UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒QUARTERLY REPORT PURSUANT TO SECTION 13 or 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 24, 2017June 28, 2020

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___ to ___

Commission file number 1-5837

THE NEW YORK TIMES COMPANY

(Exact name of registrant as specified in its charter)

|

| | |

NEW YORKNew York | | 13-1102020 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

620 EIGHTH AVENUE, NEW YORK, NEW YORKEighth Avenue, New York, New York10018

(Address and zip code of principal executive offices)

10018

(Zip Code)

Registrant’s telephone number, including area code 212-556-1234212-556-1234

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock | | NYT | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yesx No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | |

Large accelerated filerx | ☒ | Accelerated filero | ☐ | Non-accelerated filero | ☐ |

Smaller reporting companyo | ☐ | Emerging growth companyo | ☐ | | |

IfIf an emerging growth company, indicate by the check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. o☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o☐ No x

Number of shares of each class of the registrant’s common stock outstanding as of October 27, 2017July 31, 2020 (exclusive of treasury shares):

|

| | | |

| Class A Common Stock | 161,394,059165,953,189 |

| shares |

| Class B Common Stock | 808,763801,884 |

| shares |

THE NEW YORK TIMES COMPANY

INDEX

| | | | | ITEM NO. | | | | | | |

| PART I | | | Financial Information | | | | | Financial Information | | |

| Item | 1 | | Financial Statements | | | 1 | | Financial Statements | | |

| | | | Condensed Consolidated Balance Sheets as of June 28, 2020 (unaudited) and December 29, 2019 | | |

| | | Condensed Consolidated Balance Sheets as September 24, 2017 (unaudited) and December 25, 2016 | | | | Condensed Consolidated Statements of Operations (unaudited) for the quarters and six months ended June 28, 2020 and June 30, 2019 | | |

| | | Condensed Consolidated Statements of Operations (unaudited) for the quarters and nine months ended September 24, 2017 and September 25, 2016 | | | | Condensed Consolidated Statements of Comprehensive Income (unaudited) for the quarters and six months ended June 28, 2020 and June 30, 2019 | | |

| | | Condensed Consolidated Statements of Comprehensive Income (unaudited) for the quarters and nine months ended September 24, 2017 and September 25, 2016 | | | | Condensed Consolidated Statements of Changes In Stockholders’ Equity (unaudited) for the quarters and six months ended June 28, 2020 and June 30, 2019 | | |

| | | Condensed Consolidated Statements of Cash Flows (unaudited) for the nine months ended September 24, 2017 and September 25, 2016 | | | | Condensed Consolidated Statements of Cash Flows (unaudited) for the six months ended June 28, 2020 and June 30, 2019 | | |

| | | Notes to the Condensed Consolidated Financial Statements | | | | Notes to the Condensed Consolidated Financial Statements | | |

| Item | 2 | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | 2 | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | |

| Item | 3 | | Quantitative and Qualitative Disclosures about Market Risk | | | 3 | | Quantitative and Qualitative Disclosures about Market Risk | | |

| Item | | 4 | | Controls and Procedures | | | 4 | | Controls and Procedures | | |

| | | |

| PART II | | | Other Information | | | | | | Other Information | | |

| Item | 1 | | Legal Proceedings | | | 1 | | Legal Proceedings | | |

| Item | 1A | | Risk Factors | | | 1A | | Risk Factors | | |

| Item | 2 | | Unregistered Sales of Equity Securities and Use of Proceeds | | | 2 | | Unregistered Sales of Equity Securities and Use of Proceeds | | |

| Item | 6 | | Exhibits | | | 6 | | Exhibits | | |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

THE NEW YORK TIMES COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

| | | | | September 24, 2017 |

| December 25, 2016 | | June 28, 2020 |

|

| December 29, 2019 |

|

| | | (Unaudited) | | | | (Unaudited) | | |

| Assets | | | | | | | | |

| Current assets | | | | | | | | |

| Cash and cash equivalents | | $ | 244,667 |

| | $ | 100,692 |

| | $ | 249,312 |

| | $ | 230,431 |

|

| Short-term marketable securities | | 336,442 |

| | 449,535 |

| | 240,400 |

| | 201,785 |

|

| Accounts receivable (net of allowances of $13,838 in 2017 and $16,815 in 2016) | | 142,323 |

| | 197,355 |

| |

| Accounts receivable (net of allowances of $13,646 in 2020 and $14,358 in 2019) | | | 122,092 |

| | 213,402 |

|

| Prepaid expenses | | 17,869 |

| | 15,948 |

| | 28,382 |

| | 29,089 |

|

| Other current assets | | 26,462 |

| | 32,648 |

| | 42,331 |

| | 42,124 |

|

| Total current assets | | 767,763 |

| | 796,178 |

| | 682,517 |

| | 716,831 |

|

| Other assets | | | | | | | | |

| Long-term marketable securities | | 241,782 |

| | 187,299 |

| | 266,946 |

| | 251,696 |

|

| Investments in joint ventures | | 20,472 |

| | 15,614 |

| |

| Property, plant and equipment (less accumulated depreciation and amortization of $945,416 in 2017 and $903,736 in 2016) | | 618,835 |

| | 596,743 |

| |

| Property, plant and equipment (less accumulated depreciation and amortization of $978,828 in 2020 and $950,881 in 2019) | | | 611,998 |

| | 627,121 |

|

| Goodwill | | 143,171 |

| | 134,517 |

| | 144,767 |

| | 138,674 |

|

| Deferred income taxes | | 290,473 |

| | 301,342 |

| | 111,355 |

| | 115,229 |

|

| Miscellaneous assets | | 156,462 |

| | 153,702 |

| | 240,774 |

| | 239,587 |

|

| Total assets | | $ | 2,238,958 |

| | $ | 2,185,395 |

| | $ | 2,058,357 |

| | $ | 2,089,138 |

|

See Notes to Condensed Consolidated Financial Statements.

THE NEW YORK TIMES COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS-(Continued)

(In thousands, except share and per share data) | | | | | September 24, 2017 | | December 25, 2016 | | June 28, 2020 |

| | December 29, 2019 |

|

| | | (Unaudited) | | | | (Unaudited) | | |

| Liabilities and stockholders’ equity | | | | | | | | |

| Current liabilities | | | | | | | | |

| Accounts payable | | $ | 116,724 |

| | $ | 104,463 |

| | $ | 70,692 |

| | $ | 116,571 |

|

| Accrued payroll and other related liabilities | | 90,651 |

| | 96,463 |

| | 66,004 |

| | 108,865 |

|

| Unexpired subscriptions | | 76,886 |

| | 66,686 |

| |

| Unexpired subscriptions revenue | | | 99,674 |

| | 88,419 |

|

| Accrued expenses and other | | 134,411 |

| | 131,125 |

| | 134,742 |

| | 123,840 |

|

| Total current liabilities | | 418,672 |

| | 398,737 |

| | 371,112 |

| | 437,695 |

|

| Other liabilities | | | | | | | | |

| Long-term debt and capital lease obligations | | 249,375 |

| | 246,978 |

| |

| Pension benefits obligation | | 518,395 |

| | 558,790 |

| | 294,470 |

| | 313,655 |

|

| Postretirement benefits obligation | | 55,107 |

| | 57,999 |

| | 35,935 |

| | 37,688 |

|

| Other | | 78,735 |

| | 78,647 |

| | 125,809 |

| | 126,237 |

|

| Total other liabilities | | 901,612 |

| | 942,414 |

| | 456,214 |

| | 477,580 |

|

| Stockholders’ equity | | | | | | | | |

| Common stock of $.10 par value: | | | | | | | | |

| Class A – authorized: 300,000,000 shares; issued: 2017 – 170,220,136; 2016 – 169,206,879 (including treasury shares: 2017 – 8,870,801; 2016 – 8,870,801) | | 17,022 |

| | 16,921 |

| |

Class B – convertible – authorized and issued shares: 2017 – 810,933; 2016 – 816,632 (including treasury shares: 2017 – none; 2016 – none) | | 81 |

| | 82 |

| |

Class A – authorized: 300,000,000 shares; issued: 2020 – 174,820,777; 2019 – 174,242,668 (including treasury shares: 2020 – 8,870,801; 2019 – 8,870,801) | | | 17,482 |

| | 17,424 |

|

| Class B – convertible – authorized and issued shares: 2020 – 803,404; 2019 – 803,404 | | | 80 |

| | 80 |

|

| Additional paid-in capital | | 159,830 |

| | 149,928 |

| | 205,618 |

| | 208,028 |

|

| Retained earnings | | 1,373,478 |

| | 1,331,911 |

| | 1,659,158 |

| | 1,612,658 |

|

| Common stock held in treasury, at cost | | (171,211 | ) | | (171,211 | ) | | (171,211 | ) | | (171,211 | ) |

| Accumulated other comprehensive loss, net of income taxes: | | | | | | | | |

| Foreign currency translation adjustments | | 5,571 |

| | (1,822 | ) | | 3,706 |

| | 3,438 |

|

| Funded status of benefit plans | | (465,440 | ) | | (477,994 | ) | | (489,748 | ) | | (498,986 | ) |

| Net unrealized loss on available-for-sale securities | | (653 | ) | | — |

| |

| Net unrealized gain on available-for-sale securities | | | 4,086 |

| | 572 |

|

| Total accumulated other comprehensive loss, net of income taxes | | (460,522 | ) | | (479,816 | ) | | (481,956 | ) | | (494,976 | ) |

| Total New York Times Company stockholders’ equity | | 918,678 |

| | 847,815 |

| | 1,229,171 |

| | 1,172,003 |

|

| Noncontrolling interest | | (4 | ) | | (3,571 | ) | | 1,860 |

| | 1,860 |

|

| Total stockholders’ equity | | 918,674 |

| | 844,244 |

| | 1,231,031 |

| | 1,173,863 |

|

| Total liabilities and stockholders’ equity | | $ | 2,238,958 |

| | $ | 2,185,395 |

| | $ | 2,058,357 |

| | $ | 2,089,138 |

|

See Notes to Condensed Consolidated Financial Statements.

THE NEW YORK TIMES COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share data)

|

| | | | | | | | | | | | | | | | |

| | | For the Quarters Ended | | For the Nine Months Ended |

| | | September 24, 2017 |

|

| September 25, 2016 |

| | September 24, 2017 |

| | September 25, 2016 |

|

| | | (13 weeks) | | (39 weeks) |

| Revenues | | | | | | | | |

| Subscription | | $ | 246,638 |

| | $ | 217,099 |

| | $ | 739,050 |

| | $ | 654,573 |

|

| Advertising | | 113,633 |

| | 124,898 |

| | 375,895 |

| | 395,733 |

|

| Other | | 25,364 |

| | 21,550 |

| | 76,568 |

| | 65,386 |

|

| Total revenues | | 385,635 |

| | 363,547 |

| | 1,191,513 |

| | 1,115,692 |

|

| Operating costs | | | | | | | | |

| Production costs: | | | | | | | | |

| Wages and benefits | | 89,866 |

| | 91,041 |

| | 269,209 |

| | 274,142 |

|

| Raw materials | | 15,718 |

| | 18,228 |

| | 48,461 |

| | 53,115 |

|

| Other | | 44,336 |

| | 47,347 |

| | 134,771 |

| | 139,938 |

|

| Total production costs | | 149,920 |

| | 156,616 |

| | 452,441 |

| | 467,195 |

|

| Selling, general and administrative costs | | 184,483 |

| | 184,596 |

| | 595,491 |

| | 534,911 |

|

| Depreciation and amortization | | 15,677 |

| | 15,384 |

| | 46,961 |

| | 46,003 |

|

| Total operating costs | | 350,080 |

| | 356,596 |

| | 1,094,893 |

| | 1,048,109 |

|

| Headquarters redesign and consolidation | | 2,542 |

| | — |

| | 6,929 |

| | — |

|

| Restructuring charge | | — |

| | 2,949 |

| | — |

| | 14,804 |

|

| Multiemployer pension plan withdrawal expense | | — |

| | (4,971 | ) | | — |

| | 6,730 |

|

| Operating profit | | 33,013 |

| | 8,973 |

| | 89,691 |

| | 46,049 |

|

| Gain/(loss) from joint ventures | | 31,557 |

| | 463 |

| | 31,464 |

| | (41,845 | ) |

| Interest expense, net | | 4,660 |

| | 9,032 |

| | 15,118 |

| | 26,955 |

|

| Income/(loss) from continuing operations before income taxes | | 59,910 |

| | 404 |

| | 106,037 |

| | (22,751 | ) |

| Income tax expense/(benefit) | | 23,420 |

| | 121 |

| | 40,873 |

| | (8,956 | ) |

| Income/(loss) from continuing operations | | 36,490 |

| | 283 |

| | 65,164 |

| | (13,795 | ) |

| Loss from discontinued operations, net of income taxes | | 488 |

| | — |

| | 488 |

| | — |

|

| Net income/(loss) | | 36,002 |

| | 283 |

| | 64,676 |

| | (13,795 | ) |

| Net (income)/loss attributable to the noncontrolling interest | | (3,673 | ) | | 123 |

| | (3,567 | ) | | 5,719 |

|

| Net income/(loss) attributable to The New York Times Company common stockholders | | $ | 32,329 |

| | $ | 406 |

| | $ | 61,109 |

| | $ | (8,076 | ) |

| Average number of common shares outstanding: | | | | | | | | |

| Basic | | 162,173 |

| | 161,185 |

| | 161,798 |

| | 161,092 |

|

| Diluted | | 164,405 |

| | 162,945 |

| | 164,005 |

| | 161,092 |

|

| Basic earnings/(loss) per share attributable to The New York Times Company common stockholders: | | | | | | | | |

| Income/(loss) from continuing operations | | $ | 0.20 |

| | $ | — |

| | $ | 0.38 |

| | $ | (0.05 | ) |

| Loss from discontinued operations, net of income taxes | | — |

| | — |

| | — |

| | — |

|

| Net income/(loss) | | $ | 0.20 |

| | $ | — |

| | $ | 0.38 |

| | $ | (0.05 | ) |

|

| | | | | | | | | | | | | | | | |

| | | For the Quarters Ended | | For the Six Months Ended |

| | | June 28, 2020 |

|

| June 30, 2019 |

| | June 28, 2020 |

| | June 30, 2019 |

|

| | | (13 weeks) | | (26 weeks) |

| Revenues | | | | | | | | |

| Subscription | | $ | 293,189 |

| | $ | 270,456 |

| | $ | 578,623 |

| | $ | 541,266 |

|

| Advertising | | 67,760 |

| | 120,761 |

| | 173,897 |

| | 245,849 |

|

| Other | | 42,801 |

| | 45,041 |

| | 94,866 |

| | 88,205 |

|

| Total revenues | | 403,750 |

| | 436,258 |

| | 847,386 |

| | 875,320 |

|

| Operating costs | | | | | | | | |

| Cost of revenue (excluding depreciation and amortization) | | 230,147 |

| | 245,195 |

| | 473,819 |

| | 484,554 |

|

| Sales and marketing | | 39,617 |

| | 62,289 |

| | 113,413 |

| | 137,109 |

|

| Product development | | 30,737 |

| | 25,261 |

| | 61,539 |

| | 48,989 |

|

| General and administrative | | 58,812 |

| | 50,400 |

| | 111,673 |

| | 102,039 |

|

| Depreciation and amortization | | 15,631 |

| | 15,180 |

| | 30,816 |

| | 30,098 |

|

| Total operating costs | | 374,944 |

| | 398,325 |

| | 791,260 |

| | 802,789 |

|

| Operating profit | | 28,806 |

| | 37,933 |

| | 56,126 |

| | 72,531 |

|

| Other components of net periodic benefit costs | | 2,149 |

| | 1,833 |

| | 4,463 |

| | 3,668 |

|

| Interest income/(expense) and other, net | | 2,786 |

| | (1,514 | ) | | 16,640 |

| | (2,817 | ) |

| Income from continuing operations before income taxes | | 29,443 |

| | 34,586 |

| | 68,303 |

| | 66,046 |

|

| Income tax expense | | 5,781 |

| | 9,415 |

| | 11,787 |

| | 10,719 |

|

| Net income | | 23,662 |

| | 25,171 |

| | 56,516 |

| | 55,327 |

|

| Net income attributable to The New York Times Company common stockholders | | $ | 23,662 |

| | $ | 25,171 |

| | $ | 56,516 |

| | $ | 55,327 |

|

| Average number of common shares outstanding: | | | | | | | | |

| Basic | | 166,869 |

| | 166,152 |

| | 166,725 |

| | 165,915 |

|

| Diluted | | 168,083 |

| | 167,549 |

| | 167,968 |

| | 167,322 |

|

| Basic earnings per share attributable to The New York Times Company common stockholders | | $ | 0.14 |

| | $ | 0.15 |

| | $ | 0.34 |

| | $ | 0.33 |

|

| Diluted earnings per share attributable to The New York Times Company common stockholders | | $ | 0.14 |

| | $ | 0.15 |

| | $ | 0.34 |

| | $ | 0.33 |

|

| Dividends declared per share | | $ | — |

| | $ | 0.05 |

| | $ | 0.06 |

| | $ | 0.10 |

|

See Notes to Condensed Consolidated Financial Statements.

THE NEW YORK TIMES COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share data)

|

| | | | | | | | | | | | | | | | |

| | | For the Quarters Ended | | For the Nine Months Ended |

| | | September 24, 2017 |

| | September 25, 2016 |

| | September 24, 2017 |

| | September 25, 2016 |

|

| | | (13 weeks) | | (39 weeks) |

| Diluted earnings/(loss) per share attributable to The New York Times Company common stockholders: | | | | | | | | |

| Income/(loss) from continuing operations | | $ | 0.20 |

| | $ | — |

| | $ | 0.37 |

| | $ | (0.05 | ) |

| Loss from discontinued operations, net of income taxes | | — |

| | — |

| | — |

| | — |

|

| Net income/(loss) | | $ | 0.20 |

| | $ | — |

| | $ | 0.37 |

| | $ | (0.05 | ) |

| Dividends declared per share | | $ | 0.08 |

| | $ | 0.08 |

| | $ | 0.12 |

| | $ | 0.12 |

|

See Notes to Condensed Consolidated Financial Statements.

THE NEW YORK TIMES COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(In thousands)

| | | | | For the Quarters Ended | | For the Nine Months Ended | | For the Quarters Ended | | For the Six Months Ended |

| | | September 24, 2017 |

| | September 25, 2016 |

| | September 24, 2017 |

| | September 25, 2016 |

| | June 28, 2020 |

| | June 30, 2019 |

| | June 28, 2020 |

| | June 30, 2019 |

|

| | | (13 weeks) | | (39 weeks) | | (13 weeks) | | (26 weeks) |

| Net income/(loss) | | $ | 36,002 |

| | $ | 283 |

| | $ | 64,676 |

| | $ | (13,795 | ) | |

| Net income | | | $ | 23,662 |

| | $ | 25,171 |

| | $ | 56,516 |

| | $ | 55,327 |

|

| Other comprehensive income, before tax: | | | | | | | | | | | | | | | | |

| Income on foreign currency translation adjustments | | 6,099 |

| | 604 |

| | 11,170 |

| | 2,110 |

| |

| Income/(loss) on foreign currency translation adjustments | | | 619 |

| | 1,522 |

| | 365 |

| | (127 | ) |

| Pension and postretirement benefits obligation | | 6,921 |

| | 6,552 |

| | 20,762 |

| | 19,655 |

| | 6,231 |

| | 4,896 |

| | 12,628 |

| | 9,792 |

|

| Net unrealized loss on available-for-sale securities | | (1,081 | ) | | — |

| | (1,081 | ) | | — |

| |

| Net unrealized gain on available-for-sale securities | | | 4,075 |

| | 1,415 |

| | 4,790 |

| | 3,489 |

|

| Other comprehensive income, before tax | | 11,939 |

| | 7,156 |

| | 30,851 |

| | 21,765 |

| | 10,925 |

| | 7,833 |

| | 17,783 |

| | 13,154 |

|

| Income tax expense | | 4,200 |

| | 2,912 |

| | 11,557 |

| | 8,492 |

| | 2,848 |

| | 2,015 |

| | 4,763 |

| | 3,414 |

|

| Other comprehensive income, net of tax | | 7,739 |

| | 4,244 |

| | 19,294 |

| | 13,273 |

| | 8,077 |

| | 5,818 |

| | 13,020 |

| | 9,740 |

|

| Comprehensive income/(loss) | | 43,741 |

| | 4,527 |

| | 83,970 |

| | (522 | ) | |

| Comprehensive (income)/loss attributable to the noncontrolling interest | | (3,673 | ) | | 123 |

| | (3,567 | ) | | 5,719 |

| |

| Comprehensive income attributable to The New York Times Company common stockholders | | $ | 40,068 |

| | $ | 4,650 |

| | $ | 80,403 |

| | $ | 5,197 |

| | $ | 31,739 |

| | $ | 30,989 |

| | $ | 69,536 |

| | $ | 65,067 |

|

See Notes to Condensed Consolidated Financial Statements.

THE NEW YORK TIMES COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

For the Quarters Ended June 28, 2020 and June 30, 2019

(Unaudited)

(In thousands, except share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Capital Stock -

Class A

and

Class B Common | Additional

Paid-in

Capital | Retained

Earnings | Common

Stock

Held in

Treasury,

at Cost | Accumulated Other Comprehensive Loss, Net of Income Taxes | Total New York Times Company Stockholders’ Equity | Non- controlling Interest | Total Stock- holders’ Equity |

| |

| | Balance, March 31, 2019 | $ | 17,482 |

| $ | 197,626 |

| $ | 1,527,859 |

| $ | (171,211 | ) | $ | (513,802 | ) | $ | 1,057,954 |

| $ | 1,860 |

| $ | 1,059,814 |

|

| | Net income | — |

| — |

| 25,171 |

| — |

| — |

| 25,171 |

| — |

| 25,171 |

|

| | Dividends | — |

| — |

| (8,336 | ) | — |

| — |

| (8,336 | ) | — |

| (8,336 | ) |

| | Other comprehensive income | — |

| — |

| — |

| — |

| 5,818 |

| 5,818 |

| — |

| 5,818 |

|

| | Issuance of shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Restricted stock units vested – 59,967 Class A shares | 6 |

| (279 | ) | — |

| — |

| — |

| (273 | ) | — |

| (273 | ) |

| | Stock-based compensation | — |

| 3,009 |

| — |

| — |

| — |

| 3,009 |

| — |

| 3,009 |

|

| | Balance, June 30, 2019 | $ | 17,488 |

| $ | 200,356 |

| $ | 1,544,694 |

| $ | (171,211 | ) | $ | (507,984 | ) | $ | 1,083,343 |

| $ | 1,860 |

| $ | 1,085,203 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Balance, March 29, 2020 | $ | 17,552 |

| $ | 199,933 |

| $ | 1,635,473 |

| $ | (171,211 | ) | $ | (490,033 | ) | $ | 1,191,714 |

| $ | 1,860 |

| $ | 1,193,574 |

|

| | Net income | — |

| — |

| 23,662 |

| — |

| — |

| 23,662 |

| — |

| 23,662 |

|

| | Dividends | — |

| — |

| 23 |

| — |

| — |

| 23 |

| — |

| 23 |

|

| | Other comprehensive income | — |

| — |

| — |

| — |

| 8,077 |

| 8,077 |

| — |

| 8,077 |

|

| | Issuance of shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Stock options – 90,735 Class A shares | 9 |

| 933 |

| — |

| — |

| — |

| 942 |

| — |

| 942 |

|

| | Restricted stock units vested – 6,516 Class A shares | 1 |

| (275 | ) | — |

| — |

| — |

| (274 | ) | — |

| (274 | ) |

| | Stock-based compensation | — |

| 5,027 |

| — |

| — |

| — |

| 5,027 |

| — |

| 5,027 |

|

| | Balance, June 28, 2020 | $ | 17,562 |

| $ | 205,618 |

| $ | 1,659,158 |

| $ | (171,211 | ) | $ | (481,956 | ) | $ | 1,229,171 |

| $ | 1,860 |

| $ | 1,231,031 |

|

THE NEW YORK TIMES COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

For the Six Months Ended June 28, 2020 and June 30, 2019

(Unaudited)

(In thousands, except share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Capital Stock -

Class A

and

Class B Common | Additional

Paid-in

Capital | Retained

Earnings | Common

Stock

Held in

Treasury,

at Cost | Accumulated

Other

Comprehensive

Loss, Net of

Income

Taxes | Total

New York

Times

Company

Stockholders’

Equity | Non-

controlling

Interest | Total

Stock-

holders’

Equity |

| |

| | Balance, December 30, 2018 | $ | 17,396 |

| $ | 206,316 |

| $ | 1,506,004 |

| $ | (171,211 | ) | $ | (517,724 | ) | $ | 1,040,781 |

| $ | 1,860 |

| $ | 1,042,641 |

|

| | Net income | — |

| — |

| 55,327 |

| — |

| — |

| 55,327 |

| — |

| 55,327 |

|

| | Dividends | — |

| — |

| (16,637 | ) | — |

| — |

| (16,637 | ) | — |

| (16,637 | ) |

| | Other comprehensive income | — |

| — |

| — |

| — |

| 9,740 |

| 9,740 |

| — |

| 9,740 |

|

| | Issuance of shares: | | | | | | | | |

| | Stock options – 279,510 Class A shares | 28 |

| 2,937 |

| — |

| — |

| — |

| 2,965 |

| — |

| 2,965 |

|

| | Restricted stock units vested – 221,087 Class A shares | 22 |

| (3,747 | ) | — |

| — |

| — |

| (3,725 | ) | — |

| (3,725 | ) |

| | Performance-based awards – 418,491 Class A shares | 42 |

| (11,966 | ) | — |

| — |

| — |

| (11,924 | ) | — |

| (11,924 | ) |

| | Stock-based compensation | — |

| 6,816 |

| — |

| — |

| — |

| 6,816 |

| — |

| 6,816 |

|

| | Balance, June 30, 2019 | $ | 17,488 |

| $ | 200,356 |

| $ | 1,544,694 |

| $ | (171,211 | ) | $ | (507,984 | ) | $ | 1,083,343 |

| $ | 1,860 |

| $ | 1,085,203 |

|

| | | | | | | | | | |

| | Balance, December 29, 2019 | $ | 17,504 |

| $ | 208,028 |

| $ | 1,612,658 |

| $ | (171,211 | ) | $ | (494,976 | ) | $ | 1,172,003 |

| $ | 1,860 |

| $ | 1,173,863 |

|

| | Net income | — |

| — |

| 56,516 |

| — |

| — |

| 56,516 |

| — |

| 56,516 |

|

| | Dividends | — |

| — |

| (10,016 | ) | — |

| — |

| (10,016 | ) | — |

| (10,016 | ) |

| | Other comprehensive income | — |

| — |

| — |

| — |

| 13,020 |

| 13,020 |

| — |

| 13,020 |

|

| | Issuance of shares: | | | | | | | | |

| | Stock options – 179,510 Class A shares | 18 |

| 1,855 |

| — |

| — |

| — |

| 1,873 |

| — |

| 1,873 |

|

| | Restricted stock units vested – 141,501 Class A shares | 14 |

| (3,897 | ) | — |

| — |

| — |

| (3,883 | ) | — |

| (3,883 | ) |

| | Performance-based awards – 257,098 Class A shares | 26 |

| (7,850 | ) | — |

| — |

| — |

| (7,824 | ) | — |

| (7,824 | ) |

| | Stock-based compensation | — |

| 7,482 |

| — |

| — |

| — |

| 7,482 |

| — |

| 7,482 |

|

| | Balance, June 28, 2020 | $ | 17,562 |

| $ | 205,618 |

| $ | 1,659,158 |

| $ | (171,211 | ) | $ | (481,956 | ) | $ | 1,229,171 |

| $ | 1,860 |

| $ | 1,231,031 |

|

THE NEW YORK TIMES COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | For the Nine Months Ended | | For the Six Months Ended |

| | | September 24, 2017 |

| | September 25, 2016 |

| | June 28, 2020 |

| | June 30, 2019 |

|

| | | (39 weeks) | | (26 weeks) |

| Cash flows from operating activities | | | | | | | | |

| Net income/(loss) | | $ | 64,676 |

| | $ | (13,795 | ) | |

| Net income | | | $ | 56,516 |

| | $ | 55,327 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

| Restructuring charge | | — |

| | 14,804 |

| |

| Multiemployer pension plan charges | | — |

| | 11,701 |

| |

| Depreciation and amortization | | 46,961 |

| | 46,003 |

| | 30,816 |

| | 30,098 |

|

| Amortization of right of use asset | | | 4,645 |

| | 3,520 |

|

| Stock-based compensation expense | | 10,927 |

| | 8,561 |

| | 7,482 |

| | 6,826 |

|

| Undistributed (gain)/loss of joint ventures | | (31,464 | ) | | 41,845 |

| |

| Deferred income taxes | | | (1,209 | ) | | — |

|

| Gain on non-marketable equity investment | | | (10,074 | ) | | (1,886 | ) |

| Long-term retirement benefit obligations | | (21,897 | ) | | (22,366 | ) | | (8,524 | ) | | (11,574 | ) |

| Uncertain tax positions | | 139 |

| | 53 |

| |

| Fair market value adjustment on life insurance products | | | 170 |

| | (2,048 | ) |

| Other-net | | 2,609 |

| | 8,257 |

| | 1,514 |

| | (7,801 | ) |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable-net | | 55,032 |

| | 54,591 |

| | 91,310 |

| | 59,673 |

|

| Other assets | | (1,761 | ) | | (21,926 | ) | | (1,292 | ) | | (14,555 | ) |

| Accounts payable, accrued payroll and other liabilities | | 12,473 |

| | (45,546 | ) | | (64,019 | ) | | (57,217 | ) |

| Unexpired subscriptions | | 10,200 |

| | 3,461 |

| | 11,255 |

| | 3,637 |

|

| Net cash provided by operating activities | | 147,895 |

| | 85,643 |

| | 118,590 |

| | 64,000 |

|

| Cash flows from investing activities | | | | | | | | |

| Purchases of marketable securities | | (398,246 | ) | | (514,809 | ) | | (278,773 | ) | | (225,765 | ) |

| Maturities of marketable securities | | 454,022 |

| | 522,655 |

| | 228,938 |

| | 223,327 |

|

| Cash distribution from corporate-owned life insurance | | — |

| | 38,000 |

| |

| Business acquisitions | | — |

| | (15,410 | ) | | (8,055 | ) | | — |

|

| Purchase of investments – net of proceeds | | (422 | ) | | (1,840 | ) | |

| Change in restricted cash | | 7,014 |

| | 3,816 |

| |

| Proceeds from sale of investments – net | | | 4,074 |

| | 110 |

|

| Capital expenditures | | (47,831 | ) | | (21,820 | ) | | (21,510 | ) | | (23,065 | ) |

| Other-net | | 1,070 |

| | (380 | ) | | 2,388 |

| | 1,872 |

|

| Net cash provided by investing activities | | 15,607 |

| | 10,212 |

| |

| Net cash used in investing activities | | | (72,938 | ) | | (23,521 | ) |

| Cash flows from financing activities | | | | | | | | |

| Long-term obligations: | | | | | | | | |

| Repayment of debt and capital lease obligations | | (414 | ) | | (460 | ) | |

| Repayment of debt and finance lease obligations | | | — |

| | (230 | ) |

| Dividends paid | | (19,483 | ) | | (19,416 | ) | | (18,359 | ) | | (14,936 | ) |

| Capital shares: | | | | | | | | |

| Stock issuances | | 4,142 |

| | 273 |

| |

| Repurchases | | — |

| | (15,684 | ) | |

| Proceeds from stock option exercises | | | 1,873 |

| | 2,965 |

|

| Share-based compensation tax withholding | | (3,984 | ) | | (9,572 | ) | | (11,706 | ) | | (15,649 | ) |

| Net cash used in financing activities | | (19,739 | ) | | (44,859 | ) | | (28,192 | ) | | (27,850 | ) |

| Net increase in cash and cash equivalents | | 143,763 |

| | 50,996 |

| |

| Net increase in cash, cash equivalents and restricted cash | | | 17,460 |

| | 12,629 |

|

| Effect of exchange rate changes on cash | | 212 |

| | 166 |

| | 162 |

| | 305 |

|

| Cash and cash equivalents at the beginning of the period | | 100,692 |

| | 105,776 |

| |

| Cash and cash equivalents at the end of the period | | $ | 244,667 |

| | $ | 156,938 |

| |

| Cash, cash equivalents and restricted cash at the beginning of the period | | | 247,518 |

| | 259,799 |

|

| Cash, cash equivalents and restricted cash at the end of the period | | | $ | 265,140 |

| | $ | 272,733 |

|

See Notes to Condensed Consolidated Financial Statements.

THE NEW YORK TIMES COMPANY

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1. BASIS OF PRESENTATION

In the opinion of management of The New York Times Company (the “Company”), the Condensed Consolidated Financial Statements present fairly the financial position of the Company as of September 24, 2017June 28, 2020 and December 25, 2016,29, 2019, and the results of operations, changes in stockholders’ equity and cash flows of the Company for the periods ended September 24, 2017June 28, 2020, and September 25, 2016.June 30, 2019. The Company and its consolidated subsidiaries are referred to collectively as “we,” “us” or “our.” All adjustments necessary for a fair presentation have been included and are of a normal and recurring nature. All significant intercompany accounts and transactions have been eliminated in consolidation. The financial statements were prepared in accordance with the requirements of the Securities and Exchange Commission (“SEC”) for interim reporting. As permitted under those rules, certain notes or other financial information that are normally required by accounting principles generally accepted in the United States of America (“GAAP”) have been condensed or omitted from these interim financial statements. These financial statements, therefore, should be read in conjunction with the Consolidated Financial Statements and related Notes included in our Annual Report on Form 10-K for the year ended December 25, 2016.29, 2019. Due to the seasonal nature of our business, operating results for the interim periods are not necessarily indicative of a full year’s operations. The fiscal periods included herein comprise 13 weeks and 26 weeks for the third quarter.second quarter and six months, respectively.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in our Condensed Consolidated Financial Statements. Actual results could differ from these estimates.

Reclassification

The Company has changed the expense captions on its Condensed Consolidated Statement of Operations effective for the quarter ended March 29, 2020. These changes were made in order to reflect how the Company manages its business and to communicate where the Company is investing resources and how this aligns with the Company’s strategy. The Company has reclassified expenses for the prior period in order to present comparable financial results. There is no change to consolidated operating income, operating expense, net income or cash flows as a result of this change in classification. See Note 15 for more detail.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Except as described herein, as of September 24, 2017,June 28, 2020, our significant accounting policies, which are detailed in our Annual Report on Form 10-K for the year ended December 25, 2016,29, 2019, have not changed:changed materially.

Marketable Securities

We have investments in marketable debt securities. We determine the appropriate classification of our investments at the date of purchase and reevaluate the classifications at the balance sheet date. Marketable debt securities with maturities of 12 months or less are classified as short-term. Marketable debt securities with maturities greater than 12 months are classified as long-term. Historically, we have accounted for all marketable securities as held-to-maturity (“HTM”) and stated at amortized cost as we had the intent and ability to hold our marketable debt securities until maturity. However, on June 29, 2017, our Board of Directors approved a change to the Company’s cash reserve investment policy to allow the Company to sell marketable securities prior to maturity. Beginning in the third quarter of 2017, the Company reclassified all marketable securities from HTM to available-for-sale (“AFS”).

Securities that we might not hold until maturity are classified as AFS securities and reported at fair value. Unrealized gains and losses, after applicable income taxes, are reported in accumulated other comprehensive income/(loss).

We conduct an other-than-temporary impairment (“OTTI”) analysis on a quarterly basis or more often if a potential loss-triggering event occurs. We consider factors such as the duration, severity and the reason for the decline in value, the potential recovery period and whether we intend to sell. For AFS securities, we also consider whether (i) it is more likely than not that we will be required to sell the debt securities before recovery of their amortized cost basis and (ii) the amortized cost basis cannot be recovered as a result of credit losses.

Other

As of the second quarter of 2017, the Company has renamed “circulation revenues” as “subscription revenues.” Subscription revenues consist of revenues from subscriptions to our print and digital products (including our news product, as well as Crossword and Cooking products), as well as single-copy sales of our print products (which comprise approximately 10% of these revenues). These revenues are based on both the number of copies of the printed newspaper sold and digital-only subscriptions, and the rates charged to the respective customers.

Recently Adopted Accounting Pronouncements

In March 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-09, “Compensation-Stock Compensation,” which provides guidance on accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. This guidance became effective for the Company for fiscal years beginning after December 25, 2016.

As a result of the adoption of ASU 2016-09 in the first quarter of 2017, we recognized excess tax windfalls in income tax expense rather than additional paid-in capital of $0.1 million and $0.2 million for the quarter and nine months ended

THE NEW YORK TIMES COMPANY

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

September 24, 2017, respectively. Excess tax shortfalls and/or windfalls for share-based payments are now included in net cash from operating activities rather than net cash from financing activities. The changes have been applied prospectively in accordance with the ASU and prior periods have not been adjusted. Additionally, the presentation of employee taxes paid to taxing authorities for share-based transactions are now included in net cash from financing activities rather than net cash from operating activities. This change was applied retrospectively and as a result, we reclassified $9.6 million for the nine months ended September 25, 2016 in our Condensed Statement of Cash Flows from operating activities to financing activities. No other material changes resulted from the adoption of this standard.Recently Adopted Accounting Pronouncements

|

| | | |

| Accounting Standard Update(s) | Topic | Effective Period | Summary |

| 2018-15 | Intangibles—Goodwill and Other—Internal-Use Software | Fiscal years beginning after December 15, 2019, and interim periods within those fiscal years. Early adoption is permitted. | Clarifies the accounting for implementation costs in cloud computing arrangements. The standard provides that implementation costs be evaluated for capitalization using the same criteria as that used for internal-use software development costs, with amortization expense being recorded in the same income statement expense line as the hosted service costs and over the expected term of the hosting arrangement. The Company adopted this ASU prospectively on December 30, 2019 and will include capitalized implementation costs in Miscellaneous assets in the Company’s Condensed Consolidated Balance Sheet and within Total operating costs in the Condensed Consolidated Statement of Operations. The adoption did not have a material impact on the Company’s consolidated financial statements. |

| 2018-13 | Fair Value Measurement (Topic 820) Disclosure Framework | Fiscal years beginning after December 15, 2019, and interim periods within those fiscal years. Early adoption is permitted. | Modifies the disclosure requirements on fair value measurements. The amendments of disclosures related to changes in unrealized gains and losses, the range and weighted average of significant unobservable inputs used to develop Level 3 fair value measurements, and the narrative description of measurement uncertainty should be applied prospectively for only the most recent interim or annual period presented in the initial fiscal year of adoption. All other amendments should be applied retrospectively to all periods presented upon their effective date. The Company adopted this ASU on December 30, 2019. The adoption did not have a material impact on the Company’s disclosures. |

2016-13

2018-19

2019-04

| Financial Instruments—Credit Losses | Fiscal years beginning after December 15, 2019, and interim periods within those fiscal years. Early adoption is permitted for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. | Amends guidance on reporting credit losses for assets, including trade receivables, available-for-sale marketable securities and any other financial assets not excluded from the scope that have the contractual right to receive cash. For trade receivables, ASU 2016-13 eliminates the probable initial recognition threshold in current generally accepted accounting standards, and, instead, requires an entity to reflect its current estimate of all expected credit losses. For available-for-sale marketable securities, credit losses should be measured in a manner similar to current generally accepted accounting standards; however, ASU 2016-13 will require that credit losses be presented as an allowance rather than as a write-down. The Company adopted this ASU on December 30, 2019 using a modified retrospective approach. The adoption did not have a material impact on the Company’s consolidated financial statements. |

Recently Issued Accounting Pronouncements

In March 2017, the FASBThe Financial Accounting Standards Board (the “FASB”) issued ASU 2017-07, “Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost.” The new guidance requires the service cost component to be presented separately from the other components of net benefit costs. Service cost will be presented with other employee compensation cost within operations. The other components of net benefit cost, such as interest cost, amortization of prior service cost and gains or losses are required to be presented outside of operations. The new guidance is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. Early adoption is permitted. The guidance should be applied retrospectively for the presentation of the service cost component in the income statement and allows a practical expedient for the estimation basis for applying the retrospective presentation requirements.

Since the changes required in ASU 2017-07 only change the Condensed Consolidated Statements of Operations classification of the components of net periodic benefit cost, no changes are expected to net income. Upon adoption of the ASU during the first quarter of 2018, the Company will separately present the components of net periodic benefit cost or income, excluding the service cost component, in non-operating expenses on a retrospective basis. The historical components of net periodic benefit cost are disclosed in the Company’s previously filed Quarterly Reports on Form 10-Q and its 2016 Annual Report on Form 10-K.

In June 2016, FASB issued ASU 2016-13, “Financial Instruments - Credit Losses.” The new guidance introduces an approach based on expected losses to estimate credit losses on certain types of financial instruments. It also modifies the impairment model for available-for-sale (AFS) debt securities and provides for a simplified accounting model for purchased financial assets with credit deterioration since their origination. The new guidance is effective for fiscal years beginning after December 15, 2019, and interim periods within those fiscal years. Early adoption is permitted for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. We are currently in the process of evaluating the impact of thisauthoritative guidance on our consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02, “Leases,” which provides guidance on accounting for leases and disclosure of key information about leasing arrangements. The guidance requires lessees to recognize the following for all operating and finance leases at the commencement date: (1) a lease liability, which is the obligation to make lease payments arising from a lease, measured on a discounted basis and (2) a right-of-use asset representing the lessee’s right to use, or control the use of, the underlying asset for the lease term. A lessee is permitted to make an accounting policy election not to recognize lease assets and lease liabilities for short-term leases with a term of 12 months or less. The guidance does not fundamentally change lessor accounting; however, some changes have been made to align that guidance with the lessee guidance and other areas within GAAP. This guidance becomes effective for the Company for fiscal years beginning after December 30, 2018. Early application is permitted. This guidance will be applied on a modified retrospective basis for leases existing at, or entered into after, the earliest period presented in the financial statements. We are currently in the process of evaluating the impact of the new leasing guidance and expect that most of our operating lease commitments will be subject to the new standard. The adoption of the standard will require us to add right-of-use assets and lease liabilities onto our balance sheet. Based upon our initial evaluation, we do not expect the adoption of the standard to have a material effect on our results of operations and liquidity.

In January 2016, the FASB issued ASU 2016-01, “Financial Instruments-Overall: Recognition and Measurement of Financial Assets and Financial Liabilities” which addresses certain aspects of recognition, measurement, presentation, and disclosure of financial instruments including requirements to measure most equity investments at fair value with changes in fair value recognized in net income, to perform a qualitative assessment of equity investments without readily determinable fair values, and to separately present financial assets and liabilities by measurement category and by type of financial asset on the balance sheet or the accompanying notes to the financial statements. The new guidance is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. Early adoption is permitted. We are currently in the process of evaluating the impact of this guidance on our consolidated financial statements.

In May 2014, the FASB issued ASU 2014-09, “Revenue from Contracts with Customers,” which prescribes a single comprehensive model for entities to use in the accounting for revenue arising from contracts with customers. The new guidance

topics:

8 |

| | | |

| Accounting Standard Update(s) | Topic | Effective Period | Summary |

| 2019-12 | Simplifying the Accounting for Income Taxes (Topic 740) | Fiscal years, and interim periods within those fiscal years, beginning after December 15, 2021. Early adoption is permitted.

| Simplifies the accounting for income taxes by eliminating certain exceptions to the guidance in Accounting Standards Codification (“ASC”) 740 related to the approach for intraperiod tax allocation, the methodology for calculating income taxes in an interim period and the recognition of deferred tax liabilities for outside basis differences. The standard also simplifies aspects of the accounting for franchise taxes and enacted changes in tax laws or rates and clarifies the accounting for transactions that result in a step-up in the tax basis of goodwill. We do not expect this guidance to have a material impact on our consolidated financial statements. |

| 2018-14 | Compensation—Retirement Benefits—Defined Benefit Plans—General | Fiscal years ending after December 15, 2020. Early adoption is permitted. | Modifies the disclosure requirements for employers that sponsor defined benefit pension or other postretirement benefit plans. The guidance removes disclosures, clarifies the specific requirements of disclosures and adds disclosure requirements identified as relevant. We are currently in the process of evaluating the impact on our consolidated financial statements. |

THE NEW YORK TIMES COMPANY

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

will supersede virtually all existing revenue guidance under GAAP and International Financial Reporting Standards and is effective for fiscal years beginning after December 31, 2017. There are two transition options available to entities: the full retrospective approach or the modified retrospective approach. Under the full retrospective approach, the Company would restate prior periods in compliance with Accounting Standards Codification 250, “Accounting Changes and Error Corrections.” Alternatively, the Company may elect the modified retrospective approach, which allows for the new revenue standard to be applied to existing contracts as of the effective date with a cumulative catch-up adjustment recorded to retained earnings. We currently anticipate adopting the new standard using the modified retrospective method beginning January 1, 2018.

Subsequently, in March 2016, the FASB issued ASU 2016-08, “Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net),” which clarifies the implementation guidance on principal versus agent considerations in ASU 2014-09. In April 2016, the FASB also issued ASU 2016-10, “Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing,” to reduce the cost and complexity of applying the guidance on identifying promised goods or services when identifying a performance obligation and improve the operability and understandability of the licensing implementation guidance. In May 2016, the FASB issued ASU 2016-12, “Revenue from Contracts with Customers (Topic 606): Narrow Scope Improvements and Practical Expedients,” to reduce the cost and complexity of applying the guidance to address certain issues on assessing collectability, presentation of sales taxes, noncash consideration, and completed contracts and contract modifications at transition. The amendments in ASU 2014-09, 2016-10, and 2016-12 do not change the core principle of ASU 2014-09.

Based upon our initial evaluation, we do not expect the adoption of ASU 2014-09 to have a material effect on our financial condition or results of operations. While we continue to evaluate the impact of the new revenue guidance, we currently believe that the most significant changes will be primarily related to how we account for certain licensing arrangements in the other revenue category.

The Company considers the applicability and impact of all recently issued accounting pronouncements. Recent accounting pronouncements not specifically identified in our disclosures are either not applicable to the Company or are not expected to have a material effect on our financial condition or results of operations.

NOTE 3. REVENUE

We generate revenues principally from subscriptions and advertising. Subscription revenues consist of revenues from subscriptions to our print and digital products (which include our news product, as well as our Crossword, Cooking and audio products) and single-copy and bulk sales of our print products. Subscription revenues are based on both the number of copies of the printed newspaper sold and digital-only subscriptions, and the rates charged to the respective customers.

Advertising revenues are primarily derived from offerings sold directly to marketers by our advertising sales team. A significantly smaller and diminishing proportion of our total advertising revenues is generated through programmatic auctions run by third-party ad exchanges. Advertising revenues are primarily determined by the volume, rate and mix of advertisements. Display advertising revenue is principally from advertisers promoting products, services or brands. Display advertising also includes advertisements that direct viewers to branded content on our platforms. Other print advertising revenue primarily includes classified advertising revenue. Other digital advertising revenue primarily includes creative services fees, including those associated with our branded content studio; advertising revenue from our podcasts; and advertising revenue generated by Wirecutter, our product review and recommendation website.

Other revenues primarily consist of revenues from licensing, affiliate referrals from Wirecutter, the leasing of floors in the New York headquarters building located at 620 Eighth Avenue, New York, New York (the “Company Headquarters”), commercial printing, television and film, retail commerce and NYT Live (our live events business).

Subscription, advertising and other revenues were as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Quarters Ended | | For the Six Months Ended |

| (In thousands) | | June 28, 2020 |

| | As % of total | | June 30, 2019 |

| | As % of total | | June 28, 2020 |

| | As % of total | | June 30, 2019 |

| | As % of total |

| Subscription | | $ | 293,189 |

| | 72.6 | % | | $ | 270,456 |

| | 62.0 | % | | $ | 578,623 |

| | 68.3 | % | | $ | 541,266 |

| | 61.8 | % |

| Advertising | | 67,760 |

| | 16.8 | % | | 120,761 |

| | 27.7 | % | | 173,897 |

| | 20.5 | % | | 245,849 |

| | 28.1 | % |

Other (1) | | 42,801 |

| | 10.6 | % | | 45,041 |

| | 10.3 | % | | 94,866 |

| | 11.2 | % | | 88,205 |

| | 10.1 | % |

| Total | | $ | 403,750 |

| | 100.0 | % | | $ | 436,258 |

| | 100.0 | % | | $ | 847,386 |

| | 100.0 | % | | $ | 875,320 |

| | 100.0 | % |

(1) Other revenue includes building rental revenue, which is not under the scope of Revenue from Contracts with Customers (Topic 606). Building rental revenue was approximately $7 million for the second quarters of 2020 and 2019, respectively, and approximately $15 million for the first six months of 2020 and 2019, respectively.

THE NEW YORK TIMES COMPANY

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The following table summarizes print and digital subscription revenues, which are components of subscription revenues above, for the second quarters and first six months ended June 28, 2020, and June 30, 2019:

|

| | | | | | | | | | | | | | | | |

| | | For the Quarters Ended | | For the Six Months Ended |

| (In thousands) | | June 28, 2020 |

| | June 30, 2019 |

| | June 28, 2020 |

| | June 30, 2019 |

|

| Print subscription revenues: | | | | | | | | |

Domestic home delivery subscription revenues(1) | | $ | 132,971 |

| | $ | 133,038 |

| | $ | 266,708 |

| | $ | 268,241 |

|

Single copy, NYT International and other subscription revenues(2) | | 14,234 |

| | 24,783 |

| | 35,921 |

| | 50,531 |

|

| Subtotal print subscription revenues | | 147,205 |

| | 157,821 |

| | 302,629 |

| | 318,772 |

|

| Digital-only subscription revenues: | | | | | | | | |

News product subscription revenues(3) | | 132,922 |

| | 104,430 |

| | 251,880 |

| | 206,776 |

|

Other product subscription revenues(4) | | 13,062 |

| | 8,205 |

| | 24,114 |

| | 15,718 |

|

| Subtotal digital-only subscriptions | | 145,984 |

| | 112,635 |

| | 275,994 |

| | 222,494 |

|

| Total subscription revenues | | $ | 293,189 |

| | $ | 270,456 |

| | $ | 578,623 |

| | $ | 541,266 |

|

(1) Includes free access to some or all of the Company’s digital products. |

(2) NYT International is the international edition of our print newspaper. |

(3) Includes revenues from subscriptions to the Company’s news product. News product subscription packages that include access to the Company’s Crossword and Cooking products are also included in this category. |

(4) Includes revenues from standalone subscriptions to the Company’s Crossword, Cooking and audio products. |

Advertising revenues (print and digital) by category were as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

|

| For the Quarters Ended |

|

| June 28, 2020 |

| June 30, 2019 |

| (In thousands) |

| Print |

| Digital |

| Total |

| Print |

| Digital |

| Total |

| Advertising revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| Display |

| $ | 21,460 |

|

| $ | 30,466 |

|

| $ | 51,926 |

|

| $ | 55,859 |

|

| $ | 42,833 |

|

| $ | 98,692 |

|

| Other |

| 6,769 |

|

| 9,065 |

|

| 15,834 |

|

| 6,876 |

|

| 15,193 |

|

| 22,069 |

|

| Total advertising |

| $ | 28,229 |

|

| $ | 39,531 |

|

| $ | 67,760 |

|

| $ | 62,735 |

|

| $ | 58,026 |

|

| $ | 120,761 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Six Months Ended |

| | | June 28, 2020 | | June 30, 2019 |

| (In thousands) | | Print | | Digital | | Total | | Print | | Digital | | Total |

| Advertising revenues: | | | | | | | | | | | | |

| Display | | $ | 69,619 |

| | $ | 70,360 |

| | $ | 139,979 |

| | $ | 118,201 |

| | $ | 84,945 |

| | $ | 203,146 |

|

| Other | | 13,589 |

| | 20,329 |

| | 33,918 |

| | 14,079 |

| | 28,624 |

| | 42,703 |

|

| Total advertising | | $ | 83,208 |

| | $ | 90,689 |

| | $ | 173,897 |

| | $ | 132,280 |

| | $ | 113,569 |

| | $ | 245,849 |

|

Performance Obligations

We have remaining performance obligations related to digital archive and other licensing and certain advertising contracts. As of June 28, 2020, the aggregate amount of transaction price allocated to the remaining performance obligations for contracts with a duration greater than one year was approximately $138 million. The Company will recognize this revenue as performance obligations are satisfied. We expect that approximately $26 million, $45 million and $67 million will be recognized in the remainder of 2020, 2021 and thereafter, respectively.

THE NEW YORK TIMES COMPANY

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Contract Assets

As of June 28, 2020, and December 29, 2019, the Company had $2.6 million and $3.4 million, respectively, in contract assets recorded in the Condensed Consolidated Balance Sheets related to digital archiving licensing revenue. The contract asset is reclassified to Accounts receivable when the customer is invoiced based on the contractual billing schedule. The decrease in the contract assets balance of $0.8 million for the six months ended June 28, 2020, is due to consideration that was reclassified to Accounts receivable when invoiced based on the contractual billing schedules for the period ended June 28, 2020.

NOTE 3.4. MARKETABLE SECURITIES

As noted in Note 2, theThe Company reclassified allaccounts for its marketable securities from HTM to AFS in the third quarteras available for sale (“AFS”). The Company recorded $5.6 million and $0.8 million of 2017, following a change to the Company’s cash reserve investment policy that allows the Company to sell marketable securities prior to maturity. This change resulted in the recording of a $1.1 million net unrealized lossgains inAccumulated other comprehensive income. The reclassificationincome (“AOCI”) as of the investment portfolio to AFS was made to provide increased flexibility in the use of our investments to support current operations.June 28, 2020, and December 29, 2019, respectively.

The following table presentstables present the amortized cost, gross unrealized gains and losses, and fair market value of our AFS debt securities as of September 24, 2017:June 28, 2020, and December 29, 2019:

|

| | | | | | | | | | | | | | | | |

| | | June 28, 2020 |

| (In thousands) | | Amortized Cost | | Gross unrealized gains | | Gross unrealized losses | | Fair Value |

| Short-term AFS securities | | | | | | | | |

| Corporate debt securities | | $ | 105,615 |

| | $ | 669 |

| | $ | (13 | ) | | $ | 106,271 |

|

| U.S. Treasury securities | | 78,826 |

| | 179 |

| | (1 | ) | | 79,004 |

|

| U.S. governmental agency securities | | 35,965 |

| | 180 |

| | (1 | ) | | 36,144 |

|

| Commercial paper | | 15,981 |

| | — |

| | — |

| | 15,981 |

|

| Certificates of deposit | | 3,000 |

| | — |

| | — |

| | 3,000 |

|

| Total short-term AFS securities | | $ | 239,387 |

| | $ | 1,028 |

| | $ | (15 | ) | | $ | 240,400 |

|

| Long-term AFS securities | | | | | | | |

|

| Corporate debt securities | | $ | 114,618 |

| | $ | 1,751 |

| | $ | (28 | ) | | $ | 116,341 |

|

| U.S. Treasury securities | | 92,680 |

| | 2,714 |

| | — |

| | 95,394 |

|

| U.S. governmental agency securities | | 55,089 |

| | 125 |

| | (3 | ) | | 55,211 |

|

| Total long-term AFS securities | | $ | 262,387 |

| | $ | 4,590 |

| | $ | (31 | ) | | $ | 266,946 |

|

|

| | | | | | | | | | | | | | | | |

| | | September 24, 2017 |

| (In thousands) | | Amortized Cost | | Gross unrealized gains | | Gross unrealized losses | | Fair Value |

| Short-term AFS securities | | | | | | | | |

| U.S Treasury securities | | $ | 73,220 |

| | $ | — |

| | $ | (45 | ) | | $ | 73,175 |

|

| Corporate debt securities | | 156,683 |

| | 35 |

| | (79 | ) | | 156,639 |

|

| U.S. governmental agency securities | | 53,842 |

| | 1 |

| | (89 | ) | | 53,754 |

|

| Certificates of deposit | | 20,403 |

| | — |

| | — |

| | 20,403 |

|

| Commercial paper | | 32,471 |

| | — |

| | — |

| | 32,471 |

|

| Total short-term AFS securities | | $ | 336,619 |

| | $ | 36 |

| | $ | (213 | ) | | $ | 336,442 |

|

| Long-term AFS securities | | | | | | | |

|

| U.S. governmental agency securities | | $ | 97,431 |

| | $ | 2 |

| | $ | (616 | ) | | 96,817 |

|

| Corporate debt securities | | 97,583 |

| | 21 |

| | (259 | ) | | 97,345 |

|

| U.S Treasury securities | | 47,672 |

| | — |

| | (52 | ) | | 47,620 |

|

| Total long-term AFS securities | | $ | 242,686 |

| | $ | 23 |

| | $ | (927 | ) | | $ | 241,782 |

|

9 |

| | | | | | | | | | | | | | | | |

| | | December 29, 2019 |

| (In thousands) | | Amortized Cost | | Gross unrealized gains | | Gross unrealized losses | | Fair Value |

| Short-term AFS securities | | | | | | | | |

| Corporate debt securities | | $ | 98,864 |

| | $ | 271 |

| | $ | (9 | ) | | $ | 99,126 |

|

| U.S. Treasury securities | | 43,098 |

| | 8 |

| | (11 | ) | | 43,095 |

|

| U.S. governmental agency securities | | 37,471 |

| | 35 |

| | (4 | ) | | 37,502 |

|

| Commercial paper | | 12,561 |

| | — |

| | — |

| | 12,561 |

|

| Certificates of deposit | | 9,501 |

| | — |

| | — |

| | 9,501 |

|

| Total short-term AFS securities | | $ | 201,495 |

| | $ | 314 |

| | $ | (24 | ) | | $ | 201,785 |

|

| Long-term AFS securities | | | | | | | | |

| Corporate debt securities | | $ | 103,149 |

| | $ | 617 |

| | $ | (29 | ) | | $ | 103,737 |

|

| U.S. Treasury securities | | 101,457 |

| | 84 |

| | (103 | ) | | 101,438 |

|

| U.S. governmental agency securities | | 46,600 |

| | 5 |

| | (84 | ) | | 46,521 |

|

| Total long-term AFS securities | | $ | 251,206 |

| | $ | 706 |

| | $ | (216 | ) | | $ | 251,696 |

|

THE NEW YORK TIMES COMPANY

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The following table representstables represent the AFS securities as of September 24, 2017June 28, 2020, and December 29, 2019, that were in an unrealized loss position for which an allowance for credit losses has not been recorded, aggregated by investment category and the length of time that individual securities have been in a continuous unrealized loss position:

| | | | | September 24, 2017 | | June 28, 2020 |

| | | Less than 12 Months | | 12 Months or Greater | | Total | | Less than 12 Months | | 12 Months or Greater | | Total |

(In thousands)

| | Fair Value | | Gross unrealized losses | | Fair Value | | Gross unrealized losses | | Fair Value | | Gross unrealized losses | | Fair Value | | Gross unrealized losses | | Fair Value | | Gross unrealized losses | | Fair Value | | Gross unrealized losses |

| Short-term AFS securities | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S Treasury securities | | $ | 73,175 |

| | $ | (45 | ) | | $ | — |

| | $ | — |

| | $ | 73,175 |

| | $ | (45 | ) | |

| Corporate debt securities | | 101,648 |

| | (77 | ) | | 2,500 |

| | (2 | ) | | 104,148 |

| | (79 | ) | | $ | 22,721 |

| | $ | (13 | ) | | $ | — |

| | $ | — |

| | $ | 22,721 |

| | $ | (13 | ) |

| U.S. Treasury securities | | | 14,496 |

| | (1 | ) | | — |

| | — |

| | 14,496 |

| | (1 | ) |

| U.S. governmental agency securities | | 42,490 |

| | (53 | ) | | 8,964 |

| | (36 | ) | | 51,454 |

| | (89 | ) | | 9,999 |

| | (1 | ) | | — |

| | — |

| | 9,999 |

| | (1 | ) |

| Total short-term AFS securities | | $ | 217,313 |

| | $ | (175 | ) | | $ | 11,464 |

| | $ | (38 | ) | | $ | 228,777 |

| | $ | (213 | ) | | $ | 47,216 |

| | $ | (15 | ) | | $ | — |

| | $ | — |

| | $ | 47,216 |

| | $ | (15 | ) |

| Long-term AFS securities | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate debt securities | | | $ | 17,542 |

| | $ | (28 | ) | | $ | — |

| | $ | — |

| | $ | 17,542 |

| | $ | (28 | ) |

| U.S. governmental agency securities | | $ | 47,620 |

| | $ | (312 | ) | | $ | — |

| | (304 | ) | | $ | 47,620 |

| | $ | (616 | ) | | 8,747 |

| | (3 | ) | | — |

| | — |

| | 8,747 |

| | (3 | ) |

| Corporate debt securities | | 66,428 |

| | (196 | ) | | 8,918 |

| | (63 | ) | | 75,346 |

| | (259 | ) | |

| U.S Treasury securities | | 53,142 |

| | (52 | ) | | 39,697 |

| | — |

| | 92,839 |

| | (52 | ) | |

| Total long-term AFS securities | | $ | 167,190 |

| | $ | (560 | ) | | $ | 48,615 |

| | $ | (367 | ) | | $ | 215,805 |

| | $ | (927 | ) | | $ | 26,289 |

| | $ | (31 | ) | | $ | — |

| | $ | — |

| | $ | 26,289 |

| | $ | (31 | ) |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 29, 2019 |

| | | Less than 12 Months | | 12 Months or Greater | | Total |

| (In thousands) | | Fair Value | | Gross unrealized losses | | Fair Value | | Gross unrealized losses | | Fair Value | | Gross unrealized losses |

| Short-term AFS securities | | | | | | | | | | | | |

| Corporate debt securities | | $ | 20,975 |

| | $ | (6 | ) | | $ | 8,251 |

| | $ | (3 | ) | | $ | 29,226 |

| | $ | (9 | ) |

| U.S. Treasury securities | | 13,296 |

| | (3 | ) | | 11,147 |

| | (8 | ) | | 24,443 |

| | (11 | ) |

| U.S. governmental agency securities | | — |

| | — |

| | 15,000 |

| | (4 | ) | | 15,000 |

| | (4 | ) |

| Total short-term AFS securities | | $ | 34,271 |

| | $ | (9 | ) | | $ | 34,398 |

| | $ | (15 | ) | | $ | 68,669 |

| | $ | (24 | ) |

| Long-term AFS securities | | | | | | | | | | | | |

| Corporate debt securities | | $ | 35,891 |

| | $ | (25 | ) | | $ | 4,502 |

| | $ | (4 | ) | | $ | 40,393 |

| | $ | (29 | ) |

| U.S. Treasury securities | | 60,935 |

| | (103 | ) | | — |

| | — |

| | 60,935 |

| | (103 | ) |

| U.S. governmental agency securities | | 34,167 |

| | (84 | ) | | — |

| | — |

| | 34,167 |

| | (84 | ) |

| Total long-term AFS securities | | $ | 130,993 |

| | $ | (212 | ) | | $ | 4,502 |

| | $ | (4 | ) | | $ | 135,495 |

| | $ | (216 | ) |

We periodically review ourassess AFS securities for OTTI. See Note 2 for factorson a quarterly basis or more often if a potential loss-triggering event occurs. For AFS securities in an unrealized loss position, we first assess whether we intend to sell, or if it is more likely than not that we will be required to sell the security before recovery of its amortized cost basis. If either of the criteria regarding intent or requirement to sell is met, the security’s amortized cost basis is written down to fair value through income. For AFS securities that do not meet the aforementioned criteria, we evaluate whether the decline in fair value has resulted from credit losses or other factors. In making this assessment, we consider when assessing AFS securitiesthe extent to which fair value is less than amortized cost, creditworthiness of the security, and adverse conditions specifically related to the security. If this assessment indicates that a credit loss exists, the present value of cash flows expected to be collected from the security is compared to the amortized cost basis of the security. If the present value of cash flows expected to be collected is less than the amortized cost basis, a credit loss exists and an allowance for OTTI. credit losses

THE NEW YORK TIMES COMPANY

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

is recorded, limited by the amount that the fair value is less than the amortized cost basis. Any impairment that has not been recorded through an allowance for credit losses is recognized in other comprehensive income.

As of September 24, 2017,June 28, 2020, we did not intend to sell and it was not likely that we would be required to sell these investments before recovery of their amortized cost basis, which may be at maturity. UnrealizedAs of June 28, 2020, we have recognized 0 losses or allowance for credit losses related to these investments are primarily due to interest rate fluctuations as opposed to changes in credit quality. Therefore, as of September 24, 2017, we have recognized no OTTI loss.

The following table presents the amortized cost of our HTM securities as of December 25, 2016: |

| | | | |

| | | December 25, 2016 |

(In thousands)

| | Amortized Cost |

Short-term HTM securities (1) | | |

| U.S Treasury securities | | $ | 150,623 |

|

| Corporate debt securities | | 150,599 |

|

| U.S. governmental agency securities | | 64,135 |

|

| Commercial paper | | 84,178 |

|

| Total short-term HTM securities | | $ | 449,535 |

|

Long-term HTM securities (1) | |

|

| U.S. governmental agency securities | | $ | 110,732 |

|

| Corporate debt securities | | 61,775 |

|

| U.S Treasury securities | | 14,792 |

|

| Total long-term HTM securities | | $ | 187,299 |

|

(1) All HTM securities were recorded at amortized cost and not adjusted to fair value in accordance with the HTM accounting treatment. As of December 25, 2016, the amortized cost approximated fair value because of the short-term maturity and highly liquid nature of these investments.AFS securities.

As of September 24, 2017,June 28, 2020, our short-term and long-term marketable securities had remaining maturities of less than 1 month to 12 months and 13 months to 3436 months, respectively. See Note 8 for additionalmore information regarding the fair value of our marketable securities.

THE NEW YORK TIMES COMPANY

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 4.5. GOODWILL AND INTANGIBLES

In 2016,During the first quarter of 2020, the Company acquired two digital marketing agencies, HelloSociety, LLC and Fake Love, LLC for an aggregate of $15.4 millionListen In Audio, Inc., a company that transforms journalism articles into audio that is made available in separate all-cash transactions. Also in 2016, the Company acquired Submarine Leisure Club, Inc., which owned thea subscription-based product review and recommendation websites The Wirecutter and The Sweethome,named “Audm,” in an all-cash transaction. We paid $25.0$8.6 million including a (comprised of $8.0 million cash payment made for a non-compete agreement, and also$0.6 million note receivable previously issued by the Company, which was canceled at the close of the transaction) and entered into a consulting agreement and retention agreements that will likely require retention payments over the three years following the acquisition.

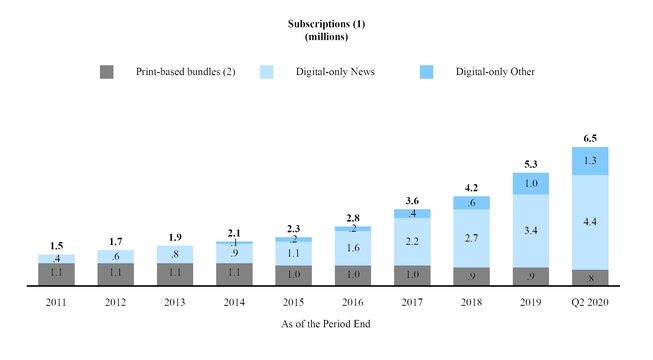

The Company allocated the purchase pricesprice for these acquisitionsthis acquisition based on the final valuation of assets acquired and liabilities assumed, resulting in allocations primarily to goodwill and intangibles property, plant and equipment and other miscellaneous assets.