UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

|

| |

ý☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended September 30, 2017 |

For the quarterly period ended March 31, 2020

or

|

| |

¨☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission File Number 1-4717

KANSAS CITY SOUTHERN

(Exact name of registrant as specified in its charter)

|

| | | | | | |

| Delaware | | | | 44-0663509 |

(State or other jurisdiction of incorporation or organization) | | | (I.R.S. Employer Identification No.) |

427 West 12th Street Kansas City, Missouri

| | |

|

| Kansas City | , | Missouri | | | 64105 |

| (Address of principal executive offices) | | | (Zip Code) |

816.983.1303816.983.1303

(Registrant’s telephone number, including area code)

No Change

(Former name, former address and former fiscal year, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Preferred Stock, Par Value $25 Per Share, 4%, Noncumulative | KSU | New York Stock Exchange |

| Common Stock, $.01 Per Share Par Value | KSU | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨☐

Indicate by check mark whether the registrant has submitted electronically, and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer Accelerated Filer ýAccelerated filer ¨ ☐ Non-accelerated filer (Do not check if a smaller reporting company) ¨

☐ Smaller reporting company ¨ ☐

Emerging growth company ¨☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨☐ No ý

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

| | |

| Class | | October 13, 2017April 10, 2020 |

| Common Stock, $0.01 per share par value | | 103,543,12195,020,228 Shares |

Kansas City Southern and Subsidiaries

Form 10-Q

September 30, 2017March 31, 2020

Index

|

| | |

| | Page |

| PART I — FINANCIAL INFORMATION | |

| Item 1. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| PART II — OTHER INFORMATION | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| | | |

PART I — FINANCIAL INFORMATION

| |

| Item 1. | Financial Statements (unaudited) |

Kansas City Southern and Subsidiaries

Consolidated Statements of Income

| | | | Three Months Ended | | Nine Months Ended | Three Months Ended |

| | September 30, | | September 30, | March 31, |

| | 2017 | | 2016 | | 2017 | | 2016 | 2020 | | 2019 |

| | (In millions, except share and per share amounts) (Unaudited) | (In millions, except share and per share amounts) (Unaudited) |

| Revenues | $ | 656.6 |

| | $ | 604.5 |

| | $ | 1,922.5 |

| | $ | 1,735.7 |

| $ | 731.7 |

| | $ | 674.8 |

|

| Operating expenses: | | | | | | | | | | |

| Compensation and benefits | 129.0 |

| | 127.9 |

| | 371.6 |

| | 347.0 |

| 133.4 |

| | 128.9 |

|

| Purchased services | 46.3 |

| | 54.5 |

| | 146.5 |

| | 159.1 |

| 53.3 |

| | 52.8 |

|

| Fuel | 80.1 |

| | 67.6 |

| | 234.4 |

| | 186.0 |

| 74.9 |

| | 83.0 |

|

| Mexican fuel excise tax credit | (11.1 | ) | | (15.6 | ) | | (35.6 | ) | | (49.6 | ) | |

| Equipment costs | 30.9 |

| | 32.0 |

| | 93.3 |

| | 85.9 |

| 21.9 |

| | 30.4 |

|

| Depreciation and amortization | 81.9 |

| | 76.9 |

| | 241.6 |

| | 226.9 |

| 89.4 |

| | 88.5 |

|

| Materials and other | 65.7 |

| | 61.4 |

| | 186.9 |

| | 172.8 |

| 64.0 |

| | 63.4 |

|

| Restructuring charges | | 6.0 |

| | 67.5 |

|

| Total operating expenses | 422.8 |

| | 404.7 |

| | 1,238.7 |

| | 1,128.1 |

| 442.9 |

| | 514.5 |

|

| Operating income | 233.8 |

| | 199.8 |

| | 683.8 |

| | 607.6 |

| 288.8 |

| | 160.3 |

|

| Equity in net earnings of affiliates | 2.8 |

| | 3.5 |

| | 9.7 |

| | 10.4 |

| 1.0 |

| | 1.7 |

|

| Interest expense | (25.2 | ) | | (25.2 | ) | | (74.9 | ) | | (73.2 | ) | (34.2 | ) | | (28.2 | ) |

| Debt retirement costs | | — |

| | (0.6 | ) |

| Foreign exchange gain (loss) | 0.8 |

| | (19.8 | ) | | 61.8 |

| | (47.3 | ) | (59.5 | ) | | 4.6 |

|

| Other income (expense), net | (0.3 | ) | | — |

| | 0.7 |

| | (0.5 | ) | |

| Other income, net | | 1.4 |

| | 0.1 |

|

| Income before income taxes | 211.9 |

| | 158.3 |

| | 681.1 |

| | 497.0 |

| 197.5 |

| | 137.9 |

|

| Income tax expense | 82.0 |

| | 37.3 |

| | 269.6 |

| | 147.4 |

| 45.2 |

| | 34.7 |

|

| Net income | 129.9 |

| | 121.0 |

| | 411.5 |

| | 349.6 |

| 152.3 |

| | 103.2 |

|

| Less: Net income attributable to noncontrolling interest | 0.6 |

| | 0.4 |

| | 1.2 |

| | 1.1 |

| 0.5 |

| | 0.4 |

|

| Net income attributable to Kansas City Southern and subsidiaries | 129.3 |

| | 120.6 |

| | 410.3 |

| | 348.5 |

| 151.8 |

| | 102.8 |

|

| Preferred stock dividends | 0.1 |

| | 0.1 |

| | 0.2 |

| | 0.2 |

| 0.1 |

| | 0.1 |

|

| Net income available to common stockholders | $ | 129.2 |

| | $ | 120.5 |

| | $ | 410.1 |

| | $ | 348.3 |

| $ | 151.7 |

| | $ | 102.7 |

|

| | | | | | | | | | | |

| Earnings per share: | | | | | | | | | | |

| Basic earnings per share | $ | 1.24 |

| | $ | 1.12 |

| | $ | 3.89 |

| | $ | 3.23 |

| $ | 1.59 |

| | $ | 1.02 |

|

| Diluted earnings per share | $ | 1.23 |

| | $ | 1.12 |

| | $ | 3.88 |

| | $ | 3.23 |

| $ | 1.58 |

| | $ | 1.02 |

|

| | | | | | | | | | | |

Average shares outstanding (in thousands): | | | | | | | | | | |

| Basic | 104,324 |

| | 107,621 |

| | 105,297 |

| | 107,800 |

| 95,662 |

| | 100,500 |

|

| Potentially dilutive common shares | 354 |

| | 191 |

| | 285 |

| | 199 |

| 509 |

| | 415 |

|

| Diluted | 104,678 |

| | 107,812 |

| | 105,582 |

| | 107,999 |

| 96,171 |

| | 100,915 |

|

See accompanying notes to the unaudited consolidated financial statements.

Kansas City Southern and Subsidiaries

Consolidated Statements of Comprehensive Income

| | | | Three Months Ended | | Nine Months Ended | Three Months Ended |

| | September 30, | | September 30, | March 31, |

| | 2017 | | 2016 | | 2017 | | 2016 | 2020 | | 2019 |

| | (In millions)

(Unaudited) | (In millions)

(Unaudited) |

| Net income | $ | 129.9 |

| | $ | 121.0 |

| | $ | 411.5 |

| | $ | 349.6 |

| $ | 152.3 |

| | $ | 103.2 |

|

| Other comprehensive loss: | | | | | | | | |

| Unrealized loss on interest rate derivative instruments during the period, net of tax of $(0.3) million and $(1.8) million, respectively | (0.5 | ) | | — |

| | (2.8 | ) | | — |

| |

| Foreign currency translation adjustments, net of tax of $(0.1) million, $(0.2) million, $0.7 million and $(0.7) million, respectively | (0.2 | ) | | (0.3 | ) | | 1.1 |

| | (1.0 | ) | |

| Other comprehensive loss | (0.7 | ) | | (0.3 | ) | | (1.7 | ) | | (1.0 | ) | |

| Other comprehensive income (loss): | | | | |

| Unrealized gain (loss) on interest rate derivative instruments, net of tax of $1.2 million and $(1.7) million, respectively | | 4.8 |

| | (5.1 | ) |

| Reclassification adjustment from cash flow hedges included in net income, net of tax of $0.1 million | | 0.5 |

| | — |

|

| Foreign currency translation adjustments | | (1.7 | ) | | 0.2 |

|

| Other comprehensive income (loss) | | 3.6 |

| | (4.9 | ) |

| Comprehensive income | 129.2 |

| | 120.7 |

| | 409.8 |

| | 348.6 |

| 155.9 |

| | 98.3 |

|

| Less: Comprehensive income attributable to noncontrolling interest | 0.6 |

| | 0.4 |

| | 1.2 |

| | 1.1 |

| 0.5 |

| | 0.4 |

|

| Comprehensive income attributable to Kansas City Southern and subsidiaries | $ | 128.6 |

| | $ | 120.3 |

| | $ | 408.6 |

| | $ | 347.5 |

| $ | 155.4 |

| | $ | 97.9 |

|

See accompanying notes to the unaudited consolidated financial statements.

Kansas City Southern and Subsidiaries

Consolidated Balance Sheets

| | | | September 30,

2017 | | December 31,

2016 | March 31,

2020 | | December 31,

2019 |

| | (In millions, except share and per share amounts) | (In millions, except share and per share amounts) |

| | (Unaudited) | | | (Unaudited) | | |

| ASSETS | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | $ | 88.4 |

| | $ | 170.6 |

| $ | 91.0 |

| | $ | 148.8 |

|

| Accounts receivable, net | 237.2 |

| | 191.0 |

| 269.8 |

| | 274.2 |

|

| Materials and supplies | 151.2 |

| | 152.6 |

| 143.6 |

| | 150.6 |

|

| Other current assets | 163.7 |

| | 133.8 |

| 117.5 |

| | 155.0 |

|

| Total current assets | 640.5 |

| | 648.0 |

| 621.9 |

| | 728.6 |

|

| Operating lease right-of-use assets | | 81.4 |

| | 158.4 |

|

| Investments | 51.9 |

| | 32.9 |

| 45.9 |

| | 47.6 |

|

| Property and equipment (including concession assets), net | 8,335.6 |

| | 8,069.7 |

| 8,924.0 |

| | 8,806.3 |

|

| Other assets | 72.3 |

| | 66.9 |

| 92.5 |

| | 45.9 |

|

| Total assets | $ | 9,100.3 |

| | $ | 8,817.5 |

| $ | 9,765.7 |

| | $ | 9,786.8 |

|

| LIABILITIES AND EQUITY | | | | | | |

| Current liabilities: | | | | | | |

| Long-term debt due within one year | $ | 40.5 |

| | $ | 25.4 |

| $ | 17.1 |

| | $ | 18.0 |

|

| Short-term borrowings | 355.9 |

| | 181.3 |

| |

| Accounts payable and accrued liabilities | 528.4 |

| | 537.7 |

| 453.6 |

| | 473.3 |

|

| Total current liabilities | 924.8 |

| | 744.4 |

| 470.7 |

| | 491.3 |

|

| Long-term operating lease liabilities | | 51.4 |

| | 85.7 |

|

| Long-term debt | 2,238.4 |

| | 2,271.5 |

| 3,227.0 |

| | 3,228.0 |

|

| Deferred income taxes | 1,432.3 |

| | 1,289.3 |

| 1,149.2 |

| | 1,128.0 |

|

| Other noncurrent liabilities and deferred credits | 98.4 |

| | 107.8 |

| 105.4 |

| | 107.9 |

|

| Total liabilities | 4,693.9 |

| | 4,413.0 |

| 5,003.7 |

| | 5,040.9 |

|

| Stockholders’ equity: | | | | | | |

| $25 par, 4% noncumulative, preferred stock, 840,000 shares authorized, 649,736 shares issued, 242,170 shares outstanding | 6.1 |

| | 6.1 |

| |

| $.01 par, common stock, 400,000,000 shares authorized; 123,352,185 shares issued; 103,694,613 and 106,606,619 shares outstanding at September 30, 2017 and December 31, 2016, respectively | 1.0 |

| | 1.1 |

| |

| $25 par, 4% noncumulative, preferred stock, 840,000 shares authorized, 649,736 shares issued; 222,625 shares outstanding at March 31, 2020 and December 31, 2019, respectively | | 5.6 |

| | 5.6 |

|

| $.01 par, common stock, 400,000,000 shares authorized; 123,352,185 shares issued; 95,014,649 and 96,115,669 shares outstanding at March 31, 2020 and December 31, 2019, respectively | | 1.0 |

| | 1.0 |

|

| Additional paid-in capital | 930.5 |

| | 954.8 |

| 925.0 |

| | 843.7 |

|

| Retained earnings | 3,160.9 |

| | 3,134.1 |

| 3,532.0 |

| | 3,601.3 |

|

| Accumulated other comprehensive loss | (7.9 | ) | | (6.2 | ) | (25.5 | ) | | (29.1 | ) |

| Total stockholders’ equity | 4,090.6 |

| | 4,089.9 |

| 4,438.1 |

| | 4,422.5 |

|

| Noncontrolling interest | 315.8 |

| | 314.6 |

| 323.9 |

| | 323.4 |

|

| Total equity | 4,406.4 |

| | 4,404.5 |

| 4,762.0 |

| | 4,745.9 |

|

| Total liabilities and equity | $ | 9,100.3 |

| | $ | 8,817.5 |

| $ | 9,765.7 |

| | $ | 9,786.8 |

|

See accompanying notes to the unaudited consolidated financial statements.

Kansas City Southern and Subsidiaries

Consolidated Statements of Cash Flows

| | | | Nine Months Ended | Three Months Ended |

| | September 30, | March 31, |

| | 2017 | | 2016 | 2020 | | 2019 |

| | (In millions) (Unaudited) | (In millions) (Unaudited) |

| Operating activities: | | | | | | |

| Net income | $ | 411.5 |

| | $ | 349.6 |

| $ | 152.3 |

| | $ | 103.2 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | |

| Depreciation and amortization | 241.6 |

| | 226.9 |

| 89.4 |

| | 88.5 |

|

| Deferred income taxes | 146.6 |

| | 117.4 |

| 19.8 |

| | 6.9 |

|

| Equity in net earnings of affiliates | (9.7 | ) | | (10.4 | ) | (1.0 | ) | | (1.7 | ) |

| Share-based compensation | 14.6 |

| | 15.2 |

| 10.3 |

| | 6.0 |

|

| Distributions from affiliates | 5.0 |

| | 5.0 |

| |

| Settlement of foreign currency derivative instruments | (14.4 | ) | | (58.4 | ) | (3.7 | ) | | 0.7 |

|

| (Gain) loss on foreign currency derivative instruments | (45.5 | ) | | 35.8 |

| 33.7 |

| | (3.6 | ) |

| Mexican fuel excise tax credit | (35.6 | ) | | (49.6 | ) | |

| Foreign exchange (gain) loss | | 25.8 |

| | (1.0 | ) |

| Restructuring charges | | 6.0 |

| | 67.5 |

|

| Cash payments for restructuring charges | | (0.5 | ) | | (0.5 | ) |

| Changes in working capital items: | | | | | | |

| Accounts receivable | (46.8 | ) | | (21.5 | ) | (2.9 | ) | | 33.8 |

|

| Materials and supplies | 1.1 |

| | (6.0 | ) | 5.9 |

| | (8.7 | ) |

| Other current assets | (24.4 | ) | | (4.2 | ) | (6.7 | ) | | 4.2 |

|

| Accounts payable and accrued liabilities | 109.0 |

| | 86.3 |

| (38.0 | ) | | (15.6 | ) |

| Other, net | (19.3 | ) | | (2.5 | ) | (7.2 | ) | | (7.0 | ) |

| Net cash provided by operating activities | 733.7 |

| | 683.6 |

| 283.2 |

| | 272.7 |

|

| | | | | | | |

| Investing activities: | | | | | | |

| Capital expenditures | (446.9 | ) | | (405.1 | ) | (98.8 | ) | | (179.9 | ) |

| Purchase or replacement of equipment under operating leases | (42.6 | ) | | (26.6 | ) | |

| Purchase or replacement of assets under operating leases | | (78.2 | ) | | — |

|

| Property investments in MSLLC | (23.7 | ) | | (31.2 | ) | (4.3 | ) | | (4.7 | ) |

| Investments in and advances to affiliates | (20.3 | ) | | (0.9 | ) | (4.3 | ) | | (8.4 | ) |

| Proceeds from disposal of property | 6.6 |

| | 3.6 |

| 3.3 |

| | 2.2 |

|

| Other, net | (15.1 | ) | | (5.8 | ) | (6.3 | ) | | 1.1 |

|

| Net cash used for investing activities | (542.0 | ) | | (466.0 | ) | (188.6 | ) | | (189.7 | ) |

| | | | | | | |

| Financing activities: | | | | | | |

| Proceeds from short-term borrowings | 9,772.2 |

| | 6,499.0 |

| |

| Repayment of short-term borrowings | (9,600.9 | ) | | (6,579.3 | ) | |

| Proceeds from issuance of long-term debt | — |

| | 248.7 |

| |

| Repayment of long-term debt | (20.2 | ) | | (20.8 | ) | (2.4 | ) | | (2.7 | ) |

| Dividends paid | (105.1 | ) | | (107.2 | ) | (38.6 | ) | | (36.4 | ) |

| Shares repurchased | (320.4 | ) | | (99.8 | ) | (111.7 | ) | | (50.3 | ) |

| Debt costs | — |

| | (2.6 | ) | |

| Debt issuance costs paid | | — |

| | (1.6 | ) |

| Proceeds from employee stock plans | 0.5 |

| | 0.9 |

| 4.4 |

| | 0.2 |

|

| Net cash used for financing activities | (273.9 | ) | | (61.1 | ) | (148.3 | ) | | (90.8 | ) |

| | | | | |

| Effect of exchange rate changes on cash | | (4.1 | ) | | — |

|

| | | | | |

| Cash and cash equivalents: | | | | | | |

| Net increase (decrease) during each period | (82.2 | ) | | 156.5 |

| |

| Net decrease during each period | | (57.8 | ) | | (7.8 | ) |

| At beginning of year | 170.6 |

| | 136.6 |

| 148.8 |

| | 100.5 |

|

| At end of period | $ | 88.4 |

| | $ | 293.1 |

| $ | 91.0 |

| | $ | 92.7 |

|

See accompanying notes to the unaudited consolidated financial statements.

Kansas City Southern and Subsidiaries

Consolidated Statements of Changes in Equity

(in millions, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $25 Par Preferred Stock | | $.01 Par Common Stock | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Non- controlling Interest | | Total |

| |

| | | | | | | | | | | | | | |

| Balance at December 31, 2018 | $ | 5.7 |

| | $ | 1.0 |

| | $ | 946.6 |

| | $ | 3,870.6 |

| | $ | (10.9 | ) | | $ | 319.7 |

| | $ | 5,132.7 |

|

| Net income | | | | | | | 102.8 |

| | | | 0.4 |

| | 103.2 |

|

| Other comprehensive loss | | | | | | | | | (4.9 | ) | | | | (4.9 | ) |

| Contribution from noncontrolling interest | | | | | | | | | | | 1.8 |

| | 1.8 |

|

| Dividends on common stock ($0.36/share) | | | | | | | (36.3 | ) | | | | | | (36.3 | ) |

| Dividends on $25 par preferred stock ($0.25/share) | | | | | | | (0.1 | ) | | | | | | (0.1 | ) |

| Share repurchases | — |

| | — |

| | (4.4 | ) | | (45.9 | ) | | | | | | (50.3 | ) |

| Options exercised and stock subscribed, net of shares withheld for employee taxes | | | | | (2.1 | ) | | | | | | | | (2.1 | ) |

| Share-based compensation | | | | | 6.0 |

| | | | | | | | 6.0 |

|

| Balance at March 31, 2019 | 5.7 |

| | 1.0 |

| | 946.1 |

| | 3,891.1 |

| | (15.8 | ) | | 321.9 |

| | 5,150.0 |

|

| Net income | | | | | | | 128.7 |

| | | | 0.4 |

| | 129.1 |

|

| Other comprehensive loss | | | | | | | | | (7.5 | ) | | | | (7.5 | ) |

| Dividends on common stock ($0.36/share) | | | | | | | (36.0 | ) | | | | | | (36.0 | ) |

| Dividends on $25 par preferred stock ($0.25/share) | | | | | | | — |

| | | | | | — |

|

| Share repurchases | (0.1 | ) | | — |

| | (7.3 | ) | | (85.0 | ) | | | | | | (92.4 | ) |

| Options exercised and stock subscribed, net of shares withheld for employee taxes | | | | | 2.3 |

| | | | | | | | 2.3 |

|

| Share-based compensation | | | | | 6.0 |

| | | | | | | | 6.0 |

|

| Balance at June 30, 2019 | 5.6 |

| | 1.0 |

| | 947.1 |

| | 3,898.8 |

| | (23.3 | ) | | 322.3 |

| | 5,151.5 |

|

| Net income | | | | | | | 180.2 |

| | | | 0.4 |

| | 180.6 |

|

| Other comprehensive loss | | | | | | | | | (7.3 | ) | | | | (7.3 | ) |

| Dividends on common stock ($0.36/share) | | | | | | | (35.6 | ) | | | | | | (35.6 | ) |

| Dividends on $25 par preferred stock ($0.25/share) | | | | | | | (0.1 | ) | | | | | | (0.1 | ) |

| Share repurchases | — |

| | — |

| | (7.7 | ) | | (92.1 | ) | | | | | | (99.8 | ) |

| Options exercised and stock subscribed, net of shares withheld for employee taxes | | | | | 2.7 |

| | | | | | | | 2.7 |

|

| Share-based compensation | | | | | 5.2 |

| | | | | | | | 5.2 |

|

| Balance at September 30, 2019 | 5.6 |

| | 1.0 |

| | 947.3 |

| | 3,951.2 |

| | (30.6 | ) | | 322.7 |

| | 5,197.2 |

|

| Net income | | | | | | | 127.2 |

| | | | 0.7 |

| | 127.9 |

|

| Other comprehensive income | | | | | | | | | 1.5 |

| | | | 1.5 |

|

| Dividends on common stock ($0.40/share) | | | | | | | (38.6 | ) | | | | | | (38.6 | ) |

| Dividends on $25 par preferred stock ($0.25/share) | | | | | | | — |

| | | | | | — |

|

| Share repurchases | — |

| | — |

| | (29.0 | ) | | (438.5 | ) | | | | | | (467.5 | ) |

| Forward contract for accelerated share repurchases | | | | | (82.5 | ) | | | | | | | | (82.5 | ) |

| Options exercised and stock subscribed, net of shares withheld for employee taxes | | | | | 1.2 |

| | | | | | | | 1.2 |

|

| Share-based compensation | | | | | 6.7 |

| | | | | | | | 6.7 |

|

| Balance at December 31, 2019 | 5.6 |

| | 1.0 |

| | 843.7 |

| | 3,601.3 |

| | (29.1 | ) | | 323.4 |

| | 4,745.9 |

|

| Net income | | | | | | | 151.8 |

| | | | 0.5 |

| | 152.3 |

|

| Other comprehensive income | | | | | | | | | 3.6 |

| | | | 3.6 |

|

| Dividends on common stock ($0.40/share) | | | | | | | (38.2 | ) | | | | | | (38.2 | ) |

| Dividends on $25 par preferred stock ($0.25/share) | | | | | | | (0.1 | ) | | | | | | (0.1 | ) |

| Share repurchases | | | — |

| | (11.4 | ) | | (182.8 | ) | | | | | | (194.2 | ) |

| Settlement of forward contract for accelerated share repurchases | | | | | 82.5 |

| | | | | | | | 82.5 |

|

| Options exercised and stock subscribed, net of shares withheld for employee taxes | | | | | (0.1 | ) | | | | | | | | (0.1 | ) |

| Share-based compensation | | | | | 10.3 |

| | | | | | | | 10.3 |

|

| Balance at March 31, 2020 | $ | 5.6 |

| | $ | 1.0 |

| | $ | 925.0 |

| | $ | 3,532.0 |

| | $ | (25.5 | ) | | $ | 323.9 |

| | $ | 4,762.0 |

|

See accompanying notes to the unaudited consolidated financial statements.

Kansas City Southern and Subsidiaries

Notes to the Unaudited Consolidated Financial Statements

For purposes of this report, “KCS” or the “Company” may refer to Kansas City Southern or, as the context requires, to one or more subsidiaries of Kansas City Southern.

1. Basis of Presentation

In the opinion of the management of KCS, the accompanying unaudited consolidated financial statements contain all adjustments (consisting of normal and recurring adjustments) necessary to fairly presentreflect a fair statement of the results for interim periods in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). Pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”), certain information and note disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted. These consolidated financial statements should be read in conjunction with the consolidated financial statements and accompanying notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 20162019. The results of operations for the three and nine months ended September 30, 2017March 31, 2020, are not necessarily indicative of the results to be expected for the full year ending December 31, 20172020. Certain prior year amounts have been reclassified to conform to the current year presentation.

During the first quarter of 2017,2020, the Company adopted Accounting Standards Update (“ASU”) No. 2016-09, Improvements2016-13, “Financial Instruments - Credit Losses,” which required the Company to Employee Share-Based Payment Accounting. The Company now recognizes forfeitures as they occur rather than estimating a forfeiture ratemeasure all expected credit losses for the year. Excess tax benefits or deficiencies resulting from the exercise or vesting of awards are included in income tax expense infinancial instruments held at the reporting period in which they occur. Upon adoption,date based on historical experience, current conditions, and reasonable supportable forecasts. This replaced the Company recognized a cumulative-effect adjustment to equity at the beginning of 2017, as disclosed in Note 10 - Equity.

During the third quarter of 2017, the Company early adopted ASU No. 2017-12, Derivativesexisting incurred loss model and Hedging: Targeted Improvements to Accounting for Hedging Activities. The Company now asserts qualitatively, on a quarterly basis, that the hedging relationship was and continues to be highly effective as long as facts and circumstances relatedis applicable to the hedging relationship have not changed. If facts and circumstances have changed, the Company will perform a quantitative assessment to ensure the hedging relationship is still deemed highly effective. In addition, the ineffective portionmeasurement of an effective hedge is no longer measured periodically and included in the income statement; rather, the total periodic change in fair value of an effective hedge is included in accumulated other comprehensive incomecredit losses on the balance sheet, until settlement occurs. The adoptionfinancial assets, including trade receivables. Adoption of the new guidance had nostandard did not have a material impact on the Company’s consolidated financial statements as there was no ineffectiveness recognized on the Company’s cash flow hedges prior to adoption.statements.

2. New Accounting Pronouncements

In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers, which requires companies to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration it expects to be entitled in exchange for those goods or services. The new standard will become effective for the Company beginning withDuring the first quarter 2018 andof 2020, the Company plans to adoptearly adopted the accounting standard usingSEC’s, Financial Disclosures About Guarantors and Issuers of Guaranteed Securities and Affiliates Whose Securities Collateralize a Registrant’s Securities rules, which simplify the modified retrospective transition approach. The modified retrospective transition approach will recognize any changes from the beginning of the year of initial application through retained earnings with no restatement of comparative periods.The Company has substantially completed a review of the likely impacts of the application of the new standard to its existing portfolio of customer contracts. Under the new standard, the Company will continue to recognize freight revenue proportionally as a shipment moves from origin to destination. Furthermore, the Company will be required to assess variable consideration included in its contracts and make judgments and estimates throughout the applicable periods. Certain additional financial statement disclosure requirements are mandated byrelated to the new standard includingCompany’s registered securities under Rule 3-10 of Regulation S-X. The final rule also allows for the simplified disclosure of contract assets and contract liabilities as well as a disaggregated view of revenue, which the Company expects to be similar to the current disclosuresincluded within the “Results of Operations” for revenues section of Item 2, “Management’sManagement’s Discussion and Analysis of Financial Condition and Results of Operations.” Based

2. COVID-19

In March 2020, the World Health Organization categorized Coronavirus Disease 2019 (“COVID-19”) as a pandemic, and the President of the United States declared the COVID-19 outbreak a national emergency. The U.S. and Mexico governments have deemed rail transportation as “critical infrastructure” providing essential services during this global emergency. As a provider of critical infrastructure, Kansas City Southern has an obligation to keep employees working and freight moving. KCS remains focused on protecting the health and wellbeing of its employees and the communities in which it operates while assuring the continuity of its business operations.

The Company’s consolidated financial statements reflect estimates and assumptions made by management that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and reported amounts of revenue and expenses during the reporting periods presented. The Company considered the impact of COVID-19 on the assumptions and estimates used and determined that there were no material adverse impacts on the Company’s review,first quarter 2020 results of operations, excluding the adoptionimpacts of this guidanceforeign exchange losses. The Company recognized $59.5 million of foreign currency exchange losses due to the depreciation of the Mexican peso against the U.S. dollar, partially resulting from the increased market volatility driven by the global COVID-19 pandemic. The Company hedges its exposure to foreign currency fluctuations and the related impacts in Mexican income tax expense by entering into foreign currency contracts, which have historically offset on an annual basis.

On March 27, 2020, the U.S. government enacted the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) which includes modifications to the limitation on business interest expense and net operating loss provisions, and provides a payment delay of employer payroll taxes during 2020 after the date of enactment. The Company estimates the payment of approximately $12.0 million of employer payroll taxes otherwise due in 2020 will be delayed with 50% due by December 31, 2021 and the remaining 50% by December 31, 2022. The CARES Act is not expected to have a significantmaterial impact on the Company’s consolidated financial statements.

In February 2016,

3. Restructuring Charges

During 2019, the FASB issued ASU No. 2016-02, LeasesCompany began implementing principles of Precision Scheduled Railroading (“PSR”), which requires lessees to recognize for all leasesfocus on providing reliable customer service, facilitating growth, improving asset utilization, and improving the cost profile of the Company. As a right-to-use asset andresult of the PSR initiatives in 2019, management approved 4 separate restructuring plans that totaled $168.8 million, including a lease obligation$67.5 million restructuring plan in the Consolidated Balance Sheet. Expenses are recognized in the Consolidated Statement of Income in a manner similar to current accounting guidance. Lessees are permitted to make an accounting policy election to not recognize an asset and liability for leases with a term of twelve months or less. Lessor accounting under the new standard is substantially unchanged. Additional qualitative and quantitative disclosures, including significant judgments made by management, will be required. The new standard will become effective for the Company beginning with the first quarter 2019 and requires a modified retrospective transition approach.of 2019. The Company has created a cross functional team to develop an implementation plan for the new standard and is assessing contractual arrangements that may qualify as a lease under the new standard. The Company has selected a lease management system and is progressing towards implementation. At December 31, 2016, KCS disclosed approximately $300 million of operating leasesrestructuring plans were substantially completed in the contractual obligations table in the Company’s most recent Form 10-K and will evaluate those contracts as well as other existing2019.

Kansas City Southern and Subsidiaries

Notes to the Unaudited Consolidated Financial Statements—(Continued)

arrangements to determine if they qualifyDuring the first quarter of 2020, the Company purchased 91 locomotives for $78.2 million that were part of 2 existing leases. Of the 91 locomotives, 13 were impaired during the fourth quarter of 2019. The purchase of the impaired lease accounting underlocomotives resulted in $6.0 million of make-whole payments recorded as incremental restructuring charges in the new standard. The Company is continuing to evaluate the impacts the adoptionfirst quarter of this accounting guidance will have on the consolidated financial statements.2020.

3. Mexican Fuel Excise Tax Credit4. Revenue

Fuel purchases made Disaggregation of Revenue

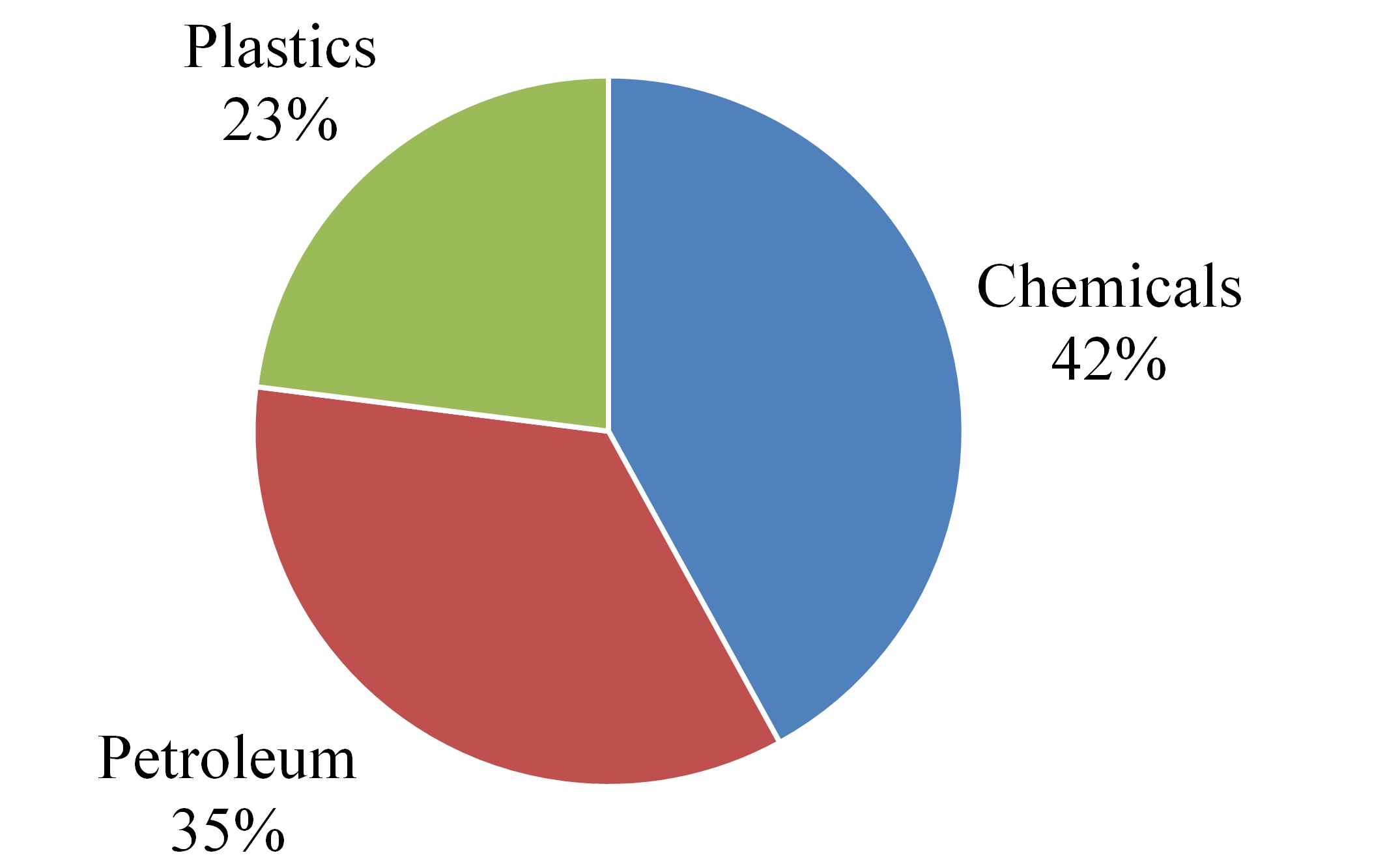

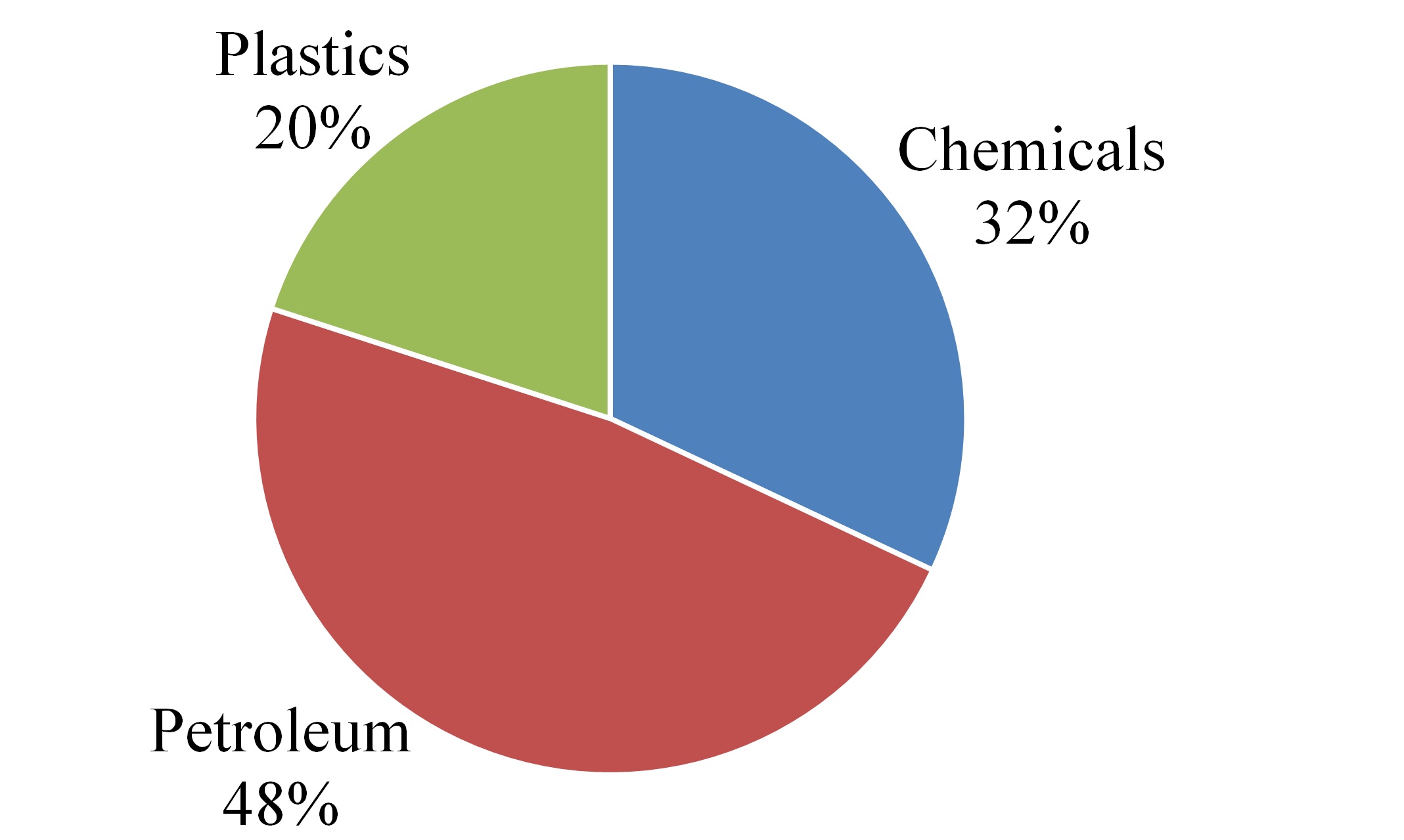

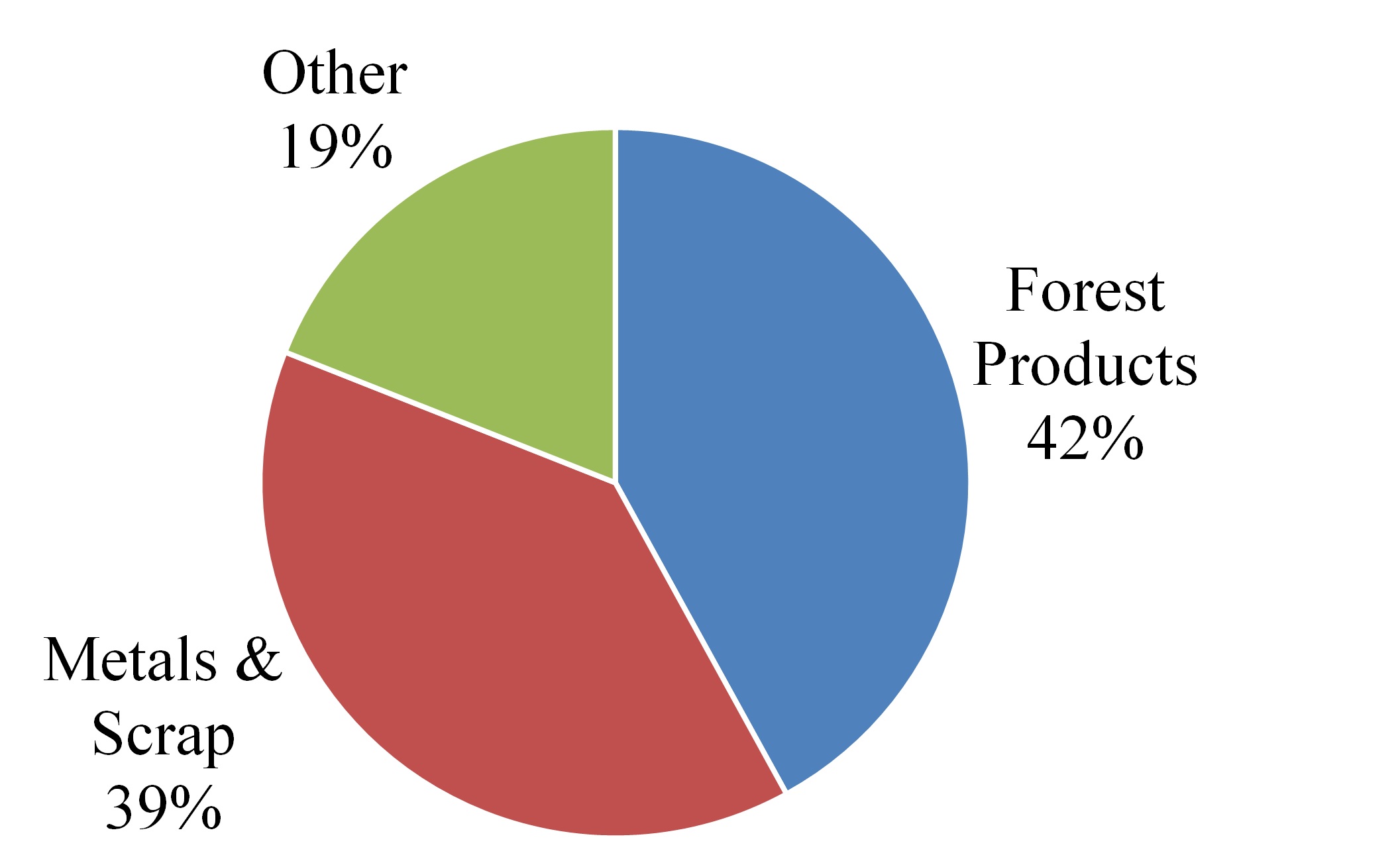

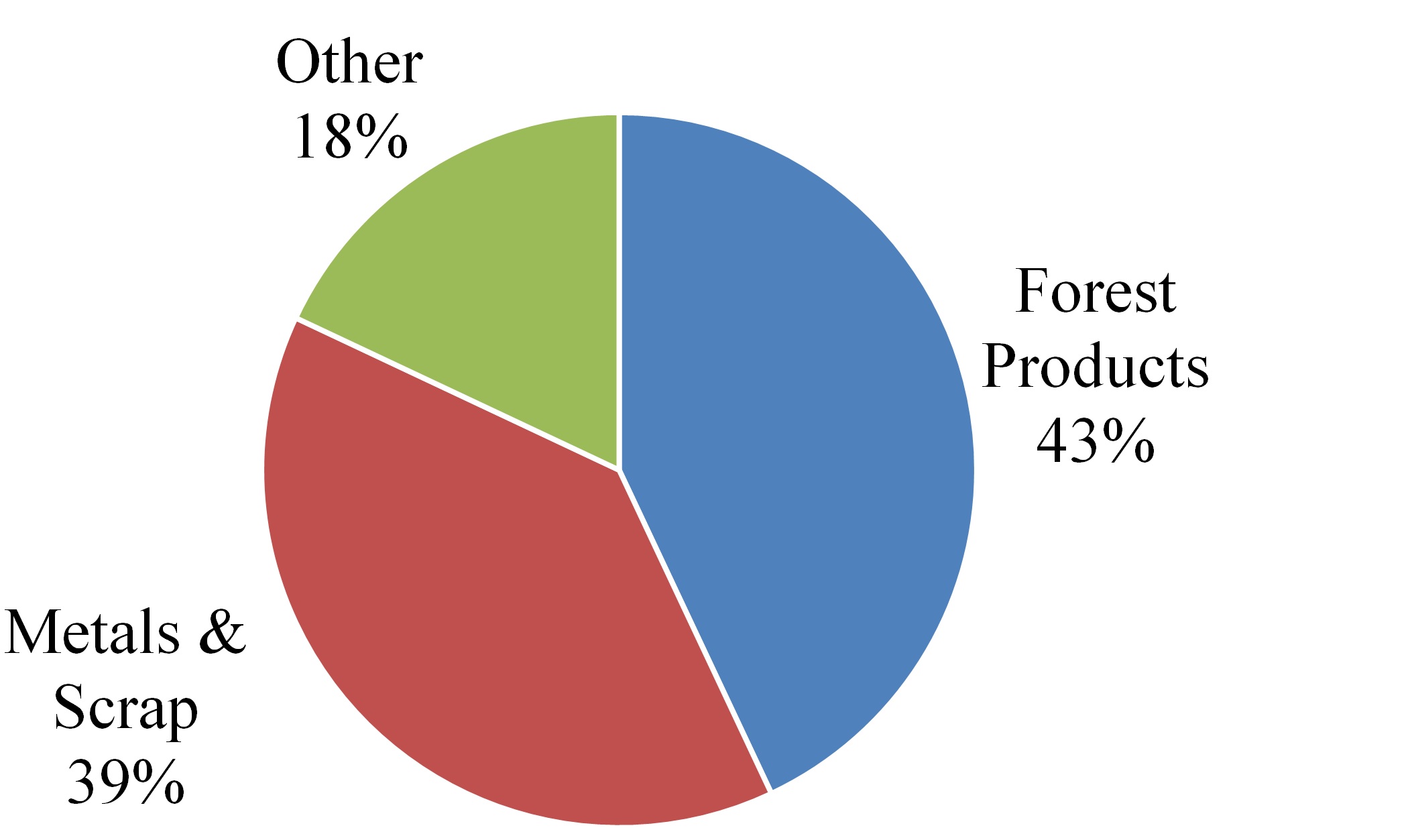

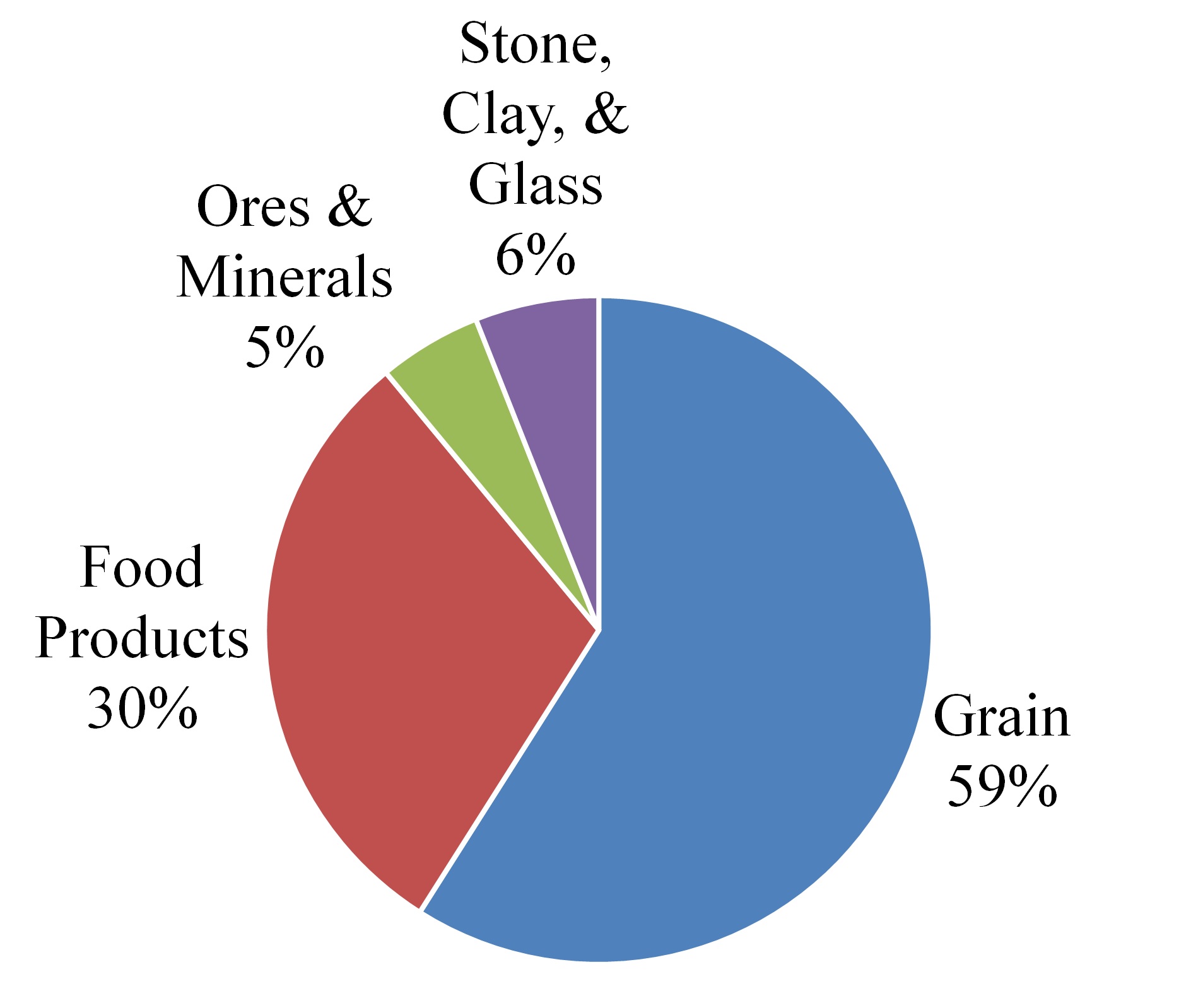

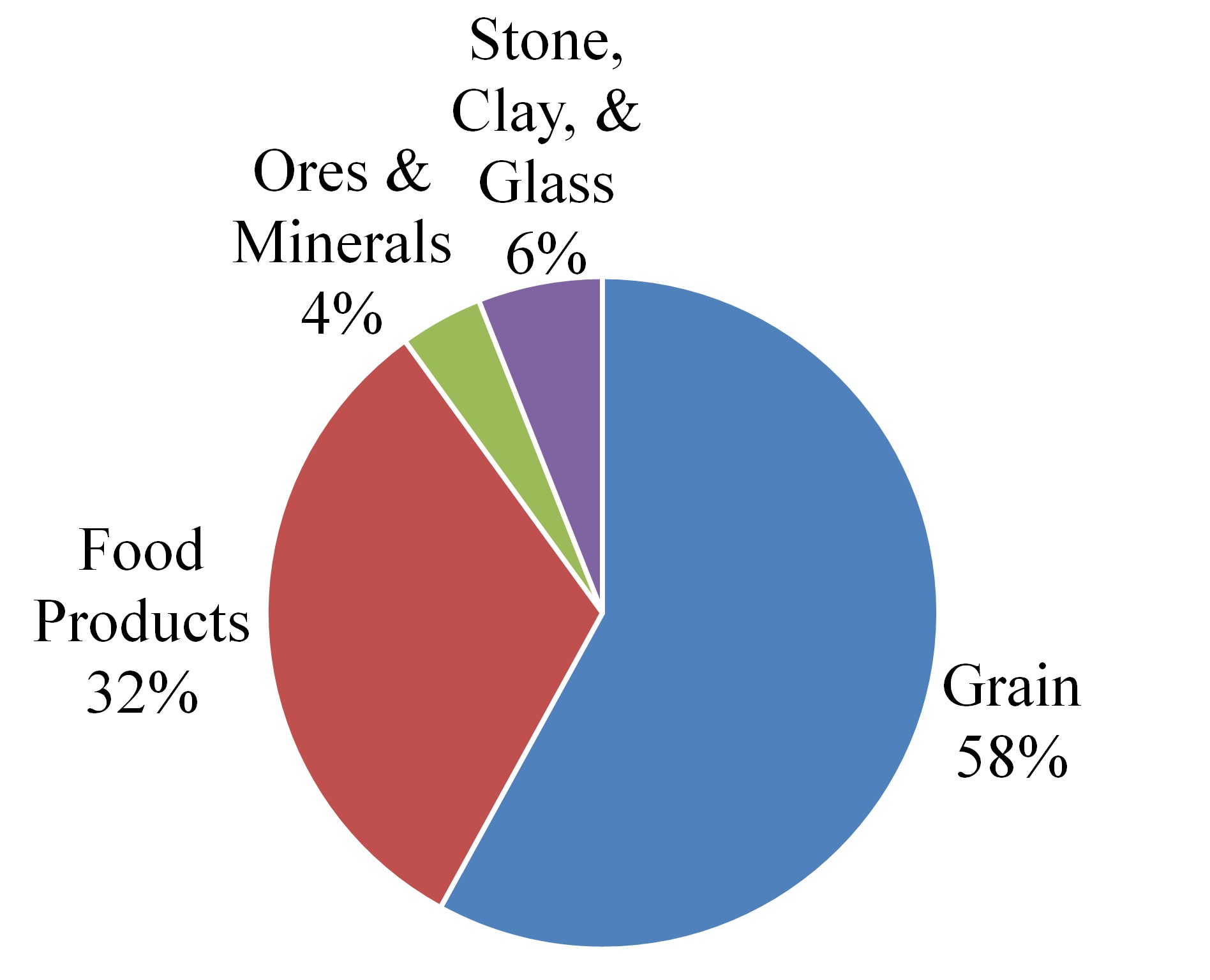

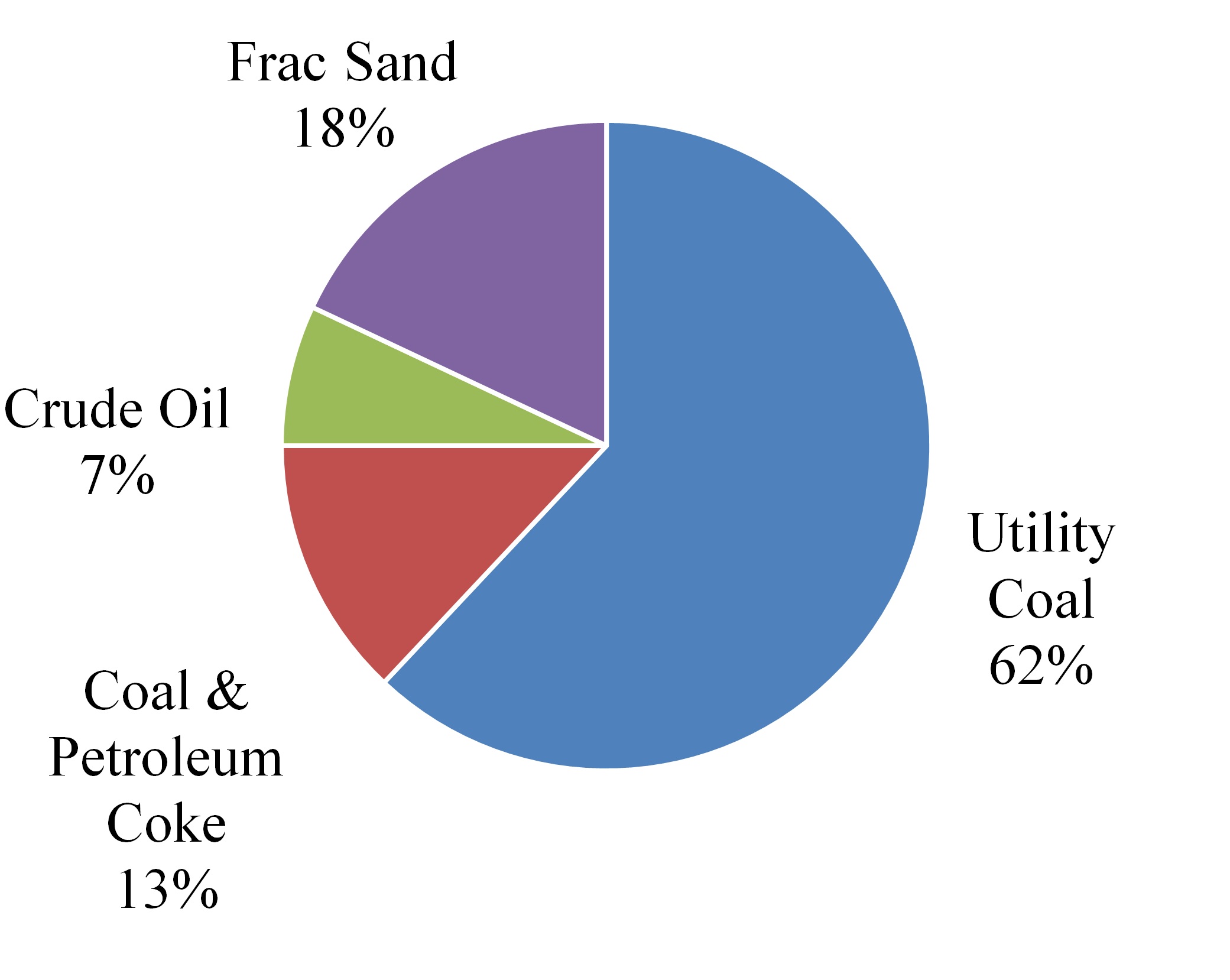

The following table presents revenues disaggregated by the major commodity groups as well as the product types included within the major commodity groups (in Mexicomillions). The Company believes disaggregation by product type best depicts how cash flows are subjectaffected by economic factors. See Note 12 for revenues by geographical area.

|

| | | | | | | |

| | Three Months Ended |

| | March 31, |

| | 2020 | | 2019 |

| Chemical & Petroleum | | | |

| Chemicals | $ | 62.5 |

| | $ | 60.5 |

|

| Petroleum | 95.8 |

| | 74.3 |

|

| Plastics | 40.3 |

| | 33.8 |

|

| Total | 198.6 |

| | 168.6 |

|

| | | | |

| Industrial & Consumer Products | | | |

| Forest Products | 68.9 |

| | 66.4 |

|

| Metals & Scrap | 62.3 |

| | 57.0 |

|

| Other | 27.8 |

| | 26.4 |

|

| Total | 159.0 |

| | 149.8 |

|

| | | | |

| Agriculture & Minerals | | | |

| Grain | 77.8 |

| | 72.7 |

|

| Food Products | 42.7 |

| | 35.7 |

|

| Ores & Minerals | 5.8 |

| | 6.5 |

|

| Stone, Clay & Glass | 8.2 |

| | 8.0 |

|

| Total | 134.5 |

| | 122.9 |

|

| | | | |

| Energy | | | |

| Utility Coal | 23.6 |

| | 32.5 |

|

| Coal & Petroleum Coke | 11.6 |

| | 10.5 |

|

| Frac Sand | 3.8 |

| | 8.0 |

|

| Crude Oil | 17.3 |

| | 13.6 |

|

| Total | 56.3 |

| | 64.6 |

|

| | | | |

| Intermodal | 88.7 |

| | 79.9 |

|

| | | | |

| Automotive | 53.9 |

| | 57.6 |

|

| | | | |

| Total Freight Revenues | 691.0 |

| | 643.4 |

|

| | | | |

| Other Revenue | 40.7 |

| | 31.4 |

|

| | | | |

| Total Revenues | $ | 731.7 |

| | $ | 674.8 |

|

Contract Balances

The amount of revenue recognized in the first quarter of 2020 from performance obligations partially satisfied in previous periods was $17.7 million. The performance obligations that were unsatisfied or partially satisfied as of March 31, 2020, were $18.2 million, which represents in-transit shipments that are fully satisfied the following month.

A receivable is any unconditional right to an excise taxconsideration, and is recognized as shipments have been completed and the relating performance obligation has been fully satisfied. At March 31, 2020 and December 31, 2019, the accounts receivable, net balance was $269.8 million and $274.2 million, respectively. Contract assets represent a conditional right to consideration in exchange for goods or services. The Company did not have any contract assets at March 31, 2020 and December 31, 2019.

Kansas City Southern and Subsidiaries

Notes to the Unaudited Consolidated Financial Statements—(Continued)

Contract liabilities represent consideration received in advance from customers, and are recognized as revenue over time as the relating performance obligation is satisfied. The amount of revenue recognized in the first quarter of 2020 that iswas included in the price of fuel.opening contract liability balance was $10.5 million. The Company is eligible forhas recognized contract liabilities within the accounts payable and utilizes an available credit for the excise tax included in the price of fuel that is purchased and consumed in locomotives and certain work equipment in Mexico. For the three and nine months ended September 30, 2017, the Company recognized an $11.1 million and $35.6 million benefit, respectively, and a $15.6 million and $49.6 million benefit for the same periods in 2016. The Mexican fuel excise tax credit is realized through the offset of the total annual Mexico income tax liability and income tax withholding payment obligations of Kansas City Southern de Mexico, S.A. de C.V. (“KCSM”), with no carryforward to future periods.

4. Hurricane Harvey

In late August 2017, Hurricane Harvey made landfallaccrued liabilities financial statement caption on the Texas coast and caused flood damage to the Company’s track infrastructure and significantly disrupted the Company’s rail service. The Company continues to evaluate the impact of Hurricane Harvey on the business and intends to file a claim under its insurance program for property damage, incremental expenses, and lost profits caused by Hurricane Harvey. Accordingly, during the three months ended September 30, 2017, the Company recognized a receivable for probable insurance recovery offsetting the impact of incremental expenses recognized in the quarter. The recognition of remaining probable insurance recoveries in excess of incremental expenses and self-insured retention represents a contingent gain, whichbalance sheet. These are considered current liabilities as they will be recognized when all contingencies have been resolved, which generally occurs atsettled in less than 12 months.

The following tables summarize the time of final settlement or when nonrefundable cash payments are received.changes in contract liabilities (in millions):

|

| | | | | | | |

| Contract liabilities | Three Months Ended |

| | March 31, |

| | 2020 | | 2019 |

| Beginning balance | $ | 30.5 |

| | $ | 32.4 |

|

| Revenue recognized that was included in the contract liability balance at the beginning of the period | (10.5 | ) | | (15.7 | ) |

| Increases due to consideration received, excluding amounts recognized as revenue during the period | 1.1 |

| | 5.6 |

|

| Ending balance | $ | 21.1 |

| | $ | 22.3 |

|

5. Earnings Per Share Data

Basic earnings per common share is computed by dividing net income available to common stockholders by the weighted-average number of common shares outstanding for the period. Diluted earnings per share adjusts basic earnings per common share for the effects of potentially dilutive common shares, if the effect is not anti-dilutive. Potentially dilutive common shares include the dilutive effects of shares issuable under the stock option and performance award plans.

The following table reconciles the basic earnings per share computation to the diluted earnings per share computation (in millions, except share and per share amounts):

|

| | | | | | | |

| | Three Months Ended |

| | March 31, |

| | 2020 | | 2019 |

| Net income available to common stockholders for purposes of computing basic and diluted earnings per share | $ | 151.7 |

| | $ | 102.7 |

|

Weighted-average number of shares outstanding (in thousands): | | | |

| Basic shares | 95,662 |

| | 100,500 |

|

| Effect of dilution | 509 |

| | 415 |

|

| Diluted shares | 96,171 |

| | 100,915 |

|

| Earnings per share: | | | |

| Basic earnings per share | $ | 1.59 |

| | $ | 1.02 |

|

| Diluted earnings per share | $ | 1.58 |

| | $ | 1.02 |

|

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Net income available to common stockholders for purposes of computing basic and diluted earnings per share | $ | 129.2 |

| | $ | 120.5 |

| | $ | 410.1 |

| | $ | 348.3 |

|

Weighted-average number of shares outstanding (in thousands): | | | | | | | |

| Basic shares | 104,324 |

| | 107,621 |

| | 105,297 |

| | 107,800 |

|

| Effect of dilution | 354 |

| | 191 |

| | 285 |

| | 199 |

|

| Diluted shares | 104,678 |

| | 107,812 |

| | 105,582 |

| | 107,999 |

|

| Earnings per share: | | | | | | | |

| Basic earnings per share | $ | 1.24 |

| | $ | 1.12 |

| | $ | 3.89 |

| | $ | 3.23 |

|

| Diluted earnings per share | $ | 1.23 |

| | $ | 1.12 |

| | $ | 3.88 |

| | $ | 3.23 |

|

Potentially dilutive shares excluded from the calculation (in thousands): |

| | | | | |

| Stock options excluded as their inclusion would be anti-dilutive | 72 |

| | 212 |

|

|

| | | | | | | | | | | |

| Stock options excluded as their inclusion would be anti-dilutive | 14 |

| | 34 |

| | 159 |

| | 220 |

|

Kansas City Southern and Subsidiaries

Notes to the Unaudited Consolidated Financial Statements—(Continued)

6. Property and Equipment (including Concession Assets)

Property and equipment, including concession assets, and related accumulated depreciation and amortization are summarized below (in millions):

|

| | | | | | | |

| | March 31,

2020 | | December 31,

2019 |

| Land | $ | 225.2 |

| | $ | 224.9 |

|

| Concession land rights | 141.1 |

| | 141.1 |

|

| Road property | 7,969.3 |

| | 7,962.1 |

|

| Equipment | 2,762.8 |

| | 2,652.6 |

|

| Technology and other | 348.8 |

| | 345.1 |

|

| Construction in progress | 203.5 |

| | 170.2 |

|

| Total property | 11,650.7 |

| | 11,496.0 |

|

| Accumulated depreciation and amortization | 2,726.7 |

| | 2,689.7 |

|

| Property and equipment (including concession assets), net | $ | 8,924.0 |

| | $ | 8,806.3 |

|

|

| | | | | | | |

| | September 30,

2017 | | December 31,

2016 |

| Land | $ | 218.7 |

| | $ | 219.2 |

|

| Concession land rights | 141.2 |

| | 141.2 |

|

| Road property | 7,438.5 |

| | 7,186.0 |

|

| Equipment | 2,530.9 |

| | 2,439.8 |

|

| Technology and other | 209.7 |

| | 182.2 |

|

| Construction in progress | 388.4 |

| | 293.4 |

|

| Total property | 10,927.4 |

| | 10,461.8 |

|

| Accumulated depreciation and amortization | 2,591.8 |

| | 2,392.1 |

|

| Property and equipment (including concession assets), net | $ | 8,335.6 |

| | $ | 8,069.7 |

|

Concession assets, net of accumulated amortization of $667.5$695.0 million and $610.7$678.1 million, totaled $2,177.8$2,342.1 million and $2,131.62,335.5 million at September 30, 2017March 31, 2020 and December 31, 20162019, respectively.

7. Fair Value Measurements

Assets and liabilities recognized at fair value are required to be classified into a three-level hierarchy. In general, fair values determined by Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access. Level 2 inputs include quoted prices for similar assets and liabilities in active markets, and inputs other than quoted prices that are observable for the asset or liability. Level 3 inputs are unobservable inputs for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value hierarchy within which the fair value measurement in its entirety falls has been determined based on the lowest level input that is significant to the fair value measurement in its entirety. The Company’s assessment of the significance of a particular input to the fair value in its entirety requires judgment and considers factors specific to the asset or liability.

The Company’s derivative financial instruments are measured at fair value on a recurring basis and consist of foreign currency forward and option contracts and treasury lock agreements, which are classified as Level 2 valuations. The Company determines the fair value of its derivative financial instrument positions based upon pricing models using inputs observed from actively quoted markets and also takes into consideration the contract terms as well as other inputs, including market currency exchange rates and in the case of option contracts, volatility, the risk-free interest rate and the time to expiration. The fair value of the foreign currency derivative instruments was an asset of $18.8 million and a liability of $41.1 million at September 30, 2017 and December 31, 2016, respectively, and the fair value of the forward treasury lock agreements was a liability of $4.6 million at September 30, 2017. There were no outstanding treasury lock agreements at December 31, 2016.

The Company’s short-term financial instruments include cash and cash equivalents, accounts receivable, accounts payable and short-term borrowings. The carrying value of the short-term financial instruments approximates their fair value.

The fair value of the Company’s debt is estimated using quoted market prices when available. When quoted market prices are not available, fair value is estimated based on current market interest rates for debt with similar maturities and credit quality. The faircarrying value of the Company’s debt was $2,396.0$3,244.1 million and $2,303.8$3,246.0 million at September 30, 2017March 31, 2020 and December 31, 2016, respectively. The carrying value was $2,278.9 million and $2,296.9 million at September 30, 2017 and December 31, 2016,2019, respectively. If the Company’s debt were measured at fair value, the fair value measurements of the individual debt instruments would have been classified as either Level 1 or Level 2 in the fair value hierarchy.

The fair value of the Company’s financial instruments is presented in the following table (in millions):

9 |

| | | | | | | | |

| | | March 31, 2020 | | December 31, 2019 |

| | | Level 2 | | Level 2 |

| Assets | | | | |

| Foreign currency derivative instruments | | $ | — |

| | $ | 2.5 |

|

| Treasury lock agreements | | 6.0 |

| | — |

|

| Liabilities | | | | |

| Debt instruments | | 3,403.0 |

| | 3,535.7 |

|

| Foreign currency derivative instruments | | 27.5 |

| | — |

|

Kansas City Southern and Subsidiaries

Notes to Consolidated Financial Statements—(Continued)

8. Derivative Instruments

The Company enters into derivative transactions in certain situations based on management’s assessment of current market conditions and perceived risks. Management intends to respond to evolving business and market conditions and in doing so, may enter into such transactions as deemed appropriate.

Kansas City Southern and Subsidiaries

Notes to the Unaudited Consolidated Financial Statements—(Continued)

Credit Risk. As a result of the use of derivative instruments, the Company is exposed to counterparty credit risk. The Company manages this risk by limiting its counterparties to large financial institutions which meet the Company’s credit rating standards and have an established banking relationship with the Company. As of September 30, 2017,March 31, 2020, the Company did not expect any losses as a result of default of its counterparties.

Interest Rate Derivative Instruments. In May 2017,March 2020, the Company executed four3 30-year treasury lock agreements with an aggregate notional value of $275.0$400.0 million and a weighted average interest rate of 2.85%1.45%. The purpose of the treasury locks is to hedge the U.S. Treasury benchmark interest rate associated with future interest payments related to the anticipated refinancing of the $275.0$444.7 million, of KCS 2.35%3.00% senior notes due May 15, 2020.2023 (the “3.00% Senior Notes”). The Company has designated the treasury locks as cash flow hedges and recorded unrealized gains and losses in Accumulatedaccumulated other comprehensive income.loss. Upon settlement, the unrealized gain or loss in Accumulatedaccumulated other comprehensive income will be amortized to interest expense over the life of the future underlying debt issuance.

Foreign Currency Derivative Instruments. The Company’s Mexican subsidiaries have net U.S. dollar-denominated monetary liabilities which, for Mexican income tax purposes, are subject to periodic revaluation based on changes in the value of the Mexican peso against the U.S. dollar. This revaluation creates fluctuations in the Company’s Mexican income tax expense and the amount of income taxes paid in Mexico. The Company hedges its exposure to this cash tax risk by entering into foreign currency forward contracts and foreign currency option contracts known as zero-cost collars.

The foreign currency forward contracts involve the Company’s purchase of pesos at an agreed-upon weighted-average exchange rate to each U.S dollar. The zero-cost collars involve the Company’s purchase of a Mexican peso call option and a simultaneous sale of a Mexican peso put option, with equivalent U.S. dollar notional amounts for each option and no net cash premium paid by the Company. The Company’s foreign currency forward and zero-cost collar contracts are executed with counterparties in the U.S. and are governed by International Swaps and Derivatives Association agreements that include standard netting arrangements. Asset and liability positions from contracts with the same counterparty are net settled upon maturity/expiration and presented on a net basis in the consolidated balance sheets prior to settlement. There was no offsetting of derivative assets or liabilities in the consolidated balance sheets as of March 31, 2020 and December 31, 2019.

Below is a summary of the Company’s 2020 and 2019 foreign currency derivative contracts (amounts in millions, except Ps./USD):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency forward contracts | | | | | | |

| | Contracts to purchase Ps./pay USD | | Offsetting contracts to sell Ps./receive USD | | |

| | Notional amount | | Notional amount | | Weighted-average exchange rate (in Ps./USD) | | Notional amount | | Notional amount | | Weighted-average exchange rate (in Ps./USD) | | Cash received/(paid) on settlement |

| Contracts executed in 2020 and outstanding | $ | 155.0 |

| | Ps. | 3,158.4 |

| | Ps. | 20.4 |

| | — |

| | — |

| | — |

| | — |

|

| Contracts executed in 2020 and settled in 2020 | $ | 305.0 |

| | Ps. | 5,816.0 |

| | Ps. | 19.1 |

| | $ | 293.3 |

| | Ps. | 5,816.0 |

| | Ps. | 19.8 |

| | $ | (7.3 | ) (i) |

| Contracts executed in 2019 and settled in 2020 | $ | 105.0 |

| | Ps. | 2,041.2 |

| | Ps. | 19.4 |

| | $ | 108.6 |

| | Ps. | 2,041.2 |

| | Ps. | 18.8 |

| | $ | 3.6 |

|

| Contracts executed in 2019 and settled in 2019 (ii) | $ | 400.0 |

| | Ps. | 7,892.5 |

| | Ps. | 19.7 |

| | $ | 410.7 |

| | Ps. | 7,892.5 |

| | Ps. | 19.2 |

| | $ | 10.7 |

|

| Contracts executed in 2018 and settled in 2019 (ii) | $ | 20.0 |

| | Ps. | 410.9 |

| | Ps. | 20.5 |

| | $ | 20.9 |

| | Ps. | 410.9 |

| | Ps. | 19.6 |

| | $ | 0.9 |

|

| | | | | | | | | | | | | | |

| Foreign currency zero-cost collar contracts | | | | |

| | Notional amount | | Cash received/(paid) on settlement | | | | | | | | | | |

| Contracts executed in 2018 and settled in 2019 (ii) | $ | 120.0 |

| | $ | 0.3 |

| | | | | | | | | | |

(i) During April 2020, the Company does not physically exchange currencies upon maturity or expirationpaid an additional $4.4 million for the settlement of itsthese forward contracts.

(ii) During the first quarter of 2019, the Company settled $120.0 million and $75.0 million of zero-cost collar contracts and forward contracts, or zero-cost collars. Instead, the Company settles the maturing/expiring transactions by entering into offsetting transactions, which resultsrespectively, resulting in a physical exchangecash received of only the net gain or loss between the Company$0.3 million and the counterparty.$0.4 million.

Kansas City Southern and Subsidiaries

Notes to the Unaudited Consolidated Financial Statements—(Continued)

Below is a summary of the Company’s 2017 and 2016 foreign currency derivative contracts (amounts in millions, except Ps./USD):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency forward contracts | | | | | | | | | | |

| | Contracts to purchase Ps./pay USD | | Offsetting contracts to sell Ps./receive USD | | |

| | Notional amount | | Notional amount | | Weighted-average exchange rate (in Ps./USD) | | Maturity date | | Notional amount | | Notional amount | | Weighted-average exchange rate (in Ps./USD) | | Maturity date | | Cash received/(paid) on settlement |

| Contracts executed in 2016 and settled in 2017 | $ | 340.0 |

| | Ps. | 6,207.7 |

| | Ps. | 18.3 |

| | 1/17/2017 |

| | $ | 287.0 |

| | Ps. | 6,207.7 |

| | Ps. | 21.6 |

| | 1/17/2017 | | $ | (53.0 | ) |

| Contracts executed in 2016 and settled in 2016 | $ | 60.0 |

| | Ps. | 1,057.3 |

| | Ps. | 17.6 |

| | 4/29/2016 |

| | $ | 60.7 |

| | Ps. | 1,057.3 |

| | Ps. | 17.4 |

| | 4/29/2016 | | $ | 0.7 |

|

| Contracts executed in 2015 and settled in 2016 | $ | 300.0 |

| | Ps. | 4,480.4 |

| | Ps. | 14.9 |

| | 1/15/2016 |

| | $ | 251.0 |

| | Ps. | 4,480.4 |

| | Ps. | 17.9 |

| | 1/15/2016 | | $ | (49.0 | ) |

| | | | | | | | | | | | | | | | | | |

| Foreign currency zero-cost collar contracts | | | | | | | | | | | | |

| | Notional amount | | Maturity date | | Weighted-average call rate outstanding options (in Ps./USD) | | Weighted-average put rate outstanding options (in Ps./USD) | | Cash received/(paid) on settlement | | | | | | | | |

| Contracts executed in 2017 and partially settled in 2017 | $ | 255.0 |

| | 1/16/2018 |

| | Ps. | 21.6 |

| | Ps. | 24.7 |

| | $ | 7.7 | (i) | | | | | | | | |

| Contracts executed in 2017 and settled in 2017 | $ | 10.0 |

| | 1/18/2018 |

| | — |

| | — |

| | $ | 0.4 |

| | | | | | | | |

| Contracts executed in 2017 and settled in 2017 | $ | 70.0 |

| | 7/27/2017 |

| | — |

| | — |

| | $ | 4.7 |

| | | | | | | | |

| Contracts executed in 2017 and settled in 2017 | $ | 195.0 |

| | 4/25/2017 |

| | — |

| | — |

| | $ | 25.8 |

| | | | | | | | |

| Contracts executed in 2015 and settled in 2016 | $ | 80.0 |

| | 1/15/2016 |

| | — |

| | — |

| | $ | (10.1 | ) | | | | | | | | |

(i) During February and September 2017, the Company settled $115.0 million and $25.0 million, respectively, of the zero-cost collar contracts.

The Company has not designated any of the foreign currency derivative contracts as hedging instruments for accounting purposes. The Company measures the foreign currency derivative contracts at fair value each period and recognizes any change in fair value in Foreignforeign exchange gain (loss) within the Consolidated Statementsconsolidated statements of Income.income. The cash flows associated with these instruments is classified as an operating activity within the consolidated statements of cash flows.

Kansas City Southern and Subsidiaries

Notes to Consolidated Financial Statements—(Continued)

The following tables present the fair value of derivative instruments included in the Consolidated Balance Sheets (in millions): | | | | Derivative Assets | Derivative Assets |

| | Balance Sheet Location | | September 30,

2017 | | December 31, 2016 | Balance Sheet Location | | March 31,

2020 | | December 31, 2019 |

| Derivatives designated as hedging instruments: | | | | | |

| Treasury lock agreements | | Other assets | | $ | 6.0 |

| | $ | — |

|

| Total derivatives designated as hedging instruments | | | 6.0 |

| | — |

|

| Derivatives not designated as hedging instruments: | | | | | | | | |

| Foreign currency zero-cost collar contracts | Other current assets | | $ | 18.8 |

| | $ | — |

| |

| Foreign currency forward contracts | | Other current assets | | — |

| | 2.5 |

|

| Total derivatives not designated as hedging instruments | | 18.8 |

| | — |

| | — |

| | 2.5 |

|

| Total derivative assets | | $ | 18.8 |

| | $ | — |

| | $ | 6.0 |

| | $ | 2.5 |

|

|

| | | | | | | | | |

| | Derivative Liabilities |

| | Balance Sheet Location | | March 31,

2020 | | December 31, 2019 |

| Derivatives not designated as hedging instruments: | | | | | |

| Foreign currency forward contracts | Accounts payable and accrued liabilities | | $ | 27.5 |

| | $ | — |

|

| Total derivatives not designated as hedging instruments | | | 27.5 |

| | — |

|

| Total derivative liabilities | | | $ | 27.5 |

| | $ | — |

|

|

| | | | | | | | | |

| | Derivative Liabilities |

| | Balance Sheet Location | | September 30,

2017 | | December 31, 2016 |

| Derivatives designated as hedging instruments: | | | | | |

| Treasury lock agreements | Other noncurrent liabilities and deferred credits | | $ | 4.6 |

| | $ | — |

|

| Total derivatives designated as hedging instruments | | | 4.6 |

| | — |

|

| Derivatives not designated as hedging instruments: | | | | | |

| Foreign currency forward contracts | Accounts payable and accrued liabilities | | — |

| | 41.1 |

|

| Total derivatives not designated as hedging instruments | | | — |

| | 41.1 |

|

| Total derivative liabilities | | | $ | 4.6 |

| | $ | 41.1 |

|

The following table presents the effects of derivative instruments on the Consolidated Statements of Income and Consolidated Statements of Comprehensive Income for the three months ended March 31 (in millions):

|

| | | | | | | | | | | | | | | | | | |

| Derivatives in Cash Flow Hedging Relationships | | Amount of Gain/(Loss) Recognized in OCI on Derivative | | Location of Gain/(Loss) Reclassified from AOCI into Income | | Amount of Gain/(Loss) Reclassified from AOCI into Income |

| | | 2020 | | 2019 | | | | 2020 | | 2019 |

| Treasury lock agreements | | $ | 6.0 |

| | $ | (6.8 | ) | | Interest expense | | $ | (0.6 | ) | | $ | — |

|

| Total | | $ | 6.0 |

| | $ | (6.8 | ) | | | | $ | (0.6 | ) | | $ | — |

|

| | | Derivatives in Cash Flow Hedging Relationships | | | Amount of Gain/(Loss) Recognized in OCI on Derivative | |

| | | Three Months Ended | | Nine Months Ended | |

| | | September 30, | | September 30, | |

| | | 2017 | | 2016 | | 2017 | | 2016 | |

| Treasury lock agreements | | $ | (0.8 | ) | | $ | — |

| | $ | (4.6 | ) | | $ | — |

| |

| Total | | $ | (0.8 | ) | | $ | — |

| | $ | (4.6 | ) | | $ | — |

| |

|

| | | | | | | |

| Derivatives Not Designated as Hedging Instruments | Location of Gain/(Loss) Recognized in Income on Derivative | | Amount of Gain/(Loss) Recognized in Income on Derivative | | Location of Gain/(Loss) Recognized in Income on Derivative | | Amount of Gain/(Loss) Recognized in Income on Derivative |

| | | Three Months Ended | | Nine Months Ended | | 2020 | | 2019 |

| | | September 30, | | September 30, | |

| | | 2017 | | 2016 | | 2017 | | 2016 | |

| Foreign currency forward contracts | Foreign exchange gain (loss) | | $ | — |

| | $ | (16.1 | ) | | $ | (11.9 | ) | | $ | (31.9 | ) | | Foreign exchange gain (loss) | | $ | (33.7 | ) | | $ | 3.6 |

|

| Foreign currency zero-cost collar contracts | Foreign exchange gain (loss) | | 3.3 |

| | — |

| | 57.4 |

| | (3.9 | ) | |

| Total | | $ | 3.3 |

| | $ | (16.1 | ) | | $ | 45.5 |

| | $ | (35.8 | ) | | $ | (33.7 | ) | | $ | 3.6 |

|

See Note 7, Fair Value Measurements, for the determination of the fair values of derivatives.

9. Short-Term Borrowings

Commercial Paper. The Company’s commercial paper program generally serves as the primary means of short-term funding. As of September 30, 2017,March 31, 2020 and December 31, 2019, KCS had $355.9 million0 commercial paper outstanding, net of $0.1 million discount, at a weighted-average interest rate of 1.661%. As of Decemberoutstanding. For the three months ended March 31, 2016, KCS had $181.3 million of2020 and 2019, any commercial paper borrowings were outstanding for less than 90 days and the related activity is presented on a net basis in the consolidated statements of $0.1 million discount, at a weighted-average interest rate of 1.290%.cash flows.

Kansas City Southern and Subsidiaries

Notes to the Unaudited Consolidated Financial Statements—(Continued)

10. EquityShare Repurchases

The following tables summarize the changes in equity (in millions):

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2017 | | Three Months Ended September 30, 2016 |

| | Kansas City Southern Stockholders’ Equity | | Noncontrolling Interest | | Total Equity | | Kansas City Southern Stockholders’ Equity | | Noncontrolling Interest | | Total Equity |

| Beginning balance | $ | 4,192.6 |

| | $ | 315.2 |

| | $ | 4,507.8 |

| | $ | 4,020.6 |

| | $ | 311.1 |

| | $ | 4,331.7 |

|

| Net income | 129.3 |

| | 0.6 |

| | 129.9 |

| | 120.6 |

| | 0.4 |

| | 121.0 |

|

| Other comprehensive loss | (0.7 | ) | | — |

| | (0.7 | ) | | (0.3 | ) | | — |

| | (0.3 | ) |

| Contribution from noncontrolling interest | — |

| | — |

| | — |

| | — |

| | 2.4 |

| | 2.4 |

|

| Dividends on common stock | (37.3 | ) | | — |

| | (37.3 | ) | | (35.5 | ) | | — |

| | (35.5 | ) |

Dividends on $25 par preferred stock

| (0.1 | ) | | — |

| | (0.1 | ) | | (0.1 | ) | | — |

| | (0.1 | ) |

| Share repurchases | (200.0 | ) | | — |

| | (200.0 | ) | | (40.6 | ) | | — |

| | (40.6 | ) |

| Options exercised and stock subscribed, net of shares withheld for employee taxes | 2.7 |

| | — |

| | 2.7 |

| | 2.9 |

| | — |

| | 2.9 |

|

| Excess tax benefit from share-based compensation | — |

| | — |

| | — |

| | 0.2 |

| | — |

| | 0.2 |

|

| Share-based compensation | 4.1 |

| | — |

| | 4.1 |

| | 4.1 |

| | — |

| | 4.1 |

|

| Ending balance | $ | 4,090.6 |

| | $ | 315.8 |

| | $ | 4,406.4 |

| | $ | 4,071.9 |

| | $ | 313.9 |

| | $ | 4,385.8 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2017 | | Nine Months Ended September 30, 2016 |

| | Kansas City Southern Stockholders’ Equity | | Noncontrolling Interest | | Total Equity | | Kansas City Southern Stockholders’ Equity | | Noncontrolling Interest | | Total Equity |

| Beginning balance | $ | 4,089.9 |

| | $ | 314.6 |

| | $ | 4,404.5 |

| | $ | 3,914.3 |

| | $ | 310.4 |

| | $ | 4,224.7 |

|

| Cumulative-effect adjustment (i) | 2.5 |

| | — |

| | 2.5 |

| | — |

| | — |

| | — |

|

| Net income | 410.3 |

| | 1.2 |

| | 411.5 |

| | 348.5 |

| | 1.1 |

| | 349.6 |

|

| Other comprehensive loss | (1.7 | ) | | — |

| | (1.7 | ) | | (1.0 | ) | | — |

| | (1.0 | ) |

| Contribution from noncontrolling interest | — |

| | — |

| | — |

| | — |

| | 2.4 |

| | 2.4 |

|

| Dividends on common stock | (107.2 | ) | | — |

| | (107.2 | ) | | (106.7 | ) | | — |

| | (106.7 | ) |

| Dividends on $25 par preferred stock | (0.2 | ) | | — |

| | (0.2 | ) | | (0.2 | ) | | — |

| | (0.2 | ) |

| Share repurchases | (320.4 | ) | | — |

| | (320.4 | ) | | (99.8 | ) | | — |

| | (99.8 | ) |

| Options exercised and stock subscribed, net of shares withheld for employee taxes | 2.8 |

| | — |

| | 2.8 |

| | 1.8 |

| | — |

| | 1.8 |

|

| Excess tax benefit from share-based compensation | — |

| | — |

| | — |

| | (0.2 | ) | | — |

| | (0.2 | ) |

| Share-based compensation | 14.6 |

| | — |

| | 14.6 |

| | 15.2 |

| | — |

| | 15.2 |

|

| Ending balance | $ | 4,090.6 |

| | $ | 315.8 |

| | $ | 4,406.4 |

| | $ | 4,071.9 |

| | $ | 313.9 |

| | $ | 4,385.8 |

|

| |

(i) | The Company recognized a $2.5 million net cumulative-effect adjustment to equity as of January 1, 2017, due to the adoption of ASU 2016-09, Improvements to Employee Share-Based Payment Accounting. For additional discussion, see Note 1 - Basis of Presentation.

|

Kansas City Southern and Subsidiaries

Notes to Consolidated Financial Statements—(Continued)

Share Repurchase Programs

During the second quarter of 2017, the Company concluded a $500.0 million share repurchase program that was announced in May 2015 (the “2015 Program”). In August 2017,November 2019, the Company announced a new common share repurchase program authorizing the Company to repurchasepurchase up to $800.0 million$2.0 billion of its outstanding shares of common stock through June 30, 2020December 31, 2022 (the “2017“2019 Program”). Share repurchases may be made in the open market, through privately negotiated transactions, or through an accelerated share repurchase (“ASR”) program limited to $200.0 million.transactions.

Under an ASR agreement, the Company pays a specified amount to a financial institution and receives an initial delivery of shares. Upon settlement of the ASR agreement, typically the financial institution delivers additional shares, with theThe final aggregate number and total cost of shares delivered determined with reference torepurchased is then based on the volume weighted-averagevolume-weighted average price per share of the Company’s common stock overduring the term of the ASR agreement, less a negotiated discount.agreements. The transactions are accounted for as equity transactions with any excess of repurchase price over par value allocated between additional paid-in capital and retained earnings. At the time the shares are received, there is an immediate reduction in the weighted-average number of shares outstanding for purposes of the basic and diluted earnings per share computation.

During the thirdfourth quarter of 2017,2019, the Company entered into twopaid $550.0 million under 2 ASR agreements and received an aggregate initial delivery of shares, which represented approximately 85% of the total shares to be received under the agreements. The final number and total cost of shares repurchased was then based on the volume-weighted-average price of the Company’s common stock during the term of the agreements, which were settled in March 2020. The terms of the ASR agreements, structured as outlined above, were as follows:

| | | Third Party Institution | | Agreement Date | | Settlement Date | | Total Amount of Agreement (in millions) | | Initial Shares Delivered | | Fair Market Value of Initial Shares (in millions) | | Additional Shares Delivered | | Fair Market Value of Additional Shares (in millions) | | Total Shares Delivered | | Weighted-Average Price Per Share | | Agreement Date | | Settlement Date | | Total Amount of Agreement (in millions) | | Initial Shares Delivered | | Fair Market Value of Initial Shares (in millions) | | Additional Shares Delivered | | Fair Market Value of Additional Shares (in millions) | | Total Shares Delivered | | Weighted-Average Price Per Share |

| ASR Agreement #1 | | August 2017 | | August 2017 | | $ | 100.0 |

| | 799,398 |

| | $ | 85.0 |

| | 151,481 |

| | $ | 15.0 |

| | 950,879 |

| | $ | 105.17 |

| | November 2019 | | March 2020 | | $ | 275.0 |

| | 1,511,380 | | $ | 233.75 |

| | 224,244 |

| | $ | 41.25 |

| | 1,735,624 | | $ | 158.44 |

|

| ASR Agreement #2 | | August 2017 | | October 2017 | | $ | 100.0 |

| | 799,398 |

| | $ | 85.0 |

| | 151,492 |

| | $ | 15.0 | (i) | | 950,890 |

| | $ | 105.16 |

| | November 2019 | | March 2020 | | $ | 275.0 |

| | 1,511,380 | | $ | 233.75 |

| | 221,692 |

| | $ | 41.25 |

| | 1,733,072 | | $ | 158.68 |

|

| Total | | $ | 200.0 |

| | 1,598,796 |

| | $ | 170.0 |

| | 302,973 |

| | $ | 30.0 |

| | 1,901,769 |

| | $ | 105.17 |

| | $ | 550.0 |

| | 3,022,760 |

| | $ | 467.5 |

| | 445,936 |

| | $ | 82.5 |

| | 3,468,696 |

| | $ | 158.56 |

|

(i)The remaining $15.0 million as of September 30, 2017 was recorded as a forward contract indexed to

During the Company’s own common stock and included in capital surplus within Additional paid-in capital in the accompanying Consolidated Balance Sheet, and was subsequently settled in October 2017.

Following settlement of the ASR program in October 2017, the Company’s 2017 repurchasesthree months ended March 31, 2020, KCS repurchased 1,291,635 shares of common stock for $194.2 million, which includes shares delivered to settle the ASR agreements noted above. Since inception of the 2019 Program, KCS has repurchased through the 2015 Program and the 2017 Program, totaled 3,241,9784,314,395 shares of common stock for $661.7 million at an average price of $98.83$153.37 per shareshare. The excess of repurchase price over par value is allocated between additional paid-in capital and a total cost of $320.4 million.retained earnings.

Cash Dividends on Common Stock

On August 15, 2017, the Company’s Board of Directors declared a cash dividend of $0.360 per share payable on October 4, 2017, to common stockholders of record as of September 11, 2017. The aggregate amount of the dividends declared for the three and nine months ended September 30, 2017 was $37.3 million and $107.2 million, respectively.

The following table presents the amount of cash dividends declared per common share by the Company’s Board of Directors:

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Cash dividends declared per common share | $ | 0.360 |

| | $ | 0.330 |

| | $ | 1.020 |

| | $ | 0.990 |

|

11. Commitments and Contingencies

Concession Duty. Under KCSM’s 50-yearKansas City Southern de México, S.A. de C.V. (“KCSM”)’s 50-year railroad concession from the Mexican government (the “Concession”), which wouldcould expire in 2047 unless extended, KCSM pays annual concession duty expense of 1.25% of gross revenues. For the three and nine months ended September 30, 2017March 31, 2020, the concession duty expense, which is recorded within Materialsmaterials and other in operating expenses, was $4.2$4.8 million, and $12.7 million, respectively, compared to $3.9 million and $11.2$4.2 million for the same periodsperiod in 2016.2019.

Kansas City Southern and Subsidiaries

Notes to Consolidated Financial Statements—(Continued)

Litigation. The Occasionally, the Company is a party to various legal proceedings, and regulatory examinations, investigations,

administrative actions, alland other legal matters, arising for the most part in the ordinary course of which, except as set forth below, are of an ordinary, routine nature andbusiness, incidental to its operations. Included in these proceedings are various tort claims brought by current and former employees for job-related injuries and by third parties for injuries related to railroad operations. KCS aggressively defends these matters and has established liability provisions whichthat management believes are adequate to cover expected costs. AlthoughThe outcome of litigation and other legal matters is always uncertain. KCS believes it has valid defenses to the legal matters currently pending against it, is not possibledefending itself vigorously, and has recorded accruals determined in accordance with U.S. GAAP, where appropriate. In making a determination regarding accruals, using available information, KCS evaluates the likelihood of an unfavorable outcome in legal or regulatory proceedings to predict with certaintywhich it is a party to and records a loss contingency when it is probable a liability has been incurred and the outcomeamount of any legal proceeding, in the opinion of management, other than those proceedings described in detail below, such proceedings and actions should not, individually, or in the aggregate, have a material adverse effectloss can be reasonably estimated. These subjective determinations are based on the Company’sstatus of such legal or regulatory proceedings, the merits of KCS’s defenses and consultation with legal counsel. Actual outcomes of these legal and regulatory proceedings may materially differ from the current

Kansas City Southern and Subsidiaries

Notes to the Unaudited Consolidated Financial Statements—(Continued)

estimates. It is possible that resolution of one or more of the legal matters currently pending or threatened could result in losses material to KCS’s consolidated results of operations, liquidity or financial statements.condition.

Environmental Liabilities. The Company’s U.S. operations are subject to extensive federal, state and local environmental laws and regulations. The major U.S. environmental laws to which the Company is subject include, among others, the federal Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA,” also known as the Superfund law), the Toxic Substances Control Act, the FederalClean Water Pollution Control Act, and the Hazardous Materials Transportation Act. CERCLA can impose joint and several liabilities for cleanup and investigation costs, without regard to fault or legality of the original conduct, on current and predecessor owners and operators of a site, as well as those who generate, or arrange for the disposal of hazardous substances. The Company does not believe that compliance with the requirements imposed by the environmental lawslegislation will impair its competitive capability or result in any material additional capital expenditures, operating or maintenance costs. The Company is, however, subject to environmental remediation costs as described in the following paragraphs.

The Company’s Mexico operations are subject to Mexican federal and state laws and regulations relating to the protection of the environment through the establishment of standards for water discharge, water supply, emissions, noise pollution, hazardous substances and transportation and handling of hazardous and solid waste. The Mexican government may bring administrative and criminal proceedings, impose economic sanctions against companies that violate environmental laws, and temporarily or even permanently close non-complying facilities.