UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)2)

| ☒ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | ||||

For the fiscal year ended December 31, 2023

or

| ☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | ||||

For the transition period from _______ to _______.

Commission File Numberfile number 001-38694

ARCADIUM LITHIUM PLC

| Bailiwick of Jersey | 98-1737136 | |||||||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| 1818 Market Street, Suite 2550 | Suite 12, Gateway Hub | |||||||

| Philadelphia, PA | Shannon Airport House | |||||||

| United States | Shannon, Co. Clare | |||||||

| 19103 | Ireland | |||||||

| V14 E370 | ||||||||

(Address of principal executive offices) | (Zip Code) | |||||||

| 215-299-5900 | 353-1-6875238 | |||||||

| (Registrant’s telephone number, including area code) | ||||||||

Securities registered pursuant to Section 12(b) of the Act: | ||||||||||

| Title of each class | Trading | Name of each exchange on which registered | ||||||||

| Ordinary Shares, | ALTM | New York Stock Exchange | ||||||||

Securities registered pursuant to Section 12(g) of the Act: | ||||||||||

| None | ||||||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large | Accelerated filer | ☐ | ||||||||||||||||||

| Non-accelerated filer ☐ | Smaller reporting company | ☐ | ||||||||||||||||||

| Emerging growth company | ☐ | |||||||||||||||||||

Indicate by check mark whether the registrant has filed a report on and attestation to its management'smanagement’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☒ No ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2023, the last day of the registrant’s second fiscal quarter, was $4,896,548,501. The market value of voting stock held by non-affiliates excludes the value of those shares held by executive officers and directors of the registrant. ☐

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Class | January 31, 2024 | |||||||

| Ordinary Shares, par value $1.00 per share | 1,074,397,786 | |||||||

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

On February 29, 2024, Arcadium Lithium plc (the "Company"“Company,” “we,” “us,” or “our”) is filing this Amendment No. 1 on Form 10-K/A ("Amended 10-K") tofiled its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 ("(the “Original 10-K"Form 10-K”) filed with the U.S. Securities and Exchange Commission ("SEC"(the “SEC”). The Original Form 10-K was subsequently amended by Amendment No. 1 to the Original Form 10-K (the “Amendment No. 1”), which was filed with the SEC on April 1, 2024.

The Company was formed on January 4, 2024, at the closing of the merger of equals transaction between Livent Corporation (“Livent”) and Allkem Limited (“Allkem”). All references to periods prior to January 4, 2024 refer to Livent, the Company’s predecessor. The Original Form 10-K omitted certain disclosures under Part III, Items 10, 11, 12, 13 and 14 of Form 10-K in reliance on February 29,General Instruction G(3) to Form 10-K, which provides that such information may be either incorporated by reference from the registrant’s definitive proxy statement or included in an amendment to Form 10-K, in either case filed with the SEC not later than 120 days after the end of the fiscal year.

We currently do not expect to file our definitive proxy statement for the 2024 annual meeting of our stockholders within 120 days of December 31, 2023. Accordingly, we are filing this Amendment No. 2 to the Original Form 10-K (this “Amendment No. 2”) solely to:

| • | amend Part III, Items 10 (Directors, Executive Officers And Corporate Governance), 11 (Executive Compensation), 12 (Security Ownership Of Certain Beneficial Owners And Management And Related Stockholder Matters), 13 (Certain Relationships And Related Transactions, And Director Independence) and 14 (Principal Accountant Fees And Services) of the Original Form 10-K to include the information required to be disclosed under such Items; |

| • | delete the reference on the cover of the Original Form 10-K regarding the incorporation by reference into Part III of the Original Form 10-K of portions of our definitive proxy statement to be delivered to stockholders and filed with the SEC in connection with the 2024 annual meeting of our stockholders; and |

| • | file new certifications of our principal executive officer and principal financial officer as exhibits to this Amendment under Item 15 of Part IV hereof, pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). |

This Amendment No. 2 does not otherwise change or update any of the disclosures set forth in the Original Form 10-K or the Amendment No. 1, and, except as expressly stated herein, does not reflect events occurring after the filing of the Original Form 10-K. This Amendment No. 2 modifies and amends the Original Form 10-K and should be read in conjunction with the Original Form 10-K as amended by the Amendment No. 1. References to “this Annual Report” contained in this Amendment No. 2 refer to the Original Form 10-K, as modified and amended by the Amendment No. 1 and this Amendment No. 2. Capitalized terms not otherwise defined in this Amendment No. 2 have the meanings given to them in the Original Form 10-K. The term shareholder in relation to the Company means a member of the Company (as used in the Company's Articles of Association).

3

Arcadium Lithium plc

2023 Form 10-K/A

| Page | ||

| PART III | ||

| Item 10. | 5 | |

| Item 11. | 14 | |

| Item 12. | 44 | |

| Item 13. | 45 | |

| Item 14. | 46 | |

| PART IV | ||

| Item 15. | 47 | |

PART III

Executive Officers

Information regarding the executive officers of the Company is set forth under “Information About Our Executive Officers” at the end of Part I of the Original Form 10-K.

Directors

All directors serve for a term ending at the next annual general meeting of shareholders following their appointment or the annual general meeting of shareholders at which they were elected, as applicable, and until their successors are elected and qualified, or until their earlier death, resignation, disqualification or removal. Vacancies on the Company’s board of directors (the “Board of Directors”) are filled by a majority of the directors then in office, even though fewer than a quorum, or by a sole remaining director. Any director appointed by the Board of Directors to fill a vacancy will hold office until the next annual general meeting of shareholders following his or her appointment.

The Board of Directors currently consists of 12 directors.

Each director was appointed to the Board of Directors on January 4, 2024 at the closing of the merger of equals transaction between Livent and Allkem forming the Company.

The professional experience, qualifications, skills and expertise of each director is set forth below.

MICHAEL F. BARRY

Age: 66 Director since: 2024 | PRINCIPAL OCCUPATION: Former Chief Executive Officer and President of Quaker Chemical Corporation d/b/a Quaker Houghton (“Quaker”)and Chairman of the Board of Quaker since 2009 Mr. Michael F. Barry, age 66, previously served as a director of Livent from 2018 to 2024. Mr. Barry held various leadership and executive positions of increasing responsibility after joining Quaker, a NYSE-listed industrial process fluids company, in 1998, including, in addition to his role as Chief Executive Officer and President from October 2008 to November 2021, Senior Vice President and Managing Director—North America from January 2006 to October 2008; Senior Vice President and Global Industry Leader—Metalworking and Coatings from July to December 2005; Vice President and Global Industry Leader—Industrial Metalworking and Coatings from January 2004 to June 2005; and Vice President and Chief Financial Officer from 1998 to August 2004. OTHER BOARD EXPERIENCE: Mr. Barry was also a member of the board of directors of Rogers Corporation, a NYSE listed specialty materials and components company, from which he retired in May 2020. Mr. Barry also served on the Board of Trustees of Drexel University. QUALIFICATIONS: Mr. Barry brings significant business experience from his senior executive positions in the global chemical industry, as well as valuable experience as a director of other public companies, to the Board of Directors. |

PETER COLEMAN

Age: 64 Director since: 2024 | PRINCIPAL OCCUPATION: Chairman, Board of Directors Mr. Peter Coleman, age 64, is the former Chair of the Allkem board of directors and served on the board from 2022 to 2024. Mr. Coleman is also the former Chief Executive Officer and Managing Director of Woodside Energy Group Limited (Australia’s largest independent gas producer) having served in that role from 2011 until his retirement in June 2021. Prior to joining Woodside, Mr. Coleman spent 27 years with the ExxonMobil group in a variety of roles, including Vice President—Asia Pacific from 2010 to 2011 and Vice President—Americas from 2008 to 2010. Since 2012, Mr. Coleman has been an adjunct professor of corporate strategy at the University of Western Australia Business School. He is the recipient of an Alumni Lifetime Achievement Award from Monash University and a Fellowship from the Australian Academy of Technological Sciences and Engineering. Mr. Coleman has been awarded Honorary Doctoral degrees in Law and Engineering from Monash and Curtin Universities, respectively and was awarded the Heungin Medal for Diplomatic Service by the Republic of South Korea. Mr. Coleman holds a Bachelor of Engineering (Civil and Computing) and an MBA. OTHER BOARD EXPERIENCE: Mr. Coleman has been a director of Schlumberger N.V. (Schlumberger Limited) (a NYSE listed oilfield services company) since 2021, is a member of the Singapore Energy International Advisory Panel and has chaired the Australia Korea Foundation since 2016. QUALIFICATIONS: Mr. Coleman is an experienced executive who brings a wealth of corporate knowledge from the global energy sector to the Board of Directors. |

ALAN FITZPATRICK

Age: 74 Director since: 2024 | PRINCIPAL OCCUPATION: Consultant and Owner of Alan Fitzpatrick Consulting since 2013 Mr. Alan Fitzpatrick, age 74, previously served as a director of Allkem from 2021 to 2024. Throughout his career, Mr. Fitzpatrick has held senior positions with BHP Group Limited (a public Australian multinational mining and metals company), Gold Fields Limited (a public South African gold mining company), Newmont Corporation (a public American gold mining company) and Bechtel Corporation (an engineering, construction and project management company). OTHER BOARD EXPERIENCE: Mr. Fitzpatrick previously served as a director of Galaxy Resources Limited (“Galaxy”) from 2019 until the merger of equals transaction between Orocobre Limited (“Orocobre”) and Galaxy, pursuant to an Australian members’ scheme of arrangement, which was implemented on August 25, 2021, that led to the formation of Allkem (the “Galaxy/Orocobre Merger”). QUALIFICATIONS: Mr. Fitzpatrick brings a wide range of knowledge and significant experience in the technical mining industry to the Board of Directors. |

PAUL W. GRAVES

Age: 53 Director since: 2024 | PRINCIPAL OCCUPATION: President and Chief Executive Officer of the Company Mr. Paul W. Graves, age 53, previously served as the President and Chief Executive Officer and as a director of Livent from 2018 to 2024. Before joining Livent, Mr. Graves served as Executive Vice President and Chief Financial Officer of FMC Corporation (“FMC”) from 2012 to 2018. Mr. Graves previously served as a managing director and partner in the Investment Banking Division at Goldman Sachs Group in Hong Kong and was the co-head of Natural Resources for Asia (excluding Japan). In that capacity, he was responsible for managing Goldman Sachs Group’s Pan-Asian Natural Resources Investment Banking business. Mr. Graves also served as Global Head of Chemical Investment Banking for Goldman Sachs, which he joined in 2000. Mr. Graves previously held finance and auditing roles of increasing responsibility at Ernst & Young, British Sky Broadcasting Group, ING Barings and J. Henry Schroder & Co. OTHER BOARD EXPERIENCE: Mr. Graves was a member of the board of directors of Lydall, Inc., a global provider of specialty filtration and advanced materials solutions, from April 2021 until October 2021. Mr. Graves previously served on the board of directors of the Farmers Business Network, a private independent agricultural tech and commerce platform, from April 2022 to October 2023 and the board of directors of Nemaska Lithium, a fully integrated lithium hydroxide development project located in Québec, Canada in which the Company owns an indirect interest of 50%, from February 2020 to February 2024. QUALIFICATIONS: Mr. Graves’s in-depth knowledge of the lithium business, his experience as FMC’s Chief Financial Officer and his financial expertise enables him to offer valuable insights to the Board of Directors. |

FLORENCIA HEREDIA

Age: 57 Director since: 2024 | PRINCIPAL OCCUPATION: Senior partner of Allende & Brea since 2017 Ms. Florencia Heredia, age 57, previously served as a director of Allkem from 2021 to 2024. Ms. Heredia is currently a senior partner of Allende & Brea, an Argentine law firm, where she currently heads the energy and natural resources practice and co-heads the ESG and sustainability practice. Ms. Heredia has a long-standing experience of 31 years in the mining industry. Ms. Heredia regularly teaches courses in mining and environmental law topics at the Universidad Catolico de Cuyo, the Universidad Catolica Argentina and as guest lecturer at Dundee University. For the past 20 years, Ms. Heredia has been repeatedly cited as a leading practitioner in Natural Resources law by, among others, Chambers & Partners, Who’s Who Legal and Legal 500 including being named “Mining Lawyer of the Year” in 2013, 2015, 2016, 2018, 2019, 2020 and 2021. OTHER BOARD EXPERIENCE: Ms. Heredia previously served as a director of Galaxy from 2018 until the Galaxy/Orocobre Merger. Ms. Heredia serves as Chair of SEERIL (Section of Energy, Environment, Natural Resources and Infrastructure Law) of the International Bar Association, has been a Trustee and Secretary of the Board to the Foundation of Natural Resources and Energy Law (former Rocky Mountain Mineral Law Foundation) and is a member of the International Affairs Committee of PDAC (Prospectors and Developers Association of Canada), the Argentinean-Canadian Chamber of Commerce and the Board of the Argentinean-British Chamber of Commerce, the Executive Committee of the International Women Forum (Argentinean Chapter) and the Academic Board of RADHEM in Argentina. She has also been a member of the Advisory Board to the Law School of Universidad Torcuato di Tella in Argentina since 2018. QUALIFICATIONS: Ms. Heredia brings extensive experience advising financial institutions and companies in complex mining transactions to the Board of Directors. |

LEANNE HEYWOOD

Age: 59 Director since: 2024 | PRINCIPAL OCCUPATION: Former senior position at Rio Tinto Group Ms. Leanne Heywood OAM (Order of Australia Medal), age 59, previously served as a director of Allkem from 2016 to 2024. Ms. Heywood previously held a senior position at Rio Tinto Group, from 2005 to 2015. Ms. Heywood’s experience includes strategic marketing, business finance (as Fellow of CPA Australia) and compliance and she has led organizational restructurings, dispositions and acquisitions. Additionally, Ms. Heywood has deep experience in international customer relationship management, stakeholder management (including with respect to governments and investment partners) and executive leadership in Asia, the Americas and Europe. OTHER BOARD EXPERIENCE: Since 2019, Ms. Heywood has been a director of two companies listed only in Australia that are not U.S. public companies: Midway Limited (a company processing and exporting woodfibre) and Quickstep Holdings Limited (a company developing and manufacturing defense technology). Ms. Heywood previously served as a director of Orocobre Limited until 2021 and as a director of Symbio Holdings Limited until February 2024. QUALIFICATIONS: Ms. Heywood is an experienced board member who brings significant corporate, financial and compliance experience in the mining sector to the Board of Directors. |

CHRISTINA LAMPE-ÖNNERUD

Age: 57 Director since: 2024 | PRINCIPAL OCCUPATION: Founder, Chairperson and Chief Executive Officer of Cadenza Innovation, Inc. since 2012 Dr. Christina Lampe-Önnerud, age 57, previously served as a director of Livent from 2020 to 2024. Dr. Lampe-Önnerud is an internationally recognized expert on lithium-ion batteries for EVs and energy storage. She currently serves as Founder, Chairperson and Chief Executive Officer of Cadenza Innovation, Inc., a private lithium-ion battery technology provider, having served in those positions since 2012. She previously founded Boston-Power, Inc., a private global lithium-ion battery manufacturer (“Boston-Power”), where she served as Chairperson and Chief Executive Officer. She has also held a senior executive position at hedge fund firm Bridgewater Associates, LP and served as director and partner in the Technology and Innovation Practice at innovation and management consulting firm, Arthur D. Little, Inc. Dr. Lampe-Önnerud also serves as Co-Chair of Li-Bridge, a U.S. Department of Energy initiative to accelerate the development of a robust and secure supply chain for lithium-based batteries. OTHER BOARD EXPERIENCE: In addition to her role as Chairperson for Cadenza Innovation’s board of directors, Dr. Lampe-Önnerud serves on the board of directors of ON Semiconductor Corporation (also known as onsemi), a semiconductor supplier company listed on the Nasdaq Global Market (“Nasdaq”), and the board of directors of the New York Battery and Energy Storage Technology Consortium, a private not-for-profit industry trade association. She previously served on the boards of directors for FuelCell Energy, Inc., a Nasdaq listed public fuel cell company, from 2018 to 2019, Syrah Resources Limited, an ASX listed industrial minerals and technology company, from 2016 until 2019, and Boston-Power from 2005 until 2012. QUALIFICATIONS: Renowned for her pioneering work in developing and commercializing lithium-ion batteries, Dr. Lampe-Önnerud holds more than 80 patents. She is a two-time World Economic Forum Technology Pioneer winner, an organization for which she co-chaired its Global Futures Council on Energy Technologies. She has served as an advisor to the United Nations, is a member of Sweden’s Royal Academy of Engineering Sciences and serves on MIT’s Visiting Committee for the Chemistry Department. Dr. Lampe-Önnerud’s lithium-ion battery industry experience and her executive positions at technology-based businesses makes her a significant contributor to the Board of Directors. |

PABLO MARCET

Age: 60 Director since: 2024 | PRINCIPAL OCCUPATION: Founder of Geo Logic S.A., and President since 2003 Executive Director of Piche Resources Ltd. since 2024 Mr. Pablo Marcet, age 60, previously served as a director of Livent from 2020 to 2024. He is the founder of Geo Logic S.A., a private management consulting company that services the mining sector, and has served as President since 2003. In addition, Mr. Marcet currently serves as an executive director of Piche Resources Ltd., a mineral exploration company, a position he has held since March 2024. He has also served as the President and Chief Executive Officer of Waymar Resources Limited, a private Canadian mineral exploration company, from 2010 to 2014, until its acquisition by Orosur Mining Inc. Prior to this, Mr. Marcet served as President, Subsidiaries and Operations, Argentina, of Northern Orion Resources Inc., a private copper and gold producer, from 2003 until 2007, and held senior roles with BHP Billiton, an Australian multinational mining, metals and natural gas petroleum company, from 1988 until 2003. OTHER BOARD EXPERIENCE: Mr. Marcet previously served on the board of directors of St. George’s College and was a member of the board of directors of U3O8 Corp. (recently renamed as Green Shift Commodities Ltd.), a former private uranium and battery commodities company that was previously listed on Canada’s TSX Venture Exchange (“TSXV”), from 2011 until August 2020; Esrey Resources Ltd., a private metal extraction company that was previously listed on the TSXV, from 2017 until 2020; Barrick Gold Corporation, a NYSE-listed gold and copper mining company, from 2016 until 2019; Orosur Mining Inc., a TSXV-listed minerals exploration and development company, from 2014 until 2016; and Waymar Resources Limited from 2010 until 2014. QUALIFICATIONS: Mr. Marcet brings valuable knowledge of the mining industry in Latin America, and particularly in Argentina, to the Board of Directors. |

STEVEN T. MERKT

Age: 56 Director since: 2024 | PRINCIPAL OCCUPATION: President of the Transportation Solutions segment at TE Connectivity Ltd. (“TE”) since 2012 Mr. Steven T. Merkt, age 56, previously served as a director of Livent from 2018 to 2024. Since August 2012, Mr. Merkt has been the President of the Transportation Solutions segment at TE, a NYSE listed company and one of the world’s largest suppliers of connectivity and sensor solutions to the automotive and commercial vehicle marketplaces. Before August 2012, Mr. Merkt was President of TE’s Automotive business. Since joining TE in 1989, Mr. Merkt has held various leadership positions in general management, operations, engineering, marketing, supply chain and new product launches. OTHER BOARD EXPERIENCE: Mr. Merkt is also a member of the board of directors of the Isonoma Foundation, a foundation whose mission is to help diminish disparities in healthcare, housing and education in the Philadelphia and Harrisburg regions of Pennsylvania. QUALIFICATIONS: Mr. Merkt’s experience, particularly in the automotive and commercial vehicle sectors, makes him a valuable contributor to the Board of Directors. |

FERNANDO ORIS DE ROA

Age: 71 Director since: 2024 | PRINCIPAL OCCUPATION: Former Ambassador of Argentina to the United States Mr. Fernando Oris de Roa, age 71, previously served as a director of Allkem from 2010 to 2024. Mr. Oris de Roa previously served as Ambassador of Argentina to the United States in 2018 and 2019. Mr. Oris de Roa is a highly successful business leader with a history of developing and operating large enterprises within Argentina and a reputation for upholding integrity and social responsibility in his business practices. Mr. Oris de Roa holds a Masters Degree from the Harvard Kennedy School of Government. OTHER BOARD EXPERIENCE: Mr. Oris de Roa previously served as a director of Orocobre Limited from 2010 until the Galaxy/Orocobre Merger. QUALIFICATIONS: Mr. Oris de Roa brings valuable corporate experience and Argentine political perspectives to the Board of Directors. |

ROBERT C. PALLASH

Age: 73 Director since: 2024 | PRINCIPAL OCCUPATION: Retired President, Global Customer Group and Senior Vice President of Visteon Corporation (“Visteon”) Mr. Robert C. Pallash, age 73, previously served as a director of Livent from 2018 to 2024. From January 2008 to December 2013, Mr. Pallash served as President, Global Customer Group and Senior Vice President of Visteon, a Nasdaq listed automotive parts manufacturer, and he retired from such positions in December 2013. Prior to becoming President, Global Customer Group, from August 2005 to January 2008, Mr. Pallash served as Senior Vice President, Asia Customer Group for Visteon. He joined Visteon in September 2001 as Vice President, Asia Pacific. Prior to joining Visteon, Mr. Pallash served as President of TRW Automotive Japan, a private automotive part manufacturer, beginning in 1999. OTHER BOARD EXPERIENCE: Mr. Pallash has served as a member of the board of directors of FMC since 2008, and previously served on the board of directors of Halia Climate Controls, a majority-owned subsidiary of Visteon, in South Korea until December 2013. QUALIFICATIONS: Mr. Pallash’s international experience, particularly in Asia, which is a critical region for lithium and the broader energy storage supply chain, as well as his automotive industry experience enables him to bring significant value as a member of the Board of Directors. |

JOHN TURNER

Age: 62 Director since: 2024 | PRINCIPAL OCCUPATION: Partner of Fasken Martineau DuMoulin LLP (“Fasken”) since 1997 Mr. John Turner, age 62, previously served as a director of Allkem from 2021 to 2024. Mr. Turner is currently a partner of Fasken, a law firm with offices in Canada, the UK, South Africa and China, and is currently the leader of the Global Mining Group and Chair of the Capital Markets and Mergers and Acquisitions Group. Mr. Turner has been involved in many of the leading corporate finance and merger and acquisition deals in the resources sector. OTHER BOARD EXPERIENCE: Mr. Turner previously served as a director of Galaxy from 2017 until the Galaxy/Orocobre Merger. Mr. Turner has also been the non-executive Chairman of GoGold Resources, Inc., a TSX-listed gold and silver mining company, since 2019. QUALIFICATIONS: Mr. Turner brings significant corporate, legal and transactional experience in the mining sector to the Board of Directors. |

Committees of the Board of Directors

The Board of Directors has four standing Committees: an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and a Sustainability Committee.

Audit Committee

The Board of Directors has adopted a written charter that outlines the duties of the Audit Committee, including conducting an annual self-assessment. A current copy of the Charter is posted on the Company’s website located at www.arcadiumlithium.com. The principal duties of this Committee, among other things, include:

| • | reviewing the annual audited financial statements prior to the filing of the Company’s Form 10-K, and recommending to the Board of Directors whether the audited financial statements should be included in the Company’s Form 10-K; |

| • | reviewing the quarterly financial statements prior to the filing of the Company’s Form 10-Q; |

| • | reviewing with management the Company’s earnings press releases; |

| • | discussing with management, including the Chief Executive Officer and Chief Financial Officer, the Company’s disclosure controls and procedures and internal controls over financial reporting; |

| • | selecting an independent registered public accounting firm and evaluating its qualifications, performance and independence; |

| • | pre-approving audit and permitted non-audit services provided by the independent registered public accounting firm; and |

| • | evaluating the performance, responsibilities budget and staffing of the Company’s internal audit function. |

Members: Ms. Heywood (Chair), Mr. Barry, Mr. Merkt and Mr. Oris de Roa. The Board of Directors has determined that each member of the Audit Committee (i) is “independent” as defined by SEC and NYSE rules, (ii) meets the SEC requirements for an “audit committee financial statementsexpert,” and related notes(iii) is “financially literate” as required by the NYSE. No Audit Committee member currently sits on the audit committee of Nemaska Lithium, Inc. ("NLI")more than three public companies.

Compensation Committee

The Board of Directors has adopted a written charter that outlines the duties of the Compensation Committee, including conducting an annual self-assessment. A current copy of the Charter is posted on the Company’s website located at www.arcadiumlithium.com. The principal duties of this Committee, among other things, include:

| • | reviewing and approving executive compensation policies and practices and establishing total compensation for the Chief Executive Officer, among other officers; |

| • | reviewing annually the Company’s compensation policies and practices; |

| • | reviewing the terms of employment agreements, severance agreements, change in control protections and other compensatory arrangements for the Company’s executive officers; |

| • | monitoring the Company’s environmental, social and governance practices related to human capital management, including those relating to diversity, equity and inclusion initiatives; |

| • | recommending to the Board of Directors the Company’s submissions to shareholders on executive compensation matters and assessing the results of such votes; and |

| • | reviewing executive stock ownership guidelines and overseeing clawback, hedging, and pledging policies. |

Members: Mr. Turner (Chair), Mr. Barry, Mr. Marcet and Mr. Oris de Roa. The Board of Directors has determined that each member of the Compensation Committee is independent as defined by NYSE rules.

Nominating and Corporate Governance Committee

The Board of Directors has adopted a written charter that outlines the duties of the Nominating and Corporate Governance Committee, including conducting an annual self-assessment. A current copy of the Charter is posted on the Company’s website located at www.arcadiumlithium.com. The principal duties of this Committee, among other things, include:

| • | reviewing and recommending director candidates; |

| • | recommending the number, function, composition and Chairs of the Board of Directors’ committees; |

| • | overseeing corporate governance, including an annual review of governance guidelines; |

| • | overseeing director compensation; |

| • | overseeing Board of Directors and committee evaluation procedures; and |

| • | determining director independence. |

Members: Mr. Merkt (Chair), Mr. Coleman, Mr. Fitzpatrick and Mr. Pallash. The Board of Directors has determined that each member of the Nominating and Corporate Governance Committee is independent as defined by NYSE rules.

Sustainability Committee

The Board of Directors has adopted a written charter that outlines the duties of the Sustainability Committee, including conducting an annual self-assessment. A current copy of the Charter is posted on the Company’s website located at www.arcadiumlithium.com. The principal duties of this Committee, among other things, include:

| • | reviewing and overseeing employee and contractor occupational safety and health, and process safety programs; |

| • | monitoring environmental performance and risk mitigation programs; |

| • | monitoring corporate social responsibility programs; |

| • | reviewing sustainability disclosures; |

| • | monitoring audits and assurance of sustainability data and data collection methodology; and |

| • | reviewing and overseeing sustainability management systems. |

Members: Mr. Pallash (Chair), Mr. Fitzpatrick, Ms. Heredia, Ms. Heywood, Ms. Lampe-Önnerud and Mr. Marcet.

Code of Ethics and Business Conduct Policy

The Company has a Code of Ethics and Business Conduct policy that applies to the Company, its subsidiaries and all other entities that in each case are directly or indirectly controlled or managed by the Company and the employees, officers, directors and contractors of these entities (to the extent applicable to their work for the fiscalCompany). It is posted on the Company’s website at www.arcadiumlithium.com.

The Company intends to post any amendments to, or waivers from, the policy required to be disclosed by either SEC or NYSE regulations on the Company’s website at www.arcadiumlithium.com.

Director Recommendation Process

The Nominating and Corporate Governance Committee is responsible for, among other things, considering, selecting and recommending to the Board of Directors candidates qualified to become members of the Board of Directors. An executive search firm may also be utilized to identify qualified candidates for consideration. The Nominating and Corporate Governance Committee evaluates candidates based on the qualifications for directors described in the Corporate Governance Guidelines. The Nominating and Corporate Governance Committee then presents qualified candidates to the Board of Directors for consideration and selection. The Nominating and Corporate Governance Committee will consider recommendations for membership on the Board of Directors from shareholders or other interested parties. Recommendations may be submitted to the Board of Directors by writing to the Company Secretary and must be accompanied by a complete description of the nominee’s qualifications for the directorship, experience and background.

Section 16(a) Reports

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and persons who own more than 10% of a registered class of the Company’s equity securities, to file with the SEC reports of beneficial ownership and reports of changes in beneficial ownership in the Company’s securities. Based solely upon a review of Forms 3, 4 and 5, and amendments thereto, filed electronically with the SEC during the year ended December 31, 2023, the Company believes that all Section 16(a) filings applicable to its directors, officers, and 10% shareholders were filed on a timely basis.

COMPENSATION DISCUSSION AND ANALYSIS

Subsequent to the end of 2023, on January 4, 2024, Livent and Allkem, completed an all-stock merger of equals. The Company, the combined new company, is one of the largest integrated producers of lithium chemicals in the world, with roughly $2.0 billion of combined pro forma revenue in 2023 and a team of approximately 2,400 employees. As a result of the merger, the Company became the successor issuer to Livent pursuant to SEC rules.

In accordance with SEC rules, this Compensation Discussion and Analysis (“CD&A”) describes the philosophy, objectives, process, components and additional aspects of the 2023 executive compensation program of Livent, the predecessor SEC-registered issuer to the Company. Because the merger was completed after December 31, 2023, this CD&A does not describe any of the compensation arrangements for the Company or the Company’s executive officers. This CD&A is intended to be read in conjunction with the tables that immediately follow this section, which provide further historical compensation information for the following named executive officers (“NEOs”), who were the sole executive officers of Livent in 2023:

| Name | Title at Livent |

| Paul W. Graves | President and Chief Executive Officer |

| Gilberto Antoniazzi | Vice President, Chief Financial Officer and Treasurer |

| Sara Ponessa | Vice President, General Counsel and Secretary |

This CD&A also discusses decisions of Livent’s Compensation and Organization Committee (the “Livent Committee”) regarding the compensation paid to the NEOs in 2023. During 2023, the members of the Livent Committee were G. Peter D’Aloia (Chair), Michael F. Barry, Pierre Brondeau and Pablo Marcet.

QUICK CD&A REFERENCE GUIDE

| Executive Summary | Section I |

| Compensation Philosophy | Section II |

| Compensation Determination Process | Section III |

| Compensation Program Components | Section IV |

| Additional Compensation Policies and Practices | Section V |

| I. | EXECUTIVE SUMMARY |

OVERVIEW

The primary objectives of Livent’s executive compensation program were to:

| • | Link pay to performance over both the short and long terms; |

| • | Align executive officers’ interests with those of Livent and Livent’s stockholders over the long term, generally through the use of equity as a significant component; |

| • | Establish components of the program that were consistent with Livent’s business strategy and objectives; |

| • | Provide market compensation to attract, motivate and retain executive talent; and |

| • | Achieve all objectives in ways that incorporate due consideration of risk. |

In light of these objectives, Livent’s compensation plans were designed to reward executive officers for generating performance that achieves Livent and individual goals, and for increasing shareholder returns. When Livent fell short of achieving company and individual goals, Livent’s executive officers’ compensation reflected that performance accordingly.

2023 SELECT BUSINESS RESULTS FOR LIVENT

Livent achieved strong year-over-year Revenue, Adjusted EBITDA and margin growth following record 2022 financial results. Livent also made progress on multiple expansion projects related to extracting and processing lithium materials, and, after year-end, completed the merger with Allkem in January 2024 to create a leading global lithium chemicals producer.

Revenue

| • | Revenue was $882.5 million, an increase of $69.3 million versus 2022, primarily due to the favorable impact of higher pricing mainly driven by lithium hydroxide sales, partially offset by a net unfavorable volume impact, with a decrease in butyllithium sales volumes offset by favorable lithium carbonate and lithium hydroxide sales volumes. |

Net Income

| • | Net income was $330.1 million, an increase of $56.6 million compared to the 2022 amount of $273.5 million, primarily due to higher gross margin and an increase in the gain from the sale of Argentina Sovereign U.S. dollar-denominated bonds partially offset by higher restructuring and other charges, which were driven by an increase from transaction-related fees for the merger with Allkem. |

Adjusted EBITDA

| • | Adjusted EBITDA was $502.5 million, compared to the 2022 amount of $366.7 million, primarily due to the favorable impact of higher pricing, which was driven by lithium hydroxide, and a favorable mix of raw material costs, partially offset by higher selling, general and administration costs. (For the purpose of the 2023 annual incentive plan, the Livent Committee modified Adjusted EBITDA modestly, as described below under “Notable Aspects of Livent’s 2023 Executive Compensation Program”.) |

EBITDA is defined as net income plus interest expense, net income tax expense, and depreciation and amortization.

Adjusted EBITDA is defined as EBITDA adjusted for Argentina remeasurement losses, restructuring and other charges, separation-related costs, COVID-19 related costs and other non-recurring losses/(gains).

For a reconciliation of Adjusted EBITDA to the nearest GAAP measure, see the section captioned “Results of Operations — Years Ended December 31, 2023 and 2022” in this Annual Report.

NOTABLE ASPECTS OF LIVENT’S 2023 EXECUTIVE COMPENSATION PROGRAM

The Livent Committee took the following actions with respect to 2023 executive compensation, each as described in more detail under “Compensation Program Components,” below.

Base Salaries

The Livent Committee adjusted annual base salaries for its NEOs to maintain market competitive pay, as determined by reference to comparable positions at the peer group companies.

Annual Cash Incentive Plan

The Livent annual cash incentive plan was comprised of company and individual performance metrics.

For the company component (80% of the annual incentive opportunity), the performance metrics were Adjusted EBITDA (weighted 60%) and key operational goals related to delivery of two expansion projects (weighted 20%).

The Livent Committee used an unconsolidated joint ventureAdjusted EBITDA measure in order to focus executive officers on the critical strategic priority of achieving and improving operating profitability. The Livent Committee set the target at a level that it believed to be challenging and rigorous. Specifically, the Livent Committee set the target for Adjusted EBITDA significantly higher than the 2022 actual result. The Livent Committee also again included two goals related to expanding Livent’s production capacity which, as described below, focused on the development and expansion of carbonate production capacity in Argentina and the production of lithium hydroxide in North Carolina.

Immediately prior to the closing of the merger with Allkem, the Livent Committee determined the level of company performance relative to the annual incentive goals. The Livent Committee modified Adjusted EBITDA for annual incentive plan purposes modestly from $502.5 million to $504 million to remove the effects of foreign exchange rate fluctuations versus rates assumed in the budget and by adjusting certain costs associated with the ramp up and commissioning activities of the two expansion facilities in Bessemer City and Argentina if higher or lower than assumed in the budget. Based on this financial result, the Livent Committee determined that:

| • | Livent’s Adjusted EBITDA, which represented 60% of the Company Measures, was achieved at 85% of target, yielding a 0.45 achievement level. In light of market pricing conditions, and the Board’s related strategic considerations surrounding the timing of expansion project operations commencement, the Livent Committee adjusted the achievement rating modestly from 0.45 to 0.50 to account for the decision that was in the best interest of shareholders but that nevertheless affected results. |

| • | On the delivery of expansion goals, which represented 20% of the Company Measures, Livent achieved: 0.96 with respect to the Argentina Expansion and 0.80 with respect to the North Carolina Expansion, yielding a combined 0.92 achievement level. |

| • | Combined, the overall achievement level for Company Measures was 0.60. |

For the individual component, which represented 20% of the total opportunity, the targets, achievements, and payouts of the NEOs varied, but were earned at a rating of 1.5 (on a rating scale of 0.0 to 2.0, where 1.0 is the target).

Long-Term Incentives

In the first quarter of 2023, the Livent Committee again granted the NEOs performance-based restricted stock units (“PSUs”), options, and time-based restricted stock units (“RSUs”). The PSUs used relative TSR as a metric for the 2023-25 performance period. The Livent Committee allocated 25% of the long-term incentive equity opportunity to the relative TSR PSUs. The other elements of the 2023 long-term incentives consisted of 25% stock options and 50% RSUs. Pursuant to the Transaction Agreement, the outstanding equity awards held by NEOs were treated as follows:

| • | Stock options were assumed by the Company and converted to equivalent awards with respect to Company stock and remain subject to the same terms and conditions. |

| • | Time-based RSUs were assumed by the Company, with a pro rata portion vesting in Company shares following such assumption, and with the unvested portion converted to equivalent awards with respect to Company stock and remaining subject to the same terms and conditions. |

| • | PSUs fully vested at target. The vesting of the PSUs was accelerated from January 4, 2024, the closing of the merger, to December 22, 2023. |

2023 LIVENT SAY ON PAY VOTE

At the 2023 annual meeting of Livent’s stockholders, Livent’s stockholders approved the compensation of NEOs on an advisory basis, with approximately 86.6% of the votes cast “For” such approval. The Livent Committee interpreted stockholder approval of the executive compensation program at such a level as indicating that a substantial majority of stockholders viewed Livent’s executive compensation program, plan design and governance as continuing to be well aligned with stockholder interests, their investor experience and business outcomes.

To ensure investor views were incorporated into the planning process, Livent engaged with stockholders on an ongoing basis to gather their perspectives. Through this stockholder outreach, Livent established important feedback channels that served as a valuable resource for ongoing input from Livent stockholders.

| II. | COMPENSATION PHILOSOPHY |

Pay-for-performance: Livent’s program was designed to motivate its executive officers to achieve goals by closely linking their performance and Livent’s performance to the compensation they receive. As such, a significant portion of the total compensation of its executive officers was based on measures that supported Livent goals, as well as on the executive officer’s individual performance. To tighten this link, Livent defined clear and measurable quantitative and qualitative objectives that, in combination, were designed to improve Livent’s results and returns to stockholders.

Alignment of executive officers’ interests with those of Livent and its stockholders: A significant portion of Livent’s executive officers’ overall compensation was in the form of equity-based compensation. Livent used equity as the form for long-term incentive opportunities in order to motivate and reward executive officers to (i) achieve multiyear strategic goals and (ii) deliver sustained long-term value to stockholders. Using equity for long-term incentives creates strong alignment between the interests of executive officers and those of stockholders, as it provides executive officers with a common interest with stockholders in stock price performance and it fosters an ownership culture among executive officers by making them stockholders with a personal stake in the value they are being motivated to create.

Provide market competitive pay to attract and retain talent: Livent had to compete in the market for executive talent. Livent sought executive officers and managers to lead the business and carry out the strategy who have diverse experience, expertise, capabilities and backgrounds. In recruiting executive officers and determining competitive pay levels, Livent referenced the market median amounts and compensation structures of executive officers of the companies in Livent’s peer group and as shown in general industry surveys. Executive officers’ total compensation may deviate from the level referenced in the peer group or surveys in order to attract or retain certain individuals or reflect their respective characteristics or performance.

Risk management: While Livent designed the executive compensation program to create incentives for executive officers to deliver high performance. Livent also simultaneously sought to minimize risk by striving to reduce undue pressure on, or incentives for, executive officers to take excessive risks to achieve goals and receive rewards. Livent sought to include mechanisms intended to mitigate such risk, including (i) placing maximum limits on short- and long-term incentive pay-outs and awards; (ii) measuring performance using key performance indicators that by design have lower potential to promote excessive risk-taking; (iii) utilizing a mix of equity vehicles with longer term vesting; (iv) requiring clawback of compensation payments under certain plans or in certain circumstances; and (v) maintaining executive officer stock ownership guidelines. The Livent Committee determined that its compensation policies and programs did not give rise to inappropriate risk taking or risks that were reasonably likely to have a material adverse effect on Livent.

COMPENSATION PROGRAM GOVERNANCE

Livent assessed the effectiveness of the executive compensation program from time to time and reviewed risk mitigation and governance matters, which included the following best practices:

| What We Do | |||

| ☑ | Pay for Performance | The majority of total executive compensation opportunity was variable and at-risk. | |

| ☑ | Independent Compensation Consultant | Engaged an independent compensation consultant to provide information and advice for use in the Livent Committee’s decision-making. | |

| ☑ | Clawback | Incentive compensation subject to clawback if Livent restated its financials due to material non-compliance with a financial reporting requirement. Equity awards could also be clawed back if a participant engaged in serious misconduct, was terminated for cause, or competed with Livent. | |

| ☑ | Stock Ownership Guidelines | Adopted guidelines for executive officers to maintain meaningful levels of stock ownership. | |

| ☑ | Cap Bonus Payouts and Equity Grants | Annual incentive plan and equity awards had upper limits on the amounts of cash and equity that may be earned. | |

| ☑ | Double Trigger Change-in-Control Severance | Livent entered into agreements with NEOs that provide certain financial benefits if there was both a change in control and termination of employment (a “double trigger”). A change in control alone did not trigger severance pay. | |

| What We Don’t Do | |||

| ☒ | No Repricing of Underwater Stock Options | The equity plan expressly prohibited repricing of stock options or exchanges of underwater stock options without shareholder approval. | |

| ☒ | No Excessive Perks | Did not provide large perquisites to executive officers. | |

| ☒ | No Excise Tax Gross-Ups | Did not provide excise tax gross-ups on change-in-control payments. | |

| ☒ | No hedging or pledging of Company shares | Did not permit executive officers and directors to pledge or hedge their shares. | |

| III. | COMPENSATION DETERMINATION PROCESS |

ROLE OF THE COMMITTEE

The Livent Committee established the compensation philosophy and objectives, determined the structure, components and other elements of executive compensation, and reviewed and approved the compensation of the NEOs or recommended it for approval by the Board of Directors.

The Livent Committee structured the executive compensation program to accomplish articulated compensation objectives in light of the compensation philosophy described above.

In accordance with its charter, the Livent Committee established total compensation for the CEO (generally at its February meeting). The Livent Committee reviewed and evaluated the performance of the CEO and developed base salary and incentive compensation recommendations. The CEO did not play any role with respect to any matter affecting his own compensation and was not present when the Livent Committee discussed and formulated their recommendation for his compensation.

With the input of the CEO, the Livent Committee also established the compensation for all the other executive officers. As part of this process, the CEO evaluated the market competitiveness of the various components of compensation and the performance of the other executive officers annually and made recommendations to the Livent Committee in February regarding the compensation of each executive officer. The CEO’s input was particularly important in connection with base salary adjustments and the determination of each executive officer’s individual goals under the annual incentive plan. The Livent Committee gave significant weight to the CEO’s recommendations in light of his greater familiarity with the day-to-day performance of his direct reports and the importance of incentive compensation in driving the execution of managerial initiatives developed and led by the CEO. Nevertheless, the Livent Committee or the Board made the ultimate determination regarding the compensation for the executive officers.

Pursuant to its charter, the Livent Committee was permitted to delegate its authority to subcommittees, other than any power or authority required by law or stock exchange requirements to be exercised by the Livent Board of Directors or the Livent Committee.

ROLE OF THE INDEPENDENT COMPENSATION CONSULTANT

The Livent Committee recognized the importance of obtaining objective, independent expertise and advice in carrying out its responsibilities. The Livent Committee had the power to retain an independent compensation consultant to assist it in the performance of its duties and responsibilities.

The Livent Committee retained Aon’s Human Capital Solutions practice, a division of Aon plc (“Aon”), as its independent compensation consultant. Aon reported directly to the Livent Committee, and the Livent Committee had the sole authority to retain, terminate and obtain the advice of Aon at Livent’s expense. The Livent Committee selected Aon as its consultant because of the firm’s expertise and experience.

The Livent Committee worked with Aon to: (i) assess the executive compensation objectives and components; (ii) review considerations, market practices, and trends related to short-term annual incentive plans and long-term equity and other incentive plans; (iii) collect comparative compensation levels for each of the executive officer positions, as needed; and (iv) review the equity compensation strategy.

While the Livent Committee took into consideration the review and recommendations of Aon when making decisions about the executive compensation program, ultimately, the Livent Committee made its own independent decisions about compensation matters.

The Livent Committee assessed the independence of Aon pursuant to SEC and NYSE rules. In doing so, the Livent Committee considered each of the factors set forth by the SEC and the NYSE with respect to a compensation consultant’s independence. The Livent Committee also considered the nature and amount of work performed for the Livent Committee and the fees paid for those services in relation to the firm’s total revenues. Based on its consideration of the foregoing and other relevant factors, the Livent Committee concluded that there were no conflicts of interest, and that Aon is independent.

For 2023, in determining the independence of Aon, the Livent Committee considered independence in light of the independence factors set forth in the SEC rules and NYSE listing standards. In total, fees paid to Aon during 2023 for services not related to Aon’s work with the Livent Committee, such as global commercial risk brokerage services, were approximately $898,148. The engagement of Aon to performance such other services was recommended by management and was reviewed by the Livent Committee, including as part of its review of Aon’s independence. Fees paid to Aon during 2023 for services related to recommending the amount and form of executive and director compensation were approximately $588,764.

In terms of assessing independence, the Livent Committee also gave credit to the safeguards that Aon’s executive compensation practice has put in place to maintain its independence. The Livent Committee also considered that no business or personal relationships exist between any members of the consultants’ teams advising the Company on the one hand, and the Company, any members of the Livent Committee or any executive officers on the other hand, other than in connection with the services provided. Therefore, the Livent Committee has concluded that Aon is independent, as no conflict of interest exists between Aon and the Company.

EXECUTIVE COMPENSATION COMPETITIVE MARKET INFORMATION

In making determinations about executive compensation, the Livent Committee believed that obtaining relevant market data was important, because it served as a reference point for making decisions and provided very helpful context. When making decisions about the structure and component mix of the executive compensation program, the Livent Committee considered the structure and components of, and the amounts paid under, the executive compensation programs of other comparable peer companies, as derived from public filings and other sources.

The Livent Committee, with the assistance of Aon, its independent compensation consultant, developed a peer group in 2022 for purposes of 2023 compensation. The criteria used to determine the peer group included: companies in the chemicals sector traded on U.S. exchanges; revenue in the range of 1/3 to 3 times Livent’s revenue; market capitalization in the range of 1/3 to 3 times Livent’s market capitalization; and primarily in the specialty chemicals industry with additional revenues from outside the U.S.

Based on these criteria and considerations, the peer group selected for decisions relating to 2023 executive compensation, as approved by the Livent Committee, consisted of the following 21 companies:

| Albemarle Corporation (ALB)* | CVR Partners, LP(UAN) | Innospec Inc. (IOSP) |

| American Vanguard Corporation (AVD) | Ecovyst Inc. (ECVT) | Intrepid Potash, Inc. (IPI) |

| Amyris, Inc. (AMRS) | Element Solutions Inc. (ESI)* | Mineral Technologies, Inc. (MTX)* |

| Ashland Inc. (ASH)* | FutureFuel Corporation (FF) | Quaker Chemical Corporation (KWR) |

| Balchem Corporation (BCPC) | GCP Applied Technologies, Inc. (GCP) | Sensient Technologies Corporation (SXT) |

| Chase Corporation (CCF) | Hawkins, Inc. (HW KN) | Sisecam Resources LP (SIRE) |

| Compass Minerals International, Inc. (CMP) | Ingevity Corporation (NGVT) | Tredegar Corporation (TG) |

*New peer for 2023 peer group. Albemarle Corporation, Ashland Inc., Element Solutions Inc. and Mineral Technologies, Inc. met the peer group criteria and therefore were added for 2023. Kraton Corporation and Trecora Resources, who were included in the peer group for 2022, were removed for purposes of the 2023 peer group as they no longer met the applicable criteria.

Market Cap ($mm) | Revenue ($mm) | |||||||

| Peers | ||||||||

25th percentile | $ | 669.0 | $ | 590.2 | ||||

| Median | $ | 1,313.5 | $ | 878.2 | ||||

75th percentile | $ | 2,463.3 | $ | 1,616.2 | ||||

| Livent Corporation | $ | 3,724.4 | $ | 472.2 | ||||

| Rank | 83rd% | 18th% | ||||||

In addition to the criteria above, the Livent Committee also referenced general and specific industry surveys from other sources. The Livent Committee determined that the appropriate market reference continued to be the 50th percentile. The market data are used as a reference point and to provide information on the range of competitive pay levels and current compensation practices in Livent’s industry.

The Livent Committee believed that the compensation practices of the peer group provided it with appropriate compensation reference points for evaluating the 2023 compensation of the NEOs. Consistent with best practices for corporate governance, the Livent Committee historically reviewed the peer group annually.

| IV. | COMPENSATION PROGRAM COMPONENTS |

2023 COMPONENTS IN GENERAL

The Livent Committee selected the components of compensation set forth in the chart below to achieve Livent’s executive compensation program objectives. The Livent Committee regularly reviewed all components of the program to verify that each executive officer’s total compensation was consistent with the compensation philosophy and objectives and that the component was serving a purpose in supporting the execution of the strategy. Taking into consideration the 2023 grants of equity to the CEO and other NEOs, the majority of each executive officer’s compensation was variable and at-risk.

Long-term incentive equity awards are prospective in nature and intended to tie a substantial portion of an executive’s pay to creating long-term stockholder value. The Livent Committee structured the 2023 long-term incentive opportunity with PSUs, stock options and RSUs in order to motivate executive officers to achieve multi-year strategic goals and deliver sustained long-term value to stockholders, and to reward them for doing so.

| Element | Description | Additional Detail | ||

| Base Salary | Fixed cash compensation. Determined based on each executive officer’s role, individual skills, experience, performance, and external market value. | Base salaries are intended to provide stable compensation to executive officers, allow Livent to attract and retain skilled executive talent and maintain a stable leadership team. | ||

Short-Term Incentives: Annual Cash Incentive Opportunities | Variable cash compensation based on the level of achievement of pre-determined annual corporate and individual goals. 80% of the award is based on corporate objectives and 20% is based on individual measures. For the corporate objectives and individual measures, cash incentives are capped at a maximum of 200% of each NEO’s target opportunity. Performance against the corporate objectives must exceed a threshold level of performance in order to earn any credit toward a payout with respect to that goal. | Annual cash incentive opportunities are designed to ensure that executive officers are motivated to achieve Livent’s annual goals; payout levels are generally determined based on actual financial results and non-financial objectives, and individual goals specific to each NEO. | ||

Long-Term Incentives: Annual Equity-Based Compensation | Variable equity-based compensation. Stock Options: Right to purchase shares at a price equal to the stock price on the grant date with three-year cliff vesting. RSUs: Restricted stock units that are time-based with three-year cliff vesting. PSUs: Restricted stock units that are performance-based with three-year cliff vesting. For 2023 grants, the applicable performance-based vesting measure was relative TSR. | Designed to motivate and reward executive officers to achieve multi-year strategic goals and to deliver sustained long-term value to stockholders, as well as to attract and retain executive officers. Links with stockholder value creation; aligns with stockholders; filters out macroeconomic and other factors not within management’s control. |

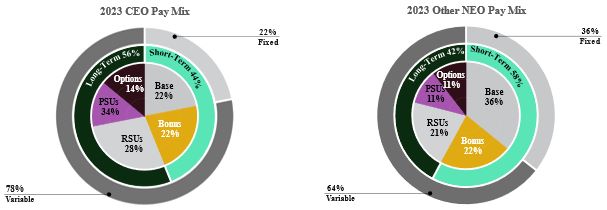

2023 TARGET PAY MIX

The target pay mix supported the core principles of Livent’s executive compensation philosophy of pay for performance and aligning executive officers’ interests with those of Livent and its shareholders, by emphasizing short- and long-term incentives.

The following charts outline the Livent Committee’s allocation of annual target total direct compensation payable to the CEO and to other NEOs. The Livent Committee allocated compensation among (i) base salary, (ii) a short-term annual cash incentive opportunity and (iii) long-term annual equity.

A sizeable majority of target total direct compensation was variable, at-risk pay, consistent with Livent’s pay-for-performance philosophy. Specifically, in 2023, 78% of the CEO’s target total direct compensation was at-risk compensation, and 65%, on average, of the target total direct compensation of the other NEOs was at-risk compensation. Livent considered compensation to be “at risk” if it is subject to performance-based payment or vesting conditions or if its value depended on stock price appreciation.

The percentages of target total direct compensation as calculated above are based on the annualized 2023 base salary, the 2023 annual cash incentive compensation opportunity (assuming achievement at the target level), and the grant date fair value of the annual equity grants.

BASE SALARY

Base salaries provided fixed compensation to Livent’s executive officers and helped to attract and retain the executive talent needed to lead the business and maintain a stable leadership team. Base salaries were individually determined according to each executive officer’s areas of responsibility, role and experience, and vary among executive officers based on a variety of considerations, including skills, experience, achievements and the competitive market for the position.

In 2023, the Livent Committee adjusted the base salaries of the NEOs to maintain market competitive pay, as determined by reference to comparable positions at the peer group companies.

| NEO | 2023 Base Salary | 2022 Base Salary | % Change | |||||||||

| Paul W. Graves | $ | 860,000 | $ | 825,000 | 4.2 | % | ||||||

| Gilberto Antoniazzi | $ | 450,000 | $ | 420,000 | 7.1 | % | ||||||

| Sara Ponessa | $ | 390,000 | $ | 360,000 | 8.3 | % | ||||||

ANNUAL INCENTIVE PLAN

The annual incentive plan for executive officers was a cash-based plan that rewarded Livent’s NEOs for the achievement of key short-term objectives. The structure of the annual cash plan incentivized NEOs to achieve annual financial and operational results that the Livent Committee viewed as critical to the execution of Livent’s business strategy.

For the NEOs, the amount of the payout, if any, under the annual incentive plan was based on achievement against two categories of performance measures: Company Measure and Individual Measures.

Target Opportunities

The Livent Committee determined a target cash incentive opportunity for each NEO under the annual cash incentive plan by taking the individual’s base salary and multiplying it by the individual’s target incentive percentage. The target incentive percentages for Mr. Graves and Ms. Ponessa remained unchanged since 2018. The Livent Committee approved a 5% increase to Mr. Antoniazzi’s target incentive percentage in 2023 based on his performance and the target percentages in the competitive market for the position.

2023 Threshold Level Opportunity | 2023 Target Level Opportunity (as % of Applicable Base Salary) | 2023 Maximum Level Opportunity (as % of Applicable Base Salary) | ||||||||||

| Paul W. Graves | 0 | % | 100 | % | 200 | % | ||||||

| Gilberto Antoniazzi | 0 | % | 65 | % | 130 | % | ||||||

| Sara Ponessa | 0 | % | 60 | % | 120 | % | ||||||

Company Measures

The amount of the payout, if any, under the Company Measure component of the Annual Incentive Plan was based on Livent’s achievement against 1) a financial metric and 2) the execution of two expansion projects. The financial metric, which represented 60% of the target annual incentive opportunity, was again Adjusted EBITDA. The two expansion project metrics related to (a) the development and expansion of carbonate production capacity in Argentina through safety, timeliness of completion, operational readiness and progress on engineering studies (15%), and (b) engineering milestones for the production of lithium hydroxide at a new facility in North Carolina (5%). The Company Measures collectively represented 80% of the annual cash incentive opportunity, underscoring the emphasis on Livent performance.

The Livent Committee continued to use Adjusted EBITDA as the financial metric for 2023 in order to focus executive officers on the critical strategic priority of achieving and improving operating profitability.

The Adjusted EBITDA metric gave a clear line of sight into how achieving operating goals drives performance and generates rewards. The Livent Committee believed that this non-GAAP measure was useful as an incentive compensation performance metric because it excluded various items that do not relate to or were not indicative of operating performance for Livent.

The Livent Committee again included the expansion project goals in 2023 in order to focus executive officers on the critical strategic priority of delivery of two key expansion projects in order to grow Livent’s ability to grow capacity and produce more lithium carbonate and lithium hydroxide.

EBITDA is defined as net income plus interest expense, net income tax expense, and depreciation and amortization.

Adjusted EBITDA is defined as EBITDA adjusted for Argentina remeasurement losses, restructuring and other charges, separation-related costs, COVID-19 related costs and other non-recurring losses/(gains). The Non-GAAP measure Adjusted EBITDA should not be considered as a substitute for net income or cash flows from continuing operations or other measures of profitability or liquidity determined in accordance with GAAP. For a reconciliation of Adjusted EBITDA to the nearest GAAP measure, see the section captioned “Results of Operations — Years Ended December 31, 2023 and 2022” in this Annual Report.

Target, Threshold and Maximum Performance Levels

The Livent Committee set the target for Adjusted EBITDA at a level that it considered rigorous and challenging and that took into account the relevant risks and opportunities of Livent’s business. In particular, the Livent Committee reviewed Livent’s 2023 annual operating budget that resulted from Livent’s detailed budgeting process and evaluated various factors that might affect whether the budget targets could be achieved, including the risks to achieving certain preliminary objectives that were necessary prerequisites to achieving the budget targets.

Considering these factors, the Livent Committee set the 2023 target for Adjusted EBITDA at $545 million, a 101 percent increase in Adjusted EBITDA over 2022 Adjusted EBITDA results as reported for purposes of the 2022 annual incentive plan.

Having set the target at double the level of prior year actual results (for annual incentive plan purposes), the Livent Committee also set the threshold and maximum performance levels for Adjusted EBITDA. For 2023, the Livent Committee set threshold at what it believed to be a high level of performance equating to approximately just above 83% of the target for Adjusted EBITDA. The Livent Committee set the maximum level of performance equating to approximately 116% of target for Adjusted EBITDA, a level that required exceptionally strong performance and represented a significant challenge.

The Livent Committee also set target, threshold and maximum performance levels for each of the two expansion project goals. The Argentina expansion project goals were based on achieving high levels of safety, keeping to the timeline for delivery of the expansion project, staffing the facility and retaining employees, and timely progress on engineering studies. The North Carolina expansion project performance curve was based on the timeliness of completing engineering milestones.

Payout Levels

Payout levels represent the amount to be paid to NEOs based on the level of actual performance relative to the goals. In order to motivate performance and underscore the importance of achieving, or closely approaching, the performance goals at this critical time in Livent’s development, the Livent Committee set the payout at 0% for achievement below the threshold level of performance. For performance between the target level and the maximum level, the payout ranges from 100% of the target opportunity to 200% of the target opportunity. Achievement above the maximum level is capped at the maximum payout of 200% of target. For the Adjusted EBITDA metric, performance between the threshold, target and maximum levels was calculated in a straight-line manner.

2023 Achievements for Company Measures

For 2023, Adjusted EBITDA increased meaningfully as compared to 2022, primarily due to the favorable impact of higher pricing mainly driven by lithium hydroxide and a favorable mix of raw material costs partially offset by higher selling, general and administration costs. For purposes of the 2023 annual incentive plan, the Livent Committee normalized the Adjusted EBITDA result from $502.5 million to $504 million by excluding the effect of foreign exchange rate fluctuations versus rates assumed in the budget, and by adjusting certain costs associated with the ramp up and commissioning activities of the two expansion facilities in Bessemer City and Argentina if higher or lower than assumed in the budget. The actual result landed between the threshold and target levels. In light of market pricing conditions, and the Board’s related strategic considerations surrounding the timing of expansion project operations commencement, the Livent Committee adjusted the achievement rating modestly from 0.45 to 0.50 (i.e., 45% to 50%) to account for the decision that was in the best interest of shareholders but that nevertheless affected results.

The table below sets forth the 2023 performance goals for the Company Measures and Livent’s achievement against these goals in 2023, including the Livent Committee’s assessment of achievement of the expansion project goals against the targets.

| Company Measures | ||||||

| Financial Performance Metric | Weighting | Threshold ($ in millions) | Target ($ in millions) | Maximum ($ in millions) | Actual Result ($ in millions) | Achievement Rating |

| Adjusted EBITDA | 60% | 450 | 545 | 630 | 504 | 0.50 |

| Payout Percentage (as a % of target payout) | 0% | 100% | 200% | 85% | ||

Financial Metric Payout Percentage | 0.50 | |||||

Delivery of Expansion Projects Metrics | Weighting | Actual Result | Achievement Rating |

| Argentina carbonate expansion | 15% | Excellent safety performance, fully staffed the facility and trained the team, made engineering study progress. As described above, based on the strategic decision regarding the timing of expansion project operations commencement, which was in the best interest of shareholders, the timeline measure was not fully met. | 0.96 |

| North Carolina lithium hydroxide expansion | 5% | Livent partially completed engineering milestones. | 0.80 |

| Delivery of Expansion Projects Payout Percentage | 0.92 | |||

| Total Financial Metric and Expansion Projects Metric Payout Percentage | 0.60 |

Individual Measures

The Livent Committee also established Individual Measures under the annual incentive plan, which represented 20% of the annual incentive target opportunity. The Individual Measures were set in the beginning of 2023, prior to the completion of the due diligence process for the merger with Allkem, and were designed to align with Livent’s strategic and operating initiatives. NEOs were eligible to receive anywhere between 0% - 200% of target for this portion of the award, based on performance against individual goals. The NEOs 2023 Individual Measures are set forth below:

| • | Mr. Graves: Continue to build Livent organization’s capabilities to ensure it can take advantage of the opportunities presented to it from its leadership role in the fast-growing lithium industry. Lead organizational focuses on safety and quality. Develop roadmap for Livent’s next phase of growth: Deliver additional expansion of existing resources, Identification of additional potential resources for Livent to consider developing with a focus on Nemaska Lithium Inc. Define target customer relationships, including mix of customers, maximum acceptable customer exposures and contracting strategy, Develop future financing roadmap. Develop internal capabilities in critical areas: expansion and resource development, mining, recycling, process technology, R&D and global commercial. Lead long-term sustainability goals and plan to achieve. |

| • | Mr. Antoniazzi: Continue to lead timely delivery of capacity expansion projects across the globe. Continue to drive cash-flow discipline, and secure both funding and access to financing for deploying growth strategies. Advance Nemaska Lithium Inc. project through more active involvement in both the commercial and capital deployment areas. Continue to support/drive safety and quality continuous improvement. Continue to actively promote further diversity in the workplace and strengthen talent pool/leadership to support growing business complexity. Actively engage on relevant commercial decisions and contract strategies, with a particular focus on both pricing and product flow dynamics. Maintain active engagement with the Livent Audit Committee with a continued focus on timely and fair representation of the company’s operations and results. |

| • | Ms. Ponessa: Drive agile and effective support of commercial contract, business growth, and asset development strategic initiatives. Lead impactful compliance and ethics efforts; achieve strong safety performance across the global Law Department. Advance Company goals through leadership in recruitment, retention, and mentoring activities that support positive DE&I outcomes. Implement Law Department talent development and staffing plans to meet the future needs of the business and ensure agile and effective support. Provide sound corporate governance advice and support to the Livent Board of Directors and the Livent Nominating Committee. |

2023 ACHIEVEMENTS FOR INDIVIDUAL MEASURES

For the Individual Measures component, the Livent Committee determined that Mr. Graves, Mr. Antoniazzi, and Ms. Ponessa each earned 150% of their individual targets, based on the performance assessments described below: