UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

FORM 10-Q

__________________________________________

|

| |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 20172018

or

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 1-2328

GATX Corporation

(Exact name of registrant as specified in its charter)

|

| |

| New York | 36-1124040 |

| (State of incorporation) | (I.R.S. Employer Identification No.) |

222 West Adams Street233 South Wacker Drive |

Chicago, Illinois 60606-531460606-7147 |

| (Address of principal executive offices, including zip code) |

| (312) 621-6200 |

| (Registrant's telephone number, including area code) |

Indicate by check mark whether the registrantregistrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company, (as defined" and "emerging growth company" in Rule 12b-2 of the Exchange Act).Act.

|

| | | | | |

| | x | Large accelerated filer | | ¨ | Accelerated filerSmaller reporting company |

| | ¨ | Non-accelerated filer | | ¨ | Smaller reportingEmerging growth company |

| | ¨ | Accelerated filer | | | ¨ | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

Common shares outstanding were 38.337.6 million at September 30, 2017.2018.

GATX CORPORATION

FORM 10-Q

QUARTERLY REPORT FOR THE PERIOD ENDED SEPTEMBER 30, 20172018

INDEX

|

| | |

| Item No. | | Page No. |

Part I - FINANCIAL INFORMATION |

| | | |

| | |

| Part I - FINANCIAL INFORMATION |

| Item 1. | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 3. | | |

| Item 4. | | |

| | |

| Part II - OTHER INFORMATION |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 6. | | |

| |

| | |

FORWARD-LOOKING STATEMENTS

Statements in this report not based on historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and, accordingly, involve known and unknown risks and uncertainties that are difficult to predict and could cause our actual results, performance, or achievements to differ materially from those discussed. These statements include statements as to our future expectations, beliefs, plans, strategies, objectives, events, conditions, financial performance, prospects, or future events. In some cases, forward-looking statements can be identified by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “outlook,” “continue,” “likely,” “will,” and “would”, and similar words and phrases. Forward-looking statements are necessarily based on estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Accordingly, you should not place undue reliance on forward-looking statements, which speak only as of the date they are made, and are not guarantees of future performance. We do not undertake any obligation to publicly update or revise these forward-looking statements.

A detailed discussion of the known material risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in our Annual Report on Form 10-K for the year ended December 31, 2016,2017, and in our other filings with the Securities and Exchange Commission ("SEC"). The following factors, in addition to those discussed under "Risk Factors", in our Annual Report on Form 10-K for the year ended December 31, 2016,2017, could cause actual results to differ materially from our current expectations expressed in forward looking statements:

|

| | |

• exposure to damages, fines, criminal and civil penalties, and reputational harm arising from a negative outcome in litigation, including claims arising from an accident involving our railcars• inability to maintain our assets on lease at satisfactory rates due to oversupply of railcars in the market or other changes in supply and demand• weak economic conditions and other factors that may decreasea significant decline in customer demand for our railcars or other assets andor services, including as a result of:•◦

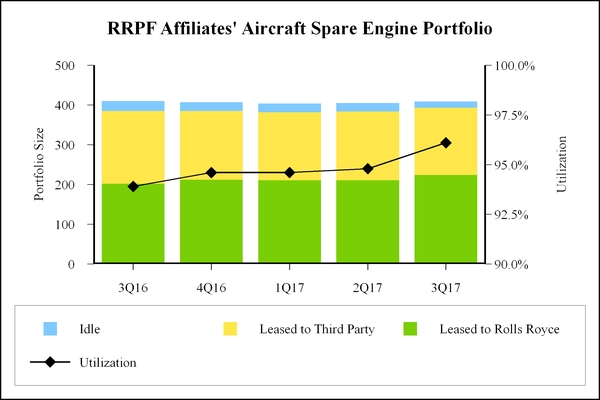

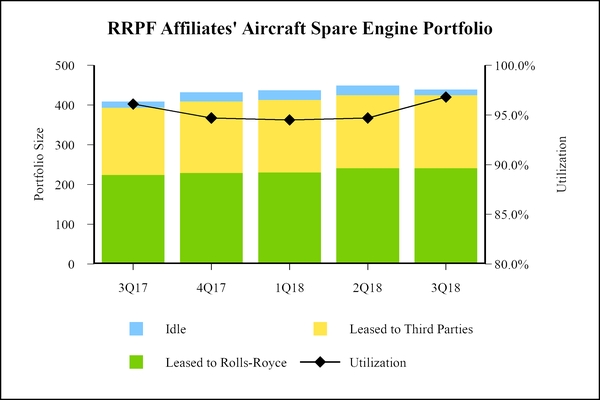

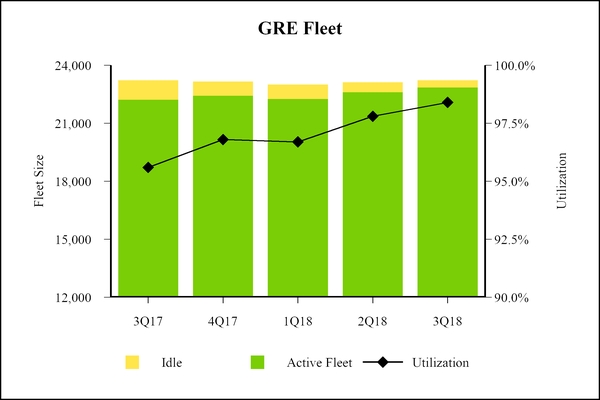

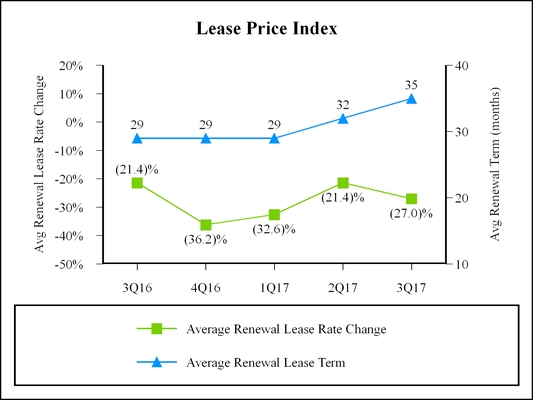

decreased demand for portions ofweak macroeconomic conditions◦ weak market conditions in our railcar fleet due to customers' businesses◦ declines in harvest or production volumes◦ adverse changes in the price of, or demand for, commodities that are shipped◦ changes in railroad operations or efficiency◦ changes in supply chains◦ availability of pipelines, trucks, and other alternative modes of transportation◦ other operational or commercial needs or decisions of our railcarscustomers• higher costs associated with increased railcar assignments following non-renewal of leases, customer defaults, and compliance maintenance programs or other maintenance initiatives• events having an adverse impact on assets, customers, or regions where we have a concentrated investment exposure• financial and operational risks associated with long-term railcar purchase commitments, including increased costs due to tariffs or trade disputes• reduced opportunities to generate asset remarketing income | | • operational and financial risks related to our affiliate investments, including the Rolls-Royce & Partners Finance joint ventures (collectively the “RRPF affiliates”"RRPF affiliates")• the impact of changes to the Internal Revenue Code as a result of the Tax Cuts and Jobs Act of 2017 (the "Tax Act"), and uncertainty as to how this legislation will be interpreted and applied.• fluctuations in foreign exchange rates | | • failure to successfully negotiate collective bargaining agreements with the unions representing a substantial portion of our employees•

changes in railroad operations that could decrease demand for railcars, either due to increased railroad efficiency or decreased attractiveness of rail service relative to other modes•

the impact of regulatory requirements applicable to tank cars carrying crude, ethanol, and other flammable liquids• asset impairment charges we may be required to recognize• deterioration of conditions in the capital markets, reductions in our credit ratings, or increases in our financing costs• competitive factors in our primary markets, including competitors with a significantly lower cost of capital than GATX• risks related to our international operations and expansion into new geographic markets, including the imposition of new or additional tariffs, quotas, or trade barriers• changes in, or failure to comply with, laws, rules, and regulations• inability to obtain cost-effective insurance• environmental remediation costs• inadequate allowances to cover credit losses in our portfolio• inability to maintain and secure our information technology infrastructure from cybersecurity threats and related disruption of our business |

PART I - FINANCIAL INFORMATION

Item 1.Financial Statements

GATX CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (Unaudited)

(In millions, except share data)

| | | | September 30 | | December 31 | | | | | |

| | 2017 | | 2016 | September 30 | | December 31 |

| | (Unaudited) | | | 2018 | | 2017 |

| Assets | | | | | | |

Cash and Cash Equivalents | $ | 199.2 |

| | $ | 307.5 |

| $ | 254.5 |

| | $ | 296.5 |

|

Restricted Cash | 3.7 |

| | 3.6 |

| 4.1 |

| | 3.2 |

|

| Receivables | | | | | | |

| Rent and other receivables | 83.2 |

| | 85.9 |

| 85.2 |

| | 83.4 |

|

| Finance leases | 139.1 |

| | 147.7 |

| 129.0 |

| | 136.1 |

|

| Less: allowance for losses | (6.5 | ) | | (6.1 | ) | (6.5 | ) | | (6.4 | ) |

| | 215.8 |

| | 227.5 |

| 207.7 |

| | 213.1 |

|

| | | | | | | |

| Operating Assets and Facilities | 8,915.9 |

| | 8,446.4 |

| 9,262.9 |

| | 9,045.4 |

|

| Less: allowance for depreciation | (2,814.6 | ) | | (2,641.7 | ) | (2,965.0 | ) | | (2,853.3 | ) |

| | 6,101.3 |

| | 5,804.7 |

| 6,297.9 |

| | 6,192.1 |

|

Investments in Affiliated Companies | 449.3 |

| | 387.0 |

| 478.5 |

| | 441.0 |

|

Goodwill | 84.6 |

| | 78.0 |

| 83.6 |

| | 85.6 |

|

Other Assets | 208.0 |

| | 297.1 |

| 191.1 |

| | 190.9 |

|

Total Assets | $ | 7,261.9 |

| | $ | 7,105.4 |

| $ | 7,517.4 |

| | $ | 7,422.4 |

|

| | | | | | | |

| Liabilities and Shareholders’ Equity | | | | | | |

Accounts Payable and Accrued Expenses | $ | 133.8 |

| | $ | 174.8 |

| $ | 152.8 |

| | $ | 154.3 |

|

| Debt | | | | | | |

| Commercial paper and borrowings under bank credit facilities | 15.7 |

| | 3.8 |

| — |

| | 4.3 |

|

| Recourse | 4,266.7 |

| | 4,253.2 |

| 4,397.3 |

| | 4,371.7 |

|

| Capital lease obligations | 12.8 |

| | 14.9 |

| 11.6 |

| | 12.5 |

|

| | 4,295.2 |

| | 4,271.9 |

| 4,408.9 |

| | 4,388.5 |

|

Deferred Income Taxes | 1,157.7 |

| | 1,089.4 |

| 890.7 |

| | 853.7 |

|

Other Liabilities | 205.0 |

| | 222.1 |

| 227.0 |

| | 233.2 |

|

Total Liabilities | 5,791.7 |

| | 5,758.2 |

| 5,679.4 |

| | 5,629.7 |

|

| Shareholders’ Equity | | | | | | |

Common stock, $0.625 par value: Authorized shares — 120,000,000 Issued shares — 67,071,263 and 66,953,606 Outstanding shares — 38,311,330 and 39,442,893 | 41.6 |

| | 41.5 |

| |

Common stock, $0.625 par value: Authorized shares — 120,000,000 Issued shares — 67,325,950 and 67,083,149 Outstanding shares — 37,632,377 and 37,895,641 | | 41.6 |

| | 41.6 |

|

| Additional paid in capital | 695.8 |

| | 687.8 |

| 703.6 |

| | 698.0 |

|

| Retained earnings | 1,936.2 |

| | 1,828.0 |

| 2,387.0 |

| | 2,261.7 |

|

| Accumulated other comprehensive loss | (129.4 | ) | | (211.1 | ) | (157.8 | ) | | (109.6 | ) |

| Treasury stock at cost (28,759,933 and 27,510,713 shares) | (1,074.0 | ) | | (999.0 | ) | |

| Treasury stock at cost (29,693,573 and 29,187,508 shares) | | (1,136.4 | ) | | (1,099.0 | ) |

Total Shareholders’ Equity | 1,470.2 |

| | 1,347.2 |

| 1,838.0 |

| | 1,792.7 |

|

| Total Liabilities and Shareholders’ Equity | $ | 7,261.9 |

| | $ | 7,105.4 |

| $ | 7,517.4 |

| | $ | 7,422.4 |

|

See accompanying notes to consolidated financial statements.

GATX CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Unaudited)

(In millions, except per share data)

| | | | Three Months Ended

September 30 | | Nine Months Ended

September 30 | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| | 2017 | | 2016 | | 2017 | | 2016 | 2018 | | 2017 | | 2018 | | 2017 |

| Revenues | | | | | | | | | | | | | | |

| Lease revenue | $ | 276.6 |

| | $ | 281.8 |

| | $ | 823.4 |

| | $ | 847.5 |

| $ | 271.9 |

| | $ | 276.6 |

| | $ | 816.1 |

| | $ | 823.4 |

|

| Marine operating revenue | 62.9 |

| | 62.1 |

| | 135.0 |

| | 139.7 |

| 60.8 |

| | 62.9 |

| | 130.8 |

| | 135.0 |

|

| Other revenue | 20.1 |

| | 19.0 |

| | 65.7 |

| | 69.0 |

| 17.0 |

| | 20.1 |

| | 57.6 |

| | 65.7 |

|

| Total Revenues | 359.6 |

| | 362.9 |

| | 1,024.1 |

| | 1,056.2 |

| 349.7 |

| | 359.6 |

| | 1,004.5 |

| | 1,024.1 |

|

| Expenses | | | | | | | | | | | | | | |

| Maintenance expense | 84.9 |

| | 79.6 |

| | 247.7 |

| | 244.6 |

| 77.5 |

| | 84.9 |

| | 240.7 |

| | 247.7 |

|

| Marine operating expense | 38.9 |

| | 39.2 |

| | 89.8 |

| | 88.9 |

| 39.4 |

| | 38.9 |

| | 89.5 |

| | 89.8 |

|

| Depreciation expense | 78.6 |

| | 75.9 |

| | 227.9 |

| | 221.0 |

| 81.6 |

| | 78.6 |

| | 240.1 |

| | 227.9 |

|

| Operating lease expense | 15.8 |

| | 19.2 |

| | 46.8 |

| | 54.5 |

| 11.8 |

| | 15.8 |

| | 37.5 |

| | 46.8 |

|

| Other operating expense | 8.5 |

| | 10.1 |

| | 25.9 |

| | 33.7 |

| 8.5 |

| | 8.5 |

| | 26.2 |

| | 25.9 |

|

| Selling, general and administrative expense | 42.8 |

| | 48.1 |

| | 128.8 |

| | 127.8 |

| 46.5 |

| | 42.5 |

| | 137.6 |

| | 127.8 |

|

| Total Expenses | 269.5 |

| | 272.1 |

| | 766.9 |

| | 770.5 |

| 265.3 |

| | 269.2 |

| | 771.6 |

| | 765.9 |

|

| Other Income (Expense) | | | | | | | | | | | | | | |

| Net gain on asset dispositions | 9.4 |

| | 62.7 |

| | 56.3 |

| | 122.8 |

| 10.3 |

| | 9.4 |

| | 72.5 |

| | 56.3 |

|

| Interest expense, net | (40.2 | ) | | (36.2 | ) | | (119.4 | ) | | (109.9 | ) | (42.6 | ) | | (40.2 | ) | | (124.7 | ) | | (119.4 | ) |

| Other (expense) income | (2.1 | ) | | 4.3 |

| | (4.5 | ) | | (2.9 | ) | |

| Other expense | | (3.8 | ) | | (2.4 | ) | | (14.9 | ) | | (5.5 | ) |

Income before Income Taxes and Share of Affiliates’ Earnings | 57.2 |

| | 121.6 |

| | 189.6 |

| | 295.7 |

| 48.3 |

| | 57.2 |

| | 165.8 |

| | 189.6 |

|

| Income taxes | (20.4 | ) | | (41.1 | ) | | (60.3 | ) | | (98.6 | ) | (13.1 | ) | | (20.4 | ) | | (42.8 | ) | | (60.3 | ) |

| Share of affiliates’ earnings, net of taxes | 12.2 |

| | 15.2 |

| | 30.6 |

| | 29.1 |

| 11.8 |

| | 12.2 |

| | 39.1 |

| | 30.6 |

|

Net Income | $ | 49.0 |

| | $ | 95.7 |

| | $ | 159.9 |

| | $ | 226.2 |

| $ | 47.0 |

| | $ | 49.0 |

| | $ | 162.1 |

| | $ | 159.9 |

|

| Other Comprehensive Income, Net of Taxes | | | | | | | | | | | | | | |

| Foreign currency translation adjustments | 15.4 |

| | 11.0 |

| | 74.0 |

| | 16.2 |

| (4.7 | ) | | 15.4 |

| | (40.2 | ) | | 74.0 |

|

| Unrealized gain on securities | — |

| | 1.3 |

| | — |

| | 1.6 |

| |

| Unrealized gain (loss) on derivative instruments | 0.7 |

| | 0.5 |

| | 3.6 |

| | (6.8 | ) | |

| Unrealized gain on derivative instruments | | 1.6 |

| | 0.7 |

| | 2.3 |

| | 3.6 |

|

| Post-retirement benefit plans | 1.4 |

| | (6.0 | ) | | 4.1 |

| | (3.3 | ) | 5.3 |

| | 1.4 |

| | 9.1 |

| | 4.1 |

|

| Other comprehensive income | 17.5 |

| | 6.8 |

| | 81.7 |

| | 7.7 |

| |

| Other comprehensive income (loss) | | 2.2 |

| | 17.5 |

| | (28.8 | ) | | 81.7 |

|

Comprehensive Income | $ | 66.5 |

| | $ | 102.5 |

| | $ | 241.6 |

| | $ | 233.9 |

| $ | 49.2 |

| | $ | 66.5 |

| | $ | 133.3 |

| | $ | 241.6 |

|

| | | | | | | | | | | | | | | |

| Share Data | | | | | | | | | | | | | | |

| Basic earnings per share | $ | 1.27 |

| | $ | 2.39 |

| | $ | 4.10 |

| | $ | 5.55 |

| $ | 1.25 |

| | $ | 1.27 |

| | $ | 4.29 |

| | $ | 4.10 |

|

| Average number of common shares | 38.6 |

| | 40.1 |

| | 39.0 |

| | 40.7 |

| 37.7 |

| | 38.6 |

| | 37.8 |

| | 39.0 |

|

| | | | | | | | | | | | | | | |

| Diluted earnings per share | $ | 1.25 |

| | $ | 2.36 |

| | $ | 4.04 |

| | $ | 5.49 |

| $ | 1.22 |

| | $ | 1.25 |

| | $ | 4.21 |

| | $ | 4.04 |

|

| Average number of common shares and common share equivalents | 39.2 |

| | 40.6 |

| | 39.6 |

| | 41.2 |

| 38.5 |

| | 39.2 |

| | 38.5 |

| | 39.6 |

|

| | | | | | | | | | | | | | | |

| Dividends declared per common share | $ | 0.42 |

| | $ | 0.40 |

| | $ | 1.26 |

| | $ | 1.20 |

| $ | 0.44 |

| | $ | 0.42 |

| | $ | 1.32 |

| | $ | 1.26 |

|

See accompanying notes to consolidated financial statements.

GATX CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(In millions)

| | | | Nine Months Ended September 30 | Nine Months Ended September 30 |

| | 2017 | | 2016 | 2018 | | 2017 |

| Operating Activities | | | | | | |

| Net income | $ | 159.9 |

| | $ | 226.2 |

| $ | 162.1 |

| | $ | 159.9 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | |

| Depreciation expense | 238.5 |

| | 230.6 |

| 253.3 |

| | 238.5 |

|

| Change in accrued operating lease expense | (21.2 | ) | | (11.0 | ) | (2.2 | ) | | (21.2 | ) |

| Net gains on sales of assets | (48.4 | ) | | (41.3 | ) | (70.9 | ) | | (48.4 | ) |

| Deferred income taxes | 44.8 |

| | 83.6 |

| 28.0 |

| | 44.8 |

|

| Change in income taxes payable | (4.9 | ) | | (8.1 | ) | (0.4 | ) | | (4.9 | ) |

| Share of affiliates’ earnings, net of dividends | (22.0 | ) | | (29.0 | ) | (39.0 | ) | | (22.0 | ) |

| Other | (29.2 | ) | | (15.5 | ) | 10.4 |

| | (28.9 | ) |

| Net cash provided by operating activities | 317.5 |

| | 435.5 |

| 341.3 |

| | 317.8 |

|

| Investing Activities | | | | | | |

| Additions to operating assets and facilities | (422.4 | ) | | (442.6 | ) | (536.7 | ) | | (422.4 | ) |

| Investments in affiliates | (36.6 | ) | | — |

| — |

| | (36.6 | ) |

| Portfolio investments and capital additions | (459.0 | ) | | (442.6 | ) | (536.7 | ) | | (459.0 | ) |

| Purchases of previously leased-in assets | (93.2 | ) | | (116.5 | ) | |

| Purchases of leased-in assets | | (66.6 | ) | | (93.2 | ) |

| Portfolio proceeds | 131.0 |

| | 170.6 |

| 198.6 |

| | 131.0 |

|

| Proceeds from sales of other assets | 24.3 |

| | 18.6 |

| 28.5 |

| | 24.3 |

|

| Proceeds from sale-leasebacks | 90.6 |

| | 82.5 |

| 59.2 |

| | 90.6 |

|

| Other | | 2.7 |

| | (0.2 | ) |

| Net cash used in investing activities | (306.3 | ) | | (287.4 | ) | (314.3 | ) | | (306.5 | ) |

| Financing Activities | | | | | | |

| Net proceeds from issuances of debt (original maturities longer than 90 days) | 297.5 |

| | 801.8 |

| 297.1 |

| | 297.5 |

|

| Repayments of debt (original maturities longer than 90 days) | (301.5 | ) | | (798.7 | ) | (263.1 | ) | | (301.5 | ) |

| Net increase (decrease) in debt with original maturities of 90 days or less | 11.1 |

| | (2.5 | ) | |

| Net decrease (increase) in debt with original maturities of 90 days or less | | (4.2 | ) | | 11.1 |

|

| Stock repurchases | (75.0 | ) | | (95.1 | ) | (37.4 | ) | | (75.0 | ) |

| Dividends | (51.8 | ) | | (51.2 | ) | (52.7 | ) | | (51.8 | ) |

| Other | (2.8 | ) | | (6.0 | ) | (3.6 | ) | | (2.9 | ) |

| Net cash used in by financing activities | (122.5 | ) | | (151.7 | ) | |

| Net cash used in financing activities | | (63.9 | ) | | (122.6 | ) |

Effect of Exchange Rate Changes on Cash and Cash Equivalents | 3.1 |

| | (0.2 | ) | (4.2 | ) | | 3.1 |

|

Net decrease in Cash, Cash Equivalents, and Restricted Cash during the period | (108.2 | ) | | (3.8 | ) | (41.1 | ) | | (108.2 | ) |

| Cash, Cash Equivalents, and Restricted Cash at beginning of period | 311.1 |

| | 219.7 |

| 299.7 |

| | 311.1 |

|

| Cash, Cash Equivalents, and Restricted Cash at end of period | $ | 202.9 |

| | $ | 215.9 |

| $ | 258.6 |

| | $ | 202.9 |

|

See accompanying notes to consolidated financial statements.

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 1. Description of Business

As used herein, "GATX," "we," "us," "our," and similar terms refer to GATX Corporation and its subsidiaries, unless indicated otherwise.

We lease, operate, manage, and remarket long-lived, widely-used assets, primarily in the rail market. We report our financial results through fourprimary business segments: Rail North America, Rail International, Portfolio Management, and American Steamship Company (“ASC”), and Portfolio Management..

NOTE 2. Basis of Presentation

We prepared the accompanying unaudited consolidated financial statements in accordance with USU.S. Generally Accepted Accounting Principles ("GAAP") for interim financial information and the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, our unaudited consolidated financial statements do not include all of the information and footnotes required for complete financial statements. We have included all of the normal recurring adjustments that we deemed necessary for a fair presentation. Certain prior year amounts have been reclassified to conform to the 2018 presentation.

Operating results for the nine months ended September 30, 2017,2018 are not necessarily indicative of the results we may achieve for the entire year ending December 31, 2017.2018. In particular, ASC's fleet is inactive for a significant portion of the first quarter of each year due to winter conditions on the Great Lakes. In addition, asset remarketing income does not occur evenly throughout the year. For more information, refer to the consolidated financial statements and footnotes in our Annual Report on Form 10-K for the year ended December 31, 2016.2017.

New Accounting Pronouncements Adopted

Equity Method and Joint Ventures

|

| | |

| Standard/Description | Effective Date and Adoption Considerations | Effect on Financial Statements or Other Significant Matters |

Revenue from Contracts with Customers

In March 2016, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2016-07, Investments - Equity Method and Joint Ventures (Topic 323): Simplifying the Transition to the Equity Method of Accounting, which eliminates the requirement to retrospectively apply equity method accounting when an entity increases ownership or influence in a previously held investment. The new guidance was effective for us in the first quarter of 2017. Application of the new guidance did not impact our financial statements or related disclosures.

Stock Compensation

In March 2016, the FASB issued ASU 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting, which simplifies and clarifies certain aspects of share-based payments accounting and presentation. The update requires recognition of excess tax benefits and tax deficiencies, which arise due to differences between the measure of compensation expense and the amount deductible for tax purposes, to be recorded directly through earnings as a component of income tax expense. Previously, these differences were generally recorded in additional paid-in capital and thus had no impact on net income. The change in treatment of excess tax benefits and tax deficiencies also impacts the computation of diluted earnings per share, and the cash flows associated with those items are classified as operating activities on the consolidated statements of cash flows. The guidance also clarifies that all cash payments made to taxing authorities on the employees' behalf for withheld shares should be classified as financing activities on the consolidated statements of cash flows. Additionally, the guidance permits entities to make an accounting policy election for the impact of forfeitures on the recognition of expense for share-based payment awards. Forfeitures can be estimated as of the initial valuation date, as allowed under the previous guidance, or recognized when they occur. We changed our accounting policy to recognize forfeitures when they occur as part of this adoption. These amendments became effective in the first quarter of 2017, and we adopted this guidance as of January 1, 2017. Adoption of this new standard did not have a material impact on our financial statements or related disclosures.

In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2014-09, Revenue from Contracts with Customers(Topic 606), which supersedes most current revenue recognition guidance, including industry-specific guidance. Subsequently, the FASB has issued updates which provide additional implementation guidance. The new guidance requires companies to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration it expects to be entitled to in exchange for those goods or services.

|

We adopted this guidance in the first quarter of 2018 applying the modified retrospective approach. |

We have completed our review of all revenue sources in scope for the new standard, and marine operating revenue is our largest component. In accordance with the new standard, the basis for determining revenue and expenses allocable to in-process shipments has been modified; however, the impact does not have a material impact on our financial statements. The net cumulative effect adjustment for this change was immaterial to retained earnings as of January 1, 2018. |

Financial Instruments

In January 2016, the FASB issued ASU 2016-01, Financial Instruments - Overall (Topic 825): Recognition and Measurement of Financial Assets and Financial Liabilities, which modifies the accounting and reporting requirements for certain equity securities and financial liabilities. |

We adopted the new guidance in the first quarter of 2018. |

The application of this new guidance did not impact our financial statements or related disclosures. |

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

Statement of Cash Flows

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash, which clarifies the classification and presentation of changes in restricted cash on the statement of cash flows. We elected to early adopt the new guidance as of January 1, 2017, using the retrospective method. Application of the new guidance requires presentation of restricted cash together with cash and cash equivalents on the consolidated statements of cash flows and eliminates the disclosure of the related changes in restricted cash within investing activities.

New Accounting Pronouncements Not Yet Adopted (Continued)

|

| | |

| Standard/Description | Effective Date and Adoption Considerations | Effect on Financial Statements or Other Significant Matters |

Income Taxes

In October 2016, the FASB issued ASU 2016-16, Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory, which modifies how an entity will recognize the income tax consequences of an intra-entity transfer of an asset when the transfer occurs. |

We adopted the new guidance in the first quarter of 2018, applying the modified retrospective method. |

The application of this new guidance had an immaterial impact on our financial statements and related disclosures, including the net cumulative effect adjustment recorded in retained earnings as of January 1, 2018. |

Compensation

In March 2017, the FASB issued ASU 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost, which modifies how an entity must present service costs and other components of net benefit cost. |

We adopted the new guidance in the first quarter of 2018, applying the retrospective method. The optional practical expedient was elected. |

Application of the new guidance had an immaterial impact on the presentation of our financial statements as certain components of our net periodic pension and other post-retirement benefits costs were reclassified to an alternative income statement line. |

Deferred Income Tax

In December 2017, the FASB issued ASU 2017-15, Codification Improvements to Topic 995, U.S. Steamship Entities, which supersedes obsolete guidance in Topic 995 on unrecognized deferred taxes related to certain statutory reserve deposits. If an entity has unrecognized deferred income taxes related to statutory deposits made on or before December 15, 1992, the entity would be required to recognize the unrecognized income taxes in accordance with Topic 740. |

We elected to early adopt this new guidance in the first quarter of 2018, applying the modified retrospective method. |

The application of this new guidance had an immaterial impact on our financial statements and related disclosures, including the net cumulative effect adjustment recorded in retained earnings as of January 1, 2018. |

Accumulated Other Comprehensive Income

In February 2018, the FASB issued ASU 2018-02, Income Statement Reporting - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income, which permits reclassification of certain stranded tax effects from the Tax Cuts and Jobs Act from Accumulated Other Comprehensive Income to Retained Earnings. The amount of the reclassification is calculated on the basis of the difference between the historical and newly enacted tax rates recorded for the applicable AOCI components. |

We adopted the new guidance in the first quarter of 2018. |

The application of this new guidance resulted in the reclassification of stranded tax effects resulting from the newly enacted Tax Act of $19.4 million from Accumulated Other Comprehensive Income to Retained Earnings. |

Revenue from Contracts with Customers

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606), which supersedes most current revenue recognition guidance, including industry-specific guidance. Subsequently, the FASB has issued updates which provide additional implementation guidance. The new guidance requires companies to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration it expects to be entitled to in exchange for those goods or services. The FASB delayed the effective date of this guidance to the first quarter of 2018, with early adoption permitted as of the original effective date of the first quarter of 2017. We plan to adopt this guidance as of January 1, 2018, using the modified retrospective approach. Our primary source of revenue is lease revenue, which will continue to be within the scope of existing lease accounting guidance upon adoption of Topic 606. We have substantially completed our review of all other revenue sources in scope for the new standard and have concluded the new guidance will not have a material impact on our financial statements.

Leases

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), which supersedes most current lease guidance. The new guidance requires companies to recognize most leases on the balance sheet and modifies accounting, presentation, and disclosure for both lessors and lessees. The new guidance is effective for us in the first quarter of 2019, with early adoption permitted. We plan to adopt this guidance on January 1, 2019, using a modified retrospective transition method, and we expect to utilize the package of three optional practical expedients as provided in the standard. We continue to assess the effect the new guidance will have on our consolidated financial statements and related disclosures.

Financial Instruments

In January 2016, the FASB issued ASU 2016-01, Financial Instruments - Overall (Topic 825): Recognition and Measurement of Financial Assets and Financial Liabilities, which modifies the accounting and reporting requirements for certain equity securities and financial liabilities. The new guidance is effective for us beginning in the first quarter of 2018, with certain provisions eligible for early adoption. We do not expect the new guidance to have a significant impact on our financial statements or related disclosures.

Credit Losses

In June 2016, the FASB issued ASU 2016-13, Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which modifies how entities will measure credit losses. The new guidance is effective for us in the first quarter of 2020, with early adoption permitted. We are evaluating the effect the new guidance will have on our financial statements and related disclosures.

Statement of Cash Flows

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments, which clarifies the classification of certain cash receipts and payments in the statement of cash flows. The new guidance is effective for us in the first quarter of 2018, with early adoption permitted. We do not expect the new guidance to have a significant impact on our financial statements or related disclosures.

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

New Accounting Pronouncements Not Yet Adopted

In October 2016, the FASB issued ASU 2016-16, Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory, which modifies how an entity will recognize the income tax consequences of an intra-entity transfer of an asset when the transfer occurs. The new guidance is effective for us in the first quarter of 2018, with early adoption permitted. We plan to adopt this guidance on January 1, 2018, applying the retrospective method. We do not expect the new guidance to have a material impact on our financial statements and related disclosures. |

| | |

| Standard/Description | Effective Date and Adoption Considerations | Effect on Financial Statements or Other Significant Matters |

Leases

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), which supersedes most current lease guidance. The FASB subsequently issued ASU 2018-10 and ASU 2018-11, Lease (Topic 842), for codification and targeted improvements to the standard. The new guidance requires companies to recognize most leases on the balance sheet and modifies accounting, presentation, and disclosure for both lessors and lessees. |

Compensation

In March 2017, the FASB issued ASU 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost, which modifies how an entity must present service costs and other components of net benefit cost. The new guidance is effective for us in the first quarter of 2018, with early adoption permitted. We plan to adopt this guidance on January 1, 2018, applying the retrospective method. We do not expect the new guidance to have a significant impact on our financial statements and related disclosures.

Derivatives and Hedging

In August 2017, the FASB issued ASU 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities, which expands and refines hedge accounting for both financial and non-financial risk components, aligns the recognition and presentation of the effects of hedging instruments and hedge items in the financial statements, and includes certain targeted improvements to ease the application of current guidance related to the assessment of hedge effectiveness. The update to the standard is effective for us beginning in the first quarter of 2019, with early adoption permitted in any interim period. We do not expect the new guidance to have a significant impact on our financial statements or related disclosures.

The new guidance is effective for us in the first quarter of 2019 with early adoption permitted.

We plan to adopt this guidance on January 1, 2019, using a modified retrospective transition method with a cumulative effect adjustment upon adoption, and we expect to utilize the package of optional practical expedients as provided in the standard. |

We continue to assess the effect the new guidance will have on our consolidated financial statements and related disclosures. The adoption of the amended lease guidance will require us to recognize right of use assets and lease liabilities on our balance sheet attributable to operating leases for railcars, offices, and certain equipment. We are in the process of completing our analysis to determine applicable amounts. |

Credit Losses

In June 2016, the FASB issued ASU 2016-13, Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which modifies how entities will measure credit losses. |

The new guidance is effective for us in the first quarter of 2020, with early adoption permitted. |

We are evaluating the effect the new guidance will have on our financial statements and related disclosures. |

Derivatives and Hedging

In August 2017, the FASB issued ASU 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities, which expands and refines hedge accounting for both financial and non-financial risk components, aligns the recognition and presentation of the effects of hedging instruments and hedge items in the financial statements, and includes certain targeted improvements to ease the application of current guidance related to the assessment of hedge effectiveness. |

The update to the standard is effective for us beginning in the first quarter of 2019, with early adoption permitted in any interim period. |

We do not expect the new guidance to have a significant impact on our financial statements or related disclosures. |

Compensation

In June 2018, the FASB issued ASU 2018-07, Compensation - Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting, which modifies the accounting for nonemployee share-based payments. |

The new guidance is effective for us in the first quarter of 2019, with early adoption permitted in any interim period. |

We are evaluating the effect the new guidance will have on our financial statements and related disclosures. |

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

NOTE 3. Revenue

Adoption of Accounting Standards Codification Topic 606, “Revenue from Contracts with Customers”

In the first quarter of 2018, we adopted Topic 606 using the modified retrospective method with respect to applicable contracts existing as of January 1, 2018. As provided in the guidance, we recognize marine operating revenue in the amount that corresponds directly to the value transferred to the customer. Contract assets and liabilities related to our customer performance obligations are not material to our financial statements. Results for reporting periods beginning after January 1, 2018 are presented under Topic 606, while prior period amounts have not been adjusted and continue to be reported in accordance with appropriate accounting guidance. We recorded an immaterial cumulative adjustment to opening retained earnings, with the impact completely attributable to our marine operating revenue.

Revenue Recognition

Revenue is recognized when control of the promised goods or services is transferred to our customers, in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services.

We disaggregate revenue into three categories as presented on our income statement:

Lease Revenue

Lease revenue, which includes operating lease revenue and finance lease revenue, is our primary source of revenue which continues to be within the scope of existing lease guidance. Therefore, the adoption of Topic 606 had no impact on our recognition or presentation of lease revenue.

Operating Lease Revenue

We lease railcars and other operating assets under full-service and net operating leases. We price full-service leases as an integrated service that includes amounts related to executory costs, such as maintenance, insurance, and ad valorem taxes. We do not offer stand-alone maintenance service contracts and are unable to separate executory costs from full-service lease revenue. Operating lease revenue, including amounts related to executory costs, is recognized on a straight-line basis over the term of the underlying lease. As a result, we may not recognize lease revenue in the same period as maintenance and other executory costs, which we expense as incurred. Contingent rents are recognized when the contingency is resolved. Revenue is not recognized if collectability is not reasonably assured.

Finance Lease Revenue

In certain cases, we lease railcars and other operating assets that, at lease inception, are classified as finance leases. We recognize unearned income as lease revenue using the interest method, which produces a constant yield over the lease term. Initial unearned income is the amount that the original lease payment receivable and the estimated residual value of the leased asset exceeds the original cost or carrying value of the leased asset.

Marine Operating Revenue

We generate marine operating revenue through shipping services completed by our marine vessels. Upon adoption of Topic 606, marine operating revenue is recognized over time as the performance obligation is satisfied, beginning when cargo is loaded through its delivery and discharge. Revenue is recognized pro rata over the projected duration of each voyage, which is derived from our historical voyage data.

Other Revenue

Other revenue comprises customer liability repair revenue, utilization income, fee income, interest on loans, and other miscellaneous revenues. Select components of other revenue are within the scope of Topic 606 but based on our assessment, we determined that our

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

current revenue elements and timing for purposes of income recognition are consistent with applicable provisions in the new standard. The remaining items are considered lease components that continue to be within the scope of existing lease guidance.

NOTE 3.4. Fair Value Disclosure

The following tables show our assets and liabilities that are measured at fair value on a recurring basis (in millions):

| | | Assets | Total September 30 2017 | | Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | Total September 30 2018 | | Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) |

| Interest rate derivatives (1) | $ | 0.1 |

| | $ | — |

| | $ | 0.1 |

| | $ | — |

| |

| Foreign exchange rate derivatives (1) | 2.6 |

| | — |

| | 2.6 |

| | — |

| $ | 3.2 |

| | $ | — |

| | $ | 3.2 |

| | $ | — |

|

| Foreign exchange rate derivatives (2) | 0.3 |

| | — |

| | 0.3 |

| | — |

| 0.2 |

| | — |

| | 0.2 |

| | — |

|

| Liabilities |

|

| | | | | | |

|

| | | | | | |

| Interest rate derivatives (1) | 0.9 |

| | — |

| | 0.9 |

| | — |

| 13.3 |

| | — |

| | 13.3 |

| | — |

|

| Foreign exchange rate derivatives (1) | 22.8 |

| | — |

| | 22.8 |

| | — |

| 21.4 |

| | — |

| | 21.4 |

| | — |

|

| Foreign exchange rate derivatives (2) | 2.9 |

| | — |

| | 2.9 |

| | — |

| 4.0 |

| | — |

| | 4.0 |

| | — |

|

| | | Assets | Total December 31 2016 | | Quoted

Prices in

Active Markets for

Identical Assets

(Level 1) | | Significant Observable Inputs

(Level 2) | | Significant Unobservable

Inputs

(Level 3) | Total December 31 2017 | | Quoted

Prices in

Active Markets for

Identical Assets

(Level 1) | | Significant Observable Inputs

(Level 2) | | Significant Unobservable

Inputs

(Level 3) |

| Foreign exchange rate derivatives (1) | | $ | 1.2 |

| | $ | — |

| | $ | 1.2 |

| | $ | — |

|

| Liabilities | | | | | | | | |

| Interest rate derivatives (1) | $ | 2.9 |

| | $ | — |

| | $ | 2.9 |

| | $ | — |

| 4.7 |

| | — |

| | 4.7 |

| | — |

|

| Foreign exchange rate derivatives (1) | 12.2 |

| | — |

| | 12.2 |

| | — |

| 27.7 |

| | — |

| | 27.7 |

| | — |

|

| Foreign exchange rate derivatives (2) | 1.3 |

| | — |

| | 1.3 |

| | — |

| 6.9 |

| | — |

| | 6.9 |

| | — |

|

| Liabilities | | | | | | | | |

| Interest rate derivatives (1) | 0.1 |

| | — |

| | 0.1 |

| | — |

| |

_________

| |

| (2) | Not designated as hedges. |

We value derivatives using a pricing model with inputs (such as yield curves and foreign currency rates) that are observable in the market or that can be derived principally from observable market data.

Derivative instruments

Fair Value Hedges

We use interest rate swaps to manage the fixed-to-floating rate mix of our debt obligations by converting thea portion of our fixed rate debt to floating rate debt. For fair value hedges, we recognize changes in fair value of both the derivative and the hedged item as interest expense. We had eightnine instruments outstanding with an aggregate notional amount of $450.0$500.0 million as of September 30, 2017 that mature2018 with maturities ranging from 20182019 to 2022 and eightten instruments outstanding with an aggregate notional amount of $550.0 million as of December 31, 20162017 with maturities ranging from 20172018 to 2020.2022.

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

Cash Flow Hedges

We use interest rate swaps to convert floating rate debt to fixed rate debt. We use Treasury rate locks and swap rate locks to hedge our exposure to interest rate risk on anticipated transactions. We also use currency swaps to hedge our exposure to fluctuations in the exchange rates of the foreign currencies in which we conduct business. We had eleven8 instruments outstanding with an aggregate notional amount of $290.2$291.1 million as of September 30, 20172018 that mature from 20172018 to 2022 and ninefive instruments outstanding with an aggregate notional amount of $412.1$285.6 million as of December 31, 20162017 with maturities ranging from 20172019 to 2022. Within the next 12 months, we expect to reclassify $5.2$2.9 million ($3.32.2 million after-tax) of net losses on previously terminated derivatives from accumulated other comprehensive income (loss) to interest expense or operating lease expense, as applicable. We reclassify these amounts when interest and operating lease expense on the related hedged transactions affect earnings.

Non-designated Derivatives

We do not hold derivative financial instruments for purposes other than hedging, although certain of our derivatives are not designated as accounting hedges. We recognize changes in the fair value of these derivatives in other (income) expense immediately.

Some of our derivative instruments contain credit risk provisions that could require us to make immediate payment on net liability positions in the event that we default on certain outstanding debt obligations. The aggregate fair value of our derivative instruments with credit risk related contingent features that are in a liability position as of September 30, 2017,2018 was $23.7$34.7 million. We are not required to post any collateral on our derivative instruments and do not expect the credit risk provisions to be triggered.

In the event that a counterparty fails to meet the terms of an interest rate swap agreement or a foreign exchange contract, our exposure is limited to the fair value of the swap, if in our favor. We manage the credit risk of counterparties by transacting with institutions that we consider financially sound and by avoiding concentrations of risk with a single counterparty. We believe that the risk of non-performance by any of our counterparties is remote.

The following table shows the impacts of our derivative instruments on our statement of comprehensive income (in millions):

| | | | | | | Three Months Ended

September 30 | | Nine Months Ended

September 30 | | | | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| Derivative Designation | | Location of Loss (Gain) Recognized | | 2017 | | 2016 | | 2017 | | 2016 | | Location of Loss (Gain) Recognized | | 2018 | | 2017 | | 2018 | | 2017 |

| Fair value hedges (1) | | Interest expense | | $ | 0.6 |

| | $ | 2.6 |

| | $ | 1.5 |

| | $ | (3.3 | ) | | Interest expense | | $ | 1.0 |

| | $ | 0.6 |

| | $ | 8.6 |

| | $ | 1.5 |

|

| Cash flow hedges | | Other comprehensive (income) loss (effective portion) | | (11.1 | ) | | (2.8 | ) | | (34.8 | ) | | (26.8 | ) | | Other comprehensive loss (effective portion) | | 2.7 |

| | (11.1 | ) | | 8.4 |

| | (34.8 | ) |

| Cash flow hedges | | Interest expense (effective portion reclassified from accumulated other comprehensive loss) | | 1.7 |

| | 1.7 |

| | 5.1 |

| | 5.1 |

| | Interest expense (effective portion reclassified from accumulated other comprehensive loss) | | 1.1 |

| | 1.7 |

| | 3.3 |

| | 5.1 |

|

| Cash flow hedges | | Operating lease expense (effective portion reclassified from accumulated other comprehensive loss) | | — |

| | 0.7 |

| | — |

| | 1.1 |

| | Operating lease expense (effective portion reclassified from accumulated other comprehensive loss) | | 0.1 |

| | — |

| | 0.1 |

| | — |

|

| Cash flow hedges (2) | | Other (income) expense (effective portion reclassified from accumulated other comprehensive loss) | | 10.1 |

| | 3.3 |

| | 33.8 |

| | 13.6 |

| | Other (income) expense (effective portion reclassified from accumulated other comprehensive loss) | | (2.2 | ) | | 10.1 |

| | (10.3 | ) | | 33.8 |

|

| Non-designated | | Other (income) expense | | (2.0 | ) | | 2.2 |

| | 4.1 |

| | (0.1 | ) | | Other (income) expense | | 3.0 |

| | (2.0 | ) | | (2.7 | ) | | 4.1 |

|

_________

| |

| (1) | The fair value adjustments related to the underlying debt equally offset the amounts recognized in interest expense. |

| |

| (2) | Includes (income) expense on foreign currency derivatives that are substantially offset by foreign currency remeasurement adjustments on related hedged instruments, also recognized in Other (income) expense. |

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

Other Financial Instruments

The carrying amounts of cash and cash equivalents, restricted cash, rent and other receivables, accounts payable, and commercial paper and bank credit facilities approximate fair value due to the short maturity of those instruments. We base the fair values of investment funds, which are accounted for under the cost method, on the best information available, which may include quoted investment fund values. We estimate the fair values of loans and fixed and floating rate debt using discounted cash flow analyses that are based on interest rates currently offered for loans with similar terms to borrowers of similar credit quality. The inputs we use to estimate each of these values are classified in Level 2 of the fair value hierarchy because they are directly or indirectly observable inputs.

The following table shows the carrying amounts and fair values of our other financial instruments (in millions):

| | | | September 30, 2017 | | December 31, 2016 | September 30, 2018 | | December 31, 2017 |

| Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

| Assets | | | | | | | | |

| Investment funds | $ | 0.6 |

| | $ | 1.2 |

| | $ | 0.6 |

| | $ | 1.2 |

| |

| Loans | 0.2 |

| | 0.2 |

| | 6.2 |

| | 6.2 |

| |

| Liabilities | | | | | | | | | | | | | | |

| Recourse fixed rate debt | $ | 3,864.6 |

| | $ | 3,977.6 |

| | $ | 3,858.5 |

| | $ | 3,852.6 |

| $ | 3,998.4 |

| | $ | 3,935.5 |

| | $ | 3,971.2 |

| | $ | 4,089.1 |

|

| Recourse floating rate debt | 425.0 |

| | 429.4 |

| | 417.8 |

| | 412.2 |

| 423.8 |

| | 425.2 |

| | 426.0 |

| | 428.7 |

|

NOTE 4. Assets Held for Sale

The following table summarizes our assets held for sale (in millions):

|

| | | | | | | |

| | September 30 | | December 31 |

| | 2017 | | 2016 |

| Rail North America | $ | 4.4 |

| | $ | 43.9 |

|

| Portfolio Management | 19.2 |

| | 45.6 |

|

| | $ | 23.6 |

| | $ | 89.5 |

|

For assets classified as held for sale, in the first nine months of 2017, we sold inland marine assets in the Portfolio Management segment with a carrying value of $26.4 million for proceeds of $28.2 million, resulting in a net gain of $1.8 million. At Rail North America, we sold certain railcars with a carrying value of $21.8 million for proceeds of $49.9 million, resulting in a net gain of $28.1 million. In addition, other railcars that were not sold with a carrying value of $19.7 million were reclassified out of assets held for sale and written down to their estimated fair value, resulting in the recognition of a $1.9 million impairment loss. All assets classified as held for sale at September 30 are expected to be sold in 2017.

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

NOTE 5. Pension and Other Post-Retirement Benefits

The following table shows the components of our pension and other post-retirement benefits expense for the three months ended September 30, 20172018 and 20162017 (in millions):

| | | | 2017 Pension

Benefits | | 2016 Pension

Benefits | | 2017 Retiree

Health

and Life | | 2016 Retiree

Health

and Life | 2018 Pension Benefits | | 2017 Pension Benefits | | 2018 Retiree Health and Life | | 2017

Retiree Health and Life |

| Service cost | $ | 1.6 |

| | $ | 1.5 |

| | $ | — |

| | $ | 0.1 |

| $ | 2.0 |

| | $ | 1.6 |

| | $ | 0.1 |

| | $ | — |

|

| Interest cost | 3.8 |

| | 3.9 |

| | 0.2 |

| | 0.2 |

| 3.7 |

| | 3.8 |

| | 0.2 |

| | 0.2 |

|

| Expected return on plan assets | (5.9 | ) | | (6.5 | ) | | — |

| | — |

| (5.6 | ) | | (5.9 | ) | | — |

| | — |

|

| Settlement expense | — |

| | 5.7 |

| | — |

| | — |

| 2.1 |

| | — |

| | — |

| | — |

|

| Amortization of (1): | | | | | | | | | | | | | | |

| Unrecognized prior service credit | — |

| | (0.2 | ) | | — |

| | (0.1 | ) | — |

| | — |

| | (0.1 | ) | | — |

|

| Unrecognized net actuarial loss | 2.2 |

| | 2.6 |

| | — |

| | — |

| 2.5 |

| | 2.2 |

| | — |

| | — |

|

| Net expense | $ | 1.7 |

| | $ | 7.0 |

| | $ | 0.2 |

| | $ | 0.2 |

| |

| Net periodic cost | | $ | 4.7 |

| | $ | 1.7 |

| | $ | 0.2 |

| | $ | 0.2 |

|

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

The following table shows the components of our pension and other post-retirement benefits expense for the nine months ended September 30, 20172018 and 20162017 (in millions):

| | | | 2017 Pension

Benefits | | 2016 Pension

Benefits | | 2017 Retiree

Health

and Life | | 2016 Retiree

Health

and Life | 2018 Pension Benefits | | 2017 Pension Benefits | | 2018 Retiree Health and Life | | 2017

Retiree Health and Life |

| Service cost | $ | 4.9 |

| | $ | 4.5 |

| | $ | 0.1 |

| | $ | 0.2 |

| $ | 6.1 |

| | $ | 4.9 |

| | $ | 0.2 |

| | $ | 0.1 |

|

| Interest cost | 11.5 |

| | 11.8 |

| | 0.7 |

| | 0.7 |

| 11.1 |

| | 11.5 |

| | 0.7 |

| | 0.7 |

|

| Expected return on plan assets | (17.9 | ) | | (19.5 | ) | | — |

| | — |

| (16.7 | ) | | (17.9 | ) | | — |

| | — |

|

| Settlement expense | 0.1 |

| | 5.7 |

| | — |

| | — |

| 2.1 |

| | 0.1 |

| | — |

| | — |

|

| Amortization of (1): | | | | | | | | | | | | | | |

| Unrecognized prior service credit | — |

| | (0.7 | ) | | (0.1 | ) | | (0.2 | ) | — |

| | — |

| | (0.2 | ) | | (0.1 | ) |

| Unrecognized net actuarial loss (gain) | 6.9 |

| | 7.7 |

| | (0.2 | ) | | (0.2 | ) | 7.6 |

| | 6.9 |

| | — |

| | (0.2 | ) |

| Net expense | $ | 5.5 |

| | $ | 9.5 |

| | $ | 0.5 |

| | $ | 0.5 |

| |

| Net periodic cost | | $ | 10.2 |

| | $ | 5.5 |

| | $ | 0.7 |

| | $ | 0.5 |

|

________

(1) Amounts reclassified from accumulated other comprehensive loss.

In 2018, we adopted ASU 2017-07 which modifies how an entity must present service costs and other components of net benefit cost. See "Note 2. Basis of Presentation" for further details. In accordance with this new guidance, the service cost component of net periodic cost is recorded in the applicable operating expense line, including maintenance expense and selling, general and administrative expense in the Statements of Comprehensive Income; and the other components are recorded in other expense.

During the third quarter of 2016,2018, we recorded a settlement accounting adjustmentexpense of $5.7$2.1 million attributable to lump sum payments elected by eligible retirees as part of a voluntary early retirement program offered in 2015.certain lump-sum distributions made during the period.

NOTE 6. Share-Based Compensation

During the nine months ended September 30, 2017,2018, we granted eligible incentive plan participants the aggregate of 354,400320,100 non-qualified employee stock options, 49,84061,490 restricted stock units, 63,71058,440 performance shares, and 18,08017,709 phantom stock units. For the three months and nine months ended September 30, 2018, total share-based compensation expense was $5.7 million and $15.4 million and the related tax benefits were $1.4 million and $3.9 million. For the three months and nine months ended September 30, 2017, total share-based compensation expense was $3.4 million and $10.6 million and the related tax benefits were $1.3 million and $4.1 million. For the three months and nine months ended September 30, 2016, total share-based compensation expense was $3.2 million and $9.1 million and the related tax benefits were $1.3 million and $3.5 million.

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

The estimated fair value of our 20172018 non-qualified employee stock option awards and related underlying assumptions are shown in the table below.

| | | | 2017 | 2018 |

| Estimated fair value, including present value of dividends | $ | 19.40 |

| |

| Weighted average estimated fair value | | $ | 21.87 |

|

| Quarterly dividend rate | $ | 0.42 |

| $ | 0.44 |

|

| Expected term of stock option awards, in years | 4.7 |

| |

| Expected term of stock options and stock appreciation rights, in years | | 4.5 |

| Risk-free interest rate | 1.9 | % | 1.4 | % |

| Dividend yield | 2.8 | % | 2.5 | % |

| Expected stock price volatility | 27.7 | % | 27.9 | % |

| Present value of dividends | $ | 7.50 |

| $ | 7.51 |

|

NOTE 7. Income Taxes

On December 22, 2017, the Tax Act was enacted, which made broad and complex changes to the U.S. tax laws. In particular, the U.S. corporation income tax rate was reduced to 21% from 35%, and a new territorial tax system was implemented that will affect the future

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

U.S. taxation of earnings repatriated from our foreign subsidiaries and affiliates. Other provisions included an immediate deduction for qualified investments and limitations on the deductibility of interest expense and executive compensation. Due to our net operating loss position, these adjustments had no cash impact on our tax positions.

In 2017, we recorded a one-time non-cash net tax benefit of $315.9 million, which represented our provisional estimate of the impact of the Tax Act. This amount included a net benefit of $371.4 million associated with the re-measurement of our net deferred tax liability utilizing the lower U.S. tax rate. The Tax Act also imposed a one-time transitional repatriation tax of $57.2 million on certain undistributed earnings of our non-U.S. subsidiaries and affiliates.

We continue to evaluate the provisions of the Tax Act, and the ultimate impact may differ from this provisional estimate, due to, among other things, changes in interpretations and assumptions made by us, additional guidance that may be issued by the Internal Revenue Service and the U.S. Department of the Treasury, and actions that we may take. In addition, these estimates may change due to guidance provided by state taxing authorities and the completion of our 2017 U.S. and state income tax returns. No adjustments were made to our initial provisional estimate during the nine months ended September 30, 2018.

Our effective tax rate was 26% for the nine months ended September 30, 2018, compared to 32% for the nine months ended September 30, 2017, compared to 33% for the nine months ended September 30, 2016.2017. The difference in the effective rates for the current year compared to the prior year is primarily attributable to the reduction in the U.S. corporation income tax rate from 35% to 21%, as part of the Tax Act. Additionally, the effective tax rate was impacted by the mix of pre-tax income among domestic and foreign jurisdictions, which are taxed at different rates. Additionally, during the quarter, based upon the status of our current state incomeIncremental tax audits and our expectations of the ultimate resolution, we released the remaining balance of our liability for unrecognized tax benefits and recognized an income tax benefit of $4.3 million ($2.8 million, net of federal tax). Also, our consolidated state income tax rate increased, effective July 1, 2017, due to legislation enacted in the state of Illinois. Accordingly, we recorded a deferred state income tax adjustment of $3.1 million in the quarter. Finally, the 2017 effective tax rate reflects incremental benefits associated with equity awardsshare-based compensation were also recognized in accordance witheach of the adoption of new accounting rulesnine-month periods ended September 30, 2018 and the impact of reductions in the statutory tax rates in Quebec and Saskatchewan, Canada and India, partially offset by an increase to the effective tax rate in Germany.2017.

NOTE 8. Commercial Commitments

We have entered into various commercial commitments, such as guarantees, standby letters of credit, and performance bonds, related to certain transactions. These commercial commitments require us to fulfill specific obligations in the event of third-party demands. Similar to our balance sheet investments, these commitments expose us to credit, market, and equipment risk. Accordingly, we evaluate these commitments and other contingent obligations using techniques similar to those we use to evaluate funded transactions.

The following table shows our commercial commitments (in millions):

| | | | September 30 | | December 31 | | | | | |

| | 2017 | | 2016 | September 30 2018 | | December 31 2017 |

| Lease payment guarantees | $ | 7.6 |

| | $ | 15.0 |

| $ | 2.7 |

| | $ | 4.9 |

|

| Standby letters of credit and performance bonds | 8.8 |

| | 8.9 |

| 17.4 |

| | 17.8 |

|

| Total commercial commitments (1) | $ | 16.4 |

| | $ | 23.9 |

| $ | 20.1 |

| | $ | 22.7 |

|

_______

| |

(1) | The carrying value of liabilities on the balance sheet for commercial commitments was $2.3 million at September 30, 2017 and $3.0 million at December 31, 2016. The expirations of these commitments range from 2017 to 2023.(1) The carrying value of liabilities on the balance sheet for commercial commitments was $1.2 million at September 30, 2018 and $2.0 million at December 31, 2017. The expirations of these commitments range from 2019 to 2023. We are not aware of any event that would require us to satisfy any of our commitments. |

Lease payment guarantees are commitments to financial institutions to make lease payments for a third party in the event they default. We reduce any liability that may result from these guarantees by the value of the underlying asset or group of assets.

We are also parties to standby letters of credit and performance bonds, which primarily relate to contractual obligations and general liability insurance coverages. No material claims have been made against these obligations, and no material losses are anticipated.

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

NOTE 9. Earnings per Share

We compute basic earnings per share by dividing net income available to our common shareholders by the weighted average number of shares of our common stock outstanding. We weightedweight shares issued or reacquired during the period for the portion of the period that they were outstanding. Our diluted earnings per share reflect the impacts of our potentially dilutive securities, which include our equity compensation awards.

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

The following table shows the computation of our basic and diluted net income per common share (in millions, except per share amounts):

| | | | Three Months Ended

September 30 | | Nine Months Ended

September 30 | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| | 2017 | | 2016 | | 2017 | | 2016 | 2018 | | 2017 | | 2018 | | 2017 |

| Numerator: | | | | | | | | | | | | | | |

| Net income | $ | 49.0 |

| | $ | 95.7 |

| | $ | 159.9 |

| | $ | 226.2 |

| $ | 47.0 |

| | $ | 49.0 |

| | $ | 162.1 |

| | $ | 159.9 |

|

| | | | | | | | | | | | | | | |

| Denominator: | | | | | | | | | | | | | | |

| Weighted average shares outstanding - basic | 38.6 |

| | 40.1 |

| | 39.0 |

| | 40.7 |

| 37.7 |

| | 38.6 |

| | 37.8 |

| | 39.0 |

|

| Effect of dilutive securities: | | | | | | | | | | | | | | |

| Equity compensation plans | 0.6 |

| | 0.5 |

| | 0.6 |

| | 0.5 |

| 0.8 |

| | 0.6 |

| | 0.7 |

| | 0.6 |

|

| Weighted average shares outstanding - diluted | 39.2 |

| | 40.6 |

| | 39.6 |

| | 41.2 |

| 38.5 |

| | 39.2 |

| | 38.5 |

| | 39.6 |

|

| Basic earnings per share | $ | 1.27 |

| | $ | 2.39 |

| | $ | 4.10 |

| | $ | 5.55 |

| $ | 1.25 |

| | $ | 1.27 |

| | $ | 4.29 |

| | $ | 4.10 |

|

| Diluted earnings per share | $ | 1.25 |

| | $ | 2.36 |

| | $ | 4.04 |

| | $ | 5.49 |

| $ | 1.22 |

| | $ | 1.25 |

| | $ | 4.21 |

| | $ | 4.04 |

|

NOTE 10. Accumulated Other Comprehensive Income (Loss)

The following table shows the change in components for accumulated other comprehensive loss (in millions):

| |

| Foreign Currency Translation Gain (Loss) | | Unrealized Gain (Loss) on Derivative Instruments | | Post-Retirement Benefit Plans | | Total | Foreign Currency Translation Gain (Loss) | | Unrealized Loss on Derivative Instruments | | Post-Retirement Benefit Plans | | Total |

| Balance at December 31, 2016 | (103.7 | ) | | (20.3 | ) | | (87.1 | ) | | (211.1 | ) | |

| Balance at December 31, 2017 | | $ | (10.5 | ) | | $ | (15.5 | ) | | $ | (83.6 | ) | | $ | (109.6 | ) |

| Change in component | 17.9 |

| | (5.1 | ) | | — |

| | 12.8 |

| 14.9 |

| | (11.5 | ) | | — |

| | 3.4 |

|

Reclassification adjustments into earnings | — |

| | 5.8 |

| | 2.2 |

| | 8.0 |

| — |

| | 9.3 |

| | 2.5 |

| | 11.8 |

|

| Income tax effect | — |

| | 0.1 |

| | (0.9 | ) | | (0.8 | ) | — |

| | 0.7 |

| | (0.6 | ) | | 0.1 |

|

| Balance at March 31, 2017 | $ | (85.8 | ) | | $ | (19.5 | ) | | $ | (85.8 | ) | | $ | (191.1 | ) | |

| Reclassification adjustments into retained earnings (2) | | — |

| | (3.0 | ) | | (16.4 | ) | | (19.4 | ) |

| Balance at March 31, 2018 | | $ | 4.4 |

| | $ | (20.0 | ) | | $ | (98.1 | ) | | $ | (113.7 | ) |

| Change in component | 40.7 |

| | (18.4 | ) | | — |

| | 22.3 |

| (50.4 | ) | | 18.0 |

| | — |

| | (32.4 | ) |

| Reclassification adjustments into earnings | — |

| | 21.3 |

| | 2.2 |

| | 23.5 |

| |

| Reclassification adjustments into earnings (1) | | — |

| | (15.2 | ) | | 2.5 |

| | (12.7 | ) |

| Income tax effect | — |

| | (0.8 | ) | | (0.8 | ) | | (1.6 | ) | — |

| | (0.6 | ) | | (0.6 | ) | | (1.2 | ) |

| Balance at June 30, 2017 | $ | (45.1 | ) | | $ | (17.4 | ) | | $ | (84.4 | ) | | $ | (146.9 | ) | |

| Balance at June 30, 2018 | | $ | (46.0 | ) | | $ | (17.8 | ) | | $ | (96.2 | ) | | $ | (160.0 | ) |

| Change in component | 15.4 |

| | (10.5 | ) | | — |

| | 4.9 |

| (4.7 | ) | | 2.8 |

| | 4.6 |

| | 2.7 |

|

| Reclassification adjustments into earnings | — |

| | 11.8 |

| | 2.2 |

| | 14.0 |

| |

| Reclassification adjustments into earnings (1) | | — |

| | (1.0 | ) | | 2.4 |

| | 1.4 |

|

| Income tax effect | — |

| | (0.6 | ) | | (0.8 | ) | | (1.4 | ) | — |

| | (0.2 | ) | | (1.7 | ) | | (1.9 | ) |

| Balance at September 30, 2017 | (29.7 | ) | | (16.7 | ) | | (83.0 | ) | | (129.4 | ) | |

| Balance at September 30, 2018 | | $ | (50.7 | ) | | $ | (16.2 | ) | | $ | (90.9 | ) | | $ | (157.8 | ) |

________

| |

| (1) | See "Note 4. Fair Value Disclosure" and "Note 5. Pension and Other Post-Retirement Benefits" for impacts of the reclassification adjustments on the statement of comprehensive income. |

| |

| (2) | As detailed in "Note 2. Basis of Presentation", we adopted ASU 2018-02, which permits reclassification of certain stranded tax effects related to the Tax Act from Accumulated Other Comprehensive Income to Retained Earnings. |

See "Note 3. Fair Value Disclosure" and "Note 5. Pension and Other Post-Retirement Benefits" for impacts of the reclassification adjustments on the statement of comprehensive income.

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

NOTE 11. Legal Proceedings and Other Contingencies

Various legal actions, claims, assessments and other contingencies arising in the ordinary course of business are pending against GATX and certain of our subsidiaries. These matters are subject to many uncertainties, and it is possible that some of these matters could ultimately be decided, resolved or settled adversely. For a full discussion of our pending legal matters, please refer to "Note 22. Legal Proceedings and Other Contingencies" of our consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2016.2017.

Viareggio Derailment

In June 2009, a train consisting of fourteen liquefied petroleum gas (“LPG”) tank cars owned by GATX Rail Austria GmbH and its subsidiaries (collectively, “GRA”) derailed while passing through the City of Viareggio, in the province of Lucca, Italy. Five tank cars overturned and one of the overturned cars was punctured by a peg or obstacle along the side of the track, resulting in a release of LPG, which subsequently ignited. The accident resulted in multiple deaths, personal injuries and property damage. The LPG tank cars were leased to FS Logistica S.p.A., a subsidiary of the Italian state-owned railway, Ferrovie dello Stato S.p.A (the “Italian Railway”).

On December 14, 2012, the prosecutors for Lucca charged the Italian Railway, GRA, and a number of their maintenance, operations, and managerial employees with various negligence-based crimes related to the accident. A trial was held in the court of Lucca and, on January 31, 2017, the court announced guilty verdicts against various Italian Railway companies, GRA, and certain of their employees. The court imposed a fine of 1.4 million Euros against GRA and prison sentences against the employees. GRA disagrees with the trial court’s ruling and believes that the evidence shows it and its employees acted diligently and in accordance with all applicable laws and regulations at all times. On October 14, 2017, GRA filed its appeal of the trial court’s ruling with the Court of Appeal in Florence (Corte d’Appello di Firenze) and, pending the final disposition of the appeal, these fines and penalties are not enforceable.

With respect to civil claims, the insurers for the Italian Railway and GRA have fully settled and resolved most of the claims arising out of the accident. With respect to unsettled claims, the Lucca court ordered all convicted defendants (including various Italian Railway entities and GRA) to pay final damages or advances to the remaining 56 claimants. The amount of these awards is immaterial and GRA expects that its insurers will continue to cover most of these damages to claimants except for a small number of civil claims. GRA will continue to incur legal expenses for the criminal appeals although they are not expected to be material. We cannot predict the outcome of the appeals process and thus cannot reasonably estimate the possible amount or range of costs that may be ultimately incurred in connection with this litigation.

NOTE 12. Financial Data of Business Segments

The financial data presented below depicts the profitability, financial position, and capital expenditures of each of our business segments.

We lease, operate, manage, and remarket long-lived, widely-used assets, primarily in the rail market. We report our financial results through four primary business segments: Rail North America, Rail International, Portfolio Management, and American Steamship Company (“ASC”), and Portfolio Management..

Rail North America is composed of our wholly owned operations in the United States, Canada, and Mexico, as well as an affiliate investment. Rail North America primarily provides railcars pursuant to full-service leases under which it maintains the railcars, pays ad valorem taxes and insurance, and provides other ancillary services.