to the integration of the legacy Cempra, IDB and Melinta businesses post-merger and acquisition, and (c) negotiation with various third-parties to reduce and/or extend payment for certain large commitments. |

| 3. | Optimize partnerships to maximize the value of the Product Portfolio. We have a number of partnerships, including established partnerships for our Product Portfolio in Europe and Asia-Pacific (excluding Japan) with Menarini, and for Baxdela in Central and South America with Eurofarma Laboratórios S.A. We have a development partnership with a contract research organization (“CRO”) for our pipeline asset, radezolid, which is focused on the topical dermatology space. We plan to evaluate the potential of existing and new business development opportunities to further generate non-dilutive capital and enhance shareholder value. |

| 4. | Leverage the enterprise’s commercial organization to promote complementary internally or externally developed products upon achievement of FDA regulatory approval. With an experienced team and commercial infrastructure in place, we believe we are well positioned to add either internally or externally developed products to our portfolio while adding minimal new costs. We may selectively pursue the addition of externally developed products to our existing marketed products and pipeline, leveraging our commercial infrastructure. |

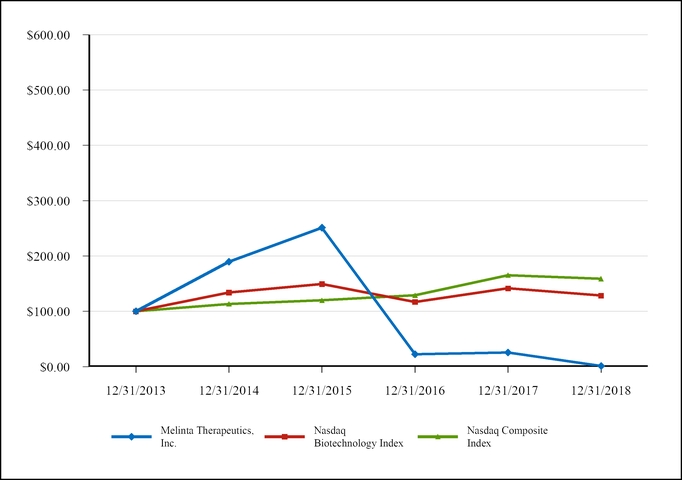

| $100 investment in stock or index | Ticker | 12/31/2013 | 12/31/2014 | 12/31/2015 | 12/31/2016 | 12/31/2017 | 12/31/2018 | |||||||||||||||||||

| Melinta Therapeutics, Inc. | MLNT | $ | 100.00 | $ | 189.75 | $ | 251.25 | $ | 22.60 | $ | 25.50 | $ | 1.28 | |||||||||||||

| Nasdaq Biotechnology Index | NBI | $ | 100.00 | $ | 134.10 | $ | 149.41 | $ | 117.01 | $ | 141.61 | $ | 128.45 | |||||||||||||

| Nasdaq Composite Index | IXIC | $ | 100.00 | $ | 113.40 | $ | 119.89 | $ | 128.89 | $ | 165.29 | $ | 158.87 | |||||||||||||

| Consolidated Statement of Operations Data | |||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||

| (in thousands, except share and per share data) | |||||||||||||||||||

| Revenue: | |||||||||||||||||||

| Total revenue | $ | 96,430 | $ | 33,864 | $ | — | $ | — | $ | — | |||||||||

| Operating expenses: | |||||||||||||||||||

| Cost of goods sold | 41,057 | — | — | — | — | ||||||||||||||

| Research and development | 55,409 | 49,475 | 49,791 | 62,788 | 53,647 | ||||||||||||||

| Goodwill impairment | 25,088 | — | — | — | — | ||||||||||||||

| Selling, general and administrative | 133,312 | 63,325 | 19,410 | 14,159 | 13,562 | ||||||||||||||

| Total operating expenses | 254,866 | 112,800 | 69,201 | 76,947 | 67,209 | ||||||||||||||

| Loss from operations | (158,436 | ) | (78,936 | ) | (69,201 | ) | (76,947 | ) | (67,209 | ) | |||||||||

| Other income (expense), net | 1,244 | 20,020 | (4,731 | ) | (1,729 | ) | (575 | ) | |||||||||||

| Net loss | (157,192 | ) | (58,916 | ) | (73,932 | ) | (78,676 | ) | (67,784 | ) | |||||||||

| Accretion of redeemable convertible preferred stock dividends | — | (19,259 | ) | (21,117 | ) | (16,248 | ) | (9,859 | ) | ||||||||||

| Net loss attributable to common shareholders | (157,192 | ) | (78,175 | ) | (95,049 | ) | (94,924 | ) | (77,643 | ) | |||||||||

| Basic and diluted loss per share | $ | (17.12 | ) | $ | (109.28 | ) | $ | (20,600.13 | ) | $ | (130,929.66 | ) | $ | (246,485.71 | ) | ||||

| Weighted average shares used in computation of basic and diluted loss per share | 9,181,668 | 715,369 | 4,614 | 725 | 315 | ||||||||||||||

| Consolidated Balance Sheet Data | |||||||||||||||||||

| As of December 31, | |||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||

| (in thousands) | |||||||||||||||||||

| Balance sheet data: | |||||||||||||||||||

| Cash and equivalents | $ | 81,808 | $ | 128,387 | $ | 11,409 | $ | 30,158 | $ | 10,541 | |||||||||

| Working capital | $ | 15,876 | $ | 118,034 | $ | (8,330 | ) | $ | 13,385 | $ | (10,800 | ) | |||||||

| Total assets | $ | 441,590 | $ | 160,273 | $ | 16,634 | $ | 36,228 | $ | 13,702 | |||||||||

| Total debt, net | $ | 110,476 | $ | 39,555 | $ | 68,849 | $ | 28,226 | $ | 17,552 | |||||||||

| Total shareholders' equity (deficit) | $ | 190,064 | $ | 72,336 | $ | (293,451 | ) | $ | (222,099 | ) | $ | (145,573 | ) | ||||||

| 2018 | 2017 | 2016 | ||||||

| Risk-free interest rate | 2.6% - 3.1% | 1.8% - 2.1% | 1.5 | % | ||||

| Weighted-average volatility | 84.8% - 88.9% | 87.5% - 108.1% | 67.1 | % | ||||

| Expected term - employee awards (in years) | 1.0 - 6.1 | 3.1 - 6.1 | 6.0 | |||||

| Forfeiture rate | — | — | — | |||||

| Dividend yield | 0 | % | 0 | % | 0 | % | ||

| Year Ended December 31, | Increase (Decrease) | |||||||||||||

| 2018 | 2017 | Dollars | Percent | |||||||||||

| Product sales, net | $ | 46,580 | $ | — | 46,580 | NA | ||||||||

| Contract research | 11,677 | 13,959 | (2,282 | ) | (16.3 | )% | ||||||||

| License revenue | 38,173 | 19,905 | 18,268 | 91.8 | % | |||||||||

| Total revenue | $ | 96,430 | $ | 33,864 | 62,566 | 184.8 | % | |||||||

| Cost of goods sold | $ | 41,057 | $ | — | $ | 41,057 | NA | |||||||

| Research and development | $ | 55,409 | $ | 49,475 | $ | 5,934 | 12.0 | % | ||||||

| Goodwill impairment | $ | 25,088 | $ | — | $ | 25,088 | NA | |||||||

| Selling, general and administrative | $ | 133,312 | $ | 63,325 | $ | 69,987 | 110.5 | % | ||||||

| Total other income (expense), net | $ | 1,244 | $ | 20,020 | $ | (18,776 | ) | (93.8 | )% | |||||

| ◦ | Principal accretion and debt cost amortization related to the Deerfield Facility of $6.3 million; |

| ◦ | Accretion of deferred purchase price and contingent royalty liabilities from the IDB acquisition of $15.4 million; and |

| ◦ | Accretion of a milestone liability from the IDB acquisition of $4.0 million. |

| Year Ended December 31, | Increase (Decrease) | |||||||||||||

| 2017 | 2016 | Dollars | Percent | |||||||||||

| Revenue | $ | 33,864 | $ | — | $ | 33,864 | NA | |||||||

| Research and development | $ | 49,475 | $ | 49,791 | $ | (316 | ) | (0.6 | )% | |||||

| Selling, general and administrative | $ | 63,325 | $ | 19,410 | $ | 43,915 | 226.2 | % | ||||||

| Total other expense, net | $ | 20,020 | $ | (4,731 | ) | $ | 24,751 | (523.2 | )% | |||||

| Year Ended December 31, | |||||||||||

| 2018 | 2017 | 2016 | |||||||||

| Cash, cash equivalents and restricted cash as of the end of the period | $ | 82,008 | $ | 128,587 | $ | 11,409 | |||||

| Net cash provided by (used in): | |||||||||||

| Operating activities | (171,545 | ) | (75,598 | ) | (70,580 | ) | |||||

| Investing activities | (170,072 | ) | 155,061 | (463 | ) | ||||||

| Financing activities | 295,038 | 37,715 | 52,294 | ||||||||

| Net increase in cash and equivalents | $ | (46,579 | ) | $ | 117,178 | $ | (18,749 | ) | |||

Contractual Obligations(1) | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 & Thereafter | Total | ||||||||||||||||||||

Note payable(2) | $ | 17,508 | $ | 17,653 | $ | 17,605 | $ | 81,391 | $ | 78,756 | $ | 93,892 | $ | 306,805 | |||||||||||||

Purchase commitments(3) | 19,145 | — | — | — | — | — | 19,145 | ||||||||||||||||||||

Operating lease obligations(4) | 2,348 | 2,269 | 1,827 | 1,238 | 624 | 262 | 8,568 | ||||||||||||||||||||

Total contractual cash obligations | $ | 39,001 | $ | 19,922 | $ | 19,432 | $ | 82,629 | $ | 79,380 | $ | 94,154 | $ | 334,518 | |||||||||||||

| (1) | Table excludes milestones and other contingent payments that may become due under Melinta’s license and collaboration agreements because they are payable upon the occurrence of certain future events that are not currently probable. It also excludes any amounts that may become payable when we draw additional amounts under the Vatera Loan Agreement. |

| (2) | Represents amounts payable under the Deerfield Facility, as amended, and the Vatera Loan Agreement, to the extent we have drawn funds under either agreement (see Note 4 to the Consolidated Financial Statements). |

| (3) | Represents amounts that will be owed for firm commitments to purchase goods or services, principally inventory. |

| (4) | Includes the minimum lease rental payments for our corporate office building in Lincolnshire, Illinois, our research and administrative facility in New Haven, Connecticut, our facilities in Chapel Hill, North Carolina, office equipment leases and vehicle leases. |

In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, new certifications by our principal executive officer and principal financial officer are filed as exhibits to this Amendment under Item 15 of Part IV hereof.

Except as stated herein, this Amendment does not reflect events occurring after the filingassets of the Original Form 10-KCompany; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with U.S. GAAP, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

|

|

| ||||||

| Name | Age | Position | ||||||

| Kevin T. Ferro |

| Chairman of the Board of Directors | ||||||

|

|

| ||||||

|

|

| ||||||

|

|

| ||||||

John H. Johnson |

| Chief Executive Officer and Director | ||||||

Bruce L. Downey | 71 | Director | ||||||

| Jay Galeota | 53 | Director | ||||||

| David Gill | 64 | Director | ||||||

| Thomas P. Koestler, Ph.D. |

| Director | ||||||

Garheng Kong, M.D., Ph.D. |

| Director | ||||||

|

|

| ||||||

David Zaccardelli, Pharm.D. |

| Director | ||||||

to 2009, he served on several public and private company boards of directors, including those of LeMaitre Vascular (NASDAQ: LMAT), and IsoTis, Inc. Earlier in his career, Mr. Gill served in a variety of senior executive leadership roles for several medical device and information technology companies, including NxStage Medical, CTIMolecular Imaging, Inc., InterlnadInterland Inc., Novoste Corporation and Dornier Medical. Mr. Gill holds a B.S. degree, cum laude, in Accounting from Wake Forest University and an M.B.A. degree, with honors, from Emory University, and was formerly a certified public accountant.

Cecilia Gonzalo

John H. Johnson—Mr. Johnson has served on the Company’s board of directors since June 2009. He served as president and chief executive officer of Dendreon Corp., a publicly traded biotechnology company (NASDAQ: DNDN), from February 2012, became chairman in July 2013, and served as chairman until June 2014 and president and chief executive officer until August 2014. He served as the chief executive officer and as a director of Savient Pharmaceuticals, Inc., a company that developed and commercialized specialty pharmaceuticals, from 2011 to January 2012. Mr. Johnson was senior vice president of Eli Lilly and Company (NYSE: LLY) and president of Lilly Oncology, Eli Lilly’s oncology business unit, from 2009 to 2011. From 2007 to 2009, Mr. Johnson was chief executive officer of ImClone Systems Incorporated, a biopharmaceutical development company, and was also a member of ImClone’s board of directors until it became a wholly owned subsidiary of Eli Lilly in 2008. From 2005 to 2007, Mr. Johnson served as company group chairman of Johnson & Johnson’s Worldwide Biopharmaceuticals unit. Mr. Johnson served as chairman of the board of Tranzyme, Inc. (NASDAQ: TZYM), a publicly traded biopharmaceutical company, from December 2010 until July 2013. Mr. Johnson serves as the chairman of the board of Strongbridge Biopharma PLC (NASDAQ: SBBP), a global biopharmaceutical company, and also serves as lead independent director of Portola Pharmaceuticals, Inc. (NASDAQ: PTLA), a biopharmaceutical company, and Histogenics Corporation (NASDAQ: HSGX), a regenerative medicine company. Mr. Johnson also serves on the board of directors of Aveo Pharmaceuticals, Inc. (NASDAQ: AVEO), a biopharmaceutical company. Mr. Johnson holds a B.S. in Education from East Stroudsburg University of Pennsylvania.

Thomas P. Koestler, Ph.D.—Dr. Koestler has served as a member of the Company’s board of directors since November 2017. Dr. KoestlerHe has served as an executive director of Vatera Holdings LLC, the manager ofa consultant to Vatera Healthcare Partners LLC since February 2010.January 2019. Dr. Koestler is also a member of the boards of directors of Momenta Pharmaceuticals Inc., ImmusanT, Inc. and was a member of the board of directors of Arisaph Pharmaceuticals, Inc. From March 2011 to April 2016, Dr. Koestler served as a member of the board of directors of Novo Nordisk A/S. Dr. Koestler served as an executive director of Vatera Holdings LLC, the former manager of Vatera Healthcare Partners LLC, from February 2010 through January 1, 2019. From 2006 to 2009, Dr. Koestler served as executive vice president of Schering Corporation and president of Schering-Plough Research Institute, the pharmaceutical research and development arm of Schering-Plough Corporation, and served as executive vice president, global development, of Schering-Plough Research Institute from 2005 to 2006, and executive vice president of Schering-Plough Research Institute from 2003 to 2005. Before joining Schering-Plough, Dr. Koestler served as senior vice president and head of global regulatory affairs for Pharmacia Corporation from 2001 to 2003. Before that, Dr. Koestler was senior vice president and global head, drug regulatory affairs, compliance assurance, clinical safety and epidemiology for Novartis. Dr. Koestler received his B.S. from Daemen College and his Ph.D. in Medicine and Pathology from SUNY Buffalo, Roswell Park Memorial Institute.

Garheng Kong, M.D., Ph.D.—Dr. Kong has served on the Company’s board of directors since September 2006. Dr. Kong has been the managing partner of Sofinnova HealthQuest, a healthcare investment firm, since July 2013. He was a general partner at Sofinnova Ventures, a venture firm focused on life sciences, from September 2010 to December 2013. From 2000 to September 2010, he was at Intersouth Partners, a venture capital firm, most recently as a general partner, where he was a founding investor or board member for various life sciences ventures, several of which were acquired by large pharmaceutical companies. Dr. Kong has also served on the board of directors of Histogenics Corporation (NASDAQ: HSGX)Avedro, Inc (Nasdaq: AVDR), a regenerative medicinecorneal health company, since July 2012,2018, Alimera Sciences, Inc. (NASDAQ:(Nasdaq: ALIM), a biopharmaceutical company, since October 2012, has served on the board of Laboratory Corporation of America Holdings (NYSE: LH), a healthcare company, since December 2013, and has served on the board of StrongBridge BioPharma plc (NASDAQ:(Nasdaq: SBBP) since September 2015. Dr. Kong holds a B.S. from Stanford University. Heholds an M.D., Ph.D. and M.B.A. from Duke University.

Daniel Wechsler

David Zaccardelli, Pharm.D.— Dr. Zaccardelli has served on the Company’s board of directors since August 2016 and was acting chief executive officer of Cempra from December 2016 until November 2017. From 2004 until 2016, Dr. Zaccardelli served in several senior management roles at United Therapeutics Corporation (NASDAQ:(Nasdaq: UTHR), including chief operating officer, chief manufacturing officer and executive vice president, pharmaceutical development and operations. Prior to joining United Therapeutics, Dr. Zaccardelli founded and led a startup company focused on contract pharmaceutical development services, from 1997 through 2003. From 1988 to 1996, Dr. Zaccardelli worked at Burroughs Wellcome & Co. and

| ||||

| Name | Age (as of 4/30/18) | Business Experience For Last Five Years | ||

|

|

| ||

Sue Cammarata, M.D. |

| Dr. Cammarata, current Executive Vice President and Chief Medical Officer of Melinta, has more than 20 years of clinical experience in the development, approval and launch of pharmaceuticals, including several anti-infective brands such as Cubicin (daptomycin) in the E.U., and Zyvox (linezolid) globally. Since joining Melinta in 2014, she has led the successful Phase 3 clinical development of Baxdela, which was approved by the FDA in June, and is also responsible for medical affairs. Prior to joining Melinta, Dr. Cammarata served as vice president of clinical research at Shire HGT, where she was responsible for clinical development and post approval commitments for novel therapies in rare and orphan diseases. Earlier, she held several senior positions at Novartis, most recently as vice president and global program head for the company’s immunology and infectious disease franchises. In this role, she managed the integration of Chiron’s infectious disease portfolio after its acquisition by Novartis in 2006. In addition, she managed the E.U. approval process for Cubicin’s endocarditis and bacteremia indications. Before joining Novartis, Dr. Cammarata held several positions at Pharmacia Upjohn (later Pfizer, Inc.) where she was an integral member of the team that led the Phase 3 and subsequent global regulatory programs for Zyvox, a first-in-class antibiotic for gram-positive infections, including those resistant to vancomycin. Dr. Cammarata received her M.D. from Michigan State University, completed her residency in internal medicine and her fellowship in pulmonary and critical care medicine at Henry Ford Health Systems and was a pulmonary and critical care medicine specialist for several years in private practice before entering the pharmaceutical industry. Dr. Cammarata earned her B.S. in pharmacy from Purdue University. | ||

| ||||

| Name | Age (as of 4/30/18) | Business Experience For Last Five Years | ||

|

|

Mr. Milligan joined Melinta in 2018 as Chief Financial | ||

Erin Duffy, Ph.D. |

| Dr. Duffy, current Executive Vice President and Chief Scientific Officer of Melinta, has more than 21 years of pharmaceutical research experience and has been responsible for translating Melinta’s Nobel Prize-winning ribosome technology platform into the discovery and early-stage development of novel antibiotic candidates. She joined the company in 2002 and has become one of the world’s leading experts on the structure and function of the bacterial ribosome and the interaction of antibiotics with their ribosomal targets. Dr. Duffy has led Melinta’s ESKAPE Pathogen Program from its infancy and has been instrumental in advancing the platform while also contributing to the development programs for other drug candidates. The ESKAPE Pathogen Program is Melinta’s most advanced preclinical initiative, focused on using a discrete, novel binding site within the bacterial ribosome to design and develop completely new classes of antibiotics to treat some of the deadliest multi-drug resistant gram-positive and gram-negative infections. Prior to joining Melinta, Dr. Duffy served as associate director of innovative discovery technologies at Achillion Pharmaceuticals, Inc. Dr. Duffy began her scientific career as a computational chemist with Pfizer Global Research and Development. Dr. Duffy trained at Yale University, where she received her Ph.D. in physical-organic chemistry and was a Howard Hughes postdoctoral fellow. She holds a B.S. in chemistry from Wheeling Jesuit University. | ||