UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

FORM 10-K/A10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ForFor the fiscal year ended April 30, 2019 December 31, 2020

or

| TRANSITION REPORT |

ForFor the transition period from ___________ _______________ to___________ _______________

Commission file number 000-55519Force Protection Video Equipment Corp.

(Exact name of registrant as specified in its charter)

| 000-55519 | 45-1443512 | ||

|

|

| |||

(State

| (Commission File Number) | (IRS Employer Identification | ||

|

| |||

|

|

(919) 780-78972629 Townsgate Road, Suite 215

Westlake Village, CA 91361

(Address of principal executive offices)

(714) 312-6844

(Registrant’s telephone number, including area code)

Securities registered pursuant tounder Section 12(b) of the Act:None

| Title of Class | Trading Symbol | Name of Each Exchange on Which Registered | ||

| N/A | N/A | N/A |

Securities registered pursuant tounder Section 12(g) of the Act:

Common Stock, $0.0001 Par ValueNone

(Title of Class)class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes o [X] No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes o [X] No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes ☒[ ] Noo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12-months12 months (or for such shorter period that the registrant was required to submit and post such files). [X] Yes ☒[ ] Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] |

| Accelerated filer |

|

|

| Smaller reporting company [X] | |

| Emerging Growth Company [ ] |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes ☐[X] No☒

TheState the aggregate market value of the voting and non-voting common stock of the registrantequity held by non-affiliates computed by reference to the price at which the common equity was approximately $76,000sold, or the average bid and asked prices of such common equity, as of October 31, 2018, the last business day of the registrant’s most recently completed second fiscal quarter. As$2,018,842 based on the closing price of July 10,$0.002 on October 31, 2020 there were 841,184,289.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, outstanding.as of the latest practicable date. 158,244,935,162 shares of Class A common stock are outstanding as of April 14, 2021.

DOCUMENTS INCORPORATED BY REFERENCE

None.Portions of the registrant’s definitive proxy statement relating to its 2021 annual meeting of shareholders (the “2021 Proxy Statement”) are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The 2021 Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

TABLE OF CONTENTS

| Page No. | ||

| Part I | ||

| Item 1. | Business. | 3 |

FORCE PROTECTION VIDEO EQUIPMENT CORP.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED APRIL 30, 2019

| Item 1A. | Risk Factors. |

| 10 | ||

| Item 1B. | Unresolved Staff Comments. | 28 | |||

| 2. |

| 28 | |||

| 3. |

| 28 | |||

| |||||

| |||||

| 28 | ||||

| Item 5. |

| 28 | |||

Item 6. | Selected Financial Data. | 29 | |||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of |

| 29 | ||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 42 | |||

| Item 8. |

| 42 | |||

Changes in and Disagreements |

| 42 | |||

| 43 | ||||

| 43 | ||||

| Item 10. | Directors, Executive Officers and Corporate | 43 | |||

| 43 | ||||

| 44 | ||||

Certain Relationships and Related Transactions, and Director |

| 44 | |||

| 44 | ||||

| Item 15. |

| 44 | |||

| Item 16. | Form 10-K Summary. | ||||

| |||||

| |||||

| 44 | ||||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements inExcept for historical information, this Report may be “forward-lookingreport contains forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which can be identified by1934. Such forward-looking statements involve risks and uncertainties, including, among other things, statements regarding our business strategy, future revenues and anticipated costs and expenses. Such forward-looking statements include, among others, those statements including the use of terminology such as “estimates,” “projects,” “plans,” “believes,”words “expects,” “anticipates,” “intends,” “believes” and similar language. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that might cause or the negative or other variations, or by discussions of strategy that involve risks and uncertainties. However, as the Company issues “penny stock,” ascontribute to such term is defined in Rule 3a51-1 promulgated under the Exchange Act, the Company is ineligible to rely on these safe harbor provisions. Forward-looking statementsdifferences include, but are not limited to, those discussed in the sections “Description of Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You should carefully review the risks described in this Annual Report on Form 10-K and in other documents we file from time to time with the Securities and Exchange Commission including and our Quarterly Reports on Form 10-Q. You are cautioned not to place undue reliance on the forward-looking statements, that express our intentions, beliefs, expectations, strategies, predictionswhich speak only as of the date of this report. We undertake no obligation to publicly release any revisions to the forward-looking statements or any other statements relating to our future activities or other futurereflect events or conditions. Thesecircumstances after the date of this document.

Although we believe that the expectations reflected in these forward-looking statements are based on current expectations, estimatesreasonable assumptions, there are a number of risks and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those described above and those risks discussed from time to time in this Report, including the risks described under “Risk Factors,” “Management’s Discussion and Analysis” and “Our Business.”

There are important factors that could cause our actual results to differ materially from those in thesuch forward-looking statements. These factors, include, without limitation, the following: our ability to develop our technology platform and our products; our ability to protect our intellectual property; the risk that we will not be able to develop our technology platform and products in the current projected timeframe; the risk that our products will not achieve performance standards in clinical trials; the risk that the clinical trial process will take longer than projected; the risk that our products will not receive regulatory approval; the risk that the regulatory review process will take longer than projected; the risk that we will not be unsuccessful in implementing our strategic, operating and personnel initiatives; the risk that we will not be able to commercialize our products; any of which could impact sales, costs and expenses and/or planned strategies. Additional information regarding factors that could cause results to differ can be found

All references in this Report and in our other filings with the Securities and Exchange Commission.

The Company disclaims any obligation to update any such factors or to announce publicly the results of any revisions of the forward-looking statements contained or incorporated by reference herein to reflect future events or developments, except as required by the Exchange Act. Unless otherwise provided in this Report, referencesAnnual to the “Company,” the “Registrant,” the “Issuer,” “we,” “us,” and“us” or “our” refer to Force Protection Video Equipment Corp.Corporation and our wholly owned subsidiary BIG Token, Inc. on a consolidated basis. All references to “Common Stock” or “Common Shares” refers to the common stock, $0.00000001 par value (upon effectiveness of our amendment to the articles of incorporation filed on April 15, 2021), of Forced Protection Video Equipment. All references to “BIG Token”, “BIG Token Application” or “BIG Token business” refers to our wholly owned subsidiary and corresponding operations that consist of a consumer based platform, technologies offer and services used to identify and reach target consumers which we purchased from SRAX, Inc. (“SRAX”) on February 4, 2021.

As used herein, references to (i) “Exchange Agreement” refer to that certain share exchange agreement entered into by and between the Company, SRAX, and Paul Feldman (the Company’s prior CEO) on September 30, 2020, (ii) “Exchange Amendment” refer to the amendment to the Exchange Agreement entered into by between the Company, SRAX, and Paul Feldman on January 27, 2021, (iii) “TSA” refer to the transition services agreement entered into by and between SRAX and BIGtoken on January 27, 2021, (iv) “MSA” refer to the master separation agreement entered into by BIGtoken and SRAX on January 27, 2021, (v) “FPVD Warrants” refer to the common stock purchase warrants the Company issued as a result of SRAX’s June 30, 2020 convertible debt offering whereby we assumed the obligation to issue 25,568,064,462 Common Stock purchase warrants, and (vi) “Debt Exchange Agreement” refer to the debt exchange agreement the Company entered into with Red Diamond Partners, LLC pursuant to which Red Diamond exchanged an aggregate of $815,520 of principal plus accrued interest for (i) 7,000,000,000 shares of unrestricted Common Stock and (ii) 8,313 shares of Series C Convertible Preferred Stock, convertible into approximately 12,864,419,313 shares of common Stock.

| ITEM 1. | BUSINESS. |

Our Business

Prior to the completion of the Share Exchange, BIG Token was an operating segment of SRAX. On February 4, 2021 we completed the Share Exchange. As a result, BIG Token became our wholly owned subsidiary and we adopted BIG Token’s business plan. We anticipate formally changing our name to BIG Token in the future. In connection with the Share Exchange, we also entered into certain agreements with SRAX including but not limited to the TSA and MSA, as more fully described below. The terms of these agreements may be more or less favorable to us than if they had been negotiated with unaffiliated third parties.

We were initially incorporated as M Street Gallery, Inc. in March of 2011, in the state of Florida. On September 25, 2013, we changed our name to Enhance-Your-Reputation.com, Inc. On February 1, 2015, we changed our name to Force Protection Video Equipment Corporation. Our headquarters are located in Westlake Village, California, but we work as a virtually distributed organization. On February 4, 2021 we completed a share exchange with BIG Token, Inc., a wholly owned subsidiary of SRAX. As a result of the exchange, BIG Token became our wholly owned subsidiary. Additionally, simultaneous with the exchange, we adopted BIG Token’s business plan.

| 3 |

Company Overview

We are a data technology company offering a consumer based mobile application that allows consumers to own and earn from their digital data. We generate revenue by anonymizing the data, and using it to extract consumer insights that we sell to brand advertisers. Our consumer- based platform and technologies offer tools and services to identify and reach the target consumers of our brand advertisers. Our technologies assist our clients to identify their core consumers and such consumers’ characteristics across various channels in order to discover new and measurable opportunities that amplify the performance of marketing campaigns and maximize a return on marketing spend.

When consumers download our app, we ask them some questions, engage them with surveys, and ask them to connect their various online accounts including their bank accounts, credit card accounts, and social media accounts. Based on the amount of information they provide directly by answering questions or taking surveys, or passively, by connecting accounts, we’re able to track more than 4,000 attributes per consumer.

We derive our revenues from applying the data we collect, and deriving insights and audiences that we use to increase the efficiency of the online advertising of our clients. We then share the revenue generated with our consumers based on their activity and various other parameters.

To date, there have been more than 16 million accounts registered on BIG Token. The vast majority of our registrations have been driven by referrals from existing users who get rewards for driving new users. Of the 16 million, we’ve “verified” over 9 million through emails and bot detection techniques.

Our Market Opportunity – Data Economy

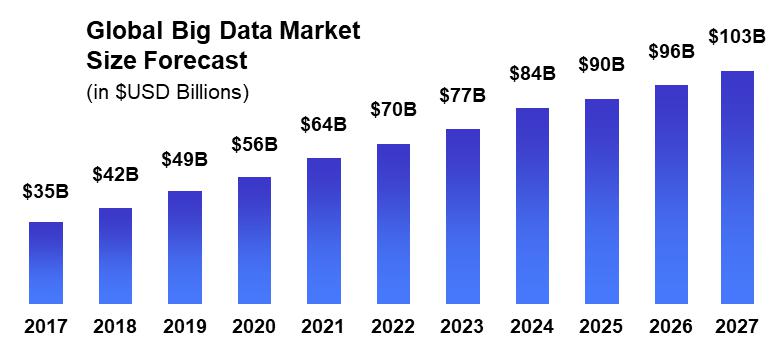

The global big data market is forecasted to grow to $103B by 2027, more than double its market size in 2018. A consumer’s digital footprint includes everything they search for, view, read, listen to, purchase, like or comment on.

Data spending keeps rising - The majority of survey respondents (69.2%) said their organizations increased spending on data and related services in 2018 (relative to 2017), while over three-fourths (78.2%) anticipate investing even more in the coming year.

Companies are prioritizing data-driven insights in order to develop marketing strategy and allocate marketing spend.

| 4 |

Government Regulation On Data Privacy Is Driving Major Tech Companies To Restrict Or Eliminate Traditional Data Collection Techniques

Regulation is changing the way businesses and tech can use data. In 2016, the European Union (EU) passed the General Data Protection Regulation (GDPR) to give individuals control over their personal data and to unify regulations within the EU. Other seminal regulatory events include the 2018 passage of the California Consumer Privacy Act (CCPA) intended to enhance privacy rights and consumer protection for Californians.

In response to the changing global regulatory environment around data privacy, major tech companies are changing how they allow their customers to collect user data. Notably, the major browsers, including Google’s Chrome and Apple’s Safari, are eliminating, or severely restricting, the use of 3rd party cookies. Those cookies have been a principal way that brands have been able to identify and market to consumers. In addition, in iOS 14, Apple is changing the Identifier For Advertiser (IDFA) tags used by mobile apps to identify users from opt out, to opt-in.

As a result of the intensifying regulatory landscape, and the tech industry’s response, first-party opt-in data, like that collected by BIGtoken, is becoming increasingly valuable. As we scale our compliant first party data set, BIGtoken will be strongly positioned to capitalize on the rapidly evolving data marketplace. We are currently focused on increasing registered users on the platform, increasing the engagement of our users, monetizing our data driven insights, and rewarding our users for sharing their data.

Given the massive tailwinds in data privacy, and our focus on first-party opt-in data, we believe BIGtoken is well positioned to accelerate growth as we play an increasingly larger role in ensuring data privacy is treated as a human right.

For additional information about government regulation applicable to our business, see Risk Factors in Part I, Item 1A.

Our Competitive Advantages — What Sets Us Apart

With the changing data privacy landscape, BIGtoken’s product offering is well positioned to provide marketing solutions compliant with these new and evolving regulations. BIGtoken’s product offering provides marketers with data solutions that traditional data providers cannot:

| Data accuracy for research and ad targeting | ||

| ● | Manage reach and frequency with greater accuracy across multiple media platforms | |

| ● | Access to consumers at scale for research, measurement, and attribution | |

| ● | Speed of | |

| ● | Ability to target advertising to consumers based on identity without cookies |

PART IConsumers are increasingly demanding data privacy, compensation for their data, and transparency and choice of how their data is used. The BIGtoken platform is focused on providing consumers with the tools and preferences they need to achieve their unique data requirements, including:

| ● | Compensation | |

| Consumers earn when they opt-in to sharing their data and when that data is purchased. | ||

| ● | Choice | |

| Consumers decide what data is shared & who can buy it. | ||

| ● | Transparency | |

| Consumers are fully aware of how their data is used. |

| 5 |

Our Growth Strategy

Overview

The CompanyOur business is in the business of selling videocurrently based on using our mobile app to aggregate users who opt-in to provide us their data via direct and audio capture devices initially targetedpassive actions, anonymizing that data, and using that data to law enforcement agencies. With over 30 years of marketingprovide unique consumer insights that enable marketers to law enforcement, the Company’s CEO, Paul Feldman is able to leverage his extensive knowledge and base of contacts to produce sales. The Company has established a web site at www.forceprovideo.com whereby customers can view the Company’s products and place orders.advertise more efficiently. We believe that given recentas the information gathered through the BIGtoken platform scales, we will be able to introduce new products, and monetize our growing user base at increasingly higher rates.

We are currently focused on increasing registered users on the platform, increasing the engagement of our users, monetizing our data driven insights, and rewarding our users for sharing their data. As part of this strategy, we continue to explore partnership opportunities that would allow us to leverage the capabilities of the BIGtoken platform to effectively grow the platform and increase and enhance our user experience and user rewards / compensation.

Examples of how we plan to use BIGtoken and the proprietary consumer data derived therefrom include:

| ● | The use of BIGtoken user surveys and the sale of such information received from surveys. | |

| ● | The creation and management of targeted rewards and loyalty programs based on information and buying trends ascertained by data captured on our BIGtoken platform. We offer this solution both on and off the BIGtoken app. | |

| ● | The ability to assist our customers in conducting market research based on analytics received from users of the BIGtoken platform. | |

| ● | The ability to identify specific audiences for our customers and to target questions, surveys and data analytics geared toward our customers’ products / industries. Additionally, if we are unable to scale the needed information for a customer’s target audience, we may utilize our proprietary analytics to gain insight to further focus and refine user segments that need to be targeted in order to optimize data and media spend. | |

| ● | The use of Lightning Insights that allow our customers to conduct research around specific audience groups through both long and short research studies. | |

| ● | The creation of customized loyalty programs that utilize rewards to drive consumer purchasing habits. | |

| ● | We plan to increasingly embrace crypto-currencies, including, but limited to, offering to reward our users with Bitcoin and other cryptocurrency, offering to pay our employees and vendors with such currency. offering our users digital wallets to store their crypto, enabling our users to store rewards in interest bearing stablecoins, holding cryptocurrency in our Treasury, developing our own Layer One Protocol optimized for users to own and monetize data, developing our own cryptocurrency to be used as rewards. |

Marketing and sales

We market our services through our in-house sales team, with a focus today on the largest brand advertisers with the biggest advertising budgets. Our customers include 8 of the 10 largest brand advertisers, each poised to dramatically increase their spend with BIGtoken in 2021. We believe that our focus on the largest brand advertisers will not only drive meaningful revenue growth but will help build the BIGtoken brand as the leader in privacy focused, opt in, first-party data, positioning us well when we expand our focus to mid-market agencies and brands.

On the client side, our in-house marketing is focused on positioning BIGtoken as a thought leader in data privacy, via social media, including Facebook, LinkedIn and Twitter, public relations (PR), industry events and the creation of white papers which assist in our marketing efforts and are used as lead generation tools for our sales team.

On the consumer side, we are focused on marrying our privacy leadership, with a reward system that provides meaningful value to our users who provide us with meaningful data.

| 6 |

Intellectual property

We currently rely on a combination of trade secret laws and restrictions on disclosure to protect our intellectual property rights. Our success depends on the protection of the proprietary aspects of our technology as well as our ability to operate without infringing on the proprietary rights of others. We also enter into proprietary information and confidentiality agreements with our employees, consultants and commercial partners and control access to, and distribution of, our software documentation and other proprietary information. We have one Trademark, “BIGtoken.”

Competition

We operate in a highly competitive digital media and ad tech environment. We compete based on our ability to: assist our customers in obtaining the best available prices, data, and analytics, our customer service and, the quality and accessibility of our innovative products and service offerings. We believe our platform provides for a competitive advantage. We expect an increasing number of other companies to provide similar services, leading to an increasingly competitive landscape.

Government Regulations

We are subject to a variety of laws and regulations in the United States and abroad that involve matters central to our business. Many of these laws and regulations are still evolving and being tested in courts and could be interpreted in ways that could harm our business. These may involve privacy, data protection and personal information, rights of publicity, content, intellectual property, advertising, marketing, distribution, data security, data retention and deletion, electronic contracts and other communications, competition, protection of minors, consumer protection, product liability, taxation, economic or other trade prohibitions or sanctions, anti-corruption law compliance, securities law compliance, and online payment services. In particular, we are subject to federal, state, and foreign laws regarding privacy and protection of people’s data. Foreign data protection, privacy, content, competition, and other laws and regulations can impose different obligations or be more restrictive than those in the United States. U.S. federal and state and foreign laws and regulations, which in some cases can be enforced by private parties in addition to government entities, are constantly evolving and can be subject to significant change. As a result, the application, interpretation, and enforcement of these laws and regulations are often uncertain, particularly in the new and rapidly evolving industry in which we operate, and may be interpreted and applied inconsistently from country to country and inconsistently with our current events betweenpolicies and practices.

Proposed or new legislation and regulations could also significantly affect our business. For example, the European General Data Protection Regulation (GDPR) took effect in May 2018 and applies to all of our products and services used by people in Europe. The GDPR includes operational requirements for companies that receive or process personal data of residents of the European Union that are different from those previously in place in the European Union and includes significant penalties for non-compliance. The California Consumer Privacy Act, which took effect in January 2020, also establishes certain transparency rules and creates new data privacy rights for users. Similarly, there are a number of legislative proposals in the European Union, the United States, at both the federal and state level, as well as other jurisdictions that could impose new obligations or limitations in areas affecting our business, such as liability for copyright infringement. In addition, some countries are considering or have passed legislation implementing data protection requirements or requiring local storage and processing of data or similar requirements that could increase the cost and complexity of delivering our services.

We may become the subject of investigations, inquiries, data requests, requests for information, actions, and audits by government authorities and regulators in the United States, Europe, and around the world, particularly in the areas of privacy, data protection, law enforcement, agenciesconsumer protection, and competition, as we continue to grow and expand our operations. We are currently, and may in the future be, subject to regulatory orders or consent decrees, including the modified consent order we entered into in July 2019 with the U.S. Federal Trade Commission (FTC) which is pending federal court approval and which, among other matters, will require us to implement a comprehensive expansion of our privacy program. Orders issued by, or inquiries or enforcement actions initiated by, government or regulatory authorities could cause us to incur substantial costs, expose us to unanticipated civil and criminal liability or penalties (including substantial monetary remedies), interrupt or require us to change our business practices in a manner materially adverse to our business, divert resources and the public, which has been widely reported byattention of management from our business, or subject us to other remedies that adversely affect our business.

| 7 |

We anticipate embracing crypto and digital assets in the media, therefuture. The regulatory regime governing blockchain technologies, cryptocurrencies, digital assets, utility tokens, security tokens and offerings of digital assets is a significant market opportunity for the Company’s products. In the first quarter of fiscal 2016, the Company received multiple orders for the LE10 camera System. The LE10 is a small bodied, high definition (HD) camera which is half the sizeuncertain, and half the price of most law enforcement cameras currently available. The LE10 and more recent addition the LE50 are rich with features that make them ideal for on-demand video and audio capture. The LE10 and LE50 do not require special softwarenew regulations or expensive storage contracts. The video files can quickly be downloaded into a standard law enforcement case filepolicies may materially adversely affect our development and the micro SD cards are sealedvalue. Regulation of digital assets, like cryptocurrencies, blockchain technologies and cryptocurrency exchanges, is currently undeveloped and likely to rapidly evolve as government agencies take greater interest in them. Regulation also varies significantly among international, federal, state and local jurisdictions and is subject to significant uncertainty. Various legislative and executive bodies in the provided static evidence bagsUnited States and then securely storedin other countries may in the department’s evidence locker. The Company’s Video LE10future adopt laws, regulations, or guidance, or take other actions, which may severely impact the permissibility of tokens generally and LE50 camerasthe technology behind them or the means of transaction or in transferring them. Failure by us to comply with any laws, rules and regulations, some of which may not exist yet or are subject to interpretation and may be subject to change, could result in a rugged design which incorporates Ambarella (NASDAQ “AMBA”) made chips that allow the cameras to record high definition video.variety of adverse consequences, including civil penalties and fines.

Product DevelopmentEmployees and SalesHuman Capital Resources

Our on-body mini-camera was developed by Paul Feldman,As of March 26, 2021, we had 86 full-time employees. 7 are engaged in executive management such as our Chief Executive Officer, President57 in information technology including those participating in our research and Director who has significant experiencedevelopment efforts, 7 in the developmentsales and commercialization of securitymarketing, 8 in integration and surveillance related products. From 2001 through August 2009, Mr. Feldman served as Presidentcustomer support and a Director of Law Enforcement Associates, Inc., a manufacturer of surveillance products7 in administration. All employees are employed “at will.” We believe our relations with our employees are generally positive and audio intelligent devices which were sold to the U.S. military and law enforcement. Patent technologies previously developed by Mr. Feldman include U.S. Patent Number 7,631,601 Surveillance Projectile and U.S. Patent Number 2006/0283,345 Surveillance Projectile.we have no collective bargaining agreements with any labor unions.

Our videohuman capital resources objectives include, as applicable, identifying, recruiting, retaining, incentivizing and audio capture devices are compact, ergonomic, tamperproofintegrating our existing and designed to capture HD video and/or audio on demand enabling our customers to capture content while engaged in a wide range of activity. We also sell accessories that enhance the functionality and versatilitynew employees. The principal purposes of our products,equity and cash incentive plans are to attract, retain and reward personnel, whether existing employees or new hires, through the granting of stock-based and cash-based compensation awards. We believe that this increases value to our stockholders and the success of our company by motivating such individuals to perform to the best of their abilities and achieve our objectives.

As the success of our business is fundamentally connected to the well-being of our employees, we are committed to their health, safety and wellness. We provide our employees and their families with access to convenient health and wellness programs, including mounts, such asbenefits that provide protection and security giving them peace of mind concerning events that may require time away from work or that impact their financial well-being; and that offer choice where possible so they can customize their benefits to meet their needs and the helmet, handlebar, roll bar and tripod mounts,needs of their families. In response to the COVID-19 pandemic, we implemented significant changes that we determined were in the best interest of our employees, as well as mounts that enable users to wear the camera on their bodies, such as the wrist housing, chest harnesscommunity in which we operate, and head strap. Other accessories include spare batteries, charging accessories and memory drives. Our products are marketed primarily to law enforcement due to their unique need to capture important eventswhich comply with government regulations, including working in the course of their duties.a remote environment where appropriate or required.

Our primary products consist of video and audio recording devices as follows:

LE10 Law Enforcement Video Recorder. Retail price: $195. The LE10 on-body camera is designed for use by law enforcement and can be mounted on helmets, tactical vest and riot shields. The LE10 provides high quality video and a sensor that allows the device to shoot in full HD at 30 fps, and 8 MP photosRelationship with shutter speed of 8fps in burst mode. In photo mode, the user can take pictures with a delayed timer. The device has three (3) resolutions and slow-motion capability allowing its user to create highly quality video while engaged in a variety of physical activity. The LE10 has built-in Wi-Fi, providing connectivity with a smartphone or tablet to enable remote control and content viewing functionality. Video taken by the LE10 is stored on a micro HD SD card which can be transferred to a computer for use as evidence. Downloading the video into evidence requires no special software or expensive cloud storage contracts. The LE10 is equipped with a high definition microphone to capture and record audio. The LE10 can also be used only as a standalone audio recorder to record witness statements or conduct interviews.

LE50 HD Body Cam. Retail price: $495. The LE50 includes many of the LE10 features in an on-body camera designed for use by law enforcement which can be mounted on helmets, tactical vest and riot shields. The LE50 provides up to 10 hours of high quality video with a built in audio announcement feature, 50 hours of standby time, sound and vibration operation indication, 2″ TFT-LCD High Resolution Color Display, 32 GB of internal tamper proof storage, supports up to 128GB of memory, 140 degree field of view, white led illumination, waterproof level of IP65, metal clip with 360 degrees rotation, one button tag of important file feature and GPS recording.

SC1 Sunglass Camera. Retail price: $199.95. The SC1 Sunglass Camera is made from TR90 high impact resistant and flexible material and features a 150° wide-angle full HD 1080p video camera, with one-hour record time, built between the eyes with the controls and battery built into the glasses’ ultra slim frame. A full range of polarized and clear lenses are available and easily interchangeable.

Surveillance Cameras. Retail price: $100-$1,800. The Surveillance cameras now offered are state of the art, disguised cameras sold exclusively to law enforcement. Due to the sensitive nature of these products no further information may be disclosed.

Our manufacturer provides a one (1) year warranty for our products, and customers can purchase another year.

Our customers include the federal government and more than five hundred (500) state and local law enforcement agencies.

Distribution

Customers purchase products from our website, printed catalogs and by telephone order. All products are shipped from our manufacturer to our facility in North Carolina where we process and ship product to our customers using Federal Express or United Parcel Services. Customers pay all shipping charges for orders less than $200.

ManufacturingSRAX

We purchasehave operated as an operating segment of SRAX since April 1, 2020. SRAX currently provides certain services to us, and costs associated with these functions are billed to us. These services relate to: executive management, information technology, legal, finance and accounting, human resources, tax, treasury, research and development, sales and marketing, shared facilities and other services.

On February 4, 2021, we completed the share exchange transaction (“Share Exchange”) as described in the share exchange agreement (“Exchange Agreement”). The Exchange Agreement and proposed Share Exchange was disclosed in our finished productsCurrent Report on Form 8-K that was filed with the Securities and Exchange Commission (the “Commission” or “SEC”)) on October 5, 2020.

Pursuant to the Share Exchange, we acquired all of the outstanding capital stock of BIG Token. As a result, we became a majority owned subsidiary of SRAX, BIG Token became our wholly owned subsidiary and Force Protection Video Equipment Corporation adopted BIG Token’s business plan. In connection with the Share Exchange, we entered into the following agreements:

| 8 |

Transition Services Agreement

On January 27, 2021, we entered into the Transition Services Agreement (“TSA”) with SRAX and BIG Token. Pursuant to the TSA, SRAX will provide us with certain transitional related services for such period of time as needed. Pursuant to the TSA, we pay SRAX, on a monthly basis, for certain services required to run the BIG Token business and platform, including but not limited to: (i) general and administrative services, (ii) finance and accounting services, (iii) technical operations, (iv) software services, (v) human resources services, (vi) use of facilities, (vii) and other services on an as needed basis from several manufacturers in Shenzhen China, Taiwan,if requested by the Company.

Master Separation Agreement

On January 27, 2021, we entered into a Master Separation Agreement (“MSA”) with SRAX. Pursuant to the MSA: (a) SRAX transferred all of the BIG Token assets required to run the BIG Token business including but not limited to (i) SRAXauto, SRAXcore, and SRAXshopper advertising tools and software, (ii) the USA. Our manufacturers provide production, labelingBIG Token platform, (iii) associated BIG Token software and packaginghardware; (iv) contracts associated with BIG Token, (v) intellectual property rights associated with BIG Token, (vi) bank accounts and certain inventory of our finished product according to our specifications which is confirmed with each order placed. We are not subject to any supplier agreements which means we are not obligated to purchase a minimum amount of product or place ordersBIG Token, and (vii) other assets required in the future. We pay for all products we order atBIG Token business; and (b) certain liabilities and obligations related to the timeBIG Token business including but not limited to (v) liabilities related to the order is placed. Upon placing an order, our manufacturer creates a purchase order reflecting: (i)BIG Token business, (w) certain BIG Token accounts payable, (x) liabilities resulting from BIG Token contracts, (y) liabilities arising out of third-party claims against the product ordered, (ii) price per item (iii) total cost forBIG Token business and its assets, and (z) other liabilities that arise out of or result from the order, (iv) total costBIG Token business prior or subsequent to ship product ordered from our manufacturer to our facility, (iv) that immediate payment in required at the timeclosing of the order, and (v) the delivery date and delivery address. All material used to manufacture our products is located, purchased and paid for by our manufacturers who invoices us only for our finished product. All products offered by Force Protection Video have a twelve (12) month warranty.

Marketing

Currently, our sales and marketing efforts include printed marketing brochures catalogs featuring our products which we distribute to state and local law enforcement agencies. We create and deliver brochures to state and local law enforcement, every four (4) weeks, using U.S. Mail. Our data base contains over 25,000 law enforcement agencies nationwide.

We believe that a marketing strategy focused on print marketing to law enforcement will provide our target customers with the opportunity to view our specific information about our products and their features, which is an optimal strategy to increase sales.

Product Development

We expense all product development costs as incurred. Product development costs have been negligible for the past few years but are incurred as needed to support new product ideas and launches.

Product Warranty

We accept returns of products two (2) weeks after purchase. Additionally, our manufacturer provides a twelve (12) month warranty on all products manufacturedShare Exchange. SRAX and the Company offers an extended warranty for year two. The occurrencefurther agreed to take such steps necessary to facilitate the transfers, including continued efforts on each party if there is any delay in the assignment of any material defectsasset or product recalls could make us liableliability.

The MSA also requires, for damagesas long as SRAX is required to consolidate our results of operations and warranty claims. Any negative publicityfinancial position, that we agree to: (i) prepare its annual and quarterly financial statements in accordance with the general accepted accounting principles (GAAP), (ii) undertake certain internal controls and procedures over financial reporting, (iii) provide our preliminary financial statements to SRAX for review, (iv) file all required quarterly and annual reports with the Commission on a timely basis, (v) provide SRAX with all annual budgets and periodic financial projections related to our operations on a consolidated basis, (vi) cooperate with SRAX on all public filings, press releases, and proxy statements filed or disseminated by SRAX as needed, and (vii) to use the perceived qualitysame certified public accountant as SRAX.

Provided that SRAX owns at least fifty percent (50%) of the total voting power of our productscapital stock, without the prior consent of SRAX, we (i) will not restrict the ability of SRAX to sell, transfer or dispose of the Common Stock, (ii) will not breach certain contraction obligation to which SRAX is a party to and pursuant to which we receive a benefit pursuant to the TSA, and (iii) will not make any acquisitions or dispositions of businesses or assets in excess of $3,000,000 in the aggregate, or acquire shares, or interest in any company or partnership or loans in excess of $3,000,000 in the aggregate.

SRAX as our Controlling Stockholder

SRAX currently owns 149,562,566,584 shares of our Common Stock or approximately 95% of the voting power of the Company. For as long as SRAX continues to control more than 50% of our outstanding common stock, SRAX or its successor-in-interest will be able to direct the election of all the members of our board of directors. Similarly, SRAX will have the power to determine matters submitted to a vote of our stockholders without the consent of our other stockholders, will have the power to prevent a change in control of us and will have the power to take certain other actions that might be favorable to SRAX. In addition, the master separation agreement will provide that, as long as SRAX beneficially owns at least 50% of the total voting power of our outstanding capital stock entitled to vote in the election of our board of directors, we will not (without SRAX’s prior written consent) take certain actions, such as incurring additional indebtedness and acquiring businesses or assets or disposing of assets in excess of certain amounts. To preserve the tax-free treatment of the separation, the master separation agreement will include certain covenants and restrictions to ensure that, until immediately prior to the share exchange, SRAX will retain beneficial ownership of at least 80% of our carve-out voting power and 80% of each class of nonvoting capital stock, if any is outstanding. In addition, to preserve the tax-free treatment of the separation, we will agree in the tax matters agreement to restrictions, including restrictions that would be effective during the period following the distribution, that could affectlimit our brand image, decrease retailer, distributorability to pursue certain strategic transactions, equity issuances or repurchases or other transactions that we may believe to be in the best interests of our stockholders or that might increase the value of our business.

| 9 |

| ITEM 1A. | RISK FACTORS. |

Investing in our Common Stock involves substantial risk. You should carefully consider the risks and customer demand,uncertainties described below, together with all of the other information in this Annual Report, including our financial statements and the related notes included elsewhere in this Annual Report, before deciding whether to invest in shares of our common stock. We describe below what we believe are currently the material risks and uncertainties we face, but they are not the only risks and uncertainties we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our operating results and financial condition. Warranty claims may result in litigation,business. If any of the occurrence of which could adversely affectfollowing risks actually occur, our business, financial condition, results of operations and operating results.future prospects could be materially and adversely affected. In that event, the market price of our common stock could decline and you could lose part or all of your investment.

CompetitionRisks Related to the COVID-19 Pandemic

The marketCOVID-19 pandemic, or other epidemic and pandemic diseases or governmental or other actions taken in response to them, could significantly disrupt our business.

Outbreaks of epidemic, pandemic or contagious diseases, such as the recent SARS-CoV-2 virus, or coronavirus, which causes coronavirus disease 2019, or COVID-19, or, historically, the Ebola virus, Middle East Respiratory Syndrome, Severe Acute Respiratory Syndrome or the H1N1 virus, could significantly disrupt our business. These outbreaks pose the risk that we or our employees, contractors, and other partners may be prevented from conducting business activities for on-body camerasan indefinite period of time due to spread of the disease within these groups, or due to restrictions that may be requested or mandated by governmental authorities. Business disruptions could include disruptions or restrictions on our ability to travel, as well as temporary closures of all or part of our facilities and the facilities of our partners. As the COVID-19 pandemic rapidly evolves and spreads, both across the United States and through much of the world, we continue to actively monitor the impact that COVID-19 is highly competitive. Further, we expect competition to increasehaving and may have on our business.

As a result of the COVID-19 pandemic, many states and counties have issued and may in the future issue orders for all residents to remain at home, except as existing competitors introduce newneeded for essential activities, and more competitive offerings alongside their existing products,have placed restrictions on the scope and as new market entrants introduce new products into our markets. We compete against established, well-known camera manufacturers such as Axon- Taser,WatchGuard and Provision. Manyconduct of business activities. As a result, we have implemented work from home policies for a majority of our current competitorsemployees that may continue for an indefinite period. We have substantial market share, diversified product lines, well- established supplytaken steps to ensure the safety of our patients and distribution systems, strong worldwide brand recognition and greater financial, marketing, research and development and other resources than we do.employees, while working to ensure the sustainability of our business operations as this unprecedented situation continues to evolve.

In addition, manya significant outbreak of our existing and potential competitors have substantial competitive advantages, such as:

| |

| |

| |

| |

| |

| |

|

Moreover, smartphones and tablets with photo and video functionality have significantly displaced traditional camera sales. It is possible that,epidemic, pandemic or contagious diseases in the future, the manufacturers of these devices,human population, such as Apple Inc. and Samsung, may design them for use in a range of conditions, including challenging physical environments, or develop products similar to ours. In addition to competition or potential competition from large, established companies, new companies may emerge and offer competitive products. Further, we are aware that certain companies have developed cameras designed and labeled to appear similar to our products, which may confuse consumers or distract consumers from purchasing our products.

Increased competition maythe global COVID-19 pandemic, could result in pricing pressures and reduced profit margins and may impede our ability to continue to increase the sales of our products or cause us to lose market share, any of which could substantially harm our business and results of operations

Seasonality

Our business, as well as the industry in which we operate, is not seasonal.

Intellectual Property

We currently have a patent pending on a new product

Other than the aforementioned pending patent, we have no registered or patented intellectual property. Trademarks and trade names distinguish the various companies from each other. If customers are unable to distinguish our products from those of other companies, we could lose sales to our competitors. We do not have any registered trademarks and trade names, so we only have common law rights with respect to infractions or infringements on its products. Many subtleties exist in product descriptions, offering and names that can easily confuse customers. The name of our principal products may be found in numerous variations of the name and descriptions in various media and product labels. This presents a risk of losing potential customers looking for our products and buying someone else’s because they cannot differentiate between them.

Employees

As of the date of this report, we have three full time employees including Paul Feldman who is our Director, Chief Executive Officer and Chief Financial Officer. Mr. Feldman spends approximately sixty (60) hours per week on our business. We have one full time employees who provide clerical and administrative services and one full time sales person.

None of our employees are represented by a collective bargaining agreement, nor have we experienced any work stoppages. We maintain good relationships with our employees.

In December 2019, a novel strain of coronavirus (COVID-19) emerged in Wuhan, Hubei Province, China. While initially the outbreak was largely concentrated in China and caused significant disruptions to its economy, it has now spread to several other countries, including the United States, and infections have been reported globally. The spread of COVID-19 has affected segments of the global economy and may affect our operations.

Our business has been disrupted, but the extent to which the coronavirus impacts our operations will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the duration of the outbreak, new information which may emerge concerning the severity of the coronavirus and the actions to contain the coronavirus or treat its impact. International stock markets have begun to reflect the uncertainty associated with the slow-down in the American, European, and Asian economies, and the reduced levels of international travel experienced since the beginning of January 2020 and the significant decline in the Dow Industrial Average in February and March 2020, was largely attributed to the effects of COVID-19.

The COVID-19 outbreak is a widespread health crisis that couldand adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could materially impactaffect demand for our efforts to effectuate a business combination.current or future products.

PROPERTIESRisks Related to Our Business

We have a history of operating losses and there are no assurances we will report profitable operations in the foreseeable future.

We occupy approximately 1600 square feet at 1600 Olive Chapel Rd., Apex, NC 27502-6764 pursuanthave losses from operations of $8,581,000 and $15,981,000 for the years ended December 31, 2020 and 2019, respectively. Our future success depends upon our ability to continue to grow our revenues, contain our operating expenses and generate profits. We do not have any long-term agreements with our customers. There are no assurances that we will be able to increase our revenues and cash flow to a lease agreementlevel which expires on November 30, 2020. Our annual rent payments for this locationsupports profitable operations. We may continue to incur losses in future periods until such time, if ever, as we are $19,800successful in year 1significantly increasing our revenues and $20,394cash flow beyond what is necessary to fund our ongoing operations and pay our obligations as they become due. If we are not able to grow, increase revenue and begin generating consistent profits, it is unlikely we will be able to generate sufficient cash from operations to pay our operating expenses and service our debt obligations, or report profitable operations in year 2.future periods.

| 10 |

LEGAL PROCEEDINGS

We may not be able to continue as a going concern if we do not obtain additional financing.

We have incurred losses since our inception and have not demonstrated an ability to generate revenues from the sales of our proposed products. Our ability to continue as a going concern is dependent on raising capital from the sale of our common stock and/or obtaining debt financing. Our cash, cash equivalents and short-term investment balance as of December 31, 2020 was approximately $1,000. On March 12, 2021 we closed on the private placement of our Series B Preferred Stock. The offering resulted in gross proceeds of 4,724,827, not including an additional $1,050,000 that we closed on in October 2020. Based on our cash, cash equivalents and short term investments, as well as the proceeds from our offering, as well as our current expected level of operating expenditures, we expect to be able to fund our operations through the third quarter of 2021. Our ability to remain a going concern is wholly dependent upon our ability to continue to obtain sufficient capital to fund our operations. Accordingly, despite our ability to secure capital in the past, there can be no assurance that additional equity or debt financing will be available to us when needed or that we may be able to secure funding from any other sources. In the event that we are not awareable to secure funding, we may be forced to curtail operations, delay or stop ongoing clinical trials, cease operations altogether or file for bankruptcy.

We will need to raise additional capital to continue operations.

We have historically operated as a business unit of any pendingSRAX and accordingly, SRAX has funded our operations. As of December 31, 2020, we had minimal cash or threatened litigation against us thatcash equivalents or short-term investment. On March 12, 2021, we closed on a private placement of our Series B Preferred Stock resulting in gross proceeds of approximately $4.7 million. Based on our cash, cash equivalents and short term investments, as well as the proceeds from our offering, as well as our current expected level of operating expenditures, we expect will have a material adverse effect onto be able to fund our business, financial condition, liquidity, or operating results.operations through the third quarter of 2021. We cannot assure you that we will not be adversely affected in the future by legal proceedings.able to secure additional capital through financing transactions, including issuance of debt. Our inability to operate profitably, or secure additional financing will materially impact our ability to fund our current and planned operations.

ITEM 4: MINE SAFETY DISCLOSUREWe have spent and expect to continue spending substantial cash in the execution of our business plan and the development of the BIG Token platform. We cannot assure you that financing will be available if needed. If additional financing is not available, we may not be able to fund our operations, develop or enhance our product offerings, take advantage of business opportunities or respond to competitive market pressures. If we exhaust our cash reserves and are unable to secure additional financing, we may be unable to meet our obligations which could result in us initiating bankruptcy proceedings or delaying or eliminating some or all our research and product development programs.

Not Applicable.

PART IIOur failure to maintain an effective system of internal control over financial reporting may result in the need for us to restate previously issued financial statements. As a result, current and potential stockholders may lose confidence in our financial reporting, which could harm our business and value of our stock.

ITEM 5:MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIESOr management has determined that, as of December 31, 2020, we did not maintain effective internal controls over financial reporting based on criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission in Internal Control-Integrated Framework as a result of identified material weaknesses in our internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis.

Market InformationOur auditors have expressed substantial doubt about our ability to continue as a going concern.

Our common stock tradesauditors’ report on our December 31, 2020 consolidated financial statements expresses an opinion that our capital resources as of the Overdate of their audit report were not sufficient to sustain operations or complete our planned activities for the Counter Markets Group Inc. Pink tier underupcoming year unless we raised additional funds. Our current cash level raises substantial doubt about our ability to continue as a going concern past the symbol “FPVD”.third quarter of 2021. If we do not obtain additional capital by such time, we may no longer be able to continue as a going concern and may cease operation or seek bankruptcy protection.

| 11 |

The following table sets forth the closing high

If we are unable to successfully retain and low bid quotations ofintegrate a new management team, our common stock for each quarter during the past two fiscal years as reported by the OTC:business could be harmed.

|

| As of April 30, 2019 |

| |||||

Fiscal Year 2019 |

| High* |

|

| Low* |

| ||

First quarter ended July 31, 2018 |

| $ | 0.0012 |

|

| $ | 0.0002 |

|

Second quarter ended October 31, 2018 |

| $ | 0.0003 |

|

| $ | 0.0001 |

|

Third quarter ended January 31, 2019 |

| $ | 0.0003 |

|

| $ | 0.0001 |

|

Fourth quarter ended April 30, 2019 |

| $ | 0.0002 |

|

| $ | 0.0001 |

|

|

| As of April 30, 2018 |

| |||||

Fiscal Year 2018 |

| High* |

|

| Low* |

| ||

First quarter ended July 31, 2017 |

| $ | 0.2290 |

|

| $ | 0.0121 |

|

Second quarter ended October 31, 2017 |

| $ | 0.0400 |

|

| $ | 0.0062 |

|

Third quarter ended January 31, 2018 |

| $ | 0.0067 |

|

| $ | 0.0025 |

|

Fourth quarter ended April 30, 2018 |

| $ | 0.0040 |

|

| $ | 0.0007 |

|

Transfer Agent

Our Transfer Agent is Interwest Transfer Co., Inc. located at 1981 Murray Holladay Road, Suite 100, Salt Lake City, Utah. Their telephone number is 801-272-9294 and their website is www.interwesttc.com.

Holders

As of April 13, 2020, there are approximately 41 holders of record of our common stock in certificate form, exclusive of those brokerage firms and/or clearing houses holding our Common Stock in street name for their clientele (with each such brokerage house and/or clearing house being considered as one holder). We have 841,184,289 shares of common stock issued and outstanding.

Dividend Policy

We have not paidhistorically operated as a business unit of SRAX. Our success depends largely on the development and execution of our business strategy by our senior management team. Effective February 16, 2021, Lou Kerner was appointed Chief Executive Officer. Our success depends largely on the development and execution of our business strategy by our senior management team. We currently have a limited executive team which may adversely affect our business. Additionally, the loss of any dividendsmembers or key personnel would likely harm our ability to implement our business strategy and respond to the holdersrapidly changing market conditions in which we operate. There may be a limited number of persons with the requisite skills to serve in these positions, and we cannot assure you that we would be able to identify or employ such qualified personnel on acceptable terms, if at all. We cannot assure you that management will succeed in working together as a team. In the event we are unsuccessful, our business and prospects could be harmed.

We depend on the services of our common stockexecutive officers and the loss of any of their services could harm our ability to operate our business in future periods.

Our success largely depends on the efforts and abilities of our or Chief Executive Officer, Lou Kerner. We are a party to an employment agreement with Mr. Kerner. Although we do not expect to pay any such dividendslose his services in the foreseeable future, the loss of any of them could materially harm our business and operations in future periods until such time as we expectwere able to retainengage a suitable replacement.

We have no operating history as a standalone entity or management team as presently configured which results in a high degree of uncertainty regarding our future earnings for useability to effectively operate our business.

Our limited staff, operating history as well as our recently appointed management team means that there is a high degree of uncertainty regarding our ability to:

| ● | develop and commercialize our technologies and proposed products; | |

| ● | identify, hire and retain the needed personnel to implement our business plan; | |

| ● | manage growth; or | |

| ● | respond to competition. |

No assurances can be given as to exactly when, if at all, we will be able to develop our business or take the necessary steps to derive net income.

The employment contract of Lou Kerner contains anti-termination provisions which could make changes in management difficult or expensive.

We have entered into an employment agreement with Lou Kerner, our Chief Executive Officer. This agreement may require the payment of severance in the operationevent he ceases to be employed. The provision makes the replacement of Mr. Kerner costly and expansioncould cause difficulty in effecting any required changes in management or a change in control.

We may be required to expend significant capital to redeem BIGtoken Points which will negatively impact our ability to fund our core operations.

Users of BIGtoken receive points for undertaking certain actions on the platform that may be redeemed directly for cash from us, with such value as determined by management. Accordingly, we are currently obligated to redeem users’ points which are earned on BIGtoken. We are currently redeeming each point for up to $0.01, subject to the user meeting certain conditions. As of December 31, 2020, we recorded a contingent liability for future point redemptions equal to approximately $445,000 and we have redeemed an aggregate amount of approximately $1,250,000. As of December 31, 2020, we had approximately 16 million application downloads. If our users continue to increase, we will be required to have enough cash reserves to redeem points held by our qualified users for cash. There can be no assurance that we will have enough cash reserves, or if we do have sufficient cash, if we will be able to continue to fund our other business obligations and operational expenses.

| 12 |

If our efforts to attract and retain BIGtoken users are not successful, our number of users and the amount of data collected could fail to reach critical mass, grow or decline and our potential for BIGtoken to earn revenues may be materially affected.

We will be dependent on advertisers to pay us for access to user data. We must attract users to grow the amount of accessible data and make it attractive to these third parties. If the public does not perceive our mission or our services to be reliable, valuable or of high quality, we may not be able to attract or retain users and create a critical mass of data which will impact our ability to earn revenues which could have a materially adversely affected us.

The regulatory regime governing blockchain technologies, cryptocurrencies, digital assets, utility tokens, security tokens and offerings of digital assets is evolving and uncertain, and new regulations or policies may materially adversely affect our development.

We anticipate embracing digital assets and cryptocurrencies in the future. Regulation of digital assets like, cryptocurrencies, blockchain technologies and cryptocurrency exchanges, is currently undeveloped and likely to rapidly evolve as government agencies take greater interest in them. Regulation also varies significantly among international, federal, state and local jurisdictions and is subject to significant uncertainty. Various legislative and executive bodies in the United States and in other countries may in the future adopt laws, regulations, or guidance, or take other actions, which may severely impact the permissibility of tokens generally and the technology behind them or the means of transaction or in transferring them. The regulatory regime governing blockchain technologies, cryptocurrencies, digital assets, utility tokens, security tokens and offerings of digital assets is uncertain, and new regulations or policies may materially adversely affect the development and the value of the Company if we materially embrace digital assets and cryptocurrencies in the future.

Natural disasters, epidemic or pandemic disease outbreaks, trade wars, political unrest or other events could disrupt our business or operations or those of our development partners, manufacturers, regulators or other third parties with whom we conduct business now or in the future.

A wide variety of events beyond our control, including natural disasters, epidemic or pandemic disease outbreaks (such as the recent novel coronavirus outbreak), trade wars, political unrest or other events could disrupt our business or operations or those of our manufacturers, regulatory authorities, or other third parties with whom we conduct business. These events may cause businesses and government agencies to be shut down, supply chains to be interrupted, slowed, or rendered inoperable, and individuals to become ill, quarantined, or otherwise unable to work and/or travel due to health reasons or governmental restrictions. For example, California recently ordered most businesses closed, mandating work-from-home arrangements, where feasible, in response to the coronavirus pandemic. These limitations could negatively affect our business operations and continuity and could negatively impact our ability to timely perform basic business functions, including making SEC filings and preparing financial reports. If our operations or those of third parties with whom we have business are impaired or curtailed as a result of these events, the development and commercialization of our products and product candidates could be impaired or halted, which could have a material adverse impact on our business.

Securities Authorized for Issuance Under Equity Compensation PlansChallenges in acquiring user data could adversely affect our ability to retain and expand BIGtoken, and therefore could materially affect our business, financial condition and results of operations.

AtIn order to expand BIGtoken, we must continue to expend resources to make the present time, we have no securities authorizedsubmission of user data as user-friendly as possible. We, and our users, may face legal, logistical, cultural and commercial challenges in procuring user data. Additionally, once such data is obtained, if the process for issuance under equity compensation plans.validation and collection of rewards may be perceived as too cumbersome and discourage potential users from submission. We may need to expend significant resources on user interfaces for evolving platforms, such as mobile devices. Inconveniences to our users or potential users at any stage of the process may materially challenge our growth.

Additional InformationIf we fail to ensure that the user data derived from BIGtoken is of high quality, our ability to attract customers or monetize the data may be materially impaired.

CopiesThe reliability of our annual reports, quarterly reports, current reports,user data depends upon the integrity and the quality of the process of accepting user data into BIGtoken. We will take certain measures to validate user data submitted by our users and potential users to assure a high quality of data in BIGtoken and generally confirming that data is submitted in accordance with our terms for such data. We must continue to invest in our quality control measures relating to BIGtoken in order to provide a high-quality product to potential customers.

If BIGtoken experiences an excessive rate of user attrition, our ability to attract customers could fail.

Users may elect to have their data deleted from BIGtoken at any amendmentstime. We must continually add new users both to those reports,replace users who choose to delete their data and to increase our user base. Users may choose to delete their data for many reasons. If users are available freeconcerned about privacy and security and do not perceive BIGtoken to be reliable, if we fail to keep users engaged and interested in our application, or if we simply lose our users’ attention, we could fail to gather sufficient user data and our ability to earn revenues may be materially affected.

| 13 |

If we are unable to manage our marketing and advertising expenses, it could materially harm our results of chargeoperations and growth.

We plan to rely in part on our marketing and advertising efforts to attract new members. Our future growth and profitability, as well as the maintenance and enhancement of our brand, will depend in large part on the internet at www.sec.gov. All statements made in anyeffectiveness and efficiency of our filings, including all forward-looking statements, are made as of the date of the document, in which the statement is included,marketing and we do not assume or undertake any obligation to update any of those statements or documents unlessadvertising strategies and expenditures. If we are requiredunable to do so by law.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward Looking Statements

The following discussion of themaintain our marketing and advertising channels on cost-effective terms, our marketing and advertising expenses could increase substantially, and our business, financial condition and results of operations may suffer. In addition, we may be required to incur significantly higher marketing and advertising expenses than we currently anticipate if excessive numbers of members withdraw their member data from our database.

Failure to comply with federal, state and local laws and regulations or our contractual obligations relating to data privacy, protection and security of BIGtoken user data, and civil liabilities relating to breaches of privacy and security of user data, could damage our reputation and harm our business.

A variety of federal, state and local laws and regulations govern the collection, use, retention, sharing and security of user data. We will collect BIGtoken user data from and about our members when they redeem rewards and maintain that date in our BIGtoken Application. Claims or allegations that we have violated applicable laws or regulations related to privacy, data protection or data security could in the future result in negative publicity and a loss of confidence in us by our users and potential new users and may subject us to fines and penalties by regulatory authorities. In addition, we have privacy policies and practices concerning the collection, use and disclosure of user data as part of our agreements with our members, including ones posted on our website. Several Internet companies have incurred penalties for failing to abide by the representations made in their privacy policies and practices. In addition, our use and retention of user data could lead to civil liability exposure in the event of any disclosure of such information due to hacking, malware, phishing, inadvertent action or other unauthorized use or disclosure. Several companies have been subject to civil actions, including class actions, relating to this exposure.

We have incurred, and will continue to incur, expenses to comply with data privacy, protection and security standards and protocols for BIGtoken user data imposed by law, regulation, self-regulatory bodies, industry standards and contractual obligations. Such laws, standards and regulations, however, are evolving and subject to potentially differing interpretations, and federal, state and provincial legislative and regulatory bodies may expand current or enact new laws or regulations regarding privacy matters. Additionally, we accept user from foreign countries which subjects us to the personal and other data privacy, protection and security laws of those countries, We are unable to predict what additional legislation, standards or regulation in the area of privacy and security of personal information could be enacted or its effect on our operations and business.

If we are unable to satisfy data privacy, protection, security, and other government- and industry-specific requirements, our growth could be harmed.

We need or may in the future need to comply with a number of data protection, security, privacy and other government- and industry-specific requirements, including those that require companies to notify individuals of data security incidents involving certain types of personal data. Security compromises could harm our reputation, erode user confidence in the effectiveness of our security measures, negatively impact our ability to attract new members, or cause existing users to withdraw their data from BIGtoken.

| 14 |

Regulatory, legislative or self-regulatory developments regarding internet privacy matters could adversely affect our ability to conduct our business.