On January 16, 2020, the | |||

| Amount Authorized | Average Price Per Share (1) | Total Shares Retired | Shares Repurchased | |||

| $1,000,000,000 | $75.33 | 3,680,017 | 3,680,017 | |||

Dividend Program

On July 11, 2019,May 5, 2020, the Company’s Board of Directors declared a quarterly dividend of $0.17$0.19 per share of the Company’s common stock to be paid on August 23, 2019,June 17, 2020, to shareholders of record on the close of business on July 26, 2019.May 20, 2020. Future dividend declarations are subject to review and approval by the Company’s Board of Directors. Dividends paid through the thirdsecond fiscal quarter of 20192020 and the preceding fiscal year are as follows:

| Declaration Date | Record Date | Payment Date | Cash Amount (per share) | |||||||||||||||||

| January 16, 2020 | January 31, 2020 | February 28, 2020 | $0.19 | |||||||||||||||||

| September 19, 2019 | October 4, 2019 | November 1, 2019 | $0.17 | |||||||||||||||||

| July 11, 2019 | July 26, 2019 | August 23, 2019 | $0.17 | |||||||||||||||||

| May 2, 2019 | May 17, 2019 | June 14, 2019 | $0.17 | |||||||||||||||||

| January 17, 2019 | February 15, 2019 | March 15, 2019 | $0.17 | |||||||||||||||||

| September 11, 2018 | September 28, 2018 | October 26, 2018 | $0.15 | |||||||||||||||||

Derivative Financial Instruments

Due to the nature of the Company's international operations, we are at times exposed to foreign currency risk. Additionally, the Company is exposed to interest rate risk under its variable rate borrowings. As such, we sometimes enter into foreign exchange contracts and interest rate contracts in order to limit our exposure to fluctuating foreign currencies

Page 31

JACOBS ENGINEERING GROUP INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED)

and interest rates. The Company did not have outstanding foreign currency or interest rate derivatives that would have a material effect on our consolidated financial statements or results of operations as of March 27, 2020.

Contractual Guarantees and Insurance

In the normal course of business, we make contractual commitments some(some of which are supported by separate guarantees;guarantees) and on occasion we are a party in a litigation or arbitration proceeding. The litigation or arbitration in which we are involved includes personal injury claims, professional liability claims and breach of contract claims. Where we provide a separate guarantee, it is strictly in support of the underlying contractual commitment. Guarantees take various forms including surety bonds required by law, or standby letters of credit ("LOC") (also and also referred to as “bank guarantees”) or corporate guarantees given to induce a party to enter into a contract with a subsidiary. Standby LOCs are also used as security for advance payments or in various other transactions. The

guarantees have various expiration dates ranging from an arbitrary date to completion of our work (e.g., engineering only) to completion of the overall project. We record in the Consolidated Balance Sheets amounts representing our estimated liabilityliability relating to such guarantees, litigation and insurance claims. Guarantees are accounted for in accordance with ASC 460-10, Guarantees, at fair value at the inception of the guarantee.

At June 28, 2019March 27, 2020 and September 28, 2018,27, 2019, the Company had issued and outstanding approximately $359.0$262.8 million and $446.6and $262.2 million, respectively, in LOCs and $1.16 $1.97 billion and $870.3 million,and $2.0 billion, respectively, in surety bonds.

We maintain insurance coverage for most insurable aspects of our business and operations. Our insurance programs have varying coverage limits depending upon the type of insurance and include certain conditions and exclusions which insurance companies may raise in response to any claim that is asserted by or against the Company. We have also elected to retain a portion of losses and liabilities that occur through using various deductibles, limits, and retentions under our insurance programs. As a result, we may be subject to a future liability for which we are only partially insured or completely uninsured. We intend to mitigate any such future liability by continuing to exercise prudent business judgment in negotiating the terms and conditions of the contracts which the Company enters with its clients. Our insurers are also subject to business risk and, as a result, one or more of them may be unable to fulfill their insurance obligations due to insolvency or otherwise.

Additionally, as a contractor providing services to the U.S. federal government, we are subject to many types of audits, investigations, and claims by, or on behalf of, the government including with respect to contract performance, pricing, cost allocations, procurement practices, labor practices, and socioeconomic obligations. Furthermore, our income, franchise, and similar tax returns and filings are also subject to audit and investigation by the Internal Revenue Service, most states within the United States, as well as by various government agencies representing jurisdictions outside the United States.

Our Consolidated Balance Sheets include amounts representing our probable estimated liability relating to such claims, guarantees, litigation, audits, and investigations. We perform an analysis to determine the level of reserves to establish for insurance-related claims that are known and have been asserted against us, as well as for insurance-related claims that are believed to have been incurred based on actuarial analysis but have not yet been reported to our claims administrators as of the respective balance sheet dates. We include any adjustments to such insurance reserves in our consolidated results of operations. Insurance recoveries are recorded as assets if recovery is probable and estimated liabilities are not reduced by expected insurance recoveries.

The Company believes, after consultation with counsel, that such guarantees, litigation, U.S. government contract-related audits, investigations and claims, and income tax audits and investigations should not have a material adverse effect on our consolidated financial statements, beyond amounts currently accrued.

Litigation and Investigations

Page 32

JACOBS ENGINEERING GROUP INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED)

On September 30, 2015, Nui Phao Mining Company Limited (“NPMC”) commenced arbitration proceedings against Jacobs E&C Australia Pty Limited (“Jacobs E&C”) in Singapore before the Singapore International Arbitration Centre. Jacobs E&C was engaged by NPMC for the provision of management, design, engineering, and procurement services for a Nui Phao mine/mineral processing project in Vietnam as part of the Company’s former Energy, Chemicals & Resources (“ECR”) line of business. A three-week hearing on the merits concluded on December 15, 2017. On2017, and on March 28, 2019, the arbitration panel issued a decision finding against Jacobs E&C. On August 30, 2019, NPMC and awarding damagesJacobs E&C settled all of the proceedings related to this matter. Under the terms of the settlement, Jacobs E&C made a payment to NPMC in the amount of approximately $95.0 million. NPMC has asserted a claim for interest, costs and attorneys' fees for approximately $70.0$130.0 million whichin the Company intends to dispute.fourth fiscal quarter of 2019. The awardsettlement otherwise remains confidential. A hearing onDuring the interest and cost claim is scheduled to begin on October 28, 2019. On June 28,quarter ended December 27, 2019, the Company filed an applicationrecognized the reduction of $50.0 million of selling, general and administrative expenses in Singapore to set aside the award. In addition, NPMC has filed an application to enforce the award in Australia. A hearing on that application is scheduled to begin on September 4, 2019. In connection withdiscontinued operations as a temporary stayresult of the proceedings to enforce the award, the Company delivered a bank guarantee in the amountrealization of $95.0 million. The Company expects that a portion of the award is subject to recovery from insurance, however, the Company currently has not accrued a receivable for related insurance recoveries. Under the terms of the sale of the Company’sCompany's ECR business to WorleyParsonsWorley on April 26, 2019, the Company has retained liability with respect to this matter. The Company recorded pre-tax charges in discontinued operations for estimates related to the award and recovery of costs, estimated related interest and attorneys' fees in the amount of $147.0 million in the second quarter of 2019.

In 2012, CH2M HILL Australia Pty Limited, a subsidiary of CH2M, entered into a 50/50 integrated joint venture with Australian construction contractor UGL Infrastructure Pty Limited. The joint venture entered into a Consortium Agreement with General Electric and GE Electrical International Inc. The Consortium was awarded a subcontract by JKC Australia LNG Pty Limited ("JKC") for the engineering, procurement, construction and commissioning of a 360 MW Combined Cycle Power Plant for INPEX Operations Australia Pty Limited at Blaydin Point, Darwin, NT, Australia. In January 2017, the Consortium terminated the Subcontract because of JKC’s repudiatory breach and demobilized from the work site. JKC claimed the Consortium abandoned the work and itself purported to terminate the Subcontract. The Consortium and JKC are now in dispute over the termination. In August 2017, the Consortium filed an International Chamber of Commerce arbitration against JKC and is seeking compensatory damages in the amount of approximately

JACOBS ENGINEERING GROUP INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED)

On December 22, 2008, a coal fly ash pond at the Kingston Power Plant of the Tennessee Valley Authority ("TVA") was breached, releasing fly ash waste into the Emory River and surrounding community. In February 2009, TVA awarded a contract to the Company to provide project management services associated with the clean-up. All remediation and dredging were completed in August 2013 by other contractors under direct contracts with TVA. The Company did not perform the remediation, and its scope was limited to program management services. Certain employees of the contractors performing the cleanup work on the project filed lawsuits against the Company beginning in August 2013, alleging they were injured due to the Company's failure to protect the plaintiffs from exposure to fly ash, and asserting related personal injuries. There are currently 6 separate cases pending against the Company. The primary case, Greg Adkisson, et al. v. Jacobs Engineering Group Inc., case No. 3:13-CV-505-TAV-HBG, filed in the U.S. District Court for the Eastern District of Tennessee, consists of 10 consolidated cases. This case and the related cases involve several hundred plaintiffs that have been filed against the Company by employees of the contractors that completed the remediation and dredging work. The cases are at various stages of litigation, and several of the cases are currently stayed pending resolution of other cases. Separately, in May 2019, Roane County and the cities of King and Herriman filed a claim against TVA and the Company alleging that they misled the public about risks associated with the released fly ash. In December 2019, the court granted the Company's motion to dismiss a portion of the plaintiffs' complaint and scheduled this matter for trial in 2021 with respect to the remaining claims. In addition, in November 2019, a resident of Roane County filed a putative class action against TVA and the Company alleging they failed to adequately warn local residents about risks associated with the released fly ash. There has been no finding of liability against the Company or that any of the alleged illnesses are the result of exposure to fly ash in any of the above matters. The Company disputes the claims asserted in all of the above matters and is vigorously defending these claims. The Company does not expect the resolution of these matters to have a material adverse effect on the Company's business, financial condition, results of operations or cash flows.

On October 31, 2019, the Company received a request from the Enforcement Division of the Securities and Exchange Commission (the "SEC") for the voluntary production of certain information and documents. The information and documents sought by the SEC primarily relate to the operations of a joint venture in Morocco which was at one time partially-owned by the Company (and subsequently divested), including in respect of possible corrupt practices. The Company is fully cooperating with the SEC and is producing the requested information and documents in its possession. The Company does not expect the resolution of this matter to have a material adverse effect on the Company's business, financial condition, results of operations or cash flows.

Page 34

General

The purpose of this Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is to provide a narrative analysis explaining the reasons for material changes in the Company’s (i) financial condition from the most recent fiscal year-end to June 28, 2019March 27, 2020 and (ii) results of operations during the current fiscal period(s) as compared to the corresponding period(s) of the preceding fiscal year. In order to better understand such changes, readers of this MD&A should also read:

•The discussion of the critical and significant accounting policies used by the Company in preparing its consolidated financial statements. The most current discussion of our critical accounting policies appears in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations of our 2019 Form 10-K, and the most current discussion of our significant accounting policies appears in Note 2- Significant Accounting Polices in Notes to Consolidated Financial Statements of our 2019 Form 10-K. See also Note 13- Revenue Accounting for Contracts and Adoption of ASC 606 for a discussion of our updated policies related to revenue recognition; • |

The Company’s fiscal 20182019 audited consolidated financial statements and notes thereto included in our 20182019 Form 10-K; and

•Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our 2019 Form 10-K. |

In addition to historical information, this MD&A and other parts of this Quarterly Report on Form 10-Q may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that do not directly relate to any historical or current fact. When used herein, words such as “expects,” “anticipates,” “believes,” “seeks,” “estimates,” “plans,” “intends,” “future,” “will,” “would,” “could,” “can,” “may,” and similar words are intended to identify forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements we make concerning the potential effects of the COVID-19 pandemic on our business, financial condition and results of operations and our expectations as to our future growth, prospects, financial outlook and business strategy for fiscal 2020 or future fiscal years. You should not place undue reliance on these forward-looking statements. Although such statements are based on management’s current estimates and expectations, and/or currently available competitive, financial, and economic data, forward-looking statements are inherently uncertain, and involveyou should not place undue reliance on such statements as actual results may differ materially. We caution the reader that there are a variety of risks, uncertainties and uncertaintiesother factors that could cause our actual results to differ materially from what may be inferred from theis contained, projected or implied by our forward-looking statements. SomeSuch factors include the magnitude, timing, duration and ultimate impact of the COVID-19 pandemic and any resulting economic downturn on our results, prospects and opportunities. Such impact includes, but is not limited to, the possible reduction in demand for certain of our services and the delay or abandonment of ongoing or anticipated projects due to the financial condition of our clients and suppliers or to governmental budget constraints; the inability of our clients to meet their payment obligations in a timely manner or at all; potential issues and risks related to a significant portion of our employees working remotely; illness, travel restrictions and other workforce disruptions that could negatively affect our supply chain and our ability to timely and satisfactorily complete our clients’ projects; difficulties associated with hiring additional employees or replacing any furloughed employees; increased volatility in the capital markets that may affect our ability to access sources of liquidity on acceptable pricing or borrowing terms or at all; and the inability of governments in certain of the countries in which we operate to effectively mitigate the financial or other impacts of the COVID-19 pandemic on their economies and workforces and our operations therein. The foregoing factors and potential future developments are inherently uncertain, unpredictable and, in many cases, beyond our control. For a description of these and additional factors that may occur that could cause or contributeactual results to such differences include, but are not limited to,differ from our forward-looking statements, see those listed and discussed in Item 1A, Risk Factors included in our 20182019 Form 10-K and this Quarterly Report on Form 10-Q. We undertake no obligation to release publicly any revisions or updates to any forward-looking statements. We encourage you to read carefully the risk factors, as well as the financial and business disclosures contained in this Quarterly Report on Form 10-Q and in other documents we file from time to time with the United States Securities and Exchange Commission ("SEC").

On March 11, 2020, the World Health Organization characterized the outbreak of the novel coronavirus (“COVID-19”) as a global pandemic and recommended certain containment and mitigation measures. On March 13, 2020, the United States declared a national emergency concerning the outbreak, and the vast majority of states and many

Page 35

municipalities have declared public health emergencies or taken similar actions. Along with these declarations, there have been extraordinary and wide-ranging actions taken by international, federal, state and local public health and governmental authorities to contain and combat the outbreak of COVID-19 in regions across the United States and around the world. These actions include quarantines and “stay-at-home” or “shelter-in-place” orders, social distancing measures, travel restrictions, school closures and similar mandates for many individuals in order to substantially restrict daily activities and orders for many businesses to curtail or cease normal operations unless their work is critical, essential or life-sustaining.In addition, governments and central banks in the United States and other countries in which we operate have enacted fiscal and monetary stimulus measures to counteract the impacts of COVID-19.

We are a company operating in a critical infrastructure industry, as defined by the U.S. Department of Homeland Security. Consistent with international, federal, state and local requirements to date, we currently continue to materially operate. In addition, demand for certain of our services, including those supporting health care relief efforts relating to COVID-19, could increase as a result of COVID-19. Notwithstanding our continued critical operations, it is expected that the COVID-19 may have further adverse impacts on our continued operations. Accordingly, we are reducing spending more broadly across the Company, only proceeding with operating and capital spending that is critical. We have also ceased all non-essential hiring and reduced discretionary expenses, including certain employee benefits and compensation. Looking ahead, we have developed contingency plans to reduce costs further if the situation deteriorates. We will continue to actively monitor the situation and may take further actions that alter our business operations as may be necessary or appropriate for the health and safety of employees, contractors, customers, suppliers or others or as required by international, federal, state or local authorities.

Based on current estimates, we expect the impact of COVID-19 to primarily occur in the third fiscal quarter of 2020, which impact may continue into the fourth fiscal quarter of 2020 or beyond. Although this business disruption is expected to be temporary, significant uncertainty exists concerning the magnitude, duration and impacts of the COVID-19 pandemic, including with regard to the effects on our customers and customer demand for our services. Accordingly, actual results for future fiscal periods could differ materially versus current expectations and current results and financial condition discussed herein may not be indicative of future operating results and trends.

For a discussion of risks and uncertainties related to COVID-19, including the potential impacts on our business, financial condition and results of operations, see “Part II - Item 1A - Risk Factors”.

Business Overview

At Jacobs, we’re challenging today to reinvent tomorrow by solving the world’s most critical problems for thriving cities, resilient environments, mission-critical outcomes, operational advancement, scientific discovery and cutting-edge manufacturing, turning abstract ideas into realities that transform the world for good. Leveraging a talent force of approximately 55,000, Jacobs provides a full spectrum of professional services including consulting, technical, scientific and project delivery for the government and private sector.

The Company’s deep global domain knowledge - applied together with the latest advances in technology - are why customers large and small choose to partner with Jacobs. We operate in two lines of business: Critical Mission Solutions (formerly Aerospace, Technology and Nuclear) and People & Places Solutions (formerly Buildings, Infrastructure and Advanced Facilities). These new names better reflect outcome-focused solutions for our customers and the changes have no impact on reported financial statements, line of business leadership or customer relationships.

After spending three years transforming our portfolio and setting the foundation to get us where we are today, we launched a three-year accelerated profitable growth strategy at our Investor Day in February 2019, focused on innovation and continued transformation to build upon our position as the leading solutions provider for our clients. This transformation included the $3.2 billion acquisition of CH2M and the $3.4 billion divestiture of the Company's energy, chemicals and resources business. Our acquisitions of KeyW and John Wood Group’s nuclear business will further position us as a leader in high-value government services and technology-enabled solutions, enhancing our portfolio by adding intellectual property-driven technology with unique proprietary C5ISR (command, control, communications, computer, combat systems, intelligence, surveillance and reconnaissance) rapid solutions, and amplifying Jacobs’ position as a Tier-1 global nuclear services provider.

We have turned the course of Jacobs’ future and are now focused on broadening our leadership in high growth sectors. As part of our strategy, our new brand was created from an understanding of where we’ve been, what’s true to our culture and our strategy going forward. Central to it is our new tagline: Challenging today. Reinventing tomorrow. Signaling our transition from an engineering and construction company to a global technology-forward solutions company, we have a new look, and we plan to change our name to Jacobs Solutions Inc.

Page 36

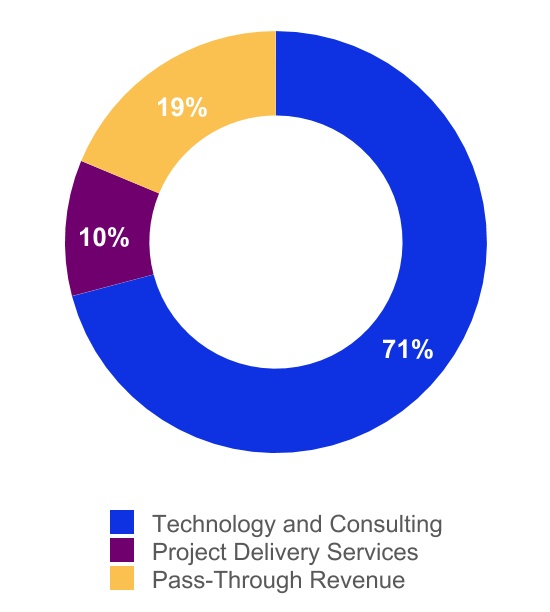

Revenue by Type (Q2 FY2020)1

1 Due to COVID-19 and the actions taken by governmental authorities and others related thereto, some of the information provided in this summary relating to sources of revenue could be substantially different in the third quarter of fiscal 2020 and subsequent periods.

Lines of Business

Critical Mission Solutions (CMS)

Our Critical Mission Solutions line of business provides a full spectrum of cybersecurity, data analytics, software application development, enterprise and mission IT, systems integration and other highly technical consulting solutions to move the Global Environmental Solutions ("GES") business from the ATN segment to the BIAF segment. This reorganization occurred in conjunction with the integration of CH2M into the Company's legacy businesses,government agencies as well as selective aerospace, automotive and is intended to better serve our global clients, leverage our workforce, help streamline operations, and provide enhanced growth opportunities.

Serving mission-critical industry sectors

Critical Mission Solutions serves broad sectors, including U.S. government services, cybersecurity, nuclear, commercial, and international sectors.

The U.S. government is the world’s largest buyer of technical services, and in fiscal 2019, approximately 77% of CMS’s revenue was earned from serving the DoD, Intelligence Community and civil governmental entities.

Trends affecting our government clients include electronic and cyber warfare, IT modernization, space exploration and intelligence, defense systems and intelligent asset management, which are driving demand for our highly technical solutions. Attacks by foreign entities and insider threats highlight potential cyber defense vulnerabilities.

Another trend we are witnessing is an increase in the capabilities of unmanned aircraft and hypersonic weapons, which is impacting both offensive and defensive spending priorities among our clients and is a driver for next generation solutions such as C5ISR (command, control, communications, computer, combat systems, intelligence, surveillance and reconnaissance) and advanced aeronautical testing, respectively. We are also seeing an increase in space exploration

Page 37

initiatives both from the U.S. government, such as NASA’s Artemis program to return to the moon in 2024, as well as the commercial sector.

Within the Nuclear sector, our customers have decades-long initiatives to manage, upgrade, decommission and remediate existing nuclear weapons and energy infrastructure.

Leveraging our base market of offering valued technical services to U.S. government customers, CMS also serves commercial and international markets. In fiscal 2019, approximately 12% of CMS’s revenue was from various U.S. commercial sectors, including the telecommunications market, which anticipates a large cellular infrastructure build-out from 4G to 5G technology. And like our government facility-based clients, our commercial manufacturing clients are seeking ways to reduce maintenance costs and optimize their facilities with network connected facilities and equipment to optimize operational systems, which we refer to as Intelligent Asset Management.

Our international customers, which accounted for 11% of fiscal 2019 revenue, have also increased demand for our IT and cybersecurity solutions and nuclear projects, and the U.K. Ministry of Defence continues to focus on accelerating its strategic innovative and technology focused initiatives.

Leveraging strong domain expertise to deliver solutions

CMS brings domain-specific capability and cross-market innovations in each of the above sectors by leveraging six core capability groups.

•Information Technology Services. Across various business units in CMS, we provide a wide range of software development and enterprise IT solutions. We develop, modify and maintain software solutions and complex systems. This service includes a broad array of lifecycle services, including requirements analysis, design, integration, testing, maintenance, quality assurance and documentation management. Our software activities support all major methodologies, including Agile, DevSecOps and other hybrid methodologies. For our enterprise IT capability, we develop, implement and sustain enterprise information technology systems, with a focus on improving mission performance, increasing security and reducing cost for our customers. Solutions typically include IT service management, data center consolidation, network operations, enterprise architecture, mobile computing, cloud computing and migration, software, infrastructure and platform as a service (SaaS, IaaS and PaaS), and data collection and analytics.

•Cybersecurity and Data Analytics. With our recent acquisition of KeyW, CMS offers a full suite of cyber services for its government and commercial clients, including defensive cyber operations and training, offensive cyber operations, cloud and data analytics, threat intelligence, intelligence analysis, incident response and forensics, software and infrastructure security engineering, computer forensics and exploitation and information technology-operational technology (IT-OT) convergence services.

•C5ISR (Command, Control, Communications, Computers, Combat Systems, Intelligence, Surveillance and Reconnaissance). CMS is a leader in the design, development, analysis, implementation and support of C5ISR systems and technology in any environment, including land, sea, air, space and cyber domains. We provide advanced solutions for collecting, processing, exploiting and disseminating geospatial intelligence for the U.S. and Allied Intelligence Communities and Special Forces organizations. Core capabilities include: imaging systems, radar systems, precision geo-location products, custom packaging and microelectronics and customizable tagging, tracking and locating devices.

•Technical Services. We provide a broad range of technical consulting services to our government and commercial clients, including: systems integration, specialized propulsion, avionics, electrical, materials, aerodynamics, manufacturing processes modeling and simulation, testing and evaluation, scientific research, intelligent asset management, program management and consulting. NASA is one of our major government customers in the U.S., iswhere we provide a wide range of technology services. For our abilitytelecommunications customers, we provide permitting, site planning and engineering to design, build, operate,enable the development of wireline and maintain highly complex facilities relating to spacewireless communications including the development of 5G small cell sites.

•Facility Engineering and Operations. We provide services for advanced technical structures and systems, including test and evaluation facilities, flight/launch facilities, R&D facilities, test facilities and support infrastructure.military range facilities. Customers also engage us to operate, maintain and provide technical services for these facilities and systems over their lives. We also provide support to all phases ofsustainment and technical services for facility-oriented clients including for the nuclear life-cycle from initial planning through design, construction, commissioning, operations and decommissioning/decontamination on government sites within the U.S., and Canada and on both government and commercial sites in the U.K.

Page 38

•Nuclear Solutions. We provide support across the nuclear energy life-cycle, including operational site management, program management and research and consulting, mainly to the U.S. Department of Energy (DoE) and the Office for Nuclear Regulation (“ONR”) and NDA with the U.K. government.

Applying internally-developed technology

Across multiple businesses within CMS we license internally developed technology such as:

•KeyRadar®: The acquisition of KeyW brought numerous internally developed technologies, including KeyRadar, a scalable, software-defined synthetic aperture radar that can be configured to address a variety of missions, ranging from foliage penetration to long-range maritime domain awareness or long-range moving target detection.

•Ginkgo: Ginkgo is the only virtual learning environment specifically created for cybersecurity training. Designed by experienced cybersecurity instructors at CMS’s Parrot Labs, Ginkgo offers a complete solution for implementing hands-on IT and cybersecurity training for both local and distance learning environments on desktops, tablets, and other mobile devices.

•TITANTM: With the exponential growth of information being harvested, deriving meaningful insights from data collecting can be challenging for organizations. TITAN is a suite of solutions (including Graph Database, Elastic Stack, and SocTraq) that leverages open-source technology to filter out noise to find the real needle in supportthe haystack of threats, offering real-time detection and alerting capabilities for high-value asset and mission critical systems.

•SOCTRAQ: SOCTRAQ is a next-generation component of the automotive industry,larger TITAN cyber data platform that aids our federal clients in the automation of cybersecurity found in a security operations center (SOC). The technology is a real-time threat detection and alerting heads-up display run on a client’s computer to provide incident detection, recommended response actions, and case management. Features include alert visualization, depiction of threat-chain, and adaptive machine learning.

People & Places Solutions(P&PS)

Jacobs' People & Places Solutions line of business provides end-to-end solutions for our clients’ most complex projects - whether connected mobility, water, smart cities, advanced manufacturing or the environment. In doing so, we employ data analytics, artificial intelligence and automation, and software development to enable technology and digitally-driven consulting, planning, architecture, engineering, and implementation, as well as provide a wide rangelong-term operation of services in the telecommunications market.

Serving broad industry sectors that support people and local departmentsplaces

Environmental and infrastructure resilience, urbanization, digital transformation and the convergence of transportation withininformation and operational technology (IT/OT) are driving new infrastructure requirements and opportunities for our clients. For example, an airport is no longer simply aviation infrastructure but is now a smart city with extensive operational, cybersecurity and autonomous mobility requirements. Master planning for a city now requires advanced analytics to plan for the U.Sadaptation of next-generation mobility as well as revenue generating fiber infrastructure. Furthermore, the future of nearly all water infrastructure will be highly technology-enabled, leveraging solutions with digital twins, predictive analytics and private industry firms.smart metering technology.

This increase in technology requirements is a key factor in our organic growth strategy as well as our recent acquisitions and divestitures. Moreover, our business model is evolving to now being a provider of digitally-enabled solutions to our infrastructure clients with less exposure to craft construction services. Our focus on five core sectors of Transportation, Water, Built Environment, Environmental and Advanced Facilities provides us with the unique opportunity to leverage expertise across all sectors to provide end-to-end connected solutions for our client’s most complex projects.

We are executing complex city solutions that pull expertise from all markets, fused with digital expertise, for highways, bridges,major developments in places like London, Dubai, Sydney, India and the United States.

Leveraging global platform to deliver integrated solutions to our customers

One of our key differentiators is our global integrated delivery model, which harnesses deep domain expertise from our global technology and solution organization that is leveraged with the benefits of scale when we focus the world’s best talent to deliver differentiated solutions and value to our clients.

•Within transportation, we provide sustainable solutions to plan, develop, finance, design and engineer, construct, operate and maintain, next generation mobility across all modes, including highway, bridge, rail and transit, tunnels, airports, railroads, intermodal facilitiesaviation, port and maritime or port projects. Our interdisciplinary teams can work independently or as an extensioninfrastructure. For example, we do this by assessing the impact of autonomous vehicles on roadways and cities for transportation agencies, engineering and specifying vehicles for mass-transit, consulting services for digital fare payment systems, program management of the client’s staff.largest airport developments, designing cutting edge automated container terminals and ports infrastructure and utilizing digital data to develop cross modal mobility solutions. Our customers include the world’s largest transportation agencies as well as private shipping and logistics companies worldwide, including the multi-modal Port Authority of New York and New Jersey, Transport for London, and Etihad Rail.

•Water is one of the most precious resources in the world, and extreme weather events are exacerbating supply and demand issues with drought, desertification and flooding at the same time population growth and industrialization are increasing demands. We have experience with alternative financing methods, which have been used in Europe through the privatization of public infrastructure systems.

•For the built environment, we deliver full-service solutions for cities, places and flood defense projects. We provide full life cycle services including engineering design, construction management, design build and operations and maintenance.

•In our environmental business we provide all aspects of environmental planning, permitting, regulatory and compliance management, and consulting services (sometimes through joint ventures with third parties)related to remediation, revitalization and redevelopment. We also provide critical consulting and technology related services to clients responsible for which we assume responsibility for the ongoing operationdisaster planning, mitigation and maintenance of entire commercial or industrial complexes on behalf of clients.

•In our advanced facilities mission-critical business, we provide fully integrated solutions for highly specialized facilities municipal and civic buildings, courts and correctional facilities, mixed-use and commercial centers, healthcare and education campuses, and recreational complexes. For advanced technology clients, who require highly

In addition to each of the industry sectors that we serve, we deploy solutions to the world’s most complex projects and major programs that span across all markets, such as the London 2012 Olympic and Paralympic Games, the Dubai Expo, and LaGuardia Airport Redevelopment.

Applying internally developed technology

A strong foundation of data-rich innovative solutions is woven into every project that we deliver. These solutions employ an array of technical expertise to enable the most efficient, effective and predictable solutions for our customers, such as our proprietary technology software. Examples of these technologies include:

Page 40

•TrackRecord is a workflow automation and compliance management platform for the delivery of major projects.

•AquaDNA is a wastewater asset management platform that lowers operation and maintenance costs and facilitates a move from reactive to proactive maintenance.

•Travel Service Optimisation (TSO) is Jacobs' travel sharing solution for Special Education needs children which centers on the children’s ability to travel together rather than focusing on their disability.

•SafetyWeb is a site hazard management and compliance tool.

•ProjectMapper is a web based geospatial mapping and project visualization software platform.

•Flood Modeller provides proactive decision-making to help manage our environment and the challenges associated with flood risk. It is suitable for a wide range of engineering and environmental applications, from calculating simple backwater profiles to modeling entire catchments to mapping potential flood risk for entire countries.

•Replica™ is Jacobs’ digital twin solution software platform and consists of the following capabilities:

•Replica Parametric Design™ (formerly CPES™) provides outputs on construction quantities and costs, life cycle quantities and costs, and estimates of environmental impacts. Rapid process design in Replica Process and the resulting development of the Replica Parametric Designs allows for thorough alternatives analysis and enhanced team communication.

•Replica Preview™ is used for early stage visualization of facility designs. This software rapidly creates scaled three-dimensional designs, which can be placed on Google Earth®. Rapid design development in Replica Parametric Design and visualization with Replica Preview allows for informed analysis of many alternatives and sound decision-making.

•Replica Systems Analysis™ (formerly Voyage™) is a very flexible platform that can simulate resource systems dynamically, over time. Examples of modeled systems include water resources, energy, solid waste and traffic. The ability to connect complex systems together in a single interface that is visually intuitive leads to informed team collaboration and creative solutions. We also have global

•Replica Process™ allows Jacobs' world-renowned expertise in water treatment to be simulated both statically and dynamically over time in Replica Process™ software. Much of the process predictive capabilities in Replica Process are founded on the pharma-bio, data center, government intelligence, corporate headquarters/interiors,Jacobs' Pro2D2™ and scienceSource™ software. Informed decisions are founded on the ability of Replica Process to provide details on system performance among many alternatives, very quickly.

•Replica Hydraulics™ was designed to simulate all pressurized and technology-based education markets. Our government building projects include large, multi-year programsgravity flow hydraulics of a system, simultaneously. Replica’s hydraulic blocks were built on accepted engineering practice equations and have been successfully verified on hundreds of projects. The Replica Hydraulics library is the foundation for complete, dynamic water system analysis and can be used exclusively for hydraulic analysis of a system or in the U.S.conjunction with Replica Process, Replica Controls and/or Replica Air.

•Replica Controls™ allows for dynamic simulation of system instrumentation such as flow meters, indicator transmitters, limit switches and Europe supporting various U.S. and U.K. government agencies.

•Replica Air™ simulates all aspects of compressible fluid (e.g. air) supply system including pipes, valves, diffusers and more efficiently.

Energy, Chemicals and Resources (ECR)

ECR Disposition

On April 26, 2019, Jacobs completed the sale of its Energy, Chemicals and Resources ("ECR") business to WorleyParsonsWorley Limited, a company incorporated in Australia ("WorleyParsons"Worley"), for a purchase price of $3.4 billion consisting of (i) $2.8 billion in cash plus (ii) 58.2 million ordinary shares of WorleyParsons,Worley, subject to adjustments for changes in working capital and certain other items (the “ECR sale”).

Page 41

As a result of the ECR sale, substantially all ECR-related assets and liabilities have beenwere sold (the "Disposal Group"). We determined that the disposal group should be reported as discontinued operations in accordance with ASC 210-05, Discontinued Operations because their disposal representsrepresented a strategic shift that had a major effect on our operations and financial results. As such, the financial results of the ECR business are reflected in our unaudited Consolidated Statements of Earnings as discontinued operations for all periods presented. Additionally, current and non-current assets and liabilities of the Disposal Group areECR business were reflected as held-for-sale in the unaudited Consolidated Balance Sheet asSheets through December 27, 2019. As of September 28, 2018. Further, as of the quarter ended June 28, 2019, a portionMarch 27, 2020, all of the ECR business remains held by Jacobsunder the terms of the sale has been conveyed to Worley and as described above and continues to be classified assuch, no amounts remain held for sale during the third fiscal quarter of 2019 in accordance with U.S. GAAP.sale. For further discussion see Note 7- Sale of Energy, Chemicals and Resources ("ECR") Business to the consolidated financial statements.

Prior to the sale, we served the energy, chemicals and resources sectors, including upstream, midstream and downstream oil, gas, refining, chemicals and mining and minerals industries. We provided integrated delivery of complex projects for our Oil and Gas, Refining, and Petrochemicals clients. Bridging the upstream, midstream and downstream industries, our services encompassencompassed consulting, engineering, procurement, construction, maintenance and project management.

Page 42

Results of Operations for the three and ninesix months ended June 28,March 27, 2020 and March 29, 2019 and June 29, 2018

(in thousands, except per share information)

| For the Three Months Ended | For the Six Months Ended | ||||||||||||||||||||||||||||||||||

| March 27, 2020 | March 29, 2019 | March 27, 2020 | March 29, 2019 | ||||||||||||||||||||||||||||||||

| Revenues | $ | 3,427,180 | $ | 3,091,596 | $ | 6,787,229 | $ | 6,175,384 | |||||||||||||||||||||||||||

| Direct cost of contracts | (2,779,045) | (2,474,755) | (5,494,522) | (4,990,023) | |||||||||||||||||||||||||||||||

| Gross profit | 648,135 | 616,841 | 1,292,707 | 1,185,361 | |||||||||||||||||||||||||||||||

| Selling, general and administrative expenses | (480,357) | (514,160) | (973,582) | (969,551) | |||||||||||||||||||||||||||||||

| Operating Profit | 167,778 | 102,681 | 319,125 | 215,810 | |||||||||||||||||||||||||||||||

| Other (Expense) Income: | |||||||||||||||||||||||||||||||||||

| Interest income | 985 | 1,670 | 1,931 | 3,774 | |||||||||||||||||||||||||||||||

| Interest expense | (15,154) | (29,423) | (29,971) | (54,749) | |||||||||||||||||||||||||||||||

| Miscellaneous (expense) income, net | (330,414) | 36,904 | (213,719) | 39,186 | |||||||||||||||||||||||||||||||

| Total other (expense) income, net | (344,583) | 9,151 | (241,759) | (11,789) | |||||||||||||||||||||||||||||||

| (Loss) Earnings from Continuing Operations Before Taxes | (176,805) | 111,832 | 77,366 | 204,021 | |||||||||||||||||||||||||||||||

| Income Tax Benefit (Expense) for Continuing Operations | 61,122 | 7,947 | (7,368) | (14,811) | |||||||||||||||||||||||||||||||

| Net (Loss) Earnings of the Group from Continuing Operations | (115,683) | 119,779 | 69,998 | 189,210 | |||||||||||||||||||||||||||||||

| Net Earnings (Loss) of the Group from Discontinued Operations | 29,880 | (57,006) | 107,468 | 3,153 | |||||||||||||||||||||||||||||||

| Net (Loss) Earnings of the Group | (85,803) | 62,773 | 177,466 | 192,363 | |||||||||||||||||||||||||||||||

| Net Earnings Attributable to Noncontrolling Interests from Continuing Operations | (6,284) | (5,024) | (12,540) | (9,562) | |||||||||||||||||||||||||||||||

| Net (Loss) Earnings Attributable to Jacobs from Continuing Operations | (121,967) | 114,755 | 57,458 | 179,648 | |||||||||||||||||||||||||||||||

| Net Earnings Attributable to Noncontrolling Interests from Discontinued Operations | — | (832) | — | (1,588) | |||||||||||||||||||||||||||||||

| Net Earnings (Loss) Attributable to Jacobs from Discontinued Operations | 29,880 | (57,838) | 107,468 | 1,565 | |||||||||||||||||||||||||||||||

| Net (Loss) Earnings Attributable to Jacobs | $ | (92,087) | $ | 56,917 | $ | 164,926 | $ | 181,213 | |||||||||||||||||||||||||||

| Net (Loss) Earnings Per Share: | |||||||||||||||||||||||||||||||||||

| Basic Net (Loss) Earnings from Continuing Operations Per Share | $ | (0.92) | $ | 0.83 | $ | 0.43 | $ | 1.28 | |||||||||||||||||||||||||||

| Basic Net Earnings (Loss) from Discontinued Operations Per Share | $ | 0.23 | $ | (0.42) | $ | 0.81 | $ | 0.01 | |||||||||||||||||||||||||||

| Basic (Loss) Earnings Per Share | $ | (0.69) | $ | 0.41 | $ | 1.24 | $ | 1.29 | |||||||||||||||||||||||||||

| Diluted Net (Loss) Earnings from Continuing Operations Per Share | $ | (0.92) | $ | 0.82 | $ | 0.43 | $ | 1.27 | |||||||||||||||||||||||||||

| Diluted Net Earnings (Loss) from Discontinued Operations Per Share | $ | 0.23 | $ | (0.41) | $ | 0.80 | $ | 0.01 | |||||||||||||||||||||||||||

| Diluted (Loss) Earnings Per Share | $ | (0.69) | $ | 0.41 | $ | 1.23 | $ | 1.28 | |||||||||||||||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||

| June 28, 2019 | June 29, 2018 | June 28, 2019 | June 29, 2018 | ||||||||||||

| Revenues | $ | 3,169,622 | $ | 2,933,623 | $ | 9,345,005 | $ | 7,587,916 | |||||||

| Direct cost of contracts | (2,543,488 | ) | (2,325,028 | ) | (7,533,511 | ) | (6,035,598 | ) | |||||||

| Gross profit | 626,134 | 608,595 | 1,811,494 | 1,552,318 | |||||||||||

| Selling, general and administrative expenses | (536,180 | ) | (446,083 | ) | (1,505,731 | ) | (1,325,722 | ) | |||||||

| Operating Profit | 89,954 | 162,512 | 305,763 | 226,596 | |||||||||||

| Other Income (Expense): | |||||||||||||||

| Interest income | 3,398 | 1,277 | 7,172 | 6,896 | |||||||||||

| Interest expense | (18,978 | ) | (23,788 | ) | (73,727 | ) | (50,107 | ) | |||||||

| Miscellaneous income (expense), net | 19,025 | 6,632 | 58,211 | 5,195 | |||||||||||

| Total other (expense) income, net | 3,445 | (15,879 | ) | (8,344 | ) | (38,016 | ) | ||||||||

| Earnings from Continuing Operations Before Taxes | 93,399 | 146,633 | 297,419 | 188,580 | |||||||||||

| Income Tax Benefit (Expense) for Continuing Operations | 1,981 | (31,174 | ) | (12,829 | ) | (110,230 | ) | ||||||||

| Net Earnings of the Group from Continuing Operations | 95,380 | 115,459 | 284,590 | 78,350 | |||||||||||

| Net Earnings of the Group from Discontinued Operations | 435,684 | 34,612 | 438,837 | 126,215 | |||||||||||

| Net Earnings of the Group | 531,064 | 150,071 | 723,427 | 204,565 | |||||||||||

| Net Earnings Attributable to Noncontrolling Interests from Continuing Operations | (6,015 | ) | (2,123 | ) | (15,578 | ) | (5,539 | ) | |||||||

| Net Earnings Attributable to Jacobs from Continuing Operations | 89,365 | 113,336 | 269,012 | 72,811 | |||||||||||

| Net (Earnings) Losses Attributable to Noncontrolling Interests from Discontinued Operations | (607 | ) | 2,274 | (2,195 | ) | 1,946 | |||||||||

| Net Earnings Attributable to Jacobs from Discontinued Operations | 435,077 | 36,886 | 436,642 | 128,161 | |||||||||||

| Net Earnings Attributable to Jacobs | $ | 524,442 | $ | 150,222 | $ | 705,654 | $ | 200,972 | |||||||

| Net Earnings Per Share: | |||||||||||||||

| Basic Net Earnings from Continuing Operations Per Share | $ | 0.65 | $ | 0.79 | $ | 1.93 | $ | 0.53 | |||||||

| Basic Net Earnings from Discontinued Operations Per Share | $ | 3.18 | $ | 0.26 | $ | 3.14 | $ | 0.94 | |||||||

| Basic Earnings Per Share | $ | 3.83 | $ | 1.05 | $ | 5.07 | $ | 1.47 | |||||||

| Diluted Net Earnings from Continuing Operations Per Share | $ | 0.65 | $ | 0.79 | $ | 1.92 | $ | 0.53 | |||||||

| Diluted Net Earnings from Discontinued Operations Per Share | $ | 3.15 | $ | 0.26 | $ | 3.11 | $ | 0.93 | |||||||

| Diluted Earnings Per Share | $ | 3.80 | $ | 1.05 | $ | 5.02 | $ | 1.46 | |||||||

Overview – Three and NineSix Months Ended June 28, 2019March 27, 2020

COVID-19 Pandemic. There are many risks and uncertainties regarding the COVID-19 pandemic, including the anticipated duration of the pandemic and the extent of local and worldwide social, political, and economic disruption it

Page 43

may cause. The Company’s operations for the second fiscal quarter of 2020 were not materially impacted by COVID-19, in part due to the timing of the spread of the virus, which escalated towards the end of the quarter. While certain business units of both Critical Mission Solutions and People & Places Solutions may experience an increase in demand for certain of their services regarding new projects that may arise in response to the COVID-19 pandemic, it is still expected that COVID-19 is likely tohave an adverse impact on each of Critical Missions Solutions and People & Places Solutions in the third fiscal quarter of 2020, which may continue into the fourth fiscal quarter and beyond.

For a discussion of risks and uncertainties related to COVID-19, including the potential impacts on the Company’s business, financial condition and results of operations, see “Part II - Item 1A - Risk Factors”.

Net earningsloss attributable to Jacobsthe Company from continuing operations for the thirdsecond fiscal quarter 2019 ended June 28, 2019March 27, 2020 were $89.4$(122.0) million (or $0.65$(0.92) per diluted share), a decrease of $24.0$236.7 million, or 21.2%206.3%, from $113.3earnings of $114.8 million (or $0.79$0.82 per diluted share) for the corresponding period last year. Included in the Company’s operating results from continuing operations for the three months ended March 27, 2020 were $258.6 million in after-tax fair value losses recorded in miscellaneous (expense) income, net, associated with our investment in Worley stock (net of Worley stock dividend and certain foreign currency revaluations relating to the ECR sale) and after-tax Restructuring and other charges and transaction costs of $32.8 million associated in part with the Company's acquisition of John Wood Groups' Nuclear consulting, remediation and program management business.

Net earnings attributable to the Company from discontinued operations for the second fiscal quarter ended March 27, 2020 were $29.9 million (or $0.23 per diluted share), an increase of $87.7 million, or 151.7%, from a loss of $(57.8) million (or $(0.41) per diluted share) for the corresponding period last year. Included in net earnings attributable to the Company from discontinued operations for the current quarter was the recognition of the deferred gain for the delayed conveyance of the international entities discussed in Note 7- Sale of Energy, Chemicals and Resources ("ECR") Business and adjustments for working capital and certain other items in connection with the ECR sale. Included in the prior year pre-tax results was a charge for the award and recovery of costs, estimated related interest and attorneys' fees in the amount of $147.0 million for the Nui Phao legal matter, see Note 19- Commitments and Contingencies. Additionally, the change year-over-year was also driven by the absence in the current period of normal operating results of the ECR business as reported in the prior period.

For the six months ended March 27, 2020, net earnings attributable to the Company from continuing operations were $57.5 million (or $0.43 per diluted share), a decrease of $122.2 million, or 68.0%, from $179.6 million (or $1.27 per diluted share) for the corresponding period last year. Included in the Company’s operating results from continuingcontinuing operations for the threesix months ended June 28, 2019March 27, 2020 were $70.3$183.7 million in fair value losses recorded in miscellaneous income (expense), net, associated with our investment in Worley stock (net of Worley stock dividend) and certain foreign currency revaluations relating to the ECR sale, $73.1 million in after-tax Restructuring and other charges and $10.0 million in transaction costs associated in part with the Company's acquisition of KeyW. Our third quarter fiscal 2018 operating results from continuing operations included $22.1 million in after tax RestructuringJohn Wood Groups' Nuclear consulting, remediation and other charges and $3.5 million in CH2M transaction costs.program management business.

for the corresponding period last year. Included in net earnings attributable to the current quarter resultsCompany from discontinued operations isfor the pre-taxcurrent year to date period was the settlement of the Nui Phao ("NPMC") legal matter described in Note 19- Commitments and Contingencies that was reimbursed by insurance, the recognition of the deferred gain on salefor the delayed conveyance of the international entities and for the delivery of the ECR business of $917.7 million, seeIT assets, as discussed in Note 7- Sale of Energy, Chemicals and Resources ("ECR") Business.Business

On June 12, 2019, the Company acquired KeyW and on December 15, 2017, the CompanyMarch 6, 2020, Jacobs completed the acquisition of CH2M.John Wood Group's Nuclear consulting, remediation and program management business. For further discussion, see Note 5- Business Combinations.

Page 44

Consolidated Results of Operations

Revenues for the thirdsecond fiscal quarter of 20192020 were $3.17$3.43 billion, an increase of $0.24 billion,$335.6 million, or 8.0%10.9% from $2.93$3.09 billion for the corresponding period last year. For the ninesix months ended June 28, 2019,March 27, 2020, revenues were $9.35$6.79 billion, an increase of $1.76$611.8 million or 9.9% from $6.18 billion or 23.2% from $7.59 billion for the corresponding period last year. The increase in revenues for the three month period year over year was due in part to fiscal 2020 incremental revenues from the June 2019 KeyW of $23.9 million in fiscal 2019and the March 2020 John Wood Group Nuclear business acquisitions, in addition to overall growth in ATNour Critical Mission Solutions (CMS) and BIAF legacyPeople & Places Solutions (P&PS) businesses. The increase in revenues for the year to date period was due primarily to the three-month period ended December 28, 2018 including only fifteen days of results attributable from the CH2M acquisition and to an overall increase in legacy Jacobs ATN and BIAF businesses along with the KeyW revenue in the current period but not in the prior. Pass-through costs included in revenues for the three and ninesix months ended June 28, 2019March 27, 2020 amounted to $533.9$641.4 million and $1.84$1.34 billion, respectively, a decrease of $49.5 million and an increase of $236.6$9.0 million and $36.5 million, or (8.5)%1.4% and 14.8%2.8%, from $583.4from $632.4 million and $1.60$1.31 billion respectively from the corresponding periodperiods last year. The nine month year-over-year increase is due primarily to the full quarter of incremental revenue in the first fiscal quarter of 2019 from the December 15, 2017 acquisition of CH2M and growth in the legacy ATN and BIAF businesses.

Gross profit for the thirdsecond quarter of 20192020 was $626.1$648.1 million, an increase of $17.5$31.3 million, or 2.9%5.1% from $608.6$616.8 million fromfrom the corresponding period last year. Our gross profit margins were 19.8%18.9% and 20.7%20.0% for the three month periods ended June 28,March 27, 2020 and March 29, 2019, and June 29, 2018, respectively.respectively, with these trend differences being mainly attributable to project mix impacts in our legacy portfolio year over year, as well as year over year impacts from lower overhead reimbursement rates resulting from our ongoing cost reduction programs as well as COVID-19 cost mitigation efforts. Gross profit for the ninesix months ended June 28, 2019March 27, 2020 was $1.81$1.29 billion, an increase of $259.2$107.3 million, or 16.7%9.1% from $1.55$1.19 billion from the corresponding period to date last year. Our gross profit margins were 19.4%19.0% and 20.5%19.2% for the nine monthssix month periods ended June 28,March 27, 2020 and March 29, 2019, and June 29, 2018, respectively. The increase in our gross profit forwas attributable to overall growth in both our P&PS and CMS businesses along with favorable impacts from the nine month periodKeyW and John Wood Group Nuclear business acquisitions. The slight differences in year over year wasgross margin trends for the three and six month periods were attributable mainly to the full quarter of incremental revenue in the first fiscal quarter of 2019legacy portfolio mix and lower overhead rate impacts mentioned above, with partial offsets from the December 15, 2017 acquisition of CH2M which benefited bothfavorable margin trends from our ATNrecent KeyW and BIAF businesses. Additionally, for both the three month and nine month year over year periods, gross profit increased due to growth in our ATN and BIAF legacy businesses. The decrease in our gross profit margins quarter over quarter and year over year was due to a higher mix of ATN reimbursable versus fixed price revenue and the revenue mix impact from entering the final stages of a large BIAF advanced facilities project.Wood Group acquisitions.

See Segment Financial Information discussion for further information on the Company’s results of operations at the operating segment.

SG&A expenses for the three months ended June 28, 2019March 27, 2020 were $536.2$480.4 million, a decrease of $33.8 million, or 6.6%, from $514.2 million for the corresponding period last year. The decrease in SG&A expenses as compared to the corresponding period last year was due primarily to less expense relating to the Transition Services Agreement (the "TSA") with Worley which terminated in April 2020 and reductions in personnel related and other overhead costs, partly offset by incremental SG&A increases from the KeyW and John Wood Group Nuclear business acquisitions. SG&A expenses for the six months ended March 27, 2020 were $973.6 million, an increase of $90.1$4.0 million, or 20.2%0.4%, from $446.1$969.6 million for the corresponding period last year. The increase in SG&A expenses as compared to the corresponding period last year was due mainly to restructuring charges and transaction costs. SG&A expenses for the nine months ended June 28, 2019 were $1.51 billion, an increase of $180.0 million or 13.6%, from $1.33 billion for the corresponding period last year. The increase in SG&A expenses as compared to the corresponding period last year was due mainlyprimarily to incremental SG&A expense from the acquired CH2M businesses. ImpactsKeyW and John Wood Group Nuclear business acquisitions, offset by less expense relating to the Transition Services Agreement (the "TSA") with Worley which terminated in April 2020 and reductions in personnel related and other overhead costs resulting from our ongoing cost reduction programs as well as COVID-19 cost mitigation efforts. Favorable impacts on SG&A expenses from foreign exchange were favorable by $9.4$6.3 million and $6.7 million, respectively for the three and six months ended June 28, 2019 and $42.4 million for the nine months ended June 28, 2019. SG&A expense for the three months ended June 28, 2019 included Restructuring and other charges of $92.4 million and $12.7 million in KeyW transaction costs, while SG&A expense for the three months ended June 29, 2018 included $30.5 million in Restructuring and other charges and $4.4 million in CH2M transaction costs. For the nine months ended June 28, 2019, SG&A expense included Restructuring and other charges of $233.6 million and $12.7 million in KeyW transactionMarch 27, 2020.

Net interest expense for the three and ninesix months ended June 28, 2019March 27, 2020 was $15.6$14.2 million and $66.6$28.0 million, respectively, a decrease of $6.8$13.6 million and an increase of $23.3$22.9 million from $22.5$27.8 million and $43.2$51.0 million forfor the corresponding periodsperiod last year. The decrease in net interest expense for the three month period year over year is due to the paydown of debt subsequent to the ECR sale in the currentprior year third quarter. The increase in

Miscellaneous (expense) income, net interest expense for the nine month period .year overthree and six months ended March 27, 2020 was $(330.4) million and $(213.7) million, respectively, a decrease of $367.3 million and $252.9 million from $36.9 million and $39.2 million for the corresponding periods last year. The decrease from the prior year was due primarily to higher levels of average debt balances outstanding related to financing activities for the acquisition of CH2M which was not funded until December 15, 2017.

The Company’s effective tax rates from continuing operations for the three months ended March 27, 2020 and March 29, 2019 were 34.6% and (7.1)%, respectively. The Company’s effective tax rates from continuing operations for the six months ended March 27, 2020 and March 29, 2019 were 9.5% and 7.3%, respectively. The comparatively higher quarterly tax rate was primarily due to a $37.4 million tax benefit in the three months ended March 29, 2019 for remeasurement of the Company's deferred tax liability for unremitted earnings to account for the change in expected manner of recovery due to the ECR divestiture. For the three months ended March 27, 2020, the effective tax rate was impacted by $5.8 million from amended returns for foreign tax credits and research and development credits, a

Page 45

$4.1 million benefit related to an India withholding tax rate change and benefits from an Internal Revenue Code section 179D energy credit. The Company’s effective tax rate from continuing operations for the six months ended March 27, 2020 was impacted by the quarterly tax benefit items noted above as well as impacts from a $3.7 million favorable settlement with the Indian Revenue Services in the first quarter fiscal 2020.

See Note 7- Sale of Energy, Chemicals and Resources ("ECR") Business for further information on the Company's discontinued operations reporting for the sale of the ECR business.

On December 22, 2017, the Tax Cuts and Jobs Act (the “Act”) was enacted in the United States and significantly revised the U.S. corporate income tax laws. Given the significance of the legislation, the SEC staff issued Staff Accounting Bulletin No. 118 (SAB 118), which allowsallowed registrants to record provisional amounts during a one year “measurement period” like that used when accounting for business combinations. As of December 22, 2018, we have completed our accounting for the tax effects of the enactment of the Act. For the deferred tax balances, we remeasured the U.S. deferred tax assets and liabilities based on the rates at which they are expected to reverse in the future, which is generally 21%. The Company’s revised remeasurement resulted in cumulative charges to income tax expense of $144.4 million for the measurement period. The Act callscalled for a one-time tax on deemed repatriation of foreign earnings. This one-time transition tax iswas based on our total post-1986 earnings and profits (E&P) of certain of our foreign subsidiaries. InWe recorded $14.3 million in cumulative transition taxes during the current reportingmeasurement period, the Company filed its tax return which reflectedalthough the transition tax. The net tax liability after consideringwas expected to be offset by foreign tax credits resulted in athe future, resulting in no additional cash tax liability of $0.8 million.liability. In addition, the Company recorded $104.2 million in cumulative valuation expense charges during the measurement period with respect to certain foreign tax credit deferred tax assets as a result of the Tax Act and CH2M integration.

The amount of income taxes the Company pays is subject to ongoing audits by tax jurisdictions around the world. In the normal course of business, the Company is subject to examination by tax authorities throughout the world, including such major jurisdictions as Australia, Canada, India, the Netherlands, the United Kingdom and the United States. Our estimate of the potential outcome of any uncertain tax issue is subject to our assessment of the relevant risks, facts, and circumstances existing at the time. The Company believes that it has adequately provided for reasonably foreseeable outcomes related to these matters. However, future results may include favorable or unfavorable adjustments to our estimated tax liabilities in the period the assessments are made or resolved, which may impact our effective tax rate. It is reasonably possible that, during the next twelve months, we may realize a decrease in our uncertain tax positions of approximately $16.3 million as a result of concluding various tax audits and closing tax years.

Segment Financial Information

The following table provides selected financial information for our operating segments and includes a reconciliation of segment operating profit to total U.S. GAAP operating profit from continuing operations by including certain corporate-level expenses, Restructuring and other charges and transaction and integration costs (in thousands).

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||

| March 27, 2020 | March 29, 2019 | March 27, 2020 | March 29, 2019 | ||||||||||||||||||||||||||||||||||||||||||||

| Revenues from External Customers: | |||||||||||||||||||||||||||||||||||||||||||||||

| Critical Mission Solutions | $ | 1,243,378 | $ | 1,059,508 | $2,425,835 | $2,094,537 | |||||||||||||||||||||||||||||||||||||||||

| People & Places Solutions | 2,183,802 | 2,032,088 | 4,361,394 | 4,080,847 | |||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 3,427,180 | $ | 3,091,596 | $6,787,229 | $6,175,384 | |||||||||||||||||||||||||||||||||||||||||

Page 46

| Three Months Ended | Nine Months Ended | ||||||||||||||

| June 28, 2019 | June 29, 2018 | June 28, 2019 | June 29, 2018 | ||||||||||||

| Revenues from External Customers: | |||||||||||||||

| Aerospace, Technology and Nuclear | $ | 1,156,488 | $ | 1,021,523 | $ | 3,251,024 | $ | 2,656,303 | |||||||

| Buildings, Infrastructure and Advanced Facilities | 2,013,134 | 1,912,100 | 6,093,981 | 4,931,613 | |||||||||||

| Total | $ | 3,169,622 | $ | 2,933,623 | $ | 9,345,005 | $ | 7,587,916 | |||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| June 28, 2019 | June 29, 2018 | June 28, 2019 | June 29, 2018 | ||||||||||||

| Segment Operating Profit: | |||||||||||||||

| Aerospace, Technology and Nuclear | $ | 76,306 | $ | 69,085 | $ | 222,289 | $ | 182,609 | |||||||

| Buildings, Infrastructure and Advanced Facilities | 183,318 | 163,193 | 515,465 | 374,809 | |||||||||||

| Total Segment Operating Profit | 259,624 | 232,278 | 737,754 | 557,418 | |||||||||||

| Other Corporate Expenses (1) | (64,525 | ) | (34,802 | ) | (185,674 | ) | (131,163 | ) | |||||||

| Restructuring and Other Charges | (92,407 | ) | (30,544 | ) | (233,579 | ) | (122,744 | ) | |||||||

| Transaction Costs | (12,738 | ) | (4,420 | ) | (12,738 | ) | (76,915 | ) | |||||||

| Total U.S. GAAP Operating Profit | 89,954 | 162,512 | 305,763 | 226,596 | |||||||||||

| Total Other (Expense) Income, net (2) | 3,445 | (15,879 | ) | (8,344 | ) | (38,016 | ) | ||||||||

| Earnings from Continuing Operations Before Taxes | $ | 93,399 | $ | 146,633 | $ | 297,419 | $ | 188,580 | |||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||

| March 27, 2020 | March 29, 2019 | March 27, 2020 | March 29, 2019 | ||||||||||||||||||||||||||||||||||||||||||||

| Segment Operating Profit: | |||||||||||||||||||||||||||||||||||||||||||||||

| Critical Mission Solutions | $ | 84,293 | $ | 73,831 | $ | 174,715 | $ | 145,982 | |||||||||||||||||||||||||||||||||||||||

| People & Places Solutions | 189,082 | 172,689 | 367,411 | 332,148 | |||||||||||||||||||||||||||||||||||||||||||

| Total Segment Operating Profit | 273,375 | 246,520 | 542,126 | 478,130 | |||||||||||||||||||||||||||||||||||||||||||

| Other Corporate Expenses (1) | (61,216) | (49,901) | (127,934) | (121,149) | |||||||||||||||||||||||||||||||||||||||||||

| Restructuring, Transaction and Other Charges | (44,381) | (93,938) | (95,067) | (141,171) | |||||||||||||||||||||||||||||||||||||||||||

| Total U.S. GAAP Operating Profit | 167,778 | 102,681 | 319,125 | 215,810 | |||||||||||||||||||||||||||||||||||||||||||

| Total Other (Expense) Income, net (2) | (344,583) | 9,151 | (241,759) | (11,789) | |||||||||||||||||||||||||||||||||||||||||||

| (Loss) Earnings from Continuing Operations Before Taxes | $ | (176,805) | $ | 111,832 | $ | 77,366 | $ | 204,021 | |||||||||||||||||||||||||||||||||||||||

(1)Other corporate expenses include costs that were previously allocated to the ECR segment prior to discontinued operations presentation in connection with the ECR sale in the approximate amount of $6.4 million and $12.8 million for the three and six month periods ended March 29, 2019. Other corporate expenses also include intangibles amortization of $22.1 million and $18.7 million for the three-month periods ended March 27, 2020 and March 29, 2019, respectively, and $43.9 million and $37.3 million for the six months ended March 27, 2020 and March 29, 2019, respectively.

| Three Months Ended | Nine Months Ended | ||||||||||||||

| June 28, 2019 | June 29, 2018 | June 28, 2019 | June 29, 2018 | ||||||||||||

| Revenue | $ | 1,156,488 | $ | 1,021,523 | $ | 3,251,024 | $ | 2,656,303 | |||||||

| Operating Profit | $ | 76,306 | $ | 69,085 | $ | 222,289 | $ | 182,609 | |||||||

Critical Mission Solutions

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||

| March 27, 2020 | March 29, 2019 | March 27, 2020 | March 29, 2019 | ||||||||||||||||||||||||||||||||||||||||||||

| Revenue | $ | 1,243,378 | $ | 1,059,508 | $ | 2,425,835 | $ | 2,094,537 | |||||||||||||||||||||||||||||||||||||||

| Operating Profit | $ | 84,293 | $ | 73,831 | $ | 174,715 | $ | 145,982 | |||||||||||||||||||||||||||||||||||||||

Critical Mission Solutions (CMS) segment revenues for the three and ninesix months ended June 28, 2019March 27, 2020 were $1.16$1.24 billion and $3.25$2.43 billion, respectively, an increase of $135.0$183.9 million and $594.7$331.3 million, or 13.2%,17.4% and 22.4%15.8% from $1.02$1.06 billion and $2.66$2.09 billion for the corresponding periods last year. Our revenues were positively impacted byincrease in revenue was primarily attributable to incremental revenue from the KeyW and John Wood Group Nuclear business acquisitions, combined with year over year revenue volume growth across our legacy portfolio, highlighted by increased spending by customers in the U.S. government business sector. Also, the increases in revenue for the nine months ended were due in large part to the incremental revenue resulting from the CH2M acquisition which closed on December 15, 2017. Impacts on revenues from unfavorable foreign currency translation were approximately $7.3$5.1 million for the

Operating profit for the segment was $76.3$84.3 million and $222.3$174.7 million, respectively, for the three and ninesix months ended June 28, 2019,March 27, 2020, an increase of $7.2$10.5 million and $39.7$28.7 million, or 10.5%14.2% and 21.7%19.7%, from $69.1$73.8 million and $182.6$146.0 million for the corresponding periods last year. In addition to incremental operating profit benefits from the CH2M acquisition, theThe increases from the prior year were primarily attributable to incremental operating profit from the KeyW and John Wood Group Nuclear business acquisitions, the continued growth in profits from our U.S. governmental business sector.

Page 47

| Three Months Ended | Nine Months Ended | ||||||||||||||

| June 28, 2019 | June 29, 2018 | June 28, 2019 | June 29, 2018 | ||||||||||||

| Revenue | $ | 2,013,134 | $ | 1,912,100 | $ | 6,093,981 | $ | 4,931,613 | |||||||

| Operating Profit | $ | 183,318 | $ | 163,193 | $ | 515,465 | $ | 374,809 | |||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||

| March 27, 2020 | March 29, 2019 | March 27, 2020 | March 29, 2019 | ||||||||||||||||||||||||||||||||||||||||||||

| Revenue | $ | 2,183,802 | $ | 2,032,088 | $ | 4,361,394 | $ | 4,080,847 | |||||||||||||||||||||||||||||||||||||||

| Operating Profit | $ | 189,082 | $ | 172,689 | $ | 367,411 | $ | 332,148 | |||||||||||||||||||||||||||||||||||||||

Revenues for the Buildings, Infrastructure and Advanced FacilitiesPeople & Places Solutions (P&PS) segment for the three and ninesix months ended June 28, 2019March 27, 2020 were $2.01$2.18 billion and $6.09$4.36 billion, respectively, an increase of $101.0$151.7 million and $1.16 billion,$280.5 million, or 5.3%7.5%, and 23.6%,6.9% from $1.91$2.03 billion and $4.93$4.08 billion for the corresponding periods last year. The increases in revenue were due in large part to the incremental revenue resulting from the CH2M acquisition which closed on December 15, 2017 for the year to date period, together with revenue increasesportfolio growth across all our businesses, withhighlighted by strong investment in Advanced Facilities,advanced facilities, water and transport infrastructure and project management/construction management ("PMCM") sectors. Impacts on revenues from unfavorable foreign currency translation were approximately $33$19.7 million and $29.3 million, respectively, for the three-month period of fiscal 2019three and six month periods ended March 27, 2020 compared to the corresponding prior year periods in fiscal 2018 and $105.4 million for the nine-month period of fiscal 2019 compared to the corresponding prior year periods in fiscal 2018.periods.