UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 20202021

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 1-2328

GATX Corporation

(Exact name of registrant as specified in its charter)

| | | | | |

| New York | 36-1124040 |

| (State of incorporation) | (I.R.S. Employer Identification No.) |

233 South Wacker Drive

Chicago, Illinois 60606-7147

(Address of principal executive offices, including zip code)

(312) 621-6200

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock | GATX | New York Stock Exchange |

| GATX | Chicago Stock Exchange |

5.625% Senior Notes due 2066 | GMTA | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| ☒ | Large accelerated filer | | ☐ | Smaller reporting company |

| ☐ | Non-accelerated filer | | ☐ | Emerging growth company |

| ☐ | Accelerated filer | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

There were 35.035.5 million common shares outstanding at September 30, 2020.2021.

GATX CORPORATION

FORM 10-Q

QUARTERLY REPORT FOR THE PERIOD ENDED SEPTEMBER 30, 20202021

INDEX

| | | | | | | | |

| Item No. | | Page No. |

| | |

| | |

| Part I - FINANCIAL INFORMATION |

| Item 1 | | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2 | | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 3 | | |

| Item 4 | | |

| | |

| Part II - OTHER INFORMATION |

| Item 1 | | |

| Item 1A | | |

| Item 2 | | |

| Item 6 | | |

| |

| |

FORWARD-LOOKING STATEMENTS

Statements in this report not based on historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and, accordingly, involve known and unknown risks and uncertainties that are difficult to predict and could cause our actual results, performance, or achievements to differ materially from those discussed. These include statements as to our future expectations, beliefs, plans, strategies, objectives, events, conditions, financial performance, prospects, or future events. In some cases, forward-looking statements can be identified by the use of words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "predict," "potential," "outlook," "continue," "likely," "will," "would", and similar words and phrases. Forward-looking statements are necessarily based on estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Accordingly, you should not place undue reliance on forward-looking statements, which speak only as of the date they are made, and are not guarantees of future performance. We do not undertake any obligation to publicly update or revise these forward-looking statements.

A detailed discussion of the known material risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in our Annual Report on Form 10-K for the year ended December 31, 2019,2020, and in our other filings with the Securities and Exchange Commission ("SEC"). The following factors, in addition to those discussed under "Risk Factors", in our Annual Report on Form 10-K for the year ended December 31, 2019, and Part II, Item 1A of this Quarterly Report on Form 10-Q,2020 could cause actual results to differ materially from our current expectations expressed in forward looking statements:

| | | | | | | | |

•the severityduration and durationeffects of the global COVID-19 pandemic, including adverse impacts of the pandemic and of businesses’, governments’, and suppliers' responses to the pandemic on our business, personnel, operations, commercial activity, supply chain, the demand for our transportation assets, the value of our assets, and our liquidity, and macroeconomic conditions •exposure to damages, fines, criminal and civil penalties, and reputational harm arising from a negative outcome in litigation, including claims arising from an accident involving our railcars and other transportation assets •inability to maintain our transportation assets on lease at satisfactory rates due to oversupply of assets in the market or other changes in supply and demand •a significant decline in customer demand for our transportation assets or services, including as a result of: ◦weak macroeconomic conditions ◦weak market conditions in our customers' businesses ◦declines in harvest or production volumes ◦adverse changes in the price of, or demand for, commodities

◦changes in railroad operations, or efficiency, ◦changes in railroad pricing and service offerings, including those related to "precision scheduled railroading"

◦changes in supply chains ◦availability of pipelines, trucks, and other alternative modes of transportation ◦changes in conditions affecting the aviation industry, including reduced demand for air travel, geographic exposure and customer concentrations ◦other operational or commercial needs or decisions of our customers ◦customers' desire to buy, rather than lease, our transportation assets •higher costs associated with increased assignments of our transportation assets following non-renewal of leases, customer defaults, and compliance maintenance programs or other maintenance initiatives | |

•events having an adverse impact on assets, customers, or regions where we have a concentrated investment exposure | |

•financial and operational risks associated with long-term railcar purchase commitments including increased costs due to tariffs or trade disputesfor transportation assets •reduced opportunities to generate asset remarketing income •inability to successfully consummate and manage ongoing acquisition and divestiture activities •operational and financial risks related toreliance on Rolls-Royce in connection with our affiliate investments, including the Rolls-Royce & Partners Finance joint ventures,aircraft spare engine leasing businesses, and the durability and reliability of aircraft enginesrisks that certain factors that adversely affect Rolls-Royce could have an adverse effect on those businesses •fluctuations in foreign exchange rates •failure to successfully negotiate collective bargaining agreements with the unions representing a substantial portion of our employees •asset impairment charges we may be required to recognize •deterioration of conditions in the capital markets, reductions in our credit ratings, or increases in our financing costs •uncertainty relating tochanges in banks' inter-lending rate reporting practices and the LIBOR calculation process and potential phasing out of LIBOR after 2021 •competitive factors in our primary markets, including competitors with a significantly lower costcosts of capital than GATX •risks related to our international operations and expansion into new geographic markets, including the inability to access railcar supply and the imposition of new or additionallaws, regulations, tariffs, quotas,taxes, treaties or trade barriers affecting our activities in the countries where we do business •changes in, or failure to comply with, laws, rules, and regulations •inability to obtain cost-effective insurance •environmental liabilities and remediation costs •potential obsolescence of our assets •inadequate allowances to cover credit losses in our portfolio •operational, functional and regulatory risks associated with severe weather events, climate change and natural disasters •inability to maintain and secure our information technology infrastructure from cybersecurity threats and related disruption of our business |

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

GATX CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (Unaudited)

(In millions, except share data)

| | | September 30 | | December 31 | | September 30 | | December 31 |

| | 2020 | | 2019 | | 2021 | | 2020 |

| Assets | Assets | | | | Assets | | | |

Cash and Cash Equivalents | Cash and Cash Equivalents | $ | 459.8 | | | $ | 151.0 | | Cash and Cash Equivalents | $ | 566.0 | | | $ | 292.2 | |

| | Restricted Cash | | Restricted Cash | 0.2 | | | 0.4 | |

| Receivables | Receivables | | Receivables | |

| Rent and other receivables | Rent and other receivables | 70.6 | | | 65.9 | | Rent and other receivables | 75.2 | | | 74.7 | |

| Finance leases (as lessor) | Finance leases (as lessor) | 63.3 | | | 90.3 | | Finance leases (as lessor) | 71.5 | | | 74.0 | |

| Less: allowance for losses | Less: allowance for losses | (6.2) | | | (6.2) | | Less: allowance for losses | (6.4) | | | (6.5) | |

| | 127.7 | | | 150.0 | | | 140.3 | | | 142.2 | |

| | Operating Assets and Facilities | Operating Assets and Facilities | 10,070.2 | | | 9,523.5 | | Operating Assets and Facilities | 11,025.8 | | | 10,484.0 | |

| Less: allowance for depreciation | Less: allowance for depreciation | (3,226.0) | | | (3,066.2) | | Less: allowance for depreciation | (3,352.3) | | | (3,313.3) | |

| | 6,844.2 | | | 6,457.3 | | | 7,673.5 | | | 7,170.7 | |

| Lease Assets (as lessee) | Lease Assets (as lessee) | | Lease Assets (as lessee) | |

| Right-of-use assets, net of accumulated depreciation | Right-of-use assets, net of accumulated depreciation | 364.3 | | | 411.7 | | Right-of-use assets, net of accumulated depreciation | 279.2 | | | 335.9 | |

| Finance leases, net of accumulated depreciation | Finance leases, net of accumulated depreciation | 0 | | | 8.9 | | Finance leases, net of accumulated depreciation | — | | | 37.5 | |

| | 364.3 | | | 420.6 | | | 279.2 | | | 373.4 | |

| Investments in Affiliated Companies | Investments in Affiliated Companies | 582.5 | | | 512.6 | | Investments in Affiliated Companies | 564.4 | | | 584.7 | |

Goodwill | Goodwill | 84.2 | | | 81.5 | | Goodwill | 138.7 | | | 143.7 | |

Other Assets | Other Assets | 227.6 | | | 221.0 | | Other Assets | 224.0 | | | 230.3 | |

| Assets of Discontinued Operations | 0 | | | 291.1 | | |

Total Assets | Total Assets | $ | 8,690.3 | | | $ | 8,285.1 | | Total Assets | $ | 9,586.3 | | | $ | 8,937.6 | |

| | Liabilities and Shareholders’ Equity | Liabilities and Shareholders’ Equity | | Liabilities and Shareholders’ Equity | |

Accounts Payable and Accrued Expenses | Accounts Payable and Accrued Expenses | $ | 139.2 | | | $ | 119.4 | | Accounts Payable and Accrued Expenses | $ | 164.1 | | | $ | 147.3 | |

| Debt | Debt | | Debt | |

| Commercial paper and borrowings under bank credit facilities | Commercial paper and borrowings under bank credit facilities | 13.5 | | | 15.8 | | Commercial paper and borrowings under bank credit facilities | 20.7 | | | 23.6 | |

| Recourse | Recourse | 5,183.0 | | | 4,780.4 | | Recourse | 6,029.8 | | | 5,329.0 | |

| | 5,196.5 | | | 4,796.2 | | | 6,050.5 | | | 5,352.6 | |

| Lease Obligations (as lessee) | Lease Obligations (as lessee) | | Lease Obligations (as lessee) | |

| Operating leases | Operating leases | 368.0 | | | 429.4 | | Operating leases | 292.1 | | | 348.6 | |

| Finance leases | Finance leases | 0 | | | 7.9 | | Finance leases | — | | | 33.3 | |

| | 368.0 | | | 437.3 | | | 292.1 | | | 381.9 | |

| Deferred Income Taxes | Deferred Income Taxes | 936.4 | | | 888.5 | | Deferred Income Taxes | 977.7 | | | 962.8 | |

Other Liabilities | Other Liabilities | 120.2 | | | 139.1 | | Other Liabilities | 125.0 | | | 135.6 | |

| Liabilities of Discontinued Operations | 0 | | | 69.5 | | |

Total Liabilities | Total Liabilities | 6,760.3 | | | 6,450.0 | | Total Liabilities | 7,609.4 | | | 6,980.2 | |

| Shareholders’ Equity | Shareholders’ Equity | | Shareholders’ Equity | |

Common stock, $0.625 par value: Authorized shares — 120,000,000 Issued shares — 67,685,423 and 67,536,794 Outstanding shares — 34,981,666 and 34,833,037 | 41.9 | | | 41.8 | | |

Common stock, $0.625 par value: Authorized shares — 120,000,000 Issued shares — 68,186,431 and 67,751,074 Outstanding shares — 35,478,446 and 35,047,317 | | Common stock, $0.625 par value: Authorized shares — 120,000,000 Issued shares — 68,186,431 and 67,751,074 Outstanding shares — 35,478,446 and 35,047,317 | 42.2 | | | 41.9 | |

| Additional paid in capital | Additional paid in capital | 730.8 | | | 720.1 | | Additional paid in capital | 761.7 | | | 735.4 | |

| Retained earnings | Retained earnings | 2,682.0 | | | 2,601.3 | | Retained earnings | 2,708.9 | | | 2,682.1 | |

| Accumulated other comprehensive loss | Accumulated other comprehensive loss | (160.2) | | | (163.6) | | Accumulated other comprehensive loss | (171.0) | | | (137.5) | |

| Treasury stock at cost (32,703,757 and 32,703,757 shares) | (1,364.5) | | | (1,364.5) | | |

| Treasury stock at cost (32,707,985 and 32,703,757 shares) | | Treasury stock at cost (32,707,985 and 32,703,757 shares) | (1,364.9) | | | (1,364.5) | |

Total Shareholders’ Equity | Total Shareholders’ Equity | 1,930.0 | | | 1,835.1 | | Total Shareholders’ Equity | 1,976.9 | | | 1,957.4 | |

| Total Liabilities and Shareholders’ Equity | Total Liabilities and Shareholders’ Equity | $ | 8,690.3 | | | $ | 8,285.1 | | Total Liabilities and Shareholders’ Equity | $ | 9,586.3 | | | $ | 8,937.6 | |

See accompanying notes to consolidated financial statements.

GATX CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Unaudited)

(In millions, except per share data)

| | | Three Months Ended

September 30 | | Nine Months Ended

September 30 | | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| | 2020 | | 2019 | | 2020 | | 2019 | | 2021 | | 2020 | | 2021 | | 2020 |

| Revenues | Revenues | | | | | | | | Revenues | | | | | | | |

| Lease revenue | Lease revenue | $ | 273.3 | | | $ | 270.5 | | | $ | 813.3 | | | $ | 816.8 | | Lease revenue | $ | 283.9 | | | $ | 273.3 | | | $ | 852.1 | | | $ | 813.3 | |

| Marine operating revenue | Marine operating revenue | 5.0 | | | 1.9 | | | 11.6 | | | 4.4 | | Marine operating revenue | 5.0 | | | 5.0 | | | 13.7 | | | 11.6 | |

| Other revenue | Other revenue | 26.1 | | | 26.4 | | | 79.4 | | | 80.4 | | Other revenue | 24.6 | | | 26.1 | | | 70.6 | | | 79.4 | |

| Total Revenues | Total Revenues | 304.4 | | | 298.8 | | | 904.3 | | | 901.6 | | Total Revenues | 313.5 | | | 304.4 | | | 936.4 | | | 904.3 | |

| Expenses | Expenses | | Expenses | |

| Maintenance expense | Maintenance expense | 76.7 | | | 76.2 | | | 244.8 | | | 235.3 | | Maintenance expense | 74.2 | | | 76.7 | | | 225.1 | | | 244.8 | |

| Marine operating expense | Marine operating expense | 3.6 | | | 3.4 | | | 10.9 | | | 12.0 | | Marine operating expense | 3.7 | | | 3.6 | | | 13.8 | | | 10.9 | |

| Depreciation expense | Depreciation expense | 83.4 | | | 80.0 | | | 245.4 | | | 240.2 | | Depreciation expense | 91.1 | | | 83.4 | | | 271.2 | | | 245.4 | |

| Operating lease expense | Operating lease expense | 12.3 | | | 13.7 | | | 38.1 | | | 41.1 | | Operating lease expense | 9.0 | | | 12.3 | | | 30.1 | | | 38.1 | |

| Other operating expense | Other operating expense | 8.3 | | | 7.7 | | | 26.0 | | | 23.5 | | Other operating expense | 9.7 | | | 8.3 | | | 31.3 | | | 26.0 | |

| Selling, general and administrative expense | Selling, general and administrative expense | 42.0 | | | 42.6 | | | 125.8 | | | 129.6 | | Selling, general and administrative expense | 45.9 | | | 42.0 | | | 140.8 | | | 125.8 | |

| Total Expenses | Total Expenses | 226.3 | | | 223.6 | | | 691.0 | | | 681.7 | | Total Expenses | 233.6 | | | 226.3 | | | 712.3 | | | 691.0 | |

| Other Income (Expense) | Other Income (Expense) | | Other Income (Expense) | |

| Net gain on asset dispositions | Net gain on asset dispositions | 8.9 | | | 5.1 | | | 42.3 | | | 46.9 | | Net gain on asset dispositions | 21.9 | | | 8.9 | | | 79.1 | | | 42.3 | |

| Interest expense, net | Interest expense, net | (48.6) | | | (44.7) | | | (141.5) | | | (135.3) | | Interest expense, net | (49.8) | | | (48.6) | | | (153.4) | | | (141.5) | |

| Other expense | Other expense | (1.2) | | | (1.7) | | | (12.2) | | | (5.3) | | Other expense | (0.3) | | | (1.2) | | | (9.7) | | | (12.2) | |

Income before Income Taxes and Share of Affiliates’ Earnings | Income before Income Taxes and Share of Affiliates’ Earnings | 37.2 | | | 33.9 | | | 101.9 | | | 126.2 | | Income before Income Taxes and Share of Affiliates’ Earnings | 51.7 | | | 37.2 | | | 140.1 | | | 101.9 | |

| Income taxes | Income taxes | (11.8) | | | (9.5) | | | (29.6) | | | (31.1) | | Income taxes | (14.4) | | | (11.8) | | | (36.4) | | | (29.6) | |

| Share of affiliates’ earnings, net of taxes | Share of affiliates’ earnings, net of taxes | 22.8 | | | 12.8 | | | 60.1 | | | 43.6 | | Share of affiliates’ earnings, net of taxes | 2.8 | | | 22.8 | | | (21.6) | | | 60.1 | |

| Net Income from Continuing Operations | Net Income from Continuing Operations | $ | 48.2 | | | $ | 37.2 | | | $ | 132.4 | | | $ | 138.7 | | Net Income from Continuing Operations | $ | 40.1 | | | $ | 48.2 | | | $ | 82.1 | | | $ | 132.4 | |

| | Discontinued Operations, Net of Taxes | Discontinued Operations, Net of Taxes | | Discontinued Operations, Net of Taxes | |

| Net income (loss) from discontinued operations, net of taxes | $ | 0 | | | $ | 7.9 | | | $ | (2.2) | | | $ | 15.9 | | |

| Net loss from discontinued operations, net of taxes | | Net loss from discontinued operations, net of taxes | $ | — | | | $ | — | | | $ | — | | | $ | (2.2) | |

| (Loss) gain on sale of discontinued operations, net of taxes | (Loss) gain on sale of discontinued operations, net of taxes | (0.3) | | | 0 | | | 3.3 | | | 0 | | (Loss) gain on sale of discontinued operations, net of taxes | — | | | (0.3) | | | — | | | 3.3 | |

| Total Discontinued Operations, Net of Taxes | $ | (0.3) | | | $ | 7.9 | | | $ | 1.1 | | | $ | 15.9 | | |

| Discontinued Operations, Net of Taxes | | Discontinued Operations, Net of Taxes | $ | — | | | $ | (0.3) | | | $ | — | | | $ | 1.1 | |

| | Net Income | Net Income | $ | 47.9 | | | $ | 45.1 | | | $ | 133.5 | | | $ | 154.6 | | Net Income | $ | 40.1 | | | $ | 47.9 | | | $ | 82.1 | | | $ | 133.5 | |

| Other Comprehensive Income, Net of Taxes | Other Comprehensive Income, Net of Taxes | | | | | | | | Other Comprehensive Income, Net of Taxes | | | | | | | |

| Foreign currency translation adjustments | Foreign currency translation adjustments | 19.7 | | | (33.6) | | | (0.9) | | | (32.4) | | Foreign currency translation adjustments | (20.7) | | | 19.7 | | | (42.0) | | | (0.9) | |

| | Unrealized gain (loss) on derivative instruments | Unrealized gain (loss) on derivative instruments | 0.3 | | | (1.0) | | | (3.7) | | | 2.1 | | Unrealized gain (loss) on derivative instruments | 0.3 | | | 0.3 | | | 1.3 | | | (3.7) | |

| Post-retirement benefit plans | Post-retirement benefit plans | 2.3 | | | 1.4 | | | 8.0 | | | 5.9 | | Post-retirement benefit plans | 2.4 | | | 2.3 | | | 7.2 | | | 8.0 | |

| Other comprehensive income (loss) | 22.3 | | | (33.2) | | | 3.4 | | | (24.4) | | |

| Other comprehensive (loss) income | | Other comprehensive (loss) income | (18.0) | | | 22.3 | | | (33.5) | | | 3.4 | |

| Comprehensive Income | Comprehensive Income | $ | 70.2 | | | $ | 11.9 | | | $ | 136.9 | | | $ | 130.2 | | Comprehensive Income | $ | 22.1 | | | $ | 70.2 | | | $ | 48.6 | | | $ | 136.9 | |

| | Share Data | Share Data | | Share Data | |

| Basic earnings per share from continuing operations | Basic earnings per share from continuing operations | $ | 1.38 | | | $ | 1.05 | | | $ | 3.79 | | | $ | 3.86 | | Basic earnings per share from continuing operations | $ | 1.13 | | | $ | 1.38 | | | $ | 2.32 | | | $ | 3.79 | |

| Basic earnings per share from discontinued operations | Basic earnings per share from discontinued operations | (0.01) | | | 0.23 | | | 0.03 | | | 0.44 | | Basic earnings per share from discontinued operations | — | | | (0.01) | | | — | | | 0.03 | |

| Basic earnings per share from consolidated operations | Basic earnings per share from consolidated operations | $ | 1.37 | | | $ | 1.28 | | | $ | 3.82 | | | $ | 4.30 | | Basic earnings per share from consolidated operations | $ | 1.13 | | | $ | 1.37 | | | $ | 2.32 | | | $ | 3.82 | |

| Average number of common shares | Average number of common shares | 35.0 | | | 35.4 | | | 34.9 | | | 35.9 | | Average number of common shares | 35.5 | | | 35.0 | | | 35.4 | | | 34.9 | |

| | Diluted earnings per share from continuing operations | Diluted earnings per share from continuing operations | $ | 1.36 | | | $ | 1.03 | | | $ | 3.74 | | | $ | 3.79 | | Diluted earnings per share from continuing operations | $ | 1.11 | | | $ | 1.36 | | | $ | 2.28 | | | $ | 3.74 | |

| Diluted earnings per share from discontinued operations | Diluted earnings per share from discontinued operations | (0.01) | | | 0.22 | | | 0.03 | | | 0.43 | | Diluted earnings per share from discontinued operations | — | | | (0.01) | | | — | | | 0.03 | |

| Diluted earnings per share from consolidated operations | Diluted earnings per share from consolidated operations | $ | 1.35 | | | $ | 1.25 | | | $ | 3.77 | | | $ | 4.22 | | Diluted earnings per share from consolidated operations | $ | 1.11 | | | $ | 1.35 | | | $ | 2.28 | | | $ | 3.77 | |

| Average number of common shares and common share equivalents | Average number of common shares and common share equivalents | 35.4 | | | 36.0 | | | 35.4 | | | 36.6 | | Average number of common shares and common share equivalents | 36.0 | | | 35.4 | | | 36.0 | | | 35.4 | |

See accompanying notes to consolidated financial statements.

GATX CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(In millions)

| | | Nine Months Ended

September 30 | | Nine Months Ended

September 30 |

| | 2020 | | 2019 | | 2021 | | 2020 |

| Operating Activities | Operating Activities | | | | Operating Activities | | | |

| Net income | Net income | $ | 133.5 | | | $ | 154.6 | | Net income | $ | 82.1 | | | $ | 133.5 | |

| Income from discontinued operations, net of taxes | Income from discontinued operations, net of taxes | 1.1 | | | 15.9 | | Income from discontinued operations, net of taxes | — | | | 1.1 | |

| Net income from continuing operations | Net income from continuing operations | 132.4 | | | 138.7 | | Net income from continuing operations | 82.1 | | | 132.4 | |

| | Adjustments to reconcile net income to net cash provided by operating activities: | Adjustments to reconcile net income to net cash provided by operating activities: | | Adjustments to reconcile net income to net cash provided by operating activities: | |

| Depreciation expense | Depreciation expense | 254.6 | | | 248.4 | | Depreciation expense | 281.9 | | | 254.6 | |

| | Net gains on sales of assets | Net gains on sales of assets | (40.5) | | | (45.5) | | Net gains on sales of assets | (76.6) | | | (40.5) | |

| Deferred income taxes | Deferred income taxes | 29.8 | | | 20.9 | | Deferred income taxes | 19.7 | | | 29.8 | |

| Share of affiliates’ earnings, net of dividends | Share of affiliates’ earnings, net of dividends | (60.1) | | | (43.6) | | Share of affiliates’ earnings, net of dividends | 21.5 | | | (60.1) | |

| Changes in working capital items | Changes in working capital items | (14.1) | | | (40.7) | | Changes in working capital items | 11.4 | | | (14.1) | |

| Net cash provided by operating activities of continuing operations | Net cash provided by operating activities of continuing operations | 302.1 | | | 278.2 | | Net cash provided by operating activities of continuing operations | 340.0 | | | 302.1 | |

| Investing Activities | Investing Activities | | Investing Activities | |

| Additions to operating assets and facilities | | Additions to operating assets and facilities | (891.4) | | | (641.4) | |

| Acquisition of new businesses | | Acquisition of new businesses | (1.4) | | | — | |

| Investments in affiliates | | Investments in affiliates | (0.4) | | | — | |

| Portfolio investments and capital additions | Portfolio investments and capital additions | (641.4) | | | (503.8) | | Portfolio investments and capital additions | (893.2) | | | (641.4) | |

| Purchases of assets previously leased | — | | | (1.0) | | |

| Portfolio proceeds | Portfolio proceeds | 120.2 | | | 185.6 | | Portfolio proceeds | 159.0 | | | 120.2 | |

| Proceeds from sales of other assets | Proceeds from sales of other assets | 17.5 | | | 18.9 | | Proceeds from sales of other assets | 43.7 | | | 17.5 | |

| | Other | Other | 1.3 | | | 2.0 | | Other | 0.6 | | | 1.3 | |

| Net cash used in investing activities of continuing operations | Net cash used in investing activities of continuing operations | (502.4) | | | (298.3) | | Net cash used in investing activities of continuing operations | (689.9) | | | (502.4) | |

| Financing Activities | Financing Activities | | Financing Activities | |

| Net proceeds from issuances of debt (original maturities longer than 90 days) | Net proceeds from issuances of debt (original maturities longer than 90 days) | 1,465.8 | | | 549.7 | | Net proceeds from issuances of debt (original maturities longer than 90 days) | 1,319.1 | | | 1,465.8 | |

| Repayments of debt (original maturities longer than 90 days) | Repayments of debt (original maturities longer than 90 days) | (1,100.0) | | | (410.0) | | Repayments of debt (original maturities longer than 90 days) | (584.0) | | | (1,100.0) | |

| Net decrease in debt with original maturities of 90 days or less | Net decrease in debt with original maturities of 90 days or less | (3.1) | | | 2.0 | | Net decrease in debt with original maturities of 90 days or less | (1.9) | | | (3.1) | |

| Stock repurchases | Stock repurchases | 0 | | | (129.0) | | Stock repurchases | (0.4) | | | — | |

| Dividends | Dividends | (53.7) | | | (52.8) | | Dividends | (56.2) | | | (53.7) | |

| Purchases of assets previously leased | Purchases of assets previously leased | (40.0) | | | 0 | | Purchases of assets previously leased | (77.2) | | | (40.0) | |

| Other | Other | (13.1) | | | 3.3 | | Other | 24.4 | | | (13.1) | |

| Net cash provided by (used in) financing activities of continuing operations | 255.9 | | | (36.8) | | |

| Net cash provided by financing activities of continuing operations | | Net cash provided by financing activities of continuing operations | 623.8 | | | 255.9 | |

Effect of Exchange Rate Changes on Cash and Cash Equivalents | Effect of Exchange Rate Changes on Cash and Cash Equivalents | (1.0) | | | (1.2) | | Effect of Exchange Rate Changes on Cash and Cash Equivalents | (1.4) | | | (1.0) | |

| Net cash used in (provided by) operating activities from discontinued operations | (8.5) | | | 18.9 | | |

| Net cash provided by (used in) investing activities from discontinued operations | 240.9 | | | (18.7) | | |

| Net cash provided by (used in) financing activities from discontinued operations | 21.8 | | | (0.2) | | |

| Net cash used in operating activities from discontinued operations | | Net cash used in operating activities from discontinued operations | — | | | (8.5) | |

| Net cash provided by investing activities from discontinued operations | | Net cash provided by investing activities from discontinued operations | 1.1 | | | 240.9 | |

| Net cash provided by financing activities from discontinued operations | | Net cash provided by financing activities from discontinued operations | — | | | 21.8 | |

| Cash provided by discontinued operations, net | Cash provided by discontinued operations, net | 254.2 | | | 0 | | Cash provided by discontinued operations, net | 1.1 | | | 254.2 | |

| Net increase (decrease) in Cash and Cash Equivalents during the period | 308.8 | | | (58.1) | | |

| Cash and Cash Equivalents at beginning of the period | 151.0 | | | 106.7 | | |

| Cash and Cash Equivalents at end of the period | $ | 459.8 | | | $ | 48.6 | | |

| Net increase in Cash, Cash Equivalents, and Restricted Cash during the period | | Net increase in Cash, Cash Equivalents, and Restricted Cash during the period | 273.6 | | | 308.8 | |

| Cash, Cash Equivalents, and Restricted Cash at beginning of the period | | Cash, Cash Equivalents, and Restricted Cash at beginning of the period | 292.6 | | | 151.0 | |

| Cash, Cash Equivalents, and Restricted Cash at end of the period | | Cash, Cash Equivalents, and Restricted Cash at end of the period | $ | 566.2 | | | $ | 459.8 | |

|

See accompanying notes to consolidated financial statements.

GATX CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (Unaudited)

(In millions)

| | | Three Months Ended

September 30 | | Nine Months Ended

September 30 | | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| | 2020 | | 2019 | | 2020 | | 2019 | | 2021 | | 2020 | | 2021 | | 2020 |

| | Shares | | Dollars | | Shares | | Dollars | | Shares | | Dollars | | Shares | | Dollars | | Shares | | Dollars | | Shares | | Dollars | | Shares | | Dollars | | Shares | | Dollars |

| Common Stock | Common Stock | | | | | | | | | | | | | | | | Common Stock | | | | | | | | | | | | | | | |

| Balance at beginning of the period | Balance at beginning of the period | 67.7 | | | $ | 41.8 | | | 67.5 | | | $ | 41.8 | | | 67.5 | | | $ | 41.8 | | | 67.3 | | | $ | 41.6 | | Balance at beginning of the period | 68.2 | | | $ | 42.2 | | | 67.7 | | | $ | 41.8 | | | 67.8 | | | $ | 41.9 | | | 67.5 | | | $ | 41.8 | |

| Issuance of common stock | Issuance of common stock | 0 | | | 0.1 | | | 0 | | | 0 | | | 0.2 | | | 0.1 | | | 0.2 | | | 0.2 | | Issuance of common stock | — | | | — | | | — | | | 0.1 | | | 0.4 | | | 0.3 | | | 0.2 | | | 0.1 | |

| Balance at end of the period | Balance at end of the period | 67.7 | | | 41.9 | | | 67.5 | | | 41.8 | | | 67.7 | | | 41.9 | | | 67.5 | | | 41.8 | | Balance at end of the period | 68.2 | | | 42.2 | | | 67.7 | | | 41.9 | | | 68.2 | | | 42.2 | | | 67.7 | | | 41.9 | |

| Treasury Stock | Treasury Stock | | Treasury Stock | |

| Balance at beginning of the period | Balance at beginning of the period | (32.7) | | | (1,364.5) | | | (31.8) | | | (1,297.7) | | | (32.7) | | | (1,364.5) | | | (30.7) | | | (1,214.5) | | Balance at beginning of the period | (32.7) | | | (1,364.5) | | | (32.7) | | | (1,364.5) | | | (32.7) | | | (1,364.5) | | | (32.7) | | | (1,364.5) | |

| Stock repurchases | Stock repurchases | 0 | | | 0 | | | (0.6) | | | (46.7) | | | 0 | | | 0 | | | (1.7) | | | (129.9) | | Stock repurchases | — | | | (0.4) | | | — | | | — | | | — | | | (0.4) | | | — | | | — | |

| Balance at end of the period | Balance at end of the period | (32.7) | | | (1,364.5) | | | (32.4) | | | (1,344.4) | | | (32.7) | | | (1,364.5) | | | (32.4) | | | (1,344.4) | | Balance at end of the period | (32.7) | | | (1,364.9) | | | (32.7) | | | (1,364.5) | | | (32.7) | | | (1,364.9) | | | (32.7) | | | (1,364.5) | |

| Additional Paid In Capital | Additional Paid In Capital | | Additional Paid In Capital | |

| Balance at beginning of the period | Balance at beginning of the period | | 728.8 | | | 713.0 | | | 720.1 | | | 706.4 | | Balance at beginning of the period | | 759.4 | | | 728.8 | | | 735.4 | | | 720.1 | |

| Share-based compensation effects | Share-based compensation effects | | 2.0 | | | 3.6 | | | 10.7 | | | 10.2 | | Share-based compensation effects | | 2.3 | | | 2.0 | | | 26.3 | | | 10.7 | |

| Balance at end of the period | Balance at end of the period | | 730.8 | | | 716.6 | | | 730.8 | | | 716.6 | | Balance at end of the period | | 761.7 | | | 730.8 | | | 761.7 | | | 730.8 | |

| Retained Earnings | Retained Earnings | | Retained Earnings | |

| Balance at beginning of the period | Balance at beginning of the period | | 2,651.7 | | | 2,533.5 | | | 2,601.3 | | | 2,419.2 | | Balance at beginning of the period | | 2,687.3 | | | 2,651.7 | | | 2,682.1 | | | 2,601.3 | |

| Net income | Net income | | 47.9 | | | 45.1 | | | 133.5 | | | 154.6 | | Net income | | 40.1 | | | 47.9 | | | 82.1 | | | 133.5 | |

| Dividends declared ($0.48 and $0.46 per share QTR and $1.44 and $1.38 YTD) | | (17.6) | | | (17.1) | | | (52.8) | | | (51.7) | | |

| Cumulative impact of accounting standard adoption | | 0 | | | 0 | | | 0 | | | 39.4 | | |

| Dividends declared ($0.50 and $0.48 per share QTR and $1.50 and $1.44 YTD) | | Dividends declared ($0.50 and $0.48 per share QTR and $1.50 and $1.44 YTD) | | (18.5) | | | (17.6) | | | (55.3) | | | (52.8) | |

| | Balance at end of the period | Balance at end of the period | | 2,682.0 | | | | 2,561.5 | | | 2,682.0 | | | 2,561.5 | | Balance at end of the period | | 2,708.9 | | | 2,682.0 | | | 2,708.9 | | | 2,682.0 | |

| Accumulated Other Comprehensive Loss | Accumulated Other Comprehensive Loss | | Accumulated Other Comprehensive Loss | |

| Balance at beginning of the period | Balance at beginning of the period | | (182.5) | | | (155.8) | | | (163.6) | | | (164.6) | | Balance at beginning of the period | | (153.0) | | | (182.5) | | | (137.5) | | | (163.6) | |

| Other comprehensive income (loss) | | 22.3 | | | (33.2) | | | 3.4 | | | (24.4) | | |

| Other comprehensive (loss) income | | Other comprehensive (loss) income | | (18.0) | | | 22.3 | | | (33.5) | | | 3.4 | |

| | Balance at end of the period | Balance at end of the period | | (160.2) | | | | (189.0) | | | (160.2) | | | (189.0) | | Balance at end of the period | | (171.0) | | | | (160.2) | | | (171.0) | | | (160.2) | |

Total Shareholders’ Equity | Total Shareholders’ Equity | | $ | 1,930.0 | | | | $ | 1,786.5 | | | $ | 1,930.0 | | | $ | 1,786.5 | | Total Shareholders’ Equity | | $ | 1,976.9 | | | | $ | 1,930.0 | | | $ | 1,976.9 | | | $ | 1,930.0 | |

See accompanying notes to consolidated financial statements.

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 1. Description of Business

As used herein, "GATX," "we," "us," "our," and similar terms refer to GATX Corporation and its subsidiaries, unless indicated otherwise.

We lease, operate, manage, and remarket long-lived, widely-used assets, primarily in the rail market. We report our financial results through 3 primary business segments: Rail North America, Rail International, and Portfolio Management. Historically, we also reported financial results for American Steamship Company ("ASC") as a fourth segment.

In the first quarter of 2021, GATX began investing directly in aircraft spare engines through its new entity, GATX Engine Leasing ("GEL"). During the first quarter of 2021, GEL acquired 14 aircraft spare engines for approximately $352 million, including 4 engines for $120 million from the Rolls-Royce & Partners Finance joint ventures (collectively the “RRPF affiliates” or "RRPF"). Financial results for this business are reported in the Portfolio Management segment.

On December 29, 2020, GATX acquired Trifleet Leasing Holding B.V. ("Trifleet"), one of the largest tank container lessors in the world. Financial results for this business are reported in the Other segment. See "Note 3. Business Combinations" for additional information.

On May 14, 2020, we completed the sale of our ASC business, subject to customary post-closing adjustments. As a result, ASC is now reported as discontinued operations, and financial data for the ASC segment has been segregated and presented as discontinued operations for all periods presented. See "Note 16. Discontinued Operations" of this Form 10-Q for additional information.

NOTE 2. Coronavirus Impacts

On March 11, 2020, the World Health Organization declared the Coronavirus Disease 2019 (“COVID-19”) a pandemic and on March 13, 2020, the United States declared a national emergency related to COVID-19. Our consolidated financial statements reflect estimates and assumptions at the date of the consolidated financial statements and reported amounts of revenue and expenses during the reporting periods presented. We considered the impact of COVID-19 on our operations and the assumptions and estimates used. While COVID-19 did have a negative impact on operating conditions in the three and nine months ended September 30, 2020, we determined the impact to our assumptions and estimates was not significant. However, we expect COVID-19 will continue to have an adverse impact on our operating and financial results in future periods, the magnitude and duration of which cannot be determined at this time.

On March 27, 2020, the U.S. government enacted the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”), which includes modifications to the interest expense limitation threshold and net operating loss carryback period and utilization limitation, the acceleration of payments for alternative minimum tax credit refunds, and the deferral of employer payroll tax payments. The CARES Act is not expected to have a material impact on our consolidated financial statements.

NOTE 3.2. Basis of Presentation

We prepared the accompanying unaudited consolidated financial statements in accordance with U.S. Generally Accepted Accounting Principles ("GAAP") for interim financial information and the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, our unaudited consolidated financial statements do not include all of the information and footnotes required for complete financial statements. We have included all of the normal recurring adjustments that we deemed necessary for a fair presentation. Certain prior year amounts have been reclassified to conform to the 20202021 presentation, including the separate presentation and reporting of discontinued operations.

Operating results for the nine months ended September 30, 20202021 are not necessarily indicative of the results we may achieve for the entire year ending December 31, 2020.2021. In particular, asset remarketing income does not occur evenly throughout the year. For more information, refer to the consolidated financial statements and footnotes in our Annual Report on Form 10-K for the year ended December 31, 2019.2020.

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

New Accounting Pronouncements Adopted

| | | | | | | | |

| Standard/Description | Effective Date and Adoption Considerations | Effect on Financial Statements or Other Significant Matters |

Credit LossesIncome Taxes

In June 2016,December 2019, the FASB issued ASU 2016-13,2019-12, Credit LossesIncome Taxes (Topic 326)740): MeasurementSimplifying the Accounting for Income Taxes, which eliminates exceptions for intraperiod tax allocation and the recognition of Credit Losses on Financial Instruments, which supersedes previous guidance. The FASB subsequently issued ASU 2018-19, clarifying operating lease receivables are not withindeferred tax liabilities for outside basis differences and clarifies the scope of subtopic 326-20 and should be accountedmethodology for calculating income taxes in accordance with Topic 842, Leases. The new guidance modifies the impairment model to be based on expected losses rather than incurred losses.an interim period. |

We adopted the new guidance in the first quarter of 2020.2021. |

The adoption of this standard required us to modify our assessment for a limited population of receivables, including the net investment in our finance leases, as well as our trade receivables at ASC. As part of our modified assessment, we considered historical information as well as current and future economic conditions. The application of this new guidance did not impact our financial statements orand had an immaterial impact on related disclosures. |

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

New Accounting Pronouncements Not Yet Adopted

| | | | | | | | |

| Standard/Description | Effective Date and Adoption Considerations | Effect on Financial Statements or Other Significant Matters |

Income TaxesReference Rate Reform

In December 2019,March 2020, the FASB issued ASU 2019-12,2020-04, Income TaxesReference Rate Reform (Topic 740)848): SimplifyingFacilitation of the Accounting for Income Taxes,Effects of Reference Rate Reform on Financial Reporting, which eliminatesprovides optional practical expedients and exceptions for intraperiod tax allocation,in the methodology for calculating income taxes in an interim period,application of GAAP principles to contracts, hedging relationships, and the recognitionother transactions that reference LIBOR or other reference rates being discontinued as a result of deferred tax liabilities for outside basis differences.reference rate reform. |

Optional expedients are available for adoption from March 12, 2020 through December 31, 2022. |

For any contracts that reference LIBOR, we are currently assessing how this standard may be applied to specific contract modifications. |

Variable Lease Payments

In July 2021, the FASB issued ASU 2021-05, Leases (Topic 842) - Lessors - Certain Leases with Variable Lease Payments, which classifies leases with variable rate payments (not dependent on a rate or index) as operating for a lessor if the lease would have been a finance lease that recognized a selling loss at lease commencement. |

The new guidance is effective for us in the first quarter of 2021, with early adoption permitted.

We plan to adopt this standard on January 1, 2021.2022. |

We are evaluating the potential impactdo not expect the new guidance willto have a significant impact on our financial statements andor related disclosures. |

NOTE 3. Business Combinations

On December 29, 2020, GATX acquired Trifleet Leasing Holding B.V. ("Trifleet"), one of the largest tank container lessors in the world, for approximately €165 million ($203.2 million) in cash. Transaction costs associated with this acquisition were approximately $2.7 million. In the third quarter of 2021, GATX paid an additional €1.1 million ($1.4 million), attributable to post-closing adjustments. Headquartered in the Netherlands with offices worldwide, Trifleet owns and manages a fleet of tank containers leased to a diverse customer base in the chemical, industrial gas, energy, food, cryogenic and pharmaceutical industries, as well as to tank container operators.

As of September 30, 2021, we have allocated $146.2 million to tangible net assets and $58.4 million to goodwill in the preliminary purchase accounting for the acquisition. The allocation of the purchase price is incomplete with respect to certain assets and liabilities acquired. The purchase price allocation will be finalized during the measurement period, which will not exceed 12 months from the acquisition date. The acquisition was not significant in relation to our financial results and, therefore, pro-forma financial information has not been presented.

NOTE 4. Revenue

Revenue Recognition

Revenue is recognized when control of the promised goods or services is transferred to our customers, in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services.

We disaggregate revenue into three categories as presented on our income statement:

Lease Revenue

Lease revenue, which includes operating lease revenue and finance lease revenue, is our primary source of revenue. In accordance with ASU 2016-02, Leases (Topic 842) ("Topic 842"), we utilize the practical expedient that allows lessors to not separate non-lease components from the associated lease components for our operating leases.

Operating Lease Revenue

We lease railcars, tank containers, aircraft spare engines, and other operating assets under full-service and net operating leases. We price full-service leases as an integrated service that includes amounts related to maintenance, insurance, and ad valorem taxes. We do not offer stand-alone maintenance service contracts. Operating lease revenue is within the scope of Topic 842, and we dohave elected not to separate non-lease components from the associated lease component for qualifying leases. Operating lease revenue is recognized on a straight-line basis over the term of the underlying lease. As a result, lease revenue may not be recognized in the same period as maintenance

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

recognized in the same period as maintenance and other costs, which we expense as incurred. Variable rents are recognized when applicable contingencies are resolved. Revenue is not recognized if collectability is not reasonably assured. See "Note 5. Leases".

Finance Lease Revenue

In certain cases, we lease railcars, tank containers, and other operating assets that, at lease inception, are classified as finance leases. In accordance with Topic 842, we recognize finance lease revenue is recognized using the interest method, which produces a constant yield over the lease term. Initial unearned income is the amount by which the original lease payment receivable and the estimated residual value of the leased asset exceeds the original cost or carrying value of the leased asset. See "Note 5. Leases".

Marine Operating Revenue

We generate marine operating revenue through shipping services completed by our marine vessels. In accordanceFor vessels operating in a pooling arrangement, we recognize pool revenue based on the right to receive our portion of net distributions reported by the pool, with ASU 2014-09, Revenue from Contracts and Customers (Topic 606) ("Topic 606"), marinenet distributions being the net voyage revenue of the pool after deduction of voyage expenses. For vessels operating out of the pool, we recognize revenue is recognized over time as the performance obligation is satisfied, beginning when cargo is loaded through its delivery and discharge. Revenue is recognized pro rata over the projected duration of each voyage, which is derived from historical voyage data.

Other Revenue

Other revenue is comprised of customer liability repair revenue, termination fees, utilization income, fee income, and other miscellaneous revenues. Select components of other revenue are within the scope of Topic 606. Revenue attributable to terms provided in our lease contracts are variable lease components that are recognized when earned, in accordance with Topic 842.

NOTE 5. Leases

GATX as Lessor

We lease railcars, tank containers, aircraft spare engines, and other operating assets under full-service and net operating leases. We price full-service leases as an integrated service that includes amounts related to maintenance, insurance, and ad valorem taxes. Upon adoption of the new lease accounting standard in 2019,In accordance with applicable guidance, we elected the lessor practical expedient which allows usdo not to separate lease and non-lease components when reporting revenue for our full-service operating leases. In some cases, we lease railcars and tank containers that, at commencement, are classified as finance leases. For certain operating leases, revenue is based on equipment usage and is recognized when earned. Typically, our leases do not provide customers with renewal options or options to purchase the asset. Our lease agreements do not generally have residual value guarantees. We collect reimbursements from customers for damage to our railcars, as well as additional rental payments for usage above specified levels, as provided in the lease agreements.

The following table shows the components of our lease income (in millions):

| | | Three Months Ended

September 30 | | Nine Months Ended

September 30 | | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| | 2020 | | 2019 | | 2020 | | 2019 | | 2021 | | 2020 | | 2021 | | 2020 |

| Operating lease income: | Operating lease income: | | | | | | | | Operating lease income: | | | | | | | |

| Fixed lease income | Fixed lease income | $ | 258.6 | | | $ | 253.4 | | | $ | 764.7 | | | $ | 759.1 | | Fixed lease income | $ | 264.6 | | | $ | 258.6 | | | $ | 795.0 | | | $ | 764.7 | |

| Variable lease income | Variable lease income | 13.2 | | | 14.9 | | | 43.7 | | | 50.0 | | Variable lease income | 17.4 | | | 13.2 | | | 51.9 | | | 43.7 | |

| Total operating lease income | Total operating lease income | $ | 271.8 | | | $ | 268.3 | | | $ | 808.4 | | | $ | 809.1 | | Total operating lease income | $ | 282.0 | | | $ | 271.8 | | | $ | 846.9 | | | $ | 808.4 | |

| Finance lease income | Finance lease income | 1.5 | | | 2.2 | | | 4.9 | | | 7.7 | | Finance lease income | 1.9 | | | 1.5 | | | 5.2 | | | 4.9 | |

| Total lease income | Total lease income | $ | 273.3 | | | $ | 270.5 | | | $ | 813.3 | | | $ | 816.8 | | Total lease income | $ | 283.9 | | | $ | 273.3 | | | $ | 852.1 | | | $ | 813.3 | |

In accordance with the terms of our leases with customers, we may earn additional revenue, primarily for customer liability repairs. These amounts are reported in other revenue in the statements of comprehensive income and were $18.9 million and $54.6 million for the three and nine months ended September 30, 2021 and $22.7 million and $69.1 million for the three and nine months ended September 30, 2020 and $22.3 million and $66.6 million for the three and nine months ended September 30, 2019.

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

NOTE 6. Investments in Affiliated Companies

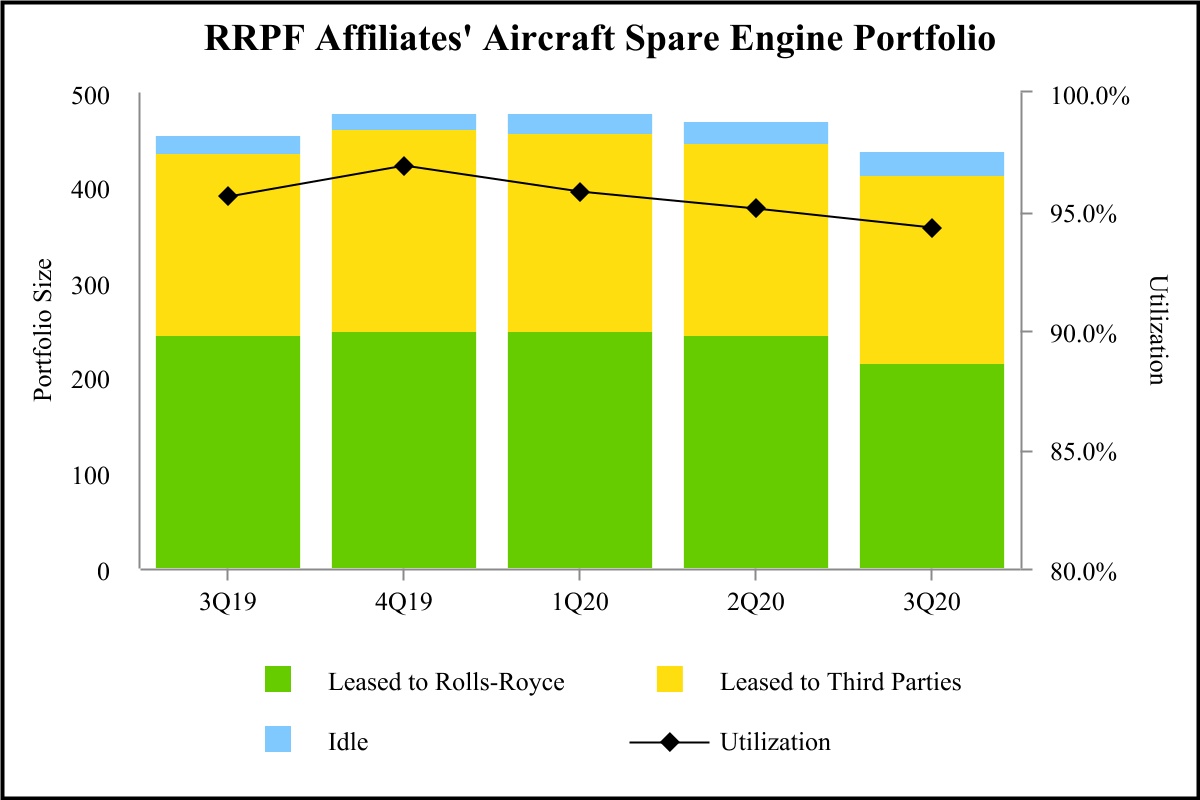

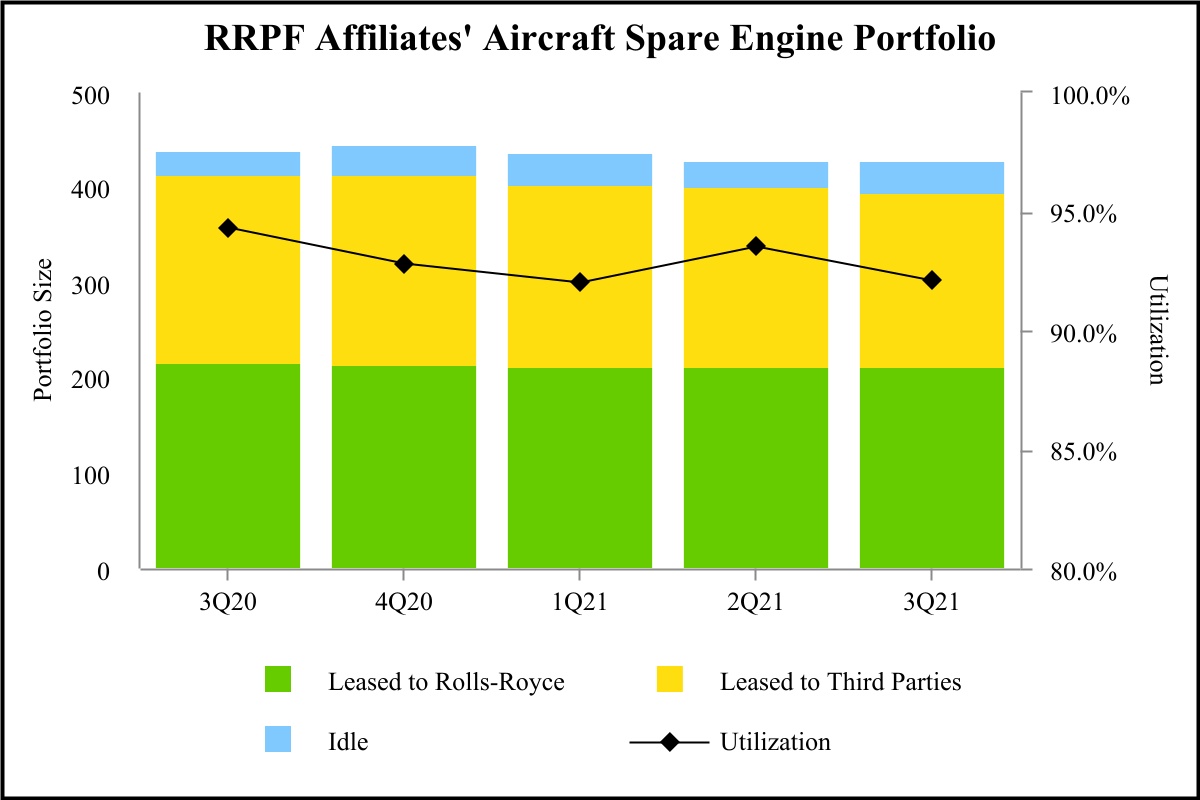

Our affiliate investments primarily include interests in each of the Rolls-Royce & Partners Finance joint ventures (collectively the “RRPF affiliates”),RRPF affiliates, a group of 50% owned domestic and foreign joint ventures with Rolls-Royce plc, a leading manufacturer of commercial aircraft jet engines.

In accordance with Regulation S-X, we must assess if any of our investments in affiliated companies is a “significant subsidiary”. As of September 30, 2020,Although we determined that Alpha Partners Leasing Limited, which is part of the RRPF affiliates, triggereddid not trigger any of the significance tests as of September 30, 2021, we determined that at least one of the significance tests.tests was triggered as of September 30, 2020. As a result, and in accordance with Rule 10-01(b) of Regulation S-X, the following table shows summarized unaudited financial information for Alpha Partners Leasing Limited (in millions):

| | | Three Months Ended

September 30 | | Nine Months Ended

September 30 | | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| | 2020 | | 2019 | | 2020 | | 2019 | | 2021 | | 2020 | | 2021 | | 2020 |

| Total revenue | Total revenue | $ | 112.5 | | | $ | 94.0 | | | $ | 318.5 | | | $ | 283.5 | | Total revenue | $ | 91.1 | | | $ | 112.5 | | | $ | 277.3 | | | $ | 318.5 | |

| Total expenses | Total expenses | (95.9) | | | (75.1) | | | (271.0) | | | (227.7) | | Total expenses | (91.9) | | | (95.9) | | | (267.4) | | | (271.0) | |

| Other income, including net gains on sales of assets | Other income, including net gains on sales of assets | 10.0 | | | 6.8 | | | 48.2 | | | 33.1 | | Other income, including net gains on sales of assets | 7.7 | | | 10.0 | | | 36.2 | | | 48.2 | |

Net income | Net income | 21.7 | | | 20.8 | | | 77.6 | | | 72.0 | | Net income | 5.5 | | | 21.7 | | | 37.2 | | | 77.6 | |

(1) Net income for the nine months ended September 30, 2021 excludes the impact from the change in the enacted corporate income tax rate increase in the United Kingdom in 2021. Net income for the three and nine months ended September 30, 2020 exclude the impact from the elimination of a previously announced corporate income tax rate reduction in 2020.

NOTE 7. Fair Value Disclosure

The assets and liabilities that GATX records at fair value on a recurring basis consisted entirely of derivatives at September 30, 20202021 and December 31, 2019.2020.

In addition, we review long-lived assets, such as operating assets and facilities, investments in affiliates, and goodwill, for impairment whenever circumstances indicate that the carrying amount of these assets may not be recoverable or when assets may be classified as held for sale. We considered COVID-19 as part of our assessment during the quarter and determined there were no material impacts on our final conclusions. We will continue to monitor our long-lived assets, investments in affiliates, and goodwill for indicators of impairment as COVID-19 continues to impact the global economy.

Derivative Instruments

Fair Value Hedges

We use interest rate swaps to manage the fixed-to-floating rate mix of our debt obligations by converting a portion of our fixed rate debt to floating rate debt. For fair value hedges, we recognize changes in fair value of both the derivative and the hedged item as interest expense. We had 3 instruments outstanding with an aggregate notional amount of $200.0 million as of September 30, 2021 with maturities in 2022 and 5 instruments outstanding with an aggregate notional amount of $300.0 million as of September 30,December 31, 2020 with maturities ranging from 2021 to 2022 and 8 instruments outstanding with an aggregate notional amount of $450.0 million as of December 31, 2019 with maturities ranging from 2020 to 2022.

Cash Flow Hedges

We use Treasury rate locks and swap rate locks to hedge our exposure to interest rate risk on anticipated transactions. We also use currency swaps, forwards, and put/call options to hedge our exposure to fluctuations in the exchange rates of foreign currencies for certain loans and operating expenses denominated in non-functional currencies. We had 6 instruments outstanding with an aggregate notional amount of $136.1$293.7 million as of September 30, 2020 that mature2021 with maturities ranging from 20202021 to 2022 and 7 instruments1 instrument outstanding with an aggregate notional amount of $336.5$105.7 million as of December 31, 2019 with maturities ranging from 2020 to 2022.that matures in 2021. Within the next 12 months, we expect to reclassify $2.11.7 million ($1.61.2 million after-tax) of net losses on previously terminated derivatives from accumulated other comprehensive income (loss) to interest expense or operating lease expense, as applicable. We reclassify these amounts when interest and operating lease expense on the related hedged transactions affect earnings.

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

Non-Designated Derivatives

We do not hold derivative financial instruments for purposes other than hedging, although certain of our derivatives are not designated as accounting hedges. We recognize changes in the fair value of these derivatives in other (income) expense immediately.

Certain of our derivative instruments contain credit risk provisions that could require us to make immediate payment on net liability positions in the event that we default on certain outstanding debt obligations. The aggregate fair value of ourWe had no derivative instruments

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

with credit risk related contingent features that arewere in a liability position as of September 30, 2020 was $9.0 million.2021. We are not required to post any collateral on our derivative instruments and do not expect the credit risk provisions to be triggered.

In the event that a counterparty fails to meet the terms of an interest rate swap agreement or a foreign exchange contract, our exposure is limited to the fair value of the swap, if in our favor. We manage the credit risk of counterparties by transacting with institutions that we consider financially sound and by avoiding concentrations of risk with a single counterparty. We believe that the risk of non-performance by any of our counterparties is remote.

The following tables show our derivative assets and liabilities that are measured at fair value (in millions):

| | | Balance Sheet Location | | Fair Value

September 30, 2020 | | Quoted

Prices in

Active Markets for

Identical Assets

(Level 1) | | Significant Observable Inputs

(Level 2) | | Significant Unobservable

Inputs

(Level 3) | | Balance Sheet Location | | Fair Value

September 30,

2021 | | Quoted

Prices in

Active Markets for

Identical Assets

(Level 1) | | Significant Observable Inputs

(Level 2) | | Significant Unobservable

Inputs

(Level 3) |

| Derivative Assets | Derivative Assets | | | | | | | | | | Derivative Assets | | | | | | | | | |

| Interest rate contracts (1) | Interest rate contracts (1) | Other assets | | $ | 6.9 | | | $ | 0 | | | $ | 6.9 | | | $ | 0 | | Interest rate contracts (1) | Other assets | | $ | 2.4 | | | $ | — | | | $ | 2.4 | | | $ | — | |

| Foreign exchange contracts (1) | | Foreign exchange contracts (1) | Other assets | | 6.7 | | | — | | | 6.7 | | | — | |

| Foreign exchange contracts (2) | | Foreign exchange contracts (2) | Other assets | | 1.7 | | | — | | | 1.7 | | | — | |

| | Total derivative assets | | Total derivative assets | | $ | 10.8 | | | $ | — | | | $ | 10.8 | | | $ | — | |

| | Total derivative assets | | $ | 6.9 | | | $ | 0 | | | $ | 6.9 | | | $ | 0 | | |

| Derivative Liabilities | | | | | | | | | |

| | Foreign exchange contracts (1) | Other liabilities | | $ | 9.0 | | | $ | 0 | | | $ | 9.0 | | | $ | 0 | | |

| Foreign exchange contracts (2) | Other liabilities | | 0.9 | | | 0 | | | 0.9 | | | 0 | | |

| Total derivative liabilities | | $ | 9.9 | | | $ | 0 | | | $ | 9.9 | | | $ | 0 | | |

|

| | | Balance Sheet Location | | Fair Value

December 31, 2019 | | Quoted

Prices in

Active Markets for

Identical Assets

(Level 1) | | Significant Observable Inputs

(Level 2) | | Significant Unobservable

Inputs

(Level 3) | | Balance Sheet Location | | Fair Value

December 31,

2020 | | Quoted

Prices in

Active Markets for

Identical Assets

(Level 1) | | Significant Observable Inputs

(Level 2) | | Significant Unobservable

Inputs

(Level 3) |

| Derivative Assets | Derivative Assets | | | | | | | | | | Derivative Assets | | | | | | | | | |

| Interest rate contracts (1) | Interest rate contracts (1) | Other assets | | $ | 1.4 | | | $ | 0 | | | $ | 1.4 | | | $ | 0 | | Interest rate contracts (1) | Other assets | | $ | 5.6 | | | $ | — | | | $ | 5.6 | | | $ | — | |

| Foreign exchange contracts (1) | Foreign exchange contracts (1) | Other assets | | 6.9 | | | 0 | | | 6.9 | | | 0 | | Foreign exchange contracts (1) | Other assets | | 0.4 | | | — | | | 0.4 | | | — | |

| Foreign exchange contracts (2) | Foreign exchange contracts (2) | Other assets | | 0.2 | | | 0 | | | 0.2 | | | 0 | | Foreign exchange contracts (2) | Other assets | | 0.4 | | | — | | | 0.4 | | | — | |

| Total derivative assets | Total derivative assets | | $ | 8.5 | | | $ | 0 | | | $ | 8.5 | | | $ | 0 | | Total derivative assets | | $ | 6.4 | | | $ | — | | | $ | 6.4 | | | $ | — | |

| Derivative Liabilities | | | | | | | | | |

| Interest rate contracts (1) | Other liabilities | | $ | 0.6 | | | $ | 0 | | | $ | 0.6 | | | $ | 0 | | |

| Foreign exchange contracts (1) | Other liabilities | | 7.0 | | | 0 | | | 7.0 | | | 0 | | |

| Foreign exchange contracts (2) | Other liabilities | | 6.0 | | | 0 | | | 6.0 | | | 0 | | |

| Total derivative liabilities | | $ | 13.6 | | | $ | 0 | | | $ | 13.6 | | | $ | 0 | | |

|

_________

(1) Designated as hedges.

(2) Not designated as hedges.

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

We value derivatives using a pricing model with inputs (such as yield curves and foreign currency rates) that are observable in the market or that can be derived principally from observable market data. As of September 30, 20202021 and December 31, 2019,2020, all derivatives were classified as Level 2 in the fair value hierarchy. There were no derivatives classified as Level 1 or Level 3.

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

The following table shows the amounts recorded on the balance sheet related to cumulative basis adjustments for fair value hedges as of September 30, 20202021 and December 31, 20192020 (in millions).:

| | | Carrying Amount of the Hedged Assets/(Liabilities) | | Cumulative Amount of Fair Value Hedging Adjustment Included in the Carrying Amount of the Hedged Assets/(Liabilities) | | Carrying Amount of the Hedged Assets/(Liabilities) | | Cumulative Amount of Fair Value Hedging Adjustment Included in the Carrying Amount of the Hedged Assets/(Liabilities) |

| Line Item in the Balance Sheet in Which the Hedged Item is Included | Line Item in the Balance Sheet in Which the Hedged Item is Included | | September 30

2020 | | December 31

2019 | | September 30

2020 | | December 31

2019 | Line Item in the Balance Sheet in Which the Hedged Item is Included | | September 30

2021 | | December 31

2020 | | September 30

2021 | | December 31

2020 |

| Recourse debt | Recourse debt | | $ | (304.3) | | | $ | (449.9) | | | $ | 6.9 | | | $ | 1.4 | | Recourse debt | | $ | (201.7) | | | $ | (303.6) | | | $ | 2.4 | | | $ | 5.6 | |

The following tables show the impacts of our derivative instruments on our statement of comprehensive income for the three and nine months ended September 30, 20202021 and 20192020 (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Amount of Loss (Gain) Recognized in Other Comprehensive Income | | Location of Loss (Gain) Reclassified from Accumulated Other Comprehensive Income into Income | | Amount of Loss (Gain) Reclassified from Accumulated Other Comprehensive Income into Income | |

| | Three Months Ended September 30 | | | Three Months Ended September 30 | | | |

| Derivative Designation | | 2020 | | 2019 | | | 2020 | | 2019 | | | |

| Derivatives in cash flow hedging relationships: | | | | | | | | | |

| Interest rate contracts | | $ | 0 | | | $ | 1.6 | | | Interest expense | | $ | 0.6 | | | $ | 0.5 | | | | |

| Foreign exchange contracts | | 10.5 | | | (19.8) | | | Other (income) expense | | 10.4 | | | (19.3) | | | | |

| Total | | $ | 10.5 | | | $ | (18.2) | | | Total | | $ | 11.0 | | | $ | (18.8) | | | | |

| | | Amount of Loss (Gain) Recognized in Other Comprehensive Income | | Location of Loss (Gain) Reclassified from Accumulated Other Comprehensive Income into Income | | Amount of Loss (Gain) Reclassified from Accumulated Other Comprehensive Income into Income | | | Amount of Loss (Gain) Recognized in Other Comprehensive Income | | Location of Loss (Gain) Reclassified from Accumulated Other Comprehensive Income into Income | | Amount of Loss (Gain) Reclassified from Accumulated Other Comprehensive Income into Income | |

| | Nine Months Ended

September 30 | | Nine Months Ended September 30 | | | Three Months

Ended September 30 | | Three Months

Ended September 30 | |

| Derivative Designation | Derivative Designation | | 2020 | | 2019 | | 2020 | | 2019 | | Derivative Designation | | 2021 | | 2020 | | 2021 | | 2020 | |

| Derivatives in cash flow hedging relationships: | Derivatives in cash flow hedging relationships: | | | | | | | | Derivatives in cash flow hedging relationships: | | | | | | | |

| Interest rate contracts | Interest rate contracts | | $ | (0.5) | | | $ | 1.6 | | | Interest expense | | $ | 1.4 | | | $ | 2.0 | | Interest rate contracts | | $ | — | | | $ | — | | | Interest expense | | $ | 0.4 | | | $ | 0.6 | | |

| Foreign exchange contracts | Foreign exchange contracts | | 15.2 | | | (28.5) | | | Other (income) expense | | 9.5 | | | (24.4) | | | Foreign exchange contracts | | (6.4) | | | 10.5 | | | Other (income) expense | | (6.4) | | | 10.4 | | |

| Total | Total | | $ | 14.7 | | | $ | (26.9) | | | Total | | $ | 10.9 | | | $ | (22.4) | | | Total | | $ | (6.4) | | | $ | 10.5 | | | Total | | $ | (6.0) | | | $ | 11.0 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Amount of Loss (Gain) Recognized in Other Comprehensive Income | | Location of Loss (Gain) Reclassified from Accumulated Other Comprehensive Income into Income | | Amount of Loss (Gain) Reclassified from Accumulated Other Comprehensive Income into Income | |

| | Nine Months Ended

September 30 | | | Nine Months Ended

September 30 | | | |

| Derivative Designation | | 2021 | | 2020 | | | 2021 | | 2020 | | | |

| Derivatives in cash flow hedging relationships: | | | | | | | | | |

| Interest rate contracts | | $ | — | | | $ | (0.5) | | | Interest expense | | $ | 1.5 | | | $ | 1.4 | | | | |

| Foreign exchange contracts | | (10.3) | | | 15.2 | | | Other (income) expense | | (10.6) | | | 9.5 | | | | |

| Total | | $ | (10.3) | | | $ | 14.7 | | | Total | | $ | (9.1) | | | $ | 10.9 | | | | |

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

The following tables show the impact of our fair value and cash flow hedge accounting relationships, as well as the impact of our non-designated derivatives, on the statement of comprehensive income for the three and nine months ended September 30, 20202021 and 20192020 (in millions):

| | | Location and Amount of Gain (Loss) Recognized in Income on Fair Value and Cash Flow Hedging Relationships | | Location and Amount of Gain (Loss) Recognized in Income on Fair Value and Cash Flow Hedging Relationships | |

| | Three Months Ended

September 30 | Three Months Ended

September 30 | | Three Months Ended

September 30 | | | Three Months Ended

September 30 |

| | 2020 | 2019 | | 2021 | 2020 | |

|

| Interest (expense), net | | Other income (expense) | | | Interest (expense), net | | Other income (expense) | |

| Interest (expense),

net | | Other income

(expense) | | | Interest (expense),

net | | Other income

(expense) | |

| Total amounts of income and expense presented in the statements of comprehensive income in which the effects of fair value or cash flow hedges are recorded | Total amounts of income and expense presented in the statements of comprehensive income in which the effects of fair value or cash flow hedges are recorded | $ | (48.6) | | | $ | (1.2) | | | | $ | (44.7) | | | $ | (1.7) | | | Total amounts of income and expense presented in the statements of comprehensive income in which the effects of fair value or cash flow hedges are recorded | $ | (49.8) | | | $ | (0.3) | | | | $ | (48.6) | | | $ | (1.2) | | |

| Gain (loss) on fair value hedging relationships | Gain (loss) on fair value hedging relationships | | | | | Gain (loss) on fair value hedging relationships | | | | |

| Interest rate contracts: | Interest rate contracts: | | | | | Interest rate contracts: | | | | |

| Hedged items | Hedged items | 1.3 | | | 0 | | | | (1.3) | | | 0 | | | Hedged items | 0.8 | | | — | | | | 1.3 | | | — | | |

| Derivatives designated as hedging instruments | Derivatives designated as hedging instruments | (1.3) | | | 0 | | | | 1.3 | | | 0 | | | Derivatives designated as hedging instruments | (0.8) | | | — | | | | (1.3) | | | — | | |

| Gain (loss) on cash flow hedging relationships | Gain (loss) on cash flow hedging relationships | | | | | Gain (loss) on cash flow hedging relationships | | | | |

| Interest rate contracts: | Interest rate contracts: | | | | | Interest rate contracts: | | | | |

| Amount of gain (loss) reclassified from accumulated other comprehensive income into income | Amount of gain (loss) reclassified from accumulated other comprehensive income into income | (0.6) | | | 0 | | | | (0.5) | | | 0 | | | Amount of gain (loss) reclassified from accumulated other comprehensive income into income | (0.4) | | | — | | | | (0.6) | | | — | | |

| Foreign exchange contracts: | Foreign exchange contracts: | | | | | Foreign exchange contracts: | | | | |

| Amount of gain (loss) reclassified from accumulated other comprehensive income into income (1) | Amount of gain (loss) reclassified from accumulated other comprehensive income into income (1) | 0 | | | (10.4) | | | | 0 | | | 19.3 | | | Amount of gain (loss) reclassified from accumulated other comprehensive income into income (1) | — | | | 6.4 | | | | — | | | (10.4) | | |

| Gain (loss) on non-designated derivative contracts | Gain (loss) on non-designated derivative contracts | 0 | | | 2.2 | | | | 0 | | | 4.0 | | | Gain (loss) on non-designated derivative contracts | — | | | 2.6 | | | | — | | | 2.2 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Location and Amount of Gain (Loss) Recognized in Income on Fair Value and Cash Flow Hedging Relationships |

| Nine Months Ended

September 30 | Nine Months Ended

September 30 |

| 2020 | 2019 |

| Interest (expense), net | | Other income (expense) | | | Interest (expense), net | | Other income (expense) | | |

| Total amounts of income and expense presented in the statements of comprehensive income in which the effects of fair value or cash flow hedges are recorded | $ | (141.5) | | | $ | (12.2) | | | | $ | (135.3) | | | $ | (5.3) | | | |

| Gain (loss) on fair value hedging relationships | | | | | | | | | | |

| Interest rate contracts: | | | | | | | | | | |

| Hedged items | (5.4) | | | 0 | | | | (9.8) | | | 0 | | | |

| Derivatives designated as hedging instruments | 5.4 | | | 0 | | | | 9.8 | | | 0 | | | |

| Gain (loss) on cash flow hedging relationships | | | | | | | | | | |

| Interest rate contracts: | | | | | | | | | | |

| Amount of gain (loss) reclassified from accumulated other comprehensive income into income | (1.4) | | | 0 | | | | (2.0) | | | 0 | | | |

| Foreign exchange contracts: | | | | | | | | | | |

| Amount of gain (loss) reclassified from accumulated other comprehensive income into income (1) | 0 | | | (9.5) | | | | 0 | | | 24.4 | | | |

| Gain (loss) on non-designated derivative contracts | 0 | | | 4.6 | | | | 0 | | | 1.3 | | | |

_________ | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Location and Amount of Gain (Loss) Recognized in Income on Fair Value and Cash Flow Hedging Relationships | |

| Nine Months Ended

September 30 | | | Nine Months Ended

September 30 |

| 2021 | 2020 | |

| Interest (expense),

net | | Other income

(expense) | | | Interest (expense),

net | | Other income

(expense) | | |

| Total amounts of income and expense presented in the statements of comprehensive income in which the effects of fair value or cash flow hedges are recorded | $ | (153.4) | | | $ | (9.7) | | | | $ | (141.5) | | | $ | (12.2) | | | |

| Gain (loss) on fair value hedging relationships | | | | | | | | | | |

| Interest rate contracts: | | | | | | | | | | |

| Hedged items | 3.2 | | | — | | | | (5.4) | | | — | | | |

| Derivatives designated as hedging instruments | (3.2) | | | — | | | | 5.4 | | | — | | | |

| Gain (loss) on cash flow hedging relationships | | | | | | | | | | |

| Interest rate contracts: | | | | | | | | | | |

| Amount of gain (loss) reclassified from accumulated other comprehensive income into income | (1.5) | | | — | | | | (1.4) | | | — | | | |

| Foreign exchange contracts: | | | | | | | | | | |

| Amount of gain (loss) reclassified from accumulated other comprehensive income into income (1) | — | | | 10.6 | | | | — | | | (9.5) | | | |

| Gain (loss) on non-designated derivative contracts | — | | | 0.9 | | | | — | | | 4.6 | | | |

_______(1) These amounts are substantially offset by foreign currency remeasurement adjustments on related hedged instruments, also recognized in other income (expense).

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

Other Financial Instruments

Except for derivatives, as disclosed above, GATX has no other assets and liabilities measured at fair value on a recurring basis. The carrying amounts of cash and cash equivalents, rent and other receivables, accounts payable, and commercial paper and borrowings under bank credit facilities with maturities under one year approximate fair value due to the short maturity of those instruments. We estimate the fair values of fixed and floating rate debt using discounted cash flow analyses that are based on interest rates currently offered for loans with similar terms to borrowers of similar credit quality. The inputs we use to estimate each of these values are classified in Level 2 of the fair value hierarchy because they are directly or indirectly observable inputs.

The following table shows the carrying amounts and fair values of our other financial instruments (in millions):

| | | September 30, 2020 | | December 31, 2019 | | September 30, 2021 | | December 31, 2020 |

|

| Carrying

Amount | | Fair

Value | | Carrying

Amount | | Fair

Value |

| Carrying

Amount | | Fair

Value | | Carrying

Amount | | Fair

Value |

| Liabilities | Liabilities | | | | | | | | Liabilities | | | | | | | |

| Recourse fixed rate debt | Recourse fixed rate debt | $ | 4,788.3 | | | $ | 5,295.4 | | | $ | 4,389.3 | | | $ | 4,644.6 | | Recourse fixed rate debt | $ | 5,508.5 | | | $ | 5,926.0 | | | $ | 5,056.3 | | | $ | 5,696.9 | |

| Recourse floating rate debt | Recourse floating rate debt | 422.9 | | | 419.7 | | | 417.5 | | | 419.0 | | Recourse floating rate debt | 550.0 | | | 550.1 | | | 299.9 | | | 300.4 | |

|

NOTE 8. Pension and Other Post-Retirement Benefits

The following table shows the components of our pension and other post-retirement net periodic cost for the three months ended September 30, 20202021 and 20192020 (in millions):

|

|

| 2020

Pension

Benefits | | 2019

Pension

Benefits | | 2020

Retiree Health and Life | | 2019

Retiree Health and Life |

| 2021

Pension

Benefits | | 2020

Pension

Benefits | | 2021

Retiree Health and Life | | 2020

Retiree Health and Life |

| Service cost | Service cost | $ | 2.0 | | | $ | 1.7 | | | $ | 0 | | | $ | 0 | | Service cost | $ | 2.1 | | | $ | 2.0 | | | $ | — | | | $ | — | |

| Interest cost | Interest cost | 3.1 | | | 3.8 | | | 0.1 | | | 0.2 | | Interest cost | 2.1 | | | 3.1 | | | 0.1 | | | 0.1 | |

| Expected return on plan assets | Expected return on plan assets | (5.0) | | | (5.6) | | | 0 | | | 0 | | Expected return on plan assets | (4.6) | | | (5.0) | | | — | | | — | |

| Amortization of (1): | Amortization of (1): | | Amortization of (1): | |

| Unrecognized prior service credit | Unrecognized prior service credit | 0 | | | — | | | 0 | | | 0 | | Unrecognized prior service credit | — | | | — | | | — | | | — | |

| Unrecognized net actuarial loss (gain) | Unrecognized net actuarial loss (gain) | 3.1 | | | 2.0 | | | (0.1) | | | 0 | | Unrecognized net actuarial loss (gain) | 3.3 | | | 3.1 | | | (0.1) | | | (0.1) | |

| Net periodic cost | Net periodic cost | $ | 3.2 | | | $ | 1.9 | | | $ | 0 | | | $ | 0.2 | | Net periodic cost | $ | 2.9 | | | $ | 3.2 | | | $ | — | | | $ | — | |

|

The following table shows the components of our pension and other post-retirement benefits expensenet periodic cost for the nine months ended September 30, 20202021 and 20192020 (in millions):

|

|

| 2020

Pension

Benefits | | 2019

Pension

Benefits | | 2020

Retiree Health and Life | | 2019

Retiree Health and Life |

| 2021

Pension

Benefits | | 2020

Pension

Benefits | | 2021

Retiree Health and Life | | 2020

Retiree Health and Life |