Delaware | 37-0602744 | |||||||||||||

| (State or other jurisdiction of incorporation) | (IRS Employer I.D. No.) | |||||||||||||

| 5205 N. O'Connor Boulevard, | Suite 100, | Irving, | Texas | 75039 | ||||||||||

(Address of principal executive offices) | (Zip Code) | |||||||||||||

| Title of each class | Trading Symbol (s) | Name of each exchange on which registered | |||||||||

| Common Stock ($1.00 par value) | CAT | New York Stock Exchange | ¹ | ||||||||

| 8% Debentures due February 15, 2023 | CAT23 | New York Stock Exchange | |||||||||

| 5.3% Debentures due September 15, 2035 | CAT35 | New York Stock Exchange | |||||||||

| Large accelerated filer | Accelerated filer | ||||||||||

| Non-accelerated filer | |||||||||||

| Smaller reporting company | |||||||||||

| Emerging growth company | |||||||||||

| Item 3. | Defaults Upon Senior Securities | * | ||||||

| Item 4. | Mine Safety Disclosures | * | ||||||

| Item 5. | Other Information | * | ||||||

| Three Months Ended September 30 | Three Months Ended September 30 | |||||||||||||||||

| 2017 | 2016 | 2022 | 2021 | |||||||||||||||

| Sales and revenues: | Sales and revenues: | |||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 10,713 | $ | 8,463 | Sales of Machinery, Energy & Transportation | $ | 14,278 | $ | 11,707 | |||||||||

| Revenues of Financial Products | 700 | 697 | Revenues of Financial Products | 716 | 690 | |||||||||||||

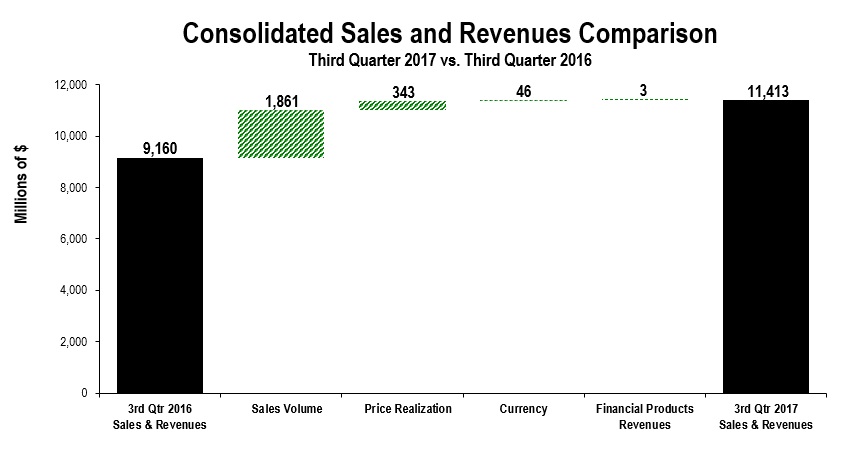

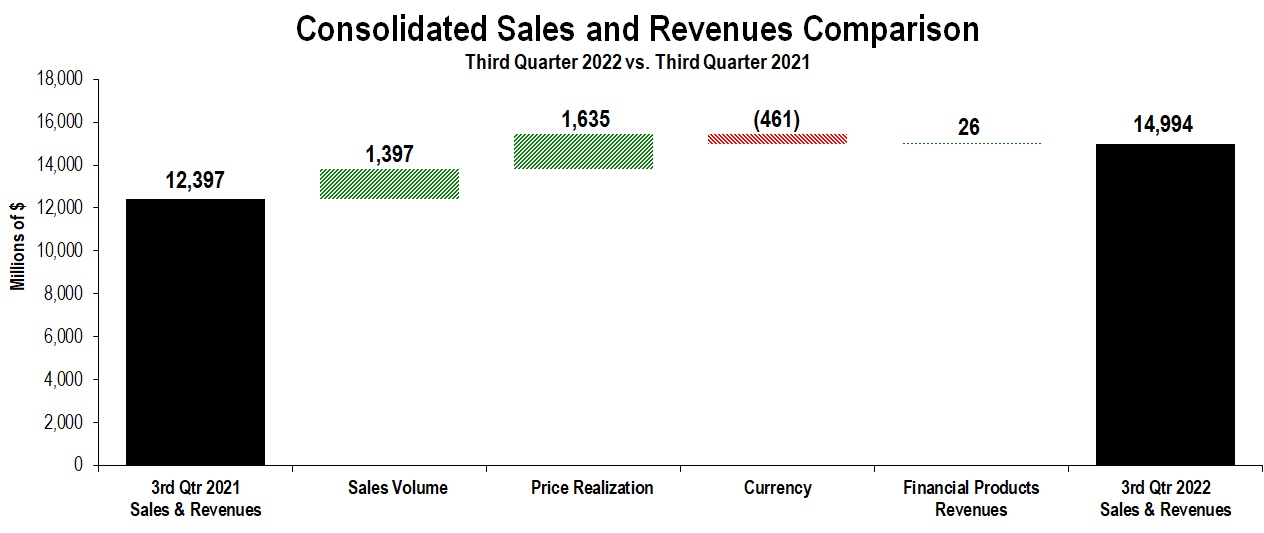

| Total sales and revenues | 11,413 | 9,160 | Total sales and revenues | 14,994 | 12,397 | |||||||||||||

| Operating costs: | Operating costs: | |||||||||||||||||

| Cost of goods sold | 7,633 | 6,527 | Cost of goods sold | 10,202 | 8,617 | |||||||||||||

| Selling, general and administrative expenses | 1,237 | 992 | Selling, general and administrative expenses | 1,401 | 1,340 | |||||||||||||

| Research and development expenses | 455 | 453 | Research and development expenses | 476 | 427 | |||||||||||||

| Interest expense of Financial Products | 163 | 147 | Interest expense of Financial Products | 151 | 111 | |||||||||||||

| Other operating (income) expenses | 348 | 560 | Other operating (income) expenses | 339 | 238 | |||||||||||||

| Total operating costs | 9,836 | 8,679 | Total operating costs | 12,569 | 10,733 | |||||||||||||

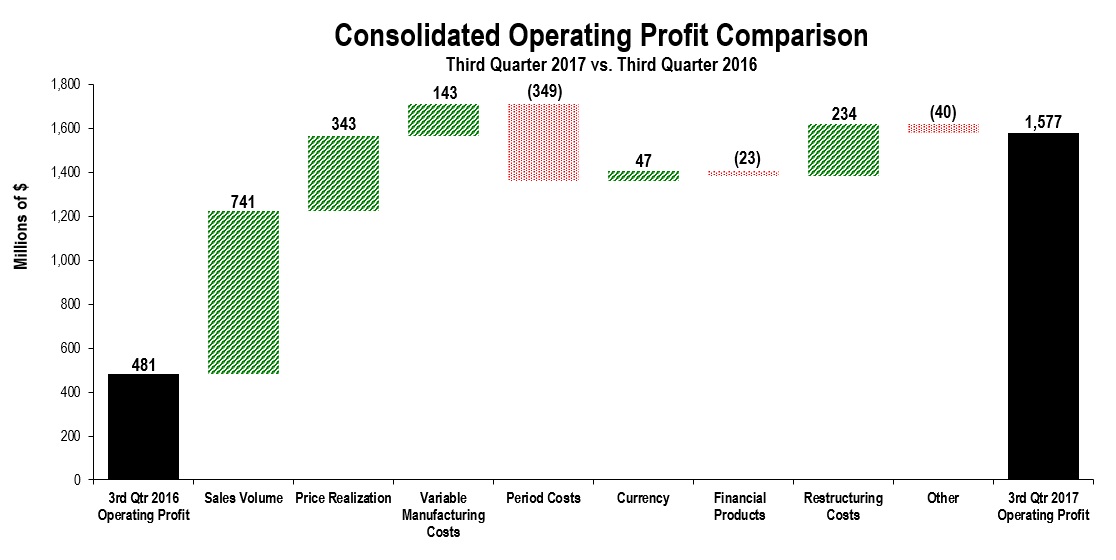

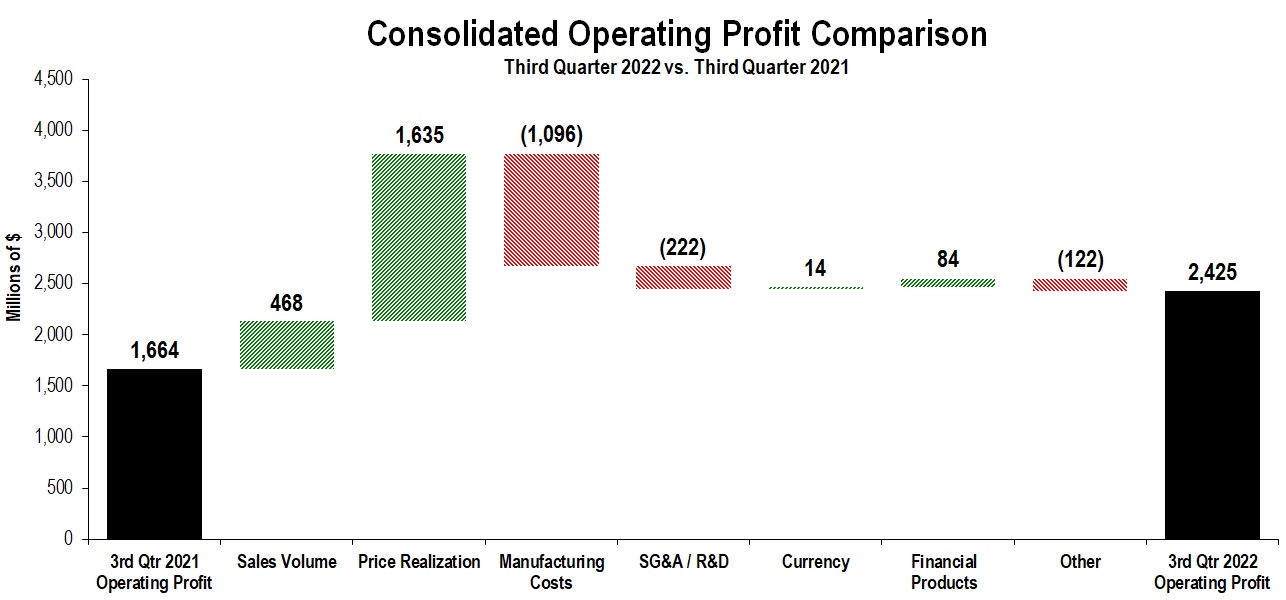

| Operating profit | 1,577 | 481 | Operating profit | 2,425 | 1,664 | |||||||||||||

| Interest expense excluding Financial Products | 118 | 126 | Interest expense excluding Financial Products | 109 | 114 | |||||||||||||

| Other income (expense) | 64 | 28 | Other income (expense) | 242 | 225 | |||||||||||||

| Consolidated profit before taxes | 1,523 | 383 | Consolidated profit before taxes | 2,558 | 1,775 | |||||||||||||

| Provision (benefit) for income taxes | 470 | 96 | Provision (benefit) for income taxes | 527 | 368 | |||||||||||||

| Profit of consolidated companies | 1,053 | 287 | Profit of consolidated companies | 2,031 | 1,407 | |||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 8 | (4 | ) | Equity in profit (loss) of unconsolidated affiliated companies | 9 | 21 | ||||||||||||

| Profit of consolidated and affiliated companies | 1,061 | 283 | Profit of consolidated and affiliated companies | 2,040 | 1,428 | |||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 2 | — | Less: Profit (loss) attributable to noncontrolling interests | (1) | 2 | |||||||||||||

Profit 1 | $ | 1,059 | $ | 283 | Profit 1 | $ | 2,041 | $ | 1,426 | |||||||||

| Profit per common share | $ | 1.79 | $ | 0.48 | Profit per common share | $ | 3.89 | $ | 2.62 | |||||||||

Profit per common share – diluted 2 | $ | 1.77 | $ | 0.48 | Profit per common share – diluted 2 | $ | 3.87 | $ | 2.60 | |||||||||

| Weighted-average common shares outstanding (millions) | Weighted-average common shares outstanding (millions) | |||||||||||||||||

| – Basic | 592.9 | 584.7 | – Basic | 525.0 | 544.0 | |||||||||||||

– Diluted 2 | 600.1 | 589.6 | – Diluted 2 | 527.6 | 547.6 | |||||||||||||

| Cash dividends declared per common share | $ | — | $ | — | ||||||||||||||

| Three Months Ended September 30 | |||||||||||

| 2022 | 2021 | ||||||||||

| Profit of consolidated and affiliated companies | $ | 2,040 | $ | 1,428 | |||||||

| Other comprehensive income (loss), net of tax (Note 13): | |||||||||||

| Foreign currency translation: | (618) | (242) | |||||||||

| Pension and other postretirement benefits: | (1) | (8) | |||||||||

| Derivative financial instruments: | (191) | (31) | |||||||||

| Available-for-sale securities: | (44) | (5) | |||||||||

| Total other comprehensive income (loss), net of tax | (854) | (286) | |||||||||

| Comprehensive income | 1,186 | 1,142 | |||||||||

| Less: comprehensive income attributable to the noncontrolling interests | (1) | 2 | |||||||||

| Comprehensive income attributable to shareholders | $ | 1,187 | $ | 1,140 | |||||||

| Three Months Ended September 30 | |||||||

| 2017 | 2016 | ||||||

| Profit of consolidated and affiliated companies | $ | 1,061 | $ | 283 | |||

| Other comprehensive income (loss), net of tax: | |||||||

| Foreign currency translation, net of tax (provision)/benefit of: 2017 - $28; 2016 - $4 | 248 | 137 | |||||

| Pension and other postretirement benefits: | |||||||

| Current year prior service credit (cost), net of tax (provision)/benefit of: 2017 - $0; 2016 - $0 | — | 2 | |||||

| Amortization of prior service (credit) cost, net of tax (provision)/benefit of: 2017 - $2; 2016 - $5 | (4 | ) | (10 | ) | |||

| Derivative financial instruments: | |||||||

| Gains (losses) deferred, net of tax (provision)/benefit of: 2017 - $2; 2016 - $16 | (4 | ) | (28 | ) | |||

| (Gains) losses reclassified to earnings, net of tax (provision)/benefit of: 2017 - $(5); 2016 - $(2) | 11 | 6 | |||||

| Available-for-sale securities: | |||||||

| Gains (losses) deferred, net of tax (provision)/benefit of: 2017 - $(8); 2016 - $(1) | 11 | 5 | |||||

| (Gains) losses reclassified to earnings, net of tax (provision)/benefit of: 2017 - $12; 2016 - $3 | (24 | ) | (6 | ) | |||

| Total other comprehensive income (loss), net of tax | 238 | 106 | |||||

| Comprehensive income | 1,299 | 389 | |||||

| Less: comprehensive income attributable to the noncontrolling interests | (2 | ) | — | ||||

| Comprehensive income attributable to shareholders | $ | 1,297 | $ | 389 | |||

| Nine Months Ended September 30 | |||||||||||

| 2022 | 2021 | ||||||||||

| Sales and revenues: | |||||||||||

| Sales of Machinery, Energy & Transportation | $ | 40,703 | $ | 35,091 | |||||||

| Revenues of Financial Products | 2,127 | 2,082 | |||||||||

| Total sales and revenues | 42,830 | 37,173 | |||||||||

| Operating costs: | |||||||||||

| Cost of goods sold | 29,736 | 25,510 | |||||||||

| Selling, general and administrative expenses | 4,172 | 3,943 | |||||||||

| Research and development expenses | 1,413 | 1,247 | |||||||||

| Interest expense of Financial Products | 377 | 352 | |||||||||

| Other operating (income) expenses | 908 | 854 | |||||||||

| Total operating costs | 36,606 | 31,906 | |||||||||

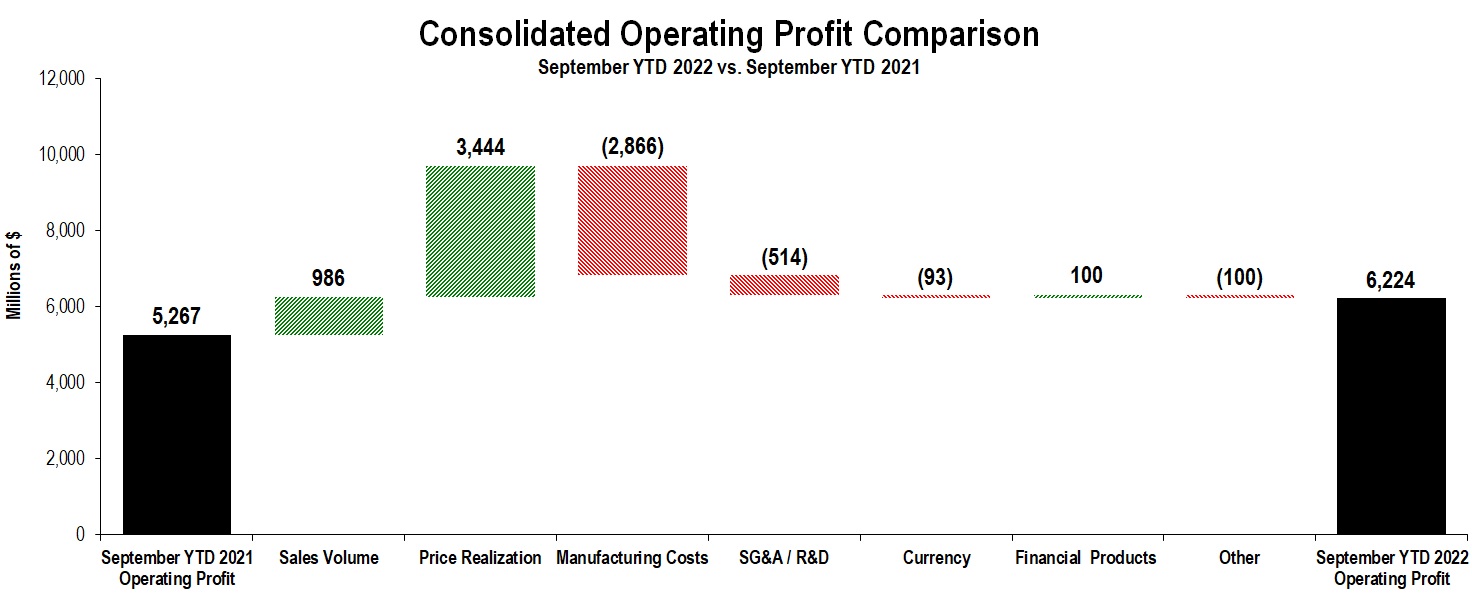

| Operating profit | 6,224 | 5,267 | |||||||||

| Interest expense excluding Financial Products | 326 | 376 | |||||||||

| Other income (expense) | 755 | 751 | |||||||||

| Consolidated profit before taxes | 6,653 | 5,642 | |||||||||

| Provision (benefit) for income taxes | 1,423 | 1,313 | |||||||||

| Profit of consolidated companies | 5,230 | 4,329 | |||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 20 | 44 | |||||||||

| Profit of consolidated and affiliated companies | 5,250 | 4,373 | |||||||||

| Less: Profit (loss) attributable to noncontrolling interests | (1) | 4 | |||||||||

Profit 1 | $ | 5,251 | $ | 4,369 | |||||||

| Profit per common share | $ | 9.91 | $ | 8.00 | |||||||

Profit per common share – diluted 2 | $ | 9.85 | $ | 7.94 | |||||||

| Weighted-average common shares outstanding (millions) | |||||||||||

| – Basic | 530.1 | 545.8 | |||||||||

– Diluted 2 | 533.2 | 550.2 | |||||||||

| Nine Months Ended September 30 | |||||||

| 2017 | 2016 | ||||||

| Sales and revenues: | |||||||

| Sales of Machinery, Energy & Transportation | $ | 30,482 | $ | 26,888 | |||

| Revenues of Financial Products | 2,084 | 2,075 | |||||

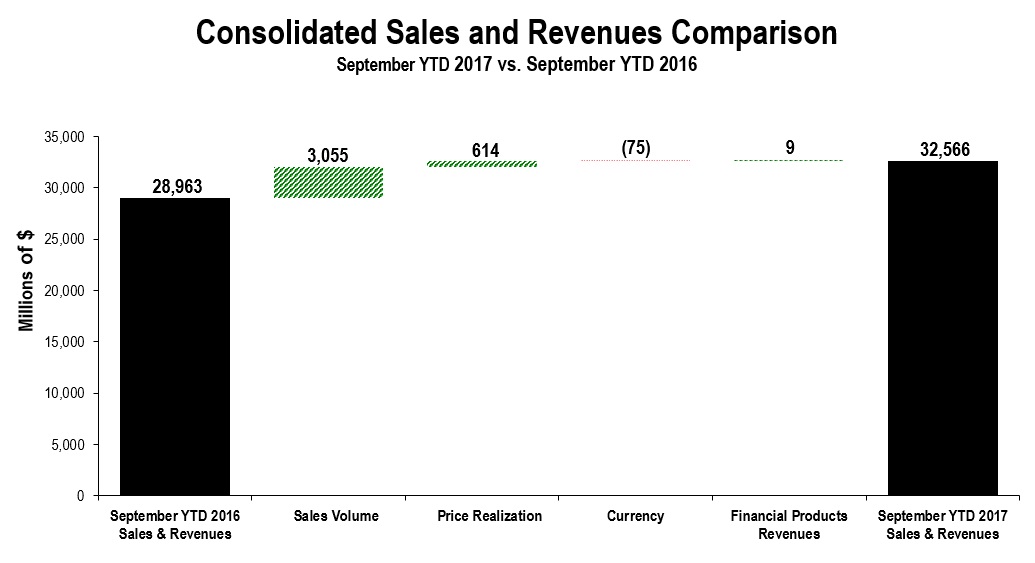

| Total sales and revenues | 32,566 | 28,963 | |||||

| Operating costs: | |||||||

| Cost of goods sold | 22,160 | 20,768 | |||||

| Selling, general and administrative expenses | 3,571 | 3,203 | |||||

| Research and development expenses | 1,326 | 1,429 | |||||

| Interest expense of Financial Products | 484 | 447 | |||||

| Other operating (income) expenses | 1,780 | 1,356 | |||||

| Total operating costs | 29,321 | 27,203 | |||||

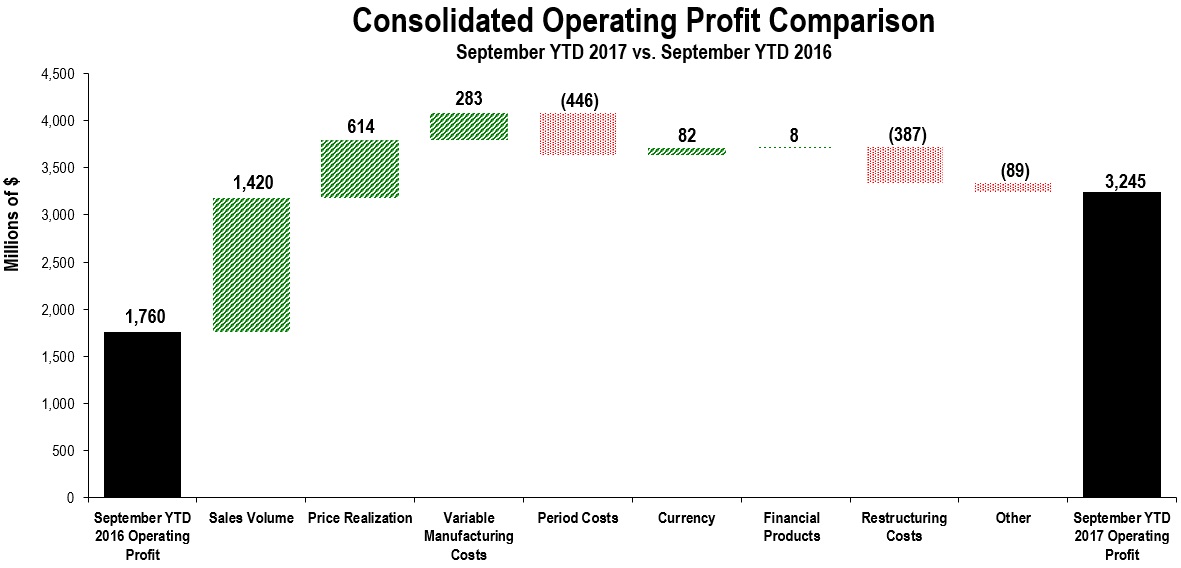

| Operating profit | 3,245 | 1,760 | |||||

| Interest expense excluding Financial Products | 362 | 385 | |||||

| Other income (expense) | 88 | 112 | |||||

| Consolidated profit before taxes | 2,971 | 1,487 | |||||

| Provision (benefit) for income taxes | 921 | 372 | |||||

| Profit of consolidated companies | 2,050 | 1,115 | |||||

| Equity in profit (loss) of unconsolidated affiliated companies | 8 | (7 | ) | ||||

| Profit of consolidated and affiliated companies | 2,058 | 1,108 | |||||

| Less: Profit (loss) attributable to noncontrolling interests | 5 | 4 | |||||

Profit 1 | $ | 2,053 | $ | 1,104 | |||

| Profit per common share | $ | 3.48 | $ | 1.89 | |||

Profit per common share – diluted 2 | $ | 3.44 | $ | 1.88 | |||

| Weighted-average common shares outstanding (millions) | |||||||

| – Basic | 590.3 | 583.8 | |||||

– Diluted 2 | 596.5 | 588.7 | |||||

| Cash dividends declared per common share | $ | 1.55 | $ | 1.54 | |||

| Nine Months Ended September 30 | |||||||||||

| 2022 | 2021 | ||||||||||

| Profit of consolidated and affiliated companies | $ | 5,250 | $ | 4,373 | |||||||

| Other comprehensive income (loss), net of tax (Note 13): | |||||||||||

| Foreign currency translation: | (1,392) | (490) | |||||||||

| Pension and other postretirement benefits: | (3) | (23) | |||||||||

| Derivative financial instruments: | (254) | (19) | |||||||||

| Available-for-sale securities: | (151) | (20) | |||||||||

| Total other comprehensive income (loss), net of tax | (1,800) | (552) | |||||||||

| Comprehensive income | 3,450 | 3,821 | |||||||||

| Less: comprehensive income attributable to the noncontrolling interests | (1) | 4 | |||||||||

| Comprehensive income attributable to shareholders | $ | 3,451 | $ | 3,817 | |||||||

| Nine Months Ended September 30 | |||||||

| 2017 | 2016 | ||||||

| Profit of consolidated and affiliated companies | $ | 2,058 | $ | 1,108 | |||

| Other comprehensive income (loss), net of tax: | |||||||

| Foreign currency translation, net of tax (provision)/benefit of: 2017 - $86; 2016 - $16 | 719 | 442 | |||||

| Pension and other postretirement benefits: | |||||||

| Current year prior service credit (cost), net of tax (provision)/benefit of: 2017 - $(4); 2016 - $(69) | 8 | 119 | |||||

| Amortization of prior service (credit) cost, net of tax (provision)/benefit of: 2017 - $6; 2016 - $16 | (12 | ) | (29 | ) | |||

| Derivative financial instruments: | |||||||

| Gains (losses) deferred, net of tax (provision)/benefit of: 2017 - $(3); 2016 - $21 | 6 | (37 | ) | ||||

| (Gains) losses reclassified to earnings, net of tax (provision)/benefit of: 2017 - $(41); 2016 - $(8) | 77 | 16 | |||||

| Available-for-sale securities: | |||||||

| Gains (losses) deferred, net of tax (provision)/benefit of: 2017 - $(17); 2016 - $(9) | 29 | 21 | |||||

| (Gains) losses reclassified to earnings, net of tax (provision)/benefit of: 2017 - $11; 2016 - $12 | (21 | ) | (24 | ) | |||

| Total other comprehensive income (loss), net of tax | 806 | 508 | |||||

| Comprehensive income | 2,864 | 1,616 | |||||

| Less: comprehensive income attributable to the noncontrolling interests | (5 | ) | (4 | ) | |||

| Comprehensive income attributable to shareholders | $ | 2,859 | $ | 1,612 | |||

| September 30, 2017 | December 31, 2016 | September 30, 2022 | December 31, 2021 | |||||||||||||||

| Assets | Assets | |||||||||||||||||

| Current assets: | Current assets: | |||||||||||||||||

| Cash and short-term investments | $ | 9,591 | $ | 7,168 | ||||||||||||||

| Cash and cash equivalents | Cash and cash equivalents | $ | 6,346 | $ | 9,254 | |||||||||||||

| Receivables – trade and other | 6,691 | 5,981 | Receivables – trade and other | 8,158 | 8,477 | |||||||||||||

| Receivables – finance | 8,984 | 8,522 | Receivables – finance | 8,918 | 8,898 | |||||||||||||

| Prepaid expenses and other current assets | 1,707 | 1,682 | Prepaid expenses and other current assets | 2,295 | 2,788 | |||||||||||||

| Inventories | 10,212 | 8,614 | Inventories | 16,860 | 14,038 | |||||||||||||

| Total current assets | 37,185 | 31,967 | Total current assets | 42,577 | 43,455 | |||||||||||||

| Property, plant and equipment – net | 14,187 | 15,322 | Property, plant and equipment – net | 11,643 | 12,090 | |||||||||||||

| Long-term receivables – trade and other | 969 | 1,029 | Long-term receivables – trade and other | 1,278 | 1,204 | |||||||||||||

| Long-term receivables – finance | 13,192 | 13,556 | Long-term receivables – finance | 11,859 | 12,707 | |||||||||||||

| Noncurrent deferred and refundable income taxes | 2,845 | 2,790 | Noncurrent deferred and refundable income taxes | 2,218 | 1,840 | |||||||||||||

| Intangible assets | 2,175 | 2,349 | Intangible assets | 806 | 1,042 | |||||||||||||

| Goodwill | 6,196 | 6,020 | Goodwill | 6,092 | 6,324 | |||||||||||||

| Other assets | 1,811 | 1,671 | Other assets | 4,434 | 4,131 | |||||||||||||

| Total assets | $ | 78,560 | $ | 74,704 | Total assets | $ | 80,907 | $ | 82,793 | |||||||||

| Liabilities | Liabilities | |||||||||||||||||

| Current liabilities: | Current liabilities: | |||||||||||||||||

| Short-term borrowings: | Short-term borrowings: | |||||||||||||||||

| Machinery, Energy & Transportation | $ | 11 | $ | 209 | Machinery, Energy & Transportation | $ | 3 | $ | 9 | |||||||||

| Financial Products | 5,459 | 7,094 | Financial Products | 4,199 | 5,395 | |||||||||||||

| Accounts payable | 6,113 | 4,614 | Accounts payable | 8,260 | 8,154 | |||||||||||||

| Accrued expenses | 3,114 | 3,003 | Accrued expenses | 4,013 | 3,757 | |||||||||||||

| Accrued wages, salaries and employee benefits | 2,333 | 1,296 | Accrued wages, salaries and employee benefits | 2,204 | 2,242 | |||||||||||||

| Customer advances | 1,510 | 1,167 | Customer advances | 1,831 | 1,087 | |||||||||||||

| Dividends payable | — | 452 | Dividends payable | — | 595 | |||||||||||||

| Other current liabilities | 1,744 | 1,635 | Other current liabilities | 2,878 | 2,256 | |||||||||||||

| Long-term debt due within one year: | Long-term debt due within one year: | |||||||||||||||||

| Machinery, Energy & Transportation | 5 | 507 | Machinery, Energy & Transportation | 120 | 45 | |||||||||||||

| Financial Products | 5,614 | 6,155 | Financial Products | 6,694 | 6,307 | |||||||||||||

| Total current liabilities | 25,903 | 26,132 | Total current liabilities | 30,202 | 29,847 | |||||||||||||

| Long-term debt due after one year: | Long-term debt due after one year: | |||||||||||||||||

| Machinery, Energy & Transportation | 8,820 | 8,436 | Machinery, Energy & Transportation | 9,479 | 9,746 | |||||||||||||

| Financial Products | 16,015 | 14,382 | Financial Products | 16,030 | 16,287 | |||||||||||||

| Liability for postemployment benefits | 8,973 | 9,357 | Liability for postemployment benefits | 5,038 | 5,592 | |||||||||||||

| Other liabilities | 3,152 | 3,184 | Other liabilities | 4,536 | 4,805 | |||||||||||||

| Total liabilities | 62,863 | 61,491 | Total liabilities | 65,285 | 66,277 | |||||||||||||

| Commitments and contingencies (Notes 10 and 13) | ||||||||||||||||||

| Commitments and contingencies (Notes 11 and 14) | Commitments and contingencies (Notes 11 and 14) | |||||||||||||||||

| Shareholders’ equity | Shareholders’ equity | |||||||||||||||||

| Common stock of $1.00 par value: | Common stock of $1.00 par value: | |||||||||||||||||

| Authorized shares: 2,000,000,000 Issued shares: (9/30/17 and 12/31/16 – 814,894,624) at paid-in amount | 5,460 | 5,277 | ||||||||||||||||

| Treasury stock (9/30/17 – 219,961,042 shares; 12/31/16 – 228,408,600 shares) at cost | (17,130 | ) | (17,478 | ) | ||||||||||||||

Authorized shares: 2,000,000,000 Issued shares: (9/30/22 and 12/31/21 – 814,894,624) at paid-in amount | Authorized shares: 2,000,000,000 Issued shares: (9/30/22 and 12/31/21 – 814,894,624) at paid-in amount | 6,523 | 6,398 | |||||||||||||||

| Treasury stock: (9/30/22 – 294,485,269 shares; 12/31/21 – 279,006,573 shares) at cost | Treasury stock: (9/30/22 – 294,485,269 shares; 12/31/21 – 279,006,573 shares) at cost | (30,883) | (27,643) | |||||||||||||||

| Profit employed in the business | 28,530 | 27,377 | Profit employed in the business | 43,304 | 39,282 | |||||||||||||

| Accumulated other comprehensive income (loss) | (1,233 | ) | (2,039 | ) | Accumulated other comprehensive income (loss) | (3,353) | (1,553) | |||||||||||

| Noncontrolling interests | 70 | 76 | Noncontrolling interests | 31 | 32 | |||||||||||||

| Total shareholders’ equity | 15,697 | 13,213 | Total shareholders’ equity | 15,622 | 16,516 | |||||||||||||

| Total liabilities and shareholders’ equity | $ | 78,560 | $ | 74,704 | Total liabilities and shareholders’ equity | $ | 80,907 | $ | 82,793 | |||||||||

| Common stock | Treasury stock | Profit employed in the business | Accumulated other comprehensive income (loss) | Noncontrolling interests | Total | |||||||||||||||||||||||||||||||||

| Three Months Ended September 30, 2021 | ||||||||||||||||||||||||||||||||||||||

| Balance at June 30, 2021 | $ | 6,293 | $ | (25,240) | $ | 36,934 | $ | (1,154) | $ | 47 | $ | 16,880 | ||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | — | — | 1,426 | — | 2 | 1,428 | ||||||||||||||||||||||||||||||||

| Foreign currency translation, net of tax | — | — | — | (242) | — | (242) | ||||||||||||||||||||||||||||||||

| Pension and other postretirement benefits, net of tax | — | — | — | (8) | — | (8) | ||||||||||||||||||||||||||||||||

| Derivative financial instruments, net of tax | — | — | — | (31) | — | (31) | ||||||||||||||||||||||||||||||||

| Available-for-sale securities, net of tax | — | — | — | (5) | — | (5) | ||||||||||||||||||||||||||||||||

| Change in ownership from noncontrolling interests | — | — | — | — | (16) | (16) | ||||||||||||||||||||||||||||||||

| Dividends declared | — | — | 1 | — | — | 1 | ||||||||||||||||||||||||||||||||

| Distribution to noncontrolling interests | — | — | — | — | (2) | (2) | ||||||||||||||||||||||||||||||||

| Common shares issued from treasury stock for stock-based compensation: 80,571 | (5) | 4 | — | — | — | (1) | ||||||||||||||||||||||||||||||||

| Stock-based compensation expense | 58 | — | — | — | — | 58 | ||||||||||||||||||||||||||||||||

Common shares repurchased: 6,610,438 1 | — | (1,371) | — | — | — | (1,371) | ||||||||||||||||||||||||||||||||

| Other | 6 | (1) | — | — | (1) | 4 | ||||||||||||||||||||||||||||||||

| Balance at September 30, 2021 | $ | 6,352 | $ | (26,608) | $ | 38,361 | $ | (1,440) | $ | 30 | $ | 16,695 | ||||||||||||||||||||||||||

| Three Months Ended September 30, 2022 | ||||||||||||||||||||||||||||||||||||||

| Balance at June 30, 2022 | $ | 6,464 | $ | (29,501) | $ | 41,263 | $ | (2,499) | $ | 32 | $ | 15,759 | ||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | — | — | 2,041 | — | (1) | 2,040 | ||||||||||||||||||||||||||||||||

| Foreign currency translation, net of tax | — | — | — | (618) | — | (618) | ||||||||||||||||||||||||||||||||

| Pension and other postretirement benefits, net of tax | — | — | — | (1) | — | (1) | ||||||||||||||||||||||||||||||||

| Derivative financial instruments, net of tax | — | — | — | (191) | — | (191) | ||||||||||||||||||||||||||||||||

| Available-for-sale securities, net of tax | — | — | — | (44) | — | (44) | ||||||||||||||||||||||||||||||||

| Common shares issued from treasury stock for stock-based compensation: 75,534 | (5) | 4 | — | — | — | (1) | ||||||||||||||||||||||||||||||||

| Stock-based compensation expense | 55 | — | — | — | — | 55 | ||||||||||||||||||||||||||||||||

Common shares repurchased: 7,575,322 1 | — | (1,385) | — | — | — | (1,385) | ||||||||||||||||||||||||||||||||

| Other | 9 | (1) | — | — | — | 8 | ||||||||||||||||||||||||||||||||

| Balance at September 30, 2022 | $ | 6,523 | $ | (30,883) | $ | 43,304 | $ | (3,353) | $ | 31 | $ | 15,622 | ||||||||||||||||||||||||||

Common stock | Treasury stock | Profit employed in the business | Accumulated other comprehensive income (loss) | Noncontrolling interests | Total | ||||||||||||||||||

| Nine Months Ended September 30, 2016 | |||||||||||||||||||||||

| Balance at December 31, 2015 | $ | 5,238 | $ | (17,640 | ) | $ | 29,246 | $ | (2,035 | ) | $ | 76 | $ | 14,885 | |||||||||

| Profit of consolidated and affiliated companies | — | — | 1,104 | — | 4 | 1,108 | |||||||||||||||||

| Foreign currency translation, net of tax | — | — | — | 442 | — | 442 | |||||||||||||||||

| Pension and other postretirement benefits, net of tax | — | — | — | 90 | — | 90 | |||||||||||||||||

| Derivative financial instruments, net of tax | — | — | — | (21 | ) | — | (21 | ) | |||||||||||||||

| Available-for-sale securities, net of tax | — | — | — | (3 | ) | — | (3 | ) | |||||||||||||||

| Dividends declared | — | — | (900 | ) | — | — | (900 | ) | |||||||||||||||

| Distribution to noncontrolling interests | — | — | — | — | (10 | ) | (10 | ) | |||||||||||||||

| Common shares issued from treasury stock for stock-based compensation: 2,750,695 | (150 | ) | 96 | — | — | — | (54 | ) | |||||||||||||||

| Stock-based compensation expense | 187 | — | — | — | — | 187 | |||||||||||||||||

| Net excess tax benefits from stock-based compensation | (18 | ) | — | — | — | — | (18 | ) | |||||||||||||||

| Other | 9 | — | — | — | — | 9 | |||||||||||||||||

| Balance at September 30, 2016 | $ | 5,266 | $ | (17,544 | ) | $ | 29,450 | $ | (1,527 | ) | $ | 70 | $ | 15,715 | |||||||||

| Nine Months Ended September 30, 2017 | |||||||||||||||||||||||

| Balance at December 31, 2016 | $ | 5,277 | $ | (17,478 | ) | $ | 27,377 | $ | (2,039 | ) | $ | 76 | $ | 13,213 | |||||||||

Adjustment to adopt stock-based compensation guidance1 | — | — | 15 | — | — | 15 | |||||||||||||||||

| Balance at January 1, 2017 | $ | 5,277 | $ | (17,478 | ) | $ | 27,392 | $ | (2,039 | ) | $ | 76 | $ | 13,228 | |||||||||

| Profit of consolidated and affiliated companies | — | — | 2,053 | — | 5 | 2,058 | |||||||||||||||||

| Foreign currency translation, net of tax | — | — | — | 719 | — | 719 | |||||||||||||||||

| Pension and other postretirement benefits, net of tax | — | — | — | (4 | ) | — | (4 | ) | |||||||||||||||

| Derivative financial instruments, net of tax | — | — | — | 83 | — | 83 | |||||||||||||||||

| Available-for-sale securities, net of tax | — | — | — | 8 | — | 8 | |||||||||||||||||

| Change in ownership from noncontrolling interests | 4 | — | — | — | (3 | ) | 1 | ||||||||||||||||

| Dividends declared | — | — | (915 | ) | — | — | (915 | ) | |||||||||||||||

| Distribution to noncontrolling interests | — | — | — | — | (8 | ) | (8 | ) | |||||||||||||||

| Common shares issued from treasury stock for stock-based compensation: 8,447,558 | 5 | 348 | — | — | — | 353 | |||||||||||||||||

| Stock-based compensation expense | 165 | — | — | — | — | 165 | |||||||||||||||||

| Other | 9 | — | — | — | — | 9 | |||||||||||||||||

| Balance at September 30, 2017 | $ | 5,460 | $ | (17,130 | ) | $ | 28,530 | $ | (1,233 | ) | $ | 70 | $ | 15,697 | |||||||||

1 See Note 2 for additional information. | |||||||||||||||||||||||

| Common stock | Treasury stock | Profit employed in the business | Accumulated other comprehensive income (loss) | Noncontrolling interests | Total | |||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2021 | ||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2020 | $ | 6,230 | $ | (25,178) | $ | 35,167 | $ | (888) | $ | 47 | $ | 15,378 | ||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | — | — | 4,369 | — | 4 | 4,373 | ||||||||||||||||||||||||||||||||

| Foreign currency translation, net of tax | — | — | — | (490) | — | (490) | ||||||||||||||||||||||||||||||||

| Pension and other postretirement benefits, net of tax | — | — | — | (23) | — | (23) | ||||||||||||||||||||||||||||||||

| Derivative financial instruments, net of tax | — | — | — | (19) | — | (19) | ||||||||||||||||||||||||||||||||

| Available-for-sale securities, net of tax | — | — | — | (20) | — | (20) | ||||||||||||||||||||||||||||||||

| Change in ownership from noncontrolling interests | — | — | — | — | (16) | (16) | ||||||||||||||||||||||||||||||||

Dividends declared 1 | — | — | (1,175) | — | — | (1,175) | ||||||||||||||||||||||||||||||||

| Distribution to noncontrolling interests | — | — | — | — | (4) | (4) | ||||||||||||||||||||||||||||||||

| Common shares issued from treasury stock for stock-based compensation: 3,410,146 | (70) | 192 | — | — | — | 122 | ||||||||||||||||||||||||||||||||

| Stock-based compensation expense | 169 | — | — | — | — | 169 | ||||||||||||||||||||||||||||||||

Common shares repurchased: 7,772,393 2 | — | (1,622) | — | — | — | (1,622) | ||||||||||||||||||||||||||||||||

| Other | 23 | — | — | — | (1) | 22 | ||||||||||||||||||||||||||||||||

| Balance at September 30, 2021 | $ | 6,352 | $ | (26,608) | $ | 38,361 | $ | (1,440) | $ | 30 | $ | 16,695 | ||||||||||||||||||||||||||

| Nine Months Ended September 30, 2022 | ||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2021 | $ | 6,398 | $ | (27,643) | $ | 39,282 | $ | (1,553) | $ | 32 | $ | 16,516 | ||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | — | — | 5,251 | — | (1) | 5,250 | ||||||||||||||||||||||||||||||||

| Foreign currency translation, net of tax | — | — | — | (1,392) | — | (1,392) | ||||||||||||||||||||||||||||||||

| Pension and other postretirement benefits, net of tax | — | — | — | (3) | — | (3) | ||||||||||||||||||||||||||||||||

| Derivative financial instruments, net of tax | — | — | — | (254) | — | (254) | ||||||||||||||||||||||||||||||||

| Available-for-sale securities, net of tax | — | — | — | (151) | — | (151) | ||||||||||||||||||||||||||||||||

Dividends declared 1 | — | — | (1,229) | — | — | (1,229) | ||||||||||||||||||||||||||||||||

| Common shares issued from treasury stock for stock-based compensation: 1,529,753 | (67) | 69 | — | — | — | 2 | ||||||||||||||||||||||||||||||||

| Stock-based compensation expense | 162 | — | — | — | — | 162 | ||||||||||||||||||||||||||||||||

Common shares repurchased: 17,007,819 2 | — | (3,309) | — | — | — | (3,309) | ||||||||||||||||||||||||||||||||

| Other | 30 | — | — | — | — | 30 | ||||||||||||||||||||||||||||||||

| Balance at September 30, 2022 | $ | 6,523 | $ | (30,883) | $ | 43,304 | $ | (3,353) | $ | 31 | $ | 15,622 | ||||||||||||||||||||||||||

| Nine Months Ended September 30 | |||||||||||

| 2022 | 2021 | ||||||||||

| Cash flow from operating activities: | |||||||||||

| Profit of consolidated and affiliated companies | $ | 5,250 | $ | 4,373 | |||||||

| Adjustments for non-cash items: | |||||||||||

| Depreciation and amortization | 1,661 | 1,766 | |||||||||

| Provision (benefit) for deferred income taxes | (349) | (321) | |||||||||

| Other | 132 | 102 | |||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | |||||||||||

| Receivables – trade and other | 365 | (326) | |||||||||

| Inventories | (3,088) | (2,195) | |||||||||

| Accounts payable | 786 | 1,232 | |||||||||

| Accrued expenses | 70 | 46 | |||||||||

| Accrued wages, salaries and employee benefits | 15 | 934 | |||||||||

| Customer advances | 751 | 39 | |||||||||

| Other assets – net | 57 | 138 | |||||||||

| Other liabilities – net | (623) | (2) | |||||||||

| Net cash provided by (used for) operating activities | 5,027 | 5,786 | |||||||||

| Cash flow from investing activities: | |||||||||||

| Capital expenditures – excluding equipment leased to others | (868) | (673) | |||||||||

| Expenditures for equipment leased to others | (1,023) | (1,014) | |||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 666 | 877 | |||||||||

| Additions to finance receivables | (9,914) | (9,603) | |||||||||

| Collections of finance receivables | 9,738 | 9,221 | |||||||||

| Proceeds from sale of finance receivables | 50 | 44 | |||||||||

| Investments and acquisitions (net of cash acquired) | (44) | (449) | |||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 1 | 23 | |||||||||

| Proceeds from sale of securities | 2,080 | 424 | |||||||||

| Investments in securities | (2,399) | (934) | |||||||||

| Other – net | 15 | (8) | |||||||||

| Net cash provided by (used for) investing activities | (1,698) | (2,092) | |||||||||

| Cash flow from financing activities: | |||||||||||

| Dividends paid | (1,820) | (1,733) | |||||||||

| Common stock issued, including treasury shares reissued | 2 | 122 | |||||||||

| Common shares repurchased | (3,309) | (1,622) | |||||||||

| Proceeds from debt issued (original maturities greater than three months): | |||||||||||

| Machinery, Energy & Transportation | — | 494 | |||||||||

| Financial Products | 5,570 | 6,437 | |||||||||

| Payments on debt (original maturities greater than three months): | |||||||||||

| Machinery, Energy & Transportation | (20) | (1,910) | |||||||||

| Financial Products | (5,269) | (6,710) | |||||||||

| Short-term borrowings – net (original maturities three months or less) | (1,311) | 1,324 | |||||||||

| Other – net | (1) | (4) | |||||||||

| Net cash provided by (used for) financing activities | (6,158) | (3,602) | |||||||||

| Effect of exchange rate changes on cash | (79) | (9) | |||||||||

| Increase (decrease) in cash, cash equivalents and restricted cash | (2,908) | 83 | |||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 9,263 | 9,366 | |||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 6,355 | $ | 9,449 | |||||||

| Nine Months Ended September 30 | |||||||

| 2017 | 2016 | ||||||

| Cash flow from operating activities: | |||||||

| Profit of consolidated and affiliated companies | $ | 2,058 | $ | 1,108 | |||

| Adjustments for non-cash items: | |||||||

| Depreciation and amortization | 2,153 | 2,255 | |||||

| Other | 592 | 640 | |||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | |||||||

| Receivables – trade and other | (455 | ) | 1,128 | ||||

| Inventories | (1,489 | ) | 331 | ||||

| Accounts payable | 1,371 | (163 | ) | ||||

| Accrued expenses | 121 | (153 | ) | ||||

| Accrued wages, salaries and employee benefits | 962 | (727 | ) | ||||

| Customer advances | 310 | (24 | ) | ||||

| Other assets – net | (137 | ) | (141 | ) | |||

| Other liabilities – net | (325 | ) | (279 | ) | |||

| Net cash provided by (used for) operating activities | 5,161 | 3,975 | |||||

| Cash flow from investing activities: | |||||||

| Capital expenditures – excluding equipment leased to others | (566 | ) | (807 | ) | |||

| Expenditures for equipment leased to others | (1,071 | ) | (1,393 | ) | |||

| Proceeds from disposals of leased assets and property, plant and equipment | 864 | 572 | |||||

| Additions to finance receivables | (8,246 | ) | (6,911 | ) | |||

| Collections of finance receivables | 8,532 | 6,968 | |||||

| Proceeds from sale of finance receivables | 98 | 55 | |||||

| Investments and acquisitions (net of cash acquired) | (47 | ) | (72 | ) | |||

| Proceeds from sale of businesses and investments (net of cash sold) | 93 | — | |||||

| Proceeds from sale of securities | 431 | 304 | |||||

| Investments in securities | (594 | ) | (339 | ) | |||

| Other – net | 38 | 5 | |||||

| Net cash provided by (used for) investing activities | (468 | ) | (1,618 | ) | |||

| Cash flow from financing activities: | |||||||

| Dividends paid | (1,367 | ) | (1,348 | ) | |||

| Distribution to noncontrolling interests | (7 | ) | (8 | ) | |||

| Common stock issued, including treasury shares reissued | 353 | (54 | ) | ||||

| Proceeds from debt issued (original maturities greater than three months): | |||||||

| Machinery, Energy & Transportation | 362 | 6 | |||||

| Financial Products | 6,972 | 4,424 | |||||

| Payments on debt (original maturities greater than three months): | |||||||

| Machinery, Energy & Transportation | (506 | ) | (525 | ) | |||

| Financial Products | (5,714 | ) | (5,077 | ) | |||

| Short-term borrowings – net (original maturities three months or less) | (2,403 | ) | (111 | ) | |||

| Net cash provided by (used for) financing activities | (2,310 | ) | (2,693 | ) | |||

| Effect of exchange rate changes on cash | 40 | (11 | ) | ||||

| Increase (decrease) in cash and short-term investments | 2,423 | (347 | ) | ||||

| Cash and short-term investments at beginning of period | 7,168 | 6,460 | |||||

| Cash and short-term investments at end of period | $ | 9,591 | $ | 6,113 | |||

| (Millions of dollars) | September 30, 2017 | December 31, 2016 | |||||||

| Receivables - trade and other | $ | 18 | $ | 55 | |||||

| Receivables - finance | 161 | 174 | |||||||

| Long-term receivables - finance | 218 | 246 | |||||||

| Investments in unconsolidated affiliated companies | 38 | 31 | |||||||

| Guarantees | 270 | 210 | |||||||

| Total | $ | 705 | $ | 716 | |||||

| ASU | Description | ||||

| 2020-06 | Debt with conversion and other options and derivatives and hedging | ||||

| 2021-05 | Lessor - Variable lease payments | ||||

| 2021-10 | Government assistance | ||||

| Nine Months Ended September 30, 2017 | Nine Months Ended September 30, 2016 | Nine Months Ended September 30, 2022 | Nine Months Ended September 30, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares Granted | Weighted-Average Fair Value Per Share | Weighted-Average Grant Date Stock Price | Shares Granted | Weighted-Average Fair Value Per Share | Weighted-Average Grant Date Stock Price | Shares Granted | Weighted-Average Fair Value Per Share | Weighted-Average Grant Date Stock Price | Shares Granted | Weighted-Average Fair Value Per Share | Weighted-Average Grant Date Stock Price | |||||||||||||||||||||||||||||||||||||||||||||

| Stock options | 2,701,644 | $ | 25.01 | $ | 95.66 | 4,243,272 | $ | 20.64 | $ | 74.77 | Stock options | 1,029,202 | $ | 51.69 | $ | 196.70 | 1,084,821 | $ | 56.30 | $ | 219.76 | |||||||||||||||||||||||||||||||||||

| RSUs | 924,421 | $ | 90.11 | $ | 96.01 | 1,085,505 | $ | 68.04 | $ | 74.77 | RSUs | 484,025 | $ | 196.70 | $ | 196.70 | 448,311 | $ | 219.76 | $ | 219.76 | |||||||||||||||||||||||||||||||||||

| PRSUs | 437,385 | $ | 86.78 | $ | 95.66 | 614,347 | $ | 64.71 | $ | 74.77 | PRSUs | 258,900 | $ | 196.70 | $ | 196.70 | 266,894 | $ | 219.76 | $ | 219.76 | |||||||||||||||||||||||||||||||||||

| Grant Year | Grant Year | |||||||||||||

| 2017 | 2016 | 2022 | 2021 | |||||||||||

| Weighted-average dividend yield | 3.42% | 3.23% | Weighted-average dividend yield | 2.60% | 2.60% | |||||||||

| Weighted-average volatility | 29.2% | 31.1% | Weighted-average volatility | 31.7% | 32.9% | |||||||||

| Range of volatilities | 22.1-33.0% | 22.5-33.4% | Range of volatilities | 25.3% - 36.8% | 29.2% - 45.8% | |||||||||

| Range of risk-free interest rates | 0.81-2.35% | 0.62-1.73% | Range of risk-free interest rates | 1.03% - 2.00% | 0.06% - 1.41% | |||||||||

| Weighted-average expected lives | 8 years | 8 years | Weighted-average expected lives | 8 years | 8 years | |||||||||

(Millions of dollars) | Consolidated Statement of Financial | Asset (Liability) Fair Value | |||||||

| Position Location | September 30, 2017 | December 31, 2016 | |||||||

| Designated derivatives | |||||||||

| Foreign exchange contracts | |||||||||

| Machinery, Energy & Transportation | Receivables – trade and other | $ | 14 | $ | 13 | ||||

| Machinery, Energy & Transportation | Long-term receivables – trade and other | 3 | — | ||||||

| Machinery, Energy & Transportation | Accrued expenses | (8 | ) | (93 | ) | ||||

| Machinery, Energy & Transportation | Other liabilities | (5 | ) | (36 | ) | ||||

| Financial Products | Long-term receivables – trade and other | 8 | 29 | ||||||

| Financial Products | Accrued expenses | (41 | ) | (3 | ) | ||||

| Interest rate contracts | |||||||||

| Financial Products | Long-term receivables – trade and other | 3 | 4 | ||||||

| Financial Products | Accrued expenses | (1 | ) | (1 | ) | ||||

| $ | (27 | ) | $ | (87 | ) | ||||

| Undesignated derivatives | |||||||||

| Foreign exchange contracts | |||||||||

| Machinery, Energy & Transportation | Receivables – trade and other | $ | 11 | $ | — | ||||

| Machinery, Energy & Transportation | Accrued expenses | (2 | ) | (30 | ) | ||||

| Financial Products | Receivables – trade and other | 42 | 39 | ||||||

| Financial Products | Accrued expenses | (8 | ) | (4 | ) | ||||

| Commodity contracts | |||||||||

| Machinery, Energy & Transportation | Receivables – trade and other | 12 | 10 | ||||||

| $ | 55 | $ | 15 | ||||||

| (Millions of dollars) | Fair Value | ||||||||||||||||||||||

| September 30, 2022 | December 31, 2021 | ||||||||||||||||||||||

Assets1 | Liabilities2 | Assets1 | Liabilities2 | ||||||||||||||||||||

| Designated derivatives | |||||||||||||||||||||||

| Foreign exchange contracts | $ | 692 | $ | (394) | $ | 228 | $ | (64) | |||||||||||||||

| Interest rate contracts | 94 | (302) | 38 | (15) | |||||||||||||||||||

| Total | $ | 786 | $ | (696) | $ | 266 | $ | (79) | |||||||||||||||

| Undesignated derivatives | |||||||||||||||||||||||

| Foreign exchange contracts | $ | 118 | $ | (78) | $ | 46 | $ | (42) | |||||||||||||||

| Commodity contracts | 9 | (43) | 30 | (9) | |||||||||||||||||||

| Total | $ | 127 | $ | (121) | $ | 76 | $ | (51) | |||||||||||||||

1 Assets are classified on the Consolidated Statement of Financial Position as Receivables - trade and other or Long-term receivables - trade and other. | |||||||||||||||||||||||

2 Liabilities are classified on the Consolidated Statement of Financial Position as Accrued expenses or Other liabilities. | |||||||||||||||||||||||

| (Millions of dollars) | September 30, 2017 | December 31, 2016 | ||||||

| Machinery, Energy & Transportation | $ | 2,081 | $ | 2,530 | ||||

| Financial Products | $ | 3,560 | $ | 2,626 | ||||

| (Millions of dollars) | Three Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| Fair Value / Undesignated Hedges | Cash Flow Hedges | ||||||||||||||||||||||||||||||||||

Gains (Losses) Recognized on the Consolidated Statement of Results of Operations1 | Gains (Losses) Recognized in AOCI | Gains (Losses) Reclassified from AOCI2 | |||||||||||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||||||||||

| Foreign exchange contracts | $ | (2) | $ | 46 | $ | 18 | $ | 42 | $ | 289 | $ | 90 | |||||||||||||||||||||||

| Interest rate contracts | (5) | 5 | 26 | 3 | 7 | (5) | |||||||||||||||||||||||||||||

| Commodity contracts | (42) | (30) | — | — | — | — | |||||||||||||||||||||||||||||

| Total | $ | (49) | $ | 21 | $ | 44 | $ | 45 | $ | 296 | $ | 85 | |||||||||||||||||||||||

1 Foreign exchange contract and Commodity contract gains (losses) are included in Other income (expense). Interest rate contract gains (losses) are primarily included in Interest expense of Financial Products. | |||||||||||||||||||||||||||||||||||

2 Foreign exchange contract gains (losses) are primarily included in Other income (expense) in the Consolidated Statement of Results of Operations. Interest rate contract gains (losses) are primarily included in Interest expense of Financial Products in the Consolidated Statement of Results of Operations. | |||||||||||||||||||||||||||||||||||

| (Millions of dollars) | Nine Months Ended September 30 | ||||||||||||||||||||||||||||||||||

| Fair Value / Undesignated Hedges | Cash Flow Hedges | ||||||||||||||||||||||||||||||||||

Gains (Losses) Recognized on the Consolidated Statement of Results of Operations1 | Gains (Losses) Recognized in AOCI | Gains (Losses) Reclassified from AOCI2 | |||||||||||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||||||||||

| Foreign exchange contracts | $ | (32) | $ | 77 | $ | 195 | $ | 130 | $ | 638 | $ | 187 | |||||||||||||||||||||||

| Interest rate contracts | 12 | 18 | 103 | 11 | (2) | (23) | |||||||||||||||||||||||||||||

| Commodity contract | 3 | 35 | — | — | — | — | |||||||||||||||||||||||||||||

| Total | $ | (17) | $ | 130 | $ | 298 | $ | 141 | $ | 636 | $ | 164 | |||||||||||||||||||||||

1 Foreign exchange contract and Commodity contract gains (losses) are included in Other income (expense). Interest rate contract gains (losses) are primarily included in Interest expense excluding Financial Products. | |||||||||||||||||||||||||||||||||||

2 Foreign exchange contract gains (losses) are primarily included in Other income (expense). Interest rate contract gains (losses) are primarily included in Interest expense excluding Financial Products. | |||||||||||||||||||||||||||||||||||

| Fair Value Hedges | ||||||||||||||||||

| Three Months Ended September 30, 2017 | Three Months Ended September 30, 2016 | |||||||||||||||||

(Millions of dollars) | Classification | Gains (Losses) on Derivatives | Gains (Losses) on Borrowings | Gains (Losses) on Derivatives | Gains (Losses) on Borrowings | |||||||||||||

| Interest rate contracts | ||||||||||||||||||

| Financial Products | Other income (expense) | $ | — | $ | — | $ | (11 | ) | $ | 11 | ||||||||

| $ | — | $ | — | $ | (11 | ) | $ | 11 | ||||||||||

| Nine Months Ended September 30, 2017 | Nine Months Ended September 30, 2016 | |||||||||||||||||

| Classification | Gains (Losses) on Derivatives | Gains (Losses) on Borrowings | Gains (Losses) on Derivatives | Gains (Losses) on Borrowings | ||||||||||||||

| Interest rate contracts | ||||||||||||||||||

| Financial Products | Other income (expense) | $ | (1 | ) | $ | 1 | $ | (11 | ) | $ | 10 | |||||||

| $ | (1 | ) | $ | 1 | $ | (11 | ) | $ | 10 | |||||||||

| (Millions of dollars) | Carrying Value of the Hedged Liabilities | Cumulative Amount of Fair Value Hedging Adjustment Included in the Carrying Value of the Hedged Liabilities | |||||||||||||||||||||

| September 30, 2022 | December 31, 2021 | September 30, 2022 | December 31, 2021 | ||||||||||||||||||||

| Long-term debt due within one year | $ | — | $ | 755 | $ | — | $ | 5 | |||||||||||||||

| Long-term debt due after one year | 3,796 | 1,304 | (227) | (2) | |||||||||||||||||||

| Total | $ | 3,796 | $ | 2,059 | $ | (227) | $ | 3 | |||||||||||||||

| Cash Flow Hedges | ||||||||||||||

| Three Months Ended September 30, 2017 | ||||||||||||||

| Recognized in Earnings | ||||||||||||||

(Millions of dollars) | Amount of Gains (Losses) Recognized in AOCI (Effective Portion) | Classification of Gains (Losses) | Amount of Gains (Losses) Reclassified from AOCI to Earnings | Recognized in Earnings (Ineffective Portion) | ||||||||||

| Foreign exchange contracts | ||||||||||||||

| Machinery, Energy & Transportation | $ | 16 | Other income (expense) | $ | 4 | $ | — | |||||||

| Financial Products | (21 | ) | Other income (expense) | (20 | ) | — | ||||||||

| Interest rate contracts | ||||||||||||||

| Machinery, Energy & Transportation | — | Interest expense excluding Financial Products | (2 | ) | — | |||||||||

| Financial Products | (1 | ) | Interest expense of Financial Products | 2 | — | |||||||||

| $ | (6 | ) | $ | (16 | ) | $ | — | |||||||

| Three Months Ended September 30, 2016 | ||||||||||||||

| Recognized in Earnings | ||||||||||||||

Amount of Gains (Losses) Recognized in AOCI (Effective Portion) | Classification of Gains (Losses) | Amount of Gains (Losses) Reclassified from AOCI to Earnings | Recognized in Earnings (Ineffective Portion) | |||||||||||

| Foreign exchange contracts | ||||||||||||||

| Machinery, Energy & Transportation | $ | (29 | ) | Other income (expense) | $ | 4 | $ | — | ||||||

| Financial Products | (17 | ) | Other income (expense) | (10 | ) | — | ||||||||

| Interest rate contracts | ||||||||||||||

| Machinery, Energy & Transportation | — | Interest expense excluding Financial Products | (2 | ) | — | |||||||||

| Financial Products | 2 | Interest expense of Financial Products | — | — | ||||||||||

| $ | (44 | ) | $ | (8 | ) | $ | — | |||||||

| Nine Months Ended September 30, 2017 | ||||||||||||||

| Recognized in Earnings | ||||||||||||||

Amount of Gains (Losses) Recognized in AOCI (Effective Portion) | Classification of Gains (Losses) | Amount of Gains (Losses) Reclassified from AOCI to Earnings | Recognized in Earnings (Ineffective Portion) | |||||||||||

| Foreign exchange contracts | ||||||||||||||

| Machinery, Energy & Transportation | $ | 72 | Other income (expense) | $ | (49 | ) | $ | — | ||||||

| Financial Products | (62 | ) | Other income (expense) | (69 | ) | — | ||||||||

| Interest rate contracts | ||||||||||||||

| Machinery, Energy & Transportation | — | Interest expense excluding Financial Products | (5 | ) | — | |||||||||

| Financial Products | (1 | ) | Interest expense of Financial Products | 5 | — | |||||||||

| $ | 9 | $ | (118 | ) | $ | — | ||||||||

| Nine Months Ended September 30, 2016 | ||||||||||||||

| Recognized in Earnings | ||||||||||||||

Amount of Gains (Losses) Recognized in AOCI (Effective Portion) | Classification of Gains (Losses) | Amount of Gains (Losses) Reclassified from AOCI to Earnings | Recognized in Earnings (Ineffective Portion) | |||||||||||

| Foreign exchange contracts | ||||||||||||||

| Machinery, Energy & Transportation | $ | (35 | ) | Other income (expense) | $ | — | $ | — | ||||||

| Financial Products | (23 | ) | Other income (expense) | (16 | ) | — | ||||||||

| Interest rate contracts | ||||||||||||||

| Machinery, Energy & Transportation | — | Interest expense excluding Financial Products | (5 | ) | — | |||||||||

| Financial Products | — | Interest expense of Financial Products | (3 | ) | — | |||||||||

| $ | (58 | ) | $ | (24 | ) | $ | — | |||||||

(Millions of dollars) | Classification of Gains (Losses) | Three Months Ended September 30, 2017 | Three Months Ended September 30, 2016 | ||||||

| Foreign exchange contracts | |||||||||

| Machinery, Energy & Transportation | Other income (expense) | $ | 15 | $ | 2 | ||||

| Financial Products | Other income (expense) | 11 | (5 | ) | |||||

| Commodity contracts | |||||||||

| Machinery, Energy & Transportation | Other income (expense) | 11 | 3 | ||||||

| $ | 37 | $ | — | ||||||

| Classification of Gains (Losses) | Nine Months Ended September 30, 2017 | Nine Months Ended September 30, 2016 | |||||||

| Foreign exchange contracts | |||||||||

| Machinery, Energy & Transportation | Other income (expense) | $ | 67 | $ | 24 | ||||

| Financial Products | Other income (expense) | 21 | (33 | ) | |||||

| Commodity contracts | |||||||||

| Machinery, Energy & Transportation | Other income (expense) | 12 | 9 | ||||||

| $ | 100 | $ | — | ||||||

| (Millions of dollars) | September 30, 2022 | December 31, 2021 | |||||||||||||||||||||

| Assets | Liabilities | Assets | Liabilities | ||||||||||||||||||||

| Gross Amounts Recognized | $ | 913 | $ | (817) | $ | 342 | $ | (130) | |||||||||||||||

| Financial Instruments Not Offset | (282) | 282 | (114) | 114 | |||||||||||||||||||

| Cash Collateral Received | — | — | — | — | |||||||||||||||||||

| Net Amount | $ | 631 | $ | (535) | $ | 228 | $ | (16) | |||||||||||||||

| September 30, 2017 | Gross Amounts Not Offset in the Statement of Financial Position | |||||||||||||||||||||||

| (Millions of dollars) | Gross Amount of Recognized Assets | Gross Amounts Offset in the Statement of Financial Position | Net Amount of Assets Presented in the Statement of Financial Position | Financial Instruments | Cash Collateral Received | Net Amount of Assets | ||||||||||||||||||

| Derivatives | ||||||||||||||||||||||||

| Machinery, Energy & Transportation | $ | 40 | $ | — | $ | 40 | $ | (14 | ) | $ | — | $ | 26 | |||||||||||

| Financial Products | 53 | — | 53 | (8 | ) | — | 45 | |||||||||||||||||

| Total | $ | 93 | $ | — | $ | 93 | $ | (22 | ) | $ | — | $ | 71 | |||||||||||

| September 30, 2017 | Gross Amounts Not Offset in the Statement of Financial Position | |||||||||||||||||||||||

| (Millions of dollars) | Gross Amount of Recognized Liabilities | Gross Amounts Offset in the Statement of Financial Position | Net Amount of Liabilities Presented in the Statement of Financial Position | Financial Instruments | Cash Collateral Pledged | Net Amount of Liabilities | ||||||||||||||||||

| Derivatives | ||||||||||||||||||||||||

| Machinery, Energy & Transportation | $ | (15 | ) | $ | — | $ | (15 | ) | $ | 14 | $ | — | $ | (1 | ) | |||||||||

| Financial Products | (50 | ) | — | (50 | ) | 8 | — | (42 | ) | |||||||||||||||

| Total | $ | (65 | ) | $ | — | $ | (65 | ) | $ | 22 | $ | — | $ | (43 | ) | |||||||||

| December 31, 2016 | Gross Amounts Not Offset in the Statement of Financial Position | |||||||||||||||||||||||

| (Millions of dollars) | Gross Amount of Recognized Assets | Gross Amounts Offset in the Statement of Financial Position | Net Amount of Assets Presented in the Statement of Financial Position | Financial Instruments | Cash Collateral Received | Net Amount of Assets | ||||||||||||||||||

| Derivatives | ||||||||||||||||||||||||

| Machinery, Energy & Transportation | $ | 23 | $ | — | $ | 23 | $ | (21 | ) | $ | — | $ | 2 | |||||||||||

| Financial Products | 72 | — | 72 | (7 | ) | — | 65 | |||||||||||||||||

| Total | $ | 95 | $ | — | $ | 95 | $ | (28 | ) | $ | — | $ | 67 | |||||||||||

| December 31, 2016 | Gross Amounts Not Offset in the Statement of Financial Position | |||||||||||||||||||||||

| (Millions of dollars) | Gross Amount of Recognized Liabilities | Gross Amounts Offset in the Statement of Financial Position | Net Amount of Liabilities Presented in the Statement of Financial Position | Financial Instruments | Cash Collateral Pledged | Net Amount of Liabilities | ||||||||||||||||||

| Derivatives | ||||||||||||||||||||||||

| Machinery, Energy & Transportation | $ | (159 | ) | $ | — | $ | (159 | ) | $ | 21 | $ | — | $ | (138 | ) | |||||||||

| Financial Products | (8 | ) | — | (8 | ) | 7 | — | (1 | ) | |||||||||||||||

| Total | $ | (167 | ) | $ | — | $ | (167 | ) | $ | 28 | $ | — | $ | (139 | ) | |||||||||

| (Millions of dollars) | September 30, 2017 | December 31, 2016 | |||||

| Raw materials | $ | 2,777 | $ | 2,102 | |||

| Work-in-process | 2,241 | 1,719 | |||||

| Finished goods | 4,990 | 4,576 | |||||

| Supplies | 204 | 217 | |||||

| Total inventories | $ | 10,212 | $ | 8,614 | |||

| (Millions of dollars) | September 30, 2022 | December 31, 2021 | |||||||||

| Raw materials | $ | 6,335 | $ | 5,528 | |||||||

| Work-in-process | 1,836 | 1,318 | |||||||||

| Finished goods | 8,387 | 6,907 | |||||||||

| Supplies | 302 | 285 | |||||||||

| Total inventories | $ | 16,860 | $ | 14,038 | |||||||

| (Millions of dollars) | September 30, 2017 | December 31, 2016 | |||||

| Investments in equity method companies | $ | 219 | $ | 192 | |||

| Plus: Investments in cost method companies | 33 | 57 | |||||

| Total investments in unconsolidated affiliated companies | $ | 252 | $ | 249 | |||

| September 30, 2022 | |||||||||||||||||||||||

| (Millions of dollars) | Weighted Amortizable Life (Years) | Gross Carrying Amount | Accumulated Amortization | Net | |||||||||||||||||||

| Customer relationships | 16 | $ | 2,183 | $ | (1,604) | $ | 579 | ||||||||||||||||

| Intellectual property | 12 | 1,470 | (1,287) | 183 | |||||||||||||||||||

| Other | 16 | 128 | (84) | 44 | |||||||||||||||||||

| Total finite-lived intangible assets | 14 | $ | 3,781 | $ | (2,975) | $ | 806 | ||||||||||||||||

| September 30, 2017 | |||||||||||||

| (Millions of dollars) | Weighted Amortizable Life (Years) | Gross Carrying Amount | Accumulated Amortization | Net | |||||||||

| Customer relationships | 15 | $ | 2,433 | $ | (1,077 | ) | $ | 1,356 | |||||

| Intellectual property | 11 | 1,529 | (812 | ) | 717 | ||||||||

| Other | 13 | 191 | (89 | ) | 102 | ||||||||

| Total finite-lived intangible assets | 14 | $ | 4,153 | $ | (1,978 | ) | $ | 2,175 | |||||

| December 31, 2021 | |||||||||||||||||||||||

| Weighted Amortizable Life (Years) | Gross Carrying Amount | Accumulated Amortization | Net | ||||||||||||||||||||

| Customer relationships | 15 | $ | 2,421 | $ | (1,709) | $ | 712 | ||||||||||||||||

| Intellectual property | 12 | 1,472 | (1,192) | 280 | |||||||||||||||||||

| Other | 14 | 156 | (106) | 50 | |||||||||||||||||||

| Total finite-lived intangible assets | 14 | $ | 4,049 | $ | (3,007) | $ | 1,042 | ||||||||||||||||

| December 31, 2016 | |||||||||||||

Weighted Amortizable Life (Years) | Gross Carrying Amount | Accumulated Amortization | Net | ||||||||||

| Customer relationships | 15 | $ | 2,378 | $ | (934 | ) | $ | 1,444 | |||||

| Intellectual property | 11 | 1,496 | (706 | ) | 790 | ||||||||

| Other | 14 | 192 | (77 | ) | 115 | ||||||||

| Total finite-lived intangible assets | 14 | $ | 4,066 | $ | (1,717 | ) | $ | 2,349 | |||||

| (Millions of dollars) | ||||||||||

| Remaining Three Months of 2017 | 2018 | 2019 | 2020 | 2021 | Thereafter | |||||

| $81 | $319 | $313 | $302 | $284 | $876 | |||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||

| Remaining Three Months of 2022 | 2023 | 2024 | 2025 | 2026 | Thereafter | |||||||||||||||||||||||||||

| $70 | $222 | $163 | $153 | $85 | $113 | |||||||||||||||||||||||||||

| (Millions of dollars) | December 31, 2021 | Acquisitions | Other Adjustments 1 | September 30, 2022 | ||||||||||||||||||||||||||||

| Construction Industries | ||||||||||||||||||||||||||||||||

| Goodwill | $ | 302 | $ | — | $ | (39) | $ | 263 | ||||||||||||||||||||||||

| Impairments | (22) | — | — | (22) | ||||||||||||||||||||||||||||

| Net goodwill | 280 | — | (39) | 241 | ||||||||||||||||||||||||||||

| Resource Industries | ||||||||||||||||||||||||||||||||

| Goodwill | 4,182 | — | (127) | 4,055 | ||||||||||||||||||||||||||||

| Impairments | (1,175) | — | — | (1,175) | ||||||||||||||||||||||||||||

| Net goodwill | 3,007 | — | (127) | 2,880 | ||||||||||||||||||||||||||||

| Energy & Transportation | ||||||||||||||||||||||||||||||||

| Goodwill | 2,985 | 25 | (81) | 2,929 | ||||||||||||||||||||||||||||

All Other 2 | ||||||||||||||||||||||||||||||||

| Goodwill | 52 | — | (10) | 42 | ||||||||||||||||||||||||||||

| Consolidated total | ||||||||||||||||||||||||||||||||

| Goodwill | 7,521 | 25 | (257) | 7,289 | ||||||||||||||||||||||||||||

| Impairments | (1,197) | — | — | (1,197) | ||||||||||||||||||||||||||||

| Net goodwill | $ | 6,324 | $ | 25 | $ | (257) | $ | 6,092 | ||||||||||||||||||||||||

| (Millions of dollars) | December 31, 2016 | Other Adjustments 1 | September 30, 2017 | |||||||||

| Construction Industries | ||||||||||||

| Goodwill | $ | 296 | $ | 10 | $ | 306 | ||||||

| Impairments | (22 | ) | — | (22 | ) | |||||||

| Net goodwill | 274 | 10 | 284 | |||||||||

| Resource Industries | ||||||||||||

| Goodwill | 4,110 | 111 | 4,221 | |||||||||

| Impairments | (1,175 | ) | — | (1,175 | ) | |||||||

| Net goodwill | 2,935 | 111 | 3,046 | |||||||||

| Energy & Transportation | ||||||||||||

| Goodwill | 2,756 | 54 | 2,810 | |||||||||

All Other 2 | ||||||||||||

| Goodwill | 55 | 1 | 56 | |||||||||

| Consolidated total | ||||||||||||

| Goodwill | 7,217 | 176 | 7,393 | |||||||||

| Impairments | (1,197 | ) | — | (1,197 | ) | |||||||

| Net goodwill | $ | 6,020 | $ | 176 | $ | 6,196 | ||||||

| September 30, 2017 | December 31, 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Available-for-sale debt securities | Available-for-sale debt securities | September 30, 2022 | December 31, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | Cost Basis | Unrealized Pretax Net Gains (Losses) | Fair Value | Cost Basis | Unrealized Pretax Net Gains (Losses) | Fair Value | (Millions of dollars) | Cost Basis | Unrealized Pretax Net Gains (Losses) | Fair Value | Cost Basis | Unrealized Pretax Net Gains (Losses) | Fair Value | |||||||||||||||||||||||||||||||||||||||||||||

| Government debt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government debt securities | Government debt securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. treasury bonds | $ | 10 | $ | — | $ | 10 | $ | 9 | $ | — | $ | 9 | U.S. treasury bonds | $ | 10 | $ | — | $ | 10 | $ | 10 | $ | — | $ | 10 | |||||||||||||||||||||||||||||||||

| Other U.S. and non-U.S. government bonds | 48 | — | 48 | 60 | — | 60 | Other U.S. and non-U.S. government bonds | 51 | (2) | 49 | 61 | — | 61 | |||||||||||||||||||||||||||||||||||||||||||||

| Corporate bonds | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate bonds | 529 | 3 | 532 | 489 | 3 | 492 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate debt securities | Corporate debt securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate bonds and other debt securities | Corporate bonds and other debt securities | 2,156 | (108) | 2,048 | 1,027 | 19 | 1,046 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset-backed securities | 76 | — | 76 | 90 | — | 90 | Asset-backed securities | 185 | (5) | 180 | 175 | 1 | 176 | |||||||||||||||||||||||||||||||||||||||||||||

| Mortgage-backed debt securities | Mortgage-backed debt securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. governmental agency | 245 | (2 | ) | 243 | 225 | (2 | ) | 223 | U.S. governmental agency | 384 | (36) | 348 | 319 | 6 | 325 | |||||||||||||||||||||||||||||||||||||||||||

| Residential | 8 | — | 8 | 10 | — | 10 | Residential | 3 | — | 3 | 4 | — | 4 | |||||||||||||||||||||||||||||||||||||||||||||

| Commercial | 17 | — | 17 | 36 | — | 36 | Commercial | 139 | (10) | 129 | 98 | 1 | 99 | |||||||||||||||||||||||||||||||||||||||||||||

| Total available-for-sale debt securities | Total available-for-sale debt securities | $ | 2,928 | $ | (161) | $ | 2,767 | $ | 1,694 | $ | 27 | $ | 1,721 | |||||||||||||||||||||||||||||||||||||||||||||

| Equity securities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Large capitalization value | 313 | 36 | 349 | 280 | 32 | 312 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Real estate investment trust (REIT) | 104 | 5 | 109 | 77 | 2 | 79 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Smaller company growth | 43 | 22 | 65 | 41 | 15 | 56 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 1,393 | $ | 64 | $ | 1,457 | $ | 1,317 | $ | 50 | $ | 1,367 | ||||||||||||||||||||||||||||||||||||||||||||||

| Available-for-sale investments in an unrealized loss position that are not other-than-temporarily impaired: | |||||||||||||||||||||||

| September 30, 2017 | |||||||||||||||||||||||

Less than 12 months 1 | 12 months or more 1 | Total | |||||||||||||||||||||

| (Millions of dollars) | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | |||||||||||||||||

| Mortgage-backed debt securities | |||||||||||||||||||||||

| U.S. governmental agency | 102 | 1 | 89 | 2 | 191 | 3 | |||||||||||||||||

| Equity securities | |||||||||||||||||||||||

| Large capitalization value | 72 | 5 | 14 | 3 | 86 | 8 | |||||||||||||||||

| Small company growth | 9 | 1 | 2 | — | 11 | 1 | |||||||||||||||||

| Total | $ | 183 | $ | 7 | $ | 105 | $ | 5 | $ | 288 | $ | 12 | |||||||||||

| Available-for-sale debt securities in an unrealized loss position: | |||||||||||||||||||||||||||||||||||

| September 30, 2022 | |||||||||||||||||||||||||||||||||||

Less than 12 months 1 | 12 months or more 1 | Total | |||||||||||||||||||||||||||||||||

| (Millions of dollars) | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | |||||||||||||||||||||||||||||

| Government debt securities | |||||||||||||||||||||||||||||||||||

| Other U.S. and non-U.S. government bonds | $ | 31 | $ | 1 | $ | 15 | $ | 1 | $ | 46 | $ | 2 | |||||||||||||||||||||||

| Corporate debt securities | |||||||||||||||||||||||||||||||||||

| Corporate bonds | 1,774 | 75 | 218 | 33 | 1,992 | 108 | |||||||||||||||||||||||||||||

| Asset-backed securities | 102 | 4 | 35 | 1 | 137 | 5 | |||||||||||||||||||||||||||||

| Mortgage-backed debt securities | |||||||||||||||||||||||||||||||||||

| U.S. governmental agency | 293 | 27 | 51 | 9 | 344 | 36 | |||||||||||||||||||||||||||||

| Commercial | 88 | 7 | 41 | 3 | 129 | 10 | |||||||||||||||||||||||||||||

| $ | 2,288 | $ | 114 | $ | 360 | $ | 47 | $ | 2,648 | $ | 161 | ||||||||||||||||||||||||

| December 31, 2016 | December 31, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Less than 12 months 1 | 12 months or more 1 | Total | Less than 12 months 1 | 12 months or more 1 | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | (Millions of dollars) | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | |||||||||||||||||||||||||||||||||||||||||||||

| Corporate debt securities | Corporate debt securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate bonds | Corporate bonds | $ | 270 | $ | 4 | $ | 33 | $ | 1 | $ | 303 | $ | 5 | |||||||||||||||||||||||||||||||||||||||||||||

| Corporate bonds | $ | 131 | $ | 1 | $ | 13 | $ | — | $ | 144 | $ | 1 | ||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage-backed debt securities | Mortgage-backed debt securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. governmental agency | 167 | 2 | 11 | — | 178 | 2 | U.S. governmental agency | 89 | 1 | 22 | — | 111 | 1 | |||||||||||||||||||||||||||||||||||||||||||||

| Equity securities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Large capitalization value | 68 | 6 | 11 | 2 | 79 | 8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Smaller company growth | 10 | 1 | 3 | 1 | 13 | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 376 | $ | 10 | $ | 38 | $ | 3 | $ | 414 | $ | 13 | Total | $ | 359 | $ | 5 | $ | 55 | $ | 1 | $ | 414 | $ | 6 | |||||||||||||||||||||||||||||||||

1 Indicates the length of time that individual securities have been in a continuous unrealized loss position. | 1 Indicates the length of time that individual securities have been in a continuous unrealized loss position. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2022 | |||||||||||

| (Millions of dollars) | Cost Basis | Fair Value | |||||||||

| Due in one year or less | $ | 696 | $ | 687 | |||||||

| Due after one year through five years | 1,354 | 1,277 | |||||||||

| Due after five years through ten years | 282 | 256 | |||||||||

| Due after ten years | 70 | 67 | |||||||||

| U.S. governmental agency mortgage-backed securities | 384 | 348 | |||||||||

| Residential mortgage-backed securities | 3 | 3 | |||||||||

| Commercial mortgage-backed securities | 139 | 129 | |||||||||

| Total debt securities – available-for-sale | $ | 2,928 | $ | 2,767 | |||||||

| Sales of available-for-sale debt securities: | |||||||||||||||||||||||

| Three Months Ended September 30 | Nine Months Ended September 30 | ||||||||||||||||||||||

| (Millions of dollars) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Proceeds from the sale of available-for-sale securities | $ | 204 | $ | 97 | $ | 474 | $ | 322 | |||||||||||||||

| Gross gains from the sale of available-for-sale securities | — | 1 | 1 | 3 | |||||||||||||||||||

| Gross losses from the sale of available-for-sale securities | — | — | 1 | — | |||||||||||||||||||

| September 30, 2017 | |||||||

| (Millions of dollars) | Cost Basis | Fair Value | |||||

| Due in one year or less | $ | 169 | $ | 170 | |||

| Due after one year through five years | 415 | 417 | |||||

| Due after five years through ten years | 55 | 55 | |||||

| Due after ten years | 24 | 24 | |||||

| U.S. governmental agency mortgage-backed securities | 245 | 243 | |||||

| Residential mortgage-backed securities | 8 | 8 | |||||

| Commercial mortgage-backed securities | 17 | 17 | |||||

| Total debt securities – available-for-sale | $ | 933 | $ | 934 | |||

| Sales of Securities: | |||||||||||||||

| Three Months Ended September 30 | Nine Months Ended September 30 | ||||||||||||||

| (Millions of dollars) | 2017 | 2016 | 2017 | 2016 | |||||||||||

| Proceeds from the sale of available-for-sale securities | $ | 244 | $ | 109 | $ | 431 | $ | 304 | |||||||

| Gross gains from the sale of available-for-sale securities | $ | 38 | $ | 10 | $ | 40 | $ | 43 | |||||||

| Gross losses from the sale of available-for-sale securities | $ | 1 | $ | 1 | $ | 3 | $ | 3 | |||||||

U.S. Pension Benefits | Non-U.S. Pension Benefits | Other Postretirement Benefits | |||||||||||||||||||||||||||||||||

| September 30 | September 30 | September 30 | |||||||||||||||||||||||||||||||||

| (Millions of dollars) | 2022 | 2021 | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||||||||

| For the three months ended: | |||||||||||||||||||||||||||||||||||

| Components of net periodic benefit cost: | |||||||||||||||||||||||||||||||||||

| Service cost | $ | — | $ | — | $ | 15 | $ | 15 | $ | 24 | $ | 25 | |||||||||||||||||||||||

| Interest cost | 100 | 82 | 17 | 16 | 20 | 16 | |||||||||||||||||||||||||||||

| Expected return on plan assets | (167) | (180) | (33) | (33) | (3) | (1) | |||||||||||||||||||||||||||||

| Amortization of prior service cost (credit) | — | — | — | — | (1) | (11) | |||||||||||||||||||||||||||||

Net periodic benefit cost (benefit) 1 | $ | (67) | $ | (98) | $ | (1) | $ | (2) | $ | 40 | $ | 29 | |||||||||||||||||||||||

| For the nine months ended: | |||||||||||||||||||||||||||||||||||

| Components of net periodic benefit cost: | |||||||||||||||||||||||||||||||||||

| Service cost | $ | — | $ | — | $ | 40 | $ | 44 | $ | 74 | $ | 75 | |||||||||||||||||||||||

| Interest cost | 301 | 247 | 53 | 43 | 60 | 48 | |||||||||||||||||||||||||||||

| Expected return on plan assets | (502) | (538) | (100) | (98) | (9) | (4) | |||||||||||||||||||||||||||||

| Amortization of prior service cost (credit) | — | — | — | — | (4) | (31) | |||||||||||||||||||||||||||||

Net periodic benefit cost (benefit) 1 | $ | (201) | $ | (291) | $ | (7) | $ | (11) | $ | 121 | $ | 88 | |||||||||||||||||||||||

U.S. Pension Benefits | Non-U.S. Pension Benefits | Other Postretirement Benefits | |||||||||||||||||||||

(Millions of dollars) | September 30 | September 30 | September 30 | ||||||||||||||||||||

| 2017 | 2016 | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||

| For the three months ended: | |||||||||||||||||||||||

| Components of net periodic benefit cost: | |||||||||||||||||||||||

| Service cost | $ | 29 | $ | 30 | $ | 23 | $ | 22 | $ | 19 | $ | 20 | |||||||||||

| Interest cost | 131 | 129 | 23 | 30 | 33 | 33 | |||||||||||||||||

| Expected return on plan assets | (184 | ) | (190 | ) | (55 | ) | (59 | ) | (10 | ) | (11 | ) | |||||||||||

Amortization of prior service cost (credit) 1 | — | — | — | — | (6 | ) | (15 | ) | |||||||||||||||

| Net periodic benefit cost (benefit) | (24 | ) | (31 | ) | (9 | ) | (7 | ) | 36 | 27 | |||||||||||||

Curtailments and termination benefits 2 | — | — | — | 1 | — | — | |||||||||||||||||

| Total cost (benefit) included in operating profit | $ | (24 | ) | $ | (31 | ) | $ | (9 | ) | $ | (6 | ) | $ | 36 | $ | 27 | |||||||

| For the nine months ended: | |||||||||||||||||||||||

| Components of net periodic benefit cost: | |||||||||||||||||||||||

| Service cost | $ | 87 | $ | 89 | $ | 70 | $ | 68 | $ | 58 | $ | 61 | |||||||||||

| Interest cost | 393 | 388 | 73 | 90 | 98 | 98 | |||||||||||||||||

| Expected return on plan assets | (551 | ) | (568 | ) | (168 | ) | (176 | ) | (28 | ) | (33 | ) | |||||||||||

Amortization of prior service cost (credit) 1 | — | — | (1 | ) | — | (17 | ) | (45 | ) | ||||||||||||||

| Net periodic benefit cost (benefit) | (71 | ) | (91 | ) | (26 | ) | (18 | ) | 111 | 81 | |||||||||||||

Curtailments and termination benefits 2 | 9 | — | 20 | 1 | — | (2 | ) | ||||||||||||||||

| Total cost (benefit) included in operating profit | $ | (62 | ) | $ | (91 | ) | $ | (6 | ) | $ | (17 | ) | $ | 111 | $ | 79 | |||||||

| Weighted-average assumptions used to determine net cost: | |||||||||||||||||||||||

| Discount rate used to measure service cost | 4.2 | % | 4.5 | % | 2.3 | % | 2.9 | % | 3.9 | % | 4.4 | % | |||||||||||

| Discount rate used to measure interest cost | 3.3 | % | 3.4 | % | 2.3 | % | 2.8 | % | 3.3 | % | 3.3 | % | |||||||||||

| Expected rate of return on plan assets | 6.7 | % | 6.9 | % | 5.9 | % | 6.1 | % | 7.5 | % | 7.5 | % | |||||||||||

| Rate of compensation increase | 4.0 | % | 4.0 | % | 4.0 | % | 3.5 | % | 4.0 | % | 4.0 | % | |||||||||||

| Three Months Ended September 30 | Nine Months Ended September 30 | ||||||||||||||||||||||

| (Millions of dollars) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| U.S. Plans | $ | 87 | $ | 81 | $ | 236 | $ | 321 | |||||||||||||||

| Non-U.S. Plans | 29 | 29 | 85 | 83 | |||||||||||||||||||

| $ | 116 | $ | 110 | $ | 321 | $ | 404 | ||||||||||||||||

| Three Months Ended September 30 | Nine Months Ended September 30 | ||||||||||||||

| (Millions of dollars) | 2017 | 2016 | 2017 | 2016 | |||||||||||

| U.S. Plans | $ | 97 | $ | 83 | $ | 267 | $ | 235 | |||||||

| Non-U.S. Plans | 19 | 16 | 54 | 51 | |||||||||||

| $ | 116 | $ | 99 | $ | 321 | $ | 286 | ||||||||

| Three Months Ended September 30 | Nine Months Ended September 30 | |||||||||||||||||||||||||

| (Millions of dollars) | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||

| Finance lease revenue | $ | 105 | $ | 120 | $ | 326 | $ | 369 | ||||||||||||||||||

| Operating lease revenue | 270 | 275 | 819 | 850 | ||||||||||||||||||||||

| Total | $ | 375 | $ | 395 | $ | 1,145 | $ | 1,219 | ||||||||||||||||||

| (Millions of dollars) | September 30, 2022 | December 31, 2021 | |||||||||

| Caterpillar dealer performance guarantees | $ | 137 | $ | 747 | |||||||

| Supplier consortium performance guarantee | 17 | 242 | |||||||||

| Other guarantees | 284 | 232 | |||||||||

| Total guarantees | $ | 438 | $ | 1,221 | |||||||

| (Millions of dollars) | September 30, 2017 | December 31, 2016 | |||||

| Caterpillar dealer performance guarantees | $ | 1,425 | $ | 1,384 | |||

| Customer loan guarantees | 51 | 51 | |||||

| Supplier consortium performance guarantee | 564 | 278 | |||||

| Third party logistics business lease guarantees | 73 | 87 | |||||

| Other guarantees | 100 | 56 | |||||

| Total guarantees | $ | 2,213 | $ | 1,856 | |||

| (Millions of dollars) | 2017 | |||

| Warranty liability, January 1 | $ | 1,258 | ||

| Reduction in liability (payments) | (637 | ) | ||

| Increase in liability (new warranties) | 749 | |||

| Warranty liability, September 30 | $ | 1,370 | ||

| (Millions of dollars) | 2016 | |||

| Warranty liability, January 1 | $ | 1,354 | ||

| Reduction in liability (payments) | (909 | ) | ||

| Increase in liability (new warranties) | 813 | |||

| Warranty liability, December 31 | $ | 1,258 | ||

| Computations of profit per share: | Three Months Ended September 30 | Nine Months Ended September 30 | |||||||||||||||

| (Dollars in millions except per share data) | 2017 | 2016 | 2017 | 2016 | |||||||||||||

Profit for the period (A) 1 | $ | 1,059 | $ | 283 | $ | 2,053 | $ | 1,104 | |||||||||

| Determination of shares (in millions): | |||||||||||||||||

| Weighted-average number of common shares outstanding (B) | 592.9 | 584.7 | 590.3 | 583.8 | |||||||||||||

| Shares issuable on exercise of stock awards, net of shares assumed to be purchased out of proceeds at average market price | 7.2 | 4.9 | 6.2 | 4.9 | |||||||||||||

Average common shares outstanding for fully diluted computation (C) 2 | 600.1 | 589.6 | 596.5 | 588.7 | |||||||||||||

| Profit per share of common stock: | |||||||||||||||||

| Assuming no dilution (A/B) | $ | 1.79 | $ | 0.48 | $ | 3.48 | $ | 1.89 | |||||||||

Assuming full dilution (A/C) 2 | $ | 1.77 | $ | 0.48 | $ | 3.44 | $ | 1.88 | |||||||||

| Shares outstanding as of September 30 (in millions) | 594.9 | 585.1 | |||||||||||||||

1 Profit attributable to common shareholders. | |||||||||||||||||

2 Diluted by assumed exercise of stock-based compensation awards using the treasury stock method. | |||||||||||||||||

| First Nine Months | |||||||||||

| (Millions of dollars) | 2022 | 2021 | |||||||||

| Warranty liability, beginning of period | $ | 1,689 | $ | 1,612 | |||||||

| Reduction in liability (payments) | (589) | (638) | |||||||||

| Increase in liability (new warranties) | 562 | 716 | |||||||||

| Warranty liability, end of period | $ | 1,662 | $ | 1,690 | |||||||

| Computations of profit per share: | Three Months Ended September 30 | Nine Months Ended September 30 | |||||||||||||||||||||||||||

| (Dollars in millions except per share data) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||||

Profit for the period (A) 1 | $ | 2,041 | $ | 1,426 | $ | 5,251 | $ | 4,369 | |||||||||||||||||||||

| Determination of shares (in millions): | |||||||||||||||||||||||||||||

| Weighted-average number of common shares outstanding (B) | 525.0 | 544.0 | 530.1 | 545.8 | |||||||||||||||||||||||||

| Shares issuable on exercise of stock awards, net of shares assumed to be purchased out of proceeds at average market price | 2.6 | 3.6 | 3.1 | 4.4 | |||||||||||||||||||||||||

Average common shares outstanding for fully diluted computation (C) 2 | 527.6 | 547.6 | 533.2 | 550.2 | |||||||||||||||||||||||||

| Profit per share of common stock: | |||||||||||||||||||||||||||||

| Assuming no dilution (A/B) | $ | 3.89 | $ | 2.62 | $ | 9.91 | $ | 8.00 | |||||||||||||||||||||

Assuming full dilution (A/C) 2 | $ | 3.87 | $ | 2.60 | $ | 9.85 | $ | 7.94 | |||||||||||||||||||||

| Shares outstanding as of September 30 (in millions) | 520.4 | 540.9 | |||||||||||||||||||||||||||

1 Profit attributable to common shareholders. | |||||||||||||||||||||||||||||

2 Diluted by assumed exercise of stock-based compensation awards using the treasury stock method. | |||||||||||||||||||||||||||||

| (Millions of dollars) | Foreign currency translation | Pension and other postretirement benefits | Derivative financial instruments | Available-for-sale securities | Total | |||||||||||||||

| Three Months Ended September 30, 2017 | ||||||||||||||||||||

| Balance at June 30, 2017 | $ | (1,499 | ) | $ | 14 | $ | (39 | ) | $ | 53 | $ | (1,471 | ) | |||||||

| Other comprehensive income (loss) before reclassifications | 237 | — | (4 | ) | 11 | 244 | ||||||||||||||

| Amounts reclassified from accumulated other comprehensive (income) loss | 11 | (4 | ) | 11 | (24 | ) | (6 | ) | ||||||||||||

| Other comprehensive income (loss) | 248 | (4 | ) | 7 | (13 | ) | 238 | |||||||||||||

| Balance at September 30, 2017 | $ | (1,251 | ) | $ | 10 | $ | (32 | ) | $ | 40 | $ | (1,233 | ) | |||||||