UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)10-K

|

| |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20172018

|

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-38038

Valeritas Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 46-5648907 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

| | |

750 Route 202 South, Suite 600 Bridgewater, NJ | | 08807 |

| (Address of principal executive offices) | | (Zip code) |

(908) 927-9920

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Common Stock, Par Value $0.001 Per ShareTitle of each class | | Nasdaq Capital MarketName of each exchange on which registered |

(Title of Class)Common Stock, $0.001 par value | | (Name of Exchange on Which Registered)The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

| Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☐ (Do not check if a smaller reporting company)☒ | | Smaller reporting company | | ☒ |

| | | | | Emerging growth company | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the voting common equity held by non-affiliates as of June 30, 2017,29, 2018, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $10,999,881.$25,983,391. The registrant has no non-voting common equity.

The number of outstanding shares of common stock of the registrant as of April 25, 2018March 4, 2019 was 7,092,869.99,948,437.

Documents Incorporated By Reference

Portions of registrant’s proxy statement relating to registrant’s 2019 Annual Meeting of Stockholders (the “Proxy Statement”) to be filed with the Securities and Exchange Commission pursuant to Regulation 14A, not later than 120 days after the close of the registrant’s fiscal year, are incorporated by reference in Part III of this Annual Report on Form 10-K. Except with respect to information specifically incorporated by reference in this Annual Report on Form 10-K, the Proxy Statement is not deemed to be filed as part of this Annual Report on Form 10-K.

Explanatory Note

We are filing this Amendment No. 1 on Form 10-K/A (the “Amendment”) of Valeritas Holdings, Inc. to amend our Annual Report on Form 10-K for the fiscal year ended December 31, 2017, filed on February 28, 2018 (the “Original Form 10-K”, and together with the Amendment, the “Form 10-K”), to include the information required by Part III of the Form 10-K as we no longer anticipate filing our proxy statement for the 2018 Annual Meeting of Stockholders within 120 days of December 31, 2017. With the exception of the inclusion of the information required by Part III, no information contained in the Original Form 10-K has been changed. Accordingly, this Amendment should be read in conjunction with the Original Form 10-K.

VALERITAS HOLDINGS, INC.

ANNUAL REPORT ON FORM 10-K/A10-K

TABLE OF CONTENTS

|

| | |

| | |

| PART I | | |

| Item 1 | | |

| Item 1A. | | |

| Item 1B | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | | |

| PART III | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | | |

| PART IV | | |

| Item 15. | | |

| | Signatures | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements, including, without limitation, in the sections captioned “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Plan of Operations”, and “Business”. Any and all statements contained in this report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the development of commercially viable new products, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the Securities and Exchange Commission, or the SEC, and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation:

our history of operating losses and uncertainty regarding our ability to achieve profitability;

our reliance on V-Go to generate all of our revenue;

our inability to retain a high percentage of our patient customer base or our significant wholesale customers;

the failure of V-Go to achieve and maintain market acceptance;

competitive products and other technological breakthroughs that may render V-Go obsolete or less desirable;

our inability to maintain or expand our sales and marketing infrastructure;

our inability to operate in a highly competitive industry and to compete successfully against competitors with greater resources;

any inaccuracies in our assumptions about the insulin-dependent diabetes market;

manufacturing risks, including risks related to manufacturing in Southern China, damage to facilities or equipment and failure to efficiently increase production to meet demand;

our dependence on limited source suppliers and our inability to obtain components for our product;

our failure to secure or retain adequate coverage or reimbursement for V-Go by third-party payors;

our inability to enhance and broaden our product offering, including through the successful commercialization of the pre-fill V-Go;

our inability to protect our intellectual property and proprietary technology;

our failure to comply with the applicable governmental regulations to which our product and operations are subject; and

other risks and uncertainties, including those listed under the section entitled “Risk Factors.”

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. The forward-looking statements contained in this report reflect our views and assumptions only as of the date that this report is signed. We disclaim any obligation to update the forward-looking statements contained in this report to reflect any new information or future events or circumstances or otherwise, except as required by law.

We qualify all of our forward-looking statements by these cautionary statements. In addition, with respect to all of our forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Readers should read this report in conjunction with the discussion under the caption “Risk Factors”, our financial statements and the related notes thereto in this report.

PART IIII

Item 1. Business

About this Annual Report

On May 3, 2016, pursuant to an Agreement and Plan of Merger and Reorganization, or the Merger Agreement, by and among Valeritas Holdings, Inc., a Delaware Corporation, Valeritas Acquisition Corp., a Delaware corporation and a direct wholly-owned subsidiary of Valeritas Holdings, Inc., or the Acquisition Subsidiary, and Valeritas, Inc., a Delaware Corporation, Acquisition Subsidiary was merged with and into Valeritas, with Valeritas surviving as a direct wholly-owned subsidiary of Valeritas Holdings, Inc.

As used in this Annual Report on Form 10-K, unless otherwise stated or the context otherwise indicates, references to “Valeritas,” the “Company,” “we,” “our,” “us” or similar terms refer to Valeritas Holdings, Inc. and its subsidiary Valeritas, Inc.

Overview

We are a commercial-stage medical technology company, focused on improving health and simplifying life for people with diabetes by developing and commercializing innovative technologies. Valeritas’ flagship product, V-Go® Wearable Insulin Delivery device, is a simple, affordable, all-in-one basal-bolus insulin delivery option for patients with type 2 diabetes that is worn like a patch and can eliminate the need for taking multiple daily shots. V-Go administers a continuous preset basal rate of insulin over 24 hours and it provides discreet on-demand bolus dosing at mealtimes. It is the only basal-bolus insulin delivery device on the market today specifically designed keeping in mind the needs of type 2 diabetes patients.

V-Go enables patients to closely mimic the body’s normal physiologic pattern of insulin delivery throughout the day and to manage their diabetes with insulin without the need to plan a daily routine around multiple daily injections.

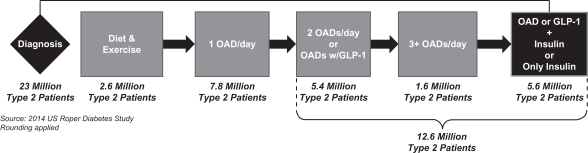

We currently focus on the treatment of patients with type 2 diabetes- a pervasive and costly disease that, according to the 2017 National Diabetes Statistics Report released by the U.S. Centers for Disease Control and Prevention, or CDC, currently affects 90% to 95% of the approximately 23 million U.S. adults diagnosed with diabetes. The American Diabetes Association estimates the total costs of diagnosed diabetes in the United States, which includes direct medical and drug costs and indirect lost productivity costs, have risen to $327 billion in 2017 from $245 billion in 2012. We believe the majority of the 12.6 million U.S. adults treating their type 2 diabetes with more than one daily oral anti-diabetic drug, or OAD, or an injectable diabetes medicine can benefit from the innovative approach of V-Go to manage type 2 diabetes.

Our primary market consists of approximately 5.6 million of these patients who currently take insulin, of which up to 4.5 million may not be achieving their target blood glucose goal. This patient population represents a $19.3 billion annual U.S. market when applying the annual wholesale acquisition cost, or WAC, of V-Go to the 4.5 million patients not achieving glycemic control. WAC is the gross price paid by wholesalers and does not take into account fees, discounts, and rebates from us.

Insulin therapies using syringes, pens and programmable insulin pumps are often burdensome to the daily routine of a patient with type 2 diabetes, which can lead to poor adherence to prescribed insulin regimens and, as a result, ineffective diabetes management. We developed V-Go utilizing our core technology, the h-Patch platform, as a patient-focused solution to address the challenges of traditional insulin therapies. Our h-Patch platform facilitates the simple and effective subcutaneous delivery of injectable medicines to patients across a broad range of therapeutic areas. V-Go enables patients to closely mimic the body’s normal physiologic pattern of insulin delivery by releasing a single type of insulin at a continuous preset background, or basal, rate over a 24-hour period and on demand mealtime dosing (bolus dosing). We believe V-Go is an attractive management tool for patients with type 2 diabetes requiring insulin because it only requires a single fill of insulin prior to use and provides comprehensive basal-bolus therapy without the burden and inconvenience associated with multiple daily injections. V-Go is available in three different dosages depending on the patient’s needs and is generally cost competitive for both patients and third-party payors when compared to insulin pens or programmable insulin pumps.

V-Go was one of the first insulin delivery devices cleared by the U.S. Food and Drug Administration, or FDA, under its Infusion Pump Improvement Initiative, which established additional device manufacturing requirements designed to foster the development of safer, more effective infusion pumps, and is the only FDA-cleared mechanical basal-bolus insulin delivery device on the market in the United States. All other FDA-cleared basal-bolus insulin delivery products currently available in the United States are electronic and are classified as Durable Medical Equipment and, although cleared for both type 1 and type 2 diabetes, were designed primarily for patients with type 1 diabetes. As V-Go is a mechanical device, it does not include any electronics, batteries or audible alarms and does not require any recharging or programming, which allows for simple and discreet use. Unlike electronic insulin delivery devices, V-Go is not classified as durable medical equipment by the Centers for Medicare and Medicaid Services, or

Item 10. Directors, Executive Officers

CMS, allowing for potential Medicare reimbursement under Medicare Part D. The Medicare Part D outpatient drug benefit defines V-Go and Corporate Governance.certain other supplies used for injecting insulin as “drugs,” which allows V-Go to be available for coverage by Part D Plans under Medicare Part D. In addition to Medicare, a majority of commercially insured patients are currently covered for V-Go under their insurance plans.

DirectorsWe commenced commercial sales of V-Go in the United States during 2012. During the first half of 2012, we initiated an Early Access Program to provide a limited number of physicians with free V-Go devices for patients and Executive Officersbegan shipments to major wholesalers in anticipation of commercial launch. In the second half of 2012, we began hiring sales representatives in selected U.S. markets. In February 2016, we optimized our sales force to implement a high-service, high-touch sales model. At the end of 2018 and 2017, our field-based sales team consisted of 52 and 50 sales representatives, respectively and covered 52 and 50 territories, respectively, primarily within the East, South, Midwest and Southwest regions of the United States.

BelowOur net loss was $45.9 million and $49.3 million for the years ended December 31, 2018 and 2017, respectively. Our accumulated deficit as of December 31, 2018 and 2017 was $519.9 million and $473.9 million, respectively. Based on prescription data, we estimate that there were approximately 99,000 and 88,000 prescriptions reported for V-Go filled during both the years ended December 31, 2018 and 2017. Refill prescriptions account for slightly more than two-thirds of our total prescriptions, and generally move in parallel with our patient retention rates, so can be used as a proxy to determine patient retention. We estimate that as of December 31, 2018, V-Go had been used for over 17 million cumulative patient days.

Market Opportunity

Diabetes is a chronic, life-threatening disease and was reported in 2017 to impact an estimated 425 million people worldwide and is characterized by the body’s inability to properly metabolize glucose. Management of glucose is regulated by insulin, a hormone that allows cells in the body to absorb glucose from blood and convert it into energy. In people without diabetes, the body releases small amounts of insulin regularly over 24 hours and additional amounts of insulin when eating meals. Diabetes is classified into two main types. Type 1 diabetes is caused by an autoimmune response in which the body attacks and destroys the insulin-producing cells of the pancreas. As a result, the pancreas can no longer produce insulin, requiring patients to administer daily insulin injections to survive. Type 2 diabetes, the more prevalent form of the disease, occurs when either the body does not produce enough insulin to regulate the amount of glucose in the blood or cells become resistant to insulin and are unable to use it effectively. Type 1 diabetes is frequently diagnosed during childhood or adolescence, and the onset of type 2 diabetes generally occurs in adulthood, but its incidence is growing among the younger population, primarily due to the increasing incidence of childhood obesity. In addition, other factors commonly thought to be contributing to the prevalence and growth of type 2 diabetes include aging populations, sedentary lifestyles, worsening diets and increased adult obesity.

In 2017, the CDC estimated that 30.3 million people or 9.4% of the population in the United States have diabetes, but 8.1 million may be undiagnosed and unaware of their condition. About 1.4 million new cases of diabetes are diagnosed in United States every year. More than one in every 10 adults who are 20 years or older has diabetes. For seniors (65 years and older), that figure rises to more than one in four.

The CDC estimated in 2018 that 86 million Americans have "pre-diabetes" where their blood sugar (glucose) levels are higher than it should be and are likely on the path to diabetes. The American Diabetes Association released new research on March 22, 2018 estimating the total costs of diagnosed diabetes have risen to $327 billion in 2017 from $245 billion in 2012, when the cost was last examined. This cost includes $237 billion in direct medical costs and $90 billion in reduced productivity. Current diabetes forecasts report the prevalence of diabetes will increase by 54% to more than 54.9 million Americans between 2015 and 2030; and total annual medical and societal costs related to diabetes will increase 53% to more than $622 billion by 2030.

Type 2 diabetes is a progressive disease. Data from the United Kingdom Prospective Diabetes Study suggest that individuals with type 2 diabetes lose on average approximately 50% of the function of their beta cells, the cells that produce insulin, prior to diagnosis. If not closely monitored and properly treated, diabetes can lead to serious medical complications. According to the CDC, diabetes is the leading cause of kidney failure, non-traumatic lower limb amputations and new cases of blindness in the United States. The prevalence of other chronic disorders commonly occurring in patients with type 2 diabetes, including high blood pressure and high cholesterol, can significantly impact a patient’s lifestyle given the various daily treatment regimens often used to treat these conditions. Diabetes has a significant impact on overall patient mortality; according to the CDC, the risk for death among people with diabetes is approximately one and a half that of similarly aged people without diabetes.

A hemoglobin A1C test, which measures a patient’s trailing three-month average blood glucose level, or A1C level, is a key indicator of how well a patient is controlling his or her diabetes. Specifically, the A1C test measures the percentage of a patient’s hemoglobin, a protein in red blood cells that carries oxygen that is coated with sugar. A higher A1C level correlates with poorer blood sugar control and an increased risk of diabetes complications. The American Diabetes Association, or ADA, recommends an A1C goal of no more than 7% for most patients.

Once type 2 diabetes has been diagnosed, physicians and patients often first seek to manage the disease through meal planning and physical activity before progressing to medications designed to manage A1C levels. Patients often begin medical treatment with a once-daily OAD. If OAD monotherapy does not achieve or maintain the A1C target, combination therapy is recommended, which can include additional oral agents, a glucagon-like peptide 1 receptor agonist, or once-daily basal insulin. If basal insulin has been appropriately titrated and glucose levels remain elevated, advancement to an insulin regimen including mealtime insulin, or bolus dosing, is a recommended option. Generally, the introduction of insulin occurs within 10 years of diagnosis.

The following diagram depicts an illustrative treatment progression of a typical patient with type 2 diabetes, as well as the number of patients currently in each category according to the 2014 U.S. Roper Diabetes Patient Market Study.

Illustrative type 2 Diabetes Treatment Progression

As of December 31, 2017, there were approximately 12.6 million patients with type 2 diabetes in the United States using more than one OAD or some other injectable, such as insulin. Approximately 5.6 million patients were prescribed insulin. Our near-term target market consists of the up to 4.5 million patients in this group who may not be achieving the recommended target blood glucose goal (A1C <7%). Of these patients, nearly 3.0 million have an A1C greater than or equal to 8%. In addition, of the remaining approximately 7.0 million U.S. adults with type 2 diabetes who do not inject insulin, we believe those who are treating their diabetes with more than one OAD per day and/or an injectable GLP-1 diabetes medicine other than insulin can also benefit from the innovative approach of V-Go to manage type 2 diabetes.

We believe we compete primarily with insulin injections by either insulin pens or insulin syringes. We do not consider insulin pumps as competition because these are electronic devices that are replaced every two to four years based on medical necessity, which we consider common industry practice; have annual medical deductibles and require monthly medical co-insurance due to their classification as durable medical equipment; and, although cleared for type 1 and type 2 diabetes, are designed primarily for patients with type 1 diabetes.

Therapeutic Challenges and Limitations of Current Insulin Delivery Mechanisms

The goal of insulin therapy should be to closely mimic natural or non-diabetic insulin secretion as described below.

Insulin is secreted continuously (in the background) over 24 hours from the pancreas into the blood stream to keep blood glucose controlled overnight, during periods of fasting and between meals. Approximately 50% of the daily insulin requirement by the body is released in this continuous fashion; however, this nearly constant rate of insulin release is inadequate to treat post-mealtime glucose excursions (the change in blood glucose concentration from before to after a meal); thus

At mealtime a burst (bolus) of insulin is released by the body in response to food intake or a meal to control post-mealtime hyperglycemia- the exaggerated rise in blood glucose following a meal. This surge of insulin provides the remaining, approximate 50%, of the daily insulin requirement.

There are two components needed to mimic this insulin secretion, a background, or basal insulin replacement and a bolus insulin replacement. Multiple studies indicate that, when taken as prescribed, a basal-bolus insulin regimen is a very effective means for lowering blood glucose levels of patients with type 2 diabetes because it most closely mimics the body’s normal physiologic pattern of insulin delivery throughout the day. Unfortunately, despite the known advantages of basal-bolus therapy, patient adherence and compliance with basal-bolus insulin therapy using syringes and/or pens has proven difficult. Non-adherence has been associated with the inconvenience to daily living, pain and anxiety associated with the requirement to inject multiple times per day, and the complexity of the regimen as these therapies require the use of various forms of insulin and can require complicated dosing instructions.

The Diabetes Control and Complications Trial, a study of patients with type 1 diabetes conducted by the National Institute of Diabetes and Digestive and Kidney Diseases, or NIDDK, the results of which were published in TheNew England Journal of Medicine in 1993, indicated that conventional insulin therapy, defined as one or two insulin injections per day without routine changing of the insulin dose in response to blood glucose levels, is less effective in achieving recommended blood glucose levels over time than intensive insulin therapy in which a patient administers three or more insulin injections per day with varying doses depending upon blood glucose levels. Additionally, the Treating to Target in Type 2 Diabetes study of 708 men and women with suboptimal A1C levels published in The New England Journal of Medicine in 2009, found that by three years or study end, 81.6% of patients initiated on a basal insulin-based regimen required the addition of mealtime insulin three times daily. Sixty-three percent of patients in this basal insulin-based subgroup achieved the A1C goal of less than 7% by study end. We believe the outcomes of these studies confirm that an important factor of any insulin therapy is its ability to mimic the body’s normal physiologic pattern of insulin delivery.

Challenges Associated with Type 2 Diabetes Management

Regardless of the type of insulin therapy, many patients with type 2 diabetes on insulin fail to reach their A1C goal. Adding mealtime insulin to a basal-only regimen can help, but patient adherence to the prescribed treatment regimen is often a challenge. In a database analysis of 27,897 adult patients prescribed insulin in the United States, the results of which were published in the journal ClinicoEconomics and Outcomes Research in 2013, only 20.4% of patients had reached the ADA’s recommended A1C goal of less than 7%. Similarly poor results were observed across each patient group in the study regardless of whether they were prescribed basal-only insulin, basal-bolus insulin or a combination of both long-acting and fast-acting insulin.

Patient non-adherence to prescribed insulin therapy is often an important contributing factor in a patient’s failure to achieve target A1C goals. In a 2012 survey of 1,250 physicians who treat patients with diabetes and 1,530 insulin-treated patients (180 with type 1 diabetes and 1,350 with type 2 diabetes) published in Diabetic Medicine, patients reported insulin omission/non-adherence an average of 3.3 days per month. Additionally, 72.5% of physicians in the study reported that a typical patient did not take his or her insulin as prescribed, with an average of 4.3 days per month of non-compliance with a basal insulin regimen and 5.7 days per month of noncompliance with mealtime administration of insulin. Common reasons cited by patients for failing to comply with a prescribed treatment regimen include the burden of multiple daily injections, the potential embarrassment about injecting medication around family and friends or in public, and interference with the patient’s daily activities and resulting loss of freedom. Similarly, in the 2011 US Roper Diabetes Patient Market Study, or the 2011 Roper Study, of 2,104 patients with diabetes, of which 692 were on insulin, 72% of respondents who had been prescribed to take three or more insulin injections per day did not inject themselves when they were away from home. Failure to comply with prescribed insulin therapy, particularly mealtime insulin therapy, reduces the overall efficacy of insulin treatment in managing type 2 diabetes.

Limitations of Current Insulin Therapy

OADs are the namesfirst line of diabetic therapy for patients with type 2 diabetes, along with diet and certain information regarding our executive officerslifestyle changes. However, given that type 2 diabetes is progressive in nature and directorsthat the effectiveness of oral agents and other therapies may decline over time, patients are typically prescribed insulin therapy within 10 years of diagnosis. Depending on the progression of diabetes, there are four primary types of insulin therapy prescribed today for patients with type 2 diabetes that seek to control or manage their blood glucose levels:

a once-daily dose of basal insulin, typically a long-acting insulin such as Levemir® or Lantus®;

a twice-daily injection regimen comprised of either a daily injection of long-acting basal insulin in addition to a dose of insulin, typically a short- or fast-acting insulin, such as Humalog®, Apidra® or NovoLog®, with the datelargest meal or two injections of this report:premixed insulin, which combines long-acting and fast-acting formulations within a single insulin dose;

intensive therapy requiring multiple daily injections, or MDI, with syringes or preloaded insulin pens; and

continuous subcutaneous insulin infusion using programmable insulin pumps.

We believe conventional insulin therapy is among the least expensive insulin-based diabetes treatments and is typically initiated with a once-daily dose of a long-acting insulin. MDI intensive therapy with syringes can be effective and less costly than other therapies. MDI intensive therapy with insulin pens offers a more convenient alternative to syringes but can be more expensive. In addition, programmable insulin pumps offer an effective means of implementing intensive diabetes management with the goal of achieving near-normal blood glucose levels. However, we believe that patient concerns with lifestyle factors, ease of use, convenience and high costs have limited overall adherence to insulin regimens, resulting in a significant number of patients with type 2 diabetes failing to meet their A1C goals with MDI or the use of programmable insulin pumps.

We believe, based on customer feedback and experience, that the current insulin therapies described below present the following advantages and limitations for patients with type 2 diabetes.

|

| | |

| | |

| Basal Insulin |

|

Description: Once-daily dose of long-acting insulin (such as Lantus® and Levemir®) at bedtime or in the morning, although some patients require two injections (morning and bedtime). |

| |

| Advantages | | Limitations/Challenges |

| |

• Easiest to train, learn and correctly administer insulin as injections and can be performed at home • Least costly analog insulin therapy, which uses genetically altered (or chemically altered) human insulin designed to release injected insulin to more closely mimic human insulin, for patients with most favorable reimbursement coverage • Lowest risk for patient dosing error | | • Insulin absorption can have variability from day to day or between different patients such that insulin is not released over the entire intended delivery period • Basal insulin addresses fasting and pre-mealtime glucose levels only, no direct impact on mealtime glucose excursions • Most patients eventually need mealtime insulin to achieve their A1C goal |

|

Basal Insulin + 1 or Premixed Insulin |

|

Description: Considered a transition regimen towards MDI or intensive therapy typically consisting of a twice-daily injection regimen of either: (i) a daily injection of long-acting insulin (such as Lantus® and Levemir ®) at bedtime (basal) plus an injection of fast acting insulin (such as Humalog® and NovoLog®), before the day’s largest meal, or basal + 1; or (ii) premixed insulin injections before breakfast and dinner. |

| |

| Advantages | | Limitations/Challenges |

| |

• Basal +1 and Premix • Compared to basal only insulin regimens, provides insulin for at least one, or in the case of premix, two of the patient’s meals | | • Basal +1 and Premix • No insulin coverage for at least one meal each day, or in the case of Basal+1, two meals each day |

|

| | |

Name• Premixed Insulin • Injections can normally be performed at home • Single type of insulin used in a single device | | Age• Basal Insulin +1 • Additional patient co-pay for additional dose of mealtime insulin • Potential for dosing error increased with two types of insulin • Premix • Patients typically use more insulin, may be at increased risk of hypoglycemia and may gain more weight • Requires planning activities and eating around the timing of injections and absorption of insulin |

|

| Multiple Daily Injections—MDI (Intensive Therapy) |

|

Description: A once- or twice-daily injection of long-acting insulin at bedtime or in the morning (basal rate) plus an injection of fast-acting insulin before meals and, if appropriate, with snacks (bolus dose). |

| |

| Advantages | | Position Limitations/Challenges |

John E. Timberlake | |

• With strict adherence, can closely mimic the body’s normal physiologic pattern of insulin release • Allows insulin dosing based on the requirements of individual meals • Lower cost with favorable reimbursement coverage compared to programmable insulin pumps • Easier to teach, learn and correctly administer compared to programmable insulin pumps | | 53• Frequent injections (usually at least four per day) • Requires training around two different types of insulin and the need to carry two types of insulin or insulin pens • Potential for dosing error increased with two types of insulin • Requires careful planning of meals and other activities • Injections often administered outside the home creating adherence challenges especially around meals • Requires two patient co-pays |

|

|

| |

| | Chief Executive Officer, President and Director |

Erick J. LuceraProgrammable Insulin Pumps |

|

Description: A wearable electronic programmable insulin pump filled with a fast-acting insulin that delivers a continuous dose of insulin (basal rate) and the ability to deliver insulin with meals or snacks (bolus dose), based upon programmable settings and patient input. Most pumps require an infusion set to deliver the insulin in addition to the pump. |

| |

| Advantages | | 50 Limitations/Challenges |

|

|

• When used properly, can most closely mimic the body’s normal physiologic pattern of insulin release • Customized basal and bolus insulin doses • Eliminates the need for daily needle injections | | Chief Financial Officer |

Mark Conley | | 56 |

| | Vice President, Corporate Controller• Most complicated to teach, learn and Treasurer |

Geoffrey Jenkins | | 66 |

| | Executive Vice President, Manufacturing, Operationscorrectly administer and Research & Development |

Matthew Nguyen | | 48 | normally requires a proactive and adherent patient

| | Chief Commercial Officer |

Joseph Saldanha | | 53 |

| | Chief Business Officer |

Joe Mandato, D.M. | | 73 | • Bothersome to wear and least discreet alternative

| | Director |

Luke Düster | | 43 | • Most significant risk of dosing errors due to the wide range of programmable functions and features

| | Director |

Katherine D. Crothall, Ph.D. | | 68 |

| | Director |

Rodney Altman, M.D. | | 55 | • Highest up-front and maintenance cost

| | Director |

Peter Devlin | | 50 |

| | Director, Chair |

Brian K. Roberts | | 46 |

| | Director• Reimbursement coverage for patients with type 2 diabetes significantly less accessible than for injections |

Executive officers

Given the reasons cited by patients for non-adherence to and the limitations of currently prescribed insulin therapy, we believe simplicity of insulin delivery contributes to adherence with therapy. In turn, when patients more fully comply with their prescribed treatment regimen, we believe that insulin therapy will be more effective. While insulin syringes, insulin pens and programmable insulin pumps are appointedcapable of facilitating basal-bolus therapy, we believe these methods of administration generally lack the simplicity of operation and lifestyle adaptability desired by patients with type 2 diabetes. We believe that, in general, programmable insulin pump therapies tend to have more advantages for type 1 patients who may require varying basal rates over a 24-hour period or more complex bolus dosing regimens. These complexities are generally not encountered by patients with type 2 diabetes.

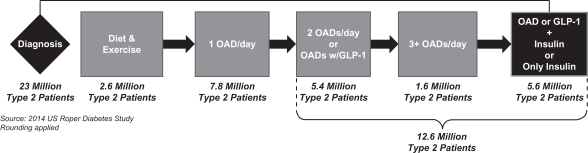

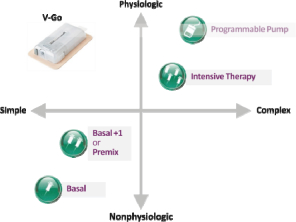

The following diagram demonstrates the benefits of V-Go as compared to other currently available insulin therapies in terms of simplicity of use and ability to mimic the body’s normal physiologic pattern of insulin delivery. We estimate that more than 95% of patients with type 2 diabetes are prescribed a regimen that relies on an insulin pen device or insulin syringe to deliver insulin including basal, basal + 1, premix and intensive therapy or multiple daily injection regimens.

We believe V-Go is appealing to healthcare providers and patients because it combines the benefits of physiologic basal-bolus therapy with the convenience of a once-daily injection using just one type of insulin and lower insulin utilization compared to conventional injection (i.e. syringes or pens). Our internal studies indicate that these characteristics help support patient compliance with basal-bolus regimens, thereby improving glycemic control (lowers A1C). We also believe V-Go is an attractive option because it is discreet and simple to operate, yet mimics the body’s normal physiologic pattern of insulin delivery without the inconvenience associated with syringes and pens or the complexities associated with programmable pumps.

Our Solution

Simple, Discreet and Effective Type 2 Diabetes Management

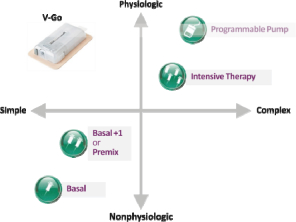

V-Go fills a critical need of patients with type 2 diabetes who, we believe, desire and benefit from an easy-to-use, more discreet, basal-bolus insulin regimen. As depicted in the following image, V-Go is designed to be worn on the skin under clothing and measures just 2.4 inches wide by 1.3 inches long by 0.5 inches thick (excluding the adhesive component), weighing approximately less than two ounces when filled with insulin.

Specifically Designed for Patients with Type 2 Diabetes

Patients with type 2 diabetes who are prescribed intensive insulin therapy report the burden of multiple injections, embarrassment of injection and interference with daily activities as key factors for non-compliance with insulin therapy. Unlike programmable insulin pumps, V-Go is a 24 hour, disposable mechanical device that operates without electronics, batteries, infusion sets or programming and with fewer injections than using insulin syringes or pens. In the 2011 Roper Study, 72% of patients with type 2 diabetes prescribed basal-bolus injectable insulin regimens reported not taking injections away from home, making it difficult for many of them to remain in compliance with their prescribed therapy. V-Go was designed to facilitate basal-bolus therapy compliance by removing the complexity and stigma of insulin injections in patients with type 2 diabetes. In patients we surveyed prior to starting V-Go and again 30 days after being on V-Go, 53% of patients found V-Go very convenient compared to only 10% reporting their prior therapy was very convenient. In this same survey, 64% of patients felt their quality of life, based on how they felt physically or mentally, was generally good to excellent compared to only 35% prior to V-Go.

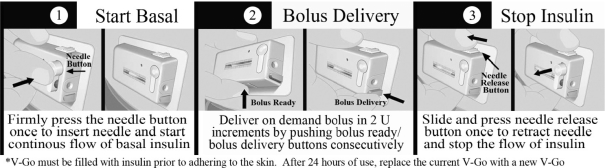

The following diagram demonstrates the basal and bolus functions of V-Go. The bolus operation can be completed through the patient’s clothing.

Simple, Effective and Innovative Approach to Insulin-Based Diabetes Management

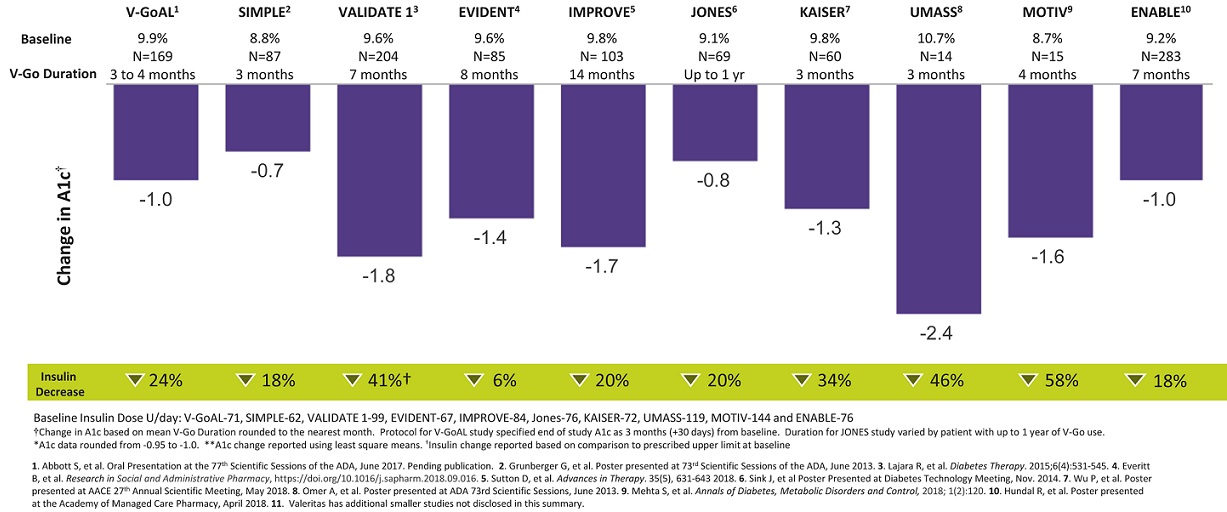

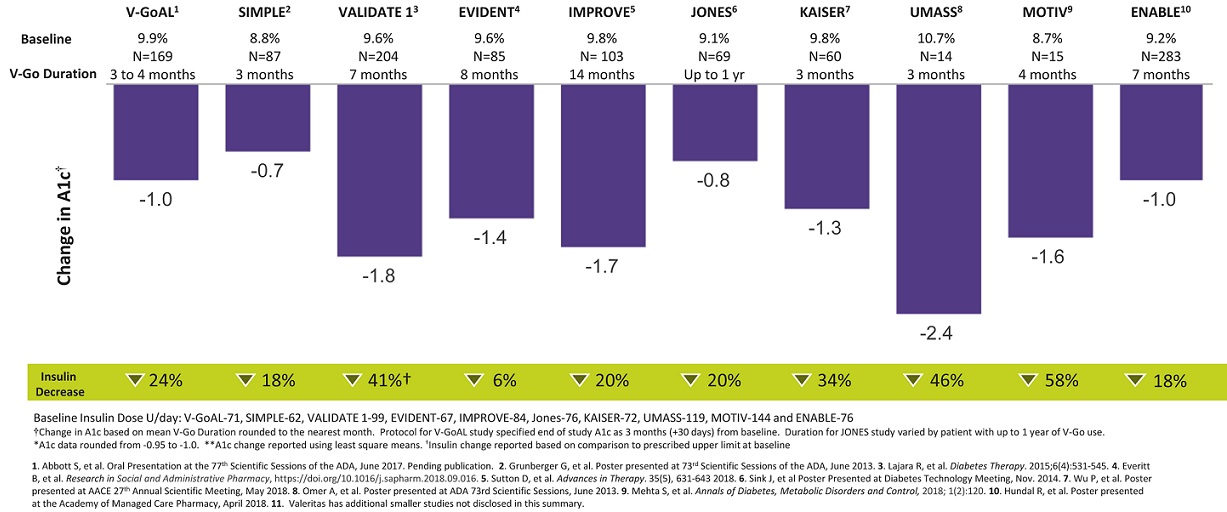

V-Go utilizes our proprietary h-Patch drug delivery technology to enable patients to closely mimic the body’s normal physiologic pattern of insulin delivery by delivering a single type of insulin at a predictable and continuous preset basal rate over a 24-hour period and providing convenient and discreet on-demand bolus dosing at mealtimes. We believe V-Go is a simple and effective approach to insulin therapy and facilitates patient adherence to basal-bolus insulin regimens, which leads to better patient results. In a series of clinical studies examining patients with diabetes using V-Go, clinically relevant reductions in A1C levels were observed after switching to or initiating V-Go therapy, as well as reductions in the prescribed total daily insulin dose. These findings are summarized in the following figure and are described in more detail under “—Extensive Clinical Evidence Demonstrating Results.” As with all research, study design limitations should be considered when interpreting the results and whether or not the results can be applied to a general population. Refer to the full findings in the referenced public disclosure for additional information.

V‑GoAL=randomized controlled trial. SIMPLE=multicenter prospective observational study. VALIDATE 1= multicenter retrospective study. EVIDENT= retrospective study. IMPROVE= multicenter retrospective study. JONES= The Jones Center for Diabetes & Endocrine Wellness, retrospective study. KAISER= multicenter internal evaluation of V‑Go. UMASS=University of Massachusetts, retrospective study. MOTIV=retrospective pilot study. ENABLE=multicenter retrospective study.

User-Friendly Design

In addition to its small size and dosage versatility, V-Go offers many additional user-friendly features designed to treat and improve the quality of life of patients with type 2 diabetes requiring insulin, including:

using a single fast-acting insulin, such as Humalog® or NovoLog®, rather than a combination of multiple types or premixed insulin;

not requiring patients to carry syringes, pens or other supplies for mealtime bolus dosing;

offering the convenience of pressing buttons for on-demand bolus dosing through clothing;

allowing patients to easily maintain their daily routines and activities, including showering, exercising and sleeping;

only requiring application of a new V-Go every 24 hours, which offers patients the flexibility to selectively choose an application site that best suits the day’s activities; and

not burdening patients with the complexities associated with learning to use an electronic device or programming a pump.

Cost Effective for Payor and Patient Alike

V-Go is generally a cost competitive option for payors and patients when compared to insulin pens, which is the delivery method prescribed for a majority of all insulin therapies and approximately 66% of newly prescribed basal and mealtime insulin therapies. V-Go is available at retail and mail order pharmacies and is covered by Medicare as well as commercial insurance plans covering a majority of patients. As a result, out-of-pocket costs for covered patients using V-Go are generally equivalent to what they would pay if taking basal-bolus injections with insulin pens or syringes. We believe that, from a payor’s perspective, using V-Go for insulin delivery will generally be associated with an equal or lower cost, net of rebates and co-pays, to treat a patient compared to the cost of using multiple daily injections to deliver basal-bolus insulin therapy. This opinion is supported by a recent retrospective analysis by Raval, et al using medical and pharmacy claims from HealthCore Integrated Research Database to evaluate the clinical and economic outcomes for V‑Go compared to standard multiple daily injection insulin therapy for treating type 2 diabetes. With similar baseline number of insulin Rx fills and insulin total daily dose (TDD), V‑Go users had fewer insulin Rx fills (p<0.001), and a 21% decline in insulin TDD (p<0.001), as compared to MDI users, during the last 6 months of follow‑up. Also, with similar baseline diabetes‑related medication costs, V‑Go users experienced a lower increase in diabetes‑related medication costs ($1287, p=0.012), as compared to MDI users, during the last 6 months of follow‑up.

Moreover, insulin delivery with V-Go is significantly less expensive, especially in the first year, than treatment with programmable insulin pumps. This cost difference in the first year is attributed to the programmable durable medical equipment component associated with electronic insulin pumps that are not needed for V-Go. This durable medical equipment component can have initial costs for the pump and supplies of approximately $5,000 per device. In addition, daily consumables such as tubing and insertion sets are required for electronic pump therapy and not on V-Go.

Another consideration is out-of-pocket costs for patients with different diabetes regimens. Pharmacy formularies are separated into multiple tiers, of which Tier 2 and Tier 3 are most applicable to the V-Go. Tier 1 products are the lowest cost tier of prescription products, which mainly consists of generic drugs; Tier 2 products are generally preferred brand name products, for which co-pays are more than Tier 1; and Tier 3 consists mainly of non-preferred brand name products, which are more expensive than Tier 2. We believe that patient costs can be neutral when switching from basal-bolus insulin pen therapy to V-Go therapy. As every payor and every employer plan within a payor has their own co-pay structure, we reached this conclusion by utilizing national averages provided by a national employer health benefits survey conducted in 2014 by Kaiser Permanente to make comparisons. We estimated co-pays for insulin pens and pen needles to be $73 per month, which assumes national Tier 2 co-pay equal to $31 for each pen box and $11 for pen needles. The V-Go co-pay can be $31 for Tier 2 or $53 for Tier 3 for a month supply, depending on which formulary Tier it is assigned to. Insulin vials for V-Go would be similar to insulin pens at $31 per month. Therefore, expected monthly co-pay for V-Go can be $62 when in Tier 2 or $84 when in Tier 3, which is essentially cost neutral to patients.

Comprehensive Customer Support

The majority of patients using V-Go are trained to use the device by their healthcare provider or a Certified Diabetes Educator, or CDE, who has been trained by our sales force using a “train the trainer” approach. Our sales force has the ability to train patients directly or offer training through a contracted trainer and also trains physicians, physicians’ assistants, nurse practitioners, CDEs and any other staff in a healthcare provider’s office who are responsible for training their patients to properly use V-Go. Additionally, we provide a starter kit for new V-Go patients, which contains all the materials a patient needs to deliver basal-bolus insulin therapy with V-Go. We also offer supplemental training support and resources when healthcare providers or patients need additional V-Go training assistance, including online resources such as a learning management system and online videos.

Our V-Go Customer Care Center, or VCC, is a live customer care center operating 24 hours a day, seven days a week. The VCC provides broad-based V-Go operational assistance to healthcare providers, patients, caregivers and pharmacists. Every patient is encouraged to call the VCC in order to opt-in for support and, once a patient does opt- in, a VCC staff-member proactively contacts the patient at various times to provide additional patient support and promote proper use of V-Go. VCC representatives can also train patients on the operational aspects of V-Go either via phone or video. The VCC also offers a reimbursement support service to answer patients’ reimbursement-related questions.

Extensive Clinical Evidence Demonstrating Results

The V-Go solution to type 2 diabetes management is focused both on A1C management and on providing patients the requisite support to achieve their goal of improved health. We and others have conducted several studies, analyses and research surveys to evaluate the role of V-Go in A1C management. These studies include prospective studies, user preference studies, retrospective analyses of electronic medical records and patient and physician surveys. The results of these studies and analyses are described below.

V-GoAL: A Randomized Prospective Pragmatic Clinical Trial to Compare the Real-World Use of V-Go in Type 2 Diabetes Patients to Standard Treatment Optimization

In collaboration with HealthCore Inc., we conducted a randomized, observational, prospective trial to assess the effectiveness of V-Go compared with standard treatment optimization, or STO in adult patients with type 2 diabetes treated with insulin with or without concomitant anti-hyperglycemic medications in the United States in a real-world, community-based practice setting. Participating clinics were randomized to enroll patients to insulin delivery with V-Go or to optimize current insulin treatment based on standard of care for up to 4 months. Patients in the V-Go group discontinued baseline insulin therapy and patients in the STO group continued baseline insulin therapy and could add and/or change diabetes-related therapy to improve treatment. The primary endpoint was change in A1C from baseline to the end of study.

The analysis population consisted of 169 V-Go patients and 246 STO patients from 52 clinical sites. Baseline A1C ranged from 7.9% to 14.2% with a mean A1C of 9.9% in the V-Go group and 9.3% in the STO group. The mean insulin total daily dose or TDD at baseline was not significantly different between groups (V-Go 71 units/day vs STO of 72 units/day). Both groups demonstrated significant reductions in A1C from baseline with those in the V-Go group demonstrating significantly greater A1C reductions when compared to STO (V-Go=0.95% vs. STO=0.46%).

SIMPLE Study: A Prospective Clinical Trial to Evaluate Effectiveness of V-Go Across Multiple Centers

We conducted a multicenter prospective clinical trial of 89 patients to evaluate the effectiveness of V-Go for patients with diabetes in a real-world setting. Findings from this study have been presented in past years at the American Diabetes Association and American Association of Clinical Endocrinologists Annual Scientific Congresses. The primary objective was to compare changes of average glycemic control as measured by A1C from baseline to the end of V-Go use. Patients with type 2 diabetes who were administering one or more insulin injections per day and not meeting target A1C control of less than 7% were included in the study. The patient types included in this trial were:

Basal: Patients receiving once or twice daily injections of an intermediate- or long-acting insulin regardless of oral anti-diabetes medication (OAD) use (26 patients).

Premix: Patients receiving one to three daily injections of premix insulin regardless of OAD medication use (13 patients).

MDI: Patients receiving any insulin therapy with three or more insulin injections a day regardless of OAD medication use (47 patients).

Other: Patients receiving OADs only and patients receiving OADs plus non-insulin injectable (3 patients).

A1C levels in the overall population (n=89) decreased from 8.8% at baseline to 8.1% at month three, representing a statistically significant reduction of 0.7% with a p-value less than 0.0001. A1C levels were not available for two of the 89 patients at 3 months, therefore the statistical analysis is based on repeated measures for 87 patients.

When classifying the data by subgroups, both the basal and MDI subgroups demonstrated statistically significant A1C reductions from baseline (basal -0.76%, p=0.0003; Premix -0.66%, p=0.3006; MDI -0.66%, p=0.0002). In addition to the significant improvements in blood glucose, the average daily dose of insulin across all patients was also reduced by 18% (62.4 to 51.0 units, p=0.001) from baseline. A small but statistically significant decrease in body weight (-0.71 lbs., p<0.0001) was observed, although not clinically meaningful given the baseline weight of the patient population. Overall, the incidence of hypoglycemia after three months of V-Go use was low, with 90% of patients reporting no hypoglycemia.

VALIDATE 1: Use of the V-Go Insulin Delivery Device in Patients with Sub-optimally Controlled Diabetes Mellitus

A study was initiated by Lajara et al. in 2014 to evaluate the effect of switching patients with sub-optimally controlled (A1C > 7.0%) diabetes to V-Go. The study was conducted as a retrospective review of the EMR database for a specialized diabetes comprehensive care clinic setting which includes 13 centers located across major metropolitan areas of Texas. Patients were prescribed V-Go by health care providers as part of their standard clinical practice with the goal of improving A1C levels. The primary endpoint was change in A1C from baseline. Secondary endpoints included change in insulin dose, body weight, and hypoglycemic events.

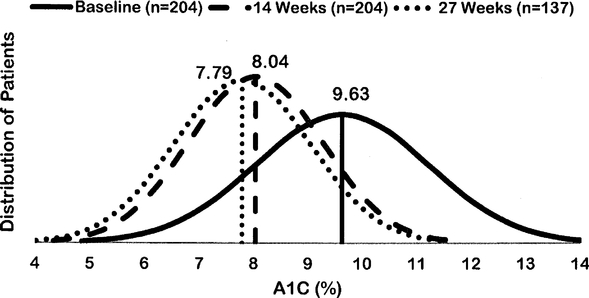

The mean time from start of V-Go to the first follow-up visit was 13.87 ± 6.14 weeks and the mean time to the second follow-up visit was 26.86 ± 8.96 weeks. Results will therefore be presented for 14-week and 27-week visits. Of 245 eligible patients based on inclusion criteria, 204 were included in the analysis population.

The distribution of A1C values for the study population was compared to baseline for each follow-up A1C time point in the figure below. On V-Go, the A1C distribution curve has narrowed and progressively shifted to the left, representing a reduction in variability and lower A1C values. We did not commission Diabetes Centers of America to conduct this study.

Change in A1C Distribution: Improved A1C Across the Entire Population

Change in A1C distribution. A1C data are arithmetic means at baseline (week 0) compared to first recorded A1C on V-Go (14 week mean) and second recorded A1C on V-Go (27 week mean). Curves represent the A1C distribution of patients for each time point based on available data. These results were published in a peer reviewed journal, Diabetes Therapy in 2015.

EVIDENT: Clinical and Economic Considerations based on Persistency with a Novel Insulin Delivery Device vs Conventional Insulin Delivery in Patients with Type 2 Diabetes

In 2016, Everitt et al. conducted a retrospective analysis in patients with type 2 diabetes to evaluate the clinical and economic impact of persistent use (>150 days) of V‑Go to resumed persistent use of conventional insulin delivery (CID) in patients discontinuing V‑Go after short‑term use. EMR were used to identify patients based on predetermined criteria. Insulin TDD, A1C, self‑monitored glucose or SMBG logs, all concomitant diabetes medications and weight were collected at baseline and at each follow‑up visit. Data analysis was conducted for all patients and was stratified based on persistent use of V‑Go or persistent use of CID in those that discontinued V‑Go. There were no significant differences in persistency time between groups, with V‑Go patients averaging a little over 8 months and CID patients nearly 7.5 months.

Persistent use of V‑Go resulted in a significantly greater reduction in A1C (−1.42 vs −0.20; p=0.003) with significantly less prescribed insulin (difference of 17.39 u/day; p=0.003) and resulted in a lower change in therapy cost. Persistency with V‑Go proved more cost‑effective compared to persistent CID use as the incremental cost impact to the pharmacy budget was $695.61 less per 1% change in A1C. These results were published in a peer reviewed journal, Research in Social and Administrative Pharmacy in September 2018. We provided an educational grant to the lead study author to conduct this retrospective analysis.

IMPROVE: Clinical Benefits Over Time Associated with V-Go

In 2015, we provided an educational grant to a large specialty clinical practice in Northeast Florida to conduct a retrospective analysis to evaluate the impact on glycemic control of switching to V-Go for patients with diabetes that were sub-optimally controlled. 103 patients were evaluated across four follow-up visits when an A1C result was recorded. Duration of V-Go use was approximately two, six, ten and fourteen months for the first, second, third and fourth follow-up visits. The baseline A1C was 9.8%. Statistically significant A1C reductions from baseline were seen at each of the four follow-up office visits. After six months of V-Go use, a reduction in A1C of 1.7% (p<0.001) was observed and sustained at 14 months. For the 80 patients previously administering insulin at baseline, a substantial reduction in total daily insulin from baseline was also observed at all follow-up visits. Insulin was reduced from 84 to 67 units/day (p<0.05) in these 80 patients after fourteen months of V-Go use. There was no reported change in the incidence of hypoglycemia compared to baseline. These results were published in a peer reviewed journal, Advances in Therapy in May 2018. We did not commission NEFEDA to conduct this study.

Jones: The Jones Center for Diabetes & Endocrine Wellness Clinical Evaluation

A retrospective clinical analysis was conducted to evaluate the clinical experience with V-Go in 91 patients treated at the Jones Center for Diabetes and Endocrine Wellness, a specialized diabetes care clinic. Using electronic medical records, clinical data was collected at V-Go initiation and up to one year of follow-up. Prior to V-Go initiation, 39.6% of patients were prescribed only insulin and 58.2% were prescribed combination therapy that included insulin. Of the 86 patients with type 2 diabetes, 69 patients, or 80%, had at least one follow-up visit. Mean baseline A1C in this group was 9.1% at baseline and 8.3% at follow-up for an average improvement in A1C of 0.8% (not tested for statistical significance). The mean total daily dose of insulin at baseline was 76 units and decreased to 61 units, a 20% (not tested for statistical significance) reduction, on V-Go. These results were also published and presented in the Journal of Diabetes Science and Technology. We did not commission the Jones Center to conduct this study.

Kaiser: Short‑Term Evaluation of Clinical Effectiveness.

A three month pragmatic evaluation was conducted across multiple clinics within the Southern California Kaiser Permanente Group. The purpose was to determine if switching to V‑Go insulin delivery device resulted in improved A1C control in patients with type 2 diabetes poorly controlled on prior regimens. Each participating clinician initiated and intensified therapy based on standard clinical practice. V‑Go devices were provided by the Boardmanufacturer for the 3 month study. Changes in A1C and insulin TDD as well as percentage of Directorspatients achieving A1C ≤ 9.0% were assessed.

Out of 85 patients initiated on V‑Go, 60 completed the evaluation with a baseline mean A1C of 9.8% and serveinsulin total daily dose of 72 units/day (range 30 to 200 units/day). Prior to initiating V‑Go, 60% of patients were poorly controlled defined by A1C values > 9.0%.. After 3 months of insulin delivery with V‑Go, significant mean reductions in A1C (−1.3%; p<0.0001) and TDD (−34 units/day; p<0.0001) were observed. Achievement of A1C ≤ 9.0% increased from 40% before V‑Go to 78% on V‑Go (p<0.0001).

UMASS: The University of Massachusetts Clinical Evaluation

In 2013, researchers at the University of Massachusetts examined 21 patients with type 2 diabetes who lacked glycemic control and switched from MDI therapy to V-Go. The clinical evaluation observed that, after 88 days of V-Go use, based on data from 14 of the 21 patients observed, A1C levels decreased from 10.7% to 8.3% (p<0.001) and total daily doses of insulin decreased by 46% from 119 units to 64 units (p=0.01). These results were also published and presented at the 73rd Scientific Sessions of the American Diabetes Association in June 2013. We did not commission nor sponsor this study.

MOTIV: Retrospective Proof‑of Concept Study Evaluating Optimization and Titration of Dosing with V‑Go

A retrospective proof‑of‑concept analysis based on data from EMR was conducted by Mehta et al. The objective was to evaluate the safety and efficacy of a physician‑directed insulin titration algorithm in patients prescribed V‑Go who were diagnosed with type 2 diabetes and were ≥ 21 years old. Primary endpoints were achievement of A1C targets (<7.5%) and prevalence of hypoglycemia. Of the 24 patients screened, 15 patients met eligibility requirements and were evaluated after 4 months of V‑Go use. Patients kept daily four‑point (fasting and 2 hour postprandial breakfast, lunch, and dinner) self-monitored blood glucose profiles which were used for weekly titration decisions. Based on the algorithm, bolus up‑titration was recommended weekly when 2 hour postprandial averages exceeded 170 mg/dl and down‑titrated when 2 hour postprandial averages were below 100 mg/dl. Basal rates were adjusted if needed following the optimization of bolus dosing for all meals.

A majority of the insulin titration occurred over the first three weeks with bolus up‑titration occurring in 73% of patients (from 18 to 33 total bolus units/day) at week one. V‑Go basal dose was increased in 5 patients and decreased in 1 patient by month one.

The A1C target of <7.5% was achieved in 67% of patients after switching to V‑Go for 4 months. A mean significant A1C reduction of −1.6% (8.7 to 7.1%; p<0.001) was observed despite a significant decrease in the mean insulin TDD (144 to 60 U/day; p=0.002). No change in weight from baseline was observed. Incidence of hypoglycemia decreased from 23% of patients at baseline to 7% of patients by month four. These results were published in a peer reviewed journal, Annals of Diabetes, Metabolic Disorders and Control in October 2018. We did not commission nor sponsor this study.

ENABLE: Multicenter Retrospective Study Evaluating Effectiveness of V‑Go

Hundal et al. conducted a retrospective multi‑state analysis to evaluate the clinical benefits of switching patients from insulin delivery via insulin pens/syringes to V‑Go. Electronic medical records across 9 specialty diabetes centers were used to identify patients and evaluate change in A1C and TDD. Patients (N=283) were evaluated after a mean of 3 and 7 months of V‑Go use.

A significant reduction in A1C of 1.0% (p<0.0001) from a baseline of 9.2% after 3 months of V‑Go use was observed and sustained at 7 months. Insulin total daily dose was reduced by 17 units/day and 14 units/day (p<0.0001) from a baseline of 76 units/day at 3 and 7 months, respectively

Clinical Evidence Summaries

Across these multiple peer-reviewed and published clinical trials, analyses and surveys using both prospective and retrospective study designs, switching patients who had suboptimal glycemic control to V-Go for insulin delivery resulted in statistically significant improvements in A1C, with A1C reductions ranging from 0.7% to 2.4%, depending on the patient population. Moreover, across this body of evidence, switching patients who had suboptimal glycemic control to V-Go for insulin delivery resulted in better glucose control with less insulin being used. Daily insulin dose reductions ranged from 7% to 46%, depending on the study and influenced by the amount of insulin patients were prescribed prior to using V-Go. Currently, clinical evidence in support of V-Go has been disclosed across 14 publications and 59 presentations and represents clinical experience in > 1500 patients with diabetes.

Our Current and Future Products

We believe our core technology represents a fundamentally different approach to basal-bolus insulin delivery. To facilitate therapy compliance, we have sought to eliminate the need for complex electronics and software by utilizing mechanical technology that delivers prescribed dosages of insulin and other injectable drugs with great accuracy without any electronics, batteries, recharging or programming.

For users and health care providers who desire additional data points, the Company is developing a V-Go accessory device which provides injectable drug delivery details through Bluetooth communication with smart devices utilizing a Valeritas developed application.

V-Go Wearable Insulin Delivery Device

V-Go is a wearable insulin delivery device for basal-bolus therapy that deploys our innovative proprietary h-Patch technology. Unlike programmable insulin pumps, V-Go is a small, discreet, daily-disposable insulin delivery device that operates without electronics, batteries, infusion sets or programming. V-Go measures just 2.4 inches wide by 1.3 inches long by 0.5 inches thick and weighs approximately less than two ounces when filled with insulin.

V-Go enables patients to closely mimic the body’s normal physiologic pattern of insulin delivery by delivering a single type of insulin at a continuous preset basal rate over a 24-hour period and also providing for on-demand bolus dosing at mealtimes, without the need for electronics or programming. A patient adheres V-Go to his or her skin and presses a button that inserts a small needle that commences a continuous preset basal rate of insulin. At mealtimes, a patient can discreetly press the bolus ready and bolus delivery buttons to deliver insulin on-demand at meals.

Each day prior to applying V-Go, a patient fills it with insulin using a filling accessory known as EZ Fill, which is included with each monthly supply of V-Go. V-Go uses a single type of fast-acting insulin, such as Humalog® or NovoLog®, and is available in a preset basal rate to continuously deliver 20, 30 or 40 units of insulin in one 24-hour period (0.83, 1.25 or 1.67 units per hour, respectively) and on-demand bolus dosing in two unit increments (up to 36 units per 24-hour time period). Our proprietary Floating Needle is deployed with the press of a button after V-Go is applied to the skin making the connection between the insulin reservoir and the patient’s tissue. The Floating Needle then pivots with the body’s natural movements, allowing for maximum comfort. After 24 hours of use, a patient presses a button that retracts the needle and then removes V-Go from the skin, discards V-Go in regular trash and replaces it with a new insulin-filled V-Go for the next 24 hours. The EZ fill device makes the filling process simple and does not require calculations, measuring or needles. The use of the EZ fill device can also prevent accidental needle sticks that occur with pen needles or syringes.

h-Patch Controlled Delivery Technology Platform

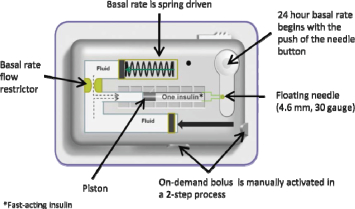

Our proprietary hydraulic h-Patch drug delivery core technology, which is a critical component of V-Go, facilitates the simple and effective delivery of injectable medicines to patients across a broad range of therapeutic areas. The deployment of our h-Patch technology results in a device specifically designed for patients with type 2 diabetes who, we believe, do not require complex and costly programmable insulin pumps generally designed to meet the needs of type 1 patients.

The hydraulic approach of our h-Patch technology can be used to deliver constant basal or on-demand bolus dosing of any drug than can be delivered subcutaneously. We believe it combines the user advantages of transdermal patches with the accuracy and flexibility of conventional electronic pumps. Once activated, our h-Patch device places a custom-formulated viscous fluid under pressure, which is separately compartmentalized and therefore designed not to come into contact with the active drug. Once pressurized, the fluid is forced through a flow restrictor that is designed to control the flow rate. After passing through the flow restrictor, the viscous fluid couples with and moves a piston in a cartridge that contains active drug. The viscous fluid continually pushes the piston, dispensing the drug at the prescribed preset basal rate through a needle into the patient’s subcutaneous tissue. Bolus delivery on demand is similarly driven by viscous fluid dispensed from a separate side chamber, which allows a patient to dispense active drug in two unit increments through a user-activated bolus button. Our h-Patch basal drug delivery technology results in a simple, yet innovative, device that operates without complex controls or an infusion set.

The operation of our h-Patch technology is depicted in the graphic below:

h-Patch Controlled Delivery Technology

We will continue to explore the use of our h-Patch technology in other drug delivery applications beyond the use of insulin to treat type 2 diabetes. We believe it has the potential to improve the utility of a variety of drugs that require frequent and cumbersome dosing regimens.

Next-Generation V-Go: V-Go Prefill & V-Go® SIMTM (Simple Insulin Management)

We are developing a next-generation, single-use disposable V-Go device that will feature a separate prefilled insulin cartridge that can be snapped by the patient into V-Go. While the current V-Go simplifies the use of insulin for patients with type 2 diabetes, we believe that a pre-filled V-Go will make insulin therapy even simpler by eliminating the device-filling process by the patient and the need for EZ fill refrigeration, which we expect could further promote adoption by patients with type 2 diabetes. Additionally, we believe V-Go Prefill could lower the number of co-pays because the insulin and V-Go would be packaged together, generate revenue from the sale of insulin and extend the patent life to 2032. A pre-filled V-Go would also enable V-Go usage for other injectable therapeutic drugs beyond insulin that are used by patients who could benefit from simple, convenient and continuous drug delivery. Currently, the V-Go Prefill is in the design-development stage, with a focus on ease of customer use and optimization of manufacturing efficiency.

We are in the later stages of developing V-Go SIMTM, which we intend to feature one-way communication to glucose meters and smart devices such as phones and tablets through RF/Bluetooth technology. V-Go SIMTM is a snap-on accessory for use with V-Go, is optional to use, and does not change the functionality of V-Go. We intend V-Go SIMTM to provide real-time tracking information of basal and bolus dosing utilization, allowing patients and their healthcare professionals to have a deeper understanding of their current dosing habits. We believe access to this technology could increase patient adherence and could be used as a diagnostic tool to make treatment adjustments.

Our Strategy

Our long term goal is to significantly expand and further penetrate the type 2 diabetes market and become a leading provider of simple-to-use insulin delivery devices designed for basal-bolus insulin therapy.

In 2016, we made a significant adjustment in our commercialization strategy by shifting from aggressively expanding sales representative headcount to focusing on fewer high—volume insulin prescribers and on maximizing our sales and marketing infrastructure’s frequency of interactions and contact points and methods with high-prescribing physicians. We estimate as of December 31, 2018 our sales force structure can directly focus on approximately 1,000 prescribers. This restructuring reduced our monthly cash burn rate significantly and resulted in a business plan that is more capital efficient.

We have learned that, in the competitive type 2 diabetes market, those prescribers of diabetes products who had more contacts with our sales representatives and marketing programs, both directly and indirectly, remember and prescribe V-Go to more patients, and more appropriate patients, and we believe that, under our prior sales and marketing model, we had diluted our resources across too many sales territories. By focusing on fewer and prioritized markets, while increasing the contacts each healthcare professional has through supplemental inside sales team, an inside peer to peer clinical sales team and through other marketing resources, we can be more competitive in those markets.

Our current business strategies include the following:

We intend to continue to focus the majority of our resources towards the prioritized markets through the use of sales professionals, inside sales, peer-to-peer programs, targeted direct-to-patient promotions, customer care and additional multi-channel promotional services. Some examples of multi-channel promotion include direct mail, search engine optimization, peer-to-peer email, and other forms of advertising. We intend to optimize our customer acquisition, conversion and retention programs by focusing all our resources. We believe this should allow us to significantly increase our promotional efforts on a per-territory basis, which will allow us to grow these markets. In addition, we plan to improve on and leverage our patient programs such as V-Go life, patient forums, enhanced starter kits and in-office material and promotion, such as context media to empower patients to ask for V-Go as an option for their diabetes treatment.

We intend to continue to drive V-Go sales growth by:

Leveraging the clinical and economic data that has been published in the last year, including several recent manuscripts, with healthcare professionals and payors. We believe this new data will help more prescribers see the value and understand the benefits of V-Go across a wider spectrum of patients.

Expanding third-party reimbursement for V-Go in the United States. We intend to expand patient coverage of V-Go by commercial insurance plans as a pharmacy benefit rather than a medical benefit. We believe that more than 70% of the approximate 158 million commercially insured lives in the United States and 60% of the approximate 43.5 million lives insured by Medicare Part D cover V-Go. In addition, TRICARE, a health care program of the United States Department of Defense Military Health System, covers V-Go as a pharmacy benefit and some State Medicaid plans cover V-Go as a pharmacy or medical benefit. We also offer reimbursement support services to assist patients in gaining access to V-Go throughout the reimbursement process.

Pursing our new business model. We intend to increase use and grow V-Go share by initially targeting approximately 20 to 30 doctors per sales representative and increasing to approximately 50 potential targets over time. We will either add new territories or split existing territories when adding new sales reps. We will expand our direct sales reach to approximately 300 additional prescribers so that we can provide the same higher level of inside sales and promotion as we provide our current prioritized markets. We believe we can grow these markets more quickly than our territories have grown in the past, since they will have significantly more support with our new strategy.

Our long-term business strategies include the following.

Continue to expand our U.S. sales force in a capital efficient and disciplined manner utilizing our new business model. We intend to eventually establish a national sales force, internally or through other means, such as

contract sales organization, co-promotion or other strategic relationships to ensure we can reach all the very high volume prescribers or explore other means to increase the number of prescribers we can reach.

Continue to explore additional international expansion opportunities. We intend to continue exploring international expansion through strategic collaborations, in-licensing arrangements or alliances outside the United States which not only would provide a revenue stream, but would also increase our production volume thereby improving our gross margins in the United States.