MOBIQUITY TECHNOLOGIES, INC.

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A10-K

(Amendment No. 2)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 20212023

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

COMMISSION FILE NUMBER: 001-41117

MOBIQUITY TECHNOLOGIES, INC.

(Exact name of Registrant as specified in its charter)

| New York | 11-3427886 |

(State of jurisdiction of incorporation or organization) | (I.R.S. Employee Identification Number) |

| 35 Torrington LaneShoreham, NY | 11786 |

| (Address of principal executive offices) | (Zip Code) |

Securities registered pursuant to Section 12(b) of the Act: None

|

| |

Securities registered pursuant to Section 12(g) of the Act:None

Common stock, $0.0001 par value, Common stock Purchase Warrants

(Title of each class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Check whether the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically, every Interactive data file required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | ||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. Yes ☐ No ☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No No☒ ☒

As of June 30, 2021,2023, the number of shares of Common Stock held by non-affiliates was approximately 2,382,1002,268,300 shares based upon 3,100,782 post-split2,574,084 shares of Common Stock outstanding. The approximate market value based on the last sale (i.e. $9.50$1.65 per share as of June 30, 2021)2023) of the Company’s Common Stock held by non-affiliates was approximately $22,629,9503,743,000.

The number of shares outstanding of the Registrant’s Common Stock as of March 25, 2022,2024, was .

On September 9, 2020, the CompanyAugust 7, 2023, we effected a one-for-400one-for-15 reverse stock split. All share and per share amounts set forth herein giveThis Form 10-K gives retroactive effect to suchthe reverse stock split unlessas if the context indicates otherwise.split had occurred prior to any reported transactions and prior to the dates on the financial statements included herein.

FORWARD-LOOKING STATEMENTS

We believe this annual report contains "forward-looking statements"“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties and are based on the beliefs and assumptions of our management, based on information currently available to our management. When we use words such as "believes," "expects," "anticipates," "intends," "plans," "estimates," "should," "likely"“believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “should,” “likely” or similar expressions, we are making forward-looking statements. Forward-looking statements include information concerning our possible or assumed future results of operations set forth under "Business"“Business” and/or "Management's“Management’s Discussion and Analysis of Financial Condition and Results of Operations."” Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Our future results and stockholder values may differ materially from those expressed in the forward-looking statements. Many of the factors that will determine these results and values are beyond our ability to control or predict. Stockholders are cautioned not to put undue reliance on any forward-looking statements. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. For a discussion of some of the factors that may cause actual results to differ materially from those suggested by the forward-looking statements, please read carefully the information under "Risk“Risk Factors."” In addition to the Risk Factors and other important factors discussed elsewhere in this annual report, you should understand that other risks and uncertainties and our public announcements and filings under the Securities Exchange Act of 1934, as amended could affect our future results and could cause results to differ materially from those suggested by the forward-looking statements.

Among others, the forward-looking statements appearing in this Report that may not occur include, but are not limited to, statements regarding plans to remediate the material weakness with respect to the Company’s internal control over financial reporting and the impact of these matters on the outlook of the Company and the restatement on the Company’s previously issued financial statements for the Affected Period.

As used in this Form 10-K, the terms “we,” “our,” “us,” “Mobiquity Technologies” or “the Company” refer to Mobiquity Technologies, Inc. and its subsidiaries, taken as a whole, unless the context otherwise requires it.

Our financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.Principles in the United States. All references to “common stock” refer to the common shares in our capital stock.

| i |

TABLE OF CONTENTS

| ii |

EXPLANATORY NOTE

Mobiquity Technologies, Inc. (the “Company”) filed its Annual Report on Form 10-K for the fiscal year ended December 31, 2021 with the U.S. Securities and Exchange Commission (“SEC”) on March 30, 2022 (the “Original Form 10-K”). Amendment No. 1 on Form 10-K ("Amendment No. 1" or "Form 10-K/A No. 1") was filed May 23, 2022 to restate the Company’s previously issued consolidated financial statements and financial information as of and for the fiscal year ended December 31, 2021, contained in the Original Form 10-K, and to amend the Company’s conclusions and disclosures included in Item 9A Controls and Procedures of the Original Form 10-K related to disclosure controls and procedures and internal control over financial reporting. This Amendment No. 2 on Form 10-K (“Amendment No. 2” or “Form 10-K/A No. 2”) is being filed to amend previously restated and issued consolidated financial statements and financial information as of and for the fiscal years ended December 31, 2021 and 2020, contained in the Amendment No. 1, and to restate previously issued consolidated financial statements and financial information for quarterly periods within fiscal 2020 and 2021.

Background of Restatement

Subsequent to the filing of the Amendment No. 1, management identified certain accounting errors primarily relating to the accounting for the sale of capital stock of the Company for cash, conversions of debt to equity, exercises of common stock warrants, and vesting of stock-based compensation expense in connection with the issuance of common stock warrants to employees. In connection with this restatement, management has also elected to reclassify certain presentations within the consolidated balance sheets, statements of operations, statements of stockholders’ equity and statements of cash flows to better reflect the nature of the transactions.

Finally, certain grammatical and technical corrections were made. These changes did not affect the restated balances herein.

On November 28, 2022, the audit committee of the Company's board of directors concluded, after discussion with the Company’s management, that the previously issued and amended financial statements as of and for the years ended December 31, 2021 and 2020 should no longer be relied upon due to these errors and require restatement. This Amendment No. 2 reflects the changes discussed above as of and for the years ended December 31, 2021 and 2020, restates the Company’s consolidated financial statements for these periods, with expanded financial and other disclosures in lieu of filing separate amended Annual Report on Form 10-K/A for the year ended December 31, 2020, and Quarterly Reports on Form 10-Q/A for each of the quarters ended March 31, 2020, June 30, 2020, September 30, 2020, March 31, 2021, June 30, 2021, and September 30, 2021. We believe that the filing of this expanded annual report enables us to provide information to investors in a more efficient manner than separately filing each of the amended filings described above.

As discussed in further detail below and in Note 3 to the accompanying consolidated financial statements, the restatements of the prior filings are the result of the following summarized transactions:

Items Amended in this Amendment

This Amendment No. 2 sets forth the Amendment No. 1, as modified and superseded where necessary to reflect the restatement considerations. Accordingly, the following items included in the Amendment No. 1 have been amended:

· Part I, Item 1A, Risk Factors

· Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations

· Part II, Item 8, Financial Statements and Supplementary Data

· Part IV, Item 15, Exhibits and Financial Statement Schedules

Additionally, in accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended, the Company is including with this Amendment No. 2 currently dated certifications from its Chief Executive Officer and Chief Financial Officer. These certifications are filed or furnished, as applicable, as Exhibits 31.1, 31.2, 32.1 and 32.2.

Except as described above, this Amendment No. 2 does not amend, update or change any other disclosures in the Original Form 10-K or Amendment No. 1. In addition, the information contained in this Amendment No. 2 does not reflect events occurring after the Original Form 10-K or Amendment No. 1 and does not modify or update the disclosures therein, except to reflect the effects of the restatement. This Amendment No. 2 should be read in conjunction with the Company’s other filings with the SEC.

PART I

Item 1. Business

Company Background

Mobiquity Technologies, Inc. is a next-generation marketing and advertising technology, data compliance and data intelligence company which operates through our various proprietary software platforms in the programmatic advertising space.platforms. Our product solutions are comprised of twothree proprietary software platforms:

| · |

| |

| · | ||

| · | Publisher Platform for Monetization and Compliance |

Our Products

The ATOS Platform

Our ATOS platform blends artificial intelligence (or AI) and machine learning (ML) based optimization technology for automatic ad serving that manages digital advertising inventory and campaigns. The ATOS platform:

| · | creates an automated marketplace of advertisers and publishers on digital media outlets to host online auctions to facilitate the sale of digital advertising (known as digital real estate) targeted at users while engaged on their internet-connected TV, laptop, tablet, desktop computer, mobile, and over-the-top (or OTT) streaming media devices; and | |

| · | gives advertisers the capability to understand and interact with their audiences and engage them in a meaningful way by using ads in both image and video formats (known as rich media) to increase their awareness, customer base and |

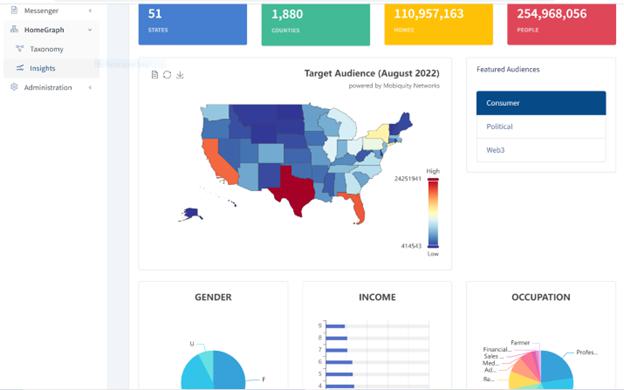

(Screenshot of ATOS Platform Campaign Management landing page.)

| 1 |

Our ATOS platform engages with an average of approximately 10 billion advertisement opportunities per day, based on our daily logs. Our sales and marketing strategy for our ATOS platform is focused on providing a de-fragmented operating system that facilitates a considerably more efficient and effective way for advertisers and publishers to transact with each other. Our goal is to become the programmatic display advertising industry standard for brands directly and small and medium sized advertisers.

Our ATOS technology is proprietary and primarily consists of know-how and trade secrets developed internally, as well as certain open-source software.

Users of the ATOS platform get access to benefits including among other things:

| · | ease of set up; | |

| · | targeting features based on audience profiles and location and context through an in-house data management platform (or DMP); | |

| · | Inventory management and yield optimization; |

| · | support for all rich media creators’ ad tags; | |

| · | machine learning and AI powered optimization which aids in delivering a higher click through rate on ad links; | |

| · | support for third-party trackers and custom scripts for make-the-most-of-your media (or MOAT) analytics, Integral Ad Science (or IAS), and forensics to enable independent verification by advertisers for transparency; | |

| · | detailed campaign wrap-up reporting that gives a breakdown on publishers, categories, demonstrations, and devices to better understand advertisement campaign performance; | |

| · | access to business intelligence via an analytics dashboard; | |

| · | advanced ad targeting; | |

| · | easy campaign uploading; | |

| · | automated performance optimization; | |

| · | real time reporting; | |

| · | fraud prevention tools; and | |

| · | 24x7 support, along with guided managed services to enable users to rapidly harness and operate all the features of the ATOS platform. |

Our ATOS platform includes:

| 2 |

Our ATOS platform includes:

| · | ||

| · | ||

| · | ||

| · | ||

| · | ||

| · | ||

| · | ||

| · | ||

| · | ||

| · | ||

| · | An Advertisement software development kit (or SDK); | |

| · | Prebid adaptor; | |

| · | contextual targeting; | |

| · | identity graph capabilities; | |

| · | cookie syncing; and | |

| · | the updated version of our quality and security tools, among other things for our ATOS platform. |

The

| 3 |

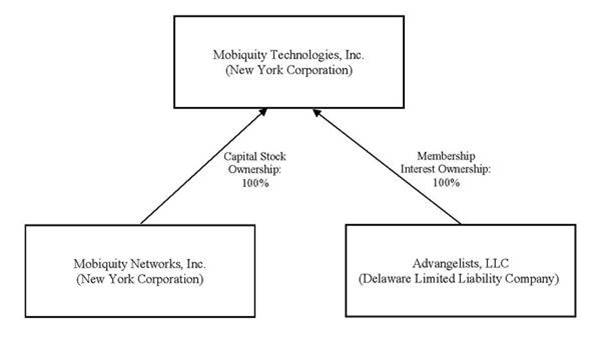

Data Intelligence Platform

Our data intelligence platform provides precise data and insights on consumer’s real-world behavior and trends for use in marketing and research. We believe, based on our experience in our industry, that we provide one of the most accurate and scaled solutions for data collection and analysis, utilizing multiple proprietary technologies. Our data intelligence platform technology allows for the ingestion and normalization of various data sources, such as location data, transactional data, contextual data, and search data to reach the right target audience with the right message. Utilizing massively parallel cluster computing and machine learning algorithms and technology, our data intelligence solutions make available actionable data for marketers, researchers and application publishers through an automated platform. We are seeking to generate several revenue streams from our data collection and analysis, including, among other things; advertising, data licensing, attribution reporting, and custom research.

(Screenshot of Data Intelligence HomeGraph landing page.)

We also offer a self-service alternative through our MobiExchange product, which is a SaaS fee model. MobiExchange is a data focused technology solution that enables individuals and companies to rapidly build actionable data and insights for their own use or for resale.use. MobiExchange’s easy-to-use, self-service tools allow users to reduce the complex technical and financial barriers typically associated with turning offline data, and other business data, into actionable digital products and services. MobiExchange provides out-of-the-box private labeling, flexible branding, content management, user management, user communications, subscriptions, payment, invoices, reporting, gateways to third party platforms, and help desk among other things.

We believe, based on our experience in our industry, that we provide one of the most accurate and scaled solutions for data collection and analysis, utilizing multiple proprietary technologies. MobiExchange is a data focused technology solution that enables individuals and companies to rapidly build actionable data and insights for its own use or for resale. MobiExchange’s easy-to-use, self-service tools allow anyone to reduce the complex technical and financial barriers typically associated with turning offline data, and other business data, into actionable digital products and services. MobiExchange provides out-of-the box private labeling, flexible branding, content management, user management, user communications, subscriptions, payment, invoices, reporting, gateways to third party platforms, and help desk among other things.

Our data intelligence platform is hosted and managed on Amazon Web Service (AWS) and takes full advantage of open standards for processing, storage, security and big data technology. Specifically, our data intelligence platform uses the following AWS services: EC2, Lambda, Kafka, Kinesis, S3, Storm, Spark, Machine Learning, RDS, Redshift, Elastic Map Reduction, CloudWatch, DataBricks, and Elastic Search Service with built-in Kibana integration.

Our Strategy

Our strategy in the programmatic advertising space is to provide small- to medium-sized enterprises with an efficient and effective end-to-end, fully integrated ATOS platform. We believe that our ATOS platform gives users in these markets the capability of running marketing and branding campaigns without the need for an extensive marketing team, which enables them to better compete with their larger competitors who have greater marketing financial and human capital resources. Our sales and marketing approach is focused on providing a de-fragmented operating system that facilitates a considerably more efficient and effective way for advertisers and publishers to transact with each other. Our goal is to become the programmatic display advertising industry standard for small- and medium-sized advertisers. Mobiquity plans to hire several new sales and sales support individuals to help generate additional revenue through the use of our ATOS platform.

Our strategy is based on a problem we perceived in the advertising technology industry as it has rapidly grown over the last 10 years. We viewed the technology in the industry to be highly fragmented and thus inefficient. Many advertisers have had to mix multiple vendors’ different technologies, or bolt-on third-party technology to legacy technology, in an effort to create an integrated solution. Often this has resulted in the absence of a central source to address problems with an integrated system that arise. The flaws that this type of stacked technology ecosystem has includes:

We believe our products address and solve the flaws of a stacked system.

| 4 |

A typical digitalPublisher Platform for Monetization and Compliance

Our Content publisher platform is a single-vendor ad tech operating system that allows publishers to better monetize their opt-in user data and advertising campaign requiresinventory. The platform includes tools for: consent management, audience building, a direct advertising interface and inventory enhancement. Due to the following components:much publicized developments in privacy and data security laws and regulations (such as the European Union’s General Data Protection Regulation or GDPR and the California Consumer Privacy Act of 2018 or CCPA by way of example) along with Apple and Google’s removal of identifiers, we believe that content publishers are facing two material issues: increased costs due to privacy compliance rules, and decreased revenue due to the restrictions selling user identifier data to third parties. We believe this is causing a paradigm shift in the publishing market. Previously content publishers could provide user identifier information to demand-side platforms (or DSP’s) to create user profiles for audience targeting. Now both the user identifier data and the functionality to create profiled data segments from that identifier data (known as first party data) must be owned by the content publisher. Additionally, publishers must also manage the targeting of their audiences in-house utilizing this identifier and targeting data. We recently launched our SaaS publisher platform in response to these needs.

All Publisher data is siloed and secured, using the highest industry standards, optimizing compliance with privacy and data laws that may be applicable. Our platform helps publishers worry less about the integrity of their first party data and allows them to focus on effectively monetizing their inventory.

Users of the publisher platform get access to benefits of our publisher platform, including among other things:

| · | ||

| · | ||

| · | ||

| · | ||

Many

(Screenshot of Publisher Platform Audience Management landing page.)

| 5 |

We believe that irrespective of whether a publisher chooses to engage with us to use our publisher platform or not, they will need to find a solution that allows advertisers to advertise to the publisher’s audience directly through the publisher.

Our Strategy

We are a cutting-edge AdTech company at the forefront of data-driven advertising, publisher compliance, and monetization solutions. With a commitment to innovation, we have positioned ourselves as a next-generation player in the industry, providing a comprehensive suite of services through our three proprietary technology platforms.

Advangelists Advertising Platform:

The Advangelists advertising platform is a cornerstone of Mobiquity’s offerings. This advanced platform leverages data analytics and cutting-edge technology to deliver targeted and effective advertising solutions. By harnessing the power of data, Advangelists enables advertisers to reach their desired audience with precision, maximizing the impact of their advertising and awareness campaigns.

MobiExchange Data Intelligence Platform:

Mobiquity’s MobiExchange is a data intelligence platform designed to empower businesses with valuable insights. This platform facilitates the seamless exchange of data, allowing clients to make informed decisions based on real-time information. MobiExchange plays a pivotal role in enhancing the effectiveness of advertising strategies by providing a robust foundation of data-driven intelligence.

AdHere Publisher Platform:

The AdHere Publisher platform addresses the critical aspect of publisher compliance and monetization. This platform empowers publishers to navigate the complex landscape of compliance requirements seamlessly. Additionally, it offers monetization opportunities for publishers, creating a win-win scenario where content creators can thrive while adhering to industry standards.

Integrated Revenue Streams:

One of the companies we target have between 50-70%distinctive features of our company is its anticipated ability to generate revenue through three independent yet synergistic streams. Each platform - Advangelists, MobiExchange, and AdHere – is expected in 2024 to contribute to the overall financial success of the above componentscompany. This integrated approach allows us to adapt to the evolving needs of the market and outsourceprovide comprehensive solutions to its clients.

Versatile Collaboration:

Our platforms are designed to work independently, providing specialized solutions for specific needs. Simultaneously, the restplatforms seamlessly integrate with each other, offering clients the flexibility to vendors who bolt-on technologycreate customized, end-to-end solutions that cater to those companies’ legacy technology which often resultsdiverse requirements. This versatility positions us as a dynamic and adaptable partner in the flaws discussed above. Werapidly evolving landscape.

In summary, Mobiquity Technologies, Inc. is not merely an AdTech company; it combines innovation, data-driven precision, and versatility to redefine the standards of advertising, data intelligence, publisher compliance and monetization. With our proprietary platforms, our company continues to provide a single-vendor end-to-end solution integratingclients with the required components from a single source that work together becausetools they are built together,need to thrive in an effective and cost-efficient way. Our ATOS platform decreases the effective cost-basis for users by integrating all the necessary capabilities at no additional cost: DSP and bidding technologies, AdCop™ Fraud Protection, rich media and ad serving, attribution, reporting dashboard and DMP are all included.digital marketplace.

| 6 |

Our Revenue StreamsSources

We target publishers, brands, advertising agencies and other advertising technology companies as our audience for our ATOSthree platform products. The ATOS platform creates threeWe generate revenue streams.from our platforms through two verticals:

| · | The first is licensing | |

| · | The second revenue stream is a managed services model, in which, the user is billed a higher percentage of revenue run through | |

Our data intelligence revenue is driven by managed services for advertising agencies; brands; market researchers; university research departments; healthcare; and financial, sports, pet, civil planning, transportation, and other data and technology companies. Often-times sales to users of our data intelligence platform will lead to them to our ATOS platform as well.

Our Intellectual Property

Our portfolio of technology consists of various intellectual property including proprietary source code, trade secrets and know-how that we have developed internally. We own our technology, although we use open sourceopen-source software for certain aspects, and we protect it though trade secrets and confidentiality requirements set out in our employee handbook which each employee acknowledges, and assigning any technology creations and improvements to us. We also have two patents that relate to our location-based mobile advertising technology business which we are not operating. These patents and patents pending are not material to, or used in, our ATOS or data intelligenceplatform related technology that we use in our current operations.

Governmental Regulations

Federal, state, and international laws and regulations govern the collection, use, retention, sharing and security of data that we collect. We strive to comply with all applicable laws, regulations, self-regulatory requirements, and legal obligations relating to privacy, data protection and consumer protection, including those relating to the use of data for marketing purposes. As we develop and provide solutions that address new market segments, we may become subject to additional laws and regulations, which could create unexpected liabilities for us, cause us to incur additional costs or restrict our operations. From time to time, we may be notified of or otherwise become aware of additional laws and regulations that governmental organizations or others may claim should be applicable to our business. Our failure to anticipate the application of these laws and regulations accurately, or other failure to comply, could create liability for us, result in adverse publicity or cause us to alter our business practices, which could cause our net revenues to decrease, our costs to increase or our business otherwise to be harmed. See “Item 1A.”

We are subject to general business regulations and laws as well as regulations and laws specifically governing the internet, e-commerce, and m-commerce in a number of jurisdictions around the world. Existing and future regulations and laws could impede the growth of the Internet, e-commerce, m-commerce, or other online services. These regulations and laws may involve taxation, tariffs, privacy and data security, anti-spam, data protection, content, copyrights, distribution, electronic contracts, electronic communications, and consumer protection. It is not clear how existing laws and regulations governing issues such as property ownership, sales and other taxes, libel and personal privacy apply to the Internet as the vast majority of these laws and regulations were adopted prior to the advent of the Internet and do not contemplate or address the unique issues raised by the Internet, e-commerce or m-commerce. It is possible that general business regulations and laws, or those specifically governing the Internet, e-commerce or m-commerce may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules or our practices. See “Item 1A.“Risk Factors—Our business practices with respect to data and consumer protection could give rise to liabilities or reputational harm as a result of governmental regulation, legal requirements or industry standards relating to consumer privacy, data protection and consumer protection”; and “Risk Factors-- Changes in consumer sentiment or laws, rules or regulations regarding tracking technologies and other privacy matters could have a material adverse effect on our ability to generate net revenues and could adversely affect our ability to collect data on consumer shopping behavior.”

| 7 |

Competition

We compete in the programmatic advertising, data marketingmanagement, and research businessuser compliance management industries and in all other facets of our business against small, medium and large companies throughout the United States. Some examples include companies such as Liveramp, GroundtruthThe TradeDesk and Nielsen.OneTrust. Although we can give no assurance that our business will be able to compete against other companies with greater experience and resources, we believe we have a competitive advantage with our proprietary software and technology platform based on our view that our competitor’s products do not provide the end-to-end solutions that our product solutions do, and their minimum fees are substantially higher than ours for a comparative suite of solutions. See “Item 1A.“Risk Factors — We face intense and growing competition, which could result in reduced sales and reduced operating margins and limit our market share.”

Employees and Contractors

As of DecemberJanuary 31, 2021,2024, we have 1312 employees, including executive management, technical personnel, salespeople, and support staff employees. We also utilize several additional firms/persons who provide services to us on a non-exclusive basis as independent consultants.

Customers

During 2020,For fiscal 2023 and 2022, sales of our products to fourtwo customers generated approximately 36%73% and 48% of our revenues. During 2021, sales of our products to four customers generated approximately 31% of our revenues.revenues, respectively. Our contracts with our customers generally do not obligate them to a specified term and they can generally terminate their relationship with us at any time with a minimal amount of notice.

Debt and Receivables Purchase Financing

We have the following debt financing in place:

Gene Salkind, who is our Chairman of the Board and one of our directors, and his affiliate provided us an aggregate of $2,700,000 in convertible debt financing for convertible promissory notes and common stock purchase warrants. Dr. Salkind’s principal debt was reduced to $2,562,500 in December 2021. See “Item 13.”

Business Capital Providers, Inc. purchased certain future receivables from the Company at a 26% discount under the following agreements on the following terms:

19 private lender-investors, who were unaffiliated shareholders of the Company and accredited investors as provided under Regulation D Rule 501 promulgated under the Securities Act of 1933, provided us convertible debt financing during the period May 2021 through September 2021 pursuant to subscription agreements as described below. (Certain of these investors provided us multiple investments in one or more of these convertible debt structures.):

In May of 2020, the Company received Small Business Administration Cares Act loan of $265,842 due to the COVID-19 pandemic. This loan carried a five-year term, with interests at the annual rate of 1%. During second fiscal quarter of 2021 the Cares Act loan was forgiven in full under the SBA Cares Act loan rules.

In June 2020, the Company received a $150,000 Economic Injury Disaster Loan from the SBA which carries a 30-year term, payable in monthly installments of principal plus interest at the annual rate of 3.75%. This loan is secured by all the assets of the Company. The loan proceeds were used for working capital to alleviate economic injury cause by disaster in January 2020 and after that as required by the loan agreement.

On September 20, 2021, the Company entered into securities purchase agreements, with two accredited investors, Talos Victory Fund, LLC and Blue Lake Partners LLC, pursuant to which the Company issued 10% promissory notes with a maturity date of September 20, 2022, in the aggregate principal amount of $1,125,000. In addition, the Company issued warrants to purchase an aggregate of 56,250 shares of its common stock to these holders. Spartan Capital Securities LLC and Revere Securities LLC acted as placement agents on this transaction. The promissory notes include the following terms:

On the closing date of this financing, the holders delivered the net amount of $910,000 of the purchase price to the Company in exchange for the notes (which was net of the original issue discount and other fees and expenses relate to this financing).

On October 19, 2021, the Company filed a Form S-1 Registration Statement (File no. 333-260364) with the Securities and Exchange Commission to raise over $10 million dollars in an underwritten public offering. The next day the Company filed an application to list our common stock on the NASDAQ Capital Market under the symbol “MOBQ.” This offering was completed on December 13, 2021, and the Company retired the loans of, Talos Victory Fund, LLC and Blue Lake Partners LLC out of the gross proceeds it received of approximately $10.3 million. Also, Talos Victory Fund, LLC and Blue Lake Partners, LLC converted all of their warrants on a cashless basis into 24,692 common shares and 24,692 common shares, respectively.

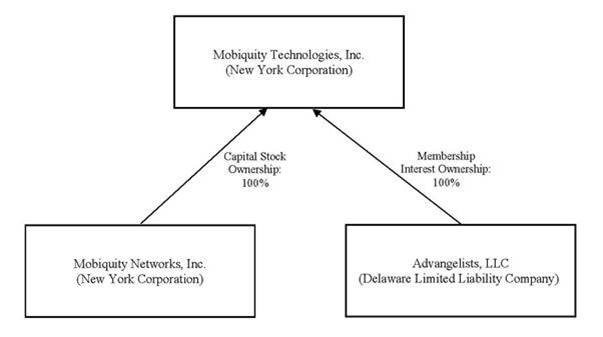

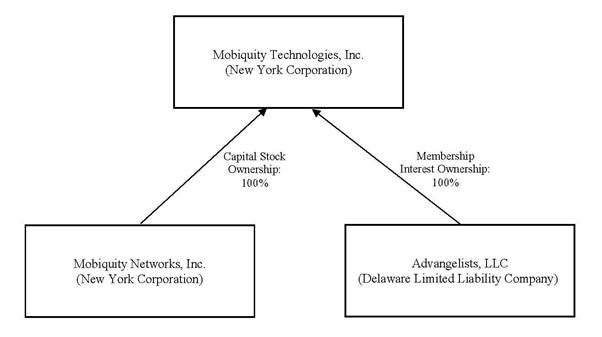

Corporate Structure

We operate our business through two wholly owned subsidiaries, Advangelists, LLC and Mobiquity Networks, Inc. Our corporate structure is as follows:

Subsidiaries

Advangelists, LLC

Advangelists LLC operates our ATOS platform business.

We originally acquired a 48% membership interest and Glen Eagles Acquisition LP acquired a 52% membership interest in Advangelists in a merger transaction in December 2018 for consideration valued at $20 Million. At the time Glen Eagles was a shareholder of the Company, owning 412,500 shares of our common stock. The Company became, and remains, the sole manager of Advangelists following the merger with sole management power. In consideration for the merger:

The Company acquired 3% of the Advangelists’ membership interests from Glen Eagles in April 2019 in satisfaction of the Company’s $500,000 closing payment advance to Glen Eagles, resulting in Mobiquity owning 51% and Glen Eagles owning 49% of Advangelists.

In May 2019 the Company acquired the remaining 49% of Advangelists’ membership interests from Glen Eagles, becoming the 100% owner of Advangelists, in a transaction involving the Company, Glen Eagles, and Gopher Protocol, Inc. In that transaction, Gopher acquired the 49% Advangelists membership interest from Glen Eagles and assumed Glen Eagles’ promissory note to Deepanker Katyal, as representative of the pre-merger Advangelists owners, which had a remaining balance of $7,512,500, in satisfaction of indebtedness owed by Glen Eagles to Gopher. Concurrently with that transaction, the Company acquired the 49% of Advangelists membership interest from Gopher and assumed the promissory note in consideration. Additionally, warrants for 300,000 shares of Company common stock which are issuable upon the conversion of Mobiquity Class AAA preferred stock owned by Gopher were amended to provide for a cashless exercise. In September 2019, the assumed note, which then had a principal balance of $6,780,000, was amended and restated to provide that:

The promissory note was paid in full in November 2019.

Mobiquity Networks, Inc.

We have established Mobiquity Networks, Inc and have operated it since January 2011. Mobiquity Networks started and developed as a mobile advertising technology company focused on driving foot-traffic throughout its indoor network and has evolved and grown into a next generation data intelligence company. Mobiquity Networks operates our data intelligence platform business.

Reports to Securities Holders

We provide an annual report that includes audited financial information to our shareholders. We make our financial information equally available to any interested parties or investors through compliance with the disclosure rules for a small business issuer under the Exchange Act. We are subject to disclosure filing requirements including filing Annual Reports on Form 10-K annually and Quarterly Reports on Form 10-Q quarterly. In addition, we will file Current Reports on Form 8-K and other proxy and information statements from time to time as required. We do not intend to voluntarily file the above reports in the event that our obligation to file such reports is suspended under the Exchange Act. The public may read and copy any materials that we file with the Securities and Exchange Commission, including our Forms 10-K, 10-Q and 8-K and registration statements and proxy and information statements, at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549, or you can read our SEC filings over the Internet at the SEC’s website at http://www.sec.gov.

The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Item 1A. Risk Factors

An investment in our securities is highly speculative, involves a high degree of risk and should be made only by investors who can afford a complete loss. You should carefully consider the following risk factors, together with the other information in this Amendment No. 2 on Form 10-K, including our financial statements and the related notes, before you decide to buy our securities. If any of the following risks actually occurs, then our business, financial condition or results of operations could be materially adversely affected, the trading of our common stock and warrants could decline, and you may lose all or part of your investment therein. In addition to the risks outlined below, risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. Potential risks and uncertainties that could affect our operating results and financial condition include, without limitation, the following:

In this Amendment No. 2, we reached a determination to restate our previously issued December 31, 2021 consolidated financial statements and related disclosures as filed on Form 10-K/A and quarterly periods within fiscal years 2021 and 2020 as filed on Form 10-Q. The restatement primarily related to the following:

The restatement of the consolidated financial statements does not affect the Company’s previously reported total assets, total liabilities or revenues. Additionally, there are no compliance matters with any lender or other third parties as a result of the restatement.

In addition, management has concluded that the Company’s disclosure controls and procedures were not effective as of December 31, 2021 and that the Company’s internal control over financial reporting was not effective as of December 31, 2021 solely as a result of a material weakness in controls related to the aforementioned.

As a result, we have incurred unanticipated costs for accounting and legal fees in connection with or related to the restatement and may become subject to additional risks and uncertainties related to the restatement, such as a negative impact on investor confidence in the accuracy of our financial disclosures and may raise reputational risks for our business.

Risks Relating to our Business Operations

We have a history of operating losses, and our management has concluded that factors raise substantial doubt about our ability to continue as a going concern and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its audit report for the past several fiscal years ended December 31, 2021, and 2020.years.

To date, we have not been profitable and have incurred significant losses and cash flow deficits. For the fiscal years ended December 31, 2021,2023, and 2020,2022, we reported net losses of $18,333,383and $11,745,835 (as restated),$6,533,117 and $8,062,328, respectively, and net cash used in operating activities of $6,717,324$4,362,868 and $3,286,764 (as restated),$6,187,383, respectively. As of December 31, 2021,2023, we had an aggregate accumulated deficit of $202,444,894.$217,040,339. Our operating losses for the past several years are primarily attributable to the transformation of our company into an advertising technology corporation. We can provide no assurances that our operations will generate consistent or predictable revenue or be profitable in the foreseeable future. Our management has concluded that our historical recurring losses from operations and negative cash flows from operations as well as our dependence on private equity and other financings raise substantial doubt about our ability to continue as a going concern, and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its audit report for the past several fiscal year ended December 31, 2021, and 2020.

years. Our consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. These adjustments would likely include substantial impairment of the carrying amount of our assets and potential contingent liabilities that may arise if we are unable to fulfill various operational commitments. In addition, the value of our securities including common stock issued in this offering, would be greatly impaired. Our ability to continue as a going concern is dependent upon generating sufficient cash flow from operations and obtaining additional capital and financing, including funds to be raised in this offering.financing. If our ability to generate cash flow from operations is delayed or reduced and we are unable to raise additional funding from other sources, we may be unable to continue in business even if this offering is successful. For further discussion about our ability to continue as a going concern and our plan for future liquidity, see “Item 7.”liquidity.

| 9 |

We cannot predict our future capital needs and we may not be able to secure additional financing.

From January 2013 through December 2021, we raised a total of over $60 million in private equity and debt financingWe have substantial funds since formation to support our transformation from an integrated marketing company to a technology company. Since we might be unable to generate recurring or predictable revenue or cash flow to fund our operations, we will likely need to seek additional (perhaps substantial) equity or debt financing even following this offering to provide the capital required to maintain or expand our operations. We expect that we will also need additional funding for developing products and services, increasing our sales and marketing capabilities, and acquiring complementary companies, technologies, and assets (there being no such acquisitions which we have identified or are pursuing as of the date of this Form 10-K)Prospectus), as well as for working capital requirements and other operating and general corporate purposes. We cannot predict our future capital needs with precision, and we may not be able to secure additional financing on terms satisfactory to us, if at all, which could lead to termination of our business.

If we elect to raise additional funds or additional funds are required, we may seek to raise funds from time to time through public or private equity offerings, debt financings or other financing alternatives. Additional equity or debt financing may not be available on acceptable terms, if at all. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we will be prevented from pursuing operational development and commercialization efforts and our ability to generate revenues and achieve or sustain profitability will be substantially harmed.

If we raise additional funds by issuing equity securities, our shareholders will experience dilution. Debt financing, if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures, or declaring dividends. Any debt financing or additional equity that we raise may contain terms, such as liquidation and other preferences, which are not favorable to us or our stockholders. If we raise additional funds through collaboration and licensing arrangements with third parties, it may be necessary to relinquish valuable rights to our technologies, future revenue streams or product candidates or to grant licenses on terms that may not be favorable to us. Should the financing we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, our business, operating results, financial condition and prospects could be materially and adversely affected, and we may be unable to continue our operations. Failure to secure additional financing on favorable terms could have severe adverse consequences to us.

The Company’s financial condition and results of operations have been and may continue to be adversely affected by the COVID-19 pandemic.

Since March 2020, COVID -19 has caused a material and substantial adverse impact on our general economy and our business operations. It has caused there to be a substantial decrease in our sales, cancellations of purchase orders and has resulted in accounts receivables not being timely paid as anticipated. Further, it has caused us to have concerns about our ability to meet our obligations as they become due and payable. In this respect, our business is directly dependent upon and correlates closely to the marketing levels and ongoing business activities of our existing clients. If material adverse developments in domestic and global economic and market conditions adversely affect our clients’ businesses, such as COVID-19, our business and results of operations could (and in the case of COVID-19) equally suffer. Our results of operations are affected directly by the level of business activity of our clients, which in turn is affected by the level of economic activity in the industries and markets that they serve. COVID-19 future widespread economic slowdowns in any of these markets, particularly in the United States, may negatively affect the businesses, purchasing decisions and spending of our clients and prospective clients, and payment of accounts receivable due us, which could result in reductions in our existing business as well as our new business development and difficulties in meeting our cash obligations as they become due. In the event of continued widespread economic downturn caused by COVID-19, we will likely continue to experience a reduction in projects, longer sales and collection cycles, deferral or delay of purchase commitments for our data products, processing functionality, software systems and services, and increased price competition, all of which could substantially adversely affect revenue and our ability to remain a going concern.

In the event we remain a going concern, the impacts of the global emergence of Coronavirus disease (COVID-19) on our business, sources of revenues and the general economy, are currently not fully known. We are conducting business as usual with some modifications to employee work locations, and cancellation of certain marketing events, among other modifications. We lost a purchase order in excess of one million dollars with a major US sports organization. We have observed other companies taking precautionary and preemptive actions to address COVID-19 and companies may take further actions that alter their normal business operations. We will continue to actively monitor the situation and may take further actions that alter our business operations as may be required by federal, state or local authorities or that we determine are in the best interests of our employees, customers, partners, suppliers and stockholders. It is not clear what the potential effects any such alterations or modifications may have on our business, including the effects on our customers and prospects, although we do anticipate it to continue to negatively impact our financial results during fiscal years 2022 and 2023.

Forecasts of our revenue are difficult.

When purchasing our products and services, our clients and prospects are often faced with a significant commitment of capital, the need to integrate new software and/or hardware platforms and other changes in company-wide operational procedures, all of which result in cautious deliberation and evaluation by prospective clients, longer sales cycles, and delays in completing transactions. Additional delays result from the significant up-front expenses and substantial time, effort, and other resources necessary for our clients to implement our solutions. For example, depending on the size of a prospective client’s business and its needs, a sales cycle can range from two weeks to 12 months. Because of these longer sales cycles, revenues and operating results may vary significantly from period to period. As a result, it is often difficult to accurately forecast our revenues for any fiscal period as it is not always possible for us to predict the fiscal period in which sales will actually be completed. This difficulty in predicting revenue, combined with the revenue fluctuations we may experience from period to period, can adversely affect and cause substantial fluctuations in our stock price.

| 10 |

The reliability of our product solutions is dependent on data from third parties and the integrity and quality of that data.

Much of the data that we use is licensed from third-party data suppliers, and we are dependent upon our ability to obtain necessary data licenses on commercially reasonable terms. We could suffer material adverse consequences if our data suppliers were to withhold their data from us. For example, data suppliers could withhold their data from us if there is a competitive reason to do so; if we breach our contract with a supplier; if they are acquired by one of our competitors; if legislation is passed restricting the use or dissemination of the data they provide; or if judicial interpretations are issued restricting use of such data. Additionally, we could terminate relationships with our data suppliers if they fail to adhere to our data quality standards. If a substantial number of data suppliers were to withdraw or withhold their data from us, or if we sever ties with our data suppliers based on their inability to meet our data standards, our ability to provide products and services to our clients could be materially adversely impacted, which could result in decreased revenues.

The reliability of our solutions depends upon the integrity and quality of the data in our database. A failure in the integrity or a reduction in the quality of our data could cause a loss of customer confidence in our solutions, resulting in harm to our brand, loss of revenue and exposure to legal claims. We may experience an increase in risks to the integrity of our database and quality of our data as we move toward real-time, non-identifiable, consumer-powered data through our products. We must continue to invest in our database to improve and maintain the quality, timeliness, and coverage of the data if we are to maintain our competitive position. Failure to do so could result in a material adverse effect on our business, growth, and revenue prospects.

Our business practices with respect to data and consumer protection could give rise to liabilities or reputational harm as a result of governmental regulation, legal requirements or industry standards relating to consumer privacy, data protection and consumer protection.

Federal, state, and international laws and regulations govern the collection, use, retention, sharing and security of data that we collect. We strive to comply with all applicable laws, regulations, self-regulatory requirements, and legal obligations relating to privacy, data protection and consumer protection, including those relating to the use of data for marketing purposes. It is possible, however, that these requirements may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules or our practices. We cannot assure you that our practices have complied, comply, or will comply fully with all such laws, regulations, requirements, and obligations. Any failure, or perceived failure, by us to comply with federal, state, or international laws or regulations, including laws and regulations regulating privacy, data security, marketing communications or consumer protection, or other policies, self-regulatory requirements or legal obligations could result in harm to our reputation, a loss in business, and proceedings or actions against us by governmental entities, consumers, retailers, or others. We may also be contractually liable to indemnify and hold harmless performance marketing networks or other third parties from the costs or consequences of noncompliance with any laws, regulations, self-regulatory requirements, or other legal obligations relating to privacy, data protection and consumer protection or any inadvertent or unauthorized use or disclosure of data that we store or handle as part of operating our business. Any such proceeding or action, and any related indemnification obligation, could hurt our reputation, force us to incur significant expenses in defense of these proceedings, distract our management, increase our costs of doing business and cause consumers and retailers to decrease their use of our marketplace, and may result in the imposition of monetary liability. Furthermore, the costs of compliance with, and other burdens imposed by, the data and privacy laws, regulations, standards, and policies that are applicable to the businesses of our clients may limit the use and adoption of, and reduce the overall demand for, our products.

| 11 |

A significant breach of the confidentiality of the information we hold or of the security of our or our customers’, suppliers’, or other partners’ computer systems could be detrimental to our business, reputation, and results of operations. Our business requires the storage, transmission, and utilization of data. Although we have security and associated procedures, our databases may be subject to unauthorized access by third parties. Such third parties could attempt to gain entry to our systems for the purpose of stealing data or disrupting the systems. We believe we have taken appropriate measures to protect our systems from intrusion, but we cannot be certain that advances in criminal capabilities, discovery of new vulnerabilities in our systems and attempts to exploit those vulnerabilities, physical system or facility break-ins and data thefts or other developments will not compromise or breach the technology protecting our systems and the information we possess. Furthermore, we face increasing cyber security risks as we receive and collect data from new sources, and as we and our customers continue to develop and operate in cloud-based information technology environments. In the event that our protection efforts are unsuccessful, and we experience an unauthorized disclosure of confidential information or the security of such information or our systems are compromised, we could suffer substantial harm. Any breach could result in one or more third parties obtaining unauthorized access to our customers’ data or our data, including personally identifiable information, intellectual property and other confidential business information. Such a security breach could result in operational disruptions that impair our ability to meet our clients’ requirements, which could result in decreased revenues. Also, whether there is an actual or a perceived breach of our security, our reputation could suffer irreparable harm, causing our current and prospective clients to reject our products and services in the future and deterring data suppliers from supplying us data. Further, we could be forced to expend significant resources in response to a security breach, including repairing system damage, increasing cyber security protection costs by deploying additional personnel and protection technologies, and litigating and resolving legal claims, all of which could divert the attention of our management and key personnel away from our business operations. In any event, a significant security breach could materially harm our business, financial condition and operating results.

Significant system disruptions, loss of data center capacity or interruption of telecommunication links could adversely affect our business and results of operations.

Our product platforms are hosted and managed on Amazon Web Service (AWS) and takes full advantage of open standards for processing, storage, security, and big data technology. Specifically, our data intelligence platform uses the following AWS services: EC2, Lambda, Kafka, Kinesis, S3, Storm, Spark, Machine Learning, RDS, Redshift, Elastic Map Reduction, CloudWatch, DataBricks, and Elastic Search Service with built-in Kibana integration. Significant system disruptions, loss of data center capacity or interruption of telecommunication links could adversely affect our business, results of operations and financial condition. Our business is heavily dependent upon highly complex data processing capability. The ability of our platform hosts and managers to protect these data centers against damage or interruption from fire, flood, tornadoes, power loss, telecommunications or equipment failure or other disasters is beyond our control and is critical to our ability to succeed.

We rely on information technology to operate our business and maintain competitiveness, and any failure to adapt to technological developments or industry trends could harm our business.

We depend on the use of information technologies and systems. As our operations grow in size and scope, we will be required to continuously improve and upgrade our systems and infrastructure while maintaining or improving the reliability and integrity of our infrastructure. Our future success also depends on our ability to adapt our systems and infrastructure to meet rapidly evolving consumer trends and demands while continuing to improve the performance, features and reliability of our solutions in response to competitive services and product offerings. The emergence of alternative platforms will require new investment in technology. New developments in other areas, such as cloud computing, could also make it easier for competition to enter our markets due to lower up-front technology costs. In addition, we may not be able to maintain our existing systems or replace or introduce new technologies and systems as quickly as we would like or in a cost-effective manner.

| 12 |

Our technology and associated business processes may contain undetected errors, which could limit our ability to provide our services and diminish the attractiveness of our offerings.

Our technology may contain undetected errors, defects, or bugs. As a result, our customers or end users may discover errors or defects in our technology or the systems incorporating our technology may not operate as expected. We may discover significant errors or defects in the future that we may not be able to fix. Our inability to fix any of those errors could limit our ability to provide our solution, impair the reputation of our brand and diminish the attractiveness of our product offerings to our customers. In addition, we may utilize third party technology or components in our products, and we rely on those third parties to provide support services to us. Failure of those third parties to provide necessary support services could materially adversely impact our business.

We need to protect our intellectual property, or our operating results may suffer.

Third parties may infringe our intellectual property and we may suffer competitive injury or expend significant resources enforcing our rights. As our business is focused on data-driven results and analytics, we rely heavily on proprietary information technology. Our proprietary portfolio consists of various intellectual property including source code, trade secrets, and know-how. The extent to which such rights can be protected is substantially based on federal, state and common law rights as well as contractual restrictions. The steps we have taken to protect our intellectual property may not prevent the misappropriation of our proprietary information or deter independent development of similar technologies by others. If we do not enforce our intellectual property rights vigorously and successfully, our competitive position may suffer which could harm our operating results.

We could incur substantial costs and disruption to our business as a result of any claim of infringement of another party’s intellectual property rights, which could harm our business and operating results.

From time to time, third parties may claim that one or more of our products or services infringe their intellectual property rights. We analyze and take action in response to such claims on a case-by-case basis. Any dispute or litigation regarding patents or other intellectual property could be costly and time-consuming due to the complexity of our technology and the uncertainty of intellectual property litigation, which could divert the attention of our management and key personnel away from our business operations. A claim of intellectual property infringement could force us to enter into a costly or restrictive license agreement, which might not be available under acceptable terms or at all or could subject us to significant damages or to an injunction against development and sale of certain of our products or services.

We face intense and growing competition, which could result in reduced sales and reduced operating margins and limit our market share.

We compete in the data, marketing, and research business and in all other facets of our business against small, medium and large companies throughout the United States. Some examples include companies such as LiveRamp, BeeswaxThe TradeDesk and TradeDesk.OneTrust. If we are unable to successfully compete for new business our revenue growth and operating margins may decline. The market for our advertising and marketing technology operating system platform is competitive. We believe that our competitors’ product offerings do not provide the end-to-end solutions our product solutions do, and their minimum fees are substantially higher than ours for a comparative suite of solutions. However, barriers to entry in our markets are relatively low. With the introduction of new technologies and market entrants, we expect competition to intensify in the future. Some of these competitors may be in a better position to develop new products and strategies that more quickly and effectively respond to changes in customer requirements in our markets. The introduction of competent, competitive products, pricing strategies or other technologies by our competitors that are superior to or that achieve greater market acceptance than our products and services could adversely affect our business. Our failure to meet a client’s expectations in any type of contract may result in an unprofitable engagement, which could adversely affect our operating results and result in future rejection of our products and services by current and prospective clients. Some of our principal competitors offer their products at a lower price, which may result in pricing pressures. These pricing pressures and increased competition generally could result in reduced sales, reduced margins or the failure of our product and service offerings to achieve or maintain more widespread market acceptance.

Many of our competitors are substantially larger than we are and have significantly greater financial, technical, and marketing resources, and have established direct and indirect channels of distribution. As a result, they are able to devote greater resources to the development, promotion and sale of their products than we can.

| 13 |

We can provide no assurance that our business will be able to maintain a competitive technology advantage in the future.

Our ability to generate revenues is substantially based upon our proprietary intellectual property that we own and protect through trade secrets and agreements with our employees to maintain ownership of any improvements to our intellectual property. Our ability to generate revenues now and in the future is based upon maintaining a competitive technology advantage over our competition. We can provide no assurances that we will be able to maintain a competitive technology advantage in the future over our competitors, many of whom have significantly more experience, more extensive infrastructure and are better capitalized than us.

No assurances can be given that we will be able to keep up with a rapidly changing business information market.

Consumer needs and the business information industry as a whole are in a constant state of change. Our ability to continually improve our current processes and products in response to these changes and to develop new products and services to meet those needs are essential in maintaining our competitive position and meeting the increasingly sophisticated requirements of our customers. If we fail to enhance our current products and services or fail to develop new products in light of emerging industry standards and information requirements, we could lose customers to current or future competitors, which could result in impairment of our growth prospects and revenues.

The market for programmatic advertising campaigns is relatively new and evolving. If this market develops slower or differently than we expect, our business, growth prospects and financial condition would be adversely affected.

A substantial portion of our revenue has been derived from customers that programmatically purchase and sell advertising inventory through our platform. We expect that spending on programmatic ad buying and selling will continue to be a significant source of revenue for the foreseeable future, and that our revenue growth will largely depend on increasing spend through our platform. The market for programmatic ad buying is an emerging market, and our current and potential customers may not shift quickly enough to programmatic ad buying from other buying methods, reducing our growth potential. Because our industry is relatively new, we will encounter risks and difficulties frequently encountered by early-stage companies in similarly rapidly evolving industries, including the need to:

| · | Maintain our reputation and build trust with advertisers and digital media property owners; | |

| · | Offer competitive pricing to publishers, advertisers, and digital media agencies; | |

| · | Maintain quality and expand quantity of our advertising inventory; | |

| · | Continue to develop, launch, and upgrade the technologies that enable us to provide our solutions; | |

| · | Respond to evolving government regulations relating to the internet, telecommunications, mobile, privacy, marketing, and advertising aspects of our business; | |

| · | Identify, attract, retain, and motivate qualified personnel; and | |

| · | Cost-effectively manage our operations, including our international operations. |

If the market for programmatic ad buying deteriorates or develops more slowly than we expect, it could reduce demand for our platform, and our business, growth prospects and financial condition would be adversely affected.

| 14 |

Our failure to maintain and grow the customer base on our platform may negatively impact our revenue and business.

To sustain or increase our revenue, we must regularly add both new advertiser customers and publishers, while simultaneously keeping existing customers to maintain or increase the amount of advertising inventory purchased through our platform and adopt new features and functionalities that we add to our platform. If our competitors introduce lower cost or differentiated offerings that compete with or are perceived to compete with ours, our ability to sell access to our platform to new or existing customers could be impaired. Our agreements with our customers allow them to change the amount of spending on our platform or terminate our services with limited notice. Our customers typically have relationships with different providers and there is limited cost to moving budgets to our competitors. As a result, we may have limited visibility as to our future advertising revenue streams. We cannot assure you that our customers will continue to use our platform or that we will be able to replace, in a timely or effective manner, departing customers with new customers that generate comparable revenue. If a major customer representing a significant portion of our business decides to materially reduce its use of our platform or to cease using our platform altogether, it is possible that our revenue could be significantly reduced.

We rely substantially on a limited number of customers for a significant percentage of our sales.

DuringFor the yearyears ended December 31, 2021,2023, and 2022, total sales of our products to fourtwo customers generated 31%represented approximately 73% and 48% of our revenues.revenues, respectively. Our contracts with our customers generally do not obligate them to a specified term and they can generally terminate their relationship with us at any time with a minimal amount of notice. If we lose any of our customers, or any of them decide to scale back on purchases of our products, it will have a material adverse effect on our financial condition and prospects. Therefore, we must engage in continual sales efforts to maintain revenue, sustain our customer relationships, and expand our client base or our operating results will suffer. If a significant client fails to renew a contract or renews the contract on terms less favorable to us than before, our business could be negatively impacted if additional business is not obtained to replace or supplement that which was lost. We may require additional financial resources to expand our internal and external sales capabilities, although we plan to use a portion of the net proceeds from our December 2021 publicof this offering for this purpose. We cannot assure that we will be able to sustain our customer relationships and expand our client base. The loss of any of our current customers or our inability to expand our customer base will have a material adverse effect on our business plans and prospects.

If we fail to innovate and make the right investment decisions in our offerings and platform, we may not attract and retain advertisers and publishers and our revenue and results of operations may decline.

Our industry is subject to rapid and frequent changes in technology, evolving customer needs and the frequent introduction by our competitors of new and enhanced offerings. We must constantly make investment decisions regarding our offerings and technology to meet customer demand and evolving industry standards. We may make wrong decisions regarding these investments. If new or existing competitors have more attractive offerings or functionalities, we may lose customers or customers may decrease their use of our platform. New customer demands, superior competitive offerings or new industry standards could require us to make unanticipated and costly changes to our platform or business model. If we fail to adapt to our rapidly changing industry or to evolving customer needs, demand for our platform could decrease and our business, financial condition and operating results may be adversely affected.

We may not be able to integrate, maintain and enhance our advertising solutions to keep pace with technological and market developments.

The market for digital video advertising solutions is characterized by rapid technological change, evolving industry standards and frequent introductions of new products and services. To keep pace with technological developments, satisfy increasing publisher and advertiser requirements, maintain the attractiveness and competitiveness of our advertising solutions and ensure compatibility with evolving industry standards and protocols, we will need to anticipate and respond to varying product lifecycles, regularly enhance our current advertising solutions and develop and introduce new solutions and functionality on a timely basis. This requires significant investment of financial and other resources. For example, we will need to invest significant resources into expanding and developing our platforms in order to maintain a comprehensive solution. Ad exchanges and other technological developments may displace us or introduce an additional intermediate layer between us and our customers and digital media properties that could impair our relationships with those customers.

| 15 |

If we fail to detect advertising fraud, we could harm our reputation and hurt our ability to execute our business plan.

As we are in the business of providing services to publishers, advertisers, and agencies, we must deliver effective digital advertising campaigns. Despite our efforts to implement fraud protection techniques in our platforms, some of our advertising and agency campaigns may experience fraudulent and other invalid impressions, clicks or conversions that advertisers may perceive as undesirable, such as non-human traffic generated by computers designed to simulate human users and artificially inflate user traffic on websites. These activities could overstate the performance of any given digital advertising campaign and could harm our reputation. It may be difficult for us to detect fraudulent or malicious activity because we do not own content and rely in part on our digital media properties to control such activity. Industry self-regulatory bodies, the U.S. Federal Trade Commission and certain influential members of Congress have increased their scrutiny and awareness of, and have taken recent actions to address, advertising fraud and other malicious activity. If we fail to detect or prevent fraudulent or other malicious activity, the affected advertisers may experience or perceive a reduced return on their investment and our reputation may be harmed. High levels of fraudulent or malicious activity could lead to dissatisfaction with our solutions, refusals to pay, refund or future credit demands or withdrawal of future business.

The loss of advertisers and publishers as customers could significantly harm our business, operating results, and financial condition.

Our customer base consists primarily of advertisers and publishers. We do not have exclusive relationships with advertising agencies, companies that are advertisers, or publishers, such that we largely depend on agencies to work with us as they embark on advertising campaigns for advertisers. The loss of agencies as customers and referral sources could significantly harm our business, operating results and financial condition. If we fail to maintain satisfactory relationships with an advertising agency, we risk losing business from the advertisers represented by that agency.