UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 20152016

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 001-00368

Chevron Corporation

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 94-0890210 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

6001 Bollinger Canyon Road, San Ramon, California | | 94583-2324 (Zip Code) |

| (Address of principal executive offices) | |

Registrant’s telephone number, including area code: (925) 842-1000

NONE

(Former name, former address and former fiscal year, if changed since last report.)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer þ | | Accelerated filer o | | Non-accelerated filer o | | Smaller reporting company o |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

|

| | |

| Class | | Outstanding as of September 30, 20152016 |

| Common stock, $.75 par value | | 1,882,036,7041,887,769,320 |

INDEX

|

| | |

| | | Page No. |

| | | |

PART I FINANCIAL INFORMATION |

| Item 1. | | |

| | Consolidated Statement of Income for the Three and Nine Months Ended September 30, 2015,2016, and 20142015 | |

| | Consolidated Statement of Comprehensive Income for the Three and Nine Months Ended September 30, 2015,2016, and 20142015 | |

| | Consolidated Balance Sheet at September 30, 2015,2016, and December 31, 20142015 | |

| | Consolidated Statement of Cash Flows for the Nine Months Ended September 30, 2015,2016, and 20142015 | |

| | | 7-23 |

| Item 2. | | 24-3724-35 |

| Item 3. | | 37 |

| Item 4. | | 37 |

PART II OTHER INFORMATION |

| Item 1. | | 38 |

| Item 1A. | | 38 |

| Item 2. | | 39 |

| Item 4. | | 39 |

| Item 5. | Other Information | 39 |

| Item 6. | | 40 |

| 4138 |

| Exhibits: | Computation of Ratio of Earnings to Fixed Charges | 4340 |

| Rule 13a-14(a)/15d-14(a) Certifications | 44-4541-42 |

| Rule 13a-14(b)/15d-14(b) Certifications | 46-4743-44 |

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

FOR THE PURPOSE OF “SAFE HARBOR” PROVISIONS OF THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This quarterly report on Form 10-Q of Chevron Corporation contains forward-looking statements relating to Chevron’s operations that are based on management’s current expectations, estimates and projections about the petroleum, chemicals and other energy-related industries. Words or phrases such as “anticipates,” “expects,” “intends,” “plans,” “targets,” “forecasts,” “projects,” “believes,” “seeks,” “schedules,” “estimates,” “positions,” “may,” “could,” “should,” “budgets,” “outlook,” “on schedule,” “on track”track,” “goals,” “objectives” and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond the company’s control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this report. Unless legally required, Chevron undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Among the important factors that could cause actual results to differ materially from those in the forward-looking statements are: changing crude oil and natural gas prices; changing refining, marketing and chemicals margins; the company's ability to realize anticipated cost savings and expenditure reductions; actions of competitors or regulators; timing of exploration expenses; timing of crude oil liftings; the competitiveness of alternate-energy sources or product substitutes; technological developments; the results of operations and financial condition of the company's suppliers, vendors, partners and equity affiliates;affiliates, particularly during extended periods of low prices for crude oil and natural gas; the inability or failure of the company’s joint-venture partners to fund their share of operations and development activities; the potential failure to achieve expected net production from existing and future crude oil and natural gas development projects; potential delays in the development, construction or start-up of planned projects; the potential disruption or interruption of the company’s business, production or manufacturing facilities or delivery/transportation networksoperations due to war, accidents, political events, civil unrest, severe weather, cyber threats and terrorist acts, other natural or human factors, or crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries;Countries, or other natural or human causes beyond its control; changing economic, regulatory and political environments in the various countries in which the company operates; general domestic and international economic and political conditions; the potential liability for remedial actions or assessments under existing or future environmental regulations and litigation; significant operational, investment or product changes required by existing or future environmental statutes and regulations, including international agreements and litigation;national or regional legislation and regulatory measures to limit or reduce greenhouse gas emissions; the potential liability resulting from other pending or future litigation; the company’s future acquisition or disposition of assets and gains and losses from asset dispositions or impairments; government-mandated sales, divestitures, recapitalizations, industry-specific taxes, changes in fiscal terms or restrictions on scope of company operations; foreign currency movements compared with the U.S. dollar; material reductions in corporate liquidity and access to debt markets; the effects of changed accounting rules under generally accepted accounting principles promulgated by rule-setting bodies; the company's ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry; and the factors set forth under the heading “Risk Factors” on pages 2221 through 2423 of the company’s 20142015 Annual Report on Form 10-K. In addition, such results could be affected by general domestic and international economic and political conditions. Other unpredictable or unknown factors not discussed in this report could also have material adverse effects on forward-looking statements.

PART I.

FINANCIAL INFORMATION

| |

| Item 1. | Consolidated Financial Statements |

CHEVRON CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF INCOME

(Unaudited)

| | | | Three Months Ended

September 30 | | Nine Months Ended

September 30 | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| | 2015 | | 2014 | | 2015 | | 2014 | 2016 | | 2015 | | 2016 | | 2015 |

| | (Millions of dollars, except per-share amounts) | (Millions of dollars, except per-share amounts) |

| Revenues and Other Income | | | | | | | | | | |

| Sales and other operating revenues* | $ | 32,767 |

| | $ | 51,822 |

| | $ | 101,911 |

| | $ | 158,383 |

| $ | 29,159 |

| | $ | 32,767 |

| | $ | 80,073 |

| | $ | 101,911 |

|

| Income from equity affiliates | 1,195 |

| | 1,912 |

| | 3,765 |

| | 5,543 |

| 555 |

| | 1,195 |

| | 1,883 |

| | 3,765 |

|

| Other income | 353 |

| | 945 |

| | 3,554 |

| | 1,956 |

| 426 |

| | 353 |

| | 1,019 |

| | 3,554 |

|

| Total Revenues and Other Income | 34,315 |

| | 54,679 |

| | 109,230 |

| | 165,882 |

| 30,140 |

| | 34,315 |

| | 82,975 |

| | 109,230 |

|

| Costs and Other Deductions | | | | | | | | | | | | | | |

| Purchased crude oil and products | 17,447 |

| | 30,741 |

| | 55,181 |

| | 95,408 |

| 15,842 |

| | 17,447 |

| | 42,345 |

| | 55,181 |

|

| Operating expenses | 5,592 |

| | 6,403 |

| | 17,064 |

| | 18,713 |

| 4,666 |

| | 5,592 |

| | 15,124 |

| | 17,064 |

|

| Selling, general and administrative expenses | 1,026 |

| | 1,122 |

| | 3,140 |

| | 3,126 |

| 1,109 |

| | 1,026 |

| | 3,140 |

| | 3,140 |

|

| Exploration expenses | 315 |

| | 366 |

| | 1,982 |

| | 1,475 |

| 258 |

| | 315 |

| | 842 |

| | 1,982 |

|

| Depreciation, depletion and amortization | 4,268 |

| | 3,948 |

| | 15,637 |

| | 11,920 |

| 4,130 |

| | 4,268 |

| | 15,254 |

| | 15,637 |

|

| Taxes other than on income* | 2,883 |

| | 3,236 |

| | 9,174 |

| | 9,422 |

| 2,962 |

| | 2,883 |

| | 8,799 |

| | 9,174 |

|

| Interest and debt expense | | 64 |

| | — |

| | 143 |

| | — |

|

| Total Costs and Other Deductions | 31,531 |

| | 45,816 |

| | 102,178 |

| | 140,064 |

| 29,031 |

| | 31,531 |

| | 85,647 |

| | 102,178 |

|

| Income Before Income Tax Expense | 2,784 |

| | 8,863 |

| | 7,052 |

| | 25,818 |

| |

| Income Tax Expense | 727 |

| | 3,236 |

| | 1,787 |

| | 9,980 |

| |

| Net Income | 2,057 |

| | 5,627 |

| | 5,265 |

| | 15,838 |

| |

| Income (Loss) Before Income Tax Expense | | 1,109 |

| | 2,784 |

| | (2,672 | ) | | 7,052 |

|

| Income Tax Expense (Benefit) | | (192 | ) | | 727 |

| | (1,803 | ) | | 1,787 |

|

| Net Income (Loss) | | 1,301 |

| | 2,057 |

| | (869 | ) | | 5,265 |

|

| Less: Net income attributable to noncontrolling interests | 20 |

| | 34 |

| | 90 |

| | 68 |

| 18 |

| | 20 |

| | 43 |

| | 90 |

|

| Net Income Attributable to Chevron Corporation | $ | 2,037 |

| | $ | 5,593 |

| | $ | 5,175 |

| | $ | 15,770 |

| |

| Net Income (Loss) Attributable to Chevron Corporation | | $ | 1,283 |

| | $ | 2,037 |

| | $ | (912 | ) | | $ | 5,175 |

|

| Per Share of Common Stock: | | | | | | | | | | | | | | |

| Net Income Attributable to Chevron Corporation | | | | | | | | |

| Net Income (Loss) Attributable to Chevron Corporation | | | | | | | | |

| — Basic | $ | 1.09 |

| | $ | 2.97 |

| | $ | 2.77 |

| | $ | 8.35 |

| $ | 0.68 |

| | $ | 1.09 |

| | $ | (0.49 | ) | | $ | 2.77 |

|

| — Diluted | $ | 1.09 |

| | $ | 2.95 |

| | $ | 2.76 |

| | $ | 8.29 |

| $ | 0.68 |

| | $ | 1.09 |

| | $ | (0.49 | ) | | $ | 2.76 |

|

| Dividends | $ | 1.07 |

| | $ | 1.07 |

| | $ | 3.21 |

| | $ | 3.14 |

| $ | 1.07 |

| | $ | 1.07 |

| | $ | 3.21 |

| | $ | 3.21 |

|

| Weighted Average Number of Shares Outstanding (000s) | | | | | | | | | | | | | | |

| — Basic | 1,868,444 |

| | 1,880,915 |

| | 1,867,560 |

| | 1,887,778 |

| 1,873,649 |

| | 1,868,444 |

| | 1,871,813 |

| | 1,867,560 |

|

| — Diluted | 1,872,420 |

| | 1,896,492 |

| | 1,875,193 |

| | 1,902,698 |

| 1,883,342 |

| | 1,872,420 |

| | 1,871,813 |

| | 1,875,193 |

|

| ____________________ | | | | | | | | |

| * Includes excise, value-added and similar taxes: | | $ | 1,772 |

| | $ | 1,800 |

| | $ | 5,208 |

| | $ | 5,642 |

|

See accompanying notes to consolidated financial statements.

CHEVRON CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(Unaudited)

|

| | | | | | | | | | | | | | | |

| * Includes excise, value-added and similar taxes: | $ | 1,800 |

| | $ | 2,116 |

| | $ | 5,642 |

| | $ | 6,182 |

|

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| | 2016 | | 2015 | | 2016 | | 2015 |

| | (Millions of dollars) |

| Net Income (Loss) | $ | 1,301 |

| | $ | 2,057 |

| | $ | (869 | ) | | $ | 5,265 |

|

| Currency translation adjustment | 7 |

| | (16 | ) | | 9 |

| | (35 | ) |

| Unrealized holding gain on securities: | | | | | | | |

| Net gain (loss) arising during period | 21 |

| | (18 | ) | | 31 |

| | (24 | ) |

| Defined benefit plans: | | | | | | | |

| Actuarial gain (loss): | | | | | | | |

| Amortization to net income of net actuarial and settlement losses | 265 |

| | 204 |

| | 644 |

| | 548 |

|

| Actuarial loss arising during period | (9 | ) | | — |

| | (23 | ) | | — |

|

| Prior service cost: | | | | | | | |

| Amortization to net income of net prior service costs | 2 |

| | 5 |

| | 15 |

| | 19 |

|

| Defined benefit plans sponsored by equity affiliates | 5 |

| | 7 |

| | 19 |

| | 34 |

|

| Income tax expense on defined benefit plans | (102 | ) | | (80 | ) | | (247 | ) | | (232 | ) |

| Total | 161 |

| | 136 |

| | 408 |

| | 369 |

|

| Other Comprehensive Gain, Net of Tax | 189 |

| | 102 |

| | 448 |

| | 310 |

|

| Comprehensive Income (Loss) | 1,490 |

| | 2,159 |

| | (421 | ) | | 5,575 |

|

| Comprehensive income attributable to noncontrolling interests | (18 | ) | | (20 | ) | | (43 | ) | | (90 | ) |

| Comprehensive Income (Loss) Attributable to Chevron Corporation | $ | 1,472 |

| | $ | 2,139 |

| | $ | (464 | ) | | $ | 5,485 |

|

See accompanying notes to consolidated financial statements.

CHEVRON CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(Unaudited)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| | 2015 | | 2014 | | 2015 | | 2014 |

| | (Millions of dollars) |

| Net Income | $ | 2,057 |

| | $ | 5,627 |

| | $ | 5,265 |

| | $ | 15,838 |

|

| Currency translation adjustment | (16 | ) | | (19 | ) | | (35 | ) | | (49 | ) |

| Unrealized holding (loss) gain on securities: | | | | | | | |

| Net (loss) gain arising during period | (18 | ) | | (4 | ) | | (24 | ) | | 4 |

|

| Derivatives: | | | | | | | |

| Net derivatives loss on hedge transactions | — |

| | — |

| | — |

| | (66 | ) |

| Reclassification to net income of net realized gain | — |

| | — |

| | — |

| | (17 | ) |

| Income tax benefit on derivatives transactions | — |

| | — |

| | — |

| | 29 |

|

| Total | — |

| | — |

| | — |

| | (54 | ) |

| Defined benefit plans: | | | | | | | |

| Actuarial loss: | | | | | | | |

| Amortization to net income of net actuarial and settlement losses | 204 |

| | 125 |

| | 548 |

| | 350 |

|

| Prior service cost: | | | | | | | |

| Amortization to net income of net prior service costs | 5 |

| | 6 |

| | 19 |

| | 19 |

|

| Defined benefit plans sponsored by equity affiliates | 7 |

| | 6 |

| | 34 |

| | 18 |

|

| Income tax expense on defined benefit plans | (80 | ) | | (55 | ) | | (232 | ) | | (147 | ) |

| Total | 136 |

| | 82 |

| | 369 |

| | 240 |

|

| Other Comprehensive Gain, Net of Tax | 102 |

| | 59 |

| | 310 |

| | 141 |

|

| Comprehensive Income | 2,159 |

| | 5,686 |

| | 5,575 |

| | 15,979 |

|

| Comprehensive income attributable to noncontrolling interests | (20 | ) | | (34 | ) | | (90 | ) | | (68 | ) |

| Comprehensive Income Attributable to Chevron Corporation | $ | 2,139 |

| | $ | 5,652 |

| | $ | 5,485 |

| | $ | 15,911 |

|

See accompanying notes to consolidated financial statements.

CHEVRON CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(Unaudited)

| | | | At September 30

2015 | | At December 31

2014 | At September 30

2016 | | At December 31

2015 |

| | (Millions of dollars, except per-share amounts) | (Millions of dollars, except per-share amounts) |

| ASSETS | ASSETS | | | ASSETS | | |

| Cash and cash equivalents | $ | 12,933 |

| | $ | 12,785 |

| $ | 7,351 |

| | $ | 11,022 |

|

| Time deposits | — |

| | 8 |

| |

| Marketable securities | 306 |

| | 422 |

| 321 |

| | 310 |

|

| Accounts and notes receivable, net | 14,240 |

| | 16,736 |

| 12,522 |

| | 12,860 |

|

| Inventories | | | | | | |

| Crude oil and petroleum products | 4,048 |

| | 3,854 |

| 3,231 |

| | 3,535 |

|

| Chemicals | 439 |

| | 467 |

| 440 |

| | 490 |

|

| Materials, supplies and other | 2,377 |

| | 2,184 |

| 2,305 |

| | 2,309 |

|

| Total inventories | 6,864 |

| | 6,505 |

| 5,976 |

| | 6,334 |

|

| Prepaid expenses and other current assets | 5,476 |

| | 5,776 |

| |

Prepaid expenses and other current assets 1 | | 2,703 |

| | 3,904 |

|

| Total Current Assets | 39,819 |

| | 42,232 |

| 28,873 |

| | 34,430 |

|

| Long-term receivables, net | 2,436 |

| | 2,817 |

| 2,444 |

| | 2,412 |

|

| Investments and advances | 26,710 |

| | 26,912 |

| 30,002 |

| | 27,110 |

|

| Properties, plant and equipment, at cost | 340,558 |

| | 327,289 |

| 341,066 |

| | 340,277 |

|

| Less: Accumulated depreciation, depletion and amortization | 153,153 |

| | 144,116 |

| 157,627 |

| | 151,881 |

|

| Properties, plant and equipment, net | 187,405 |

| | 183,173 |

| 183,439 |

| | 188,396 |

|

| Deferred charges and other assets | 6,593 |

| | 6,299 |

| |

Deferred charges and other assets 1, 2 | | 6,631 |

| | 6,155 |

|

| Goodwill | 4,588 |

| | 4,593 |

| 4,581 |

| | 4,588 |

|

| Assets held for sale | 898 |

| | — |

| 3,893 |

| | 1,449 |

|

| Total Assets | $ | 268,449 |

| | $ | 266,026 |

| $ | 259,863 |

| | $ | 264,540 |

|

| LIABILITIES AND EQUITY | LIABILITIES AND EQUITY | | | LIABILITIES AND EQUITY | | |

| Short-term debt | $ | 6,580 |

| | $ | 3,790 |

| |

Short-term debt 2 | | $ | 6,057 |

| | $ | 4,927 |

|

| Accounts payable | 15,307 |

| | 19,000 |

| 12,205 |

| | 13,516 |

|

| Accrued liabilities | 5,062 |

| | 5,328 |

| 4,441 |

| | 4,833 |

|

| Federal and other taxes on income | 2,039 |

| | 2,575 |

| |

Federal and other taxes on income 1 | | 1,000 |

| | 1,073 |

|

| Other taxes payable | 1,156 |

| | 1,233 |

| 1,041 |

| | 1,118 |

|

| Total Current Liabilities | 30,144 |

| | 31,926 |

| 24,744 |

| | 25,467 |

|

| Long-term debt | 29,210 |

| | 23,960 |

| |

Long-term debt 2 | | 39,462 |

| | 33,542 |

|

| Capital lease obligations | 86 |

| | 68 |

| 66 |

| | 80 |

|

| Deferred credits and other noncurrent obligations | 23,129 |

| | 23,549 |

| 22,288 |

| | 23,465 |

|

| Noncurrent deferred income taxes | 21,869 |

| | 21,920 |

| |

Noncurrent deferred income taxes 1 | | 17,817 |

| | 20,165 |

|

| Noncurrent employee benefit plans | 8,073 |

| | 8,412 |

| 7,534 |

| | 7,935 |

|

| Total Liabilities | 112,511 |

| | 109,835 |

| 111,911 |

| | 110,654 |

|

| Preferred stock (authorized 100,000,000 shares, $1.00 par value, none issued) | — |

| | — |

| — |

| | — |

|

Common stock (authorized 6,000,000,000 shares; $0.75 par value; 2,442,676,580 shares issued at September 30, 2015, and December 31, 2014) | 1,832 |

| | 1,832 |

| |

Common stock (authorized 6,000,000,000 shares; $0.75 par value;

2,442,676,580 shares issued at September 30, 2016, and December 31, 2015) | | 1,832 |

| | 1,832 |

|

| Capital in excess of par value | 16,254 |

| | 16,041 |

| 16,512 |

| | 16,330 |

|

| Retained earnings | 184,167 |

| | 184,987 |

| 174,657 |

| | 181,578 |

|

| Accumulated other comprehensive loss | (4,549 | ) | | (4,859 | ) | (3,843 | ) | | (4,291 | ) |

| Deferred compensation and benefit plan trust | (240 | ) | | (240 | ) | (240 | ) | | (240 | ) |

| Treasury stock, at cost (560,639,876 and 563,027,772 shares at September 30, 2015, and December 31, 2014, respectively) | (42,552 | ) | | (42,733 | ) | |

| Treasury stock, at cost (554,907,260 and 559,862,580 shares at September 30, 2016, and December 31, 2015, respectively) | | (42,118 | ) | | (42,493 | ) |

| Total Chevron Corporation Stockholders’ Equity | 154,912 |

| | 155,028 |

| 146,800 |

| | 152,716 |

|

| Noncontrolling interests | 1,026 |

| | 1,163 |

| 1,152 |

| | 1,170 |

|

| Total Equity | 155,938 |

| | 156,191 |

| 147,952 |

| | 153,886 |

|

| Total Liabilities and Equity | $ | 268,449 |

| | $ | 266,026 |

| $ | 259,863 |

| | $ | 264,540 |

|

| ____________________ | | | | |

1 2015 adjusted to conform to ASU 2015-17. Refer to Note 10, "Income Taxes" beginning on page 14. | | 1 2015 adjusted to conform to ASU 2015-17. Refer to Note 10, "Income Taxes" beginning on page 14. |

2 2015 adjusted to conform to ASU 2015-03. Refer to Note 5, "New Accounting Standards" on page 10. | | 2 2015 adjusted to conform to ASU 2015-03. Refer to Note 5, "New Accounting Standards" on page 10. |

See accompanying notes to consolidated financial statements.

CHEVRON CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(Unaudited)

| | | | Nine Months Ended

September 30 | Nine Months Ended

September 30 |

| | 2015 | | 2014 | 2016 | | 2015 |

| | (Millions of dollars) | (Millions of dollars) |

| Operating Activities | | | | | | |

| Net Income | $ | 5,265 |

| | $ | 15,838 |

| |

| Net Income (Loss) | | $ | (869 | ) | | $ | 5,265 |

|

| Adjustments | | | | | | |

| Depreciation, depletion and amortization | 15,637 |

| | 11,920 |

| 15,254 |

| | 15,637 |

|

| Dry hole expense | 1,265 |

| | 622 |

| 472 |

| | 1,265 |

|

| Distributions less than income from equity affiliates | (576 | ) | | (1,505 | ) | (708 | ) | | (576 | ) |

| Net before-tax gains on asset retirements and sales | (3,104 | ) | | (1,516 | ) | (872 | ) | | (3,104 | ) |

| Net foreign currency effects | (34 | ) | | (61 | ) | 321 |

| | (34 | ) |

| Deferred income tax provision | (478 | ) | | 474 |

| (3,139 | ) | | (478 | ) |

| Net increase in operating working capital | (2,321 | ) | | (376 | ) | (1,266 | ) | | (2,321 | ) |

| Increase in long-term receivables | (92 | ) | | (75 | ) | (81 | ) | | (92 | ) |

| Net decrease (increase) in other deferred charges | 92 |

| | (59 | ) | |

| Net decrease in other deferred charges | | 30 |

| | 92 |

|

| Cash contributions to employee pension plans | (719 | ) | | (227 | ) | (697 | ) | | (719 | ) |

| Other | (36 | ) | | (57 | ) | 538 |

| | (36 | ) |

| Net Cash Provided by Operating Activities | 14,899 |

| | 24,978 |

| 8,983 |

| | 14,899 |

|

| Investing Activities | | | | | | |

| Capital expenditures | (22,055 | ) | | (25,739 | ) | (14,100 | ) | | (22,055 | ) |

| Proceeds and deposits related to asset sales | 5,408 |

| | 2,588 |

| 2,209 |

| | 5,408 |

|

| Net sales of time deposits | 8 |

| | — |

| |

| Net maturities of time deposits | | — |

| | 8 |

|

| Net sales of marketable securities | 122 |

| | 1 |

| 2 |

| | 122 |

|

| Net (borrowing) repayment of loans by equity affiliates | (147 | ) | | 66 |

| |

| Net sales (purchases) of other short-term investments | 64 |

| | (67 | ) | |

| Net borrowing of loans by equity affiliates | | (2,195 | ) | | (147 | ) |

| Net sales of other short-term investments | | 155 |

| | 64 |

|

| Net Cash Used for Investing Activities | (16,600 | ) | | (23,151 | ) | (13,929 | ) | | (16,600 | ) |

| Financing Activities | | | | | | |

| Net borrowings of short-term obligations | 2,049 |

| | 5,294 |

| 869 |

| | 2,049 |

|

| Proceeds from issuance of long-term debt | 5,989 |

| | — |

| 6,924 |

| | 5,989 |

|

| Repayments of long-term debt and other financing obligations | (22 | ) | | (27 | ) | (812 | ) | | (22 | ) |

| Cash dividends — common stock | (5,993 | ) | | (5,926 | ) | (6,007 | ) | | (5,993 | ) |

| Distributions to noncontrolling interests | (122 | ) | | (18 | ) | (57 | ) | | (122 | ) |

| Net sales (purchases) of treasury shares | 158 |

| | (3,174 | ) | |

| Net Cash Provided by (Used for) Financing Activities | 2,059 |

| | (3,851 | ) | |

| Net sales of treasury shares | | 359 |

| | 158 |

|

| Net Cash Provided by Financing Activities | | 1,276 |

| | 2,059 |

|

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | (210 | ) | | (6 | ) | (1 | ) | | (210 | ) |

| Net Change in Cash and Cash Equivalents | 148 |

| | (2,030 | ) | (3,671 | ) | | 148 |

|

| Cash and Cash Equivalents at January 1 | 12,785 |

| | 16,245 |

| 11,022 |

| | 12,785 |

|

| Cash and Cash Equivalents at September 30 | $ | 12,933 |

| | $ | 14,215 |

| $ | 7,351 |

| | $ | 12,933 |

|

See accompanying notes to consolidated financial statements.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1. Interim Financial Statements

The accompanying consolidated financial statements of Chevron Corporation and its subsidiaries (the company) have not been audited by an independent registered public accounting firm. In the opinion of the company’s management, the interim data includes all adjustments necessary for a fair statement of the results for the interim periods. These adjustments were of a normal recurring nature. The results for the three- and nine-month periods ended September 30, 20152016, are not necessarily indicative of future financial results. The term “earnings” is defined as net income (loss) attributable to Chevron Corporation.

Certain notes and other information have been condensed or omitted from the interim financial statements presented in this Quarterly Report on Form 10-Q. Therefore, these financial statements should be read in conjunction with the company’s 20142015 Annual Report on Form 10-K.

Note 2. Changes in Accumulated Other Comprehensive Losses

The change in Accumulated Other Comprehensive Losses (AOCL) presented on the Consolidated Balance Sheet and the impact of significant amounts reclassified from AOCL on information presented in the Consolidated Statement of Income for the nine months ending September 30, 20152016, are reflected in the table below.

Changes in Accumulated Other Comprehensive Income (Loss) by Component (1)

(Millions of Dollars)

| | | | | Nine Months Ended September 30, 2015 | | Nine Months Ended September 30, 2016 |

| | | Currency Translation Adjustment | | Unrealized Holding Gains (Losses) on Securities | | Derivatives | | Defined Benefit Plans | | Total | | Currency Translation Adjustment | | Unrealized Holding Gains (Losses) on Securities | | Derivatives | | Defined Benefit Plans | | Total |

| | |

| |

|

| Balance at January 1 | | $ | (96 | ) | | $ | (8 | ) | | $ | (2 | ) | | $ | (4,753 | ) | | $ | (4,859 | ) | | $ | (140 | ) | | $ | (29 | ) | | $ | (2 | ) | | $ | (4,120 | ) | | $ | (4,291 | ) |

| Components of Other Comprehensive Income (Loss): | Components of Other Comprehensive Income (Loss): | | | | | | | | | Components of Other Comprehensive Income (Loss): | | | | | | | | |

| Before Reclassifications | | (35 | ) | | (24 | ) | | — |

| | 15 |

| | (44 | ) | | 9 |

| | 31 |

| | — |

| | — |

| | 40 |

|

Reclassifications (2) | | — |

| | — |

| | — |

| | 354 |

| | 354 |

| | — |

| | — |

| | — |

| | 408 |

| | 408 |

|

| Net Other Comprehensive Income (Loss) | | (35 | ) | | (24 | ) | | — |

| | 369 |

| | 310 |

| | 9 |

| | 31 |

| | — |

| | 408 |

| | 448 |

|

| Balance at September 30 | | $ | (131 | ) | | $ | (32 | ) | | $ | (2 | ) | | $ | (4,384 | ) | | $ | (4,549 | ) | | $ | (131 | ) | | $ | 2 |

| | $ | (2 | ) | | $ | (3,712 | ) | | $ | (3,843 | ) |

______________________

(1) All amounts are net of tax.

(2) Refer to Note 10,9, Employee Benefits for reclassified components totaling $567$659 million that are included in employee benefit costs for the nine months ending September 30, 20152016. Related income taxes for the same period, totaling $213$251 million, are reflected in Income Tax Expense on the Consolidated Statement of Income. All other reclassified amounts were insignificant.

Note 3. Noncontrolling Interests

Ownership interests in the company’s subsidiaries held by parties other than the parent are presented separately from the parent’s equity on the Consolidated Balance Sheet. The amount of consolidated net income attributable to the parent and the noncontrolling interests are both presented on the face of the Consolidated Statement of Income.

Activity for the equity attributable to noncontrolling interests for the first nine months of 20152016 and 20142015 is as follows:

| | | | 2015 | | 2014 | 2016 | | 2015 |

| | Chevron Corporation Stockholders’ Equity | | Non-controlling Interest | | Total Equity | | Chevron Corporation Stockholders’ Equity | | Non-controlling Interest | | Total Equity | Chevron Corporation Stockholders’ Equity | | Non-controlling Interest | | Total Equity | | Chevron Corporation Stockholders’ Equity | | Non-controlling Interest | | Total Equity |

| | (Millions of dollars) | (Millions of dollars) |

| Balance at January 1 | $ | 155,028 |

| | $ | 1,163 |

| | $ | 156,191 |

| | $ | 149,113 |

| | $ | 1,314 |

| | $ | 150,427 |

| $ | 152,716 |

| | $ | 1,170 |

| | $ | 153,886 |

| | $ | 155,028 |

| | $ | 1,163 |

| | $ | 156,191 |

|

| Net income | 5,175 |

| | 90 |

| | 5,265 |

| | 15,770 |

| | 68 |

| | 15,838 |

| |

| Net income (loss) | | (912 | ) | | 43 |

| | (869 | ) | | 5,175 |

| | 90 |

| | 5,265 |

|

| Dividends | (5,995 | ) | | — |

| | (5,995 | ) | | (5,929 | ) | | — |

| | (5,929 | ) | (6,009 | ) | | — |

| | (6,009 | ) | | (5,995 | ) | | — |

| | (5,995 | ) |

| Distributions to noncontrolling interests | — |

| | (122 | ) | | (122 | ) | | — |

| | (18 | ) | | (18 | ) | — |

| | (57 | ) | | (57 | ) | | — |

| | (122 | ) | | (122 | ) |

| Treasury shares, net | 181 |

| | — |

| | 181 |

| | (3,210 | ) | | — |

| | (3,210 | ) | 375 |

| | — |

| | 375 |

| | 181 |

| | — |

| | 181 |

|

| Other changes, net* | 523 |

| | (105 | ) | | 418 |

| | 396 |

| | (197 | ) | | 199 |

| 630 |

| | (4 | ) | | 626 |

| | 523 |

| | (105 | ) | | 418 |

|

| Balance at September 30 | $ | 154,912 |

| | $ | 1,026 |

| | $ | 155,938 |

| | $ | 156,140 |

| | $ | 1,167 |

| | $ | 157,307 |

| $ | 146,800 |

| | $ | 1,152 |

| | $ | 147,952 |

| | $ | 154,912 |

| | $ | 1,026 |

| | $ | 155,938 |

|

__________________________________ * Includes components of comprehensive income, which are disclosed separately in the Consolidated Statement of Comprehensive Income.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Note 4. Information Relating to the Consolidated Statement of Cash Flows

The “Net increase in operating working capital” was composed of the following operating changes:

| | | | Nine Months Ended

September 30 | Nine Months Ended

September 30 |

| | 2015 | | 2014 | 2016 | | 2015 |

| | (Millions of dollars) | (Millions of dollars) |

| Decrease in accounts and notes receivable | $ | 2,337 |

| | $ | 1,388 |

| |

| Increase in inventories | (445 | ) | | (931 | ) | |

| (Increase) decrease in accounts and notes receivable | | $ | (455 | ) | | $ | 2,337 |

|

| Decrease (increase) in inventories | | 232 |

| | (445 | ) |

| Decrease in prepaid expenses and other current assets | 167 |

| | 237 |

| 844 |

| | 167 |

|

| Decrease in accounts payable and accrued liabilities | (3,769 | ) | | (946 | ) | (1,783 | ) | | (3,769 | ) |

| Decrease in income and other taxes payable | (611 | ) | | (124 | ) | (104 | ) | | (611 | ) |

| Net increase in operating working capital | $ | (2,321 | ) | | $ | (376 | ) | $ | (1,266 | ) | | $ | (2,321 | ) |

The “Net increase in operating working capital” includes reductions of $14 million and $55 millionin each period for excess income tax benefits associated with stock options exercised during the nine months ended September 30, 2015,2016, and 2014, respectively.2015. These amounts are offset by an equal amount in “Net sales (purchases) of treasury shares.”

“Net Cash Provided by Operating Activities” included the following cash payments for interest on debt and for income taxes:

|

| | | | | | | |

| | Nine Months Ended

September 30 |

| | 2015 | | 2014 |

| | (Millions of dollars) |

| Income taxes | $ | 4,081 |

| | $ | 8,625 |

|

|

| | | | | | | |

| | Nine Months Ended

September 30 |

| | 2016 | | 2015 |

| | (Millions of dollars) |

| Interest on debt (net of capitalized interest) | $ | 28 |

| | $ | — |

|

| Income taxes | 1,492 |

| | 4,081 |

|

"Depreciation, depletion and amortization," "Dry hole expense,"amortization" and "Deferred income tax provision," "Net decrease (increase) in other deferred charges" and "Other"provision" collectively include $2.6$2.8 billion in non-cash reductions to properties, plant and equipment recorded in second quarter 2015 relating to impairments and project suspensionsother non-cash charges due to reservoir performance and associated adverse tax effects, all of which stem from a downward revision in the company's longer-termlower crude oil price outlook.prices.

"Other" includes changes in postretirement benefits obligations and other long-term liabilities.

Information related to "Restricted Cash" is included on page 21 in Note 1314 under the heading "Restricted Cash."

The “Net salesmaturities of time deposits” consisted of the following gross amounts:

|

| | | | | | | |

| | Nine Months Ended

September 30 |

| | 2015 | | 2014 |

| | (Millions of dollars) |

| Time deposits purchased | $ | — |

| | $ | (317 | ) |

| Time deposits matured | 8 |

| | 317 |

|

| Net sales of time deposits | $ | 8 |

| | $ | — |

|

|

| | | | | | | |

| | Nine Months Ended

September 30 |

| | 2016 | | 2015 |

| | (Millions of dollars) |

| Maturities of time deposits | — |

| | 8 |

|

| Net maturities of time deposits | $ | — |

| | $ | 8 |

|

The “Net sales of marketable securities” consisted of the following gross amounts:

| | | | Nine Months Ended

September 30 | Nine Months Ended

September 30 |

| | 2015 | | 2014 | 2016 | | 2015 |

| | (Millions of dollars) | (Millions of dollars) |

| Marketable securities purchased | $ | (6 | ) | | $ | (11 | ) | $ | (9 | ) | | $ | (6 | ) |

| Marketable securities sold | 128 |

| | 12 |

| 11 |

| | 128 |

|

| Net sales of marketable securities | $ | 122 |

| | $ | 1 |

| $ | 2 |

| | $ | 122 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The “Net borrowing of loans by equity affiliates” consisted of the following gross amounts:

|

| | | | | | | |

| | Nine Months Ended

September 30 |

| | 2016 | | 2015 |

| | (Millions of dollars) |

| Borrowing of loans by equity affiliates | $ | (2,271 | ) | | $ | (149 | ) |

| Repayment of loans by equity affiliates | 76 |

| | 2 |

|

| Net borrowing of loans by equity affiliates | $ | (2,195 | ) | | $ | (147 | ) |

A loan to Tengizchevroil LLP for the development of the Future Growth and Wellhead Pressure Management Project represents the majority of "Net borrowing of loans by equity affiliates."

The “Net sales (purchases)of other short-term investments” consisted of the following gross amounts:

|

| | | | | | | |

| | Nine Months Ended

September 30 |

| | 2016 | | 2015 |

| | (Millions of dollars) |

| Purchases of other short-term investments | $ | — |

| | $ | (55 | ) |

| Sales of other short-term investments | 155 |

| | 119 |

|

| Net sales of other short-term investments | $ | 155 |

| | $ | 64 |

|

The “Net borrowings of short-term obligations" consisted of the following gross and net amounts:

|

| | | | | | | |

| | Nine Months Ended

September 30 |

| | 2016 | | 2015 |

| | (Millions of dollars) |

| Repayments of short-term obligations | $ | (8,415 | ) | | $ | (10,443 | ) |

| Proceeds from issuances of short-term obligations | 11,695 |

| | 11,042 |

|

| Net borrowings of short-term obligations with three months or less maturity | (2,411 | ) | | 1,450 |

|

| Net borrowings of short-term obligations | $ | 869 |

| | $ | 2,049 |

|

The “Net sales of treasury shares” represents the cost of common shares acquired less the cost of shares issued for share-based compensation plans. Purchases totaled $2 million for the first nine months in 2016 and $1 million for the first nine months in 2015 and $3.8 billion for the first nine months in 2014.2015. No purchases were made under the company's share repurchase program in the first nine months of 2016 or 2015. During the first nine months of 2014, the company purchased 30.6 million common shares under the program for $3.7 billion.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The major components of “Capital expenditures” and the reconciliation of this amount to the capital and exploratory expenditures, including equity affiliates, are as follows:

| | | | Nine Months Ended

September 30 | Nine Months Ended

September 30 |

| | 2015 | | 2014 | 2016 | | 2015 |

| | (Millions of dollars) | (Millions of dollars) |

| Additions to properties, plant and equipment | $ | 21,273 |

| | $ | 25,094 |

| $ | 13,757 |

| | $ | 21,273 |

|

| Additions to investments | 382 |

| | 341 |

| 38 |

| | 382 |

|

| Current year dry hole expenditures | 400 |

| | 320 |

| 305 |

| | 400 |

|

| Payments for other liabilities and assets, net | — |

| | (16 | ) | |

| Capital expenditures | 22,055 |

| | 25,739 |

| 14,100 |

| | 22,055 |

|

| Expensed exploration expenditures | 717 |

| | 853 |

| 370 |

| | 717 |

|

| Assets acquired through capital lease obligations | 44 |

| | 12 |

| 4 |

| | 44 |

|

| Capital and exploratory expenditures, excluding equity affiliates | 22,816 |

| | 26,604 |

| 14,474 |

| | 22,816 |

|

| Company’s share of expenditures by equity affiliates | 2,456 |

| | 2,422 |

| 2,693 |

| | 2,456 |

|

| Capital and exploratory expenditures, including equity affiliates | $ | 25,272 |

| | $ | 29,026 |

| $ | 17,167 |

| | $ | 25,272 |

|

Note 5. Operating Segments and Geographic Data

Although each subsidiary of Chevron is responsible for its own affairs, Chevron Corporation manages its investments in these subsidiaries and their affiliates. The investments are grouped into two business segments, Upstream and Downstream, representing the company’s “reportable segments” and “operating segments.” Upstream operations consist primarily of exploring for, developing and producing crude oil and natural gas; liquefaction, transportation and regasification associated with liquefied natural gas (LNG); transporting crude oil by major international oil export pipelines; processing, transporting, storage and marketing of natural gas; and a gas-to-liquids plant. Downstream operations consist primarily of refining of crude oil into petroleum products; marketing of crude oil and refined products; transporting of crude oil and refined products by pipeline, marine vessel, motor equipment and rail car; and manufacturing and marketing of commodity petrochemicals, plastics for industrial uses, and fuel and lubricant additives. All Other activities of the company include worldwide cash management and debt financing activities, corporate administrative functions, insurance operations, real estate activities and technology companies.

The segments are separately managed for investment purposes under a structure that includes “segment managers” who report to the company’s “chief operating decision maker” (CODM). The CODM is the company’s Executive Committee (EXCOM), a committee of senior officers that includes the Chief Executive Officer. EXCOM reports to the Board of Directors of Chevron Corporation.

The operating segments represent components of the company that engage in activities (a) from which revenues are earned and expenses are incurred; (b) whose operating results are regularly reviewed by the CODM, which makes decisions about resources to be allocated to the segments and assesses their performance; and (c) for which discrete financial information is available.

Segment managers for the reportable segments are directly accountable to, and maintain regular contact with, the company’s CODM to discuss the segment’s operating activities and financial performance. The CODM approves annual capital and exploratory budgets at the reportable segment level, as well as reviews capital and exploratory funding for major projects and approves major changes to the annual capital and exploratory budgets. However, business-unit managers within the operating segments are directly responsible for decisions relating to project implementation and all other matters connected with daily operations. Company officers who are members of the EXCOM also have individual management responsibilities and participate in other committees for purposes other than acting as the CODM.

The company’s primary country of operation is the United States of America, its country of domicile. Other components of the company’s operations are reported as “International” (outside the United States).

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Note 5. New Accounting Standards

Segment EarningsInterest - Imputation of Interest (Topic 835): Simplifying the Presentation of Debt Issuance Costs. Effective January 1, 2016, Chevron adopted ASU 2015-03 on a retrospective basis. The company evaluatesstandard requires that debt issuance costs related to a recognized liability be presented on the performancebalance sheet as a direct deduction from the carrying amount of its operating segments on an after-tax basis, without considering thethat debt liability. The effects of debt financing interest expense or investment interest income, bothretrospective adoption on the December 31, 2015, Consolidated Balance Sheet were reductions of $43 million in "Deferred charges and other assets," $1 million in "Short-term debt" and $42 million in "Long-term debt".

Revenue Recognition (Topic 606): Revenue from Contracts with Customers.In July 2015, the FASB approved a one-year deferral of the effective date of ASU 2014-09, which are managed bybecomes effective for the company onJanuary 1, 2018. The standard provides a worldwide basis. Corporate administrative costssingle comprehensive revenue recognition model for contracts with customers, eliminates most industry-specific revenue recognition guidance, and assets are not allocated to the operating segments. However, operating segments are billed for the direct use of corporate services. Nonbillable costs remain at the corporate level in “All Other.” Earnings by major operating area for the three- and nine-month periods ended September 30, 2015, and 2014, are presented in the following table:

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| Segment Earnings | 2015 | | 2014 | | 2015 | | 2014 |

| | (Millions of dollars) |

| Upstream | | | | | | | |

| United States | $ | (603 | ) | | $ | 929 |

| | $ | (2,101 | ) | | $ | 2,895 |

|

| International | 662 |

| | 3,720 |

| | 1,501 |

| | 11,325 |

|

| Total Upstream | 59 |

| | 4,649 |

| | (600 | ) | | 14,220 |

|

| Downstream | | | | | | | |

| United States | 1,249 |

| | 809 |

| | 2,686 |

| | 1,748 |

|

| International | 962 |

| | 578 |

| | 3,904 |

| | 1,070 |

|

| Total Downstream | 2,211 |

| | 1,387 |

| | 6,590 |

| | 2,818 |

|

| Total Segment Earnings | 2,270 |

| | 6,036 |

| | 5,990 |

| | 17,038 |

|

| All Other | | | | | | | |

| Interest Income | 16 |

| | 16 |

| | 49 |

| | 54 |

|

| Other | (249 | ) | | (459 | ) | | (864 | ) | | (1,322 | ) |

| Net Income Attributable to Chevron Corporation | $ | 2,037 |

| | $ | 5,593 |

| | $ | 5,175 |

| | $ | 15,770 |

|

Segment Assets Segment assets do not include intercompany investments or intercompany receivables. “All Other” assets consist primarily of worldwide cash, cash equivalents, time deposits and marketable securities; real estate; information systems; technology companies; and assets of the corporate administrative functions. Segment assets at September 30, 2015, and December 31, 2014, are as follows:

|

| | | | | | | |

| Segment Assets | At September 30

2015 | | At December 31

2014 |

| | (Millions of dollars) |

| Upstream | | | |

| United States | $ | 48,638 |

| | $ | 49,205 |

|

| International | 159,833 |

| | 152,736 |

|

| Goodwill | 4,588 |

| | 4,593 |

|

| Total Upstream | 213,059 |

| | 206,534 |

|

| Downstream | | | |

| United States | 21,579 |

| | 23,068 |

|

| International | 16,229 |

| | 17,723 |

|

| Total Downstream | 37,808 |

| | 40,791 |

|

| Total Segment Assets | 250,867 |

| | 247,325 |

|

| All Other | | | |

| United States | 5,304 |

| | 6,741 |

|

| International | 12,278 |

| | 11,960 |

|

| Total All Other | 17,582 |

| | 18,701 |

|

| Total Assets — United States | 75,521 |

| | 79,014 |

|

| Total Assets — International | 188,340 |

| | 182,419 |

|

| Goodwill | 4,588 |

| | 4,593 |

|

| Total Assets | $ | 268,449 |

| | $ | 266,026 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Segment Salesexpands disclosure requirements. "Sales and Other Operating Revenues SegmentRevenues” on the Consolidated Statement of Income includes excise, value-added and similar taxes on sales and other operating revenues, including internal transfers,transactions. Upon adoption of the standard, revenue will exclude sales-based taxes collected on behalf of third parties, which will have no impact to earnings. The company continues to evaluate the effect of the standard on its consolidated financial statements.

Leases (Topic 842)In February 2016, the FASB issued ASU 2016-02 which becomes effective for the three-company January 1, 2019. The standard requires that lessees present right-of-use assets and nine-month periods ended September 30, 2015, and 2014, are presented inlease liabilities on the following table. Products are transferred between operating segments at internal product values that approximate market prices. Revenues forbalance sheet. The company is evaluating the upstream segment are derived primarily fromeffect of the production and sale of crude oil and natural gas, as well asstandard on the sale of third-party production of natural gas. Revenues for the downstream segment are derived from the refining and marketing of petroleum products such as gasoline, jet fuel, gas oils, lubricants, residual fuel oils and other products derived from crude oil. This segment also generates revenues from the manufacture and sale of fuel and lubricant additives and the transportation and trading of refined products and crude oil. “All Other” activities include revenues from insurance operations, real estate activities and technology companies.company’s consolidated financial statements.

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| Sales and Other Operating Revenues | 2015 | | 2014 | | 2015 | | 2014 |

| | (Millions of dollars) |

| Upstream | | | | | | | |

| United States | $ | 3,207 |

| | $ | 5,676 |

| | $ | 10,089 |

| | $ | 18,386 |

|

| International | 6,540 |

| | 12,084 |

| | 21,163 |

| | 37,419 |

|

| Subtotal | 9,747 |

| | 17,760 |

| | 31,252 |

| | 55,805 |

|

| Intersegment Elimination — United States | (2,165 | ) | | (4,127 | ) | | (6,829 | ) | | (12,319 | ) |

| Intersegment Elimination — International | (2,774 | ) | | (6,317 | ) | | (9,047 | ) | | (18,676 | ) |

| Total Upstream | 4,808 |

| | 7,316 |

| | 15,376 |

| | 24,810 |

|

| Downstream | | | | | | | |

| United States | 13,795 |

| | 20,623 |

| | 41,336 |

| | 62,043 |

|

| International | 14,484 |

| | 26,071 |

| | 46,326 |

| | 78,474 |

|

| Subtotal | 28,279 |

| | 46,694 |

| | 87,662 |

| | 140,517 |

|

| Intersegment Elimination — United States | (6 | ) | | (6 | ) | | (20 | ) | | (18 | ) |

| Intersegment Elimination — International | (360 | ) | | (2,252 | ) | | (1,222 | ) | | (7,146 | ) |

| Total Downstream | 27,913 |

| | 44,436 |

| | 86,420 |

| | 133,353 |

|

| All Other | | | | | | | |

| United States | 413 |

| | 474 |

| | 1,176 |

| | 1,349 |

|

| International | 13 |

| | 11 |

| | 30 |

| | 24 |

|

| Subtotal | 426 |

| | 485 |

| | 1,206 |

| | 1,373 |

|

| Intersegment Elimination — United States | (368 | ) | | (404 | ) | | (1,065 | ) | | (1,130 | ) |

| Intersegment Elimination — International | (12 | ) | | (11 | ) | | (26 | ) | | (23 | ) |

| Total All Other | 46 |

| | 70 |

| | 115 |

| | 220 |

|

| Sales and Other Operating Revenues | | | | | | | |

| United States | 17,415 |

| | 26,773 |

| | 52,601 |

| | 81,778 |

|

| International | 21,037 |

| | 38,166 |

| | 67,519 |

| | 115,917 |

|

| Subtotal | 38,452 |

| | 64,939 |

| | 120,120 |

| | 197,695 |

|

| Intersegment Elimination — United States | (2,539 | ) | | (4,537 | ) | | (7,914 | ) | | (13,467 | ) |

| Intersegment Elimination — International | (3,146 | ) | | (8,580 | ) | | (10,295 | ) | | (25,845 | ) |

| Total Sales and Other Operating Revenues | $ | 32,767 |

| | $ | 51,822 |

| | $ | 101,911 |

| | $ | 158,383 |

|

Note 6. Summarized Financial Data — Chevron U.S.A. Inc.

Chevron U.S.A. Inc. (CUSA) is a major subsidiary of Chevron Corporation. CUSA and its subsidiaries manage and operate most of Chevron’s U.S. businesses. Assets include those related to the exploration and production of crude oil, natural gas and natural gas liquids and those associated with refining, marketing, and supply and distribution of products derived from petroleum, excluding most of the regulated pipeline operations of Chevron. CUSA also holds the company’s investment in the Chevron Phillips Chemical Company LLC joint venture, which is accounted for using the equity method.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The summarized financial information for CUSA and its consolidated subsidiaries is as follows:

|

| | | | | | | |

| Nine Months Ended

September 30 |

| | 2015 | | 2014 |

| | (Millions of dollars) |

| Sales and other operating revenues | $ | 77,434 |

| | $ | 124,957 |

|

| Costs and other deductions | 78,116 |

| | 120,977 |

|

| Net income attributable to CUSA | 424 |

| | 3,697 |

|

|

| | | | | | | |

| | At September 30

2015 | | At December 31

2014 |

| | (Millions of dollars) |

| Current assets | $ | 11,427 |

| | $ | 13,724 |

|

| Other assets | 60,978 |

| | 62,195 |

|

| Current liabilities | 11,963 |

| | 16,191 |

|

| Other liabilities | 30,512 |

| | 30,175 |

|

| Total CUSA net equity | $ | 29,930 |

| | $ | 29,553 |

|

| Memo: Total debt | $ | 14,466 |

| | $ | 14,473 |

|

Note 7. Summarized Financial Data — Tengizchevroil LLP

Chevron has a 50 percent equity ownership interest in Tengizchevroil LLP (TCO). Summarized financial information for 100 percent of TCO is presented in the following table:

|

| | | | | | | |

| | Nine Months Ended

September 30 |

| | 2015 | | 2014 |

| | (Millions of dollars)

|

| Sales and other operating revenues | $ | 10,215 |

| | $ | 18,628 |

|

| Costs and other deductions | 5,779 |

| | 8,112 |

|

| Net income attributable to TCO | 3,109 |

| | 7,360 |

|

Note 8. Income Taxes

Taxes on income for the third quarter and first nine months of 2015 were $0.7 billion and $1.8 billion, respectively, compared with $3.2 billion and $10.0 billion for the corresponding periods in 2014. The associated effective tax rates (calculated as the amount of Income Tax Expense divided by Income Before Income Tax Expense) for the third quarters of 2015 and 2014 were 26 percent and 37 percent, respectively. For the comparative nine-month periods, the effective tax rates were 25 percent and 39 percent, respectively.

The decrease in the effective tax rate between the quarterly periods primarily resulted from the effects of equity earnings, foreign currency remeasurement and one-time tax benefits, partially offset by the effects of valuation allowances recognized on deferred tax assets. The decrease in the effective tax rate for the nine-month comparative period was primarily due to the effects of equity earnings, foreign currency remeasurement, a reduction in statutory tax rates in the United Kingdom and jurisdictional mix, partially offset by the effects of valuation allowances recognized on deferred tax assets.

Tax positions for Chevron and its subsidiaries and affiliates are subject to income tax audits by many tax jurisdictions throughout the world. For the company’s major tax jurisdictions, examinations of tax returns for certain prior tax years had not been completed as of September 30, 2015. For these jurisdictions, the latest years for which income tax examinations had been finalized were as follows: United States — 2008, Nigeria — 2000, Angola — 2001, Saudi Arabia — 2012 and Kazakhstan — 2007.

The company engages in ongoing discussions with tax authorities regarding the resolution of tax matters in the various jurisdictions. Both the outcomes for these tax matters and the timing of resolution and/or closure of the tax audits are highly uncertain. However, it is reasonably possible that developments regarding tax matters in certain tax jurisdictions may result in significant increases or decreases in the company’s total unrecognized tax

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

benefits within the next 12 months. Given the number of years that still remain subject to examination and the number of matters being examined in the various tax jurisdictions, the company is unable to estimate the range of possible adjustments to the balance of unrecognized tax benefits.

Note 9. Assets Held For Sale6. Operating Segments and Geographic Data

AtAlthough each subsidiary of Chevron is responsible for its own affairs, Chevron Corporation manages its investments in these subsidiaries and their affiliates. The investments are grouped into two business segments, Upstream and Downstream, representing the company’s “reportable segments” and “operating segments.” Upstream operations consist primarily of exploring for, developing and producing crude oil and natural gas; liquefaction, transportation and regasification associated with liquefied natural gas (LNG); transporting crude oil by major international oil export pipelines; processing, transporting, storage and marketing of natural gas; and a gas-to-liquids plant. Downstream operations consist primarily of refining of crude oil into petroleum products; marketing of crude oil and refined products; transporting of crude oil and refined products by pipeline, marine vessel, motor equipment and rail car; and manufacturing and marketing of commodity petrochemicals, plastics for industrial uses, and fuel and lubricant additives. All Other activities of the company include worldwide cash management and debt financing activities, corporate administrative functions, insurance operations, real estate activities and technology companies.

The company’s segments are managed by “segment managers” who report to the “chief operating decision maker” (CODM). The segments represent components of the company that engage in activities (a) from which revenues are earned and expenses are incurred; (b) whose operating results are regularly reviewed by the CODM, which makes decisions about resources to be allocated to the segments and assesses their performance; and (c) for which discrete financial information is available.

The company’s primary country of operation is the United States of America, its country of domicile. Other components of the company’s operations are reported as “International” (outside the United States).

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Segment Earnings The company evaluates the performance of its operating segments on an after-tax basis, without considering the effects of debt financing interest expense or investment interest income, both of which are managed by the company on a worldwide basis. Corporate administrative costs and assets are not allocated to the operating segments. However, operating segments are billed for the direct use of corporate services. Nonbillable costs remain at the corporate level in “All Other.” Earnings by major operating area for the three- and nine-month periods ended September 30, 2016, and 2015, are presented in the company classified $898 millionfollowing table:

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| Segment Earnings | 2016 | | 2015 | | 2016 | | 2015 |

| | (Millions of dollars) |

| Upstream | | | | | | | |

| United States | $ | (212 | ) | | $ | (603 | ) | | $ | (2,175 | ) | | $ | (2,101 | ) |

| International | 666 |

| | 662 |

| | (1,292 | ) | | 1,501 |

|

| Total Upstream | 454 |

| | 59 |

| | (3,467 | ) | | (600 | ) |

| Downstream | | | | | | | |

| United States | 523 |

| | 1,249 |

| | 1,307 |

| | 2,686 |

|

| International | 542 |

| | 962 |

| | 1,771 |

| | 3,904 |

|

| Total Downstream | 1,065 |

| | 2,211 |

| | 3,078 |

| | 6,590 |

|

| Total Segment Earnings | 1,519 |

| | 2,270 |

| | (389 | ) | | 5,990 |

|

| All Other | | | | | | | |

| Interest expense | (53 | ) | | — |

| | (120 | ) | | — |

|

| Interest income | 15 |

| | 16 |

| | 47 |

| | 49 |

|

| Other | (198 | ) | | (249 | ) | | (450 | ) | | (864 | ) |

| Net Income (Loss) Attributable to Chevron Corporation | $ | 1,283 |

| | $ | 2,037 |

| | $ | (912 | ) | | $ | 5,175 |

|

Segment Assets Segment assets do not include intercompany investments or intercompany receivables. “All Other” assets consist primarily of net properties, plantworldwide cash, cash equivalents, time deposits and equipmentmarketable securities; real estate; information systems; technology companies; and assets of the corporate administrative functions. Segment assets at September 30, 2016, and December 31, 2015, are as “Assets heldfollows:

|

| | | | | | | |

| Segment Assets | At September 30

2016 | | At December 31

2015 |

| | (Millions of dollars) |

| Upstream | | | |

United States 1 | $ | 42,914 |

| | $ | 46,383 |

|

International 1 | 163,681 |

| | 162,030 |

|

| Goodwill | 4,581 |

| | 4,588 |

|

| Total Upstream | 211,176 |

| | 213,001 |

|

| Downstream | | | |

United States 1 | 21,416 |

| | 21,404 |

|

| International | 15,887 |

| | 14,982 |

|

| Total Downstream | 37,303 |

| | 36,386 |

|

| Total Segment Assets | 248,479 |

| | 249,387 |

|

| All Other | | | |

United States 1,2 | 5,125 |

| | 4,728 |

|

| International | 6,259 |

| | 10,425 |

|

| Total All Other | 11,384 |

| | 15,153 |

|

| Total Assets — United States | 69,455 |

| | 72,515 |

|

| Total Assets — International | 185,827 |

| | 187,437 |

|

| Goodwill | 4,581 |

| | 4,588 |

|

| Total Assets | $ | 259,863 |

| | $ | 264,540 |

|

| ____________________ | | | |

1 2015 adjusted to conform to ASU 2015-17. Refer to Note 10, "Income Taxes" beginning on page 14. |

2 2015 adjusted to conform to ASU 2015-03. Refer to Note 5, "New Accounting Standards" on page 10. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Segment Sales and Other Operating Revenues Segment sales and other operating revenues, including internal transfers, for sale” on the Consolidated Balance Sheet. These assetsthree- and nine-month periods ended September 30, 2016, and 2015, are presented in the following table. Products are transferred between operating segments at internal product values that approximate market prices. Revenues for the upstream segment are derived primarily from the production and sale of crude oil and natural gas, as well as the sale of third-party production of natural gas. Revenues for the downstream segment are derived from the refining and marketing of petroleum products such as gasoline, jet fuel, gas oils, lubricants, residual fuel oils and other products derived from crude oil. This segment also generates revenues from the manufacture and sale of fuel and lubricant additives and the transportation and trading of refined products and crude oil. “All Other” activities include revenues from insurance operations, real estate activities and technology companies.

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| Sales and Other Operating Revenues | 2016 | | 2015 | | 2016 | | 2015 |

| | (Millions of dollars) |

| Upstream | | | | | | | |

| United States | $ | 2,847 |

| | $ | 3,207 |

| | $ | 7,386 |

| | $ | 10,089 |

|

| International | 5,927 |

| | 6,540 |

| | 16,325 |

| | 21,163 |

|

| Subtotal | 8,774 |

| | 9,747 |

| | 23,711 |

| | 31,252 |

|

| Intersegment Elimination — United States | (1,979 | ) | | (2,165 | ) | | (5,120 | ) | | (6,829 | ) |

| Intersegment Elimination — International | (2,742 | ) | | (2,774 | ) | | (6,949 | ) | | (9,047 | ) |

| Total Upstream | 4,053 |

| | 4,808 |

| | 11,642 |

| | 15,376 |

|

| Downstream | | | | | | | |

| United States | 11,958 |

| | 13,795 |

| | 32,841 |

| | 41,336 |

|

| International | 13,415 |

| | 14,484 |

| | 36,262 |

| | 46,326 |

|

| Subtotal | 25,373 |

| | 28,279 |

| | 69,103 |

| | 87,662 |

|

| Intersegment Elimination — United States | (4 | ) | | (6 | ) | | (12 | ) | | (20 | ) |

| Intersegment Elimination — International | (303 | ) | | (360 | ) | | (762 | ) | | (1,222 | ) |

| Total Downstream | 25,066 |

| | 27,913 |

| | 68,329 |

| | 86,420 |

|

| All Other | | | | | | | |

| United States | 280 |

| | 413 |

| | 825 |

| | 1,176 |

|

| International | 10 |

| | 13 |

| | 29 |

| | 30 |

|

| Subtotal | 290 |

| | 426 |

| | 854 |

| | 1,206 |

|

| Intersegment Elimination — United States | (240 | ) | | (368 | ) | | (724 | ) | | (1,065 | ) |

| Intersegment Elimination — International | (10 | ) | | (12 | ) | | (28 | ) | | (26 | ) |

| Total All Other | 40 |

| | 46 |

| | 102 |

| | 115 |

|

| Sales and Other Operating Revenues | | | | | | | |

| United States | 15,085 |

| | 17,415 |

| | 41,052 |

| | 52,601 |

|

| International | 19,352 |

| | 21,037 |

| | 52,616 |

| | 67,519 |

|

| Subtotal | 34,437 |

| | 38,452 |

| | 93,668 |

| | 120,120 |

|

| Intersegment Elimination — United States | (2,223 | ) | | (2,539 | ) | | (5,856 | ) | | (7,914 | ) |

| Intersegment Elimination — International | (3,055 | ) | | (3,146 | ) | | (7,739 | ) | | (10,295 | ) |

| Total Sales and Other Operating Revenues | $ | 29,159 |

| | $ | 32,767 |

| | $ | 80,073 |

| | $ | 101,911 |

|

Note 7. Summarized Financial Data — Chevron U.S.A. Inc.

Chevron U.S.A. Inc. (CUSA) is a major subsidiary of Chevron Corporation. CUSA and its subsidiaries manage and operate most of Chevron’s U.S. businesses. Assets include those related to the exploration and production of crude oil, natural gas and natural gas liquids and those associated with upstreamrefining, marketing, and downstreamsupply and distribution of products derived from petroleum, excluding most of the regulated pipeline operations that are anticipated to be soldof Chevron. CUSA also holds the company’s investment in the next 12 months. The revenues and earnings contributions of these assets in 2014 and nine months of 2015 were not material.Chevron Phillips Chemical Company LLC joint venture, which is accounted for using the equity method.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The summarized financial information for CUSA and its consolidated subsidiaries is as follows:

|

| | | | | | | |

| Nine Months Ended

September 30 |

| | 2016 | | 2015 |

| | (Millions of dollars) |

| Sales and other operating revenues | $ | 60,882 |

| | $ | 77,434 |

|

| Costs and other deductions | 63,596 |

| | 78,116 |

|

| Net income (loss) attributable to CUSA | (917 | ) | | 424 |

|

|

| | | | | | | |

| | At September 30

2016 | | At December 31

2015* |

| | (Millions of dollars) |

| Current assets | $ | 9,872 |

| | $ | 9,097 |

|

| Other assets | 56,004 |

| | 59,170 |

|

| Current liabilities | 13,268 |

| | 13,664 |

|

| Other liabilities | 21,992 |

| | 28,465 |

|

| Total CUSA net equity | $ | 30,616 |

| | $ | 26,138 |

|

| Memo: Total debt | $ | 9,457 |

| | $ | 14,462 |

|

| ____________________ | | | |

| *2015 adjusted to conform to ASU 2015-17. | | | |

Note 8. Summarized Financial Data — Tengizchevroil LLP

Chevron has a 50 percent equity ownership interest in Tengizchevroil LLP (TCO). Summarized financial information for 100 percent of TCO is presented in the following table:

|

| | | | | | | |

| Nine Months Ended

September 30 |

| | 2016 | | 2015 |

| | (Millions of dollars) |

| Sales and other operating revenues | $ | 7,355 |

| | $ | 10,215 |

|

| Costs and other deductions | 5,172 |

| | 5,779 |

|

| Net income attributable to TCO | 1,534 |

| | 3,109 |

|

Note 10.9. Employee Benefits

Chevron has defined benefit pension plans for many employees. The company typically prefunds defined benefit plans as required by local regulations or in certain situations where prefunding provides economic advantages. In the United States, all qualified plans are subject to the Employee Retirement Income Security Act minimum funding standard. The company does not typically fund U.S. nonqualified pension plans that are not subject to funding requirements under laws and regulations because contributions to these pension plans may be less economic and investment returns may be less attractive than the company’s other investment alternatives.

The company also sponsors other postretirement employee benefit (OPEB) plans that provide medical and dental benefits, as well as life insurance for some active and qualifying retired employees. The plans are unfunded, and the company and the retirees share the costs. Medical coverage for Medicare-eligible retirees in the company’s

main U.S. medical plan is secondary to Medicare (including Part D) and the increase to the company contribution for retiree medical coverage is limited to no more than 4 percent each year. Certain life insurance benefits are paid by the company.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The components of net periodic benefit costs for 20152016 and 20142015 are as follows:

| | | | Three Months Ended

September 30 | | Nine Months Ended

September 30 | Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| | 2015 | | 2014 | | 2015 | | 2014 | 2016 | | 2015 | | 2016 | | 2015 |

| | (Millions of dollars) | (Millions of dollars) |

| Pension Benefits | | | | | | | | | | | | | | |

| United States | | | | | | | | | | | | | | |

| Service cost | $ | 135 |

| | $ | 113 |

| | $ | 404 |

| | $ | 338 |

| $ | 123 |

| | $ | 135 |

| | $ | 370 |

| | $ | 404 |

|

| Interest cost | 125 |

| | 124 |

| | 376 |

| | 371 |

| 95 |

| | 125 |

| | 283 |

| | 376 |

|

| Expected return on plan assets | (195 | ) | | (197 | ) | | (587 | ) | | (591 | ) | (181 | ) | | (195 | ) | | (542 | ) | | (587 | ) |

| Amortization of prior service credits | (3 | ) | | (3 | ) | | (7 | ) | | (7 | ) | (2 | ) | | (3 | ) | | (6 | ) | | (7 | ) |

| Amortization of actuarial losses | 89 |

| | 52 |

| | 267 |

| | 157 |

| 84 |

| | 89 |

| | 251 |

| | 267 |

|

| Settlement losses | 87 |

| | 48 |

| | 195 |

| | 114 |

| 162 |

| | 87 |

| | 324 |

| | 195 |

|

| Total United States | 238 |

| | 137 |

| | 648 |

| | 382 |

| 281 |

| | 238 |

| | 680 |

| | 648 |

|

| International | | | | | | | | | | | | | | |

| Service cost | 46 |

| | 46 |

| | 140 |

| | 143 |

| 37 |

| | 46 |

| | 120 |

| | 140 |

|

| Interest cost | 68 |

| | 84 |

| | 209 |

| | 257 |

| 68 |

| | 68 |

| | 198 |

| | 209 |

|

| Expected return on plan assets | (66 | ) | | (75 | ) | | (196 | ) | | (227 | ) | (61 | ) | | (66 | ) | | (184 | ) | | (196 | ) |

| Amortization of prior service costs | 5 |

| | 6 |

| | 16 |

| | 16 |

| 1 |

| | 5 |

| | 11 |

| | 16 |

|

| Amortization of actuarial losses | 19 |

| | 23 |

| | 60 |

| | 74 |

| 14 |

| | 19 |

| | 37 |

| | 60 |

|

| Settlement losses | | 1 |

| | — |

| | 18 |

| | — |

|

| Total International | 72 |

| | 84 |

| | 229 |

| | 263 |

| 60 |

| | 72 |

| | 200 |

| | 229 |

|

| Net Periodic Pension Benefit Costs | $ | 310 |

| | $ | 221 |

| | $ | 877 |

| | $ | 645 |

| $ | 341 |

| | $ | 310 |

| | $ | 880 |

| | $ | 877 |

|

| Other Benefits* | | | | | | | | | | | | | | |

| Service cost | $ | 18 |

| | $ | 13 |

| | $ | 54 |

| | $ | 38 |

| $ | 15 |

| | $ | 18 |

| | $ | 45 |

| | $ | 54 |

|

| Interest cost | 37 |

| | 37 |

| | 112 |

| | 112 |

| 32 |

| | 37 |

| | 96 |

| | 112 |

|

| Amortization of prior service costs | 3 |

| | 3 |

| | 10 |

| | 10 |

| 3 |

| | 3 |

| | 10 |

| | 10 |

|

| Amortization of actuarial losses | 9 |

| | 2 |

| | 26 |

| | 5 |

| 5 |

| | 9 |

| | 15 |

| | 26 |

|

| Net Periodic Other Benefit Costs | $ | 67 |

| | $ | 55 |

| | $ | 202 |

| | $ | 165 |

| $ | 55 |

| | $ | 67 |

| | $ | 166 |

| | $ | 202 |

|

__________________________

* Includes costs for U.S. and international OPEB plans. Obligations for plans outside the United States are not significant relative to the company’s total OPEB obligation.

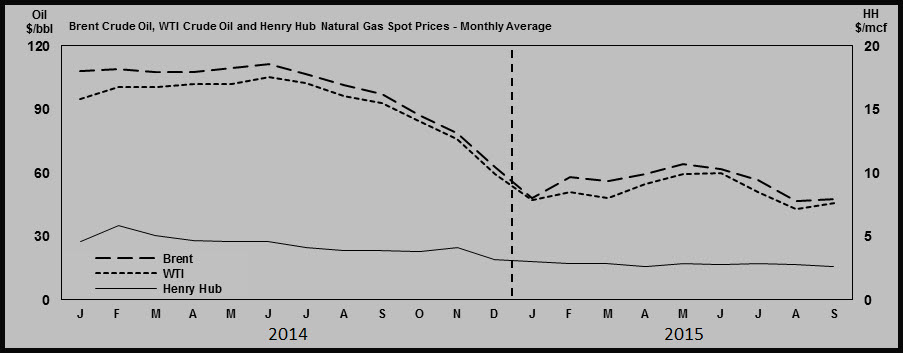

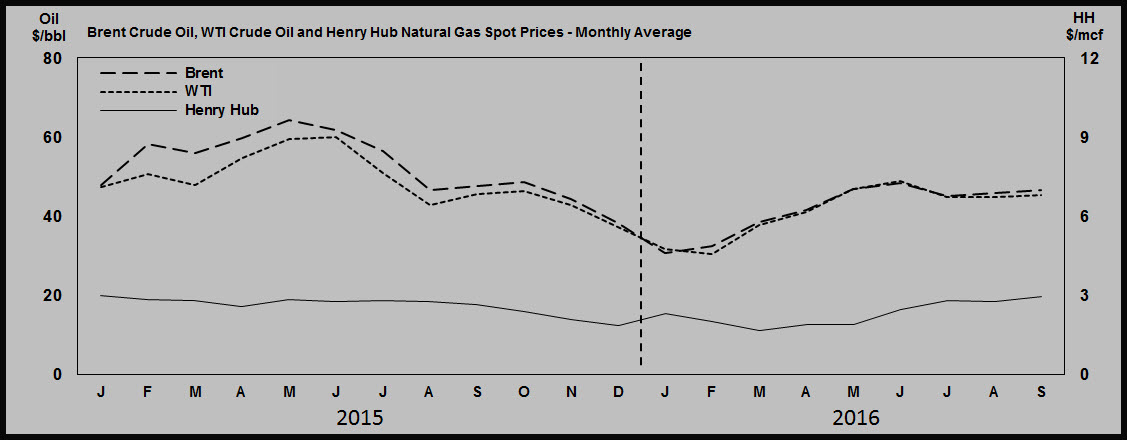

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)