UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________________________________________________

FORM 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended JuneSeptember 30, 2016

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-15283

DineEquity, Inc.

DineEquity, Inc.

(Exact name of registrant as specified in its charter) |

| | |

Delaware (State or other jurisdiction of incorporation or organization) | | 95-3038279 (I.R.S. Employer Identification No.) |

| | | |

450 North Brand Boulevard, Glendale, California (Address of principal executive offices) | | 91203-1903 (Zip Code) |

(818) 240-6055

(Registrant’s telephone number, including area code)

______________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | |

Large accelerated filer x | | Accelerated filer o |

| | | |

Non-accelerated filer o | | Smaller reporting company o |

| (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

| | |

| Class | | Outstanding as of July 29,October 28, 2016 |

| Common Stock, $0.01 par value | | 18,212,61118,094,014 |

DineEquity, Inc. and Subsidiaries

Index

Cautionary Statement Regarding Forward-Looking Statements

Statements contained in this report may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors, which may cause actual results to be materially different from those expressed or implied in such statements. You can identify these forward-looking statements by words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan” and other similar expressions. You should consider our forward-looking statements in light of the risks discussed under the heading “Risk Factors” in our most recent Annual Report on Form 10-K, as well as our consolidated financial statements, related notes, and the other financial information appearing elsewhere in this report and our other filings with the United States Securities and Exchange Commission. The forward-looking statements contained in this report are made as of the date hereof and the Company assumes no obligation to update or supplement any forward-looking statements.

Fiscal Quarter End

The Company’s fiscal quarters end on the Sunday closest to the last day of each calendar quarter. For convenience, unless otherwise specified herein, the fiscal quarters of each year are referred to as ending on March 31, June 30, September 30 and December 31. The first fiscal quarter of 2016 began on January 4, 2016 and ended on April 3, 2016; the second and third fiscal quarterquarters of 2016 ended on July 3, 2016.2016 and October 2, 2016, respectively. The first fiscal quarter of 2015 began on December 29, 2014 and ended on March 29, 2015; the second and third fiscal quarterquarters of 2015 ended on June 28, 2015.2015 and September 27, 2015, respectively.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

DineEquity, Inc. and Subsidiaries

Consolidated Balance Sheets

(In thousands, except share and per share amounts) | | | Assets | | June 30,

2016 | | December 31, 2015 | | September 30,

2016 | | December 31, 2015 |

| | | (Unaudited) | | | | (Unaudited) | | |

| Current assets: | | |

| | |

| | |

| | |

|

| Cash and cash equivalents | | $ | 118,293 |

| | $ | 144,785 |

| | $ | 107,823 |

| | $ | 144,785 |

|

| Receivables, net | | 101,081 |

| | 139,206 |

| | 93,935 |

| | 139,206 |

|

| Restricted cash | | 42,831 |

| | 32,528 |

| | 34,958 |

| | 32,528 |

|

| Prepaid gift card costs | | 36,455 |

| | 46,792 |

| | 36,728 |

| | 46,792 |

|

| Prepaid income taxes | | — |

| | 5,186 |

| | 1,966 |

| | 5,186 |

|

| Other current assets | | 5,637 |

| | 4,212 |

| | 5,036 |

| | 4,212 |

|

| Total current assets | | 304,297 |

| | 372,709 |

| | 280,446 |

| | 372,709 |

|

| Long-term receivables, net | | 150,922 |

| | 160,695 |

| | 145,072 |

| | 160,695 |

|

| Property and equipment, net | | 209,323 |

| | 219,580 |

| | 205,230 |

| | 219,580 |

|

| Goodwill | | 697,470 |

| | 697,470 |

| | 697,470 |

| | 697,470 |

|

| Other intangible assets, net | | 768,096 |

| | 772,949 |

| | 765,773 |

| | 772,949 |

|

| Deferred rent receivable | | 88,802 |

| | 90,030 |

| | 88,034 |

| | 90,030 |

|

| Other non-current assets, net | | 18,358 |

| | 18,417 |

| | 18,396 |

| | 18,417 |

|

| Total assets | | $ | 2,237,268 |

| | $ | 2,331,850 |

| | $ | 2,200,421 |

| | $ | 2,331,850 |

|

| Liabilities and Stockholders’ Equity | | |

| | |

| | |

| | |

|

| Current liabilities: | | |

| | |

| | |

| | |

|

| Accounts payable | | $ | 46,625 |

| | $ | 55,019 |

| | $ | 32,625 |

| | $ | 55,019 |

|

| Gift card liability | | 114,302 |

| | 167,657 |

| | 104,201 |

| | 167,657 |

|

| Accrued employee compensation and benefits | | 14,136 |

| | 25,085 |

| | 15,792 |

| | 25,085 |

|

| Dividends payable | | 16,792 |

| | 17,082 |

| | 16,675 |

| | 17,082 |

|

| Current maturities of capital lease and financing obligations | | 14,559 |

| | 14,320 |

| | 14,346 |

| | 14,320 |

|

| Income taxes payable | | 5,278 |

| | — |

| |

| Accrued advertising | | 5,948 |

| | 8,758 |

| | 11,875 |

| | 8,758 |

|

| Accrued interest payable | | 4,310 |

| | 4,257 |

| | 4,314 |

| | 4,257 |

|

| Other accrued expenses | | 13,725 |

| | 6,251 |

| | 6,565 |

| | 6,251 |

|

| Total current liabilities | | 235,675 |

| | 298,429 |

| | 206,393 |

| | 298,429 |

|

| Long-term debt, net | | 1,281,064 |

| | 1,279,473 |

| | 1,281,873 |

| | 1,279,473 |

|

| Capital lease obligations, less current maturities | | 77,116 |

| | 84,781 |

| | 73,603 |

| | 84,781 |

|

| Financing obligations, less current maturities | | 42,325 |

| | 42,395 |

| | 39,518 |

| | 42,395 |

|

| Deferred income taxes, net | | 254,758 |

| | 269,469 |

| | 252,907 |

| | 269,469 |

|

| Deferred rent payable | | 71,929 |

| | 69,397 |

| | 71,574 |

| | 69,397 |

|

| Other non-current liabilities | | 18,235 |

| | 20,683 |

| | 18,027 |

| | 20,683 |

|

| Total liabilities | | 1,981,102 |

| | 2,064,627 |

| | 1,943,895 |

| | 2,064,627 |

|

| Commitments and contingencies | |

|

| |

|

| |

|

| |

|

|

| Stockholders’ equity: | | |

| | |

| | |

| | |

|

| Common stock, $0.01 par value, shares: 40,000,000 authorized; June 30, 2016 - 25,153,608 issued, 18,218,872 outstanding; December 31, 2015 - 25,186,048 issued, 18,535,027 outstanding | | 252 |

| | 252 |

| |

| Common stock, $0.01 par value, shares: 40,000,000 authorized; September 30, 2016 - 25,138,172 issued, 18,092,139 outstanding; December 31, 2015 - 25,186,048 issued, 18,535,027 outstanding | | | 251 |

| | 252 |

|

| Additional paid-in-capital | | 288,279 |

| | 286,952 |

| | 290,365 |

| | 286,952 |

|

| Retained earnings | | 370,546 |

| | 351,923 |

| | 378,172 |

| | 351,923 |

|

| Accumulated other comprehensive loss | | (106 | ) | | (107 | ) | | (107 | ) | | (107 | ) |

| Treasury stock, at cost; shares: June 30, 2016 - 6,934,736; December 31, 2015 - 6,651,021 | | (402,805 | ) | | (371,797 | ) | |

| Treasury stock, at cost; shares: September 30, 2016 - 7,046,033; December 31, 2015 - 6,651,021 | | | (412,155 | ) | | (371,797 | ) |

| Total stockholders’ equity | | 256,166 |

| | 267,223 |

| | 256,526 |

| | 267,223 |

|

| Total liabilities and stockholders’ equity | | $ | 2,237,268 |

| | $ | 2,331,850 |

| | $ | 2,200,421 |

| | $ | 2,331,850 |

|

See the accompanying Notes to Consolidated Financial Statements.

DineEquity, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income

(In thousands, except per share amounts)

(Unaudited)

| | | | | Three Months Ended | | Six Months Ended | | Three Months Ended | | Nine Months Ended |

| | | June 30, | | June 30, | | September 30, | | September 30, |

| | | 2016 | | 2015 | | 2016 | | 2015 | | 2016 | | 2015 | | 2016 | | 2015 |

| Revenues: | | |

| | |

| | | | | | |

| | |

| | | | |

| Franchise and restaurant revenues | | $ | 126,989 |

| | $ | 137,768 |

| | $ | 256,775 |

| | $ | 279,586 |

| | $ | 123,259 |

| | $ | 128,188 |

| | $ | 380,034 |

| | $ | 407,774 |

|

| Rental revenues | | 30,830 |

| | 31,132 |

| | 62,239 |

| | 62,534 |

| | 30,507 |

| | 31,221 |

| | 92,746 |

| | 93,755 |

|

| Financing revenues | | 2,439 |

| | 2,649 |

| | 4,768 |

| | 5,243 |

| | 2,251 |

| | 3,028 |

| | 7,019 |

| | 8,271 |

|

| Total revenues | | 160,258 |

| | 171,549 |

| | 323,782 |

| | 347,363 |

| | 156,017 |

| | 162,437 |

| | 479,799 |

| | 509,800 |

|

| Cost of revenues: | | |

| | |

| | | | | | |

| | |

| | | | |

| Franchise and restaurant expenses | | 39,707 |

| | 51,423 |

| | 80,576 |

| | 103,449 |

| | 41,553 |

| | 41,984 |

| | 122,129 |

| | 145,433 |

|

| Rental expenses | | 23,030 |

| | 23,319 |

| | 46,261 |

| | 46,809 |

| | 22,771 |

| | 23,264 |

| | 69,032 |

| | 70,073 |

|

| Financing expenses | | 146 |

| | — |

| | 146 |

| | 12 |

| | 9 |

| | 504 |

| | 155 |

| | 516 |

|

| Total cost of revenues | | 62,883 |

| | 74,742 |

| | 126,983 |

| | 150,270 |

| | 64,333 |

| | 65,752 |

| | 191,316 |

| | 216,022 |

|

| Gross profit | | 97,375 |

| | 96,807 |

| | 196,799 |

| | 197,093 |

| | 91,684 |

| | 96,685 |

| | 288,483 |

| | 293,778 |

|

| General and administrative expenses | | 36,511 |

| | 34,577 |

| | 75,935 |

| | 68,807 |

| | 36,002 |

| | 41,577 |

| | 111,937 |

| | 110,384 |

|

| Interest expense | | 15,383 |

| | 15,677 |

| | 30,749 |

| | 31,323 |

| | 15,358 |

| | 15,434 |

| | 46,107 |

| | 46,757 |

|

| Amortization of intangible assets | | 2,500 |

| | 2,500 |

| | 4,980 |

| | 5,000 |

| | 2,500 |

| | 2,500 |

| | 7,480 |

| | 7,500 |

|

| Closure and impairment charges, net | | 3,291 |

| | 475 |

| | 3,726 |

| | 2,302 |

| | 206 |

| | (72 | ) | | 3,932 |

| | 2,230 |

|

| (Gain) loss on disposition of assets | | (48 | ) | | 66 |

| | 566 |

| | 57 |

| |

| Loss (gain) on disposition of assets | | | 113 |

| | (2,351 | ) | | 679 |

| | (2,294 | ) |

| Income before income tax provision | | 39,738 |

| | 43,512 |

| | 80,843 |

| | 89,604 |

| | 37,505 |

| | 39,597 |

| | 118,348 |

| | 129,201 |

|

| Income tax provision | | (12,909 | ) | | (16,615 | ) | | (28,471 | ) | | (34,295 | ) | | (13,232 | ) | | (15,340 | ) | | (41,703 | ) | | (49,635 | ) |

| Net income | | 26,829 |

| | 26,897 |

| | 52,372 |

| | 55,309 |

| | 24,273 |

| | 24,257 |

| | 76,645 |

| | 79,566 |

|

| Other comprehensive income (loss), net of tax: | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | — |

| | 3 |

| | 1 |

| | (12 | ) | | (1 | ) | | (14 | ) | | — |

| | (26 | ) |

| Total comprehensive income | | $ | 26,829 |

| | $ | 26,900 |

| | $ | 52,373 |

| | $ | 55,297 |

| | $ | 24,272 |

| | $ | 24,243 |

| | $ | 76,645 |

| | $ | 79,540 |

|

| Net income available to common stockholders: | | | | |

| | | | | | | | |

| | | | |

| Net income | | $ | 26,829 |

| | $ | 26,897 |

| | $ | 52,372 |

| | $ | 55,309 |

| | $ | 24,273 |

| | $ | 24,257 |

| | $ | 76,645 |

| | $ | 79,566 |

|

| Less: Net income allocated to unvested participating restricted stock | | (384 | ) | | (359 | ) | | (766 | ) | | (726 | ) | | (338 | ) | | (316 | ) | | (1,103 | ) | | (1,042 | ) |

| Net income available to common stockholders | | $ | 26,445 |

| | $ | 26,538 |

| | $ | 51,606 |

| | $ | 54,583 |

| | $ | 23,935 |

| | $ | 23,941 |

| | $ | 75,542 |

| | $ | 78,524 |

|

| Net income available to common stockholders per share: | | |

| | |

| | | | | | |

| | |

| | | | |

| Basic | | $ | 1.46 |

| | $ | 1.41 |

| | $ | 2.84 |

| | $ | 2.90 |

| | $ | 1.33 |

| | $ | 1.29 |

| | $ | 4.17 |

| | $ | 4.19 |

|

| Diluted | | $ | 1.45 |

| | $ | 1.40 |

| | $ | 2.82 |

| | $ | 2.88 |

| | $ | 1.33 |

| | $ | 1.28 |

| | $ | 4.15 |

| | $ | 4.16 |

|

| Weighted average shares outstanding: | | |

| | |

| | | | | | |

| | |

| | | | |

| Basic | | 18,085 |

| | 18,763 |

| | 18,173 |

| | 18,819 |

| | 17,950 |

| | 18,573 |

| | 18,099 |

| | 18,737 |

|

| Diluted | | 18,188 |

| | 18,895 |

| | 18,280 |

| | 18,959 |

| | 18,041 |

| | 18,706 |

| | 18,201 |

| | 18,874 |

|

| | | | | | | | | | | | | | | | | |

| Dividends declared per common share | | $ | 0.92 |

| | $ | 0.875 |

| | $ | 1.84 |

| | $ | 1.75 |

| | $ | 0.92 |

| | $ | 0.875 |

| | $ | 2.76 |

| | $ | 2.625 |

|

| Dividends paid per common share | | $ | 0.92 |

| | $ | 0.875 |

| | $ | 1.84 |

| | $ | 1.75 |

| | $ | 0.92 |

| | $ | 0.875 |

| | $ | 2.76 |

| | $ | 2.625 |

|

See the accompanying Notes to Consolidated Financial Statements.

DineEquity, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In thousands)

| | | | | Six Months Ended | | Nine Months Ended |

| | | June 30, | | September 30, |

| | | 2016 | | 2015 | | 2016 | | 2015 |

| Cash flows from operating activities: | | |

| | |

| | |

| | |

|

| Net income | | $ | 52,372 |

| | $ | 55,309 |

| | $ | 76,645 |

| | $ | 79,566 |

|

| Adjustments to reconcile net income to cash flows provided by operating activities: | | |

| | |

| | |

| | |

|

| Depreciation and amortization | | 15,554 |

| | 15,855 |

| | 22,924 |

| | 24,134 |

|

| Non-cash interest expense | | 1,591 |

| | 1,519 |

| | 2,400 |

| | 2,292 |

|

| Deferred income taxes | | (11,896 | ) | | (12,612 | ) | | (14,852 | ) | | (12,512 | ) |

| Non-cash stock-based compensation expense | | 5,647 |

| | 4,593 |

| | 8,215 |

| | 6,312 |

|

| Tax benefit from stock-based compensation | | 1,169 |

| | 4,688 |

| | 1,153 |

| | 4,850 |

|

| Excess tax benefit from stock-based compensation | | (865 | ) | | (4,572 | ) | | (966 | ) | | (4,577 | ) |

| Closure and impairment charges | | 1,249 |

| | 2,302 |

| | 1,461 |

| | 2,230 |

|

| Loss on disposition of assets | | 566 |

| | 57 |

| |

| Loss (gain) on disposition of assets | | | 679 |

| | (2,294 | ) |

| Other | | 416 |

| | (1,534 | ) | | 456 |

| | (1,303 | ) |

| Changes in operating assets and liabilities: | | |

| | |

| | |

| | |

|

| Accounts receivable, net | | 880 |

| | (11,249 | ) | | 4,312 |

| | (95 | ) |

| Current income tax receivables and payables | | 5,291 |

| | 5,561 |

| | (1,138 | ) | | 5,703 |

|

| Gift card receivables and payables | | (18,311 | ) | | (3,256 | ) | | (30,355 | ) | | (11,816 | ) |

| Other current assets | | (1,424 | ) | | (2,299 | ) | | (824 | ) | | (3,304 | ) |

| Accounts payable | | 8,544 |

| | 6,024 |

| | (1,397 | ) | | 2,147 |

|

| Accrued employee compensation and benefits | | (10,949 | ) | | (10,790 | ) | | (9,293 | ) | | (4,915 | ) |

| Accrued interest payable | | 53 |

| | (10,240 | ) | | 57 |

| | (10,275 | ) |

| Other current liabilities | | 4,024 |

| | 8,767 |

| | 2,581 |

| | (5,554 | ) |

| Cash flows provided by operating activities | | 53,911 |

| | 48,123 |

| | 62,058 |

| | 70,589 |

|

| Cash flows from investing activities: | | |

| | |

| | |

| | |

|

| Additions to property and equipment | | (1,931 | ) | | (4,612 | ) | | (3,543 | ) | | (5,765 | ) |

| Proceeds from sale of property and equipment | | — |

| | 800 |

| | — |

| | 10,782 |

|

| Principal receipts from notes, equipment contracts and other long-term receivables | | 8,658 |

| | 9,517 |

| | 13,969 |

| | 16,498 |

|

| Other | | (250 | ) | | (110 | ) | | (393 | ) | | (274 | ) |

| Cash flows provided by investing activities | | 6,477 |

| | 5,595 |

| | 10,033 |

| | 21,241 |

|

| Cash flows from financing activities: | | | | |

| | | | |

|

| Principal payments on capital lease and financing obligations | | (6,853 | ) | | (5,975 | ) | | (10,391 | ) | | (9,711 | ) |

| Dividends paid on common stock | | | (50,790 | ) | | (49,786 | ) |

| Repurchase of common stock | | (35,008 | ) | | (35,007 | ) | | (45,010 | ) | | (50,010 | ) |

| Dividends paid on common stock | | (34,029 | ) | | (33,271 | ) | |

| Tax payments for restricted stock upon vesting | | (2,432 | ) | | (3,010 | ) | | (2,680 | ) | | (3,389 | ) |

| Proceeds from stock options exercised | | 880 |

| | 8,374 |

| | 1,282 |

| | 8,426 |

|

| Excess tax benefit from stock-based compensation | | 865 |

| | 4,572 |

| | 966 |

| | 4,577 |

|

| Change in restricted cash | | (10,303 | ) | | 11,007 |

| | (2,430 | ) | | 10,036 |

|

| Other | | — |

| | (29 | ) | | — |

| | (91 | ) |

| Cash flows used in financing activities | | (86,880 | ) | | (53,339 | ) | | (109,053 | ) | | (89,948 | ) |

| Net change in cash and cash equivalents | | (26,492 | ) | | 379 |

| | (36,962 | ) | | 1,882 |

|

| Cash and cash equivalents at beginning of period | | 144,785 |

| | 104,004 |

| | 144,785 |

| | 104,004 |

|

| Cash and cash equivalents at end of period | | $ | 118,293 |

| | $ | 104,383 |

| | $ | 107,823 |

| | $ | 105,886 |

|

| Supplemental disclosures: | | |

| | |

| | |

| | |

|

| Interest paid in cash | | $ | 34,747 |

| | $ | 46,419 |

| | $ | 51,940 |

| | $ | 64,094 |

|

| Income taxes paid in cash | | $ | 33,980 |

| | $ | 36,968 |

| | $ | 56,734 |

| | $ | 51,794 |

|

See the accompanying Notes to Consolidated Financial Statements.

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(Unaudited)

1. General

The accompanying unaudited consolidated financial statements of DineEquity, Inc. (the “Company” or “DineEquity”) have been prepared in accordance with United States generally accepted accounting principles (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. The operating results for the sixnine months ended JuneSeptember 30, 2016 are not necessarily indicative of the results that may be expected for the twelve months ending December 31, 2016.

The consolidated balance sheet at December 31, 2015 has been derived from the audited consolidated financial statements at that date, but does not include all of the information and footnotes required by U.S. GAAP for complete financial statements.

These consolidated financial statements should be read in conjunction with the consolidated financial statements and footnotes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015.

2. Basis of Presentation

The Company’s fiscal quarters end on the Sunday closest to the last day of each calendar quarter. For convenience, the fiscal quarters of each year are referred to as ending on March 31, June 30, September 30 and December 31. The first fiscal quarter of 2016 began on January 4, 2016 and ended on April 3, 2016; the second and third fiscal quarterquarters of 2016 ended on July 3, 2016.2016 and October 2, 2016, respectively. The first fiscal quarter of 2015 began on December 29, 2014 and ended on March 29, 2015; the second and third fiscal quarterquarters of 2015 ended on June 28, 2015.2015 and September 27, 2015, respectively.

The accompanying consolidated financial statements include the accounts of the Company and its subsidiaries that are consolidated in accordance with U.S. GAAP. All intercompany balances and transactions have been eliminated.

The preparation of financial statements in conformity with U.S. GAAP requires the Company’s management to make assumptions and estimates that affect the reported amounts of assets and liabilities, disclosures of contingent assets and liabilities, if any, at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Significant estimates are made in the calculation and assessment of the following: impairment of tangible assets, goodwill and other intangible assets; income taxes; allowance for doubtful accounts and notes receivables; lease accounting estimates; contingencies; and stock-based compensation. On an ongoing basis, the Company evaluates its estimates based on historical experience, current conditions and various other assumptions that are believed to be reasonable under the circumstances. The Company adjusts such estimates and assumptions when facts and circumstances dictate. Actual results could differ from those estimates.

3. Accounting Policies

Accounting Standards Adopted in the Current Fiscal Year

Various updates to accounting guidance became effective in the Company's first fiscal quarter of 2016. The majority of these updates either did not apply to the Company's operations or will only apply if the activity addressed in the guidance takes place in the future. Adoption of updates that did apply to the Company's operations did not have a material effect on the Company's financial statements.

Newly Issued Accounting Standards Not Yet Adopted

In JuneAugust 2016, the Financial Accounting Standards Board (“FASB”) issued new guidance on the classification of certain cash receipts and payments in the statement of cash flows. The new guidance is intended to reduce diversity in practice in how certain transactions are classified in the statement of cash flows. The Company will be required to adopt the new guidance beginning with its first fiscal quarter of 2018; early adoption is permitted. The Company is currently assessing the impact that the new guidance will have on its consolidated statements of cash flows.

In June 2016, the FASB issued new guidance on the measurement of credit losses on financial instruments. The new guidance will replace the incurred loss methodology of recognizing credit losses on financial instruments that is currently required with a methodology that estimates the expected credit loss on financial instruments and reflects the net amount

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

3. Accounting Policies (Continued)

expected to be collected on the financial instrument. Application of the new guidance may result in the earlier recognition of credit losses as the new methodology will require entities to consider forward-looking information in addition to historical and current information used in assessing incurred losses. The Company will be required to adopt the new guidance on a modified retrospective basis beginning with its first fiscal quarter of 2020, with early adoption permitted in its first fiscal quarter of 2019. The Company is currently evaluating the impact of the new guidance on its consolidated financial statements and related disclosures and whether early adoption will be elected.

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

3. Accounting Policies (Continued)

In March 2016, the FASB issued new guidance that addresses accounting for certain aspects of share-based payments, including excess tax benefits or deficiencies, forfeiture estimates, statutory tax withholding and cash flow classification of certain share-based payment activity. The Company will be required to adopt the new guidance beginning with its first fiscal quarter of 2017. Early adoption is permitted as long as all amendments addressed in the new guidance are adopted in the same period. The method of adoption varies based on each individual amendment.specific aspect addressed in the new guidance.

The Company believes one impact of the new guidance on its financial statements will be the recording of excess tax benefits or deficiencies in its provision for income taxes upon adoption of the new guidance instead of the current recording in additional paid-in capital (“APIC”).capital. The Company is currently evaluating the impact of other aspects of the new guidance on its consolidated financial statements and disclosures.

In February 2016, the FASB issued new guidance with respect to the accounting for leases. The new guidance will require lessees to recognize a right-of-use asset and a lease liability for virtually all leases, other than leases with a term of 12 months or less, and to provide additional disclosures about leasing arrangements. Accounting by lessors is largely unchanged from existing accounting guidance. The Company will be required to adopt the new guidance on a modified retrospective basis beginning with its first fiscal quarter of 2019. Early adoption is permitted.

While the Company is still in the process of evaluating the impact of the new guidance on its consolidated financial statements and disclosures, the Company expects adoption of the new guidance will have a material impact on its Consolidated Balance Sheets due to recognition of the right-of-use asset and lease liability related to its operating leases. While the new guidance willis also expected to impact the measurement and presentation of elements of expenses and cash flows related to leasing arrangements, the Company does not presently believe there will be a material impact on its Consolidated Statements of Comprehensive Income or Consolidated Statements of Cash Flows.

In May 2014, the FASB issued new accounting guidance on revenue recognition, which provides for a single, five-step model to be applied to all revenue contracts with customers. The new standard also requires additional financial statement disclosures that will enable users to understand the nature, amount, timing and uncertainty of revenue and cash flows relating to customer contracts. Companies have an option to use either a retrospective approach or cumulative effect adjustment approach to implement the standard. In August 2015, the FASB deferred the effective date of the new revenue guidance by one year such that the Company will be required to adopt the new guidance beginning with its first fiscal quarter of 2018. During 2016, the FASB issued three clarifications on specific topics within the new revenue recognition guidance that did not change the core principles of the guidance originally issued in May 2014.

This new guidance supersedes nearly all of the existing general revenue recognition guidance under U.S. GAAP as well as most industry-specific revenue recognition guidance, including guidance with respect to revenue recognition by franchisors. The Company believes the recognition of the majority of its revenues, including franchise royalty revenues, sales of IHOP pancake and waffle dry mix and retail sales at company-operated restaurants, will not materially be affected by the new guidance. Additionally, lease rental revenues and financing interest revenue are not within the scope of the new revenue guidance. The Company is currently evaluating the impact of the new guidance on its consolidated financial statements and related disclosures and which method of adoption will be used.

The Company reviewed all other newly issued accounting pronouncements and concluded that they either are not applicable to the Company or are not expected to have a material effect on the Company's consolidated financial statements as a result of future adoption.

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

4. Stockholders' Equity

Dividends

During the sixnine months ended JuneSeptember 30, 2016, the Company paid dividends on common stock of $34.0$50.8 million, representing cash dividends of $0.92 per share declared in the fourth quarter of 2015 and the first quarterand second quarters of 2016. On May 16, 2016, the Company's Board of Directors declared a second quarter 2016 cash dividend of $0.92 per share of common stock. This dividend was paid on July 8, 2016 to the Company's stockholders of record at the close of business on June 17, 2016. The Company reported a payable for this dividend of $16.8 million at June 30, 2016.

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

4. Stockholders' Equity (Continued)

On July 28, 2016, the Company's Board of Directors declared a third quarter 2016 cash dividend of $0.92 per share of common stock, payablestock. This dividend was paid on October 7, 2016 to the Company's stockholders of record at the close of business on September 16, 2016. The Company reported a payable for this dividend of $16.7 million at September 30, 2016.

On October 31, 2016, the Company's Board of Directors declared a fourth quarter 2016 cash dividend of $0.97 per share of common stock, payable on January 6, 2017 to stockholders of record at close of business on December 16, 2016.

Stock Repurchase Program

In October 2015, the Company's Board of Directors approved a stock repurchase program authorizing the Company to repurchase up to $150 million of DineEquity common stock (the “2015 Repurchase Program”) on an opportunistic basis from time to time in open market transactions and in privately negotiated transactions based on business, market, applicable legal requirements and other considerations. The 2015 Repurchase Program, as approved by the Board of Directors, does not require the repurchase of a specific number of shares and can be terminated at any time. During the sixnine months ended JuneSeptember 30, 2016, the Company repurchased 395,891525,550 shares of common stock at a cost of $35.0$45.0 million under the 2015 Repurchase Program. As of JuneSeptember 30, 2016, the Company has repurchased a cumulative total of 600,378730,037 shares of common stock under the 2015 Repurchase Program at a total cost of $52.5$62.5 million. As of JuneSeptember 30, 2016, a total of $97.5$87.5 million remains available for additional repurchases under the 2015 Repurchase Program.

Treasury Stock

Repurchases of DineEquity common stock are included in treasury stock at the cost of shares repurchased plus any transaction costs. Treasury stock may be re-issued when stock options are exercised, when restricted stock awards are granted and when restricted stock units settle in stock upon vesting. The cost of treasury stock re-issued is determined using the first-in, first-out (“FIFO”) method. During the sixnine months ended JuneSeptember 30, 2016, the Company re-issued 112,176130,538 shares of treasury stock at a total FIFO cost of $4.0$4.7 million.

5. Income Taxes

The Company's effective tax rate was 35.2% for the sixnine months ended JuneSeptember 30, 2016 as compared to 38.3%38.4% for the sixnine months ended JuneSeptember 30, 2015. The effective tax rate in 2016 was lower primarily due to application of a lower state tax rate to the deferred tax balances.

The total gross unrecognized tax benefit as of JuneSeptember 30, 2016 and December 31, 2015 was $4.2$3.7 million and $3.9 million, respectively, excluding interest, penalties and related tax benefits. The Company estimates the unrecognized tax benefit may decrease over the upcoming 12 months by an amount up to $1.3$1.5 million related to settlements with taxing authorities and the lapse of statutes of limitations. For the remaining liability, due to the uncertainties related to these tax matters, the Company is unable to make a reasonably reliable estimate as to when cash settlement with a taxing authority will occur.

As of JuneSeptember 30, 2016, accrued interest was $5.3$1.0 million and accrued penalties were less than $0.1 million, excluding any related income tax benefits. As of December 31, 2015, accrued interest was $4.9 million and accrued penalties were less than $0.1 million, excluding any related income tax benefits. The decrease of $3.9 million of accrued interest is primarily related to resolution of recent audits with taxing authorities. The Company recognizes interest accrued related to unrecognized tax benefits and penalties as a component of its income tax provision recognized in the Consolidated Statements of Comprehensive Income.

The Company files federal income tax returns and the Company or one of its subsidiaries files income tax returns in various state and foreign jurisdictions. With few exceptions, theThe Company is no longer subject to federal, state or non-United States tax examinations by tax authorities for years before 2008. In2011. During the secondthird quarter of 2013,2016, the Company resolved the appeals process with the Internal Revenue Service (“IRS”) issued a Revenue Agent’s Report related to its examination of the Company’s U.S federal income tax return for the tax years 2008 to 2010. The Company disagrees with a portion ofreserve previously provided related to the proposed assessmentsissues under appeal was adequate and has contested them through the IRS administrative appeals procedures. The Company anticipates the appeals process will conclude during 2016. The Company continues to believe that adequate reserves have been provided relating to all matters contained in the tax periods open to examination.did not require any additional adjustment.

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

6. Stock-Based Compensation

The following table summarizes the components of stock-based compensation expense included in general and administrative expenses in the Consolidated Statements of Comprehensive Income:

| | | | Three months ended June 30, | | Six months ended June 30, | Three months ended September 30, | | Nine months ended September 30, |

| | 2016 | | 2015 | | 2016 | | 2015 | 2016 | | 2015 | | 2016 | | 2015 |

| | (In millions) | (In millions) |

| Total stock-based compensation expense: | | | | | | | | | | | | | | |

| Equity classified awards expense | $ | 2.5 |

| | $ | 2.2 |

| | $ | 5.7 |

| | $ | 4.6 |

| $ | 2.6 |

| | $ | 1.8 |

| | $ | 8.3 |

| | $ | 6.4 |

|

| Liability classified awards expense | 0.3 |

| | (1.1 | ) | | 1.1 |

| | (0.8 | ) | (0.5 | ) | | 0.3 |

| | 0.6 |

| | (0.5 | ) |

| Total pre-tax stock-based compensation expense | 2.8 |

| | 1.1 |

| | 6.8 |

| | 3.8 |

| 2.1 |

| | 2.1 |

| | 8.9 |

| | 5.9 |

|

| Book income tax benefit | (1.1 | ) | | (0.4 | ) | | (2.6 | ) | | (1.4 | ) | (0.7 | ) | | (0.8 | ) | | (3.3 | ) | | (2.2 | ) |

| Total stock-based compensation expense, net of tax | $ | 1.7 |

| | $ | 0.7 |

| | $ | 4.2 |

| | $ | 2.4 |

| $ | 1.4 |

| | $ | 1.3 |

| | $ | 5.6 |

| | $ | 3.7 |

|

As of JuneSeptember 30, 2016, total unrecognized compensation expense of $16.6$14.7 million related to restricted stock and restricted stock units and $5.4$4.5 million related to stock options are expected to be recognized over a weighted average period of 1.641.55 years for restricted stock and restricted stock units and 1.651.51 years for stock options.

Equity Classified Awards - Stock Options

The estimated fair value of the stock options granted during the sixnine months ended JuneSeptember 30, 2016 was calculated using a Black-Scholes option pricing model. The following summarizes the assumptions used in the Black-Scholes model:

|

| | |

| Risk-free interest rate | 1.08 | % |

| Weighted average historical volatility | 27.1 | % |

| Dividend yield | 4.05 | % |

| Expected years until exercise | 4.5 |

|

| Weighted average fair value of options granted | $13.55 |

Stock option balances as of JuneSeptember 30, 2016 and related activity for the sixnine months ended JuneSeptember 30, 2016 were as follows:

| | | | | Shares | | Weighted Average Exercise Price | | Weighted Average Remaining Contractual Term (in Years) | | Aggregate Intrinsic Value (in Millions) | | Shares | | Weighted Average Exercise Price | | Weighted Average Remaining Contractual Term (in Years) | | Aggregate Intrinsic Value (in Millions) |

| Outstanding at December 31, 2015 | | 504,462 |

| | $ | 69.99 |

| | | | |

| | 504,462 |

| | $ | 69.99 |

| | | | |

|

| Granted | | 255,825 |

| | 90.90 |

| | | | |

| | 255,825 |

| | 90.90 |

| | | | |

|

| Exercised | | (36,088 | ) | | 24.39 |

| | | | |

| | (44,813 | ) | | 28.61 |

| | | | |

|

| Outstanding at June 30, 2016 | | 724,199 |

| | 79.65 |

| | 7.6 | | $ | 8.4 |

| |

| Vested at June 30, 2016 and Expected to Vest | | 668,490 |

| | 78.46 |

| | 7.5 | | $ | 8.4 |

| |

| Exercisable at June 30, 2016 | | 361,851 |

| | $ | 64.98 |

| | 5.9 | | $ | 8.3 |

| |

| Outstanding at September 30, 2016 | | | 707,550 |

| | 79.90 |

| | 7.4 | | $ | 6.3 |

|

| Vested at September 30, 2016 and Expected to Vest | | | 661,880 |

| | 78.94 |

| | 7.3 | | $ | 6.3 |

|

| Exercisable at September 30, 2016 | | | 353,126 |

| | $ | 65.44 |

| | 5.4 | | $ | 6.3 |

|

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference between the closing stock price of the Company’s common stock on the last trading day of the secondthird quarter of 2016 and the exercise price, multiplied by the number of in-the-money options) that would have been received by the option holders had all option holders exercised their options on JuneSeptember 30, 2016. The aggregate intrinsic value will change based on the fair market value of the Company’s common stock and the number of in-the-money options.

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

6. Stock-Based Compensation (Continued)

Equity Classified Awards - Restricted Stock and Restricted Stock Units

Outstanding balances as of JuneSeptember 30, 2016 and activity related to restricted stock and restricted stock units for the sixnine months ended JuneSeptember 30, 2016 were as follows:

| | | | | Restricted Stock | | Weighted Average Grant Date Fair Value | | Restricted Stock Units | | Weighted Average Grant Date Fair Value | | Restricted Stock | | Weighted Average Grant Date Fair Value | | Restricted Stock Units | | Weighted Average Grant Date Fair Value |

| Outstanding at December 31, 2015 | | 257,594 |

| | $ | 89.99 |

| | 35,116 |

| | $ | 86.30 |

| | 257,594 |

| | $ | 89.99 |

| | 35,116 |

| | $ | 86.30 |

|

| Granted | | 76,088 |

| | 90.64 |

| | 12,291 |

| | 90.90 |

| | 85,725 |

| | 89.26 |

| | 12,657 |

| | 90.90 |

|

| Released | | (63,151 | ) | | 76.33 |

| | (14,027 | ) | | 72.01 |

| | (71,876 | ) | | 77.95 |

| | (14,027 | ) | | 72.01 |

|

| Forfeited | | (19,260 | ) | | 93.05 |

| | — |

| | — |

| | (31,472 | ) | | 92.58 |

| | — |

| | — |

|

| Outstanding at June 30, 2016 | | 251,271 |

| | $ | 93.39 |

| | 33,380 |

| | $ | 93.97 |

| |

| Outstanding at September 30, 2016 | | | 239,971 |

| | $ | 93.00 |

| | 33,746 |

| | $ | 93.97 |

|

Liability Classified Awards - Long-Term Incentive Awards

The Company has granted cash long-term incentive awards (“LTIP awards”) to certain employees. Annual LTIP awards vest over a three-year period and are determined using a multiplier from 0% to 200% of the target award based on the total stockholder return of DineEquity common stock compared to the total stockholder returns of a peer group of companies. Although LTIP awards are only paid in cash, since the multiplier is based on the price of the Company's common stock, the awards are considered stock-based compensation in accordance with U.S. GAAP and are classified as liabilities. For the three months ended JuneSeptember 30, 2016 and 2015, a credit of $0.5 million and an expense of $0.3 million and a credit of $1.1 million, respectively, were included in total stock-based compensation expense related to LTIP awards. For the sixnine months ended JuneSeptember 30, 2016 and 2015, an expense of $1.1$0.6 million and a credit of $0.8$0.5 million, respectively, were included in total stock-based compensation expense related to LTIP awards. At JuneSeptember 30, 2016 and December 31, 2015, liabilities of $2.8$2.3 million and $1.6 million, respectively, related to LTIP awards were included as part of accrued employee compensation and benefits in the Consolidated Balance Sheets.

7. Segments

The Company has two reportablefour operating segments: franchise operations (an aggregation of Applebee’s and IHOP franchise operations) and, rental operations. The Company also hasoperations, company-operated restaurant operations and financing operations, but neitheroperations. The Company views all operating segments as reportable segments regardless of these operations exceededwhether any segment exceeds 10% of consolidated revenues, income before income tax provisionsegment profit or total assets.

As of JuneSeptember 30, 2016, the franchise operations segment consisted of (i) 2,027 restaurants operated by Applebee’s franchisees in the United States, two U.S. territories and 15 countries outside the United States and (ii) 1,6851,699 restaurants operated by IHOP franchisees and area licensees in the United States, twothree U.S. territories and 10 countries outside the United States. Franchise operations revenue consists primarily of franchise royalty revenues, sales of proprietary products to franchisees (primarily pancake and waffle dry mixes for the IHOP restaurants), IHOP franchise advertising fees from domestic IHOP restaurants and international restaurants of both brands and franchise fees. Franchise operations expenses include IHOP advertising expenses from domestic IHOP restaurants and international restaurants of both brands, the cost of IHOP proprietary products, IHOP and Applebee's pre-opening training expenses and other franchise-related costs.

Rental operations revenue includes revenue from operating leases and interest income from direct financing leases. Rental operations expenses are costs of operating leases and interest expense from capital leases on franchisee-operated restaurants.

At JuneSeptember 30, 2016, the company restaurant operations segment consisted of 10 IHOP company-operated restaurants, all of which are located in the United States. Company restaurant sales are retail sales at company-operated restaurants. Company restaurant expenses are operating expenses at company-operated restaurants and include food, labor, utilities, rent and other restaurant operating costs.

Financing operations revenue primarily consists of interest income from the financing of franchise fees and equipment leases and sales of equipment associated with refranchised IHOP restaurants. Financing expenses are primarily the cost of restaurant equipment associated with refranchised IHOP restaurants.

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

7. Segments (Continued)

Information on segments is as follows:

| | | | | Three months ended June 30, | | Six months ended June 30, | | Three months ended September 30, | | Nine months ended September 30, |

| | | 2016 | | 2015 | | 2016 | | 2015 | | 2016 | | 2015 | | 2016 | | 2015 |

| | | (In millions) | | (In millions) |

| Revenues from external customers: | | |

| | |

| | | | | | |

| | |

| | | | |

| Franchise operations | | $ | 122.5 |

| | $ | 120.3 |

| | $ | 247.5 |

| | $ | 244.8 |

| | $ | 119.2 |

| | $ | 120.1 |

| | $ | 366.7 |

| | $ | 364.9 |

|

| Rental operations | | 30.8 |

| | 31.1 |

| | 62.2 |

| | 62.5 |

| | 30.5 |

| | 31.2 |

| | 92.7 |

| | 93.8 |

|

| Company restaurants | | 4.5 |

| | 17.4 |

| | 9.3 |

| | 34.8 |

| | 4.0 |

| | 8.1 |

| | 13.4 |

| | 42.8 |

|

| Financing operations | | 2.5 |

| | 2.7 |

| | 4.8 |

| | 5.3 |

| | 2.3 |

| | 3.0 |

| | 7.0 |

| | 8.3 |

|

| Total | | $ | 160.3 |

| | $ | 171.5 |

| | $ | 323.8 |

| | $ | 347.4 |

| | $ | 156.0 |

| | $ | 162.4 |

| | $ | 479.8 |

| | $ | 509.8 |

|

| | | | | | | | | | | | | | | | | |

| Interest expense: | | |

| | |

| | | | | | |

| | |

| | | | |

| Rental operations | | $ | 3.0 |

| | $ | 3.4 |

| | $ | 6.1 |

| | $ | 6.9 |

| | $ | 2.9 |

| | $ | 3.3 |

| | $ | 9.0 |

| | $ | 10.1 |

|

| Company restaurants | | 0.1 |

| | 0.1 |

| | 0.2 |

| | 0.2 |

| | 0.1 |

| | 0.1 |

| | 0.3 |

| | 0.3 |

|

| Corporate | | 15.4 |

| | 15.7 |

| | 30.7 |

| | 31.3 |

| | 15.4 |

| | 15.4 |

| | 46.1 |

| | 46.8 |

|

| Total | | $ | 18.5 |

| | $ | 19.2 |

| | $ | 37.0 |

| | $ | 38.4 |

| | $ | 18.4 |

| | $ | 18.8 |

| | $ | 55.4 |

| | $ | 57.2 |

|

| | | | | | | | | | | | | | | | | |

| Depreciation and amortization: | | |

| | |

| | | | | | |

| | |

| | | | |

| Franchise operations | | $ | 2.6 |

| | $ | 2.6 |

| | $ | 5.2 |

| | $ | 5.2 |

| | $ | 2.7 |

| | $ | 2.6 |

| | $ | 7.9 |

| | $ | 7.8 |

|

| Rental operations | | 3.2 |

| | 3.2 |

| | 6.3 |

| | 6.4 |

| | 3.1 |

| | 3.2 |

| | 9.4 |

| | 9.6 |

|

| Company restaurants | | 0.1 |

| | 0.2 |

| | 0.2 |

| | 0.4 |

| | 0.1 |

| | 0.1 |

| | 0.3 |

| | 0.5 |

|

| Corporate | | 1.6 |

| | 2.1 |

| | 3.8 |

| | 3.9 |

| | 1.5 |

| | 2.4 |

| | 5.3 |

| | 6.2 |

|

| Total | | $ | 7.5 |

| | $ | 8.1 |

| | $ | 15.5 |

| | $ | 15.9 |

| | $ | 7.4 |

| | $ | 8.3 |

| | $ | 22.9 |

| | $ | 24.1 |

|

| | | | | | | | | | | | | | | | | |

| Income (loss) before income tax provision: | | |

| | |

| | | | | |

| Gross profit, by segment: | | | |

| | |

| | | | |

| Franchise operations | | $ | 87.5 |

| | $ | 86.2 |

| | $ | 176.8 |

| | $ | 175.2 |

| | $ | 81.9 |

| | $ | 86.8 |

| | $ | 258.7 |

| | $ | 262.0 |

|

| Rental operations | | 7.8 |

| | 7.8 |

| | 16.0 |

| | 15.7 |

| | 7.7 |

| | 8.0 |

| | 23.7 |

| | 23.7 |

|

| Company restaurants | | (0.2 | ) | | 0.1 |

| | (0.6 | ) | | 0.9 |

| | (0.2 | ) | | (0.6 | ) | | (0.7 | ) | | 0.3 |

|

| Financing operations | | 2.3 |

| | 2.7 |

| | 4.6 |

| | 5.3 |

| | 2.3 |

| | 2.5 |

| | 6.8 |

| | 7.8 |

|

| Corporate | | (57.7 | ) | | (53.3 | ) | | (116.0 | ) | | (107.5 | ) | |

| Total | | $ | 39.7 |

| | $ | 43.5 |

| | $ | 80.8 |

| | $ | 89.6 |

| |

| Total gross profit | | | 91.7 |

| | 96.7 |

| | 288.5 |

| | 293.8 |

|

| Corporate and unallocated expenses, net | | | (54.2 | ) | | (57.1 | ) | | (170.2 | ) | | (164.6 | ) |

| Income before income tax provision | | | $ | 37.5 |

| | $ | 39.6 |

| | $ | 118.3 |

| | $ | 129.2 |

|

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

8. Net Income per Share

The computation of the Company's basic and diluted net income per share is as follows:

| | | | Three months ended June 30, | | Six months ended June 30, | Three months ended September 30, | | Nine months ended September 30, |

| | 2016 | | 2015 | | 2016 | | 2015 | 2016 | | 2015 | | 2016 | | 2015 |

| | (In thousands, except per share data) | (In thousands, except per share data) |

| Numerator for basic and diluted income per common share: | |

| | |

| | | | | |

| | |

| | | | |

| Net income | $ | 26,829 |

| | $ | 26,897 |

| | $ | 52,372 |

| | $ | 55,309 |

| $ | 24,273 |

| | $ | 24,257 |

| | $ | 76,645 |

| | $ | 79,566 |

|

| Less: Net income allocated to unvested participating restricted stock | (384 | ) | | (359 | ) | | (766 | ) | | (726 | ) | (338 | ) | | (316 | ) | | (1,103 | ) | | (1,042 | ) |

| Net income available to common stockholders - basic | 26,445 |

| | 26,538 |

| | 51,606 |

| | 54,583 |

| 23,935 |

| | 23,941 |

| | 75,542 |

| | 78,524 |

|

| Effect of unvested participating restricted stock in two-class calculation | 1 |

| | 1 |

| | 1 |

| | 2 |

| 1 |

| | 1 |

| | 3 |

| | 3 |

|

| Net income available to common stockholders - diluted | $ | 26,446 |

| | $ | 26,539 |

| | $ | 51,607 |

| | $ | 54,585 |

| $ | 23,936 |

| | $ | 23,942 |

| | $ | 75,545 |

| | $ | 78,527 |

|

| Denominator: | |

| | |

| | | | | |

| | |

| | | | |

| Weighted average outstanding shares of common stock - basic | 18,085 |

| | 18,763 |

| | 18,173 |

| | 18,819 |

| 17,950 |

| | 18,573 |

| | 18,099 |

| | 18,737 |

|

| Dilutive effect of stock options | 103 |

| | 132 |

| | 107 |

| | 140 |

| 91 |

| | 133 |

| | 102 |

| | 137 |

|

| Weighted average outstanding shares of common stock - diluted | 18,188 |

| | 18,895 |

| | 18,280 |

| | 18,959 |

| 18,041 |

| | 18,706 |

| | 18,201 |

| | 18,874 |

|

| Net income per common share: | |

| | |

| | | | | |

| | |

| | | | |

| Basic | $ | 1.46 |

| | $ | 1.41 |

| | $ | 2.84 |

| | $ | 2.90 |

| $ | 1.33 |

| | $ | 1.29 |

| | $ | 4.17 |

| | $ | 4.19 |

|

| Diluted | $ | 1.45 |

| | $ | 1.40 |

| | $ | 2.82 |

| | $ | 2.88 |

| $ | 1.33 |

| | $ | 1.28 |

| | $ | 4.15 |

| | $ | 4.16 |

|

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

9. Fair Value Measurements

The Company does not have a material amount of financial assets or liabilities that are required under U.S. GAAP to be measured on a recurring basis at fair value. The Company is not a party to any derivative financial instruments. The Company does not have a material amount of non-financial assets or non-financial liabilities that are required under U.S. GAAP to be measured at fair value on a recurring basis. The Company has not elected to use the fair value measurement option, as permitted under U.S. GAAP, for any assets or liabilities for which fair value measurement is not presently required.

The Company believes the fair values of cash equivalents, accounts receivable and accounts payable approximate their carrying amounts due to their short duration.

The fair values of the Company's Series 2014-1 Class A-2 Notes (the “Class A-2 Notes”) at JuneSeptember 30, 2016 and December 31, 2015 were as follows:

|

| | | | | | | | | | | | | | | | |

| | | June 30, 2016 | | December 31, 2015 |

| | | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

| | | (In millions) |

| Long-term debt | | $ | 1,281.1 |

| | $ | 1,326.8 |

| | $ | 1,279.5 |

| | $ | 1,306.1 |

|

|

| | | | | | | | | | | | | | | | |

| | | September 30, 2016 | | December 31, 2015 |

| | | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

| | | (In millions) |

| Long-term debt | | $ | 1,281.9 |

| | $ | 1,321.2 |

| | $ | 1,279.5 |

| | $ | 1,306.1 |

|

The fair values were determined based on Level 2 inputs, including information gathered from brokers who trade in the Company’s Class A-2 Notes and information on notes that are similar to those of the Company.

10. Commitments and Contingencies

Litigation, Claims and Disputes

The Company is subject to various lawsuits, administrative proceedings, audits and claims arising in the ordinary course of business. Some of these lawsuits purport to be class actions and/or seek substantial damages. The Company is required under U.S. GAAP to record an accrual for litigation loss contingencies that are both probable and reasonably estimable. Legal fees and expenses associated with the defense of all of the Company's litigation are expensed as such fees and expenses are incurred. Management regularly assesses the Company's insurance coverage, analyzes litigation information with the Company's attorneys and evaluates the Company's loss experience in connection with pending legal proceedings. While the Company does not presently believe that any of the legal proceedings to which it is currently a party will ultimately have a material adverse impact on the Company, there can be no assurance that the Company will prevail in all the proceedings the Company is party to, or that the Company will not incur material losses from them.

Lease Guarantees

In connection with the sale of Applebee’s restaurants or previous brands to franchisees and other parties, the Company has, in certain cases, guaranteed or has potential continuing liability for lease payments totaling $386.9372.5 million as of JuneSeptember 30, 2016. This amount represents the maximum potential liability for future payments under these leases. These leases have been assigned to the buyers and expire at the end of the respective lease terms, which range from 2016 through 2048. In the event of default, the indemnity and default clauses in the sale or assignment agreements govern the Company's ability to pursue and recover damages incurred. No material lease payment guarantee liabilities have been recorded as of JuneSeptember 30, 2016.

11. Facility Exit Costs

In September 2015, the Company approved a plan to consolidate many core restaurant and franchisee support functions at its headquarters in Glendale, California and communicated the plan to employees. In conjunction with this action, the Company will exit a significant portion of the Applebee's restaurant support center in Kansas City, Missouri. The Company estimates it will incur a total of approximately $8$7 million in employee termination benefits, primarily severance and other personnel-relatedrelocation costs, associated with the consolidation, of which $5.7$5.8 million in employee termination costs has been incurred through JuneSeptember 30, 2016. The Company also estimates it will incur approximately $4 million in costs related to the exit of the facility, of which $2.5 million has been incurred through JuneSeptember 30, 2016.

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

11. Facility Exit Costs (Continued)

During the sixnine months ended JuneSeptember 30, 2016, the Company incurred $1.1$1.2 million of employee termination costs, primarily relocation and severance costs associated with the consolidation. These charges were included as general and administrative expenses in the Consolidated Statements of Comprehensive Income.

During the sixnine months ended JuneSeptember 30, 2016, the Company negotiated the termination of its lease on two of four floors of the Kansas City facility and recorded charges of $2.5 million related to this termination that were included as closure and impairment charges in the Consolidated Statements of Comprehensive Income.

| | | | | Employee Termination Costs | | Facility Costs | | Total Exit Costs | | Employee Termination Costs | | Facility Costs | | Total Exit Costs |

| | | (In millions ) | | (In millions ) |

| Accrued exit costs at December 31, 2014 | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

| Charges | | 4.6 |

| | — |

| | 4.6 |

| | 4.6 |

| | — |

| | 4.6 |

|

| Payments | | (1.1 | ) | | — |

| | (1.1 | ) | | (1.1 | ) | | — |

| | (1.1 | ) |

| Accrued exit costs at December 31, 2015 | | 3.5 |

| | — |

| | 3.5 |

| | 3.5 |

| | — |

| | 3.5 |

|

| Charges | | 1.1 |

| | 2.5 |

| | 3.6 |

| | 1.2 |

| | 2.5 |

| | 3.7 |

|

| Payments | | (3.6 | ) | | (2.1 | ) | | (5.7 | ) | | (4.4 | ) | | (2.5 | ) | | (6.9 | ) |

| Accrued exit costs at June 30, 2016 | | $ | 1.0 |

| | $ | 0.4 |

| | $ | 1.4 |

| |

| Accrued exit costs at September 30, 2016 | | | $ | 0.3 |

| | $ | — |

| | $ | 0.3 |

|

At JuneSeptember 30, 2016, the $1.0$0.3 million of accrued termination costs was included in accrued employee compensation and benefits. At December 31, 2015, $3.3 million of accrued termination costs was included in accrued employee compensation and benefits and the $0.4 million of accrued facilities costs was included in accounts payable in the Consolidated Balance Sheet. At December 31, 2015, $3.3 million of accrued termination costs were included in accrued employee compensation and benefits and $0.2 million werewas included in other accrued expenses in the Consolidated Balance Sheet.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Cautionary Statement Regarding Forward-Looking Statements

Statements contained in this report may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors, which may cause actual results to be materially different from those expressed or implied in such statements. You can identify these forward-looking statements by words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan” and other similar expressions. You should consider our forward-looking statements in light of the risks discussed under the heading “Risk Factors” in our most recent Annual Report on Form 10-K, as well as our consolidated financial statements, related notes, and the other financial information appearing elsewhere in this report and our other filings with the United States Securities and Exchange Commission. The forward-looking statements contained in this report are made as of the date hereof and the Company assumes no obligation to update or supplement any forward-looking statements.

You should read the following Management's Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) in conjunction with the consolidated financial statements and the related notes that appear elsewhere in this report.

Business Overview

The following discussion and analysis provides information which we believe is relevant to an assessment and understanding of our consolidated results of operations and financial condition. The discussion should be read in conjunction with the consolidated financial statements and the notes thereto included in Item 1 of Part I of this Quarterly Report and the audited consolidated financial statements and notes thereto and MD&A contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015. Except where the context indicates otherwise, the words “we,” “us,” “our,” “DineEquity” and the “Company” refer to DineEquity, Inc., together with its subsidiaries that are consolidated in accordance with United States generally accepted accounting principles (“U.S. GAAP”).

Through various subsidiaries, we own and franchise the Applebee's Neighborhood Grill & Bar® (“Applebee's”) concept in the bar and grill segment within the casual dining category of the restaurant industry, and we own, franchise and operate the International House of Pancakes® (“IHOP”) concept in the family dining category of the restaurant industry. References herein to Applebee's® and IHOP® restaurants are to these two restaurant concepts, whether operated by franchisees, area licensees and their sub-licensees (collectively, “area licensees”) or by us. With over 3,700 restaurants combined, 99%virtually all of which are franchised, we believe we are one of the largest full-service restaurant companies in the world. The June 20, 2016 issue of Nation's Restaurant News reported that IHOP and Applebee's were the largest restaurant systems in their respectivethe family dining and casual dining categories, respectively, in terms of United States system-wide sales duringfor 2015. This marks the ninth consecutive year our two brands have achieved the number one ranking in their respective categories in Nation's Restaurant News.

Key Performance Indicators

In evaluating the performance of each restaurant concept, we consider the key performance indicators to be net franchise restaurant development and the percentage change in domestic system-wide same-restaurant sales. Since we are a 99% franchised company, expanding the number of Applebee's and IHOP franchise restaurants is an important driver of revenue growth. Growth in both the number of franchise restaurants and sales at those restaurants will drive franchise revenues in the form of higher royalty revenues, additional franchise fees and, in the case of IHOP restaurants, sales of proprietary pancake and waffle dry mix.

An overview of these key performance indicators for the three and sixnine months ended JuneSeptember 30, 2016 is as follows:

| | | | Three months ended | | Six months ended | Three months ended September 30, | | Nine months ended September 30, |

| | June 30, 2016 | | June 30, 2016 | Applebee's | | IHOP | | Applebee's | | IHOP |

| | Applebee's | | IHOP | | Applebee's | | IHOP | |

Net franchise restaurant (reduction) development (1) | (2 | ) | | 11 |

| | (6 | ) | | 12 |

| |

Net franchise restaurant development (reduction) (1) | | — |

| | 14 |

| | (6 | ) | | 26 |

|

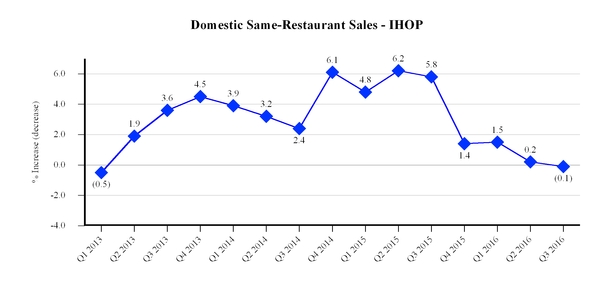

| % (decrease) increase in domestic system-wide same-restaurant sales | (4.2 | )% | | 0.2 | % | | (3.9 | )% | | 0.8 | % | (5.2 | )% | | (0.1 | )% | | (4.4 | )% | | 0.5 | % |

(1) Franchise and area license restaurant openings, net of closings

Detailed information on each of these key performance indicators is presented under the captions “Restaurant Development Activity,” “Domestic Same-Restaurant Sales” and “Restaurant Data” that follow.

| | Restaurant Development Activity | Three months ended June 30, | | Six months ended June 30, | Three months ended September 30, | | Nine months ended September 30, |

| | 2016 | | 2015 | | 2016 | | 2015 | 2016 | | 2015 | | 2016 | | 2015 |

| Applebee's | (Unaudited) | (Unaudited) |

| Summary - beginning of period: | | | | | | | | | | | | | | |

| Franchise | 2,029 |

| | 1,991 |

| | 2,033 |

| | 1,994 |

| 2,027 |

| | 1,993 |

| | 2,033 |

| | 1,994 |

|

| Company restaurants | — |

| | 23 |

| | — |

| | 23 |

| — |

| | 23 |

| | — |

| | 23 |

|

| Total Applebee's restaurants, beginning of period | 2,029 |

| | 2,014 |

| | 2,033 |

| | 2,017 |

| 2,027 |

| | 2,016 |

| | 2,033 |

| | 2,017 |

|

| | | | | | | | | | | | | | | |

| Franchise restaurants opened: | |

| | |

| | | | | |

| | |

| | | | |

| Domestic | 2 |

| | 6 |

| | 7 |

| | 10 |

| 6 |

| | 7 |

| | 13 |

| | 17 |

|

| International | 3 |

| | 2 |

| | 4 |

| | 4 |

| 3 |

| | 2 |

| | 7 |

| | 6 |

|

| Total franchise restaurants opened | 5 |

| | 8 |

| | 11 |

| | 14 |

| 9 |

| | 9 |

| | 20 |

| | 23 |

|

| Franchise restaurants closed: | |

| | |

| | | | | |

| | |

| | | | |

| Domestic | (6 | ) | | (4 | ) | | (12 | ) | | (8 | ) | (8 | ) | | (6 | ) | | (20 | ) | | (14 | ) |

| International | (1 | ) | | (2 | ) | | (5 | ) | | (7 | ) | (1 | ) | | (1 | ) | | (6 | ) | | (8 | ) |

| Total franchise restaurants closed | (7 | ) | | (6 | ) | | (17 | ) | | (15 | ) | (9 | ) | | (7 | ) | | (26 | ) | | (22 | ) |

| Net franchise restaurant (reduction) development | (2 | ) | | 2 |

| | (6 | ) | | (1 | ) | |

| Net franchise restaurant development (reduction) | | — |

| | 2 |

| | (6 | ) | | 1 |

|

| Refranchised from Company restaurants | | — |

| | 23 |

| | — |

| | 23 |

|

| Net franchise restaurant additions (reductions) | | — |

| | 25 |

| | (6 | ) | | 24 |

|

| | | | | | | | | | | | | | | |

| Summary - end of period: | | | | | | | | | | | | | | |

| Franchise | 2,027 |

| | 1,993 |

| | 2,027 |

| | 1,993 |

| 2,027 |

| | 2,018 |

| | 2,027 |

| | 2,018 |

|

| Company restaurants | — |

| | 23 |

| | — |

| | 23 |

| — |

| | — |

| | — |

| | — |

|

| Total Applebee's restaurants, end of period | 2,027 |

| | 2,016 |

| | 2,027 |

| | 2,016 |

| 2,027 |

| | 2,018 |

| | 2,027 |

| | 2,018 |

|

| | | IHOP | |

| | |

| | | | | |

| | |

| | | | |

| Summary - beginning of period: | | | | | | | | | | | | | | |

| Franchise | 1,509 |

| | 1,470 |

| | 1,507 |

| | 1,472 |

| 1,519 |

| | 1,479 |

| | 1,507 |

| | 1,472 |

|

| Area license | 164 |

| | 167 |

| | 165 |

| | 167 |

| 166 |

| | 166 |

| | 165 |

| | 167 |

|

| Company | 11 |

| | 13 |

| | 11 |

| | 11 |

| 10 |

| | 13 |

| | 11 |

| | 11 |

|

| Total IHOP restaurants, beginning of period | 1,684 |

| | 1,650 |

| | 1,683 |

| | 1,650 |

| 1,695 |

| | 1,658 |

| | 1,683 |

| | 1,650 |

|

| | | | | | | | | | | | | | | |

| Franchise/area license restaurants opened: | | | | | | | | | | | | | | |

| Domestic franchise | 13 |

| | 7 |

| | 19 |

| | 13 |

| 7 |

| | 11 |

| | 26 |

| | 24 |

|

| Domestic area license | 2 |

| | 1 |

| | 2 |

| | 2 |

| 1 |

| | — |

| | 3 |

| | 2 |

|

| International franchise | 2 |

| | 3 |

| | 3 |

| | 3 |

| 8 |

| | 2 |

| | 11 |

| | 5 |

|

| Total franchise/area license restaurants opened | 17 |

| | 11 |

| | 24 |

| | 18 |

| 16 |

| | 13 |

| | 40 |

| | 31 |

|

| Franchise/area license restaurants closed: | |

| | |

| | | | | |

| | |

| | | | |

| Domestic franchise | (5 | ) | | (1 | ) | | (8 | ) | | (7 | ) | (2 | ) | | (4 | ) | | (10 | ) | | (11 | ) |

| Domestic area license | — |

| | (2 | ) | | (1 | ) | | (3 | ) | — |

| | — |

| | (1 | ) | | (3 | ) |

| International franchise | (1 | ) | | — |

| | (3 | ) | | — |

| — |

| | — |

| | (3 | ) | | — |

|

| Total franchise/area license restaurants closed | (6 | ) | | (3 | ) | | (12 | ) | | (10 | ) | (2 | ) | | (4 | ) | | (14 | ) | | (14 | ) |

| Net franchise/area license restaurant development | 11 |

| | 8 |

| | 12 |

| | 8 |

| 14 |

| | 9 |

| | 26 |

| | 17 |

|

| Refranchised from Company restaurants | 1 |

| | — |

| | 1 |

| | 1 |

| — |

| | 2 |

| | 1 |

| | 3 |

|

| Franchise restaurants reacquired by the Company | — |

| | — |

| | — |

| | (3 | ) | — |

| | — |

| | — |

| | (3 | ) |

| Net franchise/area license restaurant additions (reductions) | 12 |

| | 8 |

| | 13 |

| | 6 |

| |

| Net franchise/area license restaurant additions | | 14 |

| | 11 |

| | 27 |

| | 17 |

|

| | | | | | | | | | | | | | | |

| Summary - end of period: | | | | | | | | | | | | | | |

| Franchise | 1,519 |

| | 1,479 |

| | 1,519 |

| | 1,479 |

| 1,532 |

| | 1,490 |

| | 1,532 |

| | 1,490 |

|

| Area license | 166 |

| | 166 |

| | 166 |

| | 166 |

| 167 |

| | 166 |

| | 167 |

| | 166 |

|

| Company | 10 |

| | 13 |

| | 10 |

| | 13 |

| 10 |

| | 11 |

| | 10 |

| | 11 |

|

| Total IHOP restaurants, end of period | 1,695 |

| | 1,658 |

| | 1,695 |

| | 1,658 |

| 1,709 |

| | 1,667 |

| | 1,709 |

| | 1,667 |

|

Both the gross and netGross development by Applebee's franchisees for the three and six months ended JuneSeptember 30, 2016 werewas equal to the same period of the prior year, while gross development by Applebee's franchisees for the nine months ended September 30, 2016 was lower than the same period of 2015. Applebee's net development for both the three and nine months ended September 30, 2016 was lower than the same respective periods of 2015, whereasthe prior year due to a slight increase in the number of Applebee's restaurant closures.

Both the gross and net development by IHOP franchisees for the three and sixnine months ended JuneSeptember 30, 2016 werewas higher than the respective periods of 2015. The increases primarily were due to higher gross and net development by international IHOP franchisees. On a combined basis, DineEquity gross and net franchise restaurant development for the three and sixnine months ended JuneSeptember 30, 2016 was lowerhigher than the respective periods of the prior year by one restaurant in each period. Typically, the majority of gross and net franchise restaurant development for each brand takes place in the second half of any given year.

For the full year of 2016, we expect IHOP franchisees to open a total of 65 to 77 new restaurants and Applebee's franchisees to open a total of 25 to 33 new restaurants. The majority of openings for each brand is expected to be in domestic markets. The actual number of openings in 2016 may differ from both our expectations and development commitments. Historically, the actual number of restaurants developed in a particular year has been less than the total number committed to be developed due to various factors, including economic conditions and franchisee noncompliance with restaurant opening commitments in development agreements. The timing of new restaurant openings also may be affected by other factors including weather-related and other construction delays, difficulties in obtaining timely regulatory approvals and the impact of currency fluctuations on our international franchisees.

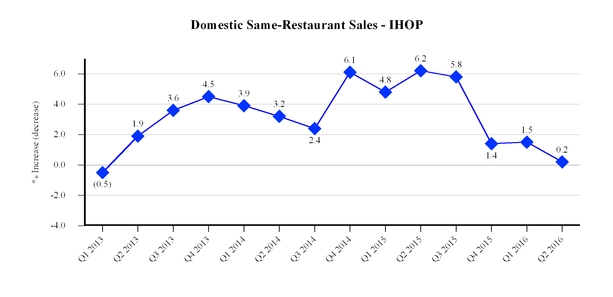

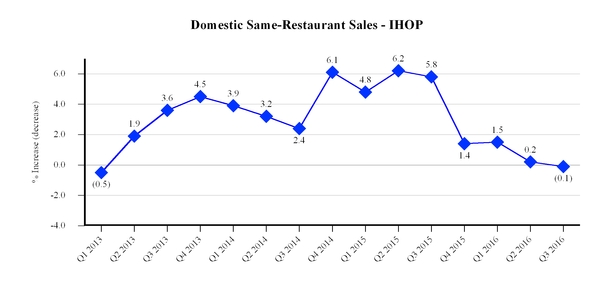

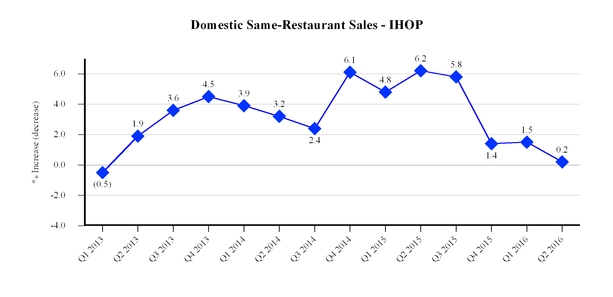

Domestic Same-Restaurant Sales

We believe that, while the U.S. economy has continued to grow in 2016, the rate of growth has been slower than in 2015 and average wages have grown at a slower pace than the overall economy. In addition, restaurants have been faced with increased competition from prepared food retailers and a widening gap between the cost of food purchased for consumption at home and the cost of food purchased at restaurants. As a result, consumers seem to be allocating less disposable personal income to restaurant visits. Based on data from Black Box Intelligence (“Black Box”), a restaurant sales reporting firm, the third quarter of 2016 was the weakest quarter for the overall restaurant industry since the second quarter of 2010.

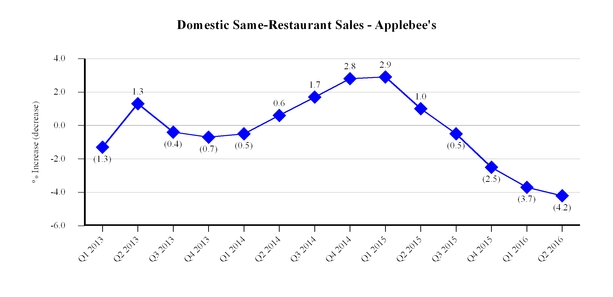

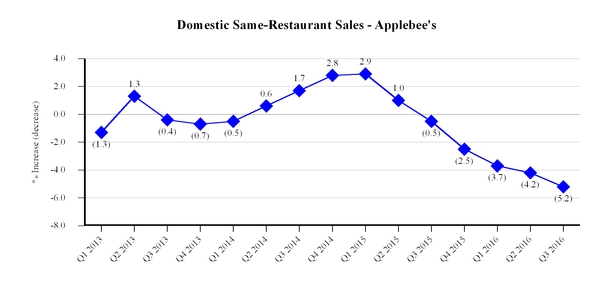

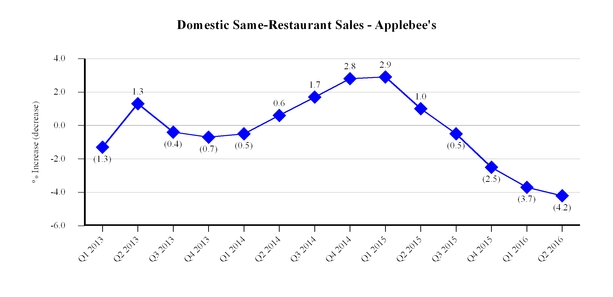

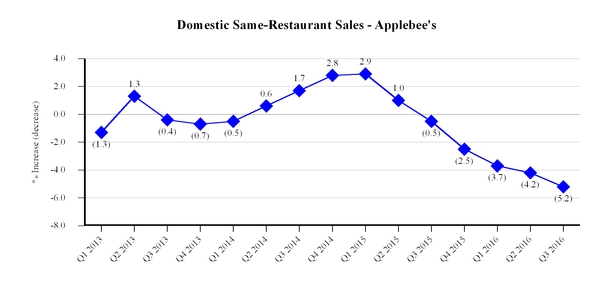

Applebee’s domestic system-wide same-restaurant sales decreased 4.2%5.2% for the three months ended JuneSeptember 30, 2016 from the same period in 2015. The decrease resulted from a decline in customer traffic that was only partially offset by a higher average customer check. The decline in Applebee's quarter-over-quarter customer traffic has grown progressively larger from the first quarter of 2015 to the secondthird quarter of 2016. To date, marketing, promotional and other initiatives have not been successful in reversing that trend, and we expect to makeWe made an incremental investments ininvestment of $2.5 million during the next several monthsthird quarter of 2016 to test additional marketing initiatives. initiatives to help address that trend.

Applebee’s domestic system-wide same-restaurant sales decreased 3.9%4.4% for the sixnine months ended JuneSeptember 30, 2016 from the same period in 2015, also due to a decline in customer traffic that was only partially offset by a higher average customer check. Same-restaurant sales for the first sixnine months of 2016 are not necessarily indicative of results expected for the full year.

Based on data from Black Box, Intelligence (“Black Box”), a restaurant sales reporting firm, the casual dining segment of the restaurant industry also experienced a decline in customer traffic and an overall decline in same-restaurant sales during the three and sixnine months ended JuneSeptember 30, 2016.2016 compared to the respective periods of the prior year. Applebee's declines in traffic and same-restaurant sales were larger than those experienced by the overall casual dining segment as reported by Black Box.segment.