0000109380us-gaap:ConsumerPortfolioSegmentMemberzions:FinancingReceivableNonaccruingMemberzions:OneThroughFourFamilyResidentialMemberzions:MultipleModificationTypesMember2021-01-012021-12-31OperatingSegmentsMemberzions:CaliforniaBankAndTrustSegmentMemberzions:ProductsAndServicesCapitalMarketsAndForeignExchangeFeesMember2022-01-012022-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended March 31, 20222023 OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________ to __________

COMMISSION FILE NUMBER 001-12307

ZIONS BANCORPORATION, NATIONAL ASSOCIATION

(Exact name of registrant as specified in its charter)

| | | | | |

| United States of America | 87-0189025 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

| One South Main | |

| Salt Lake City, Utah | 84133-1109 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (801) 844-7637

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of Each Class | Trading Symbols | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.001 | ZION | The NASDAQ Stock Market LLC |

| Depositary Shares each representing a 1/40th ownership interest in a share of: | | |

| Series A Floating-Rate Non-Cumulative Perpetual Preferred Stock | ZIONP | The NASDAQ Stock Market LLC |

| Series G Fixed/Floating-Rate Non-Cumulative Perpetual Preferred Stock | ZIONO | The NASDAQ Stock Market LLC |

| 6.95% Fixed-to-Floating Rate Subordinated Notes due September 15, 2028 | ZIONL | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ☐ Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Number of common shares outstanding at April 29, 2022 151,358,74828, 2023 148,100,701 shares

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES

Table of Contents

| | | | | | | | |

| | Page |

| |

| | |

Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| |

| |

| | |

Item 1. | | |

| | |

Item 1A. | | |

| | |

Item 2. | | |

| | |

Item 6. | | |

| |

| |

Table of Contents

| | | | | | | | |

| | Page |

| |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| |

| |

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 2. | | |

| | |

| Item 6. | | |

| |

| |

Table of Contents

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES

GLOSSARY OF ACRONYMS AND ABBREVIATIONS

| | | | | | | | | | | |

| ACL | Allowance for Credit Losses | IMGHECL | International Manufacturing GroupHome Equity Credit Line |

| AFS | Available-for-Sale | IPOHTM | Initial Public OfferingHeld-to-Maturity |

| ALLL | Allowance for Loan and Lease Losses | IRSIPO | Internal Revenue ServiceInitial Public Offering |

| Amegy | Amegy Bank, a division of Zions Bancorporation, National Association | LIBORLIHTC | London Interbank Offered RateLow-income Housing Tax Credit |

| AMERIBOR | American Interbank Offered Rate | LIBOR | London Interbank Offered Rate |

| AOCI | Accumulated Other Comprehensive Income or Loss | Municipalities | State and Local Governments |

AOCIASC | Accumulated Other Comprehensive IncomeAccounting Standards Codification | NAICS | North American Industry Classification System |

ASCASU | Accounting Standards CodificationUpdate | NASDAQ | National Association of Securities Dealers Automated Quotations |

ASUBOLI | Accounting Standards UpdateBank-Owned Life Insurance | NBAZ | National Bank of Arizona, a division of Zions Bancorporation, National Association |

BOLIbps | Bank-Owned Life InsuranceBasis Points | NIM | Net Interest Margin |

bpsBSBY | Basis PointsBloomberg Short-Term Bank Yield | NM | Not Meaningful |

BSBYBTFP | Bloomberg Short-Term Bank YieldTerm Funding Program | NSB | Nevada State Bank, a division of Zions Bancorporation, National Association |

| CB&T | California Bank & Trust, a division of Zions Bancorporation, National Association | OCC | Office of the Comptroller of the Currency |

CCPACECL | California Consumer Privacy Act of 2018Current Expected Credit Loss | OCI | Other Comprehensive Income or Loss |

CECLCLTV | Current Expected Credit LossCombined Loan-to-Value Ratio | OREO | Other Real Estate Owned |

CLTVCMT | Constant Maturity Treasury | PAM | Combined Loan-to-Value RatioProportional Amortization Method |

| CRE | Commercial Real Estate | PEI | Private Equity Investment |

CMTCVA | Constant Maturity TreasuryCredit Valuation Adjustment | PPNR | Pre-provision Net Revenue |

CREDTA | Commercial Real EstateDeferred Tax Asset | PPP | Paycheck Protection Program |

CVADTL | Credit Valuation AdjustmentDeferred Tax Liability | ROU | Right-of-Use |

DTAEaR | Deferred Tax AssetEarnings at Risk | RULC | Reserve for Unfunded Lending Commitments |

EaREPS | Earnings at Riskper Share | S&P | Standard and& Poor's |

EPSEVE | Earnings per ShareEconomic Value of Equity | SBA | U.S. Small Business Administration |

EVEFASB | Economic Value of EquityFinancial Accounting Standards Board | SBIC | Small Business Investment Company |

FASBFDIC | Financial Accounting Standards BoardFederal Deposit Insurance Corporation | SEC | Securities and Exchange Commission |

FDICFHLB | Federal Deposit Insurance CorporationHome Loan Bank | SOFR | Secured Overnight Financing Rate |

FHLBFICO | Federal Home Loan BankFair Isaac Corporation | TCBW | The Commerce Bank of Washington, a division of Zions Bancorporation, National Association |

| FRB | Federal Reserve Board | TDR | Troubled Debt Restructuring |

| FTP | Funds Transfer Pricing | U.K.U.S. | United KingdomStates |

| GAAP | Generally Accepted Accounting Principles | U.S. | United States |

HECL | Home Equity Credit Line | Vectra | Vectra Bank Colorado, a division of Zions Bancorporation, National Association |

HTMGCF | Held-to-MaturityGeneral Collateral Funding | Zions Bank | Zions Bank, a division of Zions Bancorporation, National Association |

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES

PART I. FINANCIAL INFORMATION

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FORWARD-LOOKING INFORMATION

This quarterly report includes “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and assumptions regarding future events or determinations, all of which are subject to known and unknown risks, uncertainties, and other factors that may cause our actual results, performance or achievements, industry trends, and results or regulatory outcomes to differ materially from those expressed or implied. Forward-looking statements include, among others:

•statementsStatements with respect to the beliefs, plans, objectives, goals, targets, commitments, designs, guidelines, expectations, anticipations, and future financial condition, results of operations and performance of Zions Bancorporation, National Association and its subsidiaries (collectively “Zions Bancorporation, N.A.,” “the Bank,” “we,” “our,” “us”); and

•statementsStatements preceded or followed by, or that include the words “may,” “might,” “can,” “continue,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “forecasts,” “expect,” “intend,” “target,” “commit,” “design,” “plan,” “projects,” “will,” and the negative thereof and similar words and expressions.

These forward-lookingForward-looking statements are not guarantees, nor should they be relied upon as representing management’s views as of any subsequent date. Actual results and outcomes may differ materially from those presented. Although thisthe following list is not comprehensive, important factors that may cause material differences include changes in general industry and economic conditions, including inflation; changes and uncertainties in legislation and fiscal, monetary, regulatory, trade, and tax policies; changes in interest and reference rates; theinclude:

•The quality and composition of our loan and securities portfolios;portfolios and the quality and composition of our deposits;

•Changes in general industry, political and economic conditions, including continued high inflation, economic slowdown or recession, or other economic disruptions; changes in interest and reference rates which could adversely affect our revenue and expenses, the value of assets and obligations, and the availability and cost of capital and liquidity; deterioration in economic conditions that may result in increased loan and leases losses;

•Securities and capital markets behavior, including volatility and changes in market liquidity and our ability to raise capital;

•The impact of bank failures or adverse developments at other banks on general investor sentiment regarding the stability and liquidity of banks;

•The possibility that our recorded goodwill could become impaired, which may have an adverse impact on our earnings;

•Our ability to recruit and retain talent, including increased competition for qualified candidates as a result of expanded remote-work opportunities and increased compensation expenses; competitive

•Competitive pressures and other factors that may affect aspects of our business, such as pricing and demand for our products and services; our

•Our ability to complete projects and initiatives and execute on our strategic plans, manage our risks, and achieve our business objectives;

•Our ability to provide adequate oversight of our suppliers or prevent inadequate performance by third parties upon whom we rely for the delivery of various products and services;

•Our ability to develop and maintain technology, information security systems and controls designed to guard against fraud, cyber,cybersecurity, and privacy risks;

•Changes and uncertainties in applicable laws, and fiscal, monetary, regulatory, trade, and tax policies, and actions taken by governments, agencies, central banks and similar organizations; adverse media and other expressions of negative public opinion whether directed at us, other banks, the banking industry generally or otherwise that may adversely affect our reputation and that of the banking industry generally;

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES

•The effects of pandemics and other health emergencies, including the lingering effects of the COVID-19 pandemic (including variants) and associated actions that may affect our business, employees, customers, and communities;communities, such as ongoing effects on availability and cost of labor;

•The effects of wars and geopolitical conflicts, and other local, national, or international disasters, crises, or conflicts that may occur in the future;

•Natural disasters that may impact our and governmentalour customer's operations and business; and

•Governmental and social responses to environmental, social, and governance issues, andincluding those with respect to climate change. These factors, risks, and uncertainties, among others, are discussed in our 2021 Form 10-K and subsequent filings with the Securities and Exchange Commission (“SEC”).

We caution against the undue reliance on forward-looking statements, which reflect our views only as of the date they are made. Except to the extent required by law, we specifically disclaim any obligation to update any factors or to publicly announce the revisions to any of the forward-looking statements included herein to reflect future events or developments.

GAAPRECENT DEVELOPMENTS

As this quarterly report is filed, the Nasdaq Regional Banking Index is down about 30% year-to-date in 2023, reflecting broad weakness in bank valuations due in large part to NON-GAAP RECONCILIATIONSseveral regional banks being closed and placed into receivership with the Federal Deposit Insurance Corporation (“FDIC”). The root causes of these closures appear to be centered on weaknesses in liquidity risk, interest rate risk, and capital management. Investor sentiment has also been adversely impacted by concerns about future losses in commercial real estate.

This Form 10-Q presents non-GAAPIn light of the current banking environment, below we have summarized key strategic actions that we employ (and have employed since the 2008 global financial measures, in additioncrisis) to generally accepted accounting principles (“GAAP”) financial measures,prudently manage the associated risks.

Liquidity Risk

We manage liquidity to provide investors with additional information. The adjustments to reconcile fromnecessary funds in varying circumstances. As a result, we have readily available sources of liquidity, including cash, interest-bearing funds held at the applicable GAAP financial measures to the non-GAAP financial measures are presented in the following schedules. We consider these adjustments to be relevant to ongoing operating resultsFederal Reserve, and to provide a meaningful base for period-to-periodadvances and company-to-company comparisons. We use these non-GAAP financial measures to assessother borrowings against loans and highly-liquid investment securities, which all together exceed our performance, financial position, and for presentationslevel of uninsured deposits. An important source of our performanceliquidity is an approximately $22 billion investment securities portfolio, comprised primarily of United States (“U.S.”) government mortgage-backed securities that can be readily pledged for future borrowings without effecting a sale.

Interest Rate Risk

We actively manage the volatility of net interest income and economic value of equity associated with changes in interest rates. Our investment securities portfolio, which has an estimated duration of 4.1 years, facilitates the balancing of the mismatch between our loan and deposit durations.

Capital Management

We maintain strong regulatory capital ratios, exceeding all capital adequacy and regulatory requirements for well-capitalized banks, and have current and projected earnings capacity to investors. augment capital going forward. We regularly utilize stress testing as an important mechanism to inform our decisions on the appropriate level of capital and funding.

Credit Risk

We believe that presentingwe have strong credit discipline, solid underwriting standards, and a well-diversified loan portfolio, all of which has resulted in very good credit quality for more than a decade. Specifically, we have actively managed the credit risk in our commercial real estate loan portfolio, reducing these non-GAAP financial measures permits investorsloans to assess our performance on the same basis as that applied by our management and the financial services industry.

ZIONS BANCORPORATION, NATIONAL ASSOCIATION

Non-GAAP financial measures have inherent limitations and are not necessarily comparable to similar financial measures that may be presented by other financial services companies. Although non-GAAP financial measures are frequently used by stakeholders to evaluate a company, they have limitations as an analytical tool and should not be consideredtotal loans, compared with 33% in isolation or as a substitute for analysis of results reported under GAAP.

Tangible Common Equity and Related Measures

Tangible common equity and related measures are non-GAAP measures that exclude the impact of intangible assets and their related amortization. We believe these non-GAAP measures provide useful information about our use of shareholders’ equity and provide a basis for evaluating the performance of a business more consistently, whether acquired or developed internally.

RETURN ON AVERAGE TANGIBLE COMMON EQUITY (NON-GAAP) | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| (Dollar amounts in millions) | | March 31,

2022 | | December 31,

2021 | | | | March 31,

2021 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

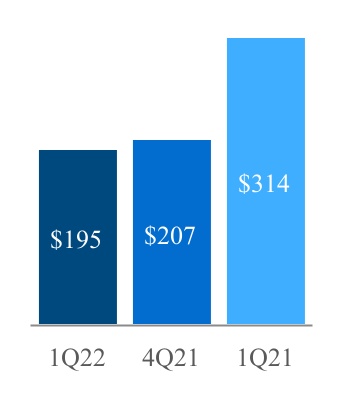

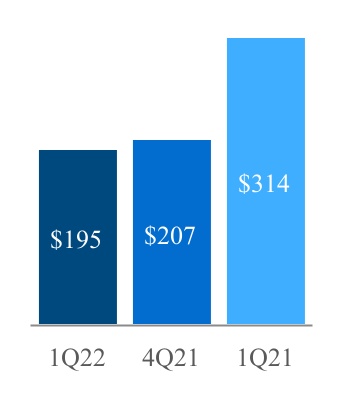

| Net earnings applicable to common shareholders, net of tax | (a) | $ | 195 | | | $ | 207 | | | | | $ | 314 | |

| Average common equity (GAAP) | | $ | 6,700 | | | $ | 7,146 | | | | | $ | 7,333 | |

| Average goodwill and intangibles | | (1,015) | | | (1,015) | | | | | (1,016) | |

| Average tangible common equity (non-GAAP) | (b) | $ | 5,685 | | | $ | 6,131 | | | | | $ | 6,317 | |

| Number of days in quarter | (c) | 90 | | | 92 | | | | | 90 | |

| Number of days in year | (d) | 365 | | | 365 | | | | | 365 | |

| Return on average tangible common equity (non-GAAP) | (a/b/c)*d | 13.9 | % | | 13.4 | % | | | | 20.2 | % |

TANGIBLE EQUITY RATIO, TANGIBLE COMMON EQUITY RATIO, AND TANGIBLE BOOK VALUE PER COMMON SHARE (ALL NON-GAAP MEASURES) | | | | | | | | | | | | | | | | | | | | | | |

| (Dollar amounts in millions, except per share amounts) | | March 31,

2022 | | December 31,

2021 | | | | March 31,

2021 |

| | | | | | | | |

| Total shareholders’ equity (GAAP) | | $ | 6,294 | | | $ | 7,463 | | | | | $ | 7,933 | |

| Goodwill and intangibles | | (1,015) | | | (1,015) | | | | | (1,016) | |

| Tangible equity (non-GAAP) | (a) | 5,279 | | | 6,448 | | | | | 6,917 | |

| Preferred stock | | (440) | | | (440) | | | | | (566) | |

| Tangible common equity (non-GAAP) | (b) | $ | 4,839 | | | $ | 6,008 | | | | | $ | 6,351 | |

| Total assets (GAAP) | | $ | 91,126 | | | $ | 93,200 | | | | | $ | 85,121 | |

| Goodwill and intangibles | | (1,015) | | | (1,015) | | | | | (1,016) | |

| Tangible assets (non-GAAP) | (c) | $ | 90,111 | | | $ | 92,185 | | | | | $ | 84,105 | |

| Common shares outstanding (thousands) | (d) | 151,348 | | | 151,625 | | | | | 163,800 | |

| Tangible equity ratio (non-GAAP) | (a/c) | 5.9 | % | | 7.0 | % | | | | 8.2 | % |

| Tangible common equity ratio (non-GAAP) | (b/c) | 5.4 | % | | 6.5 | % | | | | 7.6 | % |

| Tangible book value per common share (non-GAAP) | (b/d) | $ | 31.97 | | | $ | 39.62 | | | | | $ | 38.77 | |

ZIONS BANCORPORATION, NATIONAL ASSOCIATION

Efficiency Ratio and Adjusted Pre-Provision Net Revenue

The efficiency ratio is a measure of operating expense relative to revenue. We believe the efficiency ratio provides useful information regarding the cost of generating revenue. The methodology of determining the efficiency ratio may differ among companies. We make adjustments to exclude certain items that are not generally expected to recur frequently, as identified in the subsequent schedule, which we believe allow for more consistent comparability across periods. Adjusted noninterest expense provides a measure as to how well we are managing our expenses; adjusted pre-provision net revenue (“PPNR”) enables management and others to assess our ability to generate capital. Taxable-equivalent net interest income allows us to assess the comparability of revenue arising from both taxable and tax-exempt sources.

EFFICIENCY RATIO (NON-GAAP) AND ADJUSTED PRE-PROVISION NET REVENUE (NON-GAAP) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Year Ended |

| (Dollar amounts in millions) | | March 31,

2022 | | December 31,

2021 | | March 31,

2021 | | | | | | December 31,

2021 |

| | | | | | | | | | | | |

| Noninterest expense (GAAP) | (a) | $ | 464 | | | $ | 449 | | | $ | 435 | | | | | | | $ | 1,741 | |

| Adjustments: | | | | | | | | | | | | |

| Severance costs | | — | | | — | | | — | | | | | | | 1 | |

| Other real estate expense, net | | 1 | | | — | | | — | | | | | | | — | |

| | | | | | | | | | | | |

| Amortization of core deposit and other intangibles | | — | | | 1 | | | — | | | | | | | 1 | |

| | | | | | | | | | | | |

Pension termination-related (income) expense 1 | | — | | | — | | | (5) | | | | | | | (5) | |

SBIC investment success fee accrual 2 | | (1) | | | 2 | | | — | | | | | | | 7 | |

| Total adjustments | (b) | — | | | 3 | | | (5) | | | | | | | 4 | |

| Adjusted noninterest expense (non-GAAP) | (a-b)=(c) | $ | 464 | | | $ | 446 | | | $ | 440 | | | | | | | $ | 1,737 | |

| Net interest income (GAAP) | (d) | $ | 544 | | | $ | 553 | | | $ | 545 | | | | | | | $ | 2,208 | |

| Fully taxable-equivalent adjustments | (e) | 8 | | | 10 | | | 8 | | | | | | | 32 | |

| Taxable-equivalent net interest income (non-GAAP) | (d+e)=f | 552 | | | 563 | | | 553 | | | | | | | 2,240 | |

| Noninterest income (GAAP) | g | 142 | | | 190 | | | 169 | | | | | | | 703 | |

| Combined income (non-GAAP) | (f+g)=(h) | 694 | | | 753 | | | 722 | | | | | | | 2,943 | |

| Adjustments: | | | | | | | | | | | | |

| Fair value and nonhedge derivative gain (loss) | | 6 | | | (1) | | | 18 | | | | | | | 14 | |

Securities gains (losses), net 2 | | (17) | | | 20 | | | 11 | | | | | | | 71 | |

| Total adjustments | (i) | (11) | | | 19 | | | 29 | | | | | | | 85 | |

| Adjusted taxable-equivalent revenue (non-GAAP) | (h-i)=(j) | $ | 705 | | | $ | 734 | | | $ | 693 | | | | | | | $ | 2,858 | |

| Pre-provision net revenue (non-GAAP) | (h)-(a) | $ | 230 | | | $ | 304 | | | $ | 287 | | | | | | | $ | 1,202 | |

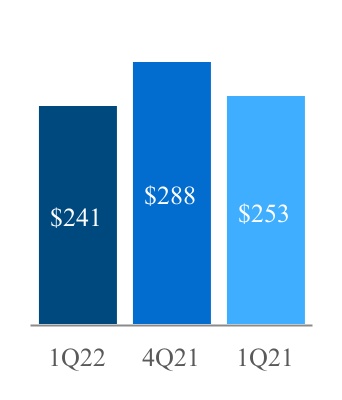

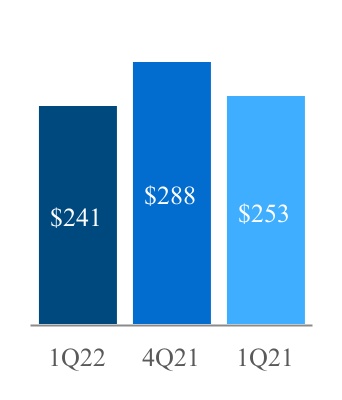

| Adjusted PPNR (non-GAAP) | (j)-(c) | 241 | | | 288 | | | 253 | | | | | | | 1,121 | |

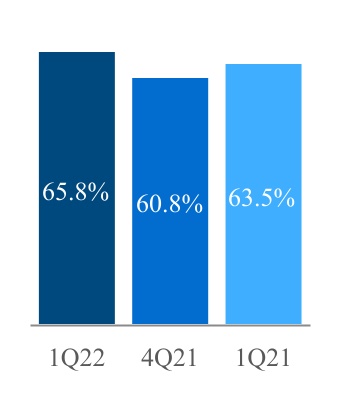

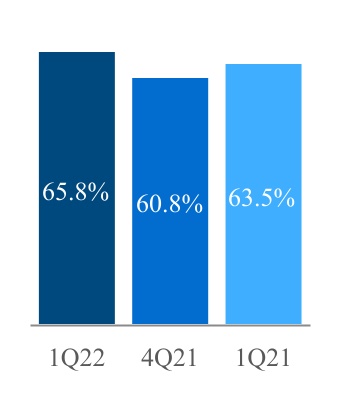

Efficiency ratio (non-GAAP) 3 | (c/j) | 65.8 | % | | 60.8 | % | | 63.5 | % | | | | | | 60.8 | % |

1 Represents a valuation adjustment related to the termination of our defined benefit pension plan.

2 The success fee accrual is associated with the gains/(losses) from our SBIC investments. The gains/(losses) related to these investments are excluded from the efficiency ratio through securities gains, net.

3 Results for the first quarter of 2022 benefited from a one-time adjustment of approximately $6 million in commercial account fees. Excluding the $6 million adjustment, the efficiency ratio for the first quarter of 2022 would have been 66.4%.

ZIONS BANCORPORATION, NATIONAL ASSOCIATIONSUBSIDIARIES

Comparisons noted below are calculated for the current quarter versuscompared with the same prior-year period unless otherwise specified. Growth rates of 100% or more are considered not meaningful (“NM”) as they generally reflect a low starting point.

RESULTS OF OPERATIONS

Executive Summary

Our financial results in the first quarter of 20222023 reflected strong non-PPP loancredit quality and revenue growth, solidwhich was partially offset by increases in the provision for credit performance,losses and improving customer-related noninterest income.expense. Diluted earnings per share (“EPS”) decreased to $1.27,was $1.33, compared with $1.90$1.27 in the first quarter of 2021.2022.

Net interest income remained relatively stable at $544increased $135 million, as significant growthor 25%, to $679 million, primarily due to a higher interest rate environment and a favorable change in the mix of $7.8 billion in average interest-earning assets was partially offset byassets. The net interest margin (“NIM”) compression arising from an increased concentration in cash and securities and the low interest rate environment. The NIM was 2.60% in the first quarter of 2022,3.33%, compared with 2.86%2.60%.

Our results benefited from a negative $33Nonperforming assets decreased $79 million, provision for credit losses, reflecting improvements in economic forecastsor 31%, and strong credit quality. This compares with a negative $132classified loans decreased $236 million, provision for credit losses in the first quarter of 2021. Netor 21%. We had zero net loan and lease charge-offs, were $6 million, or 0.05% of average loans (ex-PPP), compared with net charge-offs of $8$6 million, or 0.07% of average loans (ex-PPP), in the prior year quarter. Despite improvements in most of our credit quality metrics, the provision for credit losses was $45 million, compared with a $(33) million provision in the prior year period, reflecting deterioration in economic forecasts and growth in the loan portfolio.

Total customer-related noninterest income remained stable at $151 million, compared with the prior year period, driven by increases in commercial treasury management, foreign exchange, and capital markets syndication fees, offset by a decrease in retail and business banking fees. Total noninterest income increased $18 million, or 14%13%, primarily due to improved card, retail and business banking, and wealth management activity. Total noninterest income decreased $27 million, or 16%, largely due to $17 million of negative mark-to-market adjustments recorded during the quarter primarily relatingprior year period related to our Small Business Investment Company (“SBIC”) investment in Recursion Pharmaceuticals, Inc.portfolio.

Total noninterest expense increased $29$48 million, or 7%10%. The increase was driven largely driven by a $24$27 million increase in salaries and benefits expense, which was impacted by (1)ongoing inflationary and competitive labor market pressures on wages and (2) increases in incentive compensation accruals arising from improvements in anticipated full-year profitability.benefits, increased headcount, and an additional business day during the current quarter. Our efficiency ratio was 65.8%59.9%, compared with 63.5% for the first quarter of 2021.

The65.8%, as growth in averageadjusted taxable-equivalent revenue significantly outpaced growth in adjusted noninterest expense.

Average interest-earning assets wasdecreased $2.3 billion, or 3%, from the prior year quarter, driven by a $9.4declines of $4.2 billion increase in average available-for-sale (“AFS”) investment securities and a $1.2$3.2 billion increase in average money market investments. Over the past year, we actively deployed excess liquidity into medium-duration assets, as we sought to balance competing objectivesinvestments and average securities, respectively, and partially offset by an increase of increasing current income, maintaining asset sensitivity to benefit from rising rates,$5.2 billion in average loans and maintaining sufficient liquidity for loan growth and changes in deposit trends.leases.

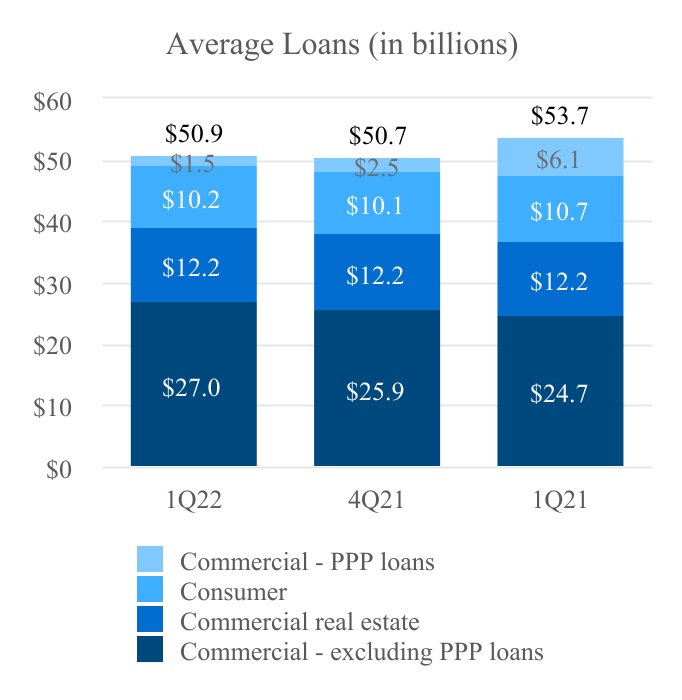

Excluding Paycheck Protection Program (“PPP”) loans, totalTotal loans and leases increased $3.2$5.1 billion, or 7%10%, to $50.2$56.3 billion. The increases were primarily in the consumer 1-4 family residential mortgage, commercial real estate term, commercial and industrial, commercial owner-occupied, municipal, and home equity credit lineconsumer construction loan portfolios.

Total loans and leasesdeposits decreased $2.2$13.1 billion, or 4%16%, to $69.2 billion, from the prior year quarter, primarilymainly due to declines in larger-balance and more rate-sensitive, nonoperating deposits during the forgivenessprior year, which continued into the first quarter of PPP loans2023 due to market uncertainty and a declineheightened sensitivity of large depositors in 1-4 family residential mortgage loans.

Total depositsthe wake of prominent bank failures. Our loan-to-deposit ratio was 81%, compared with 62% in the prior year quarter. Borrowed funds, consisting primarily of secured borrowings, increased $8.5$11.5 billion or 12%, from the prior year quarter primarily duein response to a $6.1 billion increasedeclines in noninterest-bearing deposits.total deposits and loan growth.

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES

First Quarter 20222023 Financial Performance

| | | | | | | | | | | | | | | | | | | | |

Net Earnings Applicable to Common Shareholders

(in millions) | | Diluted EPS | | Adjusted PPNR

(in millions) | | Efficiency Ratio |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net earnings applicable to common shareholders decreasedincreased from the first quarter of 2021. The prior year quarter benefited from a negative $132 million2022, primarily due to an increase in net revenue, driven largely by the higher interest rate environment and change in the mix of interest-earning assets, partially offset by increases in the provision for credit losses compared with negative $33 million in the first quarter of 2022.and noninterest expense, as well as a higher effective tax rate. | | Diluted earnings per share declinedimproved from the first quarter of 20212022 as a result of decreasedincreased net earnings the effect of which was partially offset byand a 12.23.6 million decrease in weighted average diluted shares, primarily due to share repurchases. | | Adjusted PPNR decreased $12pre-provision net revenue (“PPNR”) increased $100 million from the first quarter of 2021,2022, primarily due to thegrowth in net interest income. This increase in adjusted noninterest expense, driven by increases in salaries and benefits expense,was partially offset by increases in customer-related fee income.higher adjusted noninterest expense. | | The efficiency ratio increasedimproved from the prior year quarter, primarily as growth in adjusted taxable-equivalent revenue significantly outpaced growth in adjusted noninterest expense, due to the increaseresulting in salaries and benefits expense exceeded growth in adjusted revenue.positive operating leverage. |

Net Interest Income and Net Interest Margin

Net interest income is the difference between interest earned on interest-earning assets and interest paid on interest-bearing liabilities, and was approximately 79% of our net revenue (net interest income plus noninterest income) for the quarter. The net interest margin is derived from both the amount of interest-earning assets and interest-bearing liabilities and their respective yields and rates.

NET INTEREST INCOME AND NET INTEREST MARGIN

| | | Three Months Ended

March 31, | | Amount change | | Percent change | | Three Months Ended

March 31, | | Amount change | | Percent change |

| (Dollar amounts in millions) | (Dollar amounts in millions) | 2022 | | 2021 | | (Dollar amounts in millions) | 2023 | | 2022 | |

| | Interest and fees on loans | $ | 437 | | $ | 488 | | $ | (51) | | | (10) | % | |

Interest and fees on loans 1 | | Interest and fees on loans 1 | $ | 726 | | $ | 437 | | $ | 289 | | | 66 | % |

| Interest on money market investments | Interest on money market investments | 6 | | 3 | | 3 | | | NM | Interest on money market investments | 57 | | 6 | | 51 | | | NM |

| Interest on securities | Interest on securities | 112 | | 71 | | 41 | | | 58 | | Interest on securities | 137 | | 112 | | 25 | | | 22 | |

| Total interest income | Total interest income | 555 | | 562 | | (7) | | | (1) | | Total interest income | 920 | | 555 | | 365 | | | 66 | |

| Interest on deposits | Interest on deposits | 6 | | 9 | | (3) | | | (33) | | Interest on deposits | 82 | | 6 | | 76 | | | NM |

| Interest on short- and long-term borrowings | Interest on short- and long-term borrowings | 5 | | 8 | | (3) | | | (38) | | Interest on short- and long-term borrowings | 159 | | 5 | | 154 | | | NM |

| Total interest expense | Total interest expense | 11 | | 17 | | (6) | | | (35) | | Total interest expense | 241 | | 11 | | 230 | | | NM |

| Net interest income | Net interest income | $ | 544 | | $ | 545 | | $ | (1) | | | — | % | Net interest income | $ | 679 | | $ | 544 | | $ | 135 | | | 25 | % |

| | Average interest-earning assets | Average interest-earning assets | $ | 86,093 | | $ | 78,294 | | $ | 7,799 | | | 10 | % | Average interest-earning assets | $ | 83,832 | | $ | 86,093 | | $ | (2,261) | | | (3) | % |

| Average interest-bearing liabilities | Average interest-bearing liabilities | $ | 42,136 | | $ | 40,157 | | $ | 1,979 | | | 5 | % | Average interest-bearing liabilities | $ | 49,012 | | $ | 42,136 | | $ | 6,876 | | | 16 | % |

| | bps | | | bps | |

Yield on interest-earning assets 1 | 2.65 | % | | 2.95 | % | | (30) | | | |

Rate paid on total deposits and interest-bearing liabilities1 | 0.06 | % | | 0.09 | % | | (3) | | | |

Cost of total deposits 1 | 0.03 | % | | 0.05 | % | | (2) | | | |

Net interest margin 1 | 2.60 | % | | 2.86 | % | | (26) | | | |

Yield on interest-earning assets 2 | | Yield on interest-earning assets 2 | 4.49 | % | | 2.65 | % | | 184 | | |

Rate paid on total deposits and interest-bearing liabilities 2 | | Rate paid on total deposits and interest-bearing liabilities 2 | 1.17 | % | | 0.06 | % | | 111 | | |

Cost of total deposits 2 | | Cost of total deposits 2 | 0.47 | % | | 0.03 | % | | 44 | | |

Net interest margin 2 | | Net interest margin 2 | 3.33 | % | | 2.60 | % | | 73 | | |

1Includes interest income recoveries of $2 million for both the three months ended March 31, 2023, and 2022.

2 Rates are calculated using amounts in thousands; taxable-equivalent rates are used where applicable.

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES

Net interest income accounted for approximately 81% of our net revenue (net interest income plus noninterest income) for the quarter and increased $135 million, or 25%, relative to the prior year quarter. The increase was primarily due to the higher interest rate environment and a favorable change in the mix of interest-earning assets.

Average interest-earning assets decreased $2.3 billion, or 3%, from the prior year quarter, driven by declines of $4.2 billion and $3.2 billion in average money market investments and average securities, respectively. A majority of the decrease in average securities was due to payments and maturities. These decreases were partially offset by an increase of $5.2 billion in average loans and leases.

The NIM was 3.33%, compared with 2.60%. The yield on average interest-earning assets was 4.49% in the first quarter of 2023, an increase of 184 basis points (“bps”), reflecting higher interest rates and a favorable mix change from money market investments to loans. The yield also benefited from a decrease in the market value of available-for-sale (“AFS”) securities due to rising interest rates. The rate paid on average interest-bearing liabilities increased to 1.99%, compared with 0.11%, reflecting the higher interest rate environment and increased borrowings. We expect that the funding mix change toward the end of the first quarter of 2023, combined with the continued improvement in earning asset yields, will result in an estimated NIM of approximately 3.0% in the near term.

Average loans and leases increased $5.2 billion, or 10%, to $56.1 billion, mainly due to growth in average consumer and commercial loans. The yield on total loans increased 178 basis points to 5.30%, reflecting the higher interest rate environment.

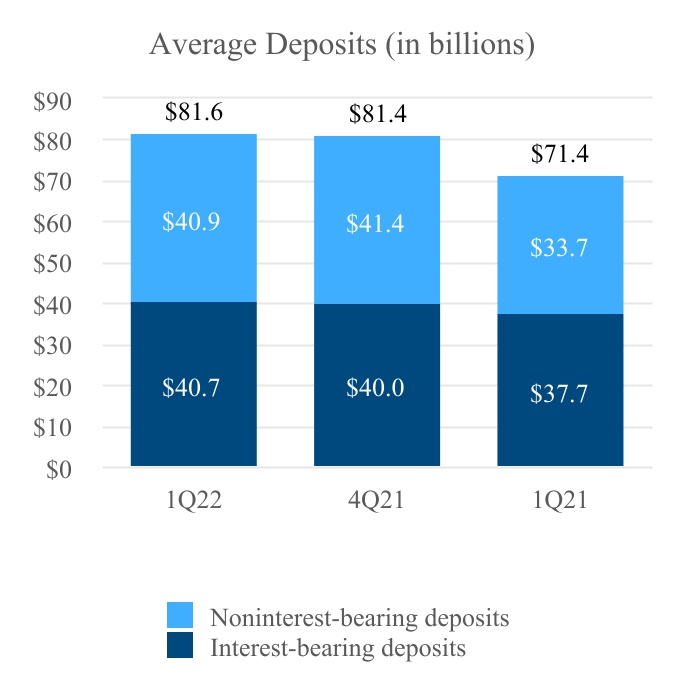

Average deposits decreased $11.4 billion, or 14%, to $70.2 billion at an average cost of 0.47%, from $81.6 billion at an average cost of 0.03% in the first quarter of 2022. The rate paid on total deposits and interest-bearing liabilities was 1.17%, compared with 0.06%, reflecting the higher interest rate environment and increased short-term borrowings. Average noninterest-bearing deposits as a percentage of total deposits were 49%, compared with 50% during the same prior year period.

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES

Net interest income remained relatively stable at $544 million during the first quarter of 2022, as significant growth in average interest-earning assets was partially offset by NIM compression arising from an increased concentration in cash and securities and the low interest rate environment.

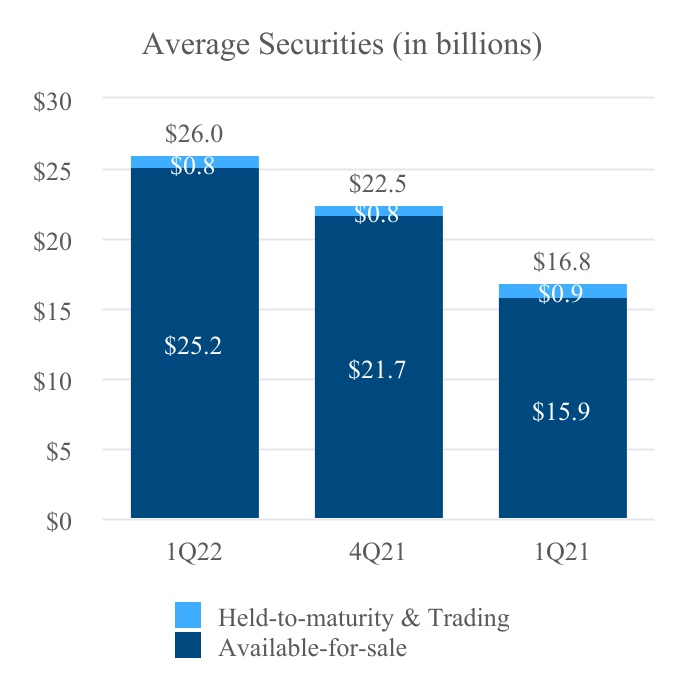

Average interest-earning assets increased $7.8 billion, or 10%, driven by growth of $9.4 billion in AFS securities, $2.3 billion in commercial loans (ex-PPP), and $1.2 billion in money market investments. These increases were partially offset by a $4.7 billion decline in average PPP loans. Average securities increased to 30% of average interest-earning assets, compared with 21%, as we actively deployed excess liquidity into medium duration assets.

The NIM was 2.60%, compared with 2.86%. The yield on average interest-earning assets was 2.65% in the first quarter of 2022, a decrease of 30 basis points (“bps”), primarily due to a decrease in the yield on loans. The average rate paid on interest-bearing liabilities decreased 6 bps to 0.11%.

Average loans and leases (ex-PPP) increased $1.9 billion, or 4%, primarily in the commercial and industrial loan portfolio. Total average loans and leases decreased $2.8 billion, or 5%, from $53.7 billion in the first quarter of 2021, primarily due to the forgiveness of PPP loans and a decrease in 1-4 family residential mortgage loans. The decline in our mortgage loan portfolio is partly due to refinancing activity. We generally originate residential mortgage loans and sell them to government-sponsored entities as part of our interest rate risk management efforts to limit our balance sheet exposure to long-term assets.

The yield on total loans decreased 21 basis points to 3.52%. The yield on non-PPP loans decreased 26 basis points, primarily driven by (1) lower yields on loans originated during the past year, compared with yields on loans maturing and amortizing during the same period, and (2) promotional rates on commercial owner-occupied loans and home equity credit lines.

During the first quarter of 2022 and 2021, PPP loans totaling $0.8 billion and $1.6 billion, respectively, were forgiven by the Small Business Administration (“SBA”). PPP loans contributed $24 million and $60 million in interest income during the same time periods. The yield on these loans was 6.64% and 3.98% for the first quarter of 2022 and 2021, respectively, and was positively impacted by accelerated amortization of deferred fees on paid off or forgiven PPP loans. At March 31, 2022 and 2021, the remaining unamortized net deferred fees on these loans totaled $24 million and $168 million, respectively.

Average total deposits increased $10.2 billion to $81.6 billion at an average cost of 0.03%, from $71.4 billion at an average cost of 0.05% in the first quarter of 2021. Average interest-bearing liabilities increased $2.0 billion, or 5%.

ZIONS BANCORPORATION, NATIONAL ASSOCIATION

The rate paid on total deposits and interest-bearing liabilities was 0.06%, a decrease from 0.09% during the first quarter of 2021, which was primarily due to low interest-bearing deposit rates and strong noninterest-bearing deposit growth.

Average AFS securities balances increased $9.3decreased $13.3 billion, or 59%53%, from $15.9to $11.9 billion. During the fourth quarter of 2022, we transferred approximately $10.7 billion mainly duefair value ($13.1 billion amortized cost) of mortgage-backed AFS securities to an increase inthe held-to-maturity (“HTM”) category to reflect our mortgage-backed securities portfolio. The yield on securities remained relatively stable at 1.78%.intent for these securities.

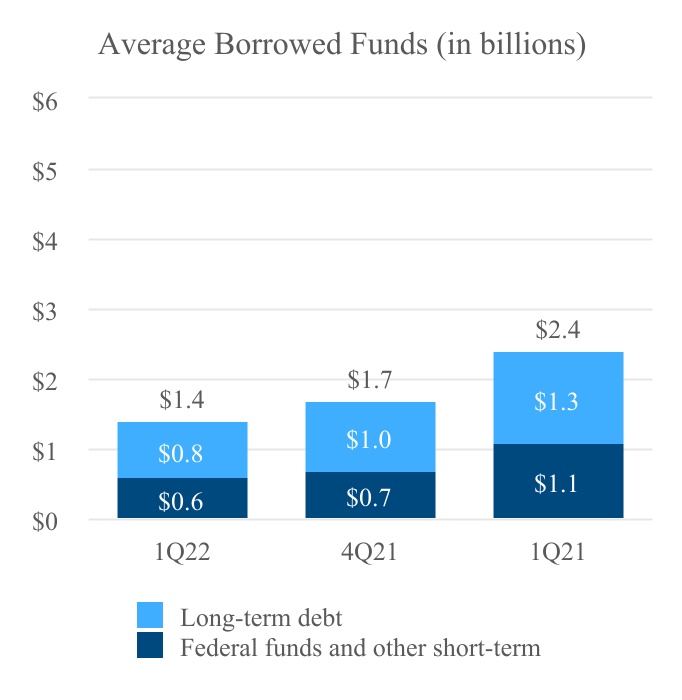

Average borrowed funds, decreased $1.0consisting primarily of secured borrowings, increased $11.8 billion or 42%, from $2.4 billion, with both average short-term borrowings and average long-term borrowings decreasing $0.5 billion. The average rate paid on short-term borrowings remained stable at 0.08%, while the rate paid on long-term debt increased 36 bps from the prior year quarter primarily duein response to lower-yielding senior debt that was redeemed or matured over the past few quarters. The decreasedeclines in overalltotal deposits and loan growth.

For more information on our investments securities portfolio and borrowed funds continuesand how we manage liquidity risk, refer to reflect strong deposit growth.

the “Investment Securities Portfolio” section on page 15 and the “Liquidity Risk Management” section on page 31. For further discussion of the effects of market rates on net interest income and how we manage interest rate risk, refer to the “Interest Rate and Market Risk Management” section on page 27. For more information on how we manage liquidity risk, refer to the “Liquidity Risk Management” section on page 31.28.

The following schedule summarizes the average balances, the amount of interest earned or paid, and the applicable yields for interest-earning assets and the costs of interest-bearing liabilities.

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES

CONSOLIDATED AVERAGE BALANCE SHEETS, YIELDS AND RATES | | (Unaudited) | (Unaudited) | Three Months Ended

March 31, 2022 | | Three Months Ended

March 31, 2021 | (Unaudited) | Three Months Ended

March 31, 2023 | | Three Months Ended

March 31, 2022 |

| (Dollar amounts in millions) | (Dollar amounts in millions) | Average

balance | | Amount of interest | | Average yield/rate 1 | | Average

balance | | Amount of interest 1 | | Average yield/rate 1 | (Dollar amounts in millions) | Average

balance | | Amount of interest | | Average yield/rate 1 | | Average

balance | | Amount of interest 1 | | Average yield/rate 1 |

| ASSETS | ASSETS | | | | | | | | | | | | ASSETS | | | | | | | | | | | |

| Money market investments: | Money market investments: | | Money market investments: | |

| Interest-bearing deposits | Interest-bearing deposits | $ | 6,735 | | | $ | 3 | | | 0.19 | % | | $ | 4,592 | | | $ | 1 | | | 0.11 | % | Interest-bearing deposits | $ | 2,724 | | | $ | 31 | | | 4.72 | % | | $ | 6,735 | | | $ | 3 | | | 0.19 | % |

| Federal funds sold and security resell agreements | 2,300 | | | 3 | | | 0.52 | | | 3,199 | | | 2 | | | 0.24 | | |

Federal funds sold and securities purchased under

agreements to resell | | Federal funds sold and securities purchased under

agreements to resell | 2,081 | | | 26 | | | 5.02 | | | 2,300 | | | 3 | | | 0.52 | |

| Total money market investments | Total money market investments | 9,035 | | | 6 | | | 0.27 | | | 7,791 | | | 3 | | | 0.16 | | Total money market investments | 4,805 | | | 57 | | | 4.85 | | | 9,035 | | | 6 | | | 0.27 | |

| Securities: | Securities: | | | | | | | | | Securities: | | | | | | | | |

| Held-to-maturity | Held-to-maturity | 438 | | | 3 | | | 3.12 | | | 663 | | | 5 | | | 2.98 | | Held-to-maturity | 11,024 | | | 62 | | | 2.28 | | | 438 | | | 3 | | | 3.12 | |

| Available-for-sale | 25,246 | | | 106 | | | 1.71 | | | 15,876 | | | 66 | | | 1.69 | | |

| Trading account | 384 | | | 5 | | | 4.76 | | | 231 | | | 2 | | | 3.96 | | |

Total securities 2 | 26,068 | | | 114 | | | 1.78 | | | 16,770 | | | 73 | | | 1.77 | | |

Available-for-sale 2 | | Available-for-sale 2 | 11,824 | | | 76 | | | 2.62 | | | 25,246 | | | 106 | | | 1.71 | |

| Trading | | Trading | 21 | | | — | | | 4.01 | | | 384 | | | 5 | | | 4.76 | |

Total securities 3 | | Total securities 3 | 22,869 | | | 138 | | | 2.46 | | | 26,068 | | | 114 | | | 1.78 | |

| Loans held for sale | Loans held for sale | 57 | | | — | | | 1.92 | | | 68 | | | — | | | 2.81 | | Loans held for sale | 5 | | | — | | | 0.26 | | | 57 | | | — | | | 1.92 | |

Loans and leases 3 | | |

| Commercial - excluding PPP loans | 27,037 | | | 236 | | | 3.54 | | | 24,732 | | | 234 | | | 3.83 | | |

| Commercial - PPP loans | 1,459 | | | 24 | | | 6.64 | | | 6,135 | | | 60 | | | 3.98 | | |

Loans and leases 4 | | Loans and leases 4 | |

| Commercial | | Commercial | 30,678 | | | 381 | | | 5.03 | | | 28,496 | | | 260 | | | 3.70 | |

| Commercial real estate | Commercial real estate | 12,171 | | | 101 | | | 3.37 | | | 12,133 | | | 105 | | | 3.50 | | Commercial real estate | 12,876 | | | 209 | | | 6.59 | | | 12,171 | | | 101 | | | 3.37 | |

| Consumer | Consumer | 10,266 | | | 82 | | | 3.23 | | | 10,665 | | | 95 | | | 3.59 | | Consumer | 12,599 | | | 144 | | | 4.62 | | | 10,266 | | | 82 | | | 3.23 | |

| Total loans and leases | Total loans and leases | 50,933 | | | 443 | | | 3.52 | | | 53,665 | | | 494 | | | 3.73 | | Total loans and leases | 56,153 | | | 734 | | | 5.30 | | | 50,933 | | | 443 | | | 3.52 | |

| Total interest-earning assets | Total interest-earning assets | 86,093 | | | 563 | | | 2.65 | | | 78,294 | | | 570 | | | 2.95 | | Total interest-earning assets | 83,832 | | | 929 | | | 4.49 | | | 86,093 | | | 563 | | | 2.65 | |

| Cash and due from banks | Cash and due from banks | 625 | | | | | 614 | | | | | Cash and due from banks | 543 | | | | | 625 | | | | |

| Allowance for credit losses on loans and debt securities | Allowance for credit losses on loans and debt securities | (515) | | | (774) | | | Allowance for credit losses on loans and debt securities | (576) | | | (515) | | |

| Goodwill and intangibles | Goodwill and intangibles | 1,015 | | | 1,016 | | | Goodwill and intangibles | 1,064 | | | 1,015 | | |

| Other assets | Other assets | 4,211 | | | 3,930 | | | Other assets | 5,624 | | | 4,211 | | |

| Total assets | Total assets | $ | 91,429 | | | $ | 83,080 | | | Total assets | $ | 90,487 | | | $ | 91,429 | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Interest-bearing deposits: | Interest-bearing deposits: | | Interest-bearing deposits: | |

| Savings and money market | Savings and money market | $ | 39,132 | | | $ | 5 | | | 0.05 | % | | $ | 35,232 | | | $ | 6 | | | 0.07 | % | Savings and money market | $ | 32,859 | | | $ | 62 | | | 0.77 | % | | $ | 39,132 | | | $ | 5 | | | 0.05 | % |

| Time | Time | 1,587 | | | 1 | | | 0.26 | | | 2,491 | | | 3 | | | 0.55 | | Time | 2,934 | | | 20 | | | 2.68 | | | 1,587 | | | 1 | | | 0.26 | |

| | Total interest-bearing deposits | Total interest-bearing deposits | 40,719 | | | 6 | | | 0.06 | | | 37,723 | | | 9 | | | 0.10 | | Total interest-bearing deposits | 35,793 | | | 82 | | | 0.92 | | | 40,719 | | | 6 | | | 0.06 | |

| Borrowed funds: | Borrowed funds: | | | | | | | | | Borrowed funds: | | | | | | | | |

| Federal funds purchased and other short-term borrowings | 594 | | | — | | | 0.08 | | | 1,110 | | | — | | | 0.07 | | |

| Federal funds and security repurchase agreements | | Federal funds and security repurchase agreements | 5,614 | | | 64 | | | 4.65 | | | 585 | | | — | | | 0.08 | |

| Other short-term borrowings | | Other short-term borrowings | 6,952 | | | 84 | | | 4.89 | | | 9 | | | — | | | — | |

| Long-term debt | Long-term debt | 823 | | | 5 | | | 2.66 | | | 1,324 | | | 8 | | | 2.30 | | Long-term debt | 653 | | | 11 | | | 6.85 | | | 823 | | | 5 | | | 2.66 | |

| Total borrowed funds | Total borrowed funds | 1,417 | | | 5 | | | 1.58 | | | 2,434 | | | 8 | | | 1.28 | | Total borrowed funds | 13,219 | | | 159 | | | 4.88 | | | 1,417 | | | 5 | | | 1.58 | |

| Total interest-bearing liabilities | Total interest-bearing liabilities | 42,136 | | | 11 | | | 0.11 | | | 40,157 | | | 17 | | | 0.17 | | Total interest-bearing liabilities | 49,012 | | | 241 | | | 1.99 | | | 42,136 | | | 11 | | | 0.11 | |

| Noninterest-bearing demand deposits | Noninterest-bearing demand deposits | 40,886 | | | | | 33,723 | | | | | Noninterest-bearing demand deposits | 34,363 | | | | | 40,886 | | | | |

| Other liabilities | Other liabilities | 1,267 | | | 1,301 | | | Other liabilities | 2,058 | | | 1,267 | | |

| Total liabilities | Total liabilities | 84,289 | | | 75,181 | | | Total liabilities | 85,433 | | | 84,289 | | |

| Shareholders’ equity: | Shareholders’ equity: | | Shareholders’ equity: | |

| Preferred equity | Preferred equity | 440 | | | 566 | | | Preferred equity | 440 | | | 440 | | |

| Common equity | Common equity | 6,700 | | | 7,333 | | | Common equity | 4,614 | | | 6,700 | | |

| Total shareholders’ equity | Total shareholders’ equity | 7,140 | | | 7,899 | | | Total shareholders’ equity | 5,054 | | | 7,140 | | |

| Total liabilities and shareholders’ equity | Total liabilities and shareholders’ equity | $ | 91,429 | | | $ | 83,080 | | | Total liabilities and shareholders’ equity | $ | 90,487 | | | $ | 91,429 | | |

| Spread on average interest-bearing funds | Spread on average interest-bearing funds | | | 2.54 | % | | | | 2.78 | % | Spread on average interest-bearing funds | | | 2.50 | % | | | | 2.54 | % |

| Net impact of noninterest-bearing sources of funds | Net impact of noninterest-bearing sources of funds | | 0.06 | % | | 0.08 | % | Net impact of noninterest-bearing sources of funds | | 0.83 | % | | 0.06 | % |

| Net interest margin | Net interest margin | | $ | 552 | | | 2.60 | % | | $ | 553 | | | 2.86 | % | Net interest margin | | $ | 688 | | | 3.33 | % | | $ | 552 | | | 2.60 | % |

| Memo: total loans and leases, excluding PPP loans | $ | 49,474 | | | 419 | | 3.43 | % | | $ | 47,530 | | | 434 | | 3.69 | % | |

| | Memo: total cost of deposits | Memo: total cost of deposits | | 0.03 | % | | 0.05 | % | Memo: total cost of deposits | | 0.47 | % | | 0.03 | % |

| Memo: total deposits and interest-bearing liabilities | Memo: total deposits and interest-bearing liabilities | 83,022 | | | 11 | | | 0.06 | % | | 73,880 | | | 17 | | | 0.09 | % | Memo: total deposits and interest-bearing liabilities | 83,375 | | | 241 | | | 1.17 | % | | 83,022 | | | 11 | | | 0.06 | % |

1 Rates are calculated using amounts in thousands and a tax rate of 21% for the periods presented. The taxable-equivalent rates used are the rates that were applicable at the time of each respective reporting period.

2Interest on total securities includes $28 million and $30 million of taxable-equivalent premium amortization for the first quarters of 2022 and 2021, respectively.

3 Net of unamortized purchase premiums, discounts, and deferred loan fees and costs.

ZIONS BANCORPORATION, NATIONAL ASSOCIATION

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES

Provision for Credit Losses

The allowance for credit losses (“ACL”) is the combination of both the allowance for loan and lease losses (“ALLL”) and the reserve for unfunded lending commitments (“RULC”). The ALLL represents the estimated current expected credit losses related to the loan and lease portfolio as of the balance sheet date. The RULC represents the estimated reserve for current expected credit losses associated with off-balance sheet commitments. Changes in the ALLL and RULC, net of charge-offs and recoveries, are recorded as the provision for loan and lease losses and the provision for unfunded lending commitments, respectively, in the income statement. The ACL for debt securities is estimated separately from loans.loans and is recorded in investment securities on the consolidated balance sheet.

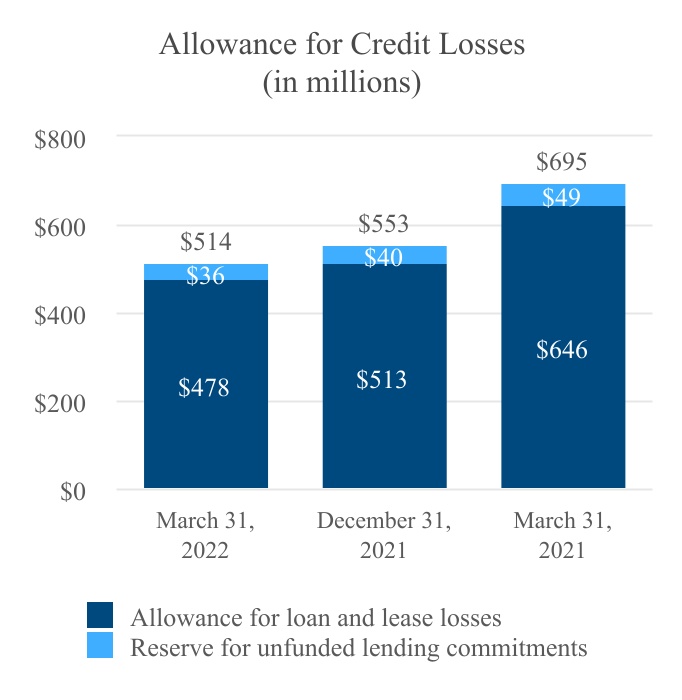

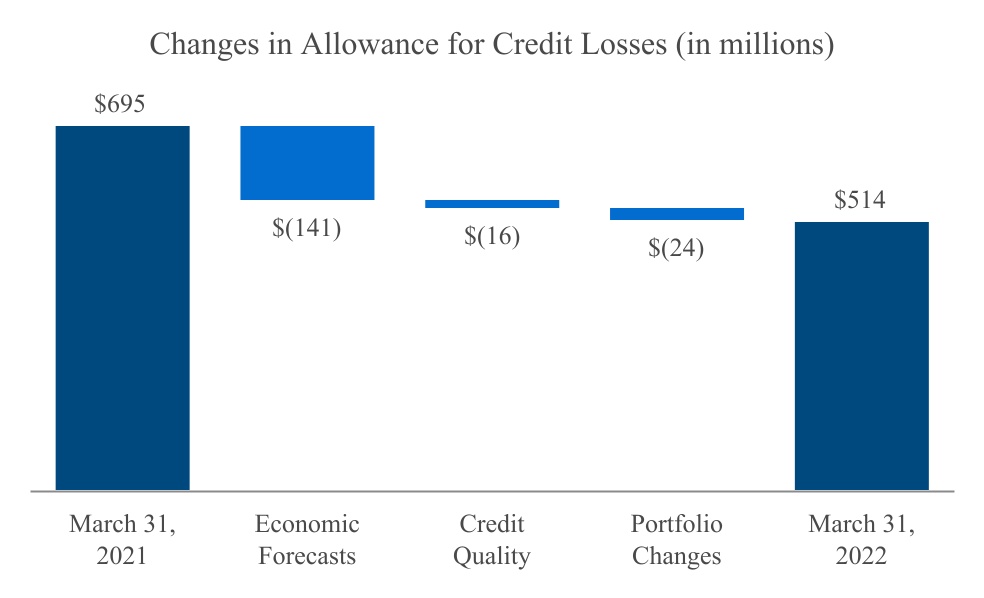

The provision for credit losses, which is the combination of both the provision for loan and lease losses and the provision for unfunded lending commitments, was negative $33$45 million, compared with negative $132$(33) million in the first quarter of 2021.2022. The ACL was $678 million at March 31, 2023, compared with $514 million at March 31, 2022, compared with $695 million at March 31, 2021.2022. The increase in the ACL was primarily due to deterioration in economic forecasts and growth in the loan portfolio. The ratio of ACL to net loans and leases (ex-PPP) was 1.02%1.20% and 1.48%1.00% at March 31, 20222023 and 2021,2022, respectively. The provision for securities losses was less than $1 million during the first quarter of 20222023 and 2021.2022.

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES

The total ACL was $514 million at March 31, 2022, compared with $695 million at March 31, 2021. The bar chart above illustrates the broad categories of change in the ACL from the prior year period. The second bar represents changes in economic forecasts and current economic conditions, which decreasedincreased the ACL by $141$114 million from the prior year quarter due to improvements in both realized economic results and forecasts, partially offset by economic uncertainty caused by inflation, supply chain disruptions, and the conflict in Eastern Europe.quarter.

The third bar represents changes in credit quality factors and includes risk-grade migration and specific reserves against loans, which, when combined, decreasedincreased the ACL by $16$6 million, indicating improvements inreflecting relatively stable credit quality. NetNonperforming assets decreased $79 million, or 31%, and classified loans decreased $236 million, or 21%. We had zero net loan and lease charge-offs, wereor 0.00% annualized of average loans, compared with net charge-offs of $6 million, or 0.05% annualized of average loans (ex-PPP), in the first quarter of 2022, compared with net charge-offs of $8 million, or 0.07% annualized of average loans (ex-PPP), in the prior year quarter.

The fourth bar represents loan portfolio changes, driven primarily by loan growth, as well as changes in portfolio mix, the aging of the portfolio, and other risk factors; all of which resulted in a $24$44 million reductionincrease in the ACL.

See “Credit Risk Management” on page 20 and Note 6 of the Notes to Consolidated Financial Statements in our 20212022 Form 10-K for more information on how we determine the appropriate level of the ALLL and the RULC.

Noninterest Income

Noninterest income represents revenue we earn from products and services that generally have no associated interest rate or yield and is classified as either customer-related or noncustomer-related. Customer-related noninterest income excludes items such as securities gains and losses, dividends, insurance-related income, and mark-to-market adjustments on certain derivatives.

Total noninterest income decreased $27increased $18 million, or 16%13%, from $169 million duringrelative to the prior year quarter.year. Noninterest income accounted for approximately 19% and 21% and 24% of our net revenue during the first quarter of 20222023 and 2021,2022, respectively. The following schedule presents a comparison of the major components of noninterest income.

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES

NONINTEREST INCOME

| | | Three Months Ended

March 31, | | Amount

change | | Percent

change | | | Three Months Ended

March 31, | | Amount

change | | Percent

change | |

| (Dollar amounts in millions) | (Dollar amounts in millions) | 2022 | | 2021 | | | (Dollar amounts in millions) | 2023 | | 2022 | | Amount

change | |

| | Commercial account fees | Commercial account fees | $ | 41 | | | $ | 32 | | | $ | 9 | | | 28 | % | | Commercial account fees | $ | 43 | | | $ | 41 | | | $ | 2 | | | 5 | % | |

| Card fees | Card fees | 25 | | | 21 | | | 4 | | | 19 | | | Card fees | 24 | | | 25 | | | (1) | | | (4) | | |

| Retail and business banking fees | Retail and business banking fees | 20 | | | 17 | | | 3 | | | 18 | | | Retail and business banking fees | 16 | | | 20 | | | (4) | | | (20) | | |

| Loan-related fees and income | Loan-related fees and income | 22 | | | 25 | | | (3) | | | (12) | | | Loan-related fees and income | 21 | | | 22 | | | (1) | | | (5) | | |

| Capital markets and foreign exchange fees | 15 | | | 15 | | | — | | | — | | | |

| Capital markets fees | | Capital markets fees | 17 | | | 15 | | | 2 | | | 13 | | |

| Wealth management fees | Wealth management fees | 14 | | | 12 | | | 2 | | | 17 | | | Wealth management fees | 15 | | | 14 | | | 1 | | | 7 | | |

| Other customer-related fees | Other customer-related fees | 14 | | | 11 | | | 3 | | | 27 | | | Other customer-related fees | 15 | | | 14 | | | 1 | | | 7 | | |

| Customer-related noninterest income | Customer-related noninterest income | 151 | | | 133 | | | 18 | | | 14 | | | Customer-related noninterest income | 151 | | | 151 | | | — | | | — | | |

| | Fair value and nonhedge derivative income | Fair value and nonhedge derivative income | 6 | | | 18 | | | (12) | | | (67) | | | Fair value and nonhedge derivative income | (3) | | | 6 | | | (9) | | | NM | |

| Dividends and other income | 2 | | | 7 | | | (5) | | | (71) | | | |

| Dividends and other income (loss) | | Dividends and other income (loss) | 11 | | | 2 | | | 9 | | | NM | |

| Securities gains (losses), net | Securities gains (losses), net | (17) | | | 11 | | | (28) | | | NM | | Securities gains (losses), net | 1 | | | (17) | | | 18 | | | NM | |

| Noncustomer-related noninterest income | Noncustomer-related noninterest income | (9) | | | 36 | | | (45) | | | NM | | Noncustomer-related noninterest income | 9 | | | (9) | | | 18 | | | NM | |

| Total noninterest income | Total noninterest income | $ | 142 | | | $ | 169 | | | $ | (27) | | | (16) | % | | Total noninterest income | $ | 160 | | | $ | 142 | | | $ | 18 | | | 13 | % | |

Customer-related Noninterest Income

Total customer-related noninterest income increased $18remained stable at $151 million, or 14%, mainly due to increased card, retailcompared with the prior year period. Increases in commercial treasury management, foreign exchange, and business banking, and wealth management activity, partiallycapital markets syndication fees were offset by a decrease in loan-related fees and income. Results for the first quarter of 2022 benefited from a one-time adjustment of approximately $6 million in commercial account fees.

Retailretail and business banking fees includelargely as a result of a change in our overdraft and non-sufficient funds fees. Beginning inpractices effected during the third quarter of 2022, we expect to reduce the rate and frequency with which such fees are assessed, specifically to consumer accounts. Relative to current activity levels, we expect this will reduce our customer-related noninterest income by approximately $5 million per quarter.2022.

Noncustomer-related Noninterest Income

Total noncustomer-related noninterest income decreased $45increased $18 million relative tofrom the prior year quarter. Net securities gains and losses decreased $28increased $18 million, due largely to $17 million of negative mark-to-market adjustments primarilyrecorded during the prior year period related to our SBIC investment portfolio. Dividends and other income increased $9 million, primarily due to an increase in Recursion Pharmaceuticals, Inc., and an $11dividends on Federal Home Loan Bank (“FHLB”) stock. These increases were offset by a $9 million gain on the sale of Farmer Mac Class C stock recognized during the prior year period.

Fairdecrease in fair value and nonhedge derivative income, decreased $12primarily due to a $3 million from the prior year period. We recognized a $6 million gainloss during the quarter related to a credit valuation adjustment (“CVA”) on client-related interest rate swaps, compared with an $18a $6 million CVA gain in the prior year period. The CVA may fluctuate from period-to-period based on the credit quality of our clients and changes in interest rates, which impacts the value of, and our credit exposure to, the client-related interest rate swaps.

Noninterest Expense

During the first quarter of 2022, we made certain financial reporting reclassifications to noninterest expense in our Consolidated Statements of Income, primarily to improve the presentation and disclosure of certain expenses related to our ongoing technology initiatives and investments and to provide a more relevant presentation of our business and operations. Other expense line items were also impacted by these reclassifications, which were adopted retrospectively to January 1, 2020.

ZIONS BANCORPORATION, NATIONAL ASSOCIATION

The following schedule presents a comparison of the major components of noninterest expense.

NONINTEREST EXPENSE

| | | Three Months Ended

March 31, | | Amount

change | | Percent

change | | | Three Months Ended

March 31, | | Amount

change | | Percent

change | |

| (Dollar amounts in millions) | (Dollar amounts in millions) | 2022 | | 2021 | | | (Dollar amounts in millions) | 2023 | | 2022 | | Amount

change | |

| | Salaries and employee benefits | Salaries and employee benefits | $ | 312 | | | $ | 288 | | | $ | 24 | | | 8 | % | | Salaries and employee benefits | $ | 339 | | | $ | 312 | | | $ | 27 | | | 9 | % | |

| Technology, telecom, and information processing | Technology, telecom, and information processing | 52 | | | 49 | | | 3 | | | 6 | | | Technology, telecom, and information processing | 55 | | | 52 | | | 3 | | | 6 | | |

| Occupancy and equipment, net | Occupancy and equipment, net | 38 | | | 39 | | | (1) | | | (3) | | | Occupancy and equipment, net | 40 | | | 38 | | | 2 | | | 5 | | |

| Professional and legal services | Professional and legal services | 14 | | | 21 | | | (7) | | | (33) | | | Professional and legal services | 13 | | | 14 | | | (1) | | | (7) | | |

| Marketing and business development | Marketing and business development | 8 | | | 7 | | | 1 | | | 14 | | | Marketing and business development | 12 | | | 8 | | | 4 | | | 50 | | |

| Deposit insurance and regulatory expense | Deposit insurance and regulatory expense | 10 | | | 10 | | | — | | | — | | | Deposit insurance and regulatory expense | 18 | | | 10 | | | 8 | | | 80 | | |

| Credit-related expense | Credit-related expense | 7 | | | 6 | | | 1 | | | 17 | | | Credit-related expense | 6 | | | 7 | | | (1) | | | (14) | | |

| Other real estate expense, net | Other real estate expense, net | 1 | | | — | | | 1 | | | NM | | Other real estate expense, net | — | | | 1 | | | (1) | | | NM | |

| Other | Other | 22 | | | 15 | | | 7 | | | 47 | | | Other | 29 | | | 22 | | | 7 | | | 32 | | |

| Total noninterest expense | Total noninterest expense | $ | 464 | | | $ | 435 | | | $ | 29 | | | 7 | % | | Total noninterest expense | $ | 512 | | | $ | 464 | | | $ | 48 | | | 10 | % | |

Adjusted noninterest expense 1 | Adjusted noninterest expense 1 | $ | 464 | | | $ | 440 | | | $ | 24 | | | 5 | % | | Adjusted noninterest expense 1 | $ | 509 | | | $ | 464 | | | $ | 45 | | | 10 | % | |

1 For information on non-GAAP financial measures, see “GAAP to Non-GAAP Reconciliations”“Non-GAAP Financial Measures” on page 4.36.

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES

Total noninterest expense increased $29$48 million, or 7%10%, relative to the prior year quarter. Salaries and benefits expense increased $24$27 million, or 8%9%, due to (1) the ongoing impact of inflationary and competitive labor market pressures on wages (2) increases in commissions, (3) increases in incentive compensation accruals arising from improvements in anticipated full-year profitability, and (4) declinesbenefits, increased headcount, a decline in deferred salaries, primarily associated with PPP loans originatedand an additional business day during the current quarter.

Deposit insurance and regulatory expense increased $8 million, driven largely by an increased base rate beginning in the prior year period.

2023 and a higher FDIC insurance assessment resulting from changes in balance sheet composition. Other noninterest expense increased $7 million, or 47%, primarily due to lower expenses in the prior year period, which benefited from a $5 million valuation adjustment related to the termination of our defined benefit pension plan. Professional and legal services expense decreased $7 million, or 33%, due to third-party assistance associated with PPP loan forgiveness as well as various technology-relatedincreased travel, intangible amortization, and other outsourced servicesexpenses incurred induring the prior year period.current quarter.

Adjusted noninterest expense increased $24 million, or 5%, to $464 million, compared with $440 million for the prior year period, driven primarily by the increase in salaries and benefits expense described previously. The efficiency ratio was 65.8%59.9%, compared with 63.5%. Given the seasonality associated with employee benefits, the efficiency ratio is generally elevated65.8%, as growth in the first quarter of the year. This effect was more pronouncedadjusted taxable-equivalent revenue significantly outpaced growth in the first quarter of 2022 due to the aforementioned increases in incentive compensation accruals arising from improvements in anticipated full-year profitability.adjusted noninterest expense. For information on non-GAAP financial measures, including differences between noninterest expense and adjusted noninterest expense, see page 4.36.

Technology Spend

Technology spend represents expenditures associated with technology-related investments, operations, systems, and infrastructure, and includes current period expenses reported on our consolidated statement of income, and capitalized investments, net of related amortization and depreciation, reported on our consolidated balance sheet. Technology spend is reported as a combination of the following:

•Technology, telecom, and information processing expense — includes expenses related to application software licensing and maintenance, related amortization, telecommunications, and data processing;

•Other technology-related expense — includes related noncapitalized salaries and employee benefits, occupancy and equipment, and professional and legal services; and

•Technology investments — includes capitalized technology infrastructure equipment, hardware, and purchased or internally developed software, less related amortization or depreciation.

The following schedule provides information related to our technology spend:

TECHNOLOGY SPEND

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | | | | | | | | | | | |

| (In millions) | 2023 | | 2022 | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Technology, telecom, and information processing expense | $ | 55 | | | $ | 52 | | | | | | | | | | | | | | | | | |

| Other technology-related expense | 54 | | | 49 | | | | | | | | | | | | | | | | | |

| Technology investments | 26 | | | 22 | | | | | | | | | | | | | | | | | |

| Less: related amortization and depreciation | (14) | | | (14) | | | | | | | | | | | | | | | | | |

| Total technology spend | $ | 121 | | | $ | 109 | | | | | | | | | | | | | | | | | |

Total technology spend increased $12 million relative to the prior year quarter, largely due to technology-related compensation and investments in application resiliency.

Income Taxes

The following schedule summarizes the income tax expense and effective tax rates for the periods presented:

INCOME TAXES

| | | Three Months Ended

March 31, | | | Three Months Ended

March 31, | |

| (Dollar amounts in millions) | (Dollar amounts in millions) | 2022 | | 2021 | | (Dollar amounts in millions) | 2023 | | 2022 | |

| | Income before income taxes | Income before income taxes | $ | 255 | | | $ | 411 | | | Income before income taxes | $ | 282 | | | $ | 255 | | |

| Income tax expense | Income tax expense | 52 | | | 89 | | | Income tax expense | 78 | | | 52 | | |

| Effective tax rate | Effective tax rate | 20.4 | % | | 21.7 | % | | Effective tax rate | 27.7 | % | | 20.4 | % | |

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES

The effective tax rate was 27.7% at March 31, 2023, compared with 20.4% at March 31, 2022, primarily as a result of a discrete item that affected the reserve for uncertain tax positions during the current quarter. See Note 12 of the Notes to Consolidated Financial Statements for more information about the factors that influenced the income tax rates as well as information about deferred income tax assets and liabilities.

ZIONS BANCORPORATION, NATIONAL ASSOCIATION

liabilities, and valuation allowances.Preferred Stock Dividends

Preferred stock dividends totaled $6 million and $8 million for both the first quarter of 2023 and 2022, and 2021.

Technology Spend

As the banking industry continues to move toward information technology-based products and services, we recognize there are disparate ways of discussing expenditures associated with technology-related investments and operations. We generally describe these expenditures as total technology spend, which includes current period expenses reported on our consolidated statement of income, and capitalized investments, net of related amortization and depreciation, reported on our consolidated balance sheet. We believe these disclosures provide more relevant presentation and discussion regarding our technology-related investments and operations.

The following schedule provides information related to our technology spend:

TECHNOLOGY SPEND

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | | | | | | | | | |

| (In millions) | 2022 | | 2021 | | | | | | |

| | | | | | | | | | | | | | | |

| Technology, telecom, and information processing expense | $ | 52 | | | $ | 49 | | | | | | | | | | | | | |

| Other technology-related expenses | 49 | | | 44 | | | | | | | | | | | | | |

| Technology investments | 22 | | | 28 | | | | | | | | | | | | | |

| Less: related amortization and depreciation | (14) | | | (13) | | | | | | | | | | | | | |

| Total technology spend | $ | 109 | | | $ | 108 | | | | | | | | | | | | | |

Total technology spend represents expenditures for technology systems and infrastructure and is reported as a combination of the following:

•Technology, telecom, and information processing expense — includes expenses related to application software licensing and maintenance, related amortization, telecommunications, and data processing;

•Other technology-related expenses — includes related noncapitalized salaries and employee benefits, occupancy and equipment, and professional and legal services; and

•Technology investments — includes capitalized technology infrastructure equipment, hardware, and purchased or internally developed software, less related amortization or depreciation.respectively.

BALANCE SHEET ANALYSIS

Interest-Earning Assets

Interest-earning assets are assets that have associated interest rates or yields, and generally consist of money market investments, securities, loans, and leases. We strive to maintain a high level of interest-earning assets relative to total assets. For more information regarding the average balances, associated revenue generated, and the respective yields of our interest-earning assets, see the Consolidated Average Balance Sheet on page 11.10.

Investment Securities Portfolio

We invest in securities to generate interest income and to actively manage liquidity and interest rate risk and credit risk. Referto generate interest income. We primarily own securities that can readily provide us cash and liquidity through secured borrowing agreements without the need to sell the securities. We also manage the duration extension risk of our investment securities portfolio. At March 31, 2023, the estimated duration of our securities portfolio remained unchanged at 4.1 years, compared with December 31, 2022. This duration helps to manage the inherent interest rate mismatch between loans and deposits, as fixed-rate term investments facilitate the balancing of asset and liability durations, as well as protect the expected economic value of shareholders' equity.

For information about our borrowing capacity associated with the investment securities portfolio and how we manage our liquidity risk, refer to the “Liquidity Risk Management” section on page 31 for additional information about how we manage our liquidity risk.31. See also Note 3 and Note 5of the Notes to Consolidated Financial Statements for more information on fair value measurements and the accounting for our investment securities portfolio.

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES

The following schedule presents the components of our investment securities portfolio.

INVESTMENT SECURITIES PORTFOLIO | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2023 | | December 31, 2022 |

| (In millions) | Par Value | | Amortized

cost | | Fair

value | | Par Value | | Amortized

cost | | Fair

value |

| Held-to-maturity | | | | | | | | | | | |

| U.S. Government agencies and corporations: | | | | | | | | | | | |

| Agency securities | $ | 98 | | | $ | 98 | | | $ | 92 | | | $ | 100 | | | $ | 100 | | | $ | 93 | |

Agency guaranteed mortgage-backed securities 1 | 12,707 | | | 10,471 | | | 10,750 | | | 12,921 | | | 10,621 | | | 10,772 | |

| Municipal securities | 392 | | | 392 | | | 368 | | | 404 | | | 405 | | | 374 | |

| Total held-to-maturity | 13,197 | | | 10,961 | | | 11,210 | | | 13,425 | | | 11,126 | | | 11,239 | |

| Available-for-sale | | | | | | | | | | | |

| U.S. Treasury securities | 655 | | | 656 | | | 511 | | | 555 | | | 557 | | | 393 | |

| U.S. Government agencies and corporations: | | | | | | | | | | | |

| Agency securities | 760 | | | 753 | | | 716 | | | 790 | | | 782 | | | 736 | |

| Agency guaranteed mortgage-backed securities | 9,341 | | | 9,423 | | | 8,220 | | | 9,566 | | | 9,652 | | | 8,367 | |

| Small Business Administration loan-backed securities | 655 | | | 701 | | | 676 | | | 691 | | | 740 | | | 712 | |

| Municipal securities | 1,379 | | | 1,517 | | | 1,447 | | | 1,571 | | | 1,732 | | | 1,634 | |

| Other debt securities | 25 | | | 25 | | | 24 | | | 75 | | | 75 | | | 73 | |

| Total available-for-sale | 12,815 | | | 13,075 | | | 11,594 | | | 13,248 | | | 13,538 | | | 11,915 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Total HTM and AFS investment securities | $ | 26,012 | | | $ | 24,036 | | | $ | 22,804 | | | $ | 26,673 | | | $ | 24,664 | | | $ | 23,154 | |

1 During the fourth quarter of 2022, we transferred approximately $10.7 billion fair value ($13.1 billion amortized cost) of mortgage-backed AFS securities to the HTM category to reflect our intent for these securities. The transfer of these securities from AFS to HTM at fair value resulted in a discount to the amortized cost basis of the HTM securities equivalent to the $2.4 billion ($1.8 billion after-tax) of unrealized losses in AOCI. The amortization of the unrealized losses will offset the effect of the accretion of the discount created by the transfer.

The amortized cost of total HTM and AFS investment securities decreased $0.6 billion, or 3%, from December 31, 2022, primarily due to payments and maturities. Approximately 8% of the total HTM and AFS investment securities portfolio were floating rate at both March 31, 2023 and December 31, 2022, respectively. Additionally, we have $1.2 billion of pay-fixed swaps held as fair value hedges against fixed-rate AFS securities that effectively convert the fixed interest income to a floating rate on the hedged portion of the securities.

At March 31, 2023, the AFS investment securities portfolio included approximately $260 million of net premium that was distributed across the various security categories. Total taxable-equivalent premium amortization for these investment securities was $26 million for the first quarter of 2023, compared with $28 million for the same prior year period.

In addition to HTM and AFS securities, we also have a trading securities portfolio comprised of municipal securities that totaled $12 million at March 31, 2023, compared with $465 million at December 31, 2022. The prior quarter also included $395 million of money market mutual sweep accounts.

Refer to the “Capital Management” section on page 34 and Note 5 of the Notes to Consolidated Financial Statements for more discussion regarding our investment securities portfolio and related unrealized gains and losses.

Municipal Investments and Extensions of Credit

We support our communities by providing products and services to state and local governments (“municipalities”), including deposit services, loans, and investment banking services. We also invest in securities issued by municipalities. Our municipal lending products generally include loans in which the debt service is repaid from general funds or pledged revenues of the municipal entity, or to private commercial entities or 501(c)(3) not-for-profit entities utilizing a pass-through municipal entity to achieve favorable tax treatment.

ZIONS BANCORPORATION, NATIONAL ASSOCIATION AND SUBSIDIARIES