UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended September 30, 20202021

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period From to

_________________________________________

Commission File Number 001-03157

INTERNATIONAL PAPER COMPANY

(Exact name of registrant as specified in its charter)

| | | | | |

| New York | 13-0872805 |

(State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) |

| |

| 6400 Poplar Avenue, Memphis, Tennessee | 38197 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (901) 419-7000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares | IP | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (paragraph 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange

Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of the registrant’s common stock, par value $1.00 per share, as of October 23, 202021, 2021 was 393,095,466.387,263,169.

INDEX

| | | | | | | | |

| | | PAGE NO. |

| | |

| | |

| | |

| | |

| Condensed Consolidated Statement of Operations - Three Months and Nine Months Ended September 30, 20202021 and 20192020 | |

| | |

| Condensed Consolidated Statement of Comprehensive Income - Three Months and Nine Months Ended September 30, 20202021 and 20192020 | |

| | |

| Condensed Consolidated Balance Sheet - September 30, 20202021 and December 31, 20192020 | |

| | |

| Condensed Consolidated Statement of Cash Flows - Nine Months Ended September 30, 20202021 and 20192020 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| |

INTERNATIONAL PAPER COMPANY

(Unaudited)

(In millions, except per share amounts)

| | | | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2020 | | 2019 | | 2020 | | 2019 | | 2021 | | 2020 | | 2021 | | 2020 |

| Net Sales | Net Sales | $ | 5,123 | | | $ | 5,568 | | | $ | 15,341 | | | $ | 16,878 | | Net Sales | $ | 5,714 | | | $ | 5,123 | | | $ | 16,693 | | | $ | 15,341 | |

| Costs and Expenses | Costs and Expenses | | Costs and Expenses | |

| Cost of products sold | Cost of products sold | 3,541 | | | 3,772 | | | 10,714 | | | 11,602 | | Cost of products sold | 3,924 | | | 3,541 | | | 11,684 | | | 10,714 | |

| Selling and administrative expenses | Selling and administrative expenses | 360 | | | 387 | | | 1,110 | | | 1,202 | | Selling and administrative expenses | 434 | | | 360 | | | 1,255 | | | 1,110 | |

| Depreciation, amortization and cost of timber harvested | Depreciation, amortization and cost of timber harvested | 320 | | | 327 | | | 955 | | | 963 | | Depreciation, amortization and cost of timber harvested | 318 | | | 320 | | | 933 | | | 955 | |

| Distribution expenses | Distribution expenses | 377 | | | 395 | | | 1,149 | | | 1,168 | | Distribution expenses | 446 | | | 377 | | | 1,272 | | | 1,149 | |

| Taxes other than payroll and income taxes | Taxes other than payroll and income taxes | 44 | | | 42 | | | 129 | | | 128 | | Taxes other than payroll and income taxes | 42 | | | 44 | | | 131 | | | 129 | |

| Restructuring and other charges, net | Restructuring and other charges, net | 105 | | | 21 | | | 131 | | | 21 | | Restructuring and other charges, net | 39 | | | 105 | | | 243 | | | 131 | |

| Net (gains) losses on sales and impairments of businesses | Net (gains) losses on sales and impairments of businesses | (5) | | | 8 | | | 347 | | | 153 | | Net (gains) losses on sales and impairments of businesses | (360) | | | (5) | | | (367) | | | 347 | |

| Net (gains) losses on sales of equity method investments | Net (gains) losses on sales of equity method investments | (2) | | | 0 | | | (35) | | | 0 | | Net (gains) losses on sales of equity method investments | (1) | | | (2) | | | (205) | | | (35) | |

| Antitrust fines | 0 | | | 32 | | | 0 | | | 32 | | |

| Net (gains) losses on sales of fixed assets | | Net (gains) losses on sales of fixed assets | (86) | | | — | | | (86) | | | — | |

| Interest expense, net | Interest expense, net | 112 | | | 123 | | | 345 | | | 378 | | Interest expense, net | 93 | | | 112 | | | 242 | | | 345 | |

| Non-operating pension expense (income) | Non-operating pension expense (income) | (11) | | | 9 | | | (31) | | | 27 | | Non-operating pension expense (income) | (51) | | | (11) | | | (156) | | | (31) | |

| Earnings (Loss) Before Income Taxes and Equity Earnings | Earnings (Loss) Before Income Taxes and Equity Earnings | 282 | | | 452 | | | 527 | | | 1,204 | | Earnings (Loss) Before Income Taxes and Equity Earnings | 916 | | | 282 | | | 1,747 | | | 527 | |

| Income tax provision (benefit) | Income tax provision (benefit) | 50 | | | 137 | | | 211 | | | 371 | | Income tax provision (benefit) | 146 | | | 50 | | | 347 | | | 211 | |

| Equity earnings (loss), net of taxes | Equity earnings (loss), net of taxes | (28) | | | 27 | | | 13 | | | 221 | | Equity earnings (loss), net of taxes | 94 | | | (28) | | | 247 | | | 13 | |

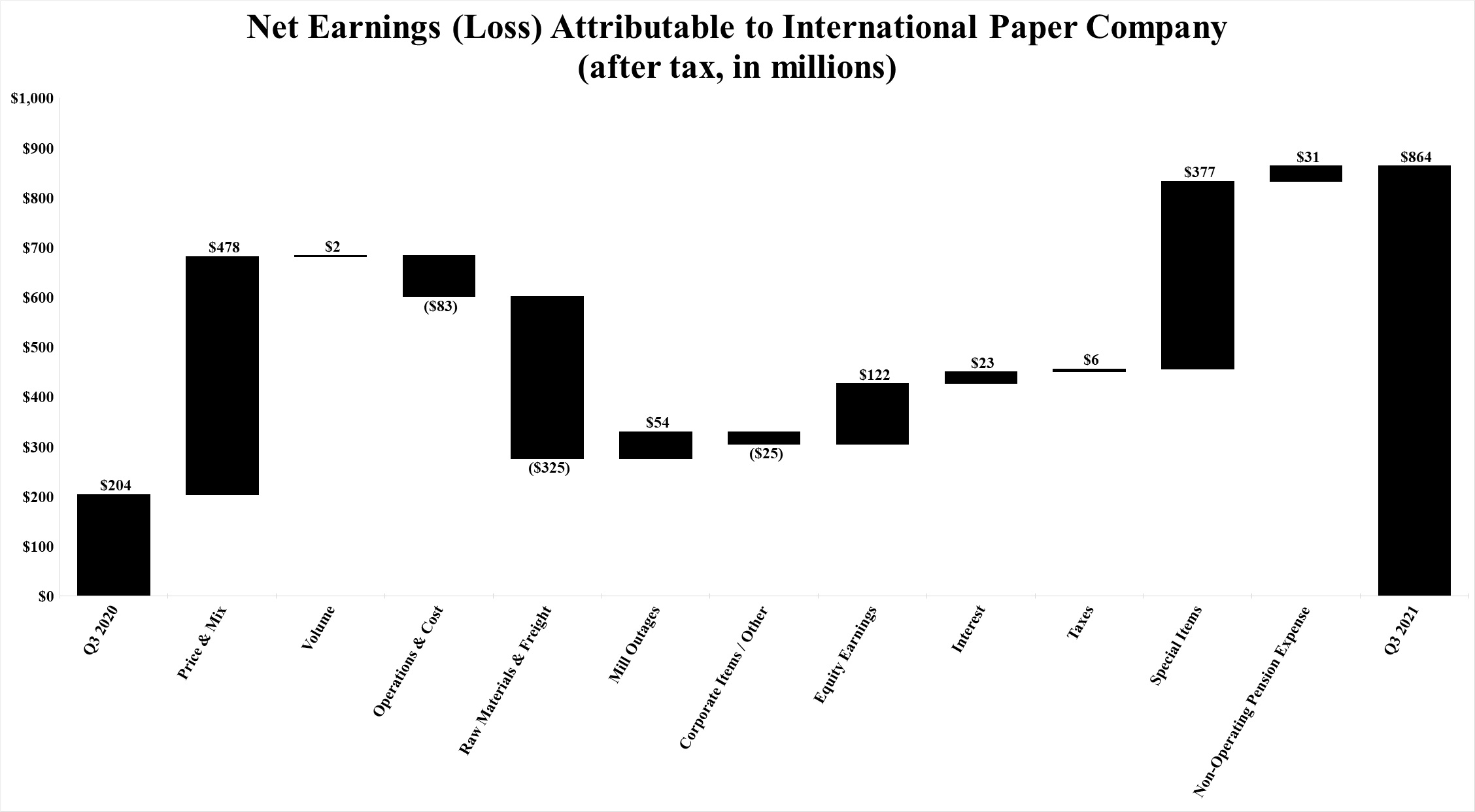

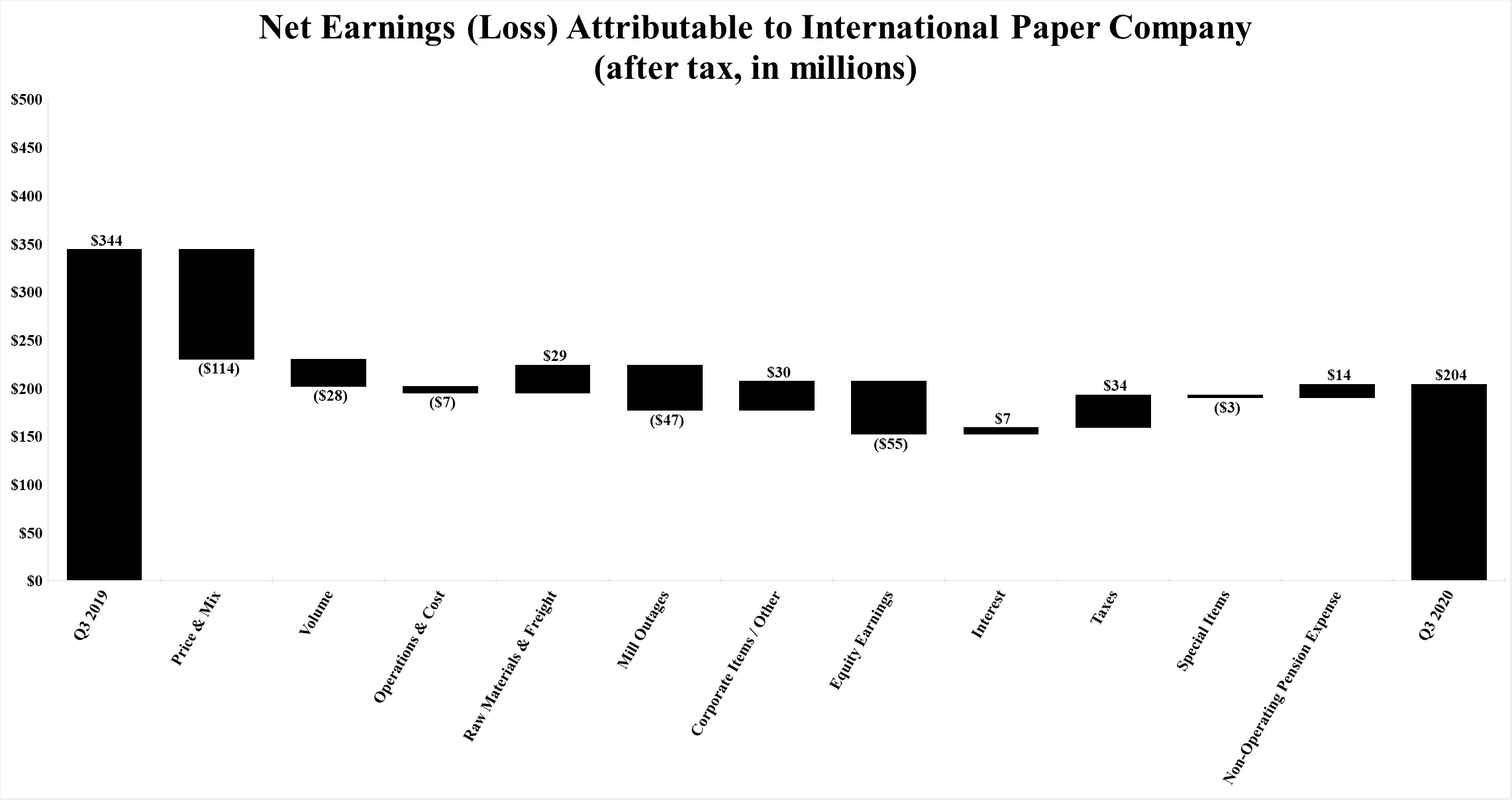

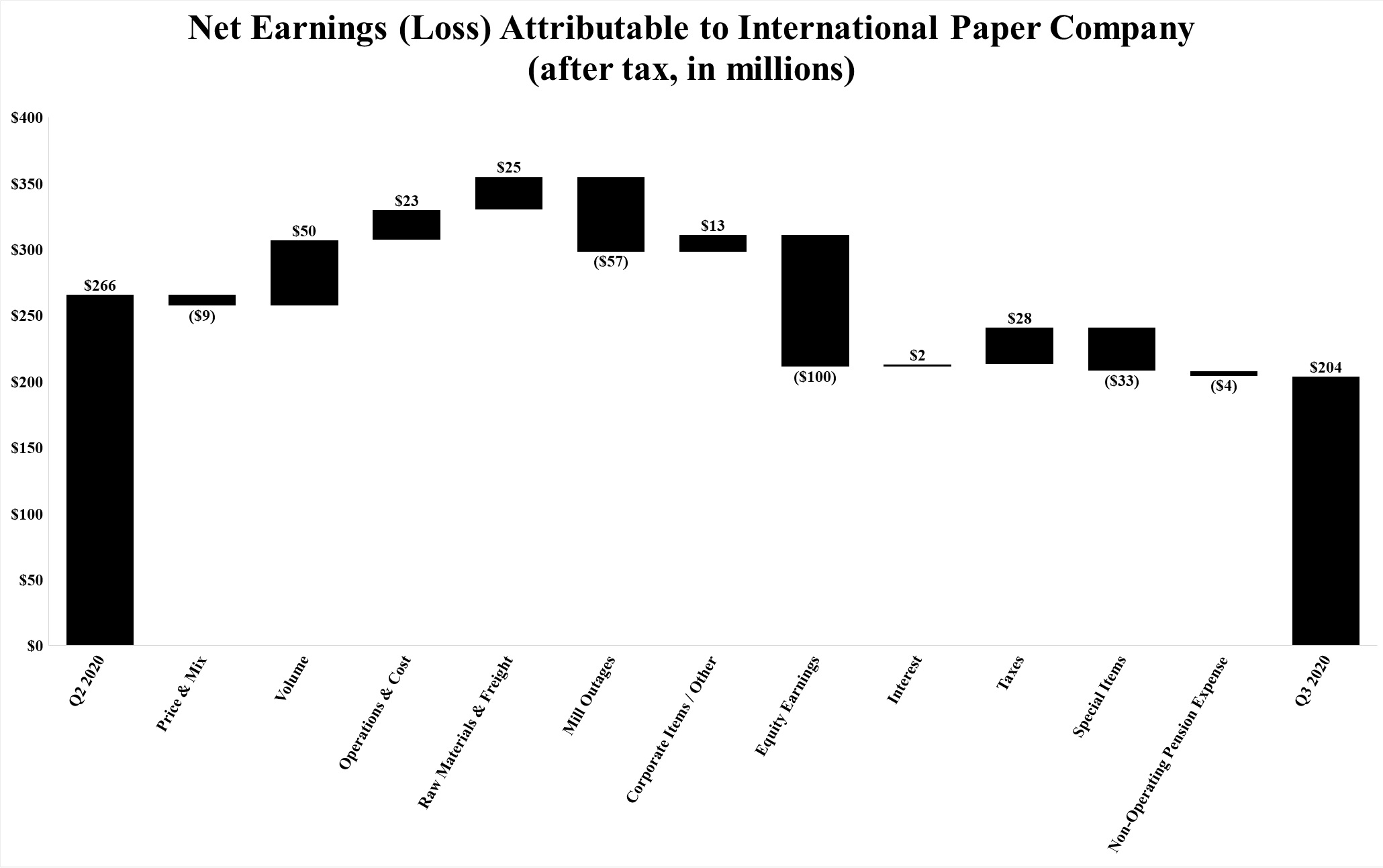

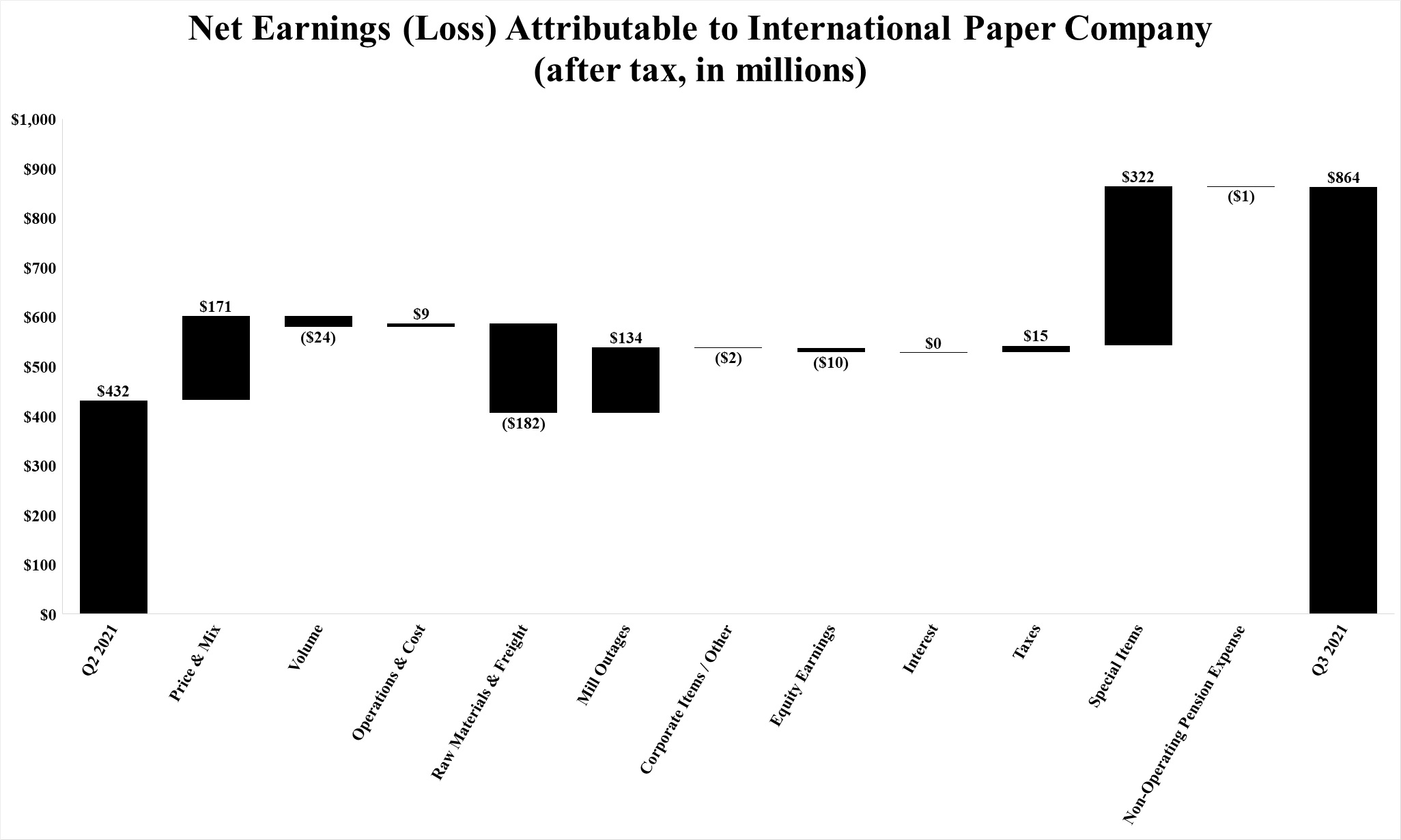

| Net Earnings (Loss) | Net Earnings (Loss) | 204 | | | 342 | | | 329 | | | 1,054 | | Net Earnings (Loss) | $ | 864 | | | $ | 204 | | | $ | 1,647 | | | $ | 329 | |

| Less: Net earnings (loss) attributable to noncontrolling interests | Less: Net earnings (loss) attributable to noncontrolling interests | 0 | | | (2) | | | 0 | | | (6) | | Less: Net earnings (loss) attributable to noncontrolling interests | — | | | — | | | 2 | | | — | |

| Net Earnings (Loss) Attributable to International Paper Company | Net Earnings (Loss) Attributable to International Paper Company | $ | 204 | | | $ | 344 | | | $ | 329 | | | $ | 1,060 | | Net Earnings (Loss) Attributable to International Paper Company | $ | 864 | | | $ | 204 | | | $ | 1,645 | | | $ | 329 | |

| Basic Earnings (Loss) Per Share Attributable to International Paper Company Common Shareholders | Basic Earnings (Loss) Per Share Attributable to International Paper Company Common Shareholders | | Basic Earnings (Loss) Per Share Attributable to International Paper Company Common Shareholders | |

| Net earnings (loss) | Net earnings (loss) | $ | 0.52 | | | $ | 0.88 | | | $ | 0.84 | | | $ | 2.67 | | Net earnings (loss) | $ | 2.22 | | | $ | 0.52 | | | $ | 4.21 | | | $ | 0.84 | |

| Diluted Earnings (Loss) Per Share Attributable to International Paper Company Common Shareholders | Diluted Earnings (Loss) Per Share Attributable to International Paper Company Common Shareholders | | Diluted Earnings (Loss) Per Share Attributable to International Paper Company Common Shareholders | |

| Net earnings (loss) | Net earnings (loss) | $ | 0.52 | | | $ | 0.87 | | | $ | 0.83 | | | $ | 2.65 | | Net earnings (loss) | $ | 2.20 | | | $ | 0.52 | | | $ | 4.16 | | | $ | 0.83 | |

| Average Shares of Common Stock Outstanding – assuming dilution | Average Shares of Common Stock Outstanding – assuming dilution | 394.6 | | | 395.4 | | | 394.5 | | | 399.6 | | Average Shares of Common Stock Outstanding – assuming dilution | 392.6 | | | 394.6 | | | 395.3 | | | 394.5 | |

The accompanying notes are an integral part of these condensed financial statements.

INTERNATIONAL PAPER COMPANY

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Net Earnings (Loss) | $ | 204 | | | $ | 342 | | | $ | 329 | | | $ | 1,054 | |

| Other Comprehensive Income (Loss), Net of Tax: | | | | | | | |

| Amortization of pension and post-retirement prior service costs and net loss: | | | | | | | |

| U.S. plans | 42 | | | 41 | | | 127 | | | 122 | |

| Non-U.S. plans | 1 | | | 0 | | | 1 | | | 0 | |

| Change in cumulative foreign currency translation adjustment | (28) | | | (179) | | | (515) | | | (106) | |

| Net gains/losses on cash flow hedging derivatives: | | | | | | | |

| Net gains (losses) arising during the period | (4) | | | (10) | | | (34) | | | (6) | |

| Reclassification adjustment for (gains) losses included in net earnings (loss) | 6 | | | 4 | | | 26 | | | 5 | |

| Total Other Comprehensive Income (Loss), Net of Tax | 17 | | | (144) | | | (395) | | | 15 | |

| Comprehensive Income (Loss) | 221 | | | 198 | | | (66) | | | 1,069 | |

| Net (earnings) loss attributable to noncontrolling interests | 0 | | | 2 | | | 0 | | | 6 | |

| Other comprehensive (income) loss attributable to noncontrolling interests | 0 | | | 0 | | | 2 | | | 0 | |

| Comprehensive Income (Loss) Attributable to International Paper Company | $ | 221 | | | $ | 200 | | | $ | (64) | | | $ | 1,075 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Net Earnings (Loss) | $ | 864 | | | $ | 204 | | | $ | 1,647 | | | $ | 329 | |

| Other Comprehensive Income (Loss), Net of Tax: | | | | | | | |

| Amortization of pension and post-retirement prior service costs and net loss: | | | | | | | |

| U.S. plans | 31 | | | 42 | | | 101 | | | 127 | |

| Non-U.S. plans | — | | | 1 | | | — | | | 1 | |

| Pension and postretirement adjustments: | | | | | | | |

| U.S. plans | 826 | | | — | | | 826 | | | — | |

| Non-U.S. plans | 5 | | | — | | | 6 | | | — | |

| Change in cumulative foreign currency translation adjustment | (70) | | | (28) | | | 99 | | | (515) | |

| Net gains/losses on cash flow hedging derivatives: | | | | | | | |

| Net gains (losses) arising during the period | (4) | | | (4) | | | 3 | | | (34) | |

| Reclassification adjustment for (gains) losses included in net earnings (loss) | (8) | | | 6 | | | (9) | | | 26 | |

| Total Other Comprehensive Income (Loss), Net of Tax | 780 | | | 17 | | | 1,026 | | | (395) | |

| Comprehensive Income (Loss) | 1,644 | | | 221 | | | 2,673 | | | (66) | |

| Net (earnings) loss attributable to noncontrolling interests | — | | | — | | | (2) | | | — | |

| Other comprehensive (income) loss attributable to noncontrolling interests | — | | | — | | | 2 | | | 2 | |

| Comprehensive Income (Loss) Attributable to International Paper Company | $ | 1,644 | | | $ | 221 | | | $ | 2,673 | | | $ | (64) | |

The accompanying notes are an integral part of these condensed financial statements.

INTERNATIONAL PAPER COMPANY

(In millions)

| | | | | | | | | | | |

| September 30,

2020 | | December 31,

2019 |

| | (unaudited) | | |

| Assets | | | |

| Current Assets | | | |

| Cash and temporary investments | $ | 678 | | | $ | 511 | |

| Accounts and notes receivable, net | 3,034 | | | 3,280 | |

| Contract assets | 388 | | | 393 | |

| Inventories | 2,007 | | | 2,208 | |

| Current financial assets of variable interest entities (Note 16) | 4,850 | | | 0 | |

| Assets held for sale | 114 | | | 0 | |

| Other current assets | 217 | | | 247 | |

| Total Current Assets | 11,288 | | | 6,639 | |

| Plants, Properties and Equipment, net | 12,410 | | | 13,004 | |

| Forestlands | 288 | | | 391 | |

| Investments | 1,100 | | | 1,721 | |

| Long-Term Financial Assets of Variable Interest Entities (Note 16) | 2,252 | | | 7,088 | |

| Goodwill | 3,304 | | | 3,347 | |

| Right of Use Assets | 422 | | | 434 | |

| Deferred Charges and Other Assets | 776 | | | 847 | |

| Total Assets | $ | 31,840 | | | $ | 33,471 | |

| Liabilities and Equity | | | |

| Current Liabilities | | | |

| Notes payable and current maturities of long-term debt | $ | 179 | | | $ | 168 | |

| Current nonrecourse financial liabilities of variable interest entities (Note 16) | 4,220 | | | 4,220 | |

| Accounts payable | 2,226 | | | 2,423 | |

| Accrued payroll and benefits | 453 | | | 466 | |

| Liabilities held for sale | 376 | | | 0 | |

| Other current liabilities | 1,022 | | | 1,369 | |

| Total Current Liabilities | 8,476 | | | 8,646 | |

| Long-Term Debt | 8,525 | | | 9,597 | |

| Long-Term Nonrecourse Financial Liabilities of Variable Interest Entities (Note 16) | 2,091 | | | 2,085 | |

| Deferred Income Taxes | 2,639 | | | 2,633 | |

| Pension Benefit Obligation | 1,421 | | | 1,578 | |

| Postretirement and Postemployment Benefit Obligation | 246 | | | 270 | |

| Long-Term Lease Obligations | 290 | | | 304 | |

| Other Liabilities | 1,056 | | | 640 | |

| Equity | | | |

| Common stock, $1 par value, 2020 – 448.9 shares and 2019 – 448.9 shares | 449 | | | 449 | |

| Paid-in capital | 6,302 | | | 6,297 | |

| Retained earnings | 8,122 | | | 8,408 | |

| Accumulated other comprehensive loss | (5,132) | | | (4,739) | |

| 9,741 | | | 10,415 | |

| Less: Common stock held in treasury, at cost, 2020 – 55.8 shares and 2019 – 56.8 shares | 2,648 | | | 2,702 | |

| Total International Paper Shareholders’ Equity | 7,093 | | | 7,713 | |

| Noncontrolling interests | 3 | | | 5 | |

| Total Equity | 7,096 | | | 7,718 | |

| Total Liabilities and Equity | $ | 31,840 | | | $ | 33,471 | |

| | | | | | | | | | | |

| September 30,

2021 | | December 31,

2020 |

| | (unaudited) | | |

| Assets | | | |

| Current Assets | | | |

| Cash and temporary investments | $ | 2,122 | | | $ | 595 | |

| Restricted cash | 1,499 | | | — | |

| Accounts and notes receivable, net | 3,549 | | | 3,064 | |

| Contract assets | 427 | | | 355 | |

| Inventories | 2,053 | | | 2,050 | |

| Current financial assets of variable interest entities (Note 16) | — | | | 4,850 | |

| Assets held for sale | — | | | 138 | |

| Other current assets | 246 | | | 184 | |

| Total Current Assets | 9,896 | | | 11,236 | |

| Plants, Properties and Equipment, net | 11,360 | | | 12,217 | |

| Forestlands | 303 | | | 311 | |

| Investments | 713 | | | 1,178 | |

| Long-Term Financial Assets of Variable Interest Entities (Note 16) | 2,270 | | | 2,257 | |

| Goodwill | 3,274 | | | 3,315 | |

| Pension Assets | 545 | | | 5 | |

| Right of Use Assets | 405 | | | 459 | |

| Deferred Charges and Other Assets | 705 | | | 740 | |

| Total Assets | $ | 29,471 | | | $ | 31,718 | |

| Liabilities and Equity | | | |

| Current Liabilities | | | |

| Notes payable and current maturities of long-term debt | $ | 233 | | | $ | 29 | |

| Current nonrecourse financial liabilities of variable interest entities (Note 16) | — | | | 4,220 | |

| Accounts payable | 2,704 | | | 2,320 | |

| Accrued payroll and benefits | 489 | | | 466 | |

| Liabilities held for sale | — | | | 181 | |

| Other current liabilities | 1,272 | | | 1,068 | |

| Total Current Liabilities | 4,698 | | | 8,284 | |

| Long-Term Debt | 8,241 | | | 8,064 | |

| Long-Term Nonrecourse Financial Liabilities of Variable Interest Entities (Note 16) | 2,098 | | | 2,092 | |

| Deferred Income Taxes | 2,728 | | | 2,743 | |

| Pension Benefit Obligation | 418 | | | 1,055 | |

| Postretirement and Postemployment Benefit Obligation | 235 | | | 251 | |

| Long-Term Lease Obligations | 263 | | | 315 | |

| Other Liabilities | 1,167 | | | 1,046 | |

| Equity | | | |

| Common stock, $1 par value, 2021 – 448.9 shares and 2020 – 448.9 shares | 449 | | | 449 | |

| Paid-in capital | 6,371 | | | 6,325 | |

| Retained earnings | 9,103 | | | 8,070 | |

| Accumulated other comprehensive loss | (3,314) | | | (4,342) | |

| 12,609 | | | 10,502 | |

| Less: Common stock held in treasury, at cost, 2021 – 61.7 shares and 2020 – 55.8 shares | 2,987 | | | 2,648 | |

| Total International Paper Shareholders’ Equity | 9,622 | | | 7,854 | |

| Noncontrolling interests | 1 | | | 14 | |

| Total Equity | 9,623 | | | 7,868 | |

| Total Liabilities and Equity | $ | 29,471 | | | $ | 31,718 | |

The accompanying notes are an integral part of these condensed financial statements.

INTERNATIONAL PAPER COMPANY

(Unaudited)

(In millions)

| | | | | | | | | | | |

| | Nine Months Ended

September 30, |

| | 2020 | | 2019 |

| Operating Activities | | | |

| Net earnings (loss) | $ | 329 | | | $ | 1,054 | |

| Depreciation, amortization and cost of timber harvested | 955 | | | 963 | |

| Deferred income tax provision (benefit), net | (5) | | | 68 | |

| Restructuring and other charges, net | 131 | | | 21 | |

| Net (gains) losses on sales and impairments of businesses | 347 | | | 153 | |

| Net (gains) losses on sales of equity method investments | (35) | | | 0 | |

| Antitrust fines | 0 | | | 32 | |

| Equity method dividends received | 158 | | | 260 | |

| Equity (earnings) losses, net | (13) | | | (221) | |

| Periodic pension expense, net | 24 | | | 70 | |

| Other, net | 212 | | | 106 | |

| Changes in current assets and liabilities | | | |

| Accounts and notes receivable | 96 | | | 168 | |

| Contract assets | 2 | | | 6 | |

| Inventories | 74 | | | (9) | |

| Accounts payable and accrued liabilities | 0 | | | (11) | |

| Interest payable | (26) | | | (31) | |

| Other | 25 | | | 53 | |

| Cash Provided By (Used For) Operations | 2,274 | | | 2,682 | |

| Investment Activities | | | |

| Invested in capital projects, net of insurance recoveries | (657) | | | (913) | |

| Acquisitions, net of cash acquired | (64) | | | (99) | |

| Proceeds from sales of equity method investments | 500 | | | 0 | |

| Proceeds from sales of businesses, net of cash divested | 0 | | | 17 | |

| Proceeds from sale of fixed assets | 3 | | | 15 | |

| Other | 18 | | | (14) | |

| Cash Provided By (Used For) Investment Activities | (200) | | | (994) | |

| Financing Activities | | | |

| Repurchases of common stock and payments of restricted stock tax withholding | (42) | | | (535) | |

| Issuance of debt | 692 | | | 381 | |

| Reduction of debt | (1,795) | | | (772) | |

| Change in book overdrafts | 16 | | | (29) | |

| Dividends paid | (605) | | | (595) | |

| Debt tender premiums paid | (124) | | | 0 | |

| Other | (1) | | | 3 | |

| Cash Provided By (Used For) Financing Activities | (1,859) | | | (1,547) | |

| Cash Included in Assets Held for Sale | (11) | | | (19) | |

| Effect of Exchange Rate Changes on Cash | (37) | | | (14) | |

| Change in Cash and Temporary Investments | 167 | | | 108 | |

| Cash and Temporary Investments | | | |

| Beginning of period | 511 | | | 589 | |

| End of period | $ | 678 | | | $ | 697 | |

| | | | | | | | | | | |

| | Nine Months Ended

September 30, |

| | 2021 | | 2020 |

| Operating Activities | | | |

| Net earnings (loss) | $ | 1,647 | | | $ | 329 | |

| Depreciation, amortization and cost of timber harvested | 933 | | | 955 | |

| Deferred income tax provision (benefit), net | (151) | | | (5) | |

| Restructuring and other charges, net | 243 | | | 131 | |

| Net (gains) losses on sales of equity method investments | (205) | | | (35) | |

| Net (gains) losses on sales and impairments of businesses | (367) | | | 347 | |

| Net (gains) losses on sales of fixed assets | (86) | | | — | |

| Equity method dividends received | 149 | | | 158 | |

| Equity (earnings) losses, net | (247) | | | (13) | |

| Periodic pension (income) expense, net | (84) | | | 24 | |

| Other, net | 129 | | | 212 | |

| Changes in current assets and liabilities | | | |

| Accounts and notes receivable | (510) | | | 96 | |

| Contract assets | (74) | | | 2 | |

| Inventories | (133) | | | 74 | |

| Accounts payable and accrued liabilities | 716 | | | — | |

| Interest payable | 9 | | | (26) | |

| Other | (46) | | | 25 | |

| Cash Provided By (Used For) Operations | 1,923 | | | 2,274 | |

| Investment Activities | | | |

| Invested in capital projects, net of insurance recoveries | (348) | | | (657) | |

| Acquisitions, net of cash acquired | (80) | | | (64) | |

| Proceeds from sales of equity method investments | 843 | | | 500 | |

| Proceeds from sales of businesses, net of cash divested | 827 | | | — | |

| Proceeds from settlement of Variable Interest Entity installment notes | 4,850 | | | — | |

| Proceeds from sale of fixed assets | 95 | | | 3 | |

| Other | (3) | | | 18 | |

| Cash Provided By (Used For) Investment Activities | 6,184 | | | (200) | |

| Financing Activities | | | |

| Repurchases of common stock and payments of restricted stock tax withholding | (425) | | | (42) | |

| Issuance of debt | 1,511 | | | 692 | |

| Reduction of debt | (1,132) | | | (1,795) | |

| Change in book overdrafts | 29 | | | 16 | |

| Dividends paid | (602) | | | (605) | |

| Reduction of Variable Interest Entity loans | (4,220) | | | — | |

| Net debt tender premiums paid | (221) | | | (124) | |

| Other | (14) | | | (1) | |

| Cash Provided By (Used For) Financing Activities | (5,074) | | | (1,859) | |

| Cash Included in Assets Held for Sale | — | | | (11) | |

| Effect of Exchange Rate Changes on Cash and Temporary Investments and Restricted Cash | (7) | | | (37) | |

| Change in Cash and Temporary Investments and Restricted Cash | 3,026 | | | 167 | |

| Cash and Temporary Investments and Restricted Cash | | | |

| Beginning of period | 595 | | | 511 | |

| End of period | $ | 3,621 | | | $ | 678 | |

The accompanying notes are an integral part of these condensed financial statements.

INTERNATIONAL PAPER COMPANY

(Unaudited)

The accompanying unaudited condensed financial statements have been prepared in conformity with accounting principles generally accepted in the United States and in accordance with the instructions to Form 10-Q and, in the opinion of management, include all adjustments that are necessary for the fair presentation of International Paper Company’s (International Paper’s, the Company’s or our) financial position, results of operations, and cash flows for the interim periods presented. Except as disclosed herein, such adjustments are of a normal, recurring nature. Results for the first nine months of the year may not necessarily be indicative of full year results. It is suggested that these condensed financial statements be read in conjunction with the audited financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019,2020, which have previously been filed with the Securities and Exchange Commission.

On March 11, 2020 the World Health Organization (WHO) declared the novel strain of coronavirus (COVID-19) a global pandemic and recommended containment and mitigation measures worldwide. During the third quarter of 2021, the number of COVID-19 cases and deaths increased in the United States and numerous other countries, and restrictive measures, including mask and vaccine requirements, have been implemented or reinstituted by various governmental authorities and private businesses. Economic recovery in the United States has continued but may be threatened by the resurgence of COVID-19 cases and other factors. Most of our manufacturing and converting facilities have remained open and operational during the pandemic. The healthpandemic and safety ofat the current time our employeesmanufacturing and contractors is our most important responsibility as we manage through the COVID-19 pandemic. We have implemented work-systems across the Company, including hygiene, social distancing, site cleaning, contact tracing, and other measures, as recommended by the Centers for Disease Control (CDC) and WHO. Our COVID-19 measuresconverting facilities are proving to be effective and we have not had any material disruptions to our operations.generally operational.

We have seenThe pandemic has had a significant negativemixed impact on demand for our products. Initially, demand for printing papers products.products was significantly impacted by the pandemic, but has seen a steady increase over the first nine months of 2021. Demand for our pulp, containerboard and corrugated box products has not been negatively impacted and in some cases has been positively impacted by COVID-19 to date, but could be unfavorably impacted going forward if negative economic conditions associated with COVID-19 persist or deteriorate. Furthermore, if there is a resurgencedate. However, all of the virus leadingour operations continue to additional governmental measures, such as stay-at-home orders or business and school closures, ourexperience higher supply chain costs and therefore our production, could be negatively impacted.a constrained transportation environment due in part to the impacts of COVID-19.

There continue to be significant uncertainties associated with the COVID-19 pandemic, including with respect to the various economic reopening plans and the resurgence of new variants of the virus in many areas;areas globally; the additional actions that may be taken by governmental authorities and private businesses, including mask and vaccine requirements, to attempt to contain the COVID-19 outbreak or to mitigate its impact; the extentefficacy, acceptance and durationavailability of social distancingvarious vaccines and stay-at-home orders;booster shots, as well as the possibility that strains of development of a vaccine;the virus may be resistant to current available vaccines; and the ongoing impact of COVID-19 on unemployment,economic conditions, including with respect to labor market conditions, economic activity, consumer behavior, supply shortages and consumer confidence. Developments related todisruptions and inflationary pressures. COVID-19 are significantly adversely affectinghas had a significant adverse effect on portions of our business, and could have a material adverse effect on our financial condition, results of operations and cash flows particularly if negativepublic health and/or global economic conditions persistdeteriorate.

Printing Papers Spinoff

On October 1, 2021, the Company completed the previously announced spin-off of its Printing Papers segment along with certain mixed-use coated paperboard and pulp businesses in North America, France and Russia into a standalone, publicly-traded company, Sylvamo Corporation. The transaction was implemented through the distribution of shares of the standalone company to International Paper's shareholders (the "Distribution"). As a result of the Distribution, Sylvamo Corporation is an independent public company that trades on the New York Stock Exchange under the symbol "SLVM".

The Distribution was made to the Company's stockholders of record as of the close of business on September 15, 2021 (the "Record Date"), and such stockholders received one share of Sylvamo Corporation common stock for every 11 shares of International Paper common stock held as of the close of business on the Record Date. The Company retained 19.9% of the shares of Sylvamo at the time of the separation, with the intent to monetize its investment and to provide additional proceeds to the Company. The Company is accounting for its ownership interest in Sylvamo at fair value as an investment in equity securities. In the third quarter of 2021, Sylvamo incurred $1.5 billion in debt in anticipation of a significant periodnet cash distribution of time or deteriorate.$1.4 billion to be made to the Company as part of the spin-off. See Note 17 – Debt for further details regarding the Sylvamo debt.

All current and historical operating results of the Sylvamo Corporation businesses will be presented as Discontinued Operations, net of tax, in the consolidated statement of operations in the fourth quarter of 2021. The spin-off was tax-free for the Company and its shareholders for U.S. federal income tax purposes.

In connection with the Distribution, on September 29, 2021, the Company and Sylvamo Corporation entered into a separation and distribution agreement as well as various other agreements that govern the relationships between the parties following the Distribution, including a transition services agreement, a tax matters agreement and an employee matters agreement. These

agreements provide for the allocation between International Paper Company and Sylvamo Corporation of assets, liabilities and obligations attributable to periods prior to, at and after the Distribution and govern certain relationships between International Paper and Sylvamo Corporation after the Distribution.

Recently Adopted Accounting Pronouncements

Financial Instruments - Credit Losses

In June 2016, the FASB issued ASU 2016-13, "Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments." This guidance replaces the current incurred loss impairment method with a method that reflects expected credit losses. The Company adopted this guidance using the modified retrospective approach on January 1, 2020. As a result of using this approach, the Company recognized a cumulative effect adjustment of $2 million to the opening balance of retained earnings representing the adjustment to our opening allowance for doubtful accounts required to state our trade receivables and contract assets net of their expected credit losses, net of deferred taxes.

Recently Issued Accounting Pronouncements Not Yet Adopted

Reference Rate Reform

In March 2020, the FASB issued ASU 2020-04, "Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting." This guidance provides companies with optional guidance to ease the potential accounting burden associated with transitioning away from reference rates that are expected to be discontinued. This guidance

is effective upon issuance and generally can be applied through December 31, 2022. The Company is currently evaluating the provisions of this guidance.

Income Taxes

In December 2019, the FASB issued ASU 2019-12, "Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes." This guidance removes certain exceptions from recognizing deferred taxes for investments, performing intraperiod allocation and calculating income taxes in interim periods. It also adds guidance to reduce complexity in certain areas, including recognizing deferred taxes for tax goodwill and allocating taxes to members of a consolidated group. This guidance is effective for annual reporting periods beginning after December 15, 2020, and interim periods within those years. Early adoption of the amendments is permitted, including adoption in any interim period for public business entities for periods for which financial statements have not yet been issued. The Company plans to early adopt the provisions of this guidance in the fourth quarter of 2020 and does not expect the impact to be material.

Generally, the Company recognizes revenue on a point-in-time basis when the customer takes title to the goods and assumes the risks and rewards for the goods. For customized goods where the Company has a legally enforceable right to payment for the goods, the Company recognizes revenue over time which, generally, is as the goods are produced.

Disaggregated Revenue

A geographic disaggregation of revenues across our company segmentation in the following tables provides information to assist in evaluating the nature, timing and uncertainty of revenue and cash flows and how they may be impacted by economic factors.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2020 |

| In millions | | Industrial Packaging | | Global Cellulose Fibers | | Printing Papers | | Corporate and Inter-segment Sales | | Total |

| Primary Geographical Markets (a) | | | | | | | | | | |

| United States | | $ | 3,169 | | | $ | 479 | | | $ | 362 | | | $ | 44 | | | $ | 4,054 | |

| EMEA | | 394 | | | 59 | | | 244 | | | (3) | | | 694 | |

| Pacific Rim and Asia | | 15 | | | 26 | | | 6 | | | 10 | | | 57 | |

| Americas, other than U.S. | | 190 | | | 0 | | | 131 | | | (3) | | | 318 | |

| Total | | $ | 3,768 | | | $ | 564 | | | $ | 743 | | | $ | 48 | | | $ | 5,123 | |

| | | | | | | | | | |

| Operating Segments | | | | | | | | | | |

| North American Industrial Packaging | | $ | 3,351 | | | $ | — | | | $ | — | | | $ | — | | | $ | 3,351 | |

| EMEA Industrial Packaging | | 306 | | | — | | | — | | | — | | | 306 | |

| Brazilian Industrial Packaging | | 52 | | | — | | | — | | | — | | | 52 | |

| European Coated Paperboard | | 90 | | | — | | | — | | | — | | | 90 | |

| Global Cellulose Fibers | | — | | | 564 | | | — | | | — | | | 564 | |

| North American Printing Papers | | — | | | — | | | 362 | | | — | | | 362 | |

| Brazilian Papers | | — | | | — | | | 150 | | | — | | | 150 | |

| European Papers | | — | | | — | | | 232 | | | — | | | 232 | |

| Indian Papers | | — | | | — | | | 0 | | | — | | | 0 | |

| Intra-segment Eliminations | | (31) | | | — | | | (1) | | | — | | | (32) | |

| Corporate & Inter-segment Sales | | — | | | — | | | — | | | 48 | | | 48 | |

| Total | | $ | 3,768 | | | $ | 564 | | | $ | 743 | | | $ | 48 | | | $ | 5,123 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2021 |

| In millions | | Industrial Packaging | | Global Cellulose Fibers | | Printing Papers | | Corporate and Inter-segment Sales | | Total |

| Primary Geographical Markets (a) | | | | | | | | | | |

| United States | | $ | 3,514 | | | $ | 623 | | | $ | 425 | | | $ | 50 | | | $ | 4,612 | |

| EMEA | | 383 | | | 69 | | | 232 | | | (1) | | | 683 | |

| Pacific Rim and Asia | | 12 | | | 37 | | | 8 | | | 3 | | | 60 | |

| Americas, other than U.S. | | 178 | | | — | | | 181 | | | — | | | 359 | |

| Total | | $ | 4,087 | | | $ | 729 | | | $ | 846 | | | $ | 52 | | | $ | 5,714 | |

| | | | | | | | | | |

| Operating Segments | | | | | | | | | | |

| North American Industrial Packaging | | $ | 3,738 | | | $ | — | | | $ | — | | | $ | — | | | $ | 3,738 | |

| EMEA Industrial Packaging | | 331 | | | — | | | — | | | — | | | 331 | |

| European Coated Paperboard | | 52 | | | — | | | — | | | — | | | 52 | |

| Global Cellulose Fibers | | — | | | 729 | | | — | | | — | | | 729 | |

| North American Printing Papers | | — | | | — | | | 425 | | | — | | | 425 | |

| Brazilian Papers | | — | | | — | | | 200 | | | — | | | 200 | |

| European Papers | | — | | | — | | | 218 | | | — | | | 218 | |

| Intra-segment Eliminations | | (34) | | | — | | | 3 | | | — | | | (31) | |

| Corporate & Inter-segment Sales | | — | | | — | | | — | | | 52 | | | 52 | |

| Total | | $ | 4,087 | | | $ | 729 | | | $ | 846 | | | $ | 52 | | | $ | 5,714 | |

(a) Net sales are attributed to countries based on the location of the seller.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2020 |

| In millions | | Industrial Packaging | | Global Cellulose Fibers | | Printing Papers | | Corporate and Inter-segment Sales | | Total |

| Primary Geographical Markets (a) | | | | | | | | | | |

| United States | | $ | 9,364 | | | $ | 1,507 | | | $ | 1,069 | | | $ | 146 | | | $ | 12,086 | |

| EMEA | | 1,213 | | | 175 | | | 765 | | | (11) | | | 2,142 | |

| Pacific Rim and Asia | | 43 | | | 55 | | | 20 | | | 20 | | | 138 | |

| Americas, other than U.S. | | 600 | | | 0 | | | 380 | | | (5) | | | 975 | |

| Total | | $ | 11,220 | | | $ | 1,737 | | | $ | 2,234 | | | $ | 150 | | | $ | 15,341 | |

| | | | | | | | | | |

| Operating Segments | | | | | | | | | | |

| North American Industrial Packaging | | $ | 9,947 | | | $ | — | | | $ | — | | | $ | — | | | $ | 9,947 | |

| EMEA Industrial Packaging | | 953 | | | — | | | — | | | — | | | 953 | |

| Brazilian Industrial Packaging | | 148 | | | — | | | — | | | — | | | 148 | |

| European Coated Paperboard | | 266 | | | — | | | — | | | — | | | 266 | |

| Global Cellulose Fibers | | — | | | 1,737 | | | — | | | — | | | 1,737 | |

| North American Printing Papers | | — | | | — | | | 1,073 | | | — | | | 1,073 | |

| Brazilian Papers | | — | | | — | | | 434 | | | — | | | 434 | |

| European Papers | | — | | | — | | | 728 | | | — | | | 728 | |

| Indian Papers | | — | | | — | | | 0 | | | — | | | 0 | |

| Intra-segment Eliminations | | (94) | | | — | | | (1) | | | — | | | (95) | |

| Corporate & Inter-segment Sales | | — | | | — | | | — | | | 150 | | | 150 | |

| Total | | $ | 11,220 | | | $ | 1,737 | | | $ | 2,234 | | | $ | 150 | | | $ | 15,341 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2021 |

| In millions | | Industrial Packaging | | Global Cellulose Fibers | | Printing Papers | | Corporate and Inter-segment Sales | | Total |

| Primary Geographical Markets (a) | | | | | | | | | | |

| United States | | $ | 10,125 | | | $ | 1,682 | | | $ | 1,195 | | | $ | 139 | | | $ | 13,141 | |

| EMEA | | 1,371 | | | 209 | | | 765 | | | (6) | | | 2,339 | |

| Pacific Rim and Asia | | 44 | | | 90 | | | 25 | | | 10 | | | 169 | |

| Americas, other than U.S. | | 556 | | | — | | | 488 | | | — | | | 1,044 | |

| Total | | $ | 12,096 | | | $ | 1,981 | | | $ | 2,473 | | | $ | 143 | | | $ | 16,693 | |

| | | | | | | | | | |

| Operating Segments | | | | | | | | | | |

| North American Industrial Packaging | | $ | 10,810 | | | $ | — | | | $ | — | | | $ | — | | | $ | 10,810 | |

| EMEA Industrial Packaging | | 1,121 | | | — | | | — | | | — | | | 1,121 | |

| European Coated Paperboard | | 252 | | | — | | | — | | | — | | | 252 | |

| Global Cellulose Fibers | | — | | | 1,981 | | | — | | | — | | | 1,981 | |

| North American Printing Papers | | — | | | — | | | 1,201 | | | — | | | 1,201 | |

| Brazilian Papers | | — | | | — | | | 557 | | | — | | | 557 | |

| European Papers | | — | | | — | | | 723 | | | — | | | 723 | |

| Intra-segment Eliminations | | (87) | | | — | | | (8) | | | — | | | (95) | |

| Corporate & Inter-segment Sales | | — | | | — | | | — | | | 143 | | | 143 | |

| Total | | $ | 12,096 | | | $ | 1,981 | | | $ | 2,473 | | | $ | 143 | | | $ | 16,693 | |

(a) Net sales are attributed to countries based on the location of the seller.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2019 |

| In millions | | Industrial Packaging | | Global Cellulose Fibers | | Printing Papers | | Corporate & Intersegment | | Total |

Primary Geographical Markets (a) | | | | | | | | | | |

| United States | | $ | 3,180 | | | $ | 535 | | | $ | 486 | | | $ | 56 | | | $ | 4,257 | |

| EMEA | | 415 | | | 62 | | | 315 | | | (1) | | | 791 | |

| Pacific Rim and Asia | | 20 | | | 27 | | | 47 | | | 3 | | | 97 | |

| Americas, other than U.S. | | 205 | | | 0 | | | 223 | | | (5) | | | 423 | |

| Total | | $ | 3,820 | | | $ | 624 | | | $ | 1,071 | | | $ | 53 | | | $ | 5,568 | |

| | | | | | | | | | |

| Operating Segments | | | | | | | | | | |

| North American Industrial Packaging | | $ | 3,368 | | | $ | — | | | $ | — | | | $ | — | | | $ | 3,368 | |

| EMEA Industrial Packaging | | 324 | | | — | | | — | | | — | | | 324 | |

| Brazilian Industrial Packaging | | 61 | | | — | | | — | | | — | | | 61 | |

| European Coated Paperboard | | 92 | | | — | | | — | | | — | | | 92 | |

| Global Cellulose Fibers | | — | | | 624 | | | — | | | — | | | 624 | |

| North American Printing Papers | | — | | | — | | | 492 | | | — | | | 492 | |

| Brazilian Papers | | — | | | — | | | 247 | | | — | | | 247 | |

| European Papers | | — | | | — | | | 299 | | | — | | | 299 | |

| Indian Papers | | — | | | — | | | 38 | | | — | | | 38 | |

| Intra-segment Eliminations | | (25) | | | — | | | (5) | | | — | | | (30) | |

| Corporate & Inter-segment Sales | | — | | | — | | | — | | | 53 | | | 53 | |

| Total | | $ | 3,820 | | | $ | 624 | | | $ | 1,071 | | | $ | 53 | | | $ | 5,568 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2020 |

| In millions | | Industrial Packaging | | Global Cellulose Fibers | | Printing Papers | | Corporate & Intersegment | | Total |

Primary Geographical Markets (a) | | | | | | | | | | |

| United States | | $ | 3,169 | | | $ | 479 | | | $ | 362 | | | $ | 44 | | | $ | 4,054 | |

| EMEA | | 394 | | | 59 | | | 244 | | | (3) | | | 694 | |

| Pacific Rim and Asia | | 15 | | | 26 | | | 6 | | | 10 | | | 57 | |

| Americas, other than U.S. | | 190 | | | — | | | 131 | | | (3) | | | 318 | |

| Total | | $ | 3,768 | | | $ | 564 | | | $ | 743 | | | $ | 48 | | | $ | 5,123 | |

| | | | | | | | | | |

| Operating Segments | | | | | | | | | | |

| North American Industrial Packaging | | $ | 3,351 | | | $ | — | | | $ | — | | | $ | — | | | $ | 3,351 | |

| EMEA Industrial Packaging | | 306 | | | — | | | — | | | — | | | 306 | |

| Brazilian Industrial Packaging | | 52 | | | — | | | — | | | — | | | 52 | |

| European Coated Paperboard | | 90 | | | — | | | — | | | — | | | 90 | |

| Global Cellulose Fibers | | — | | | 564 | | | — | | | — | | | 564 | |

| North American Printing Papers | | — | | | — | | | 362 | | | — | | | 362 | |

| Brazilian Papers | | — | | | — | | | 150 | | | — | | | 150 | |

| European Papers | | — | | | — | | | 232 | | | — | | | 232 | |

| Intra-segment Eliminations | | (31) | | | — | | | (1) | | | — | | | (32) | |

| Corporate & Inter-segment Sales | | — | | | — | | | — | | | 48 | | | 48 | |

| Total | | $ | 3,768 | | | $ | 564 | | | $ | 743 | | | $ | 48 | | | $ | 5,123 | |

(a) Net sales are attributed to countries based on the location of the seller.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2019 |

| In millions | | Industrial Packaging | | Global Cellulose Fibers | | Printing Papers | | Corporate & Intersegment | | Total |

Primary Geographical Markets (a) | | | | | | | | | | |

| United States | | $ | 9,531 | | | $ | 1,656 | | | $ | 1,448 | | | $ | 174 | | | $ | 12,809 | |

| EMEA | | 1,263 | | | 207 | | | 986 | | | (8) | | | 2,448 | |

| Pacific Rim and Asia | | 50 | | | 111 | | | 167 | | | 9 | | | 337 | |

| Americas, other than U.S. | | 672 | | | 0 | | | 623 | | | (11) | | | 1,284 | |

| Total | | $ | 11,516 | | | $ | 1,974 | | | $ | 3,224 | | | $ | 164 | | | $ | 16,878 | |

| | | | | | | | | | |

| Operating Segments | | | | | | | | | | |

| North American Industrial Packaging | | $ | 10,158 | | | $ | — | | | $ | — | | | $ | — | | | $ | 10,158 | |

| EMEA Industrial Packaging | | 994 | | | — | | | — | | | — | | | 994 | |

| Brazilian Industrial Packaging | | 176 | | | — | | | — | | | — | | | 176 | |

| European Coated Paperboard | | 275 | | | — | | | — | | | — | | | 275 | |

| Global Cellulose Fibers | | — | | | 1,974 | | | — | | | — | | | 1,974 | |

| North American Printing Papers | | — | | | — | | | 1,474 | | | — | | | 1,474 | |

| Brazilian Papers | | — | | | — | | | 702 | | | — | | | 702 | |

| European Papers | | — | | | — | | | 929 | | | — | | | 929 | |

| Indian Papers | | — | | | — | | | 144 | | | — | | | 144 | |

| Intra-segment Eliminations | | (87) | | | — | | | (25) | | | — | | | (112) | |

| Corporate & Inter-segment Sales | | — | | | — | | | — | | | 164 | | | 164 | |

| Total | | $ | 11,516 | | | $ | 1,974 | | | $ | 3,224 | | | $ | 164 | | | $ | 16,878 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2020 |

| In millions | | Industrial Packaging | | Global Cellulose Fibers | | Printing Papers | | Corporate & Intersegment | | Total |

Primary Geographical Markets (a) | | | | | | | | | | |

| United States | | $ | 9,364 | | | $ | 1,507 | | | $ | 1,069 | | | $ | 146 | | | $ | 12,086 | |

| EMEA | | 1,213 | | | 175 | | | 765 | | | (11) | | | 2,142 | |

| Pacific Rim and Asia | | 43 | | | 55 | | | 20 | | | 20 | | | 138 | |

| Americas, other than U.S. | | 600 | | | — | | | 380 | | | (5) | | | 975 | |

| Total | | $ | 11,220 | | | $ | 1,737 | | | $ | 2,234 | | | $ | 150 | | | $ | 15,341 | |

| | | | | | | | | | |

| Operating Segments | | | | | | | | | | |

| North American Industrial Packaging | | $ | 9,947 | | | $ | — | | | $ | — | | | $ | — | | | $ | 9,947 | |

| EMEA Industrial Packaging | | 953 | | | — | | | — | | | — | | | 953 | |

| Brazilian Industrial Packaging | | 148 | | | — | | | — | | | — | | | 148 | |

| European Coated Paperboard | | 266 | | | — | | | — | | | — | | | 266 | |

| Global Cellulose Fibers | | — | | | 1,737 | | | — | | | — | | | 1,737 | |

| North American Printing Papers | | — | | | — | | | 1,073 | | | — | | | 1,073 | |

| Brazilian Papers | | — | | | — | | | 434 | | | — | | | 434 | |

| European Papers | | — | | | — | | | 728 | | | — | | | 728 | |

| Intra-segment Eliminations | | (94) | | | — | | | (1) | | | — | | | (95) | |

| Corporate & Inter-segment Sales | | — | | | — | | | — | | | 150 | | | 150 | |

| Total | | $ | 11,220 | | | $ | 1,737 | | | $ | 2,234 | | | $ | 150 | | | $ | 15,341 | |

(a) Net sales are attributed to countries based on the location of the seller.

Revenue Contract Balances

A contract asset is created when the Company recognizes revenue on its customized products prior to having an unconditional right to payment from the customer, which generally does not occur until title and risk of loss passes to the customer.

A contract liability is created when customers prepay for goods prior to the Company transferring those goods to the customer. The contract liability is reduced once control of the goods is transferred to the customer. The majority of our customer prepayments are received during the fourth quarter each year for goods that will be transferred to customers over the following twelve months. Contract liabilities of $20$25 million and $56$31 million are included in Other current liabilities in the accompanying condensed consolidated balance sheet as of September 30, 20202021 and December 31, 2019,2020, respectively. During the second quarter of 2021, the Company also recorded a contract liability of $115 million related to the April 2021 acquisition disclosed in Note 8.

The difference between the opening and closing balances of the Company's contract assets and contract liabilities primarily results from the difference between the price and quantity at comparable points in time for goods for which we have an unconditional right to payment or receive pre-paymentprepayment from the customer, respectively.

A summary of the changes in equity for the three months and nine months ended September 30, 20202021 and 20192020 is provided below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2020 |

| In millions, except per share amounts | Common Stock Issued | | Paid-in Capital | | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | | Common Stock Held In Treasury, At Cost | | Total

International

Paper

Shareholders’

Equity | | Noncontrolling

Interests | | Total

Equity | |

| Balance, July 1 | $ | 449 | | | $ | 6,283 | | | $ | 8,123 | | $ | (5,149) | | | $ | 2,649 | | | $ | 7,057 | | | $ | 3 | | | $ | 7,060 | | |

| Issuance of stock for various plans, net | — | | | 18 | | | — | | — | | | (2) | | | 20 | | | — | | | 20 | | |

| Repurchase of stock | — | | | — | | | — | | — | | | 1 | | | (1) | | | — | | | (1) | | |

Common stock dividends ($0.5125 per share) | — | | | — | | | (205) | | — | | | — | | | (205) | | | — | | | (205) | | |

| Transactions of equity method investees | — | | | 1 | | | — | | — | | | — | | | 1 | | | — | | | 1 | | |

| Comprehensive income (loss) | — | | | — | | | 204 | | 17 | | | — | | | 221 | | | 0 | | | 221 | | |

| Ending Balance, September 30 | $ | 449 | | | $ | 6,302 | | | $ | 8,122 | | $ | (5,132) | | | $ | 2,648 | | | $ | 7,093 | | | $ | 3 | | | $ | 7,096 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2021 |

| In millions, except per share amounts | Common Stock Issued | | Paid-in Capital | | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | | Common Stock Held In Treasury, At Cost | | Total

International

Paper

Shareholders’

Equity | | Noncontrolling

Interests | | Total

Equity | |

| Balance, July 1 | $ | 449 | | | $ | 6,330 | | | $ | 8,442 | | $ | (4,094) | | | $ | 2,775 | | | $ | 8,352 | | | $ | 2 | | | $ | 8,354 | | |

| Issuance of stock for various plans, net | — | | | 41 | | | — | | — | | | — | | | 41 | | | — | | | 41 | | |

| Repurchase of stock | — | | | — | | | — | | — | | | 212 | | | (212) | | | — | | | (212) | | |

Common stock dividends ($0.5125 per share) | — | | | — | | | (203) | | — | | | — | | | (203) | | | — | | | (203) | | |

| | | | | | | | | | | | | | | |

| Divestiture of noncontrolling interests | — | | | — | | | — | | — | | | — | | | — | | | (1) | | | (1) | | |

| Comprehensive income (loss) | — | | | — | | | 864 | | 780 | | | — | | | 1,644 | | | — | | | 1,644 | | |

| Ending Balance, September 30 | $ | 449 | | | $ | 6,371 | | | $ | 9,103 | | $ | (3,314) | | | $ | 2,987 | | | $ | 9,622 | | | $ | 1 | | | $ | 9,623 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2020 |

| In millions, except per share amounts | Common Stock Issued | | Paid-in Capital | | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | | Common Stock Held In Treasury, At Cost | | Total

International

Paper

Shareholders’

Equity | | Noncontrolling

Interests | | Total

Equity | |

| Balance, January 1 | $ | 449 | | | $ | 6,297 | | | $ | 8,408 | | $ | (4,739) | | | $ | 2,702 | | | $ | 7,713 | | | $ | 5 | | | $ | 7,718 | | |

| Adoption of ASU 2016-13 measurement of credit losses on financial instruments | — | | | — | | | (2) | | — | | | — | | | (2) | | | — | | | (2) | | |

| Issuance of stock for various plans, net | — | | | (31) | | | — | | — | | | (96) | | | 65 | | | — | | | 65 | | |

| Repurchase of stock | — | | | — | | | — | | — | | | 42 | | | (42) | | | — | | | (42) | | |

Common stock dividends ($1.5375 per share) | — | | | — | | | (613) | | — | | | — | | | (613) | | | — | | | (613) | | |

| Transactions of equity method investees | — | | | 36 | | | — | | — | | | — | | | 36 | | | — | | | 36 | | |

| Comprehensive income (loss) | — | | | — | | | 329 | | (393) | | | — | | | (64) | | | (2) | | | (66) | | |

| Ending Balance, September 30 | $ | 449 | | | $ | 6,302 | | | $ | 8,122 | | $ | (5,132) | | | $ | 2,648 | | | $ | 7,093 | | | $ | 3 | | | $ | 7,096 | | |

| | | Three Months Ended September 30, 2019 | | Nine Months Ended September 30, 2021 |

| In millions, except per share amounts | In millions, except per share amounts | Common Stock Issued | | Paid-in Capital | | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | | Common Stock Held In Treasury, At Cost | | Total

International

Paper

Shareholders’

Equity | | Noncontrolling

Interests | | Total

Equity | | In millions, except per share amounts | Common Stock Issued | | Paid-in Capital | | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | | Common Stock Held In Treasury, At Cost | | Total

International

Paper

Shareholders’

Equity | | Noncontrolling

Interests | | Total

Equity | |

| Balance, July 1 | $ | 449 | | | $ | 6,229 | | | $ | 8,302 | | $ | (4,870) | | | $ | 2,628 | | | $ | 7,482 | | | $ | 17 | | | $ | 7,499 | | | |

| Balance, January 1 | | Balance, January 1 | $ | 449 | | | $ | 6,325 | | | $ | 8,070 | | $ | (4,342) | | | $ | 2,648 | | | $ | 7,854 | | | $ | 14 | | | $ | 7,868 | | |

| Issuance of stock for various plans, net | Issuance of stock for various plans, net | — | | | 32 | | | — | | — | | | (1) | | | 33 | | | — | | | 33 | | | Issuance of stock for various plans, net | — | | | 27 | | | — | | — | | | (86) | | | 113 | | | — | | | 113 | | |

| Repurchase of stock | Repurchase of stock | — | | | — | | | — | | — | | | 75 | | | (75) | | | — | | | (75) | | | Repurchase of stock | — | | | — | | | — | | — | | | 425 | | | (425) | | | — | | | (425) | | |

| Common stock dividends ($0.5000 per share) | — | | | — | | | (199) | | — | | | — | | | (199) | | | — | | | (199) | | | |

Common stock dividends ($1.5375 per share) | | Common stock dividends ($1.5375 per share) | — | | | — | | | (612) | | — | | | — | | | (612) | | | — | | | (612) | | |

| Transactions of equity method investees | Transactions of equity method investees | — | | | 0 | | | — | | — | | | — | | | 0 | | | — | | | 0 | | | Transactions of equity method investees | — | | | 19 | | | — | | — | | | — | | | 19 | | | — | | | 19 | | |

| Divestiture of noncontrolling interests | | Divestiture of noncontrolling interests | — | | | — | | | — | | — | | | — | | | — | | | (13) | | | (13) | | |

| Comprehensive income (loss) | Comprehensive income (loss) | — | | | — | | | 344 | | (144) | | | — | | | 200 | | | (2) | | | 198 | | | Comprehensive income (loss) | — | | | — | | | 1,645 | | 1,028 | | | — | | | 2,673 | | | — | | | 2,673 | | |

| Ending Balance, September 30 | Ending Balance, September 30 | $ | 449 | | | $ | 6,261 | | | $ | 8,447 | | $ | (5,014) | | | $ | 2,702 | | | $ | 7,441 | | | $ | 15 | | | $ | 7,456 | | | Ending Balance, September 30 | $ | 449 | | | $ | 6,371 | | | $ | 9,103 | | $ | (3,314) | | | $ | 2,987 | | | $ | 9,622 | | | $ | 1 | | | $ | 9,623 | | |

| | | Nine Months Ended September 30, 2019 | | Three Months Ended September 30, 2020 |

| In millions, except per share amounts | In millions, except per share amounts | Common Stock Issued | | Paid-in Capital | | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | | Common Stock Held In Treasury, At Cost | | Total

International

Paper

Shareholders’

Equity | | Noncontrolling

Interests | | Total

Equity | | In millions, except per share amounts | Common Stock Issued | | Paid-in Capital | | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | | Common Stock Held In Treasury, At Cost | | Total

International

Paper

Shareholders’

Equity | | Noncontrolling

Interests | | Total

Equity | |

| Balance, January 1 | $ | 449 | | | $ | 6,280 | | | $ | 7,465 | | $ | (4,500) | | | $ | 2,332 | | | $ | 7,362 | | | $ | 21 | | | $ | 7,383 | | | |

| Adoption of ASU 2018-02 reclassification of stranded tax effects resulting from Tax Reform | — | | | — | | | 529 | | (529) | | | — | | | — | | | — | | | 0 | | | |

| Balance, July 1 | | Balance, July 1 | $ | 449 | | | $ | 6,283 | | | $ | 8,123 | | $ | (5,149) | | | $ | 2,649 | | | $ | 7,057 | | | $ | 3 | | | $ | 7,060 | | |

| Issuance of stock for various plans, net | Issuance of stock for various plans, net | — | | | (52) | | | — | | — | | | (165) | | | 113 | | | — | | | 113 | | | Issuance of stock for various plans, net | — | | | 18 | | | — | | — | | | (2) | | | 20 | | | — | | | 20 | | |

| Repurchase of stock | Repurchase of stock | — | | | — | | | — | | — | | | 535 | | | (535) | | | — | | | (535) | | | Repurchase of stock | — | | | — | | | — | | — | | | 1 | | | (1) | | | — | | | (1) | | |

| Common stock dividends ($1.5000 per share) | — | | | — | | | (607) | | — | | | — | | | (607) | | | — | | | (607) | | | |

| Common stock dividends ($0.5125 per share) | | Common stock dividends ($0.5125 per share) | — | | | — | | | (205) | | — | | | — | | | (205) | | | — | | | (205) | | |

| Transactions of equity method investees | Transactions of equity method investees | — | | | 33 | | | — | | — | | | — | | | 33 | | | — | | | 33 | | | Transactions of equity method investees | — | | | 1 | | | — | | — | | | — | | | 1 | | | — | | | 1 | | |

| Comprehensive income (loss) | Comprehensive income (loss) | — | | | — | | | 1,060 | | 15 | | | — | | | 1,075 | | | (6) | | | 1,069 | | | Comprehensive income (loss) | — | | | — | | | 204 | | 17 | | | — | | | 221 | | | — | | | 221 | | |

| Ending Balance, September 30 | Ending Balance, September 30 | $ | 449 | | | $ | 6,261 | | | $ | 8,447 | | $ | (5,014) | | | $ | 2,702 | | | $ | 7,441 | | | $ | 15 | | | $ | 7,456 | | | Ending Balance, September 30 | $ | 449 | | | $ | 6,302 | | | $ | 8,122 | | $ | (5,132) | | | $ | 2,648 | | | $ | 7,093 | | | $ | 3 | | | $ | 7,096 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2020 |

| In millions, except per share amounts | Common Stock Issued | | Paid-in Capital | | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | | Common Stock Held In Treasury, At Cost | | Total

International

Paper

Shareholders’

Equity | | Noncontrolling

Interests | | Total

Equity | |

| Balance, January 1 | $ | 449 | | | $ | 6,297 | | | $ | 8,408 | | $ | (4,739) | | | $ | 2,702 | | | $ | 7,713 | | | $ | 5 | | | $ | 7,718 | | |

| Adoption of ASU 2016-13 measurement of credit losses on financial instruments | — | | | — | | | (2) | | — | | | — | | | (2) | | | — | | | (2) | | |

| Issuance of stock for various plans, net | — | | | (31) | | | — | | — | | | (96) | | | 65 | | | — | | | 65 | | |

| Repurchase of stock | — | | | — | | | — | | — | | | 42 | | | (42) | | | — | | | (42) | | |

Common stock dividends ($1.5375 per share) | — | | | — | | | (613) | | — | | | — | | | (613) | | | — | | | (613) | | |

| Transactions of equity method investees | — | | | 36 | | | — | | — | | | — | | | 36 | | | — | | | 36 | | |

| Comprehensive income (loss) | — | | | — | | | 329 | | (393) | | | — | | | (64) | | | (2) | | | (66) | | |

| Ending Balance, September 30 | $ | 449 | | | $ | 6,302 | | | $ | 8,122 | | $ | (5,132) | | | $ | 2,648 | | | $ | 7,093 | | | $ | 3 | | | $ | 7,096 | | |

The following table presents changes in accumulated other comprehensive income (AOCI) for the three months and nine months ended September 30, 20202021 and 2019:2020:

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| In millions | In millions | | 2020 | | 2019 | | 2020 | | 2019 | In millions | 2021 | | 2020 | | 2021 | | 2020 |

| Defined Benefit Pension and Postretirement Adjustments | Defined Benefit Pension and Postretirement Adjustments | | Defined Benefit Pension and Postretirement Adjustments | |

| Balance at beginning of period | Balance at beginning of period | | $ | (2,192) | | | $ | (2,362) | | | $ | (2,277) | | | $ | (1,916) | | Balance at beginning of period | $ | (1,809) | | | $ | (2,192) | | | $ | (1,880) | | | $ | (2,277) | |

| Reclassification of stranded tax effects | | 0 | | | 0 | | | 0 | | | (527) | | |

| Other comprehensive income (loss) before reclassifications | | Other comprehensive income (loss) before reclassifications | 831 | | | — | | | 832 | | | — | |

| Amounts reclassified from accumulated other comprehensive income | Amounts reclassified from accumulated other comprehensive income | | 43 | | | 41 | | | 128 | | | 122 | | Amounts reclassified from accumulated other comprehensive income | 31 | | | 43 | | | 101 | | | 128 | |

| Balance at end of period | Balance at end of period | | (2,149) | | | (2,321) | | | (2,149) | | | (2,321) | | Balance at end of period | (947) | | | (2,149) | | | (947) | | | (2,149) | |

| Change in Cumulative Foreign Currency Translation Adjustments | Change in Cumulative Foreign Currency Translation Adjustments | | Change in Cumulative Foreign Currency Translation Adjustments | |

| Balance at beginning of period | Balance at beginning of period | | (2,950) | | | (2,508) | | | (2,465) | | | (2,581) | | Balance at beginning of period | (2,286) | | | (2,950) | | | (2,457) | | | (2,465) | |

| Other comprehensive income (loss) before reclassifications | Other comprehensive income (loss) before reclassifications | | (28) | | | (179) | | | (515) | | | (110) | | Other comprehensive income (loss) before reclassifications | (114) | | | (28) | | | (85) | | | (515) | |

| Amounts reclassified from accumulated other comprehensive income | Amounts reclassified from accumulated other comprehensive income | | 0 | | | 0 | | | 0 | | | 4 | | Amounts reclassified from accumulated other comprehensive income | 44 | | | — | | | 184 | | | — | |

| Other comprehensive income (loss) attributable to noncontrolling interest | Other comprehensive income (loss) attributable to noncontrolling interest | | 0 | | | 0 | | | 2 | | | 0 | | Other comprehensive income (loss) attributable to noncontrolling interest | — | | | — | | | 2 | | | 2 | |

| Balance at end of period | Balance at end of period | | (2,978) | | | (2,687) | | | (2,978) | | | (2,687) | | Balance at end of period | (2,356) | | | (2,978) | | | (2,356) | | | (2,978) | |

| Net Gains and Losses on Cash Flow Hedging Derivatives | Net Gains and Losses on Cash Flow Hedging Derivatives | | Net Gains and Losses on Cash Flow Hedging Derivatives | |

| Balance at beginning of period | Balance at beginning of period | | (7) | | | 0 | | | 3 | | | (3) | | Balance at beginning of period | 1 | | | (7) | | | (5) | | | 3 | |

| Other comprehensive income (loss) before reclassifications | Other comprehensive income (loss) before reclassifications | | (4) | | | (10) | | | (34) | | | (6) | | Other comprehensive income (loss) before reclassifications | (4) | | | (4) | | | 3 | | | (34) | |

| Reclassification of stranded tax effects | | 0 | | | 0 | | | 0 | | | (2) | | |

| | Amounts reclassified from accumulated other comprehensive income | Amounts reclassified from accumulated other comprehensive income | | 6 | | | 4 | | | 26 | | | 5 | | Amounts reclassified from accumulated other comprehensive income | (8) | | | 6 | | | (9) | | | 26 | |

| Balance at end of period | Balance at end of period | | (5) | | | (6) | | | (5) | | | (6) | | Balance at end of period | (11) | | | (5) | | | (11) | | | (5) | |

| Total Accumulated Other Comprehensive Income (Loss) at End of Period | Total Accumulated Other Comprehensive Income (Loss) at End of Period | | $ | (5,132) | | | $ | (5,014) | | | $ | (5,132) | | | $ | (5,014) | | Total Accumulated Other Comprehensive Income (Loss) at End of Period | $ | (3,314) | | | $ | (5,132) | | | $ | (3,314) | | | $ | (5,132) | |

The following table presents details of the reclassifications out of AOCI for the three months and nine months ended September 30, 20202021 and 2019:2020:

| | In millions: | In millions: | | Amounts Reclassified from Accumulated Other Comprehensive Income | Location of Amount Reclassified from AOCI | In millions: | Amount Reclassified from Accumulated Other Comprehensive Income | | Location of Amount Reclassified from AOCI |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, | | Three Months Ended

September 30, | | Nine Months Ended

September 30, | |

| 2020 | | 2019 | | 2020 | | 2019 | | 2021 | | 2020 | | 2021 | | 2020 | |

| Defined benefit pension and postretirement items: | Defined benefit pension and postretirement items: | | Defined benefit pension and postretirement items: | |

| Prior-service costs | Prior-service costs | | $ | (5) | | | $ | (4) | | | $ | (15) | | | $ | (10) | | | (a) | Non-operating pension expense | Prior-service costs | $ | (5) | | | $ | (5) | | | $ | (17) | | | $ | (15) | | | (a) | Non-operating pension expense |

| Actuarial gains (losses) | Actuarial gains (losses) | | (52) | | | (50) | | | (155) | | | (152) | | | (a) | Non-operating pension expense | Actuarial gains (losses) | (36) | | | (52) | | | (118) | | | (155) | | | (a) | Non-operating pension expense |

| Total pre-tax amount | Total pre-tax amount | | (57) | | | (54) | | | (170) | | | (162) | | | Total pre-tax amount | (41) | | | (57) | | | (135) | | | (170) | | |

| Tax (expense) benefit | Tax (expense) benefit | | 14 | | | 13 | | | 42 | | | 40 | | | Tax (expense) benefit | 10 | | | 14 | | | 34 | | | 42 | | |

| Net of tax | | (43) | | | (41) | | | (128) | | | (122) | | | |

| Reclassification of stranded tax effects | | 0 | | | 0 | | | 0 | | | 527 | | | Retained Earnings | |

| Total, net of tax | Total, net of tax | | (43) | | | (41) | | | (128) | | | 405 | | | Total, net of tax | (31) | | | (43) | | | (101) | | | (128) | | |

| | Change in cumulative foreign currency translation adjustments: | Change in cumulative foreign currency translation adjustments: | | Change in cumulative foreign currency translation adjustments: | |

| Business acquisitions/divestitures | Business acquisitions/divestitures | | 0 | | | 0 | | | 0 | | | (4) | | | Cost of products sold | Business acquisitions/divestitures | (44) | | | — | | | (184) | | | — | | | Net (gains) losses on sales and impairments of businesses and Cost of products sold |

| Tax (expense) benefit | Tax (expense) benefit | | 0 | | | 0 | | | 0 | | | 0 | | | Tax (expense) benefit | — | | | — | | | — | | | — | | |

| Net of tax | Net of tax | | 0 | | | 0 | | | 0 | | | (4) | | | Net of tax | (44) | | | — | | | (184) | | | — | | |

| | Net gains and losses on cash flow hedging derivatives: | Net gains and losses on cash flow hedging derivatives: | | Net gains and losses on cash flow hedging derivatives: | |

| Foreign exchange contracts | Foreign exchange contracts | | (8) | | | (6) | | | (39) | | | (7) | | | (b) | Cost of products sold | Foreign exchange contracts | 10 | | | (8) | | | 12 | | | (39) | | | (b) | Cost of products sold |

| Total pre-tax amount | Total pre-tax amount | | (8) | | | (6) | | | (39) | | | (7) | | | Total pre-tax amount | 10 | | | (8) | | | 12 | | | (39) | | |

| Tax (expense)/benefit | Tax (expense)/benefit | | 2 | | | 2 | | | 13 | | | 2 | | | Tax (expense)/benefit | (2) | | | 2 | | | (3) | | | 13 | | |

| Net of tax | Net of tax | | (6) | | | (4) | | | (26) | | | (5) | | | Net of tax | 8 | | | (6) | | | 9 | | | (26) | | |

| Reclassification of stranded tax effects | | 0 | | | 0 | | | 0 | | | 2 | | | Retained Earnings | |

| Total, net of tax | | (6) | | | (4) | | | (26) | | | (3) | | | |

| | Total reclassifications for the period | Total reclassifications for the period | | $ | (49) | | | $ | (45) | | | $ | (154) | | | $ | 398 | | | Total reclassifications for the period | $ | (67) | | | $ | (49) | | | $ | (276) | | | $ | (154) | | |

(a)These accumulated other comprehensive income components are included in the computation of net periodic pension cost (see Note 19 for additional details). (b)This accumulated other comprehensive income component is included in our derivatives and hedging activities (see Note 18 for additional details).

Basic earnings per share is computed by dividing earnings by the weighted average number of common shares outstanding. Diluted earnings per share is computed assuming that all potentially dilutive securities were converted into common shares. There are no adjustments required to be made to net income for purposes of computing basic and diluted earnings per share. A reconciliation of the amounts included in the computation of basic earnings (loss) per share and diluted earnings (loss) per share is as follows:

| | | | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| In millions, except per share amounts | In millions, except per share amounts | 2020 | | 2019 | | 2020 | | 2019 | In millions, except per share amounts | 2021 | | 2020 | | 2021 | | 2020 |

| Earnings (loss) attributable to International Paper Company common shareholders | Earnings (loss) attributable to International Paper Company common shareholders | $ | 204 | | | $ | 344 | | | $ | 329 | | | $ | 1,060 | | Earnings (loss) attributable to International Paper Company common shareholders | $ | 864 | | | $ | 204 | | | $ | 1,645 | | | $ | 329 | |

| Weighted average common shares outstanding | Weighted average common shares outstanding | 393.1 | | | 392.6 | | | 392.9 | | | 396.3 | | Weighted average common shares outstanding | 388.8 | | | 393.1 | | | 391.0 | | | 392.9 | |

| Effect of dilutive securities | Effect of dilutive securities | | Effect of dilutive securities | |

| Restricted performance share plan | Restricted performance share plan | 1.5 | | | 2.8 | | | 1.6 | | | 3.3 | | Restricted performance share plan | 3.8 | | | 1.5 | | | 4.3 | | | 1.6 | |

| Weighted average common shares outstanding – assuming dilution | Weighted average common shares outstanding – assuming dilution | 394.6 | | | 395.4 | | | 394.5 | | | 399.6 | | Weighted average common shares outstanding – assuming dilution | 392.6 | | | 394.6 | | | 395.3 | | | 394.5 | |

| Basic earnings (loss) per share attributable to International Paper Company Common Shareholders | Basic earnings (loss) per share attributable to International Paper Company Common Shareholders | $ | 0.52 | | | $ | 0.88 | | | $ | 0.84 | | | $ | 2.67 | | Basic earnings (loss) per share attributable to International Paper Company Common Shareholders | $ | 2.22 | | | $ | 0.52 | | | $ | 4.21 | | | $ | 0.84 | |

| Diluted earnings (loss) per share attributable to International Paper Company Common Shareholders | Diluted earnings (loss) per share attributable to International Paper Company Common Shareholders | $ | 0.52 | | | $ | 0.87 | | | $ | 0.83 | | | $ | 2.65 | | Diluted earnings (loss) per share attributable to International Paper Company Common Shareholders | $ | 2.20 | | | $ | 0.52 | | | $ | 4.16 | | | $ | 0.83 | |

2021: During the three months ended September 30, 2021, the Company recorded a $35 million pre-tax charge in Corporate related to early debt extinguishment costs and a $4 million pre-tax charge in Corporate for severance. The majority of the severance is expected to be paid over the next twelve months.

During the three months ended June 30, 2021, the Company recorded a $170 million pre-tax charge in Corporate related to early debt extinguishment costs and a $4 million pre-tax charge in Corporate for severance. The majority of the severance is expected to be paid over the next twelve months.

During the three months ended March 31, 2021, the Company recorded an $18 million pre-tax charge in Corporate related to early debt extinguishment costs and a $12 million pre-tax charge in the Industrial Packaging segment for severance related to the optimization of our EMEA Packaging business. The majority of the severance is expected to be paid over the next twelve months.

In connection with our Building a Better IP initiative, we expect to incur additional restructuring charges over the course of the initiative, which could be material. At this time, the plans have not been finalized.

2020: During the three months ended September 30, 2020, the Company recorded a $105 million pre-tax charge in Corporate related to early debt extinguishment costs.

During the three months ended June 30, 2020, the Company recorded an $18 million pre-tax charge in Corporate related to early debt extinguishment costs.

During the three months ended March 31, 2020, the Company recorded an $8 million pre-tax charge in Corporate related to early debt extinguishment costs.

2019: During the three months and nine months ended September 30, 2019, the Company recorded an $11 million pre-tax charge in Corporate, a $6 million pre-tax charge in the Printing Papers segment and a $4 million pre-tax charge in the Global Cellulose Fibers segment for severance related to an overhead cost reduction initiative. The majority of the severance was paid over the next twelve months.

2020:2021: In May 2020, the Company increased its noncontrolling interest in an entity that produces corrugated sheets. The equity purchase price was $64 million. The Company is party to various agreements with the entity which includes a containerboard supply agreement. The Company will account for its interest as an equity method investment.

2019:On June 28, 2019,April 1, 2021, the Company closed on the previously announced acquisition of two packaging businessesbox plants located in Portugal (Ovar) and France (Torigni and Cabourg) from DS Smith Packaging.Spain. The total purchase consideration, inclusive of working capital adjustments, was approximately €71 million (approximately $81$83 million at June 30, 2019based on the April 1, 2021 exchange rates).

The following table summarizes the finalprovisional fair value assigned to assets and liabilities acquired as of June 28, 2019:April 1, 2021:

| | | | | |

| In millions | |

| Cash and temporary investments | $ | 25 | |

| Accounts and notes receivable | 2210 | |

InventoryInventories | 83 | |

| Plants, properties and equipment | 3738 | |

| Goodwill | 2730 | |

| Intangible assets | 14 | |

Right of use assets | 3 | |

Deferred charges and other assets | 2 | |

| Total assets acquired | $ | 115100 | |

| Short-term debt | $ | 23 | |

| Accounts payable and accrued liabilities | 174 | |

| Other current liabilities | 51 | |

| Deferred income taxes | 4 | |

Long-term debt | 1 | |

Postretirement and postemployment benefit obligation | 3 | |

Long-term lease obligations | 29 | |

| Total liabilities assumed | 3417 | |

| Net assets acquired | $ | 8183 | |

Since the date of acquisition, Net sales of $9 million and $18 million and Earnings from continuing operations before income taxes and equity earnings of $0 and $1 million have been included in the Company's consolidated statement of operations for the three months and year to date ended September 30, 2021, respectively.

The purchase price and related allocation are preliminary and could be revised as a result of adjustments made to the purchase price, additional information obtained regarding assets acquired and liabilities assumed, and revisions of provisional estimates of fair values, including, but not limited to, the completion of independent appraisals and valuations related to inventory, property, plant and equipment and acquired intangible assets. Adjustments to provisional amounts will be finalized as new information becomes available, but within the adjustment period of up to one year from the acquisition date.

Pro forma information has not been included as it is impracticable to obtain the information due to the lack of availability of historical U.S. GAAP financial data. The results of the operations of these businesses do not have a material effect on the Company's condensed consolidated results of operations.

The Company has accounted for the above acquisition under ASC 805, "Business Combinations" and the results of operations have been included in International Paper's financial statements beginning with the date of acquisition.