| PO Box 3030 | Winnemucca, Nevada 89446 | | | | (Zip Code)Address of principal executive offices) (Zip code) | |

(303) 253-3267

| (775) 304-0260 | | | | (Registrant’s telephone number, including area code) | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | Securities registered pursuant to Section 12(b) of the Act: | | Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered | Class A common stock,par value $0.0001 per share | | HYMC | | The Nasdaq CapitalStock Market LLC | | Warrants to purchase common stock | | HYMCW | | The Nasdaq CapitalStock Market LLC | | Warrants to purchase common stock | | HYMCZHYMCL | | The Nasdaq CapitalStock Market LLC | | | | WarrantsSecurities registered pursuant to purchase common stockSection 12(g) of the Act: None | | HYMCL | | The Nasdaq Capital Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒ | | | Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ | | | Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ | | | Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐ | | | Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | |

| | | | | | | | | | | | | | | | ☐ | | Large accelerated filer | ☐ | | Accelerated filer | | ☒ | | Non-accelerated filer | ☒ | | Smaller reporting company | | | | ☒☐ | | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

The aggregate market value of the registrant's Common Stock held by non-affiliates of the registrant as of June 30, 2020, the last business day of the registrants most recently completed second fiscal quarter, was $86,679,426.

As of May 12, 2021, there were 59,901,306 | | | | | | | | | | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ | | | Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐ | | | If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐ | | | Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b)). ☐ | | | Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒ | | | | | | The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, was $52,124,124. | | | As of March 13, 2024, there were 21,005,192 shares of the Company’s common stock and no shares of the Company’s preferred stock issued and outstanding. | |

DOCUMENTS INCORPORATED BY REFERENCE Portion of the registrant's Proxy Statement of the 2021 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant's fiscal year ended December 31, 2020. | | | | | | | | | | Portions of the registrant’s definitive Proxy Statement for its 2024 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K. The Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2023. | |

Explanatory Note

Hycroft Mining Holding Corporation (the “Company”) is filing this second amendment to Form 10- (“Form 10-K/A”) to amend our Annual Report on Form 10-K for the year ended December 31, 2020, originally filed with the Securities and Exchange Commission (the “SEC”) on March 24, 2021 and amended on April 9, 2021 (“Original Form 10-K”), to restate our financial statements and related footnote disclosures as of December 31, 2020, and for the year ended December 31, 2020. On May 6, 2021, the Company filed a Current Report on Form 8-K with the SEC disclosing the determination by the Audit Committee that, as a result of the re-evaluation described below, the Company will restate previously issued consolidated financial statements and related disclosures as of and for the year ended December 31, 2020. Refer to Note 25 - Restatement of Previously Issued Financial Statements, of Notes to Consolidated Financial Statements of this Form 10-K/A for additional information. This Form 10-K/A also amends certain other Items in the Original Form 10-K, as listed in “Items Amended in this Form 10-K/A” below.

Restatement Background

On April 12, 2021, the Acting Director of the Division of Corporation Finance and Acting Chief Accountant of the Securities and Exchange Commission together issued a statement regarding the accounting and reporting considerations for warrants issued by special purpose acquisition companies entitled "Staff Statement on Accounting and Reporting Considerations for Warrants Issued by Special Purpose Acquisition Companies (“SPACs”) (the “SEC Statement”). Specifically, the SEC Statement clarified guidance for all SPAC-related companies regarding the accounting and reporting for their warrants and focused in part on provisions in warrant agreements that provide for potential changes to the settlement amounts dependent upon the characteristics of the warrant holder, and because the holder of such warrants would not be an input into the pricing of a fixed-for-fixed option on equity shares, such provision would preclude such warrants from being classified in equity and thus such warrants should be classified as a liability.

As a result of the SEC Statement, the Company re- evaluated the accounting treatment of the warrants that were issued prior to or in conjunction with the business combination and reverse recapitalization transaction that closed on May 29, 2020 (refer to Note 3 - Recapitalization Transaction of Notes to the Financial Statements), and the warrants issued October 6, 2020, with its public unit offering that had been recorded in equity in the Company’s consolidated balance sheet. Because the Company’s 5-Year Private Warrants (as such term is defined herein) contain provisions whereby the settlement amount varies depending upon the characteristics of the warrant holder, the 5-Year Private Warrants should have been recorded at fair value as a liability in the Company’s consolidated balance sheet. Accordingly, due to this reclassification and restatement, the 5-Year Private Warrants are now classified as a liability at fair value on the Company’s consolidated balance sheet at December 31, 2020, and the change in the fair value of such liability in each period is recognized as a gain or loss in the Company’s consolidated statement of operations.

A summary of the accounting impact of this adjustment to the Company’s consolidated financial statements as of and for the year ended December 31, 2020 is provided in Note 25 - Restatement of Previously Issued Financial Statements of the Notes to the Financial Statements of this Form 10-K/A.

In connection with the restatement, management has re-evaluated the effectiveness of the Company’s disclosure controls and procedures and internal control over financial reporting as of December 31, 2020 based on the framework in “Internal Control- Integrated Framework (2013 framework)” issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Management has concluded that the Company’s disclosure controls and procedures and internal controls over financial reporting were not effective as of December 31, 2020, due to a material weakness in internal control over financial reporting related to the accounting for equity instruments. For a discussion of management’s consideration of our disclosure controls and procedures, internal controls over financial reporting, and the material weaknesses identified, see Part II, Item 9A, “Controls and Procedures” of this Form 10-K/A.

Items Amended in this Form 10-K/A

This Form 10-K/A presents the Original Report, amended and restated with modifications as necessary to reflect the restatements. The following items have been amended to reflect the restatement:

Part I, Item 1A. Risk Factors

Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Part II, Item 8. Financial Statements

Part II, Item 9A. Controls and Procedures

In addition, the Company’s Chief Executive Officer and Principal Accounting Officer have provided new certifications dated as of the date of this filing in connection with this Form 10-K/A (Exhibits 31.1, 31.2, 32.1 and 32.2), and the Company's Independent Auditors, Plante & Moran, PLLC have provided a new consent as of the date of this filing in connection with this Form 10-K/A (Exhibits 23.1).

Except as described above, this Form 10-K/A does not amend, update, or change any other items or disclosures in the Original Form 10-K and does not purport to reflect any information or events subsequent to the filing thereof. As such, this Form 10-K/A speaks only as of the date the Original Form 10-K was filed, and we have not undertaken herein to amend, supplement or update any information contained in the Original Form 10-K to give effect to any subsequent events. Accordingly, this Form 10-K/A should be read in conjunction with our filings made with the SEC subsequent to the filing of the Original Form 10-K, including any amendment to those filings. Further, as a smaller reporting company, as defined by Rule 12b-2 of the Exchange Act, we were not required to provide quarterly selected financial data in the Original Form 10-K. We will restate prior quarterly periods in Quarterly Reports on Form 10-Q filed subsequent to this Form 10-K/A. Accordingly,

investors should rely only on the financial information and other disclosures regarding the restated periods in this Form 10-K/A or in future filings with the SEC (as applicable), and not on any previously issued or filed reports, earnings releases or similar communications relating to these periods.

HYCROFT MINING HOLDING CORPORATION Annual Report on Form 10-K TABLE OF CONTENTS

PART I

Cautionary Statement Regarding Forward-Looking Statements Certain statements in this Annual Report on Form 10-K for the year ended December 31, 20202023, (“20202023 Form 10-K”) may constitute “forward-looking” statements as defined inwithin the meaning of Section 27A of the Securities Act of 1933, (theas amended ( the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or the Private Securities Litigation Reform Act of 1995 (the “PSLRA”)1995. All statements, other than statements of historical facts, included herein and public statements by our officers or representatives, that address activities, events or developments that our management expects or anticipates will or may occur in releases made by the Securities and Exchange Commission (“SEC”), all as may be amended from time to time. Suchfuture are forward-looking statements, involve knownincluding but not limited to such things as future business strategy, plans and unknown risks, uncertaintiesgoals, competitive strengths and other important factors that could cause the actual results, performance or achievementsexpansion and growth of Hycroft Mining Holding Corporation and its subsidiaries (“Hycroft”) or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Statements that are not historical fact are forward-looking statements. Forward-looking statements can be identified by, among other things, the use of forward-looking language, such as theour business. The words “estimate,” “plan,” “anticipate,” “expect,” “intend,” “believe,” “expect,“target,” “anticipate,” “intend,” “estimate,” “project,“budget,” “may,” “can,” “will,” “would,” “could,” “should,” “seeks,” or “scheduled to,” or otherto” and similar words or the negativeexpressions, or negatives of these terms or other variations of these terms or comparable language or byany discussion of strategy or intentions. intention identify forward-looking statements. Forward-looking statements address activities, events or developments that the Company expects or anticipates will or may occur in the future and are based on current expectations and assumptions. These cautionary statements are being made pursuantinvolve known and unknown risks, uncertainties, assumptions and other factors which may cause our actual results, performance or achievements to be materially different from any results, performance or achievements expressed or implied by such forward-looking statements. See our other reports filed with the Securities Act, theand Exchange ActCommission (the “SEC”) for more information about these and the PSLRA with the intention of obtaining the benefits of the “safe harbor” provisions of such laws. Hycroft cautions investorsother risks. You are cautioned against attributing undue certainty to forward-looking statements. Although we have attempted to identify important factors that any forward-looking statements made by us are not guarantees or indicative of future performance ascould cause actual results and future events couldto differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Although these forward-looking statements were based on assumptions that the Company believes are reasonable when made, you are cautioned that forward-looking statements are not guarantees of future performance and that actual results, performance or achievements may differ materially from those made in or suggested by the statements. The forward-looking statements contained in this 20202023 Form 10-K. In addition, even if our results, performance, or achievements are consistent with the forward-looking statements contained in this 2023 Form 10-K, those results, performance or achievements may not be indicative of results, performance or achievements in subsequent periods. Given these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Any forward-looking statements made in this 2023 Form 10-K speak only as of the date hereofof those statements, and we do not have, or undertake anyno obligation to update those statements or reviseto publicly announce the results of any forward-lookingrevisions to any of those statements whether as a result of new information, subsequentto reflect future events or otherwise, unless required by law.developments. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer tosee the Risk Factors section of this 2020 Form 10-K, and the Summary of Risk Factors in Item 1A. Risk Factors.of this 2023 Form 10-K.

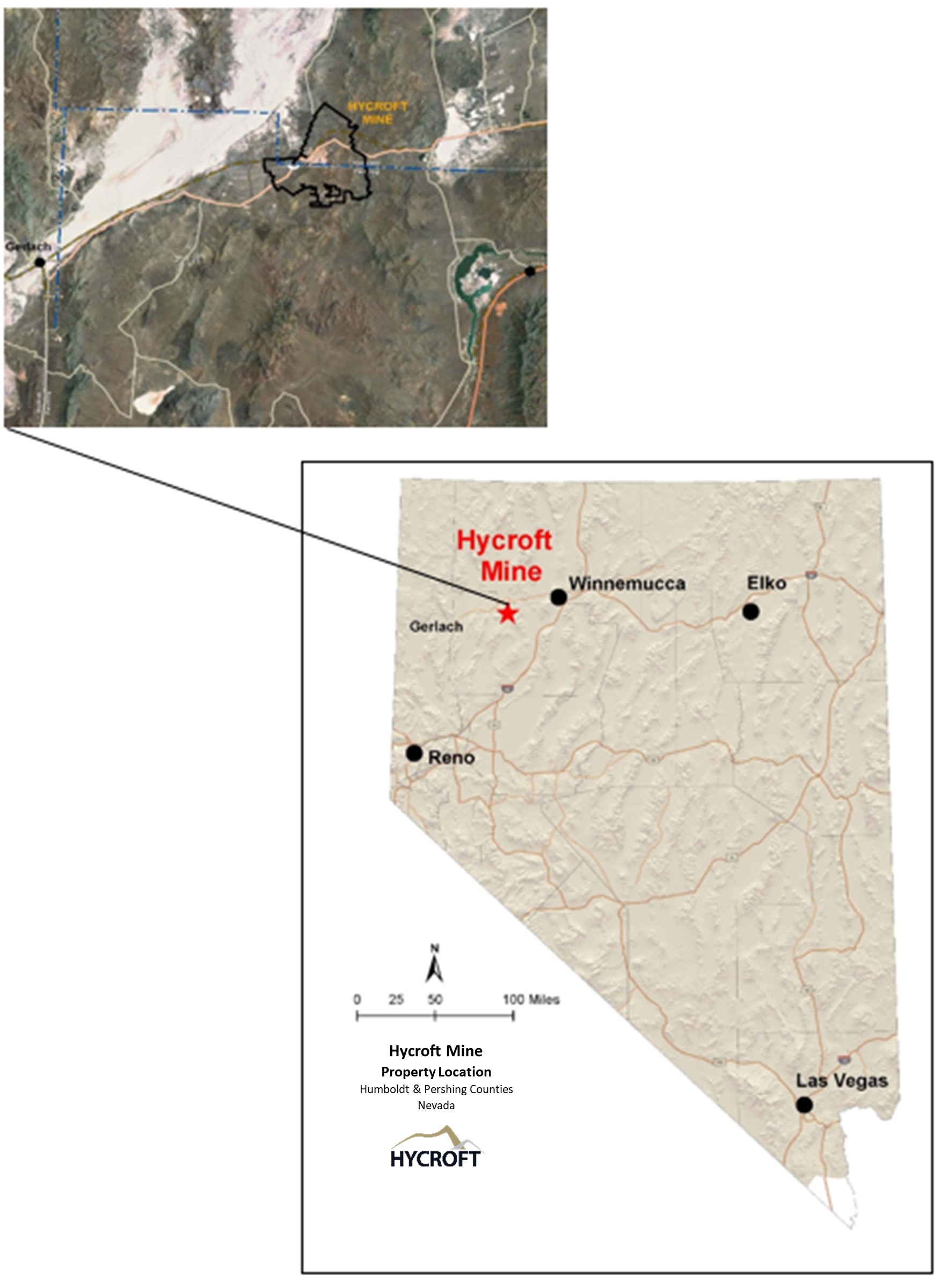

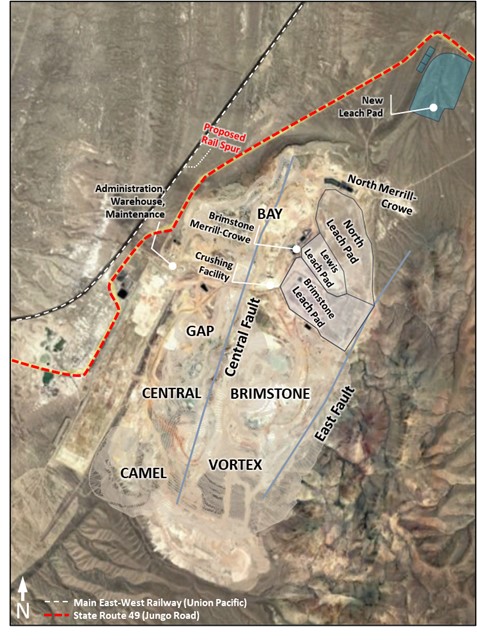

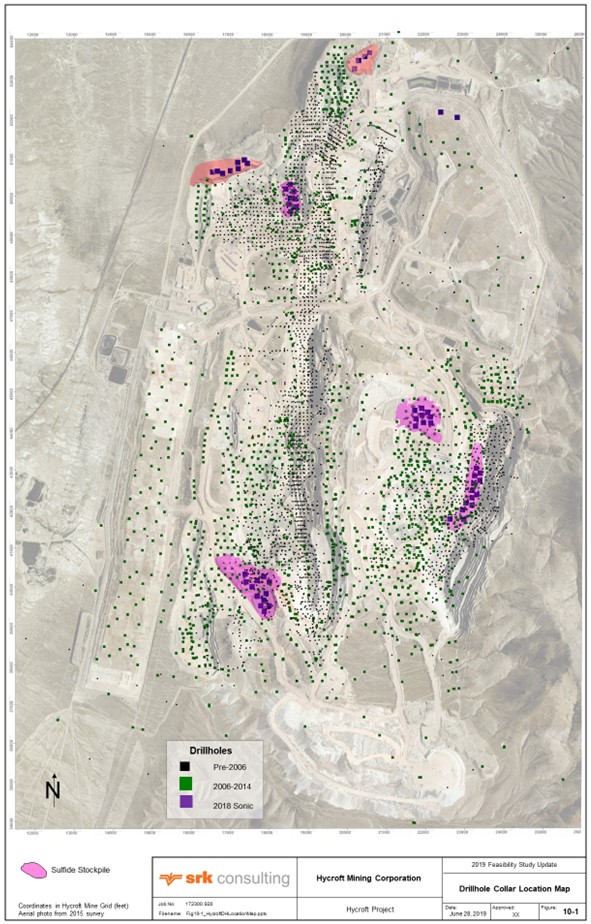

PART I ITEM 1. BUSINESS About the Company Hycroft Mining Holding Corporation (formerly known as Mudrick Capital Acquisition Corporation) was incorporated under the laws of the state of Delaware on August 28, 2017. In this Annual Report on2023 Form 10-K, “we”, “us”, “our”, the “Company”, “Hycroft”,“we,” “us,” “our,” “Company,” “Hycroft,” and "HYMC"“HYMC” refer to Hycroft Mining Holding Corporation and its subsidiaries. We are a U.S.-based gold producer focused on operating and developing its wholly ownedsilver exploration and development company that owns the Hycroft Mine in a safe, environmentally responsible, and cost-effective manner. Our operating mine, the Hycroft Mine, is an open-pit heap leach operation located approximately 54 miles westprolific mining region of Winnemucca,Northern Nevada. Mining operations at the Hycroft Mine were restartedThe following discussion should be read in 2019. As part of the restart, Hycroft, along with third party consultants, completed the Hycroft Technical Report Summary, Heap Leaching Feasibility Study, prepared in accordanceconjunction with the requirements of the Modernization of Property Disclosures for Mining Registrants, with an effective date of July 31, 2019 (the “Hycroft Technical Report”Company’s Consolidated Financial Statements (“Financial Statements”) for our proprietary two-stage heap oxidation and leach process for sulfide ore, which is discussed in further detail in Item 2. Properties. During the year ended December 31, 2020 we sold 24,892 ounces of gold and 136,238 ounces of silver. As of December 31, 2020, the Hycroft Mine had proven and probable mineral reserves of 11.9 million ounces of gold and 478.5 million ounces of silver, which are contained in oxide, transitional, and sulfide ores. We currently recover gold and silver through our heap leach process operations, while we continue to study and conduct testing of commercial production using our proprietary two-stage heap oxidation and leach process.

The Hycroft Mine, our sole operating property, is located outside of Winnemucca, Nevada. Our corporate headquarters is located at 8181 E. Tufts Avenue, Suite 510, Denver, Colorado 80237, and our telephone number is (303) 253-3267. Our website is www.hycroftmining.com.

Recapitalization Transaction with MUDS

As discussed in Note 1 - Company Overview and Note 3 - Recapitalization Transaction to the Notes to the Financial Statements on(“Notes”) included in Part II – Item 8. Financial Statements of this 2023 Form 10-K.

On May 29, 2020, we formerly known as Mudrick Capital Acquisition Corporation (“MUDS”), consummated a business combination transaction (the “Recapitalization Transaction”) that resulted in Autar Gold Corporation (formerly known as MUDS Acquisition Sub, Inc. (“Acquisition Sub”) acquiring all of the issued and outstanding equity interests of the direct subsidiaries of Hycroft Mining Corporation (“Seller”) and substantially all of the other assets of Seller and assuming substantially all of the liabilities of Seller. In conjunction with the Recapitalization Transaction, Seller’s indebtedness existing prior to the Recapitalization Transaction was either repaid, exchanged for indebtedness of the Company, exchanged for shares of common stock or converted into shares of Seller common stock, and our post-Recapitalization Transaction indebtedness included amounts drawn under the Credit Agreement among MUDS,Hycroft, AuxAg Mining Corporation (formerly known as MUDS Holdco Inc.), Allied VGH LLC, Hycroft Mining Holding Corporation, Hycroft Resources and Development, LLC Sprott Private Resource Lending II (Collector) Inc., and Sprott Resources Lending Corp. (“Sprott Credit Agreement”) and the assumption of the newly issued 10% Senior Secured Notes (“Subordinated Notes (as such are defined herein)Notes”). Upon closing Our property, the Hycroft Mine, historically operated as an open-pit oxide mining and heap leach processing operation and is located approximately 54 miles northwest of Winnemucca, Nevada. Mining operations at the Hycroft Mine were restarted in 2019 on a pre-commercial scale and discontinued in November 2021 as a result of the Recapitalization Transaction, our unrestricted cashthen-current and expected ongoing cost pressures for many of the reagents and consumables used at the Hycroft Mine and to further determine the most effective processing method for the sulfide ore. In March 2023, Hycroft, along with its third-party consultants, completed and filed the Hycroft Property Initial Assessment Technical Report Summary Humboldt and Pershing Counties, Nevada with an effective date of March 27, 2023 (the “2023 Hycroft TRS”) and prepared in accordance with the SEC’s Modernization of Property Disclosures for Mining Registrants as set forth in subpart 1300 of Regulation S-K (“Modernization Rules”). The 2023 Hycroft TRS provides an initial assessment of the mineral resource estimate utilizing a milling and pressure oxidation (“POX”) process for sulfide and transition mineralization and a heap leaching process for oxide mineralization. The 2023 Hycroft TRS included: (i) additional exploration drilling results from 2021 and 2022; (ii) additional assay information associated with historical drilling that was previously missing; (iii) other updates after additional review of historical assay certificates; and (iv) other adjustments. The 2023 Hycroft TRS supersedes and replaces the Initial Assessment Technical Report Summary for the Hycroft Mine, prepared in accordance with the requirements of the Modernization Rules, with an effective date of February 18, 2022 (“2022 Hycroft TRS”), and the 2022 Hycroft TRS should no longer be relied upon. Our ongoing disclosures and many of management’s estimates and judgments as of and for the periods ended December 31, 2023 and 2022, are based on the 2023 Hycroft TRS. The Company will continue to build on the work to date, incorporate exploration data as it becomes available, for use totaled $68.9 million.and investigate opportunities identified through progressing the technical and data analyses leading up to the 2023 Hycroft TRS and subsequent studies and analyses, and we will provide an updated technical report at an appropriate time. We ceased mining activities in November 2021, and completed processing of gold and silver ore previously placed on leach pads as of December 31, 2022. We do not expect to generate revenues from gold and silver sales until after further developing the Hycroft Mine and recommencing mining and processing operations. As of December 31, 2023, the Hycroft Mine had measured and indicated mineral resources of 10.6 million ounces of gold and 360.7 million ounces of silver and inferred mineral resources of 3.4 million ounces of gold and 96.1 million ounces of silver, which are contained in oxide, transitional, and sulfide ores. Segment Information The Hycroft Mine is our only operating segment and includes the operations, development,exploration, and explorationdevelopment activities and containsaccounts for 100% of our revenues and production costs.Production costs. Corporate and Other includes corporate generalGeneral and administrative costs. See Note 18 -20 – Segment Informationto the Notes to the Consolidated Financial Statements for additional information on our segments. Principal Products, Revenues, and Market Overview During the year ended December 31, 2023, the Company generated no Revenues due to the cessation of active mining operations.

The principal products produced during 2022 at the Hycroft Mine arewere unrefined gold and silver bars (doré) and in-process inventories (metal-ladengold and silver-laden carbons and slags),slags, both of which arewere sent to third party refineries before beingand sold generally at prevailing spot prices after adjustments for refining and other associated fees, to financial institutions or to precious metals traders. Doré bars and metal-ladengold and silver laden carbons and slags arewere sent to refineries to produce bullion that meetsmeet the required market standards of 99.95% pure gold and 99.90% pure silver. Under the terms of our refining agreements, doré bars and metal-ladengold and silver laden carbons and slags arewere refined for a fee, and our share of the separately recovered refined gold and refined silver arewere credited to our account or delivered to our buyers. Product Revenues and Customers In 2020, revenuesAs the Company ceased active mining operations in November 2021 and completed the processing of gold and silver ounces from the leach pads, we do not expect to have Revenues from gold and silver made up 94%sales until restarting mining operations.

Gold and 6%, respectively, of our total revenue and, as such, we consider gold our principal product. In 2020, all of our revenues were derived from metal sales to two customers; however, we do not believe we have any dependencies on these customers due to the liquidity of the metal markets and the availability of other metal buyers and financial institutions. GoldSilver Uses

Gold hasand silver have two main categories of use: fabrication and investment. Fabricated gold has a variety of end uses, including jewelry, electronics, dentistry, industrial and decorative uses,applications, medals, medallions and coins. Fabricated silver also has a variety of end uses, including jewelry, mirrors, cameras, electronics, energy production, engines, novelty explosives, and coins. Gold and silver investors buy gold and silver bullion, coins and jewelry. Gold and Silver Supply and Demand The supply of gold consists of a combination of current production from mining and metal recycling and the draw-down of existing stocks of gold held by governments, financial institutions, industrial organizations, and private individuals. Based on publicly available information published by the World Gold Council, gold production from mines decreased slightly for 2020increased 0.9% in 2023 compared to 2019with 2022 totaling approximately 3,4013,644 metric tons (or 109.3117.2 million troy ounces) and represented approximately 73.4%74.4% of the 20202023 global gold supply.supply of 4,899 metric tons. According to the World Gold Council, gold demand in 20202023 was approximately 3,7604,448 metric tons (or 120.9 million 143.0 million troy ounces) and totaled approximately $214$277.5 billion in value. In 2020,2023, gold demand by sector was comprised of jewelry (38%(49%), investments including bar and coin (24%and ETFs (21%), ETF investments (23%), technology (8%), and central bank purchases (23%), and technology (7%).

silver consists of a combination of current production from mining (approximately 82%) and metal recycling and other (approximately 18%). Based on publicly available information, estimated silver production from mines increased approximately 2% in 2023 compared with 2022 totaling approximately 842 million troy ounces and represented approximately 82% of the 2023 global silver supply of 1,025 million troy ounces. Silver demand in 2023 was approximately 1,167 million troy ounces and totaled approximately $24.9 billion in value. In 2023, silver demand by sector was comprised of photovoltaics (14%), other industrial (12%), jewelry (17%), silverware (5%), photography (2%), and investments (26%). Gold and Silver Prices The price of gold and silver is volatile and is affected by many factors beyond our control, including geopolitical events, such as conflicts or trade tensions, the sale or purchase of gold by central banks and financial institutions, inflation or deflation and monetary policies, fluctuation in the value of the U.S. dollar and foreign currencies, global and regional demand, and the political and economic conditions of major gold and silver producing countries throughout the world. The following table presents the annual high, low, and average afternoon fixingfix prices for gold and silver over the past tenthree years on the London Bullion Market (in U.S. dollars per ounce). | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | GOLD PRICES | | SILVER PRICES | | Year | | High | | Low | | Average | | High | | Low | | Average | | 2018 | | 1,355 | | 1,178 | | 1,268 | | 17.52 | | 13.97 | | 15.71 | | 2019 | | 1,546 | | 1,270 | | 1,393 | | 19.31 | | 14.38 | | 16.21 | | 2020 | | 2,067 | | 1,474 | | 1,770 | | 28.89 | | 12.01 | | 20.55 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | GOLD PRICES | | SILVER PRICES | | Year | | High | | Low | | Average | | High | | Low | | Average | | 2021 | | $ | 1,943 | | | $ | 1,684 | | | $ | 1,799 | | | $ | 29.59 | | | $ | 21.53 | | | $ | 25.04 | | | 2022 | | $ | 2,039 | | | $ | 1,628 | | | $ | 1,800 | | | $ | 26.18 | | | $ | 17.77 | | | $ | 21.71 | | | 2023 | | $ | 2,150 | | | $ | 1,907 | | | $ | 1,944 | | | $ | 24.43 | | | $ | 22.00 | | | $ | 23.33 | | | 2024 (through Mar. 12th) | | $ | 2,180 | | | $ | 1,985 | | | $ | 2,046 | | | $ | 24.50 | | | $ | 22.09 | | | $ | 22.98 | |

On March 22, 2021,12, 2024, the afternoon fixingfix price for gold and silver on the London Bullion Market was $1,736$2,161 per ounce and $25.74$24.38 per ounce, respectively. Competition The top 10ten producers of gold comprise approximately one thirdone-quarter of total worldwide mined gold production. We are a developing producergold and silver exploration and development company with a single mine.property, the Hycroft Mine. The Hycroft Mine has a large gold and silver reserves with an expected average annual production of approximately 366,000 gold equivalent ounces, based on a 34-year mine life includedmineral resource as noted in the 2023 Hycroft Technical Report.TRS. We have not completed our engineering studies and we have not fully developed our operationsulfide ore milling and weprocessing studies and therefore, have not established our long-term

production and cost structure. Our costs are expected to be determined by the location, grade and nature of our ore body, processing technologies applied to our ore, and costs including energy, labor and equipment. The metals markets are cyclical, and our ability to maintain our competitive positioncompete in that market over the long-term iswill be based on our ability to develop and cost effectively operate the Hycroft Mine in a safe and environmentally responsible manner. We compete with other mining companies in connection with hiring and retaining qualified employees. There is substantial competition for qualified employees in the mining industry, some of which is with larger companies having substantially greater financial resources than us and a more stable history. As a result, we may have difficulty hiring and retaining qualified employees. Please seeSee Item 1A. Risk Factors —Industry— Industry Related Risks — We faceThe Company faces intense competition in the mining industryrecruitment and retention of qualified employees and contractors, for additional discussion related to our current and potential competition.

Employees At December 31, 2020,2023, we had approximately 24078 employees, of which 22869 were employed at the Hycroft Mine. None of our employees are represented by unions. COVID-19

We have implementedbelieve safety is a core value and support that belief through our philosophy of safe work performance. Our mandatory mine safety and health programs include employee engagement and ownership of safety policies forperformance, accountability, employee and contractor training, risk management, workplace inspection, emergency response, accident investigation, anti-harassment, and program auditing. This integrated approach is essential to ensure that our employees, contractors, and visitors that follow guidelines fromoperate safely. We reported no lost time incidents during the Centeryear ended December 31, 2023, and achieved one million workhours without a lost time incident in the second quarter of 2023. The Hycroft Mine’s total recordable injury frequency rate (“TRIFR”) for Disease Control (CDC)the trailing 12 months, which includes other reportable incidents, is one of the metrics we use to assess safety performance, and it is well below industry averages and significantly below pre-2021 historical levels experienced at the Mine SafetyHycroft Mine. During the year ended 2023, we continued our critical focus on safety, including allocating personnel, resources, workforce time, and Health Administration (MSHA). During 2020, especiallycommunications to operate safely. These actions contributed to maintaining our TRIFR of Nil (0.00) at December 31, 2023 and December 31, 2022. We remain committed to adapting our safety initiatives as necessary to ensure the fourth quarter,well-being of our operations faced certain limitations due to COVID-19 related absences, however the impact did not significantly adversely affect our operations. Please see Item 1A. Risk Factors — Industry Related Risks — The COVID-19 pandemic may adversely impact our business, financial condition,workforce, contractors, and results of operations as well as Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations for additional discussion related to COVID-19.

Government Regulation of Mining-Related Activities Government Regulation Mining operations and exploration activities are subject to various federal, state and local laws and regulations in the United States, which govern prospecting, exploration, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We have obtained or have pending applications for those licenses, permits or other authorizations currently required to conduct our current mining, exploration and other programs. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations passed thereunder in Nevada and at the federal level in the United States. Although we are not aware of any current claims, orders or directions relating to our business with respect to the foregoing laws and regulations, changes to, or more stringent application, interpretation, or enforcement of, such laws and regulations in Nevada, or in jurisdictions where we may operate in the future, could require additional capital expenditures and increased operating and/or reclamation costs, which could adversely impact the profitability levels of our projects. On January 20, 2021, the Department of the Interior, Washington Office, issued order number 3395 (the “Order”) promulgating a suspension of authority for Department Bureaus and Offices to take actions including to take actions in accordance with the National Environmental Policy Act; to approve plans of operation, or to amend existing plans of operation under the General Mining Law of 1872; or any notices to proceed under previous surface use authorizations that will authorize ground-disturbing activities. The suspension will remain in effect for 60 days from January 20, 2021, or until any of its provisions are amended, superseded, or revoked. The Order suspended the authority of the local offices of the Bureau of Land Management (“BLM”) to make decisions or to approve any new ground-disturbing actions under previous decisions related to the Company’s planned operations. At the time of the suspension of authority, the Company had no material proposed actions pending with the local office of the Bureau of Land Management, will proceed with currently approved actions for the duration of the anticipated 60-day suspension of authority, and is not currently aware of any material adverse effects from the suspension of authority based on the duration stated in the Order. The Company may require authorization to proceed with new ground-disturbing activities under previous authorizations prior to proceeding into the sulfide ore bodies planned for 2022, in the event the Order has not been amended, superseded, or revoked.

Environmental Regulation Our mining projects are subject to various federal and state laws and regulations governing protection of the environment. These laws and regulations are continually changing and, in general, are becoming more restrictive. The federal laws and regulations, among other things: •impose strict, joint and several liability on current and former owners and operators of sites and on persons who disposed of or arranged for the disposal of hazardous substances found at such sites (the Comprehensive Environmental Response, Compensation, and Liability Act)Act of 1980, as amended (“CERCLA”)); •govern the generation, treatment, storage and disposal of solid waste and hazardous waste (the Federal Resource Conservation and Recovery Act)Act of 1976, as amended (“RCRA”)); •restrict the emission of air pollutants from many sources, including mining and processing activities (the Clean Air Act)Act of 1970, as amended (the “Clean Air Act”)); •require federal agencies to integrate environmental considerations into their decision-making processes by evaluating the environmental impacts of their proposed actions, including the issuance of permits to mining facilities and assessing alternatives to these actions (the National Environmental Policy Act)Act of 1970, as amended (“NEPA”));

•regulate the use of federal public lands to prevent undue and unnecessary degradation of the public lands (the Federal Land Policy and Management Act of 1976)1976, as amended (the “FLPMA”)); •restrict and control the discharge of pollutants and dredged and fill materials into waters of the United States (the Clean Water Act)Act of 1972, as amended (the “Clean Water Act”)); and •regulate the drilling of subsurface injection wells (the Safe Drinking Water Act of 1974, as amended (the “Safe Drinking Water Act”) and the Underground Injection Control programProgram promulgated thereunder).

We cannot predict at this time what changes, if any, to federal laws or regulations may be adopted or imposed by the new Biden Administration.current governmental administration. At the state level, mining operations in Nevada are regulated by the Nevada Department of Conservation and Natural Resources, Division of Environmental Protection, (the "Division"), which has the authority to implement and enforce many of the federal regulatory programs described above as well as state environmental laws and regulations. Compliance with these and other federal and state laws and regulations could result in delays in obtaining, or failure to obtain, government permits and approvals, delays in beginning or expanding operations, limitations on production levels, incurring additional costs for investigation or cleanup of hazardous substances, payment of fines, penalties or remediation costs for non-compliance, and post-mining closure, reclamation and bonding. It is our policy to conduct business in a way that safeguards our employees, public health and the environment. We believe that our operations are, and will be, conducted in material compliance with applicable laws and regulations. However, our past and future activities in the United States may cause us to be subject to liability under such laws and regulations. For information about the risks to our business related to environmental regulation, see the following risk factors in Item 1A. Risk Factors -– Industry Related Risks: •Our operations are subject toThe Company relies upon numerous governmental permits that are difficult to obtain, and wethe Company may not be able to obtain or renew all of the required permits, we require, or such permits may not be timely obtained or renewed; •Changes in environmental regulations could adversely affect our cost of operations or result in operations delays; •Environmental regulations could require usthe Company to make significant expenditures or expose usthe Company to potential liability;

•Failure to comply with environmental regulations could result in penalties and costs; and •Our explorationCompliance with current and development operations are subjectfuture government regulations may cause the Company to extensive environmental regulations, which could result in the incurrence of additional costs and operational delays.incur significant costs. During 2020the year ended December 31, 2022, the Company received a notice of non-compliance from the closure branch of the Nevada Division of Environmental Protection (“NDEP”) Bureau of Mining Regulation and 2019,Reclamation regarding a historical reclamation matter. As such, the Company has accelerated certain reclamation activities in order to regain compliance. During 2023 and 2022, there were no known material environmental incidents or non-compliance with any applicable environmental regulations on the properties now held by us, except as follows: On March 19, 2019, we executed an Administrative Order of Consent and agreed to a payment of $11,521 to the State of Nevada acting by and through the Division to settle a Finding of Alleged Violation and Order issued November 7, 2018 for non-compliance with the Resource Conservation and Recovery Act requirements to remove hazardous waste within 90 days of accumulation of such waste. Additionally, on December 11, 2019, the Division held an enforcement conference with our management to determine whether the issuance of Notices of Alleged Air Quality Violation Order No 2701 was or was not warranted. The Division issued a formal warning and has indicated that it did not intend to take any further action.incidents. We did not incur material capital expenditures for environmental control facilities during 20202023 and 20192022, and we do not expect to incur any material expenditures in 20212024 for such environmental control facilities. Reclamation We are required to mitigate long-term environmental impacts by amending, backfilling, stabilizing, contouring, re-sloping, and re-vegetating various portions of a site after mining and mineral processing are completed, mitigating potential impacts to surface water and groundwater resources. These reclamation efforts will be conducted in accordance with detailed plans, which must be reviewed and approved by the appropriate regulatory agencies. Our reclamation obligations at the Hycroft Mine are secured by surface management surety bonds that meet the financial assurance requirements of the State of Nevada and the BLM.Bureau of Land Management (“BLM”). Our most recent reclamation cost estimate was approved by the BLM and the State of Nevada in July 2020. AtAs of December 31, 2020,2023, our surface management surety bonds totaled $59.9$58.7 million, of which $58.3 million secures the financial assurance requirements for the Hycroft Mine, $1.0and $0.4 million secures the financial assurance requirements for the adjacent water supply well field and exploration within the project boundary. The Company began performing reclamation activities on its Crofoot leach pad beginning in 2023 and $0.6 million securesexpects to continue the financial assurance requirements for an archaeological mitigation project. Based on the December 31, 2020 estimate, noCrofoot reclamation activities in 2024. The Company also expects to treat and manage solutions in certain ponds beginning in 2024 and continuing through 2026. No additional material reclamation expenditures are expected to be incurred until 2047after mining and themineral processing are completed. If we incur additional long-term environmental impacts from future mining activities, we will likely have additional reclamation work is projectedobligations, as well as additional financial assurance requirements. For our existing obligations, as well as any future obligations we may incur, we may choose to engage in reclamation activities before mining and mineral processing are completed, but these expenses are not anticipated to be completed by 2065.material to the overall reclamation obligation. When we perform reclamation work in the future, the work will be planned to conform to our mining operations and will be required to be documented when completed under our governing permits with the government regulatory agencies. The reclamation obligation would be adjusted accordingly as allowed under current regulations, and the financial assurance requirements would be adjusted to account for the completed reclamation work. If we are required to comply with material unanticipated financial assurance requirements in the future, our financial position could be adversely affected, or our posted financial assurance may

be insufficient. For financial information about our estimated future reclamation costs, refer tosee Note 128 – Asset Retirement Obligation to ourthe Notes to the Consolidated Financial Statements.

Mine Safety and Health Administration Regulations Safety and health is aare core valuevalues, which is why we have mandatory mine safety and health programs that include employee and contractor training, risk management, workplace inspection, emergency response, accident investigation, and program auditing. We consider these programs to be essential at all levels within Hycroft to ensure that our employees, contractors, and visitors only operate in a safe and healthy workplace. Our operations and exploration properties are subject to regulation by the Federal Mine Safety and Health Administration (“MSHA”) under the Federal Mine Safety and Health Act of 1977, as amended (the “Mine Act”). Pursuant to Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, as amended (the “Dodd-Frank Act”), issuers are required to disclose specified health and safety violations, orders and citations, related assessments and legal actions, and mining-related fatalities in periodic reports. MSHA inspects our mines on a regular basis and issues various citations and orders when it believes a violation has occurred under the Mine Act. The number of citations and orders charged against mining operations in the U.S., and the dollar penalties assessed for such citations, have generally increased in recent years. The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) requires us to provide acertain mine safety disclosure, which we have done in Part I - – Item 4. Mine Safety DisclosuresDisclosures of this 2023 Form 10-K. Property Interests and Mining Claims Our exploration and development activities are conducted in the State of Nevada. Mineral interests in Nevada may be owned by the United States, the State of Nevada, or private parties. Where prospective mineral properties are held by the United States, mineral rights may be acquired through the location of unpatented mineral claims upon unappropriated federal land. Where prospective mineral properties are owned by the State of Nevada or private parties, some type of property acquisition agreement or access agreement is necessary in order for us to explore or develop such property. Mining claims are subject to the same risk of defective title that is common to all real property interests. Additionally, mining claims are self-initiated and self-maintained and, therefore, possess some unique vulnerabilities not associated with other types of property interests. It is impossible to ascertain the validity of unpatented mining claims solely from an examination of the public real estate records and, therefore, it can be difficult or impossible to confirm that all of the requisite steps have been followed for location and maintenance of a claim. For general information about our mineral properties and mining claims, refer tosee Item 2. Properties. For information about the risks to our business related to our property interests and mining claims, see the following risk factors in Item 1A. Risk Factors -– Industry Related Risks: •There are uncertainties as to title matters in the mining industry. Any defects in such title could cause usthe Company to lose ourits rights in mineral properties and jeopardize our business operations; and •Legislation has been proposed periodically that could, if enacted, significantly affect the cost of our operationsmine development on ourthe Company’s unpatented mining claimsclaims. Technical Report Summaries (“TRS”) and Qualified Persons The scientific and technical information concerning our mineral projects in the 2023 Form 10-K have been reviewed and approved by third-party “qualified persons” under the Modernization Rules, including Ausenco Engineering South USA, Inc. (“Ausenco”), Independent Mining Consultants, Inc, (“IMC”), and WestLand Engineering & Environmental Services, Inc. (“WestLand”). For a description of the key assumptions, parameters and methods used to estimate mineral resources included in the 2023 Form 10-K, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant factors, please review the amount2023 Hycroft TRS incorporated by reference herein. Available Information The Company is a remote first company and does not maintain a corporate headquarters. Our mailing address is PO Box 3030 Winnemucca, Nevada 89446. Our telephone number is (775) 304-0260. Our website is www.hycroftmining.com. We encourage investors to use our website to find information about us. We promptly make available on this website, free of Net Proceeds Mineral Taxcharge, the reports that we payfile or furnish with the SEC, as well as corporate governance information (including our Code of Business Conduct & Ethics and our Code of Conduct and Ethics for Senior Financial Officers). The SEC maintains a website at www.sec.gov that contains annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy and information statements and other information regarding Hycroft and other issuers that file electronically with the SEC. In addition, paper copies of these documents will be furnished to the Stateany stockholder, upon request, free of Nevada.charge.

ITEM 1A. RISK FACTORS You should carefully review and consider the following risk factors and the other information contained in this 2023 Form 10-K/A. We10-K. Investing in the Company’s common stock or warrants is speculative and involves a high degree of risk due to the nature of the business and the present stage of exploration and advancement of the Company’s mineral properties. The Company may face additional risks and uncertainties that are not presently known, to us, or that weare currently deemdeemed immaterial, which may also impair ourthe Company’s business or financial condition. If any of those risks actually occur, ourthe business, financial condition, and results of operations would suffer. The risks discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See also Cautionary Statement Regarding Forward-Looking Statements above.in this 2023 Form 10-K. The following discussion should be read in conjunction with the financial statementsFinancial Statements and notes to the financial statements included herein.Notes. Summary of Risk Factors: The following list provides a summary ourof risk factors discussed in further detail below: Risks related to changes in the Company’s operations at the Hycroft Mine, including: •Risks associated with cessation of mining operations at the Hycroft Mine; •Uncertainties concerning estimates of mineral resources; •Risks relating to a lack of a completed pre-feasibility or feasibility study; and •Risks related to the Company’s ability to finance and establish commercially feasible mining operations. Industry-related risks, including: •Fluctuations in the prices of gold and silver; •Uncertainties concerning estimatesIntense competition within the mining industry for mineral properties, employees, contractors and consultants; •The commercial success of, mineral reserves and mineral resources;risks relating to, the Company’s exploration and development activities; •Uncertainties relatingand risks related to the COVID-19 pandemic;reliance on contractors and consultants; •The intense competition within the mining industry;Availability and cost of equipment, supplies, energy, or commodities; •The inherently hazardous nature of mining activities, including safety and environmental risks; •OurPotential effects of U.S. federal and state governmental regulations, including environmental regulation and permitting requirements; •Uncertainties relating to obtaining, retaining or renewing approvals and permits from governmental regulatory authorities; •Cost of compliance with current and future government regulations, including environmental regulations; •Potential challenges to title in our mineral properties; •Inadequate insurance may not be adequate to cover all risks associated with our business, or cover the replacement costs of our assets or may not be available for some risks; •Potential effects on our operations of U.S. federal and state governmental regulations, including environmental regulation and permitting requirements; •Cost of compliance with current and future government regulations;

•Uncertainties relating to obtaining or retaining approvals and permits from governmental regulatory authorities;

•Potential challenges to title in our mineral properties;

•Risks associated with proposedpotential legislation in Nevada that could significantly increase the cost of mine development on the Company’s unpatented mining claims;

•Risks associated with regulations and pending legislation involving climate change could result in increased costs, or taxation of our operations; andwhich could have a material adverse effect the Company’s business; •Changes to the climate and regulations and pending legislation regarding climate change.change; and •Continued uncertainties relating to the COVID-19 pandemic or other pandemics. Business-related risks, including: •Risks related to our liquidity and going concern considerations; •Risks related to ourthe Company’s ability to raise capital on favorable terms or at all;

•Risks related to the proprietary two-stage heap oxidation and leach process at the Hycroft Mine and estimates of production; •Our ability to achieve our estimated production and sales rates and stay within our estimated operating and production costs and capital expenditure projections;

•Risks related to a decline in our gold and silver production;

•Our ability to successfully eliminate or meaningfully reduce processing and mining constraints; the results of our planned 2021 technical efforts and how the data resulting from such efforts could adversely impact processing technologies applied to our ore, future operations and profitability.

•Risks related to our reliance on one mine with a new process;

•Risks related to our limited experience with a largely untested process of oxidizing and heap leaching sulfide ore;

•Uncertainties and risks related to our reliance on contractors and consultants;

•Availability and cost of equipment, supplies, energy, or commodities;

•The commercial success of, and risks relating to, our development activities;

•Risks related to slope stability;

•Risks related to our substantial indebtedness, including cross acceleration and our ability to generate sufficient cash to service our indebtedness;

•Uncertainties resulting from the possible incurrence of operating and net losses in the future;

•Uncertainties related to our ability to replace and expand our mineral reserves;

•The costs related to our land reclamation requirements;

•The loss of key personnel or ourthe Company’s failure to attract and retain personnel;

•Risks related to technology systemsthe Company’s substantial indebtedness, including operating and security breaches;financial restrictions under existing indebtedness, cross-acceleration and the Company’s ability to generate sufficient cash to service the indebtedness; •Any failureThe costs related to remediate and possibleland reclamation requirements;

•Future litigation as a result ofor similar legal proceedings could have a material weakness in our internal controls over financial reporting;adverse effect on the Company’s business and results of operations; •Risks related to information and operational technology systems, new technologies and security breaches; and •Risks that our principal stockholders will be able to exert significant influence over matters submitted to stockholders for approval. Risks related to ourthe Company’s common stock and warrants, including: •Volatility in the price of ourthe Company’s common stock and warrants; •Potential declines in the valueRisks relating to a potential dilution as a result of our common stock and warrants due to substantial future sales of our common stock and/or warrants;equity offerings; •Risks relating to a short “squeeze” resulting in sudden increases in demand for the Company’s common stock; •Risks relating to decreased liquidity of the Company’s common stock as a result of the reverse stock split; •Risks relating to information published by third parties about the Company that may not be reliable or accurate; •Risks associated with interest rate changes; •Volatility in the price of the Company’s common stock could subject it to securities litigation; •Risks associated with the Company’s current plan not to pay dividends; •Risks associated with future offerings of senior debt or equity securities; •Risks related to a failure to comply with the Nasdaq Stock Market LLC (“Nasdaq”) listing requirements and a potential delisting by Nasdaq; •Risks warrants may expire worthless; •The valuation of our 5-Year Private Warrants could increase the volatility in our net income (loss);Risks that certain warrants are being accounted for as a liability; •Anti–takeover provisions could make a third-party acquisition of usthe Company difficult; and •Risks related to limited access to ourthe Company’s financial information as we havedue to the fact the Company elected to take advantage of the disclosure requirement exemptions granted to emerging growth companies and smaller reporting companies. Risks Related to Changes in the Hycroft Mine’s Operations The Company has mineral resources at the Hycroft Mine, but the mine may not be brought into production. The Company is not currently conducting commercial mining operations at the Hycroft Mine. There is no certainty that the mineral resources estimated at the Hycroft Mine will be mined or, if mined, processed profitably. The Company has no specific plans and cannot currently predict when the Hycroft Mine may be back in production. The commercial viability of the Hycroft Mine is dependent on many factors, including metal prices, the availability of and ability to raise capital for development, government policy and regulation and environmental protection, which are beyond the Company’s control. The Company may not generate commercial-scale revenues until the Hycroft Mine is back in production. The figures for the Company’s mineral resources are estimates based on interpretation and assumptions and the Hycroft Mine may yield less mineral production or less profit under actual conditions than is currently estimated. Unless otherwise indicated, mineral resource figures in the Company’s filings with the SEC, press releases, and other public statements made from time to time are based upon estimates made by the Company’s personnel and independent geologists. These estimates are imprecise and depend upon geologic interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be inaccurate. There can be no assurance that mineral resources or other mineralization figures will be accurate or that this mineralization could be mined or processed profitably. Because the Company has not completed a feasibility study or recommenced commercial production at the Hycroft Mine, mineral resource estimates may require adjustments or downward revisions based upon further exploration or advancement work or actual production experience. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by drilling results. There can be no assurance that recovery of minerals in small-scale tests will be duplicated in larger-scale tests under on-site conditions or in production scale. Until mineral resources are mined and processed, the quantity of ore and grades must be considered as an estimate only. In addition, the quantity of mineral resources may vary depending on metal prices, which largely determine whether mineral resources are classified as ore (economic to mine) or waste (uneconomic to mine). Current mineral resource estimates were calculated using sales prices of $1,900 per ounce of gold price and $24.50 per ounce of silver. A material decline in the current price of gold or silver or material changes in processing methods or cost assumptions could require a reduction in mineral

resource estimates. Any material reductions in estimates of mineral resources, or of the Company’s ability to upgrade these mineral resources to mineral reserves and extract these mineral resources, could have a material adverse effect on the Company’s prospects, and restrict its ability to successfully implement strategies for long-term growth. In addition, the Company cannot provide assurances that gold and silver recoveries experienced in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production. The Company has not completed a feasibility study for the Hycroft Mine. There are no assurances future advancement activities by the Company, if any, will lead to a favorable feasibility study or profitable mining operations. The Company completed and issued the 2023 Hycroft TRS, which replaced the 2022 Hycroft TRS. The 2023 Hycroft TRS provides an initial assessment of the mineral resource estimate and is not a feasibility study for the Hycroft Mine. Typically, a company will not make a production decision until it has completed a feasibility study. There is no certainty that a feasibility study for the Hycroft Mine will be completed or, if completed, that it will result in sufficiently favorable estimates of the economic viability of the Hycroft Mine to justify a construction decision. The Company may not be able to successfully establish mining operations or profitably produce precious metals. The Company currently has no commercial mining operations or sustaining revenue from the exploration, development and care and maintenance operations currently conducted at the Hycroft Mine. Mineral exploration and advancement involve a high degree of risk and few properties that are explored are ultimately developed into producing mines. The future advancement of the Hycroft Mine will require obtaining permits and financing and the construction and operation of the mine, processing plants, and related infrastructure. The Company’s ability to establish mining operations or profitably produce precious metals from the Hycroft Mine will be affected by: •timing and cost, which can be considerable, of the construction of additional mining and processing facilities; •availability and costs of skilled labor and mining equipment; •availability and cost of appropriate refining arrangements; •necessity to obtain additional environmental and other governmental approvals and permits, and the timing of those approvals and permits; •availability of funds to finance equipment purchases, construction, and advancement activities; •management of an increased workforce and coordination of contractors; •potential opposition from non-governmental organizations, environmental groups, or local groups, which may delay or prevent advancement activities; and •potential increases in construction and operating costs due to changes in the cost of fuel, power, labor, supplies and foreign exchange rates. It is common in new mining operations to experience unexpected problems and delays during advancement, construction, start-up commissioning, and transition to commercial operations. In addition, delays in the commencement of mineral production often occur. Accordingly, there are no assurances that, if the Company decides to initiate construction or mining activities, that it will be able to successfully establish mining operations or profitably produce gold and silver at the Hycroft Mine. Industry-Related Risks The market prices of gold and silver are volatile. A decline in gold andor silver prices could result in decreased revenues, decreased net income, increased losses, and decreased cash inflows which may negatively affect ourthe business. Gold and silver are commodities. TheirCommodity prices fluctuate and are affected by many factors beyond ourthe Company’s control, including interest rates, expectations regarding inflation, speculation, currency values, central bank activities, governmental decisions regarding the disposal of precious metals stockpiles, global and regional demand and production, political and economic conditions and other factors. The prices of gold and silver, as quoted by The London Bullion Market Association on December 31, 20202023 and December 31, 2019,2022, were $1,888$2,062.40 and $1,515$1,813.75 per ounce for gold, respectively, and $26.49$23.79 and $18.04$23.945 per ounce for silver, respectively. The prices of gold and silver may decline in the future. A substantial or extended decline in gold or silver prices would adversely impact ourthe Company’s financial position, revenues, net income and cash flows, particularly in light of our current strategy of not engaging in hedging transactions with respect to gold or silver.position. In addition, sustained lower gold or silver prices may:may materially adversely affect the Company’s business, including: •reduce revenue potential due to cessation of the mining of deposits,halting, delaying, modifying, or portions of deposits, that have become uneconomic at the then-prevailing gold or silver price; •reduce or eliminate the profit, if any, that we currently expect from mining operations;

•halt, delay, modify, or cancelcanceling plans for the mining of oxide, transitional, and sulfide ores or the development of new and existing projects;

•Table of Contentsmake it more difficult for us to satisfy and/or service our debt obligations;•reducereducing existing mineral reservesresources by removing oresore from mineral reservesresources that can no longer be economically processed at prevailing prices; and •cause uscausing the Company to recognize an impairment to the carrying values of its long-lived assets. Mineral reserve and mineral resource calculations are estimates only and are subject to uncertainty due to factors including metal prices, inherent variability of the ore and recoverability of metal in the mining process.

The calculation of mineral reserves, mineral resources and grades are estimates and depend upon geological interpretation and statistical inferences or assumptions drawn from drilling and sampling analysis, which may prove to be unpredictable. There is a degree of uncertainty attributable to the calculation of mineral reserves and mineral resources, and corresponding grades. Until mineral reserves and mineral resources are actually mined and processed, the quantity of ore and grades must be considered as an estimate only. In addition, the quantity of mineral reserves and mineral resources may vary depending on metal prices, which largely determine whether mineral reserves and mineral resources are classified as ore (economic to mine) or waste (uneconomic to mine). A decline in metal prices may result in previously reported mineral reserves (ore) becoming uneconomic to mine (waste). Current mineral reserve estimates were calculated using sales prices of $1,200 per ounce of gold price and $16.50 per ounce of silver. A material decline in the current price of gold or silver or material changes in our processing methods could require a reduction in our mineral reserve estimates. Any material change in the quantity of mineral reserves, mineral resources, mineralization, grade or stripping ratio may affect the economic viability of our properties. In addition, we can provide no assurance that gold and silver recoveries experienced in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production. The COVID-19 pandemic may adversely impact our business, financial condition, and results of operations.

The COVID-19 global pandemic and efforts to reduce its spread have led to a significant decline of economic activity and significant disruption and volatility in global markets. An outbreak could adversely affect our operations if significant portions of our workforce are unable to work or travel effectively for a prolonged period because of government-mandated quarantines, closures, or other restrictions, then our business and financial operations will be significantly impacted and could result in a temporary shutdown of the Hycroft Mine. The continued spread of coronavirus without any impact from effective vaccines or therapeutic treatments may cause further financial instability, and disruptions to our supply chain, which could increase supply costs or prevent us from procuring the supplies necessary to operate the Hycroft Mine. We cannot at this time predict the duration of the coronavirus pandemic or the impact of government regulations that might be imposed in response of the pandemic; however, the coronavirus pandemic may have a material adverse effect on our business, financial position, results of operations and cash flows.

We faceCompany faces intense competition in the mining industry.recruitment and retention of qualified employees and contractors.

The mining industry is intensely competitive some of which is withfor employees and contractors and includes several large established mining companies with substantial mining capabilities and with greater financial and technical resources than ours. We competethe Company’s. The Company competes with other mining companies in the recruitment and retention of qualified managerial and technical employees and in acquiring attractive mining claims.as well as contractors. If we are unable to successfully attract and retain qualified employees ourand contractors, the Company’s exploration and development programs and/or our operations may be slowed down or suspended, which may materially adversely impact our development,the Company’s financial condition and results of operations. The Company cannot be certain that future exploration and development activities will be commercially successful. Substantial expenditures are required to construct and operate the Hycroft Mine, including additional equipment and infrastructure that is typically seen in milling and processing operations to allow for extraction of gold and silver from the sulfide mineral resource, to further develop the Hycroft Mine to establish mineral reserves and identify new mineral resources through exploration drilling and analysis. In 2024, the Company expects to continue to advance its evaluation reflected in the 2023 Hycroft TRS. In conjunction with the 2023 Hycroft TRS, the Company intends to complete additional exploration drilling, focusing on higher grade opportunities, conducting trade-off studies using the results from the 2022-2023 drill program and variability test work program and conduct alternatives analyses. The Company cannot provide any assurance that an economic process can be developed for the sulfide mineral resource using POX or other similar sulfide extraction processes, that any mineral resources discovered will be in sufficient quantities and grades to justify commercial operations or that the funds required for development can be obtained on a timely or economic basis. Several factors, including costs, actual mineralization, consistency and reliability of ore grades, and commodity and reagent quantities and prices, affect successful project development. The efficient operation of processing facilities, the existence of competent operational management, as well as the availability and reliability of appropriately skilled and experienced consultants also can affect successful project development. The Company can provide no assurance that the exploration, development and advancement of the Hycroft Mine sulfide processing operations will result in economically viable mining operations. The Company’s reliance on third-party contractors and consultants to conduct exploration and development projects exposes the Company to risks. In connection with the exploration and development of the Hycroft Mine, the Company contracts and engages third-party contractors and consultants to assist with aspects of the project. As a result, the Company is subject to a number of risks, some of which are outside its control, including: •negotiating agreements with contractors and consultants on acceptable terms; •the inability to replace a contractor or consultant and their operating equipment in the event that either party terminates the agreement; •reduced control over those aspects of exploration or development operations that are the responsibility of the contractor or consultant; •failure of a contractor or consultant to perform under their agreement or disputes relative to their performance; •interruption of exploration or development operations or increased costs in the event that a contractor or consultant ceases their business due to insolvency or other unforeseen events; •failure of a contractor or consultant to comply with applicable legal and regulatory requirements, to the extent they are responsible for such compliance; and •problems of a contractor or consultant with managing their workforce, labor unrest or other employment issues. In addition, the Company may incur liability to third parties as a result of the actions of contractors or consultants. The occurrence of one or more of these risks could increase the Company’s costs, interrupt or delay exploration or development activities or the ability to access its mineral resources, and materially adversely affect the Company’s liquidity, results of operations and financial position. A shortage of equipment and supplies and/or the time it takes such items to arrive at the Hycroft Mine could adversely affect the Company’s ability to operate.

The Company is dependent on various supplies and equipment to engage in exploration and development activities. The shortage of supplies, equipment, and parts and/or the time it takes such items to arrive at the Hycroft Mine could have a material adverse effect on the Company’s ability to explore and develop the Hycroft Mine. Such shortages could also result in increased costs and cause delays in exploration and development projects. Mining, exploration, development and processing operations pose inherent risks and costs that may negatively impact ourthe Company’s business. Mining, exploration, development and processing operations involve many hazards and uncertainties, including, among others: •metallurgical or other processing problems; •ground or slope failures; •industrial accidents; •unusual and unexpected rock formations or water conditions; •environmental contamination or leakage; •flooding and periodic interruptions due to inclement or hazardous weather conditions or other acts of nature; •fires; •seismic activity; •organized labor disputes or work slow-downs or civil disturbances, including road closures or blockades;supply and transportation interruptions; •pandemics adversely affecting the availability of workforces and supplies; •mechanical equipment failure and facility performance problems; and •the availability of skilled labor, critical materials, equipment, reagents, and skilled labor.consumable items. These occurrences could result in damage to, or destruction of, ourthe Company’s properties or production facilities, personal injury or death, environmental damage, delays in future mining or processing, increased future production costs, long-lived asset write downs,impairments, monetary losses and legal liability, any of which could have a material adverse effect on ourfuture exploration and development plans, the Company’s ability to raise additional capital, and/or the Company’s financial condition, results of operations and financial condition and adversely affect our projected development and production estimates.

Our insurance may not cover all of the risks associated with our business.