UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| |

| (X) | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2018March 31, 2019

OR

( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

|

| | | | |

| Commission File Number 1-8022 |

|

| | | | | | | | | | |

| CSX CORPORATION |

| (Exact name of registrant as specified in its charter) |

| Virginia | | | | | | | | 62-1051971 | | |

| (State or other jurisdiction of incorporation or organization) | | | | | | | | (I.R.S. Employer Identification No.) | | |

| | | | | | | | | | | |

| 500 Water Street, 15th Floor, Jacksonville, FL | | | | | | 32202 | | (904) 359-3200 | | |

| (Address of principal executive offices) | | | | | | (Zip Code) | | (Telephone number, including area code) | | |

| | | | | | | | | | | |

| | | | | No Change | | | | | | |

| (Former name, former address and former fiscal year, if changed since last report.) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes (X) No ( )

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes (X) No ( )

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer", "accelerated filer” and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (check one)

Large Accelerated Filer (X) Accelerated Filer ( ) Non-accelerated Filer ( ) Smaller Reporting Company ( ) Emerging growth company ( )

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ( )

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ( ) No (X)

There were 844,420,361809,163,666 shares of common stock outstanding on September 30, 2018March 31, 2019 (the latest practicable date that is closest to the filing date).

|

| | |

| | CSX Q3 2018Q1 2019 Form 10-Q p.1

|

|

CSX CORPORATION

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2018MARCH 31, 2019

INDEX

|

| | | |

| | | | Page |

| PART I. | FINANCIAL INFORMATION | | |

| Item 1. | | | |

| | | | |

| | Quarters Ended September 30,March 31, 2019 and March 31, 2018 and September 30, 2017 | | |

| | | | |

| | Quarters Ended September 30,March 31, 2019 and March 31, 2018 and September 30, 2017 | | |

| | | | |

| | At September 30, 2018March 31, 2019 (Unaudited) and December 31, 20172018 | | |

| | | | |

| | NineThree Months Ended September 30,March 31, 2019 and March 31, 2018 and September 30, 2017

| | |

| | | | |

| | Three Months Ended March 31, 2019 and March 31, 2018 | | |

| | | | |

| | | |

| | | |

| Item 2. | | | |

| | | | |

| Item 3. | | | |

| | | | |

| Item 4. | | | |

| | | | |

| PART II. | OTHER INFORMATION | | |

| Item 1. | | | |

| | | |

| Item 1A. | | | |

| | | |

| Item 2. | | | |

| | | |

| Item 3. | | | |

| | | |

| Item 4. | | | |

| | | |

| Item 5. | | | |

| | | |

| Item 6. | | | |

| | | | |

Item 1A. | | | |

| | | |

Item 2. | | | |

| | | |

Item 3. | | | |

| | | |

Item 4. | | | |

| | | |

Item 5. | | | |

| | | |

Item 6. | | | |

| | | |

| | | |

|

| | |

| | CSX Q3 2018Q1 2019 Form 10-Q p.2

|

|

CSX CORPORATION

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CONSOLIDATED INCOME STATEMENTS (Unaudited)

(Dollars in millions, except per share amounts)

| | | | Third Quarters | | Nine Months | First Quarters |

| | 2018 | 2017 | | 2018 | 2017 | 2019 | 2018 |

| | | | | |

| Revenue | $ | 3,129 |

| $ | 2,743 |

| | $ | 9,107 |

| $ | 8,545 |

| $ | 3,013 |

| $ | 2,876 |

|

| Expense | | | | |

| Labor and Fringe | 695 |

| 725 |

| | 2,060 |

| 2,271 |

| 672 |

| 696 |

|

| Materials, Supplies and Other | 474 |

| 523 |

| | 1,425 |

| 1,590 |

| 478 |

| 482 |

|

| Depreciation | 334 |

| 331 |

| | 986 |

| 978 |

| 330 |

| 323 |

|

| Fuel | 268 |

| 205 |

| | 793 |

| 621 |

| 233 |

| 255 |

|

| Equipment and Other Rents | 89 |

| 109 |

| | 302 |

| 313 |

| 100 |

| 101 |

|

| Restructuring Charge (Note 1) | — |

| 1 |

| | — |

| 226 |

| |

| Equity Earnings of Affiliates | (24 | ) | (19 | ) | | (79 | ) | (48 | ) | (19 | ) | (25 | ) |

| Total Expense | 1,836 |

| 1,875 |

| | 5,487 |

| 5,951 |

| 1,794 |

| 1,832 |

|

| | | | | |

| Operating Income | 1,293 |

| 868 |

| | 3,620 |

| 2,594 |

| 1,219 |

| 1,044 |

|

| | | | | |

| Interest Expense | (162 | ) | (132 | ) | | (468 | ) | (406 | ) | (178 | ) | (149 | ) |

| Restructuring Charge - Non-Operating (Note 1) | — |

| — |

| | — |

| (70 | ) | |

| Other Income - Net | 19 |

| 14 |

| | 54 |

| 41 |

| 23 |

| 17 |

|

| Earnings Before Income Taxes | 1,150 |

| 750 |

| | 3,206 |

| 2,159 |

| 1,064 |

| 912 |

|

| | | | | |

| Income Tax Expense | (256 | ) | (291 | ) | | (740 | ) | (828 | ) | (230 | ) | (217 | ) |

| Net Earnings | $ | 894 |

| $ | 459 |

| | $ | 2,466 |

| $ | 1,331 |

| $ | 834 |

| $ | 695 |

|

| | | | | |

| Per Common Share (Note 2) | | | | |

| Net Earnings Per Share, Basic | $ | 1.05 |

| $ | 0.51 |

| | $ | 2.85 |

| $ | 1.45 |

| $ | 1.02 |

| $ | 0.78 |

|

| Net Earnings Per Share, Assuming Dilution | $ | 1.05 |

| $ | 0.51 |

| | $ | 2.83 |

| $ | 1.45 |

| $ | 1.02 |

| $ | 0.78 |

|

| | | | | |

| | | | | |

Average Shares Outstanding (In millions) | 850 |

| 902 |

| | 866 |

| 916 |

| 814 |

| 885 |

|

Average Shares Outstanding, Assuming Dilution (In millions) | 854 |

| 906 |

| | 870 |

| 919 |

| 817 |

| 888 |

|

| | | | | |

| | | | | |

| Cash Dividends Paid Per Common Share | $ | 0.22 |

| $ | 0.20 |

| | $ | 0.66 |

| $ | 0.58 |

| |

CONDENSED CONSOLIDATED COMPREHENSIVE INCOME STATEMENTS (Unaudited)

(Dollars in millions, except per share amounts)

|

| | | | | | | | | | | | | |

| | Third Quarters | | Nine Months |

| | 2018 | 2017 | | 2018 | 2017 |

| Total Comprehensive Earnings (Note 10) | $ | 901 |

| $ | 467 |

| | $ | 2,378 |

| $ | 1,410 |

|

|

| | | | | | |

| | First Quarters |

| | 2019 | 2018 |

| Total Comprehensive Earnings (Note 12) | $ | 836 |

| $ | 596 |

|

Certain prior year data has been reclassified to conform to the current presentation.

See accompanying notes to consolidated financial statements.

|

| | |

| | CSX Q3 2018Q1 2019 Form 10-Q p.3

|

|

CSX CORPORATION

ITEM 1. FINANCIAL STATEMENTS

CONSOLIDATED BALANCE SHEETS

| | | | (Unaudited) | | (Unaudited) | |

| | September 30,

2018 | December 31,

2017 | March 31,

2019 | December 31,

2018 |

ASSETS | | Current Assets: | | |

| Cash and Cash Equivalents | $ | 663 |

| $ | 401 |

| $ | 1,188 |

| $ | 858 |

|

| Short-term Investments | 615 |

| 18 |

| 822 |

| 253 |

|

| Accounts Receivable - Net (Note 11) | 1,090 |

| 970 |

| |

| Accounts Receivable - Net (Note 9) | | 1,106 |

| 1,010 |

|

| Materials and Supplies | 283 |

| 372 |

| 241 |

| 263 |

|

| Other Current Assets | 133 |

| 154 |

| 122 |

| 181 |

|

| Total Current Assets | 2,784 |

| 1,915 |

| 3,479 |

| 2,565 |

|

| | | |

| Properties | 44,485 |

| 44,324 |

| 44,826 |

| 44,805 |

|

| Accumulated Depreciation | (12,614 | ) | (12,560 | ) | (12,838 | ) | (12,807 | ) |

| Properties - Net | 31,871 |

| 31,764 |

| 31,988 |

| 31,998 |

|

| | | |

| Investment in Conrail | 941 |

| 907 |

| 948 |

| 943 |

|

| Affiliates and Other Companies | 823 |

| 779 |

| 845 |

| 836 |

|

| Right-of-Use Lease Asset (Note 5) | | 550 |

| — |

|

| Other Long-term Assets | 442 |

| 374 |

| 344 |

| 387 |

|

| Total Assets | $ | 36,861 |

| $ | 35,739 |

| $ | 38,154 |

| $ | 36,729 |

|

| | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | Current Liabilities: | | |

| Accounts Payable | $ | 982 |

| $ | 847 |

| $ | 1,019 |

| $ | 949 |

|

| Labor and Fringe Benefits Payable | 517 |

| 602 |

| 406 |

| 550 |

|

| Casualty, Environmental and Other Reserves (Note 4) | 110 |

| 108 |

| 112 |

| 113 |

|

| Current Maturities of Long-term Debt (Note 7) | 18 |

| 19 |

| |

| Current Maturities of Long-term Debt (Note 8) | | 18 |

| 18 |

|

| Income and Other Taxes Payable | 166 |

| 157 |

| 193 |

| 106 |

|

| Other Current Liabilities | 151 |

| 161 |

| 178 |

| 179 |

|

| Total Current Liabilities | 1,944 |

| 1,894 |

| 1,926 |

| 1,915 |

|

| | | |

| Casualty, Environmental and Other Reserves (Note 4) | 231 |

| 266 |

| 207 |

| 211 |

|

| Long-term Debt (Note 7) | 13,754 |

| 11,790 |

| |

| Long-term Debt (Note 8) | | 15,748 |

| 14,739 |

|

| Deferred Income Taxes - Net | 6,584 |

| 6,418 |

| 6,743 |

| 6,690 |

|

| Long-term Lease Liability (Note 5) | | 502 |

| — |

|

| Other Long-term Liabilities | 613 |

| 650 |

| 583 |

| 594 |

|

| Total Liabilities | 23,126 |

| 21,018 |

| 25,709 |

| 24,149 |

|

| | | |

| Shareholders' Equity: | | |

| Common Stock, $1 Par Value | 844 |

| 890 |

| 809 |

| 818 |

|

| Other Capital | 129 |

| 217 |

| 267 |

| 249 |

|

| Retained Earnings | 13,320 |

| 14,084 |

| 12,011 |

| 12,157 |

|

| Accumulated Other Comprehensive Loss (Note 10) | (574 | ) | (486 | ) | |

| Accumulated Other Comprehensive Loss (Note 12) | | (659 | ) | (661 | ) |

| Noncontrolling Interest | 16 |

| 16 |

| 17 |

| 17 |

|

| Total Shareholders' Equity | 13,735 |

| 14,721 |

| 12,445 |

| 12,580 |

|

| Total Liabilities and Shareholders' Equity | $ | 36,861 |

| $ | 35,739 |

| $ | 38,154 |

| $ | 36,729 |

|

See accompanying notes to consolidated financial statements.

|

| | |

| | CSX Q3 2018Q1 2019 Form 10-Q p.4

|

|

CSX CORPORATION

ITEM 1. FINANCIAL STATEMENTS

CONSOLIDATED CASH FLOW STATEMENTS (Unaudited)

(Dollars in millions)

| | | | Nine Months | Three Months |

| | 2018 | 2017 | 2019 | 2018 |

| | | |

| OPERATING ACTIVITIES | | |

| Net Earnings | $ | 2,466 |

| $ | 1,331 |

| $ | 834 |

| $ | 695 |

|

| Adjustments to Reconcile Net Earnings to Net Cash Provided by Operating Activities: | | |

| Depreciation | 986 |

| 978 |

| 330 |

| 323 |

|

| Deferred Income Taxes | 148 |

| 161 |

| 51 |

| 54 |

|

| Gain on Property Dispositions | (122 | ) | (5 | ) | (27 | ) | (32 | ) |

| Equity Earnings of Affiliates | (79 | ) | (48 | ) | (19 | ) | (25 | ) |

| Restructuring Charge | — |

| 296 |

| |

| Cash Payments for Restructuring Charge | (14 | ) | (147 | ) | — |

| (12 | ) |

| Other Operating Activities | (13 | ) | 40 |

| (14 | ) | 6 |

|

| Changes in Operating Assets and Liabilities: | | |

| Accounts Receivable | (97 | ) | (78 | ) | (56 | ) | (50 | ) |

| Other Current Assets | 70 |

| 47 |

| 22 |

| (19 | ) |

| Accounts Payable | 140 |

| 102 |

| 74 |

| 64 |

|

| Income and Other Taxes Payable | 19 |

| 180 |

| 150 |

| 127 |

|

| Other Current Liabilities | (98 | ) | 4 |

| (172 | ) | (165 | ) |

| Net Cash Provided by Operating Activities | 3,406 |

| 2,861 |

| 1,173 |

| 966 |

|

| | | |

| INVESTING ACTIVITIES | | |

| Property Additions | (1,240 | ) | (1,462 | ) | (353 | ) | (368 | ) |

| Proceeds from Property Dispositions | 257 |

| 38 |

| 48 |

| 52 |

|

| Purchase of Short-term Investments | (611 | ) | (645 | ) | (813 | ) | — |

|

| Proceeds from Sales of Short-term Investments | 15 |

| 957 |

| 250 |

| 8 |

|

| Other Investing Activities | (8 | ) | 33 |

| (2 | ) | (8 | ) |

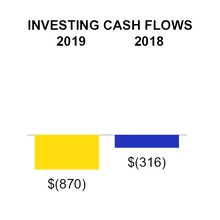

| Net Cash Used In Investing Activities | (1,587 | ) | (1,079 | ) | (870 | ) | (316 | ) |

| | | |

| FINANCING ACTIVITIES | | |

| Long-term Debt Issued (Note 7) | 2,000 |

| 850 |

| |

| Long-term Debt Repaid (Note 7) | (19 | ) | (332 | ) | |

| Long-term Debt Issued (Note 8) | | 1,000 |

| 2,000 |

|

| Dividends Paid | (570 | ) | (530 | ) | (195 | ) | (194 | ) |

| Shares Repurchased | (2,816 | ) | (1,763 | ) | (796 | ) | (836 | ) |

| Accelerated Share Repurchase Pending Final Settlement (Note 2) | (100 | ) | — |

| |

| Other Financing Activities | (52 | ) | (19 | ) | 18 |

| (41 | ) |

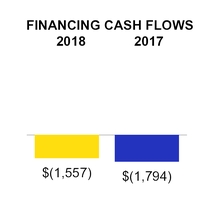

| Net Cash Used in Financing Activities | (1,557 | ) | (1,794 | ) | |

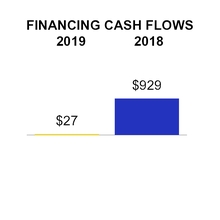

| Net Cash Provided by Financing Activities | | 27 |

| 929 |

|

| | | |

| Net Increase (Decrease) in Cash and Cash Equivalents | 262 |

| (12 | ) | |

| Net Increase in Cash and Cash Equivalents | | 330 |

| 1,579 |

|

| | | |

| CASH AND CASH EQUIVALENTS | | |

| Cash and Cash Equivalents at Beginning of Period | 401 |

| 603 |

| 858 |

| 401 |

|

| Cash and Cash Equivalents at End of Period | $ | 663 |

| $ | 591 |

| $ | 1,188 |

| $ | 1,980 |

|

| | | |

Certain prior year data has been reclassified to conform to the current presentation.

See accompanying notes to consolidated financial statements.

|

| | |

| | CSX Q3 2018Q1 2019 Form 10-Q p.5

|

|

CSX CORPORATION

ITEM 1. FINANCIAL STATEMENTS

CONSOLIDATED STATEMENTS OF CHANGES

IN SHAREHOLDERS' EQUITY

(Dollars in Millions)

|

| | | | | | | | | | | | | | | | | |

| | Common Shares Outstanding (Thousands) | Common Stock and Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Income (Loss)(a) | Non-controlling Interest | Total Shareholders' Equity |

| | | | | | | |

| Balance December 31, 2018 | 818,180 |

| $ | 1,067 |

| $ | 12,157 |

| $ | (661 | ) | $ | 17 |

| $ | 12,580 |

|

| Comprehensive Earnings: | | | | | | |

| Net Earnings | — |

| — |

| 834 |

| — |

| — |

| 834 |

|

| Other Comprehensive Income (Note 12) | — |

| — |

| — |

| 2 |

| — |

| 2 |

|

| Total Comprehensive Earnings | | | | | | 836 |

|

| | | | | | | |

| Common stock dividends, $0.24 per share | — |

| — |

| (195 | ) | — |

| — |

| (195 | ) |

| Share Repurchases | (11,540 | ) | (12 | ) | (784 | ) | — |

| — |

| (796 | ) |

| Stock Option Exercises and Other | 2,524 |

| 21 |

| (1 | ) | — |

| — |

| 20 |

|

| Balance March 31, 2019 | 809,164 |

| $ | 1,076 |

| $ | 12,011 |

| $ | (659 | ) | $ | 17 |

| $ | 12,445 |

|

| | | | | | | |

| | | | | | | |

| Balance December 31, 2017 | 889,851 |

| $ | 1,107 |

| $ | 14,084 |

| $ | (486 | ) | $ | 16 |

| $ | 14,721 |

|

| Comprehensive Earnings: | | | | | | |

| Net Earnings | — |

| — |

| 695 |

| — |

| — |

| 695 |

|

| Other Comprehensive Loss (Note 12) | — |

| — |

| — |

| (99 | ) | — |

| (99 | ) |

| Total Comprehensive Earnings | | | | | | 596 |

|

| | | | | | | |

| Common stock dividends, $0.22 per share | — |

| — |

| (194 | ) | — |

| — |

| (194 | ) |

| Share Repurchases | (14,966 | ) | (15 | ) | (821 | ) | — |

| — |

| (836 | ) |

| Stock Option Exercises and Other | 469 |

| (2 | ) | 109 |

| — |

| (3 | ) | 104 |

|

| Balance March 31, 2018 | 875,354 |

| $ | 1,090 |

| $ | 13,873 |

| $ | (585 | ) | $ | 13 |

| $ | 14,391 |

|

| | | | | | | |

(a) Accumulated Other Comprehensive Loss balances shown above are net of tax. The associated taxes were $179 million and $160 million as of March 31, 2019 and March 31, 2018, respectively. For additional information, see Note 12, Other Comprehensive Income.

See accompanying notes to consolidated financial statements.

|

| | |

| CSX Q1 2019 Form 10-Q p.6

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1.Nature of Operations and Significant Accounting Policies

Background

CSX Corporation (“CSX”), together with its subsidiaries (the “Company”), based in Jacksonville, Florida, is one of the nation's leading transportation companies. The Company provides rail-based transportation services including traditional rail service and the transport of intermodal containers and trailers.

CSX's principal operating subsidiary, CSX Transportation, Inc. (“CSXT”), provides an important link to the transportation supply chain through its approximately 21,00020,500 route mile rail network, which serves major population centers in 23 states east of the Mississippi River, the District of Columbia and the Canadian provinces of Ontario and Quebec. The Company's intermodal business links customers to railroads via trucks and terminals.

After a merger on July 1, 2017 with CSX Real Property, Inc., a former wholly-owned CSX subsidiary, CSXT is nowalso responsible for the Company's real estate sales, leasing, acquisition and management and development activities. In addition, as substantially all real estate sales, leasing, acquisition and management and development activities are focused on supporting railroad operations, all results of these activities are included in operating income beginning in 2017. Previously, the results of these activities were classified as operating or non-operating based on the nature of the activity and were not material for any periods presented.income.

Other entities

In addition to CSXT, the Company’s subsidiaries include CSX Intermodal Terminals, Inc. (“CSX Intermodal Terminals”), Total Distribution Services, Inc. (“TDSI”), Transflo Terminal Services, Inc. (“Transflo”), CSX Technology, Inc. (“CSX Technology”) and other subsidiaries. CSX Intermodal Terminals owns and operates a system of intermodal terminals, predominantly in the eastern United States and also performs drayage services (the pickup and delivery of intermodal shipments) for certain customers and trucking dispatch operations. TDSI serves the automotive industry with distribution centers and storage locations. Transflo connects non-rail served customers to the many benefits of rail by transferring products from rail to trucks. The biggest Transflo markets are chemicals and agriculture, which include shipments of plastics and ethanol. CSX Technology and other subsidiaries provide support services for the Company.

Basis of Presentation

In the opinion of management, the accompanying consolidated financial statements contain all normal, recurring adjustments necessary to fairly present the following:

Consolidated income statements for the quarter ended March 31, 2019 and nine months ended September 30, 2018 and September 30, 2017;March 31, 2018;

Condensed consolidated comprehensive income statements for the quarter ended March 31, 2019 and nine months ended September 30, 2018 and September 30, 2017;March 31, 2018;

Consolidated balance sheets at September 30, 2018March 31, 2019 and December 31, 2017; and2018;

Consolidated cash flow statements for the ninethree months ended September 30, 2018March 31, 2019 and September 30, 2017.March 31, 2018; and

Consolidated statements of changes in shareholders' equity for the three months ended March 31, 2019 and March 31, 2018.

|

| | |

| CSX Q3 2018 Form 10-Q p.6

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1. Nature of Operations and Significant Accounting Policies, continued

Pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”), certain information and disclosures normally included in the notes to the annual financial statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) have been omitted from these interim financial statements. CSX suggests that these financial statements be read in conjunction with the audited financial statements and the notes included in CSX's most recent annual report on Form 10-K and any subsequently filed current reports on Form 8-K.

Fiscal Year

Through the second quarter 2017, CSX followed a 52/53 week fiscal reporting calendar with the last day of each reporting period ending on a Friday. On July 7, 2017 the Board of Directors of CSX approved a change in the fiscal reporting calendar from a 52/53 week year ending on the last Friday of December to a calendar year ending on December 31 each year, effective beginning with fiscal third quarter 2017. Related to the change in the fiscal calendar:

Fiscal year 2018 (January 1, 2018 through December 31, 2018) will contain 365 days, and fiscal year 2017 (December 31, 2016 through December 31, 2017) contained 366 days.

Fiscal first quarter 2018 (January 1, 2018 through March 31, 2018) contained 90 days, and fiscal first quarter 2017 (December 31, 2016 through March 31, 2017) contained 91 days.

Fiscal second quarter 2018 (April 1, 2018 through June 30, 2018) contained 91 days, and fiscal second quarter 2017 (April 1, 2017 through June 30, 2017) contained 91 days.

Fiscal third quarter 2018 (July 1, 2018 through September 30, 2018) contained 92 days, and fiscal third quarter 2017 (July 1, 2017 through September 30, 2017) contained 92 days.

This change did not materially impact the comparability of the Company’s financial results. Accordingly, the change to a calendar fiscal year was made on a prospective basis and operating results for prior periods were not adjusted. The Company was not required to file a transition report because this change was not deemed a change in fiscal year for purposes of reporting subject to Rule 13a-10 or Rule 15d-10 of the Securities Exchange Act of 1934 as the new fiscal year commenced with the end of the prior fiscal year end and within seven days of the prior fiscal year end.

Except as otherwise specified, references to “third quarter(s)” or “nine months” indicate CSX's fiscal periods ending September 30, 2018 and September 30, 2017, and references to "year-end" indicate the fiscal year ended December 31, 2017.

New Accounting Pronouncements

Pronouncements adopted in 2018

In February 2018, the Financial Accounting Standards Board ("FASB") issued Accounting Standard Update ("ASU") Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income, which permits entities to reclassify tax effects stranded in accumulated other comprehensive income as a result of tax reform to retained earnings. Companies that elect to reclassify these amounts must reclassify stranded tax effects for all items accounted for in accumulated other comprehensive income. The Company adopted this standard update in first quarter 2018 and applied it prospectively. Adoption resulted in the reclassification of $107 million in tax effects related to employee benefit plans from accumulated other comprehensive loss, increasing retained earnings by the same amount.

|

| | |

| | CSX Q3 2018Q1 2019 Form 10-Q p.7

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1. Nature of Operations and Significant Accounting Policies, continued

InFiscal Year

The Company's fiscal periods are based upon the calendar year. Except as otherwise specified, references to “first quarter(s)” or “three months” indicate CSX's fiscal periods ending March 2017, the FASB issued ASU Improving the Presentation of Net Periodic Pension Cost31, 2019 and Net Periodic Postretirement Benefit Cost, whichrequires that only the service cost component of net periodic benefit costs be recorded as compensation cost in operating expense on the consolidated income statement. All other components of net periodic benefit cost (interest cost, expected return on plan assets, amortization of net loss, special termination benefits and settlement and curtailment effects) should be presented as non-operating charges on the consolidated income statement. If these non-operating charges are related to prior year restructuring activities, they are presented as restructuring charge - non-operating. Other non-operating charges are presented as other income - net. The Company adopted the provisions of this standard during first quarterMarch 31, 2018, and applied them retrospectively. The retrospective impact of adoption for third quarter and nine months 2017 is shown inreferences to "year-end" indicate the following table.fiscal year ended December 31, 2018.

|

| | | | | | | | | | | | | | | | | | | |

| | Third Quarter 2017 | | Nine Months 2017 |

| (Dollars in millions) | As Previously Reported | Reclass | As Reclassified | | As Previously Reported | Reclass | As Reclassified |

| Operating Expense: | | | | | | | |

| Labor and Fringe | $ | 717 |

| $ | 8 |

| $ | 725 |

| | $ | 2,249 |

| $ | 22 |

| $ | 2,271 |

|

| Restructuring Charge | 1 |

| — |

| 1 |

| | 296 |

| (70 | ) | 226 |

|

| Non-Operating Income (Expense): | | | | | | | |

| Restructuring Charge - Non-Operating | $ | — |

| $ | — |

| $ | — |

| | $ | — |

| $ | (70 | ) | $ | (70 | ) |

| Other Income - Net | 6 |

| 8 |

| 14 |

| | 19 |

| 22 |

| 41 |

|

In May 2014, the FASB issued ASU Revenue from Contracts with Customers, which supersedes previous revenue recognition guidance. The new standard requires that a company recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration the company expects to receive in exchange for those goods or services. In-depth reviews of commercial contracts were completed and changes to processes and internal controls to meet the standard’s reporting and disclosure requirements were implemented. The Company adopted the guidance effective January 1, 2018 using the modified retrospective approach. The adoption did not affect the Company’s financial condition, results of operations or liquidity. Disclosures related to the nature, amount and timing of revenue and cash flows arising from contracts with customers are included in Note 11, Revenues.

New Accounting Pronouncements

Pronouncements to be adopted in 2019

In February 2016, the FASB issued ASU, Leases, which will requirerequires lessees to recognize most leases on their balance sheets as a right-of-use asset with a corresponding lease liability, and lessors to recognize a net lease investment.liability. Lessor accounting under the standard is substantially unchanged. Additional qualitative and quantitative disclosures willare also be required. ThisCSX adopted the standard update is effective for CSX beginning with the first quarterJanuary 1, 2019 and the Company plans to adopt it using the cumulative-effect adjustment transition method, approved bywhich applies the FASB in July 2018. Changesprovisions of the standard at the effective date without adjusting the comparative periods presented. The Company adopted the following practical expedients and elected the following accounting policies related to processesthis standard update:

Carry forward of historical lease classifications and internal controlscurrent accounting treatment for existing land easements;

Short-term lease accounting policy election allowing lessees to meet the standard’s reportingnot recognize right-of-use assets and disclosure requirements have been identifiedliabilities for leases with a term of 12 months or less; and are being implemented. Software has been implemented that will assist

The option to not separate lease and non-lease components for certain equipment lease asset categories such as freight car, vehicles and work equipment.

Adoption of this standard resulted in the recognition of additional assets and liabilities to be included on the balance sheet related to leases currently classified as operating leases with durations greater than twelve months, with certain allowable exceptions. In addition to lease agreements, service contracts and other agreements are also being reviewed to determine if they contain an embedded lease. The Company continues to evaluate the expected impact of this standard update on disclosures, but does not anticipate any material changes to operating results or liquidity as a result of right-of-use assets and corresponding lease liabilities thatof $534 million on the consolidated balance sheet as of January 1, 2019.This amount is lower than previous estimates due to a lease amendment. The Company’s accounting for finance leases remained substantially unchanged.The standard did not materially impact operating results or liquidity. Disclosures related to the amount, timing and uncertainty of cash flows arising from leases are included in Note 5, Leases.

Pronouncements to be adopted

In June 2016, the FASB issued ASU Measurement of Credit Losses on Financial Instruments, which replaces current methods for evaluating impairment of financial instruments not measured at fair value, including trade accounts receivable and certain debt securities, with a current expected credit loss model. CSX will be recorded.adopt this new standard update effective January 1, 2020, and does not expect it to have a material effect on the Company's results of operations.

|

| | |

| | CSX Q3 2018Q1 2019 Form 10-Q p.8

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1. Nature of Operations and Significant Accounting Policies, continued

In January 2018, the FASB issued ASU Leases - Land Easement Practical Expedient, which permits entities to forgo the evaluation of existing land easement arrangements to determine if they contain a lease as part of the adoption of the Leases ASU issued in February 2016. Accordingly, the Company’s accounting treatment of existing land easements will not change. CSX will adopt this standard update concurrently with the Leases ASU issued in February 2016. New land easement arrangements, or modifications to existing arrangements, after the adoption of the standard update will still be evaluated to determine if they meet the definition of a lease.

In March 2017, the FASB issued ASU Simplifying the Test for Goodwill Impairment, which eliminates step two, the calculation of the implied fair value of goodwill, from the goodwill impairment test. Impairment will be quantified in step one of the test as the amount by which the carrying amount exceeds the fair value. This standard update is effective beginning first quarter 2020 and must be applied prospectively. The Company does not believe this standard update will have a material effect on its financial condition, results of operations or liquidity.

Restructuring Charge

The prior year restructuring charge includes costs related to the management workforce reduction program completed in 2017, reimbursement arrangements with MR Argent Advisor LLC (“Mantle Ridge”) and the Company’s former President and Chief Executive Officer, E. Hunter Harrison, the proration of equity awards and other advisory costs related to the leadership transition. Payments related to the 2017 restructuring charge were substantially complete as of March 31, 2018. For further details on the charge, see the Company's most recent annual report on Form 10-K.

During third quarter 2017, restructuring charge of $1 million was incurred for advisory fees related to shareholder matters. Expenses related to the management workforce reduction and other costs during the nine months 2017 are shown in the following table.

|

| | | | | | | | | | | |

| | Nine Months 2017 |

| (Dollars in millions) | As Previously Reported | | Operating Restructuring Charge | | Non-Operating Restructuring Charge |

| Severance and Pension | $ | 144 |

| | $ | 91 |

| | $ | 53 |

|

| Other Post-Retirement Benefits Curtailment | 17 |

| | — |

| | 17 |

|

| Employee Equity Awards Proration and Other | 16 |

| | 16 |

| | — |

|

| Subtotal Management Workforce Reduction | $ | 177 |

| | $ | 107 |

| | $ | 70 |

|

| Reimbursement Arrangements | 84 |

| | 84 |

| | — |

|

| Executive Equity Awards Proration | 24 |

| | 24 |

| | — |

|

| Advisory Fees Related to Shareholder Matters | 11 |

| | 11 |

| | — |

|

| Total Restructuring Charge | $ | 296 |

| | $ | 226 |

| | $ | 70 |

|

|

| | |

| CSX Q3 2018 Form 10-Q p.9

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 2. Earnings Per Share

The following table sets forth the computation of basic earnings per share and earnings per share, assuming dilution:

|

| | | | | | |

| | First Quarters |

| | 2019 | 2018 |

Numerator (Dollars in millions): | | |

| Net Earnings | $ | 834 |

| $ | 695 |

|

| | | |

Denominator (Units in millions): | | |

| Average Common Shares Outstanding | 814 |

| 885 |

|

| Other Potentially Dilutive Common Shares | 3 |

| 3 |

|

| Average Common Shares Outstanding, Assuming Dilution | 817 |

| 888 |

|

| | | |

| Net Earnings Per Share, Basic | $ | 1.02 |

| $ | 0.78 |

|

| Net Earnings Per Share, Assuming Dilution | $ | 1.02 |

| $ | 0.78 |

|

|

| | | | | | | | | | | | | |

| | Third Quarters | | Nine Months |

| | 2018 | 2017 | | 2018 | 2017 |

Numerator (Dollars in millions): | | | | | |

| Net Earnings | $ | 894 |

| $ | 459 |

| | $ | 2,466 |

| $ | 1,331 |

|

| Dividend Equivalents on Restricted Stock | — |

| — |

| | — |

| (1 | ) |

| Net Earnings, Attributable to Common Shareholders | $ | 894 |

| $ | 459 |

| | $ | 2,466 |

| $ | 1,330 |

|

| | | | | | |

Denominator (Units in millions): | | | | | |

| Average Common Shares Outstanding | 850 |

| 902 |

| | 866 |

| 916 |

|

| Other Potentially Dilutive Common Shares | 4 |

| 4 |

| | 4 |

| 3 |

|

| Average Common Shares Outstanding, Assuming Dilution | 854 |

| 906 |

| | 870 |

| 919 |

|

| | | | | | |

| Net Earnings Per Share, Basic | $ | 1.05 |

| $ | 0.51 |

| | $ | 2.85 |

| $ | 1.45 |

|

| Net Earnings Per Share, Assuming Dilution | $ | 1.05 |

| $ | 0.51 |

| | $ | 2.83 |

| $ | 1.45 |

|

Basic earnings per share is based on the weighted-average number of shares of common stock outstanding. Earnings per share, assuming dilution, is based on the weighted-average number of shares of common stock outstanding and common stock equivalents outstanding adjusted for the effects of common stock that may be issued as a result of potentially dilutive instruments. CSX's potentially dilutive instruments are made up of equity awards, which include long-term incentive awardsincluding performance units and employee stock options.

The Earnings Per Share Topic in the FASB's ASC requires CSX to include additional shares in the computation of earnings per share, assuming dilution. The additional shares included in diluted earnings per share represent the number of shares that would be issued if all of the above potentially dilutive instruments were converted into CSX common stock.

When calculating diluted earnings per share, this rule requires CSX to include the potential shares that would be outstanding if all outstanding stock options were exercised.exercised are included. This number is different from outstanding stock options because it is offset by shares CSX could repurchase using the proceeds from these hypothetical exercises to obtain the common stock equivalent. Approximately seven600 thousandand10 million800 thousand of total average outstanding stock options for the thirdfirst quarters ended September 30,March 31, 2019 and March 31, 2018, and September 30, 2017, respectively, were excluded from the diluted earnings per share calculation because their effect was antidilutive.

|

| | |

| CSX Q3 2018 Form 10-Q p.10

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 2. Earnings Per Share, continued

Share Repurchases

In February 2018, the Company announced an increase to the $1.5 billion share repurchase program first announced in October 2017, bringing the total authorized to $5 billion. This program is expected to bewas completed byon January 16, 2019. Also on January 16, 2019, the end of first quarter 2019.Company announced a new $5 billion share repurchase program. During the thirdfirst quartersof 20182019 and 2017,2018, the Company repurchased approximately $1.0 billion,$796 million, or 12 million shares, and $836 million, or 15 million shares, and $1.0 billion, or 20 million shares, respectively. During the nine months of 2018 and 2017, the Company repurchased $2.8 billion, or 46 million shares, and $1.8 billion, or 35 million shares, respectively.

On July 19, 2018, the Company entered into an accelerated share repurchase agreement to repurchase shares of the Company’s common stock. Under this agreement, the Company made a prepayment of $500 million to a financial institution and received an initial delivery of 6 million shares valued at $400 million. The remaining balance of $100 million was settled through receipt of additional shares on October 11, 2018, with the final net number of shares calculated based on the volume-weighted average price of the Company's common stock over the term of the agreement, less a discount. Approximately 7 million total shares were repurchased under the agreement.

Under an accelerated share repurchase agreement executed in April 2018, the Company made a prepayment of $450 million to a financial institution and received an initial delivery of 6 million shares valued at $360 million. The remaining balance of $90 million was settled through receipt of additional shares in July 2018, with the final net number of shares calculated based on the volume-weighted average price of the Company's common stock over the term of the agreement, less a discount. Approximately 7 million total shares were repurchased under the agreement.

Under an accelerated share repurchase agreement executed in January 2018, the Company made a prepayment of $150 million to a financial institution and received an initial delivery of shares valued at $120 million. The remaining balance of $30 million was settled through receipt of additional shares in February 2018 with the final net number of shares calculated based on the volume-weighted average price of the Company's common stock over the term of the agreement, less a discount. Approximately 3 million total shares were repurchased under the agreement.

Management's

|

| | |

| CSX Q1 2019 Form 10-Q p.9

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 2. Earnings Per Share, continued

Share repurchases may be made through a variety of methods including, but not limited to, open market purchases, purchases pursuant to Rule 10b5-1 plans, accelerated share repurchases and negotiated block purchases. The timing of share repurchases depends upon management's assessment of marketmarketplace conditions and other factors, guidesand the timing and volumeprogram remains subject to the discretion of repurchases.the Board of Directors. Future share repurchases are expected to be funded by cash on hand, cash generated from operations and debt issuances. Shares are retired immediately upon repurchase. In accordance with the Equity Topic in the ASC, the excess of repurchase price over par value is recorded in retained earnings.

Dividend Increase

On February 6, 2019, the Company announced a 9 percent increase to the quarterly dividend from $0.22 per share of common stock to $0.24 per share of common stock, payable on March 15, 2019 to shareholders of record at the close of business on February 28, 2019.

|

| | |

| CSX Q3 2018 Form 10-Q p.11

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 3. Share-Based Compensation

Under CSX's share-based compensation plans, awards consist of performance units, restricted stock awards, restricted stock units and stock options for management and stock grants for directors. Awards granted under the various programs are determined and approved by the Compensation Committee of the Board of Directors or, in certain circumstances, by the Chief Executive Officer for awards to management employees other than senior executives. The Board of Directors approves awards granted to CSX's non-management directors upon recommendation of the Governance Committee.

Share-based compensation expense for awards under share-based compensation plans and purchases made as part of the employee stock purchase plan is measured using the fair value of the award on the grant date and is recognized on a straight-line basis over the service period of the respective award. Total pre-tax expense and income tax benefits associated with share-based compensation are shown in the table below. Income tax benefits include impacts from option exercises and the vesting of other equity awards.

|

| | | | | | |

| | First Quarters |

| (Dollars in millions) | 2019 | 2018 |

| | | |

| Share-Based Compensation Expense: | | |

| Performance Units | $ | 6 |

| $ | 6 |

|

| Stock Options | 2 |

| 4 |

|

| Restricted Stock Units and Awards | 2 |

| 1 |

|

| Stock Awards for Directors | 2 |

| 2 |

|

| Employee Stock Purchase Plan | 1 |

| — |

|

| Total Share-Based Compensation Expense | $ | 13 |

| $ | 13 |

|

| Income Tax Benefit | $ | 28 |

| $ | 8 |

|

|

| | |

| CSX Q1 2019 Form 10-Q p.10

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 3. Share-Based Compensation, continued

Long-term Incentive Plan

On February 6, 2019, the Company granted approximately 300 thousand performance units to certain employees under a new long-term incentive plan ("LTIP") for the years 2019 through 2021, which was adopted under the CSX Stock and Incentive Award Plan. During first quarter 2018, approximately 350 thousand performance units were granted pursuant to the corresponding LTIP.

Payouts of performance units for the cycle ending with fiscal year 2021 will be based on the achievement of goals related to both operating ratio and free cash flow, in each case excluding non-recurring items as disclosed in the Company's financial statements. The cumulative operating ratio and cumulative free cash flow over the plan period will each comprise 50% of the payout and will be measured independently of the other.

Grants were made in performance units, with each unit representing the right to receive one share of CSX common stock, and payouts will be made in CSX common stock. The payout range for participants will be between 0% and 200% of the target awards depending on Company performance against predetermined goals. Payouts for certain executive officers are subject to formulaic upward or downward adjustment by up to 25%, capped at an overall payout of 225%, based upon the Company's total shareholder return relative to specified comparable groups over the performance period. The fair values of the performance units awarded during the quarters ended March 31, 2019 and March 31, 2018 were calculated using a Monte-Carlo simulation model with the following weighted-average assumptions:

|

| | | | |

| | First Quarters |

| | 2019 | 2018 |

| Weighted-average assumptions used: | | |

| Annual dividend yield | 1.4 | % | 1.6 | % |

| Risk-free interest rate | 2.5 | % | 2.3 | % |

| Annualized volatility | 27.63 | % | 29.15 | % |

| Expected life (in years) | 2.9 |

| 2.9 |

|

Stock Options

Also, on February 6, 2019, the Company granted approximately 843 thousand stock options along with the corresponding LTIP. The fair value of stock options on the date of grant was $17.45 per option, which was calculated using the Black-Scholes valuation model. These stock options were granted with ten-year terms and vest over three years in equal installments each year on the anniversary of the grant date. The exercise price for stock options granted equals the closing market price of the underlying stock on the date of grant. These awards are time-based and are not based upon attainment of performance goals. During first quarter 2018, approximately 950 thousand stock options were granted pursuant to the corresponding LTIP.

|

| | |

| CSX Q1 2019 Form 10-Q p.11

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 3. Share-Based Compensation, continued

The fair values of all stock option awards during first quarters 2019 and 2018 were estimated at the grant date with the following weighted average assumptions:

|

| | | | | | |

| | First Quarters |

| | 2019 | 2018 |

| Weighted-average grant-date fair value | $ | 17.45 |

| $ | 14.62 |

|

| | | |

| Stock options valuation assumptions: | | |

| Annual dividend yield | 1.3 | % | 1.5 | % |

| Risk-free interest rate | 2.6 | % | 2.6 | % |

| Annualized volatility | 25.8 | % | 27.0 | % |

| Expected life (in years) | 6.0 |

| 6.5 |

|

| | | |

| Other pricing model inputs: | | |

| Weighted-average grant-date market price of CSX stock (strike price) | $ | 68.09 |

| $ | 54.07 |

|

Restricted Stock Units

Finally, on February 6, 2019, the Company granted approximately 65 thousand restricted stock units along with the corresponding LTIP. The restricted stock units vest three years after the date of grant. Participants receive cash dividend equivalents on the unvested shares during the restriction period. These awards are time-based and are not based upon CSX's attainment of operational targets. For information related to the Company's other outstanding long-term incentive compensation, see CSX's most recent annual report on Form 10-K. During first quarter 2018, approximately 85 thousand restricted stock units were granted pursuant to the corresponding LTIP. Restricted stock units are paid-out in CSX common stock on a one-for-one basis.

Employee Stock Purchase Plan

In May 2018, shareholders approved the 2018 CSX Employee Stock Purchase Plan (“ESPP”) for the benefit of Company employees. The Company registered 4 million shares of common stock that may be issued pursuant to this plan. Under the ESPP, employees may contribute between 1% and 10% of base compensation, after-tax, to purchase up to $25,000 of CSX common stock per year. No shares will be issued under the ESPP until first quarter 2019.

Share-based compensation expense is measured using the fair valueyear at 85% of the awardclosing market price on either the grant date and is recognized on a straight-line basis overor the service periodlast day of the respective award. Total pre-tax expense associated with share-based compensation and its related income tax benefitsix-month offering period, whichever is shown inlower. During the table below. The year over year decrease in third quarter share-based compensation expense is primarily due to the prior year expenseended March 31, 2019, 105 thousand shares of CSX stock were issued at a weighted average purchase price of $52.81 per share. These issuances were related to 9 million stock options grantedemployee contributions in February 2017 to former President and CEO E. Hunter Harrison, which were forfeited upon his death in December 2017. Additionally, the decrease in nine months expense was also due to modifications to the terms of awards in the first and second quarters of 2017 (see Equity Award Modifications below).2018.

|

| | | | | | | | | | | | | |

| | Third Quarters | | Nine Months |

| (Dollars in millions) | 2018 | 2017 | | 2018 | 2017 |

| | | | | | |

| Share-Based Compensation Expense: | | | | | |

| Performance Units | $ | 8 |

| $ | 3 |

| | $ | 22 |

| $ | 41 |

|

| Stock Options | 4 |

| 14 |

| | 10 |

| 47 |

|

| Restricted Stock Units and Awards | 1 |

| 2 |

| | 4 |

| 11 |

|

| Stock Awards for Directors | — |

| — |

| | 2 |

| 2 |

|

| Total Share-Based Compensation Expense | $ | 13 |

| $ | 19 |

| | $ | 38 |

| $ | 101 |

|

| Income Tax Benefit | $ | 6 |

| $ | 12 |

| | $ | 23 |

| $ | 41 |

|

Long-term Incentive Plan

In February 2018, the Company granted approximately 350 thousand performance units to certain employees under a new long-term incentive plan ("LTIP") for the years 2018 through 2020, which was adopted under the CSX Stock and Incentive Award Plan. During third quarter 2018, there were immaterial grants of performance units to certain members of management. No performance units were granted during third quarter 2017.

Payouts of performance units for the cycle ending with fiscal year 2020 will be based on the achievement of goals related to both operating ratio and free cash flow, in each case excluding non-recurring items as disclosed in the Company's financial statements. The final year operating ratio and cumulative free cash flow over the plan period will each comprise 50% of the payout and will be measured independently of the other.

|

| | |

| | CSX Q3 2018Q1 2019 Form 10-Q p.12

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 3. Share-Based Compensation, continued

Grants were made in performance units, with each unit representing the right to receive one share of CSX common stock, and payouts will be made in CSX common stock. The payout range for participants will be between 0% and 200% of the target awards depending on Company performance against predetermined goals. Payouts for certain executive officers are subject to upward or downward adjustment by up to 25%, capped at an overall payout of 200%, based upon the Company's total shareholder return relative to specified comparable groups over the performance period. The fair value of the performance units awarded during the quarter and nine months ended September 30, 2018 was calculated using a Monte-Carlo simulation model with the following weighted-average assumptions:

|

| | | | | |

| | Third Quarter | | Nine Months |

| | 2018 | | 2018 |

| Weighted-average assumptions used: | | | |

| Annual dividend yield | 1.2 | % | | 1.6 | % |

| Risk-free interest rate | 2.7 | % | | 2.3 | % |

| Annualized volatility | 27.9 | % | | 29.1 | % |

| Expected life (in years) | 2.3 |

| | 2.9 |

|

Stock Options

Also, in February 2018, the Company granted approximately 950 thousand stock options along with the corresponding LTIP. The fair value of stock options on the date of grant was $14.55 per option which was calculated using the Black-Scholes valuation model. Stock options have been granted with ten-year terms and vest three years after the date of grant. The exercise price for stock options granted equals the closing market price of the underlying stock on the date of grant. These awards are time-based and are not based upon attainment of performance goals. During third quarter 2018, there were immaterial grants of stock options to certain members of management. No stock options awards were granted during third quarter 2017.

The fair values of all stock option awards during the quarter and nine months ended September 30, 2018 and September 30, 2017 were estimated at the grant date with the following weighted average assumptions:

|

| | | | | | | | | | | | | |

| | Third Quarters | | Nine Months |

| | 2018 | 2017 | | 2018 | 2017 |

| Weighted-average grant date fair value | $ | 20.52 |

| $ | — |

| | $ | 14.65 |

| $ | 12.83 |

|

| | | | | | |

| Stock options valuation assumptions: | | | | | |

| Annual dividend yield | 1.2 | % | — | % | | 1.5 | % | 1.5 | % |

| Risk-free interest rate | 2.8 | % | — | % | | 2.6 | % | 2.2 | % |

| Annualized volatility | 25.5 | % | — | % | | 27.0 | % | 27.1 | % |

| Expected life (in years) | 6.5 |

| — |

| | 6.5 |

| 6.3 |

|

| | | | | | |

| Other pricing model inputs: | | | | | |

| Weighted-average grant-date market price of CSX stock (strike price) | $ | 74.84 |

| $ | — |

| | $ | 54.19 |

| $ | 49.60 |

|

|

| | |

| CSX Q3 2018 Form 10-Q p.13

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 3. Share-Based Compensation, continued

Restricted Stock Units

Finally, in February 2018, the Company granted approximately 85 thousand restricted stock units along with the corresponding LTIP. The restricted stock units vest three years after the date of grant. Participants receive cash dividend equivalents on the unvested shares during the restriction period. These awards are time-based and are not based upon attainment of performance goals. For information related to the Company's other outstanding long-term incentive compensation, see CSX's most recent annual report on Form 10-K. During third quarter 2018, there were immaterial grants of restricted stock units to certain members of management. No restricted stock units were granted during third quarter 2017.

Equity Award Modifications

In 2017, as part of an enhanced severance benefit under the management streamlining and realignment initiative discussed in Note 1, unvested performance units, restricted stock units and stock options for separated employees not eligible for retirement were permitted to vest on a pro-rata basis. Additionally, the terms of unvested equity awards for the former Chief Executive Officer, Michael J. Ward, and former President, Clarence W. Gooden, were modified prior to their retirements on March 6, 2017 to permit prorated vesting through May 31, 2018. These award modifications impacted approximately 70 employees and resulted in an increase to share-based compensation expense for revaluation of the affected awards of $31 million for the nine months ended September 30, 2017. The expense associated with these award modifications was included in the 2017 restructuring charge. No significant award modifications took place in 2018 or in third quarter 2017.

NOTE 4. Casualty, Environmental and Other Reserves

Personal injury and environmental reserves are considered critical accounting estimates due to the need for significant management judgment. Casualty, environmental and other reserves are provided for in the consolidated balance sheets as shown in the table below.

|

| | | | | | | | | | | | | | | | | | | |

| | March 31, 2019 | | December 31, 2018 |

| (Dollars in millions) | Current | Long-term | Total | | Current | Long-term | Total |

| | | | | | | | |

| Casualty: | | | | | | | |

| Personal Injury | $ | 41 |

| $ | 100 |

| $ | 141 |

| | $ | 40 |

| $ | 103 |

| $ | 143 |

|

| Occupational | 10 |

| 44 |

| 54 |

| | 10 |

| 46 |

| 56 |

|

| Total Casualty | 51 |

| 144 |

| 195 |

| | 50 |

| 149 |

| 199 |

|

| Environmental | 38 |

| 42 |

| 80 |

| | 39 |

| 41 |

| 80 |

|

| Other | 23 |

| 21 |

| 44 |

| | 24 |

| 21 |

| 45 |

|

| Total | $ | 112 |

| $ | 207 |

| $ | 319 |

| | $ | 113 |

| $ | 211 |

| $ | 324 |

|

|

| | | | | | | | | | | | | | | | | | | |

| | September 30, 2018 | | December 31, 2017 |

| (Dollars in millions) | Current | Long-term | Total | | Current | Long-term | Total |

| | | | | | | | |

| Casualty: | | | | | | | |

| Personal Injury | $ | 42 |

| $ | 108 |

| $ | 150 |

| | $ | 43 |

| $ | 125 |

| $ | 168 |

|

| Occupational | 7 |

| 47 |

| 54 |

| | 6 |

| 54 |

| 60 |

|

| Total Casualty | 49 |

| 155 |

| 204 |

| | 49 |

| 179 |

| 228 |

|

| Environmental | 37 |

| 52 |

| 89 |

| | 31 |

| 59 |

| 90 |

|

| Other | 24 |

| 24 |

| 48 |

| | 28 |

| 28 |

| 56 |

|

| Total | $ | 110 |

| $ | 231 |

| $ | 341 |

| | $ | 108 |

| $ | 266 |

| $ | 374 |

|

These liabilities are accrued when probable and reasonably estimable and probable in accordance with the Contingencies Topic in the ASC. Actual settlements and claims received could differ, and final outcomes of these matters cannot be predicted with certainty. Considering the legal defenses currently available, the liabilities that have been recorded and other factors, it is the opinion of management that none of these items individually, when finally resolved, will have a material adverse effect on the Company's financial condition, results of operations or liquidity. Should a number of these items occur in the same period, however, their combined effect could be material in that particular period.

|

| | |

| CSX Q3 2018 Form 10-Q p.14

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 4. Casualty, Environmental and Other Reserves, continued

Casualty

Casualty reserves of $204$195 million and $228$199 million as of September 30, 2018March 31, 2019 and December 31, 2017,2018, respectively, represent accruals for personal injury, occupational disease and occupational injury claims. During second quarter 2018, the Company increased its self-insured retention amount for these claims from $50 million to $75 million per occurrence for claims occurring on or after June 1, 2018. Currently, no individual claim is expected to exceed the self-insured retention amount. In accordance with the Contingencies Topic in the ASC, to the extent the value of an individual claim exceeds the self-insured retention amount, the Company would present the liability on a gross basis with a corresponding receivable for insurance recoveries. These reserves fluctuate based upon the timing of payments as well as changes in estimate. Actual results may vary from estimates due to the number, type and severity of the injury, costs of medical treatments and uncertainties in litigation. Most of the Company's casualty claims relate to CSXT unless otherwise noted below.CSXT. Defense and processing costs, which historically have been insignificant and are anticipated to be insignificant in the future, are not included in the recorded liabilities.

|

| | |

| CSX Q1 2019 Form 10-Q p.13

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 4. Casualty, Environmental and Other Reserves, continued

Personal Injury

Personal injury reserves represent liabilities for employee work-related and third-party injuries. Work-related injuries for CSXT employees are primarily subject to the Federal Employers’ Liability Act (“FELA”). CSXT retains an independent actuary to assist management in assessing the value of personal injury claims. An analysis is performed by the actuary quarterly and is reviewed by management. This analysis for the quarter resulted in an immaterial adjustment to the personal injury reserve. The methodology used by the actuary includes a development factor to reflect growth or reduction in the value of these personal injury claims based largely on CSXT's historical claims and settlement experience.

Occupational

Occupational reserves represent liabilities for occupational disease and injury claims. Occupational disease claims arise primarily from allegations of exposure to asbestos in the workplace. Occupational injury claims arise from allegations of exposure to certain other materials in the workplace, such as solvents, soaps, chemicals (collectively referred to as “irritants”) and diesel fuels (like exhaust fumes) or allegations of chronic physical injuries resulting from work conditions, such as repetitive stress injuries.

Environmental

Environmental reserves were $89 million and $90$80 million as of September 30, 2018each March 31, 2019 and December 31, 2017, respectively.2018. The Company is a party to various proceedings related to environmental issues, including administrative and judicial proceedings involving private parties and regulatory agencies. The Company has been identified as a potentially responsible party at approximately 216226 environmentally impaired sites. Many of these are, or may be, subject to remedial action under the federal Comprehensive Environmental Response, Compensation and Liability Act of 1980 ("CERCLA"), also known as the Superfund Law, or similar state statutes. Most of these proceedings arose from environmental conditions on properties used for ongoing or discontinued railroad operations. A number of these proceedings, however, are based on allegations that the Company, or its predecessors, sent hazardous substances to facilities owned or operated by others for treatment, recycling or disposal. In addition, some of the Company's land holdings were leased to others for commercial or industrial uses that may have resulted in releases of hazardous substances or other regulated materials onto the property and could give rise to proceedings against the Company.

|

| | |

| CSX Q3 2018 Form 10-Q p.15

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 4. Casualty, Environmental and Other Reserves, continued

In any such proceedings, the Company is subject to environmental clean-up and enforcement actions under the Superfund Law, as well as similar state laws that may impose joint and several liability for clean-up and enforcement costs on current and former owners and operators of a site without regard to fault or the legality of the original conduct. These costs could be substantial.

|

| | |

| CSX Q1 2019 Form 10-Q p.14

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 4. Casualty, Environmental and Other Reserves, continued

In accordance with the Asset Retirement and Environmental Obligations Topic in the ASC, the Company reviews its role with respect to each site identified at least quarterly, giving consideration to a number of factors such as:

type of clean-up required;

nature of the Company's alleged connection to the location (e.g., generator of waste sent to the site or owner or operator of the site);

extent of the Company's alleged connection (e.g., volume of waste sent to the location and other relevant factors); and

number, connection and financial viability of other named and unnamed potentially responsible parties at the location.

Based on the review process, the Company has recorded amounts to cover contingent anticipated future environmental remediation costs with respect to each site to the extent such costs are reasonably estimable and probable. The recorded liabilities for estimated future environmental costs are undiscounted. The liability includes future costs for remediation and restoration of sites as well as any significant ongoing

monitoring costs, but excludes any anticipated insurance recoveries. Payments related to these liabilities are expected to be made over the next several years. Environmental remediation costs are included in materials, supplies and other on the consolidated income statements.

Currently, the Company does not possess sufficient information to reasonably estimate the amounts of additional liabilities, if any, on some sites until completion of future environmental studies. In addition, conditions that are currently unknown could, at any given location, result in additional exposure, the amount and materiality of which cannot presently be reasonably estimated. Based upon information currently available, however, the Company believes its environmental reserves accurately reflect the estimated cost of remedial actions currently required.

Other

Other reserves of $48$44 million and $56$45 million as of September 30, 2018March 31, 2019 and December 31, 2017, respectively,2018, respectively. These reserves include liabilities for various claims, such as property, automobile and general liability. Also included in other reserves are longshoremen disability claims related to a previously owned international shipping business (these claims are in runoff) as well as claims for current port employees.

|

| | |

| | CSX Q3 2018Q1 2019 Form 10-Q p.16p.15

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 5. Leases

CSX has various lease agreements with terms up to 50 years, including leases of land, land with integral equipment (e.g. track), buildings and various equipment. Some leases include options to purchase, terminate or extend for one or more years. These options are included in the lease term when it is reasonably certain that the option will be exercised.

At inception, the Company determines if an arrangement contains a lease and whether that lease meets the classification criteria of a finance or operating lease. Some of the Company’s lease arrangements contain lease components (e.g. minimum rent payments) and non-lease components (e.g. maintenance, labor charges, etc.). The Company generally accounts for each component separately based on the estimated standalone price of each component. For certain equipment leases, such as freight car, vehicles and work equipment, the Company accounts for the lease and non-lease components as a single lease component.

Certain of the Company’s lease agreements include rental payments that are adjusted periodically for an index or rate. The leases are initially measured using the projected payments adjusted for the index or rate in effect at the commencement date. The Company’s lease agreements do not contain any material residual value guarantees or material restrictive covenants.

Operating Leases

Operating leases are included in right-of-use lease assets, other current liabilities and long-term lease liabilities on the consolidated balance sheets. These assets and liabilities are recognized at the commencement date based on the present value of remaining lease payments over the lease term using the Company’s secured incremental borrowing rates or implicit rates, when readily determinable. Short-term operating leases, which have an initial term of 12 months or less, are not recorded on the balance sheet.

Lease expense for operating leases is recognized on a straight-line basis over the lease term. Variable lease expense is recognized in the period in which the obligation for those payments is incurred. Lease expense is included in equipment and other rents on the consolidated income statements and is reported net of lease income. Lease income is not material to the results of operations for the quarter ended March 2019.

|

| | |

| CSX Q1 2019 Form 10-Q p.16

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 5. Leases, continued

The following table presents information about the amount, timing and uncertainty of cash flows arising from the Company’s operating leases as of March 31, 2019.

|

| | | |

| (Dollars in Millions) | March 31, 2019 |

| Maturity of Lease Liabilities | Lease Payments |

| 2019 (remaining) | $ | 41 |

|

| 2020 | 56 |

|

| 2021 | 49 |

|

| 2022 | 44 |

|

| 2023 | 38 |

|

| Thereafter | 1,241 |

|

| Total undiscounted operating lease payments | $ | 1,469 |

|

| Less: Imputed interest | (914 | ) |

| Present value of operating lease liabilities | $ | 555 |

|

| | |

| Balance Sheet Classification | |

| Current lease liabilities (recorded in other current liabilities) | $ | 53 |

|

| Long-term lease liabilities | 502 |

|

| Total operating lease liabilities | $ | 555 |

|

| | |

| Other Information | |

| Weighted-average remaining lease term for operating leases | 33 years |

|

| Weighted-average discount rate for operating leases | 5.0 | % |

Cash Flows

An initial right-of-use asset of $534 million was recognized as a non-cash asset addition with the adoption of the new lease accounting standard. Additional right-of-use assets of $30 million were recognized as non-cash asset additions that resulted from new operating lease liabilities during first quarter 2019. Cash paid for amounts included in the present value of operating lease liabilities was $14 million during first quarter 2019 and is included in operating cash flows.

Operating Lease Costs

Operating lease costs were $18 million during first quarter 2019. These costs are primarily related to long-term operating leases, but also include immaterial amounts for variable leases and short-term leases with terms greater than 30 days.

Finance Leases

Finance leases are included in properties - net and long-term debt on the consolidated balance sheets. The associated amortization expense and interest expense are included in depreciation and interest expense, respectively, on the consolidated income statements. These leases are not material to the consolidated financial statements as of March 31, 2019.

|

| | |

| CSX Q1 2019 Form 10-Q p.17

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 5.6. Commitments and Contingencies

Insurance

The Company maintains numerous insurance programs with substantial limits for property damage (which includes business interruption) and third-party liability. A certain amount of risk is retained by the Company on each of the property and liability programs. The Company has a $50 million per occurrence retention for floods and named windstorms and a $25 million per occurrence retention for property losses other than floods and named windstorms. For claims occurring on or after June 1, 2018, the Company increased its self-insured retention for third-party liability claims from $50 million to $75 million per occurrence. While the Company believes its insurance coverage is adequate, future claims could exceed existing insurance coverage or insurance may not continue to be available at commercially reasonable rates.

Legal

The Company is involved in litigation incidental to its business and is a party to a number of legal actions and claims, various governmental proceedings and private civil lawsuits, including, but not limited to, those related to fuel surcharge practices, tax matters, environmental and hazardous material exposure matters, FELA and labor claims by current or former employees, other personal injury or property claims and disputes and complaints involving certain transportation rates and charges. Some of the legal proceedings include claims for compensatory as well as punitive damages and others are, or are purported to be, class actions. While the final outcome of these matters cannot be reasonably determined, considering, among other things, the legal defenses available and liabilities that have been recorded along with applicable insurance, it is currently the opinion of management that none of these pending items is likely to have a material adverse effect on the Company's financial condition, results of operations or liquidity. An unexpected adverse resolution of one or more of these items, however, could have a material adverse effect on the Company's financial condition, results of operations or liquidity in that particular period.

The Company is able to estimate a range of possible loss for certain legal proceedings for which a loss is reasonably possible in excess of reserves established. The Company has estimated this range to be $2$4 million to $118$102 million in aggregate at September 30, 2018.March 31, 2019. This estimated aggregate range is based upon currently available information and is subject to significant judgment and a variety of assumptions. Accordingly, the Company's estimate will change from time to time, and actual losses may vary significantly from the current estimate.

Fuel Surcharge Antitrust Litigation

In May 2007, class action lawsuits were filed against CSXT and three other U.S.-based Class I railroads alleging that the defendants' fuel surcharge practices relating to contract and unregulated traffic resulted from an illegal conspiracy in violation of antitrust laws. In November 2007, the class action lawsuits were consolidated in federal court in the District of Columbia, where they are now pending. The suit seeks treble damages allegedly sustained by purported class members as well as attorneys' fees and other relief. Plaintiffs are expected to allege damages at least equal to the fuel surcharges at issue.

|

| | |

| | CSX Q3 2018Q1 2019 Form 10-Q p.17p.18

|

|

CSX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 5.6. Commitments and Contingencies, continued

In June 2012, the District Court certified the case as a class action. The decision was not a ruling on the merits of plaintiffs' claims, but rather a decision to allow the plaintiffs to seek to prove the case as a class. The defendant railroads petitioned the U.S. Court of Appeals for the D.C. Circuit for permission to appeal the District Court's class certification decision. In August 2013, the D.C. Circuit issued a decision vacating the class certification decision and remanded the case to the District Court to reconsider its class certification decision. On October 10, 2017, the District Court issued an order denying class certification. The U.S. Court of Appeals for the D.C. Circuit is reviewing the District Court's denial of class certification and held oral argument on September 28, 2018, with a decision yet to be issued. The District Court has delayed proceedings on the merits of the case pending the outcome of the class certification proceedings.