UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||

| For the quarterly period ended | March 28, 2020 | ||

Or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the transition period from to | ||

Commission File Number 000-06217

INTEL CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 94-1672743 | |||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

| 2200 Mission College Boulevard, | Santa Clara, | California | 95054-1549 | |

| (Address of principal executive offices) | (Zip Code) | |||

(408) 765-8080

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value | INTC | Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ☑ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ☑ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | Accelerated filer | Non-accelerated filer | Smaller reporting company | Emerging growth company |

| ☑ | ¨ | ☐ | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨☐ No þ☑

TABLE OF CONTENTS

THE ORGANIZATION OF OUR QUARTERLY REPORT ON FORM 10-Q

The order and presentation of content in our Form 10-Q differs from the Registrant’s common stock:traditional SEC Form 10-Q format. Our format is designed to improve readability and better presents how we organize and manage our business. See "Form 10-Q Cross-Reference Index" within Other Key Information for a cross-reference index to the traditional SEC Form 10-Q format. To reflect our focus on transforming from a PC-centric1 company to a data-centric company, we have presented our data-centric businesses1 first in the "Segment Trends and Results" within MD&A.

We have defined certain terms and abbreviations used throughout our Form 10-Q in "Key Terms" within the Consolidated Condensed Financial Statements and Supplemental Details.

The preparation of our Consolidated Condensed Financial Statements is in conformity with U.S. GAAP. Our Form 10-Q includes key metrics that we use to measure our business, some of which are non-GAAP measures. See "Non-GAAP Financial Measures" within MD&A for an explanation of these measures and why management uses them and believes they provide investors with useful supplemental information.

| Page | ||||

| FORWARD-LOOKING STATEMENTS | ||||

| OUR PANDEMIC RESPONSE | ||||

| CONSOLIDATED CONDENSED FINANCIAL STATEMENTS AND SUPPLEMENTAL DETAILS | ||||

| Consolidated Condensed Statements of Income | ||||

| Consolidated Condensed Statements of Comprehensive Income | ||||

| Consolidated Condensed Balance Sheets | ||||

| Consolidated Condensed Statements of Cash Flows | ||||

| Consolidated Condensed Statements of Stockholders' Equity | ||||

| Notes to Consolidated Condensed Financial Statements | ||||

| Key Terms | ||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS | ||||

| Segment Trends and | ||||

| Consolidated Results of Operations | ||||

| Liquidity and Capital Resources | ||||

| Contractual Obligations | ||||

| Quantitative and Qualitative Disclosures | ||||

| Non-GAAP Financial Measures | ||||

| OTHER KEY INFORMATION | ||||

| Risk Factors | ||||

| Controls and Procedures | ||||

| Issuer Purchases of Equity Securities | ||||

| Form 10-Q Cross-Reference Index | ||||

1 | Intel's definition is included in "Key Terms" within the Consolidated Condensed Financial Statements and Supplemental Details. |

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements that involve a number of risks and uncertainties. Words such as "anticipates,"anticipate," "expects,"expect," "intends,"intend," "goals,"pledge," "committed," "plans," "opportunities," "future," "believes," "seeks,"target," "on-track," "estimates," "continues,"continue," "likely," "may," "will," “would,”"would," "should," “could,”"could," and variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to future responses to and effects of COVID-19; projections of our future financial performance and demand; our anticipated growth and trends in our businesses or operations; projected growth and trends in markets relevant to our businesses; future products and technology and the expected availability and benefits of such products and technology; expectations regarding construction projects; expected timing and impact of acquisitions, divestitures, and other significant transactions; expected completion of restructuring activities; availability, uses, sufficiency, and cost of capital and capital resources, including expected returns to stockholders such as dividends and share repurchases; accounting estimates and judgments regarding reported matters, events and contingencies and the actual results thereof; future production capacity and product supply, uncertain events or assumptions, and other characterizations of future events or circumstances are forward-looking statements. Such statements are based on management's expectations as of the date of this filing and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include those described throughout this report and our Annual Report on Form 10-K for the year ended December 31, 2016,28, 2019, particularly the "Risk Factors" sections of such reports. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Readers are urged to carefully review and consider the various disclosures made in this Form 10-Q and in other documents we file from time to time with the Securities and Exchange CommissionSEC that disclose risks and uncertainties that may affect our business. TheUnless specifically indicated otherwise, the forward-looking statements in this Form 10-Q do not reflect the potential impact of any divestitures, mergers, acquisitions, or other business combinations that hadhave not been completed as of October 26, 2017.the date of this filing. In addition, the forward-looking statements in this Form 10-Q are made as of the date of this filing, including expectations based on third-party information and projections that management believes to be reputable, and Intel does not undertake, and expressly disclaims any duty, to update such statements, whether as a result of new information, new developments, or otherwise, except to the extent that disclosure may be required by law.

Intel, the Intel logo, 3D XPoint, Intel Atom, Intel Core, Intel Optane, and Xeon, are trademarks of Intel Corporation or its subsidiaries in the U.S. and/or other countries.

* Other names and brands may be claimed as the property of others.

| 1 | |

| OUR PANDEMIC RESPONSE |

Our top priority during the COVID-19 pandemic is protecting the health and safety of our employees. As governments institute new restrictions on commercial operations, we are working to ensure our compliance while also maintaining business continuity for essential operations in our factories. At this time, our factories continue to operate around the world in accordance with guidance issued by local and national government authorities. We remain open as we support our employees who work in labs and factories critical to our world’s digital infrastructure.

For the first three months of 2020 we observed strong notebook platform demand driven by the increase in working and learning from home and saw continued strength in data center demand as cloud service providers increased capacity. However, weakness in the industrial and retail verticals drove weaker demand in our IOTG business.

Our technology runs most of the world’s internet, communications, and government digital infrastructures, and our products and capabilities are delivering vital computing power for medical research, robotics for assisted patient care, and artificial intelligence and data analytics for public health. Our platforms that support telemedicine have also taken on greater importance since the outbreak of COVID-19 as hospitals and healthcare workers scale to meet the increasing demand for care. The PCs and networking technologies that we and our customers deliver are supporting the unprecedented volume of remote workers and enabling personal connections while social distancing.

We are focused on protecting the health and safety of our employees and we continue to operate to deliver for our customers while contributing to our communities.

OUR EMPLOYEES

Intel’s Pandemic Leadership Team, established more than 15 years ago to improve Intel’s crisis management response capability, is deeply engaged to keep our employees safe. This specialized team includes medical and safety experts who work to safeguard the well-being of employees and minimize the spread of infection. They also collaborate with local governments and public health organizations and implement their recommendations. In the past, the team has successfully helped us manage through global health issues such as bird flu, SARS, Ebola, Zika, and the H1N1 virus.

Working-from-home and social distancing policies. As we navigate through the effects of the COVID-19 pandemic we are working to ensure compliance with orders and restrictions imposed by government authorities. We have significantly reduced the number of people in our offices, helping to protect our employees who work in our labs and factories and who are essential to keeping our business running. Maintaining safe facilities is core to how we operate, and we are implementing additional practices in our fabs and assembly test plants so manufacturing employees can safely continue performing critical work on site. In addition to increased cleaning of our facilities, our manufacturing sites are taking extra steps to effectively implement social distancing. Some of these measures include staggering shift changes, adjusting meeting locations and schedules, limiting activities that require close proximity, and making thermometers and masks available (in addition to the normal protective gear worn by many factory employees). At our construction sites, we are working closely with our general contractors to implement social distancing, increased cleaning, and other protocols to safeguard the health of all workers on site.

Compensation and expanded benefits. We are investing more than $100 million in additional benefits to aid and support employees, including special recognition for employees that have been working on-site and healthcare coverage changes under the U.S. Coronavirus Aid, Relief, and Economic Security Act (CARES Act).

Employees and contractors asked to work from home or self-quarantine due to travel restrictions will be paid their regular pay, and Intel will reimburse up to 30 days of care services for employees who need backup childcare and/or elder care in the case where there are school or care center closures or if an employee or family member is required to be self-quarantined.

To aid in the overall well-being of our employees, we also have our existing global Employee Assistance Plan that provides confidential counseling and work-life services to employees and immediate family members.

OUR CUSTOMERS

We are in the midst of what is likely a historic deployment of remote work and digital access to services. We are committed to our customers to enable the support they need to continue providing vital services, tools, and infrastructure to millions.

Operations. Our factories continue to operate world-wide in compliance with the orders and restrictions imposed by government authorities in each of our locations, and we are working with our customers to meet their specific shipment needs. Our world-class safety standards have to date allowed our factories to continue to operate safely and with mostly on-time deliveries. We only allow employees in our factories who are essential to the factories’ operations. By design, our “cleanrooms” and factories are among the cleanest places in the world. While most of our construction projects have remained operational, we temporarily paused a few projects due to local government restrictions at a small number of our sites. We currently expect these interruptions to have minimal impact on our product ramps and do not expect them to impact our process technology transition timelines. We remain on-track to add sufficient wafer capacity this year to meet anticipated market demand and restore our PC unit inventory levels.

OUR PANDEMIC RESPONSE OUR PANDEMIC RESPONSE | 2 | |

Supply chain. Our employees and partners around the world have collaborated and leveraged lessons learned—in recent months and from past challenges—to safely keep the global tech supply chain functioning. Our Pandemic Leadership Team is at the center of these efforts and through our Business Continuity Program we perform ongoing work with our suppliers to review their preparations to handle sudden disruptions to the supply chain. We have taken several actions throughout the pandemic to address our supply chain. For example:

Where feasible and practicable, we increased inventory of raw materials as well as our supply of our finished goods coming out of China in early February. It is our practice to plan for scenarios where supply will be restricted or compromised in our supply chain for 30-60 days or more.

We activated backup planning to reroute and obtain charter flights if needed into and from China, securing capacity early. As the virus spread, we leveraged the successful methodology used in China for other parts of Asia and Europe.

We evaluated the end-to-end supply line needs for all products ramping this year, worked on securing supply lines and deployed our business continuity plans to mitigate potential risks.

We are working with governments around the world to confirm our compliance with local requirements for continued operation as an essential business. We have also worked closely with our suppliers to help protect their employees' health and safety, to provide supplier assistance to mitigate supply disruptions, and to clarify our continued expectations for labor practices and human rights in line with the Responsible Business Alliance Code of Conduct.

OUR COMMUNITY

Intel has a longstanding commitment to support the local communities where we operate and to create a better world through the power of our technology. We have committed over $60 million to accelerate access to technology needed to combat the crisis and to support the needs of frontline healthcare workers and people in our local communities. We've also been inspired by our employees who have proposed innovative ideas for how we can apply our resources and technology to support our stakeholders throughout this crisis.

Using our technology to help. In April, we pledged $50 million in a Pandemic Response Technology Initiative to combat COVID-19 through accelerating access to technology at the point of patient care, speeding scientific research, and ensuring access to online learning for students. A portion of this amount has been allocated to an additional innovation fund that supports requests from external partners and employee-led relief projects where access to Intel expertise and resources can have immediate impact. This initiative builds on prior announcements of $10 million in donations that are supporting local communities during this critical time.

We are providing access to our intellectual property and partnering with customers to put technology to work towards understanding and fighting COVID-19. For example:

We are giving COVID-19 scientists and researchers free access to our worldwide intellectual property portfolio. We will continue to invent—and protect—our intellectual property, but we offer it freely to those working to protect people from this pandemic.

We are teaming with Lenovo and BGI Genomics to accelerate the analysis of genomic characteristics of COVID-19. Our combined work will further advance the capabilities of BGI’s sequencing tools to help scientists investigate transmission patterns of the virus and create better diagnostic methods.

We are deploying Intel platform-based robots in hospitals to protect doctors and nurses by transporting medical supplies and surgical equipment to reduce human-to-human interactions.

We are working with Dyson and medical consultancy firm TTP to supply FPGAs for CoVent, a new ventilator specifically designed in response to the U.K. government’s request for help.

We are collaborating with Medtronic to add remote monitoring capabilities to their PB980 ventilator, which helps reduce exposure for healthcare providers treating COVID-19 patients.

Philanthropic efforts. We are also committed to providing monetary and non-monetary support to our communities. For example:

We committed a $1 million donation to the International Red Cross to support global relief efforts for the COVID-19 pandemic.

We announced the Intel Foundation is providing $4 million to support COVID-19 relief efforts in communities where we have significant presence. The foundation also offered a special monetary matching opportunity for every regular full-time and part-time employee and U.S. Intel retiree up to a total of $2 million for relief efforts around major Intel sites.

We donated more than 1 million items of personal protective equipment—masks, gloves, and other gear—to healthcare workers that were sourced from our factory stock and emergency supplies.

We also joined the global XPRIZE Pandemic Alliance along with other companies to fuel collaboration on solutions through shared innovation to effectively address the immediate needs of the crisis.

OUR PANDEMIC RESPONSE OUR PANDEMIC RESPONSE | 3 | |

MOVING FORWARD

There is uncertainty around the impacts the pandemic will have on our business and the additional measures that may be necessary going forward. We will continue to actively monitor the situation, including the status of our workforce and factories, supply chain, and customers, suppliers, and vendors, to determine the appropriate actions to protect the health and safety of our employees and our ongoing operations for our customers. This includes actions informed by the requirements and recommendations of the federal, state or local authorities.

Economic and demand uncertainty in the current environment may impact our future results. We continue to assess how the effects of COVID-19 on the economy may offset the immediate catalysts from more remote work and learning, and we recognize that our operations could be disrupted if our employees working in our fabs and factories contract the virus. We expect continued strength from cloud service providers and communications service providers in the second quarter of 2020, and anticipate enterprise and government demand to weaken in the second half of 2020. We also expect lower demand in IOTG and Mobileye for the rest of the year. As global GDP estimates are revised down, we expect PC TAM to decline in the second half of the year. We remain focused on cash flow management, including careful management of operating expenses, capital expenditures, and working capital.

OUR PANDEMIC RESPONSE OUR PANDEMIC RESPONSE | 4 | |

| A QUARTER IN REVIEW |

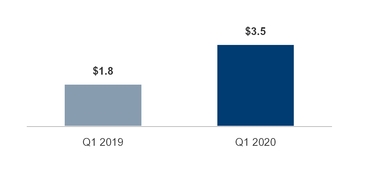

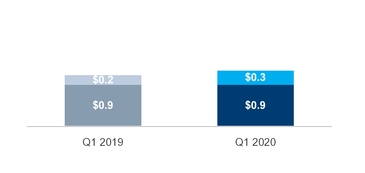

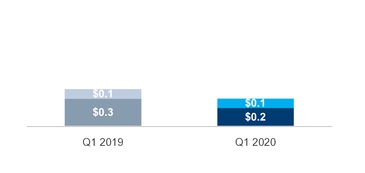

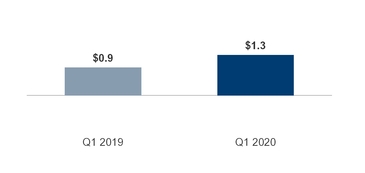

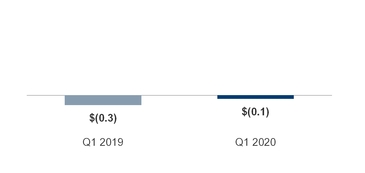

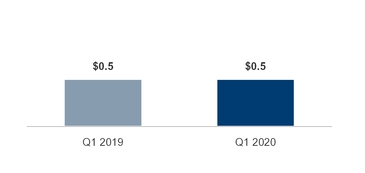

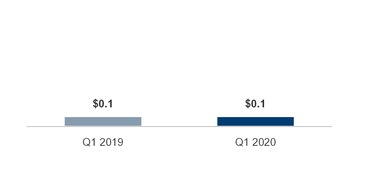

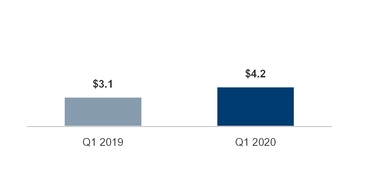

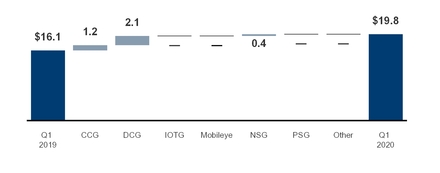

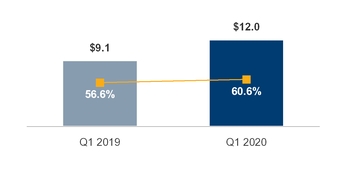

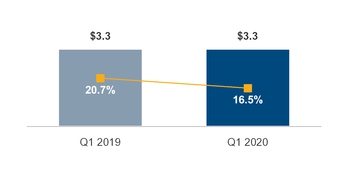

Total revenue of $19.8 billion was up $3.8 billion year over year as our data-centric businesses and PC-centric business grew by 34% and 14% respectively. Data-centric revenue was up, driven by growth across all DCG business market segments, strong mix of high-performance Intel® Xeon® processors, NSG bit growth, and improved NAND pricing. Our PC-centric business was up, driven by notebook platform1 volume strength and higher modem sales. Increased platform unit sales, ASP strength, and lower period charges resulted in higher gross margins and operating income, partially offset by higher platform unit cost. In the first three months we generated $6.2 billion of cash flow from operations and returned $5.6 billion to stockholders, including $1.4 billion in dividends and $4.2 billion in buybacks.

| REVENUE | OPERATING INCOME | DILUTED EPS | CASH FLOWS | |||

■PC-CENTRIC $B ■DATA-CENTRIC $B | ■ GAAP $B■NON-GAAP $B | ■ GAAP■NON-GAAP | ■OPERATING CASH FLOW$B ■FREE CASH FLOW $B | |||

| $19.8B | $7.0B | $7.5B | $1.31 | $1.45 | $6.2B | $2.9B | ||||||||

| GAAP | GAAP | non-GAAP2 | GAAP | non-GAAP2 | GAAP | non-GAAP2 | ||||||||

| Revenue up $3.8B or 23% from Q1 2019 | Operating income up $2.9B or 69% from Q1 2019; Q1 2020 operating margin at 35% | Operating income up $3.0B or 67% from Q1 2019; Q1 2020 operating margin at 38% | Diluted EPS up $0.44 or 51% from Q1 2019 | Diluted EPS up $0.56 or 63% from Q1 2019 | Operating cash flow up $1.2B or 24% from Q1 2019 | Free cash flow up $1.3B or 76% from Q1 2019 | ||||||||

| Growth in most data-centric businesses and growth in the PC-centric business | Higher gross margin from increase in platform unit sales and platform ASP strength, lower period charges, NAND market recovery and improved NAND unit cost, partially offset by increase in platform unit cost | Higher platform volume, platform ASP strength, lower period charges, NAND market recovery and improved unit cost, and lower shares outstanding, partially offset by higher platform unit cost and higher tax | Higher net income offset by working capital changes driven by other assets and liabilities and accounts receivable | |||||||||||

BUSINESS SUMMARY

We introduced a broad, data-centric portfolio for 5G network infrastructure including the new Intel Atom® P5900, a 10nm SoC for wireless base stations; a next-generation structured ASIC for 5G network acceleration; and the launch of new 2nd Gen Intel® Xeon® Scalable processors. |

| • | We announced the 10th Gen Intel® Core™ H-series mobile processors, a new family of mobile processors aimed at gamers and creators everywhere, which deliver faster performance with up to 5.3GHz Turbo, eight cores, and 16 threads. |

| • | We experienced growth in most data-centric businesses. DCG grew across all segments and adjacencies continued to ramp. NSG grew with record revenue driven by NAND and Intel® Optane™ memory bit growth and higher ASP. Mobileye recognized record revenue with increasing ADAS adoption. IOTG declined on COVID-19 impact. |

PC-centric growth was driven by notebook demand strength as consumers and businesses are relying on PCs for working and learning at home.

| Three Months Ended | Nine Months Ended | |||||||||||||||

| (In Millions, Except Per Share Amounts) | Sep 30, 2017 | Oct 1, 2016 | Sep 30, 2017 | Oct 1, 2016 | ||||||||||||

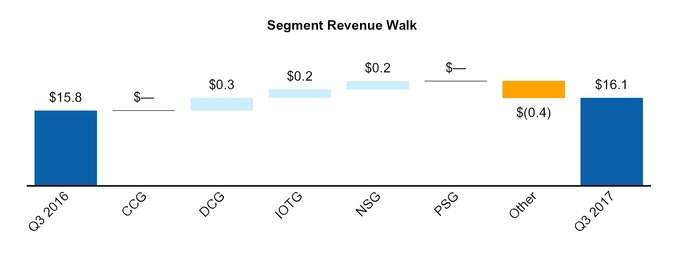

| Net revenue | $ | 16,149 | $ | 15,778 | $ | 45,708 | $ | 43,013 | ||||||||

| Cost of sales | 6,092 | 5,795 | 17,406 | 16,927 | ||||||||||||

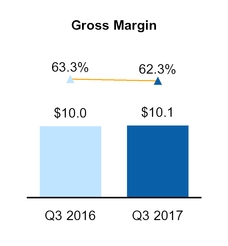

| Gross margin | 10,057 | 9,983 | 28,302 | 26,086 | ||||||||||||

| Research and development | 3,223 | 3,069 | 9,824 | 9,460 | ||||||||||||

| Marketing, general and administrative | 1,666 | 2,006 | 5,624 | 6,239 | ||||||||||||

| Restructuring and other charges | 4 | 372 | 189 | 1,786 | ||||||||||||

| Amortization of acquisition-related intangibles | 49 | 74 | 124 | 253 | ||||||||||||

| Operating expenses | 4,942 | 5,521 | 15,761 | 17,738 | ||||||||||||

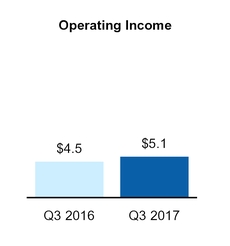

| Operating income | 5,115 | 4,462 | 12,541 | 8,348 | ||||||||||||

| Gains (losses) on equity investments, net | 846 | (12 | ) | 1,440 | 488 | |||||||||||

| Interest and other, net | (31 | ) | (132 | ) | 336 | (340 | ) | |||||||||

| Income before taxes | 5,930 | 4,318 | 14,317 | 8,496 | ||||||||||||

| Provision for taxes | 1,414 | 940 | 4,029 | 1,742 | ||||||||||||

| Net income | $ | 4,516 | $ | 3,378 | $ | 10,288 | $ | 6,754 | ||||||||

| Basic earnings per share of common stock | $ | 0.96 | $ | 0.71 | $ | 2.19 | $ | 1.43 | ||||||||

| Diluted earnings per share of common stock | $ | 0.94 | $ | 0.69 | $ | 2.12 | $ | 1.39 | ||||||||

| Cash dividends declared per share of common stock | $ | 0.5450 | $ | 0.5200 | $ | 1.0775 | $ | 1.0400 | ||||||||

| Weighted average shares of common stock outstanding: | ||||||||||||||||

| Basic | 4,688 | 4,734 | 4,707 | 4,728 | ||||||||||||

| Diluted | 4,821 | 4,877 | 4,849 | 4,872 | ||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| (In Millions) | Sep 30, 2017 | Oct 1, 2016 | Sep 30, 2017 | Oct 1, 2016 | ||||||||||||

| Net income | $ | 4,516 | $ | 3,378 | $ | 10,288 | $ | 6,754 | ||||||||

| Changes in other comprehensive income, net of tax: | ||||||||||||||||

| Net unrealized holding gains (losses) on available-for-sale investments | 399 | 412 | 408 | 357 | ||||||||||||

| Deferred tax asset valuation allowance | — | (2 | ) | — | (5 | ) | ||||||||||

| Net unrealized holding gains (losses) on derivatives | 19 | 61 | 350 | 274 | ||||||||||||

| Net prior service (costs) credits | 2 | 1 | (8 | ) | 4 | |||||||||||

| Actuarial valuation | 11 | 10 | 241 | (289 | ) | |||||||||||

| Net foreign currency translation adjustment | 5 | (2 | ) | 513 | (1 | ) | ||||||||||

| Other comprehensive income (loss) | 436 | 480 | 1,504 | 340 | ||||||||||||

| Total comprehensive income | $ | 4,952 | $ | 3,858 | $ | 11,792 | $ | 7,094 | ||||||||

| (In Millions) | Sep 30, 2017 | Dec 31, 2016 | ||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 9,075 | $ | 5,560 | ||||

| Short-term investments | 1,446 | 3,225 | ||||||

| Trading assets | 6,983 | 8,314 | ||||||

| Accounts receivable, net | 5,954 | 4,690 | ||||||

| Inventories | 6,929 | 5,553 | ||||||

| Assets held for sale | — | 5,210 | ||||||

| Other current assets | 2,767 | 2,956 | ||||||

| Total current assets | 33,154 | 35,508 | ||||||

| Property, plant and equipment, net of accumulated depreciation of $58,048 ($53,934 as of December 31, 2016) | 39,472 | 36,171 | ||||||

| Marketable equity securities | 6,059 | 6,180 | ||||||

| Other long-term investments | 3,844 | 4,716 | ||||||

| Goodwill | 24,389 | 14,099 | ||||||

| Identified intangible assets, net | 13,058 | 9,494 | ||||||

| Other long-term assets | 7,112 | 7,159 | ||||||

| Total assets | $ | 127,088 | $ | 113,327 | ||||

| Liabilities, temporary equity, and stockholders’ equity | ||||||||

| Current liabilities: | ||||||||

| Short-term debt | $ | 4,142 | $ | 4,634 | ||||

| Accounts payable | 3,554 | 2,475 | ||||||

| Accrued compensation and benefits | 2,805 | 3,465 | ||||||

| Accrued advertising | 892 | 810 | ||||||

| Deferred income | 1,706 | 1,718 | ||||||

| Liabilities held for sale | — | 1,920 | ||||||

| Other accrued liabilities | 7,590 | 5,280 | ||||||

| Total current liabilities | 20,689 | 20,302 | ||||||

| Long-term debt | 27,498 | 20,649 | ||||||

| Long-term deferred tax liabilities | 2,943 | 1,730 | ||||||

| Other long-term liabilities | 4,152 | 3,538 | ||||||

| Contingencies (Note 18) | ||||||||

| Temporary equity | 870 | 882 | ||||||

| Stockholders’ equity: | ||||||||

| Preferred stock | — | — | ||||||

| Common stock and capital in excess of par value, 4,680 issued and outstanding (4,730 issued and outstanding as of December 31, 2016) | 26,547 | 25,373 | ||||||

| Accumulated other comprehensive income (loss) | 1,610 | 106 | ||||||

| Retained earnings | 42,779 | 40,747 | ||||||

| Total stockholders’ equity | 70,936 | 66,226 | ||||||

| Total liabilities, temporary equity, and stockholders’ equity | $ | 127,088 | $ | 113,327 | ||||

| Nine Months Ended | ||||||||

| (In Millions) | Sep 30, 2017 | Oct 1, 2016 | ||||||

| Cash and cash equivalents, beginning of period | $ | 5,560 | $ | 15,308 | ||||

| Cash flows provided by (used for) operating activities: | ||||||||

| Net income | 10,288 | 6,754 | ||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation | 4,990 | 4,684 | ||||||

| Share-based compensation | 1,051 | 1,136 | ||||||

| Restructuring and other charges | 189 | 1,786 | ||||||

| Amortization of intangibles | 999 | 1,176 | ||||||

| (Gains) losses on equity investments, net | (1,372 | ) | (414 | ) | ||||

| (Gains) losses on divestitures | (387 | ) | — | |||||

| Deferred taxes | 570 | (188 | ) | |||||

Changes in assets and liabilities:1 | ||||||||

| Accounts receivable | (1,128 | ) | (100 | ) | ||||

| Inventories | (1,245 | ) | (118 | ) | ||||

| Accounts payable | 171 | 188 | ||||||

| Accrued compensation and benefits | (551 | ) | (1,874 | ) | ||||

| Income taxes payable and receivable | 979 | 961 | ||||||

| Other assets and liabilities | 315 | (333 | ) | |||||

| Total adjustments | 4,581 | 6,904 | ||||||

| Net cash provided by operating activities | 14,869 | 13,658 | ||||||

| Cash flows provided by (used for) investing activities: | ||||||||

| Additions to property, plant and equipment | (7,709 | ) | (6,095 | ) | ||||

| Acquisitions, net of cash acquired | (14,499 | ) | (15,151 | ) | ||||

| Purchases of available-for-sale investments | (1,977 | ) | (7,962 | ) | ||||

| Sales of available-for-sale investments | 4,610 | 3,793 | ||||||

| Maturities of available-for-sale investments | 3,488 | 4,928 | ||||||

| Purchases of trading assets | (9,792 | ) | (9,953 | ) | ||||

| Maturities and sales of trading assets | 11,806 | 7,867 | ||||||

| Investments in loans receivable and reverse repurchase agreements | — | (223 | ) | |||||

| Collection of loans receivable and reverse repurchase agreements | 250 | 911 | ||||||

| Investments in non-marketable equity investments | (726 | ) | (893 | ) | ||||

| Proceeds from divestitures | 3,124 | — | ||||||

| Other investing | 893 | 405 | ||||||

| Net cash used for investing activities | (10,532 | ) | (22,373 | ) | ||||

| Cash flows provided by (used for) financing activities: | ||||||||

| Increase (decrease) in short-term debt, net | (5 | ) | 426 | |||||

| Issuance of long-term debt, net of issuance costs | 7,716 | 2,734 | ||||||

| Repayment of debt | (1,502 | ) | — | |||||

| Proceeds from sales of common stock through employee equity incentive plans | 637 | 1,024 | ||||||

| Repurchase of common stock | (3,611 | ) | (2,054 | ) | ||||

| Restricted stock unit withholdings | (424 | ) | (434 | ) | ||||

| Payment of dividends to stockholders | (3,794 | ) | (3,692 | ) | ||||

| Other financing | 161 | 155 | ||||||

| Net cash provided by (used for) financing activities | (822 | ) | (1,841 | ) | ||||

| Net increase (decrease) in cash and cash equivalents | 3,515 | (10,556 | ) | |||||

| Cash and cash equivalents, end of period | $ | 9,075 | $ | 4,752 | ||||

| Supplemental disclosures of noncash investing activities and cash flow information: | ||||||||

| Acquisition of property, plant, and equipment included in accounts payable and accrued liabilities | $ | 1,736 | $ | 1,505 | ||||

| Non-marketable equity investment in McAfee from divestiture | $ | 1,078 | $ | — | ||||

| Cash paid during the period for: | ||||||||

| Interest, net of capitalized interest and interest rate swap payments/receipts | $ | 386 | $ | 472 | ||||

| Income taxes, net of refunds | $ | 2,328 | $ | 843 | ||||

1 | See "Key Terms" within Consolidated Condensed Financial Statements and |

2 | See "Non-GAAP Financial Measures" within |

A QUARTER IN REVIEW A QUARTER IN REVIEW | 5 | |

| CONSOLIDATED CONDENSED STATEMENTS OF INCOME |

| Three Months Ended | ||||||||

| (In Millions, Except Per Share Amounts; Unaudited) | Mar 28, 2020 | Mar 30, 2019 | ||||||

| Net revenue | $ | 19,828 | $ | 16,061 | ||||

| Cost of sales | 7,812 | 6,972 | ||||||

| Gross margin | 12,016 | 9,089 | ||||||

| Research and development | 3,275 | 3,332 | ||||||

| Marketing, general and administrative | 1,541 | 1,583 | ||||||

| Restructuring and other charges | 162 | — | ||||||

| Operating expenses | 4,978 | 4,915 | ||||||

| Operating income | 7,038 | 4,174 | ||||||

| Gains (losses) on equity investments, net | (111 | ) | 434 | |||||

| Interest and other, net | (313 | ) | (61 | ) | ||||

| Income before taxes | 6,614 | 4,547 | ||||||

| Provision for taxes | 953 | 573 | ||||||

| Net income | $ | 5,661 | $ | 3,974 | ||||

| Earnings per share—basic | $ | 1.33 | $ | 0.88 | ||||

| Earnings per share—diluted | $ | 1.31 | $ | 0.87 | ||||

| Weighted average shares of common stock outstanding: | ||||||||

| Basic | 4,266 | 4,492 | ||||||

| Diluted | 4,312 | 4,564 | ||||||

See accompanying notes.

FINANCIAL STATEMENTS FINANCIAL STATEMENTS | Consolidated Condensed Statements of Income | 6 |

| CONSOLIDATED CONDENSED STATEMENTS OF COMPREHENSIVE INCOME |

| Three Months Ended | ||||||||

| (In Millions; Unaudited) | Mar 28, 2020 | Mar 30, 2019 | ||||||

| Net income | $ | 5,661 | $ | 3,974 | ||||

| Changes in other comprehensive income, net of tax: | ||||||||

| Net unrealized holding gains (losses) on derivatives | (268 | ) | 102 | |||||

| Actuarial valuation and other pension benefits (expenses), net | 12 | 9 | ||||||

| Translation adjustments and other | (5 | ) | 50 | |||||

| Other comprehensive income (loss) | (261 | ) | 161 | |||||

| Total comprehensive income | $ | 5,400 | $ | 4,135 | ||||

See accompanying notes.

FINANCIAL STATEMENTS FINANCIAL STATEMENTS | Consolidated Condensed Statements of Comprehensive Income | 7 |

| CONSOLIDATED CONDENSED BALANCE SHEETS |

| (In Millions) | Mar 28, 2020 | Dec 28, 2019 | ||||||

| (unaudited) | ||||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 11,380 | $ | 4,194 | ||||

| Short-term investments | 1,296 | 1,082 | ||||||

| Trading assets | 8,127 | 7,847 | ||||||

| Accounts receivable | 8,455 | 7,659 | ||||||

| Inventories | 9,246 | 8,744 | ||||||

| Other current assets | 2,997 | 1,713 | ||||||

| Total current assets | 41,501 | 31,239 | ||||||

| Property, plant and equipment, net of accumulated depreciation of $75,686 ($73,321 as of December 28, 2019) | 56,770 | 55,386 | ||||||

| Equity investments | 3,880 | 3,967 | ||||||

| Other long-term investments | 2,943 | 3,276 | ||||||

| Goodwill | 26,276 | 26,276 | ||||||

| Identified intangible assets, net | 10,429 | 10,827 | ||||||

| Other long-term assets | 5,911 | 5,553 | ||||||

| Total assets | $ | 147,710 | $ | 136,524 | ||||

| Liabilities, temporary equity, and stockholders’ equity | ||||||||

| Current liabilities: | ||||||||

| Short-term debt | $ | 3,464 | $ | 3,693 | ||||

| Accounts payable | 4,638 | 4,128 | ||||||

| Accrued compensation and benefits | 2,358 | 3,853 | ||||||

| Other accrued liabilities | 13,435 | 10,636 | ||||||

| Total current liabilities | 23,895 | 22,310 | ||||||

| Debt | 36,455 | 25,308 | ||||||

| Contract liabilities | 1,353 | 1,368 | ||||||

| Income taxes payable, non-current | 4,651 | 4,919 | ||||||

| Deferred income taxes | 2,027 | 2,044 | ||||||

| Other long-term liabilities | 2,975 | 2,916 | ||||||

| Contingencies (Note 12) | ||||||||

| Temporary equity | — | 155 | ||||||

| Stockholders’ equity: | ||||||||

| Preferred stock | — | — | ||||||

| Common stock and capital in excess of par value, 4,234 issued and outstanding (4,290 issued and outstanding as of December 28, 2019) | 25,251 | 25,261 | ||||||

| Accumulated other comprehensive income (loss) | (1,541 | ) | (1,280 | ) | ||||

| Retained earnings | 52,644 | 53,523 | ||||||

| Total stockholders’ equity | 76,354 | 77,504 | ||||||

| Total liabilities, temporary equity, and stockholders’ equity | $ | 147,710 | $ | 136,524 | ||||

See accompanying notes.

FINANCIAL STATEMENTS FINANCIAL STATEMENTS | Consolidated Condensed Balance Sheets | 8 |

| CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS |

| Three Months Ended | ||||||||

| (In Millions; Unaudited) | Mar 28, 2020 | Mar 30, 2019 | ||||||

| Cash and cash equivalents, beginning of period | $ | 4,194 | $ | 3,019 | ||||

| Cash flows provided by (used for) operating activities: | ||||||||

| Net income | 5,661 | 3,974 | ||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation | 2,623 | 2,229 | ||||||

| Share-based compensation | 449 | 389 | ||||||

| Amortization of intangibles | 427 | 396 | ||||||

| (Gains) losses on equity investments, net | 134 | (274 | ) | |||||

| Changes in assets and liabilities: | ||||||||

| Accounts receivable | (796 | ) | (235 | ) | ||||

| Inventories | (548 | ) | (512 | ) | ||||

| Accounts payable | 117 | 196 | ||||||

| Accrued compensation and benefits | (1,500 | ) | (1,620 | ) | ||||

| Prepaid supply agreements | (87 | ) | (228 | ) | ||||

| Income taxes | 753 | 440 | ||||||

| Other assets and liabilities | (1,075 | ) | 204 | |||||

| Total adjustments | 497 | 985 | ||||||

| Net cash provided by operating activities | 6,158 | 4,959 | ||||||

| Cash flows provided by (used for) investing activities: | ||||||||

| Additions to property, plant and equipment | (3,268 | ) | (3,321 | ) | ||||

| Purchases of available-for-sale debt investments | (513 | ) | (872 | ) | ||||

| Maturities and sales of available-for-sale debt investments | 625 | 948 | ||||||

| Purchases of trading assets | (3,897 | ) | (1,869 | ) | ||||

| Maturities and sales of trading assets | 3,660 | 1,554 | ||||||

| Sales of equity investments | 20 | 1,077 | ||||||

| Other investing | (363 | ) | (239 | ) | ||||

| Net cash used for investing activities | (3,736 | ) | (2,722 | ) | ||||

| Cash flows provided by (used for) financing activities: | ||||||||

| Increase (decrease) in short-term debt, net | — | 1,682 | ||||||

| Issuance of long-term debt, net of issuance costs | 10,247 | 135 | ||||||

| Repayment of debt and debt conversion | (1,075 | ) | (861 | ) | ||||

| Proceeds from sales of common stock through employee equity incentive plans | 503 | 290 | ||||||

| Repurchase of common stock | (4,229 | ) | (2,530 | ) | ||||

| Payment of dividends to stockholders | (1,408 | ) | (1,414 | ) | ||||

| Other financing | 726 | 596 | ||||||

| Net cash provided by (used for) financing activities | 4,764 | (2,102 | ) | |||||

| Net increase (decrease) in cash and cash equivalents | 7,186 | 135 | ||||||

| Cash and cash equivalents, end of period | $ | 11,380 | $ | 3,154 | ||||

| Supplemental disclosures of noncash investing activities and cash flow information: | ||||||||

| Acquisition of property, plant, and equipment included in accounts payable and accrued liabilities | $ | 2,294 | $ | 2,259 | ||||

| Cash paid during the period for: | ||||||||

| Interest, net of capitalized interest | $ | 67 | $ | 109 | ||||

| Income taxes, net of refunds | $ | 211 | $ | 125 | ||||

See accompanying notes.

FINANCIAL STATEMENTS FINANCIAL STATEMENTS | Consolidated Condensed Statements of Cash Flows | 9 |

| CONSOLIDATED CONDENSED STATEMENTS OF STOCKHOLDERS' EQUITY |

| Common Stock and Capital in Excess of Par Value | Accumulated Other Comprehensive Income (Loss) | Retained Earnings | Total | ||||||||||||||||

| (In Millions, Except Per Share Amounts; Unaudited) | Shares | Amount | |||||||||||||||||

| Three Months Ended | |||||||||||||||||||

| Balance as of December 29, 2019 | 4,290 | $ | 25,261 | $ | (1,280 | ) | $ | 53,523 | $ | 77,504 | |||||||||

| Net income | — | — | — | 5,661 | 5,661 | ||||||||||||||

| Other comprehensive income (loss) | — | — | (261 | ) | — | (261 | ) | ||||||||||||

| Employee equity incentive plans and other | 17 | 620 | — | — | 620 | ||||||||||||||

| Share-based compensation | — | 449 | — | — | 449 | ||||||||||||||

| Temporary equity reduction | — | 155 | — | — | 155 | ||||||||||||||

| Convertible debt | — | (750 | ) | — | — | (750 | ) | ||||||||||||

| Repurchase of common stock | (71 | ) | (420 | ) | — | (3,689 | ) | (4,109 | ) | ||||||||||

| Restricted stock unit withholdings | (2 | ) | (64 | ) | — | (32 | ) | (96 | ) | ||||||||||

| Cash dividends declared ($0.66 per share) | — | — | — | (2,819 | ) | (2,819 | ) | ||||||||||||

| Balance as of March 28, 2020 | 4,234 | $ | 25,251 | $ | (1,541 | ) | $ | 52,644 | $ | 76,354 | |||||||||

| Balance as of December 28, 2018 | 4,516 | $ | 25,365 | $ | (974 | ) | $ | 50,172 | $ | 74,563 | |||||||||

| Net income | — | — | — | 3,974 | 3,974 | ||||||||||||||

| Other comprehensive income (loss) | — | — | 161 | — | 161 | ||||||||||||||

| Employee equity incentive plans and other | 11 | 372 | — | — | 372 | ||||||||||||||

| Share-based compensation | — | 389 | — | — | 389 | ||||||||||||||

| Temporary equity reduction | — | 145 | — | — | 145 | ||||||||||||||

| Convertible debt | — | (592 | ) | — | — | (592 | ) | ||||||||||||

| Repurchase of common stock | (49 | ) | (278 | ) | — | (2,172 | ) | (2,450 | ) | ||||||||||

| Restricted stock unit withholdings | (1 | ) | (55 | ) | — | (17 | ) | (72 | ) | ||||||||||

| Cash dividends declared ($0.63 per share) | — | — | — | (2,829 | ) | (2,829 | ) | ||||||||||||

| Balance as of March 30, 2019 | 4,477 | $ | 25,346 | $ | (813 | ) | $ | 49,128 | $ | 73,661 | |||||||||

See accompanying notes.

FINANCIAL STATEMENTS FINANCIAL STATEMENTS | Consolidated Condensed Statements of Stockholders' Equity | 10 |

| NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS |

| NOTE 1 : | BASIS OF PRESENTATION |

We prepared our interim consolidated condensed financial statementsConsolidated Condensed Financial Statements that accompany these notes in conformity with U.S. generally accepted accounting principles,GAAP, consistent in all material respects with those applied in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 (2016 Form 10-K).

We have made estimates and judgments affecting the amounts reported in our consolidated condensed financial statementsConsolidated Condensed Financial Statements and the accompanying notes. The inputs into our judgments and estimates consider the economic implications of COVID-19 on our critical and significant accounting estimates. The actual results that we experience may differ materially from our estimates. The interim financial information is unaudited, butand reflects all normal adjustments that are, in our opinion, necessary to provide a fair statement of results for the interim periods presented. This report should be read in conjunction with the consolidated financial statementsConsolidated Financial Statements in our 20162019 Form 10-K.10-K where we include additional information about our policies and the methods and assumptions used in our estimates.

We manage our business through the following operating segments:

DCG

Mobileye

NSG

PSG

CCG

We derive a substantial majority of our revenue from platform products, which are our principal products and considered as one class of product. We offer platformsplatform products that incorporate various components and technologies, including a microprocessor and chipset, a stand-alone System-on-Chip,SoC, or a multichip package. A platform may be enhanced by additional hardware, software, and services offered by Intel. PlatformsPlatform products are used in various form factors across our DCG, IOTG, and CCG operating segments. Our non-platform, or adjacent products, can be combined with platform products to form comprehensive platform solutions to meet customer needs.

DCG and IOTGCCG are our reportable operating segments. IOTG, Mobileye, NSG, and PSG do not meet the quantitative thresholds to qualify as reportable operating segments; however, we have elected to disclose the results of these non-reportable operating segments. Our Internet of Things portfolio, presented as Internet of Things, is comprised of IOTG and Mobileye operating segments.

We derive a substantial majority of our revenue from platforms, which is our principal product.

results of operations from non-reportable segments;

| • | historical results of operations from divested businesses; |

| • | results of operations of start-up businesses that support our initiatives, including our foundry business; |

| • | amounts included within restructuring and other charges; |

| • | a portion of employee benefits, compensation, and other expenses not allocated to the operating segments; and |

acquisition-related costs, including amortization and any impairment of acquisition-related intangibles and goodwill.

The Chief Operating Decision Maker (CODM), whichCODM, who is our Chief Executive Officer (CEO),CEO, does not evaluate operating segments using discrete asset information. Operating segments do not record inter-segment revenue. We do not allocate gains and losses from equity investments, interest and other income, or taxes to operating segments. Although the CODM uses operating income to evaluate the segments, operating costs included in one segment may benefit other segments. Except for these differences, the accounting policies for segment reporting are the same as for Intel as a whole.

FINANCIAL STATEMENTS FINANCIAL STATEMENTS | Notes to Financial Statements | 11 |

Net revenue and operating income (loss) for each period were as follows:

| Three Months Ended | ||||||||

| (In Millions) | Mar 28, 2020 | Mar 30, 2019 | ||||||

| Net revenue: | ||||||||

| Data Center Group | ||||||||

| Platform | $ | 6,427 | $ | 4,482 | ||||

| Adjacent | 566 | 420 | ||||||

| 6,993 | 4,902 | |||||||

| Internet of Things | ||||||||

| IOTG | 883 | 910 | ||||||

| Mobileye | 254 | 209 | ||||||

| 1,137 | 1,119 | |||||||

| Non-Volatile Memory Solutions Group | 1,338 | 915 | ||||||

| Programmable Solutions Group | 519 | 486 | ||||||

| Client Computing Group | ||||||||

| Platform | 8,712 | 7,824 | ||||||

| Adjacent | 1,063 | 762 | ||||||

| 9,775 | 8,586 | |||||||

| All other | 66 | 53 | ||||||

| Total net revenue | $ | 19,828 | $ | 16,061 | ||||

| Operating income (loss): | ||||||||

| Data Center Group | $ | 3,492 | $ | 1,841 | ||||

| Internet of Things | ||||||||

| IOTG | 243 | 251 | ||||||

| Mobileye | 88 | 68 | ||||||

| 331 | 319 | |||||||

| Non-Volatile Memory Solutions Group | (66 | ) | (297 | ) | ||||

| Programmable Solutions Group | 97 | 89 | ||||||

| Client Computing Group | 4,225 | 3,072 | ||||||

| All other | (1,041 | ) | (850 | ) | ||||

| Total operating income | $ | 7,038 | $ | 4,174 | ||||

FINANCIAL STATEMENTS FINANCIAL STATEMENTS | Notes to Financial Statements | 12 |

| Three Months Ended | Nine Months Ended | |||||||||||||||

| (In Millions) | Sep 30, 2017 | Oct 1, 2016 | Sep 30, 2017 | Oct 1, 2016 | ||||||||||||

| Net revenue: | ||||||||||||||||

| Client Computing Group | ||||||||||||||||

| Platform | $ | 8,132 | $ | 8,258 | $ | 23,163 | $ | 22,395 | ||||||||

| Other | 728 | 634 | 1,886 | 1,384 | ||||||||||||

| 8,860 | 8,892 | 25,049 | 23,779 | |||||||||||||

| Data Center Group | ||||||||||||||||

| Platform | 4,439 | 4,164 | 12,344 | 11,589 | ||||||||||||

| Other | 439 | 378 | 1,138 | 979 | ||||||||||||

| 4,878 | 4,542 | 13,482 | 12,568 | |||||||||||||

| Internet of Things Group | ||||||||||||||||

| Platform | 680 | 605 | 1,926 | 1,673 | ||||||||||||

| Other | 169 | 84 | 364 | 239 | ||||||||||||

| 849 | 689 | 2,290 | 1,912 | |||||||||||||

| Non-Volatile Memory Solutions Group | 891 | 649 | 2,631 | 1,760 | ||||||||||||

| Programmable Solutions Group | 469 | 425 | 1,334 | 1,249 | ||||||||||||

| All other | 202 | 581 | 922 | 1,745 | ||||||||||||

| Total net revenue | $ | 16,149 | $ | 15,778 | $ | 45,708 | $ | 43,013 | ||||||||

| Operating income (loss): | ||||||||||||||||

| Client Computing Group | $ | 3,600 | $ | 3,327 | $ | 9,656 | $ | 7,123 | ||||||||

| Data Center Group | 2,255 | 2,110 | 5,403 | 5,639 | ||||||||||||

| Internet of Things Group | 146 | 191 | 390 | 403 | ||||||||||||

| Non-Volatile Memory Solutions Group | (52 | ) | (134 | ) | (291 | ) | (453 | ) | ||||||||

| Programmable Solutions Group | 113 | 78 | 302 | (184 | ) | |||||||||||

| All other | (947 | ) | (1,110 | ) | (2,919 | ) | (4,180 | ) | ||||||||

| Total operating income | $ | 5,115 | $ | 4,462 | $ | 12,541 | $ | 8,348 | ||||||||

| Three Months Ended | ||||||||

| (In Millions) | Mar 28, 2020 | Mar 30, 2019 | ||||||

| Platform revenue | ||||||||

| DCG platform | $ | 6,427 | $ | 4,482 | ||||

| IOTG platform | 795 | 825 | ||||||

| CCG Desktop platform | 2,840 | 2,886 | ||||||

| CCG Notebook platform | 5,857 | 4,926 | ||||||

CCG other platform1 | 15 | 12 | ||||||

| 15,934 | 13,131 | |||||||

Adjacent revenue2 | 3,894 | 2,930 | ||||||

| Total revenue | $ | 19,828 | $ | 16,061 | ||||

1 | Includes our tablet and service provider revenue. |

2 | Includes all of our non-platform products for DCG, IOTG, and CCG such as modem, Ethernet, and silicon photonics, as well as Mobileye, NSG, and PSG products. |

Planned Divestiture of our Home Gateway Platform Division

We signed a definitive agreement on April 5, 2020 to sell the majority of Home Gateway Platform, a division of CCG. The transaction contemplates the transfer of certain employees, equipment, and an on-going supply agreement for future units. We reclassified the assets and liabilities as held-for-sale within other current assets/liabilities. We expect to close the transaction in the third quarter of 2020.

| NOTE 3 : | EARNINGS PER SHARE |

We computed basic earnings per share of common stock based on the weighted average number of shares of common stock outstanding during the period. We computed diluted earnings per share of common stock based on the weighted average number of shares of common stock outstanding plus potentially dilutive shares of common stock outstanding during the period.

In all periods presented, potentially dilutive securitiesSecurities which would have been antidilutiveanti-dilutive are insignificant and are excluded from the computation of diluted earnings per share.Inshare in all periods presented, we includedpresented.

Note 6: Other Financial Statement Details

InventoriesINVENTORIES

Deferred IncomeINTEREST AND OTHER, NET

INTEL CORPORATIONNOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Gains (Losses) on Equity Investments, NetThe components of gains (losses) on equity investments, net for each period were as follows:

Interest and Other, Net

Note 7: Restructuring and Other Charges

2016 Restructuring ProgramInA restructuring program was approved in the secondfirst quarter of 2017, we2020 to further align our workforce with our continuing investments in the business and execute the planned divestiture of Home Gateway Platform, a division of CCG. We expect these actions to be substantially completedcomplete in the 2016 Restructuring Program. For further information, see "Note 7: Restructuring and Other Charges" in Part II, Item 8third quarter of our 2016 Form 10-K.2020.

INTEL CORPORATIONNOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Restructuring and other activity for the 2016 Restructuring Program for the first nine months of 2017 was as follows:

A substantial majority of the accrued restructuring balance as of September 30, 2017 is expected to be paid within the next 12 months and was recorded within accrued compensation and benefits. Restructuring actions related to this program that were approved in 2016 impacted approximately 15,000 employees.Other charges

Note 8: Income Taxes

Our effective income tax rate was 28.1%DEBT INVESTMENTSNote 9: InvestmentsAvailable-for-Sale Investments

INTEL CORPORATIONNOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

During the third quarter of 2017, we sold available-for sale investments for proceeds of $2.9 billion ($195 million in the third quarter of 2016). During the first nine months of 2017, we sold available-for-sale investments for proceeds of $4.7 billion ($4.0 billion in the first nine months of 2016). The gross realized gains on sales of available-for-sale investments were $927 million in the third quarter of 2017 and $2.0 billion in the first nine months of 2017 ($41 million in the third quarter of 2016 and $538 million in the first nine months of 2016).On April 28, 2017, Cloudera, Inc. (Cloudera) completed its initial public offering and we have designated our previous equity and cost method investments in Cloudera as available-for-sale. During the second quarter of 2017, we determined we had an other-than-temporary decline in the fair value of our investment and recognized an impairment charge of $278 million. We recognized the impairment in the second quarter due to the duration and severity of the decline in the investment's fair value, which we determined was below cost based upon observable market prices after the initial public offering.

Equity Method InvestmentsMcAfeeIn the second quarter1 Sale of 2017, we closed our divestitureequity investments and other includes realized gains (losses) on sales of the ISecG business and retained a 49% interest in McAfee as partial consideration. Our investment is accounted for under thenon-marketable equity method of accounting and is classified within other long-term assets. In the third quarter of 2017, we received a $735 million dividend from McAfee and recordedinvestments, our share of equity method investee losses. The carryinggains (losses) and distributions, and initial fair value ofadjustments recorded upon a security becoming marketable.IM Flash Technologies, LLCSince the inception of IM Flash Technologies, LLC (IMFT)formed in 2006 by Micron Technology, Inc. (Micron) and Intel haveto jointly developeddevelop NAND flash memory and most recently, 3D XPoint™ technology products. Intel also purchases jointly developed products directly from Micron under certain supply agreements.

IMFT is a variable interest entity and all costs of IMFT are passed on to Micron and Intel through sale of products or services in proportional share of ownership. Our portion of IMFT costs, primarily related to product purchases and production-related services, was approximately $115 million in the third quarter of 2017and approximately $350 million in the first nine months of 2017 (approximately $115 million in the third quarter of 2016 and approximately $315 million in the first nine months of 2016)28, 2019). The amount due to IMFT for product purchases and services provided was approximately $73 million as of September 30, 2017 (approximately $95 million as of December 31, 2016).IMFT depends on Micron and Intel for any additional cash needs. Our known maximum exposure to loss approximated the carrying value of our investment balance in IMFT. Except for the amount due to IMFT for product purchases and production-related services, we did not have any additional liabilities recognized on our consolidated condensed balance sheets in connection with our interests in this joint venture as of September 30, 2017. Our potential future losses could be higher than the carrying amount of our investment, as Intel and Micron are liable for other future operating costs or obligations of IMFT. Future cash calls could also increase our investment balance and the related exposure to loss. In addition, because we are currently committed to purchasing 49%of IMFT’s production output and production-related services, we may be required to purchase products at a cost in excess of realizable value.INTEL CORPORATIONNOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Non-marketable Cost Method InvestmentsBeijing UniSpreadtrum Technology Ltd.During 2014, we entered into a series of agreements with Tsinghua Unigroup Ltd. (Tsinghua Unigroup), an operating subsidiary of Tsinghua Holdings Co. Ltd., to, among other things, jointly develop Intel® architecture- and communications-based solutions for phones. We agreed to invest up to 9.0 billion Chinese yuan (approximately $1.5 billion as of the date of the agreement) for a minority stake of approximately 20% of Beijing UniSpreadtrum Technology Ltd., a holding company under Tsinghua Unigroup. During 2015, we invested$966 million to complete the first phase of the equity investment and accounted for our interest using the cost method of accounting. During the second quarter of 2017, we reduced our expectation of the company's future operating performance due to competitive pressures, which resulted in an other-than-temporary impairment charge of $147 million.Trading AssetsNet gains related to trading assets still held at the reporting date were $81 million in the third quarter of 2017 and $433 million in the first nine months of 2017 (there were $72 million net gains related to trading assets still held at the reporting date in the third quarter of 2016 and $245 million of net gains in the first nine months of 2016). Net losses on the related derivatives were $75 millionin the third quarter of 2017 and $402 millionin the first nine months of 2017 (net losses of $54 million in the third quarter of 2016 and $224 million in the first nine months of 2016).Note 10: Acquisitions and DivestituresAcquisition of MobileyeOn August 21, 2017, we completed our tender offer for all of the outstanding ordinary shares of Mobileye, a global leader in the development of computer vision and machine learning, data analysis, localization and mapping for advanced driver assistance systems and autonomous driving. This acquisition combines Mobileye's leading computer vision expertise with Intel’s high-performance computing and connectivity expertise to create automated driving solutions from car to cloud. The combination is expected to accelerate innovation for the automotive industry and position Intel as a leading technology provider in the fast-growing market for highly and fully autonomous vehicles. The transaction also extends Intel’s strategy to invest in data-intensive market opportunities that build on our strengths in computing and connectivity from the cloud, through the network, to the device.As of the completion of the tender offer, we acquired substantially all of the outstanding ordinary shares of Mobileye. We acquired 84.4% of the outstanding shares on August 8, 2017 and 97.3% as of August 21, 2017, and we intend to acquire all remaining outstanding shares. We have reflected the acquisition of the additional outstanding shares and reduction to the noncontrolling interest by $1.8 billion in the tables below.Total consideration to acquire Mobileye was $14.5 billion (net of $366 million of cash and cash equivalents acquired).The preliminary fair values of the assets acquired and liabilities assumed by major class in the acquisition of Mobileye were recognized as follows:

We assumed outstanding unvested Mobileye stock options and RSUs granted under two Mobileye equity plans. We will not grant additional equity awards under these two Mobileye equity plans. In connection with the acquisition, we recognized share-based compensation expense of $71 million for cash-settled awards.INTEL CORPORATIONNOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

The preliminary allocation of the purchase price was based upon estimates and assumptions that are subject to change within the one year measurement period. The primary areas of the purchase price allocation that are not yet finalized are certain tax matters, identification of contingencies, and goodwill.The fair value of the noncontrolling interest was determined based on the quoted share price of Mobileye as of August 8, 2017, and the remaining outstanding shares that constitute the noncontrolling interest. We recorded the noncontrolling interest as a component of equity.Goodwill of $10.3 billion arising from the acquisition is attributed to the expected synergies and other benefits that will be generated from the combination of Intel and Mobileye. Substantially all of the goodwill recognized is not expected to be deductible for tax purposes. The goodwill recognized from the acquisition is included within "all other."The identified intangible assets assumed in the acquisition of Mobileye were recognized as follows:

Acquired developed technology represents the fair value of Mobileye products that have reached technological feasibility and are a part of Mobileye’s product offerings, as opposed to in-process research and development which represents the fair value of products that have not reached technological feasibility. Customer relationships represent the fair values of the underlying relationships and agreements with Mobileye’s customers.Divestiture of Intel Security GroupOn April 3, 2017, we closed the transaction with TPG VII Manta Holdings, L.P., now known as Manta Holdings, L.P. (TPG), transferring certain assets and liabilities relating to ISecG to a newly formed, jointly-owned, separate cybersecurity company called McAfee.Total consideration received was $4.2 billion, consisting of $924 million in cash proceeds, $1.1 billion in the form of equity representing a 49% ownership interest in McAfee, and $2.2 billion in the form of promissory notes issued by McAfee and TPG. During the third quarter of 2017, McAfee and TPG repaid the $2.2 billion of promissory notes, which are included within proceeds from divestiture.The carrying amounts of the major classes of ISecG assets and liabilities as of the transaction close date included the following:

INTEL CORPORATIONNOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

As of the transaction close date, we recognized a pre-tax gain of $387 million within "Interest and other, net," which is net of $507 million of currency translation adjustment losses reclassified from accumulated other comprehensive income (loss) associated with currency charges on the carrying values of ISecG goodwill and identified intangible assets. In addition, we recognized a tax expense of $822 million.Note 11: Identified Intangible AssetsAs a result of our acquisition of Mobileye during the third quarter of 2017, we recorded $4.5 billion of identified intangible assets. For further information about these acquired identified intangible assets, see "Note 10: Acquisitions and Divestitures."

Amortization expenses recorded in the consolidated condensed statements of income for each period were as follows:

INTEL CORPORATIONNOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

We expect future amortization expense for the next five years to be as follows:

Note 12: Other Long-Term Assets

Note 13: BorrowingsShort-Term Debt

Our current portion of long-term debt includes our 2009 junior subordinated convertible debentures due 2039.

During the second quarter of 2017, we repaid $500 million of our 1.75% senior notes that matured in May 2017.INTEL CORPORATIONNOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Long-Term DebtLONG-TERM DEBT

Our indebtedness is carried at amortized cost net of applicable hedge adjustments.

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

During the third quarter of 2017, we redeemed the $1.0 billion 4.90% senior notes due August 2045. Additionally, we issued a total of $640 million aggregate principal amount of senior notes. We used the net proceeds from the offering of the notes to finance a portion of the redemption price of our 4.90% senior notes due August 2045.For further information on our debt instruments, see "Note 14: Borrowings" in Part II, Item 8

Fair Value Option for Loans Receivable

As of September 30, 2017 and December 31, 2016, the fair value of our loans receivable for which we elected the fair value option did not significantly differ from the contractual principal balance based on the contractual currency.

Assets Measured and Recorded at Fair Value on a Non-Recurring BasisASSETS MEASURED AND RECORDED AT FAIR VALUE ON A NON-RECURRING BASISWe classifiedrecognized in the current period. If an observable price adjustment or impairment is recognized on our non-marketable equity investmentssecurities during the period, we classify these assets as Level 3. Impairments recognized3 within the fair value hierarchy based on non-marketable equity investments held asthe nature of September 30, 2017 were insignificant during the third quarter of 2017 and $335 million during the first nine months of 2017 ($48 million during the third quarter of 2016 and $132 million during the first nine months of 2016 on non-marketable equity investments held as of October 1, 2016).fair value inputs.The carrying amounts and fair values of financial instruments not recorded at fair value on a recurring basis atinclude non-marketable equity securities and equity method investments that have not been remeasured or impaired in the endcurrent period, grants receivable, loans receivable, reverse repurchase agreements, and issued debt.

Inthese financial instruments approximates their carrying value and is categorized as Level 2 within the third quarter of 2017, we began assigning fair value hierarchy levels for our short-term and long-term debt based on the underlying instrument type. We have reclassified prior period amounts to conform tonature of the current period presentation.fair value inputs.

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Note 15: Other Comprehensive Income (Loss)

INTEL CORPORATIONNOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

The amounts reclassified out of accumulated other comprehensive income (loss) into the consolidated condensed statements of income for each period were as follows:

The amortization of pension and postretirement benefit components are included in the computation of net periodic benefit cost. For further information, see "Note 18: Retirement Benefit Plans" in Part II, Item 8 of our 2016 Form 10-K.During the second quarter of 2017, we reclassified approximately $507 million (before taxes) of currency translation adjustment losses included in accumulated other comprehensive income (loss) into earnings as a result of our divestiture of ISecG. For more information see "Note 10: Acquisitions and Divestitures."

INTEL CORPORATIONNOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Note 16: Derivative Financial Instruments

For further information on our derivative policies, see “Note 2: Accounting Policies" in Part II, Item 8 of our 2016 Form 10-K.VOLUME OF DERIVATIVE ACTIVITYVolume of Derivative Activity

Fair Value of Derivative Instruments in the Consolidated Condensed Balance SheetsFAIR VALUE OF DERIVATIVE INSTRUMENTS

INTEL CORPORATION

NOTES TO

Amounts Offset in the Consolidated Condensed Balance SheetsBALANCE SHEETS

INTEL CORPORATIONNOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Derivatives in Cash Flow Hedging RelationshipsDERIVATIVES IN CASH FLOW HEDGING RELATIONSHIPSFor information on the unrealized holding gains (losses) on derivatives reclassified out

Derivatives in Fair Value Hedging Relationships

ThereThe amounts recorded on the Consolidated Condensed Balance Sheets related to cumulative basis adjustments for fair value hedges for each period were as follows:

Derivatives Not Designated as Hedging InstrumentsDERIVATIVES NOT DESIGNATED AS HEDGING INSTRUMENTS

Note 17: Employee Equity Incentive Plans

Our equity incentive plans are broad-based, long-term programs intended to attract and retain talented employees and align stockholder and employee interests.In May 2017, stockholders approved an extension of the expiration date of the 2006 Equity Incentive Plan to June 2020 and approved an additional 33 million shares reserved for issuance under the plan. As of September 30, 2017, 218 million shares of common stock remained available for future grants.Share-Based CompensationShare-based compensation expense recognized was $397 million, which includes $71 million of cash-settled awards in connection with the Mobileye acquisition, in the third quarter of 2017 and $1.1 billion in the first nine months of 2017 ($324 million in the third quarter of 2016 and $1.1 billion in the first nine months of 2016).INTEL CORPORATIONNOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Restricted Stock Unit AwardsRestricted stock unit activity in the first nine months of 2017 was as follows:

The aggregate fair value of awards that vested in the first nine months of 2017 was $1.5 billion, which represents the market value of our common stock on the date that the RSUs vested. The grant-date fair value of awards that vested in first nine months of 2017 was $1.0 billion. The number of RSUs vested includes shares of common stock that we withheld on behalf of employees to satisfy the minimum statutory tax withholding requirements. RSUs that are expected to vest are net of estimated future forfeitures.Stock Purchase PlanThe 2006 Stock Purchase Plan allows eligible employees to purchase shares of our common stock at 85% of the value of our common stock on specific dates. Rights to purchase shares of common stock are granted during the first and third quarters of each year. The 2006 Stock Purchase Plan has 150 million shares of common stock remaining through August 2021 for issuance.Employees purchased 15 million shares of common stock in the first nine months of 2017 for $432 million (16.5 million shares of common stock in the first nine months of 2016 for $415 million) under the 2006 Stock Purchase Plan.Note 18: ContingenciesLegal ProceedingsLEGAL PROCEEDINGSINTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Shareholder Derivative Litigation regarding Related to Security Vulnerabilities

In June 2015, the International Brotherhood of Electrical Workers (IBEW)2019 Intel filed a shareholder derivative actionrequest for rehearing on the second IPR petition. In January 2020, the USPTO denied the rehearing and petition on the first IPR petition.INTEL CORPORATIONNOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

In April 2016, John Esposito filed a shareholder derivative action in the Superior Court of California in Santa Clara County against Intel, current members of our Board of Directors, and certain former officers and employees. Esposito made a demand on our Board in 2013 to investigate whether our officers or directors should be sued for their participation in the events described in In re High Tech Employee Antitrust Litigation. In November 2015, our Board decided not to take further action on Esposito’s demandChinese Patent No. CN 102386226 (‘226 Patent) based on the recommendationmanufacturing and sale of Intel’s Core i3 microprocessors. Defendants in the Audit Committeesecond case are Lenovo (Beijing) Co., Ltd. (Lenovo) and Beijing Jiayun Huitong Technology Development Co. Ltd. (BJHT). Defendants in the third case are Intel Corp., Intel China Co., Ltd., the Intel China Beijing Branch, Beijing Digital China Co., Ltd. (Digital China), and JD. Both complaints demand injunctions plus litigation costs and reserve the right to claim damages in unspecified amounts. No proceedings have occurred or are yet scheduled in these lawsuits. In December 2019, Lenovo tendered indemnity to Intel, which Intel granted in March 2020. Given the procedural posture and the nature of these cases, the Board after its investigation of relevant factsunspecified nature and circumstances. Esposito seeks to set aside such decision, and alleges that the Board was not disinterested in making that decision and that the investigation was inadequate. In November 2016, the court granted Intel’s motion to dismiss the case, without leave to amend. In March 2017, plaintiff filed a motion for fees. The court denied plaintiff’s fee motion in May 2017, and entered final judgment in this matter in June 2017. In August 2017, Esposito appealed the final judgment.McAfee, Inc. Shareholder LitigationOn August 19, 2010, we announced that we had agreed to acquire all of the common stock of McAfee, Inc. (McAfee) for $48.00 per share. Four McAfee shareholders filed putative class-action lawsuits in Santa Clara County, California Superior Court challenging the proposed transaction. The cases were ordered consolidated in September 2010. Plaintiffs filed an amended complaint that named former McAfee board members, McAfee, and Intel as defendants, and alleged that the McAfee board members breached their fiduciary duties and that McAfee and Intel aided and abetted those breaches of duty. The complaint requested rescission of the merger agreement, such other equitable relief as the court may deem proper, and an awardextent of damages in an unspecified amount. In June 2012,claimed by IMECAS, and uncertainty regarding the plaintiffs’ damages expert asserted that the valueavailability of a McAfee share for the purposes of assessing damages should be $62.08.In January 2012, the court certified the action as a class action, appointed the Central Pension Laborers’ Fund to act as the class representative and scheduled trial to begin in January 2013. In March 2012, defendants filed a petition with the California Court of Appeal for a writ of mandate to reverse the class certification order; the petition was denied in June 2012. In March 2012, at defendants’ request, the court held that plaintiffs were not entitled to a jury trial and ordered a bench trial. In April 2012, plaintiffs filed a petition with the California Court of Appeal for a writ of mandate to reverse that order, which the court of appeal denied in July 2012. In August 2012, defendants filed a motion for summary judgment. The trial court granted that motion in November 2012, and entered final judgment in the case in February 2013. In April 2013, plaintiffs appealed the final judgment. The California Court of Appeal heard oral argument in October 2017, and the parties await the court’s decision. Because the resolution of the appeal may materially impact the scope and nature of the proceeding,injunctive relief under applicable law, we are unable to make a reasonable estimate of the potential loss or range of losses, if any, arising from this matter.these matters. We dispute the class-actionIMECAS’s claims and intend to continue tovigorously defend the lawsuit vigorously.against them.In March 2014, we filed a complaint against Future Link Systems, LLC (Future Link) in the United States District Court for the District of Delaware, requesting a declaratory judgment that Intel and our customers do not infringe any valid, enforceable claim of nine patents owned by Future Link. In July 2015, Future Link filed counterclaims against Intel alleging infringement of fifteen patents. In June 2017, the court denied both parties’ Daubert motions to exclude opinions of the other parties’ damages experts. In July 2017, the court ruled on numerous motions for summary judgment of certain claims filed by both Intel and Future Link. As of July 2017, Future Link alleged infringement of fourteen patents, claimed past damages in the amount of approximately $9.9 billion in its experts’ reports, and sought additional damages accrued through trial and ongoing royalties after trial in an unspecified amount. The court scheduled a jury trial for September 2017 on Future Link’s infringement claims regarding three patents with a past damages claim of approximately $2.9 billion and ordered that other proceedings be stayed. In August 2017, the parties reached a confidential settlement agreement resolving all claims. The settlement did not have a material financial impact to Intel.

| Three Months Ended | ||||||||

| (In Millions, Except Per Share Amounts) | Mar 28, 2020 | Mar 30, 2019 | ||||||