UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑Q

(Mark One)

|

| |

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31,June 30, 2017

or

|

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_____________________to__________

Commission File Number 1‑3473

TESORO CORPORATIONANDEAVOR

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 95‑0862768 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| | |

| | |

| 19100 Ridgewood Pkwy, San Antonio, Texas 78259-1828 |

| (Address of principal executive offices) (Zip Code) |

| 210-626-6000 |

| (Registrant’s telephone number, including area code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YesþNoo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YesþNoo

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth companycompany” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

| | Large accelerated filer | þ | | Accelerated filer | o | |

| | Non-accelerated filer | o(Do (Do not check if a smaller reporting company) | | Smaller reporting company | o | |

| | | | | Emerging growth company | o | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YesoNoþ

There were 117,520,990156,901,569 shares of the registrant’s Common Stock outstanding at MayAugust 4, 2017.

TESORO CORPORATIONANDEAVOR

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED MARCH 31,JUNE 30, 2017

This Quarterly Report on Form 10-Q (including documents incorporated by reference herein) contains statements with respect to our expectations or beliefs as to future events. These types of statements are “forward-looking” and subject to uncertainties. See “Important Information Regarding Forward-Looking Statements” in Management’s Discussion and Analysis of Financial Condition and Results of Operations in Part I, Item 2.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

TESORO CORPORATION

ANDEAVOR

CONDENSED STATEMENTS OF CONSOLIDATED OPERATIONS

(Unaudited)

| | | | Three Months Ended March 31, | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2017 | | 2016 | 2017 | | 2016 | | 2017 | | 2016 |

| | (In millions, except per share amounts) | (In millions, except per share amounts) |

| Revenues (a) | $ | 6,638 |

| | $ | 5,101 |

| $ | 7,849 |

| | $ | 6,285 |

| | $ | 14,487 |

| | $ | 11,386 |

|

| Costs and Expenses | | | | | | | | | | |

| Cost of sales (excluding the lower of cost or market inventory valuation adjustment) (a) | 5,426 |

| | 3,866 |

| 6,217 |

| | 5,023 |

| | 11,643 |

| | 8,889 |

|

| Lower of cost or market inventory valuation adjustment | — |

| | 147 |

| 209 |

| | (363 | ) | | 209 |

| | (216 | ) |

| Operating expenses | 654 |

| | 611 |

| 739 |

| | 602 |

| | 1,393 |

| | 1,213 |

|

| General and administrative expenses | 136 |

| | 82 |

| 248 |

| | 94 |

| | 384 |

| | 176 |

|

| Depreciation and amortization expenses | 226 |

| | 212 |

| 240 |

| | 210 |

| | 466 |

| | 422 |

|

| Loss on asset disposals and impairments | 1 |

| | 4 |

| |

| (Gain) loss on asset disposals and impairments | | (22 | ) | | 1 |

| | (21 | ) | | 5 |

|

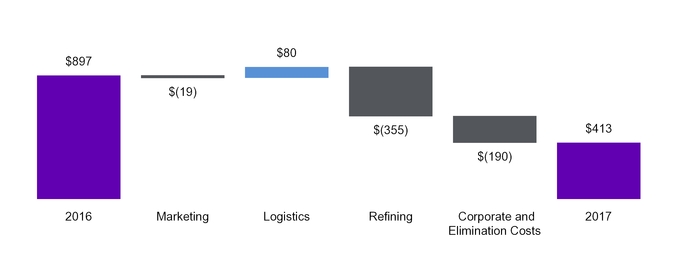

| Operating Income | 195 |

| | 179 |

| 218 |

| | 718 |

| | 413 |

| | 897 |

|

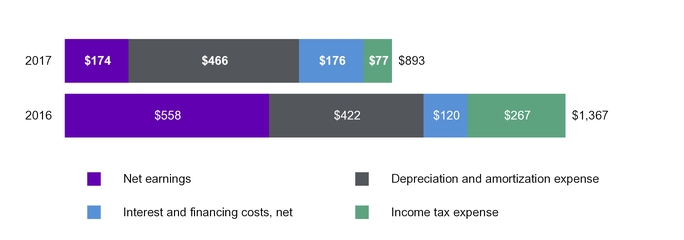

| Interest and financing costs, net | (89 | ) | | (60 | ) | (87 | ) | | (60 | ) | | (176 | ) | | (120 | ) |

| Equity in earnings of equity method investments | | 3 |

| | 3 |

| | 3 |

| | 5 |

|

| Other income, net | 2 |

| | 9 |

| 9 |

| | 25 |

| | 11 |

| | 32 |

|

| Earnings Before Income Taxes | 108 |

| | 128 |

| 143 |

| | 686 |

| | 251 |

| | 814 |

|

| Income tax expense | 21 |

| | 30 |

| 56 |

| | 237 |

| | 77 |

| | 267 |

|

| Net Earnings from Continuing Operations | 87 |

| | 98 |

| 87 |

| | 449 |

| | 174 |

| | 547 |

|

| Earnings from discontinued operations, net of tax | — |

| | 11 |

| — |

| | — |

| | — |

| | 11 |

|

| Net Earnings | 87 |

| | 109 |

| 87 |

| | 449 |

| | 174 |

| | 558 |

|

| Less: Net earnings from continuing operations attributable to noncontrolling interest | 37 |

| | 40 |

| 47 |

| | 31 |

| | 84 |

| | 71 |

|

| Net Earnings Attributable to Tesoro Corporation | $ | 50 |

| | $ | 69 |

| |

| Net Earnings Attributable to Andeavor | | $ | 40 |

| | $ | 418 |

| | $ | 90 |

| | $ | 487 |

|

| | | | | | | | | | | |

| Net Earnings Attributable to Tesoro Corporation | | | | |

| Net Earnings Attributable to Andeavor | | | | | | | | |

| Continuing operations | $ | 50 |

| | $ | 58 |

| $ | 40 |

| | $ | 418 |

| | $ | 90 |

| | $ | 476 |

|

| Discontinued operations | — |

| | 11 |

| — |

| | — |

| | — |

| | 11 |

|

| Total | $ | 50 |

| | $ | 69 |

| $ | 40 |

| | $ | 418 |

| | $ | 90 |

| | $ | 487 |

|

| Net Earnings per Share - Basic | | | | | | | | | | |

| Continuing operations | $ | 0.43 |

| | $ | 0.49 |

| $ | 0.31 |

| | $ | 3.50 |

| | $ | 0.73 |

| | $ | 3.98 |

|

| Discontinued operations | — |

| | 0.09 |

| — |

| | — |

| | — |

| | 0.09 |

|

| Total | $ | 0.43 |

| | $ | 0.58 |

| $ | 0.31 |

| | $ | 3.50 |

| | $ | 0.73 |

| | $ | 4.07 |

|

| Weighted average common shares outstanding - Basic | 117.1 |

| | 119.6 |

| 130.8 |

| | 119.5 |

| | 124.0 |

| | 119.5 |

|

| Net Earnings per Share - Diluted | | | | | | | | | | |

| Continuing operations | $ | 0.42 |

| | $ | 0.48 |

| $ | 0.31 |

| | $ | 3.47 |

| | $ | 0.72 |

| | $ | 3.94 |

|

| Discontinued operations | — |

| | 0.09 |

| — |

| | — |

| | — |

| | 0.09 |

|

| Total | $ | 0.42 |

| | $ | 0.57 |

| $ | 0.31 |

| | $ | 3.47 |

| | $ | 0.72 |

| | $ | 4.03 |

|

| Weighted average common shares outstanding - Diluted | 118.1 |

| | 121.2 |

| 131.7 |

| | 120.6 |

| | 125.0 |

| | 120.8 |

|

| | | | | | | | | | | |

| Dividends per Share | $ | 0.55 |

| | $ | 0.50 |

| $ | 0.55 |

| | $ | 0.50 |

| | $ | 1.10 |

| | $ | 1.00 |

|

| | | | | |

| Supplemental Information | | | | | | | | | | |

(a) Includes excise taxes collected by our Marketing segment | $ | 134 |

| | $ | 142 |

| $ | 153 |

| | $ | 148 |

| | $ | 287 |

| | $ | 290 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

|

| | |

| | | March 31,June 30, 2017 | 3

|

TESORO CORPORATIONANDEAVOR

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | March 31,

2017 | | December 31,

2016 | June 30,

2017 | | December 31,

2016 |

| | (In millions, except share data) | (In millions, except share data) |

| ASSETS | | | | | | |

| Current Assets | | | | | | |

Cash and cash equivalents (TLLP: $35 and $688, respectively) | $ | 2,298 |

| | $ | 3,295 |

| |

Cash and cash equivalents (Logistics: $31 and $688, respectively) | | $ | 1,061 |

| | $ | 3,295 |

|

| Receivables, net of allowance for doubtful accounts | 1,007 |

| | 1,108 |

| 1,391 |

| | 1,108 |

|

| Inventories | 2,624 |

| | 2,640 |

| |

| Inventories, net | | 3,075 |

| | 2,640 |

|

| Prepayments and other current assets | 332 |

| | 371 |

| 508 |

| | 371 |

|

| Total Current Assets | 6,261 |

| | 7,414 |

| 6,035 |

| | 7,414 |

|

Property, Plant and Equipment, Net (TLLP: $3,986 and $3,444, respectively) | 10,603 |

| | 9,976 |

| |

Acquired Intangibles, Net (TLLP: $1,090 and $947, respectively) | 1,413 |

| | 1,277 |

| |

Other Noncurrent Assets, Net (TLLP: $504 and $531, respectively) | 1,792 |

| | 1,731 |

| |

Property, Plant and Equipment, Net (Logistics: $4,420 and $3,444, respectively) | | 14,143 |

| | 9,976 |

|

Goodwill (Logistics: $127 and $117, respectively) | | 3,202 |

| | 190 |

|

Acquired Intangibles, Net (Logistics: $1,054 and $947, respectively) | | 1,621 |

| | 1,277 |

|

Other Noncurrent Assets, Net (Logistics: $402 and $414, respectively) | | 2,028 |

| | 1,541 |

|

| Total Assets | $ | 20,069 |

| | $ | 20,398 |

| $ | 27,029 |

| | $ | 20,398 |

|

| | | | | | | |

| LIABILITIES AND EQUITY | | | | | | |

| Current Liabilities | | | | | | |

| Accounts payable | $ | 1,644 |

| | $ | 2,032 |

| $ | 2,445 |

| | $ | 2,032 |

|

| Current maturities of debt | 465 |

| | 465 |

| 478 |

| | 465 |

|

| Other current liabilities | 944 |

| | 1,057 |

| 1,230 |

| | 1,057 |

|

| Total Current Liabilities | 3,053 |

| | 3,554 |

| 4,153 |

| | 3,554 |

|

| Deferred Income Taxes | 1,493 |

| | 1,428 |

| 2,088 |

| | 1,428 |

|

Debt, Net of Unamortized Issuance Costs (TLLP: $3,765 and $4,053, respectively) | 6,178 |

| | 6,468 |

| |

Debt, Net of Unamortized Issuance Costs (Logistics: $4,092 and $4,053, respectively) | | 7,164 |

| | 6,468 |

|

| Other Noncurrent Liabilities | 1,011 |

| | 821 |

| 1,201 |

| | 821 |

|

| Total Liabilities | 11,735 |

| | 12,271 |

| 14,606 |

| | 12,271 |

|

| Commitments and Contingencies (Note 8) | | | | |

| Commitments and Contingencies (Note 9) | | | | |

| Equity | | | | | | |

| Tesoro Corporation Stockholders’ Equity | | | | |

Common stock, par value $0.162/3; authorized 300,000,000 shares (200,000,000 in 2016); 160,222,281 shares issued (159,474,572 in 2016) | 27 |

| | 27 |

| |

| Andeavor Stockholders’ Equity | | | | |

Common stock, par value $0.162/3; authorized 300,000,000 shares (200,000,000 in 2016); 200,004,789 shares issued (159,474,572 in 2016) | | 33 |

| | 27 |

|

| Additional paid-in capital | 1,531 |

| | 1,473 |

| 4,929 |

| | 1,473 |

|

| Retained earnings | 6,422 |

| | 6,437 |

| 6,397 |

| | 6,437 |

|

Treasury stock, 42,825,622 common shares (42,574,625 in 2016), at cost | (2,306 | ) | | (2,284 | ) | |

Treasury stock, 41,446,523 common shares (42,574,625 in 2016), at cost | | (2,293 | ) | | (2,284 | ) |

| Accumulated other comprehensive loss, net of tax | (188 | ) | | (188 | ) | (188 | ) | | (188 | ) |

| Total Tesoro Corporation Stockholders’ Equity | 5,486 |

| | 5,465 |

| |

| Total Andeavor Stockholders’ Equity | | 8,878 |

| | 5,465 |

|

| Noncontrolling Interest | 2,848 |

| | 2,662 |

| 3,545 |

| | 2,662 |

|

| Total Equity | 8,334 |

| | 8,127 |

| 12,423 |

| | 8,127 |

|

| Total Liabilities and Equity | $ | 20,069 |

| | $ | 20,398 |

| $ | 27,029 |

| | $ | 20,398 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

TESORO CORPORATIONANDEAVOR

CONDENSED STATEMENTS OF CONSOLIDATED CASH FLOWS

(Unaudited)

| | | | Three Months Ended March 31, | Six Months Ended June 30, |

| | 2017 | | 2016 | 2017 | | 2016 |

| | (In millions) | (In millions) |

| Cash Flows From (Used In) Operating Activities | | | | | | |

| Net earnings | $ | 87 |

| | $ | 109 |

| $ | 174 |

| | $ | 558 |

|

| Adjustments to reconcile net earnings to net cash from operating activities: | | | | | | |

| Depreciation and amortization expenses | 226 |

| | 212 |

| 466 |

| | 422 |

|

| Lower of cost or market inventory valuation adjustment | — |

| | 147 |

| 209 |

| | (216 | ) |

| Stock-based compensation expense (benefit) | 14 |

| | (3 | ) | |

| Amortization of debt issuance costs and discounts | | 10 |

| | 8 |

|

| Gain on asset disposals and improvements | | (21 | ) | | (12 | ) |

| Stock-based compensation expense | | 34 |

| | 8 |

|

| Deferred income taxes | 38 |

| | — |

| 50 |

| | 91 |

|

| Turnaround and branding charges | (117 | ) | | (133 | ) | (311 | ) | | (226 | ) |

| Equity in earnings of equity method investments, net of distributions | | 13 |

| | 10 |

|

| Other operating activity | 10 |

| | (3 | ) | (6 | ) | | (3 | ) |

| Changes in current assets and current liabilities | (315 | ) | | (22 | ) | (4 | ) | | 22 |

|

| Changes in noncurrent assets and noncurrent liabilities | 157 |

| | (123 | ) | 156 |

| | (34 | ) |

| Net cash from operating activities | 100 |

| | 184 |

| 770 |

| | 628 |

|

| Cash Flows From (Used In) Investing Activities | | | | | | |

| Capital expenditures | (258 | ) | | (217 | ) | (539 | ) | | (426 | ) |

| Acquisitions, net of cash | (672 | ) | | (314 | ) | (938 | ) | | (394 | ) |

| Proceeds from asset sales | | 44 |

| | 18 |

|

| Other investing activities | 1 |

| | (4 | ) | (15 | ) | | (4 | ) |

| Net cash used in investing activities | (929 | ) | | (535 | ) | (1,448 | ) | | (806 | ) |

| Cash Flows From (Used In) Financing Activities | | | | | | |

| Borrowings under revolving credit agreements | 44 |

| | 297 |

| 764 |

| | 600 |

|

| Repayments on revolving credit agreements | (334 | ) | | (67 | ) | (514 | ) | | (666 | ) |

| Proceeds from debt offering | | — |

| | 701 |

|

| Repayments of debt | (3 | ) | | (252 | ) | (1,636 | ) | | (253 | ) |

| Dividend payments | (65 | ) | | (60 | ) | (130 | ) | | (121 | ) |

| Net proceeds from issuance of Tesoro Logistics LP common units | 281 |

| | 5 |

| |

| Distributions by Tesoro Logistics LP to noncontrolling interest | (63 | ) | | (48 | ) | |

| Net proceeds from issuance of Andeavor Logistics LP common units | | 281 |

| | 334 |

|

| Distributions by Andeavor Logistics LP to noncontrolling interest | | (133 | ) | | (98 | ) |

| Purchases of common stock | | (148 | ) | | (100 | ) |

| Taxes paid related to net share settlement of equity awards | (22 | ) | | (20 | ) | (31 | ) | | (24 | ) |

| Other financing activities | (6 | ) | | (7 | ) | (9 | ) | | (16 | ) |

| Net cash used in financing activities | (168 | ) | | (152 | ) | |

| Decrease in Cash and Cash Equivalents | (997 | ) | | (503 | ) | |

| Net cash from (used in) financing activities | | (1,556 | ) | | 357 |

|

| Increase (Decrease) in Cash and Cash Equivalents | | (2,234 | ) | | 179 |

|

| Cash and Cash Equivalents, Beginning of Period | 3,295 |

| | 942 |

| 3,295 |

| | 942 |

|

| Cash and Cash Equivalents, End of Period | $ | 2,298 |

| | $ | 439 |

| $ | 1,061 |

| | $ | 1,121 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

|

| | |

| | | March 31,June 30, 2017 | 5

|

|

| | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | | |

NOTE 1 – BASIS OF PRESENTATION

ORGANIZATION

Effective August 1, 2017, Tesoro Corporation changed its name to Andeavor. As used in this report, the terms “Tesoro,“Andeavor,” the “Company,” “we,” “us” or “our” may refer to Tesoro Corporation,Andeavor, one or more of its consolidated subsidiaries or all of them taken as a whole. The words “we,” “us” or “our” generally include TesoroAndeavor Logistics LP (“TLLP”Andeavor Logistics”) (formerly Tesoro Logistics LP) and Western Refining Logistics, LP (“WNRL”), a publicly tradedpublicly-traded limited partnership,partnerships, and itstheir subsidiaries as consolidated subsidiaries of Tesoro CorporationAndeavor with certain exceptions where there are transactions or obligations between TLLPAndeavor Logistics, WNRL and Tesoro CorporationAndeavor or its other subsidiaries. When used in descriptions

WESTERN REFINING.On June 1, 2017, pursuant to the Agreement and Plan of agreementsMerger, dated as of November 16, 2016 (the “Merger Agreement”), by and transactions, “TLLP”among Western Refining, Inc. (“Western Refining”), the Company, our wholly-owned subsidiaries Tahoe Merger Sub 1, Inc. and Tahoe Merger Sub 2, LLC, Tahoe Merger Sub 1 was merged with and into Western Refining, with Western Refining surviving such merger as a wholly-owned subsidiary of the Company (the “Merger” or the “Partnership” refers“Western Refining Acquisition”). As a result of the Merger, we obtained Western Refining’s 53% ownership interest in WNRL. Thus, these condensed consolidated financial statements reflect the operations, financial position and cash flows associated with Western Refining, WNRL and their related subsidiaries with all intercompany transactions eliminated upon consolidation.

WNRL is a publicly-traded master limited partnership that owns and operates logistic assets consisting of pipeline and gathering, terminalling, storage and transportation assets and provides services to TLLPour Refining segment. The majority of WNRL's logistics assets are integral to the operations of our El Paso, Gallup and its consolidated subsidiaries.St. Paul Park refineries. It also owns a wholesale business that operates primarily in the Southwest United States and includes the operations of several bulk petroleum distribution plants and a fleet of crude oil, asphalt and refined product delivery trucks. It distributes commercial wholesale petroleum products primarily in Arizona, Colorado, Nevada, New Mexico and Texas.

PRINCIPLES OF CONSOLIDATION AND BASIS OF PRESENTATION

PRINCIPLES OF CONSOLIDATION. These interim condensed consolidated financial statements and notes hereto of Tesoro CorporationAndeavor and its subsidiaries have been prepared by management without audit according to the rules and regulations of the Securities and Exchange Commission (“SEC”) and reflect all adjustments that, in the opinion of management, are necessary for a fair presentation of results for the periods presented. Such adjustments are of a normal recurring nature, unless otherwise disclosed. The consolidated balance sheet at December 31, 2016 has been condensed from the audited consolidated financial statements at that date. We prepare our condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). However, certain information and notes normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to the SEC’s rules and regulations. Management believes that the disclosures presented herein are adequate to present the information fairly. The accompanying condensed consolidated financial statements and notes should be read in conjunction with ourthe Andeavor and Western Refining Annual ReportReports on Form 10-K for the year ended December 31, 2016.

BASIS OF PRESENTATION. We are required under U.S. GAAP to make estimates and assumptions that affect the reported amounts and disclosures of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the periods presented. We review our estimates on an ongoing basis. Changes in facts and circumstances may result in revised estimates and actual results could differ from those estimates. The results of operations for any interim period are not necessarily indicative of results for the full year. Certain prior year balances have been aggregated or disaggregated in order to conform to the current year presentation.

ForThe consolidated statements of comprehensive income for the threesix months ended March 31,June 30, 2017 have been omitted, as there was no change to accumulated other comprehensive income. Due to there being no material impactchange to accumulated other comprehensive income for the threesix months ended March 31,June 30, 2017. For the six months ended June 30, 2016, accumulated other comprehensive income decreased $10 million, net of tax, due to the recognition of a settlement loss for one of our executive retirement plans and remeasurement of the pension liability.

CONDENSED CONSOLIDATING FINANCIAL INFORMATION.Andeavor’s senior notes and its revolving credit facility (the “Revolving Credit Facility”) were fully and unconditionally and jointly and severally guaranteed by certain of our subsidiaries. Andeavor Logistics, in which we had a 33%ownership interest as of June 30, 2017, and 2016,other subsidiaries did not guarantee these obligations. Pursuant to the consolidated statementsterms of comprehensive income have been omitted.the Revolving Credit Facility and the indentures governing the Andeavor senior notes, any guarantees on our obligations were subject to release if the Company satisfactorily achieved an investment grade rating from either Moody’s Investors Service or S&P Global Ratings, as the Company already had achieved such rating from Fitch Ratings, Inc. On June 5, 2017, S&P Global Ratings raised its corporate credit and senior unsecured debt rating on the Company to BBB- from BB+, with a stable outlook. As a result, the guarantees of the Andeavor senior notes and Revolving Credit Facility were released upon the discharge of the terms of the Andeavor senior notes and Revolving Credit Facility agreements. The Company is now exempt from disclosing condensed consolidating financial information in accordance with Rule 3-10 of Regulation S-X, as enacted under the Securities Act of 1933.

|

| | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | |

TLLP.VARIABLE INTEREST ENTITIES. Our condensed consolidated financial statements include TLLP, atwo variable interest entity. TLLPentities, Andeavor Logistics and WNRL, which together comprise our Logistics segment. For variable interest entity reporting purposes, we aggregate these entities based on the similarity of their operations. For parenthetical purposes on the consolidated statement of financial position, balances do not include Andeavor’s basis in WNRL. Andeavor Logistics is a publicly traded limited partnership that waswe formed to own, operate, develop and acquire logistics assets. Its assets are integral to the success of Tesoro’sour refining and marketing operations and are used to gather crude oil and natural gas, process natural gas, and distribute, transport and store crude oil and refined products. TLLPAndeavor Logistics provides us and third parties with various terminal distribution, storage, pipeline transportation, natural gas liquids processing, trucking and petroleum-coke handling services under long-term, fee-based commercial agreements, many of which contain minimum volume commitments. We do not provide financial or equity support through any liquidity arrangements or financial guarantees to TLLP.Andeavor Logistics.

Tesoro Logistics GP, LLC (“TLGP”), our wholly-owned subsidiary, serves as the general partner of TLLP.Andeavor Logistics. We held an approximate 33% and 34% interest in TLLPAndeavor Logistics at March 31,June 30, 2017 and December 31, 2016, respectively, including the general partner interest (approximately 2% at both March 31,June 30, 2017 and December 31, 2016) and all of the incentive distribution rights. As the general partner of TLLP,Andeavor Logistics, we have the sole ability to direct the activities of TLLPAndeavor Logistics that most significantly impact its economic performance.performance, and therefore we consolidate Andeavor Logistics. We are also considered to be the primary beneficiary for accounting purposes and are TLLP’sAndeavor Logistics’ largest customer. In the event TLLPAndeavor Logistics incurs a loss, our operating results will reflect TLLP’sAndeavor Logistics’ loss, net of intercompany eliminations. Under our various long-term, fee-based commercial agreements with TLLP,Andeavor Logistics, transactions with us accounted for 48%49% of Andeavor Logistics’ total revenues for both the three and 56%six months ended June 30, 2017, respectively, and 57% of TLLP’sAndeavor Logistics’ total revenues for both the three and six months ended June 30, 2016.

As of June 30, 2017, we owned a 53% interest in WNRL. Western Refining Logistics GP, LLC (“WGP”), our wholly-owned subsidiary, serves as the general partner of WNRL and has the sole ability to direct the activities that most significantly impact WNRL's economic performance, and therefore we consolidate WNRL. All intercompany transactions with WNRL are eliminated upon consolidation. We are WNRL’s primary logistics customer and a significant wholesale customer through our Marketing segment. WNRL generates revenues by charging tariffs and fees for transporting petroleum products and crude oil though its pipelines by charging fees for terminalling refined products and other hydrocarbons, and storing and providing other services at its storage tanks and terminals. Additionally, WNRL sells various finished petroleum products to us and other third-party customers. We accounted for 36% of WNRL’s total revenues for the three months ended March 31,period of June 1, 2017 through June 30, 2017 under our long-term agreements with WNRL. These agreements contain minimum volume commitments. Each agreement has fees that are indexed for inflation and 2016, respectively.provides us with options to renew for two additional five-year terms. In addition to commercial agreements, we are also party to an omnibus agreement with WNRL that among other things provides for reimbursement to us for various general and administrative services provided to WNRL. We are also party to an operational services agreement with WNRL, under which we are reimbursed for personnel services provided by us in support of WNRL's operations of its pipelines, terminals and storage facilities. We do not provide financial or equity support through any liquidity arrangements and/or debt guarantees to WNRL.

DISCONTINUED OPERATIONS. On September 25, 2013, we completed the sale of all of our interest in Tesoro Hawaii, LLC, which operated a 94 thousand barrels per day Hawaii refinery, retail stationssites and associated logistics assets (the “Hawaii Business”). The sale of the Hawaii Business was subject to an earn-out provision based on the annual gross margin (as defined in sale agreement) in the three annual periods beginning with the year ended December 31, 2014 and ending with the year ended December 31, 2016. Additionally, we retained liability for certain regulatory improvements required at the Hawaii refinery and

|

| | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | |

tank replacement efforts at certain retail sites. The results of operations for this business have been presented as discontinued operations in the condensed statements of consolidated operations. There were no revenues and no earnings or loss recorded for the three and six months ended March 31,June 30, 2017 and there were no revenues for the three and six months ended March 31,June 30, 2016. However, we recorded $17 million in pre-tax earnings ($11 million after-tax) primarily related to the earn-out provision of the sale during the six months ended June 30, 2016. No gain or loss was recorded for the three months ended March 31,June 30, 2016. Cash flows used in discontinued operations were $5$6 million for the threesix months ended March 31,June 30, 2017 and $2cash flows from discontinued operations were $12 million for the threesix months ended March 31,June 30, 2016. Unless otherwise noted, the information in the notes to the condensed consolidated financial statements relates to our continuing operations.

WESTERN REFINING. On November 16, 2016, Tesoro entered into an Agreement and Plan of Merger with Western Refining, Inc. (“Western Refining”) and Tesoro’s wholly-owned subsidiaries Tahoe Merger Sub 1, Inc. and Tahoe Merger Sub 2, LLC (the “Merger”). Under the terms of the agreement, Western Refining’s shareholders can elect to receive 0.4350 shares of Tesoro for each share of Western Refining stock they own, or $37.30 in cash per share of Western Refining stock. Elections to receive cash will be subject to proration to the extent they exceed 10,843,042 shares (or approximately $404 million in the aggregate). Stock elections will not be subject to proration. On March 24, 2017, stockholders of both Tesoro and Western Refining voted to approve Tesoro’s expected acquisition of Western Refining. At separate special stockholders’ meetings, Tesoro stockholders approved, among other things, the issuance of shares of Tesoro common stock in connection with the expected acquisition and stockholders of Western Refining approved the adoption of the previously disclosed agreement and plan of merger. Completion of the Merger is subject to the satisfaction or waiver of certain customary closing conditions, including the expiration or termination of the waiting period applicable under the Hart-Scott-Rodino Antitrust Improvements Act of 1976. The aggregate proceeds of the debt financing, together with the available cash of the Company, will be sufficient for the Company to pay the aggregate cash consideration, refinance certain indebtedness of Western Refining and its subsidiaries and pay all related fees and expenses payable in connection with the Merger.

NEW ACCOUNTING STANDARDS AND DISCLOSURES

REVENUE RECOGNITION. In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2014-09, “Revenue from Contracts with Customers” (“ASU 2014-09”) and has since amended the standard with ASU 2015-14, “Revenue from Contracts with Customers: Deferral of the Effective Date”, ASU 2016-08, “Revenue from Contracts with Customers: Principal versus Agent Considerations (Reporting Revenue Gross versus Net)”, ASU 2016-10, “Revenue from Contracts with Customers: Identifying Performance Obligations and Licensing”, and ASU 2016-12, “Revenue from Contracts with Customers: Narrow-Scope Improvements and Practical Expedients”. These standards replace existing revenue recognition rules with a single comprehensive model to use in accounting for revenue arising from contracts with customers. We are required to adopt ASU 2014-09 on January 1, 2018. We preliminarily expect to transition to the new standard under the modified retrospective transition method, whereby a cumulative effect adjustment iswill be recognized upon adoption, if applicable, and the guidance iswill be applied prospectively.

|

| | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) |

We are progressing through our implementation plan and continue to evaluate the impact of the standard’s revenue recognition model on our contracts with customers in the Refining, Marketing, Logistics and TLLPRefining segments along with our business processes, accounting systems, controls and financial statement disclosures. Additionally, we have commenced our assessment of the standard’s impact on Western Refining and WNRL following the Western Refining Acquisition. While we have made substantial progress in our review and documentation of the impact of the standard on our revenue agreements, we continue to assess the impact in certain areas where industry consensus continues to be formed such as agreements with terms that include non-cash consideration tiered pricing structures and other unique considerations. At this time, we are unable to estimate the full impact of the standard until the industry reaches a consensus on certain industry specific issues, especially in relation to the TLLP segment. We do not expect the standard to have a material impact to the amount or timing of revenues recognized for substantially all of our revenue arrangements in the RefiningMarketing and MarketingRefining segments, although we do expect some impact on presentation and disclosures in our financial statements.statements relating to Logistics segment for contracts that include minimum volume commitments with claw back provisions, or where revenue is based on non-cash consideration. In addition, we will make an election to present our Marketing segment revenues net of excise taxes, consistent with our current presentation of Refining and Logistics segment revenues.

INVENTORY.In July 2015, the FASB issued ASU 2015-11, “Inventory: Simplifying the Measurement of Inventory” (“ASU 2015-11”), which simplifies the subsequent measurement of inventories by replacing the lower of cost or market test with a lower of cost and net realizable value test for inventories determined by methods other than last-in-first-out (“LIFO”) and the retail inventory method, which remain subject to existing impairment models. We adopted ASU 2015-11 is effective for the three months ended March 31,as of January 1, 2017, which resulted in changes to how we performedperform our lower of cost or market tests for inventory. These changes did not have an impact on our financial statements.

LEASES. In February 2016, the FASB issued ASU 2016-02, “Leases” (“ASU 2016-02”), which amends existing accounting standards for lease accounting and adds additional disclosures about leasing arrangements. Under the new guidance, lessees are required to recognize right-of-use assets and lease liabilities on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either a financing lease or operating lease, with classification affecting the pattern of expense recognition in the income statement and presentation of cash flows in the statement of cash flows. ASU 2016-02 is effective for

|

| | |

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | | |

annual reporting periods beginning after December 15, 2018, and interim reporting periods within those annual reporting periods. Early adoption is permitted and modified retrospective application is required, however, we do not intend to early adopt the standard. While it is early in our assessment of the impacts from this standard, we expect that the recognition of right-of-use assets and lease liabilities not currently reflected in our balance sheet could have a material impact on total assets and liabilities. Additionally, we expect the presentation changes required for amounts currently reflected in our statement of operations to impact certain financial statement line items. We cannot estimate the impact on our business processes, accounting systems, controls and financial statement disclosures due to the implementation of this standard given the preliminary stage of our assessment.

CREDIT LOSSES.In June 2016, the FASB issued ASU 2016-13, “Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”), which amends guidance on the impairment of financial instruments. The ASU estimatesrequires the estimation of credit losses based on expected losses and provides for a simplified accounting model for purchased financial assets with credit deterioration. ASU 2016-13 is effective for annual reporting periods beginning after December 15, 2019, and interim reporting periods within those annual reporting periods. Early adoption is permitted for annual reporting periods beginning after December 15, 2018. While we are still evaluating the impact of ASU 2016-13, we do not expect the adoption of this standard to have a material impact on our financial statements.

DEFINITION OF A BUSINESS.In January 2017, the FASB issued ASU 2017-01, “Clarifying the Definition of a Business” (“ASU 2017-01”), which revises the definition of a business and assists in the evaluation of when a set of transferred assets and activities is a business. ASU 2017-01 is effective for interim and annual reporting periods beginning after December 15, 2017, and should be applied prospectively. Early adoption is permitted under certain circumstances. At this time, we are evaluating the potential impact of this standard on our financial statements, including the reporting requirements for transactions between entities under common control, and whether we will early adopt this standard in 2017.

GOODWILL.In January 2017, the FASB issued ASU 2017-04, “Simplifying the Test for Goodwill Impairment” (“ASU 2017-04”), which eliminates the second step from the goodwill impairment test that requires goodwill impairments to be measured atas the amount thethat a reporting unit’s carrying amount of goodwill exceeds theexceeded its implied fair value of reporting unit goodwill. Instead, an entity can perform its annual, or interim, goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount with any impairment being limited to the total amount of goodwill allocated to that reporting unit. ASU 2017-04 is effective for interim and annual reporting periods beginning after December 15, 2019 and should be applied on a prospective basis. As permitted under ASU 2017-04, we have elected to early adopt this standard for our 2017 goodwill impairment tests to be performed as of November 1, 2017. The adoption of this standard is not expected to have a material impact on our financial statements.

PENSION AND POSTRETIREMENT COSTS. In March 2017, the FASB issued ASU 2017-07, “Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost” (“ASU 2017-07”), which requires the current service-cost component of net benefit costs to be presented similarly with other current compensation costs for related employees on the condensed statement of consolidated operations. Additionally,operations, and stipulates that only the service cost component of net benefit costs is eligible for capitalization. The Company will present other components of net benefit costs elsewhere on the condensed statement of consolidated operations and stipulates that only the service cost component of net benefit cost is eligible for capitalization.operations. ASU 2017-07 is effective for interim and annual reporting periods beginning after December 15, 2017, with early adoption permitted in the first quarter of 2017 only. The amendments to the presentation of the condensed statement of consolidated operations in this update should be applied retrospectively while the change in capitalized benefit cost is to be applied prospectively. We have evaluated the impact of this standard on our financial statements and determined there will be no impact

|

| | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | |

to net earnings, but it is expected to have an immaterial impact on other line items such as operating income. We have elected not to early adopt and will implement when the standard becomes effective.

SHARE-BASED COMPENSATION. In May 2017, the FASB issued ASU 2017-09, “Compensation - Stock Compensation (Topic 718): Scope of Modification Accounting” (“ASU 2017-09”), which provides guidance about which changes to the terms or conditions of a share-based payment awarded require an entity to apply modification accounting. ASU 2017-09 is effective for interim and annual reporting periods beginning after December 15, 2017, with early adoption permitted. The amendments in ASU 2017-09 are to be applied prospectively to an award modified on or after the adoption date, consequently the impact will be dependent on whether we modify any share-based payment awards and the nature of such modifications. The adoption of this standard is not expected to have a material impact on our financial statements.

NOTE 2 – INVENTORIESACQUISITIONS AND DIVESTITURES

COMPONENTS OF INVENTORIESWESTERN REFINING, INC. ACQUISITION

On June 1, 2017, we completed the Western Refining Acquisition. Under the terms of the Merger Agreement, the shareholders of Western Refining elected cash consideration of $37.30 per share up to the maximum aggregate cash election of $405 million with each remaining Western Refining share being exchanged for 0.4350 shares of the Company. This resulted in the issuance of 42,617,738 of our shares, which was comprised of 39,499,524 newly issued shares of common stock and 3,118,214 shares of treasury stock. Based on our $83.25 per share closing stock price on June 1, 2017, the aggregate value of consideration paid to Western Refining shareholders was $4.0 billion, including approximately $3.6 billion of our stock and approximately $424 million of cash, including cash payable upon accelerated vesting of Western Refining equity awards. The cash portion of the purchase price, along with the settlement of $1.6 billion of certain Western Refining debt and other transaction related costs, was funded using cash on hand and $575 million of funds drawn on the Revolving Credit Facility, the capacity of which increased to $3.0 billion following the Merger.

We accounted for the Western Refining Acquisition using the acquisition method of accounting, which requires, among other things, that assets acquired at their fair values and liabilities assumed be recognized on the balance sheet as of the acquisition date. The purchase price allocation for the Western Refining Acquisition is preliminary and has been allocated based on estimated fair values of the assets acquired and liabilities assumed at the acquisition date, pending the completion of an independent valuation and other information as it becomes available to us. We expect that, as we obtain more information, the preliminary purchase price allocation disclosed below may change. The purchase price allocation adjustments can be made through the end of Andeavor’s measurement period, which is not to exceed one year from the acquisition date.

PRELIMINARY ACQUISITION DATE PURCHASE PRICE ALLOCATION (in millions)

|

| | | | | | | |

| | March 31,

2017 | | December 31,

2016 |

| Domestic crude oil and refined products | $ | 2,219 |

| | $ | 2,099 |

|

| Foreign subsidiary crude oil | 171 |

| | 310 |

|

| Materials and supplies | 153 |

| | 149 |

|

| Oxygenates and by-products | 80 |

| | 81 |

|

| Merchandise | 1 |

| | 1 |

|

| Total Inventories | $ | 2,624 |

| | $ | 2,640 |

|

|

| | | |

| Cash | $ | 159 |

|

| Receivables | 499 |

|

| Inventories | 807 |

|

| Prepayments and Other Current Assets | 213 |

|

| Property, Plant and Equipment (a) | 3,390 |

|

| Goodwill | 3,001 |

|

| Acquired Intangibles | 258 |

|

| Other Noncurrent Assets | 158 |

|

| Accounts Payable | (701 | ) |

| Accrued Liabilities | (326 | ) |

| Current Portion of Long-term Debt | (12 | ) |

| Deferred Income Taxes | (586 | ) |

| Debt | (2,073 | ) |

| Other Noncurrent Liabilities | (88 | ) |

| Noncontrolling Interest | (719 | ) |

| Total purchase price | $ | 3,980 |

|

| |

| (a) | Estimated useful lives ranging from 3 to 28 years have been assumed based on the preliminary valuation. |

GOODWILL. Andeavor evaluated several factors that contributed to the amount of goodwill presented above. These factors include the acquisition of an existing integrated refining, marketing and logistics business located in areas with access to cost-advantaged feedstocks with an assembled workforce that cannot be duplicated at the same costs by a new entrant. Further, the Western Refining Acquisition provides a platform for future growth through operating efficiencies Andeavor expects to gain from the application of best practices across the combined company and an ability to realize synergies from the geographic diversification

|

| | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) |

of Andeavor’s business and rationalization of general and administrative costs. The amount of goodwill by reportable segment is as follows: Refining $1.9 billion, Logistics $1.0 billion and Marketing $84 million. Based on information evaluated to date, we estimate approximately $2.1 billion of the $3.0 billion in goodwill resulting from the tax-free Merger with Western Refining to be non-deductible for tax purposes. As a result of prior acquisitions, Western Refining has tax-deductible goodwill, in which we received carryover basis, providing tax deductibility for an estimated $0.9 billion of the $3.0 billion in goodwill that otherwise would not be deductible.

PROPERTY, PLANT AND EQUIPMENT. The fair value of property, plant and equipment is $3.4 billion. This preliminary fair value is based on a valuation using a combination of the income, cost and market approaches. The useful lives are based on similar assets at Andeavor.

ACQUIRED INTANGIBLE ASSETS. We estimated the fair value of the acquired identifiable intangible assets at $258 million. This fair value is based on a preliminary valuation completed for the business enterprise, along with the related tangible assets, using a combination of the income method, cost method and comparable market transactions. We recognized intangible assets associated with customer relationships, trade names and favorable leases, all of which will be amortized over a definite-life. We also recognized an intangible asset of approximately $38 million related to liquor licenses, which have an indefinite life. We considered the assets' history, accounting by Western Refining, our plans for the continued use and marketing of the assets, and how a market participant would use the assets in determining whether the intangible assets have an indefinite or definite life. We amortize acquired intangibles with finite lives on a straight-line basis over an estimated weighted average useful life of 15years, and we include the amortization in depreciation and amortization expenses on our condensed statement of consolidated operations. The gross carrying value of our finite life intangibles acquired from the Western Refining Acquisition was $220 million and the accumulated amortization was $1 millionas of June 30, 2017. Amortization expense is expected to be approximately $15 million per year for the next five years. We have not yet finalized our valuation estimate and related evaluation of the useful lives; accordingly, future amortization of intangible assets related to customer relationships may be revised.

CONTINGENCIES. We assumed environmental, legal and asset retirement obligation liabilities of approximately $23 million in the Western Refining Acquisition. The fair value of these liabilities is preliminary, pending the completion of an independent valuation and other information as it becomes available to us.

INTERESTS IN WNRL AND MINNESOTA PIPE LINE COMPANY. With the Western Refining Acquisition, we acquired a controlling interest in WNRL. The fair value of the non-controlling interest in WNRL is based on the share price, shares outstanding and the percent of public unitholders of WNRL on June 1, 2017. Additionally, we acquired a 17% common equity interest in Minnesota Pipe Line Company, LLC (“MPL”). We are accounting for our investment in MPL under the equity method of accounting given our ability to exercise significant influence over MPL.

ACQUISITION COSTS. We recognized acquisition costs related to the Western Refining Acquisition of $61 million and $68 million in general and administrative expenses for the three and six months ended June 30, 2017, respectively.Additionally, we recognized $48 million of severance costs, of which $41 million was due to the change of control and $7 million of expected severance and retention payments in future periods. We had $7 million recognized in accrued liabilities remaining to be paid.

WESTERN REFINING REVENUES AND NET EARNINGS. For the period from June 1, 2017 through June 30, 2017, we recognized $831 millionin revenues and $32 millionof netloss related to the business acquired. The net loss for this period includes an allocation of the lower of cost or market adjustment related to Western Refining’s post-Merger operations along with related acquisition and severance costs.

PRO FORMA FINANCIAL INFORMATION. The following unaudited pro forma information combines the historical operations of Tesoro and Western Refining, giving effect to the merger and related transactions as if they had been consummated on January 1, 2016, the beginning of the earliest period presented.

PRO FORMA CONSOLIDATED REVENUES AND CONSOLIDATED NET EARNINGS (in millions)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Revenues | $ | 9,591 |

| | $ | 8,426 |

| | $ | 18,581 |

| | $ | 15,010 |

|

| Net earnings (a) | 215 |

| | 565 |

| | 360 |

| | 637 |

|

| |

| (a) | While many recurring adjustments impact the pro forma figures presented, the increase in pro forma net earnings compared to our net earnings presented on the condensed statements of consolidated operations for both the three months and six months ended June 30, 2017 include a significant non-recurring adjustment removing acquisition and integration costs from 2017 and reflects these costs in the first quarter of 2016, the period the acquisition was assumed to be completed for pro forma purposes. |

|

| | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | |

NORTH DAKOTA GATHERING AND PROCESSING ASSETS ACQUISITION

On January 1, 2017, Andeavor Logistics acquired crude oil, natural gas and produced water gathering systems and two natural gas processing facilities from Whiting Oil and Gas Corporation, GBK Investments, LLC and WBI Energy Midstream, LLC (the "North Dakota Gathering and Processing Assets") for total consideration of approximately $705 million, including payments for working capital adjustments. The replacementNorth Dakota Gathering and Processing Assets include crude oil, natural gas and produced water gathering pipelines, natural gas processing and fractionation capacity in the Sanish and Pronghorn fields of the Williston Basin in North Dakota. This acquisition was immaterial to our condensed consolidated financial statements.

DIVESTITURES

On June 2, 2017, pursuant to our consent decree with the state of Alaska associated with our acquisition of certain terminalling and storage assets in Alaska during 2016, Andeavor Logistics sold one of its existing Alaska products terminals (“Alaska Terminal”). The sale of the Alaska Terminal resulted in a $25 million gain on sale being recognized in our condensed consolidated statement of operations for both the three and six months ended June 30, 2017. The Alaska Terminal divestiture did not have an impact on our Logistics segment’s operations.

NOTE 3 – INVENTORIES

COMPONENTS OF INVENTORIES (in millions)

|

| | | | | | | |

| | June 30,

2017 | | December 31,

2016 |

| Domestic crude oil and refined products (a) | $ | 2,911 |

| | $ | 2,099 |

|

| Foreign subsidiary crude oil (b) | 35 |

| | 310 |

|

| Materials and supplies (a) | 227 |

| | 149 |

|

| Oxygenates and by-products | 62 |

| | 81 |

|

| Merchandise (a) | 49 |

| | 1 |

|

| Less: Lower of cost or market reserve | (209 | ) | | — |

|

| Total Inventories | $ | 3,075 |

| | $ | 2,640 |

|

| |

| (a) | Increase primarily related to Western Refining Acquisition. See Note 2. |

| |

| (b) | In April 2017, our pipeline and storage lease in Panama terminated. |

We recorded a lower of cost or market reserve adjustment of$209 million at June 30, 2017 for our crude oil, refined products, oxygenates and refined productby-product inventories accounted for usingto adjust the LIFO costing method exceeded carrying value by approximately $25 millionof our inventories to reflect replacement costs at March 31, 2017.the reporting date. We reverse any lower of cost or market reserve in the subsequent period because the inventories are sold or used and then perform a complete lower of cost or market assessment of ending inventories at the end of each reporting period to determine if a reserve is required. At December 31, 2016, prior to changes in our lower of cost or market test following the effectiveness of ASU 2015-11, the replacement cost of our crude oil and refined product inventories exceeded carrying value, both in the aggregate, by approximately $107 million.

NOTE 34 – PROPERTY, PLANT AND EQUIPMENT

PROPERTY, PLANT AND EQUIPMENT (in millions)

| | | | March 31,

2017 | | December 31,

2016 | June 30,

2017 | | December 31,

2016 |

Refining | $ | 8,196 |

| | $ | 8,067 |

| $ | 10,169 |

| | $ | 8,067 |

|

| TLLP | 4,645 |

| | 4,059 |

| |

| Logistics (a) | | 6,011 |

| | 4,059 |

|

Marketing | 936 |

| | 934 |

| 1,208 |

| | 934 |

|

| Corporate | 455 |

| | 412 |

| 523 |

| | 412 |

|

| Property, Plant and Equipment, at Cost | 14,232 |

| | 13,472 |

| 17,911 |

| | 13,472 |

|

| Accumulated depreciation | (3,629 | ) | | (3,496 | ) | (3,768 | ) | | (3,496 | ) |

| Property, Plant and Equipment, Net | $ | 10,603 |

| | $ | 9,976 |

| $ | 14,143 |

| | $ | 9,976 |

|

| |

| (a) | Increase primarily related to Western Refining Acquisition. See Note 2. |

|

| | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) |

We capitalize interest as part of the cost of major projects during the construction period. Capitalized interest totaled $10$12 million and $6 million for the three months ended March 31,June 30, 2017 and 2016, respectively, and $22 million and $12 million for the six months ended June 30, 2017 and 2016, respectively, and is recorded as a reduction to net interest and financing costs in our condensed statements of consolidated operations.

NORTH DAKOTA GATHERING AND PROCESSING ASSETS ACQUISITION

On January 1, 2017, TLLP acquired crude oil, natural gas and produced water gathering systems and two natural gas processing facilities from Whiting Oil and Gas Corporation, GBK Investments, LLC and WBI Energy Midstream, LLC (the "North Dakota Gathering and Processing Assets") for total consideration of approximately $705 million, including payments for working capital adjustments. The North Dakota Gathering and Processing Assets include crude oil, natural gas and produced water gathering pipelines, natural gas processing and fractionation capacity in the Sanish and Pronghorn fields of the Williston Basin in North Dakota. This acquisition was immaterial to our condensed consolidated financial statements.

NOTE 45 – DERIVATIVE INSTRUMENTS

In the ordinary course of business, our profit margins, earnings and cash flows are impacted by the timing, direction and overall change in pricing for commodities used throughout our operations. We use non-trading derivative instruments to manage our exposure to the following:

price risks associated with the purchase or sale of feedstocks, refined products and energy supplies related to our refineries, terminals, marketing fuel inventory and customers;

price risks associated with inventories above or below our target levels;

future emission credit requirements; and

exchange rate fluctuations on our purchases of Canadian crude oil.

Our accounting for derivative instruments depends on whether the underlying commodity will be used or sold in the normal course of business. For contracts where the crude oil or refined products are expected to be used or sold in the normal course of business, we apply the normal purchase normal sale exception and follow the accrual method of accounting. All other derivative instruments are recorded at fair value using mark-to-market accounting.

Our derivative instruments can include forward purchase and sale contracts (“Forward Contracts”), exchange-traded futures (“Futures Contracts”), over-the-counter swaps, including those cleared on an exchange (“Swap Contracts”), options (“Options”), and over-the-counter options (“OTC Option Contracts”). Forward Contracts are agreements to buy or sell the commodity at a predetermined price at a specified future date. Futures Contracts are standardized agreements, traded on a futures exchange, to buy or sell the commodity at a predetermined price at a specified future date. Options provide the right, but not the obligation to buy or sell the commodity at a specified price in the future. Swap Contracts and OTC Option Contracts require cash settlement for the commodity based on the difference between a contracted fixed or floating price and the market price on the settlement date. Certain of these contracts require cash collateral to be received or paid if our asset or liability position, respectively, exceeds specified thresholds. We believe that we have minimal credit risk with respect to our counterparties.

|

| | |

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | | |

The following table presents the fair value of our derivative instruments as of March 31,June 30, 2017 and December 31, 2016. The fair value amounts below are presented on a gross basis and do not reflect the netting of asset and liability positions permitted under the terms of our master netting arrangements including cash collateral on deposit with, or received from, brokers. We offset the recognized fair value amounts for multiple derivative instruments executed with the same counterparty in our financial statements when a legal right of offset exists. As a result, the asset and liability amounts below will not agree with the amounts presented in our condensed consolidated balance sheets.

DERIVATIVE ASSETS AND LIABILITIES (in millions)

| | | | | Derivative Assets | | Derivative Liabilities | | Derivative Assets | | Derivative Liabilities |

| | Balance Sheet Location | March 31,

2017 | | December 31,

2016 | | March 31,

2017 | | December 31,

2016 | Balance Sheet Location | June 30,

2017 | | December 31,

2016 | | June 30,

2017 | | December 31,

2016 |

| Commodity Futures Contracts | Prepayments and other current assets | $ | 566 |

| | $ | 821 |

| | $ | 567 |

| | $ | 871 |

| Prepayments and other current assets | $ | 756 |

| | $ | 821 |

| | $ | 724 |

| | $ | 871 |

|

| Commodity Swap Contracts | | Prepayments and other current assets | 15 |

| | 11 |

| | 9 |

| | 13 |

|

| Commodity Swap Contracts | Prepayments and other current assets | 5 |

| | 11 |

| | 6 |

| | 13 |

| Receivables | 5 |

| | — |

| | — |

| | — |

|

| Commodity Swap Contracts | Accounts payable | — |

| | — |

| | — |

| | 2 |

| Payables | — |

| | — |

| | 1 |

| | 2 |

|

| Commodity Options Contracts | Prepayments and other current assets | — |

| | 1 |

| | — |

| | — |

| Prepayments and other current assets | — |

| | 1 |

| | — |

| | — |

|

| Commodity Forward Contracts | Receivables | 2 |

| | 6 |

| | — |

| | — |

| Receivables | 8 |

| | 6 |

| | — |

| | — |

|

| Commodity Forward Contracts | Accounts payable | — |

| | — |

| | 2 |

| | 2 |

| Accounts payable | — |

| | — |

| | 5 |

| | 2 |

|

| Total Gross Mark-to-Market Derivatives | Total Gross Mark-to-Market Derivatives | 573 |

| | 839 |

| | 575 |

| | 888 |

| Total Gross Mark-to-Market Derivatives | 784 |

| | 839 |

| | 739 |

| | 888 |

|

| Less: Counterparty Netting and Cash Collateral (a) | Less: Counterparty Netting and Cash Collateral (a) | (533 | ) | | (744 | ) | | (565 | ) | | (832 | ) | Less: Counterparty Netting and Cash Collateral (a) | (731 | ) | | (744 | ) | | (725 | ) | | (832 | ) |

| Total Net Fair Value of Derivatives | Total Net Fair Value of Derivatives | $ | 40 |

| | $ | 95 |

| | $ | 10 |

| | $ | 56 |

| Total Net Fair Value of Derivatives | $ | 53 |

| | $ | 95 |

| | $ | 14 |

| | $ | 56 |

|

| |

| (a) | Certain of our derivative contracts, under master netting arrangements, include both asset and liability positions. We offset both the fair value amounts and any related cash collateral amounts recognized for multiple derivative instruments executed with the same counterparty when there is a legally enforceable right and an intention to settle net or simultaneously. As of March 31,June 30, 2017 and December 31, 2016, weour counterparties had provided cash collateral amounts of $32 million and $88 million, respectively, related to our unrealized derivative positions. Cash collateral amounts are netted with mark-to-market derivative assets. |

|

| | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | |

provided cash collateral of $6 million related to our unrealized derivative positions. As of December 31, 2016, we had provided cash collateral amounts of $88 million related to our unrealized derivative positions. Cash collateral amounts are netted with mark-to-market derivative assets.

GAINS (LOSSES) ON MARK-TO-MARKET DERIVATIVES (in millions)

| | | | Three Months Ended March 31, | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2017 | | 2016 | 2017 | | 2016 | | 2017 | | 2016 |

| Commodity Contracts | $ | 28 |

| | $ | 38 |

| $ | 92 |

| | $ | (82 | ) | | $ | 120 |

| | $ | (44 | ) |

| Foreign Currency Forward Contracts | — |

| | 1 |

| — |

| | — |

| | — |

| | 1 |

|

| Total Gain on Mark-to-Market Derivatives | $ | 28 |

| | $ | 39 |

| |

| Total Gain (Loss) on Mark-to-Market Derivatives | | $ | 92 |

| | $ | (82 | ) | | $ | 120 |

| | $ | (43 | ) |

INCOME STATEMENT LOCATION OF GAINS (LOSSES) ON MARK-TO-MARKET DERIVATIVES (in millions)

| | | | Three Months Ended March 31, | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2017 | | 2016 | 2017 | | 2016 | | 2017 | | 2016 |

| Revenues | $ | 8 |

| | $ | 15 |

| $ | 1 |

| | $ | (20 | ) | | $ | 9 |

| | $ | (5 | ) |

| Cost of sales | 20 |

| | 23 |

| 91 |

| | (62 | ) | | 111 |

| | (39 | ) |

| Other income, net | — |

| | 1 |

| — |

| | — |

| | — |

| | 1 |

|

| Total Gain on Mark-to-Market Derivatives | $ | 28 |

| | $ | 39 |

| |

| Total Gain (Loss) on Mark-to-Market Derivatives | | $ | 92 |

| | $ | (82 | ) | | $ | 120 |

| | $ | (43 | ) |

|

| | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | |

OPEN LONG (SHORT) POSITIONS

OUTSTANDING COMMODITY AND OTHER CONTRACTS (units in thousands)

| | | | Contract Volumes by Year of Maturity | | Unit of Measure | Contract Volumes by Year of Maturity | | Unit of Measure |

| Mark-to-Market Derivative Instrument | 2017 | | 2018 | | 2019 | | 2017 | | 2018 | | 2019 | |

| Crude oil, refined products and blending products: | | |

| Futures Contracts - short | (3,687) | | (785) | | — | | Barrels | |

| Swap Contracts - long | — | | 990 | | — | | Barrels | 3,931 | | 367 | | — | | Barrels |

| Swap Contracts - short | (853) | | — | | — | | Barrels | |

| Forward Contracts - Long | 394 | | — | | — | | Barrels | |

| Futures Contracts - long | | 7,193 | | 864 | | — | | Barrels |

| Options - short | | (274) | | — | | — | | Barrels |

| Forward Contracts - long | | 2,045 | | — | | — | | Barrels |

| Carbon emissions credits: | | |

| Futures Contracts - long | 1,000 | | — | | — | | Tons | 50 | | — | | — | | Tons |

| Corn: | | |

| Futures Contracts - short | (145) | | — | | — | | Bushels | |

| Futures Contracts - long | | 545 | | 20 | | — | | Bushels |

At March 31,June 30, 2017, we had open Forward Contracts to purchase CAD $14$5 million that were settled on AprilJuly 24, 2017.

NOTE 56 – FAIR VALUE MEASUREMENTS

We classify financial assets and liabilities according to the fair value hierarchy. Financial assets and liabilities classified as level 1 instruments are valued using quoted prices in active markets for identical assets and liabilities. Level 2 instruments are valued using quoted prices for similar assets and liabilities in active markets, and inputs other than quoted prices, such as liquidity, that are observable for the asset or liability. Our level 2 instruments include derivatives valued using market quotations from independent price reporting agencies, third-party brokers and commodity exchange price curves that are corroborated with market data. Level 3 instruments are valued using significant unobservable inputs that are not supported by sufficient market activity. We do not have any financial assets or liabilities classified as level 3 at March 31,June 30, 2017 or December 31, 2016.

Our financial assets and liabilities measured at fair value on a recurring basis include derivative instruments. Additionally, our financial liabilities include obligations for Renewable Identification Numbers (“RINs”) and cap-and-trade emission credits for the state of California (together with RINs, our “Environmental Credit Obligations”). See Note 45 for further information on our derivative instruments. Amounts presented below for Environmental Credit Obligations represent the estimated fair value amount at each balance sheet date for which we do not have sufficient RINs and California cap-and-trade credits to satisfy our obligations to the U.S. Environmental Protection Agency (“EPA”) and the state of California, respectively.

FINANCIAL ASSETS AND LIABILITIES AT FAIR VALUE (in millions)

|

| | | | | | | | | | | | | | | | | | | |

| | March 31, 2017 |

| | Level 1 | | Level 2 | | Level 3 | | Netting and Collateral (a) | | Total |

| Assets: | | | | | | | | | |

| Commodity Futures Contracts | $ | 562 |

| | $ | 4 |

| | $ | — |

| | $ | (528 | ) | | $ | 38 |

|

| Commodity Swap Contracts | — |

| | 5 |

| | — |

| | (5 | ) | | — |

|

| Commodity Forward Contracts | — |

| | 2 |

| | — |

| | — |

| | 2 |

|

| Total Assets | $ | 562 |

| | $ | 11 |

| | $ | — |

| | $ | (533 | ) | | $ | 40 |

|

| | | | | | | | | | |

| Liabilities: | | | | | | | | | |

| Commodity Futures Contracts | $ | 567 |

| | $ | — |

| | $ | — |

| | $ | (560 | ) | | $ | 7 |

|

| Commodity Swap Contracts | — |

| | 6 |

| | — |

| | (5 | ) | | 1 |

|

| Commodity Forward Contracts | — |

| | 2 |

| | — |

| | — |

| | 2 |

|

| Environmental Credit Obligations | — |

| | 199 |

| | — |

| | — |

| | 199 |

|

| Total Liabilities | $ | 567 |

| | $ | 207 |

| | $ | — |

| | $ | (565 | ) | | $ | 209 |

|

|

| | |

| | | March 31,June 30, 2017 | 1113

|

|

| | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | | |

FINANCIAL ASSETS AND LIABILITIES AT FAIR VALUE (in millions)

|

| | | | | | | | | | | | | | | | | | | |

| | June 30, 2017 |

| | Level 1 | | Level 2 | | Level 3 | | Netting and Collateral (a) | | Total |

| Assets: | | | | | | | | | |

| Commodity Futures Contracts | $ | 751 |

| | $ | 5 |

| | $ | — |

| | $ | (722 | ) | | $ | 34 |

|

| Commodity Swap Contracts | — |

| | 20 |

| | — |

| | (9 | ) | | 11 |

|

| Commodity Forward Contracts | — |

| | 8 |

| | — |

| | — |

| | 8 |

|

| Total Assets | $ | 751 |

| | $ | 33 |

| | $ | — |

| | $ | (731 | ) | | $ | 53 |

|

| | | | | | | | | | |

| Liabilities: | | | | | | | | | |

| Commodity Futures Contracts | $ | 723 |

| | $ | 1 |

| | $ | — |

| | $ | (716 | ) | | $ | 8 |

|

| Commodity Swap Contracts | — |

| | 10 |

| | — |

| | (9 | ) | | 1 |

|

| Commodity Forward Contracts | — |

| | 5 |

| | — |

| | — |

| | 5 |

|

| Environmental Credit Obligations | — |

| | 217 |

| | — |

| | — |

| | 217 |

|

| Total Liabilities | $ | 723 |

| | $ | 233 |

| | $ | — |

| | $ | (725 | ) | | $ | 231 |

|

|

| | | | | | | | | | | | | | | | | | | |

| | December 31, 2016 |

| | Level 1 | | Level 2 | | Level 3 | | Netting and Collateral (a) | | Total |

| Assets: | | | | | | | | | |

| Commodity Futures Contracts | $ | 821 |

| | $ | — |

| | $ | — |

| | $ | (733 | ) | | $ | 88 |

|

| Commodity Swap Contracts | — |

| | 11 |

| | — |

| | (11 | ) | | — |

|

| Commodity Options Contracts | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

| Commodity Forward Contracts | — |

| | 6 |

| | — |

| | — |

| | 6 |

|

| Total Assets | $ | 822 |

| | $ | 17 |

| | $ | — |

| | $ | (744 | ) | | $ | 95 |

|

| | | | | | | | | | |

| Liabilities: | | | | | | | | | |

| Commodity Futures Contracts | $ | 870 |

| | $ | 1 |

| | $ | — |

| | $ | (821 | ) | | $ | 50 |

|

| Commodity Swap Contracts | — |

| | 15 |

| | — |

| | (11 | ) | | 4 |

|

| Commodity Forward Contracts | — |

| | 2 |

| | — |

| | — |

| | 2 |

|

| Environmental Credit Obligations | — |

| | 79 |

| | — |

| | — |

| | 79 |

|

| Total Liabilities | $ | 870 |

| | $ | 97 |

| | $ | — |

| | $ | (832 | ) | | $ | 135 |

|

| |

| (a) | Certain of our derivative contracts, under master netting arrangements, include both asset and liability positions. We offset both the fair value amounts and any related cash collateral amounts recognized for multiple derivative instruments executed with the same counterparty when there is a legally enforceable right and an intention to settle net or simultaneously. As of March 31,June 30, 2017, and our counterparties had provided cash collateral of $6 million related to our unrealized derivative positions. As of December 31, 2016, we had provided cash collateral amounts of $32$88 million and $88 million, respectively, related to our unrealized derivative positions. Cash collateral amounts are netted with mark-to-market derivative assets. |

We believe the carrying value of our other financial instruments, including cash and cash equivalents, receivables, accounts payable and certain accrued liabilities approximate fair value. Our fair value assessment incorporates a variety of considerations, including the short-term duration of the instruments and the expected continued insignificance of bad debt expense, which includes an evaluation of counterparty credit risk. The borrowings under our Revolving Credit Facility, the Tesoro Corporation revolving credit facility (the “Revolving Credit Facility”), the TLLPAndeavor Logistics senior secured revolving credit agreement (the “TLLP“Andeavor Logistics Revolving Credit Facility”), the secured Andeavor Logistics drop down credit facility (the “Andeavor Logistics Dropdown Credit Facility”) and the secured TLLP drop downWNRL revolving credit facility (the “TLLP Dropdown“WNRL Revolving Credit Facility”), which include variable interest rates, approximate fair value. The fair value of our fixed rate debt is based on prices from recent trade activity and is categorized in level 2 of the fair value hierarchy. The carrying value and fair value of our debt were approximately $6.7$7.7 billionand $7.0$8.1 billion as of March 31,June 30, 2017, respectively, and $7.0 billion and $7.3 billion at December 31, 2016, respectively. These carrying and fair values of our debt do not consider the unamortized issuance costs, which are netted against our total debt.

NOTE 6 – DEBT

DEBT BALANCE, NET OF UNAMORTIZED ISSUANCE COSTS (in millions)

|

| | | | | | | |

| | March 31,

2017 | | December 31,

2016 |

| Total debt (a) | $ | 6,749 |

| | $ | 7,042 |

|

| Unamortized issuance costs | (106 | ) | | (109 | ) |

| Current maturities | (465 | ) | | (465 | ) |

| Debt, Net of Current Maturities and Unamortized Issuance Costs | $ | 6,178 |

| | $ | 6,468 |

|

| |

(a) | Total debt related to TLLP, which is non-recourse to Tesoro, except for TLGP, was $3.8 billion and $4.1 billion at March 31, 2017 and December 31, 2016, respectively.

|

|

| | |

1214 | Tesoro Corporation

| | |

|

| | |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | |

CREDIT FACILITIESNOTE 7 – DEBT

DEBT BALANCE, NET OF CURRENT MATURITIES AND UNAMORTIZED ISSUANCE COSTS (in millions)

|

| | | | | | | |

| | June 30,

2017 | | December 31,

2016 |

| Total debt (a) | $ | 7,715 |

| | $ | 7,042 |

|

| Unamortized issuance costs and premiums (b) | (73 | ) | | (109 | ) |

| Current maturities | (478 | ) | | (465 | ) |

| Debt, Net of Current Maturities and Unamortized Issuance Costs (c) | $ | 7,164 |

| | $ | 6,468 |

|

| |

| (a) | Total debt related to Andeavor Logistics, which is non-recourse to Andeavor, except for TLGP, was $3.8 billion and $4.1 billion at June 30, 2017 and December 31, 2016, respectively. Total debt related to WNRL, which is non-recourse to Andeavor, except for WGP, was $320 million at June 30, 2017. |

| |

| (b) | Includes premium of $26 million related to the incremental fair value of the WNRL Revolving Credit Facility upon acquisition. |

| |

| (c) | Increase primarily related to borrowings on our Revolving Credit Facility for the Western Refining Acquisition and WNRL’s outstanding debt. See Note 2. |

AVAILABLE CAPACITY UNDER CREDIT FACILITIES (in millions)

|

| | | | | | | | | | | | | | | | | |

| | Total Capacity | | Amount Borrowed as of March 31, 2017 | | Outstanding Letters of Credit | | Available Capacity | | Expiration |

| Tesoro Corporation Revolving Credit Facility (a) | $ | 2,000 |

| | $ | — |

| | $ | 4 |

| | $ | 1,996 |

| | September 30, 2020 |

| TLLP Revolving Credit Facility (b) | 600 |

| | 40 |

| | — |

| | 560 |

| | January 29, 2021 |

| TLLP Dropdown Credit Facility | 1,000 |

| | — |

| | — |

| | 1,000 |

| | January 29, 2021 |

| Letter of Credit Facilities | 975 |

| | — |

| | — |

| | 975 |

| | |

| Total Credit Facilities | $ | 4,575 |

| | $ | 40 |

| | $ | 4 |

| | $ | 4,531 |

| | |

|

| | | | | | | | | | | | | | | | | | | | |

| | Total Capacity | | Amount Borrowed as of June 30, 2017 | | Outstanding Letters of Credit | | Available Capacity | | Weighted Average Interest Rate | | Expiration |

| Andeavor Revolving Credit Facility (a) | $ | 3,000 |

| | $ | 575 |

| | $ | 46 |

| | $ | 2,379 |

| | 2.56 | % | | September 30, 2020 |

| Andeavor Logistics Revolving Credit Facility | 600 |

| | 50 |

| | — |

| | 550 |

| | 3.31 | % | | January 29, 2021 |

| Andeavor Logistics Dropdown Credit Facility | 1,000 |

| | — |

| | — |

| | 1,000 |

| | — | % | | January 29, 2021 |

| WNRL Revolving Credit Facility | 500 |

| | 20 |

| | 1 |

| | 479 |

| | 3.08 | % | | October 16, 2018 |

| Letter of Credit Facilities | 975 |

| | — |