UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

ý ☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended SeptemberJune 30, 20172023

¨ ☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period From to

_________________________________________

Commission File Number 1-3157001-03157

INTERNATIONAL PAPER COMPANY

(Exact name of registrant as specified in its charter)

|

| | | | |

| New York | 13-0872805 |

(State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) |

incorporation of organization) | Identification No.) |

| |

6400 Poplar Avenue, Memphis, TNTennessee | 38197 |

(Address of principal executive offices)Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (901) 419-7000

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares | IP | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý☒ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (paragraph 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý☒ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | |

| Large accelerated filer | ý☒ | Accelerated filer | ¨☐ |

| | | |

| Non-accelerated filer | ¨☐ | Smaller reporting company | ¨☐ |

| | Emerging growth company | ¨☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange

Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨☐ No ý☒

The number of shares outstanding of the registrant’s common stock, par value $1.00 per share, as of October 27, 2017July 21, 2023 was 412,928,210.345,999,129.

INDEX

| | | | | | | | |

| | PAGE NO. |

| | |

| | |

| | PAGE NO. |

| | |

| | |

| | |

| | |

| Condensed Consolidated Statement of Operations - Three Months and NineSix Months Ended SeptemberJune 30, 20172023 and 20162022 | |

| | |

| Condensed Consolidated Statement of Comprehensive Income - Three Months and NineSix Months Ended SeptemberJune 30, 20172023 and 20162022 | |

| | |

| Condensed Consolidated Balance Sheet - SeptemberJune 30, 20172023 and December 31, 20162022 | |

| | |

| Condensed Consolidated Statement of Cash Flows - NineSix Months Ended SeptemberJune 30, 20172023 and 20162022 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| |

PART I. FINANCIAL INFORMATION

| |

ITEM 1. | FINANCIAL STATEMENTS |

INTERNATIONAL PAPER COMPANY

Condensed Consolidated Statement of Operations

(Unaudited)

(In millions, except per share amounts)

| | | | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2017 | | 2016 | | 2017 | | 2016 | | 2023 | | 2022 | | 2023 | | 2022 |

| Net Sales | $ | 5,913 |

| | $ | 5,266 |

| | $ | 17,196 |

| | $ | 15,698 |

| Net Sales | $ | 4,682 | | | $ | 5,389 | | | $ | 9,702 | | | $ | 10,626 | |

| Costs and Expenses | | | | | | | | Costs and Expenses | |

| Cost of products sold | 4,024 |

| | 3,622 |

| | 12,069 |

| | 11,345 |

| Cost of products sold | 3,360 | | | 3,806 | | | 7,002 | | | 7,645 | |

| Selling and administrative expenses | 431 |

| | 380 |

| | 1,275 |

| | 1,142 |

| Selling and administrative expenses | 336 | | | 300 | | | 717 | | | 641 | |

| Depreciation, amortization and cost of timber harvested | 373 |

| | 314 |

| | 1,075 |

| | 899 |

| Depreciation, amortization and cost of timber harvested | 244 | | | 267 | | | 485 | | | 528 | |

| Distribution expenses | 386 |

| | 353 |

| | 1,155 |

| | 1,012 |

| Distribution expenses | 376 | | | 442 | | | 798 | | | 866 | |

| Taxes other than payroll and income taxes | 44 |

| | 41 |

| | 132 |

| | 123 |

| Taxes other than payroll and income taxes | 40 | | | 36 | | | 76 | | | 72 | |

| Restructuring and other charges | — |

| | 46 |

| | (16 | ) | | 47 |

| |

| Net (gains) losses on sales and impairments of businesses | — |

| | 5 |

| | 9 |

| | 70 |

| |

| Litigation settlement | — |

| | — |

| | 354 |

| | — |

| |

| Net bargain purchase gain on acquisition of business | — |

| | — |

| | (6 | ) | | — |

| |

| Net (gains) losses on mark to market investments | | Net (gains) losses on mark to market investments | — | | | (3) | | | — | | | (49) | |

| Interest expense, net | 152 |

| | 132 |

| | 431 |

| | 384 |

| Interest expense, net | 59 | | | 74 | | | 121 | | | 143 | |

| Non-operating pension expense (income) | | Non-operating pension expense (income) | 12 | | | (47) | | | 27 | | | (96) | |

| Earnings (Loss) From Continuing Operations Before Income Taxes and Equity Earnings | 503 |

| | 373 |

| | 718 |

| | 676 |

| Earnings (Loss) From Continuing Operations Before Income Taxes and Equity Earnings | 255 | | | 514 | | | 476 | | | 876 | |

| Income tax provision (benefit) | 153 |

| | 107 |

| | 147 |

| | 139 |

| Income tax provision (benefit) | 33 | | | 96 | | | 81 | | | 191 | |

| Equity earnings (loss), net of taxes | 45 |

| | 43 |

| | 113 |

| | 151 |

| Equity earnings (loss), net of taxes | — | | | (2) | | | (1) | | | (2) | |

| Earnings (Loss) From Continuing Operations | 395 |

| | 309 |

| | 684 |

| | 688 |

| Earnings (Loss) From Continuing Operations | $ | 222 | | | $ | 416 | | | $ | 394 | | | $ | 683 | |

| Discontinued operations, net of taxes | — |

| | — |

| | — |

| | (5 | ) | Discontinued operations, net of taxes | 13 | | | 95 | | | 13 | | | 188 | |

| Net Earnings (Loss) | 395 |

| | 309 |

| | 684 |

| | 683 |

| Net Earnings (Loss) | $ | 235 | | | $ | 511 | | | $ | 407 | | | $ | 871 | |

| Less: Net earnings (loss) attributable to noncontrolling interests | — |

| | (3 | ) | | — |

| | (3 | ) | |

| Net Earnings (Loss) Attributable to International Paper Company | $ | 395 |

| | $ | 312 |

| | $ | 684 |

| | $ | 686 |

| |

| Basic Earnings (Loss) Per Share Attributable to International Paper Company Common Shareholders | | | | | | | | |

| Basic Earnings (Loss) Per Share | | Basic Earnings (Loss) Per Share | |

| Earnings (loss) from continuing operations | $ | 0.96 |

| | $ | 0.76 |

| | $ | 1.65 |

| | $ | 1.68 |

| Earnings (loss) from continuing operations | $ | 0.64 | | | $ | 1.13 | | | $ | 1.13 | | | $ | 1.83 | |

| Discontinued operations, net of taxes | — |

| | — |

| | — |

| | (0.01 | ) | Discontinued operations, net of taxes | 0.04 | | | 0.26 | | | 0.04 | | | 0.51 | |

| Net earnings (loss) | $ | 0.96 |

| | $ | 0.76 |

| | $ | 1.65 |

| | $ | 1.67 |

| Net earnings (loss) | $ | 0.68 | | | $ | 1.39 | | | $ | 1.17 | | | $ | 2.34 | |

| Diluted Earnings (Loss) Per Share Attributable to International Paper Company Common Shareholders | | | | | | | | |

| Diluted Earnings (Loss) Per Share | | Diluted Earnings (Loss) Per Share | |

| Earnings (loss) from continuing operations | $ | 0.95 |

| | $ | 0.75 |

| | $ | 1.64 |

| | $ | 1.66 |

| Earnings (loss) from continuing operations | $ | 0.64 | | | $ | 1.13 | | | $ | 1.12 | | | $ | 1.82 | |

| Discontinued operations, net of taxes | — |

| | — |

| | — |

| | (0.01 | ) | Discontinued operations, net of taxes | 0.04 | | | 0.25 | | | 0.04 | | | 0.50 | |

| Net earnings (loss) | $ | 0.95 |

| | $ | 0.75 |

| | $ | 1.64 |

| | $ | 1.65 |

| Net earnings (loss) | $ | 0.68 | | | $ | 1.38 | | | $ | 1.16 | | | $ | 2.32 | |

| Average Shares of Common Stock Outstanding – assuming dilution | 417.4 |

| | 415.3 |

| | 417.4 |

| | 415.5 |

| Average Shares of Common Stock Outstanding – assuming dilution | 346.5 | | | 370.7 | | | 349.5 | | | 375.7 | |

| Cash Dividends Per Common Share | $ | 0.4625 |

| | $ | 0.4400 |

| | $ | 1.3875 |

| | $ | 1.3200 |

| |

| Amounts Attributable to International Paper Company Common Shareholders | | | | | | | | |

| Earnings (loss) from continuing operations | $ | 395 |

| | $ | 312 |

| | $ | 684 |

| | $ | 691 |

| |

| Discontinued operations, net of taxes | — |

| | — |

| | — |

| | (5 | ) | |

| Net earnings (loss) | $ | 395 |

| | $ | 312 |

| | $ | 684 |

| | $ | 686 |

| |

The accompanying notes are an integral part of these condensed financial statements.

INTERNATIONAL PAPER COMPANY

(Unaudited)

(In millions)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Net Earnings (Loss) | $ | 395 |

| | $ | 309 |

| | $ | 684 |

| | $ | 683 |

|

| Other Comprehensive Income (Loss), Net of Tax: | | | | | | | |

| Amortization of pension and post-retirement prior service costs and net loss: | | | | | | | |

| U.S. plans | 59 |

| | 72 |

| | 176 |

| | 471 |

|

| Pension and postretirement liability adjustments: | | | | | | | |

| U.S. plans | — |

| | (53 | ) | | — |

| | (598 | ) |

| Non-U.S. plans | — |

| | — |

| | 1 |

| | 17 |

|

| Change in cumulative foreign currency translation adjustment | 100 |

| | 3 |

| | 234 |

| | 373 |

|

| Net gains/losses on cash flow hedging derivatives: | | | | | | | |

| Net gains (losses) arising during the period | 1 |

| | 5 |

| | 9 |

| | (5 | ) |

| Reclassification adjustment for (gains) losses included in net earnings (loss) | (2 | ) | | (3 | ) | | (6 | ) | | (7 | ) |

| Total Other Comprehensive Income (Loss), Net of Tax | 158 |

| | 24 |

| | 414 |

| | 251 |

|

| Comprehensive Income (Loss) | 553 |

| | 333 |

| | 1,098 |

| | 934 |

|

| Net (earnings) loss attributable to noncontrolling interests | — |

| | 3 |

| | — |

| | 3 |

|

| Other comprehensive (income) loss attributable to noncontrolling interests | 1 |

| | (1 | ) | | (1 | ) | | (1 | ) |

| Comprehensive Income (Loss) Attributable to International Paper Company | $ | 554 |

| | $ | 335 |

| | $ | 1,097 |

| | $ | 936 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net Earnings (Loss) | $ | 235 | | | $ | 511 | | | $ | 407 | | | $ | 871 | |

| Other Comprehensive Income (Loss), Net of Tax: | | | | | | | |

| Amortization of pension and post-retirement prior service costs and net loss: | | | | | | | |

| U.S. plans | 21 | | | 23 | | | 44 | | | 43 | |

| Change in cumulative foreign currency translation adjustment | (30) | | | 182 | | | (39) | | | 134 | |

| Total Other Comprehensive Income (Loss), Net of Tax | (9) | | | 205 | | | 5 | | | 177 | |

| Comprehensive Income (Loss) | $ | 226 | | | $ | 716 | | | $ | 412 | | | $ | 1,048 | |

The accompanying notes are an integral part of these condensed financial statements.

INTERNATIONAL PAPER COMPANY

|

| | | | | | | |

| | September 30,

2017 | | December 31,

2016 |

| | (unaudited) | | |

| Assets | | | |

| Current Assets | | | |

| Cash and temporary investments | $ | 998 |

| | $ | 1,033 |

|

| Accounts and notes receivable, net | 3,343 |

| | 3,001 |

|

| Inventories | 2,465 |

| | 2,438 |

|

| Other current assets | 405 |

| | 198 |

|

| Total Current Assets | 7,211 |

| | 6,670 |

|

| Plants, Properties and Equipment, net | 14,065 |

| | 13,990 |

|

| Forestlands | 468 |

| | 456 |

|

| Investments | 336 |

| | 360 |

|

| Financial Assets of Special Purpose Entities (Note 13) | 7,047 |

| | 7,033 |

|

| Goodwill | 3,420 |

| | 3,364 |

|

| Deferred Charges and Other Assets | 1,266 |

| | 1,220 |

|

| Total Assets | $ | 33,813 |

| | $ | 33,093 |

|

| Liabilities and Equity | | | |

| Current Liabilities | | | |

| Notes payable and current maturities of long-term debt | $ | 958 |

| | $ | 239 |

|

| Accounts payable | 2,408 |

| | 2,309 |

|

| Accrued payroll and benefits | 447 |

| | 430 |

|

| Other accrued liabilities | 1,056 |

| | 1,091 |

|

| Total Current Liabilities | 4,869 |

| | 4,069 |

|

| Long-Term Debt | 11,373 |

| | 11,075 |

|

| Nonrecourse Financial Liabilities of Special Purpose Entities (Note 13) | 6,289 |

| | 6,284 |

|

| Deferred Income Taxes | 3,505 |

| | 3,127 |

|

| Pension Benefit Obligation | 2,069 |

| | 3,400 |

|

| Postretirement and Postemployment Benefit Obligation | 315 |

| | 330 |

|

| Other Liabilities | 460 |

| | 449 |

|

| Equity | | | |

| Common stock, $1 par value, 2017 – 448.9 shares and 2016 – 448.9 shares | 449 |

| | 449 |

|

| Paid-in capital | 6,176 |

| | 6,189 |

|

| Retained earnings | 4,918 |

| | 4,818 |

|

| Accumulated other comprehensive loss | (4,949 | ) | | (5,362 | ) |

| | 6,594 |

| | 6,094 |

|

| Less: Common stock held in treasury, at cost, 2017 – 36.0 shares and 2016 – 37.7 shares | 1,680 |

| | 1,753 |

|

| Total International Paper Shareholders’ Equity | 4,914 |

| | 4,341 |

|

| Noncontrolling interests | 19 |

| | 18 |

|

| Total Equity | 4,933 |

| | 4,359 |

|

| Total Liabilities and Equity | $ | 33,813 |

| | $ | 33,093 |

|

| | | | | | | | | | | |

| June 30,

2023 | | December 31,

2022 |

| | (unaudited) | | |

| Assets | | | |

| Current Assets | | | |

| Cash and temporary investments | $ | 746 | | | $ | 804 | |

| Accounts and notes receivable, net | 3,140 | | | 3,284 | |

| Contract assets | 490 | | | 481 | |

| Inventories | 1,911 | | | 1,942 | |

| Assets held for sale | 30 | | | 133 | |

| Other current assets | 159 | | | 126 | |

| Total Current Assets | 6,476 | | | 6,770 | |

| Plants, Properties and Equipment, net | 10,473 | | | 10,431 | |

| Investments | 183 | | | 186 | |

| Long-Term Financial Assets of Variable Interest Entities (Note 14) | 2,303 | | | 2,294 | |

| Goodwill | 3,043 | | | 3,041 | |

| Overfunded Pension Plan Assets | 315 | | | 297 | |

| Right of Use Assets | 449 | | | 424 | |

| Deferred Charges and Other Assets | 441 | | | 497 | |

| Total Assets | $ | 23,683 | | | $ | 23,940 | |

| Liabilities and Equity | | | |

| Current Liabilities | | | |

| Notes payable and current maturities of long-term debt | $ | 248 | | | $ | 763 | |

| Accounts payable | 2,394 | | | 2,708 | |

| Accrued payroll and benefits | 385 | | | 355 | |

| Other current liabilities | 1,040 | | | 1,174 | |

| Total Current Liabilities | 4,067 | | | 5,000 | |

| Long-Term Debt | 5,572 | | | 4,816 | |

| Long-Term Nonrecourse Financial Liabilities of Variable Interest Entities (Note 14) | 2,110 | | | 2,106 | |

| Deferred Income Taxes | 1,735 | | | 1,732 | |

| Underfunded Pension Benefit Obligation | 283 | | | 281 | |

| Postretirement and Postemployment Benefit Obligation | 139 | | | 150 | |

| Long-Term Lease Obligations | 304 | | | 283 | |

| Other Liabilities | 1,069 | | | 1,075 | |

| Equity | | | |

| Common stock, $1 par value, 2023 – 448.9 shares and 2022 – 448.9 shares | 449 | | | 449 | |

| Paid-in capital | 4,688 | | | 4,725 | |

| Retained earnings | 9,938 | | | 9,855 | |

| Accumulated other comprehensive loss | (1,920) | | | (1,925) | |

| 13,155 | | | 13,104 | |

| Less: Common stock held in treasury, at cost, 2023 – 102.9 shares and 2022 – 98.6 shares | 4,751 | | | 4,607 | |

| Total Equity | 8,404 | | | 8,497 | |

| Total Liabilities and Equity | $ | 23,683 | | | $ | 23,940 | |

The accompanying notes are an integral part of these condensed financial statements.

INTERNATIONAL PAPER COMPANY

(Unaudited)

(In millions)

| | | | | | | | | | | |

| | Six Months Ended

June 30, |

| | 2023 | | 2022 |

| Operating Activities | | | |

| Net earnings (loss) | $ | 407 | | | $ | 871 | |

| Depreciation, amortization and cost of timber harvested | 485 | | | 528 | |

| Deferred income tax provision (benefit), net | (13) | | | (5) | |

| Net (gains) losses on mark to market investments | — | | | (49) | |

| Net (gains) losses on sales and impairments of equity method investments | 76 | | | — | |

| Equity method dividends received | 13 | | | 204 | |

| Equity (earnings) losses, net of taxes | (88) | | | (186) | |

| Periodic pension (income) expense, net | 47 | | | (58) | |

| Other, net | 34 | | | 72 | |

| Changes in current assets and liabilities | | | |

| Accounts and notes receivable | 160 | | | (276) | |

| Contract assets | (9) | | | (129) | |

| Inventories | 87 | | | (133) | |

| Accounts payable and accrued liabilities | (280) | | | 199 | |

| Interest payable | (23) | | | 3 | |

| Other | (23) | | | (63) | |

| Cash Provided By (Used For) Operations | 873 | | | 978 | |

| Investment Activities | | | |

| Invested in capital projects, net of insurance recoveries | (608) | | | (371) | |

| Proceeds from exchange of equity securities | — | | | 144 | |

| Proceeds from sale of fixed assets | 3 | | | 11 | |

| Other | 2 | | | (1) | |

| Cash Provided By (Used For) Investment Activities | (603) | | | (217) | |

| Financing Activities | | | |

| Repurchases of common stock and payments of restricted stock tax withholding | (218) | | | (823) | |

| Issuance of debt | 772 | | | 232 | |

| Reduction of debt | (536) | | | (243) | |

| Change in book overdrafts | (33) | | | (47) | |

| Dividends paid | (322) | | | (344) | |

| Other | (1) | | | (1) | |

| Cash Provided By (Used For) Financing Activities | (338) | | | (1,226) | |

| Effect of Exchange Rate Changes on Cash and Temporary Investments | 10 | | | (4) | |

| Change in Cash and Temporary Investments | (58) | | | (469) | |

| Cash and Temporary Investments | | | |

| Beginning of period | 804 | | | 1,295 | |

| End of period | $ | 746 | | | $ | 826 | |

|

| | | | | | | |

| | Nine Months Ended

September 30, |

| | 2017 | | 2016 |

| Operating Activities | | | |

| Net earnings (loss) | $ | 684 |

| | $ | 683 |

|

| Depreciation, amortization and cost of timber harvested | 1,075 |

| | 899 |

|

| Deferred income tax provision (benefit), net | 295 |

| | 45 |

|

| Restructuring and other charges | (16 | ) | | 47 |

|

| Pension plan contributions | (1,250 | ) | | (750 | ) |

| Net bargain purchase gain on acquisition of business | (6 | ) | | — |

|

| Net (gains) losses on sales and impairments of businesses | 9 |

| | 70 |

|

| Ilim dividends received | 129 |

| | 58 |

|

| Equity (earnings) loss, net | (113 | ) | | (151 | ) |

| Periodic pension expense, net | 237 |

| | 718 |

|

| Other, net | 92 |

| | 67 |

|

| Changes in current assets and liabilities | | | |

| Accounts and notes receivable | (293 | ) | | (83 | ) |

| Inventories | (70 | ) | | (6 | ) |

| Accounts payable and accrued liabilities | 5 |

| | (37 | ) |

| Interest payable | (11 | ) | | 24 |

|

| Other | (198 | ) | | (18 | ) |

| Cash Provided By (Used For) Operations | 569 |

| | 1,566 |

|

| Investment Activities | | | |

| Invested in capital projects | (935 | ) | | (903 | ) |

| Acquisitions, net of cash acquired | (45 | ) | | (56 | ) |

| Proceeds from divestitures, net of cash divested | 4 |

| | 105 |

|

| Proceeds from sale of fixed assets | 22 |

| | 13 |

|

| Other | (54 | ) | | (130 | ) |

| Cash Provided By (Used For) Investment Activities | (1,008 | ) | | (971 | ) |

| Financing Activities | | | |

| Repurchases of common stock and payments of restricted stock tax withholding | (46 | ) | | (132 | ) |

| Issuance of debt | 1,366 |

| | 3,447 |

|

| Reduction of debt | (369 | ) | | (1,855 | ) |

| Change in book overdrafts | 5 |

| | (5 | ) |

| Dividends paid | (573 | ) | | (543 | ) |

| Debt tender premiums paid | (1 | ) | | (31 | ) |

| Other | (2 | ) | | (3 | ) |

| Cash Provided By (Used For) Financing Activities | 380 |

| | 878 |

|

| Effect of Exchange Rate Changes on Cash | 24 |

| | 39 |

|

| Change in Cash and Temporary Investments | (35 | ) | | 1,512 |

|

| Cash and Temporary Investments | | | |

| Beginning of period | 1,033 |

| | 1,050 |

|

| End of period | $ | 998 |

| | $ | 2,562 |

|

The accompanying notes are an integral part of these condensed financial statements.

INTERNATIONAL PAPER COMPANY

(Unaudited)

The accompanying unaudited condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States and in accordance with the instructions to Form 10-Q and, in the opinion of management, include all adjustments that are necessary for the fair presentation of International Paper Company’s (International Paper’s, the Company’s("International Paper's," "the Company’s" or our)"our") financial position, results of operations, and cash flows for the interim periods presented. Except as disclosed herein, such adjustments are of a normal, recurring nature. Results for the first ninesix months of the year may not necessarily be indicative of full year results. It is suggested thatYou should read these condensed financial statements be read in conjunction with the audited financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016 and the Company's Current Report on Form 8-K dated July 31, 2017 (collectively the "2016 10-K"2022 (the "Annual Report"), both of which have previously been filed with the Securities and Exchange Commission.

These condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States that require the use of management’s estimates. Actual results could differ from management’s estimates.

Russia-Ukraine Conflict

The Current Report on Form 8-K dated July 31, 2017 was filedmilitary conflict between Russia and Ukraine, including ongoing sanctions, actions by the Russian government, and associated domestic and global economic and geopolitical conditions, has adversely affected and may continue to retrospectively adjust portionsadversely affect our Ilim joint venture and our businesses, financial condition, results of operations and cash flows. On January 24, 2023, we announced that we have reached an agreement to sell our equity interest in Ilim S.A. ("Ilim") and have also received from the same purchaser an indication of interest to purchase our equity investment in JSC Ilim Group ("Ilim Group" and together with Ilim, the "Ilim joint venture"), however, we cannot be certain if and when the completion of these sales may occur. Our ability to complete such sales is subject to various risks, including (i) purchasers’ inability to obtain necessary regulatory approvals or to finance the purchase pursuant to the terms of the Company's Annual Reportagreement, (ii) adverse actions by the Russian government, and (iii) new or expanded sanctions imposed by the U.S., the United Kingdom, or the European Union or its member countries. We are unable to predict the full impact that Russia’s ongoing invasion of Ukraine, current or potential future sanctions, ongoing or potential disruptions resulting from the conflict, the changing regulatory environment in Russia, negative macroeconomic conditions arising from such conflict, supply chain disruptions, and geopolitical instability and shifts, may have on Form 10-K forus or our ability to complete the year ended December 31, 2016, to reflect the adoptionsale of the required guidance in ASU 2015-17, "Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes." In addition, as a result of an internal reorganizationour interest in the 2017 first quarter, the net sales and operating profits for the Asian Distribution operations are included in the results of the businesses that manufacture the products, and as such, prior year amounts have been reclassified to conform with the presentation in 2017.Ilim joint venture.

During the fourth quarter of 2016, the Company completed the acquisition of Weyerhaeuser's pulp business (see Note 7). Subsequent to the acquisition, the Company began reporting Global Cellulose Fibers as a separate reportable business segment in the fourth quarter of 2016 due to the increased materiality of the results of this business. This segment includes the Company's legacy pulp business and the newly acquired pulp business. As such, amounts related to the legacy pulp business have been reclassified out of the Printing Papers' segment and included in the new Global Cellulose Fibers business segment for all prior periods to conform with current year presentation.

NOTE 2 - RECENT ACCOUNTING DEVELOPMENTS

Derivatives and HedgingRecently Adopted Accounting Pronouncements

Reference Rate Reform

In August 2017,March 2020, the FASB issued ASU 2017-12, "Derivatives and Hedging2020-04, "Reference Rate Reform (Topic 815)848): Targeted ImprovementsFacilitation of the Effects of Reference Rate Reform on Financial Reporting." This guidance provides companies with optional guidance to Accounting for Hedging Activities." The objective of this newease the potential accounting burden associated with transitioning away from reference rates that are expected to be discontinued. This guidance is the improvement of the financial reporting of hedging relationshipseffective upon issuance and generally can be applied through December 31, 2024. The Company has applied and will continue to better portray the economic results of an entity’s risk management activities in its financial statements. In addition to that main objective,apply the amendments in this update to account for contract modifications due to changes in reference rates as those modifications occur. We do not expect these amendments to have a material impact on our consolidated financial statements and related disclosures.

Liabilities - Supplier Finance Programs

In September 2022, the FASB issued ASU 2022-04, "Liabilities - Supplier Finance Programs (Subtopic 405-50): Disclosure of Supplier Finance Program Obligations." This guidance make certain targeted improvementsrequires a business entity operating as a buyer in a supplier finance agreement to simplify the application of the hedge accounting guidance in current GAAP.disclose qualitative and quantitative information about its supplier finance programs. This guidance is effective for annual reporting periods beginning after December 15, 2018, and interim periods within those years. Early adoption is permitted. The Company is currently evaluating the provisions of this guidance, but plans to early adopt the provisions of this guidance for the year beginning January 1, 2018.

Retirement Benefits

In March 2017, the FASB issued ASU 2017-07, "Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost." Under this new guidance, employers will present the service costs component of the net periodic benefit cost in the same income statement line item(s) as other employee compensation costs arising from services rendered during the period. In addition, only the service cost component will be eligible for capitalization in assets. Employers will present the other components separately from the line items(s) that includes the service cost and outside of any subtotal of operating income. In addition, disclosure of the line(s) used to present the other components of net periodic benefit cost will be required if the components are not presented separately in the income statement. This guidance is effective for annual reporting periods beginning after December 15, 2017, and interim periods within those years. Early adoption is permitted as of the beginning of an annual period for which financial statements (interim or annual) have not been issued or made available for issuance. The Company is currently evaluating the provisions of this guidance; however, we expect the adoption of ASU 2017-07 to result in a change in our adjusted operating profit (used to measure the earnings performance of the Company's business segments), which will be offset by a corresponding change in non-operating pension expense to reflect the impact of presenting the amortization of the prior service cost component of net periodic pension expense outside of operating income. We expect to adopt the provisions of this guidance on January 1, 2018 using the retrospective method. We also do not expect ASU 2017-07 to have an impact on our statements of financial position or cash flows.

Intangibles

In January 2017, the FASB issued ASU 2017-04, "Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment." This guidance eliminates the requirement to calculate the implied fair value of goodwill under Step 2 of today's goodwill impairment test to measure a goodwill impairment charge. Instead, entities will record an impairment charge based on the excess of a reporting unit's carrying amount over its fair value. This guidance should be applied prospectively and is effective for annual reporting periods beginning after December 15, 2019, for any impairment test performed in 2020. Early adoption is permitted for annual and interim goodwill impairment testing dates after January 1, 2017. The Company is currently evaluating the provisions of this guidance; however, we do not anticipate adoption having material impact given we have no impairment triggers.

Business Combinations

In January 2017, the FASB issued ASU 2017-01, "Business Combinations (Topic 805): Clarifying the Definition of a Business." Under the new guidance, an entity must first determine whether substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets. If this threshold is met, the set of transferred assets and activities is not a business. If this threshold is not met, the entity then evaluates whether the set meets the requirement that a business include, at a minimum, an input and a substantive process that together significantly contribute to the ability to create outputs. This guidance is effective for annual reporting periods beginning after December 15, 2017, and interim periods within those years. Early adoption is permitted. The Company is currently evaluating the provisions of this guidance; however, we do not anticipate the adoption having a material impact on the financial statements.

Income Taxes

In October 2016, the FASB issued ASU 2016-16, "Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory." This ASU requires companies to recognize the income tax effects of intercompany sales and transfers of assets other than inventory in the period in which the transfer occurs rather than defer the income tax effects which is current practice. This new guidance is effective for annual reporting periods beginning after December 15, 2017,2022, and interim periods within those years. The guidance requires companies to apply a modified retrospective approach with a cumulative catch-up adjustment to opening retained earnings in the period of adoption. Early adoption is permitted. The Company does not expect that the adoption of the standard will result in a material impact on the financial statements.

Stock Compensation

In May 2017, the FASB issued ASU 2017-09, "Compensation - Stock Compensation (Topic 718): Scope of Modification Accounting." This guidance clarifies when changes to the terms or conditions of a share-based payment award must be accounted for as modifications. Under this guidance, entities will apply the modification accounting guidance if the value, vesting conditions or classification of the award changes. This guidance is effective for annual reporting periods beginning after December 15, 2017, and interim periods within those years. Early adoption is permitted, including adoption in any interim period. The Company is currently evaluating the provisions of this guidance; however, we do not anticipate the adoption having a material impact on the financial statements.

In March 2016, the FASB issued ASU 2016-09, "Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting." Under this new guidance, all excess tax benefits and tax deficiencies are recognized in the income statement as they occur and therefore impact the Company's effective tax rate. This guidance replaced previous guidance which required tax benefits that exceed compensation costs (windfalls) to be recognized in equity. The new guidance also changed the cash flow presentation of excess tax benefits, classifying them as operating inflows rather than financing activities as they were previously classified. In addition, the new guidance allows companies to provide net settlement of stock-based compensation to cover tax withholding as long as the net settlement does not exceed the maximum individual statutory tax rate in the employee's tax jurisdiction. Amendments related to the timing of when excess tax benefits are recognized, minimum statutory withholding requirements, forfeitures, and intrinsic value were to be applied using a modified retrospective transition method by means of a cumulative-effect adjustment to equity as of the beginning of the period in which the guidance is adopted. Amendments related to the presentation of employee taxes paid on the statement of cash flows when an employer withholds shares to meet the minimum statutory withholding requirement were to be applied retrospectively. Amendments requiring recognition of excess tax benefits and tax deficiencies in the income statement and the practical expedient for estimating expected term were applied prospectively. An entity could elect to apply the amendments related to the presentation of excess tax benefits on the statement of cash flows using either a prospective transition method or a retrospective transition method. This ASU was effective for annual reporting periods beginning after December 15, 2016, and interim periods with those years. The Company prospectively adopted the provisions of this

ASUguidance in the first quarter of

2017 with no material impact2023. See Note 8 - Supplemental Financial Information.

Generally, the Company recognizes revenue on a point-in-time basis when the financial statements.

Leases

In February 2016,customer takes title to the FASB issued ASU 2016-02, "Leases Topic (842): Leases." This ASU will require most leases to be recognized on the balance sheet which will increase reported assets and liabilities. Lessor accounting will remain substantially similar to current U.S. GAAP. This ASU is effective for annual reporting periods beginning after December 15, 2018, and interim periods within those years, and mandates a modified retrospective transition method for all entities. The Company expects to adopt this guidance using a modified retrospective transition approach for leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements. We expect to recognize a liability and corresponding asset associated with in-scope operating and finance leases but are still in the process of determining those amounts and the processes required to account for leasing activity on an ongoing basis.

Revenue Recognition

In May 2014, the FASB issued ASU 2014-09, "Revenue from Contracts with Customers." This guidance replaces most existing revenue recognition guidance and provides that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods and services. This ASU was effectiveassumes the risks and rewards for annual reporting periods beginning after December 15, 2016, and interim periods within those years and permits the use of either the retrospective or cumulative effect transition method; however, in August 2015, the FASB issued ASU 2015-14 which defers the effective date by one year making the guidance effective for annual reporting periods beginning after December 15, 2017. The FASB has continued to clarify this guidance in various updates during 2015, 2016 and 2017, all of which, have the same effective date as the original guidance.

We are currently evaluating the impact of ASU 2014-09 and all related ASU's on our financial statements. During the second quarter of 2017, we finalized our plan to adopt the new revenue guidance effective January 1, 2018 using the modified retrospective transition method. The Company's transition team, including representatives from all of our business segments, continues to review and analyze the impact of the standard on our revenue contracts. Surveys were developed and reviews of customer contracts have been performed in order to gather information and identify areas of the Company's business where potential differences could result in applying the requirements of the new standard to its revenue contracts. The results of the surveys and contract reviews indicate that the adoption of the standard may require acceleration of revenue for products produced by the Company without an alternative future use andgoods. For customized goods where the Company would havehas a legally enforceable right ofto payment for productionthe goods, the Company recognizes revenue over time which, generally, is as the goods are produced.

Disaggregated Revenue

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2023 |

| In millions | | Industrial Packaging | | Global Cellulose Fibers | | Corporate & Intersegment | | Total |

| Primary Geographical Markets (a) | | | | | | | | |

| United States | | $ | 3,305 | | | $ | 616 | | | $ | 100 | | | $ | 4,021 | |

| EMEA | | 351 | | | 26 | | | — | | | 377 | |

| Pacific Rim and Asia | | 7 | | | 56 | | | — | | | 63 | |

| Americas, other than U.S. | | 221 | | | — | | | — | | | 221 | |

| Total | | $ | 3,884 | | | $ | 698 | | | $ | 100 | | | $ | 4,682 | |

| | | | | | | | |

| Operating Segments | | | | | | | | |

| North American Industrial Packaging | | $ | 3,550 | | | $ | — | | | $ | — | | | $ | 3,550 | |

| EMEA Industrial Packaging | | 351 | | | — | | | — | | | 351 | |

| Global Cellulose Fibers | | — | | | 698 | | | — | | | 698 | |

| Intra-segment Eliminations | | (17) | | | — | | | — | | | (17) | |

| Corporate & Intersegment Sales | | — | | | — | | | 100 | | | 100 | |

| Total | | $ | 3,884 | | | $ | 698 | | | $ | 100 | | | $ | 4,682 | |

(a) Net sales are attributed to countries based on the location of the seller.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2023 |

| In millions | | Industrial Packaging | | Global Cellulose Fibers | | Corporate & Intersegment | | Total |

| Primary Geographical Markets (a) | | | | | | | | |

| United States | | $ | 6,760 | | | $ | 1,346 | | | $ | 226 | | | $ | 8,332 | |

| EMEA | | 742 | | | 51 | | | — | | | 793 | |

| Pacific Rim and Asia | | 15 | | | 112 | | | — | | | 127 | |

| Americas, other than U.S. | | 450 | | | — | | | — | | | 450 | |

| Total | | $ | 7,967 | | | $ | 1,509 | | | $ | 226 | | | $ | 9,702 | |

| | | | | | | | |

| Operating Segments | | | | | | | | |

| North American Industrial Packaging | | $ | 7,274 | | | $ | — | | | $ | — | | | $ | 7,274 | |

| EMEA Industrial Packaging | | 742 | | | — | | | — | | | 742 | |

| Global Cellulose Fibers | | — | | | 1,509 | | | — | | | 1,509 | |

| Intra-segment Eliminations | | (49) | | | — | | | — | | | (49) | |

| Corporate & Intersegment Sales | | — | | | — | | | 226 | | | 226 | |

| Total | | $ | 7,967 | | | $ | 1,509 | | | $ | 226 | | | $ | 9,702 | |

(a) Net sales are attributed to countries based on the location of the seller.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2022 |

| In millions | | Industrial Packaging | | Global Cellulose Fibers | | Corporate & Intersegment | | Total |

Primary Geographical Markets (a) | | | | | | | | |

| United States | | $ | 3,842 | | | $ | 752 | | | $ | 109 | | | $ | 4,703 | |

| EMEA | | 413 | | | 25 | | | — | | | 438 | |

| Pacific Rim and Asia | | 11 | | | 11 | | | 1 | | | 23 | |

| Americas, other than U.S. | | 225 | | | — | | | — | | | 225 | |

| Total | | $ | 4,491 | | | $ | 788 | | | $ | 110 | | | $ | 5,389 | |

| | | | | | | | |

| Operating Segments | | | | | | | | |

| North American Industrial Packaging | | $ | 4,126 | | | $ | — | | | $ | — | | | $ | 4,126 | |

| EMEA Industrial Packaging | | 413 | | | — | | | — | | | 413 | |

| Global Cellulose Fibers | | — | | | 788 | | | — | | | 788 | |

| Intra-segment Eliminations | | (48) | | | — | | | — | | | (48) | |

| Corporate & Intersegment Sales | | — | | | — | | | 110 | | | 110 | |

| Total | | $ | 4,491 | | | $ | 788 | | | $ | 110 | | | $ | 5,389 | |

(a) Net sales are attributed to countries based on the location of the seller.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2022 |

| In millions | | Industrial Packaging | | Global Cellulose Fibers | | Corporate & Intersegment | | Total |

| Primary Geographical Markets (a) | | | | | | | | |

| United States | | $ | 7,603 | | | $ | 1,414 | | | $ | 229 | | | $ | 9,246 | |

| EMEA | | 823 | | | 55 | | | — | | | 878 | |

| Pacific Rim and Asia | | 21 | | | 29 | | | 2 | | | 52 | |

| Americas, other than U.S. | | 450 | | | — | | | — | | | 450 | |

| Total | | $ | 8,897 | | | $ | 1,498 | | | $ | 231 | | | $ | 10,626 | |

| | | | | | | | |

| Operating Segments | | | | | | | | |

| North American Industrial Packaging | | $ | 8,151 | | | $ | — | | | $ | — | | | $ | 8,151 | |

| EMEA Industrial Packaging | | 823 | | | — | | | — | | | 823 | |

| Global Cellulose Fibers | | — | | | 1,498 | | | — | | | 1,498 | |

| Intra-segment Eliminations | | (77) | | | — | | | — | | | (77) | |

| Corporate & Intersegment Sales | | — | | | — | | | 231 | | | 231 | |

| Total | | $ | 8,897 | | | $ | 1,498 | | | $ | 231 | | | $ | 10,626 | |

(a) Net sales are attributed to countries based on the location of the seller.

Revenue Contract Balances

A contract asset is created when the Company recognizes revenue on its customized products completedprior to date.having an unconditional right to payment from the customer, which generally does not occur until title and risk of loss passes to the customer.

A contract liability is created when customers prepay for goods prior to the Company transferring those goods to the customer. The contract liability is reduced once control of the goods is transferred to the customer. The majority of our customer prepayments are received during the fourth quarter each year for goods that will be transferred to customers over the following twelve months. Contract liabilities of $22 million and $38 million are included in Other current liabilities in the accompanying condensed consolidated balance sheet as of June 30, 2023 and December 31, 2022, respectively. The Company also recorded a contract liability of $115 million related to a previous acquisition. The balance of this contract liability was $95 million and $99 million at June 30, 2023 and December 31, 2022, respectively, and is continuing to evaluaterecorded in Other current liabilities and Other Liabilities in the terms of its revenue contracts, including evaluatingaccompanying condensed consolidated balance sheet.

The difference between the materialityopening and closing balances of the potential impactCompany's contract assets and contract liabilities primarily results from the difference between the price and quantity at comparable points in time for goods for which we have an unconditional right to payment or receive prepayment from the financial statements; however, due to the repetitive naturecustomer, respectively.

NOTE 34 - EQUITY

A summary of the changes in equity for the ninethree and six months ended SeptemberJune 30, 20172023 and 20162022 is provided below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2023 |

| In millions, except per share amounts | Common Stock Issued | | Paid-in Capital | | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | | Treasury Stock | | Total

Equity | |

| Balance, April 1 | $ | 449 | | | $ | 4,699 | | | $ | 9,866 | | $ | (1,911) | | | $ | 4,714 | | | $ | 8,389 | | |

| Issuance of stock for various plans, net | — | | | (11) | | | — | | — | | | (3) | | | (8) | | |

| Repurchase of stock | — | | | — | | | — | | — | | | 40 | | | (40) | | |

Common stock dividends ($0.4625 per share) | — | | | — | | | (163) | | — | | | — | | | (163) | | |

| Comprehensive income (loss) | — | | | — | | | 235 | | (9) | | | — | | | 226 | | |

| Ending Balance, June 30 | $ | 449 | | | $ | 4,688 | | | $ | 9,938 | | $ | (1,920) | | | $ | 4,751 | | | $ | 8,404 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2023 |

| In millions, except per share amounts | Common Stock Issued | | Paid-in Capital | | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | | Treasury Stock | | Total

Equity | |

| Balance, January 1 | $ | 449 | | | $ | 4,725 | | | $ | 9,855 | | $ | (1,925) | | | $ | 4,607 | | | $ | 8,497 | | |

| Issuance of stock for various plans, net | — | | | (37) | | | — | | — | | | (75) | | | 38 | | |

| Repurchase of stock | — | | | — | | | — | | — | | | 219 | | | (219) | | |

Common stock dividends ($0.9250 per share) | — | | | — | | | (324) | | — | | | — | | | (324) | | |

| Comprehensive income (loss) | — | | | — | | | 407 | | 5 | | | — | | | 412 | | |

| Ending Balance, June 30 | $ | 449 | | | $ | 4,688 | | | $ | 9,938 | | $ | (1,920) | | | $ | 4,751 | | | $ | 8,404 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2022 |

| In millions, except per share amounts | Common Stock Issued | | Paid-in Capital | | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | | Treasury Stock | | Total

Equity | |

| Balance, April 1 | $ | 449 | | | $ | 4,670 | | | $ | 9,218 | | $ | (1,694) | | | $ | 3,756 | | | $ | 8,887 | | |

| Issuance of stock for various plans, net | — | | | 5 | | | — | | — | | | (2) | | | 7 | | |

| Repurchase of stock | — | | | — | | | — | | — | | | 395 | | | (395) | | |

| Common stock dividends ($0.4625 per share) | — | | | — | | | (172) | | — | | | — | | | (172) | | |

| Comprehensive income (loss) | — | | | — | | | 511 | | 205 | | | — | | | 716 | | |

| Ending Balance, June 30 | $ | 449 | | | $ | 4,675 | | | $ | 9,557 | | $ | (1,489) | | | $ | 4,149 | | | $ | 9,043 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2022 |

| In millions, except per share amounts | Common Stock Issued | | Paid-in Capital | | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | | Treasury Stock | | Total

Equity | |

| Balance, January 1 | $ | 449 | | | $ | 4,668 | | | $ | 9,029 | | $ | (1,666) | | | $ | 3,398 | | | $ | 9,082 | | |

| Issuance of stock for various plans, net | — | | | 7 | | | — | | — | | | (72) | | | 79 | | |

| Repurchase of stock | — | | | — | | | — | | — | | | 823 | | | (823) | | |

Common stock dividends ($0.9250 per share) | — | | | — | | | (343) | | — | | | — | | | (343) | | |

| Comprehensive income (loss) | — | | | — | | | 871 | | 177 | | | — | | | 1,048 | | |

| Ending Balance, June 30 | $ | 449 | | | $ | 4,675 | | | $ | 9,557 | | $ | (1,489) | | | $ | 4,149 | | | $ | 9,043 | | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended

September 30, |

| | 2017 | | 2016 |

| In millions, except per share amounts | Total International Paper Shareholders’ Equity | | Noncontrolling Interests | | Total Equity | | Total International Paper Shareholders’ Equity | | Noncontrolling Interests | | Total Equity |

| Balance, January 1 | $ | 4,341 |

| | $ | 18 |

| | $ | 4,359 |

| | $ | 3,884 |

| | $ | 25 |

| | $ | 3,909 |

|

| Issuance of stock for various plans, net | 130 |

| | — |

| | 130 |

| | 100 |

| | — |

| | 100 |

|

| Repurchase of stock | (46 | ) | | — |

| | (46 | ) | | (132 | ) | | — |

| | (132 | ) |

| Common stock dividends ($1.3875 per share in 2017 and $1.3200 per share in 2016) | (584 | ) | | — |

| | (584 | ) | | (550 | ) | | — |

| | (550 | ) |

| Transactions of equity method investees | (24 | ) | | — |

| | (24 | ) | | (37 | ) | | — |

| | (37 | ) |

| Divestiture of noncontrolling interests | — |

| | — |

| | — |

| | — |

| | (3 | ) | | (3 | ) |

| Other | — |

| | — |

| | — |

| | 8 |

| | — |

| | 8 |

|

| Comprehensive income (loss) | 1,097 |

| | 1 |

| | 1,098 |

| | 936 |

| | (2 | ) | | 934 |

|

| Ending Balance, September 30 | $ | 4,914 |

| | $ | 19 |

| | $ | 4,933 |

| | $ | 4,209 |

| | $ | 20 |

| | $ | 4,229 |

|

The following table presents changes in AOCIAccumulated Other Comprehensive Income (Loss) (AOCI), net of tax, for the three-month periodthree months and six months ended SeptemberJune 30, 2017:2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| In millions | 2023 | | 2022 | | 2023 | | 2022 |

| Defined Benefit Pension and Postretirement Adjustments | | | | | | | |

| Balance at beginning of period | $ | (1,172) | | | $ | (942) | | | $ | (1,195) | | | $ | (962) | |

| | | | | | | |

| Amounts reclassified from accumulated other comprehensive income | 21 | | | 23 | | | 44 | | | 43 | |

| Balance at end of period | (1,151) | | | (919) | | | (1,151) | | | (919) | |

| Change in Cumulative Foreign Currency Translation Adjustments | | | | | | | |

| Balance at beginning of period | (731) | | | (742) | | | (722) | | | (694) | |

| Other comprehensive income (loss) before reclassifications | (30) | | | 182 | | | (39) | | | 134 | |

| | | | | | | |

| Balance at end of period | (761) | | | (560) | | | (761) | | | (560) | |

| Net Gains and Losses on Cash Flow Hedging Derivatives | | | | | | | |

| Balance at beginning of period | (8) | | | (10) | | | (8) | | | (10) | |

| | | | | | | |

| | | | | | | |

| Balance at end of period | (8) | | | (10) | | | (8) | | | (10) | |

| Total Accumulated Other Comprehensive Income (Loss) at End of Period | $ | (1,920) | | | $ | (1,489) | | | $ | (1,920) | | | $ | (1,489) | |

|

| | | | | | | | | | | | | | | | |

| In millions | | Defined Benefit Pension and Postretirement Items (a) | | Change in Cumulative Foreign Currency Translation Adjustments (a) | | Net Gains and Losses on Cash Flow Hedging Derivatives (a) | | Total (a) |

| Balance, July 1, 2017 | | $ | (2,954 | ) | | $ | (2,155 | ) | | $ | 1 |

| | $ | (5,108 | ) |

| Other comprehensive income (loss) before reclassifications | | — |

| | 101 |

| | 1 |

| | 102 |

|

| Amounts reclassified from accumulated other comprehensive income | | 59 |

| | (1 | ) | | (2 | ) | | 56 |

|

| Net Current Period Other Comprehensive Income (Loss) | | 59 |

| | 100 |

| | (1 | ) | | 158 |

|

| Other Comprehensive Income (Loss) Attributable to Noncontrolling Interest | | — |

| | 1 |

| | — |

| | 1 |

|

| Balance, September 30, 2017 | | $ | (2,895 | ) | | $ | (2,054 | ) | | $ | — |

| | $ | (4,949 | ) |

| |

(a) | All amounts are net of tax. |

The following table presents changes in AOCI for the three-month period ended September 30, 2016:

|

| | | | | | | | | | | | | | | | |

| In millions | | Defined Benefit Pension and Postretirement Items (a) | | Change in Cumulative Foreign Currency Translation Adjustments (a) | | Net Gains and Losses on Cash Flow Hedging Derivatives (a) | | Total (a) |

| Balance, July 1, 2016 | | $ | (3,298 | ) | | $ | (2,179 | ) | | $ | (4 | ) | | $ | (5,481 | ) |

| Other comprehensive income (loss) before reclassifications | | (53 | ) | | 3 |

| | 5 |

| | (45 | ) |

| Amounts reclassified from accumulated other comprehensive income | | 72 |

| | — |

| | (3 | ) | | 69 |

|

| Net Current Period Other Comprehensive Income (Loss) | | 19 |

| | 3 |

| | 2 |

| | 24 |

|

| Other Comprehensive Income (Loss) Attributable to Noncontrolling Interest | | — |

| | (1 | ) | | — |

| | (1 | ) |

| Balance, September 30, 2016 | | $ | (3,279 | ) | | $ | (2,177 | ) | | $ | (2 | ) | | $ | (5,458 | ) |

| |

(a) | All amounts are net of tax. |

The following table presents changes in AOCI for the nine-month period ended September 30, 2017:

|

| | | | | | | | | | | | | | | | |

| In millions | | Defined Benefit Pension and Postretirement Items (a) | | Change in Cumulative Foreign Currency Translation Adjustments (a) | | Net Gains and Losses on Cash Flow Hedging Derivatives (a) | | Total (a) |

| Balance, January 1, 2017 | | $ | (3,072 | ) | | $ | (2,287 | ) | | $ | (3 | ) | | $ | (5,362 | ) |

| Other comprehensive income (loss) before reclassifications | | 1 |

| | 235 |

| | 9 |

| | 245 |

|

| Amounts reclassified from accumulated other comprehensive income | | 176 |

| | (1 | ) | | (6 | ) | | 169 |

|

| Net Current Period Other Comprehensive Income | | 177 |

| | 234 |

| | 3 |

| | 414 |

|

| Other Comprehensive Income (Loss) Attributable to Noncontrolling Interest | | — |

| | (1 | ) | | — |

| | (1 | ) |

| Balance, September 30, 2017 | | $ | (2,895 | ) | | $ | (2,054 | ) | | $ | — |

| | $ | (4,949 | ) |

| |

(a) | All amounts are net of tax. |

The following table presents changes in AOCI for the nine-month period ended September 30, 2016:

|

| | | | | | | | | | | | | | | | |

| In millions | | Defined Benefit Pension and Postretirement Items (a) | | Change in Cumulative Foreign Currency Translation Adjustments (a) | | Net Gains and Losses on Cash Flow Hedging Derivatives (a) | | Total (a) |

| Balance, January 1, 2016 | | $ | (3,169 | ) | | $ | (2,549 | ) | | $ | 10 |

| | $ | (5,708 | ) |

| Other comprehensive income (loss) before reclassifications | | (581 | ) | | 376 |

| | (5 | ) | | (210 | ) |

| Amounts reclassified from accumulated other comprehensive income | | 471 |

| | (3 | ) | | (7 | ) | | 461 |

|

| Net Current Period Other Comprehensive Income | | (110 | ) | | 373 |

| | (12 | ) | | 251 |

|

| Other Comprehensive Income (Loss) Attributable to Noncontrolling Interest | | — |

| | (1 | ) | | — |

| | (1 | ) |

| Balance, September 30, 2016 | | $ | (3,279 | ) | | $ | (2,177 | ) | | $ | (2 | ) | | $ | (5,458 | ) |

| |

(a) | All amounts are net of tax. |

The following table presents details of the reclassifications out of AOCI for the three-monththree months and nine-month periodssix months ended SeptemberJune 30, 20172023 and 2016:2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| In millions: | Amount Reclassified from Accumulated Other Comprehensive Income | | Location of Amount Reclassified from AOCI |

Three Months Ended

June 30, | Six Months Ended

June 30, | |

| 2023 | | 2022 | | 2023 | | 2022 | |

| Defined benefit pension and postretirement items: | | | | | | | | | |

| Prior-service costs | $ | (6) | | | $ | (6) | | | $ | (12) | | | $ | (11) | | (a) | Non-operating pension expense (income) |

| Actuarial gains (losses) | (22) | | | (24) | | | (46) | | | (46) | | (a) | Non-operating pension expense (income) |

| Total pre-tax amount | (28) | | | (30) | | | (58) | | | (57) | | | |

| Tax (expense) benefit | 7 | | | 7 | | | 14 | | | 14 | | | |

| Net of tax | (21) | | | (23) | | | (44) | | | (43) | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total reclassifications for the period | $ | (21) | | | $ | (23) | | | $ | (44) | | | $ | (43) | | | |

(a)These accumulated other comprehensive income components are included in the computation of net periodic pension cost (see Note 16 for additional details).

|

| | | | | | | | | | | | | | | | | | | |

| Details About Accumulated Other Comprehensive Income Components | | Amounts Reclassified from Accumulated Other Comprehensive Income | | Location of Amount Reclassified from AOCI |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | |

| | 2017 | | 2016 | | 2017 | | 2016 | | |

| In millions: | | | | | | | | | | | |

| Defined benefit pension and postretirement items: | | | | | | | | | | | |

| Prior-service costs | | $ | (6 | ) | | $ | (9 | ) | | $ | (19 | ) | | $ | (27 | ) | | (a) | Cost of products sold |

| Actuarial gains (losses) | | (89 | ) | | (108 | ) | | (266 | ) | | (739 | ) | | (a) | Cost of products sold |

| Total pre-tax amount | | (95 | ) | | (117 | ) | | (285 | ) | | (766 | ) | | | |

| Tax (expense) benefit | | 36 |

| | 45 |

| | 109 |

| | 295 |

| | | |

| Net of tax | | (59 | ) | | (72 | ) | | (176 | ) | | (471 | ) | | | |

| | | | | | | | | | | | |

| Change in cumulative foreign currency translation adjustments: | | | | | | | | | | | |

| Business acquisitions/divestitures | | 1 |

| | — |

| | 1 |

| | 3 |

| | | Net (gains) losses on sales and impairments of businesses |

| Tax (expense)/benefit | | — |

| | — |

| | — |

| | — |

| | | |

| Net of tax | | 1 |

| | — |

| | 1 |

| | 3 |

| | | |

| | | | | | | | | | | | |

| Net gains and losses on cash flow hedging derivatives: | | | | | | | | | | | |

| Foreign exchange contracts | | 3 |

| | 5 |

| | 8 |

| | 10 |

| | (b) | Cost of products sold |

| Total pre-tax amount | | 3 |

| | 5 |

| | 8 |

| | 10 |

| | | |

| Tax (expense)/benefit | | (1 | ) | | (2 | ) | | (2 | ) | | (3 | ) | | | |

| Net of tax | | 2 |

| | 3 |

| | 6 |

| | 7 |

| | | |

| Total reclassifications for the period | | $ | (56 | ) | | $ | (69 | ) | | $ | (169 | ) | | $ | (461 | ) | | | |

| |

(a) | These accumulated other comprehensive income components are included in the computation of net periodic pension cost (see Note 16 for additional details). |

| |

(b) | This accumulated other comprehensive income component is included in our derivatives and hedging activities (see Note 15 for additional details). |

Basic earnings per common share areis computed by dividing earnings by the weighted average number of common shares outstanding. Diluted earnings per common share areis computed assuming that all potentially dilutive securities were converted into common shares. There are no adjustments required to be made to net income for purposes of computing basic and diluted earnings per share. A reconciliation of the amounts included in the computation of basic earnings (loss) per common share from continuing operations and diluted earnings (loss) per common share from continuing operations is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| In millions, except per share amounts | 2023 | | 2022 | | 2023 | | 2022 |

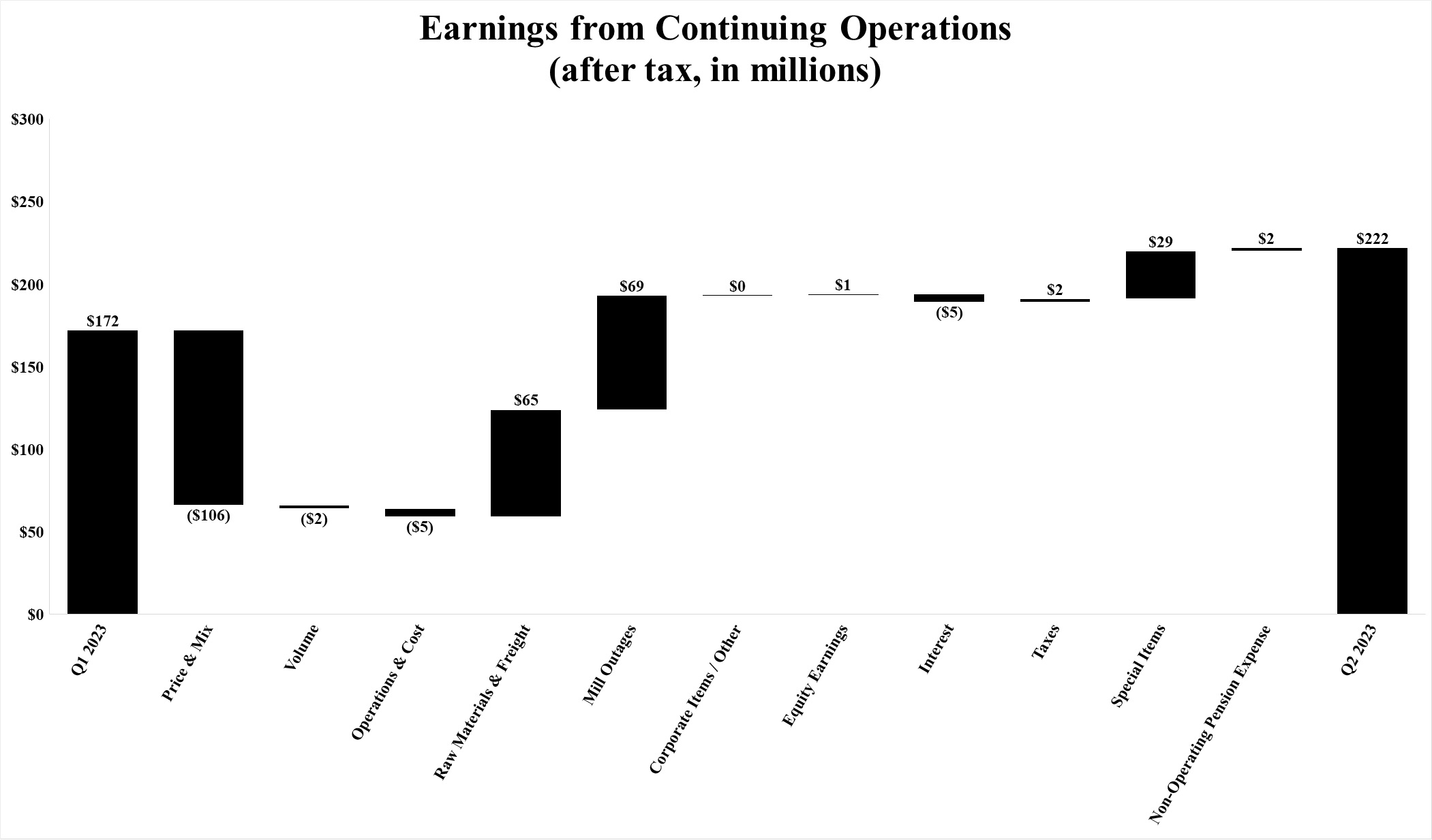

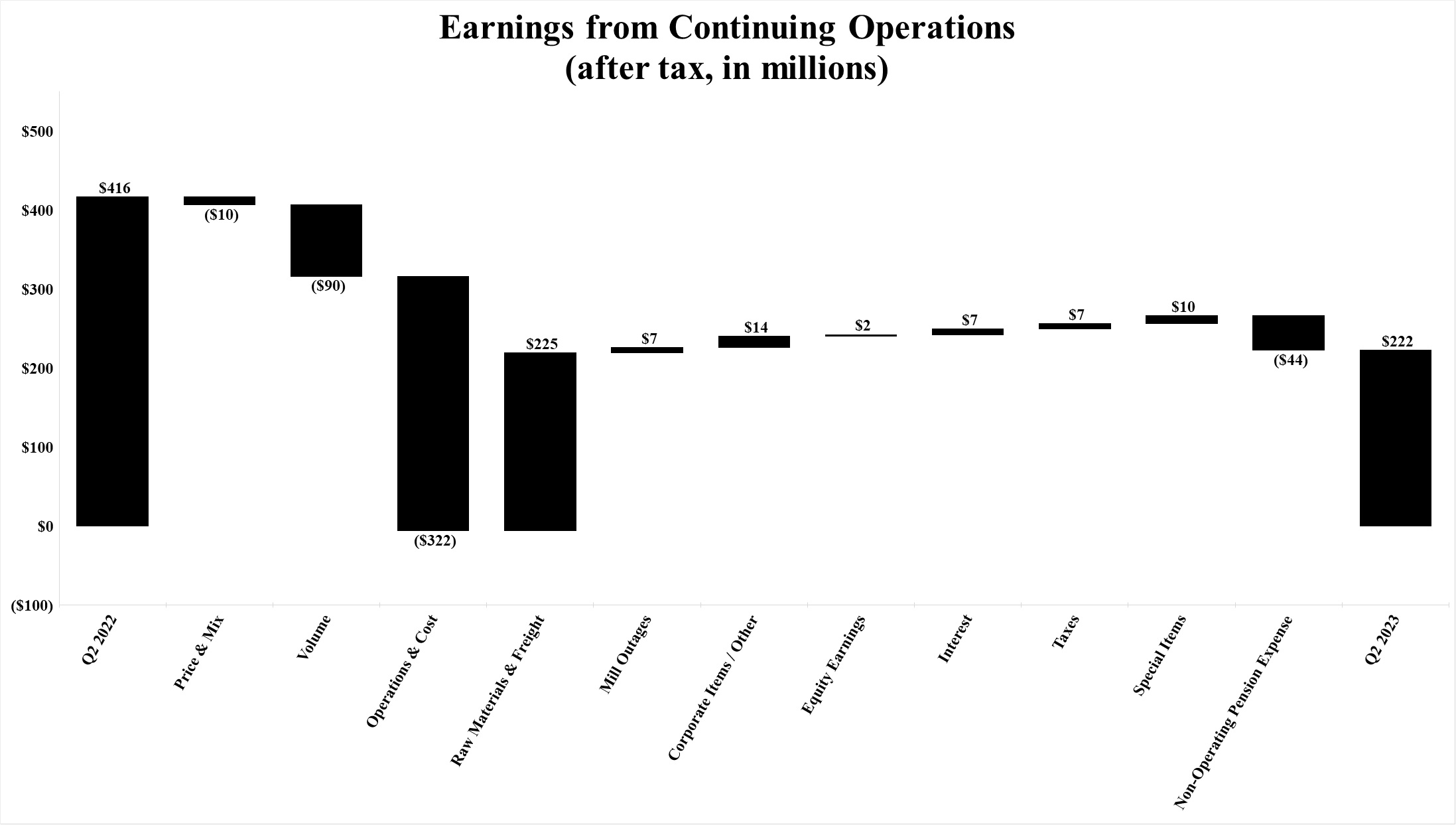

| Earnings (loss) from continuing operations | $ | 222 | | | $ | 416 | | | $ | 394 | | | $ | 683 | |

| Weighted average common shares outstanding | 346.2 | | | 367.6 | | | 347.7 | | | 371.4 | |

| Effect of dilutive securities | | | | | | | |

| Restricted performance share plan | 0.3 | | | 3.1 | | | 1.8 | | | 4.3 | |

| Weighted average common shares outstanding – assuming dilution | 346.5 | | | 370.7 | | | 349.5 | | | 375.7 | |

| Basic earnings (loss) per share from continuing operations | $ | 0.64 | | | $ | 1.13 | | | $ | 1.13 | | | $ | 1.83 | |

| Diluted earnings (loss) per share from continuing operations | $ | 0.64 | | | $ | 1.13 | | | $ | 1.12 | | | $ | 1.82 | |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| In millions, except per share amounts | 2017 | | 2016 | | 2017 | | 2016 |

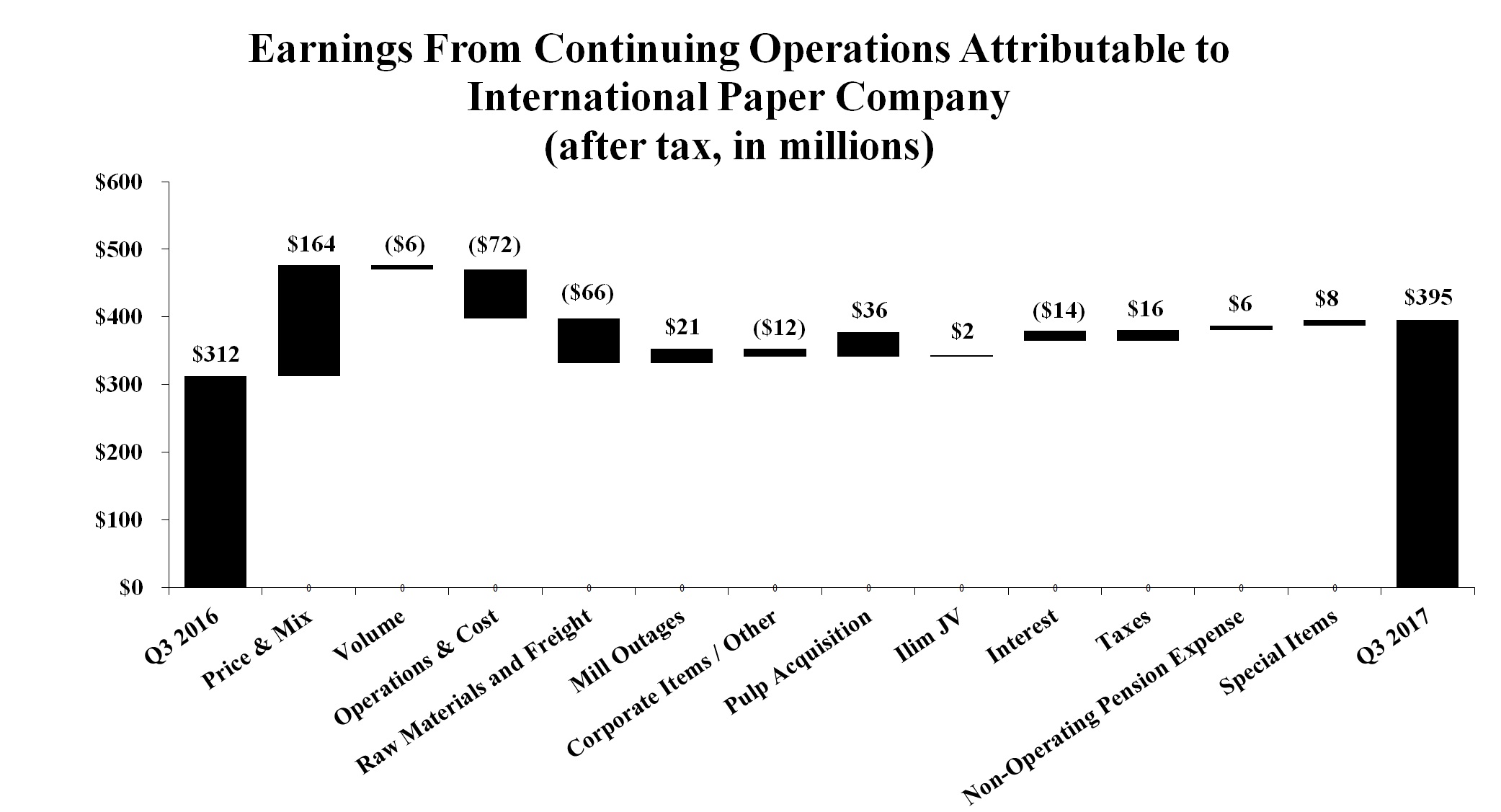

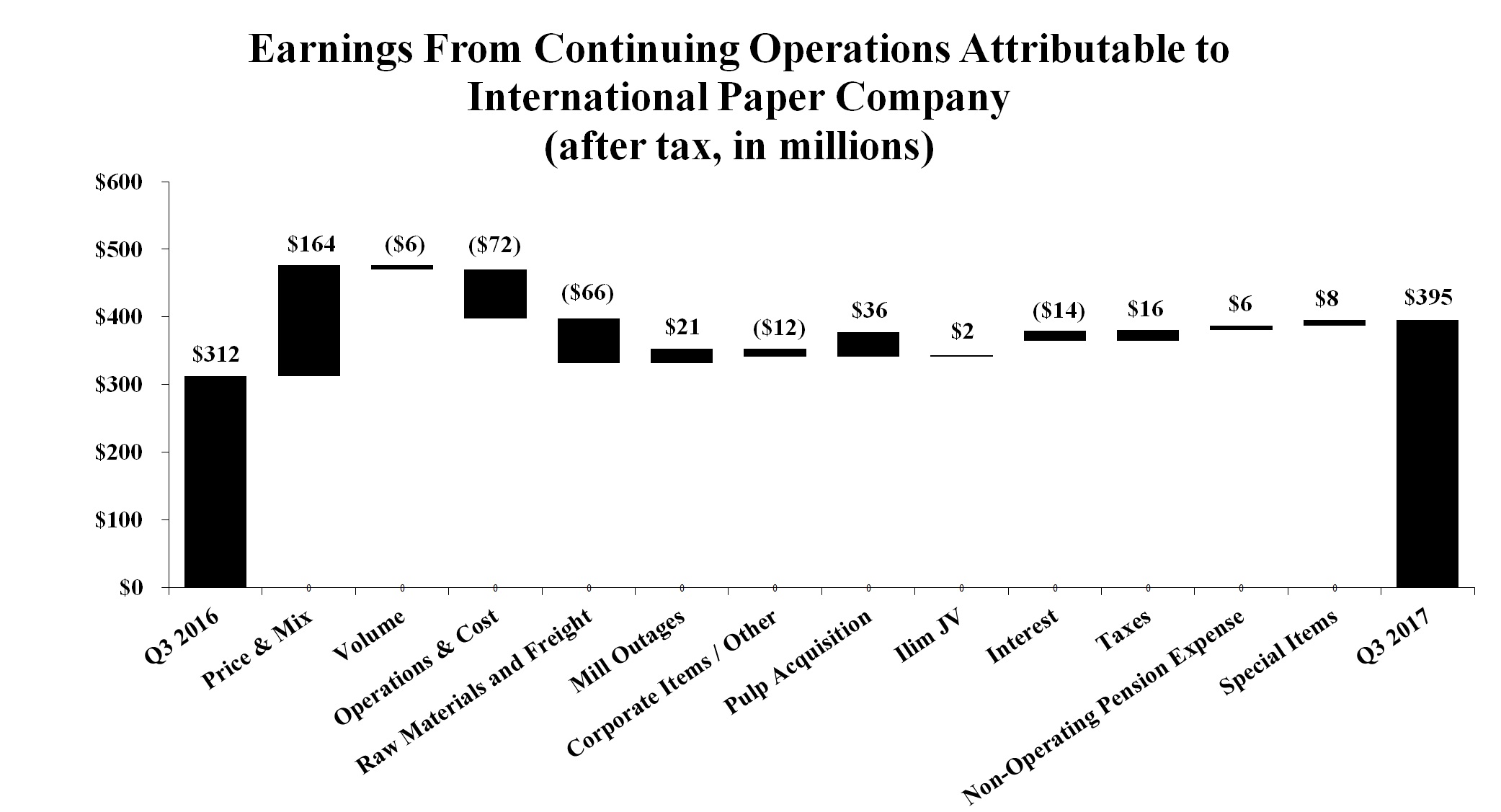

| Earnings (loss) from continuing operations | $ | 395 |

| | $ | 312 |

| | $ | 684 |

| | $ | 691 |

|

| Effect of dilutive securities | — |

| | — |

| | — |

| | — |

|

| Earnings (loss) from continuing operations – assuming dilution | $ | 395 |

| | $ | 312 |

| | $ | 684 |

| | $ | 691 |

|

| Average common shares outstanding | 412.9 |

| | 411.2 |

| | 412.6 |

| | 411.0 |

|

| Effect of dilutive securities | | | | | | | |

| Restricted stock performance share plan | 4.5 |

| | 4.1 |

| | 4.8 |

| | 4.5 |

|

| Average common shares outstanding – assuming dilution | 417.4 |

| | 415.3 |

| | 417.4 |

| | 415.5 |

|

| Basic earnings (loss) from continuing operations per common share | $ | 0.96 |

| | $ | 0.76 |

| | $ | 1.65 |

| | $ | 1.68 |

|

| Diluted earnings (loss) from continuing operations per common share | $ | 0.95 |

| | $ | 0.75 |

| | $ | 1.64 |

| | $ | 1.66 |

|

NOTE 6 - RESTRUCTURING AND OTHER CHARGES

2017: There were no restructuring and other charges recorded during the three months ended September 30, 2017.

During the three months ended June 30, 2017, restructuring and other charges totaling a $16 million benefit before taxes were recorded. Details of these charges were as follows:

|

| | | |

| In millions | Three Months Ended

June 30, 2017 |

| Gain on sale of investment in ArborGen | $ | (14 | ) |

| Other | (2 | ) |

| Total | $ | (16 | ) |

There were no restructuring and other charges recorded during the three months ended March 31, 2017.

2016: During the three months ended September 30, 2016, restructuring and other charges totaling $46 million before taxes were recorded. Details of these charges were as follows:

|

| | | |

| In millions | Three Months Ended

September 30, 2016 |

| Early debt extinguishment costs | $ | 29 |

|

| India packaging evaluation write-off | 17 |

|

| Total | $ | 46 |

|

There were no restructuring and other charges recorded during the three months ended June 30, 2016.

During the three months ended March 31, 2016, restructuring and other charges totaling $1 million before taxes were recorded. Details of these charges were as follows: |

| | | |

| In millions | Three Months Ended

March 31, 2016 |

| Gain on sale of investment in Arizona Chemical | $ | (8 | ) |

| Riegelwood mill conversion costs | 9 |

|

| Total | $ | 1 |

|

NOTE 7 - ACQUISITIONSDIVESTITURES AND IMPAIRMENTS

Tangier, Morocco Facility

On June 30, 2017, the Company completed the acquisition of Europac's Tangier, Morocco facility, a corrugated packaging facility, for €40 million (approximately $46 million using the June 30, 2017 exchange rate), subject to certain post-closing adjustments. Approximately 80% of the fair value has been provisionally allocated to property, plant and equipment. Adjustments, if any, to provisional amounts will be finalized within the measurement period of up to one year from the acquisition date. Pro forma information related to the acquisition of the Europac business has not been included as it is impractical to obtain the information due to the lack of availability of financial data and does not have a material effect on the Company’s consolidated results of operations.

Weyerhaeuser Pulp Business

On DecemberOctober 1, 2016, the Company completed the acquisition of Weyerhaeuser Company's pulp business for approximately $2.2 billion in cash. Under the terms of the agreement, International Paper acquired four fluff pulp mills, one Northern bleached softwood kraft mill and two converting facilities of modified fiber, located in the United States, Canada and Poland.

The following table summarizes the provisional fair value assigned to assets and liabilities acquired as of December 1, 2016:

|

| | | |

| In millions | |

| Cash and temporary investments | $ | 12 |

|

| Accounts and notes receivable | 195 |

|

| Inventory | 238 |

|

| Other current assets | 11 |

|

| Plants, properties and equipment | 1,711 |

|

| Goodwill | 52 |

|

| Other intangible assets | 212 |

|

| Deferred charges and other assets | 6 |

|

| Total assets acquired | 2,437 |

|

| Accounts payable and accrued liabilities | 114 |

|

| Long-term debt | 104 |

|

| Other long-term liabilities | 28 |

|

| Total liabilities assumed | 246 |

|

| Net assets acquired | $ | 2,191 |

|

The assignment to fair value is provisional and could be revised as a result of additional information obtained regarding assets acquired and liabilities assumed, and revisions of provisional estimates of fair values, including, but not limited to, the completion of independent appraisals and valuations related to property, plant and equipment and intangible assets. While we do not anticipate these changes to be significant, the provisional amounts will not be finalized until the end of the measurement period of up to one year from the acquisition date.

In connection with the business combination, inventories were written up by $33 million to their estimated fair value. During the first quarter of 2017, $14 million before taxes ($8 million after taxes) were expensed to Cost of products sold as the related inventory was sold.

The identifiable intangible assets acquired in connection with the acquisition of the Weyerhaeuser pulp business included the following:

|

| | | | | |

| In millions | | Estimated

Fair Value | Average

Remaining

Useful Life |

| Asset Class: | | | (at acquisition

date) |

| Customer relationships and lists | | $ | 95 |

| 24 years |

| Trade names, patents, trademarks and developed technology | | 113 |

| 8 years |

| Other | | 4 |

| 10 years |

| Total | | $ | 212 |

| |

Holmen Paper Newsprint Mill

On June 30, 2016, the Company completed the acquisition of Holmen Paper's newsprint mill in Madrid, Spain. Under the terms of the acquisition agreement, International Paper purchased the Madrid newsprint mill, as well as associated recycling operations and a 50% ownership interest in a cogeneration facility. The Company intends to convert the mill during the fourth quarter of 2017, to produce recycled containerboard with an expected capacity of 440,000 tons. Once completed, the converted mill will support the Company's corrugated packaging business in EMEA.

The Company's aggregate purchase price for the mill, recycling operations and 50% ownership of the cogeneration facility was €53 million (approximately $59 million using the June 30, 2016 exchange rate). The assignment of fair value to assets acquired and liabilities assumed was completed in the first quarter of 2017. Approximately $60 million was allocated to property, plant and equipment, $14 million to current assets (primarily cash and accounts receivable), $14 million to equity method investments, $5 million to long-term assets, $9 million to short-term liabilities and $16 million to long-term liabilities related to a supply contract entered into with the seller. The final fair values assigned indicated that the sum of the cash consideration paid was less than the fair value of the underlying net assets, after adjustments, by $6 million, resulting in a bargain purchase gain being recorded on this transaction. Pro forma information related to the acquisition of the Holmen business has not been included as it is impractical to obtain the information due to the lack of availability of financial data and does not have a material effect on the Company’s consolidated results of operations.

The Company has accounted for the above acquisitions under ASC 805, "Business Combinations" and the results of operations have been included in International Paper's financial statements beginning with the dates of acquisition.

NOTE 8 - DIVESTITURES / SPINOFF

Other Divestitures and Impairments

2017: On September 7, 2017,2021, the Company completed the previously announced salespin-off of its foodservice businessPrinting Papers segment along with certain mixed-use coated paperboard and pulp businesses in China to Huhtamaki Hong Kong Limited. Proceeds received totaled approximately RMB 129 million ($18 million usingNorth America, France and Russia into a standalone, publicly-traded company, Sylvamo Corporation. The transaction was implemented through the September 30, 2017 exchange rate). Under the termsdistribution of shares of the transaction,standalone company to International Paper's shareholders (the "Distribution"). The Company retained 19.9% of the shares of Sylvamo at the time of the separation with the intent to monetize its investment and after post-closing adjustments, International Paper received approximately RMB 49 million in exchange for its ownership interest in two China foodservice entities and RMB 80 million for the sale of notes receivable from the acquired entities.

Subsequentprovide additional proceeds to the announced agreement in June 2017, a determination was made that the current book value of the asset group exceeded its estimated fair value of $7 million, which was the agreed upon selling price.Company. As a result a pre-tax charge of $9 million was recorded during the second quarter of 2017, inDistribution, Sylvamo Corporation is an independent public company that trades on the Company's Consumer Packaging segment, to write downNew York Stock Exchange under the long-lived assets of this business to their estimated fair value. Amounts related to this business included insymbol "SLVM."

In connection with the Company's statement of operations were immaterial for both the three months and nine months ended September 30, 2017.

2016: On June 30, 2016,Distribution, the Company completedand Sylvamo entered into a separation and distribution agreement as well as various other agreements that govern the previously announced salerelationships between the parties following the Distribution, including a transition services agreement, a tax matters agreement and an employee matters agreement. These agreements provide for the allocation between the Company and Sylvamo of its corrugated packaging business in Chinaassets, liabilities and Southeast Asiaobligations attributable to Xiamen Bridge Hexing Equity Investment Partnership Enterprise. Under the terms of the transactionperiods prior to, at and after post-closing adjustments, International Paper received a total of approximately RMB 957 million (approximately $144 million at the June 30, 2016 exchange rate), which included the buyer's assumption of the liability for outstanding loans of approximately $55 million which are payable up to three years from the closing of the sale. The remaining balance of the outstanding loans payable to International Paper as of September 30, 2017, totaled $9 million.

Subsequent to the announced agreement in March 2016, a determination was made that the current book value of the asset group exceeded its estimated fair value of $155 million which was the agreed upon selling price, less costs incurred to sell. As a result, a pre-tax charge of $41 million was recorded during the six months ended June 30, 2016 in the Company's Industrial Packaging segment to write down the long-lived assets of this business to their estimated fair value. In addition,Distribution and govern certain relationships between the Company recorded a pre-tax charge of $24 million inand Sylvamo after the 2016 second quarter for severance that was contingent upon the sale of this business.Distribution. The amount of pre-tax losses related to this IP Asia Packaging business included in the Company's statement of operationsCompany has various ongoing operational agreements with Sylvamo under which it sells fiber, paper and other products. Related party sales under these agreements were $7$211 million and $80$409 million for the three months and ninesix months ended SeptemberJune 30, 2016.2022, respectively. Following the sale of the Company's ownership interest in Sylvamo during the third quarter 2022, Sylvamo is no longer considered a related party.

In the second quarter 2022, the Company exchanged 4,132,000 shares of Sylvamo common stock owned by the Company in exchange and as repayment for an approximately $144 million term loan obligation which resulted in the reversal of a $31 million deferred tax liability due to the tax-free exchange of the Sylvamo Corporation common stock. In the third quarter 2022, the Company exchanged the remaining 4,614,358 shares of Sylvamo common stock owned by the Company in exchange for $167 million and as partial repayment of a $210 million term loan obligation. This also resulted in the reversal of a $35 million deferred tax liability due to the tax-free exchange of the Sylvamo Corporation common stock. As of the end of the third quarter 2022, the Company no longer had an ownership interest in Sylvamo.

Temporary Investments

Temporary investments with an original maturity of three months or less and money market funds with greater than three month maturities but with the right to redeem without notices are treated as cash equivalents and are stated at cost. Temporary investments totaled $663$642 million and $757$690 million at SeptemberJune 30, 20172023 and December 31, 2016,2022, respectively.

Accounts and Notes Receivable

| | | In millions | September 30, 2017 | | December 31, 2016 | In millions | June 30, 2023 | | December 31, 2022 |

| Accounts and notes receivable, net: | | | | Accounts and notes receivable, net: | |

| Trade | $ | 3,098 |

| | $ | 2,759 |

| |