UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

| |

| (Mark one) | |

| ý | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | For the quarterly period ended June 30, 20172018 |

| | |

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | For the transition period from _________to_________ |

Commission File Number 1-8052

TORCHMARK CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

| DELAWARE | | 63-0780404 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| 3700 South Stonebridge Drive, McKinney, Texas | | 75070 |

| (Address of principal executive offices) | | (Zip Code) |

NONE

Former name, former address and former fiscal year, if changed since last report.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yesý No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YesýNo¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

| Large accelerated filer | | ý | | Accelerated filer | | ¨ |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

| | | | | Emerging growth company | | ¨ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes¨Noý

Indicate the number of shares outstanding for each of the issuer’s classes of common stock, as of the last practicable date. |

| | | | |

| | CLASS | | OUTSTANDING AT July 31, 20172018 | |

| | Common Stock, $1.00 Par Value | | 116,320,319112,693,381 | |

INDEX

|

| | | |

| | | | Page |

| |

| | | | |

| Item 1. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| Item 2. | | |

| | | | |

| Item 3. | | |

| | | | |

| Item 4. | | |

| | | |

| |

| | | | |

| Item 1. | | |

| | | | |

| Item 1A. | | |

| | | | |

| Item 2. | | |

| | | | |

| Item 6. | | |

PART I–FINANCIAL INFORMATION

|

| |

| Item 1. | Condensed Consolidated Financial Statements |

TORCHMARK CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(Dollar amounts in thousands)thousands, except per share data)

| | | | June 30,

2017 | | December 31,

2016 | June 30,

2018 | | December 31,

2017 |

| Assets: |

| | |

| | |

| Investments: | | | | | | |

| Fixed maturities—available for sale, at fair value (amortized cost: 2017—$14,651,551; 2016—$14,188,050) | $ | 16,318,286 |

| | $ | 15,245,861 |

| |

| Fixed maturities—available for sale, at fair value (amortized cost: 2018—$15,350,152; 2017—$14,995,101) | | $ | 16,284,691 |

| | $ | 16,969,325 |

|

| Policy loans | 516,064 |

| | 507,975 |

| 537,808 |

| | 529,529 |

|

| Other long-term investments | 55,532 |

| | 53,852 |

| |

| Other long-term investments (includes: 2018—$108,452; 2017—$0, under the fair value option) | | 181,676 |

| | 108,559 |

|

| Short-term investments | 94,387 |

| | 72,040 |

| 68,544 |

| | 127,071 |

|

| Total investments | 16,984,269 |

| | 15,879,728 |

| 17,072,719 |

| | 17,734,484 |

|

| Cash | 97,652 |

| | 76,163 |

| 82,230 |

| | 118,563 |

|

| Accrued investment income | 228,347 |

| | 223,148 |

| 237,985 |

| | 233,453 |

|

| Other receivables | 380,028 |

| | 384,454 |

| 407,676 |

| | 391,775 |

|

| Deferred acquisition costs | 3,862,418 |

| | 3,783,158 |

| 4,045,890 |

| | 3,958,063 |

|

| Goodwill | 441,591 |

| | 441,591 |

| 441,591 |

| | 441,591 |

|

| Other assets | 515,012 |

| | 520,313 |

| 522,042 |

| | 528,536 |

|

| Assets related to discontinued operations | 68,623 |

| | 127,532 |

| 68,568 |

| | 68,520 |

|

| Total assets | $ | 22,577,940 |

| | $ | 21,436,087 |

| $ | 22,878,701 |

| | $ | 23,474,985 |

|

| Liabilities: | | | | | | |

| Future policy benefits | $ | 13,127,651 |

| | $ | 12,825,837 |

| $ | 13,702,887 |

| | $ | 13,439,472 |

|

| Unearned and advance premiums | 69,106 |

| | 64,017 |

| 66,872 |

| | 61,430 |

|

| Policy claims and other benefits payable | 307,384 |

| | 299,565 |

| 329,469 |

| | 333,294 |

|

| Other policyholders' funds | 97,237 |

| | 96,993 |

| 96,575 |

| | 97,635 |

|

| Total policy liabilities | 13,601,378 |

| | 13,286,412 |

| 14,195,803 |

| | 13,931,831 |

|

| Current and deferred income taxes payable | 2,009,825 |

| | 1,743,990 |

| 1,098,411 |

| | 1,312,002 |

|

| Other liabilities | 436,105 |

| | 413,760 |

| 474,264 |

| | 489,609 |

|

| Short-term debt | 306,271 |

| | 264,475 |

| 671,666 |

| | 328,067 |

|

| Long-term debt (estimated fair value: 2017—$1,250,875; 2016—$1,233,019) | 1,131,796 |

| | 1,133,165 |

| |

| Long-term debt (estimated fair value: 2018—$849,903; 2017—$1,228,392) | | 817,474 |

| | 1,132,201 |

|

| Liabilities related to discontinued operations | 39,149 |

| | 27,424 |

| 49,474 |

| | 49,854 |

|

| Total liabilities | 17,524,524 |

| | 16,869,226 |

| 17,307,092 |

| | 17,243,564 |

|

Commitments and Contingencies (Note 6) |

| |

|

| |

|

| Shareholders’ equity: | | | | | | |

| Preferred stock, par value $1 per share—Authorized 5,000,000 shares; outstanding: -0- in 2017 and 2016 | — |

| | — |

| |

| Common stock, par value $1 per share—Authorized 320,000,000 shares; outstanding: (2017—127,218,183 issued, less 10,959,454 held in treasury and 2016—127,218,183 issued, less 9,187,075 held in treasury) | 127,218 |

| | 127,218 |

| |

| Preferred stock, par value $1 per share—Authorized 5,000,000 shares; outstanding: -0- in 2018 and 2017 | | — |

| | — |

|

| Common stock, par value $1 per share—Authorized 320,000,000 shares; outstanding: (2018—124,218,183 issued, less 11,294,710 held in treasury and 2017—124,218,183 issued, less 9,625,104 held in treasury) | | 124,218 |

| | 124,218 |

|

| Additional paid-in capital | 500,123 |

| | 490,421 |

| 517,077 |

| | 508,476 |

|

| Accumulated other comprehensive income | 984,560 |

| | 577,574 |

| 603,499 |

| | 1,424,274 |

|

| Retained earnings | 4,112,757 |

| | 3,890,798 |

| 5,115,071 |

| | 4,806,208 |

|

| Treasury stock, at cost | (671,242 | ) | | (519,150 | ) | (788,256 | ) | | (631,755 | ) |

| Total shareholders’ equity | 5,053,416 |

| | 4,566,861 |

| 5,571,609 |

| | 6,231,421 |

|

| Total liabilities and shareholders’ equity | $ | 22,577,940 |

| | $ | 21,436,087 |

| $ | 22,878,701 |

| | $ | 23,474,985 |

|

See accompanying Notes to Condensed Consolidated Financial Statements.

1

TMK 2018 FORM 10-Q QTR 2

TORCHMARK CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(Dollar amounts in thousands, except per share data)

| | | | Three Months Ended

June 30, | | Six Months Ended

June 30, | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2017 | | 2016 | | 2017 | | 2016 | 2018 | | 2017 | | 2018 | | 2017 |

| Revenue: | | | | | | | | | | | | | | |

| Life premium | $ | 573,836 |

| | $ | 548,590 |

| | $ | 1,149,673 |

| | $ | 1,092,741 |

| $ | 602,534 |

| | $ | 573,836 |

| | $ | 1,200,837 |

| | $ | 1,149,673 |

|

| Health premium | 242,775 |

| | 237,252 |

| | 487,566 |

| | 472,949 |

| 251,440 |

| | 242,775 |

| | 503,238 |

| | 487,566 |

|

| Other premium | 3 |

| | 13 |

| | 6 |

| | 25 |

| 5 |

| | 3 |

| | 10 |

| | 6 |

|

| Total premium | 816,614 |

| | 785,855 |

| | 1,637,245 |

| | 1,565,715 |

| 853,979 |

| | 816,614 |

| | 1,704,085 |

| | 1,637,245 |

|

| Net investment income | 212,776 |

| | 201,642 |

| | 421,058 |

| | 398,695 |

| 218,568 |

| | 212,776 |

| | 436,652 |

| | 421,058 |

|

| Realized investment gains (losses) | (705 | ) | | 4,005 |

| | (6,453 | ) | | 4,298 |

| 11,813 |

| | (705 | ) | | 13,764 |

| | (6,453 | ) |

| Other income | 393 |

| | 382 |

| | 809 |

| | 803 |

| 416 |

| | 393 |

| | 711 |

| | 809 |

|

| Total revenue | 1,029,078 |

| | 991,884 |

| | 2,052,659 |

| | 1,969,511 |

| 1,084,776 |

| | 1,029,078 |

| | 2,155,212 |

| | 2,052,659 |

|

| | | | | | | | | | | | | | | |

| Benefits and expenses: | | | | | | | | | | | | | | |

| Life policyholder benefits | 390,859 |

| | 369,342 |

| | 781,938 |

| | 732,202 |

| 399,334 |

| | 390,859 |

| | 799,915 |

| | 781,938 |

|

| Health policyholder benefits | 156,579 |

| | 153,261 |

| | 314,330 |

| | 306,036 |

| 160,461 |

| | 156,579 |

| | 321,080 |

| | 314,330 |

|

| Other policyholder benefits | 8,977 |

| | 8,882 |

| | 17,923 |

| | 18,220 |

| 8,582 |

| | 8,977 |

| | 17,271 |

| | 17,923 |

|

| Total policyholder benefits | 556,415 |

| | 531,485 |

| | 1,114,191 |

| | 1,056,458 |

| 568,377 |

| | 556,415 |

| | 1,138,266 |

| | 1,114,191 |

|

| Amortization of deferred acquisition costs | 122,121 |

| | 117,245 |

| | 248,029 |

| | 236,051 |

| 129,077 |

| | 122,121 |

| | 258,697 |

| | 248,029 |

|

| Commissions, premium taxes, and non-deferred acquisition costs | 65,032 |

| | 62,854 |

| | 130,148 |

| | 124,456 |

| 69,427 |

| | 65,032 |

| | 139,066 |

| | 130,148 |

|

| Other operating expense | 62,428 |

| | 57,846 |

| | 124,769 |

| | 115,275 |

| 68,620 |

| | 62,428 |

| | 135,444 |

| | 124,769 |

|

| Interest expense | 21,156 |

| | 23,110 |

| | 41,855 |

| | 42,479 |

| 22,411 |

| | 21,156 |

| | 44,033 |

| | 41,855 |

|

| Total benefits and expenses | 827,152 |

| | 792,540 |

| | 1,658,992 |

| | 1,574,719 |

| 857,912 |

| | 827,152 |

| | 1,715,506 |

| | 1,658,992 |

|

| | | | | | | | | | | | | | | |

| Income before income taxes | 201,926 |

| | 199,344 |

| | 393,667 |

| | 394,792 |

| 226,864 |

| | 201,926 |

| | 439,706 |

| | 393,667 |

|

| Income taxes | (61,563 | ) | | (60,050 | ) | | (116,126 | ) | | (121,924 | ) | (42,471 | ) | | (61,563 | ) | | (81,602 | ) | | (116,126 | ) |

| Income from continuing operations | 140,363 |

| | 139,294 |

| | 277,541 |

| | 272,868 |

| 184,393 |

| | 140,363 |

| | 358,104 |

| | 277,541 |

|

| | | | | | | | | | | | | | | |

| Income (loss) from discontinued operations, net of tax | (90 | ) | | (865 | ) | | (3,727 | ) | | (10,406 | ) | 32 |

| | (90 | ) | | (79 | ) | | (3,727 | ) |

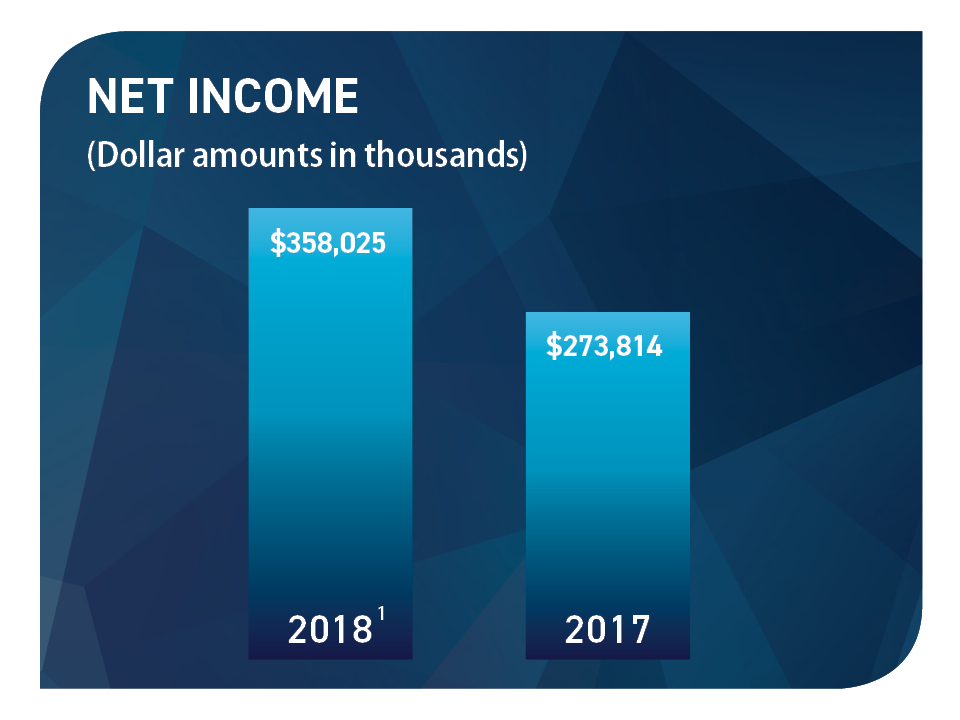

| Net income | $ | 140,273 |

| | $ | 138,429 |

| | $ | 273,814 |

| | $ | 262,462 |

| $ | 184,425 |

| | $ | 140,273 |

| | $ | 358,025 |

| | $ | 273,814 |

|

| | | | | | | | | | | | | | | |

| Basic net income (loss) per common share: | | | |

| | | | | | |

| | | |

| Continuing operations | $ | 1.20 |

| | $ | 1.16 |

| | $ | 2.37 |

| | $ | 2.26 |

| $ | 1.63 |

| | $ | 1.20 |

| | $ | 3.15 |

| | $ | 2.37 |

|

| Discontinued operations | — |

| | (0.01 | ) | | (0.03 | ) | | (0.09 | ) | — |

| | — |

| | — |

| | (0.03 | ) |

| Total basic net income per common share | $ | 1.20 |

| | $ | 1.15 |

| | $ | 2.34 |

| | $ | 2.17 |

| $ | 1.63 |

| | $ | 1.20 |

| | $ | 3.15 |

| | $ | 2.34 |

|

| | | | | | | | | | | | | | | |

| Diluted net income (loss) per common share: | | | |

| | | | | | |

| | | |

| Continuing operations | $ | 1.18 |

| | $ | 1.13 |

| | $ | 2.32 |

| | $ | 2.22 |

| $ | 1.59 |

| | $ | 1.18 |

| | $ | 3.08 |

| | $ | 2.32 |

|

| Discontinued operations | — |

| | — |

| | (0.03 | ) | | (0.09 | ) | — |

| | — |

| | — |

| | (0.03 | ) |

| Total diluted net income per common share | $ | 1.18 |

| | $ | 1.13 |

| | $ | 2.29 |

| | $ | 2.13 |

| $ | 1.59 |

| | $ | 1.18 |

| | $ | 3.08 |

| | $ | 2.29 |

|

| | | | | | | | | | | | | | | |

| Dividends declared per common share | $ | 0.15 |

| | $ | 0.14 |

| | $ | 0.30 |

| | $ | 0.28 |

| $ | 0.16 |

| | $ | 0.15 |

| | $ | 0.32 |

| | $ | 0.30 |

|

See accompanying Notes to Condensed Consolidated Financial Statements.

2

TMK 2018 FORM 10-Q QTR 2

TORCHMARK CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(Dollar amounts in thousands)

| | | | Three Months Ended

June 30, | | Six Months Ended

June 30, | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2017 | | 2016 | | 2017 | | 2016 | 2018 | | 2017 | | 2018 | | 2017 |

| Net income | $ | 140,273 |

| | $ | 138,429 |

| | $ | 273,814 |

| | $ | 262,462 |

| $ | 184,425 |

| | $ | 140,273 |

| | $ | 358,025 |

| | $ | 273,814 |

|

| | | | | | | | | | | | | | | |

| Other comprehensive income (loss): | | | | | | | | | | | | | | |

| Unrealized investment gains (losses): | | | | | | | | |

| | | | | | | | | |

| Investments: | | | | | | | | |

| Unrealized gains (losses) on securities: | | | | | | | | | | | | | | |

| Unrealized holding gains (losses) arising during period | 394,004 |

| | 695,984 |

| | 609,531 |

| | 1,161,141 |

| (417,616 | ) | | 394,004 |

| | (1,029,164 | ) | | 609,531 |

|

| Reclassification adjustment for (gains) losses on securities included in net income | 681 |

| | (3,983 | ) | | (354 | ) | | (4,296 | ) | (9,431 | ) | | 681 |

| | (10,817 | ) | | (354 | ) |

| Reclassification adjustment for amortization of (discount) and premium | (61 | ) | | (1,204 | ) | | (498 | ) | | (2,568 | ) | 870 |

| | (61 | ) | | 1,560 |

| | (498 | ) |

| Foreign exchange adjustment on securities recorded at fair value | 230 |

| | 593 |

| | 245 |

| | 1,048 |

| (679 | ) | | 230 |

| | (1,264 | ) | | 245 |

|

| Unrealized gains (losses) on securities | 394,854 |

| | 691,390 |

| | 608,924 |

| | 1,155,325 |

| (426,856 | ) | | 394,854 |

| | (1,039,685 | ) | | 608,924 |

|

| Unrealized gains (losses) on other investments | 2,075 |

| | 1,225 |

| | 3,071 |

| | 1,883 |

| 1,051 |

| | 2,075 |

| | (1,802 | ) | | 3,071 |

|

| Total unrealized investment gains (losses) | 396,929 |

| | 692,615 |

|

| 611,995 |

|

| 1,157,208 |

| (425,805 | ) | | 396,929 |

|

| (1,041,487 | ) |

| 611,995 |

|

| Less applicable tax (expense) benefit | (138,931 | ) | | (242,401 | ) | | (214,254 | ) | | (404,990 | ) | 89,423 |

| | (138,931 | ) | | 218,712 |

| | (214,254 | ) |

| Unrealized investment gains (losses), net of tax | 257,998 |

| | 450,214 |

| | 397,741 |

| | 752,218 |

| (336,382 | ) | | 257,998 |

| | (822,775 | ) | | 397,741 |

|

| | | | | | | | | | | | | | | |

| Deferred acquisition costs: | | | | | | | | |

| Unrealized gains (losses) attributable to deferred acquisition costs | (727 | ) | | (2,681 | ) | | (1,497 | ) | | (5,450 | ) | 2,041 |

| | (727 | ) | | 2,491 |

| | (1,497 | ) |

| Less applicable tax (expense) benefit | 254 |

| | 938 |

| | 524 |

| | 1,907 |

| (429 | ) | | 254 |

| | (523 | ) | | 524 |

|

| Unrealized gains (losses) attributable to deferred acquisition costs, net of tax | (473 | ) | | (1,743 | ) | | (973 | ) | | (3,543 | ) | 1,612 |

| | (473 | ) | | 1,968 |

| | (973 | ) |

| | | | | | | | | | | | | | | |

| Foreign exchange translation: | | | | | | | | |

| Foreign exchange translation adjustments, other than securities | 3,302 |

| | 5,382 |

| | 7,516 |

| | 7,142 |

| (6,217 | ) | | 3,302 |

| | (7,516 | ) | | 7,516 |

|

| Less applicable tax (expense) benefit | (1,153 | ) | | (1,898 | ) | | (1,581 | ) | | (2,438 | ) | 1,303 |

| | (1,153 | ) | | 1,579 |

| | (1,581 | ) |

| Foreign exchange translation adjustments, other than securities, net of tax | 2,149 |

| | 3,484 |

| | 5,935 |

| | 4,704 |

| (4,914 | ) | | 2,149 |

| | (5,937 | ) | | 5,935 |

|

| | | | | | | | | | | | | | | |

| Pension adjustments: | | | | | | | | |

| Pension: | | | | | | | | |

| Amortization of pension costs | 3,109 |

| | 2,551 |

| | 6,218 |

| | 5,103 |

| 3,778 |

| | 3,109 |

| | 7,556 |

| | 6,218 |

|

| Experience gain (loss) | — |

| | 105 |

| | 371 |

| | 791 |

| — |

| | — |

| | — |

| | 371 |

|

| Pension adjustments | 3,109 |

| | 2,656 |

| | 6,589 |

| | 5,894 |

| 3,778 |

| | 3,109 |

| | 7,556 |

| | 6,589 |

|

| Less applicable tax (expense) benefit | (1,088 | ) | | (929 | ) | | (2,306 | ) | | (2,063 | ) | (794 | ) | | (1,088 | ) | | (1,587 | ) | | (2,306 | ) |

| Pension adjustments, net of tax | 2,021 |

| | 1,727 |

| | 4,283 |

| | 3,831 |

| 2,984 |

| | 2,021 |

| | 5,969 |

| | 4,283 |

|

| | | | | | | | | | | | | | | |

| Other comprehensive income (loss) | 261,695 |

| | 453,682 |

| | 406,986 |

| | 757,210 |

| (336,700 | ) | | 261,695 |

| | (820,775 | ) | | 406,986 |

|

| Comprehensive income (loss) | $ | 401,968 |

| | $ | 592,111 |

| | $ | 680,800 |

| | $ | 1,019,672 |

| $ | (152,275 | ) | | $ | 401,968 |

| | $ | (462,750 | ) | | $ | 680,800 |

|

See accompanying Notes to Condensed Consolidated Financial Statements.

3

TMK 2018 FORM 10-Q QTR 2

TORCHMARK CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

(Unaudited)

(Dollar amounts in thousands, except per share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Preferred Stock | | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income (Loss) | | Retained Earnings | | Treasury Stock | | Total Shareholders’ Equity |

| | | | | | | | | | | | | | | |

| Balance at January 1, 2017 | | $ | — |

| | $ | 127,218 |

| | $ | 490,421 |

| | $ | 577,574 |

| | $ | 3,890,798 |

| | $ | (519,150 | ) | | $ | 4,566,861 |

|

| Comprehensive income (loss) | |

| |

| |

| | 406,986 |

| | 273,814 |

| |

| | 680,800 |

|

| Common dividends declared ($0.30 per share) | |

| |

| |

| |

| | (35,005 | ) | |

| | (35,005 | ) |

| Acquisition of treasury stock | |

| |

| |

| |

| |

| | (203,756 | ) | | (203,756 | ) |

| Stock-based compensation | |

| |

| | 9,702 |

| |

| | (606 | ) | | 7,450 |

| | 16,546 |

|

| Exercise of stock options | |

| |

| |

|

| |

| | (16,244 | ) | | 44,214 |

| | 27,970 |

|

| Balance at June 30, 2017 | | $ | — |

| | $ | 127,218 |

| | $ | 500,123 |

| | $ | 984,560 |

| | $ | 4,112,757 |

| | $ | (671,242 | ) | | $ | 5,053,416 |

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Preferred Stock | | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income (Loss) | | Retained Earnings | | Treasury Stock | | Total Shareholders’ Equity |

| | | | | | | | | | | | | | | |

| Balance at January 1, 2018 | | $ | — |

| | $ | 124,218 |

| | $ | 508,476 |

| | $ | 1,424,274 |

| | $ | 4,806,208 |

| | $ | (631,755 | ) | | $ | 6,231,421 |

|

Adoption of ASU 2016-01(1) | | | | | | | | | | 4,896 |

| | | | 4,896 |

|

| Comprehensive income (loss) | |

| |

| |

| | (820,775 | ) | | 358,025 |

| |

| | (462,750 | ) |

| Common dividends declared ($0.32 per share) | |

| |

| |

| |

| | (36,278 | ) | |

| | (36,278 | ) |

| Acquisition of treasury stock | |

| |

| |

| |

| |

| | (206,589 | ) | | (206,589 | ) |

| Stock-based compensation | |

| |

| | 8,601 |

| |

| | (1,803 | ) | | 12,759 |

| | 19,557 |

|

| Exercise of stock options | |

| |

| |

|

| |

| | (15,977 | ) | | 37,329 |

| | 21,352 |

|

| Balance at June 30, 2018 | | $ | — |

| | $ | 124,218 |

| | $ | 517,077 |

| | $ | 603,499 |

| | $ | 5,115,071 |

| | $ | (788,256 | ) | | $ | 5,571,609 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Preferred Stock | | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income (Loss) | | Retained Earnings | | Treasury Stock | | Total Shareholders’ Equity |

| | | | | | | | | | | | | | | |

| Balance at January 1, 2016 | | $ | — |

| | $ | 130,218 |

| | $ | 482,284 |

| | $ | 231,947 |

| | $ | 3,614,369 |

| | $ | (403,266 | ) | | $ | 4,055,552 |

|

| Comprehensive income (loss) | |

| |

| |

| | 757,210 |

| | 262,462 |

| |

| | 1,019,672 |

|

| Common dividends declared ($0.28 per share) | |

| |

| |

| |

| | (33,766 | ) | |

| | (33,766 | ) |

| Acquisition of treasury stock | |

| |

| |

| |

| |

| | (202,975 | ) | | (202,975 | ) |

| Stock-based compensation | |

| |

| | 7,442 |

| |

| | (2,224 | ) | | 8,771 |

| | 13,989 |

|

| Exercise of stock options | |

| |

| |

|

| |

| | (23,175 | ) | | 48,461 |

| | 25,286 |

|

| Balance at June 30, 2016 | | $ | — |

| | $ | 130,218 |

| | $ | 489,726 |

| | $ | 989,157 |

| | $ | 3,817,666 |

| | $ | (549,009 | ) | | $ | 4,877,758 |

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Preferred Stock | | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income (Loss) | | Retained Earnings | | Treasury Stock | | Total Shareholders’ Equity |

| | | | | | | | | | | | | | | |

| Balance at January 1, 2017 | | $ | — |

| | $ | 127,218 |

| | $ | 490,421 |

| | $ | 577,574 |

| | $ | 3,890,798 |

| | $ | (519,150 | ) | | $ | 4,566,861 |

|

| Comprehensive income (loss) | |

| |

| |

| | 406,986 |

| | 273,814 |

| |

| | 680,800 |

|

| Common dividends declared ($0.30 per share) | |

| |

| |

| |

| | (35,005 | ) | |

| | (35,005 | ) |

| Acquisition of treasury stock | |

| |

| |

| |

| |

| | (203,756 | ) | | (203,756 | ) |

| Stock-based compensation | |

| |

| | 9,702 |

| |

| | (606 | ) | | 7,450 |

| | 16,546 |

|

| Exercise of stock options | |

| |

| |

|

| |

| | (16,244 | ) | | 44,214 |

| | 27,970 |

|

| Balance at June 30, 2017 | | $ | — |

| | $ | 127,218 |

| | $ | 500,123 |

| | $ | 984,560 |

| | $ | 4,112,757 |

| | $ | (671,242 | ) | | $ | 5,053,416 |

|

See accompanying Notes to Condensed Consolidated Financial Statements.

4

TMK 2018 FORM 10-Q QTR 2

TORCHMARK CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(Dollar amounts in thousands)

| | | | Six Months Ended June 30, | Six Months Ended June 30, |

| | 2017 | | 2016 | 2018 | | 2017 |

| Cash provided from operating activities | $ | 739,056 |

| | $ | 604,935 |

| $ | 616,520 |

| | $ | 739,056 |

|

| | | | | | | |

| Cash provided from (used for) investing activities: | | | | | | |

| Investments sold or matured: | | | | | | |

| Fixed maturities available for sale—sold | — |

| | 51,299 |

| |

| Fixed maturities available for sale—matured, called, and repaid | 216,170 |

| | 92,475 |

| 179,793 |

| | 216,170 |

|

| Other long-term investments | 3,046 |

| | 1,394 |

| 23 |

| | 3,046 |

|

| Total long-term investments sold or matured | 219,216 |

| | 145,168 |

| 179,816 |

| | 219,216 |

|

| Acquisition of investments: | | | | | | |

| Fixed maturities—available for sale | (676,648 | ) | | (651,267 | ) | (540,442 | ) | | (676,648 | ) |

| Other long-term investments | (1,775 | ) | | (21,762 | ) | (64,444 | ) | | (1,775 | ) |

| Total investments acquired | (678,423 | ) | | (673,029 | ) | (604,886 | ) | | (678,423 | ) |

| Net increase in policy loans | (8,089 | ) | | (9,093 | ) | |

| Net (increase) decrease in policy loans | | (8,279 | ) | | (8,089 | ) |

| Net (increase) decrease in short-term investments | (22,347 | ) | | 6,185 |

| 58,527 |

| | (22,347 | ) |

| Net change in payable or receivable for securities | — |

| | (711 | ) | |

| Additions to property and equipment | (8,080 | ) | | (6,740 | ) | (18,735 | ) | | (8,080 | ) |

| Sale of other assets | 18 |

| | — |

| 17 |

| | 18 |

|

| Investment in low-income housing interests | (8,875 | ) | | (9,260 | ) | (15,701 | ) | | (8,875 | ) |

| Cash provided from (used for) investing activities | (506,580 | ) | | (547,480 | ) | (409,241 | ) | | (506,580 | ) |

| | | | | | | |

| Cash provided from (used for) financing activities: | | | | | | |

| Issuance of common stock | 27,970 |

| | 25,286 |

| 21,352 |

| | 27,970 |

|

| Cash dividends paid to shareholders | (34,093 | ) | | (33,478 | ) | (35,406 | ) | | (34,093 | ) |

| Proceeds from issuance of debt | — |

| | 400,000 |

| |

| Payment for debt issuance costs | — |

| | (9,638 | ) | |

| Repayment of debt | (625 | ) | | (250,000 | ) | (21,875 | ) | | (625 | ) |

| Net borrowing (repayment) of commercial paper | 40,546 |

| | 45,010 |

| 50,213 |

| | 40,546 |

|

| Acquisition of treasury stock | (203,756 | ) | | (202,975 | ) | (206,589 | ) | | (203,756 | ) |

| Net receipts (payments) from deposit-type product | (44,294 | ) | | (38,193 | ) | (58,662 | ) | | (44,294 | ) |

| Cash provided from (used for) financing activities | (214,252 | ) | | (63,988 | ) | (250,967 | ) | | (214,252 | ) |

| | | | | | | |

| Effect of foreign exchange rate changes on cash | 3,265 |

| | (5,172 | ) | 7,355 |

| | 3,265 |

|

| Net increase (decrease) in cash | 21,489 |

| | (11,705 | ) | (36,333 | ) | | 21,489 |

|

| Cash at beginning of year | 76,163 |

| | 61,383 |

| 118,563 |

| | 76,163 |

|

| Cash at end of period | $ | 97,652 |

| | $ | 49,678 |

| $ | 82,230 |

| | $ | 97,652 |

|

See accompanying Notes to Condensed Consolidated Financial Statements.

5

TMK 2018 FORM 10-Q QTR 2

TORCHMARK CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Dollar amounts in thousands, except per share data)

Note 1—Significant Accounting Policies

Basis of Presentation: The accompanying condensed consolidated financial statements of Torchmark Corporation (Torchmark or alternatively, the Company) have been prepared in accordance with the instructions to Form 10-Q. Therefore, they do not include all of the annual disclosures required by accounting principles generally accepted in the United States of America (GAAP). However, in the opinion of management, these statements include all adjustments, consisting of normal recurring adjustments, which are necessary for a fair presentation of the condensed consolidated financial position at June 30, 2017,2018, and the condensed consolidated results of operations, comprehensive income, and cash flows for the periods ended June 30, 20172018 and 2016.2017. The interim period condensed consolidated financial statements should be read in conjunction with the Consolidated Financial Statements that are included in the Form 10-K filed with the Securities Exchange Commission (SEC) on February 27, 2017.26, 2018. Note 2—New Accounting Standards

Accounting Pronouncements Not Yet Adopted in the Current Year:

ASU 2016-01: In January 2016, the FASBFinancial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2016-01, Financial Instruments—Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities, which primarily revises the classification and measurement of certain equity investments such that they will be measured at fair value through net income. Additionally, itthe guidance eliminates the cost method for partnerships and joint ventures and requires these types of investments to be accounted for under the fair value through net income method or equity method. Lastly, the guidance will require certain disclosures associated with fair value of financial instruments. This standard will becomebecame effective for the Company beginningon January 1, 2018. The Company does not expect the adoption to have a significant impact on the financial statements as we have limited ownership in equity investments and partnerships, representing less than 1% of total invested assets.

ASU 2016-02: In February 2016, the FASB issued Accounting Standards Update No. 2016-02, Leases (Topic 842), which requires all lessees to report a right-of-use asset and a lease liability for leases with a term life greater than 12 months. Operating and financing leases will be recognized on the balance sheet going forward. Additional qualitative and quantitative disclosures will be required. This standard will become effective forOn January 1, 2018, the Company beginning January 1, 2019 and will require recognizing and measuring leases at the beginning of the earliest period presented usingadopted this standard on a modified retrospective approach. Earlybasis for two types of investments: equity securities and limited partnerships. The adoption is permitted. The Company does not expectresulted in a $4.9 million after tax positive adjustment to the opening balance of retained earnings. Subsequent to the adoption, the Company elected to have a significant impact onmeasure its investment in certain limited partnerships at fair value in accordance with the fair value option for financial statements. Refer toinstruments with changes recognized in "Realized Investment Gains (Losses)" in the 2016 form 10-KCondensed Consolidated Statements of Operations. As of June 30, 2018, the fair value balance of the limited partnerships were $108 million. See Note 15—Commitments and Contingencies4—Investments for consideration of the noncancellable operating lease commitments. The Company does not have any lessor commitments.ASU 2016-13: In June 2016, the FASB issued Accounting Standards Update No. 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments to provide financial statement users with more decision-useful information about the expected credit losses on financial instruments as well as to change the loss impairment methodology for available-for-sale debt securities. This standard will become effective on January 1, 2020. The applicable section of the standard related to debt securities requires a prospective transition. The Company does not expect the adoption to have a significant impact on the financial statements as we have limited credit losses with respect to our available-for-sale portfolio.further discussion.

ASU 2016-15: In August 2016, the FASB issued Accounting Standards UpdateASU No. 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments to provide uniformity in the classification of cash receipts and payments recorded in the statement of cash flows including debt prepayment or debt extinguishment costs, settlement of zero-coupon bonds, and proceeds from the settlement of insurance claims. This standard will becomebecame effective on January 1, 2018. This adoption will2018 and did not have a significant impact to the classification on the financial statements.CondensedStatement of Cash Flows.

ASU 2016-16: In October 2016, the FASB issued Accounting Standards UpdateASU No. 2016-16, Income Taxes (Topic 740): Intra-Entity Transfer of Assets Other Than Inventory. This guidance was issued to improve the accounting for income tax consequences of intra-entity transfers of assets other than inventory by allowing the immediate recognition of the current and deferred income tax effects. Current guidance prohibits the recognition of current and deferred income taxes for an intra-entity transfer until the asset has been sold to an outside party. This new guidance should

TORCHMARK CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Dollar amounts in thousands, except per share data)

Note 2—New Accounting Standards (continued)

beis applied on a modified retrospective approach and will becomebecame effective on January 1, 2018. This adoption will not have a significant impact on the financial statements.

ASU 2017-04:In January 2017, the FASB issued Accounting Standards Update No. 2017-04, Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment. This guidance was issued to simplify the subsequent measurement of goodwill through the elimination of Step 2 from the goodwill impairment test. It will become effective on January 1, 2020 and should be applied on a prospective basis. This adoption willdid not have a significant impact on the financial statements.

ASU 2017-07: In March 2017, the FASB issued Accounting Standards UpdateASU No. 2017-07, Compensation—Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost. This guidance was issued to simplify the reporting of pension costs by disaggregating the service-cost component from the other components of net benefit costs and reporting it separately on the income statement. The service-cost component is the only component of net benefit cost that will be eligible for capitalization. The guidance will becomebecame effective on January 1, 2018 with a retrospective transition method for separation of net benefit costs and a prospective transition method for the capitalization of service costs. The Company will record approximately $3.5 million in additional expense to the 2018 Condensed Consolidated Statements of Operationsdue to the elimination of the ability to capitalize a portion of the benefit costs. For the six months ended June 30, 2018, the Company recorded $1.6 million in additional expense.

6

TMK 2018 FORM 10-Q QTR 2

TORCHMARK CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Dollar amounts in thousands, except per share data)

Note 2—New Accounting Standards (continued)

ASU 2017-09: In May 2017, the FASB issued ASU No. 2017-09, Compensation—Stock Compensation (Topic 718): Scope of Modification Accounting. This guidance was issued to provide clarity and guidance regarding changes to the terms or conditions of a share-based payment award that requires an entity to apply modification accounting. It became effective on January 1, 2018. The adoption had no significant impact on the financial statements as modifications to stock compensation are infrequent.

ASU 2018-02: In February 2018, the FASB issued ASU No. 2018-02, Income Statement—Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income (AOCI). This guidance was issued to allow the reclassification of taxes from AOCI to retained earnings as a result of the reduction in corporate income tax rates due to the Tax Cuts and Jobs Act of 2017 (Tax Legislation). Current accounting requires the effect of changes in tax rates used to measure deferred tax assets and liabilities to be reported in net income as of the date of enactment even though deferred taxes were previously recognized in AOCI (stranded taxes). This guidance, however, allows a company to elect to reclassify the stranded taxes in AOCI to retained earnings and is effective for years beginning after December 15, 2018, with early adoption permitted. The Company elected to early adopt this guidance resulting in a reclassification of $252 million from AOCI to retained earnings for the period ended December 31, 2017.

Accounting Pronouncements Not Yet Adopted

ASU 2016-02/ASU 2018-11: In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842), with clarification guidance issued in July 2018. The guidance requires lessees to record a right-of-use asset and corresponding lease liability on the balance sheet for all operating leases that do not qualify for the practical expedients allowed for in this standard. Additional qualitative and quantitative disclosures will be required. This standard will become effective for the Company beginning January 1, 2019. The Company plans to adopt the transition method allowed for under ASU 2018-11 and will not restate comparative periods upon adoption. Early adoption is permitted. The Company does not expect the adoption to have a significant impact on the financial statements. Refer to Note 15—Commitments and Contingencies of the 2017 10-K for consideration of the noncancelable operating lease commitments. The Company is not a lessor. ASU 2016-13: In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments to provide financial statement users with more decision-useful information about the expected credit losses on financial instruments as well as to change the loss impairment methodology for available-for-sale debt securities by use of an allowance rather than a direct write-down. This standard will become effective on January 1, 2020. The applicable section of the standard related to debt securities requires a prospective transition. The Company does not expect the adoption to have a significant impact on the financial statements as we have limited credit losses with respect to our current available-for-sale portfolio.

ASU 2017-04:In January 2017, the change in pension capitalizationFASB issued ASU No. 2017-04, Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment. This guidance was issued to simplify the subsequent measurement of goodwill through the elimination of Step 2 from the goodwill impairment test which required a hypothetical purchase price allocation. It will become effective on January 1, 2020 and should be less than 1% of Total Benefits and Expenses forapplied on a prospective basis. This adoption will not have an impact to the year.financial statements.

ASU 2017-08: In March 2017, the FASB issued Accounting Standards UpdateASU No. 2017-08, Receivables—Nonrefundable Fees and Other Costs (Topic 310-20): Premium Amortization on Purchased Callable Debt Securities. This guidance was issued to shorten the amortization period for certain callable debt securities held at a premium. The guidance requires the premium to be amortized to the earliest call date. It will become effective on January 1, 2019 with early adoption permitted, including during interim periods. The adoption is to be applied on a modified retrospective basis through an adjustment to retained earnings. This adoption will not have a significant impact on the financial statements.

ASU 2017-09: In May 2017, the FASB issued Accounting Standards Update No. 2017-09, Compensation—Stock Compensation (Topic 718): Scope of Modification Accounting. This guidance was issued to provide clarity and guidance regarding changes to the terms or conditions of a share-based payment award that requires an entity to apply modification accounting. It will become effective on January 1, 2018 with early adoption permitted, including adoption in any interim periods. The Company does not expect the adoption to have a significant impact on the financial statements as modifications to stock compensation are infrequent.

7

TMK 2018 FORM 10-Q QTR 2

TORCHMARK CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Dollar amounts in thousands, except per share data)

Note 3—Supplemental Information about Changes to Accumulated Other Comprehensive Income

An analysis of the change in balance by component of Accumulated Other Comprehensive Income is as follows for the three and six month periods ended June 30, 20172018 and 2016.2017.

Components of Accumulated Other Comprehensive Income

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, 2017 | Three Months Ended June 30, 2017 |

| | | Available

for Sale

Assets | | Deferred

Acquisition

Costs | | Foreign

Exchange | | Pension

Adjustments | | Total | Available

for Sale

Assets | | Deferred

Acquisition

Costs | | Foreign

Exchange | | Pension

Adjustments | | Total |

| Balance at April 1, 2017 | | $ | 832,057 |

| | $ | (7,182 | ) | | $ | 8,753 |

| | $ | (110,763 | ) | | $ | 722,865 |

| $ | 832,057 |

| | $ | (7,182 | ) | | $ | 8,753 |

| | $ | (110,763 | ) | | $ | 722,865 |

|

| Other comprehensive income (loss) before reclassifications, net of tax | | 257,595 |

| | (473 | ) | | 2,149 |

| | — |

| | 259,271 |

| 257,595 |

| | (473 | ) | | 2,149 |

| | — |

| | 259,271 |

|

| Reclassifications, net of tax | | 403 |

| | — |

| | — |

| | 2,021 |

| | 2,424 |

| 403 |

| | — |

| | — |

| | 2,021 |

| | 2,424 |

|

| Other comprehensive income (loss) | | 257,998 |

| | (473 | ) | | 2,149 |

| | 2,021 |

| | 261,695 |

| 257,998 |

| | (473 | ) | | 2,149 |

| | 2,021 |

| | 261,695 |

|

| Balance at June 30, 2017 | | $ | 1,090,055 |

| | $ | (7,655 | ) | | $ | 10,902 |

| | $ | (108,742 | ) | | $ | 984,560 |

| $ | 1,090,055 |

| | $ | (7,655 | ) | | $ | 10,902 |

| | $ | (108,742 | ) | | $ | 984,560 |

|

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, 2016 | | | | | | | | | |

| | | Available

for Sale

Assets | | Deferred

Acquisition

Costs | | Foreign

Exchange | | Pension

Adjustments | | Total | Three Months Ended June 30, 2018 |

| Balance at April 1, 2016 | | $ | 634,337 |

| | $ | (6,915 | ) | | $ | 4,847 |

| | $ | (96,794 | ) | | $ | 535,475 |

| |

| | | Available

for Sale

Assets | | Deferred

Acquisition

Costs | | Foreign

Exchange | | Pension

Adjustments | | Total |

| Balance at April 1, 2018 | | $ | 1,082,896 |

| | $ | (8,191 | ) | | $ | 15,279 |

| | $ | (149,785 | ) | | $ | 940,199 |

|

| Other comprehensive income (loss) before reclassifications, net of tax | | 453,586 |

| | (1,743 | ) | | 3,484 |

| | 69 |

| | 455,396 |

| (329,619 | ) | | 1,612 |

| | (4,914 | ) | | — |

| | (332,921 | ) |

| Reclassifications, net of tax | | (3,372 | ) | | — |

| | — |

| | 1,658 |

| | (1,714 | ) | (6,763 | ) | | — |

| | — |

| | 2,984 |

| | (3,779 | ) |

| Other comprehensive income (loss) | | 450,214 |

| | (1,743 | ) | | 3,484 |

| | 1,727 |

| | 453,682 |

| (336,382 | ) | | 1,612 |

| | (4,914 | ) | | 2,984 |

| | (336,700 | ) |

| Balance at June 30, 2016 | | $ | 1,084,551 |

| | $ | (8,658 | ) | | $ | 8,331 |

| | $ | (95,067 | ) | | $ | 989,157 |

| |

| Balance at June 30, 2018 | | $ | 746,514 |

| | $ | (6,579 | ) | | $ | 10,365 |

| | $ | (146,801 | ) | | $ | 603,499 |

|

8

TMK 2018 FORM 10-Q QTR 2

TORCHMARK CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Dollar amounts in thousands except, per share data)

Note 3—Supplemental Information about Changes to Accumulated Other Comprehensive Income (continued)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2017 |

| | | Available

for Sale

Assets | | Deferred

Acquisition

Costs | | Foreign

Exchange | | Pension

Adjustments | | Total |

| Balance at January 1, 2017 | | $ | 692,314 |

| | $ | (6,682 | ) | | $ | 4,967 |

| | $ | (113,025 | ) | | $ | 577,574 |

|

| Other comprehensive income (loss) before reclassifications, net of tax | | 398,295 |

| | (973 | ) | | 5,935 |

| | 241 |

| | 403,498 |

|

| Reclassifications, net of tax | | (554 | ) | | — |

| | — |

| | 4,042 |

| | 3,488 |

|

| Other comprehensive income (loss) | | 397,741 |

| | (973 | ) | | 5,935 |

| | 4,283 |

| | 406,986 |

|

| Balance at June 30, 2017 | | $ | 1,090,055 |

| | $ | (7,655 | ) | | $ | 10,902 |

| | $ | (108,742 | ) | | $ | 984,560 |

|

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | Six Months Ended June 30, 2018 |

| | | Available

for Sale

Assets | | Deferred

Acquisition

Costs | | Foreign

Exchange | | Pension

Adjustments | | Total |

| Balance at January 1, 2018 | | $ | 1,569,289 |

| | $ | (8,547 | ) | | $ | 16,302 |

| | $ | (152,770 | ) | | $ | 1,424,274 |

|

| Other comprehensive income (loss) before reclassifications, net of tax | | (815,462 | ) | | 1,968 |

| | (5,937 | ) | | — |

| | (819,431 | ) |

| Reclassifications, net of tax | | (7,313 | ) | | — |

| | — |

| | 5,969 |

| | (1,344 | ) |

| Other comprehensive income (loss) | | (822,775 | ) | | 1,968 |

| | (5,937 | ) | | 5,969 |

| | (820,775 | ) |

| Balance at June 30, 2018 | | $ | 746,514 |

| | $ | (6,579 | ) | | $ | 10,365 |

| | $ | (146,801 | ) | | $ | 603,499 |

|

9

TMK 2018 FORM 10-Q QTR 2

TORCHMARK CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Dollar amounts in thousands except, per share data)

Note 3—Supplemental Information about Changes to Accumulated Other Comprehensive Income (continued)

|

| | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2017 |

| | | Available

for Sale

Assets | | Deferred

Acquisition

Costs | | Foreign

Exchange | | Pension

Adjustments | | Total |

| Balance at January 1, 2017 | | $ | 692,314 |

| | $ | (6,682 | ) | | $ | 4,967 |

| | $ | (113,025 | ) | | $ | 577,574 |

|

| Other comprehensive income (loss) before reclassifications, net of tax | | 398,295 |

| | (973 | ) | | 5,935 |

| | 241 |

| | 403,498 |

|

| Reclassifications, net of tax | | (554 | ) | | — |

| | — |

| | 4,042 |

| | 3,488 |

|

| Other comprehensive income (loss) | | 397,741 |

| | (973 | ) | | 5,935 |

| | 4,283 |

| | 406,986 |

|

| Balance at June 30, 2017 | | $ | 1,090,055 |

| | $ | (7,655 | ) | | $ | 10,902 |

| | $ | (108,742 | ) | | $ | 984,560 |

|

| | | | | | | | | | | |

| | | Six Months Ended June 30, 2016 |

| | | Available

for Sale

Assets | | Deferred

Acquisition

Costs | | Foreign

Exchange | | Pension

Adjustments | | Total |

| Balance at January 1, 2016 | | $ | 332,333 |

| | $ | (5,115 | ) | | $ | 3,627 |

| | $ | (98,898 | ) | | $ | 231,947 |

|

| Other comprehensive income (loss) before reclassifications, net of tax | | 756,680 |

| | (3,543 | ) | | 4,704 |

| | 514 |

| | 758,355 |

|

| Reclassifications, net of tax | | (4,462 | ) | | — |

| | — |

| | 3,317 |

| | (1,145 | ) |

| Other comprehensive income (loss) | | 752,218 |

| | (3,543 | ) | | 4,704 |

| | 3,831 |

| | 757,210 |

|

| Balance at June 30, 2016 | | $ | 1,084,551 |

| | $ | (8,658 | ) | | $ | 8,331 |

| | $ | (95,067 | ) | | $ | 989,157 |

|

Reclassifications out of Accumulated Other Comprehensive Income are presented below for the three and six month periods ended June 30, 20172018 and 2016.2017.

Reclassification Adjustments

| | | | | Three Months Ended

June 30, | | Six Months Ended

June 30, | | Affected line items in the Statement of Operations | | Three Months Ended

June 30, | | Six Months Ended

June 30, | | Affected line items in the Statement of Operations |

| | | 2017 | | 2016 | | 2017 | | 2016 | | | 2018 | | 2017 | | 2018 | | 2017 | |

| Unrealized investment gains (losses) on available for sale assets: | | | | | | | | | | | | | | | | | | |

| Realized (gains) losses | | $ | 681 |

| | $ | (3,983 | ) | | $ | (354 | ) | | $ | (4,296 | ) | | Realized gains (losses) | | $ | (9,431 | ) | | $ | 681 |

| | $ | (10,817 | ) | | $ | (354 | ) | | Realized investment gains (losses) |

| Amortization of (discount) premium | | (61 | ) | | (1,204 | ) | | (498 | ) | | (2,568 | ) | | Net investment income | | 870 |

| | (61 | ) | | 1,560 |

| | (498 | ) | | Net investment income |

| Total before tax | | 620 |

| | (5,187 | ) | | (852 | ) | | (6,864 | ) | | | (8,561 | ) | | 620 |

| | (9,257 | ) | | (852 | ) | |

| Tax | | (217 | ) | | 1,815 |

| | 298 |

| | 2,402 |

| | Income taxes | | 1,798 |

| | (217 | ) | | 1,944 |

| | 298 |

| | Income taxes |

| Total after tax | | 403 |

| | (3,372 | ) | | (554 | ) | | (4,462 | ) | | | (6,763 | ) | | 403 |

| | (7,313 | ) | | (554 | ) | |

| Pension adjustments: | | | | | | | | | | | | | | | | | | |

| Amortization of prior service cost | | 119 |

| | 120 |

| | 238 |

| | 240 |

| | Other operating expenses | | 119 |

| | 119 |

| | 238 |

| | 238 |

| | Other operating expense |

| Amortization of actuarial gain (loss) | | 2,990 |

| | 2,431 |

| | 5,980 |

| | 4,863 |

| | Other operating expenses | | 3,659 |

| | 2,990 |

| | 7,318 |

| | 5,980 |

| | Other operating expense |

| Total before tax | | 3,109 |

| | 2,551 |

| | 6,218 |

| | 5,103 |

| | | 3,778 |

| | 3,109 |

| | 7,556 |

| | 6,218 |

| |

| Tax | | (1,088 | ) | | (893 | ) | | (2,176 | ) | | (1,786 | ) | | Income taxes | | (794 | ) | | (1,088 | ) | | (1,587 | ) | | (2,176 | ) | | Income taxes |

| Total after tax | | 2,021 |

| | 1,658 |

| | 4,042 |

| | 3,317 |

| | | 2,984 |

| | 2,021 |

| | 5,969 |

| | 4,042 |

| |

| Total reclassifications (after tax) | | $ | 2,424 |

| | $ | (1,714 | ) | | $ | 3,488 |

| | $ | (1,145 | ) | | | $ | (3,779 | ) | | $ | 2,424 |

| | $ | (1,344 | ) | | $ | 3,488 |

| |

910

TMK 2018 FORM 10-Q QTR 2

TORCHMARK CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Dollar amounts in thousands, except per share data)

Note 4—Investments

Portfolio Composition:Composition:

A summary of fixed maturities available for sale by cost or amortized cost and estimated fair value at June 30, 2018 and December 31, 2017 is as follows:

Portfolio Composition as of June 30, 2017

| | | | | | | | | | | | June 30, 2018 |

| | Cost or Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Value(1) | | % of Total Fixed Maturities(2) | Cost or Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Value(1) | | % of Total Fixed Maturities(2) |

| Fixed maturities available for sale: | | | | | | | | | | | | | | | | | | |

| U.S. Government direct, guaranteed, and government-sponsored enterprises | $ | 387,331 |

| | $ | 8,552 |

| | $ | (1,696 | ) | | $ | 394,187 |

| | 2 | $ | 390,021 |

| | $ | 2,266 |

| | $ | (4,383 | ) | | $ | 387,904 |

| | 2 |

| States, municipalities, and political subdivisions | 1,182,708 |

| | 128,175 |

| | (185 | ) | | 1,310,698 |

| | 8 | 1,232,142 |

| | 103,365 |

| | (281 | ) | | 1,335,226 |

| | 9 |

| Foreign governments | 20,720 |

| | 1,592 |

| | — |

| | 22,312 |

| | — | 19,609 |

| | 1,705 |

| | — |

| | 21,314 |

| | — |

| Corporates, by sector: | | | | | | | | | | | | | | | | |

| Financial | 3,152,297 |

| | 413,004 |

| | (25,309 | ) | | 3,539,992 |

| | 22 | 3,372,221 |

| | 269,494 |

| | (51,445 | ) | | 3,590,270 |

| | 22 |

| Utilities | 1,909,247 |

| | 314,825 |

| | (3,351 | ) | | 2,220,721 |

| | 14 | 1,947,899 |

| | 255,504 |

| | (12,164 | ) | | 2,191,239 |

| | 14 |

| Energy | 1,589,769 |

| | 170,566 |

| | (35,952 | ) | | 1,724,383 |

| | 11 | 1,619,674 |

| | 133,584 |

| | (40,101 | ) | | 1,713,157 |

| | 11 |

| Other corporate sectors | 5,847,507 |

| | 651,703 |

| | (20,017 | ) | | 6,479,193 |

| | 40 | 6,183,619 |

| | 362,020 |

| | (146,563 | ) | | 6,399,076 |

| | 39 |

| Total corporates | 12,498,820 |

| | 1,550,098 |

| | (84,629 | ) | | 13,964,289 |

| | 87 | 13,123,413 |

| | 1,020,602 |

| | (250,273 | ) | | 13,893,742 |

| | 86 |

| Collateralized debt obligations | 59,871 |

| | 16,677 |

| | (10,303 | ) | | 66,245 |

| | — | 58,582 |

| | 23,437 |

| | (5,823 | ) | | 76,196 |

| | — |

| Other asset-backed securities | 126,019 |

| | 3,607 |

| | (15 | ) | | 129,611 |

| | 1 | 150,843 |

| | 2,386 |

| | (429 | ) | | 152,800 |

| | 1 |

| Redeemable preferred stocks, by sector: | | | | | | | | | | | | | | | | |

| Financial | 347,505 |

| | 59,206 |

| | (5,849 | ) | | 400,862 |

| | 2 | 347,014 |

| | 45,481 |

| | (4,518 | ) | | 387,977 |

| | 2 |

| Utilities | 28,577 |

| | 1,725 |

| | (220 | ) | | 30,082 |

| | — | 28,528 |

| | 1,360 |

| | (356 | ) | | 29,532 |

| | — |

| Total redeemable preferred stocks | 376,082 |

| | 60,931 |

| | (6,069 | ) | | 430,944 |

| | 2 | 375,542 |

| | 46,841 |

| | (4,874 | ) | | 417,509 |

| | 2 |

| Total fixed maturities | $ | 14,651,551 |

| | $ | 1,769,632 |

| | $ | (102,897 | ) | | $ | 16,318,286 |

| | 100 | $ | 15,350,152 |

| | $ | 1,200,602 |

| | $ | (266,063 | ) | | $ | 16,284,691 |

| | 100 |

(1) Amounts reported on the balance sheet.

(2) At fair value.

A schedule of fixed maturities available for sale by contractual maturity date at June 30, 2017 is shown below on an amortized cost basis and on a fair value basis. Actual maturity dates could differ from contractual maturities due to call or prepayment provisions.

|

| | | | | | | |

| | June 30, 2017 |

| | Amortized

Cost | | Fair Value |

| Fixed maturities available for sale: | | | |

| Due in one year or less | $ | 143,830 |

| | $ | 148,150 |

|

| Due after one year through five years | 578,037 |

| | 622,103 |

|

| Due after five years through ten years | 1,434,971 |

| | 1,597,721 |

|

| Due after ten years through twenty years | 4,363,391 |

| | 5,019,819 |

|

| Due after twenty years | 7,944,279 |

| | 8,733,397 |

|

| Mortgage-backed and asset-backed securities | 187,043 |

| | 197,096 |

|

| | $ | 14,651,551 |

| | $ | 16,318,286 |

|

| |

| (1) | Amounts reported on the balance sheet. |

1011

TMK 2018 FORM 10-Q QTR 2

TORCHMARK CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Dollar amounts in thousands, except per share data)

Note 4—Investments (continued)

Selected information about |

| | | | | | | | | | | | | | | | | |

| | December 31, 2017 |

| | Cost or Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Value(1) | | % of Total Fixed Maturities(2) |

| Fixed maturities available for sale: | | | | | | | | | |

| U.S. Government direct, guaranteed, and government-sponsored enterprises | $ | 390,646 |

| | $ | 18,173 |

| | $ | (1,373 | ) | | $ | 407,446 |

| | 2 |

| States, municipalities, and political subdivisions | 1,091,960 |

| | 127,890 |

| | (135 | ) | | 1,219,715 |

| | 7 |

| Foreign governments | 20,236 |

| | 1,782 |

| | — |

| | 22,018 |

| | — |

| Corporates, by sector: | | | | | | |

|

| | |

| Financial | 3,282,526 |

| | 475,961 |

| | (23,392 | ) | | 3,735,095 |

| | 22 |

| Utilities | 1,955,737 |

| | 369,406 |

| | (1,298 | ) | | 2,323,845 |

| | 14 |

| Energy | 1,619,349 |

| | 226,140 |

| | (25,392 | ) | | 1,820,097 |

| | 11 |

| Other corporate sectors | 6,065,803 |

| | 747,612 |

| | (20,616 | ) | | 6,792,799 |

| | 40 |

| Total corporates | 12,923,415 |

| | 1,819,119 |

| | (70,698 | ) | | 14,671,836 |

| | 87 |

| Collateralized debt obligations | 59,150 |

| | 20,084 |

| | (7,653 | ) | | 71,581 |

| | — |

| Other asset-backed securities | 144,520 |

| | 4,835 |

| | — |

| | 149,355 |

| | 1 |

| Redeemable preferred stocks, by sector: | | | | | | | | | |

| Financial | 336,621 |

| | 62,892 |

| | (2,727 | ) | | 396,786 |

| | 3 |

| Utilities | 28,553 |

| | 2,132 |

| | (97 | ) | | 30,588 |

| | — |

| Total redeemable preferred stocks | 365,174 |

| | 65,024 |

| | (2,824 | ) | | 427,374 |

| | 3 |

| Total fixed maturities | $ | 14,995,101 |

| | $ | 2,056,907 |

| | $ | (82,683 | ) | | $ | 16,969,325 |

| | 100 |

| |

| (1) | Amounts reported on the balance sheet. |

A schedule of fixed maturities available for sale by contractual maturity date at June 30, 2018 is shown below on an amortized cost basis and on a fair value basis. Actual disposition dates could differ from contractual maturities due to call or prepayment provisions.

|

| | | | | | | |

| | June 30, 2018 |

| | Amortized

Cost | | Fair Value |

| Fixed maturities available for sale: | | | |

| Due in one year or less | $ | 80,564 |

| | $ | 81,901 |

|

| Due after one year through five years | 732,395 |

| | 757,040 |

|

| Due after five years through ten years | 1,611,476 |

| | 1,745,491 |

|

| Due after ten years through twenty years | 5,051,297 |

| | 5,607,509 |

|

| Due after twenty years | 7,664,183 |

| | 7,862,890 |

|

| Mortgage-backed and asset-backed securities | 210,237 |

| | 229,860 |

|

| | $ | 15,350,152 |

| | $ | 16,284,691 |

|

There were no sales of fixed maturities available for sale is as follows.of June 30, 2018 or 2017.

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Proceeds from sales | $ | — |

| | $ | 36,968 |

| | $ | — |

| | $ | 51,299 |

|

| Gross realized gains | — |

| | 3,061 |

| | — |

| | 3,556 |

|

| Gross realized losses | — |

| | — |

| | — |

| | (214 | ) |

Fair Value Measurements:

The following table represents the fair value of fixed maturities available for sale measured on a recurring basis.

|

| | | | | | | | | | | | | | | | |

| Fair Value Measurements at June 30, 2017 using: |

| Description | | Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | | Total Fair Value |

| Bonds: | | | | | | | | |

| U.S. Government direct, guaranteed, and government-sponsored enterprises | | $ | — |

| | $ | 394,187 |

| | $ | — |

| | $ | 394,187 |

|

| States, municipalities, and political subdivisions | | — |

| | 1,310,698 |

| | — |

| | 1,310,698 |

|

| Foreign governments | | — |

| | 22,312 |

| | — |

| | 22,312 |

|

| Corporates, by sector: | |

|

| |

|

| |

|

| |

|

|

| Financial | | — |

| | 3,477,619 |

| | 62,373 |

| | 3,539,992 |

|

| Utilities | | — |

| | 2,065,431 |

| | 155,290 |

| | 2,220,721 |

|

| Energy | | — |

| | 1,683,064 |

| | 41,319 |

| | 1,724,383 |

|

| Other corporate sectors | | — |

| | 6,151,889 |

| | 327,304 |

| | 6,479,193 |

|

| Total corporates | | — |

| | 13,378,003 |

| | 586,286 |

| | 13,964,289 |

|

| Collateralized debt obligations | | — |

| | — |

| | 66,245 |

| | 66,245 |

|

| Other asset-backed securities | | — |

| | 115,458 |

| | 14,153 |

| | 129,611 |

|

| Redeemable preferred stocks, by sector: | |

|

| |

|

| |

|

| |

|

|

| Financial | | — |

| | 400,862 |

| | — |

| | 400,862 |

|

| Utilities | | — |

| | 30,082 |

| | — |

| | 30,082 |

|

| Total redeemable preferred stocks | | — |

| | 430,944 |

| | — |

| | 430,944 |

|

| Total fixed maturities | | $ | — |

| | $ | 15,651,602 |

| | $ | 666,684 |

| | $ | 16,318,286 |

|

| Percent of total | | — | % | | 95.9 | % | | 4.1 | % | | 100.0 | % |

1112

TMK 2018 FORM 10-Q QTR 2

TORCHMARK CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Dollar amounts in thousands, except per share data)

Note 4—Investments (continued)

The following table represents an analysis of changes in fair value measurements using significant unobservable inputs (Level 3).

Analysis of Changes in Fair Value Measurements Using

Significant Unobservable Inputs (Level 3): The following tables represents the fair value of fixed maturities available for sale measured on a recurring basis at June 30, 2018 and December 31, 2017.

|

| | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2017 |

| | Asset-

Backed

Securities | | Collateralized

Debt

Obligations | | Corporates(1) | | Total |

| Balance at January 1, 2017 | $ | — |

| | $ | 63,503 |

| | $ | 559,600 |

| | $ | 623,103 |

|

| Total gains or losses: | | | | | | | |

| Included in realized gains/losses | — |

| | — |

| | — |

| | — |

|

| Included in other comprehensive income | 261 |

| | 3,597 |

| | 11,637 |

| | 15,495 |

|

| Acquisitions | 14,000 |

| | — |

| | 21,666 |

| | 35,666 |

|

| Sales | — |

| | — |

| | — |

| | — |

|

| Amortization | — |

| | 2,481 |

| | 8 |

| | 2,489 |

|

Other(2) | (108 | ) | | (3,336 | ) | | (6,625 | ) | | (10,069 | ) |

Transfers in and/or out of Level 3(3) | — |

| | — |

| | — |

| | — |

|

| Balance at June 30, 2017 | $ | 14,153 |

| | $ | 66,245 |

| | $ | 586,286 |

| | $ | 666,684 |

|

| Percent of total fixed maturities | 0.1 | % | | 0.4 | % | | 3.6 | % | | 4.1 | % |

| | | | | | | | |

| | Six Months Ended June 30, 2016 |

| | Asset-

Backed

Securities | | Collateralized

Debt

Obligations | | Corporates(1) | | Total |

| Balance at January 1, 2016 | $ | — |

| | $ | 70,382 |

| | $ | 530,806 |

| | $ | 601,188 |

|

| Total gains or losses: | | | | | | | |

| Included in realized gains/losses | — |

| | — |

| | — |

| | — |

|

| Included in other comprehensive income | — |

| | (4,831 | ) | | 24,291 |

| | 19,460 |

|

| Acquisitions | — |

| | — |

| | 15,800 |

| | 15,800 |

|

| Sales | — |

| | — |

| | — |

| | — |

|

| Amortization | — |

| | 2,639 |

| | 8 |

| | 2,647 |

|

Other(2) | — |

| | (4,127 | ) | | (1,740 | ) | | (5,867 | ) |

Transfers in and/or out of Level 3(3) | — |

| | — |

| | — |

| | — |

|

| Balance at June 30, 2016 | $ | — |

| | $ | 64,063 |

| | $ | 569,165 |

| | $ | 633,228 |

|

| Percent of total fixed maturities | — | % | | 0.4 | % | | 3.7 | % | | 4.1 | % |

(1) Includes redeemable preferred stocks.

(2) Includes capitalized interest, foreign exchange adjustments, and principal repayments.

(3) Considered to be transferred at the end of the period. Transfers into Level 3 occur when observable inputs are no longer available. Transfers out of Level 3 occur when observable inputs become available.

|

| | | | | | | | | | | | | | | |

| | Fair Value Measurements at June 30, 2018 using: |

| Description | Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | | Total Fair Value |

| Fixed maturities available for sale: | | | | | | | |

| U.S. Government direct, guaranteed, and government-sponsored enterprises | $ | — |

| | $ | 387,904 |

| | $ | — |

| | $ | 387,904 |

|

| States, municipalities, and political subdivisions | — |

| | 1,335,226 |

| | — |

| | 1,335,226 |

|

| Foreign governments | — |

| | 21,314 |

| | — |

| | 21,314 |

|

| Corporates, by sector: | | | | | | | |

| Financial | — |

| | 3,529,651 |

| | 60,619 |

| | 3,590,270 |

|

| Utilities | — |

| | 2,044,141 |

| | 147,098 |

| | 2,191,239 |

|

| Energy | — |

| | 1,673,305 |

| | 39,852 |

| | 1,713,157 |

|

| Other corporate sectors | — |

| | 6,069,835 |

| | 329,241 |

| | 6,399,076 |

|

| Total corporates | — |

| | 13,316,932 |

| | 576,810 |

| | 13,893,742 |

|

| Collateralized debt obligations | — |

| | — |

| | 76,196 |

| | 76,196 |

|

| Other asset-backed securities | — |

| | 139,647 |

| | 13,153 |

| | 152,800 |

|

| Redeemable preferred stocks, by sector: | | | | | | | |

| Financial | — |

| | 387,977 |

| | — |

| | 387,977 |

|

| Utilities | — |

| | 29,532 |

| | — |

| | 29,532 |

|

| Total redeemable preferred stocks | — |

| | 417,509 |

| | — |

| | 417,509 |

|

| Total fixed maturities | $ | — |

| | $ | 15,618,532 |

| | $ | 666,159 |

| | $ | 16,284,691 |

|

| Percent of total | — | % | | 95.9 | % | | 4.1 | % | | 100.0 | % |

1213

TMK 2018 FORM 10-Q QTR 2

TORCHMARK CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Dollar amounts in thousands, except per share data)

Note 4—Investments (continued)

|

| | | | | | | | | | | | | | | |

| | Fair Value Measurements at December 31, 2017 using: |

| Description | Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | | Total Fair Value |

| Fixed maturities available for sale: | | | | | | | |

| U.S. Government direct, guaranteed, and government-sponsored enterprises | $ | — |

| | $ | 407,446 |

| | $ | — |

| | $ | 407,446 |

|

| States, municipalities, and political subdivisions | 44 |

| | 1,219,671 |

| | — |

| | 1,219,715 |

|

| Foreign governments | — |

| | 22,018 |

| | — |

| | 22,018 |

|

| Corporates, by sector: | | | | | | |

|

|

| Financial | — |

| | 3,673,089 |

| | 62,006 |

| | 3,735,095 |

|

| Utilities | — |

| | 2,168,115 |

| | 155,730 |

| | 2,323,845 |

|

| Energy | — |

| | 1,779,281 |

| | 40,816 |

| | 1,820,097 |

|

| Other corporate sectors | — |

| | 6,468,541 |

| | 324,258 |

| | 6,792,799 |

|

| Total corporates | — |

| | 14,089,026 |

| | 582,810 |

| | 14,671,836 |

|

| Collateralized debt obligations | — |

| | — |

| | 71,581 |

| | 71,581 |

|

| Other asset-backed securities | — |

| | 135,306 |

| | 14,049 |

| | 149,355 |

|

| Redeemable preferred stocks, by sector: | | | | | | | |

| Financial | — |

| | 396,786 |

| | — |

| | 396,786 |

|

| Utilities | — |

| | 30,588 |

| | — |

| | 30,588 |

|

| Total redeemable preferred stocks | — |

| | 427,374 |

| | — |

| | 427,374 |

|

| Total fixed maturities | $ | 44 |

| | $ | 16,300,841 |

| | $ | 668,440 |

| | $ | 16,969,325 |

|

| Percentage of total | — | % | | 96.1 | % | | 3.9 | % | | 100.0 | % |

The following tables represent an analysis of changes in fair value measurements using significant unobservable inputs (Level 3) for the six months ended June 30, 2018 and 2017.

Analysis of Changes in Fair Value Measurements Using

Significant Unobservable Inputs (Level 3)

|

| | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2018 |

| | Asset-

Backed

Securities | | Collateralized

Debt

Obligations | | Corporates(1) | | Total |

| Balance at January 1, 2018 | $ | 14,049 |

| | $ | 71,581 |

| | $ | 582,810 |

| | $ | 668,440 |

|

| Total gains or losses: | | | | | | | |

| Included in realized gains/losses | — |

| | — |

| | — |

| | — |

|

| Included in other comprehensive income | (697 | ) | | 5,183 |

| | (19,611 | ) | | (15,125 | ) |

| Acquisitions | — |

| | — |

| | 20,300 |

| | 20,300 |

|

| Sales | — |

| | — |

| | — |

| | — |

|

| Amortization | — |

| | 2,389 |

| | 8 |

| | 2,397 |

|

Other(2) | (199 | ) | | (2,957 | ) | | (6,697 | ) | | (9,853 | ) |

Transfers in and/or out of Level 3(3) | — |

| | — |

| | — |

| | — |

|

| Balance at June 30, 2018 | $ | 13,153 |

| | $ | 76,196 |

| | $ | 576,810 |

| | $ | 666,159 |

|

| Percent of total fixed maturities | 0.1 | % | | 0.5 | % | | 3.5 | % | | 4.1 | % |

| |

| (1) | Includes redeemable preferred stocks. |

| |

| (2) | Includes capitalized interest, foreign exchange adjustments, and principal repayments. |

| |

| (3) | Considered to be transferred at the end of the period. Transfers into Level 3 occur when observable inputs are no longer available. Transfers out of Level 3 occur when observable inputs become available. |

14

TMK 2018 FORM 10-Q QTR 2

TORCHMARK CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Dollar amounts in thousands, except per share data)

Note 4—Investments (continued)

|

| | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2017 |

| | Asset-

Backed

Securities | | Collateralized

Debt

Obligations | | Corporates(1) | | Total |

| Balance at January 1, 2017 | $ | — |

| | $ | 63,503 |

| | $ | 559,600 |

| | $ | 623,103 |

|

| Total gains or losses: | | | | | | | |

| Included in realized gains/losses | — |

| | — |

| | — |

| | — |

|

| Included in other comprehensive income | 261 |

| | 3,597 |

| | 11,637 |

| | 15,495 |

|

| Acquisitions | 14,000 |

| | — |

| | 21,666 |

| | 35,666 |

|

| Sales | — |

| | — |

| | — |

| | — |

|

| Amortization | — |

| | 2,481 |

| | 8 |

| | 2,489 |

|

Other(2) | (108 | ) | | (3,336 | ) | | (6,625 | ) | | (10,069 | ) |

Transfers in and/or out of Level 3(3) | — |

| | — |

| | — |

| | — |

|

| Balance at June 30, 2017 | $ | 14,153 |

| | $ | 66,245 |

| | $ | 586,286 |

| | $ | 666,684 |

|

| Percent of total fixed maturities | 0.1 | % | | 0.4 | % | | 3.6 | % | | 4.1 | % |

| |

| (1) | Includes redeemable preferred stocks. |

| |

| (2) | Includes capitalized interest, foreign exchange adjustments, and principal repayments. |

| |

| (3) | Considered to be transferred at the end of the period. Transfers into Level 3 occur when observable inputs are no longer available. Transfers out of Level 3 occur when observable inputs become available. |

The following table presents transfers in and out of each of the valuation levels of fair values.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, |

| | | 2018 | | 2017 |

| | | In | | Out | | Net | | In | | Out | | Net |

| Level 1 | |