UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________

FORM 10-Q

(Mark One)

x☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended SeptemberJune 30, 20172019

OR

o☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-15283

DineEquity, Dine Brands Global, Inc.

Dine Brands Global, Inc.

(Exact name of registrant as specified in its charter) |

| | | | |

Delaware | | | 95-3038279 |

| (State or other jurisdiction of incorporation or organization) | | 95-3038279

| (I.R.S. Employer Identification No.) |

| 450 North Brand Boulevard, | | | 91203-1903 |

| Glendale, | CA | | | |

450 North Brand Boulevard, Glendale, California (Address of principal executive offices)

| | 91203-1903

| (Zip Code) |

|

| |

| (818) | 240-6055 |

| (Registrant’s telephone number, including area code) |

______________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

| | | |

| Title of each class | | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | DIN | New York Stock Exchange |

(818) 240-6055

(Registrant’s telephone number, including area code)

______________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x☒ No o☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x☒ No o☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | |

Large accelerated filerx | ☒ | | Accelerated filero | ☐ |

| Non-accelerated filer | ☐ | | | |

| | | |

Non-accelerated filer o (Do not check if a smallerSmaller reporting company)

company | ☐ |

| | | Smaller reporting company o

|

| | | Emerging growth companyo | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act o☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o☐

No x☒

As of July 25, 2019, the Registrant had 17,175,598 shares of Common Stock outstanding.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

| | |

Class | | Outstanding as of November 3, 2017 |

Common Stock, $0.01 par value | | 17,988,168 |

DineEquity,Dine Brands Global, Inc. and Subsidiaries

Index

Cautionary Statement Regarding Forward-Looking Statements

Statements contained in this reportQuarterly Report on Form 10-Q may constitute forward-looking statements“forward-looking statements” within the meaning of Section 27A of the Private Securities Litigation Reform Act of 1995.1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements involve known and unknown risks, uncertainties and other factors, which may cause actual results to be materially different from those expressed or implied in such statements. You can identify these forward-looking statements by words such as “may,” “will,” “would,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan”“plan,” “goal” and other similar expressions. You should consider our forward-looking statements in light of the risks discussed under the heading “Risk Factors” in our most recent Annual Report on Form 10-K,Factors,” as well as our consolidated financial statements, related notes, and the other financial information appearing elsewhere in this report and our other filings with the United States Securities and Exchange Commission. The forward-looking statements contained in this report are made as of the date hereof and the Company assumes noDine Brands Global, Inc. does not intend to, nor does it assume any obligation to, update or supplement any forward-looking statements.statements after the date of this report to reflect actual results or future events or circumstances.

Factors that could cause actual results to differ materially from the projections, forecasts, estimates and expectations discussed in this Quarterly Report on Form 10-Q include, among other things: general economic conditions; our level of indebtedness; compliance with the terms of our securitized debt; our ability to refinance our current indebtedness or obtain additional financing; our dependence on information technology; potential cyber incidents; the implementation of restaurant development plans; our dependence on our franchisees; the concentration of our Applebee’s franchised restaurants in a limited number of franchisees; the financial health of our franchisees, including any insolvency or bankruptcy; credit risks from our IHOP franchisees operating under our Previous IHOP Business Model; insufficient insurance coverage to cover potential risks associated with the ownership and operation of restaurants; our franchisees’ and other licensees’ compliance with our quality standards and trademark usage; general risks associated with the restaurant industry; potential harm to our brands’ reputation; risks of food-borne illness or food tampering; possible future impairment charges; trading volatility and fluctuations in the price of our stock; our ability to achieve the financial guidance we provide to investors; successful implementation of our business strategy; the availability of suitable locations for new restaurants; shortages or interruptions in the supply or delivery of products from third parties or availability of utilities; the management and forecasting of appropriate inventory levels; development and implementation of innovative marketing and use of social media; changing health or dietary preference of consumers; risks associated with doing business in international markets; the results of litigation and other legal proceedings; third-party claims with respect to intellectual property assets; delivery initiatives and use of third-party delivery vendors; our

allocation of human capital and our ability to attract and retain management and other key employees; compliance with federal, state and local governmental regulations; risks associated with our self-insurance; natural disasters or other serious incidents; our success with development initiatives outside of our core business; the adequacy of our internal controls over financial reporting and future changes in accounting standards; and other matters in the “Risk Factors” section of this report and our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, many of which are beyond our control.

Fiscal Quarter End

The Company’s fiscal quarters end on the Sunday closest to the last day of each calendar quarter. For convenience, the fiscal quarters of each year are referred to as ending on March 31, June 30, September 30 and December 31. The first fiscal quarter of 20172019 began on January 2, 2017December 31, 2018 and ended on April 2, 2017 andMarch 31, 2019; the second and third fiscal quartersquarter of 20172019 ended on July 2, 2017 and October 1, 2017, respectively.June 30, 2019. The first fiscal quarter of 20162018 began on January 4, 20161, 2018 and ended on April 3, 2016 and1, 2018; the second and third fiscal quartersquarter of 20162018 ended on July 3, 2016 and October 2, 2016, respectively.1, 2018.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

DineEquity,Dine Brands Global, Inc. and Subsidiaries

Consolidated Balance Sheets

(In thousands, except share and per share amounts) | | | Assets | | September 30, 2017 | | December 31, 2016 | | June 30, 2019 | | December 31, 2018 |

| | | (Unaudited) | | | | (Unaudited) | | |

| Current assets: | | |

| | |

| | |

| | |

|

| Cash and cash equivalents | | $ | 104,212 |

| | $ | 140,535 |

| | $ | 127,555 |

| | $ | 137,164 |

|

| Receivables, net | | 96,657 |

| | 141,389 |

| | 98,786 |

| | 137,504 |

|

| Restricted cash | | 31,338 |

| | 30,256 |

| | 34,387 |

| | 48,515 |

|

| Prepaid gift card costs | | 36,667 |

| | 47,115 |

| | 29,411 |

| | 38,195 |

|

| Prepaid income taxes | | 8,749 |

| | 2,483 |

| | 7,123 |

| | 17,402 |

|

| Other current assets | | 5,703 |

| | 4,370 |

| | 7,016 |

| | 3,410 |

|

| Total current assets | | 283,326 |

| | 366,148 |

| | 304,278 |

| | 382,190 |

|

| Other intangible assets, net | | | 580,197 |

| | 585,889 |

|

| Operating lease right-of-use assets | | | 378,520 |

| | — |

|

| Goodwill | | | 343,862 |

| | 345,314 |

|

| Property and equipment, net | | | 222,818 |

| | 240,264 |

|

| Long-term receivables, net | | 131,033 |

| | 141,152 |

| | 93,607 |

| | 103,102 |

|

| Property and equipment, net | | 199,857 |

| | 205,055 |

| |

| Goodwill | | 339,236 |

| | 697,470 |

| |

| Other intangible assets, net | | 585,160 |

| | 763,431 |

| |

| Deferred rent receivable | | 84,071 |

| | 86,981 |

| | 74,075 |

| | 77,069 |

|

| Non-current restricted cash | | 14,700 |

| | 14,700 |

| | 15,700 |

| | 14,700 |

|

| Other non-current assets, net | | 3,825 |

| | 3,646 |

| | 27,601 |

| | 26,152 |

|

| Total assets | | $ | 1,641,208 |

| | $ | 2,278,583 |

| | $ | 2,040,658 |

| | $ | 1,774,680 |

|

| Liabilities and Stockholders’ (Deficit) Equity | | |

| | |

| |

| Liabilities and Stockholders’ Deficit | | | |

| | |

|

| Current liabilities: | | |

| | |

| | |

| | |

|

| Current maturities of long-term debt | | | $ | — |

| | $ | 25,000 |

|

| Accounts payable | | $ | 26,452 |

| | $ | 50,503 |

| | 43,982 |

| | 43,468 |

|

| Gift card liability | | 104,317 |

| | 170,812 |

| | 111,281 |

| | 160,438 |

|

| Current maturities of operating lease obligations | | | 67,724 |

| | — |

|

| Current maturities of finance lease and financing obligations | | | 13,563 |

| | 14,031 |

|

| Accrued employee compensation and benefits | | | 17,607 |

| | 27,479 |

|

| Dividends payable | | 17,755 |

| | 17,465 |

| | 12,176 |

| | 11,389 |

|

| Accrued employee compensation and benefits | | 13,527 |

| | 14,609 |

| |

| Current maturities of long-term debt, capital lease and financing obligations | | 16,202 |

| | 13,144 |

| |

| Accrued advertising | | 8,359 |

| | 6,369 |

| |

| Deferred franchise revenue, short-term | | | 10,244 |

| | 10,138 |

|

| Other accrued expenses | | 16,775 |

| | 13,410 |

| | 19,824 |

| | 24,243 |

|

| Total current liabilities | | 203,387 |

| | 286,312 |

| | 296,401 |

| | 316,186 |

|

| Long-term debt, less current maturities | | 1,281,950 |

| | 1,282,691 |

| | 1,287,227 |

| | 1,274,087 |

|

| Capital lease obligations, less current maturities | | 64,923 |

| | 74,665 |

| |

| Operating lease obligations, less current maturities | | | 379,123 |

| | — |

|

| Finance lease obligations, less current maturities | | | 84,344 |

| | 87,762 |

|

| Financing obligations, less current maturities | | 39,292 |

| | 39,499 |

| | 38,125 |

| | 38,482 |

|

| Deferred income taxes, net | | 178,848 |

| | 253,898 |

| | 98,294 |

| | 105,816 |

|

| Deferred rent payable | | 65,449 |

| | 69,572 |

| |

| Deferred franchise revenue, long-term | | | 60,302 |

| | 64,557 |

|

| Other non-current liabilities | | 24,036 |

| | 19,174 |

| | 11,967 |

| | 90,063 |

|

| Total liabilities | | 1,857,885 |

| | 2,025,811 |

| | 2,255,783 |

| | 1,976,953 |

|

| Commitments and contingencies | |

|

| |

|

| |

|

| |

|

|

| Stockholders’ (deficit) equity: | | |

| | |

| |

| Common stock, $0.01 par value, shares: 40,000,000 authorized; September 30, 2017 - 25,033,220 issued, 17,996,223 outstanding; December 31, 2016 - 25,134,223 issued, 17,969,636 outstanding | | 250 |

| | 251 |

| |

| Stockholders’ deficit: | | | |

| | |

|

| Common stock, $0.01 par value; shares: 40,000,000 authorized; June 30, 2019 - 24,949,103 issued, 17,252,391 outstanding; December 31, 2018 - 24,984,898 issued, 17,644,267 outstanding | | | 249 |

| | 250 |

|

| Additional paid-in-capital | | 292,255 |

| | 292,809 |

| | 240,555 |

| | 237,726 |

|

| (Accumulated deficit) retained earnings | | (86,634 | ) | | 382,082 |

| |

| Retained earnings | | | 33,832 |

| | 10,414 |

|

| Accumulated other comprehensive loss | | (105 | ) | | (107 | ) | | (59 | ) | | (60 | ) |

| Treasury stock, at cost; shares: September 30, 2017 - 7,036,997; December 31, 2016 - 7,164,587 | | (422,443 | ) | | (422,263 | ) | |

| Total stockholders’ (deficit) equity | | (216,677 | ) | | 252,772 |

| |

| Total liabilities and stockholders’ (deficit) equity | | $ | 1,641,208 |

| | $ | 2,278,583 |

| |

| Treasury stock, at cost; shares: June 30, 2019 - 7,696,712; December 31, 2018 - 7,340,631 | | | (489,702 | ) | | (450,603 | ) |

| Total stockholders’ deficit | | | (215,125 | ) | | (202,273 | ) |

| Total liabilities and stockholders’ deficit | | | $ | 2,040,658 |

| | $ | 1,774,680 |

|

See the accompanying Notes to Consolidated Financial Statements.

DineEquity,Dine Brands Global, Inc. and Subsidiaries

Consolidated Statements of Comprehensive (Loss) Income

(In thousands, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended |

| | | September 30, | | September 30, |

| | | 2017 | | 2016 | | 2017 | | 2016 |

| Revenues: | | |

| | |

| | | | |

| Franchise and restaurant revenues | | $ | 112,347 |

| | $ | 123,259 |

| | $ | 358,912 |

| | $ | 380,034 |

|

| Rental revenues | | 30,263 |

| | 30,507 |

| | 90,852 |

| | 92,746 |

|

| Financing revenues | | 2,061 |

| | 2,251 |

| | 6,280 |

| | 7,019 |

|

| Total revenues | | 144,671 |

| | 156,017 |

| | 456,044 |

| | 479,799 |

|

| Cost of revenues: | | |

| | |

| | | | |

| Franchise and restaurant expenses | | 41,800 |

| | 41,553 |

| | 123,476 |

| | 122,129 |

|

| Rental expenses | | 22,318 |

| | 22,771 |

| | 67,665 |

| | 69,032 |

|

| Financing expenses | | 449 |

| | 9 |

| | 449 |

| | 155 |

|

| Total cost of revenues | | 64,567 |

| | 64,333 |

| | 191,590 |

| | 191,316 |

|

| Gross profit | | 80,104 |

| | 91,684 |

| | 264,454 |

| | 288,483 |

|

| General and administrative expenses | | 38,030 |

| | 36,002 |

| | 125,701 |

| | 111,937 |

|

| Impairment and closure charges | | 532,522 |

| | 206 |

| | 535,440 |

| | 3,932 |

|

| Interest expense | | 15,353 |

| | 15,358 |

| | 46,496 |

| | 46,107 |

|

| Amortization of intangible assets | | 2,507 |

| | 2,500 |

| | 7,507 |

| | 7,480 |

|

| (Gain) loss on disposition of assets | | (35 | ) | | 113 |

| | (6,387 | ) | | 679 |

|

| (Loss) income before income tax benefit (provision) | | (508,273 | ) | | 37,505 |

| | (444,303 | ) | | 118,348 |

|

| Income tax benefit (provision) | | 56,555 |

| | (13,232 | ) | | 28,228 |

| | (41,703 | ) |

| Net (loss) income | | (451,718 | ) | | 24,273 |

| | (416,075 | ) | | 76,645 |

|

| Other comprehensive (loss) income, net of tax: | | | | | | | | |

| Foreign currency translation adjustment | | (2 | ) | | (1 | ) | | (2 | ) | | — |

|

| Total comprehensive (loss) income | | $ | (451,720 | ) | | $ | 24,272 |

| | $ | (416,077 | ) | | $ | 76,645 |

|

| Net (loss) income available to common stockholders: | | | | |

| | | | |

| Net (loss) income | | $ | (451,718 | ) | | $ | 24,273 |

| | $ | (416,075 | ) | | $ | 76,645 |

|

| Less: Net loss (income) allocated to unvested participating restricted stock | | 8,496 |

| | (338 | ) | | 6,921 |

| | (1,103 | ) |

| Net (loss) income available to common stockholders | | $ | (443,222 | ) | | $ | 23,935 |

| | $ | (409,154 | ) | | $ | 75,542 |

|

| Net (loss) income available to common stockholders per share: | | |

| | |

| | | | |

| Basic | | $ | (24.98 | ) | | $ | 1.33 |

| | $ | (23.09 | ) | | $ | 4.17 |

|

| Diluted | | $ | (24.98 | ) | | $ | 1.33 |

| | $ | (23.09 | ) | | $ | 4.15 |

|

| Weighted average shares outstanding: | | |

| | |

| | | | |

| Basic | | 17,742 |

| | 17,950 |

| | 17,718 |

| | 18,099 |

|

| Diluted | | 17,742 |

| | 18,041 |

| | 17,718 |

| | 18,201 |

|

| | | | | | | | | |

| Dividends declared per common share | | $ | 0.97 |

| | $ | 0.92 |

| | $ | 2.91 |

| | $ | 2.76 |

|

| Dividends paid per common share | | $ | 0.97 |

| | $ | 0.92 |

| | $ | 2.91 |

| | $ | 2.76 |

|

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| | | June 30, | | June 30, |

| | | 2019 | | 2018 | | 2019 | | 2018 |

| Revenues: | | |

| | | | | | |

| Franchise revenues: | | | | | | | | |

| Royalties, franchise fees and other | | 90,930 |

| | 93,236 |

| | $ | 187,226 |

| | $ | 184,713 |

|

| Advertising revenue | | 71,738 |

| | 58,705 |

| | 144,368 |

| | 122,541 |

|

| Total franchise revenues | | 162,668 |

| | 151,941 |

| | 331,594 |

| | 307,254 |

|

| Company restaurant sales | | 33,751 |

| | — |

| | 69,486 |

| | — |

|

| Rental revenues | | 29,878 |

| | 30,324 |

| | 60,589 |

| | 61,165 |

|

| Financing revenues | | 1,783 |

| | 2,206 |

| | 3,593 |

| | 4,215 |

|

| Total revenues | | 228,080 |

| | 184,471 |

| | 465,262 |

| | 372,634 |

|

| Cost of revenues: | | |

| | |

| | | | |

| Franchise expenses: | | | | | | | | |

| Advertising expenses | | 71,738 |

| | 58,705 |

| | 144,368 |

| | 122,541 |

|

| Other franchise expenses | | 7,169 |

| | 24,239 |

| | 14,842 |

| | 42,275 |

|

| Total franchise expenses | | 78,907 |

| | 82,944 |

| | 159,210 |

| | 164,816 |

|

| Company restaurant expenses | | 31,232 |

| | — |

| | 62,770 |

| | — |

|

| Rental expenses: | | | | | | | | |

| Interest expense from finance leases | | 1,445 |

| | 1,770 |

| | 2,974 |

| | 3,647 |

|

| Other rental expenses | | 21,495 |

| | 21,018 |

| | 42,590 |

| | 41,782 |

|

| Total rental expenses | | 22,940 |

| | 22,788 |

| | 45,564 |

| | 45,429 |

|

| Financing expenses | | 146 |

| | 149 |

| | 292 |

| | 299 |

|

| Total cost of revenues | | 133,225 |

| | 105,881 |

| | 267,836 |

| | 210,544 |

|

| Gross profit | | 94,855 |

| | 78,590 |

| | 197,426 |

| | 162,090 |

|

| General and administrative expenses | | 39,364 |

| | 38,759 |

| | 82,183 |

| | 80,670 |

|

| Interest expense, net | | 14,602 |

| | 15,481 |

| | 29,995 |

| | 30,680 |

|

| Amortization of intangible assets | | 2,925 |

| | 2,506 |

| | 5,849 |

| | 5,008 |

|

| Closure and impairment charges (credits) | | 289 |

| | (2,702 | ) | | 483 |

| | (98 | ) |

| Loss on extinguishment of debt | | 8,276 |

| | — |

| | 8,276 |

| | — |

|

| Loss (gain) on disposition of assets | | 332 |

| | (50 | ) | | 441 |

| | (1,477 | ) |

| Income before income tax provision | | 29,067 |

| | 24,596 |

| | 70,199 |

| | 47,307 |

|

| Income tax provision | | (7,677 | ) | | (11,883 | ) | | (17,166 | ) | | (17,521 | ) |

| Net income | | 21,390 |

| | 12,713 |

| | 53,033 |

| | 29,786 |

|

| Other comprehensive income (loss) net of tax: | | | | | | | | |

| Adjustment to unrealized loss on available-for-sale investments | | — |

| | — |

| | — |

| | 50 |

|

| Foreign currency translation adjustment | | 2 |

| | (3 | ) | | 1 |

| | (6 | ) |

| Total comprehensive income | | $ | 21,392 |

| | $ | 12,710 |

| | $ | 53,034 |

| | $ | 29,830 |

|

| Net income available to common stockholders: | | | | |

| | | | |

| Net income | | $ | 21,390 |

| | $ | 12,713 |

| | $ | 53,033 |

| | $ | 29,786 |

|

| Less: Net income allocated to unvested participating restricted stock | | (719 | ) | | (428 | ) | | (1,827 | ) | | (1,000 | ) |

| Net income available to common stockholders | | $ | 20,671 |

| | $ | 12,285 |

| | $ | 51,206 |

| | $ | 28,786 |

|

| Net income available to common stockholders per share: | | |

| | |

| | | | |

| Basic | | $ | 1.20 |

| | $ | 0.70 |

| | $ | 2.97 |

| | $ | 1.63 |

|

| Diluted | | $ | 1.18 |

| | $ | 0.69 |

| | $ | 2.91 |

| | $ | 1.61 |

|

| Weighted average shares outstanding: | | |

| | |

| | | | |

| Basic | | 17,181 |

| | 17,544 |

| | 17,262 |

| | 17,623 |

|

| Diluted | | 17,563 |

| | 17,803 |

| | 17,626 |

| | 17,827 |

|

See the accompanying Notes to Consolidated Financial Statements.

DineEquity,Dine Brands Global, Inc. and Subsidiaries

Consolidated Statements of Stockholders' Deficit

Three and Six Months ended June 30, 2019

(In thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months ended June 30, 2019 |

| | | Common Stock | | | | | | Accumulated

Other

Comprehensive

Loss | | Treasury Stock | | |

| | | Shares

Outstanding | | Amount | | Additional

Paid-in

Capital | | Retained Earnings | | Shares | | Cost | | Total |

| Balance at March 31, 2019 | | 17,651 |

| | $ | 250 |

| | $ | 239,585 |

| | $ | 24,588 |

| | $ | (61 | ) | | 7,324 |

| | $ | (455,183 | ) | | $ | (190,821 | ) |

| Net income | | — |

| | — |

| | — |

| | 21,390 |

| | — |

| | — |

| | — |

| | 21,390 |

|

| Other comprehensive gain | | — |

| | — |

| | — |

| | — |

| | 2 |

| | — |

| | — |

| | 2 |

|

| Purchase of Company common stock | | (392 | ) | | — |

| | — |

| | — |

| | — |

| | 392 |

| | (35,341 | ) | | (35,341 | ) |

| Reissuance of treasury stock | | 19 |

| | (1 | ) | | (651 | ) | | — |

| | — |

| | (19 | ) | | 822 |

| | 170 |

|

| Net issuance of shares for stock plans | | (21 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Repurchase of restricted shares for taxes | | (5 | ) | | — |

| | (425 | ) | | — |

| | — |

| | — |

| | — |

| | (425 | ) |

| Stock-based compensation | | — |

| | — |

| | 1,787 |

| | — |

| | — |

| | — |

| | — |

| | 1,787 |

|

| Dividends on common stock | | — |

| | — |

| | 259 |

| | (12,146 | ) | | — |

| | — |

| | — |

| | (11,887 | ) |

| Balance at June 30, 2019 | | 17,252 |

| | $ | 249 |

| | $ | 240,555 |

| | $ | 33,832 |

| | $ | (59 | ) | | 7,697 |

| | $ | (489,702 | ) | | $ | (215,125 | ) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months ended June 30, 2019 |

| | | Common Stock | | | | | | Accumulated

Other

Comprehensive

Loss | | Treasury Stock | | |

| | | Shares

Outstanding | | Amount | | Additional

Paid-in

Capital | | Retained Earnings | | Shares | | Cost | | Total |

| Balance at December 31, 2018 | | 17,644 |

| | $ | 250 |

| | $ | 237,726 |

| | $ | 10,414 |

| | $ | (60 | ) | | 7,341 |

| | $ | (450,603 | ) | | $ | (202,273 | ) |

| Adoption of ASC 842 (Note 3) | | — |

| | — |

| | — |

| | (5,030 | ) | | — |

| | — |

| | — |

| | (5,030 | ) |

| Net income | | — |

| | — |

| | — |

| | 53,033 |

| | — |

| | — |

| | — |

| | 53,033 |

|

| Other comprehensive gain | | — |

| | — |

| | — |

| | — |

| | 1 |

| | — |

| | — |

| | 1 |

|

| Purchase of Company common stock | | (543 | ) | | — |

| | — |

| | — |

| | — |

| | 543 |

| | (47,356 | ) | | (47,356 | ) |

| Reissuance of treasury stock | | 187 |

| | (1 | ) | | (1,318 | ) | | — |

| | — |

| | (187 | ) | | 8,257 |

| | 6,938 |

|

| Net issuance of shares for stock plans | | (12 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Repurchase of restricted shares for taxes | | (24 | ) | | — |

| | (2,242 | ) | | — |

| | — |

| | — |

| | — |

| | (2,242 | ) |

| Stock-based compensation | | — |

| | — |

| | 5,894 |

| | — |

| | — |

| | — |

| | — |

| | 5,894 |

|

| Dividends on common stock | | — |

| | — |

| | 495 |

| | (24,585 | ) | | — |

| | — |

| | — |

| | (24,090 | ) |

| Balance at June 30, 2019 | | 17,252 |

| | $ | 249 |

| | $ | 240,555 |

| | $ | 33,832 |

| | $ | (59 | ) | | 7,697 |

| | $ | (489,702 | ) | | $ | (215,125 | ) |

See the accompanying Notes to Consolidated Financial Statements.

Dine Brands Global, Inc. and Subsidiaries

Consolidated Statements of Stockholders' Deficit

Three and Six Months ended June 30, 2018

(In thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months ended June 30, 2018 |

| | | Common Stock | | | | | | Accumulated Other Comprehensive Loss | | Treasury Stock | | |

| | | Shares Outstanding | | Amount | | Additional Paid-in Capital | | Retained Earnings (Accumulated Deficit) | | Shares | | Cost | | Total |

| Balance at March 31, 2018 | | 17,922 |

| | $ | 250 |

| | $ | 264,994 |

| | $ | (52,867 | ) | | $ | (58 | ) | | 7,091 |

| | $ | (429,205 | ) | | $ | (216,886 | ) |

| Net income | | — |

| | — |

| | — |

| | 12,713 |

| | — |

| | — |

| | — |

| | 12,713 |

|

| Other comprehensive loss | | — |

| | — |

| | — |

| | — |

| | (3 | ) | | — |

| | — |

| | (3 | ) |

| Purchase of Company common stock | | (137 | ) | | — |

| | — |

| | — |

| | — |

| | 137 |

| | (10,000 | ) | | (10,000 | ) |

| Reissuance of treasury stock | | 26 |

| | — |

| | (843 | ) | | — |

| | — |

| | (26 | ) | | 1,007 |

| | 164 |

|

| Net issuance of shares for stock plans | | (3 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Repurchase of restricted shares for taxes | | (5 | ) | | — |

| | (317 | ) | | — |

| | — |

| | — |

| | — |

| | (317 | ) |

| Stock-based compensation | | — |

| | — |

| | 2,273 |

| | — |

| | — |

| | — |

| | — |

| | 2,273 |

|

| Dividends on common stock | | — |

| | — |

| | (295 | ) | | — |

| | — |

| | — |

| | — |

| | (295 | ) |

| Dividends on common stock in excess of retained earnings | | — |

| | — |

| | (10,900 | ) | | — |

| | — |

| | — |

| | — |

| | (10,900 | ) |

| Balance at June 30, 2018 | | 17,803 |

|

| $ | 250 |

|

| $ | 254,912 |

|

| $ | (40,154 | ) |

| $ | (61 | ) |

| 7,202 |

|

| $ | (438,198 | ) |

| $ | (223,251 | ) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months ended June 30, 2018 |

| | | Common Stock | | | | | | Accumulated Other Comprehensive Loss | | Treasury Stock | | |

| | | Shares Outstanding | | Amount | | Additional Paid-in Capital | | Retained Earnings (Accumulated Deficit) | | Shares | | Cost | | Total |

| Balance at December 31, 2017 | | 17,993 |

| | $ | 250 |

| | $ | 276,408 |

| | $ | (69,940 | ) | | $ | (105 | ) | | 7,029 |

| | $ | (422,153 | ) | | $ | (215,540 | ) |

| Net income | | — |

| | — |

| | — |

| | 29,786 |

| | — |

| | — |

| | — |

| | 29,786 |

|

| Other comprehensive gain | | — |

| | — |

| | — |

| | — |

| | 44 |

| | — |

| | — |

| | 44 |

|

| Purchase of Company common stock | | (276 | ) | | — |

| | — |

| | — |

| | — |

| | 276 |

| | (20,003 | ) | | (20,003 | ) |

| Reissuance of treasury stock | | 103 |

| | — |

| | (3,338 | ) | | — |

| | — |

| | (103 | ) | | 3,958 |

| | 620 |

|

| Net issuance of shares for stock plans | | 3 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Repurchase of restricted shares for taxes | | (20 | ) | | — |

| | (1,400 | ) | | — |

| | — |

| | — |

| | — |

| | (1,400 | ) |

| Stock-based compensation | | — |

| | — |

| | 5,641 |

| | — |

| | — |

| | — |

| | — |

| | 5,641 |

|

| Dividends on common stock | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Dividends on common stock in excess of retained earnings | | — |

| | — |

| | (22,399 | ) | | — |

| | — |

| | — |

| | — |

| | (22,399 | ) |

| Balance at June 30, 2018 | | 17,803 |

| | $ | 250 |

| | $ | 254,912 |

| | $ | (40,154 | ) | | $ | (61 | ) | | 7,202 |

| | $ | (438,198 | ) | | $ | (223,251 | ) |

See the accompanying Notes to Consolidated Financial Statements.

Dine Brands Global, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In thousands)

| | | | | Nine Months Ended | | Six Months Ended |

| | | September 30, | | June 30, |

| | | 2017 | | 2016 | | 2019 | | 2018 |

| Cash flows from operating activities: | | |

| | |

| | |

| | |

| Net (loss) income | | $ | (416,075 | ) | | $ | 76,645 |

| |

| Adjustments to reconcile net (loss) income to cash flows provided by operating activities: | | |

| | |

| |

| Impairment and closure charges | | 535,306 |

| | 1,461 |

| |

| Net income | | | $ | 53,033 |

| | $ | 29,786 |

|

| Adjustments to reconcile net income to cash flows provided by operating activities: | | | | | |

|

| Depreciation and amortization | | 23,053 |

| | 22,924 |

| | 20,800 |

| | 15,842 |

|

| Non-cash stock-based compensation expense | | | 5,894 |

| | 5,641 |

|

| Non-cash interest expense | | 2,509 |

| | 2,400 |

| | 2,083 |

| | 1,744 |

|

| Closure and impairment charges (credits) | | | 483 |

| | (114 | ) |

| Loss on extinguishment of debt | | | 8,276 |

| | — |

|

| Deferred income taxes | | (77,345 | ) | | (14,852 | ) | | (3,186 | ) | | (3,606 | ) |

| Non-cash stock-based compensation expense | | 8,826 |

| | 8,215 |

| |

| Tax benefit from stock-based compensation | | — |

| | 1,153 |

| |

| Excess tax benefit from stock-based compensation | | — |

| | (966 | ) | |

| (Gain) loss on disposition of assets | | (6,422 | ) | | 679 |

| |

| Loss (gain) on disposition of assets | | | 441 |

| | (1,477 | ) |

| Other | | (2,791 | ) | | 456 |

| | (7,678 | ) | | (8,438 | ) |

| Changes in operating assets and liabilities: | | |

| | |

| | | | |

|

| Accounts receivable, net | | (1,569 | ) | | 4,312 |

| | (1,976 | ) | | (10,924 | ) |

| Current income tax receivables and payables | | (1,699 | ) | | (1,138 | ) | | 9,442 |

| | 2,776 |

|

| Gift card receivables and payables | | (26,387 | ) | | (30,355 | ) | | (7,444 | ) | | (10,334 | ) |

| Other current assets | | (1,336 | ) | | (824 | ) | | (3,607 | ) | | 5,851 |

|

| Accounts payable | | (7,530 | ) | | (1,397 | ) | | 8,995 |

| | 3,816 |

|

| Accrued employee compensation and benefits | | (1,146 | ) | | (9,293 | ) | | (9,872 | ) | | (1,411 | ) |

| Other current liabilities | | 3,606 |

| | 2,638 |

| | (6,355 | ) | | (3,360 | ) |

| Cash flows provided by operating activities | | 31,000 |

| | 62,058 |

| | 69,329 |

| | 25,792 |

|

| Cash flows from investing activities: | | |

| | |

| | |

| | |

|

| Principal receipts from notes, equipment contracts and other long-term receivables | | | 11,386 |

| | 14,923 |

|

| Additions to property and equipment | | (9,608 | ) | | (3,543 | ) | | (9,175 | ) | | (7,339 | ) |

| Proceeds from sale of property and equipment | | 1,100 |

| | — |

| | 400 |

| | 655 |

|

| Principal receipts from notes, equipment contracts and other long-term receivables | | 15,283 |

| | 13,969 |

| |

| Additions to long-term receivables | | | (1,555 | ) | | (3,030 | ) |

| Other | | (356 | ) | | (393 | ) | | (186 | ) | | (246 | ) |

| Cash flows provided by investing activities | | 6,419 |

| | 10,033 |

| | 870 |

| | 4,963 |

|

| Cash flows from financing activities: | | | | |

| | | | |

|

| Borrowings under revolving financing facility | | | — |

| | 20,000 |

|

| Repayment of revolving financing facility | | | (25,000 | ) | | — |

|

| Proceeds from issuance of long-term debt | | | 1,300,000 |

| | — |

|

| Repayment of long-term debt | | | (1,283,750 | ) | | (6,500 | ) |

| Payment of debt issuance costs | | | (12,189 | ) | | — |

|

| Dividends paid on common stock | | (52,326 | ) | | (50,790 | ) | | (23,346 | ) | | (28,757 | ) |

| Repurchase of common stock | | (10,003 | ) | | (45,010 | ) | | (46,383 | ) | | (20,003 | ) |

| Principal payments on capital lease and financing obligations | | (10,621 | ) | | (10,391 | ) | |

| Principal payments on finance lease obligations | | | (6,964 | ) | | (8,013 | ) |

| Proceeds from stock options exercised | | | 6,938 |

| | 620 |

|

| Tax payments for restricted stock upon vesting | | (2,345 | ) | | (2,680 | ) | | (2,242 | ) | | (1,400 | ) |

| Proceeds from stock options exercised | | 2,635 |

| | 1,282 |

| |

| Excess tax benefit from stock-based compensation | | — |

| | 966 |

| |

| Cash flows used in financing activities | | (72,660 | ) | | (106,623 | ) | | (92,936 | ) | | (44,053 | ) |

| Net change in cash, cash equivalents and restricted cash | | (35,241 | ) | | (34,532 | ) | | (22,737 | ) | | (13,298 | ) |

| Cash, cash equivalents and restricted cash at beginning of period | | 185,491 |

| | 192,013 |

| | 200,379 |

| | 163,146 |

|

| Cash, cash equivalents and restricted cash at end of period | | $ | 150,250 |

| | $ | 157,481 |

| | $ | 177,642 |

| | $ | 149,848 |

|

| Supplemental disclosures: | | |

| | |

| | |

| | |

|

| Interest paid in cash | | $ | 50,808 |

| | $ | 51,940 |

| | $ | 32,954 |

| | $ | 33,199 |

|

| Income taxes paid in cash | | $ | 50,813 |

| | $ | 56,734 |

| | $ | 24,205 |

| | $ | 18,267 |

|

| Non-cash conversion of accounts receivable to notes receivable | | | $ | — |

| | $ | 5,856 |

|

See the accompanying Notes to Consolidated Financial Statements.

DineEquity,Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(Unaudited)

1. General

The accompanying unaudited consolidated financial statements of DineEquity,Dine Brands Global, Inc. (the “Company” or “DineEquity”“Dine Brands Global”) have been prepared in accordance with United States generally accepted accounting principles (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. The operating results for the ninesix months ended SeptemberJune 30, 20172019 are not necessarily indicative of the results that may be expected for the twelve months ending December 31, 2017.2019.

The consolidated balance sheet at December 31, 20162018 has been derived from the audited consolidated financial statements at that date but does not include all of the information and footnotes required by U.S. GAAP for complete financial statements.

These consolidated financial statements should be read in conjunction with the consolidated financial statements and footnotes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016.2018.

2. Basis of Presentation

The Company’s fiscal quarters end on the Sunday closest to the last day of each calendar quarter. For convenience, the fiscal quarters of each year are referred to as ending on March 31, June 30, September 30 and December 31. The first fiscal quarter of 20172019 began on January 2, 2017December 31, 2018 and ended on April 2, 2017 andMarch 31, 2019; the second and third fiscal quartersquarter of 20172019 ended on July 2, 2017 and October 1, 2017, respectively.June 30, 2019. The first fiscal quarter of 20162018 began on January 4, 20161, 2018 and ended on April 3, 2016 and1, 2018; the second and third fiscal quartersquarter of 20162018 ended on July 3, 2016 and October 2, 2016, respectively.1, 2018.

The accompanying consolidated financial statements include the accounts of the Company and its subsidiaries that are consolidated in accordance with U.S. GAAP. All intercompany balances and transactions have been eliminated.

The preparation of financial statements in conformity with U.S. GAAP requires the Company’s management to make assumptions and estimates that affect the reported amounts of assets and liabilities, disclosures of contingent assets and liabilities, if any, at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Significant estimates are made in the calculation and assessment of the following: impairment of goodwill, other intangible assets and tangible assets; income taxes; allowance for doubtful accounts and notes receivables; lease accounting estimates; contingencies; and stock-based compensation. On an ongoing basis, the Company evaluates its estimates based on historical experience, current conditions and various other assumptions that are believed to be reasonable under the circumstances. The Company adjusts such estimates and assumptions when facts and circumstances dictate. Actual results could differ from those estimates.

3. Accounting PoliciesStandards Adopted and Newly Issued Accounting Standards Not Yet Adopted

Accounting Standards Adopted Effective January 2, 2017

In MarchFebruary 2016, the Financial Accounting Standards Board (“FASB”) issued new guidance that addresses accounting for certain aspects of share-based payments, including excess tax benefits or deficiencies, forfeiture estimates, statutory tax withholding and cash flow classification of certain share-based payment activity. The Company applied the prospective transition method in adopting the new guidance and prior period amounts have not been restated. Because of the adoption, the Company recognized an excess tax deficiency from stock-based compensation as a discrete item, increasing the income tax provision for the three and nine months ended September 30, 2017 by $0.1 million and $1.8 million, respectively. Historically, excess tax benefits or deficiencies were recorded as additional paid-in capital. The Company applied the prospective transition method with respect to the cash flow classificationaccounting for leases, as codified in Accounting Standards Topic 842 (“ASC 842”). The guidance is intended to improve financial reporting of certain share-based payment activity; accordingly, the cash flowsleasing transactions by requiring entities that lease assets to recognize assets and liabilities for the nine months ended September 30, 2016 have not been restated. rights and obligations created by leases, as well as requiring additional disclosures related to an entity's leasing activities. The Company has elected to maintain its practiceadopted this change in accounting principle using the modified retrospective method as of estimating forfeitures when recognizing expense for share-based payment awards. Amendments to the accounting for minimum statutory withholding requirements had no impact on the Company's Consolidated Financial Statements.

In November 2016, the FASB issued new guidance to reduce diversity in practice in the classification and presentationfirst day of changes in restricted cash in the statement of cash flows. The new guidance requires amounts generally described as restricted cash should be included with cash and cash equivalents when reconciling the beginning-of-period total amounts to the end-of-period total amounts shown on the statement of cash flows. Calendar year public entities will be required to adopt the new guidance beginning with the first fiscal quarter of 2018.2019. Accordingly, financial information for periods prior to the date of initial application has not been adjusted. The Company has elected the package of practical expedients for adoption that permitted the Company not to adoptreassess its prior conclusions regarding lease identification, lease classification and initial direct costs. The Company did not elect to use an allowable expedient that permitted the new guidance retrospectivelyuse of hindsight in performing evaluations of its leases.

Upon adoption of ASC 842, the Company recognized operating lease obligations of $453.0 million, which represented the present value of the remaining minimum lease payments, discounted using the Company's incremental borrowing rate. The Company recognized operating lease right-of-use assets of $395.6 million. The Company recognized an adjustment to retained earnings upon adoption of $5.0 million, net of tax of $1.7 million, primarily related to an impairment resulting from an unfavorable differential between lease payments to be made and sublease rentals to be received on certain leases. The remaining difference of $50.7 million between the recognized operating lease obligation and right-of-use assets related to the

DineEquity,Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

3. Accounting PoliciesStandards Adopted and Newly Issued Accounting Standards Not Yet Adopted (Continued)

effective January 2, 2017derecognition of certain liabilities and assets that had been recorded in accordance with U.S. GAAP that had been applied prior to the adoption of ASC 842, primarily $43.3 million of accrued rent payments. Lease-related reserves for lease incentives, closed restaurants and unfavorable leaseholds were also derecognized.

The accounting for the Company's existing finance (capital) leases upon adoption of ASC 842 remained substantially unchanged. Adoption of ASC 842 had no significant impact on the Company's cash flows for the nine months ended September 30, 2017 were restated. Adoptionfrom operations or its results of the new guidanceoperations and did not impact any covenant related to the Company's Consolidated Balance Sheets or Consolidated Statements of Comprehensive Income.

In January 2017, the FASB issued new guidance simplifying the test of goodwill for impairment.long-term debt. The new guidance requires a single-step quantitative testCompany implemented internal controls necessary to measure potential impairment based on the excess of a reporting unit's carrying amount over its fair value. Calendar year public entities will be required to adopt the new guidance beginningensure compliance with the first fiscal quarteraccounting and disclosure requirements of 2020. TheASC 842.

Additional new accounting guidance became effective for the Company has elected early adoptionas of the new guidance, as is permitted for interimbeginning of fiscal 2019 that the Company reviewed and concluded was either not applicable to its operations or annual tests of goodwill performed after January 1, 2017.had no material effect on its consolidated financial statements in the current or future fiscal years.

Newly Issued Accounting Standards Not Yet Adopted

In August 2016, the FASB issued new guidance on the classification of certain cash receipts and payments in the statement of cash flows. The new guidance is intended to reduce diversity in practice in how certain transactions are classified in the statement of cash flows. The Company will be required to adopt the new guidance beginning with its first fiscal quarter of 2018. Early adoption is permitted. The Company is currently assessing the impact that the new guidance will have on its consolidated statements of cash flows.

In June 2016, the FASB issued new guidance on the measurement of credit losses on financial instruments. The new guidance will replace the incurred loss methodology of recognizing credit losses on financial instruments that is currently required with a methodology that estimates the expected credit loss on financial instruments and reflects the net amount expected to be collected on the financial instrument. Application of the new guidance may result in the earlier recognition of credit losses as the new methodology will require entities to consider forward-looking information in addition to historical and current information used in assessing incurred losses. The Company will be required to adopt the new guidance on a modified retrospective basis beginning with its first fiscal quarter of 2020, with early adoption permitted in its first fiscal quarter of 2019. The Company is currently evaluating the impact of the new guidance on its consolidated financial statements and related disclosures and whether early adoption will be elected.

disclosures.

In February 2016, the FASB issued new guidance with respect to the accounting for leases. The new guidance will require lessees to recognize a right-of-use asset and a lease liability for virtually all leases, other than leases with a term of 12 months or less, and to provide additional disclosures about leasing arrangements. Accounting by lessors is largely unchanged from existing accounting guidance. The Company will be required to adopt the new guidance on a modified retrospective basis beginning with its first fiscal quarter of 2019. Early adoption is permitted.

While the Company is still in the process of evaluating the impact of the new guidance on its consolidated financial statements and disclosures, the Company expects adoption of the new guidance will have a material impact on its Consolidated Balance Sheets due to recognition of the right-of-use asset and lease liability related to its operating leases. While the new guidance is also expected to impact the measurement and presentation of elements of expenses and cash flows related to leasing arrangements, the Company does not presently believe there will be a material impact on its Consolidated Statements of Comprehensive Income or Consolidated Statements of Cash Flows. Recognition of a lease liability related to operating leases will not impact any covenants related to the Company's long-term debt because the debt agreements specify that covenant ratios be calculated using U.S. GAAP in effect at the time the debt agreements were entered into.

In January 2016,August 2018, the FASB issued guidance ondesigned to improve the recognitioneffectiveness of disclosures by removing, modifying and measurement of financial instruments. The guidance modifies how entities measure certain equity investments and present changes in theadding disclosures related to fair value of those investments, as well as changes how fair value of financial instruments is measured for disclosure purposes.measurements. The amendment is effective commencing with the Company's first fiscal quarter of 2018. The Company is currently evaluating the impact of the new guidance on its financial statements and disclosures.

In May 2014, the FASB issued new accounting guidance on revenue recognition, which provides for a single, five-step model to be applied to all revenue contracts with customers. The new standard also requires additional financial statement disclosures that will enable users to understand the nature, amount, timing and uncertainty of revenue and cash flows relating to customer contracts. Companies have an option to use either the full retrospective method or the modified retrospective method to implement the standard. In August 2015, the FASB deferred the effective date of the new revenue guidance by one year such that the Company will be required to adopt the new guidance beginning with its first fiscal quarter of 2018. The FASB has subsequently issued several clarifications on specific topics within the new revenue recognition guidance that did not change the core principles of the guidance originally issued in May 2014.

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

3. Accounting Policies (Continued)

This new guidance supersedes nearly all the existing general revenue recognition guidance under U.S. GAAP as well as most industry-specific revenue recognition guidance, including guidance with respect to revenue recognition by franchisors. The Company believes the recognition of the majority of its revenues, including franchise royalty revenues and sales of IHOP pancake and waffle dry mix will not be affected by the new guidance. Additionally, lease rental revenues are not within the scope of the new guidance.

The Company believes the new guidance will impact the timing of recognition of franchise and development fees. Under existing guidance, these fees are typically recognized upon the opening of restaurants. Under the new guidance, the Company believes the fees will have to be deferred and recognized as revenue over the term of the individual franchise agreements. However, the effect of the required deferral of fees received2020; early adoption in any given year will be mitigated by the recognition of revenue from fees retrospectively deferred from prior years. The Company has essentially completed reviewing most of its nearly 4,000 agreements to obtain the data elements necessary to implement the new guidance and is in the process of quantifying the impactinterim period after issuance of the new guidance is permitted. The Company is currently assessing the impact this guidance will have on its consolidated financial statementsstatements.

In August 2018, the FASB issued new guidance on the accounting for implementation costs incurred in a cloud computing arrangement that is a service contract. The guidance aligns the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with existing guidance for capitalizing implementation cost incurred to develop or obtain internal-use software. The guidance also provides presentation and related disclosures.

disclosure requirements for such capitalized costs. The Company also believeswill be required to adopt the new guidance will impact the accounting for transactions related to the Applebee's national advertising fund. Currently, franchisee contributions to and expenditures of the Applebee's national advertising fund are not included in the Consolidated Statements of Comprehensive Income. Under the new guidance, the Company would include contributions to and expenditures from the Applebee's advertising fund within the Consolidated Statements of Comprehensive Income as is currently donebeginning with contributions to and expenditures from the IHOP national advertising fund and with international restaurants of both brands. While this change will materially impact the gross amount of reported franchise revenues and expenses, the impact would be an offsetting increase to both revenue and expense such that the impact on gross profit and net income, if any, would not be material.

The Company presently expects to use the full retrospective method of adoption when the new revenue guidance is adopted in theits first fiscal quarter of 2018.

2020; early adoption in any interim period after issuance of the new guidance is permitted. The Company is currently assessing the impact this guidance will have on its consolidated financial statements.

The Company reviewed all other newly issued accounting pronouncements and concluded that they either are not applicable to the Company's operations or that no material effect is expected on the Company's financial statements because of future adoption.

4. GoodwillRevenue Disclosures

Franchise revenue (which comprises most of the Company's revenues) and Intangible Assetsrevenue from company-operated restaurants are recognized in accordance with current guidance for revenue recognition as codified in Accounting Standards Topic (“ASC 606”). Under ASC 606, revenue is recognized upon transfer of control of promised services or goods to customers in an amount that reflects the consideration the Company expects to receive for those services or goods.

ChangesFranchising Activities

The Company owns and franchises the Applebee’s and IHOP restaurant concepts. The franchise arrangement for both brands is documented in the carrying amountform of goodwill fora franchise agreement and, in most cases, a development agreement. The franchise arrangement between the nine months ended September 30, 2017 areCompany as follows:the franchisor and the franchisee as the customer requires the Company to perform various activities to support the brand that do not directly transfer goods and services to the franchisee, but instead represent a single performance obligation, which is the transfer of the franchise license. The intellectual property subject to the franchise license is symbolic intellectual property as it does not have significant standalone functionality, and substantially all the utility is derived from its association with the Company’s past or ongoing activities. The nature of the Company’s promise in granting the franchise license is to provide the franchisee with access to the brand’s symbolic intellectual property over the term of the

|

| | | | | | | | | | | |

| | Applebee's Franchise Unit | | IHOP Franchise Unit | | Total |

| | (In millions) |

| Balance at December 31, 2016: | |

| | |

| | |

| Goodwill, gross | $ | 686.7 |

| | $ | 10.8 |

| | $ | 697.5 |

|

| Accumulated impairment loss | — |

| | — |

| | — |

|

| Goodwill | 686.7 |

| | 10.8 |

| | 697.5 |

|

| Impairment loss | (358.2 | ) | | — |

| | (358.2 | ) |

| Balance at September 30, 2017: | | | | | |

| Goodwill, gross | 686.7 |

| | 10.8 |

| | 697.5 |

|

| Accumulated impairment loss | (358.2 | ) | | — |

| | (358.2 | ) |

| Goodwill | $ | 328.5 |

| | $ | 10.8 |

| | $ | 339.2 |

|

DineEquity,Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

4. Goodwill and Intangible AssetsRevenue Disclosures (Continued)

Changeslicense. The services provided by the Company are highly interrelated with the franchise license and as such are considered to represent a single performance obligation.

The transaction price in a standard franchise arrangement for both brands primarily consists of (a) initial franchise/development fees; (b) continuing franchise fees (royalties); and (c) advertising fees. Since the carrying amountCompany considers the licensing of intangible assets for the nine months ended September 30, 2017 arefranchising right to be a single performance obligation, no allocation of the transaction price is required. Additionally, all domestic IHOP franchise agreements require franchisees to purchase proprietary pancake and waffle dry mix from the Company.

The Company recognizes the primary components of the transaction price as follows:

|

| | | | | | | | | | | | | | | | | | | |

| | Not Subject to Amortization | | Subject to Amortization | | |

| | Applebee's Tradename | | Other | | Applebee's Franchising Rights | | Leaseholds | | Total |

| | (In millions) |

| Balance at December 31, 2016 | $ | 652.4 |

| | $ | 2.0 |

| | $ | 109.0 |

| | $ | — |

| | $ | 763.4 |

|

| Impairment | (173.4 | ) | | — |

| | — |

| | — |

| | (173.4 | ) |

| Amortization expense | — |

| | — |

| | (7.5 | ) | | (0.0 | ) | | (7.5 | ) |

| Additions | — |

| | 0.4 |

| | — |

| | 2.3 |

| | 2.7 |

|

| Balance at September 30, 2017 | $ | 479.0 |

| | $ | 2.4 |

| | $ | 101.5 |

| | $ | 2.3 |

| | $ | 585.2 |

|

Franchise and development fees are recognized as revenue ratably on a straight-line basis over the term of the franchise agreement commencing with the restaurant opening date. As these fees are typically received in cash at or near the beginning of the franchise term, the cash received is initially recorded as a contract liability until recognized as revenue over time;

The Company evaluates its goodwillis entitled to royalties and advertising fees based on a percentage of the indefinite-lived Applebee's tradename for impairment annuallyfranchisee's gross sales as defined in the fourth quarterfranchise agreement. Royalty and advertising revenue are recognized when the franchisee's reported sales occur. Depending on timing within a fiscal period, the recognition of each year. In additionrevenue results in either what is considered a contract asset (unbilled receivable) or, once billed, accounts receivable, on the balance sheet.

Revenue from the sale of proprietary pancake and waffle dry mix is recognized in the period in which distributors ship the franchisee's order; recognition of revenue results in accounts receivable on the balance sheet.

Company Restaurant Revenue

Sales by company-operated restaurants are recognized when food and beverage items are sold. Company restaurant sales are reported net of sales taxes collected from guests that are remitted to the annual evaluation for impairment, goodwillappropriate taxing authorities.

In determining the amount and indefinite-lived intangible assets are evaluated more frequently iftiming of revenue from contracts with customers, the Company exercises significant judgment with respect to collectibility of the amount; however, the timing of recognition does not require significant judgments as it is based on either the term of the franchise agreement, the month of reported sales by the franchisee or the date of product shipment, none of which require estimation. The Company does not incur a significant amount of contract acquisition costs in conducting its franchising activities. The Company believes indicatorsits franchising arrangements do not contain a significant financing component.

The following table disaggregates franchise revenue by major type for the three and six months ended June 30, 2019 and 2018:

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| | | June 30, | | June 30, |

| | | 2019 | | 2018 | | 2019 | | 2018 |

| | | (In thousands) |

| Franchise Revenue: | | |

| | |

| | | | |

| Royalties | | $ | 75,747 |

| | $ | 78,102 |

| | $ | 154,382 |

| | $ | 153,199 |

|

| Advertising fees | | 71,738 |

| | 58,705 |

| | 144,368 |

| | 122,541 |

|

| Pancake and waffle dry mix sales and other | | 12,526 |

| | 12,172 |

| | 26,957 |

| | 25,269 |

|

| Franchise and development fees | | 2,657 |

| | 2,962 |

| | 5,887 |

| | 6,245 |

|

| Total franchise revenue | | $ | 162,668 |

| | $ | 151,941 |

| | $ | 331,594 |

| | $ | 307,254 |

|

Accounts receivable from franchisees as of impairment exist.

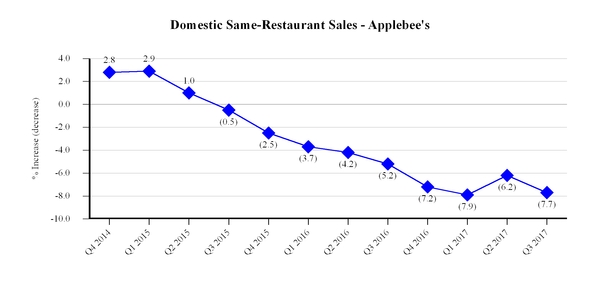

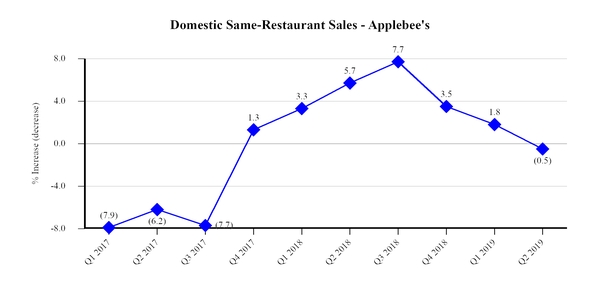

In the third quarterJune 30, 2019 and December 31, 2018 were $65.9 million (net of 2017, the Company noted that the declineallowance of $2.1 million) and $62.6 million (net of allowance of $4.6 million), respectively, and were included in receivables, net in the market price of the Company's common stock since December 31, 2016, which the Company had believed to be temporary, persisted throughout the first eight months of 2017 and that the favorable trend in Applebee's domestic same-restaurant sales experienced in the second quarter of 2017 did not continue into the first two months of the third quarter. The Company also noted a continuing increase in Applebee's bad debt expense and in royalties not recognized in income until paid in cash. Additionally, the Company also determined an increasing shortfall in franchisee contributions to the Applebee's national advertising fund could require a larger amount of future subsidization in the form of additional franchisor contributions to the fund than previously estimated. Based on these unfavorable developments, primarily the decline in the market price of the Company's common stock, the Company determined that indicators of impairment existed and that an interim test of goodwill and indefinite-lived intangible assets for impairment should be performed.Consolidated Balance Sheets.

The Company performed an interim quantitative test of impairment of Applebee's goodwill and tradename in the third quarter of 2017. In performing the quantitative test of goodwill, the Company used the income approach method of valuation that included the discounted cash flow method as well as other generally accepted valuation methodologies to determine the fair value of goodwill and intangible assets. Significant assumptions used to determine fair value under the discounted cash flow model included expected future trends in sales, operating expenses, overhead expenses, capital expenditures and changes in working capital, along with an appropriate discount rate based on the Company's estimated cost of equity capital and after-tax cost of debt.

In performing the impairment review of the tradename, the Company used the relief of royalty method under the income approach method of valuation. Significant assumptions used to determine fair value under the relief of royalty method include future trends in sales, a royalty rate and a discount rate to be applied to the forecast revenue stream.

As a result of performing the quantitative test of impairment, the Company recognized an impairment of Applebee's goodwill of $358.2 million and an impairment of Applebee's tradename of $173.4 million. The Company adopted the guidance in FASB Accounting Standards Update 2017-04 on January 1, 2017; accordingly, the amount of the goodwill impairment was determined as the amount by which the carrying amount of the goodwill exceeded the fair value of the Applebee's franchise reporting unit as estimated in the impairment test. These assets are at risk of additional impairment in the future in the event of sustained downward movement in the Company's stock price, downward revisions of long-term performance assumptions or increases in the assumed long-term discount rate.

DineEquity,Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

4. Revenue Disclosures (Continued)

Changes in the Company's contract liability for deferred franchise and development fees during the six months ended June 30, 2019 are as follows:

|

| | | | |

| | | Deferred Franchise Revenue (short- and long-term) |

| | | (In thousands) |

| Balance at December 31, 2018 | | $ | 74,695 |

|

| Recognized as revenue during the six months ended June 30, 2019 | | (5,515 | ) |

| Fees deferred during the six months ended June 30, 2019 | | 1,366 |

|

| Balance at June 30, 2019 | | $ | 70,546 |

|

The balance of deferred revenue as of June 30, 2019 is expected to be recognized as follows:

|

| | | |

| (In thousands) |

| Remainder of 2019 | $ | 6,582 |

|

| 2020 | 7,887 |

|

| 2021 | 7,798 |

|

| 2022 | 7,269 |

|

| 2023 | 6,693 |

|

| 2024 | 6,005 |

|

| Thereafter | 28,312 |

|

| Total | $ | 70,546 |

|

5. Lease Disclosures

The Company engages in leasing activity as both a lessee and a lessor. The majority of the Company's lease portfolio originated when the Company was actively involved in the development and financing of IHOP restaurants prior to the franchising of the restaurant to the franchisee. This activity included the Company's leasing or purchase of the site on which the restaurant was located and subsequently leasing/subleasing the site to the franchisee. With a few exceptions, the Company ended this practice in 2003 and the Company's current lease activity is predominantly comprised of renewals of existing lease arrangements and exercises of options on existing lease arrangements.

The Company currently leases from third parties the real property on which approximately 610 IHOP franchisee-operated restaurants and one Applebee's franchisee-operated restaurant are located; the Company (as lessor) subleases the property to the franchisees that operate those restaurants. The Company also leases property it owns to the franchisees that operate approximately 60 IHOP restaurants and one Applebee's restaurant. The Company leases from third parties the real property on which 69 Applebee's company-operated restaurants are located. The Company also leases office space for its principal corporate office in Glendale, California and restaurant support centers in Kansas City, Missouri and Raleigh, North Carolina. The Company does not have a significant amount of non-real estate leases.

The Company's existing leases related to IHOP restaurants generally provided for an initial term of 20 to 25 years with most having one or more five-year renewal options. Option periods were not included in determining liabilities and right-of-use assets related to operating leases. Approximately 240 of the Company's leases contain provisions requiring additional rent payments to the Company (as lessor) based on a percentage of restaurant sales. Approximately 260 of the Company's leases contain provisions requiring additional rent payments by the Company (as lessee) based on a percentage of restaurant sales.

The individual lease agreements do not provide information to determine the implicit rate in the agreements. The Company made significant judgments in determining the incremental borrowing rates that were used in calculating operating lease liabilities as of the adoption date. Due to the large number of leases, the Company applied a portfolio approach by grouping the leases based on the original lease term. The Company estimated the rate for each grouping primarily by reference to yield rates on debt issuances by companies of a similar credit rating as the Company, U.S. Treasury rates as of the adoption date and adjustments for differences in years to maturity.

Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

5. Lease Disclosures (Continued)

The Company's lease cost for the three and six months ended June 30, 2019 was as follows:

|

| | | | | | | |

| | Three months ended June 30, 2019 | | Six months ended June 30, 2019 |

| Finance lease cost: | (In millions) |

| Amortization of right-of-use assets | $ | 1.3 |

| | $ | 2.6 |

|

| Interest on lease liabilities | 2.0 |

| | 4.1 |

|

| Operating lease cost | 26.8 |

| | 53.2 |

|

| Variable lease cost | 0.6 |

| | 1.3 |

|

| Short-term lease cost | 0.0 |

| | 0.0 |

|

| Sublease income | (27.3 | ) | | (55.4 | ) |

| Lease cost | $ | 3.4 |

| | $ | 5.8 |

|

Future minimum lease payments under noncancelable leases as lessee as of June 30, 2019 were as follows:

|

| | | | | | | |

| | Finance Leases | | Operating Leases |

| | (In millions) |

| 2019 (remaining six months) | $ | 10.3 |

| | $ | 46.2 |

|

| 2020 | 20.1 |

| | 94.6 |

|

| 2021 | 16.5 |

| | 77.8 |

|

| 2022 | 14.7 |

| | 70.0 |

|

| 2023 | 11.6 |

| | 57.5 |

|

| Thereafter | 65.0 |

| | 217.7 |

|

| Total minimum lease payments | 138.2 |

| | 563.8 |

|

| Less: interest/imputed interest | (41.0 | ) | | (117.0 | ) |

| Total obligations | 97.2 |

| | 446.8 |

|

| Less: current portion | (12.9 | ) | | (67.7 | ) |

| Long-term lease obligations | $ | 84.3 |

| | $ | 379.1 |

|

The weighted average remaining lease term as of June 30, 2019 was 8.6 years for finance leases and 7.9 years for operating leases. The weighted average discount rate as of June 30, 2019 was 10.4% for finance leases and 5.8% for operating leases.

During the three and six months ended June 30, 2019, the Company made the following payments for leases:

|

| | | | | | | |

| | Three months ended June 30, 2019 | | Six months ended June 30, 2019 |

| | (In millions) |

| Principal payments on finance lease obligations | $ | 3.5 |

| | $ | 7.0 |

|

| Interest payments on finance lease obligations | $ | 2.0 |

| | $ | 4.1 |

|

| Payments on operating leases | $ | 22.8 |

| | $ | 45.8 |

|

| Variable lease payments | $ | 0.6 |

| | $ | 1.5 |

|

The Company's income from operating leases for the three and six months ended June 30, 2019 was as follows:

|

| | | | | | | |

| | Three months ended June 30, 2019 | | Six months ended June 30, 2019 |

| | (In millions) |

| Minimum lease payments | $ | 25.4 |

| | $ | 51.1 |

|

| Variable lease income | 2.8 |

| | 6.0 |

|

| Total operating lease income | $ | 28.2 |

| | $ | 57.1 |

|

Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

5. Lease Disclosures (Continued)

Future minimum payments to be received as lessor under noncancelable operating leases as of June 30, 2019 were as follows:

|

| | | |

| | (In millions) |

| 2019 (remaining six months) | $ | 53.1 |

|

| 2020 | 107.3 |

|

| 2021 | 101.5 |

|

| 2022 | 98.4 |

|

| 2023 | 94.0 |

|

| Thereafter | 289.6 |

|

| Total minimum rents receivable | 743.9 |

|

The Company's income from direct financing leases for the three and six months ended June 30, 2019 was as follows:

|

| | | | | | | |

| | Three months ended June 30, 2019 | | Six months ended June 30, 2019 |

| | (In millions) |

| Interest income | $ | 1.3 |

| | $ | 2.7 |

|

| Variable lease income | 0.3 |

| | 0.7 |

|

| Total operating lease income | $ | 1.6 |

| | $ | 3.4 |

|

Future minimum payments to be received as lessor under noncancelable direct financing leases as of June 30, 2019 were as follows:

|

| | | |

| | (In millions) |

| 2019 (remaining six months) | $ | 7.9 |

|

| 2020 | 14.7 |

|

| 2021 | 11.6 |

|

| 2022 | 8.2 |

|

| 2023 | 3.6 |

|

| Thereafter | 3.8 |

|

| Total minimum rents receivable | 49.8 |

|

| Less: unearned income | (10.0 | ) |

| Total net investment in direct financing leases | 39.8 |

|

| Less: current portion | (11.2 | ) |

| Long-term investment in direct financing leases | $ | 28.6 |

|

6. Long-Term Debt

At June 30, 2019 and December 31, 2018, long-term debt consisted of the following:

|

| | | | | | | |

| | June 30, 2019 | | December 31, 2018 |

| | (In millions) |

| Series 2019-1 4.194% Fixed Rate Senior Secured Notes, Class A-2-I | $ | 700.0 |

| | $ | — |

|

| Series 2019-1 4.723% Fixed Rate Senior Secured Notes, Class A-2-II | 600.0 |

| | — |

|

| Series 2014-1 4.277% Fixed Rate Senior Secured Notes, Class A-2 | — |

| | 1,283.8 |

|

| Series 2018-1 Variable Funding Senior Notes Class A-1, variable interest rate of 4.93% at December 31, 2018 | — |

| | 25.0 |

|

| Class A-2-I and A-2-II (2019) and Class A-2 (2018) Note debt issuance costs | (12.8 | ) | | (9.7 | ) |

| Long-term debt, net of debt issuance costs | 1,287.2 |

| | 1,299.1 |

|

| Current portion of long-term debt | — |

| | (25.0 | ) |

| Long-term debt | $ | 1,287.2 |

| | $ | 1,274.1 |

|

Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

6. Long-Term Debt (Continued)

On June 5, 2019, Applebee’s Funding LLC and IHOP Funding LLC (the “Co-Issuers”), each a special purpose, wholly-owned indirect subsidiary of the Company, issued two tranches of fixed rate senior secured notes, the Series 2019-1 4.194% Fixed Rate Senior Secured Notes, Class A-2-I (“Class A-2-I Notes”) in an initial aggregate principal amount of $700 million and the Series 2019-1 4.723% Fixed Rate Senior Secured Notes, Class A-2-II (“Class A-2-II Notes”) in an initial aggregate principal amount of $600 million (the “Class A-2-II Notes” and, together with the Class A-2-I Notes, the “2019 Class A-2 Notes”). The 2019 Class A-2 Notes were issued pursuant to an offering exempt from registration under the Securities Act of 1933, as amended.

The Co-Issuers also replaced their existing revolving financing facility, the 2018-1 Variable Funding Senior Notes, Class A-1 (“2018-1 Class A-1 Notes”), with a new revolving financing facility, the 2019-1 Variable Funding Senior Notes, Class A-1 (the “2019 Class A-1 Notes”), on substantially the same terms as the 2018-1 Class A-1 Notes in order to conform the term of the 2019 Class A-1 Notes to the anticipated repayment dates for the 2019 Class A-2 Notes. The 2019 Class A-1 Notes and the 2019 Class A-2 Notes are referred to collectively herein as the “New Notes.”