The attributes of IPL’s receivables sold under the Receivables Agreement were as follows (in millions):

NOTE 5. INVESTMENTS

NOTE 6. COMMON EQUITY

NOTE 7. DEBT

NOTE 8. REVENUES

NOTE 11. DERIVATIVE INSTRUMENTS

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Alliant Energy | | IPL | | WPL |

| | September 30,

2017 | | December 31,

2016 | | September 30,

2017 | | December 31,

2016 | | September 30,

2017 | | December 31,

2016 |

| Current derivative assets |

| $26.7 |

| |

| $29.4 |

| |

| $20.3 |

| |

| $19.1 |

| |

| $6.4 |

| |

| $10.3 |

|

| Non-current derivative assets | 2.7 |

| | 12.0 |

| | 0.8 |

| | 1.7 |

| | 1.9 |

| | 10.3 |

|

| Current derivative liabilities | 18.5 |

| | 13.3 |

| | 4.6 |

| | 2.7 |

| | 13.9 |

| | 10.6 |

|

| Non-current derivative liabilities | 26.6 |

| | 15.3 |

| | 14.1 |

| | 5.6 |

| | 12.5 |

| | 9.7 |

|

During the nine months ended September 30, 2022, Alliant Energy’s, IPL’s and WPL’s derivative assets increased primarily due to the annual FTR auction operated by MISO and as a result of higher natural gas prices. Alliant Energy’s, IPL’s and WPL’s derivative liabilities increased primarily due to new natural gas contracts entered into in the second quarter of 2022. Based on IPL’s and WPL’s cost recovery mechanisms, the changes in the fair value of derivative liabilities/assets resulted in comparable changes to regulatory assets/liabilities on the balance sheets.

Credit Risk-related Contingent Features - Various agreements contain credit risk-related contingent features, including requirements to maintain certain credit ratings and/or limitations on liability positions under the agreements based on credit ratings. Certain of these agreements with credit risk-related contingency features are accounted for as derivative instruments. In the event of a material change in creditworthiness or if liability positions exceed certain contractual limits, credit support may need to be provided in the form of letters of credit or cash collateral up to the amount of exposure under the contracts, or the contracts may need to be unwound and underlying liability positions paid. At September 30, 20172022 and December 31, 2016,2021, the aggregate fair value of all derivative instruments with credit risk-related contingent features in a net liability position was not materially different than amounts that would be required to be posted as credit support to counterparties by Alliant Energy, IPL or WPL if the most restrictive credit risk-related contingent features for derivative agreements in a net liability position were triggered.

Balance Sheet Offsetting - The fair value amounts of derivative instruments subject to a master netting arrangement are not netted by counterparty on the balance sheets. However, if the fair value amounts of derivative instruments by counterparty were netted, amounts would not be materially different from gross amounts of derivative assets and derivative liabilities at September 30, 2017 and December 31, 2016. related to commodity contracts would have been presented on the balance sheets as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Alliant Energy | | IPL | | WPL |

| Gross | | | | Gross | | | | Gross | | |

| (as reported) | | Net | | (as reported) | | Net | | (as reported) | | Net |

| September 30, 2022 | | | | | | | | | | | |

| Derivative assets | $360 | | $308 | | $202 | | $165 | | $158 | | $143 |

| Derivative liabilities | 98 | | 46 | | 66 | | 29 | | 32 | | 17 |

| December 31, 2021 | | | | | | | | | | | |

| Derivative assets | 176 | | 171 | | 84 | | 83 | | 92 | | 88 |

| Derivative liabilities | 9 | | 4 | | 4 | | 3 | | 5 | | 1 |

Fair value amounts recognized for the right to reclaim cash collateral (receivable) or the obligation to return cash collateral (payable) are not offset against fair value amounts recognized for derivative instruments executed with the same counterparty under the same master netting arrangement.

NOTE 12. COMMITMENTS AND CONTINGENCIESFAIR VALUE MEASUREMENTS

NOTE 12(a) Capital Purchase ObligationsFair Value of Financial Instruments - Various contractual obligations contain minimum future commitmentsThe carrying amounts of current assets and current liabilities approximate fair value because of the short maturity of such financial instruments. Carrying amounts and related to capital expenditures for certain construction projects. IPL’s projects include the installationestimated fair values of an SCR system at Ottumwa Unit 1 to reduce NOx emissions at the EGU. WPL’s projects include West Riverside. At September 30, 2017, Alliant Energy’s, IPL’s and WPL’s minimum future commitments related to certain contractual obligations for these projectsother financial instruments were $105 million, $8 million and $97 million, respectively.as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Alliant Energy | September 30, 2022 | | December 31, 2021 |

| | | Fair Value | | | | Fair Value |

| Carrying | | Level | | Level | | Level | | | | Carrying | | Level | | Level | | Level | | |

| Amount | | 1 | | 2 | | 3 | | Total | | Amount | | 1 | | 2 | | 3 | | Total |

| Assets: | | | | | | | | | | | | | | | | | | | |

| Money market fund investments | $334 | | | $334 | | | $— | | | $— | | | $334 | | | $32 | | | $32 | | | $— | | | $— | | | $32 | |

| Derivatives | 360 | | | — | | | 295 | | | 65 | | | 360 | | | 176 | | | — | | | 146 | | | 30 | | | 176 | |

| Deferred proceeds | 248 | | | — | | | — | | | 248 | | | 248 | | | 214 | | | — | | | — | | | 214 | | | 214 | |

| Liabilities: | | | | | | | | | | | | | | | | | | | |

| Derivatives | 98 | | | — | | | 78 | | | 20 | | | 98 | | | 9 | | | — | | | 8 | | | 1 | | | 9 | |

| Long-term debt (incl. current maturities) | 8,228 | | | — | | | 7,473 | | | 1 | | | 7,474 | | | 7,368 | | | — | | | 8,329 | | | 1 | | | 8,330 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| IPL | September 30, 2022 | | December 31, 2021 |

| | | Fair Value | | | | Fair Value |

| Carrying | | Level | | Level | | Level | | | | Carrying | | Level | | Level | | Level | | |

| Amount | | 1 | | 2 | | 3 | | Total | | Amount | | 1 | | 2 | | 3 | | Total |

| Assets: | | | | | | | | | | | | | | | | | | | |

| Money market fund investments | $39 | | | $39 | | | $— | | | $— | | | $39 | | | $32 | | | $32 | | | $— | | | $— | | | $32 | |

| Derivatives | 202 | | | — | | | 150 | | | 52 | | | 202 | | | 84 | | | — | | | 65 | | | 19 | | | 84 | |

| Deferred proceeds | 248 | | | — | | | — | | | 248 | | | 248 | | | 214 | | | — | | | — | | | 214 | | | 214 | |

| Liabilities: | | | | | | | | | | | | | | | | | | | |

| Derivatives | 66 | | | — | | | 47 | | | 19 | | | 66 | | | 4 | | | — | | | 3 | | | 1 | | | 4 | |

| Long-term debt | 3,645 | | | — | | | 3,228 | | | — | | | 3,228 | | | 3,643 | | | — | | | 4,124 | | | — | | | 4,124 | |

NOTE 12(b) Other Purchase Obligations - Various commodity supply, transportation and storage contracts help meet obligations to provide electricity and natural gas to utility customers. In addition, there are various purchase obligations associated with other goods and services. At September 30, 2017, minimum future commitments related to these purchase obligations were | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| WPL | September 30, 2022 | | December 31, 2021 |

| | | Fair Value | | | | Fair Value |

| Carrying | | Level | | Level | | Level | | | | Carrying | | Level | | Level | | Level | | |

| Amount | | 1 | | 2 | | 3 | | Total | | Amount | | 1 | | 2 | | 3 | | Total |

| Assets: | | | | | | | | | | | | | | | | | | | |

| Money market fund investments | $295 | | | $295 | | | $— | | | $— | | | $295 | | | $— | | | $— | | | $— | | | $— | | | $— | |

| Derivatives | 158 | | | — | | | 145 | | | 13 | | | 158 | | | 92 | | | — | | | 81 | | | 11 | | | 92 | |

| Liabilities: | | | | | | | | | | | | | | | | | | | |

| Derivatives | 32 | | | — | | | 31 | | | 1 | | | 32 | | | 5 | | | — | | | 5 | | | — | | | 5 | |

| Long-term debt (incl. current maturities) | 3,019 | | | — | | | 2,778 | | | — | | | 2,778 | | | 2,429 | | | — | | | 2,862 | | | — | | | 2,862 | |

Information for fair value measurements using significant unobservable inputs (Level 3 inputs) was as follows (in millions):

|

| | | | | | | | | | | |

| | Alliant Energy | | IPL | | WPL |

| Purchased power (a) |

| $1,278 |

| |

| $1,194 |

| |

| $84 |

|

| Natural gas | 847 |

| | 422 |

| | 425 |

|

| Coal (b) | 144 |

| | 66 |

| | 78 |

|

| Other (c) | 34 |

| | 25 |

| | 1 |

|

| |

| $2,303 |

| |

| $1,707 |

| |

| $588 |

|

| |

(a) | Includes payments required by purchased power agreements for capacity rights and minimum quantities of MWhs required to be purchased. |

| |

(b) | Corporate Services entered into system-wide coal contracts on behalf of IPL and WPL that include minimum future commitments. These commitments were assigned to IPL and WPL based on information available as of September 30, 2017 regarding expected future usage, which is subject to change.

|

| |

(c) | Includes individual commitments incurred during the normal course of business that exceeded $1 million at September 30, 2017.

|

NOTE 12(c) Legal Proceedings -

Flood Damage Claims - In 2013, several plaintiffs purporting to represent a class of residential and commercial property owners filed a complaint against Cedar Rapids and Iowa City Railway Company (CRANDIC), Alliant Energy and various other defendants in the Iowa District Court for Linn County. Plaintiffs assert claims of negligence and strict liability based on their allegations that CRANDIC (along with other defendants) caused or exacerbated flooding of the Cedar River in June 2008. In February 2016, the Iowa District Court for Linn County ruled in favor of Alliant Energy and CRANDIC and dismissed all claims against them, resulting in no loss. In August 2016, the Iowa District Court for Linn County dismissed all claims against the remaining defendants. In September 2016, plaintiffs filed a notice of appeal with the Supreme Court of Iowa. Alliant Energy does not currently believe any material losses for this complaint are both probable and reasonably estimated, and therefore has not recognized any material loss contingency amounts as of September 30, 2017.

NOTE 12(d) Guarantees and Indemnifications -

RMT - In 2013, Alliant Energy sold RMT. RMT provided renewable energy services, including construction and high voltage connection services for wind and solar projects. As part of the sale, Alliant Energy indemnified the buyer for any claims, including claims of warranty under the project obligations that were commenced or are based on actions that occurred prior to the sale, except for liabilities already accounted for through adjustments to the purchase price. Alliant Energy also guaranteed RMT’s performance obligations related to certain of RMT’s projects that were commenced prior to Alliant Energy’s sale of RMT. In the first quarter of 2017, all warranty periods and performance guarantees expired and all outstanding warranty claims were resolved.

Whiting Petroleum - In 2004, Alliant Energy sold its remaining interest in Whiting Petroleum. Whiting Petroleum is an independent oil and gas company. Alliant Energy Resources, LLC, as the successor to a predecessor entity that owned Whiting Petroleum, and a wholly-owned subsidiary of AEF, continues to guarantee the partnership obligations of an affiliate of Whiting Petroleum under general partnership agreements in the oil and gas industry, including with respect to the future abandonment of certain platforms off the coast of California and related onshore plant and equipment owned by the partnerships. The guarantees do not include a maximum limit. As of September 30, 2017, the present value of the abandonment obligations is estimated at $33 million. Alliant Energy is not aware of any material liabilities related to these guarantees of which it is probable that Alliant Energy Resources, LLC will be obligated to pay and therefore has not recognized any material liabilities related to this guarantee as of September 30, 2017.

Non-regulated Wind Investment in Oklahoma - In July 2017, a wholly-owned subsidiary of AEF acquired a cash equity ownership interest in a non-regulated wind farm located in Oklahoma. The wind farm provides electricity to a third-party under a long-term purchased power agreement. Alliant Energy provided a parent guarantee of its subsidiary’s indemnification obligations under the related operating agreement and purchased power agreement. Alliant Energy’s obligations under the operating agreement were $98 million as of September 30, 2017 and will reduce annually until expiring in July 2047. Alliant Energy’s obligations under the purchased power agreement are subject to a maximum limit of $17 million and expire in December 2031, subject to potential extension. Alliant Energy is not aware of any material liabilities related to this guarantee that it is probable that it will be obligated to pay and therefore has not recognized any material

| | | | | | | | | | | | | | | | | | | | | | | |

| Alliant Energy | Commodity Contract Derivative | | |

| Assets and (Liabilities), net | | Deferred Proceeds |

| Three Months Ended September 30 | 2022 | | 2021 | | 2022 | | 2021 |

| Beginning balance, July 1 | $72 | | $39 | | $244 | | $154 |

| Total net gains (losses) included in changes in net assets (realized/unrealized) | (1) | | 5 | | — | | — |

| | | | | | | |

| Transfers out of Level 3 | — | | (8) | | — | | — |

| | | | | | | |

| | | | | | | |

| Settlements (a) | (26) | | (7) | | 4 | | 10 |

| Ending balance, September 30 | $45 | | $29 | | $248 | | $164 |

| The amount of total net gains (losses) for the period included in changes in net assets attributable to the change in unrealized gains (losses) relating to assets and liabilities held at September 30 | ($1) | | $5 | | $— | | $— |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Alliant Energy | Commodity Contract Derivative | | |

| Assets and (Liabilities), net | | Deferred Proceeds |

| Nine Months Ended September 30 | 2022 | | 2021 | | 2022 | | 2021 |

| Beginning balance, January 1 | $29 | | $29 | | $214 | | $188 |

| Total net gains (losses) included in changes in net assets (realized/unrealized) | (17) | | 6 | | — | | — |

| | | | | | | |

| Transfers out of Level 3 | — | | (8) | | — | | — |

| Purchases | 79 | | 21 | | — | | — |

| | | | | | | |

| Settlements (a) | (46) | | (19) | | 34 | | (24) |

| Ending balance, September 30 | $45 | | $29 | | $248 | | $164 |

| The amount of total net gains (losses) for the period included in changes in net assets attributable to the change in unrealized gains (losses) relating to assets and liabilities held at September 30 | ($17) | | $6 | | $— | | $— |

| | | | | | | | | | | | | | | | | | | | | | | |

| IPL | Commodity Contract Derivative | | |

| Assets and (Liabilities), net | | Deferred Proceeds |

| Three Months Ended September 30 | 2022 | | 2021 | | 2022 | | 2021 |

| Beginning balance, July 1 | $58 | | $30 | | $244 | | $154 |

| Total net gains (losses) included in changes in net assets (realized/unrealized) | (6) | | 2 | | — | | — |

| | | | | | | |

| Transfers out of Level 3 | — | | (8) | | — | | — |

| | | | | | | |

| | | | | | | |

| Settlements (a) | (19) | | (5) | | 4 | | 10 |

| Ending balance, September 30 | $33 | | $19 | | $248 | | $164 |

| The amount of total net gains (losses) for the period included in changes in net assets attributable to the change in unrealized gains (losses) relating to assets and liabilities held at September 30 | ($6) | | $2 | | $— | | $— |

liabilities related to this guarantee as of September 30, 2017. Refer to Note 5(a) for further discussion of the non-regulated wind investment. | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| IPL | Commodity Contract Derivative | | |

| Assets and (Liabilities), net | | Deferred Proceeds |

| Nine Months Ended September 30 | 2022 | | 2021 | | 2022 | | 2021 |

| Beginning balance, January 1 | $18 | | $26 | | $214 | | $188 |

| Total net losses included in changes in net assets (realized/unrealized) | (13) | | — | | — | | — |

| | | | | | | |

| Transfers out of Level 3 | — | | (8) | | — | | — |

| Purchases | 58 | | 16 | | — | | — |

| | | | | | | |

| Settlements (a) | (30) | | (15) | | 34 | | (24) |

| Ending balance, September 30 | $33 | | $19 | | $248 | | $164 |

| The amount of total net losses for the period included in changes in net assets attributable to the change in unrealized losses relating to assets and liabilities held at September 30 | ($14) | | $— | | $— | | $— |

IPL’s Minnesota Electric Distribution Assets - IPL provided indemnifications associated with the July 2015 sale of its Minnesota electric distribution assets for losses resulting from potential breach of IPL’s representations, warranties and obligations under the sale agreement. Alliant Energy and IPL believe the likelihood of having to make any material cash payments under these indemnifications is remote. IPL has not recorded any material liabilities related to these indemnifications as of September 30, 2017. The general terms of the indemnifications provided by IPL included a maximum limit of $17 million and expire in October 2020.

NOTE 12(e) Environmental Matters -

Manufactured Gas Plant (MGP) Sites - IPL and WPL have current or previous ownership interests in various sites that are previously associated with the production of gas for which IPL and WPL have, or may have in the future, liability for investigation, remediation and monitoring costs. IPL and WPL are working pursuant to the requirements of various federal and state agencies to investigate, mitigate, prevent and remediate, where necessary, the environmental impacts to property, including natural resources, at and around these former MGP sites in order to protect public health and the environment.

Environmental liabilities related to the MGP sites are recorded based upon periodic studies. Such amounts are based on the best current estimate of the remaining amount to be incurred for investigation, remediation and monitoring costs for those sites where the investigation process has been or is substantially completed, and the minimum of the estimated cost range for those sites where the investigation is in its earlier stages. There are inherent uncertainties associated with the estimated remaining costs for MGP projects primarily due to unknown site conditions and potential changes in regulatory agency requirements. It is possible that future cost estimates will be greater than current estimates as the investigation process proceeds and as additional facts become known. Costs of future expenditures for environmental remediation obligations are not discounted. At September 30, 2017, estimated future costs expected to be incurred for the investigation, remediation and monitoring of the MGP sites, as well as environmental liabilities recorded on the balance sheets for these sites, were as follows (in millions). At September 30, 2017, such amounts for WPL were not material.

|

| | | | | | | | | | | |

| | Alliant Energy | | IPL |

| Range of estimated future costs |

| $12 |

| - | $31 | |

| $10 |

| - | $27 |

| Current and non-current environmental liabilities | 16 | | 14 |

WPL Consent Decree - In 2013, the U.S. District Court for the Western District of Wisconsin approved a Consent Decree that WPL, along with the other owners of Edgewater and Columbia, entered into with the EPA and the Sierra Club, thereby resolving claims against WPL. Such claims included allegations that the owners of Edgewater, Nelson Dewey and Columbia violated the Prevention of Significant Deterioration program requirements, Title V Operating Permit requirements of the Clean Air Act (CAA) and the Wisconsin State Implementation Plan designed to implement the CAA.

WPL has completed various requirements under the Consent Decree. WPL’s remaining requirements include installing an SCR system at Columbia Unit 2 and fuel switching or retiring Edgewater Unit 4 by December 31, 2018. The Consent Decree also establishes SO2, NOx and particulate matter emission rate limits for Columbia Units 1 and 2, and Edgewater Units 4 and 5. In addition, the Consent Decree includes annual plant-wide SO2 and NOx emission caps for Columbia and Edgewater. WPL is also in the process of completing approximately $7 million in environmental mitigation projects. Alliant Energy and WPL currently expect to recover material costs incurred by WPL related to compliance with the terms of the Consent Decree from WPL’s electric customers.

IPL Consent Decree - In 2015, the U.S. District Court for the Northern District of Iowa approved a Consent Decree that IPL entered into with the EPA, the Sierra Club, the State of Iowa and Linn County in Iowa, thereby resolving potential CAA issues associated with emissions from IPL’s coal-fired generating facilities in Iowa. IPL has completed various requirements under the Consent Decree. IPL’s remaining requirements include installing an SCR system or equivalent NOx reduction system at Ottumwa by December 31, 2019; fuel switching or retiring Prairie Creek Unit 4 by June 1, 2018, Burlington by December 31, 2021 and Prairie Creek Units 1 and 3 by December 31, 2025.

The Consent Decree also establishes SO2, NOx and particulate matter emission rate limits with varying averaging times for Burlington, Lansing, M.L. Kapp, Ottumwa and Prairie Creek. In addition, the Consent Decree includes calendar-year SO2 and NOx emission caps for Prairie Creek, and calendar-year SO2 and NOx emission caps in aggregate for Burlington, Dubuque, Lansing, M.L. Kapp, Ottumwa, Prairie Creek and Sutherland. IPL is also in the process of completing approximately $6 million in environmental mitigation projects. Alliant Energy and IPL currently expect to recover material

| | | | | | | | | | | |

| WPL | Commodity Contract Derivative |

| Assets and (Liabilities), net |

| Three Months Ended September 30 | 2022 | | 2021 |

| Beginning balance, July 1 | $14 | | $9 |

| Total net gains included in changes in net assets (realized/unrealized) | 5 | | 3 |

| | | |

| | | |

| | | |

| | | |

| Settlements | (7) | | (2) |

| Ending balance, September 30 | $12 | | $10 |

| The amount of total net gains for the period included in changes in net assets attributable to the change in unrealized gains relating to assets and liabilities held at September 30 | $5 | | $3 |

| | | | | | | | | | | |

| | | |

| WPL | Commodity Contract Derivative |

| Assets and (Liabilities), net |

| Nine Months Ended September 30 | 2022 | | 2021 |

| Beginning balance, January 1 | $11 | | $3 |

| Total net gains (losses) included in changes in net assets (realized/unrealized) | (4) | | 6 |

| | | |

| | | |

| Purchases | 21 | | 5 |

| | | |

| Settlements | (16) | | (4) |

| Ending balance, September 30 | $12 | | $10 |

| The amount of total net gains (losses) for the period included in changes in net assets attributable to the change in unrealized gains (losses) relating to assets and liabilities held at September 30 | ($3) | | $6 |

costs incurred by IPL

(a)Settlements related to the environmental control systems and environmental mitigation projects from IPL’s electric customers.

Other Environmental Contingencies - In additiondeferred proceeds are due to the environmental liabilities discussed above, various environmental rules are monitored that may have a significant impact on future operations. Severalchange in the carrying amount of these environmental rules are subject to legal challenges, reconsideration and/or other uncertainties. Given uncertainties regardingreceivables sold less the outcome, timingallowance for expected credit losses associated with the receivables sold and compliance plans for these environmental matters,cash amounts received from the complete financial impactreceivables sold.

Commodity Contracts - The fair value of each of these rules is not able to be determined; however future capital investments and/or modifications to EGUs to comply with certain of these rules could be significant. Specific current, proposed or potential environmental matters include, among others: Cross-State Air Pollution Rule, Effluent Limitation Guidelines, Coal Combustion Residuals Rule,FTR and various legislation and EPA regulations to monitor and regulate the emission of greenhouse gases, including carbon emissions from new (CAA Section 111(b)) and existing (CAA Section 111(d)) fossil-fueled EGUs.natural gas commodity contracts categorized as Level 3 was recognized as net derivative assets (liabilities) as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Alliant Energy | | IPL | | WPL |

| Excluding FTRs | | FTRs | | Excluding FTRs | | FTRs | | Excluding FTRs | | FTRs |

| September 30, 2022 | ($14) | | $59 | | ($15) | | $48 | | $1 | | $11 |

| December 31, 2021 | 9 | | 20 | | 8 | | 10 | | 1 | | 10 |

NOTE 13. SEGMENTS OF BUSINESSCOMMITMENTS AND CONTINGENCIES

NOTE 13(a) Capital Purchase Commitments - Various contractual obligations contain minimum future commitments related to capital expenditures for certain construction projects, including WPL’s expansion of solar generation. At September 30, 2022, Alliant Energy’s and WPL’s minimum future commitments for these projects were $208 million and $206 million, respectively.

NOTE 13(b) Other Purchase Commitments - Various commodity supply, transportation and storage contracts help meet obligations to provide electricity and natural gas to utility customers. In addition, there are various purchase commitments associated with other goods and services. At September 30, 2022, related minimum future commitments were as follows (in millions):

| | | | | | | | | | | | | | | | | |

| Alliant Energy | | IPL | | WPL |

| | | | | |

| Natural gas | $1,608 | | $742 | | $866 |

| Coal | 197 | | 95 | | 102 |

| Other (a) | 126 | | 57 | | 28 |

| $1,931 | | $894 | | $996 |

(a)Includes individual commitments incurred during the normal course of business that exceeded $1 million at September 30, 2022.

NOTE 13(c) Guarantees and Indemnifications -

Whiting Petroleum - Whiting Petroleum is an independent oil and gas company. In 2004, Alliant Energy - Certain financial sold its remaining interest in Whiting Petroleum. Alliant Energy Resources, LLC, as the successor to a predecessor entity that owned Whiting Petroleum, and a wholly-owned subsidiary of AEF, continues to guarantee the partnership obligations of an affiliate of Whiting Petroleum under multiple general partnership agreements in the oil and gas industry. The guarantees do not include a maximum limit. Based on information relatingmade available to Alliant Energy’s business segmentsEnergy by Whiting Petroleum, the Whiting Petroleum affiliate holds an approximate 6% share in the partnerships, and currently known obligations include costs associated with the future abandonment of certain facilities owned by the partnerships. The general partnerships were formed under California law, and Alliant Energy Resources, LLC may need to perform under the guarantees if the affiliate of Whiting Petroleum is as follows. Intersegment revenues were not materialunable to meet its partnership obligations.

As of September 30, 2022, the currently known partnership obligations for the abandonment obligations are estimated at $58 million, which represents Alliant Energy’s

operations. Refercurrently estimated maximum exposure under the guarantees. Alliant Energy estimates its expected loss to

Note 5(a) for discussionbe a portion of the $58 million of known partnership abandonment obligations of the Whiting Petroleum affiliate and the other partners. Alliant Energy is not aware of any material liabilities related to these guarantees that it is probable that it will be obligated to pay; however, as of both September 30, 2022 and December 31, 2021, a liability of $5 million is recorded in “Other liabilities” on Alliant Energy’s acquisition of an interest in a non-regulated wind farm in Oklahoma in July 2017, which increased the assetsbalance sheets for “Non-Regulated, Parent and Other.” Refer to Note 3 for discussion of asset valuation charges recorded in the third quarter of 2016expected credit losses related to the Franklin County wind farm.contingent obligations that are in the scope of these guarantees. |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Utility (a) | | Non-Regulated, | | Alliant Energy |

| | Electric | | Gas | | Other | | Total | | Parent and Other | | Consolidated |

| | (in millions) |

| Three Months Ended September 30, 2017 | | | | | | | | | | | |

| Operating revenues |

| $840.6 |

| |

| $45.8 |

| |

| $11.2 |

| |

| $897.6 |

| |

| $9.3 |

| |

| $906.9 |

|

| Operating income (loss) | 232.6 |

| | (2.4 | ) | | (7.7 | ) | | 222.5 |

| | 9.0 |

| | 231.5 |

|

| Net income (loss) attributable to Alliant Energy common shareowners | | | | | | | 176.3 |

| | (7.5 | ) | | 168.8 |

|

| Three Months Ended September 30, 2016 | | | | | | | | | | | |

| Operating revenues |

| $864.3 |

| |

| $39.5 |

| |

| $9.4 |

| |

| $913.2 |

| |

| $11.4 |

| |

| $924.6 |

|

| Operating income (loss) | 244.2 |

| | (3.7 | ) | | 0.4 |

| | 240.9 |

| | (78.3 | ) | | 162.6 |

|

| Amounts attributable to Alliant Energy common shareowners: | | | | | | | | | | | |

| Income (loss) from continuing operations, net of tax | | | | | | | 183.1 |

| | (54.3 | ) | | 128.8 |

|

| Loss from discontinued operations, net of tax | | | | | | | — |

| | (0.4 | ) | | (0.4 | ) |

| Net income (loss) | | | | | | | 183.1 |

| | (54.7 | ) | | 128.4 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Utility (a) | | Non-Regulated, | | Alliant Energy |

| | Electric | | Gas | | Other | | Total | | Parent and Other | | Consolidated |

| | (in millions) |

| Nine Months Ended September 30, 2017 | | | | | | | | | | | |

| Operating revenues |

| $2,199.1 |

| |

| $262.7 |

| |

| $34.4 |

| |

| $2,496.2 |

| |

| $29.9 |

| |

| $2,526.1 |

|

| Operating income (loss) | 475.4 |

| | 29.5 |

| | (6.8 | ) | | 498.1 |

| | 25.6 |

| | 523.7 |

|

| Amounts attributable to Alliant Energy common shareowners: | | | | | | | | | | | |

| Income from continuing operations, net of tax | | | | | | | 353.5 |

| | 8.6 |

| | 362.1 |

|

| Income from discontinued operations, net of tax | | | | | | | — |

| | 1.4 |

| | 1.4 |

|

| Net income | | | | | | | 353.5 |

| | 10.0 |

| | 363.5 |

|

| Nine Months Ended September 30, 2016 | | | | | | | | | | | |

| Operating revenues |

| $2,209.1 |

| |

| $248.7 |

| |

| $35.0 |

| |

| $2,492.8 |

| |

| $30.2 |

| |

| $2,523.0 |

|

| Operating income (loss) | 473.3 |

| | 27.0 |

| | 4.4 |

| | 504.7 |

| | (67.6 | ) | | 437.1 |

|

| Amounts attributable to Alliant Energy common shareowners: | | | | | | | | | | | |

| Income (loss) from continuing operations, net of tax | | | | | | | 350.3 |

| | (39.5 | ) | | 310.8 |

|

| Loss from discontinued operations, net of tax | | | | | | | — |

| | (2.0 | ) | | (2.0 | ) |

| Net income (loss) | | | | | | | 350.3 |

| | (41.5 | ) | | 308.8 |

|

| |

(a) | Alliant Energy’s utility business segments include: a) utility electric operations, which include Alliant Energy’s entire investment in ATC; b) utility gas operations; and c) utility other, which includes steam operations and the unallocated portions of the utility business. |

Whiting Petroleum completed a business combination with Oasis Petroleum Inc. in July 2022. The combined operations are now known as Chord Energy Corporation. The business combination is not expected to affect the scope of the Whiting Petroleum affiliate’s obligations to Alliant Energy or Alliant Energy’s related guarantees.

IPL

Non-utility Wind Farm in Oklahoma - Certain financial information relatingIn 2017, a wholly-owned subsidiary of AEF acquired a cash equity ownership interest in a non-utility wind farm located in Oklahoma. The wind farm provides electricity to IPL’s business segmentsa third party under a long-term PPA. Alliant Energy provided a parent guarantee of its subsidiary’s indemnification obligations under the related operating agreement and PPA. Alliant Energy’s obligations under the operating agreement were $59 million as of September 30, 2022 and will reduce annually until expiring in July 2047. Alliant Energy’s obligations under the PPA are subject to a maximum limit of $17 million and expire in December 2031, subject to potential extension. Alliant Energy is not aware of any material liabilities related to this guarantee that it is probable that it will be obligated to pay and therefore has not recognized any material liabilities related to this guarantee as follows. Intersegment revenues were not material to IPL’s operations.of September 30, 2022 and December 31, 2021.

|

| | | | | | | | | | | | | | | |

| | Electric | | Gas | | Other | | Total |

| | (in millions) |

| Three Months Ended September 30, 2017 | | | | | | | |

| Operating revenues |

| $489.0 |

| |

| $27.4 |

| |

| $11.0 |

| |

| $527.4 |

|

| Operating income (loss) | 138.3 |

| | (2.1 | ) | | (4.4 | ) | | 131.8 |

|

| Earnings available for common stock | | | | | | | 120.4 |

|

| Three Months Ended September 30, 2016 | | | | | | | |

| Operating revenues |

| $483.2 |

| |

| $23.9 |

| |

| $9.1 |

| |

| $516.2 |

|

| Operating income (loss) | 125.9 |

| | (1.4 | ) | | 1.4 |

| | 125.9 |

|

| Earnings available for common stock | | | | | | | 114.1 |

|

| Nine Months Ended September 30, 2017 | | | | | | | |

| Operating revenues |

| $1,217.6 |

| |

| $147.2 |

| |

| $33.3 |

| |

| $1,398.1 |

|

| Operating income (loss) | 234.5 |

| | 14.7 |

| | (1.5 | ) | | 247.7 |

|

| Earnings available for common stock | | | | | | | 200.4 |

|

| Nine Months Ended September 30, 2016 | | | | | | | |

| Operating revenues |

| $1,209.2 |

| |

| $142.6 |

| |

| $34.1 |

| |

| $1,385.9 |

|

| Operating income | 213.8 |

| | 15.3 |

| | 6.8 |

| | 235.9 |

|

| Earnings available for common stock | | | | | | | 191.6 |

|

WPLManufactured Gas Plant (MGP) Sites - Certain financial information relating to WPL’s business segments is as follows. Intersegment revenues were not material to WPL’s operations.

|

| | | | | | | | | | | | | | | |

| | Electric | | Gas | | Other | | Total |

| | (in millions) |

| Three Months Ended September 30, 2017 | | | | | | | |

| Operating revenues |

| $351.6 |

| |

| $18.4 |

| |

| $0.2 |

| |

| $370.2 |

|

| Operating income (loss) | 94.3 |

| | (0.3 | ) | | (3.3 | ) | | 90.7 |

|

| Earnings available for common stock | | | | | | | 49.8 |

|

| Three Months Ended September 30, 2016 | | | | | | | |

| Operating revenues |

| $381.1 |

| |

| $15.6 |

| |

| $0.3 |

| |

| $397.0 |

|

| Operating income (loss) | 118.3 |

| | (2.3 | ) | | (1.0 | ) | | 115.0 |

|

| Earnings available for common stock | | | | | | | 69.0 |

|

| Nine Months Ended September 30, 2017 | | | | | | | |

| Operating revenues |

| $981.5 |

| |

| $115.5 |

| |

| $1.1 |

| |

| $1,098.1 |

|

| Operating income (loss) | 240.9 |

| | 14.8 |

| | (5.3 | ) | | 250.4 |

|

| Earnings available for common stock | | | | | | | 133.4 |

|

| Nine Months Ended September 30, 2016 | | | | | | | |

| Operating revenues |

| $999.9 |

| |

| $106.1 |

| |

| $0.9 |

| |

| $1,106.9 |

|

| Operating income (loss) | 259.5 |

| | 11.7 |

| | (2.4 | ) | | 268.8 |

|

| Earnings available for common stock | | | | | | | 158.7 |

|

NOTE 14. RELATED PARTIES

Service Agreements - Pursuant to service agreements, IPL and WPL receivehave current or previous ownership interests in various administrative and general services from an affiliate, Corporate Services. These servicessites that are billed topreviously associated with the production of gas for which IPL and WPL at cost based on expenses incurred by Corporate Serviceshave, or may have in the future, liability for the benefit ofinvestigation, remediation and monitoring costs. IPL and WPL respectively. These costs consisted primarily of employee compensation and benefits, fees associated with various professional services, depreciation and amortization of property, plant and equipment, and a return on net assets. Corporate Services also acts as agent on behalf of IPL and WPLare working pursuant to the service agreements.requirements of various federal and state agencies to investigate, mitigate, prevent and remediate, where necessary, the environmental impacts to property, including natural resources, at and around these former MGP sites in order to protect public health and the environment. At September 30, 2022, estimated future costs expected to be incurred for the investigation, remediation and monitoring of the MGP sites, as well as environmental liabilities recorded on the balance sheets for these sites, which are not discounted, were as follows (in millions). At September 30, 2022, such amounts for WPL were not material.

| | | | | | | | | | | | | | | | | | | | | | | |

| Alliant Energy | | IPL |

| Range of estimated future costs | $9 | | - | $25 | | $6 | | - | $19 |

| Current and non-current environmental liabilities | $12 | | $8 |

IPL Consent Decree - In 2015, the U.S. District Court for the Northern District of Iowa approved a Consent Decree that IPL entered into with the EPA, the Sierra Club, the State of Iowa and Linn County in Iowa, thereby resolving potential Clean Air Act issues associated with emissions from IPL’s coal-fired generating facilities in Iowa. IPL has completed various requirements under the Consent Decree. IPL’s remaining requirements include fuel switching or retiring Prairie Creek Units 1 and 3 by December 31, 2025. Alliant Energy and IPL currently expect to recover material costs incurred by IPL related to compliance with the terms of the Consent Decree from IPL’s electric customers.

Other Environmental Contingencies - In addition to the environmental liabilities discussed above, various environmental rules are monitored that may have a significant impact on future operations. Several of these environmental rules are subject to legal challenges, reconsideration and/or other uncertainties. Given uncertainties regarding the outcome, timing and compliance plans for these environmental matters, the complete financial impact of each of these rules is not able to be determined; however, future capital investments and/or modifications to EGUs and electric and gas distribution systems to comply with certain of these rules could be significant. Specific current, proposed or potential environmental matters include, among others: Effluent Limitation Guidelines, Coal Combustion Residuals Rule, and various legislation and EPA regulations to monitor and regulate the emission of greenhouse gases, including the Clean Air Act.

NOTE 13(e) MISO Transmission Owner Return on Equity Complaints - A group of stakeholders, including MISO cooperative and municipal utilities, previously filed complaints with FERC requesting a reduction to the base return on equity authorized for MISO transmission owners, including ITC Midwest LLC and ATC. In 2019, FERC issued an order on the previously filed complaints and reduced the base return on equity authorized for the MISO transmission owners to 9.88% for November 12, 2013 through February 11, 2015, and subsequent to September 28, 2016. In 2020, FERC issued orders in response to various rehearing requests and increased the base return on equity authorized for the MISO transmission owners from 9.88% to 10.02% for November 12, 2013 through February 11, 2015, and subsequent to September 28, 2016. In August 2022, the U.S. Court of Appeals for the District of Columbia Circuit vacated FERC’s prior orders that established the base return on equity authorized for the MISO transmission owners and remanded the cases to FERC for further proceedings, which may result in additional changes to the base return on equity authorized for the MISO transmission owners. As agent, Corporate Services enters into energy, capacity, ancillary services, and transmission sale and purchase transactions within MISO. Corporate Services assigns such sales and purchases among IPL and WPL based on statements receiveda result of the August 2022 court decision, Alliant Energy recorded a $5 million reduction in “Equity income from MISO. The amounts billed for services provided, sales credited and purchasesunconsolidated investments” in its income statement for the three and nine months ended September 30, were as follows (in millions):2022 to reflect the anticipated reduction in the base return on equity authorized for the MISO transmission owners. Any further changes in FERC’s decisions may have an impact on Alliant Energy’s share of ATC’s future earnings and customer costs.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | IPL | | WPL |

| | Three Months | | Nine Months | | Three Months | | Nine Months |

| | 2017 | | 2016 | | 2017 | | 2016 | | 2017 | | 2016 | | 2017 | | 2016 |

| Corporate Services billings |

| $48 |

| |

| $41 |

| |

| $130 |

| |

| $124 |

| |

| $37 |

| |

| $33 |

| |

| $100 |

| |

| $103 |

|

| Sales credited | 8 |

| | 4 |

| | 15 |

| | 7 |

| | 6 |

| | 3 |

| | 8 |

| | 6 |

|

| Purchases billed | 109 |

| | 126 |

| | 271 |

| | 324 |

| | 32 |

| | 23 |

| | 99 |

| | 65 |

|

Net intercompany payables to Corporate Services were as follows (in millions):

|

| | | | | | | |

| | IPL | | WPL |

| | September 30, 2017 | | December 31, 2016 | | September 30, 2017 | | December 31, 2016 |

| Net payables to Corporate Services | $118 | | $104 | | $64 | | $72 |

ATC LLC - Pursuant to various agreements, WPL receives a range of transmission services from ATC LLC. WPL provides operation, maintenance, and construction services to ATC LLC. WPL and ATC LLC also bill each other for use of shared facilities owned by each party. The related amounts billed between the parties for the three and nine months ended September 30 were as follows (in millions):

|

| | | | | | | | | | | | | | | |

| | Three Months | | Nine Months |

| | 2017 | | 2016 | | 2017 | | 2016 |

| ATC LLC billings to WPL |

| $26 |

| |

| $28 |

| |

| $79 |

| |

| $82 |

|

| WPL billings to ATC LLC | 2 |

| | 4 |

| | 8 |

| | 10 |

|

WPL owed ATC LLC net amounts of $8 million as of September 30, 2017 and $8 million as of December 31, 2016.

Refer to Note 5(a) for discussion of WPL’s transfer of its investment in ATC LLC to ATI on December 31, 2016.

Franklin County Wind Farm - Refer to Note 3 for discussion of the transfer of the Franklin County wind farm from AEF to IPL in April 2017.

NOTE 14. SEGMENTS OF BUSINESS

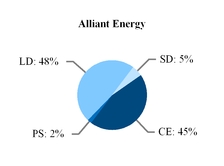

Certain financial information relating to Alliant Energy’s, IPL’s and WPL’s business segments is as follows. Intersegment revenues were not material to their respective operations.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Alliant Energy | | | | | | | | | ATC Holdings, | | Alliant |

| Utility | | Non-Utility, | | Energy |

| Electric | | Gas | | Other | | Total | | Parent and Other | | Consolidated |

| (in millions) |

| Three Months Ended September 30, 2022 | | | | | | | | | | | |

| Revenues | $1,039 | | $62 | | $11 | | $1,112 | | $23 | | $1,135 |

| Operating income (loss) | 304 | | (3) | | 1 | | 302 | | 7 | | 309 |

| Net income (loss) attributable to Alliant Energy common shareowners | | | | | | | 245 | | (18) | | 227 |

| Three Months Ended September 30, 2021 | | | | | | | | | | | |

| Revenues | $939 | | $50 | | $13 | | $1,002 | | $22 | | $1,024 |

| Operating income (loss) | 290 | | (5) | | (5) | | 280 | | 9 | | 289 |

| Net income attributable to Alliant Energy common shareowners | | | | | | | 250 | | 6 | | 256 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Alliant Energy | | | | | | | | | ATC Holdings, | | Alliant |

| Utility | | Non-Utility, | | Energy |

| Electric | | Gas | | Other | | Total | | Parent and Other | | Consolidated |

| (in millions) |

| Nine Months Ended September 30, 2022 | | | | | | | | | | | |

| Revenues | $2,624 | | $418 | | $35 | | $3,077 | | $70 | | $3,147 |

| Operating income | 680 | | 62 | | 4 | | 746 | | 23 | | 769 |

| Net income attributable to Alliant Energy common shareowners | | | | | | | 574 | | 5 | | 579 |

| Nine Months Ended September 30, 2021 | | | | | | | | | | | |

| Revenues | $2,357 | | $289 | | $36 | | $2,682 | | $60 | | $2,742 |

| Operating income (loss) | 601 | | 42 | | (4) | | 639 | | 24 | | 663 |

| Net income attributable to Alliant Energy common shareowners | | | | | | | 537 | | 34 | | 571 |

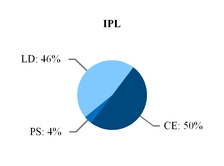

| | | | | | | | | | | | | | | | | | | | | | | |

| IPL | Electric | | Gas | | Other | | Total |

| (in millions) |

| Three Months Ended September 30, 2022 | | | | | | | |

| Revenues | $596 | | $33 | | $11 | | $640 |

| Operating income (loss) | 174 | | (3) | | — | | 171 |

| Net income available for common stock | | | | | | | 154 |

| Three Months Ended September 30, 2021 | | | | | | | |

| Revenues | $555 | | $31 | | $13 | | $599 |

| Operating income (loss) | 186 | | (3) | | (3) | | 180 |

| Net income available for common stock | | | | | | | 157 |

| Nine Months Ended September 30, 2022 | | | | | | | |

| Revenues | $1,438 | | $224 | | $34 | | $1,696 |

| Operating income | 353 | | 33 | | 3 | | 389 |

| Net income available for common stock | | | | | | | 327 |

| Nine Months Ended September 30, 2021 | | | | | | | |

| Revenues | $1,343 | | $165 | | $35 | | $1,543 |

| Operating income (loss) | 365 | | 30 | | (1) | | 394 |

| Net income available for common stock | | | | | | | 322 |

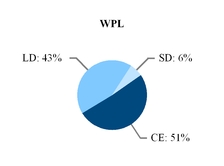

| | | | | | | | | | | | | | | | | | | | | | | |

| WPL | Electric | | Gas | | Other | | Total |

| (in millions) |

| Three Months Ended September 30, 2022 | | | | | | | |

| Revenues | $443 | | $29 | | $— | | $472 |

| Operating income | 130 | | — | | 1 | | 131 |

| Net income | | | | | | | 91 |

| Three Months Ended September 30, 2021 | | | | | | | |

| Revenues | $384 | | $19 | | $— | | $403 |

| Operating income (loss) | 104 | | (2) | | (2) | | 100 |

| Net income | | | | | | | 93 |

| Nine Months Ended September 30, 2022 | | | | | | | |

| Revenues | $1,186 | | $194 | | $1 | | $1,381 |

| Operating income | 327 | | 29 | | 1 | | 357 |

| Net income | | | | | | | 247 |

| Nine Months Ended September 30, 2021 | | | | | | | |

| Revenues | $1,014 | | $124 | | $1 | | $1,139 |

| Operating income (loss) | 236 | | 12 | | (3) | | 245 |

| Net income | | | | | | | 215 |

NOTE 15. RELATED PARTIES

Service Agreements - Pursuant to service agreements, IPL and WPL receive various administrative and general services from an affiliate, Corporate Services. These services are billed to IPL and WPL at cost based on expenses incurred by Corporate Services for the benefit of IPL and WPL, respectively. These costs consisted primarily of employee compensation and benefits, fees associated with various professional services, depreciation and amortization of property, plant and equipment, and a return on net assets. Corporate Services also acts as agent on behalf of IPL and WPL pursuant to the service agreements. As agent, Corporate Services enters into energy, capacity, ancillary services, and transmission sale and purchase transactions within MISO. Corporate Services assigns such sales and purchases among IPL and WPL based on statements received from MISO. The amounts billed for services provided, sales credited and purchases for the three and nine months ended September 30 were as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| IPL | | WPL |

| Three Months | | Nine Months | | Three Months | | Nine Months |

| 2022 | | 2021 | | 2022 | | 2021 | | 2022 | | 2021 | | 2022 | | 2021 |

| Corporate Services billings | $45 | | $50 | | $136 | | $138 | | $39 | | $37 | | $117 | | $113 |

| Sales credited | 11 | | 4 | | 11 | | 9 | | 31 | | 16 | | 62 | | 23 |

| Purchases billed | 119 | | 105 | | 342 | | 347 | | 42 | | 24 | | 103 | | 71 |

Net intercompany payables to Corporate Services were as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| IPL | | WPL |

| September 30, 2022 | | December 31, 2021 | | September 30, 2022 | | December 31, 2021 |

| Net payables to Corporate Services | $113 | | $110 | | $88 | | $83 |

ATC - Pursuant to various agreements, WPL receives a range of transmission services from ATC. WPL provides operation, maintenance, and construction services to ATC. WPL and ATC also bill each other for use of shared facilities owned by each party. The related amounts billed between the parties for the three and nine months ended September 30 were as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months | | Nine Months |

| 2022 | | 2021 | | 2022 | | 2021 |

| ATC billings to WPL | $38 | | $29 | | $107 | | $91 |

| WPL billings to ATC | 6 | | 4 | | 14 | | 13 |

WPL owed ATC net amounts of $9 million as of September 30, 2022 and $10 million as of December 31, 2021.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This MDA includes information relating to Alliant Energy, and IPL and WPL (collectively, the Utilities), as well as ATC Holdings, AEF and Corporate Services. Where appropriate, information relating to a specific entity has been segregated and labeled as such. The following discussion and analysis should be read in conjunction with the Financial Statements and the Notes included in this report, as well as the financial statements, notes and MDA included in the 20162021 Form 10-K.10-K. Unless otherwise noted, all “per share” references in MDA refer to earnings per diluted share.

EXECUTIVE OVERVIEW

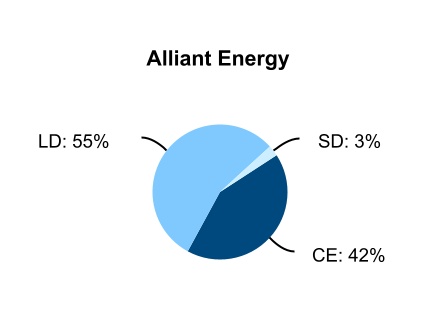

Description of Business

General - Alliant Energy is a Midwest U.S. energy holding company whose primary subsidiaries are IPL, WPL, AEF and Corporate Services. IPL and WPL are public utilities, and AEF is the parent company for Alliant Energy’s non-regulated businesses and holds all of Alliant Energy’s investment in ATC. Corporate Services provides administrative services to Alliant Energy and its subsidiaries. An illustration of Alliant Energy’s primary businesses is shown below.

|

| | | | | | | |

| 27 | Alliant Energy | | |

| | | | | |

| | | | |

Utilities, ATC Investment and Corporate Services | | Non-regulated and Parent |

- Retail electric and gas services in IA (IPL) | | - Transportation (AEF) |

- Retail electric and gas services in WI (WPL) | | - Non-regulated wind investment (AEF) |

- ATC Investment (ATI) | | - Sheboygan Falls Energy Facility (AEF) |

- Wholesale electric service in MN, IL & IA (IPL) | | - Parent Company |

- Wholesale electric service in WI (WPL) | | |

- Corporate Services | |

|

Financial Results - Alliant Energy’s net income

2022 HIGHLIGHTS

Key highlights since the filing of the 2021 Form 10-K include the following:

Customer Investments:

•In response to a petition from a U.S.-based solar panel assembler, in March 2022, the U.S. Department of Commerce initiated an investigation into whether the sourcing of solar project materials and EPS attributable toequipment from certain Southeast Asian countries circumvent tariffs and duties imposed on such materials and equipment imported from China. In June 2022, a presidential executive order postponed through 2024 any additional tariffs on solar project materials and equipment while the U.S. Department of Commerce completes its investigation. Alliant Energy, common shareownersIPL and WPL are currently unable to predict with certainty the future outcome or impact of these matters, including from any related legal challenges; however, this could result in delays and/or higher costs for the third quarter were as follows (dollars in millions, except per share amounts):

|

| | | | | | | | | | | | | | | |

| | 2017 | | 2016 |

| | Income (Loss) | | EPS | | Income (Loss) | | EPS |

| Continuing operations: | | | | | | | |

| Utilities, ATC Investment and Corporate Services |

| $179.7 |

| |

| $0.78 |

| |

| $186.7 |

| |

| $0.82 |

|

| Non-regulated and Parent | (10.9 | ) | | (0.05 | ) | | (57.9 | ) | | (0.25 | ) |

| Income from continuing operations | 168.8 |

| | 0.73 |

| | 128.8 |

| | 0.57 |

|

| Loss from discontinued operations | — |

| | — |

| | (0.4 | ) | | — |

|

| Net income |

| $168.8 |

| |

| $0.73 |

| |

| $128.4 |

| |

| $0.57 |

|

The table above includes EPS from continuing operations for utilities, ATC InvestmentIPL’s and Corporate Services,WPL’s planned development and non-regulatedacquisition of additional renewable energy, and parent, which are non-GAAP financial measures. Alliant Energy believes these non-GAAP financial measures are useful to investors because they facilitate an understanding of segment performance and trends and provide additional information about Alliant Energy’s operations on a basis consistent with the measures that management uses to manage its operations and evaluate its performance.

impact Alliant Energy’s, IPL’s and WPL’s incomeanticipated future construction and acquisition expenditures.

•In June 2022, the PSCW issued an order approving WPL’s second certificate of authority to acquire, construct, own, and operate up to 414 MW of new solar generation in the following Wisconsin counties: Dodge (150 MW), Waushara (99 MW), Rock (65 MW), Grant (50 MW) and Green (50 MW).

•In June 2022, IPL filed for a revised fixed cost cap of $1,934/kilowatt with the IUB related to IPL’s November 2021 advance rate-making principles filing for up to 400 MW of solar generation with in-service dates in 2023 and 2024 and approximately 75 MW of battery storage in 2024, which reflects higher materials, labor and shipping costs. The revised fixed cost cap includes allowance for funds used during construction and transmission upgrade costs among other costs. In September 2022, IPL provided the IUB with a summary of the Inflation Reduction Act of 2022, as well as an economic analysis indicating full ownership for its planned solar and battery storage projects is currently expected to result in lower costs for its customers compared to previous plans to utilize tax equity financing. IPL currently expects a decision from continuing operations increased (decreased)the IUB on its filing by $40 million, $6 million and ($19) million, respectively,the end of 2022.

•In August 2022, FERC approved MISO’s proposal to change its methodology for procuring capacity in the three-month period. Alliant Energy’s increase was primarilyenergy market effective with the 2023/2024 MISO Planning Year, as a result of changes in the overall generation resource mix due to asset valuation charges at AEF relatedthe shift to renewable generation and the Franklin Countyretirement of certain fossil-fueled generation. The capacity construct will change from the current Summer-based annual construct to four distinct seasons to help ensure the continued reliability of the electric transmission grid. FERC’s approval also includes establishing planning reserve margin requirements for all market participants on a seasonal basis and determining a seasonal accredited capacity value for certain classes of generating resources, including higher accredited capacity for wind farm ingeneration during the third quarter of 2016, higher revenues resulting from IPL’s interim retail electric base rate increase implemented in April 2017Spring, Fall and WPL’s retail electric and gas base rate increases implemented in January 2017, partially offset by estimated temperature impacts on IPL’s and WPL’s retail electric and gas sales, higher depreciation expense, higher energy efficiency cost recovery amortization at WPL,Winter seasons and lower AFUDC at IPL. WPL’s decrease was also impacted by reduced equity income resulting from the transfer of WPL’s investment in ATC LLC to ATI on December 31, 2016.

Refer to “Results of Operations”accredited capacity for additional details regarding the various factors impacting earningssolar generation during the third quarters of 2017 and 2016.

2017 Overview -Winter season. Alliant Energy, IPL and WPL continueare currently unable to focus on achieving their financial objectives and executing their strategic plan. Key developments sincepredict with certainty the filingfuture outcome or impact of these matters, but anticipate additional generating resources will be needed to comply with the requirements of the 2016 Form 10-K include the following:new capacity construct. Refer to “Liquidity and Capital Resources” for discussion of proposed changes to IPL’s and WPL’s current resource plans resulting from these matters.Marshalltown Generating Station - IPL’s construction of Marshalltown, an approximate 660 MW natural gas-fired combined-cycle EGU, was completed in April 2017. Final capital expenditures are currently estimated to be approximately $645 million to construct the EGU and a pipeline to supply natural gas to the EGU, excluding transmission network upgrades and AFUDC.

Franklin County Wind Farm - In April 2017, the 99 MW Franklin County wind farm was transferred from AEF to IPL.

| |

• | IPL’s and WPL’s Potential Expansion of Wind Generation - In addition to IPL’s 500 MW expansion of wind generation approved by the IUB in October 2016 and transfer of the 99 MW Franklin County wind farm to IPL in 2017, IPL and WPL are currently exploring options to own and operate up to 500 MW and 200 MW, respectively, of additional new wind generation. In August 2017, IPL filed an application with the IUB for advance rate-making principles for the up to 500 MW of the additional wind generation. In the fourth quarter of 2017, WPL expects to file for approval from the PSCW and FERC for the acquisition of 55 MW of the Forward Wind Energy Center, and plans to file for authority for the remaining up to 200 MW of new wind generation. Refer to “Strategic Overview” for further discussion. The amount and timing of these wind projects will largely depend on regulatory approvals and the acquisition of wind sites. |

WPL’s Construction of West Riverside - In October 2017, WPL received an order from the PSCW authorizing various electric cooperatives, which currently have wholesale power supply agreements with WPL, to acquire approximately 65 MW of West Riverside while the EGU is being constructed. As part of the electric cooperatives’ acquisitions, which are currently expected to be completed in the fourth quarter of 2017, the current wholesale power supply agreements with the various electric cooperatives will be extended by at least four years until 2026 with automatic continuation of such agreements unless terminated by either party, with a five-year notice requirement.

| |

• | Non-regulated Wind Investment in Oklahoma - In July 2017, a wholly-owned subsidiary of AEF acquired a 50% cash equity ownership interest in a 225 MW non-regulated wind farm located in Oklahoma. Refer to Note 5(a) for further discussion. |

IPL’s Retail Electric Rate Review (2016 Test Year) - In April 2017, IPL filed a request with the IUB to increase annual electric base rates for its Iowa retail electric customers. The request was based on a 2016 historical Test Year as adjusted for certain known and measurable changes occurring up to 12 months after the commencement of the proceeding. The key drivers for the filing included recovery of capital projects, primarily power grid modernization and investments that

advance cleaner energy, including Marshalltown. An interim retail electric base rate increase of $102 million, or approximately 7%, on an annual basis, was implemented effective April 13, 2017. •In September 2017, IPL reached a partial, non-unanimous settlement agreement with the Iowa Office of Consumer Advocate, the Iowa Business Energy Coalition and the Large Energy Group to increase annual retail electric base rates by $130 million, or approximately 9%, subject to IUB approval. As a result of the proposed settlement, in the third quarter of 2017, IPL recorded a write-down of regulatory assets of $9 million. IPL currently expects to implement final rates in the first quarter of 2018.

WPL’s Retail Fuel-related Rate Filing (2018 Test Year) - In July 2017,2022, WPL filed a request with the PSCW for approval to construct, own and operate 175 MW of battery storage, with 100 MW and 75 MW at the Grant County and Wood County solar projects, respectively. Estimated capital expenditures for these planned projects for 2023 through 2025 are included in the “Renewables and battery storage” line in the construction and acquisition table in “Liquidity and Capital Resources.”•In September 2022, after the enactment of the Inflation Reduction Act of 2022, WPL informed the PSCW of its decision to retain full ownership of its planned solar projects instead of financing a portion of the projects with tax equity partners, which is currently expected to result in lower costs for its customers compared to previous plans to utilize tax equity financing.

•In September 2022, WPL completed the construction of the Bear Creek Solar Garden in Richland County, Wisconsin (50 MW).

•In October 2022, WPL completed the construction of the North Rock Solar Garden in Rock County, Wisconsin (50 MW).

•Refer to Note 3 for discussion of revised expected timing for the retirements of various IPL and WPL coal-fired EGUs.

Rate Matters:

•In June 2022, WPL filed a limited reopener request with the PSCW to increase annual retail gas rates for WPL’sthe 2023 forward-looking Test Period by approximately $10 million, which reflects changes in weighted average cost of capital, updated depreciation rates and modifications to certain regulatory asset and regulatory liability amortizations. WPL currently expects a decision from the PSCW on its request by the end of 2022.

•In August 2022, the PSCW authorized WPL to collect $37 million in 2023 from its retail electric customers, by $6 million, or approximately 1%, in 2018. The increase primarily reflects a change in expectedplus interest, for an under-collection of fuel-related costs incurred by WPL in 2018,2021 that were higher than fuel-related costs used to determine rates for such period. In addition, in November 2022, WPL filed updated fuel-related cost information for 2023 with the PSCW, which are expectedreflects an increase in annual retail electric rates of approximately $63 million in 2023 compared to be offset by $3 million of over-collections from WPL’s 2016approved 2022 fuel-related costs. WPL currently expects a decision from the PSCW on its request by the end of 2022.

•WPL currently expects to file a retail electric and gas rate review with the PSCW in the second quarter of 2023 for the 2024/2025 forward-looking Test Period. The key drivers for the anticipated filing include revenue requirement impacts of increasing electric and gas rate base, including investments in solar generation and battery storage. Any rate changes granted from this pending request are expected to be effective on January 1, 2018.

2024, with a decision from the PSCW expected by the end of 2023.MISO Transmission Owner Return on Equity Complaints - A group of MISO cooperative•IPL currently expects to file a retail electric and municipal utilities previously filed two complaintsgas rate review with FERC requesting a reduction to the base return on equity usedIUB by MISO transmission owners, including ITC and ATC LLC, to determine electric transmission costs billed to utilities, including IPL and WPL. In September 2016, FERC issued an order on the first complaint and established a base return on equityhalf of 10.32%, excluding any incentive adders granted by FERC, effective September 28, 2016, and2024. The key drivers for the refund period from November 12, 2013 through February 11, 2015 (first complaint period). Duringanticipated filing include revenue requirement impacts of increasing electric and gas rate base, including investments in solar generation and battery storage.

Legislative Matters:

•Refer to Note 9 for discussion of Iowa tax reform enacted in March 2022. •In August 2022, the nine months ended September 30, 2017,Inflation Reduction Act of 2022 was enacted. The most significant provisions of the new legislation for Alliant Energy, IPL and WPL receivedrelate to a 10-year extension of tax credits for clean energy projects, a new production tax credit eligible for solar projects, a new stand-alone investment tax credit for battery storage projects and the refundsright to transfer future renewable credits to other corporate taxpayers. The new legislation also includes a requirement for the first complaint period of $50 million, $39 million and $11 million, respectively, after final true-ups. Pursuantcorporations with income over $1 billion to IUB approval, IPL’s retail portion of the refund from ITCpay a 15% minimum tax; however, Alliant Energy is currently being refunded to its retail customers in 2017. WPL’s retail portion of the refund from ATC LLC will remain in a regulatory liability until such refunds are approved to be returned to retail customers in a future rate proceeding.

Credit Facility Agreement - In August 2017,below this income level. Alliant Energy, IPL and WPL entered intocurrently expect to utilize various provisions of the new legislation to enhance the tax benefits expected from their announced approximately 1,500 MW of solar and 250 MW of battery storage projects, including transferring the future tax credits from such projects to other corporate taxpayers and opting to retain full ownership of such projects instead of financing a single new credit facility agreement, which expiresportion of the projects with tax equity partners. Compared to previous plans to utilize tax equity financing, the impact of these changes is expected to result in August 2022. The new credit facility agreement includes financial covenants similarlower costs for IPL's and WPL's customers, higher rate base amounts, additional financing needs expected to those that were included in the previous credit facility agreements. As of September 30, 2017, the short-term borrowing capacity totaled $1 billion ($300 million for Alliant Energy at the parent company level, $300 million for IPLbe satisfied with additional long-term debt and $400 million for WPL).

At-the-Market Offering Program - In the second quarter of 2017, Alliant Energy issued 3.1 million shares of common stock through an at-the-market offering programissuances, and receivedimprovements in long-term cash proceedsflows over the life of $124 million, netthe solar and battery storage projects.

Financings and Common Stock Dividends:

Future Developments - The following includes key items expected to impact Alliant Energy, IPL and WPL in the future that have been identified since the filing of the 2016 Form 10-K:

2018 Forecast - In 2018, the following financing activities, and impacts to results of operations, are currently anticipated to occur:

Financing Plans - Alliant Energy currently expects to issue up to $200 million of common stock in 2018 through one or more offeringsdividends, and its Shareowner Direct Plan. IPL currently expects to issue up to $700 millionexpected future issuances and retirements of long-term debt, securities in 2018,by the end of which $350 million would be used to retire maturing long-term debt in 2018. AEF currently expects to issue up to $1.0 billion of long-term debt in 2018, of which $595 million would be used to refinance term loans.

2023.Common Stock Dividends - Alliant Energy announced a 6% increase in its targeted 2018 annual common stock dividend to $1.34 per share, which is equivalent to a quarterly rate of $0.335 per share, beginning with the February 2018 dividend payment. The timing and amount of future dividends is subject to an approved dividend declaration from Alliant Energy’s Board of Directors, and is dependent upon earnings expectations, capital requirements, and general financial business conditions, among other factors.

| |

• | Utility Electric and Gas Margins - Alliant Energy and IPL currently expect an increase in electric and gas margins in 2018 compared to 2017 as a result of base rate increases in effect from IPL’s retail electric rate review (2016 Test Year) and IPL’s planned retail gas rate review (2017 Test Year). Refer to “Rate Matters” for further discussion of these rate reviews, as well as “Other Future Considerations” for discussion of expected changes in Alliant Energy’s, IPL’s and WPL’s electric transmission service expense in 2018 compared to 2017. |

Depreciation and Amortization Expenses - Alliant Energy and IPL currently expect an increase in depreciation and amortization expenses in 2018 compared to 2017 due to property additions, and the implementation of updated depreciation rates for IPL as a result of a recently completed depreciation study, which is expected to be effective with the implementation of final rates from IPL’s retail electric rate review (2016 Test Year).

Interest Expense - Alliant Energy currently expects interest expense to increase in 2018 compared to 2017 due to financings completed in 2017 and planned in 2018 as discussed above.

AFUDC - Alliant Energy currently expects AFUDC to increase in 2018 compared to 2017 primarily due to increased construction work in progress balances related to IPL’s expansion of wind generation and WPL’s West Riverside facility.

RESULTS OF OPERATIONS

Overview - “Executive Overview” provides an overview of Alliant Energy’s, IPL’s and WPL’s earnings for the three months ended September 30, 2017 and 2016. Additional earnings details for the three and nine months ended September 30, 2017 and 2016 are discussed below.

Results of operations include financial information prepared in accordance with GAAP as well as utility electric margins and utility gas margins, which are not measures of financial performance under GAAP. Utility electric margins are defined as electric operating revenues less electric production fuel, purchased power and electric transmission service expenses. Utility gas margins are defined as gas operating revenues less cost of gas sold. Utility electric margins and utility gas margins are non-GAAP financial measures because they exclude other utility and non-regulated operatingnon-utility revenues, other operation and maintenance expenses, depreciation and amortization expenses, and taxes other than income tax expense.

Management believes that utility electric and gas margins provide a meaningful basis for evaluating and managing utility operations since electric production fuel, purchased power and electric transmission service expenses and cost of gas sold are generally passed through to customers, and therefore, result in changes to electric and gas operating revenues that are comparable to changes in such expenses. The presentation of utility electric and gas margins herein is intended to provide supplemental information for investors regarding operating performance. These utility electric and gas margins may not be comparable to how other entities define utility electric and gas margin. Furthermore, these measures are not intended to replace operating income as determined in accordance with GAAP as an indicator of operating performance.

Additionally, the table below includes EPS for Utilities and Corporate Services, ATC Holdings, and Non-utility and Parent, which are non-GAAP financial measures. Alliant Energy believes these non-GAAP financial measures are useful to investors because they facilitate an understanding of segment performance and trends, and provide additional information about Alliant Energy’s operations on a basis consistent with the measures that management uses to manage its operations and evaluate its performance.

Financial Results Overview - Alliant Energy’s net income and EPS attributable to Alliant Energy common shareowners for the three months ended September 30 were as follows (dollars in millions, except per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | |

| 2022 | | 2021 |

| Income (Loss) | | EPS | | Income (Loss) | | EPS |

| | | | | | | |

| Utilities and Corporate Services | $249 | | $0.99 | | $254 | | $1.01 |

| ATC Holdings | 5 | | 0.02 | | 8 | | 0.03 |

| Non-utility and Parent | (27) | | (0.11) | | (6) | | (0.02) |

| | | | | | | |

| | | | | | | |

| Alliant Energy Consolidated | $227 | | $0.90 | | $256 | | $1.02 |

Alliant Energy’s Utilities and Corporate Services net income decreased by $5 million for the three-month period, primarily due to higher interest expense and the timing of income taxes.

Alliant Energy’s Non-utility and Parent net income decreased by $21 million for the three-month period, primarily due to higher interest expense, the timing of income taxes and the impact of the Iowa corporate income tax rate change.

For the three and nine months ended September 30, operating income and a reconciliation of utility electric and gas margins to the most directly comparable GAAP measure, operating income, was as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Alliant Energy | | IPL | | WPL |

| Three Months | 2022 | | 2021 | | 2022 | | 2021 | | 2022 | | 2021 |

| Operating income | $309 | | $289 | | $171 | | $180 | | $131 | | $100 |

| Electric utility revenues | $1,039 | | $939 | | $596 | | $555 | | $443 | | $384 |

| Electric production fuel and purchased power expenses | (274) | | (207) | | (140) | | (101) | | (134) | | (105) |

| Electric transmission service expense | (157) | | (148) | | (115) | | (103) | | (42) | | (44) |

| Utility Electric Margin (non-GAAP) | 608 | | 584 | | 341 | | 351 | | 267 | | 235 |

| Gas utility revenues | 62 | | 50 | | 33 | | 31 | | 29 | | 19 |

| Cost of gas sold | (26) | | (18) | | (14) | | (12) | | (13) | | (6) |

| Utility Gas Margin (non-GAAP) | 36 | | 32 | | 19 | | 19 | | 16 | | 13 |

| Other utility revenues | 11 | | 13 | | 11 | | 13 | | — | | — |

| Non-utility revenues | 23 | | 22 | | — | | — | | — | | — |

| Other operation and maintenance expenses | (172) | | (171) | | (90) | | (95) | | (70) | | (66) |

| Depreciation and amortization expenses | (169) | | (165) | | (95) | | (94) | | (71) | | (70) |

| Taxes other than income tax expense | (28) | | (26) | | (15) | | (14) | | (11) | | (12) |

| Operating income | $309 | | $289 | | $171 | | $180 | | $131 | | $100 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Alliant Energy | | IPL | | WPL |

| | Three Months | | Nine Months | | Three Months | | Nine Months | | Three Months | | Nine Months |

| | 2017 | | 2016 | | 2017 | | 2016 | | 2017 | | 2016 | | 2017 | | 2016 | | 2017 | | 2016 | | 2017 | | 2016 |

| Operating income |

| $231.5 |

| |

| $162.6 |

| |

| $523.7 |

| |

| $437.1 |

| |

| $131.8 |

| |

| $125.9 |

| |

| $247.7 |

| |

| $235.9 |

| |

| $90.7 |

| |

| $115.0 |

| |

| $250.4 |

| |

| $268.8 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Alliant Energy | | IPL | | WPL |