| UNITED STATES SECURITIES AND EXCHANGE COMMISSION | ||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common stock, par value $0.0833 per share | TGT | New York Stock Exchange | ||||||||||||

Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | ||||||||||||||||||||||||

Smaller reporting company | ☐ | Emerging growth company | ☐ | ||||||||||||||||||||||||||

Financial Statements (unaudited) | ||||||||

| FINANCIAL STATEMENTS | ||||||||

| Consolidated Statements of Operations | Consolidated Statements of Operations | |||||||||||||||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||||||||||

| (millions, except per share data) (unaudited) | October 28, 2017 | October 29, 2016 | October 28, 2017 | October 29, 2016 | (millions, except per share data) (unaudited) | October 31, 2020 | November 2, 2019 | October 31, 2020 | November 2, 2019 | |||||||||||||||||||||||||||||

| Sales | $ | 16,667 | $ | 16,441 | $ | 49,113 | $ | 48,805 | Sales | $ | 22,336 | $ | 18,414 | $ | 64,403 | $ | 53,997 | |||||||||||||||||||||

Cost of sales (a) | 11,712 | 11,536 | 34,330 | 33,957 | ||||||||||||||||||||||||||||||||||

| Gross margin | 4,955 | 4,905 | 14,783 | 14,848 | ||||||||||||||||||||||||||||||||||

| Other revenue | Other revenue | 296 | 251 | 819 | 716 | |||||||||||||||||||||||||||||||||

| Total revenue | Total revenue | 22,632 | 18,665 | 65,222 | 54,713 | |||||||||||||||||||||||||||||||||

| Cost of sales | Cost of sales | 15,509 | 12,935 | 45,692 | 37,808 | |||||||||||||||||||||||||||||||||

| Selling, general and administrative expenses | 3,512 | 3,339 | 10,027 | 9,741 | Selling, general and administrative expenses | 4,647 | 4,153 | 13,167 | 11,728 | |||||||||||||||||||||||||||||

Depreciation and amortization (exclusive of depreciation included in cost of sales) | 574 | 505 | 1,596 | 1,486 | 541 | 575 | 1,660 | 1,717 | ||||||||||||||||||||||||||||||

| Earnings from continuing operations before interest expense and income taxes | 869 | 1,061 | 3,160 | 3,621 | ||||||||||||||||||||||||||||||||||

| Operating income | Operating income | 1,935 | 1,002 | 4,703 | 3,460 | |||||||||||||||||||||||||||||||||

| Net interest expense | 254 | 142 | 532 | 864 | Net interest expense | 632 | 113 | 871 | 359 | |||||||||||||||||||||||||||||

| Net other (income) / expense | Net other (income) / expense | 5 | (12) | 16 | (38) | |||||||||||||||||||||||||||||||||

| Earnings from continuing operations before income taxes | 615 | 919 | 2,628 | 2,757 | Earnings from continuing operations before income taxes | 1,298 | 901 | 3,816 | 3,139 | |||||||||||||||||||||||||||||

| Provision for income taxes | 137 | 311 | 802 | 910 | Provision for income taxes | 284 | 195 | 828 | 703 | |||||||||||||||||||||||||||||

| Net earnings from continuing operations | 478 | 608 | 1,826 | 1,847 | Net earnings from continuing operations | 1,014 | 706 | 2,988 | 2,436 | |||||||||||||||||||||||||||||

| Discontinued operations, net of tax | 2 | — | 7 | 73 | Discontinued operations, net of tax | 0 | 8 | 0 | 11 | |||||||||||||||||||||||||||||

| Net earnings | $ | 480 | $ | 608 | $ | 1,833 | $ | 1,920 | Net earnings | $ | 1,014 | $ | 714 | $ | 2,988 | $ | 2,447 | |||||||||||||||||||||

| Basic earnings per share | Basic earnings per share | |||||||||||||||||||||||||||||||||||||

| Continuing operations | $ | 0.88 | $ | 1.07 | $ | 3.33 | $ | 3.16 | Continuing operations | $ | 2.02 | $ | 1.38 | $ | 5.97 | $ | 4.75 | |||||||||||||||||||||

| Discontinued operations | — | — | 0.01 | 0.12 | Discontinued operations | 0 | 0.02 | 0 | 0.02 | |||||||||||||||||||||||||||||

| Net earnings per share | $ | 0.88 | $ | 1.07 | $ | 3.34 | $ | 3.29 | Net earnings per share | $ | 2.02 | $ | 1.40 | $ | 5.97 | $ | 4.77 | |||||||||||||||||||||

| Diluted earnings per share | Diluted earnings per share | |||||||||||||||||||||||||||||||||||||

| Continuing operations | $ | 0.87 | $ | 1.06 | $ | 3.31 | $ | 3.14 | Continuing operations | $ | 2.01 | $ | 1.37 | $ | 5.91 | $ | 4.71 | |||||||||||||||||||||

| Discontinued operations | — | — | 0.01 | 0.12 | Discontinued operations | 0 | 0.02 | 0 | 0.02 | |||||||||||||||||||||||||||||

| Net earnings per share | $ | 0.88 | $ | 1.06 | $ | 3.32 | $ | 3.26 | Net earnings per share | $ | 2.01 | $ | 1.39 | $ | 5.91 | $ | 4.74 | |||||||||||||||||||||

| Weighted average common shares outstanding | Weighted average common shares outstanding | |||||||||||||||||||||||||||||||||||||

| Basic | 544.5 | 570.1 | 548.7 | 583.5 | Basic | 500.6 | 509.7 | 500.6 | 512.5 | |||||||||||||||||||||||||||||

| Dilutive impact of share-based awards | 3.4 | 4.7 | 3.1 | 5.0 | ||||||||||||||||||||||||||||||||||

| Diluted | 547.9 | 574.8 | 551.8 | 588.5 | Diluted | 505.4 | 514.8 | 505.2 | 516.8 | |||||||||||||||||||||||||||||

| Antidilutive shares | 4.5 | 0.2 | 4.1 | 0.1 | Antidilutive shares | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||||||

| Dividends declared per share | $ | 0.62 | $ | 0.60 | $ | 1.84 | $ | 1.76 | ||||||||||||||||||||||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 1 | ||||||||

| Consolidated Statements of Comprehensive Income | ||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||

| (millions) (unaudited) | October 28, 2017 | October 29, 2016 | October 28, 2017 | October 29, 2016 | ||||||||||

| Net earnings | $ | 480 | $ | 608 | $ | 1,833 | $ | 1,920 | ||||||

| Other comprehensive income | ||||||||||||||

| Pension and other benefit liabilities, net of taxes of $5, $3, $15 and $11 | 8 | 6 | 22 | 17 | ||||||||||

| Currency translation adjustment and cash flow hedges, net of taxes of $1, $1, $2, and $2 | (2 | ) | — | 6 | 5 | |||||||||

| Other comprehensive income | 6 | 6 | 28 | 22 | ||||||||||

| Comprehensive income | $ | 486 | $ | 614 | $ | 1,861 | $ | 1,942 | ||||||

| FINANCIAL STATEMENTS | ||||||||

| Consolidated Statements of Comprehensive Income | |||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| (millions) (unaudited) | October 31, 2020 | November 2, 2019 | October 31, 2020 | November 2, 2019 | |||||||||||||||||||

| Net earnings | $ | 1,014 | $ | 714 | $ | 2,988 | $ | 2,447 | |||||||||||||||

| Other comprehensive income | |||||||||||||||||||||||

| Pension, net of tax | 22 | 10 | 66 | 30 | |||||||||||||||||||

| Currency translation adjustment and cash flow hedges, net of tax | 14 | (1) | 5 | 2 | |||||||||||||||||||

| Other comprehensive income | 36 | 9 | 71 | 32 | |||||||||||||||||||

| Comprehensive income | $ | 1,050 | $ | 723 | $ | 3,059 | $ | 2,479 | |||||||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 2 | ||||||||

| Consolidated Statements of Financial Position | |||||||||||

| (millions) (unaudited) | October 28, 2017 | January 28, 2017 | October 29, 2016 | ||||||||

| Assets | |||||||||||

| Cash and cash equivalents | $ | 2,725 | $ | 2,512 | $ | 1,231 | |||||

| Inventory | 10,586 | 8,309 | 10,057 | ||||||||

| Assets of discontinued operations | 6 | 69 | 62 | ||||||||

| Other current assets | 1,392 | 1,100 | 1,492 | ||||||||

| Total current assets | 14,709 | 11,990 | 12,842 | ||||||||

| Property and equipment | |||||||||||

| Land | 6,087 | 6,106 | 6,106 | ||||||||

| Buildings and improvements | 28,310 | 27,611 | 27,518 | ||||||||

| Fixtures and equipment | 5,548 | 5,503 | 5,467 | ||||||||

| Computer hardware and software | 2,658 | 2,651 | 2,538 | ||||||||

| Construction-in-progress | 389 | 200 | 219 | ||||||||

| Accumulated depreciation | (17,880 | ) | (17,413 | ) | (16,946 | ) | |||||

| Property and equipment, net | 25,112 | 24,658 | 24,902 | ||||||||

| Noncurrent assets of discontinued operations | 9 | 12 | 17 | ||||||||

| Other noncurrent assets | 878 | 771 | 842 | ||||||||

| Total assets | $ | 40,708 | $ | 37,431 | $ | 38,603 | |||||

| Liabilities and shareholders’ investment | |||||||||||

| Accounts payable | $ | 9,986 | $ | 7,252 | $ | 8,250 | |||||

| Accrued and other current liabilities | 4,036 | 3,737 | 3,662 | ||||||||

| Current portion of long-term debt and other borrowings | 1,354 | 1,718 | 729 | ||||||||

| Total current liabilities | 15,376 | 12,707 | 12,641 | ||||||||

| Long-term debt and other borrowings | 11,277 | 11,031 | 12,097 | ||||||||

| Deferred income taxes | 944 | 861 | 920 | ||||||||

| Liabilities of discontinued operations | 11 | 19 | 19 | ||||||||

| Other noncurrent liabilities | 1,963 | 1,860 | 1,857 | ||||||||

| Total noncurrent liabilities | 14,195 | 13,771 | 14,893 | ||||||||

| Shareholders’ investment | |||||||||||

| Common stock | 45 | 46 | 47 | ||||||||

| Additional paid-in capital | 5,762 | 5,661 | 5,598 | ||||||||

| Retained earnings | 5,940 | 5,884 | 6,031 | ||||||||

| Accumulated other comprehensive loss | (610 | ) | (638 | ) | (607 | ) | |||||

| Total shareholders’ investment | 11,137 | 10,953 | 11,069 | ||||||||

| Total liabilities and shareholders’ investment | $ | 40,708 | $ | 37,431 | $ | 38,603 | |||||

| FINANCIAL STATEMENTS | ||||||||

| Consolidated Statements of Financial Position | |||||||||||||||||

| (millions, except footnotes) (unaudited) | October 31, 2020 | February 1, 2020 | November 2, 2019 | ||||||||||||||

| Assets | |||||||||||||||||

| Cash and cash equivalents | $ | 5,996 | $ | 2,577 | $ | 969 | |||||||||||

| Inventory | 12,712 | 8,992 | 11,396 | ||||||||||||||

| Other current assets | 1,601 | 1,333 | 1,440 | ||||||||||||||

| Total current assets | 20,309 | 12,902 | 13,805 | ||||||||||||||

| Property and equipment | |||||||||||||||||

| Land | 6,063 | 6,036 | 6,040 | ||||||||||||||

| Buildings and improvements | 31,398 | 30,603 | 30,467 | ||||||||||||||

| Fixtures and equipment | 5,843 | 6,083 | 6,032 | ||||||||||||||

| Computer hardware and software | 2,706 | 2,692 | 2,636 | ||||||||||||||

| Construction-in-progress | 518 | 533 | 298 | ||||||||||||||

| Accumulated depreciation | (19,755) | (19,664) | (19,089) | ||||||||||||||

| Property and equipment, net | 26,773 | 26,283 | 26,384 | ||||||||||||||

| Operating lease assets | 2,208 | 2,236 | 2,151 | ||||||||||||||

| Other noncurrent assets | 1,371 | 1,358 | 1,401 | ||||||||||||||

| Total assets | $ | 50,661 | $ | 42,779 | $ | 43,741 | |||||||||||

| Liabilities and shareholders’ investment | |||||||||||||||||

| Accounts payable | $ | 14,203 | $ | 9,920 | $ | 11,258 | |||||||||||

| Accrued and other current liabilities | 5,023 | 4,406 | 4,191 | ||||||||||||||

| Current portion of long-term debt and other borrowings | 131 | 161 | 1,159 | ||||||||||||||

| Total current liabilities | 19,357 | 14,487 | 16,608 | ||||||||||||||

| Long-term debt and other borrowings | 12,490 | 11,338 | 10,513 | ||||||||||||||

| Noncurrent operating lease liabilities | 2,196 | 2,275 | 2,208 | ||||||||||||||

| Deferred income taxes | 1,171 | 1,122 | 1,215 | ||||||||||||||

| Other noncurrent liabilities | 2,128 | 1,724 | 1,652 | ||||||||||||||

| Total noncurrent liabilities | 17,985 | 16,459 | 15,588 | ||||||||||||||

| Shareholders’ investment | |||||||||||||||||

| Common stock | 42 | 42 | 42 | ||||||||||||||

| Additional paid-in capital | 6,285 | 6,226 | 6,006 | ||||||||||||||

| Retained earnings | 7,789 | 6,433 | 6,270 | ||||||||||||||

| Accumulated other comprehensive loss | (797) | (868) | (773) | ||||||||||||||

| Total shareholders’ investment | 13,319 | 11,833 | 11,545 | ||||||||||||||

| Total liabilities and shareholders’ investment | $ | 50,661 | $ | 42,779 | $ | 43,741 | |||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 3 | ||||||||

| Consolidated Statements of Cash Flows | |||||||

| Nine Months Ended | |||||||

| (millions) (unaudited) | October 28, 2017 | October 29, 2016 | |||||

| Operating activities | |||||||

| Net earnings | $ | 1,833 | $ | 1,920 | |||

| Earnings from discontinued operations, net of tax | 7 | 73 | |||||

| Net earnings from continuing operations | 1,826 | 1,847 | |||||

| Adjustments to reconcile net earnings to cash provided by operations | |||||||

| Depreciation and amortization | 1,784 | 1,686 | |||||

| Share-based compensation expense | 81 | 85 | |||||

| Deferred income taxes | 37 | 83 | |||||

| Loss on debt extinguishment | 123 | 422 | |||||

Noncash losses / (gains) and other, net | 189 | (5 | ) | ||||

| Changes in operating accounts | |||||||

| Inventory | (2,277 | ) | (1,455 | ) | |||

| Other assets | (89 | ) | (14 | ) | |||

| Accounts payable | 2,738 | 832 | |||||

| Accrued and other liabilities | 2 | (711 | ) | ||||

| Cash provided by operating activities—continuing operations | 4,414 | 2,770 | |||||

Cash provided by operating activities—discontinued operations | 75 | 111 | |||||

| Cash provided by operations | 4,489 | 2,881 | |||||

| Investing activities | |||||||

| Expenditures for property and equipment | (2,049 | ) | (1,184 | ) | |||

| Proceeds from disposal of property and equipment | 27 | 23 | |||||

| Other investments | (62 | ) | 23 | ||||

| Cash required for investing activities | (2,084 | ) | (1,138 | ) | |||

| Financing activities | |||||||

| Change in commercial paper, net | — | 89 | |||||

| Additions to long-term debt | 739 | 1,977 | |||||

| Reductions of long-term debt | (1,087 | ) | (2,625 | ) | |||

| Dividends paid | (1,001 | ) | (1,011 | ) | |||

| Repurchase of stock | (757 | ) | (3,034 | ) | |||

| Prepayment of accelerated share repurchase | (111 | ) | (120 | ) | |||

| Stock option exercises | 25 | 166 | |||||

| Cash required for financing activities | (2,192 | ) | (4,558 | ) | |||

Net increase / (decrease) in cash and cash equivalents | 213 | (2,815 | ) | ||||

| Cash and cash equivalents at beginning of period | 2,512 | 4,046 | |||||

| Cash and cash equivalents at end of period | $ | 2,725 | $ | 1,231 | |||

| FINANCIAL STATEMENTS | ||||||||

| Consolidated Statements of Cash Flows | ||||||||||||||

| Nine Months Ended | ||||||||||||||

| (millions) (unaudited) | October 31, 2020 | November 2, 2019 | ||||||||||||

| Operating activities | ||||||||||||||

| Net earnings | $ | 2,988 | $ | 2,447 | ||||||||||

| Earnings from discontinued operations, net of tax | 0 | 11 | ||||||||||||

| Net earnings from continuing operations | 2,988 | 2,436 | ||||||||||||

| Adjustments to reconcile net earnings to cash provided by operations | ||||||||||||||

| Depreciation and amortization | 1,848 | 1,905 | ||||||||||||

| Share-based compensation expense | 161 | 116 | ||||||||||||

| Deferred income taxes | 26 | 235 | ||||||||||||

| Loss on debt extinguishment | 512 | 0 | ||||||||||||

Noncash losses / (gains) and other, net | 124 | 6 | ||||||||||||

| Changes in operating accounts | ||||||||||||||

| Inventory | (3,720) | (1,899) | ||||||||||||

| Other assets | (174) | (10) | ||||||||||||

| Accounts payable | 4,287 | 1,473 | ||||||||||||

| Accrued and other liabilities | 992 | (121) | ||||||||||||

| Cash provided by operating activities—continuing operations | 7,044 | 4,141 | ||||||||||||

Cash provided by operating activities—discontinued operations | 0 | 18 | ||||||||||||

| Cash provided by operations | 7,044 | 4,159 | ||||||||||||

| Investing activities | ||||||||||||||

| Expenditures for property and equipment | (2,009) | (2,403) | ||||||||||||

| Proceeds from disposal of property and equipment | 27 | 29 | ||||||||||||

| Other investments | (3) | 14 | ||||||||||||

| Cash required for investing activities | (1,985) | (2,360) | ||||||||||||

| Financing activities | ||||||||||||||

| Additions to long-term debt | 2,480 | 994 | ||||||||||||

| Reductions of long-term debt | (2,395) | (1,041) | ||||||||||||

| Dividends paid | (1,002) | (995) | ||||||||||||

| Repurchase of stock | (741) | (959) | ||||||||||||

| Accelerated share repurchase pending final settlement | 0 | (450) | ||||||||||||

| Stock option exercises | 18 | 65 | ||||||||||||

| Cash required for financing activities | (1,640) | (2,386) | ||||||||||||

| Net increase in cash and cash equivalents | 3,419 | (587) | ||||||||||||

| Cash and cash equivalents at beginning of period | 2,577 | 1,556 | ||||||||||||

| Cash and cash equivalents at end of period | $ | 5,996 | $ | 969 | ||||||||||

| Supplemental information | ||||||||||||||

| Leased assets obtained in exchange for new finance lease liabilities | $ | 344 | $ | 301 | ||||||||||

| Leased assets obtained in exchange for new operating lease liabilities | 186 | 334 | ||||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 4 | ||||||||

| Consolidated Statements of Shareholders’ Investment | ||||||||||||||||||||||

| Common | Stock | Additional | Accumulated Other | |||||||||||||||||||

| Stock | Par | Paid-in | Retained | Comprehensive | ||||||||||||||||||

| (millions) (unaudited) | Shares | Value | Capital | Earnings | (Loss) / Income | Total | ||||||||||||||||

| January 30, 2016 | 602.2 | $ | 50 | $ | 5,348 | $ | 8,188 | $ | (629 | ) | $ | 12,957 | ||||||||||

| Net earnings | — | — | — | 2,737 | — | 2,737 | ||||||||||||||||

| Other comprehensive loss | — | — | — | — | (9 | ) | (9 | ) | ||||||||||||||

| Dividends declared | — | — | — | (1,359 | ) | — | (1,359 | ) | ||||||||||||||

| Repurchase of stock | (50.9 | ) | (4 | ) | — | (3,682 | ) | — | (3,686 | ) | ||||||||||||

| Stock options and awards | 4.9 | — | 313 | — | — | 313 | ||||||||||||||||

| January 28, 2017 | 556.2 | $ | 46 | $ | 5,661 | $ | 5,884 | $ | (638 | ) | $ | 10,953 | ||||||||||

| Net earnings | — | — | — | 1,833 | — | 1,833 | ||||||||||||||||

| Other comprehensive income | — | — | — | — | 28 | 28 | ||||||||||||||||

| Dividends declared | — | — | — | (1,016 | ) | — | (1,016 | ) | ||||||||||||||

| Repurchase of stock | (13.3 | ) | (1 | ) | — | (750 | ) | — | (751 | ) | ||||||||||||

| Stock to be received upon settlement of ASR | — | — | — | (11 | ) | — | (11 | ) | ||||||||||||||

| Stock options and awards | 1.0 | — | 101 | — | — | 101 | ||||||||||||||||

| October 28, 2017 | 543.9 | $ | 45 | $ | 5,762 | $ | 5,940 | $ | (610 | ) | $ | 11,137 | ||||||||||

| FINANCIAL STATEMENTS | ||||||||

| Consolidated Statements of Shareholders’ Investment | |||||||||||||||||||||||||||||||||||

| Common | Stock | Additional | Accumulated Other | ||||||||||||||||||||||||||||||||

| Stock | Par | Paid-in | Retained | Comprehensive | |||||||||||||||||||||||||||||||

| (millions) (unaudited) | Shares | Value | Capital | Earnings | (Loss) / Income | Total | |||||||||||||||||||||||||||||

| February 2, 2019 | 517.8 | $ | 43 | $ | 6,042 | $ | 6,017 | $ | (805) | $ | 11,297 | ||||||||||||||||||||||||

| Net earnings | — | — | — | 795 | — | 795 | |||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | 13 | 13 | |||||||||||||||||||||||||||||

| Dividends declared | — | — | — | (330) | — | (330) | |||||||||||||||||||||||||||||

| Repurchase of stock | (3.6) | — | — | (277) | — | (277) | |||||||||||||||||||||||||||||

| Accelerated share repurchase pending final settlement | (3.0) | — | (153) | (247) | — | (400) | |||||||||||||||||||||||||||||

| Stock options and awards | 1.1 | — | 19 | — | — | 19 | |||||||||||||||||||||||||||||

| May 4, 2019 | 512.3 | $ | 43 | $ | 5,908 | $ | 5,958 | $ | (792) | $ | 11,117 | ||||||||||||||||||||||||

| Net earnings | — | — | — | 938 | — | 938 | |||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | 10 | 10 | |||||||||||||||||||||||||||||

| Dividends declared | — | — | — | (341) | — | (341) | |||||||||||||||||||||||||||||

| Repurchase of stock | (1.3) | — | 153 | (94) | — | 59 | |||||||||||||||||||||||||||||

| Stock options and awards | 0.3 | — | 53 | — | — | 53 | |||||||||||||||||||||||||||||

| August 3, 2019 | 511.3 | $ | 43 | $ | 6,114 | $ | 6,461 | $ | (782) | $ | 11,836 | ||||||||||||||||||||||||

| Net earnings | — | — | — | 714 | — | 714 | |||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | 9 | 9 | |||||||||||||||||||||||||||||

| Dividends declared | — | — | — | (338) | — | (338) | |||||||||||||||||||||||||||||

| Repurchase of stock | (3.0) | (1) | — | (295) | — | (296) | |||||||||||||||||||||||||||||

| Accelerated share repurchase pending final settlement | (2.5) | — | (178) | (272) | — | (450) | |||||||||||||||||||||||||||||

| Stock options and awards | 0.9 | — | 70 | — | — | 70 | |||||||||||||||||||||||||||||

| November 2, 2019 | 506.7 | $ | 42 | $ | 6,006 | $ | 6,270 | $ | (773) | $ | 11,545 | ||||||||||||||||||||||||

| Net earnings | — | — | — | 834 | — | 834 | |||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | (95) | (95) | |||||||||||||||||||||||||||||

| Dividends declared | — | — | — | (336) | — | (336) | |||||||||||||||||||||||||||||

| Repurchase of stock | (2.6) | — | 178 | (335) | — | (157) | |||||||||||||||||||||||||||||

| Stock options and awards | 0.1 | — | 42 | — | — | 42 | |||||||||||||||||||||||||||||

| February 1, 2020 | 504.2 | $ | 42 | $ | 6,226 | $ | 6,433 | $ | (868) | $ | 11,833 | ||||||||||||||||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 5 | ||||||||

| FINANCIAL STATEMENTS | ||||||||

| Consolidated Statements of Shareholders’ Investment | |||||||||||||||||||||||||||||||||||

| Common | Stock | Additional | Accumulated Other | ||||||||||||||||||||||||||||||||

| Stock | Par | Paid-in | Retained | Comprehensive | |||||||||||||||||||||||||||||||

| (millions) (unaudited) | Shares | Value | Capital | Earnings | (Loss) / Income | Total | |||||||||||||||||||||||||||||

| February 1, 2020 | 504.2 | $ | 42 | $ | 6,226 | $ | 6,433 | $ | (868) | $ | 11,833 | ||||||||||||||||||||||||

| Net earnings | — | — | — | 284 | — | 284 | |||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | 14 | 14 | |||||||||||||||||||||||||||||

| Dividends declared | — | — | — | (333) | — | (333) | |||||||||||||||||||||||||||||

| Repurchase of stock | (5.7) | — | — | (609) | — | (609) | |||||||||||||||||||||||||||||

| Stock options and awards | 1.4 | — | (20) | — | — | (20) | |||||||||||||||||||||||||||||

| May 2, 2020 | 499.9 | $ | 42 | $ | 6,206 | $ | 5,775 | $ | (854) | $ | 11,169 | ||||||||||||||||||||||||

| Net earnings | — | — | — | 1,690 | — | 1,690 | |||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | 21 | 21 | |||||||||||||||||||||||||||||

| Dividends declared | — | — | — | (344) | — | (344) | |||||||||||||||||||||||||||||

| Stock options and awards | 0.4 | — | 42 | — | — | 42 | |||||||||||||||||||||||||||||

| August 1, 2020 | 500.3 | $ | 42 | $ | 6,248 | $ | 7,121 | $ | (833) | $ | 12,578 | ||||||||||||||||||||||||

| Net earnings | — | — | — | 1,014 | — | 1,014 | |||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | 36 | 36 | |||||||||||||||||||||||||||||

| Dividends declared | — | — | — | (346) | — | (346) | |||||||||||||||||||||||||||||

| Stock options and awards | 0.5 | — | 37 | — | — | 37 | |||||||||||||||||||||||||||||

| October 31, 2020 | 500.8 | $ | 42 | $ | 6,285 | $ | 7,789 | $ | (797) | $ | 13,319 | ||||||||||||||||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 6 | ||||||||

| FINANCIAL STATEMENTS | ||||||||

| INDEX | ||||||||

| INDEX TO NOTES | |||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 7 | ||||||||

| FINANCIAL STATEMENTS | ||||||||

| NOTES | ||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 8 | ||||||||

| FINANCIAL STATEMENTS | ||||||||

| NOTES | ||||||||

| Revenues | Three Months Ended | Nine Months Ended | |||||||||||||||||||||

| (millions) | October 31, 2020 | November 2, 2019 | October 31, 2020 | November 2, 2019 | |||||||||||||||||||

Apparel and accessories (a) | $ | 3,927 | $ | 3,564 | $ | 10,630 | $ | 10,510 | |||||||||||||||

Beauty and household essentials (b) | 6,103 | 5,125 | 18,172 | 15,172 | |||||||||||||||||||

Food and beverage (c) | 4,397 | 3,717 | 13,158 | 10,899 | |||||||||||||||||||

Hardlines (d) | 3,377 | 2,460 | 9,959 | 7,348 | |||||||||||||||||||

Home furnishings and décor (e) | 4,506 | 3,527 | 12,395 | 9,985 | |||||||||||||||||||

| Other | 26 | 21 | 89 | 83 | |||||||||||||||||||

| Sales | 22,336 | 18,414 | 64,403 | 53,997 | |||||||||||||||||||

| Credit card profit sharing | 164 | 177 | 488 | 505 | |||||||||||||||||||

| Other | 132 | 74 | 331 | 211 | |||||||||||||||||||

| Other revenue | 296 | 251 | 819 | 716 | |||||||||||||||||||

| Total revenue | $ | 22,632 | $ | 18,665 | $ | 65,222 | $ | 54,713 | |||||||||||||||

| Gift Card Liability Activity | February 1, 2020 | Gift Cards Issued During Current Period But Not Redeemed (b) | Revenue Recognized From Beginning Liability | October 31, 2020 | |||||||||||||||||||

| (millions) | |||||||||||||||||||||||

Gift card liability (a) | $ | 935 | $ | 372 | $ | (549) | $ | 758 | |||||||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 9 | ||||||||

| FINANCIAL STATEMENTS | ||||||||

| Fair Value Measurements - Recurring Basis | Fair Value at | ||||||||||||||||||||||

| (millions) | Classification | Pricing Category | October 31, 2020 | February 1, 2020 | November 2, 2019 | ||||||||||||||||||

| Assets | |||||||||||||||||||||||

| Short-term investments | Cash and Cash Equivalents | Level 1 | $ | 5,089 | $ | 1,810 | $ | 163 | |||||||||||||||

| Prepaid forward contracts | Other Current Assets | Level 1 | 32 | 23 | 24 | ||||||||||||||||||

Equity securities (a) | Other Current Assets | Level 1 | 19 | 39 | 80 | ||||||||||||||||||

| Interest rate swaps | Other Noncurrent Assets | Level 2 | 205 | 137 | 122 | ||||||||||||||||||

| Liabilities | |||||||||||||||||||||||

| Interest rate swaps | Other Noncurrent Liabilities | Level 2 | 3 | 0 | 0 | ||||||||||||||||||

| Fair Value Measurements - Recurring Basis | Fair Value at | |||||||||||

| (millions) | Pricing Category | October 28, 2017 | January 28, 2017 | October 29, 2016 | ||||||||

| Assets | ||||||||||||

| Cash and cash equivalents | ||||||||||||

| Short-term investments held by U.S. entities | Level 1 | $ | 953 | $ | 1,110 | $ | — | |||||

Short-term investments held by entities located outside the U.S. (a) | Level 1 | 1,050 | 762 | 514 | ||||||||

| Other current assets | ||||||||||||

| Prepaid forward contracts | Level 1 | 30 | 26 | 28 | ||||||||

| Beneficial interest asset | Level 3 | 3 | 12 | 10 | ||||||||

Interest rate swaps (b) | Level 2 | — | 1 | — | ||||||||

| Other noncurrent assets | ||||||||||||

Interest rate swaps (b) | Level 2 | 1 | 4 | 19 | ||||||||

| Beneficial interest asset | Level 3 | — | — | 5 | ||||||||

Significant Financial Instruments Not Measured at Fair Value (a) (millions) | October 31, 2020 | February 1, 2020 | November 2, 2019 | |||||||||||||||||||||||

| Carrying Amount | Fair Value | Carrying Amount | Fair Value | Carrying Amount | Fair Value | |||||||||||||||||||||

Long-term debt, including current portion (b) | $ | 10,641 | $ | 12,787 | $ | 9,992 | $ | 11,864 | $ | 10,246 | $ | 11,870 | ||||||||||||||

Significant Financial Instruments not Measured at Fair Value (a) (millions) | October 28, 2017 | January 28, 2017 | October 29, 2016 | |||||||||||||||||

Carrying Amount | Fair Value | Carrying Amount | Fair Value | Carrying Amount | Fair Value | |||||||||||||||

Debt (b) | $ | 11,522 | $ | 12,403 | $ | 11,715 | $ | 12,545 | $ | 11,802 | $ | 13,171 | ||||||||

| (millions) | October 28, 2017 | January 28, 2017 | October 29, 2016 | ||||||

| Cash held by U.S. entities | $ | 242 | $ | 257 | $ | 247 | |||

Cash held by entities located outside the U.S. (a) | 34 | 17 | 35 | ||||||

| Short-term investments held by U.S. entities | 953 | 1,110 | — | ||||||

Short-term investments held by entities located outside the U.S. (a) | 1,050 | 762 | 514 | ||||||

| Receivables from third-party financial institutions for credit and debit card transactions | 446 | 366 | 435 | ||||||

| Cash and cash equivalents | $ | 2,725 | $ | 2,512 | $ | 1,231 | |||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 10 | ||||||||

| FINANCIAL STATEMENTS | ||||||||

| NOTES | ||||||||

Effect of Hedges on Debt (millions) | October 31, 2020 | February 1, 2020 | November 2, 2019 | |||||||||||||||||

| Long-term debt and other borrowings | ||||||||||||||||||||

| Carrying amount of hedged debt | $ | 1,696 | $ | 1,630 | $ | 1,614 | ||||||||||||||

| Cumulative hedging adjustments, included in carrying amount | 203 | 137 | 122 | |||||||||||||||||

| Effect of Hedges on Net Interest Expense | Three Months Ended | Nine Months Ended | |||||||||||||||||||||

| (millions) | October 31, 2020 | November 2, 2019 | October 31, 2020 | November 2, 2019 | |||||||||||||||||||

| Gain (loss) on fair value hedges recognized in Net Interest Expense | |||||||||||||||||||||||

| Interest rate swap designated as fair value hedges | $ | (36) | $ | 14 | $ | 66 | $ | 115 | |||||||||||||||

| Hedged debt | 36 | (14) | (66) | (115) | |||||||||||||||||||

| Total | $ | 0 | $ | 0 | $ | 0 | $ | 0 | |||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| (dollars in millions) | October 28, 2017 | October 29, 2016 | October 28, 2017 | October 29, 2016 | |||||||||||

| Income tax expense | $ | 137 | $ | 311 | $ | 802 | $ | 910 | |||||||

Effective tax rate (a) | 22.3 | % | 33.8 | % | 30.5 | % | 33.0 | % | |||||||

| Nine Months Ended | |||||||

| (millions, except per share data) | October 28, 2017 | October 29, 2016 | |||||

| Total number of shares purchased | 10.8 | 38.5 | |||||

| Average price paid per share | $ | 56.80 | $ | 72.87 | |||

| Total investment | $ | 611 | $ | 2,807 | |||

| Share Repurchase Activity | Three Months Ended | Nine Months Ended | |||||||||||||||||||||

| (millions, except per share data) | October 31, 2020 | November 2, 2019 (a) | October 31, 2020 | November 2, 2019 (a) | |||||||||||||||||||

| Number of shares purchased | 0 | 3.0 | 5.7 | 10.8 | |||||||||||||||||||

| Average price paid per share | $ | 0 | $ | 99.25 | $ | 107.58 | $ | 84.28 | |||||||||||||||

| Total investment | $ | 0 | $ | 294 | $ | 609 | $ | 912 | |||||||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 11 | ||||||||

| FINANCIAL STATEMENTS | ||||||||

| NOTES | ||||||||

| Net Pension Benefits Expense | Three Months Ended | Nine Months Ended | |||||||||||||

| (millions) | October 28, 2017 | October 29, 2016 | October 28, 2017 | October 29, 2016 | |||||||||||

| Service cost | $ | 21 | $ | 20 | $ | 63 | $ | 61 | |||||||

| Interest cost | 34 | 34 | 103 | 103 | |||||||||||

| Expected return on assets | (61 | ) | (64 | ) | (184 | ) | (193 | ) | |||||||

| Amortization of losses | 15 | 12 | 45 | 37 | |||||||||||

| Amortization of prior service cost | (3 | ) | (2 | ) | (8 | ) | (8 | ) | |||||||

| Total | $ | 6 | $ | — | $ | 19 | $ | — | |||||||

| Net Pension Benefits Expense | Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||

| (millions) | Classification | October 31, 2020 | November 2, 2019 | October 31, 2020 | November 2, 2019 | |||||||||||||||||||||

| Service cost benefits earned | SG&A Expenses | $ | 25 | $ | 23 | $ | 76 | $ | 69 | |||||||||||||||||

| Interest cost on projected benefit obligation | Net Other (Income) / Expense | 30 | 37 | 89 | 111 | |||||||||||||||||||||

| Expected return on assets | Net Other (Income) / Expense | (61) | (62) | (182) | (186) | |||||||||||||||||||||

| Amortization of losses | Net Other (Income) / Expense | 32 | 16 | 96 | 47 | |||||||||||||||||||||

| Amortization of prior service cost | Net Other (Income) / Expense | (3) | (3) | (9) | (8) | |||||||||||||||||||||

| Settlement charges | Net Other (Income) / Expense | 1 | 0 | 1 | 0 | |||||||||||||||||||||

| Total | $ | 24 | $ | 11 | $ | 71 | $ | 33 | ||||||||||||||||||

| Change in Accumulated Other Comprehensive Loss | Cash Flow Hedges | Currency Translation Adjustment | Pension | Total | |||||||||||||||||||

| (millions) | |||||||||||||||||||||||

| February 1, 2020 | $ | (12) | $ | (19) | $ | (837) | $ | (868) | |||||||||||||||

| Other comprehensive loss before reclassifications, net of tax | (1) | 0 | 0 | (1) | |||||||||||||||||||

| Amounts reclassified from AOCI, net of tax | 6 | 0 | 66 | 72 | |||||||||||||||||||

| October 31, 2020 | $ | (7) | $ | (19) | $ | (771) | $ | (797) | |||||||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 12 | ||||||||

| (millions) | Cash Flow Hedges | Currency Translation Adjustment | Pension and Other Benefits | Total | |||||||||||

| January 28, 2017 | $ | (16 | ) | $ | (21 | ) | $ | (601 | ) | $ | (638 | ) | |||

| Other comprehensive income before reclassifications | — | 3 | 1 | 4 | |||||||||||

| Amounts reclassified from AOCI | 3 | (a) | — | 21 | (b) | 24 | |||||||||

| October 28, 2017 | $ | (13 | ) | $ | (18 | ) | $ | (579 | ) | $ | (610 | ) | |||

| MANAGEMENT'S DISCUSSION AND ANALYSIS | ||||||||

| FINANCIAL SUMMARY | ||||||||

| Business Segment Results | Three Months Ended | Nine Months Ended | |||||||||||||

| (millions) | October 28, 2017 | October 29, 2016 | October 28, 2017 | October 29, 2016 | |||||||||||

| Sales | $ | 16,667 | $ | 16,441 | $ | 49,113 | $ | 48,805 | |||||||

Cost of sales (a) | 11,712 | 11,536 | 34,330 | 33,957 | |||||||||||

| Gross margin | 4,955 | 4,905 | 14,783 | 14,848 | |||||||||||

Selling, general, and administrative expenses (c) | 3,512 | 3,343 | 10,027 | 9,741 | |||||||||||

Depreciation and amortization (exclusive of depreciation included in cost of sales) (a) | 574 | 505 | 1,596 | 1,486 | |||||||||||

| Segment earnings before interest expense and income taxes | 869 | 1,057 | 3,160 | 3,621 | |||||||||||

Pharmacy Transaction-related costs (b)(c) | — | 4 | — | — | |||||||||||

| Earnings from continuing operations before interest expense and income taxes | 869 | 1,061 | 3,160 | 3,621 | |||||||||||

| Net interest expense | 254 | 142 | 532 | 864 | |||||||||||

| Earnings from continuing operations before income taxes | $ | 615 | $ | 919 | $ | 2,628 | $ | 2,757 | |||||||

Reconciliation of Segment Assets to Total Assets (millions) | October 28, 2017 | January 28, 2017 | October 29, 2016 | ||||||||

| Segment assets | $ | 40,693 | $ | 37,350 | $ | 38,524 | |||||

| Assets of discontinued operations | 15 | 81 | 79 | ||||||||

| Total assets | $ | 40,708 | $ | 37,431 | $ | 38,603 | |||||

| Earnings Per Share from Continuing Operations | Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||||||||

| October 31, 2020 | November 2, 2019 | Change | October 31, 2020 | November 2, 2019 | Change | ||||||||||||||||||||||||||||||

| GAAP diluted earnings per share | $ | 2.01 | $ | 1.37 | 46.3 | % | $ | 5.91 | $ | 4.71 | 25.5 | % | |||||||||||||||||||||||

| Adjustments | 0.78 | (0.01) | 0.83 | (0.01) | |||||||||||||||||||||||||||||||

| Adjusted diluted earnings per share | $ | 2.79 | $ | 1.36 | 105.1 | % | $ | 6.75 | $ | 4.70 | 43.5 | % | |||||||||||||||||||||||

| Earnings Per Share from Continuing Operations | Three Months Ended | Nine Months Ended | |||||||||||||||||||

| October 28, 2017 | October 29, 2016 | Change | October 28, 2017 | October 29, 2016 | Change | ||||||||||||||||

| GAAP diluted earnings per share | $ | 0.87 | $ | 1.06 | (17.7 | )% | $ | 3.31 | $ | 3.14 | 5.4 | % | |||||||||

| Adjustments | 0.04 | (0.01 | ) | 0.03 | 0.42 | ||||||||||||||||

| Adjusted diluted earnings per share | $ | 0.91 | $ | 1.04 | (13.1 | )% | $ | 3.34 | $ | 3.56 | (6.2 | )% | |||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 13 | ||||||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS | ||||||||

| FINANCIAL SUMMARY | ||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 14 | ||||||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS | ||||||||

| ANALYSIS OF OPERATIONS | ||||||||

| Summary of Operating Income | Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||||||||

| (dollars in millions) | October 31, 2020 | November 2, 2019 | Change | October 31, 2020 | November 2, 2019 | Change | |||||||||||||||||||||||||||||

| Sales | $ | 22,336 | $ | 18,414 | 21.3 | % | $ | 64,403 | $ | 53,997 | 19.3 | % | |||||||||||||||||||||||

| Other revenue | 296 | 251 | 18.1 | 819 | 716 | 14.3 | |||||||||||||||||||||||||||||

| Total revenue | 22,632 | 18,665 | 21.3 | 65,222 | 54,713 | 19.2 | |||||||||||||||||||||||||||||

| Cost of sales | 15,509 | 12,935 | 19.9 | 45,692 | 37,808 | 20.9 | |||||||||||||||||||||||||||||

| Selling, general and administrative expenses | 4,647 | 4,153 | 11.9 | 13,167 | 11,728 | 12.3 | |||||||||||||||||||||||||||||

| Depreciation and amortization (exclusive of depreciation included in cost of sales) | 541 | 575 | (5.8) | 1,660 | 1,717 | (3.3) | |||||||||||||||||||||||||||||

| Operating income | $ | 1,935 | $ | 1,002 | 93.1 | % | $ | 4,703 | $ | 3,460 | 35.9 | % | |||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||

| (dollars in millions) | October 28, 2017 | October 29, 2016 | Change | October 28, 2017 | October 29, 2016 | Change | |||||||||||||||

| Sales | $ | 16,667 | $ | 16,441 | 1.4 | % | $ | 49,113 | $ | 48,805 | 0.6 | % | |||||||||

Cost of sales (a) | 11,712 | 11,536 | 1.5 | 34,330 | 33,957 | 1.1 | |||||||||||||||

| Gross margin | 4,955 | 4,905 | 1.0 | 14,783 | 14,848 | (0.4 | ) | ||||||||||||||

SG&A expenses (b) | 3,512 | 3,343 | 5.1 | 10,027 | 9,741 | 2.9 | |||||||||||||||

Depreciation and amortization (exclusive of depreciation included in cost of sales) (a) | 574 | 505 | 13.7 | 1,596 | 1,486 | 7.4 | |||||||||||||||

| EBIT | $ | 869 | $ | 1,057 | (17.8 | )% | $ | 3,160 | $ | 3,621 | (12.7 | )% | |||||||||

| Rate Analysis | Three Months Ended | Nine Months Ended | |||||||||||||||||||||

| October 31, 2020 | November 2, 2019 | October 31, 2020 | November 2, 2019 | ||||||||||||||||||||

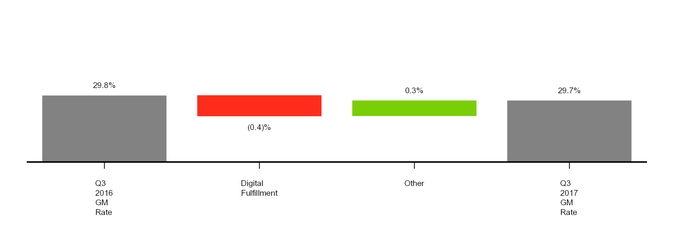

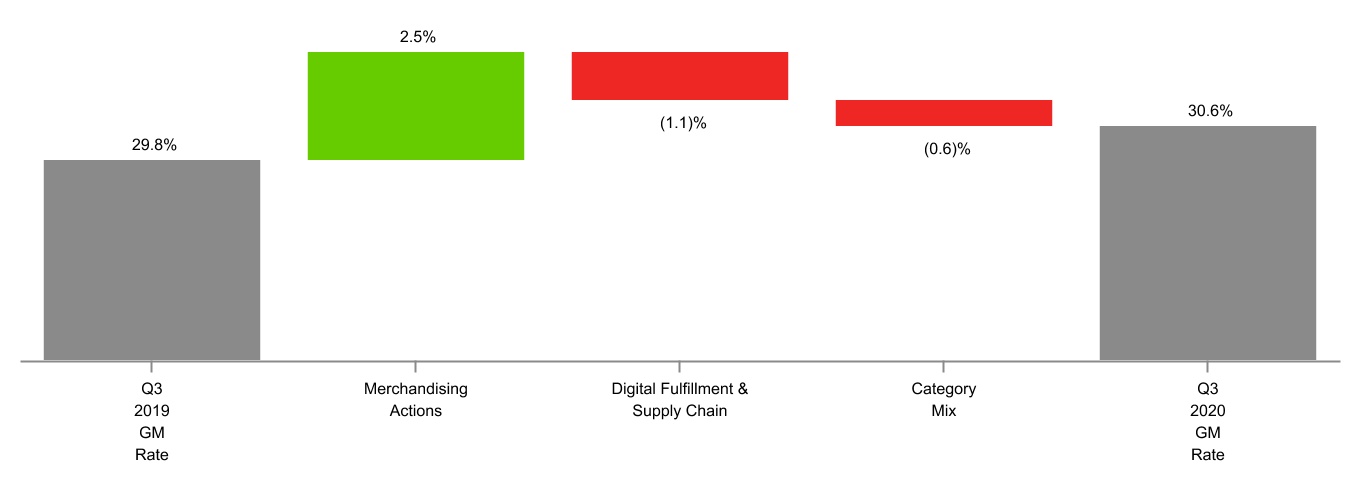

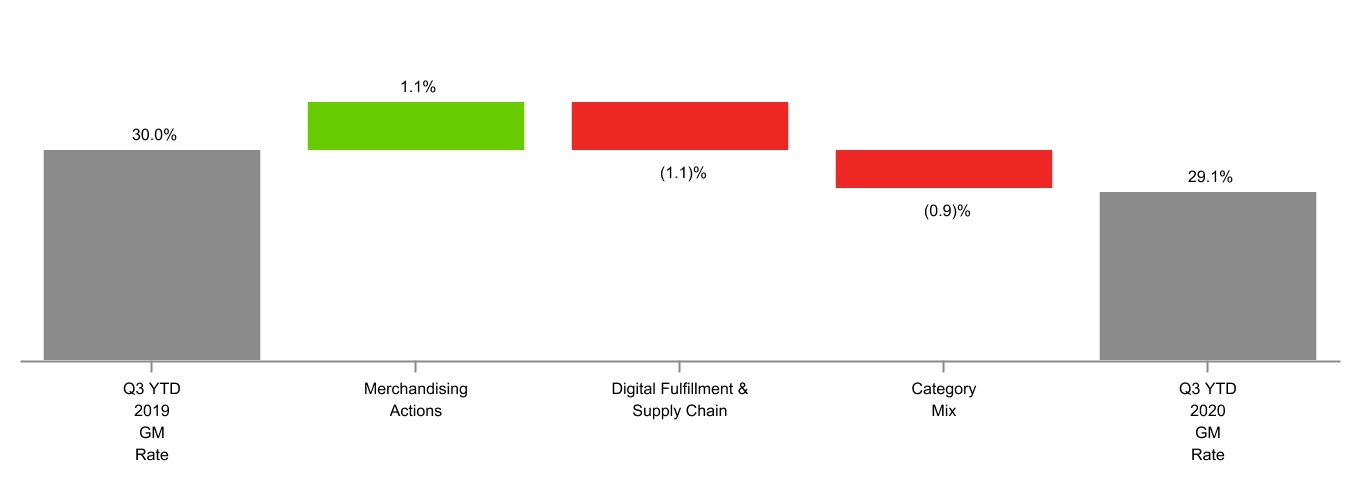

| Gross margin rate | 30.6 | % | 29.8 | % | 29.1 | % | 30.0 | % | |||||||||||||||

| SG&A expense rate | 20.5 | 22.3 | 20.2 | 21.4 | |||||||||||||||||||

| Depreciation and amortization (exclusive of depreciation included in cost of sales) expense rate | 2.4 | 3.1 | 2.5 | 3.1 | |||||||||||||||||||

| Operating income margin rate | 8.5 | 5.4 | 7.2 | 6.3 | |||||||||||||||||||

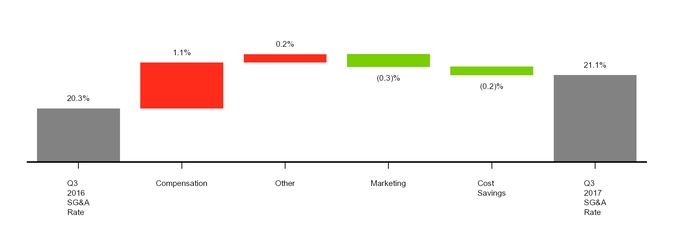

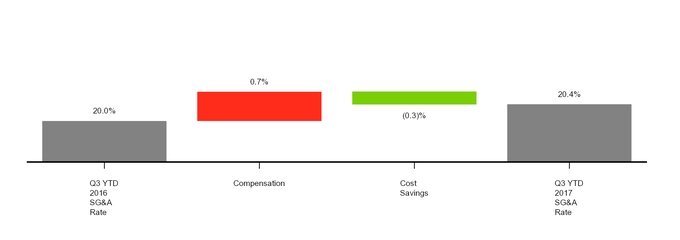

| Rate Analysis | Three Months Ended | Nine Months Ended | ||||||||

| October 28, 2017 | October 29, 2016 | October 28, 2017 | October 29, 2016 | |||||||

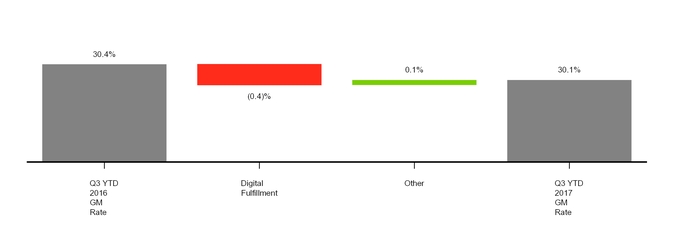

Gross margin rate (a) | 29.7 | % | 29.8 | % | 30.1 | % | 30.4 | % | ||

| SG&A expense rate | 21.1 | 20.3 | 20.4 | 20.0 | ||||||

Depreciation and amortization (exclusive of depreciation included in cost of sales) expense rate (a) | 3.4 | 3.1 | 3.2 | 3.0 | ||||||

| EBIT margin rate | 5.2 | 6.4 | 6.4 | 7.4 | ||||||

| Sales by Channel | Three Months Ended | Nine Months Ended | |||||||||

| October 28, 2017 | October 29, 2016 | October 28, 2017 | October 29, 2016 | ||||||||

| Stores | 95.7 | % | 96.5 | % | 95.7 | % | 96.5 | % | |||

| Digital | 4.3 | 3.5 | 4.3 | 3.5 | |||||||

| Total | 100 | % | 100 | % | 100 | % | 100 | % | |||

| Sales by Product Category | Three Months Ended | Nine Months Ended | |||||||||

| October 28, 2017 | October 29, 2016 | October 28, 2017 | October 29, 2016 | ||||||||

Household essentials (a) | 25 | % | 25 | % | 25 | % | 25 | % | |||

| Apparel and accessories | 21 | 21 | 21 | 21 | |||||||

Food and beverage (a) | 20 | 21 | 21 | 21 | |||||||

| Home furnishings and décor | 20 | 19 | 18 | 19 | |||||||

| Hardlines | 14 | 14 | 15 | 14 | |||||||

| Total | 100 | % | 100 | % | 100 | % | 100 | % | |||

| Comparable Sales | Three Months Ended | Nine Months Ended | |||||||||||||||||||||

| October 31, 2020 | November 2, 2019 | October 31, 2020 | November 2, 2019 | ||||||||||||||||||||

| Comparable sales change | 20.7 | % | 4.5 | % | 18.7 | % | 4.2 | % | |||||||||||||||

| Drivers of change in comparable sales | |||||||||||||||||||||||

| Number of transactions | 4.5 | 3.1 | 2.6 | 3.3 | |||||||||||||||||||

| Average transaction amount | 15.6 | 1.4 | 15.7 | 0.9 | |||||||||||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 15 | ||||||||

| Comparable Sales | Three Months Ended | Nine Months Ended | |||||||||

| October 28, 2017 | October 29, 2016 | October 28, 2017 | October 29, 2016 | ||||||||

| Comparable sales change | 0.9 | % | (0.2 | )% | 0.3 | % | — | % | |||

| Drivers of change in comparable sales | |||||||||||

| Number of transactions | 1.4 | (1.2 | ) | 0.9 | (1.0 | ) | |||||

| Average transaction amount | (0.5 | ) | 1.0 | (0.6 | ) | 1.0 | |||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS | ||||||||

| ANALYSIS OF OPERATIONS | ||||||||

| Contribution to Comparable Sales Change | Three Months Ended | Nine Months Ended | |||||||||||||||||||||

| October 31, 2020 | November 2, 2019 | October 31, 2020 | November 2, 2019 | ||||||||||||||||||||

| Stores originated channel comparable sales change | 9.9 | % | 2.8 | % | 7.3 | % | 2.3 | % | |||||||||||||||

| Contribution from digitally originated sales | 10.9 | 1.7 | 11.4 | 1.9 | |||||||||||||||||||

| Total comparable sales change | 20.7 | % | 4.5 | % | 18.7 | % | 4.2 | % | |||||||||||||||

| Sales by Channel | Three Months Ended | Nine Months Ended | |||||||||||||||||||||

| October 31, 2020 | November 2, 2019 | October 31, 2020 | November 2, 2019 | ||||||||||||||||||||

| Stores originated | 84.3 | % | 92.5 | % | 83.9 | % | 92.7 | % | |||||||||||||||

| Digitally originated | 15.7 | 7.5 | 16.1 | 7.3 | |||||||||||||||||||

| Total | 100 | % | 100 | % | 100 | % | 100 | % | |||||||||||||||

| Contribution to Comparable Sales Change | Three Months Ended | Nine Months Ended | |||||||||

| October 28, 2017 | October 29, 2016 | October 28, 2017 | October 29, 2016 | ||||||||

| Stores channel comparable sales change | — | % | (1.0 | )% | (0.6 | )% | (0.7 | )% | |||

| Digital channel contribution to comparable sales change | 0.8 | 0.7 | 0.9 | 0.6 | |||||||

| Total comparable sales change | 0.9 | % | (0.2 | )% | 0.3 | % | — | % | |||

| Sales by Product Category | Three Months Ended | Nine Months Ended | |||||||||||||||||||||

| October 31, 2020 | November 2, 2019 | October 31, 2020 | November 2, 2019 | ||||||||||||||||||||

| Apparel and accessories | 18 | % | 20 | % | 17 | % | 19 | % | |||||||||||||||

| Beauty and household essentials | 27 | 28 | 28 | 28 | |||||||||||||||||||

| Food and beverage | 20 | 20 | 20 | 20 | |||||||||||||||||||

| Hardlines | 15 | 13 | 16 | 14 | |||||||||||||||||||

| Home furnishings and décor | 20 | 19 | 19 | 19 | |||||||||||||||||||

| Total | 100 | % | 100 | % | 100 | % | 100 | % | |||||||||||||||

| REDcard Penetration | Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||

| RedCard Penetration | RedCard Penetration | Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||||||

| October 28, 2017 | October 29, 2016 | October 28, 2017 | October 29, 2016 | October 31, 2020 | November 2, 2019 | October 31, 2020 | November 2, 2019 | |||||||||||||||||||||||||||

| Target Debit Card | 12.9 | % | 12.9 | % | 13.1 | % | 12.9 | % | Target Debit Card | 12.2 | % | 12.5 | % | 12.2 | % | 12.7 | % | |||||||||||||||||

| Target Credit Cards | 11.4 | 11.4 | 11.3 | 11.0 | Target Credit Cards | 9.3 | 10.7 | 9.2 | 10.6 | |||||||||||||||||||||||||

| Total REDcard Penetration | 24.2 | % | 24.3 | % | 24.4 | % | 23.9 | % | ||||||||||||||||||||||||||

| Total RedCard Penetration | Total RedCard Penetration | 21.5 | % | 23.1 | % | 21.4 | % | 23.3 | % | |||||||||||||||||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 16 | ||||||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS | ||||||||

| ANALYSIS OF OPERATIONS | ||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 17 | ||||||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS | ||||||||

| ANALYSIS OF OPERATIONS | ||||||||

| Change in Number of Stores | Three Months Ended | Nine Months Ended | |||||||||||||||||||||

| October 31, 2020 | November 2, 2019 | October 31, 2020 | November 2, 2019 | ||||||||||||||||||||

| Beginning store count | 1,871 | 1,853 | 1,868 | 1,844 | |||||||||||||||||||

| Opened | 27 | 9 | 30 | 20 | |||||||||||||||||||

| Closed | (1) | — | (1) | (2) | |||||||||||||||||||

| Ending store count | 1,897 | 1,862 | 1,897 | 1,862 | |||||||||||||||||||

| Change in Number of Stores | Three Months Ended | Nine Months Ended | |||||||||

| October 28, 2017 | October 29, 2016 | October 28, 2017 | October 29, 2016 | ||||||||

| Beginning store count | 1,816 | 1,797 | 1,802 | 1,792 | |||||||

| Opened | 12 | 5 | 26 | 11 | |||||||

| Closed | — | (2 | ) | — | (3 | ) | |||||

| Ending store count | 1,828 | 1,800 | 1,828 | 1,800 | |||||||

| Number of Stores and Retail Square Feet | Number of Stores | Retail Square Feet (a) | |||||||||||||||||||||

| October 31, 2020 | February 1, 2020 | November 2, 2019 | October 31, 2020 | February 1, 2020 | November 2, 2019 | ||||||||||||||||||

| 170,000 or more sq. ft. | 273 | 272 | 272 | 48,798 | 48,619 | 48,619 | |||||||||||||||||

| 50,000 to 169,999 sq. ft. | 1,509 | 1,505 | 1,504 | 189,508 | 189,227 | 189,164 | |||||||||||||||||

| 49,999 or less sq. ft. | 115 | 91 | 86 | 3,342 | 2,670 | 2,475 | |||||||||||||||||

| Total | 1,897 | 1,868 | 1,862 | 241,648 | 240,516 | 240,258 | |||||||||||||||||

| Number of Stores and Retail Square Feet | Number of Stores | Retail Square Feet (a) | |||||||||||

| October 28, 2017 | January 28, 2017 | October 29, 2016 | October 28, 2017 | January 28, 2017 | October 29, 2016 | ||||||||

| 170,000 or more sq. ft. | 276 | 276 | 278 | 49,326 | 49,328 | 49,685 | |||||||

| 50,000 to 169,999 sq. ft. | 1,508 | 1,504 | 1,503 | 190,038 | 189,620 | 189,496 | |||||||

| 49,999 or less sq. ft. | 44 | 22 | 19 | 1,268 | 554 | 464 | |||||||

| Total | 1,828 | 1,802 | 1,800 | 240,632 | 239,502 | 239,645 | |||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 18 | ||||||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS | ||||||||

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES | ||||||||

| Reconciliation of Non-GAAP Adjusted EPS | Three Months Ended | |||||||||||||||||||||||||||||||||||||

| October 31, 2020 | November 2, 2019 | |||||||||||||||||||||||||||||||||||||

| (millions, except per share data) | Pretax | Net of Tax | Per Share Amounts | Pretax | Net of Tax | Per Share Amounts | ||||||||||||||||||||||||||||||||

| GAAP diluted earnings per share from continuing operations | $ | 2.01 | $ | 1.37 | ||||||||||||||||||||||||||||||||||

| Adjustments | ||||||||||||||||||||||||||||||||||||||

| Loss on debt extinguishment | $ | 512 | $ | 379 | $ | 0.75 | $ | — | $ | — | $ | — | ||||||||||||||||||||||||||

Loss on investment (a) | 8 | 9 | 0.02 | — | — | — | ||||||||||||||||||||||||||||||||

Other (b) | 8 | 6 | 0.01 | (9) | (6) | (0.01) | ||||||||||||||||||||||||||||||||

| Adjusted diluted earnings per share from continuing operations | $ | 2.79 | $ | 1.36 | ||||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||

| October 28, 2017 | October 29, 2016 | |||||||||||||||||||||||

| (millions, except per share data) | Pretax | Net of Tax | Per Share Amounts | Pretax | Net of Tax | Per Share Amounts | ||||||||||||||||||

| GAAP diluted earnings per share from continuing operations | $ | 0.87 | $ | 1.06 | ||||||||||||||||||||

| Adjustments | ||||||||||||||||||||||||

| Loss on early retirement of debt | $ | 123 | $ | 75 | $ | 0.14 | $ | — | $ | — | $ | — | ||||||||||||

| Pharmacy Transaction-related costs | — | — | — | (4 | ) | (3 | ) | — | ||||||||||||||||

Income tax matters (a) | — | (55 | ) | (0.10 | ) | — | (5 | ) | (0.01 | ) | ||||||||||||||

| Adjusted diluted earnings per share from continuing operations | $ | 0.91 | $ | 1.04 | ||||||||||||||||||||

| Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reconciliation of Non-GAAP Adjusted EPS | Reconciliation of Non-GAAP Adjusted EPS | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| October 28, 2017 | October 29, 2016 | October 31, 2020 | November 2, 2019 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (millions, except per share data) | Pretax | Net of Tax | Per Share Amounts | Pretax | Net of Tax | Per Share Amounts | (millions, except per share data) | Pretax | Net of Tax | Per Share Amounts | Pretax | Net of Tax | Per Share Amounts | |||||||||||||||||||||||||||||||||||||||||||||||||

| GAAP diluted earnings per share from continuing operations | $ | 3.31 | $ | 3.14 | GAAP diluted earnings per share from continuing operations | $ | 5.91 | $ | 4.71 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjustments | Adjustments | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loss on early retirement of debt | $ | 123 | $ | 75 | $ | 0.14 | $ | 422 | $ | 257 | $ | 0.44 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Pharmacy Transaction-related costs | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Income tax matters (a) | — | (56 | ) | (0.10 | ) | — | (8 | ) | (0.01 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loss on debt extinguishment | Loss on debt extinguishment | $ | 512 | $ | 379 | $ | 0.75 | $ | — | $ | — | $ | — | |||||||||||||||||||||||||||||||||||||||||||||||||

Loss on investment (a) | Loss on investment (a) | 19 | 18 | 0.03 | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other (b) | Other (b) | 33 | 24 | 0.05 | (9) | (6) | (0.01) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjusted diluted earnings per share from continuing operations | $ | 3.34 | $ | 3.56 | Adjusted diluted earnings per share from continuing operations | $ | 6.75 | $ | 4.70 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 19 | ||||||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS | ||||||||

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES | ||||||||

| EBIT and EBITDA | Three Months Ended | Nine Months Ended | EBIT and EBITDA | Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

(millions) (unaudited) | October 28, 2017 | October 29, 2016 | Change | October 28, 2017 | October 29, 2016 | Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

(dollars in millions) (unaudited) | (dollars in millions) (unaudited) | October 31, 2020 | November 2, 2019 | Change | October 31, 2020 | November 2, 2019 | Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings from continuing operations | $ | 478 | $ | 608 | (21.5 | )% | $ | 1,826 | $ | 1,847 | (1.1 | )% | Net earnings from continuing operations | $ | 1,014 | $ | 706 | 43.6 | % | $ | 2,988 | $ | 2,436 | 22.6 | % | |||||||||||||||||||||||||||||||||||

| + Provision for income taxes | 137 | 311 | (55.8 | ) | 802 | 910 | (11.9 | ) | + Provision for income taxes | 284 | 195 | 45.7 | 828 | 703 | 17.8 | |||||||||||||||||||||||||||||||||||||||||||||

| + Net interest expense | 254 | 142 | 79.1 | 532 | 864 | (38.4 | ) | + Net interest expense | 632 | 113 | 457.7 | 871 | 359 | 142.6 | ||||||||||||||||||||||||||||||||||||||||||||||

| EBIT | 869 | 1,061 | (18.1 | ) | 3,160 | 3,621 | (12.7 | ) | EBIT | $ | 1,930 | $ | 1,014 | 90.2 | % | $ | 4,687 | $ | 3,498 | 34.0 | % | |||||||||||||||||||||||||||||||||||||||

+ Total depreciation and amortization (a) | 633 | 570 | 11.1 | 1,784 | 1,686 | 5.8 | + Total depreciation and amortization (a) | 603 | 637 | (5.1) | 1,848 | 1,905 | (2.9) | |||||||||||||||||||||||||||||||||||||||||||||||

| EBITDA | $ | 1,502 | $ | 1,631 | (7.9 | )% | $ | 4,944 | $ | 5,307 | (6.8 | )% | EBITDA | $ | 2,533 | $ | 1,651 | 53.5 | % | $ | 6,535 | $ | 5,403 | 21.0 | % | |||||||||||||||||||||||||||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 20 | ||||||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS | ||||||||

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES | ||||||||

| After-Tax Return on Invested Capital | ||||||||||||||||||||||||||

| (dollars in millions) | ||||||||||||||||||||||||||

| Trailing Twelve Months | ||||||||||||||||||||||||||

| Numerator | October 31, 2020 | November 2, 2019 | ||||||||||||||||||||||||

| Operating income | $ | 5,901 | $ | 4,577 | ||||||||||||||||||||||

| + Net other income / (expense) | (46) | 45 | ||||||||||||||||||||||||

| EBIT | 5,855 | 4,622 | ||||||||||||||||||||||||

+ Operating lease interest (a) | 87 | 86 | ||||||||||||||||||||||||

- Income taxes (b) | 1,277 | 1,043 | ||||||||||||||||||||||||

| Net operating profit after taxes | $ | 4,665 | $ | 3,665 | ||||||||||||||||||||||

| After-Tax Return on Invested Capital | ||||||||||||

| Numerator | Trailing Twelve Months | |||||||||||

| (dollars in millions) | October 28, 2017 | October 29, 2016 | ||||||||||

| Earnings from continuing operations before interest expense and income taxes | $ | 4,508 | $ | 5,790 | ||||||||

+ Operating lease interest (a)(b) | 78 | 72 | ||||||||||

| Adjusted earnings from continuing operations before interest expense and income taxes | 4,586 | 5,862 | ||||||||||

- Income taxes (c) | 1,420 | 1,849 | ||||||||||

| Net operating profit after taxes | $ | 3,166 | $ | 4,013 | ||||||||

| Denominator | October 31, 2020 | November 2, 2019 | November 3, 2018 | |||||||||||||||||

| Current portion of long-term debt and other borrowings | $ | 131 | $ | 1,159 | $ | 1,535 | ||||||||||||||

| + Noncurrent portion of long-term debt | 12,490 | 10,513 | 10,104 | |||||||||||||||||

| + Shareholders' investment | 13,319 | 11,545 | 11,080 | |||||||||||||||||

+ Operating lease liabilities (c) | 2,400 | 2,390 | 2,208 | |||||||||||||||||

| - Cash and cash equivalents | 5,996 | 969 | 825 | |||||||||||||||||

| Invested capital | $ | 22,344 | $ | 24,638 | $ | 24,102 | ||||||||||||||

Average invested capital (d) | $ | 23,491 | $ | 24,369 | ||||||||||||||||

| After-tax return on invested capital | 19.9 | % | 15.0 | % | ||||||||||||||||

Denominator (dollars in millions) | October 28, 2017 | October 29, 2016 | October 31, 2015 | |||||||||

| Current portion of long-term debt and other borrowings | $ | 1,354 | $ | 729 | $ | 825 | ||||||

| + Noncurrent portion of long-term debt | 11,277 | 12,097 | 11,887 | |||||||||

| + Shareholders' equity | 11,137 | 11,069 | 13,256 | |||||||||

+ Capitalized operating lease obligations (b)(d) | 1,298 | 1,192 | 1,503 | |||||||||

| - Cash and cash equivalents | 2,725 | 1,231 | 1,977 | |||||||||

| - Net assets of discontinued operations | 4 | 60 | 197 | |||||||||

| Invested capital | $ | 22,337 | $ | 23,796 | $ | 25,298 | ||||||

Average invested capital (e) | $ | 23,067 | $ | 24,547 | ||||||||

After-tax return on invested capital (f) | 13.7 | % | 16.3 | % | ||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 21 | ||||||||

| Reconciliation of Capitalized Operating Leases | Trailing Twelve Months | |||||||||||||

| (dollars in millions) | October 28, 2017 | October 29, 2016 | October 31, 2015 | |||||||||||

| Total rent expense | $ | 162 | $ | 149 | $ | 188 | ||||||||

| Capitalized operating lease obligations (total rent expense x 8) | 1,298 | 1,192 | 1,503 | |||||||||||

| Operating lease interest (capitalized operating lease obligations x 6%) | 78 | 72 | n/a | |||||||||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS | ||||||||

| ANALYSIS OF FINANCIAL CONDITION | ||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 22 | ||||||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS | ||||||||

| ANALYSIS OF FINANCIAL CONDITION | ||||||||

| Credit Ratings | Moody’s | Standard and Poor’s | Fitch | ||||||||

| Long-term debt | A2 | A | A- | ||||||||

| Commercial paper | P-1 | A-1 | |||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 23 | ||||||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS & SUPPLEMENTAL INFORMATION | ||||||||

| FORWARD LOOKING STATEMENTS & CONTROLS AND PROCEDURES | ||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 24 | ||||||||

| SUPPLEMENTAL INFORMATION | ||||||||

| Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Programs | Dollar Value of Shares that May Yet Be Purchased Under Publicly Announced Programs | ||||||||

| July 30, 2017 through August 26, 2017 | ||||||||||||

August 2017 ASR (a) | 2,500,000 | TBD | 2,500,000 | $ | 3,884,046,448 | |||||||

| August 27, 2017 through September 30, 2017 | ||||||||||||

| Open market and privately negotiated purchases | 169,233 | 58.74 | 169,233 | 3,874,106,311 | ||||||||

| October 1, 2017 through October 28, 2017 | ||||||||||||

| Open market and privately negotiated purchases | — | — | — | 3,874,106,311 | ||||||||

| Total | 2,669,233 | TBD | 2,669,233 | $ | 3,874,106,311 | |||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 25 | ||||||||

| SUPPLEMENTAL INFORMATION | ||||||||

| (3)A | ||||||||

| (3)B | ||||||||

| (31)B | ||||||||

| (32)A | ||||||||

| (32)B | ||||||||

| 101.INS | XBRL Instance Document | |||||||

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document | |||||||

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document | |||||||

| 101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document | |||||||

| 101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document | |||||||

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document | |||||||

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) | |||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 26 | ||||||||

| SUPPLEMENTAL INFORMATION | ||||||||

| TARGET CORPORATION | |||||||||||

| Dated: November 25, 2020 | By: | /s/ Michael J. Fiddelke | |||||||||

| Michael J. Fiddelke | |||||||||||

| Executive Vice President and | |||||||||||

| Chief Financial Officer | |||||||||||

| (Duly Authorized Officer and | |||||||||||

| Principal Financial Officer) | |||||||||||

| /s/ Robert M. Harrison | |||||||||||

| Robert M. Harrison | |||||||||||

| Senior Vice President, Chief Accounting Officer | |||||||||||

| and Controller | |||||||||||

| TARGET CORPORATION |  | Q3 2020 Form 10-Q | 27 | ||||||||