UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 10-Q

__________________________

|

|

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended February 28,August 31, 2018

OR

|

|

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-7102

__________________________

NATIONAL RURAL UTILITIES

COOPERATIVE FINANCE CORPORATION

(Exact name of registrant as specified in its charter)

__________________________

|

| | |

| District of Columbia | | 52-0891669 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

|

| 20701 Cooperative Way, Dulles, Virginia, 20166 |

| (Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including area code: (703) 467-1800

__________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer☒ Smaller reporting company☐ Emerging growth company ☐

(Do not check if a smaller reporting company)

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transaction period for complying with any new or revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

TABLE OF CONTENTS

INDEX OF MD&A TABLES

| | | Table | | Description | | Page | | Description | | Page |

| — | | MD&A Tables: | | | |

| 1 | | Summary of Selected Financial Data | | 2 |

| | Summary of Selected Financial Data | | 2 |

|

| 2 | | Average Balances, Interest Income/Interest Expense and Average Yield/Cost | | 8 |

| | Average Balances, Interest Income/Interest Expense and Average Yield/Cost | | 8 |

|

| 3 | | Rate/Volume Analysis of Changes in Interest Income/Interest Expense | | 11 |

| | Rate/Volume Analysis of Changes in Interest Income/Interest Expense | | 10 |

|

| 4 | | Non-Interest Income | | 13 |

| | Non-Interest Income | | 12 |

|

| 5 | | Derivative Average Notional Amounts and Average Interest Rates | | 13 |

| | Derivative Average Notional Amounts and Average Interest Rates | | 12 |

|

| 6 | | Derivative Gains (Losses) | | 15 |

| | Derivative Gains (Losses) | | 13 |

|

| 7 | | Non-Interest Expense | | 16 |

| | Non-Interest Expense | | 14 |

|

| 8 | | Loans Outstanding by Type and Member Class | | 17 |

| | Loans Outstanding by Type and Member Class | | 15 |

|

| 9 | | Historical Retention Rate and Repricing Selection | | 18 |

| | Historical Retention Rate and Repricing Selection | | 16 |

|

| 10 | | Total Debt Outstanding | | 19 |

| | Total Debt Outstanding | | 17 |

|

| 11 | | Member Investments | | 20 |

| | Member Investments | | 18 |

|

| 12 | | Collateral Pledged | | 21 |

| | Collateral Pledged | | 19 |

|

| 13 | | Unencumbered Loans | | 22 |

| | Unencumbered Loans | | 20 |

|

| 14 | | Guarantees Outstanding | | 23 |

| | Guarantees Outstanding | | 21 |

|

| 15 | | Maturities of Guarantee Obligations | | 24 |

| | Maturities of Guarantee Obligations | | 22 |

|

| 16 | | Unadvanced Loan Commitments | | 24 |

| | Unadvanced Loan Commitments | | 22 |

|

| 17 | | Notional Maturities of Unadvanced Loan Commitments | | 25 |

| | Notional Maturities of Unadvanced Loan Commitments | | 22 |

|

| 18 | | Maturities of Notional Amount of Unconditional Committed Lines of Credit | | 26 |

| | Maturities of Notional Amount of Unconditional Committed Lines of Credit | | 23 |

|

| 19 | | Loan Portfolio Security Profile | | 27 |

| | Loan Portfolio Security Profile | | 25 |

|

| 20 | | Credit Exposure to 20 Largest Borrowers | | 29 |

| | Credit Exposure to 20 Largest Borrowers | | 26 |

|

| 21 | | TDR Loans | | 30 |

| | Troubled Debt Restructured Loans | | 28 |

|

| 22 | | Net Charge-Offs (Recoveries) | | 30 |

| | Allowance for Loan Losses | | 29 |

|

| 23 | | Allowance for Loan Losses | | 31 |

| | Rating Triggers for Derivatives | | 30 |

|

| 24 | | Rating Triggers for Derivatives | | 32 |

| | Available Liquidity | | 31 |

|

| 25 | | Liquidity Reserve | | 33 |

| | Committed Bank Revolving Line of Credit Agreements | | 32 |

|

| 26 | | Committed Bank Revolving Line of Credit Agreements | | 34 |

| | Short-Term Borrowings—Funding Sources | | 33 |

|

| 27 | | Short-Term Borrowings | | 36 |

| | Short-Term Borrowings | | 34 |

|

| 28 | | Issuances and Maturities of Long-Term and Subordinated Debt | | 37 |

| | Issuances and Maturities of Long-Term and Subordinated Debt | | 34 |

|

| 29 | | Principal Maturity of Long-Term and Subordinated Debt | | 37 |

| | Principal Maturity of Long-Term and Subordinated Debt | | 35 |

|

| 30 | | Projected Sources and Uses of Liquidity | | 38 |

| | Projected Sources and Uses of Liquidity | | 36 |

|

| 31 | | Credit Ratings | | 39 |

| | Credit Ratings | | 36 |

|

| 32 | | Interest Rate Gap Analysis | | 41 |

| | Interest Rate Gap Analysis | | 38 |

|

| 33 | | Adjusted Financial Measures — Income Statement | | 42 |

| | Adjusted Financial Measures—Income Statement | | 39 |

|

| 34 | | TIER and Adjusted TIER | | 42 |

| | TIER and Adjusted TIER | | 40 |

|

| 35 | | Adjusted Financial Measures — Balance Sheet | | 43 |

| | Adjusted Financial Measures—Balance Sheet | | 40 |

|

| 36 | | Debt-to-Equity Ratio | | 43 |

| | Debt-to-Equity Ratio | | 40 |

|

| 37 | | | Members’ Equity | | 41 |

|

PART I—FINANCIAL INFORMATION

| |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) |

|

|

| FORWARD-LOOKING STATEMENTS |

This Quarterly Report on Form 10-Q contains certain statements that are considered “forward-looking statements” within the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, are generally identified by our use of words such as “intend,” “plan,” “may,” “should,” “will,” “project,” “estimate,” “anticipate,” “believe,” “expect,” “continue,” “potential,” “opportunity” and similar expressions, whether in the negative or affirmative. All statements about future expectations or projections, including statements about loan volume, the appropriateness of the allowance for loan losses, operating income and expenses, leverage and debt-to-equity ratio,ratios, borrower financial performance, impaired loans, and sources and uses of liquidity, are forward-looking statements. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, actual results and performance may differ materially from our forward-looking statements due to several factors. Factors that could cause future results to vary from our forward-looking statements include, but are not limited to, general economic conditions, legislative changes including those that could affect our tax status, governmental monetary and fiscal policies, demand for our loan products, lending competition, changes in the quality or composition of our loan portfolio, changes in our ability to access external financing, changes in the credit ratings on our debt, valuation of collateral supporting impaired loans, charges associated with our operation or disposition of foreclosed assets, technological changes within the rural electric utility industry, regulatory and economic conditions in the rural electric industry, nonperformance of counterparties to our derivative agreements, the costs and effects of legal or governmental proceedings involving us or our members and the factors listed and described under “Item 1A. Risk Factors” ofin our Annual Report on Form 10-K for the fiscal year ended May 31, 20172018 (“20172018 Form 10-K”). Except as required by law, we undertake no obligation to update or publicly release any revisions to forward-looking statements to reflect events, circumstances or changes in expectations after the date on which the statement is made.

National Rural Utilities Cooperative Finance Corporation (“CFC”) is a member-owned cooperative association incorporated under the laws of the District of Columbia in April 1969. CFC’s principal purpose is to provide its members with financing to supplement the loan programs of the Rural Utilities Service (“RUS”) of the United States Department of Agriculture (“USDA”). CFC makes loans to its rural electric members so they can acquire, construct and operate electric distribution, generation and transmission (“power supply”) systems and related facilities. CFC also provides its members with credit enhancements in the form of letters of credit and guarantees of debt obligations. As a cooperative, CFC is owned by and exclusively serves its membership, which consists of not-for-profit entities or subsidiaries or affiliates of not-for-profit entities. CFC is exempt from federal income taxes under Section 501(c)(4) of the Internal Revenue Code. As a member-owned cooperative, CFC’s objective is not to maximize profit, but rather to offer its members cost-based financial products and services. CFC funds its activities primarily through a combination of public and private issuances of debt securities, member investments and retained equity. As a Section 501(c)(4) tax-exempt, member-owned cooperative, we cannot issue equity securities.

Our financial statements include the consolidated accounts of CFC, National Cooperative Services Corporation (“NCSC”), Rural Telephone Finance Cooperative (“RTFC”) and subsidiaries created and controlled by CFC to hold foreclosed assets resulting from defaulted loans or bankruptcy. NCSC is a taxable member-owned cooperative that may provide financing to members of CFC, government or quasi-government entities which own electric utility systems that meet the Rural Electrification Act definition of “rural” and for-profit and nonprofit entities that are owned, operated or controlled by, or provide significant benefits to certain members of CFC. RTFC is a taxable Subchapter T cooperative association that provides financing for its rural telecommunications members and their affiliates. CFC did not hold, and did not have any subsidiaries or other entities that held, foreclosed assets as of February 28,August 31, 2018 or May 31, 2017.2018. See “Item 1. Business—Overview” ofin our 20172018 Form 10-K for additional information on the business activities of each of these entities. Unless stated otherwise, references to “we,” “our” or “us” relate to CFC and its consolidated entities. All references to members within this document include members, associates and affiliates of CFC and its consolidated entities.

Our principal operations are currently organized for management reporting purposes into three business segments: CFC, NCSC and RTFC. Management monitors a variety of key indicators to evaluate our business performance. The following MD&A is intended to provide the reader with an understanding of our results of operations, financial condition and liquidity by discussing the drivers offactors influencing changes from period to period and the key measures used by management to evaluate performance, such as net interest income, net interest yield, loan growth, debt-to-equity ratio, growth and credit quality metrics. We provide additional information on the financial performance of each of our business segments in “Note 13—Business Segments.” The MD&A section is provided as a supplement to, and should be read in conjunction with our unaudited condensed consolidated financial statements and related notes in this Report, our audited consolidated financial statements and related notes in our 20172018 Form 10-K and additional information contained in our 20172018 Form 10-K, including the risk factors discussed under “Part I—Item 1A. Risk Factors,” as well as any risk factors identified under “Part II—Item 1A. Risk Factors” in this Report.

|

|

| SUMMARY OF SELECTED FINANCIAL DATA |

Table 1 provides a summary of consolidated selected financial data for the three and nine months ended February 28,August 31, 2018 and 2017, and as of February 28,August 31, 2018 and May 31, 2017.2018. In addition to financial measures determined in accordance with generally accepted accounting principles in the United States (“GAAP”), management also evaluates performance based on certain non-GAAP measures and metrics, which we refer to as “adjusted” measures. Certain financial covenant provisions in our credit agreements are also based on non-GAAP financial measures. Our key non-GAAP financial measures are adjusted net income, adjusted net interest income, adjusted interest expense, adjusted net interest yield, adjusted times interest earned ratio (“adjusted TIER”) and adjusted debt-to-equity ratio. The most comparable GAAP measures are net income, net interest income, interest expense, net interest yield, TIER and debt-to-equity ratio, respectively. The primary adjustments we make to calculate these non-GAAP measures consist of (i) adjusting interest expense and net interest income to include the impact of net periodic derivative cash settlements; (ii) adjusting net income, senior debt and total equity to exclude the non-cash impact of the accounting for derivative financial instruments; (iii) adjusting senior debt to exclude the amount that funds CFC member loans guaranteed by RUS, subordinated deferrable debt and members’ subordinated certificates; and (iv) adjusting total equity to include subordinated deferrable debt and members’ subordinated certificates and exclude cumulative derivative forward value gains and losses and accumulated other comprehensive income. We believe our non-GAAP adjusted measures, which are not a substitute for GAAP and may not be consistent with similarly titled non-GAAP measures used by other companies, provide meaningful information and are useful to investors because management evaluates performance based on these metrics, and certain financial covenants in our committed bank revolving line of credit agreements and debt indentures are based on adjusted measures. See “Non-GAAP Financial Measures” for a detailed reconciliation of these adjusted measures to the most comparable GAAP measures.

Table 1: Summary of Selected Financial Data

| | | | | Three Months Ended February 28, | | Nine Months Ended February 28, | | | Three Months Ended August 31, | |

| (Dollars in thousands) | | 2018 | | 2017 | | Change | | 2018 | | 2017 | | Change | | 2018 | | 2017 | | Change |

| Statement of operations | | | | | | | | | | | |

| Statement of income | | | | | | | |

| Interest income | | $ | 271,468 |

| | $ | 259,920 |

| | 4% | | $ | 803,206 |

| | $ | 773,911 |

| | 4% | | $ | 278,491 |

| | $ | 265,915 |

| | 5% |

| Interest expense | | (198,071 | ) | | (186,740 | ) | | 6 | | (585,972 | ) | | (551,474 | ) | | 6 | | (210,231 | ) | | (192,731 | ) | | 9 |

| Net interest income | | 73,397 |

| | 73,180 |

| | — | | 217,234 |

| | 222,437 |

| | (2) | | 68,260 |

| | 73,184 |

| | (7) |

| Fee and other income | | 3,935 |

| | 5,810 |

| | (32) | | 13,422 |

| | 15,437 |

| | (13) | | 3,185 |

| | 3,945 |

| | (19) |

| Total net revenue | | 77,332 |

| | 78,990 |

| | (2) | | 230,656 |

| | 237,874 |

| | (3) | |

| Provision for loan losses | | (1,105 | ) | | (2,065 | ) | | (46) | | (503 | ) | | (4,731 | ) | | (89) | |

Derivative gains(1) | | 168,048 |

| | 42,455 |

| | 296 | | 247,443 |

| | 194,822 |

| | 27 | |

| Total revenue | | | 71,445 |

| | 77,129 |

| | (7) |

| Benefit for loan losses | | | 109 |

| | 298 |

| | (63) |

Derivative gains (losses)(1) | | | 7,183 |

| | (46,198 | ) | | ** |

| Results of operations of foreclosed assets | | — |

| | (29 | ) | | ** | | (34 | ) | | (1,690 | ) | | (98) | | — |

| | (24 | ) | | ** |

Operating expenses(2) | | (22,212 | ) | | (20,710 | ) | | 7 | | (65,762 | ) | | (62,201 | ) | | 6 | | (23,205 | ) | | (21,636 | ) | | 7 |

| Other non-interest expense | | (402 | ) | | (294 | ) | | 37 | | (1,542 | ) | | (1,254 | ) | | 23 | | (7,494 | ) | | (522 | ) | | 1,336 |

| Income before income taxes | | 221,661 |

| | 98,347 |

| | 125 | | 410,258 |

| | 362,820 |

| | 13 | | 48,038 |

| | 9,047 |

| | 431 |

| Income tax expense | | (632 | ) | | (385 | ) | | 64 | | (1,491 | ) | | (1,815 | ) | | (18) | | (60 | ) | | (32 | ) | | 88 |

| Net income | | $ | 221,029 |

| | $ | 97,962 |

| | 126 | | $ | 408,767 |

| | $ | 361,005 |

| | 13 | | $ | 47,978 |

| | $ | 9,015 |

| | 432 |

| | | | | Three Months Ended February 28, | | Nine Months Ended February 28, | | | Three Months Ended August 31, | |

| | | 2018 | | 2017 | | Change | | 2018 |

| 2017 | | Change | | 2018 |

| 2017 | | Change |

| Adjusted operational financial measures | | | | | | | | | | | | | | |

Adjusted interest expense(3) | | $ | (216,995 | ) | | $ | (206,094 | ) | | 5% | | $ | (644,753 | ) | | $ | (615,805 | ) | | 5% | | $ | (223,060 | ) | | $ | (212,953 | ) | | 5% |

Adjusted net interest income(3) | | 54,473 |

| | 53,826 |

| | 1 | | 158,453 |

| | 158,106 |

| | — | | 55,431 |

| | 52,962 |

| | 5 |

Adjusted net income(3) | | 34,057 |

| | 36,153 |

| | (6) | | 102,543 |

| | 101,852 |

| | 1 | | 27,966 |

| | 34,991 |

| | (20) |

| | | | | | | | | | | | | | | |

| Selected ratios | | | | | | | | | | | | | | |

Fixed-charge coverage ratio/TIER (4) | | 2.12 |

| | 1.52 |

| | 60 bps | | 1.70 |

| | 1.65 |

| | 5 bps | | 1.23 |

| | 1.05 |

| | 18 bps |

Adjusted TIER(3) | | 1.16 |

| | 1.18 |

| | (2) | | 1.16 |

| | 1.17 |

| | (1) | | 1.13 |

| | 1.16 |

| | (3) |

Net interest yield(5) | | 1.16 | % | | 1.19 | % | | (3) | | 1.15 | % | | 1.22 | % | | (7) | | 1.04 | % | | 1.16 | % | | (12) |

Adjusted net interest yield(3)(6) | | 0.86 |

| | 0.87 |

| | (1) | | 0.84 |

| | 0.86 |

| | (2) | | 0.85 |

| | 0.84 |

| | 1 |

Net charge-off rate(7) | | — |

| | — |

| | — | | — |

| | 0.01 |

| | (1) | |

| | | | | | | | | | | | | | | |

| | | | | | | February 28, 2018 | | May 31, 2017 | | Change | | August 31, 2018 | | May 31, 2018 | | Change |

| Balance sheet | | | | | | | | | | | | | | |

| Cash and cash equivalents | | | | | | $ | 250,697 |

| | $ | 166,615 |

| | 50% | |

| Cash, cash equivalents and restricted cash | | | $ | 274,502 |

| | $ | 238,824 |

| | 15% |

| Investment securities | | | | | | 337,900 |

| | 92,554 |

| | 265 | | 642,360 |

| | 609,851 |

| | 5 |

Loans to members(8) | | | | | | 25,342,922 |

| | 24,367,044 |

| | 4 | |

Loans to members(7) | | | 25,182,654 |

| | 25,178,608 |

| | — |

| Allowance for loan losses | | | | | | (37,879 | ) | | (37,376 | ) | | 1 | | (18,692 | ) | | (18,801 | ) | | (1) |

| Loans to members, net | | | | | | 25,305,043 |

| | 24,329,668 |

| | 4 | | 25,163,962 |

| | 25,159,807 |

| | — |

| Total assets | | | | | | 26,476,407 |

| | 25,205,692 |

| | 5 | | 26,676,207 |

| | 26,690,204 |

| | — |

| Short-term borrowings | | | | | | 3,493,736 |

| | 3,342,900 |

| | 5 | | 3,793,136 |

| | 3,795,910 |

| | — |

| Long-term debt | | | | | | 18,813,136 |

| | 17,955,594 |

| | 5 | | 18,674,932 |

| | 18,714,960 |

| | — |

| Subordinated deferrable debt | | | | | | 742,375 |

| | 742,274 |

| | — | | 742,445 |

| | 742,410 |

| | — |

| Members’ subordinated certificates | | | | | | 1,379,693 |

| | 1,419,025 |

| | (3) | | 1,378,097 |

| | 1,379,982 |

| | — |

| Total debt outstanding | | | | | | 24,428,940 |

| | 23,459,793 |

| | 4 | | 24,588,610 |

| | 24,633,262 |

| | — |

| Total liabilities | | | | | | 25,017,303 |

| | 24,106,887 |

| | 4 | | 25,169,631 |

| | 25,184,351 |

| | — |

| Total equity | | | | | | 1,459,104 |

| | 1,098,805 |

| | 33 | | 1,506,576 |

| | 1,505,853 |

| | — |

Guarantees(9) | | | | | | 679,968 |

| | 889,617 |

| | (24) | |

Guarantees(8) | | | 776,687 |

| | 805,161 |

| | (4) |

| | | | | | | | | | | | | | | |

| Selected ratios period end | | | | | | | | | |

| | | | | |

|

Allowance coverage ratio(10) | | | | | | 0.15 | % | | 0.15 | % | | — | |

Debt-to-equity ratio(11) | | | | | | 17.15 |

| | 21.94 |

| | (479) | |

Allowance coverage ratio(9) | | | 0.07 | % | | 0.07 | % | | — |

Debt-to-equity ratio(10) | | | 16.71 |

| | 16.72 |

| | (1) |

Adjusted debt-to-equity ratio(3) | | | | | | 6.21 |

| | 5.95 |

| | 26 | | 6.21 |

| | 6.18 |

| | 3 |

** ChangeCalculation of percentage change is not meaningful.

(1)Consists of derivativeinterest rate swap cash settlements and derivative forward value gains (losses). Derivative cash settlement amounts represent net periodic contractual interest accruals related to derivatives not designated for hedge accounting. Derivative forward value gains (losses) represent changes in fair value during the period, excluding net periodic contractual interest accruals, related to derivatives not designated for hedge accounting and expense amounts reclassified into income related to the cumulative transition loss recorded in accumulated other comprehensive income as of June 1, 2001, as a result of the adoption of the derivative accounting guidance that required derivatives to be reported at fair value on the balance sheet.

(2)Consists of salaries and employee benefits and the other general and administrative expenses components of non-interest expense, each of which are presented separately on our consolidated statements of operations.income.

(3)See “Non-GAAP Financial Measures” for details on the calculation of these non-GAAP adjusted measures and the reconciliation to the most comparable GAAP measures.

(4)Calculated based on net income (loss) plus interest expense for the period divided by interest expense for the period. The fixed-charge coverage ratios and TIER were the same during each period presented because we did not have any capitalized interest during these periods.

(5)Calculated based on annualized net interest income for the period divided by average interest-earning assets for the period.

(6)Calculated based on annualized adjusted net interest income for the period divided by average interest-earning assets for the period.

(7)Calculated based on annualized net charge-offs (recoveries) for the period divided by average total outstanding loans for the period.

(8)Consists of the outstanding principal balance of member loans plus unamortized deferred loan origination costs, which totaled $11 million as of both February 28,August 31, 2018 and May 31, 2017.2018.

(9)(8)Reflects the total amount of member obligations for which CFC has guaranteed payment to a third party as of the end of each period. This amount represents our maximum exposure to loss, which significantly exceeds the guarantee liability recorded on our consolidated balance sheets. See “Note 10—11—Guarantees” for additional information.

(10)(9)Calculated based on the allowance for loan losses at period end divided by total outstanding loans at period end.

(11)(10)Calculated based on total liabilities at period end divided by total equity at period end.

Our primary objective as a member-owned cooperative lender is to provide cost-based financial products to our rural electric members while maintaining a sound financial position required for investment-grade credit ratings on our debt instruments. Our objective is not to maximize net income; therefore, the rates we charge our member-borrowers reflect our adjusted interest expense plus a spread to cover our operating expenses, a provision for loan losses and earnings sufficient to achieve interest coverage to meet our financial objectives. Our goal is to earn an annual minimum adjusted TIER of 1.10 and to maintain an adjusted debt-to-equity ratio at approximately or below 6.00-to-1.

We are subject to period-to-period volatility in our reported GAAP results due to changes in market conditions and differences in the way our financial assets and liabilities are accounted for under GAAP. Our financial assets and liabilities expose us to interest-rate risk. We use derivatives, primarily interest rate swaps, as part of our strategy in managing this risk. Our derivatives are intended to economically hedge and manage the interest-rate sensitivity mismatch between our financial assets and liabilities. We are required under GAAP to carry derivatives at fair value on our consolidated balance sheet; however, the financial assets and liabilities for which we use derivatives to economically hedge are carried at amortized cost. Changes in interest rates and spreads result in periodic fluctuations in the fair value of our derivatives, which may cause volatility in our earnings because we do not apply hedge accounting.accounting for our interest rate swaps. As a result, the mark-to-market changes in our derivativesinterest rate swaps are recorded in earnings. Based on the composition of our derivatives,interest rate swaps, we generally record derivative losses in earnings when interest rates decline and derivative gains when interest rates rise. This earnings volatility generally is not indicative of the underlying economics of our business, as the derivative forward fair value gains or losses recorded each period may or may not be realized over time, depending on the terms of our derivative instruments and future changes in market conditions that impact actual derivativethe periodic cash settlement amounts.amounts of our interest rate swaps. As such, management uses our adjusted non- GAAPnon-GAAP results whichto evaluate our operating performance. Our adjusted results include realized net periodic derivative settlementsinterest rate swap settlement amounts but exclude the impact of unrealized derivative forward fair value gains and losses, to evaluate our operating performance. Because derivative forward fair value gains and losses do not impact our cash flows, liquidity or ability to service our debt costs, ourlosses. Our financial debt covenants are also based on our non-GAAP adjusted results.results, as the forward fair value gains and losses related to our interest rate swaps do not affect our cash flows, liquidity or ability to service our debt.

Financial Performance

Reported Results

We reported net income of $221$48 million and a TIER of 2.121.23 for the quarter ended February 28,August 31, 2018 (“current quarter”), compared with net income of $98$9 million and a TIER of 1.521.05 for the same prior-year quarter. We reported net income of $409 million and a TIER of 1.70 for the nine months ended February 28, 2018, compared with net income of $361 million and a TIER of 1.65 for the same prior-year period. Our debt-to-equity ratio decreased slightly to 17.15-to-116.71 as of February 28,August 31, 2018, from 21.94-to-116.72 as of May 31, 2017,2018, primarily due to ana decline in liabilities as equity remained relatively unchanged. In July 2018, the CFC Board of Directors authorized the allocation of patronage capital of $95 million for fiscal year 2018 and the retirement of 50% of this amount, or $48 million, which was returned to members in August 2018. The increase in equity resulting from our reported net income of $409$48 million for the nine months ended February 28, 2018, whichcurrent quarter was partially offset by patronage capitalthe retirement of $45 million in September 2017.patronage capital.

The variance of $123$39 million between our reported net income of $221$48 million infor the current quarter and our net income of $98$9 million for the same prior-year quarter was primarily driven primarily by a favorable shift in the mark-to-market changes in the fair value of our derivatives. We recognized derivative gains of $168$7 million in the current quarter compared with derivative gains of $42 million in the same prior-year quarter, both of which were attributabledue to a net increase in the fair value of our pay-fixed swaps resulting from a slight rise in medium- and long-term interest rates. In contrast, we recognized derivative losses of $46 million during the comparable prior-year quarter, mainly due to a modest flattening of the swap curve as interest rates increased acrosson the swap yieldshorter end of the curve during each period. The increase inrose while medium- and long-term interest rates however, was more pronounced during the current quarter, which resulteddeclined slightly. The favorable shift of $53 million in the significantly higher derivative gains relative tofair value of our derivatives was offset in part by the same prior-year quarter. Althoughrecognition of losses of $7 million on the early extinguishment of debt, a decrease in net interest income of $73$5 million forand an increase in operating expenses of $2 million. The decrease in net interest income resulted from compression in the current quarter was relatively unchanged from the same

prior-year quarter, net interest yield, decreased 3which was partially offset by an increase in average interest-earning assets of $1,068 million, or 4%. Net interest yield declined by 12 basis points to 1.16%1.04%, largely due toprimarily driven by an overall increase in our overall average cost of funds attributabledue to the increase in short-term interest rates, which resulted in a higher average cost for our short-term and variable-rate borrowings.

The variance of $48 million between our reported net income of $409 million for the nine months ended February 28, 2018 and our net income of $361 million for the same prior-year period was also driven primarily by mark-to-market changes in the fair value of our derivatives. We recognized derivative gains of $247 million for the nine months ended February 28, 2018, compared with derivative gains of $195 million for the same prior-year period, both due to an increase in interest rates across the swap yield curve. The increase in interest rates, however, was more pronounced during the current nine-month period, with the 10-year and 30-year swap rates increasing by 74 basis pointsand 53 basis points, respectively, compared with increases of 64 basis points and 44 basis points, respectively, in the same prior year period. We experienced a decrease in net interest income of $5 million due to compression in the net interest yield and an increase in operating expenses of $4 million, which were partially offset by a decrease in the provision for loan losses of $4 million. Our net interest yield was 1.15% for the nine months ended February 28, 2018, a decrease of 7 basis points from the same prior-year period. The decrease was primarily due to an overall increase in our average cost of fundsborrowings resulting from the higher average cost of ourrise in short-term and variable-rate borrowings.interest rates.

Adjusted Non-GAAP Results

Our adjusted net income totaled $34$28 million and our adjusted TIER was 1.161.13 for the current quarter, compared with adjusted net income of $36$35 million and adjusted TIER of 1.181.16 for the same prior-year quarter. Our adjusted net income totaled $103debt-to-equity ratio increased to 6.21 as of August 31, 2018, from 6.18 as of May 31, 2018, primarily attributable to a decrease in adjusted equity due to the patronage capital retirement of $48 million, andwhich more than offset our adjusted TIER was 1.16 for the nine months ended February 28, 2018, compared with adjusted net income of $102$28 million.

The decrease in adjusted net income of $7 million and adjusted TIERin the current quarter from the comparable prior-year quarter was primarily driven by losses on the early extinguishment of 1.17 for the same prior-year period. Our adjusted debt-to-equity ratio increased to 6.21-to-1 asdebt of February 28, 2018, from 5.95-to-1 as of May 31, 2017, largely due to$7 million and an increase in debt outstanding to fund loan growth.

Ouroperating expenses of $2 million, offset in part by an increase in adjusted net interest income for the current quarter and nine months ended February 28, 2018 remained relatively unchanged from the same prior-year periods, as the compressionof $2 million. The increase in the adjusted net interest yield resulting from an increase in our overall average cost of fundsincome was offset byattributable to the increase in average interest-earning assets. In addition, the decrease in fee incomeassets $1,068 million and thea slight increase in operating expenses were offset by the decrease in the provision for loan losses. Our adjusted net interest yield was 0.86% and 0.84% for the current quarter and the nine months ended February 28, 2018, respectively, reflecting a decrease of 1 basis point and 2 basis points, respectively, from the same prior-year periods due to the overall increase in our average cost of funds driven by the higher average cost of our short-term and variable-rate borrowings resulting from the increase in short-term interest rates.0.85%.

Lending Activity and Credit Performance

Loans to members totaled $25,343$25,183 million as of February 28,August 31, 2018, an increase of $976 million, or 4%,relatively unchanged from May 31, 2017. The increase was primarily due to an increase in2018. CFC distribution loans of $862 million, an increase in NCSC loans of $187 million and an increase in RTFC loans of $9increased by $87 million, which were partiallywas offset by a decreasedecreases in CFC power supply loans, NCSC loans and RTFC loans of $82 million.$76 million, $6 million and $5 million, respectively.

Long-term loan advances totaled $1,864$468 million during the nine months ended February 28, 2018,current quarter, with approximately 64%71% of those advances for capital expenditures by members and 25% for the refinancing of loans made by other lenders. CFC had long-term fixed-rate loans totaling $783$193 million that were scheduled to reprice during the nine months ended February 28, 2018.current quarter. Of this total, $646$96 million repriced to a new long-term fixed rate, $135rate; $48 million repriced to a long-term variable raterate; and $2$49 million werewas repaid in full.

The overall credit quality of our loan portfolio remained high as of August 31, 2018, as evidenced by our strong credit performance metrics. We had no delinquent or nonperforming loans as of August 31, 2018, and no loan defaults or charge-offs during the current quarter. Outstanding loans to electric utility organizations represented approximately 99% of total outstanding loan portfolio as of August 31, 2018, unchanged from May 31, 2018. We historically have had limited defaults and losses on loans in our electric utility loan portfolio. We generally lend to members on a senior secured basis, which reduces the risk of loss in the event of a borrower default. Of our total loans outstanding, 93% were secured and 7% were unsecured as of both August 31, 2018 and May 31, 2018.

Financing Activity

OurWe issue debt primarily to fund growth in our loan portfolio. As such, our outstanding debt volume generally increases and decreases in response to member loan demand. As total outstanding loans increased during the nine months ended February 28, 2018, our debt volume also increased. Total debt outstanding was $24,429$24,589 million as of February 28,August 31, 2018, an increase of $969 million, or 4%,relatively unchanged from May 31, 2017. The increase was primarily attributable2018, as loans to a net increasemembers also remained flat. Decreases in collateral trust bonds, dealer medium-term notes of $694 million, a net increase in thecommercial paper and Federal Agricultural Mortgage Corporation (“Farmer Mac”) notes payable of $292$296 million, a net increase$135 million, and $114 million, respectively, were largely offset by increases in dealer medium-term notes of $291 million and in member commercial

paper, select notes and daily liquidity fund notes of $49 million and a net increase in$238 million. Outstanding dealer commercial paper outstanding of $55 million. These increases were partially offset by a net decrease in notes payable to the Federal Financing Bank under the Guaranteed Underwriter Program$929 million and $1,064 million as of the USDA (“Guaranteed Underwriter Program”)August 31, 2018 and May 31, 2018, respectively, was below our maximum threshold of $114$1,250 million.

We provide additional information on our financing activities below under “Consolidated Balance Sheet Analysis—Debt” and “Liquidity Risk.”

Outlook for the Next 12 Months

We currently expect that our net interest income, net interest yield, adjusted net interest income, net income, adjusted net income, tier, adjusted tier, net interest yield and adjusted net interest yield will increase over the next 12 months as a result of a projected decrease in our average cost of funds and an increase in average outstanding loans. We havefunds. Long-term debt scheduled maturities of higher-cost debtto mature over the next 12 months including $1,830totaled $2,820 million as of August 31, 2018. Included in this amount is $880 million aggregate principal amount of higher-cost collateral trust bonds with a weighted average coupon rate of 6.98%.9.60%, scheduled to mature on November 1, 2018. On July 12, 2018, we redeemed $300 million of our 10.375% collateral trust bonds due November 1, 2018, leaving a remaining outstanding principal

amount of $700 million. We expect that we will be able to replace this higher-cost debt with lower-cost funding, which will reduce our aggregate weighted average cost of funds. We expect the amount of long-term loan advances to exceed anticipated loan repayments over the next 12 months, resulting in an increase in average outstanding loans.

Long-term debt scheduled to mature over the next 12 months totaled $2,862 million as of February 28, 2018. We believe we have sufficient liquidity from the combination of existing cash and cash equivalents, member loan repayments, committed bank revolving lines of credit, committed loan facilities from the Federal Financing Bank guaranteed by RUS under the Guaranteed Underwriter Program (“Guaranteed Underwriter Program”), revolving note purchase agreements with Farmer Mac and our ability to issue debt in the capital markets, to our members and in private placements, to meet the demand for member loan advances and to satisfy our obligations to repay long-term debt maturing over the next 12 months. As of February 28,August 31, 2018, we hadsources of liquidity readily available for access to liquidity reserves totaling $7,254totaled $7,295 million, which consistedconsisting of (i) $251$266 million in cash and cash equivalents,equivalents; (ii) up to $1,225 million available under committed loan facilities under the Guaranteed Underwriter Program,Program; (iii) up to $3,083$3,082 million available under committed bank revolving line of credit agreements,agreements; (iv) up to $300 million available under a committed revolving note purchase agreement with Farmer Mac,Mac; and (v) up to $2,395$2,422 million available under a revolving note purchase agreement with Farmer Mac, subject to market conditions. On August 17, 2018, we executed a commitment letter for a $750 million loan facility under the Guaranteed Underwriter Program. The amount available for access under the Guaranteed Underwriter Program, based on amounts advanced to us as of August 31, 2018, will increase to $1,975 million upon closing of the facility.

We believe we can continue to roll over the outstanding member short-term debt of $2,439$2,864 million as of February 28,August 31, 2018, based on our expectation that our members will continue to reinvest their excess cash in our commercial paper, daily liquidity fund notes, select notes and medium-term notes. Although we expect to continue accessing the dealer commercial paper market to help meet our liquidity needs, we intend to manage our short-term wholesale funding risk by maintaining outstanding dealer commercial paper at an amount below $1,250 million for the foreseeable future. We expect to continue to be in compliance with the covenants under our committed bank revolving line of credit agreements, which will allow us to mitigate our roll-over risk, as we can draw on these facilities to repay dealer or member commercial paper that cannot be

rolled over. refinanced with similar debt.

While we are not subject to bank regulatory capital rules, we generally aim to maintain an adjusted debt-to-equity ratio at approximately or below 6.00-to-1. Our adjusted debt-to-equity ratio was 6.21 as of February 28,August 31, 2018, above our targeted threshold due to the increasedecrease in debt outstanding to fund loan growth. Due to anticipated asset growth, weadjusted equity resulting from the patronage capital retirement of $48 million during the quarter. We expect that our adjusted debt-to-equity ratio will decrease during the remainder of the fiscal year due to be abovean increase in equity from earnings. As a result, we believe our adjusted debt-to equity ratio will decrease closer to our target ratio of 6.00-to-1 over the next 12 months.

|

|

| CRITICAL ACCOUNTING POLICIES AND ESTIMATES |

The preparation of financial statements in accordance with GAAP requires management to make a number of judgments, estimates and assumptions that affect the amount of assets, liabilities, income and expenses in the consolidated financial statements. Understanding our accounting policies and the extent to which we use management’s judgment and estimates in applying these policies is integral to understanding our financial statements. We provide a discussion of our significant accounting policies under “Note 1—Summary of Significant Accounting Policies” in our 20172018 Form 10-K.

We have identified certain accounting policies as critical because they involve significant judgments and assumptions about highly complex and inherently uncertain matters, and the use of reasonably different estimates and assumptions could have a material impact on our results of operations or financial condition. Our most critical accounting policies and estimates involve the determination of the allowance for loan losses and fair value. We evaluate our critical accounting estimates and judgments required by our policies on an ongoing basis and update them as necessary based on changing conditions. There

were no material changes in the key inputs and assumptions used in our critical accounting policies during the nine months ended February 28, 2018.current quarter. Management has discussed significant judgments and assumptions in applying our critical accounting policies with the Audit Committee of our board of directors. We provide additional information on our critical accounting policies and estimates under “MD&A—Critical Accounting Policies and Estimates” in our 20172018 Form 10-K. See “Item 1A. Risk Factors” in our 20172018 Form 10-K for a discussion of the risks associated with management’s judgments and estimates in applying our accounting policies and methods.

|

|

| RECENT ACCOUNTING CHANGES AND OTHER DEVELOPMENTS |

See “Note 1—Summary of Significant Accounting Policies” for information on accounting standards adopted during the current quarter, as well as recently issued accounting standards not yet required to be adopted and the expected impact of the adoption of these accounting standards. We also discuss the expected impact of the Tax Cuts and Jobs Act (“The Act”), which the President of the United States signed and enacted into law on December 22, 2017. To the extent we believe the adoption of new accounting standards has had or will have a material impact on our consolidated results of operations, financial condition or liquidity, we also discuss the impact in the applicable section(s) of this MD&A.

|

|

| CONSOLIDATED RESULTS OF OPERATIONS |

The section below provides a comparative discussion of our condensed consolidated results of operations between the three months ended February 28, 2018 and 2017 and the nine months ended February 28,August 31, 2018 and 2017. Following this section, we provide a comparative analysis of our condensed consolidated balance sheets as of February 28,August 31, 2018 and May 31, 2017.2018. You should read these sections together with our “Executive Summary—Outlook for the Next 12 Months” where we discuss trends and other factors that we expect will affect our future results of operations.

Net Interest Income

Net interest income represents the difference between the interest income earned on our interest-earning assets, which includeincludes loans and investment securities, and the interest expense on our interest-bearing liabilities. Our net interest yield represents the difference between the yield on our interest-earning assets and the cost of our interest-bearing liabilities plus the impact from non-interest bearing funding. We expect net interest income and our net interest yield to fluctuate based on changes in interest rates and changes in the amount and composition of our interest-earning assets and interest-bearing liabilities. We do not fund each individual loan with specific debt. Rather, we attempt to minimize costs and maximize efficiency by proportionately funding large aggregated amounts of loans.

Table 2 presents our average balance sheetsbalances for the three and nine months ended February 28,August 31, 2018 and 2017, and for each major category of our interest-earning assets and interest-bearing liabilities, the interest income earned or interest expense incurred, and the average yield or cost. Table 2 also presents non-GAAP adjusted interest expense, adjusted net interest income and adjusted net interest yield, which reflect the inclusion of net accrued periodic derivative cash settlements in interest expense. We provide reconciliations of our non-GAAP adjusted measures to the most comparable GAAP measures under “Non-GAAP Financial Measures.”

Table 2: Average Balances, Interest Income/Interest Expense and Average Yield/Cost

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended February 28, |

| (Dollars in thousands) | | 2018 | | 2017 |

| Assets: | | Average Balance | | Interest Income/Expense | | Average Yield/Cost | | Average Balance | | Interest Income/Expense | | Average Yield/Cost |

Long-term fixed-rate loans(1) | | $ | 22,706,134 |

| | $ | 250,201 |

| | 4.47 | % | | $ | 22,106,076 |

| | $ | 245,480 |

| | 4.50 | % |

| Long-term variable-rate loans | | 972,399 |

| | 7,020 |

| | 2.93 |

| | 811,080 |

| | 5,047 |

| | 2.52 |

|

| Line of credit loans | | 1,512,664 |

| | 10,367 |

| | 2.78 |

| | 1,162,268 |

| | 6,538 |

| | 2.28 |

|

TDR loans(2) | | 12,808 |

| | 221 |

| | 7.00 |

| | 13,381 |

| | 228 |

| | 6.91 |

|

Other income, net(3) | | — |

| | (314 | ) | | — |

| | — |

| | (230 | ) | | — |

|

| Total loans | | 25,204,005 |

| | 267,495 |

| | 4.30 |

| | 24,092,805 |

| | 257,063 |

| | 4.33 |

|

| Cash, time deposits and investment securities | | 539,728 |

| | 3,973 |

| | 2.99 |

| | 875,438 |

| | 2,857 |

| | 1.32 |

|

| Total interest-earning assets | | $ | 25,743,733 |

| | $ | 271,468 |

| | 4.28 | % | | $ | 24,968,243 |

| | $ | 259,920 |

| | 4.22 | % |

| Other assets, less allowance for loan losses | | 853,563 |

| | | | | | 617,010 |

| | | | |

| Total assets | | $ | 26,597,296 |

| | | | | | $ | 25,585,253 |

| | | | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Short-term borrowings | | $ | 3,777,158 |

| | $ | 14,593 |

| | 1.57 | % | | $ | 3,673,501 |

| | $ | 7,907 |

| | 0.87 | % |

| Medium-term notes | | 3,392,554 |

| | 28,051 |

| | 3.35 |

| | 3,377,615 |

| | 25,166 |

| | 3.02 |

|

| Collateral trust bonds | | 7,590,459 |

| | 83,730 |

| | 4.47 |

| | 7,256,227 |

| | 85,582 |

| | 4.78 |

|

| Guaranteed Underwriter Program notes payable | | 4,899,496 |

| | 34,233 |

| | 2.83 |

| | 4,864,585 |

| | 35,086 |

| | 2.93 |

|

| Farmer Mac notes payable | | 2,507,350 |

| | 13,316 |

| | 2.15 |

| | 2,305,681 |

| | 8,406 |

| | 1.48 |

|

| Other notes payable | | 32,970 |

| | 369 |

| | 4.54 |

| | 38,445 |

| | 437 |

| | 4.61 |

|

| Subordinated deferrable debt | | 742,351 |

|

| 9,414 |

| | 5.14 |

| | 742,217 |

|

| 9,410 |

| | 5.14 |

|

| Subordinated certificates | | 1,372,508 |

| | 14,365 |

| | 4.24 |

| | 1,430,089 |

| | 14,746 |

| | 4.18 |

|

| Total interest-bearing liabilities | | $ | 24,314,846 |

| | $ | 198,071 |

| | 3.30 | % | | $ | 23,688,360 |

| | $ | 186,740 |

| | 3.20 | % |

| Other liabilities | | 954,482 |

| | | | | | 798,848 |

| | | | |

| Total liabilities | | 25,269,328 |

| | | | | | 24,487,208 |

| | | | |

| Total equity | | 1,327,968 |

| | | | | | 1,098,045 |

| | | | |

| Total liabilities and equity | | $ | 26,597,296 |

| | | | | | $ | 25,585,253 |

| | | | |

| | | | | | | | | | | | | |

Net interest spread(4) | | | | | | 0.98 | % | | | | | | 1.02 | % |

Impact of non-interest bearing funding(5) | | | | | | 0.18 |

| | | | | | 0.17 |

|

Net interest income/net interest yield(6) | | | | $ | 73,397 |

| | 1.16 | % | | | | $ | 73,180 |

| | 1.19 | % |

| | | | | | | | | | | | | |

| Adjusted net interest income/adjusted net interest yield: | | | | | | | | | | | | |

| Interest income | | | | $ | 271,468 |

| | 4.28 | % | | | | $ | 259,920 |

| | 4.22 | % |

| Interest expense | | | | 198,071 |

| | 3.30 |

| | | | 186,740 |

| | 3.20 |

|

Add: Net accrued periodic derivative cash settlements(7) | | | | 18,924 |

| | 0.71 |

| | | | 19,354 |

| | 0.74 |

|

Adjusted interest expense/adjusted average cost(8) | | | | $ | 216,995 |

| | 3.62 | % | | | | $ | 206,094 |

| | 3.53 | % |

| | | | | | | | | | | | | |

Adjusted net interest spread(4) | | | | | | 0.66 | % | | | | | | 0.69 | % |

| Impact of non-interest bearing funding | | | | | | 0.20 |

| | | | | | 0.18 |

|

Adjusted net interest income/adjusted net interest yield(9) | | | | $ | 54,473 |

| | 0.86 | % | | | | $ | 53,826 |

| | 0.87 | % |

| | | | | Nine Months Ended February 28, | | Three Months Ended August 31, |

| (Dollars in thousands) | | 2018 | | 2017 | | 2018 | | 2017 |

| Assets: | | Average Balance | | Interest Income/Expense | | Average Yield/Cost | | Average Balance | | Interest Income/Expense | | Average Yield/Cost | | Average Balance | | Interest Income/Expense | | Average Yield/Cost | | Average Balance | | Interest Income/Expense | | Average Yield/Cost |

Long-term fixed-rate loans(1) | | $ | 22,510,725 |

| | $ | 748,491 |

| | 4.45 | % | | $ | 21,832,967 |

| | $ | 733,425 |

| | 4.49 | % | | $ | 22,695,516 |

| | $ | 251,801 |

| | 4.40 | % | | $ | 22,371,291 |

| | $ | 249,364 |

| | 4.42 | % |

| Long-term variable-rate loans | | 900,067 |

| | 18,980 |

| | 2.82 |

| | 763,831 |

| | 14,561 |

| | 2.55 |

| | 1,071,550 |

| | 9,381 |

| | 3.47 |

| | 842,968 |

| | 5,863 |

| | 2.76 |

|

| Line of credit loans | | 1,398,346 |

| | 27,662 |

| | 2.64 |

| | 1,083,863 |

| | 18,057 |

| | 2.23 |

| | 1,422,853 |

| | 11,633 |

| | 3.24 |

| | 1,353,349 |

| | 8,707 |

| | 2.55 |

|

TDR loans(2) | | 12,954 |

| | 669 |

| | 6.90 |

| | 14,717 |

| | 677 |

| | 6.15 |

| | 12,552 |

| | 218 |

| | 6.89 |

| | 13,122 |

| | 226 |

| | 6.83 |

|

Other income, net(3) | | — |

| | (852 | ) | | — |

| | — |

| | (795 | ) | | — |

| | — |

| | (325 | ) | | — |

| | — |

| | (232 | ) | | — |

|

| Total loans | | 24,822,092 |

| | 794,950 |

| | 4.28 |

| | 23,695,378 |

| | 765,925 |

| | 4.32 |

| | 25,202,471 |

| | 272,708 |

| | 4.29 |

| | 24,580,730 |

| | 263,928 |

| | 4.26 |

|

| Cash, time deposits and investment securities | | 476,532 |

| | 8,256 |

| | 2.32 |

| | 749,508 |

| | 7,986 |

| | 1.42 |

| | 809,409 |

| | 5,783 |

| | 2.83 |

| | 363,645 |

| | 1,987 |

| | 2.17 |

|

| Total interest-earning assets | | $ | 25,298,624 |

| | $ | 803,206 |

| | 4.24 | % | | $ | 24,444,886 |

| | $ | 773,911 |

| | 4.23 | % | | $ | 26,011,880 |

| | $ | 278,491 |

| | 4.25 | % | | $ | 24,944,375 |

| | $ | 265,915 |

| | 4.23 | % |

| Other assets, less allowance for loan losses | | 645,712 |

| | | | | | 634,590 |

| | | | | | 726,260 |

| | | | | | 560,169 |

| | | | |

| Total assets | | $ | 25,944,336 |

| |

|

| | | | $ | 25,079,476 |

| |

|

| |

|

| | $ | 26,738,140 |

| |

|

| | | | $ | 25,504,544 |

| |

|

| |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | |

|

| |

|

| |

|

| |

|

| |

|

| | | |

|

| |

|

| |

|

| |

|

| |

|

|

| Short-term borrowings | | $ | 3,330,949 |

| | $ | 35,248 |

| | 1.41 | % | | $ | 3,209,128 |

| | $ | 18,198 |

| | 0.76 | % | | $ | 3,519,995 |

| | $ | 19,419 |

| | 2.19 | % | | $ | 3,223,476 |

| | $ | 10,539 |

| | 1.30 | % |

| Medium-term notes | | 3,258,159 |

| | 80,711 |

| | 3.31 |

| | 3,353,107 |

| | 73,456 |

| | 2.93 |

| | 3,757,196 |

| | 32,410 |

| | 3.42 |

| | 3,010,730 |

| | 25,116 |

| | 3.31 |

|

| Collateral trust bonds | | 7,621,435 |

| | 254,328 |

| | 4.46 |

| | 7,255,745 |

| | 255,582 |

| | 4.71 |

| | 7,474,361 |

| | 77,705 |

| | 4.12 |

| | 7,635,433 |

| | 85,277 |

| | 4.43 |

|

| Guaranteed Underwriter Program notes payable | | 4,987,617 |

| | 105,523 |

| | 2.83 |

| | 4,833,701 |

| | 107,074 |

| | 2.96 |

| | 4,848,435 |

| | 35,334 |

| | 2.89 |

| | 4,995,723 |

| | 35,602 |

| | 2.83 |

|

| Farmer Mac notes payable | | 2,503,828 |

| | 36,753 |

| | 1.96 |

| | 2,297,045 |

| | 22,892 |

| | 1.33 |

| | 2,790,527 |

| | 21,111 |

| | 3.00 |

| | 2,507,545 |

| | 11,490 |

| | 1.82 |

|

| Other notes payable | | 34,511 |

| | 1,150 |

| | 4.46 |

| | 40,155 |

| | 1,353 |

| | 4.50 |

| | 29,877 |

| | 322 |

| | 4.28 |

| | 35,243 |

| | 390 |

| | 4.39 |

|

| Subordinated deferrable debt | | 742,318 |

| | 28,247 |

| | 5.09 |

| | 742,186 |

| | 28,247 |

| | 5.09 |

| | 742,422 |

| | 9,417 |

| | 5.03 |

| | 742,285 |

| | 9,416 |

| | 5.03 |

|

| Subordinated certificates | | 1,402,077 |

| | 44,012 |

| | 4.20 |

| | 1,438,578 |

| | 44,672 |

| | 4.15 |

| | 1,377,954 |

| | 14,513 |

| | 4.18 |

| | 1,417,872 |

| | 14,901 |

| | 4.17 |

|

| Total interest-bearing liabilities | | $ | 23,880,894 |

| | $ | 585,972 |

| | 3.28 | % | | $ | 23,169,645 |

| | $ | 551,474 |

| | 3.18 | % | | $ | 24,540,767 |

| | $ | 210,231 |

| | 3.40 | % | | $ | 23,568,307 |

| | $ | 192,731 |

| | 3.24 | % |

| Other liabilities | | 882,937 |

| | | |

| | 1,019,306 |

| |

| | | | 697,954 |

| | | |

| | 853,196 |

| |

| | |

| Total liabilities | | 24,763,831 |

| | | |

| | 24,188,951 |

| |

| | | | 25,238,721 |

| | | |

| | 24,421,503 |

| |

| | |

| Total equity | | 1,180,505 |

| | | | | | 890,525 |

| |

| | | | 1,499,419 |

| | | | | | 1,083,041 |

| |

| | |

| Total liabilities and equity | | $ | 25,944,336 |

| |

|

| | | | $ | 25,079,476 |

| |

|

| | | | $ | 26,738,140 |

| |

|

| | | | $ | 25,504,544 |

| |

|

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest spread(4) | | | |

|

| | 0.96 | % | |

|

| |

|

| | 1.05 | % | | | |

|

| | 0.85 | % | |

|

| |

|

| | 0.99 | % |

Impact of non-interest bearing funding(5) | | | | | | 0.19 |

| | | | | | 0.17 |

| |

Benefit from non-interest bearing funding(5) | | | | | | | 0.19 |

| | | | | | 0.17 |

|

Net interest income/net interest yield(6) | | | | $ | 217,234 |

| | 1.15 | % | | | | $ | 222,437 |

| | 1.22 | % | | | | $ | 68,260 |

| | 1.04 | % | | | | $ | 73,184 |

| | 1.16 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted net interest income/adjusted net interest yield: | | | | | |

|

| | | | | | | | | | | |

|

| | | | | | |

| Interest income | | | | $ | 803,206 |

| | 4.24 | % | | | | $ | 773,911 |

| | 4.23 | % | | | | $ | 278,491 |

| | 4.25 | % | | | | $ | 265,915 |

| | 4.23 | % |

| Interest expense | | | | 585,972 |

| | 3.28 |

| | | | 551,474 |

| | 3.18 |

| | | | 210,231 |

| | 3.40 |

| | | | 192,731 |

| | 3.24 |

|

Add: Net accrued periodic derivative cash settlements(7) | | | | 58,781 |

| | 0.73 |

| | | | 64,331 |

| | 0.82 |

| | | | 12,829 |

| | 0.46 |

| | | | 20,222 |

| | 0.75 |

|

Adjusted interest expense/adjusted average cost(8) | | | | $ | 644,753 |

| | 3.61 | % | |

|

| | $ | 615,805 |

| | 3.55 | % | | | | $ | 223,060 |

| | 3.61 | % | |

|

| | $ | 212,953 |

| | 3.58 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted net interest spread(4) | | | | | | 0.63 | % | |

| | | | 0.68 | % | | | | | | 0.64 | % | |

| | | | 0.65 | % |

| Impact of non-interest bearing funding | | | | | | 0.21 |

| | | | | | 0.18 |

| |

Benefit from non-interest bearing funding(5) | | | | | | | 0.21 |

| | | | | | 0.19 |

|

Adjusted net interest income/adjusted net interest yield(9) | | | | $ | 158,453 |

| | 0.84 | % | |

| | $ | 158,106 |

|

| 0.86 | % | | | | $ | 55,431 |

| | 0.85 | % | |

| | $ | 52,962 |

|

| 0.84 | % |

____________________________

(1)Interest income on long-term, fixed-rate loans includes loan conversion fees, which are generally deferred and recognized as interest income using the effective interest method.

(2)Troubled debt restructuring (“TDR”) loans.

(3)Consists of late payment fees and net amortization of deferred loan fees and loan origination costs.

(4)Net interest spread represents the difference between the average yield on total average interest-earning assets and the average cost of total average interest-bearing liabilities. Adjusted net interest spread represents the difference between the average yield on total average interest-earning assets and the adjusted average cost of total average interest-bearing liabilities.

(5)Includes other liabilities and equity.

(6)Net interest yield is calculated based on annualized net interest income for the period divided by total average interest-earning assets for the period.

(7)Represents the impact of net accrued periodic derivative cashinterest rate swap settlements during the period, whichperiod. This amount is added to interest expense to derive non-GAAP adjusted interest expense. The average (benefit)/cost associated with derivatives is calculated based on annualized net accrued periodic derivative cashinterest rate swap settlements during the period divided by the average outstanding notional amount of derivatives during the period. The average outstanding notional amount of derivativesinterest rate swaps was $10,841$10,955 million and $10,610$10,682 million for the three months ended February 28, 2018 and 2017, respectively. The average outstanding notional amount of derivatives was $10,808 million and $10,532 million for the nine months ended February 28,August 31, 2018 and 2017, respectively.

(8)Adjusted interest expense represents interest expense plus net accrued periodic derivativeinterest rate swap cash settlements during the period. Net accrued periodic derivative cash settlements are reported on our consolidated statements of operationsincome as a component of derivative gains (losses). Adjusted average cost is calculated based on annualized adjusted interest expense for the period divided by total average interest-bearing liabilities during the period.

(9)Adjusted net interest yield is calculated based on annualized adjusted net interest income for the period divided by total average interest-earning assets for the period.

Table 3 displays the change in net interest income between periods and the extent to which the variance is attributable to: (i) changes in the volume of our interest-earning assets and interest-bearing liabilities or (ii) changes in the interest rates of these assets and liabilities. The table also presents the change in adjusted net interest income between periods. Changes that are not solely due to either volume or rate are allocated to these categories on a pro-rata basis based on the absolute value of the change due to average volume and average rate.

Table 3: Rate/Volume Analysis of Changes in Interest Income/Interest Expense | | | | | Three Months Ended February 28, | | Nine Months Ended February 28, | | Three Months Ended August 31, |

| | | 2018 versus 2017 | | 2018 versus 2017 | | 2018 versus 2017 |

| | | | | Variance due to:(1) | | | | Variance due to:(1) | | Total | | Variance due to:(1) |

| (Dollars in thousands) | | Total Variance | | Volume | | Rate | | Total Variance | | Volume | | Rate | | Variance | | Volume | | Rate |

| Interest income: | | | | | | | | | | | | | | | | | | |

| Long-term fixed-rate loans | | $ | 4,721 |

| | $ | 6,663 |

| | $ | (1,942 | ) | | $ | 15,066 |

| | $ | 22,768 |

| | $ | (7,702 | ) | | $ | 2,437 |

| | $ | 3,614 |

| | $ | (1,177 | ) |

| Long-term variable-rate loans | | 1,973 |

| | 1,004 |

| | 969 |

| | 4,419 |

| | 2,597 |

| | 1,822 |

| | 3,518 |

| | 1,590 |

| | 1,928 |

|

| Line of credit loans | | 3,829 |

| | 1,971 |

| | 1,858 |

| | 9,605 |

| | 5,239 |

| | 4,366 |

| | 2,926 |

| | 447 |

| | 2,479 |

|

| Restructured loans | | (7 | ) | | (10 | ) | | 3 |

| | (8 | ) | | (81 | ) | | 73 |

| | (8 | ) | | (10 | ) | | 2 |

|

| Other income, net | | (84 | ) | | — |

| | (84 | ) | | (57 | ) | | — |

| | (57 | ) | | (93 | ) | | — |

| | (93 | ) |

| Total loans | | 10,432 |

| | 9,628 |

| | 804 |

| | 29,025 |

| | 30,523 |

| | (1,498 | ) | | 8,780 |

| | 5,641 |

| | 3,139 |

|

| Cash, time deposits and investment securities | | 1,116 |

| | (1,096 | ) | | 2,212 |

| | 270 |

| | (2,909 | ) | | 3,179 |

| | 3,796 |

| | 2,436 |

| | 1,360 |

|

| Interest income | | 11,548 |

| | 8,532 |

| | 3,016 |

| | 29,295 |

| | 27,614 |

| | 1,681 |

| | 12,576 |

| | 8,077 |

| | 4,499 |

|

| | | | | | | | | | | | | | | | | | | |

| Interest expense: | | | | | | | | | | | | | | | | | | |

| Short-term borrowings | | 6,686 |

| | 223 |

| | 6,463 |

| | 17,050 |

| | 691 |

| | 16,359 |

| | 8,880 |

| | 969 |

| | 7,911 |

|

| Medium-term notes | | 2,885 |

| | 111 |

| | 2,774 |

| | 7,255 |

| | (2,080 | ) | | 9,335 |

| | 7,294 |

| | 6,227 |

| | 1,067 |

|

| Collateral trust bonds | | (1,852 | ) | | 3,942 |

| | (5,794 | ) | | (1,254 | ) | | 12,881 |

| | (14,135 | ) | | (7,572 | ) | | (1,799 | ) | | (5,773 | ) |

| Guaranteed Underwriter Program notes payable | | (853 | ) | | 252 |

| | (1,105 | ) | | (1,551 | ) | | 3,409 |

| | (4,960 | ) | | (268 | ) | | (1,050 | ) | | 782 |

|

| Farmer Mac notes payable | | 4,910 |

| | 735 |

| | 4,175 |

| | 13,861 |

| | 2,061 |

| | 11,800 |

| | 9,621 |

| | 1,297 |

| | 8,324 |

|

| Other notes payable | | (68 | ) | | (62 | ) | | (6 | ) | | (203 | ) | | (190 | ) | | (13 | ) | | (68 | ) | | (59 | ) | | (9 | ) |

| Subordinated deferrable debt | | 4 |

| | 2 |

| | 2 |

| | — |

| | 5 |

| | (5 | ) | | 1 |

| | 2 |

| | (1 | ) |

| Subordinated certificates | | (381 | ) | | (594 | ) | | 213 |

| | (660 | ) | | (1,133 | ) | | 473 |

| | (388 | ) | | (420 | ) | | 32 |

|

| Interest expense | | 11,331 |

| | 4,609 |

| | 6,722 |

| | 34,498 |

| | 15,644 |

| | 18,854 |

| | 17,500 |

| | 5,167 |

| | 12,333 |

|

| Net interest income | | $ | 217 |

| | $ | 3,923 |

| | $ | (3,706 | ) | | $ | (5,203 | ) | | $ | 11,970 |

| | $ | (17,173 | ) | | $ | (4,924 | ) | | $ | 2,910 |

| | $ | (7,834 | ) |

| | | | | | | | | | | | | | | | | | | |

| Adjusted net interest income: | | | | | | | | | | | | | | | | | | |

| Interest income | | $ | 11,548 |

| | $ | 8,532 |

| | $ | 3,016 |

| | $ | 29,295 |

| | $ | 27,614 |

| | $ | 1,681 |

| | $ | 12,576 |

| | $ | 8,077 |

| | $ | 4,499 |

|

| Interest expense | | 11,331 |

| | 4,609 |

| | 6,722 |

| | 34,498 |

| | 15,644 |

| | 18,854 |

| | 17,500 |

| | 5,167 |

| | 12,333 |

|

Net accrued periodic derivative cash settlements(2) | | (430 | ) | | 422 |

| | (852 | ) | | (5,550 | ) | | 1,684 |

| | (7,234 | ) | | (7,393 | ) | | 516 |

| | (7,909 | ) |

Adjusted interest expense(3) | | 10,901 |

| | 5,031 |

| | 5,870 |

| | 28,948 |

| | 17,328 |

| | 11,620 |

| | 10,107 |

| | 5,683 |

| | 4,424 |

|

| Adjusted net interest income | | $ | 647 |

| | $ | 3,501 |

| | $ | (2,854 | ) | | $ | 347 |

| | $ | 10,286 |

| | $ | (9,939 | ) | | $ | 2,469 |

| | $ | 2,394 |

| | $ | 75 |

|

____________________________

(1)The changes for each category of interest income and interest expense are divided between the portion of change attributable to the variance in volume and the portion of change attributable to the variance in rate for that category. The amount attributable to the combined impact of volume and rate has been allocated to each category based on the proportionate absolute dollar amount of change for that category.

(2)For net accrued periodic derivative cash settlements, the variance due to average volume represents the change in derivative cash settlements resulting from the change in the average notional amount of derivative contracts outstanding. The variance due to average rate represents the change in derivative cash settlements resulting from the net difference between the average rate paid and the average rate received for interest rate swaps during the period.

(3)See “Non-GAAP Financial Measures” for additional information on our adjusted non-GAAP measures.

Net interest income of $73$68 million for the current quarter was relatively unchanged from the same prior-year quarter, as the decrease in the net interest yield of 3% (3 basis points) to 1.16% was offset by an increase in average interest-earning assets of 3%.

Net interest income of $217 million for the nine months ended February 28, 2018 decreased by $5 million, or 2%7%, from the samecomparable prior-year period,quarter, driven by a decrease in the net interest yield of 6% (710% (12 basis points) to 1.15%1.04%, which was partially offset by an increase in average interest-earning assets of 3%4%.

Average Interest-Earning Assets: The increase in average interest-earning assets for the current quarter and nine months ended February 28, 2018 was primarily attributable to growth in average total loans of $1,111 million, or 5% and $1,127 million, or 5%, respectively, over the same prior-year periods, as members obtained advances to fund capital investments and refinanced with us loans made by other lenders.

Net Interest Yield: The decrease in the net interest yield for the current quarter and nine months ended February 28, 2018 was primarily due to an increase in our average cost of funds. Our average cost of funds increased by 1016 basis points during both the current quarter and nine months ended February 28, 2018 to 3.30% and 3.28%3.40%, respectively, largely due to increases in the cost of our short-term and variable-rate debt resulting from an increasethe rise in short-term interest rates.

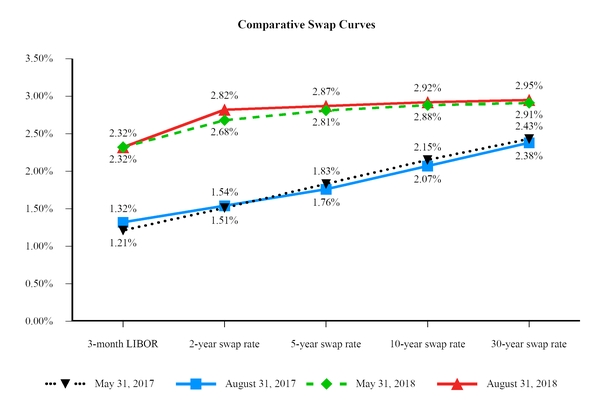

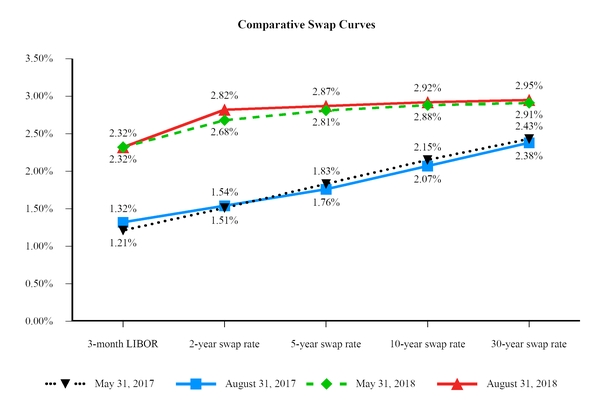

The 3-month London Interbank Offered Rate (“LIBOR”) was 2.02%2.32% as of February 28,August 31, 2018, an increase of 96100 basis points from February 28,August 31, 2017, while the federal funds target rate ranged from 1.00% to 1.50%was 2.00% as of February 28,August 31, 2018, up 75 basis points from February 28,August 31, 2017.

Average Interest-Earning Assets: The increase of $1,068 million, or 4%, in average interest-earning assets during the current quarter was attributable to growth in average total loans of $622 million, as members obtained advances to fund capital investments and refinanced with us loans made by other lenders, and an increase in average investment securities of $543 million.

Adjusted net interest income of $54$55 million for the current quarter increased by $1$2 million, or 1%5%, from the samecomparable prior-year quarter, driven bydue to the combined impact of an increase in average interest-earning assets of 3%, which was partially offset by4% and a decreaseslight increase in the adjusted net interest yield of 1% (1 basis point) to 0.86%0.85%.

Adjusted net interest income of $158 million for the nine months ended February 28, 2018 was relatively unchanged from the same prior-year period, as the The increase in average interest-earning assets of 3% was largely offset by a decrease in the adjusted net interest yield reflected the combined impact of 2% (2 basis points) to 0.84%. The decreaseincreases in the adjusted net interestaverage yield was primarily attributable toon interest-earning assets and the benefit from non-interest bearing funding, which were partially offset by an overall increase in the adjusted average cost of funds of 6 basis points to 3.61%, driven by the higher average cost of our short-term and variable-rate borrowings resulting from the increase in short-term interest rates.debt.

Our adjusted net interest income and adjusted net interest yield include the impact of net accrued periodic derivative cash settlements during the period. We recorded net periodic derivative cash settlement expense of $19$13 million and $20 million for both the three months ended February 28, 2018 and 2017, and $59 million and $64 million for the nine months ended February 28,August 31, 2018 and 2017, respectively. See “Non-GAAP Financial Measures” for additional information on our adjusted measures.

Provision for Loan Losses

Our provision for loan losses in each period is primarily driven by the level of allowance that we determine is necessary for probable incurred loan losses inherent in our loan portfolio as of each balance sheet date.

We recorded a provisionbenefit for loan losses of less than $1 million for both the threecurrent quarter and nine months ended February 28, 2018, compared with a provision for loan losses of $2 million and $5 million, respectively, for the samecomparable prior-year periods.quarter. The credit quality and performance statistics of our loan portfolio continued to remain strong. We experiencedhad no payment defaults, charge-offs, delinquent loans or nonperforming loans in our loan portfolio during the three and nine months ended February 28, 2018, and we had no loans classified as nonperforming as ofcurrent quarter or the end of the period. In comparison, we recorded a net charge-off of $2 million during the nine months ended February 28, 2017.comparable prior-year quarter.

We provide additional information on our allowance for loan losses under “Credit Risk—Allowance for Loan Losses” and “Note 4—Loans and Commitments”5—Allowance for Loan Losses” of this Report.report. For additional information on our allowance methodology, see “MD&A—Critical Accounting Policies and Estimates” and “Note 1—Summary of Significant Accounting Policies” in our 20172018 Form 10-K.

Non-Interest Income

Non-interest income consists of fee and other income, gains and losses on derivatives not accounted for in hedge accounting relationships and results of operations of foreclosed assets.

Table 4 presents the components of non-interest income recorded in our condensed consolidated results of operations for the three and nine months ended February 28,August 31, 2018 and 2017.

Table 4: Non-Interest Income

| | | | | Three Months Ended February 28, | | Nine Months Ended February 28, | | Three Months Ended August 31, |

| (Dollars in thousands) | | 2018 | | 2017 | | 2018 |

| 2017 | | 2018 |

| 2017 |

| Non-interest income: | | | | | | | | | | | | |

| Fee and other income | | $ | 3,935 |

| | $ | 5,810 |

| | $ | 13,422 |

| | $ | 15,437 |

| | $ | 3,185 |

| | $ | 3,945 |

|

| Derivative gains | | 168,048 |

| | 42,455 |

| | 247,443 |

| | 194,822 |

| |

| Derivative gains (losses) | | | 7,183 |

| | (46,198 | ) |

| Results of operations of foreclosed assets | | — |

| | (29 | ) | | (34 | ) | | (1,690 | ) | | — |

| | (24 | ) |

| Total non-interest income | | $ | 171,983 |

| | $ | 48,236 |

| | $ | 260,831 |

| | $ | 208,569 |

| | $ | 10,368 |

| | $ | (42,277 | ) |

Non-interest income of $172 million for the current quarter increased by $124 million from the same prior-year quarter. Non-interest income of $261 million for the nine months ended February 28, 2018 increased by $52 million from the same prior-year period. The significant variances in non-interest income for the three and nine months ended February 28, 2018 between the same prior-year periods were primarily attributable to changes in net derivative gains (losses) recognized in our consolidated statements of operations.income.

Derivative Gains (Losses)