UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 10-Q

__________________________

| | |

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended November 30, 2020February 28, 2021

OR

| | |

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-7102

__________________________

NATIONAL RURAL UTILITIES

COOPERATIVE FINANCE CORPORATION

(Exact name of registrant as specified in its charter)

__________________________

| | | | | | | | |

| District of Columbia | | 52-0891669 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 20701 Cooperative Way, | Dulles, | Virginia, | 20166 |

| (Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including area code: (703) 467-1800

__________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| 7.35% Collateral Trust Bonds, due 2026 | NRUC 26 | New York Stock Exchange |

| 5.50% Subordinated Notes, due 2064 | NRUC | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨ Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transaction period for complying with any new or revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨☐ No x

TABLE OF CONTENTS

MD&A TABLE CROSS REFERENCE INDEX

| | Table | Table | | Description | | Page | Table | | Description | | Page |

| 1 | 1 | | Summary of Selected Financial Data | | 3 | | 1 | | Summary of Selected Financial Data | | 4 | |

| 2 | 2 | | Average Balances, Interest Income/Interest Expense and Average Yield/Cost | | 12 | | 2 | | Average Balances, Interest Income/Interest Expense and Average Yield/Cost | | 15 | |

| 3 | 3 | | Rate/Volume Analysis of Changes in Interest Income/Interest Expense | | 15 | | 3 | | Rate/Volume Analysis of Changes in Interest Income/Interest Expense | | 18 | |

| 4 | 4 | | Non-Interest Income | | 18 | | 4 | | Non-Interest Income | | 21 | |

| 5 | 5 | | Derivative Gains (Losses) | | 19 | | 5 | | Derivative Gains (Losses) | | 22 | |

| 6 | 6 | | Derivative Cash Settlements Expense—Average Notional Amounts and Interest Rates | | 20 | | 6 | | Derivatives—Average Notional Amounts and Interest Rates | | 22 | |

| 7 | 7 | | Non-Interest Expense | | 21 | | 7 | | Non-Interest Expense | | 24 | |

| 8 | 8 | | Loans Outstanding by Member Class and Loan Type | | 23 | | 8 | | Loans Outstanding by Member Class and Loan Type | | 25 | |

| 9 | 9 | | Historical Retention Rate and Repricing Selection | | 24 | | 9 | | Historical Retention Rate and Repricing Selection | | 26 | |

| 10 | 10 | | Total Debt Outstanding | | 25 | | 10 | | Total Debt Outstanding | | 27 | |

| 11 | 11 | | Member Investments | | 26 | | 11 | | Member Investments | | 28 | |

| 12 | 12 | | Collateral Pledged | | 27 | | 12 | | Collateral Pledged | | 29 | |

| 13 | 13 | | Unencumbered Loans | | 28 | | 13 | | Unencumbered Loans | | 30 | |

| 14 | 14 | | Equity | | 29 | | 14 | | Equity | | 31 | |

| 15 | 15 | | Guarantees Outstanding | | 30 | | 15 | | Guarantees Outstanding | | 32 | |

| 16 | 16 | | Maturities of Guarantee Obligations | | 31 | | 16 | | Maturities of Guarantee Obligations | | 33 | |

| 17 | 17 | | Unadvanced Loan Commitments | | 31 | | 17 | | Unadvanced Loan Commitments | | 33 | |

| 18 | 18 | | Unadvanced Loan Commitments Maturities of Notional Amount | | 32 | | 18 | | Unadvanced Loan Commitments Maturities of Notional Amount | | 34 | |

| 19 | 19 | | Unconditional Committed Lines of Credit Maturities of Notional Amount | | 33 | | 19 | | Unconditional Committed Lines of Credit Maturities of Notional Amount | | 35 | |

| 20 | 20 | | Loan Portfolio Security Profile | | 35 | | 20 | | Loan Portfolio Security Profile | | 37 | |

| 21 | 21 | | Loan Exposure to 20 Largest Borrowers | | 36 | | 21 | | Loan Exposure to 20 Largest Borrowers | | 38 | |

| 22 | 22 | | Troubled Debt Restructured Loans | | 37 | | 22 | | Troubled Debt Restructured Loans | | 39 | |

| 23 | 23 | | Allowance for Credit Losses | | 40 | | 23 | | Nonperforming Loans | | 40 | |

| 24 | 24 | | Rating Triggers for Derivatives | | 41 | | 24 | | Allowance for Credit Losses | | 43 | |

| 25 | 25 | | Available Liquidity | | 42 | | 25 | | Rating Triggers for Derivatives | | 44 | |

| 26 | 26 | | Committed Bank Revolving Line of Credit Agreements | | 43 | | 26 | | Available Liquidity | | 45 | |

| 27 | 27 | | Short-Term Borrowings—Funding Sources | | 44 | | 27 | | Committed Bank Revolving Line of Credit Agreements | | 46 | |

| 28 | 28 | | Short-Term Borrowings | | 45 | | 28 | | Short-Term Borrowings—Funding Sources | | 48 | |

| 29 | 29 | | Long-Term and Subordinated Debt Issuances and Repayments | | 46 | | 29 | | Short-Term Borrowings | | 48 | |

| 30 | 30 | | Long-Term and Subordinated Debt Principal Maturity and Amortization | | 46 | | 30 | | Long-Term and Subordinated Debt Issuances and Repayments | | 49 | |

| 31 | 31 | | Projected Sources and Uses of Liquidity from Debt and Investment Activity | | 47 | | 31 | | Long-Term and Subordinated Debt Principal Maturity and Amortization | | 49 | |

| 32 | 32 | | Credit Ratings | | 48 | | 32 | | Projected Sources and Uses of Liquidity from Debt and Investment Activity | | 50 | |

| 33 | 33 | | Interest Rate Gap Analysis | | 50 | | 33 | | Credit Ratings | | 51 | |

| 34 | 34 | | Adjusted Financial Measures—Income Statement | | 51 | | 34 | | Interest Rate Gap Analysis | | 54 | |

| 35 | 35 | | TIER and Adjusted TIER | | 52 | | 35 | | Adjusted Financial Measures—Income Statement | | 55 | |

| 36 | 36 | | Adjusted Financial Measures—Balance Sheet | | 52 | | 36 | | TIER and Adjusted TIER | | 56 | |

| 37 | 37 | | Debt-to-Equity Ratio and Adjusted Debt-to-Equity Ratio | | 53 | | 37 | | Adjusted Financial Measures—Balance Sheet | | 56 | |

| 38 | 38 | | Members’ Equity | | 53 | | 38 | | Debt-to-Equity Ratio and Adjusted Debt-to-Equity Ratio | | 57 | |

| 39 | | 39 | | Members’ Equity | | 57 | |

PART I—FINANCIAL INFORMATION

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”)

| | |

| FORWARD-LOOKING STATEMENTS |

This Quarterly Report on Form 10-Q for the quarterly period ended November 30, 2020February 28, 2021 (“this Report”) contains certain statements that are considered “forward-looking statements” as defined in and within the meaning of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements do not represent historical facts or statements of current conditions. Instead, forward-looking statements represent management’s current beliefs and expectations, based on certain assumptions and estimates made by, and information available to, management at the time the statements are made, regarding our future plans, strategies, operations, financial results or other events and developments, many of which, by their nature, are inherently uncertain and outside our control. Forward-looking statements are generally identified by the use of words such as “intend,” “plan,” “may,” “should,” “will,” “project,” “estimate,” “anticipate,” “believe,” “expect,” “continue,” “potential,” “opportunity” and similar expressions, whether in the negative or affirmative. All statements about future expectations or projections, including statements about loan volume, the adequacy of the allowance for credit losses, operating income and expenses, leverage and debt-to-equity ratios, borrower financial performance, impaired loans, and sources and uses of liquidity, are forward-looking statements. Although we believe the expectations reflected in our forward-looking statements are based on reasonable assumptions, actual results and performance may differ materially from our forward-looking statements. Therefore, you should not place undue reliance on any forward-looking statement and should consider the risks and uncertainties that could cause our current expectations to vary from our forward-looking statements, including, but not limited to, general economic conditions, legislative changes including those that could affect our tax status governmental monetary and fiscal policies,other matters, demand for our loan products, lending competition, changes in the quality or composition of our loan portfolio, changes in our ability to access external financing, changes in the credit ratings on our debt, valuation of collateral supporting impaired loans, charges associated with our operation or disposition of foreclosed assets, technological changes within the rural electric utility industry, regulatory and economic conditions in the rural electric industry, nonperformance of counterparties to our derivative agreements, economic conditions and regulatory or technological changes within the rural electric industry, the costs and impact of legal or governmental proceedings involving us or our members, general economic conditions, governmental monetary and fiscal policies, the occurrence and effect of natural disasters, including severe weather events or public health emergencies, such as the emergence in 2019 and continued spread of a novel coronavirus that causes coronavirus disease 2019 (“COVID-19”) and the factors identified under “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended May 31, 2020 (“2020 Form 10-K”), as well as any risk factors identified under “Part II—Item 1A. Risk Factors” in this Report. Forward-looking statements speak only as of the date they are made, and, except as required by law, we undertake no obligation to update any forward-looking statement to reflect the impact of events, circumstances or changes in expectations that arise after the date any forward-looking statement is made.

National Rural Utilities Cooperative Finance Corporation (“CFC”) is a member-owned cooperative association incorporated under the laws of the District of Columbia in April 1969. CFC’s principal purpose is to provide its members with financing to supplement the loan programs of the Rural Utilities Service (“RUS”) of the United States Department of Agriculture (“USDA”). CFC makes loans to its rural electric members so they can acquire, construct and operate electric distribution systems, generation and transmission (“power supply”) systems and related facilities. CFC also provides its members with credit enhancements in the form of letters of credit and guarantees of debt obligations. As a cooperative, CFC is owned by and exclusively serves its membership, which consists of not-for-profit entities or subsidiaries or affiliates of not-for-profit entities. CFC is exempt from federal income taxes under Section 501(c)(4) of the Internal Revenue Code. As a member-owned cooperative, CFC’s objective is not to maximize profit, but rather to offer members cost-based financial products and services. CFC funds its activities primarily through a combination of public and private issuances of debt securities, member investments and retained equity. As a Section 501(c)(4) tax-exempt, member-owned cooperative, we cannot issue equity securities.

Our financial statements include the consolidated accounts of CFC, National Cooperative Services Corporation (“NCSC”), Rural Telephone Finance Cooperative (“RTFC”) and subsidiaries created and controlled by CFC to hold foreclosed assets resulting from defaulted loans or bankruptcy. NCSC is a taxable member-owned cooperative that may provide financing to members of CFC, government or quasi-government entities which own electric utility systems that meet the Rural

Electrification Act definition of “rural,” and for-profit and nonprofit entities that are owned, operated or controlled by, or provide significant benefits to certain members of CFC. RTFC is a taxable Subchapter T cooperative association that provides financing for its rural telecommunications members and their affiliates. CFC and its consolidated entities have not held any foreclosed assets since the fiscal year ended May 31, 2017 (“fiscal year 2017”). See “Item 1. Business—Overview” in our 2020 Form 10-K for additional information on the business activities of each of these entities. Unless stated otherwise, references to “we,” “our” or “us” relate to CFC and its consolidated entities. All references to members within this document include members, associates and affiliates of CFC and its consolidated entities, except where indicated otherwise.

We conduct our operations through three business segments, which are based on each of the legal entities included in our consolidated financial statements: CFC, NCSC and RTFC. CFC’s business operations account for the substantial majority of our loans and revenue. Loans to members totaled $27,063$28,327 million as of November 30, 2020,February 28, 2021, of which 96% was attributable to CFC. We generated total revenue, which consists of net interest income and fee and other income, of $212$320 million for the sixnine months ended November 30, 2020,February 28, 2021 (“current year-to-date period”), compared with $171$258 million for the sixnine months ended November 30, 2019February 29, 2020 (“same prior year-to-date period”). Our adjusted total revenue was $155$234 million for the sixnine months ended November 30, 2020,February 28, 2021, compared with $146$219 million for the same prior year-to-date period. We provide information on the financial performance of our business segments in “Note 14—Business Segments.”

Management monitors a variety of key indicators to evaluate our business performance. In addition to financial measures determined in accordance with generally accepted accounting principles in the United States (“GAAP”), management also evaluates performance based on certain non-GAAP measures and metrics, which we refer to as “adjusted” measures. The following MD&A is intended to provide the reader with an understanding of our consolidated results of operations, financial condition and liquidity by discussing the factors influencing changes from period to period and key measures used by management to evaluate performance, including, among others, net interest income, net interest yield, debt-to-equity ratio and the related non-GAAP adjusted measures, loan activity and credit quality metrics. Our MD&A is provided as a supplement to, and should be read in conjunction with the unaudited consolidated financial statements and related notes in this Report, our audited consolidated financial statements and related notes in our 2020 Form 10-K and additional information, contained in our 2020 Form 10-K, including the risk factors identified under “Part I—Item 1A. Risk Factors,” contained in our 2020 Form 10-K, as well as additional information contained elsewhere in this Report.

| | |

| SUMMARY OF SELECTED FINANCIAL DATA |

Table 1 provides a summary of consolidated selected financial data for the three and sixnine months ended November 30,February 28, 2021 and February 29, 2020, and 2019, and as of November 30, 2020February 28, 2021 and May 31, 2020. In addition to financial measures determined in accordance with GAAP, management also evaluates performance based on certain non-GAAP measures, which we refer to as “adjusted” measures. Our key non-GAAP financial measures are adjusted net income, adjusted net interest income, adjusted interest expense, adjusted net interest yield, adjusted times interest earned ratio (“TIER”) and adjusted debt-to-equity ratio. The most comparable GAAP measures are net income, net interest income, interest expense, net interest yield, TIER and debt-to-equity ratio, respectively. The primary adjustments we make to calculate these non-GAAP measures consist of: (i) adjusting interest expense and net interest income to include the impact of net periodic derivative cash settlements expense; (ii) adjusting net income, total liabilities and total equity to exclude the non-cash impact of the accounting for derivative financial instruments; (iii) adjusting total liabilities to exclude the amount that funds CFC member loans guaranteed by RUS, subordinated deferrable debt and members’ subordinated certificates; and (iv) adjusting total equity to include subordinated deferrable debt and members’ subordinated certificates and exclude cumulative derivative forward value gains and losses and accumulated other comprehensive income (“AOCI”). We believe our non-GAAP adjusted measures, which are not a substitute for GAAP and may not be consistent with similarly titled non-GAAP measures used by other companies, provide meaningful information and are useful to investors because management evaluates performance based on these metrics for purposes of: (i) budgeting and forecasting; (ii) comparing period-to-period operating results, analyzing changes in results and identifying potential trends; (iii) making compensation decisions;decisions and (iv) informing the establishment of short- and long-term strategic goals. In addition, certain of the financial covenants in our committed bank revolving line of credit agreements and debt indentures are based on these non-GAAP adjusted measures. We provide a reconciliation of our non-GAAP adjusted measures to the most comparable GAAP measures in the section “Non-GAAP Financial Measures.”

Table 1: Summary of Selected Financial Data(1)

| | | Three Months Ended November 30, | | Six Months Ended November 30, | | | Three Months Ended | | Nine Months Ended | |

| (Dollars in thousands) | (Dollars in thousands) | | 2020 | | 2019 | | Change | | 2020 | | 2019 | | Change | (Dollars in thousands) | | February 28, 2021 | | February 29, 2020 | | Change | | February 28, 2021 | | February 29, 2020 | | Change | |

| Statement of operations | Statement of operations | | | | | | | | | | | | | Statement of operations | | | | | | | | | | | | | |

| Interest income | Interest income | | $ | 276,499 | | | $ | 287,037 | | | (4)% | | $ | 556,083 | | | $ | 577,052 | | | (4)% | Interest income | | $ | 278,172 | | | $ | 287,195 | | | (3) | | % | $ | 834,255 | | | $ | 864,247 | | | (3) | | % |

| Interest expense | Interest expense | | (174,422) | | | (207,871) | | | (16) | | (354,398) | | | (421,142) | | | (16) | Interest expense | | | (173,040) | | | (203,040) | | | (15) | | | (527,438) | | | (624,182) | | | (15) | | |

| Net interest income | Net interest income | | 102,077 | | | 79,166 | | | 29 | | 201,685 | | | 155,910 | | | 29 | Net interest income | | | 105,132 | | | 84,155 | | | 25 | | | 306,817 | | | 240,065 | | | 28 | | |

| Fee and other income | Fee and other income | | 6,332 | | | 3,842 | | | 65 | | 9,848 | | | 14,783 | | | (33) | Fee and other income | | | 3,819 | | | 3,647 | | | 5 | | | 13,667 | | | 18,430 | | | (26) | | |

| Total revenue | Total revenue | | 108,409 | | | 83,008 | | | 31 | | 211,533 | | | 170,693 | | | 24 | Total revenue | | | 108,951 | | | 87,802 | | | 24 | | | 320,484 | | | 258,495 | | | 24 | | |

| Benefit (provision) for credit losses | | (1,638) | | | 1,045 | | | ** | | (1,964) | | | 1,015 | | | ** | |

| Provision for credit losses | | Provision for credit losses | | | (33,023) | | | (2,382) | | | 1,286 | | | (34,987) | | | (1,367) | | | 2,459 | | |

Derivative gains (losses)(2) | Derivative gains (losses)(2) | | 81,287 | | | 183,450 | | | (56) | | 141,563 | | | (212,275) | | | ** | Derivative gains (losses)(2) | | | 330,196 | | | (337,936) | | | ** | | 471,759 | | | (550,211) | | | ** | |

| Investment securities gains (losses) | Investment securities gains (losses) | | (1,361) | | | (114) | | | 1,094 | | 3,298 | | | 1,506 | | | 119 | Investment securities gains (losses) | | | (2,807) | | | 749 | | | ** | | 491 | | | 2,255 | | | (78) | | |

Operating expenses(3) | Operating expenses(3) | | (24,136) | | | (24,769) | | | (3) | | (46,799) | | | (50,098) | | | (7) | Operating expenses(3) | | | (23,562) | | | (25,269) | | | (7) | | | (70,361) | | | (75,367) | | | (7) | | |

Other non-interest income (expense)(1) | Other non-interest income (expense)(1) | | (1,778) | | | (929) | | | 91 | | (2,110) | | | 6,250 | | | ** | Other non-interest income (expense)(1) | | | (301) | | | (359) | | | (16) | | | (2,411) | | | 5,891 | | | ** | |

| Income (loss) before income taxes | Income (loss) before income taxes | | 160,783 | | | 241,691 | | | (33) | | 305,521 | | | (82,909) | | | ** | Income (loss) before income taxes | | | 379,454 | | | (277,395) | | | ** | | 684,975 | | | (360,304) | | | ** | |

| Income tax benefit (provision) | Income tax benefit (provision) | | (262) | | | (91) | | | 188 | | (413) | | | 430 | | | ** | Income tax benefit (provision) | | (507) | | | 426 | | | ** | | (920) | | | 856 | | | ** | |

| Net income (loss) | Net income (loss) | | $ | 160,521 | | | $ | 241,600 | | | (34) | | $ | 305,108 | | | $ | (82,479) | | | ** | Net income (loss) | | $ | 378,947 | | | $ | (276,969) | | | ** | | $ | 684,055 | | | $ | (359,448) | | | ** | |

| | Adjusted operational financial measures | Adjusted operational financial measures | | Adjusted operational financial measures | |

Adjusted interest expense(4) | Adjusted interest expense(4) | | $ | (204,222) | | | $ | (222,021) | | | (8) | | $ | (411,170) | | | $ | (446,335) | | | (8) | Adjusted interest expense(4) | | $ | (202,775) | | | $ | (217,394) | | | (7) | | | $ | (613,945) | | | $ | (663,729) | | | (8) | | |

Adjusted net interest income(4) | Adjusted net interest income(4) | | 72,277 | | | 65,016 | | | 11 | | 144,913 | | | 130,717 | | | 11 | Adjusted net interest income(4) | | 75,397 | | | 69,801 | | | 8 | | | 220,310 | | | 200,518 | | | 10 | | |

Adjusted total revenue(4) | Adjusted total revenue(4) | | 78,609 | | | 68,858 | | | 14 | | 154,761 | | | 145,500 | | | 6 | Adjusted total revenue(4) | | 79,216 | | | 73,448 | | | 8 | | | 233,977 | | | 218,948 | | | 7 | | |

Adjusted net income(4) | Adjusted net income(4) | | 49,434 | | | 44,000 | | | 12 | | 106,773 | | | 104,603 | | | 2 | Adjusted net income(4) | | 19,016 | | | 46,613 | | | (59) | | | 125,789 | | | 151,216 | | | (17) | | |

| | Selected ratios | | |

Fixed-charge coverage ratio/TIER(5) | | 1.92 | | | 2.16 | | | (24) bps | | 1.86 | | | 0.80 | | | 106 bps | |

Adjusted TIER(4) | | 1.24 | | | 1.20 | | | 4 | | 1.26 | | | 1.23 | | | 3 | |

Net interest yield(6) | | 1.48 | % | | 1.17 | % | | 31 | | 1.45 | % | | 1.16 | % | | 29 | |

Adjusted net interest yield(4)(7) | | 1.05 | | | 0.96 | | | 9 | | 1.04 | | | 0.97 | | | 7 | |

Net charge-off rate(8) | | 0.00 | | | 0.00 | | | — | | 0.00 | | | 0.00 | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected ratios | | | | | | | | | | | | | |

Fixed-charge coverage ratio/TIER(5) | | 3.19 | | | — | | | ** | | 2.30 | | | 0.42 | | | 448 | | |

Adjusted TIER(4) | | 1.09 | | | 1.21 | | | (10) | | | 1.20 | | | 1.23 | | | (2) | | |

Net interest yield(6) | | 1.51 | | % | 1.23 | | % | 28 | | bps | 1.47 | | % | 1.18 | | % | 29 | | bps |

Adjusted net interest yield(4)(7) | | 1.08 | | | 1.02 | | | 6 | | | 1.05 | | | 0.99 | | | 6 | | |

Net charge-off rate(8) | | 0.00 | | | 0.00 | | | — | | | 0.00 | | | 0.00 | | | — | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | November 30, 2020 | | May 31, 2020 | | Change |

| Balance sheet | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | |

| Cash, cash equivalents and restricted cash | | | | | | | | $ | 177,191 | | | $ | 680,019 | | | (74)% |

| Investment securities | | | | | | | | 584,086 | | | 370,135 | | | 58 |

Loans to members(9) | | | | | | | | 27,062,969 | | | 26,702,380 | | | 1 |

Allowance for credit losses(10) | | | | | | | | (58,989) | | | (53,125) | | | 11 |

| Loans to members, net | | | | | | | | 27,003,980 | | | 26,649,255 | | | 1 |

| Total assets | | | | | | | | 28,176,102 | | | 28,157,605 | | | — |

| Liabilities and equity: | | | | | | | | | | | | |

| Short-term borrowings | | | | | | | | 4,687,968 | | | 3,961,985 | | | 18 |

| Long-term debt | | | | | | | | 19,070,919 | | | 19,712,024 | | | (3) |

| Subordinated deferrable debt | | | | | | | | 986,217 | | | 986,119 | | | — |

| Members’ subordinated certificates | | | | | | | | 1,272,374 | | | 1,339,618 | | | (5) |

| Total debt outstanding | | | | | | | | 26,017,478 | | | 25,999,746 | | | — |

| Total liabilities | | | | | | | | 27,284,383 | | | 27,508,783 | | | (1) |

| Total equity | | | | | | | | 891,719 | | | 648,822 | | | 37 |

Guarantees(11) | | | | | | | | 676,858 | | | 820,786 | | | (18) |

| | | | | | | | | | | | |

| Selected ratios period end | | | | | | | | | | | | |

Allowance coverage ratio(10)(12) | | | | | | | | 0.22 | % | | 0.20 | % | | 2 bps |

Debt-to-equity ratio(13) | | | | | | | | 30.60 | | | 42.40 | | | (28)% |

Adjusted debt-to-equity ratio(4) | | | | | | | | 5.90 | | | 5.85 | | | 1 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | February 28, 2021 | | May 31, 2020 | | Change | |

| Balance sheet | | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | | |

| Cash, cash equivalents and restricted cash | | | | | | | | $ | 177,453 | | | $ | 680,019 | | | (74) | | % |

| Investment securities | | | | | | | | 607,254 | | | 370,135 | | | 64 | | |

Loans to members(9) | | | | | | | | 28,327,481 | | | 26,702,380 | | | 6 | | |

Allowance for credit losses(10) | | | | | | | | (92,012) | | | (53,125) | | | 73 | | |

| Loans to members, net | | | | | | | | 28,235,469 | | | 26,649,255 | | | 6 | | |

| Total assets | | | | | | | | 29,414,988 | | | 28,157,605 | | | 4 | | |

| Liabilities and equity: | | | | | | | | | | | | | |

| Short-term borrowings | | | | | | | | 4,407,957 | | | 3,961,985 | | | 11 | | |

| Long-term debt | | | | | | | | 20,555,544 | | | 19,712,024 | | | 4 | | |

| Subordinated deferrable debt | | | | | | | | 986,265 | | | 986,119 | | | — | | |

| Members’ subordinated certificates | | | | | | | | 1,257,024 | | | 1,339,618 | | | (6) | | |

| Total debt outstanding | | | | | | | | 27,206,790 | | | 25,999,746 | | | 5 | | |

| Total liabilities | | | | | | | | 28,146,399 | | | 27,508,783 | | | 2 | | |

| Total equity | | | | | | | | 1,268,589 | | | 648,822 | | | 96 | | |

Guarantees(11) | | | | | | | | 676,385 | | | 820,786 | | | (18) | | |

| | | | | | | | | | | | | |

| Selected ratios period end | | | | | | | | | | | | | |

Allowance coverage ratio(10)(12) | | | | | | | | 0.32 | | % | 0.20 | | % | 12 | | bps |

Debt-to-equity ratio(13) | | | | | | | | 22.19 | | | 42.40 | | | (48) | | % |

Adjusted debt-to-equity ratio(4) | | | | | | | | 6.21 | | | 5.85 | | | 6 | | |

____________________________

** Calculation of percentage change is not meaningful.

(1)Certain reclassifications have been made to prior periods to conform to the current period presentation.

(2)Consists of net periodic contractual interest amounts on our interest rate swaps, which we refer to as derivatives cash settlements interest (expense) income, and derivative forward value gains (losses) on derivatives not designated for hedge accounting. Derivative forward value gains (losses) represent changes in fair value during the period, excluding net periodic contractual interest amounts, related to derivatives not designated for hedge accounting and amounts reclassified into income related to the cumulative transition adjustment amount recorded in accumulated other comprehensive income as of June 1, 2001, the adoption date of the derivative accounting guidance requiring derivatives to be reported at fair value on the balance sheet.

(3)Consists of salaries and employee benefits and the other general and administrative expenses components of non-interest expense, each of which are presented separately on our consolidated statements of operations.

(4)See “Non-GAAP Financial Measures” for details on the calculation of these non-GAAP adjusted measures and the reconciliation to the most comparable GAAP measures.

(5)Calculated based on net income (loss) plus interest expense for the period divided by interest expense for the period. The fixed-charge coverage ratios and TIER were the same during each period presented because we did not have any capitalized interest during these periods.

(6)Calculated based on annualized net interest income for the period divided by average interest-earning assets for the period.

(7)Calculated based on annualized adjusted net interest income for the period divided by average interest-earning assets for the period.

(8)Calculated based on annualized net charge-offs (recoveries) for the period divided by average total loans outstanding for the period.

(9)Consists of the outstanding principal balance of member loans plus unamortized deferred loan origination costs, which totaled $12 million and $11 million as of November 30, 2020both February 28, 2021 and May 31, 2020, respectively.2020.

(10)On June 1, 2020, we adopted Accounting Standards Update (“ASU”) 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which replaces the incurred loss methodology previously used for estimating our allowance for credit losses with an expected loss methodology referred to as the current expected credit loss (“CECL”) model. At adoption, we recorded an increase in our allowance for credit losses of $4 million and a corresponding decrease in retained earnings through a cumulative-effect adjustment.

(11)Reflects the total amount of member obligations for which CFC has guaranteed payment to a third party as of the end of each period. This amount represents our maximum exposure to loss, which significantly exceeds the guarantee liability recorded on our consolidated balance sheets. See “Note 11—Guarantees” for additional information.

(12)Calculated based on the allowance for credit losses at period end divided by total outstanding loans at period end.

(13)Calculated based on total liabilities at period end divided by total equity at period end.

Our primary objective as a member-owned cooperative lender is to provide cost-based financial products to our rural electric members while maintaining a sound financial position required for investment-grade credit ratings on our debt instruments. Our objective is not to maximize profit; therefore, the rates we charge our member-borrowers reflect our funding costs plus a spread to cover our operating expenses, a provision for credit losses and earnings sufficient to achieve interest coverage to meet our financial objectives. Our goal is to earn an annual minimum adjusted TIER of 1.10 and to maintain an adjusted debt-to-equity ratio at approximately 6.00-to-1 or below.

We are subject to period-to-period volatility in our reported GAAP results due to changes in market conditions and differences in the way our financial assets and liabilities are accounted for under GAAP. Our financial assets and liabilities expose us to interest-rate risk. We use derivatives, primarily interest rate swaps, as part of our strategy in managing this risk. Our derivatives are intended to economically hedge and manage the interest-rate sensitivity mismatch between our financial assets and liabilities. We are required under GAAP to carry derivatives at fair value on our consolidated balance sheets; however, the financial assets and liabilities for which we use derivatives to economically hedge are carried at amortized cost. Changes in interest rates and the shape of the swap curve result in periodic fluctuations in the fair value of our derivatives, which may cause volatility in our earnings because we do not apply hedge accounting for our interest rate swaps. As a result, the mark-to-market changes in our interest rate swaps are recorded in earnings. Because our derivative portfolio consists of a higher proportion of pay-fixed swaps than receive-fixed swaps, we generally record derivative losses when interest rates decline and derivative gains when interest rates rise. This earnings volatility generally is not indicative of the underlying economics of our business, as the derivative forward fair value gains or losses recorded each period may or may not be realized over time, depending on the terms of our derivative instruments and future changes in market conditions that impact the periodic cash settlement amounts of our interest rate swaps. As such, management uses our non-GAAP adjusted results to evaluate our operating performance. Our adjusted results include realized net periodic interest rate swap settlement amounts but exclude the impact of unrealized forward fair value gains and losses. Certain of the financial covenants in our committed bank revolving line of credit agreements and debt indentures are also based on our non-GAAP adjusted results, as the forward fair value gains and losses related to our interest rate swaps do not affect our cash flows, liquidity or ability to service our debt.

Financial Performance

Reported Results

We reported net income of $161$379 million and a TIER of 1.923.19 for the three months ended November 30, 2020February 28, 2021 (“current quarter”). In comparison, we reported a net incomeloss of $242$277 million, and awhich resulted in no TIER of 2.16coverage for the three months ended November 30, 2019February 29, 2020 (“same prior-year quarter”). We reported net income of $305$684 million and a TIER of 1.862.30 for the sixnine months ended November 30, 2020,February 28, 2021, compared with a net loss of $82$359 million and a TIER of 0.800.42 for the same prior year-to-date period. The significant variance between our reported results for the current-year periods and the same prior-year periods was attributable to mark-to-market changes in the fair value of our derivative instruments. Our debt-to-equity ratio decreased to 30.6022.19 as of November 30, 2020,February 28, 2021, from 42.40 as of May 31, 2020, primarily due to an increase in equity from our reported net income of $305$684 million, which was partially offset by a decrease in equity from the retirement of patronage capital of $60 million authorized by the CFC Board of Directors in July 2020 and paid to members in September 2020.

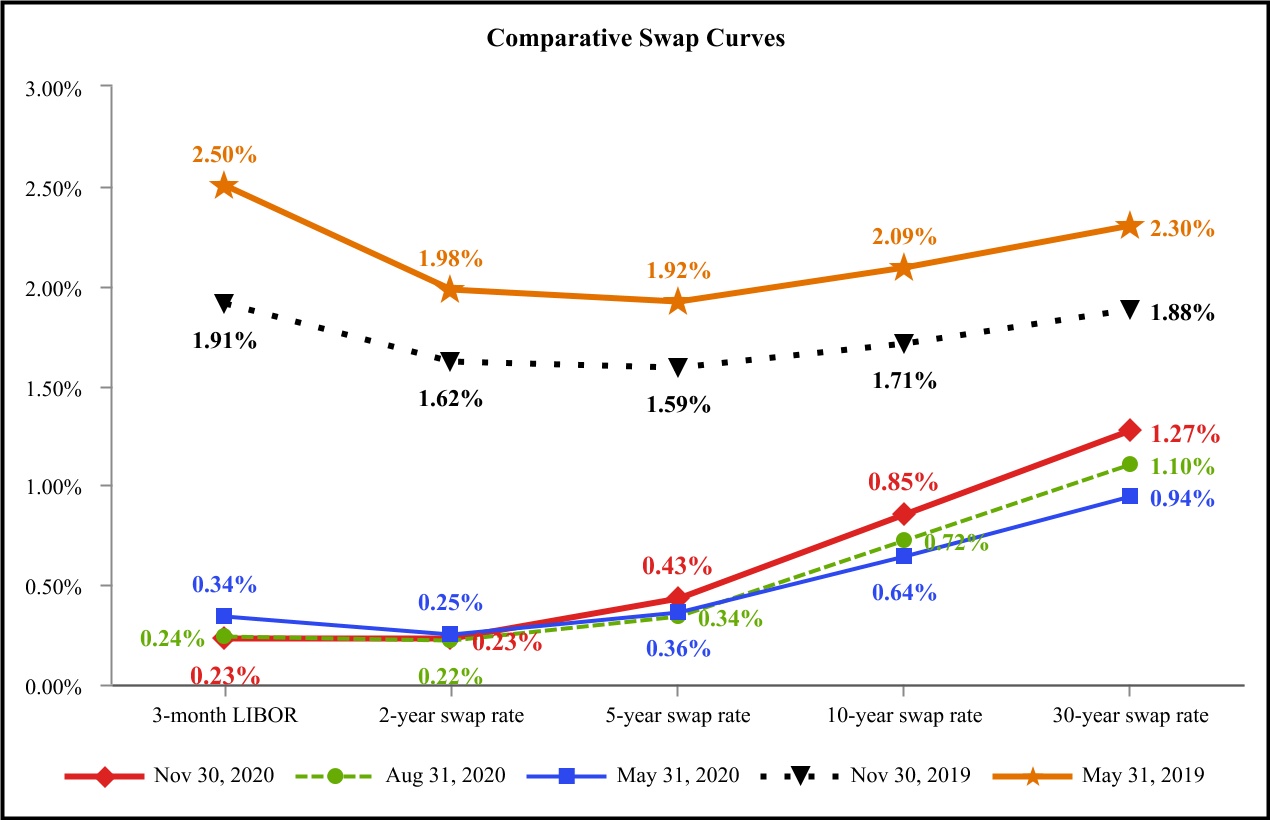

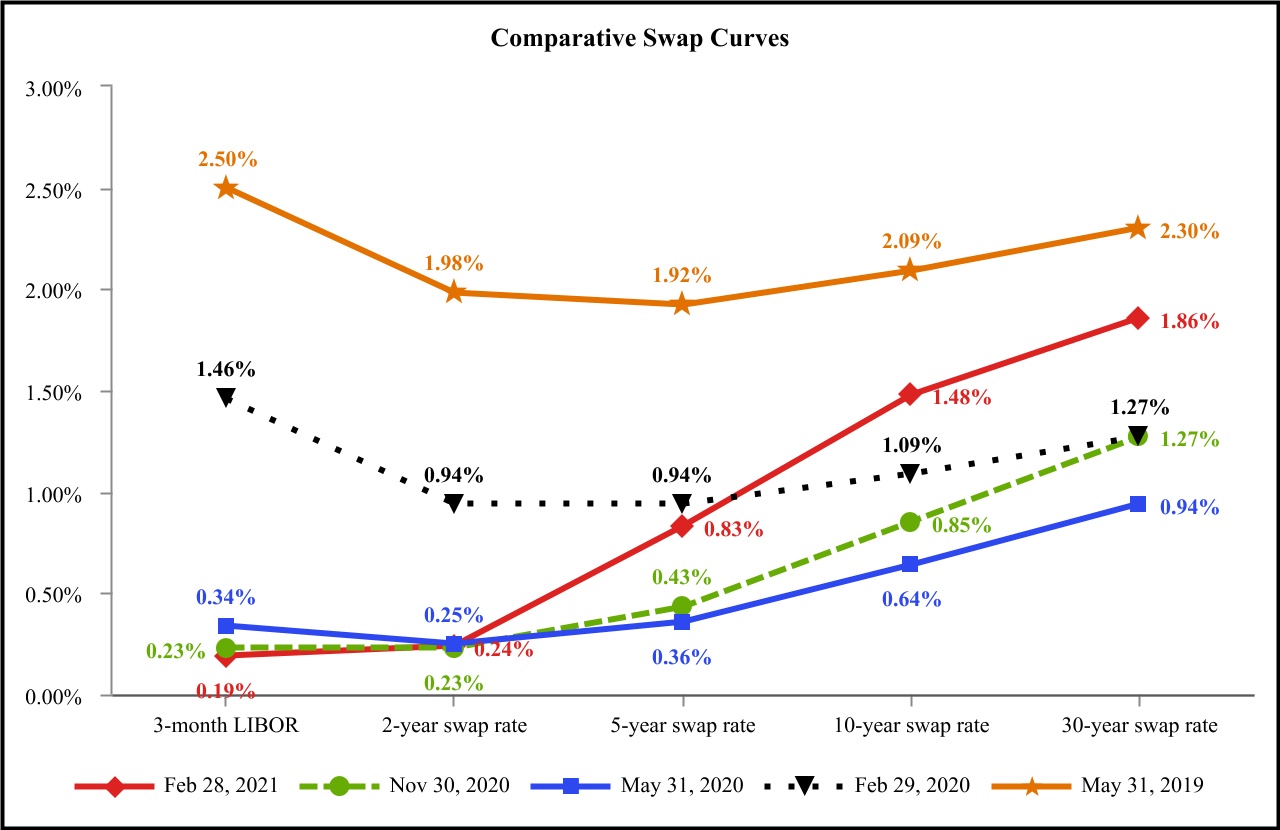

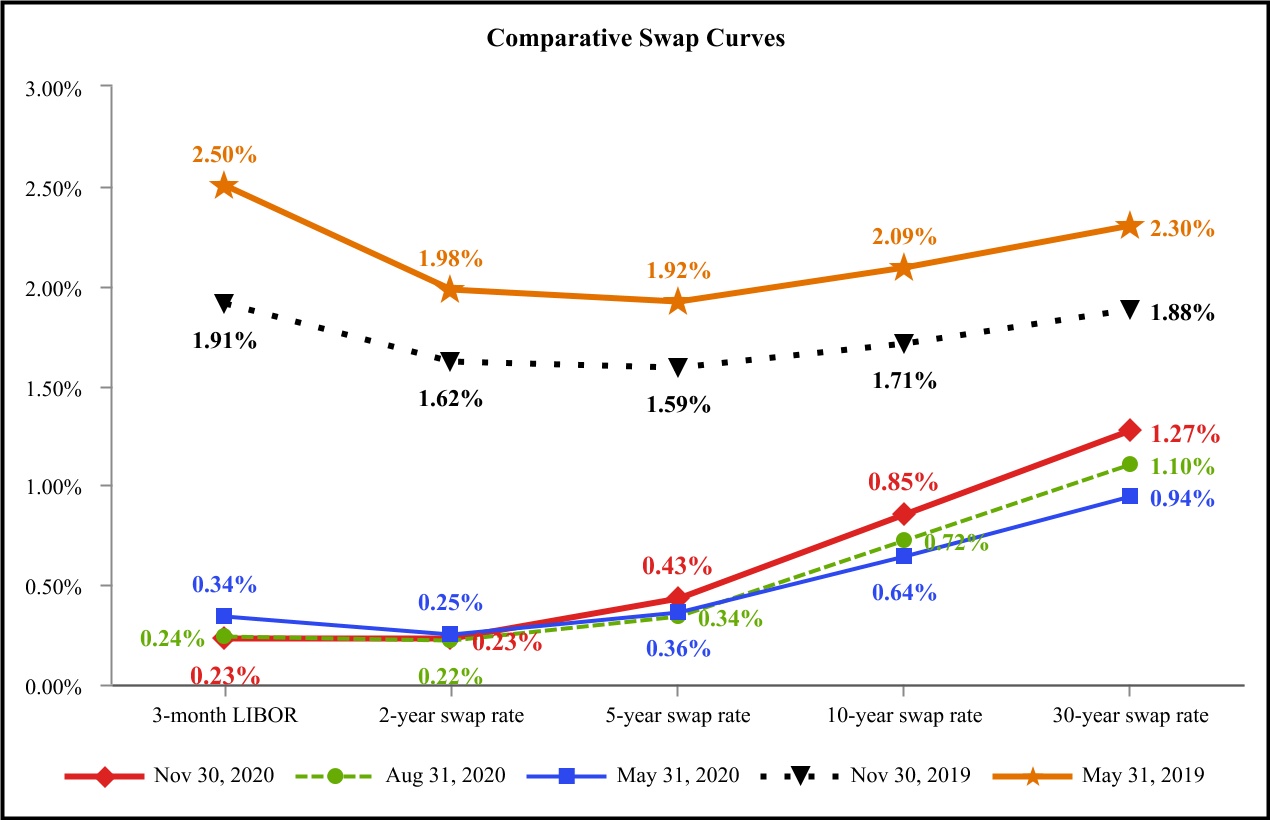

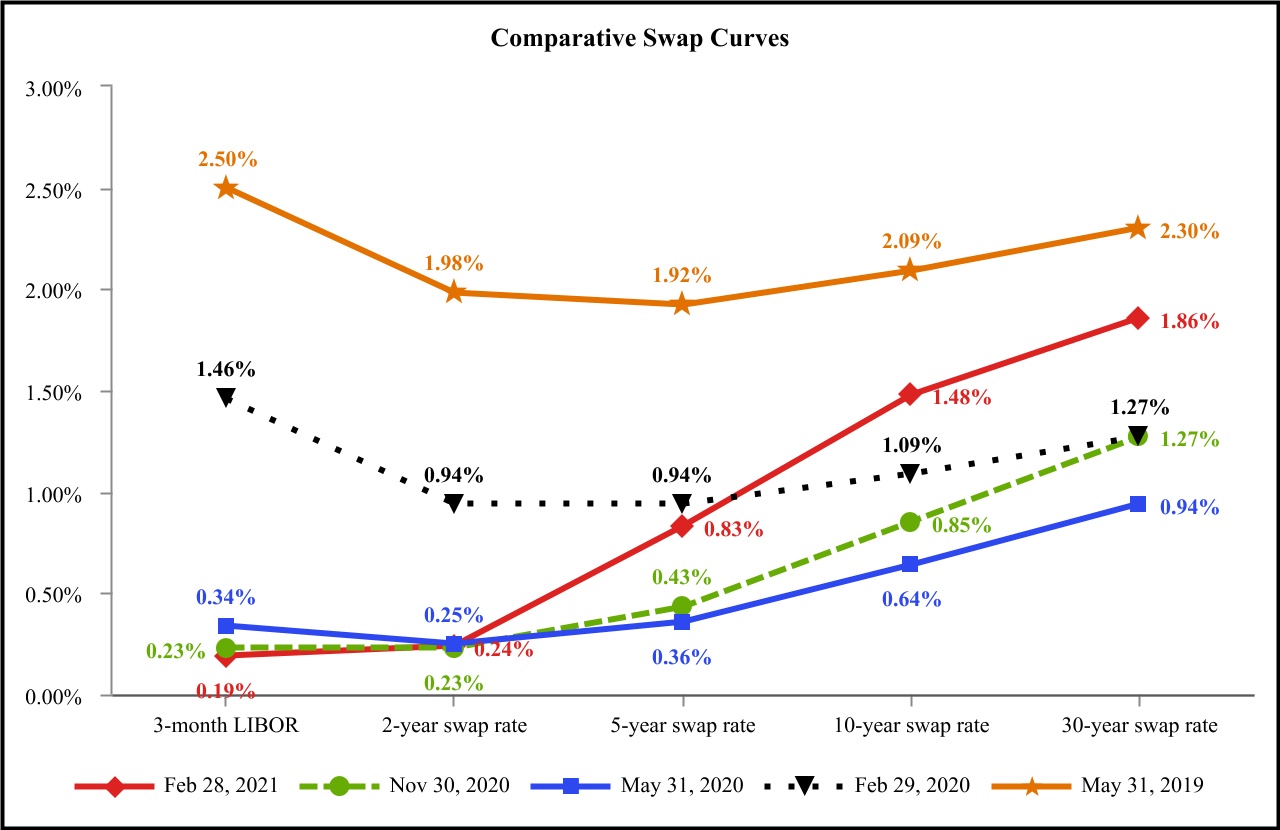

We experienced a decreasevariance of $81$656 million inbetween our reported net income of $161$379 million for the current quarter, fromand our reported net incomeloss of $242$277 million for the same prior-year quarter, which was primarily driven by a reductionfavorable shift in derivative gainsfair value changes of $102 million.$668 million between periods. We recorded derivative gains of $81$330 million for the current quarter, compared with derivative gains of q$183 million for the same prior-year quarter. The derivative gains in each period resulted fromuarter due to an increase in the net fair value of our swap portfolio which consists predominately of pay-fixed swaps, due to increasesresulting from an increase in medium- and longer-term swap interest rates. The increases in medium- and longer-term swap interest rates, however, were more pronounced during In comparison, we recorded derivative losses of $338 million for the same prior-year quarter resulting in higher derivative gains. Thedue to a decrease in derivative gains was partially offset by an increasethe net fair value of our swap portfolio resulting from a decline in ninterest rates across the swap curve. Net interest income of $23increased $21 million, or 29%25%, to $102$105 million for the current quarter, attributable to the combined impact of an increase in the net interest yield of 3128 basis points, or 26%23%, to 1.48%1.51% and an increase in our average interest-earning assets of $575$818 million, or 2%3%. The increase in the net interest yield was largely due to a reduction in our average cost of borrowings of 5851 basis points to 2.70%2.65%, partially offset by a decrease in the average yield on interest-earning assets of 2521 basis points to 4.01%3.99%.The favorable impact from the derivative gains and increase in net interest income for the current quarter was partially offset by an increase in our provision for credit losses of $31 million to $33 million for the current

quarter due to an addition to our allowance for credit losses of $33 million in the current quarter. The addition to the allowance was primarily attributable to a significant adverse financial impact on two CFC Texas-based electric power supply borrowers due to their exposure to elevated wholesale electric power costs during the mid-February 2021 polar vortex (the “February 2021 polar vortex”), which we discuss further under “Credit Quality.”

We experienced a variance of $387$1,043 million between our reported net income of $305$684 million for the six months ended November 30, 2020,current year-to-date period and our reported net loss of $82$359 million for the same prior year-to-date period, driven by a favorable shift in derivativethe change in the fair value changes of $354our derivatives of $1,022 million between periods. We recorded derivative gains of $142$472 million for the sixnine months ended November 30, 2020,February 28, 2021, due to a netan increase in the net fair value of our swap portfolio resulting from an increaseattributable to increases in long-termmedium- and longer-term swap interest rates. In contrast, we recorded derivative losses of $212$550 million during the same prior year-to-date period due to a decrease in the net fair value of our pay-fixed swaps attributable toswap portfolio resulting from declines in interest rates across the swap curve. In addition, net interest income increased $46$67 million, or 29%28%, to $202$307 million for the six months ended November 30, 2020,current year-to-date period, attributable to an increase in the net interest yield of 29 basis points, or 25%, to 1.45%1.47% and an increase in average interest-earning assets of $762$779 million, or 3%. The increase in the net interest yield reflected the impact of a reduction in our average cost of borrowings of 6056 basis points to 2.72%2.70%, which was partially offset by a decrease in the average yield on interest-earning assets of 2826 basis point to 4.00%3.99%.

A decreaseThe decreases in the average cost of our short-term borrowings of 183 basis points to 0.33% for the current quarter and 197 basis points to 0.39% for the six months ended November 30, 2020 was the primary factor driving the reduction in our overall average cost of borrowings during each period. The respective reductions in our average short-term borrowing cost, as well as the declines in theand average yield on our interest-earning assets reflect in part the impact ofwere driven by lower interest rates on our short-term borrowings and line-of-credit and variable rate loans attributable to the overall lower interest rate environment. Since November 30, 2019,February 29, 2020, the end of the same prior-year quarter, the benchmark federal funds rate has decreased 150 basis points as a result of the decision by the Federal Open Market Committee (“FOMC”) of the Federal Reserve in March 2020 to lower the federal funds rate to a near-zero target range of 0% to 0.25% as part of a series of measures implemented to ease the economic impact of the COVID-19 pandemic. The target federal funds rate range has remained unchanged since that time. Over the last 12 months, the 3-month London Interbank Offered Rate (“LIBOR”) decreased by 168127 basis points to 0.23%0.19% as of November 30, 2020.February 28, 2021. While medium- and longer-term interest rates also fell during the first nine months of this 12-month period, the decreases were not as pronounced as the reduction in short-term interest rates. Medium- and longer-term interest rates began trending up during the current quarter and subsequently following the enactment of additional COVID-19 relief bills totaling $900 billion under the Consolidated Appropriations Act, 2021 (“Appropriations Act”), signed into law on December 27, 2020, and $1.9 trillion under the American Rescue Plan Act of 2021, signed into law on March 11, 2021.

Other factors affecting the variance between our reported results for the six months ended November 30, 2020current year-to-date period and the same prior year-to-date period include the unfavorable impact of an increase in the provision for credit losses of $34 million to $35 million resulting from the current quarter allowance addition of $33 million, the absence of a gain of $8 million recorded in connection with the sale of land in the same prior year-to-date period and a decrease in fee income of $5 million due to a reduction in prepayment fees, and an unfavorable shift in the provision for credit losses of $3 million to an expense fromwhich together more than offset a benefit amount recorded in the same prior year-to-date period, partially offset by a decreasereduction in other general and administrative expenses of $5$8 million largely due to reduced travel and in-person meeting costsmeetings and the cancellation of certain events because of the COVID-19 pandemic.

Adjusted Non-GAAP Results

Adjusted net income totaled $49$19 million and adjusted TIER was 1.241.09 for the current quarter, compared with adjusted net income of $44$47 million and adjusted TIER of 1.201.21 for the same prior-year quarter. Adjusted net income totaled $107$126 million and adjusted TIER was 1.261.20 for the sixnine months ended November 30, 2020,February 28, 2021, compared with adjusted net income of $105$151 million and adjusted TIER of 1.23 for the same prior year-to-date period. Our adjusted debt-to-equity ratio increased above our targeted threshold of 6.00-to-1 to 5.906.21 as of November 30, 2020,February 28, 2021, from 5.85 as of May 31, 2020,2020. The increase was primarily attributable to a reductionan increase in adjusted equityliabilities due to additional borrowings to fund the maturity and redemption of subordinated certificates and the authorized patronage capital retirement amount, partially offset by adjusted net income for the current quarter. Our adjusted debt-to-equity ratio of 5.90 as of November 30, 2020, remained belowgrowth in our targeted threshold of 6.00-to-1.loan portfolio.

We experienced an increasea decrease in adjusted net income of $5$28 million in the current quarter from the same prior-year quarter, largelyprimarily attributable to anthe increase in adjusted net interest incomethe provision of $7credit losses of $31 million, or 11%, to $72$33 million for the current quarter. The increase in adjustedquarter due to the allowance addition resulting from the significant adverse financial impact of the February 2021 polar vortex on two CFC Texas-based electric power supply borrowers. Adjusted net interest income wasincreased $6 million, or 8%, to $75 million for the current quarter, driven by an increase in the adjusted net interest yield of 96 basis points, or 9%6%, to 1.05%1.08% and an increase in average interest-earning assets of $575$818 million, or 2%3%. The increase in our adjusted net interest yield reflected

the favorable impact of a reduction in our adjusted average cost of borrowings of 3429 basis points to 3.16%3.10%, which was partially offset by a decrease in the average yield on interest-earning assets of 2521 basis points to 4.01%3.99%. As noted above, the lower interest rate environment had a favorable impact on our adjusted average cost of borrowings and contributed to the decrease in the average yield on interest-earnings assets.

We experienced an increasea decrease in adjusted net income of $2$25 million for the sixnine months ended November 30, 2020February 28, 2021 from the same prior year-to-date period, duelargely attributable to the increase in partthe provision of credit losses of $34 million to$35 million resulting from the current quarter allowance addition of $33 million. The increase in the provision for credit losses was partially offset by an increase in our adjusted net interest income of $14$20 million, or 11%10%, to $145 million. The increase in adjusted net interest income was$220 million, driven by an increase in the adjusted net interest yield of 76 basis points, or 7%6%, to 1.04%1.05% and an increase in average interest-earning assets of $762$779 million, or 3%. The increase in our

adjusted net interest yield reflected the favorable impact of a reduction in our adjusted average cost of borrowings of 3633 basis points to 3.16%3.14%, which was partially offset by a decrease in the average yield on interest-earning assets of 2826 basis points to 4.00%3.99%, both of which were attributable to the lower interest rate environment.

A decrease in other general and administrative expenses of $5 million, largely due to reduced travel and in-person meeting and event costs because ofOther factors affecting the COVID-19 pandemic, also contributed to the increase invariance between our adjusted net income of $2 millionresults for the six months ended November 30, 2020. The combined favorable impact ofcurrent year-to-date period and the increase in adjusted net interest income and reduction in other general and administrative expense of $19 million was partially offset bysame prior year-to-date period include the absence of a gain of $8 million recorded in connection with ourthe sale of land in same the same prior year-to-date period and a decrease in fee income of $5 million due to a reduction in prepayment fees, which together more than offset a reduction in other general and an unfavorable shift inadministrative expenses of $8 million due to reduced travel and in-person meetings and the provision for credit lossescancellation of $3 million from a benefit recorded incertain events because of the same prior year-to-date period.COVID-19 pandemic.

See “Non-GAAP Financial Measures” for additional information on our adjusted measures, including a reconciliation of these measures to the most comparable GAAP measures.

Lending Activity

Loans to members totaled $27,063$28,327 million as of November 30, 2020,February 28, 2021, an increase of $361$1,625 million, or 1%6%, from May 31, 2020. The increase was driven primarily by an increase in long-term loans of $492 million, partially offset by a decrease in line of credit loans of $132 million. We experienced increases in CFC distribution loans, NCSC loans and RTFC loans of $453 million, $7 million and $46 million, respectively, and decreases in CFC power supply loans and CFC statewide and associate loans of $135 million and $11 million, respectively. Subsequent to the quarter end, during the month of December 31, 2020, our outstanding loans to members increased by an additional $476 million, driven by increases in long-term and line of credit loans of $274$941 million and $202$684 million, respectively. We experienced increases in CFC distribution loans, CFC power supply loans, NCSC loans and RTFC loans of $1,108 million, $456 million, $24 million and $46 million, respectively, and a decrease in CFC statewide and associate loans of $9 million.

Long-term loan advances totaled $1,271$2,050 million during the sixnine months ended November 30, 2020,February 28, 2021, of which approximately 85%84% was provided to members for capital expenditures and 5%9% was provided for the refinancing of loans made by other lenders. In comparison, long-term loan advances totaled $1,387$1,950 million during the same prior year-to-date period, of which approximately 69%77% was provided to members for capital expenditures and 25%18% was provided for the refinancing of loans made by other lenders. CFC had long-term fixed-rate loans totaling $204$281 million that were scheduled to reprice during the sixnine months ended November 30, 2020.February 28, 2021. Of this total, $198$268 million repriced to a new long-term fixed rate, $5$9 million repriced to a long-term variable rate and $1$4 million was repaid in full. In comparison, CFC had long-term fixed-rate loans totaling $234$350 million that were scheduled to reprice during the same prior year-to-date period, of which $224$330 million repriced to a new long-term fixed rate, $7$10 million repriced to a long-term variable rate $3and $10 million was repaid in full.

Credit Quality

We believe the overall credit qualityIn mid-February 2021, Texas and several neighboring states experienced a series of our loan portfolio remained highsevere winter storms and record-low temperatures as of November 30, 2020, as evidenced by our continued strong credit performance metrics. We had no delinquent loans as of either November 30, 2020 or May 31, 2020, and we have not experienced any loan defaults or charge-offs since fiscal year 2017. During the fourth quartera result of the fiscal year ended May 31, 2020polar vortex. The freezing conditions affected power demand, supply and market prices in Texas, triggering unprecedented increases in electrical power load demand in combination with significant reductions in power supply across Texas, including a loss of almost half of the electric generation within the Electric Reliability Council of Texas (“fiscal year 2020”ERCOT”) service area. ERCOT raised wholesale electric power prices per megawatt hour to the maximum allowable amount of $9,000, to spur greater power generation by providing a financial incentive for power generators in the state to remain online. According to ERCOT data, pre-storm wholesale power prices were less than $50 per megawatt hour. ERCOT also initiated controlled rolling power outages, which impacted millions of residential and commercial customers, to protect and maintain the stability of the Texas electric grid.

The surge in wholesale electricity prices had a direct financial impact primarily on certain electric power supply utilities, including a significant adverse financial impact on two CFC Texas-based electric power supply borrowers that had insufficient generation supply during the February 2021 polar vortex and were forced, at the height of the surge in power prices, to purchase power at peak prices to meet the electric demand of their member distribution system customers. On March 1, 2021, we were informed that Brazos Electric Power Cooperative, Inc. (“Brazos”), we classified one loan to a CFC Texas-based electric power supply borrower, with an outstanding balance of $168filed for Chapter 11 bankruptcy protection. We had exposure to Brazos totaling $85 million as of May 31, 2020,February 28, 2021, consisting of unsecured loans outstanding of $82 million and letters of credit of $3 million, pursuant to a $500 million syndicated revolving credit agreement administered by Bank of America. As a result of draws on the letters of credit in March 2021, subsequent to Brazos’ bankruptcy filing, we currently have unsecured loans outstanding to Brazos of $85 million. We downgraded Brazos’ borrower risk rating from a rating within the pass category to doubtful, classified its loans outstanding of $82 million as of February 28, 2021 as nonperforming, placed the loanloans on nonaccrual status, and established an asset-specific allowance for credit lossesreversed unpaid interest amounts previously accrued and recognized in interest income. In addition to the downgrade of $34Brazos, we made a material downgrade in the risk rating of another CFC Texas-based electric power supply borrower, which had loans outstanding of $383 million as of May 31, 2020. Payments receivedFebruary 28, 2021. The risk rating for this borrower was downgraded from a rating within the borrower on this loan resulted in a reduction in the outstanding balancepass category to $153 millionspecial mention as of November 30, 2020. The asset-specific allowance for credit losses for this nonperforming loan, which remains on nonaccrual status, was $32 million as of November 30, 2020. We had no other loans classified as nonperforming or on nonaccrual status as of November 30, 2020 or May 31, 2020.February 28, 2021.

Under the terms of the syndicated Bank of America revolving credit agreement, in the event of bankruptcy by Brazos, each lending participant is permitted to hold any deposited or investment funds from Brazos, up to the amount of the participant’s exposure to Brazos pursuant to the agreement, for set off against such exposure to Brazos. The total so held by all participants is required to be shared among the participants in accordance with the pro rata share of each participant in the agreement. As of the bankruptcy filing date, funds on deposit from or invested by Brazos with participating lenders of the agreement, available for set off against Brazos’s obligations, totaled $117 million. Based on our exposure of $85 million under the $500 million syndicated Bank of America agreement, our pro rata share set-off right is 17%, or approximately $20 million. The set-off rights have been agreed to and confirmed by Brazos and the bankruptcy court, subject only to challenge by parties other than Brazos until May 16, 2021, and subject to extension beyond this date by order of the court. In order to allow Brazos to access such deposited or invested funds, the lenders have been granted adequate protection liens and super-priority claims in an amount equal to the diminution of value of the amount available for set off.

Loans outstanding to electric utility organizations of $27,885 million and $26,306 million as of February 28, 2021 and May 31, 2020, respectively, represented approximately 98% and 99% of total loans outstanding as of November 30, 2020each date. Loans outstanding to Texas-based electric utility organizations accounted for 17% and 16% of total loans outstanding as of each respective date. Loans outstanding to Texas-based electric utility organizations covered by the Federal Agricultural Mortgage Corporation (“Farmer Mac”) standby repurchase agreement of $174 million and $181 million as of February 28, 2021 and May 31, 2020, respectively.respectively, reduced our Texas-based exposure to 16% and 15% of total loans outstanding as of each respective date. We historically have had limited defaults and losses on loans in our electric utility loan portfolio largely because of the essential nature of the service provided by electric utility cooperatives as well as other factors, such as limited rate regulation and competition, which we discuss further in the section “Credit Risk—Loan Portfolio Credit Risk.” We generally lend to members on a senior secured basis, which reduces the risk of loss in the event of a borrower default. Of our total loans outstanding, 92% and 94% were secured as of both November 30, 2020February 28, 2021 and May 31, 2020, respectively.

Nonperforming loans increased $72 million to $240 million, or 0.85% of total loans outstanding, as of February 28, 2021, from $168 million, or 0.63% of total loans outstanding, as of May 31, 2020, primarily due to our classification of the loans outstanding of $82 million to Brazos as nonperforming as a result of its bankruptcy filing. In addition to Brazos, we classified loans outstanding to two affiliated RTFC telecommunications borrowers totaling $10 million as nonperforming as of February 28, 2021. Although we experienced an increase in nonperforming and criticized loans due to the downgrade of the two CFC Texas-based electric power supply borrowers during the current quarter, we believe the overall credit quality of our loan portfolio remained strong as of February 28, 2021, as the adverse impact on the credit quality of our loan portfolio from the February 2021 polar vortex is primarily limited to these two Texas-based electric power supply borrowers. Prior to Brazos’ bankruptcy filing, we had not experienced any defaults or charge-offs in our electric utility and telecommunications loan portfolios since fiscal year 2013 and 2017, respectively. In addition, we had no delinquent loans as of either February 28, 2021 or May 31, 2020. However, as a result of its bankruptcy filing, we expect that Brazos will be unable to make future scheduled loan payments without approval of the bankruptcy court.

Our allowance for credit losses and allowance coverage ratio increased to $92 million and 0.32%, respectively, as of February 28, 2021, from $53 million and 0.20%, respectively, as of May 31, 2020, primarily due to the current quarter

The allowance for credit losses for our loan portfolio increasedaddition to $59 million as of November 30, 2020, from $53 million as of May 31, 2020, and the allowance coverage ratio increased to 0.22% from 0.20%. The increase in the allowance for credit losses of $33 million. This addition was primarily attributabledriven by the material risk rating downgrade of the CFC Texas-based power supply borrower with loans outstanding totaling $383 million as of February 28, 2021, and the classification of the loans outstanding of $82 million to the impactBrazos as nonperforming as of ourFebruary 28, 2021.

On June 1, 2020, adoption ofwe adopted the current expected credit loss (“CECL”) accounting standard, which replaces the incurred loss methodology for estimating credit losses with an expected loss methodology. The incurred loss model delayed the recognition of credit losses until it was probable that a loss had occurred, while the CECL model requires the immediate recognition of expected credit losses over the contractual term for financial instruments that fall within the scope of CECL at the date of origination or purchase of the financial instrument. The CECL model, which is applicable to the measurement of credit losses on financial assets measured at amortized cost and certain off-balance sheet credit exposures, affects our estimates of the allowance for credit losses for our loan portfolio and the reserve for our off-balance sheet credit exposures related to unadvanced loan commitments and financial guarantees. The adoption of CECL resulted in an increase in our allowance for credit losses for our loan portfolio of $4 million and a corresponding decrease to retained earnings of $4 million, recorded through a cumulative-effect adjustment. The impact on the reserve for credit losses for our off-balance sheet credit exposures related to unadvanced loan commitments and financial guarantees was not material. While CECL had no impact on our earnings at adoption on June 1, 2020, subsequent estimates of lifetime expected credit losses for newly recognized loans, unadvanced loan commitments and financial guarantees, as well as changes during the period in our estimate of lifetime expected credit losses for existing financial instruments subject to CECL, are now recognized in earnings.

We discuss our methodology for estimating the allowance for credit losses under the CECL model in “Note 1—Summary of Significant Accounting Policies” of this Report. We also provide information on the allowance for credit losses below in the section “Credit Risk—Allowance for Credit Losses” and in “Note 5—Allowance for Credit Losses.”

Financing Activity

We issue debt primarily to fund growth in our loan portfolio. As such, our outstanding debt volume generally increases and decreases in response to member loan demand. Total debt outstanding was $26,017$27,207 million as of November 30, 2020,February 28, 2021, an increase of $17$1,207 million from May 31, 2020. In the fourth quarter of fiscal year 2020, we increased our cash position to $671 million, as a precaution in case there were disruptions in the capital markets due to Covid-19 that would impact our ability to fund operations in fiscal year 2021. During the first six months of fiscal year 2021 there have not been disruptions in our ability to access the capital markets or in our issuance of debt to our members. As a result we have been able to use the $671 million of cash that was on hand as of May 31, 2020borrowings to fund the majority of our operations through November 30, 2020, at which date our cash balance had been reducedincrease in loans to $167 million.members. Debt activity during this period consisted of net increases in medium-term notes of $1,257 million and outstanding dealer commercial paper of $715 million and member commercial paper, select notes and daily liquidity fund notes of $104$655 million, which together totaled $819$1,912 million. This increase was partially offset by net decreases in collateral trust bonds of $351 million, Federal Agricultural Mortgage Corporation (“Farmer Mac”)Mac notes payable of $161 million, medium-term notes of $151$384 million, borrowings under the United States Department of Agriculture (“USDA”) Guaranteed Underwriter Program (“Guaranteed Underwriter Program”) of $71$231 million, and members’ subordinated certificates of $68$83 million and the combined outstanding amounts of member commercial paper, select notes and daily liquidity fund notes of $4 million, which together totaled $802$702 million. Outstanding dealer commercial paper which totaled $715of $655 million as of November 30, 2020,February 28, 2021 was below our targeted maximum threshold of $1,250 million.

On October 8, 2020, we issued $400 million aggregate principal amount of 1.35% sustainability collateral trust bonds due March 15, 2031. On November 19, 2020, we closed on a $375 million committed loan facility (“Series R”) from the Federal Financing Bank under the Guaranteed Underwriter Program. Pursuant to this facility, we may borrow any time before July 15, 2025. Each advance is subject to quarterly amortization and a final maturity not longer than 30 years from the date of the advance. On February 8, 2021, we issued $350 million of aggregate principal amount of 1.65% collateral trust bonds due June 15, 2031. In February 2021, we issued dealer medium-term notes totaling $1,425 million.

On March 5, 2021, S&P Global Inc. (“S&P”) issued a downgrade of our long-term issuer credit rating, citing a shift from “Strong” to “Adequate” in its view of CFC’s risk position due to CFC’s loan portfolio concentration in the State of Texas. S&P also revised its outlook on CFC to negative based on the potential for additional elevated credit stress posed by Texas electric cooperatives due to the February 2021 polar vortex. The downgrade of CFC’s long-term issuer credit rating by S&P resulted in a downgrade of: (i) our senior secured and senior unsecured debt ratings to A- from A; (ii) our subordinated debt rating to BBB from BBB+; and (iii) our short-term issuer credit and commercial paper ratings to A-2 from A-1, each with a negative outlook. Our credit ratings by Moody’s Investors Service (“Moody’s”) and Fitch Ratings (“Fitch”) remain unchanged from May 31, 2020, and as of the date of this Report.

As discussed in the “Liquidity Risk” section, we believe CFC is well capitalized with adequate sources of liquidity and funding to meet our maturing debt obligations and loan demand from our members.

Liquidity

As of November 30, 2020,February 28, 2021, our sources of liquidity readily available for access totaled $7,317$7,566 million, consisting of (i) $167$170 million in cash and cash equivalents; (ii) investments in debt securities with a fair value of $552$575 million, subject to changes in market value; (iii) up to $2,722 million available for access under committed bank revolving line of credit agreements; (iv) up to $1,275 million available under committed loan facilities under the Guaranteed Underwriter Program; and (v) up to $2,601$2,824 million available under a revolving note purchase agreement with Farmer Mac, subject to market conditions.

Long-term debtDebt scheduled to mature over the next 12 months totaled $1,742$7,082 million as of November 30, 2020,February 28, 2021, consisting of short-term borrowings of $4,408 million and long-term debt of $2,674 million. The short-term borrowings scheduled maturity amount of $4,408 million consists of member investments of $3,753 million and dealer commercial paper of $655 million. The long-term debt scheduled maturity amount of $2,674 million consists of fixed-rate debt of $697totaling $1,579 million with a weighted average cost of 2.69%2.42%, variable-rate debt of $810totaling $860 million and scheduled amortization on borrowings under the Guaranteed Underwriter Program and notes payable to Farmer Mac oftotaling $235 million. Our available liquidity of $7,317$7,566 million as of November 30, 2020,February 28, 2021, was $5,575$484 million in excess of our total debt obligations over the next 12 months of $7,082 million and $4,237 million in excess of, or 3.22.3 times, our long-term debt and dealer commercial paper obligations of $1,742 million over the next 12 months. We currently believe that our available liquidity along with our ability to access the capital markets as a well-known seasoned issuermonths of debt$2,674 million and to issue debt to our members and in private placements will be more than sufficient to meet the borrowing needs of our members and to cover the payment of long-term debt maturing over the 12 months subsequent to November 30, 2020.$655 million, respectively, which together total $3,329 million.

Our members historically have maintained a relatively stable level of short-term investments in CFC in the form of daily liquidity fund notes, commercial paper, select notes daily liquidity fund notes and medium-term notes. Member short-term investments in CFC averaged $3,658 million over the last six fiscal quarter-end reporting periods. We believe we can continue to roll over outstanding member short-term debt, which totaled $3,848$3,753 million as of November 30, 2020,February 28, 2021, based on our expectation that our members will continue to reinvest their excess cash in our commercial paper, daily liquidity fund notes, select notes and medium-term notes.these short-term investment products offered by CFC. We expect to continue accessing the dealer commercial paper market as a cost-effective means of satisfying our incremental short-term liquidity needs. Although the intra-period amount of outstanding dealer commercial paper may fluctuate based on our liquidity requirements, we intend to manage our short-term wholesale funding risk by maintaining outstanding dealer commercial paper at an amount near or below $1,250 million for the foreseeable future. We expect to continue to be in compliance with the covenants under our committed bank revolving line of credit agreements, which will allow us to mitigate roll-over risk, as we can draw on these facilities to repay dealer or member commercial paper that cannot be refinanced with similar debt.

We provide additional information on our primary sources and uses of liquidity and our liquidity profile below in the section “Liquidity Risk.”

COVID-19

TheOur priorities during the COVID-19 pandemic, which continues to persist, have an ongoing disruptive impact onbeen to protect the health and safety of our employees, while also ensuring that we are able to meet the needs of our electric cooperative borrowers as they operate in a sector in which the service provided to residential and commercial customers is considered essential. We continue to adhere to the COVID-19 workplace safety and health standards established by Virginia, where CFC is headquartered, and the guidance provided by the United States (“U.S.”). The continuing duration and severity of the pandemic and its long-term economic impact remain uncertain. CFC is headquartered in the Commonwealth of Virginia and is following workplace guidelines established by the Commonwealth and the U.S. Center for Disease Control and Prevention. We are currently staffingSince June 2020, we have been operating under a plan in which staff work at our corporate office at no more thanand remotely based on a rotating schedule that limits the office occupancy level to approximately 25% occupancy, with other personnel working remotely, andof normal capacity. In addition, since the onset of the pandemic we have limited travel and in-person meetings. To date, our business resiliency plans and technology systems have effectively supported both remote and on-site operations. Based on current conditions, our expectation is that we will maintain current remote working levels for the foreseeable futureOn March 23, 2021, Virginia’s governor announced an easing of some COVID-19 restrictions beginning April 1, 2021. Our plan, assuming there are no additional changes to current governmental and public health directives.directives, is to move toward more normal operations beginning in May 2021, by bringing our staff back to our corporate office under a gradual transition schedule, with appropriate workplace protocols to mitigate risk and maintain the safety of our employees in compliance with federal, state and local laws and guidance.

WeWhile several U.S. industry sectors have been severely affected by the COVID-19 pandemic, we believewe have been able to navigate the challenges of the COVID-19 pandemic to date and that the pandemic has not had any significant negative effect on our liquidity, and that our portfolio credit quality remains strong. Inliquidity. During the first sixnine months of the fiscal year ending May 31, 2021 (“fiscal year 2021”), we have remainedcontinued to be able to access the capital markets, private funding programs and our members for the capitalfunds required to repay maturing debt and we have made long-termprovide loan advances of $1.3 billion to our members for capital improvements and to fund their operations. In comparison, we made $1.4 billion of long-term loan advances in first six months of the prior year, prior to the impacts of COVID-19. We also believe that we currently have sufficient liquidity to meet memberthe credit quality of our loan demand and repay maturing debt overportfolio has remained strong throughout the next 12 months.pandemic. Our electric utility

Our electric utility cooperative borrowers operate in a sector identified by the U.S. government as one of the 16 critical infrastructure sectors because the nature of the services provided to residential customers and commercial customers in other industrythese sectors are considered essential and vital in supporting and maintaining the overall functioning of the U.S. economy. Historically, the utility sector in which our electric utility borrowers operate has been resilient to economic downturns. While our electric cooperative members continue to be subject to certain state-mandated suspensions on utility shut-offs due to nonpayment, we have not experienced any delinquencies in scheduled loan payments or received requests for payment deferrals or covenant relief from our borrowers due to the pandemic. We are in contact with our member borrowers on a continuous basis, and, to date, we believe that the pandemic has not had a significant negative impact on their overall financial performance.

Outlook for the Next 12 Months

We believe we have been able to navigate the challenges of the COVID-19 pandemic to date. As noted above, we currently believe that we have sufficient cash flow and liquidity to cover our existing debt obligations and meet the borrowing needs of our members. Although we believe the overall credit quality of our loan portfolio remains high, we continue to actively monitor conditions andclosely monitoring developments includingand key credit metrics of our borrowers, to facilitate the timely identification of loans with potential credit weaknesses and assess any notable shifts in the credit quality of our loan portfolioportfolio. To date, we believe that the pandemic has not had a significant negative impact on the overall financial performance of our members.

Recent Developments

On March 10, 2021, the CFC Board of Directors appointed J. Andrew Don, who has served as senior vice president and CFC’s Chief Financial Officer since 2013, to succeed Sheldon C. Petersen as CFC’s Chief Executive Officer (“CEO”), effective May 3, 2021, the date on which the July 23, 2020 announced retirement of Mr. Petersen as CEO is expected to occur. We do not anticipate any fundamental changes in CFC’s overall business model as a result of this leadership change. As a member-owned cooperative, we plan to continue working with our members to ensure that CFC is able to meet the financing needs of our members, as well as any impact on our financial position. Assuming no material adverse changesprovide industry expertise and strategic services to aid them in delivering affordable and reliable essential services to their communities.

Outlook

We currently believe that the growth in outstanding loans coupled with an anticipated continued steepening of the yield curve in the credit quality ofnear term will contribute to an increase in our borrowers, we expectnet interest income, net interest yield, adjusted net interest income and adjusted net interest yield over the next 12 months. We anticipate that our financial performance for the fiscal year ended May 31, 2021 (“fiscal year 2021”) will be comparable to or slightly better than our financial performance for fiscal year 2020, absentadjusted debt-to-equity ratio, which excludes the impact of (i)derivative forward fair value gains and losses, will remain above our targeted threshold of 6.00-to-1 for the non-cash impairment charge of $31 million recorded in the fourth quarter of fiscal year 2020 resulting from the abandonment of an internal-use software project; (ii) the loan impairment charge of $34 million recorded in the fourth quarter of fiscal year 2020next 12 months due to the establishmentcurrent year-to-date increase in total debt outstanding to fund the growth in our loan portfolio. Our reported income and equity include the impact of an asset-specific allowance for the outstanding loan to the CFC power supply borrower noted above; and (iii) changesperiodic unrealized fluctuations in the fair value of our derivatives and investment securities thatinterest rate swaps. These periodic fluctuations are primarily driven by changes in marketexpected interest rates and prices,over the life of the swaps, which we are unable to predict.predict because the majority of our swaps are long-term, with an average remaining life of approximately 15 years as of February 28, 2021. We therefore exclude the potential impact of derivative forward value gains and losses from our forecasted adjusted net income-related measures.

We believe the overall credit quality of our loan portfolio remained high as of February 28, 2021, and the significant adverse financial impact from the surge in wholesale power costs in Texas during the February 2021 polar vortex was primarily limited to the two CFC Texas-based electric power supply borrowers discussed above. Our estimate of expected credit losses on loans outstanding to these two borrowers, which together totaled $465 million as of February 28, 2021, involves significant judgment and assumptions that are based on information available to us as of the date of this Report. Given that a resolution on these elevated power costs has not been reached and the process to reach a resolution is in a very early stage, there is significant uncertainty with regard to the ultimate outcome. Therefore, we are unable at this time to provide a reasonably reliable forecast of adjusted net income and adjusted TIER for the next 12 months. Our projected adjusted measures exclude the impact of derivative forward value gains and losses because we are unable to predict these amounts. We expect to adjust our current expected credit loss estimate for these two Texas-based electric power supply borrowers as developments occur in the resolution process and we accumulate additional, relevant information. As the outcome becomes more certain, we expect that we will resume providing a 12-month projected trend of adjusted net income and adjusted TIER.

See “Item 1A. Risk Factors” in our 2020 Form 10-K for a discussion of the potential adverse impact of natural disasters, including weather-related events such as the February 2021 polar vortex, and widespread health emergencies, such as COVID-19, on our business, results of operations, financial condition and liquidity.

| | |

| CRITICAL ACCOUNTING POLICIES AND ESTIMATES |

The preparation of financial statements in accordance with GAAP requires management to make a number of judgments, estimates and assumptions that affect the reported amount of assets, liabilities, income and expenses in our consolidated financial statements. Understanding our accounting policies and the extent to which we use management’s judgment and estimates in applying these policies is integral to understanding our financial statements. We provide a discussion of our significant accounting policies under “Note 1—Summary of Significant Accounting Policies” in our 2020 Form 10-K. Pursuant to our June 1, 2020 adoption of the CECL accounting standard, we have provided updates to certain of our significant accounting policies, including the allowance for credit losses, in “Note 1—Summary of Significant Accounting Policies” of this Report.